Prospector Capital Appreciation Fund

Prospector Opportunity Fund

Annual Report

| www.prospectorfunds.com | December 31, 2017 |

January 30, 2018

Dear Shareholders of the Prospector Capital Appreciation Fund and Prospector Opportunity Fund,

We often repeat the mantra “now is the most difficult time to invest” in our communications to you. This feels especially germane today. A significant stock market correction is overdue after nine years of upward markets. We are concerned that the consequences of a correction, should it occur, could be high.

The U.S. economy continues to expand, even accelerating from a below 2% annualized rate a year ago, to an above 3% current growth rate. Economic conditions are healthy globally as well. Interest rates remain close to historically low levels and short rates in particular are gently lifting at a pace that would make Goldilocks proud. Corporate earnings delivered a strong statement in 2017, well above the expectations that were in place when the year began, driven by healthy business conditions and reduced regulation.

All of this manifested itself in a fantastic year for stocks, both in the U.S. and around the world. 2017 was an extraordinary year in the stock market which increased every month for the first time in history, a feat accompanied with record low levels of volatility. Stocks in the U.S., as represented by the S&P 500, rose 21.83% for the full year without once experiencing a 3% correction, another first. Growth stocks outperformed value stocks by a significant amount, regardless of the size of the company. Large growth stocks, as measured by the Russell 1000 Growth Index, rose 30.21%, easily outpacing the Russell 1000 Value Index which posted a 13.64% gain. In addition large capitalization shares handily beat their smaller capitalization brethren with the Russell 1000 Index earning 21.68% as compared to the Russell 2000 Index which gained 14.65%.

The key driver of these strong results was the technology sector which delivered almost 40% of the total return for the S&P 500. By year end 2017, the technology sector represented 24% of the market capitalization of the S&P 500, the third highest sector weighting ever (after the technology sector during 1999-00 internet “bubble” and the energy sector in 1980-81). Other strong sectors included healthcare, which rebounded sharply from dual fears over the repeal of Obamacare and/or price controls, and consumer discretionary, which was propelled by strong performance from Amazon and Netflix.

While we are satisfied with the absolute performance of the Funds, we are somewhat disappointed with the performance relative to broad market indices. Our value orientation and affinity for also investing in smaller and medium sized companies conspired to mute our gains. With the benefit of hindsight, 2017 was not a year to play defense of any sort.

While the environment for equity investing was benign in 2017, there are no shortage of issues to worry about either. China is finding its way through a tough transition from an emerging market, export driven country to a global economic leader with a difficult North Korean neighbor rattling its sabre on the world stage. The UK is attempting to extricate itself from the European Union, which has other issues such as the Catalan independence movement to consider. Iran’s nuclear ambitions continue to loom unabated, adding fuel to the combustible Middle East equation.

Recent Catastrophic Events

The hurricane season of 2017 will likely be remembered for many years, given the significant catastrophic activity experienced. In total, current estimates of insured losses from all catastrophes in 2017 is about $135B, potentially the highest level ever recorded. These losses have validated the risk management models for many companies and the negative impact was well contained in the context of balance sheet positions. Recent years had experienced

relatively light catastrophic loss experience, and at a minimum, this year’s results will be a healthy reminder of the volatility inherent in the business.

There are both cyclical and secular forces at work in the insurance and reinsurance industries. In our view, the huge catastrophe losses will have a demonstrable cyclical impact and a negligible secular impact. Pricing will cyclically improve in catastrophe-prone lines of business such as homeowners, personal auto, commercial property, and business interruption, as well as property reinsurance. Indeed, during the recent January 1st reinsurance renewal period, pricing improved in catastrophe-prone lines of business and will likely improve at the mid-year renewals in a similar manner. Recent industry pricing surveys for U.S. primary commercial lines have illustrated pricing stability and personal lines pricing trends have been favorable for some time; we suspect that higher reinsurance costs will likely further this trend. At the same time, nontraditional capital sources that have entered the industry, mostly through the reinsurance channel, will continue to grow in scope and influence.

This nontraditional capital, which is able to react quickly to industry events, has served to somewhat mute the sharp rate hikes once seen following large industry events. In part due to this dynamic, we had concentrated your portfolios’ reinsurance holdings to a handful of what we believe are the best run companies with solid balance sheets and which were trading well below our estimates of private market value. Examples of companies fitting this description, and which were holdings in both Funds during hurricane season are RenaissanceRe (RNR) and Validus Holdings (VR).

It’s noteworthy that, while we went into storm season comfortable in our reinsurance-exposed holdings, we made some modest tactical changes in both Funds as storms approached or hit – using our industry knowledge to trim names which we felt could be over-exposed to certain catastrophes, and adding to names which were likely to weather the events relatively well (or even be net beneficiaries from the catastrophes). We will go into more specifics in the Highlights sections below.

Subsequent to year end, AIG announced the acquisition of Validus (on the date it was announced, a significant position in both Funds) for $68.00 per share – a 46% premium to the prior day’s close, and significantly above where the stock traded prior to hurricane season. This transaction illustrates the attractive growth opportunities in third-party (reinsurance) capital management (of which VR is an industry leader), as well as the longer-term pressures faced by management teams of traditional reinsurance companies. We also believe this reaffirms our thesis that these portfolio companies trade significantly below private market value.

Prospector Opportunity Fund Highlights

The Prospector Opportunity Fund advanced 10.33% for the year ended December 31, 2017. While this is an acceptable absolute result, it trailed in comparison to the 14.65% increase in the Russell 2000 Index and the 18.52% rise in the Russell Midcap Index. The outstanding returns in the overall stock market were heavily fueled by technology and healthcare stocks. The portfolio underweighting in POPFX to these two sectors hampered our results. Also our value orientation worked against us as growth investing decisively led the market. Our results were broadly in line with other value investors who are active in the small and midcap arena.

Not surprisingly our second half of 2017 portfolio activity was dominated by a repositioning of our insurance holdings in the wake of the heavy catastrophe losses incurred in Texas, Florida, Puerto Rico, and California. Specifically, our two largest purchases during the second half were White Mountains Insurance Group and Cincinnati Financial. White Mountains is a merchant banking operation with expert insurance and reinsurance

operating and acquisition skills plus significant undeployed capital following the 2017 sale of OneBeacon Insurance Group. White Mountains is well poised to opportunistically deploy capital into an improving fundamental insurance pricing market. Also White Mountains sells for an attractive discount to tangible book value valuation. Cincinnati Financial is a solid regional underwriter with a long tradition of conservative reserving whose stock has lagged the growth-oriented stock market the last few years. The improved pricing environment post catastrophe translates into better business conditions for this blue chip company which sells for a reasonable 1.6 times tangible book value.

Another top purchase during the second half was Powell Industries which sells systems that manage the flow of electricity in heavy industry, including oil & gas. Not surprisingly, the profitability of Powell has collapsed with the decline in energy prices since 2015. Powell management has elected to endure the downturn, hold onto their skilled labor force, and await the recovery which is signaled by the 2017 oil price rise. This strategy is enabled by Powell’s pristine balance sheet. Tom Powell, the Chairman and founder is 77, and would have no shortage of bidders should he decide to entertain them. The combination of a fortress balance sheet and a share price that fell from $70 to current levels below $30 make this an attractive investment.

On the sales side, POPFX benefited from merger and acquisition activity. Buffalo Wild Wings was the largest divestiture from the portfolio following a buyout from Arby’s restaurant Group. We owned Buffalo Wild Wings for less than a year and remained attracted to the potential turnaround of this unique franchise. We believe Arby’s has a winner on their hands. Another large divestiture was State National Companies, a growing insurance enterprise bought in a cash transaction at a 38% premium by Markel Insurance.

Prospector Capital Appreciation Fund Highlights

The Prospector Capital Appreciation Fund gained 11.38% for the year ended December 31, 2017. As mentioned above, these results trailed the tech-heavy benchmark S&P 500, but were more in line with value indices. While we are never happy trailing “the market,” we gain comfort when considering your portfolio’s holdings, which we constantly question as to valuation and downside protection offered. This includes our allocation to fixed income and convertible securities – many of which trade near par value, but offer the ability to participate in the upside of their relevant stocks. Significantly, your portfolio’s relative underweight to technology stocks explained the majority of the Fund’s underperformance relative to the S&P 500 during 2017. It should be noted that while the tech sector certainly contains many well-run companies with solid balance sheets, our under exposure has historically stemmed from avoiding companies threatened by short product cycles that could be made obsolete in the blink of an eye (we have a similar aversion to consumer stocks exposed to the latest fashion trends).

A significant portion of portfolio movements during the second half of 2017 could be attributed to the aforementioned trading surrounding the summer’s hurricanes (Harvey, Irma, and Maria). More specifically, as hurricane Irma approached Florida, we sold positions we believed would be more heavily impacted than peers to the (then forecasted) direct hit up the center of the state. The largest such position being Validus – a company we admire, and viewed as a potential takeout target. For this reason, we re-initiated a position in the company following storm season and have benefited from their acquisition by AIG. We also added to positions which would likely benefit either from potentially increasing insurance rates (e.g., insurance broker Brown & Brown), or from real estate demand just outside of Harvey-impacted Houston (e.g., real estate developer Howard Hughes).

The Fund’s convert position was also reduced during the latter part of the year. This was due to our Hologic (HOLX) issue being called by the company as well as the sale of our Electronics for Imaging (EFII) position – small additions of convertibles did not fully offset these deletions. Given still low interest rates, issuances of convertible

securities remains sparse (when debt is so cheap, companies don’t feel the need to add a convertible feature and opt to issue straight debt instead). Add to that the long-running bull market, and the pool of attractive converts continues to dwindle. We do, however, occasionally find the attractive issue, and continue to look for opportunities. Patience is a virtue.

Delving into the convert sales a bit more: As you may recall from our first half 2015 letter, after a successful investment in HOLX’s 2037 convertible, we initiated a position in the 2043 issue given better downside protection while still being able to participate in much of the upside. We felt that new CEO (at the time) Steve MacMillan had effected positive change quickly, and that there could be more upside. While we eked out a small gain in the 2043 issue, it was called by the company before we could achieve the larger gains we believed attainable. We continue to follow the company closely.

The EFII convert was sold under very different circumstances. Electronics for Imaging, a leader in the manufacturing of digital printers (which are in a period of secular growth as they take share from analog printing), saw its stock take a hit of over 40% when it was announced they were conducting an internal review of their accounting policies. EFII has a strong balance sheet and a history of producing solid cash flows; and, while the accounting issue seemed likely to be less severe than the plummeting stock price would suggest, prudency dictated that we sell the convert position (which we purchased slightly above par) at a small loss and follow the story from the sidelines.

Outlook

After a nine year post-financial crisis period of consistent underlying conditions for equity investing, things are slightly shifting. The interest rate and regulatory cycles have reached an inflection point. One thing that hasn’t changed is that the equity market continues to perform better than the underlying economy. The U.S. economy remains in a modest growth mode with signs of improvement. Our economy’s performance remains a global leader, but the margin has shrunk relative to Europe and the rest of the world.

Energy prices are still low, despite their 2017 increase. This stimulates consumer spending and confidence in the long run both here and for non-oil producing countries abroad. In the U.S. we enjoy the competitive advantage of a long-term supply of abundant cheap natural gas. The USD Index fell 10% in 2017, reversing the strong dollar trend and giving a boost to our export competitiveness.

Interest and mortgage rates continue near historically low levels, although they have moved off the lows and look poised to move higher still. Ultimately, higher rates will likely accompany better economic performance and some inflation, both of which are relative positives for equities compared to bonds. Much depends on the path and pace of interest rates’ return to normalcy. The yield curve flattened markedly in recent months, which is usually a precursor to an economic slowdown. Although we are clearly late in the economic cycle, the odds of an imminent recession seem low.

Investment-grade corporations have solid balance sheets and are accumulating excess cash and capital. Importantly, post tax reform they should start to spend more on new capital projects, new employees, and new acquisitions. The corporate tax cuts and the inducement to repatriate foreign cash holdings, of which there is more than $3 trillion, is fueling optimism. High-yield financing remains abundant and relatively inexpensive. Profit margins sit near all-time high levels, currently 10%.

In our estimation equity valuations remain at historically extended levels, in the tenth decile on trailing operating earnings. We feel we are in the later stages of a bull market, although nothing is certain. Equities look most reasonable when comparing earnings yields to Treasury or even corporate bond yields. In any case, the values inherent in your portfolio should attract acquirers and other investors over time. Meanwhile, we believe equities are a superior asset allocation alternative to bonds over the longer term.

Thank you for entrusting us with your money.

Respectfully submitted,

| John D. Gillespie | Kevin R. O’Brien | Jason A. Kish |

Performance data quoted represents past performance; past performance does not guarantee future results.

Opinions expressed are those of the Funds and are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds invest in smaller and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may hold restricted securities purchased through private placements. Such securities can be difficult to sell without experiencing delays or additional costs. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

The Russell 1000 Growth Index is an unmanaged index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in an index.

The Russell 1000 Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

The Russell 1000 Index is an unmanaged index that measures the performance of the highest-ranking 1,000 stocks in the Russell 3000 Index, which represents about 90% of the total market capitalization of that index. You cannot invest directly in an index.

The Russell 2000 Index is an unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. You cannot invest directly in an index.

The Russell MidCap Index is an unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. You cannot invest directly in an index.

Tangible Book value is the total net asset value of a company’s assets that shareholders would theoretically receive if a company were liquidated less intangible assets and goodwill.

The U.S. dollar index is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.’s most significant trading partners.

Fund holdings and/or security allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedule of Investments section in this report for a full listing of the Fund’s holdings.

Prospector Funds, Inc. are distributed by Quasar Distributors, LLC.

Capital Appreciation Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – As of December 31, 2017

| | One Year | Three Year | Five Year | Ten Year | Since Inception(1) |

| Capital Appreciation Fund | 11.38% | 7.58% | 9.09% | 5.86% | 5.67% |

S&P 500 Index(2) | 21.83% | 11.41% | 15.79% | 8.50% | 7.88% |

| (1) | September 28, 2007 |

| (2) | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

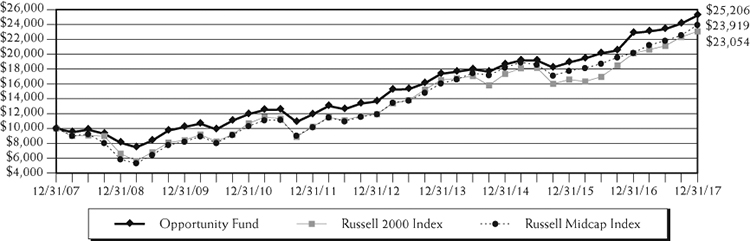

Opportunity Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – As of December 31, 2017

| | One Year | Three Year | Five Year | Ten Year | Since Inception(1) |

| Opportunity Fund | 10.33% | 10.60% | 13.07% | 9.69% | 9.44% |

Russell 2000 Index(2) | 14.65% | 9.96% | 14.12% | 8.71% | 7.88% |

Russell Midcap Index(3) | 18.52% | 9.58% | 14.96% | 9.11% | 8.46% |

| (1) | September 28, 2007 |

| (2) | An unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. This index cannot be invested in directly. |

| (3) | An unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. This index cannot be invested in directly. |

Expense Example

December 31, 2017

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, wire transfer fees, maintenance fee (IRA accounts), and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2017 – December 31, 2017).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. The example below includes, but is not limited to, management fees, shareholder servicing fees and other Fund expenses. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (07/01/2017) | Value (12/31/2017) | (07/01/2017 to 12/31/2017) |

Capital Appreciation Actual(2) | $1,000.00 | $1,070.40 | $6.78 |

| Capital Appreciation Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.65 | 6.61 |

| | | | |

Opportunity Actual(2) | 1,000.00 | 1,078.70 | 6.81 |

| Opportunity Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.65 | 6.61 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.30% and 1.30% for Capital Appreciation Fund and Opportunity Fund, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2017 of 7.04% and 7.87% for Capital Appreciation Fund and Opportunity Fund, respectively. |

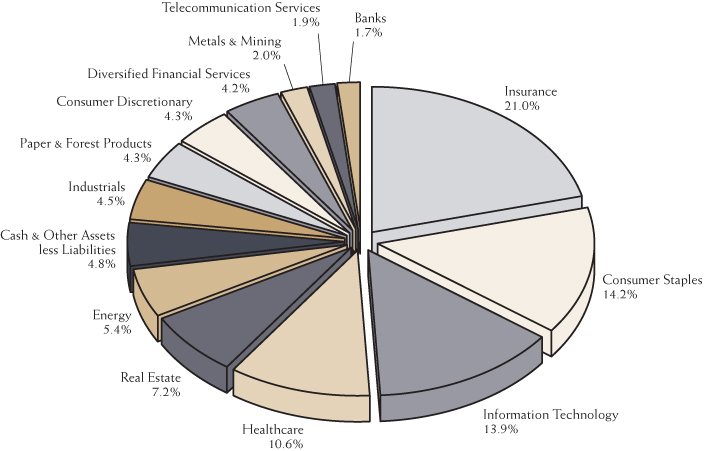

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2017(1)(2)

Capital Appreciation Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2017(1)(3)

Capital Appreciation Fund

| Hartford Financial Services Group | 3.3% |

| Forestar Group, 3.750%, 03/01/2020 | 3.1% |

| Brown & Brown | 3.0% |

| Verint Systems, 1.500%, 06/01/2021 | 2.9% |

| Domtar | 2.8% |

| Abbott Laboratories | 2.7% |

| FLIR Systems | 2.6% |

| Coca-Cola | 2.6% |

| Johnson & Johnson | 2.5% |

| Berkshire Hathaway, Class B | 2.4% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Sector allocation includes all investment types. |

| (3) | Invesco Treasury Portfolio excluded from top 10 holdings. |

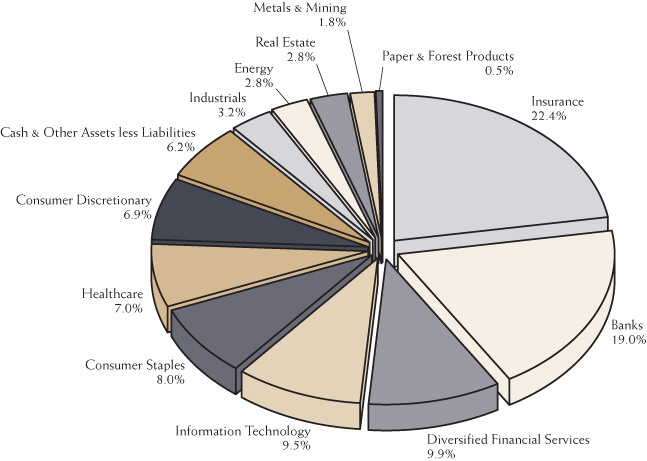

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2017(1)(2)

Opportunity Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2017(1)(3)

Opportunity Fund

| Brown & Brown | 3.9% |

| Federated Investors, Class B | 2.9% |

| Torchmark | 2.8% |

| T. Rowe Price Group | 2.8% |

| HomeTrust Bancshares | 2.4% |

| Validus Holdings | 2.3% |

| Del Frisco’s Restaurant Group | 2.1% |

| RenaissanceRe Holdings | 2.0% |

| FLIR Systems | 2.0% |

| Microsoft | 2.0% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Sector allocation includes all investment types. |

| (3) | Invesco Treasury Portfolio excluded from top 10 holdings. |

Schedule of Investments

December 31, 2017

Capital Appreciation Fund

Description | | Shares | | | Value | |

| COMMON STOCKS – 77.1% | | | | | | |

| | | | | | | |

| Banks – 1.7% | | | | | | |

| Associated Banc-Corp | | | 6,500 | | | $ | 165,100 | |

| Comerica | | | 1,900 | | | | 164,939 | |

| Opus Bank* | | | 4,900 | | | | 133,770 | �� |

| | | | | | | | 463,809 | |

| Consumer Discretionary – 2.3% | | | | | | | | |

| Lowe’s Companies | | | 6,600 | | | | 613,404 | |

| | | | | | | | | |

| Consumer Staples – 13.2% | | | | | | | | |

| Campbell Soup | | | 4,100 | | | | 197,251 | |

| Coca-Cola | | | 15,125 | | | | 693,935 | |

| Colgate-Palmolive | | | 7,900 | | | | 596,055 | |

| Mondelez International, Class A | | | 13,250 | | | | 567,100 | |

| Nestle | | | 6,300 | | | | 541,783 | |

| Tootsie Roll Industries | | | 15,638 | | | | 569,223 | |

| Walgreens Boots Alliance | | | 5,150 | | | | 373,993 | |

| | | | | | | | 3,539,340 | |

| Diversified Financial Services – 4.2% | | | | | | | | |

| Invesco | | | 7,800 | | | | 285,012 | |

| Leucadia National | | | 10,300 | | | | 272,847 | |

| T. Rowe Price Group | | | 5,300 | | | | 556,129 | |

| | | | | | | | 1,113,988 | |

| Energy – 5.4% | | | | | | | | |

| Hess | | | 10,200 | | | | 484,194 | |

| Noble Energy | | | 18,063 | | | | 526,356 | |

| Suncor Energy | | | 11,800 | | | | 433,296 | |

| | | | | | | | 1,443,846 | |

| Healthcare – 9.3% | | | | | | | | |

| Abbott Laboratories | | | 12,600 | | | | 719,082 | |

| AstraZeneca – ADR | | | 14,000 | | | | 485,800 | |

| GlaxoSmithKline – ADR | | | 5,650 | | | | 200,405 | |

| Johnson & Johnson | | | 4,725 | | | | 660,177 | |

| Merck & Co. | | | 7,600 | | | | 427,652 | |

| | | | | | | | 2,493,116 | |

| Industrials – 2.2% | | | | | | | | |

| Eaton | | | 7,450 | | | | 588,624 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2017

Capital Appreciation Fund

Description | | Shares | | | Value | |

COMMON STOCKS – 77.1% (Continued) | | | | | | |

| | | | | | | |

| Information Technology – 7.5% | | | | | | |

| FARO Technologies* | | | 6,400 | | | $ | 300,800 | |

| FLIR Systems | | | 14,950 | | | | 696,969 | |

| Microsoft | | | 6,700 | | | | 573,118 | |

| Paychex | | | 3,000 | | | | 204,240 | |

| Science Applications International | | | 3,200 | | | | 245,024 | |

| | | | | | | | 2,020,151 | |

| Insurance – 21.0% | | | | | | | | |

| Aflac | | | 4,600 | | | | 403,788 | |

| Arch Capital Group* | | | 2,950 | | | | 267,772 | |

| Berkshire Hathaway, Class B* | | | 3,250 | | | | 644,215 | |

| Brown & Brown | | | 15,700 | | | | 807,922 | |

| Cincinnati Financial | | | 3,200 | | | | 239,904 | |

| First American Financial | | | 9,775 | | | | 547,791 | |

| Hanover Insurance Group | | | 2,000 | | | | 216,160 | |

| Hartford Financial Services Group | | | 15,800 | | | | 889,224 | |

| Loews | | | 9,100 | | | | 455,273 | |

| RenaissanceRe Holdings | | | 4,214 | | | | 529,236 | |

| Selective Insurance Group | | | 6,500 | | | | 381,550 | |

| Validus Holdings | | | 5,100 | | | | 239,292 | |

| | | | | | | | 5,622,127 | |

| Paper & Forest Products – 4.3% | | | | | | | | |

| Domtar | | | 15,251 | | | | 755,229 | |

| Louisiana-Pacific* | | | 14,800 | | | | 388,648 | |

| | | | | | | | 1,143,877 | |

| Real Estate – 4.1% | | | | | | | | |

| Camden Property Trust | | | 1,400 | | | | 128,884 | |

| EastGroup Properties, Inc. | | | 1,400 | | | | 123,732 | |

| Four Corners Property Trust | | | 20,248 | | | | 520,374 | |

| Howard Hughes* | | | 2,500 | | | | 328,175 | |

| | | | | | | | 1,101,165 | |

| Telecommunication Services – 1.9% | | | | | | | | |

| Telephone & Data Systems | | | 17,875 | | | | 496,925 | |

| Total Common Stocks | | | | | | | | |

| (Cost $15,861,991) | | | | | | | 20,640,372 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2017

Capital Appreciation Fund

Description | | Par | | | Value | |

| CONVERTIBLE BONDS – 15.8% | | | | | | |

| | | | | | | |

| Consumer Discretionary – 2.0% | | | | | | |

| Shutterfly | | | | | | |

| 0.250%, 05/15/2018 | | $ | 523,000 | | | $ | 520,385 | |

| | | | | | | | | |

| Industrials – 2.3% | | | | | | | | |

| Chart Industries | | | | | | | | |

| 2.000%, 08/01/2018 | | | 625,000 | | | | 623,438 | |

| | | | | | | | | |

| Information Technology – 6.4% | | | | | | | | |

| Akamai Technologies | | | | | | | | |

| 0.000%, 02/15/2019 | | | 580,000 | | | | 583,625 | |

| Synaptics | | | | | | | | |

| 0.500%, 06/15/2022 | | | 368,500 | | | | 339,941 | |

| Verint Systems | | | | | | | | |

| 1.500%, 06/01/2021 | | | 810,000 | | | | 786,713 | |

| | | | | | | | 1,710,279 | |

| Metals & Mining – 2.0% | | | | | | | | |

| RTI International | | | | | | | | |

| 1.625%, 10/15/2019 | | | 460,000 | | | | 524,975 | |

| | | | | | | | | |

| Real Estate – 3.1% | | | | | | | | |

| Forestar Group | | | | | | | | |

| 3.750%, 03/01/2020 | | | 825,000 | | | | 832,734 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $4,185,312) | | | | | | | 4,211,811 | |

| | | | | | | | | |

| CORPORATE BONDS – 2.3% | | | | | | | | |

| | | | | | | | | |

| Consumer Staples – 1.0% | | | | | | | | |

| CVS Health | | | | | | | | |

| 2.250%, 08/12/2019 | | | 263,000 | | | | 262,205 | |

| | | | | | | | | |

| Healthcare – 1.3% | | | | | | | | |

| Amgen | | | | | | | | |

| 2.200%, 05/22/2019 | | | 350,000 | | | | 350,071 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $614,903) | | | | | | | 612,276 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2017

Capital Appreciation Fund

Description | | Shares | | | Value | |

| SHORT-TERM INVESTMENT – 4.9% | | | | | | |

| Invesco Treasury Portfolio, 1.170%^ | | | | | | |

| (Cost $1,320,999) | | | 1,320,999 | | | $ | 1,320,999 | |

| Total Investments – 100.1% | | | | | | | | |

| (Cost $21,983,205) | | | | | | | 26,785,458 | |

| Other Assets and Liabilities, Net – (0.1)% | | | | | | | (20,459 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 26,764,999 | |

| * | Non-income producing security |

ADR – American Depositary Receipt

| ^ | The rate shown is the annualized seven-day yield effective as of December 31, 2017. |

See Notes to the Financial Statements

Schedule of Investments

December 31, 2017

Opportunity Fund

Description | | Shares | | | Value | |

| COMMON STOCKS – 93.4% | | | | | | |

| | | | | | | |

| Banks – 19.0% | | | | | | |

| Associated Banc-Corp | | | 29,400 | | | $ | 746,760 | |

| Bank of N.T. Butterfield & Son | | | 46,300 | | | | 1,680,227 | |

| Beneficial Bancorp | | | 94,500 | | | | 1,554,525 | |

| Blue Hills Bancorp | | | 42,500 | | | | 854,250 | |

| BSB Bancorp* | | | 10,680 | | | | 312,390 | |

| Central Pacific Financial | | | 47,800 | | | | 1,425,874 | |

| Citigroup | | | 15,970 | | | | 1,188,328 | |

| Clifton Bancorp | | | 13,372 | | | | 228,661 | |

| Comerica | | | 7,100 | | | | 616,351 | |

| First Connecticut Bancorp | | | 34,700 | | | | 907,405 | |

| HomeTrust Bancshares* | | | 106,600 | | | | 2,744,951 | |

| KeyCorp | | | 109,600 | | | | 2,210,632 | |

| OceanFirst Financial | | | 44,100 | | | | 1,157,625 | |

| Opus Bank* | | | 21,600 | | | | 589,680 | |

| Oritani Financial | | | 40,450 | | | | 663,380 | |

| PCSB Financial* | | | 67,300 | | | | 1,282,065 | |

| SI Financial Group | | | 51,200 | | | | 752,640 | |

| Waterstone Financial | | | 100,100 | | | | 1,706,705 | |

| Western New England Bancorp | | | 144,735 | | | | 1,577,611 | |

| | | | | | | | 22,200,060 | |

| Consumer Discretionary – 6.9% | | | | | | | | |

| Del Frisco’s Restaurant Group* | | | 157,700 | | | | 2,404,925 | |

| Habit Restaurants* | | | 82,100 | | | | 784,055 | |

| Home Depot | | | 11,900 | | | | 2,255,407 | |

| Hyatt Hotels, Class A* | | | 16,600 | | | | 1,220,764 | |

| Noodles & Company* | | | 103,763 | | | | 544,756 | |

| Ruth’s Hospitality Group | | | 38,800 | | | | 840,020 | |

| | | | | | | | 8,049,927 | |

| Consumer Staples – 8.0% | | | | | | | | |

| Church & Dwight | | | 37,000 | | | | 1,856,290 | |

| Coca-Cola | | | 25,300 | | | | 1,160,764 | |

| Colgate-Palmolive | | | 15,200 | | | | 1,146,840 | |

| Mondelez International, Class A | | | 36,400 | | | | 1,557,920 | |

| Nestle | | | 24,200 | | | | 2,081,133 | |

| Tootsie Roll Industries | | | 41,439 | | | | 1,508,380 | |

| | | | | | | | 9,311,327 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2017

Opportunity Fund

Description | | Shares | | | Value | |

COMMON STOCKS – 93.4% (Continued) | | | | | | |

| | | | | | | |

| Diversified Financial Services – 9.9% | | | | | | |

| Federated Investors, Class B | | | 94,600 | | | $ | 3,413,168 | |

| Franklin Resources | | | 40,900 | | | | 1,772,197 | |

| Invesco | | | 48,100 | | | | 1,757,574 | |

| Leucadia National | | | 50,500 | | | | 1,337,745 | |

| T. Rowe Price Group | | | 30,700 | | | | 3,221,351 | |

| | | | | | | | 11,502,035 | |

| Energy – 2.8% | | | | | | | | |

| Hess | | | 35,100 | | | | 1,666,197 | |

| Noble Energy | | | 53,600 | | | | 1,561,904 | |

| | | | | | | | 3,228,101 | |

| Healthcare – 7.0% | | | | | | | | |

| AstraZeneca – ADR | | | 25,400 | | | | 881,380 | |

| GlaxoSmithKline – ADR | | | 24,500 | | | | 869,015 | |

| Haemonetics* | | | 18,600 | | | | 1,080,288 | |

| Invacare | | | 37,500 | | | | 631,875 | |

| Medtronic | | | 12,700 | | | | 1,025,525 | |

| Merck & Co. | | | 30,148 | | | | 1,696,428 | |

| Patterson Companies | | | 55,900 | | | | 2,019,667 | |

| | | | | | | | 8,204,178 | |

| Industrials – 3.2% | | | | | | | | |

| CIRCOR International | | | 22,400 | | | | 1,090,432 | |

| Landstar System | | | 13,100 | | | | 1,363,710 | |

| Powell Industries | | | 45,700 | | | | 1,309,305 | |

| | | | | | | | 3,763,447 | |

| Information Technology – 9.5% | | | | | | | | |

| FARO Technologies* | | | 24,400 | | | | 1,146,800 | |

| FLIR Systems | | | 49,800 | | | | 2,321,676 | |

| Maxim Integrated Products | | | 20,300 | | | | 1,061,284 | |

| Microsoft | | | 26,600 | | | | 2,275,364 | |

| Paychex | | | 26,000 | | | | 1,770,080 | |

| Synopsys* | | | 6,700 | | | | 571,108 | |

| VeriSign* | | | 9,900 | | | | 1,132,956 | |

| Xilinx | | | 12,300 | | | | 829,266 | |

| | | | | | | | 11,108,534 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2017

Opportunity Fund

Description | | Shares | | | Value | |

COMMON STOCKS – 93.4% (Continued) | | | | | | |

| | | | | | | |

| Insurance – 22.4% | | | | | | |

| Arch Capital Group* | | | 6,500 | | | $ | 590,005 | |

| Brown & Brown | | | 87,300 | | | | 4,492,458 | |

| Cincinnati Financial | | | 23,700 | | | | 1,776,789 | |

| Hanover Insurance Group | | | 20,000 | | | | 2,161,600 | |

| Hartford Financial Services Group | | | 25,500 | | | | 1,435,140 | |

| Hiscox | | | 84,715 | | | | 1,674,490 | |

| Primerica | | | 14,900 | | | | 1,513,095 | |

| RenaissanceRe Holdings | | | 18,500 | | | | 2,323,415 | |

| Safety Insurance Group | | | 7,400 | | | | 594,960 | |

| Selective Insurance Group | | | 23,600 | | | | 1,385,320 | |

| Torchmark | | | 35,600 | | | | 3,229,276 | |

| Validus Holdings | | | 57,000 | | | | 2,674,440 | |

| White Mountains Insurance Group | | | 2,640 | | | | 2,247,379 | |

| | | | | | | | 26,098,367 | |

| Metals & Mining – 1.8% | | | | | | | | |

| Kinross Gold* | | | 79,800 | | | | 344,736 | |

| Newmont Mining | | | 44,900 | | | | 1,684,648 | |

| Victoria Gold* | | | 96,500 | | | | 33,601 | |

| | | | | | | | 2,062,985 | |

| Paper & Forest Products – 0.5% | | | | | | | | |

| Domtar | | | 12,300 | | | | 609,096 | |

| | | | | | | | | |

| Real Estate – 2.4% | | | | | | | | |

| Camden Property Trust | | | 6,000 | | | | 552,360 | |

| Cousins Properties | | | 130,892 | | | | 1,210,751 | |

| Easterly Government Properties | | | 200 | | | | 4,268 | |

| EastGroup Properties | | | 6,100 | | | | 539,118 | |

| Four Corners Property Trust | | | 18,547 | | | | 476,658 | |

| | | | | | | | 2,783,155 | |

| Total Common Stocks | | | | | | | | |

| (Cost 84,479,258) | | | | | | | 108,921,212 | |

| | | | | | | | | |

| | | Par | | | | | |

| CONVERTIBLE BOND – 0.4% | | | | | | | | |

| | | | | | | | | |

| Real Estate – 0.4% | | | | | | | | |

| Forestar Group | | | | | | | | |

| 3.750%, 03/01/2020 | | | | | | | | |

| (Cost $461,757) | | $ | 450,000 | | | | 454,219 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2017

Opportunity Fund

Description | | Shares | | | Value | |

| SHORT-TERM INVESTMENT – 6.3% | | | | | | |

| Invesco Treasury Portfolio, 1.170%^ | | | | | | |

| (Cost $7,291,396) | | | 7,291,396 | | | $ | 7,291,396 | |

| Total Investments – 100.1% | | | | | | | | |

| (Cost $92,232,411) | | | | | | | 116,666,827 | |

| Other Assets and Liabilities, Net – (0.1)% | | | | | | | (57,481 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 116,609,346 | |

| * | Non-income producing security |

ADR – American Depositary Receipt

| ^ | The rate shown is the annualized seven-day yield effective as of December 31, 2017. |

See Notes to the Financial Statements

Statements of Assets and Liabilities

December 31, 2017

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| ASSETS: | | | | | | |

| Investments, at market value | | | | | | |

| (Cost of $21,983,205 and $92,232,411, respectively) | | $ | 26,785,458 | | | $ | 116,666,827 | |

| Receivable for dividends and interest | | | 62,224 | | | | 131,217 | |

| Receivable for capital shares sold | | | 4 | | | | 1,535,854 | |

| Prepaid expenses | | | 9,187 | | | | 18,313 | |

| Total assets | | | 26,856,873 | | | | 118,352,211 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable for capital shares redeemed | | | 11,746 | | | | 1,538,313 | |

| Payable to adviser, net | | | 8,583 | | | | 80,424 | |

| Accrued distribution fees | | | 1,948 | | | | 10,283 | |

| Accrued expenses and other liabilities | | | 69,597 | | | | 113,845 | |

| Total liabilities | | | 91,874 | | | | 1,742,865 | |

| | | | | | | | | |

| NET ASSETS | | $ | 26,764,999 | | | $ | 116,609,346 | |

| | | | | | | | | |

| COMPOSITION OF NET ASSETS: | | | | | | | | |

| Portfolio capital | | $ | 21,969,734 | | | $ | 92,212,874 | |

| Distributions in excess of net investment income | | | (6,421 | ) | | | (5,623 | ) |

| Accumulated net realized loss on investments | | | (638 | ) | | | (30,923 | ) |

| Net unrealized appreciation of investments | | | 4,802,324 | | | | 24,433,018 | |

| Total net assets | | $ | 26,764,999 | | | $ | 116,609,346 | |

| | | | | | | | | |

CAPITAL STOCK, $0.0001 par value | | | | | | | | |

| Authorized | | | 500,000,000 | | | | 500,000,000 | |

| Issued and outstanding | | | 1,518,102 | | | | 5,593,369 | |

| | | | | | | | | |

| NET ASSET VALUE, REDEMPTION PRICE, | | | | | | | | |

| AND OFFERING PRICE PER SHARE | | $ | 17.63 | | | $ | 20.85 | |

See Notes to the Financial Statements

Statements of Operations

For the Year Ended December 31, 2017

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| INVESTMENT INCOME: | | | | | | |

| Interest income | | $ | 74,731 | | | $ | 82,552 | |

| Dividend income | | | 396,496 | | | | 1,913,031 | |

| Less: Foreign taxes withheld | | | (4,019 | ) | | | (6,978 | ) |

| Total investment income | | | 467,208 | | | | 1,988,605 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 287,592 | | | | 1,210,884 | |

| Administration fees | | | 53,819 | | | | 118,151 | |

| Audit & tax fees | | | 41,846 | | | | 41,846 | |

| Fund accounting fees | | | 40,225 | | | | 43,313 | |

| Registration fees | | | 24,770 | | | | 26,269 | |

| Transfer agent fees | | | 24,726 | | | | 44,621 | |

| Legal fees | | | 14,049 | | | | 60,322 | |

| Distribution fees | | | 13,172 | | | | 92,322 | |

| Directors’ fees | | | 12,006 | | | | 50,262 | |

| Other expenses | | | 6,034 | | | | 22,370 | |

| Custodian fees | | | 5,838 | | | | 8,774 | |

| Postage and printing fees | | | 2,762 | | | | 14,693 | |

| Total expenses | | | 526,839 | | | | 1,733,827 | |

| Less: Fee waivers | | | (186,958 | ) | | | (302,782 | ) |

| Total net expenses | | | 339,881 | | | | 1,431,045 | |

| NET INVESTMENT INCOME | | | 127,327 | | | | 557,560 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS: | | | | | | | | |

| Net realized gain on investments | | | 1,021,358 | | | | 5,417,263 | |

| Net change in unrealized appreciation of investments | | | 1,682,148 | | | | 5,023,381 | |

| Net gain on investments | | | 2,703,506 | | | | 10,440,644 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 2,830,833 | | | $ | 10,998,204 | |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Capital Appreciation Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2017 | | | December 31, 2016 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 127,327 | | | $ | 324,293 | |

| Net realized gain on investments | | | 1,021,358 | | | | 631,615 | |

| Net change in unrealized appreciation of investments | | | 1,682,148 | | | | 2,350,669 | |

| Net increase resulting from operations | | | 2,830,833 | | | | 3,306,577 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 263,509 | | | | 62,641 | |

| Proceeds from reinvestment of distributions | | | 1,496,681 | | | | 322,596 | |

| Payments for shares redeemed | | | (1,934,889 | ) | | | (2,025,395 | ) |

| Redemption fees | | | 21 | | | | 91 | |

| Net decrease from capital share transactions | | | (174,678 | ) | | | (1,640,067 | ) |

| | | | | | | | | |

| DISTRIBUTIONS PAID FROM: | | | | | | | | |

| Net investment income | | | (131,991 | ) | | | (331,651 | ) |

| Net realized gains | | | (1,422,407 | ) | | | — | |

| Total distributions to shareholders | | | (1,554,398 | ) | | | (331,651 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,101,757 | | | | 1,334,859 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 25,663,242 | | | | 24,328,383 | |

| | | | | | | | | |

| End of period (including distributions | | | | | | | | |

| in excess of net investment income of | | | | | | | | |

| $(6,421) and $(1,841), respectively) | | $ | 26,764,999 | | | $ | 25,663,242 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 15,323 | | | | 3,882 | |

| Shares issued in reinvestment of distributions | | | 84,654 | | | | 19,145 | |

| Shares redeemed | | | (109,788 | ) | | | (134,596 | ) |

| Net decrease | | | (9,811 | ) | | | (111,569 | ) |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2017 | | | December 31, 2016 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 557,560 | | | $ | 645,990 | |

| Net realized gain on investments | | | 5,417,263 | | | | 3,963,408 | |

| Net change in unrealized appreciation of investments | | | 5,023,381 | | | | 13,795,516 | |

| Net increase resulting from operations | | | 10,998,204 | | | | 18,404,914 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 12,146,454 | | | | 14,729,319 | |

| Proceeds from reinvestment of distributions | | | 6,917,514 | | | | 3,580,862 | |

| Payments for shares redeemed | | | (12,535,701 | ) | | | (12,419,401 | ) |

| Redemption fees | | | 1,267 | | | | 3,259 | |

| Net increase from capital share transactions | | | 6,529,534 | | | | 5,894,039 | |

| | | | | | | | �� | |

| DISTRIBUTIONS PAID FROM: | | | | | | | | |

| Net investment income | | | (544,927 | ) | | | (1,137,845 | ) |

| Net realized gains | | | (6,915,897 | ) | | | (2,746,242 | ) |

| Total distributions to shareholders | | | (7,460,824 | ) | | | (3,884,087 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 10,066,914 | | | | 20,414,866 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 106,542,432 | | | | 86,127,566 | |

| | | | | | | | | |

| End of period (including distributions | | | | | | | | |

| in excess of net investment income of | | | | | | | | |

| $(5,623) and $(6,827), respectively) | | $ | 116,609,346 | | | $ | 106,542,432 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 586,858 | | | | 819,972 | |

| Shares issued in reinvestment of distributions | | | 329,877 | | | | 176,920 | |

| Shares redeemed | | | (605,456 | ) | | | (695,195 | ) |

| Net increase | | | 311,279 | | | | 301,697 | |

See Notes to the Financial Statements

Financial Highlights

| | | Capital Appreciation Fund | |

| | | Year Ended December 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the period | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 16.80 | | | $ | 14.84 | | | $ | 15.61 | | | $ | 17.11 | | | $ | 15.19 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.09 | | | | 0.22 | | | | 0.21 | | | | 0.11 | | | | 0.18 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 1.82 | | | | 1.96 | | | | (0.60 | ) | | | 0.63 | | | | 2.72 | |

| Total from operations | | | 1.91 | | | | 2.18 | | | | (0.39 | ) | | | 0.74 | | | | 2.90 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.09 | ) | | | (0.22 | ) | | | (0.37 | ) | | | (0.27 | ) | | | (0.17 | ) |

| From net realized gains | | | (0.99 | ) | | | — | | | | (0.01 | ) | | | (1.97 | ) | | | (0.81 | ) |

| Total distributions | | | (1.08 | ) | | | (0.22 | ) | | | (0.38 | ) | | | (2.24 | ) | | | (0.98 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of period | | $ | 17.63 | | | $ | 16.80 | | | $ | 14.84 | | | $ | 15.61 | | | $ | 17.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 11.38 | % | | | 14.68 | % | | | (2.52 | )% | | | 4.18 | % | | | 19.10 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 26,765 | | | $ | 25,663 | | | $ | 24,328 | | | $ | 38,398 | | | $ | 41,659 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 2.02 | % | | | 2.06 | % | | | 1.88 | % | | | 1.74 | % | | | 1.77 | % |

| After expense reimbursement | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | (0.23 | )% | | | 0.58 | % | | | 0.47 | % | | | 0.05 | % | | | 0.61 | % |

| After expense reimbursement | | | 0.49 | % | | | 1.34 | % | | | 1.05 | % | | | 0.49 | % | | | 1.08 | % |

| Portfolio turnover rate | | | 23 | % | | | 32 | % | | | 35 | % | | | 48 | % | | | 31 | % |

See Notes to the Financial Statements

Financial Highlights

| | | Opportunity Fund | |

| | | Year Ended December 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the period | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 20.17 | | | $ | 17.29 | | | $ | 20.75 | | | $ | 21.51 | | | $ | 18.05 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | | | 0.13 | | | | 0.14 | | | | 0.13 | | | | 0.07 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain on investments | | | 1.98 | | | | 3.50 | | | | 0.18 | | | | 1.48 | | | | 4.84 | |

| Total from operations | | | 2.09 | | | | 3.63 | | | | 0.32 | | | | 1.61 | | | | 4.91 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.10 | ) | | | (0.22 | ) | | | (0.17 | ) | | | (0.16 | ) | | | (0.07 | ) |

| From net realized gains | | | (1.31 | ) | | | (0.53 | ) | | | (3.61 | ) | | | (2.21 | ) | | | (1.38 | ) |

| Total distributions | | | (1.41 | ) | | | (0.75 | ) | | | (3.78 | ) | | | (2.37 | ) | | | (1.45 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of period | | $ | 20.85 | | | $ | 20.17 | | | $ | 17.29 | | | $ | 20.75 | | | $ | 21.51 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 10.33 | % | | | 21.02 | % | | | 1.33 | % | | | 7.36 | % | | | 27.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 116,609 | | | $ | 106,542 | | | $ | 86,128 | | | $ | 91,448 | | | $ | 97,751 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.58 | % | | | 1.59 | % | | | 1.61 | % | | | 1.53 | % | | | 1.57 | % |

| After expense reimbursement | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 0.23 | % | | | 0.41 | % | | | 0.28 | % | | | 0.23 | % | | | 0.08 | % |

| After expense reimbursement | | | 0.51 | % | | | 0.70 | % | | | 0.59 | % | | | 0.46 | % | | | 0.35 | % |

| Portfolio turnover rate | | | 26 | % | | | 42 | % | | | 36 | % | | | 40 | % | | | 25 | % |

See Notes to the Financial Statements

Notes to the Financial Statements

December 31, 2017

1. ORGANIZATION

Prospector Funds, Inc. (the “Corporation”) was organized as a Maryland corporation on June 6, 2007 and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end diversified management investment company. The Corporation issues its shares in series, each series representing a distinct portfolio with its own investment objectives and policies. There are two series presently authorized, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (individually a “Fund” and collectively the “Funds”). Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Board Codification Topic 946 Financial Services – Investment Companies. The Funds commenced operations on September 28, 2007.

2. FAIR VALUE MEASUREMENT

The following is a summary of significant accounting policies consistently followed by each Fund:

Security Valuation – The Fund has adopted fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, discounts and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Common Stock – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the last bid price on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Convertible and Corporate Bonds – Convertible and corporate bonds, including listed issues, are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Convertible and corporate bonds are generally categorized in Level 2 of the fair value hierarchy.

Notes to the Financial Statements – Continued

December 31, 2017

Investment Companies – Investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board of Directors. These procedures consider many factors, including the type of security, size of holding, trading volume and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines their net asset values per share.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of December 31, 2017, each Fund’s investments in securities were classified as follows:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Capital Appreciation Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 20,640,372 | | | $ | — | | | $ | — | | | $ | 20,640,372 | |

| Convertible Bonds | | | — | | | | 4,211,811 | | | | — | | | | 4,211,811 | |

| Corporate Bonds | | | — | | | | 612,276 | | | | — | | | | 612,276 | |

| Short-Term Investment | | | 1,320,999 | | | | — | | | | — | | | | 1,320,999 | |

| Total Investments | | $ | 21,961,371 | | | $ | 4,824,087 | | | $ | — | | | $ | 26,785,458 | |

| | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Opportunity Fund | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 108,921,212 | | | $ | — | | | $ | — | | | $ | 108,921,212 | |

| Convertible Bond | | | — | | | | 454,219 | | | | — | | | | 454,219 | |

| Short-Term Investment | | | 7,291,396 | | | | — | | | | — | | | | 7,291,396 | |

| Total Investments | | $ | 116,212,608 | | | $ | 454,219 | | | $ | — | | | $ | 116,666,827 | |

Refer to each Fund’s Schedule of Investments for further sector breakout.

Transfers between levels are recognized at the beginning of the reporting period. During the year ended December 31, 2017, the Funds recognized no transfers between levels. The Funds did not invest in any Level 3 investments during the period.

The Funds may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The Funds’ investment objectives allow the Funds to enter into various types of derivative contracts, including, but not limited to, futures contracts, forward foreign exchange contracts, and purchased and written options. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the funds to gains or losses in excess of the amounts shown on the Statements of Assets and Liabilities. As of and for the year ended December 31, 2017, the Funds held no derivative instruments.

Notes to the Financial Statements – Continued

December 31, 2017

3. SIGNIFICANT ACCOUNTING POLICIES

Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. The character of distributions made during the period from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. All short-term capital gains are included in ordinary income for tax purposes.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds intend to meet the requirements of subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is required. As of December 31, 2017, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Generally, each of the tax years in the four-year period ended December 31, 2017 remains subject to examination by taxing authorities.

Reclassification of Capital Accounts – GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The difference between book and tax relates primarily to contingent preferred debt instruments, foreign currency and reclassifications of dividends. For the fiscal year ended December 31, 2017, the following reclassifications were made on the Statements of Assets and Liabilities:

| | | Distributions in | | | Accumulated | | | | |

| | | Excess of | | | Net Realized | | | | |

| | | Investment Income | | | Loss | | | Portfolio Capital | |

| Capital Appreciation Fund | | $ | 84 | | | $ | (84 | ) | | $ | — | |

| Opportunity Fund | | | (11,429 | ) | | | 11,429 | | | | — | |

Foreign Currency Translation – The books and records relating to the Funds’ non-U.S. dollar denominated investments are maintained in U.S. dollars on the following bases: (1) market value of investment securities, assets, and liabilities are translated at the current rate of exchange; and (2) purchases and sales of investment securities, income, and expenses are translated at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate the portion of gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. The Funds report certain foreign currency-related transactions as components of realized gains for financial reporting purposes, whereas such components are treated as ordinary income for federal income tax purposes.

Illiquid or Restricted Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Fund. Illiquid securities may be valued under methods approved by the Funds’ board of directors as reflecting fair value. Each Fund intends to invest no

Notes to the Financial Statements – Continued

December 31, 2017

more than 15% of its total assets in illiquid securities. Certain restricted securities may be considered illiquid. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Funds’ board of directors as reflecting fair value. Certain restricted securities eligible for resale to qualified institutional investors, including Rule 144A securities, are not subject to the limitation on a Fund’s investment in illiquid securities if they are determined to be liquid in accordance with procedures adopted by the Funds’ board of directors. At December 31, 2017, the Funds had no investments in illiquid securities.

Expenses – Expenses directly attributable to a Fund are charged to that Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based on relative net assets or another appropriate basis.

Other – Investment and shareholder transactions are recorded on the trade date. Each Fund determines the gain or loss realized from the investment transactions on the basis of identified cost. Dividend income is recognized on the ex-dividend date. Interest income, including amortization of bond premium and discount, is recognized on an accrual basis.

Subsequent Events – Management has evaluated fund related events and transactions that occurred subsequent to December 31, 2017, through the date of issuance of the Funds’ financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Funds’ financial statements.

4. INVESTMENT TRANSACTIONS

During the year ended December 31, 2017, purchases of securities and proceeds from sales of securities, other than temporary investments in short-term securities, were as follows:

| | | Purchases | | | Sales | |

| Capital Appreciation Fund | | $ | 5,799,815 | | | $ | 7,546,561 | |

| Opportunity Fund | | | 28,264,031 | | | | 26,831,459 | |

There were no purchases or sales of long-term U.S. Government securities.

The aggregate gross unrealized appreciation and depreciation of securities held by the Funds and the total cost of securities for federal income tax purposes at December 31, 2017, the Funds’ most recently completed fiscal year end, were as follows:

| | | Aggregate | | | Aggregate | | | Net | | | Federal | |

| | | Gross | | | Gross | | | Appreciation/ | | | Income | |

| | | Appreciation | | | Depreciation | | | Depreciation | | | Tax Cost | |

| Capital Appreciation Fund | | $ | 4,942,892 | | | $ | (228,164 | ) | | $ | 4,714,728 | | | $ | 22,070,801 | |

| Opportunity Fund | | | 25,772,294 | | | | (1,346,902 | ) | | | 24,425,392 | | | | 92,240,038 | |

The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to wash sales and different book and tax accounting methods for certain securities.

Notes to the Financial Statements – Continued

December 31, 2017

At December 31, 2017, the Funds’ most recently completed fiscal year end, components of accumulated earnings (deficit) on a tax-basis were as follows:

| | | Undistributed | | | Undistributed | | | Other | | | | | | Total | |

| | | Ordinary | | | Long-Term | | | Accumulated | | | Unrealized | | | Accumulated | |

| | | Income | | | Capital Gains | | | Losses | | | Appreciation | | | Earnings | |

| Capital Appreciation Fund | | $ | 24,744 | | | $ | 62,772 | | | $ | (6,979 | ) | | $ | 4,714,728 | | | $ | 4,795,265 | |

| Opportunity Fund | | | — | | | | — | | | | (28,920 | ) | | | 24,425,392 | | | | 24,396,472 | |

As of December 31, 2017, the Funds did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. The Capital Appreciation Fund did not defer any late year losses. The Opportunity Fund plans to defer, on a tax basis, late year losses of $23,297.

The tax character of distributions paid during the fiscal year ended December 31, 2017 were as follows:

| | | Ordinary | | | Long Term | | | | |

| | | Income* | | | Capital Gains** | | | Total | |

| Capital Appreciation Fund | | $ | 305,965 | | | $ | 1,248,433 | | | $ | 1,554,398 | |

| Opportunity Fund | | | 1,207,785 | | | | 6,253,039 | | | | 7,460,824 | |

The tax character of distributions paid during the fiscal year ended December 31, 2016 were as follows:

| | | Ordinary | | | Long Term | | | | |

| | | Income* | | | Capital Gains** | | | Total | |

| Capital Appreciation Fund | | $ | 331,651 | | | $ | — | | | $ | 331,651 | |

| Opportunity Fund | | | 1,133,169 | | | | 2,750,918 | | | | 3,884,087 | |

| * | | For federal income tax purposes, distributions of short-term capital gains are included in ordinary income distributions. |

| ** | | Funds designate long-term capital gain dividends pursuant to IRC Sec. 852(b)(3)(C). |

5. AGREEMENTS

The Funds have entered into an Investment Advisory Agreement with Prospector Partners Asset Management, LLC (the “Adviser”), with whom certain directors and officers of the Corporation are affiliated, to furnish investment advisory services to the Funds. Pursuant to this Agreement, the Adviser is entitled to receive a management fee, calculated daily and payable monthly, at the annual rate of 1.10% as applied to each Fund’s daily net assets.

The Adviser has contractually agreed to waive its management fee and reimburse each Fund’s other expenses to the extent necessary to ensure that each Fund’s operating expenses do not exceed 1.30% of its average daily net assets. Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of three fiscal years following the fiscal year during which such waiver or reimbursement was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the waiver or reimbursement occurred. As of December 31, 2017, the Adviser did not recoup any previously waived expenses. The Operating Expense

Notes to the Financial Statements – Continued

December 31, 2017

Limitation Agreement will be in effect through at least September 30, 2018. Waived fees and reimbursed expenses subject to potential recovery by year of expiration are as follows:

| Expiration | | Capital Appreciation Fund | | | Opportunity Fund | |

| 12/31/18 | | $ | 189,898 | | | $ | 272,070 | |

| 12/31/19 | | | 184,289 | | | | 270,491 | |

| 12/31/20 | | | 186,958 | | | | 302,782 | |

| Total | | $ | 561,145 | | | $ | 845,343 | |

As of December 31, 2017, it was possible, but not probable, those amounts would be recovered by the Adviser. At the end of each fiscal year in the future, the Funds will continue to assess the potential recovery of waived/reimbursed fees and expenses for financial reporting purposes.

Quasar Distributors, LLC (“Quasar”), a subsidiary of U.S. Bancorp, serves as distributor of the Funds’ shares pursuant to a Distribution Agreement with the Corporation. Each Fund’s shares are sold on a no-load basis and, therefore, Quasar receives no sales commission or sales load for providing services to the Funds. The Corporation has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which authorizes the Corporation to reimburse Quasar and certain financial intermediaries who assist in distributing each Fund’s shares or who provide shareholder services to Fund shareholders a distribution and/or shareholder servicing fee of up to 0.25% of each Fund’s average daily net assets (computed on an annual basis). All or a portion of the fee may be used by the Funds or Quasar to pay the Fund’s distribution fees and costs of printing reports and prospectuses for potential investors and the costs of other distribution and shareholder services expenses. During the year ended December 31, 2017, Capital Appreciation Fund and Opportunity Fund incurred expenses of $13,172 and $92,322 respectively, pursuant to the 12b-1 Plan.

U.S. Bancorp Fund Services, LLC serves as transfer agent, administrator and fund accountant for the Funds. U.S. Bank N.A. serves as custodian for the Funds.

6. INDEMNIFICATIONS

The Funds enter into contracts that contain a variety of indemnifications. The Funds’ maximum exposure under these arrangements is unknown. However, the Funds have not had prior claims or losses pursuant to these contracts and expect the risk of loss to be remote.

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors of

Prospector Funds, Inc.:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Prospector Funds, Inc. (the “Corporation”) (comprising the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (individually a “Fund” and collectively referred to as the “Funds”)), including the schedules of investments, as of December 31, 2017, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds comprising the Corporation at December 31, 2017, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on each of the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Corporation in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.