UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21210

Alpine Income Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for

Service) | Copy to: |

Samuel A. Lieber Alpine Woods Capital Investors, LLC 2500 Westchester Avenue, Suite 215 Purchase, New York 10577 | Rose DiMartino Attorney at Law Willkie Farr & Gallagher 787 7th Avenue, 40th Floor New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2012 - April 30, 2013

Item 1: Shareholder Report

Equity & Income Funds

| | | | | |

| | Alpine Dynamic Dividend Fund

Institutional Class (ADVDX)

Class A (ADAVX) | | Alpine Transformations Fund

Institutional Class (ADTRX)

Class A (ADATX) | |

| | Alpine Accelerating Dividend Fund Institutional Class (AADDX)

Class A (AAADX) | | Alpine Foundation Fund

Institutional Class (ADBYX)

Class A (ADABX) | |

| | Alpine Financial Services Fund

Institutional Class (ADFSX)

Class A (ADAFX) | | Alpine Ultra Short Tax Optimized Income Fund

Institutional Class (ATOIX)

Class A (ATOAX) | |

| | Alpine Innovators Fund

Institutional Class (ADINX)

Class A (ADIAX) | | Alpine Municipal Money Market Fund

Investor Class (AMUXX) | |

Semi-Annual Report

Table of Contents

Additional Alpine Funds are offered in the Alpine Equity Trust. These Funds include:

| Alpine International Real Estate Equity Fund | Alpine Global Infrastructure Fund |

| | |

| Alpine Realty Income & Growth Fund | Alpine Global Consumer Growth Fund |

| | |

| Alpine Cyclical Advantage Property Fund | |

| | |

| Alpine Emerging Markets Real Estate Fund | |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

Dear Shareholders:

Over the past six months, capital markets have been induced by cheap money into following the “hope” trade. The ‘hope’ is that global central bank stimuli will continue to drive demand for stocks, bonds and alternative investments, allowing for continued balance sheet recapitalization and debt cost reduction until the onset of meaningful job and income growth kicks in. Nevertheless, if the markets are broadly heeding the call of ‘don’t fight the Fed (Federal Reserve)’, an increasing number of market participants are focusing on the potential impact of an eventual unwinding of this global pump priming with considerable trepidation. For example, if the Fed ‘tapers’ the amount of its asset buying program known as quantitative easing (QE), will this be akin to setting a raft adrift in mid-ocean, or will they only do so when land is visible, when employment and economic growth have been sustained? We just learned that the Fed will keep some assets bought under QE ($3.5 trillion to date) on its balance sheet until the bonds mature. While speculating on when, how quickly, and on what scale, the Fed divests fills considerable time on CNBC, it is really just another set of data points in setting investment policy.

These as yet uncertain outcomes are already being partly discounted by the market, potentially years in advance. Perhaps such concerns will continue to create a waltz-like pattern of returns, advancing two steps forward for each move sideways or back, a pattern some call “climbing a wall of worry.” This typically occurs when the market has yet to embrace a trend, despite overall positive sentiment. While at times the ensuing volatility is unsettling, this trend limits excess exuberance.

Alpine believes that all of the world’s major central banks will gradually join the fight against potential deflation, brought on by debt repayment and deleveraging at a time of slow growth which is characterized by moderating consumer demand. However, without the conventional push of fiscal stimulus working in tandem with monetary easing, the recovery from the Great Recession has been anemic. This has been reflected in the velocity of global monetary growth, which already slow,

has been declining over the past year. Instead, global growth has moderated while we hope for a job creating economic recovery fueled by pent up consumer demand and expansionary corporate capex. Over time, such a rise in activity would hopefully launch a self-sustaining surge in corporate profits and equity market expansion which would offset the negative impact of rising bond yields. If this occurs, it is more likely that other factors or even global events, financial or otherwise, would temper such an optimistic scenario. Nonetheless, we should be able to bank on the Fed’s own statement “...that a highly accommodative stance ... will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens.” The Fed has stated that the Fed-Funds rate is not projected to rise until 2015, leading us to project limited increases in long rates for the next few years with 10-year U.S. Treasury yields fluctuating around the average of the past five years centered at 2.78%. Some fear that this could prove inflationary over time, and we believe this is precisely what the Fed is in fact targeting.

Historical Precedents for Stimulus

Historically, government intervention via monetary and fiscal policy tools has induced both economic slowdowns and surges. Former Fed Governor Paul Volker squeezed inflationary expectations and pressures out of the U.S. financial system, inducing the recession of 1981-82 through a highly restrictive monetary policy. The subsequent “Reagan recovery” used massive tax and fiscal stimulus to drive the economy forward. However, lax regulation and continued monetary stimulus following 1987’s “Black Monday” stock market crash led to the excesses and bust of the Savings & Loan (“S&L”) industry in 1989-90.

After the S&L crisis of 1990, our economy was rebooted and rallied in the aftermath of the “Desert Storm” campaign to contain Iraq. By mid-decade, we enjoyed a great surge in growth, job expansion and family wealth creation throughout the U.S., pulling along much of the world over a prolonged recovery. Innovation and internet expansion were further fueled by easy money (leading up

1

to Y2K), which ended with the collapse of the internet bubble in 2000. After the tragedy of “9/11”, this millennium’s first decade endured a bad experience of “guns and butter” stimulus through draining wars, tax cuts and uncontrolled financial excesses. This set up a roller coaster ride, first down and then way up, without functional brakes, before crashing in 2008.

Alas, this near systemic meltdown has required an extended period of adjustment, absorption, and/or rationalization of excesses, in the form of jobs, businesses, corporate spending, and inevitably, government tax receipts and spending. In essence, the credit based capital delivery system was broken, perhaps beyond repair, but the collective response has not been to redesign and build anew. Instead, we cut back the weak branches but have not fed or fertilized the plant, providing only a steady drip for life support. This period of downsizing has been supported by central bankers around the world who have pumped capital into the global financial system in order to stabilize markets, support weak bank balance sheets until they can become healthy, and moderate the impact of slow economic growth on unemployment.

Must There be An Era of Austerity?

The product of monetary stimulus over the past four and one-half years is a modest recovery in the U.S., new hope for recovery in Japan, a stable if somewhat slower China, and a still weak, if not further receding European economy. Notably, all of the major global economies withdrew or significantly reduced their fiscal stimulus following the initial stabilization efforts after the desperate days of 2008 and 2009. This is in contrast with the historic patterns of prior recessionary periods in the U.S., such as 1981-1982, or 1990-1991, when there were rising levels of aggregate fiscal stimulus for extended periods of two to three years. That is, historically our Government either extended tax relief, program support and/or made direct investments to foster economic activity over a sustained period of time. This time, substantial monetary and fiscal stimulus during 2009 was not extended amidst fears that higher Government debt would further strain weak GDP levels in an economy already straining against an aging demographic profile with higher future costs. The prospect of higher debt burdens just as many faced retirement was not politically palatable. However, unlike past recoveries which typically took hold a few years after recession ended, the significant short term erosion of tax receipts due to lower taxable sales and earnings, had made annual fiscal deficits appear much higher than the long term trend.

Now, it appears that prospective deficits are smaller than some feared, just as fiscal policy paralysis set in, compounded by election cycles around the world. In fact, the confluence of strong current positions of politically and fiscally conservative parties in power across many key countries led to the imposition of virtual, if not outright, austerity beginning in 2010 and extending throughout Europe and North America. Many believe that the impact of sequestration in the U.S. will slow our economy, notably in the second quarter, limiting the prior period’s buildup. However, we now see an alternative emerging, perhaps out of desperation. A very bold, and potentially very powerful economic experiment is underway in Japan. If Japan’s experiment fails, it will become yet another drag to economic growth (albeit at 7% of global GDP, no longer large enough to be catastrophic). If it succeeds in fostering a dynamic level of economic activity, however, the rest of the world may follow suit.

Japan can be viewed as the progenitor of the recent decade’s debt fueled bubble economics and, perhaps, is an example of how bad things can get if they are not handled correctly. Japan has muddled through a period of extended wealth depreciation, asset deflation and debt expansion since its stock market peaked in 1990. This predicament has evolved by alternating between ineffectual austerity programs and inadequate stimulus packages. The recently elected President, Shinzaro Abe, has reshuffled the Bank of Japan and the Finance Ministry to push quantitative easing on a relative scale of three-fold what our Fed has done. Of perhaps greater impact, Abe will seek a parliamentary victory this summer as a mandate for creating fiscal and structural economic reforms. If indeed there are material reforms, there is a possibility that Japan can restart a new period of economic growth with a more dynamic economy. This could happen despite demographic constraints, the world’s highest government debt to GDP ratio (in excess of 200% or over 400% when corporate and household debt are included) and a history of negative consumer and investor sentiment.

Our View: Fiscal Stimulus Has Already Had Success Here

In October 2008, President Bush signed the legislation creating the $700 billion Troubled Asset Relief Program (TARP), which was used initially to help keep AIG, Citigroup and Bank of America afloat, and later provided much needed assistance (which President Obama augmented) to Chrysler and General Motors (GM). On June 6, both GM and AIG rejoined the S&P 500, a triumphant (if symbolic) victory since their near collapse some five years ago. And as unthinkable as it was five years ago, the taxpayers have

2

turned a profit on the AIG deal. Later, the Obama administration provided stimulus via loans through the Department of Energy to green tech entrepreneurs like Solyndra and Tesla Motors. And while the Solyndra bankruptcy was a politically embarrassing poor investment, it turns out that Tesla was a pretty good one, having recently raised capital to pay the government back - nine years ahead of schedule. It’s worth noting that cars being made in the U.S., relative to foreign competitors, are now widely judged as comparable in terms of quality and value for the first time in a generation. Also, it is significant that Consumer Reports gave the Tesla ‘S’ its highest score of any car since a top of the line Lexus in 2008. Pretty impressive for a new company!

Obama’s 2009 stimulus package also offered investments beyond “shovel-ready” projects, such as advanced manufacturing tax credits for clean energy that went to approximately 200 U.S. factories, with significant results. To provide one example, in 2008, approximately 80% of the average U.S. wind turbine was made of imported parts. But after the stimulus created these factories that make one or several of the 8,000 parts that go into a turbine, the percentage of imported parts has dropped to 40%. In some ways, this is not very different than when the government subsidizes oil well drilling, or private equity investments by allowing deferred payback of gains or carrying losses on poor investments to offset future gains from productive ones. All of this suggests that stimulus investing could be beneficial in retaining jobs for the short run and aiding the growth of new businesses in the medium to long run.

What Should We Do Next?

In the U.S., we can take pride not only in the quality of our new cars but also in the fact that we still have the most significant economy in the world. Over time, our banks’ balance sheets and business models have become more stable, while economic output and household and corporate balance sheets are stronger than they were before the bust. As a result, the U.S. consumer is recovering confidence and household net worth is again growing now that housing prices are returning to long term trend levels. It does not hurt that the potential realization of huge oil and gas reserves through improved extraction technology promises energy cost advantages for the U.S. over the next generation, although its initial benefits have yet been barely realized. Indeed, in 2008 “drill baby drill” became a rallying cry that ultimately was more political inspiration than economic necessity. Perhaps today a more beneficial and promising slogan should be “build baby build”. To realize this energy wealth, we believe we need to build pipelines

and transportation systems that are secure from storms, hackers or other forms of attack. We also believe that we need refineries, fertilizer plants, and environmental control procedures that are state of the art. Pressure is intensifying to rebuild those under- maintained bridges and roads upon which our interstate commerce is dependent and rebuild or expand regional rail networks for commuters. It is our opinion that we need to enhance our water treatment and distribution plants, and to take our above-ground electric and telephone utility wires underground before too many hurricanes, tornados or mudslides force us to continually rebuild them. Major ports of entry into the country, be they by air or sea, for people or freight, should be upgraded to a level commensurate with the stature of our economy. We feel these efforts would not only create much needed engineering and construction jobs now, but would be investments that could have meaningful returns over many years. That is just what we did with the interstate highway system and the GPS navigation system, both of which were created by government, and have dramatically aided industry, consumption, and individual use. The myriad of benefits over the years, including job creation and a generation of strong returns, probably sounds like a good investment to most people.

It is often said that the 1944 GI bill, with its low cost mortgages, business loans and tuition assistance, created the middle class. Well, another level of investment that should be made is for our soldiers returning from active deployment and desirous of further service, training or perhaps advanced education, but who are unable to access these for various reasons. The payback as illustrated by the unemployment data is quite stark in the disparity between those with a college degree (-3.9%) versus those without a secondary degree (-11.65%). So beyond further assistance, perhaps we should strengthen an independent Coast Guard, rebuild the Park Service, expand the Job Corps, and institutionalize technical training more broadly. Here the payback will not be as quick and the monetary returns will be partially indirect, but it is a worthy undertaking if we can lower prison populations, reduce alcoholism or drug dependency, and host fewer homeless people in emergency rooms.

What Could This Mean for Markets?

So what does this mean for stock investing? Money is still flowing into the U.S. to invest, which should strengthen the dollar over time and keep inflation in this country low while also supporting our bond and equity markets. The U.S., U.K. and Japan have all adopted quantitative easing strategies and it is likely that the Europeans will probably do so within the next three to six months, depending

3

upon unemployment rates and contested German elections in September. In recent months, European equities and bonds have traded well in response to stabilization efforts, and in anticipation of funds flowing out of Japanese debt markets in a global search of higher yields. While Italian and Spanish 10-year debt trades at yields of 3.88% and 4.11% respectively, this is a big spread over Japanese bonds at 0.88%, or even U.S. bonds at 1.64% (Bloomberg, May 1st). If the European Central Bank (ECB) also undertakes quantitative easing before year end, we believe that the global equity rally may continue and sustain current trends well into 2014.

The big test will be whether the global economy shows increased prospects for gradual expansion into 2015. We believe a major wild card will be whether Japan undertakes meaningful fiscal and structural reforms as well as direct stimulus of the economy to help boost business and consumer demand. This means no more bridges to nowhere, but practical and impactful investments which create jobs and provide a return on invested capital that appeals to global investors. It will require streamlining regulations and revamping or redefining bureaucracies. It is possible that Japan could become a model for other countries to follow. Such a scenario suggests a meaningful and robust economic climate could unfold for an extended period of time. While prudence suggests that one should rarely bet on the most optimistic scenario, it has often been the case that great challenges set the stage for positive change and new opportunity.

Alpine believes that the forces for change are stronger than those of complacency and the status quo. High unemployment led to the street riots in Tunisia, which set off the Jasmine Revolution in the Middle East two years ago, and today we find youth unemployment in Spain and Greece is over 55%, over 30% in Ireland, 33% in Italy, 26% in France, and even 20% in the U.K. Historically, civilizations either adapt and survive when one crisis begets another, or they perish.

The globalization of labor, ideas and capital has dramatically shifted the landscape over the past 50 years, yet the organization and operational structure of many of our institutions often dates back 50 years. In that time, demographic profiles have changed dramatically within countries and between regions. In similar fashion, economic powers are shifting as industries expand and contract across countries and regions. Now, with the advent of rapid mass mobile communications, more people know what they want and have the means to figure out how to get it. All of this increases the odds that the flashpoint which unleashes change could come from unlikely places.

Could the last ‘Bubble Economy’ of the Twentieth Century be the first economy to shift from deflation to inflation and show the rest of us how to reignite growth? We are hopeful that if Japan sets a successful model for fiscal and structural reform and stimulus, other countries will follow. If not Japan, we firmly believe that another protagonist will emerge.

We thank you for your support and interest.

Sincerely,

Samuel A. Lieber

President

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to the individual fund letters for risks specific to that fund.

This letter and the letters that follow represent the opinions of the Fund’s management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice.

4

| Disclosures and Definitions |  |

Equity Income Disclosures –

Please refer to the Schedule of Portfolio Investments for each Fund’s holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Current and future portfolio holdings are subject to risk.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

A portion of the Fund’s distributions may be comprised of return of capital or short-term or long-term capital gains. To the extent that the distribution is from a source other than net investment income, a 19a-1 notice will be provided and is available on our website.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Diversification does not assure a profit or protect against loss in a declining market.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Equity Income Definitions

A Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Cash Burn is the rate at which a new company uses up its venture capital to finance overhead before generating positive cash flow from operations. Also used as a measure of negative cash flow.

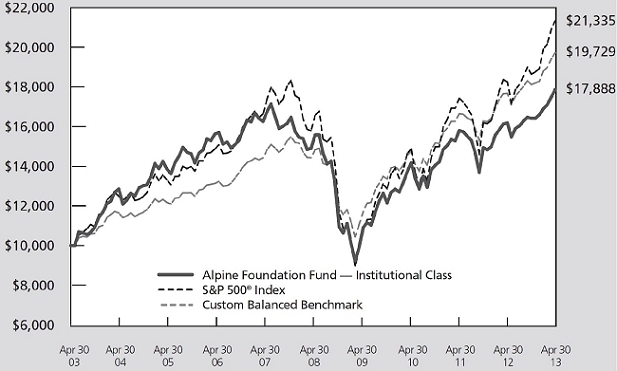

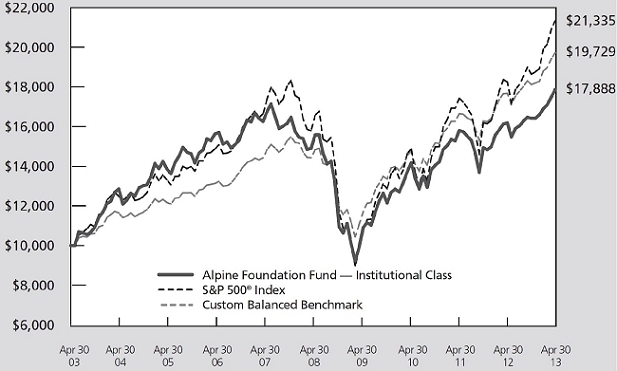

Custom Balanced Benchmark reflects an unmanaged portfolio (rebalanced monthly) of 60% of the S&P 500 Index, which is a market capitalization-weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market, and 40% of the Barclays Capital U.S. Aggregate Bond Index (BCAG), which is a widely recognized, unmanaged index of U.S. dollar-denominated investment-grade fixed income securities. The Fund may, however, invest up to 75% of its total assets in equity securities.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is essentially Net Income with Interest, Taxes, Depreciation, and Amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. However, this is a non-GAAP measure that allows a

greater amount of discretion as to what is (and is not) included in the calculation. This also means that companies often change the items included in their EBITDA calculation from one reporting period to the next.

Hedge involves making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions.”

Lipper Mixed-Asset Target Allocation Growth Funds Average is an average of funds that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash, and cash equivalents.

MSCI All Country World Index Gross USD is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

NASDAQ Financial-100 Index includes 100 of the largest domestic and international financial securities listed on the NASDAQ Stock Market based on market capitalization. They include companies classified according to the Industry Classification Benchmark as Financials, which are included within the NASDAQ Bank, NASDAQ Insurance, and NASDAQ Other Finance Indexes.

Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market.

S&P 500® Index is float-adjusted, market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance.

5

[THIS PAGE INTENTIONALLY LEFT BLANK]

6

Equity Manager Reports

| | Alpine Dynamic Dividend Fund | |

| | | |

| | Alpine Accelerating Dividend Fund | |

| | | |

| | Alpine Financial Services Fund | |

| | | |

| | Alpine Innovators Fund | |

| | | |

| | Alpine Transformations Fund | |

| | | |

| | Alpine Foundation Fund | |

7

| Alpine Dynamic Dividend Fund |  |

| Comparative Annualized Returns as of 4/30/13 (unaudited) | | |

| | | 6 Months(1) | | 1 Year | | 3 Years | | 5 Years | | Since Inception(2) |

| Alpine Dynamic Dividend Fund — Institutional Class | | | 9.88 | % | | | 10.78 | % | | | 3.57 | % | | | -4.70 | % | | | 4.04 | % |

| Alpine Dynamic Dividend Fund — Class A (Without Load) | | | 9.74 | % | | | 10.54 | % | | | N/A | | | | N/A | | | | 13.87 | % |

| Alpine Dynamic Dividend Fund — Class A (With Load) | | | 3.80 | % | | | 4.36 | % | | | N/A | | | | N/A | | | | 9.14 | % |

| MSCI All Country World Index Gross USD | | | 13.72 | % | | | 15.60 | % | | | 9.22 | % | | | 2.01 | % | | | 7.81 | % |

| S&P 500® Index | | | 14.42 | % | | | 16.89 | % | | | 12.80 | % | | | 5.21 | % | | | 6.77 | % |

| Lipper Global Equity Income Funds Average(3) | | | 12.29 | % | | | 15.48 | % | | | 9.16 | % | | | 1.13 | % | | | 6.29 | % |

| Lipper Global Equity Income Funds Ranking(3) | | | N/A | (4) | | | 74/76 | | | | 50/50 | | | | 38/38 | | | | 12/12 | |

| Gross Expense Ratio (Institutional Class): 1.28%(5) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.28%(5) | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.53%(5) | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.53%(5) | | | | | | | | | | | | | | | | | | | | |

| (1) | Not annualized. |

| (2) | Institutional Class shares commenced on September 22, 2003 and Class A shares commenced on December 30, 2011. Returns for indices are since September 22, 2003. |

| (3) | The since inception return represents the period beginning September 25, 2003 (Institutional Class only). |

| (4) | FINRA does not recognize rankings for less than one year. |

| (5) | As disclosed in the prospectus dated February 28, 2013. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

The MSCI All Country World Index Gross USD is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. The S&P 500® Index is float-adjusted market capitalization index of 500 common stocks chosen for market size, liquidity and industry group representation to represent U.S. equity performance. The Lipper Global Equity Income Funds Average is an average of funds that by prospectus language and portfolio practice seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend-paying securities of domestic and foreign companies. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500® Index and the Lipper Global Equity Income Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Dynamic Dividend Fund has a contractual expense waiver that continues through February 28, 2014. Where a Fund’s gross and net expense ratio are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

8

| Alpine Dynamic Dividend Fund (continued) |  |

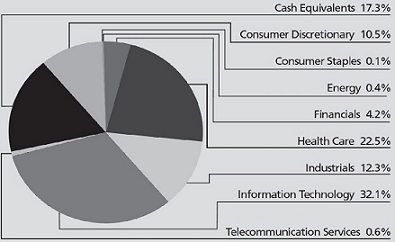

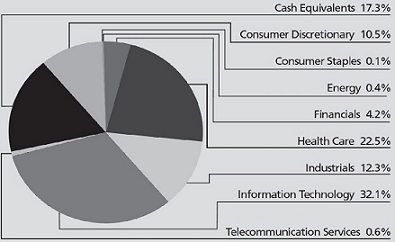

Portfolio Distributions* (unaudited)

Top 10 Holdings* (unaudited)

| 1. | | Apple, Inc. | | 2.62% |

| 2. | | Vodafone Group PLC-ADR | | 2.09% |

| 3. | | QUALCOMM, Inc. | | 1.87% |

| 4. | | Canadian Pacific Railway, Ltd. | | 1.77% |

| 5. | | Nestle SA | | 1.76% |

| 6. | | Accenture PLC-Class A | | 1.75% |

| 7. | | Novartis AG-ADR | | 1.72% |

| 8. | | Corrections Corp. of America | | 1.69% |

| 9. | | Comcast Corp.-Class A | | 1.66% |

| 10. | | Roche Holding AG | | 1.64% |

| | | |

| * | Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio Distributions percentages are based on total investments. Portfolio holdings and sector distributions are as of 04/30/13 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

| |

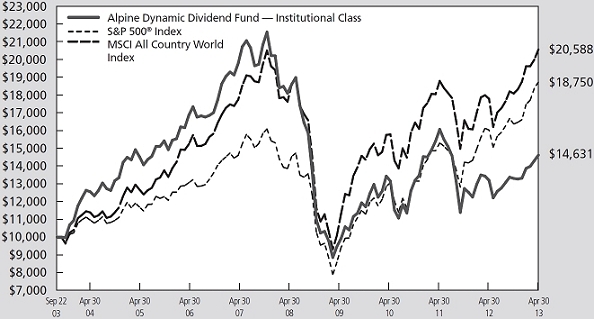

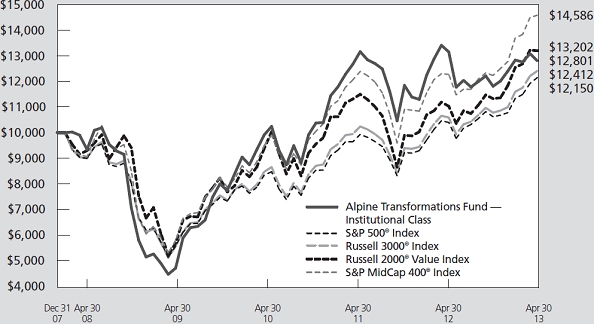

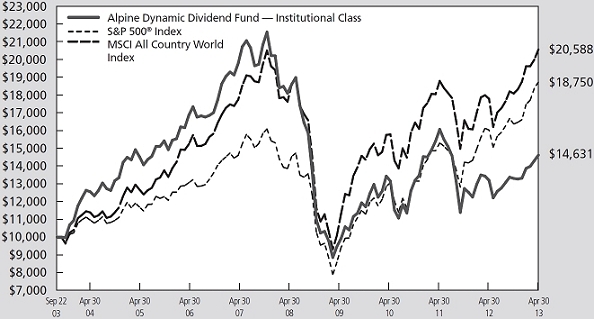

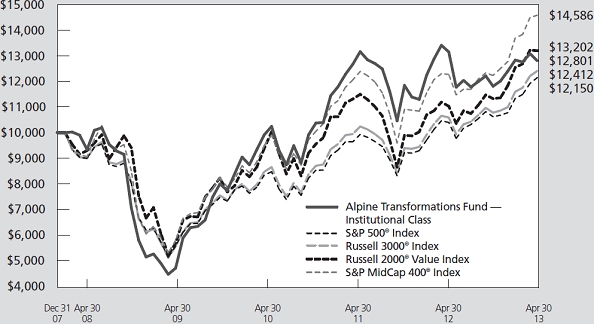

| Value of a $10,000 Investment (unaudited) |

| |

|

|---|

|

| |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

9

| Alpine Dynamic Dividend Fund (continued) |  |

Commentary

Dear Investor:

In the six-month period ended April 30, 2013, the Alpine Dynamic Dividend Fund generated a total return of 9.88% versus our benchmark, the MSCI All Country World Index Gross USD, which had a total return of 13.72%. All returns include reinvestment of all distributions. On December 13, 2012, we were named co-portfolio managers of this Fund. From that date until April 30, 2013, the total return was 10.13% versus the benchmark return of 10.73%. All returns include reinvestment of all distributions. The Fund distributed $0.164 per share during the period. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

The Fund’s investment objectives remain the same – to seek high current dividend income, a majority of which is intended to be qualified dividend income, and secondarily, long-term growth of capital. As previously announced in January, 2013, we reduced the distribution rate during the period to align the Fund’s distribution rate with our assessment of the Fund’s long-term return potential as well as our projected levels of dividend income available to the Fund and to provide the Fund more flexibility to seek capital appreciation.

PERFORMANCE DRIVERS

Over the past six months, the stock market marched higher due to a number of factors including highly accommodative global monetary policy, improving macroeconomic indicators, bullish sentiment and inflows into equity-oriented mutual funds and exchange-traded funds. Although economic growth has been slow by historical standards, the central banks’ policies have helped fuel the stock market rally. Government interventions such as quantitative easing in the United States, the launch of the long-term refinancing operations (“LTRO”) in Europe by the European Central Bank and the Bank of Japan’s aggressive stimulus policy have put significant downward pressure on yields of a wide variety of fixed-income investments. As a result, we believe equities are becoming the favored asset class among market participants.

For the six-month period, the industrials and utilities sectors had the greatest positive effect on the Fund’s total return on a relative basis. In the industrials sector the Fund benefited from its exposure to companies that had a specific catalyst such as a new CEO at Canadian Pacific, and a successful debt refinancing at R.R. Donnelley. In the utilities sector, the Fund benefited from its overweight in domestic companies. On a relative basis, Consumer discretionary and information technology were the sectors that had the greatest negative effect on

total return. The Fund was adversely impacted by its exposure to companies in the consumer discretionary sector that were directly impacted by the hike in payroll taxes, colder-than-normal weather in the spring, and persistently high gasoline prices in the United States. In the information technology sector, the Fund underperformed due primarily to its overweight in Apple, which experienced margin pressure amidst increasing competition in smart phones.

PORTFOLIO ANALYSIS

The top five contributors to the Fund’s performance for the six-month period ended April 30, 2013 based on contribution to total return were Canadian Pacific Railway Ltd. (35.95%), Walgreen Co. (42.67%), R.R. Donnelley & Sons Co. (30.86%), Vodafone Group PLC (21.45%), and HollyFrontier Corp. (31.84%).

Canadian Pacific Railway (average weight 1.61%) was a top-performing stock for the period as the new CEO, Hunter Harrison’s efforts to restructure the railway began to bear fruit, and the company reported its highest first quarter earnings results in history. The restructuring has included headcount reduction, running more efficient (longer) trains, and a fuel conservation strategy. These changes have been implemented faster than the original timetable set out by the new management team.

Walgreen Company (average weight 1.25%) is the largest drugstore chain in the United States with over 7,900 stores. The stock outperformed during the period due primarily to the game-changing ten year distribution agreement with AmerisourceBergen, which allowed Walgreen to benefit from greater purchasing scale, distribution efficiencies and global growth opportunities. The company also benefited from the highly accretive and strategic acquisition of UK retailer and pharmaceutical wholesaler Alliance Boots.

R.R. Donnelley & Sons (average weight 0.76%) outperformed during the period despite weakness in the printing business. Increased revenue in their logistics segment partially offset lower printing revenue worldwide, and extending debt maturities allayed fears about the security of the dividend. Strong cash flow expected by management this year along with limited capital expenditure needs is also encouraging.

Vodafone (average weight 1.91%) is a multi-national telecommunications company. The stock outperformed during the period due to speculation that the company will sell its stake in Verizon Wireless to Verizon Communications, potentially unlocking significant shareholder value in the process. Vodafone currently owns a 45% stake in the joint venture.

10

| Alpine Dynamic Dividend Fund (continued) |  |

HollyFrontier Corp. (average weight 1.44%) created by the 2011 merger of Holly and Frontier Oil, is one of the most profitable refining companies in North America. The company has been among the most significant beneficiaries of the widening spreads between crude oil-based inputs and refined product outputs that have arisen from the strong production growth of oil in North America and the insufficient pipeline capacity to transport that oil from the mid-continent to the coastal markets. HollyFrontier’s outperformance is also a result of its generous dividend policy, with quarterly special dividends enhancing its yield.

The following companies had the largest adverse impact on the performance of the Fund based on contribution to return for the six month period ended April 30, 2013: Apple Inc. (-24.85%), Freeport-McMoran Copper & Gold Inc. (-20.12%), Tronox Ltd. (-25.33%), Petrofac Ltd. (-19.13%) and Oi S.A. (-27.90%).

Apple (average weight 2.53%) underperformed during the period as its industry-leading operating margins came under pressure with intensified competition in smart phones. The negative earnings revisions by Wall Street analysts during the period also hurt the performance of the stock. In addition, investors have been concerned that Apple has lost its cachet as an innovator. On the flipside, Apple has generated goodwill by returning some of its enormous cash hoard to shareholders via increased dividends and share buybacks.

Freeport-McMoRan Copper & Gold (average weight 0.39%) is the second largest copper producer in the world behind Chile’s Codelco with reserves of 117 billion pounds and annual production of nearly 4 billion pounds, 8% of the global supply of copper. In December 2012, Freeport McMoRan announced a deal to buy McMoRan Exploration Company and Plains Exploration & Production for a combined $10 billion. The deal was a big surprise to us and the market, and the stock underperformed as a result.

Tronox (average weight 0.09%) is the only vertically-integrated producer of titanium dioxide (TiO2), a whitening/brightening pigment used in paints, plastics, paper, sunscreen and food coloring with no effective substitutes. Due to an extended destocking period in China and weak end markets in Europe, the Board of Tronox decided to cancel the special dividend which was the basis of the Fund’s investment in the stock and we sold the position.

Petrofac (average weight 0.83%) is a high quality oil and gas-focused engineering, procurement and construction company with a strong reputation as a primary contractor able to execute large capital projects in a range of competencies from upstream to downstream facilities. The stock underperformed as a dearth of project awards in the

increasingly competitive onshore markets led to questions around near term revenues and margins.

Oi S.A. (average weight 0.18%) is one of the largest integrated telecommunication companies in Brazil. Oi underperformed due to concerns regarding the sustainability of its high dividend yield with net debt-to-EBITDA exceeding 3 times and negative cash flow accelerating due to rising capital expenditures and weak operating results. We exited the position as the headwinds mounted for the company.

We have hedged a portion of our currency exposures to the Swiss Franc, Japanese Yen and British Pound. We also used leverage at times both in the execution of the strategy of the Fund and to help manage significant amounts of net outflows during the period.

SUMMARY

We believe the Alpine Dynamic Dividend Fund has been reinvigorated in order to best pursue its primary objective: to seek high current dividend income that qualifies for the reduced U.S. Federal income tax rates created by the “Jobs and Growth Tax Relief Reconciliation Act of 2003” while also focusing on total return for long-term growth of capital. We have shifted to a team-based structure that incorporates both top-down and bottom-up stock picking. The investment team includes experienced Alpine portfolio managers and research analysts who provide analysis and recommendations on stocks within the sectors they cover. We, along with our CEO, CIO and Senior Investment Risk Strategist, comprise a committee that provides strategic oversight to the Fund and monitors sector and regional exposures, as well as quantitative and qualitative risk factors.

We believe dividend-paying stocks may be an attractive asset class for three reasons. The first is that we are in a historically low yield environment. The second is that these dividend-paying stocks have the potential for great risk/reward, and may offer the potential for less volatility than other equity investments. The third is that while bonds offer fixed rates, therefore tending to do poorly in inflationary environments, dividends have historically grown at a faster rate than inflation.

We are pleased with the structure of our portfolio. We will continue to adapt our investment approach as economic conditions change and look forward to discussing the portfolio and the prospects for the Fund in future communications.

Sincerely,

Brian Hennessey

Joshua Duitz

Co-Portfolio Managers

11

| Alpine Dynamic Dividend Fund (continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Credit Risk – Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future. The Fund may hold securities for short periods of time related to the dividend payment periods and may experience loss during these periods.

Emerging Market Securities Risk – The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates. The Fund may enter into forward foreign currency exchange contracts in order to protect against possible losses on foreign investments resulting from adverse changes in the relationship between the U.S. dollar and foreign currencies. Although this method attempts to protect the value of the Fund’s portfolio securities against a decline in the value of a currency, it does not eliminate fluctuations in the underlying prices of the securities and while such contracts tend to minimize the risk of loss due to a decline in the value of the hedged currency, they tend to limit any potential gain which might result should the value of such currency increase.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investment are heightened when investing in issuers of emerging market countries.

Growth Stock Risk – Growth stocks are stocks of companies believed to have above-average potential for growth in revenue and earnings. Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

12

| Alpine Dynamic Dividend Fund (continued) |  |

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Qualified Dividend Tax Risk – Favorable U.S. federal tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Swaps Risk – Swap agreements are derivative instruments that can be individually negotiated and structured to address exposure to a variety of different types of investments or market factors. Depending on their structure, swap agreements may increase or decrease the Fund’s exposure to long- or short-term interest rates, foreign currency values, mortgage securities, corporate borrowing rates, or other factors such as security prices or inflation rates. The Fund also may enter into swaptions, which are options to enter into a swap agreement. Since these transactions generally do not involve the delivery of securities or other underlying assets or principal, the risk of loss with respect to swap agreements and swaptions generally is limited to the net amount of payments that the Fund is contractually obligated to make. There is also a risk of a default by the other party to a swap agreement or swaption, in which case the Fund may not receive the net amount of payments that the Fund contractually is entitled to receive.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to page 5 for other important disclosures and definitions.

13

| Alpine Accelerating Dividend Fund |  |

| Comparative Annualized Returns as of 4/30/13 (unaudited) | | |

| | | |

| | | | 6 Months(1) | | | 1 Year | | | 3 Years | | | Since Inception(2) |

| Alpine Accelerating Dividend Fund — Institutional Class | | | 15.11 | % | | | 16.12 | % | | | 12.04 | % | | | 14.24 | % | |

| Alpine Accelerating Dividend Fund — Class A (Without Load) | | | 14.98 | % | | | 15.85 | % | | | N/A | | | 19.49 | % | |

| Alpine Accelerating Dividend Fund — Class A (With Load) | | | 8.65 | % | | | 9.46 | % | | | N/A | | | 14.52 | % | |

| S&P 500® Index | | | 14.42 | % | | | 16.89 | % | | | 12.80 | % | | | 13.37 | % | |

| Dow Jones Industrial Average | | | 14.86 | % | | | 15.39 | % | | | 13.48 | % | | | 13.31 | % | |

| Lipper Equity Income Funds Average(3) | | | 14.08 | % | | | 17.00 | % | | | 12.57 | % | | | 15.02 | % | |

| Lipper Equity Income Funds Ranking(3) | | | N/A | (4) | | | 240/337 | | | 158/263 | | | 170/248 | |

| Gross Expense Ratio (Institutional Class): 3.26%(5) | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.35%(5) | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 3.51%(5) | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.60%(5) | | | | | | | | | | | | | | | | | |

| (1) | Not annualized. |

| (2) | Institutional Class shares commenced on November 5, 2008 and Class A shares commenced on December 30, 2011. Returns for indices are since November 5, 2008. |

| (3) | The since inception data represents the period beginning November 6, 2008 (Institutional Class only). |

| (4) | FINRA does not recognize rankings for less than one year. |

| (5) | As disclosed in the prospectus dated February 28, 2013. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

The S&P 500® Index is a float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally the leaders in their industry. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500® Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Accelerating Dividend Fund has a contractual expense waiver that continues through February 28, 2014. Where a Fund’s gross and net expense ratio are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

14

| Alpine Dynamic Dividend Fund (continued) |  |

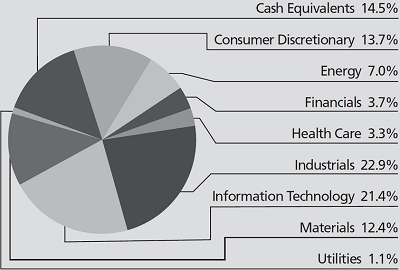

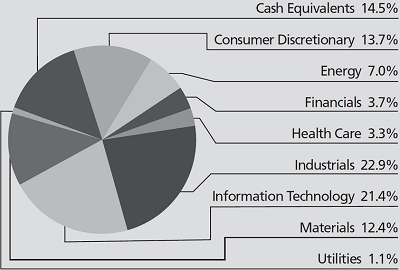

Portfolio Distributions* (unaudited)

| | |

| Top 10 Holdings* (unaudited) | |

| 1. | | American Tower Corp. | 1.78% | |

| 2. | | Walgreen Co. | 1.65% | |

| 3. | | Comcast Corp.-Class A | 1.63% | |

| 4. | | Apple, Inc. | 1.61% | |

| 5. | | Dick’s Sporting Goods, Inc. | 1.60% | |

| 6. | | Xcel Energy, Inc. | 1.59% | |

| 7. | | CMS Energy Corp. | 1.59% | |

| 8. | | QUALCOMM, Inc. | 1.59% | |

| 9. | | Agilent Technologies, Inc. | 1.57% | |

| 10. | | The J.M. Smucker Co. | 1.57% | |

| * | Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio Distributions percentages are based on total investments. Portfolio holdings and sector distributions are as of 04/30/13 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

| | |

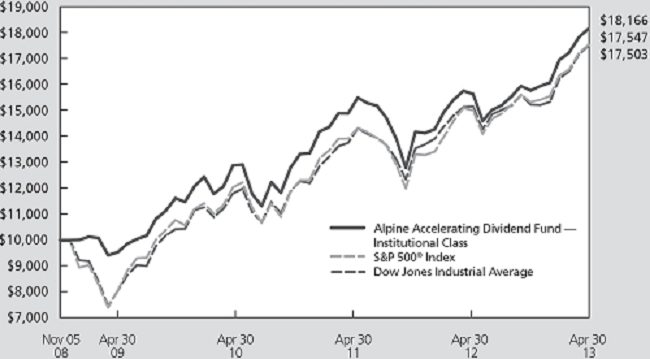

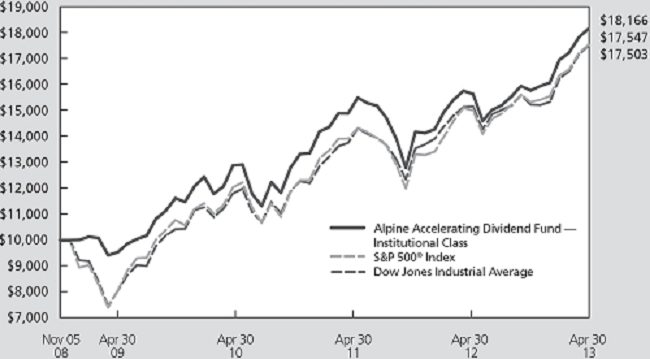

| Value of a $10,000 Investment (unaudited) |

| | |

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

15

| Alpine Accelerating Dividend Fund (continued) |  |

Commentary

For the six months ended April 30, 2013, the Alpine Accelerating Dividend Fund generated a total return of 15.11%. This compares with a total return of 14.42% for the S&P 500® for the same period. During the last six months, the Fund steadily increased its monthly payout from $0.0397 to $0.0403 per share. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

PERFORMANCE DRIVERS

The Fund generally prefers to take a conservative investment stance with regard to portfolio construction and security selection during times of economic and geopolitical uncertainty. For example, the Fund had an average cash holding of 7.7% during the six months ended April 30, 2013 and a portfolio beta of less than 1.0 during the same span. Given the rally in the markets in the second half of the fiscal year, the cash position was a drag on the Fund’s total return. Despite this conservative posture, the fund was able to outperform the S&P 500® by 0.69% for the semi-annual period as our security selection more than compensated for the cash drag.

On a sector basis, the financials had the largest positive impact on the absolute performance of the Fund, followed by consumer staples and healthcare. Telecommunications was the only segment to generate a negative return over the past six months. On a relative basis, financials generated the largest outperformance versus the S&P 500®, followed by consumer staples and industrials. Telecommunications, consumer discretionary, and materials were the worst relative performers.

PORTFOLIO ANALYSIS

The top five contributors to the Fund’s performance during the six months ended April 30, 2013, based on contribution to total return were CBS Corp (42.50%), WisdomTree Investments (85.93%), FXCM Inc. (47.89%), Walgreen Co. (42.62%), and Energizer Holdings Inc. (33.54%).

| | • | CBS Corp. (average weight 1.65%) shares continue to outperform the market for several reasons. Management has improved the visibility of the business by reducing its exposure to the advertising market and the company has made several moves in seeking to improve shareholder returns, such as increasing its buyback program and its dividend payout. |

| | • | WisdomTree (average weight 0.74%) has seen its assets under management grow from $16.7B to $28.0B in the six months ended April 30, 2013 due in large part to the popularity and success of its Japan Hedged Equity ETF, which has received net inflows in excess of $6B and has generated a total return of 50.4% during the period. |

| | • | FXCM (average weight 1.08%), an online foreign exchange broker, enjoyed a rebound in FX trading volumes in the wake of the Japanese central bank’s decision to engage in massive monetary stimulus. As a result of these actions, the Yen has depreciated by over 20% versus the U.S. dollar during the fiscal half year ended April 30, 2013. |

| | | |

| | • | In the period, Walgreens (average weight 1.59%) benefited from improved prescription trends since its settlement with Express Scripts in the latter half of 2012. Plus, the synergies from its Alliance Boots acquisition and the partnership with AmerisourceBergen led to an improvement in the company’s outlook. |

| | | |

| | • | Energizer’s (average weight 1.68%) outlook rose as management was able to achieve its cost savings targets faster than expected. Meanwhile, the battery business has held up a bit better than many investors had feared. |

Apple Inc. (-24.53%), Oi S.A. (-21.99%), Devon Energy Corp. (-4.77%), Suncor Energy (-6.63%), and Elisa OYJ (-7.84%) had the largest adverse impact on the performance of the Fund over the fiscal half year ended April 30, 2013.

| | • | Apple (average weight 1.61%) shares tumbled as the company appeared to reach maturity in its product line and competition began to take a technology lead. In addition, concerns about margins have increased as newer products (such as the iPad Mini) carry margins lower than the corporate average. |

| | | |

| | • | The Brazilian telecommunications industry has struggled this year and Oi S.A. (average weight 0.19%) has been caught in the downdraft. Investors continued to sell shares of Oi as they became frustrated with the slow pace of operational improvements despite multiple years of restructuring. |

| | | |

| | • | Shares of Devon (average weight 1.29%) fell in the wake of its fourth quarter earnings report in February. Investors were disappointed with the |

16

| Alpine Accelerating Dividend Fund (continued) |  |

| | | flattish production growth outlook for 2013 as well as the slow pace of management’s strategic review. |

| | | |

| | • | Similar to Devon, Suncor’s (average weight 1.41%) shares fell after a difficult fourth quarter that witnessed several operating challenges and included a $1.4B non-cash charge for the impairment of the Voyageur JV project that was subsequently cancelled in March. |

| | | |

| | • | Elisa OYJ (average weight 0.18%) shares sold off on the heels of a disappointing first quarter earnings report highlighting an extremely challenging operating environment in the Nordic mobile telecommunications market. |

SUMMARY & OUTLOOK

The Alpine Accelerating Dividend Fund seeks to invest in dividend-paying companies which have the potential to increase or accelerate their dividends in the future, based on our analysis of their growth prospects and cash flow-generating capabilities. The Fund aims to achieve a sustainable and rising stream of dividend income as well as long-term capital growth. We believe that companies with strong franchises characterized by defensible margins and a solid balance sheet are best positioned to increase, and even accelerate, their dividends over time. Overall, we aim to manage the fund conservatively by limiting our international exposure, eschewing the use of leverage, and avoiding large sector bets when possible.

As we look towards the balance of 2013, we remain cautious in our investment stance. The geopolitical environment remains unsettled and there is a great deal of uncertainty as to the strength and durability of the economic recovery underway in the U.S. while Europe remains mired in recession. As such, even in the face of potentially higher taxes in the U.S., we believe that dividend income may become a key signpost for investors to gauge the true financial strength of companies. In a world currently offering low single-digit yields on government bonds, companies with track records of increasing dividends could be the winners in the equity market, in our view. As a result, we are sticking to our knitting – we believe a strategy that seeks to identify stocks with rising dividends as well as those with the potential to not only increase the dividend, but to do so at an accelerating pace, may succeed in the uncertain market environment in which we currently find ourselves and to potentially outperform over time. We think the Fund offers investors an attractive combination of current yield with the potential for increasing payouts over time.

We thank our shareholders for their support and look forward to continued success over the next year.

Sincerely,

Bryan Keane

Andrew Kohl

Co-Portfolio Managers

17

| Alpine Accelerating Dividend Fund (continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future or the anticipated acceleration of dividends could not occur.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investments are heightened when investing in issuers in emerging market countries.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Although the Fund will not concentrate its investments in any one industry or industry group, it may, like many growth funds, weight its investments toward certain industries, thus increasing its exposure to factors adversely affecting issuers within those industries.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

18

| Alpine Accelerating Dividend Fund (continued) |  |

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to page 5 for other important disclosures and definitions.

19

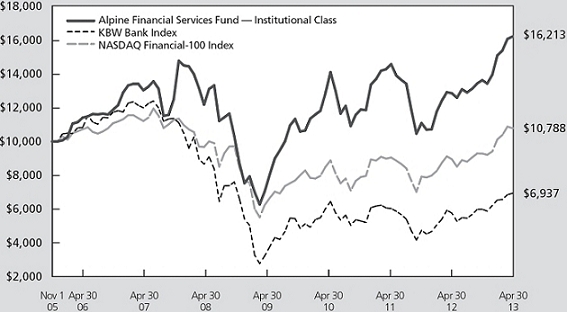

| Alpine Financial Services Fund |  |

| Comparative Annualized Returns as of 4/30/13 (unaudited) | |

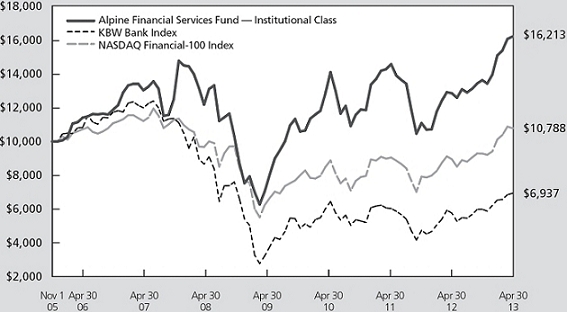

| | | 6 Months(1) | | 1 Year | | 3 Years | | 5 Years | | Since Inception(2) |

| Alpine Financial Services Fund — Institutional Class | | | 18.93 | % | | | 26.12 | % | | | 4.75 | % | | | 4.34 | % | | | | 6.66 | % |

| Alpine Financial Services Fund — Class A (Without Load) | | | 18.86 | % | | | 25.91 | % | | | N/A | | | | N/A | | | | | 36.00 | % |

| Alpine Financial Services Fund — Class A (With Load) | | | 12.31 | % | | | 18.99 | % | | | N/A | | | | N/A | | | | | 30.38 | % |

| KBW Bank Index | | | 15.87 | % | | | 20.32 | % | | | 2.45 | % | | | -5.23 | % | | | | -4.72 | % |

| NASDAQ Financial-100 Index | | | 16.16 | % | | | 20.48 | % | | | 6.78 | % | | | 1.58 | % | | | | 1.07 | % |

| S&P 500® Index | | | 14.42 | % | | | 16.89 | % | | | 12.80 | % | | | 5.21 | % | | | | 6.05 | % |

| Lipper Financial Services Funds Average(3) | | | 15.78 | % | | | 20.54 | % | | | 5.32 | % | | | -0.41 | % | | | | -1.05 | % |

| Lipper Financial Services Funds Ranking(3) | | | N/A | (4) | | | 11/79 | | | | 35/68 | | | | 11/62 | | | | | 2/51 | |

| Gross Expense Ratio (Institutional Class): 1.98%(5) | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.42%(5) | | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 2.23%(5) | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.67%(5) | | | | | | | | | | | | | | | | | | | | | |

| (1) | Not annualized. |

| (2) | Institutional Class shares commenced on November 1, 2005 and Class A shares commenced on December 30, 2011. Returns for indices are since November 1, 2005. |

| (3) | The since inception data represents the period beginning November 3, 2005 (Institutional Class only). |

| (4) | FINRA does not recognize rankings for less than one year. |

| (5) | As disclosed in the prospectus dated February 28, 2013. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions. The NASDAQ Financial-100 Index includes 100 of the largest domestic and international financial securities listed on The NASDAQ Stock Market based on market capitalization. They include companies classified according to the Industry Classification Benchmark as Financials, which are included within the NASDAQ Bank, NASDAQ Insurance, and NASDAQ Other Finance Indexes. The S&P 500® Index is a float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The Lipper Financial Services Funds Average is an average of funds whose primary objective is to invest primarily in equity securities of companies engaged in providing financial services. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The KBW Bank Index, the NASDAQ Financial-100 Index, the S&P 500® Index and the Lipper Financial Services Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Financial Services Fund Average reflects fees charged by the underlying funds. The performance for the Alpine Financial Services Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Financial Services Fund has a contractual expense waiver that continues through February 28, 2014. Where a Fund’s gross and net expense ratio are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.