July 2024 Project Zodiac Reference Materials Exhibit 16(c)(vii) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Overview [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Company Overview Valuation & Trading Statistics(1) Company Overview Core Strategic Priorities [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Overview of [***] Street Forecast Source: FactSet mean consensus estimates as of July 9, 2024. Note: [***] Revenue represents [***]. [***] Non-GAAP Operating Income ($MM) Levered Free Cash Flow ($MM) Non-GAAP Operating Margin (%) LFCF Margin (%) Revenue ($MM) YoY Revenue Growth (%) Non-GAAP EBITDA ($MM) Non-GAAP EBITDA Margin (%) [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] is Primarily Valued on [***] Today, with a Median Price Target of [***] Source: Wall Street research and FactSet as of July 9, 2024. Note: [***] Analyst Ratings & Valuation Methodologies Valuation Methodology and Broker Recommendation Summary [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Trading Performance Since 2022 From January 3, 2022 to Current (July 9, 2024) Source: Company filings and FactSet as of July 9, 2024. Note: [***] Revenue represents [***]. Selected Earnings Releases e Legend 1-Day Price Reaction +% [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Illustrative [***] + Zodiac Transaction Analysis [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] and Zodiac Pro Forma Income Statement Source: Company filings, Company transcripts, Wall Street research, and FactSet mean consensus estimates as of July 9, 2024. Note: Zodiac fiscal year ends [***] Zodiac FY-1 used as proxy for CY. [***] Revenue represents [***]. (1) Pro Forma [***] does not account for transaction adjustments (interest rate on new debt, foregone interest on cash, etc.) for illustrative purposes. Illustrative CY25E Synergies [***] ($MM) PF Combined [***] Street Estimates Zodiac Street Estimates (Excluding Synergies) CY24E CY25E CY24E CY25E CY24E CY25E [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

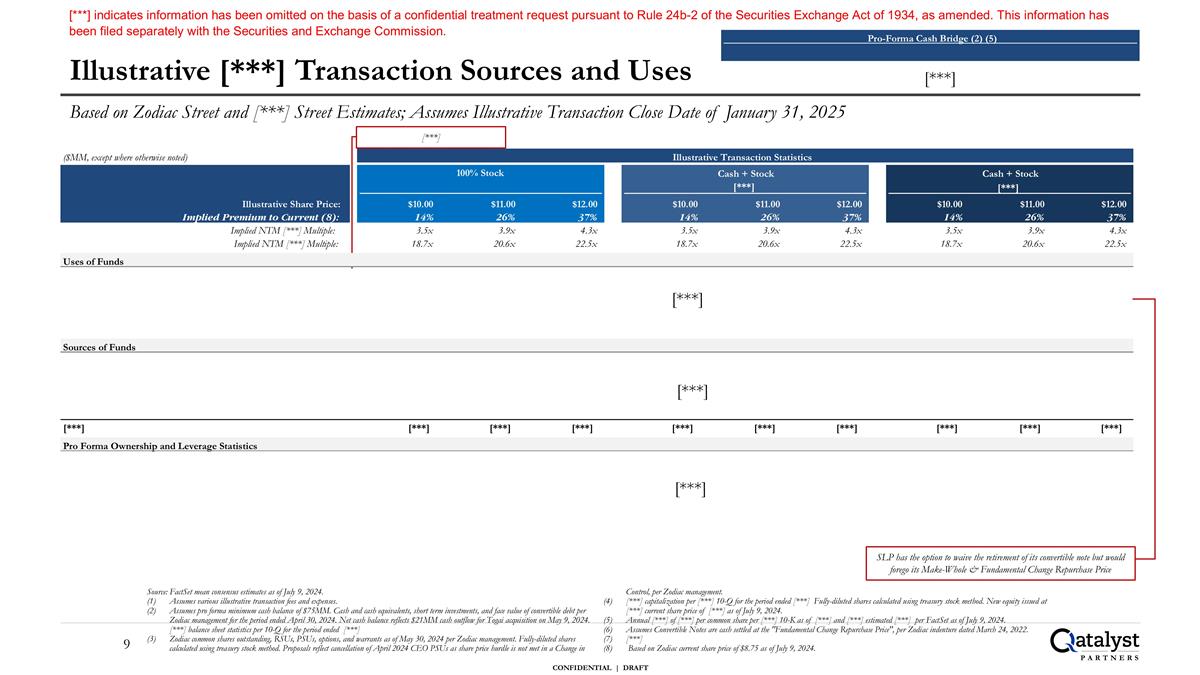

Illustrative [***] Transaction Sources and Uses Source: FactSet mean consensus estimates as of July 9, 2024. Assumes various illustrative transaction fees and expenses. Assumes pro forma minimum cash balance of $75MM. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. [***] balance sheet statistics per 10-Q for the period ended [***] Zodiac common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Proposals reflect cancellation of April 2024 CEO PSUs as share price hurdle is not met in a Change in Control, per Zodiac management. [***] capitalization per [***] 10-Q for the period ended [***] Fully-diluted shares calculated using treasury stock method. New equity issued at [***] current share price of [***] as of July 9, 2024. Annual [***] of [***] per common share per [***] 10-K as of [***] and [***] estimated [***] per FactSet as of July 9, 2024. Assumes Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. [***] Based on Zodiac current share price of $8.75 as of July 9, 2024. Based on Zodiac Street and [***] Street Estimates; Assumes Illustrative Transaction Close Date of January 31, 2025 [***] SLP has the option to waive the retirement of its convertible note but would forego its Make-Whole & Fundamental Change Repurchase Price ($MM, except where otherwise noted) Illustrative Transaction Statistics Cash + Stock Cash + Stock [***] [***] Illustrative Share Price: $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 Implied Premium to Current (8): 14% 26% 37% 14% 26% 37% 14% 26% 37% Implied NTM [***] Multiple: 3.5x 3.9x 4.3x 3.5x 3.9x 4.3x 3.5x 3.9x 4.3x Implied NTM [***] Multiple: 18.7x 20.6x 22.5x 18.7x 20.6x 22.5x 18.7x 20.6x 22.5x Uses of Funds Sources of Funds [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] Pro Forma Ownership and Leverage Statistics 100% Stock [***] [***] [***] Pro-Forma Cash Bridge (2) (5) [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

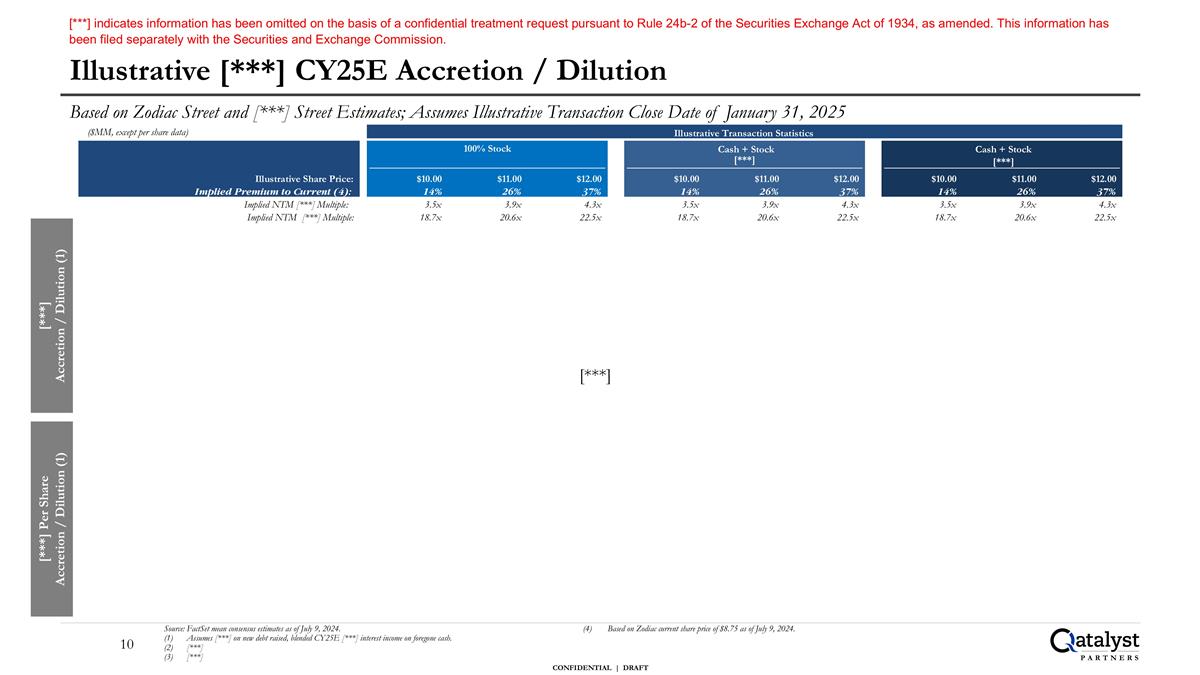

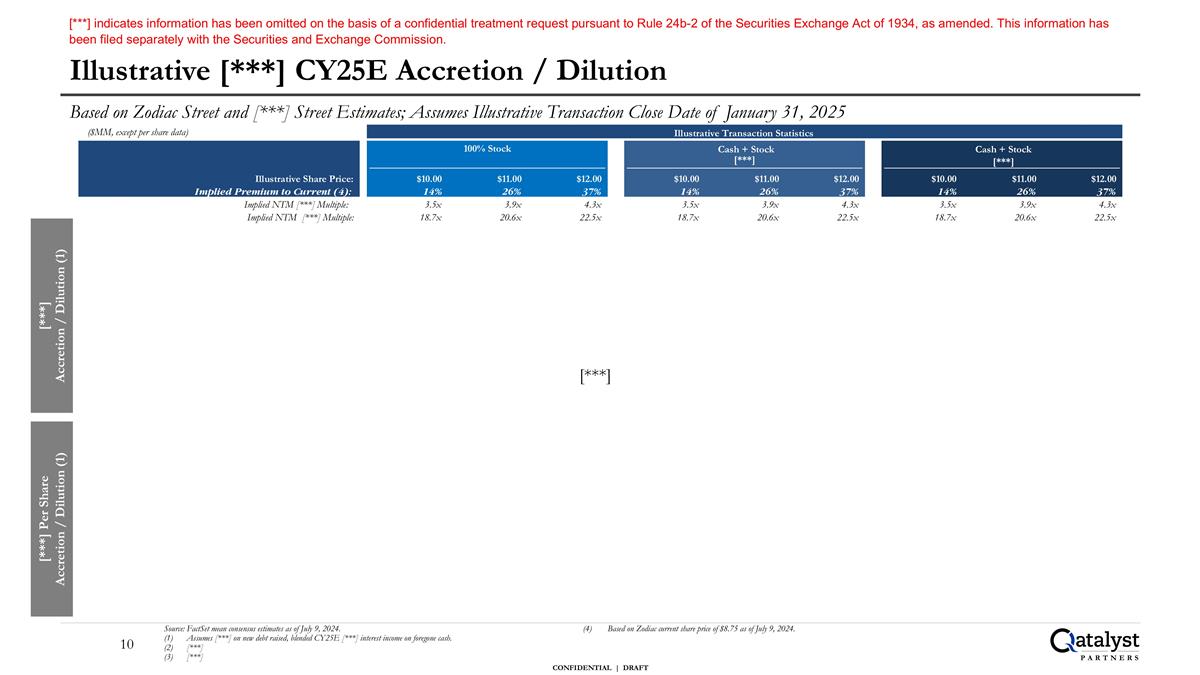

Illustrative [***] CY25E Accretion / Dilution Source: FactSet mean consensus estimates as of July 9, 2024. Assumes [***] on new debt raised, blended CY25E [***] interest income on foregone cash. [***] [***] Based on Zodiac current share price of $8.75 as of July 9, 2024. Based on Zodiac Street and [***] Street Estimates; Assumes Illustrative Transaction Close Date of January 31, 2025 [***] Accretion / Dilution (1) [***] Per Share Accretion / Dilution (1) ($MM, except per share data) Illustrative Transaction Statistics Cash + Stock Cash + Stock [***] [***] Illustrative Share Price: $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 Implied Premium to Current (4): 14% 26% 37% 14% 26% 37% 14% 26% 37% Implied NTM [***] Multiple: 3.5x 3.9x 4.3x 3.5x 3.9x 4.3x 3.5x 3.9x 4.3x Implied NTM [***] Multiple: 18.7x 20.6x 22.5x 18.7x 20.6x 22.5x 18.7x 20.6x 22.5x 100% Stock [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

Appendix

[***] Selected M&A History [***] Source: Company filings and 451 Research as of July 9, 2024. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

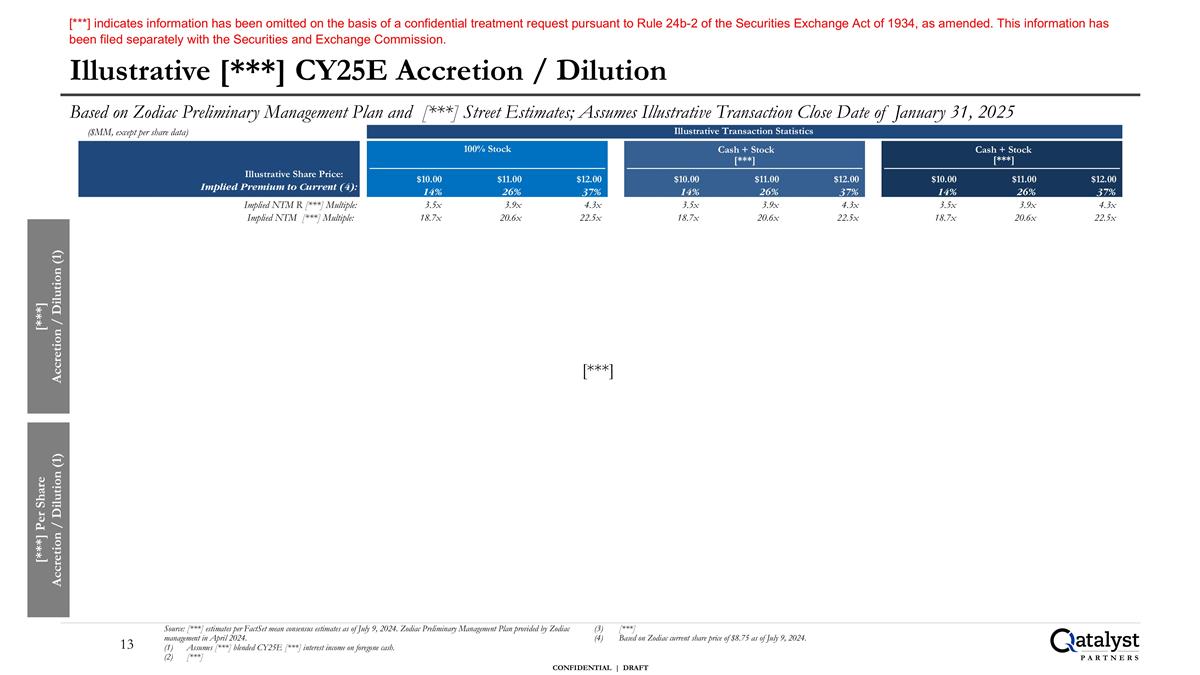

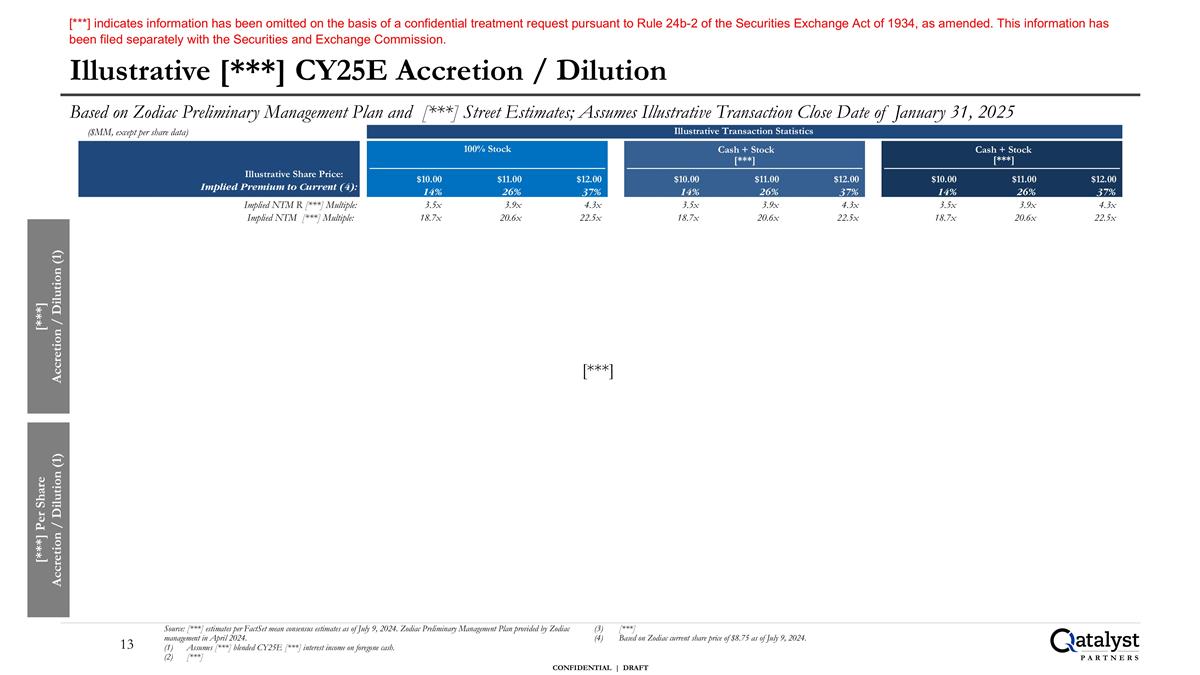

Illustrative [***] CY25E Accretion / Dilution Source: [***] estimates per FactSet mean consensus estimates as of July 9, 2024. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Assumes [***] blended CY25E [***] interest income on foregone cash. [***] [***] Based on Zodiac current share price of $8.75 as of July 9, 2024. Based on Zodiac Preliminary Management Plan and [***] Street Estimates; Assumes Illustrative Transaction Close Date of January 31, 2025 ($MM, except per share data) [***] Accretion / Dilution (1) [***] Per Share Accretion / Dilution (1) Illustrative Transaction Statistics Cash + Stock Cash + Stock [***] [***] Illustrative Share Price: $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 Implied Premium to Current (4): 14% 26% 37% 14% 26% 37% 14% 26% 37% Implied NTM R [***] Multiple: 3.5x 3.9x 4.3x 3.5x 3.9x 4.3x 3.5x 3.9x 4.3x Implied NTM [***] Multiple: 18.7x 20.6x 22.5x 18.7x 20.6x 22.5x 18.7x 20.6x 22.5x 100% Stock [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

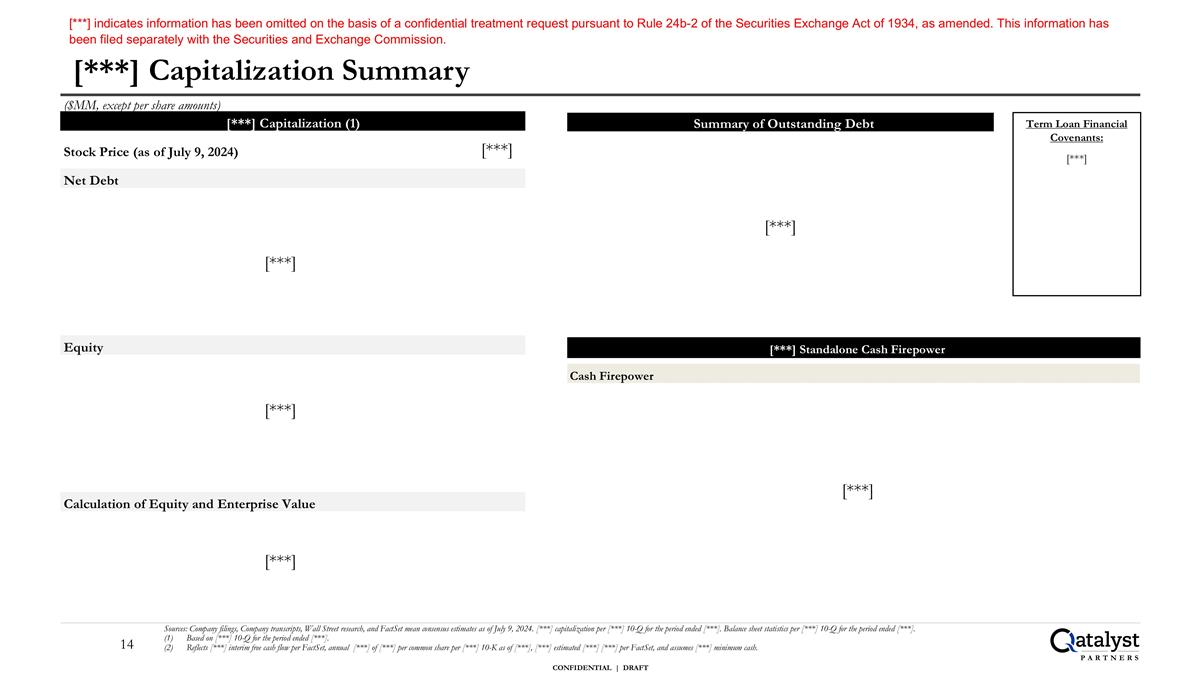

[***] Capitalization Summary Sources: Company filings, Company transcripts, Wall Street research, and FactSet mean consensus estimates as of July 9, 2024. [***] capitalization per [***] 10-Q for the period ended [***]. Balance sheet statistics per [***] 10-Q for the period ended [***]. Based on [***] 10-Q for the period ended [***]. Reflects [***] interim free cash flow per FactSet, annual [***] of [***] per common share per [***] 10-K as of [***], [***] estimated [***] [***] per FactSet, and assumes [***] minimum cash. Term Loan Financial Covenants: [***] ($MM, except per share amounts) [***] Capitalization (1) Stock Price (as of July 9, 2024) Net Debt Equity Calculation of Equity and Enterprise Value Summary of Outstanding Debt [***] Standalone Cash Firepower Cash Firepower [***] [***] [***] [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

Disclaimer