UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21457

Name of Fund: BlackRock Bond Allocation Target Shares

Series C Portfolio

Series M Portfolio

Series S Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock Bond

Allocation Target Shares, 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing address: P.O.

Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2008

Date of reporting period: 10/01/2007 – 09/30/2008

Item 1 – Report to Stockholders

| | |

| EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS |

| |

Blackrock Bond Allocation Target Shares | |  |

| |

| ANNUAL REPORT | SEPTEMBER 30, 2008 | | |

Series S Portfolio

Series C Portfolio

Series M Portfolio

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| | | | | | |

2 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

A Letter to Shareholders

Dear Shareholder

It has been a tumultuous period for investors, marked by almost daily headlines related to the housing market turmoil, volatile energy prices, and the escalating credit crisis. The news took an extraordinarily heavy tone in September as the credit crisis boiled over and triggered unprecedented failures and consolidation in the financial sector, stoking fears of a market and economic collapse and prompting the largest government rescue plan since the Great Depression.

Through it all, the Federal Reserve Board (the “Fed”) has taken decisive action to restore liquidity and bolster financial market stability. Key moves included slashing the target federal funds rate 275 basis points (2.75%) between October 2007 and April 2008 and providing massive cash injections and lending programs. As the credit crisis took an extreme turn for the worse, the Fed, in concert with five other global central banks, cut interest rates by 50 basis points in early October in a rare move intended to stave off worldwide economic damage from the intensifying financial market turmoil. The U.S. economy managed to grow at a slow-but-positive pace through the second quarter of the year, though recent events almost certainly portend a global economic recession.

Against this backdrop, U.S. stocks experienced intense volatility and generally posted losses for the current reporting period, with small-cap stocks faring noticeably better than their larger counterparts. Non-U.S. markets followed the U.S. on the way down and, notably, decelerated at a faster pace than domestic equities – a stark reversal of recent years’ trends, when international stocks generally outpaced U.S. stocks.

Treasury securities also traded in a volatile fashion, but rallied overall (yields fell and prices correspondingly rose) amid an ongoing flight to quality. The yield on 10-year Treasury issues, which fell to 3.34% in March, climbed to the 4.20% range in mid-June as investors temporarily shifted out of Treasury issues in favor of riskier assets (such as stocks and other high-quality fixed income sectors), then declined again to 3.85% by period-end as the financial market contagion widened. Tax-exempt issues underperformed overall, as problems among municipal bond insurers and the collapse in the market for auction rate securities pressured the group throughout the course of the past year. At the same time, the above mentioned economic headwinds and malfunctioning credit markets led to considerable weakness in the high yield sector.

Facing unprecedented volatility and macro pressures, the major benchmark indexes generally recorded losses over the six- and 12-month reporting periods:

| | | | | | |

Total Returns as of September 30, 2008 | | 6-month | | | 12-month | |

U.S. equities (S&P 500 Index) | | (10.87 | )% | | (21.98 | )% |

Small cap U.S. equities (Russell 2000 Index) | | (0.54 | )% | | (14.48 | )% |

International equities (MSCI Europe, Australasia, Far East Index) | | (22.35 | )% | | (30.50 | )% |

Fixed income (Barclays Capital U.S. Aggregate Index)* | | (1.50 | )% | | 3.65 | % |

Tax-exempt fixed income (Barclays Capital Municipal Bond Index)* | | (2.59 | )% | | (1.87 | )% |

High yield bonds (Barclays Capital U.S. Corporate High Yield 2% Issuer Capped Index)* | | (6.77 | )% | | (10.51 | )% |

| * | Formerly a Lehman Brothers index. |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Through periods of market turbulence, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For our most current views on the economy and financial markets, we invite you to visit www.blackrock.com/funds. As always, we thank you for entrusting BlackRock with your investments, and we look forward to continuing to serve you in the months and years ahead.

|

| Sincerely, |

|

|

| Rob Kapito |

| President, BlackRock Advisors, LLC |

THIS PAGE NOT PART OF YOUR FUND REPORT

| | |

| Portfolio Summary | | Series S Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s total return underperformed its benchmark for the 12-month period. (The Merrill Lynch 1-3 Year Treasury Index is the de facto benchmark used for reporting purposes. Because an investment in the Bond Allocation Target Shares (“BATS”) Series S Portfolio represents only a portion of a client’s investment in a broader short duration account, comparisons of the Portfolio’s performance to that of the benchmark typically will not be meaningful. The Portfolio is part of a broader strategy.) |

What factors influenced performance?

| | • | | Events experienced over the past 12 months in the financial markets have been unprecedented, fueling extreme levels of volatility and technical dislocation. This was exacerbated in the final three months of the annual period, as a lethal combination of deteriorating economic fundamentals and deleveraging of balance sheets brought further declines in the prices of securitized assets. Spread sectors – including mortgage-backed securities (MBS), commercial MBS (CMBS), investment-grade corporate bonds, asset-backed securities (ABS) and U.S. agency issues – significantly underperformed, losing ground as investors fled to the perceived safety of U.S. Treasury issues. |

| | • | | The benchmark Merrill Lynch 1-3 Year Treasury Index is a 100% Treasury index, whereas the Portfolio has the ability to invest in spread assets in an effort to achieve yields above those offered by Treasuries alone. In the prevailing macro environment, the Portfolio’s exposure to spread product detracted from performance amid a massive investor flight to quality over the year. On the positive side, the Portfolio’s bias toward a steepening yield curve benefited performance, as short-term rates fell and the curve steepened. |

Describe recent Portfolio activity.

| | • | | Throughout the annual period, we continued to emphasize high-quality, short-duration assets, with a focus on agency fixed-rate MBS, as well as CMBS. We have had marginal exposure to high-quality corporate bonds, and have been reducing this allocation over the past several months. |

Describe Portfolio positioning at period-end.

| | • | | At period-end, the Portfolio was positioned primarily in high-quality spread assets, such as MBS, CMBS and ABS, with only a slight exposure to corporate credit. The Portfolio was modestly long duration relative to the benchmark, with a bias towards a steepening yield curve. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of September 30, 2008

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Collateralized Mortgage Obligations | | 39 | % |

Commercial Mortgage Backed Securities | | 21 | |

Asset Backed Securities | | 19 | |

Mortgage Pass-Throughs | | 14 | |

U.S. Government & Agency Obligations | | 7 | |

| |

Credit Quality Allocations1 | | Percent of

Long-Term

Investments | |

AAA | | 99 | % |

Unrated | | 1 | |

| 1 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) ratings. |

Although the sector and credit quality allocations listed above were current as of the period indicated, the Portfolio is actively managed and its composition will vary.

| | | | | | |

4 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

| |

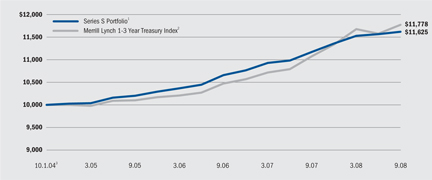

Total Return Based on a $10,000 Investment | | |

| 1 | The Portfolio is non-diversified and is available solely to wrap-fee clients or other managed accounts from whom BlackRock has a short duration fixed income mandate. |

| 2 | An unmanaged index comprised of treasury securities with maturities from 1 to 2.99 years. |

| 3 | Commencement of operations. |

Performance Summary for the Period Ended September 30, 2008

| | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | | 1 Year | | | From Inception5 | |

Series S Portfolio | | 0.76 | % | | 3.98 | % | | 3.84 | % |

Merrill Lynch 1-3 Year Treasury Index | | 0.82 | | | 6.27 | | | 4.18 | |

| 4 | See “About Portfolios’ Performance” on page 10 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on 10/1/04. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses Paid

During the Period7 | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses Paid

During the Period7 |

Series S Portfolio | | $ | 1,000.00 | | $ | 1,007.57 | | $ | — | | $ | 1,000.00 | | $ | 1,025.00 | | $ | — |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

| 7 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). BlackRock has agreed irrevocably to waive all fees and reimburse all expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. |

See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 5 |

| | |

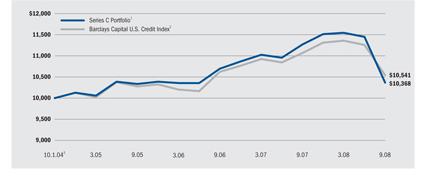

| Portfolio Summary | | Series C Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s total return underperformed its benchmark for the 12-month period. (The Barclays Capital U.S. Credit Index (formerly a Lehman Brothers Index) is the de facto benchmark used for reporting purposes. Because an investment in the BATS Series C Portfolio represents only a portion of a client’s investment in a broader fixed income account, comparisons of the Portfolio’s performance to that of the benchmark typically will not be meaningful. The Portfolio is part of a broader strategy.) |

What factors influenced performance?

| | • | | Events experienced over the past 12 months in the financial markets have been unprecedented, fueling extreme levels of volatility and technical dislocation. This was exacerbated in the final three months of the annual period, as a lethal combination of deteriorating economic fundamentals and deleveraging of balance sheets brought further declines in the prices of spread assets. Credit spreads widened dramatically in September, in particular, as we witnessed the conservatorship of Fannie Mae (FNMA) and Freddie Mac (FHLMC), the bankruptcy of Lehman Brothers, the U.S. government rescue of AIG, a seizure in short-term funding markets, and numerous consolidations within the financial sector, both in the U.S. and Europe. Liquidity was scarce and new issuance was practically non-existent as the market succumbed to these extraordinary pressures. |

| | • | | Spreads widened sharply across fixed income sectors, as investors poured assets into U.S. Treasury securities on a continued flight to quality. Within credit, the financials subsector was hit the hardest in this environment. Consequently, the Portfolio’s overweight exposure to financials and industrials hampered performance, with the overweight to financials being the largest detractor. |

Describe recent Portfolio activity.

| | • | | During the 12 months, the Portfolio was primarily invested in investment-grade corporate credit, with a small allocation to high yield credit. As the period progressed, we utilized cash in the Portfolio to invest as we uncovered select opportunities. However, we remained cautious in our approach. |

Describe Portfolio positioning at period-end.

| | • | | At period-end, the Portfolio was fully invested in the investment-grade corporate market, as we expect spreads to normalize over the intermediate term. From a sector perspective, the Portfolio was overweight financials and industrials, and underweight utilities and non-corporate sectors. We continue to favor institutions that have been identified by the government as systemically important. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of September 30, 2008

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Corporate Bonds | | 94 | % |

Trust Preferred | | 6 | |

| |

Credit Quality Allocations1 | | Percent of

Long-Term

Investments | |

AAA | | 4 | % |

AA | | 32 | |

A | | 38 | |

BBB | | 25 | |

Unrated | | 1 | |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

Although the sector and credit quality allocations listed above were current as of the period indicated, the Portfolio is actively managed and its composition will vary.

| | | | | | |

6 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

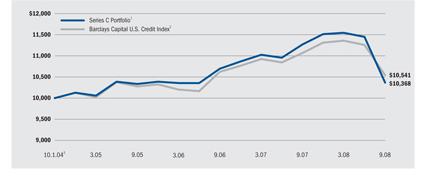

| |

Total Return Based on a $10,000 Investment | | |

| 1 | The Portfolio is non-diversified and is available solely to wrap-fee clients or other managed accounts from whom BlackRock has a core and/or core PLUS fixed income mandate, including corporate securities exposure. |

| 2 | An unmanaged index that includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. |

| 3 | Commencement of operations. |

Performance Summary for the Period Ended September 30, 2008

| | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | | 1 Year | | | From Inception5 | |

Series C Portfolio | | (10.23 | )% | | (8.02 | )% | | 0.91 | % |

Barclays Capital U.S. Credit Index | | (7.23 | ) | | (4.79 | ) | | 1.33 | |

| 4 | See “About Portfolios’ Performance” on page 10 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on 10/1/04. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses Paid

During the Period7 | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses Paid

During the Period7 |

Series C Portfolio | | $ | 1,000.00 | | $ | 897.69 | | $ | 2.13 | | $ | 1,000.00 | | $ | 1,022.72 | | $ | 2.28 |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

| 7 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.45%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). BlackRock has agreed irrevocably to waive all fees and reimburse all expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. |

See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 7 |

| | |

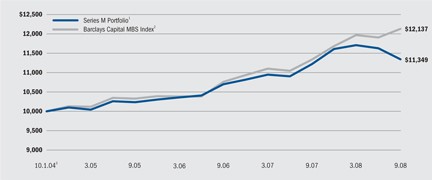

| Portfolio Summary | | Series M Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s total return underperformed its benchmark for the 12-month period. (The Barclays Capital MBS Index (formerly a Lehman Brothers Index) is the de facto benchmark used for reporting purposes. Because an investment in the BATS Series M Portfolio represents only a portion of a client’s investment in a broader fixed income account, comparisons of the Portfolio’s performance to that of the benchmark typically will not be meaningful. The Portfolio is part of a broader strategy.) |

What factors influenced performance?

| | • | | Events experienced over the past 12 months in the financial markets have been unprecedented, fueling extreme levels of volatility and technical dislocation. This was exacerbated in the final three months of the annual period, as a lethal combination of deteriorating economic fundamentals and deleveraging of balance sheets brought further declines in the prices of securitized assets. Spread sectors – including mortgage-backed securities (MBS), commercial MBS (CMBS), investment-grade corporate bonds, asset-backed securities (ABS) and U.S. agency issues – significantly underperformed, losing ground as investors fled to the perceived safety of U.S. Treasury issues. |

| | • | | In this environment, the Portfolio’s relative performance suffered, given our focus on mortgage-related products (MBS and CMBS) and ABS. Conversely, the Portfolio’s bias toward a steepening yield curve was beneficial, as concerns in the financial markets prompted a flight to quality characterized by strong demand for shorter-term government debt. |

Describe recent Portfolio activity.

| | • | | During the 12 months, we reduced the Portfolio’s exposure to fixed-rate MBS, selling into strength experienced in early January. We subsequently increased our allocations to short-dated CMBS and ABS. We maintained exposure to 15- and 30-year mortgages, with a bias toward higher-coupon mortgage issues. We also maintained small, non-indexed positions in collateralized mortgage obligations (CMOs) and ABS, while adding to CMBS holdings. |

Describe Portfolio positioning at period-end.

| | • | | While the markets remain volatile and liquidity is almost non-existent, the Federal Reserve and U.S. government have stepped in with tremendous efforts to help ease the strain on the banking system and mortgage market. We continue to look favorably upon the agency subsector of the U.S. mortgage market given their government guarantee, attractive current valuations and their liquidity, which is better relative to most other sectors. |

| | • | | At period-end, the Portfolio was positioned in high-quality MBS, CMBS and ABS. We believe that as stability returns to the financial markets, spreads on high-quality mortgage and commercial mortgage bonds should gradually begin to recover. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of September 30, 2008

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Commercial Mortgage Backed Securities | | 71 | % |

Asset Backed Securities | | 18 | |

Collateralized Mortgage Obligations | | 7 | |

U.S. Government & Agency Obligations | | 4 | |

| |

Credit Quality Allocations1 | | Percent of

Long-Term

Investments | |

AAA | | 100 | % |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

Although the sector and credit quality allocations listed above were current as of the period indicated, the Portfolio is actively managed and its composition will vary.

| | | | | | |

8 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

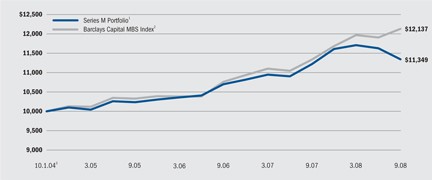

| |

Total Return Based on a $10,000 Investment | | |

| 1 | The Portfolio is non-diversified and is available solely to wrap-fee clients or other managed accounts from whom BlackRock has a core and/or core PLUS fixed income mandate, including mortgage securities exposure. |

| 2 | An unmanaged index that includes the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC) that meet the maturity and liquidity criteria. |

| 3 | Commencement of operations. |

Performance Summary for the Period Ended September 30, 2008

| | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | | 1 Year | | | From Inception5 | |

Series M Portfolio | | (3.12 | )% | | 1.12 | % | | 3.22 | % |

Barclays Capital MBS Index | | 1.37 | | | 7.02 | | | 4.96 | |

| 4 | See “About Portfolios’ Performance” on page 10 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on 10/1/04. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses Paid

During the Period7 | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses Paid

During the Period7 |

Series M Portfolio | | $ | 1,000.00 | | $ | 968.78 | | $ | — | | $ | 1,000.00 | | $ | 1,025.00 | | $ | — |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

| 7 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). BlackRock has agreed irrevocably to waive all fees and reimburse all expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. |

See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 9 |

About Portfolios’ Performance

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance table on the previous pages assumes reinvestment of all dividends and distributions, if any, at net asset value on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The performance information also reflects fee waivers and reimbursements that subsidize and reduce the total operating expenses of each Portfolio. The Portfolios’ returns would have been lower if there were not such waivers and reimbursements.

Disclosure of Expenses

Shareholders of these Portfolios may incur the following charges: (a) expenses related to transactions, including sales charges and redemption fees; and (b) operating expenses, including administration fees and other Portfolio expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on April 1, 2008 and held through September 30, 2008) are intended to assist shareholders both in calculating expenses based on an investment in the Portfolios and in comparing these expenses with similar costs of investing in other mutual funds.

The table provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The table also provides information about hypothetical account values and hypothetical expenses based on the Portfolios’ actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Portfolios and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical table is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

10 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

| Schedule of Investments September 30, 2008 | | Series S Portfolio (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Trust Preferred | | | | | | |

Finance — 0.1% | | | | | | |

Goldman Sachs Capital Trust III, Capital Security, | | | | | | |

3.58%(a)(b)(c) | | $ | 175 | | $ | 61,840 |

| | | | | | |

U.S. Government & Agency Obligations | | | | | | |

Federal Home Loan Bank Bonds, | | | | | | |

3.50%, 7/16/10 | | | 400 | | | 401,275 |

U.S. Treasury Notes, | | | | | | |

2.00%, 2/28/10 | | | 1,200 | | | 1,200,937 |

3.38%, 7/31/13(b) | | | 900 | | | 916,383 |

| | | | | | |

Total U.S. Government & Agency Obligations — 4.2% | | | | | | 2,518,595 |

| | | | | | |

Mortgage Pass-Throughs | | | | | | |

Federal Home Loan Mortgage Corp. 1 Year CMT, | | | | | | |

5.04%, 12/01/35(a) | | | 847 | | | 860,497 |

Federal Home Loan Mortgage Corp. 12 Month LIBOR, | | | | | | |

4.45%, 7/01/34(a) | | | 31 | | | 31,426 |

Federal Home Loan Mortgage Corp. ARM, | | | | | | |

4.40%, 6/01/33(a) | | | 281 | | | 282,147 |

4.74%, 4/01/35(a) | | | 542 | | | 545,437 |

4.72%, 8/01/35(a) | | | 630 | | | 635,855 |

6.03%, 11/01/36(a) | | | 965 | | | 989,377 |

Federal National Mortgage Assoc. 12 Month LIBOR, | | | | | | |

4.28%, 1/01/34(a) | | | 236 | | | 237,555 |

4.87%, 6/01/35(a) | | | 204 | | | 204,969 |

5.34%, 10/01/35(a) | | | 539 | | | 541,269 |

Government National Mortgage Assoc. II ARM, | | | | | | |

4.75%, 10/20/34-11/20/34(a) | | | 372 | | | 374,695 |

| | | | | | |

Total Mortgage Pass-Throughs — 7.9% | | | | | | 4,703,227 |

| | | | | | |

Collateralized Mortgage Obligations | | | | | | |

Banc of America Funding Corp., Series 04-C, Class 4A1, | | | | | | |

3.52%, 12/20/34(a) | | | 28 | | | 19,386 |

Banc of America Mortgage Securities, Series 04-A, Class 2A2, | | | | | | |

4.10%, 2/25/34(a) | | | 450 | | | 414,010 |

Bear Stearns Mortgage Trust, Series 04-13, Class A1, | | | | | | |

3.58%, 11/25/34(a) | | | 18 | | | 11,676 |

Bear Stearns Mortgage Trust, Series 04-7, Class 4A, | | | | | | |

5.03%, 10/25/34(a) | | | 232 | | | 167,428 |

Countrywide Alternative Loan Trust, Series 05-28CB, Class 1A5, | | | | | | |

5.50%, 8/25/35 | | | 53 | | | 45,682 |

Countrywide Home Loans, Series 04-HYB1, Class 2A, | | | | | | |

4.22%, 5/20/34(a) | | | 461 | | | 450,918 |

Federal Home Loan Mortgage Corp., Series 3128, Class BA, | | | | | | |

5.00%, 1/15/24 | | | 568 | | | 570,896 |

Federal Home Loan Mortgage Corp., Series 3162, Class 0A, | | | | | | |

6.00%, 10/15/26 | | | 607 | | | 617,454 |

Federal Home Loan Mortgage Corp., Series 3165, Class NA, | | | | | | |

5.50%, 2/15/26 | | | 305 | | | 310,661 |

Federal Home Loan Mortgage Corp., Series 3280, Class MA, | | | | | | |

5.50%, 5/15/26(b) | | | 2,739 | | | 2,792,441 |

Federal National Mortgage Assoc., Series 03-67, Class GL, | | | | | | |

3.00%, 1/25/25 | | | 392 | | | 391,030 |

Federal National Mortgage Assoc., Series 05, Class PA, | | | | | | |

5.50%, 9/25/24 | | | 196 | | | 196,990 |

Federal National Mortgage Assoc., Series 05-48, Class OH, | | | | | | |

5.00%, 7/25/26 | | | 188 | | | 188,916 |

Federal National Mortgage Assoc., Series 05-57, Class PA, | | | | | | |

5.50%, 5/25/27 | | | 340 | | | 344,674 |

Federal National Mortgage Assoc., Series 05-63, Class PA, | | | | | | |

5.50%, 10/25/24 | | | 345 | | | 347,024 |

Federal National Mortgage Assoc., Series 06, Class JA, | | | | | | |

5.50%, 5/25/20 | | | 421 | | | 424,102 |

Federal National Mortgage Assoc., Series 06-54, Class OA, | | | | | | |

6.00%, 3/25/27 | | | 617 | | | 627,272 |

Federal National Mortgage Assoc., Series 06-99, Class PA, | | | | | | |

5.50%, 5/25/30 | | | 1,282 | | | 1,309,845 |

Federal National Mortgage Assoc., Series 3186, Class NA, | | | | | | |

6.00%, 7/15/27 | | | 629 | | | 641,781 |

First Horizon Commercial Mortgage Trust, Series 03-AR4, Class 2A1, | | | | | | |

4.38%, 12/25/33(a) | | | 170 | | | 159,564 |

First Horizon Mortgage Pass-Through Trust, Series 04-AR6, Class 2A1, | | | | | | |

4.75%, 12/25/34(a) | | | 412 | | | 363,073 |

Goldman Sachs Residential Mortgage Loan Trust, Series 05, Class 1A1, | | | | | | |

5.31%, 10/25/35(a) | | | 165 | | | 128,685 |

JPMorgan Mortgage Trust, Series 06-A2, Class 5A3, | | | | | | |

4.33%, 11/25/33(a) | | | 330 | | | 315,023 |

Portfolios Abbreviations

| | | | | | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names of many of the securities have been abbreviated according to the list on the right. | | ARM CMT LIBOR | | Adjustable Rate Mortgage Constant Maturity Treasury Rate London InterBank Offered Rate | | REIT TBA | | Real Estate Investment Trust To Be Announced |

| | | | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 11 |

| | |

| Schedule of Investments (continued) | | Series S Portfolio (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

| | |

Collateralized Mortgage Obligations | | | | | | |

JPMorgan Mortgage Trust, Series 07-A1, Class 4A1, | | | | | | |

4.07%, 7/25/35(a) | | $ | 811 | | $ | 742,089 |

Structured Mortgage ARM Loan Trust, Series 04-6, Class 4A1, | | | | | | |

4.84%, 6/25/34(a) | | | 443 | | | 373,932 |

Thornburg Mortgage Securities Trust, Series 05-4, Class A4, | | | | | | |

3.41%, 12/25/45(a) | | | 327 | | | 325,687 |

Wells Fargo Mortgage Backed Securities Trust, Series 04-EE, Class 2A1, | | | | | | |

4.11%, 12/25/34(a) | | | 664 | | | 613,810 |

Wells Fargo Mortgage Backed Securities Trust, Series 05-AR2, Class 2A1, | | | | | | |

4.55%, 3/25/35(a) | | | 588 | | | 508,747 |

| | | | | | |

Total Collateralized Mortgage Obligations — 22.4% | | | | | | 13,402,796 |

| | | | | | |

Commercial Mortgage Backed Securities | | | | | | |

ARM Trust, Series 05-9, Class 5A1, | | | | | | |

3.48%, 11/25/35(a) | | | 31 | | | 19,062 |

Banc of America Commercial Mortgage, Inc., Series 02-PB2, Class A4, | | | | | | |

6.19%, 6/11/35 | | | 400 | | | 399,312 |

Bear Stearns Commercial Mortgage Securities, Inc., Series 00-WF2, Class A2, | | | | | | |

7.32%, 10/15/32 | | | 500 | | | 507,822 |

Chase Manhattan Bank-First Union National Bank, Series 99-1, Class A2, | | | | | | |

7.44%, 8/15/31 | | | 640 | | | 643,785 |

Commercial Mortgage Asset Trust, Series 99-C1, Class A3, | | | | | | |

6.64%, 1/17/32 | | | 192 | | | 192,421 |

Credit Suisse First Boston Mortgage Securities Corp., Series 02, Class A3, | | | | | | |

5.60%, 7/15/35 | | | 250 | | | 242,241 |

Donaldson, Lufkin & Jenrette, Inc., Commercial Mortgage Corp., Series 99-CG3, Class A1B, | | | | | | |

7.34%, 9/10/24 | | | 471 | | | 474,876 |

Donaldson, Lufkin & Jenrette, Inc., Commercial Mortgage Corp., Series 00-CKP1, Class A1B, | | | | | | |

7.18%, 11/10/33 | | | 523 | | | 531,397 |

First Union National Bank Commercial Mortgage Trust, Series 00-C1, Class A2, | | | | | | |

7.84%, 3/15/10 | | | 262 | | | 267,366 |

General Motors Acceptance Corp. Commercial Mortgage Securities, Inc., Series 99, Class A2, | | | | | | |

6.18%, 5/15/33 | | | 111 | | | 111,154 |

General Motors Acceptance Corp. Commercial Mortgage Securities, Inc., Series 00-C1, Class A2, | | | | | | |

7.72%, 3/15/33 | | | 214 | | | 217,100 |

Greenwich Capital Commercial Funding Corp., Series 02-C1, Class A2, | | | | | | |

4.11%, 3/11/12 | | | 220 | | | 210,586 |

JPMorgan Chase Commercial Mortgage Securities Corp., Series 01-CIB2, Class A2, | | | | | | |

6.24%, 10/15/10 | | | 164 | | | 164,370 |

JPMorgan Chase Commercial Mortgage Securities Corp., Series 01-CIB2, Class A3, | | | | | | |

6.43%, 6/15/11 | | | 315 | | | 315,372 |

Lehman Brothers-UBS Commercial Mortgage Trust, Series 00-C4, Class A2, | | | | | | |

7.37%, 8/15/26 | | | 612 | | | 621,912 |

Lehman Brothers-UBS Commercial Mortgage Trust, Series 01-WM, Class A1, | | | | | | |

6.16%, 7/14/16(d) | | | 288 | | | 288,564 |

Lehman Brothers-UBS Commercial Mortgage Trust, Series 03-C7, Class A2, | | | | | | |

4.06%, 8/15/10(a) | | | 509 | | | 498,465 |

Morgan Stanley Dean Witter Capital I, Inc., Series 01, Class A4, | | | | | | |

6.39%, 7/15/33 | | | 263 | | | 262,810 |

Salomon Brothers Mortgage Securities VII, Series 99-C1, Class A2, | | | | | | |

7.15%, 1/18/09(a) | | | 7 | | | 6,822 |

Salomon Brothers Mortgage Securities VII, Series 00-C3, Class A2, | | | | | | |

6.59%, 12/18/33 | | | 889 | | | 892,793 |

Salomon Brothers Mortgage Securities VII, Series 02-KEY2, Class A2, | | | | | | |

4.47%, 3/18/36 | | | 97 | | | 92,702 |

TIAA Retail Commercial LLC, Series 01-C1A, Class A4, | | | | | | |

6.68%, 6/19/31(a)(d) | | | 291 | | | 291,359 |

| | | | | | |

Total Commercial Mortgage Backed Securities — 12.1% | | | | | | 7,252,291 |

| | | | | | |

Asset Backed Securities | | | | | | |

Bank of America Credit Card Trust, Series 08-A9, Class A9, | | | | | | |

4.07%, 7/15/12 | | | 350 | | | 347,406 |

Carrington Mortgage Loan Trust, Series 06-NC4, Class A1, | | | | | | |

3.26%, 10/25/36(a) | | | 158 | | | 153,985 |

Chase Issuance Trust, Series 05, Class A5, | | | | | | |

2.49%, 2/15/12(a) | | | 900 | | | 892,501 |

Chase Issuance Trust, Series 08-A9, Class A9, | | | | | | |

4.26%, 5/15/13 | | | 520 | | | 506,672 |

Citibank Credit Card Issuance Trust, Series 06-A2, Class A2, | | | | | | |

4.85%, 2/10/11 | | | 400 | | | 400,395 |

Citibank Credit Card Issuance Trust, Series 06-A5, Class A5, | | | | | | |

5.30%, 5/20/11 | | | 495 | | | 497,193 |

Credit Suisse First Boston Mortgage Securities Corp., Series 99-C1, Class A2, | | | | | | |

7.29%, 9/15/41 | | | 363 | | | 365,109 |

Ford Credit Auto Owner Trust, Series 06-A, Class A3, | | | | | | |

5.05%, 3/15/10 | | | 106 | | | 106,215 |

GSAA Home Equity Trust, Series 04-11, Class 2A2, | | | | | | |

3.53%, 12/25/34(a) | | | 19 | | | 13,863 |

Nissan Auto Receivables Owner Trust, Series 06-C, Class A3, | | | | | | |

5.44%, 4/15/10 | | | 208 | | | 208,932 |

PECO Energy Transition Trust, Series 01-A, Class A1, | | | | | | |

6.52%, 9/01/10 | | | 260 | | | 266,833 |

PG&E Energy Recovery Funding LLC, Series 05-1, Class A4, | | | | | | |

4.37%, 6/25/12 | | | 335 | | | 325,832 |

Residential Asset Securities Corp., Series 06-EMX6, Class A1, | | | | | | |

3.27%, 10/25/30(a) | | | 97 | | | 96,416 |

Student Loan Marketing Assoc. Student Loan Trust, Series 08-5, Class A2, | | | | | | |

3.90%, 10/25/16(a) | | | 1,000 | | | 987,011 |

See Notes to Financial Statements.

| | | | | | |

12 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

| Schedule of Investments (concluded) | | Series S Portfolio (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

| | |

Asset Backed Securities | | | | | | |

USAA Auto Owner Trust, Series 05-4, Class A4, | | | | | | |

4.89%, 8/15/12 | | $ | 500 | | $ | 499,968 |

USAA Auto Owner Trust, Series 06-1, Class A3, | | | | | | |

5.01%, 9/15/10 | | | 103 | | | 103,677 |

USAA Auto Owner Trust, Series 06-1, Class A4, | | | | | | |

5.04%, 12/15/11 | | | 575 | | | 574,975 |

| | | | | | |

Total Asset Backed Securities — 10.6% | | | | | | 6,346,983 |

| | | | | | |

Corporate Bonds | | | | | | |

Oil & Gas — 0.0% | | | | | | |

Anadarko Petroleum Corp., Senior Unsecured Notes, | | | | | | |

3.22%, 9/15/09 (a) | | | 15 | | | 14,823 |

ConocoPhillips Funding Co. (Australia), Unsecured Notes, | | | | | | |

2.89%, 4/09/09 (a)(e) | | | 19 | | | 18,814 |

| | | | | | |

Total Corporate Bonds — 0.0% | | | | | | 33,637 |

| | | | | | |

Total Long-Term Investments

(Cost — $34,952,213) — 57.3% | | | | | | 34,319,369 |

| | | | | | |

| | | Par/Shares

(000) | | |

| | | | |

Short-Term Securities | | | | | | |

Federal Home Loan Bank, Discount Notes, | | | | | | |

0.10%, 10/01/08 (f) | | | 1,800 | | | 1,800,000 |

0.75%, 10/09/08 (f) | | | 600 | | | 599,900 |

0.40%, 10/16/08 (f) | | | 5,200 | | | 5,199,133 |

Federal National Mortgage Assoc., Discount Notes, | | | | | | |

2.08%, 11/04/08 (f) | | | 15,300 | | | 15,270,089 |

TCW Money Market Fund, 2.41% (g) | | | 620 | | | 620,012 |

| | | | | | |

Total Short-Term Securities

(Cost — $23,489,134) — 39.3% | | | | | | 23,489,134 |

| | | | | | |

Total Investments (Cost — $58,441,347*) — 96.6% | | | | | | 57,808,503 |

Other Assets in Excess of Liabilities — 3.4% | | | | | | 2,034,514 |

| | | | | | |

Net Assets — 100.0% | | | | | $ | 59,843,017 |

| | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of September 30, 2008, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 58,441,347 | |

| | | | |

Gross unrealized appreciation | | $ | 153,367 | |

Gross unrealized depreciation | | | (786,211 | ) |

| | | | |

Net unrealized depreciation | | $ | (632,844 | ) |

| | | | |

| (a) | Variable rate security. Rate shown is as of report date. |

| (b) | All or a portion of security pledged as collateral in connection with open financial futures contracts. |

| (c) | Security is perpetual in nature and has no stated maturity date. In certain instances, a final maturity date may be extended and/or the final payment of principal may be deferred at the issuer’s option for a specified time without default. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (e) | U.S. dollar denominated security issued by foreign domiciled entity. |

| (f) | The rate shown is the effective yield on the discount notes at the time of purchase. |

| (g) | Represents current yield as of report date. |

| • | | Financial futures contracts purchased as of September 30, 2008 were as follows: |

| | | | | | | | | | |

| | | | | Expiration

Date | | Face

Value | | Unrealized

Appreciation |

Contracts | | Issue | | | |

241 | | U.S. Treasury Notes

(2 Year) | | December 2008 | | $ | 51,438,438 | | $ | 216,807 |

24 | | U.S. Treasury Notes

(5 Year) | | December 2008 | | $ | 2,693,625 | | | 1,178 |

| | | | | | | | | | |

Total | | | | | | | | | $ | 217,985 |

| | | | | | | | | | |

| • | | Financial futures contracts sold as of September 30, 2008 were as follows: |

| | | | | | | | | | |

| | | | | Expiration

Date | | Face

Value | | Unrealized

Appreciation |

Contracts | | Issue | | | |

55 | | U.S. Treasury Notes

(10 Year) | | December 2008 | | $ | 6,304,375 | | $ | 50,199 |

15 | | U.S. Treasury Bonds

(20 Year) | | December 2008 | | $ | 1,757,578 | | | 30,918 |

| | | | | | | | | | |

Total | | | | | | | | | $ | 81,117 |

| | | | | | | | | | |

| • | | For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. These industry classifications are unaudited. |

See Notes to Financial Statements.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 13 |

| | |

| Schedule of Investments September 30, 2008 | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Trust Preferred | | | | | | |

Banks — 5.1% | | | | | | |

Bank of America Corp., Depositary Shares, | | | | | | |

8.00%(a)(b) | | $ | 4,495 | | $ | 3,559,442 |

Barclays Bank Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.93%(b)(c)(d) | | | 100 | | | 69,542 |

7.43%(a)(b)(c)(d) | | | 2,820 | | | 2,296,368 |

Citigroup Capital XXI, Trust Preferred Securities, | | | | | | |

8.30%, 12/21/57(a) | | | 900 | | | 670,555 |

Credit Agricole SA (France), Unsecured Notes, | | | | | | |

6.64%(a)(b)(c)(d) | | | 2,925 | | | 1,972,257 |

JPMorgan Chase & Co., Depositary Shares, | | | | | | |

7.90%(b) | | | 4,300 | | | 3,620,084 |

JPMorgan Chase Capital XXII, Capital Securities, | | | | | | |

6.45%, 2/02/37 | | | 200 | | | 144,909 |

JPMorgan Chase Capital XXIII, Capital Securities, | | | | | | |

3.80%, 5/15/47(a) | | | 500 | | | 268,163 |

Royal Bank of Scotland Group Plc (United Kingdom), Capital Securities, | | | | | | |

6.99%(a)(b)(c)(d) | | | 2,000 | | | 1,490,502 |

7.64%(a)(b)(c) | | | 1,100 | | | 819,520 |

State Street Capital Trust III, Capital Securities, | | | | | | |

8.25%(a)(b) | | | 2,900 | | | 2,843,624 |

State Street Capital Trust IV, Capital Securities, | | | | | | |

3.82%, 6/15/37(a) | | | 1,075 | | | 709,057 |

Wachovia Corp., Capital Securities, | | | | | | |

7.98%(a)(b) | | | 2,200 | | | 919,468 |

| | | | | | |

| | | | | | 19,383,491 |

| | | | | | |

Finance — 1.1% | | | | | | |

American International Group, Inc., Junior Subordinated Debentures, | | | | | | |

8.18%, 5/15/58(d) | | | 2,325 | | | 372,451 |

Credit Suisse (Guernsey), Unsecured Notes, | | | | | | |

5.86%, 5/15/17(a)(c) | | | 4,760 | | | 3,603,639 |

Financial Security Assurance Holdings Ltd., Junior Subordinated Debentures, | | | | | | |

6.40%, 12/15/66(a)(d) | | | 50 | | | 22,323 |

Lehman Brothers Holdings Capital Trust VII, Trust Preferred Securities, | | | | | | |

5.86%(a)(b)(e) | | | 4,070 | | | 407 |

Rabobank Capital Funding Trust II, Capital Securities, | | | | | | |

5.26%(b)(d) | | | 75 | | | 69,429 |

| | | | | | |

| | | | | | 4,068,249 |

| | | | | | |

Insurance — 0.0% | | | | | | |

Lincoln National Corp., Capital Securities, | | | | | | |

7.00%, 5/17/66(a) | | | 75 | | | 57,194 |

| | | | | | |

Total Trust Preferred — 6.2% | | | | | | 23,508,934 |

| | | | | | |

Corporate Bonds | | | | | | |

Aerospace — 2.1% | | | | | | |

Lockheed Martin Corp., Unsecured Notes, | | | | | | |

6.15%, 9/01/36 | | | 1,020 | | | 971,700 |

Northrop Grumman Corp., Debentures, | | | | | | |

7.88%, 3/01/26 | | | 1,000 | | | 1,131,944 |

Northrop Grumman Corp., Senior Debentures, | | | | | | |

7.75%, 2/15/31 | | | 75 | | | 86,109 |

Northrop Grumman Corp., Senior Unsecured Notes, | | | | | | |

7.13%, 2/15/11 | | | 2,000 | | | 2,123,072 |

Raytheon Co., Unsecured Notes, | | | | | | |

5.38%, 4/01/13 | | | 50 | | | 50,606 |

United Technologies Corp., Senior Unsecured Notes, | | | | | | |

6.35%, 3/01/11 | | | 125 | | | 132,259 |

United Technologies Corp., Unsecured Notes, | | | | | | |

6.05%, 6/01/36 | | | 3,650 | | | 3,401,731 |

| | | | | | |

| | | | | | 7,897,421 |

| | | | | | |

Banks — 17.8% | | | | | | |

Bank of America Corp., Senior Unsecured Notes, | | | | | | |

4.50%, 8/01/10 | | | 5,000 | | | 4,833,965 |

5.38%, 8/15/11 | | | 2,205 | | | 2,130,520 |

6.00%, 9/01/17 | | | 3,000 | | | 2,587,815 |

Bank of America Corp., Subordinated Bank Notes, | | | | | | |

6.10%, 6/15/17 | | | 2,000 | | | 1,766,986 |

Bank of America Corp., Subordinated Notes, | | | | | | |

7.40%, 1/15/11 | | | 65 | | | 63,674 |

5.30%, 3/15/17 | | | 3,000 | | | 2,492,097 |

Bank of New York Mellon Corp., Senior Notes, | | | | | | |

4.50%, 4/01/13(f) | | | 3,000 | | | 2,808,711 |

Citigroup, Inc., Senior Unsecured Notes, | | | | | | |

5.30%, 1/07/16 | | | 4,375 | | | 3,524,675 |

6.00%, 8/15/17 | | | 1,500 | | | 1,270,703 |

Citigroup, Inc., Subordinated Notes, | | | | | | |

5.50%, 2/15/17 | | | 75 | | | 57,534 |

5.88%, 2/22/33 | | | 20 | | | 13,106 |

Citigroup, Inc., Unsecured Notes, | | | | | | |

4.13%, 2/22/10 | | | 65 | | | 59,986 |

4.63%, 8/03/10 | | | 1,600 | | | 1,460,933 |

HSBC Bank USA, Subordinated Notes, | | | | | | |

4.63%, 4/01/14 | | | 9,750 | | | 8,768,272 |

HSBC Holdings Plc (United Kingdom), Subordinated Notes, | | | | | | |

6.80%, 6/01/38(c) | | | 2,180 | | | 1,845,985 |

JPMorgan Chase & Co., Unsecured Notes, | | | | | | |

6.00%, 1/15/18 | | | 2,050 | | | 1,869,338 |

JPMorgan Chase Bank N.A., Subordinated Notes, | | | | | | |

6.00%, 7/05/17 | | | 3,500 | | | 3,196,260 |

6.00%, 10/01/17 | | | 4,575 | | | 4,193,386 |

Northern Trust Corp., Subordinated Notes, | | | | | | |

4.60%, 2/01/13 | | | 125 | | | 120,879 |

Royal Bank of Scotland Group Plc (United Kingdom), Subordinated Notes, | | | | | | |

5.00%, 11/12/13(c) | | | 3,000 | | | 2,940,807 |

State Street Corp., Subordinated Notes, | | | | | | |

7.65%, 6/15/10 | | | 50 | | | 51,740 |

U.S. Bank N.A., Subordinated Bank Notes, | | | | | | |

6.38%, 8/01/11 | | | 2,500 | | | 2,523,562 |

UBS AG, Senior Notes, | | | | | | |

5.88%, 12/20/17 | | | 3,400 | | | 3,018,938 |

UBS AG, Senior Unsecured Notes, | | | | | | |

5.75%, 4/25/18 | | | 3,000 | | | 2,609,250 |

Wachovia Bank N.A., Subordinated Notes, | | | | | | |

6.60%, 1/15/38 | | | 725 | | | 429,524 |

Wachovia Corp., Senior Notes, | | | | | | |

4.38%, 6/01/10 | | | 300 | | | 262,952 |

See Notes to Financial Statements.

| | | | | | |

14 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

| Schedule of Investments (continued) | | Series C Portfolio (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

| | |

Corporate Bonds | | | | | | |

Banks (concluded) | | | | | | |

Wachovia Corp., Subordinated Notes, | | | | | | |

5.25%, 8/01/14 | | $ | 185 | | $ | 113,439 |

Wachovia Corp., Unsecured Notes, | | | | | | |

2.94%, 3/15/11(a) | | | 2,500 | | | 1,838,807 |

5.30%, 10/15/11 | | | 1,000 | | | 833,876 |

Wells Fargo & Co., Unsecured Notes, | | | | | | |

4.88%, 1/12/11 | | | 5,000 | | | 4,984,290 |

4.38%, 1/31/13 | | | 5,500 | | | 5,055,721 |

| | | | | | |

| | | | | | 67,727,731 |

| | | | | | |

Beverages & Bottling — 0.5% | | | | | | |

SABMiller Plc, Unsecured Notes, | | | | | | |

5.70%, 1/15/14(d) | | | 1,850 | | | 1,805,630 |

| | | | | | |

Broadcasting — 2.6% | | | | | | |

Cox Communications, Inc., Senior Unsecured Notes, | | | | | | |

7.13%, 10/01/12 | | | 2,250 | | | 2,292,451 |

Cox Communications, Inc., Unsecured Notes, | | | | | | |

4.63%, 6/01/13 | | | 5,000 | | | 4,622,070 |

News America, Inc., Senior Debentures, | | | | | | |

7.28%, 6/30/28 | | | 1,075 | | | 1,013,559 |

News America, Inc., Senior Unsecured Notes, | | | | | | |

6.40%, 12/15/35 | | | 2,500 | | | 2,100,078 |

| | | | | | |

| | | | | | 10,028,158 |

| | | | | | |

Computer & Office Equipment — 1.4% | | | | | | |

International Business Machines Corp., Unsecured Notes, | | | | | | |

5.70%, 9/14/17(g) | | | 5,575 | | | 5,400,380 |

| | | | | | |

Computer Software & Services — 2.1% | | | | | | |

Oracle Corp., Senior Unsecured Notes, | | | | | | |

5.75%, 4/15/18 | | | 1,800 | | | 1,671,309 |

Oracle Corp., Unsecured Notes, | | | | | | |

5.25%, 1/15/16 | | | 4,100 | | | 3,860,039 |

Thomson Reuters Corp., Unsecured Notes, | | | | | | |

5.95%, 7/15/13 | | | 2,300 | | | 2,297,286 |

| | | | | | |

| | | | | | 7,828,634 |

| | | | | | |

Consumer Products — 1.4% | | | | | | |

General Mills, Inc., Senior Unsecured Notes, | | | | | | |

5.20%, 3/17/15 | | | 2,375 | | | 2,278,896 |

Kimberly-Clark Corp., Senior Unsecured Notes, | | | | | | |

6.63%, 8/01/37 | | | 3,000 | | | 3,001,554 |

| | | | | | |

| | | | | | 5,280,450 |

| | | | | | |

Energy & Utilities — 4.2% | | | | | | |

Nexen, Inc. (Canada), Unsecured Notes, | | | | | | |

6.40%, 5/15/37(c) | | | 1,025 | | | 811,477 |

Carolina Power & Light Co., First Mortgage Bonds, | | | | | | |

6.30%, 4/01/38 | | | 750 | | | 723,899 |

Cleveland Electric Illuminating Co., Senior Unsecured Notes, | | | | | | |

5.65%, 12/15/13 | | | 450 | | | 432,801 |

Duke Energy Corp., First Mortgage Bonds, | | | | | | |

5.25%, 1/15/18 | | | 450 | | | 425,435 |

Florida Power & Light Co., First Mortgage Bonds, | | | | | | |

5.95%, 2/01/38 | | | 1,825 | | | 1,694,494 |

Georgia Power Co., Senior Unsecured Notes, | | | | | | |

5.25%, 12/15/15 | | | 1,050 | | | 1,005,882 |

Kiowa Power Partners LLC, Senior Secured Notes, | | | | | | |

4.81%, 12/30/13(d) | | | 16 | | | 16,330 |

MidAmerican Energy Holdings Co., Senior Unsecured Notes, | | | | | | |

5.30%, 3/15/18 | | | 675 | | | 612,893 |

5.75%, 4/01/18 | | | 1,195 | | | 1,102,376 |

NiSource Finance Corp., Unsecured Notes, | | | | | | |

3.38%, 11/23/09(a) | | | 25 | | | 24,362 |

Scottish Power Ltd. (United Kingdom), Unsecured Notes, | | | | | | |

4.91%, 3/15/10(c) | | | 2,050 | | | 2,059,225 |

Virginia Electric and Power Co., Senior Unsecured Notes, | | | | | | |

6.00%, 1/15/36 | | | 1,550 | | | 1,345,784 |

Virginia Electric and Power Co., Unsecured Notes, | | | | | | |

5.40%, 1/15/16 | | | 3,000 | | | 2,814,750 |

XTO Energy, Inc., Senior Unsecured Notes, | | | | | | |

6.50%, 12/15/18 | | | 1,750 | | | 1,623,241 |

6.75%, 8/01/37 | | | 1,610 | | | 1,428,580 |

| | | | | | |

| | | | | | 16,121,529 |

| | | | | | |

Entertainment & Leisure — 4.0% | | | | | | |

Comcast Cable Communications Holdings, Inc., Unsecured Notes, | | | | | | |

8.38%, 3/15/13 | | | 3,000 | | | 3,146,370 |

Comcast Cable Communications, Inc., Senior Unsecured Notes, | | | | | | |

6.75%, 1/30/11 | | | 4,115 | | | 4,173,828 |

Comcast Cable Holdings LLC, Senior Debentures, | | | | | | |

7.88%, 2/15/26 | | | 50 | | | 48,144 |

Comcast Corp., Unsecured Notes, | | | | | | |

6.50%, 11/15/35 | | | 3,000 | | | 2,504,772 |

Time Warner Cable, Inc., Debentures, | | | | | | |

6.55%, 5/01/37 | | | 3,000 | | | 2,429,664 |

Time Warner Cable, Inc., Unsecured Notes, | | | | | | |

5.85%, 5/01/17 | | | 2,000 | | | 1,762,076 |

Time Warner Cos., Inc., Senior Debentures, | | | | | | |

7.57%, 2/01/24 | | | 95 | | | 85,633 |

Time Warner, Inc., Senior Unsecured Notes, | | | | | | |

6.75%, 4/15/11 | | | 100 | | | 99,777 |

6.88%, 5/01/12 | | | 1,000 | | | 991,496 |

Turner Broadcasting Corp., Senior Notes, | | | | | | |

8.38%, 7/01/13 | | | 25 | | | 25,809 |

| | | | | | |

| | | | | | 15,267,569 |

| | | | | | |

Finance — 14.4% | | | | | | |

Allstate Life Global Funding Trust, Secured Notes, | | | | | | |

4.50%, 5/29/09 | | | 9,050 | | | 8,959,410 |

American Express Co., Senior Unsecured Notes, | | | | | | |

4.75%, 6/17/09 | | | 550 | | | 535,262 |

American International Group, Inc., Senior Unsecured Notes, | | | | | | |

5.85%, 1/16/18 | | | 3,375 | | | 1,694,071 |

The Bear Stearns Cos., Inc., Senior Unsecured Notes, | | | | | | |

6.95%, 8/10/12 | | | 3,275 | | | 3,308,156 |

The Bear Stearns Cos., Inc., Unsecured Notes, | | | | | | |

3.25%, 3/25/09 | | | 500 | | | 492,746 |

6.40%, 10/02/17 | | | 1,050 | | | 980,592 |

Covidien International Finance SA (Luxembourg), Senior Unsecured Notes, | | | | | | |

6.00%, 10/15/17(c) | | | 2,300 | | | 2,272,384 |

See Notes to Financial Statements.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 15 |

| | |

| Schedule of Investments (continued) | | Series C Portfolio (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Finance (concluded) | | | | | | |

Credit Suisse First Boston USA, Inc., Senior Unsecured Notes, | | | | | | |

3.88%, 1/15/09 | | $ | 5,000 | | $ | 4,952,380 |

EDP Finance BV (Netherlands) Senior Unsecured Notes, | | | | | | |

6.00%, 2/02/18(c)(d) | | | 1,475 | | | 1,411,436 |

General Electric Capital Corp., Senior Unsecured Notes, | | | | | | |

6.13%, 2/22/11 | | | 1,300 | | | 1,291,811 |

6.75%, 3/15/32 | | | 90 | | | 75,122 |

General Electric Capital Corp., Unsecured Notes, | | | | | | |

3.60%, 10/15/08 | | | 95 | | | 94,902 |

5.00%, 11/15/11 | | | 100 | | | 96,771 |

5.63%, 9/15/17 | | | 1,500 | | | 1,287,375 |

6.15%, 8/07/37 | | | 6,350 | | | 4,861,814 |

Golden West Financial Corp., Senior Unsecured Notes, | | | | | | |

4.75%, 10/01/12 | | | 6,825 | | | 5,221,903 |

Goldman Sachs Group, Inc., Unsecured Notes, | | | | | | |

5.25%, 10/15/13 | | | 3,525 | | | 2,965,043 |

5.35%, 1/15/16 | | | 350 | | | 283,072 |

6.25%, 9/01/17 | | | 1,500 | | | 1,255,799 |

5.95%, 1/18/18 | | | 3,200 | | | 2,639,885 |

Lehman Brothers Holdings, Inc., Senior Unsecured Notes, | | | | | | |

5.75%, 7/18/11(e) | | | 150 | | | 18,750 |

4.52%, 9/15/22(a)(e) | | | 1,200 | | | 150,000 |

Lehman Brothers Holdings, Inc., Subordinated Notes, | | | | | | |

6.75%, 12/28/17(e) | | | 2,225 | | | 2,781 |

Lehman Brothers Holdings, Inc., Unsecured Notes, | | | | | | |

6.00%, 7/19/12(e) | | | 4,075 | | | 509,375 |

Morgan Stanley, Senior Notes, | | | | | | |

5.05%, 1/21/11 | | | 200 | | | 144,013 |

5.63%, 1/09/12 | | | 7,400 | | | 5,159,421 |

5.55%, 4/27/17 | | | 1,200 | | | 743,916 |

6.25%, 8/28/17 | | | 1,230 | | | 762,650 |

Morgan Stanley, Unsecured Notes, | | | | | | |

6.75%, 4/15/11 | | | 50 | | | 37,006 |

Student Loan Marketing Corp., Unsecured Notes, | | | | | | |

2.96%, 12/15/08(a)(d) | | | 1,300 | | | 1,288,429 |

5.40%, 10/25/11 | | | 1,900 | | | 1,330,000 |

UnitedHealth Group, Inc., Unsecured Notes, | | | | | | |

5.80%, 3/15/36 | | | 45 | | | 34,139 |

| | | | | | |

| | | | | | 54,860,414 |

| | | | | | |

Food & Agriculture — 3.8% | | | | | | |

Kellogg Co., Senior Unsecured Notes, | | | | | | |

5.13%, 12/03/12 | | | 4,425 | | | 4,412,384 |

Kraft Foods, Inc., Senior Unsecured Notes, | | | | | | |

5.63%, 11/01/11 | | | 1,615 | | | 1,621,021 |

6.50%, 8/11/17 | | | 2,075 | | | 1,996,571 |

6.13%, 2/01/18 | | | 3,500 | | | 3,278,720 |

Tesco Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.50%, 11/15/17(c)(d) | | | 3,540 | | | 3,169,751 |

| | | | | | |

| | | | | | 14,478,447 |

| | | | | | |

Insurance — 5.4% | | | | | | |

American General Corp., Senior Unsecured Notes, | | | | | | |

7.50%, 8/11/10 | | | 105 | | | 69,035 |

ASIF Global Financing XXIII, Unsecured Notes, | | | | | | |

3.90%, 10/22/08(d) | | | 660 | | | 620,400 |

CHUBB Corp., Senior Unsecured Notes, | | | | | | |

6.00%, 5/11/37 | | | 1,400 | | | 1,175,348 |

John Hancock Financial Services, Inc., Senior Unsecured Notes, | | | | | | |

5.63%, 12/01/08 | | | 25 | | | 25,042 |

Lincoln National Corp., Senior Unsecured Notes, | | | | | | |

6.15%, 4/07/36 | | | 1,500 | | | 1,235,808 |

Marsh & McLennan Co., Inc., Senior Unsecured Notes, | | | | | | |

5.15%, 9/15/10 | | | 25 | | | 24,379 |

MetLife, Inc., Senior Notes, | | | | | | |

5.38%, 12/15/12 | | | 4,400 | | | 4,252,059 |

MetLife, Inc., Senior Unsecured Notes, | | | | | | |

6.13%, 12/01/11 | | | 1,200 | | | 1,211,639 |

Metropolitan Life Global Funding I, Senior Unsecured Notes, | | | | | | |

5.13%, 4/10/13(d) | | | 2,550 | | | 2,477,264 |

Metropolitan Life Global Funding I, Unsecured Notes, | | | | | | |

4.25%, 7/30/09(d) | | | 200 | | | 196,397 |

Pricoa Global Funding I, Secured Notes, | | | | | | |

5.40%, 10/18/12(d) | | | 2,125 | | | 2,128,721 |

Protective Life Corp., Secured Notes, | | | | | | |

3.70%, 11/24/08 | | | 2,000 | | | 1,994,796 |

Prudential Financial, Inc., Senior Notes, | | | | | | |

6.63%, 12/01/37 | | | 875 | | | 734,642 |

Prudential Financial, Inc., Unsecured Notes, | | | | | | |

5.70%, 12/14/36 | | | 1,375 | | | 1,015,583 |

TIAA Global Markets, Unsecured Notes, | | | | | | |

5.13%, 10/10/12(d) | | | 1,700 | | | 1,731,130 |

WellPoint, Inc., Unsecured Notes, | | | | | | |

5.00%, 12/15/14 | | | 1,825 | | | 1,668,132 |

| | | | | | |

| | | | | | 20,560,375 |

| | | | | | |

Manufacturing — 3.3% | | | | | | |

AstraZeneca Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.90%, 9/15/17(c) | | | 1,500 | | | 1,476,949 |

Alcoa, Inc., Senior Unsecured Notes, | | | | | | |

5.87%, 2/23/22 | | | 130 | | | 111,982 |

Cisco Systems, Inc., Senior Unsecured Notes, | | | | | | |

5.25%, 2/22/11 | | | 1,550 | | | 1,582,291 |

Hewlett-Packard Co., Unsecured Notes, | | | | | | |

5.25%, 3/01/12 | | | 3,000 | | | 3,037,008 |

Honeywell International, Inc., Senior Unsecured Notes, | | | | | | |

5.30%, 3/15/17 | | | 2,835 | | | 2,699,442 |

Ingersoll-Rand Global Holding Co. Ltd, Senior Unsecured Notes, | | | | | | |

6.00%, 8/15/13 | | | 2,395 | | | 2,386,821 |

International Paper Co., Senior Unsecured Notes, | | | | | | |

7.95%, 6/15/18 | | | 1,150 | | | 1,130,003 |

Siemens Financieringsmat (Netherlands), Unsecured Notes, | | | | | | |

5.50%, 2/16/12(c)(d) | | | 100 | | | 100,830 |

| | | | | | |

| | | | | | 12,525,326 |

| | | | | | |

Medical & Medical Services — 0.4% | | | | | | |

Hospira, Inc., Unsecured Notes, | | | | | | |

6.05%, 3/30/17 | | | 1,660 | | | 1,582,717 |

| | | | | | |

Medical Instruments & Supplies — 0.3% | | | | | | |

Johnson & Johnson, Unsecured Notes, | | | | | | |

5.55%, 8/15/17 | | | 1,000 | | | 1,016,727 |

| | | | | | |

See Notes to Financial Statements.

| | | | | | |

16 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | |

| Schedule of Investments (continued) | | Series C Portfolio (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Metal & Mining — 0.6% | | | | | | |

Falconbridge Ltd. (Canada), Unsecured Notes, | | | | | | |

6.00%, 10/15/15(c) | | $ | 75 | | $ | 67,964 |

United States Steel Corp., Senior Unsecured Notes, | | | | | | |

5.65%, 6/01/13 | | | 2,450 | | | 2,191,576 |

| | | | | | |

| | | | | | 2,259,540 |

| | | | | | |

Motor Vehicles — 0.5% | | | | | | |

DaimlerChrysler N.A. Holding Corp., Unsecured Notes, | | | | | | |

5.75%, 9/08/11 | | | 2,000 | | | 1,974,600 |

Nissan Motor Acceptance Corp., Unsecured Notes, | | | | | | |

4.63%, 3/08/10(d) | | | 25 | | | 25,085 |

| | | | | | |

| | | | | | 1,999,685 |

| | | | | | |

Oil & Gas — 6.0% | | | | | | |

Anadarko Petroleum Corp., Senior Unsecured Notes, | | | | | | |

3.22%, 9/15/09(a) | | | 655 | | | 647,287 |

Canadian Natural Resources (Canada), Unsecured Notes, | | | | | | |

5.70%, 5/15/17(c) | | | 3,295 | | | 2,880,456 |

5.90%, 2/01/18(c) | | | 1,125 | | | 990,142 |

6.25%, 3/15/38(c) | | | 1,110 | | | 856,065 |

ConocoPhillips Funding Co. (Australia), Unsecured Notes, | | | | | | |

2.89%, 4/09/09(a)(c) | | | 19 | | | 18,814 |

ConocoPhillips Funding Co. (Canada), Unsecured Notes, | | | | | | |

5.30%, 4/15/12(c)(g) | | | 5,200 | | | 5,267,569 |

Devon Energy Corp., Senior Debentures, | | | | | | |

7.95%, 4/15/32 | | | 450 | | | 463,114 |

Devon Financing Corp., Senior Unsecured Notes, | | | | | | |

6.88%, 9/30/11 | | | 90 | | | 93,875 |

Halliburton Co., Senior Unsecured Notes, | | | | | | |

5.50%, 10/15/10 | | | 25 | | | 25,733 |

Nakilat, Inc., Senior Unsecured Notes, | | | | | | |

6.07%, 12/31/33(d) | | | 25 | | | 22,270 |

Transocean, Inc., Senior Unsecured Notes, | | | | | | |

6.00%, 3/15/18 | | | 2,750 | | | 2,566,564 |

Western Oil Sands, Inc. (Canada), Senior Secured Notes, | | | | | | |

8.38%, 5/01/12(c) | | | 8,650 | | | 9,125,283 |

| | | | | | |

| | | | | | 22,957,172 |

| | | | | | |

Paper & Forest Products — 0.2% | | | | | | |

Weyerhaeuser Co., Debentures, | | | | | | |

7.13%, 7/15/23 | | | 750 | | | 668,508 |

| | | | | | |

Pharmaceuticals — 5.5% | | | | | | |

Abbott Laboratories, Unsecured Notes, | | | | | | |

5.60%, 5/15/11 | | | 2,575 | | | 2,661,332 |

Bristol-Myers Squibb Co., Unsecured Notes, | | | | | | |

5.88%, 11/15/36 | | | 2,500 | | | 2,203,117 |

Eli Lilly & Co., Unsecured Notes, | | | | | | |

5.20%, 3/15/17 | | | 1,500 | | | 1,456,693 |

5.55%, 3/15/37 | | | 2,975 | | | 2,719,909 |

GlaxoSmithKline Capital, Inc., Senior Unsecured Notes, | | | | | | |

4.85%, 5/15/13 | | | 2,050 | | | 2,012,536 |

Schering-Plough Corp., Senior Unsecured Notes, | | | | | | |

6.55%, 9/15/37 | | | 1,275 | | | 1,167,785 |

Teva Pharmaceutical Finance Co. LLC, Senior Unsecured Notes, | | | | | | |

5.55%, 2/01/16 | | | 2,400 | | | 2,230,810 |

Teva Pharmaceutical Finance Co. LLC, Unsecured Notes, | | | | | | |

6.15%, 2/01/36 | | | 1,000 | | | 875,360 |

Wyeth, Unsecured Notes, | | | | | | |

5.50%, 2/15/16 | | | 3,110 | | | 3,035,316 |

5.45%, 4/01/17 | | | 1,500 | | | 1,449,578 |

5.95%, 4/01/37 | | | 1,175 | | | 1,059,466 |

| | | | | | |

| | | | | | 20,871,902 |

| | | | | | |

Real Estate — 0.0% | | | | | | |

AvalonBay Communities, Inc., Senior Unsecured Notes (REIT), | | | | | | |

6.13%, 11/01/12 | | | 100 | | | 97,263 |

| | | | | | |

Retail Merchandising — 5.4% | | | | | | |

CVS Caremark Corp., Senior Unsecured Notes, | | | | | | |

4.00%, 9/15/09 | | | 75 | | | 73,549 |

CVS Caremark Corp., Unsecured Notes, | | | | | | |

5.75%, 6/01/17 | | | 4,450 | | | 4,158,489 |

Home Depot, Inc., Senior Unsecured Notes, | | | | | | |

4.63%, 8/15/10 | | | 125 | | | 122,391 |

Target Corp., Senior Unsecured Notes, | | | | | | |

7.50%, 8/15/10 | | | 200 | | | 213,285 |

5.13%, 1/15/13(g) | | | 6,000 | | | 6,020,904 |

Wal-Mart Stores, Inc., Senior Unsecured Notes, | | | | | | |

6.88%, 8/10/09 | | | 2,000 | | | 2,054,130 |

6.50%, 8/15/37 | | | 1,000 | | | 938,264 |

Wal-Mart Stores, Inc., Unsecured Notes, | | | | | | |

4.13%, 7/01/10 | | | 4,210 | | | 4,292,638 |

5.00%, 4/05/12 | | | 2,000 | | | 2,047,594 |

5.25%, 9/01/35 | | | 675 | | | 539,551 |

| | | | | | |

| | | | | | 20,460,795 |

| | | | | | |

Telecommunications — 11.5% | | | | | | |

America Movil SAB de CV (Mexico), | | | | | | |

6.38%, 3/01/35(c) | | | 1,500 | | | 1,327,623 |

AT&T, Inc., Unsecured Notes, | | | | | | |

5.63%, 6/15/16 | | | 1,500 | | | 1,389,165 |

5.50%, 2/01/18 | | | 3,500 | | | 3,116,820 |

6.45%, 6/15/34 | | | 60 | | | 51,482 |

6.50%, 9/01/37 | | | 2,775 | | | 2,360,637 |

BellSouth Capital Funding Corp., Senior Unsecured Notes, | | | | | | |

7.75%, 2/15/10 | | | 3,130 | | | 3,228,094 |

6.55%, 6/15/34 | | | 3,000 | | | 2,571,990 |

Rogers Communications, Inc., Senior Unsecured Notes, | | | | | | |

6.80%, 8/15/18 | | | 1,525 | | | 1,442,696 |

Rogers Wireless Communications, Inc. (Canada), Notes, | | | | | | |

7.50%, 3/15/15(c) | | | 2,125 | | | 2,160,041 |

Sprint Capital Corp., Senior Notes, | | | | | | |

6.88%, 11/15/28 | | | 975 | | | 653,250 |

Sprint Capital Corp., Senior Unsecured Notes, | | | | | | |

6.38%, 5/01/09 | | | 100 | | | 98,000 |

Telecom Italia Capital SA (Italy), Senior Notes, | | | | | | |

5.25%, 11/15/13(c) | | | 5,210 | | | 4,622,260 |

Telecom Italia Capital SA (Italy), Senior Unsecured Notes, | | | | | | |

4.00%, 1/15/10(c) | | | 75 | | | 72,824 |

5.25%, 10/01/15(c) | | | 100 | | | 83,240 |

See Notes to Financial Statements.

| | | | | | |

| | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | 17 |

| | |

| Schedule of Investments (concluded) | | Series C Portfolio (Percentages shown are based on Net Assets) |

| | | | | | | |

| | | Par

(000) | | Value | |

Corporate Bonds | | | | | | | |

Telecommunications (concluded) | | | | | | | |

Telefonica Emisiones SAU (Spain), Senior Unsecured Notes, | | | | | | | |

7.05%, 6/20/36(c) | | $ | 1,075 | | $ | 972,284 | |

Telefonica Europe BV (Netherlands), Senior Unsecured Notes, | | | | | | | |

7.75%, 9/15/10(c) | | | 1,600 | | | 1,633,536 | |

Verizon Communications, Inc., Senior Unsecured Notes, | | | | | | | |

6.10%, 4/15/18 | | | 3,350 | | | 3,093,424 | |

6.90%, 4/15/38 | | | 2,000 | | | 1,772,840 | |

Verizon Communications, Inc., Unsecured Notes, | | | | | | | |

6.25%, 4/01/37 | | | 1,625 | | | 1,338,880 | |

Verizon Global Funding Corp., Senior Unsecured Notes, | | | | | | | |

6.88%, 6/15/12 | | | 600 | | | 610,638 | |

Verizon Maryland, Inc., Senior Debentures, | | | | | | | |

6.13%, 3/01/12 | | | 305 | | | 301,474 | |

Vodafone Group Plc (United Kingdom), Senior Unsecured Notes, | | | | | | | |

7.75%, 2/15/10(c)(g) | | | 7,150 | | | 7,369,362 | |

Vodafone Group Plc (United Kingdom), Unsecured Notes, | | | | | | | |

5.75%, 3/15/16(c) | | | 2,000 | | | 1,816,140 | |

6.15%, 2/27/37(c) | | | 2,125 | | | 1,706,609 | |

| | | | | | | |

| | | | | | 43,793,309 | |

| | | | | | | |

Transportation — 2.0% | | | | | | | |

Burlington North Santa Fe Corp., Debentures, | | | | | | | |

5.65%, 5/01/17 | | | 425 | | | 407,154 | |

Canadian National Railway Co. (Canada), Senior Unsecured Notes, | | | | | | | |

6.38%, 10/15/11(c) | | | 50 | | | 51,690 | |

6.25%, 8/01/34(c) | | | 2,000 | | | 1,864,928 | |

Norfolk Southern Corp., Senior Unsecured Notes, | | | | | | | |

8.63%, 5/15/10 | | | 1,500 | | | 1,595,268 | |

Union Pacific Corp., Unsecured Notes, | | | | | | | |

3.88%, 2/15/09 | | | 100 | | | 98,539 | |

United Parcel Service, Inc., Senior Unsecured Notes, | | | | | | | |

6.20%, 1/15/38 | | | 4,000 | | | 3,720,220 | |

| | | | | | | |

| | | | | | 7,737,799 | |

| | | | | | | |

Total Corporate Bonds — 95.4% | | | | | | 363,227,481 | |

| | | | | | | |

Total Long-Term Investments

(Cost — $439,802,394) — 101.6% | | | | | | 386,736,415 | |

| | | | | | | |

| | |

| | | Par/Shares

(000) | | | |

Short-Term Securities | | | | | | | |

Federal Home Loan Bank, Discount Notes, | | | | | | | |

0.10%, 10/01/08 (h) | | | 8,100 | | | 8,100,000 | |

TCW Money Market Fund, 2.41%(i) | | | 3,911 | | | 3,911,217 | |

| | | | | | | |

Total Short-Term Securities

(Cost — $12,011,217) — 3.1% | | | | | | 12,011,217 | |

| | | | | | | |

Total Investments (Cost — $451,813,611*) — 104.7% | | | | | | 398,747,632 | |

Liabilities in Excess of Other Assets — (4.7)% | | | | | | (18,042,072 | ) |

| | | | | | | |

Net Assets — 100.0% | | | | | $ | 380,705,560 | |

| | | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of September 30, 2008, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 451,813,611 | |

| | | | |

Gross unrealized appreciation | | $ | 657,237 | |

Gross unrealized depreciation | | | (53,723,216 | ) |

| | | | |

Net unrealized depreciation | | $ | (53,065,979 | ) |

| | | | |

| (a) | Variable rate security. Rate shown is as of report date. |

| (b) | Security is perpetual in nature and has no stated maturity date. In certain instances, a final maturity date may be extended and/or the final payment of principal may be deferred at the issuer’s option for a specified time without default. |

| (c) | U.S. dollar denominated security issued by foreign domiciled entity. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (e) | Issuer filed for bankruptcy and/or is in default of interest payments. |

| (f) | All or a portion of security pledged as collateral in connection with open financial futures contracts. |

| (g) | All or a portion of security pledged as collateral for reverse repurchase agreements. |

| (h) | The rate shown is the effective yield on the discount notes at the time of purchase. |

| (i)Represents | current yield as of report date. |

| • | Reverse repurchase agreements outstanding as of September 30, 2008 were as follows: |

| | | | | | | | | | | | | |

Counterparty | | Interest

Rate | | | Settlement

Date | | Maturity

Date | | Net Closing

Amount | | Par |

Credit Suisse Securities LLC | | 4.00 | % | | 09/26/08 | | Open | | $ | 22,057,948 | | $ | 22,045,700 |

| • | Financial futures contracts purchased as of September 30, 2008 were as follows: |

| | | | | | | | | | | | |

Contracts | | Issue | | Expiration Date | | Face

Value | | | Unrealized

Appreciation

(Depreciation) | |

93 | | U.S. TreasuryNotes (5 Year) | | December 2008 | | $ | 10,437,797 | | | $ | 23,024 | |

104 | | U.S. Treasury Notes (10 Year) | | December 2008 | | $ | 11,921,000 | ) | | | (154,796 | ) |

242 | | U.S. Treasury Bonds (20 Year) | | December 2008 | | $ | 28,355,594 | | | | (97,973 | ) |

| | | | | | | | | | | | |

Total | | | | | | | | | | $ | (229,745 | ) |

| | | | | | | | | | | | |

| • | For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. These industry classifications are unaudited. |

See Notes to Financial Statements.

| | | | | | |

18 | | ANNUAL REPORT | | SEPTEMBER 30, 2008 | | |

| | | | |

| Schedule of Investments September 30, 2008 | | Series M Portfolio |

| | | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

| | | |

U.S. Government & Agency Obligations | | | | | | |

U.S. Treasury Bonds, | | | | | | |

4.38%, 2/15/38 | | $ | 9,515 | | $ | 9,636,164 |

U.S. Treasury Inflation Protected Bonds, | | | | | | |

1.75%, 1/15/28 | | | 2,315 | | | 2,120,196 |

U.S. Treasury Notes, | | | | | | |

3.88%, 5/15/18 | | | 3,650 | | | 3,673,951 |

| | | | | | |

Total U.S. Government & Agency Obligations — 3.7% | | | | | | 15,430,311 |

| | | | | | |

Mortgage Pass-Throughs — 0.3% | | | | | | |

Federal National Mortgage Assoc. 15 Year TBA, | | | | | | |

5.00%, 10/01/23 | | | 1,000 | | | 992,813 |

| | | | | | |

Collateralized Mortgage Obligations | | | | | | |

Federal Home Loan Mortgage Corp., Series 2864, Class NA, | | | | | | |

5.50%, 1/15/31 | | | 299 | | | 305,767 |

Federal Home Loan Mortgage Corp., Series 2875, Class MA, | | | | | | |

5.50%, 5/15/26 | | | 4,802 | | | 4,846,861 |

Federal Home Loan Mortgage Corp., Series 2945, Class BD, | | | | | | |

5.50%, 10/15/34 | | | 2,628 | | | 2,662,740 |

Federal Home Loan Mortgage Corp., Series 2964, Class NA, | | | | | | |

5.50%, 2/15/26 | | | 3,647 | | | 3,697,379 |

Federal Home Loan Mortgage Corp., Series 3018, Class GN, | | | | | | |

6.00%, 9/15/26 | | | 5,053 | | | 5,117,036 |

Federal Home Loan Mortgage Corp., Series 3128, Class BA, | | | | | | |

5.00%, 1/15/24 | | | 284 | | | 285,448 |

Federal Home Loan Mortgage Corp., Series 3200, Class GA, | | | | | | |

5.50%, 10/15/27 | | | 4,258 | | | 4,343,942 |

Federal National Mortgage Assoc., Series 03-86, Class DL, | | | | | | |

4.00%, 9/25/10 | | | 372 | | | 377,617 |

Federal National Mortgage Assoc., Series 07-32, Class KP, | | | | | | |

5.50%, 4/25/37(a) | | | 8,513 | | | 8,637,625 |

| | | | | | |

Total Collateralized Mortgage Obligations — 7.3% | | | | | | 30,274,415 |

| | | | | | |

Commercial Mortgage Backed Securities | | | | | | |

Banc of America Commercial Mortgage, Inc., Series 01-1, Class A2, | | | | | | |

6.50%, 4/15/36 | | | 5,819 | | | 5,843,191 |

Banc of America Commercial Mortgage, Inc., Series 01-1, Class B, | | | | | | |

6.67%, 4/15/36 | | | 175 | | | 176,007 |

Banc of America Commercial Mortgage, Inc., Series 01-PB1, Class A2, | | | | | | |

5.79%, 8/11/11 | | | 4,587 | | | 4,527,446 |

Banc of America Commercial Mortgage, Inc., Series 02-2, Class B, | | | | | | |

5.27%, 5/11/12 | | | 1,000 | | | 957,947 |

Banc of America Commercial Mortgage, Inc., Series 05-4, Class A5A, | | | | | | |

4.93%, 7/10/45 | | | 750 | | | 671,360 |

Banc of America Commercial Mortgage, Inc., Series 06-2, Class A4, | | | | | | |

5.93%, 5/10/45(b) | | | 3,580 | | | 3,239,759 |

Banc of America Commercial Mortgage, Inc., Series 06-4, Class A4, | | | | | | |

5.63%, 7/10/46 | | | 5,000 | | | 4,450,550 |

Banc of America Commercial Mortgage, Inc., Series 06-6, Class A4, | | | | | | |

5.36%, 10/10/45 | | | 6,015 | | | 5,257,583 |

Banc of America Commercial Mortgage, Inc., Series 07-2, Class A4, | | | | | | |

5.87%, 4/10/49(b) | | | 6,000 | | | 5,140,580 |

Banc of America Commercial Mortgage, Inc., Series 07-3, Class A4, | | | | | | |

5.84%, 5/10/17(b) | | | 3,950 | | | 3,356,880 |

Banc of America Commercial Mortgage, Inc., Series 07-5, Class A4, | | | | | | |

5.49%, 10/10/17 | | | 5,000 | | | 4,161,442 |

Bear Stearns Commercial Mortgage Securities, Inc., Series 00-WF2, Class A2, | | | | | | |

7.32%, 10/15/32 | | | 2,300 | | | 2,335,979 |