| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael J. Leary |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| | |

| Registrant's telephone number, including area code: 617-663-4490 |

| | | |

| Date of fiscal year end: | March 31 |

| |

| |

| Date of reporting period: | September 30, 2009 |

ITEM 1. REPORT TO SHAREHOLDERS.

A look at performance

| | | | | | | | | | |

| For the period ended September 30, 2009 | | | | | | |

| |

| | | Average annual returns (%) | Cumulative total returns (%) | | |

| | | with maximum sales charge (POP) | with maximum sales charge (POP) | | |

| |

|

|

| | Inception | | | | Since | Six | | | | Since |

| Class | date | 1-year | 5-year | 10-year | inception | months | 1-year | 5-year | 10-year | inception |

|

| A2 | 6-15-00 | –12.68 | 1.41 | — | –4.97 | 21.23 | –12.68 | 7.26 | — | –37.73 |

|

| B2 | 6-15-00 | –13.32 | 0.89 | — | –5.61 | 22.13 | –13.32 | 4.51 | — | –41.55 |

|

| C2 | 6-15-00 | –9.67 | 1.27 | — | –5.61 | 26.13 | –9.67 | 6.51 | — | –41.55 |

|

| I1,2 | 6-15-00 | –7.72 | 2.78 | — | –4.15 | 27.86 | –7.72 | 14.67 | — | –32.56 |

|

| R11,2 | 6-15-00 | –8.45 | 1.67 | — | –5.24 | 27.34 | –8.45 | 8.63 | — | –39.34 |

|

| R31,2 | 6-15-00 | –8.34 | 1.78 | — | –5.14 | 27.47 | –8.34 | 9.22 | — | –38.75 |

|

| R41,2 | 6-15-00 | –8.05 | 2.08 | — | –4.85 | 27.72 | –8.05 | 10.86 | — | –37.02 |

|

| R51,2 | 6-15-00 | –7.75 | 2.39 | — | –4.57 | 27.89 | –7.75 | 12.54 | — | –35.23 |

|

| T2 | 6-15-00 | –13.37 | 0.68 | — | –5.65 | 20.75 | –13.37 | 3.44 | — | –41.76 |

|

| ADV1,2 | 6-15-00 | –7.99 | 2.51 | — | –4.40 | 27.67 | –7.99 | 13.19 | — | –34.15 |

|

| NAV1,2 | 6-15-00 | –7.68 | 2.85 | — | –4.07 | 27.96 | –7.68 | 15.11 | — | –32.01 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A and Class T shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I, Class R1, Class R3, Class R4, Class R5, Class ADV and Class NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until July 31, 2010. The net expenses are as follows: Class A — 1.35%, Class B — 2.10%, Class C — 2.10%, Class R1 — 1.80%, Class R3— 1.65%, Class R4 — 1.35%, Class R5 — 1.05% and Class T — 1.98%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.47%, Class B —2.82%, Class C — 2.82%, Class R1 — 8.70%, Class R3 — 8.57%, Class R4 — 8.26%, Class R5 — 7.95% and Class T — 2.07%. For other classes, the net expenses equ al the gross expenses and are as follows: Class I—0.86%, Class ADV — 1.14% and Class NAV — 0.83%. The Fund’s expenses for the current fiscal year may be higher than the expenses listed above, for some of the following reasons: i) a significant decrease in average net assets may result in a higher advisory fee rate; ii) a significant decrease in average net assets may result in an increase in the expense ratio; and iii) the termination or expiration of expense cap reimbursements.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors, as described in the Fund’s Class I, Class R1, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV prospectuses.

2 On April 25, 2008, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund offered its Original share class and Institutional share class in exchange for Class A and Class I shares, respectively, of the John Hancock Rainier Growth Fund. Classes A, B, C, I, R1, R3, R4, R5, ADV and NAV of the John Hancock Rainier Growth Fund were first offered on April 28, 2008. The predecessor fund’s Original share class returns have been recalculated to reflect the gross fees and expenses of Class A shares. The returns prior to April 28, 2008 are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class B, C, I, R1, R3, R4, R5, ADV, and NAV, respectively. Class T shares were first offered October 6, 2008; the returns prior to this date are those of Class A share s that have been recalculated to apply the gross fees and expenses of Class T shares.

| |

| 6 | Rainier Growth Fund | Semiannual report |

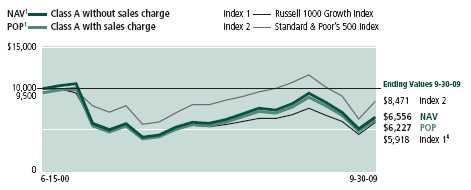

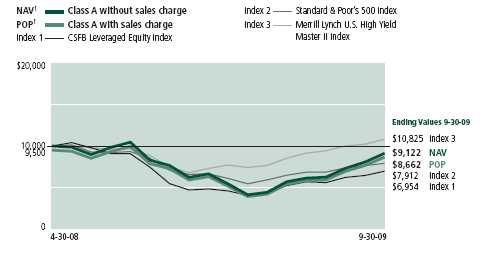

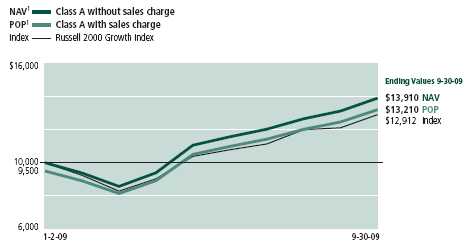

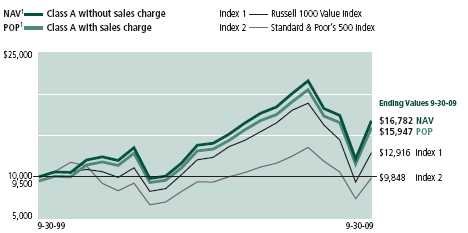

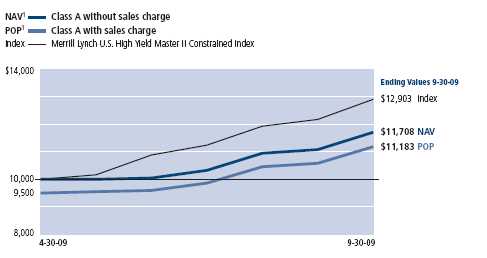

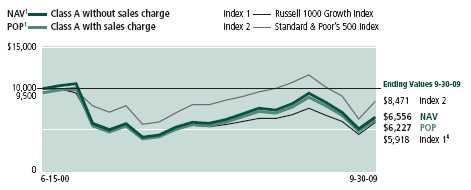

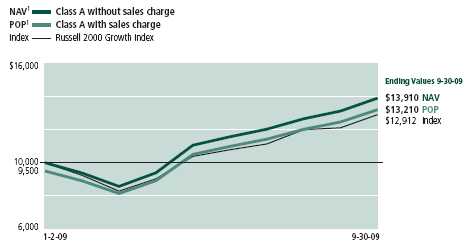

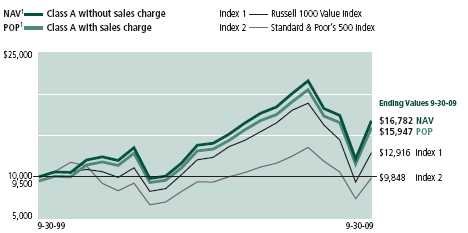

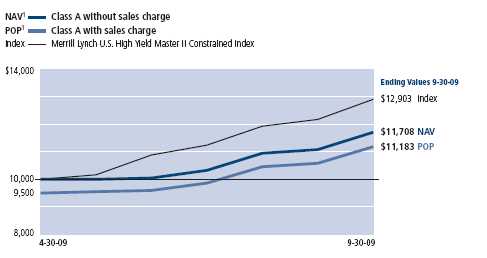

Growth of $10,000

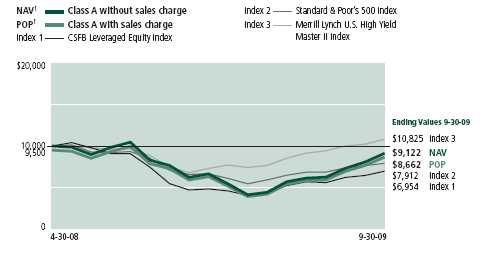

This chart shows what happened to a hypothetical $10,000 investment in Rainier Growth Fund Class A5 shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | | | | |

| | | Without sales | With maximum | | |

| Class | Period beginning | charge | sales charge | Index 1 | Index 2 |

|

| B2,4,5 | 6-15-00 | $5,845 | $5,845 | $5,918 | $8,471 |

|

| C2,4,5 | 6-15-00 | 5,845 | 5,845 | 5,918 | 8,471 |

|

| I3,4,5 | 6-15-00 | 6,744 | 6,744 | 5,918 | 8,471 |

|

| R13,4,5 | 6-15-00 | 6,066 | 6,066 | 5,918 | 8,471 |

|

| R33,4,5 | 6-15-00 | 6,125 | 6,125 | 5,918 | 8,471 |

|

| R43,4,5 | 6-15-00 | 6,298 | 6,298 | 5,918 | 8,471 |

|

| R53,4,5 | 6-15-00 | 6,477 | 6,477 | 5,918 | 8,471 |

|

| T4,5 | 6-15-00 | 6,131 | 5,824 | 5,918 | 8,471 |

|

| ADV3,4,5 | 6-15-00 | 6,585 | 6,585 | 5,918 | 8,471 |

|

| NAV3,4,5 | 6-15-00 | 6,799 | 6,799 | 5,918 | 8,471 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV shares, respectively, as of September 30, 2009. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 1000 Growth Index — Index 1 — is an unmanaged index of the 1,000 largest companies in the Russell 3,000 Index.

Standard & Poor’s 500 Index — Index 2 — is an unmanaged index that includes 500 widely traded commonstocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

3 For certain types of investors, as described in the Fund’s Class I, Class R1, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV share prospectuses.

4 Index 1 as of closest month end to fund inception date.

5 On April 25, 2008, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund offered its Original share class and Institutional share class in exchange for Class A and Class I shares, respectively, of the John Hancock Rainier Growth Fund. ClassesA, B, C, I, R1, R3, R4, R5, ADV and NAV of the John Hancock Rainier Growth Fund were first offered on April 28, 2008. The predecessor fund’s Original share class returns have been recalculated to reflect the gross fees and expenses of Class A shares. The returns prior to April 28, 2008 are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class B, C, I, R1, R3, R4, R5, ADV, and NAV, respectively. Class T shares were first offered October 6, 2008; the returns prior to this date are those of Class A shares th at have been recalculated to apply the gross fees and expenses of Class T shares.

| | |

| | Semiannual report | Rainier Growth Fund | 7 |

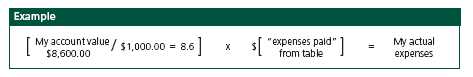

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on April 1, 2009, with the same investment held until September 30, 2009.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 4-1-09 | on 9-30-09 | period ended 9-30-091 |

|

| Class A | $1,000.00 | $1,276.50 | $7.19 |

|

| Class B | 1,000.00 | 1,271.30 | 11.33 |

|

| Class C | 1,000.00 | 1,271.30 | 11.39 |

|

| Class I | 1,000.00 | 1,278.60 | 4.86 |

|

| Class R1 | 1,000.00 | 1,273.40 | 9.57 |

|

| Class R3 | 1,000.00 | 1,274.70 | 8.72 |

|

| Class R4 | 1,000.00 | 1,277.20 | 6.96 |

|

| Class R5 | 1,000.00 | 1,278.90 | 5.26 |

|

| Class T | 1,000.00 | 1,271.40 | 10.93 |

|

| Class ADV | 1,000.00 | 1,276.70 | 6.05 |

|

| Class NAV | 1,000.00 | 1,279.60 | 4.69 |

|

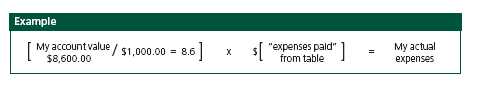

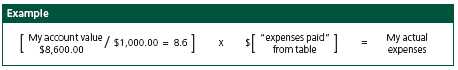

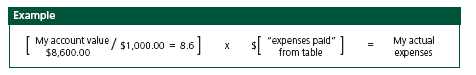

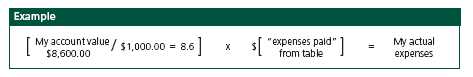

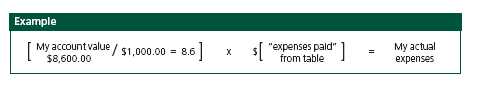

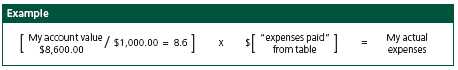

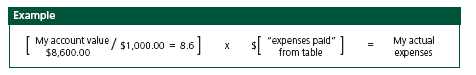

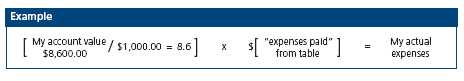

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at September 30, 2009, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | Rainier Growth Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on April 1, 2009, with the same investment held until September 30, 2009. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 4-1-09 | on 9-30-09 | period ended 9-30-091 |

|

| Class A | $1,000.00 | $1,018.80 | $6.38 |

|

| Class B | 1,000.00 | 1,015.10 | 10.05 |

|

| Class C | 1,000.00 | 1,015.00 | 10.10 |

|

| Class I | 1,000.00 | 1,020.80 | 4.31 |

|

| Class R1 | 1,000.00 | 1,016.60 | 8.49 |

|

| Class R3 | 1,000.00 | 1,017.40 | 7.74 |

|

| Class R4 | 1,000.00 | 1,019.00 | 6.17 |

|

| Class R5 | 1,000.00 | 1,020.50 | 4.66 |

|

| Class T | 1,000.00 | 1,015.40 | 9.70 |

|

| Class ADV | 1,000.00 | 1,019.80 | 5.37 |

|

| Class NAV | 1,000.00 | 1,021.00 | 4.15 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.26%, 1.99%, 2.00%, 0.85%, 1.68%, 1.53%, 1.22%, 0.92%, 1.92%, 1.06% and 0.82% for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). Fund proxy expenses have been excluded from the expenses shown above.

| | |

| | Semiannual report | Rainier Growth Fund | 9 |

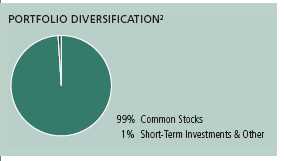

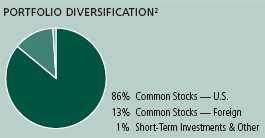

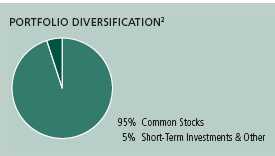

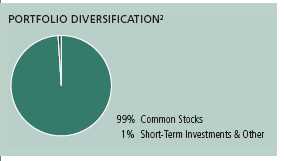

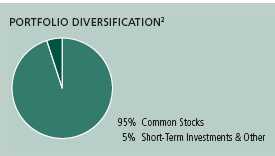

Portfolio summary

| | | | |

| Top 10 Holdings1 | | | | |

|

| Apple, Inc. | 3.7% | | Microsoft Corp. | 2.3% |

| |

|

| Cisco Systems, Inc. | 3.3% | | Visa, Inc. (Class A) | 2.2% |

| |

|

| Amazon.com, Inc. | 2.7% | | Southwestern Energy Co. | 2.0% |

| |

|

| Google, Inc. (Class A) | 2.4% | | Praxair, Inc. | 2.0% |

| |

|

| Transocean, Ltd. | 2.3% | | Colgate-Palmolive Co. | 2.0% |

| |

|

|

| |

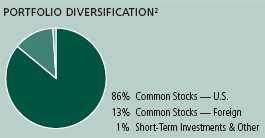

| Sector Composition2,3 | | | | |

|

| Information Technology | 32% | | Energy | 5% |

| |

|

| Health Care | 14% | | Materials | 4% |

| |

|

| Consumer Discretionary | 13% | | Telecommunication Services | 1% |

| |

|

| Industrials | 11% | | Utilities | 1% |

| |

|

| Consumer Staples | 9% | | Short-Term Investments & Other | 1% |

| |

|

| Financials | 9% | | | |

| | |

1 As a percentage of net assets on September 30, 2009. Excludes cash and cash equivalents.

2 As a percentage of net assets on September 30, 2009.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 10 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 9-30-09 (unaudited)

| | |

| | Shares | Value |

|

| Common stocks 98.78% | | $1,195,574,556 |

|

| (Cost $1,053,928,017) | | |

| | |

| Consumer Discretionary 12.81% | | 154,992,263 |

| | | |

| Hotels, Restaurants & Leisure 1.68% | | |

|

| Carnival Corp. | 385,440 | 12,827,443 |

|

| McDonald’s Corp. | 130,510 | 7,448,206 |

| | | |

| Internet & Catalog Retail 2.65% | | |

|

| Amazon.com, Inc. (I) | 343,600 | 32,078,496 |

| | | |

| Media 2.75% | | |

|

| Comcast Corp. (Class A) | 531,370 | 8,974,839 |

|

| DIRECTV Group, Inc. (I)(L) | 299,560 | 8,261,865 |

|

| Time Warner, Inc. | 559,250 | 16,095,215 |

| | | |

| Multiline Retail 1.00% | | |

|

| Kohl’s Corp. (I) | 212,010 | 12,095,171 |

| | | |

| Specialty Retail 3.03% | | |

|

| Best Buy Co., Inc. | 298,290 | 11,191,841 |

|

| Gap, Inc. | 383,830 | 8,213,962 |

|

| Lowe’s Cos., Inc. | 822,400 | 17,221,056 |

| | | |

| Textiles, Apparel & Luxury Goods 1.70% | | |

|

| Coach, Inc. | 321,560 | 10,585,755 |

|

| NIKE, Inc. (Class B) | 154,535 | 9,998,414 |

| | | |

| Consumer Staples 9.24% | | 111,820,222 |

| | | |

| Beverages 1.69% | | |

|

| PepsiCo, Inc. | 348,510 | 20,443,597 |

| | | |

| Food & Staples Retailing 2.16% | | |

|

| CVS Caremark Corp. | 478,065 | 17,086,043 |

|

| Wal-Mart Stores, Inc. | 184,440 | 9,054,160 |

| | | |

| Food Products 1.39% | | |

|

| General Mills, Inc. | 261,860 | 16,858,547 |

| | | |

| Household Products 2.84% | | |

|

| Church & Dwight Co., Inc. | 201,160 | 11,413,818 |

|

| Colgate-Palmolive Co. | 301,410 | 22,991,555 |

| | | |

| Personal Products 1.16% | | |

|

| Avon Products, Inc. | 411,440 | 13,972,502 |

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 11 |

F I N A N C I A L S T A T E M E N T S

| | |

| | Shares | Value |

| | | |

| Energy 5.14% | | $62,207,273 |

| | | |

| Energy Equipment & Services 3.17% | | |

|

| Cameron International Corp. (I) | 281,630 | 10,651,247 |

|

| Transocean, Ltd. (I) | 324,083 | 27,718,819 |

| | | |

| Oil, Gas & Consumable Fuels 1.97% | | |

|

| Southwestern Energy Co. (I) | 558,510 | 23,837,207 |

| | |

| Financials 9.12% | | 110,346,863 |

| | | |

| Capital Markets 5.63% | | |

|

| BlackRock, Inc. (L) | 87,415 | 18,953,320 |

|

| Charles Schwab Corp. | 822,325 | 15,747,524 |

|

| Franklin Resources, Inc. | 137,070 | 13,789,242 |

|

| Goldman Sachs Group, Inc. | 48,450 | 8,931,757 |

|

| Morgan Stanley | 344,650 | 10,642,792 |

| | | |

| Diversified Financial Services 3.49% | | |

|

| IntercontinentalExchange, Inc. (I) | 140,825 | 13,686,782 |

|

| JPMorgan Chase & Co. | 460,320 | 20,171,222 |

|

| MSCI, Inc. (Class A) (I) | 284,410 | 8,424,224 |

| | | |

| Health Care 13.73% | | 166,240,033 |

| | | |

| Biotechnology 4.30% | | |

|

| Alexion Pharmaceuticals, Inc. (I) | 118,680 | 5,286,007 |

|

| Amgen, Inc. (I) | 274,020 | 16,504,225 |

|

| Celgene Corp. (I) | 154,315 | 8,626,208 |

|

| Gilead Sciences, Inc. (I) | 464,715 | 21,646,425 |

| | | |

| Health Care Equipment & Supplies 3.76% | | |

|

| Alcon, Inc. | 104,240 | 14,454,961 |

|

| Baxter International, Inc. | 254,470 | 14,507,335 |

|

| St. Jude Medical, Inc. (I) | 424,760 | 16,569,888 |

| | | |

| Health Care Providers & Services 1.60% | | |

|

| Aveta, Inc. (I)(S) | 97,210 | 437,445 |

|

| Express Scripts, Inc. (I) | 244,265 | 18,950,079 |

| | | |

| Life Sciences Tools & Services 1.33% | | |

|

| Illumina, Inc. (I)(L) | 233,590 | 9,927,575 |

|

| QIAGEN NV (I) | 288,430 | 6,137,790 |

| | | |

| Pharmaceuticals 2.74% | | |

|

| Abbott Laboratories | 128,240 | 6,344,033 |

|

| Allergan, Inc. | 270,650 | 15,362,094 |

|

| Teva Pharmaceutical Industries, Ltd., SADR | 227,175 | 11,485,968 |

| | | |

| Industrials 10.79% | | 130,597,598 |

| | | |

| Aerospace & Defense 2.81% | | |

|

| Precision Castparts Corp. | 162,005 | 16,503,449 |

|

| United Technologies Corp. | 288,235 | 17,562,159 |

| | | |

| Air Freight & Logistics 1.09% | | |

|

| Expeditors International of Washington, Inc. | 373,965 | 13,144,870 |

| | | |

| Electrical Equipment 2.34% | | |

|

| ABB, Ltd., SADR | 476,745 | 9,553,970 |

|

| AMETEK, Inc. | 247,330 | 8,634,290 |

|

| First Solar, Inc. (I)(L) | 66,430 | 10,154,490 |

See notes to financial statements

| |

| 12 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| | Shares | Value |

| Industrials (continued) | | |

| | |

| Industrial Conglomerates 1.05% | | |

|

| 3M Co. | 171,680 | $12,669,984 |

| | | |

| Machinery 2.40% | | |

|

| Cummins, Inc. | 338,330 | 15,160,567 |

|

| Danaher Corp. | 206,760 | 13,919,083 |

| | | |

| Road & Rail 1.10% | | |

|

| CSX Corp. | 317,600 | 13,294,736 |

| | | |

| Information Technology 31.36% | | 379,583,861 |

| | | |

| Communications Equipment 6.37% | | |

|

| BancTec, Inc. (I)(K)(S) | 197,026 | 1,202,752 |

|

| Cisco Systems, Inc. (I) | 1,709,340 | 40,237,864 |

|

| Juniper Networks, Inc. (I) | 309,770 | 8,369,985 |

|

| QUALCOMM, Inc. | 425,175 | 19,124,371 |

|

| Research In Motion, Ltd. (I) | 121,445 | 8,203,610 |

| | | |

| Computers & Peripherals 6.53% | | |

|

| Apple, Inc. (I) | 240,875 | 44,650,999 |

|

| EMC Corp. (I) | 1,241,250 | 21,150,900 |

|

| Hewlett-Packard Co. | 279,385 | 13,189,766 |

| | | |

| Electronic Equipment, Instruments & Components 0.40% | | |

|

| Amphenol Corp. (Class A) | 126,660 | 4,772,549 |

| | | |

| Internet Software & Services 2.89% | | |

|

| eBay, Inc. (I) | 271,140 | 6,401,615 |

|

| Google, Inc. (Class A) (I) | 57,690 | 28,605,586 |

| | | |

| IT Services 3.46% | | |

|

| Cognizant Technology Solutions Corp. (Class A) (I) | 279,240 | 10,795,418 |

|

| Mastercard, Inc. (Class A) | 22,900 | 4,629,235 |

|

| Visa, Inc. (Class A) (L) | 383,415 | 26,497,811 |

| | | |

| Semiconductors & Semiconductor Equipment 5.04% | | |

|

| Broadcom Corp. (Class A) (I) | 524,760 | 16,104,884 |

|

| Intel Corp. | 1,009,625 | 19,758,361 |

|

| Marvell Technology Group, Ltd. (I) | 570,980 | 9,244,166 |

|

| NVIDIA Corp. (I) | 507,960 | 7,634,639 |

|

| Taiwan Semiconductor Manufacturing Co., Ltd., SADR | 758,452 | 8,312,634 |

| | | |

| Software 6.67% | | |

|

| Adobe Systems, Inc. (I) | 417,300 | 13,787,592 |

|

| Check Point Software Technologies, Ltd. (I) | 469,370 | 13,306,639 |

|

| Citrix Systems, Inc. (I) | 309,590 | 12,145,216 |

|

| Microsoft Corp. | 1,050,325 | 27,192,914 |

|

| Oracle Corp. | 684,470 | 14,264,355 |

| | | |

| Materials 4.20% | | 50,890,950 |

| | | |

| Chemicals 2.51% | | |

|

| FMC Corp. | 115,360 | 6,489,000 |

|

| Praxair, Inc. | 292,350 | 23,882,071 |

| | | |

| Metals & Mining 1.69% | | |

|

| Freeport-McMoRan Copper & Gold, Inc. | 299,080 | 20,519,879 |

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 13 |

F I N A N C I A L S T A T E M E N T S

| | |

| | Shares | Value |

| Telecommunication Services 1.23% | | $14,890,148 |

| | | |

| Wireless Telecommunication Services 1.23% | | |

|

| American Tower Corp. (Class A) (I) | 409,070 | 14,890,148 |

| | | |

| Utilities 1.16% | | 14,005,345 |

| | | |

| Independent Power Producers & Energy Traders 1.16% | | |

|

| AES Corp. (I) | 945,030 | 14,005,345 |

| |

| | Par value | Value |

|

| Short-Term Investments 6.95% | | $84,141,566 |

| | | |

| (Cost $84,142,824) | | |

| | | |

| Repurchase Agreement 1.28% | | 15,502,000 |

|

| Repurchase Agreement with State Street Corp. dated | | |

| 9-30-09 at 0.01% to be repurchased at $15,502,004 on | | |

| 10-1-09, collateralized by $95,000 Federal Home Loan Bank, | | |

| 4.645% due 10-5-17 (valued at $97,613, including interest), | | |

| $4,130,000 Federal Home Loan Bank, 2.10% due 8-10-12 | | |

| (valued at $4,145,488, including interest), and $10,590,000 | | |

| Federal Home Loan Mortgage Corp., 4.50% due 1-15-13 | | |

| (valued at $11,569,575, including interest). | $15,502,000 | 15,502,000 |

| | | |

| | Rate | Shares | Value |

| Cash Equivalents 5.67% | | | 68,639,566 |

|

| John Hancock Cash Investment Trust (T)(W) | 0.2762% (Y) | 6,857,100 | 68,639,566 |

|

| Total investments (Cost $1,138,070,841)† 105.73% | | | $1,279,716,122 |

|

| Other assets and liabilities, net (5.73%) | | | ($69,306,685) |

|

| Total net assets 100.00% | | | $1,210,409,437 |

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

SADR Sponsored American Depositary Receipts

(I) Non-income producing security.

(K) Direct placement securities are restricted to resale. The Fund may be unable to sell a direct placement security and it may be more difficult to determine a market value for a direct placement security. Moreover, if adverse market conditions were to develop during the period between the Fund’s decision to sell a direct placement security and the point at which the Fund is permitted or able to sell such security, the Fund might obtain a price less favorable than the price that prevailed when it decided to sell. This investment practice, therefore, could have the effect of increasing the level of illiquidity of the Fund. The Fund has limited rights to registration under the Securities Act of 1933 with respect to these restricted securities.

| | | | |

| | | | Value as a percentage | Value as of |

| Issuer, description | Acquisition date | Acquisition cost | of Fund’s net assets | September 30, 2009 |

|

| |

| BancTec, Inc. | | | | |

| common stock | 6-20-07 | $4,728,640 | 0.10% | $1,202,752 |

(L) All or a portion of this security is on loan as of September 30, 2009.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(T) Represents investment of securities lending collateral.

(W) Issuer is an affiliate of the Adviser.

See notes to financial statements

| |

| 14 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

(Y) The rate shown is the annualized seven-day yield as of September 30, 2009.

† At September 30, 2009, the aggregate cost of investment securities for federal income tax purposes was $1,178,800,525. Net unrealized appreciation aggregated $100,915,597, of which $152,123,282 related to appreciated investment securities and $51,207,685 related to depreciated investment securities.

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 9-30-09 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $1,053,928,017) | |

| including $67,391,903 of securities loaned (Note 2) | $1,195,574,556 |

| Investments in affiliated issuers, at value (Cost $68,640,824) (Note 2) | 68,639,566 |

| Repurchase agreements, at value (Cost $15,502,000) (Note 2) | 15,502,000 |

| | |

| Total investments, at value (Cost $1,138,070,841) | 1,279,716,122 |

| | |

| Cash | 304 |

| Receivable for investments sold | 13,198,938 |

| Receivable for fund shares sold | 1,585,246 |

| Dividends and interest receivable | 254,197 |

| Receivable for securities lending income | 15,933 |

| Receivable from affiliates | 30,365 |

| Receivable due from adviser | 101,177 |

| Other receivables and prepaid assets | 330,727 |

| | |

| Total assets | 1,295,233,009 |

| | |

| Liabilities | |

|

| Payable for investments purchased | 14,622,606 |

| Payable for fund shares repurchased | 696,511 |

| Payable upon return of securities loaned (Note 2) | 68,641,492 |

| Payable to affiliates | |

| Accounting and legal services fees | 9,408 |

| Transfer agent fees | 355,630 |

| Distribution and service fees | 1,046 |

| Other liabilities and accrued expenses | 496,879 |

| | |

| Total liabilities | 84,823,572 |

| |

| Net assets | |

|

| Capital paid-in | $2,348,657,543 |

| Undistributed net investment income | 179,469 |

| Accumulated net realized loss on investments and foreign | |

| currencytransactions | (1,280,073,555) |

| Net unrealized appreciation on investments and translation of assets and | |

| liabilities in foreign currencies | 141,645,980 |

| | |

| Net assets | $1,210,409,437 |

|

See notes to financial statements

| |

| 16 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($259,483,507 ÷ 15,833,318 shares) | $16.39 |

| Class B ($27,320,295 ÷ 1,680,257 shares)1 | $16.26 |

| Class C ($17,120,573 ÷ 1,053,064 shares)1 | $16.26 |

| Class I ($181,436,560 ÷ 10,982,615 shares) | $16.52 |

| Class R1 ($152,668 ÷ 9,336 shares) | $16.35 |

| Class R3 ($72,915 ÷ 4,452 shares) | $16.38 |

| Class R4 ($73,228 ÷ 4,452 shares) | $16.45 |

| Class R5 ($73,543 ÷ 4,456 shares) | $16.512 |

| Class T ($80,845,933 ÷ 4,943,883 shares) | $16.35 |

| Class ADV ($17,970,207 ÷ 1,090,941 shares) | $16.47 |

| Class NAV ($625,860,008 ÷ 37,892,244 shares) | $16.52 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)3 | $17.25 |

| Class T (net asset value per share ÷ 95%)3 | $17.21 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 Net assets and shares outstanding have been rounded for presentation purposes. The net asset value is as reported on September 30, 2009.

3 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price isreduced.

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 9-30-09 (unaudited)1

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $6,073,207 |

| Securities lending | 57,941 |

| Interest | 4,835 |

| Less foreign taxes withheld | (163,424) |

| Total investment income | 5,972,559 |

| |

| Expenses | |

|

| Investment management fees (Note 4) | 3,946,514 |

| Distribution and service fees (Note 4) | 651,193 |

| Transfer agent fees (Note 4) | 1,270,163 |

| Accounting and legal services fees (Note 4) | 34,202 |

| Trustees’ fees (Note 5) | 41,919 |

| State registration fees (Note 4) | 26,851 |

| Printing and postage fees (Note 4) | 119,797 |

| Professional fees | 126,465 |

| Custodian fees | 60,301 |

| Registration and filing fees | 98,943 |

| Proxy fees | 267,357 |

| Other | 25,533 |

| | |

| Total expenses | 6,669,238 |

| Less expense reductions (Note 4) | (839,164) |

| |

| Net expenses | 5,830,074 |

| | |

| Net investment income | 142,485 |

|

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | (86,454,346) |

| Investments in affiliated issuers | 4,344 |

| Foreign currency transactions | (74) |

| | (86,450,076) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 338,694,014 |

| Investments in affiliated underlying funds | (1,258) |

| Translation of assets and liabilities in foreign currencies | 662 |

| | 338,693,418 |

| Net realized and unrealized gain | 252,243,342 |

| | |

| Increase in net assets from operations | $252,385,827 |

1 Semiannual period from 4-1-09 to 9-30-09.

See notes to financial statements

| |

| 18 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Period | Year |

| | ended | ended |

| | 9-30-091 | 3-31-09 |

|

| Increase (decrease) in net assets | | |

| From operations | | |

| Net investment income | $142,485 | $679,905 |

| Net realized loss | (86,450,076) | (310,987,326) |

| Change in net unrealized appreciation (depreciation) | 338,693,418 | (143,822,280) |

| | | |

| Increase (decrease) in net assets resulting from operations | 252,385,827 | (454,129,701) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class I | — | (128,337) |

| Class R5 | — | (43) |

| Class NAV | — | (498,835) |

| | | |

| Total distributions | — | (627,215) |

| | | |

| From Fund share transactions (Note 6) | 101,687,124 | 1,010,863,775 |

| | | |

| Total increase | 354,072,951 | 556,106,859 |

| |

| Net assets | | |

|

| Beginning of period | 856,336,486 | 300,229,627 |

| | |

| End of period | $1,210,409,437 | $856,336,486 |

| | | |

| Undistributed net investment income | $179,469 | $36,984 |

| |

| 1 Semiannual period from 4-1-09 to 9-30-09. Unaudited. | | |

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 19 |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | | |

| CLASS A SHARES Period ended | 9-30-091 | 3-31-092 | 3-31-083 | 3-31-073 | 3-31-063 | 3-31-05 |

|

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $12.84 | $20.91 | $20.44 | $19.07 | $15.64 | $14.83 |

| Net investment loss | (0.01)4 | (0.01)4 | (0.02) | (0.04) | (0.07)4 | (0.06) |

| Net realized and unrealized gain | | | | | | |

| (loss) on investments | 3.56 | (8.06) | 0.49 | 1.41 | 3.50 | 0.87 |

| Total from investment operations | 3.55 | (8.07) | 0.47 | 1.37 | 3.43 | 0.81 |

| Net asset value, end of period | $16.39 | $12.84 | $20.91 | $20.44 | $19.07 | $15.64 |

| Total return (%)5,6 | 27.657 | (38.59) | 2.30 | 7.18 | 21.93 | 5.46 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $259 | $193 | $164 | $33 | $15 | $7 |

| Ratios (as a percentage of average net | | | | | | |

| assets): | | | | | | |

| Expenses before reductions | 1.708 | 1.47 | 1.179 | 1.30 | 1.72 | 2.19 |

| Expenses net of fee waivers and credits | 1.318 | 1.18 | 1.199 | 1.19 | 1.19 | 1.19 |

| Expenses net of fee waivers | 1.318 | 1.18 | 1.199 | 1.19 | 1.19 | 1.19 |

| Net investment loss | (0.17)10 | (0.04) | (0.27) | (0.38) | (0.42) | (0.43) |

| Portfolio turnover (%) | 67 | 101 | 86 | 101 | 96 | 119 |

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 After the close of business on April 25, 2008, holders of Original Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class A shares of the John Hancock Rainier Growth Fund. These shares were first offered on April 28, 2008. Additionally, the accounting and performance history of the Original Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class A.

3 Audited by previous independent registered public accounting firm.

4 Based on the average daily shares outstanding.

5 Assumes dividend reinvestment.

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Not annualized.

8 Includes the proxy expenses, which amounted to 0.03% of average net assets.

9 Prior to the reorganization (see Note 8), the Fund was subject to a contractual expense reimbursement and recoupment plan.

10 Annualized.

See notes to financial statements

| |

20 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| CLASS B SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.79 | $22.46 |

| Net investment loss3 | (0.07) | (0.09) |

| Net realized and unrealized gain (loss) on investments | 3.54 | (9.58) |

| Total from investment operations | 3.47 | (9.67) |

| Net asset value, end of period | $16.26 | $12.79 |

| Total return (%)4,5 | 27.136 | (43.05)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $27 | $27 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 2.717 | 2.828 |

| Expenses net of fee waivers | 2.067 | 2.058 |

| Expenses net of fee waivers and credits | 2.067 | 2.048 |

| Net investment loss | (0.91)8 | (0.75)8 |

| Portfolio turnover (%) | 67 | 1019 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class B shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Includes the proxy expenses, which amounted to 0.03% of average net assets.

8 Annualized.

9 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | |

| CLASS C SHARES Period ended | 9-30-091 | 3-31-092 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.79 | $22.46 |

| Net investment loss3 | (0.07) | (0.09) |

| Net realized and unrealized gain (loss) on investments | 3.54 | (9.58) |

| Total from investment operations | 3.47 | (9.67) |

| Net asset value, end of period | $16.26 | $12.79 |

| Total return (%)4,5 | 27.136 | (43.05)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $17 | $15 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 2.237 | 2.828 |

| Expenses net of fee waivers | 2.067 | 2.058 |

| Expenses net of fee waivers and credits | 2.067 | 2.048 |

| Net investment loss | (0.92)8 | (0.77)8 |

| Portfolio turnover (%) | 67 | 1019 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class C shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Includes the proxy expenses, which amounted to 0.03% of average net assets.

8 Annualized.

9 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 21 |

F I N A N C I A L S T A T E M E N T S

| | | | |

| CLASS I SHARES Period ended | 9-30-091 | 3-31-092 | 3-31-083 | 3-31-073,4 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $12.92 | $20.98 | $20.44 | $20.94 |

| Net investment income5 | 0.02 | 0.04 | —6 | —6 |

| Net realized and unrealized gain (loss) on investments | 3.58 | (8.09) | 0.54 | (0.50) |

| Total from investment operations | 3.60 | (8.05) | 0.54 | (0.50) |

| Less distributions | | | | |

| From net investment income | — | (0.01) | — | — |

| Net asset value, end of year | $16.52 | $12.92 | $20.98 | $20.44 |

| Total return (%)7 | 27.868 | (38.36) | 2.64 | (2.39)9 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $181 | $133 | $136 | $537 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 0.9310 | 0.86 | 0.9211 | 1.0012 |

| Expenses net of fee waivers | 0.9010 | 0.86 | 0.9411 | 0.9412 |

| Expenses net of fee waivers and credits | 0.9010 | 0.86 | 0.9411 | 0.9412 |

| Net investment income (loss) | 0.2412 | 0.22 | (0.02) | 0.1512 |

| Portfolio turnover (%) | 67 | 101 | 86 | 10113 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 After the close of business on April 25, 2008, holders of Institutional Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class I shares of the John Hancock Rainier Growth Fund. These shares were first offered on April 28, 2008. Additionally, the accounting and performance history of the Institutional Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class I.

3 Audited by previous independent registered public accounting firm.

4 Class I shares began operations on 2-20-07.

5 Based on the average daily shares outstanding.

6 Less than (0.01) per share.

7 Assumes dividend reinvestment.

8 Not annualized.

9 Total returns would have been lower had certain expenses not been reduced during the periods shown.

10 Includes the proxy expenses, which amounted to 0.03% of average net assets.

11 Prior to the reorganization (see Note 8), the Fund was subject to a contractual expense reimbursement and recoupment plan.

12 Annualized.

13 Annualized based on investments held for a full year.

| | |

| CLASS R1 SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of year | $12.84 | $22.46 |

| Net investment loss3 | (0.05) | (0.08) |

| Net realized and unrealized gain (loss) on investments | 3.56 | (9.54) |

| Total from investment operations | 3.51 | (9.62) |

| Net asset value, end of year | $16.35 | $12.84 |

| Total return (%)4,5 | 27.346 | (42.83)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | —7 | —7 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 8.418 | 8.709 |

| Expenses net of fee waivers | 1.728 | 1.649 |

| Expenses net of fee waivers and credits | 1.728 | 1.649 |

| Net investment loss | (0.67)9 | (0.50)9 |

| Portfolio turnover (%) | 67 | 10110 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class R1 shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Less than $500,000.

8 Includes the proxy expenses, which amounted to 0.02% of average net assets.

9 Annualized.

10 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 22 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| CLASS R3 SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.85 | $22.46 |

| Net investment loss3 | (0.03) | (0.06) |

| Net realized and unrealized gain (loss) on investments | 3.56 | (9.55) |

| Total from investment operations | 3.53 | (9.61) |

| Net asset value, end of period | $16.38 | $12.85 |

| Total return (%)4,5 | 27.476 | (42.79)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | —7 | —7 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 9.478 | 8.579 |

| Expenses net of fee waivers | 1.588 | 1.549 |

| Expenses net of fee waivers and credits | 1.588 | 1.549 |

| Net investment loss | (0.44)9 | (0.40)9 |

| Portfolio turnover (%) | 67 | 10110 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class R3 shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Less than $500,000.

8 Includes the proxy expenses, which amounted to 0.03% of average net assets.

9 Annualized.

10 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | |

| CLASS R4 SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.88 | $22.46 |

| Net investment loss3 | (0.01) | (0.02) |

| Net realized and unrealized gain (loss) on investments | 3.58 | (9.56) |

| Total from investment operations | 3.57 | (9.58) |

| Net asset value, end of period | $16.45 | $12.88 |

| Total return (%)4,5 | 27.726 | (42.65)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | —7 | —7 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 9.148 | 8.269 |

| Expenses net of fee waivers | 1.288 | 1.249 |

| Expenses net of fee waivers and credits | 1.288 | 1.249 |

| Net investment loss | (0.14)9 | (0.10)9 |

| Portfolio turnover (%) | 67 | 10110 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class R4 shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Less than $500,000.

8 Includes the proxy expenses, which amounted to 0.03% of average net assets.

9 Annualized.

10 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 23 |

F I N A N C I A L S T A T E M E N T S

| | |

| CLASS R5 SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.91 | $22.46 |

| Net investment income3 | 0.01 | 0.03 |

| Net realized and unrealized gain (loss) on investments | 3.59 | (9.57) |

| Total from investment operations | 3.60 | (9.54) |

| Less distributions | | |

| From net investment income | — | (0.01) |

| Net asset value, end of period | $16.51 | $12.91 |

| Total return (%)4,5 | 27.896 | (42.48)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | —7 | —7 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 8.818 | 7.959 |

| Expenses net of fee waivers | 0.988 | 0.949 |

| Expenses net of fee waivers and credits | 0.988 | 0.949 |

| Net investment income | 0.169 | 0.209 |

| Portfolio turnover (%) | 67 | 10110 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class R5 shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Less than $500,000.

8 Includes the proxy expenses, which amounted to 0.03% of average net assets.

9 Annualized.

10 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | |

| CLASS T SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.86 | $16.59 |

| Net investment loss3 | (0.06) | (0.05) |

| Net realized and unrealized gain (loss) on investments | 3.55 | (3.68) |

| Total from investment operations | 3.49 | (3.73) |

| Net asset value, end of period | $16.35 | $12.86 |

| Total return (%)4,5 | 27.146 | (22.48)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $81 | $72 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 2.527 | 2.078 |

| Expenses net of fee waivers | 1.987 | 1.998 |

| Expenses net of fee waivers and credits | 1.987 | 1.988 |

| Net investment loss | (0.83)8 | (0.74)8 |

| Portfolio turnover (%) | 67 | 1019 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class T shares began operations on 10-6-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Includes the proxy expenses, which amounted to 0.03% of average net assets.

8 Annualized.

9 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 24 | Rainier Growth Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| CLASS ADV SHARES Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.90 | $22.46 |

| Net investment income (loss)3 | —4 | (0.01) |

| Net realized and unrealized gain (loss) on investments | 3.57 | (9.55) |

| Total from investment operations | 3.57 | (9.56) |

| Net asset value, end of period | $16.47 | $12.90 |

| Total return (%)5 | 27.676 | (42.56)6 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $18 | $17 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 1.307 | 1.148 |

| Expenses net of fee waivers | 1.147 | 1.148 |

| Expenses net of fee waivers and credits | 1.147 | 1.148 |

| Net investment income (loss) | 0.018 | (0.04)8 |

| Portfolio turnover (%) | 67 | 1019 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class ADV shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Less than $0.01 per share.

5 Assumes dividend reinvestment.

6 Not annualized.

7 Includes the proxy expenses, which amounted to 0.04% of average net assets.

8 Annualized.

9 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | |

| CLASS NAV Period ended | 9-30-091 | 3-31-092 |

|

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.91 | $22.46 |

| Net investment income3 | 0.02 | 0.04 |

| Net realized and unrealized gain (loss) on investments | 3.59 | (9.57) |

| Total from investment operations | 3.61 | (9.53) |

| Less distributions | | |

| From net investment income | — | (0.02) |

| Net asset value, end of period | $16.52 | $12.91 |

| Total return (%)4 | 27.965 | (42.44)5 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $626 | $400 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 0.876 | 0.837 |

| Expenses net of fee waivers | 0.876 | 0.837 |

| Expenses net of fee waivers and credits | 0.876 | 0.837 |

| Net investment income | 0.267 | 0.267 |

| Portfolio turnover (%) | 67 | 1018 |

|

1 Semiannual period from 4-1-09 to 9-30-09. Unaudited.

2 Class NAV shares began operations on 4-28-08.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Includes the proxy expenses, which amounted to 0.02% of average net assets.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| | |

| | Semiannual report | Rainier Growth Fund | 25 |

Notes to financial statements (unaudited)

Note 1

Organization

John Hancock Rainier Growth Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust). The Trust was established as a Massachusetts business trust on June 9, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end investment management company. The investment objective of the Fund is to seek to maximize long-term capital appreciation.

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

The Board of Trustees have authorized the issuance of multiple classes of shares of the Fund, including classes designated as Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV shares. Class A, Class B and Class C shares are open to all retail investors. Class I shares are offered without any sales charge to various institutional and certain individual investors. Class R1, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class T and Class ADV shares are closed to new investors. Class NAV shares are sold to affiliated funds of funds, within the John Hancock funds complex. The shares of each class represent an interest in the same portfolio of investments of the Fund, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Board of Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bear distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

The Fund is the accounting and performance successor of the Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund). On April 28, 2008, the Fund acquired substantially all the assets and assumed the liabilities of the Predecessor Fund pursuant to an agreement and plan of reorganization, in exchange for Class A and Class I shares of the Fund.

The Adviser and affiliates owned 10.03%, 95.22% 100%, 100% and 100% of Class A, Class R1, Class R3, Class R4 and Class R5 shares, respectively, of the Fund on September 30, 2009.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after period end through the date that the financial statements were issued, November 23, 2009, have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation

Investments are stated at value as of the close of the regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Equity securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated price if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade. Debt obligations are valued based on the evaluated prices provided by independent pricing services, which utilizes both dealer-supplied quotes and electronic data processing techniques, which

| |

| 26 | Rainier Growth Fund | Semiannual report |

take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Equity and debt obligations, for which there are no prices available from an independent pricing service, are valued based on broker quotes or fair valued as described below. Certain short-term debt instruments are valued at amortized cost. John Hancock Collateral Investment Trust (JHCIT), an affiliated registered investment company managed by Manulife Global Investment Management (U.S.), LLC, a subsidiary of MFC, is valued at its net asset value each business d ay. JHCIT is a floating rate fund investing in money market investments.

Other assets and securities for which no such quotations are readily available are valued at fair value as determined in good faith by the Fund’s Pricing Committee in accordance with procedures adopted by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

Fair value measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs and the valuation techniques used are summarized below:

Level 1 — Exchange traded prices in active markets for identical securities. This technique is used for exchange-traded domestic common and preferred equities, certain foreign equities, warrants, rights, options and futures.

Level 2 — Prices determined using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and are based on an evaluation of the inputs described. These techniques are used for certain domestic preferred equities, certain foreign equities, unlisted rights and warrants, and fixed income securities. Also, over-the-counter derivative contracts, including swaps, foreign forward currency contracts, and certain options use these techniques.

Level 3 — Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s Pricing Committee’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available. Securities using this technique are generally thinly traded or privately placed, and may be valued using broker quotes, which may not only use observable or unobservable inputs but may also include the use of the brokers’ own judgments about the assumptions that market participants would use.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| | |

| | Semiannual report | Rainier Growth Fund | 27 |

The following is a summary of the inputs used to value the Fund’s investments as of September 30, 2009, by major security category or security type.

| | | | |

| INVESTMENTS IN SECURITIES | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTALS |

|

| Consumer Discretionary | $154,992,263 | — | — | $154,992,263 |

|

| Consumer Staples | 111,820,222 | — | — | 111,820,222 |

|

| Energy | 62,207,273 | — | — | 62,207,273 |

|

| Financials | 110,346,863 | — | — | 110,346,863 |

|

| Health Care | 165,802,588 | — | $437,445 | 166,240,033 |

|

| Industrials | 130,597,598 | — | — | 130,597,598 |

|

| Information Technology | 378,381,109 | — | 1,202,752 | 379,583,861 |

|

| Materials | 50,890,950 | — | — | 50,890,950 |

| Telecommunication | | | | |

| Services | 14,890,148 | — | — | 14,890,148 |

|

| Utilities | 14,005,345 | — | — | 14,005,345 |

|

| Short-Term Investments | 68,639,566 | $15,502,000 | — | 84,141,566 |

| |

|

| Total Investments in | | | | |

| Securities | $1,262,573,925 | $15,502,000 | $1,640,197 | $1,279,716,122 |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| |

| INVESTMENTS IN SECURITIES | FINANCIALS |

|

| Balance as of March 31, 2009 | $1,760,643 |

|

| Realized gain (loss) | (3,408,603) |

|

| Change in unrealized appreciation (depreciation) | 3,288,157 |

|

| Net purchases (sales) | — |

|

| Transfers in and/or out of Level 3 | — |

| Balance as of September 30, 2009 | $1,640,197 |

Repurchase agreements

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement through its custodian, it receives delivery of securities, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the market value is generally at least 102% of the repurchase amount. The Fund will take receipt of all securities underlying the repurchase agreements it has entered into until such agreements expire. If the seller defaults, the Fund would suffer a loss to the extent that proceeds from the sale of underlying securities were less than the repurchase amount. The Fund may enter into repurchase agreements maturing within seven days with domestic dealers, banks or other financial institutions deemed to be creditworthy by the Adviser.

Security transactions and related

investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Foreign dividends are recorded on the ex-date or when the Fund becomes aware of the dividends from cash collections. Discounts/premiums are accreted/amortized for financial reporting purposes. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful. The Fund uses identified cost method for determining realized gain or loss on investments for both

| |

| 28 | Rainier Growth Fund | Semiannual report |

financial statement and federal income tax reporting purposes.

Securities lending

The Fund may lend portfolio securities from time to time in order to earn additional income. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends associated with securities and to participate in any changes in their value. On the settlement date of the loan, the Fund receives cash collateral against the loaned securities and maintains the cash collateral in an amount no less than the market value of the loaned securities.

The market value of the loaned securities is determined at the close of business of the Fund. Any additional required cash collateral is delivered to the Fund or excess collateral is returned to the borrower on the next business day. Cash collateral received is invested in JHCIT. JHCIT is not a stable value fund and thus the Fund receives the benefit of any gains and bears any losses generated by JHCIT.

The Fund may receive compensation for lending their securities either in the form of fees, and/or by retaining a portion of interest on the investment of any cash received as collateral. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. The Fund bears the risk in the event that invested collateral is not sufficient to meet obligations due on loans.

Foreign currency translation

The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the disposition of forward foreign currency exchange contracts and foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

The Fund may be subject to capital gains and repatriation taxes imposed by certain countries in which it invests. Such taxes are generally based upon income and/or capital gains earned or repatriated. Taxes are accrued based upon net investment income, net realized gains and net unrealized appreciation.

Expenses

The majority of expenses are directly identifiable to an individual fund. Trust expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage fees for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Line of credit

The Fund and other affiliated funds have entered into an agreement which enables it to participate in a $150 million unsecured committed line of credit with its Custodian. The Fund is permitted to have bank borrowings for temporary or emergency purposes, including

| | |

| | Semiannual report | Rainier Growth Fund | 29 |

the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is charged to each participating fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 0.50%. In addition, a commitment fee of 0.08% per annum, payable at the end of each calendar quarter, based on the average daily-unused portion of the line of credit, is charged to each participating fund on a prorated basis based on average net assets. For the period ended September 30, 2009, there were no borrowings under the line of credit by the Fund.

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien, security interest or security entitlement in any Fund property, that is not segregated, to the maximum extent permitted by law to the extent of any overdraft.

Federal income taxes

The Fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has $967,402,549 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, it will reduce the amount of capital gain distribution to be paid. The loss carryforward expires as follows: March 31, 2010 — $499,103,584, March 31, 2011 — $260,334,070, March 31, 2012 —$86,800,122, March 31, 2016 — $25,380,418 and March 31, 2017 — $95,784,355. It is estimated that $803,569,744 of the loss carryforwards, which were acquired on October 3, 2008, in mergers with John Hancock Core Equity Fund, John Hancock Growth Trends Fund and John Hancock Technology Fund, will likely expire unused because of limitations.

As of September 30, 2009, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. Each of the Fund’s federal tax returns filed in the 3-year period ended March 31, 2009 remains subject to examination by the Internal Revenue Service.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund generally declares and pays dividends and capital gains distributions, if any, annually. During the year ended March 31, 2009, the tax character of distributions paid was $627,215 of ordinary income. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Note 3

Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

| |

| 30 | Rainier Growth Fund | Semiannual report |

Note 4

Investment advisory and

other agreements

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment of the assets of the Fund, subject to the supervision of the Trust’s Board of Trustees. As compensation for its services, the Adviser receives an advisory fee from the Trust. Under the Advisory Agreement, the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.75% of the first $3,000,000,000 of the Fund’s aggregated daily net assets; (b) 0.725% of the next $3,000,000,000 of the Fund’s aggregated daily net assets; and (c) 0.70% of the Fund’s aggregated daily net assets in excess of $6,000,000,000. The Adviser has a subadvisory agreement with Rainier Investment Management, Inc. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the period ended September 30, 2009, were equivalent to an annual effective rate of 0.75% of the Fund’s average daily net assets.

Prior to July 31, 2009, the Adviser agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business and shareholder service fees. The reimbursements and limits are such that these expenses will not exceed 1.32% for Class A shares, 2.04% for Class B, 2.04% for Class C, 0.89% for Class I, 1.64% for Class R1, 1.54% for Class R3, 1.24% for Class R4, 0.94% for Class R5, 1.64% for Class T and 1.14% for Class ADV. Prior to April 30, 2009, the reimbursements and limits was 1.19% for Class A shares.

Effective August 1, 2009, the Adviser agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business and shareholder service fees. The reimbursements and limits are such that these expenses will not exceed 1.35% for Class A shares, 2.10% for Class B, 2.10% for Class C, 0.92% for Class I, 1.80% for Class R1, 1.65% for Class R3, 1.35% for Class R4, 1.05% for Class R5, 1.98% for Class T and 1.14% for Class ADV. Accordingly, the expense reductions or reimbursements related to this agreement were $454,379, $90,259, $14,049, $21,123, $4,721, $2,595, $2,595, $2,595, $215,444, and $13,832, for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class T and Class ADV, respectively, for the period ended September 30, 2009. The expense reimbursements and limits will continue in effect until July 31, 2010, and thereafter until terminated by the Adviser on notice to the Trust.

Pursuant to the Advisory Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative share of net assets of each class at the time the expense was incurred.

The accounting and legal service fees for the period ended September 30, 2009, had an effective rate of 0.01% of the Fund’s daily net assets.