| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Gordon M. Shone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-3000 |

| |

| Date of fiscal year end: | February 28 |

| |

| |

| Date of reporting period: | August 31, 2008 |

ITEM 1. REPORT TO SHAREHOLDERS.

John Hancock

Intrinsic Value Fund

Semiannual Report

8.31.08

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

• Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

• Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on March 1, 2008 with the same investment held until August 31, 2008.

| Actual expenses/actual return | | | | | |

|

| Account value | | | | Expenses paid | |

| $1,000.00 | | Ending value | | during period | |

| on 3-1-08 | | on 8-31-08 | | ending 8-31-08 | 1 |

| | | | | | |

| Class A | $ | 948.40 | $ | 6.63 | |

| Class B | $ | 945.00 | $ | 10.05 | |

| Class C | $ | 945.50 | $ | 10.06 | |

| Class I | $ | 950.60 | $ | 4.67 | |

| Class R1 | $ | 947.70 | $ | 7.12 | |

| Class 1 | $ | 950.60 | $ | 4.42 | |

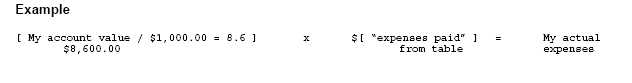

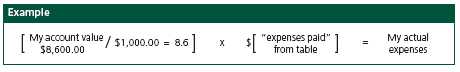

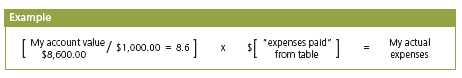

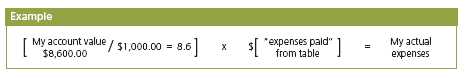

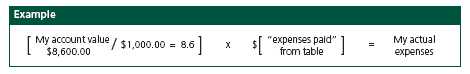

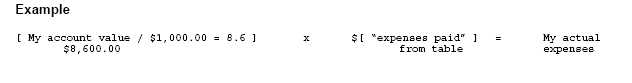

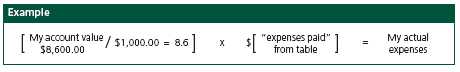

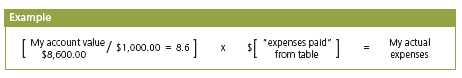

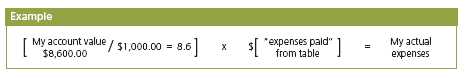

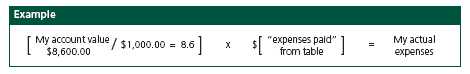

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at August 31, 2008, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on March 1, 2008, with the same investment held until August 31, 2008. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Hypothetical example for comparison purposes | | | | | |

|

| Account value | | | | Expenses paid | |

| $1,000.00 | | Ending value | | during period | |

| on 3-1-08 | | on 8-31-08 | | ending 8-31-08 | 1 |

| | | | | | |

| Class A | $ | 1,018.40 | $ | 6.87 | |

| Class B | $ | 1,014.90 | $ | 10.41 | |

| Class C | $ | 1,014.90 | $ | 10.41 | |

| Class I | $ | 1,020.40 | $ | 4.84 | |

| Class R1 | $ | 1,017.90 | $ | 7.38 | |

| Class 1 | $ | 1,020.70 | $ | 4.58 | |

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund's annualized expense ratio of 1.35%, 2.05%, 2.05%, 0.95%, 1.45% and 0.90% for Class A, Class B, Class C, Class I, Class R1 and Class 1, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year/365 (to reflect the one-half year period).

JOHN HANCOCK FUNDS III

PORTFOLIO OF INVESTMENTS - August 31, 2008 (Unaudited)

(showing percentage of total net assets)

| | | |

| Intrinsic Value Fund | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| |

|

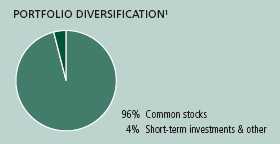

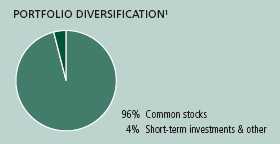

| COMMON STOCKS - 96.81% | | | |

| | | | |

| Aerospace - 1.61% | | | |

| General Dynamics Corp. | 1,700 | $ | 156,910 |

| Northrop Grumman Corp. | 200 | | 13,770 |

| Raytheon Company | 400 | | 23,996 |

| Rockwell Collins, Inc. | 200 | | 10,518 |

| United Technologies Corp. | 1,200 | | 78,708 |

| | |

|

| | | | 283,902 |

| Agriculture - 0.20% | | | |

| Archer-Daniels-Midland Company | 1,400 | | 35,644 |

| | | | |

| Apparel & Textiles - 0.32% | | | |

| Coach, Inc. * | 700 | | 20,293 |

| Jones Apparel Group, Inc. | 100 | | 1,986 |

| Liz Claiborne, Inc. | 500 | | 8,105 |

| Mohawk Industries, Inc. * | 200 | | 13,810 |

| NIKE, Inc., Class B | 200 | | 12,122 |

| | |

|

| | | | 56,316 |

| Auto Parts - 0.39% | | | |

| AutoZone, Inc. * | 180 | | 24,701 |

| BorgWarner, Inc. | 100 | | 4,135 |

| Johnson Controls, Inc. | 700 | | 21,644 |

| O'Reilly Automotive, Inc. * | 400 | | 11,648 |

| TRW Automotive Holdings Corp. * | 400 | | 7,672 |

| | |

|

| | | | 69,800 |

| Auto Services - 0.24% | | | |

| AutoNation, Inc. * | 1,700 | | 19,295 |

| Avis Budget Group, Inc. * | 1,800 | | 13,716 |

| Copart, Inc. * | 200 | | 8,802 |

| | |

|

| | | | 41,813 |

| Automobiles - 0.25% | | | |

| General Motors Corp. (a) | 1,700 | | 17,000 |

| PACCAR, Inc. | 650 | | 27,989 |

| | |

|

| | | | 44,989 |

| Banking - 3.82% | | | |

| Bank of America Corp. | 11,355 | | 353,595 |

| BB&T Corp. | 1,800 | | 54,000 |

| Comerica, Inc. | 800 | | 22,472 |

| Fifth Third Bancorp | 1,200 | | 18,936 |

| First Horizon National Corp. | 800 | | 8,984 |

| Hudson City Bancorp, Inc. | 1,700 | | 31,348 |

| KeyCorp | 400 | | 4,804 |

| Marshall & Ilsley Corp. | 700 | | 10,780 |

| Popular, Inc. (a) | 900 | | 7,335 |

| SunTrust Banks, Inc. | 200 | | 8,378 |

| U.S. Bancorp | 3,000 | | 95,580 |

| UnionBanCal Corp. | 400 | | 29,472 |

| Wachovia Corp. | 1,400 | | 22,246 |

| Zions Bancorp | 300 | | 8,052 |

| | |

|

| | | | 675,982 |

| Biotechnology - 1.21% | | | |

| Amgen, Inc. * | 1,500 | | 94,275 |

| Biogen Idec, Inc. * | 1,300 | | 66,209 |

| Charles River Laboratories International, Inc. * | 200 | | 13,122 |

| Genzyme Corp. * | 300 | | 23,490 |

| | | |

| Intrinsic Value Fund (continued) | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| |

|

| COMMON STOCKS (continued) | | | |

| Biotechnology (continued) | | | |

| Invitrogen Corp. * | 400 | $ | 16,984 |

| | |

|

| | | | 214,080 |

| Broadcasting - 0.07% | | | |

| Discovery Holding Company * | 600 | | 12,138 |

| | | | |

| Building Materials & Construction - 0.12% | | | |

| Lennox International, Inc. | 300 | | 11,100 |

| Masco Corp. | 500 | | 9,530 |

| | |

|

| | | | 20,630 |

| Business Services - 0.54% | | | |

| Affiliated Computer Services, Inc., Class A * | 100 | | 5,324 |

| FactSet Research Systems, Inc. | 200 | | 12,542 |

| Fiserv, Inc. * | 700 | | 36,302 |

| Global Payments, Inc. | 200 | | 9,642 |

| Hewitt Associates, Inc., Class A * | 300 | | 12,063 |

| Manpower, Inc. | 200 | | 9,612 |

| URS Corp. * | 200 | | 9,592 |

| | |

|

| | | | 95,077 |

| Cellular Communications - 0.04% | | | |

| Telephone & Data Systems, Inc. | 200 | | 7,680 |

| | | | |

| Chemicals - 0.31% | | | |

| Air Products & Chemicals, Inc. | 200 | | 18,370 |

| Dow Chemical Company | 300 | | 10,239 |

| FMC Corp. | 200 | | 14,708 |

| Sigma-Aldrich Corp. | 200 | | 11,352 |

| | |

|

| | | | 54,669 |

| Colleges & Universities - 0.08% | | | |

| Career Education Corp. * | 800 | | 15,000 |

| | | | |

| Computers & Business Equipment - 2.79% | | | |

| Cisco Systems, Inc. * | 9,300 | | 223,665 |

| Dell, Inc. * | 2,200 | | 47,806 |

| EMC Corp. * | 800 | | 12,224 |

| Hewlett-Packard Company | 800 | | 37,536 |

| Ingram Micro, Inc., Class A * | 1,000 | | 18,910 |

| International Business Machines Corp. | 600 | | 73,038 |

| Juniper Networks, Inc. * | 600 | | 15,420 |

| Lexmark International, Inc. * | 500 | | 17,985 |

| Tech Data Corp. * | 400 | | 13,656 |

| Western Digital Corp. * | 1,200 | | 32,712 |

| | |

|

| | | | 492,952 |

| Cosmetics & Toiletries - 2.45% | | | |

| Avon Products, Inc. | 300 | | 12,849 |

| Colgate-Palmolive Company | 600 | | 45,618 |

| Estee Lauder Companies, Inc., Class A | 200 | | 9,954 |

| Kimberly-Clark Corp. | 600 | | 37,008 |

| Procter & Gamble Company | 4,700 | | 327,919 |

| | |

|

| | | | 433,348 |

| Crude Petroleum & Natural Gas - 5.08% | | | |

| Apache Corp. | 1,690 | | 193,302 |

| Chesapeake Energy Corp. | 1,100 | | 53,240 |

| Cimarex Energy Company | 300 | | 16,662 |

| Devon Energy Corp. | 1,200 | | 122,460 |

| EOG Resources, Inc. | 500 | | 52,210 |

|

| The accompanying notes are an integral part of the financial statements. |

| 1 |

JOHN HANCOCK FUNDS III

PORTFOLIO OF INVESTMENTS - August 31, 2008 (Unaudited) - continued

(showing percentage of total net assets)

| | | |

| Intrinsic Value Fund (continued) | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| |

|

| |

| COMMON STOCKS (continued) | | | |

| Crude Petroleum & Natural Gas | | | |

| (continued) | | | |

| Forest Oil Corp. * | 200 | $ | 11,384 |

| Hess Corp. | 700 | | 73,297 |

| Newfield Exploration Company * | 200 | | 9,044 |

| Noble Energy, Inc. | 200 | | 14,346 |

| Occidental Petroleum Corp. | 3,500 | | 277,760 |

| Patterson-UTI Energy, Inc. | 900 | | 25,578 |

| Sunoco, Inc. | 400 | | 17,752 |

| Unit Corp. * | 200 | | 13,546 |

| W&T Offshore, Inc. | 200 | | 7,032 |

| Whiting Petroleum Corp. * | 100 | | 9,624 |

| | |

|

| | | | 897,237 |

| Domestic Oil - 0.08% | | | |

| Encore Aquisition Company * | 100 | | 5,156 |

| St. Mary Land & Exploration Company | 200 | | 8,444 |

| | |

|

| | | | 13,600 |

| Drugs & Health Care - 0.37% | | | |

| Wyeth | 1,500 | | 64,920 |

| | | | |

| Educational Services - 0.14% | | | |

| Apollo Group, Inc., Class A * | 100 | | 6,368 |

| ITT Educational Services, Inc. * | 200 | | 17,782 |

| | |

|

| | | | 24,150 |

| Electrical Equipment - 0.05% | | | |

| Emerson Electric Company | 200 | | 9,360 |

| | | | |

| Electrical Utilities - 0.08% | | | |

| FirstEnergy Corp. | 200 | | 14,528 |

| | | | |

| Electronics - 0.35% | | | |

| L-3 Communications Holdings, Inc. | 600 | | 62,364 |

| | | | |

| Financial Services - 3.27% | | | |

| BlackRock, Inc. | 200 | | 43,450 |

| Capital One Financial Corp. | 400 | | 17,656 |

| Citigroup, Inc. | 17,800 | | 338,022 |

| Federal Home Loan Mortgage Corp. | 300 | | 1,353 |

| Federal National Mortgage Association | 4,500 | | 30,780 |

| Goldman Sachs Group, Inc. | 100 | | 16,397 |

| JP Morgan Chase & Company | 300 | | 11,547 |

| Knight Capital Group, Inc. * | 600 | | 10,344 |

| Leucadia National Corp. | 600 | | 27,774 |

| Morgan Stanley | 500 | | 20,415 |

| SLM Corp. * | 500 | | 8,255 |

| State Street Corp. | 100 | | 6,767 |

| Synovus Financial Corp. | 1,100 | | 10,120 |

| T. Rowe Price Group, Inc. | 200 | | 11,872 |

| Washington Mutual, Inc. | 2,700 | | 10,935 |

| Wells Fargo & Company | 400 | | 12,108 |

| | |

|

| | | | 577,795 |

| Food & Beverages - 4.18% | | | |

| Coca-Cola Enterprises, Inc. | 900 | | 15,363 |

| General Mills, Inc. | 400 | | 26,472 |

| Kellogg Company | 200 | | 10,888 |

| Kraft Foods, Inc., Class A | 822 | | 25,901 |

| PepsiAmericas, Inc. | 500 | | 11,715 |

| PepsiCo, Inc. | 3,900 | | 267,072 |

| | | |

| Intrinsic Value Fund (continued) | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| |

|

| |

| COMMON STOCKS (continued) | | | |

| Food & Beverages (continued) | | | |

| The Coca-Cola Company | 6,800 | $ | 354,076 |

| Tyson Foods, Inc., Class A | 800 | | 11,616 |

| William Wrigley, Jr. Company | 200 | | 15,896 |

| | |

|

| | | | 738,999 |

| Gas & Pipeline Utilities - 0.07% | | | |

| Transocean, Inc. * | 100 | | 12,720 |

| | | | |

| Healthcare Products - 5.09% | | | |

| Johnson & Johnson | 8,600 | | 605,698 |

| Medtronic, Inc. | 1,300 | | 70,980 |

| Patterson Companies, Inc. * | 300 | | 9,762 |

| Stryker Corp. | 800 | | 53,752 |

| Zimmer Holdings, Inc. * | 2,200 | | 159,258 |

| | |

|

| | | | 899,450 |

| Healthcare Services - 6.23% | | | |

| Cardinal Health, Inc. | 1,800 | | 98,964 |

| Coventry Health Care, Inc. * | 1,500 | | 52,530 |

| Express Scripts, Inc. * | 800 | | 58,728 |

| Health Net, Inc. * | 400 | | 11,060 |

| Lincare Holdings, Inc. * | 300 | | 9,900 |

| McKesson Corp. | 3,000 | | 173,340 |

| Medco Health Solutions, Inc. * | 500 | | 23,425 |

| Quest Diagnostics, Inc. | 400 | | 21,620 |

| UnitedHealth Group, Inc. | 14,834 | | 451,695 |

| WellPoint, Inc. * | 3,800 | | 200,602 |

| | |

|

| | | | 1,101,864 |

| Holdings Companies/Conglomerates - 1.49% | | | |

| General Electric Company | 9,400 | | 264,140 |

| | | | |

| Homebuilders - 0.45% | | | |

| Centex Corp. | 600 | | 9,732 |

| D.R. Horton, Inc. | 900 | | 11,214 |

| KB Home | 300 | | 6,240 |

| Lennar Corp., Class A | 700 | | 9,205 |

| M.D.C. Holdings, Inc. | 400 | | 16,580 |

| Pulte Homes, Inc. | 800 | | 11,608 |

| Toll Brothers, Inc. * | 600 | | 14,928 |

| | |

|

| | | | 79,507 |

| Hotels & Restaurants - 0.18% | | | |

| McDonald's Corp. | 500 | | 31,025 |

| | | | |

| Household Appliances - 0.07% | | | |

| Black & Decker Corp. | 200 | | 12,650 |

| | | | |

| Household Products - 0.10% | | | |

| Energizer Holdings, Inc. * | 200 | | 16,988 |

| | | | |

| Industrial Machinery - 0.99% | | | |

| AGCO Corp. * | 200 | | 12,326 |

| Deere & Company | 1,400 | | 98,798 |

| Ingersoll-Rand Company, Ltd., Class A | 292 | | 10,784 |

| Kennametal, Inc. | 400 | | 14,092 |

| Parker-Hannifin Corp. | 600 | | 38,442 |

| | |

|

| | | | 174,442 |

| Insurance - 7.61% | | | |

| ACE, Ltd. * | 500 | | 26,305 |

| Aetna, Inc. | 400 | | 17,256 |

|

| The accompanying notes are an integral part of the financial statements. |

| 2 |

JOHN HANCOCK FUNDS III

PORTFOLIO OF INVESTMENTS - August 31, 2008 (Unaudited) - continued

(showing percentage of total net assets)

| | | |

| Intrinsic Value Fund (continued) | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| |

|

| |

| COMMON STOCKS (continued) | | | |

| Insurance (continued) | | | |

| AFLAC, Inc. | 800 | $ | 45,360 |

| Allstate Corp. | 5,300 | | 239,189 |

| American International Group, Inc. | 9,600 | | 206,304 |

| Aon Corp. | 400 | | 18,996 |

| Arch Capital Group, Ltd. * | 200 | | 13,952 |

| Assurant, Inc. | 400 | | 23,372 |

| Axis Capital Holdings, Ltd. | 300 | | 10,029 |

| Chubb Corp. | 2,900 | | 139,229 |

| Everest Re Group, Ltd. | 200 | | 16,426 |

| First American Corp. | 400 | | 10,108 |

| Hartford Financial Services Group, Inc. | 1,100 | | 69,388 |

| HCC Insurance Holdings, Inc. | 400 | | 10,072 |

| MBIA, Inc. (a) | 1,300 | | 21,086 |

| MetLife, Inc. | 400 | | 21,680 |

| MGIC Investment Corp. | 800 | | 6,728 |

| Nationwide Financial Services, Inc., Class A | 400 | | 20,576 |

| Old Republic International Corp. | 1,600 | | 17,488 |

| PartnerRe, Ltd. | 100 | | 6,891 |

| Progressive Corp. | 3,100 | | 57,257 |

| Protective Life Corp. | 400 | | 14,516 |

| SAFECO Corp. | 300 | | 20,280 |

| The Travelers Companies, Inc. | 4,900 | | 216,384 |

| Torchmark Corp. | 500 | | 29,870 |

| Transatlantic Holdings, Inc. | 200 | | 12,020 |

| Unum Group | 600 | | 15,246 |

| W.R. Berkley Corp. | 1,200 | | 28,272 |

| XL Capital, Ltd., Class A | 500 | | 10,050 |

| | | |

| | | | 1,344,330 |

| International Oil - 18.60% | | | |

| Anadarko Petroleum Corp. | 1,300 | | 80,249 |

| Chevron Corp. | 11,400 | | 984,048 |

| ConocoPhillips | 8,500 | | 701,335 |

| Exxon Mobil Corp. | 17,800 | | 1,424,178 |

| Murphy Oil Corp. | 500 | | 39,265 |

| Nabors Industries, Ltd. * | 500 | | 17,800 |

| Noble Corp. | 200 | | 10,058 |

| Weatherford International, Ltd. * | 800 | | 30,864 |

| | |

| | | | 3,287,797 |

| Internet Content - 0.34% | | | |

| Google, Inc., Class A * | 130 | | 60,228 |

| | | | |

| Internet Retail - 0.44% | | | |

| eBay, Inc. * | 3,100 | | 77,283 |

| | | | |

| Internet Software - 0.05% | | | |

| VeriSign, Inc. * | 300 | | 9,591 |

| | | | |

| Manufacturing - 1.38% | | | |

| 3M Company | 900 | | 64,440 |

| Danaher Corp. | 1,000 | | 81,570 |

| Harley-Davidson, Inc. | 500 | | 19,890 |

| SPX Corp. | 100 | | 11,925 |

| Tyco International, Ltd. | 1,550 | | 66,464 |

| | |

|

| | | | 244,289 |

| Metal & Metal Products - 0.11% | | | |

| Commercial Metals Company | 300 | | 7,809 |

| | | |

| Intrinsic Value Fund (continued) | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| |

|

| |

| COMMON STOCKS (continued) | | | |

| Metal & Metal Products (continued) | | | |

| Reliance Steel & Aluminum Company | 200 | $ | 11,402 |

| | |

|

| | | | 19,211 |

| Mining - 0.10% | | | |

| Newmont Mining Corp. | 400 | | 18,040 |

| | | | |

| Office Furnishings & Supplies - 0.03% | | | |

| Office Depot, Inc. * | 700 | | 4,928 |

| | | | |

| Petroleum Services - 0.85% | | | |

| Baker Hughes, Inc. | 100 | | 8,001 |

| BJ Services Company | 1,000 | | 26,850 |

| Helmerich & Payne, Inc. | 200 | | 11,424 |

| Valero Energy Corp. | 3,000 | | 104,280 |

| | |

|

| | | | 150,555 |

| Pharmaceuticals - 5.67% | | | |

| Abbott Laboratories | 1,200 | | 68,916 |

| AmerisourceBergen Corp. | 1,700 | | 69,717 |

| Bristol-Myers Squibb Company | 400 | | 8,536 |

| Eli Lilly & Company | 2,100 | | 97,965 |

| Endo Pharmaceutical Holdings, Inc. * | 400 | | 9,088 |

| Forest Laboratories, Inc. * | 1,600 | | 57,104 |

| Gilead Sciences, Inc. * | 1,500 | | 79,020 |

| King Pharmaceuticals, Inc. * | 1,400 | | 16,016 |

| Merck & Company, Inc. | 1,600 | | 57,072 |

| Pfizer, Inc. | 28,200 | | 538,902 |

| | |

|

| | | | 1,002,336 |

| Publishing - 0.21% | | | |

| Gannett Company, Inc. | 2,100 | | 37,359 |

| | | | |

| Railroads & Equipment - 0.41% | | | |

| Burlington Northern Santa Fe Corp. | 230 | | 24,702 |

| CSX Corp. | 500 | | 32,340 |

| Norfolk Southern Corp. | 200 | | 14,706 |

| | |

|

| | | | 71,748 |

| Real Estate - 0.48% | | | |

| Annaly Capital Management, Inc., REIT | 1,000 | | 14,960 |

| Boston Properties, Inc., REIT | 100 | | 10,247 |

| Equity Residential, REIT | 500 | | 21,100 |

| HCP, Inc., REIT | 300 | | 10,866 |

| Health Care, Inc., REIT | 200 | | 10,374 |

| Public Storage, Inc., REIT | 200 | | 17,664 |

| | |

|

| | | | 85,211 |

| Retail Grocery - 0.09% | | | |

| SUPERVALU, Inc. | 700 | | 16,233 |

| | | | |

| Retail Trade - 10.03% | | | |

| Abercrombie & Fitch Company, Class A | 400 | | 20,980 |

| Advance Auto Parts, Inc. | 300 | | 12,912 |

| American Eagle Outfitters, Inc. | 600 | | 9,030 |

| Bed Bath & Beyond, Inc. * | 1,100 | | 33,726 |

| Best Buy Company, Inc. | 200 | | 8,954 |

| Costco Wholesale Corp. | 800 | | 53,648 |

| CVS Caremark Corp. | 900 | | 32,940 |

| Dollar Tree, Inc. * | 500 | | 19,180 |

| Family Dollar Stores, Inc. | 700 | | 17,444 |

| Home Depot, Inc. | 15,100 | | 409,512 |

| Kohl's Corp. * | 900 | | 44,253 |

|

| The accompanying notes are an integral part of the financial statements. |

| 3 |

JOHN HANCOCK FUNDS III

PORTFOLIO OF INVESTMENTS - August 31, 2008 (Unaudited) - continued

(showing percentage of total net assets)

| | | | |

| Intrinsic Value Fund (continued) | | | | |

| | | Shares or | | |

| | | Principal | | |

| | | Amount | | Value |

| |

|

| COMMON STOCKS (continued) | | | | |

| Retail Trade (continued) | | | | |

| Lowe's Companies, Inc. | | 7,900 | $ | 194,656 |

| Staples, Inc. | | 3,000 | | 72,600 |

| Target Corp. | | 2,100 | | 111,342 |

| The Gap, Inc. | | 1,200 | | 23,340 |

| Walgreen Company | | 3,400 | | 123,862 |

| Wal-Mart Stores, Inc. | | 9,900 | | 584,793 |

| | |

|

| | | | | 1,773,172 |

| |

| |

| Semiconductors - 0.27% | | | | |

| |

| Cypress Semiconductor Corp. * | | 400 | | 12,968 |

| Intel Corp. | | 600 | | 13,722 |

| |

| Lam Research Corp. * | | 300 | | 11,028 |

| QLogic Corp. * | | 500 | | 9,340 |

| | |

|

| | | | | 47,058 |

| Software - 3.50% | | | | |

| Citrix Systems, Inc. * | | 300 | | 9,081 |

| Microsoft Corp. | | 14,300 | | 390,247 |

| Oracle Corp. * | | 9,500 | | 208,335 |

| Sybase, Inc. * | | 300 | | 10,323 |

| | |

|

| | | | | 617,986 |

| Steel - 0.21% | | | | |

| Nucor Corp. | | 700 | | 36,750 |

| |

| Telecommunications Equipment & | | | | |

| Services - 1.28% | | | | |

| QUALCOMM, Inc. | | 4,300 | | 226,394 |

| | | | | |

| Telephone - 0.66% | | | | |

| AT&T, Inc. | | 1,427 | | 45,650 |

| Verizon Communications, Inc. | | 2,000 | | 70,240 |

| | |

|

| | | | | 115,890 |

| |

| Tobacco - 1.43% | | | | |

| Altria Group, Inc. | | 6,700 | | 140,901 |

| Philip Morris International, Inc. | | 1,900 | | 102,030 |

| UST, Inc. | | 200 | | 10,718 |

| | |

|

| | | | | 253,649 |

| Transportation - 0.06% | | | | |

| C.H. Robinson Worldwide, Inc. | | 200 | | 10,422 |

| | | | | |

| Trucking & Freight - 0.29% | | | | |

| FedEx Corp. | | 100 | | 8,282 |

| Ryder Systems, Inc. | | 100 | | 6,452 |

| United Parcel Service, Inc., Class B | | 400 | | 25,648 |

| YRC Worldwide, Inc. * | | 600 | | 10,860 |

| | |

|

| | | | | 51,242 |

|

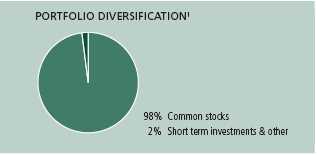

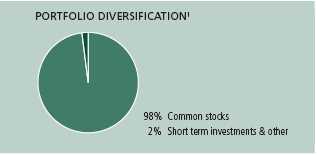

| TOTAL COMMON STOCKS (Cost $19,219,845) | | | $ | 17,111,461 |

|

| SHORT TERM INVESTMENTS - 0.24% | | | | |

| John Hancock Cash | | | | |

| Investment Trust, 2.5657% (c)(f) | $ | 42,542 | $ | 42,542 |

|

| TOTAL SHORT TERM INVESTMENTS | | | | |

| (Cost $42,542) | | | $ | 42,542 |

|

| | | | |

| Intrinsic Value Fund (continued) | | | | |

| | | Shares or | | |

| | | Principal | | |

| | | Amount | | Value |

| |

|

| REPURCHASE AGREEMENTS - 3.17% | | | | |

| Repurchase Agreement with State | | | | |

| Street Corp. dated 08/29/2008 at | | | | |

| 1.70% to be repurchased at | | | | |

| $561,106 on 09/02/2008, | | | | |

| collateralized by $565,000 Federal | | | | |

| National Mortgage Association, | | | | |

| 3.375% due 03/05/2010 (valued at | | | | |

| $574,775, including interest) | $ | 561,000 | $ | 561,000 |

|

| TOTAL REPURCHASE AGREEMENTS | | | | |

| (Cost $561,000) | | | $ | 561,000 |

|

| |

| Total Investments (Intrinsic Value Fund) | | | | |

| (Cost $19,823,387) - 100.22% | | | $ | 17,715,003 |

| Liabilities in Excess of Other Assets - (0.22)% | | | | (39,248 ) |

| | | |

|

| TOTAL NET ASSETS - 100.00% | | | $ | 17,675,755 |

| | | |

|

Percentages are stated as a percent of net assets.

Key to Security Abbreviations and Legend

REIT - Real Estate Investment Trust

Non-Income Producing

(a) All or a portion of this security was out on loan.

(c) The investment is an affiliate of the Fund, the adviser and/or subadviser.

(f) John Hancock Cash Investment Trust is managed by MFC Global Investment Management (U.S.), LLC. The rate shown is the seven-day effective yield at period end.

|

| The accompanying notes are an integral part of the financial statements. |

| 4 |

† At August 31, 2008, the aggregate cost of investment securities for federal income tax purposes was $19,874,332. Net unrealized depreciation aggregated $2,159,329, of which $788,997 related to appreciated investment securities and $2,948,326 related to depreciated investment securities.

The Fund had the following financial futures contracts open on August 31, 2008:

| | | | |

| | NUMBER OF | | | |

| OPEN CONTRACTS | CONTRACTS | POSITION | EXPIRATION | UNREALIZED APPRECIATION |

|

| |

| S&P Mini 500 Index Futures | 5 | Long | Sep 2008 | $6,173 |

|

John Hancock Funds III

Intrinsic Value Fund

Statements of Assets and Liabilities — August 31, 2008 (Unaudited))1

| | |

| Assets | | |

|

| Investments in unaffiliated issuers, at value | | |

| (Cost $19,780,845) including $41,708 of | | |

| securities loaned (Note 2) | $ | 17,672,461 |

| Investments in affiliated issuers, at value (Cost | | |

| $42,542) | | 42,542 |

| | | |

| Total investments, at value (Cost | | |

| $19,823,387) | | 17,715,003 |

| | | |

| Cash | | 186 |

| Cash collateral at broker for futures contracts | | 21,600 |

| Receivable for fund shares sold | | 572 |

| Dividends and interest receivable | | 47,003 |

| Other assets | | 33,745 |

| | | |

| Total assets | | 17,818,109 |

| |

| |

| Liabilities | | |

|

| Payable for fund shares repurchased | | 16,314 |

| Payable upon return of securities loaned (Note | | |

| 2) | | 42,542 |

| Payable for futures variation margin | | 3,875 |

| Payable to affiliates | | |

| Fund administration fees | | 133 |

| Transfer agent fees | | 4,105 |

| Trustees’ fees | | 935 |

| Distribution and service fees | | 189 |

| Investment management fees | | 2,489 |

| Other payables and accrued expenses | | 71,772 |

| | | |

| Total liabilities | | 142,354 |

| |

| |

| Net assets | | |

|

| Capital paid-in | $ | 20,862,305 |

| Undistributed net investment income | | 106,050 |

| Accumulated undistributed net realized loss on | | |

| investments and futures contracts | | (1,190,389) |

| Net unrealized depreciation on investments and | | |

| futures | | (2,102,211) |

| | | |

| Net assets | $ | 17,675,755 |

| | |

| Net asset value per share | | |

|

| The Funds have an unlimited number of shares | | |

| authorized with no par value. Net asset value is | | |

| calculated by dividing the net assets of each | | |

| class of shares by the number of outstanding | | |

| shares in the class. | | |

| | |

| Class A | | |

| Net assets | $ | 16,757,558 |

| Shares outstanding | | 970,909 |

| Net asset value and redemption price per share | $ | 17.26 |

| | | |

| Class B1 | | |

| Net assets | $ | 235,167 |

| Shares outstanding | | 13,687 |

| Net asset value and offering price per share | $ | 17.18 |

| | | |

| Class C1 | | |

| Net assets | $ | 353,915 |

| Shares outstanding | | 20,589 |

| Net asset value and offering price per share | $ | 17.19 |

| | | |

| Class I | | |

| Net assets | $ | 129,042 |

| Shares outstanding | | 7,456 |

| Net asset value, offering price and redemption | | |

| price per share | $ | 17.31 |

| | | |

| Class R1 | | |

|

| See notes to financial statements |

| | |

| Net assets | $ | 103,572 |

| Shares outstanding | | 6,017 |

| Net asset value, offering price and redemption | | |

| price per share | $ | 17.21 |

| | | |

| Class 1 | | |

| Net assets | $ | 96,501 |

| Shares outstanding | | 5,575 |

| Net asset value, offering price and redemption | | |

| price per share | $ | 17.31 |

| |

| Maximum public offering price per share | | |

| Class A (net asset value per share ÷ 95%)2 | $ | 18.17 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

|

| See notes to financial statements |

John Hancock Funds III

Intrinsic Value Fund

Statements of Operations — August 31, 2008 (Unaudited)1

| | |

| Investment income | | |

|

| Dividends | $ | 200,382 |

| Interest | | 5,178 |

| Income from affiliated issuers | | 302 |

| Securities lending | | 184 |

| Less foreign taxes withheld | | (14) |

| | | |

| Total investment income | | 206,032 |

| |

| Expenses | | |

|

| Investment management fees (Note 3) | | 71,852 |

| Distribution and service fees (Note 3) | | 29,714 |

| Transfer agent fees (Note 3) | | 7,748 |

| Blue sky fees (Note 3) | | 37,282 |

| Fund administration fees (Note 3) | | 1,061 |

| Audit and legal fees | | 19,693 |

| Printing and postage fees (Note 3) | | 4,762 |

| Custodian fees | | 12,636 |

| Trustees' fees (Note 3) | | 1,275 |

| Registration and filing fees | | 7,273 |

| Miscellaneous | | 158 |

| | | |

| Total expenses | | 193,454 |

| Less expense reductions (Note 3) | | (67,216) |

| Transfer agent credits (Note 3) | | (20) |

| | | |

| Net expenses | | 126,218 |

| |

| Net investment loss | | 79,814 |

| |

| |

| Realized and unrealized gain (loss) | | |

|

| Net realized loss on | | |

| Investments in unaffiliated issuers | | (700,097) |

| Futures contracts | | (25,881) |

| | | (725,978) |

| |

| Change in net unrealized appreciation | | |

| (depreciation) of | | |

| Investments in unaffiliated issuers | | (348,461) |

| Futures contracts | | 17,926 |

| | | (330,535) |

| |

| Net realized and unrealized gain (loss) | | (1,056,513) |

| |

| Decrease in net assets from operations | $ | (976,699) |

|

| 1Semiannual period from 3-1-08 to 8-31-08. |

|

| See notes to financial statements |

John Hancock Funds III

Intrinsic Value Fund

Statements of Changes in Net Assets

| | | | |

| | | Year ended | | Period ended |

| | | 2-29-08 | | 8-31-081 |

| |

| Increase (decrease) in net assets | | | | |

|

| From operations | | | | |

| Net investment income | $ | 216,099 | $ | 79,814 |

| Net realized gain (loss) | | 617,049 | | (725,978) |

| Change in net unrealized appreciation | | | | |

| (depreciation) | | (3,490,770) | | (330,535) |

| | | | | |

| Decrease in net assets resulting from | | | | |

| operations | | (2,657,622) | | (976,699) |

| |

| |

| Distributions to shareholders | | | | |

| From net investment income | | | | |

| Class A | | (224,181) | | — |

| Class B | | (1,449) | | — |

| Class C | | (2,335) | | — |

| Class I | | (2,359) | | — |

| Class R1 | | (1,273) | | — |

| Class 1 | | (1,843) | | — |

| From net realized gain | | | | |

| Class A | | (1,330,407) | | — |

| Class B | | (23,393) | | — |

| Class C | | (37,862) | | — |

| Class I | | (10,289) | | — |

| Class R1 | | (8,307) | | — |

| Class 1 | | (7,782) | | — |

| Total distributions | | (1,651,480) | | — |

| |

| From Fund share transactions (Note 5) | | 2,600,501 | | 49,825 |

| |

| |

| Total increase decrease | | (1,708,601) | | (926,874) |

| |

| Net assets | | | | |

|

| Beginning of period | | 20,311,230 | | 18,602,629 |

| End of period | $ | 18,602,629 | $ | 17,675,755 |

| |

| Undistributed net investment income | $ | 26,236 | $ | 106,050 |

|

| 1 Semiannual period from 3-1-08 to 8-31-08. Unaudited. |

|

| See notes to financial statements |

Intrinsic Value Fund

Financial Highlights

Class A

| | | | | | | |

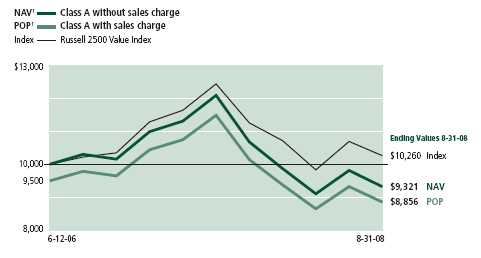

| Period ended | | 2-28-07 | 1 | 2-29-08 | | 8-31-08 | 2 |

| | | | | | | | |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning of period | | $20.00 | | $22.68 | | $18.20 | |

| Net investment income | 3 | 0.18 | | 0.24 | | 0.08 | |

| Net realized and unrealized gain (loss) on investments | | 2.85 | | (2.93) | | (1.02) | |

| Total from investment operations | | 3.03 | | (2.69) | | (0.94) | |

| Less distributions | | | | | | | |

| From net investment income | | (0.13) | | (0.26) | | - | |

| From net realized gain | | (0.22) | | (1.53) | | - | |

| | | (0.35) | | (1.79) | | - | |

| Net asset value, end of period | | $22.68 | | $18.20 | | $17.26 | |

| Total return (%) | 4,5 | 15.19 | 6 | (12.52) | | (5.16) | 6 |

| | | | | | | | |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period (in millions) | | $19 | | $18 | | $17 | |

| Ratios (as a percentage of average net assets): | | | | | | | |

| Expenses before reductions | | 1.94 | 7 | 1.89 | | 1.75 | 7 |

| Expenses net of fee waivers | | 1.34 | 7 | 1.35 | | 1.35 | 7 |

| Expenses net of all fee waivers and credits | | 1.34 | 7 | 1.35 | | 1.35 | 7 |

| Net investment income | | 1.13 | 7 | 1.05 | | 0.89 | 7 |

| Portfolio turnover (%) | | 32 | | 72 | | 27 | |

1 Class A shares began operations on 6-12-06.

2 Semiannual period from 3-1-08 to 8-31-08. Unaudited.

3 Based on the average of the shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Annualized.

Intrinsic Value Fund

Financial Highlights

Class B

| | | | | | | |

| Period ended | | 2-28-07 | 1 | 2-29-08 | | 8-31-08 | 2 |

| | | | | | | | |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning of period | | $20.00 | | $22.64 | | $18.18 | |

| Net investment income | 3 | 0.07 | | 0.08 | | 0.02 | |

| Net realized and unrealized gain (loss) on investments | | 2.85 | | (2.92) | | (1.02) | |

| Total from investment operations | | 2.92 | | (2.84) | | (1.00) | |

| Less distributions | | | | | | | |

| From net investment income | | (0.06) | | (0.09) | | - | |

| From net realized gain | | (0.22) | | (1.53) | | - | |

| | | (0.28) | | (1.62) | | - | |

| Net asset value, end of period | | $22.64 | | $18.18 | | $17.18 | |

| Total return (%) | 4,5 | 14.61 | 6 | (13.13) | | (5.50) | 6 |

| | | | | | | | |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period (in millions) | | - | 7 | - | 7 | - | 7 |

| Ratios (as a percentage of average net assets): | | | | | | | |

| Expenses before reductions | | 9.00 | 8 | 6.13 | | 7.82 | 8 |

| Expenses net of fee waivers | | 2.04 | 8 | 2.06 | | 2.05 | 8 |

| Expenses net of all fee waivers and credits | | 2.04 | 8 | 2.05 | | 2.05 | 8 |

| Net investment income | | 0.42 | 8 | 0.35 | | 0.18 | 8 |

| Portfolio turnover (%) | | 32 | | 72 | | 27 | |

1 Class B shares began operations on 6-12-06.

2 Semiannual period from 3-1-08 to 8-31-08. Unaudited.

3 Based on the average of the shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Less than $500,000.

8 Annualized.

Intrinsic Value Fund

Financial Highlights

Class C

| | | | | | | |

| Period ended | | 2-28-07 | 1 | 2-29-08 | | 8-31-08 | 2 |

| | | | | | | | |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning of period | | $20.00 | | $22.64 | | $18.18 | |

| Net investment income | 3 | 0.06 | | 0.08 | | 0.02 | |

| Net realized and unrealized gain (loss) on investments | | 2.86 | | (2.92) | | (1.01) | |

| Total from investment operations | | 2.92 | | (2.84) | | (0.99) | |

| Less distributions | | | | | | | |

| From net investment income | | (0.06) | | (0.09) | | - | |

| From net realized gain | | (0.22) | | (1.53) | | - | |

| | | (0.28) | | (1.62) | | - | |

| Net asset value, end of period | | $22.64 | | $18.18 | | $17.19 | |

| Total return (%) | 4,5 | 14.61 | 6 | (13.13) | | (5.45) | 6 |

| | | | | | | | |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period (in millions) | | - | 7 | - | 7 | - | 7 |

| Ratios (as a percentage of average net assets): | | | | | | | |

| Expenses before reductions | | 10.08 | 8 | 6.21 | | 6.33 | 8 |

| Expenses net of fee waivers | | 2.04 | 8 | 2.06 | | 2.05 | 8 |

| Expenses net of all fee waivers and credits | | 2.04 | 8 | 2.05 | | 2.05 | 8 |

| Net investment income | | 0.37 | 8 | 0.36 | | 0.18 | 8 |

| Portfolio turnover (%) | | 32 | | 72 | | 27 | |

1 Class C shares began operations on 6-12-06.

2 Semiannual period from 3-1-08 to 8-31-08. Unaudited.

3 Based on the average of the shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Less than $500,000.

8 Annualized.

Intrinsic Value Fund

Financial Highlights

Class I

| | | | | | | |

| Period ended | | 2-28-07 | 1 | 2-29-08 | | 8-31-08 | 2 |

| | | | | | | | |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning of period | | $20.00 | | $22.70 | | $18.21 | |

| Net investment income | 3 | 0.24 | | 0.32 | | 0.12 | |

| Net realized and unrealized gain (loss) on investments | | 2.86 | | (2.93) | | (1.02) | |

| Total from investment operations | | 3.10 | | (2.61) | | (0.90) | |

| Less distributions | | | | | | | |

| From net investment income | | (0.18) | | (0.35) | | - | |

| From net realized gain | | (0.22) | | (1.53) | | - | |

| | | (0.40) | | (1.88) | | - | |

| Net asset value, end of period | | $22.70 | | $18.21 | | $17.31 | |

| Total return (%) | 4,5 | 15.50 | 6 | (12.18) | | (4.94) | 6 |

| | | | | | | | |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period (in millions) | | - | 7 | - | 7 | - | 7 |

| Ratios (as a percentage of average net assets): | | | | | | | |

| Expenses before reductions | | 17.60 | 8 | 13.79 | | 12.49 | 8 |

| Expenses net of fee waivers | | 0.95 | 8 | 0.95 | | 0.95 | 8 |

| Expenses net of all fee waivers and credits | | 0.95 | 8 | 0.95 | | 0.95 | 8 |

| Net investment income | | 1.53 | 8 | 1.45 | | 1.29 | 8 |

| Portfolio turnover (%) | | 32 | | 72 | | 27 | |

1 Class I shares began operations on 6-12-06.

2 Semiannual period from 3-1-08 to 8-31-08. Unaudited.

3 Based on the average of the shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Less than $500,000.

8 Annualized.

Intrinsic Value Fund

Financial Highlights

Class R1

| | | | | | | |

| Period ended | | 2-28-07 | 1 | 2-29-08 | | 8-31-08 | 2 |

| |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning of period | | $20.00 | | $22.63 | | $18.16 | |

| Net investment income | 3 | 0.12 | | 0.21 | | 0.07 | |

| Net realized and unrealized gain (loss) on investments | | 2.85 | | (2.92) | | (1.02) | |

| Total from investment operations | | 2.97 | | (2.71) | | (0.95) | |

| Less distributions | | | | | | | |

| From net investment income | | (0.12) | | (0.23) | | - | |

| From net realized gain | | (0.22) | | (1.53) | | - | |

| | | (0.34) | | (1.76) | | - | |

| Net asset value, end of period | | $22.63 | | $18.16 | | $17.21 | |

| Total return (%) | 4,5 | 14.88 | 6 | (12.60) | | (5.23) | 6 |

| | | | | | | | |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period (in millions) | | - | 7 | - | 7 | - | 7 |

| Ratios (as a percentage of average net assets): | | | | | | | |

| Expenses before reductions | | 20.85 | 8 | 15.27 | | 16.61 | 8 |

| Expenses net of fee waivers | | 1.69 | 8 | 1.45 | | 1.45 | 8 |

| Expenses net of all fee waivers and credits | | 1.69 | 8 | 1.45 | | 1.45 | 8 |

| Net investment income | | 0.78 | 8 | 0.95 | | 0.79 | 8 |

| Portfolio turnover (%) | | 32 | | 72 | | 27 | |

1 Class R1 shares began operations on 6-12-06.

2 Semiannual period from 3-1-08 to 8-31-08. Unaudited.

3 Based on the average of the shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Less than $500,000.

8 Annualized.

Intrinsic Value Fund

Financial Highlights

Class 1

| | | | | | | |

| Period ended | | 2-28-07 | 1 | 2-29-08 | | 8-31-08 | 2 |

| |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning of period | | $20.00 | | $22.70 | | $18.21 | |

| Net investment income | 3 | 0.25 | | 0.34 | | 0.12 | |

| Net realized and unrealized gain (loss) on investments | | 2.85 | | (2.94) | | (1.02) | |

| Total from investment operations | | 3.10 | | (2.60) | | (0.90) | |

| Less distributions | | | | | | | |

| From net investment income | | (0.18) | | (0.36) | | - | |

| From net realized gain | | (0.22) | | (1.53) | | - | |

| | | (0.40) | | (1.89) | | - | |

| Net asset value, end of period | | $22.70 | | $18.21 | | $17.31 | |

| Total return (%) | 4,5 | 15.53 | 6 | (12.13) | | (4.94) | 6 |

| |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period (in millions) | | - | 7 | - | 7 | - | 7 |

| Ratios (as a percentage of average net assets): | | | | | | | |

| Expenses before reductions | | 1.44 | 8 | 1.47 | | 1.32 | 8 |

| Expenses net of fee waivers | | 0.90 | 8 | 0.90 | | 0.90 | 8 |

| Expenses net of all fee waivers and credits | | 0.90 | 8 | 0.90 | | 0.90 | 8 |

| Net investment income | | 1.58 | 8 | 1.50 | | 1.34 | 8 |

| Portfolio turnover (%) | | 32 | | 72 | | 27 | |

1 Class 1 shares began operations on 6-12-06.

2 Semiannual period from 3-1-08 to 8-31-08. Unaudited.

3 Based on the average of the shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Less than $500,000.

8 Annualized.

Note 1

Organization

John Hancock Intrinsic Value Fund (the Fund) is a non-diversified series of John Hancock Funds III (the Trust). The Trust was established as a Massachusetts business trust on June 9, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end investment management company. The investment objective of the Fund is to seek long-term capital growth.

John Hancock Life Insurance Company of New York (John Hancock New York) is a wholly owned subsidiary of John Hancock Life Insurance Company (U.S.A.) (John Hancock USA). John Hancock USA and John Hancock New York are indirect wholly owned subsidiaries of The Manufacturers Life Insurance Company (Manulife), which in turn is a wholly owned subsidiary of Manulife Financial Corporation (MFC), a publicly traded company. MFC and its subsidiaries are known collectively as “Manulife Financial.”

John Hancock Investment Management Services, LLC (the Adviser), a Delaware limited liability company controlled by John Hancock USA, serves as investment adviser for the Trust and John Hancock Funds, LLC (the Distributor), a Delaware limited liability company, an affiliate of the Adviser, serves as principal underwriter.

The Board of Trustees have authorized the issuance of multiple classes of shares of the Fund, including classes designated as Class A, Class B, Class C, Class I, Class R1 and Class 1 shares. Class A, Class B and Class C shares are open to all retail investors. Class I shares are offered without any sales charge to various institutional and certain individual investors. Class R1 shares are available only to certain retirement plans. Class 1 shares are sold only to certain exempt separate accounts of John Hancock USA and John Hancock New York. The shares of each class represent an interest in the same portfolio of investments of the Fund, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Board of Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission (SEC) and the Internal Revenue Service. Shareho lders of a class that bear distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security valuation

The net asset value of Class A, Class B and Class C, Class I, Class R1 and Class 1 shares of the Fund is determined daily as of the close of the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Short-term debt investments that have a remaining maturity of 60 days or less are valued at amortized cost, and thereafter assume a constant amortization to maturity of any discount or premium, which approximates market value. Investments in John Hancock Cash Investment Trust (JHCIT), an affiliate of John Hancock Advisers, LLC (the Adviser), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (MFC), are valued at their net asset value each business day. All other securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) as of the close of business on the principal securities exchange (domestic or f oreign) on which they trade or, lacking any sales, at the closing bid price. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Securities for which there are no such quotations, principally debt securities, are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data.

Other assets and securities for which no such quotations are readily available are valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

In deciding whether to make a fair value adjustment to the price of a security, the Board of Trustees or their designee may review a variety of factors, including developments in foreign markets, the performance of U.S. securities markets and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Fund may also fair value securities in other situations, for example, when a particular foreign market is closed, but the Fund is calculating the net asset value. In view of these factors, it is likely that a Fund investing significant amounts of assets in securities in foreign markets will be fair valued more frequently than a Fund investing significant amounts of assets in frequently traded, U.S. exchange listed securities of large-capitalization U.S. issuers.

For purposes of determining when fair value adjustments may be appropriate with respect to investments in securities in foreign markets that close prior to the NYSE, the Fund will, on an ongoing basis, monitor for “significant market events.” A

significant market event may be a certain percentage change in the value of an index that tracks foreign markets in which the Fund has significant investments. If a significant market event occurs due to a change in the value of the index, the pricing for investments in foreign markets that have closed prior to the NYSE will promptly be reviewed and potential adjustments to the net asset value will be recommended to the Fund’s Pricing Committee where applicable.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity.

The Fund adopted Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements, effective with the beginning of the Fund’s fiscal year. FAS 157 established a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Prices determined using other significant observable inputs. Observable inputs are inputs that other market participants would use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others.

Level 3 – Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2008:

| | |

| | Investments in | Other Financial |

| Valuation Inputs | Securities | Instruments* |

| |

| |

| Level 1 – Quoted Prices | $17,154,003 | $6,173 |

|

| Level 2 – Other Significant Observable Inputs | 561,000 | - |

|

| Level 3 – Significant Unobservable Inputs | - | - |

|

| Total | $17,715,003 | $6,173 |

|

* Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument.

Repurchase agreements

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement through its custodian, it receives delivery of securities, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the market value is generally at least 102% of the repurchase amount. The Fund will take constructive receipt of all securities underlying the repurchase agreements it has entered into until such agreements expire. If the seller defaults, the Fund would suffer a loss to the extent that proceeds from the sale of underlying securities were less than the repurchase amount. The Fund may enter into repurchase agreements maturing within seven days with domestic dealers, banks or other financial institutions deemed to be creditworthy by the Adviser. Collateral for certain tri-party repurchase agreements is held at the custodian bank in a segregated account for the benefit of the Fund and the coun terparty.

Investment transactions

Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment security transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, and transfer agent fees for Class A, Class B, Class C, Class I, Class R1 and Class 1 shares are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these

arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Expenses

The majority of expenses are directly identifiable to an individual fund. Trust expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

Line of credit

The Fund has entered into an agreement which enables them to participate in a $150 million unsecured committed line of credit with State Street Corporation. Borrowings will be made solely to temporarily finance the repurchase of capital shares. Interest is charged to the Fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 0.50% . In addition, a commitment fee of 0.05% per annum, payable at the end of each calendar quarter, based on the average daily-unused portion of the line of credit, is charged to the Fund on a prorated basis based on average net assets. For the period ended August 31, 2008, there were no significant borrowings under the line of credit.

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien and security interest in any Fund property to the extent of any overdraft.

Securities lending

The Fund may lend portfolio securities from time to time in order to earn additional income. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the issuer of securities and to participate in any changes in their value. On the settlement date of the loan, the Fund receives cash collateral against the loaned securities and maintains the cash collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required cash collateral is delivered to the Fund on the next business day. Cash collateral received is invested in the JHCIT. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. The Fund may receive compensation for lending their securities either in the form of fees, guarantees, and/or by retaining a portion of interest on the investment of any cash received as collateral.

The Fund has entered into an agreement with Morgan Stanley & Co., Inc. and MS Securities Services, Inc. (collectively, Morgan Stanley) which permits the Fund to lend securities to Morgan Stanley on a principal basis. Morgan Stanley is the primary borrower of securities of the Fund. The risk of having one primary borrower of Fund securities (as opposed to several borrowers) is that should Morgan Stanley fail financially, all securities lent will be affected by the failure and by any delays in recovery of the securities (or in the rare event, loss of rights in the collateral).

Futures

The Fund may purchase and sell financial futures contracts and options on those contracts. The Fund invests in contracts based on financial instruments such as U.S. Treasury Bonds or Notes or on securities indices such as the Standard & Poor’s 500 Index, in order to hedge against a decline in the value of securities owned by the Fund.

Initial margin deposits required upon entering into futures contracts are satisfied by the delivery of specific securities or cash as collateral to the broker (the Fund’s agent in acquiring the futures position). If the position is closed out by an opposite position prior to the settlement date of the futures contract, a final determination of variation margin is made, cash is required to be paid to or released by the broker and the Fund realizes a gain or loss.

When the Fund sells a futures contract based on a financial instrument, the Fund becomes obligated to deliver that kind of instrument at an agreed upon date for a specified price. The Fund realizes a gain or loss depending on whether the price of an offsetting purchase is less or more than the price of the initial sale or on whether the price of an offsetting sale is more or less than the price of the initial purchase. The Fund could be exposed to risks if it could not close out futures positions because of an illiquid secondary market or the inability of counterparties to meet the terms of their contracts. Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. Net capital losses of $425,219 that are attributable to security transactions incurred after October 31, 2007, are treated as arising on March 1, 2008, the first day of the Fund’s next taxable year.

The Fund has adopted the provisions of Financial Accounting Standards Board (FASB) Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement 109 (FIN 48), at the beginning of the Fund's fiscal year. FIN 48 prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not have a material impact on the Fund's financial statements. Each of the Fund’s federal tax returns for the prior three years remain subject to examination by the Internal Revenue Service.

New accounting pronouncements

In March 2008, FASB No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133 (FAS 133), was issued and is effective for fiscal years beginning after November 15, 2008. FAS 161 amends and expands the disclosure requirements of FAS 133 in order to provide financial statement users an understanding of a company’s use of derivative instruments, how derivative instruments are accounted for under FAS 133 and related interpretations and how these instruments affect a company’s financial position, performance, and cash flows. FAS 161 requires companies to disclose information detailing the objectives and strategies for using derivative instruments, the level of derivative activity entered into by the company, and any credit risk-related contingent features of the agreements. Management is currently evaluating the adoption of FAS 161 on the Fund’s financial statement disclosures.

Distribution of income and gains

The Fund generally declares dividends and pays dividends annually. Capital gains, if any, are distributed annually. The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. During the year ended February 29, 2008, the tax character of distributions paid was as follows: ordinary income $1,019,233 and long-term capital gain $632,247. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Note 3

Investment advisory and other agreements

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment of the assets of the Fund, subject to the supervision of the Trust’s Board of Trustees. As compensation for its services, the Adviser receives an advisory fee from the Trust. Under the Advisory Agreement, the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.78% of the first $500,000,000 of the Fund’s aggregate daily net assets; (b) 0.76% of the next $500,000,000 of the Fund’s aggregate daily net assets; (c) 0.75% of the Fund’s next $1,500,000,000 of the Fund’s aggregate daily net assets; and (d) 0.74% of the Fund’s aggregate daily net assets in excess of $2,500,000,000. Aggregate net assets include the net assets of the Fund and Intrinsic Value Trust , a series of John Hancock Trust. The Adviser has a subadvisory agreement with Grantham, Mayo, Van Otterloo & Co. LLC. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the period ended August 31, 2008, were equivalent to an annual effective rate of 0.78% of the Fund’s average daily net assets.

The Adviser has contractually agreed to reimburse or limit certain Fund level expenses to 0.08% of the Fund’s average annual net assets which are allocated pro rata to all share classes. This agreement excludes taxes, portfolio brokerage commissions, interest, advisory fees, Rule 12b-1 fees, transfer agency fees, blue sky fees, printing and postage and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, are excluded.

In addition, the Adviser has agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, are excluded. The reimbursements and limits are such that these expenses will not exceed 1.35% for Class A shares, 2.05% for Class B, 2.05% for Class C, 0.95% for Class I, 1.45% for Class R1 and 0.90% for Class 1. Accordingly, the expense reductions or reimbursements related to this agreement were $35,061, $7,992, $8,119, $7,711, $8,082 and $210 for Class A, Class B, Class C, Class I, Class R1 and Class 1, respectively for the period ended August 31, 2008. The expense reimbursements and limits will continue in effect until December 31, 2008 and thereafter until terminated by the Adviser on notice to the Trust.

Pursuant to the Advisory Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative share of net assets of each class at the time the expense was incurred.

The fund administration fees incurred for the period ended August 31, 2008, were $1,061 with an annual effective rate of 0.01% of the Fund’s average daily net assets.

The Trust has a Distribution Agreement with the Distributor. The Fund has adopted Distribution Plans with respect to Class A, Class B, Class C, Class R1 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to the Distributor at an annual rate not to exceed 0.30%, 1.00%, 1.00%, 0.50% and 0.05% of average daily net asset value of Class A, Class B, Class C, Class R1 and Class 1, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the Financial Industry Regulatory Authority (formerly the National Association of

Securities Dealers). Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

In addition, the Fund has also adopted a Service Plan for Class R1 shares. Under the Service Plan, the Fund may pay up to 0.25% of Class R1 average daily net asset value for certain other services. There were no Service Plan fees incurred for the period ended August 31, 2008.

Class A shares are assessed up-front sales charges. During the period ended August 31, 2008, the Distributor received net up-front sales charges of $3,365 with regard to sales of Class A shares. Of this amount, $562 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $2,698 was paid as sales commissions to unrelated broker-dealers and $105 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a related broker-dealer, an indirect subsidiary of MFC.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (CDSC) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to the Distributor and are used in whole or in part to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the period ended August 31, 2008, CDSCs received by JH Funds amounted to $85 for Class C shares. There were no CDSCs received for Class B shares.

The Fund has a Transfer Agency Agreement with John Hancock Signature Services, Inc. (Signature Services), an indirect subsidiary of MFC. For Class A, Class B, Class C, Class I and Class R1 shares, the Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’ average daily net assets, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses. Expenses not directly attributable to a particular class of shares are aggregated and allocated to each class on the basis of its relative net asset value. The Fund pays a monthly fee which is based on an annual rate of $16.50 for each Class A, Class B, Class C, Class I and Class R1 shareholder accounts.

Signature Services has agreed to limit the transfer agent fees so that such fees do not exceed 0.20% annually of Class A, Class B, Class C, Class I and Class R1 share average daily net assets. This agreement is effective until December 31, 2008. Signature Services reserves the right to terminate this limitation in the future. There were no transfer agent fee reductions for Class A, Class B, Class C, Class I and Class R1 shares, respectively, during the period ended August 31, 2008.

In addition, Signature Services has voluntarily agreed to further limit transfer agent fees for Class R1 shares so that such fees do not exceed 0.05% annually of each class’s average daily net assets. For the period ended August 31, 2008, the transfer agent fees reductions for Class R1 were $41.

The Fund receives earnings credits from its transfer agent as a result of uninvested cash balances. These credits are used to reduce a portion of the Fund’s transfer agent fees and out-of-pocket expenses. During the period ended August 31, 2008, the Fund’s transfer agent fees and out-of-pocket expenses were reduced by $20 for transfer agent credits earned.

Class level expenses including the allocation of the transfer agent fees for the period ended August 31, 2008, were as follows:

| | | | |

| | Distribution and | Transfer | | Printing and |

| Share class | service fees | agent fees | Blue sky fees | postage fees |

|

| Class A | $26,140 | $6,984 | $7,440 | $4,364 |

| Class B | 1,384 | 280 | 7,331 | 122 |

| Class C | 1,897 | 383 | 7,267 | 117 |

| Class I | - | 33 | 7,430 | 55 |

| Class R1 | 268 | 68 | 7,814 | 87 |

| Class 1 | 25 | - | - | 17 |

| Total | $29,714 | $7,748 | $37,282 | $4,762 |

Note 4

Trustees’ Fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated to the Fund based on its average daily net asset value.

Note 5

Fund share transactions

The listing illustrates the number of Fund shares sold, reinvested and repurchased during the year ended February 28, 2007, and the period ended August 31, 2008, along with the corresponding dollar value:

| | | | | | | |

| | Year ended | | Period ended |

| | 2-29-08 | | 8-31-081 |

|

| |

|

| | Shares | | Amount | | Shares | | Amount |

| Class A shares | | | | | | | |

| Sold | 133,987 | $ | 2,940,726 | | 52,388 | $ | 935,216 |

| Distributions reinvested | 76,470 | | 1,516,395 | | — | | — |

| Repurchased | (92,564) | | (2,053,477) | | (45,974) | | (808,743) |

|

| |

| |

| |

|

| Net increase | 117,893 | $ | 2,403,644 | | 6,414 | $ | 126,473 |

|

| |

| |

| |

|

| Class B shares | | | | | | | |

| Sold | 5,662 | $ | 132,547 | | 2,042 | $ | 36,002 |

| Distributions reinvested | 1,131 | | 22,436 | | — | | — |

| Repurchased | (11,519) | | (264,243) | | (4,297) | | (74,637) |

|

| |

| |

| |

|

| Net decrease | (4,726) | $ | (109,260) | | (2,255) | $ | (38,635) |

|

| |

| |

| |

|

| Class C shares | | | | | | | |

| Sold | 16,074 | $ | 359,010 | | 3,031 | $ | 54,947 |

| Distributions reinvested | 1,822 | | 36,151 | | — | | — |

| Repurchased | (7,825) | | (155,541) | | (5,186) | | (94,810) |

| Net increase (decrease) | 10,071 | $ | 239,620 | | (2,155) | $ | (39,863) |

|

| |

| |

| |

|

| Class I shares | | | | | | | |

| Sold | 1,135 | $ | 26,925 | | 60 | $ | 1,050 |

| Distributions reinvested | 638 | | 12,648 | | — | | — |

| Repurchased | (22) | | (500) | | — | | — |

|

| |

| |

| |

|

| Net increase | 1,751 | $ | 39,073 | | 60 | $ | 1,050 |

|

| |

| |

| |

|

| Class R1 shares | | | | | | | |

| Sold | 407 | $ | 8,923 | | 49 | $ | 800 |

| Distributions reinvested | 484 | | 9,580 | | — | | — |

| Repurchased | (32) | | (704) | | — | | — |

|

| |

| |

| |

|

| Net increase | 859 | $ | 17,799 | | 49 | $ | 800 |

| | | | | | | |

| Class 1 shares | | | | | | | |

| Distributions reinvested | 485 | | 9,625 | | — | | — |

|

| |

| |

| |

|

| Net increase | 485 | $ | 9,625 | | — | $ | — |

|

| |

| |

| |

|

| Net increase | 126,333 | $ | 2,600,501 | | 2,113 | $ | 49,825 |

|

| |

| |

| |

|

1Semiannual period from 3-1-08 to 8-31-08. Unaudited.

The Adviser and other affiliates of John Hancock USA owned 802,790, 5,571, 5,529 and 5,575 shares of beneficial interest of Class A, Class I, Class R1 and Class 1, respectively, on August 31, 2008.

Note 6

Purchase and sale of securities

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended August 31, 2008, aggregated $4,997,546 and $4,791,360, respectively.

Note 7

Subsequent event

On September 8, 2008, the Board of Trustees of the Fund approved the proposed liquidation of the Fund. The liquidation occurred on October 24, 2008.

|

| INSERT TO SHAREHOLDER REPORTS |

|

| Board Consideration of and Continuation of |

| Investment Advisory Agreement and Sub-Advisory Agreement: |

| John Hancock Intrinsic Value Fund |