UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21673

THE ALLIANCEBERNSTEIN POOLING PORTFOLIOS

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: August 31, 2012

Date of reporting period: February 29, 2012

ITEM 1. REPORTS TO STOCKHOLDERS.

SEMI-ANNUAL REPORT

AllianceBernstein Pooling Portfolios

U.S. Value

U.S. Large Cap Growth

International Value

International Growth

Short Duration Bond

Global Core Bond

(formerly Intermediate Duration Bond)

Bond Inflation Protection

High-Yield

Small-Mid Cap Value

Small-Mid Cap Growth

Multi-Asset Real Return

Volatility Management

February 29, 2012

Semi-Annual Report

Investment Products Offered

•Are Not FDIC Insured •May Lose Value •Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the

Fund carefully before investing. For copies of our prospectus or summary prospectus, which

contain this and other information, visit us online at www.alliancebernstein.com or contact your

AllianceBernstein Investments representative. Please read the prospectus and/or summary

prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals

who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information

regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month

period ended June 30, without charge. Simply visit AllianceBernstein’s website at

www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”)

website at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third

quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s

website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the

Commission’s Public Reference Room in Washington, DC; information on the operation of the Public

Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio

holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AllianceBernstein family of

mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of

the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission

of the owner, AllianceBernstein L.P.

April 23, 2012

Semi-Annual Report

This report provides management’s discussion of fund performance for the AllianceBernstein Pooling Portfolios (collectively, the “Portfolios”; individually a “Portfolio”) for the semi-annual reporting period ended February 29, 2012.

The tables on pages 23–25 show each Portfolio’s performance for the six- and 12-month periods ended February 29, 2012, compared to their respective benchmarks. Additional performance can be found on pages 26–28. Each Portfolio’s benchmark is as follows: U.S. Value Portfolio—Russell 1000 Value Index; U.S. Large Cap Growth Portfolio—Russell 1000 Growth Index; International Value Portfolio—Morgan Stanley Capital International (“MSCI”) All Country World Index (“ACWI”) ex U.S.; International Growth Portfolio—MSCI AC World Index ex U.S.; Short Duration Bond Portfolio—Bank of America Merrill Lynch (“BofA ML”) 1-3 Year Treasury Index; Global Core Bond Portfolio—Barclays Capital (“BC”) Global Aggregate Bond Index (U.S. dollar hedged); Bond Inflation Protection Portfolio—BC 1-10 Year Treasury Inflation Protected Securities (“TIPS”) Index; High-Yield Portfolio—BC U.S. High Yield 2% Issuer Cap Index; Small-Mid Cap Value Portfolio—Russell 2500 Value Index; Small-Mid Cap Growth Portfolio—Russell 2500 Growth Index; Multi-Asset Real Return Portfolio—MSCI AC World Commodity Producers Index; Volatility Management—MSCI ACWI.

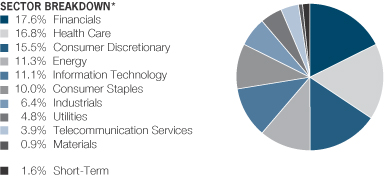

U.S. Value Portfolio

Investment Objective and Policies

The Portfolio seeks long-term growth of capital. The Portfolio invests primarily in a diversified portfolio of equity securities of U.S. companies, emphasizing investments in companies that AllianceBernstein L.P. (the “Adviser”) believes are undervalued. The Portfolio uses the fundamental value approach of the Adviser’s Bernstein unit (“Bernstein”). This fundamental value approach seeks to identify investments that are considered to be undervalued because they are attractively priced relative to future earnings power and dividend-paying capability. The Adviser relies heavily on the fundamental analysis and research of Bernstein’s large internal research staff in making investment decisions for the Portfolio. Under normal circumstances, the Portfolio invests in at least 80% of its net assets in equity securities of U.S. companies.

Investment Results

During the six-and 12-month periods ended February 29, 2012, the Portfolio underperformed its benchmark, the Russell 1000 Value Index. In the six-month period, security selection detracted; sector selection helped offset some of the underperformance. Stock selection in capital equipment, technology and consumer growth detracted most. Underweights in financials and utilities, as well as an overweight in consumer cyclicals, benefitted performance. During the 12-month period, the Portfolio declined in absolute terms. Stock selection detracted from performance, particularly in energy, consumer

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 1 |

growth, and technology. An underweight in financials and overweights in consumer growth and consumer cyclicals benefitted performance.

The Portfolio did not utilize derivatives during the six- and 12- month periods.

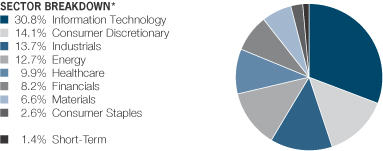

U.S. Large Cap Growth Portfolio

Investment Objective and Policies

The Portfolio seeks long-term growth of capital. The Portfolio invests primarily in the equity securities of a limited number of large, carefully selected, high-quality U.S. companies that are judged likely to achieve superior earnings growth. The Adviser tends to focus on companies that have strong management, superior industry positions, excellent balance sheets and superior earnings growth prospects. Under normal circumstances, the Portfolio invests at least 80% of its net assets in equity securities of large-capitalization U.S. companies. For these purposes, “large-capitalization U.S. companies” are those that, at the time of investment, have market capitalizations within the range of market capitalizations of companies appearing in the Russell 1000 Growth Index.

The Portfolio normally will invest in common stocks of companies with market capitalizations of at least $5 billion at the time of purchase. The Portfolio thus differs from more typical equity mutual funds by focusing on a relatively small number of intensively researched companies. The Portfolio also may invest in non-U.S. securities.

Investment Results

The Portfolio outperformed its benchmark, the Russell 1000 Growth Index,

for the six-month period, and underperformed for the 12-month period ended February 29, 2012. For the six-month period, both security and sector selection contributed to returns. An underweight in the consumer staples sector was beneficial, as was stock selection in the consumer discretionary and healthcare sectors. The healthcare sector performed well over both periods, helped by its defensive characteristics. Detracting was both an overweight in the financial sector, as well as stock selection in the sector, hurt by a handful of large banks that traded down on concerns about potential losses due to the euro-area crisis and the contagion effects of the crisis.

For the 12-month period, sector and security selection both detracted from performance. The Portfolio’s overweight and stock selection in the financial sector detracted, on fears of contagion in the euro-area crisis. Several of the Portfolio’s technology holdings also detracted. Contributing to returns were positions in the more defensive healthcare and energy sectors.

Derivatives were not used during the six- or 12-month periods ended February 29, 2012.

U.S. Market Review and Investment Strategy

U.S. equity markets began 2011 amid strong corporate earnings, encouraging economic data and an uptick in mergers. By midyear, investor anxiety started to build on concerns of the European sovereign debt crisis and nervousness about the end of the Federal Reserve’s asset-purchasing

| 2 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

program, Quantitative Easing 2. The third quarter was plagued by a series of unfavorable events: Standard & Poor’s lowered its credit rating on U.S. government debt, slowing global growth, and continued fears of a European financial meltdown. Investor risk aversion dominated markets for most of the fourth quarter, though December saw signs of improving macroeconomic data. At the end of the reporting period, resilient U.S. data (particularly stronger-than-expected construction spending, automotive sales, and a reduced unemployment rate), better-than-forecasted Chinese manufacturing data and the potential for a resolution to the European sovereign debt crisis contributed to increased investor confidence.

The current economic climate has allowed the U.S. Value Senior Investment Management Team to invest the U.S. Value Portfolio opportunistically in quality companies without sacrificing the Portfolio’s deep-value discipline. As the economy remains unsettled, the Portfolio’s emphasis continues to be at the stock-specific level, where the trend is focused on attractively-valued companies with solid balance sheets and strong free cash flow.

In managing the U.S. Large Cap Portfolio, the U.S. Large Cap Growth Team (the “Team”) has attempted to navigate through the current market environment by increasingly focusing on) by focusing on companies with solid, durable growth, sustainable

competitive advantages and high return on invested capital.

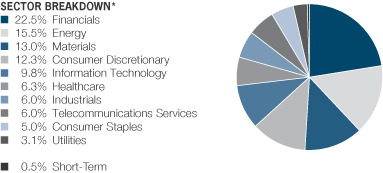

International Value Portfolio

Investment Objective and Policies

The Portfolio seeks long-term growth of capital. The Portfolio invests primarily in a diversified portfolio of equity securities of established companies selected from more than 40 industries and from more than 40 developed and emerging market countries. These countries currently include the developed nations in Europe and the Far East, Canada, Australia and emerging market countries worldwide. Under normal market conditions, the Portfolio invests significantly (at least 40%, unless market conditions are not deemed favorable by the Adviser in securities of non-U.S. companies.) In addition, the Portfolio invests, under normal market conditions, in companies in at least three countries other than the United States.

The Portfolio invests in companies that Bernstein determines are undervalued, using a fundamental value approach. In selecting securities for the Portfolio, Bernstein uses its fundamental and quantitative research to identify companies whose stocks are priced low in relation to their perceived long-term earnings power.

The Portfolio may invest in depositary receipts, instruments of supranational entities denominated in the currency of any country, securities of multi-national companies and “semi-governmental securities”, and enter into forward commitments. The

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 3 |

Portfolio may enter into derivatives transactions, such as options, futures, forwards and swap agreements.

Investment Results

Effective January 1, 2012, the Portfolio’s benchmark was changed from the MSCI Europe, Australasia and Far East (“EAFE”) Index to the MSCI ACWI ex U.S., because the new index more closely resembles its investments.

For the six-month period ended February 29, 2012, the Portfolio outperformed its current and prior benchmarks, with sector positioning and security selection combining to drive the premium. Currency selection was modestly negative. Overweight and underweight exposures to the medical sector and gold, respectively, boosted performance, as did stock selection in finance and consumer staples. Stock selection in consumer cyclicals, medical and industrial commodities undercut performance. During this period, the Fund employed derivatives in the form of futures and forwards, each of which detracted from performance. Leverage had a nominal impact to the Portfolio’s performance.

For the 12-month period, the Portfolio declined in absolute terms and underperformed its current and prior benchmarks, with security selection driving the deficit. Sector positioning and currency selection were both positive and combined to partially offset the losses. Stock selection in finance and utilities, as well as an underweight exposure to the consumer staples sector, undercut relative performance. An

overweight exposure to the medical sector boosted performance, as did stock selection in energy and consumer staples. During this period, the Portfolio employed derivatives in the form of futures and forwards, which detracted and contributed, respectively, to performance. Leverage had a nominal impact to the Portfolio’s performance.

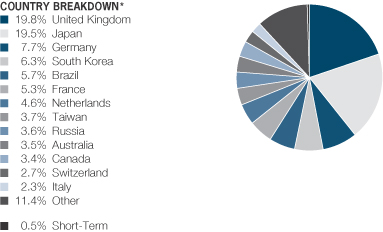

International Growth Portfolio

Investment Objective and Policies

The Portfolio’s investment objective is long-term growth of capital. The Portfolio invests primarily in an international portfolio of companies selected by the Adviser whose growth potential appears likely to outpace market expectations. The Adviser’s growth analysts use proprietary research to seek to identify companies that grow while creating a significant amount of “economic value”. These companies typically exhibit solid, durable growth; strong, sustainable competitive advantages; high return on invested capital and robust free cash flow.

The Portfolio invests, under normal circumstances, in the equity securities of companies located in at least three countries (and normally substantially more) other than the United States. The Portfolio invests in securities of companies in both developed and emerging market countries. Geographic distribution of the Portfolio’s investments among countries or regions also will be a product of the stock selection process rather than a predetermined allocation. The Portfolio may also invest in synthetic foreign

| 4 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

equity securities, which are types of warrants used internationally that entitle a holder to buy or sell underlying securities. The Adviser expects that normally the Portfolio will tend to emphasize investments in larger capitalization companies.

Currencies can have a dramatic impact on equity returns, significantly adding to returns in some years and greatly diminishing them in others. Currency and equity positions are evaluated separately. The Adviser may seek to hedge the currency exposure resulting from securities positions when it finds the currency exposure unattractive. To hedge a portion of its currency risk, the Portfolio may from time to time invest in currency-related derivatives, including forward currency exchange contracts, futures, options on futures, swaps and options. The Adviser may also seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives.

Investment Results

Effective January 1, 2012, the Portfolio’s benchmark was changed from the MSCI EAFE Index to the MSCI ACWI ex-U.S., because the new index more closely resembles its investments.

In the six-month period ended February 29, 2012, the Portfolio declined in absolute terms and underperformed its current and prior benchmarks. Security selection, particularly in the UK, China and India, was responsible for most of the shortfall. Country positioning and net currency selection were both positive and tempered the

underperformance. Overweight and underweight exposures to the markets in the UK and Canada, respectively, boosted relative performance, as did stock selection in Hong Kong and Belgium. While the relative performance of the Fund was unaffected by leverage in the six-month period, it was undercut by held currency forwards.

During the 12-month period, the Portfolio declined in absolute terms and underperformed its current and prior benchmarks, with security selection, particularly in Switzerland, China and Taiwan, driving the deficit. Net currency selection also detracted, while country positioning was positive and partially offset some of the losses. Stock selection in Japan and Spain, as well as overweight exposure to the UK markets, bolstered relative performance. While the relative performance of the Portfolio was unaffected by leverage in the 12-month period, it was boosted by held currency forwards.

International Equity Market Review and Investment Strategy

The rally in global equity markets that started in the latter half of 2010 came to an abrupt end in May 2011, as mounting global economic woes accelerated investor de-risking. Financial markets were mired in a severe correction mode for much of the second half of the year, as a huge overhang of debt burdened the U.S. and Europe, and growth in emerging markets slowed. Consequently, investor confidence eroded and the markets fluctuated wildly on rising volatility. A rescue plan for the euro-area put forth in October

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 5 |

by European leaders offered a brief respite from the market’s slump. The market upturn proved to be short-lived, however, as investors deemed the grand plan to be insufficient to arrest debt pressure and moreover, feared that the situation was escalating to dangerous new levels amid signs that the contagion was spreading from the region’s peripheral economies to its core ones. Encouraging U.S. economic data suggesting that the world’s largest economy may be gaining momentum, coupled with the preemptive, coordinated actions of the world’s leading central banks, including the U.S. Federal Reserve and the European Central Bank (“ECB”), to avert both a liquidity shortage in the global financial system and the undercapitalized European banking system eased investor concerns. The calm in the global macroeconomic climate, fortified by the approval by European leaders of a bailout plan for debt-laden Greece and a second massive injection of liquidity by the ECB, ignited a market rally during the first two months of 2012.

In managing the International Value Portfolio, the International Value Senior Investment Management Team (the “Team”) has navigated current market conditions by investing opportunistically across a wide range of countries and sectors with an eye toward risk control in light of the recent volatility. The Team has positioned the Portfolio to capture the potential it sees in undervalued companies recovering from the recent market downturn that exhibit strong free cash flows and solid balance sheets.

In managing the International Growth Portfolio, the International Growth Team (the “Team”) has navigated through the current market fluctuations by focusing on companies with solid, durable growth, sustainable competitive advantages and high return on invested capital. In developed markets, the Team has sidestepped European sovereign debt risk by avoiding the mature, overleveraged European financial institutions and investing instead in banks where market penetration and leverage are low. The Team has also continued to underweight the Japanese market due to the lack of high-return growth companies. As the greater part of world growth is coming from emerging markets, the Team has found opportunities both in companies domiciled in rapidly expanding regions of the developing world, as well as in advanced-market companies with high or increasing exposure to emerging markets. The longer-term growth of these holdings is bolstered by exposure to powerful long-term secular trends, such as the rising affluence and elevated spending habits of the middle-class consumer in developing countries.

Short Duration Bond Portfolio

Investment Objective and Policies

The Portfolio seeks a moderate rate of income that is subject to taxes. The Portfolio may invest in many types of fixed income securities, including corporate bonds, notes, U.S. government and agency securities, asset-backed securities, mortgage-related securities, and inflation-protected securities, as well as other securities of

| 6 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

U.S. and non-U.S. issuers. Under normal circumstances, the Portfolio invests at least 80% of its net assets in fixed income securities. The Portfolio may invest up to 20% of its total assets in debt securities denominated in currencies other than the U.S. dollar. The Portfolio may also invest up to 20% of its assets in hybrid instruments, which have characteristics of futures, options, currencies and securities. The Portfolio seeks to maintain a relatively short duration of one to three years under normal market conditions. The Portfolio may invest in variable, floating, and inverse floating rate investments. The Portfolio may also invest in zero-coupon and interest-only or principal-only securities.

Investment Results

The Portfolio outperformed its benchmark, the BofA ML 1-3 Year Treasury Index, for both the six- and 12-month periods ended February 29, 2012. For the six-month period, both yield curve positioning and sector allocation contributed positively. Exposure to spread product—specifically agency mortgage pass-throughs and investment-grade corporates, as well as inflation-protected securities—all contributed positively. A small position in New Zealand government bonds was also positive. Non-agency mortgage obligations and commercial mortgage-backed securities (“CMBS”) holdings were modest detractors.

For the 12-month period, yield curve positioning was the primary positive contributor—followed by non-U.S. government exposure to both Canada and New Zealand. Overall sector

allocation detracted from relative performance, as investors were more risk-averse earlier in the period. Exposure to both asset-backed securities and non-agency mortgage obligations detracted, while most other sector allocation impacts were close to flat.

During both periods, the Portfolio utilized derivative instruments, including Treasury futures in order to manage duration and yield curve positioning. The Portfolio also utilized currency forwards for hedging purposes, which had an immaterial impact to performance.

Global Core Bond Portfolio (formerly Intermediate Duration Bond Portfolio)

Investment Objective and Policies

Effective December 31, 2011, the Portfolio changed its name from AllianceBernstein Intermediate Duration Bond Portfolio to AllianceBernstein Global Core Bond Portfolio, eliminated its policy of limiting its investments in debt securities denominated in currencies other than the U.S. dollar to 20% of its total assets, and adopted non-fundamental policies to invest at least 40% of its assets in securities of non-U.S. issuers. The performance information shown includes periods prior to implementation of these changes and may not be representative of performance the Portfolio will achieve under its new policies.

The Portfolio seeks a moderate to high rate of income that is subject to taxes. The Portfolio invests, under normal circumstances, at least 80% of its net assets in fixed-income securities.

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 7 |

Fixed income securities include, among other things, bonds. Under normal market conditions, the Portfolio invests at least 40% of its assets in fixed income securities of non-U.S. issuers. In addition, the Portfolio invests, under normal circumstances, in the fixed income securities of issuers located in at least three countries.

The Portfolio may invest in fixed-income securities with any maturity or duration. The Portfolio may invest in mortgage-related and other asset-backed securities, loan participations, inflation-protected securities, structured securities, variable, floating, and inverse floating rate instruments and preferred stock, and may use other investment techniques. The Portfolio may hedge a significant portion of its currency exposure. The Portfolio may also invest in other derivatives, including, without limitation, forward futures, credit default swaps and interest rate swaps. The Portfolio may, among other things, enter into transactions such as reverse repurchase agreements and dollar rolls.

Investment Results

Effective January 1, 2012, the Portfolio’s benchmark was changed from the BC U.S. Aggregate Bond Index to the BC Global Aggregate Bond Index (U.S. dollar hedged), because the new index more closely resembles its investments.

For the six-month period ended February 29, 2012, the Portfolio underperformed its current benchmark and outperformed its prior benchmark. Sector allocation was positive for the

period, as non-government sectors outperformed. An underweight position in governments and overweight allocations to CMBS and U.S. investment-grade corporates contributed positively against both benchmarks. Security selection in corporate holdings—specifically in financials—detracted against both benchmarks. An underweight to peripheral Europe detracted against the new benchmark as those countries rallied at the beginning of 2012.

During the 12-month period ended February 29, 2012, the Portfolio outperformed its current benchmark, due to its overweight in the U.S., which outperformed within the global capital markets. The Portfolio underperformed against the prior benchmark, due to both negative security selection and sector allocation. Security selection in the Portfolio’s corporate, agency mortgage and CMBS holdings detracted for the period. An underweight to governments and overweights to corporates and CMBS detracted, as investors were more risk-averse earlier in the period. Yield curve positioning—specifically an overweight in intermediate maturities—contributed positively for the 12-month period.

During both periods, the Portfolio utilized derivative instruments, including interest rate swaps and Treasury futures in order to manage duration and yield curve positioning. The Portfolio also utilized currency forwards for hedging purposes, which had an immaterial impact to performance.

| 8 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

Bond Inflation Protection Portfolio

Investment Objective and Policies

The Portfolio’s investment objective is to maximize real return without assuming what the Adviser considers to be undue risk. The Portfolio pursues its objective by investing principally in TIPS directly or by gaining indirect exposure to TIPS through derivatives transactions such as total return swaps linked to TIPS. The Portfolio may invest in other fixed income investments such as U.S. and non-U.S. government securities, corporate fixed income securities and mortgage-related securities, as well as derivatives linked to such securities.

Under normal circumstances, the Portfolio invests at least of 80% of its net assets in fixed income securities. While the Portfolio invests principally in investment-grade securities, it may invest up to 15% of its total assets in fixed income securities rated BB or B, or the equivalent by at least one national ratings agency (or deemed by the Adviser to be of comparable credit quality) which are not investment-grade (“junk bonds”). The Portfolio may also invest in other inflation-indexed securities, issued by both U.S. and non-U.S. issuers, and in derivative instruments linked to these securities, such as options, futures, forwards, or swap agreements. The Portfolio may also invest in loan participations, structured securities, asset-backed securities, variable, floating, and inverse floating rate instruments, and preferred stock, and may use other investment techniques. The Portfolio may invest in fixed income securities of any maturity and duration.

Investment Results

The Portfolio outperformed its benchmark, the BC 1-10 Year TIPS Index, for both the six- and 12-month periods ended February 29, 2012. For the six-month period, exposure to corporates, asset-backed securities, CMBS and agency mortgages contributed positively. Credit default swap positions contributed positively. For the 12-month period, exposure to corporates and agency mortgages detracted while CMBS contributed positively. As part of the Portfolio’s credit position, credit default swaps were utilized early in the 12-month period to add risk. As market volatility increased during the year, credit default swaps were utilized as a hedge against credit risk, resulting in an immaterial impact on performance.

Overall currency positioning contributed positively for both periods, helped by long positions in the Australian dollar and Mexican peso. The Portfolio’s short position in the euro offset some of those gains. Currency forwards were utilized during both periods for hedging and non-hedging purposes.

The Portfolio’s longer-duration positioning contributed positively for the 12-month period, as interest rates significantly declined. Additionally, an overweight in the intermediate part of the curve where yields fell most also helped for the period. For the six-month period, yield curve positioning was only slightly positive. During both periods, Treasury futures and interest rate swaps were utilized, in order to manage duration and yield curve positioning.

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 9 |

High-Yield Portfolio

Investment Objective and Policies

The Portfolio seeks a high total return by maximizing current income and, to the extent consistent with that objective, capital appreciation. Under normal circumstances, the Portfolio invests at least 80% of its net assets in high-yield debt securities. The Portfolio invests in a diversified mix of high yield, below-investment grade debt securities, known as “junk bonds”. The Portfolio seeks to maximize current income by taking advantage of market developments, yield disparities and variations in the creditworthiness of issuers. The Portfolio may invest in debt securities with a range of maturities from short- to long-term. The Portfolio may also invest in U.S. and non-U.S. dollar-denominated foreign fixed income securities, as well as mortgage-related and other asset-backed securities, loan participations, inflation-protected securities, structured securities and preferred stocks. The Portfolio may use leverage for investment purposes by entering into transactions such as repurchase agreements and dollar rolls. The Portfolio may invest in variable, floating and inverse floating rate investments. The Portfolio may also invest in zero-coupon and interest-only or principal-only securities.

Investment Results

The Portfolio posted positive absolute returns for the six- and 12-month periods ended February 29, 2012, as the high yield market rallied after several bouts of risk aversion caused by global events, especially the European sovereign debt crisis. The Portfolio

underperformed its benchmark, the BC U.S. High Yield 2% Issuer Cap Index, for both periods. The Portfolio’s overweight to subordinated financials within the capital structure detracted from relative performance for both periods, while a small allocation to Treasuries and cash also detracted. For the six-month period, security selection within the Portfolio’s capital goods, consumer non-cyclical and energy holdings contributed positively. For the 12-month period, security selection within energy and services was positive, while consumer non-cyclicals detracted. An allocation to foreign sovereigns and Build America bonds contributed positively. An allocation to CMBS contributed positively. Security selection within the Portfolio’s airlines holdings detracted for both periods.

Within the Portfolio’s derivative positions, high yield credit default swap exposure contributed positively for both periods, while interest rate swaps did not have a meaningful impact. The Portfolio also utilized currency forwards for hedging purposes, which had an immaterial impact on performance.

Fixed Income Market Review and Investment Strategy

Volatility continued during the six-month period ended February 29, 2012, as global markets remained highly correlated with ongoing European debt sentiment and perceptions of the overall health of the economy. Globally, central banks continued to ease monetary policy or indicate that rates would remain low. In the U.S., the Federal Reserve announced that

| 10 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

rates would be kept on hold until 2014.

After early bouts of investor risk aversion which drove Treasury yields lower, market sentiment improved in the first two months of 2012. Global economic data turned more positive, and worries over the European sovereign debt crisis abated with positive policy intervention. In the U.S., labor and manufacturing data showed improvement, resulting in more solid consumer confidence numbers. In the euro area, finance ministers agreed to grant Greece a second bailout package and the ECB’s second long-term refinancing operation further increased liquidity in the euro area banking system—reducing investor concerns across the globe, at least in the near term.

Fixed income markets benefited from low interest rates and global volatility with all high-grade sectors in positive territory. Global governments posted positive returns, with European governments—particularly peripheral countries—outperforming after a rebound. With the U.S. Federal Reserve indicating that it will keep rates near zero until late 2014, the U.S. yield curve flattened during the period, with short-term rates rising modestly and longer-term rates declining.

Non-government sectors, particularly CMBS and corporates (both investment-grade and high yield), outperformed. CMBS benefited from a stabilization of property fundamentals and investor appetite for yield, while corporate securities were helped

overall by strong revenue and earnings growth. With both fundamental and quantitative signals indicating a more positive environment, risk has been added to multi-sector portfolios across sectors with a focus on maintaining liquidity.

Small-Mid Cap Value Portfolio

Investment Objective and Policies

The Portfolio seeks long-term growth of capital. The Portfolio invests primarily in a diversified portfolio of equity securities of small- to mid-capitalization U.S. companies, generally representing 60-125 companies. Under normal circumstances, the Portfolio invests at least 80% of its net assets in small- to mid-capitalization companies. The Portfolio may invest in securities issued by non-U.S. companies and enter into forward commitments. The Portfolio may enter into derivatives transactions, such as options, futures, forwards and swap agreements.

Investment Results

During the six-month period ended February 29, 2012, the Portfolio outperformed its benchmark, the Russell 2500 Value Index. Stock selection in capital equipment, energy and technology were the main drivers of the gain; overweights in consumer cyclicals and technology, as well as an underweight in utilities, also contributed to positive performance. An underweight and adverse stock selection in housing-related companies was a detractor, as was stock selection in consumer cyclicals.

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 11 |

For the 12-month period ended February 29, 2012, the Portfolio declined and underperformed its benchmark. Stock selection in financials, consumer cyclicals, and consumer staples detracted, but was partially offset by positive sector selection in consumer cyclicals, consumer growth and consumer staples, as well as positive stock selection in capital equipment.

The Portfolio did not utilize derivatives during the six- and 12-month periods.

Market Review and Investment Strategy

U.S. equity markets began 2011 amid strong corporate earnings, encouraging economic data and an uptick in mergers. By midyear, investor anxiety started to build on concerns of the European sovereign debt crisis and nervousness about the end of the Federal Reserve’s asset-purchasing program, Quantitative Easing 2. The third quarter was plagued by a series of unfavorable events: Standard & Poor’s lowered its credit rating on U.S. government debt, slowing global growth, and continued fears of a European financial meltdown. Investor confidence has improved, more recently driven by resilient U.S. data (particularly stronger-than-expected construction spending, automotive sales, and a reduced unemployment rate) and the potential for a resolution to the European sovereign debt crisis.

The current economic climate has allowed the Small-Mid Cap Value Senior Investment Management Team

to invest opportunistically in quality companies without sacrificing the Portfolio’s deep-value discipline. As the economy remains unsettled, the Portfolio’s emphasis continues to be at the stock-specific level, where the trend is focused on attractively valued companies with solid balance sheets and strong free cash flow.

Small-Mid Cap Growth Portfolio

Investment Objective and Policies

The Portfolio seeks long-term growth of capital. The Portfolio invests primarily in a diversified portfolio of equity securities with relatively smaller capitalizations as compared to the overall market. Under normal circumstances, the Portfolio invests at least 80% of its net assets in the equity securities of small- and mid-capitalization U.S. companies. For these purposes, “small- and mid-capitalization companies” are generally those companies that, at the time of investment, fall within the lowest 25% of the total U.S. equity market capitalization (excluding, for purposes of this calculation, companies with market capitalizations of less than $10 million). As of October 31, 2011, there were approximately 4,400 companies within the lowest 25% of the total U.S. equity market capitalization (excluding companies with market capitalizations of less than $10 million) with market capitalizations ranging from $10 million to $12.5 billion. In the future, the Portfolio may define small- and mid-capitalization companies using a different classification system.

The Portfolio may invest in any company and industry and in any type of

| 12 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

equity security with potential for capital appreciation. It invests in well-known and established companies and in new and less-seasoned companies. The Portfolio’s investment policies emphasize investments in companies that are demonstrating improving financial results and a favorable earnings outlook. The Portfolio may invest in foreign securities.

The Portfolio invests principally in equity securities but may also invest in other types of securities, such as preferred stocks. The Portfolio may also invest in exchange-traded funds (“ETFs”), reverse repurchase agreements and up to 20% of its total assets in rights and warrants.

Investment Results

The Portfolio outperformed its benchmark, the Russell 2500 Growth Index, for both the six- and 12-month periods ended February 29, 2012. The outperformance was driven by the Small/Mid Cap Growth Team’s (the “Team’s”) preference for companies with superior earnings growth, favorable earnings revisions and positive earnings surprise that were rewarded during both periods. For the six-month period, outperformance was driven by strong stock selection in the technology, industrials, financial and energy sectors, which offset stock selection in the consumer/commercial services and healthcare sectors, which modestly detracted from relative returns.

For the 12-month period, stock selection in the technology, industrials, energy and consumer/

commercial services sectors contributed positively to relative performance, while stock selection in the financials and healthcare sectors detracted.

The Portfolio did not utilize leverage or derivatives during the six- and 12-month periods.

Market Review and Investment Strategy

Global macroeconomic volatility drove equity returns during both the six- and 12-months periods. Equity market gains early in 2011 were followed by a plunge in equity prices from May through September 2011, as the U.S. budget ceiling debate loomed large, and fears grew that the worsening European sovereign debt crisis would spread beyond the euro region. Buoyed by better-than-expected U.S. economic data and tentative hopes that the euro-area crisis could be contained, small- and mid-cap growth stocks rebounded strongly in the last several months of the 12-month period.

The Team continues to build the Portfolio from the bottom `up with company-focused fundamental research. As such, sector allocations which result from stock selection decisions remain muted when compared to the benchmark. As of February 29, 2012, the largest overweight was in the technology sector; the largest underweight was in the financial sector. Consistent with the Team’s disciplined investment approach, the Portfolio continues to emphasize the growth attributes the Team seeks to deliver strong returns. The Portfolio offers more prospective superior earnings

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 13 |

revisions and positive earnings surprise compared to its benchmark. Importantly, given the market backdrop of the past several years—one defined by high stock return correlations and limited fundamental differentiation—these growth attributes continue to trade at historically attractive relative valuations.

Multi-Asset Real Return

Investment Objective and Policies

The Portfolio seeks to maximize real return over inflation. The Portfolio pursues an aggressive investment strategy involving a variety of asset classes. The Portfolio invests primarily in instruments that the Adviser expects to outperform broad equity indices during periods of rising inflation. Under normal circumstances, the Portfolio invests its assets principally in the following instruments that, in the judgment of the Adviser, are affected directly or indirectly by the level and change in rate of inflation: inflation-protected fixed income securities, such as TIPS, and similar bonds issued by governments outside of the U.S., commodities, equity securities such as commodity-related stocks, real estate securities, utility securities, infrastructure related securities, securities and derivatives linked to the price of other assets (such as commodities, stock indices and real estate) and currencies. The Portfolio seeks inflation protection from global investments, both in developed and emerging market countries.

The Portfolio invests in both U.S. and non-U.S. dollar-denominated equity or fixed income securities. The Portfolio may invest in currencies for

hedging or investment purposes, both in the spot market and through long- or short positions in currency-related derivatives. The Portfolio may invest in derivatives such as options, futures, forwards, swap agreements or structured notes. The Portfolio may seek to gain exposure to physical commodities traded in the commodities markets through investments in a variety of derivative instruments, including commodity index-linked notes.

Investment Results

For the six-month period ended February 29, 2012, the Portfolio posted a positive absolute return but underperformed its benchmark, the MSCI AC Commodity Producers Index. Underperformance was driven primarily by the Portfolio’s strategic exposure to the commodity futures asset class (exposure to commodity futures was obtained via commodity index swaps, commodity futures, and options on commodity futures). The Portfolio’s strategic exposure to real estate also detracted from performance. Within the Portfolio’s commodity-related equities allocation, security and sector selection contributed to performance. Within the commodity futures allocation, value was added by the Portfolio’s curve positioning and security selection. Positive contributions from top-down asset allocation, risk management and collateral management decisions were partially offset by active management within the real estate allocation. For the six-month period, the Portfolio’s currency management strategies, including forwards, contributed positively to total return. Total return swaps and purchased options were used for hedging and investment purposes,

| 14 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

which detracted from performance. Written options were used for hedging and investment purposes which added to performance.

For the 12-month period ended February 29, 2012, the Portfolio registered a negative absolute return but outperformed its benchmark. Relative performance was driven primarily by the Portfolio’s strategic allocation to real estate equities, partially offset by the strategy’s strategic allocation to commodity futures. Active management within the commodity-related equities allocation contributed positively to performance. Within the commodity futures allocation, value added by the Portfolio’s curve positioning was modestly offset by security selection. Positive contributions from top-down asset allocation, risk management and collateral management decisions were partially offset by active management within the real estate allocation. Currency management strategies, including forwards, detracted from total return over the 12-month period. Total return swaps and purchased options were used for hedging and investment purposes, which detracted from performance. Written options were used for hedging and investment purposes which added to performance.

Market Review and Investment Strategy

Global equity markets fell in March 2011 as oil prices rose and the natural disaster in Japan triggered a sharp drop in the region’s equities. Broad market performance deteriorated further in the second quarter—driving risks higher—

on the European sovereign debt crisis, supply chain disruption concerns following the disasters in Japan and the U.S. deficit. By May 2011, as volatility began to accelerate in the commodity markets, Portfolio exposures were significantly reallocated away from commodity futures and toward cash and short-term inflation-linked bonds. Risk markets generally plunged further in the third quarter as investors were unnerved by further deteriorating macroeconomic conditions and the inability of policymakers to find credible solutions to deal with them. During this time, the Real Asset Strategy Team (the “Team”) modestly scaled back exposure to global real estate equities, thereby adding additional capital to defensive cash and bond positions. By the end of the third-quarter, however, attractive valuations and highly-depressed sentiment suggested, in the Team’s view, that the broad risk market selloff was potentially overdone. In response, the Team increased risk exposures over the course of the fourth quarter, first in commodity futures, then in commodity-related equities, and finally within the real estate allocation.

Global equities rose sharply in the fourth quarter as the rescue plan put forth by European leaders in October—subsequently deemed to be insufficient to resolve the two-year old crisis—sparked a large recovery; in the final weeks of December the ECB injected significant amounts of liquidity into the undercapitalized European banking system bringing about a late-year rally. By year-end 2011, the Team was targeting a small overweight in

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 15 |

commodity-related equities and modest underweights in both real estate and commodity futures. Global equities rose strongly in the first two months of 2012, as 2011’s year-end rally continued into the new year. The period saw stronger-than-expected global macroeconomic data points and increased investor risk appetite due to encouraging developments surrounding the European sovereign debt crisis and a second Greek bailout. The Team continued to target a roughly neutral risk profile through the end of the period, though with a bias toward the purchase of modest downside put option protection in the event market-implied volatilities continue to decline (thus, in the Team’s view, making the purchase of such protection more attractive).

Volatility Management Portfolio

Investment Objective and Policies

The Portfolio’s investment objective is long-term growth of capital and income. The Portfolio is designed to reduce the overall portfolio volatility and the effects of adverse equity market conditions for a blended style investor (an “Investing Fund”). The Portfolio will not pursue its investment objective of long-term growth of capital and income in isolation, but always with the goal of reducing an Investing Fund’s overall equity exposure when appropriate to mitigate equity risk. In other words, in making investment decisions for the Portfolio, the Adviser will consider the blended investing style of the Investing Fund and not necessarily the goal of achieving the Portfolio’s investment objective. The Portfolio will have the ability to invest in a wide array of asset

classes, including U.S., non-U.S. and emerging market equity and fixed income securities, commodities, Real Estate Investment Trusts (“REITs”) and other real estate-related securities, currencies, and inflation-protected securities. The Portfolio will invest directly in equity securities, but it will also be able to invest without limit in derivative instruments, including futures, forwards, options, swaps and other financially-linked investments.

To effectuate the Portfolio’s dynamic, opportunistic asset allocation approach, the Adviser may invest in derivatives rather than investing directly in equity securities. The Portfolio may use index futures, for example, to gain broad exposure to a particular segment of the market, while buying representative equity securities to achieve exposure to another. The Adviser will choose in each case based on concerns of cost and efficiency of access. The Portfolio’s holdings may be frequently adjusted to reflect the Adviser’s assessment of changing risks. The Adviser believes that these adjustments can also frequently be made efficiently and economically through the use of derivatives strategies. Similarly, when the Adviser decides to reduce (or eliminate) the Portfolio’s exposure to the equity markets, the Adviser may choose to gain this alternative exposure directly through securities purchases or indirectly through derivatives transactions. The asset classes selected may or may not be represented by the holdings of other of the Pooling Portfolios, because investment decisions for the Portfolio will be driven by risk mitigation concerns that may be best facilitated through exposure to asset

| 16 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

classes not represented elsewhere in the Portfolio’s overall exposure. The Portfolio has the risk that it may not accomplish its purpose if the Adviser does not correctly assess the risk in equity markets and, consequently, its performance could be affected adversely.

Investment Results

Effective January 1, 2012, the Portfolio’s benchmark was changed from the S&P 500 Index to the MSCI ACWI, because the new index more closely resembles its investments.

The Portfolio underperformed both its current and prior benchmarks for the six- and 12-month periods ended February 29, 2012. The Portfolio seeks to moderate risk during periods of high market volatility. To meet that objective, the Dynamic Asset Allocation Team (the “Team”) began to reduce the exposure to equities in mid-June 2011, as the Team became concerned about risks emanating from Europe as the sovereign debt crisis spread to Italy and Spain. The Team continued to reduce the Portfolio’s exposure to equities through September, as market volatility rose and equities declined sharply. The Portfolio’s underweight to equities reduced the impact of the fall in equity prices and high market volatility during the third quarter.

However, in October equities rallied sharply, posting gains over 10%, causing the bulk of the Portfolio’s underperformance for both the six- and 12- month periods. While the Team added equity exposure as volatility declined and fundamental conditions improved,

the Portfolio underperformed equities when the rally resumed in January and February. In addition, the Portfolio is more diversified than the S&P 500 Index, with holdings in international equities and global REITs in addition to U.S. equities. International equities and global REITs underperformed U.S. equities over both periods.

Total return swaps were used for investment purposes which added to performance for the six- and 12-month periods. Futures were used for hedging and investment purposes which added to performance for both periods. Currency forwards were used for hedging purposes which detracted from performance. Purchased options were used for hedging and investment purposes and detracted from performance.

Market Review and Investment Strategy

The 12-month period under review can be divided into two sharply distinct sub-periods. From March through September 2011 the S&P 500 declined nearly 14%, while overseas markets performed even worse, with the MSCI ACWI down over 17%. The decline can be traced to concerns that the European sovereign debt crisis could trigger a global financial meltdown similar to that seen in 2008 following the bankruptcy of Lehman Brothers. The magnitude of the crisis grew considerably as concerns about the solvency of Greece, Portugal and Ireland spread to much larger Spain and Italy. As the Team saw yields on Spanish and Italian debt widen in June, it decided to reduce the Portfolio’s exposure to equities as

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 17 |

a safeguard against market volatility and declines. This strategy proved favorable during July through September, as equity markets fell sharply and volatility soared to its highest levels since 2008. The Team continued to reduce equity risk during this period, as concerns about Europe were compounded by fears of a global economic slowdown, political gridlock in the U.S. over the federal debt ceiling, and the S&P downgrade of the U.S. credit rating.

From October through February, however, the S&P 500 rallied nearly 22% and the MSCI ACWI was up over 19%, with both markets gaining more than 10% in October. In retrospect, in the Team’s view, it is difficult to

pinpoint a cause for the sharp reversal in October, as both fundamental and market risks remained high. In accordance with the Portfolio’s objective, the Team maintained an underweight position in equities at the time. The Team began adding equity exposure in December on evidence that economic growth outside of Europe was weathering the storm better than expected and the ECB’s longer term refinancing operations offered support for the European banking system, reducing the likelihood of a Lehman-like crisis. The Team continued to add equities as market volatility declined and fundamental conditions improved. As of the end of February 2012 the Portfolio has a normal allocation to equities.

| 18 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

HISTORICAL PERFORMANCE

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown on the following pages represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

Please note: Shares of the Portfolios are offered exclusively to mutual funds advised by, and certain institutional clients of, AllianceBernstein that seek a blend of asset classes for investment. These share classes are not currently offered for direct investment from the general public. The AllianceBernstein Pooling Portfolios can be purchased at the relevant net asset value (“NAV”) without a sales charge or other fee. However, there are sales charges in connection to purchases of other AllianceBernstein share classes invested in these Pooling Portfolios. For additional information regarding other retail share classes and their sales charges and fees, please visit www.alliancebernstein.com. All fees and expenses related to the operation of the Portfolios have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

Benchmark Disclosures

None of the indices listed below reflect fees and expenses associated with the active management of a mutual fund portfolio.

The unmanaged Russell 1000® Value Index represents the performance of 1,000 large-cap value companies within the U.S.

The unmanaged Russell 1000® Growth Index represents the performance of 1,000 large-cap growth companies within the U.S.

The unmanaged MSCI ACWI ex U.S. (free float-adjusted, market capitalization weighted) represents the equity market performance of developed and emerging markets, excluding the United States.

The unmanaged MSCI EAFE Index (net; free float-adjusted, market capitalization weighted) represents the equity market performance of developed markets, excluding the U.S. and Canada. Net returns include the reinvestment of dividends after deduction of non-U.S. withholding tax; gross returns include reinvestment of dividends prior to such deduction.

The unmanaged BofA ML® 1-3 Year U.S. Treasury Index represents the performance of U.S. dollar-denominated sovereign debt publicly issued by the U.S. government in its domestic market with a remaining term to final maturity of 1-3 years.

The unmanaged BC Global Aggregate Bond Index (U.S. dollar hedged) represents the performance of the global investment-grade developed fixed income markets.

The unmanaged BC U.S. Aggregate Bond Index represents the performance of securities within the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities, and commercial mortgage-backed securities.

The unmanaged BC 1-10 Year TIPS Index represents the performance of inflation-protected securities issued by the U.S. Treasury.

The unmanaged BC U.S. High Yield 2% Issuer Cap Index is the 2% issuer cap component of the U.S. Corporate High Yield Index, which represents the performance of fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity.

(Historical Performance continued on next page)

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 19 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

The unmanaged Russell 2500™ Value Index represents the performance of 2,500 small- to mid-cap value companies within the U.S.

The unmanaged Russell 2500™ Growth Index represents the performance of 2,500 small- to mid-cap growth companies within the U.S.

The unmanaged MSCI AC World Commodity Producers Index is an equity-based index designed to reflect the performance related to commodity producers stocks. The index is free- float-adjusted, market capitalization-weighted and comprised of commodity producer companies based on the Global Industry Classification Standard (“GICS”).

The unmanaged S&P 500® Index includes 500 U.S. stocks and is a common representation of the performance of the overall U.S. stock market.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI.

An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Portfolios.

A Word About Risk

All Portfolios

Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

Derivatives Risk: Investing in derivative instruments such as options, futures, forwards or swaps can be riskier than traditional investments, and may be more volatile, especially in a down market.

Foreign (Non-U.S.) Risk: Non-U.S. securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets.

Management Risk: The portfolio is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

U.S. Value Portfolio

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the portfolio’s investments or reduce its returns.

U.S. Large Cap Growth Portfolio

Focused Portfolio Risk: Investments in a limited number of companies may have more risk because changes in the value of a single security may have a more significant effect, either negative or positive, on the portfolio’s NAV.

International Value Portfolio, International Growth Portfolio

Emerging Market Risk: Investments in emerging market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory or other uncertainties.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the portfolio’s investments or reduce its returns.

(Historical Performance continued on next page)

| 20 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

Short Duration Bond Portfolio, Global Core Bond Portfolio, Bond Inflation Protection Portfolio, High Yield Portfolio

Interest Rate Risk: As interest rates rise, bond prices fall and vice versa—long-term securities tend to rise and fall more than short-term securities.

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline.

Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the portfolio’s investments or reduce its returns.

Global Core Bond Portfolio, Bond Inflation Protection Portfolio, High-Yield Portfolio

Leverage Risk: When the portfolio borrows money or otherwise leverages its portfolio, the value of an investment in the portfolio will be more volatile because leverage tends to exaggerate the effect of any increase or decrease in the value of the portfolio’s investments. The portfolio may create leverage through the use of reverse repurchase agreements, forward contracts or dollar rolls, or by borrowing money.

Global Core Bond Portfolio

Emerging Market Risk: Investments in emerging market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory or other uncertainties.

Bond Inflation Protection Portfolio

Liquidity Risk: Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the portfolio from selling out of these illiquid securities at an advantageous price. The portfolio invests in derivatives and securities involving substantial market and credit risk, which tend to involve greater liquidity risk.

High-Yield Portfolio

Below Investment-Grade Securities Risk: Investments in fixed income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Small-Mid Cap Value Portfolio, Small Mid-Cap Growth Portfolio

Capitalization Risk: Small- and mid-cap stocks are often more volatile than large-cap stocks—smaller companies generally face higher risks due to their limited product lines, markets and financial resources.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the portfolio’s investments or reduce its returns.

Multi-Asset Real Return Portfolio, Volatility Management Portfolio

Interest Rate Risk: As interest rates rise, bond prices fall and vice versa—long-term securities tend to rise and fall more than short-term securities.

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline.

(Historical Performance continued on next page)

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 21 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

Commodity Risk: Commodity-linked investments may experience greater volatility than investments in traditional securities. The value of commodity-linked investments may be affected by financial factors, political developments and natural disasters.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the portfolio’s investments or reduce its returns.

Multi-Asset Real Return Portfolio

Leverage Risk: When the portfolio borrows money or otherwise leverages its portfolio, the value of an investment in the portfolio will be more volatile because leverage tends to exaggerate the effect of any increase or decrease in the value of the portfolio’s investments. The portfolio may create leverage through the use of reverse repurchase agreements, forward contracts or dollar rolls, or by borrowing money.

Liquidity Risk: Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the portfolio from selling out of these illiquid securities at an advantageous price. The portfolio invests in derivatives and securities involving substantial market and credit risk, which tend to involve greater liquidity risk.

Subsidiary Risk: Investments in commodities and commodity-linked derivative instruments directly, or in the case of Multi-Asset Real Return Portfolio also through its wholly owned subsidiary (the “Subsidiary”), may subject a portfolio to greater volatility than investments in traditional securities.

Real Estate Risk: Investments in real estate can decline due to a variety of factors affecting the real estate market, such as economic conditions, mortgage rates and availability. REITs may have additional risks due to limited diversification and the impact of tax law changes.

Diversification Risk: The portfolio may have more risk because it is “non-diversified,” meaning that it can invest more of its assets in a smaller number of issuers and that adverse changes in the value of one security could have a more significant effect on the portfolio’s NAV.

All Portfolios

While the equity Portfolios invest principally in common stocks and other equity securities and the fixed income Portfolios invest principally in bonds and fixed income securities, in order to achieve their investment objectives, the Portfolios may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. These risks are fully discussed in the Portfolios’ prospectus.

(Historical Performance continued on next page)

| 22 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

THE PORTFOLIOS VS. THEIR BENCHMARKS

PERIODS ENDED FEBRUARY 29, 2012

| Returns | ||||||||||

| U.S. VALUE PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein U.S. Value Portfolio | 12.42% | -0.70% | ||||||||

| ||||||||||

Russell 1000 Value Index | 12.84% | 2.18% | ||||||||

| ||||||||||

| Returns | ||||||||||

| U.S. LARGE CAP GROWTH PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein U.S. Large Cap Growth Portfolio* | 15.09% | 3.03% | ||||||||

| ||||||||||

Russell 1000 Growth Index | 13.76% | 7.62% | ||||||||

| ||||||||||

* Includes the impact of proceeds received and credited to the Strategy resulting from class action settlements, which enhanced the Strategy’s performance by 0.01% for the 12-month period ended February 29, 2012. | ||||||||||

| Returns | ||||||||||

| INTERNATIONAL VALUE PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein International Value Portfolio | 5.42% | -12.66% | ||||||||

| ||||||||||

Current Benchmark: MSCI AC World Index ex-U.S. | 3.97% | -6.10% | ||||||||

| ||||||||||

Prior Benchmark: MSCI EAFE Index | 4.13% | -7.45% | ||||||||

| ||||||||||

| Returns | ||||||||||

| INTERNATIONAL GROWTH PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein International Growth Portfolio | -1.18% | -8.88% | ||||||||

| ||||||||||

Current Benchmark: MSCI ACWI ex-U.S. | 3.97% | -6.10% | ||||||||

| ||||||||||

Prior Benchmark: MSCI ACWI ex U.S. Growth | 4.13% | -7.45% | ||||||||

| ||||||||||

MSCI EAFE Growth Index | 3.62% | -5.04% | ||||||||

| ||||||||||

See Historical Performance and Benchmark disclosures on pages 19-22.

(Historical Performance continued on next page)

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 23 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

THE PORTFOLIOS VS. THEIR BENCHMARKS

PERIODS ENDED FEBRUARY 29, 2012

| Returns | ||||||||||

| SHORT DURATION BOND PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Short Duration Bond Portfolio | 0.38% | 1.53% | ||||||||

| ||||||||||

BofA ML 1-3 Year Treasury Index | 0.02% | 1.44% | ||||||||

| ||||||||||

| Returns | ||||||||||

| GLOBAL CORE BOND PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Global Core Bond Portfolio | 2.75% | 7.90% | ||||||||

| ||||||||||

Current Benchmark: BC Global Aggregate Bond Index (U.S. dollar hedged) | 2.85% | 6.96% | ||||||||

| ||||||||||

Prior Benchmark: BC U.S. Aggregate Bond Index | 2.73% | 8.37% | ||||||||

| ||||||||||

| Returns | ||||||||||

| BOND INFLATION PROTECTION PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Bond Inflation Protection Portfolio | 3.36% | 9.48% | ||||||||

| ||||||||||

BC 1-10 Year TIPS Index | 2.84% | 9.30% | ||||||||

| ||||||||||

| Returns | ||||||||||

| HIGH-YIELD PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein High-Yield Portfolio | 7.78% | 5.55% | ||||||||

| ||||||||||

BC U.S. High Yield 2% Issuer Cap Index | 8.62% | 6.92% | ||||||||

| ||||||||||

See Historical Performance and Benchmark disclosures on pages 19-22.

(Historical Performance continued on next page)

| 24 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

THE PORTFOLIOS VS. THEIR BENCHMARKS

PERIODS ENDED FEBRUARY 29, 2012

| Returns | ||||||||||

| SMALL-MID CAP VALUE PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Small-Mid Cap Value Portfolio | 13.93% | -2.98% | ||||||||

| ||||||||||

Russell 2500 Value Index | 12.07% | -0.80% | ||||||||

| ||||||||||

| Returns | ||||||||||

| SMALL-MID CAP GROWTH PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Small-Mid Growth Portfolio* | 18.66% | 9.00% | ||||||||

| ||||||||||

Russell 2500 Growth Index | 13.97% | 3.95% | ||||||||

| ||||||||||

* Includes the impact of proceeds received and credited to the Strategy resulting from class action settlements, which enhanced the Strategy’s performance by 0.01% for the 12-month period ended February 29, 2012. | ||||||||||

| Returns | ||||||||||

| MULTI-ASSET REAL RETURN PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Multi Asset Real Return Portfolio | 1.85% | -3.94% | ||||||||

| ||||||||||

MSCI AC World Commodity Producers Index | 4.51% | -8.25% | ||||||||

| ||||||||||

| Returns | ||||||||||

| VOLATILITY MANAGEMENT PORTFOLIO | 6 Months | 12 Months | ||||||||

AllianceBernstein Volatility Management Portfolio | 6.02% | -1.55% | ||||||||

| ||||||||||

Current Benchmark: MSCI ACWI | 7.87% | -1.49% | ||||||||

| ||||||||||

Prior Benchmark: S&P 500 Index | 13.31% | 5.12% | ||||||||

| ||||||||||

See Historical Performance and Benchmark disclosures on pages 19-22.

(Historical Performance continued on next page)

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 25 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| AVERAGE ANNUAL RETURNS AS OF FEBRUARY 29, 2012 | ||||

| NAV/SEC Returns† | ||||

| AllianceBernstein U.S. Value Portfolio | ||||

1 Year | -0.70 | % | ||

5 Years | -3.05 | % | ||

Since Inception* | 1.51 | % | ||

| AllianceBernstein U.S. Large Cap Growth Portfolio | ||||

1 Year | 3.03 | % | ||

5 Years | 2.64 | % | ||

Since Inception* | 4.60 | % | ||

| AllianceBernstein International Value Portfolio | ||||

1 Year | -12.66 | % | ||

5 Years | -6.95 | % | ||

Since Inception* | 2.08 | % | ||

| AllianceBernstein International Growth Portfolio | ||||

1 Year | -8.88 | % | ||

5 Years | -5.29 | % | ||

Since Inception* | 1.01 | % | ||

| AllianceBernstein Short Duration Bond Portfolio | ||||

1 Year | 1.53 | % | ||

5 Years | 2.65 | % | ||

Since Inception* | 3.00 | % | ||

| AllianceBernstein Global Core Bond Portfolio | ||||

1 Year | 7.90 | % | ||

5 Years | 6.97 | % | ||

Since Inception* | 6.28 | % | ||

| AllianceBernstein Bond Inflation Protection Portfolio | ||||

1 Year | 9.48 | % | ||

5 Years | 7.44 | % | ||

Since Inception* | 6.11 | % | ||

| AllianceBernstein High-Yield Portfolio | ||||

1 Year | 5.55 | % | ||

5 Years | 8.72 | % | ||

Since Inception* | 8.88 | % | ||

| AllianceBernstein Small-Mid Cap Value Portfolio | ||||

1 Year | -2.98 | % | ||

5 Years | 3.84 | % | ||

Since Inception* | 6.76 | % | ||

| † | These Portfolios are offered at NAV and their SEC returns and the same as their NAV returns. |

| * | Inception date: 5/20/05. |

See Historical Performance disclosures on pages 19-22.

(Historical Performance continued on next page)

| 26 | • ALLIANCEBERNSTEIN POOLING PORTFOLIOS |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| AVERAGE ANNUAL RETURNS AS OF FEBRUARY 29, 2012 | ||||

| NAV/SEC Returns† | ||||

| AllianceBernstein Small-Mid Cap Growth Portfolio | ||||

1 Year | 9.00 | % | ||

5 Years | 10.12 | % | ||

Since Inception* | 12.23 | % | ||

| AllianceBernstein Multi-Asset Return Portfolio | ||||

1 Year | -3.94 | % | ||

5 Years | -3.63 | % | ||

Since Inception* | 5.20 | % | ||

| AllianceBernstein Volatility Management Portfolio | ||||

1 Year | -1.55 | % | ||

Since Inception** | 7.31 | % | ||

| SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END (MARCH 31, 2012) | ||||

| SEC Returns† | ||||

| AllianceBernstein U.S. Value Portfolio | ||||

1 Year | 2.64 | % | ||

5 Years | -2.69 | % | ||

Since Inception* | 1.99 | % | ||

| AllianceBernstein U.S. Large Cap Growth Portfolio | ||||

1 Year | 7.22 | % | ||

5 Years | 3.11 | % | ||

Since Inception* | 5.13 | % | ||

| AllianceBernstein International Value Portfolio | ||||

1 Year | -10.15 | % | ||

5 Years | -7.65 | % | ||

Since Inception* | 1.76 | % | ||

| AllianceBernstein International Growth Portfolio | ||||

1 Year | -9.49 | % | ||

5 Years | -5.90 | % | ||

Since Inception* | 0.94 | % | ||

| † | These Portfolios are offered at NAV and their SEC returns and the same as their NAV returns. |

| * | Inception date: 5/20/05. |

| ** | Inception date: 4/16/10. |

See Historical Performance disclosures on pages 19-22.

(Historical Performance continued on next page)

| ALLIANCEBERNSTEIN POOLING PORTFOLIOS • | 27 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END (MARCH 31, 2012) | ||||

| SEC Returns† | ||||

| AllianceBernstein Short Duration Bond Portfolio | ||||

1 Year | 1.49 | % | ||

5 Years | 2.57 | % | ||

Since Inception* | 2.96 | % | ||

| AllianceBernstein Global Core Bond Portfolio | ||||

1 Year | 7.50 | % | ||

5 Years | 6.88 | % | ||

Since Inception* | 6.15 | % | ||