June 2024 Project Zodiac Discussion Materials Exhibit 16(c)(v) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Process and Proposal Summary

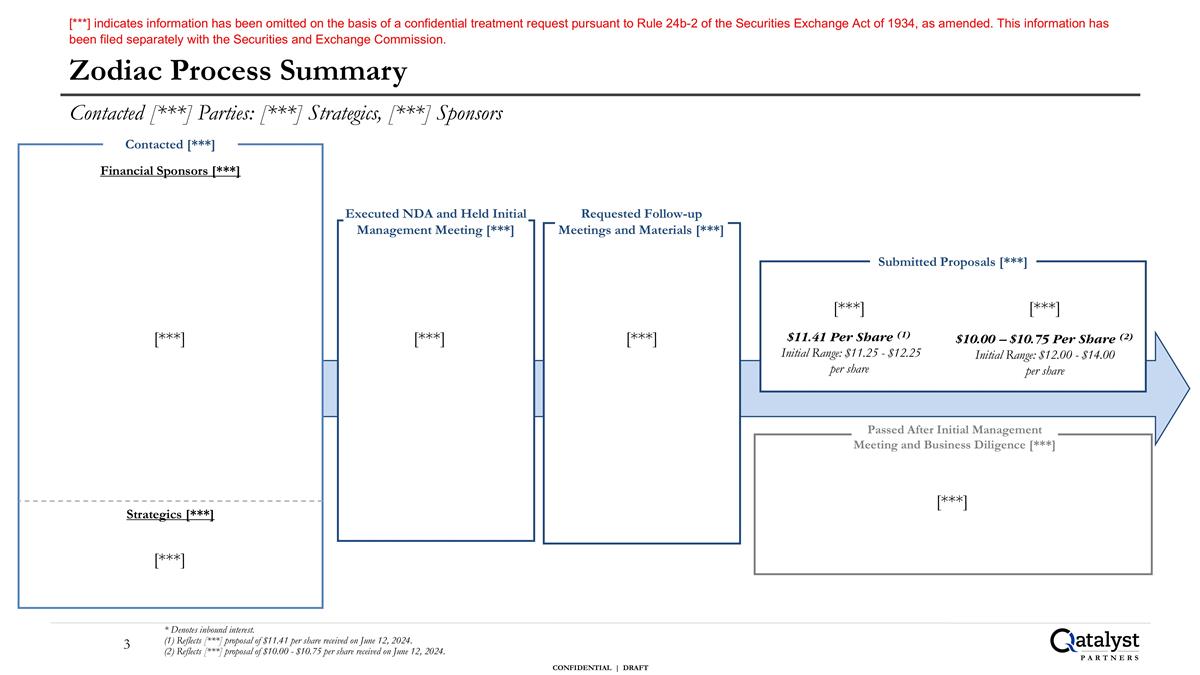

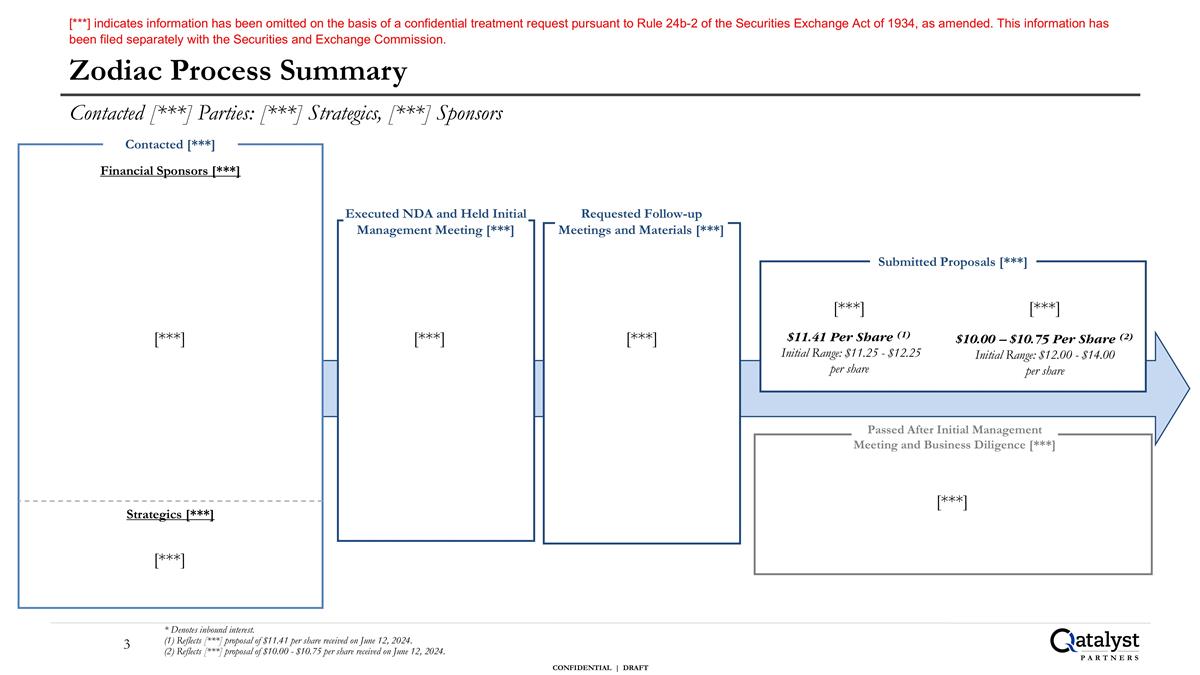

Zodiac Process Summary Contacted [***] Parties: [***] Strategics, [***] Sponsors * Denotes inbound interest. (1) Reflects [***] proposal of $11.41 per share received on June 12, 2024. (2) Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Executed NDA and Held Initial Management Meeting [***] Contacted [***] Financial Sponsors [***] Strategics [***] Requested Follow-up Meetings and Materials [***] Submitted Proposals [***] $11.41 Per Share (1) Initial Range: $11.25 - $12.25 per share $10.00 – $10.75 Per Share (2) Initial Range: $12.00 - $14.00 per share Passed After Initial Management Meeting and Business Diligence [***] [***] [***] [***] [***] [***] [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

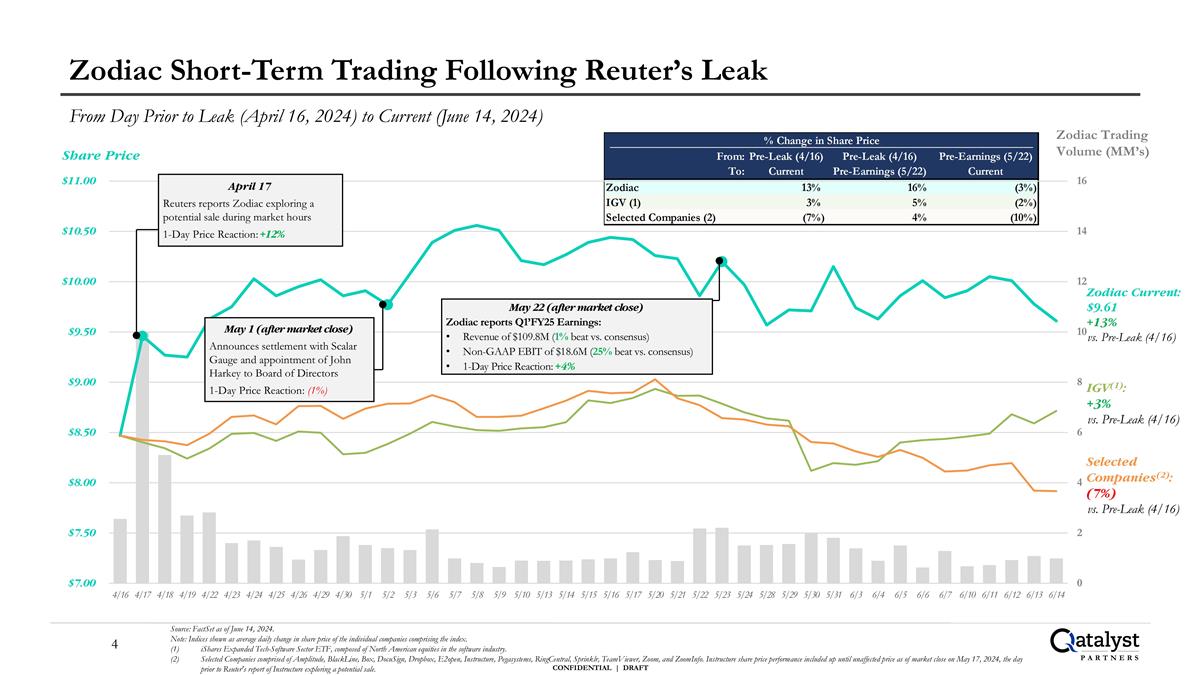

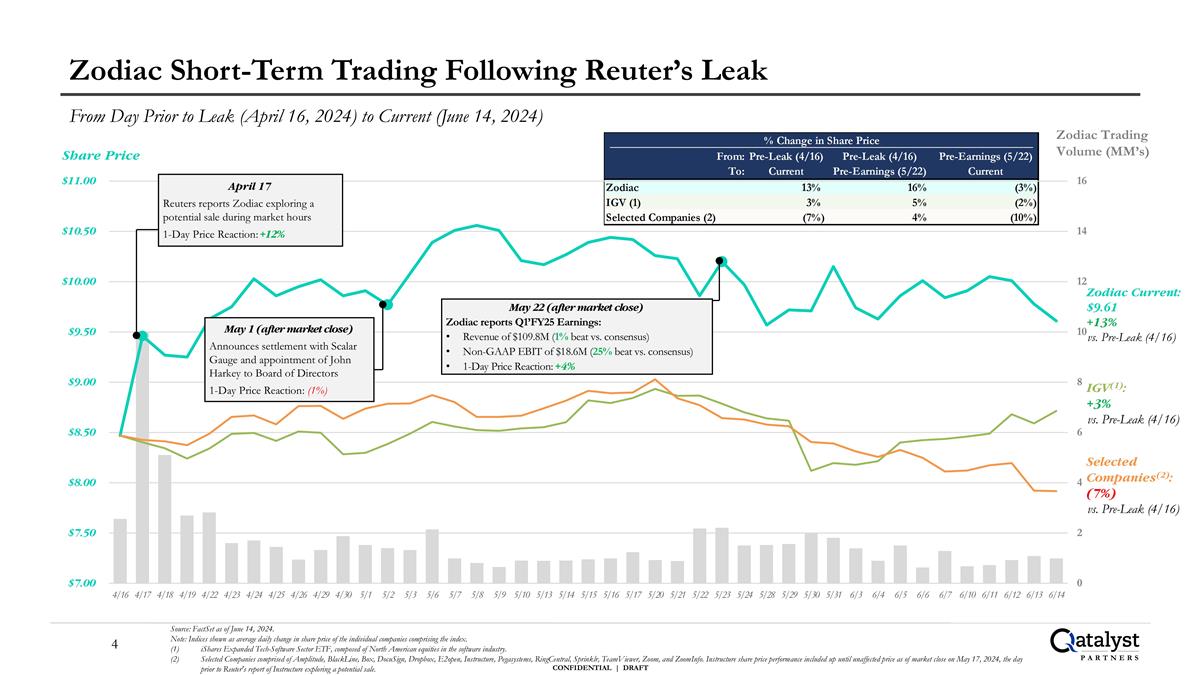

Source: FactSet as of June 14, 2024. Note: Indices shown as average daily change in share price of the individual companies comprising the index. iShares Expanded Tech-Software Sector ETF, composed of North American equities in the software industry. Selected Companies comprised of Amplitude, BlackLine, Box, DocuSign, Dropbox, E2open, Instructure, Pegasystems, RingCentral, Sprinklr, TeamViewer, Zoom, and ZoomInfo. Instructure share price performance included up until unaffected price as of market close on May 17, 2024, the day prior to Reuter's report of Instructure exploring a potential sale. Zodiac Current: $9.61 +13% vs. Pre-Leak (4/16) From Day Prior to Leak (April 16, 2024) to Current (June 14, 2024) Zodiac Short-Term Trading Following Reuter’s Leak April 17 Reuters reports Zodiac exploring a potential sale during market hours 1-Day Price Reaction: +12% Zodiac Trading Volume (MM’s) Share Price May 22 (after market close) Zodiac reports Q1’FY25 Earnings: Revenue of $109.8M (1% beat vs. consensus) Non-GAAP EBIT of $18.6M (25% beat vs. consensus) 1-Day Price Reaction: +4% May 1 (after market close) Announces settlement with Scalar Gauge and appointment of John Harkey to Board of Directors 1-Day Price Reaction: (1%) IGV(1): +3% vs. Pre-Leak (4/16) Selected Companies(2): (7%) vs. Pre-Leak (4/16)

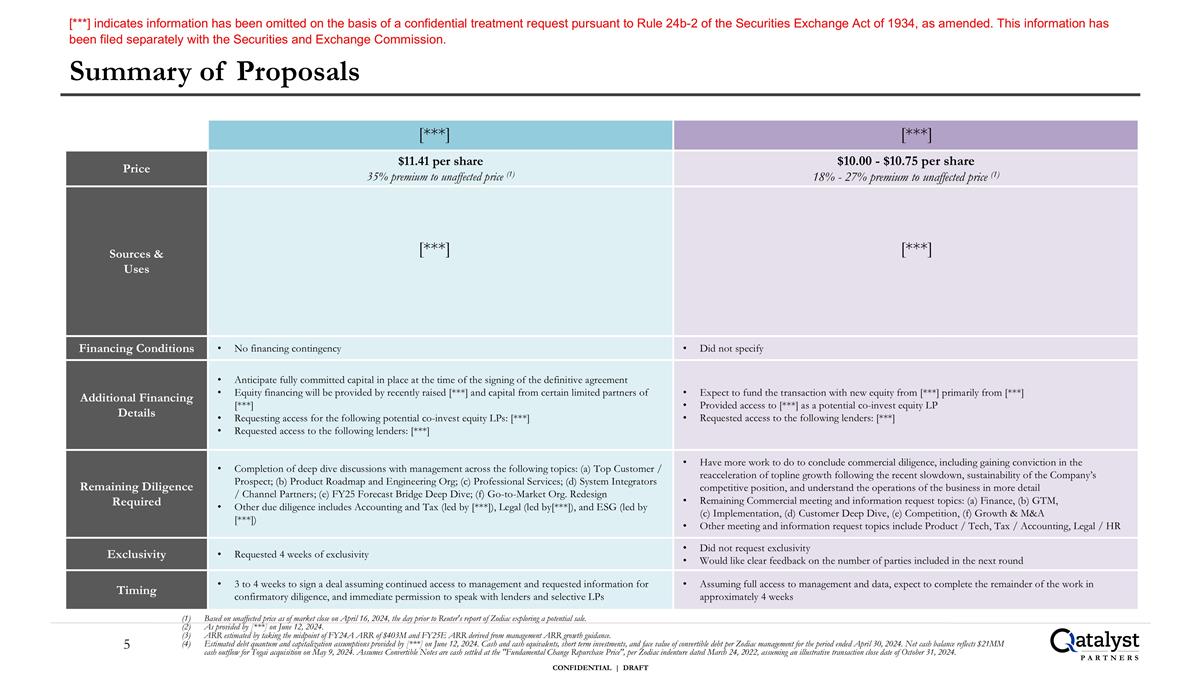

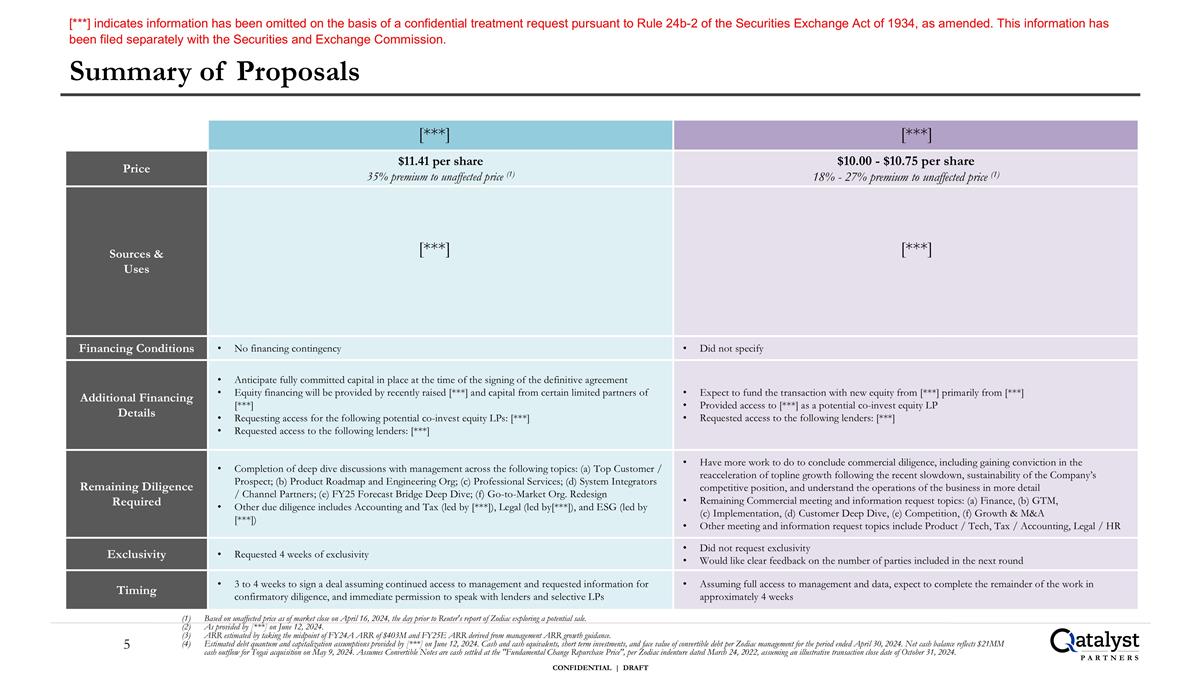

Summary of Proposals Price $11.41 per share 35% premium to unaffected price (1) $10.00 - $10.75 per share 18% - 27% premium to unaffected price (1) Sources & Uses Financing Conditions No financing contingency Did not specify Additional Financing Details Anticipate fully committed capital in place at the time of the signing of the definitive agreement Equity financing will be provided by recently raised [***] and capital from certain limited partners of [***] Requesting access for the following potential co-invest equity LPs: [***] Requested access to the following lenders: [***] Expect to fund the transaction with new equity from [***] primarily from [***] Provided access to [***] as a potential co-invest equity LP Requested access to the following lenders: [***] Remaining Diligence Required Completion of deep dive discussions with management across the following topics: (a) Top Customer / Prospect; (b) Product Roadmap and Engineering Org; (c) Professional Services; (d) System Integrators / Channel Partners; (e) FY25 Forecast Bridge Deep Dive; (f) Go-to-Market Org. Redesign Other due diligence includes Accounting and Tax (led by [***]), Legal (led by[***]), and ESG (led by [***]) Have more work to do to conclude commercial diligence, including gaining conviction in the reacceleration of topline growth following the recent slowdown, sustainability of the Company’s competitive position, and understand the operations of the business in more detail Remaining Commercial meeting and information request topics: (a) Finance, (b) GTM, (c) Implementation, (d) Customer Deep Dive, (e) Competition, (f) Growth & M&A Other meeting and information request topics include Product / Tech, Tax / Accounting, Legal / HR Exclusivity Requested 4 weeks of exclusivity Did not request exclusivity Would like clear feedback on the number of parties included in the next round Timing 3 to 4 weeks to sign a deal assuming continued access to management and requested information for confirmatory diligence, and immediate permission to speak with lenders and selective LPs Assuming full access to management and data, expect to complete the remainder of the work in approximately 4 weeks Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. As provided by [***] on June 12, 2024. ARR estimated by taking the midpoint of FY24A ARR of $403M and FY25E ARR derived from management ARR growth guidance. Estimated debt quantum and capitalization assumptions provided by [***] on June 12, 2024. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Assumes Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022, assuming an illustrative transaction close date of October 31, 2024. [***] [***] [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

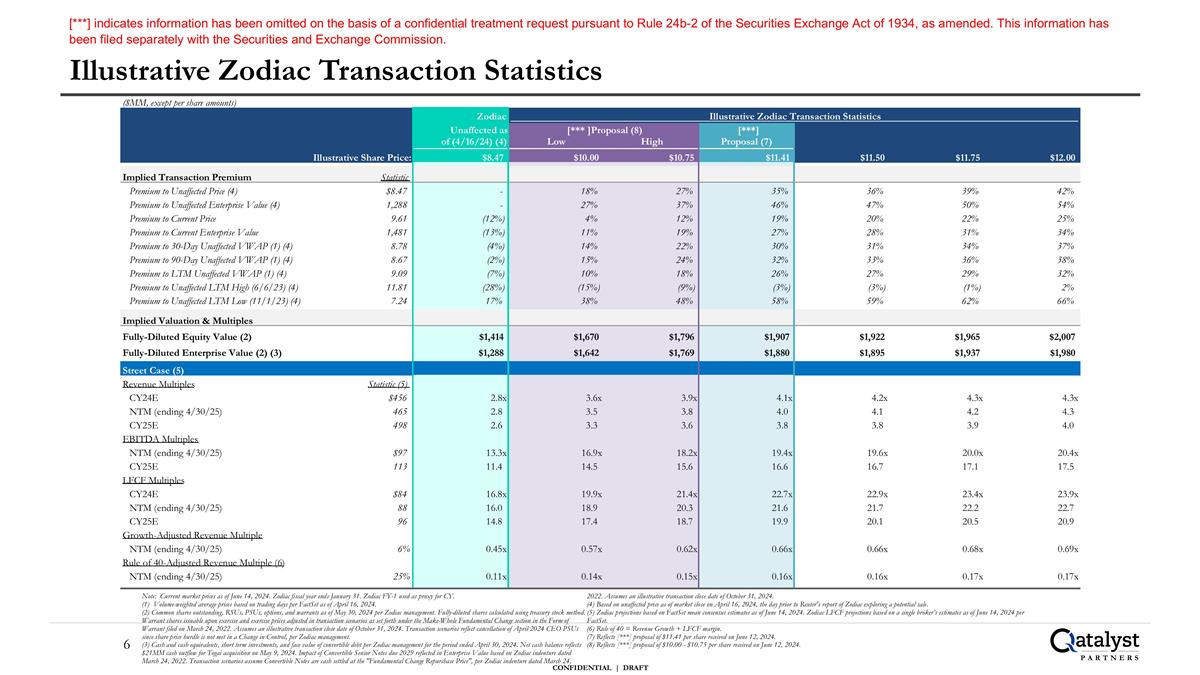

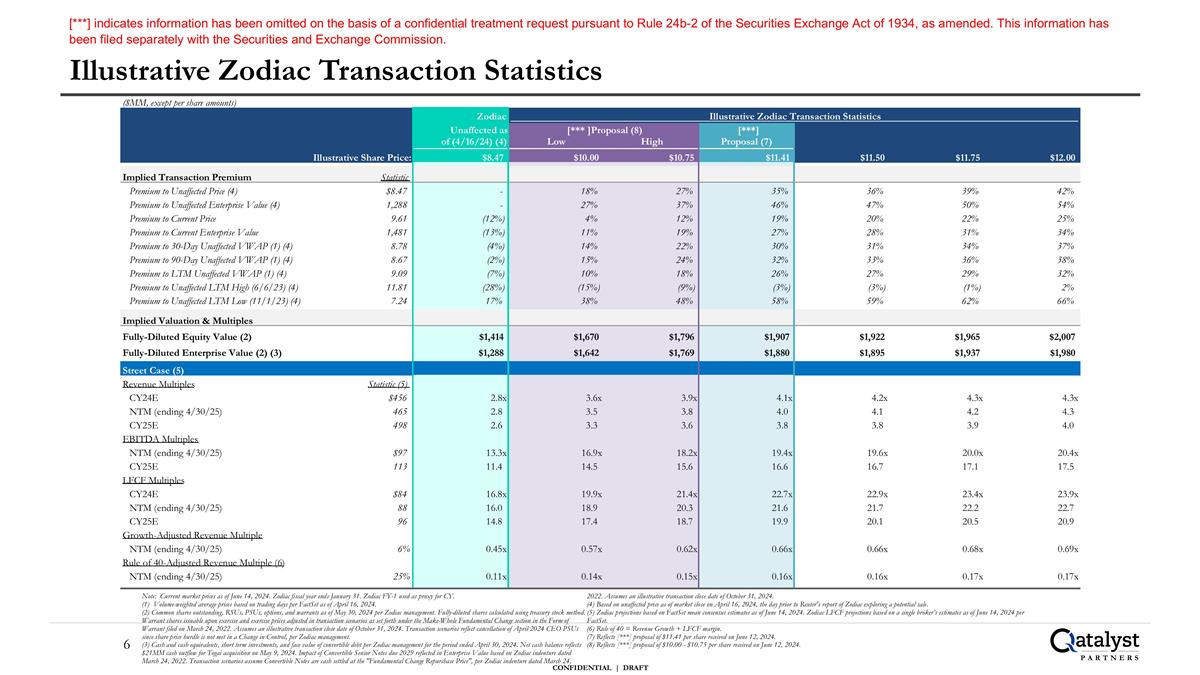

Illustrative Zodiac Transaction Statistics Note: Current market prices as of June 14, 2024. Zodiac fiscal year ends January 31. Zodiac FY-1 used as proxy for CY. (1) Volume-weighted average prices based on trading days per FactSet as of April 16, 2024. (2) Common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Warrant shares issuable upon exercise and exercise prices adjusted in transaction scenarios as set forth under the Make-Whole Fundamental Change section in the Form of Warrant filed on March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. Transaction scenarios reflect cancellation of April 2024 CEO PSUs since share price hurdle is not met in a Change in Control, per Zodiac management. (3) Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Impact of Convertible Senior Notes due 2029 reflected in Enterprise Value based on Zodiac indenture dated March 24, 2022. Transaction scenarios assume Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. (4) Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. (5) Zodiac projections based on FactSet mean consensus estimates as of June 14, 2024. Zodiac LFCF projections based on a single broker’s estimates as of June 14, 2024 per FactSet. (6) Rule of 40 = Revenue Growth + LFCF margin. (7) Reflects [***] proposal of $11.41 per share received on June 12, 2024. (8) Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. ($MM, except per share amounts) Zodiac Illustrative Zodiac Transaction Statistics Unaffected as [*** ]Proposal (8) [***] of (4/16/24) (4) Low High Proposal (7) Illustrative Share Price: $8.47 $10.00 $10.75 $11.41 $11.50 $11.75 $12.00 Implied Transaction Premium Statistic Premium to Unaffected Price (4) $8.47 - 18% 27% 35% 36% 39% 42% Premium to Unaffected Enterprise Value (4) 1,288 - 27% 37% 46% 47% 50% 54% Premium to Current Price 9.61 (12%) 4% 12% 19% 20% 22% 25% Premium to Current Enterprise Value 1,481 (13%) 11% 19% 27% 28% 31% 34% Premium to 30-Day Unaffected VWAP (1) (4) 8.78 (4%) 14% 22% 30% 31% 34% 37% Premium to 90-Day Unaffected VWAP (1) (4) 8.67 (2%) 15% 24% 32% 33% 36% 38% Premium to LTM Unaffected VWAP (1) (4) 9.09 (7%) 10% 18% 26% 27% 29% 32% Premium to Unaffected LTM High (6/6/23) (4) 11.81 (28%) (15%) (9%) (3%) (3%) (1%) 2% Premium to Unaffected LTM Low (11/1/23) (4) 7.24 17% 38% 48% 58% 59% 62% 66% Implied Valuation & Multiples Fully-Diluted Equity Value (2) $1,414 $1,670 $1,796 $1,907 $1,922 $1,965 $2,007 Fully-Diluted Enterprise Value (2) (3) $1,288 $1,642 $1,769 $1,880 $1,895 $1,937 $1,980 Street Case (5) Revenue Multiples Statistic (5) CY24E $456 2.8x 3.6x 3.9x 4.1x 4.2x 4.3x 4.3x NTM (ending 4/30/25) 465 2.8 3.5 3.8 4.0 4.1 4.2 4.3 CY25E 498 2.6 3.3 3.6 3.8 3.8 3.9 4.0 EBITDA Multiples NTM (ending 4/30/25) $97 13.3x 16.9x 18.2x 19.4x 19.6x 20.0x 20.4x CY25E 113 11.4 14.5 15.6 16.6 16.7 17.1 17.5 LFCF Multiples CY24E $84 16.8x 19.9x 21.4x 22.7x 22.9x 23.4x 23.9x NTM (ending 4/30/25) 88 16.0 18.9 20.3 21.6 21.7 22.2 22.7 CY25E 96 14.8 17.4 18.7 19.9 20.1 20.5 20.9 Growth-Adjusted Revenue Multiple NTM (ending 4/30/25) 6% 0.45x 0.57x 0.62x 0.66x 0.66x 0.68x 0.69x Rule of 40-Adjusted Revenue Multiple (6) NTM (ending 4/30/25) 25% 0.11x 0.14x 0.15x 0.16x 0.16x 0.17x 0.17x

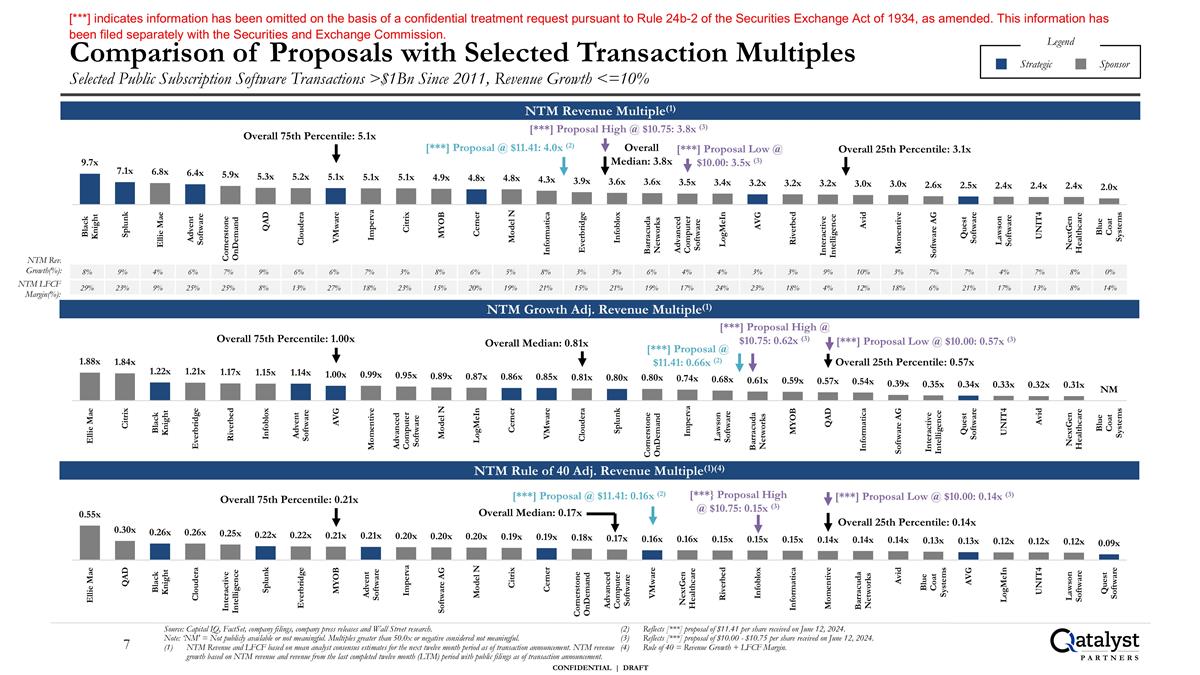

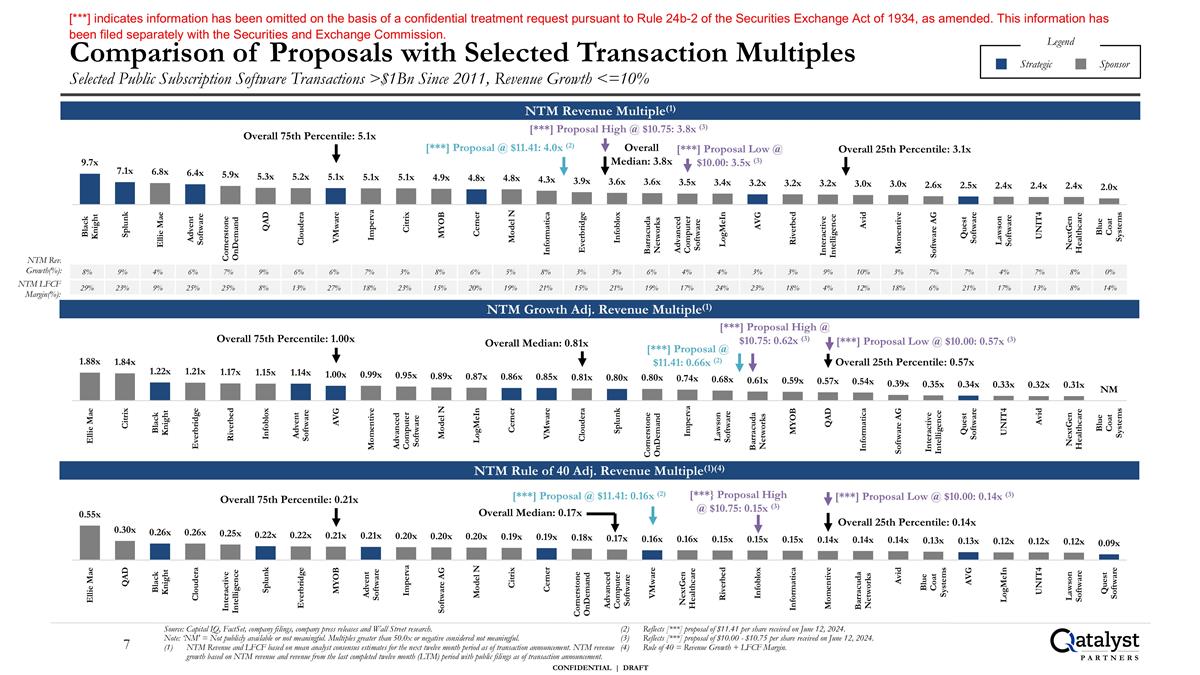

Comparison of Proposals with Selected Transaction Multiples Selected Public Subscription Software Transactions >$1Bn Since 2011, Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Note: ‘NM' = Not publicly available or not meaningful. Multiples greater than 50.0x or negative considered not meaningful. NTM Revenue and LFCF based on mean analyst consensus estimates for the next twelve month period as of transaction announcement. NTM revenue growth based on NTM revenue and revenue from the last completed twelve month (LTM) period with public filings as of transaction announcement. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Rule of 40 = Revenue Growth + LFCF Margin. NTM Revenue Multiple(1) Overall Median: 3.8x Overall 25th Percentile: 3.1x Overall 75th Percentile: 5.1x NTM Rev. Growth(%): 8% 9% 4% 6% 7% 9% 6% 6% 7% 3% 8% 6% 5% 8% 3% 3% 6% 4% 4% 3% 3% 9% 10% 3% 7% 7% 4% 7% 8% 0% NTM LFCF Margin(%): 29% 23% 9% 25% 25% 8% 13% 27% 18% 23% 15% 20% 19% 21% 15% 21% 19% 17% 24% 23% 18% 4% 12% 18% 6% 21% 17% 13% 8% 14% NTM Growth Adj. Revenue Multiple(1) Overall Median: 0.81x Overall 25th Percentile: 0.57x Overall 75th Percentile: 1.00x [***] Proposal @ $11.41: 4.0x (2) [***] Proposal @ $11.41: 0.66x (2) NTM Rule of 40 Adj. Revenue Multiple(1)(4) Overall Median: 0.17x Overall 25th Percentile: 0.14x Overall 75th Percentile: 0.21x [***] Proposal @ $11.41: 0.16x (2) [***] Proposal Low @ $10.00: 3.5x (3) [***] Proposal High @ $10.75: 3.8x (3) [***] Proposal Low @ $10.00: 0.57x (3) [***] Proposal High @ $10.75: 0.62x (3) [***] Proposal Low @ $10.00: 0.14x (3) [***} Proposal High @ $10.75: 0.15x (3) Legend Strategic Sponsor [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

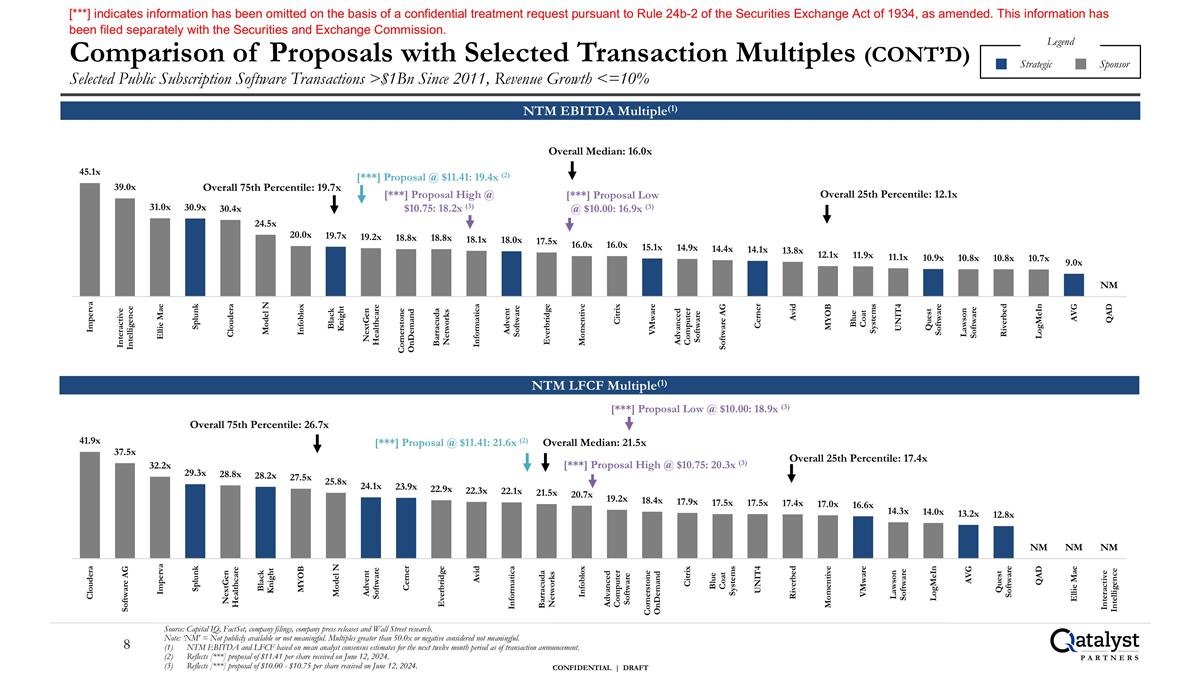

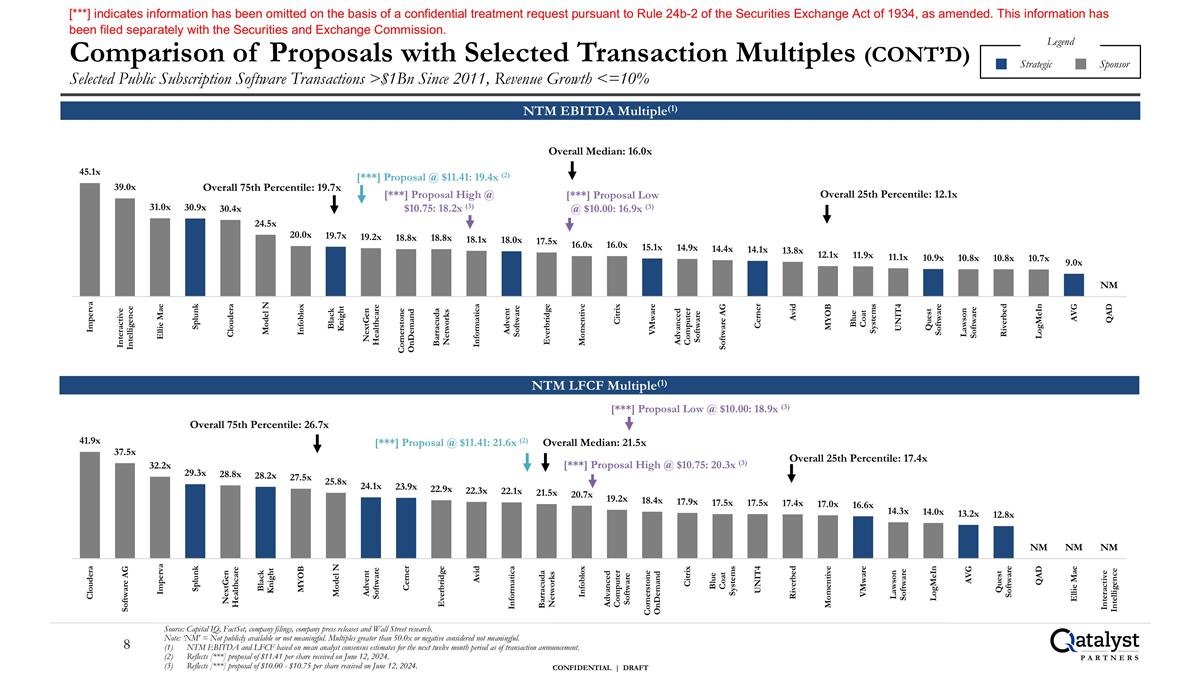

Comparison of Proposals with Selected Transaction Multiples (CONT’D) Selected Public Subscription Software Transactions >$1Bn Since 2011, Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Note: ‘NM' = Not publicly available or not meaningful. Multiples greater than 50.0x or negative considered not meaningful. NTM EBITDA and LFCF based on mean analyst consensus estimates for the next twelve month period as of transaction announcement. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. NTM EBITDA Multiple(1) Legend Strategic Sponsor Overall 75th Percentile: 19.7x Overall 25th Percentile: 12.1x Overall Median: 16.0x [***] Proposal @ $11.41: 19.4x (2) NTM LFCF Multiple(1) Overall Median: 21.5x Overall 25th Percentile: 17.4x Overall 75th Percentile: 26.7x [***] Proposal @ $11.41: 21.6x (2) [***] Proposal Low @ $10.00: 16.9x (3) [***] Proposal High @ $10.75: 18.2x (3) [***] Proposal Low @ $10.00: 18.9x (3) [***] Proposal High @ $10.75: 20.3x (3) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

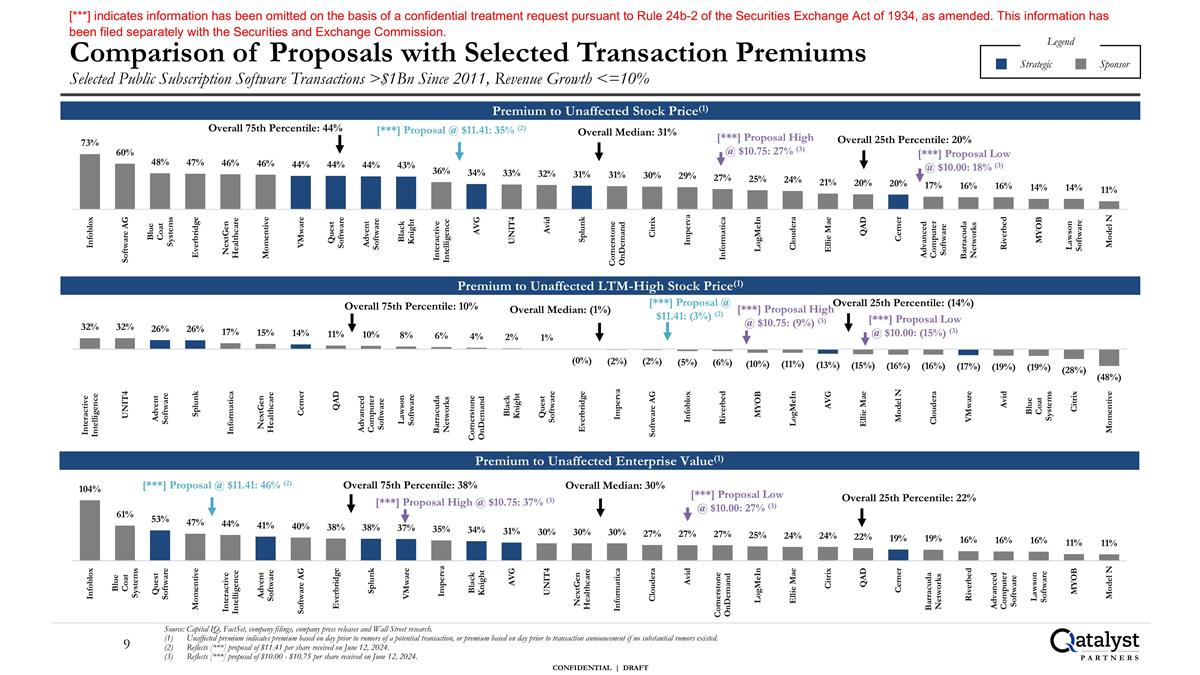

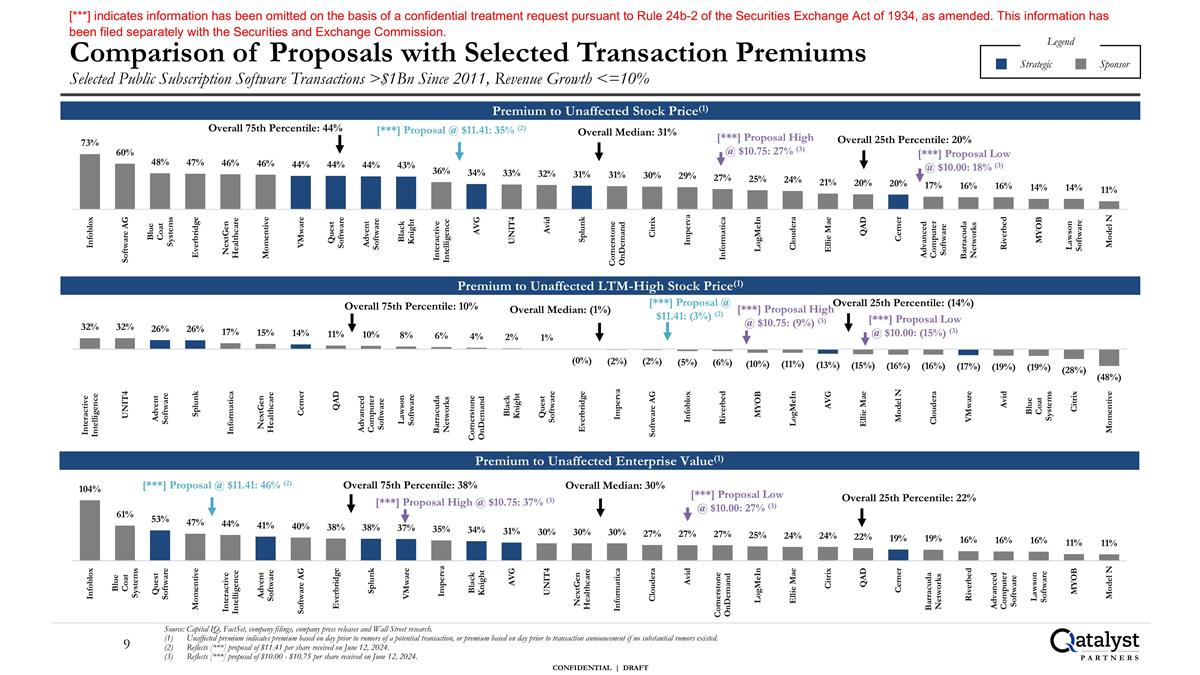

Comparison of Proposals with Selected Transaction Premiums Selected Public Subscription Software Transactions >$1Bn Since 2011, Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Premium to Unaffected Stock Price(1) Premium to Unaffected Enterprise Value(1) Overall 25th Percentile: 20% Overall 75th Percentile: 44% Overall Median: 31% [***] Proposal @ $11.41: 35% (2) Overall Median: 30% Overall 25th Percentile: 22% Overall 75th Percentile: 38% [***] Proposal @ $11.41: 46% (2) Premium to Unaffected LTM-High Stock Price(1) Overall Median: (1%) Overall 25th Percentile: (14%) Overall 75th Percentile: 10% [***] Proposal @ $11.41: (3%) (2) [***] Proposal Low @ $10.00: 18% (3) [***] Proposal High @ $10.75: 27% (3) [***] Proposal Low @ $10.00: (15%) (3) [***] Proposal High @ $10.75: (9%) (3) [***] Proposal Low @ $10.00: 27% (3) [***] Proposal High @ $10.75: 37% (3) Legend Strategic Sponsor [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

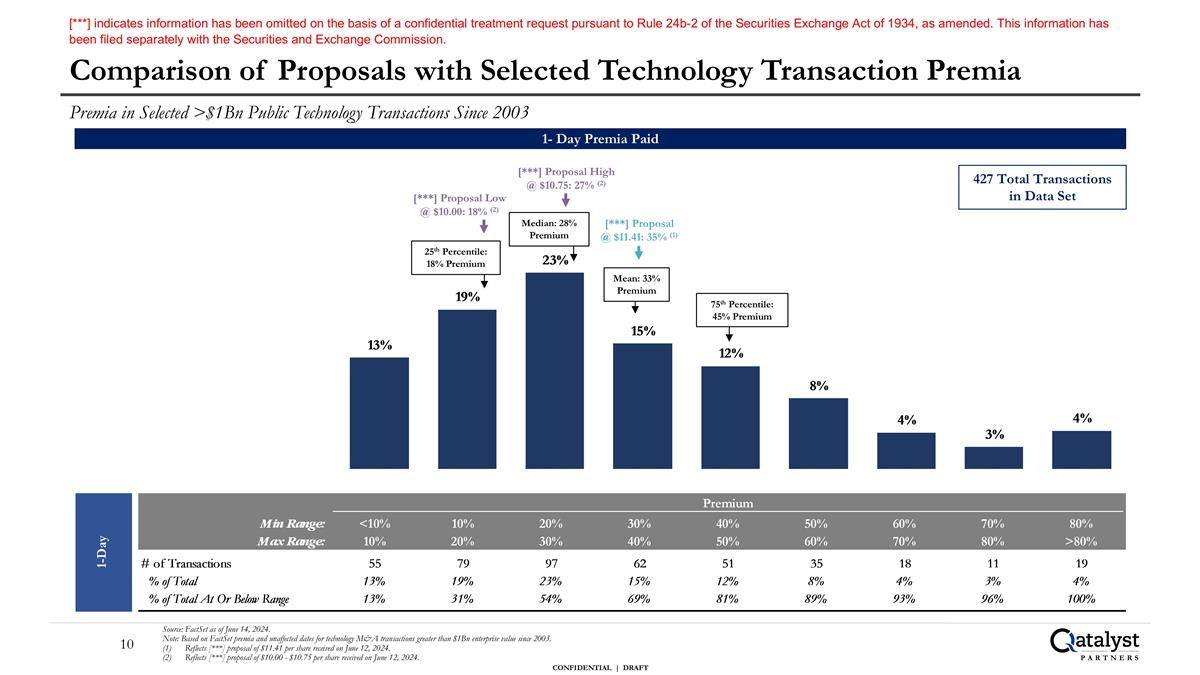

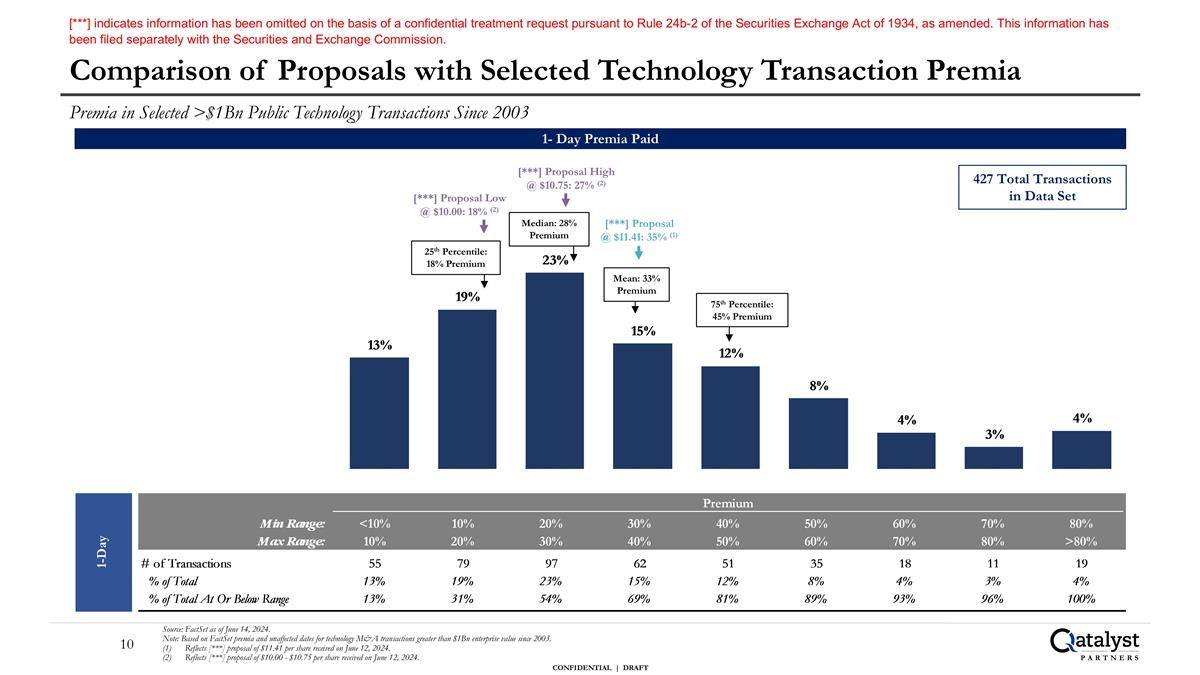

Comparison of Proposals with Selected Technology Transaction Premia Premia in Selected >$1Bn Public Technology Transactions Since 2003 Source: FactSet as of June 14, 2024. Note: Based on FactSet premia and unaffected dates for technology M&A transactions greater than $1Bn enterprise value since 2003. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. 1- Day Premia Paid 427 Total Transactions in Data Set 75th Percentile: 45% Premium Median: 28% Premium Mean: 33% Premium [***] Proposal @ $11.41: 35% (1) 25th Percentile: 18% Premium [***] Proposal High @ $10.75: 27% (2) [***] Proposal Low @ $10.00: 18% (2) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

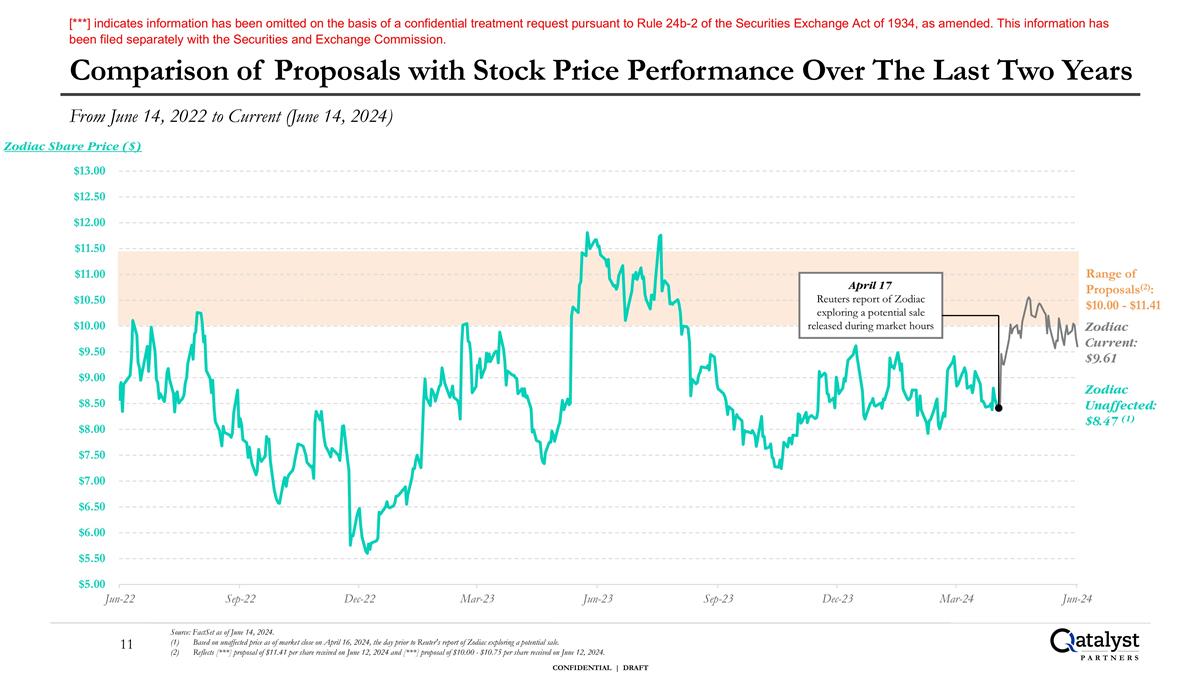

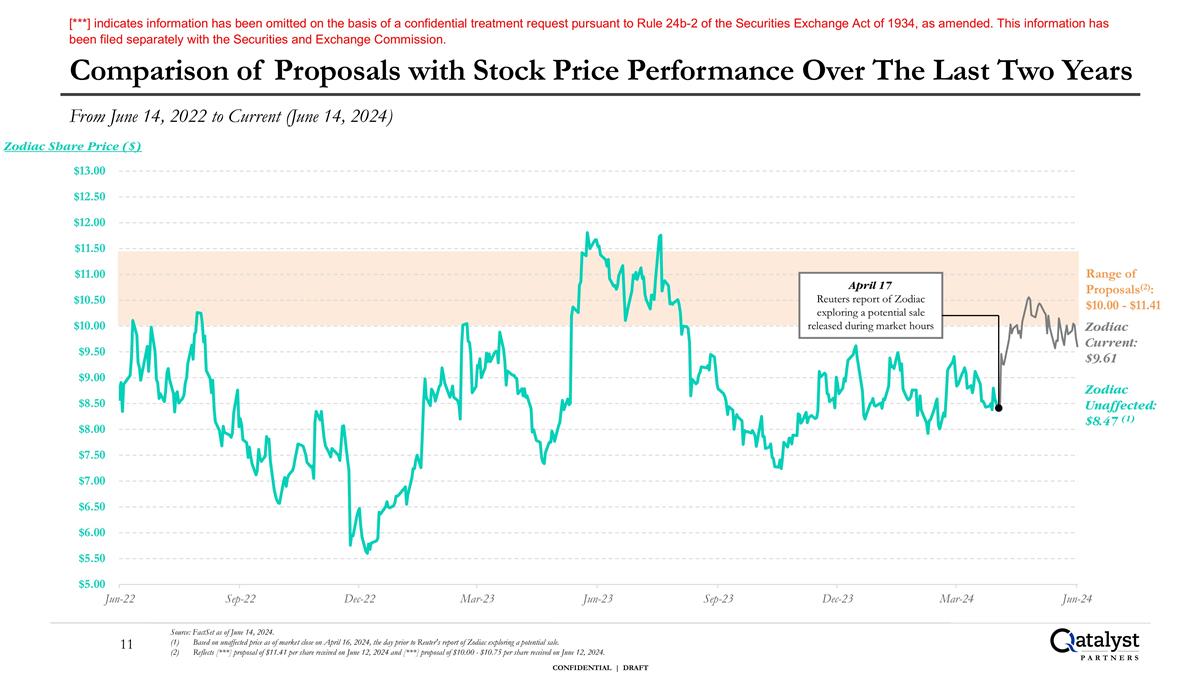

Range of Proposals(2): $10.00 - $11.41 Source: FactSet as of June 14, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Reflects [***] proposal of $11.41 per share received on June 12, 2024 and [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Zodiac Current: $9.61 Zodiac Share Price ($) From June 14, 2022 to Current (June 14, 2024) Comparison of Proposals with Stock Price Performance Over The Last Two Years April 17 Reuters report of Zodiac exploring a potential sale released during market hours Zodiac Unaffected: $8.47 (1) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Zodiac Financial Overview and Preliminary Valuation Analysis

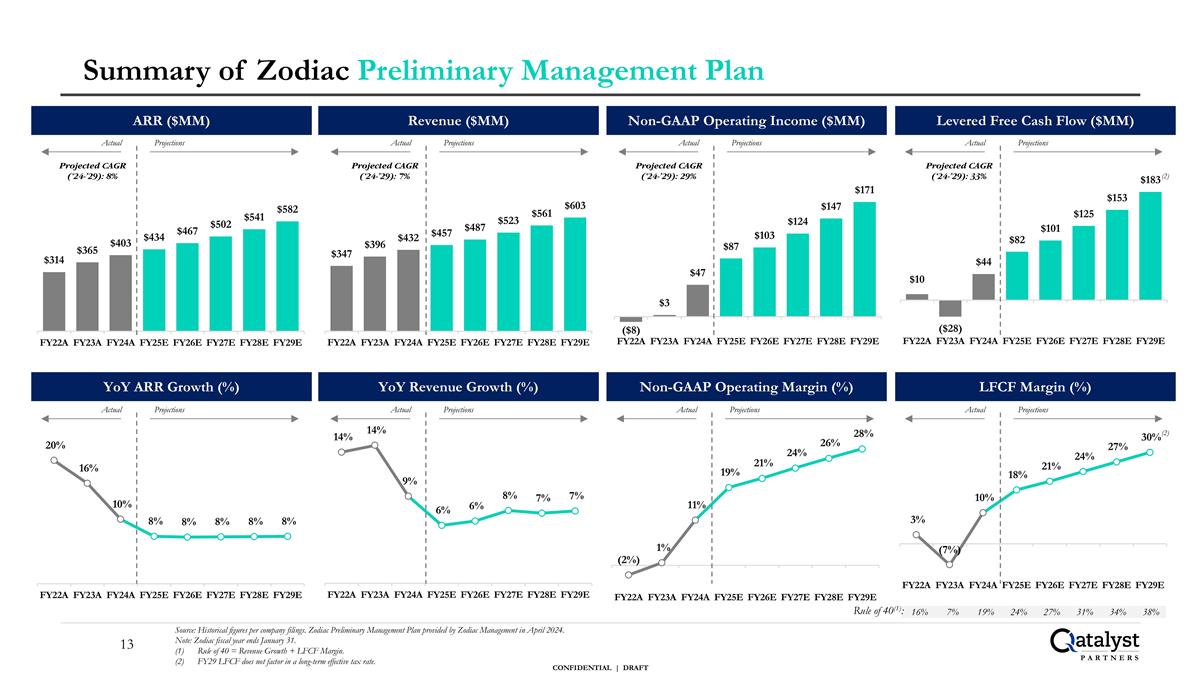

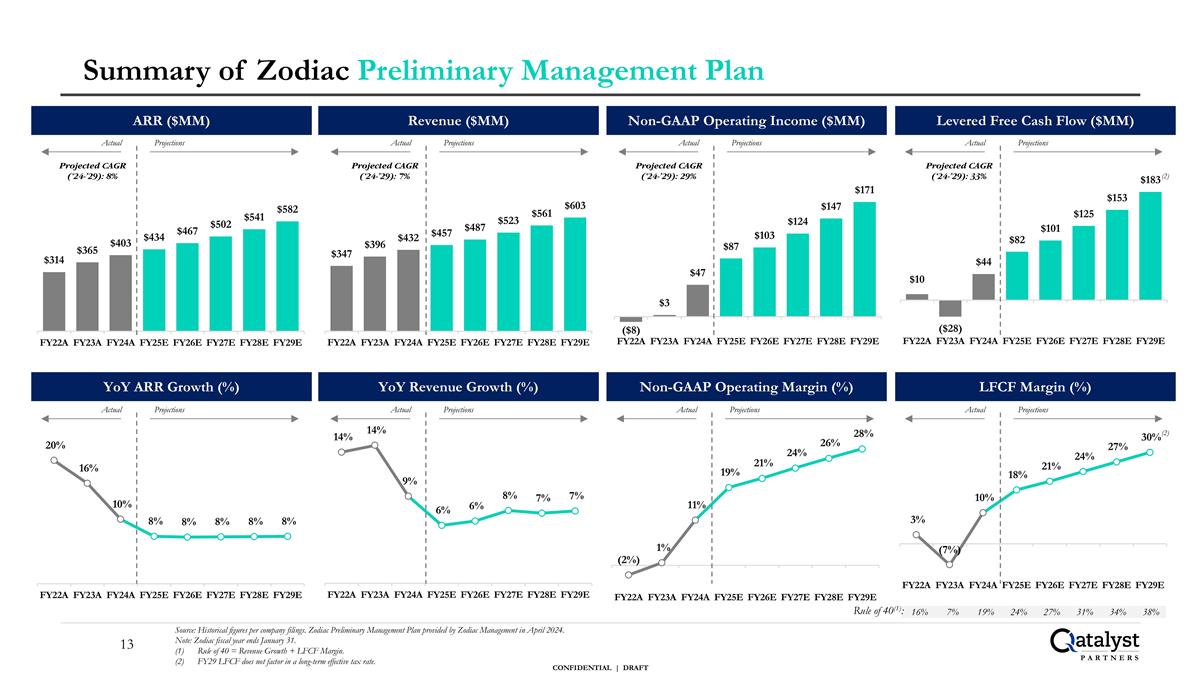

Summary of Zodiac Preliminary Management Plan Source: Historical figures per company filings. Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Note: Zodiac fiscal year ends January 31. Rule of 40 = Revenue Growth + LFCF Margin. FY29 LFCF does not factor in a long-term effective tax rate. Non-GAAP Operating Income ($MM) Levered Free Cash Flow ($MM) Non-GAAP Operating Margin (%) LFCF Margin (%) ARR ($MM) YoY ARR Growth (%) Revenue ($MM) YoY Revenue Growth (%) 16% 7% 19% 24% 27% 31% 34% 38% Rule of 40(1): Actual Projections Projected CAGR (‘24-’29): 8% Projected CAGR (‘24-’29): 7% Projected CAGR (‘24-’29): 29% Projected CAGR (‘24-’29): 33% Actual Projections Actual Projections Actual Projections Actual Projections Actual Projections Actual Projections Actual Projections (2) (2)

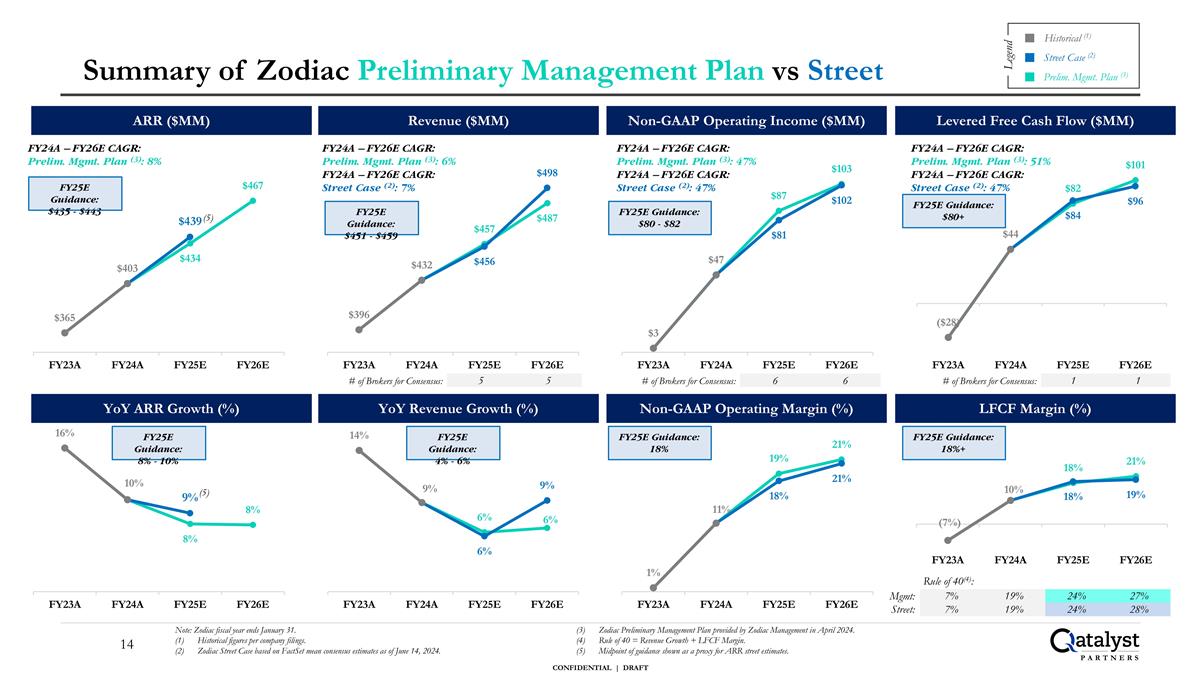

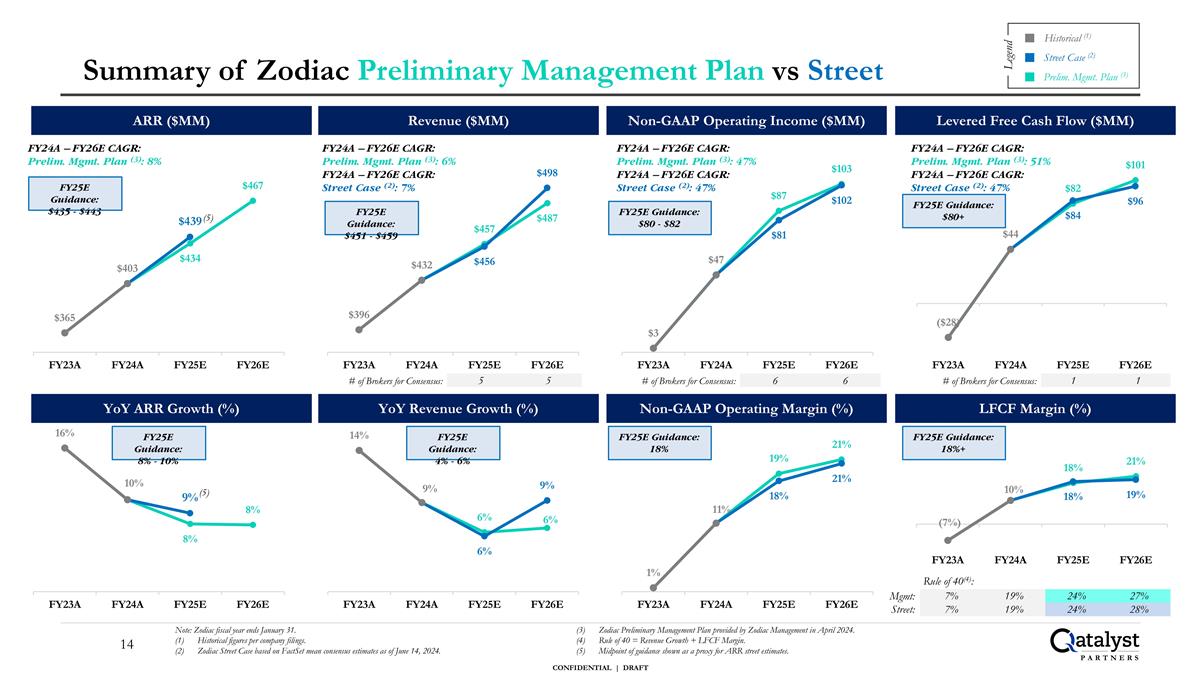

Summary of Zodiac Preliminary Management Plan vs Street Note: Zodiac fiscal year ends January 31. Historical figures per company filings. Zodiac Street Case based on FactSet mean consensus estimates as of June 14, 2024. Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Rule of 40 = Revenue Growth + LFCF Margin. Midpoint of guidance shown as a proxy for ARR street estimates. 5 5 # of Brokers for Consensus: 7% 19% 24% 27% 7% 19% 24% 28% Rule of 40(4): FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 6% FY24A – FY26E CAGR: Street Case (2): 7% FY25E Guidance: $451 - $459 FY25E Guidance: $80 - $82 FY25E Guidance: $80+ Legend Historical (1) Street Case (2) Prelim. Mgmt. Plan (3) 6 6 # of Brokers for Consensus: 1 1 # of Brokers for Consensus: FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 8% FY25E Guidance: $435 - $443 Mgmt: Street: FY25E Guidance: 8% - 10% FY25E Guidance: 4% - 6% FY25E Guidance: 18% FY25E Guidance: 18%+ (5) (5) FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 47% FY24A – FY26E CAGR: Street Case (2): 47% FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 51% FY24A – FY26E CAGR: Street Case (2): 47% Non-GAAP Operating Income ($MM) Levered Free Cash Flow ($MM) ARR ($MM) Revenue ($MM) Non-GAAP Operating Margin (%) LFCF Margin (%) YoY ARR Growth (%) YoY Revenue Growth (%)

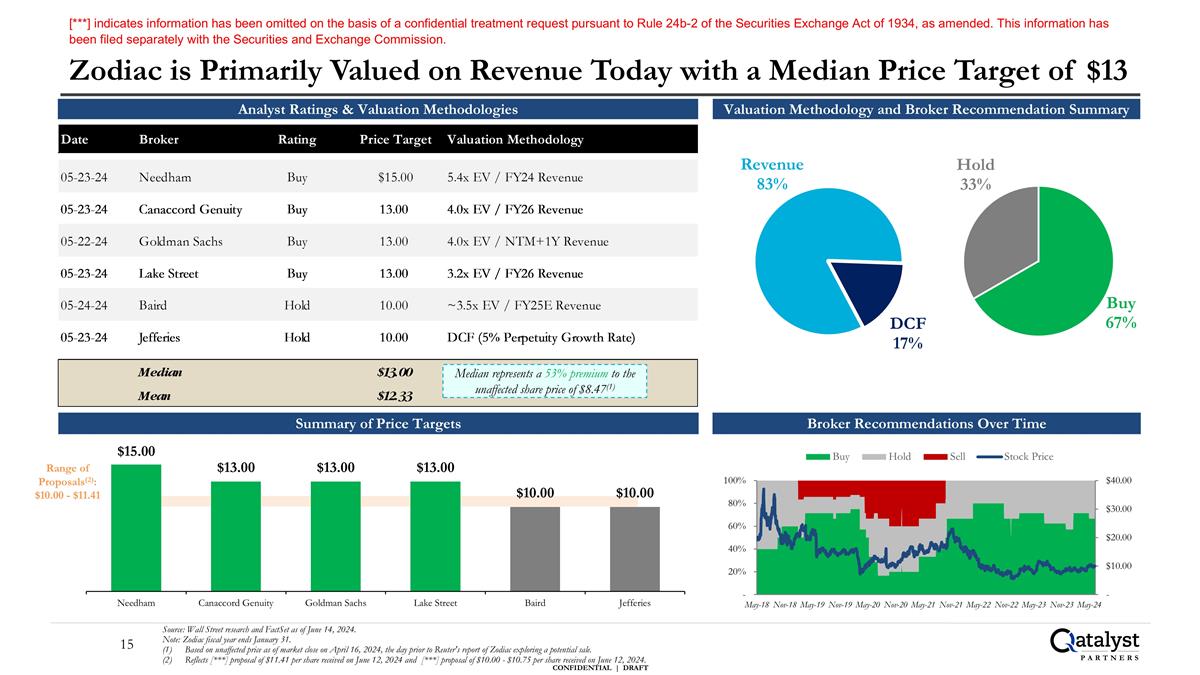

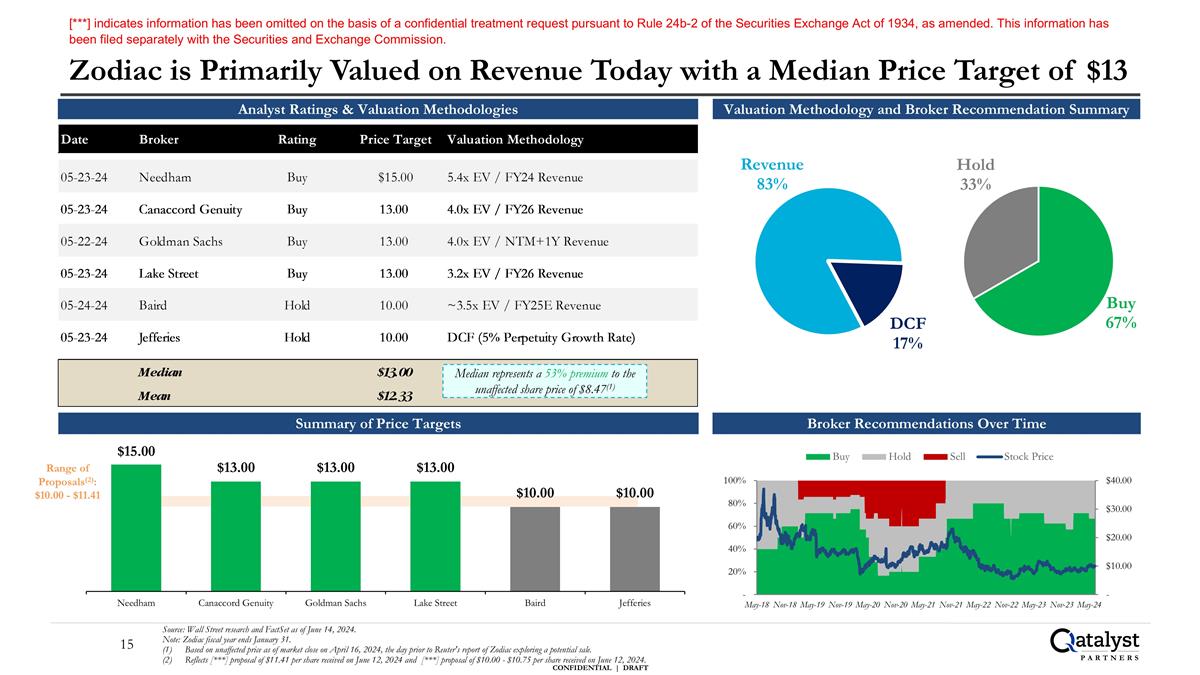

Zodiac is Primarily Valued on Revenue Today with a Median Price Target of $13 Source: Wall Street research and FactSet as of June 14, 2024. Note: Zodiac fiscal year ends January 31. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Reflects [***] proposal of $11.41 per share received on June 12, 2024 and [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Analyst Ratings & Valuation Methodologies Summary of Price Targets Valuation Methodology and Broker Recommendation Summary Median represents a 53% premium to the unaffected share price of $8.47(1) Broker Recommendations Over Time Range of Proposals(2): $10.00 - $11.41 [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

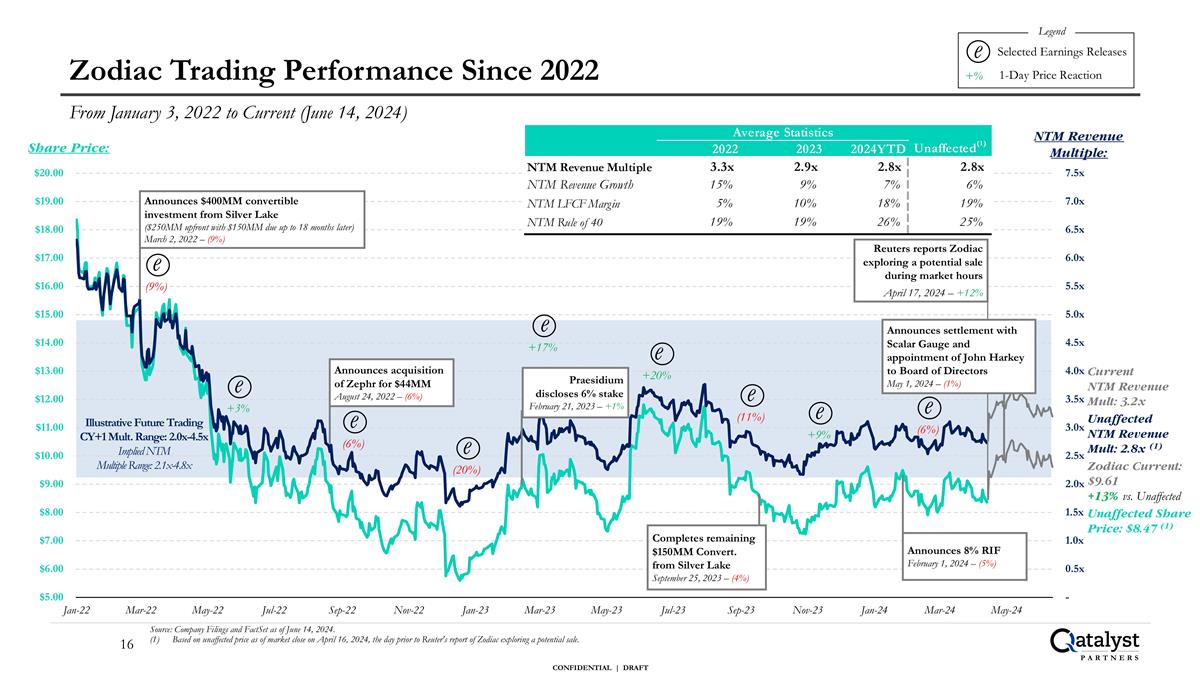

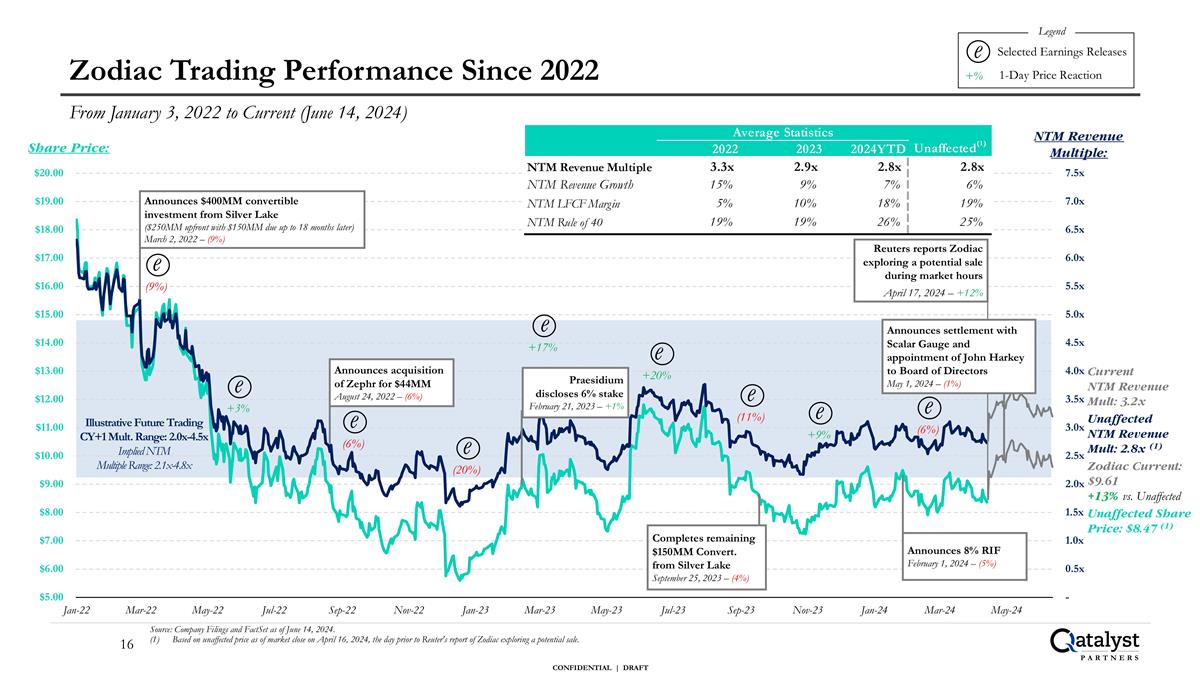

Zodiac Trading Performance Since 2022 From January 3, 2022 to Current (June 14, 2024) NTM Revenue Multiple: Share Price: Unaffected NTM Revenue Mult: 2.8x (1) Source: Company Filings and FactSet as of June 14, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Announces $400MM convertible investment from Silver Lake ($250MM upfront with $150MM due up to 18 months later) March 2, 2022 – (9%) e (9%) e (6%) Unaffected Share Price: $8.47 (1) e (11%) e +20% e +9% e +17% Praesidium discloses 6% stake February 21, 2023 – +1% e (6%) e (20%) e +3% Reuters reports Zodiac exploring a potential sale during market hours April 17, 2024 – +12% Illustrative Future Trading CY+1 Mult. Range: 2.0x-4.5x Implied NTM Multiple Range: 2.1x-4.8x Announces acquisition of Zephr for $44MM August 24, 2022 – (6%) Selected Earnings Releases e Legend 1-Day Price Reaction +% Announces 8% RIF February 1, 2024 – (5%) Announces settlement with Scalar Gauge and appointment of John Harkey to Board of Directors May 1, 2024 – (1%) Completes remaining $150MM Convert. from Silver Lake September 25, 2023 – (4%) Zodiac Current: $9.61 +13% vs. Unaffected Current NTM Revenue Mult: 3.2x

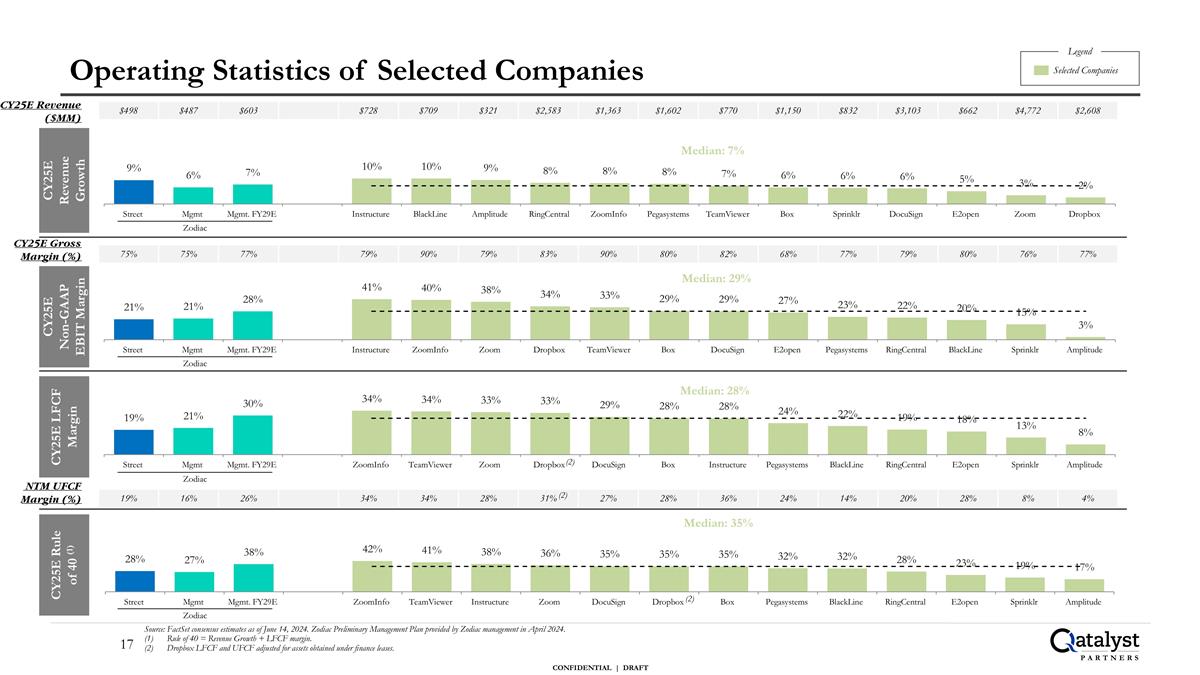

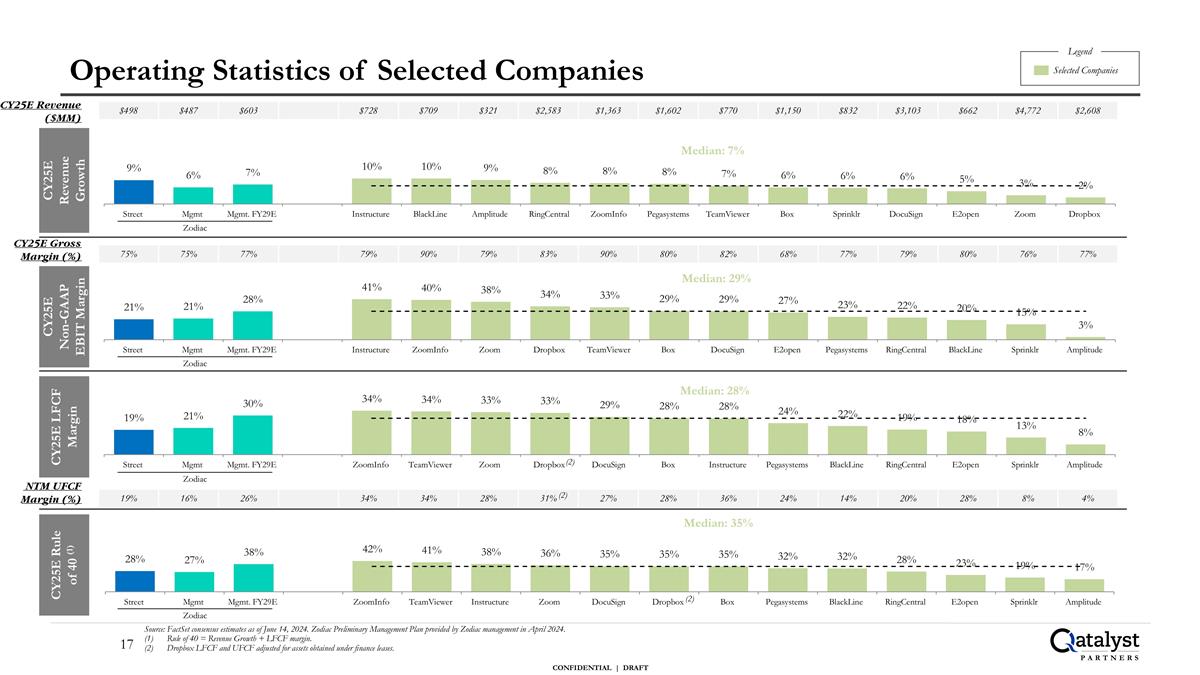

Operating Statistics of Selected Companies $498 $487 $603 $728 $709 $321 $2,583 $1,363 $1,602 $770 $1,150 $832 $3,103 $662 $4,772 $2,608 Source: FactSet consensus estimates as of June 14, 2024. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Rule of 40 = Revenue Growth + LFCF margin. Dropbox LFCF and UFCF adjusted for assets obtained under finance leases. CY25E Revenue ($MM) CY25E Gross Margin (%) 75% 75% 77% 79% 90% 79% 83% 90% 80% 82% 68% 77% 79% 80% 76% 77% (2) (2) NTM UFCF Margin (%) 19% 16% 26% 34% 34% 28% 31% 27% 28% 36% 24% 14% 20% 28% 8% 4% Zodiac (2) CY25E Revenue Growth CY25E Non-GAAP EBIT Margin CY25E Rule of 40 (1) CY25E LFCF Margin Zodiac Zodiac Zodiac Selected Companies Legend

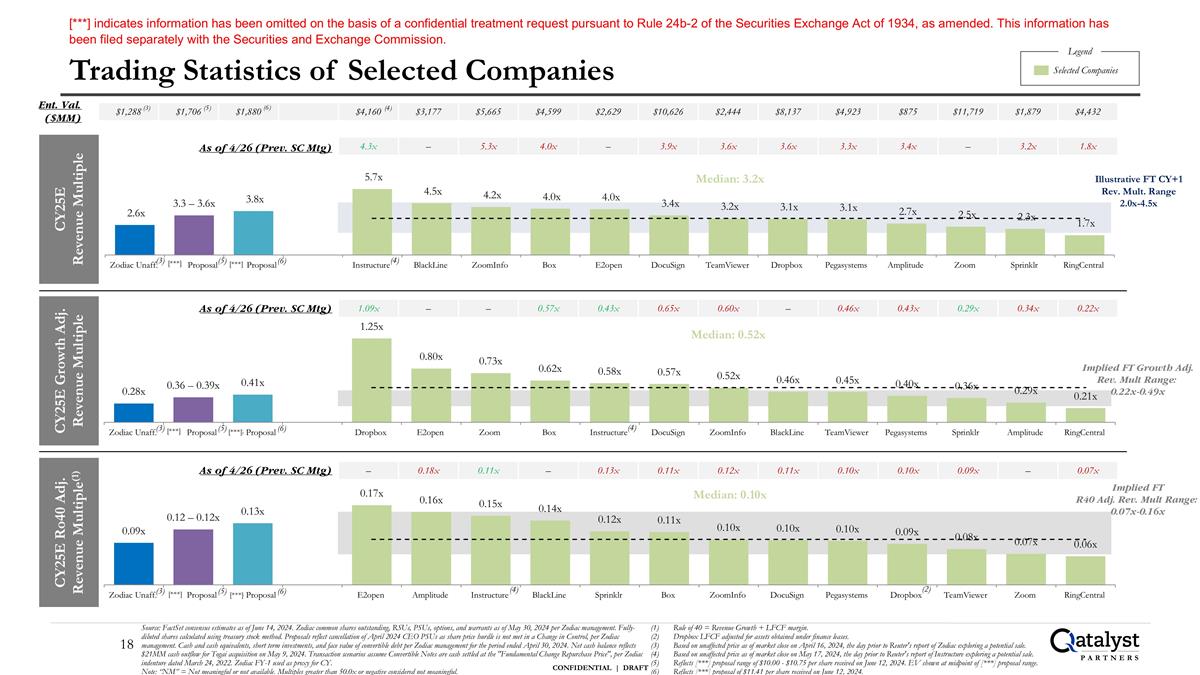

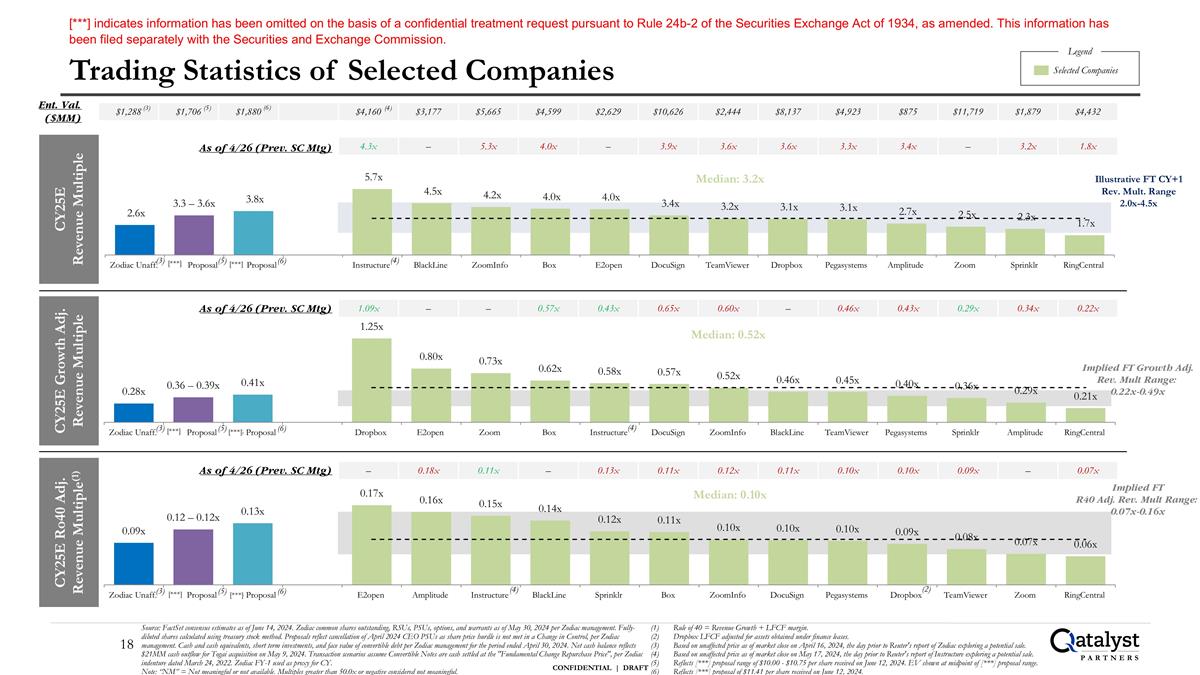

Trading Statistics of Selected Companies Ent. Val. ($MM) Source: FactSet consensus estimates as of June 14, 2024. Zodiac common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Proposals reflect cancellation of April 2024 CEO PSUs as share price hurdle is not met in a Change in Control, per Zodiac management. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Transaction scenarios assume Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Zodiac FY-1 used as proxy for CY. Note: “NM” = Not meaningful or not available. Multiples greater than 50.0x or negative considered not meaningful. Rule of 40 = Revenue Growth + LFCF margin. Dropbox LFCF adjusted for assets obtained under finance leases. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Based on unaffected price as of market close on May 17, 2024, the day prior to Reuter's report of Instructure exploring a potential sale. Reflects [***] proposal range of $10.00 - $10.75 per share received on June 12, 2024. EV shown at midpoint of [***] proposal range. Reflects [***] proposal of $11.41 per share received on June 12, 2024. $1,288 $1,706 $1,880 $4,160 $3,177 $5,665 $4,599 $2,629 $10,626 $2,444 $8,137 $4,923 $875 $11,719 $1,879 $4,432 Selected Companies Legend (2) Illustrative FT CY+1 Rev. Mult. Range 2.0x-4.5x (3) (3) (3) (3) CY25E Revenue Multiple CY25E Ro40 Adj. Revenue Multiple(1) CY25E Growth Adj. Revenue Multiple (4) (4) (4) (5) (5) (5) (5) (4) Implied FT Growth Adj. Rev. Mult Range: 0.22x-0.49x Implied FT R40 Adj. Rev. Mult Range: 0.07x-0.16x (6) (6) (6) (6) As of 4/26 (Prev. SC Mtg) 4.3x – 5.3x 4.0x – 3.9x 3.6x 3.6x 3.3x 3.4x – 3.2x 1.8x As of 4/26 (Prev. SC Mtg) 1.09x – – 0.57x 0.43x 0.65x 0.60x – 0.46x 0.43x 0.29x 0.34x 0.22x As of 4/26 (Prev. SC Mtg) – 0.18x 0.11x – 0.13x 0.11x 0.12x 0.11x 0.10x 0.10x 0.09x – 0.07x [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***] [***] [***] [***] [***] [***]

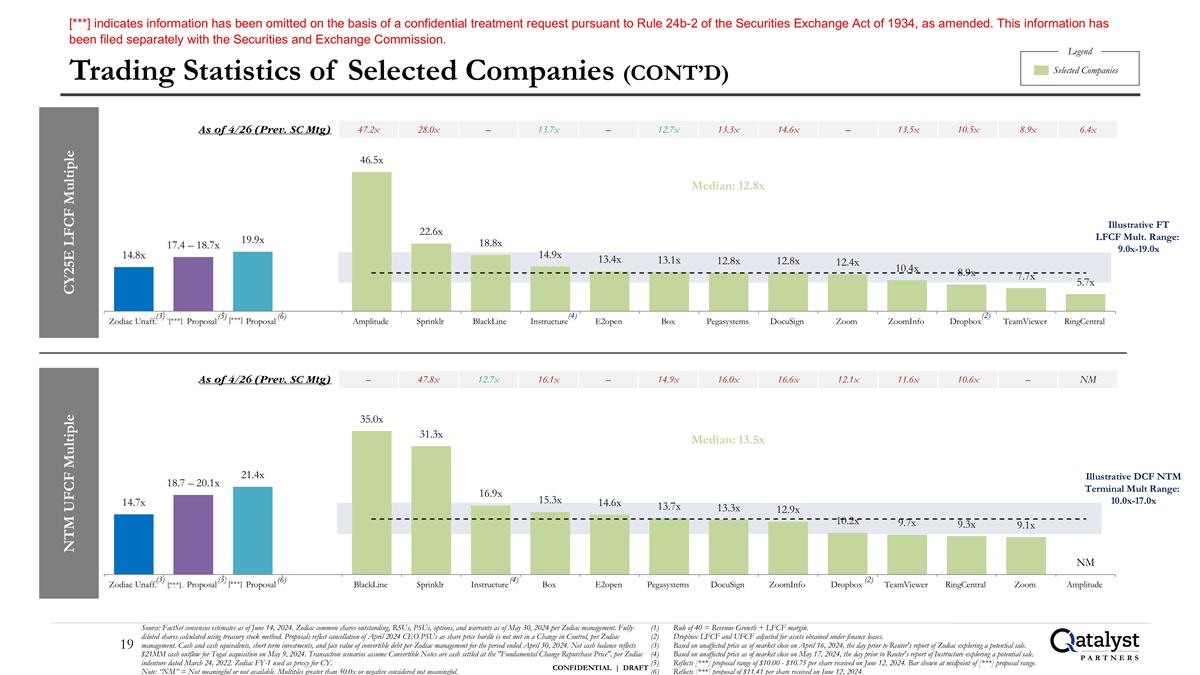

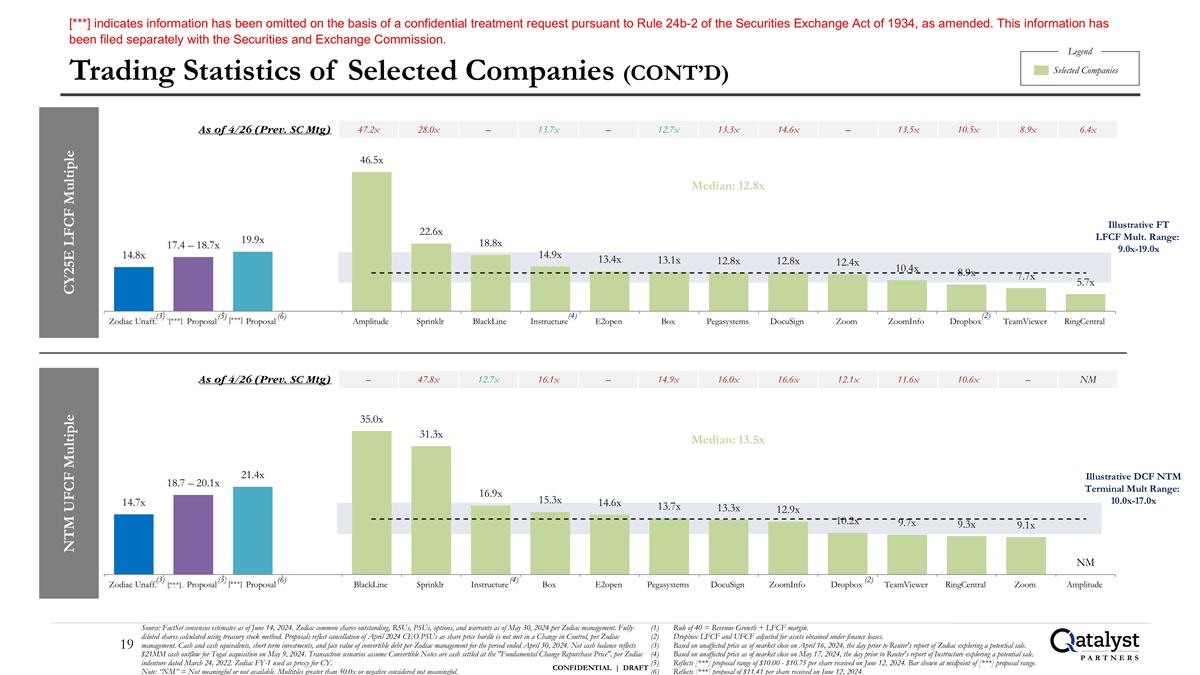

Trading Statistics of Selected Companies (CONT’D) Source: FactSet consensus estimates as of June 14, 2024. Zodiac common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Proposals reflect cancellation of April 2024 CEO PSUs as share price hurdle is not met in a Change in Control, per Zodiac management. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Transaction scenarios assume Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Zodiac FY-1 used as proxy for CY. Note: “NM” = Not meaningful or not available. Multiples greater than 50.0x or negative considered not meaningful. Rule of 40 = Revenue Growth + LFCF margin. Dropbox LFCF and UFCF adjusted for assets obtained under finance leases. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Based on unaffected price as of market close on May 17, 2024, the day prior to Reuter's report of Instructure exploring a potential sale. Reflects [***] proposal range of $10.00 - $10.75 per share received on June 12, 2024. Bar shown at midpoint of [***] proposal range. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Selected Companies Legend (2) Illustrative FT LFCF Mult. Range: 9.0x-19.0x (3) CY25E LFCF Multiple (4) (5) (6) Illustrative DCF NTM Terminal Mult Range: 10.0x-17.0x (3) NTM UFCF Multiple (4) (2) (5) (6) As of 4/26 (Prev. SC Mtg) – 47.8x 12.7x 16.1x – 14.9x 16.0x 16.6x 12.1x 11.6x 10.6x – NM As of 4/26 (Prev. SC Mtg) 47.2x 28.0x – 13.7x – 12.7x 13.3x 14.6x – 13.5x 10.5x 8.9x 6.4x [***] [***] [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

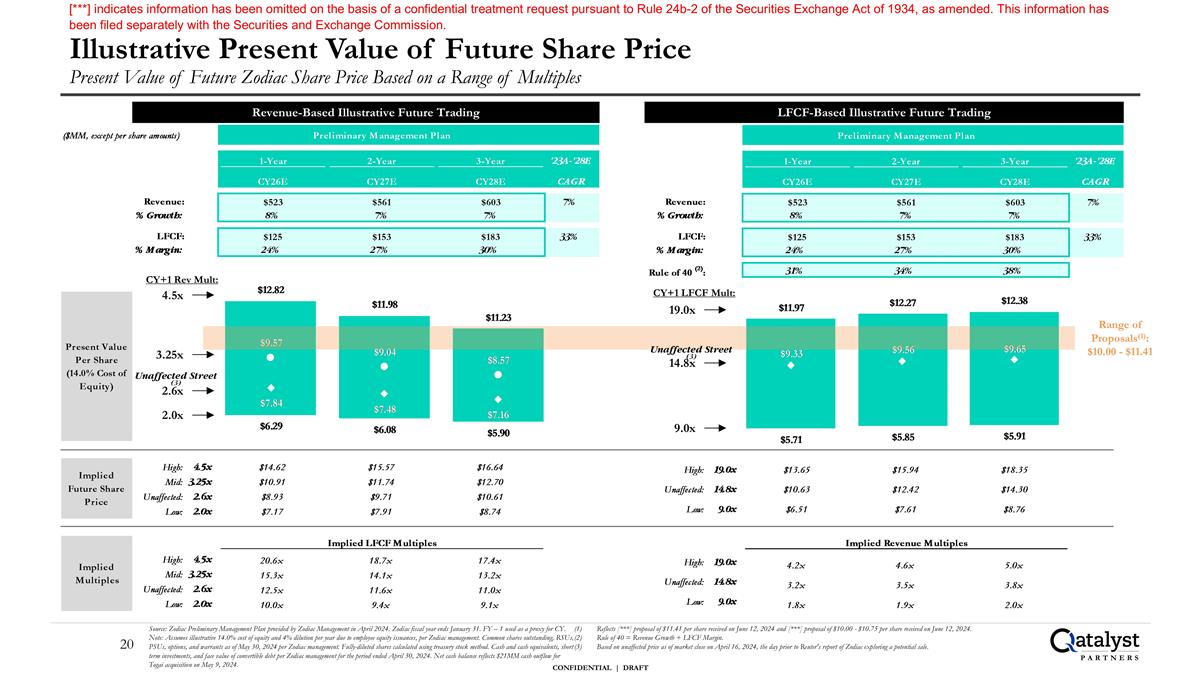

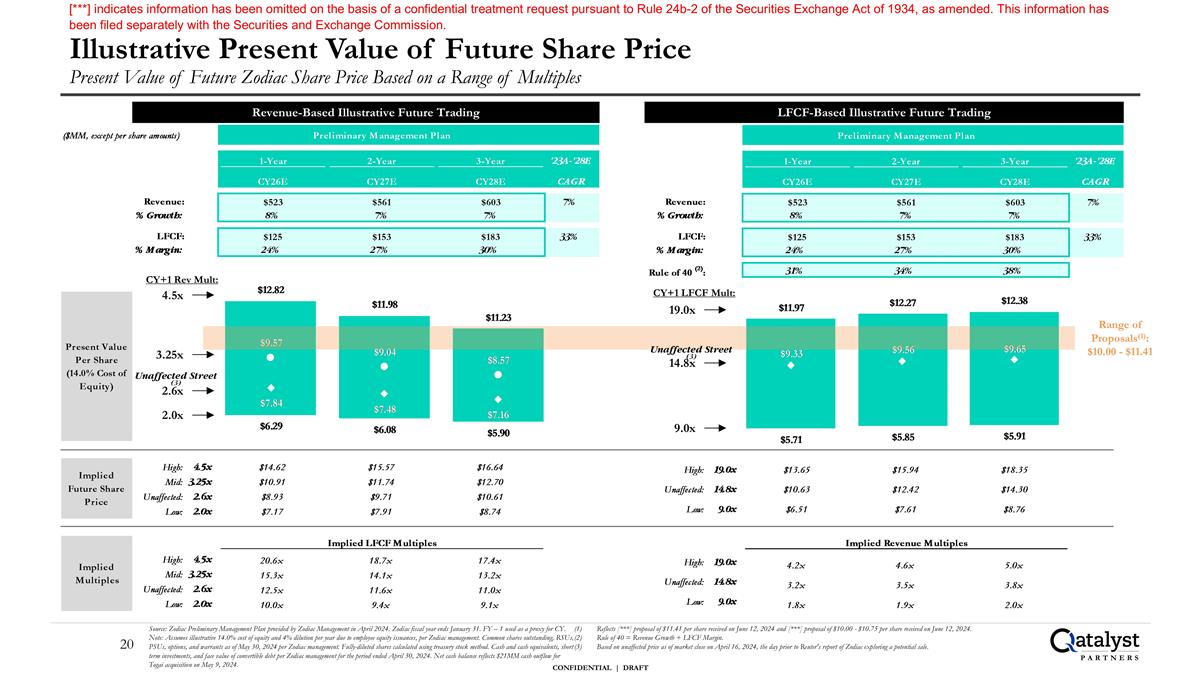

Illustrative Present Value of Future Share Price Present Value of Future Zodiac Share Price Based on a Range of Multiples Source: Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Note: Assumes illustrative 14.0% cost of equity and 4% dilution per year due to employee equity issuances, per Zodiac management. Common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Reflects [***] proposal of $11.41 per share received on June 12, 2024 and [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Rule of 40 = Revenue Growth + LFCF Margin. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. 2.0x 3.25x 4.5x CY+1 Rev Mult: Revenue-Based Illustrative Future Trading LFCF-Based Illustrative Future Trading CY+1 LFCF Mult: 9.0x 19.0x Range of Proposals(1): $10.00 - $11.41 Unaffected Street (3) 2.6x Unaffected Street (3) 14.8x [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

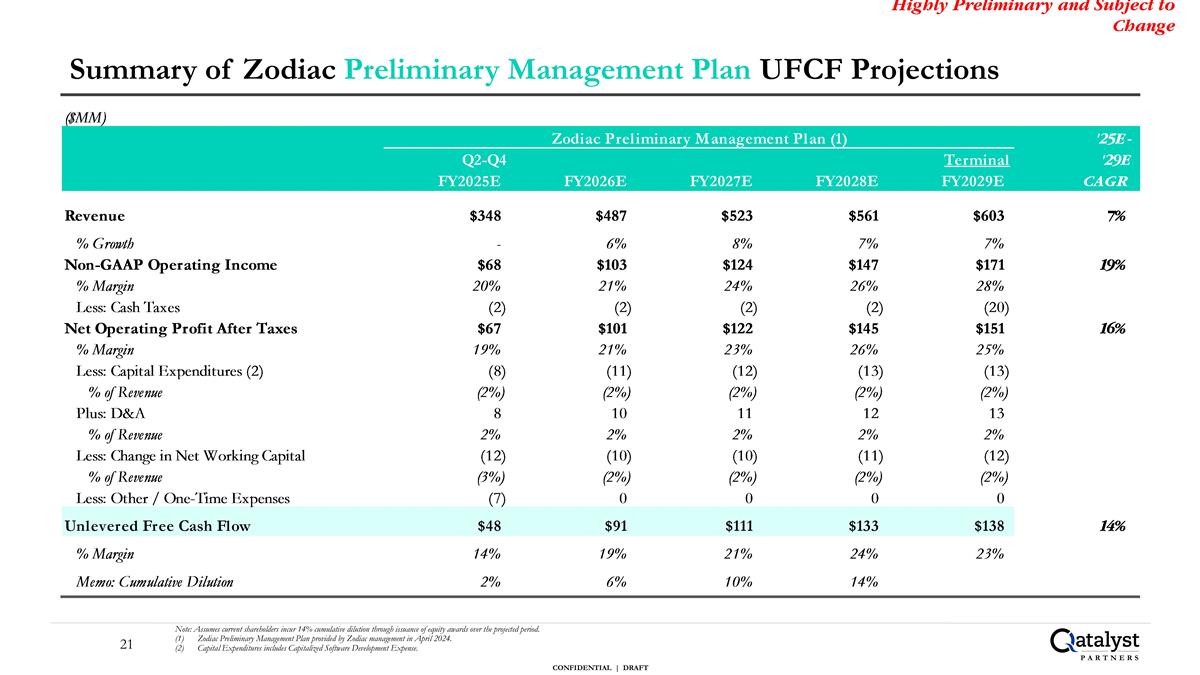

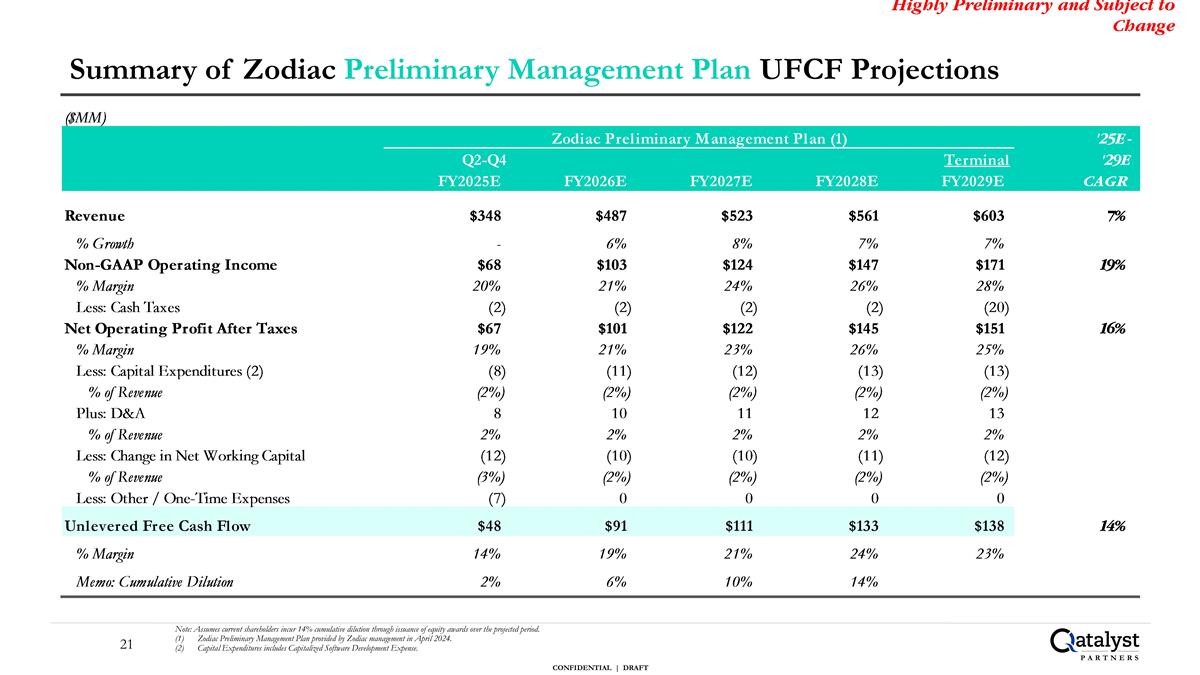

Summary of Zodiac Preliminary Management Plan UFCF Projections Highly Preliminary and Subject to Change Note: Assumes current shareholders incur 14% cumulative dilution through issuance of equity awards over the projected period. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Capital Expenditures includes Capitalized Software Development Expense.

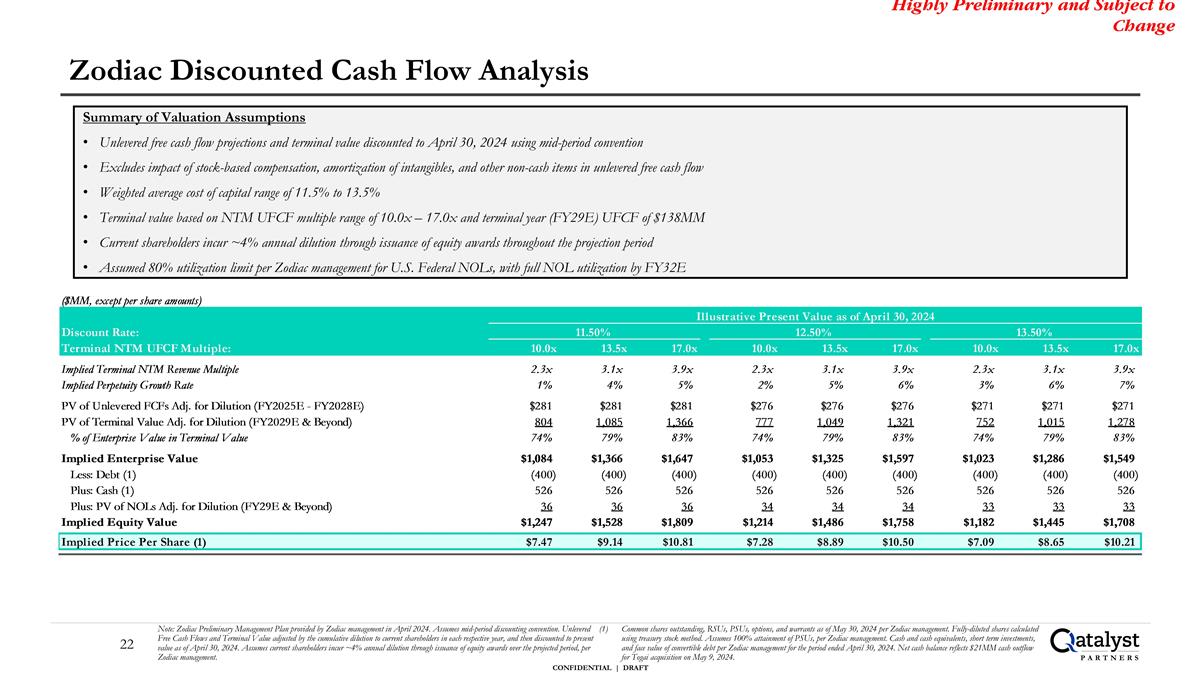

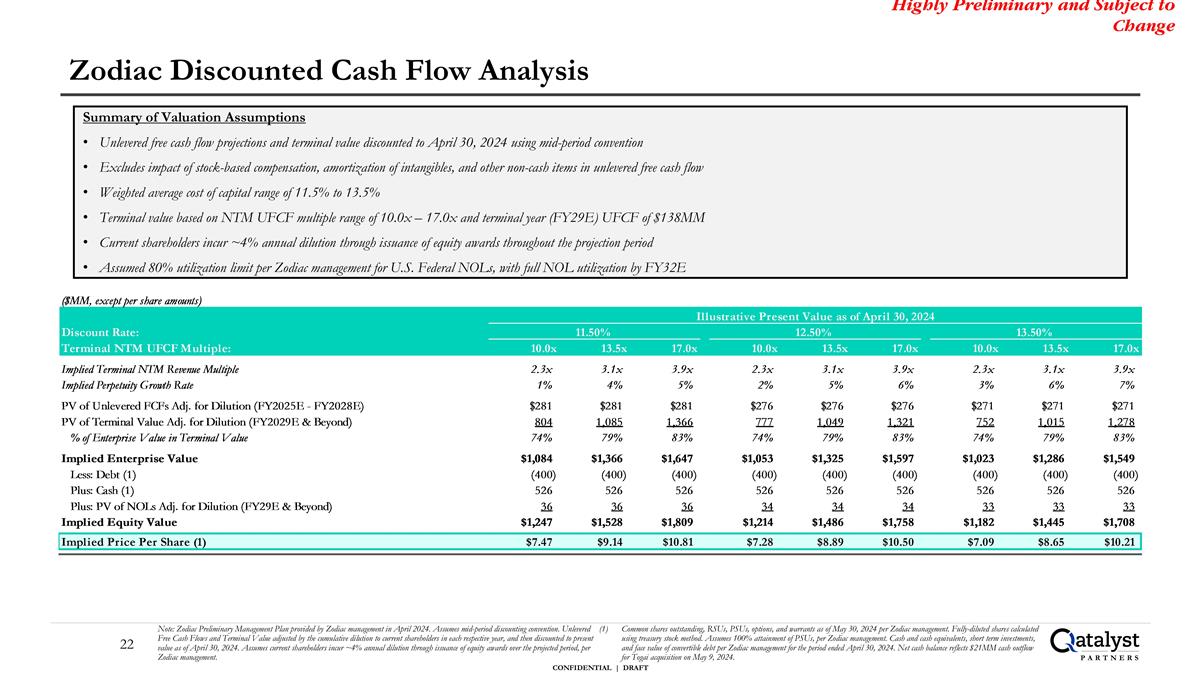

Zodiac Discounted Cash Flow Analysis Summary of Valuation Assumptions Unlevered free cash flow projections and terminal value discounted to April 30, 2024 using mid-period convention Excludes impact of stock-based compensation, amortization of intangibles, and other non-cash items in unlevered free cash flow Weighted average cost of capital range of 11.5% to 13.5% Terminal value based on NTM UFCF multiple range of 10.0x – 17.0x and terminal year (FY29E) UFCF of $138MM Current shareholders incur ~4% annual dilution through issuance of equity awards throughout the projection period Assumed 80% utilization limit per Zodiac management for U.S. Federal NOLs, with full NOL utilization by FY32E Highly Preliminary and Subject to Change Note: Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Assumes mid-period discounting convention. Unlevered Free Cash Flows and Terminal Value adjusted by the cumulative dilution to current shareholders in each respective year, and then discounted to present value as of April 30, 2024. Assumes current shareholders incur ~4% annual dilution through issuance of equity awards over the projected period, per Zodiac management. Common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Assumes 100% attainment of PSUs, per Zodiac management. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024.

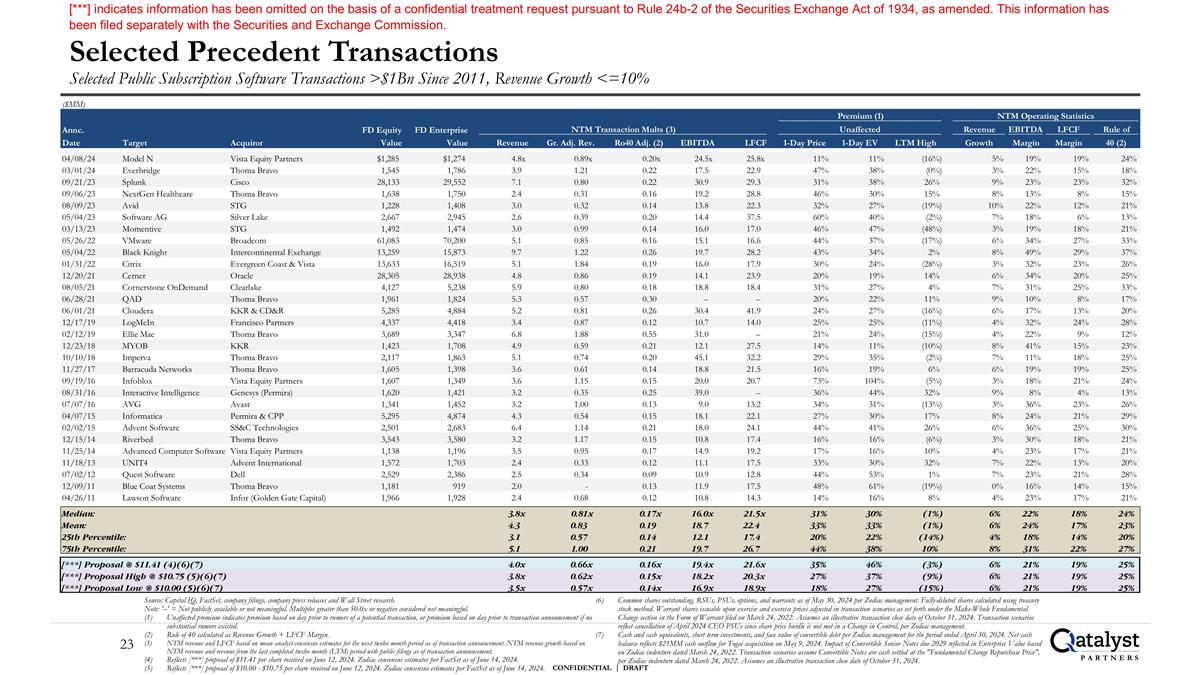

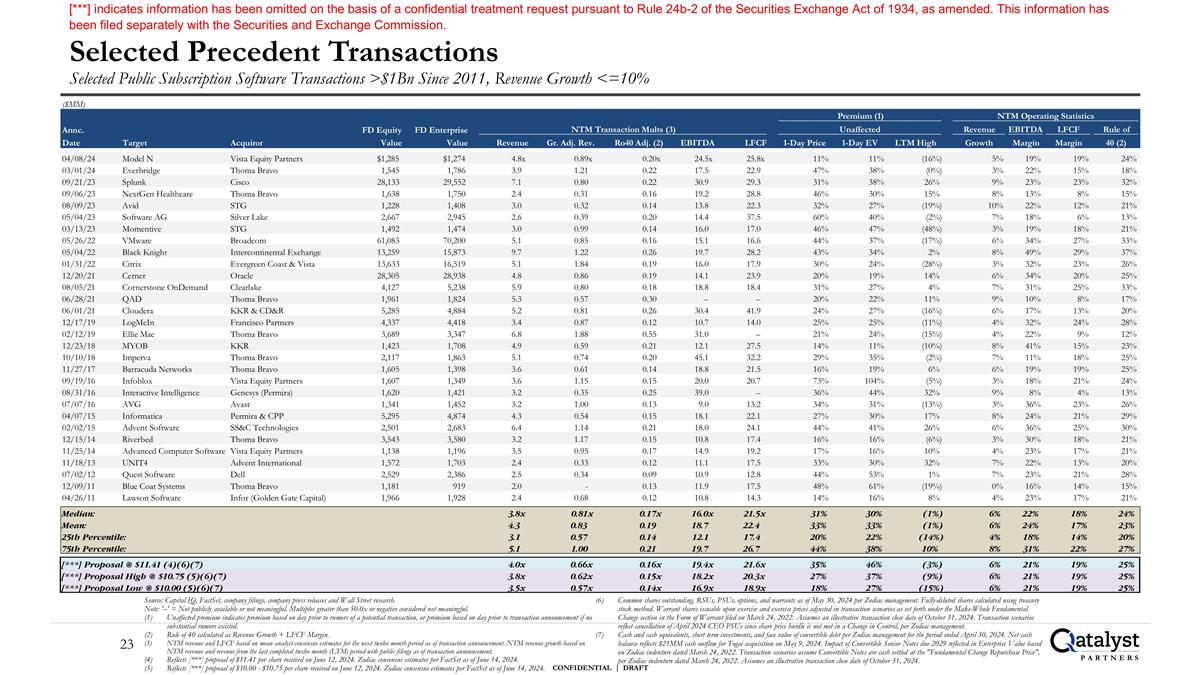

Selected Precedent Transactions Selected Public Subscription Software Transactions >$1Bn Since 2011, Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Note: '–' = Not publicly available or not meaningful. Multiples greater than 50.0x or negative considered not meaningful. Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. Rule of 40 calculated as Revenue Growth + LFCF Margin. NTM revenue and LFCF based on mean analyst consensus estimates for the next twelve month period as of transaction announcement. NTM revenue growth based on NTM revenue and revenue from the last completed twelve month (LTM) period with public filings as of transaction announcement. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Zodiac consensus estimates per FactSet as of June 14, 2024. Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Zodiac consensus estimates per FactSet as of June 14, 2024. Common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Warrant shares issuable upon exercise and exercise prices adjusted in transaction scenarios as set forth under the Make-Whole Fundamental Change section in the Form of Warrant filed on March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. Transaction scenarios reflect cancellation of April 2024 CEO PSUs since share price hurdle is not met in a Change in Control, per Zodiac management. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Impact of Convertible Senior Notes due 2029 reflected in Enterprise Value based on Zodiac indenture dated March 24, 2022. Transaction scenarios assume Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. ($MM) Premium (1) NTM Operating Statistics Annc. FD Equity FD Enterprise NTM Transaction Mults (3) Unaffected Revenue EBITDA LFCF Rule of Date Target Acquiror Value Value Revenue Gr. Adj. Rev. Ro40 Adj. (2) EBITDA LFCF 1-Day Price 1-Day EV LTM High Growth Margin Margin 40 (2) 04/08/24 Model N Vista Equity Partners $1,285 $1,274 4.8x 0.89x 0.20x 24.5x 25.8x 11% 11% (16%) 5% 19% 19% 24% 03/01/24 Everbridge Thoma Bravo 1,545 1,786 3.9 1.21 0.22 17.5 22.9 47% 38% (0%) 3% 22% 15% 18% 09/21/23 Splunk Cisco 28,133 29,552 7.1 0.80 0.22 30.9 29.3 31% 38% 26% 9% 23% 23% 32% 09/06/23 NextGen Healthcare Thoma Bravo 1,638 1,750 2.4 0.31 0.16 19.2 28.8 46% 30% 15% 8% 13% 8% 15% 08/09/23 Avid STG 1,228 1,408 3.0 0.32 0.14 13.8 22.3 32% 27% (19%) 10% 22% 12% 21% 05/04/23 Software AG Silver Lake 2,667 2,945 2.6 0.39 0.20 14.4 37.5 60% 40% (2%) 7% 18% 6% 13% 03/13/23 Momentive STG 1,492 1,474 3.0 0.99 0.14 16.0 17.0 46% 47% (48%) 3% 19% 18% 21% 05/26/22 VMware Broadcom 61,083 70,200 5.1 0.85 0.16 15.1 16.6 44% 37% (17%) 6% 34% 27% 33% 05/04/22 Black Knight Intercontinental Exchange 13,259 15,873 9.7 1.22 0.26 19.7 28.2 43% 34% 2% 8% 49% 29% 37% 01/31/22 Citrix Evergreen Coast & Vista 13,633 16,519 5.1 1.84 0.19 16.0 17.9 30% 24% (28%) 3% 32% 23% 26% 12/20/21 Cerner Oracle 28,305 28,938 4.8 0.86 0.19 14.1 23.9 20% 19% 14% 6% 34% 20% 25% 08/05/21 Cornerstone OnDemand Clearlake 4,127 5,238 5.9 0.80 0.18 18.8 18.4 31% 27% 4% 7% 31% 25% 33% 06/28/21 QAD Thoma Bravo 1,961 1,824 5.3 0.57 0.30 – – 20% 22% 11% 9% 10% 8% 17% 06/01/21 Cloudera KKR & CD&R 5,285 4,884 5.2 0.81 0.26 30.4 41.9 24% 27% (16%) 6% 17% 13% 20% 12/17/19 LogMeIn Francisco Partners 4,337 4,418 3.4 0.87 0.12 10.7 14.0 25% 25% (11%) 4% 32% 24% 28% 02/12/19 Ellie Mae Thoma Bravo 3,689 3,347 6.8 1.88 0.55 31.0 – 21% 24% (15%) 4% 22% 9% 12% 12/23/18 MYOB KKR 1,423 1,708 4.9 0.59 0.21 12.1 27.5 14% 11% (10%) 8% 41% 15% 23% 10/10/18 Imperva Thoma Bravo 2,117 1,863 5.1 0.74 0.20 45.1 32.2 29% 35% (2%) 7% 11% 18% 25% 11/27/17 Barracuda Networks Thoma Bravo 1,605 1,398 3.6 0.61 0.14 18.8 21.5 16% 19% 6% 6% 19% 19% 25% 09/19/16 Infoblox Vista Equity Partners 1,607 1,349 3.6 1.15 0.15 20.0 20.7 73% 104% (5%) 3% 18% 21% 24% 08/31/16 Interactive Intelligence Genesys (Permira) 1,620 1,421 3.2 0.35 0.25 39.0 – 36% 44% 32% 9% 8% 4% 13% 07/07/16 AVG Avast 1,341 1,452 3.2 1.00 0.13 9.0 13.2 34% 31% (13%) 3% 36% 23% 26% 04/07/15 Informatica Permira & CPP 5,295 4,874 4.3 0.54 0.15 18.1 22.1 27% 30% 17% 8% 24% 21% 29% 02/02/15 Advent Software SS&C Technologies 2,501 2,683 6.4 1.14 0.21 18.0 24.1 44% 41% 26% 6% 36% 25% 30% 12/15/14 Riverbed Thoma Bravo 3,543 3,580 3.2 1.17 0.15 10.8 17.4 16% 16% (6%) 3% 30% 18% 21% 11/25/14 Advanced Computer Software Vista Equity Partners 1,138 1,196 3.5 0.95 0.17 14.9 19.2 17% 16% 10% 4% 23% 17% 21% 11/18/13 UNIT4 Advent International 1,572 1,703 2.4 0.33 0.12 11.1 17.5 33% 30% 32% 7% 22% 13% 20% 07/02/12 Quest Software Dell 2,529 2,386 2.5 0.34 0.09 10.9 12.8 44% 53% 1% 7% 23% 21% 28% 12/09/11 Blue Coat Systems Thoma Bravo 1,181 919 2.0 - 0.13 11.9 17.5 48% 61% (19%) 0% 16% 14% 15% 04/26/11 Lawson Software Infor (Golden Gate Capital) 1,966 1,928 2.4 0.68 0.12 10.8 14.3 14% 16% 8% 4% 23% 17% 21% Median: 3.8x 0.81x 0.17x 16.0x 21.5x 31% 30% (1%) 6% 22% 18% 24% Mean: 4.3 0.83 0.19 18.7 22.4 33% 33% (1%) 6% 24% 17% 23% 25th Percentile: 3.1 0.57 0.14 12.1 17.4 20% 22% (14%) 4% 18% 14% 20% 75th Percentile: 5.1 1.00 0.21 19.7 26.7 44% 38% 10% 8% 31% 22% 27% [***] Proposal @ $11.41 (4)(6)(7) 4.0x 0.66x 0.16x 19.4x 21.6x 35% 46% (3%) 6% 21% 19% 25% [***] Proposal High @ $10.75 (5)(6)(7) 3.8x 0.62x 0.15x 18.2x 20.3x 27% 37% (9%) 6% 21% 19% 25% [***] Proposal Low @ $10.00 (5)(6)(7) 3.5x 0.57x 0.14x 16.9x 18.9x 18% 27% (15%) 6% 21% 19% 25%

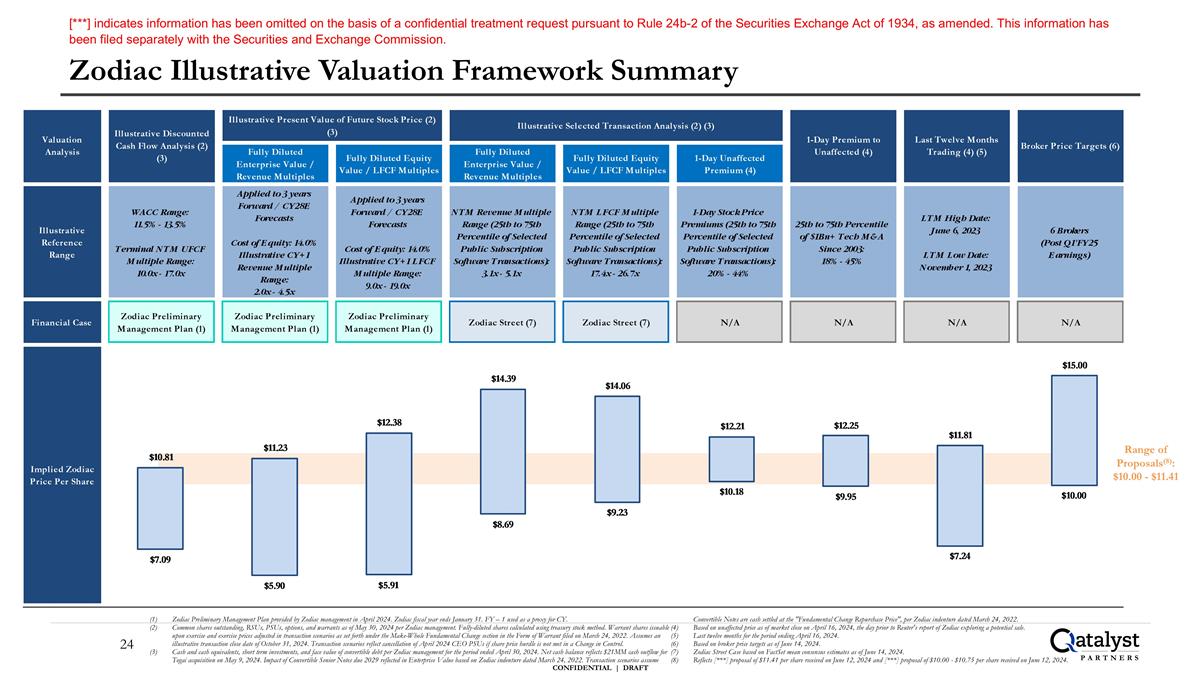

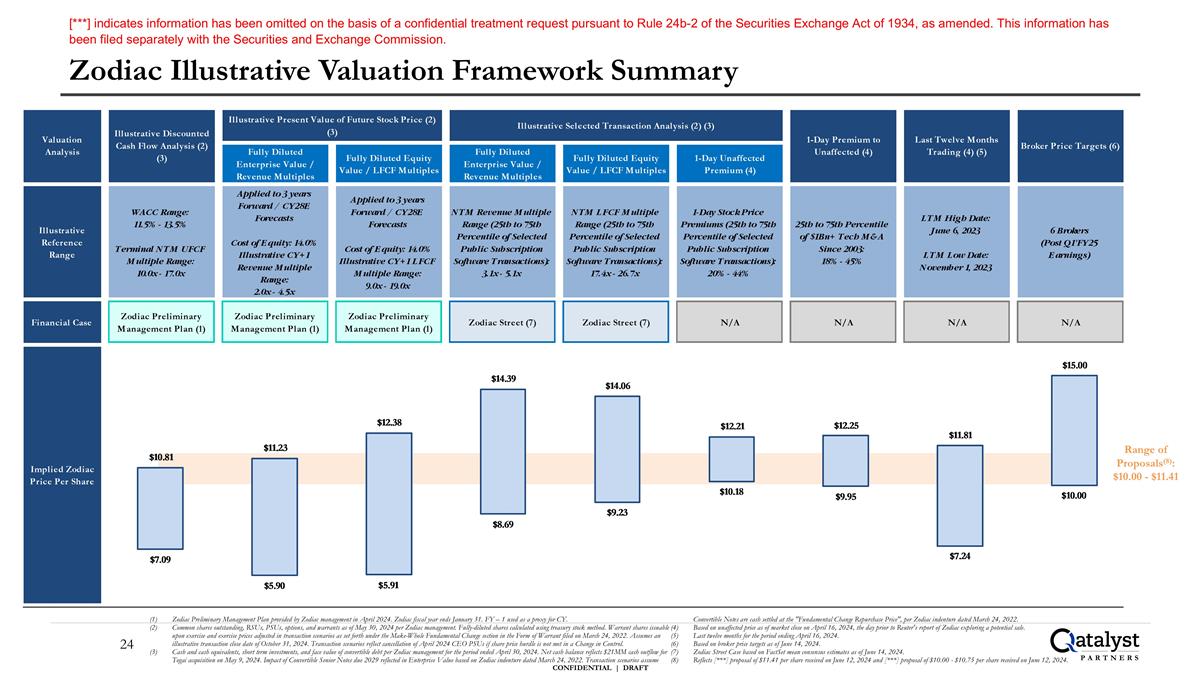

Zodiac Illustrative Valuation Framework Summary Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Warrant shares issuable upon exercise and exercise prices adjusted in transaction scenarios as set forth under the Make-Whole Fundamental Change section in the Form of Warrant filed on March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. Transaction scenarios reflect cancellation of April 2024 CEO PSUs if share price hurdle is not met in a Change in Control. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Impact of Convertible Senior Notes due 2029 reflected in Enterprise Value based on Zodiac indenture dated March 24, 2022. Transaction scenarios assume Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Last twelve months for the period ending April 16, 2024. Based on broker price targets as of June 14, 2024. Zodiac Street Case based on FactSet mean consensus estimates as of June 14, 2024. Reflects [***] proposal of $11.41 per share received on June 12, 2024 and [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Range of Proposals(8): $10.00 - $11.41 [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Illustrative Take-Private Analysis

Illustrative Sources and Uses at $11.41 Per Share Assumes 10/31/24 Entry Date and 1.9x ARR for Entry Leverage [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

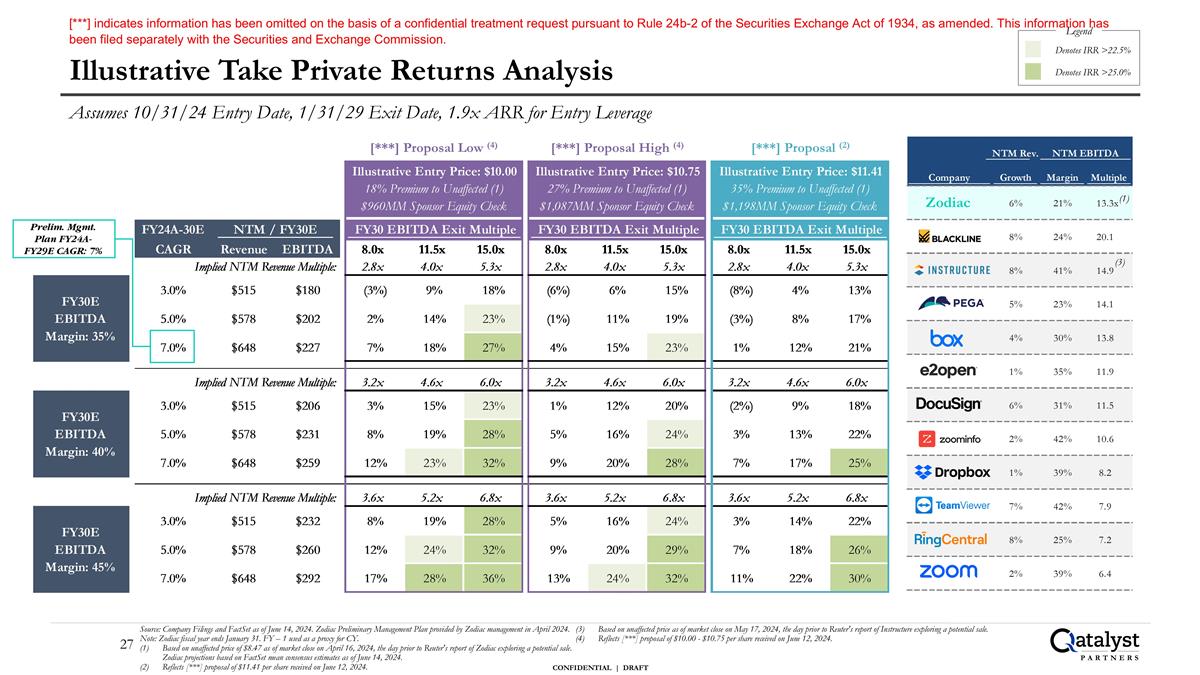

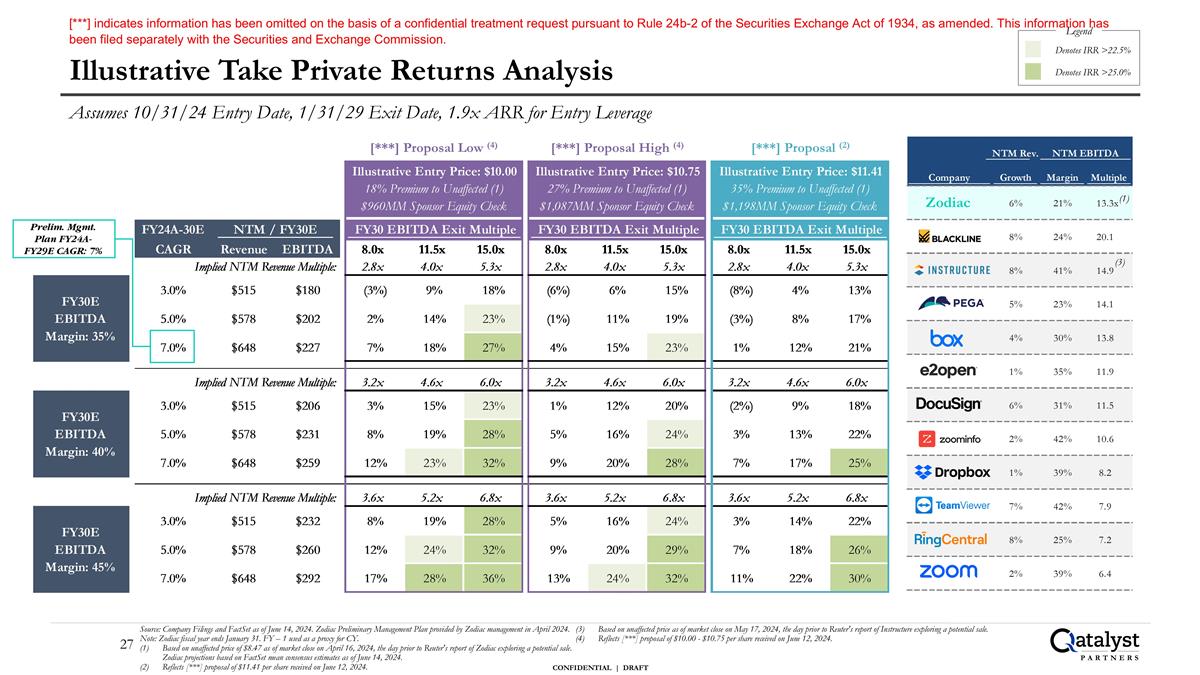

Illustrative Take Private Returns Analysis Assumes 10/31/24 Entry Date, 1/31/29 Exit Date, 1.9x ARR for Entry Leverage Source: Company Filings and FactSet as of June 14, 2024. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Note: Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Based on unaffected price of $8.47 as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Zodiac projections based on FactSet mean consensus estimates as of June 14, 2024. Reflects [***] proposal of $11.41 per share received on June 12, 2024. Based on unaffected price as of market close on May 17, 2024, the day prior to Reuter's report of Instructure exploring a potential sale. Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. Legend Denotes IRR >25.0% Denotes IRR >22.5% Prelim. Mgmt. Plan FY24A-FY29E CAGR: 7% [***] Proposal (2) [***] Proposal Low (4) [***] Proposal High (4) (3) Zodiac (1) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Appendix [***] and [***] Bidding History [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Appendix Additional Information

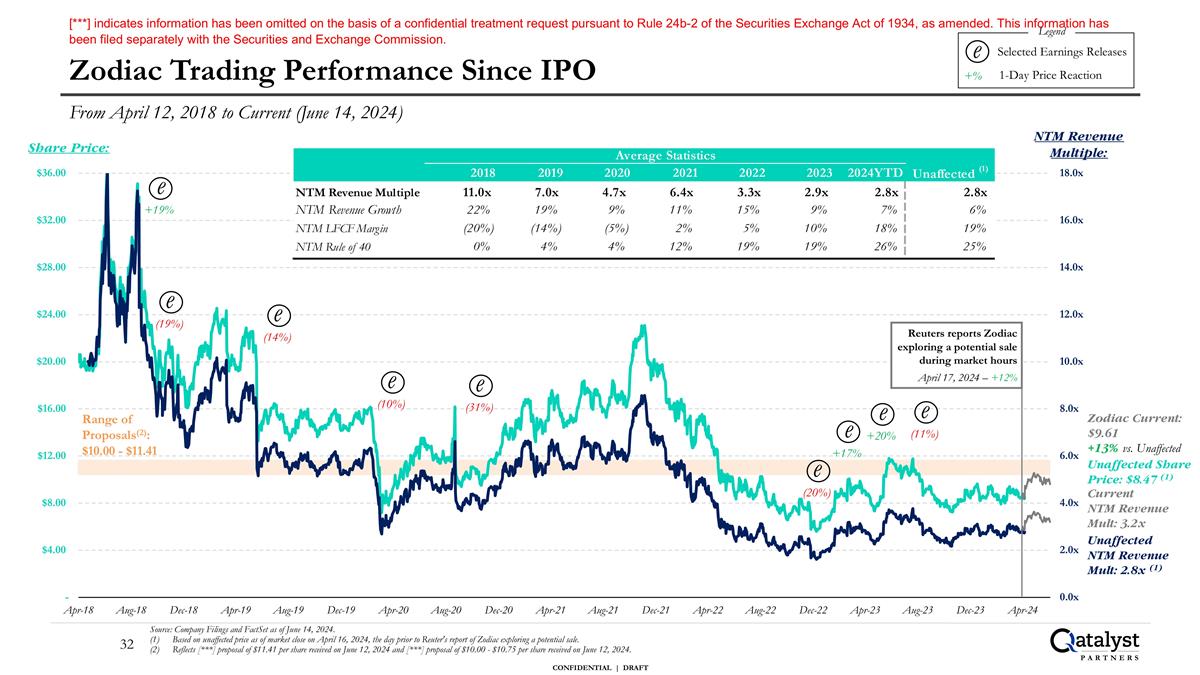

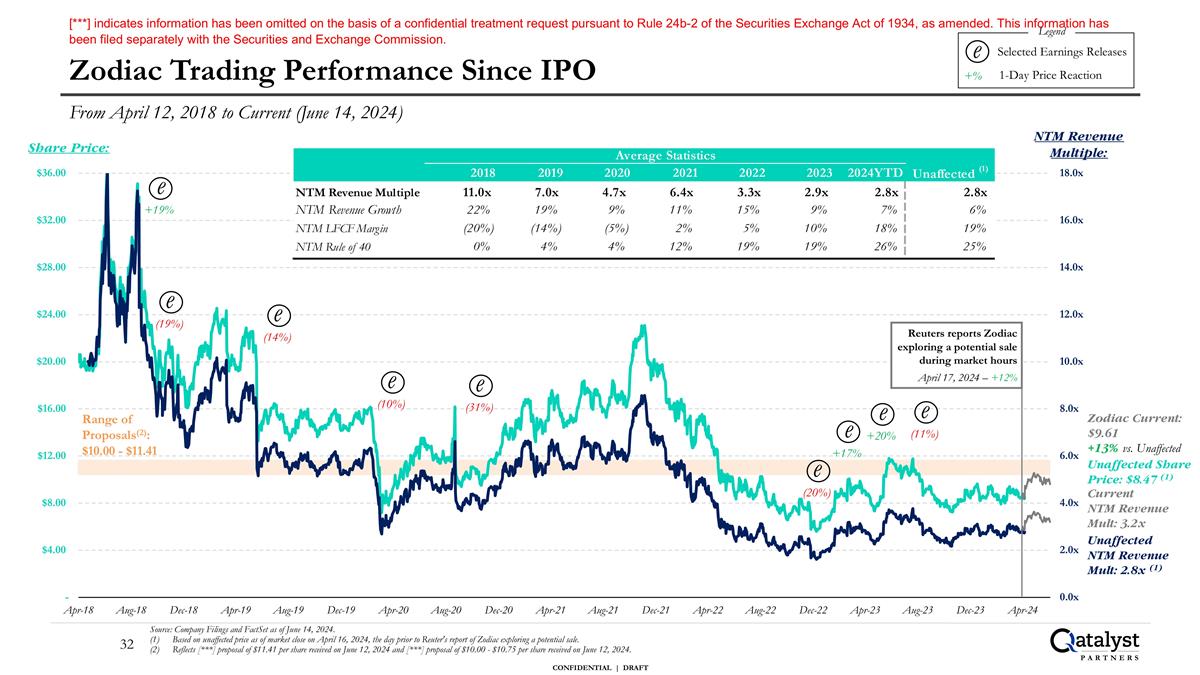

Range of Proposals(2): $10.00 - $11.41 Zodiac Trading Performance Since IPO From April 12, 2018 to Current (June 14, 2024) NTM Revenue Multiple: Share Price: Source: Company Filings and FactSet as of June 14, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Reflects [***] proposal of $11.41 per share received on June 12, 2024 and [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. e (11%) e +20% e +17% e (20%) e (31%) e (10%) e (19%) e (14%) e +19% Selected Earnings Releases e Legend 1-Day Price Reaction +% Unaffected NTM Revenue Mult: 2.8x (1) Unaffected Share Price: $8.47 (1) Zodiac Current: $9.61 +13% vs. Unaffected Current NTM Revenue Mult: 3.2x Reuters reports Zodiac exploring a potential sale during market hours April 17, 2024 – +12% [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

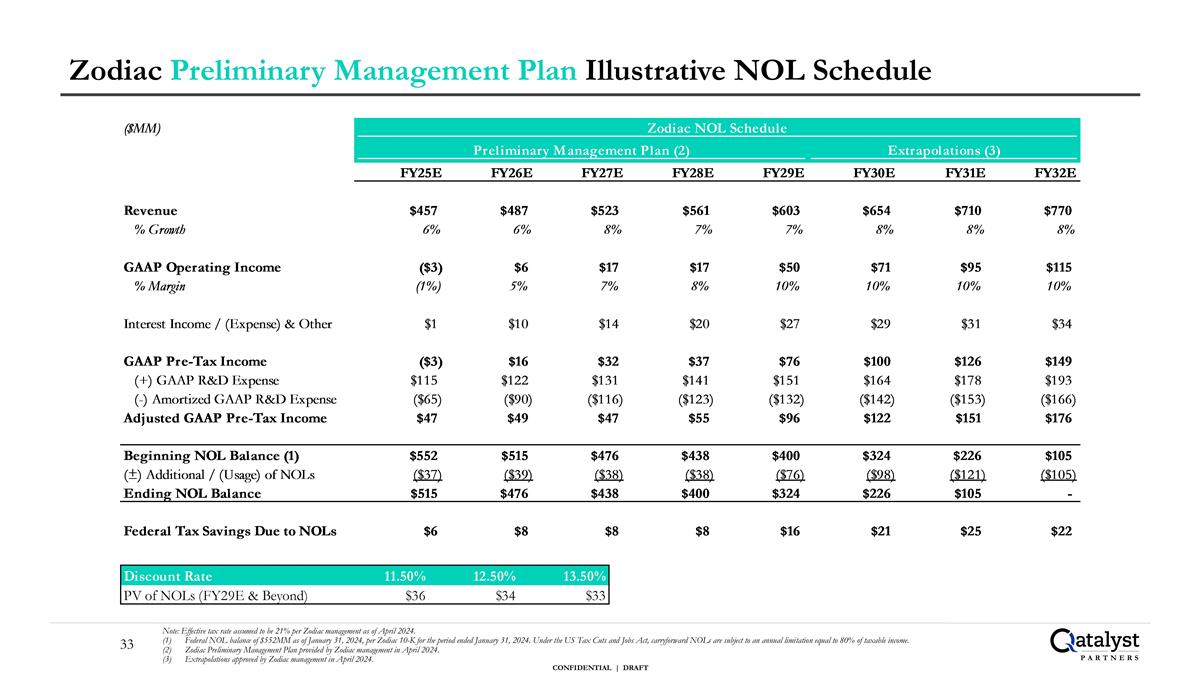

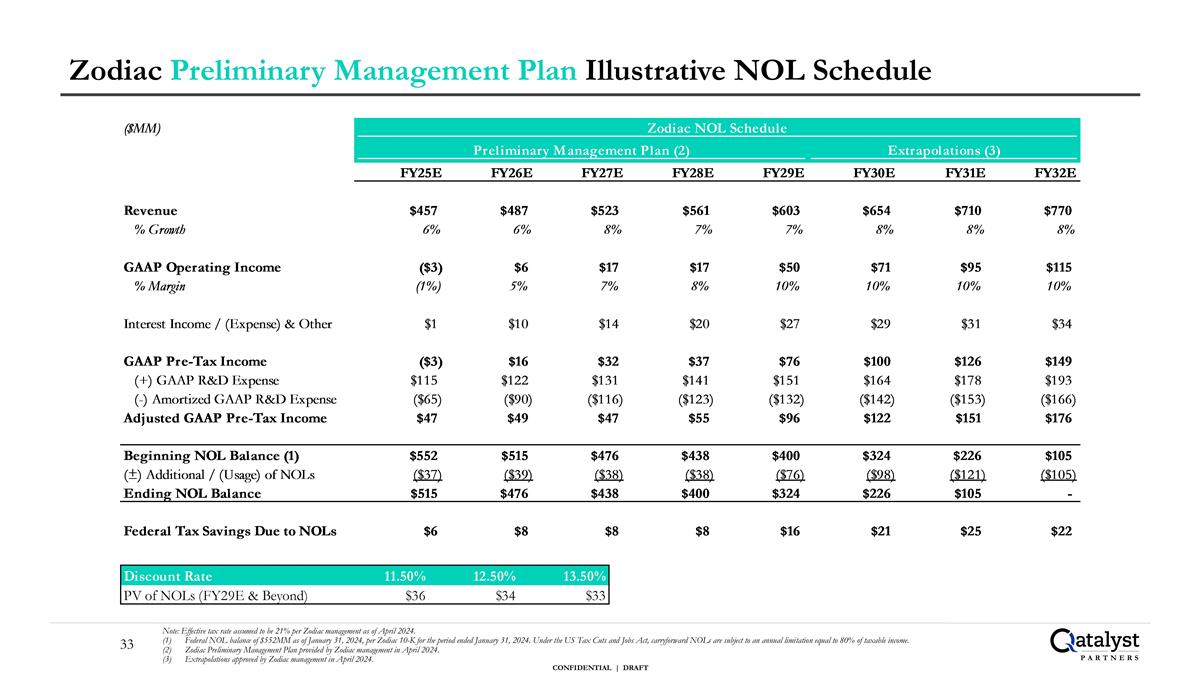

Zodiac Preliminary Management Plan Illustrative NOL Schedule Note: Effective tax rate assumed to be 21% per Zodiac management as of April 2024. Federal NOL balance of $552MM as of January 31, 2024, per Zodiac 10-K for the period ended January 31, 2024. Under the US Tax Cuts and Jobs Act, carryforward NOLs are subject to an annual limitation equal to 80% of taxable income. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Extrapolations approved by Zodiac management in April 2024.

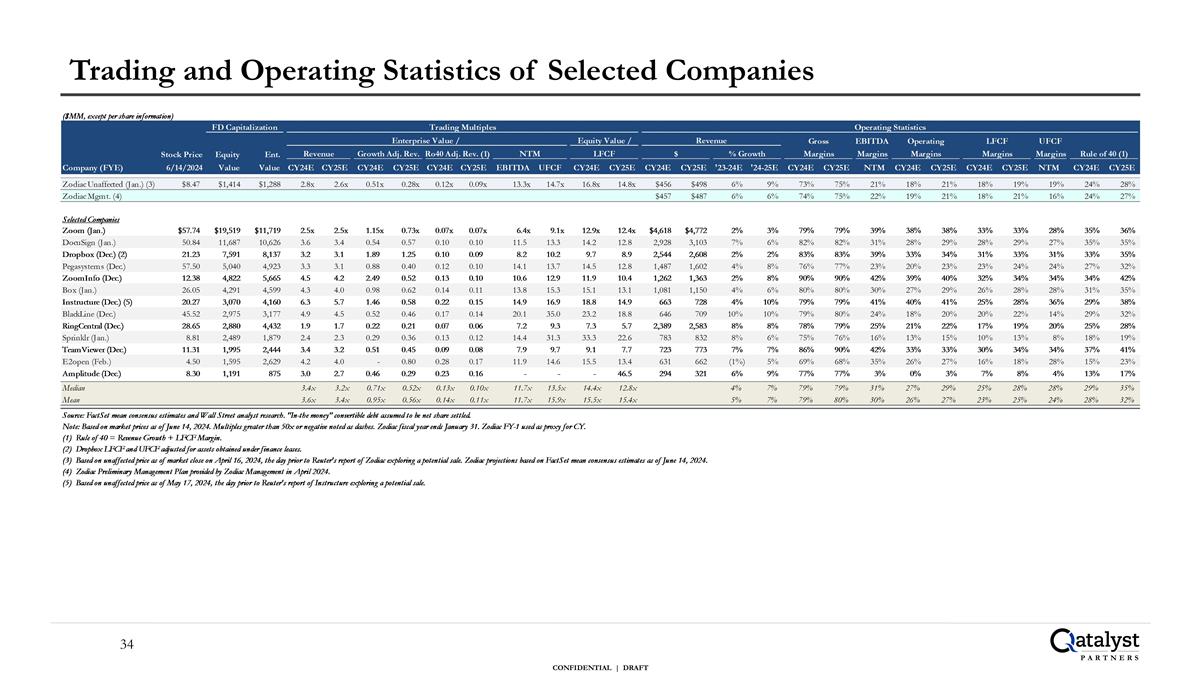

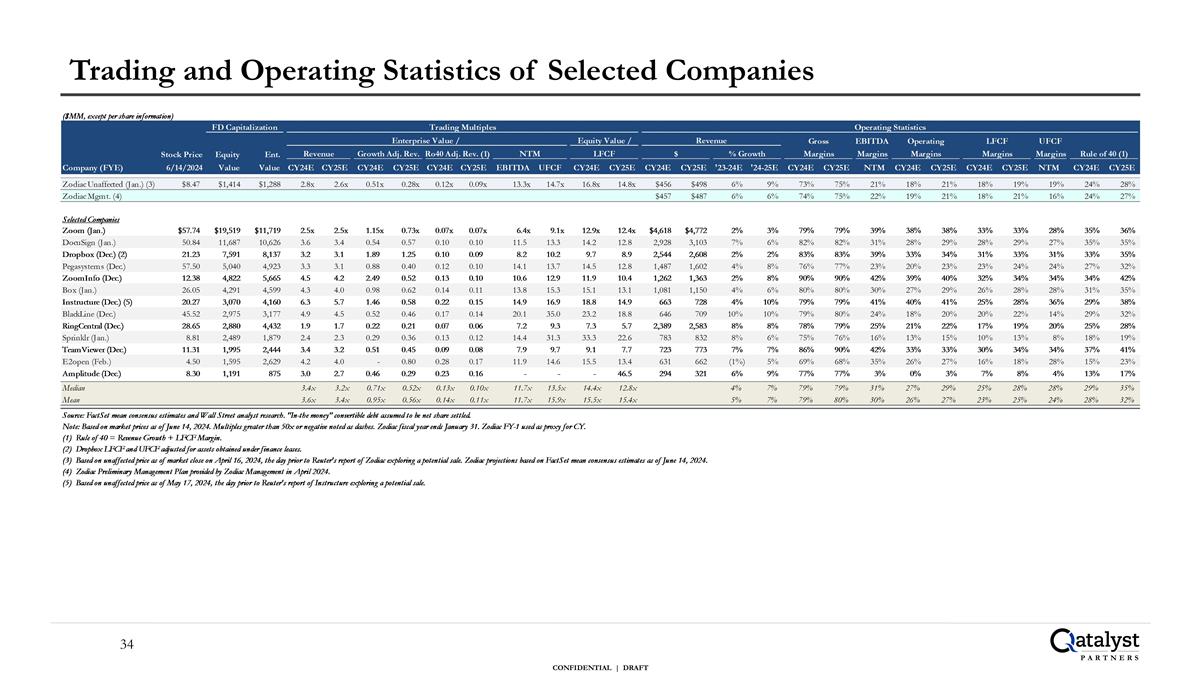

Trading and Operating Statistics of Selected Companies

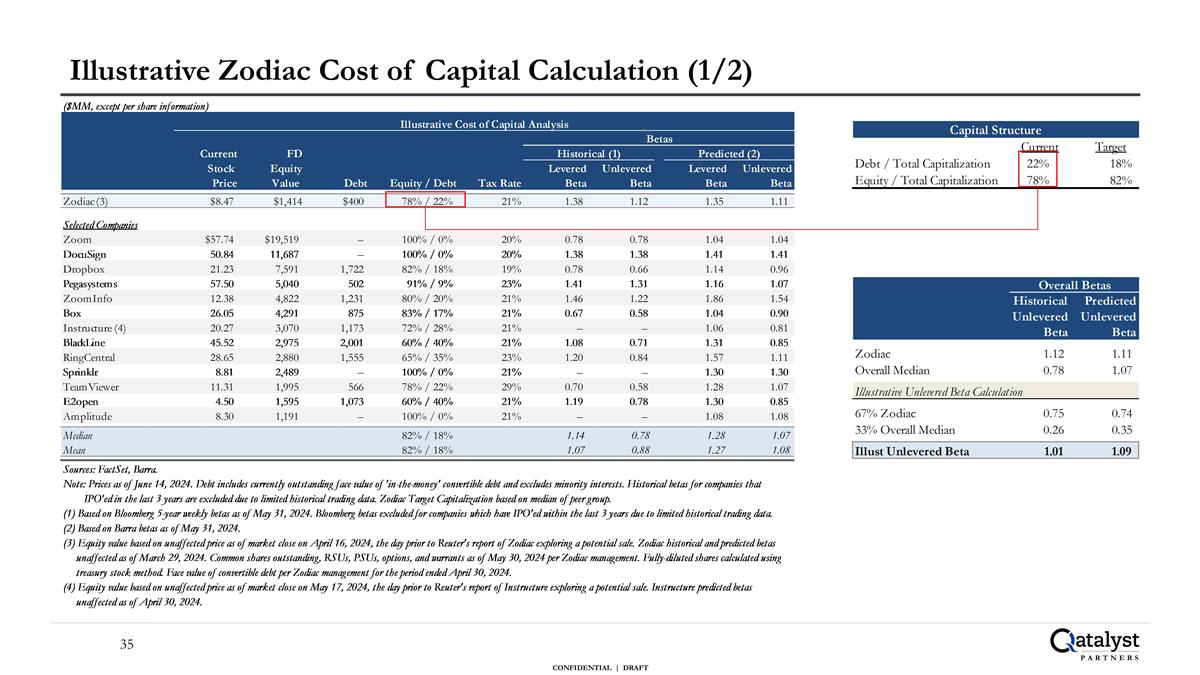

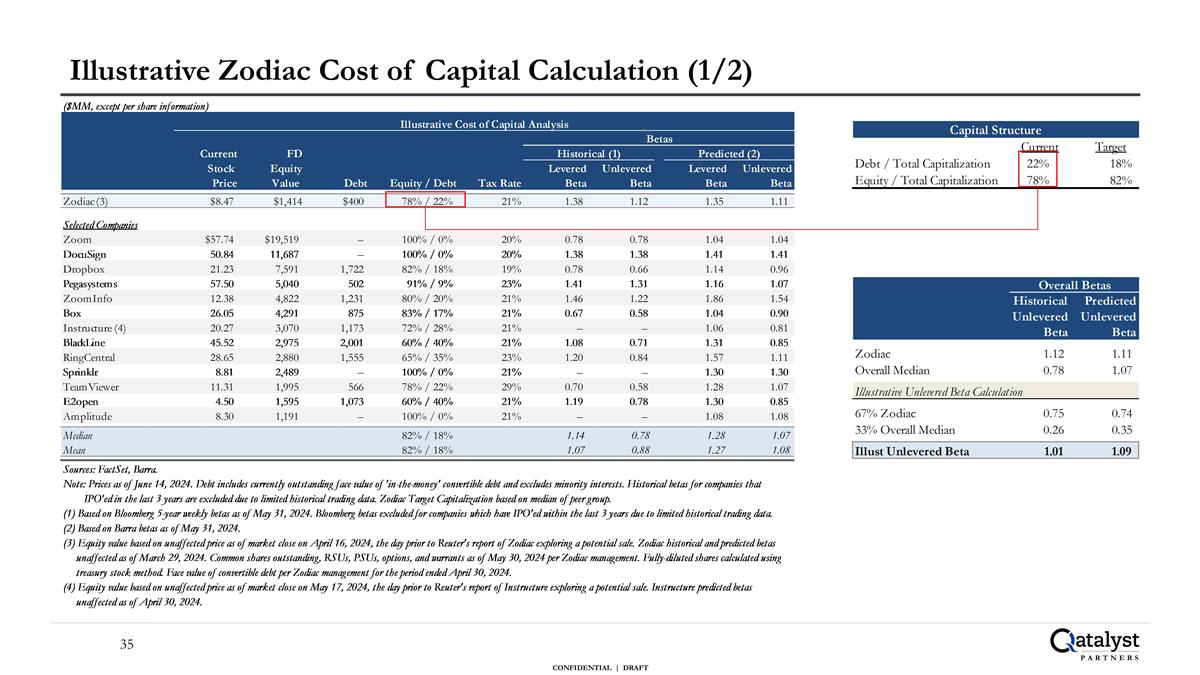

Illustrative Zodiac Cost of Capital Calculation (1/2)

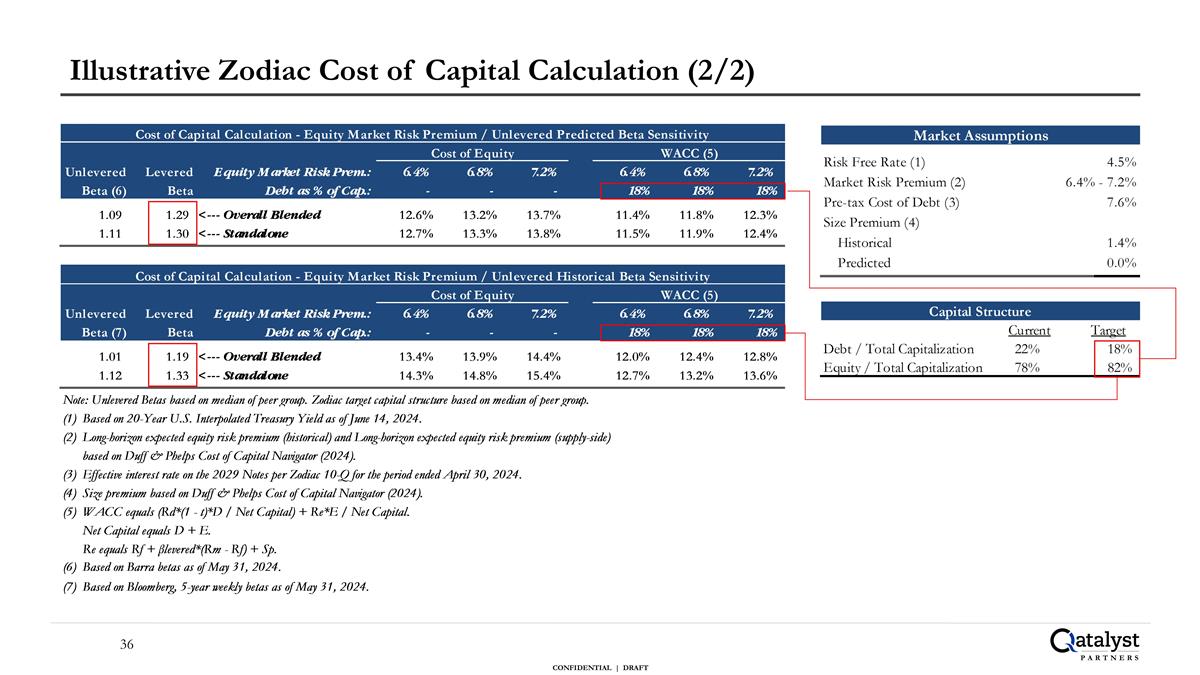

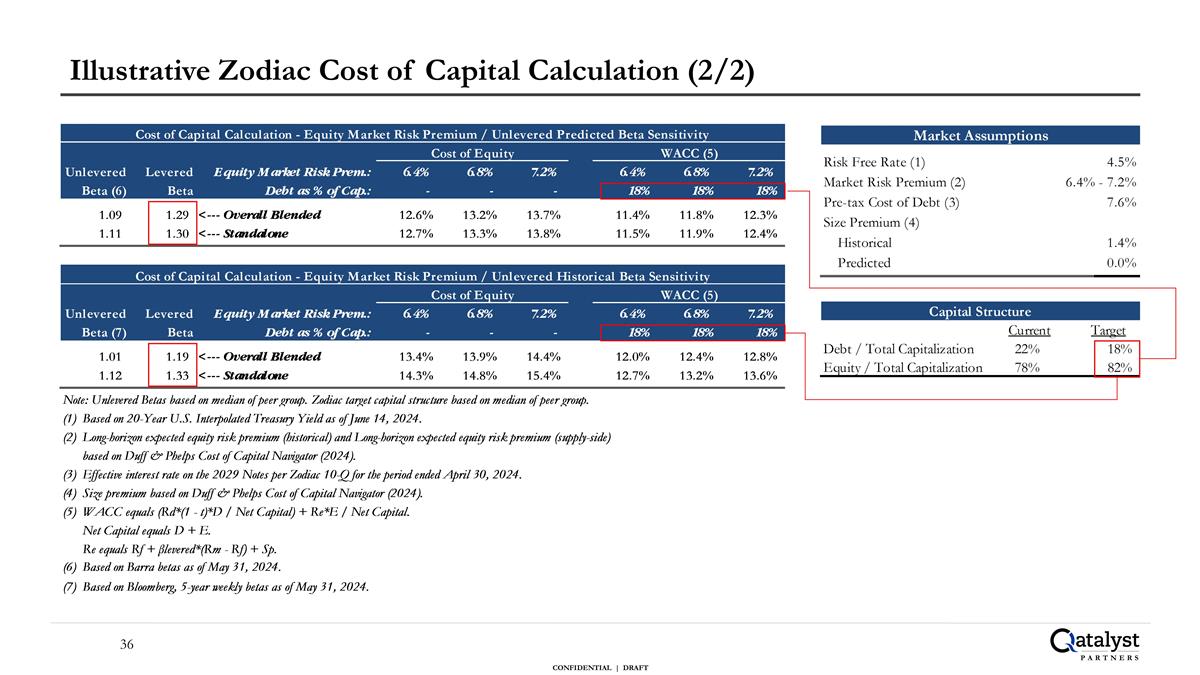

Illustrative Zodiac Cost of Capital Calculation (2/2)

Disclaimer