UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-22114 | |

| |

| Name of Registrant: | Vanguard Montgomery Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| |

| Name and address of agent for service: | Anne E. Robinson, Esquire | |

| | P.O. Box 876 | |

| | Valley Forge, PA 19482 | |

Registrant s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2016 - December 31, 2016

Item 1: Reports to Shareholders

Annual Report | December 31, 2016

Vanguard Market Neutral Fund

A new format, unwavering commitment

As you begin reading this report, you ll notice that we ve made some improvements to the opening sections based on feedback from you, our clients.

Page 1 starts with a new Your Fund s Performance at a Glance, a concise, handy summary of how your fund performed during the period.

In the renamed Chairman s Perspective, Bill McNabb will focus on enduring principles and investment insights.

We ve modified some tables, and eliminated some redundancy, but we haven t removed any information.

At Vanguard, we re always looking for better ways to communicate and to help you make sound investment decisions. Thank you for entrusting your assets to us.

| |

| Contents | |

| Your Fund s Performance at a Glance. | 1 |

| Chairman s Perspective. | 3 |

| Advisor s Report. | 7 |

| Fund Profile. | 9 |

| Performance Summary. | 11 |

| Financial Statements. | 13 |

| Your Fund s After-Tax Returns. | 30 |

| About Your Fund s Expenses. | 31 |

| Glossary. | 33 |

Please note: The opinions expressed in this report are just that informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: No matter what language you speak, Vanguard has one consistent message and set of principles. Our primary focus is on you, our clients. We conduct our business with integrity as a faithful steward of your assets. This message is shown translated into seven languages, reflecting our expanding global presence.

Your Funds Performance at a Glance

* For the 12 months ended December 31, 2016, Vanguard Market Neutral Fund returned well over 2%, achieving its mandate of beating the returns of 3-month U.S. Treasury bills, which gained 0.27%. Your fund also bested its market neutral peers, which averaged a 1.08% return over the period.

* Your fund s stock selection model generated broad-based performance. As a reminder, the model focuses on five signals that rank a universe of stocks. Four of those signals valuation, management, quality, and growth contributed to performance. The momentum signal was the lone detractor.

* Stock selection results in seven out of 11 sectors were positive, led by information technology, consumer discretionary, and health care. Several holdings in the materials sector were among the stocks that most detracted from performance.

* Over the decade ended December 31, the Market Neutral Fund produced an average annual return of 1.67% for Investor Shares, outpacing its peers by a percentage point.

| |

| Total Returns: Fiscal Year Ended December 31, 2016 | |

| | Total |

| | Returns |

| Vanguard Market Neutral Fund | |

| Investor Shares | 2.62% |

| Institutional Shares | 2.70 |

| Spliced Market Neutral Index | 0.27 |

| Alternative Equity Market Neutral Funds Average | 1.08 |

| For a benchmark description, see the Glossary. | |

| Alternative Equity Market Neutral Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria.

1

| |

| Total Returns: Ten Years Ended December 31, 2016 | |

| | Average |

| | Annual Return |

| Market Neutral Fund Investor Shares | 1.67% |

| Spliced Market Neutral Index | 0.72 |

| Alternative Equity Market Neutral Funds Average | 0.68 |

For a benchmark description, see the Glossary.

Alternative Equity Market Neutral Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor s shares, when sold, could be worth more or less than their original cost.

2

Chairman s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

If you re like most investors, a big question on your mind is: What s in store for the markets and the economy in 2017?

At Vanguard, we re just as curious about the immediate future. But our curiosity is tempered by our belief that forecasts should give a range of possible outcomes, not pinpoint predictions. After all, there are bound to be occurrences the experts won t see coming.

What really matters for investors

In 2016, we saw two cases in point: The United Kingdom s June vote to exit the European Union and the November election of Donald Trump as U.S. president. Both unexpected outcomes triggered swift market reactions. But despite some short-term volatility, the markets 12-month performance as of December 31, 2016, proved to be less dramatic. U.S. stocks posted healthy returns, and U.S. bonds provided returns close to their long-term averages. International stocks and bonds also advanced, although returns for U.S. investors were reduced by the strength of the U.S. dollar.

The surprises of 2016 remind us to be skeptical of overly precise short-term predictions about 2017. At the cusp of a new year, market prognosticators forecast where the Standard & Poor s 500 Index or the yield on the 10-year Treasury note will end up in 12 months. Such predictions can be attention-getting. They can also be dead wrong.

Investors are better off taking note of long-term trends that stand to influence our economies and markets. We re watching these trends closely, and we discuss our latest assessment in our 2017 economic and market outlook, which you can read at vanguard.com/research.

Our global economic outlook: Expect stabilization, not stagnation

One phenomenon in particular that we re watching is the low-growth, low-interest-rate environment that has marked the global economy since the 2008 09 financial crisis. We don t think this economic backdrop is simply the result of cyclically weak demand or long-term stagnation. Instead, certain structural forces are contributing: Falling technology costs are restraining the amounts businesses are spending on

capital investment, an aging population is weighing on growth in the developed world, and the free movement of capital and products across the globe has restrained prices and wages.

In the near term, these forces will continue to dampen growth, inflation, and interest rates. They also make it unlikely that further monetary stimulus from central banks will do much to spur growth.

I realize this all may sound gloomy, but that s not how we see it. We expect global growth to stabilize at more modest levels, not stagnate. The world isn t headed for Japanese-style deflation, in which a widespread sustained drop in prices puts economic activity into hibernation.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended December 31, 2016 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 12.05% | 8.59% | 14.69% |

| Russell 2000 Index (Small-caps) | 21.31 | 6.74 | 14.46 |

| Russell 3000 Index (Broad U.S. market) | 12.74 | 8.43 | 14.67 |

| FTSE All-World ex US Index (International) | 4.80 | -1.16 | 5.52 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 2.65% | 3.03% | 2.23% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 0.25 | 4.14 | 3.28 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.27 | 0.09 | 0.08 |

| |

| CPI | | | |

| Consumer Price Index | 2.07% | 1.18% | 1.36% |

4

In fact, we believe that global growth could pick up modestly over time. Our expectation is based on a potential rebound in productivity as new digital technologies are used more effectively. We also anticipate a slight recovery in the labor force as the baby boom generation finishes its transition to retirement, nudging up demand for workers.

Put expansion in perspective

Looking to the United States, the world s largest economy remains firmly on a long-term-growth path of about 2% per year. That s lower than the historical average of 3.25% since 1950. We see such growth at this level as fundamentally sound, rather than abnormally low. Our evaluation takes into account lower U.S. population growth

and the reality that the economic expansion from the 1980s until the financial crisis was fueled by debt, distorting the numbers.

Turning to prices, we think that core U.S. inflation should modestly exceed 2% in 2017. That, in turn, will support further interest rate hikes by the Federal Reserve, similar to the one at the end of 2016.

We expect the Fed to raise rates in 2017 before taking an extended pause, and we see the federal funds rate staying below 2% through at least 2018.

Prepare for muted returns

And what about prospects for the markets? Vanguard s outlook for global stocks and bonds remains the most guarded in ten years, given fairly high stock valuations

Expect more modest returns, rely on time-tested principles

In Vanguard s economic and market outlook for 2017, Global Chief Economist Joseph Davis and his team offer a projection of more modest returns from the global stock and bond markets. They caution that, over the next decade, returns for a balanced portfolio are likely to be moderately below long-run historical averages.

The team s simulations indicate that for the decade ending in 2026, the average annualized return of a 60% stock/40% bond portfolio is likely to be centered in the 3% 5% range after inflation. That s below the actual average after-inflation return of 6% for the same portfolio for the nine decades since 1926.

Ultimately, our global market outlook points toward a somewhat more challenging environment, yet one in which, over time, investors with an appropriate level of discipline, diversification, and patience are likely to be rewarded with reasonable inflation-adjusted returns.

For more information about our expectations and the probability of various outcomes, see 2017 Economic and Market Outlook: Stabilization, Not Stagnation, available at vanguard.com/research.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® (VCMM) regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations as of September 30, 2016. Results from the model may vary with each use and over time. For more information, see the note at the end of this letter.

5

and the low-interest-rate environment. We don t expect global bond yields to increase materially from year-end 2016 levels.

Our outlook for global equities is annualized returns of 5% 8% over the next decade. This outlook isn t bearish, but is actually fairly positive when you take into account the current low-rate environment. (See the box titled Expect more modest returns, rely on time-tested principles for more.)

Focus on the four keys to investment success

Significant trends often happen gradually. Like shifting tides, they re sometimes barely noticeable at first but ultimately can change the landscape entirely. Other times, apparent trends can end up receding before they have much of a long-term impact. Given the future s inherent unpredictability, it s not reasonable to expect a surefire block-buster revelation from any prognosticator or investment firm.

What to conclude, then? No matter what scenario plays out, we believe investors have the best chance for success if they stay focused on what they can control: their goals, asset allocation, and investment costs, along with the discipline to stick to a plan. As Tim Buckley, our chief investment officer, likes to say, this can be easy to say but harder to do, especially in times of uncertainty. Investors who can stay focused on those four keys will find themselves well-positioned to weather any market.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

January 16, 2017

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding

the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results,

and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the

historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios

unobserved in the historical period on which the model estimation is based.

The VCMM is a proprietary financial simulation tool developed and maintained by Vanguard s Investment Strategy Group.

The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S.

and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international

fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and

empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation

investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic

statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly

financial and economic data. Using a system of estimated equations, the model then applies a Monte Carlo simulation method

to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over

time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are

obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each

use and over time.

6

Advisors Report

The broad U.S. equity market rebounded from a lackluster 2015, returning more than 12% for 2016. Small-capitalization stocks soared more than 20%, outpacing large-caps by more than 9 percentage points. Value stocks handily outperformed their growth counterparts. The broad U.S. bond market returned 2.65%.

Against that backdrop, Vanguard Market Neutral Fund achieved its mandate of exceeding the returns of 3-month U.S. Treasury bills while remaining neutral to market conditions. Results for the two halves of 2016 were in stark contrast. Your fund posted a negative return through the first half, but performance recovered in the second amid a broad stock market rally. The fund returned well over 2% for the 12 months, while 3-month Treasury bills gained 0.27%. It is important to note that the fund does not try to outperform the equity market.

The period began with steep declines in commodity prices and unanticipated sluggish economic growth around the world, especially in China; this triggered a move toward less-risky assets. Given the environment, the Federal Reserve seemed less inclined to raise interest rates as it became unclear whether its inflation and unemployment targets would be realized. The United Kingdom s June vote to leave the European Union further clouded the Fed s outlook.

However, U.S. growth shot up in the third quarter after disappointing results earlier in the year. The employment picture remained strong as the economy added 156,000 jobs

in December and wages increased 2.9% for the year. The unemployment rate finished 2016 at 4.7%. The strong economic and jobs figures were partly behind the dollar s strengthening against some international currencies and factored into the Fed s December decision to raise the federal funds rate by 0.25 percentage point, to 0.5% 0.75%.

Those factors, coupled with a turnaround in commodity prices and optimism about the potential for a new administration s policy initiatives, fueled a stock market rally that persisted into early 2017.

Although it s important to understand how our overall performance is affected by the macroeconomic factors we ve described, our approach to investing focuses on specific stock fundamentals and portfolio characteristics not on technical analysis of stock-price movements.

Our model uses five factor themes growth, quality, management decisions, momentum, and valuation to generate a composite rank for all the stocks in our investment universe. We seek to capitalize on investor biases across the market by taking long positions in the stocks that our model ranks high and by shorting those that score the lowest. We aim to keep your fund s sector exposures neutral, but we have the flexibility to slightly diverge from that positioning, depending on the model s signals.

U.S. stock market performance for 2016 was broad-based; ten out of 11 market sectors advanced, led by energy and

7

telecommunication services. Health care was the lone sector that declined. In that environment, our stock selection model generated strong results in identifying leaders and laggards. Our long positions gained more than our short positions, providing a positive total return for shareholders.

Four of our signals valuation, management decisions, quality, and growth contributed to performance, while momentum detracted. Stock selection results were positive in seven sectors, with information technology, consumer discretionary, and health care leading the way. Energy, industrials, and financials detracted the most.

Long positions in Advanced Micro Devices and AK Steel Holding were among the fund s top performers. Disappointing results from biotechnology firms Insys

Therapeutics and ImmunoGen washed out gains from the fund s short positions in that industry. Long positions in materials firms Royal Gold and Olin also performed poorly.

Your fund saw strong investor interest over the period, with assets reaching about $2 billion at year-end. Execution of the fund s strategy, though, isn t encumbered by asset flows, as it features a diversified portfolio of highly liquid stocks.

Portfolio Managers:

James P. Stetler, Principal

Michael R. Roach, CFA

Binbin Guo, Principal, Head of Equity Research and Portfolio Strategies

Vanguard Quantitative Equity Group

January 17, 2017

8

| | |

| Market Neutral Fund | |

| |

| |

| Fund Profile | | |

| As of December 31, 2016 | | |

| |

| Share-Class Characteristics | |

| | Investor Institutional |

| | Shares | Shares |

| Ticker Symbol | VMNFX | VMNIX |

| Total Expense Ratio1 | 1.46% | 1.36% |

| Management Expenses | 0.20% | 0.12% |

| Dividend Expenses on | | |

| Securities Sold Short2 | 1.06% | 1.06% |

| Borrowing Expenses on | | |

| Securities Sold Short2 | 0.15% | 0.15% |

| Other Expenses | 0.05% | 0.03% |

| |

| Portfolio Characteristics | | |

| | Long | Short |

| | Portfolio | Portfolio |

| Number of Stocks | 279 | 282 |

| Median Market Cap | $3.5B | $4.6B |

| Price/Earnings Ratio | 18.9x | 50.7x |

| Price/Book Ratio | 2.4x | 2.2x |

| Return on Equity | 10.8% | 12.3% |

| Earnings Growth | | |

| Rate | 10.7% | 4.6% |

| Foreign Holdings | 1.7% | 0.8% |

| |

| Fund Characteristics | | |

| Turnover Rate | | 64% |

| Short-Term Reserves | | 1.9% |

| | |

| Volatility Measures | | |

| | Spliced | DJ |

| | Market | U.S. Total |

| | Neutral | Market |

| | Index | FA Index |

| R-Squared | 0.00 | 0.02 |

| Beta | -5.69 | -0.07 |

These measures show the degree and timing of the fund s fluctuations compared with the index over 36 months.

Sector Diversification (% of equity exposure)

| | |

| | Long | Short |

| | Portfolio | Portfolio |

| Consumer Discretionary | 15.3% | 15.9% |

| Consumer Staples | 5.9 | 5.1 |

| Energy | 6.5 | 6.3 |

| Financials | 12.7 | 12.9 |

| Health Care | 10.2 | 9.2 |

| Industrials | 15.6 | 16.2 |

| Information Technology | 15.7 | 16.5 |

| Materials | 6.5 | 6.3 |

| Real Estate | 7.8 | 7.9 |

| Telecommunication Services | 0.9 | 1.0 |

| Utilities | 2.9 | 2.7 |

1 The total expense ratios shown are from the prospectus dated April 28, 2016, and represent estimated costs for the current fiscal year. For the fiscal year ended December 31, 2016, the total expense ratios were 1.60% for Investor Shares and 1.52% for Institutional Shares.

2 In connection with a short sale, the fund may receive income or be charged a fee based on the market value of the borrowed stock. When a cash dividend is declared on a stock the fund has sold short, the fund is required to pay an amount equal to that dividend to the party from which the fund borrowed the stock and to record the payment of the dividend as an expense.

9

Market Neutral Fund

Ten Largest Holdings1 (% of total net assets) Long Portfolio | | |

| EP Energy Corp. | Oil & Gas Exploration | |

| | & Production | 0.5% |

| Hospitality Properties | | |

| Trust | Hotel & Resort REITs | 0.5 |

| JetBlue Airways Corp. | Airlines | 0.5 |

| SpartanNash Co. | Food Distributors | 0.5 |

| JPMorgan Chase & Co. | Diversified Banks | 0.5 |

| Aspen Technology Inc. | Application Software | 0.5 |

| Advanced Micro Devices | | |

| Inc. | Semiconductors | 0.5 |

| Fifth Third Bancorp | Regional Banks | 0.5 |

| Wabash National Corp. | Construction | |

| | Machinery & Heavy | |

| | Trucks | 0.5 |

| Alaska Air Group Inc. | Airlines | 0.5 |

| Top Ten | | 5.0% |

| Ten Largest Holdings1 (% of total net assets) Short Portfolio | | |

| CF Industries Holdings | Fertilizers & | |

| Inc. | Agricultural | |

| | Chemicals | 0.6% |

| Ingevity Corp. | Specialty Chemicals | 0.5 |

| Banner Corp. | Regional Banks | 0.5 |

| Team Inc. | Environmental & | |

| | Facilities Services | 0.5 |

| RBC Bearings Inc. | Industrial | |

| | Machinery | 0.5 |

| M&T Bank Corp. | Regional Banks | 0.5 |

| Targa Resources Corp. | Oil & Gas Storage & | |

| | Transportation | 0.5 |

| Gentherm Inc. | Auto Parts & | |

| | Equipment | 0.5 |

| Clean Harbors Inc. | Environmental & | |

| | Facilities Services | 0.5 |

| Western Digital Corp. | Technology | |

| | Hardware, Storage | |

| | & Peripherals | 0.5 |

| Top Ten | | 5.1% |

1 The holdings listed exclude any temporary cash investments and equity index products.

10

Market Neutral Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future

results that may be achieved by the fund. (Current performance may be lower or higher than

the performance data cited. For performance data current to the most recent month-end, visit

our website at vanguard.com/performance.) Note, too, that both investment returns and principal

value can fluctuate widely, so an investor s shares, when sold, could be worth more or less than

their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund

distributions or on the sale of fund shares.

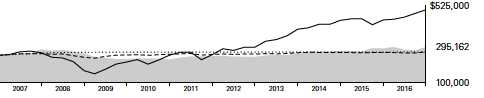

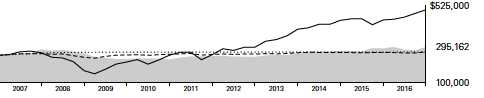

Cumulative Performance: December 31, 2006, Through December 31, 2016

Initial Investment of $250,000

For a benchmark description, see the Glossary.

Alternative Equity Market Neutral Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

| | | | |

| | | Average Annual Total Returns | |

| | Periods Ended December 31, 2016 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $250,000 |

| | Year | Years | Years | Investment |

| |

| Market Neutral Fund*Investor Shares | 2.62% | 3.82% | 1.67% | $295,162 |

| |

| Spliced Market Neutral Index | 0.27 | 0.08 | 0.72 | 268,519 |

| Alternative Equity Market Neutral | | | | |

| Funds Average | 1.08 | 1.05 | 0.68 | 267,525 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | 12.62 | 14.59 | 7.18 | 500,081 |

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $5,000,000 |

| | Year | Years | Years | Investment |

| |

| Market Neutral Fund Institutional Shares | 2.70% | 3.92% | 1.78% | $5,966,319 |

| |

| Spliced Market Neutral Index | 0.27 | 0.08 | 0.72 | 5,370,381 |

| Dow Jones U.S. Total Stock Market Float | | | | |

| Adjusted Index | 12.62 | 14.59 | 7.18 | 10,001,613 |

See Financial Highlights for dividend and capital gains information.

11

Market Neutral Fund

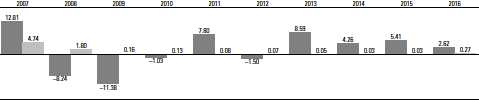

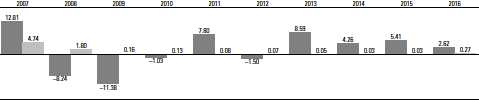

Fiscal-Year Total Returns (%): December 31, 2006, Through December 31, 2016

Market Neutral Fund Investor Shares

Spliced Market Neutral Index

For a benchmark description, see the Glossary.

12

Market Neutral Fund

Financial Statements

Statement of Net Assets

As of December 31, 2016

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund s Forms N-Q on the SEC s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| Common Stocks Long Positions (96.7%) | |

| Consumer Discretionary (14.7%) | |

| *, | Cooper-Standard | | |

| | Holdings Inc. | 103,242 | 10,673 |

| | Lear Corp. | 80,519 | 10,658 |

| *, | American Axle & | | |

| | Manufacturing | | |

| | Holdings Inc. | 549,334 | 10,602 |

| *, | Burlington Stores Inc. | 122,686 | 10,398 |

| | Children s Place Inc. | 102,857 | 10,383 |

| *, | Tenneco Inc. | 165,726 | 10,353 |

| | Regal Entertainment Group | | |

| | Class A | 501,129 | 10,323 |

| | Big Lots Inc. | 205,026 | 10,294 |

| *, ,^Smith & Wesson Holding | | |

| | Corp. | 486,230 | 10,250 |

| | Darden Restaurants Inc. | 140,893 | 10,246 |

| ,^ | Sturm Ruger & Co. Inc. | 193,515 | 10,198 |

| | Whirlpool Corp. | 55,789 | 10,141 |

| | Best Buy Co. Inc. | 231,484 | 9,877 |

| | Carnival Corp. | 188,675 | 9,822 |

| *, | Boyd Gaming Corp. | 476,439 | 9,610 |

| *, | Liberty Media Corp-Liberty | | |

| | SiriusXM Class A | 270,694 | 9,344 |

| | Bloomin Brands Inc. | 514,295 | 9,273 |

| *, | Yum China Holdings Inc. | 352,305 | 9,202 |

| | International Game | | |

| | Technology plc | 354,744 | 9,053 |

| | Bob Evans Farms Inc. | 159,540 | 8,489 |

| | Omnicom Group Inc. | 99,000 | 8,426 |

| | Tailored Brands Inc. | 329,563 | 8,420 |

| | Target Corp. | 114,310 | 8,257 |

| *, | Michael Kors Holdings Ltd. | 190,318 | 8,180 |

| | American Eagle | | |

| | Outfitters Inc. | 524,262 | 7,953 |

| | PVH Corp. | 87,390 | 7,886 |

| *, | Discovery Communications | | |

| | Inc. Class A | 260,678 | 7,145 |

| | News Corp. Class B | 584,145 | 6,893 |

| | Nordstrom Inc. | 132,703 | 6,361 |

| | | |

| *, | MSG Networks Inc. | 217,306 | 4,672 |

| *, | Michaels Cos. Inc. | 199,700 | 4,084 |

| *, | Express Inc. | 316,922 | 3,410 |

| * | Genesco Inc. | 52,793 | 3,279 |

| | Barnes & Noble Inc. | 290,287 | 3,237 |

| | Cooper Tire & Rubber Co. | 78,781 | 3,061 |

| *, | Dave & Buster s | | |

| | Entertainment Inc. | 53,231 | 2,997 |

| | Callaway Golf Co. | 242,610 | 2,659 |

| * | Tile Shop Holdings Inc. | 121,094 | 2,367 |

| | Cheesecake Factory Inc. | 39,238 | 2,350 |

| | Finish Line Inc. Class A | 114,625 | 2,156 |

| | Brinker International Inc. | 41,242 | 2,043 |

| | Kohl s Corp. | 36,337 | 1,794 |

| | AMC Entertainment | | |

| | Holdings Inc. | 49,467 | 1,665 |

| * | Liberty Media Corp-Liberty | | |

| | SiriusXM Class C | 27,957 | 948 |

| | | | 309,432 |

| Consumer Staples (5.7%) | | |

| | SpartanNash Co. | 285,416 | 11,285 |

| | Dean Foods Co. | 509,544 | 11,098 |

| | Conagra Brands Inc. | 265,715 | 10,509 |

| | Fresh Del Monte | | |

| | Produce Inc. | 167,140 | 10,134 |

| | Wal-Mart Stores Inc. | 137,594 | 9,510 |

| | Ingredion Inc. | 71,766 | 8,968 |

| *, | Avon Products Inc. | 1,658,886 | 8,361 |

| | Tyson Foods Inc. Class A | 135,192 | 8,338 |

| *, ,^Herbalife Ltd. | 148,894 | 7,168 |

| | Universal Corp. | 103,385 | 6,591 |

| *, | SUPERVALU Inc. | 1,171,692 | 5,472 |

| | Walgreens Boots | | |

| | Alliance Inc. | 62,960 | 5,210 |

| * | Post Holdings Inc. | 53,075 | 4,267 |

| *, | Blue Buffalo Pet | | |

| | Products Inc. | 143,871 | 3,459 |

| *, | Lamb Weston | | |

| | Holdings Inc. | 66,973 | 2,535 |

| | JM Smucker Co. | 18,814 | 2,409 |

13

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| * | Darling Ingredients Inc. | 152,344 | 1,967 |

| | Nu Skin Enterprises Inc. | | |

| | Class A | 28,174 | 1,346 |

| | | | 118,627 |

| Energy (6.3%) | | |

| *,^ | EP Energy Corp. Class A | 1,757,049 | 11,509 |

| *, | Denbury Resources Inc. | 2,815,726 | 10,362 |

| *, | Energen Corp. | 179,076 | 10,327 |

| *, | Rowan Cos. plc Class A | 529,975 | 10,011 |

| *, | McDermott | | |

| | International Inc. | 1,354,476 | 10,010 |

| *, | Chesapeake Energy Corp. | 1,422,335 | 9,985 |

| *, | Newfield Exploration Co. | 245,646 | 9,949 |

| *, | Southwestern Energy Co. | 897,744 | 9,714 |

| | Ensco plc Class A | 979,564 | 9,521 |

| | Apache Corp. | 129,371 | 8,211 |

| ^ | Ship Finance | | |

| | International Ltd. | 552,558 | 8,205 |

| *,^ | Seadrill Ltd. | 2,021,785 | 6,894 |

| * | Unit Corp. | 215,256 | 5,784 |

| * | Diamond Offshore | | |

| | Drilling Inc. | 209,695 | 3,712 |

| * | Transocean Ltd. | 197,096 | 2,905 |

| | Devon Energy Corp. | 49,995 | 2,283 |

| * | Carrizo Oil & Gas Inc. | 44,414 | 1,659 |

| * | Laredo Petroleum Inc. | 113,495 | 1,605 |

| | | | 132,646 |

| Financials (12.3%) | | |

| | JPMorgan Chase & Co. | 130,664 | 11,275 |

| | Fifth Third Bancorp | 414,286 | 11,173 |

| | Assured Guaranty Ltd. | 294,626 | 11,128 |

| | SunTrust Banks Inc. | 202,393 | 11,101 |

| | Citigroup Inc. | 184,906 | 10,989 |

| | Regions Financial Corp. | 764,407 | 10,977 |

| | Popular Inc. | 250,048 | 10,957 |

| | Unum Group | 249,048 | 10,941 |

| | Prudential Financial Inc. | 104,364 | 10,860 |

| | Bank of America Corp. | 484,624 | 10,710 |

| *, | E*TRADE Financial Corp. | 299,139 | 10,365 |

| | Primerica Inc. | 149,569 | 10,343 |

| | Navient Corp. | 627,777 | 10,314 |

| | Universal Insurance | | |

| | Holdings Inc. | 344,112 | 9,773 |

| *, | Flagstar Bancorp Inc. | 359,731 | 9,691 |

| | MSCI Inc. Class A | 117,469 | 9,254 |

| | Nelnet Inc. Class A | 176,916 | 8,979 |

| | Aflac Inc. | 128,709 | 8,958 |

| ^ | Banc of California Inc. | 449,253 | 7,795 |

| | Lincoln National Corp. | 111,649 | 7,399 |

| | Washington Federal Inc. | 207,605 | 7,131 |

| | Synovus Financial Corp. | 159,300 | 6,544 |

| | PNC Financial Services | | |

| | Group Inc. | 49,000 | 5,731 |

| | Citizens Financial | | |

| | Group Inc. | 153,553 | 5,471 |

| | | |

| | Maiden Holdings Ltd. | 307,200 | 5,361 |

| | Travelers Cos. Inc. | 42,300 | 5,178 |

| | Ameriprise Financial Inc. | 42,676 | 4,735 |

| | TCF Financial Corp. | 230,154 | 4,509 |

| | OM Asset Management plc | 249,836 | 3,623 |

| * | Essent Group Ltd. | 90,884 | 2,942 |

| | S&P Global Inc. | 19,202 | 2,065 |

| * | First BanCorp | 165,270 | 1,092 |

| | | | 257,364 |

| Health Care (9.9%) | | |

| *, | INC Research Holdings | | |

| | Inc. Class A | 207,313 | 10,905 |

| *, | WellCare Health Plans Inc. | 78,620 | 10,777 |

| *, | PRA Health Sciences Inc. | 194,051 | 10,696 |

| | Baxter International Inc. | 236,412 | 10,483 |

| *, | Quintiles IMS Holdings Inc. | 130,543 | 9,928 |

| *, | Healthways Inc. | 414,036 | 9,419 |

| *, | Five Prime Therapeutics Inc. | 182,980 | 9,169 |

| *, | HCA Holdings Inc. | 123,156 | 9,116 |

| *, | Hologic Inc. | 218,158 | 8,753 |

| | AmerisourceBergen Corp. | | |

| | Class A | 110,272 | 8,622 |

| *, | Charles River Laboratories | | |

| | International Inc. | 110,249 | 8,400 |

| *, | Cambrex Corp. | 154,611 | 8,341 |

| *, | Express Scripts Holding Co. | 116,492 | 8,014 |

| | Bruker Corp. | 361,389 | 7,654 |

| | McKesson Corp. | 54,297 | 7,626 |

| *, | FibroGen Inc. | 356,326 | 7,625 |

| *, | United Therapeutics Corp. | 51,176 | 7,340 |

| *, | Prestige Brands | | |

| | Holdings Inc. | 125,330 | 6,530 |

| | Bristol-Myers Squibb Co. | 101,164 | 5,912 |

| *, | Emergent BioSolutions Inc. | 167,711 | 5,508 |

| * | Halyard Health Inc. | 130,758 | 4,835 |

| *, | Masimo Corp. | 69,900 | 4,711 |

| | Eli Lilly & Co. | 42,000 | 3,089 |

| *,^ | Lexicon | | |

| | Pharmaceuticals Inc. | 216,808 | 2,998 |

| | Gilead Sciences Inc. | 37,918 | 2,715 |

| * | PAREXEL International | | |

| | Corp. | 34,846 | 2,290 |

| | Chemed Corp. | 13,700 | 2,198 |

| *,^ | Insys Therapeutics Inc. | 230,229 | 2,118 |

| *,^ | Medpace Holdings Inc. | 55,118 | 1,988 |

| | Aetna Inc. | 14,500 | 1,798 |

| * | Veeva Systems Inc. | | |

| | Class A | 41,015 | 1,669 |

| | UnitedHealth Group Inc. | 10,211 | 1,634 |

| | Anthem Inc. | 11,000 | 1,582 |

| | Cardinal Health Inc. | 13,985 | 1,007 |

| * | Amphastar | | |

| | Pharmaceuticals Inc. | 50,820 | 936 |

| * | HMS Holdings Corp. | 42,543 | 773 |

| | | | 207,159 |

14

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| Industrials (15.1%) | | |

| *, | JetBlue Airways Corp. | 509,488 | 11,423 |

| *, | Wabash National Corp. | 704,759 | 11,149 |

| | Alaska Air Group Inc. | 125,603 | 11,145 |

| ,^ | GATX Corp. | 180,789 | 11,133 |

| *, | Hawaiian Holdings Inc. | 193,495 | 11,029 |

| | Greenbrier Cos. Inc. | 263,870 | 10,964 |

| | Quad/Graphics Inc. | 405,890 | 10,910 |

| | Huntington Ingalls | | |

| | Industries Inc. | 59,214 | 10,907 |

| *, | United Rentals Inc. | 102,697 | 10,843 |

| | SkyWest Inc. | 296,761 | 10,817 |

| | Delta Air Lines Inc. | 217,564 | 10,702 |

| | Spirit AeroSystems | | |

| | Holdings Inc. Class A | 181,556 | 10,594 |

| | Brink s Co. | 251,297 | 10,366 |

| *, | MasTec Inc. | 266,325 | 10,187 |

| | Insperity Inc. | 139,518 | 9,899 |

| | BWX Technologies Inc. | 247,807 | 9,838 |

| * | Chart Industries Inc. | 268,177 | 9,660 |

| * | Trex Co. Inc. | 148,197 | 9,544 |

| | Owens Corning | 176,502 | 9,100 |

| | Masco Corp. | 272,411 | 8,614 |

| | West Corp. | 346,211 | 8,572 |

| ^ | American Railcar | | |

| | Industries Inc. | 183,385 | 8,305 |

| | Briggs & Stratton Corp. | 358,545 | 7,981 |

| | Herman Miller Inc. | 229,807 | 7,859 |

| | General Electric Co. | 229,919 | 7,265 |

| | Triumph Group Inc. | 272,363 | 7,218 |

| *, | SPX FLOW Inc. | 213,987 | 6,860 |

| | Copa Holdings SA Class A | 67,562 | 6,137 |

| * | Continental Building | | |

| | Products Inc. | 256,426 | 5,923 |

| * | NCI Building Systems Inc. | 317,133 | 4,963 |

| | Knoll Inc. | 176,940 | 4,942 |

| | Comfort Systems USA Inc. | 133,637 | 4,450 |

| | Chicago Bridge & Iron | | |

| | Co. NV | 139,803 | 4,439 |

| * | Hertz Global Holdings Inc. | 167,254 | 3,606 |

| *, | Meritor Inc. | 270,838 | 3,364 |

| | Brady Corp. Class A | 85,880 | 3,225 |

| * | TriNet Group Inc. | 123,981 | 3,176 |

| * | Gibraltar Industries Inc. | 59,063 | 2,460 |

| | General Cable Corp. | 101,369 | 1,931 |

| * | Avis Budget Group Inc. | 48,212 | 1,768 |

| | Aircastle Ltd. | 78,018 | 1,627 |

| * | DigitalGlobe Inc. | 51,363 | 1,472 |

| *,^ | Energy Recovery Inc. | 91,213 | 944 |

| | | | 317,311 |

| Information Technology (15.2%) | |

| *, | Aspen Technology Inc. | 205,950 | 11,261 |

| *, | Advanced Micro | | |

| | Devices Inc. | 989,994 | 11,227 |

| *, | Cardtronics plc Class A | 201,967 | 11,021 |

| | | |

| | Science Applications | | |

| | International Corp. | 129,903 | 11,016 |

| | NVIDIA Corp. | 103,000 | 10,994 |

| *, | NCR Corp. | 268,845 | 10,904 |

| * | Square Inc. | 797,856 | 10,875 |

| | CSG Systems | | |

| | International Inc. | 222,979 | 10,792 |

| | SYNNEX Corp. | 87,721 | 10,616 |

| | Booz Allen Hamilton | | |

| | Holding Corp. Class A | 293,537 | 10,588 |

| *, | CACI International Inc. | | |

| | Class A | 84,258 | 10,473 |

| | CDW Corp. | 200,760 | 10,458 |

| *, | Tech Data Corp. | 120,973 | 10,244 |

| | HP Inc. | 689,560 | 10,233 |

| | Travelport Worldwide Ltd. | 722,262 | 10,184 |

| | Computer Sciences Corp. | 171,043 | 10,164 |

| *, | TTM Technologies Inc. | 745,457 | 10,161 |

| *, | Cirrus Logic Inc. | 177,913 | 10,059 |

| *, | GoDaddy Inc. Class A | 281,480 | 9,838 |

| *, | First Data Corp. Class A | 687,266 | 9,752 |

| *, | Synaptics Inc. | 181,751 | 9,738 |

| | Avnet Inc. | 191,269 | 9,106 |

| *, | MaxLinear Inc. | 404,725 | 8,823 |

| *, | Sykes Enterprises Inc. | 303,162 | 8,749 |

| *, | RingCentral Inc. Class A | 415,875 | 8,567 |

| | CSRA Inc. | 259,454 | 8,261 |

| *, | Anixter International Inc. | 98,336 | 7,970 |

| *, | NETGEAR Inc. | 120,176 | 6,532 |

| * | Wix.com Ltd. | 146,251 | 6,516 |

| *, | Manhattan Associates Inc. | 113,638 | 6,026 |

| | TeleTech Holdings Inc. | 169,034 | 5,156 |

| | Accenture plc Class A | 40,291 | 4,719 |

| * | Amkor Technology Inc. | 395,130 | 4,169 |

| * | Teradata Corp. | 109,128 | 2,965 |

| *, | Sanmina Corp. | 65,900 | 2,415 |

| *, | Gigamon Inc. | 48,849 | 2,225 |

| * | Advanced Energy | | |

| | Industries Inc. | 38,762 | 2,122 |

| *, | Super Micro Computer Inc. | 55,000 | 1,543 |

| *, | Benchmark Electronics Inc. | 48,918 | 1,492 |

| * | Itron Inc. | 19,939 | 1,253 |

| | | | 319,207 |

| Materials (6.3%) | | |

| | Trinseo SA | 184,727 | 10,954 |

| *, | Coeur Mining Inc. | 1,171,472 | 10,649 |

| *, | AK Steel Holding Corp. | 1,037,511 | 10,593 |

| | Greif Inc. Class A | 200,026 | 10,263 |

| | Steel Dynamics Inc. | 286,874 | 10,207 |

| | Chemours Co. | 458,697 | 10,133 |

| * | Owens-Illinois Inc. | 581,612 | 10,126 |

| | Commercial Metals Co. | 458,455 | 9,985 |

| * | Freeport-McMoRan Inc. | 756,517 | 9,978 |

| | United States Steel Corp. | 297,622 | 9,825 |

| | Worthington Industries Inc. | 179,530 | 8,517 |

15

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| | Stepan Co. | 98,700 | 8,042 |

| | Cabot Corp. | 156,034 | 7,886 |

| *,^ | Cliffs Natural | | |

| | Resources Inc. | 490,058 | 4,121 |

| * | SunCoke Energy Inc. | 106,504 | 1,208 |

| | | | 132,487 |

| Real Estate (7.6%) | | |

| | Hospitality Properties | | |

| | Trust | 360,907 | 11,455 |

| | Lexington Realty Trust | 1,012,782 | 10,938 |

| | Washington Prime | | |

| | Group Inc. | 1,010,170 | 10,516 |

| | CBL & Associates | | |

| | Properties Inc. | 907,032 | 10,431 |

| | Select Income REIT | 403,227 | 10,161 |

| | Sabra Health Care | | |

| | REIT Inc. | 390,766 | 9,543 |

| | GEO Group Inc. | 252,554 | 9,074 |

| | Government Properties | | |

| | Income Trust | 473,628 | 9,030 |

| | DuPont Fabros | | |

| | Technology Inc. | 203,233 | 8,928 |

| | Care Capital Properties Inc. | 356,990 | 8,925 |

| | Medical Properties | | |

| | Trust Inc. | 720,440 | 8,861 |

| | Senior Housing | | |

| | Properties Trust | 439,439 | 8,319 |

| | Communications Sales & | | |

| | Leasing Inc. | 313,309 | 7,961 |

| | Ryman Hospitality | | |

| | Properties Inc. | 117,756 | 7,420 |

| | Mack-Cali Realty Corp. | 249,552 | 7,242 |

| | Xenia Hotels & Resorts Inc. | 314,218 | 6,102 |

| | Gaming and Leisure | | |

| | Properties Inc. | 118,100 | 3,616 |

| | Sunstone Hotel | | |

| | Investors Inc. | 205,317 | 3,131 |

| | VEREIT Inc. | 301,946 | 2,554 |

| | Global Net Lease Inc. | 318,804 | 2,496 |

| | NorthStar Realty Finance | | |

| | Corp. | 120,364 | 1,824 |

| | | | 158,527 |

| Telecommunication Services (0.8%) | |

| *, | Sprint Corp. | 1,273,052 | 10,719 |

| | Windstream Holdings Inc. | 932,378 | 6,834 |

| | | | 17,553 |

| Utilities (2.8%) | | |

| | FirstEnergy Corp. | 334,399 | 10,356 |

| | Entergy Corp. | 130,053 | 9,555 |

| | MDU Resources Group Inc. | 310,050 | 8,920 |

| | NiSource Inc. | 391,363 | 8,665 |

| | Edison International | 120,017 | 8,640 |

| | UGI Corp. | 132,351 | 6,099 |

| | CenterPoint Energy Inc. | 107,025 | 2,637 |

| | | |

| | National Fuel Gas Co. | 43,225 | 2,448 |

| | PPL Corp. | 49,401 | 1,682 |

| | | | 59,002 |

| Total Common Stocks Long Positions | |

| (Cost $1,709,792) | | 2,029,315 |

| Common Stocks Sold Short (-96.4%) | |

| Consumer Discretionary (-15.3%) | |

| * | Gentherm Inc. | (332,004) | (11,238) |

| | Tractor Supply Co. | (143,190) | (10,855) |

| * | Fiesta Restaurant | | |

| | Group Inc. | (361,927) | (10,803) |

| | Hilton Worldwide | | |

| | Holdings Inc. | (396,807) | (10,793) |

| | BorgWarner Inc. | (267,166) | (10,537) |

| * | Netflix Inc. | (83,948) | (10,393) |

| * | Charter Communications | | |

| | Inc. Class A | (36,083) | (10,389) |

| | PulteGroup Inc. | (562,800) | (10,344) |

| * | Under Armour Inc. | (409,731) | (10,313) |

| | Newell Brands Inc. | (229,248) | (10,236) |

| | CalAtlantic Group Inc. | (300,950) | (10,235) |

| | Harley-Davidson Inc. | (175,441) | (10,235) |

| * | Liberty Ventures Class A | (275,678) | (10,164) |

| | Monro Muffler Brake Inc. | (173,075) | (9,900) |

| | Advance Auto Parts Inc. | (58,288) | (9,858) |

| * | IMAX Corp. | (308,373) | (9,683) |

| | Delphi Automotive plc | (143,477) | (9,663) |

| * | Chipotle Mexican Grill Inc. | | |

| | Class A | (25,369) | (9,572) |

| * | Liberty Broadband Corp. | (126,946) | (9,403) |

| * | CarMax Inc. | (143,276) | (9,225) |

| | Expedia Inc. | (80,320) | (9,099) |

| * | Buffalo Wild Wings Inc. | (58,294) | (9,001) |

| | H&R Block Inc. | (391,475) | (9,000) |

| * | G-III Apparel Group Ltd. | (279,191) | (8,253) |

| * | Etsy Inc. | (650,793) | (7,666) |

| | Marriott International Inc. | | |

| | Class A | (87,557) | (7,239) |

| * | EW Scripps Co. Class A | (348,312) | (6,733) |

| * | Dorman Products Inc. | (92,043) | (6,725) |

| * | Liberty Expedia Holdings | | |

| | Inc. Class A | (164,117) | (6,510) |

| * | Houghton Mifflin | | |

| | Harcourt Co. | (592,767) | (6,431) |

| | Twenty-First Century | | |

| | Fox Inc. Class A | (225,208) | (6,315) |

| | Dunkin Brands Group Inc. | (98,296) | (5,155) |

| | Tribune Media Co. Class A | (128,718) | (4,503) |

| * | TripAdvisor Inc. | (97,000) | (4,498) |

| | Core-Mark Holding Co. Inc. | (93,380) | (4,022) |

| | ILG Inc. | (181,164) | (3,292) |

| | Standard Motor | | |

| | Products Inc. | (44,551) | (2,371) |

16

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| * | Loral Space & | | |

| | Communications Inc. | (56,384) | (2,315) |

| * | Meritage Homes Corp. | (61,200) | (2,130) |

| * | Vista Outdoor Inc. | (57,312) | (2,115) |

| * | Liberty Interactive Corp. | | |

| | QVC Group Class A | (105,824) | (2,114) |

| * | Groupon Inc. Class A | (561,374) | (1,864) |

| * | Liberty Broadband Corp. | | |

| | Class A | (12,803) | (928) |

| | | | (322,118) |

| Consumer Staples (-4.9%) | | |

| * | Monster Beverage Corp. | (249,533) | (11,064) |

| * | TreeHouse Foods Inc. | (146,800) | (10,597) |

| | Snyder s-Lance Inc. | (273,775) | (10,497) |

| | Pinnacle Foods Inc. | (194,644) | (10,404) |

| | Coty Inc. Class A | (557,391) | (10,206) |

| | Whole Foods Market Inc. | (302,225) | (9,296) |

| | Molson Coors Brewing Co. | | |

| | Class B | (89,300) | (8,690) |

| | Estee Lauder Cos. Inc. | | |

| | Class A | (104,815) | (8,017) |

| | Casey s General Stores Inc. | (58,200) | (6,919) |

| | Costco Wholesale Corp. | (41,612) | (6,663) |

| * | Hain Celestial Group Inc. | (109,700) | (4,282) |

| | B&G Foods Inc. | (62,668) | (2,745) |

| * | Revlon Inc. Class A | (78,640) | (2,292) |

| | Andersons Inc. | (37,580) | (1,680) |

| | | | (103,352) |

| Energy (-6.0%) | | |

| | Targa Resources Corp. | (200,628) | (11,249) |

| * | Cheniere Energy Inc. | (258,312) | (10,702) |

| * | Weatherford | | |

| | International plc | (2,073,447) | (10,347) |

| * | Synergy Resources Corp. | (1,157,240) | (10,311) |

| | National Oilwell Varco Inc. | (263,760) | (9,875) |

| * | Concho Resources Inc. | (72,845) | (9,659) |

| * | Kosmos Energy Ltd. | (1,232,417) | (8,639) |

| | Hess Corp. | (132,727) | (8,268) |

| | Cabot Oil & Gas Corp. | (327,048) | (7,640) |

| | Noble Energy Inc. | (199,145) | (7,579) |

| | Pioneer Natural | | |

| | Resources Co. | (38,100) | (6,861) |

| | SemGroup Corp. Class A | (148,249) | (6,189) |

| * | Cobalt International | | |

| | Energy Inc. | (4,881,167) | (5,955) |

| | ConocoPhillips | (107,024) | (5,366) |

| | Delek US Holdings Inc. | (169,484) | (4,079) |

| | Anadarko Petroleum Corp. | (38,159) | (2,661) |

| * | Oasis Petroleum Inc. | (104,864) | (1,588) |

| | | | (126,968) |

| Financials (-12.4%) | | |

| | Banner Corp. | (205,542) | (11,471) |

| | M&T Bank Corp. | (72,457) | (11,334) |

| | FNB Corp. | (684,438) | (10,972) |

| | | |

| | Huntington | | |

| | Bancshares Inc. | (826,309) | (10,924) |

| | Valley National Bancorp | (929,106) | (10,815) |

| | Pinnacle Financial | | |

| | Partners Inc. | (153,493) | (10,637) |

| * | Signature Bank | (70,497) | (10,589) |

| | CNA Financial Corp. | (254,794) | (10,574) |

| | American International | | |

| | Group Inc. | (161,761) | (10,565) |

| | Northwest | | |

| | Bancshares Inc. | (585,375) | (10,554) |

| * | Stifel Financial Corp. | (210,130) | (10,496) |

| * | LendingClub Corp. | (1,984,779) | (10,420) |

| | American Equity | | |

| | Investment Life | | |

| | Holding Co. | (458,318) | (10,331) |

| * | Enstar Group Ltd. | (50,289) | (9,942) |

| | Mercury General Corp. | (163,475) | (9,843) |

| | Chubb Ltd. | (73,100) | (9,658) |

| | New York Community | | |

| | Bancorp Inc. | (597,609) | (9,508) |

| | Legg Mason Inc. | (287,120) | (8,588) |

| | Wintrust Financial Corp. | (116,859) | (8,480) |

| | Renasant Corp. | (168,867) | (7,130) |

| | MetLife Inc. | (120,232) | (6,479) |

| | Financial Engines Inc. | (162,677) | (5,978) |

| | Arthur J Gallagher & Co. | (106,656) | (5,542) |

| | Bank of the Ozarks Inc. | (103,167) | (5,426) |

| | Intercontinental | | |

| | Exchange Inc. | (85,500) | (4,824) |

| | FirstCash Inc. | (97,941) | (4,603) |

| | Progressive Corp. | (118,600) | (4,210) |

| | Hope Bancorp Inc. | (183,605) | (4,019) |

| | Kemper Corp. | (82,460) | (3,653) |

| | CIT Group Inc. | (71,275) | (3,042) |

| * | PHH Corp. | (158,788) | (2,407) |

| | United Community | | |

| | Banks Inc. | (65,391) | (1,937) |

| * | Markel Corp. | (2,121) | (1,918) |

| | Chemical Financial Corp. | (33,325) | (1,805) |

| * | Texas Capital | | |

| | Bancshares Inc. | (20,600) | (1,615) |

| | | | (260,289) |

| Health Care (-8.8%) | | |

| * | Ligand | | |

| | Pharmaceuticals Inc. | (103,870) | (10,554) |

| * | Alnylam | | |

| | Pharmaceuticals Inc. | (275,540) | (10,316) |

| * | DexCom Inc. | (172,786) | (10,315) |

| | Dentsply Sirona Inc. | (176,559) | (10,193) |

| * | Centene Corp. | (179,701) | (10,155) |

| * | Acadia Healthcare Co. Inc. | (300,430) | (9,944) |

| * | Wright Medical Group NV | (431,289) | (9,911) |

| * | Ultragenyx | | |

| | Pharmaceutical Inc. | (136,400) | (9,590) |

17

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| * | Alexion | | |

| | Pharmaceuticals Inc. | (74,206) | (9,079) |

| | STERIS plc | (131,873) | (8,887) |

| * | Integer Holdings Corp. | (295,193) | (8,693) |

| | Perrigo Co. plc | (103,040) | (8,576) |

| * | BioMarin | | |

| | Pharmaceutical Inc. | (97,207) | (8,053) |

| * | Endo International plc | (475,132) | (7,825) |

| * | Aerie Pharmaceuticals Inc. | (198,498) | (7,513) |

| * | Neurocrine | | |

| | Biosciences Inc. | (192,970) | (7,468) |

| * | Acceleron Pharma Inc. | (288,675) | (7,367) |

| * | Nevro Corp. | (96,503) | (7,012) |

| * | Amicus Therapeutics Inc. | (1,336,445) | (6,642) |

| * | Endologix Inc. | (899,383) | (5,145) |

| | CONMED Corp. | (102,392) | (4,523) |

| * | Portola | | |

| | Pharmaceuticals Inc. | (123,616) | (2,774) |

| * | ACADIA | | |

| | Pharmaceuticals Inc. | (76,271) | (2,200) |

| * | Prothena Corp. plc | (40,123) | (1,974) |

| * | Achillion | | |

| | Pharmaceuticals Inc. | (193,048) | (797) |

| | | | (185,506) |

| Industrials (-15.6%) | | |

| * | Team Inc. | (292,026) | (11,462) |

| * | RBC Bearings Inc. | (123,404) | (11,453) |

| * | Clean Harbors Inc. | (201,415) | (11,209) |

| | Korn/Ferry International | (370,367) | (10,900) |

| | Graco Inc. | (129,600) | (10,769) |

| * | Spirit Airlines Inc. | (182,793) | (10,576) |

| | Dover Corp. | (140,630) | (10,537) |

| * | Beacon Roofing | | |

| | Supply Inc. | (226,139) | (10,418) |

| * | Stericycle Inc. | (134,799) | (10,385) |

| | Cubic Corp. | (215,034) | (10,311) |

| | AMETEK Inc. | (210,393) | (10,225) |

| * | Proto Labs Inc. | (197,735) | (10,154) |

| | Johnson Controls | | |

| | International plc | (245,011) | (10,092) |

| | Roper Technologies Inc. | (54,526) | (9,983) |

| | Union Pacific Corp. | (96,279) | (9,982) |

| * | Kirby Corp. | (149,575) | (9,947) |

| | Macquarie | | |

| | Infrastructure Corp. | (119,581) | (9,770) |

| | Covanta Holding Corp. | (622,617) | (9,713) |

| * | Middleby Corp. | (74,442) | (9,589) |

| * | Herc Holdings Inc. | (227,277) | (9,127) |

| | Allegion plc | (135,918) | (8,699) |

| | TransDigm Group Inc. | (34,570) | (8,607) |

| | ITT Inc. | (215,706) | (8,320) |

| | Flowserve Corp. | (168,905) | (8,116) |

| * | Echo Global Logistics Inc. | (308,746) | (7,734) |

| | Fastenal Co. | (151,470) | (7,116) |

| | Werner Enterprises Inc. | (263,093) | (7,090) |

| | Primoris Services Corp. | (302,200) | (6,884) |

| | | |

| * | KLX Inc. | (149,732) | (6,754) |

| * | BMC Stock Holdings Inc. | (342,202) | (6,673) |

| | KBR Inc. | (387,213) | (6,463) |

| * | SiteOne Landscape | | |

| | Supply Inc. | (132,661) | (4,607) |

| | Forward Air Corp. | (93,346) | (4,423) |

| * | WageWorks Inc. | (59,602) | (4,321) |

| | Matson Inc. | (113,688) | (4,023) |

| | EnPro Industries Inc. | (54,391) | (3,664) |

| | Acuity Brands Inc. | (15,101) | (3,486) |

| | Matthews International | | |

| | Corp. Class A | (36,000) | (2,767) |

| | Hubbell Inc. Class B | (20,850) | (2,433) |

| | CEB Inc. | (39,242) | (2,378) |

| * | Mercury Systems Inc. | (77,313) | (2,336) |

| | Healthcare Services | | |

| | Group Inc. | (57,169) | (2,239) |

| | Knight Transportation Inc. | (33,600) | (1,111) |

| | | | (326,846) |

| Information Technology (-16.0%) | |

| | Western Digital Corp. | (162,961) | (11,073) |

| * | Microsemi Corp. | (195,928) | (10,574) |

| | Visa Inc. Class A | (134,017) | (10,456) |

| * | Tyler Technologies Inc. | (72,459) | (10,345) |

| * | Universal Display Corp. | (183,327) | (10,321) |

| | Corning Inc. | (425,011) | (10,315) |

| * | NetScout Systems Inc. | (324,699) | (10,228) |

| | Microchip Technology Inc. | (158,635) | (10,176) |

| * | Akamai Technologies Inc. | (151,104) | (10,076) |

| * | Envestnet Inc. | (278,627) | (9,822) |

| * | WEX Inc. | (86,579) | (9,662) |

| * | comScore Inc. | (294,315) | (9,294) |

| | Fidelity National | | |

| | Information Services Inc. | (121,727) | (9,207) |

| * | Yahoo! Inc. | (235,133) | (9,093) |

| * | Rogers Corp. | (116,946) | (8,983) |

| | SS&C Technologies | | |

| | Holdings Inc. | (307,837) | (8,804) |

| * | Qorvo Inc. | (162,383) | (8,562) |

| | Global Payments Inc. | (123,035) | (8,540) |

| * | PayPal Holdings Inc. | (214,318) | (8,459) |

| | Cabot | | |

| | Microelectronics Corp. | (123,204) | (7,783) |

| * | Palo Alto Networks Inc. | (61,500) | (7,691) |

| | Activision Blizzard Inc. | (207,586) | (7,496) |

| | Littelfuse Inc. | (49,140) | (7,458) |

| * | Imperva Inc. | (192,325) | (7,385) |

| * | Twitter Inc. | (447,855) | (7,300) |

| * | salesforce.com Inc. | (104,833) | (7,177) |

| * | ViaSat Inc. | (107,592) | (7,125) |

| * | Zendesk Inc. | (321,446) | (6,815) |

| * | FleetCor | | |

| | Technologies Inc. | (47,249) | (6,687) |

| * | CoStar Group Inc. | (34,969) | (6,591) |

| * | Cavium Inc. | (100,582) | (6,280) |

| * | Trimble Inc. | (202,018) | (6,091) |

18

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value* |

| | | Shares | ($000) |

| | QUALCOMM Inc. | (88,956) | (5,800) |

| | AVX Corp. | (353,551) | (5,526) |

| | j2 Global Inc. | (59,914) | (4,901) |

| * | Integrated Device | | |

| | Technology Inc. | (202,284) | (4,766) |

| * | ANSYS Inc. | (50,700) | (4,689) |

| | FLIR Systems Inc. | (127,642) | (4,619) |

| * | Diodes Inc. | (177,736) | (4,563) |

| * | Workday Inc. Class A | (67,299) | (4,448) |

| * | PTC Inc. | (71,988) | (3,331) |

| | Analog Devices Inc. | (40,406) | (2,934) |

| | National Instruments Corp. | (87,625) | (2,701) |

| * | OSI Systems Inc. | (33,979) | (2,587) |

| | Oracle Corp. | (47,753) | (1,836) |

| * | Q2 Holdings Inc. | (63,442) | (1,830) |

| | Cognex Corp. | (26,000) | (1,654) |

| * | Synchronoss | | |

| | Technologies Inc. | (29,775) | (1,140) |

| | Broadcom Ltd. | (5,781) | (1,022) |

| * | Ultimate Software | | |

| | Group Inc. | (4,946) | (902) |

| | | | (335,118) |

| Materials (-6.1%) | | |

| | CF Industries Holdings Inc. | (367,364) | (11,565) |

| * | Ingevity Corp. | (209,380) | (11,487) |

| | Mosaic Co. | (368,526) | (10,809) |

| | Scotts Miracle-Gro Co. | | |

| | Class A | (111,723) | (10,675) |

| | Olin Corp. | (415,476) | (10,640) |

| | AptarGroup Inc. | (142,878) | (10,494) |

| | WestRock Co. | (206,478) | (10,483) |

| | Compass Minerals | | |

| | International Inc. | (132,216) | (10,359) |

| | Ball Corp. | (135,408) | (10,165) |

| | Westlake Chemical Corp. | (163,139) | (9,134) |

| | Tahoe Resources Inc. | (767,750) | (7,232) |

| | Ashland Global | | |

| | Holdings Inc. | (52,790) | (5,770) |

| * | Boise Cascade Co. | (130,126) | (2,928) |

| | Ferroglobe plc | (248,208) | (2,688) |

| | Vulcan Materials Co. | (13,314) | (1,666) |

| | Southern Copper Corp. | (34,169) | (1,091) |

| * | Ferroglobe R&W Trust | (82,051) | |

| | | | (127,186) |

| Real Estate (-7.7%) | | |

| | Realogy Holdings Corp. | (417,497) | (10,742) |

| | Jones Lang LaSalle Inc. | (105,985) | (10,709) |

| | Equinix Inc. | (29,740) | (10,629) |

| | Weyerhaeuser Co. | (340,952) | (10,259) |

| | Monogram Residential | | |

| | Trust Inc. | (880,468) | (9,527) |

| * | Howard Hughes Corp. | (80,124) | (9,142) |

| | Sun Communities Inc. | (117,861) | (9,029) |

| | Vornado Realty Trust | (83,414) | (8,706) |

| | Kilroy Realty Corp. | (117,310) | (8,590) |

| | | |

| | Life Storage Inc. | (98,589) | (8,406) |

| | Rayonier Inc. | (305,246) | (8,120) |

| | Alexander & Baldwin Inc. | (173,484) | (7,784) |

| | Kennedy-Wilson | | |

| | Holdings Inc. | (340,642) | (6,983) |

| | Boston Properties Inc. | (53,374) | (6,713) |

| | Paramount Group Inc. | (386,519) | (6,181) |

| | Colony Starwood Homes | (187,349) | (5,398) |

| * | CBRE Group Inc. Class A | (136,183) | (4,288) |

| * | Marcus & Millichap Inc. | (143,303) | (3,829) |

| | Hudson Pacific | | |

| | Properties Inc. | (105,733) | (3,677) |

| | Empire State Realty | | |

| | Trust Inc. | (177,889) | (3,592) |

| | Extra Space Storage Inc. | (32,186) | (2,486) |

| | Education Realty Trust Inc. | (57,356) | (2,426) |

| | HFF Inc. Class A | (67,405) | (2,039) |

| | Taubman Centers Inc. | (21,485) | (1,588) |

| | | | (160,843) |

| Telecommunication Services (-1.0%) | |

| | Frontier Communications | | |

| | Corp. | (2,500,828) | (8,453) |

| * | Vonage Holdings Corp. | (1,111,836) | (7,616) |

| | Shenandoah | | |

| | Telecommunications Co. | (181,176) | (4,946) |

| | | | (21,015) |

| Utilities (-2.6%) | | |

| * | Dynegy Inc. | (1,156,741) | (9,786) |

| | Sempra Energy | (90,661) | (9,124) |

| | Pattern Energy Group Inc. | | |

| | Class A | (427,351) | (8,115) |

| | Aqua America Inc. | (247,624) | (7,439) |

| | Dominion Resources Inc. | (67,900) | (5,200) |

| | California Water Service | | |

| | Group | (145,036) | (4,917) |

| | New Jersey Resources | | |

| | Corp. | (88,088) | (3,127) |

| | Avangrid Inc. | (78,794) | (2,985) |

| * | TerraForm Power Inc. | | |

| | Class A | (92,560) | (1,186) |

| | WGL Holdings Inc. | (15,502) | (1,182) |

| | American States Water Co. | (23,901) | (1,089) |

| | | | (54,150) |

| Total Common Stocks Sold Short | |

| (Proceeds $1,850,265) | | (2,023,391) |

| Temporary Cash Investment (3.4%) | |

| Money Market Fund (3.4%) | | |

| 1,2 | Vanguard Market | | |

| | Liquidity Fund, 0.823% | | |

| | (Cost $72,462) | 724,554 | 72,462 |

| ,2 Other Assets and Liabilities | |

| Net (96.3%) | | 2,019,742 |

| Net Assets (100%) | | 2,098,128 |

19

Market Neutral Fund

| |

| | Amount |

| | ($000) |

| Statement of Assets and Liabilities | |

| Assets | |

| Investments in Securities, | |

| Long Positions, at Value | |

| Unaffiliated Issuers | 2,029,315 |

| Affiliated Vanguard Funds | 72,462 |

| Total Long Positions | 2,101,777 |

| Investment in Vanguard | 149 |

| Cash Segregated for Short Positions | 2,050,281 |

| Receivables for Investment | |

| Securities Sold | 19,728 |

| Receivables for Accrued Income | 2,696 |

| Receivables for Capital Shares Issued | 3,681 |

| Total Assets | 4,178,312 |

| Liabilities | |

| Securities Sold Short, at Value | 2,023,391 |

| Payables for Investment | |

| Securities Purchased | 18,586 |

| Collateral for Securities on Loan | 33,641 |

| Payables for Capital Shares Redeemed | 2,182 |

| Payables to Vanguard | 2,378 |

| Other Liabilities | 6 |

| Total Liabilities | 2,080,184 |

| Net Assets | 2,098,128 |

| |

| At December 31, 2016, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 2,034,761 |

| Overdistributed Net Investment Income | (28) |

| Accumulated Net Realized Losses | (83,002) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities Long Positions | 319,523 |

| Investment Securities Sold Short | (173,126) |

| Net Assets | 2,098,128 |

| |

| |

| Investor Shares Net Assets | |

| Applicable to 142,053,553 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 1,760,069 |

| Net Asset Value Per Share | |

| Investor Shares | $12.39 |

| |

| |

| Institutional Shares Net Assets | |

| Applicable to 27,397,924 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 338,059 |

| Net Asset Value Per Share | |

| Institutional Shares | $12.34 |

* See Note A in Notes to Financial Statements. * Non-income-producing security.

Long security positions with a value of $1,293,743,000 and cash of $2,050,281,000 are held in a segregated account at the fund s custodian bank and pledged to a broker-dealer as collateral for the fund s obligation to return borrowed securities. For so long as such obligations continue, the fund s access to these assets is subject to authorization from the broker-dealer.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $30,992,000.

1 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

2 Includes $33,641,000 of collateral received for securities on loan. REIT Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

20

| |

| Market Neutral Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | December 31, 2016 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 33,231 |

| Interest1 | 224 |

| Securities Lending Net | 546 |

| Total Income | 34,001 |

| Expenses | |

| The Vanguard Group Note B | |

| Investment Advisory Services | 884 |

| Management and Administrative Investor Shares | 1,762 |

| Management and Administrative Institutional Shares | 180 |

| Marketing and Distribution Investor Shares | 387 |

| Marketing and Distribution Institutional Shares | 9 |

| Custodian Fees | 85 |

| Auditing Fees | 28 |

| Shareholders Reports Investor Shares | 54 |

| Shareholders Reports Institutional Shares | 1 |

| Trustees Fees and Expenses | 1 |

| Dividend Expense on Securities Sold Short | 22,445 |

| Borrowing Expense on Securities Sold Short | 31 |

| Total Expenses | 25,867 |

| Net Investment Income (Loss) | 8,134 |

| Realized Net Gain (Loss) | |

| Investment Securities Long Positions1 | 24,404 |

| Investment Securities Sold Short | (95,152) |

| Realized Net Gain (Loss) | (70,748) |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities Long Positions | 308,859 |

| Investment Securities Sold Short | (207,626) |

| Change in Unrealized Appreciation (Depreciation) of Investment Securities | 101,233 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 38,619 |

1 Interest income and realized net gain (loss) from an affiliated company of the fund were $224,000 and $3,000, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

21

| | |

| Market Neutral Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended December 31, |

| | 2016 | 2015 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income (Loss) | 8,134 | 124 |

| Realized Net Gain (Loss) | (70,748) | 5,194 |

| Change in Unrealized Appreciation (Depreciation) | 101,233 | 16,470 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 38,619 | 21,788 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (6,469) | (103) |

| Institutional Shares | (1,526) | (100) |

| Realized Capital Gain | | |

| Investor Shares | | |

| Institutional Shares | | |

| Total Distributions | (7,995) | (203) |

| Capital Share Transactions | | |

| Investor Shares | 1,085,149 | 374,308 |

| Institutional Shares | 230,873 | 43,646 |

| Net Increase (Decrease) from Capital Share Transactions | 1,316,022 | 417,954 |

| Total Increase (Decrease) | 1,346,646 | 439,539 |

| Net Assets | | |

| Beginning of Period | 751,482 | 311,943 |

| End of Period1 | 2,098,128 | 751,482 |

1 Net Assets End of Period includes undistributed (overdistributed) net investment income of ($28,000) and ($209,000).

See accompanying Notes, which are an integral part of the Financial Statements.

22

| | | | | |

| Market Neutral Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended December 31, |

| Throughout Each Period | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $12.12 | $11.50 | $11.03 | $10.16 | $10.36 |

| Investment Operations | | | | | |

| Net Investment Income (Loss) | . 050 | . 0021 | (. 032) | (. 007) | . 045 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | . 267 | .620 | .502 | . 880 | (. 200) |

| Total from Investment Operations | .317 | .622 | .470 | .873 | (.155) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (. 047) | (. 002) | | (. 002) | (. 045) |

| Distributions from Realized Capital Gains | | | | | |

| Return of Capital | | | | (.001) | |

| Total Distributions | (. 047) | (. 002) | | (. 003) | (. 045) |

| Net Asset Value, End of Period | $12.39 | $12.12 | $11.50 | $11.03 | $10.16 |

| |

| Total Return2 | 2.62% | 5.41% | 4.26% | 8.59% | -1.50% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $1,760 | $650 | $257 | $174 | $151 |

| Ratio of Expenses to Average Net Assets | | | | | |

| Based on Total Expenses3 | 1.60% | 1.46% | 1.64% | 1.57% | 1.88% |

| Net of Dividend and Borrowing Expense on | | | | | |

| Securities Sold Short | 0.22% | 0.25% | 0.25% | 0.25% | 0.25% |

| Ratio of Net Investment Income (Loss) to | | | | | |

| Average Net Assets | 0.48% | 0.01% | (0.38%) | (0.06%) | 0.44% |

| Portfolio Turnover Rate | 64% | 68% | 73% | 68% | 89% |

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable transaction fees.

3 Includes 2016 dividend and borrowing expense on securities sold short of 1.38% and 0.00%, respectively. Includes 2015 dividend and borrowing expense on securities sold short of 1.06% and 0.15%, respectively. Includes 2014 dividend and borrowing expense on securities sold short of 1.21% and 0.18%, respectively. Includes 2013 dividend and borrowing expense on securities sold short of 1.18% and 0.14%, respectively. Includes 2012 dividend and borrowing expense on securities sold short of 1.52% and 0.11%, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

23

| | | | | |

| Market Neutral Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| Institutional Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended December 31, |

| Throughout Each Period | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $12.07 | $11.45 | $10.97 | $10.10 | $10.33 |

| Investment Operations | | | | | |

| Net Investment Income (Loss) | . 061 | . 0111 | (.023) | .006 | .071 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | .265 | .621 | .503 | .868 | (.215) |

| Total from Investment Operations | .326 | .632 | .480 | .874 | (.144) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (. 056) | (. 012) | | (. 003) | (. 086) |

| Distributions from Realized Capital Gains | | | | | |

| Return of Capital | | | | (.001) | |

| Total Distributions | (. 056) | (. 012) | | (. 004) | (. 086) |

| Net Asset Value, End of Period | $12.34 | $12.07 | $11.45 | $10.97 | $10.10 |

| |

| Total Return2 | 2.70% | 5.52% | 4.38% | 8.66% | -1.39% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $338 | $102 | $55 | $35 | $31 |

| Ratio of Expenses to Average Net Assets | | | | | |

| Based on Total Expenses3 | 1.52% | 1.36% | 1.54% | 1.47% | 1.78% |

| Net of Dividend and Borrowing Expense on | | | | | |

| Securities Sold Short | 0.14% | 0.15% | 0.15% | 0.15% | 0.15% |

| Ratio of Net Investment Income (Loss) to | | | | | |

| Average Net Assets | 0.56% | 0.11% | (0.28%) | 0.04% | 0.54% |

| Portfolio Turnover Rate | 64% | 68% | 73% | 68% | 89% |

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable transaction fees.

3 Includes 2016 dividend and borrowing expense on securities sold short of 1.38% and 0.00%, respectively. Includes 2015 dividend and borrowing expense on securities sold short of 1.06% and 0.15%, respectively. Includes 2014 dividend and borrowing expense on securities sold short of 1.21% and 0.18%, respectively. Includes 2013 dividend and borrowing expense on securities sold short of 1.18% and 0.14%, respectively. Includes 2012 dividend and borrowing expense on securities sold short of 1.52% and 0.11%, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Market Neutral Fund

Notes to Financial Statements

Vanguard Market Neutral Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Institutional Shares. Investor Shares are available to any investor who meets the fund s minimum purchase requirements. Institutional Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund s pricing time but after the close of the securities primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund s net asset value.

2. Short Sales: Short sales are the sales of securities that the fund does not own. The fund sells a security it does not own in anticipation of a decline in the value of that security. In order to deliver the security to the purchaser, the fund borrows the security from a broker-dealer. The fund must segregate, as collateral for its obligation to return the borrowed security, an amount of cash and long security positions at least equal to the market value of the security sold short, and in the absence of a default, such collateral cannot be repledged, resold, or rehypothecated. This results in the fund holding a significant portion of its assets in cash. The fund later closes out the position by returning the security to the lender, typically by purchasing the security in the open market. A gain, limited to the price at which the fund sold the security short, or a loss, theoretically unlimited in size, is recognized upon the termination of the short sale. The fund may receive a portion of the income from the investment of collateral, or be charged a fee on borrowed securities, based on the market value of each borrowed security and a variable rate that is dependent upon the availability of such security. The net amounts of income or fees are recorded as interest income (for net income received) or borrowing expense on securities sold short (for net fees charged) on the Statement of Operations. Dividends on securities sold short are reported as an expense in the Statement of Operations.

Cash collateral segregated for securities sold short is recorded as an asset in the Statement of Assets and Liabilities. Long security positions segregated as collateral are shown in the Statement of Net Assets.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund s tax positions taken for all open federal income tax years (December 31, 2013 2016), and has concluded that no provision for federal income tax is required in the fund s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business

25

Market Neutral Fund