Prospector Capital Appreciation Fund

Prospector Opportunity Fund

Annual Report

| www.prospectorfunds.com | December 31, 2018 |

January 28, 2019

Dear Shareholders of the Prospector Capital Appreciation Fund and Prospector Opportunity Fund,

What a difference a year can make . . .

A year ago the stock market outlook was rather sanguine, which is not surprising after the S&P 500 posted a strong 21.82% gain for 2017. The consensus was for the record-setting bull market to continue notching gains on the heels of healthy economic growth, strong corporate earnings, a prolongation of the low interest rate environment relative to history, and the continuation of near-pristine credit quality. Looking back, these were “glass half full” conditions. The dramatic price appreciation of Bitcoin and related cryptocurrencies at the end of 2017 accurately reflected the market sentiment at the time.

Fast forward twelve months and conditions are different. The stock market bulls are quiet and a tone of elevated caution has taken hold of the market (not to mention that the Bitcoin bubble has ‘popped’ and sold off 80%). You might recall that in our last communication, we outlined our case for a flattening yield curve going forward and the possibility of an inversion in the not so distant future. In the latter part of 2018, we did see a brief inversion in certain portions of the curve and the 10-year / 2-year treasury rate spread ended the year at a meager 21 basis points (the spread started the year at 54 basis points). In our view the bond market has historically been a more reliable predictor of the future than the stock market. As such, concern about a recession appearing sometime in the next 18 months has increased markedly.

It’s easy to arrive at a more guarded outlook on the market when one considers these factors: the negative impact from tariffs, deteriorating trade relations with China, a possible slowdown in global economic growth, concerns over peak margins, worries over future credit quality, a weakening Chinese economy, the uncertainty surrounding Brexit, a Fed perceived as not dovish enough, and concerns over the health of the housing sector. Yikes! In December 2018, we did briefly breach the 20% sell off threshold in several market benchmarks which most often technically defines a bear market. Revered ex-Fed Chairman Alan Greenspan declared the bull market over and that investors should prepare for the worst (though to our benefit his track record on these predictions is rather poor).

All this said, we are not sounding the recession horn just yet, nor are we necessarily expecting bear market conditions to persist for the full year 2019. Actually, we remain cautiously optimistic on the year ahead (the reasons why are reflected in the ‘Outlook’ section of this letter). However, we strive to position your portfolio in a way to capture upside potential in the market while managing risk through careful security selection should a bear market scenario come to pass. In fact, should we be entering a period of market turmoil, this is a time where we believe the Prospector Partners approach to investing will demonstrate value.

Ten Year anniversary of Financial Crisis: Lessons Learned

On September 15th of 2008, a bit over a decade ago, Lehman Brothers collapsed and failed. This watershed event precipitated the worst of the global financial crisis. One day later, AIG was rescued from a similar fate by a Fed bailout. In short order, the equity markets fell by 40%, credit spreads gapped wider, correlations between risk assets spiked, liquidity dried up, and worry (fear) gripped the minds of the financially aware. It was the most difficult performance year for Prospector in our 21-year history. The tiniest of silver linings was that this traumatic experience generated important go forward lessons for your team at Prospector.

As we crossed the ten-year anniversary, we couldn’t help but notice a couple of parallels between 2008 and 2018, such as the late summer all-time high price levels for the U.S. stock market and a long in the tooth economic cycle.

These parallels, and the subsequent fourth quarter correction, compelled us to revisit and restate some of the critical lessons we learned or relearned in 2008.

Excess leverage can be the root cause of permanent financial loss.

It isn’t only the amount of financial leverage that’s a concern, but the borrowings’ characteristics or terms matter as well. There are no guarantees that debt refinancing will be available at all or on decent terms. For example, long term debentures are far superior to covenant-laden bank loans. At Prospector, we believe our intense focus on balance sheet strength and free cash flow generating businesses can potentially protect us from permanent losses as a result of excess debt.

Never underestimate the value of liquidity.

A liquid investment offers key advantages such as the ability to sell it if a better idea comes to your attention or add to the idea if your timing was early (the averaging down process). Within the portfolio, we strive to maintain good liquidity on each position with a general guideline of owning less than a day’s trading volume. This way we feel comfortable that we can buy or sell a position within a week at 20% of the daily volume. To the extent we own illiquid investments in the future, their weighting in the overall portfolio would certainly be modest.

Always maintain a “margin of safety”.

There are no perfect analyses. “Stuff” happens. No matter how comprehensive and diligent we strive to be as analysts, unforeseen events eventually transpire that lead to uncontemplated outcomes. We strive to anticipate all permutations and leave what we see as a “margin of safety” at the portfolio level by managing position sizes, sector concentrations, currency exposures, etc. We never over bet our hand with respect to a single fundamental driver of performance. A corollary lesson is that new financial products created by Wall Street are often risky and, although back tested plenty, haven’t been stress tested sufficiently. Caveat emptor.

The imperfection of risk versus reward.

Prospector’s favorite all time investments actually combine low risk and high reward. These investments are rarely available, but can abound during the depths of a crisis. Two things are critical at that point. First, you must be able to recognize them for what they are. This is where a disciplined approach around security analysis and valuation such as free cash flow and private market value helps a lot. Second, you must have the dry powder to actually buy them.

In crisis, start buying on the way down.

You often have to start buying on the descent in a crisis because that is where the lion’s share of the volume will trade. Once sentiment changes, there are often very few shares for sale at the same deeply discounted prices where there was abundant supply on the way down.

Keep your cash reserves safe and liquid.

Don’t succumb to temptation during good times and reach for incremental yield with your dry powder cash. The only broad asset category that maintained value and liquidity during the 2008 crisis was U.S. Treasury securities. Plenty of over-trusting folks discovered less than creditworthy sub-prime notes in their money market funds, a couple of which “broke the buck” of a $1 NAV.

Rating agencies and regulators may be unreliable.

Don’t trust them. Governments are the ultimate short-term thinkers, always willing to kick the can down the road. This is driven by reelection cycles. Interestingly, one could make the case that the epicenter of the 2008 crisis, the sub-prime housing market, was created and cultivated by poor government policies imposed over the prior 15 years.

This reminds us that the new financial regulatory framework of Dodd Frank and Basel, crafted in the aftermath of the crisis with the intention of lowering risk in the banking sector, remains largely untested.

There is nothing as expensive as a cheery consensus.

It feels reassuring and comfortable at family gatherings and cocktail parties to own popular positions where most agree that the business is outstanding and the management is superior. However, price is a critical component of risk. It is critical to combat complacency and cycle out of winning positions that have become risky by virtue of their higher valuations. During a crisis, premium valuations could melt away without any company-specific catalyst as the market resets.

Bank Sector Update

In 2018, the market had disdain for financial services stocks in general. While the Opportunity Fund has a heavier weighting towards banks, both Funds were impacted. Within the financial services sector, bank stocks were the weakest sub group by far. S&P 500 banks finished the year down 16.44% while the S&P financials index finished down 13.04%. Additionally, within the Russell 2000, the bank sector fell 15.50% while the overall Russell 2000 Financial group retreated by 10.93%. There were a few key reasons for this and all of which are perceived as potential headwinds for the sector going into 2019.

First off, while rate hikes are traditionally a good thing for banks (and we saw four in 2018), they were certainly not viewed as such last year. Typically, a rate hike allows banks to reprice loans in the short term and lag on deposit rates over the long term, thus capturing a higher net interest margin spread between what it receives on interest from loans versus what it pays out as interest to deposit holders. However, this year, banks experienced a meaningful ramp in deposit costs as both corporate and retail customers demanded higher deposit rates and refused to sit idle and accept a low rate relative to Fed Funds. As a result, banks have ‘given up’ a greater portion of the benefit from higher rates in the form of paying higher deposit rates to customers which has constrained earnings growth. These deposit pricing pressures remain a constant topic of focus with investors.

Additional rate hikes have also put pressure on the yield curve which flattened over the course of the year. In short, this puts more pressure on the net interest margin of banks which is another headwind to earnings. Recall that banks typically borrow on the short end of the curve and loan out at the long end, making a steeper curve preferable. Also, with an inversion realized in parts of the curve in December, some investors viewed this as a canary in a coal mine, i.e. a warning sign that a recession is just around the corner. For banks, a recession squeezes profits as credit quality deteriorates and loans turn sour. If this all seems bad enough, loan growth disappointed investors’ expectations in 2018. Despite some encouraging data that loan growth is rebounding, investors are still concerned that deteriorating U.S.-China trade relations, global political uncertainty, recession fears, and slowing economic growth will temper loan growth expectations.

While the consensus outlook for the bank sector seems dire, we believe these fears are heavily discounted in current bank stock valuations. First off, while deposit costs have accelerated, there is still room for net interest margins to expand further albeit at a more modest pace. Second, even though a few portions of the yield curve have inverted,

this data point alone is not nearly enough evidence to support the argument that a recession is imminent and that credit quality will soon turn adversely. Despite all the talk about a recession, credit quality in the U.S. remains strong and bank management teams enter this period of uncertainty with much more fortified balance sheets than prior to the last downturn a decade ago. Finally, banks still have multiple tailwinds in place in the form of an improved regulatory environment, a strong domestic economic backdrop, the potential for higher capital return, and an improving loan growth outlook per recent Fed data. In our view, the market has essentially priced in much of the downside risk and is largely ignoring the positive tailwinds. As a result, we still see plenty of high-quality opportunities in the sector that also exhibit ‘defensive’ attributes should credit turn and / or deposit costs rip higher. We detail several of these opportunities in the Fund sections below.

New Position – Leidos

Leidos Holdings, Inc. (LDOS) was the largest purchase in both Funds during the second half of the year. Established in 1969, Leidos is the largest pure-play defense-services company with more than $10 billion in revenue. It has strong capability in cyber, cloud migration, IT services for defense and intelligence, healthcare, and logistics. We view the defense services sector as attractive due it its strong cash flow characteristics, and steady, recession-resistant business model. The sector has recovered from several years of decline following the drawdowns in Iraq and Afghanistan. Leidos became the largest peer after acquiring a major asset from Lockheed Martin in 2016.

We find Leidos particularly appealing. First, Leidos has a solid balance sheet with 3.3x net debt / free cash flow, which is similar to its defense services peers. Second, it has the strongest free cash flow yield in the group at 7.1%. Third, as the largest player with the broadest set of skills, we believe Leidos is less likely to conduct risky acquisitions going forward which is important since the industry may further consolidate. Fourth, management proved their operational abilities over the past few years by successfully achieving cash generation per dollar of sales to a peer-leading 10%. Finally, with their leading cost structure, they are in good stead to compete for future business.

The latter part of the year was bumpy for defense, as it was for many sectors. Surprises from Washington were mostly to blame. In October, the President spoke about cutting the defense budget 2% in FY20, only to reverse course in December and sign onto plans for growth in FY20. Later in December came the partial government shutdown. Fortunately, the Department of Defense and some other agencies were fully funded already. Analysts are estimating about 10% of the defense services sector sales are impacted. Nonetheless, the sector has seen shutdowns before and can navigate. This will pass, and lost sales are often recoverable. Ultimately, we believe defense spending is dictated by the threat environment. The threat levels are growing, not shrinking. Despite occasional noise from individual politicians, we believe there is broad bipartisan support for defense. Furthermore, as IT and other needs become more complex, we believe there remains a trend towards more outsourcing by government, which should benefit Leidos.

Prospector Opportunity Fund Highlights

The Prospector Opportunity Fund declined 4.38% for the full year of 2018. This result compared to the 11.01% fall in the Russell 2000 Index and the 9.06% dip in the Russell Midcap Index. Once again, growth stocks outperformed value stocks within the Russell 2000 and the Russell Midcap universes, both for the second half and full year of 2018. Even though we are disappointed to register a loss for the calendar year, we are satisfied to have outperformed meaningfully during the difficult market conditions that we experienced in the later stages of the year.

Healthcare stocks delivered the best sector performance with Merck, Haemonetics, and Medtronic as the standouts. Technology companies were the other significant positive contributors fueled by strong gains at Microsoft, Verisign (which was sold during the second half of the year) and Xilinx. On the flip side, we suffered declines in cyclical groups such as financial stocks, our largest overweight, as well as the energy, material, industrial, and consumer discretionary sectors. Importantly, our stock picks outperformed their index components in four out of these five weak sectors.

As mentioned earlier, banks stocks underperformed during 2018. Given this backdrop, we took advantage of several perceived opportunities in the sector. During the second half of the year, we added to the portfolio’s position in Comerica Incorporated (CMA). Comerica is one of the nation’s most revered commercial banks with $71 billion in assets and with operations in California, Michigan, Texas, Arizona, and Florida. One of the primary reasons why we are attracted to Comerica is due to its high quality deposit base. Fully 52% of Comerica’s deposit base is in the form of noninterest bearing transaction / checking accounts, while only 4% of their deposit base is in the form of high-cost CDs. As a result, Comerica has less deposit pricing pressures than many of its peers as the bank effectively pays nothing on the majority of its deposit base. Another reason why we are drawn to the stock is due to its large tangible common equity capital buffer of 10.1% which is materially above peers. This provides a greater capital cushion against credit losses should we enter a recessionary environment. Should a recession not occur, Comerica can use the excess capital to grow organically and return the capital to shareholders via share repurchases and dividends. Either way, both avenues would help improve upon the bank’s already impressive 16.3% ROE. Finally, we view Comerica as an attractive acquisition candidate given its strong deposit franchise and excess capital base. The best part is that the stock trades at a discount valuation at 1.6x tangible book value, 9x 2019E EPS and at an 8% core deposit premium post the selloff in the bank sector.

We also added to your portfolio’s holdings in PCSB Financial Corporation (PCSB). PCSB Financial (formerly Putnam County Savings Bank) is a community bank with $1.5 billion in assets that operates in the Greater New York City Area. While PCSB Financial has a robust history dating back to 1871, the bank recently went public in April of 2017. We like that they should experience lower deposit pricing pressures. First, the bank has a very low loan / deposit ratio of 79% compared to peers in their market who are often at 100%+. This implies that PCSB Financial has ample runway to fund loan growth going forward. Meanwhile, competitors who are at the upper spectrum on the loan / deposit ratio must rely on higher cost borrowings from the Fed or must raise deposit rates in order to fund loan growth (all options which constrain earnings growth).

Additionally, PCSB Financial also has a very high capital base (19.3% of tangible common equity / tangible assets to be exact), which can be used to fund growth as an alternative to paying up for new deposits. The excess capital base has other added benefits. One is that it provides a greater capital cushion against credit losses should we enter a recessionary environment. Absent that, PCSB Financial can use their excess capital to grow organically and drive EPS growth. Further, the bank can utilize the excess capital for shareholder return in the form of share repurchases – especially if the stock is deemed undervalued or if attractive loan growth opportunities are not available. Finally, we view PCSB Financial as an attractive acquisition candidate given its strong geographic footprint in affluent markets and overfunded balance sheet. The stock trades at an attractive valuation at 125% of tangible book value and a 4% deposit premium.

While the consensus outlook for the bank sector remains bearish going into 2019, we remain confident in our outlook for your bank portfolio given our stock selection process.

Prospector Capital Appreciation Fund Highlights

The Prospector Capital Appreciation Fund declined 3.07% for the full year 2018. This result compared to the S&P 500’s decline of 4.38%. While we are never happy with a down year, when we consider that despite the market’s late-year swoon, growth-oriented stocks continued to significantly outperform in 2018, with the technology sector once again being a market leader, we are satisfied our strategy was borne out.

Despite the negative backdrop of a stock market selloff and widening high yield bond spreads, your convertible security positions had a modest positive benefit during the year. Significant gains in Shutterfly and Chart Industries converts helped here. Looking at sector-specific performance, healthcare names were your portfolio’s top gainers during 2018, with Abbott Labs, Merck and AstraZeneca all significant positive contributors. The Capital Appreciation Fund was also aided by positive contributions from consumer cyclicals (Shutterfly converts being the top gainer here) as well as communications services (specifically, Telephone and Data Systems). The largest decliners during the period were materials and energy-exposed names, as oil’s dramatic selloff hit energy names hard, and top-10 position Domtar faded late in the year, accounting for the bulk of the weakness in materials. The Fund’s largest sector, financial services, saw only modest declines during the year, significantly outperforming the S&P 500 financials, which saw double-digit percentage declines in 2018. Within financials, our insurance holdings aided performance, with Validus, which was acquired at a significant premium early in the year, the top contributor.

Given the market’s aforementioned distaste for banks in 2018, we saw an opportunity to either initiate or add to positions in several lenders during the year. These banks share similar qualities of being over-capitalized, attractively valued and, in our view, are prime acquisition candidates. Included amongst these purchases were: Comerica (detailed in the Opportunity Fund section above), two New Jersey banks (Kearny Financial, and long-time POPFX portfolio holding, Oritani Financial), Georgia-based SunTrust, as well as New York’s Dime Community Bancshares. While your Capital Appreciation portfolio’s overall bank weighting remains relatively modest, we feel we were able to take advantage of the negative environment to increase exposure to lenders that offer the potential for upside in the event of an acquisition.

The largest portfolio movement during the period was the sale of our entire Hartford Financial Services (HIG) position, formerly a top five holding. Despite earning an over twenty percent gain during our holding period, this is a disappointing outcome. You may recall from our June, 2016 letter, we viewed HIG as a collection of solid insurance businesses, selling at an attractive valuation, and also a takeout candidate. Since our purchase, management had been executing well, and the market was beginning to re-rate the stock. However, circumstances changed materially in August when HIG entered into an agreement to purchase fellow property-casualty insurer Navigators Group for $2.1 billion. HIG diluted their book value significantly, and added a substantial amount of leverage by doing the deal – making the stock much less attractive in our view and also creating an effective “poison pill” for potential suitors. While we weren’t happy to immediately liquidate a large position, the material change to our thesis necessitated the sale.

Outlook

After a ten-year post-financial crisis period of consistent underlying conditions for equity investing, fundamentals are shifting. Tightening monetary conditions and slowing economic growth overseas have given U.S. investors pause and led to a rerating of risk assets, e.g. a compression of stock market multiples and spread widening for all types of borrowers. Regardless, the U.S. economy remains fundamentally healthy and continues to be a global leader.

Interest and mortgage rates continue near historically low levels, having retraced by 50 basis points from the November highs as inflation remains benign and economic growth moderated slightly. Although we are clearly late in the economic cycle, the odds of a 2019 recession without a full-blown trade war seem modest.

Investment-grade corporations have solid balance sheets and are currently producing acceptable free cash flows. We are carefully monitoring aggregate corporate debt levels (especially the BBB- debt which is a single notch above junk status), which now sit above pre-2008 crisis levels. The 2018 corporate tax cuts and the ability to repatriate foreign cash holdings should continue to drive higher employment, M&A activity, and capital returns including buybacks and dividends. Profit margins remain near all-time high levels, currently 11%, and look to be at some risk from higher wages, interest expense, and input costs.

In our estimation, equity valuations have moderated from extremely elevated levels. We have moved to the seventh decile from the tenth decile over the past year on trailing operating earnings. As a result, equities look most reasonable when comparing earnings yields to Treasury or even corporate bond yields. In any case, we believe the values inherent in your portfolio should attract acquirers and other investors over time. Meanwhile, we believe equities are a superior asset allocation alternative to bonds over the longer term.

Thank you for entrusting us with your money.

Respectfully submitted,

| John D. Gillespie | Kevin R. O’Brien | Jason A. Kish |

Performance data quoted represents past performance; past performance does not guarantee future results.

Opinions expressed are those of the Funds and are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds invest in smaller and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may hold restricted securities purchased through private placements. Such securities can be difficult to sell without experiencing delays or additional costs. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

The Russell 2000 Index is an unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. You cannot invest directly in an index.

The Russell MidCap Index is an unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. You cannot invest directly in an index.

The Russell 2000 Bank Index is comprised of the smallest banks, savings, thrift and lending companies in the Russell 3000 Index.

The Russell 2000 Financials Index is comprised of the smallest financial services companies in the Russell 3000 Index.The S&P 500 Financials Index is the S&P 500 financials sector GICS level 1 index.

The S&P Bank Index is the S&P 500 banks industry group GICS level 2 index.

Basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Free cash flow is revenue less operating expenses including interest expenses and maintenance capital spending. It is the discretionary cash that a company has after all expenses and is available for purposes such as dividend payments, investing back into the business or share repurchases.

Tangible Book value is the total net asset value of a company’s assets that shareholders would theoretically receive if a company were liquidated less intangible assets and goodwill.

Tangible common equity / tangible assets include common equity less goodwill and other intangible assets over tangible assets. Tangible assets include a company’s total assets less goodwill and other intangible assets.

Fund holdings and/or security allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedule of Investments section in this report for a full listing of the Fund’s holdings.

Prospector Funds, Inc. are distributed by Quasar Distributors, LLC.

Capital Appreciation Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – As of December 31, 2018

| | One Year | Three Year | Five Year | Ten Year | Since Inception(1) |

| Capital Appreciation Fund | -3.07% | 7.38% | 4.69% | 8.85% | 4.87% |

S&P 500 Index(2) | -4.38% | 9.26% | 8.49% | 13.12% | 6.73% |

| (1) | September 28, 2007 |

| (2) | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

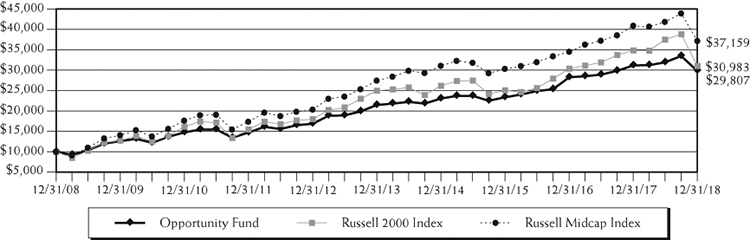

Opportunity Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – As of December 31, 2018

| | One Year | Three Year | Five Year | Ten Year | Since Inception(1) |

| Opportunity Fund | -4.38% | 8.48% | 6.79% | 11.54% | 8.14% |

Russell 2000 Index(2) | -11.01% | 7.36% | 4.41% | 11.97% | 6.05% |

Russell Midcap Index(3) | -9.06% | 7.04% | 6.26% | 14.03% | 6.78% |

| (1) | September 28, 2007 |

| (2) | An unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. This index cannot be invested in directly. |

| (3) | An unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. This index cannot be invested in directly. |

Expense Example (Unaudited)

December 31, 2018

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, wire transfer fees, maintenance fee (IRA accounts), and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2018 – December 31, 2018).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. The example below includes, but is not limited to, management fees, shareholder servicing fees and other Fund expenses. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (07/01/18) | Value (12/31/18) | (07/01/18 to 12/31/18) |

Capital Appreciation Actual(2) | $1,000.00 | $ 954.10 | $6.40 |

| Capital Appreciation Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.65 | 6.61 |

| | | | |

Opportunity Actual(2) | 1,000.00 | 933.80 | 6.34 |

| Opportunity Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.65 | 6.61 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.30% and 1.30% for Capital Appreciation Fund and Opportunity Fund, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2018 of -4.59% and -6.62% for Capital Appreciation Fund and Opportunity Fund, respectively. |

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2018(1)(2)

Capital Appreciation Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2018(1)(3)

Capital Appreciation Fund

| | RenaissanceRe Holdings | 3.5% | |

| | Brown & Brown | 3.4% | |

| | Forestar Group, 3.750%, 03/01/2020 | 3.2% | |

| | Abbott Laboratories | 3.2% | |

| | Verint Systems, 1.500%, 06/01/2021 | 3.1% | |

| | Coca-Cola | 2.7% | |

| | Berkshire Hathaway, Class B | 2.6% | |

| | Chart Industries, 1.000%, 11/15/2024 | 2.5% | |

| | Merck & Co. | 2.5% | |

| | Liberty Media, 2.125%, 03/31/2048 | 2.4% | |

| | (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. | |

| | (2) | Sector allocation includes all investment types. | |

| | (3) | Invesco Treasury Portfolio excluded from top 10 holdings. | |

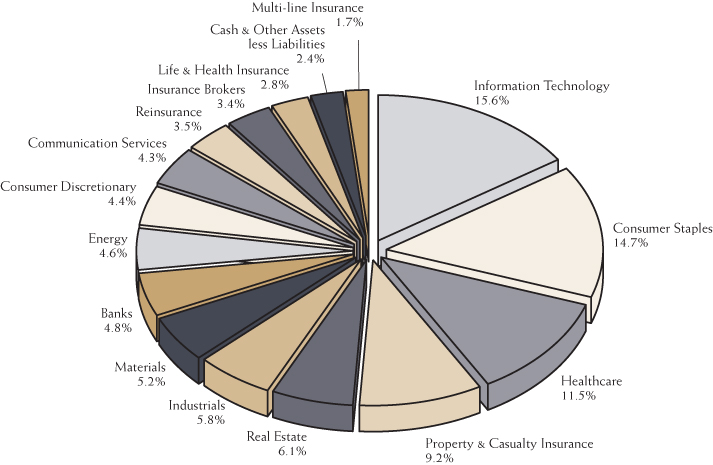

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2018(1)(2)

Opportunity Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2018(1)(3)

Opportunity Fund

| | Brown & Brown | 4.5% | |

| | RenaissanceRe Holdings | 3.7% | |

| | Federated Investors, Class B | 2.9% | |

| | Torchmark | 2.5% | |

| | Mercury General | 2.3% | |

| | Kearny Financial | 2.3% | |

| | White Mountains Insurance Group | 2.2% | |

| | Mondelez International, Class A | 2.1% | |

| | Newmont Mining | 2.1% | |

| | Cincinnati Financial | 2.0% | |

| | (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. | |

| | (2) | Sector allocation includes all investment types. | |

| | (3) | Invesco Treasury Portfolio excluded from top 10 holdings. | |

Schedule of Investments

December 31, 2018

Capital Appreciation Fund

Description | | Shares | | | Value | |

| COMMON STOCKS – 76.6% | | | | | | |

| | | | | | | |

| Banks – 4.8% | | | | | | |

| Comerica | | | 3,700 | | | $ | 254,153 | |

| Dime Community Bancshares | | | 16,600 | | | | 281,868 | |

| Kearny Financial | | | 19,700 | | | | 252,554 | |

| Oritani Financial | | | 12,500 | | | | 184,375 | |

| SunTrust Banks | | | 4,800 | | | | 242,112 | |

| | | | | | | | 1,215,062 | |

| Communication Services – 2.3% | | | | | | | | |

| Telephone & Data Systems | | | 17,875 | | | | 581,652 | |

| | | | | | | | | |

| Consumer Discretionary – 2.0% | | | | | | | | |

| Lowe’s Companies | | | 5,500 | | | | 507,980 | |

| | | | | | | | | |

| Consumer Staples – 13.7% | | | | | | | | |

| Campbell Soup | | | 7,900 | | | | 260,621 | |

| Coca-Cola | | | 14,225 | | | | 673,554 | |

| Colgate-Palmolive | | | 8,400 | | | | 499,968 | |

| Mondelez International, Class A | | | 14,050 | | | | 562,421 | |

| Nestle | | | 7,000 | | | | 568,318 | |

| Tootsie Roll Industries | | | 16,107 | | | | 537,974 | |

| Walgreens Boots Alliance | | | 5,150 | | | | 351,900 | |

| | | | | | | | 3,454,756 | |

| Energy – 4.6% | | | | | | | | |

| Exxon Mobil | | | 2,800 | | | | 190,932 | |

| Hess | | | 12,900 | | | | 522,450 | |

| Suncor Energy | | | 15,600 | | | | 436,332 | |

| | | | | | | | 1,149,714 | |

| Healthcare – 10.1% | | | | | | | | |

| Abbott Laboratories | | | 11,000 | | | | 795,630 | |

| AstraZeneca – ADR | | | 14,000 | | | | 531,720 | |

| Johnson & Johnson | | | 4,575 | | | | 590,404 | |

| Merck & Co. | | | 8,300 | | | | 634,203 | |

| | | | | | | | 2,551,957 | |

| Industrials – 3.3% | | | | | | | | |

| Eaton | | | 8,150 | | | | 559,579 | |

| Regal Beloit | | | 3,700 | | | | 259,185 | |

| | | | | | | | 818,764 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2018

Capital Appreciation Fund

Description | | Shares | | | Value | |

COMMON STOCKS – 76.6% (Continued) | | | | | | |

| | | | | | | |

| Information Technology – 8.9% | | | | | | |

| FARO Technologies * | | | 5,500 | | | $ | 223,520 | |

| FLIR Systems | | | 12,450 | | | | 542,073 | |

| Leidos Holdings | | | 5,500 | | | | 289,960 | |

| Microsoft | | | 5,050 | | | | 512,928 | |

| Oracle | | | 5,700 | | | | 257,355 | |

| Paychex | | | 3,000 | | | | 195,450 | |

| Science Applications International | | | 3,200 | | | | 203,840 | |

| | | | | | | | 2,225,126 | |

| Insurance Brokers – 3.4% | | | | | | | | |

| Brown & Brown | | | 31,400 | | | | 865,384 | |

| | | | | | | | | |

| Life & Health Insurance – 2.8% | | | | | | | | |

| Aflac | | | 10,400 | | | | 473,824 | |

| Voya Financial | | | 5,700 | | | | 228,798 | |

| | | | | | | | 702,622 | |

| Materials – 3.4% | | | | | | | | |

| Domtar | | | 15,251 | | | | 535,768 | |

| Louisiana-Pacific | | | 14,800 | | | | 328,856 | |

| | | | | | | | 864,624 | |

| Multi-line Insurance – 1.7% | | | | | | | | |

| Loews | | | 9,100 | | | | 414,232 | |

| | | | | | | | | |

| Property & Casualty Insurance – 9.2% | | | | | | | | |

| Axis Capital Holdings | | | 8,200 | | | | 423,448 | |

| Berkshire Hathaway, Class B * | | | 3,250 | | | | 663,585 | |

| First American Financial | | | 7,575 | | | | 338,148 | |

| Hanover Insurance Group | | | 2,700 | | | | 315,279 | |

| Lancashire Holdings | | | 34,700 | | | | 267,583 | |

| Mercury General | | | 6,100 | | | | 315,431 | |

| | | | | | | | 2,323,474 | |

| Real Estate – 2.9% | | | | | | | | |

| Four Corners Property Trust | | | 16,948 | | | | 444,038 | |

| Howard Hughes * | | | 2,950 | | | | 287,979 | |

| | | | | | | | 732,017 | |

| Reinsurance – 3.5% | | | | | | | | |

| RenaissanceRe Holdings | | | 6,589 | | | | 880,949 | |

| Total Common Stocks | | | | | | | | |

| (Cost $16,140,505) | | | | | | | 19,288,313 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2018

Capital Appreciation Fund

Description | | Par | | | Value | |

| CONVERTIBLE BONDS – 16.6% | | | | | | |

| | | | | | | |

| Consumer Discretionary – 2.4% | | | | | | |

| Liberty Media | | | | | | |

| 2.125%, 03/31/2048 (a) | | $ | 636,300 | | | $ | 595,017 | |

| | | | | | | | | |

| Industrials – 2.5% | | | | | | | | |

| Chart Industries | | | | | | | | |

| 1.000%, 11/15/2024 (a) | | | 511,000 | | | | 634,713 | |

| | | | | | | | | |

| Information Technology – 6.7% | | | | | | | | |

| Akamai Technologies | | | | | | | | |

| 0.125%, 05/01/2025 (a) | | | 639,000 | | | | 585,995 | |

| Synaptics | | | | | | | | |

| 0.500%, 06/15/2022 | | | 368,500 | | | | 322,917 | |

| Verint Systems | | | | | | | | |

| 1.500%, 06/01/2021 | | | 810,000 | | | | 783,581 | |

| | | | | | | | 1,692,493 | |

| Materials – 1.8% | | | | | | | | |

| RTI International | | | | | | | | |

| 1.625%, 10/15/2019 | | | 460,000 | | | | 457,700 | |

| | | | | | | | | |

| Real Estate – 3.2% | | | | | | | | |

| Forestar Group | | | | | | | | |

| 3.750%, 03/01/2020 | | | 825,000 | | | | 800,537 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $4,276,191) | | | | | | | 4,180,460 | |

| | | | | | | | | |

| CORPORATE BONDS – 4.4% | | | | | | | | |

| | | | | | | | | |

| Communication Services – 2.0% | | | | | | | | |

| Verizon Communications | | | | | | | | |

| 3.500%, 11/01/2021 | | | 500,000 | | | | 505,356 | |

| | | | | | | | | |

| Consumer Staples – 1.0% | | | | | | | | |

| CVS Health | | | | | | | | |

| 2.250%, 08/12/2019 | | | 263,000 | | | | 261,711 | |

| | | | | | | | | |

| Healthcare – 1.4% | | | | | | | | |

| Amgen | | | | | | | | |

| 2.200%, 05/22/2019 | | | 350,000 | | | | 348,649 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $1,117,495) | | | | | | | 1,115,716 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2018

Capital Appreciation Fund

Description | | Shares | | | Value | |

| SHORT-TERM INVESTMENT – 2.4% | | | | | | |

| Invesco Treasury Portfolio, 2.290%^ | | | | | | |

| (Cost $605,737) | | | 605,737 | | | $ | 605,737 | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $22,139,928) | | | | | | | 25,190,226 | |

| Other Assets and Liabilities, Net – (0.0)% | | | | | | | (10,813 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 25,179,413 | |

| * | | Non-income producing security |

| (a) | | Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of December 31, 2018, the value of these investments were $1,815,725 or 7.2% of total net assets. |

| ^ | | The rate shown is the annualized seven-day yield effective as of December 31, 2018. |

ADR – American Depositary Receipt

The industry classifications included in the Schedule of Investments are in accordance with the Global Industry Classification Standard (GICS®). GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

See Notes to the Financial Statements

Schedule of Investments

December 31, 2018

Opportunity Fund

Description | | Shares | | | Value | |

| COMMON STOCKS – 95.4% | | | | | | |

| | | | | | | |

| Banks – 19.1% | | | | | | |

| Bank of N.T. Butterfield & Son | | | 42,000 | | | $ | 1,316,700 | |

| Central Pacific Financial | | | 67,700 | | | | 1,648,495 | |

| Central Valley Community Bancorp | | | 31,200 | | | | 588,744 | |

| Citigroup | | | 13,870 | | | | 722,072 | |

| Comerica | | | 19,100 | | | | 1,311,979 | |

| Dime Community Bancshares | | | 85,700 | | | | 1,455,186 | |

| HomeTrust Bancshares | | | 50,790 | | | | 1,329,682 | |

| Kearny Financial | | | 201,226 | | | | 2,579,717 | |

| KeyCorp | | | 126,600 | | | | 1,871,148 | |

| OceanFirst Financial | | | 30,100 | | | | 677,551 | |

| Oritani Financial | | | 101,850 | | | | 1,502,288 | |

| PCSB Financial | | | 70,800 | | | | 1,384,848 | |

| People’s United Financial | | | 56,925 | | | | 821,428 | |

| PNC Financial Services Group | | | 8,400 | | | | 982,044 | |

| SunTrust Banks | | | 19,300 | | | | 973,492 | |

| Waterstone Financial | | | 78,000 | | | | 1,307,280 | |

| Western New England Bancorp | | | 130,235 | | | | 1,307,559 | |

| | | | | | | | 21,780,213 | |

| Consumer Discretionary – 7.5% | | | | | | | | |

| Darden Restaurants | | | 7,000 | | | | 699,020 | |

| eBay* | | | 54,700 | | | | 1,535,429 | |

| Home Depot | | | 11,900 | | | | 2,044,658 | |

| Hyatt Hotels, Class A | | | 16,600 | | | | 1,122,160 | |

| Noodles & Company* | | | 153,104 | | | | 1,070,197 | |

| Ruth’s Hospitality Group | | | 52,800 | | | | 1,200,144 | |

| William Hill | | | 452,300 | | | | 893,577 | |

| | | | | | | | 8,565,185 | |

| Consumer Staples – 9.7% | | | | | | | | |

| Carlsberg A/S, Class B | | | 6,100 | | | | 648,333 | |

| Church & Dwight | | | 28,400 | | | | 1,867,584 | |

| Colgate-Palmolive | | | 32,000 | | | | 1,904,640 | |

| Mondelez International, Class A | | | 60,800 | | | | 2,433,824 | |

| Nestle | | | 27,400 | | | | 2,224,560 | |

| Tootsie Roll Industries | | | 60,559 | | | | 2,022,670 | |

| | | | | | | | 11,101,611 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2018

Opportunity Fund

Description | | Shares | | | Value | |

COMMON STOCKS – 95.4% (Continued) | | | | | | |

| | | | | | | |

| Diversified Financial Services – 5.4% | | | | | | |

| Federated Investors, Class B | | | 123,500 | | | $ | 3,278,925 | |

| Franklin Resources | | | 38,400 | | | | 1,138,944 | |

| Invesco | | | 48,100 | | | | 805,194 | |

| Jefferies Financial Group | | | 50,500 | | | | 876,680 | |

| | | | | | | | 6,099,743 | |

| Energy – 2.2% | | | | | | | | |

| Hess | | | 35,100 | | | | 1,421,550 | |

| Noble Energy | | | 58,200 | | | | 1,091,832 | |

| | | | | | | | 2,513,382 | |

| Healthcare – 5.2% | | | | | | | | |

| AstraZeneca – ADR | | | 25,400 | | | | 964,692 | |

| Medtronic | | | 14,000 | | | | 1,273,440 | |

| Merck & Co. | | | 30,148 | | | | 2,303,609 | |

| Patterson Companies | | | 73,150 | | | | 1,438,129 | |

| | | | | | | | 5,979,870 | |

| Industrials – 3.8% | | | | | | | | |

| CIRCOR International* | | | 27,300 | | | | 581,490 | |

| Landstar System | | | 13,100 | | | | 1,253,277 | |

| Powell Industries | | | 45,700 | | | | 1,142,957 | |

| Regal Beloit | | | 19,800 | | | | 1,386,990 | |

| | | | | | | | 4,364,714 | |

| Information Technology – 9.2% | | | | | | | | |

| FARO Technologies* | | | 29,600 | | | | 1,202,944 | |

| FLIR Systems | | | 43,100 | | | | 1,876,574 | |

| Leidos Holdings | | | 30,900 | | | | 1,629,048 | |

| Maxim Integrated Products | | | 18,300 | | | | 930,555 | |

| Microsoft | | | 20,800 | | | | 2,112,656 | |

| Paychex | | | 26,000 | | | | 1,693,900 | |

| Xilinx | | | 12,300 | | | | 1,047,591 | |

| | | | | | | | 10,493,268 | |

| Insurance Brokers – 4.5% | | | | | | | | |

| Brown & Brown | | | 187,150 | | | | 5,157,854 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2018

Opportunity Fund

Description | | Shares | | | Value | |

COMMON STOCKS – 95.4% (Continued) | | | | | | |

| | | | | | | |

| Life & Health Insurance – 4.8% | | | | | | |

| Aflac | | | 26,300 | | | $ | 1,198,228 | |

| Primerica | | | 14,900 | | | | 1,455,879 | |

| Torchmark | | | 37,800 | | | | 2,817,234 | |

| | | | | | | | 5,471,341 | |

| Materials – 3.0% | | | | | | | | |

| Domtar | | | 12,300 | | | | 432,099 | |

| Kinross Gold* | | | 97,100 | | | | 314,604 | |

| Newmont Mining | | | 70,200 | | | | 2,432,430 | |

| Victoria Gold* | | | 887,800 | | | | 244,234 | |

| | | | | | | | 3,423,367 | |

| Property & Casualty Insurance – 16.4% | | | | | | | | |

| Axis Capital Holdings | | | 44,700 | | | | 2,308,308 | |

| Cincinnati Financial | | | 29,950 | | | | 2,318,729 | |

| Employers Holdings | | | 48,200 | | | | 2,022,954 | |

| Hanover Insurance Group | | | 17,450 | | | | 2,037,636 | |

| Lancashire Holdings | | | 228,200 | | | | 1,759,725 | |

| Mercury General | | | 51,600 | | | | 2,668,236 | |

| Safety Insurance Group | | | 5,850 | | | | 478,589 | |

| Selective Insurance Group | | | 23,600 | | | | 1,438,184 | |

| United Fire Group | | | 22,700 | | | | 1,258,715 | |

| White Mountains Insurance Group | | | 2,881 | | | | 2,471,005 | |

| | | | | | | | 18,762,081 | |

| Real Estate – 0.9% | | | | | | | | |

| Cousins Properties | | | 130,892 | | | | 1,034,047 | |

| | | | | | | | | |

| Reinsurance – 3.7% | | | | | | | | |

| RenaissanceRe Holdings | | | 31,900 | | | | 4,265,030 | |

| Total Common Stocks | | | | | | | | |

| (Cost $99,138,310) | | | | | | | 109,011,706 | |

| | | | | | | | | |

| | | Par | | | | | |

| CONVERTIBLE BOND – 0.4% | | | | | | | | |

| | | | | | | | | |

| Real Estate – 0.4% | | | | | | | | |

| Forestar Group | | | | | | | | |

| 3.750%, 03/01/2020 | | | | | | | | |

| (Cost $456,370) | | $ | 450,000 | | | | 436,657 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2018

Opportunity Fund

Description | | Shares | | | Value | |

| SHORT-TERM INVESTMENT – 4.8% | | | | | | |

| Invesco Treasury Portfolio, 2.290%^ | | | | | | |

| (Cost $5,496,408) | | | 5,496,408 | | | $ | 5,496,408 | |

| Total Investments – 100.6% | | | | | | | | |

| (Cost $105,091,088) | | | | | | | 114,944,771 | |

| Other Assets and Liabilities, Net – (0.6)% | | | | | | | (693,714 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 114,251,057 | |

| * | Non-income producing security |

| ^ | The rate shown is the annualized seven-day yield effective as of December 31, 2018. |

ADR – American Depositary Receipt

The industry classifications included in the Schedule of Investments are in accordance with the Global Industry Classification Standard (GICS®). GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

See Notes to the Financial Statements

Statements of Assets and Liabilities

December 31, 2018

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| ASSETS: | | | | | | |

| Investments, at market value | | | | | | |

| (Cost of $22,139,928 and $105,091,088, respectively) | | $ | 25,190,226 | | | $ | 114,944,771 | |

| Cash | | | 2,174 | | | | 10,527 | |

| Receivable for dividends and interest | | | 53,036 | | | | 177,386 | |

| Receivable for capital shares sold | | | 22 | | | | 550,947 | |

| Prepaid expenses | | | 9,133 | | | | 18,924 | |

| Total assets | | | 25,254,591 | | | | 115,702,555 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable for capital shares redeemed | | | 75 | | | | 937,779 | |

| Payable for investments purchased | | | — | | | | 330,729 | |

| Payable to Adviser, net | | | 6,620 | | | | 73,611 | |

| Payable for administration fees | | | 8,316 | | | | 22,517 | |

| Payable for audit & tax fees | | | 43,503 | | | | 43,503 | |

| Payable for legal fees | | | 1,509 | | | | 7,407 | |

| Accrued distribution fees | | | 1,424 | | | | 9,706 | |

| Accrued expenses and other liabilities | | | 13,731 | | | | 26,246 | |

| Total liabilities | | | 75,178 | | | | 1,451,498 | |

| | | | | | | | | |

| NET ASSETS | | $ | 25,179,413 | | | $ | 114,251,057 | |

| | | | | | | | | |

| COMPOSITION OF NET ASSETS: | | | | | | | | |

| Portfolio capital | | $ | 22,257,573 | | | $ | 104,132,223 | |

| Total distributable earnings | | | 2,921,840 | | | | 10,118,834 | |

| Total net assets | | $ | 25,179,413 | | | $ | 114,251,057 | |

| | | | | | | | | |

CAPITAL STOCK, $0.0001 par value | | | | | | | | |

| Authorized | | | 500,000,000 | | | | 500,000,000 | |

| Issued and outstanding | | | 1,541,272 | | | | 6,185,946 | |

| | | | | | | | | |

| NET ASSET VALUE, REDEMPTION PRICE, | | | | | | | | |

| AND OFFERING PRICE PER SHARE | | $ | 16.34 | | | $ | 18.47 | |

See Notes to the Financial Statements

Statements of Operations

For the Year Ended December 31, 2018

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| INVESTMENT INCOME: | | | | | | |

| Interest income | | $ | 96,414 | | | $ | 174,112 | |

| Dividend income | | | 440,927 | | | | 2,588,753 | |

| Less: Foreign taxes withheld | | | (4,717 | ) | | | (14,636 | ) |

| Total investment income | | | 532,624 | | | | 2,748,229 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 297,801 | | | | 1,378,443 | |

| Administration fees | | | 53,040 | | | | 136,406 | |

| Audit & tax fees | | | 45,503 | | | | 45,503 | |

| Fund accounting fees | | | 41,515 | | | | 49,197 | |

| Transfer agent fees | | | 24,835 | | | | 48,264 | |

| Registration fees | | | 24,257 | | | | 29,512 | |

| Distribution fees | | | 12,733 | | | | 92,049 | |

| Directors’ fees | | | 11,725 | | | | 50,377 | |

| Legal fees | | | 8,879 | | | | 40,836 | |

| Custodian fees | | | 6,310 | | | | 10,515 | |

| Other expenses | | | 5,702 | | | | 22,222 | |

| Postage and printing fees | | | 1,743 | | | | 12,431 | |

| Total expenses | | | 534,043 | | | | 1,915,755 | |

| Less: Fee waivers | | | (182,097 | ) | | | (286,686 | ) |

| Total net expenses | | | 351,946 | | | | 1,629,069 | |

| NET INVESTMENT INCOME | | | 180,678 | | | | 1,119,160 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | | | | | |

| Net realized gain on investments | | | 794,617 | | | | 7,722,717 | |

| Net change in unrealized | | | | | | | | |

| appreciation/depreciation of investments | | | (1,752,060 | ) | | | (14,581,541 | ) |

| Net loss on investments | | | (957,443 | ) | | | (6,858,824 | ) |

| NET DECREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | (776,765 | ) | | $ | (5,739,664 | ) |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Capital Appreciation Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2018 | | | December 31, 2017 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 180,678 | | | $ | 127,327 | |

| Net realized gain on investments | | | 794,617 | | | | 1,021,358 | |

| Net change in unrealized appreciation/ | | | | | | | | |

| depreciation of investments | | | (1,752,060 | ) | | | 1,682,148 | |

| Net increase (decrease) resulting from operations | | | (776,765 | ) | | | 2,830,833 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 85,822 | | | | 263,509 | |

| Proceeds from reinvestment of distributions | | | 1,050,298 | | | | 1,496,681 | |

| Payments for shares redeemed | | | (848,281 | ) | | | (1,934,889 | ) |

| Redemption fees | | | — | | | | 21 | |

| Net increase (decrease) from capital share transactions | | | 287,839 | | | | (174,678 | ) |

| | | | | | | | | |

| DISTRIBUTIONS PAID TO SHAREHOLDERS | | | (1,096,660 | ) | | | (1,554,398 | )* |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (1,585,586 | ) | | | 1,101,757 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 26,764,999 | | | | 25,663,242 | |

| End of year | | $ | 25,179,413 | | | $ | 26,764,999 | ** |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 4,959 | | | | 15,323 | |

| Shares issued in reinvestment of distributions | | | 64,753 | | | | 84,654 | |

| Shares redeemed | | | (46,542 | ) | | | (109,788 | ) |

| Net increase (decrease) | | | 23,170 | | | | (9,811 | ) |

| * | | Includes income distributions of $131,991 and net realized gain distributions of $1,422,407. |

| ** | | Includes distributions in excess of net investment income of $6,421. |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2018 | | | December 31, 2017 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 1,119,160 | | | $ | 557,560 | |

| Net realized gain on investments | | | 7,722,717 | | | | 5,417,263 | |

| Net change in unrealized appreciation/ | | | | | | | | |

| depreciation of investments | | | (14,581,541 | ) | | | 5,023,381 | |

| Net increase (decrease) resulting from operations | | | (5,739,664 | ) | | | 10,998,204 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 20,253,107 | | | | 12,146,454 | |

| Proceeds from reinvestment of distributions | | | 7,888,798 | | | | 6,917,514 | |

| Payments for shares redeemed | | | (16,227,515 | ) | | | (12,535,701 | ) |

| Redemption fees | | | 4,959 | | | | 1,267 | |

| Net increase from capital share transactions | | | 11,919,349 | | | | 6,529,534 | |

| | | | | | | | | |

| DISTRIBUTIONS PAID TO SHAREHOLDERS | | | (8,537,974 | ) | | | (7,460,824 | )* |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (2,358,289 | ) | | | 10,066,914 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 116,609,346 | | | | 106,542,432 | |

| End of year | | $ | 114,251,057 | | | $ | 116,609,346 | ** |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 958,762 | | | | 586,858 | |

| Shares issued in reinvestment of distributions | | | 430,611 | | | | 329,877 | |

| Shares redeemed | | | (796,796 | ) | | | (605,456 | ) |

| Net increase | | | 592,577 | | | | 311,279 | |

| * | | Includes income distributions of $544,927 and net realized gain distributions of $6,915,897. |

| ** | | Includes distributions in excess of net investment income of $5,623. |

See Notes to the Financial Statements

Financial Highlights

| | | Capital Appreciation Fund | |

| | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the period | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 17.63 | | | $ | 16.80 | | | $ | 14.84 | | | $ | 15.61 | | | $ | 17.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.12 | | | | 0.09 | | | | 0.22 | | | | 0.21 | | | | 0.11 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (0.67 | ) | | | 1.82 | | | | 1.96 | | | | (0.60 | ) | | | 0.63 | |

| Total from operations | | | (0.55 | ) | | | 1.91 | | | | 2.18 | | | | (0.39 | ) | | | 0.74 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.12 | ) | | | (0.09 | ) | | | (0.22 | ) | | | (0.37 | ) | | | (0.27 | ) |

| From net realized gains | | | (0.62 | ) | | | (0.99 | ) | | | — | | | | (0.01 | ) | | | (1.97 | ) |

| Total distributions | | | (0.74 | ) | | | (1.08 | ) | | | (0.22 | ) | | | (0.38 | ) | | | (2.24 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of period | | $ | 16.34 | | | $ | 17.63 | | | $ | 16.80 | | | $ | 14.84 | | | $ | 15.61 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (3.07 | )% | | | 11.38 | % | | | 14.68 | % | | | (2.52 | )% | | | 4.18 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 25,179 | | | $ | 26,765 | | | $ | 25,663 | | | $ | 24,328 | | | $ | 38,398 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.97 | % | | | 2.02 | % | | | 2.06 | % | | | 1.88 | % | | | 1.74 | % |

| After expense reimbursement | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | (0.00 | )% | | | (0.23 | )% | | | 0.58 | % | | | 0.47 | % | | | 0.05 | % |

| After expense reimbursement | | | 0.67 | % | | | 0.49 | % | | | 1.34 | % | | | 1.05 | % | | | 0.49 | % |

| Portfolio turnover rate | | | 28 | % | | | 23 | % | | | 32 | % | | | 35 | % | | | 48 | % |

See Notes to the Financial Statements

Financial Highlights

| | | Opportunity Fund | |

| | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the period | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 20.85 | | | $ | 20.17 | | | $ | 17.29 | | | $ | 20.75 | | | $ | 21.51 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.19 | | | | 0.11 | | | | 0.13 | | | | 0.14 | | | | 0.13 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (1.11 | ) | | | 1.98 | | | | 3.50 | | | | 0.18 | | | | 1.48 | |

| Total from operations | | | (0.92 | ) | | | 2.09 | | | | 3.63 | | | | 0.32 | | | | 1.61 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.19 | ) | | | (0.10 | ) | | | (0.22 | ) | | | (0.17 | ) | | | (0.16 | ) |

| From net realized gains | | | (1.27 | ) | | | (1.31 | ) | | | (0.53 | ) | | | (3.61 | ) | | | (2.21 | ) |

| Total distributions | | | (1.46 | ) | | | (1.41 | ) | | | (0.75 | ) | | | (3.78 | ) | | | (2.37 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of period | | $ | 18.47 | | | $ | 20.85 | | | $ | 20.17 | | | $ | 17.29 | | | $ | 20.75 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (4.38 | )% | | | 10.33 | % | | | 21.02 | % | | | 1.33 | % | | | 7.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 114,251 | | | $ | 116,609 | | | $ | 106,542 | | | $ | 86,128 | | | $ | 91,448 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.53 | % | | | 1.58 | % | | | 1.59 | % | | | 1.61 | % | | | 1.53 | % |

| After expense reimbursement | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 0.66 | % | | | 0.23 | % | | | 0.41 | % | | | 0.28 | % | | | 0.23 | % |

| After expense reimbursement | | | 0.89 | % | | | 0.51 | % | | | 0.70 | % | | | 0.59 | % | | | 0.46 | % |

| Portfolio turnover rate | | | 39 | % | | | 26 | % | | | 42 | % | | | 36 | % | | | 40 | % |

See Notes to the Financial Statements

Notes to the Financial Statements

December 31, 2018

1. ORGANIZATION

Prospector Funds, Inc. (the “Corporation”) was organized as a Maryland corporation on June 6, 2007 and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end diversified management investment company. The Corporation issues its shares in series, each series representing a distinct portfolio with its own investment objectives and policies. There are two series presently authorized, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (individually a “Fund” and collectively the “Funds”). Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Board Codification Topic 946 Financial Services – Investment Companies. The Funds commenced operations on September 28, 2007.

2. FAIR VALUE MEASUREMENT

The following is a summary of significant accounting policies consistently followed by each Fund:

Security Valuation – The Fund has adopted fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, discounts and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Common Stock – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the last bid price on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Convertible and Corporate Bonds – Convertible and corporate bonds, including listed issues, are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Convertible and corporate bonds are generally categorized in Level 2 of the fair value hierarchy.

Notes to the Financial Statements – Continued

December 31, 2018

Investment Companies – Investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Funds’ board of directors. These procedures consider many factors, including the type of security, size of holding, trading volume and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines their net asset values per share.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of December 31, 2018, each Fund’s investments in securities were classified as follows:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Capital Appreciation Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 19,288,313 | | | $ | — | | | $ | — | | | $ | 19,288,313 | |

| Convertible Bonds | | | — | | | | 4,180,460 | | | | — | | | | 4,180,460 | |

| Corporate Bonds | | | — | | | | 1,115,716 | | | | — | | | | 1,115,716 | |

| Short-Term Investment | | | 605,737 | | | | — | | | | — | | | | 605,737 | |

| Total Investments | | $ | 19,894,050 | | | $ | 5,296,176 | | | $ | — | | | $ | 25,190,226 | |

| | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Opportunity Fund | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 109,011,706 | | | $ | — | | | $ | — | | | $ | 109,011,706 | |

| Convertible Bond | | | — | | | | 436,657 | | | | — | | | | 436,657 | |

| Short-Term Investment | | | 5,496,408 | | | | — | | | | — | | | | 5,496,408 | |

| Total Investments | | $ | 114,508,114 | | | $ | 436,657 | | | $ | — | | | $ | 114,944,771 | |

Refer to each Fund’s Schedule of Investments for further sector breakout.

The Funds may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The Funds’ investment objectives allow the Funds to enter into various types of derivative contracts, including, but not limited to, futures contracts, forward foreign exchange contracts, and purchased and written options. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the funds to gains or losses in excess of the amounts shown on the Statements of Assets and Liabilities. As of and for the year ended December 31, 2018, the Funds held no derivative instruments.

3. SIGNIFICANT ACCOUNTING POLICIES

Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. The character of distributions made during the period from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. All short-term capital gains are included in ordinary income for tax purposes.

Notes to the Financial Statements – Continued

December 31, 2018

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds intend to meet the requirements of subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is required. As of December 31, 2018, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Generally, each of the tax years in the four-year period ended December 31, 2018 remains subject to examination by taxing authorities.

Reclassification of Capital Accounts – U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended December 31, 2018, there were no reclassifications made on the Statements of Assets and Liabilities.

Foreign Currency Translation – The books and records relating to the Funds’ non-U.S. dollar denominated investments are maintained in U.S. dollars on the following bases: (1) market value of investment securities, assets, and liabilities are translated at the current rate of exchange; and (2) purchases and sales of investment securities, income, and expenses are translated at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate the portion of gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. The Funds report certain foreign currency-related transactions as components of realized gains for financial reporting purposes, whereas such components are treated as ordinary income for federal income tax purposes.

Illiquid or Restricted Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Fund. Illiquid securities may be valued under methods approved by the Funds’ board of directors as reflecting fair value. Each Fund intends to invest no more than 15% of its total assets in illiquid securities. Certain restricted securities may be considered illiquid. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Funds’ board of directors as reflecting fair value. Certain restricted securities eligible for resale to qualified institutional investors, including Rule 144A securities, are not subject to the limitation on a Fund’s investment in illiquid securities if they are determined to be liquid in accordance with procedures adopted by the Funds’ board of directors. At December 31, 2018, the Funds had no investments in illiquid securities.

Expenses – Expenses directly attributable to a Fund are charged to that Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based on relative net assets or another appropriate basis.

Other – Investment and shareholder transactions are recorded on the trade date. Each Fund determines the gain or loss realized from the investment transactions on the basis of identified cost. Dividend income is recognized on the ex-dividend date. Interest income, including amortization of bond premium and discount, is recognized on an accrual basis.

Notes to the Financial Statements – Continued

December 31, 2018