| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

|

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael J. Leary |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| | |

| |

| (Name and address of agent for service) |

|

| Registrant's telephone number, including area code: 617-663-4490 |

| | |

| Date of fiscal year end: | February 28 |

| |

| |

| Date of reporting period: | August 31, 2009 |

ITEM 1. REPORT TO SHAREHOLDERS.

A look at performance

For the period ended August 31, 2009

| | | | | | | | | | | | |

| | | | Average annual returns (%) | | Cumulative total returns (%) |

| | | | with maximum sales charge (POP) | | with maximum sales charge (POP) |

| | |

| |

|

| | Inception | | | | | Since | | Six | | | | Since |

| Class | date | | 1-year | 5-year | 10-year | inception | | months | 1-year | 5-year | 10-year | inception |

|

| A | 6-12-06 | | –28.53 | — | — | –11.82 | | 21.56 | –28.53 | — | — | –33.36 |

|

| B | 6-12-06 | | –29.07 | — | — | –11.85 | | 22.34 | –29.07 | — | — | –33.43 |

|

| C | 6-12-06 | | –26.07 | — | — | –11.04 | | 26.32 | –26.07 | — | — | –31.44 |

|

| I1 | 6-12-06 | | –24.44 | — | — | –10.04 | | 28.08 | –24.44 | — | — | –28.93 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until June 30, 2010. The net expenses are as follows: Class A — 1.39%, Class B — 2.09%, Class C — 2.09% and Class I — 0.91%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.85%, Class B — 9.77%, Class C — 4.94% and Class I — 20.87%. The Fund’s expenses for the current fiscal year may be higher than the expenses listed above, for some of the following reasons: i) a significant decrease in average net assets may result in a higher advisory fee ra te; ii) a significant decrease in average net assets may result in an increase in the expense ratio; and iii) the termination or expiration of expense cap reimbursements.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses increase and results would have been less favorable.

1 For certain types of investors, as described in the Fund’s Class I share prospectus.

| |

| 6 | Value Opportunities Fund | Semiannual report |

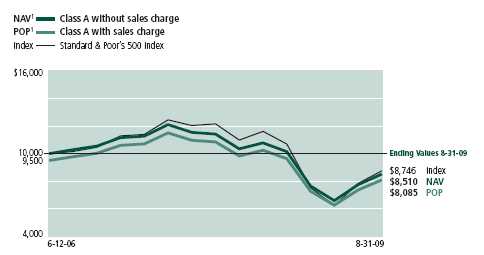

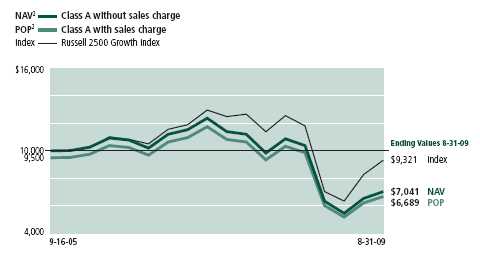

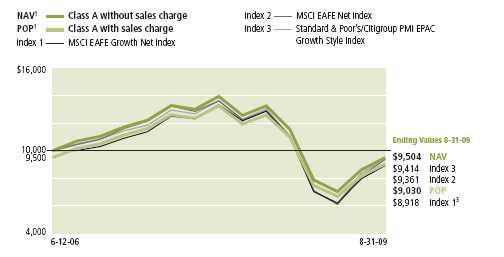

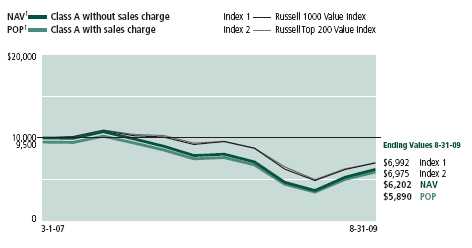

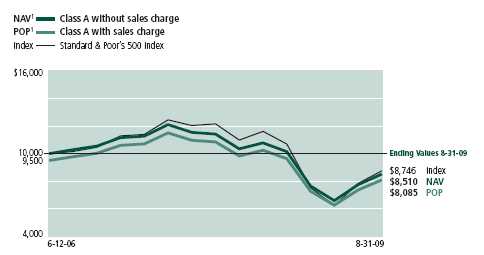

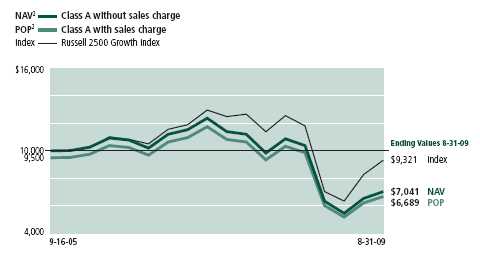

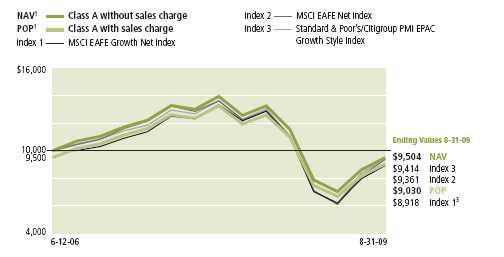

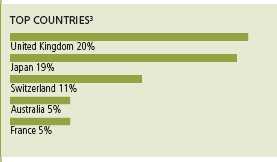

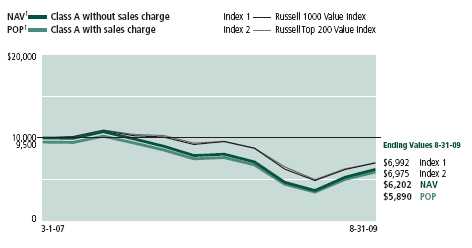

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Value Opportunities Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Russell 2500 Value Index.

| | | | |

| | | | With maximum | |

| Class | Period beginning | Without sales charge | sales charge | Index |

|

| B | 6-12-06 | $6,850 | $6,657 | $8,346 |

|

| C2 | 6-12-06 | 6,856 | 6,856 | 8,346 |

|

| I3 | 6-12-06 | 7,107 | 7,107 | 8,346 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C and Class I shares, respectively, as of August 31, 2009. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 2500 Value Index is an unmanaged index containing those securities in the Russell 2500 Index with a less-than-average growth orientation.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

3 For certain types of investors, as described in the Fund’s Class I share prospectus.

| |

| Semiannual report | Value Opportunities Fund | 7 |

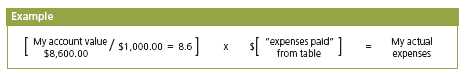

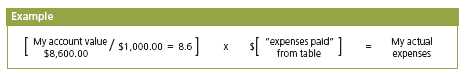

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on March 1, 2009, with the same investment held until August 31, 2009.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 3-1-09 | on 8-31-09 | period ended 8-31-091 |

|

| Class A | $1,000.00 | $1,279.10 | $7.98 |

|

| Class B | 1,000.00 | 1,273.40 | 11.98 |

|

| Class C | 1,000.00 | 1,273.20 | 11.98 |

|

| Class I | 1,000.00 | 1,280.80 | 5.52 |

|

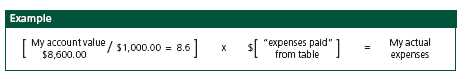

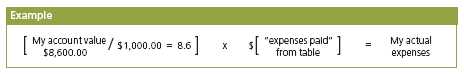

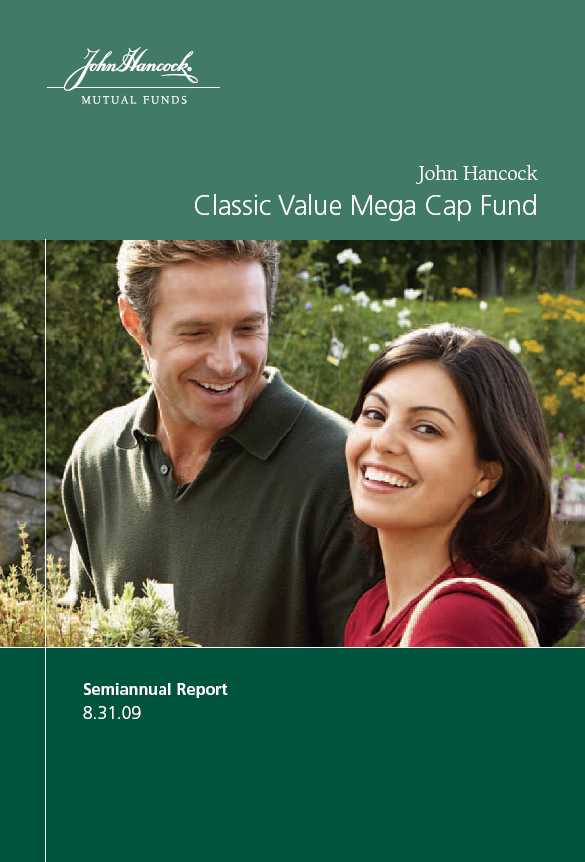

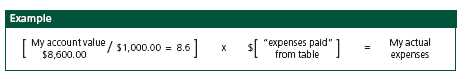

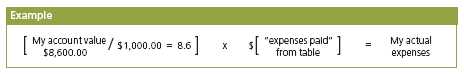

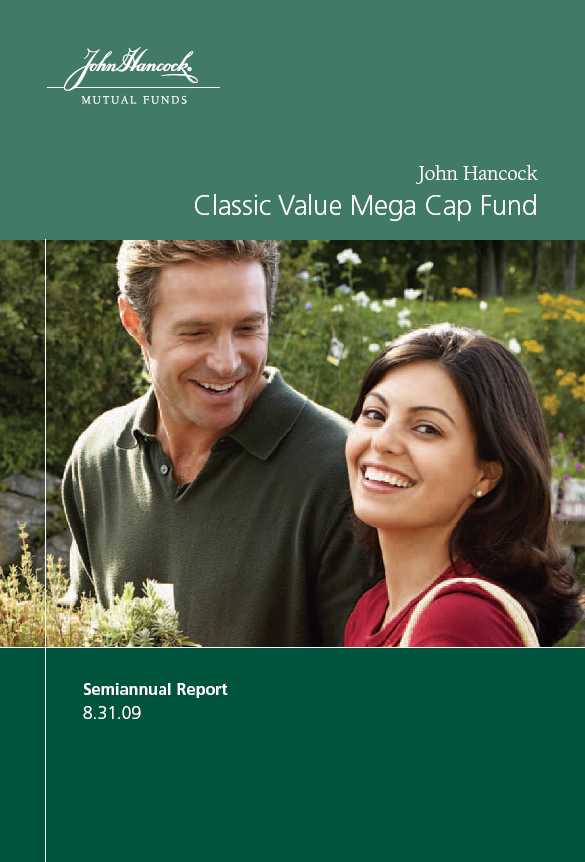

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at August 31, 2009, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | Value Opportunities Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on March 1, 2009, with the same investment held until August 31, 2009. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 3-1-09 | on 8-31-09 | period ended 8-31-091 |

|

| Class A | $1,000.00 | $1,018.20 | $7.07 |

|

| Class B | 1,000.00 | 1,014.70 | 10.61 |

|

| Class C | 1,000.00 | 1,014.70 | 10.61 |

|

| Class I | 1,000.00 | 1,020.40 | 4.89 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.39%, 2.09%, 2.09%, 0.96%, for Class A, Class B, Class C, and Class I shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| |

| Semiannual report | Value Opportunities Fund | 9 |

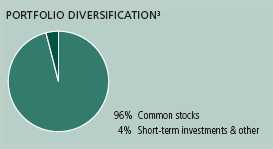

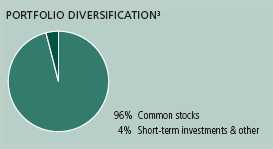

Portfolio summary

| | | | |

| Top 10 holdings1 | | | | |

|

| Watson Pharmaceuticals, Inc. | 1.1% | | SAIC, Inc. | 1.0% |

| |

|

| PartnerRe, Ltd. | 1.0% | | Dollar Tree, Inc. | 1.0% |

| |

|

| Axis Capital Holdings, Ltd. | 1.0% | | Ross Stores, Inc. | 1.0% |

| |

|

| Western Digital Corp. | 1.0% | | Nordstrom, Inc. | 1.0% |

| |

|

| Mylan, Inc. | 1.0% | | Cintas Corp. | 1.0% |

| |

|

| |

| |

| Sector composition2,3 | | | | |

|

| Consumer discretionary | 28% | | Industrials | 8% |

| |

|

| Financials | 21% | | Materials | 4% |

| |

|

| Information technology | 13% | | Energy | 2% |

| |

|

| Health care | 12% | | Short-term investments & other | 3% |

| |

|

| Consumer staples | 9% | | | |

| | |

1 As a percentage of net assets on August 31, 2009. Excluding cash and cash equivalents.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

3 As a percentage of net assets on August 31, 2009.

| |

| 10 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 8-31-09 (unaudited)

| | |

| | Shares | Value |

|

| Common stocks 97.23% | | $13,162,768 |

|

| (Cost $11,489,924) | | |

| | | |

| Advertising 0.17% | | 23,472 |

|

| Harte-Hanks, Inc. | 1,800 | 23,472 |

| | | |

| Aerospace & Defense 0.47% | | 63,830 |

|

| Alliant Techsystems, Inc. (I) | 800 | 61,824 |

|

| DigitalGlobe, Inc. (I) | 100 | 2,006 |

| | | |

| Air Freight & Logistics 0.06% | | 7,696 |

|

| Air Transport Services Group, Inc. | 2,600 | 7,696 |

| | | |

| Airlines 0.23% | | 31,761 |

|

| Republic Airways Holdings, Inc. (I) | 1,100 | 10,131 |

|

| Skywest, Inc. | 1,400 | 21,630 |

| | | |

| Apparel Retail 4.74% | | 642,033 |

|

| Aeropostale, Inc. (I) | 1,800 | 70,470 |

|

| American Eagle Outfitters, Inc. | 5,800 | 78,300 |

|

| Buckle, Inc. (L) | 1,300 | 34,385 |

|

| Cato Corp. (Class A) | 1,000 | 17,080 |

|

| Charming Shoppes, Inc. (I) | 3,600 | 18,864 |

|

| Chico’s FAS, Inc. (I) | 4,800 | 61,104 |

|

| Collective Brands, Inc. (I) | 2,100 | 33,264 |

|

| Dress Barn, Inc. (I) (L) | 1,000 | 16,230 |

|

| Finish Line, Inc. (I) | 700 | 5,775 |

|

| Foot Locker, Inc. | 4,000 | 42,640 |

|

| Genesco, Inc. (I) | 300 | 6,570 |

|

| Gymboree Corp. (I) | 500 | 22,395 |

|

| Hot Topic, Inc. (I) | 1,200 | 8,352 |

|

| JOS. A. Bank Clothiers, Inc. (I) | 700 | 30,807 |

|

| Men’s Wearhouse, Inc. (L) | 1,900 | 49,400 |

|

| Ross Stores, Inc. | 2,700 | 125,928 |

|

| Stage Stores, Inc. | 700 | 9,345 |

|

| Stein Mart, Inc. (I) | 900 | 11,124 |

| | | |

| Apparel, Accessories & Luxury Goods 1.70% | | 229,892 |

|

| Carter’s, Inc. (I) | 2,100 | 52,836 |

|

| Columbia Sportswear Co. | 1,000 | 39,310 |

|

| Fossil, Inc. (I) | 1,700 | 43,146 |

|

| Jones Apparel Group, Inc. | 2,400 | 37,416 |

|

| Maidenform Brands, Inc. (I) | 500 | 8,070 |

|

| Phillips-Van Heusen Corp. | 1,300 | 49,114 |

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 11 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Application Software 1.91% | | $258,664 |

|

| Actuate Corp., (I) | 1,200 | 6,744 |

|

| Compuware Corp. (I) | 4,900 | 35,329 |

|

| ePlus, Inc. (I) | 400 | 6,320 |

|

| Fair Isaac Corp. | 1,400 | 31,220 |

|

| Henry, Jack & Associates, Inc. | 1,500 | 34,965 |

|

| JDA Software Group, Inc. (I) | 500 | 9,670 |

|

| Manhattan Associates, Inc. (I) | 400 | 7,132 |

|

| MicroStrategy, Inc., (Class A )(I) | 200 | 12,350 |

|

| Quest Software, Inc. (I) | 2,400 | 39,576 |

|

| Smith Micro Software, Inc. (I) | 700 | 8,085 |

|

| SPSS, Inc. (I) | 300 | 14,940 |

|

| Tibco Software, Inc. (I) | 5,900 | 52,333 |

| | | |

| Asset Management & Custody Banks 0.51% | | 69,476 |

|

| Calamos Asset Management, Inc. | 500 | 5,640 |

|

| Federated Investors, Inc. (Class B) | 1,700 | 44,625 |

|

| Hercules Technology Growth Capital, Inc. | 600 | 5,562 |

|

| MCG Capital Corp. (I) | 2,300 | 6,969 |

|

| PennantPark Investment Corp. | 800 | 6,680 |

| | | |

| Auto Parts & Equipment 0.42% | | 56,930 |

|

| Dorman Products, Inc. (I) | 700 | 9,842 |

|

| Spartan Motors Inc. | 900 | 4,887 |

|

| Standard Motor Products Inc. | 700 | 8,666 |

|

| TRW Automotive Holdings Corp. (I) | 1,900 | 33,535 |

| | | |

| Automotive Retail 2.73% | | 369,746 |

|

| Advance Auto Parts, Inc. | 2,600 | 109,980 |

|

| America’s Car-Mart, Inc. (I) | 500 | 10,300 |

|

| Asbury Automotive Group, Inc. (I) | 1,100 | 13,750 |

|

| AutoNation, Inc. (I) (L) | 6,600 | 125,268 |

|

| Group 1 Automotive, Inc. | 800 | 22,536 |

|

| Lithia Motors, Inc., (Class A) | 800 | 10,248 |

|

| Monro Muffler Brake, Inc. | 500 | 12,890 |

|

| Penske Auto Group, Inc. (L) | 2,700 | 47,763 |

|

| PEP Boys-Manny Moe & Jack | 900 | 8,037 |

|

| Sonic Automative, Inc. | 700 | 8,974 |

| | | |

| Building Products 0.21% | | 29,002 |

|

| AAON, Inc. | 400 | 8,352 |

|

| Universal Forest Products, Inc. | 500 | 20,650 |

| | | |

| Casinos & Gaming 0.38% | | 51,918 |

|

| Ameristar Casinos, Inc. | 800 | 13,288 |

|

| Boyd Gaming Corp. (I) | 1,900 | 19,532 |

|

| Isle Of Capri Casinos, Inc. (I) | 1,200 | 12,276 |

|

| Shuffle Master, Inc. (I) | 900 | 6,822 |

| | | |

| Commercial Printing 0.38% | | 51,880 |

|

| Courier Corp. | 300 | 4,830 |

|

| Deluxe Corp. | 2,000 | 33,420 |

|

| Ennis, Inc. | 1,000 | 13,630 |

See notes to financial statements

| |

| 12 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Commodity Chemicals 0.11% | | $14,270 |

|

| Hawkins, Inc. | 400 | 8,500 |

|

| Spartech Corpspartech Corp. | 500 | 5,770 |

| | | |

| Communications Equipment 1.73% | | 234,320 |

|

| 3Com Corp. (I) | 8,000 | 34,800 |

|

| Adtran, Inc. | 1,100 | 25,014 |

|

| Airvana, Inc. (I) | 1,200 | 7,788 |

|

| Avocent Corp. (I) | 900 | 14,688 |

|

| Black Box Corp. | 600 | 15,024 |

|

| Brocade Communications Systems, Inc. (I) | 6,100 | 44,103 |

|

| Netgear, Inc. (I) | 600 | 10,248 |

|

| Polycom, Inc. (I) | 1,300 | 30,667 |

|

| Tellabs, Inc. (I) | 8,200 | 51,988 |

| | | |

| Computer & Electronics Retail 0.72% | | 96,859 |

|

| Conn’s, Inc. (I) | 700 | 7,917 |

|

| Hhgregg, Inc. (I) | 700 | 12,096 |

|

| RadioShack Corp. | 4,200 | 63,546 |

|

| Systemax, Inc. (I) | 1,000 | 13,300 |

| | | |

| Computer Storage & Peripherals 2.10% | | 283,991 |

|

| Lexmark International, Inc. (I) | 1,400 | 26,376 |

|

| Seagate Technology | 8,700 | 120,495 |

|

| Western Digital Corp. (I) | 4,000 | 137,120 |

| | | |

| Construction & Engineering 0.05% | | 6,696 |

|

| Michael Baker Corp. (I) | 200 | 6,696 |

| | | |

| Construction & Farm Machinery & Heavy Trucks 0.79% | | 106,831 |

|

| Force Protection, Inc. (I) | 1,200 | 6,360 |

|

| Oshkosh Corp. | 2,200 | 73,920 |

|

| Toro Cotoro Co | 700 | 26,551 |

| | | |

| Consumer Finance 1.18% | | 159,889 |

|

| Advance America Cash Advance Centers, Inc. | 1,600 | 9,184 |

|

| AmeriCredit Corp. (I) (L) | 4,900 | 84,574 |

|

| Nelnet, Inc., (Class A) (I) | 1,900 | 28,044 |

|

| Student Loan Corp. | 510 | 25,072 |

|

| World Acceptance Corp. (I) | 500 | 13,015 |

| | | |

| Data Processing & Outsourced Services 1.57% | | 212,824 |

|

| Affiliated Computer Services, Inc. (Class A) (I) | 2,500 | 112,000 |

|

| Convergys Corp. (I) | 3,700 | 40,108 |

|

| CSG Systems International, Inc. (I) | 1,400 | 21,098 |

|

| Global Cash Access Holdings, Inc. (I) | 1,900 | 13,775 |

|

| InfoGROUP, Inc. (I) | 1,700 | 10,489 |

|

| TeleTech Holdings, Inc. (I) | 900 | 15,354 |

| | | |

| Department Stores 1.11% | | 150,141 |

|

| Dillard’s, Inc., (Class A) | 2,100 | 23,961 |

|

| Nordstrom, Inc. (L) | 4,500 | 126,180 |

| | | |

| Distributors 0.08% | | 11,484 |

|

| Core-Mark Holding Co., Inc. (I) | 400 | 11,484 |

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 13 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Diversified Financial Services 0.14% | | $18,897 |

|

| First of Long Island Corp. | 100 | 2,854 |

|

| Great Southern Bancorp, Inc. (L) | 400 | 8,420 |

|

| National Bankshares, Inc. | 300 | 7,623 |

| | | |

| Diversified Support Services 0.93% | | 126,224 |

|

| Cintas Corp. | 4,600 | 126,224 |

| | | |

| Education Services 1.44% | | 194,612 |

|

| Career Education Corp. (I) | 3,400 | 80,750 |

|

| ITT Educational Services, Inc. (I) | 1,000 | 104,990 |

|

| Lincoln Educational Services Corp. (I) (L) | 400 | 8,872 |

| | | |

| Electrical Components & Equipment 0.53% | | 72,163 |

|

| Hubbell, Inc. | 1,300 | 50,011 |

|

| Thomas & Betts Corp. (I) | 800 | 22,152 |

| | | |

| Fertilizers & Agricultural Chemicals 0.72% | | 97,656 |

|

| Scotts Miracle-Gro Co. (Class A) | 2,400 | 97,656 |

| | | |

| Food Distributors 0.24% | | 32,472 |

|

| Nash Finch Co. | 400 | 10,856 |

|

| United Natural Foods, Inc. (I) | 800 | 21,616 |

| | | |

| Food Retail 2.02% | | 273,207 |

|

| Casey’s General Stores, Inc. | 1,300 | 36,075 |

|

| Pantry, Inc. (I) | 1,100 | 16,665 |

|

| SUPERVALU, Inc. | 5,800 | 83,230 |

|

| Susser Holdings Corp (I) | 400 | 4,292 |

|

| Village Super Market, Inc. | 600 | 17,190 |

|

| Weis Markets, Inc. | 1,100 | 34,331 |

|

| Whole Foods Market, Inc. (I) (L) | 2,800 | 81,424 |

| | | |

| Footwear 0.65% | | 87,312 |

|

| CROCS Inc. (I) | 1,800 | 11,430 |

|

| Steven Madden, Ltd. (I) | 700 | 22,561 |

|

| Timberland Company (Class A) (I) | 2,000 | 25,920 |

|

| Wolverine World Wide, Inc. | 1,100 | 27,401 |

| | | |

| Gas Utilities 0.89% | | 119,809 |

|

| New Jersey Resources Corp. | 900 | 33,075 |

|

| UGI Corp. | 3,400 | 86,734 |

| | | |

| General Merchandise Stores 2.23% | | 302,418 |

|

| Big Lots, Inc. (I) | 1,500 | 38,130 |

|

| Dollar Tree, Inc. (I) | 2,600 | 129,844 |

|

| Family Dollar Stores, Inc. | 3,800 | 115,064 |

|

| Fred’s, Inc. (Class A) | 1,000 | 13,080 |

|

| Tuesday Morning Corp. (I) | 1,400 | 6,300 |

| | | |

| Health Care Distributors 0.62% | | 83,423 |

|

| Owens & Minor, Inc. | 1,100 | 48,675 |

|

| PSS World Medical, Inc. (I) | 1,700 | 34,748 |

| | | |

| Health Care Equipment 1.25% | | 169,413 |

|

| Cantel Medical Corp. (I) | 600 | 8,064 |

|

| Edwards Lifesciences Corp. (I) | 1,400 | 86,632 |

|

| Invacare Corp. | 900 | 19,494 |

See notes to financial statements

| |

| 14 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Health Care Equipment (continued) | | |

|

| Orthofix International N.V. (I) | 700 | $19,159 |

|

| STERIS Corp. | 1,000 | 29,020 |

|

| Young Innovations, Inc. | 300 | 7,044 |

| | | |

| Health Care Facilities 0.65% | | 87,447 |

|

| Health Management Associates, Inc., (Class A) (I) | 7,200 | 49,752 |

|

| LifePoint Hospitals, Inc. (I) | 1,500 | 37,695 |

| | | |

| Health Care Services 2.02% | | 273,505 |

|

| BioScrip, Inc. (I) | 1,100 | 6,468 |

|

| Chemed Corp. | 800 | 34,832 |

|

| Kinetic Concepts, Inc. (I) | 1,800 | 57,510 |

|

| Lincare Holdings, Inc. (I) | 2,100 | 55,419 |

|

| Odyssey HealthCare, Inc. (I) | 1,500 | 19,320 |

|

| Omnicare, Inc. | 4,000 | 91,560 |

|

| RehabCare Group, Inc. (I) | 400 | 8,396 |

| | | |

| Health Care Supplies 0.37% | | 50,392 |

|

| Cooper Cos., Inc. | 1,300 | 35,516 |

|

| ICU Medical, Inc. (I) | 400 | 14,876 |

| | | |

| Health Care Technology 0.78% | | 105,315 |

|

| Cerner Corp. (I) | 1,300 | 80,223 |

|

| Computer Programs & Systems, Inc. | 400 | 15,480 |

|

| MedQuist, Inc. | 1,200 | 9,612 |

| | | |

| Home Furnishings 0.31% | | 41,440 |

|

| Tempur-Pedic International, Inc. (I) | 2,800 | 41,440 |

| | | |

| Homebuilding 0.06% | | 8,712 |

|

| Standard Pacific Corp. (I) | 2,400 | 8,712 |

| | | |

| Homefurnishing Retail 1.08% | | 145,669 |

|

| Aaron Rents, Inc. | 1,700 | 44,370 |

|

| Haverty Furniture Cos., Inc. (I) | 500 | 5,835 |

|

| Kirkland’s, Inc. (I) | 700 | 9,912 |

|

| Rent-A–Center, Inc. (I) | 2,300 | 45,379 |

|

| Williams-Sonoma, Inc. | 2,100 | 40,173 |

| | | |

| Hotels, Resorts & Cruise Lines 0.64% | | 86,607 |

|

| Ambassadors Group, Inc. | 400 | 6,312 |

|

| Wyndham Worldwide Corp. | 5,300 | 80,295 |

| | | |

| Household Appliances 0.72% | | 96,994 |

|

| Helen of Troy, Ltd. (I) | 700 | 15,134 |

|

| Stanley Works | 2,000 | 81,860 |

| | | |

| Household Products 0.23% | | 30,800 |

|

| Central Garden And Pet Co. (I) | 2,800 | 30,800 |

| | | |

| Housewares & Specialties 1.54% | | 208,606 |

|

| American Greetings Corp. (Class A ) | 700 | 9,723 |

|

| Blyth, Inc. | 200 | 9,100 |

|

| Jarden Corp. (I) | 3,000 | 73,050 |

|

| Newell Rubbermaid, Inc. | 4,400 | 61,248 |

|

| Tupperware Brands Corp. | 1,500 | 55,485 |

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 15 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Human Resource & Employment Services 2.07% | | $280,216 |

|

| Administaff, Inc. | 800 | 19,312 |

|

| Kelly Services, Inc. (Class A) | 800 | 9,184 |

|

| Kforce Inc. (I) | 1,600 | 17,920 |

|

| Manpower, Inc. | 2,300 | 118,910 |

|

| Robert Half International, Inc. | 3,400 | 89,386 |

|

| Spherion Corp. (I) | 1,200 | 6,504 |

|

| TrueBlue, Inc. (I) | 1,100 | 14,960 |

|

| Volt Information Sciences, Inc. (I) | 400 | 4,040 |

| | | |

| Hypermarkets & Super Centers 0.29% | | 39,120 |

|

| BJ’s Wholesale Club, Inc. (I) | 1,200 | 39,120 |

| | | |

| Industrial Conglomerates 0.27% | | 36,289 |

|

| Carlisle Cos., Inc. | 1,100 | 36,289 |

| | | |

| Industrial Machinery 0.43% | | 57,895 |

|

| Briggs & Stratton Corp (L) | 1,100 | 19,404 |

|

| Crane Co. | 1,000 | 23,470 |

|

| John Bean Technologies Corp. | 900 | 15,021 |

| | | |

| Insurance Brokers 0.05% | | 7,065 |

|

| National Financial Partners Corp. | 900 | 7,065 |

| | | |

| Integrated Telecommunication Services 1.32% | | 179,036 |

|

| CenturyTel, Inc. | 3,800 | 122,474 |

|

| Windstream Corp. | 6,600 | 56,562 |

| | | |

| Internet Retail 0.09% | | 12,807 |

|

| NutriSystem, Inc. | 900 | 12,807 |

| | | |

| Internet Software & Services 1.14% | | 153,973 |

|

| Digital River, Inc. (I) | 600 | 21,192 |

|

| Earthlink, Inc. | 4,200 | 34,944 |

|

| IAC/InterActiveCorp (I) | 2,800 | 51,856 |

|

| j2 Global Communications, Inc. (I) | 1,300 | 27,781 |

|

| United Online, Inc. | 2,600 | 18,200 |

| | | |

| Investment Banking & Brokerage 0.10% | | 12,870 |

|

| MF Global, Ltd. (I) | 1,800 | 12,870 |

| | | |

| IT Consulting & Other Services 1.56% | | 211,252 |

|

| Acxiom Corp. (I) | 1,700 | 15,504 |

|

| CACI International, Inc. (Class A) (I) | 1,000 | 45,960 |

|

| MAXIMUS, Inc. | 400 | 16,660 |

|

| SAIC, Inc. (I) | 7,200 | 133,128 |

| | | |

| Leisure Facilities 0.09% | | 12,440 |

|

| Speedway Motorsports, Inc. | 800 | 12,440 |

| | | |

| Leisure Products 0.49% | | 66,192 |

|

| Brunswick Corp. | 1,300 | 12,077 |

|

| Polaris Industries, Inc. | 700 | 26,397 |

|

| Pool Corp. | 900 | 21,438 |

|

| RC2 Corp. (I) | 400 | 6,280 |

See notes to financial statements

| |

| 16 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Life & Health Insurance 1.08% | | $146,031 |

|

| American Equity Investment Life Holding Co. | 1,900 | 15,333 |

|

| Delphi Financial Group, Inc. | 1,400 | 32,718 |

|

| StanCorp Financial Group, Inc. | 900 | 34,065 |

|

| Torchmark Corp. | 1,500 | 63,915 |

| | | |

| Managed Health Care 2.18% | | 295,609 |

|

| AMERIGROUP Corp. (I) | 2,100 | 49,665 |

|

| Centene Corp. (I) | 1,700 | 29,427 |

|

| Coventry Health Care, Inc. (I) | 5,300 | 115,699 |

|

| Health Net, Inc. (I) | 3,600 | 55,152 |

|

| Molina Healthcare, Inc. (I) | 800 | 16,200 |

|

| Triple-S Management Corp. (Class B) (I) | 500 | 9,270 |

|

| Universal American Corp. (I) | 2,200 | 20,196 |

| | | |

| Metal & Glass Containers 0.79% | | 107,486 |

|

| AEP Industries, Inc. (I) | 200 | 7,662 |

|

| Ball Corp. | 1,900 | 92,074 |

|

| Bway Holding Co. (I) | 500 | 7,750 |

| | | |

| Mortgage REIT’s 2.18% | | 294,806 |

|

| American Capital Agency Corp. | 600 | 14,934 |

|

| Annaly Capital Management, Inc. | 7,200 | 124,848 |

|

| Anworth Mortgage Asset Corp. | 3,100 | 23,219 |

|

| Capstead Mortage Corp. | 2,600 | 35,490 |

|

| Hatteras Financial Corp. | 1,500 | 44,835 |

|

| MFA Financial, Inc. | 6,500 | 51,480 |

| | | |

| Multi-Line Insurance 1.97% | | 267,280 |

|

| American Financial Group, Inc. | 3,700 | 94,905 |

|

| Genworth Financial, Inc. | 8,000 | 84,480 |

|

| HCC Insurance Holdings, Inc. | 3,000 | 79,320 |

|

| Horace Mann Educators Corp. | 700 | 8,575 |

| | | |

| Office REIT’s 0.45% | | 61,290 |

|

| HRPT Properties Trust | 8,500 | 55,080 |

|

| Mission West Properties, Inc. | 900 | 6,210 |

| | | |

| Office Services & Supplies 0.46% | | 62,328 |

|

| HNI Corp. (L) | 1,200 | 25,776 |

|

| United Stationers, Inc. (I) | 800 | 36,552 |

| | | |

| Oil & Gas Refining & Marketing 1.74% | | 236,213 |

|

| Delek US Holdings, Inc. | 800 | 6,472 |

|

| Sunoco, Inc. | 3,600 | 96,840 |

|

| Tesoro Corp. (L) | 4,100 | 57,728 |

|

| Western Refining, Inc. (I) | 3,500 | 21,245 |

|

| World Fuel Services Corp. | 1,200 | 53,928 |

| | | |

| Packaged Foods & Meats 4.25% | | 574,784 |

|

| Dean Foods Co. (I) | 5,600 | 101,584 |

|

| Del Monte Foods Co. | 8,400 | 88,116 |

|

| Hormel Foods Corp. | 3,400 | 125,630 |

|

| J&J Snack Foods Corp. | 500 | 21,850 |

|

| J.M. Smucker Co. | 2,400 | 125,448 |

|

| Lancaster Colony Corp. | 700 | 35,182 |

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 17 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Packaged Foods & Meats (continued) | | |

|

| Pilgrim’s Pride Corp. (I) | 1,300 | $6,240 |

|

| Ralcorp Holdings, Inc. (I) | 1,000 | 62,730 |

|

| Seneca Foods Corp. (Class A)(I) | 300 | 8,004 |

| | | |

| Paper Packaging 0.35% | | 47,862 |

|

| Bemis Co., Inc. | 1,800 | 47,862 |

| | | |

| Paper Products 0.07% | | 9,836 |

|

| Schweitzer-Mauduit International, Inc. | 200 | 9,836 |

| | | |

| Personal Products 1.30% | | 175,678 |

|

| Herbalife Ltd. | 1,700 | 51,476 |

|

| NBTY, Inc. (I) | 1,800 | 66,708 |

|

| Nu Skin Enterprises, Inc. (Class A) | 2,200 | 37,950 |

|

| Tiens Biotech Group USA, Inc. (I) | 2,400 | 6,936 |

|

| USANA Health Sciences (I) | 400 | 12,608 |

| | | |

| Pharmaceuticals 3.63% | | 491,320 |

|

| Endo Pharmaceuticals Holdings, Inc. (I) | 3,200 | 72,224 |

|

| King Pharmaceuticals, Inc. (I) | 9,000 | 93,420 |

|

| Matrixx Initiatives, Inc. (I) | 400 | 2,156 |

|

| Medicis Pharmaceutical Corp. (Class A) | 1,600 | 29,552 |

|

| Mylan, Inc. (I) (L) | 9,200 | 134,964 |

|

| Par Pharmaceutical Companies, Inc. (I) | 700 | 14,315 |

|

| Watson Pharmaceuticals, Inc. (I) | 4,100 | 144,689 |

| | | |

| Property & Casualty Insurance 4.53% | | 613,332 |

|

| Allied World Assurance Holdings, Ltd. | 2,000 | 92,660 |

|

| American Physicians Capital, Inc. | 200 | 5,968 |

|

| American Physicians Service Group, Inc. | 200 | 4,602 |

|

| Aspen Insurance Holdings, Ltd. | 3,100 | 78,740 |

|

| Axis Capital Holdings, Ltd. | 4,600 | 140,208 |

|

| Baldwin & Lyons, Inc. (Class B) | 300 | 6,636 |

|

| CNA Surety Corp. (I) | 1,400 | 22,232 |

|

| First American Corp. | 3,500 | 110,320 |

|

| Infinity Property & Casualty Corp. | 300 | 13,191 |

|

| Meadowbrook Insurance Group, Inc. | 1,000 | 7,970 |

|

| Safety Insurance Group, Inc. | 400 | 12,852 |

|

| Stewart Information Services Corp. | 400 | 5,668 |

|

| Universal Insurance Holdings, Inc. | 1,500 | 7,530 |

|

| W.R. Berkley Corp. | 4,100 | 104,755 |

| | | |

| Publishing 0.68% | | 92,036 |

|

| Meredith Corp. (L) | 1,600 | 44,288 |

|

| Scholastic Corp. | 800 | 19,488 |

|

| Valassis Communications, Inc. (I) | 1,800 | 28,260 |

| | | |

| Real Estate Investment Trusts 0.03% | | 3,376 |

|

| istar Financial, Inc., REIT (I) | 1,600 | 3,376 |

| Real Estate Services 0.07% | | 10,031 |

|

| Altisource Portfolio Solutions SA (I) | 700 | 10,031 |

| | | |

| Regional Banks 0.23% | | 30,638 |

|

| Camden National Corp. | 300 | 9,705 |

|

| Trustmark Corp. | 1,100 | 20,933 |

See notes to financial statements

| |

| 18 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Reinsurance 5.94% | | $803,738 |

|

| Arch Capital Group, Ltd. (I) | 1,600 | 103,952 |

|

| Endurance Specialty Holdings, Ltd. | 2,100 | 72,387 |

|

| Everest Re Group, Ltd. | 1,400 | 118,034 |

|

| IPC Holdings, Ltd. | 1,900 | 61,598 |

|

| Maiden Holdings Ltd. | 1,900 | 14,516 |

|

| Odyssey Re Holdings Corp. | 1,300 | 65,845 |

|

| PartnerRe, Ltd. | 1,900 | 140,429 |

|

| Platinum Underwriters Holdings, Ltd. | 1,700 | 61,625 |

|

| RenaissanceRe Holdings, Ltd. | 2,000 | 108,900 |

|

| Validus Holdings, Ltd. (L) | 2,200 | 56,452 |

| | | |

| Research & Consulting Services 0.68% | | 91,949 |

|

| Equifax, Inc. | 2,700 | 74,628 |

|

| ICF International, Inc. (I) | 300 | 8,205 |

|

| School Specialty, Inc. (I) | 400 | 9,116 |

| | | |

| Restaurants 2.84% | | 384,149 |

|

| Bob Evans Farms, Inc. | 800 | 21,496 |

|

| Brinker International, Inc. | 3,700 | 53,872 |

|

| California Pizza Kitchen Inc (I) | 400 | 5,624 |

|

| Carrols Restaurant Group, Inc. (I) | 800 | 6,088 |

|

| CEC Entertainment, Inc. (I) | 600 | 16,050 |

|

| Cracker Barrel Old Country Store, Inc. | 1,000 | 28,410 |

|

| Darden Restaurants Inc. | 3,700 | 121,841 |

|

| DineEquity Inc. | 500 | 10,540 |

|

| Domino’s Pizza, Inc. (I) | 2,100 | 16,989 |

|

| Frisch’s Restaurants, Inc. | 200 | 5,644 |

|

| Jack in the Box, Inc. (I) | 900 | 18,351 |

|

| O’Charley’s, Inc. (I) | 700 | 5,355 |

|

| Papa John’s International, Inc. (I) | 800 | 18,664 |

|

| PF Chang’s China Bistro, Inc. (I) (L) | 400 | 12,764 |

|

| Ruby Tuesday, Inc. (I) | 1,900 | 13,870 |

|

| Steak N Shake Co. (I) | 800 | 8,384 |

|

| The Cheesecake Factory, Inc. (I) | 1,100 | 20,207 |

| | | |

| Retail REIT’s 0.07% | | 9,436 |

|

| Getty Realty Corp. | 400 | 9,436 |

| | | |

| Semiconductors 0.05% | | 6,320 |

|

| DSP Group, Inc. (I) | 800 | 6,320 |

| | | |

| Soft Drinks 1.00% | | 135,252 |

|

| Coca-Cola Bottling Co. Consolidated | 400 | 21,624 |

|

| National Beverage Corp. (I) | 2,100 | 21,294 |

|

| PepsiAmericas, Inc. | 3,300 | 92,334 |

| | | |

| Specialized Consumer Services 0.80% | | 107,843 |

|

| CPI Corp. | 300 | 5,424 |

|

| Pre-Paid Legal Services, Inc. (I) | 400 | 18,336 |

|

| Regis Corp. (L) | 2,100 | 33,978 |

|

| Steiner Leisure, Ltd. (I) | 600 | 19,932 |

|

| Weight Watchers International, Inc. | 1,100 | 30,173 |

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 19 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Specialized Finance 0.04% | | $5,960 |

|

| Encore Capital Group, Inc. (I) | 400 | 5,960 |

| | | |

| Specialized REIT’s 0.05% | | 6,776 |

|

| Ashford Hospitality Trust, Inc. | 2,200 | 6,776 |

| | | |

| Specialty Chemicals 2.11% | | 285,630 |

|

| International Flavors & Fragrances, Inc. | 1,100 | 39,182 |

|

| Lubrizol Corp. | 1,800 | 114,696 |

|

| RPM International, Inc. | 2,500 | 40,700 |

|

| Valspar Corp. | 3,400 | 91,052 |

| | | |

| Specialty Stores 1.96% | | 265,983 |

|

| Barnes & Noble, Inc. (L) | 1,800 | 37,242 |

|

| Big 5 Sporting Goods Corp. | 800 | 12,216 |

|

| Borders Group Inc. (I) | 1,700 | 5,389 |

|

| Cabela’s, Inc. (I) | 1,900 | 30,495 |

|

| Gander Mountain Co. (I) | 900 | 5,058 |

|

| Office Depot, Inc. (I) | 6,200 | 32,364 |

|

| Officemax, Inc. | 1,400 | 15,834 |

|

| PetSmart, Inc. | 3,300 | 69,003 |

|

| Tractor Supply Co. (I) | 1,100 | 51,766 |

|

| West Marine Inc. | 800 | 6,616 |

| | | |

| Steel 0.33% | | 44,328 |

|

| Reliance Steel & Aluminum Co. | 1,200 | 44,328 |

| | | |

| | | |

| Systems Software 0.80% | | 108,035 |

|

| Sybase, Inc. (I) | 3,100 | 108,035 |

| | | |

| Technology Distributors 1.72% | | 233,352 |

|

| Brightpoint, Inc. (I) | 1,300 | 9,542 |

|

| Ingram Micro, Inc. (Class A) (I) | 6,000 | 100,560 |

|

| Insight Enterprises, Inc. | 1,000 | 11,470 |

|

| SYNNEX Corp. (I) | 1,200 | 35,580 |

|

| Tech Data Corp. (I) | 2,000 | 76,200 |

| | | |

| Thrifts & Mortgage Finance 0.39% | | 52,342 |

|

| Ocwen Financial Corp. (I) | 2,100 | 21,735 |

|

| PMI Group, Inc. | 2,300 | 7,682 |

|

| Radian Group, Inc. | 2,500 | 22,925 |

| | | |

| Tobacco 0.05% | | 6,894 |

|

| Alliance One International, Inc. (I) | 1,800 | 6,894 |

| | | |

| Trading Companies & Distributors 0.58% | | 78,568 |

|

| Applied Industrial Technologies, Inc. | 900 | 18,567 |

|

| Beacon Roofing Supply, Inc. (I) | 800 | 13,456 |

|

| H&E Equipment Services Inc. (I) | 600 | 6,012 |

|

| Interline Brands, Inc. (I) | 700 | 11,697 |

|

| WESCO International, Inc. (I) | 1,200 | 28,836 |

| | | |

| Trucking 0.35% | | 47,943 |

|

| Avis Budget Group, Inc. | 3,500 | 34,055 |

|

| Dollar Thrifty Automotive Group, Inc. | 700 | 13,888 |

See notes to financial statements

| |

| 20 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | | |

| | | Shares | Value |

| Wireless Telecommunication Services 0.17% | | | $22,481 |

|

| USA Mobility, Inc. | | 1,100 | 14,003 |

|

| Virgin Mobile USA, Inc. | | 1,800 | 8,478 |

| |

| | Rate | Shares | Value |

|

| Short-term investments 9.56% | | | $1,294,729 |

|

| (Cost $1,294,279) | | | |

| | | | |

| Cash Equivalents 6.75% | | | 913,729 |

|

| John Hancock Collateral Investment | | | |

| Trust (T)(W) | 0.3900% (Y) | 91,270 | 913,729 |

| |

| | | Par value | Value |

| Repurchase Agreement 2.81% | | | 381,000 |

|

| Repurchase Agreement with State Street Corp. dated 8-31-09 | | |

| at 0.070% to be repurchased at $381,001 on 9-1-09, | | | |

| collateralized by $355,000 Federal Home Loan Mortgage | | | |

| Corp., 5.00% due 2-16-17 (valued at $389,030, including interest) | $381,000 | 381,000 |

|

| Total investments (Cost $12,784,203)† 106.79% | | | $14,457,497 |

|

| |

| Other assets and liabilities, net (6.79%) | | | ($919,005) |

|

| |

| Total net assets 100.00% | | | $13,538,492 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

REIT Real Estate Investment Trust

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of August 31, 2009.

(T) Represents investment of securities lending collateral.

(W) Issuer is an affiliate of John Hancock Advisers, LLC (the Adviser).

(Y) The rate shown is the annualized seven-day yield as of August 31, 2009

† At August 31, 2009, the aggregate cost of investment securities for federal income tax purposes was $13,091,738. Net unrealized appreciation aggregated $1,365,759, of which $1,991,152 related to appreciated investment securities and $625,393 related to depreciated investment securities.

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 21 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 8-31-09 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $11,489,924) including | |

| $878,083 of securities loaned (Note 2) | $13,162,768 |

| Investments in affiliated issuers, at value (Cost $913,279) (Note 2) | 913,729 |

| Repurchase agreements, at value (Cost $381,000) (Note 2) | 381,000 |

| Total investments, at value (Cost $12,784,203) | 14,457,497 |

| Cash | 23,423 |

| Cash held at broker for futures contracts | 24,000 |

| Receivable for fund shares sold | 2,094 |

| Dividends and interest receivable | 14,210 |

| Receivable for security lending income | 715 |

| Receivable due from adviser | 3,952 |

| Other receivables and prepaid assets | 88,431 |

| | |

| Total assets | 14,614,322 |

| |

| Liabilities | |

|

| Payable for investments purchased | 23,098 |

| Payable for fund shares repurchased | 1,472 |

| Payable upon return of securities loaned (Note 2) | 913,185 |

| Payable for futures variation margin | 3,080 |

| Payable to affiliates | |

| Accounting and legal services fees | 230 |

| Transfer agent fees | 2,215 |

| Distribution and service fees | 81 |

| Other liabilities and accrued expenses | 132,469 |

| | |

| Total liabilities | 1,075,830 |

| |

| Net assets | |

|

| Capital paid-in | $21,578,796 |

| Accumulated undistributed net investment income | 37,569 |

| Accumulated net realized loss on investments, investments and futures | |

| contracts | (9,778,083) |

| Net unrealized appreciation on investments and futures contracts | 1,700,210 |

| | |

| Net assets | $13,538,492 |

See notes to financial statements

| |

| 22 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value. | |

| Class A ($12,856,335 ÷ 991,450 shares) | $12.97 |

| Class B ($156,389 ÷ 12,121 shares)1 | $12.90 |

| Class C ($411,636 ÷ 31,880 shares)1 | $12.91 |

| Class I ($114,132 ÷ 8,783 shares)2 | $13.00 |

|

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)3 | $13.65 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 Net assets and shares outstanding have been rounded for presentation purposes. The net asset value is as reported on August 31, 2009.

3 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 23 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 8-31-09 (unaudited)1

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $121,879 |

| Securities lending | 2,003 |

| Interest | 119 |

| Less foreign taxes withheld | (3) |

| | |

| Total investment income | 123,998 |

|

| Expenses | |

|

| Investment management fees (Note 6) | 48,709 |

| Distribution and service fees (Note 6) | 20,011 |

| Transfer agent fees (Note 6) | 10,132 |

| Accounting and legal services fees (Note 6) | 401 |

| Trustees’ fees (Note 7) | 718 |

| State registration fees (Note 6) | 36,426 |

| Printing and postage fees (Note 6) | 5,895 |

| Professional fees | 17,494 |

| Custodian fees | 27,519 |

| Registration and filing fees | 10,278 |

| Proxy fees | 3,831 |

| Other | 300 |

| | |

| Total expenses | 181,714 |

| Less expense reductions (Note 6) | (95,404) |

| | |

| Net expenses | 86,310 |

| | |

| Net investment income | 37,688 |

|

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | (4,777,839) |

| Investments in affiliated issuers | 94 |

| Futures contracts (Note 3) | 60,985 |

| | (4,716,760) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 7,551,927 |

| Investments in affiliated issuers | 450 |

| Futures contracts (Note 3) | 63,059 |

| | 7,615,436 |

| Net realized and unrealized gain | 2,898,676 |

| Increase in net assets from operations | $2,936,364 |

1 Semiannual period from 3-1-09 to 8-31-09. Unaudited.

See notes to financial statements

| |

| 24 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Period | Year |

| | ended | ended |

| | 8-31-091 | 2-28-09 |

|

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $37,688 | $101,853 |

| Net realized loss | (4,716,760) | (3,717,979) |

| Change in net unrealized appreciation (depreciation) | 7,615,436 | (3,610,530) |

| | | |

| Increase (decrease) in net assets resulting from operations | 2,936,364 | (7,226,656) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | — | (108,166) |

| Class B | — | (28) |

| Class C | — | (98) |

| Class I | — | (688) |

| Class R1 | — | (693) |

| | | |

| Total distributions | — | (109,673) |

| | | |

| From Fund share transactions (Note 8) | 32,522 | (283,575) |

| | | |

| Total increase (decrease) | 2,968,886 | (7,619,904) |

|

| Net assets | | |

|

| Beginning of period | 10,569,606 | 18,189,510 |

| | | |

| End of period | $13,538,492 | $10,569,606 |

| |

| Undistributed (distributions in excess of) net investment income | $37,569 | ($119) |

1 Semiannual period from 3-1-09 to 8-31-09. Unaudited.

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 25 |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | |

| CLASS A SHARES Period ended | 8-31-091 | 2-28-09 | 2-29-08 | 2-28-072 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $10.14 | $17.00 | $22.36 | $20.00 |

| Net investment income3 | 0.04 | 0.10 | 0.12 | 0.074 |

| Net realized and unrealized gain (loss) on investments | 2.79 | (6.84) | (4.41) | 2.53 |

| Total from investment operations | 2.83 | (6.74) | (4.29) | 2.60 |

| Less distributions | | | | |

| From net investment income | — | (0.12) | (0.11) | (0.08) |

| From net realized gain | — | — | (0.96) | (0.16) |

| Total distributions | — | (0.12) | (1.07) | (0.24) |

| Net asset value, end of period | $12.97 | $10.14 | $17.00 | $22.36 |

| Total return (%)5,6 | 27.917 | (39.79) | (19.45) | 13.067 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $13 | $10 | $16 | $20 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 2.428,9 | 2.03 | 2.04 | 2.138 |

| Expenses net of all fee waivers | 1.398,9 | 1.39 | 1.39 | 1.388 |

| Expenses net of all fee waivers and credits | 1.398,9 | 1.39 | 1.39 | 1.388 |

| Net investment income | 0.658 | 0.69 | 0.56 | 0.474,8 |

| Portfolio turnover (%) | 102 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-09 to 8-31-09. Unaudited.

2 Class A shares began operations on 6-12-06.

3 Based on the average of the shares outstanding.

4 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund which amounted to $0.02 per share and 0.09% of average net assets.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Assumes dividend reinvestment.

7 Not annualized.

8 Annualized.

9 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.06%.

See notes to financial statements

| |

| 26 | Value Opportunities Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | | | |

| CLASS B SHARES Period ended | 8-31-091 | 2-28-09 | 2-29-08 | 2-28-072 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $10.13 | $16.94 | $22.33 | $20.00 |

| Net investment income (loss)3 | — | (0.01) | (0.03) | (0.01)4 |

| Net realized and unrealized gain (loss) on investments | 2.77 | (6.80) | (4.40) | 2.51 |

| Total from investment operations | 2.77 | (6.81) | (4.43) | 2.50 |

| Less distributions | | | | |

| From net investment income | — | —5 | — | (0.01) |

| From net realized gain | — | — | (0.96) | (0.16) |

| Total distributions | — | —5 | (0.96) | (0.17) |

| Net asset value, end of period | $12.90 | $10.13 | $16.94 | $22.33 |

| Total return (%)6,7 | 27.348 | (40.19) | (20.08) | 12.548 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | —9 | —9 | —9 | —9 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 15.4110,11 | 9.95 | 6.82 | 11.3110 |

| Expenses net of fee waivers | 2.0910,11 | 2.63 | 2.10 | 2.0810 |

| Expenses net of all fee waivers and credits | 2.0910,11 | 2.09 | 2.09 | 2.0810 |

| Net investment loss | (0.06)10 | (0.02) | (0.14) | (0.07)4,10 |

| Portfolio turnover (%) | 102 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-09 to 8-31-09. Unaudited.

2 Class B shares began operations on 6-12-06.

3 Based on the average of the shares outstanding.

4 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund which amounted to $0.02 per share and 0.10% of average net assets.

5 Less than $0.01 per share.

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Assumes dividend reinvestment.

8 Not annualized.

9 Less than $500,000.

10 Annualized.

11 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.06%.

| | | | |

| CLASS C SHARES Period ended | 8-31-091 | 2-28-09 | 2-29-08 | 2-28-072 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $10.14 | $16.95 | $22.33 | $20.00 |

| Net investment income (loss)3 | — | (0.01) | (0.03) | (0.01)4 |

| Net realized and unrealized gain (loss) on investments | 2.77 | (6.80) | (4.39) | 2.51 |

| Total from investment operations | 2.77 | (6.81) | (4.42) | 2.50 |

| From net investment income | — | —5 | — | (0.01) |

| From net realized gain | — | — | (0.96) | (0.16) |

| Total distributions | — | —5 | (0.96) | (0.17) |

| Net asset value, end of period | $12.91 | $10.14 | $16.95 | $22.33 |

| Total return (%)6,7 | 27.328 | (40.17) | (20.03) | 12.548 |

|

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | —9 | —9 | $1 | $1 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 7.8110,11 | 5.12 | 3.88 | 5.0910 |

| Expenses net of fee waivers | 2.0910,11 | 2.40 | 2.10 | 2.0810 |

| Expenses net of all fee waivers and credits | 2.0910,11 | 2.09 | 2.09 | 2.0810 |

| Net investment loss | (0.04)10 | (0.03) | (0.14) | (0.07)4,10 |

| Portfolio turnover (%) | 102 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-09 to 8-31-09. Unaudited.

2 Class C shares began operations on 6-12-06.

3 Based on the average of the shares outstanding.

4 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund which amounted to $0.02 per share and 0.10% of average net assets.

5 Less than $0.01 per share.

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Assumes dividend reinvestment.

8 Not annualized.

9 Less than $500,000.

10 Annualized.

11 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.08%.

See notes to financial statements

| |

| Semiannual report | Value Opportunities Fund | 27 |

F I N A N C I A L S T A T E M E N T S

| | | | |

| CLASS I SHARES Period ended | 8-31-091 | 2-28-09 | 2-29-08 | 2-28-072 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $10.15 | $17.02 | $22.39 | $20.00 |

| Net investment income3 | 0.06 | 0.17 | 0.18 | 0.154 |

| Net realized and unrealized gain (loss) on investments | 2.78 | (6.86) | (4.41) | 2.53 |

| Total from investment operations | 2.84 | (6.69) | (4.23) | 2.68 |

| Less distributions | | | | |

| From net investment income | — | (0.18) | (0.18) | (0.13) |

| From net realized gain | — | — | (0.96) | (0.16) |

| Total distributions | — | (0.18) | (1.14) | (0.29) |

| Net asset value, end of period | $13.00 | $10.15 | $17.02 | $22.39 |

| Total return (%)5,6 | 28.087 | (39.48) | (19.16) | 13.427 |

|

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | —8 | —8 | —8 | —8 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 17.029,10 | 21.05 | 8.80 | 12.639 |

| Expenses net of all fee waivers | 0.969,10 | 0.99 | 0.99 | 0.999 |

| Expenses net of all fee waivers and credits | 0.969,10 | 0.99 | 0.99 | 0.999 |

| Net investment income | 1.079 | 1.11 | 0.86 | 0.964,9 |

| Portfolio turnover (%) | 102 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-09 to 8-31-09. Unaudited.

2 Class I shares began operations on 6-12-06.

3 Based on the average of the shares outstanding.

4 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund which amounted to $0.02 per share and 0.10% of average net assets.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Assumes dividend reinvestment.

7 Not annualized.

8 Less than $500,000.

9 Annualized.

10 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.03%.

See notes to financial statements

| |

| 28 | Value Opportunities Fund | Semiannual report |

Notes to financial statements (unaudited)

Note 1

Organization

John Hancock Value Opportunities Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust). The Trust was established as a Massachusetts business trust on June 9, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end investment management company. The investment objective of the Fund is to seek long-term capital appreciation.

John Hancock Investment Management Services, LLC (JHIMS or the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

The Board of Trustees have authorized the issuance of multiple classes of shares of the Fund, including classes designated as Class A, Class B, Class C and Class I shares. Class A, Class B and Class C shares are open to all retail investors. Class I shares are offered without any sales charge to various institutional and certain individual investors. The shares of each class represent an interest in the same portfolio of investments of the Fund, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Board of Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bear distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase. Class R1 shares merged into Class A shares on August 21, 2009.

The Adviser and other affiliates of John Hancock USA owned 789,451 shares of beneficial interest of Class A on August 31, 2009.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after period end and through the date that the financial statements were issued, October 23, 2009, have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation

Investments are stated at value as of the close of the regular trading on New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Equity securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated price if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker qu otes. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Equity and debt obligations, for which there are no prices available from an independent pricing service, are value based on broker quotes or fair valued as described

| |

| Semiannual report | Value Opportunities Fund | 29 |

below. Certain short-term investments are valued at amortized cost. John Hancock Collateral investments Trust (JHCIT), an affiliated registered investment company managed by MFC Global Investment Management (U.S.), LLC, a subsidiary of MFC, is valued at its net asset value each business day. JHCIT is a floating rate fund investing in money market instruments.

Other assets and securities for which no such quotations are readily available are valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity.

Fair value measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs and the valuation techniques used are summarized below:

Level 1 — Exchange traded prices in active markets for identical securities. This technique is used for exchange-traded domestic common and preferred equities, certain foreign equities, warrants, rights, options and futures.

Level 2 — Prices determined using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and are based on an evaluation of the inputs described. These techniques are used for certain domestic preferred equities, certain foreign equities, unlisted rights and warrants, and fixed income securities. Also, over-the-counter derivative contracts, including swaps, foreign forward currency contracts, and certain options use these techniques.

Level 3 — Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s Pricing Committee’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available. Securities using this technique are generally thinly traded or privately placed, and may be valued using broker quotes, which may not only use observable or unobservable inputs but may also include the use of the brokers’ own judgments about the assumptions that market participants would use.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| |

| 30 | Value Opportunities Fund | Semiannual report |

The following is a summary of the inputs used to value the Funds’ investments as of August 31, 2009, by major security category or security type:

| | | | |

| Investments in Securities | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

|

| Consumer discretionary | $3,746,295 | — | — | $3,746,295 |

| Consumer staples | 1,268,207 | — | — | 1,268,207 |

| Energy | 236,213 | — | — | 236,213 |

| Financials | 2,573,233 | — | — | 2,573,233 |

| Health care | 1,556,424 | — | — | 1,556,424 |

| Industrials | 1,151,271 | — | — | 1,151,271 |

| Information technology | 1,702,731 | — | — | 1,702,731 |

| Materials | 607,068 | — | — | 607,068 |

| Telecommunication | 201,517 | — | — | 201,517 |

| services | | | | |

| Utilities | 119,809 | — | — | 119,809 |

|

| Short Term Investments | 913,729 | $381,000 | — | 1,294,729 |

| |

|

| Total Investments in | $14,076,497 | $381,000 | — | $14,457,497 |

| Securities | | | | |

| Other Financial | 26,916 | — | — | 29,916 |

| Instruments | | | | |

| Totals | $14,103,413 | $381,000 | — | $14,487,413 |

Security transactions and related

investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Foreign dividends are recorded on the ex- date or when the Fund becomes aware of the dividends from cash collections. Discounts/premiums are accreted/amortized for financial reporting purposes. Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful. The Fund uses identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax report ing purposes.

From time to time, the Fund may invest in Real Estate Investment Trusts (REITs) and, as a result, will estimate the components of distributions from these securities. Distributions from REITs received in excess of income are recorded as a reduction of cost of investments and/or as a realized gain.

Securities lending

The Fund may lend portfolio securities from time to time in order to earn additional income. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends associated with securities and to participate in any changes in their value. On the settlement date of the loan, the Fund receives cash collateral against the loaned securities and maintains the cash collateral in an amount no less than the market value of the loaned securities.

The market value of the loaned securities is determined at the close of business of the Fund. Any additional required cash collateral is delivered to the Fund or excess collateral is returned to the borrower on the next business day. Cash collateral received is invested in JHCIT. JHCIT is not a stable value fund and thus the Fund receives the benefit of any gains and bears any losses generated by JHCIT.

The Fund may receive compensation for lending their securities either in the form of fees, and/or by retaining a portion of interest on the investment of any cash received as collateral. If the borrower defaults on its

| |

| Semiannual report | Value Opportunities Fund | 31 |

obligation to return the securities loaned because of insolvency or other reasons, the Fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. The Fund bears the risk in the event that invested collateral is not sufficient to meet obligations due on loans.

Foreign currency translation

The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the disposition of forward foreign currency exchange contracts and foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

The Fund may be subject to capital gains and repatriation taxes imposed by certain countries in which it invests. Such taxes are generally based upon income and/or capital gains earned or repatriated. Taxes are accrued based upon net investment income, net realized gains and net unrealized appreciation.

Expenses

The majority of expenses are directly identifiable to an individual fund. Trust expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Line of credit

The Fund and other affiliated funds have entered into an agreement which enables it to participate in a $150 million unsecured committed line of credit with State Street Corporation (the Custodian). The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is charged to each participating fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 0.50%. In addition, a commitment fee of 0.08% per annum, payable at the end of each calendar quarter, based on the average daily-unused portion of the line of credit, is charged to each participating fund on a prorated basis based on average net assets. For the period ended August 31, 2009, there were no borrowings under the line of credit by the Fund.

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien, security interest or security entitlement in any Fund property, that is not segregated, to the maximum extent permitted by law to the extent of any overdraft.

Repurchase agreements

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement through its custodian, it receives delivery of securities, the amount of which at the time of purchase and each subsequent

| |

| 32 | Value Opportunities Fund | Semiannual report |

business day is required to be maintained at such a level that the market value is generally at least 102% of the repurchase amount. The Fund will take receipt of all securities underlying the repurchase agreements it has entered into until such agreements expire. If the seller defaults, the Fund would suffer a loss to the extent that proceeds from the sale of underlying securities were less than the repurchase amount. The Fund may enter into repurchase agreements maturing within seven days with domestic dealers, banks or other financial institutions deemed to be creditworthy by the Adviser.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has $2,899,971 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, it will reduce the amount of capital gain distribution to be paid. The loss carryforward expires as follows: February 28, 2017 — $2,899,971.

As of August 31, 2009, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. Each of the Fund’s federal tax returns filed in the 3-year period ended February 28, 2009 remains subject to examination by the Internal Revenue Service.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The fund generally declares and pays dividends and capital gains distributions, if any, annually. During the year ended February 28, 2009, the tax character of distributions paid was as follows: ordinary income $109,673. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Note 3

Financial instruments

The Fund has adopted the provisions of Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (FAS 161). This new standard requires the Fund to disclose information to assist investors in understanding how the Fund uses derivative instruments, how derivative instruments are accounted for under Statement of Financial Accounting Standards No. 133, Accounting for Derivative Instruments and Hedging Activities (FAS 133) and how derivative instruments affect the Fund’s financial position, results of operations and cash flows. This disclosure for the period ended August 31, 2009 is presented in accordance with FAS 161 and is included as part of the Notes to the Financial Statements.

Futures

The Fund may purchase and sell financial futures contracts, including index futures and options on these contracts. A future is a contractual agreement to buy or sell a particular commodity, currency or financial instrument at a pre-determined price in the future. The Fund uses futures contracts to manage against a decline in the value of securities owned by the Fund due to anticipated interest rate, currency or market changes. In addition, the Fund will use futures contracts for duration management or to gain exposure to a securities market.

An index futures contract (index future) is a contract to buy a certain number of units of the relevant index at a fixed price and specific future date. The Fund may invest in index futures as a means of gaining exposure to securities without investing in them directly,

| |

| Semiannual report | Value Opportunities Fund | 33 |

thereby allowing the Fund to invest in the underlying securities over time. Investing in index futures also permits the Fund to maintain exposure to common stocks without incurring the brokerage costs associated with investment in individual common stocks.