UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21457

Name of Fund: BlackRock Bond Allocation Target Shares

Series C Portfolio

Series M Portfolio

Series N Portfolio

Series S Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock Bond Allocation Target Shares, 55 East 52nd Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 03/31/2010

Date of reporting period: 03/31/2010

| | | | |

| Item 1 | | – | | Report to Stockholders |

| | |

BlackRock Bond Allocation Target Shares ANNUAL REPORT | MARCH 31, 2010 | |  |

Series C Portfolio

Series M Portfolio

Series N Portfolio

Series S Portfolio

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| | | | | | |

| 2 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

Dear Shareholder

The past year has seen a remarkable turnaround from the conditions that plagued the global economy and financial markets in 2008 through early 2009. In our opinion, the “Great Recession” likely ended at some point last summer, thanks primarily to massive fiscal and monetary stimulus. From that point, the global economy has moved into recovery mode and, we believe, is getting ready to start transitioning into an expansion.

Global equity markets bottomed in early 2009 and since that time have soared dramatically higher as investors were lured back into the markets by depressed valuations, desire for higher yields and increasing confidence that all-out financial disaster had been averted. There have been several corrections along the way and volatility levels have remained elevated — reflections of mixed economic data, lingering deflation issues (especially in Europe) and concerns over the future direction of interest rates. On balance, however, strong corporate earnings and a positive macro backdrop have helped keep the equity bull market intact. From a geographic perspective, US equities have generally outpaced their international counterparts in recent months, as the domestic economic recovery has been more pronounced.

Within fixed income markets, improving economic conditions, concerns over the US deficit and a lack of demand at recent Treasury auctions have recently conspired to push Treasury yields higher (and prices correspondingly lower). In this environment, Treasuries have dramatically underperformed other areas of the bond market, particularly the high yield sector, which has been benefiting from increased investor demand. Meanwhile, municipal bonds outperformed taxable sectors over the twelve-month period thanks to continued high demand levels, but have struggled in recent months against a weak fundamental backdrop marked by ongoing state and local budget problems. As in the taxable arena, high yield municipals have been outperforming the rest of the market.

Regarding cash investments, yields on money market securities remain near all-time lows (producing returns only marginally above zero percent), with the Federal Open Market Committee reiterating that economic circumstances are likely to necessitate an accommodative interest rate stance for an “extended period.”

Against this backdrop, the major market averages posted the following returns:

| | | | | | |

Total Returns as of March 31, 2010 | | 6-month | | | 12-month | |

US equities (S&P 500 Index) | | 11.75 | % | | 49.77 | % |

Small cap US equities (Russell 2000 Index) | | 13.07 | | | 62.76 | |

International equities (MSCI Europe, Australasia, Far East Index) | | 3.06 | | | 54.44 | |

3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index) | | 0.05 | | | 0.17 | |

US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | | (2.62 | ) | | (6.30 | ) |

Taxable fixed income (Barclays Capital US Aggregate Bond Index) | | 1.99 | | | 7.69 | |

Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | | 0.28 | | | 9.69 | |

High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | | 10.97 | | | 55.64 | |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Global financial markets continue to show signs of improvement, but questions about the strength and sustainability of the recovery abound. Through periods of uncertainty, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For additional market perspective and investment insight, visit www.blackrock.com/shareholdermagazine, where you’ll find the most recent issue of our award-winning Shareholder® magazine, as well as its quarterly companion newsletter, Shareholder Perspectives. As always, we thank you for entrusting BlackRock with your investments, and we look forward to your continued partnership in the months and years ahead.

|

| Sincerely, |

|

|

| Rob Kapito |

| President, BlackRock Advisors, LLC |

THIS PAGE NOT PART OF YOUR FUND REPORT

| | |

| Fund Summary as of March 31, 2010 | | Series C Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | The Fund’s total return underperformed that of its benchmark for the 12-month period. (The Fund compares its performance against the Barclays Capital US Credit Index. However, because shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Fund’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | The Fund benefited from its allocation to investment-grade corporate credit during the period. In particular, the Fund’s exposure to the financials and industrials sectors of the market contributed to performance. |

| | • | | Overall duration management and yield curve positioning — both of which were traded tactically throughout the period — detracted from Fund performance. |

Describe recent portfolio activity.

| | • | | During the latter half of 2009 and through the end of the reporting period, we looked to increase the Fund’s allocation to investment-grade corporate credit. In doing so, we focused on high-quality industrials and utilities names as the credit markets continued to rally, with earnings and economic data surprising to the upside. |

Describe Fund positioning at period end.

| | • | | At period end, the Fund was almost fully invested in corporate bonds, with approximately 97% of assets invested in investment-grade credit, 1% in high yield securities and 2% in non-US government-guaranteed debt. We also held small out-of-index allocations in US Treasuries, agency debt and FDIC-guaranteed debt. We continue to focus on higher-quality names, favoring non-cyclical industries and companies with strong balance sheets. From a sector perspective, the Fund’s largest overweight relative to the benchmark is in industrials. We also hold an overweight in financials and an underweight in utilities. The Fund ended the period with a slightly short duration relative to the benchmark and a yield-curve-flattening bias. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Portfolio Composition | | Percent of

Long-Term

Investments | |

Corporate Bonds | | 90 | % |

Preferred Securities | | 3 | |

Foreign Agency Obligations | | 3 | |

Taxable Municipal Bonds | | 2 | |

Foreign Government Obligations | | 2 | |

| | | |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA/Aaa2 | | 2 | % |

AA/Aa | | 22 | |

A | | 42 | |

BBB/Baa | | 34 | |

| 1 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) ratings. |

| 2 | Includes U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations which are deemed AAA/Aaa by the investment advisor. |

| | | | | | |

| 4 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Fund Summary (concluded) | | Series C Portfolio |

| |

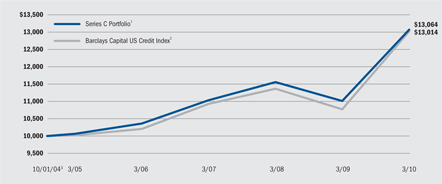

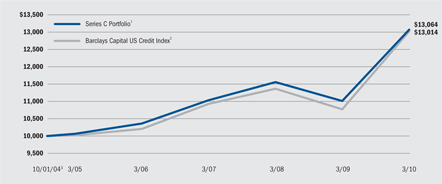

Total Return Based on a $10,000 Investment | | |

| 1 | The Fund is non-diversified and will primarily invest its assets in investment grade corporate fixed income securities. |

| 2 | An unmanaged index that includes publicly issued US corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. |

| 3 | Commencement of operations. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | 6-Month

Total Returns | | | 1 Year | | | 5 Year | | | Since Inception5 | |

Series C Portfolio | | 3.55 | % | | 18.68 | % | | 5.37 | % | | 4.98 | % |

Barclays Capital US Credit Index | | 3.33 | | | 20.83 | | | 5.37 | | | 4.91 | |

| 4 | See “About Fund Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Fund commenced operations on October 1, 2004. Past performance is not indicative of future results. |

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 |

| | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period6 |

Series C Portfolio | | $ | 1,000 | | $ | 1,035.50 | | $ | 0.00 | | $ | 1,000 | | $ | 1,024.93 | | $ | 0.00 |

| 6 | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Fund. This agreement has no fixed term. |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 5 |

| | |

| Fund Summary as of March 31, 2010 | | Series M Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | The Fund’s total return outperformed that of its benchmark for the 12-month period. (The Fund compares its performance against the Barclays Capital MBS Index. However, because shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Fund’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | A combination of continued accommodative policy from the Federal Reserve (Fed) and improved economic fundamentals have kept market volatility low and demand for higher-yielding assets robust. The Fund’s exposure to spread assets, particularly commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS), was the main driver of performance, as spread sectors outperformed during the period. |

| | • | | An underweight in agency mortgage-backed securities (MBS) detracted from Fund performance, as the sector benefited from government support through the Fed’s purchase program. The Fund’s duration management and yield curve positioning also detracted from performance over the 12 months. |

| | • | | The Fund’s cash position (18% at period end) served primarily to offset futures contracts and TBA trades and, therefore, did not have a material impact on performance during the six-month period. |

Describe recent portfolio activity.

| | • | | During the annual period, we reduced the Fund’s exposure to CMBS selling into strength as the market continued to rally. The proceeds from these sales were primarily allocated to agency MBS and ABS, which stood to benefit from continued government support. We also added exposure to agency and FDIC-guaranteed debt, which we believed was attractive versus US Treasuries. |

Describe Fund positioning at period end.

| | • | | Though the market has experienced a tremendous rally in spread assets, we continue to see value across the securitized sectors. Accordingly, at period end, the Fund holds non-index positions in CMBS and ABS. It also holds small allocations to agency and FDIC-guaranteed debt. The Fund ended the period with a long duration versus its benchmark and a yield-curve-flattening bias. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Portfolio Composition | | Percent of

Long-Term

Investments | |

Non-Agency Mortgage-Backed Securities | | 42 | % |

U.S. Government Sponsored Agency Securities | | 26 | |

U.S. Treasury Obligations | | 17 | |

Asset-Backed Securities | | 15 | |

| | | |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA/Aaa2 | | 99 | % |

AA | | 1 | |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | Includes U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations which are deemed AAA/Aaa by the investment advisor. |

| | | | | | |

| 6 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Fund Summary (concluded) | | Series M Portfolio |

| |

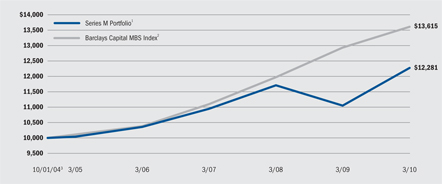

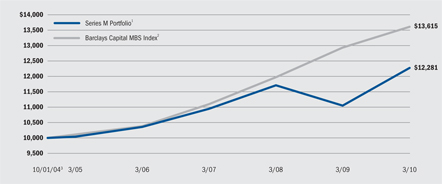

Total Return Based on a $10,000 Investment | | |

| 1 | The Fund is non-diversified and will primarily invest its assets in investment grade commercial and residential mortgage-backed securities, asset-backed securities, collateralized mortgage obligations, US Treasury and agency securities. |

| 2 | An index that includes the mortgage-backed pass-through securities of Government National Mortgage (GNMA), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC) that meet the maturity and liquidity criteria. |

| 3 | Commencement of operations. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | 6-Month

Total Returns | | | 1 Year | | | 5 Year | | | Since Inception5 | |

Series M Portfolio | | 2.61 | % | | 11.11 | % | | 4.11 | % | | 3.81 | % |

Barclays Capital MBS Index | | 2.12 | | | 5.21 | | | 6.13 | | | 5.77 | |

| 4 | See “About Fund Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Fund commenced operations on October 1, 2004. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 |

| | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period6 |

Series M Portfolio | | $ | 1,000 | | $ | 1,026.10 | | $ | 0.00 | | $ | 1,000 | | $ | 1,024.93 | | $ | 0.00 |

| 6 | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Fund. This agreement has no fixed term. |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 7 |

| | |

| Fund Summary as of March 31, 2010 | | Series N Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | For the 12-month period, the Fund’s total return outperformed both the S&P/Investortools Main Municipal Bond Index and the Barclays Capital Municipal Bond Index. (The Fund now compares its performance against the S&P/Investortools Main Municipal Bond Index. The Fund previously compared its performance against the Barclays Capital Municipal Bond Index. However, because shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Fund’s performance to that of the benchmarks will differ from comparisons of the benchmarks against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | Fund performance benefited during the period from significant tightening in credit quality spreads. The Fund also benefited from its longer duration (sensitivity to interest rates) relative to the S&P/Investortools Main Municipal Bond Index, as long-term interest rates fell and bond prices correspondingly rose. Good trading opportunities enhanced performance as well, with opportunities involving well-received primary issues and derivatives (both long and short hedges). Finally, the Fund’s average coupon structure of more than 6% generated strong income accrual. |

| | • | | Cash reserves held by the Fund for liquidity purposes represented an opportunity loss during the reporting period, as longer-term assets generally appreciated in price while yields on cash were minimal. Some degree of cash reserve is considered prudent, however, because it allows the Fund to bid on attractive opportunities in the secondary market and participate in primary bond underwritings. |

Describe recent portfolio activity.

| | • | | Management efforts over the past year were concentrated on balancing total return performance results between improving income accrual and a competitive degree of asset appreciation. For most of the period, the Fund was fully invested to maximize accrual, yet we were attentive to trading opportunities, especially as they related to the limited primary issuance. |

| | • | | Patience with spread product positions was rewarded as credit spreads tightened. This provided the major contribution to Fund performance relative to the S&P/Investortools Main Municipal Bond Index, which tends to be more high-grade in nature. |

Describe Fund positioning at period end.

| | • | | Looking ahead, we will need to be alert to signals that the Federal Reserve’s (Fed’s) accommodative stance is nearing its end because a good portion of the longer duration stance is attributable to holdings in spread product (i.e., spread duration makes the Fund appear longer versus the S&P/Investortools Main Municipal Bond Index). If it appears likely that the Fed’s accommodation will be removed, we would need to take strategic steps to temper the Fund’s duration posture. These steps could include the sales of securities that have achieved a significant degree of outperformance, swaps into shorter-maturity bonds or cushion coupon securities, a hedge overlay or, most likely, a combination of these tactics. At period end, Fund management is comfortable with each credit held in the asset mix, and will be working closely with BlackRock’s municipal research group to monitor the underlying creditworthiness of each holding. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

County/City/Special District/School District | | 29 | % |

Utilities | | 25 | |

Health | | 20 | |

Housing | | 11 | |

Transportation | | 8 | |

Education | | 7 | |

| | | |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AA/Aa | | 28 | % |

A | | 25 | |

BBB/Baa | | 28 | |

Less than BBB/Baa | | 19 | |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| | | | | | |

| 8 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Fund Summary (concluded) | | Series N Portfolio |

| |

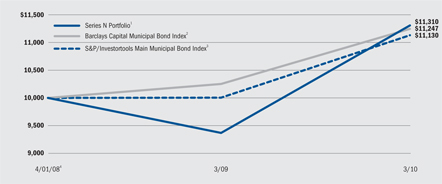

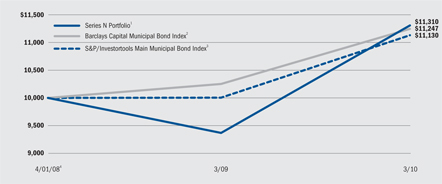

Total Return Based on a $10,000 Investment | | |

| 1 | The Fund is non-diversified and will primarily invest its assets in municipal bonds, the interest on which the management team believes is exempt from regular federal income tax. |

| 2 | An unmanaged index comprised of long-term revenue bonds, pre-refunded bonds, general obligation bonds and insured bonds. |

| 3 | The S&P/Investortools Main Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the index must have an outstanding par value of at least $2 million and a remaining maturity of not less than 1 month. |

| 4 | Commencement of operations. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | 6 Month

Total Returns | | | 1 Year | | | Since Inception6 | |

Series N Portfolio | | 2.23 | % | | 20.74 | % | | 6.36 | % |

Barclays Capital Municipal Bond Index | | 0.28 | | | 9.69 | | | 6.06 | |

S&P/Investortools Main Municipal Bond Index | | 0.28 | | | 11.26 | | | 5.50 | |

| 5 | See “About Fund Performance” on page 12 for a detailed description of performance related information. |

| 6 | The Fund commenced operations on April 1, 2008. Past performance is not indicative of future results. |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical9 |

| | | | | Including Interest

Expense

and Fees | | Excluding Interest

Expense

and Fees | | | | IncludingInterestExpense

and Fees | | Excluding Interest

Expense

and Fees |

| | | Beginning

Account

Value

October 1,

2009 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period7 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period8 | | Beginning

Account

Value

October 1,

2009 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period7 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period8 |

Series N Portfolio | | $ | 1,000 | | $ | 1,022.30 | | $ | 0.05 | | $ | 1,022.30 | | $ | 0.00 | | $ | 1,000 | | $ | 1,024.88 | | $ | 0.05 | | $ | 1,024.93 | | $ | 0.00 |

| 7 | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.01%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Fund. This agreement has no fixed term. |

| 8 | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Fund. This agreement has no fixed term. |

| 9 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 9 |

| | |

| Fund Summary as of March 31, 2010 | | Series S Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | The Fund’s total return outperformed that of its benchmark for the 12-month period. (The Fund compares its performance against the BofA Merrill Lynch 1-3 Year Treasury Index. However, because shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients, comparisons of the Fund’s performance to that of the benchmark will differ from comparisons of the benchmark against the performance of the separately managed accounts.) |

What factors influenced performance?

| | • | | A combination of continued accommodative monetary policy from the Federal Reserve (Fed) and improved economic fundamentals has kept market volatility low and demand for higher-yielding assets robust. Accordingly, exposure to spread assets, particularly commercial mortgage-backed securities (CMBS), investment-grade corporates and non-agency mortgages, was the largest contributor to Fund performance as these sectors performed strongly during the period. Performance also benefited from exposure to asset-backed securities (ABS) and agency mortgages, which outperformed risk-free Treasuries. |

| | • | | In contrast, overall duration management, which was tactically traded throughout the period, detracted from performance. |

Describe recent portfolio activity.

| | • | | During the 12 months, we reduced exposure to Treasuries, agency debentures and agency mortgages, choosing to reallocate those assets into non-government spread sectors, which traded at attractive valuations early in the reporting period. In particular, we added exposure to CMBS, ABS and investment-grade corporates, sectors that were undervalued throughout most of the year. The Fund’s duration and yield curve positioning were traded tactically all through the period as well. |

Describe Fund positioning at period end.

| | • | | Though the market has experienced a tremendous rally in spread assets, we continue to see value across securitized sectors. Accordingly, the Fund holds non-index allocations in CMBS, investment-grade corporates and ABS, as well as agency and non-agency mortgages. At the period end, the Fund had a long duration versus its benchmark. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Portfolio Composition | | Percent of

Long-Term

Investments | |

Corporate Bonds | | 47 | % |

Asset-Backed Securities | | 22 | |

Non-Agency Mortgage-Backed Securities | | 18 | |

Foreign Agency Obligations | | 6 | |

U.S. Government Sponsored Agency Securities | | 5 | |

Foreign Government Obligations | | 1 | |

Taxable Municipal Bonds | | 1 | |

| | | |

Credit Quality Allocation1 | | Percent of

Long-Term

Investments | |

AAA/Aaa2 | | 43 | % |

AA/Aa | | 20 | |

A | | 20 | |

BBB/Baa | | 17 | |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | Includes U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations which are deemed AAA/Aaa by the investment advisor. |

| | | | | | |

| 10 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Fund Summary (concluded) | | Series S Portfolio |

| |

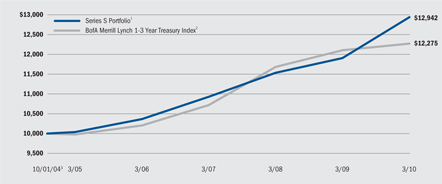

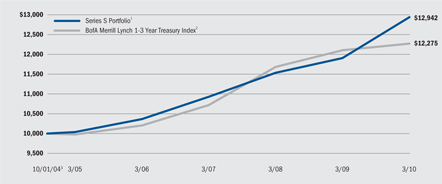

Total Return Based on a $10,000 Investment | | |

| 1 | The Fund is non-diversified and will primarily invest its assets in investment-grade fixed income securities, such as commercial and residential mortgage-backed securities, obligations of non-US governments and supra-national organizations, obligations of domestic and non-US corporations, asset-backed securities, US Treasury and agency securities, cash equivalent investments, repurchase and reverse repurchase agreements and dollar rolls. |

| 2 | An unmanaged index comprised of treasury securities with maturities from 1 to 2.99 years. |

| 3 | Commencement of operations. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | 6-Month

Total Returns | | | 1 Year | | | 5 Year | | | Since Inception5 | |

Series S Portfolio | | 3.00 | % | | 8.68 | % | | 5.21 | % | | 4.81 | % |

BofA Merrill Lynch 1-3 Year Treasury Index | | 0.73 | | | 1.41 | | | 4.24 | | | 3.80 | |

| 4 | See “About Fund Performance” on page 12 for a detailed description of performance related information. |

| 5 | The Fund commenced operations on October 1, 2004. Past performance is not indicative of future results. |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 |

| | | | | Including Interest

Expense | | Excluding Interest

Expense | | | | Including Interest

Expense | | Excluding Interest

Expense |

| | | Beginning

Account

Value

October 1,

2009 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period6 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period7 | | Beginning

Account

Value

October 1,

2009 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period6 | | Ending

Account

Value

March 31,

2010 | | Expenses

Paid

During

the

Period7 |

Series S Portfolio | | $ | 1,000 | | $ | 1,030.00 | | $ | 0.10 | | $ | 1,030.00 | | $ | 0.00 | | $ | 1,000 | | $ | 1,024.83 | | $ | 0.10 | | $ | 1,024.93 | | $ | 0.00 |

| 6 | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.02%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Fund. This agreement has no fixed term. |

| 7 | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses and interest expense, incurred by the Fund. This agreement has no fixed term. |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 11 |

About Fund Performance

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value on the payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The performance information also reflects fee waivers and reimbursements that subsidize and reduce the total operating expenses of each Fund. The Funds’ returns would have been lower if there were no such waivers and reimbursements.

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) expenses related to transactions and (b) operating expenses including administration fees and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2009 and held through March 31, 2010) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The tables provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund under the headings entitled “Expenses Paid During the Period.”

The tables also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the tables are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

| 12 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance their yields and net asset values (“NAVs”). However, these objectives cannot be achieved in all interest rate environments.

The Funds may utilize leverage through borrowings or through entering into reverse repurchase agreements and treasury rolls. The Series N Portfolio may also leverage its assets through the use of tender option bond (“TOB”) programs, as described in Note 1 of the Notes to Financial Statements. In general, the concept of leveraging is based on the premise that the cost of assets to be obtained through leverage will be based on short-term interest rates, which normally will be lower than the income earned by each Fund on its longer-term portfolio investments. To the extent that the total assets of each Fund (including the assets obtained through leverage) is invested in higher-yielding portfolio investments, each Fund’s shareholders will benefit from the incremental net income.

Furthermore, the value of the Funds’ investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. Changes in interest rates can influence the Funds’ NAVs positively or negatively in addition to the impact on the Funds’ performance from leverage.

The use of leverage may enhance opportunities for increased income to the Funds, but as described above, it also creates risks as short- or long-term interest rates fluctuate. Leverage also will generally cause greater changes in a Fund’s NAV and dividend rate than a comparable portfolio without leverage. If the income derived from securities purchased with assets received from leverage exceeds the cost of leverage, each Fund’s net income will be greater than if leverage had not been used. Conversely, if the income from the securities purchased is not sufficient to cover the cost of leverage, the Fund’s net income will be less than if leverage had not been used, and therefore the amount available for distribution to shareholders will be reduced. Each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause a Fund to incur losses. The use of leverage may limit each Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund will incur expenses in connection with the use of leverage, all of which are borne by Fund shareholders and may reduce income.

Derivative Financial Instruments

The Funds may invest in various derivative instruments, including financial futures contracts, options and swaps, as specified in Note 2 of the Notes to Financial Statements, which constitute forms of economic leverage. Such instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market, credit and/or interest rate risks. Such derivative instruments involve risks, including the imperfect correlation between the value of a derivative instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative instrument.

A Fund’s ability to successfully use a derivative instrument depends on the investment advisor’s ability to accurately predict pertinent market movements, which cannot be assured. The use of derivative instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio securities at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment or may cause a Fund to hold a security that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 13 |

| | |

| Schedule of Investments March 31, 2010 | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Aerospace & Defense — 2.5% | | | | | | |

Honeywell International, Inc., | | | | | | |

5.30%, 3/15/17 | | $ | 2,755 | | $ | 2,951,908 |

Lockheed Martin Corp., | | | | | | |

6.15%, 9/01/36 | | | 1,020 | | | 1,079,312 |

Northrop Grumman Systems Corp., | | | | | | |

7.88%, 3/01/26 | | | 1,000 | | | 1,224,841 |

United Technologies Corp., | | | | | | |

6.05%, 6/01/36 | | | 3,650 | | | 3,827,361 |

| | | | | | |

| | | | | | 9,083,422 |

| | | | | | |

Air Freight & Logistics — 0.4% | | | | | | |

United Parcel Service, Inc., | | | | | | |

6.20%, 1/15/38 | | | 1,200 | | | 1,306,091 |

| | | | | | |

Automobiles — 0.6% | | | | | | |

Daimler Finance North America LLC, | | | | | | |

5.75%, 9/08/11 | | | 2,000 | | | 2,108,088 |

| | | | | | |

Beverages — 2.7% | | | | | | |

Anheuser-Busch InBev Worldwide, Inc., | | | | | | |

8.20%, 1/15/39(a) | | | 1,800 | | | 2,321,305 |

Bottling Group LLC, | | | | | | |

5.13%, 1/15/19 | | | 1,425 | | | 1,493,094 |

Diageo Finance BV, | | | | | | |

5.50%, 4/01/13 | | | 2,300 | | | 2,508,284 |

PepsiCo, Inc., | | | | | | |

7.90%, 11/01/18 | | | 1,250 | | | 1,548,191 |

SABMiller Plc, | | | | | | |

5.70%, 1/15/14(a) | | | 1,850 | | | 2,021,258 |

| | | | | | |

| | | | | | 9,892,132 |

| | | | | | |

Capital Markets — 7.8% | | | | | | |

Ameriprise Financial, Inc., | | | | | | |

5.30%, 3/15/20 | | | 325 | | | 328,783 |

The Bank of New York Mellon Corp.: | | | | | | |

4.50%, 4/01/13 | | | 1,000 | | | 1,067,868 |

5.45%, 5/15/19 | | | 1,550 | | | 1,643,842 |

The Goldman Sachs Group, Inc.: | | | | | | |

5.25%, 10/15/13 | | | 3,525 | | | 3,789,114 |

6.25%, 9/01/17 | | | 1,500 | | | 1,613,114 |

6.15%, 4/01/18 | | | 525 | | | 555,492 |

7.50%, 2/15/19 | | | 2,050 | | | 2,342,738 |

5.38%, 3/15/20 | | | 2,200 | | | 2,179,652 |

Morgan Stanley: | | | | | | |

5.63%, 1/09/12 | | | 7,400 | | | 7,837,828 |

6.25%, 8/28/17 | | | 885 | | | 928,900 |

7.30%, 5/13/19 | | | 1,625 | | | 1,795,315 |

5.63%, 9/23/19 | | | 400 | | | 398,590 |

5.50%, 1/26/20 | | | 2,125 | | | 2,078,545 |

Nomura Holdings, Inc., | | | | | | |

5.00%, 3/04/15 | | | 1,775 | | | 1,814,432 |

| | | | | | |

| | | | | | 28,374,213 |

| | | | | | |

Chemicals — 0.2% | | | | | | |

The Dow Chemical Co., | | | | | | |

8.55%, 5/15/19 | | | 450 | | | 544,383 |

| | | | | | |

Commercial Banks — 10.0% | | | | | | |

Barclays Bank Plc, | | | | | | |

2.50%, 1/23/13 | | | 1,275 | | | 1,276,521 |

HSBC Bank USA N.A., | | | | | | |

4.63%, 4/01/14 | | | 7,100 | | | 7,408,034 |

HSBC Holdings Plc, | | | | | | |

6.80%, 6/01/38 | | | 2,180 | | | 2,337,675 |

JPMorgan Chase Bank, N.A.: | | | | | | |

6.00%, 7/05/17 | | | 3,500 | | | 3,730,748 |

6.00%, 10/01/17 | | | 4,575 | | | 4,877,691 |

Lloyds TSB Bank Plc, | | | | | | |

5.80%, 1/13/20(a) | | | 1,325 | | | 1,292,787 |

The Northern Trust Corp., | | | | | | |

4.60%, 2/01/13 | | | 125 | | | 133,010 |

Rabobank Nederland NV, | | | | | | |

4.75%, 1/15/20(a) | | | 2,350 | | | 2,347,471 |

Royal Bank of Scotland Group Plc, | | | | | | |

5.00%, 11/12/13 | | | 3,000 | | | 2,933,097 |

Standard Chartered Plc, | | | | | | |

5.50%, 11/18/14(a) | | | 2,200 | | | 2,365,583 |

UBS AG, | | | | | | |

5.88%, 12/20/17 | | | 1,415 | | | 1,465,463 |

Wells Fargo & Co., | | | | | | |

4.38%, 1/31/13 | | | 5,015 | | | 5,292,550 |

Westpac Banking Corp., | | | | | | |

4.88%, 11/19/19 | | | 1,150 | | | 1,142,271 |

| | | | | | |

| | | | | | 36,602,901 |

| | | | | | |

Commercial Services & Supplies — 0.3% | | | | | | |

Tyco International Finance SA, | | | | | | |

8.50%, 1/15/19 | | | 1,000 | | | 1,240,163 |

| | | | | | |

Communications Equipment — 0.6% | | | | | | |

Cisco Systems, Inc.: | | | | | | |

5.90%, 2/15/39 | | | 700 | | | 710,678 |

5.50%, 1/15/40 | | | 675 | | | 647,305 |

Harris Corp., | | | | | | |

6.38%, 6/15/19 | | | 825 | | | 899,450 |

| | | | | | |

| | | | | | 2,257,433 |

| | | | | | |

Computers & Peripherals — 0.5% | | | | | | |

International Business Machines Corp., | | | | | | |

5.70%, 9/14/17 | | | 1,725 | | | 1,911,617 |

| | | | | | |

Consumer Finance — 0.5% | | | | | | |

SLM Corp., | | | | | | |

5.40%, 10/25/11 | | | 1,780 | | | 1,796,700 |

| | | | | | |

Diversified Financial Services — 8.6% | | | | | | |

Bank of America Corp.: | | | | | | |

5.38%, 8/15/11 | | | 2,205 | | | 2,317,656 |

6.50%, 8/01/16 | | | 7,700 | | | 8,323,662 |

Citigroup, Inc.: | | | | | | |

5.50%, 10/15/14 | | | 4,050 | | | 4,191,369 |

5.30%, 1/07/16 | | | 2,000 | | | 2,037,434 |

8.13%, 7/15/39 | | | 405 | | | 467,533 |

CME Group Index Services LLC, | | | | | | |

4.40%, 3/15/18(a) | | | 1,700 | | | 1,666,369 |

Crown Castle Towers LLC, | | | | | | |

6.11%, 1/15/20(a) | | | 1,450 | | | 1,516,758 |

General Electric Capital Corp.: | | | | | | |

2.80%, 1/08/13 | | | 2,200 | | | 2,226,569 |

5.63%, 9/15/17 | | | 1,000 | | | 1,052,929 |

6.75%, 3/15/32 | | | 1,075 | | | 1,137,329 |

6.15%, 8/07/37 | | | 3,000 | | | 2,933,718 |

HSBC Finance Corp., | | | | | | |

6.75%, 5/15/11 | | | 450 | | | 472,998 |

Iberdrola Finance Ireland Ltd., | | | | | | |

3.80%, 9/11/14(a) | | | 750 | | | 754,244 |

Icahn Enterprises LP/Icahn Enterprises Finance Corp., | | | | | | |

7.75%, 1/15/16(a) | | | 825 | | | 794,062 |

Portfolio Abbreviations

| | | | | | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | | ACA | | American Capital Access Corp. | | GO | | General Obligation Bonds |

| | AGC | | Assured Guaranty Ltd. | | IDA | | Industrial Development Authority |

| | AMBAC | | American Municipal Bond Assurance Corp. | | LIBOR | | London InterBank Offered Rate |

| | AMT | | Alternative Minimum Tax (subject to) | | M/F | | Multi-Family |

| | BHAC | | Berkshire Hathaway Assurance Corp. | | RB | | Revenue Bonds |

| | COP | | Certificates of Participation | | S/F | | Single Family |

| | | | | | USD | | US Dollar |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Schedule of Investments (continued) | | Series C portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Diversified Financial Services (concluded) | | | | | | |

Merrill Lynch & Co., Inc., | | | | | | |

6.05%, 5/16/16 | | $ | 1,350 | | $ | 1,376,530 |

| | | | | | |

| | | | | | 31,269,160 |

| | | | | | |

Diversified Telecommunication Services — 5.3% | | | | | | |

AT&T Inc.: | | | | | | |

5.63%, 6/15/16 | | | 1,500 | | | 1,644,480 |

5.50%, 2/01/18 | | | 3,500 | | | 3,715,771 |

Qwest Corp., | | | | | | |

8.38%, 5/01/16 | | | 2,000 | | | 2,250,000 |

Telecom Italia Capital SA, | | | | | | |

5.25%, 11/15/13 | | | 3,710 | | | 3,885,947 |

Telefonica Emisiones SAU, | | | | | | |

7.05%, 6/20/36 | | | 1,075 | | | 1,211,966 |

Verizon Communications, Inc.: | | | | | | |

6.10%, 4/15/18 | | | 3,350 | | | 3,664,468 |

6.25%, 4/01/37 | | | 1,625 | | | 1,646,894 |

6.90%, 4/15/38 | | | 925 | | | 1,020,172 |

Verizon Maryland, Inc., | | | | | | |

6.13%, 3/01/12 | | | 305 | | | 327,039 |

| | | | | | |

| | | | | | 19,366,737 |

| | | | | | |

Electric Utilities — 4.9% | | | | | | |

Carolina Power & Light Co., | | | | | | |

6.30%, 4/01/38 | | | 750 | | | 807,379 |

The Cleveland Electric Illuminating Co., | | | | | | |

5.65%, 12/15/13 | | | 450 | | | 487,605 |

Duke Energy Carolinas LLC, | | | | | | |

5.25%, 1/15/18 | | | 450 | | | 473,925 |

Florida Power & Light Co., | | | | | | |

5.95%, 2/01/38 | | | 1,825 | | | 1,870,826 |

Jersey Central Power & Light Co., | | | | | | |

5.65%, 6/01/17 | | | 1,710 | | | 1,809,409 |

Kiowa Power Partners LLC, | | | | | | |

4.81%, 12/30/13(a) | | | 12 | | | 12,237 |

MidAmerican Energy Holdings Co.: | | | | | | |

5.30%, 3/15/18 | | | 2,170 | | | 2,260,804 |

5.75%, 4/01/18 | | | 1,475 | | | 1,558,724 |

Ohio Edison Co., | | | | | | |

6.40%, 7/15/16 | | | 190 | | | 208,626 |

PacifiCorp, | | | | | | |

6.00%, 1/15/39 | | | 1,300 | | | 1,336,594 |

Progress Energy, Inc., | | | | | | |

4.88%, 12/01/19 | | | 2,200 | | | 2,157,073 |

Virginia Electric & Power Co.: | | | | | | |

5.40%, 1/15/16 | | | 3,000 | | | 3,228,888 |

6.00%, 1/15/36 | | | 1,550 | | | 1,597,996 |

| | | | | | |

| | | | | | 17,810,086 |

| | | | | | |

Electronic Equipment & Instruments — 0.2% | | | | | | |

Agilent Technologies, Inc., | | | | | | |

4.45%, 9/14/12 | | | 850 | | | 890,767 |

| | | | | | |

Food & Staples Retailing — 2.3% | | | | | | |

CVS Caremark Corp., | | | | | | |

5.75%, 6/01/17 | | | 4,450 | | | 4,798,840 |

Tesco Plc, | | | | | | |

5.50%, 11/15/17(a) | | | 1,340 | | | 1,435,887 |

Wal-Mart Stores, Inc.: | | | | | | |

2.88%, 4/01/15 | | | 1,430 | | | 1,428,912 |

5.25%, 9/01/35 | | | 675 | | | 644,906 |

| | | | | | |

| | | | | | 8,308,545 |

| | | | | | |

Food Products — 2.5% | | | | | | |

General Mills, Inc., | | | | | | |

5.20%, 3/17/15 | | | 1,125 | | | 1,221,275 |

Kraft Foods, Inc.: | | | | | | |

6.50%, 8/11/17 | | | 2,075 | | | 2,324,318 |

5.38%, 2/10/20 | | | 3,700 | | | 3,760,514 |

6.50%, 11/01/31 | | | 375 | | | 386,000 |

6.88%, 2/01/38 | | | 1,375 | | | 1,487,516 |

| | | | | | |

| | | | | | 9,179,623 |

| | | | | | |

Gas Utilities — 0.3% | | | | | | |

Atmos Energy Corp., | | | | | | |

8.50%, 3/15/19 | | | 800 | | | 981,492 |

| | | | | | |

Health Care Equipment & Supplies — 1.9% | | | | | | |

CareFusion Corp., | | | | | | |

6.38%, 8/01/19 | | | 2,250 | | | 2,460,494 |

Covidien International Finance SA, | | | | | | |

6.00%, 10/15/17 | | | 2,300 | | | 2,522,283 |

Hospira, Inc., | | | | | | |

6.05%, 3/30/17 | | | 1,660 | | | 1,782,960 |

| | | | | | |

| | | | | | 6,765,737 |

| | | | | | |

Hotels, Restaurants & Leisure — 0.3% | | | | | | |

McDonald’s Corp., | | | | | | |

5.70%, 2/01/39 | | | 1,275 | | | 1,269,516 |

| | | | | | |

Industrial Conglomerates — 0.6% | | | | | | |

Holcim US Finance S.a.r.l. & Cie S.C.S., | | | | | | |

6.00%, 12/30/19(a) | | | 1,175 | | | 1,220,232 |

Hutchison Whampoa International Ltd., | | | | | | |

4.63%, 9/11/15(a) | | | 1,000 | | | 1,027,752 |

| | | | | | |

| | | | | | 2,247,984 |

| | | | | | |

Insurance — 5.5% | | | | | | |

Chubb Corp., | | | | | | |

6.00%, 5/11/37 | | | 400 | | | 410,283 |

Hartford Life Global Funding Trusts: | | | | | | |

5.20%, 2/15/11 | | | 575 | | | 595,081 |

0.35%, 1/17/12(b) | | | 1,350 | | | 1,316,517 |

Lincoln National Corp., | | | | | | |

6.15%, 4/07/36 | | | 1,500 | | | 1,430,924 |

Massachusetts Mutual Life Insurance Co., | | | | | | |

8.88%, 6/01/39(a) | | | 1,200 | | | 1,528,603 |

MetLife, Inc., | | | | | | |

5.38%, 12/15/12 | | | 4,400 | | | 4,760,492 |

Metropolitan Life Global Funding I, | | | | | | |

5.13%, 4/10/13(a) | | | 2,550 | | | 2,737,672 |

Pacific Life Insurance Co., | | | | | | |

9.25%, 6/15/39(a) | | | 1,230 | | | 1,524,129 |

Pricoa Global Funding I, | | | | | | |

5.40%, 10/18/12(a) | | | 2,125 | | | 2,291,685 |

Prudential Financial, Inc.: | | | | | | |

5.70%, 12/14/36 | | | 1,375 | | | 1,302,834 |

6.63%, 12/01/37 | | | 875 | | | 917,832 |

Teachers Insurance & Annuity Association of America, | | | | | | |

6.85%, 12/16/39(a) | | | 1,050 | | | 1,138,969 |

| | | | | | |

| | | | | | 19,955,021 |

| | | | | | |

Machinery — 1.3% | | | | | | |

Ingersoll-Rand Global Holding Co. Ltd., | | | | | | |

6.00%, 8/15/13 | | | 2,395 | | | 2,631,624 |

PACCAR, Inc., | | | | | | |

6.88%, 2/15/14 | | | 1,850 | | | 2,110,759 |

Siemens Financieringsmat, | | | | | | |

5.50%, 2/16/12(a) | | | 100 | | | 107,324 |

| | | | | | |

| | | | | | 4,849,707 |

| | | | | | |

Media — 8.9% | | | | | | |

Comcast Cable Communications Holdings, Inc., | | | | | | |

8.38%, 3/15/13 | | | 3,000 | | | 3,477,432 |

Comcast Corp.: | | | | | | |

6.50%, 11/15/35 | | | 1,375 | | | 1,408,379 |

6.55%, 7/01/39 | | | 1,725 | | | 1,785,130 |

Cox Communications, Inc.: | | | | | | |

7.13%, 10/01/12 | | | 2,250 | | | 2,514,737 |

4.63%, 6/01/13 | | | 5,000 | | | 5,286,470 |

8.38%, 3/01/39(a) | | | 1,000 | | | 1,250,700 |

News America, Inc.: | | | | | | |

7.28%, 6/30/28 | | | 1,075 | | | 1,154,379 |

6.40%, 12/15/35 | | | 2,500 | | | 2,552,880 |

6.90%, 8/15/39 | | | 900 | | | 982,488 |

TCM Sub LLC, | | | | | | |

3.55%, 1/15/15 (a) | | | 1,750 | | | 1,736,268 |

Thomson Reuters Corp., | | | | | | |

5.95%, 7/15/13 | | | 2,300 | | | 2,541,893 |

Time Warner Cable, Inc.: | | | | | | |

5.85%, 5/01/17 | | | 2,000 | | | 2,141,502 |

8.25%, 4/01/19 | | | 1,120 | | | 1,355,299 |

5.00%, 2/01/20 | | | 850 | | | 838,084 |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 15 |

| | |

| Schedule of Investments (continued) | | Series C Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Corporate Bonds | | | | | | |

Media (concluded) | | | | | | |

Time Warner, Inc.: | | | | | | |

6.88%, 5/01/12 | | $ | 1,000 | | $ | 1,099,955 |

4.88%, 3/15/20 | | | 2,300 | | | 2,247,174 |

Turner Broadcasting System, Inc., | | | | | | |

8.38%, 7/01/13 | | | 25 | | | 28,614 |

| | | | | | |

| | | | | | 32,401,384 |

| | | | | | |

Metals & Mining — 0.7% | | | | | | |

Anglo American Capital Plc, | | | | | | |

9.38%, 4/08/19(a) | | | 1,460 | | | 1,859,620 |

Newmont Mining Corp., | | | | | | |

6.25%, 10/01/39 | | | 675 | | | 674,980 |

Xstrata Canada Corp., | | | | | | |

6.00%, 10/15/15 | | | 75 | | | 80,904 |

| | | | | | |

| | | | | | 2,615,504 |

| | | | | | |

Multiline Retail — 0.1% | | | | | | |

Kohl’s Corp., | | | | | | |

6.88%, 12/15/37 | | | 460 | | | 512,635 |

| | | | | | |

Multi-Utilities — 0.5% | | | | | | |

CenterPoint Energy, Inc., | | | | | | |

6.50%, 5/01/18 | | | 850 | | | 900,040 |

Sempra Energy, | | | | | | |

6.50%, 6/01/16 | | | 975 | | | 1,089,257 |

| | | | | | |

| | | | | | 1,989,297 |

| | | | | | |

Oil, Gas & Consumable Fuels — 6.6% | | | | | | |

Anadarko Petroleum Corp., | | | | | | |

6.45%, 9/15/36 | | | 375 | | | 382,177 |

Canadian Natural Resources Ltd.: | | | | | | |

5.70%, 5/15/17 | | | 3,295 | | | 3,515,966 |

5.90%, 2/01/18 | | | 1,125 | | | 1,217,526 |

6.25%, 3/15/38 | | | 1,110 | | | 1,147,792 |

Cenovus Energy, Inc., | | | | | | |

6.75%, 11/15/39(a) | | | 3,200 | | | 3,470,608 |

CenterPoint Energy Resources Corp., | | | | | | |

7.88%, 4/01/13 | | | 325 | | | 372,144 |

ConocoPhillips: | | | | | | |

6.00%, 1/15/20 | | | 2,750 | | | 3,054,722 |

6.50%, 2/01/39 | | | 450 | | | 502,676 |

DCP Midstream LLC, | | | | | | |

5.35%, 3/15/20(a) | | | 750 | | | 751,521 |

Enterprise Products Operating LLC, | | | | | | |

5.25%, 1/31/20 | | | 1,700 | | | 1,715,449 |

Kinder Morgan Energy Partners LP, | | | | | | |

7.30%, 8/15/33 | | | 1,400 | | | 1,560,653 |

Shell International Finance BV, | | | | | | |

6.38%, 12/15/38 | | | 2,125 | | | 2,340,063 |

Valero Energy Corp., | | | | | | |

6.63%, 6/15/37 | | | 500 | | | 475,528 |

Williams Partners LP, | | | | | | |

5.25%, 3/15/20(a) | | | 1,850 | | | 1,853,770 |

XTO Energy, Inc., | | | | | | |

6.75%, 8/01/37 | | | 1,610 | | | 1,884,990 |

| | | | | | |

| | | | | | 24,245,585 |

| | | | | | |

Paper & Forest Products — 1.1% | | | | | | |

Celulosa Arauco y Constitucion SA, | | | | | | |

7.25%, 7/29/19 | | | 900 | | | 967,113 |

International Paper Co.: | | | | | | |

7.95%, 6/15/18 | | | 1,150 | | | 1,343,592 |

7.50%, 8/15/21 | | | 720 | | | 818,146 |

Weyerhaeuser Co., | | | | | | |

7.13%, 7/15/23 | | | 750 | | | 707,123 |

| | | | | | |

| | | | | | 3,835,974 |

| | | | | | |

Pharmaceuticals — 4.4% | | | | | | |

Bristol-Myers Squibb Co., | | | | | | |

5.88%, 11/15/36 | | | 900 | | | 923,873 |

Merck & Co, Inc., | | | | | | |

6.55%, 9/15/37 | | | 1,275 | | | 1,456,093 |

Roche Holding, Inc., | | | | | | |

6.00%, 3/01/19(a) | | | 2,400 | | | 2,652,300 |

Teva Pharmaceutical Finance Co. LLC: | | | | | | |

5.55%, 2/01/16 | | | 2,400 | | | 2,627,784 |

6.15%, 2/01/36 | | | 1,000 | | | 1,037,295 |

Watson Pharmaceuticals, Inc., | | | | | | |

5.00%, 8/15/14 | | | 1,025 | | | 1,067,238 |

Wyeth: | | | | | | |

5.50%, 2/15/16 | | | 3,110 | | | 3,469,221 |

5.45%, 4/01/17 | | | 1,500 | | | 1,641,770 |

5.95%, 4/01/37 | | | 1,175 | | | 1,230,199 |

| | | | | | |

| | | | | | 16,105,773 |

| | | | | | |

Real Estate Investment Trusts (REITs) — 0.6% | | | | | | |

AvalonBay Communities, Inc.: | | | | | | |

6.13%, 11/01/12 | | | 53 | | | 57,397 |

5.70%, 3/15/17 | | | 1,050 | | | 1,106,785 |

WEA Finance LLC / WT Finance Australia Ltd., | | | | | | |

5.75%, 9/02/15(a) | | | 1,075 | | | 1,131,420 |

| | | | | | |

| | | | | | 2,295,602 |

| | | | | | |

Road & Rail — 0.9% | | | | | | |

Burlington Northern Santa Fe Corp., | | | | | | |

5.65%, 5/01/17 | | | 425 | | | 455,532 |

Canadian National Railway Co., | | | | | | |

6.25%, 8/01/34 | | | 2,000 | | | 2,152,690 |

Canadian Pacific Railway Co., | | | | | | |

7.25%, 5/15/19 | | | 500 | | | 568,020 |

| | | | | | |

| | | | | | 3,176,242 |

| | | | | | |

Semiconductors & Semiconductor Equipment — 0.4% | | | | | | |

National Semiconductor Corp., | | | | | | |

3.95%, 4/15/15 | | | 1,350 | | | 1,334,840 |

| | | | | | |

Software — 1.2% | | | | | | |

Oracle Corp.: | | | | | | |

5.25%, 1/15/16 | | | 2,100 | | | 2,313,442 |

5.75%, 4/15/18 | | | 1,800 | | | 1,974,254 |

| | | | | | |

| | | | | | 4,287,696 |

| | | | | | |

Tobacco — 0.9% | | | | | | |

Altria Group, Inc., | | | | | | |

9.25%, 8/06/19 | | | 1,320 | | | 1,603,974 |

Philip Morris International, Inc., | | | | | | |

5.65%, 5/16/18 | | | 1,385 | | | 1,491,191 |

| | | | | | |

| | | | | | 3,095,165 |

| | | | | | |

Wireless Telecommunication Services — 3.5% | | | | | | |

America Movil SAB de CV: | | | | | | |

5.50%, 3/01/14 | | | 1,250 | | | 1,350,840 |

5.00%, 3/30/20(a) | | | 1,600 | | | 1,577,386 |

Cellco Partnership/Verizon Wireless Capital LLC, | | | | | | |

8.50%, 11/15/18 | | | 1,150 | | | 1,434,808 |

Rogers Communications, Inc.: | | | | | | |

7.50%, 3/15/15 | | | 2,125 | | | 2,480,304 |

6.80%, 8/15/18 | | | 1,525 | | | 1,734,762 |

Vodafone Group Plc: | | | | | | |

5.75%, 3/15/16 | | | 2,000 | | | 2,182,310 |

6.15%, 2/27/37 | | | 2,125 | | | 2,176,599 |

| | | | | | |

| | | | | | 12,937,009 |

| | | | | | |

Total Corporate Bonds — 89.6% | | | | | | 326,844,224 |

| | | | | | |

Foreign Agency Obligations | | | | | | |

CDP Financial, Inc., | | | | | | |

4.40%, 11/25/19(a) | | | 1,700 | | | 1,665,527 |

EDF SA, | | | | | | |

6.50%, 1/26/19(a) | | | 3,560 | | | 3,994,772 |

Eksportfinans ASA, | | | | | | |

5.50%, 5/25/16 | | | 1,200 | | | 1,321,696 |

Nakilat, Inc., | | | | | | |

6.07%, 12/31/33(a) | | | 25 | | | 22,752 |

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Schedule of Investments (continued) | | Series C portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | | |

| | | Par

(000) | | Value | |

Foreign Agency Obligations | | | | | | | |

Petrobras International Finance Co.: | | | | | | | |

5.88%, 3/01/18 | | $ | 2,350 | | $ | 2,454,220 | |

7.88%, 3/15/19 | | | 450 | | | 526,301 | |

6.88%, 1/20/40 | | | 150 | | | 154,828 | |

| | | | | | | |

Total Foreign Agency Obligations — 2.8% | | | | | | 10,140,096 | |

| | | | | | | |

Foreign Government Obligations | | | | | | | |

Mexico — 0.9% | | | | | | | |

United Mexican States: | | | | | | | |

5.88%, 2/17/14 | | | 1,775 | | | 1,980,012 | |

5.95%, 3/19/19 | | | 1,100 | | | 1,188,000 | |

| | | | | | | |

| | | | | | 3,168,012 | |

| | | | | | | |

Poland — 0.3% | | | | | | | |

Poland Government International Bond, | | | | | | | |

6.38%, 7/15/19 | | | 900 | | | 985,966 | |

| | | | | | | |

United Arab Emirates — 0.5% | | | | | | | |

Emirate of Abu Dhabi Notes, | | | | | | | |

6.75%, 4/08/19(a) | | | 1,750 | | | 1,991,245 | |

| | | | | | | |

Total Foreign Government Obligations — 1.7% | | | | | | 6,145,223 | |

| | | | | | | |

Preferred Securities | | | | | | | |

Capital Trusts | | | | | | | |

Commercial Banks — 0.3% | | | | | | | |

Rabobank Capital Funding II, | | | | | | | |

5.26%(a)(b)(c) | | | 75 | | | 66,893 | |

State Street Capital Trust IV, | | | | | | | |

1.26%, 6/15/37(b) | | | 1,075 | | | 806,400 | |

Wachovia Capital Trust III, | | | | | | | |

5.80%(b)(c) | | | 225 | | | 190,688 | |

| | | | | | | |

| | | | | | 1,063,981 | |

| | | | | | | |

Diversified Financial Services — 2.5% | | | | | | | |

Capital One Capital V, | | | | | | | |

10.25%, 8/15/39 | | | 1,670 | | | 1,978,424 | |

Credit Suisse/Guernsey, | | | | | | | |

5.86%(b)(c) | | | 4,760 | | | 4,462,500 | |

JPMorgan Chase Capital XXII, | | | | | | | |

6.45%, 2/02/37 | | | 200 | | | 185,682 | |

JPMorgan Chase Capital XXIII, | | | | | | | |

1.25%, 5/15/47(b) | | | 500 | | | 375,236 | |

JPMorgan Chase Capital XXVII, | | | | | | | |

7.00%, 11/01/39 | | | 1,225 | | | 1,250,117 | |

Lehman Brothers Holdings Capital Trust VII, | | | | | | | |

5.86%(b)(c)(d)(e) | | | 4,070 | | | 10,175 | |

USB Capital XIII Trust, | | | | | | | |

6.63%, 12/15/39 | | | 950 | | | 961,647 | |

| | | | | | | |

| | | | | | 9,223,781 | |

| | | | | | | |

Insurance — 0.3% | | | | | | | |

Lincoln National Corp., | | | | | | | |

7.00%, 5/17/66(b) | | | 75 | | | 68,250 | |

New York Life Insurance Co., | | | | | | | |

6.75%, 11/15/39(a) | | | 925 | | | 1,013,400 | |

| | | | | | | |

| | | | | | 1,081,650 | |

| | | | | | | |

Total Preferred Securities — 3.1% | | | | | | 11,369,412 | |

| | | | | | | |

Taxable Municipal Bonds | | | | | | | |

Metropolitan Transportation Authority, New York RB, | | | | | | | |

7.34%, 11/15/39 | | | 2,325 | | | 2,693,861 | |

State of California GO: | | | | | | | |

7.55%, 4/01/39 | | | 1,920 | | | 1,996,531 | |

7.35%, 11/01/39 | | | 475 | | | 473,314 | |

State of Illinois GO, | | | | | | | |

4.42%, 1/01/15 | | | 1,100 | | | 1,108,888 | |

| | | | | | | |

Total Taxable Municipal Bonds — 1.7% | | | | | | 6,272,594 | |

| | | | | | | |

U.S. Government Sponsored Agency Securities Agency Obligations — 0.3% | | | | | | | |

Fannie Mae, 6.35%, 10/09/19(f) | | | 2,250 | | | 1,316,452 | |

| | | | | | | |

U.S. Treasury Obligations — 0.5% | | | | | | | |

U.S. Treasury Notes, | | | | | | | |

3.63%, 2/15/20(g) | | | 1,725 | | | 1,695,622 | |

| | | | | | | |

Total Long-Term Investments

(Cost — $346,221,384) — 99.7% | | | | | | 363,783,623 | |

| | | | | | | |

| | |

| | | Shares | | | |

Short-Term Securities | | | | | | | |

Dreyfus Treasury Prime, 0.00%(h) | | | 1,537,497 | | | 1,537,497 | |

| | | | | | | |

Total Short-Term Securities

(Cost — $1,537,497) — 0.4% | | | | | | 1,537,497 | |

| | | | | | | |

Total Investments

(Cost — $347,758,881*) — 100.1% | | | | | | 365,321,120 | |

| | | | | | | |

Liabilities in Excess of Other Assets — (0.1)% | | | | | | (530,737 | ) |

| | | | | | | |

Net Assets — 100.0% | | | | | $ | 364,790,383 | |

| | | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of March 31, 2010, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 347,758,881 | |

| | | | |

Gross unrealized appreciation | | $ | 23,114,098 | |

Gross unrealized depreciation | | | (5,551,859 | ) |

| | | | |

Net unrealized appreciation | | $ | 17,562,239 | |

| | | | |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (b) | Variable rate security. Rate shown is as of report date. |

| (c) | Security is perpetual in nature and has no stated maturity date. |

| (d) | Non-income producing security. |

| (e) | Issuer filed for bankruptcy and/or is in default of interest payments. |

| (f) | Represents a zero-coupon bond. Rate shown reflects the current yield as of report date. |

| (g) | All or a portion of security pledged as collateral for reverse repurchase agreements. |

| (h) | Represents the current yield as of report date. |

| • | | Investments in companies considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, were as follows: |

| | | | | | | |

Affiliate | | Net Activity | | | Income |

BlackRock Liquidity Funds, TempFund Institutional Class | | $ | (8,766,428 | ) | | $ | 1,710 |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 17 |

| | |

| Schedule of Investments (concluded) | | Series C portfolio |

| | (Percentages shown are based on Net Assets) |

| • | | Reverse repurchase agreements outstanding as of March 31, 2010 were as follows: |

| | | | | | | | | | | | | |

Counterparty | | Interest

Rate | | | Settlement

Date | | Maturity

Date | | Net Closing

Amount | | Par |

Barclays Bank, Plc | | 0.02 | % | | 3/30/10 | | Open | | $ | 1,696,970 | | $ | 1,696,969 |

| • | | Financial futures contracts purchased as of March 31, 2010 were as follows: |

| | | | | | | | | | | |

Contracts | | Issue | | Expiration Date | | Notional

Value | | Unrealized

Appreciation

(Depreciation) | |

| 116 | | U.S. Treasury Notes

(2 Year) | | June 2010 | | $ | 25,166,563 | | $ | 9,318 | |

| 73 | | U.S. Treasury Notes

(5 Year) | | June 2010 | | $ | 8,383,594 | | | (30,636 | ) |

| 29 | | CME Ultra Bond

(5 Year) | | June 2010 | | $ | 3,479,094 | | | (9,885 | ) |

| | | | | | | | | | | |

Total | | | | | | | | | $ | (31,203 | ) |

| | | | | | | | | | | |

| • | | Financial futures contracts sold as of March 31, 2010 were as follows: |

| | | | | | | | | | | |

Contracts | | Issue | | Expiration Date | | Notional

Value | | Unrealized

Appreciation

(Depreciation) | |

| 418 | | U.S. Treasury Notes

(10 Year) | | June 2010 | | $ | 48,592,500 | | | 28,623 | |

| 89 | | U.S. Treasury Bonds

(20 Year) | | June 2010 | | $ | 10,335,125 | | | (34,238 | ) |

| | | | | | | | | | | |

Total | | | | | | | | | $ | (5,615 | ) |

| | | | | | | | | | | |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. |

| • | | Fair Value Measurements - Various inputs are used in determining the fair value of investments, which are as follows: |

| | • | | Level 1 - price quotations in active markets/exchanges for identical assets and liabilities |

| | • | | Level 2 - other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | • | | Level 3 - unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following tables summarize the inputs used as of March 31, 2010 in determining the fair valuation of the Fund’s investments:

| | | | | | | | | | | |

| | | Investments in Securities |

Valuation Inputs | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | |

Long-Term Investments1 | | | — | | $ | 363,783,623 | | — | | $ | 363,783,623 |

Short-Term Securities | | $ | 1,537,497 | | | — | | — | | | 1,537,497 |

| | | | | | | | | | | |

Total | | $ | 1,537,497 | | $ | 363,783,623 | | — | | $ | 365,321,120 |

| | | | | | | | | | | |

| 1 | See above Schedule of Investments for values in each security type. |

| | | | | | | | | | | | |

| | | Other Financial Instruments2 | |

Valuation Inputs | | Level 1 | | | Level 2 | | Level 3 | | Total | |

Assets | | $ | 37,941 | | | — | | — | | $ | 37,941 | |

Liabilities | | | (74,759 | ) | | — | | — | | | (74,759 | ) |

| | | | | | | | | | | | |

Total | | $ | (36,818 | ) | | — | | — | | $ | (36,818 | ) |

| | | | | | | | | | | | |

| 2 | Other financial instruments are financial futures contracts which are shown at the unrealized appreciation/depreciation on the instrument. |

See Notes to Financial Statements.

| | | | | | |

| 18 | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | |

| | |

| Schedule of Investments March 31, 2010 | | Series M Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Par

(000) | | Value |

Asset-Backed Securities | | | | | | |

Ally Auto Receivables Trust, | | | | | | |

Series 2009-A, Class A2, 1.32%, 3/15/12(a) | | $ | 1,000 | | $ | 1,004,215 |

AmeriCredit Automobile Receivables Trust, | | | | | | |

Series 2009-1, Class A3, 3.04%, 10/15/13 | | | 1,200 | | | 1,230,072 |

Bank of America Auto Trust: | | | | | | |

Series 2009-2A, Class A2, 1.16%, 2/15/12(a) | | | 2,185 | | | 2,191,085 |

Series 2010-1A, Class A2, 0.75%, 6/15/12(a) | | | 4,825 | | | 4,828,135 |

Series 2009-2A, Class A3, 2.13%, 9/16/13(a) | | | 2,185 | | | 2,217,956 |

Capital Auto Receivables Asset Trust: | | | | | | |

Series 2007-1, Class A3A, 5.00%, 4/15/11 | | | 294 | | | 295,462 |

Series 2006-2, Class A3A, 4.98%, 5/15/11 | | | 398 | | | 400,638 |

Capital One Auto Finance Trust, | | | | | | |

Series 2006-B, Class A4, 0.25%, 7/15/13(b) | | | 3,204 | | | 3,192,987 |

CarMax Auto Owner Trust, | | | | | | |

Series 2009-1, Class A3, 4.12%, 3/15/13 | | | 2,680 | | | 2,772,014 |

Chase Issuance Trust, | | | | | | |

Series 2009-A7, Class A7, 0.68%, 9/15/10(b) | | | 3,000 | | | 3,004,475 |

Ford Credit Auto Owner Trust: | | | | | | |

Series 2009-D, Class A2, 1.21%, 1/15/12 | | | 1,000 | | | 1,002,751 |

Series 2009-A, Class A3A, 3.96%, 5/15/13 | | | 2,900 | | | 2,996,951 |

Series 2009-D, Class A3, 2.17%, 10/15/13 | | | 1,000 | | | 1,015,122 |

Series 2009-A, Class A4, 6.07%, 5/15/14 | | | 2,720 | | | 2,983,608 |

Harley-Davidson Motorcycle Trust: | | | | | | |

Series 2007-2, Class A3, 5.10%, 5/15/12 | | | 350 | | | 351,824 |

Series 2009-4, Class A2, 1.16%, 10/15/12 | | | 1,000 | | | 1,004,106 |

Series 2009-3, Class A4, 2.54%, 4/17/17 | | | 1,000 | | | 1,017,734 |

SLM Student Loan Trust: | | | | | | |

Series 2008-5, Class A2, 1.35%, 10/25/16(b) | | | 775 | | | 787,741 |

Series 2008-5, Class A3, 1.55%, 1/25/18(b) | | | 10,000 | | | 10,318,706 |

USAA Auto Owner Trust: | | | | | | |

Series 2006-2, Class A4, 5.37%, 2/15/12 | | | 394 | | | 395,243 |

Series 2006-4, Class A4, 4.98%, 10/15/12 | | | 2,856 | | | 2,910,616 |

Volkswagen Auto Loan Enhanced Trust, | | | | | | |

Series 2010-1, Class A2, 0.66%, 5/21/12 | | | 2,400 | | | 2,400,629 |

World Omni Auto Receivables Trust: | | | | | | |

Series 2006-B, Class A4, 5.12%, 6/15/12 | | | 282 | | | 287,691 |

Series 2007-BA, Class B, 5.98%, 4/15/15(a) | | | 3,635 | | | 3,844,994 |

| | | | | | |

Total Asset-Backed Securities — 14.5% | | | | | | 52,454,755 |

| | | | | | |

Non-Agency Mortgage-Backed Securities | | | | | | |

Commercial Mortgage-Backed Securities — 40.3% | | | | | | |

Banc of America Commercial Mortgage, Inc.: | | | | | | |

Series 2001-1, Class A2, 6.50%, 4/15/11 | | | 4,875 | | | 5,030,201 |

Series 2001-PB1, Class A2, 5.79%, 8/11/11 | | | 4,364 | | | 4,530,124 |

Bear Stearns Commercial Mortgage Securities: | | | | | | |

Series 2004-T16, Class A6, 4.75%, 10/13/14 | | | 7,355 | | | 7,494,001 |

Series 2000-WF2, Class A2, 7.32%, 10/15/32 | | | 1,455 | | | 1,469,852 |

Series 2005-PW10, Class A4, 5.41%, 12/11/40(b) | | | 1,000 | | | 1,023,919 |

Chase Commercial Mortgage Securities Corp., | | | | | | |

Series 2000-3, Class A2, 7.32%, 10/15/32 | | | 4,650 | | | 4,705,412 |

Citigroup/Deutsche Bank Commercial Mortgage Trust: | | | | | | |

Series 2006-CD3, Class A5, 5.62%, 10/15/48 | | | 500 | | | 511,607 |

Series 2008-C7, Class A2A, 6.03%, 12/10/49 | | | 5,000 | | | 5,261,750 |

Commercial Mortgage Asset Trust: | | | | | | |

Series 1999-C1, Class A3, 6.64%, 1/17/32 | | | 33 | | | 32,596 |

Series 2006-C8, Class A3, 5.31%, 12/10/46 | | | 5,000 | | | 5,060,433 |

Credit Suisse First Boston Mortgage Securities Corp.: | | | | | | |

Series 2001-CF2, Class A4, 6.51%, 1/15/11 | | | 841 | | | 863,708 |

Series 2002-CKN2, Class A2, 5.94%, 9/15/11 | | | 2,138 | | | 2,189,872 |

Credit Suisse Mortgage Capital Certificates: | | | | | | |

Series 2006-C1, Class A3, 5.55%, 2/15/39(b) | | | 4,820 | | | 4,999,156 |

Series 2006-C4, Class A3, 5.47%, 9/15/39 | | | 5,770 | | | 5,542,914 |

DLJ Commercial Mortgage Corp., | | | | | | |

Series 2000-CKP1, Class A1B, 7.18%, 11/10/33 | | | 989 | | | 997,956 |

First Union National Bank Commercial Mortgage: | | | | | | |

Series 2000-C2, Class A2, 7.20%, 9/15/10 | | | 2,634 | | | 2,663,817 |

Series 2001-C3, Class A3, 6.42%, 6/15/11 | | | 262 | | | 273,296 |

GE Capital Commercial Mortgage Corp.: | | | | | | |

Series 2001-2, Class A4, 6.29%, 8/11/33 | | | 3,205 | | | 3,344,230 |

Series 2004-C2, Class A4, 4.89%, 3/10/40 | | | 1,040 | | | 1,065,396 |

Series 2005-C1, Class A2, 4.35%, 6/10/48 | | | 2,946 | | | 2,980,087 |

GMAC Commercial Mortgage Securities, Inc.: | | | | | | |

Series 2000-C2, Class A2, 7.46%, 6/16/10(b) | | | 2,538 | | | 2,542,113 |

Series 2000-C3, Class A2, 6.96%, 11/15/10 | | | 4,216 | | | 4,296,419 |

Series 2002-C3, Class B, 5.10%, 7/10/39(b) | | | 1,000 | | | 1,011,516 |

Series 2003-C2, Class A2, 5.49%, 5/10/40(b) | | | 3,465 | | | 3,693,873 |

Greenwich Capital Commercial Funding Corp.: | | | | | | |

Series 2002-C1, Class B, 5.10%, 11/11/12(b) | | | 1,000 | | | 1,029,007 |

Series 2003-C1, Class A3, 3.86%, 7/05/35 | | | 250 | | | 255,656 |

Series 2007-GG9, Class A4, 5.44%, 3/10/39 | | | 3,000 | | | 2,917,495 |

Series 2005-GG3, Class A2, 4.31%, 8/10/42 | | | 2,690 | | | 2,733,495 |

Series 2005-GG3, Class A3, 4.57%, 8/10/42 | | | 1,335 | | | 1,355,699 |

JPMorgan Chase Commercial Mortgage Securities Corp.: | | | | | | |

Series 2001-CIB2, Class A3, 6.43%, 6/15/11 | | | 5,595 | | | 5,818,028 |

Series 2001-C1, Class A3, 5.86%, 10/12/11 | | | 3,240 | | | 3,388,890 |

Series 2001-CIBC, Class A3, 6.26%, 3/15/33 | | | 1,265 | | | 1,293,854 |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BOND ALLOCATION TARGET SHARES | | MARCH 31, 2010 | | 19 |

| | |

| Schedule of Investments (continued) | | Series M portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | | |

| | | Par

(000) | | Value | |

Non-Agency Mortgage-Backed Securities | | | | | | | |