UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

|

|

Investment Company Act file number: 811-21210 | ||

|

|

|

|

| |

|

Alpine Income Trust |

|

(Exact name of registrant as specified in charter) |

|

2500 Westchester Avenue, Suite 215 |

|

(Address of principal executive offices)(Zip code) |

|

|

|

(Name and Address of Agent for |

| Copy to: |

|

|

|

Samuel A. Lieber |

| Rose DiMartino |

Alpine Woods Capital Investors, LLC |

| Attorney at Law |

2500 Westchester Avenue, Suite 215 |

| Willkie Farr & Gallagher |

Purchase, New York 10152 |

| 787 7th Avenue, 40th Floor |

|

| New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31, 2011

Date of reporting period: November 1, 2010 - April 30, 2011

Item 1: Shareholder Report

EQUITY & INCOME FUNDS

Alpine Dynamic Dividend Fund

Alpine Accelerating Dividend Fund

Alpine Dynamic Financial Services Fund

Alpine Dynamic Innovators Fund

Alpine Dynamic Transformations Fund

Alpine Dynamic Balance Fund

Alpine Ultra Short Tax Optimized Income Fund

Alpine Municipal Money Market Fund

April 30,

2011

Semi-Annual Report

|

TABLE OF CONTENTS |

|

|

|

|

|

|

| |

|

|

|

|

| 7 |

| |

|

|

|

|

| 14 |

| |

|

|

|

|

| 19 |

| |

|

|

|

|

| 24 |

| |

|

|

|

|

| 28 |

| |

|

|

|

|

| 32 |

| |

|

|

|

|

|

|

| |

|

|

|

|

| 37 |

| |

|

|

|

|

| 40 |

| |

|

|

|

|

| 46 |

| |

|

|

|

|

| 75 |

| |

|

|

|

|

| 78 |

| |

|

|

|

|

| 81 |

| |

|

|

|

|

| 89 |

| |

|

|

|

|

| 98 |

| |

|

|

|

|

| 112 |

| |

|

|

|

|

Additional Alpine Funds are offered in the Alpine Equity Trust. These funds include: | |||

|

|

| |

Alpine International Real Estate Equity Fund |

|

| |

|

|

| |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing. | |||

Mutual fund investing involves risk. Principal loss is possible. | |||

|

|

| Alpine’s Investment Outlook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dear Investor:

Recovery in Transition: Turning Credit into Jobs?

It is easy to be overwhelmed when sifting through the myriad data points and analyses of economic activity and business trends. Much of the information is providing a mixed picture which is unusual at this stage of a typical economic recovery. Even though the global economy has yet to recouple with the longer term growth trend, we believe that the world is still in a cyclical transition phase. Perhaps the single most important measure of economic prosperity and cyclical strength is job creation. However, it is unclear as to when many of the world’s developed economies will return to a sustainable higher level of full time employment. For the U.S., this would not only move unemployment from 9% to under 7%, but significantly reduce the debilitating number of long-term unemployed workers which has spiked to historic levels. How quickly we can achieve this goal of adding close to 3 million jobs to the U.S. economy will relate to the interplay of fiscal, demographic and political forces which all play roles in determining the probable rate of growth. Our economy is also subject to the influence of similar forces in other countries, many of whom are also encumbered by difficult economic circumstances. A higher proportion of countries are currently affected by a broad spectrum of maladies than I can recall over the past two decades. Many are suffering from isolated natural disasters or circumstances, while others reflect economic or societal imbalances. Thus, the duration of their impact will vary greatly. This may lead to a range of both opportunities or risks over the coming years.

An Extended Period of Transition

Globally, this recovery is both weaker and slower than the norm. Europe’s debt crisis and their decision to risk compounding the recession’s after effects with the potentially premature introduction of austerity measures has yet to be fully felt. Theoretically, austerity now will pave the way for future prosperity, but when will this be realized? The impact on the global supply chain from Japan’s tragic earthquake and tsunami, as well as other relatively less destructive yet, nonetheless, horrific natural

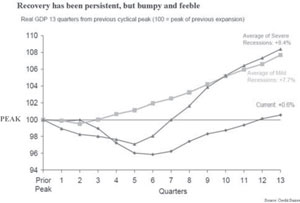

disasters around the world have all combined to slow economic growth. On top of this, civil protests, revolution and regional political change have impacted local economies and capital markets. Hopefully, the potential for multiple countries initiating major rebuilding efforts over the next few years may stimulate future growth. On top of these factors, China is leading other emerging market countries through a period of fiscal tightening. Such restraint is in response to an inflation scare, which in part relates to the emergence of growing middle class consumption trends in these countries. At the same time, China plans to further boost domestic consumption and is dramatically expanding the scale of its low cost social housing programs. Meanwhile, the U.S. economy has been further impacted by state and local government’s budget tightening and program cutting. The wind down of the Federal Reserve’s QE2 and other stimulus programs, as well as a shift in domestic consumer mentality towards saving for a rainy day and continued debt reduction is also dampening demand. For a better perspective of where this places us at this time in the cycle, please refer to Chart 1, below, which shows that the U.S. economy has been improving, but at a much slower rate than other recessions.

Chart 1:

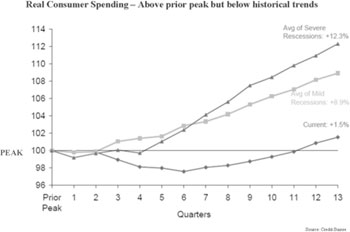

A Constrained Recovery in Consumption

Chart 2 shows the pattern of real consumer spending compared with historical trends. Higher food and fuel prices have clearly constrained the purchasing power of many Americans, as has tighter credit, and the trend

1

|

toward saving. However, the impact of fewer jobs and reduced job security are doubtless contributors. With an estimated 70% of U.S. GDP based on consumption, it is not surprising that the pace of recovery has been so slow. Since our imports have exceeded exports for many years, the global impact of our reduced spending has compelled other countries to expand their domestic consumption.

Chart 2:

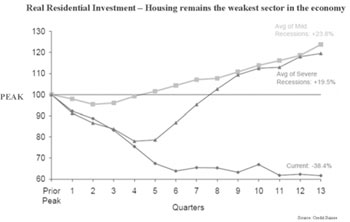

Dysfunctional Home Financing Remains a Problem

Historically, housing and automobile sales have been major drivers of prior economic recoveries due to the multiplier effect of creating jobs in many industries which would contribute to the final product. While the auto sector has improved we are buying cars at an annual rate at approximately 30% below the 2005 level. Meanwhile, permits to build new single family homes are almost 80% below peak levels of 2005 and almost 60% below the 50 year average volume!

Chart 3 illustrates the current trend of residential investment versus the patterns of prior housing recoveries. Today, a high proportion of home purchases are for cash, reflecting both the role of investors as well as the inability of banks to adjust their lending standards and clean up their poor performing loan portfolios.

Chart 3:

The creation of excessive capital beginning with ‘Y2K’ fears, followed by efforts to offset potential negative wealth effects from the ‘tech stock’ bubble bursting in 2001, combined with the poor regulatory and business decisions made over the last decade regarding the mortgage policies and the foreclosure process has led to devastating problems for many Americans. While the U.S. housing market remains under pressure almost six years past its peak, we do not believe that the current pattern of events reflects a structural shift in housing patterns, although we do think it will take at least another year of below trend housing growth before we see the light of recovery. Fundamental to creating a sustainable rebound will be a resurgence of strong job creation. The same will be true for other countries, including Ireland, Spain, and much of Eastern Europe and the Persian Gulf where capital for real estate exceeded growth in both income and populations. This is in sharp contrast with emerging markets which continue to grow in terms of their relative economic output, relative per capita incomes and, thus, relative level of prosperity.

Financial Markets and Politics in Transition

Alpine’s top down/bottom up investment approach takes into account not only macro economic fundamentals and demographic drivers of demand, but also societal themes and political trends which could influence both market psychology and fiscal policy, as well as business and consumer confidence. Sometimes these themes coalesce into a collective public will, as manifested through shifts in political power or even transformation of the political process itself. Clearly such a transition is continuing to play out in countries of North Africa and the Middle East. Over the next 18 months, politics will be a major factor for a number of countries and markets with elections in Thailand, Turkey, Egypt, Japan, France, Germany, Russia and the U.S. Even China will reconstitute its ruling council next year. By their nature, politicians will promise changes or highlight concerns, which could impact markets. We are already seeing a domestic ‘political theater’ play out in Congress, disguised as an ideological debate over budget deficits and the country’s ‘debt ceiling’, as a prelude to 2012 elections.

In light of these challenges, it is important to have perspective on the strong performance of global stocks since the “Great Recession” of 2008. Capital markets have transitioned towards recovery in advance of the economy, reflecting the return of significant liquidity to both debt and equity markets. However, there has been a bias towards both large and publicly traded companies at the expense of small businesses and private companies. Thus,

2

|

the slower pace of overall economic recovery is not reflected in the stronger relative performance of larger publicly traded companies which have access to capital and in many cases are still sitting on cash.

Given the depth and breadth of the financial frailties revealed in 2008, most central banks and treasuries chose to shore up major banks, rather than close them down. Even though the U.S. banking sector has stabilized and its viability is no longer impaired, the prospects for rejuvenating a fully functional mortgage market and small business lending capacity is not yet visible. Abroad, French and German banks remain critically exposed to weak loans in the Greek, Irish and Portuguese economies and, thus, have to continue to build reserves, while government stewardship of banks in England, Belgium and Iceland will continue for a number of years. For much of the emerging world, the banks are being required to raise their level of reserves in order to slow their pace of loan growth. Since these banks had little exposure to the bad loans leading up to 2008, this action should be viewed as fundamentally positive for strengthening long term lending capacity. Clearly, the global banking sector is still in a period of transition which may include further recapitalization and require years for full recovery at some banks.

We also see a transition in government fiscal policies. Just as the U.S. consumer has shifted towards savings in response to the ongoing deleveraging process, state and local revenues continue to lag due to moderating local retail sales tax receipts and declining property valuations. Declining assistance from the federal government to state and local governments is leading to a form of government austerity irrespective of the political posturing in Washington. European governments have already put significant fiscal austerity packages in place ranging from -3% to -5%, and this will have a greater impact on their economies than ours since over half of GDP is dependent upon the government sector in some countries. Even Europe’s extensive social safety nets may also become stretched by further contraction. However, the economic pressure on many politicians to produce for constituents will climb, just as the election season approaches. The natural tendency to ‘throw the bums out’ and let another party take on the reins of government may be very strong, but this often leads to fallow periods both before and after the election where little leadership is exerted or enacted which might otherwise provide economic stimulus. Thus, political transitions over the next 18 months might further slow the near term prospects for recovery.

From Despotism to Democracy?

The collective concerns of a people are rarely voiced when economic prosperity is widespread and opportunities for employment are plentiful. However, when a minority benefit to the detriment of the broad populace, where their leadership’s response to the distress of their people is to proverbially ‘let them eat cake’, then we see events unfold such as the “Jasmine Revolution” which unseated governments in Tunisia and Egypt, and spread with horrible effect so far to the people of Libya, Syria and Yemen. When 45% to 75% of disposable income is spent on food and the rest is split on shelter and clothes, a 10% to 20% hike in the price of food stuffs and cooking fuel could dramatically reprioritize one’s daily existence. Thus, the proverbial ‘straw which broke the camel’s back’ may have been mainly economic even though the underlying impetus for these political transitions included domestic and religious concerns. In this light, it is not surprising that some of the stronger emerging market economies have been raising minimum wages by double digit percentages over recent years. It may be inflationary but probably contributes long term stability.

Smoothing A Bumpy Transition to Greater Prosperity

Alpine remains sanguine on the prospects for the continued evolution of this business cycle even though some pundits believe that the era of extended business cycles is over because the unique period of falling interest rates from 1981 to the present softened downturns and sustained growth. Instead, a prolonged period of slower growth and measures to limit excess debt finance could moderate cyclical demand and supply imbalances. As a result, we believe that the current benign inflation trend can be continued in developed economies for a number of years, where the domestic expansion of emerging nations could be countered by higher domestic borrowing costs. Such an extended business cycle potentially permits the global economy to compound its gains and, hence, create more jobs than can a more volatile shorter cycle. Such a cycle might also smooth the evolution of emerging markets managing local resources, growing political and corporate transparency, enhancing positive demographic characteristics and pro-market fiscal policies can still have a significant impact on relative growth in GDP, per capita incomes, middle class expansion and attract foreign investment flows.

We believe the potential for the greatest value creation and earnings growth shall continue in countries such as Brazil, China, India and Indonesia, Thailand and the

3

|

Philippines. At the same time, strategically positioned nations, which include Australia, Norway and Singapore, could also be attractive. Naturally, companies with global operating platforms which can expand in growth focused economies, should also prosper. Many such companies are domiciled in Scandinavia, Germany, Canada and the U.S.

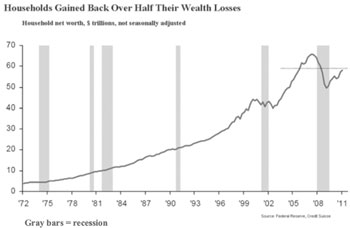

The prospect for an extended U.S. recovery is not bleak for those who can appreciate that the economic glass is now half full. The following, chart #4, shows that we have recovered half of the household wealth lost during the recession. The ongoing deleveraging of domestic balance sheets has reduced household credit market liabilities relative to household assets which fell from a peak of over 22% to about 18.5%, half way toward the 1990’s average level of 14.4%. If our economy can continue the restructuring of both bank and domestic balance sheets for another two years, it should be able to accelerate consumption and, hence, the job creation process.

Chart #4

We remain fundamentally positive that if this period of economic transition can be sustained for at least another three or four years then a solid employment base can be renewed. It is noteworthy that vast majority of the world’s central banks are still maintaining positive yield curves, which is fundamentally stimulative to economic activity by pushing investors to take on greater duration risk in return for significantly higher returns. As this long term capital is deployed, we believe it will also be focused in those regions or businesses with the greatest potential, irrespective of the country or sector in which it is deployed. As we all move further away from the financial tsunami of 2008, the market will transition to a more nuanced understanding of risk and return. However, this nuanced understanding typically comes from developing a balanced perspective of opportunity for both the upside and the downside of any investment. In that context, we hope you find the reports of our individual funds which follow to be informative.

We thank you for your interest in our funds.

|

Sincerely, |

|

Samuel A. Lieber |

4

|

|

Disclosures and Definitions |

|

Disclosure

Mutual fund investing involves risk. Principal loss is possible. Please refer to the individual fund letters for risks specific to each fund.

The President’s Letter and those that follow represent the opinion of Alpine Funds management and are subject to change, are not guaranteed, and should not be considered investment advice. The information provided is not intended to be a forecast of future events. Views expressed may vary from those of the firm as a whole.

Past performance is not a guarantee of future results.

Please refer to the schedule of investments for each fund’s holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Diversification does not assure a profit or protect against loss in a declining market.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Definitions

Book value is the net asset value of a company, calculated by subtracting total liabilities from total assets.

Build America Bonds are taxable municipal bonds that carry special tax credits and federal subsidies for either the bond issuer or the bondholder. Build America Bonds were created under Section 1531 of Title I of Division B of the American Recovery and Reinvestment Act that U.S. President Barack Obama signed into law on February 17, 2009.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Dividend Yield (Funds) represents the trailing 12-month dividend yield aggregating all income distributions per share over the past year, divided by the period ending fund share price. It does not reflect capital gains distributions.

Dividend Yield: The yield a company pays out to its shareholders in the form of dividends. It is calculated by taking the amount of dividends paid per share over a specific period of time and dividing by the stock’s price.

Earnings or Earnings Per Share Growth is a measure of a company’s net income over a specific period, generally one year, is a key indicator for measuring a company’s success, and the driving force behind stock price appreciation.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

Variable Rate Demand Note (VRDN): A debt instrument that represents borrowed funds that are payable on demand and accrue interest based on a prevailing money market rate, such as the prime rate. The interest rate applicable to the borrowed funds is specified from the outset of the debt, and is typically equal to the specified money market rate plus an extra margin.

5

|

|

|

|

| Alpine Dynamic Dividend Fund |

|

|

|

|

| Alpine Accelerating Dividend Fund |

|

|

|

|

| Alpine Dynamic Financial Services Fund |

|

|

|

|

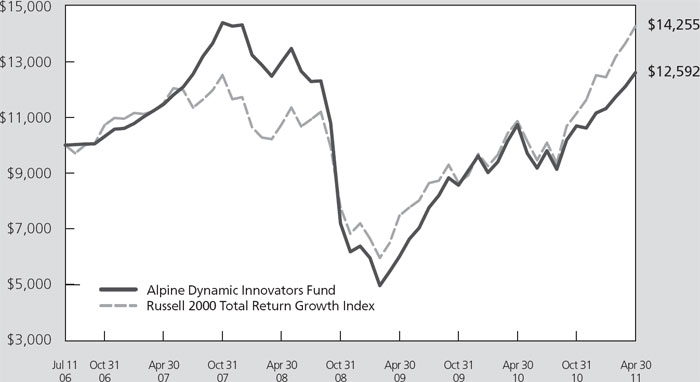

| Alpine Dynamic Innovators Fund |

|

|

|

|

| Alpine Dynamic Transformations Fund |

|

|

|

|

| Alpine Dynamic Balance Fund |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

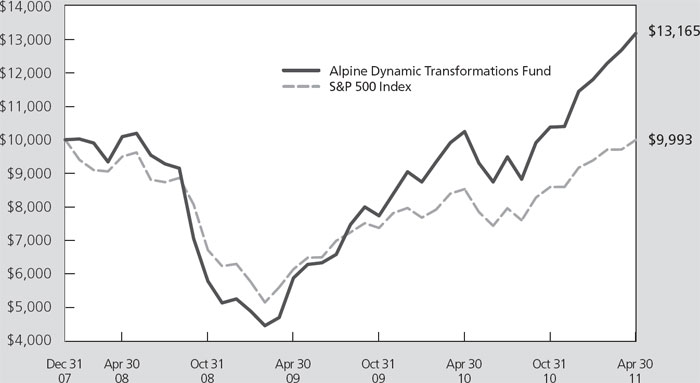

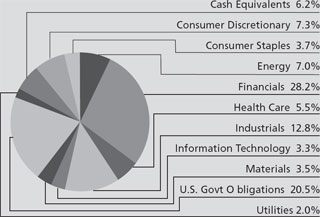

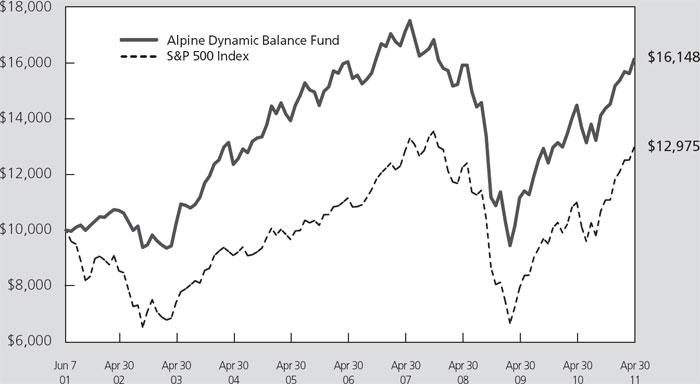

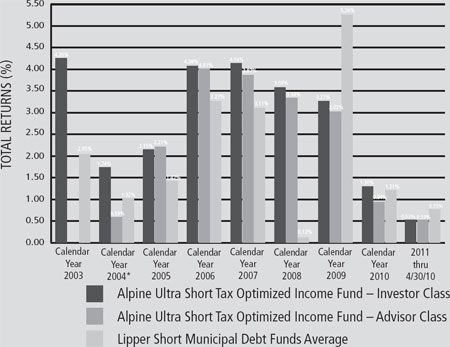

| ||||||||||||||||

Comparative Annualized Returns as of 4/30/11 (Unaudited) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6 Months (1) |

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

| |||||

Alpine Dynamic Dividend Fund |

| 21.75 | % |

| 22.11 | % |

| -4.77 | % |

| -1.52 | % |

| 6.44 | % |

|

S&P 500 Index |

| 16.36 | % |

| 17.22 | % |

| 1.73 | % |

| 2.95 | % |

| 5.77 | % |

|

STOXX Europe 600 Index(2) |

| 15.50 | % |

| 26.35 | % |

| -2.11 | % |

| 3.49 | % |

| 10.90 | % |

|

Lipper Global Multi-Cap Core Funds Average(3) |

| 13.86 | % |

| 18.25 | % |

| 0.61 | % |

| 2.10 | % |

| 7.66 | % |

|

Lipper Global Multi-Cap Core Funds Ranking(3) |

| N/A (4) |

| 25/141 |

| 93/93 |

| 70/70 |

| 38/47 |

| |||||

Gross Expense Ratio: 1.22%(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.22%(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Not annualized. |

(2) The since inception return represents the annualized return for the period beginning 9/30/2003. |

(3) The since inception return represents the annualized return for the period beginning 9/25/2003. |

(4) FINRA does not recognize rankings for less than one year. |

(5) As disclosed in the prospectus dated March 1, 2011. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 18 countries of the European region: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. The Lipper Global Multi-Cap Core Funds Average is an average of funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500 Index, the STOXX Europe 600 Index and the Lipper Global Multi-Cap Core Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Multi-Cap Core Funds Average reflects fees charged by the underlying funds. The performance for the Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

|

|

|

|

|

|

|

|

| ||||||||

| ||||||||||||||||

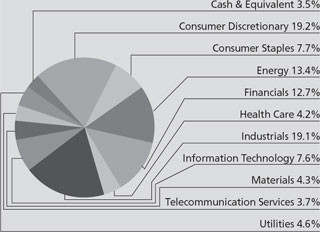

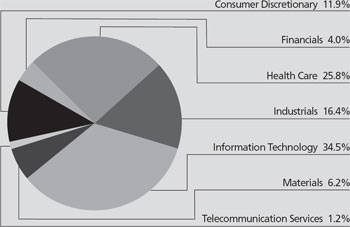

Portfolio Distributions* (Unaudited) |

| Top 10 Holdings* (Unaudited) |

|

| ||||||||||||

|

| 1. |

| ITC Holdings Corp. | 2.9 | % | ||||||||||

| 2. |

| Tele2 AB–B Shares | 2.8 | % | |||||||||||

| 3. |

| KKR & Co. Guernsey LP | 2.4 | % | |||||||||||

| 4. |

| Atlas Copco AB–A Shares | 2.3 | % | |||||||||||

| 5. |

| Marine Harvest ASA | 2.2 | % | |||||||||||

| 6. |

| Seadrill, Ltd. | 2.2 | % | |||||||||||

| 7. |

| Dollar Thrifty Automotive |

|

| |||||||||||

|

|

| Group, Inc. | 2.2 | % | |||||||||||

| 8. |

| Hyundai Motor Co. | 2.1 | % | |||||||||||

| 9. |

| International Business |

|

| |||||||||||

|

|

| Machines Corp. | 2.0 | % | |||||||||||

| 10. |

| JM AB | 1.9 | % | |||||||||||

|

|

|

|

| ||||||||||||

|

|

|

| |||||||||||||

|

|

|

|

| ||||||||||||

| * | As a percentage of net assets. Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security. | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||

7

|

|

Alpine Dynamic Dividend Fund |

|

|

|

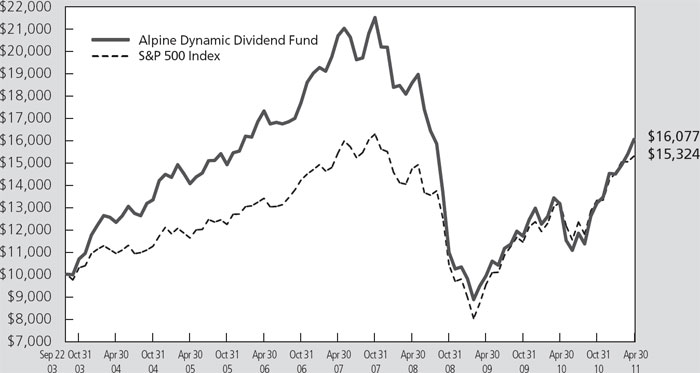

Value of a $10,000 Investment (Unaudited) |

|

|

|

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

|

Commentary |

We are pleased to report that the Alpine Dynamic Dividend Fund (ADVDX) completed its fiscal first half 2011 with strong capital appreciation in addition to distributing a high level of dividend income. For the six months ended 4/30/11, ADVDX provided a total return of 21.75% including dividend reinvestment, which compares favorably to a 16.36% increase in the S&P 500 Index and a 15.50% increase in the Dow Jones Euro STOXX 600 Index in U.S. dollar terms.

ADVDX provided an attractive dividend yield for our investors in fiscal first half 2011 in a still challenging equity income environment. The Fund has distributed a monthly dividend payment of $0.042 per share or $0.504 per share annualized. In addition, ADVDX distributed a special year end dividend payment of $0.036 per share on 12/30/10. Since inception on September 22, 2003, ADVDX has paid a total of $9.757 per share in earned dividend income.

ADVDX offers investors an opportunity for attractive yields and growth opportunities in US and international markets

The Fund’s primary goal continues to seek high current dividend income that qualifies for the reduced U.S. Federal tax rates on dividends while also focusing on total return for long-term growth of capital. We have strived to achieve our goals despite a difficult dividend investment environment and tremendous market volatility over the past several years.

We believe ADVDX is well positioned to provide our investors exposure to attractive capital appreciation opportunities in the U.S. as well as many international and emerging markets which are experiencing strong economic growth in addition to an opportunity for attractive dividend yields. The U.S. is one of the lowest yielding countries in the group of G20 nations with a 1.80% dividend yield on 4/29/11, so we can get much better yields overseas, for example, in Australia with a

8

|

|

Alpine Dynamic Dividend Fund |

|

3.98% current yield, Brazil at 3.38% and the UK at 3.12% on 4/29/11. Therefore, ADVDX has a significant portion of its assets invested overseas to help achieve our goal of high dividends and capital appreciation in comparison to the S&P 500 Index.

As of 4/30/11, the Fund had invested 46.1% of net assets in companies based in 14 different countries and 50.4% of its value in domestic U.S. companies, with 3.5% in cash and equivalents. At the end of the fiscal first half 2011, the Fund had 16.2% of the portfolio invested in emerging market countries including Brazil, China, India, South Korea, and Turkey. Following the United States, our current top five countries are Sweden, Brazil, Norway, the United Kingdom, and France.

We do not actively manage our country weightings – we pick our holdings on a stock-by-stock basis based on dividend potential and total return. We search for attractive value opportunities in the U.S., Europe, Latin America, and Asia. This bottoms-up approach had taken a large portion of our international holdings to the Euro region, as the dividend payout ratios remain higher than any other region. Given the continued uncertain outlook that still remains for the Euro region, we have strived to diversify our exposure in the region away from companies with Euro denominated currencies. On 4/30/11, approximately 28.0% of the Fund’s assets were invested in Europe, but only 3.6% in Euro denominated currencies, with the rest being in Norway, Sweden, and the UK. A portion of the gains of our equity positions in Europe, related to the appreciation of the Euro, were offset due to currency hedges entered into during the period.

We decided to hedge our currency exposure in Europe due to our concerns over the lingering sovereign debt crisis and we continue to diversify the portfolio globally with investments in Asia, South America, and Australia. These concerns did not materialize, and subsequent to the period ending 4/30/11, we have exited our position after the conclusion of our peak exposure during the dividend capture period. Our dividend capture strategy tends to be seasonally focused in Europe in the spring and that has begun to wind down and should be largely completed by June.

Our portfolio construction is illustrated by our top ten holdings

Throughout the fiscal first half 2011, we have continued to scan the globe searching for attractive dividend investment opportunities for our investors within these challenging global markets. The Fund combines three research-driven investment strategies – Dividend Capture, Value, and Growth – to maximize the amount

of distributed dividend income that is qualified for reduced U.S. Federal income tax rates and to identify companies globally with the potential for dividend increases and capital appreciation. The following sections illustrate these investment strategies using our top ten holdings as examples. The top ten holdings in ADVDX constituted 23.0% of assets as of 4/30/11.

Our “Dividend Capture Strategy” seeks to enhance the dividend income generated by the Fund

We run a portion of our portfolio with a dividend capture strategy, where we invest in high dividend stocks or in special situations where large cash balances are being returned to shareholders as one-time special dividends. We seek to enhance the dividend return of this portfolio by electively rotating a portion of our high yielding holdings after the 61-day ownership period required to obtain the reduced 15% dividend tax rate. QDI tax benefits have recently been extended by Congress through December 31, 2012. As a result, we will continue to pursue the Fund’s primary objective of high current dividend income that qualifies for the reduced federal tax rates on dividend.

In fiscal first half 2011, ADVDX participated in a total of 13 special dividends as companies distributed some of their record excess cash levels or cash was returned to shareholders due to corporate restructurings. This compares to 21 special dividends in ADVDX in fiscal first half 2010. Three of our current top 10 holdings are companies that have either recently announced large special dividends payments or there is a potential for a return of cash associated with a corporate action and we believe there is additional upside value to be realized following the dividend payment. These include Tele2, Atlas Copco, and Dollar Thrifty Group.

We search the globe looking for special dividend opportunities as is illustrated by one of our largest holding in ADVDX on 4/30/11, Tele2 AB (TEL2B SS). Based in Sweden, Tele2 is one of Europe’s largest telecommunications providers offering services in 11 countries in Europe. With a strong record of delivering profitable growth, Tele2 declared a combined ordinary and special dividend payment of nearly 19% of its market cap to be paid in May 2011. Approximately 1/3 of the dividend related to a recent tax case victory and the remaining was aimed at distributing excess cash and re-leveraging the balance sheet, which is still below the companies target range. We began acquiring Tele2 in January 2011 in anticipation of the special dividend and the stock has provided a total return of 21.94% in fiscal first half 2011 for ADVDX.

9

|

|

Alpine Dynamic Dividend Fund |

|

Another top 10 holding by weight and a top performing stock in the industrial sector was Atlas Copco AB (ATCOA SS). Based in Sweden, Atlas is a global industrial conglomerate that manufactures air compressors and generators, construction and mining equipment, and industrial power tools to various industries including mining, construction, manufacturing, auto, and utilities. The company has benefitted from strong growth in global industrial production in the 150 countries that it serves. In addition, a high percentage of revenues were derived from aftermarket business which offered strong cash flows and greater earnings resilience than many of its peers. The company paid a combined ordinary and special dividend payment of over 5% of its market cap to investors in April and May 2011 based on its excess cash from strong operating results. The holding provided ADVDX with a total return of 44.67% in the six months ended 4/30/11.

A top 10 holding and top performer for ADVDX in first half fiscal 2011 is Oklahoma-based Dollar Thrifty Automotive Group (DTG). DTG, with its Dollar and Thrifty Rent-A-Car brands, is the smallest of the four major rental car companies in the U.S., behind Avis Budget, Enterprise, and Hertz. Avis Budget began merger talks with Dollar Thrifty back in March 2008, with Hertz entering the bidding four months later. The two suitors have gone back and forth and by September 2010, both potential deals included a special dividend of $6.87, which implied a yield of about 13%. We began buying shares in DTG in December 2010 at a price of about $47. Hertz raised the stakes in May 2011, with a cash and stock offer worth about $72 per share. The stock rose to over $83 per share in early June on hopes that Avis would top the bid, and we started to take profits as we did not see significant additional upside. In mid June, Avis announced its plans to purchase Avis Europe Plc, effectively ending the bidding war for DTG and removing the prospect for a special dividend. Therefore we sold our remaining stake at around $73 per share. The stock provided a total return of 46.43% in the fiscal first half of 2011 for ADVDX.

Our “Value/Restructuring Strategy” looks for attractively valued or restructuring dividend payers

Our second major strategy is what we call “value with a catalyst or restructuring strategy”, where our research points to under-valued or mis-priced companies with, in our opinion, attractive dividend yields. We also look for turnaround situations or depressed earnings where we believe there is a catalyst for an earnings recovery or a restructuring or corporate action that is expected to add value. With many companies having responded to the global recession with significant corporate restructurings

and are still trading at discounted valuations, it is not surprising to find several of our top 10 holdings in this strategy including KKR & Co., Marine Harvest, Seadrill, and Hyundai.

In the financial sector, we believe an attractive value holding and one of our top positions on 4/30/11 is KKR & Co. Based in New York, KKR is one of the world’s oldest and largest private equity investment firms with over $50 billion of assets under management. While 75% of KKR’s assets are in its core private equity funds, the firm is expanding its product offerings into asset management and capital markets, for example recently hiring the proprietary trading team from Goldman Sachs as the base for its equity long/short business. With the rebound in global equity markets and improved capital conditions, we believe private equity should be poised for recovery both in terms of new investments and exit strategies, and KKR has over $13 billion of capital to deploy. The stock offered a 4.68% dividend yield as of 4/29/11 and provided ADVDX with a total return of 53.46% in the six months ended 4/30/11.

A value holding in the consumer staples sector and top 10 holding in the portfolio on 4/30/11 was Marine Harvest ASA (MHG NO). Based in Norway, MHG is the largest salmon producer in the world, with major fish farmeries in Norway, Canada, Scotland and Chile. With 30% of the world’s production, MHG is benefitting from strong global salmon sales in addition to the recent boost in pricing following the Japan earthquake disaster as a large amount of Japan’s fishery infrastructure was severely damaged. However, pricing has begun to decline as more production in Chile is coming on line and we have started to take profits in the name. Management targets a return of about 75% of annual free cash flow to shareholders and distributed a 12% dividend in May 2011. MHG provided a 30.29% total return for ADVDX in fiscal first half 2011.

Our largest holding in the energy sector and a top 10 position by weight was Seadrill, which provided ADVDX with a total return of 22.91% for the six months ended 4/30/11. Seadrill Ltd. (SDRL NO), based in Bermuda, is Europe’s largest offshore driller. Its aggressive newbuild program and acquisition strategy has given it one of the world’s youngest fleets. Seadrill is a leader in the high-growth and technologically advanced deepwater and ultra-deepwater rig markets which are experiencing strong demand in regions like Brazil, West Africa, and the Gulf of Mexico as oil is getting harder to find and exploration is moving further out to sea. The company continues to provide what we feel is a very attractive

10

|

|

Alpine Dynamic Dividend Fund |

|

value with a current annual dividend yield of 8.8%.

Lastly, a value holding in the consumer discretionary sector and top 10 holding in the portfolio on 4/30/11 was Hyundai Motor Company (005380 KS). Based in Seoul, Hyundai is the largest auto maker in Korea. It also owns 38% of KIA Motors, which combined have over 80% of the domestic Korean market and is the world’s fifth-largest auto manufacturer. Hyundai has reaped the benefits of its global expansion strategy started in 2002 and quality improvements have helped it gain overall share, particularly from Toyota, in its key China, India and U.S. markets. In addition, the company saw a boost in demand following the Japan earthquake disaster as the large auto producers like Honda and Toyota were severely impacted. Hyundai continues to trade at a discounted valuation relative to its peers and provided ADVDX with a total return of 51.08% in the six months ended 4/30/11.

Our “Growth and Income Strategy” targets capital appreciation in addition to yield

Our third investment strategy identifies core growth and income stocks that may have slightly lower but still attractive current dividend yields plus an outlook for strong and/or predictable earnings streams that should support additional future dividend increases. Several of our top ten holdings are industry leaders with strong growth in their categories and the potential for attractive and rising dividend payouts. These include ITC Holdings, IBM, and JM.

ADVDX’s largest holding by weight on 4/30/11 in the utility sector was ITC Holdings (ITC), based in Michigan. It is the largest U.S. independent electric transmission company with 15,000 miles of transmission lines that span five Midwestern states. As the only pure-play transmission company in the U.S., we believe that ITC is well positioned to participate in the upgrade of the nation’s electric grid, a key priority for the Obama administration. ITC raised its dividend by 5% in 2010 and we expect another 5% raise in 2011 as the company currently generates a 1.87% dividend yield as of 4/29/11. It is forecasted to possibly deliver 20% compound annual earnings per share growth in the next several years thanks to favorable regulatory treatment of electric transmission and its ambitious capital spending plan. ITC provided a 14.48% total return for the Fund in fiscal first half 2011.

We have found attractive growth and income opportunities in the technology sector in first half fiscal 2011 with one of the Fund’s top 10 holdings by weight being the bellwether International Business Machines

(IBM). Based in Armonk, NY, IBM is one of the world’s largest providers of enterprise solutions, offering a broad range of IT hardware, business and IT services, and software solutions. We believe IBM can be a steady double-digit earnings grower as it enhances its services and software offerings to add more revenue opportunities. In addition, it has benefitted from its emerging markets growth, large cost cutting efforts, and share repurchases. IBM raised its dividend by 15% in April 2011 and as of 4/29/11 offers a 1.52% dividend yield. IBM provided a 20.14% total return for ADVDX in fiscal first half 2011.

One of our best performing holdings in the top 10 largest positions on 4/30/11 was the Swedish homebuilder JM AB (JM SS). Based in Stockholm, JM manages and constructs residential and commercial buildings primarily in Sweden but also owns properties in Norway, Belgium, and Portugal. The company has benefitted from strong employment growth in Sweden, low interest rates, and solid population growth and its production starts are scheduled to increase in 2011 and 2012. The company is expected to grow earnings substantially over the next two years with housing starts and margins rebounding following the decline in construction which occurred in 2007 through 2009. JM raised its annual dividend by 80% in February 2011 and as of 4/29/11 offered a 2.61% dividend yield. JM provided a 35.86% total return for ADVDX in fiscal first half 2011.

Outlook for second half 2011: We remain cautiously optimistic but risks remain

We believe that a global economic recovery is still solidly in place heading into the second half of 2011 following the Great Recession of 2008/09 and the economic rebound and fiscal and monetary stimulus experienced in 2010. The U.S. is beginning to produce employment growth on the back of strong corporate profit growth and Europe is attempting to resolve its sovereign debt issues in the peripheral countries while the core countries of France, Germany, and the Scandinavians are experiencing strong economic growth. In addition, corporate balance sheet quality is very high and companies are sitting on large amounts of cash which should support capital growth initiatives, mergers and acquisitions, and the return of cash to shareholders via share buybacks and dividend increases.

We remain particularly optimistic about tapping opportunities to invest in growth in emerging markets like Brazil and China where strong employment and wage growth is helping to propel millions of people each year from a subsistence existence to an emerging consumer of everything from durable goods to

11

|

|

Alpine Dynamic Dividend Fund |

|

discretionary items to healthcare. Brazil is also benefiting from large infrastructure spending in its energy sector in addition to stimulus provided by hosting the soccer World Cup games in 2014 and the summer Olympics in 2016.

However, risks and volatility remain across the globe with lingering under-employment, fiscal deficits, and austerity measures in many of the developed markets and with rising commodity and wage inflation in many of the emerging markets. These risks could combine to stifle the fragile global economic recovery in place. In addition, the S&P 500 Index has more than doubled from its March 2009 low through the recent highs achieved in May 2011 and many companies are approaching peak margins which may slow down the pace of earnings growth. So we may be entering a period of consolidation or more muted increases particularly through the low volume summer months, but we continue to see opportunities for our investors.

Over the long term, we remain optimistic that dividend stocks will attract increasing amounts of capital as investors around the world search for income. With many companies sitting on record amounts of cash, we are hopeful that dividend increases will continue to occur in 2011 and beyond. In addition, as global demographics point to an aging population in the industrialized world, these millions of savers are facing

zero to low interest rates for quarters or potentially years to come. For example, the U.S. in the 1930’s and Japan in the past 20 years have shown that when interest rates go close to zero they can stay there for extended periods of time until structural economic issues are resolved. We see dividend income as an attractive investment opportunity for this increasingly large population of retirees, particularly if interest rates rise and bond valuations suffer.

In summary, we see both opportunities and risks for the remainder of 2011. Our approach during these uncertain times is to remain broadly diversified within the dividend-paying universe while actively scanning the globe for undervalued opportunities and high quality cash flow generators. We believe that we should be able to continue to distribute attractive dividend payouts by capitalizing on our research driven approach to identifying value opportunities as well as through our active management of the portfolio.

Thank you for your support of the Alpine Dynamic Dividend Fund and we look forward to more prosperous years in 2011 and beyond.

Sincerely,

Jill K. Evans and Kevin Shacknofsky

Co-Portfolio Managers

|

|

| |

|

|

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to the following risks: | |

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperforms the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future.

Emerging Market Securities Risk – The risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or operating in emerging market countries. These risks include lack of liquidity and greater price volatility, greater risks of expropriation, less developed legal systems and less reliable custodial services and settlement practices.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Securities Risk – Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Currency fluctuations could erase investment gains or add to investment losses. Additionally, foreign securities also involve possible imposition of withholding or confiscatory taxes and adverse political or economic developments. These risks may be greater in emerging markets.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

12

|

|

Alpine Dynamic Dividend Fund |

|

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Qualified Dividend Tax Risk – Favorable U.S. Federal tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws.

Undervalued Stock Risk – Undervalued stocks may perform differently from the market as a whole and may continue to be undervalued by the market for long periods of time. Although the Fund will not concentrate its investments in any one industry or industry groups, it may weigh its investments towards certain industries, thus increasing its exposure to factors adversely affecting issues within these industries.

Leverage Risk – Leverage creates the likelihood of greater volatility of net asset value; the possibility either that share income will fall if the interest rate on any borrowings rises, or that share income and distributions will fluctuate because the interest rate on any borrowings varies; and if the Fund leverages through borrowings, the Fund may not be permitted to declare dividends or other distributions with respect to its common shares or purchase its capital stock, unless at the time thereof the Fund meets certain asset coverage requirements. The Adviser in its best judgment nevertheless may determine to maintain the Fund’s leveraged position if it deems such action to be appropriate in the circumstances.

Please refer to page 5 for other important disclosures and definitions.

13

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Comparative Annualized Returns as of 4/30/11 (Unaudited) | ||||||||||

|

|

|

|

|

|

|

| |||

|

| 6 Months (1) |

| 1 Year |

| Since Inception |

| |||

Alpine Accelerating Dividend Fund |

| 16.40 | % |

| 20.08 | % |

| 19.31 | % |

|

S&P 500 Index |

| 16.36 | % |

| 17.22 | % |

| 15.61 | % |

|

Dow Jones Industrial Average |

| 16.71 | % |

| 19.49 | % |

| 15.56 | % |

|

Lipper Equity Income Funds Average(2) |

| 15.57 | % |

| 18.29 | % |

| 19.56 | % |

|

Lipper Equity Income Funds Ranking(2) |

| N/A | (3) |

| 67/269 |

| 128/250 |

| ||

Gross Expense Ratio: 2.71%(4) |

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.36%(4) |

|

|

|

|

|

|

|

|

|

|

(1) Not annualized.

(2) The since inception data represents the period beginning 11/6/2008.

(3) FINRA does not recognize rankings for less than one year.

(4) As disclosed in the prospectus dated March 1, 2011.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Dow Jones Industrial Average is a price weighted average of 30 actively traded shares of large cap U.S. industrial corporations. The Lipper Equity Income Funds Average is an average of Funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. The S&P 500 Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

The adviser contractually agreed to waive a portion of its fees and to absorb certain fund expenses. This arrangement will remain in effect unless the Board of Trustees approves its modification or termination.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

|

|

|

|

|

|

|

|

| |||||||

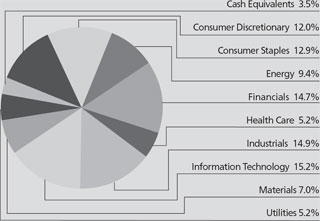

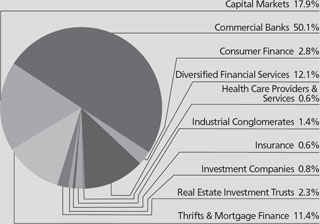

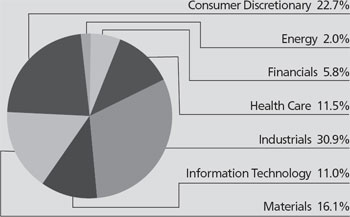

Portfolio Distributions* (Unaudited) |

| Top 10 Holdings* (Unaudited) |

|

| |||

|

| 1. |

| El Paso Pipeline Partners LP | 2.45 | % | |

| 2. |

| Chevron Corp. | 2.45 | % | ||

| 3. |

| PepsiCo, Inc. | 2.28 | % | ||

| 4. |

| International Business |

|

| ||

|

|

| Machines Corp. | 2.26 | % | ||

| 5. |

| Air Products & Chemicals, Inc. | 2.22 | % | ||

| 6. |

| Schlumberger, Ltd. | 2.17 | % | ||

| 7. |

| Comcast Corp. - Class A | 2.09 | % | ||

| 8. |

| Seadrill, Ltd. | 2.05 | % | ||

| 9. |

| Vale SA - ADR | 2.05 | % | ||

| 10. |

| United Technologies Corp. | 1.93 | % | ||

|

|

|

|

| |||

|

|

|

| ||||

|

|

|

|

| |||

| * | Portfolio holdings and sector distributions are as of 04/30/11 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. | |||||

|

|

|

|

|

|

| |

14

|

|

Alpine Accelerating Dividend Fund |

|

|

|

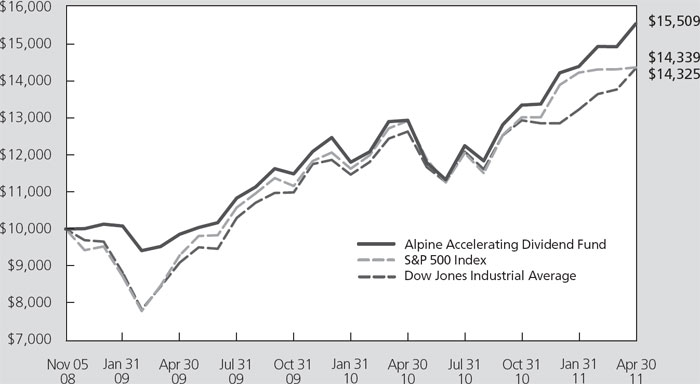

Value of a $10,000 Investment (Unaudited) |

|

|

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

|

Commentary |

For the six months ended April 30, 2011, the Alpine Accelerating Dividend Fund generated a total return of 16.40%. This compares with a total return of 16.36% for the Standard & Poor’s 500 and 16.71% for the Dow Jones Industrial Average for the same period. Since inception on November 5, 2008, the Alpine Accelerating Dividend Fund has generated an annualized total return of 19.31%. This compares with an annualized return of 15.61% for the Standard & Poor’s 500 and 15.56% for the Dow Jones Industrial Average. During the last six months, the Fund steadily increased its monthly payout from $0.0371 to $0.0379 a share.

The Accelerating Dividend Fund seeks to invest in dividend-paying companies which have the potential to increase or accelerate their dividends in the future, based on our analysis of their growth prospects and cash flow generating capabilities. The Fund aims to achieve a sustainable and rising stream of dividend income as well as long-term capital appreciation. We believe that companies with strong franchises characterized by defensible margins and a solid balance sheet are best positioned to increase, and even accelerate, their dividends over time. Among the Fund’s current holdings that have met our criteria and accelerated their dividends

over the past six months, ending April 30, 2010, include: United Technologies, Cisco, Anheuser-Busch Inbev, Chevron, Schlumberger, JP Morgan Chase & Co. and more recently CBS Corporation. These companies represent a broad cross-section of industries including technology, beverage, financials, media, energy, and industrials. While the Fund concentrates its investment in the US, we believe there is great potential for accelerating dividend ideas in the developing world as well. Our holding of China State Construction International, an E&C company with projects in Hong Kong and mainland China is one such example. At the end of the fiscal year, our emerging markets holdings totaled nearly 8% of the portfolio.

PORTFOLIO ANALYSIS

The top five contributors to the Fund’s performance over the past six months based on contribution to total return were Schlumberger (+29.07%), Chevron (+34.63%), KKR & Co (+54.17%), Danvers Bancorp (+40.78%), and Tegma Gestao Logistica (+42.67%).

|

|

|

| • | As leaders in the oil services and integrated oil industries, respectively, Schlumberger and Chevron benefited from the nearly 40% rise in crude oil prices during the past six months. Also, both |

15

|

|

Alpine Accelerating Dividend Fund |

|

|

|

|

|

| companies declared accelerating dividends in April 2011 much to our delight. We continue to be comfortable with these holdings given our view that we are still in the early stages of a long-term cycle in energy. |

|

|

|

| • | KKR & Co.’s strong return was due to a combination of factors, in our opinion. Most importantly, the Federal Reserves’ decision to undertake QE2 (i.e., a second round of quantitative easing) created a strong environment for risk assets. KKR, as a preeminent private equity manager, is a key beneficiary of such an environment. Not only did investor enthusiasm for the shares of KKR increase during the past six months, but KKR’s book value and potential for private equity realizations grew strongly during this period as well. |

|

|

|

| • | We purchased shares of Danvers Bancorp in November 2010. We thought the shares offered a compelling valuation in a bank with an attractive New England franchise, a well-capitalized balance sheet, strong credit quality, and the potential for increasing dividends. People’s United Financial, the largest independent bank in New England must have agreed with our view, as they announced the acquisition of Danvers in January 2011 for a 30% premium. |

|

|

|

| • | Tegma, a leading Brazilian logistics company is benefiting from rising auto sales in Brazil as the emerging middle class continues to grow. While we still like the outlook for the company and its potential to increase its dividend payout over time, we did take some profits given the strong performance of the stock. |

|

|

|

Cisco Systems (-23.56%), Carnival Corp. (-17.18%), Deutsche Telecom (-11.24%), Hypermarcas (-22.58%) and Archer Daniels Midland Co. (-4.41%) had the largest adverse impact on the performance of the Fund over the first six months of the fiscal year. | ||

|

|

|

| • | Cisco was added to the portfolio in anticipation of declaring its first ever dividend and with the belief that fundamentals would stabilize. While the dividend event did take place in March, the company’s fundamentals continued to deteriorate and the shares underperformed the market. We are monitoring the Cisco’s fundamentals for signs of a potential recovery. |

|

|

|

| • | Carnival Corp. was added to the portfolio in early 2011 after it announced a solid quarter and a dividend acceleration (annual dividend was increased from $0.40 to $1.00). Unfortunately, the shares underperformed as crude oil prices rose and management was forced to reduce their outlook. We continue to believe in Carnival’s long-term story and have already seen the shares recover somewhat as crude oil prices eased in early May. |

|

|

|

| • | We decided to exit our Deutsche Telecom position during the period as we felt that the company’s underperformance was set to continue as competition increased in many of its markets. |

|

|

|

| • | Hypermarcas, a Brazilian consumer products company, has been a disappointing stock since its addition to the portfolio. Aside from a market pullback, the share’s underperformance was magnified by a large acquisition, which will weigh on near term results but should be beneficial in the long term. We continue to like the investment case longer term as we believe that the company is well positioned to benefit from the growing Brazilian middle class. Management has also said that its acquisition pace will slow, which given the company’s ability to generate cash should allow Hypermarcas to increase or accelerate its dividend payout in the not too distant future. |

|

|

|

| • | Archer Daniels Midland is also no longer in the portfolio. Concerned about the company’s ability to meet earnings targets, we sold a portion of our position prior to the company reporting September period results. After our concerns were validated with the results, we exited the remainder of our position at the beginning of the calendar year. |

|

|

|

PORTFOLIO ADJUSTMENTS | ||

|

|

|

We made several changes to the portfolio over the past six months. | ||

|

|

|

| • | We added to our consumer exposure through the first half of the fiscal year. Among the additions, we bought footwear and apparel-manufacturer Nike, beverage company Anheuser-Busch Inbev, media play CBS Corp., satellite operator SES, and agri-business operator Viterra. Nike recently accelerated its quarterly dividend payout by 15%. Nike has benefitted from a strong global footwear cycle and has experienced a re-acceleration in growth in China. Near term pressures on margins due to rising input costs have hurt the shares but we continue to like the stock for its long term potential. A-B Inbev is nearing the end of its aggressive plan to reduce the leverage that came with the purchase of Anheuser Busch. Given ABI’s ability to generate large amounts of free cash flow, by the end of this calendar year, we expect the company to at least increase if not accelerate its dividend payout. We added CBS to the portfolio as we believed that the improving advertising market would enable CBS to re-accelerate its dividend payout. This came to fruition when the company reported its first quarter results and the company announced that it would double its quarterly dividend payout. We believe that there is room for additional dividend increases in the future. SES is a European satellite operator. The company is ending a large capital expenditure |

16

|

|

Alpine Accelerating Dividend Fund |

|

|

|

|

|

| cycle and is well positioned to increase or accelerate its dividend payout in the coming years. As one of the largest grain handlers in Canada and Australia, we believe Viterra is well positioned to capitalize on the growing demand for grain across the globe. Viterra initiated a dividend in December 2010, and we believe the company has ample room to grow its dividend in the future. |

|

|

|

| • | In the technology space, we added to our positions of Brazilian software provider Totvs and U.S. networking equipment maker Cisco. We also added two new names, Avago Technologies and Visa Inc. Totvs is the largest small and medium business software provider in Brazil. Business software penetration is relatively low in Brazil and Totvs has a commanding market share. Our Cisco holding was in anticipation of the introduction of a dividend payment in early 2011, which finally occurred in March. Avago manufactures semiconductor chips mainly for the telecommunication market. Management initiated its first quarterly dividend in December 2010 and increased the payout by 14% in the March interim. We believe that the company will continue to grow the payout over time. And we find the stock’s exposure to fast growing markets, such as smart phones, attractive. Visa is one of the largest global retail electronic payments networks. We found the valuation of the shares attractive after the share price declined in relation to the proposed government regulation cutting the fees its customers can charge. We believe that the ultimate program put in place will be less onerous than the original amendment. Plus, Visa raised its dividend by 20% in mid-2010 and we think that there is room for further increases in the future. |

|

|

|

| • | We made several important changes to our financial holdings during the past six months. We sold our holdings of Sterling Bancorp and Brookline Bancorp given our view that the shares were fairly valued. We also reduced our holdings of Bank of America and JPMorgan Chase given the numerous headwinds facing money center banks. Finally, the inflationary environment in Brazil led us to exit our position in Banco do Brasil as we worried that government actions to cool the growth of credit in Brazil would pose a challenge for the banks. In its place, we purchased shares of Grupo Financiero Banorte, a leading Mexican bank that is currently enjoying a more favorable macro environment in which to operate. We found several attractive small cap banks to replace those that we sold during the past six months including Danvers Bancorp, First Commonwealth Financial, Home Federal Bancorp, and Union First Market. As previously noted, Danvers was subsequently acquired at a substantial premium to our purchase price. Other new holdings include BlackRock, Chatham Lodging Trust, and Lazard. |

|

|

|

|

| BlackRock is a leading asset manager with strong positions in equity, fixed income, and ETFs. We also like its global footprint and strong management. BlackRock recently accelerated its dividend and is committed to additional shareholder friendly actions, in our view. Chatham is a small-cap REIT that is attempting to grow via smart acquisitions in the extended stay hotel space. We opportunistically purchased shares after the stock sold-off on news of a secondary offering. We believe the offering provided an attractive entry point for the Fund. Finally, we recently added shares of Lazard to the Fund after the company accelerated its dividend in April. Lazard has been on our radar and the dividend increase was the catalyst we needed to buy the stock. We like the unique exposure we get with Lazard with a roughly equal split of earnings from M&A advisory and asset management. |

|

|

|

| • | In the utilities sector, the Fund made a few minor changes to our holdings. In the US, we added new positions in Wisconsin Energy and Northwestern. Both utilities recently accelerated their dividends, and we think both companies are well positioned to grow their regulated activities at mid single digit rates over the next several years. In the wake of the devastating earthquake and tsunami in Japan, we quickly added to our holding of EVN, a European utility we first purchased in October 2010. EVN owns hydropower generation as well as a meaningful stake in larger hydro generator Verbund. Given the unfortunate new realities associated with nuclear power, we believe hydropower generators are the best way to play Western European utilities and EVN remains fundamentally undervalued in our view. We also began a small position in Tauron, Poland’s second largest utility company. We are attracted to the fundamentals of Poland’s power market given solid demand growth and a tight supply situation. Importantly, Tauron appears to be attractively valued and has declared its first dividend since its 2010 IPO. |

OUTLOOK

As we move through 2011 and look towards 2012, we remain cautious in our investment stance. We are cognizant that the market has rallied over 100% from its March 2009 lows and that the easy returns have likely been made. The geopolitical environment remains unsettled and there is a great deal of uncertainty as to the strength and durability of the economic recovery underway in the US and parts of Europe. In the emerging markets, it is unclear if uncomfortably high consumer price inflation will derail the strong growth that many countries are enjoying. Given all of this, we think that dividend income may become a key signpost for investors to gauge the true financial strength of companies. In a world currently offering paltry yields on safer investments, companies with track records of

17

|

|

Alpine Accelerating Dividend Fund |

|

increasing dividends could be the winners in the equity market, in our view. As a result, we our sticking to our knitting – we believe a strategy to identify stocks with rising dividends as well as those with the potential to not only increase the dividend, but to do so at an accelerating pace, is well positioned to succeed in the uncertain market environment in which we currently find ourselves and outperform over time. Likewise, we think the Fund offers investors an attractive yield with the potential for increasing payouts over time.

We thank our shareholders for their support and look forward to continued success over the next year.

Sincerely,

Stephen A. Lieber

Bryan Keane

Andrew Kohl

Co-Portfolio Managers

|

|

| |

| |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to the following risks: | |

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out favor with investors and underperforms the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks.

Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future.

Emerging Market Securities Risk – The risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or operating in emerging market countries. These risks include lack of liquidity and greater price volatility, greater risks of expropriation, less developed legal systems and less reliable custodial services and settlement practices.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Securities Risk – Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Currency fluctuations could erase investment gains or add to investment losses. Additionally, foreign securities also involve possible imposition of withholding or confiscatory taxes and adverse political or economic developments. These risks may be greater in emerging markets.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Although the Fund will not concentrate its investments in any one industry or industry group, it may, like many growth funds, weight its investments toward certain industries, thus increasing its exposure to factors adversely affecting issuers within those industries.

Investment Company Risk – To the extent that the Fund invests in other investment companies, there will be some duplication of expenses because the Fund would bear its pro rata portion of such funds’ management fees and operational expenses.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – Undervalued stocks may perform differently from the market as a whole and may continue to be undervalued by the market for long periods of time. Although the Fund will not concentrate its investments in any one industry or industry groups, it may weigh its investments towards certain industries, thus increasing its exposure to factors adversely affecting issues within these industries.

Please refer to page 5 for other important disclosures and definitions.

18

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

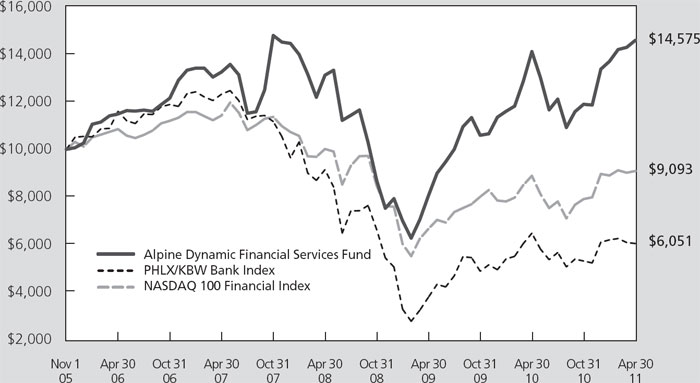

| ||||||||||||||||

Comparative Annualized Returns as of 4/30/11 (Unaudited) | ||||||||||||||||

|

| 6 Months (1) |

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

| |||||

Alpine Dynamic Financial Services Fund |

| 22.57 | % |

| 3.35 | % |

| 3.59 | % |

| 4.88 | % |

| 7.10 | % |

|

NASDAQ 100 Financial Index |

| 14.76 | % |

| 2.15 | % |

| -3.19 | % |

| -3.47 | % |

| -1.72 | % |

|

PHLX/KBW Bank Index |

| 13.97 | % |

| -6.53 | % |

| -12.73 | % |

| -12.12 | % |

| -8.74 | % |

|

S&P 500 Index |

| 16.36 | % |

| 17.22 | % |

| 1.73 | % |

| 2.95 | % |

| 4.48 | % |

|

Lipper Financial Services Funds Average(2) |

| 13.74 | % |

| 0.37 | % |

| -7.26 | % |

| -7.85 | % |

| -5.42 | % |

|

Lipper Financial Services Funds Ranking(2) |

| N/A | (3) |