declining credit and historically low interest rates. While the fund’s total return has not kept pace with other funds that had large exposure to lower-rated bonds or longer maturities during the past six months, we feel our fund is well positioned based on our primary objectives and present conditions in the marketplace.

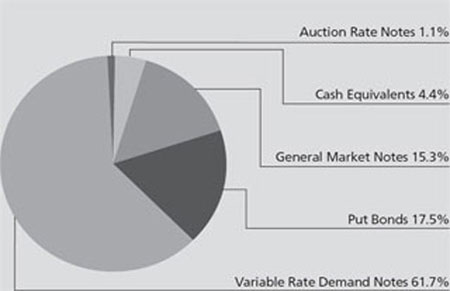

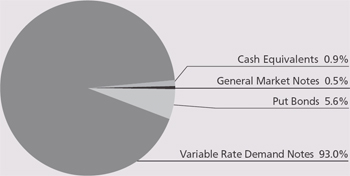

Upon examining the fundamentals of the municipal marketplace over the past six months, we saw three key strategies that formulated our investment strategy. These included historically low interest rates, a supply/demand imbalance of tax exempt securities and deteriorating credit quality. When we took all three of these factors into consideration, we concluded that, based on our specific objective for the fund that, it would be prudent to keep our average weighted maturity short and keep our liquidity high. As a result, our fund’s average weighted maturity fell to 69 days at the end of April a lot shorter than that of our benchmark. With short-term rates so low we will most likely keep the fund’s average maturity under 100 days until we see rates move higher or there are some other major changes in the market that would warrant such a move. We continued to overweight the portfolio in near-cash or short-term bonds that mature within a year with over 50% of the fund in variable rate demand notes (VRDN’s). VRDNs have been a big component of the fund for the last several years as they provide the fund both with an attractive yield relative to longer maturing securities and the ability to sell at par on a daily or weekly basis depending on the specific type. Lastly, we continue to see an increase in the yield of these securities that either have a European bank letter of credit or act as a liquidity provider. We are very conscious of the volatility overseas and have limited our exposure to no more than seven days in any one security. Many of the issues end up getting called or refinanced as the rates increase to unsatisfying levels, and we continue to seek out bonds that we know are being called at a future date. The reason being is that they provide an above average yield and relative safety of principal.

Other investments included purchasing put bonds in the three to 12-month range, general market notes and the first year or two of standard municipal bond deals. Unfortunately, yields on our holdings of tax exempt commercial paper have fallen dramatically from where we originally purchased it and we will likely sell the positions if the yield drops much further. On the other hand, we have increased our holdings in general market notes as more issuers have recently come to the market at somewhat attractive yields. Overall, these three

different types of securities helped us balance out the portfolio by extending ever so slightly on the yield curve.

ALPINE MUNICIPAL MONEY MARKET FUND

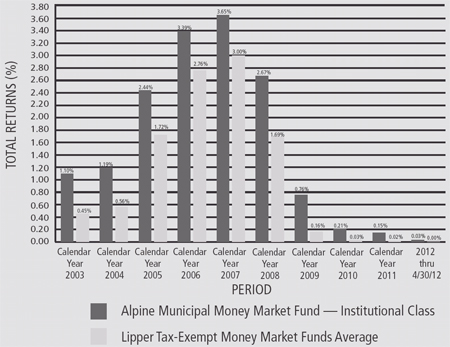

With the Federal Reserve’s zero interest rate policy now in place for more than three years and showing no signs of abating, rates in the municipal money market offer minimal return for investors. One aspect of Fed policy has been to motivate investors to shift assets away from lower risk returns of money funds towards higher risk alternatives. As a result, money fund assets are down significantly from their 2008 peaks.

Overall, rates across the money market curve were lower compared with those in place a year ago. Overnight rates at the close of our fiscal period averaged 0.28% compared with .30% in the prior period, while seven-day dates averaged 0.36% compared with 0.41%. Six-month and one-year note yields pushed lower, both yielding about half of what they were a year ago.

One interesting sidebar within the municipal money markets has been the growing popularity of tax exempt municipal variable rate demand notes within taxable money market funds. SEC rules now require money funds to maintain significant overnight and seven-day liquidity and VRDNs nicely perform that function. Moreover, for quite some time, yields on tax exempt VRDNs were comparable to taxable yields. These attributes created significant demand for VRDNs and have been a contributor to the push to lower yields.

Credit quality remains a key focus in the management of the fund, both with respect to municipal issuer as well as to the banks that figure prominently in providing forms of credit and liquidity support to so many municipal issuers. Ratings downgrade concerns force us to consistently reevaluate which banks we feel comfortable with and for what period of time. As a result, we have continued to maintain a very short average weight maturity of 10 days that provides us with the flexibility to adjust the portfolio as needed. This is significantly shorter than the industry average of 26 days.

Recently, headlines have suggested that regulators may be considering further changes to rules governing money funds. We monitor such a possibility but are unclear as to the benefits of some proposals. Despite the challenges, we continue to focus on managing the fund with an emphasis on credit quality and principal stability.

| |

Alpine Ultra Short Tax Optimized Income Fund /

Alpine Municipal Money Market Fund |

|

| | |

OUTLOOK

We believe that the municipal bond market is a high quality market with good opportunities for long-term investors. While frustrated by Federal Reserve assurances that interest rate hikes are not imminent, we do feel comforted in the belief that states and municipalities have the ability to balance their budgets in these tough times. As always, we are on the outlook for attractively

valued bonds issued by municipalities with good fundamentals – an investment strategy that has served our investors well in the past.

Sincerely,

Steven C. Shachat

Portfolio Manager

| |

| | |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to the following risks: |

Credit Risk – The credit quality and liquidity of the Ultra Short Fund’s investments in municipal obligations and other debt securities may be dependent in part on the credit quality of third parties, such as banks and other financial institutions, which provide credit and liquidity enhancements to the Ultra Short Fund’s investments. Adverse changes in the credit quality of these third parties could cause losses to a Fund and affect its share price.

Derivative Securities Risk – The Ultra Short Fund may invest in municipal derivative securities which are subject to structural risks that could cause the Ultra Short Fund to receive taxable income or to lose money.

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of the securities held by the Ultra Short Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates.

Issuer Risk – Changes in the financial condition of the issuer of an obligation, changes in general economic conditions, or changes in economic conditions that affect the issuer may impact its actual or perceived willingness or ability to make timely payments of interest or principal.

Liquidity Risk – Some securities held by the Ultra Short Fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the Ultra Short Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Ultra Short Fund may be forced to sell at a loss.

Management Risk – The Adviser’s security selections and other investment decisions might produce losses or cause the Ultra Short Fund to under perform when compared to other funds with similar investment goals.

Market Risk – The price of a security held by the Ultra Short Fund may fall due to changing market, economic or political conditions.

Mortgage Related and Asset Backed Securities Risk – These securities are subject to prepayment risk, which is the risk that the borrower will prepay some or all of the principal owed to the owner. This could reduce the Ultra Short Fund’s share price and its income distributions.

Municipal Securities Risk – Municipal securities include revenue bonds, general obligation bonds and municipal lease obligations. Revenue bonds include private activity bonds, which are not payable from the general revenues of the issuer. Consequently, the credit quality of private activity bonds is usually directly related to the credit standing of the corporate user of the facility involved. To the extent that the Fund’s assets are invested in private activity bonds, the Fund will be subject to the particular risks presented by the laws and economic conditions relating to such projects and bonds to a greater extent than if its assets were not so invested. Municipal securities also include moral obligation bonds, which are normally issued by special purpose public authorities. If the issuer of moral obligation bonds is unable to pay its debts from current revenues, it may draw on a reserve fund the restoration of which is a moral but not a legal obligation of the state or municipality which created the issuer. Municipal lease obligations are not guaranteed by the issuer and are generally less liquid than other securities. Municipal lease obligations also are subject to the risk that the municipality will not appropriate funds for lease payments. There may be less information available on the financial condition of issuers of municipal securities than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. This means that it may be harder to buy and sell municipal securities, especially on short notice, and municipal securities may be more difficult for the Fund to value accurately than securities of public corporations. In addition, municipal securities are subject to the risk that their tax treatment could be changed by the U.S. Congress or state legislatures, thereby affecting the value of outstanding municipal securities.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

44

| |

Alpine Ultra Short Tax Optimized Income Fund /

Alpine Municipal Money Market Fund |

|

| | |

Tax Risk – Changes in tax laws or adverse determinations by the Internal Revenue Service may make the income from some municipal obligations taxable. Additionally, maximizing after-tax income may require trade-offs that reduce pre-tax income. The Ultra Short Fund’s tax-efficient strategies may reduce the taxable income of the Ultra Short Fund’s shareholders, but will not eliminate it. There can be no assurance that taxable distributions can always be avoided or that the Ultra Short Fund will achieve its investment objective.

Variable Rate Demand Obligations Risk – Variable rate demand obligations are floating rate securities that combine an interest in a long term municipal bond with a right to demand payment before maturity from a bank or other financial institution. If the bank or financial institution is unable to pay, the Fund may lose money.

Credit Risk – The credit quality and liquidity of the Municipal Money Market Fund’s investments in municipal obligations and other debt securities may be dependent in part on the credit quality of third parties, such as banks and other financial institutions, which provide credit and liquidity enhancements to the Municipal Money Market Fund’s investments. Adverse changes in the credit quality of these third parties could cause losses to a Fund and affect its share price.

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of the securities held by the Municipal Money Market Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from federal tax consistent changes in interest rates.

Issuer Risk – Changes in the financial condition of the issuer of an obligation, changes in general economic conditions, or changes in economic conditions that affect the issuer may impact its actual or perceived willingness or ability to make timely payments of interest or principal.

Liquidity Risk – Some securities held by the Municipal Money Market Fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the Municipal Money Market Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Municipal Money Market Fund may be forced to sell at a loss.

Management Risk – The Adviser’s security selections and other investment decisions might produce losses or cause the Municipal Money Market Fund to under perform when compared to other funds with preservation of capital similar investment goals.

Market Risk – The price of a security held by the Municipal Money Market Fund may fall due to changing market, economic or political conditions.

Municipal Securities Concentration Risk – From time to time the Municipal Money Market Fund may invest a substantial amount of its assets in municipal securities whose interest is paid solely from revenues of similar projects. If the Municipal Money Market Fund concentrates its investments in this manner, it assumes the economic risks relating to such projects and this may have a significant impact on the Municipal Money Market Fund’s investment performance.

Municipal Securities Risk – Municipal securities risks include the ability of the issuer to repay the obligation, the relative lack of information about certain issuers of municipal securities, and the possibility of future legislative changes which could affect the market for and value of municipal securities. Certain municipal securities, including private activity bonds, are not backed by the full faith, credit and taxing power of the issuer. Additionally, if events occur after the security is acquired that impact the security’s tax-exempt status, the Municipal Money Market Fund and its shareholders could be subject to substantial tax liabilities.

Redemption Risk – The Municipal Money Market Fund may experience heavy redemptions, particularly during periods of declining or illiquid markets, that could cause the Municipal Money Market Fund to liquidate its assets at inopportune times or at a loss or depressed value and that could affect the Municipal Money Market Fund’s ability to maintain a $1.00 share price. In addition, the Municipal Money Market Fund may suspend redemptions when permitted by applicable regulations.

Regulatory Risk – The SEC recently amended the rules governing money market funds. In addition, the SEC continues to review the regulation of such funds. Any further changes by the SEC or additional legislative developments may affect the Alpine Municipal Money Market Fund’s operations, investment strategies, performance and yield.

Variable Rate Demand Obligations Risk – Variable rate demand obligations are floating rate securities that combine an interest in a long term municipal bond with a right to demand payment before maturity from a bank or other financial institution. If the bank or financial institution is unable to pay, the Fund may lose money.

Please refer to pages 4-5 for other important disclosures and definitions.

45

Information about your Funds Expenses (Unaudited)

April 30, 2012

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on November 1, 2011 and held for the six months ended April 30, 2012.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

46

Information about your Funds Expenses (Unaudited)—Continued

Expense Examples

April 30, 2012

| | | | | | | | | | | | | |

Dynamic Dividend Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 7.59 | % | | $ 1,000.00 | | $ 1,075.90 | | 1.49% | | $5.11 | |

| | | | | | | | | | | | |

Institutional | | 3.61 | % | | $ 1,000.00 | | $ 1,036.10 | | 1.23% | | $6.23 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,017.45 | | 1.49% | | $7.47 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,018.75 | | 1.23% | | $6.17 | |

| | | | | | | | | | | | |

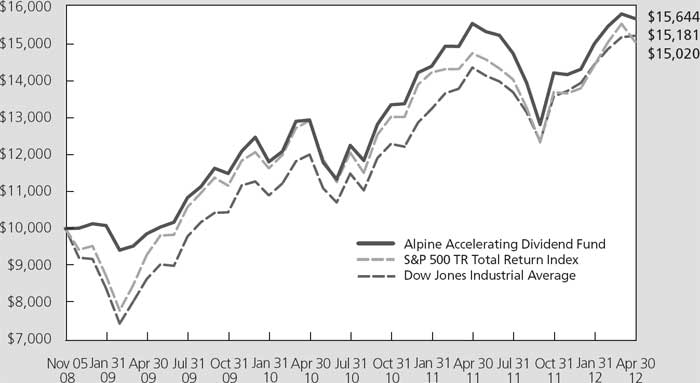

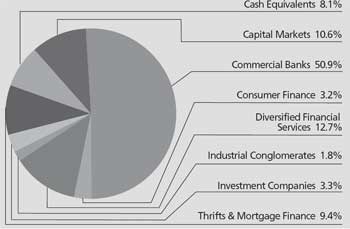

Accelerating Dividend Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 9.46 | % | | $ 1,000.00 | | $ 1,094.60 | | 1.61% | | $5.57 | |

| | | | | | | | | | | | |

Institutional | | 10.32 | % | | $ 1,000.00 | | $ 1,103.20 | | 1.36% | | $7.11 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,016.86 | | 1.61% | | $8.07 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,018.10 | | 1.36% | | $6.82 | |

| | | | | | | | | | | | |

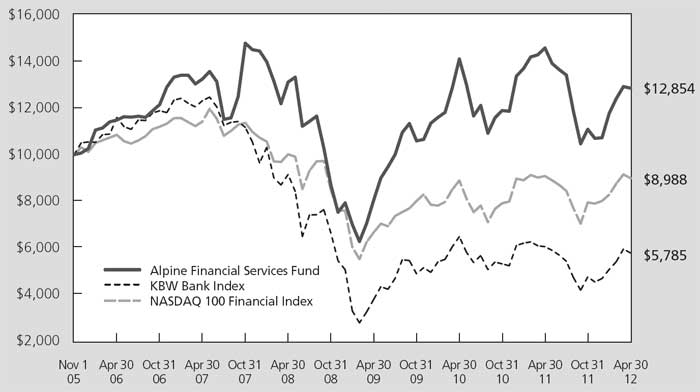

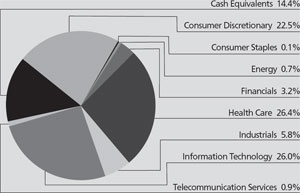

Financial Services Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 19.71 | % | | $ 1,000.00 | | $ 1,197.10 | | 1.64% | | $5.96 | |

| | | | | | | | | | | | |

Institutional | | 15.94 | % | | $ 1,000.00 | | $ 1,159.40 | | 1.41% | | $7.57 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,016.71 | | 1.64% | | $8.22 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,017.85 | | 1.41% | | $7.07 | |

47

Information about your Funds Expenses (Unaudited)—Continued

Expense Examples

April 30, 2012

| | | | | | | | | | | | | |

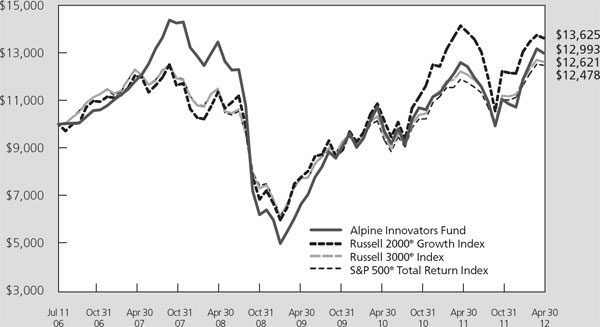

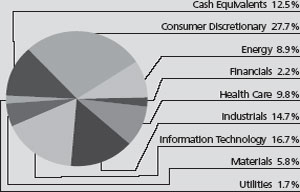

Innovators Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 21.14 | % | | $ 1,000.00 | | $ 1,211.40 | | 1.60% | | $5.85 | |

| | | | | | | | | | | | |

Institutional | | 17.65 | % | | $ 1,000.00 | | $ 1,176.50 | | 1.36% | | $7.36 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,016.91 | | 1.60% | | $8.02 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,018.10 | | 1.36% | | $6.82 | |

| | | | | | | | | | | | |

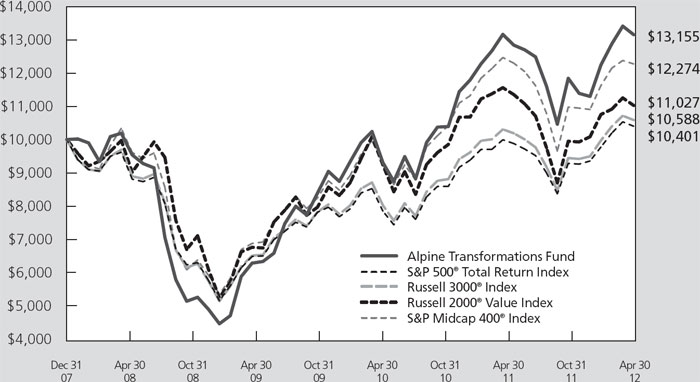

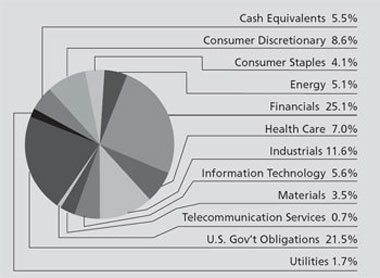

Transformations Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 16.22 | % | | $ 1,000.00 | | $ 1,162.20 | | 1.61% | | $5.75 | |

| | | | | | | | | | | | |

Institutional | | 11.05 | % | | $ 1,000.00 | | $ 1,110.50 | | 1.35% | | $7.08 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,016.86 | | 1.61% | | $8.07 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,018.15 | | 1.35% | | $6.77 | |

| | | | | | | | | | | | |

Foundation Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 7.92 | % | | $ 1,000.00 | | $ 1,079.20 | | 1.49% | | $5.12 | |

| | | | | | | | | | | | |

Institutional | | 8.44 | % | | $ 1,000.00 | | $ 1,084.40 | | 1.21% | | $6.27 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (4) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,017.45 | | 1.49% | | $7.47 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,018.85 | | 1.21% | | $6.07 | |

| | |

| | |

(1) | For the six months ended April 30, 2012. |

(2) | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

| Past performance is no guarantee of future results. |

48

Information about your Funds Expenses (Unaudited)—Continued

Expense Examples

April 30, 2012

| |

(3) | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (121 and 182, for Class A and Institutional Shares, respectfully), then divided by 366. |

(4) | Class A Shares commenced operations on December 30, 2011. Hypothetical expense examples assume a 5% return over a hypothetical 182 day period. |

| | | | | | | | | | | | | |

Ultra Short Tax Optimized Income Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 0.49 | % | | $ 1,000.00 | | $ 1,004.90 | | 0.90% | | $4.49 | |

| | | | | | | | | | | | |

Institutional | | 0.61 | % | | $ 1,000.00 | | $ 1,006.10 | | 0.65% | | $3.24 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | 5.00 | % | | $ 1,000.00 | | $ 1,020.39 | | 0.90% | | $4.52 | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,021.63 | | 0.65% | | $3.27 | |

| | | | | | | | | | | | |

Municipal Money Market Fund |

| | | | | | | | | | | | |

Based on actual total return (1) |

Class | | | Actual Total

Return Without

Sales Charges (2) | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Institutional | | 0.05 | % | | $ 1,000.00 | | $ 1,000.50 | | 0.32% | | $1.59 | |

| | | | | | | | | | | | |

Based on hypothetical total return (1) |

Class | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Institutional | | 5.00 | % | | $ 1,000.00 | | $ 1,023.27 | | 0.32% | | $1.61 | |

| | |

| | |

(1) | For the six months ended April 30, 2012. |

(2) | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

(3) | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 366. |

49

|

Alpine Dynamic Dividend Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—94.3% | | | | |

Brazil—4.1% | | | | |

| 353,100 | | All America Latina Logistica SA | | $ | 1,607,905 | |

| 293,401 | | Anhanguera Educacional

Participacoes SA | | 3,900,418 | |

| 226,400 | | Arcos Dorados Holdings, Inc. | | | 4,045,768 | |

| 122,700 | | BTG Pactual Participations, Ltd. (a) | | | 1,969,096 | |

| 2,082,700 | | PDG Realty SA Empreendimentos

e Participacoes | | | 4,916,796 | |

| | | | | | | |

| | | | | | 16,439,983 | |

| | | | | | | |

Canada—0.5% | | | | |

| 129,925 | | PetroBakken Energy,

Ltd.—Class A | | | 1,880,779 | |

| | | | | | | |

China—0.4% | | | | |

| 13,591,000 | | Daqing Dairy Holdings, Ltd.

(a)(b)(c) | | | 1,742,088 | |

| | | | | | | |

France—1.2% | | | | |

| 232,800 | | Mercialys SA | | | 4,651,636 | |

| | | | | | | |

Israel—2.0% | | | | |

| 2,351,000 | | Bezeq The Israeli

Telecommunication Corp., Ltd. | | | 3,934,205 | |

| 86,321 | | Teva Pharmaceutical

Industries, Ltd.—ADR | | | 3,948,323 | |

| | | | | | | |

| | | | | | 7,882,528 | |

| | | | | | | |

Norway—2.6% | | | | |

| 271,700 | | Seadrill, Ltd. | | | 10,515,827 | |

| | | | | | | |

Singapore—1.2% | | | | |

| 135,611 | | Avago Technologies, Ltd. | | | 4,675,867 | |

| | | | | | | |

South Korea—1.9% | | | | |

| 102,500 | | Kia Motors Corp. | | | 7,564,208 | |

| | | | | | | |

Sweden—4.9% | | | | |

| 115,800 | | Hennes & Mauritz AB—Class B | | | 3,978,132 | |

| 423,465 | | Tele2 AB-B Shares | | | 8,070,741 | |

| 765,000 | | Telefonaktiebolaget LM

Ericsson—B Shares | | | 7,580,230 | |

| | | | | | | |

| | | | | | 19,629,103 | |

| | | | | | | |

Switzerland—0.6% | | | | |

| 39,838 | | Novartis AG—ADR | | | 2,197,862 | |

| | | | | | | |

United Kingdom—4.3% | | | | |

| 178,000 | | BG Group PLC | | | 4,190,149 | |

| 128,947 | | Ensco PLC—ADR | | | 7,046,953 | |

| 127,804 | | GlaxoSmithKline PLC—ADR | | | 5,908,379 | |

| | | | | | | |

| | | | | | 17,145,481 | |

| | | | | | | |

United States—70.6% | | | | |

| 63,588 | | Abbott Laboratories | | | 3,946,271 | |

| 65,160 | | Aetna, Inc. | | | 2,869,646 | |

| 26,770 | | American Electric Power Co., Inc. | | | 1,039,747 | |

| 63,593 | | American Tower Corp.—Class A | | | 4,170,429 | |

| 10,011 | | Apple, Inc. (a) | | | 5,848,827 | |

| 30,351 | | Ashland, Inc. | | | 1,999,220 | |

| 35,617 | | Caterpillar, Inc. | | | 3,660,359 | |

| 114,991 | | CBS Corp.—Class B | | | 3,834,950 | |

| 38,048 | | Chevron Corp. | | | 4,054,395 | |

| 205,844 | | Citigroup, Inc. | | | 6,801,086 | |

| 53,430 | | Coach, Inc. | | | 3,908,939 | |

| 69,248 | | Colgate-Palmolive Co. | | | 6,851,397 | |

| 190,141 | | Comcast Corp.—Class A | | | 5,766,977 | |

| 68,164 | | ConocoPhillips | | | 4,882,587 | |

| 128,798 | | Cooper Tire & Rubber Co. | | | 1,925,530 | |

| 24,728 | | Cummins, Inc. | | | 2,864,244 | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—continued | | | | |

United States—continued | | | | |

| 95,988 | | CVS Caremark Corp. | | $ | 4,282,985 | |

| 59,304 | | Domino’s Pizza, Inc. | | | 2,242,284 | |

| 96,567 | | Eli Lilly & Co. | | | 3,996,908 | |

| 103,387 | | Exelon Corp. | | | 4,033,127 | |

| 47,118 | | Exxon Mobil Corp. | | | 4,068,168 | |

| 105,117 | | Family Dollar Stores, Inc. | | | 7,100,653 | |

| 79,086 | | Foot Locker, Inc. | | | 2,419,241 | |

| 93,318 | | Hasbro, Inc. | | | 3,428,503 | |

| 260,641 | | Healthcare Services Group, Inc. | | | 5,530,802 | |

| 177,122 | | Hewlett-Packard Co. | | | 4,385,541 | |

| 159,911 | | Intel Corp. | | | 4,541,472 | |

| 45,056 | | International Business

Machines Corp. | | | 9,330,197 | |

| 114,579 | | ITC Holdings Corp. | | | 8,875,289 | |

| 75,973 | | Johnson & Johnson | | | 4,945,083 | |

| 26,889 | | Joy Global, Inc. | | | 1,902,935 | |

| 197,753 | | JPMorgan Chase & Co. | | | 8,499,424 | |

| 221,100 | | Kaydon Corp. | | | 5,423,583 | |

| 116,900 | | KBR, Inc. | | | 3,958,234 | |

| 299,678 | | KKR & Co. Guernsey LP | | | 4,231,453 | |

| 127,476 | | Kraft Foods, Inc.—Class A | | | 5,082,468 | |

| 76,800 | | Loral Space & Communications, Inc. | | | 4,765,440 | |

| 96,634 | | McDonald’s Corp. | | | 9,416,983 | |

| 64,361 | | McKesson Corp. | | | 5,883,239 | |

| 238,425 | | Meridian Bioscience, Inc. | | | 4,899,634 | |

| 138,527 | | Microchip Technology, Inc. | | | 4,895,544 | |

| 148,190 | | Microsoft Corp. | | | 4,745,044 | |

| 41,759 | | Occidental Petroleum Corp. | | | 3,809,256 | |

| 549,907 | | Och-Ziff Capital Management

Group, LLC—Class A | | | 4,828,183 | |

| 214,714 | | Oracle Corp. | | | 6,310,444 | |

| 22,583 | | Progress Energy, Inc. | | | 1,201,867 | |

| 134,859 | | QUALCOMM, Inc. | | | 8,609,399 | |

| 231,674 | | Regal Entertainment

Group—Class A | | | 3,153,083 | |

| 471,200 | | Sara Lee Corp. | | | 10,385,248 | |

| 51,572 | | Snap-On, Inc. | | | 3,225,313 | |

| 64,079 | | The Coca-Cola Co. | | | 4,890,509 | |

| 28,385 | | The Dow Chemical Co. | | | 961,684 | |

| 46,192 | | The Estee Lauder Cos.,

Inc.—Class A | | | 3,018,647 | |

| 42,935 | | The Southern Co. | | | 1,972,434 | |

| 12,580 | | Union Pacific Corp. | | | 1,414,495 | |

| 48,951 | | United Technologies Corp. | | | 3,996,360 | |

| 99,795 | | Verizon Communications, Inc. | | | 4,029,722 | |

| 68,058 | | Wal-Mart Stores, Inc. | | | 4,009,297 | |

| 128,504 | | Walgreen Co. | | | 4,505,350 | |

| 239,439 | | Wells Fargo & Co. | | | 8,004,446 | |

| 86,520 | | Yum! Brands, Inc. | | | 6,292,600 | |

| | | | | | | |

| | | | | | 281,927,175 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $348,507,739) | | $ | 376,252,537 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

50

|

Alpine Dynamic Dividend Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited)

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | |

Short-Term Investments—4.6% | | | | |

$ | 18,369,000 | | State Street Eurodollar

Time Deposit, 0.01% | | $ | 18,369,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $18,369,000) | | | 18,369,000 | |

| | | | | | | |

| | | Total Investments

(Cost $366,876,739)—98.9% (d) | | | 394,621,537 | |

| | | Other Assets in Excess of

Liabilities—1.1% | | | 4,468,635 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 399,090,172 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

|

(a) | Non-income producing security. |

| |

(b) | Illiquid security. |

| |

(c) | Security fair valued in accordance with procedures approved by the Board of Trustees. These securities comprised 0.4% of the Fund’s net assets. |

| |

(d) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

| |

AB—Aktiebolag is the Swedish equivalent of the term corporation. |

| |

ADR—American Depositary Receipt |

|

AG—Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

|

PLC—Public Limited Company |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

51

|

Alpine Accelerating Dividend Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—94.6% | | | | |

Aerospace & Defense—2.0% | | | | |

| 700 | | Ceradyne, Inc. | | $ | 17,724 | |

| 450 | | United Technologies Corp. | | | 36,738 | |

| | | | | | | |

| | | | | | 54,462 | |

| | | | | | | |

Beverages—3.4% | | | | |

| 600 | | Anheuser-Busch InBev NV—ADR | | | 43,572 | |

| 750 | | PepsiCo, Inc. | | | 49,500 | |

| | | | | | | |

| | | | | | 93,072 | |

| | | | | | | |

Biotechnology—1.6% | | | | |

| 600 | | Amgen, Inc. | | | 42,666 | |

| | | | | | | |

Capital Markets—2.8% | | | | |

| 2,700 | | FXCM, Inc.—Class A | | | 31,266 | |

| 5,000 | | Och-Ziff Capital Management

Group, LLC—Class A | | | 43,900 | |

| | | | | | | |

| | | | | | 75,166 | |

| | | | | | | |

Chemicals—2.8% | | | | |

| 400 | | Air Products & Chemicals, Inc. | | | 34,196 | |

| 975 | | Potash Corp. of

Saskatchewan, Inc. | | | 41,418 | |

| | | | | | | |

| | | | | | 75,614 | |

| | | | | | | |

Commercial Banks—4.7% | | | | |

| 2,500 | | Financial Institutions, Inc. | | | 42,300 | |

| 6,200 | | Huntington Bancshares, Inc. | | | 41,478 | |

| 650 | | PNC Financial Services Group, Inc. | | | 43,108 | |

| | | | | | | |

| | | | | | 126,886 | |

| | | | | | | |

Communications Equipment—3.5% | | | | |

| 2,175 | | Cisco Systems, Inc. | | | 43,826 | |

| 800 | | QUALCOMM, Inc. | | | 51,072 | |

| | | | | | | |

| | | | | | 94,898 | |

| | | | | | | |

Computers & Peripherals—1.3% | | | | |

| 1,400 | | Hewlett-Packard Co. | | | 34,664 | |

| | | | | | | |

Diversified Financial Services—2.1% | | | | |

| 800 | | Citigroup, Inc. | | | 26,432 | |

| 1,250 | | The NASDAQ OMX

Group, Inc. (a) | | | 30,712 | |

| | | | | | | |

| | | | | | 57,144 | |

| | | | | | | |

Energy Equipment & Services—2.6% | | | | |

| 700 | | Bristow Group, Inc. | | | 34,195 | |

| 500 | | Schlumberger, Ltd. | | | 37,070 | |

| | | | | | | |

| | | | | | 71,265 | |

| | | | | | | |

Food & Staples Retailing—1.5% | | | | |

| 1,150 | | Walgreen Co. | | | 40,319 | |

| | | | | | | |

Food Products—3.5% | | | | |

| 1,250 | | General Mills, Inc. | | | 48,613 | |

| 570 | | The J.M. Smucker Co. | | | 45,389 | |

| | | | | | | |

| | | | | | 94,002 | |

| | | | | | | |

Gas Utilities—3.1% | | | | |

| 1,150 | | Atmos Energy Corp. | | | 37,467 | |

| 1,550 | | UGI Corp. | | | 45,229 | |

| | | | | | | |

| | | | | | 82,696 | |

| | | | | | | |

Health Care Equipment & Supplies—3.2% | | | | |

| 600 | | Becton, Dickinson & Co. | | | 47,070 | |

| 1,200 | | Hill-Rom Holdings, Inc. | | | 38,940 | |

| | | | | | | |

| | | | | | 86,010 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Health Care Providers & Services—2.4% | | | | |

| 850 | | Aetna, Inc. | | $ | 37,434 | |

| 500 | | UnitedHealth Group, Inc. | | | 28,075 | |

| | | | | | | |

| | | | | | 65,509 | |

| | | | | | | |

Hotels, Restaurants & Leisure—1.5% | | | | |

| 1,275 | | Carnival Corp. | | | 41,425 | |

| | | | | | | |

Household Durables—0.9% | | | | |

| 10,500 | | PDG Realty SA Empreendimentos

e Participacoes | | | 24,788 | |

| | | | | | | |

Household Products—1.6% | | | | |

| 700 | | The Procter & Gamble Co. | | | 44,548 | |

| | | | | | | |

Industrial Conglomerates—1.3% | | | | |

| 400 | | 3M Co. | | | 35,744 | |

| | | | | | | |

Insurance—1.3% | | | | |

| 1,700 | | Montpelier Re Holdings, Ltd. | | | 34,884 | |

| | | | | | | |

IT Services—3.4% | | | | |

| 230 | | International Business

Machines Corp. | | | 47,628 | |

| 350 | | Visa, Inc.—Class A | | | 43,043 | |

| | | | | | | |

| | | | | | 90,671 | |

| | | | | | | |

Machinery—3.3% | | | | |

| 500 | | Dover Corp. | | | 31,330 | |

| 550 | | Robbins & Myers, Inc. | | | 26,790 | |

| 500 | | Snap—On, Inc. | | | 31,270 | |

| | | | | | | |

| | | | | | 89,390 | |

| | | | | | | |

Media—4.6% | | | | |

| 1,200 | | CBS Corp.—Class B | | | 40,020 | |

| 1,550 | | Comcast Corp.—Class A | | | 47,012 | |

| 1,600 | | SES SA | | | 38,313 | |

| | | | | | | |

| | | | | | 125,345 | |

| | | | | | | |

Metals & Mining—0.8% | | | | |

| 1,000 | | Vale SA—ADR | | | 22,200 | |

| | | | | | | |

Multi-Utilities—3.1% | | | | |

| 900 | | OGE Energy Corp. | | | 48,564 | |

| 1,300 | | Xcel Energy, Inc. | | | 35,178 | |

| | | | | | | |

| | | | | | 83,742 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—8.9% | | | | |

| 4,785 | | Cairn Energy PLC | | | 26,698 | |

| 350 | | Chevron Corp. | | | 37,296 | |

| 600 | | ConocoPhillips | | | 42,978 | |

| 1,800 | | Crosstex Energy LP | | | 32,040 | |

| 450 | | Devon Energy Corp. | | | 31,433 | |

| 360 | | Occidental Petroleum Corp. | | | 32,839 | |

| 1,100 | | Suncor Energy, Inc. | | | 36,344 | |

| | | | | | | |

| | | | | | 239,628 | |

| | | | | | | |

Pharmaceuticals—3.9% | | | | |

| 800 | | Abbott Laboratories | | | 49,648 | |

| 1,200 | | Teva Pharmaceutical

Industries, Ltd.—ADR | | | 54,888 | |

| | | | | | | |

| | | | | | 104,536 | |

| | | | | | | |

Professional Services—1.0% | | | | |

| 1,200 | | VSE Corp. | | | 26,400 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

52

|

Alpine Accelerating Dividend Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Real Estate Investment Trusts—3.3% | | | | |

| 700 | | American Tower Corp. | | $ | 45,906 | |

| 2,600 | | Colony Financial, Inc. | | | 44,174 | |

| | | | | | | |

| | | | | | 90,080 | |

| | | | | | | |

Road & Rail—1.3% | | | | |

| 1,700 | | Marten Transport, Ltd. | | | 35,819 | |

| | | | | | | |

Semiconductors & Semiconductor Equipment—5.1% | | | | |

| 1,250 | | Avago Technologies, Ltd. | | | 43,100 | |

| 1,700 | | Intel Corp. | | | 48,280 | |

| 1,400 | | Linear Technology Corp. | | | 45,794 | |

| | | | | | | |

| | | | | | 137,174 | |

| | | | | | | |

Software—4.4% | | | | |

| 1,500 | | Microsoft Corp. | | | 48,030 | |

| 1,450 | | Oracle Corp. | | | 42,616 | |

| 1,500 | | Totvs SA | | | 29,234 | |

| | | | | | | |

| | | | | | 119,880 | |

| | | | | | | |

Specialty Retail—1.4% | | | | |

| 750 | | Dick’s Sporting Goods, Inc. | | | 37,950 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Textiles, Apparel & Luxury Goods—3.0% | | | | |

| 360 | | NIKE, Inc.—Class B | | $ | 40,273 | |

| 270 | | VF Corp. | | | 41,054 | |

| | | | | | | |

| | | | | | 81,327 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $2,301,175) | | | 2,559,904 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

| | | | | | | |

Short-Term Investments—6.1% | | | | |

$ | 166,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 166,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $166,000) | | | 166,000 | |

| | | | | | | |

| | | Total Investments

(Cost $2,467,175)—100.7% (b) | | | 2,725,904 | |

| | | Liabilities in Excess of | | | | |

| | | Other Assets—(0.7)% | | | (18,451) | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 2,707,453 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| |

(a) | Non-income producing security. |

| |

(b) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

| |

ADR—American Depositary Receipt |

|

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

|

PLC—Public Limited Company |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

53

|

Alpine Financial Services Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—87.4% | | | | |

Capital Markets—10.5% | | | | |

| 20,000 | | BGC Partners, Inc.—Class A | | $ | 139,400 | |

| 52,033 | | Cowen Group, Inc.—Class A (a) | | | 131,123 | |

| 18,500 | | GFI Group, Inc. | | | 61,050 | |

| 40,000 | | Gleacher & Co., Inc. (a) | | | 41,600 | |

| 13,000 | | JMP Group, Inc. | | | 96,330 | |

| 2,000 | | Och-Ziff Capital Management

Group, LLC—Class A | | | 17,560 | |

| 65,259 | | Rodman & Renshaw Capital

Group, Inc. (a) | | | 47,639 | |

| 1,705 | | SWS Group, Inc. (a) | | | 9,616 | |

| 20,000 | | The Blackstone Group LP | | | 271,200 | |

| | | | | | | |

| | | | | | 815,518 | |

| | | | | | | |

Commercial Banks—50.0% | | | | |

| 45,165 | | 1st United Bancorp, Inc. (a) | | | 273,700 | |

| 3,000 | | American River Bankshares (a) | | | 21,840 | |

| 48,940 | | Bank of Commerce Holdings | | | 208,484 | |

| 5,000 | | Bank of Georgia Holdings PLC (a) | | | 87,637 | |

| 45,737 | | Bank of Virginia (a) | | | 38,190 | |

| 13,428 | | Barclays PLC | | | 47,562 | |

| 15,000 | | California United Bank (a) | | | 164,100 | |

| 93,069 | | Carolina Trust Bank (a) | | | 232,672 | |

| 12,493 | | Centerstate Banks, Inc. | | | 100,444 | |

| 36,627 | | Citizens First Corp. (a) | | | 302,173 | |

| 7,095 | | Comerica, Inc. | | | 227,182 | |

| 4,700 | | Community National Bank of

the Lakeway Area (a)(b) | | | 15,675 | |

| 3,002 | | Fidelity Southern Corp. | | | 25,487 | |

| 4,000 | | First Business Financial

Services, Inc. | | | 90,840 | |

| 72,700 | | First California Financial

Group, Inc. (a) | | | 396,942 | |

| 1,000 | | FirstMerit Corp. | | | 16,800 | |

| 100 | | Middleburg Financial Corp. | | | 1,635 | |

| 21,000 | | Mitsubishi UFJ Financial

Group, Inc. | | | 101,791 | |

| 7,400 | | National Bank of Greece

SA—ADR (a) | | | 16,872 | |

| 10,200 | | New Century Bancorp, Inc. (a) | | | 44,064 | |

| 400 | | North Valley Bancorp (a) | | | 5,032 | |

| 2,375 | | Old Point Financial Corp. | | | 25,579 | |

| 4,000 | | Oriental Financial Group, Inc. | | | 47,280 | |

| 24,642 | | Pacific Mercantile Bancorp (a) | | | 147,113 | |

| 18,276 | | Pacific Premier Bancorp, Inc. (a) | | | 142,187 | |

| 75,000 | | Republic First Bancorp, Inc. (a) | | | 162,000 | |

| 3,120 | | Rurban Financial Corp. (a) | | | 14,976 | |

| 38,750 | | Southern National Bancorp

of Virginia, Inc. | | | 267,375 | |

| 3,000 | | Sumitomo Mitsui Financial

Group, Inc. | | | 97,094 | |

| 6,000 | | Summit State Bank | | | 37,440 | |

| 152,347 | | Synovus Financial Corp. | | | 319,929 | |

| 5,000 | | The Savannah Bancorp, Inc. (a) | | | 25,500 | |

| 2,551 | | Valley Commerce Bancorp (a)(b) | | | 25,497 | |

| 32,000 | | VTB Bank OJSC—GDR (a)(c) | | | 134,112 | |

| 1,974 | | Yadkin Valley Financial Corp. (a) | | | 6,435 | |

| | | | | | | |

| | | | | | 3,871,639 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—continued | | | | |

Consumer Finance—3.2% | | | | |

| 2,000 | | Ezcorp, Inc.—Class A (a) | | $ | 53,580 | |

| 1,000 | | Green Dot Corp.—Class A (a) | | | 26,390 | |

| 25,000 | | Imperial Holdings, Inc. (a) | | | 95,750 | |

| 9,000 | | Netspend Holdings, Inc. (a) | | | 68,670 | |

| | | | | | | |

| | | | | | 244,390 | |

| | | | | | | |

Diversified Financial Services—12.6% |

| 7,124 | | BM&F Bovespa SA | | | 40,065 | |

| 1,100 | | BTG Pactual Participations, Ltd. (a) | | | 17,653 | |

| 665 | | CME Group, Inc. | | | 176,770 | |

| 162,000 | | Dubai Financial Market (a) | | | 49,840 | |

| 3,115 | | IntercontinentalExchange, Inc. (a) | | | 414,419 | |

| 4,000 | | NYSE Euronext | | | 103,000 | |

| 7,000 | | The NASDAQ OMX Group, Inc. (a) | | | 171,990 | |

| | | | | | | |

| | | | | | 973,737 | |

| | | | | | | |

Industrial Conglomerates—1.8% | | | | |

| 7,000 | | General Electric Co. | | | 137,060 | |

| | | | | | | |

Thrifts & Mortgage Finance—9.3% | | | | |

| 17,105 | | Alliance Bancorp, Inc.

of Pennsylvania | | | 198,418 | |

| 5,000 | | Central Federal Corp. (a) | | | 2,800 | |

| 2,144 | | Fidelity Bancorp, Inc. | | | 23,423 | |

| 5,895 | | First Pactrust Bancorp, Inc. | | | 64,786 | |

| 40,000 | | Flagstar Bancorp, Inc. (a) | | | 34,816 | |

| 8,823 | | HopFed Bancorp, Inc. | | | 78,437 | |

| 29,751 | | Provident Financial Holdings, Inc. | | | 321,013 | |

| | | | | | | |

| | | | | | 723,693 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $8,955,770) | | | 6,766,037 | |

| | | | | | | |

Preferred Stocks—0.5% | | | | |

Commercial Banks—0.5% | | | | |

| 13,000 | | Banco Industrial e Comercial SA | | | 40,784 | |

| | | | | | | |

| | | Total Preferred Stocks

(Cost $92,416) | | | 40,784 | |

| | | | | | | |

Investment Companies—3.4% | | | | |

| 12,200 | | Direxion Daily Financial Bear

3X Shares (a) | | | 258,762 | |

| | | | | | | |

| | | Total Investment Companies

(Cost $310,703) | | | 258,762 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

Short-Term Investments—8.0% | | | | |

$ | 622,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 622,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $622,000) | | | 622,000 | |

| | | | | | | |

| | | Total Investments

(Cost $9,980,889)—99.3% (d) | | | 7,687,583 | |

| | | Other Assets in Excess

of Liabilities—0.7% | | | 57,306 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 7,744,889 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

54

|

Alpine Financial Services Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | |

| | |

Percentages are stated as a percent of net assets. |

|

(a) | Non-income producing security. |

| |

(b) | Illiquid security. |

| |

(c) | Restricted under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Board of Trustees. Liquid securities restricted under Rule 144A comprised 1.7% of the Fund’s net assets. |

| |

(d) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

|

ADR—American Depositary Receipt |

|

GDR—Global Depositary Receipt |

|

OJSC—Open Joint Stock Company |

|

PLC—Public Limited Company |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

55

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—86.4% | | | | |

Auto Components—1.2% | | | | |

| 2,000 | | BorgWarner, Inc. (a) | | $ | 158,080 | |

| | | | | | | |

Biotechnology—2.6% | | | | |

| 12,500 | | ARIAD Pharmaceuticals, Inc. (a) | | | 203,750 | |

| 5,000 | | Myriad Genetics, Inc. (a) | | | 130,050 | |

| | | | | | | |

| | | | | | 333,800 | |

| | | | | | | |

Commercial Banks—1.5% | | | | |

| 8,000 | | SunTrust Banks, Inc. | | | 194,240 | |

| | | | | | | |

Commercial Services & Supplies—1.3% | | | | |

| 6,000 | | Copart, Inc. (a) | | | 158,460 | |

| | | | | | | |

Communications Equipment—0.9% | | | | |

| 4,000 | | Acme Packet, Inc. (a) | | | 112,280 | |

| | | | | | | |

Computers & Peripherals—4.6% | | | | |

| 500 | | Apple, Inc. (a) | | | 292,120 | |

| 15,000 | | Cray, Inc. (a) | | | 167,250 | |

| 5,000 | | Hewlett-Packard Co. | | | 123,800 | |

| | | | | | | |

| | | | | | 583,170 | |

| | | | | | | |

Diversified Financial Services—1.7% | | | | |

| 800 | | CME Group, Inc. | | | 212,656 | |

| | | | | | | |

Electronic Equipment, Instruments & Components—6.7% | | | | |

| 11,000 | | FLIR Systems, Inc. | | | 247,060 | |

| 12,434 | | InvenSense, Inc. (a) | | | 199,939 | |

| 7,000 | | Itron, Inc. (a) | | | 285,600 | |

| 6,975 | | MOCON, Inc. | | | 124,364 | |

| | | | | | | |

| | | | | | 856,963 | |

| | | | | | | |

Energy Equipment & Services—0.7% | | | | |

| 25,000 | | Electromagnetic GeoServices (a) | | | 79,068 | |

| 10,833 | | Polarcus, Ltd. (a) | | | 11,168 | |

| | | | | | | |

| | | | | | 90,236 | |

| | | | | | | |

Health Care Equipment & Supplies—9.2% | | | | |

| 10,000 | | Endologix, Inc. (a) | | | 149,800 | |

| 1,400 | | Intuitive Surgical, Inc. (a) | | | 809,480 | |

| 5,000 | | MAKO Surgical Corp. (a) | | | 206,550 | |

| | | | | | | |

| | | | | | 1,165,830 | |

| | | | | | | |

Health Care Providers & Services—7.1% | | | | |

| 17,000 | | Bio-Reference Labs, Inc. (a) | | | 362,440 | |

| 5,000 | | HMS Holdings Corp. (a) | | | 120,300 | |

| 6,000 | | MEDNAX, Inc. (a) | | | 421,440 | |

| | | | | | | |

| | | | | | 904,180 | |

| | | | | | | |

Health Care Technology—1.5% | | | | |

| 3,228 | | Allscripts Healthcare

Solutions, Inc. (a) | | | 35,766 | |

| 4,000 | | Quality Systems, Inc. | | | 149,600 | |

| | | | | | | |

| | | | | | 185,366 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Household Durables—2.6% | | | | |

| 25,000 | | Zagg, Inc. (a) | | $ | 325,750 | |

| | | | | | | |

Internet & Catalog Retail—18.0% | | | | |

| 40 | | Amazon.com, Inc. (a) | | | 9,276 | |

| 3,000 | | priceline.com, Inc. (a) | | | 2,282,460 | |

| | | | | | | |

| | | | | | 2,291,736 | |

| | | | | | | |

Internet Software & Services—3.3% | | | | |

| 700 | | Google, Inc.—Class A (a) | | | 423,661 | |

| | | | | | | |

Leisure Equipment & Products—0.9% | | | | |

| 1,500 | | Polaris Industries, Inc. | | | 119,160 | |

| | | | | | | |

Life Sciences Tools & Services—4.9% | | | | |

| 1,000 | | Bio-Rad Laboratories,

Inc.—Class A (a) | | | 107,990 | |

| 11,000 | | Life Technologies Corp. (a) | | | 509,960 | |

| | | | | | | |

| | | | | | 617,950 | |

| | | | | | | |

Machinery—4.6% | | | | |

| 12,500 | | Commercial Vehicle Group, Inc. (a) | | | 133,000 | |

| 3,900 | | Flowserve Corp. | | | 448,227 | |

| | | | | | | |

| | | | | | 581,227 | |

| | | | | | | |

Personal Products—0.1% | | | | |

| 200 | | Herbalife, Ltd. | | | 14,064 | |

| | | | | | | |

Pharmaceuticals—1.4% | | | | |

| 8,000 | | The Medicines Co. (a) | | | 176,720 | |

| | | | | | | |

Semiconductors & Semiconductor Equipment—1.4% | | | | |

| 6,000 | | Veeco Instruments, Inc. (a) | | | 181,140 | |

| | | | | | | |

Software—10.2% | | | | |

| 16,400 | | ANSYS, Inc. (a) | | | 1,099,948 | |

| 10,000 | | Callidus Software, Inc. (a) | | | 79,200 | |

| 20,600 | | Mitek Systems, Inc. (a) | | | 116,596 | |

| | | | | | | |

| | | | | | 1,295,744 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $7,783,107) | | | 10,982,413 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

Short-Term Investments—14.6% | | | | |

$ | 1,849,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 1,849,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $1,849,000) | | | 1,849,000 | |

| | | | | | | |

| | | Total Investments

(Cost $9,632,107)—101.0% (b) | | | 12,831,413 | |

| | | Liabilities in Excess of

Other Assets—(1.0)% | | | (127,971 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 12,703,442 | |

| | | | | | | |

| | |

| | |

| |

Percentages are stated as a percent of net assets. |

| |

(a) | Non-income producing security. |

| |

(b) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

The accompanying notes are an integral part of these financial statements.

56

|

Alpine Transformations Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—87.4% | | | | |

Air Freight & Logistics—2.3% | | | | |

| 2,000 | | FedEx Corp. | | $ | 176,480 | |

| | | | | | | |

Auto Components—0.9% | | | | |

| 5,000 | | Amerigon, Inc. (a) | | | 71,500 | |

| | | | | | | |

Chemicals—4.5% | | | | |

| 2,500 | | Ashland, Inc. | | | 164,675 | |

| 13,000 | | Flotek Industries, Inc. (a) | | | 177,320 | |

| | | | | | | |

| | | | | | 341,995 | |

| | | | | | | |

Commercial Banks—0.9% | | | | |

| 1,991 | | Wells Fargo & Co. | | | 66,559 | |

| | | | | | | |

Computers & Peripherals—5.2% | | | | |

| 400 | | Apple, Inc. (a) | | | 233,696 | |

| 14,758 | | Cray, Inc. (a) | | | 164,552 | |

| | | | | | | |

| | | | | | 398,248 | |

| | | | | | | |

Diversified Financial Services—1.1% | | | | |

| 10,000 | | Bank of America Corp. | | | 81,100 | |

| | | | | | | |

Electronic Equipment, Instruments

& Components—0.9% | | | | |

| 5,000 | | Corning, Inc. | | | 71,750 | |

| | | | | | | |

Energy Equipment & Services—6.6% | | | | |

| 2,000 | | CARBO Ceramics, Inc. | | | 168,180 | |

| 25,000 | | Electromagnetic GeoServices (a) | | | 79,068 | |

| 8,000 | | ION Geophysical Corp. (a) | | | 49,840 | |

| 2,000 | | National Oilwell Varco, Inc. | | | 151,520 | |

| 10,833 | | Polarcus, Ltd. (a) | | | 11,168 | |

| 1,000 | | Transocean, Ltd. | | | 50,390 | |

| | | | | | | |

| | | | | | 510,166 | |

| | | | | | | |

Health Care Equipment & Supplies—9.7% | | | | |

| 2,000 | | Edwards Lifesciences Corp. (a) | | | 165,940 | |

| 1,000 | | Intuitive Surgical, Inc. (a) | | | 578,200 | |

| | | | | | | |

| | | | | | 744,140 | |

| | | | | | | |

Health Care Technology—0.1% | | | | |

| 728 | | Allscripts Healthcare

Solutions, Inc. (a) | | | 8,066 | |

| | | | | | | |

Hotels, Restaurants & Leisure—3.0% | | | | |

| 4,000 | | Starbucks Corp. | | | 229,520 | |

| | | | | | | |

Household Durables—11.6% | | | | |

| 5,000 | | Garmin, Ltd. | | | 235,650 | |

| 6,500 | | Helen of Troy, Ltd. (a) | | | 224,900 | |

| 4,000 | | Tempur-Pedic International,

Inc. (a) | | | 235,360 | |

| 15,000 | | Zagg, Inc. (a) | | | 195,450 | |

| | | | | | | |

| | | | | | 891,360 | |

| | | | | | | |

Industrial Conglomerates—2.6% | | | | |

| 10,300 | | General Electric Co. | | | 201,674 | |

| | | | | | | |

Internet & Catalog Retail—7.9% | | | | |

| 800 | | priceline.com, Inc. (a) | | | 608,656 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Internet Software & Services—1.6% | | | | |

| 200 | | Google, Inc.—Class A (a) | | $ | 121,046 | |

| | | | | | | |

Leisure Equipment & Products—1.6% | | | | |

| 1,500 | | Polaris Industries, Inc. | | | 119,160 | |

| | | | | | | |

Machinery—9.8% | | | | |

| 12,500 | | Commercial Vehicle Group, Inc. (a) | | | 133,000 | |

| 2,400 | | Cummins, Inc. | | | 277,992 | |

| 7,000 | | Manitex International, Inc. (a) | | | 66,710 | |

| 3,000 | | Snap-On, Inc. | | | 187,620 | |

| 10,000 | | Wabash National Corp. (a) | | | 83,700 | |

| | | | | | | |

| | | | | | 749,022 | |

| | | | | | | |

Metals & Mining—1.3% | | | | |

| 1,500 | | Walter Energy, Inc. | | | 99,465 | |

| | | | | | | |

Multi-Utilities—1.7% | | | | |

| 10,000 | | Just Energy Group, Inc. | | | 131,498 | |

| | | | | | | |

Multiline Retail—2.6% | | | |

| 2,000 | | Dollar Tree, Inc. (a) | | | 203,320 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—2.2% | | | | |

| 372 | | Apache Corp. | | | 35,690 | |

| 15,000 | | Kodiak Oil & Gas Corp. (a) | | | 132,750 | |

| | | | | | | |

| | | | | | 168,440 | |

| | | | | | | |

Real Estate Investment Trusts (REITs)—0.3% | | | | |

| 1,102 | | Walter Investment

Management Corp. | | | 22,293 | |

| | | | | | | |

Software—9.0% | | | | |

| 15,000 | | Callidus Software, Inc. (a) | | | 118,800 | |

| 20,600 | | Mitek Systems, Inc. (a) | | | 116,596 | |

| 5,000 | | Nuance Communications, Inc. (a) | | | 122,200 | |

| 5,000 | | Oracle Corp. | | | 146,950 | |

| 4,000 | | SolarWinds, Inc. (a) | | | 187,640 | |

| | | | | | | |

| | | | | | 692,186 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $5,153,623) | | | 6,707,644 | |

| | | | | | | |

| | | | | | | |

Principal | | | | | | |

Amount | | | | | | |

| | | | | | | |

Short-Term Investments—12.5% | | | | |

$ | 959,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 959,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $959,000) | | | 959,000 | |

| | | | | | | |

| | | Total Investments

(Cost $6,112,623)—99.9% (b) | | | 7,666,644 | |

| | | Other Assets in Excess

of Liabilities—0.1% | | | 10,567 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 7,677,211 | |

| | | | | | | |

| | |

| | |

| |

Percentages are stated as a percent of net assets. |

| |

(a) | Non-income producing security. |

| |

(b) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2012. |

The accompanying notes are an integral part of these financial statements.

57

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—72.6% | | | | |

Aerospace & Defense—1.5% | | | | |

| 10,000 | | Honeywell International, Inc. | | $ | 606,600 | |

| 5,000 | | The Boeing Co. | | | 384,000 | |

| | | | | | | |

| | | | | | 990,600 | |

| | | | | | | |

Auto Components—3.4% | | | | |

| 30,500 | | Autoliv, Inc. | | | 1,913,570 | |

| 20,000 | | Cooper Tire & Rubber Co. | | | 299,000 | |

| | | | | | | |

| | | | | | 2,212,570 | |

| | | | | | | |

Beverages—0.6% | | | | |

| 5,000 | | Anheuser-Busch InBev NV—ADR | | | 363,100 | |

| | | | | | | |

Capital Markets—1.8% | | | | |

| 25,900 | | State Street Corp. | | | 1,197,098 | |

| | | | | | | |

Chemicals—3.2% | | | | |

| 20,000 | | E.I. duPont de Nemours & Co. | | | 1,069,200 | |

| 12,000 | | Eastman Chemical Co. | | | 647,640 | |

| 10,000 | | The Dow Chemical Co. | | | 338,800 | |

| | | | | | | |

| | | | | | 2,055,640 | |

| | | | | | | |

Commercial Banks—4.6% | | | | |

| 5,000 | | PNC Financial Services Group, Inc. | | | 331,600 | |

| 8,262 | | Southside Bancshares, Inc. | | | 168,554 | |

| 35,000 | | Sun Bancorp, Inc. (a) | | | 101,150 | |

| 7,293 | | Susquehanna Bancshares, Inc. | | | 75,628 | |

| 33,075 | | Valley National Bancorp | | | 416,745 | |

| 10,000 | | Washington Trust Bancorp, Inc. | | | 236,700 | |

| 59,501 | | Webster Financial Corp. | | | 1,352,458 | |

| 10,432 | | Wells Fargo & Co. | | | 348,742 | |

| | | | | | | |

| | | | | | 3,031,577 | |

| | | | | | | |

Computers & Peripherals—1.4% | | | | |

| 1,000 | | Apple, Inc. (a) | | | 584,240 | |

| 14,000 | | Hewlett-Packard Co. | | | 346,640 | |

| | | | | | | |

| | | | | | 930,880 | |

| | | | | | | |

Containers & Packaging—0.4% | | | | |

| 30,000 | | Boise, Inc. | | | 229,200 | |

| | | | | | | |

Diversified Financial Services—5.8% | | | | |

| 63,041 | | Bank of America Corp. | | | 511,262 | |

| 14,367 | | Citigroup, Inc. | | | 474,686 | |

| 2,600 | | CME Group, Inc. | | | 691,132 | |

| 45,600 | | JPMorgan Chase & Co. | | | 1,959,888 | |

| 15,406 | | Medallion Financial Corp. | | | 168,388 | |

| | | | | | | |

| | | | | | 3,805,356 | |

| | | | | | | |

Diversified Telecommunication Services—0.7% | | | | |

| 66,185 | | TeliaSonera AB | | | 442,428 | |

| | | | | | | |

Electric Utilities—0.7% | | | | |

| 7,200 | | Entergy Corp. | | | 472,032 | |

| | | | | | | |

Electrical Equipment—2.9% | | | | |

| 22,500 | | AMETEK, Inc. | | | 1,132,425 | |

| 8,700 | | Preformed Line Products Co. | | | 502,251 | |

| 4,000 | | Regal-Beloit Corp. | | | 270,560 | |

| | | | | | | |

| | | | | | 1,905,236 | |

| | | | | | | |

Electronic Equipment, Instruments &

Components—0.4% | | | | |

| 20,000 | | Corning, Inc. | | | 287,000 | |

| | | | | | | |

Food & Staples Retailing—2.1% | | | | |

| 15,000 | | CVS Caremark Corp. | | | 669,300 | |

| 20,000 | | Walgreen Co. | | | 701,200 | |

| | | | | | | |

| | | | | | 1,370,500 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| |

Common Stocks—continued | | | | |

Food Products—0.8% | | | | |

| 10,000 | | H.J. Heinz Co. | | $ | 533,100 | |

| | | | | | | |

Health Care Equipment & Supplies—1.0% | | | | |

| 8,600 | | Becton, Dickinson & Co. | | | 674,670 | |

| | | | | | | |

Health Care Providers & Services—1.4% | | | | |

| 20,000 | | HCA Holdings, Inc. | | | 538,400 | |

| 4,000 | | McKesson Corp. | | | 365,640 | |

| | | | | | | |

| | | | | | 904,040 | |

| | | | | | | |

Hotels, Restaurants & Leisure—0.8% | | | |

| 10,000 | | Darden Restaurants, Inc. | | | 500,800 | |

| | | | | | | |

Household Durables—1.2% | | | | |

| 28,000 | | Lennar Corp.—Class A | | | 776,720 | |

| | | | | | | |

Household Products—0.6% | | | | |

| 4,000 | | Colgate-Palmolive Co. | | | 395,760 | |

| | | | | | | |

Industrial Conglomerates—2.9% | | | | |

| 5,000 | | 3M Co. | | | 446,800 | |

| 74,600 | | General Electric Co. | | | 1,460,668 | |

| | | | | | | |

| | | | | | 1,907,468 | |

| | | | | | | |

Insurance—0.6% | | | | |

| 5,000 | | The Chubb Corp. | | | 365,350 | |

| | | | | | | |

IT Services—3.7% | | | |

| 5,000 | | Accenture PLC—Class A | | | 324,750 | |

| 10,000 | | International Business

Machines Corp. | | | 2,070,800 | |

| | | | | | | |

| | | | | | 2,395,550 | |

| | | | | | | |

Leisure Equipment & Products—0.6% | | | | |

| 10,000 | | Hasbro, Inc. | | | 367,400 | |

| | | | | | | |

Machinery—2.1% | | | | |

| 5,000 | | Caterpillar, Inc. | | | 513,850 | |

| 7,000 | | Joy Global, Inc. | | | 495,390 | |

| 4,000 | | Stanley Black & Decker, Inc. | | | 292,640 | |

| 10,000 | | Wabash National Corp. (a) | | | 83,700 | |

| | | | | | | |

| | | | | | 1,385,580 | |

| | | | | | | |

Media—0.4% | | | | |

| 7,692 | | CBS Corp.—Class B | | | 256,528 | |

| | | | | | | |

Multi-Utilities—1.0% | | | | |

| 50,000 | | Just Energy Group, Inc. | | | 657,488 | |

| | | | | | | |

Multiline Retail—0.6% | | | | |

| 10,000 | | Macy’s, Inc. | | | 410,200 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—5.1% | | | | |

| 6,000 | | Cenovus Energy, Inc. | | | 217,500 | |

| 59,000 | | CONSOL Energy, Inc. | | | 1,961,160 | |

| 8,000 | | El Paso Pipeline Partners LP | | | 270,960 | |

| 20,000 | | Penn Virginia Corp. | | | 102,400 | |

| 17,547 | | World Fuel Services Corp. | | | 773,121 | |

| | | | | | | |

| | | | | | 3,325,141 | |

| | | | | | | |

Pharmaceuticals—4.6% | | | | |

| 7,000 | | Abbott Laboratories | | | 434,420 | |

| 10,000 | | Eli Lilly & Co. | | | 413,900 | |

| 27,000 | | Johnson & Johnson | | | 1,757,430 | |

| 8,000 | | Teva Pharmaceutical

Industries, Ltd.—ADR | | | 365,920 | |

| | | | | | | |

| | | | | | 2,971,670 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

58

Schedule of Portfolio Investments—Continued

April 30, 2012 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Real Estate Investment Trusts—11.6% | | | | |

| 13,000 | | Boston Properties, Inc. | | $ | 1,407,250 | |

| 100,000 | | CBL & Associates Properties, Inc. | | | 1,863,000 | |

| 13,804 | | DDR Corp. | | | 204,299 | |

| 5,669 | | ProLogis, Inc. | | | 202,837 | |

| 23,823 | | Simon Property Group, Inc. | | | 3,706,859 | |

| 20,000 | | Two Harbors Investment Corp. | | | 209,200 | |

| | | | | | | |

| | | | | | 7,593,445 | |

| | | | | | | |

Road & Rail—1.1% | | | | |

| 10,000 | | Norfolk Southern Corp. | | | 729,300 | |

| | | | | | | |

Textiles, Apparel & Luxury Goods—1.6% | | | | |

| 5,000 | | PVH Corp. | | | 444,000 | |

| 4,000 | | VF Corp. | | | 608,200 | |

| | | | | | | |

| | | | | | 1,052,200 | |

| | | | | | | |

Thrifts & Mortgage Finance—0.4% | | | | |

| 21,500 | | New York Community

Bancorp, Inc. | | | 290,035 | |

| | | | | | | |

Trading Companies & Distributors—1.0% | | | | |

| 3,000 | | WW Grainger, Inc. | | | 623,460 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $41,573,636) | | | 47,409,122 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Bonds—21.4% | | | | |

U.S. Treasury Bonds—21.4% | | | | |

$ | 6,000,000 | | 6.000%, 02/15/2026 | | $ | 8,535,936 | |

| 4,000,000 | | 5.250%, 11/15/2028 | | | 5,419,376 | |

| | | | | | | |

| | | | | | 13,955,312 | |

| | | | | | | |

| | | Total Bonds

(Cost $11,945,579) | | | 13,955,312 | |

| | | | | | | |

Short-Term Investments—5.5% | | | | |

| 3,601,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 3,601,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $3,601,000) | | | 3,601,000 | |

| | | | | | | |

| | | Total Investments

(Cost $57,120,215)—99.5% | | | 64,965,434 | |

| | | Other Assets in Excess

of Liabilities—0.5% | | | 351,786 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 65,317,220 | |

| | | | | | | |

| | |

| | |

| |

Percentages are stated as a percent of net assets. |

| |

(a) | Non-income producing security. |

| |

AB—Aktiebolag is the Swedish equivalent of the term corporation. |

|

ADR—American Depositary Receipt |

|

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

|

PLC—Public Limited Company |

The accompanying notes are an integral part of these financial statements.

59

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

Schedule of Portfolio Investments

April 30, 2012 (Unaudited)

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

|

Municipal Bonds—98.6% | | | | |

Alabama—3.0% | | | | |

$ | 425,000 | | Bessemer Board of Education,

School Tax Warrants—Series A

(CS: Assured Guaranty Municipal)

2.000%, 02/01/2013 | | $ | 428,205 | |

| 2,370,000 | | Birmingham Airport Authority

Airport Revenue

(CS: AMBAC)

5.000%, 07/01/2012 | | | 2,382,916 | |

| 4,500,000 | | Chatom Industrial Development

Board Gulf Opportunity Zone

Revenue, Powersouth Energy

Cooperative—Series A, VRDN

(SPA: National Rural Utilities

Finance)

0.950%, 11/15/2038

(Putable on 05/15/2012) (a) | | | 4,500,495 | |

| 2,000,000 | | Chatom Industrial Development

Board Pollution Control

Revenue, Electric—Series C, VRDN

(SPA: National Rural Utilities

Finance)

0.950%, 12/01/2024

(Putable on 06/01/2012) (a) | | | 2,000,240 | |

| 6,280,000 | | Jefferson County Sewer Revenue

Capital Improvement

Warrants—Series D

5.000%, 02/01/2032 | | | 6,349,394 | |

| 1,150,000 | | Madison Industrial Development

Board Revenue, WL Halsey

Grocery Co., VRDN

(LOC: Regions Bank)

1.320%, 04/01/2016

(Putable on 05/07/2012) (a) | | | 1,150,000 | |

| 5,915,000 | | Mobile Downtown Redevelopment

Authority Revenue, Lafayette

Plaza Hotel Project—Series A, VRDN

(LOC: Regions Bank)

0.970%, 05/01/2032

(Putable on 05/07/2012) (a) | | | 5,915,000 | |

| 20,000,000 | | Mobile Industrial Development

Board Pollution Control Revenue,

Alabama Power Co., Barry Plant,

VRDN

(CS: Alabama Power Co.)

0.750%, 07/15/2034

(Putable on 08/22/2012) (a) | | | 20,006,600 | |