UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-21236 |

| |

| DREYFUS STOCK FUNDS | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 225 Liberty Street New York, New York 10286 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 09/30 | |

Date of reporting period: | 09/30/15 | |

| | | | | | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which has a different fiscal year end and, therefore, different N-CSR reporting requirements. Separate N-CSR Form will be filed for that series, as appropriate.

Dreyfus International Equity Fund

(formerly, Dreyfus Premier International Equity Fund)

Dreyfus Small Cap Equity Fund

(formerly, Dreyfus Premier Small Cap Equity Fund)

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus International Equity Fund

| | | |

| | ANNUAL REPORT September 30, 2015 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

| | | | |

| |

Dreyfus International Equity Fund

| | The Fund |

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus International Equity Fund, covering the 12-month period from October 1, 2014, through September 30, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Financial markets proved volatile over the reporting period. For much of the year, a recovering U.S. economy enabled stocks to advance, but those gains were erased during the third quarter of 2015 when economic concerns in China, falling commodity prices, and a stronger U.S. dollar sparked sharp corrections in equity markets throughout the world. The emerging markets were especially hard hit. U.S. bonds generally fared better, rallying in late 2014 before reversing course in the spring as the domestic economy strengthened. Global economic instability sparked a renewed rally among U.S. government securities toward the reporting period’s end, but corporate-backed and inflation-linked securities lost value.

We expect market volatility to persist over the near term as investors vacillate between hopes that current turmoil represents a healthy correction and fears that further disappointments could trigger a full-blown bear market. Our investment strategists and portfolio managers are monitoring developments carefully, keeping a close watch on Chinese fiscal and monetary policy, expectations of higher short-term interest rates in the United States, liquidity factors affecting various asset classes, and other developments that could influence investor sentiment. Over the longer term, we remain confident that markets are likely to stabilize as the world adjusts to slower Chinese economic growth, abundant energy resources, and the eventual normalization of U.S. monetary policy. In our view, investors will continue to be well served under these circumstances by a long-term perspective and a disciplined investment approach.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

October 15, 2015

2

DISCUSSION OF FUND PERFORMANCE

For the period of October 1, 2014, through September 30, 2015, as provided by Sean P. Fitzgibbon and Mark A. Bogar, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended September 30, 2015, Dreyfus International Equity Fund’s Class A shares produced a total return of -8.01%, Class C shares returned -8.73%, Class I shares returned -7.77%, and Class Y shares returned -10.72%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (“MSCI EAFE Index”), produced a total return of -8.66% for the same period.2

Developed equity markets lost ground during the reporting period amid heightened volatility stemming from global economic instability. The fund’s Class A, Class I, and Class Y shares outperformed the benchmark, mainly due to strong stock selections in the United Kingdom, France, and Ireland.

The Fund’s Investment Approach

The fund seeks long-term growth of capital. The fund normally invests at least 80% of assets in shares of companies located in the foreign countries represented in the MSCI EAFE Index and Canada, and may also invest up to 20% of its assets in securities of issuers located in emerging market countries.

The fund invests in stocks that appear to be undervalued and exhibit better fundamentals than the market expects. We employ a “bottom-up” investment approach, which emphasizes individual stock selection. Our stock selection process is designed to produce a diversified portfolio that, relative to the MSCI EAFE Index, frequently has a below-average price/earnings ratio and an above-average earnings growth trend.

International Equities Declined Amid Volatility

Shifting economic sentiment produced heightened volatility for international stock markets throughout the reporting period. Major global equity indices fell in early-October 2014 before recovering much of that ground in November. Markets again declined in December 2014 and early January 2015 in the midst of plummeting energy prices as a glut of oil and gas was met by tepid demand from the emerging markets. A subsequent economic recovery through the spring of 2015 was supported by quantitative easing from major central banks, and stock prices began to rally from their lows. As a result, by mid-May 2015 the MSCI EAFE Index had posted positive absolute returns.

In June and early July, however, stock prices fell again over renewed concerns about a debt crisis in Greece and slowing economic growth in China. Those concerns were exacerbated when the Chinese central bank later devalued the country’s currency, creating an increasingly risk-averse attitude among investors and sparking further declines in international stock prices through the reporting period’s end. International investment results for U.S. residents were further undermined by a strengthening U.S. dollar against most other currencies.

3

DISCUSSION OF FUND PERFORMANCE (continued)

Fund Strategies Helped Cushion Market’s Decline

The fund’s country allocation and security selection strategies helped the Class A, Class I, and Class Y shares outperform the MSCI EAFE Index for the reporting period overall. Modestly overweighted exposure to and strong security selections in the United Kingdom proved especially helpful, as the fund held little exposure to energy stocks and no exposure to materials stocks that weighed on U.K. market results. Moreover, the fund achieved strong relative returns from favorable timing of trades in pharmaceutical developer Shire Pharmaceuticals and gains posted by broadcaster Sky. Overweighted exposure to France also bolstered relative performance, as did positions in aerospace companies Thales and Safran, which benefited from a weaker euro and lower fuel prices. Professional services firm Cap Gemini fared well amid rising enterprise spending on technology consulting. Finally, results in Ireland were bolstered by packaging supplier Smurfit Kappa Group, which saw robust demand for its products from growth in shipments from Internet retailers. From an industry group perspective, the fund’s results were supported by relative strength in the materials and industrials sectors.

Relative performance proved more disappointing in Hong Kong, where casino operator SJM Holdings was undermined by reduced traffic from mainland China. In Japan, automakers Isuzu Motors and Honda Motor struggled with weakness in emerging markets and disappointing sales of new models, respectively. In addition, energy producer Inpex was hurt by a weakening yen and delays in the completion of a project under development. As for industry groups, shortfalls in the financials sector included Germany’s Commerzbank and the U.K.’s HSBC Holdings and Royal Bank of Scotland Group.

Finding Opportunities in a Turbulent Market

We are carefully monitoring macroeconomic developments throughout the world. We expect volatility to persist over the near term, but we remain optimistic about the longer term prospects for equities in developed markets. Aggressively accommodative monetary policies are at work in Europe, Japan, and China; the U.S. economy has continued to grow; and many stocks appear to have been punished more severely than is warranted by their underlying fundamentals. Therefore, we remain watchful for opportunities to purchase stocks of fundamentally sound businesses at attractive prices. In recent months we have identified a number of compelling investment ideas in the United Kingdom and Spain, but relatively fewer in Germany and Australia.

October 15, 2015

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period.

Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social, and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability, and differing auditing and legal standards. These risks are enhanced in emerging markets countries. Investments in foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline relative to the currency being hedged. Each of these risks could increase the fund’s volatility.

1Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses by The Dreyfus Corporation and The Boston Company Asset Management,

4

LLC. Had these expenses not been absorbed, returns would have been lower. Total return for Class Y shares is from inception on 6/1/2015.

2SOURCE: LIPPER INC. – Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. Returns are calculated on a month-end basis. Investors cannot invest directly in any index.

5

FUND PERFORMANCE

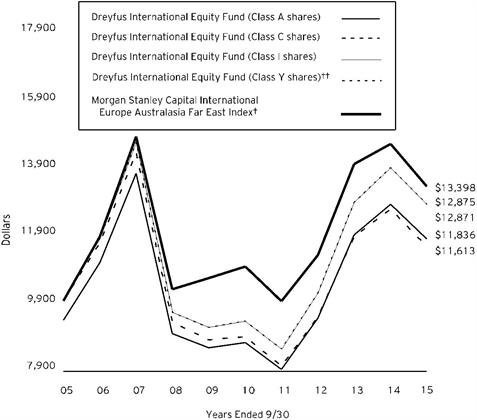

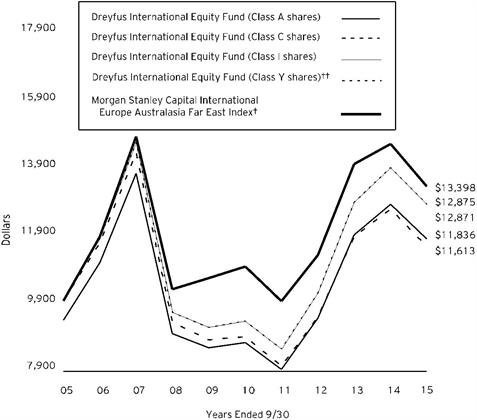

Comparison of change in value of $10,000 investment in Dreyfus International Equity Fund Class A shares, Class C shares, Class I shares and Class Y shares and the Morgan Stanley Capital International Europe Australasia Far East Index

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 6/1/15 (the inception date for Class Y shares).

Past performance is not predictive of future performance.

On July 22, 2015 the Board authorized the fund to offer Class Y shares, as a new class of shares, to certain investors, including certain institutional investors. On June 1, 2015, Class Y shares were offered at net asset value and are not subject to certain fees, including Distribution Plan and Shareholder Services Plan fees.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus International Equity Fund on 9/30/05 to a $10,000 investment made in the Morgan Stanley Capital International Europe Australasia Far East Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested.

Prior to 8/1/07, the fund invested its assets in a "master portfolio" that had the same investment objective and policies as the fund. This master/feeder arrangement was terminated on 8/1/07 and the fund operates as a stand alone fund.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 9/30/15 | | | | |

| Inception Date | 1 Year | 5 Years | 10 Years |

Class A shares | | | | |

with maximum sales charge (5.75%) | 12/8/88 | -13.31% | 4.96% | 1.70% |

without sales charge | 12/8/88 | -8.01% | 6.21% | 2.30% |

Class C shares | | | | |

with applicable redemption charge † | 12/8/88 | -9.63% | 5.39% | 1.51% |

without redemption | 12/8/88 | -8.73% | 5.39% | 1.51% |

Class I shares | 12/8/88 | -7.77% | 6.50% | 2.56% |

Class Y shares†† | 6/1/15 | -7.79% | 6.49% | 2.56% |

Morgan Stanley Capital International | | | | |

Europe Australasia Far East Index | | -8.66% | 3.98% | 2.97% |

Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 6/1/15 (the inception date for Class Y shares).

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus International Equity Fund from April 1, 2015 to September 30, 2015. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended September 30, 2015† |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000†† | | $5.41 | | $9.16 | | $4.11 | | $2.69 |

Ending value (after expenses) | | $925.90 | | $922.20 | | $927.20 | | $892.80 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended September 30, 2015††† |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000†††† | | $5.67 | | $9.60 | | $4.31 | | $4.31 |

Ending value (after expenses) | | $1,019.45 | | $1,015.54 | | $1,020.81 | | $1,020.81 |

† From June 1, 2015 (commencement of initial offering) to September 30, 2015 for Class Y.

†† Expenses are equal to the fund’s annualized expense ratio of 1.12% for Class A, 1.90% for Class C and .85% for Class I, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). Expenses are equal to the fund’s annualized expense ratio of .85% for Class Y, multiplied by the average account value over the period, multiplied by 122/365 (to reflect the actual days in the period).

††† Please note that while Class Y shares commenced operations on June 1, 2015, the hypothetical expenses paid during the period reflect projected activity for the full six month period for purposes of comparability. This projection assumes that annualized expense ratios were in effect during the period April 1, 2015 to September 30, 2015.

†††† Expenses are equal to the fund’s annualized expense ratio of 1.12% for Class A, 1.90% for Class C, .85% for Class I and .85% for Class Y, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

September 30, 2015

| | | | | | | | | |

Common Stocks - 97.6% | | Shares | | Value ($) | |

Australia - 3.8% | | | | | |

ASX | | 64,750 | | 1,727,070 | |

Dexus Property Group | | 803,740 | | 4,041,177 | |

Goodman Group | | 533,349 | | 2,196,501 | |

Lend Lease Group | | 298,082 | | 2,634,197 | |

Woodside Petroleum | | 210,786 | | 4,309,829 | |

| | | | | 14,908,774 | |

Belgium - .9% | | | | | |

bpost | | 72,832 | | 1,729,307 | |

Solvay | | 18,924 | | 1,934,219 | |

| | | | | 3,663,526 | |

France - 9.9% | | | | | |

Atos | | 39,000 | | 2,995,187 | |

AXA | | 228,197 | | 5,540,004 | |

Cap Gemini | | 43,995 | | 3,920,235 | |

Carrefour | | 158,884 | | 4,708,635 | |

Safran | | 51,358 | | 3,875,132 | |

Sanofi | | 81,397 | | 7,754,381 | |

Societe Generale | | 133,140 | | 5,955,658 | |

Thales | | 58,123 | | 4,049,370 | |

| | | | | 38,798,602 | |

Germany - 7.1% | | | | | |

Commerzbank | | 702,058 | a | 7,389,986 | |

Continental | | 24,249 | | 5,150,991 | |

Evonik Industries | | 86,461 | | 2,889,897 | |

Infineon Technologies | | 431,920 | | 4,853,984 | |

Muenchener Rueckversicherungs | | 16,741 | | 3,118,790 | |

ProSiebenSat.1 Media | | 91,844 | | 4,497,607 | |

| | | | | 27,901,255 | |

Hong Kong - 1.5% | | | | | |

AIA Group | | 1,117,200 | | 5,816,751 | |

Ireland - 1.8% | | | | | |

Bank of Ireland | | 8,193,878 | a | 3,189,881 | |

Smurfit Kappa Group | | 142,881 | | 3,841,152 | |

| | | | | 7,031,033 | |

Israel - 3.0% | | | | | |

Bezeq The Israeli Telecommunication | | 1,968,781 | | 3,766,045 | |

Teva Pharmaceutical Industries, ADR | | 143,993 | | 8,129,845 | |

| | | | | 11,895,890 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | | |

Common Stocks - 97.6% (continued) | | Shares | | Value ($) | |

Italy - 4.2% | | | | | |

Assicurazioni Generali | | 240,156 | | 4,404,849 | |

Banco Popolare | | 153,951 | a | 2,277,310 | |

Enel | | 955,573 | | 4,272,776 | |

Prysmian | | 92,867 | | 1,921,101 | |

Telecom Italia | | 2,850,448 | a | 3,504,678 | |

| | | | | 16,380,714 | |

Japan - 21.8% | | | | | |

Aisin Seiki | | 156,500 | | 5,263,717 | |

Chubu Electric Power | | 213,000 | | 3,149,652 | |

East Japan Railway | | 26,800 | | 2,267,926 | |

Fujitsu | | 842,000 | | 3,671,876 | |

Hitachi Chemical | | 113,500 | | 1,569,291 | |

Japan Airlines | | 115,300 | | 4,070,361 | |

Kaken Pharmaceutical | | 21,500 | | 2,003,650 | |

KDDI | | 250,600 | | 5,612,019 | |

Mitsubishi Electric | | 467,000 | | 4,287,860 | |

Nintendo | | 27,400 | | 4,629,004 | |

Nippon Shokubai | | 29,400 | | 2,003,195 | |

Nitto Denko | | 38,100 | | 2,288,332 | |

Panasonic | | 638,600 | | 6,483,110 | |

Resona Holdings | | 764,400 | | 3,905,487 | |

Secom | | 49,700 | | 2,994,913 | |

Seven & I Holdings | | 179,400 | | 8,219,676 | |

Shionogi & Co. | | 63,700 | | 2,289,721 | |

Sony | | 249,600 | | 6,103,079 | |

Sumitomo Mitsui Financial Group | | 216,200 | | 8,230,192 | |

TDK | | 41,900 | | 2,383,290 | |

Tosoh | | 877,000 | | 4,245,912 | |

| | | | | 85,672,263 | |

Luxembourg - .5% | | | | | |

Aperam | | 76,817 | a | 2,075,660 | |

Netherlands - 4.2% | | | | | |

Airbus Group | | 55,068 | | 3,270,837 | |

Heineken | | 50,747 | | 4,107,421 | |

NXP Semiconductors | | 34,604 | a | 3,012,970 | |

RELX | | 368,519 | | 6,016,685 | |

| | | | | 16,407,913 | |

Portugal - 1.0% | | | | | |

Galp Energia | | 397,013 | | 3,916,651 | |

10

| | | | | | | | | | | |

Common Stocks - 97.6% (continued) | | Shares | | Value ($) | |

Singapore - 1.9% | | | | | |

ComfortDelGro | | 626,600 | | 1,268,544 | |

Oversea-Chinese Banking | | 735,100 | | 4,551,377 | |

Singapore Exchange | | 307,200 | | 1,520,251 | |

| | | | | 7,340,172 | |

Spain - 3.7% | | | | | |

ACS Actividades de Construccion y Servicios | | 128,498 | | 3,695,054 | |

Banco Bilbao Vizcaya Argentaria | | 1,050,206 | | 8,907,587 | |

Distribuidora Internacional de Alimentacion | | 343,627 | a | 2,076,941 | |

| | | | | 14,679,582 | |

Sweden - 2.2% | | | | | |

Boliden | | 147,591 | | 2,310,582 | |

SKF, Cl. B | | 134,678 | | 2,481,273 | |

Svenska Cellulosa, Cl. B | | 135,814 | | 3,805,784 | |

| | | | | 8,597,639 | |

Switzerland - 9.0% | | | | | |

Actelion | | 22,760 | a | 2,895,244 | |

Adecco | | 52,036 | a | 3,815,532 | |

Julius Baer Group | | 51,578 | a | 2,346,701 | |

Novartis | | 96,051 | | 8,847,714 | |

Roche Holding | | 50,731 | | 13,410,943 | |

Swiss Life Holding | | 17,650 | a | 3,945,948 | |

| | | | | 35,262,082 | |

United Kingdom - 20.4% | | | | | |

AstraZeneca | | 131,791 | | 8,363,873 | |

Aviva | | 573,711 | | 3,932,813 | |

BAE Systems | | 400,883 | | 2,721,677 | |

BG Group | | 311,677 | | 4,494,283 | |

Compass Group | | 245,648 | | 3,921,781 | |

HSBC Holdings | | 1,138,350 | | 8,611,353 | |

Imperial Tobacco Group | | 110,077 | | 5,697,368 | |

National Grid | | 425,378 | | 5,924,119 | |

Petrofac | | 171,186 | | 1,995,340 | |

Prudential | | 254,039 | | 5,370,510 | |

Sky | | 409,695 | | 6,483,044 | |

Unilever | | 272,025 | | 11,081,050 | |

Whitbread | | 47,990 | | 3,394,392 | |

Wolseley | | 53,217 | | 3,113,146 | |

WPP | | 248,527 | | 5,175,514 | |

| | | | | 80,280,263 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Common Stocks - 97.6% (continued) | | Shares | | Value ($) | |

United States - .7% | | | | | |

iShares MSCI EAFE ETF | | 50,405 | | 2,889,215 | |

Total Common Stocks (cost $410,041,714) | | | | 383,517,985 | |

Other Investments - 1.5% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Preferred Plus Money Market Fund | | 5,749,627 | b | 5,749,627 | |

(cost $5,749,627) | | | | | |

Total Investments (cost $415,791,341) | | 99.1% | | 389,267,612 | |

Cash and Receivables (Net) | | .9% | | 3,524,997 | |

Net Assets | | 100.0% | | 392,792,609 | |

ADR—American Depository Receipt

ETF—Exchange-Traded Fund

a Non-income producing security.

b Investment in affiliated money market mutual fund.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Financials | 24.7 |

Consumer Discretionary | 13.8 |

Health Care | 13.7 |

Industrials | 12.4 |

Consumer Staples | 10.1 |

Materials | 6.5 |

Information Technology | 5.3 |

Energy | 3.7 |

Utilities | 3.4 |

Telecommunications | 3.3 |

Money Market Investment | 1.5 |

Exchange-Traded Funds | .7 |

| | 99.1 |

†Based on net assets.

See notes to financial statements.

12

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2015

| | | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments: | | | | | |

Unaffiliated issuers | | 410,041,714 | | 383,517,985 | |

Affiliated issuers | | 5,749,627 | | 5,749,627 | |

Cash | | | | | 133,271 | |

Cash denominated in foreign currency | | | 1,151,595 | | 1,132,610 | |

Receivable for investment securities sold | | | | | 1,643,936 | |

Dividends receivable | | | | | 1,237,289 | |

Receivable for shares of Beneficial Interest subscribed | | | | | 1,181,762 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | | | | 1,511 | |

Prepaid expenses and other assets | | | | | 36,794 | |

| | | | | 394,634,785 | |

Liabilities ($): | | | | |

Due to The Boston Company Asset

Management, LLC and affiliates—Note 3(c) | | | | | 293,713 | |

Payable for investment securities purchased | | | | | 1,221,016 | |

Payable for shares of Beneficial Interest redeemed | | | | | 212,486 | |

Interest payable—Note 2 | | | | | 47 | |

Accrued expenses | | | | | 114,914 | |

| | | | | 1,842,176 | |

Net Assets ($) | | | 392,792,609 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 457,420,326 | |

Accumulated undistributed investment income—net | | | | | 3,354,624 | |

Accumulated net realized gain (loss) on investments | | | | | (41,409,709) | |

Accumulated net unrealized appreciation (depreciation)

on investments and foreign currency transactions | | | | | (26,572,632) | |

Net Assets ($) | | | 392,792,609 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 77,051,700 | 11,079,252 | 83,178,539 | 221,483,118 | |

Shares Outstanding | 2,380,691 | 341,348 | 2,540,364 | 6,767,591 | |

Net Asset Value Per Share ($) | 32.37 | 32.46 | 32.74 | 32.73 | |

See notes to financial statements.

13

STATEMENT OF OPERATIONS

Year Ended September 30, 2015

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $690,147 foreign taxes withheld at source): | | | | |

Unaffiliated issuers | | | 7,613,951 | |

Affiliated issuers | | | 3,552 | |

Total Income | | | 7,617,503 | |

Expenses: | | | | |

Investment advisory fee—Note 3(a) | | | 2,667,017 | |

Shareholder servicing costs—Note 3(c) | | | 359,557 | |

Administration fee—Note 3(a) | | | 333,377 | |

Custodian fees—Note 3(c) | | | 99,877 | |

Professional fees | | | 92,677 | |

Distribution fees—Note 3(b) | | | 71,586 | |

Registration fees | | | 68,327 | |

Trustees' fees and expenses—Note 3(d) | | | 25,397 | |

Prospectus and shareholders’ reports | | | 20,868 | |

Loan commitment fees—Note 2 | | | 3,357 | |

Interest expense—Note 2 | | | 1,606 | |

Miscellaneous | | | 36,078 | |

Total Expenses | | | 3,779,724 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (638,945) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (103) | |

Net Expenses | | | 3,140,676 | |

Investment Income—Net | | | 4,476,827 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | (5,172,449) | |

Net realized gain (loss) on forward foreign currency exchange contracts | 108,089 | |

Net Realized Gain (Loss) | | | (5,064,360) | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | (31,970,008) | |

Net unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | | | 2,783 | |

Net Unrealized Appreciation (Depreciation) | | | (31,967,225) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (37,031,585) | |

Net (Decrease) in Net Assets Resulting from Operations | | (32,554,758) | |

See notes to financial statements.

14

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2015 | a | | 2014 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 4,476,827 | | | | 4,071,620 | |

Net realized gain (loss) on investments | | (5,064,360) | | | | 26,172,427 | |

Net unrealized appreciation (depreciation)

on investments | | (31,967,225) | | | | (16,444,603) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | (32,554,758) | | | | 13,799,444 | |

Dividends to Shareholders from ($): | | | | | | | | |

Investment income—net: | | | | | | | | |

Class A | | | (977,579) | | | | (815,846) | |

Class C | | | (52,770) | | | | (44,739) | |

Class I | | | (3,175,200) | | | | (2,002,948) | |

Total Dividends | | | (4,205,549) | | | | (2,863,533) | |

Beneficial Interest Transactions ($): | | | | | | | | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 33,038,509 | | | | 35,551,257 | |

Class C | | | 5,736,049 | | | | 4,351,181 | |

Class I | | | 133,826,169 | | | | 81,221,233 | |

Class Y | | | 234,043,399 | | | | - | |

Dividends reinvested: | | | | | | | | |

Class A | | | 913,376 | | | | 748,610 | |

Class C | | | 34,328 | | | | 26,128 | |

Class I | | | 3,129,817 | | | | 2,000,368 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (26,006,741) | | | | (13,515,910) | |

Class C | | | (2,430,191) | | | | (1,070,740) | |

Class I | | | (252,483,673) | | | | (9,710,277) | |

Class Y | | | (500,867) | | | | - | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | 129,300,175 | | | | 99,601,850 | |

Total Increase (Decrease) in Net Assets | 92,539,868 | | | | 110,537,761 | |

Net Assets ($): | | | | | | | | |

Beginning of Period | | | 300,252,741 | | | | 189,714,980 | |

End of Period | | | 392,792,609 | | | | 300,252,741 | |

Undistributed investment income—net | 3,354,624 | | | | 3,396,563 | |

15

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2015 | a | | 2014 | |

Capital Share Transactions: | | | | | | | | |

Class A | | | | | | | | |

Shares sold | | | 942,618 | | | | 986,190 | |

Shares issued for dividends reinvested | | | 27,119 | | | | 20,952 | |

Shares redeemed | | | (751,891) | | | | (374,866) | |

Net Increase (Decrease) in Shares Outstanding | 217,846 | | | | 632,276 | |

Class C | | | | | | | | |

Shares sold | | | 162,124 | | | | 120,097 | |

Shares issued for dividends reinvested | | | 1,010 | | | | 725 | |

Shares redeemed | | | (70,073) | | | | (29,458) | |

Net Increase (Decrease) in Shares Outstanding | 93,061 | | | | 91,364 | |

Class Ib | | | | | | | | |

Shares sold | | | 3,811,368 | | | | 2,226,017 | |

Shares issued for dividends reinvested | | | 92,080 | | | | 55,566 | |

Shares redeemed | | | (7,307,859) | | | | (265,527) | |

Net Increase (Decrease) in Shares Outstanding | (3,404,411) | | | | 2,016,056 | |

Class Yb | | | | | | | | |

Shares sold | | | 6,782,212 | | | | - | |

Shares redeemed | | | (14,621) | | | | - | |

Net Increase (Decrease) in Shares Outstanding | 6,767,591 | | | | - | |

a Effective June 1, 2015, the fund commenced offering Class Y shares. | |

b During the period ended September 30, 2015, 6,298,013 Class I shares representing $217,407,407 were exchanged for 6,298,013 Class Y shares. | |

See notes to financial statements.

16

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | | | |

| | Year Ended September 30, |

Class A Shares | | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | 35.69 | 33.61 | 27.34 | 23.42 | 26.30 |

Investment Operations: | | | | | | |

Investment income—neta | .39 | .50 | .47 | .54 | .52 |

Net realized and unrealized gain (loss) on investments | (3.23) | 2.06 | 6.52 | 3.86 | (2.81) |

Total from Investment Operations | (2.84) | 2.56 | 6.99 | 4.40 | (2.29) |

Distributions: | | | | | | |

Dividends from investment income—net | (.48) | (.48) | (.72) | (.48) | (.59) |

Net asset value, end of period | 32.37 | 35.69 | 33.61 | 27.34 | 23.42 |

Total Return (%)b | (8.01) | 7.62 | 26.02 | 19.12 | (9.06) |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses to average net assets | 1.37 | 1.40 | 1.46 | 1.54 | 1.50 |

Ratio of net expenses to average net assets | | 1.12 | 1.12 | 1.12 | 1.12 | 1.12 |

Ratio of net investment income to average net assets | 1.12 | 1.38 | 1.55 | 2.12 | 1.86 |

Portfolio Turnover Rate | 87.33 | 89.36 | 71.87 | 64.52 | 89.90 |

Net Assets, end of period ($ x 1,000) | 77,052 | 77,195 | 51,441 | 36,972 | 37,389 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

17

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | | | |

| | Year Ended September 30, |

Class C Shares | | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | 35.79 | 33.75 | 27.45 | 23.44 | 26.30 |

Investment Operations: | | | | | | |

Investment income—neta | .14 | .24 | .24 | .34 | .33 |

Net realized and unrealized gain (loss) on investments | (3.25) | 2.05 | 6.55 | 3.90 | (2.85) |

Total from Investment Operations | (3.11) | 2.29 | 6.79 | 4.24 | (2.52) |

Distributions: | | | | | | |

Dividends from investment income—net | (.22) | (.25) | (.49) | (.23) | (.34) |

Net asset value, end of period | 32.46 | 35.79 | 33.75 | 27.45 | 23.44 |

Total Return (%)b | (8.73) | 6.78 | 25.03 | 18.24 | (9.78) |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses to average net assets | 2.14 | 2.17 | 2.27 | 2.34 | 2.27 |

Ratio of net expenses to average net assets | 1.90 | 1.90 | 1.90 | 1.90 | 1.90 |

Ratio of net investment income to average net assets | .39 | .66 | .77 | 1.33 | 1.16 |

Portfolio Turnover Rate | 87.33 | 89.36 | 71.87 | 64.52 | 89.90 |

Net Assets, end of period ($ x 1,000) | 11,079 | 8,887 | 5,297 | 4,724 | 5,348 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

18

| | | | | | | | | |

| | | | | |

| | Year Ended September 30, |

Class I Shares | | 2015 | 2014 | 2013 | 2012 | 2011 | |

Per Share Data ($): | | | | | | | |

Net asset value, beginning of period | 36.03 | 33.85 | 27.47 | 23.58 | 26.49 | |

Investment Operations: | | | | | | | |

Investment income—neta | .56 | .62 | .54 | .64 | .68 | |

Net realized and unrealized gain (loss) on investments | (3.34) | 2.06 | 6.57 | 3.86 | (2.93) | |

Total from Investment Operations | (2.78) | 2.68 | 7.11 | 4.50 | (2.25) | |

Distributions: | | | | | | | |

Dividends from investment income—net | (.51) | (.50) | (.73) | (.61) | (.66) | |

Net asset value, end of period | 32.74 | 36.03 | 33.85 | 27.47 | 23.58 | |

Total Return (%) | (7.77) | 7.91 | 26.36 | 19.51 | (8.86) | |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | 1.03 | 1.04 | 1.07 | 1.10 | 1.08 | |

Ratio of net expenses to average net assets | .85 | .85 | .85 | .85 | .85 | |

Ratio of net investment income to average net assets | 1.57 | 1.70 | 1.77 | 2.49 | 2.41 | |

Portfolio Turnover Rate | 87.33 | 89.36 | 71.87 | 64.52 | 89.90 | |

Net Assets, end of period ($ x 1,000) | 83,179 | 214,170 | 132,978 | 124,328 | 111,593 | |

a Based on average shares outstanding.

See notes to financial statements.

19

FINANCIAL HIGHLIGHTS (continued)

| | | | |

| | | | |

Class Y Shares | | Year Ended

September 30, 2015 | a |

Per Share Data ($): | | | |

Net asset value, beginning of period | | 36.66 | |

Investment Operations: | | | |

Investment income—netb | | .10 | |

Net realized and unrealized gain (loss) on investments | | (4.03) | |

Total from Investment Operations | | (3.93) | |

Net asset value, end of period | | 32.73 | |

Total Return (%) | | (10.72) | c |

Ratios/Supplemental Data (%): | | | |

Ratio of total expenses to average net assets | | 1.01 | d |

Ratio of net expenses to average net assets | | .85 | d |

Ratio of net investment income to average net assets | | .95 | d |

Portfolio Turnover Rate | | 87.33 | |

Net Assets, end of period ($x 1,000) | | 221,483 | |

a From June 1, 2015 (commencement of initial offering) to September 30, 2015.

b Based on average shares outstanding.

c Not annualized.

d Annualized.

See notes to financial statements.

20

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus International Equity Fund (the “fund”) is a separate diversified series of Dreyfus Stock Funds (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering three series, including the fund. The fund’s investment objective is to seek long-term growth of capital. The Boston Company Asset Management, LLC (“TBCAM”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. The Dreyfus Corporation (the “Administrator” or “Dreyfus”), a wholly-owned subsidiary of BNY Mellon and an affiliate of TBCAM, serves as the fund’s Administrator.

On May 4, 2015, the Company’s Board of Trustees (the “Board”) approved, effective June 1, 2015 for the fund to offer Class Y shares.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I and Class Y. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I and Class Y shares are sold at net asset value per share generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under

21

NOTES TO FINANCIAL STATEMENTS (continued)

authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are

22

primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

23

NOTES TO FINANCIAL STATEMENTS (continued)

The following is a summary of the inputs used as of September 30, 2015 in valuing the fund’s investments:

| | | | | | | |

Assets ($) | Level 1 Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | | Level 3 Significant Unobservable Inputs | Total |

Investments in Securities: | | | |

Equity Securities - Foreign Common Stocks† | 11,142,815 | 369,485,955 | †† | - | 380,628,770 |

Exchange-Traded Funds | 2,889,215 | - | | - | 2,889,215 |

Mutual Funds | 5,749,627 | - | | - | 5,749,627 |

Other Financial Instruments: | | | |

Forward Foreign Currency Exchange Contracts††† | - | 1,511 | | - | 1,511 |

† See Statement of Investments for additional detailed categorizations.

†† Securities classified within Level 2 at period end as the values were determined pursuant to the fund’s fair valuation procedures. See note above for additional information.

††† Amount shown represents unrealized appreciation at period end.

At September 30, 2014, no exchange traded foreign equity securities were classified within Level 2 of the fair value hierarchy pursuant to the fund’s fair valuation procedures.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest

24

income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended September 30, 2015 were as follows:

| | | | | | |

Affiliated Investment Company | Value 9/30/2014 ($) | Purchases ($) | Sales ($) | Value 9/30/2015 ($) | Net

Assets (%) |

Dreyfus Institutional Preferred Plus Money Market Fund | 2,415,052 | 190,007,259 | 186,672,684 | 5,749,627 | 1.5 |

Certain affiliated investment companies may also invest in the fund. At September 30, 2015, Dreyfus Diversified International Fund, an affiliate of the fund, held 6,688,479 Class Y shares representing approximately 55.7% of the fund's net assets.

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable

25

NOTES TO FINANCIAL STATEMENTS (continued)

provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2015, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended September 30, 2015, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended September 30, 2015 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2015, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $3,630,258, accumulated capital losses $35,896,028 and unrealized depreciation $28,136,237. In addition, the fund had $4,225,710 of capital losses realized after October 31, 2014, which were deferred for tax purposes to the first day of the following fiscal year.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to September 30, 2015. If not applied, the carryover expires in fiscal year 2018.

The tax character of distributions paid to shareholders during the fiscal periods ended September 30, 2015 and September 30, 2014 were as follows: ordinary income $4,205,549 and $2,863,533, respectively.

During the period ended September 30, 2015, as a result of permanent book to tax differences, primarily due to the tax treatment for passive foreign investment companies and foreign currency gains and losses, the fund decreased accumulated undistributed investment income-net by $313,217 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $430 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 8, 2014, the unsecured credit facility with Citibank, N.A. was $265 million. In connection therewith, the fund has agreed to pay its pro rata portion of

26

commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended September 30, 2015 was approximately $143,800 with a related weighted average annualized interest rate of 1.12%.

NOTE 3—Investment Advisory Fee, Administration Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with TBCAM, the investment advisory fee is computed at the annual rate of .80% of the value of the fund's average daily net assets up to $500 million, .75% of the next $500 million of such assets, .70% of the next $500 million of such assets, .60% of the next $500 million of such assets and .50% of the fund’s average daily net assets in excess of $2 billion and is payable monthly. The effective investment advisory fee rate during the period ended September 30, 2015 was .80%.

Dreyfus and TBCAM have contractually agreed, from October 1, 2014 through September 30, 2015, for Class A, Class C and Class I shares and from June 1, 2015 through June 1, 2016 for Class Y shares, to assume the direct expenses of the fund, so that such expenses of Class A, Class C, Class I and Class Y shares (excluding taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) do not exceed 1.12%, 1.90%, .85% and .85% of the value of the respective class’ average daily net assets, until the fiscal year end following such time as the expenses are equal to or less than such annual rate for Class A, Class C and Class I. With respect to Class Y shares, this agreement will continue until June 1, 2016, after which the expense limitation can be terminated at any time. The reduction in expenses, pursuant to the undertaking, amounted to $638,945 during the period ended September 30, 2015.

The fund compensates Dreyfus under an administration agreement for providing personnel and facilities to perform accounting and administration services for the fund at an annual rate of .10% of the value of the fund’s average daily net assets. Pursuant to the administration agreement, the fund was charged $333,377 during the period ended September 30, 2015.

During the period ended September 30, 2015, the Distributor retained $10,238 from commissions earned on sales of the fund's Class A shares and $6,378 from CDSCs on redemptions of the fund's Class C shares.

27

NOTES TO FINANCIAL STATEMENTS (continued)

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended September 30, 2015, Class C shares were charged $71,586 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended September 30, 2015, Class A and Class C shares were charged $184,360 and $23,862, respectively, pursuant to the Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended September 30, 2015, the fund was charged $40,154 for transfer agency services and $2,508 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $103.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended September 30, 2015, the fund was charged $99,877 pursuant to the custody agreement.

During the period ended September 30, 2015, the fund was charged $11,078 for services performed by the Chief Compliance Officer and his staff.

28

The components of “Due to TBCAM and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $254,288, administration fees $31,786, Distribution Plan fees $6,674, Shareholder Services Plan fees $18,064, custodian fees $42,418, Chief Compliance Officer fees $2,606 and transfer agency fees $8,161, which are offset against an expense reimbursement currently in effect in the amount of $70,284.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended September 30, 2015, amounted to $412,327,840 and $288,465,997, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. The fund enters into International Swaps and Derivatives Association, Inc. Master Agreements or similar agreements (collectively, “Master Agreements”) with its over-the-counter (“OTC”) derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under a Master Agreement, the fund may offset with the counterparty certain derivative financial instrument’s payables and/or receivables with collateral held and/or posted and create one single net payment in the event of default or termination.

Each type of derivative instrument that was held by the fund during the period ended September 30, 2015 is discussed below.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract

29

NOTES TO FINANCIAL STATEMENTS (continued)

decreases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is generally limited to the unrealized gain on each open contract. This risk may be mitigated by Master Agreements, if any, between the fund and the counterparty and the posting of collateral, if any, by the counterparty to the fund to cover the fund’s exposure to the counterparty. The following summarizes open forward contracts at September 30, 2015:

| | | | | |

Forward Foreign Currency Exchange Contracts | Foreign Currency

Amounts | Cost ($) | Value ($) | Unrealized Appreciation ($) |

Purchases: | | | | |

Citigroup | | | | |

Israeli Shekel, | | | | |

Expiring | | | | |

10/1/2015 | 156,305 | 39,801 | 39,844 | 43 |

Goldman Sachs International | | | | |

Australian Dollar, | | | | |

Expiring | | | | |

10/1/2015 | 226,580 | 158,923 | 159,037 | 114 |

Singapore Dollar, | | | | |

Expiring | | | | |

10/1/2015 | 111,710 | 78,228 | 78,501 | 273 |

JP Morgan Chase Bank | | | | |

Japanese Yen, | | | | |

Expiring | | | | |

10/1/2015 | 105,995,956 | 882,476 | 883,557 | 1,081 |

| | | | | |

Gross Unrealized Appreciation | | | | 1,511 |

The provisions of ASC Topic 210 “Disclosures about Offsetting Assets and Liabilities” require disclosure on the offsetting of financial assets and liabilities. These disclosures are required for certain investments, including derivative financial instruments subject to Master Agreements which are

30

eligible for offsetting in the Statement of Assets and Liabilities and require the fund to disclose both gross and net information with respect to such investments. For financial reporting purposes, the fund does not offset derivative assets and derivative liabilities that are subject to Master Agreements in the Statement of Assets and Liabilities.

At September 30, 2015, derivative assets and liabilities (by type) on a gross basis are as follows:

| | | | | | |

Derivative Financial Instruments: | | Assets ($) | | Liabilities ($) | |

Forward contracts | | 1,511 | | - | |

Total gross amount of derivative | | | | | |

assets and liabilities in the | | | | | |

Statement of Assets and Liabilities | | 1,511 | | - | |

Derivatives not subject to | | | | | |

Master Agreements | | - | | - | |

Total gross amount of assets | | | | | |

and liabilities subject to | | | | | |

Master Agreements | | 1,511 | | - | |

The following table presents derivative assets net of amounts available for offsetting under Master Agreements and net of related collateral received or pledged, if any, as of September 30, 2015:

| | | | | | | |

| | | | Financial | | | |

| | | | Instruments | | | |

| | | | and Derivatives | | | |

| | Gross Amount of | | Available | Collateral | | Net Amount of |

Counterparty | Assets ($) | 1 | for Offset ($) | Received ($) | | Assets ($) |

Citigroup | 43 | | - | - | | 43 |

Goldman Sachs

International | 387 | | - | - | | 387 |

JP Morgan Chase Bank | 1,081 | | - | - | | 1,081 |

Total | 1,511 | | - | - | | 1,511 |

| | | | | | | |

| | | | | | | |

1 Absent a default event or early termination, OTC derivative assets are presented at

gross amounts and are not offset in the Statement of Assets and Liabilities. |

The following summarizes the average market value of derivatives outstanding during the period ended September 30, 2015:

| | | | | |

| | | | | Average Market Value ($) |

Forward contracts | | | | 1,762,547 |

At September 30, 2015, the cost of investments for federal income tax purposes was $417,354,946; accordingly, accumulated net unrealized depreciation on investments was $28,087,334, consisting of $9,068,265

31

NOTES TO FINANCIAL STATEMENTS (continued)

gross unrealized appreciation and $37,155,599 gross unrealized depreciation.

NOTE 5—Plan of Reorganization:

On July 27, 2015, the Board approved an Agreement and Plan of Reorganization (the “Reorganization”) between Dreyfus Stock Funds, on behalf of the fund, and Dreyfus International Value Fund (the “Acquired Fund”). The Reorganization is subject to the approval of the shareholders of the Acquired Fund. The Reorganization is anticipated to occur on or about January 22, 2016. The Reorganization provides for the Acquired Fund to transfer all of its assets, subject to its liabilities, to the fund, in exchange for a number of Class A, Class C and Class I shares of the fund of equal value to the assets less liabilities of the Acquired Fund. The fund’s Class A, Class C and Class I shares will then be distributed to the Acquired Fund’s shareholders on a pro rata basis in liquidation of the Acquired Fund.

32

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Trustees

Dreyfus International Equity Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus International Equity Fund (one of the series comprising Dreyfus Stock Funds) as of September 30, 2015, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2015 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus International Equity Fund at September 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated periods, in conformity with U.S. generally accepted accounting principles.

New York, New York

November 25, 2015

33

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund elects to provide each shareholder with their portion of the fund’s foreign taxes paid and the income sourced from foreign countries. Accordingly, the fund hereby reports the following information regarding its fiscal year ended September 30, 2015:

- the total amount of taxes paid to foreign countries was $675,266

- the total amount of income sourced from foreign countries was $8,181,954.

As required by federal tax law rules, shareholders will receive notification of their proportionate share of foreign taxes paid and foreign sourced income for the 2015 calendar year with Form 1099-DIV which will be mailed in early 2016. Also certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $4,205,549 represents the maximum amount that may be considered qualified dividend income.

34

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (71)

Chairman of the Board (2003)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

· The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director (2000-2010)

No. of Portfolios for which Board Member Serves: 142

———————

Joni Evans (73)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Chief Executive Officer, www.wowOwow.com an online community dedicated to women’s conversations and publications (2007-present)

· Principal, Joni Evans Ltd. (publishing) (2006-present)

No. of Portfolios for which Board Member Serves: 25

———————

Ehud Houminer (75)

Board Member (2003)

Principal Occupation During Past 5 Years:

· Executive-in-Residence at the Columbia Business School, Columbia

University (1992-present)

Other Public Company Board Memberships During Past 5 Years:

· Avnet, Inc., an electronics distributor, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 62

———————

Hans C. Mautner (77)

Board Member (2003)

Principal Occupation During Past 5 Years:

· President-International Division and an Advisory Director of Simon Property Group, a

real estate investment company (1998-2010)

· Chairman and Chief Executive Officer of Simon Global Limited, a real estate company (1999-2010)

No. of Portfolios for which Board Member Serves: 25

———————

35

BOARD MEMBERS INFORMATION (Unaudited) (continued)

INDEPENDENT BOARD MEMBERS (continued)

Robin A. Melvin (52)

Board Member (2003)

Principal Occupation During Past 5 Years:

· Co-chairman, Illinois Mentoring Partnership, non-profit organization dedicated to increasing the quantity and quality of mentoring services in Illinois; (2014-present; a board member since 2013)

· Director, Boisi Family Foundation, a private family foundation that supports

youth-serving organizations that promote the self sufficiency of youth from

disadvantaged circumstances (1995-2012)

No. of Portfolios for which Board Member Serves: 112

———————

Burton N. Wallack (64)

Board Member (2006)

Principal Occupation During Past 5 Years:

· President and Co-owner of Wallack Management Company, a real estate management

company (1987-present)

No. of Portfolios for which Board Member Serves: 25

———————

36

INTERESTED BOARD MEMBER

Gordon J. Davis (74)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Partner in the law firm of Venable LLP (2012-present)

· Partner in the law firm of Dewey & LeBoeuf LLP (1994-2012)

Other Public Company Board Memberships During Past 5 Years:

· Consolidated Edison, Inc., a utility company, Director (1997-2014)

· The Phoenix Companies, Inc., a life insurance company, Director (2000-2014)

No. of Portfolios for which Board Member Serves: 61

Gordon J. Davis is deemed to be an “interested person” (as defined under the Act) of the Company as a result of his affiliation with Venable LLP, which provides legal services to the Company.

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund's Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

William Hodding Carter III, Emeritus Board Member

Arnold S. Hiatt, Emeritus Board Member

37

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Executive Vice President of the Distributor since June 2007. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 68 investment companies (comprised of 142 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015

Chief Legal Officer of the Manager since June 2015; from June 2005 to June 2015, Director and Associate General Counsel of Deutsche Bank – Asset & Wealth Management Division, and Chief Legal Officer of Deutsche Investment Management Americas Inc. He is an officer of 69 investment companies (comprised of 167 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 2015.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Assistant General Counsel of BNY Mellon, and an officer of 69 investment companies (comprised of 167 portfolios) managed by the Manager. She is 52 years old and has been an employee of the Manager since February 1984.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 69 investment companies (comprised of 167 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.