UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21210

Alpine Income Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for

Service) | | Copy to: |

| | | |

Samuel A. Lieber

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, New York 10577 | | Rose DiMartino

Attorney at Law

Willkie Farr & Gallagher

787 7th Avenue, 40th Floor

New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2013 – April 30, 2014

Item 1: Shareholder Report

Table of Contents

Additional Alpine Funds are offered in the Alpine Equity Trust. These Funds include:

| Alpine International Real Estate Equity Fund | Alpine Emerging Markets Real Estate Fund |

| | |

| Alpine Realty Income & Growth Fund | Alpine Global Infrastructure Fund |

| | |

| Alpine Cyclical Advantage Property Fund | Alpine Global Consumer Growth Fund |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

The President’s Letter

Are We There Yet?

Over the past five years and two months since the S&P 500® Index intraday low of just under 667, the Index appreciated to 1,884 on April 30, 2014. Indeed, new highs subsequent to April 30 have extended the strong gains of 2013. During the past five years, we have seen a gradual, if not steady, improvement in global economic and financial market conditions, most notably in the U.S. This has been reflected in the outperformance of the U.S. equity indices over broad global and emerging market indices (MSCI World Index and MSCI Emerging Market Index) since mid-2011 but in particular for 2013 through April 30, 2014. On a cumulative basis, the U.S. market has finally recouped the lost jobs which occurred during the 2008-2009 recession and we have seen improvements in unemployment rates of other countries although, broadly speaking, Europe is a notable laggard.

This painfully slow recovery has been accomplished not by economic strategy or fiscal policy but rather on the backs of the world’s major Central Banks. Japan has been a notable exception to this pattern of constrained action, albeit they too are relying upon flexible Central Bank policy. Fundamentally, quantitative easing (QE) in the U.S., via buying bonds related to treasuries and mortgages, is currently being reduced by “tapering” the amount. It is expected that the U.K. may continue its QE program for a little longer and that the European Central Bank (ECB) may also adopt a modified QE program. Japan will continue its QE program and will likely add more fiscal stimulus over the coming year in the form of tax cuts or financial incentives for targeted businesses and investments. Even the few countries which have been tightening monetary policies over the past year including India, China and Brazil, are expected to be nearly done. We may see further loosening of monetary policy in China imminently, followed by India and Brazil over the next year. The ultimate impact of these Central Bank policies is how commercial banks and/or capital markets provide additional funding for their clients. Differing banking/corporate/retail clientele relationships require varying mechanisms to transmit downstream the impact

of monetary policies in different countries. Suffice it to say, some countries have seen financial liquidity support the residential or retail capital sector via mortgages and car loans, while others have emphasized the corporate sector. For example, mortgage rates in the U.K. are almost exclusively ‘floating rate,’ which, in combination with the government’s “help to buy” 95% loan to value program means that a lot of capital has been injected into the household sector. In contrast, the U.S. where tight credit standards and banks’ continued caution on accepting high loan to value mortgages has, in fact, constrained the household sector. This, in turn, has dampened retail sales in the U.S. leading many marginal store chains to either contract or restructure operations, while in the U.K., retail sales were up 4% year over year.

Indeed, the big impact of financial liquidity in the U.S. has been the appreciation of stock and bond prices. This has created an ongoing surge in refinancing of corporate debt, which has significantly increased the earnings potential of many companies over the last number of years. Today’s historic low lending rates in Europe and near historic low rates in the U.S. might normally have been expected to fuel a resurgence in capital expenditures (capex) on new or improved production facilities or research activity by corporations. However, the continued poor utilization of superfluous or inefficient plants and machinery has, in combination with slow demand growth, limited corporate capital expenditures. Either demand must grow or such capacity must be eliminated before capex resumes.

Instead, corporations have been using their low cost of debt to fund either mergers and acquisitions (M&A), or return cash to shareholders via dividends or share buybacks. We have recently witnessed the largest overall aggregate dividend in history as Vodafone distributed $23.9 billion to shareholders while Apple distributed $30 billion in the form of share buybacks over 2013 in addition to their substantial dividend payouts. While the U.S. is the center of such activity, we believe it may spread increasingly across the globe. The U.S. has also been the center of the M&A activity as businesses seek to increase market share or expand to new products by acquiring them from other companies using inexpensive capital.

1

While this may work in positive fashion for both the acquirer and the seller in terms of delivering value for shareholders and growth going forward, it is not adding positive investment in new facilities or increased employment. Often “Merger Synergies” are derived from eliminating redundant jobs and production facilities. That said, we believe that over time, facilities expansion will take place if demand continues to recover and inefficient productive capacity is rationalized. Thus, eventually, the pace of job growth and then wages should accelerate.

Another effect of this significant flood of financial liquidity is that the financial markets have experienced rather low volatility, which many investors have viewed in recent years as a measure of reduced risk. Witness the CBOE SPX Volatility Index (VIX Index) which peaked in 2008 at a level of 80 and has averaged just over 20 for the past ten years. The historic low in January 2007 was at 9.9, while the level at the end of April 2014 was 13.4 and has subsequently dropped below 12 during the month of May. This does not mean that there is no volatility in the stock market as significant rotation has occurred among sectors such as biotech, software and mobile technologies which offer the prospect of great long term growth and, thus, command very high price to earnings ratios. By comparison, the best performing stocks on a year to date basis are interest sensitive stocks such as utilities and real estate investment trusts (REITs) which reflect the strong performance of U.S. Treasury bonds, which rallied from over 3.00% yield on December 31, 2013 to the April close of 2.65% and in May to levels below last July’s 2.48%.

Interest rates are still near historic lows. Further easing in Europe along with recent weak U.S. gross domestic product (GDP) performance and depressed retail sales in the U.S. are factors contributing to the current low rate environment, as is the uncertainty over broad global economic recovery. However, when economic activity picks up, possibly in the fall, and more likely next year as excess capacity continues to be absorbed, we would expect to see another reversal in bonds. We do not expect such a reversal would be as violent as last May’s spike in yields, when many leveraged participants utilizing similar carry trades or other forms of financing were forced to reduce positions and take losses. Over the medium term, we expect that sustained moderate growth in the U.S. with continued recapitalization of European banks in a pattern following the past several years’ recovery in the U.S. may unfold. We expect limited price pressure over the medium term but that eventual demand growth resulting in new orders will collide with reduced industrial capacity to gradually create modest upward pressure for prices and wages.

During the interim period though, we would expect politics to intrude on the global economy in different fashions as unhappy or dissatisfied electorates work to remove or change the existing regimes and bring in new or at least different political perspectives. While their promises may prove empty, many politicians will attempt to solve some of the pressing issues related to quality of life. We suspect this will precipitate increased spending on infrastructure, housing and healthcare. We believe that many politicians will not utilize taxation, nor print more debt to fund such activity. Instead an emphasis of government oversight utilizing corporate management and private investment capital, or so called public private partnerships (PPP) could become a larger component of delivering services to meet the needs of expanding global population centers. In other words, we expect that the major drivers of long-term economic activity, which include developed as well as emerging markets, will continue to be an underlying theme over coming quarters as well as years. That, combined with new technologies used to access, communicate and transact business, pleasure or daily needs, will continue to be significant factors as we strive to maintain efficiency and security in our daily lives. This will continue to drive the prospects for stock performance even when interest rates return to historically “normal” levels.

| Thank you for your interest and support. |

| |

| Sincerely, |

|

| |

Samuel A. Lieber

President |

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to individual fund letters for risks specific to that fund.

This letter and the letters that follow represent the opinions of the Funds’ management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice.

2

| Disclosures and Definitions |  |

Please refer to the Schedule of Portfolio Investments for each Fund’s holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Funds’ monthly distributions may consist of net investment income, net realized capital gains and/or a return of capital. If a distribution includes anything other than net investment income, the Funds will provide a notice of the best estimate of its distribution sources when distributed, which will be posted on the Funds’ website: www.alpinefunds.com, or can be obtained by calling 1-800-617-7616. We estimate that the Alpine Series and Income Trusts did not pay any distributions during the fiscal semi-annual period ending April 30, 2014 through a return of capital. A return of capital distribution does not necessarily reflect the Funds’ performance and should not be confused with “yield” or “income.” Final determination of the Federal income tax characteristics of distributions paid during the calendar year will be provided on U.S. Form 1099-DIV, which will be mailed to shareholders. Please consult your tax advisor for further information.

All investments involve risk. Principal loss is possible. A small portion of the S&P 500 yield may include return of capital; the 10-year Treasury yield does not include return of capital; Corporate bonds and High Yield Bonds generally do not have return of capital; a portion of the dividend paid by REITs and REIT preferred stock may be deemed a return of capital for tax purposes in the event the company pays a dividend greater than its taxable income. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The REIT and REIT preferred stock market are smaller than the broader equity and bond markets and often trade with less liquidity than these markets depending upon the size of the individual issue and the demand of the securities. Treasury notes are guaranteed by the U.S. Government and thus they are considered to be safer than other asset classes. Tax features of a Treasury Note, Corporate bond, Stock, High Yield bond, REITs and REIT preferred stock may vary based on an individual circumstances. Consult a tax professional for additional information. Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Standard & Poor’s Financial Services LLC (S&P) is a financial services company, a division of McGraw Hill Financial that publishes financial research and analysis on stocks and bonds. S&P is considered one of the Big Three credit-rating agencies, which also include Moody’s Investor Service and Fitch Ratings.

S&P assigns rating on a scale of ‘D’ to ‘AAA’, with ‘D’ the lowest/weakest rating, indicating a default, and ‘AAA’ the highest/strongest rating, indicating the strongest credit quality in S&P’s spectrum of credit ratings.

S&P incorporates a broad number of credit areas of each entity/municipality when assigning a bond rating to an entity’s debt instrument, including: (a) financial position, which encompasses liquidity metrics, cash reserves, non-liquid assets, liabilities, and other financial metrics; (b) debt position, which includes long and short-term bonded debt and other privately-placed notes/bonds, leases and other off-balance sheet liabilities; (c) pension and Other Post-Employment Benefits (OPEB); (d) socio-economic indices; (e) the aptitude and sophistication of management.

Earnings Growth and EPS Growth are not measures of the Funds’ future performance.

Diversification does not assure a profit or protect against loss in a declining market.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Equity Income Funds – Definitions

Barclays Capital High Yield Municipal Bond Index is the Muni High Yield component of the Municipal Bond Index. The Barclays Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market.

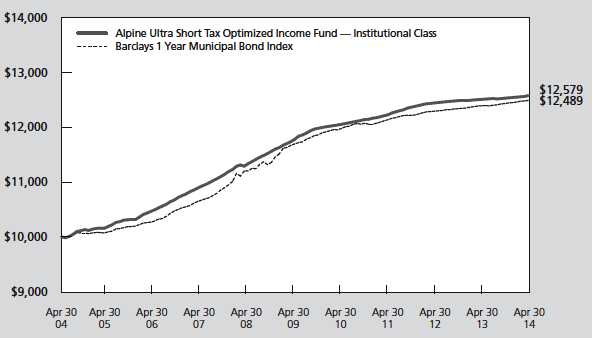

Barclays Capital 1 Year Municipal Bond Index is a total return benchmark of BAA3 ratings or better designed to measure returns for tax exempt assets.

Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Beta measures the sensitivity of the investment to the movements of its benchmark. A beta higher than 1.0 indicates the investment has been more volatile than the benchmark and a beta of less than 1.0 indicates that the investment has been less volatile than the benchmark.

Bloomberg 10-Year U.S. Muni General Obligation AAA Index is populated with U.S. municipal general obligations (G.O.) with an average rating of AAA from Moody’s and S&P, with an average maturity of ten years. The option-free yield curve is built using option-adjusted spread (OAS) model. Furthermore, the index is derived

3

| Disclosures and Definitions (continued) |  |

from contributed pricing from the Municipal Securities Rulemaking Board (MSRB), new issues calendars and other proprietary contributed prices.

Book value is the net asset value of a company, calculated by subtracting total liabilities from total assets.

Capex (aka Capitalization Expenditure) are funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations.

CBOE Volatility Index (VIX Index) Chicago Board Options Exchange SPX Volatility Index reflects a market estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes.

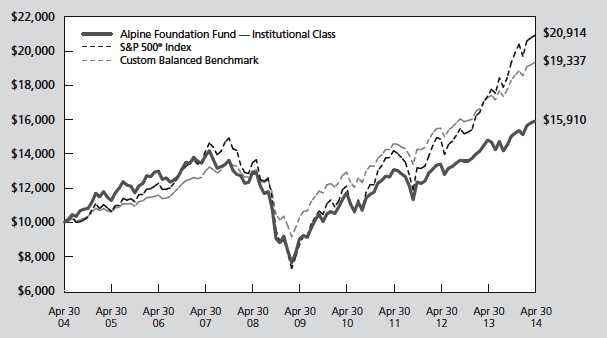

Custom Balanced Benchmark reflects an unmanaged portfolio (rebalanced monthly) of 60% of the S&P 500 Index, which is a market capitalization-weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market, and 40% of the Barclays Capital U.S. Aggregate Bond Index (BCAG), which is a widely recognized, unmanaged index of U.S. dollar-denominated investment-grade fixed income securities. The Fund may, however, invest up to 75% of its total assets in equity securities.

Effective Duration – Effective duration is a duration calculation for bonds with embedded options. Effective duration takes into account that expected cash flows will fluctuate as interest rates change. Please note, duration measures the sensitivity of price (the value of principal) of a fixed-income investment to a change in interest rates.

FICO is an American public company that provides analytics software and services-including credit scoring-intended to help financial services companies make complex, high-volume decisions. FICO also has clients outside of the financial services sector.

First Tier Security is any eligible security that: (i) is a rated security that has received a short-term rating from the requisite Nationally Recognized Statistical Rating Organizations in the highest short-term rating category for debt obligations (within which there may be subcategories or gradations indicating relative standing); or (ii) is an unrated security that is of comparable quality to a security meeting the requirements for a rated security as determined by the Fund’s Board of Trustees; or (iii) is a security issued by a registered investment company that is a money market fund; or (iv) is a government security.

Hedge involves making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions

Lipper Tax-Exempt Money Market Funds Average is an average of funds that invest in high quality municipal obligations with dollar-weighted average maturities of less than 90 days.

MSCI All Country World Index Gross USD is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

MSCI Emerging Markets Index USD is a free float-adjusted market cap weighted index that is designed to measure equity market performance in the global emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

MSCI Europe Utilities Index is designed to capture the large and mid-cap segments across 15 Developed Markets (DM) countries in Europe. All securities in the index are classified in the Utilities sector as per the Global Industry Classification Standard (GICS®). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

4

| |  |

MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries. With 1,610 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

NASDAQ Financial-100 Index includes 100 of the largest domestic and international financial securities listed on the NASDAQ Stock Market based on market capitalization. They include companies classified according to the Industry Classification Benchmark as Financials, which are included within the NASDAQ Bank, NASDAQ Insurance, and NASDAQ Other Finance Indexes.

S&P 500® Index is a float-adjusted, market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance.

Price/Earnings Ratio (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings. Normalized earnings - earnings metric that shows you what earnings look like smoothed out in the long run, taking into account the cyclical changes in an economy or stock.

Return on Equity is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

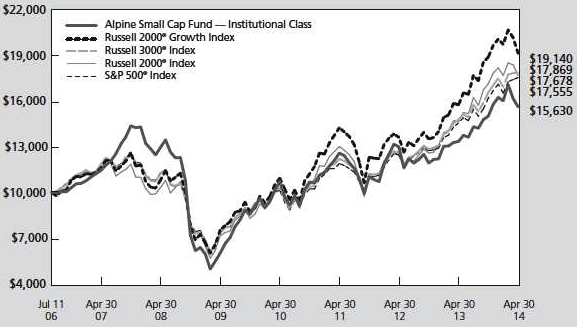

Russell 2000® Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000® Index. The Russell 2000 is by far the most common benchmark for mutual funds that identify themselves as “small-cap”, while the S&P 500® index is used primarily for large capitalization stocks. Source: Russell Investment Group. Russell is the owner of the trademarks and copyrights related to the Russell Indexes.

Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. Source: Russell Investment Group. Russell is the owner of the trademarks and copyrights related to the Russell Indexes.

S&P 500® Utilities Index comprises those companies included in the S&P 500® that are classified as members of the GICS® utilities sector.

Securities Industry and Financial Markets Association (SIFMA) is a United States industry trade group representing securities firms, banks, and asset management companies. SIFMA was formed on November 1, 2006, from the merger of the Bond Market Association and the Securities Industry Association.

S&P Municipal Bond Short Intermediate Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of one year and a maximum maturity of up to, but not including, eight years as measured from the Rebalancing Date.

Weighted Average Maturity is the average time it takes for securities in a portfolio to mature, weighted in proportion to the dollar amount that is invested in the portfolio. Weighted average maturity (WAM) measures the sensitivity of fixed-income portfolios to interest rate changes. Portfolios with longer WAMs are more sensitive to changes in interest rates because the longer a bond is held, the greater the opportunity for interest rates to move up or down and affect the performance of the bonds in the portfolio.

Yield Co – A publicly-traded company structured as a C-Corporation that is formed to own operating assets (often infrastructure assets) that are intended to produce a predictable cash flow, which is distributed to investors as dividends.

The S&P 500® Index, and the S&P Municipal Bond Short Intermediate Index (the “Indices”) are products of S&P Dow Jones Indices LLC and have been licensed for use by Alpine Woods Capital Investors, LLC. Copyright © 2014 by S&P Dow Jones Indices LLC. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written the permission of S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, its affiliates, and third party licensors make no representation or warranty, express or implied, with respect to the Index and none of such parties shall have any liability for any errors, omissions, or interruptions in the Index or the data included therein.

An investor cannot invest directly in an index.

5

Equity Manager Reports

| | Alpine Dynamic Dividend Fund | |

| | | |

| | Alpine Accelerating Dividend Fund | |

| | | |

| | Alpine Financial Services Fund | |

| | | |

| | Alpine Small Cap Fund | |

| | | |

| | Alpine Transformations Fund | |

| | | |

| | Alpine Foundation Fund | |

6

| Alpine Dynamic Dividend Fund |  |

| Comparative Annualized Returns as of 4/30/14 (Unaudited) | | | |

| | | 6 Months(1) | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Since Inception(2) |

| Alpine Dynamic Dividend Fund — Institutional Class | | | 5.65% | | | | 12.52% | | | | 0.79% | | | | 10.65% | | | | 2.92% | | | | 4.81% | |

| Alpine Dynamic Dividend Fund — Class A (Without Load) | | | 5.53% | | | | 12.24% | | | | N/A | | | | N/A | | | | N/A | | | | 13.17% | |

| Alpine Dynamic Dividend Fund — Class A (With Load) | | | -0.29% | | | | 6.15% | | | | N/A | | | | N/A | | | | N/A | | | | 10.46% | |

| MSCI All Country World Index | | | 5.48% | | | | 14.91% | | | | 7.94% | | | | 15.91% | | | | 7.82% | | | | 8.46% | |

| Lipper Global Equity Income Funds Average(3) | | | 6.18% | | | | 12.91% | | | | 7.99% | | | | 15.03% | | | | 6.17% | | | | 7.15% | |

| Lipper Global Equity Income Funds Ranking(3) | | | N/A(4) | | | | 67/122 | | | | 66/66 | | | | 50/50 | | | | 19/19 | | | | 15/15 | |

| Gross Expense Ratio (Institutional Class): 1.43%(5) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.38%(5) | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.68%(5) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.63%(5) | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Not annualized. |

| | (2) | Institutional Class shares commenced on September 22, 2003 and Class A shares commenced on December 30, 2011. Returns for indices are since September 22, 2003. |

| | (3) | The since inception return represents the period beginning September 25, 2003 (Institutional Class only). |

| | (4) | FINRA does not recognize rankings for less than one year. |

| | (5) | As disclosed in the prospectus dated February 28, 2014. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

The MSCI All Country World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. The Lipper Global Equity Income Funds Average is an average of funds that by prospectus language and portfolio practice seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend-paying securities of domestic and foreign companies. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The MSCI All Country World Index and the Lipper Global Equity Income Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Dynamic Dividend Fund has a contractual expense waiver that continues through February 28, 2015. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

7

| Alpine Dynamic Dividend Fund (continued) |  |

��

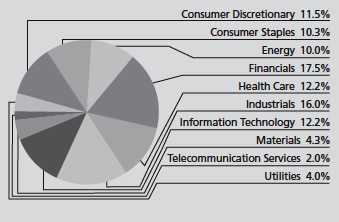

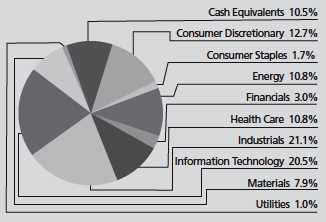

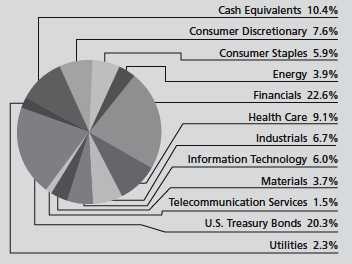

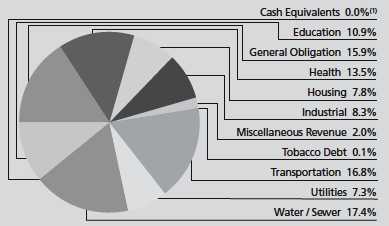

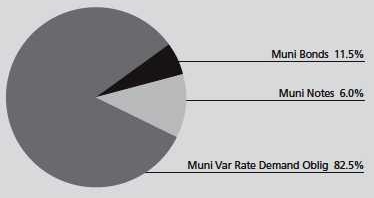

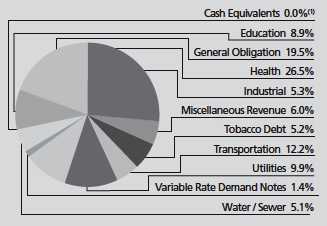

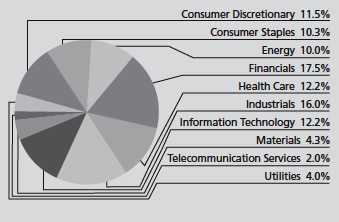

| Portfolio Distributions* (Unaudited) | |

| |

| Top 10 Holdings* (Unaudited) | |

| 1 | . | Roche Holding AG | 2.22 | % |

| 2 | . | Apple, Inc. | 2.19 | % |

| 3 | . | Vodafone Group PLC-ADR | 1.95 | % |

| 4 | . | Novartis AG-ADR | 1.78 | % |

| 5 | . | QUALCOMM, Inc. | 1.72 | % |

| 6 | . | Nestle SA | 1.65 | % |

| 7 | . | Avago Technologies, Ltd. | 1.61 | % |

| 8 | . | Covidien PLC | 1.57 | % |

| 9 | . | Canadian Pacific Railway, Ltd. | 1.52 | % |

| 10 | . | Comcast Corp.-Class A | 1.52 | % |

| | | | | |

| |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 04/30/14 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

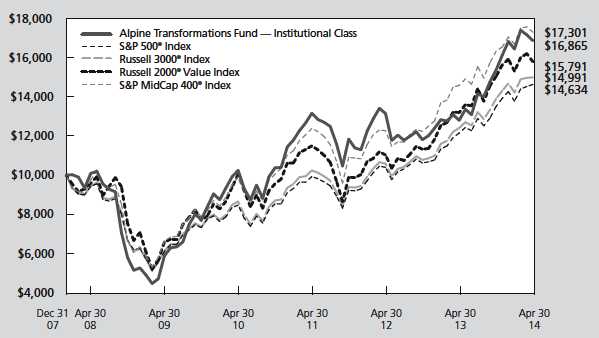

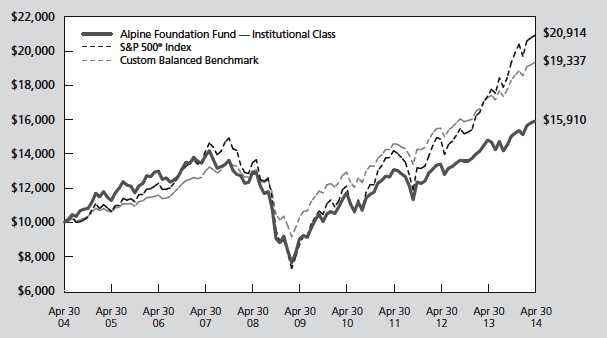

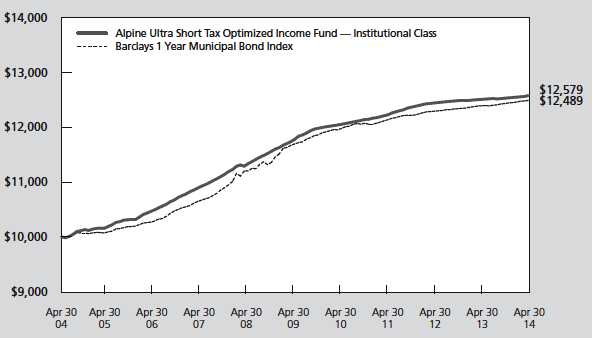

| Value of a $10,000 Investment (Unaudited) |

|

| |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

8

| Alpine Dynamic Dividend Fund (continued) |  |

Commentary

We are pleased to report the results for the Alpine Dynamic Dividend Fund (“ADVDX”) for the six month period ending April 30, 2014. For this period, the Fund generated a total return of 5.65%, versus the MSCI All Country World Index, which had a total return of 5.48%. All returns include reinvestment of all distributions. The Fund distributed $0.12 per share during the period.

Economic Analysis

Although stocks in most developed markets advanced during the six month period ending April 30, 2014, it was a volatile period characterized by a sell-off in emerging markets, increased geopolitical tensions and uncertainty in the United States amidst a transition in leadership at the Federal Reserve (the “Fed”). Economic data were mixed, with extremely cold weather affecting spending patterns in the United States this winter, and sluggish growth in Europe bringing a fresh round of deflation worries. That said, macroeconomic conditions in the United States and in the Eurozone continued to be broadly supportive of a moderate recovery.

We believe the slow recovery is the result of 1) the reluctance of U.S. banks to lend at the same levels as they did prior to the global financial crisis, 2) a less accommodative fiscal policy in the United States, and 3) a still sluggish U.S. housing market plagued by historically low mortgage originations. Bond yields in the United States remained low as the Fed reassured investors that despite the tapering of quantitative easing, interest rates would remain low for an extended period. Consequently, interest rate-sensitive sectors in the U.S. outperformed more cyclical sectors, with U.S. utilities up 13.63% as measured by the S&P 500® Utilities Index in the period. European sovereign yields decreased with both the Italian and Spanish ten-year yields dropping to multi-year lows, driving a similar rally with European utilities up 13.79% (in USD) as measured by the MSCI Europe Utilities Index. Emerging markets continued to lag behind developed markets in the period, with the MSCI Emerging Markets Index posting a total return of -2.98% vs. 8.59% for the MSCI Europe Index, 8.35% for the S&P 500 Index, and 5.48% for the MSCI All Country World Index. In Brazil, potential risk of power rationing was complicated by election politics. In China, the tightening of credit conditions and the consequent slowing of growth weighed on sectors dependent on government spending. Finally, the Russian annexation of Crimea brought investor concern about further aggression and the resulting economic impacts.

Portfolio Analysis

For the six month period ending April 30, 2014, the information technology and industrials sectors had the greatest positive effect on the Fund’s total return. In the information technology sector, the Fund benefited from its exposure to companies that had a specific catalyst such as Avago Technologies, with its accretive acquisition of LSI Corporation. In the industrials sector, the Fund benefited from owning companies with transformational events such as Abengoa SA, which is in the midst of a dramatic restructuring plan involving asset sales, debt reduction and the formation of a “yield co”. Financials and energy were the sectors that had the greatest negative effect on total return. Financials underperformed due to the Fund’s exposure to several global banks located outside of the United States. In the energy sector, the fund underperformed primarily due to its exposure to Scorpio Tankers, which suffered from near term demand weakness in the product tanker market caused by an unusually cold winter among other transient factors.

The top five stocks contributing to the Fund’s performance for the six month period ended April 30, 2014 based on contribution to total return, were Avago Technologies, Abengoa SA, Adani Ports & Special Economic Zone Ltd, Apple, and Walgreen Co.

Semiconductor manufacturer Avago Technologies received a boost during the period due to the announcement of its highly accretive acquisition of LSI Corporation. From a fundamental standpoint, Avago continued to benefit from the roll out of next generation (4G LTE) wireless networks. In addition, two of the company’s competitors in the market announced plans to merge their businesses, which we believe should be a long term positive for the industry.

Abengoa SA , an engineering and construction company focusing on the energy and water sectors, continued to execute on its turnaround plan, announcing new projects awards, further asset sales and additional debt reduction. In addition, it announced the plan to form a “yield co”, which would allow it to sell concessions from the parent company to a newly formed company, potentially allowing Abengoa to unlock significant value from its owned concessions.

Adani Ports & Special Economic Zone Ltd is a shipping port primarily on the west coast of India. The company reported strong growth in port traffic and announced a potential strategic acquisition of Dhamra Port on the eastern coast of India. The stock also rallied in anticipation of Narendra Modi (a charismatic, pro-business candidate) winning India’s general election.

9

| Alpine Dynamic Dividend Fund (continued) |  |

Innovative technology leader Apple was a positive contributor to the Fund after it reported second quarter results in which iPhone sales and gross margins were better than expected. Apple capitalized on its momentous deal to sell iPhones on China Mobile’s vast network. Furthermore, the company announced a $30 billion share buyback and a dividend increase.

Walgreen Co, the largest drugstore chain in the United States with over 8,600 stores, outperformed during the period as the company continued to reap the benefits of its highly accretive and strategic acquisition of UK retailer and pharmaceutical wholesaler Alliance Boots. The company also capitalized on the wave of generic drug launch activity through its distribution agreement with AmerisourceBergen, which allowed Walgreen to benefit from greater purchasing scale, distribution efficiencies and global growth opportunities.

The following stocks had the largest adverse impact on the performance of the Fund based on contribution to total return for the six month period ended April 30, 2014: Sberbank Russia OJSC., Scorpio Tankers, American Eagle Outfitters, East Japan Railway Company, and Corrections Corporation of America.

Sberbank Russia OJSC, Russia’s largest bank, underperformed during the period as the escalation of political turmoil in Ukraine led to concerns about a slowdown in Russia and its impact on loan growth and nonperforming loans. Fundamentally, the company continued to perform well with strong loan growth and solid cost controls, but provisioning expenses rose, reflecting the deteriorating macro environment.

Scorpio Tankers, which owns the world’s largest and most modern fleet of refined oil product tankers, underperformed during the period as an extremely cold winter increased domestic fuel demand, decreasing the attractiveness of shipping European gasoline to the U.S. and putting downward pressure on spot rates for product tankers.

American Eagle Outfitters is a specialty retailer of apparel targeting 15 to 25-year-olds. The company reported declining sales and gross margins for its 4th quarter, driven by poor customer response to the company’s core fashion merchandise, and exacerbated by weak traffic and a highly promotional retail environment. In addition, in January the CEO unexpectedly stepped down. We no longer own shares of the stock.

East Japan Railway Company is one of Japan’s leading rail carriers. The company’s shares underperformed during the period as investors took profits after a total return of over 25% (USD) in calendar 2013, and some concern that the April 2014 consumption tax increase may impact demand. We believe that the company is undervalued

due to its strong rail franchise and its underappreciated real estate, and thus continue to hold the stock.

Shares of Corrections Corp of America (CXW), an operator of prisons for state and federal government, suffered from uncertainty about the future of the California corrections market, one of its largest markets. A string of delays throughout 2013 eventually ended with a disappointing judicial decision in February 2014 that granted the state an additional two years to comply with laws meant to reduce overcrowding in prisons. With the ruling, CXW lost the opportunity to fill out-of-state beds with California inmates. While disappointing, the company still has a solid pipeline of non-California opportunities, and the long term opportunity for private prisons to increase their market share above the current 10% is still attractive.

In order to achieve its dividend, the Fund participates in a number of dividend capture strategies including (1) purchasing shares in the stock of a regular dividend payer before an upcoming ex-date and selling after the ex-date, (2) purchasing shares before an anticipated special dividend and selling opportunistically after the ex-date of the dividend, and (3) purchasing additional shares in stocks that the Fund already owns before the ex-date and selling the original shares after the ex-date, thus receiving a dividend on a larger position while still maintaining qualified dividend income eligibility (“QDI”) on its position. Although these strategies have resulted in higher turnover and associated transaction costs for the Fund, overall the Fund’s turnover rate has decreased as we have relied less upon these strategies this year. While there is the potential for market loss on the shares that are held for a short period, we seek to use these strategies to generate additional income with limited impact on the construction of the core portfolio.

We have hedged a portion of our currency exposures to the Euro, Swiss Franc, Japanese Yen and British Pound in an effort to reduce our net currency exposure.

Summary

We believe that global macroeconomic conditions generally remain positive for stocks, although the market environment remains fairly uncertain. In developed markets, we are mindful that expectations have continued to rise as growth has returned and financial risks have largely faded. In the United States, fiscal policy should be less of a drag and monetary policy will likely remain quite accommodative as the Federal Reserve unwinds its quantitative easing program at a measured pace. In Europe, we see similar characteristics but believe equity valuations are slightly more attractive, and the European Central Bank’s dovish bias should provide good support for stocks. In emerging markets, we see a mixed

10

| Alpine Dynamic Dividend Fund (continued) |  |

picture with better underlying economic growth, temporarily overshadowed by upcoming presidential or parliamentary elections in countries such as Brazil, India, South Africa and Turkey. This macro backdrop together with our view that equity market valuations are fairly robust, lead us to continue to take a more conservative investment stance.

Beyond the macroeconomic environment, the Fund continues to emphasize its focus on what we view as high quality companies with strong balance sheets and strong potential to grow earnings and dividends amidst an uncertain macro environment. Despite the extended bull

market we have experienced in several markets across the globe, we believe there are still plenty of opportunities to invest in companies with a history of paying strong dividends at attractive prices with potential for solid earnings growth. We will continue to adapt our investment approach as economic conditions change and look forward to discussing the portfolio and the prospects for the Fund in future communications.

Sincerely,

Brian Hennessey

Joshua E. Duitz

Portfolio Managers

11

| Alpine Dynamic Dividend Fund (continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole. Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The fund is subject to risks, including the following:

Credit Risk – Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future. The Fund may hold securities for short periods of time related to the dividend payment periods and may experience loss during these periods.

Emerging Market Securities Risk – The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates. The Fund may enter into forward foreign currency exchange contracts in order to protect against possible losses on foreign investments resulting from adverse changes in the relationship between the U.S. dollar and foreign currencies. Although this method attempts to protect the value of the Fund’s portfolio securities against a decline in the value of a currency, it does not eliminate fluctuations in the underlying prices of the securities and while such contracts tend to minimize the risk of loss due to a decline in the value of the hedged currency, they tend to limit any potential gain which might result should the value of such currency increase.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investment are heightened when investing in issuers of emerging market countries.

12

| Alpine Dynamic Dividend Fund (continued) |  |

Growth Stock Risk – Growth stocks are stocks of companies believed to have above-average potential for growth in revenue and earnings. Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Qualified Dividend Tax Risk – Favorable U.S. federal tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Swaps Risk – Swap agreements are derivative instruments that can be individually negotiated and structured to address exposure to a variety of different types of investments or market factors. Depending on their structure, swap agreements may increase or decrease the Fund’s exposure to long- or short-term interest rates, foreign currency values, mortgage securities, corporate borrowing rates, or other factors such as security prices or inflation rates. The Fund also may enter into swaptions, which are options to enter into a swap agreement. Since these transactions generally do not involve the delivery of securities or other underlying assets or principal, the risk of loss with respect to swap agreements and swaptions generally is limited to the net amount of payments that the Fund is contractually obligated to make. There is also a risk of a default by the other party to a swap agreement or swaption, in which case the Fund may not receive the net amount of payments that the Fund contractually is entitled to receive.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 3-5 for other important disclosures and definitions.

13

| Alpine Accelerating Dividend Fund |  |

| Comparative Annualized Returns as of 4/30/14 (Unaudited) | | |

| | | | | | | | | | | |

| | | 6 Months(1) | | | 1 Year | | | 3 Years | | | 5 Years | | | Since Inception(2) |

| Alpine Accelerating Dividend Fund — Institutional Class | | | 8.47% | | | | 18.67% | | | | 11.60% | | | | 16.93% | | | | 15.03% | |

| Alpine Accelerating Dividend Fund — Class A (Without Load) | | | 8.34% | | | | 18.30% | | | | N/A | | | | N/A | | | | 18.98% | |

| Alpine Accelerating Dividend Fund — Class A (With Load) | | | 2.40% | | | | 11.81% | | | | N/A | | | | N/A | | | | 16.13% | |

| S&P 500® Index | | | 8.35% | | | | 20.43% | | | | 13.82% | | | | 19.13% | | | | 14.63% | |

| Dow Jones Industrial Average | | | 7.90% | | | | 14.44% | | | | 11.85% | | | | 18.32% | | | | 13.52% | |

| Lipper Equity Income Funds Average(3) | | | 7.37% | | | | 16.31% | | | | 11.68% | | | | 17.51% | | | | 15.20% | |

| Lipper Equity Income Funds Ranking(3) | | | N/A(4) | | | | 109/436 | | | | 190/315 | | | | 180/270 | | | | 152/268 | |

| Gross Expense Ratio (Institutional Class): 3.43%(5) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.35%(5) | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 3.68%(5) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.60%(5) | | | | | | | | | | | | | | | | | | | | |

| | (1) | Not annualized. |

| | (2) | Institutional Class shares commenced on November 5, 2008 and Class A shares commenced on December 30, 2011. Returns for indices are since November 5, 2008. |

| | (3) | The since inception data represents the period beginning November 6, 2008 (Institutional Class only). |

| | (4) | FINRA does not recognize rankings for less than one year. |

| | (5) | As disclosed in the prospectus dated February 28, 2014. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

The S&P 500® Index is a float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally the leaders in their industry. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500® Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Accelerating Dividend Fund has a contractual expense waiver that continues through February 28, 2015. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

14

| Alpine Accelerating Dividend Fund (continued) |  |

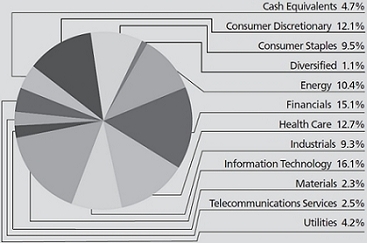

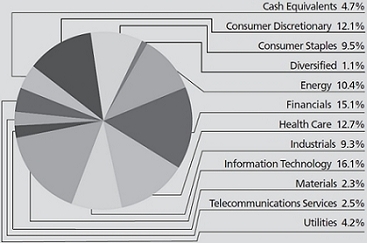

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) | |

| 1 | . | Apple, Inc. | 2.11 | % |

| 2 | . | Avago Technologies, Ltd. | 1.74 | % |

| 3 | . | Becton, Dickinson & Co. | 1.66 | % |

| 4 | . | Energizer Holdings, Inc. | 1.64 | % |

| 5 | . | Suncor Energy, Inc. | 1.62 | % |

| 6 | . | Bristow Group, Inc. | 1.61 | % |

| 7 | . | TE Connectivity, Ltd. | 1.61 | % |

| 8 | . | Schlumberger, Ltd. | 1.60 | % |

| 9 | . | AbbVie, Inc. | 1.59 | % |

| 10 | . | Comcast Corp.-Class A | 1.58 | % |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 04/30/14 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

| Value of a $10,000 Investment (Unaudited) |

|

| |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

15

| Alpine Accelerating Dividend Fund (continued) |  |

Commentary

For the six months ended April 30, 2014, the Alpine Accelerating Dividend Fund generated a total return of 8.47%. This compares with a total return of 8.35% for the S&P 500® Index for the same period. During the last six months, the Fund steadily increased its monthly per share distribution from $0.0409 in October, 2013 to $0.0415 in April, 2014. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

PERFORMANCE DRIVERS

The Fund generally prefers to take a more conservative investment stance with regard to portfolio construction and security selection during times of economic and geopolitical uncertainty. We believe that the six months ended April 30, 2014 was such a time. For this reason, the Fund had an average cash holding of 4.5% during the fiscal half year and a portfolio beta less than 1.0 during the same span. Despite this conservative positioning, the Fund was able to slightly outperform the S&P 500® Index for the six months ended April 30, 2014 due, in part, to stock selection.

On a sector basis, information technology, financials, and industrials had the largest impact on the absolute performance of the Fund. While still making positive absolute contributions, the telecommunication services, materials, and consumer discretionary sectors had the smallest impact. On a relative basis, the financial sector generated the largest outperformance versus the S&P 500® Index, followed by the information technology and industrials sectors. Energy, health care, and materials sectors were the worst relative performers.

PORTFOLIO ANALYSIS

The top five stocks contributing to the Fund’s performance during the six months ended April 30, 2014, based on contribution to total return were Avago Technologies, NorthStar Realty Finance, SES SA, Marten Transport, and Teva Pharmaceutical Industries.

| • | | Semiconductor manufacturer Avago Technologies received a boost during the period due to the announced acquisition of LSI Corporation. The purchase should be strongly accretive to earnings immediately after closing. From a fundamental standpoint, Avago continued to benefit from the roll out of next generation (4G LTE) wireless networks. The company has been gaining share in the marketplace as a technology leader. Plus, two of the company’s competitors in the market announced plans to merge their businesses, which should be a long term positive for the industry. |

| • | | Shares of NorthStar Realty Finance, a commercial mortgage Real Estate Investment Trust (REIT), enjoyed a strong rally beginning in December 2013 when the company announced that it would be spinning off its asset management business into a separate publicly traded C-corp. Investors cheered the news as the new asset management company could trade at meaningfully higher multiples than the legacy REIT. Additionally, NRF unveiled several strategic initiatives including an investment into RXR Realty, a private real estate company focused on New York City and the tri-state area. |

| | | |

| • | | Satellite operator SES’ shares rallied during the early part of the calendar year as investors began to appreciate the company’s ability to generate strong cash flow and the defensive nature of its business provided a relative sense of stability in a choppy market. Following a disappointing 2013, SES appears set to resume its steady mid-single-digit top line growth model in 2014. |

| | | |

| • | | An improving outlook for truckload freight transport has led to a strong performance for shares of Marten Transport, one of the largest truckload carriers focused on the temperature controlled market. Additionally, Marten’s business transformation from a long haul focus to a more regional model has resulted in solid improvement in asset utilization, better yields, and reduced deadhead miles. These factors bode well for the shares, in our view, as the stock trades at attractive levels relative to its peers. |

| | | |

| • | | There were several events over the first half of the fiscal year that contributed to the strong performance in Teva Pharmaceuticals shares – activist shareholders have taken an interest in the company, Teva has been the subject of merger and acquisition (M&A) speculation in the sector, and the CEO was replaced in early February by a well-regarded turnaround specialist. In addition, the underlying business has held up a bit better than expected. |

| | | |

| GNC Holdings, Pier 1 Imports, J.M. Smucker, Corrections Corporation of America , and Dawson Geophysical had the largest adverse impact on the performance of the Fund over the fiscal half year. |

| | | |

| • | | GNC Holdings shares had a poor start to the year as the underlying business stalled as we exited 2013 and it continued into the early part of 2014. Weather was one of the factors contributing to the disappointing performance but there are still some concerns that |

16

| Alpine Accelerating Dividend Fund (continued) |  |

| | | the issues may be more ongoing in nature. The shares were also hit by headlines about the safety of some of the products sold in their stores. |

| | | |

| • | | Retailer Pier 1 had a difficult start to the year. After posting solid results in mid-December, the company was hit by the weather-related issues that had an impact on much of the retail landscape. This caused management to take down its expectations three times during the first quarter. Given the multiple revisions, investors became concerned that there may be more issues in the underlying business. Housing-related names were also weak in the period as housing data experienced some slowing in the period. |

| | | |

| • | | Like many of its branded food peers, the JM Smucker Company has struggled to grow volumes given a difficult consumer spending environment. In addition, sales of its coffee K-Cups have slowed dramatically as new entrants into the market have vastly increased competition. Finally, given its large exposure to packaged coffee segment through its Folgers brand, investor sentiment has soured for the shares as prices for green coffee beans have surged due to the ongoing drought in Brazil. |

| | | |

| • | | Shares of Corrections Corp of America (CXW), an operator of prisons for state and federal government, suffered from uncertainty about the future of the California corrections market, one of its largest markets. A string of delays throughout 2013 eventually ended with a disappointing judicial decision in February 2014 that granted the state an additional two years to comply with laws meant to reduce overcrowding in prisons. With the ruling, CXW lost the opportunity to fill out-of-state beds with California inmates. |

| | | |

| • | | A stretch of bad weather this past winter as well as some operational hiccups has caused Dawson Geophysical to report a string of weaker than expected quarterly results. Additionally, the company is contending with a still challenging environment for its onshore seismic data acquisition service offering. Despite the recent challenges, we remain bullish on Dawson’s long-term prospects given its |

| | | investment in cutting edge equipment and its strong balance sheet. |

SUMMARY & OUTLOOK

As we look toward the balance of 2014, we see a market environment that remains fairly uncertain. The U.S. continues to grow below trend while contending with a partisan environment in Washington D.C. In December 2013, the Fed announced its intention to begin to taper its quantitative easing (QE3) program, and the market continues to grapple with the consequences of the Fed’s actions on all corners from Treasury yields to emerging market equities. In Europe, growth continued to be sluggish and the specter of deflation cannot be overlooked. Indeed, the European Central Bank continued to strike a dovish tone with its commitment to accommodative short rates for as long as needed to stimulate the economy and combat inflation deemed to be too low. Emerging markets (EM) appear to be undergoing a difficult transition from a world awash in liquidity to one where liquidity isn’t quite so abundant, although investment flows continue to create upside and downside volatility in the various EM equity markets. This macro backdrop together with our view that equity market valuations are fairly robust, lead us to continue to take a more conservative investment stance.

Beyond the macroeconomic environment, the Fund continues to emphasize its focus on what we view as quality companies with strong balance sheets that have a demonstrated track record of increasing and/or accelerating dividends. In addition, we remain on the lookout for stocks with the potential to initiate, grow, or accelerate their dividends over time. Although this strategy may lag behind the market in periods of robust returns, we believe it provides a more attractive risk/return profile over the long run. In conclusion, similar to the stocks in which we seek to invest, the Fund aims to provide a steadily rising distribution to its investors.

We thank our shareholders for their support.

Sincerely,

Bryan Keane

Andrew Kohl

Portfolio Managers

17

| Alpine Accelerating Dividend Fund (continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole. Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future or the anticipated acceleration of dividends could not occur.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investments are heightened when investing in issuers in emerging market countries.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Although the Fund will not concentrate its investments in any one industry or industry group, it may, like many growth funds, weight its investments toward certain industries, thus increasing its exposure to factors adversely affecting issuers within those industries.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

18

| Alpine Accelerating Dividend Fund (continued) |  |

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 3-5 for other important disclosures and definitions.

19

| Alpine Financial Services Fund |  |

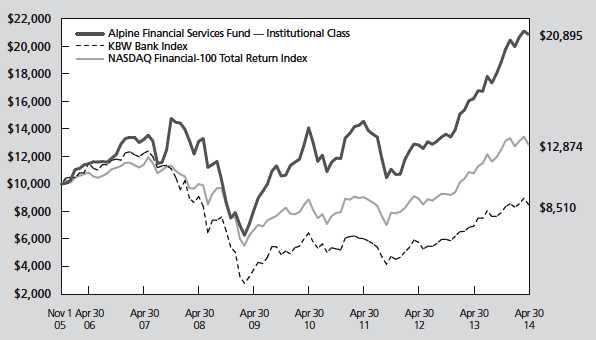

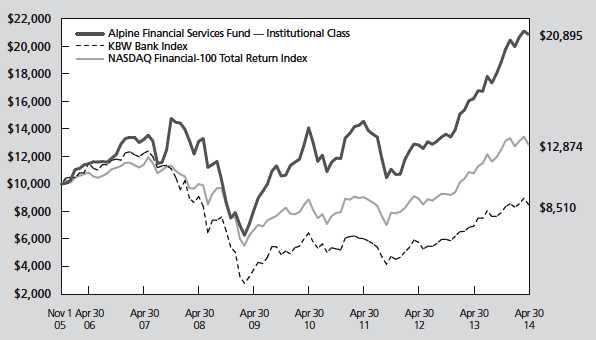

| Comparative Annualized Returns as of 4/30/14 (Unaudited) | | | | | | |

| | | 6 Months(1) | | | 1 Year | | | 3 Years | | | 5 Years | | | Since Inception(2) |

| Alpine Financial Services Fund — Institutional Class | | | 10.83% | | | | 28.89% | | | | 12.76% | | | | 21.00% | | | | 9.06% | |

| Alpine Financial Services Fund — Class A (Without Load) | | | 10.60% | | | | 28.46% | | | | N/A | | | | N/A | | | | 32.72% | |

| Alpine Financial Services Fund — Class A (With Load) | | | 4.54% | | | | 21.34% | | | | N/A | | | | N/A | | | | 29.55% | |

| KBW Bank Index | | | 7.56% | | | | 22.65% | | | | 12.16% | | | | 17.76% | | | | -1.84% | |