United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21904

(Investment Company Act File Number)

Federated MDT Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 07/31/17

Date of Reporting Period: 07/31/17

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

July 31, 2017

| Share Class | Ticker |

| A | QAACX |

| C | QCACX |

| Institutional | QIACX |

| R6 | QKACX |

Federated MDT All Cap Core Fund

Fund Established 2002

A Portfolio of Federated MDT Series

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from August 1, 2016 through July 31, 2017. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools. We invite you to register to take full advantage of its capabilities.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured • May Lose Value • No Bank Guarantee

CONTENTS

| 1 |

| 6 |

| 8 |

| 16 |

| 20 |

| 22 |

| 23 |

| 24 |

| 34 |

| 35 |

| 37 |

| 44 |

| 51 |

| 51 |

Management's Discussion of Fund Performance (unaudited)

The total return of Federated MDT All Cap Core Fund (the “Fund”), based on net asset value, for the 12-month reporting period ended July 31, 2017, was 15.56% for Class A Shares, 14.72% for Class C Shares, 15.90% for Institutional Shares and 15.80% for Class R6 Shares1. The total return for the Russell 3000® Index (R3000),2 the Fund's broad-based securities market index, was 16.14% for the same period. The total return of the Morningstar Large Blend Funds Average (MLBFA),3 a peer group average for the Fund, was 15.08% during the same period. The Fund's and MLBFA's total returns for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of the R3000.

During the reporting period, the Fund's investment strategy focused on stock selection. This was the most significant factor affecting the Fund's performance relative to the R3000 during the period.

The following discussion will focus on the performance of the Fund's Institutional Shares.

Market Overview

During the reporting period, domestic equity market performance was strong as evidenced by the 16.14% return on the whole-market R3000. On average, very small-cap stocks4 had the best year, closely followed by very large-cap stocks: the Russell Microcap® Index5 returned 20.58%, the small-cap Russell 2000® Index6 returned 18.45%, and the Russell Top 200® Index7 returned 17.13%. Mid-cap stocks trailed for the year with the Russell Midcap® Index8 returning 13.04%. Style preferences changed over the course of the fiscal year, with value preferred during the first half of the year and growth preferred in the second half. Overall, growth stocks came out ahead with the Russell 3000® Growth Index9 returning 18.02% and the Russell 3000® Value Index10 returning 14.17%.

The best performing sectors in the R3000 during the reporting period were Financials (31.25%), Information Technology (28.79%) and Industrials (18.75%). Underperforming sectors during the same period included Telecommunication Services (-5.42%), Energy (-0.49%) and Real Estate (1.84%).

Annual Shareholder Report

STOCK SELECTION

When looking at the Fund's fundamental characteristics, the Fund's underperformance relative to the R3000 during the reporting period was driven by stocks with high structural earnings but negative analyst conviction, and by stocks with neutral-to-high analyst conviction and not high earnings to price. The Fund's performance benefited in the first half of the year from value-oriented stocks with high earnings to price and high structural earnings. The Fund's sector exposures remained close to R3000 weights; at the end of the fiscal year there was a small overweight in the Financials sector and an underweight in the Real Estate sector. Weak stock selection in the Consumer Discretionary sector contributed the most to the Fund's underperformance. Favorable stock selection in the Industrials, Financials and Energy sectors provided a partial offset.

Individual stocks enhancing the Fund's performance during the reporting period included Prudential Financial, Inc., HP Inc. and Valero Energy Corporation.

Individual stocks detracting from the Fund's performance during the reporting period included Microsoft Corporation, AutoZone, Inc. and Amazon.com, Inc. Microsoft and Amazon.com outperformed the R3000 but were underweighted relative to the R3000.

| 1 | Prior to September 1, 2016, Class R6 Shares were known as Class R Shares and included 12b-1 fees and certain other expenses. As of September 1, 2016, Class R6 does not include such 12b-1 fees and certain other expenses, and the performance for Class R6 prior to September 1, 2016, reflects the higher Class R expenses. |

| 2 | Please see the footnotes to the line graphs below for definitions of, and further information about, the Russell 3000® Index. |

| 3 | Morningstar has assigned the Fund to the Morningstar Large Cap Value Funds Average peer group, however, the MLBFA is being used for comparison purposes. The Fund invests in both value and growth stocks and therefore the Fund's Adviser believes that the MLBFA is more reflective of the Fund's investment style. Please see the footnotes to the line graphs below for definitions of, and further information about, the MLBFA. |

| 4 | Small-cap stocks may be less liquid and subject to greater price volatility than large-cap stocks. |

| 5 | The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small-cap Russell 2000® Index, plus the next 1,000 smallest eligible securities by market cap. The Russell Microcap® Index is constructed to provide a comprehensive and unbiased barometer for the microcap segment trading on national exchanges and is completely reconstituted annually to ensure new and growing equities are reflected and companies continue to reflect appropriate capitalization and value characteristics.* |

| 6 | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.* |

Annual Shareholder Report

| 7 | The Russell Top 200® Index measures the performance of the largest cap segment of the U.S. equity universe. The Russell Top 200® Index is a subset of the Russell 3000® Index. It includes approximately 200 of the largest securities based on a combination of their market cap and current index membership and represents approximately 68% of the U.S. market. The Russell Top 200® Index is constructed to provide a comprehensive and unbiased barometer for this very large cap segment and is completely reconstituted annually to ensure new and growing equities are reflected.* |

| 8 | The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000® companies. The Russell Midcap® Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The Russell Midcap Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap opportunity set.* |

| 9 | The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Growth Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad growth market. The Russell 3000 Growth Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.* |

| 10 | The Russell 3000® Value Index measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000® Value Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad value market. The Russell 3000 Value Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.* |

| * | The index is unmanaged, and it is not possible to invest directly in an index. |

Annual Shareholder Report

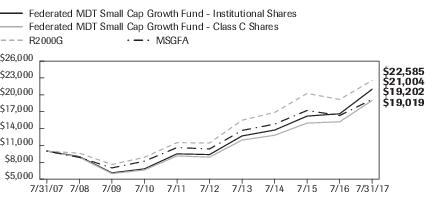

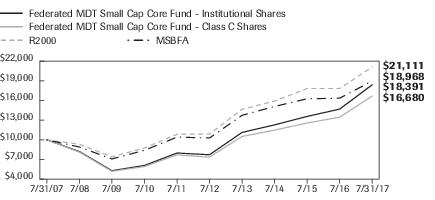

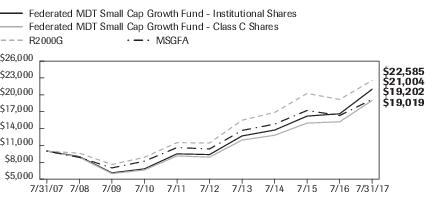

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

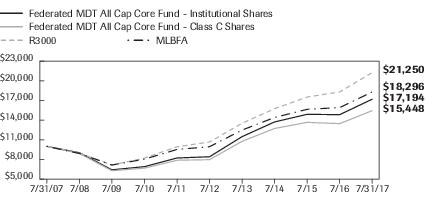

The graph below illustrates the hypothetical investment of $10,0001 in the Federated MDT All Cap Core Fund (the “Fund”) from July 31, 2007 to July 31, 2017, compared to the Russell 3000® Index (R3000)2 and the Morningstar Large Blend Funds Average (MLBFA).3 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of July 31, 2017

| Federated MDT All Cap Core Fund - | Institutional Shares | Class C Shares | R3000 | MLBFA |

| F | F | I | I |

| 7/31/2007 | 10,000 | 10,000 | 10,000 | 10,000 |

| 7/31/2008 | 9,029 | 8,931 | 8,968 | 8,920 |

| 7/31/2009 | 6,425 | 6,283 | 7,155 | 7,158 |

| 7/31/2010 | 6,909 | 6,681 | 8,215 | 8,050 |

| 7/31/2011 | 8,231 | 7,884 | 9,936 | 9,530 |

| 7/31/2012 | 8,415 | 7,976 | 10,663 | 9,946 |

| 7/31/2013 | 11,483 | 10,766 | 13,528 | 12,488 |

| 7/31/2014 | 13,727 | 12,731 | 15,743 | 14,408 |

| 7/31/2015 | 14,887 | 13,661 | 17,519 | 15,651 |

| 7/31/2016 | 14,835 | 13,466 | 18,298 | 15,913 |

| 7/31/2017 | 17,194 | 15,448 | 21,250 | 18,296 |

41 graphic description end -->

| ■ | Total returns shown for the Class C Shares include the maximum contingent deferred sales charge of 1.00% as applicable. |

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to differences in sales charges and expenses. See the Average Annual Total Return table below for the returns of additional classes not shown in the line graph above.

Average Annual Total Returns for the Period Ended 7/31/2017

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| | 1 Year | 5 Years | 10 Years |

| Class A Shares | 9.19% | 13.74% | 4.68% |

| Class C Shares | 13.72% | 14.14% | 4.44% |

| Institutional Shares | 15.90% | 15.36% | 5.57% |

| Class R6 Shares4 | 15.80% | 14.67% | 4.86% |

| R3000 | 16.14% | 14.79% | 7.83% |

| MLBFA | 15.08% | 13.50% | 6.74% |

Annual Shareholder Report

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: for Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class C Shares a 1.00% contingent deferred sales charge would be applied on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The R3000 and MLBFA have been adjusted to reflect reinvestment of dividends of securities. |

| 2 | The R3000 measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The R3000 is constructed to provide a comprehensive, unbiased, and stable barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. The R3000 is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund's performance. |

| 3 | Morningstar figures represent the average of the total returns reported by all the funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. The Morningstar figures in the Growth of $10,000 line graph are based on historical return information published by Morningstar and reflect the return of the funds comprising the category in the year of publication. Because the funds designated by Morningstar as falling into the category can change over time, the Morningstar figures in the line graph may not match the Morningstar figures in the Average Annual Total Returns table, which reflect the return of the funds that currently comprise the category. |

| 4 | Prior to September 1, 2016, Class R6 Shares were known as Class R Shares and included 12b-1 fees and certain other expenses. As of September 1, 2016, Class R6 does not include such 12b-1 fees and certain other expenses, and the performance shown above for Class R6 prior to September 1, 2016, reflects the higher Class R expenses. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At July 31, 2017, the Fund's index composition1 was as follows:

| Industry Composition | Percentage of

Total Net Assets |

| Ethical Drugs | 6.3% |

| Soft Drinks | 5.4% |

| Money Center Bank | 5.3% |

| Life Insurance | 4.5% |

| Electric Utility | 4.2% |

| Medical Supplies | 4.2% |

| Semiconductor Manufacturing Equipment | 4.2% |

| Internet Services | 3.7% |

| Property Liability Insurance | 3.4% |

| Multi-Industry Capital Goods | 2.8% |

| Computers—Low End | 2.7% |

| Integrated International Oil | 2.7% |

| Software Packaged/Custom | 2.6% |

| Financial Services | 2.5% |

| Specialty Retailing | 2.4% |

| Agricultural Machinery | 2.2% |

| Semiconductor Manufacturing | 2.2% |

| Undesignated Consumer Cyclicals | 2.1% |

| Regional Banks | 2.0% |

| Computers—Midrange | 1.6% |

| Discount Department Stores | 1.5% |

Annual Shareholder Report

| Industry Composition | Percentage of

Total Net Assets |

| Department Stores | 1.4% |

| Medical Technology | 1.4% |

| Miscellaneous Food Products | 1.4% |

| Biotechnology | 1.3% |

| Cellular Communications | 1.3% |

| Commodity Chemicals | 1.2% |

| Defense Aerospace | 1.2% |

| Oil Refiner | 1.1% |

| Clothing Stores | 1.0% |

| Computer Peripherals | 1.0% |

| Securities Brokerage | 1.0% |

| Telephone Utility | 1.0% |

| Other2 | 15.4% |

| Cash Equivalents3 | 1.5% |

| Other Assets and Liabilities—Net4 | 0.3% |

| TOTAL | 100.0% |

| 1 | Except for Cash Equivalents and Other Assets and Liabilities, industry classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

| 2 | For purposes of this table, industry classifications which constitute less than 1.0% of the Fund's total net assets have been aggregated under the designation “Other”. |

| 3 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 4 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Portfolio of Investments

July 31, 2017

| Shares | | | Value |

| | | COMMON STOCKS—98.2% | |

| | | Advertising—0.4% | |

| 13,937 | | Nielsen Holdings PLC | $599,430 |

| | | Agricultural Machinery—2.2% | |

| 9,100 | | AGCO Corp. | 656,474 |

| 18,333 | | Deere & Co. | 2,351,757 |

| | | TOTAL | 3,008,231 |

| | | Air Freight—0.2% | |

| 4,639 | 1 | Atlas Air Worldwide Holdings, Inc. | 275,557 |

| | | Airline - National—0.9% | |

| 21,800 | 1 | Jet Blue Airways Corp. | 478,074 |

| 10,981 | 1 | United Continental Holdings, Inc. | 743,194 |

| | | TOTAL | 1,221,268 |

| | | Apparel—0.3% | |

| 4,466 | 1 | Iconix Brand Group, Inc. | 29,788 |

| 2,984 | | PVH Corp. | 355,962 |

| | | TOTAL | 385,750 |

| | | AT&T Divestiture—0.7% | |

| 24,694 | | AT&T, Inc. | 963,066 |

| | | Auto Manufacturing—0.3% | |

| 35,900 | | Ford Motor Co. | 402,798 |

| | | Auto Original Equipment Manufacturers—0.2% | |

| 2,337 | | Lear Corp. | 346,320 |

| | | Auto Rentals—0.2% | |

| 7,800 | 1 | Avis Budget Group, Inc. | 240,084 |

| | | Biotechnology—1.3% | |

| 10,757 | 1 | Celgene Corp. | 1,456,605 |

| 2,167 | 1 | Vertex Pharmaceuticals, Inc. | 328,994 |

| | | TOTAL | 1,785,599 |

| | | Building Supply Stores—0.3% | |

| 2,222 | | Home Depot, Inc. | 332,411 |

| 1,670 | | Lowe's Cos., Inc. | 129,258 |

| | | TOTAL | 461,669 |

| | | Cable TV—0.7% | |

| 29,963 | | Viacom, Inc., Class B | 1,046,308 |

| | | Cellular Communications—1.3% | |

| 28,563 | 1 | T-Mobile USA, Inc. | 1,761,195 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Clothing Stores—1.0% | |

| 8,000 | | Abercrombie & Fitch Co., Class A | $78,720 |

| 1,700 | | Children's Place, Inc./The | 179,605 |

| 3,583 | | Foot Locker, Inc. | 169,082 |

| 9,671 | 1 | Fossil, Inc. | 108,799 |

| 33,449 | | Gap (The), Inc. | 797,090 |

| 4,151 | | Tailored Brands, Inc. | 52,053 |

| | | TOTAL | 1,385,349 |

| | | Commodity Chemicals—1.2% | |

| 20,478 | | Eastman Chemical Co. | 1,702,950 |

| | | Computer Networking—0.6% | |

| 31,818 | | Juniper Networks, Inc. | 889,313 |

| | | Computer Peripherals—1.0% | |

| 3,140 | | NVIDIA Corp. | 510,281 |

| 19,800 | | NetApp, Inc. | 859,716 |

| | | TOTAL | 1,369,997 |

| | | Computers - Low End—2.7% | |

| 25,774 | | Apple, Inc. | 3,833,367 |

| | | Computers - Midrange—1.6% | |

| 117,452 | | Hewlett-Packard Co. | 2,243,333 |

| | | Construction Machinery—0.2% | |

| 2,774 | 1 | United Rentals, Inc. | 329,995 |

| | | Contracting—0.1% | |

| 2,301 | 1 | Dycom Industries, Inc. | 208,471 |

| | | Cosmetics & Toiletries—0.4% | |

| 1,481 | | Estee Lauder Cos., Inc., Class A | 146,604 |

| 3,481 | 1 | Helen of Troy Ltd. | 350,711 |

| | | TOTAL | 497,315 |

| | | Crude Oil & Gas Production—0.6% | |

| 22,200 | 1 | Chesapeake Energy Corp. | 110,112 |

| 6,746 | | Cimarex Energy Co. | 668,056 |

| | | TOTAL | 778,168 |

| | | Dairy Products—0.1% | |

| 8,425 | | Dean Foods Co. | 126,375 |

| | | Defense Aerospace—1.2% | |

| 28,723 | | Spirit AeroSystems Holdings, Inc., Class A | 1,735,731 |

| | | Department Stores—1.4% | |

| 5,980 | | Dillards, Inc., Class A | 441,443 |

| 20,551 | | Kohl's Corp. | 849,784 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Department Stores—continued | |

| 17,948 | | Macy's, Inc. | $426,265 |

| 5,296 | | Nordstrom, Inc. | 257,227 |

| | | TOTAL | 1,974,719 |

| | | Discount Department Stores—1.5% | |

| 2,900 | | Big Lots, Inc. | 144,043 |

| 33,297 | | Target Corp. | 1,886,941 |

| | | TOTAL | 2,030,984 |

| | | Diversified Leisure—0.7% | |

| 43,653 | 1 | MSG Networks, Inc. | 934,174 |

| | | Electric Utility—4.2% | |

| 24,600 | | AES Corp. | 275,028 |

| 2,728 | | Ameren Corp. | 153,041 |

| 36,332 | | Exelon Corp. | 1,392,969 |

| 83,976 | | NiSource, Inc. | 2,188,415 |

| 15,235 | | P G & E Corp. | 1,031,257 |

| 6,360 | | Public Service Enterprises Group, Inc. | 286,009 |

| 8,173 | | SCANA Corp. | 526,096 |

| | | TOTAL | 5,852,815 |

| | | Electrical Equipment—0.1% | |

| 3,060 | 1 | WESCO International, Inc. | 156,825 |

| | | Electronic Instruments—0.2% | |

| 7,350 | | Xerox Corp. | 225,424 |

| | | Electronics Stores—0.7% | |

| 16,800 | | Best Buy Co., Inc. | 980,112 |

| | | Ethical Drugs—6.3% | |

| 49,813 | | AbbVie, Inc. | 3,482,427 |

| 18,847 | | Eli Lilly & Co. | 1,557,893 |

| 6,508 | | Johnson & Johnson | 863,742 |

| 87,183 | | Pfizer, Inc. | 2,890,988 |

| | | TOTAL | 8,795,050 |

| | | Financial Services—2.5% | |

| 28,700 | | Ally Financial, Inc. | 649,768 |

| 12,916 | | Discover Financial Services | 787,101 |

| 25,900 | | Navient Corp. | 382,025 |

| 2,232 | 1 | Vantiv, Inc. | 141,844 |

| 11,092 | | Visa, Inc., Class A | 1,104,319 |

| 18,900 | | Western Union Co. | 373,275 |

| | | TOTAL | 3,438,332 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Grocery Chain—0.1% | |

| 8,480 | | GNC Holdings, Inc. | $80,645 |

| | | Home Building—0.1% | |

| 5,206 | | D. R. Horton, Inc. | 185,802 |

| | | Home Products—0.4% | |

| 3,770 | | Libbey, Inc. | 33,930 |

| 1,024 | | Spectrum Brands Holdings, Inc. | 118,211 |

| 7,554 | | Tupperware Brands Corp. | 458,603 |

| | | TOTAL | 610,744 |

| | | Hospitals—0.1% | |

| 27,966 | 1 | Community Health Systems, Inc. | 199,957 |

| | | Industrial Machinery—0.6% | |

| 15,252 | 1 | Colfax Corp. | 629,603 |

| 6,829 | | Kennametal, Inc. | 251,990 |

| | | TOTAL | 881,593 |

| | | Integrated International Oil—2.7% | |

| 33,248 | | Chevron Corp. | 3,630,349 |

| 1,807 | | Exxon Mobil Corp. | 144,632 |

| | | TOTAL | 3,774,981 |

| | | Internet Services—3.7% | |

| 19,857 | 1 | eBay, Inc. | 709,491 |

| 964 | | Expedia, Inc. | 150,837 |

| 20,698 | 1 | Facebook, Inc. | 3,503,137 |

| 1,914 | 1 | NetFlix, Inc. | 347,697 |

| 8,899 | 1 | PayPal, Inc. | 521,036 |

| | | TOTAL | 5,232,198 |

| | | Life Insurance—4.5% | |

| 31,903 | | Aflac, Inc. | 2,544,264 |

| 33,135 | | Prudential Financial, Inc. | 3,751,876 |

| | | TOTAL | 6,296,140 |

| | | Medical Supplies—4.2% | |

| 16,922 | 1 | Align Technology, Inc. | 2,829,866 |

| 32,548 | | Baxter International, Inc. | 1,968,503 |

| 1,779 | 1 | Inogen, Inc. | 167,902 |

| 10,391 | | Medtronic PLC | 872,532 |

| 1,633 | 1 | Orthofix International NV | 70,840 |

| | | TOTAL | 5,909,643 |

| | | Medical Technology—1.4% | |

| 2,368 | 1 | Edwards Lifesciences Corp. | 272,746 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Medical Technology—continued | |

| 8,117 | 1 | IDEXX Laboratories, Inc. | $1,351,156 |

| 700 | 1 | Mettler-Toledo International, Inc. | 401,156 |

| | | TOTAL | 2,025,058 |

| | | Metal Distribution—0.1% | |

| 2,471 | | Reliance Steel & Aluminum Co. | 178,802 |

| | | Miscellaneous Components—0.3% | |

| 27,428 | | Vishay Intertechnology, Inc. | 489,590 |

| | | Miscellaneous Food Products—1.4% | |

| 7,300 | | Fresh Del Monte Produce, Inc. | 375,731 |

| 12,745 | | Ingredion, Inc. | 1,571,713 |

| | | TOTAL | 1,947,444 |

| | | Miscellaneous Machinery—0.3% | |

| 14,360 | 1 | SPX Corp. | 395,187 |

| | | Money Center Bank—5.3% | |

| 19,891 | | Bank of America Corp. | 479,771 |

| 37,163 | | JPMorgan Chase & Co. | 3,411,563 |

| 18,612 | | PNC Financial Services Group | 2,397,226 |

| 11,768 | | State Street Corp. | 1,097,131 |

| | | TOTAL | 7,385,691 |

| | | Mortgage and Title—0.7% | |

| 21,412 | | Assured Guaranty Ltd. | 963,754 |

| | | Multi-Industry Capital Goods—2.8% | |

| 3,321 | | Danaher Corp. | 270,628 |

| 15,517 | | Roper Technologies, Inc. | 3,607,082 |

| | | TOTAL | 3,877,710 |

| | | Office Equipment—0.2% | |

| 14,800 | | Pitney Bowes, Inc. | 232,952 |

| | | Offshore Driller—0.1% | |

| 15,800 | | Nabors Industries Ltd. | 121,818 |

| 11,813 | 1 | Noble Corp. PLC | 47,252 |

| | | TOTAL | 169,070 |

| | | Oil Refiner—1.1% | |

| 21,545 | | Valero Energy Corp. | 1,485,959 |

| | | Oil Well Supply—0.1% | |

| 8,200 | 1 | Superior Energy Services, Inc. | 88,232 |

| | | Packaged Foods—0.3% | |

| 3,397 | | Smucker (J.M.) Co. | 414,094 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Paint & Related Materials—0.7% | |

| 2,976 | | Sherwin-Williams Co. | $1,003,715 |

| | | Paper Products—0.2% | |

| 5,600 | | Domtar, Corp. | 218,736 |

| | | Personal Loans—0.1% | |

| 4,846 | | Synchrony Financial | 146,931 |

| | | Photo - Optical Component - Equipment—0.1% | |

| 1,780 | | Cognex Corp. | 169,207 |

| | | Pollution Control—0.2% | |

| 3,188 | | Waste Management, Inc. | 239,578 |

| | | Poultry Products—0.9% | |

| 16,900 | 1 | Pilgrim's Pride Corp. | 410,501 |

| 6,689 | | Sanderson Farms, Inc. | 874,587 |

| | | TOTAL | 1,285,088 |

| | | Printing—0.3% | |

| 5,086 | | Deluxe Corp. | 367,209 |

| 2,386 | | Ennis, Inc. | 45,931 |

| 3,233 | | R.R. Donnelley & Sons Co. | 39,960 |

| | | TOTAL | 453,100 |

| | | Property Liability Insurance—3.4% | |

| 3,874 | | Everest Re Group Ltd. | 1,016,499 |

| 28,682 | | The Travelers Cos., Inc. | 3,673,877 |

| | | TOTAL | 4,690,376 |

| | | Recreational Goods—0.1% | |

| 4,970 | 1 | American Outdoor Brands Corp. | 102,730 |

| | | Regional Banks—2.0% | |

| 4,063 | | Citizens Financial Group, Inc. | 142,530 |

| 29,600 | | Fifth Third Bancorp | 790,320 |

| 17,200 | | Huntington Bancshares, Inc. | 227,900 |

| 30,200 | | KeyCorp | 544,808 |

| 9,100 | | Popular, Inc. | 383,474 |

| 12,689 | | SunTrust Banks, Inc. | 726,953 |

| | | TOTAL | 2,815,985 |

| | | Rubber—0.4% | |

| 19,439 | | Goodyear Tire & Rubber Co. | 612,523 |

| | | Securities Brokerage—1.0% | |

| 6,375 | | Goldman Sachs Group, Inc. | 1,436,479 |

| | | Semiconductor Distribution—0.2% | |

| 2,931 | 1 | Arrow Electronics, Inc. | 238,261 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Semiconductor Manufacturing—2.2% | |

| 75,550 | | Intel Corp. | $2,679,759 |

| 4,537 | | KLA-Tencor Corp. | 420,262 |

| | | TOTAL | 3,100,021 |

| | | Semiconductor Manufacturing Equipment—4.2% | |

| 56,753 | | Applied Materials, Inc. | 2,514,725 |

| 20,626 | | Lam Research Corp. | 3,289,022 |

| | | TOTAL | 5,803,747 |

| | | Services to Medical Professionals—0.2% | |

| 3,753 | 1 | Molina Healthcare, Inc. | 250,700 |

| | | Shoes—0.2% | |

| 8,631 | 1 | Skechers USA, Inc., Class A | 242,445 |

| | | Soft Drinks—5.4% | |

| 38,398 | | Dr. Pepper Snapple Group, Inc. | 3,500,362 |

| 4,598 | 1 | National Beverage Corp. | 469,548 |

| 30,520 | | PepsiCo, Inc. | 3,558,937 |

| | | TOTAL | 7,528,847 |

| | | Software Packaged/Custom—2.6% | |

| 6,299 | 1 | Adobe Systems, Inc. | 922,740 |

| 14,906 | | CA, Inc. | 462,682 |

| 1,628 | 1 | Proofpoint, Inc. | 138,771 |

| 17,727 | 1 | Salesforce.com, Inc. | 1,609,612 |

| 5,175 | 1 | ServiceNow, Inc. | 571,579 |

| | | TOTAL | 3,705,384 |

| | | Specialty Retailing—2.4% | |

| 4,382 | 1 | AutoZone, Inc. | 2,365,491 |

| 16,403 | | Bed Bath & Beyond, Inc. | 490,450 |

| 5,982 | | GameStop Corp. | 129,750 |

| 2,144 | 1 | O'Reilly Automotive, Inc. | 438,019 |

| | | TOTAL | 3,423,710 |

| | | System Instruments—0.1% | |

| 4,200 | 1 | Sanmina Corp. | 150,570 |

| | | Telecommunication Equipment & Services—0.3% | |

| 11,391 | | Cisco Systems, Inc. | 358,247 |

| | | Telephone Utility—1.0% | |

| 62,812 | | CenturyLink, Inc. | 1,461,635 |

| | | Truck Manufacturing—0.1% | |

| 3,582 | | Allison Transmission Holdings, Inc. | 135,400 |

Annual Shareholder Report

| Shares | | | Value |

| | | COMMON STOCKS—continued | |

| | | Undesignated Consumer Cyclicals—2.1% | |

| 2,100 | | Adtalem Global Education, Inc. | $68,250 |

| 8,875 | 1 | CoStar Group, Inc. | 2,445,506 |

| 5,800 | | Nu Skin Enterprises, Inc., Class A | 367,488 |

| | | TOTAL | 2,881,244 |

| | | TOTAL COMMON STOCKS

(IDENTIFIED COST $128,192,597) | 137,265,979 |

| | | INVESTMENT COMPANY—1.5% | |

| 2,025,076 | 2 | Federated Institutional Prime Value Obligations Fund, Institutional Shares, 1.16%3

(IDENTIFIED COST $2,025,499) | 2,025,481 |

| | | TOTAL INVESTMENTS—99.7%

(IDENTIFIED COST $130,218,096)4 | 139,291,460 |

| | | OTHER ASSETS AND LIABILITIES - NET—0.3%5 | 479,334 |

| | | TOTAL NET ASSETS—100% | $139,770,794 |

| 1 | Non-income-producing security. |

| 2 | Affiliated holding. |

| 3 | 7-day net yield. |

| 4 | The cost of investments for federal tax purposes amounts to $130,221,133. |

| 5 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at July 31, 2017.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of July 31, 2017, all investments of the Fund utilized Level 2 inputs in valuing the Fund's assets carried at fair value.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $21.77 | $22.10 | $20.47 | $17.26 | $12.73 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.26 | 0.191 | 0.111 | 0.081 | 0.091 |

| Net realized and unrealized gain (loss) on investments | 3.11 | (0.33) | 1.55 | 3.23 | 4.49 |

| TOTAL FROM INVESTMENT OPERATIONS | 3.37 | (0.14) | 1.66 | 3.31 | 4.58 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.19) | (0.19) | (0.03) | (0.10) | (0.05) |

| Net Asset Value, End of Period | $24.95 | $21.77 | $22.10 | $20.47 | $17.26 |

| Total Return2 | 15.56% | (0.61)% | 8.10% | 19.21% | 36.10% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.38% | 1.35% | 1.35% | 1.35% | 1.35% |

| Net investment income | 0.69% | 0.94% | 0.51% | 0.41% | 0.59% |

| Expense waiver/reimbursement3 | 0.00%4 | 0.03% | 0.00%4 | 0.08% | 0.16% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $33,799 | $33,753 | $40,433 | $44,678 | $34,092 |

| Portfolio turnover | 77% | 62% | 76% | 31% | 99% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

| 4 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $20.66 | $21.00 | $19.57 | $16.55 | $12.26 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.19) | 0.031 | (0.05)1 | (0.07)1 | (0.03)1 |

| Net realized and unrealized gain (loss) on investments | 3.23 | (0.33) | 1.48 | 3.09 | 4.32 |

| TOTAL FROM INVESTMENT OPERATIONS | 3.04 | (0.30) | 1.43 | 3.02 | 4.29 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.04) | (0.04) | — | — | — |

| Net Asset Value, End of Period | $23.66 | $20.66 | $21.00 | $19.57 | $16.55 |

| Total Return2 | 14.72% | (1.43)% | 7.31% | 18.25% | 34.99% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.13% | 2.14% | 2.11% | 2.15% | 2.15% |

| Net investment income (loss) | (0.06)% | 0.15% | (0.26)% | (0.38)% | (0.21)% |

| Expense waiver/reimbursement3 | 0.00%4 | 0.00%4 | 0.00%4 | 0.06% | 0.11% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $36,440 | $36,846 | $41,509 | $35,052 | $27,674 |

| Portfolio turnover | 77% | 62% | 76% | 31% | 99% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

| 4 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Institutional Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $22.02 | $22.37 | $20.71 | $17.45 | $12.87 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.39 | 0.251 | 0.181 | 0.131 | 0.121 |

| Net realized and unrealized gain (loss) on investments | 3.09 | (0.34) | 1.57 | 3.27 | 4.55 |

| TOTAL FROM INVESTMENT OPERATIONS | 3.48 | (0.09) | 1.75 | 3.40 | 4.67 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.26) | (0.26) | (0.09) | (0.14) | (0.09) |

| Net Asset Value, End of Period | $25.24 | $22.02 | $22.37 | $20.71 | $17.45 |

| Total Return2 | 15.90% | (0.34)% | 8.45% | 19.54% | 36.46% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.08% | 1.07% | 1.05% | 1.10% | 1.10% |

| Net investment income | 1.01% | 1.22% | 0.80% | 0.65% | 0.84% |

| Expense waiver/reimbursement3 | 0.00%4 | 0.00%4 | 0.00%4 | 0.00%4 | 0.05% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $52,169 | $65,435 | $76,242 | $62,770 | $39,932 |

| Portfolio turnover | 77% | 62% | 76% | 31% | 99% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

| 4 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class R6 Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 20171 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $21.46 | $21.80 | $20.25 | $17.09 | $12.62 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | 0.21 | 0.102 | 0.022 | (0.01)2 | 0.022 |

| Net realized and unrealized gain (loss) on investments | 3.18 | (0.33) | 1.53 | 3.20 | 4.45 |

| TOTAL FROM INVESTMENT OPERATIONS | 3.39 | (0.23) | 1.55 | 3.19 | 4.47 |

| Less Distributions: | | | | | |

| Distributions from net investment income | — | (0.11) | — | (0.03) | — |

| Net Asset Value, End of Period | $24.85 | $21.46 | $21.80 | $20.25 | $17.09 |

| Total Return3 | 15.80% | (1.05)% | 7.65% | 18.68% | 35.42% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.07% | 1.80% | 1.76% | 1.81% | 1.83% |

| Net investment income (loss) | 0.95% | 0.49% | 0.09% | (0.05)% | 0.11% |

| Expense waiver/reimbursement4 | 0.00%5 | 0.00%5 | 0.00%5 | 0.00%5 | 0.02% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $17,363 | $5,717 | $6,300 | $5,467 | $4,089 |

| Portfolio turnover | 77% | 62% | 76% | 31% | 99% |

| 1 | Effective September 1, 2016, the Fund's Class R Shares were redesignated as Class R6 Shares. |

| 2 | Per share numbers have been calculated using the average shares method. |

| 3 | Based on net asset value. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

| 5 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

July 31, 2017

| Assets: | | |

| Total investment in securities, at value including $2,025,481 of investment in an affiliated holding (Note 5) (identified cost $130,218,096) | | $139,291,460 |

| Income receivable | | 106,756 |

| Receivable for investments sold | | 1,323,182 |

| Receivable for shares sold | | 73,293 |

| TOTAL ASSETS | | 140,794,691 |

| Liabilities: | | |

| Payable for investments purchased | $835,158 | |

| Payable for shares redeemed | 39,565 | |

| Payable to adviser (Note 5) | 2,867 | |

| Payable for administrative fees (Note 5) | 302 | |

| Payable for auditing fees | 25,800 | |

| Payable for distribution services fee (Note 5) | 23,156 | |

| Payable for other service fees (Notes 2 and 5) | 15,491 | |

| Payable for share registration costs | 32,774 | |

| Accrued expenses (Note 5) | 48,784 | |

| TOTAL LIABILITIES | | 1,023,897 |

| Net assets for 5,660,246 shares outstanding | | $139,770,794 |

| Net Assets Consist of: | | |

| Paid-in capital | | $184,827,768 |

| Net unrealized appreciation of investments | | 9,073,364 |

| Accumulated net realized loss on investments | | (54,592,784) |

| Undistributed net investment income | | 462,446 |

| TOTAL NET ASSETS | | $139,770,794 |

Annual Shareholder Report

Statement of Assets and Liabilities–continued

| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

Net asset value per share ($33,798,711 ÷ 1,354,646 shares outstanding),

no par value, unlimited shares authorized | | $24.95 |

| Offering price per share (100/94.50 of $24.95) | | $26.40 |

| Redemption proceeds per share | | $24.95 |

| Class C Shares: | | |

Net asset value per share ($36,439,793 ÷ 1,540,041 shares outstanding),

no par value, unlimited shares authorized | | $23.66 |

| Offering price per share | | $23.66 |

| Redemption proceeds per share (99.00/100 of $23.66) | | $23.42 |

| Institutional Shares: | | |

Net asset value per share ($52,169,176 ÷ 2,066,722 shares outstanding),

no par value, unlimited shares authorized | | $25.24 |

| Offering price per share | | $25.24 |

| Redemption proceeds per share | | $25.24 |

| Class R6 Shares: | | |

Net asset value per share ($17,363,114 ÷ 698,837 shares outstanding),

no par value, unlimited shares authorized | | $24.85 |

| Offering price per share | | $24.85 |

| Redemption proceeds per share | | $24.85 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended July 31, 2017

| Investment Income: | | | |

| Dividends (including $17,683 received from an affiliated holding (Note 5) and net of foreign taxes withheld of $728) | | | $2,897,192 |

| Interest | | | 1,459 |

| TOTAL INCOME | | | 2,898,651 |

| Expenses: | | | |

| Investment adviser fee (Note 5) | | $1,045,975 | |

| Administrative fee (Note 5) | | 109,423 | |

| Custodian fees | | 14,553 | |

| Transfer agent fee (Note 2) | | 143,461 | |

| Directors'/Trustees' fees (Note 5) | | 2,740 | |

| Auditing fees | | 28,486 | |

| Legal fees | | 10,769 | |

| Portfolio accounting fees | | 70,128 | |

| Distribution services fee (Note 5) | | 281,349 | |

| Other service fees (Notes 2 and 5) | | 175,622 | |

| Share registration costs | | 63,883 | |

| Printing and postage | | 27,578 | |

| Miscellaneous (Note 5) | | 27,175 | |

| TOTAL EXPENSES | | 2,001,142 | |

| Reimbursements: | | | |

| Reimbursement of investment adviser fee (Note 5) | $(2,562) | | |

| Reimbursement of other operating expenses (Notes 2 and 5) | (644) | | |

| TOTAL REIMBURSEMENTS | | (3,206) | |

| Net expenses | | | 1,997,936 |

| Net investment income | | | 900,715 |

| Realized and Unrealized Gain (Loss) on Investments: | | | |

| Net realized gain on investments (including realized gain of $674 on sales of investments in an affiliated holding (Note 5)) | | | 13,356,886 |

| Net change in unrealized appreciation of investments | | | 5,750,189 |

| Net realized and unrealized gain on investments | | | 19,107,075 |

| Change in net assets resulting from operations | | | $20,007,790 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended July 31 | 2017 | 2016 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $900,715 | $1,245,713 |

| Net realized gain on investments | 13,356,886 | 10,543,935 |

| Net change in unrealized appreciation/depreciation of investments | 5,750,189 | (14,227,683) |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 20,007,790 | (2,438,035) |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class A Shares | (281,217) | (331,676) |

| Class C Shares | (65,140) | (74,346) |

| Institutional Shares | (754,521) | (834,843) |

| Class R6 Shares1 | — | (30,147) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (1,100,878) | (1,271,012) |

| Share Transactions: | | |

| Proceeds from sale of shares | 39,731,276 | 16,202,436 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 1,043,477 | 1,208,182 |

| Cost of shares redeemed | (61,662,149) | (36,433,688) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | (20,887,396) | (19,023,070) |

| Change in net assets | (1,980,484) | (22,732,117) |

| Net Assets: | | |

| Beginning of period | 141,751,278 | 164,483,395 |

| End of period (including undistributed net investment income of $462,446 and $662,609, respectively) | $139,770,794 | $141,751,278 |

| 1 | Effective September 1, 2016, the Fund's Class R Shares were redesignated as Class R6 Shares. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

July 31, 2017

1. ORGANIZATION

Federated MDT Series (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of five portfolios. The financial statements included herein are only those of Federated MDT All Cap Core Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers four classes of shares: Class A Shares, Class C Shares, Institutional Shares and Class R6 Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is long-term capital appreciation.

On June 20, 2016, Class R Shares were closed to new accounts/investors.

On September 1, 2016, the Class R Shares were re-designated as Class R6 Shares.

On March 30, 2017, the Fund's T Share class became effective with the Securities and Exchange Commission (SEC), but is not yet offered for sale.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. |

| ■ | Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Board of Trustees (the “Trustees”). |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the last traded or purchase price of the security, information obtained by contacting the issuer or dealers, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded, public trading in similar securities or derivative contracts of the issuer or comparable issuers, movement of a relevant index, or other factors including but not limited to industry changes and relevant government actions. |

Annual Shareholder Report

If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the valuation committee (“Valuation Committee”), is deemed not representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share.

Fair Valuation Procedures

The Trustees have ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Trustees have appointed a Valuation Committee comprised of officers of the Fund, Federated MDTA LLC (“Adviser”) and certain of the Adviser's affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs, methods, models and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for any U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for any other types of fixed-income securities and any OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of

Annual Shareholder Report

additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income, if any, are declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Amortization/accretion of premium and discount is included in investment income. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that Class A Shares, Class C Shares, Institutional Shares and Class R6 Shares may bear distribution services fees, other service fees and transfer agent fees unique to those classes. The detail of the total fund expense reimbursements of $3,206 is disclosed in various locations in this Note 2 and Note 5. For the year ended July 31, 2017, transfer agent fees for the Fund were as follows:

| | Transfer

Agent Fees

Incurred | Transfer

Agent Fees

Reimbursed |

| Class A Shares | $44,089 | $(156) |

| Class C Shares | 48,924 | (169) |

| Institutional Shares | 45,947 | (308) |

| Class R6 Shares | 4,501 | (11) |

| TOTAL | $143,461 | $(644) |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Annual Shareholder Report

Other Service Fees

The Fund may pay other service fees up to 0.25% of the average daily net assets of the Fund's Class A Shares and Class C Shares to unaffiliated financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. For the year ended July 31, 2017, other service fees for the Fund were as follows:

| | Other Service

Fees Incurred |

| Class A Shares | $82,639 |

| Class C Shares | 92,983 |

| TOTAL | $175,622 |

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended July 31, 2017, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of July 31, 2017, tax years 2014 through 2017 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated. The Fund applies investment company accounting and reporting guidance.

Annual Shareholder Report

3. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| | Year Ended

7/31/2017 | Year Ended

7/31/2016 |

| Class A Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 238,856 | $5,600,940 | 219,344 | $4,566,247 |

| Shares issued to shareholders in payment of distributions declared | 11,576 | 265,655 | 15,315 | 317,790 |

| Shares redeemed | (446,290) | (10,342,947) | (513,803) | (10,627,905) |

NET CHANGE RESULTING FROM

CLASS A SHARE TRANSACTIONS | (195,858) | $(4,476,352) | (279,144) | $(5,743,868) |

| | Year Ended

7/31/2017 | Year Ended

7/31/2016 |

| Class C Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 274,783 | $6,059,213 | 219,633 | $4,264,493 |

| Shares issued to shareholders in payment of distributions declared | 2,697 | 58,957 | 3,342 | 66,135 |

| Shares redeemed | (520,492) | (11,483,866) | (416,914) | (8,026,807) |

NET CHANGE RESULTING FROM

CLASS C SHARE TRANSACTIONS | (243,012) | $(5,365,696) | (193,939) | $(3,696,179) |

| | Year Ended

7/31/2017 | Year Ended

7/31/2016 |

| Institutional Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 513,112 | $12,168,267 | 269,327 | $5,611,013 |

| Shares issued to shareholders in payment of distributions declared | 31,013 | 718,865 | 37,891 | 794,193 |

| Shares redeemed | (1,449,097) | (34,263,696) | (744,427) | (15,527,614) |

| NET CHANGE RESULTING FROM INSTITUTIONAL SHARE TRANSACTIONS | (904,972) | $(21,376,564) | (437,209) | $(9,122,408) |

| | Year Ended

7/31/20171 | Year Ended

7/31/2016 |

| Class R6 Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 689,644 | $15,902,856 | 87,503 | $1,760,683 |

| Shares issued to shareholders in payment of distributions declared | — | — | 1,465 | 30,064 |

| Shares redeemed | (257,198) | (5,571,640) | (111,552) | (2,251,362) |

NET CHANGE RESULTING FROM

CLASS R6 SHARE TRANSACTIONS | 432,446 | $10,331,216 | (22,584) | $(460,615) |

| NET CHANGE RESULTING FROM TOTAL FUND SHARE TRANSACTIONS | (911,396) | $(20,887,396) | (932,876) | $(19,023,070) |

| 1 | Effective September 1, 2016, the Fund's Class R Shares were redesignated as Class R6 Shares. |

Annual Shareholder Report

4. FEDERAL TAX INFORMATION

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended July 31, 2017 and 2016, was as follows:

| | 2017 | 2016 |

| Ordinary income | $1,100,878 | $1,271,012 |

As of July 31, 2017, the components of distributable earnings on a tax-basis were as follows:

| | 2017 |

| Undistributed ordinary income | $462,446 |

| Net unrealized appreciation | $9,070,327 |

| Capital loss carryforwards and deferrals | $(54,589,747) |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable to differing treatments for the deferral of losses on wash sales.

At July 31, 2017, the cost of investments for federal tax purposes was $130,221,133. The net unrealized appreciation of investments for federal tax purposes was $9,070,327. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $17,864,256 and net unrealized depreciation from investments for those securities having an excess of cost over value of $8,793,929.

At July 31, 2017, the Fund had a capital loss carryforward of $54,589,747 which will reduce the Fund's taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code, thereby reducing the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, a net capital loss incurred in taxable years beginning on or before December 22, 2010, is characterized as short-term and may be carried forward for a maximum of eight tax years (“Carryforward Limit”), whereas a net capital loss incurred in taxable years beginning after December 22, 2010, retains its character as either short-term or long-term, does not expire and is required to be utilized prior to the losses which have a Carryforward Limit.

The following schedule summarizes the Fund's capital loss carryforwards and expiration years:

| Expiration Year | Short-Term | Long-Term | Total |

| 2018 | $54,589,747 | NA | $54,589,747 |

As a result of the March 2010 tax-free transfer of assets from Federated MDT Tax Aware/All Cap Core Fund the use of certain capital loss carryforwards listed above may be limited.

The Fund used capital loss carryforwards of $13,312,131 to offset capital gains realized during the year ended July 31, 2017.

Annual Shareholder Report

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 0.75% of the Fund's average daily net assets. The Adviser may voluntarily choose to waive any portion of its fee and/or reimburse certain operating expenses of the Fund. For the year ended July 31, 2017, the Adviser voluntarily reimbursed $644 of transfer agent fees.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. For purposes of determining the appropriate rate breakpoint, “Investment Complex” is defined as all of the Federated Funds subject to a fee under the Administrative Services Agreement. The fee paid to FAS is based on the average daily net assets of the Investment Complex as specified below, plus certain out-of-pocket expenses:

| Administrative Fee | Average Daily Net Assets

of the Investment Complex |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

FAS may voluntarily choose to waive any portion of its fee. For the year ended July 31, 2017, the annualized fee paid to FAS was 0.078% of average daily net assets of the Fund.

Distribution Services Fee

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. Under the terms of the Plan, the Fund will compensate Federated Securities Corp. (FSC), the principal distributor, from the daily net assets of the Fund's Class A Shares and Class C Shares to finance activities intended to result in the sale of these shares. The Plan provides that the Fund may incur distribution expenses at the following percentages of average daily net assets annually, to compensate FSC:

| Share Class Name | Percentage of Average Daily

Net Assets of Class |

| Class A Shares | 0.05% |

| Class C Shares | 0.75% |

Prior to their re-designation as Class R6 Shares on September 1, 2016, the Class R Shares were also subject to the Plan at 0.50% of its average daily net assets. Class R6 Shares are not subject to the Plan.

Annual Shareholder Report

FSC may voluntarily choose to waive any portion of its fee. For the year ended July 31, 2017, distribution services fees for the Fund were as follows:

| | Distribution

Services

Fees Incurred |

| Class C Shares | $278,951 |

| Class R Shares (re-designated as Class R6 Shares) | 2,398 |

| TOTAL | $281,349 |

When FSC receives fees, it may pay some or all of them to financial intermediaries whose customers purchase shares. For the year ended July 31, 2017, FSC retained $16,013 of fees paid by the Fund. For the year ended July 31, 2017, the Fund's Class A Shares did not incur a distribution services fee; however, it may begin to incur this fee upon approval of the Trustees.

Other Service Fees

For the year ended July 31, 2017, FSSC received $3,301 of the other service fees disclosed in Note 2.

Sales Charges

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. For the year ended July 31, 2017, FSC retained $3,962 in sales charges from the sale of Class A Shares. FSC retained $1,495 of CDSC relating to redemptions of Class C Shares.

General

Certain Officers and Trustees of the Fund are Officers and Directors or Trustees of certain of the above companies. To efficiently facilitate payment, Directors'/Trustees' fees and certain expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses are paid by an affiliate of the Adviser which in due course are reimbursed by the Fund. These expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses may be included in Accrued and Miscellaneous Expenses on the Statement of Assets and Liabilities and Statement of Operations, respectively.

Annual Shareholder Report

Transactions Involving Affiliated Holdings

Affiliated holdings are investment companies which are managed by the Adviser or an affiliate of the Adviser. The Adviser has agreed to reimburse the Fund for certain investment adviser fees as a result of transactions in other affiliated investment companies. For the year ended July 31, 2017, the Adviser reimbursed $2,562. Transactions involving the affiliated holding during the year ended July 31, 2017, were as follows:

| | Balance of

Shares Held

7/31/2016 | Purchases/

Additions | Sales/

Reductions | Balance of

Shares Held

7/31/2017 | Value | Dividend

Income |

| Federated Institutional Prime Value Obligations Fund, Institutional Shares | 2,073,572 | 43,635,167 | (43,683,663) | 2,025,076 | $2,025,481 | $17,683 |

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments, excluding long-term U.S. government securities and short-term obligations, for the year ended July 31, 2017, were as follows:

| Purchases | $105,163,976 |

| Sales | $126,018,634 |

7. LINE OF CREDIT

The Fund participates with certain other Federated Funds, on a several basis, in an up to $500,000,000 unsecured, 364-day, committed, revolving line of credit (LOC) agreement. The LOC was made available to finance temporarily the repurchase or redemption of shares of the Fund, failed trades, payment of dividends, settlement of trades and for other short-term, temporary or emergency general business purposes. The Fund cannot borrow under the LOC if an inter-fund loan is outstanding. The Fund's ability to borrow under the LOC also is subject to the limitations of the Act and various conditions precedent that must be satisfied before the Fund can borrow. Loans under the LOC are charged interest at a fluctuating rate per annum equal to the highest, on any day, of (a) (i) the federal funds effective rate, (ii) the one month London Interbank Offered Rate (LIBOR), and (iii) 0.0%, plus (b) a margin. The LOC also requires the Fund to pay, quarterly in arrears and at maturity, its pro rata share of a commitment fee based on the amount of the lenders' commitment that has not been utilized. As of July 31, 2017, the Fund had no outstanding loans. During the year ended July 31, 2017, the Fund did not utilize the LOC.

Annual Shareholder Report

8. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other funds advised by subsidiaries of Federated Investors, Inc., may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from other participating affiliated funds. As of July 31, 2017, there were no outstanding loans. During the year ended July 31, 2017, the program was not utilized.

9. REGULATORY UPDATES

On October 13, 2016, the SEC amended existing rules intended to modernize reporting and disclosure of information. These amendments relate to Regulation S-X which sets forth the form and content of financial statements. At this time, management does not believe these amendments will have a material impact on the financial statements and accompanying notes.

10. Subsequent event

Effective September 1, 2017, the breakpoints of Administrative Fees paid to FAS described above will change to:

| Administrative Services Fee Rate | Average Daily Net Assets

of the Investment Complex |

| 0.100 of 1% | on assets up to $50 billion |

| 0.075 of 1% | on assets over $50 billion |

11. FEDERAL TAX INFORMATION (UNAUDITED)

For the fiscal year ended July 31, 2017, 100% of total income distributions made by the Fund are qualifying dividends which may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Act of 2003. Complete information is reported in conjunction with the reporting of your distributions on Form 1099-DIV.

Of the ordinary income distributions made by the Fund during the year ended July 31, 2017, 100% qualify for the dividend received deduction available to corporate shareholders.

Annual Shareholder Report

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF trustees OF Federated MDt series AND SHAREHOLDERS OF federated mdt all cap core fund:

We have audited the accompanying statement of assets and liabilities of Federated MDT All Cap Core Fund (the “Fund”) (one of the portfolios constituting Federated MDT Series), including the portfolio of investments, as of July 31, 2017, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of July 31, 2017 by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Federated MDT All Cap Core Fund, a portfolio of Federated MDT Series, at July 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

September 25, 2017

Annual Shareholder Report

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase or redemption payments; and (2) ongoing costs, including management fees and to the extent applicable, distribution (12b-1) fees and/or other service fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from February 1, 2017 to July 31, 2017.

ACTUAL EXPENSES

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Annual Shareholder Report

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) on purchase or redemption payments. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | Beginning

Account Value

2/1/2017 | Ending

Account Value

7/31/2017 | Expenses Paid

During Period1 |

| Actual: | | | |

| Class A Shares | $1,000 | $1,072.70 | $7.09 |

| Class C Shares | $1,000 | $1,068.70 | $10.93 |

| Institutional Shares | $1,000 | $1,074.00 | $5.55 |

| Class R6 Shares | $1,000 | $1,074.40 | $5.30 |

Hypothetical (assuming a 5% return

before expenses): | | | |

| Class A Shares | $1,000 | $1,018.00 | $6.90 |

| Class C Shares | $1,000 | $1,014.20 | $10.64 |

| Institutional Shares | $1,000 | $1,019.40 | $5.41 |

| Class R6 Shares | $1,000 | $1,019.70 | $5.16 |