UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21457

Name of Fund: BlackRock Bond Allocation Target Shares

| | |

| Series C Portfolio | | |

| Series M Portfolio | | |

| Series N Portfolio | | |

| Series S Portfolio | | |

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock Bond Allocation Target Shares, 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing address: P.O. Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 03/31/2009

Date of reporting period: 03/31/2009

| | | | |

| Item 1 | | – | | Report to Stockholders |

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

| | | | |

| BlackRock Bond Allocation Target Shares | |  |

| | | | |

| ANNUAL REPORT | | | | MARCH 31, 2009 |

Series C Portfolio

Series M Portfolio

Series N Portfolio

Series S Portfolio

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| | | | | | |

2 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

A Letter to Shareholders

The past 12 months have been a period investors would like to forget, but instead will vividly remember, as the global financial crisis erupted into the worst recession in decades. Daily headlines recounted the downfalls of storied financial firms, volatile swings in the world’s financial markets and monumental government actions, including the recent passage of the nearly $800 billion American Recovery and Reinvestment Act of 2009.

The economic data generally deteriorated throughout the reporting period. US gross domestic product (“GDP”) contracted at an annual rate of 6.3% in the fourth quarter of 2008, and economic activity appears on pace to be negative in the first quarter of 2009 as well. The Federal Reserve Board (the “Fed”) took forceful action to revive the global economy and ailing financial system. In addition to slashing the federal funds target rate from 3.0% to a record low range of 0% to 0.25%, the central bank provided enormous cash infusions and radically expanded its balance sheet through a range of lending and acquisition programs.

Against this backdrop, US equities contended with high levels of volatility and posted steep losses, notwithstanding a powerful rally in the final month of the reporting period. International markets also experienced sharp downturns, with some regions declining as much or more than the United States. Risk aversion remained the dominant theme in fixed income markets, as investors sought out the haven of Treasury issues at the expense of virtually all other asset classes. High yield issues, in particular, faced unprecedented challenges and posted severe underperformance; that said, the sector pared its losses in the first quarter of 2009, as both liquidity and investor sentiment toward lower-quality debt improved. At the same time, the start of the new year brought somewhat of a return to normalcy for the tax-exempt market, which registered one of its worst years on record in 2008.

In all, investors continued to gravitate toward relative safety, as evidenced in the six- and 12-month returns of the major benchmark indexes:

| | | | | | |

Total Returns as of March 31, 2009 | | 6-month | | | 12-month | |

US equities (S&P 500 Index) | | (30.54 | )% | | (38.09 | )% |

Small cap US equities (Russell 2000 Index) | | (37.17 | ) | | (37.50 | ) |

International equities (MSCI Europe, Australasia, Far East Index) | | (31.11 | ) | | (46.50 | ) |

US Treasury securities (Merrill Lynch 10-Year US Treasury Index) | | 11.88 | | | 10.46 | |

Taxable fixed income (Barclays Capital US Aggregate Bond Index) | | 4.70 | | | 3.13 | |

Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | | 5.00 | | | 2.27 | |

High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | | (12.65 | ) | | (18.56 | ) |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Through periods of market turbulence, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. We thank you for entrusting BlackRock with your investments and look forward to continuing to serve you in the months and years ahead.

|

| Sincerely, |

|

|

| Rob Kapito |

| President, BlackRock Advisors, LLC |

Seeking additional investment insights?

Visit BlackRock’s award-winning Shareholder® magazine, now available exclusively online at www.blackrock.com/shareholdermagazine. In this issue:

| | • | | Discover why portfolio diversification still matters — even as nearly every financial asset class lost value over the past year. |

| | • | | Learn how adding commodities to a more traditional mix of assets can help you to balance risks and access new potential rewards. |

| | • | | Assuage your fears about higher taxes and discover how municipal bonds may offer some relief. |

| | • | | Find out if there’s still value to be found in dividend-paying stocks. |

THIS PAGE NOT PART OF YOUR FUND REPORT

| | |

| Portfolio Summary as of March 31, 2009 | | Series C Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s fiscal year-end was changed to March 31. |

| | • | | The Portfolio’s total return outpaced that of its benchmark for the six-month period. (The Portfolio compares its performance against the Barclays Capital US Credit Index. However, because shares of the Portfolio can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Portfolio’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | Duration management benefited Portfolio performance during the six months. Security selection within the corporate sector also aided results. |

| | • | | Conversely, the Portfolio’s overweight exposure to financials was the primary performance detractor for the period, with a bulk of the underperformance coming during the fourth quarter of 2008. This coincided with the peak market stresses experienced following the Lehman Brothers bankruptcy and subsequent historical volatility that reverberated through the markets. |

Describe recent Portfolio activity.

| | • | | During the six months, we looked to reduce risk within the Portfolio. Accordingly, we reduced exposure to the financials subsector, focusing on industrials and utilities names instead. For a majority of these trades, we looked to the primary, or new-issue market, to make this shift, as issuers had to offer concessions in order to successfully complete new deals. |

Describe Portfolio positioning at period-end.

| | • | | The Portfolio was almost fully invested in corporate bonds, with approximately 98% of assets invested in the sector at period end. We continue to focus on higher-quality names, favoring non-cyclical industries and companies with strong balance sheets. From a sector perspective, the Portfolio’s largest overweight is in the industrials sector. We hold a slight overweight in financials, though this position was significantly reduced throughout the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Portfolio Composition | | Percent of

Long-Term

Investments | |

Corporate Bonds | | 98 | % |

Capital Trusts | | 1 | |

Foreign Government Obligations | | 1 | |

| |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA | | 5 | % |

AA | | 30 | |

A | | 43 | |

BBB | | 22 | |

| |

1 Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) ratings. | |

| | | | | | |

4 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

Series C Portfolio

Total Return Based on a $10,000 Investment

| 1 | The Portfolio is non-diversified and will primarily invest its assets in investment grade corporate fixed income securities. |

| 2 | An unmanaged index that includes publicly issued US corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. |

| 3 | Commencement of operations. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | 1 Year | | | Since Inception5 | |

Series C Portfolio | | 6.17 | % | | (4.70 | )% | | 2.16 | % |

Barclays Capital US Credit Index | | 2.18 | | | (5.21 | ) | | 1.66 | |

| 4 | See “About Portfolio Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on October 1, 2004. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6,7 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6,7 |

Series C Portfolio | | $ | 1,000.00 | | $ | 1,061.70 | | $ | 0.46 | | $ | 1,000.00 | | $ | 1,024.55 | | $ | 0.45 |

| 6 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.09%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. This agreement has no fixed term. |

| 7 | Expenses paid during the period would have been zero if interest expense were not included. |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 5 |

| | |

| Portfolio Summary as of March 31, 2009 | | Series M Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s fiscal year-end was changed to March 31. |

| | • | | The Portfolio’s total return lagged that of its benchmark for the six-month period. (The Portfolio compares its performance against the Barclays Capital MBS Index. However, because shares of the Portfolio can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Portfolio’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | During the period, the Portfolio’s exposure to agency mortgage-backed securities (“MBS”) had a positive impact on performance as the Federal Reserve’s support of this sector, by way of its quantitative easing, created strong technical demand. On the other hand, the performance of non-agency MBS holdings — while better than in the past — continued to hamper Portfolio results. Having said that, we feel this, too, will begin to help as the markets normalize. |

Describe recent Portfolio activity.

| | • | | During the six months, a powerful rally in non-agency residential mortgage-backed securities (“RMBS”) and commercial mortgage-backed securities (“CMBS”) was touched off after the Term Asset-Backed Securities Loan Facility was expanded to allow for these sectors to be included. The rally was further fueled by the announcement of the Public-Private Investment Program. In response, we reduced our CMBS holdings to lock in some gains. We also reduced the allocation to agency MBS and asset-backed securities (“ABS”) on the strength. The proceeds have been reinvested in US Treasury securities while we await additional opportunities, as the market continues to be volatile. |

Describe Portfolio positioning at period-end.

| | • | | At period-end, the Portfolio was invested primarily in US spread assets, including CMBS, ABS and MBS. In addition, the Portfolio maintained positions in US Treasury securities, and had an allocation to cash. The Portfolio’s duration was 6.26. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Portfolio Composition | | Percent of

Long-Term

Investments | |

Non-U.S. Government Sponsored Agency Mortgage-Backed Securities | | 66 | % |

U.S. Treasury Obligations | | 16 | |

Asset Backed Securities | | 14 | |

U.S. Government Sponsored Agency Mortgage-Backed Securities | | 4 | |

| |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA | | 100 | % |

| |

1 Using the higher of S&P’s or Moody’s ratings. | |

| | | | | | |

6 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

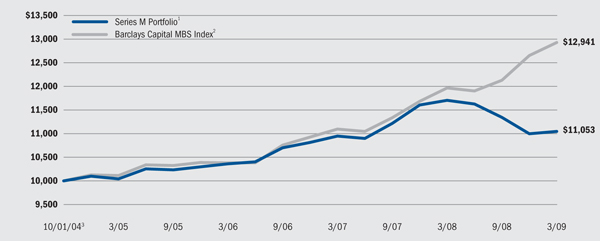

Series M Portfolio

Total Return Based on a $10,000 Investment

| 1 | The Portfolio is non-diversified and will primarily invest its assets in investment grade commercial and residential mortgage-backed securities. |

| 2 | An unmanaged index that includes the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC) that meet the maturity and liquidity criteria. |

| 3 | Commencement of operations. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | 1 Year | | | Since Inception5 | |

Series M Portfolio | | (2.61 | )% | | (5.65 | )% | | 2.25 | % |

Barclays Capital MBS Index | | 6.63 | | | 8.09 | | | 5.90 | |

| 4 | See “About Portfolio Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on October 1, 2004. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6 |

Series M Portfolio | | $ | 1,000.00 | | $ | 973.90 | | $ | 0.00 | | $ | 1,000.00 | | $ | 1,025.00 | | $ | 0.00 |

| 6 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. This agreement has no fixed term |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 7 |

| | |

| Portfolio Summary as of March 31, 2009 | | Series N Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s total return underperformed that of its benchmark for the period since inception (April 1, 2008) through March 31, 2009. (The Portfolio compares its performance against the Barclays Capital Municipal Bond Index. However, because shares of the Portfolio can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Portfolio’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of separately managed accounts.) |

What factors influenced performance?

| | • | | The Portfolio is constructed to maximize distribution yield and, as a consequence, is overweight the high yield sector of the tax-exempt market. Credit spreads remain at historical wide levels, causing the net asset valuations of the Portfolio to underperform the generally higher-quality holdings characterizing the majority of the benchmark. |

| | • | | Conversely, the focus on high current return is designed to deliver a generous accrual. The portion of total return generated by a competitive yield distribution is well served by this approach. |

Describe recent Portfolio activity.

| | • | | Cash reserves vacillated during the 12 months. In general, a degree of reserves approaching 8% may have been available to permit the Portfolio’s management some liquidity to take advantage of a heavy new-issue calendar. Having a portion of the assets in a liquid posture also seemed prudent during the historically volatile markets witnessed over the past year. |

| | • | | Management has worked in close conjunction with Municipal research to monitor the high yield credits within the Portfolio. The extreme weakness of the economic backdrop has caused reevaluations of whether securities stand a chance for future recovery, or if items should be swapped out into other sectors that provide better chances for more immediate recovery. |

Describe Portfolio positioning at period-end.

| | • | | The Portfolio’s holdings of high yield municipals give it the appearance of a higher relative duration position. Several of the positions have been discounted due to the poor performance of the high yield sector, in general. The Portfolio’s future recovery will rely more on the normalization of credit quality spreads, however, than a forecast for dramatically lower long-term rates (in which a long duration posture would benefit). |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

City, County & State | | 40 | % |

Hospital | | 20 | |

Power | | 14 | |

Education | | 10 | |

Housing | | 8 | |

Water & Sewer | | 6 | |

Lease Revenue | | 2 | |

| |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA | | 38 | % |

AA | | 12 | |

A | | 19 | |

BB | | 10 | |

BBB | | 13 | |

Unrated | | 8 | |

| |

1 Using the higher of S&P’s or Moody’s ratings. | |

| | | | | | |

8 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

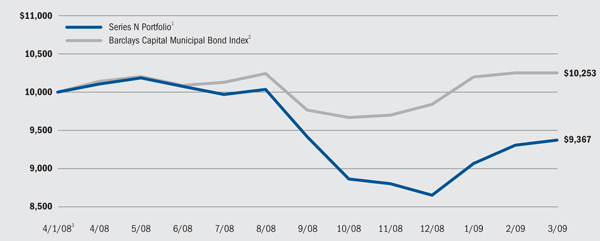

Series N Portfolio

Total Return Based on a $10,000 Investment

| 1 | The Portfolio is non-diversified and will primarily invest its assets in municipal bonds, the interest on which the management team believes is exempt from regular federal income tax. |

| 2 | An unmanaged index of municipal bonds with the following characteristics: minimum credit rating of Baa, outstanding par value of at least $5 million and issued as part of a transaction of at least $50 million. In addition, the bonds must have a dated-date after December 31, 1990 and must be at least one year from their maturity date. |

| 3 | Commencement of operations. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | |

| | | 6 Month

Total Returns | | | Total Returns4

Since Inception5 | |

Series N Portfolio | | (0.47 | )% | | (6.32 | )% |

Barclays Capital Municipal Bond Index | | 5.00 | | | 2.27 | |

| 4 | See “About Portfolio Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on April 1, 2008. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6,7 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6,7 |

Series N Portfolio | | $ | 1,000.00 | | $ | 995.30 | | $ | 0.25 | | $ | 1,000.00 | | $ | 1,024.75 | | $ | 0.25 |

| 6 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.05%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. This agreement has no fixed term. |

| 7 | Expenses paid during the period would have been zero if interest expense were not included. |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 9 |

| | |

| Portfolio Summary as of March 31, 2009 | | Series S Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio’s fiscal year-end was changed to March 31. |

| | • | | The Portfolio’s total return lagged that of its benchmark for the six-month period. (The Portfolio compares its performance against the Merrill Lynch 1-3 Year Treasury Index. However, because shares of the Portfolio can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Portfolio’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | Detracting from performance was the Portfolio’s allocation to US spread assets, including asset-backed securities (ABS) and mortgage-backed securities (MBS), which underperformed amid historic levels of volatility, most notably during October and November 2008. The allocation to non-agency mortgages proved most detrimental. |

| | • | | On the positive side, the Portfolio’s exposure to shorter-dated commercial mortgage-backed securities (CMBS) aided performance during the six months, as did tactical trading along the yield curve. |

Describe recent Portfolio activity.

| | • | | Following the dramatic spread widening in October and November 2008, the markets began to stabilize. We took this opportunity to reduce our defensive posture and add risk to the Portfolio. From December 2008 through February 2009, we utilized available cash to purchase primarily CMBS, ABS and US investment grade credit. |

Describe Portfolio positioning at period-end.

| | • | | At period-end, the Portfolio was invested primarily in US spread assets, including agency MBS and FDIC-guaranteed paper, CMBS, ABS, as well as US investment grade credit and a small exposure to non-agency MBS. In addition, the Portfolio maintained positions in US Treasury and US agency securities, and had an allocation to cash, which we will continue to invest as opportunities in the market present themselves. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Portfolio Composition | | Percent of

Long-Term

Investments | |

U.S. Treasury Obligations | | 27 | % |

Non-U.S. Government Sponsored Agency Mortgage-Backed Securities | | 25 | |

U.S. Government Sponsored Agency Mortgage-Backed Securities | | 19 | |

Asset Backed Securities | | 13 | |

Corporate Bonds | | 11 | |

U.S. Government Sponsored Agency Obligations | | 5 | |

| |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA | | 94 | % |

AA | | 2 | |

A | | 3 | |

BBB | | 1 | |

| |

1 Using the higher of S&P’s or Moody’s ratings. | |

| | | | | | |

10 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

Series S Portfolio

Total Return Based on a $10,000 Investment

| 1 | The Portfolio is non-diversified and will primarily invest its assets in investment-grade fixed income securities, such as commercial and residential mortgage-backed securities, obligations of non-US governments and supra-national organizations, obligations of domestic and non-US corporations, asset-backed securities, US Treasury and agency securities, cash equivalent investments, repurchase and reverse repurchase agreements and dollar rolls. |

| 2 | An unmanaged index comprised of treasury securities with maturities from 1 to 2.99 years. |

| 3 | Commencement of operations. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | 1 Year | | | Since Inception5 | |

Series S Portfolio | | 2.44 | % | | 3.21 | % | | 3.96 | % |

Merrill Lynch 1-3 Year Treasury Index | | 2.78 | | | 3.61 | | | 4.34 | |

| 4 | See “About Portfolio Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Portfolio commenced operations on October 1, 2004. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6 |

Series S Portfolio | | $ | 1,000.00 | | $ | 1,024.40 | | $ | 0.00 | | $ | 1,000.00 | | $ | 1,025.00 | | $ | 0.00 |

| 6 | For shares of the Portfolio, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Portfolio. This agreement has no fixed term. |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 11 |

About Portfolio Performance

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Performance results do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. Figures shown in the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The performance information also reflects fee waivers and reimbursements that subsidize and reduce the total operating expenses of each Portfolio. The Portfolios’ returns would have been lower if there were not such waivers and reimbursements.

Disclosure of Expenses

Shareholders of these Portfolios may incur the following charges: (a) expenses related to transactions, including sales charges and redemption fees; and (b) operating expenses, including administration fees and other Portfolio expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2008 and held through March 31, 2009) are intended to assist shareholders both in calculating expenses based on an investment in each Portfolio and in comparing these expenses with similar costs of investing in other mutual funds.

The Expense Example tables provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the headings entitled “Expenses Paid During the Period.”

The tables also provide information about hypothetical account values and hypothetical expenses based on the Portfolios’ actual expense ratios and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Portfolios and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical table is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

12 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

The Benefits and Risks of Leveraging

The Portfolios may utilize leverage to seek to enhance their yields and NAVs. However, these objectives cannot be achieved in all interest rate environments.

The Portfolios may utilize leverage through borrowings or issuances of short-term debt securities including reverse repurchase agreements, or through other techniques, such as dollar rolls. The Series N Portfolio may leverage its assets through the use of tender option bond (“TOB”) programs, as described in Note 1 of the Notes to Financial Statements. TOB investments generally will provide the Portfolio with economic benefits in periods of declining short-term interest rates, but expose the Portfolio to risks during periods of rising short-term interest rates. Additionally, fluctuations in the market value of municipal bonds deposited into the TOB trust may adversely affect the Portfolios’ NAVs per share. In general, the concept of leveraging is based on the premise that the cost of assets to be obtained from leverage will be based on short-term interest rates, which normally will be lower than the income earned by each Portfolio on its longer-term portfolio investments. To the extent that the total assets of each Portfolio (including the assets obtained from leverage) is invested in higher-yielding portfolio investments, each Portfolio’s shareholders will benefit from the incremental yield.

The use of leverage may enhance opportunities for increased returns to the Portfolios, but as described above, it also creates risks as short- or long-term interest rates fluctuate. Leverage also will generally cause greater changes in a Portfolio’s NAV, market price and dividend rate than a comparable portfolio without leverage. If the income derived from securities purchased with assets received from leverage exceeds the cost of leverage, the Portfolio’s net income will be greater than if leverage had not been used. Conversely, if the income from the securities purchased is not sufficient to cover the cost of leverage, the Portfolio’s net income will be less than if leverage had not been used, and therefore the amount available for distribution to shareholders will be reduced. A Portfolio may be required to sell portfolio securities at inopportune times or below fair market values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments which may cause a Portfolio to incur losses. The use of leverage may limit a Portfolio’s ability to invest in certain types of securities or use certain types of hedging strategies. A Portfolio will incur expenses in connection with the use of leverage, all of which are borne by Portfolio shareholders and may reduce investment returns.

Derivative Instruments

The Portfolios may invest in various derivative instruments, including swap agreements, swaptions, futures and other instruments specified in the Notes to Financial Statements, which constitute forms of economic leverage. Such instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market and/or interest rate risks. Such derivative instruments involve risks, including the imperfect correlation between the value of a derivative instrument and the underlying asset, possible default of the other party to the transaction and illiquidity of the derivative instrument. A Portfolio’s ability to successfully use a derivative instrument depends on the Advisor’s ability to accurately predict pertinent market movements, which cannot be assured. The use of derivative instruments may result in losses greater than if they had not been used, may require a Portfolio to sell or purchase portfolio securities at inopportune times or for prices other than current market values, may limit the amount of appreciation a Portfolio can realize on an investment or may cause a Portfolio to hold a security that it might otherwise sell. The Portfolios’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 13 |

| | |

| Schedule of Investments March 31, 2009 | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Capital Trusts | | | | | | |

Commercial Banks — 0.6% | | | | | | |

Barclays Bank Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.93%(a)(b)(c) | | $ | 1,200 | | $ | 402,492 |

Rabobank Capital Funding Trust II, Capital Securities, | | | | | | |

5.26%(b)(c) | | | 75 | | | 33,750 |

Royal Bank of Scotland Group Plc (United Kingdom), Capital Securities, | | | | | | |

6.99%(a)(b)(c)(d) | | | 1,100 | | | 484,000 |

State Street Capital Trust IV, Capital Securities, | | | | | | |

2.32%, 6/15/37(d) | | | 1,075 | | | 421,788 |

Wachovia Capital Trust III, Capital Securities, | | | | | | |

5.80%, 3/15/42(d) | | | 225 | | | 81,000 |

Wells Fargo & Co., Series K, Subordinated Notes, | | | | | | |

7.98%(c)(d) | | | 1,175 | | | 552,250 |

| | | | | | |

| | | | | | 1,975,280 |

| | | | | | |

Diversified Financial Services — 0.6% | | | | | | |

Credit Suisse Guernsey Ltd. (Switzerland), Unsecured Notes, | | | | | | |

5.86%(a)(c)(d) | | | 4,760 | | | 1,764,042 |

JPMorgan Chase Capital XXII, Capital Securities, | | | | | | |

6.45%, 2/02/37 | | | 200 | | | 126,460 |

JPMorgan Chase Capital XXIII, Capital Securities, | | | | | | |

2.24%, 5/15/47(d) | | | 500 | | | 204,585 |

Lehman Brothers Holdings Capital Trust VII, Trust Preferred Securities, | | | | | | |

5.86%(c)(d)(e) | | | 4,070 | | | 407 |

| | | | | | |

| | | | | | 2,095,494 |

| | | | | | |

Insurance — 0.0% | | | | | | |

American International Group, Inc., Junior Subordinated Debentures, | | | | | | |

8.18%, 5/15/58(b) | | | 430 | | | 36,636 |

Financial Security Assurance Holdings Ltd., Junior Subordinated Debentures, | | | | | | |

6.40%, 12/15/66(b)(d) | | | 50 | | | 9,000 |

Lincoln National Corp., Capital Securities, | | | | | | |

7.00%, 5/17/66(d) | | | 75 | | | 15,750 |

| | | | | | |

| | | | | | 61,386 |

| | | | | | |

Total Capital Trusts — 1.2% | | | | | | 4,132,160 |

| | | | | | |

Corporate Bonds | | | | | | |

Aerospace & Defense — 3.2% | | | | | | |

Honeywell International, Inc., Senior Unsecured Notes, | | | | | | |

5.30%, 3/15/17 | | | 2,835 | | | 2,885,721 |

Lockheed Martin Corp., Unsecured Notes, | | | | | | |

6.15%, 9/01/36 | | | 1,020 | | | 1,030,765 |

Northrop Grumman Corp., Debentures, | | | | | | |

7.88%, 3/01/26 | | | 1,000 | | | 1,142,615 |

Northrop Grumman Corp., Senior Debentures, | | | | | | |

7.75%, 2/15/31 | | | 75 | | | 90,653 |

Northrop Grumman Systems Corp., Senior Unsecured Notes, | | | | | | |

7.13%, 2/15/11 | | | 2,000 | | | 2,134,050 |

Raytheon Co., Unsecured Notes, | | | | | | |

5.38%, 4/01/13 | | | 50 | | | 52,458 |

United Technologies Corp., Senior Unsecured Notes, | | | | | | |

6.35%, 3/01/11 | | | 125 | | | 133,222 |

United Technologies Corp., Unsecured Notes, | | | | | | |

6.05%, 6/01/36 | | | 3,650 | | | 3,653,657 |

| | | | | | |

| | | | | | 11,123,141 |

| | | | | | |

Air Freight & Logistics — 1.2% | | | | | | |

United Parcel Service, Inc., Senior Unsecured Notes, | | | | | | |

6.20%, 1/15/38 | | | 4,000 | | | 4,069,892 |

| | | | | | |

Automobiles — 1.1% | | | | | | |

Daimler Finance North America LLC, Unsecured Notes, | | | | | | |

5.75%, 9/08/11 | | | 2,000 | | | 1,890,110 |

PACCAR, Inc., Senior Unsecured Notes, | | | | | | |

6.88%, 2/15/14 | | | 1,850 | | | 1,926,738 |

| | | | | | |

| | | | | | 3,816,848 |

| | | | | | |

Beverages — 3.1% | | | | | | |

Anheuser-Busch InBev Worldwide, Inc., Unsecured Notes, | | | | | | |

8.20%, 1/15/39(b) | | | 1,800 | | | 1,766,221 |

Bottling Group LLC, Senior Unsecured Notes, | | | | | | |

5.13%, 1/15/19 | | | 1,425 | | | 1,434,167 |

Brown-Forman Corp., Senior Unsecured Notes, | | | | | | |

5.00%, 2/01/14 | | | 1,875 | | | 1,941,405 |

Diageo Finance BV, Unsecured Notes, | | | | | | |

5.50%, 4/01/13(a) | | | 2,300 | | | 2,377,276 |

PepsiCo, Inc., Senior Unsecured Notes, | | | | | | |

7.90%, 11/01/18 | | | 1,250 | | | 1,535,821 |

SABMiller Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.70%, 1/15/14(a)(b) | | | 1,850 | | | 1,798,631 |

| | | | | | |

| | | | | | 10,853,521 |

| | | | | | |

Capital Markets — 4.9% | | | | | | |

Bank of New York Mellon Corp., Senior Notes, | | | | | | |

4.50%, 4/01/13(f) | | | 3,000 | | | 2,972,973 |

Eksportfinans A/S (Norway), Unsecured Notes, | | | | | | |

5.50%, 5/25/16(a) | | | 1,200 | | | 1,284,582 |

The Goldman Sachs Group, Inc., Unsecured Notes, | | | | | | |

5.25%, 10/15/13 | | | 3,525 | | | 3,291,627 |

6.25%, 9/01/17 | | | 1,500 | | | 1,390,017 |

| | | | | | |

Portfolios Abbreviations

| | | | | | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names of certain securities have been abbreviated according to the list on the right. | | ACA | | American Capital Access Corp. | | FGIC | | Financial Guaranty Insurance Co. |

| | AMBAC | | American Municipal Bond | | FSA | | Financial Security Assurance |

| | | | Assurance Corp. | | GO | | General Obligation Bonds |

| | AMT | | Alternative Minimum Tax (subject to) | | IDRB | | Industrial Development Revenue Bonds |

| | ARM | | Adjustable Rate Mortgage | | LIBOR | | London InterBank Offered Rate |

| | BHAC | | Berkshire Hathaway Assurance Co. | | PCRB | | Pollution Control Revenue Bonds |

| | CMT | | Constant Maturity Treasury Rate | | RB | | Revenue Bonds |

| | COP | | Certificates of Participation | | TBA | | To-Be-Announced |

| | | | | | |

14 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments (continued) | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Capital Markets (concluded) | | | | | | |

Morgan Stanley, Senior Notes, | | | | | | |

5.05%, 1/21/11 | | $ | 200 | | $ | 196,640 |

5.63%, 1/09/12 | | | 7,400 | | | 7,120,398 |

6.25%, 8/28/17 | | | 885 | | | 821,442 |

State Street Corp., Subordinated Notes, | | | | | | |

7.65%, 6/15/10 | | | 50 | | | 50,000 |

| | | | | | |

| | | | | | 17,127,679 |

| | | | | | |

Commercial Banks — 8.7% | | | | | | |

HSBC Bank USA, Subordinated Notes, | | | | | | |

4.63%, 4/01/14 | | | 9,750 | | | 9,138,431 |

HSBC Holdings Plc (United Kingdom), Subordinated Notes, | | | | | | |

6.80%, 6/01/38(a) | | | 2,180 | | | 1,853,724 |

Kreditanstalt fuer Wiederaufbau (Germany), Unsecured Notes, | | | | | | |

3.50%, 3/10/14(a) | | | 4,500 | | | 4,549,191 |

Northern Trust Corp., Subordinated Notes, | | | | | | |

4.60%, 2/01/13 | | | 125 | | | 125,776 |

Royal Bank of Scotland Group Plc (United Kingdom), Subordinated Notes, | | | | | | |

5.00%, 11/12/13(a) | | | 3,000 | | | 1,942,683 |

U.S. Bank N.A., Subordinated Bank Notes, | | | | | | |

6.38%, 8/01/11 | | | 2,500 | | | 2,625,570 |

UBS AG (Switzerland), Senior Notes, | | | | | | |

5.88%, 12/20/17(a) | | | 3,400 | | | 2,924,309 |

Wachovia Corp., Senior Notes, | | | | | | |

4.38%, 6/01/10 | | | 300 | | | 291,552 |

Wachovia Corp., Subordinated Notes, | | | | | | |

5.25%, 8/01/14 | | | 185 | | | 153,607 |

Wachovia Corp., Unsecured Notes, | | | | | | |

1.44%, 3/15/11(d) | | | 2,500 | | | 2,337,725 |

Wells Fargo & Co., Unsecured Notes, | | | | | | |

4.38%, 1/31/13 | | | 5,268 | | | 4,910,045 |

| | | | | | |

| | | | | | 30,852,613 |

| | | | | | |

Commercial Services — 1.1% | | | | | | |

Cornell University, Senior Unsecured Notes, | | | | | | |

5.45%, 2/01/19 | | | 1,750 | | | 1,772,872 |

Princeton University, Senior Unsecured Notes, | | | | | | |

4.95%, 3/01/19 | | | 2,050 | | | 2,040,386 |

| | | | | | |

| | | | | | 3,813,258 |

| | | | | | |

Commercial Services & Supplies — 0.3% | | | | | | |

Tyco International Finance SA (Luxembourg), Unsecured Notes, | | | | | | |

8.50%, 1/15/19(a) | | | 1,000 | | | 1,032,188 |

| | | | | | |

Communications Equipment — 0.4% | | | | | | |

Cisco Systems, Inc., Senior Unsecured Notes, | | | | | | |

5.90%, 2/15/39 | | | 1,375 | | | 1,263,373 |

| | | | | | |

Computers & Peripherals — 2.5% | | | | | | |

Hewlett-Packard Co., Unsecured Notes, | | | | | | |

5.25%, 3/01/12 | | | 3,000 | | | 3,150,033 |

International Business Machines Corp., Unsecured Notes, | | | | | | |

5.70%, 9/14/17 | | | 5,575 | | | 5,774,986 |

| | | | | | |

| | | | | | 8,925,019 |

| | | | | | |

Consumer Finance — 3.8% | | | | | | |

Allstate Life Global Funding Trust, Secured Notes, | | | | | | |

4.50%, 5/29/09 | | | 9,050 | | | 9,048,706 |

American Express Co., Senior Unsecured Notes, | | | | | | |

4.75%, 6/17/09 | | | 550 | | | 551,227 |

General Electric Capital Corp., Senior Unsecured Notes, | | | | | | |

6.13%, 2/22/11 | | | 1,300 | | | 1,314,307 |

General Electric Capital Corp., Unsecured Notes, | | | | | | |

5.63%, 9/15/17 | | | 1,000 | | | 876,462 |

Nissan Motor Acceptance Corp., Unsecured Notes, | | | | | | |

4.63%, 3/08/10(b) | | | 25 | | | 23,626 |

Student Loan Marketing Corp., Senior Unsecured Notes, | | | | | | |

1.30%, 7/27/09(d) | | | 500 | | | 481,735 |

Student Loan Marketing Corp., Unsecured Notes, | | | | | | |

5.40%, 10/25/11 | | | 1,900 | | | 1,178,000 |

| | | | | | |

| | | | | | 13,474,063 |

| | | | | | |

Diversified Financial Services — 7.9% | | | | | | |

Bank of America Corp., Senior Unsecured Notes, | | | | | | |

4.50%, 8/01/10 | | | 5,000 | | | 4,756,220 |

5.38%, 8/15/11 | | | 2,205 | | | 2,054,818 |

Bank of America Corp., Subordinated Notes, | | | | | | |

7.40%, 1/15/11 | | | 65 | | | 60,597 |

The Bear Stearns Cos., Inc., Senior Unsecured Notes, | | | | | | |

6.95%, 8/10/12 | | | 3,275 | | | 3,335,152 |

The Bear Stearns Cos., Inc., Unsecured Notes, | | | | | | |

6.40%, 10/02/17 | | | 1,050 | | | 1,021,908 |

Citigroup, Inc., Senior Unsecured Notes, | | | | | | |

5.30%, 1/07/16 | | | 2,000 | | | 1,545,644 |

Citigroup, Inc., Unsecured Notes, | | | | | | |

4.63%, 8/03/10 | | | 1,600 | | | 1,501,006 |

General Electric Capital Corp., Unsecured Notes, | | | | | | |

5.00%, 11/15/11 | | | 100 | | | 99,444 |

6.15%, 8/07/37 | | | 3,000 | | | 2,218,557 |

JPMorgan Chase & Co., Unsecured Notes, | | | | | | |

6.00%, 1/15/18 | | | 2,050 | | | 2,070,670 |

JPMorgan Chase Bank N.A., Subordinated Notes, | | | | | | |

6.00%, 7/05/17 | | | 3,500 | | | 3,348,261 |

6.00%, 10/01/17 | | | 4,575 | | | 4,288,495 |

TIAA Global Markets, Inc., Unsecured Notes, | | | | | | |

5.13%, 10/10/12(b) | | | 1,700 | | | 1,682,735 |

| | | | | | |

| | | | | | 27,983,507 |

| | | | | | |

Diversified Telecommunication Services — 7.0% | | | | | | |

Telefonica Emisiones SAU (Spain), Senior Unsecured Notes, | | | | | | |

7.05%, 6/20/36(a) | | | 1,075 | | | 1,104,593 |

Telefonica Europe BV (Netherlands), Senior Unsecured Notes, | | | | | | |

7.75%, 9/15/10(a) | | | 1,600 | | | 1,670,819 |

AT&T, Inc., Unsecured Notes, | | | | | | |

5.63%, 6/15/16 | | | 1,500 | | | 1,503,289 |

5.50%, 2/01/18 | | | 3,500 | | | 3,384,342 |

BellSouth Capital Funding Corp., Senior Unsecured Notes, | | | | | | |

7.75%, 2/15/10 | | | 3,130 | | | 3,264,124 |

Sprint Capital Corp., Senior Unsecured Notes, | | | | | | |

6.38%, 5/01/09 | | | 100 | | | 100,000 |

Telecom Italia Capital SA (Luxembourg), Senior Notes, | | | | | | |

5.25%, 11/15/13(a) | | | 5,210 | | | 4,678,768 |

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 15 |

| | |

| Schedule of Investments (continued) | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Diversified Telecommunication Services (concluded) | | | | | | |

Verizon Communications, Inc., Senior Unsecured Notes, | | | | | | |

6.10%, 4/15/18 | | $ | 3,350 | | $ | 3,318,795 |

6.90%, 4/15/38 | | | 2,000 | | | 1,934,352 |

Verizon Communications, Inc., Unsecured Notes, | | | | | | |

6.25%, 4/01/37 | | | 1,625 | | | 1,445,501 |

Verizon Global Funding Corp., Senior Unsecured Notes, | | | | | | |

6.88%, 6/15/12 | | | 600 | | | 636,871 |

Verizon Maryland, Inc., Senior Debentures, | | | | | | |

6.13%, 3/01/12 | | | 305 | | | 307,779 |

Verizon Wireless Capital LLC, Unsecured Notes, | | | | | | |

8.50%, 11/15/18(b) | | | 1,150 | | | 1,313,669 |

| | | | | | |

| | | | | | 24,662,902 |

| | | | | | |

Electric Utilities — 5.6% | | | | | | |

Carolina Power & Light Co., First Mortgage Bonds, | | | | | | |

6.30%, 4/01/38 | | | 750 | | | 773,395 |

Cleveland Electric Illuminating Co., Senior Unsecured Notes, | | | | | | |

5.65%, 12/15/13 | | | 450 | | | 435,942 |

Duke Energy Carolinas LLC, First Mortgage Bonds, | | | | | | |

5.25%, 1/15/18 | | | 450 | | | 458,331 |

EDF SA (France), Unsecured Notes, | | | | | | |

6.50%, 1/26/19(a)(b) | | | 3,560 | | | 3,667,306 |

EDP Finance BV (Netherlands), Senior Unsecured Notes, | | | | | | |

6.00%, 2/02/18(a)(b)(f) | | | 1,475 | | | 1,408,169 |

Florida Power & Light Co., First Mortgage Bonds, | | | | | | |

5.95%, 2/01/38 | | | 1,825 | | | 1,845,002 |

Georgia Power Co., Senior Unsecured Notes, | | | | | | |

5.25%, 12/15/15 | | | 1,050 | | | 1,068,535 |

Kiowa Power Partners LLC, Senior Secured Notes, | | | | | | |

4.81%, 12/30/13(b) | | | 15 | | | 13,518 |

MidAmerican Energy Holdings Co., Senior Unsecured Notes, | | | | | | |

5.30%, 3/15/18 | | | 2,170 | | | 2,111,805 |

NiSource Finance Corp., Unsecured Notes, | | | | | | |

1.82%, 11/23/09(d) | | | 25 | | | 23,852 |

PacifiCorp, First Mortgage Bonds, | | | | | | |

6.00%, 1/15/39 | | | 1,300 | | | 1,283,863 |

Scottish Power Ltd. (United Kingdom), Unsecured Notes, | | | | | | |

4.91%, 3/15/10(a) | | | 2,050 | | | 2,021,136 |

Virginia Electric & Power Co., Senior Unsecured Notes, | | | | | | |

6.00%, 1/15/36 | | | 1,550 | | | 1,495,851 |

Virginia Electric & Power Co., Unsecured Notes, | | | | | | |

5.40%, 1/15/16 | | | 3,000 | | | 3,036,069 |

| | | | | | |

| | | | | | 19,642,774 |

| | | | | | |

Energy Equipment & Services — 0.4% | | | | | | |

Atmos Energy Corp., Senior Unsecured Notes, | | | | | | |

8.50%, 3/15/19 | | | 800 | | | 816,814 |

Halliburton Co., Senior Unsecured Notes, | | | | | | |

5.50%, 10/15/10 | | | 25 | | | 25,981 |

Transocean Ltd. (Switzerland), Senior Unsecured Notes, | | | | | | |

6.00%, 3/15/18(a) | | | 670 | | | 631,220 |

| | | | | | |

| | | | | | 1,474,015 |

| | | | | | |

Food & Staples Retailing — 5.2% | | | | | | |

Campbell Soup Co., Senior Unsecured Notes, | | | | | | |

4.50%, 2/15/19 | | | 1,250 | | | 1,245,934 |

CVS Caremark Corp., Senior Unsecured Notes, | | | | | | |

4.00%, 9/15/09 | | | 75 | | | 75,091 |

CVS Caremark Corp., Unsecured Notes, | | | | | | |

5.75%, 6/01/17 | | | 4,450 | | | 4,339,471 |

Tesco Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.50%, 11/15/17(a)(b) | | | 3,540 | | | 3,483,576 |

Wal-Mart Stores, Inc., Senior Unsecured Notes, | | | | | | |

6.88%, 8/10/09 | | | 2,000 | | | 2,037,348 |

Wal-Mart Stores, Inc., Unsecured Notes, | | | | | | |

4.13%, 7/01/10 | | | 4,210 | | | 4,342,131 |

5.00%, 4/05/12 | | | 2,000 | | | 2,156,120 |

5.25%, 9/01/35 | | | 675 | | | 606,649 |

| | | | | | |

| | | | | | 18,286,320 |

| | | | | | |

Food Products — 3.1% | | | | | | |

General Mills, Inc., Senior Unsecured Notes, | | | | | | |

5.20%, 3/17/15 | | | 2,375 | | | 2,420,833 |

Kellogg Co., Senior Unsecured Notes, | | | | | | |

5.13%, 12/03/12 | | | 4,425 | | | 4,675,667 |

Kraft Foods, Inc., Senior Unsecured Notes, | | | | | | |

5.63%, 11/01/11 | | | 1,615 | | | 1,681,304 |

6.50%, 8/11/17 | | | 2,075 | | | 2,136,706 |

| | | | | | |

| | | | | | 10,914,510 |

| | | | | | |

Gas Utilities — 0.0% | | | | | | |

Nakilat, Inc. (Qatar), Senior Unsecured Notes, | | | | | | |

6.07%, 12/31/33(a)(b) | | | 25 | | | 16,913 |

| | | | | | |

Health Care Equipment & Supplies — 1.8% | | | | | | |

Covidien International Finance SA (Luxembourg), Senior Unsecured Notes, | | | | | | |

6.00%, 10/15/17(a) | | | 2,300 | | | 2,332,720 |

Hospira, Inc., Unsecured Notes, | | | | | | |

6.05%, 3/30/17 | | | 1,660 | | | 1,481,532 |

Roche Holdings, Inc., Unsecured Notes, | | | | | | |

6.00%, 3/01/19(b) | | | 2,400 | | | 2,470,226 |

| | | | | | |

| | | | | | 6,284,478 |

| | | | | | |

Hotels, Restaurants & Leisure — 0.3% | | | | | | |

McDonald’s Corp., Senior Unsecured Notes, | | | | | | |

5.70%, 2/01/39 | | | 1,275 | | | 1,235,757 |

| | | | | | |

Household Products — 0.5% | | | | | | |

Kimberly-Clark Corp., Senior Unsecured Notes, | | | | | | |

6.63%, 8/01/37 | | | 1,500 | | | 1,633,317 |

| | | | | | |

Insurance — 3.8% | | | | | | |

American General Corp., Senior Unsecured Notes, | | | | | | |

7.50%, 8/11/10 | | | 105 | | | 76,116 |

CHUBB Corp., Senior Unsecured Notes, | | | | | | |

6.00%, 5/11/37 | | | 400 | | | 361,475 |

Hartford Life Global Funding Trusts, Notes, | | | | | | |

5.20%, 2/15/11 | | | 575 | | | 502,784 |

Hartford Life Global Funding Trusts, Secured Notes, | | | | | | |

1.19%, 1/17/12(d) | | | 1,350 | | | 944,604 |

Lincoln National Corp., Senior Unsecured Notes, | | | | | | |

6.15%, 4/07/36 | | | 1,500 | | | 631,862 |

Marsh & McLennan Co., Inc., Senior Unsecured Notes, | | | | | | |

5.15%, 9/15/10 | | | 25 | | | 24,375 |

MetLife, Inc., Senior Notes, | | | | | | |

5.38%, 12/15/12 | | | 4,400 | | | 4,155,219 |

MetLife, Inc., Senior Unsecured Notes, | | | | | | |

6.13%, 12/01/11 | | | 1,200 | | | 1,189,458 |

| | | | | | |

16 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments (continued) | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Insurance (concluded) | | | | | | |

Metropolitan Life Global Funding I, Senior Unsecured Notes, | | | | | | |

5.13%, 4/10/13(b) | | $ | 2,550 | | $ | 2,328,892 |

Metropolitan Life Global Funding I, Unsecured Notes, | | | | | | |

4.25%, 7/30/09(b) | | | 200 | | | 199,719 |

Pricoa Global Funding I, Secured Notes, | | | | | | |

5.40%, 10/18/12(b) | | | 2,125 | | | 1,801,970 |

Prudential Financial, Inc., Senior Notes, | | | | | | |

6.63%, 12/01/37 | | | 875 | | | 473,546 |

Prudential Financial, Inc., Unsecured Notes, | | | | | | |

5.70%, 12/14/36 | | | 1,375 | | | 660,560 |

| | | | | | |

| | | | | | 13,350,580 |

| | | | | | |

Machinery — 1.0% | | | | | | |

Ingersoll-Rand Global Holding Co. Ltd (Bermuda), Senior Unsecured Notes, | | | | | | |

6.00%, 8/15/13(a) | | | 2,395 | | | 2,329,556 |

Ingersoll-Rand Global Holding Co. Ltd (Bermuda), Unsecured Notes, | | | | | | |

9.50%, 4/15/14(a) | | | 1,000 | | | 999,920 |

Siemens Financieringsmat (Netherlands), Unsecured Notes, | | | | | | |

5.50%, 2/16/12(a)(b) | | | 100 | | | 104,756 |

| | | | | | |

| | | | | | 3,434,232 |

| | | | | | |

Media — 6.6% | | | | | | |

Comcast Cable Communications Holdings, Inc., Unsecured Notes, | | | | �� | | |

8.38%, 3/15/13 | | | 3,000 | | | 3,208,287 |

Comcast Cable Communications LLC, Senior Unsecured Notes, | | | | | | |

6.75%, 1/30/11 | | | 4,115 | | | 4,257,766 |

Cox Communications, Inc., Senior Unsecured Notes, | | | | | | |

7.13%, 10/01/12 | | | 2,250 | | | 2,239,825 |

Cox Communications, Inc., Unsecured Notes, | | | | | | |

4.63%, 6/01/13 | | | 5,000 | | | 4,546,960 |

News America, Inc., Senior Debentures, | | | | | | |

7.28%, 6/30/28 | | | 1,075 | | | 892,894 |

News America, Inc., Senior Unsecured Notes, | | | | | | |

6.40%, 12/15/35 | | | 2,500 | | | 1,852,102 |

Thomson Reuters Corp., Unsecured Notes, | | | | | | |

5.95%, 7/15/13 | | | 2,300 | | | 2,246,564 |

Time Warner Cable, Inc., Senior Unsecured Notes, | | | | | | |

8.63%, 4/01/19 | | | 1,120 | | | 1,150,937 |

Time Warner Cable, Inc., Unsecured Notes, | | | | | | |

5.85%, 5/01/17 | | | 2,000 | | | 1,792,992 |

Time Warner, Inc., Senior Unsecured Notes, | | | | | | |

6.75%, 4/15/11 | | | 100 | | | 101,493 |

6.88%, 5/01/12 | | | 1,000 | | | 1,017,800 |

Turner Broadcasting Corp., Senior Notes, | | | | | | |

8.38%, 7/01/13 | | | 25 | | | 25,844 |

| | | | | | |

| | | | | | 23,333,464 |

| | | | | | |

Metals & Mining — 0.0% | | | | | | |

Xstrata Canada Corp. (Canada), Unsecured Notes, | | | | | | |

6.00%, 10/15/15(a) | | | 75 | | | 52,772 |

| | | | | | |

Multiline Retail — 0.9% | | | | | | |

Target Corp., Senior Unsecured Notes, | | | | | | |

7.50%, 8/15/10 | | | 200 | | | 213,803 |

5.13%, 1/15/13 | | | 3,000 | | | 3,124,806 |

| | | | | | |

| | | | | | 3,338,609 |

| | | | | | |

Oil, Gas & Consumable Fuels — 3.7% | | | | | | |

Anadarko Petroleum Corp., Senior Unsecured Notes, | | | | | | |

1.72%, 9/15/09(d) | | | 655 | | | 652,655 |

Canadian Natural Resources (Canada), Unsecured Notes, | | | | | | |

5.90%, 2/01/18(a) | | | 1,125 | | | 1,007,746 |

6.25%, 3/15/38(a) | | | 1,110 | | | 854,977 |

Canadian Natural Resources Ltd. (Canada), Unsecured Notes, | | | | | | |

5.70%, 5/15/17(a) | | | 3,295 | | | 2,937,822 |

ConocoPhillips Australia Funding Co., Unsecured Notes, | | | | | | |

1.50%, 4/09/09(d) | | | 19 | | | 19,000 |

ConocoPhillips, Senior Unsecured Notes, | | | | | | |

6.50%, 2/01/39 | | | 450 | | | 438,964 |

Devon Energy Corp., Senior Unsecured Notes, | | | | | | |

6.30%, 1/15/19 | | | 1,550 | | | 1,512,296 |

Devon Financing Corp., Unsecured Notes, | | | | | | |

6.88%, 9/30/11 | | | 90 | | | 94,121 |

Nexen, Inc. (Canada), Unsecured Notes, | | | | | | |

6.40%, 5/15/37(a) | | | 370 | | | 262,429 |

Shell International Finance BV (Netherlands), Unsecured Notes, | | | | | | |

6.38%, 12/15/38(a) | | | 2,125 | | | 2,237,676 |

XTO Energy, Inc., Senior Unsecured Notes, | | | | | | |

6.50%, 12/15/18 | | | 1,750 | | | 1,738,622 |

6.75%, 8/01/37 | | | 1,610 | | | 1,465,287 |

| | | | | | |

| | | | | | 13,221,595 |

| | | | | | |

Paper & Forest Products — 0.4% | | | | | | |

International Paper Co., Senior Unsecured Notes, | | | | | | |

7.95%, 6/15/18 | | | 1,150 | | | 876,515 |

Weyerhaeuser Co., Debentures, | | | | | | |

7.13%, 7/15/23 | | | 750 | | | 532,353 |

| | | | | | |

| | | | | | 1,408,868 |

| | | | | | |

Pharmaceuticals — 6.2% | | | | | | |

AstraZeneca Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.90%, 9/15/17(a) | | | 1,500 | | | 1,588,256 |

Bristol-Myers Squibb Co., Unsecured Notes, | | | | | | |

5.88%, 11/15/36 | | | 2,500 | | | 2,386,678 |

Eli Lilly & Co., Unsecured Notes, | | | | | | |

5.20%, 3/15/17 | | | 1,500 | | | 1,547,938 |

5.55%, 3/15/37 | | | 2,975 | | | 2,825,533 |

GlaxoSmithKline Capital, Inc., Senior Unsecured Notes, | | | | | | |

4.85%, 5/15/13 | | | 2,050 | | | 2,132,818 |

Johnson & Johnson, Unsecured Notes, | | | | | | |

5.95%, 8/15/37 | | | 985 | | | 1,040,889 |

Schering-Plough Corp., Senior Unsecured Notes, | | | | | | |

6.55%, 9/15/37 | | | 1,275 | | | 1,296,481 |

Teva Pharmaceutical Finance Co. LLC, Senior Unsecured Notes, | | | | | | |

5.55%, 2/01/16 | | | 2,400 | | | 2,498,465 |

Teva Pharmaceutical Finance Co. LLC, Unsecured Notes, | | | | | | |

6.15%, 2/01/36 | | | 1,000 | | | 922,497 |

Wyeth, Unsecured Notes, | | | | | | |

5.50%, 2/15/16 | | | 3,110 | | | 3,163,128 |

5.45%, 4/01/17 | | | 1,500 | | | 1,500,955 |

5.95%, 4/01/37 | | | 1,175 | | | 1,106,540 |

| | | | | | |

| | | | | | 22,010,178 |

| | | | | | |

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 17 |

| | |

| Schedule of Investments (continued) | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Real Estate Investment Trusts — 0.0% | | | | | | |

AvalonBay Communities, Inc., Senior Unsecured Notes, | | | | | | |

6.13%, 11/01/12 | | $ | 100 | | $ | 94,753 |

| | | | | | |

Road & Rail — 1.1% | | | | | | |

Burlington North Santa Fe Corp., Debentures, | | | | | | |

5.65%, 5/01/17 | | | 425 | | | 418,227 |

Canadian National Railway Co. (Canada), Senior Unsecured Notes, | | | | | | |

6.38%, 10/15/11(a) | | | 50 | | | 53,383 |

6.25%, 8/01/34(a) | | | 2,000 | | | 1,982,210 |

Norfolk Southern Corp., Senior Unsecured Notes, | | | | | | |

8.63%, 5/15/10 | | | 1,500 | | | 1,564,095 |

| | | | | | |

| | | | | | 4,017,915 |

| | | | | | |

Software — 1.7% | | | | | | |

Oracle Corp., Senior Unsecured Notes, | | | | | | |

5.75%, 4/15/18 | | | 1,800 | | | 1,878,514 |

Oracle Corp., Unsecured Notes, | | | | | | |

5.25%, 1/15/16 | | | 4,100 | | | 4,180,475 |

| | | | | | |

| | | | | | 6,058,989 |

| | | | | | |

Specialty Retail — 0.8% | | | | | | |

Home Depot, Inc., Senior Unsecured Notes, | | | | | | |

4.63%, 8/15/10 | | | 125 | | | 125,254 |

Walgreen Co., Senior Unsecured Notes, | | | | | | |

5.25%, 1/15/19 | | | 2,600 | | | 2,607,667 |

| | | | | | |

| | | | | | 2,732,921 |

| | | | | | |

Thrifts & Mortgage Finance — 1.8% | | | | | | |

Golden West Financial Corp., Senior Unsecured Notes, | | | | | | |

4.75%, 10/01/12 | | | 6,825 | | | 6,347,530 |

| | | | | | |

Tobacco — 0.6% | | | | | | |

Philip Morris International, Inc., Senior Unsecured Notes, | | | | | | |

5.65%, 5/16/18 | | | 2,250 | | | 2,235,613 |

| | | | | | |

Wireless Telecommunication Services — 4.3% | | | | | | |

Rogers Communications, Inc. (Canada), Notes, | | | | | | |

7.50%, 3/15/15(a) | | | 2,125 | | | 2,202,348 |

Rogers Communications, Inc. (Canada), Senior Unsecured Notes, | | | | | | |

6.80%, 8/15/18(a) | | | 1,525 | | | 1,524,204 |

Vodafone Group Plc (United Kingdom), Senior Unsecured Notes, | | | | | | |

7.75%, 2/15/10(a) | | | 7,150 | | | 7,418,718 |

Vodafone Group Plc (United Kingdom), Unsecured Notes, | | | | | | |

5.75%, 3/15/16(a) | | | 2,000 | | | 2,001,514 |

6.15%, 2/27/37(a) | | | 2,125 | | | 2,003,616 |

| | | | | | |

| | | | | | 15,150,400 |

| | | | | | |

Total Corporate Bonds — 95.0% | | | | | | 335,274,507 |

| | | | | | |

Foreign Government Obligations | | | | | | |

Mexico — 0.5% | | | | | | |

United Mexican States, | | | | | | |

5.88%, 2/17/14(a) | | | 1,775 | | | 1,832,688 |

| | | | | | |

Total Long-Term Investments

(Cost — $362,306,713) — 96.7% | | | | | | 341,239,355 |

| | | | | | |

| | |

| | | Shares | | |

Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, | | | | | | |

0.60%(g)(h) | | | | | | |

(Cost — $8,766,428) — 2.5% | | | 8,766,428 | | | 8,766,428 |

| | | | | | |

Total Investments (Cost — $371,073,141*) — 99.2% | | | | | | 350,005,783 |

Other Assets in Excess of Liabilities — 0.8% | | | | | | 2,924,345 |

| | | | | | |

Net Assets — 100.0% | | | | | $ | 352,930,128 |

| | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of March 31, 2009, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 371,083,839 | |

| | | | |

Gross unrealized appreciation | | $ | 4,566,363 | |

Gross unrealized depreciation | | | (25,644,419 | ) |

| | | | |

Net unrealized depreciation | | $ | (21,078,056 | ) |

| | | | |

| (a) | U.S. dollar denominated security issued by foreign domiciled entity. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | Security is perpetual in nature and has no stated maturity date. In certain instances, a final maturity date may be extended and/or the final payment of principal may be deferred at the issuer’s option for a specified time without default. |

| (d) | Variable rate security. Rate shown is as of report date. |

| (e) | Issuer filed for bankruptcy and/or is in default of interest payments. |

| (f) | All or a portion of security pledged as collateral in connection with open financial futures contracts. |

| (g) | Investments in companies considered to be an affiliate of the Portfolio, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | |

Affiliate | | Net

Activity | | | Income |

BlackRock Liquidity Funds, TempFund | | $ | 8,766,428 | ** | | $ | 14,051 |

| ** | Represents net purchase cost. |

| (h) | Represents current yield as of report date. |

| • | | Financial futures contracts purchased as of March 31, 2009 were as follows: |

| | | | | | | | | | |

Contracts | | Issue | | Expiration Date | | Face

Value | | Unrealized

Appreciation |

302 | | U.S. Treasury Bonds (20 Year) | | June 2009 | | $ | 39,170,344 | | $ | 1,154,487 |

| • | | Financial futures contracts sold as of March 31, 2009 were as follows: |

| | | | | | | | | | | |

Contracts | | Issue | | Expiration Date | | Face

Value | | Unrealized

Depreciation | |

22 | | U.S. Treasury Notes (10 Year) | | June 2009 | | $ | 2,729,719 | | $ | (95,455 | ) |

| • | | For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. These industry classifications are unaudited. |

| | | | | | |

18 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments (concluded) | | Series C Portfolio |

| | |

| • | | Effective October 1, 2008, the Portfolio adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 clarifies the definition of fair value, establishes a framework for measuring fair values and requires additional disclosures about the use of fair value measurements. Various inputs are used in determining the fair value of investments, which are as follows: |

| | • | | Level 1 – price quotations in active markets/exchanges for identical securities |

| | • | | Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market – corroborated inputs) |

| | • | | Level 3 – unobservable inputs based on the best information available in the circumstance, to the extent observable inputs are not available (including the Portfolio’s own assumptions used in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For information about the Portfolio’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of March 31, 2009 in determining the fair valuation of the Portfolio’s investments:

| | | | | | | | | | |

Valuation Inputs | | Investments in

Securities | | Other Financial

Instruments *** | |

| | | Assets | | Assets | | Liabilities | |

Level 1 | | $ | 8,766,428 | | $ | 1,154,487 | | $ | (95,455 | ) |

Level 2 | | | 341,239,355 | | | — | | | — | |

Level 3 | | | — | | | — | | | — | |

| | | | | | | | | | |

Total | | $ | 350,005,783 | | $ | 1,154,487 | | $ | (95,455 | ) |

| | | | | | | | | | |

| *** | Other financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation/depreciation on the instrument. |

See Notes to Financial Statements.

| | | | | | |

| | | ANNUAL REPORT | | MARCH 31, 2009 | | 19 |

| | |

| Schedule of Investments March 31, 2009 | | Series M Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Asset Backed Securities | | | | | | |

Capital Auto Receivables Asset Trust, Series 06-1, Class A4, | | | | | | |

5.04%, 5/17/10 | | $ | 1,406 | | $ | 1,409,379 |

Capital Auto Receivables Asset Trust, Series 06-2, Class A3A, | | | | | | |

4.98%, 5/15/11(a) | | | 2,383 | | | 2,385,304 |

Capital Auto Receivables Asset Trust, Series 07-1, Class A3A, | | | | | | |

5.00%, 4/15/11 | | | 2,662 | | | 2,665,053 |

Chase Manhattan Auto Owner Trust, Series 06-B, Class A3, | | | | | | |

5.13%, 5/15/11 | | | 2,007 | | | 2,021,510 |

DaimlerChrysler Auto Trust, Series 06-B, Class A3, | | | | | | |

5.33%, 8/08/10 | | | 106 | | | 105,896 |

DaimlerChrysler Auto Trust, Series 06-C, Class A3, | | | | | | |

5.02%, 7/08/10 | | | 181 | | | 181,347 |

Ford Credit Auto Owner Trust, Series 06-C, Class A3, | | | | | | |

5.16%, 11/15/10 | | | 2,807 | | | 2,820,808 |

Harley-Davidson Motorcycle Trust, Series 07-2, Class A3, | | | | | | |

5.10%, 5/15/12 | | | 2,127 | | | 2,109,639 |

Honda Auto Receivables Owner Trust, Series 06-3, Class A3, | | | | | | |

5.12%, 10/15/10 | | | 2,325 | | | 2,342,028 |

Nissan Auto Receivables Owner Trust, Series 06-C, Class A3, | | | | | | |

5.44%, 4/15/10 | | | 183 | | | 182,941 |

Nissan Auto Receivables Owner Trust, Series 07-A, Class A3, | | | | | | |

5.10%, 11/15/10 | | | 555 | | | 559,270 |

Student Loan Marketing Assoc. Student Loan Trust, Series 08-5, Class A3, | | | | | | |

2.46%, 1/25/18(b) | | | 10,000 | | | 9,766,900 |

USAA Auto Owner Trust, Series 05-3, Class A4, | | | | | | |

4.63%, 5/15/12 | | | 5,954 | | | 6,000,385 |

USAA Auto Owner Trust, Series 05-4, Class A4, | | | | | | |

4.89%, 8/15/12 | | | 188 | | | 189,566 |

USAA Auto Owner Trust, Series 06-2, Class A4, | | | | | | |

5.37%, 2/15/12 | | | 1,124 | | | 1,142,144 |

USAA Auto Owner Trust, Series 06-4, Class A3, | | | | | | |

5.01%, 6/15/11 | | | 3,726 | | | 3,760,486 |

USAA Auto Owner Trust, Series 06-4, Class A4, | | | | | | |

4.98%, 10/15/12 | | | 3,400 | | | 3,464,688 |

Wachovia Auto Owner Trust, Series 05-B, Class A4, | | | | | | |

4.84%, 4/20/11 | | | 231 | | | 232,834 |

World Omni Auto Receivables Trust, Series 06-B, Class A4, | | | | | | |

5.12%, 6/15/12 | | | 500 | | | 504,930 |

| | | | | | |

Total Asset Backed Securities — 12.0% | | | | | | 41,845,108 |

| | | | | | |

Non-U.S. Government Sponsored Agency Mortgage-Backed Securities | | | | | | |

Collateralized Mortgage Obligations — 1.6% | | | | | | |

Salomon Brothers Mortgage Securities VII, Inc., Series 00-C3, Class A2, | | | | | | |

6.59%, 12/18/33 | | | 5,691 | | | 5,701,981 |

Commercial Mortgage-Backed Securities — 57.4% | | | | | | |

Banc of America Commercial Mortgage, Inc., Series 01-1, Class A2, | | | | | | |

6.50%, 4/15/36 | | | 5,650 | | | 5,583,401 |

Banc of America Commercial Mortgage, Inc., Series 01-PB1, Class A2, | | | | | | |

5.79%, 8/11/11 | | | 4,517 | | | 4,404,328 |

Banc of America Commercial Mortgage, Inc., Series 05-4, Class A5A, | | | | | | |

4.93%, 7/10/45 | | | 750 | | | 562,528 |

Banc of America Commercial Mortgage, Inc., Series 06-6, Class A2, | | | | | | |

5.31%, 10/10/45 | | | 3,188 | | | 2,756,740 |

Banc of America Commercial Mortgage, Inc., Series 07-3, Class A4, | | | | | | |

5.66%, 5/10/17(b) | | | 3,950 | | | 2,677,327 |

Banc of America Commercial Mortgage, Inc., Series 07-5, Class A4, | | | | | | |

5.49%, 10/10/17 | | | 5,000 | | | 3,230,386 |

Bear Stearns Commercial Mortgage Securities, Inc., Series 00-WF2, Class A2, | | | | | | |

7.32%, 10/15/32 | | | 2,236 | | | 2,258,250 |

Bear Stearns Commercial Mortgage Securities, Inc., Series 04-T16, Class A6, | | | | | | |

4.75%, 10/13/14 | | | 7,355 | | | 5,660,964 |

Bear Stearns Commercial Mortgage Securities, Inc., Series 05-PW10, Class A4, | | | | | | |

5.41%, 12/11/40(b) | | | 1,000 | | | 785,992 |

Bear Stearns Commercial Mortgage Securities, Inc., Series 05-PWR8, Class A4, | | | | | | |

4.67%, 6/11/41 | | | 1,000 | | | 786,933 |

Chase Manhattan Bank-First Union National Bank, Series 99-1, Class A2, | | | | | | |

7.44%, 8/15/31(b) | | | 242 | | | 242,418 |

Citigroup Commercial Mortgage Trust, Series 08-C7, Class A4, | | | | | | |

6.10%, 12/10/49(b) | | | 3,500 | | | 2,594,739 |

Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 06-CD3, Class A5, | | | | | | |

5.62%, 10/15/48 | | | 500 | | | 368,674 |

Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 07-CD4, Class A4, | | | | | | |

5.32%, 12/11/49 | | | 5,200 | | | 3,459,832 |

Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 08-C7, Class A2A, | | | | | | |

6.03%, 12/10/49 | | | 5,000 | | | 4,480,117 |

Commercial Mortgage Asset Trust, Series 99-C1, Class A3, | | | | | | |

6.64%, 1/17/32 | | | 59 | | | 58,832 |

Commercial Mortgage Asset Trust, Series 06-C8, Class A3, | | | | | | |

5.31%, 12/10/46 | | | 5,000 | | | 3,874,538 |

Credit Suisse First Boston Mortgage Securities Corp., Series 01-CF2, Class A4, | | | | | | |

6.51%, 2/15/34 | | | 1,010 | | | 1,019,444 |

Credit Suisse First Boston Mortgage Securities Corp., Series 02-CKN2, Class A2, | | | | | | |

5.94%, 9/15/11 | | | 3,468 | | | 3,473,269 |

Credit Suisse Mortgage Capital Certificates, Series 06-C1, Class A3, | | | | | | |

5.55%, 2/15/39(b) | | | 4,820 | | | 3,956,173 |

Credit Suisse Mortgage Capital Certificates, Series 06-C4, Class A3, | | | | | | |

5.47%, 9/15/39 | | | 5,770 | | | 3,813,220 |

Credit Suisse Mortgage Capital Certificates, Series 07-C2, Class A2, | | | | | | |

5.45%, 1/15/49 | | | 3,275 | | | 2,546,475 |

| | | | | | |

20 | | ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments (continued) | | Series M Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Non-U.S. Government Sponsored Agency Mortgage-Backed Securities | | | | | | |

Commercial Mortgage-Backed Securities (continued) | | | | | | |

Credit Suisse Mortgage Capital Certificates, Series 07-C2, Class A3, | | | | | | |

5.54%, 1/15/49(b) | | $ | 5,615 | | $ | 3,735,803 |

Donaldson, Lufkin & Jenrette, Inc., Commercial Mortgage Corp., Series 99-CG2, Class A1B, | | | | | | |

7.30%, 6/10/09(b) | | | 37 | | | 36,471 |

First Union National Bank Commercial Mortgage Trust, Series 99-C4, Class A2, | | | | | | |

7.39%, 12/15/31 | | | 289 | | | 289,749 |

First Union National Bank Commercial Mortgage Trust, Series 00-C1, Class A2, | | | | | | |

7.84%, 3/15/10 | | | 132 | | | 133,934 |

First Union National Bank Commercial Mortgage Trust, Series 00-C2, Class A2, | | | | | | |

7.20%, 10/15/32 | | | 5,233 | | | 5,313,608 |

First Union National Bank Commercial Mortgage Trust, Series 01-C3, Class A3, | | | | | | |

6.42%, 6/15/11 | | | 270 | | | 268,899 |

First Union-Lehman Brothers-Bank of America Commercial Mortgage Trust, Series 98-C2, Class B, | | | | | | |

6.64%, 3/18/11 | | | 18 | | | 18,138 |

General Electric Capital Commercial Mortgage Corp., Series 01-2, Class A4, | | | | | | |

6.29%, 8/11/33 | | | 1,660 | | | 1,644,303 |

General Electric Capital Commercial Mortgage Corp., Series 04-C2, Class A4, | | | | | | |

4.89%, 3/10/40 | | | 1,040 | | | 855,979 |

General Electric Capital Commercial Mortgage Corp., Series 07-C1, Class A4, | | | | | | |

5.54%, 12/10/49 | | | 4,215 | | | 2,512,921 |

General Motors Acceptance Corp. Commercial Mortgage Securities, Inc., Series 99-C3, Class E, | | | | | | |

7.92%, 8/15/09(b) | | | 5,000 | | | 4,874,301 |

General Motors Acceptance Corp. Commercial Mortgage Securities, Inc., Series 00-C1, Class A2, | | | | | | |

7.72%, 3/15/33(b) | | | 320 | | | 321,774 |