UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21934

RiverNorth Funds

(Exact name of registrant as specified in charter)

433 W. Van Buren Street, 1150-E

Chicago, IL 60607

(Address of principal executive offices) (Zip code)

Marc L. Collins

433 W. Van Buren Street, 1150-E

Chicago, IL 60607

(Name and address of agent for service)

Registrant's telephone number, including area code: 312-832-1440

Date of fiscal year end: 09/30

Date of reporting period: 09/30/2021

| Item 1. | Reports to Stockholders. |

| RiverNorth Funds | Table of Contents |

| Shareholder Letter | 2 |

| Opportunistic Closed-End Fund Strategies | |

| Portfolio Update | 4 |

| RiverNorth Core Opportunity Fund | 6 |

| RiverNorth/DoubleLine Strategic Income Fund | 11 |

| RiverNorth/Oaktree High Income Fund | 16 |

| RiverNorth Funds Schedule of Investments and Financial Statements | |

| Disclosure of Fund Expenses | 24 |

| Schedule of Investments | |

| RiverNorth Core Opportunity Fund | 26 |

| RiverNorth/DoubleLine Strategic Income Fund | 30 |

| RiverNorth/Oaktree High Income Fund | 85 |

| Statement of Assets and Liabilities | |

| RiverNorth Core Opportunity Fund | 103 |

| RiverNorth/DoubleLine Strategic Income Fund | 104 |

| RiverNorth/Oaktree High Income Fund | 105 |

| Statement of Operations | |

| RiverNorth Core Opportunity Fund | 107 |

| RiverNorth/DoubleLine Strategic Income Fund | 108 |

| RiverNorth/Oaktree High Income Fund | 109 |

| Statements of Changes in Net Assets | |

| RiverNorth Core Opportunity Fund | 110 |

| RiverNorth/DoubleLine Strategic Income Fund | 112 |

| RiverNorth/Oaktree High Income Fund | 114 |

| Financial Highlights | |

| RiverNorth Core Opportunity Fund | 116 |

| RiverNorth/DoubleLine Strategic Income Fund | 124 |

| RiverNorth/Oaktree High Income Fund | 132 |

| Notes to Financial Statements | 139 |

| Report of Independent Registered Public Accounting Firm | 161 |

| Additional Information | 162 |

| Liquidity Risk Management Program | 166 |

| Trustees & Officers | 167 |

| RiverNorth Funds | Shareholder Letter |

September 30, 2021 (Unaudited)

Dear Fellow Shareholders,

RiverNorth Capital Management, LLC's ("RiverNorth") area of focus is across four specialty asset classes: Closed-End Funds (CEFs), Business Development Companies (BDCs), Special Purpose Acquisition Companies (SPACs), and Investment Company Debt (debt securities issued by registered investment companies such as CEFs and BDCs, abbreviated as ICD).

As one of the largest institutional investors in CEFs and BDCs, RiverNorth thrives on discount volatility in these assets. Our opportunistic investment strategies are structured in a way to increase CEF/BDC exposure as discounts widen and decrease CEF/BDC exposure when discounts narrow. Because these securities are mostly owned by retail investors, the discount/premium swings, that may be motivated by fear and greed, can be drastic at times. As the economy and capital markets have continued to rebound from the pandemic-driven lows, CEFs and BDCs have experienced very strong performance. This strong performance has come from a combination of net asset value (NAV) gains and significant discount narrowing. Except for commodity CEFs, every CEF peer group we track delivered a positive return over the past 12 months ended September 30, 2021. The CEF initial public offering (IPO) market has also remained open and is experiencing robust growth. It is possible that calendar year 2021 will be the best year since 2007 based on IPO assets.

SPACs were very popular into the first quarter of 2021. Acquisition announcements were being well received by the market and investor demand had skyrocketed. SPAC IPOs raised more capital in the first quarter of 2021 than they had in the previous ten years combined. By the second quarter, investor enthusiasm had cooled off considerably, and that trend continued through the end of the fiscal year ended September 30, 2021. In early 2021, high investor demand led to sponsors getting much better terms than had been normal in the past. During Q3 2021, the situation completely reversed. Investor demand for SPACs has gone down while many sponsors still wanted to go forward with their IPOs. To induce investors into buying shares, sponsors have had to be much more generous, and as a result, we are seeing the best IPO terms for investors since RiverNorth started buying SPACs in 2016. As the SPAC market has weakened, we have been active buyers.

Spreads for ICD have also narrowed considerably from pandemic levels. Notwithstanding tighter spreads, we still believe these yields, when considering the duration and credit risk, are relatively attractive vs. investment grade corporate debt. We are finding good opportunities in the smaller, off-the-run, and/or non-rated deals, where spreads are meaningfully wider.

Looking forward, we believe RiverNorth is well-positioned to capitalize on future volatility and opportunities within the CEF, BDC, ICD and SPAC markets. The fourth quarter typically provides trading opportunity as other investors reposition their CEF portfolios. Recently, investors have been selling longer duration assets in response to inflation concerns. This may give us the chance to add some additional exposure on weakness.

| 2 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Shareholder Letter |

September 30, 2021 (Unaudited)

We are pleased to provide you with the 2021 Annual Report for the RiverNorth Funds. The report reviews our three opportunistic closed-end strategies: the RiverNorth Core Opportunity Fund (RNCIX/RNCOX), the RiverNorth/DoubleLine Strategic Income Fund (RNSIX/RNDLX), and the RiverNorth/Oaktree High Income Fund (RNHIX/RNOTX).

Please visit www.rivernorth.com for additional information.

We thank you for your investment and trust in managing your assets.

Respectfully,

Patrick W. Galley, CFA

President and Chief Investment Officer

RiverNorth Funds

Opinions and estimates offered constitute our judgement and are subject to change.

Definitions:

Closed-End Fund – A closed-end fund is a portfolio of pooled assets that raises a fixed amount of capital through an initial public offering (IPO) and then lists shares for trade on a stock exchange.

Market Price – The market price at which a closed-end fund trades often varies from its NAV. Some funds have market prices below their NAVs, referred to as a discount. Conversely, some funds have market prices above their NAVs, referred to as a premium.

| Annual Report | September 30, 2021 | 3 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Closed-End Fund Market Overview

In the past twelve months, the average closed-end fund (CEF) reported a market price total return of 28.3%. The peer group index returns for equity1, taxable bond1 and municipal bond funds1 were 46.7%, 23.5%, 13.3%, respectively.

These returns reflect the continuation of the strong economic and capital markets recovery from the pandemic-driven lows of early 2020.

On September 30, 2021, the average CEF discount was 2.28%. Going back to the end of 19962, this places us in the 19th percentile of widest discounts (i.e., the average discount has been wider on 81% of the trading days since 1996). As a point of reference, in March 20202, when discounts bottomed around 20%, the market was in the 99th percentile of widest discounts.

We believe that CEF discounts are one measure of investor sentiment towards financial assets. Narrow CEF discounts combined with low interest rates, tight credit spreads, equity market indices at/near all-time highs and relatively subdued market volatility demonstrates that investors are generally comfortable with owning risk assets. However, with the recent uptick in interest rates, we have seen more volatility in the markets.

Leveraged CEFs continue to benefit from low borrowing costs. On September 30, 2021, the 1-week Security Industry and Financial Market Assoc. Index (SIFMA) and 1-month London Interbank Offered Rate (LIBOR) rates were at 0.05% and 0.08%, respectively. At the same time, the yield curve has steepened and therefore earnings power has improved. As of September 30, 2021, the average CEF distribution yield is 6.3%.

Attractive and stable distribution yields, strong recent performance, and the continuation of shareholder activism may cause discounts to narrow further. Of course, any significant and prolonged volatility in the capital markets would likely have the opposite effect as CEF market prices are generally correlated to the performance of risk assets.

| (1) | Source: RiverNorth. Derived from Morningstar and Bloomberg data. |

| (2 | Source: RiverNorth; Morningstar, Inc. |

| 4 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Definitions:

Equity Closed-End Funds – Domestic equity closed-end funds are defined as funds investing their assets primarily in U.S. equity securities; generally, these funds are seeking long-term capital appreciation rather than income.

London Interbank Offered Rate (LIBOR) – LIBOR is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Municipal Bond Closed-End Funds – Municipal bond closed-end funds are defined as funds that invest in a diversified portfolio of investment grade municipal bonds in a variety of sectors and States.

SIFMA (Security Industry/Financial Market Assoc.) Index – SIFMA is a 7-day high-grade market index comprised of tax-exempt Variable Rate Demand Obligations (VRDOs) with certain characteristics. The Index is calculated and published by Bloomberg. The indexes cannot be invested in directly and do not reflect fees and expenses.

Taxable Bond Closed-End Funds – Taxable bond closed-end funds are defined as funds that invest in debt securities whose return is subject to taxes at the local, state or federal level, or some combination thereof.

Yield – Yield is the income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment's cost, its current market value or its face value.

Yield Curve - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

| Annual Report | September 30, 2021 | 5 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

RiverNorth Core Opportunity Fund

What is the Fund's investment strategy?

The RiverNorth Core Opportunity Fund (the “Fund”) opportunistically allocates its assets to four niche asset classes: closed-end funds (CEFs), special purpose acquisition companies (SPACs), business development companies (BDCs), and investment company debt (ICD). The Fund also allocates to exchange-traded funds (ETFs) and cash/equivalents to preserve fund level liquidity, while providing a source of dry powder to take advantage of tactical allocation opportunities.

How did the RiverNorth Core Opportunity Fund perform relative to its benchmark during the reporting period?

For the twelve-month period ended September 30, 2021, the Class I share (symbol: RNCIX) returned 32.96% and the Class R share (symbol: RNCOX) returned 32.58%. These returns compare to the S&P 500 Total Return Index of 30.00%, the Bloomberg Barclays U.S. Aggregate Bond Index return of -0.90%, and the Morningstar U.S. Fund Allocation Category average return of 19.82%.

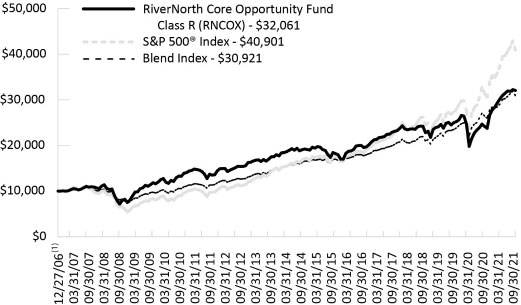

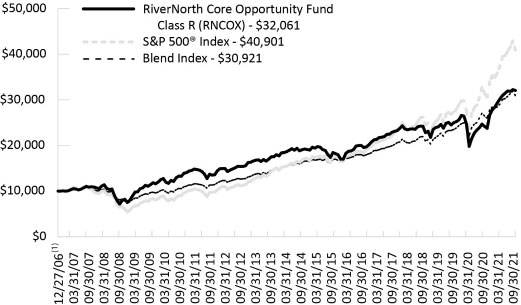

Comparison of a $10,000 Investment in the RiverNorth Core Opportunity Fund Class R, the Blend Index, and the S&P 500® Index.

| 6 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

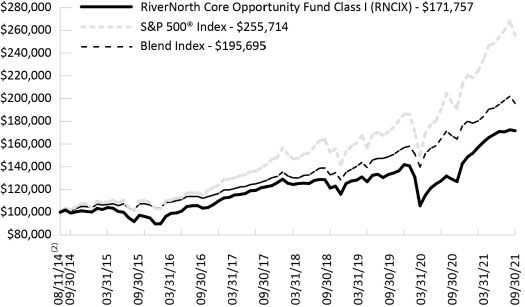

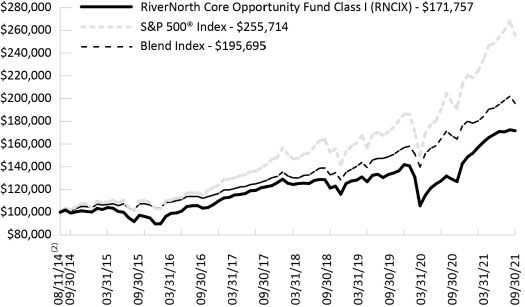

Comparison of a $100,000 Investment in the RiverNorth Core Opportunity Fund Class I, the Blend Index, and the S&P 500® Index.

| Average Annual Total Returns for Periods Ended September 30, 2021 | | |

| | 1-Year | 3-Year | 5-Year | 10 Year | Since

Inception(1)(2) |

RiverNorth Core Opportunity Fund – Class I (RNCIX)(3) | 32.96% | 10.11% | 10.18% | 9.92% | 8.48% |

RiverNorth Core Opportunity Fund – Class R (RNCOX) | 32.58% | 9.82% | 9.90% | 9.65% | 8.21% |

| Blend Index(4) | 16.92% | 12.10% | 11.43% | 11.24% | 7.95% |

| S&P 500® Index(4) | 30.00% | 15.99% | 16.90% | 16.63% | 10.01% |

| (1) | Inception date of Class R is December 27, 2006. |

| (2) | Inception date of Class I is August 11, 2014. |

| (3) | In presenting performance information for the newer Institutional share class of the Fund, the Fund includes, for periods prior to the offering of the Institutional share class, the operating expense ratio and performance of the Fund’s Retail share class, adjusted to reflect the class-related operating expenses of the Institutional share class. Actual expense differentials across classes will vary over time. The performance of the Fund’s newer Institutional share class would have been substantially similar to the performance of the Fund’s Retail share class because both share classes of the Fund are invested in the same portfolio of securities and would have differed only to the extent that the classes do not have the same expenses (although differences in expenses between share classes may change over time). |

| Annual Report | September 30, 2021 | 7 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

| (4) | Blend Index consists of 60% S&P 500® Index and 40% Bloomberg Barclays Capital U.S. Aggregate Bond Index. S&P 500® Index is a capitalization-weighted index of 500 stocks. The Bloomberg Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses. The S&P 500® and Blend Indices are indices only and cannot be invested in directly. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or visiting www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2021: 2.69% (RNCIX); 2.94% (RNCOX). In presenting expense information for the newer Institutional share class of the Fund, the Fund includes, for periods prior to the offering of the Institutional share class, the operating expense ratio of the Fund’s Retail share class, adjusted to reflect the class-related operating expenses of the Institutional share class. Actual expense differentials across share classes will vary over time. The annualized net expense ratio in this annual report dated September 30, 2021 is 1.33% (RNCIX); 1.58% (RNCOX). The expense ratio as disclosed in the Fund’s annual report dated September 30, 2021 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund’s prospectus dated January 28, 2021 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth Core Opportunity Fund's relative performance during the period?

Each of the niche asset classes referenced above contributed positively to Fund performance over the period. The most significant contributing factor was the Fund’s exposure to CEFs as net asset value (NAV) performance was strong, and discounts narrowed substantially. Within the CEF portfolio, equity CEFs (U.S. and global) were the strongest contributors to performance while commodity CEFs detracted over the period.

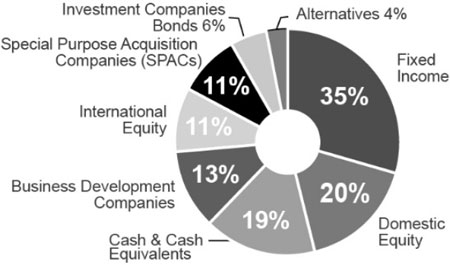

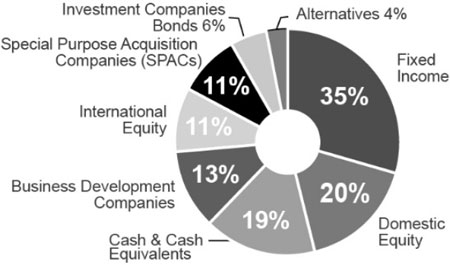

How was the RiverNorth Core Opportunity Fund positioned at the end of September 2021?

We have allocated 58.67% of the portfolio to CEFs, 9.72% to SPACs, 6.51% to BDCs, and 6.22% to ICD. Additionally, we have 17.26% of the portfolio in cash and 1.06% in ETFs.

Over the past year, we’ve decreased our exposure to CEFs, while increasing our exposure to SPACs and cash. Our allocation to BDCs and ICD was relatively unchanged.

| 8 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Investment Vehicle Allocation(1) (percentages are based on net assets)

Asset Class Allocation(1) (percentages are based on net assets)

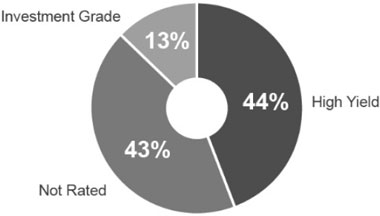

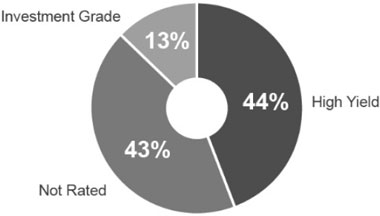

Fixed Income Allocation(1)(2) (percentages are based on net assets)

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| (1) | Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Exchange Traded Note Risk – exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Management Risk – there is no guarantee that the adviser’s investment decisions will produce the desired results. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Market Risk – economic conditions, interest rates and political events may affect the securities markets. REIT Risk – the value of REITs changes with the value of the underlying properties and changes in interest rates and are subject to additional fees. Security Risk – The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund’s portfolio. Short Sale Risk – short positions are speculative, are subject to transaction costs and are riskier than long positions in securities. Small-Cap Risk – small cap companies are more susceptible to failure, are often thinly traded and have more volatile stock prices. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

| Annual Report | September 30, 2021 | 9 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

| (2) | Credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each CEF as provided by the adviser of said CEF. If a credit breakdown is not provided by the adviser, Bloomberg is used. Investment grade refers to a bond rated BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s. High yield refers to a bond rate lower than investment grade. For more information about securities ratings, please see the Fund’s Statement of Additional information at www.rivernorth.com. |

| 10 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

RiverNorth/DoubleLine Strategic Income Fund

What is the Fund's investment strategy?

The RiverNorth/DoubleLine Strategic Income ("the Fund") invests in a broad range of fixed income securities of U.S. and foreign issuers, including closed-end funds ("CEFs").

Assets of the Fund are tactically managed across three strategies (or sleeves). RiverNorth Capital Management, LLC (“RiverNorth”) oversees the strategy weights and manages the Tactical Closed-End Fund Income Strategy. The RiverNorth strategy provides diversified exposure to the fixed income market through opportunistic investments in closed-end bond funds, and business development companies (BDC). Sector allocations are based on RiverNorth's assessment of relative value among asset classes and CEFs. Jeffrey Gundlach, CEO and CIO of DoubleLine Capital, LP (“DoubleLine”), and his team oversee the Opportunistic Income and Core Fixed Income Strategies. The Opportunistic Income Strategy seeks to achieve positive absolute returns and is managed without duration constraints. The Core Fixed Income Strategy incorporates an active asset allocation approach in an effort to mitigate risk and achieve the highest possible risk-adjusted returns.

How did the RiverNorth/DoubleLine Strategic Income Fund perform relative to its benchmark during the reporting period?

For the twelve-month period ended September 30, 2021, the Class I share (symbol: RNSIX) returned 7.52% and the Class R share (symbol: RNDLX) returned 7.23%. The Bloomberg Barclays Capital U.S. Aggregate Bond Index returned -0.90%, during the same period.

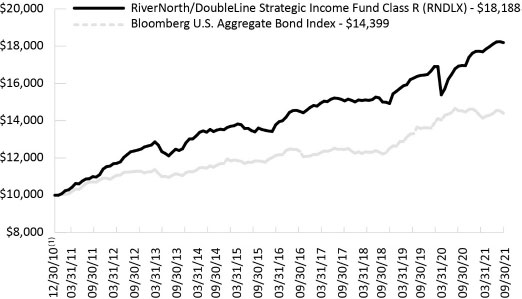

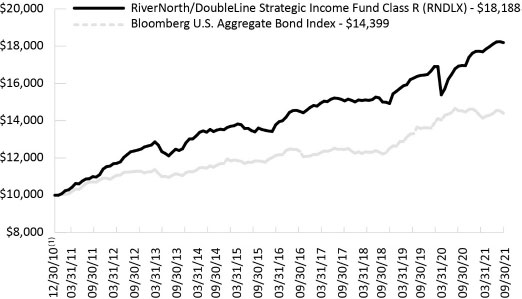

Comparison of a $10,000 Investment in the RiverNorth/DoubleLine Strategic Income Fund Class R and the Barclays Capital U.S. Aggregate Bond Index

| Annual Report | September 30, 2021 | 11 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

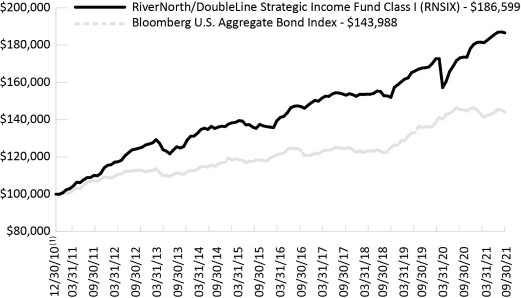

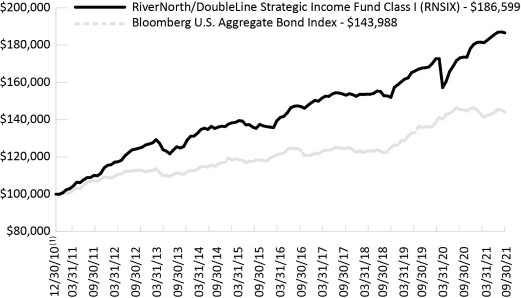

Comparison of a $100,000 Investment in the RiverNorth/DoubleLine Strategic Income Fund Class I and the Barclays Capital U.S. Aggregate Bond Index

| Average Annual Total Returns for Periods Ended September 30, 2021 |

| | 1-Year | 3-Year | 5-Year | 10 Year | Since

Inception(1) |

RiverNorth/DoubleLine Strategic Income Fund – Class I (RNSIX) | 7.52% | 6.36% | 4.83% | 5.53% | 5.97% |

RiverNorth/DoubleLine Strategic Income Fund – Class R (RNDLX) | 7.23% | 6.11% | 4.56% | 5.26% | 5.72% |

Bloomberg Barclays Capital U.S. Aggregate Bond Index(2) | -0.90% | 5.36% | 2.94% | 3.01% | 3.45% |

| (1) | Inception date is December 30, 2010. |

| (2) | The Bloomberg Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. The index cannot be invested in directly and does not reflect fees and expenses. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or visiting www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| 12 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2021: 1.39% (RNSIX); 1.64% (RNDLX). The annualized net expense ratio in this annual report dated September 30, 2021 is 0.86% (RNSIX) and 1.11% (RNDLX). The expense ratio as disclosed in the Fund’s annual report dated September 30, 2021 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund’s prospectus dated January 28, 2021 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth/DoubleLine Strategic Income Fund's relative performance during the period?

RiverNorth Tactical Closed-End Fund Income Sleeve

Each of the sleeve’s asset classes contributed positively to Fund performance over the period. The most significant contributing factor was the Fund’s exposure to CEFs as NAV performance was strong, and discounts narrowed substantially. Within the CEF portfolio, senior loan and high yield CEFs were the strongest contributors to performance while preferred CEFs had a relatively small impact.

DoubleLine Opportunistic Income Sleeve

For the 12-month period ended September 30, 2021, the portfolio materially outperformed the Bloomberg Barclays U.S. Aggregate Bond Index return of -0.90%. Outperformance was driven by asset allocation as the portfolio was overweight subordinated credit during an environment where risk taking was rewarded. Top contributors to outperformance included asset-backed securities (ABS), non-agency mortgage-backed securities (MBS), and commercial MBS. These sectors were among the hardest hit during the initial stages of the pandemic and thus stood the most to gain from the robust economic recovery that occurred over the past year. Corporate related sectors such as bank loans, collateralized loan obligations (CLOs), and emerging market debt also outperformed as corporate earnings rebounded sharply and defaults were minimal over the period. Agency residential mortgage-backed securities (RMBS) was the only sector with negative returns during the period driven by price declines as interest rates increased.

DoubleLine Core Fixed Income Sleeve

For the 12-month period ended September 30, 2021, the portfolio outperformed the Bloomberg Barclays U.S. Aggregate Bond Index return of -0.90%. Relative outperformance was driven primarily by asset allocation as the portfolio was overweight credit during an environment where risk assets outperformed. Corporate related sectors such as high yield, CLOs, and emerging market debt were the top performers over the year as corporate earnings rebounded sharply and minimal defaults occurred. Securitized credit sectors such as non-agency MBS, commercial MBS, and ABS also contributed to outperformance and benefitted from the global economic recovery. U.S. Treasuries and Agency RMBS were the only sectors with negative returns as they experienced price declines related to the increase in interest rates that occurred during the year.

How was the RiverNorth/DoubleLine Strategic Income Fund positioned at the end of September 2021?

We have allocated 31.58%, 32.97% and 35.45% to the Tactical CEF Income, Core Fixed Income, and Opportunistic Income sleeves, respectively. Compared to one year ago, the Fund reduced its exposure to the Tactical CEF Income sleeve in favor of a higher allocation to the Core Fixed Income sleeve. The allocation to the Opportunistic Income sleeve was relatively flat year-over year.

| Annual Report | September 30, 2021 | 13 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

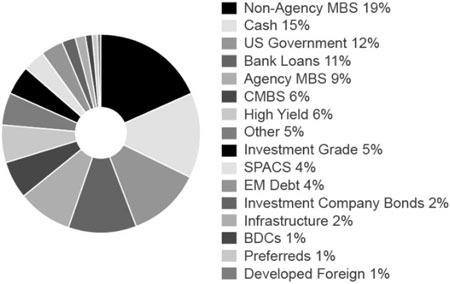

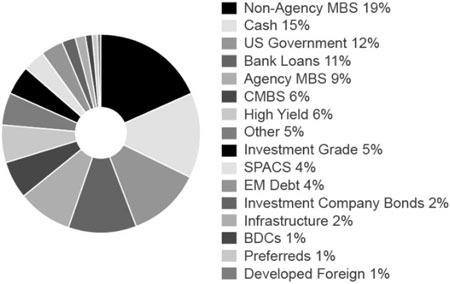

Strategy (“Sleeve”) Allocation

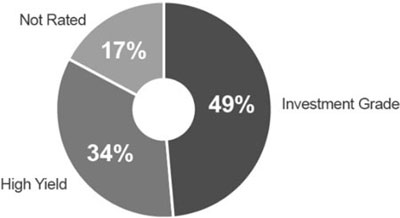

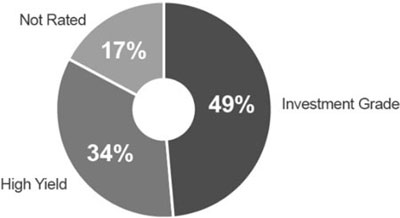

Credit Quality Distribution(1)(2) (percentages are based on net assets)

Sector Breakdown(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the estimated leverage utilized by the underlying funds.

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| 14 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

| (1) | Asset-Backed Security Risk – the risk that the value of the underlying assets will impair the value of the security. Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Derivatives Risk – derivatives are subject to counterparty risk. Exchange Traded Note Risk – exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Liquidity Risk – illiquid investments may be difficult or impossible to sell. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Management Risk – there is no guarantee that the adviser’s or sub-adviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Mortgage-Backed Security Risk – mortgage backed securities are subject to credit risk, pre-payment risk and devaluation of the underlying collateral. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Rating Agency Risk – rating agencies may change their ratings or ratings may not accurately reflect a debt issuer’s creditworthiness. REIT Risk – the value of REITs changes with the value of the underlying properties and changes in interest rates and are subject to additional fees. Security Risk –The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund’s portfolio. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

| (2) | For the sleeve managed by RiverNorth, credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each CEF as provided by the advisor of said CEF. If a credit breakdown is not provided by the advisor, Bloomberg is used. For the sleeves managed by DoubleLine, credit quality allocation is determined from the highest available credit rating from any Nationally Recognized Statistical Rating Organization (S&P, Moody’s and Fitch). Investment grade refers to a bond rated BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s. High yield refers to a bond rated lower than investment grade. For more information about securities ratings, please see the Fund’s Statement of Additional Information at www.rivernorth.com. |

| Annual Report | September 30, 2021 | 15 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

RiverNorth/Oaktree High Income Fund

What is the Fund's investment strategy?

The RiverNorth/Oaktree High Income Fund ("the Fund") invests in a broad range of income producing securities including both fixed income and equity securities.

Assets of the Fund are tactically managed across three income strategies (or sleeves). RiverNorth Capital Management, LLC (“RiverNorth”) manages the Tactical Closed-End Fund Strategy. This strategy is designed to provide diversified fixed income and equity income exposure through opportunistic investments in closed-end funds ("CEFs"). Oaktree Capital Management, LP ("Oaktree") manages the High Yield Bond and Senior Loan Strategies on a global basis. Oaktree will tactically manage the allocation between the High Yield Bond and Senior Loan Strategies based both on market opportunities and the risk and reward trade-offs between the two asset classes.

How did the RiverNorth/Oaktree High Income Fund perform relative to its benchmark during the reporting period?

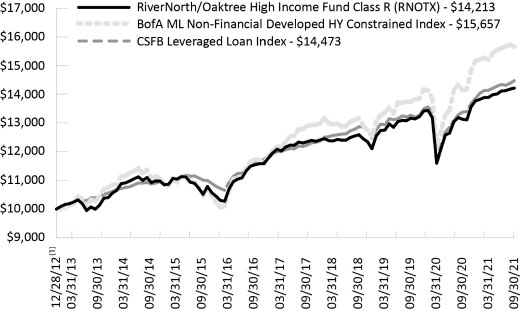

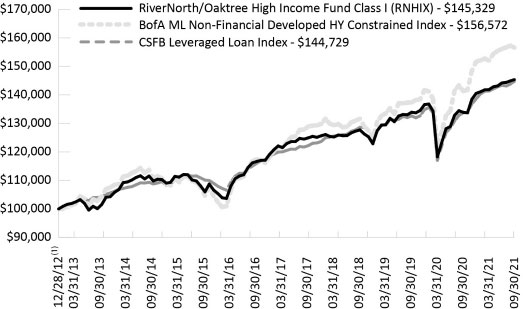

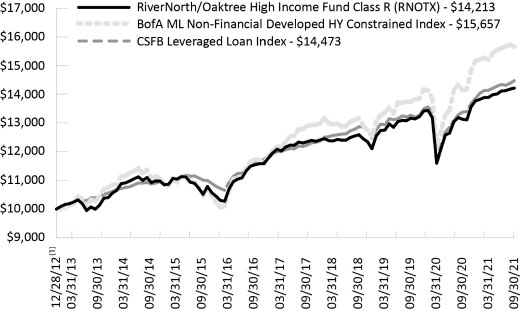

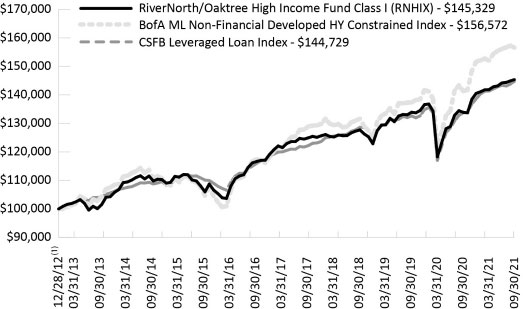

For the 12-month period ended September 30, 2021, the Class I share (symbol: RNHIX) returned 8.55% and the Class R share (symbol: RNOTX) returned 8.31%. The ICE Bank of America Merrill Lynch Non-Financial Developed High Yield Constrained Index (the "BofA Non-Financial Developed HY Constrained Index") and CSFB Leveraged Loan Index returned 10.77% and 8.24%, respectively, during the same period.

Comparison of a $10,000 Investment in the RiverNorth/Oaktree High Income Fund Class R, BofA ML Non-Financial Developed HY Constrained Index and the CSFB Leveraged Loan Index

| 16 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Comparison of a $100,000 Investment in the RiverNorth/Oaktree High Income Fund Class I, BofA ML Non-Financial Developed HY Constrained Index and the CSFB Leveraged Loan Index

Average Annual Total Returns for the Period Ended September 30, 2021

| | 1-Year | 3-Year | 5-Year | Since

Inception(1) |

RiverNorth/Oaktree High Income Fund – Class I (RNHIX) | 8.55% | 4.40% | 4.49% | 4.36% |

RiverNorth/Oaktree High Income Fund – Class R (RNOTX) | 8.31% | 4.15% | 4.24% | 4.10% |

| BofA ML Non-Financial Developed HY Constrained Index(2) | 10.77% | 5.96% | 5.93% | 5.25% |

| CSFB Leveraged Loan Index(2) | 8.24% | 4.02% | 4.53% | 4.31% |

| (1) | Inception date is December 28, 2012. |

| (2) | The BofA ML Non-Financial Developed Markets HY Constrained Index contains all securities in the BofA Merrill Lynch Global High Yield Index from developed markets countries but caps issuer exposure at 2%. Developed markets is defined as an FX-G10 member, a Western European nation, or a territory of the U.S. or a Western European nation. The BofA ML Non-Financial Developed Markets HY Constrained Index tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch). The CSFB Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. The BofA ML Non-Financial Developed Markets HY Constrained and the CSFB Leveraged Loan Indices are indices only and cannot be invested in directly. |

| Annual Report | September 30, 2021 | 17 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or visiting www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Total Annual Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2021: 1.68% (RNHIX); 1.93% (RNOTX). The adviser has contractually agreed to defer the collection of fees and/or reimburse expenses, but only to the extent necessary to limit Total Annual Fund Operating Expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests; and extraordinary expenses) to 1.35% (RNHIX) and 1.60% (RNOTX) of the average daily net assets of the Fund through January 31, 2021. The annualized net expense ratio in this annual report dated September 30, 2021 is 1.35% (RNHIX) and 1.60% (RNOTX). The expense ratio as disclosed in the Fund’s annual report dated September 30, 2021 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund’s prospectus dated January 28, 2021 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth/Oaktree High Income Fund's relative performance during the period?

RiverNorth Tactical Closed-End Fund Sleeve

The most significant contributing factor was the Fund’s exposure to high yield CEFs as NAV performance was strong, and discounts narrowed substantially. Conversely, the Fund’s exposure to BDCs had a relatively small impact on performance over the period.

Oaktree High Yield Bond & Senior Loan Sleeve

The portfolio generated a positive return over the twelve-month period.

The re-opening of the global economy, together with expansive monetary and fiscal policies, pushed risk assets higher over the trailing 12-month period. The S&P 500 was up an astounding 30%. High yield bonds and senior loans couldn’t quite keep pace with stocks but produced strong absolute returns over the period. Forward currency contracts had minimal impact on performance.

As we start the fourth quarter of 2021, credit fundamentals remain sound. In fact, there were no high yield bond defaults in the third quarter of 2021 and as of September 30, 2021, there were just a tiny number of bonds trading at or below 70% of par (an indicator of credit weakness).

The portfolio didn’t experience any defaults over the trailing twelve-month period.

There are plenty of risks to consider, including the Delta variant, rising prices and inflation. We certainly recognize that higher Treasury yields could penalize returns for all fixed income asset categories, including high yield bonds. Fortunately, high yield bonds have a moderate duration given their higher coupons and intermediate maturities. That makes them less correlated to treasuries and better positioned to hold up better in a rising rate environment than longer duration investment grade bonds.

| 18 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

For senior loans, while activity in the loan primary market is on track to set an annual record, the supply has been unable to match the tremendous demand from CLOs and retail investors. The spike in interest rates late in the quarter made floating-rate assets more attractive, buoying loan prices. At the end of September 2021, 32% of all loans were trading above par compared to 27% as of June 30, 2021. With most loans trading at or near par, we expect to earn a coupon-like return in the near to medium term, which bodes well for the Fund’s relative performance for the remainder of the year.

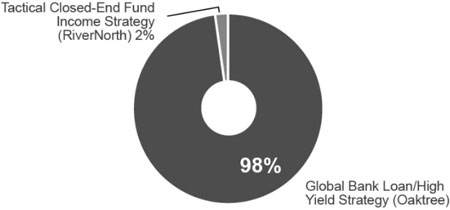

How was the RiverNorth/Oaktree High Income Fund positioned at the end of September 2021?

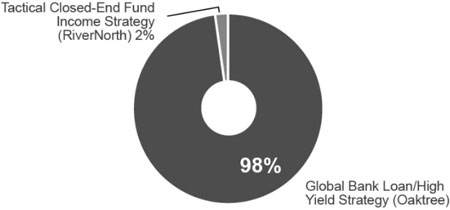

We have allocated 1.62% and 98.38% to the RiverNorth Tactical CEF Income and Oaktree High Yield Bond/Senior Loan sleeves, respectively. The CEF sleeve is primarily invested in the common shares of high yield CEFs.

Oaktree High Yield Bond & Senior Loan Sleeve

At the end of September 2021, the portfolio remained broadly diversified. Roughly 75% of the global portfolio was allocated to North America, with the balance invested in Europe. In terms of Industry exposure, Hotels, Restaurants & Leisure (7.4%) and Diversified Telecommunication Services (7.4%) represented the two largest sectors in the portfolio.

We are keeping our duration in check to ensure that the portfolio will not be disproportionately impacted if interest rates rise. Specifically, we have been monitoring our exposure to low coupon/longer duration bonds, which could prove quite vulnerable to rising rates.

Strategy Allocation

| Annual Report | September 30, 2021 | 19 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Credit Quality Distribution(1)(2) (percentages are based on net assets)

Sector Breakdown(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the leverage utilized by the underlying funds.

| (1) | Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Closed- End Fund Risk – closed-end funds are exchange traded, may trade at a discount to their net asset values and may deploy leverage. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Credit Derivatives Risk – the use of credit derivatives is highly specialized, involves default, counterparty and liquidity risks and may not perfectly correlate to the underlying asset or liability being hedged. Currency Risk – foreign currencies will rise or decline relative to the U.S. dollar. Distressed and Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Equity Risk – equity securities may experience volatility and the value of equity securities may move in opposite directions from each other and from other equity markets generally. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Floating Interest Rate Risk – loans pay interest based on the London Interbank Offered Rate (LIBOR) and a decline in LIBOR could negatively impact the Fund’s return. Investment Style Risk – investment strategies may come in and out of favor with investors and may underperform or outperform at times. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Loans Risk – loans may be unrated or rated below investment grade and the pledged collateral may lose value. Secondary trading in loans is not fully-developed and may result in illiquidity. Management Risk – there is no guarantee that the adviser’s or sub-adviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Preferred Stock Risk – preferred stocks generally pay dividends, but may be less liquid than common stocks, have less priority than debt instruments and may be subject to redemption by the issuer. Security Risk – the value of the Fund may increase or decrease in response to the prospects of the issuers of securities and loans held in the Fund. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. Valuation Risk – Loans and fixed-income securities are traded “over the counter” and because there is no centralized information regarding trading, the valuation of loans and fixed-income securities may vary. |

| 20 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

| (2) | For the sleeve managed by RiverNorth, credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each CEF as provided by the advisor of said CEF. If a credit breakdown is not provided by the advisor, Bloomberg is used. For the sleeves managed by Oaktree, the sub-adviser uses a proprietary credit scoring matrix to rank potential investments. This process offers a systematic way of reviewing the key quantitative and qualitative variables impacting credit quality for each investment. Investment grade refers to a bond rated BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s. High yield refers to a bond rated lower than investment grade. For more information about securities ratings, please see the Fund’s Statement of Additional Information at www.rivernorth.com. |

Definitions:

Agency Mortgage-Backed Securities (Agency MBS) – Agency MBS are mortgage-backed securities issued by government-sponsored enterprises such as Government National Mortgage Association (GNMA or Ginnie Mae), Federal National Mortgage Association (FNMA or Fannie Mae) or Federal Home Loan Mortgage Corporation (Freddie Mac).

Basis Point (bps) – A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001), and is used to denote the percentage change in a financial instrument.

Bloomberg Barclays U.S. Aggregate Bond Index – The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. The index cannot be invested in directly and does not reflect fees and expenses.

BofA Merrill Lynch Developed Markets High Yield Constrained Index – The BofA Merrill Lynch Developed Markets High Yield Constrained Index contains all securities in the BofA Merrill Lynch Global High Yield index from developed markets countries but cap issuer exposure at 2%. Developed markets is defined as an FX-G10 member, a Western European nation, or a territory of the U.S. or a Western European nation. The index tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch). The index cannot be invested in directly and does not reflect fees and expenses.

| Annual Report | September 30, 2021 | 21 |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Business Development Company (BDC) – A Business Development Company (BDC) is an organization that invests in small- and medium-sized companies as well as distressed companies. A BDC helps the small- and medium-sized firms grow in the initial stages of their development.

Collateralized Loan Obligation (CLO) – A CLO is a security backed by a pool of debt, often low-rated corporate loans. The investor receives scheduled debt payments from the underlying loans but assumes most of the risk in the event that borrowers default.

Commercial Mortgage-Backed Securities (CMBS) – Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Coupon – A coupon is the annual interest rate paid on a bond, expressed as a percentage of the face value.

CSFB Leveraged Loan Index – The CSFB Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated "5B" or lower, meaning that the highest rated issues included in this index are Moody's/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. The index cannot be invested in directly and does not reflect fees and expenses.

Dry Powder – Dry Powder is an informal term that refers to highly liquid securities, cash reserves and any other security that can be converted to cash right away to meet debt obligations, cover operational expenses or invest in opportunities.

Floating Rate Coupons – Floating rate coupons are derived from financial instruments paying a variable or floating interest rate.

Inverse-Floater Securities – An inverse-floater is a bond or other type of debt whose coupon rate has an inverse relationship to a benchmark rate. An inverse floater adjusts its coupon payment as the interest rate changes.

Inverse-Interest Only Securities (Inverse IOs) – Inverse IOs are interest only securities that pay a coupon inversely related to market rates (i.e., it moves in the opposite direction of interest rates).

Mezzanine Debt – Mezzanine debt has embedded equity instruments attached, often known as warrants, which increase the value of the subordinated debt and allow greater flexibility when dealing with bondholders.

Morningstar U.S. Fund Allocation Category – The Morningstar U.S. Fund Allocation Category - 50% to 70% Equity. Funds in allocation categories seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds, and cash. These portfolios are dominated by domestic holdings and have equity exposures between 50% and 70%.

| 22 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2021 (Unaudited)

Mortgage-Backed Securities (MBS) – MBS are asset-backed securities that are secured by a mortgage or collection of mortgages.

Non-Agency Residential Mortgage-Backed Securities (Non-Agency RMBS) – Non-Agency RMBS are mortgage-backed securities sponsored by private companies other than the government sponsored enterprises such as Fannie Mae, Ginnie Mae, or Freddie Mac.

Par – Par value, also known as nominal value, is the face value of a bond or the stock value stated in the corporate charter.

Residential Mortgage-Backed securities (RMBS) – RMBS are a type of mortgage-backed debt obligation whose cash flows come from residential debt, such as mortgages, home-equity loans and subprime mortgages.

Special Purpose Acquisition Company (SPAC) – A SPAC is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company.

| Annual Report | September 30, 2021 | 23 |

| RiverNorth Funds | Disclosure of Fund Expenses |

September 30, 2021 (Unaudited)

Expense Example

As a shareholder of the RiverNorth Funds (the "Trust" or "Funds"), you incur two types of costs:

(1) transaction costs; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, April 1, 2021, and held for the six months ended September 30, 2021.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your variable account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| 24 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Disclosure of Fund Expenses |

September 30, 2021 (Unaudited)

| | Beginning

Account Value

04/01/2021 | Ending

Account Value

09/30/2021 |

Expense

Ratio(a) | Expenses

Paid During

Period(b) |

| RiverNorth Core Opportunity Fund | | | |

| Class I Shares | | | | |

| Actual | $1,000.00 | $1,062.10 | 1.33% | $6.88 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.40 | 1.33% | $6.73 |

| Class R Shares | | | | |

| Actual | $1,000.00 | $1,060.70 | 1.58% | $8.16 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.15 | 1.58% | $7.99 |

| RiverNorth/DoubleLine Strategic Income Fund | | | |

| Class I Shares | | | | |

| Actual | $1,000.00 | $1,029.00 | 0.86% | $4.37 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.76 | 0.86% | $4.36 |

| Class R Shares | | | | |

| Actual | $1,000.00 | $1,027.70 | 1.11% | $5.64 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.50 | 1.11% | $5.62 |

| RiverNorth/Oaktree High Income Fund | | | |

| Class I Shares | | | | |

| Actual | $1,000.00 | $1,024.50 | 1.35% | $6.85 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.30 | 1.35% | $6.83 |

| Class R Shares | | | | |

| Actual | $1,000.00 | $1,023.40 | 1.60% | $8.12 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.05 | 1.60% | $8.09 |

| (a) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 365. Note this expense example is typically based on a six-month period. |

| Annual Report | September 30, 2021 | 25 |

RiverNorth Core Opportunity Fund | Schedule of Investments |

Shares/Description | Value | |

CLOSED-END FUNDS - 58.39% | | | |

383,467 | | Aberdeen Emerging Markets Equity Income Fund, Inc. | | $ | 3,190,445 | |

6,696 | | Barings Global Short Duration High Yield Fund | | | 114,502 | |

195,497 | | BlackRock 2022 Global Income Opportunity Trust | | | 1,020,494 | |

56,482 | | Blackrock Capital Allocation Trust | | | 1,140,936 | |

7,395 | | Blackrock Health Sciences Trust II | | | 199,517 | |

44,235 | | BlackRock Innovation & Growth Trust | | | 800,654 | |

38,867 | | Blackrock Science & Technology Trust | | | 2,027,303 | |

29,451 | | Blackstone Strategic Credit Fund | | | 407,896 | |

260,650 | | BrandywineGLOBAL - Global Income Opportunities Fund, Inc. | | | 3,263,338 | |

103,401 | | Calamos Long/Short Equity & Dynamic Income Trust | | | 2,104,210 | |

26,257 | | First Eagle Senior Loan Fund | | | 28,095 | |

56,645 | | First Trust Dynamic Europe Equity Income Fund | | | 730,154 | |

97,153 | | First Trust Energy Infrastructure Fund | | | 1,238,701 | |

116,958 | | First Trust MLP and Energy Income Fund | | | 842,098 | |

311,341 | | First Trust New Opportunities MLP & Energy Fund | | | 1,768,417 | |

26,500 | | First Trust Senior Floating Rate 2022 Target Term Fund | | | 255,460 | |

180,976 | | GDL Fund | | | 1,625,164 | |

540,375 | | Invesco Senior Income Trust | | | 2,404,669 | |

14,030 | | Ivy High Income Opportunities Fund | | | 191,790 | |

15,116 | | LMP Capital and Income Fund, Inc. | | | 207,996 | |

38,020 | | Macquarie Global Infrastructure Total Return Fund, Inc. | | | 886,246 | |

42,189 | | Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 384,342 | |

137,854 | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 806,446 | |

112,394 | | NexPoint Credit Strategies Fund | | | 1,563,401 | |

439,479 | | Nuveen Credit Strategies Income Fund | | | 2,882,982 | |

57,125 | | Nuveen Floating Rate Income Opportunity Fund | | | 570,108 | |

449,438 | | Nuveen High Income November 2021 Target Term Fund | | | 4,215,728 | |

31,997 | | Nuveen Mortgage Opportunity Term Fund | | | 663,938 | |

112,903 | | Pershing Square Holdings Ltd. | | | 4,075,798 | |

19,267 | | PIMCO Dynamic Credit Income Fund | | | 407,112 | |

108,873 | | Special Opportunities Fund, Inc. | | | 1,673,378 | |

242,778 | | Sprott Focus Trust, Inc. | | | 2,012,630 | |

170,242 | | Sprott Physical Gold and Silver Trust(a) | | | 2,916,245 | |

81,696 | | Western Asset High Income Opportunity Fund, Inc. | | | 424,002 | |

| | | | | | | |

TOTAL CLOSED-END FUNDS | | | |

(Cost $43,844,061) | | 47,044,195 | |

| | | | |

BUSINESS DEVELOPMENT COMPANIES - 6.48% | | | |

218,512 | | Barings BDC, Inc. | | | 2,408,002 | |

188,777 | | First Eagle Alternative Capital BDC, Inc. | | | 832,507 | |

See Notes to Financial Statements. | |

26 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Core Opportunity Fund | Schedule of Investments |

| September 30, 2021 |

Shares/Description | Value | |

280,706 | | Oaktree Specialty Lending Corp. | | $ | 1,981,784 | |

| | | | | | | |

TOTAL BUSINESS DEVELOPMENT COMPANIES | | | |

(Cost $4,841,292) | | 5,222,293 | |

| | | | |

SPECIAL PURPOSE ACQUISITION COMPANIES - 9.48% | | | |

13,110 | | Agba Acquisition, Ltd.(a) | | | 142,637 | |

3,099 | | Apollo Strategic Growth Capital II(a) | | | 30,835 | |

35,123 | | Ares Acquisition Corp.(a) | | | 342,099 | |

20,156 | | Austerlitz Acquisition Corp. I(a) | | | 200,351 | |

70,128 | | Austerlitz Acquisition Corp. II(a) | | | 683,748 | |

50,000 | | CC Neuberger Principal Holdings II, Class A(a) | | | 491,000 | |

40,000 | | CC Neuberger Principal Holdings III(a) | | | 390,800 | |

40,405 | | Churchill Capital Corp. VI(a) | | | 394,757 | |

40,843 | | Churchill Capital Corp. VII(a) | | | 396,994 | |

900 | | Compute Health Acquisition Corp.(a) | | | 9,009 | |

56,000 | | Conx Corp., Class A(a) | | | 548,800 | |

42,000 | | Fortress Value Acquisition Corp. IV(a) | | | 409,080 | |

41,800 | | Gores Guggenheim, Inc.(a) | | | 427,196 | |

35,400 | | Gores Holdings VII, Inc.(a) | | | 348,690 | |

65,455 | | Jaws Mustang Acquisition Corp.(a) | | | 638,842 | |

20,514 | | Khosla Ventures Acquisition Co. III(a) | | | 201,037 | |

45,258 | | KKR Acquisition Holdings I Corp.(a) | | | 441,266 | |

21,214 | | Landcadia Holdings IV, Inc.(a) | | | 211,716 | |

12,447 | | Lazard Growth Acquisition Corp. I(a) | | | 122,976 | |

22,145 | | Longview Acquisition Corp. II(a) | | | 219,014 | |

10,753 | | Merida Merger Corp. I(a) | | | 107,422 | |

35,400 | | Reinvent Technology Partners Y(a) | | | 351,522 | |

20,984 | | Spartan Acquisition Corp. III, Class A(a) | | | 207,322 | |

32,700 | | Tishman Speyer Innovation Corp. II(a) | | | 320,460 | |

| | | | | | | |

TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES | | | |

(Cost $7,578,497) | | 7,637,573 | |

| | | | |

EXCHANGE TRADED FUNDS - 1.05% | | | |

37,953 | | Invesco FTSE RAFI Emerging Markets Portfolio | | | 847,870 | |

| | | | | | | |

TOTAL EXCHANGE TRADED FUNDS | | | |

(Cost $682,207) | | 847,870 | |

See Notes to Financial Statements. | |

Annual Report | September 30, 2021 | 27 |

RiverNorth Core Opportunity Fund | Schedule of Investments |

| Shares/Description | Value | |

| PREFERRED STOCKS - 0.50% | | | |

| 15,162 | | XAI Octagon Floating Rate Alternative Income Term Trust, Series 2026, 6.500%, 03/31/2026 | $ | 400,201 | |

| | | | | | |

| TOTAL PREFERRED STOCKS | | | |

| (Cost $378,879) | | 400,201 | |

| Shares/Principal Amount/Description | | | Rate | | | Maturity | | | Value | |

| BUSINESS DEVELOPMENT COMPANY NOTES - 3.77% United States - 3.77% | | | | | |

| | 49,778 | | | First Eagle Alternative Capital BDC, Inc. | | | 5.00% | | | | 05/25/2026 | | | | 1,256,895 | |

| $ | 1,220,000 | | | PennantPark Floating Rate Capital, Ltd. | | | 4.25% | | | | 04/01/2026 | | | | 1,232,337 | |

| | 21,578 | | | PennantPark Investment Corp. | | | 5.50% | | | | 10/15/2024 | | | | 546,571 | |

| | | | | | | | | | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANY NOTES (Cost $3,005,096) | | | | | | | | | | | 3,035,803 | |

| Principal Amount/Description | | | Rate | | | Maturity | | | Value | |

CONVERTIBLE CORPORATE BONDS - 2.43% | | | | | | | | | |

| $ | 848,323 | | | BlackRock Capital Investment Corp. | | | 5.00% | | | | 06/15/2022 | | | | 859,973 | |

| | 190,456 | | | BlackRock TCP Capital Corp. | | | 4.63% | | | | 03/01/2022 | | | | 193,772 | |

| | 852,978 | | | New Mountain Finance Corp. | | | 5.75% | | | | 08/15/2023 | | | | 901,128 | |

| | | | | | | | | | | | | | | | | |

TOTAL CONVERTIBLE CORPORATE BONDS | | | | | | | | | | | | |

(Cost $1,748,771) | | | | | | | | | | | 1,954,873 | |

| Shares/Description | | | Value | |

Rights - 0.00%(a)(b) | | |

| | 13,110 | | | Agba Acquisition, Ltd., Strike Price 11.50, Expires 12/31/2049 | | | 3,320 | |

| | | | | | | | | |

TOTAL RIGHTS | | | | |

(Cost $2,960) | | | 3,320 | |

| | | | | |

Warrants - 0.19%(a) | | | | |

| | 13,110 | | | Agba Acquisition, Ltd., Strike Price 11.50, Expires 05/10/2024 | | | 2,871 | |

| | 10,614 | | | AgileThought, Inc., Strike Price 11.50, Expires 08/23/2026 | | | 11,144 | |

| | 7,024 | | | Ares Acquisition Corp., Strike Price 11.50, Expires 12/31/2027 | | | 5,970 | |

| | 5,039 | | | Austerlitz Acquisition Corp. I, Strike Price 11.50, Expires 02/19/2026 | | | 8,516 | |

| | 5,032 | | | Austerlitz Acquisition Corp. II, Strike Price 11.50, Expires 12/31/2027 | | | 5,284 | |

| | 8,081 | | | Churchill Capital Corp. VI, Strike Price 11.50, Expires 12/31/2027 | | | 9,697 | |

| | 8,168 | | | Churchill Capital Corp. VII, Strike Price 11.50, Expires 02/29/2028 | | | 7,515 | |

| | 18,643 | | | Ensysce Biosciences, Inc., Strike Price 11.50, Expires 02/01/2026 | | | 6,339 | |

See Notes to Financial Statements. | |

28 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Core Opportunity Fund | Schedule of Investments |

Shares/Description | Value | |

5,250 | | Fortress Value Acquisition Corp. IV, Strike Price 11.50, Expires 03/18/2028 | | $ | 4,252 | |

7,314 | | Ginkgo Bioworks Holdings, Inc., Strike Price 11.50, Expires 12/31/2027 | | | 24,794 | |

8,360 | | Gores Guggenheim, Inc., Strike Price 11.50, Expires 12/31/2027 | | | 17,389 | |

4,425 | | Gores Holdings VII, Inc., Strike Price 11.50, Expires 12/31/2027 | | | 5,221 | |

3,290 | | Jasper Therapeutics, Inc., Strike Price 11.50, Expires 12/01/2026 | | | 4,869 | |

10,113 | | Jaws Mustang Acquisition Corp., Strike Price 11.50, Expires 01/30/2026 | | | 11,630 | |

5,064 | | KKR Acquisition Holdings I Corp., Strike Price 11.50, Expires 12/31/2027 | | | 4,861 | |

4,429 | | Longview Acquisition Corp. II, Strike Price 11.50, Expires 05/10/2026 | | | 5,717 | |

5,376 | | Merida Merger Corp. I, Strike Price 11.50, Expires 11/07/2026 | | | 6,182 | |

4,425 | | Reinvent Technology Partners Y, Strike Price 11.50, Expires 12/31/2028 | | | 6,638 | |

6,540 | | Tishman Speyer Innovation Corp. II, Strike Price 11.50, Expires 12/31/2027 | | | 5,494 | |

| | | | | | | |

TOTAL WARRANTS | | | |

(Cost $148,587) | | 154,383 | |

| | | | |

SHORT-TERM INVESTMENTS - 17.33% | | | |

Money Market Fund - 17.33% | | | |

13,965,438 | | State Street Institutional Trust (7 Day Yield 0.01%) | | | 13,965,438 | |

| | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | |

(Cost $13,965,438) | | 13,965,438 | |

| | | | |

TOTAL INVESTMENTS - 99.62% | | | |

(Cost $76,195,788) | $ | 80,265,949 | |

OTHER ASSETS IN EXCESS OF LIABILITIES - 0.38% | | 306,581 | |

NET ASSETS - 100.00% | $ | 80,572,530 | |

(a) | Non-income producing security. |

(b) | Less than 0.005%. |

See Notes to Financial Statements. | |

Annual Report | September 30, 2021 | 29 |

RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

| September 30, 2021 |

Shares/Description | | Value | |

CLOSED-END FUNDS - 10.93% | | | | |

| 751,527 | | | AllianceBernstein Global High Income Fund, Inc. | | $ | 9,221,236 | |

| 486,456 | | | BlackRock Floating Rate Income Strategies Fund, Inc. | | | 6,499,052 | |

| 1,000,932 | | | Blackstone Strategic Credit Fund | | | 13,862,908 | |

| 1,320,021 | | | BrandywineGLOBAL - Global Income Opportunities Fund, Inc. | | | 16,526,663 | |

| 274,705 | | | Cohen & Steers Tax-Advantaged Preferred Securities & Income Fund | | | 6,873,119 | |

| 1,048,094 | | | First Trust Senior Floating Rate 2022 Target Term Fund | | | 10,103,626 | |

| 1,412,439 | | | Invesco Dynamic Credit Opportunities Fund | | | 16,525,536 | |

| 2,596,003 | | | Invesco Senior Income Trust | | | 11,552,213 | |

| 258,130 | | | Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 2,351,564 | |

| 1,449,660 | | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 8,480,511 | |

| 2,749,690 | | | Nuveen Credit Strategies Income Fund | | | 18,037,966 | |

| 855,996 | | | Nuveen Floating Rate Income Fund | | | 8,619,880 | |

| 965,801 | | | Nuveen Floating Rate Income Opportunity Fund | | | 9,638,694 | |

| 80,898 | | | Nuveen Global High Income Fund | | | 1,299,222 | |

| 534,635 | | | Nuveen High Income November 2021 Target Term Fund | | | 5,014,876 | |

| 1,085,093 | | | Nuveen Senior Income Fund | | | 6,347,794 | |

| 730,650 | | | PGIM Global High Yield Fund, Inc. | | | 11,252,010 | |

| 536,285 | | | PGIM High Yield Bond Fund, Inc. | | | 8,709,269 | |

| 22,678 | | | PGIM Short Duration High Yield Opportunities Fund | | | 425,666 | |

| 331,750 | | | Virtus AllianzGI Diversified Income & Convertible Fund | | | 8,804,645 | |

| 3,277,776 | | | Western Asset High Income Opportunity Fund, Inc. | | | 17,011,658 | |

| 1,908,270 | | | Western Asset Inflation-Linked Opportunities & Income Fund | | | 25,360,908 | |

| | | | | | | | |

TOTAL CLOSED-END FUNDS | | | | |

(Cost $204,278,093) | | | 222,519,016 | |

| | | | | | | | |

BUSINESS DEVELOPMENT COMPANIES - 0.52% | | | | |

| 954,901 | | | Barings BDC, Inc. | | | 10,523,009 | |

| | | | | | | | |

TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | |

(Cost $9,851,354) | | | 10,523,009 | |

| | | | | | | | |

SPECIAL PURPOSE ACQUISITION COMPANIES - 3.96% | | | | |

| 200,000 | | | Apollo Strategic Growth Capital II(a) | | | 1,954,000 | |

| 517,200 | | | Ares Acquisition Corp.(a) | | | 5,037,528 | |

| 860,755 | | | Austerlitz Acquisition Corp. II(a) | | | 8,392,361 | |

| 800,000 | | | CC Neuberger Principal Holdings II, Class A(a) | | | 7,856,000 | |

| 135,000 | | | CC Neuberger Principal Holdings III(a) | | | 1,318,950 | |

| 200,000 | | | Churchill Capital Corp. V(a) | | | 1,956,000 | |

| 300,000 | | | Churchill Capital Corp. VI(a) | | | 2,931,000 | |

| 550,000 | | | Churchill Capital Corp. VII(a) | | | 5,346,000 | |

| 350,000 | | | Compute Health Acquisition Corp.(a) | | | 3,419,500 | |

| 350,000 | | | Conx Corp., Class A(a) | | | 3,430,000 | |

See Notes to Financial Statements. | |

30 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

| September 30, 2021 |

Shares/Description | | Value | |

350,000 | | | Far Peak Acquisition Corp.(a) | | | $ | 3,482,500 | |

12,164 | | | Frontera Energy Corp.(a) | | | | 72,741 | |

50,000 | | | FTAC Hera Acquisition Corp.(a) | | | | 487,000 | |

200,000 | | | Gores Guggenheim, Inc.(a) | | | | 2,044,000 | |

664,046 | | | Jaws Mustang Acquisition Corp.(a) | | | | 6,481,089 | |

361,160 | | | KKR Acquisition Holdings I Corp.(a) | | | | 3,521,310 | |

500,000 | | | Lazard Growth Acquisition Corp. I(a) | | | | 4,865,000 | |

31,580 | | | McDermott International, Ltd.(a) | | | | 12,632 | |

153,882 | | | Pershing Square Tontine Holdings, Ltd.(a) | | | | 3,031,475 | |

275,000 | | | RedBall Acquisition Corp.(a) | | | | 2,706,000 | |

625,000 | | | Social Capital Hedosophia Holdings Corp. VI(a) | | | | 6,343,750 | |

250,000 | | | SVF Investment Corp.(a) | | | | 2,440,000 | |

350,000 | | | Trebia Acquisition Corp.(a) | | | | 3,468,500 | |

| | | | | | | | |

TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES | | | | | |

(Cost $81,604,556) | | | | 80,597,336 | |

| | | | | | | | |

OPEN-END FUNDS - 1.61% | | | | | |

3,435,936 | | | RiverNorth/Oaktree High Income Fund, Class I(b) | | | | 32,734,160 | |

| | | | | | | | |

TOTAL OPEN-END FUNDS | | | | | |

(Cost $32,384,291) | | | | 32,734,160 | |

Shares/Principal Amount/Description | | | Rate | | Maturity | | | Value | |

BUSINESS DEVELOPMENT COMPANY NOTES - 1.15% | | | | | | | | | | | | | |

United States - 1.15% | | | | | | | | | | | | | |

241,858 | | | First Eagle Alternative Capital BDC, Inc. | | | | 6.13 | % | | | 10/30/2023 | | | | 6,080,310 | |

246,313 | | | First Eagle Alternative Capital BDC, Inc. | | | | 5.00 | % | | | 05/25/2026 | | | | 6,219,403 | |

32,069 | | | Oxford Square Capital Corp. | | | | 6.50 | % | | | 03/30/2024 | | | | 809,742 | |

49,593 | | | Oxford Square Capital Corp. | | | | 6.25 | % | | | 04/30/2026 | | | | 1,261,646 | |

$ | 3,000,000 | | | PennantPark Floating Rate Capital, Ltd. | | | | 4.25 | % | | | 04/01/2026 | | | | 3,030,338 | |

233,620 | | | PennantPark Investment Corp. | | | | 5.50 | % | | | 10/15/2024 | | | | 5,917,595 | |

| | | | | | | | | | | | | | | | |

TOTAL BUSINESS DEVELOPMENT COMPANY NOTES | | | | | | | | | | | | | |

(Cost $22,730,914) | | | | | | | | | | | | 23,319,034 | |

Principal Amount/Description | | Rate | Maturity | | | Value | |

FOREIGN CORPORATE BONDS - 4.45% | | | | | | | | | | | | |

Argentina - 0.07% | | | | | | | | | | | | |

$ | 150,000 | | | AES Argentina Generacion SA(c) | | | 7.75 | % | | | 02/02/2024 | | | $ | 133,688 | |

See Notes to Financial Statements. | |

Annual Report | September 30, 2021 | 31 |

RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

| September 30, 2021 |

Principal Amount/Description | | | Rate | | Maturity | | | Value | |

$ | 600,000 | | | Banco Macro SA(c)(d) | | | 6.75% | | | 11/04/2026 | | | $ | 517,734 | |

| 150,000 | | | Pampa Energia SA(e) | | | 9.13% | | | 04/15/2029 | | | | 140,126 | |

| 450,000 | | | Pampa Energia SA(c) | | | 9.13% | | | 04/15/2029 | | | | 420,379 | |

| 575,629 | | | Stoneway Capital Corp.(c)(f) | | | 10.00% | | | 03/01/2027 | | | | 152,547 | |

| | | | | | | | | | | | | | 1,364,474 | |

Australia - 0.29% | | | | | | | | | | | |

| 1,000,000 | | | APT Pipelines, Ltd.(e) | | | 4.25% | | | 07/15/2027 | | | | 1,136,559 | |

| 990,000 | | | Australia & New Zealand Banking Group, Ltd.(d)(e) | | | 5Y US TI + 1.70% | | | 11/25/2035 | | | | 961,796 | |

| 675,000 | | | Commonwealth Bank of Australia(e) | | | 4.32% | | | 01/10/2048 | | | | 798,599 | |

| 680,000 | | | Macquarie Group, Ltd.(d)(e) | | | 3M US L + 1.33% | | | 03/27/2024 | | | | 714,490 | |

| 370,000 | | | Macquarie Group, Ltd.(d)(e) | | | 1D SOFR + 0.91% | | | 09/23/2027 | | | | 368,373 | |

| 475,000 | | | National Australia Bank, Ltd.(e) | | | 2.99% | | | 05/21/2031 | | | | 481,018 | |

| 340,000 | | | NBN Co., Ltd.(e) | | | 1.45% | | | 05/05/2026 | | | | 338,814 | |

| 500,000 | | | Sydney Airport Finance Co. Pty, Ltd.(e) | | | 3.38% | | | 04/30/2025 | | | | 530,790 | |

| 500,000 | | | Sydney Airport Finance Co. Pty, Ltd.(e) | | | 3.63% | | | 04/28/2026 | | | | 537,671 | |

| | | | | | | | | | | | | | 5,868,110 | |

Bermuda - 0.02% | | | | | | | | | | | |

| 300,000 | | | Investment Energy Resources, Ltd.(e) | | | 6.25% | | | 04/26/2029 | | | | 324,375 | |

| | | | | | | | | | | | | | | |

Brazil - 0.09% | | | | | | | | | | | |

| 200,000 | | | Banco do Estado do Rio Grande do Sul SA(d)(e) | | | 5Y US TI + 4.93% | | | 01/28/2031 | | | | 200,284 | |

| 400,000 | | | Nexa Resources SA(c) | | | 5.38% | | | 05/04/2027 | | | | 420,504 | |

| 950,000 | | | Oi SA(g) | | | 10.00% (10.00%) | | | 07/27/2025 | | | | 892,952 | |

| 300,000 | | | Unigel Luxembourg SA(c) | | | 8.75% | | | 10/01/2026 | | | | 322,863 | |

| | | | | | | | | | | | | | 1,836,603 | |

British Virgin Islands - 0.07% | | | | | | | | | | | |

| 1,500,000 | | | TSMC Global, Ltd.(e) | | | 1.25% | | | 04/23/2026 | | | | 1,486,000 | |

| | | | | | | | | | | | | | | |

Canada - 0.43% | | | | | | | | | | | |

| 530,000 | | | Bank of Montreal(d) | | | 3.80% | | | 12/15/2032 | | | | 581,112 | |

| 270,000 | | | CCL Industries, Inc.(e) | | | 3.05% | | | 06/01/2030 | | | | 283,269 | |

| 245,000 | | | CI Financial Corp. | | | 4.10% | | | 06/15/2051 | | | | 263,866 | |

| 220,000 | | | Eldorado Gold Corp.(e) | | | 6.25% | | | 09/01/2029 | | | | 218,338 | |

| 350,000 | | | Enbridge, Inc. | | | 3.40% | | | 08/01/2051 | | | | 353,382 | |

| 850,000 | | | Frontera Energy Corp.(e) | | | 7.88% | | | 06/21/2028 | | | | 825,562 | |

| 225,000 | | | Garda World Security Corp.(e) | | | 6.00% | | | 06/01/2029 | | | | 220,762 | |

| 200,000 | | | GFL Environmental, Inc.(e) | | | 4.00% | | | 08/01/2028 | | | | 198,750 | |

| 600,000 | | | Gran Tierra Energy, Inc.(e) | | | 7.75% | | | 05/23/2027 | | | | 520,884 | |

| 160,000 | | | Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.(e) | | | 5.00% | | | 12/31/2026 | | | | 160,000 | |

See Notes to Financial Statements. | |

32 | (888) 848-7569 | www.rivernorth.com |

RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

| September 30, 2021 |

Principal Amount/Description | | Rate | | Maturity | | | Value | |

$ | 1,430,000 | | | Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.(e) | | | 7.00% | | | 12/31/2027 | | | $ | 1,372,586 | |

| 205,000 | | | Mattamy Group Corp.(e) | | | 4.63% | | | 03/01/2030 | | | | 209,832 | |

| 160,000 | | | MEG Energy Corp.(e) | | | 7.13% | | | 02/01/2027 | | | | 168,192 | |

| 25,000 | | | MEG Energy Corp.(e) | | | 5.88% | | | 02/01/2029 | | | | 25,605 | |

| 745,000 | | | Nutrien, Ltd. | | | 4.20% | | | 04/01/2029 | | | | 849,018 | |

| 185,000 | | | Parkland Corp.(e) | | | 5.88% | | | 07/15/2027 | | | | 196,331 | |

| 155,000 | | | Parkland Corp.(e) | | | 4.50% | | | 10/01/2029 | | | | 157,302 | |

| 420,000 | | | Superior Plus LP / Superior General Partner, Inc.(e) | | | 4.50% | | | 03/15/2029 | | | | 434,175 | |

| 240,000 | | | Telesat Canada / Telesat LLC(e) | | | 5.63% | | | 12/06/2026 | | | | 230,708 | |

| 496,000 | | | Tervita Corp.(e) | | | 11.00% | | | 12/01/2025 | | | | 562,094 | |

| 750,000 | | | TransCanada PipeLines, Ltd. | | | 4.25% | | | 05/15/2028 | | | | 854,430 | |

| | | | | | | | | | | | | | 8,686,198 | |

Cayman Islands - 0.24% | | | | | | | | | | | |

| 200,000 | | | Banco Mercantil del Norte SA/Grand Cayman(d)(e)(h) | | | 7.50% | | | 06/27/2029 | | | | 223,280 | |

| 200,000 | | | Banco Mercantil del Norte SA/Grand Cayman(c)(d)(h) | | | 7.63% | | | 01/10/2028 | | | | 223,325 | |

| 300,000 | | | Banco Mercantil del Norte SA/Grand Cayman(d)(h) | | | 10Y US TI + 5.47% | | | 06/27/2029 | | | | 334,920 | |

| 500,000 | | | CK Hutchison Capital Securities 17, Ltd.(c)(d)(h) | | | 4.00% | | | 05/12/2022 | | | | 507,995 | |

| 166,440 | | | Global Aircraft Leasing Co., Ltd.(e)(g) | | | 6.50% (7.25%) | | | 09/15/2024 | | | | 163,735 | |

| 624,000 | | | Gran Tierra Energy International Holdings, Ltd. | | | 6.25% | | | 02/15/2025 | | | | 540,787 | |

| 590,824 | | | Interoceanica IV Finance, Ltd.(i) | | | 0.00% | | | 11/30/2025 | | | | 553,159 | |

| 400,000 | | | Itau Unibanco Holding SA Island(d)(e)(h) | | | 4.63% | | | 02/27/2025 | | | | 382,912 | |

| 200,000 | | | Itau Unibanco Holding SA Island(c)(d) | | | 5Y US TI + 3.88% | | | 04/15/2031 | | | | 194,155 | |

| 200,000 | | | Itau Unibanco Holding SA Island(c)(d)(h) | | | 5Y US TI + 6.13% | | | 12/12/2022 | | | | 202,017 | |

| 950,000 | | | Itau Unibanco Holding SA Island(c)(d)(h) | | | 5Y US TI + 4.63% | | | 02/27/2025 | | | | 909,416 | |

| 152,069 | | | Lima Metro Line 2 Finance, Ltd.(e) | | | 5.88% | | | 07/05/2034 | | | | 178,184 | |