As filed with the Securities and Exchange Commission on July 9, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21210

Alpine Income Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, NY 10577

(Address of principal executive offices) (Zip code)

Samuel A. Lieber

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, NY 10577

(Name and address of agent for service)

Copy to:

Thomas R. Westle, Esq.

Attorney at Law

Blank Rome LLP

The Chrysler Building

405 Lexington Avenue

New York, NY 10174

1-888-785-5578

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2010

Date of reporting period: April 30, 2010

TABLE OF CONTENTS

| EQUITY MANAGER REPORTS | |

| | |

Alpine Dynamic Dividend Fund | 6 |

| | |

Alpine Accelerating Dividend Fund | 15 |

| | |

Alpine Dynamic Financial Services Fund | 20 |

| | |

Alpine Dynamic Innovators Fund | 25 |

| | |

Alpine Dynamic Transformations Fund | 29 |

| | |

Alpine Dynamic Balance Fund | 33 |

| | |

| FIXED INCOME MANAGER REPORTS | |

| | |

Alpine Ultra Short Tax Optimized Income Fund | 37 |

| | |

Alpine Municipal Money Market Fund | 40 |

| | |

| Schedules of Portfolio Investments | 45 |

| | |

| Statements of Assets and Liabilities | 74 |

| | |

| Statements of Operations | 77 |

| | |

| Statement of Cash Flows | 80 |

| | |

| Statements of Changes in Net Assets | 81 |

| | |

| Financial Highlights | 89 |

| | |

| Notes to Financial Statements | 98 |

| | |

| Additional Information | 112 |

Additional Alpine Funds are offered in the Alpine Equity Trust. These funds include:

Alpine International Real Estate Equity Fund

Alpine Realty Income & Growth Fund

Alpine Cyclical Advantage Property Fund

Alpine Emerging Markets Real Estate Fund

Alpine Global Infrastructure Fund

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Dear Investor:

We concluded last fall’s annual letter to shareholders by stating that “. . .The U.S. and global economies will continue to transition in a positive fashion towards a multi year cycle of relatively directional positive returns. . ., but that is not to say that 2010 will be an easy year.” We expected market volatility and that is surely what we have experienced to date through the semi-annual period ending April 30, 2010 and into the May date of this letter writing. The market memory of the financial distress which precipitated the meltdown of Lehman Brothers in the Fall of 2008 and continued into early 2009 is still fresh in investors’ memories, yet the hopes for economic recovery and strong financial market returns have been growing. The forces of greed and fear remain powerfully present in the market today as witnessed by significant sector rotation over the past six months and a return to high levels on the VIX Index of market volatility. Capital market improvement, solid corporate earnings and signs of economic strength have been offset by the Euro debt crisis, BP’s Gulf oil spill, North Korean aggression, and China’s moderation of prior stimulus. In Alpine’s view, both exogenous events and economic fundamentals are continually incorporated into a natural progression towards a longer term trend, as the market alternates between dancing forward then taking a step backward before progressing further. We believe the markets will establish a stronger medium-term trend during 2011 in anticipation of improving economic prospects leading into 2012 and beyond, and long-term investors may once again replace traders as the dominant force in the market.

THE EURO AND INVESTMENT RISK

The current financial market instability brought about by the decline in the Euro versus the U.S. dollar, stems from the market’s inability to assess the ultimate impact of the Greek government’s eroded capacity to both service and stand behind its sovereign debt. The scope of the situation could be as minimal as Greece’s 2% contribution to Euro-zone Gross Domestic Product (GDP), or as significant as spawning a contagion of credit concerns which could undermine the cohesion of the European Union (EU) and the durability of its’ currency, the Euro. At their extreme, such fears of high exposure among banks and governments to potentially risky corporate and sovereign debt, suggests that even the creditworthiness of the United States of America could eventually be impaired. Thus, the range of imp lications to all financial markets could extend from insignificant to catastrophic. However, the reality is likely more benign. While disruptive to markets in the short term, the fears of contagion have forced the European Union (EU) and the European Central Bank (ECB) to provide greater safeguards than is probably warranted. In effect, the EU’s 750 billion Euro stabilization package is designed to provide adequate funding for not only Greece, but Portugal and Spain, for a period of approximately four years. This is designed as a temporary measure to enable these different countries to implement and execute austerity packages which would reduce their dependence upon debt financing of government activities. Unfortunately, for a few months market participants will likely remain unsure as to the future effectiveness of such plans or of the negative impact upon domestic or regional growth. Thus, pressure on the Euro may continue; initially to the benefit of the U.S. dollar. Devaluation of the Euro should h elp exporters, particularly in Germany, where unit labor costs rose by less than 10% over the previous decade. By comparison, Southern Europe experienced 30% to 40% increases, with Greece now the least competitive country in that region. Over the next few years, the EU will likely add institutional flexibility in order to adjust for financial inequalities amongst members. Otherwise, the membership will be forced to change for the EU to remain meaningful.

As Alpine sees it, debt funded excesses which perhaps provided a boost to prior year’s growth are being replaced by austerity measures in response to pressure from the financial markets, which remain focused on reducing risk. Governments, corporations and even individuals, are increasingly being required to live within their means, to fund debt obligations from cash flow and utilize resources productively to produce either collective, corporate or individual wealth. This emphasis on derisking has certainly entered into the equity markets where the mid-May sell-off was characterized by some observers as traders derisking exposure to stocks, taking risk off their portfolios in relation to currencies, or adjusting the amount of market risk that they were comfortable taking. This was a contrast to the strong Marc h rally which preceded this contagion conundrum, where financially leveraged cyclical stocks outperformed as some traders sought to add beta or market risk to their portfolios.

Risk aversion is evidenced by the astonishing low yields which investors are accepting for low risk. U.S. Treasury Bills are yielding 0.159% for the shortest duration risk of three months. ‘Safe Haven’ U.S. Treasury Bills are yielding 0.159% for the shortest duration risk of three months. With a yield curve that only rises above 3% after six years, investors either expect significant deflation of assets for several years or are so risk averse as to forsake opportunities to grow their net worth. The danger of a financial meltdown which was almost palpable in October of 2008 is not apparent from measures such as so-called ‘TED’ Spreads between Treasury notes and LIBOR (London Interbank Offering Rates are the cost at which banks d o business with each other) which ended May at roughly 0.21% versus a peak of over 4.53% on October 10, 2008. Further evidence comes from the U.S. Federal Reserve’s St Louis (Fed Branch) Financial Stress Index which peaked at 5.01% in that same week in 2008, yet ended May 2010 at 0.872%. Perhaps the current pattern of extreme caution could be expected after experiencing a hundred year flood as we did during the credit crisis of 2008. Thus, if important measures of financial risk are only flashing a yellow cautious and not a solid red for danger, then market psychology may be excessively cautious, with potentially significant, albeit, diverging implications for both equity and income investors.

ALPINE’S FOCUS ON FUNDING CORPORATE INVESTMENT

The market’s on again, off again reactions to a continuing stream of information and statistics reflect the powerful impact of short term trading strategies. While we must be responsive to short-term conditions, Alpine seeks to set its strategy based on larger fundamental trends and conditions. We believe that earnings growth can occur in a low or slow growth environment if market share gains are possible. In light of the recent downturn, many public companies, particularly in the real estate and banking sectors, sold new shares to investors over the past year in order to recapitalize balance sheets and position themselves to potentially expand market share. Selectively, Alpine funds have been active participants in many such offerings. Irrespective of economic conditions, companies with innovative products or processes or those which can achieve corporate transformation brought about by a change in product lines or business, may also experience increases in market share. Alpine has made these investment themes the primary focus of two different funds. However, for all of our funds, we endeavor to find such opportunities as well as emphasizing regions or sectors of growing demand. As a corollary, we are less inclined to invest in situations where growth in user demand is limited or declining. However, there are situations when such decline or such growth is more than priced in, and that creates both buying and selling opportunities, respectively. While this suggests that there will always be buying opportunities in different markets at different times, we nevertheless prefer to tilt the portfolios to the areas where we find longer term growth. Thus, Alpine’s focus on emerging market opportunities, most notably in Brazil and China where it is appropriate for the mandates of specific Funds, or for other Fu nds by investing in U.S. based companies which are seeking growth opportunities in emerging market economies.

CHINA SLOWING AND BRAZIL GROWING

Recently, China has embarked on a restrictive liquidity program bringing money supply growth down from a stimulus oriented peak of 35% after the Lehman Brothers bankruptcy, back to historic levels of 15% to18%. The government has also sought to constrain price inflation in the property sector, both of which we believe may take 2% to 4% off GDP, bringing the medium term rate of growth from 11% down to a 7% to 8% range. We believe that the major impact of this attempt to reign in price inflation will be achieved this summer, and that, to a great degree, it is already being priced into the stock market. Typically, command control economies such as China are often too blunt in their approach and methodology and, hence, the desired impact may not be as envisioned. That said, domestic income inequality between workers, their bosses, and even the growing middle class has been contentious, so the political aspect of this exercise may be as important as the economic.

A side result of this projected slowdown in China has been a decline in commodity prices around the world, impacting not only the major suppliers of such materials in natural resources, but also restraining a global source of potential inflation. With regard to Brazil, domestic demand is now growing to the point where the effect of China’s modest slowdown is not having a significant impact. There have even been a few economists who recently increased their growth prospects for Brazil from 6.5% to 7.5% GDP growth during the course of 2010, as the Central Bank may moderate ongoing plans to raise interest rates over the course of the year. It is worth noting that these interest rate increases are not tied to interest rates used for consumer mortgages. Rather they should have more impact on the commercial bor rowing than on domestic demand. We also expect to see a growing level of fixed asset investment in both infrastructure and industry in Brazil, including new roads, railroads, ports, steel mills and deep sea oil rigs. Many U.S., European, Japanese and Chinese companies are investing in Brazil to build industrial capacity from mines to factories, while others are focused on growing consumption patterns, notably including Unilever and Walmart. This is a classic pattern where countries which initially had a beneficial cost of production or abundant natural resources further enhanced productivity through modern industrialization and then created “added value” through downstream manufacturing or distribution.

INVESTING FOR FUTURE NEEDS

For the past eighty years, the U.S. has been at the head of the pack in our productivity gains, as witnessed by our economy’s 22% share of global GDP. However, we must increase the current level of investment in our infrastructure and technical capacity, with particular focus on education if we are to maintain this level of superiority. Unfortunately, it looks as if during the next few years we will share some of the burden of austerity measures which now afflict Europe and the U.K. Our municipal and state government budgets were directly stabilized by the stimulus package of 2009, yet drastic cuts to the 2010 through 2011 local budgets will be telling, both in their political and economic impact over the next year. We already see an historic excess of qualified teachers relative to job openings as class size s rise and curriculums shrink. Cuts in municipal and social services ranging from reduced waste pickup, more homeless on the streets and fewer services for the needy or house bound are already taking place. Fees, tolls and taxes will be increasing at the same time that public transit schedules are reduced. This makes the prospects for meaningful economic growth even less clear. Add to this the inevitable uncertainty over the impact of recent Federal government legislation bringing healthcare and financial reform, and the likely evolution of a revised tax regime starting next year. Thus, the ongoingpolitical debate regarding finances and priorities will take on greater significance for the next few years.

Countering such concerns for now are the benefits of a strong dollar at the expense of the Euro, and cheaper commodities which should help to sustain low interest rates for our import oriented economy. Low interest rates around the world could very well continue into the foreseeable future. With a few years of cheap money and a degree of ingenuity, the U.S. may be able to maintain the current trajectory of recovery. Europe and Japan have fewer tools with which to engage growth, so more time may be needed to rebalance their accounts. Progress could provide investors with greater economic clarity of future economic potentials as we continue to unwind the debt burden of the past decade and restructure our industrial and economic priorities. With clarity comes confidence, which reinforces action, suggesting that the ne xt two to three years may see a resurgence of long term investors in equity markets.

Where Greece was a shot across the bow of the European Union, we must make sure that it was not a ‘canary in the coal mine’ singing to the rest of us. Companies and countries which can continue to fund their finances should see their shares and currencies perform well over the near term. Those that cannot, may well be devalued or neglected by investors. Inevitably, strong players can take advantage of opportunities better than those with financial constraints. This suggests that merger and acquisition (M&A) activity, which has already resurfaced, may continue to grow in both volume and size over the next few years. The stock pickers at Alpine are looking forward to continued innovation and transformations which respond to the needs of today. . .and tomorrow!

In closing, we expect that the balance of 2010 could continue to be somewhat volatile; however, we would expect to see some measure of improvement by the time we next report to you after the end of the October fiscal year.

Thank you for your interest and support,

Samuel A. Lieber

_____________

Mutual fund investing involves risk. Principal loss is possible.

The letter and those that follow represent the opinion of Alpine Funds management and are subject to change, are not guaranteed, and should not be considered recommendations to buy or sell any security.

Past performance is not a guarantee of future results.

Please refer to the schedule of investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

VIX Index – Chicago Board Options Exchange SPX Volatility Index reflects a market estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes.

St. Louis Fed’s Financial Stress Index (STLFSI) is constructed using principal components analysis is a statistical method of extracting factors responsible for the comovement of a group of variables.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Beta measures the sensitivity of rates of return on a fund to general market movements.)

The TED spread is the difference between the interest rates on interbank loans and short-term U.S. government debt. The TED spread is an indicator of perceived credit risk in the general economy.

Yield Curve – is the relation between the interest rate (or cost of borrowing) and the time to maturity of the debt for a given borrower in a given currency.

EQUITY MANAGER REPORTS

Alpine Dynamic Dividend Fund

Alpine Accelerating Dividend Fund

Alpine Dynamic Financial Services Fund

Alpine Dynamic Innovators Fund

Alpine Dynamic Transformations Fund

Alpine Dynamic Balance Fund

Alpine Dynamic Dividend Fund |

Comparative Annualized Returns as of 4/30/10 (Unaudited) | | |

| | | | | | Since Inception |

| | 6 Months (1) | 1 Year | 3 Years | 5 Years | (9/22/2003) |

| | | | | | |

| Alpine Dynamic Dividend Fund | 12.39% | 32.66% | -14.06% | -1.33% | 4.25% |

| | | | | | |

| S&P 500 Index | 15.66% | 38.84% | -5.05% | 2.63% | 4.35% |

| | | | | | |

Lipper Equity Income Funds Average(2) | 13.89% | 36.54% | -5.14% | 2.83% | 5.42% |

| | | | | | |

Lipper Equity Income Funds Ranking(2) | N/A(3) | 228/298 | 246/247 | 185/197 | 117/158 |

| | | | | | |

| Alpine Dynamic Dividend Fund 30 Day SEC Yield (as of 4/30/10): 0.56% | | | |

| | | | | | |

Gross Expense Ratio: 1.21%(4) | | | | | |

| | | | | | |

Net Expense Ratio: 1.21%(4) | | | | | |

(1) Not annualized.

(2) The since inception return represents the annualized return for the period beginning 9/25/2003.

(3) FINRA does not recognize rankings for less than one year.

(4) As disclosed in the prospectus dated February 27, 2010.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500 Index and the Lipper Equity Income Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performan ce for the Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

Alpine Dynamic Dividend Fund

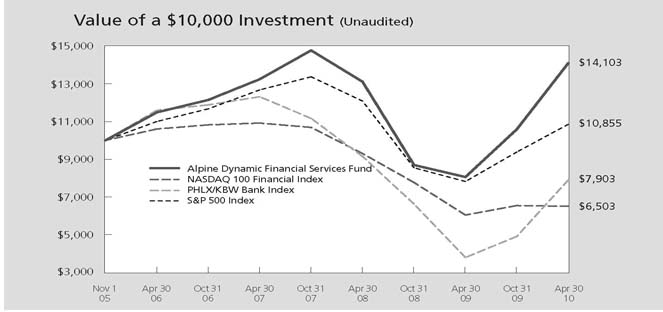

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Commentary

The Alpine Dynamic Dividend Fund (ADVDX) completed its first half fiscal 2010 ended April 30, 2010 by distributing a high level of dividend income while also focusing on total return for long-term growth of capital.

For the six month period ending April 30, 2010, the Fund produced a total return of 12.39% including dividend reinvestment. This compares to a 15.66% increase in the S&P 500 Index and a 13.89% increase for the Lipper Equity Income Fund Average in the US. For the twelve months ended 4/30/10, the Fund provided a 32.66% total return including dividend reinvestment. This compares to a 38.84% increase in the S&P 500 Index and a 36.54% increase for the Lipper Equity Income Fund Average in the U.S.

ADVDX provided a high dividend yield in a very challenging dividend income environment

We have continued to provide our investors with a high level of equity income despite many companies cutting or eliminating dividends during the global recession of 2008 and 2009. The Fund paid a regular monthly minimum dividend of $0.07 per share. In addition, in the third month of each quarter the Fund distributed additional dividend income that had been earned or expected to be earned during the year. During fiscal first half 2010, the quarter-end dividend payments were $0.15 per share in December 2009 and $0.12 per share in March 2010. The Fund paid out total dividends of $0.55 per share in first half fiscal 2010 and $1.07 per share for the trailing twelve months ended April 30, 2010. Based on a closing price of ADVDX of $4.81 on 4/30/10, the $1.07 dividend payout represents a trailing twelve-month dividend yield of 22.3%. Whi le the Fund’s distributions exceeded its net investment income on 4/30/10, our annual peak dividend capture period occured from early April through early June. At the end of June 2010, the Fund estimates that it will have generated net investment income in excess of its year-to date-distributions. Since inception, ADVDX paid a total of $9.16 per share in earned dividend income.

Alpine Dynamic Dividend Fund

Following the global economic downturn and a threatened collapse of the world financial systems in 2008 and 2009, it is not surprising that a large number of dividends were cut as companies looked to conserve cash amidst declining earnings and tight capital markets. Internationally, there were even more severe dividend cuts than in the U.S. This has been particularly tough for us since Europe has become one of our primary dividend markets. The U.S. is one of the lowest yielding countries in the group of G20 nations with a 1.8% current dividend yield versus for example 3.7% for Australia, 3.2% in Britain, and 3.2% in Italy for the 12 month period ending 4/30/10.

A major headwind for our dividend capture program has been the decline in dividends paid globally as well as the decline in liquidity available for our dividend trades. One of our risk management disciplines we use for dividend capture is that we generally will not enter a position unless there is sufficient liquidity to allow the fund to exit the holding relatively quickly in the event of company specific or market specific news flow during our targeted holding period. According to a study done by Goldman Sachs, total dividends paid by companies in the European Stoxx 600 Index have declined by 39% since their peak in early 2008 through June 2010 while liquidity in the European Index has declined by 63% from the peak in mid-2007 through June 2010. In the U.S., dividends paid by companies in the S&P 500 Index ha ve declined 20% and liquidity decreased 42% from the peak in early 2008 through June 2010 according to Goldman Sachs. These two factors have combined to produce a meaningful decline in the amount of dividend dollars available for our dividend capture universe.

Due to these challenging market conditions, the Board of Directors of ADVDX decided on June 24, 2010 to reduce the regular monthly dividend distributions paid to shareholders. The Fund will distribute a monthly payment of $0.07 per share for June 2010 and $0.042 per share per month in July, August, and September 2010. Annualized, this new dividend rate of $0.504 per share represents a current dividend yield of 12.23% on ADVDX’s closing NAV of $4.12 per share on June 24, 2010. With a goal of sustainability the Board will continue to reevaluate dividend payments on a quarterly basis. The Fund intends to continue generating dividend payouts consisting of net investment income. The Fund’s management considered a number of factors before recommending to the Board that the Fund’s current distribution be decreased, including current market outlook, equity liquidity, volatility, level of assets in the Fund, and the dividend yield of the Fund.

The reduced dividend payment reflects in large measure the adverse impact on the portfolio’s net asset value and dividend earning power from the recent decline in the currency and asset values of our major international holdings. In 2010 to date, a decline in the Euro currency of 13.92% as of June 24, and weak equity markets impacted the portfolio’s net asset value. The combination of uncertain European equity prospects and reduced asset values with lower dividend income in U.S. dollars was a principal factor leading to this decision to change the dividend amount and reduce the dividend.

The Fund remains committed to providing a high level of dividend income and there is some encouraging news in that we have started to see companies raise their dividends in 2010 in the U.S. as the economic recovery has progressed. According to data from Standard and Poor’s, the number of companies in the S&P 500 Index that raised their dividends in 2010 is 128 with only 2 companies cutting their dividend. This is in comparison to 2009 when a total of 157 companies raised dividends and 78 cut. The challenge for our Fund is that the dollar amount of dividend payments is still well below previous levels.

Historically, a significant portion of the Fund’s dividends have been comprised of income benefiting from lower federal tax rates (called Qualified Dividend Income or QDI). ADVDX seeks to maintain its current high dividend level during these difficult market conditions, by utilizing a more rapid rotation of holdings in its dividend capture program. This is reflected in the substantial increase in our portfolio turnover for the Fund from over 300% in fiscal 2008 to over 600% in fiscal 2009. The result of our reduced holding period in our dividend capture portfolio has been a decline in the percentage of QDI distributable by the Fund.

Another affect from the escalation of our portfolio turnover is an increase in our transaction expenses, but due to a substantial amount of tax loss carry-forwards, we do not expect any material capital gains tax implications from our increased turnover. In addition, to gain efficiencies and reduce friction costs associated with the increased rotation in its international holdings, the Fund has utilized swap transactions. While the income from these swaps does not qualify for QDI, their use is limited to those transactions that are short term in nature and would not otherwise be eligible for QDI. We will not have an estimate of our QDI for fiscal 2010 until the end of the tax year. However at this time we would expect it to be less than the amount of ADVDX’s fiscal 2009 dividend that was classified as qualified dividend income at approximately 77%. The QDI tax benefits are set to expire on December 31, 2010 unless Congress changes its position.

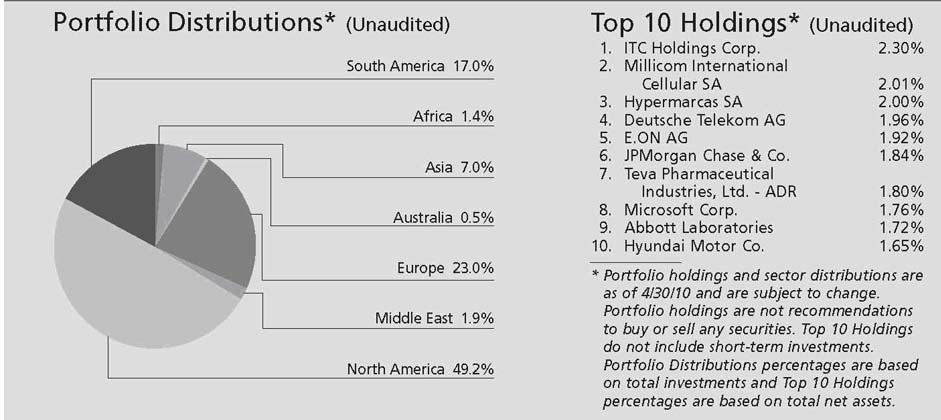

Alpine Dynamic Dividend Fund

ADVDX produced a positive total return in first half 2010 despite declines in key international markets

While we were encouraged by our total return performance in first half fiscal 2010, the Fund’s results lagged the broader U.S. indices, primarily due to its international exposure and specifically in our European equities. We have continued to find attractive growth opportunities and significantly larger dividend payouts overseas than we see in the U.S and therefore we have a larger exposure to overseas markets in comparison to the S&P 500 Index and many of our equity income peers. As of April 30, 2010, the Fund had invested 52.1% of net assets in international companies and 43.5% of its value in domestic U.S. based companies, with the 4.48% remaining 4.4% in cash and equivalents. ADVDX is currently invested in equities based in 25 different countries. On April 30, 2010 we had 17.2% of the portfolio inves ted in emerging market countries including Brazil, China, South Korea, Taiwan, and South Africa. Following the United States, our current top five countries are Brazil, Germany, France, Norway, Bermuda and Canada. The average dividend yield for the major indices in these five countries, for the 12 month period ending 4/30/10, is currently 3.46% versus the yield on the S&P 500 Index of 1.8%.

Unfortunately, the timing of the escalation of sovereign solvency concerns in Europe in April and May have occurred when we have our highest dividend capture opportunities in the region. We ended April 30 with approximately 23% of net assets invested in Europe so the Fund had been particularly hard hit at the end of fiscal first half 2010 and into May 2010. The STOXX Europe 600 Index has declined by 20.24% from April 1, 2010 through May 25, 2010 in US dollar terms. This is also reflected in the dramatic 21.4 percentage point difference in performance of the Dow Jones Industrial Average in the U.S. which increased 14.9% in first half fiscal 2010 and the 6.5% decline in the STOXX Euro 50 Index in US dollar terms.

In other international markets, the Brazil stock market as represented by the Brazil IBRX Index also lagged the S&P 500 Index, increasing 9.83% for six months ended 4/30/10 however global growth concerns and the unwinding of risk assets resulted in a decline in the Index of 15.5% in April and May in US dollar terms. The Chinese stock market as represented by the Shanghai Index declined 4.1% in fiscal first half 2010 and 16.3% in April and May in U.S. dollar terms versus a 7.2% decline for the S&P 500 Index in April and May on these same concerns of a global slowdown. The U.S. markets outperformed as investors looked for relative safety in the U.S. dollar and the U.S. economy.

Also impacting our performance has been the continuation of outperformance of lower yielding stocks since the March 2009 market lows. Three of the four industries that outperformed the S&P 500 Index in first half fiscal 2010 were the lowest yielding industries (Consumer Discretionary, Materials, Financials) while the top four yielding industries were the worst performing sectors (Telecom, Energy, Consumer Staples and Health Care).

Throughout first half fiscal 2010, it remained challenging to balance our portfolio to continue to provide a high level of current income while also investing our assets for capital appreciation. We will continue to work hard to find attractive dividend opportunities within these challenging markets. The Fund combines three research-driven investment strategies Dividend Capture, Growth and Income, and Value / Restructuring, in an effort to maximize the amount of our earned dividend income and to identify companies globally with the potential for dividend increases and capital appreciation.

Our “Dividend Capture Strategy” enhances the dividend income generated by the Fund

We run a portion of our portfolio with a dividend capture strategy, where we invest in high dividend stocks or in special situations where large cash balances are being returned to shareholders as one-time special dividends. We then look to enhance our dividend return by rotating a portion of our high yielding holdings after receiving the dividend. Our increased rotation strategy has, while increasing the available yield, also reduced the amount of dividend income to be eligible for the reduced 15% Federal dividend tax rate.

This qualified dividend income (QDI) tax benefit is set to expire on December 31, 2010, and there is uncertainty on what the tax level will be for dividends in 2011 and beyond. At this time, we do not believe that a change in the tax code will hinder our dividend capture efforts or materially change our strategy. If the QDI benefit is eliminated, we will not have the constraint of the 61 day holding period required to be eligible for the tax benefit. In addition, we could look to expand our dividend capture opportunities to different non-tax qualified equity markets (i.e. Hong Kong, Taiwan) and certain non-tax qualified equities like real estate investment trusts (REITs) or master limited partnerships (MLPs). There i s a risk that U.S. companies may be marginally less inclined to return cash to shareholders as dividends if tax requirements are increased, but we feel this risk is mitigated since we currently receive the majority of our dividends from foreign companies.

Alpine Dynamic Dividend Fund

One of our largest holdings at the end of first half 2010 was Millicom International Cellular (MICC) which announced an attractive special dividend payment associated with a return of excess cash on its balance sheet. Based in Luxembourg, MICC is an operator of wireless telephone systems in 13 emerging market countries in Latin America and Africa. MICC is experiencing strong growth by providing affordable prepaid cellular telephone services to more than 30 million current subscribers with a combined population under license of approximately 260 million people. In April 2010, MICC announced a special dividend payment of $4.60 per share in addition to its $1.40 annual dividend per share, representing a total dividend payment of 7.1% of its market value. However, Millicom provided a negative total return of 5.87% in f iscal first half 2010 which ended prior to receiving the special dividend in May although modest capital gains have since been achieved.

Our “Growth and Income Strategy” Targets Capital Appreciation in Addition to Yield

Our second strategy identifies core growth and income stocks that may have slightly lower but still attractive current dividend yields plus an outlook for strong and predictable earnings streams that should support additional future dividend increases. Several of our top ten holdings are industry leaders with strong growth in their categories and the potential for attractive and rising dividend payouts. These include ITC Holdings, Hypermarcas SA, Abbott Laboratories, Teva Pharmaceuticals, and Microsoft.

The largest holding on 4/30/10 in the Fund was ITC Holdings (ITC), based in Michigan. It is the largest U.S. independent electric transmission company with 15,000 miles of transmission lines that span 5 Midwestern states. It is also developing new transmission opportunities in Kansas and Oklahoma and has recently proposed the 3,000 mile Green Power Express project to bring wind resources from the Dakotas, Minnesota, and Iowa to the Midwest. As the only pure-play transmission company in the U.S., we believe that ITC is very well positioned to participate in the upgrade and build-out of the nation’s electric transmission grid, a key priority for the Obama administration. ITC generates a 2.4% dividend yield and is forecasted to possibly deliver 20% compound annual earnings per share growth in the next several ye ars thanks to favorable regulatory treatment of electric transmission and its ambitious capital spending plan. ITC provided a 26.15% total return for ADVDX in fiscal first half 2010.

Another top ten holding and top performer in the Fund was Hypermarcas SA (HYPE3 BZ), which as the largest independent consumer products company in Latin America offers an excellent way for investors to participate in the secular growth story of the emerging market consumer. Hypermarcas sells more than 200 brands of personal care and cosmetics, pharmaceutical, home care, and food products to wholesalers and retailers throughout Brazil. HYPE3 is estimated to produce a 25% compound annual growth in its earnings per share from 2010 through 2012. It is forecasted to initiate a 1% dividend yield this year which may grow strongly with the growth in earning and should supplement our expectations of capital appreciation potential. Hypermarcas was a top performer in the Fund with a 37.70% total return for the six months ended 4/30/10.

Two of our top growth and income holdings are considered more defensive stocks in the healthcare sector. These companies have attractive earnings outlooks that are less tied to economic growth and now have the benefit of the uncertainty of healthcare reform behind them. Abbott Laboratories (ABT), based in Illinios, is a diversified healthcare company with principal business lines in global pharmaceuticals, nutritional, and medical products. We believe that ABT’s five year growth outlook is attractive based on the strength of its new cholesterol products as well as its Humira arthritis and Xience drug stent franchises. We anticipate 10 – 12% sustainable EPS growth over the next several years supported by limited generic risk relative to its peer group, smart acquisitions including recently the largest pharmaceutical com pany in India, and solid earnings visibility. In addition, ABT raised its dividend by 10% in 2010 and now offers a 3.8% current dividend yield, after having raised its dividend every year including during the downturn in 2008 and 2009.

Teva Pharmaceuticals (TEVA) based in Israel is the largest generic drug manufacturer in the world in addition to its strong branded product portfolio. The generics business should benefit from the significant patent expirations in the pharmaceutical industry in 2011 and 2012 and their branded drugs for diseases like MS should continue to do well. Teva has one of the highest earnings growth rates in the pharmaceutical industry with a 14% long term growth and an estimated 30% growth in EPS in 2010. Teva has a current 1.4% dividend yield and has been growing its dividend by an annual rate of 25% over the past 5 years. ABT provided a 2.17% total return and TEVA provided a 16.21% total return for the Fund in fiscal first half of 2010.

Alpine Dynamic Dividend Fund

We have also found attractive total return opportunities for ADVDX in fiscal first half 2010 in the technology sector with bellwether Microsoft Corporation. Microsoft (MSFT), based in Washington, is the world’s largest software producer for a wide range of uses including operating systems, business applications, internet search, and entertainment. We see several positive drivers for MSFT in 2010 and 2011 including a strong desktop and server product upgrade cycle for its new Windows 7 operating system, a potentially significant corporate replacement cycle after several years of underinvestment, meaningful cost control efforts that should provide operating margin leverage, and accretion from its stock buyback program. Microsoft offers EPS growth estimates of 10-15% annually over the next several years plus a 2 .2% current dividend yield. MSFT provided ADVDX with a 9.17% total return in first half 2010.

Our “Value/Restructuring Strategy” looks for attractively valued or restructuring dividend payers

Our third major strategy is what we call “value with a catalyst or restructuring strategy”, where our research points to under-valued or mis-priced companies with, in our opinion, attractive dividend yields. We also look for turnaround situations or depressed earnings where we believe there is a catalyst for an earnings recovery or a restructuring or corporate action that is expected to add value. With many companies having responded to the global recession with significant corporate restructurings, it is not surprising to find several of our top 10 holdings at the end of first half fiscal 2010 in this strategy including Deutsche Telekom, E.On, Hyundai Motor, and JPMorgan Chase.

Two of our top holdings on 4/30/10 were German companies with large dividend payouts in early May in defensive industries that offered attractive valuations, however they unfortunately got hit with the recent European debt crisis. Deutsche Telekom (DTE GR) has a current 8.0% dividend yield and is the largest provider of telecommunications in Germany with leading market positions in both fixed-line and mobile services. It also has a broad international exposure with operations in the US, UK, Austria, Netherlands and the Czech Republic. E.On Ag (EOAN GR) is one of the largest electric utilities in Europe with a 6.7% current dividend yield. E.On has transformed itself from a domestic German conglomerate to one of Europe’s biggest energy utilities, with a portfolio of power and gas assets in the UK, US, Western a nd Central Europe, the Nordic Region, and Russia. With a solid Pan-European platform already in place, its strategic focus has shifted from mergers and acquisitions to cost controls and margin increases through integration and improving operational performance as well from its growth investments. DTE GR provided a 0.43% total return for the six month period ending 4/30/10 while E.On had a 4.89% loss for the same period before receiving the annual dividends in early May.

A major value holding in our portfolio and an outstanding performer in first half 2010, with a 29.76% total return, was Hyundai Motor Company. Based in Seoul, Hyundai is the largest auto maker in Korea. It also owns 38% of KIA Motors, the second-largest auto maker in Korea, which combined have over 80% of the domestic Korean market and are the world’s fifth-largest auto manufacturer. Hyundai has begun to reap the benefits of its global expansion strategy started in 2002, such as its movement toward greater penetration of its dealers into smaller China cities. Marketing efforts and quality improvements have helped Hyundai gain overall share, particularly from Toyota, in its key China, India and U.S. markets. Its new Genesis sedan received the 2009 North America Car of the Year award in the mid-luxury segment. Although auto subsidies from most countries have expired, demand is rebounding from the depressed levels of 2008/9 and secular growth is occurring in Asia and other emerging markets. Hyundai currently trades at less than 10 times forward earnings which is a deep discount to its Japanese and European peers and its historical peak multiple of 17x in 2009, yet analysts forecast pre-tax profits to more than double from 2008 to 2012.

We project that New York based JPMorgan Chase (JPM) has emerged from the recent financial crisis as one of the premier global financial services companies. We saw an extreme value opportunity in February 2009 when we began accumulating additional shares at less than $20. Although JPMorgan did reduce its dividend by 87% in February 2009 to $0.05 per share, we wanted to take advantage of what we saw as a mis-priced equity valuation and we were able to achieve an attractive capital appreciation, with the stock closing at $42.58 on 4/30/10. With JPMorgan succeeding in repaying its TARP (Troubled Asset Relief Program) loan from the government and writing down impaired assets, it is now forecasted to offer substantial earnings gr owth through 2011 with solid double digit growth in 2012-2013. In response to its improved earnings outlook, the bank is expected to raise its dividend, possibly in late 2010 or early 2011. JPMorgan provided a 3.77% negative return during the first half fiscal 2010 as the European debt concerns negatively impacted the stock.

Alpine Dynamic Dividend Fund

Outlook for Second Half 2010: Uncertainty and Volatility Likely to Remain. Soft Patch Watch

We do believe that a global economic recovery is still solidly in place following the great recession of 2008 and first half 2009, but we may be starting to see some signs of hitting a soft patch or slowdown of growth in the U.S. and globally. This has contributed to the volatility and uncertainty in equity markets and resulted in one of the worst May’s on record with an 8% decline in the S&P 500 Index. Decreases in unemployment claims in the U.S. have stalled, many leading economic indictors in the U.S., China and Europe have declined in April, credit spreads are widening, and several commodity prices have collapsed. We are also watching retail sales in the U.S. which have started to soften and monitoring how the end of housing tax credits in the U.S. in April will affect residential sales in the coming months. We have additional lack of clarity in the U.S. with financial reform regulation, mid-term elections in November, and the potential expiration of the Bush tax cuts in December.

One of the key data points to watch in the U.S. is employment. Weekly jobless claims have stopped declining in recent weeks as companies appear reluctant to hire in these uncertain economic times. In addition, structural unemployment, as measured by the 46% of unemployed that are out of work for more than six months, is at the highest point in postwar history. On the plus side, the monthly household survey which captures more small business hiring appears to be improving more strongly than the payroll survey which captures big business, so underlying employment may be a bit stronger than reported. However, we are also looking for negative headwinds in employment in the second half of 2010 from state and local governments that are facing severe budget deficit s. These budget holes will likely get balanced through large cuts in employment as we recently saw announced by the governor of NY State. There are 20 million people in the U.S. employed by state and local governments.

Dual Fronts of Global Growth Concerns: Europe and China

The two largest negatives for the global equity markets in recent weeks have been the sovereign debt crisis in Europe and the slowing of the global growth engine of the Chinese economy. The Euro has fallen from $1.51 per U.S. dollar on 11/25/09 to $1.20 on 6/4/10, a decline of 21%. This is a reflection of the tempered outlook for growth in the region as fiscal budgets throughout Europe are being reduced and austerity measures implemented in order to pay down bloated debt loads. Governments in Europe are reacting to the Greek crisis as a window of opportunity to pursue reforms, like raising retirement ages, that would be more politically difficult in the absence of a euro area crisis. This has led to a broad European effort to impose tighter fiscal restraints which JPMorgan estimates could take away about 1.2% of euro area econom ic growth in 2011 and 2012 and could push the region into recession.

In addition to Europe, fears about the outlook for Chinese growth have also impacted equity markets. We believe China is even more important than Europe for the equity markets in second half fiscal 2010 and 2011. It accounts for about a third of global economic growth. China has been orchestrating a slowdown in their economy in 2010 following the acute stimulus measures that were enacted in 2008 and 2009 to offset the great global recession but which resulted in a surge in housing prices and commodity inflation concerns. In particular, China has been tightening its bank lending in order to bring down its overheating property market. Sales of residential property in Beijing were down 80% from the Dec. 2009 high through the end of May 2010 and down over 50% from just April. This has contributed to a 28.6% fall in the Shangai stock m arket from its high on 8/4/09 through its low on 5/21/10.

We believe that the Chinese cooling process is healthy for both China and the developed world as unsustainable credit- and infrastructure-driven spending is curtained to reduce the risk of inflation. Longer term, the IMF continues to forecast China will grow far faster than the rest of the world for the next five years, with approximately 10% compound annual GDP growth on average through 2014 compared to 6% for all emerging nations and 2.5% for the developed markets.

Positives for the equities include valuations, still solid GDP growth and capital spending outlooks

On the positive side, currently equity valuations appear attractive on still solid economic growth outlooks and particularly on strong margin and productivity results in the U.S and emerging market. U.S. corporate profits were up over 30% year over year in first quarter 2010 and S&P 500 earnings are forecasted to grow 22% in 2010 and 15% in 2011. GDP growth in the U.S. is example, the U.S. in the 1930’s and Japan in the past 20 estimated to be a solid 3.5% increase in 2010 and 3.1% years have shown that when interest rates go close to in 2011 and emerging markets at 6.9% GDP growth in zero they can stay there for extended periods of time 2010 and 5.8% in 2011.

Alpine Dynamic Dividend Fund

In addition, while the recent volatility in weekly jobless claims has caused some concern, leading employment indicators such as the average work week and temporary employment levels have been consistently improving and personal income growth exhibited its largest monthly increase in April since late 2008. This should provide some support for consumer spending as the flow of fiscal stimulus fades later in 2010. Lastly, a recent survey complete by ISI research shows a 30% increase in the amount of capital spending that CFOs

anticipate spending in 2010 which should also support jobs and economic expansion.

Looking ahead, we see both catalysts and risks in second half 2010. We do remain optimistic that dividend stocks will continue to attract capital as investors around the world search for income. As global demographics point to an aging population in the industrialized world, these millions of savers are facing zero to low interest rates for quarters or potentially years to come. For example, the U.S. in the 1930’s and Japan in the past 20 years have shown that when interest rates go close to zero they can stay there for extended periods of time

until structural economic issues are resolved. We see dividend income as an attractive investment opportunity for this increasingly large population of retirees and we expect capital to flow to high dividend paying stocks over the long term.

Within the dividend-paying universe we are actively scanning the globe for undervalued opportunities and high quality cash flow generators. We are hopeful that we should be able to continue to distribute attractive dividend payouts to our shareholders by capitalizing on our research driven approach to identifying value opportunities as well as through our active management of the portfolio.

Thank you for your support of the Alpine Dynamic Dividend Fund and we look forward to more prosperous years in 2010 and beyond.

Sincerely,

Jill K. Evans and Kevin Shacknofsky

Co-Portfolio Managers

__________

Past performance is not a guarantee of future results.

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Current and future portfolio holdings are subject to risk.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Diversification does not assure a profit or protect against loss in a declining market. Investing in small and mid cap stocks involves additional risks such as limited liquidity and greater volatility as compared to large cap stocks. Investing in foreign securities tends to involve greater volatility and political, economic and currency risks and differences in accounting methods.

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company or to the industry in which the company is engaged.

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole.

All index performance reflects no deduction for direct fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Fund may include equity-linked securities and various other derivative instruments, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may magnify gains or increase losses in the Fund’s portfolio.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Alpine Dynamic Dividend Fund

Earnings Growth is a measure of a company’s net income over a specific period, generally one year, is a key indicator for measuring a company’s success, and the driving force behind stock price appreciation.

Dividend Yield: The yield a company pays out to its shareholders in the form of dividends. It is calculated by taking the amount of dividends paid per share over a specific period of time and dividing by the stock’s price.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

Lipper Averages are compiled by Lipper, Inc., an independent mutual fund research and rating service. Each Lipper average represents a universe of funds with similar investment objectives.

Lipper rankings are based on total return and do not include the effect of a sales charge. Rankings are only for the classes listed. Rankings of other classes will vary.

The S&P 500 Financial Select Sector Index (IXM) is a modified cap-weighted index that is intended to track the movements of companies that are components of the S&P 500 and are involved in the development or production of financial products. This index serves as the benchmark for the Financial Select Sector SPDR Fund XLF.

Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The index was developed on December 19, 1990 with a base value of 100.

Dow Jones Industrial Average – is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalisation companies across 18 countries of the European region: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

The Brazil Index – IBrX is an index which measures the return on a theoretical portfolio composed by 100 stocks selected among BOVESPA’s most actively traded securities, in terms of number of trades and financial value. The component stocks are weighted according to the outstanding shares’ market value.

Euro Stoxx 50: – The Dow Jones EURO STOXX 50 Index, Europe’s leading Blue-chip index for the Eurozone, provides a Blue-chip representation of supersector leaders in the Eurozone. The index covers 50 stocks from 12 Eurozone countries: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain.

The Dow Jones EURO STOXX 50 Index is licensed to financial institutions to serve as underlying for a wide range of investment products such as Exchange Traded Funds (ETF), Futures and Options, and structured products worldwide.

(1) Not annualized.

(2) The since inception return represents the annualized return for the period beginning 11/6/2008.

(3) FINRA does not recognize rankings for less than one year.

(4) As disclosed in the prospectus dated February 27, 2010.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Dow Jones Industrial Average is a price weighted average of 30 actively traded shares of large cap U.S. industrial corporations. The Lipper Equity Income Funds Average is an average of Funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. The S&P 500 Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlyi ng funds. The performance for the Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

The adviser contractually agreed to waive a portion of its fees and to absorb certain fund expenses. This arrangement will remain in effect unless the Board of Trustees approves its modification or termination.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

Alpine Accelerating Dividend Fund

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Commentary

This is the second year of operation for the Alpine Accelerating Dividend Fund, initially launched on November 5, 2008. In the first half of fiscal 2010, ending on April 30, 2010, the Fund provided a total return of 12.50%. This compares with a total return of 15.66% for the Standard & Poor’s 500 Average and 14.87% for the Dow Jones Industrial Average for the same period. Since inception, the Accelerating Dividend Fund has generated an annualized total return of 18.84%. This compares with an annualized return of 18.78% for the Standard & Poor’s 500 Average and 16.96% for the Dow Jones Industrial Average.

The objective of the Accelerating Dividend Fund is to invest in dividend-paying companies which have the potential to accelerate their dividends in the future, based on our analysis of their growth prospects and cash flow generating capabilities. The Fund aims to achieve a sustainable and rising stream of dividend income as well as long-term capital appreciation. We believe that companies with strong franchises characterized by defensible margins and a solid balance sheet and liquidity profile are best positioned to increase, and even accelerate, their dividends over time. Illustrative of companies we deem capable of meeting these standards are the top performing holdings for the previous 6 months, ending April 30, 2010: Cliffs Natural Resources +65.81%, Banco Panamericano +62.07%, Comcast C orp +37.79%, Snap-On Inc. +33.88% and Burlington Northern +33.59% (acquired by Warren Buffett’s Berkshire Hathaway). These companies represent a broad cross-section of numerous industries including materials, financials, media and industrials. Furthermore, while four of these companies are domiciled in the US, Banco Panamericano is a mid-cap Brazilian bank. Given the current fiscal and monetary situation within the European Union, we have a clear preference for investments within the US and Brazil.

In contrast, some companies in our portfolio posted disappointing total returns. Among these companies are well-know corporations, including Monsanto, GDF Suez and CF Industries, as well as smaller companies including Protective Life, and Ocwen Financial. Monsanto (-20.61%) is the leading global seeds and agricultural protection products company with a strong record of dividend increases. The Company has consistently possessed the leading technology pipeline in this field and was first to develop many of the key products in use today. Monsanto has always used a value added pricing mechanism which enabled it to charge premium prices for its higher quality products. Recently, as farmers have become more price sensitive, they have been less willing to pay for Monsanto’s premium products and have shifted more of their business to cheaper alternatives from the competition. Monsanto was very late in recognizing this shift in customer demand and, as a result, forfeited market share to the competition. While we continue to favor the secular trends in the industry, we feel that management continues to struggle with its strategy and has not developed a clear path to recapture lost market share and defend its position. Thus, after April, we sold the Fund’s position.

Alpine Accelerating Dividend Fund

GDF Suez (-18.15%) is a ~$70 billion market cap energy provider with global operations focused on electricity and natural gas with operations globally. The company is the top power producer in the world and is represented in the main international indices (e.g., DJ Euro Stoxx 50, CAC 40, etc.) Furthermore, GDF, as of 04/30/2010, yielded a very attractive dividend of over 5.5%. As a result of the European sovereign debt crisis, European equities have recently underperformed US equities significantly, especially when currency movement is taken into account. While our European exposure was never significant, we have further minimized our allocation to the Euro zone until we see signs of progress in the resolution of this fiscal and credit challenge.

CF Industries (-17.98%) is a leading fertilizer company which recently completed a large acquisition of Terra Industries. Three forces contributed to the recent declines in the stock: 1) concern that CF overpaid for Terra in a highly competitive bidding war, 2) weakness in nitrogen-based fertilizer pricing, and 3) weakness in corn prices contributing to lower margins for farmers. CF stock is partially correlated with spot prices for agricultural products such as corn and has exhibited a degree of volatility. However, we continue to like the growth potential in the industry as well as CF’s competitive position, and feel that the stock should recover from current levels. Although Protective Life (-17.92%) and Ocwen Financial (-15.46%) posted disappointing returns during this period, we had positive total return s for both investments over our holding period. Protective Life, a life insurance company headquartered in Birmingham, Alabama, generated a total return of 7.5% for our fund. Ocwen Financial, a company focused on servicing residential and commercial mortgage loans, generated a total return of 5.4% for our fund.

After the recent debt crisis, a number of companies have sought to recapitalize their balance sheets. As a result, during the Fund’s semi-annual reporting period, there have been a large number of what we consider to be attractively priced secondary offerings in which the Fund has participated. The Fund has realized substantial short term capital gains in these secondary offerings, which provided a meaningful contribution to the Fund’s total return during the Fund’s semi-annual reporting period. We cannot predict how long, if at all, these opportunities will continue to exist, but to the extent that we consider secondary offerings to be attractively priced and available the Fund may continue to participate in them.

Our 3 largest industry groups and corresponding percent of portfolio are Diversified Financial Services – 9.33%, Chemicals – 6.69% and Semiconductor and Semiconductor Equipment – 5.84%. Our holdings in financial services are balanced between exchanges and banks. We feel that given the uncertainty of the likely regulatory changes, the exchanges may provide a partial hedge of our bank investments if more revenues potentially move from the banks to exchanges. Despite the volatility in the sector, we believe that well-capitalized financial institutions that are unlikely to have an additional need for a capital raise should present attractive investment opportunities if credit costs decrease and profitability accelerates. As is evident from the percentage concentrations in our largest industry groups, shown above, we aim not to overly-concentrate our portfolio in any one particular industry group. It is our intention to continue to look for investments that meet our criteria without assuming excessive risk by maintaining a balanced and diversified portfolio.

While a limited universe of companies have provided increasing dividends for a sustained period of time, even fewer have demonstrated sustained dividend acceleration. We use a selective screening process to identify companies with the potential for future acceleration. We feel that in the long-run, these companies provide better risk-adjusted returns for investors while simultaneously providing a buffer against dramatic declines in the stock market and excessive volatility. It is important to recognize that these companies may not outperform the broader market in all environments. For example, when markets rebound off their troughs, more speculative, higher-beta stocks tend to outperform as companies with riskier financial profiles that possessed a higher probability of financial distress recover sizably off their dramatically low valuations. However, when viewed over a longer investment horizon and through a full economic cycle, we find that historically companies with more conservative balance sheets and credit profiles have ultimately outperformed, especially on a risk-adjusted basis. We believe that companies with more unencumbered balance sheets should retain flexibility in recessions which should enable them to avoid franchise-destroying actions, such as forced divestitures of strategic assets, that other companies need to pursue to reduce leverage and boost capital. In fact, companies with fortress balance sheets should be better positioned to take advantage of market opportunities and enhance their franchise at the expense of competitors by acquiring assets at the bottom, rather than the top, of the cycle.

Alpine Accelerating Dividend Fund

Many companies with long histories of consistent dividend growth were forced to cut their dividends in the previous 2 years. Now, however, we are beginning to see signs of the re-emergence of dividend growth, and even dividend acceleration, as evidenced by portfolio holdings Guess Inc, Intel and Kimberly-Clark, which have all accelerated their dividends in 2010. Many US companies are currently holding record levels of cash and liquidity, and as a result we expect the pace of dividend increases to accelerate. However, tremendous uncertainty regarding the pace of the economic recovery, the sovereign debt situation globally and significant regulatory changes that continue to evolve may lead companies to maintain a conservative profile and delay dividend increases.

As we stated in our previous letter, despite the robust rebound in equity markets in 2009 we expected a tepid economic recovery with speed bumps along the way. This theme has so far played out in 2010. The sovereign debt crisis in Europe, massive regulatory changes in banking and financial services globally, and a stubbornly high unemployment rate in the US and Europe are all dampening economic recovery. The European crisis is unequivocally the biggest economic challenge the European Union (EU) has had to deal with in its decade long history, and the first real test for the resiliency of the Euro. European officials clearly recognized the potential risks of contagion from the fiscal situation in Greece and swiftly enacted a historical expansion of monetary powers for the European Central Bank (ECB), as well as new facilities to backstop any member of the EU. Despite these powerful actions, the austerity measures put in place are expected to be very difficult to execute and will likely have adverse consequences on economic growth. Credit markets globally will continue to be volatile until significant progress in reducing fiscal deficits is achieved. Left unchecked without a coordinated Euro wide fiscal response, this situation could lead to significant credit market deterioration similar to 2008. While we don’t expect this scenario to unfold, it is important not to underestimate the significance of this challenge, not just for the Euro zone but also for other developed economies such as the UK, Japan and even the US.

In the US, we are in the midst of the biggest changes to financial regulation in over a decade, which could limit the profitability of our banking system and, more importantly, have a mixed impact on our economic recovery. As we are writing this letter, the US Senate is considering a number of amendments which may decrease credit availability and limit the global competitiveness of US broker dealers. While a US consumer protection agency can provide a valuable check on suitability of financial products to consumers, other amendments such as the forced separation of derivatives trading and state or national caps on interest rates may have unintended negative consequences on the availability of credit and the competitiveness of US businesses. Furthermore, while the labor market has shown signs of improvement, i nitial unemployment claims have stubbornly held in the mid 400,000 level, which is ~20% higher than what is needed for a robust recovery in the labor market. Given our cautious macroeconomic stance, we remain optimistic that companies which meet the high standards of dividend growth and strong liquidity, basic to this fund’s strategy, should better withstand a protracted and difficult recovery phase.

We firmly believe that, in the long run, our strategy should provide investors with attractive risk-adjusted returns over the cycle, and thank our shareholders for their confidence in our management during these unprecedented and highly volatile market conditions.

Sincerely,

Stephen A. Lieber

David Burg

Co-Portfolio Managers

_________

Past performance is not a guarantee of future results.

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk.

Investing in small and mid cap stocks involves additional risks such as limited liquidity and greater volatility as compared to large cap stocks. Investing in foreign securities tends to involve greater volatility and political, economic and currency risks and differences in accounting methods. Diversification does not assure a profit or protect against loss in a declining market.

Alpine Accelerating Dividend Fund

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company or to the industry in which the company is engaged.

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole.

All index performance reflects no deduction for direct fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Fund may include equity-linked securities and various other derivative instruments, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may magnify gains or increase losses in the Fund’s portfolio.

The Euro Stoxx 50 Index is Europe’s leading Blue-chip index for the Eurozone and provides a Blue-chip representation of supersector leaders in the Eurozone. The index covers 50 stocks from 12 Eurozone countries. The CAC 40 is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant values amoung the 100 highest market caps on the Paris Bourse (now Euronext Paris).

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Beta measures the volatility of the fund, as compared to that of the overall market. The Market’s beta is set at 1.00; a beta higher than 1.00 is considered to be more volatile than the market, while a beta lower than 1.00 is considered to be less volatile.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

(1) Not annualized.

(2) The since inception return represents the annualized return for the period beginning 11/3/2005.

(3) FINRA does not recognize rankings for less than one year.

(4) As disclosed in the prospectus dated February 27, 2010.

Performance data quoted represents past performance and is not predictive of future results. Investment returnand principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less thantheir original cost. Performance current to the most recent month end may be lower or higher than performancequoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00%redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.