| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

|

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| Date of fiscal year end: | February 28 |

| |

| Date of reporting period: | August 31, 2010 |

ITEM 1. SCHEDULE OF INVESTMENTS

A look at performance

| | | | | | | | | | |

| For the period ended August 31, 2010 | | | | | | | |

| |

| | Average annual total returns (%) | | Cumulative total returns (%) | |

| | with maximum sales charge (POP) | | with maximum sales charge (POP) | |

|

| | | | | Since | | | | | | Since |

| | 1-year | 5-year | 10-year | inception1 | | 6-months | 1-year | 5-year | 10-year | inception1 |

| |

|

| Class A | 3.13 | — | — | –7.38 | | –9.61 | 3.13 | — | — | –27.68 |

| |

|

| Class B | 2.83 | — | — | –7.33 | | –9.92 | 2.83 | — | — | –27.52 |

| |

|

| Class C | 6.82 | — | — | –6.90 | | –6.13 | 6.82 | — | — | –26.08 |

| |

|

| Class I2 | 9.04 | — | — | –5.85 | | –4.61 | 9.04 | — | — | –22.51 |

| |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable for Class I shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 6-30-11. The net expenses are as follows: Class A — 1.37%, Class B — 2.07%, Class C — 2.07% and Class I — 0.91%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 2.31%, Class B — 9.39%, Class C — 5.28% and Class I — 10.50%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses increase and results would have been less favorable.

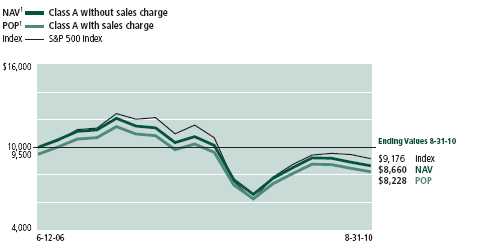

1 From 6-12-06.

2 For certain types of investors, as described in the Fund’s Class I share prospectus.

| |

| 6 | Value Opportunities Fund | Semiannual report |

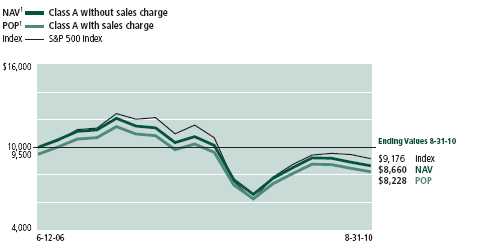

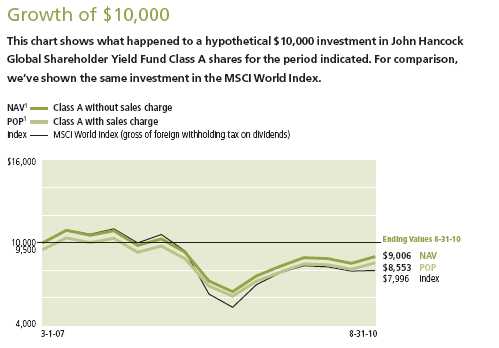

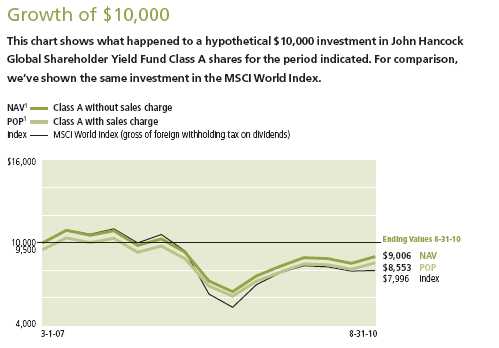

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Value Opportunities Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Russell 2500 Value Index.

| | | | |

| | Period | Without | With maximum | |

| | beginning | sales charge | sales charge | Index |

|

| Class B | 6-12-06 | $7,387 | $7,248 | $9,166 |

|

| Class C2 | 6-12-06 | 7,392 | 7,392 | 9,166 |

|

| Class I3 | 6-12-06 | 7,749 | 7,749 | 9,166 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C and Class I shares, respectively, as of 8-31-10. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 2500 Value Index is an unmanaged index containing those securities in the Russell 2500 Index with a less-than-average growth orientation.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 The contingent deferred sales charge, if any, is not applicable.

3 For certain types of investors, as described in the Fund’s Class I share prospectus.

| |

| Semiannual report | Value Opportunities Fund | 7 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on March 1, 2010 with the same investment held until August 31, 2010.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 3-1-10 | on 8-31-10 | period ended 8-31-101 |

|

| Class A | $1,000.00 | $951.80 | $6.79 |

|

| Class B | 1,000.00 | 948.20 | 10.21 |

|

| Class C | 1,000.00 | 948.20 | 10.21 |

|

| Class I | 1,000.00 | 953.90 | 4.48 |

|

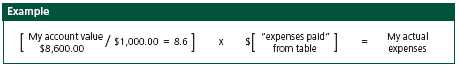

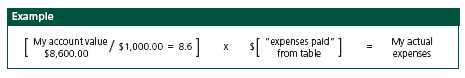

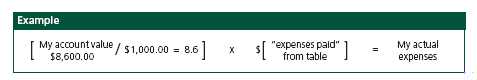

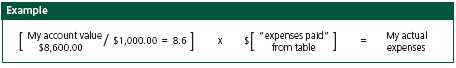

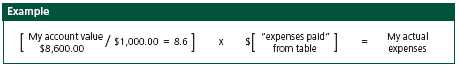

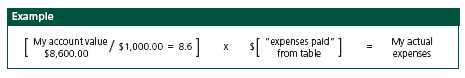

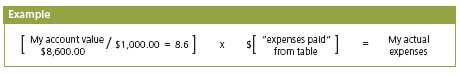

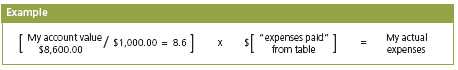

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at August 31, 2010, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | Value Opportunities Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on March 1, 2010, with the same investment held until August 31, 2010. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 3-1-10 | on 8-31-10 | period ended 8-31-101 |

|

| Class A | $1,000.00 | $1,018.20 | $7.02 |

|

| Class B | 1,000.00 | 1,014.70 | 10.56 |

|

| Class C | 1,000.00 | 1,014.70 | 10.56 |

|

| Class I | 1,000.00 | 1,020.60 | 4.63 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.38%, 2.08%, 2.08% and 0.91% for Class A, Class B, Class C and Class I shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| |

| Semiannual report | Value Opportunities Fund | 9 |

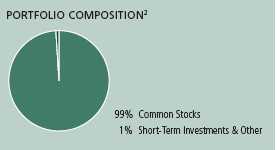

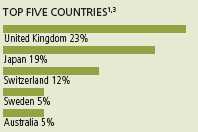

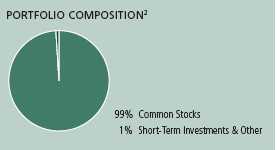

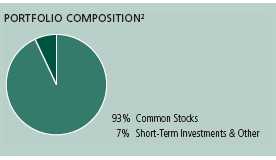

Portfolio summary

| | | | |

| Top 10 Holdings1 | | | | |

|

| Hasbro, Inc. | 1.3% | | PetSmart, Inc. | 1.1% |

| |

|

| Wyndham Worldwide Corp. | 1.2% | | Genworth Financial, Inc., Class A | 1.1% |

| |

|

| Lubrizol Corp. | 1.2% | | Torchmark Corp. | 1.0% |

| |

|

| Autoliv, Inc. | 1.1% | | TRW Automotive Holdings Corp. | 1.0% |

| |

|

| Herbalife, Ltd. | 1.1% | | Fossil, Inc. | 1.0% |

| |

|

| |

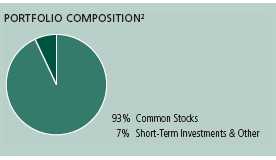

| Sector Composition2,3 | | | | |

|

| Consumer Discretionary | 35% | | Consumer Staples | 7% |

| |

|

| Health Care | 17% | | Materials | 6% |

| |

|

| Financials | 12% | | Energy | 3% |

| |

|

| Industrials | 11% | | Utilities | 1% |

| |

|

| Information Technology | 7% | | Short-Term Investments & Other | 1% |

| |

|

1 As a percentage of net assets on 8-31-10. Excludes cash and cash equivalents.

2 As a percentage of net assets on 8-31-10.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 10 | Value Opportunities Fund | Semiannual report |

Fund’s investments

As of 8-31-10 (unaudited)

| | |

| | Shares | Value |

| Common Stocks 99.32% | | $10,443,707 |

|

| (Cost $9,562,303) | | |

| | | |

| Consumer Discretionary 34.66% | | 3,644,857 |

| | | |

| Auto Components 2.53% | | |

|

| Autoliv, Inc. | 2,200 | 119,108 |

|

| Dorman Products, Inc. (I) | 400 | 9,380 |

|

| Tenneco, Inc. (I) | 1,200 | 29,664 |

|

| TRW Automotive Holdings Corp. (I) | 3,100 | 107,756 |

| | | |

| Distributors 0.05% | | |

|

| Core-Mark Holding Company, Inc. (I) | 200 | 5,178 |

| | | |

| Diversified Consumer Services 1.36% | | |

|

| Career Education Corp. (I)(L) | 2,100 | 36,813 |

|

| DeVry, Inc. | 600 | 22,866 |

|

| Hillenbrand, Inc. | 1,100 | 20,933 |

|

| Regis Corp. | 800 | 13,416 |

|

| Steiner Leisure, Ltd. (I) | 400 | 14,244 |

|

| Weight Watchers International, Inc. | 1,200 | 34,224 |

| | | |

| Hotels, Restaurants & Leisure 3.14% | | |

|

| Bluegreen Corp. (I) | 900 | 2,304 |

|

| Brinker International, Inc. | 1,400 | 22,050 |

|

| CEC Entertainment, Inc. (I) | 400 | 12,548 |

|

| Cracker Barrel Old Country Store, Inc. | 900 | 40,149 |

|

| DineEquity, Inc. (I) | 500 | 15,960 |

|

| Domino’s Pizza, Inc. (I) | 1,800 | 23,076 |

|

| Papa John’s International, Inc. (I) | 400 | 9,524 |

|

| Royal Caribbean Cruises, Ltd. (I) | 1,400 | 34,384 |

|

| Ruby Tuesday, Inc. (I) | 1,500 | 13,815 |

|

| Speedway Motorsports, Inc. | 500 | 6,660 |

|

| The Cheesecake Factory, Inc. (I) | 900 | 20,151 |

|

| Wyndham Worldwide Corp. | 5,600 | 129,864 |

| | | |

| Household Durables 3.34% | | |

|

| American Greetings Corp., Class A | 1,300 | 25,090 |

|

| Blyth, Inc. | 200 | 7,624 |

|

| Furniture Brands International, Inc. (I) | 1,100 | 5,115 |

|

| Helen of Troy, Ltd. (I) | 400 | 8,902 |

|

| Jarden Corp. | 1,300 | 35,022 |

|

| La-Z-Boy, Inc. (I) | 700 | 4,690 |

|

| Newell Rubbermaid, Inc. (L) | 4,000 | 60,080 |

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 11 |

| | |

| | Shares | Value |

| Household Durables (continued) | | |

|

| Sealy Corp. (I) | 3,100 | $7,347 |

|

| Stanley Black & Decker, Inc. | 1,800 | 96,552 |

|

| Tempur-Pedic International, Inc. (I) | 600 | 16,080 |

|

| Tupperware Brands Corp. | 1,200 | 47,208 |

|

| Whirlpool Corp. | 500 | 37,080 |

| | | |

| Internet & Catalog Retail 0.55% | | |

|

| HSN, Inc. (I) | 1,600 | 42,064 |

|

| NutriSystem, Inc. (L) | 900 | 15,804 |

| | | |

| Leisure Equipment & Products 2.21% | | |

|

| Arctic Cat, Inc. (I) | 500 | 3,495 |

|

| Eastman Kodak Company (I)(L) | 4,400 | 15,356 |

|

| Hasbro, Inc. | 3,500 | 141,260 |

|

| Jakks Pacific, Inc. (I) | 600 | 8,940 |

|

| Polaris Industries, Inc. (L) | 900 | 47,997 |

|

| RC2 Corp. (I) | 600 | 11,046 |

|

| Steinway Musical Instruments, Inc. (I) | 300 | 4,641 |

| | | |

| Media 3.52% | | |

|

| Arbitron, Inc. | 200 | 5,088 |

|

| Belo Corp., Class A (I) | 1,800 | 9,414 |

|

| Entercom Communications Corp., Class A (I) | 1,200 | 6,600 |

|

| EW Scripps Company (I) | 1,300 | 8,827 |

|

| Gannett Company, Inc. | 8,500 | 102,765 |

|

| John Wiley & Sons, Inc., Class A | 800 | 28,472 |

|

| Journal Communications, Inc., Class A (I) | 1,700 | 6,732 |

|

| Lee Enterprises, Inc. (I)(L) | 2,800 | 6,216 |

|

| LIN TV Corp., Class A (I) | 1,800 | 7,182 |

|

| Media General, Inc., Class A (I) | 900 | 6,921 |

|

| Meredith Corp. (L) | 1,300 | 38,038 |

|

| Scholastic Corp. | 800 | 18,744 |

|

| Sinclair Broadcast Group, Inc., Class A (I) | 2,800 | 16,744 |

|

| The McClatchy Company, Class A (I)(L) | 2,600 | 6,968 |

|

| The New York Times Company, Class A (I) | 3,700 | 26,566 |

|

| The Washington Post Company, Class B (L) | 61 | 21,974 |

|

| Valassis Communications, Inc. (I) | 1,800 | 52,758 |

| | | |

| Multiline Retail 1.99% | | |

|

| Big Lots, Inc. (I)(L) | 2,400 | 75,024 |

|

| Dillard’s, Inc., Class A (L) | 2,500 | 54,675 |

|

| Family Dollar Stores, Inc. | 1,400 | 59,906 |

|

| Retail Ventures, Inc. (I) | 1,500 | 12,660 |

|

| The Bon-Ton Stores, Inc. (L) | 300 | 1,905 |

|

| Tuesday Morning Corp. (I) | 1,400 | 5,194 |

| | | |

| Specialty Retail 10.18% | | |

|

| Aaron, Inc., Class B (L) | 1,300 | 21,177 |

|

| Abercrombie & Fitch Company, Class A | 2,100 | 72,660 |

|

| Advance Auto Parts, Inc. | 900 | 49,023 |

|

| Aeropostale, Inc. (I) | 1,300 | 27,690 |

|

| Americas Car-Mart, Inc. (I) | 500 | 12,500 |

| | |

| 12 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

| | |

| | Shares | Value |

| Specialty Retail (continued) | | |

|

| AnnTaylor Stores Corp. (I) | 1,500 | $22,995 |

|

| Asbury Automotive Group, Inc. (I) | 700 | 8,351 |

|

| Big 5 Sporting Goods Corp. | 500 | 5,933 |

|

| Brown Shoe Company, Inc. | 1,300 | 13,676 |

|

| Cabela’s, Inc. (I)(L) | 1,100 | 17,138 |

|

| Collective Brands, Inc. (I)(L) | 1,500 | 19,395 |

|

| Foot Locker, Inc. | 2,900 | 34,046 |

|

| Genesco, Inc. (I) | 700 | 17,668 |

|

| Gymboree Corp. (I) | 500 | 18,815 |

|

| Hibbett Sports, Inc. (I)(L) | 300 | 6,954 |

|

| Jo-Ann Stores, Inc. (I) | 800 | 32,528 |

|

| Jos. A. Bank Clothiers, Inc. (I)(L) | 900 | 32,877 |

|

| Limited Brands, Inc. | 600 | 14,160 |

|

| Office Depot, Inc. (I) | 4,800 | 16,368 |

|

| OfficeMax, Inc. (I) | 2,800 | 27,272 |

|

| PetSmart, Inc. | 3,600 | 114,804 |

|

| RadioShack Corp. | 4,000 | 73,920 |

|

| Rent-A–Center, Inc. | 1,800 | 36,144 |

|

| Shoe Carnival, Inc. (I) | 400 | 6,612 |

|

| Systemax, Inc. | 1,000 | 11,770 |

|

| Talbots, Inc. (I)(L) | 1,100 | 10,978 |

|

| The Cato Corp., Class A | 800 | 18,360 |

|

| The Children’s Place Retail Stores, Inc. (I) | 700 | 30,562 |

|

| The Dress Barn, Inc. (I) | 2,000 | 41,700 |

|

| The Finish Line, Inc., Class A | 1,200 | 15,840 |

|

| Tiffany & Company (L) | 2,200 | 87,186 |

|

| Tractor Supply Company | 1,100 | 74,778 |

|

| West Marine, Inc. (I) | 500 | 4,210 |

|

| Williams-Sonoma, Inc. (L) | 2,800 | 72,688 |

| | | |

| Textiles, Apparel & Luxury Goods 5.79% | | |

|

| Carter’s, Inc. (I) | 1,100 | 24,574 |

|

| Columbia Sportswear Company (L) | 1,100 | 51,271 |

|

| Deckers Outdoor Corp. (I) | 1,300 | 56,511 |

|

| Fossil, Inc. (I) | 2,200 | 104,478 |

|

| G-III Apparel Group, Ltd. (I) | 600 | 14,472 |

|

| Hanesbrands, Inc. (I) | 700 | 16,758 |

|

| Jones Apparel Group, Inc. | 2,700 | 41,526 |

|

| Kenneth Cole Productions, Inc., Class A (I) | 400 | 4,832 |

|

| Liz Claiborne, Inc. (I)(L) | 3,000 | 12,600 |

|

| Maidenform Brands, Inc. (I) | 500 | 13,335 |

|

| Oxford Industries, Inc. | 600 | 11,832 |

|

| Perry Ellis International, Inc. (I) | 600 | 11,016 |

|

| Phillips-Van Heusen Corp. | 2,000 | 91,360 |

|

| Quiksilver, Inc. (I) | 3,600 | 12,924 |

|

| Skechers U.S.A., Inc., Class A (I) | 1,300 | 33,111 |

|

| Steven Madden, Ltd. (I) | 600 | 20,658 |

|

| The Timberland Company, Class A (I) | 1,300 | 20,891 |

|

| True Religion Apparel, Inc. (I) | 700 | 12,306 |

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 13 |

| | |

| | Shares | Value |

| Textiles, Apparel & Luxury Goods (continued) | | |

|

| Unifirst Corp. | 400 | $15,704 |

|

| Volcom, Inc. (I) | 400 | 6,236 |

|

| Wolverine World Wide, Inc. | 1,300 | 32,851 |

| | | |

| Consumer Staples 6.87% | | 722,242 |

| | | |

| Beverages 0.60% | | |

|

| Constellation Brands, Inc., Class A (I) | 3,300 | 54,978 |

|

| National Beverage Corp. | 600 | 8,604 |

| | | |

| Food & Staples Retailing 1.41% | | |

|

| BJ’s Wholesale Club, Inc. (I)(L) | 700 | 29,372 |

|

| Nash Finch Company | 400 | 15,708 |

|

| Ruddick Corp. | 1,300 | 42,081 |

|

| Spartan Stores, Inc. | 400 | 5,228 |

|

| United Natural Foods, Inc. (I) | 1,200 | 41,688 |

|

| Weis Markets, Inc. | 400 | 14,064 |

| | | |

| Food Products 1.47% | | |

|

| Cal-Maine Foods, Inc. | 300 | 8,904 |

|

| Del Monte Foods Company | 6,800 | 88,672 |

|

| McCormick & Company, Inc. | 400 | 15,948 |

|

| The J.M. Smucker Company | 700 | 40,936 |

| | | |

| Household Products 0.14% | | |

|

| Spectrum Brands Holdings, Inc. (I) | 300 | 7,653 |

|

| WD-40 Company | 200 | 7,034 |

| | | |

| Personal Products 3.08% | | |

|

| Elizabeth Arden, Inc. (I) | 800 | 13,096 |

|

| Herbalife, Ltd. | 2,100 | 116,718 |

|

| Inter Parfums, Inc. | 1,100 | 18,062 |

|

| NBTY, Inc. (I) | 1,900 | 103,531 |

|

| Nu Skin Enterprises, Inc., Class A | 1,000 | 25,570 |

|

| Nutraceutical International Corp. (I) | 400 | 5,428 |

|

| Prestige Brands Holdings, Inc. (I) | 700 | 5,180 |

|

| Revlon, Inc. (I) | 800 | 8,680 |

|

| Schiff Nutrition International, Inc. | 700 | 6,027 |

|

| USANA Health Sciences, Inc. (I) | 500 | 21,250 |

| | | |

| Tobacco 0.17% | | |

|

| Universal Corp. | 500 | 17,830 |

| | | |

| Energy 3.20% | | 336,349 |

| | | |

| Energy Equipment & Services 1.56% | | |

|

| Complete Production Services, Inc. (I) | 2,100 | 37,044 |

|

| Lufkin Industries, Inc. | 400 | 15,464 |

|

| Oil States International, Inc. (I) | 1,600 | 65,968 |

|

| Rowan Companies, Inc. (I) | 1,500 | 38,565 |

|

| T-3 Energy Services, Inc. (I) | 300 | 6,624 |

| | | |

| Oil, Gas & Consumable Fuels 1.64% | | |

|

| Crosstex Energy, Inc. (I) | 700 | 5,201 |

|

| Energy Partners, Ltd. (I) | 500 | 5,465 |

|

| Frontline, Ltd. (L) | 1,100 | 29,150 |

| | |

| 14 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

| | |

| | Shares | Value |

| Oil, Gas & Consumable Fuels (continued) | | |

|

| Petroleum Development Corp. (I) | 300 | $8,070 |

|

| Ship Finance International, Ltd. | 2,200 | 38,522 |

|

| Sunoco, Inc. | 1,500 | 50,520 |

|

| World Fuel Services Corp. (L) | 1,400 | 35,756 |

| | |

| Financials 12.18% | | 1,280,424 |

| | | |

| Capital Markets 1.43% | | |

|

| American Capital, Ltd. (I)(L) | 11,400 | 57,798 |

|

| Ares Capital Corp. | 3,900 | 58,266 |

|

| BlackRock Kelso Capital Corp. | 1,900 | 20,520 |

|

| MCG Capital Corp. | 2,600 | 13,728 |

| | | |

| Commercial Banks 0.37% | | |

|

| Community Bank Systems, Inc. (L) | 500 | 11,290 |

|

| International Bancshares Corp. (L) | 1,800 | 28,080 |

| | | |

| Consumer Finance 1.34% | | |

|

| Cash America International, Inc. | 1,000 | 30,630 |

|

| EZCORP, Inc., Class A (I) | 1,700 | 30,566 |

|

| Nelnet, Inc., Class A | 1,400 | 30,674 |

|

| SLM Corp. (I) | 2,600 | 28,730 |

|

| World Acceptance Corp. (I) | 500 | 20,375 |

| | | |

| Diversified Financial Services 0.15% | | |

|

| Encore Capital Group, Inc. (I) | 600 | 11,886 |

|

| Primus Guaranty, Ltd. (I) | 900 | 3,447 |

| | | |

| Insurance 7.32% | | |

|

| American Equity Investment Life Holding Company | 1,900 | 18,031 |

|

| American Financial Group, Inc. | 2,400 | 69,048 |

|

| Assurant, Inc. | 2,800 | 102,368 |

|

| CNA Surety Corp. (I) | 700 | 11,732 |

|

| CNO Financial Group, Inc. (I) | 6,800 | 32,164 |

|

| Endurance Specialty Holdings, Ltd. | 1,300 | 47,892 |

|

| FBL Financial Group, Inc., Class A | 1,000 | 23,000 |

|

| Genworth Financial, Inc., Class A (I) | 10,600 | 114,798 |

|

| Horace Mann Educators Corp. | 1,000 | 16,400 |

|

| Mercury General Corp. | 800 | 31,376 |

|

| National Financial Partners Corp. (I) | 1,200 | 12,768 |

|

| Protective Life Corp. | 1,500 | 28,020 |

|

| Reinsurance Group of America, Inc. | 1,200 | 52,488 |

|

| Safety Insurance Group, Inc. | 400 | 16,300 |

|

| StanCorp Financial Group, Inc. | 1,100 | 39,193 |

|

| Torchmark Corp. | 2,200 | 108,570 |

|

| Unitrin, Inc. | 1,900 | 45,220 |

| | | |

| Real Estate Investment Trusts 1.57% | | |

|

| Agree Realty Corp. | 300 | 7,125 |

|

| American Capital Agency Corp. | 700 | 19,068 |

|

| Ashford Hospitality Trust, Inc. (I)(L) | 2,200 | 17,666 |

|

| CBL & Associates Properties, Inc. | 1,800 | 21,960 |

|

| CommonWealth REIT | 1,000 | 24,120 |

|

| General Growth Properties, Inc. | 800 | 11,256 |

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 15 |

| | |

| | Shares | Value |

| Real Estate Investment Trusts (continued) | | |

|

| Glimcher Realty Trust | 1,200 | $7,128 |

|

| iStar Financial, Inc. (I)(L) | 2,700 | 9,423 |

|

| Pennsylvania Real Estate Investment Trust | 1,000 | 10,460 |

|

| Resource Capital Corp. | 1,200 | 7,104 |

|

| Strategic Hotels & Resorts, Inc. (I) | 4,600 | 16,422 |

|

| Walter Investment Management Corp. | 400 | 6,484 |

|

| Winthrop Realty Trust, REIT | 500 | 6,850 |

| | | |

| Health Care 17.25% | | 1,813,683 |

| | | |

| Health Care Equipment & Supplies 3.96% | | |

|

| American Medical Systems Holdings, Inc. (I)(L) | 1,100 | 20,042 |

|

| ArthroCare Corp. (I) | 400 | 10,384 |

|

| CONMED Corp. (I) | 800 | 14,808 |

|

| Hill-Rom Holdings, Inc. (L) | 2,200 | 70,620 |

|

| Integra LifeSciences Holdings Corp. (I) | 700 | 24,339 |

|

| Invacare Corp. (L) | 1,000 | 22,900 |

|

| Kinetic Concepts, Inc. (I) | 2,300 | 73,416 |

|

| Orthofix International NV (I) | 400 | 10,680 |

|

| STERIS Corp. | 1,400 | 40,278 |

|

| Teleflex, Inc. | 1,200 | 57,672 |

|

| The Cooper Companies, Inc. | 1,500 | 60,510 |

|

| Young Innovations, Inc. | 100 | 2,623 |

|

| Zoll Medical Corp. (I) | 300 | 7,926 |

| | | |

| Health Care Providers & Services 8.78% | | |

|

| Almost Family, Inc. (I) | 200 | 5,054 |

|

| Amedisys, Inc. (I) | 900 | 20,808 |

|

| AMERIGROUP Corp. (I) | 1,600 | 59,040 |

|

| Centene Corp. (I) | 1,400 | 28,308 |

|

| Chemed Corp. | 500 | 24,950 |

|

| Community Health Systems, Inc. (I) | 2,000 | 52,140 |

|

| Continucare Corp. (I) | 1,600 | 5,200 |

|

| Coventry Health Care, Inc. (I) | 4,000 | 77,400 |

|

| Gentiva Health Services, Inc. (I) | 1,000 | 20,550 |

|

| Health Management Associates, Inc., Class A (I) | 6,200 | 38,750 |

|

| Health Net, Inc. (I) | 3,500 | 83,580 |

|

| Healthspring, Inc. (I) | 1,900 | 39,444 |

|

| Henry Schein, Inc. (I)(L) | 300 | 15,840 |

|

| LHC Group, Inc. (I) | 200 | 4,002 |

|

| LifePoint Hospitals, Inc. (I) | 1,500 | 45,630 |

|

| Lincare Holdings, Inc. (L) | 3,449 | 79,396 |

|

| Magellan Health Services, Inc. (I) | 900 | 39,429 |

|

| MEDNAX, Inc. (I) | 800 | 37,072 |

|

| Molina Healthcare, Inc. (I) | 600 | 15,216 |

|

| Omnicare, Inc. | 2,400 | 46,080 |

|

| Owens & Minor, Inc. | 1,400 | 37,324 |

|

| Patterson Companies, Inc. | 2,900 | 73,341 |

|

| Sunrise Senior Living, Inc. (I) | 1,500 | 3,315 |

|

| The Providence Service Corp. (I) | 600 | 8,112 |

|

| Universal American Financial Corp. | 2,600 | 35,906 |

|

| WellCare Health Plans, Inc. (I) | 1,100 | 27,291 |

| | |

| 16 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

| | |

| | Shares | Value |

| Health Care Technology 0.05% | | |

|

| MedQuist, Inc. (I) | 700 | $5,145 |

| | | |

| Life Sciences Tools & Services 1.40% | | |

|

| Kendle International, Inc. (I) | 300 | 2,349 |

|

| Mettler-Toledo International, Inc. (I) | 80 | 8,847 |

|

| Parexel International Corp. (I) | 1,400 | 27,846 |

|

| PerkinElmer, Inc. | 3,100 | 65,131 |

|

| Pharmaceutical Product Development, Inc. | 1,900 | 43,643 |

| | | |

| Pharmaceuticals 3.06% | | |

|

| Endo Pharmaceuticals Holdings, Inc. (I) | 3,200 | 86,944 |

|

| Hi-Tech Pharmacal Company, Inc. (I)(L) | 200 | 3,470 |

|

| K-V Pharmaceutical Company, Class A (I) | 1,900 | 2,793 |

|

| Medicis Pharmaceutical Corp., Class A (L) | 1,500 | 41,250 |

|

| Mylan, Inc. (I)(L) | 2,200 | 37,752 |

|

| Par Pharmaceutical Companies, Inc. (I) | 800 | 21,096 |

|

| Perrigo Company | 100 | 5,699 |

|

| Viropharma, Inc. (I) | 2,200 | 27,588 |

|

| Watson Pharmaceuticals, Inc. (I) | 2,200 | 94,754 |

| | | |

| Industrials 11.06% | | 1,162,729 |

| | | |

| Aerospace & Defense 1.81% | | |

|

| BE Aerospace, Inc. (I) | 1,600 | 43,120 |

|

| Ceradyne, Inc. (I) | 400 | 8,736 |

|

| Esterline Technologies Corp. (I) | 800 | 36,800 |

|

| LMI Aerospace, Inc. (I) | 300 | 4,539 |

|

| Moog, Inc., Class A (I) | 900 | 28,080 |

|

| Teledyne Technologies, Inc. (I) | 800 | 28,944 |

|

| Triumph Group, Inc. | 600 | 39,828 |

| | | |

| Air Freight & Logistics 0.10% | | |

|

| Air Transport Services Group, Inc. (I) | 1,200 | 5,532 |

|

| Pacer International, Inc. (I) | 1,000 | 5,120 |

| | | |

| Airlines 0.25% | | |

|

| US Airways Group, Inc. (I) | 2,900 | 26,216 |

| | | |

| Building Products 0.29% | | |

|

| A.O. Smith Corp. | 600 | 30,810 |

| | | |

| Commercial Services & Supplies 2.29% | | |

|

| ACCO Brands Corp. (I) | 1,500 | 8,715 |

|

| American Reprographics Company (I) | 900 | 5,940 |

|

| Avery Dennison Corp. | 1,600 | 52,032 |

|

| Consolidated Graphics, Inc. (I) | 300 | 11,913 |

|

| Deluxe Corp. | 1,600 | 26,768 |

|

| Ennis, Inc. | 800 | 12,312 |

|

| HNI Corp. (L) | 700 | 16,359 |

|

| Knoll, Inc. | 900 | 12,078 |

|

| M&F Worldwide Corp. (I) | 500 | 11,600 |

|

| R.R. Donnelley & Sons Company | 2,400 | 36,348 |

|

| Schawk, Inc., Class A | 700 | 10,640 |

|

| United Stationers, Inc. (I) | 800 | 35,912 |

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 17 |

| | |

| | Shares | Value |

| Electrical Equipment 0.76% | | |

|

| Acuity Brands, Inc. | 900 | $34,866 |

|

| Hubbell, Inc., Class B | 1,000 | 44,980 |

| | | |

| Industrial Conglomerates 0.33% | | |

|

| Carlisle Companies, Inc. | 1,000 | 28,050 |

|

| Standex International Corp. | 300 | 7,059 |

| | | |

| Machinery 2.62% | | |

|

| Alamo Group, Inc. | 200 | 3,900 |

|

| Crane Company | 1,700 | 57,630 |

|

| EnPro Industries, Inc. (I) | 600 | 16,386 |

|

| Gardner Denver, Inc. | 1,000 | 47,740 |

|

| Joy Global, Inc. | 200 | 11,348 |

|

| NACCO Industries, Inc., Class A | 280 | 21,711 |

|

| Oshkosh Corp. (I) | 1,400 | 34,832 |

|

| The Manitowoc Company, Inc. (L) | 2,900 | 26,564 |

|

| The Toro Company | 800 | 39,920 |

|

| TriMas Corp. (I) | 1,200 | 15,468 |

| | | |

| Professional Services 0.82% | | |

|

| Kelly Services, Inc., Class A (I) | 1,100 | 11,484 |

|

| Kforce, Inc. (I) | 1,000 | 10,570 |

|

| Manpower, Inc. | 600 | 25,500 |

|

| SFN Group, Inc. (I) | 1,500 | 8,160 |

|

| The Corporate Executive Board Company | 900 | 25,236 |

|

| Volt Information Sciences, Inc. (I) | 400 | 2,528 |

|

| VSE Corp. | 100 | 2,808 |

| | | |

| Road & Rail 0.44% | | |

|

| Avis Budget Group, Inc. (I)(L) | 1,400 | 12,768 |

|

| Dollar Thrifty Automotive Group, Inc. (I) | 700 | 32,928 |

| | | |

| Trading Companies & Distributors 1.26% | | |

|

| Aircastle, Ltd. | 2,200 | 17,182 |

|

| Applied Industrial Technologies, Inc. | 1,100 | 29,480 |

|

| CAI International, Inc. (I) | 500 | 6,835 |

|

| DXP Enterprises, Inc. (I) | 400 | 7,260 |

|

| TAL International Group, Inc. | 800 | 17,056 |

|

| Textainer Group Holdings, Ltd. | 700 | 19,110 |

|

| WESCO International, Inc. (I) | 1,100 | 35,508 |

| | | |

| Transportation Infrastructure 0.09% | | |

|

| Macquarie Infrastructure Company LLC (I) | 700 | 9,520 |

| | | |

| Information Technology 7.37% | | 774,832 |

| | | |

| Communications Equipment 0.40% | | |

|

| Black Box Corp. | 400 | 11,280 |

|

| Polycom, Inc. (I) | 1,100 | 31,328 |

| | | |

| Computers & Peripherals 1.33% | | |

|

| Imation Corp. (I) | 500 | 4,280 |

|

| Lexmark International, Inc., Class A (I) | 2,800 | 97,972 |

|

| QLogic Corp. (I) | 1,600 | 23,832 |

|

| Quantum Corp. (I) | 2,300 | 3,312 |

|

| Seagate Technology PLC (I) | 600 | 6,078 |

|

| Super Micro Computer, Inc. (I) | 500 | 4,518 |

| | |

| 18 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

| | |

| | Shares | Value |

| Electronic Equipment, Instruments & Components 1.27% | | |

|

| Ingram Micro, Inc., Class A (I) | 3,300 | $49,698 |

|

| Insight Enterprises, Inc. (I) | 1,500 | 19,710 |

|

| Measurement Specialties, Inc. (I) | 400 | 5,928 |

|

| Smart Modular Technologies (WWH), Inc. (I) | 1,500 | 7,035 |

|

| Tech Data Corp. (I)(L) | 1,400 | 50,680 |

| | | |

| Internet Software & Services 0.23% | | |

|

| Earthlink, Inc. | 1,800 | 15,408 |

|

| United Online, Inc. | 1,700 | 8,381 |

| | | |

| IT Services 1.35% | | |

|

| CACI International, Inc., Class A (I) | 600 | 24,486 |

|

| China Information Technology, Inc. (I)(L) | 1,200 | 6,072 |

|

| Convergys Corp. (I) | 1,700 | 17,221 |

|

| CSG Systems International, Inc. (I) | 1,000 | 18,300 |

|

| Heartland Payment Systems, Inc. | 800 | 11,320 |

|

| MAXIMUS, Inc. | 400 | 21,484 |

|

| MoneyGram International, Inc. (I)(L) | 900 | 1,818 |

|

| Ness Technologies, Inc. (I) | 1,000 | 4,270 |

|

| SRA International, Inc., Class A (I) | 1,100 | 21,175 |

|

| Unisys Corp. (I) | 700 | 15,652 |

| | | |

| Office Electronics 0.22% | | |

|

| Zebra Technologies Corp., Class A (I) | 800 | 22,896 |

| | | |

| Semiconductors & Semiconductor Equipment 0.05% | | |

|

| Silicon Image, Inc. (I) | 1,500 | 5,430 |

| | | |

| Software 2.52% | | |

|

| Epicor Software Corp. (I) | 1,500 | 10,185 |

|

| Fair Isaac Corp. | 1,100 | 24,629 |

|

| JDA Software Group, Inc. (I) | 800 | 18,376 |

|

| Manhattan Associates, Inc. (I) | 300 | 7,814 |

|

| MicroStrategy, Inc., Class A (I) | 200 | 15,586 |

|

| Parametric Technology Corp. (I) | 2,100 | 35,805 |

|

| Progress Software Corp. (I) | 1,400 | 37,394 |

|

| Quest Software, Inc. (I) | 1,900 | 40,716 |

|

| Radiant Systems, Inc. (I) | 1,100 | 19,701 |

|

| TIBCO Software, Inc. (I) | 3,800 | 55,062 |

| | | |

| Materials 5.90% | | 620,546 |

| | | |

| Chemicals 4.51% | | |

|

| Ashland, Inc. | 1,500 | 69,690 |

|

| Cytec Industries, Inc. | 1,200 | 56,916 |

|

| Hawkins, Inc. | 200 | 6,094 |

|

| Innophos Holdings, Inc. | 600 | 17,502 |

|

| Innospec, Inc. (I) | 500 | 6,205 |

|

| International Flavors & Fragrances, Inc. | 1,700 | 77,673 |

|

| Lubrizol Corp. | 1,300 | 121,303 |

|

| Quaker Chemical Corp. | 200 | 5,922 |

|

| RPM International, Inc. | 3,500 | 59,150 |

|

| Valspar Corp. | 1,800 | 54,216 |

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 19 |

| | | |

| | | Shares | Value |

| Containers & Packaging 0.90% | | | |

|

| Boise, Inc. (I) | | 2,000 | $13,760 |

|

| Silgan Holdings, Inc. | | 900 | 26,901 |

|

| Sonoco Products Company | | 1,700 | 53,465 |

| | | | |

| Metals & Mining 0.32% | | | |

|

| Reliance Steel & Aluminum Company | | 900 | 33,525 |

| | | | |

| Paper & Forest Products 0.17% | | | |

|

| KapStone Paper and Packaging Corp. (I) | | 1,600 | 18,224 |

| | | | |

| Telecommunication Services 0.05% | | | 5,800 |

| | | | |

| Diversified Telecommunication Services 0.05% | | | |

|

| IDT Corp., Class B (I) | | 400 | 5,800 |

| | | | |

| Utilities 0.78% | | | 82,245 |

| | | | |

| Gas Utilities 0.37% | | | |

|

| UGI Corp. | | 1,400 | 38,640 |

| | | | |

| Multi-Utilities 0.41% | | | |

|

| Integrys Energy Group, Inc. | | 900 | 43,605 |

| | | | |

| Short-Term Investments 9.39% | | | $987,456 |

|

| (Cost $987,332) | | | |

| | Yield | Par value | Value |

| Short-Term Securities 0.78% | | | 81,545 |

| State Street Institutional Investment Treasury | | | |

| Money Market Fund | 0.0344% (Y) | $81,545 | 81,545 |

| | | Shares | Value |

| Securities Lending Collateral 8.61% | | | 905,911 |

| John Hancock Collateral Investment Trust (W) | 0.3330% (Y) | 90,500 | 905,911 |

| |

| Total investments (Cost $10,549,635)† 108.71% | | $11,431,163 |

|

|

| Other assets and liabilities, net (8.71%) | | | ($915,773) |

|

|

| Total net assets 100.00% | | | $10,515,390 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of 8-31-10.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser. Also, it represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of 8-31-10.

† At 8-31-10, the aggregate cost of investment securities for federal income tax purposes was $10,693,223. Net unrealized appreciation aggregated $737,940, of which $1,478,577 related to appreciated investment securities and $740,637 related to depreciated investment securities.

| | |

| 20 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T SFinancial statements

Statement of assets and liabilities 8-31-10 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $9,643,848) including | |

| $878,863 of securities loaned (Note 2) | $10,525,252 |

| Investments in affiliated issuers, at value (Cost $905,787) (Note 2) | 905,911 |

| | |

| Total investments, at value (Cost $10,549,635) | 11,431,163 |

| Receivable for fund shares sold | 68 |

| Dividends and interest receivable | 10,205 |

| Receivable for securities lending income | 249 |

| Receivable due from adviser | 6,815 |

| Other receivables and prepaid assets | 20,931 |

| Total assets | 11,469,431 |

| |

| Liabilities | |

|

| Payable for fund shares repurchased | 11,299 |

| Payable upon return of securities loaned (Note 2) | 905,444 |

| Payable to affiliates | |

| Accounting and legal services fees | 130 |

| Transfer agent fees | 1,976 |

| Trustees’ fees | 533 |

| Other liabilities and accrued expenses | 34,659 |

| Total liabilities | 954,041 |

| |

| Net assets | |

|

| Capital paid-in | $17,502,917 |

| Accumulated net investment loss | (9,848) |

| Accumulated net realized loss on investments and futures contracts | (7,859,207) |

| Net unrealized appreciation (depreciation) on investments | 881,528 |

| Net assets | $10,515,390 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($9,557,014 ÷ 681,439 shares) | $14.02 |

| Class B ($258,685 ÷ 18,594 shares)1 | $13.91 |

| Class C ($560,093 ÷ 40,233 shares)1 | $13.92 |

| Class I ($139,598 ÷ 9,930 shares) | $14.06 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $14.76 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 21 |

F I N A N C I A L S T A T E M E N T SStatement of operations For the six-month period ended 8-31-10 (unaudited)

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $72,382 |

| Securities lending | 2,281 |

| Interest | 179 |

| Total investment income | 74,842 |

| |

| Expenses | |

|

| Investment management fees (Note 5) | 46,195 |

| Distribution and service fees (Note 5) | 20,240 |

| Accounting and legal services fees (Note 5) | 1,035 |

| Transfer agent fees (Note 5) | 10,173 |

| Trustees’ fees (Note 5) | 658 |

| State registration fees (Note 5) | 15,916 |

| Printing and postage fees (Note 5) | 4,681 |

| Professional fees | 21,614 |

| Custodian fees | 6,267 |

| Registration and filing fees | 6,806 |

| Other | 4,176 |

| | |

| Total expenses | 137,761 |

| Less expense reductions (Note 5) | (55,079) |

| | |

| Net expenses | 82,682 |

| | |

| Net investment loss | (7,840) |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain on | |

| Investments in unaffiliated issuers | 655,324 |

| Investments in affiliated issuers | 226 |

| Futures contracts (Note 3) | 20,896 |

| | 676,446 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | (1,298,764) |

| Investments in affiliated issuers | (319) |

| Futures contracts (Note 3) | 1,700 |

| | (1,297,383) |

| Net realized and unrealized loss | (620,937) |

| | |

| Decrease in net assets from operations | ($628,777) |

| | |

| 22 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T SStatements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | For the | |

| | six-month period | Year |

| | ended 8-31-10 | ended |

| | (Unaudited) | 2-28-10 |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income (loss) | ($7,840) | $36,459 |

| Net realized gain (loss) | 676,446 | (3,475,209) |

| Change in net unrealized appreciation (depreciation) | (1,297,383) | 8,094,137 |

| | | |

| Increase (decrease) in net assets resulting from operations | (628,777) | 4,655,387 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | — | (57,822) |

| Class I | — | (933) |

| | | |

| Total distributions | — | (58,755) |

| | | |

| From Fund share transactions (Note 6) | 900,101 | (4,922,172) |

| | | |

| Total increase (decrease) | 271,324 | (325,540) |

|

| Net assets | | |

|

| Beginning of period | 10,244,066 | 10,569,606 |

| | | |

| End of period | $10,515,390 | $10,244,066 |

| | | |

| Accumulated net investment loss | ($9,848) | ($2,008) |

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 23 |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | |

| CLASS A SHARES Period ended | 8-31-101 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-072 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $14.73 | $10.14 | $17.00 | $22.36 | $20.00 |

| Net investment income (loss)3 | (0.01) | 0.04 | 0.10 | 0.12 | 0.074 |

| Net realized and unrealized gain (loss) on investments | (0.70) | 4.61 | (6.84) | (4.41) | 2.53 |

| Total from investment operations | (0.71) | 4.65 | (6.74) | (4.29) | 2.60 |

| Less distributions | | | | | |

| From net investment income | — | (0.06) | (0.12) | (0.11) | (0.08) |

| From net realized gain | — | — | — | (0.96) | (0.16) |

| Total distributions | — | (0.06) | (0.12) | (1.07) | (0.24) |

| Net asset value, end of period | $14.02 | $14.73 | $10.14 | $17.00 | $22.36 |

| Total return (%)5,6,7 | (4.82)8 | 45.86 | (39.79) | (19.45) | 13.068 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $10 | $10 | $10 | $16 | $20 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 2.109 | 2.1810 | 2.03 | 2.04 | 2.139 |

| Expenses net of fee waivers | 1.389 | 1.3910 | 1.39 | 1.39 | 1.389 |

| Expenses net of fee waivers and credits | 1.389 | 1.3910 | 1.39 | 1.39 | 1.389 |

| Net investment income (loss) | (0.09)9 | 0.33 | 0.69 | 0.56 | 0.474,9 |

| Portfolio turnover (%) | 45 | 178 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-10 to 8-31-10. Unaudited.

2 The inception date for Class A shares is 6-12-06.

3 Based on the average daily shares outstanding.

4 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.09% of average net assets.

5 Assumes dividend reinvestment (if applicable).

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Does not reflect the effect of sales charges, if any.

8 Not annualized.

9 Annualized.

10 Includes the impact of proxy expenses, which amounted to 0.03% of average net assets.

| | |

| 24 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

| | | | | |

| CLASS B SHARES Period ended | 8-31-101 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-072 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $14.67 | $10.13 | $16.94 | $22.33 | $20.00 |

| Net investment loss3 | (0.06) | (0.05) | (0.01) | (0.03) | (0.01)4 |

| Net realized and unrealized gain (loss) | | | | | |

| on investments | (0.70) | 4.59 | (6.80) | (4.40) | 2.51 |

| Total from investment operations | (0.76) | 4.54 | (6.81) | (4.43) | 2.50 |

| Less distributions | | | | | |

| From net investment income | — | — | —5 | — | (0.01) |

| From net realized gain | — | — | — | (0.96) | (0.16) |

| Total distributions | — | — | —5 | (0.96) | (0.17) |

| Net asset value, end of period | $13.91 | $14.67 | $10.13 | $16.94 | $22.33 |

| Total return (%)6,7,8 | (5.18)9 | 44.82 | (40.19) | (20.08) | 12.549 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —10 | —10 | —10 | —10 | —10 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 6.1611 | 10.3712 | 9.95 | 6.82 | 11.3111 |

| Expenses net of fee waivers | 2.0811 | 2.1812 | 2.63 | 2.10 | 2.0811 |

| Expenses net of fee waivers and credits | 2.0811 | 2.0912 | 2.09 | 2.09 | 2.0811 |

| Net investment loss | (0.79)11 | (0.43) | (0.02) | (0.14) | (0.07)4,11 |

| Portfolio turnover (%) | 45 | 178 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-10 to 8-31-10. Unaudited.

2 The inception date for Class B shares is 6-12-06.

3 Based on the average daily shares outstanding.

4 Net investment loss per share and ratio of net investment loss to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.10% of average net assets.

5 Less than ($0.005) per share.

6 Assumes dividend reinvestment (if applicable).

7 Total returns would have been lower had certain expenses not been reduced during the periods shown.

8 Does not reflect the effect of sales charges, if any.

9 Not annualized.

10 Less than $500,000.

11 Annualized.

12 Includes the impact of proxy expenses, which amounted to 0.03% of average net assets.

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 25 |

| | | | | |

| CLASS C SHARES Period ended | 8-31-101 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-072 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $14.68 | $10.14 | $16.95 | $22.33 | $20.00 |

| Net investment loss3 | (0.06) | (0.05) | (0.01) | (0.03) | (0.01)4 |

| Net realized and unrealized gain (loss) | | | | | |

| on investments | (0.70) | 4.59 | (6.80) | (4.39) | 2.51 |

| Total from investment operations | (0.76) | 4.54 | (6.81) | (4.42) | 2.50 |

| From net investment income | — | — | —5 | — | (0.01) |

| From net realized gain | — | — | — | (0.96) | (0.16) |

| Total distributions | — | — | —5 | (0.96) | (0.17) |

| Net asset value, end of period | $13.92 | $14.68 | $10.14 | $16.95 | $22.33 |

| Total return (%)6,7,8 | (5.18)9 | 44.77 | (40.17) | (20.03) | 12.549 |

| | | | | | |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $1 | —10 | —10 | $1 | $1 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 4.2411 | 5.7912 | 5.12 | 3.88 | 5.0911 |

| Expenses net of fee waivers | 2.0811 | 2.2112 | 2.40 | 2.10 | 2.0811 |

| Expenses net of fee waivers and credits | 2.0811 | 2.0912 | 2.09 | 2.09 | 2.0811 |

| Net investment loss | (0.79)11 | (0.41) | (0.03) | (0.14) | (0.07)4,11 |

| Portfolio turnover (%) | 45 | 178 | 80 | 68 | 30 |

| |

1 Semiannual period from 3-1-10 to 8-31-10. Unaudited.

2 The inception date for Class C shares is 6-12-06.

3 Based on the average daily shares outstanding.

4 Net investment loss per share and ratio of net investment loss to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.10% of average net assets.

5 Less than ($0.005) per share.

6 Assumes dividend reinvestment (if applicable).

7 Total returns would have been lower had certain expenses not been reduced during the periods shown.

8 Does not reflect the effect of sales charges, if any.

9 Not annualized.

10 Less than $500,000.

11 Annualized.

12 Includes the impact of proxy expenses, which amounted to 0.04% of average net assets.

| | |

| 26 | Value Opportunities Fund | Semiannual report | See notes to financial statements |

| | | | | |

| CLASS I SHARES Period ended | 8-31-101 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-072 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.74 | $10.15 | $17.02 | $22.39 | $20.00 |

| Net investment income3 | 0.03 | 0.09 | 0.17 | 0.18 | 0.154 |

| Net realized and unrealized gain (loss) on investments | (0.71) | 4.62 | (6.86) | (4.41) | 2.53 |

| Total from investment operations | (0.68) | 4.71 | (6.69) | (4.23) | 2.68 |

| Less distributions | | | | | |

| From net investment income | — | (0.12) | (0.18) | (0.18) | (0.13) |

| From net realized gain | — | — | — | (0.96) | (0.16) |

| Total distributions | — | (0.12) | (0.18) | (1.14) | (0.29) |

| Net asset value, end of period | $14.06 | $14.74 | $10.15 | $17.02 | $22.39 |

| Total return (%)5,6 | (4.61)7 | 46.41 | (39.48) | (19.16) | 13.427 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —8 | —8 | —8 | —8 | —8 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 7.849 | 11.3910 | 21.05 | 8.80 | 12.639 |

| Expenses net of fee waivers | 0.919 | 0.9410 | 0.99 | 0.99 | 0.999 |

| Expenses net of fee waivers and credits | 0.919 | 0.9410 | 0.99 | 0.99 | 0.999 |

| Net investment income | 0.379 | 0.74 | 1.11 | 0.86 | 0.964,9 |

| Portfolio turnover (%) | 45 | 178 | 80 | 68 | 30 |

| | |

1 Semiannual period from 3-1-10 to 8-31-10. Unaudited.

2 The inception date for Class I shares is 6-12-06.

3 Based on the average daily shares outstanding.

4 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.10% of average net assets.

5 Assumes dividend reinvestment (if applicable).

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Not annualized.

8 Less than $500,000.

9 Annualized.

10 Includes the impact of proxy expenses, which amounted to 0.01% of average net assets.

| | |

| See notes to financial statements | Semiannual report | Value Opportunities Fund | 27 |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock Value Opportunities Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, print and postage, registration and transfer agent fees for each class may differ. Class B shares convert to Class A shares eight years after purchase. Class R1 shares converted into Class A shares on August 21, 2009.

Affiliates of the Fund owned 65% of shares of beneficial interest of Class A on August 31, 2010.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes significant unobservable inputs wh en market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of August 31, 2010, all investments are categorized as Level 1 under the hierarchy described above.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. John Hancock Collateral Investment Trust (JHCIT), an affiliate of the Fund, is valued at its closing net asset value

| |

| 28 | Value Opportunities Fund | Semiannual report |

(NAV). JHCIT has a floating NAV and invests in short-term investments as part of a securities lending program.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. Significant market events that affect the values of non-U.S. securities may occur after the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees. The Fund may use a fair valuation model to value non-U.S. securities in order to adjust for events which may occur between the close of foreign exchanges and the close of the NYSE.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-date.

Securities lending. The Fund may lend its securities to earn additional income. It receives and maintains cash collateral received from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, as a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Income received from JHCIT is a component of securities lending income as re corded on the Statement of Operations.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses, and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage fees, for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to a Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with the custodian which enables them to participate in a $100 million unsecured committed line of credit. Prior to

| |

| Semiannual report | Value Opportunities Fund | 29 |

March 31, 2010, the amount of the line of credit was $150 million. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis based on their relative average net assets. For the six months ended August 31, 2010, the Fund had no significant borrowings under the line of credit.

Federal income taxes. The Fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund had a capital loss carryforward of $8,395,553 available to offset future net realized capital gains as of February 28, 2010. The loss carryforward expires as follows: February 28, 2017 — $2,899,971 and February 28, 2018 — $5,495,582.

As of February 28, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, annually.

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a tax return of capital.

Capital accounts within financial statements are adjusted for permanent book/tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book/tax differences, if any, will reverse in a subsequent period. Permanent book/tax differences are primarily attributable to foreign currency transactions, net operating losses, pay-downs, defaulted bonds, derivative transactions, partnerships, amortization and accretion on debt securities, tender fees and investments in passive foreign investment companies.

Note 3 — Derivative Instruments

The Fund may invest in derivatives, including futures contracts and forward foreign currency contracts in order to meet its investment objectives. The use of derivatives may involve risks different from, or potentially greater than, the risks associated with investing directly in securities. Specifically, derivatives expose the Fund to the risk that the counterparty to an over-the-counter (OTC) derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction. If the counterparty defaults, the Fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or that the Fund will succeed in enforcing them.

For more information regarding the Fund’s use of derivatives, please refer to the Fund’s Prospectuses and Statement of Additional Information.

| |

| 30 | Value Opportunities Fund | Semiannual report |

Futures. A futures contract is a contractual agreement to buy or sell a particular commodity, currency, or financial instrument at a pre-determined price in the future. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates and potential losses in excess of the Fund’s initial investment.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. Upon entering into a futures contract, the Fund is required to deposit initial margin with the broker in the form of cash or securities. The amount of required margin is generally based on a percentage of the contract value; this amount is the initial margin for the trade. The margin deposit must then be maintained at the established level over the life of the contract. Futures contracts are marked to market daily and an appropriate payable or receivable for the change in value (variation margin) is recorded by the Fund.

During the six months ended August 31, 2010, the Fund used futures contracts to maintain diversity and liquidity of the portfolio. The range of futures contracts notional amounts held by the Fund during six months ended August 31, 2010 was $0 to $284,660. There were no open futures contracts as of August 31, 2010.

Effect of derivative instruments on the Statement of Operations

The table below summarizes the net realized gain (loss) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six months ended August 31, 2010:

| | | |

| RISK | STATEMENT OF OPERATIONS LOCATION | FUTURES | |

| |

| Equity contracts | Net realized gain | $20,896 | |

The table below summarizes the net change in unrealized appreciation (depreciation) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six months ended August 31, 2010:

| | | |

| RISK | STATEMENT OF OPERATIONS LOCATION | FUTURES | |

| |

| Equity contracts | Change in unrealized | $1,700 | |

| appreciation (depreciation) | | |

Note 4 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 5 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $500,000,000 of the Fund’s average daily net assets; (b) 0.78%

| |

| Semiannual report | Value Opportunities Fund | 31 |

of the next $500,000,000; (c) 0.77% of the next $1,500,000,000; and (d) 0.76% of the Fund’s average daily net assets in excess of $2,500,000,000. The Adviser has a subadvisory agreement with Grantham, Mayo, Van Otterloo & Co. LLC. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the six months ended August 31, 2010 were equivalent to an annual effective rate of 0.80% of the Fund’s average daily net assets.

Effective July 1, 2010, the Adviser has contractually agreed to waive fees and/or reimburse certain expenses for each share class of the Fund. This agreement excludes taxes, portfolio brokerage commissions, interest, litigation and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The fee waivers and/or reimbursements are such that these expenses will not exceed 1.37%, 2.07%, 2.07% and 0.91% for Class A, Class B, Class C and Class I shares, respectively. The fee waivers and/or reimbursements will continue in effect until June 30, 2011.

Prior to July 1, 2010, the Adviser had contractually agreed to waive fees and/or reimburse certain expenses for each share class of the Fund. This agreement excluded taxes, portfolio brokerage commissions, interest, litigation and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The fee waivers and/or reimbursements were such that these expenses would not exceed 1.39%, 2.09%, 2.09% and 0.91% for Class A, Class B, Class C and Class I shares, respectively.

Effective May 1, 2010, the Adviser has voluntarily agreed to waive fees and/or reimburse certain other fund level expenses. This agreement excludes advisory, interest, overdraft, litigation, class specific and other extraordinary expenses not incurred in the ordinary course of business. The fee waivers and/or reimbursement are such that these expenses will not exceed 0.04% of average daily net assets.

Accordingly, these expense reductions, described above, amounted to $37,815, $5,380, $6,824 and $5,060 for Class A, Class B, Class C and Class I shares, respectively, for the six months ended August 31, 2010.

Accounting and legal services. Pursuant to the service agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. The accounting and legal services fees incurred for the six months ended August 31, 2010 amounted to an annual rate of 0.02% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B and Class C shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. The Fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares.

| | | | | |

| CLASS | 12b–1 FEES | | | | |

| | | | |

| Class A | 0.30% | | | | |

| Class B | 1.00% | | | | |

| Class C | 1.00% | | | | |

| |

| 32 | Value Opportunities Fund | Semiannual report |

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $10,961 for the six months ended August 31, 2010. Of this amount, $1,828 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $9,119 was paid as sales commissions to broker-dealers and $14 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a broker-dealer affiliate of the Adviser.

Class B and Class C shares are subject to contingent deferred sales charges (CDSC). Class B shares that are redeemed within six years of purchase are subject to CDSC, at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC on the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the six months ended August 31, 2010, CDSCs received by the Distributor amounted to $201 and $0 for Class B and Class C shares, respectively.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services or Transfer Agent), an affiliate of the Adviser. Prior to July 1, 2010, the transfer agent fees were made up of three components:

• The Fund paid a monthly transfer agent fee at an annual rate of 0.05% for Class A, Class B and Class C shares and 0.04% for Class I shares, based on each class’s average daily net assets.

• The Fund paid a monthly fee based on an annual rate of $16.50 per shareholder account.

• In addition, Signature Services was reimbursed for certain out-of-pocket expenses.

Effective July 1, 2010, the transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain revenues that Signature Services received in connection with the service they provide to the funds. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. With in each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the six months ended August 31, 2010 were:

| | | | |

| | DISTRIBUTION | TRANSFER | STATE | PRINTING AND |

| CLASS | AND SERVICE FEES | AGENT FEES | REGISTRATION FEES | POSTAGE FEES |

|

| Class A | $15,761 | $7,626 | $4,021 | $4,199 |

|

| Class B | 1,320 | 818 | 3,884 | 109 |

|

| Class C | 3,159 | 1,347 | 3,884 | 272 |

|

| Class I | — | 382 | 4,127 | 101 |

| Total | $20,240 | $10,173 | $15,916 | $4,681 |

Trustee expenses. The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. These Trustees may, for tax purposes, elect to defer receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan (the Plan). Deferred amounts are invested in various John Hancock funds and remain in the funds until distributed in accordance

| |

| Semiannual report | Value Opportunities Fund | 33 |

with the Plan. The investment of deferred amounts and the offsetting liability are included within other receivables and prepaid assets and Trustees’ fees, respectively, in the accompanying Statement of Assets and Liabilities.

Note 6 — Fund share transactions

Transactions in Fund shares for the six months ended August 31, 2010 and for the year ended February 28, 2010 were as follows:

| | | | |

| | For the six-month period | | |