April 2024 Project Zodiac Discussion Materials Exhibit 16(c)(iv) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Zodiac Process Summary Initial outreach to [***] parties ([***] strategics and [***] financial sponsors) Initial Proposals Received [***] Initial Outreach [***] Initial Outreach [***] Strategics Financial Sponsors Upcoming Mgmt. Meeting [***] On Hold Legend Written Proposal * On Hold [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***] [***]

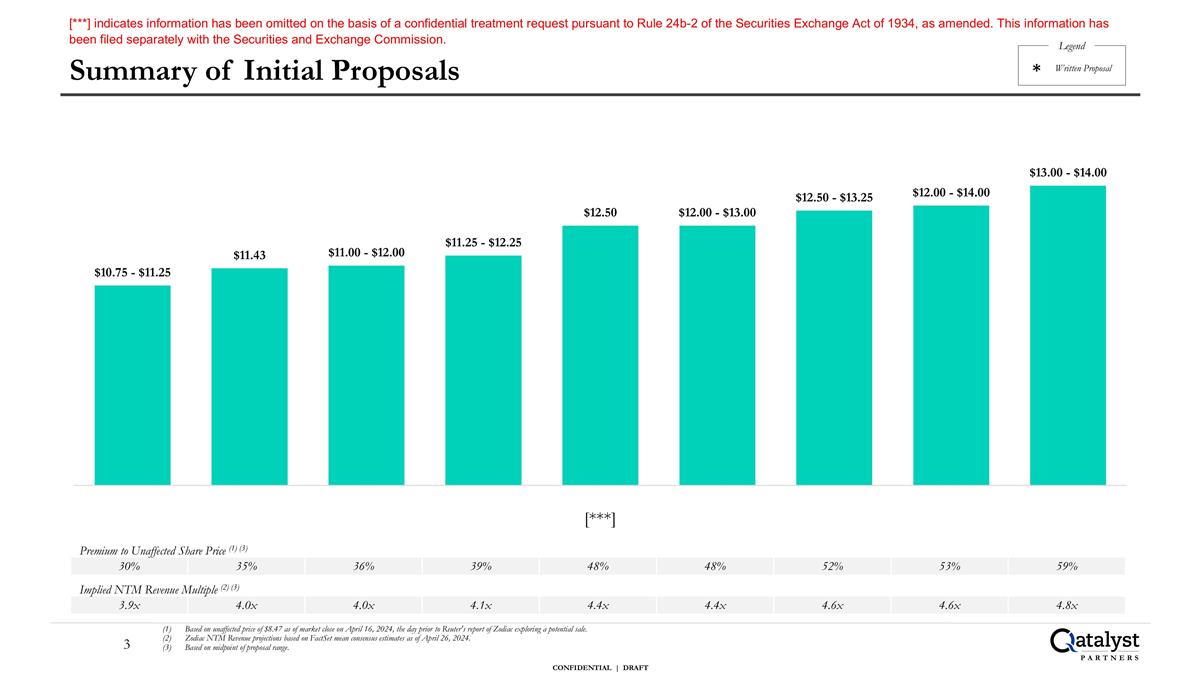

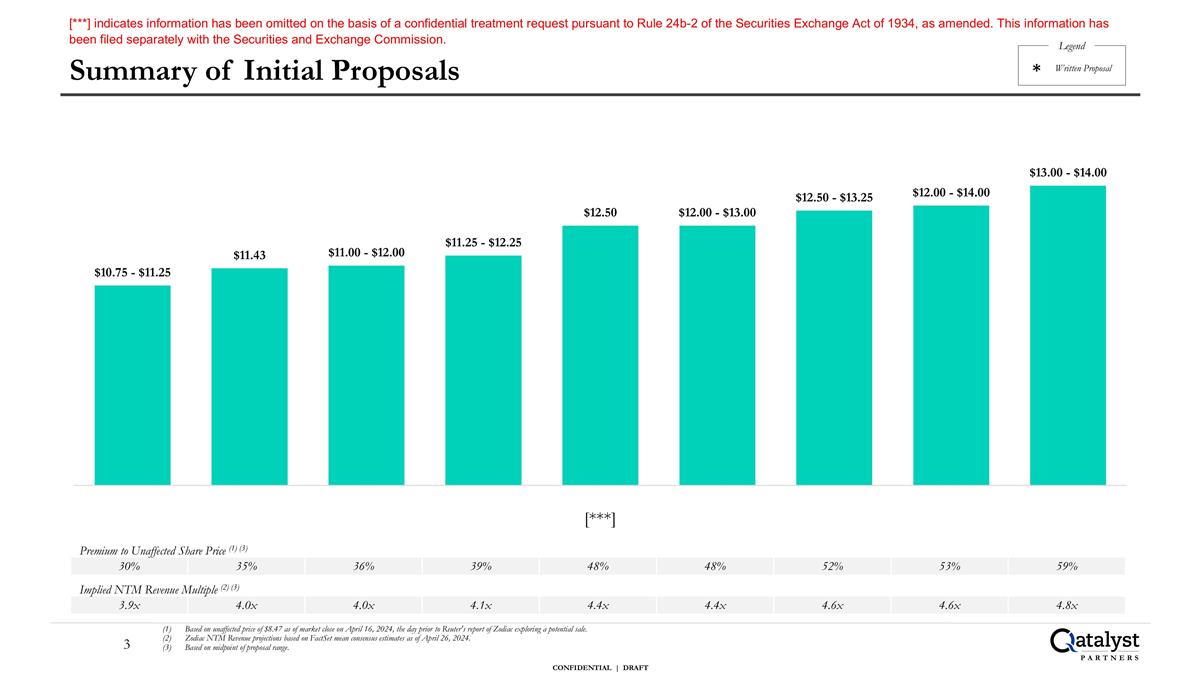

Based on unaffected price of $8.47 as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Zodiac NTM Revenue projections based on FactSet mean consensus estimates as of April 26, 2024. Based on midpoint of proposal range. Summary of Initial Proposals 30% 35% 36% 39% 48% 48% 52% 53% 59% Premium to Unaffected Share Price (1) (3) 3.9x 4.0x 4.0x 4.1x 4.4x 4.4x 4.6x 4.6x 4.8x Implied NTM Revenue Multiple (2) (3) Legend Written Proposal * [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

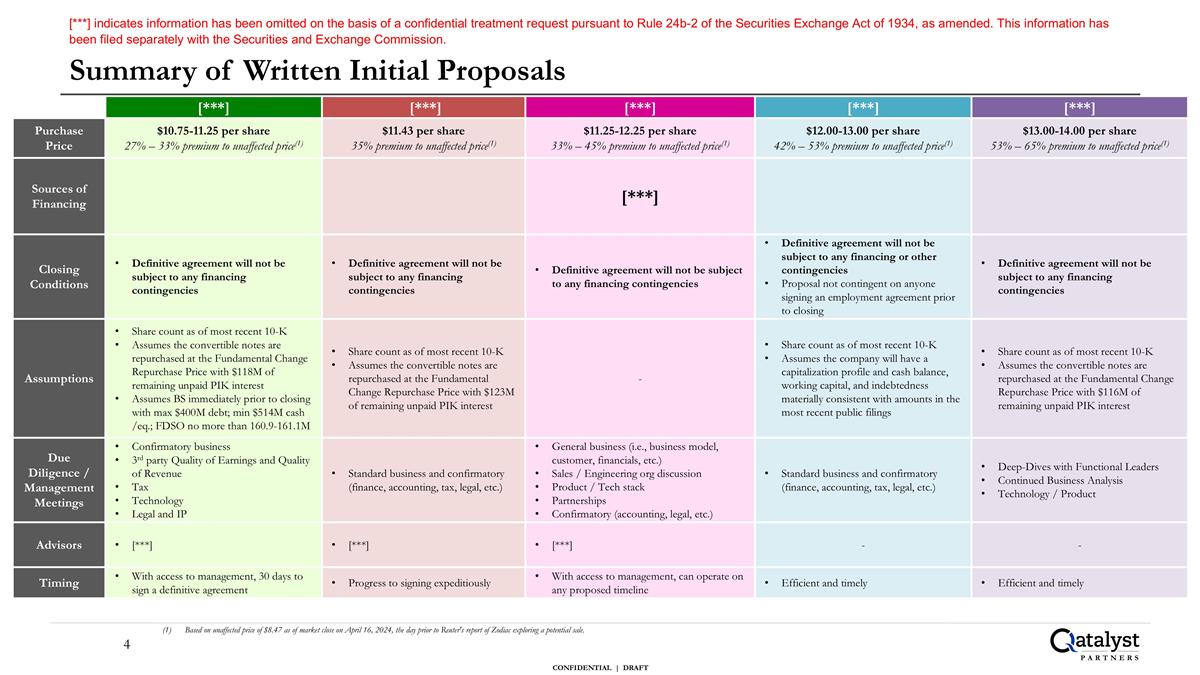

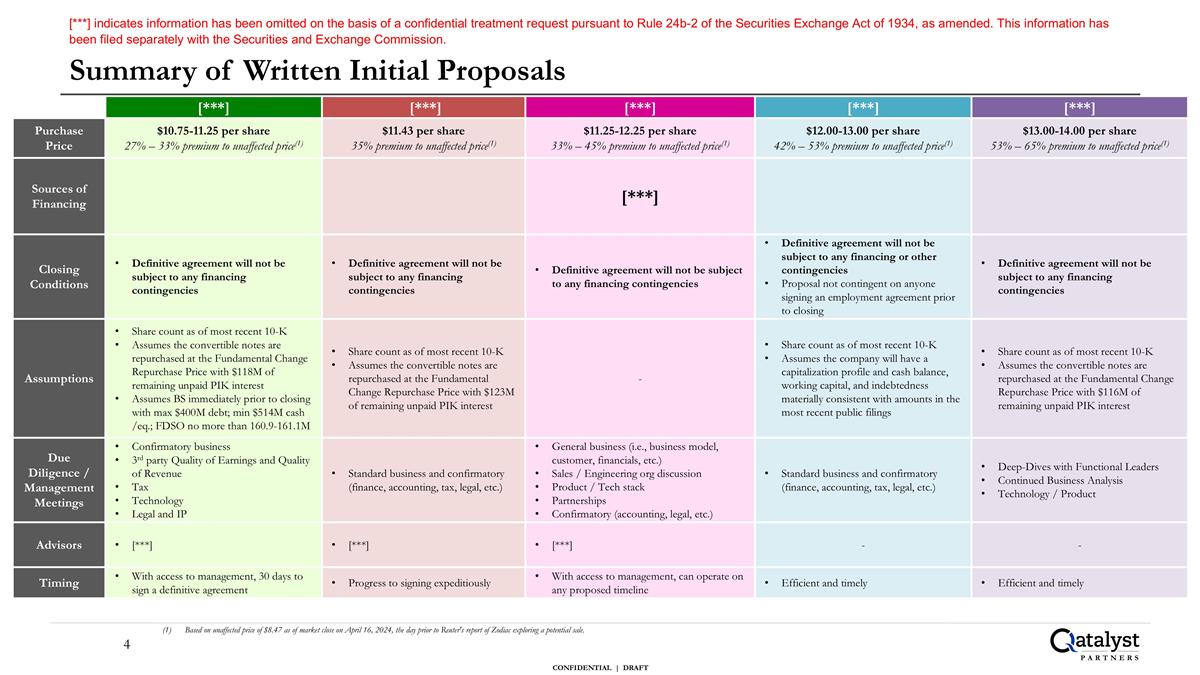

Summary of Written Initial Proposals [***] [***] [***] [***] [***] Purchase Price $10.75-11.25 per share 27% – 33% premium to unaffected price(1) $11.43 per share 35% premium to unaffected price(1) $11.25-12.25 per share 33% – 45% premium to unaffected price(1) $12.00-13.00 per share 42% – 53% premium to unaffected price(1) $13.00-14.00 per share 53% – 65% premium to unaffected price(1) Sources of Financing [***] Closing Conditions Definitive agreement will not be subject to any financing contingencies Definitive agreement will not be subject to any financing contingencies Definitive agreement will not be subject to any financing contingencies Definitive agreement will not be subject to any financing or other contingencies Proposal not contingent on anyone signing an employment agreement prior to closing Definitive agreement will not be subject to any financing contingencies Assumptions Share count as of most recent 10-K Assumes the convertible notes are repurchased at the Fundamental Change Repurchase Price with $118M of remaining unpaid PIK interest Assumes BS immediately prior to closing with max $400M debt; min $514M cash /eq.; FDSO no more than 160.9-161.1M Share count as of most recent 10-K Assumes the convertible notes are repurchased at the Fundamental Change Repurchase Price with $123M of remaining unpaid PIK interest - Share count as of most recent 10-K Assumes the company will have a capitalization profile and cash balance, working capital, and indebtedness materially consistent with amounts in the most recent public filings Share count as of most recent 10-K Assumes the convertible notes are repurchased at the Fundamental Change Repurchase Price with $116M of remaining unpaid PIK interest Due Diligence / Management Meetings Confirmatory business 3rd party Quality of Earnings and Quality of Revenue Tax Technology Legal and IP Standard business and confirmatory (finance, accounting, tax, legal, etc.) General business (i.e., business model, customer, financials, etc.) Sales / Engineering org discussion Product / Tech stack Partnerships Confirmatory (accounting, legal, etc.) Standard business and confirmatory (finance, accounting, tax, legal, etc.) Deep-Dives with Functional Leaders Continued Business Analysis Technology / Product Advisors [***] [***] [***] - - Timing With access to management, 30 days to sign a definitive agreement Progress to signing expeditiously With access to management, can operate on any proposed timeline Efficient and timely Efficient and timely Based on unaffected price of $8.47 as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

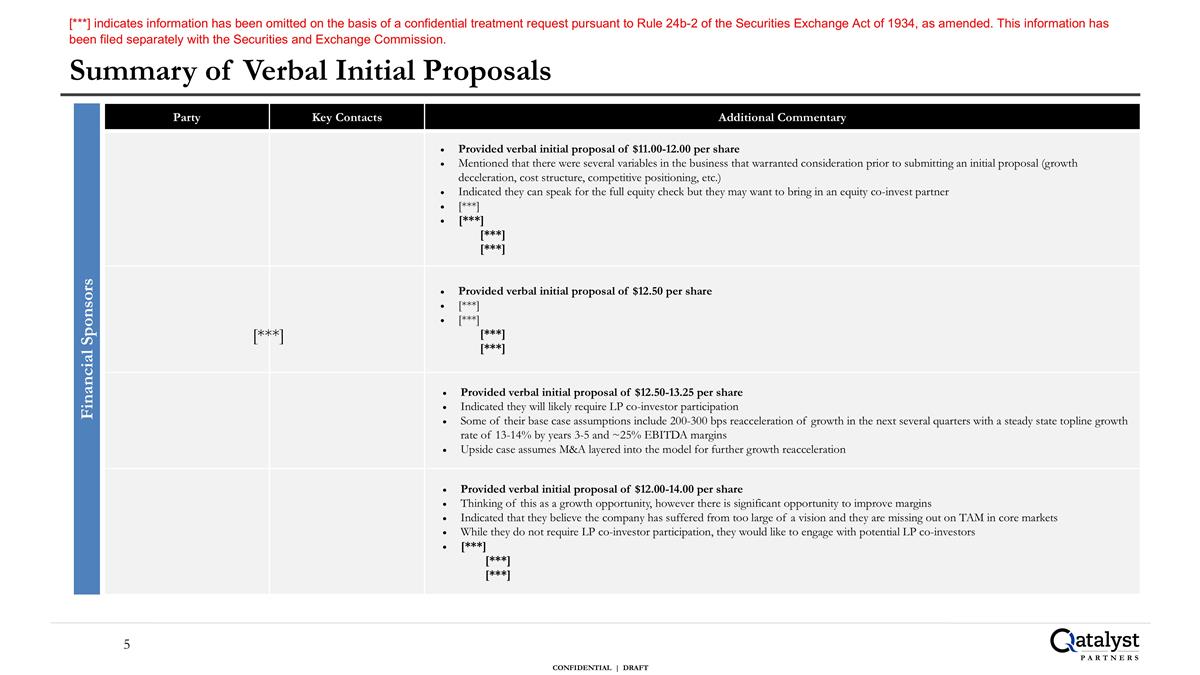

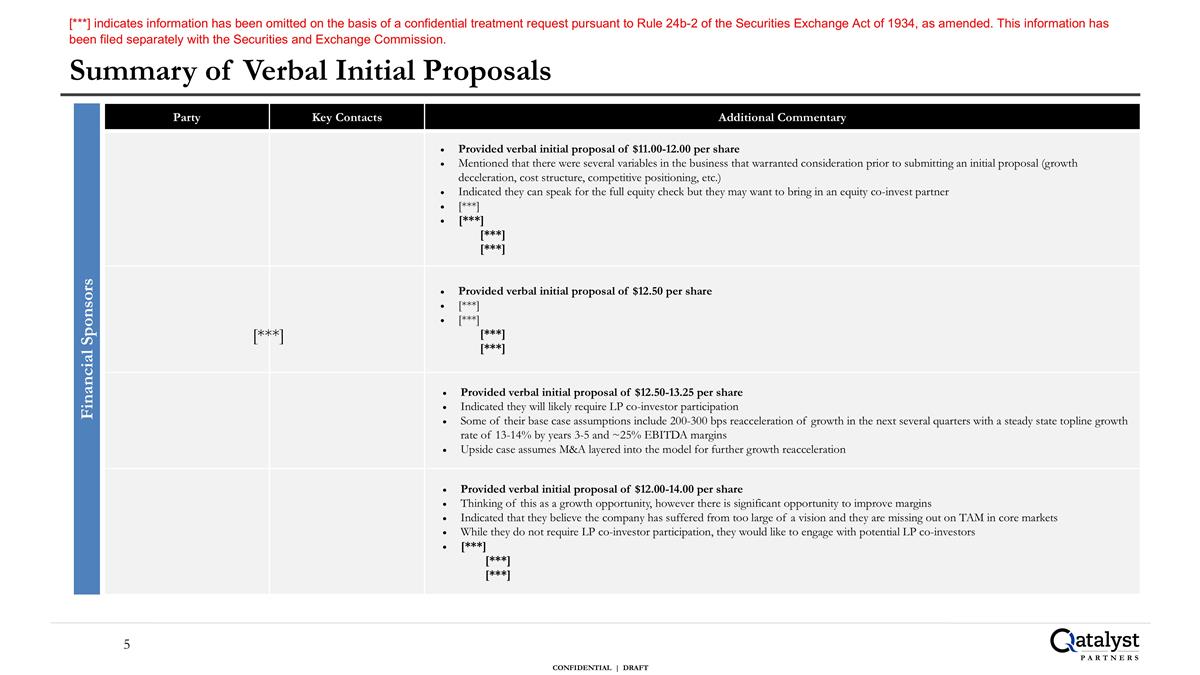

Summary of Verbal Initial Proposals Party Key Contacts Additional Commentary Provided verbal initial proposal of $11.00-12.00 per share Mentioned that there were several variables in the business that warranted consideration prior to submitting an initial proposal (growth deceleration, cost structure, competitive positioning, etc.) Indicated they can speak for the full equity check but they may want to bring in an equity co-invest partner [***] [***] [***] [***] Provided verbal initial proposal of $12.50 per share [***] [***] [***] [***] Provided verbal initial proposal of $12.50-13.25 per share Indicated they will likely require LP co-investor participation Some of their base case assumptions include 200-300 bps reacceleration of growth in the next several quarters with a steady state topline growth rate of 13-14% by years 3-5 and ~25% EBITDA margins Upside case assumes M&A layered into the model for further growth reacceleration Provided verbal initial proposal of $12.00-14.00 per share Thinking of this as a growth opportunity, however there is significant opportunity to improve margins Indicated that they believe the company has suffered from too large of a vision and they are missing out on TAM in core markets While they do not require LP co-investor participation, they would like to engage with potential LP co-investors [***] [***] [***] Financial Sponsors [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

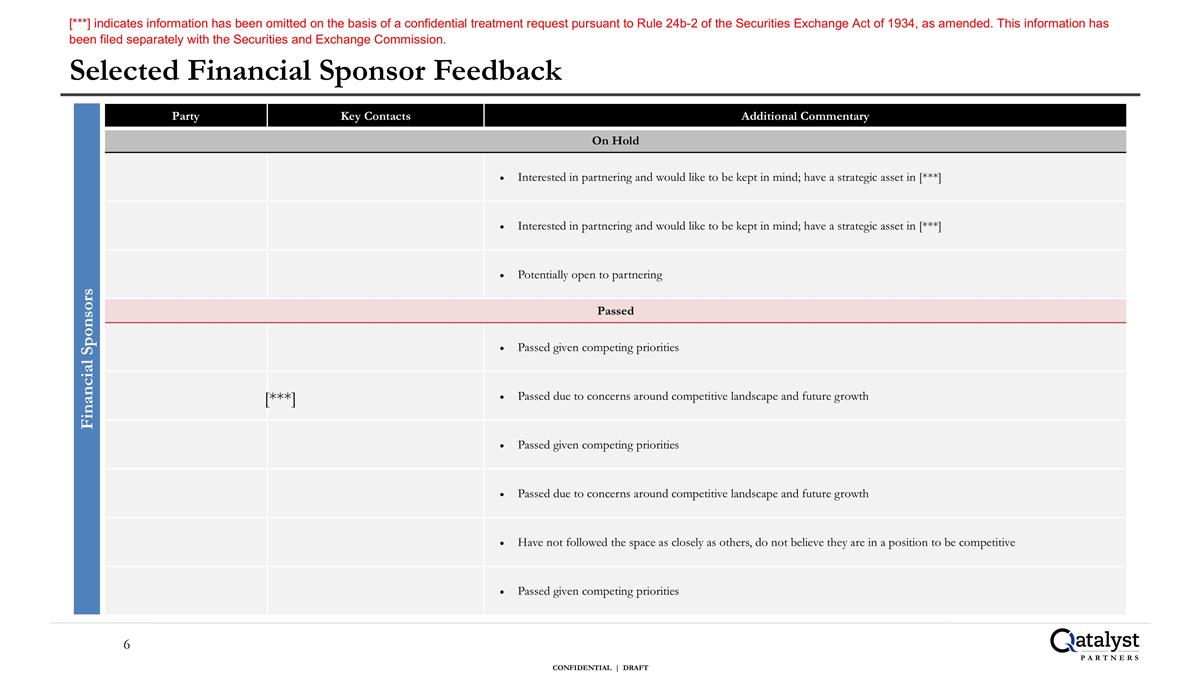

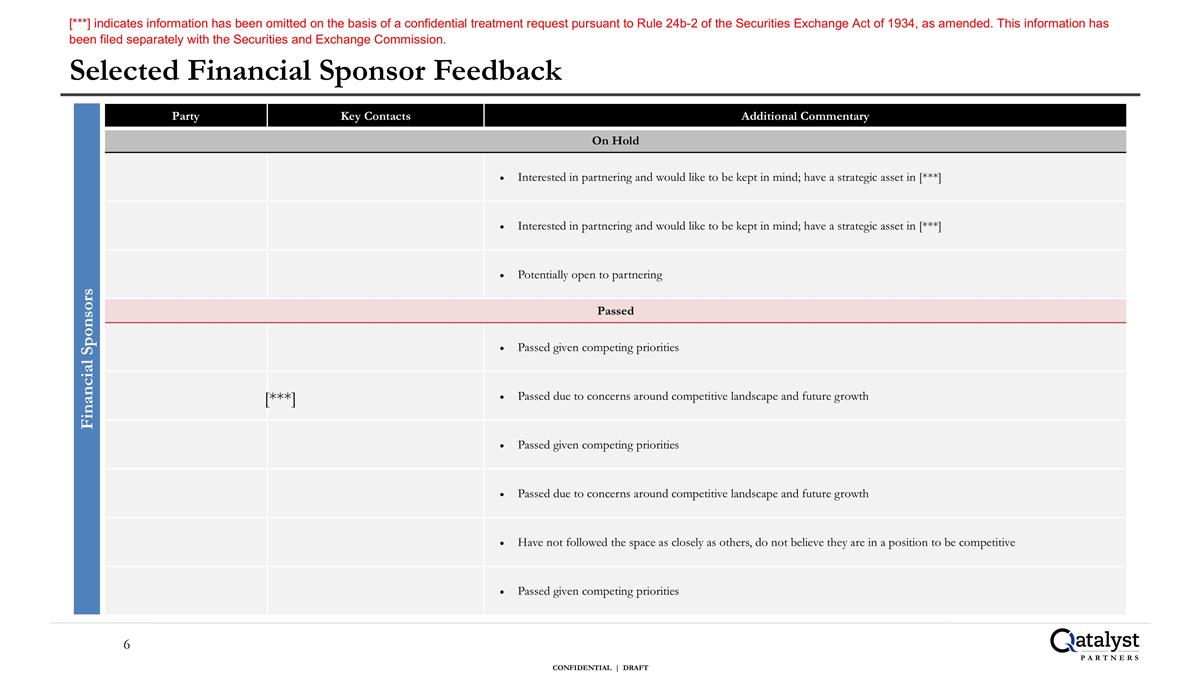

Selected Financial Sponsor Feedback Party Key Contacts Additional Commentary On Hold Interested in partnering and would like to be kept in mind; have a strategic asset in [***] Interested in partnering and would like to be kept in mind; have a strategic asset in [***] Potentially open to partnering Passed Passed given competing priorities Passed due to concerns around competitive landscape and future growth Passed given competing priorities Passed due to concerns around competitive landscape and future growth Have not followed the space as closely as others, do not believe they are in a position to be competitive Passed given competing priorities Financial Sponsors [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

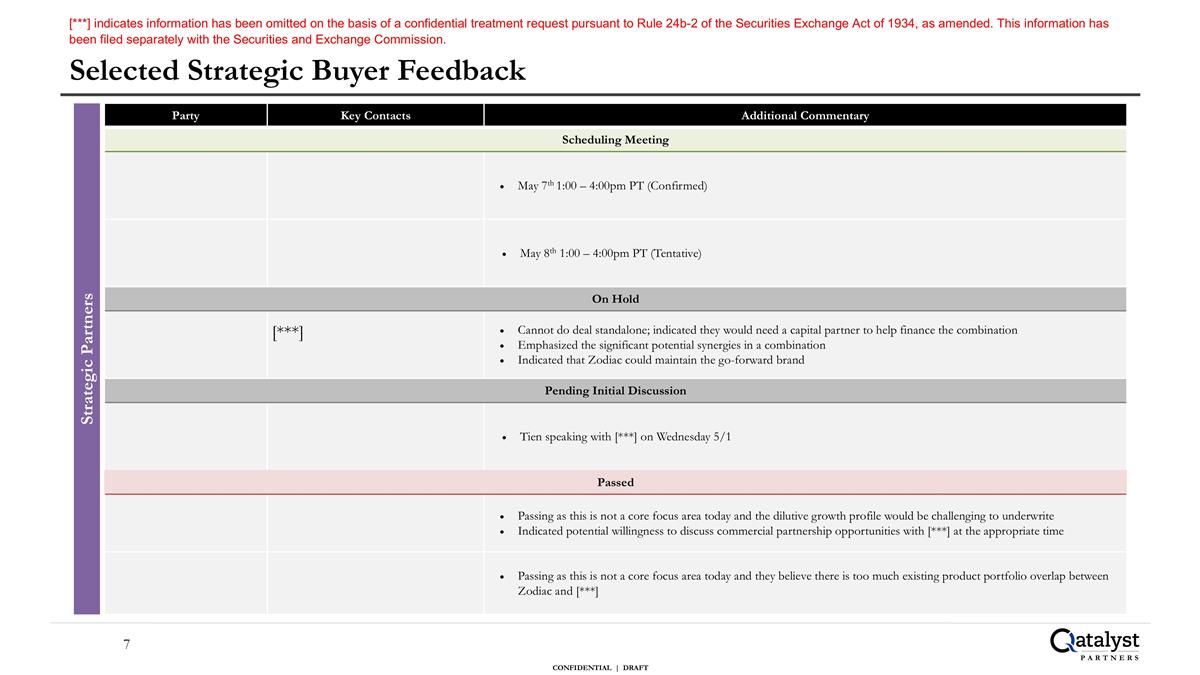

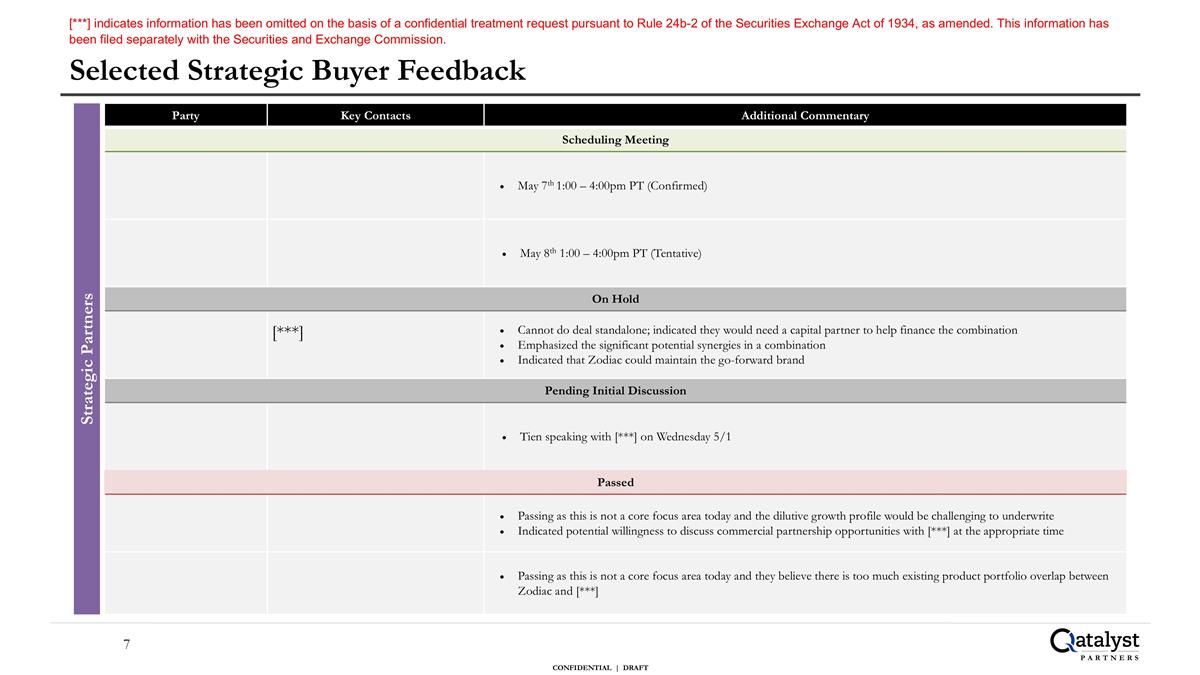

Party Key Contacts Additional Commentary Scheduling Meeting May 7th 1:00 – 4:00pm PT (Confirmed) May 8th 1:00 – 4:00pm PT (Tentative) On Hold Cannot do deal standalone; indicated they would need a capital partner to help finance the combination Emphasized the significant potential synergies in a combination Indicated that Zodiac could maintain the go-forward brand Pending Initial Discussion Tien speaking with [***] on Wednesday 5/1 Passed Passing as this is not a core focus area today and the dilutive growth profile would be challenging to underwrite Indicated potential willingness to discuss commercial partnership opportunities with [***] at the appropriate time Passing as this is not a core focus area today and they believe there is too much existing product portfolio overlap between Zodiac and [***] Selected Strategic Buyer Feedback Strategic Partners [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

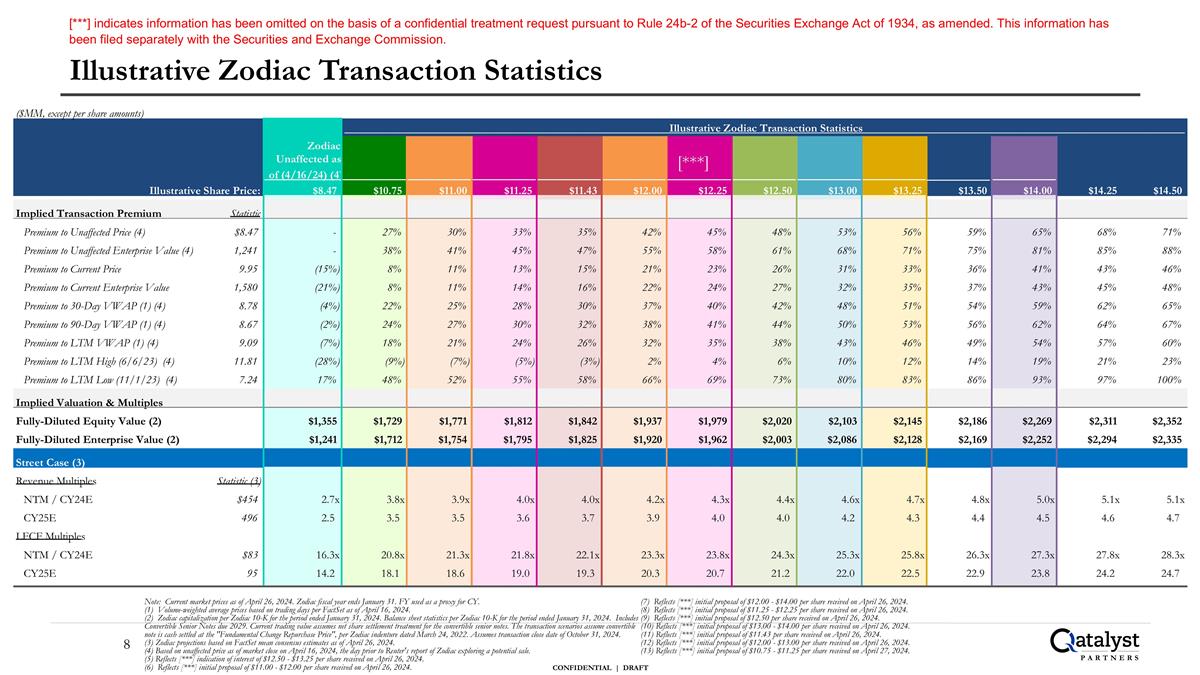

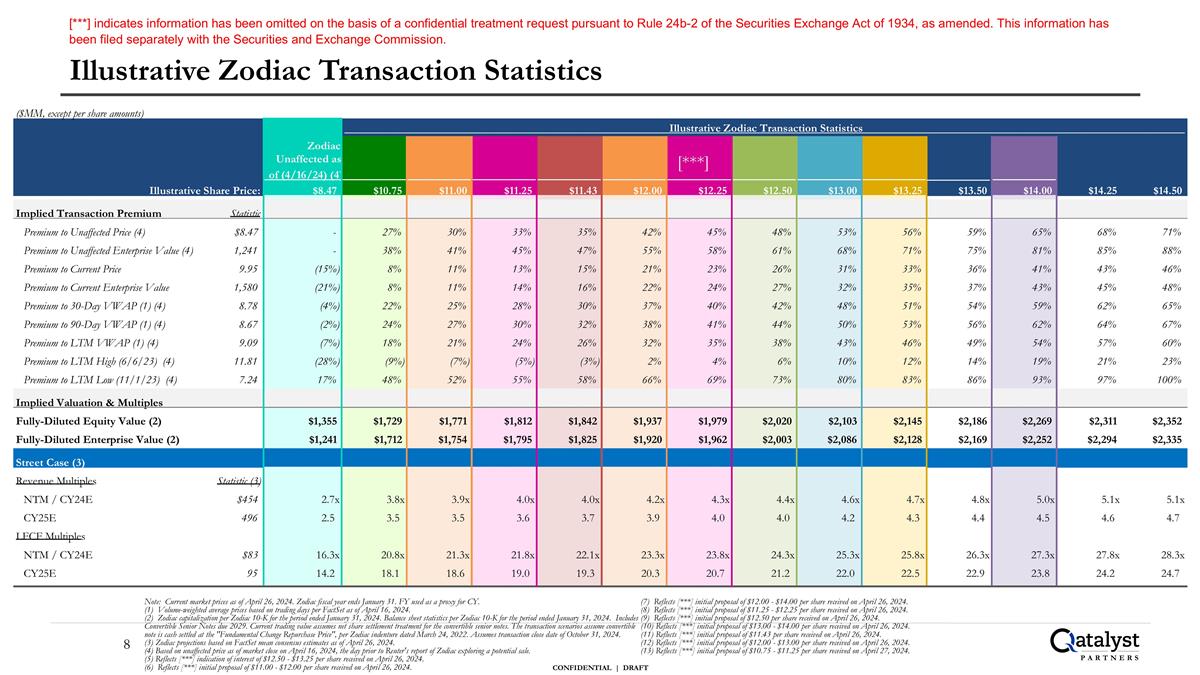

Illustrative Zodiac Transaction Statistics Note: Current market prices as of April 26, 2024. Zodiac fiscal year ends January 31. FY used as a proxy for CY. (1) Volume-weighted average prices based on trading days per FactSet as of April 16, 2024. (2) Zodiac capitalization per Zodiac 10-K for the period ended January 31, 2024. Balance sheet statistics per Zodiac 10-K for the period ended January 31, 2024. Includes Convertible Senior Notes due 2029. Current trading value assumes net share settlement treatment for the convertible senior notes. The transaction scenarios assume convertible note is cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Assumes transaction close date of October 31, 2024. (3) Zodiac projections based on FactSet mean consensus estimates as of April 26, 2024. (4) Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. (5) Reflects [***] indication of interest of $12.50 - $13.25 per share received on April 26, 2024. (6) Reflects [***] initial proposal of $11.00 - $12.00 per share received on April 26, 2024. (7) Reflects [***] initial proposal of $12.00 - $14.00 per share received on April 26, 2024. (8) Reflects [***] initial proposal of $11.25 - $12.25 per share received on April 26, 2024. (9) Reflects [***] initial proposal of $12.50 per share received on April 26, 2024. (10) Reflects [***] initial proposal of $13.00 - $14.00 per share received on April 26, 2024. (11) Reflects [***] initial proposal of $11.43 per share received on April 26, 2024. (12) Reflects [***] initial proposal of $12.00 - $13.00 per share received on April 26, 2024. (13) Reflects [***] initial proposal of $10.75 - $11.25 per share received on April 27, 2024. ($MM, except per share amounts) Illustrative Zodiac Transaction Statistics Zodiac Unaffected as of (4/16/24) (4) Illustrative Share Price: $8.47 $10.75 $11.00 $11.25 $11.43 $12.00 $12.25 $12.50 $13.00 $13.25 $13.50 $14.00 $14.25 $14.50 Implied Transaction Premium Statistic Premium to Unaffected Price (4) $8.47 - 27% 30% 33% 35% 42% 45% 48% 53% 56% 59% 65% 68% 71% Premium to Unaffected Enterprise Value (4) 1,241 - 38% 41% 45% 47% 55% 58% 61% 68% 71% 75% 81% 85% 88% Premium to Current Price 9.95 (15%) 8% 11% 13% 15% 21% 23% 26% 31% 33% 36% 41% 43% 46% Premium to Current Enterprise Value 1,580 (21%) 8% 11% 14% 16% 22% 24% 27% 32% 35% 37% 43% 45% 48% Premium to 30-Day VWAP (1) (4) 8.78 (4%) 22% 25% 28% 30% 37% 40% 42% 48% 51% 54% 59% 62% 65% Premium to 90-Day VWAP (1) (4) 8.67 (2%) 24% 27% 30% 32% 38% 41% 44% 50% 53% 56% 62% 64% 67% Premium to LTM VWAP (1) (4) 9.09 (7%) 18% 21% 24% 26% 32% 35% 38% 43% 46% 49% 54% 57% 60% Premium to LTM High (6/6/23) (4) 11.81 (28%) (9%) (7%) (5%) (3%) 2% 4% 6% 10% 12% 14% 19% 21% 23% Premium to LTM Low (11/1/23) (4) 7.24 17% 48% 52% 55% 58% 66% 69% 73% 80% 83% 86% 93% 97% 100% Implied Valuation & Multiples Fully-Diluted Equity Value (2) $1,355 $1,729 $1,771 $1,812 $1,842 $1,937 $1,979 $2,020 $2,103 $2,145 $2,186 $2,269 $2,311 $2,352 Fully-Diluted Enterprise Value (2) $1,241 $1,712 $1,754 $1,795 $1,825 $1,920 $1,962 $2,003 $2,086 $2,128 $2,169 $2,252 $2,294 $2,335 Street Case (3) Revenue Multiples Statistic (3) NTM / CY24E $454 2.7x 3.8x 3.9x 4.0x 4.0x 4.2x 4.3x 4.4x 4.6x 4.7x 4.8x 5.0x 5.1x 5.1x CY25E 496 2.5 3.5 3.5 3.6 3.7 3.9 4.0 4.0 4.2 4.3 4.4 4.5 4.6 4.7 LFCF Multiples NTM / CY24E $83 16.3x 20.8x 21.3x 21.8x 22.1x 23.3x 23.8x 24.3x 25.3x 25.8x 26.3x 27.3x 27.8x 28.3x CY25E 95 14.2 18.1 18.6 19.0 19.3 20.3 20.7 21.2 22.0 22.5 22.9 23.8 24.2 24.7 [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

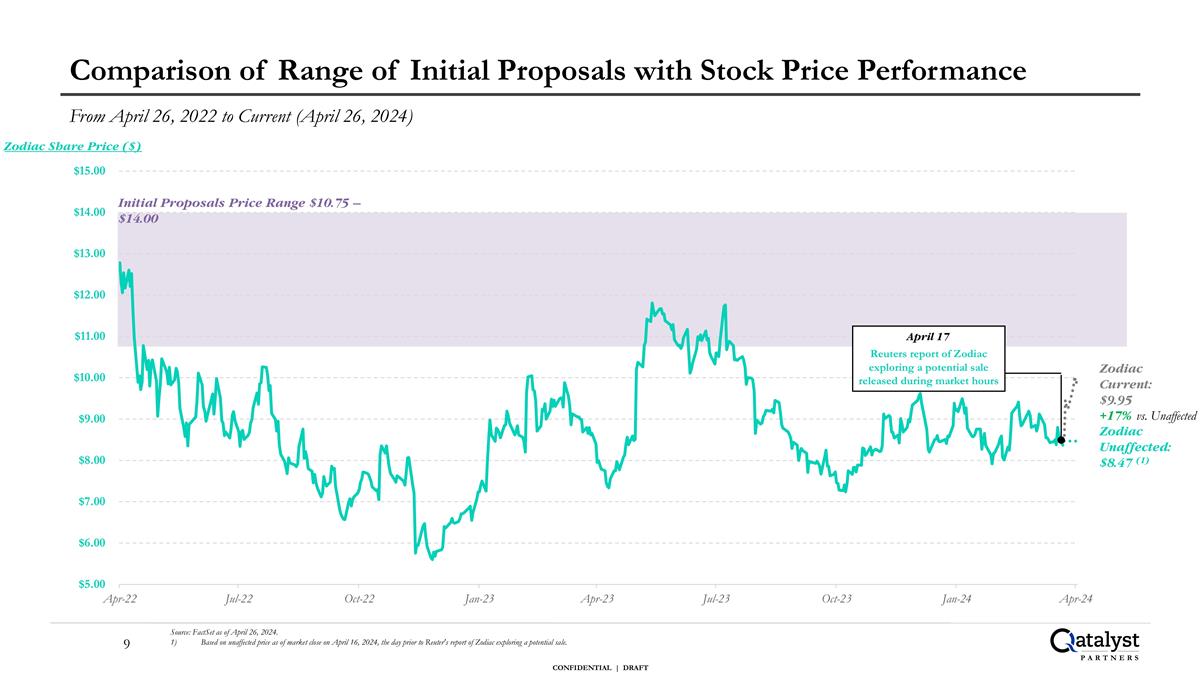

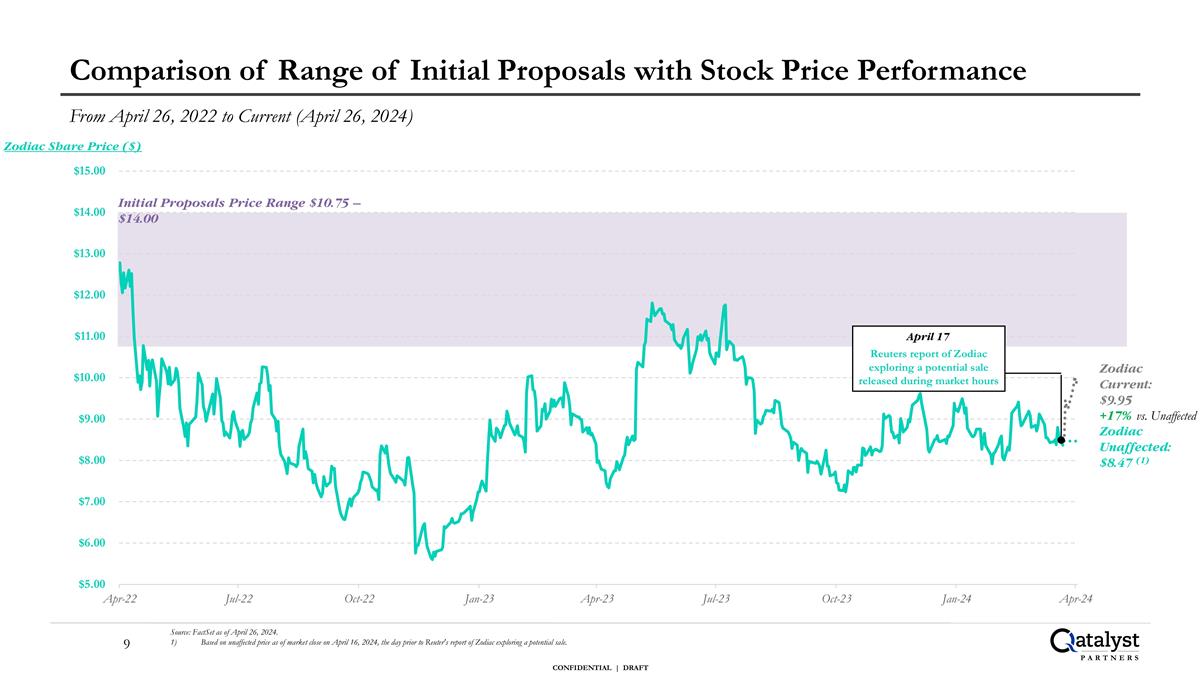

Source: FactSet as of April 26, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Zodiac Current: $9.95 +17% vs. Unaffected Zodiac Share Price ($) April 17 Reuters report of Zodiac exploring a potential sale released during market hours From April 26, 2022 to Current (April 26, 2024) Comparison of Range of Initial Proposals with Stock Price Performance Zodiac Unaffected: $8.47 (1) Initial Proposals Price Range $10.75 – $14.00

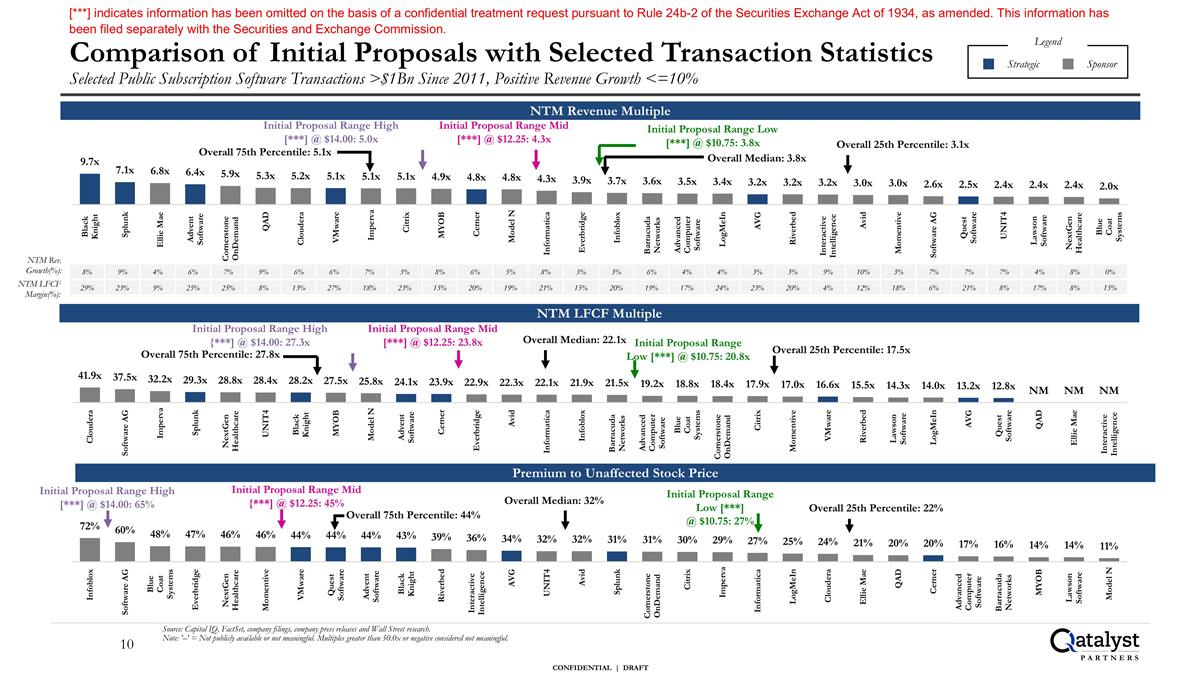

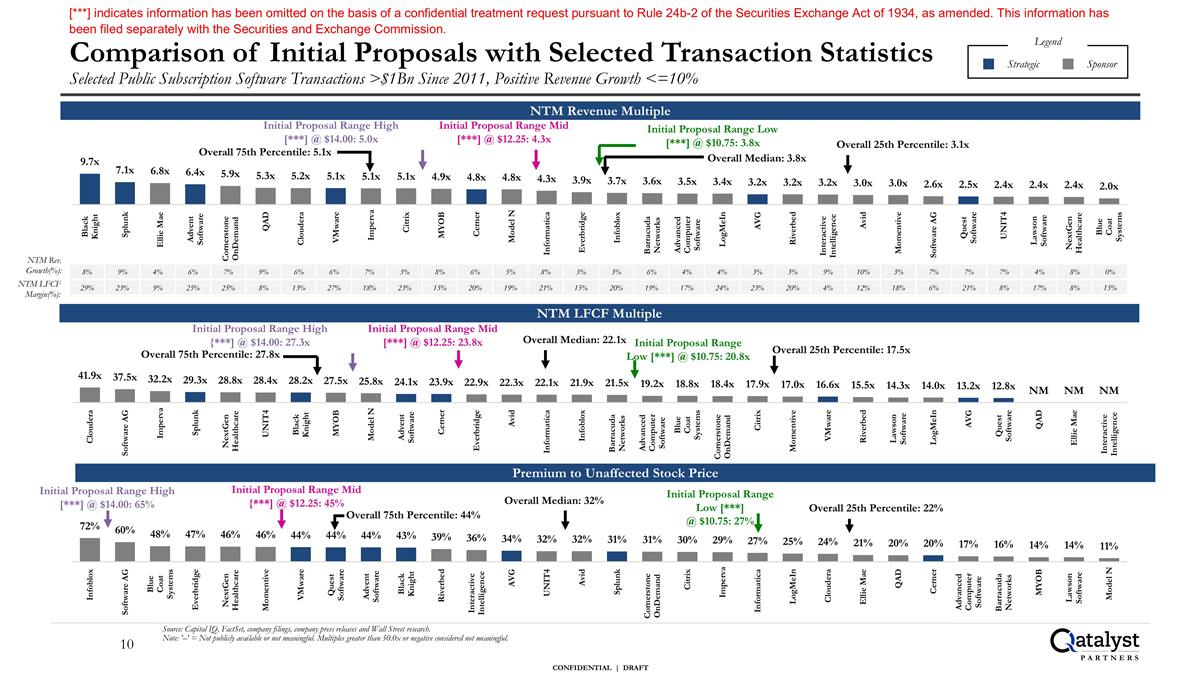

Comparison of Initial Proposals with Selected Transaction Statistics Selected Public Subscription Software Transactions >$1Bn Since 2011, Positive Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Note: '–' = Not publicly available or not meaningful. Multiples greater than 50.0x or negative considered not meaningful. NTM Revenue Multiple NTM LFCF Multiple Overall Median: 3.8x Overall 25th Percentile: 3.1x Overall 75th Percentile: 5.1x Overall Median: 22.1x Overall 25th Percentile: 17.5x Overall 75th Percentile: 27.8x NTM Rev. Growth(%): 8% 9% 4% 6% 7% 9% 6% 6% 7% 3% 8% 6% 5% 8% 3% 3% 6% 4% 4% 3% 3% 9% 10% 3% 7% 7% 7% 4% 8% 0% NTM LFCF Margin(%): 29% 23% 9% 25% 25% 8% 13% 27% 18% 23% 15% 20% 19% 21% 15% 20% 19% 17% 24% 23% 20% 4% 12% 18% 6% 21% 8% 17% 8% 15% Legend Strategic Sponsor Initial Proposal Range High [***] @ $14.00: 5.0x Initial Proposal Range High {***] @ $14.00: 27.3x Initial Proposal Range Mid [***] @ $12.25: 4.3x Initial Proposal Range Low [***] @ $10.75: 3.8x Initial Proposal Range Mid [***] @ $12.25: 23.8x Initial Proposal Range Low [***] @ $10.75: 20.8x Overall Median: 32% Overall 25th Percentile: 22% Overall 75th Percentile: 44% Initial Proposal Range High [***] @ $14.00: 65% Initial Proposal Range Mid {***] @ $12.25: 45% Initial Proposal Range Low [***] @ $10.75: 27% Premium to Unaffected Stock Price [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

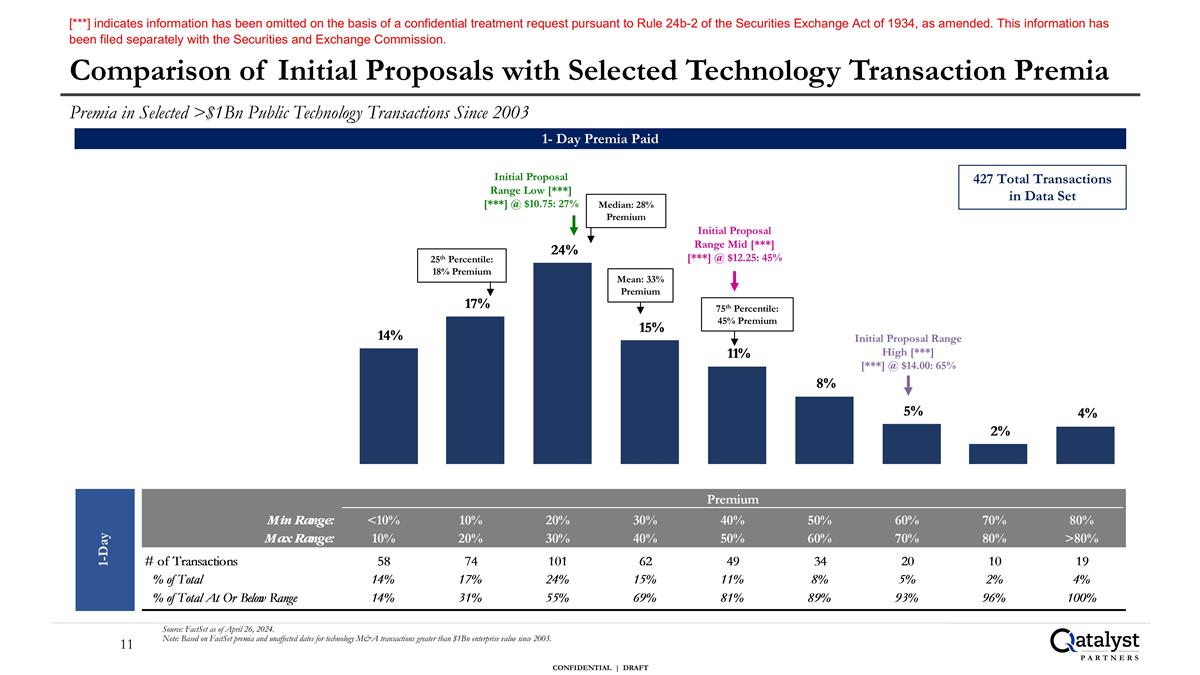

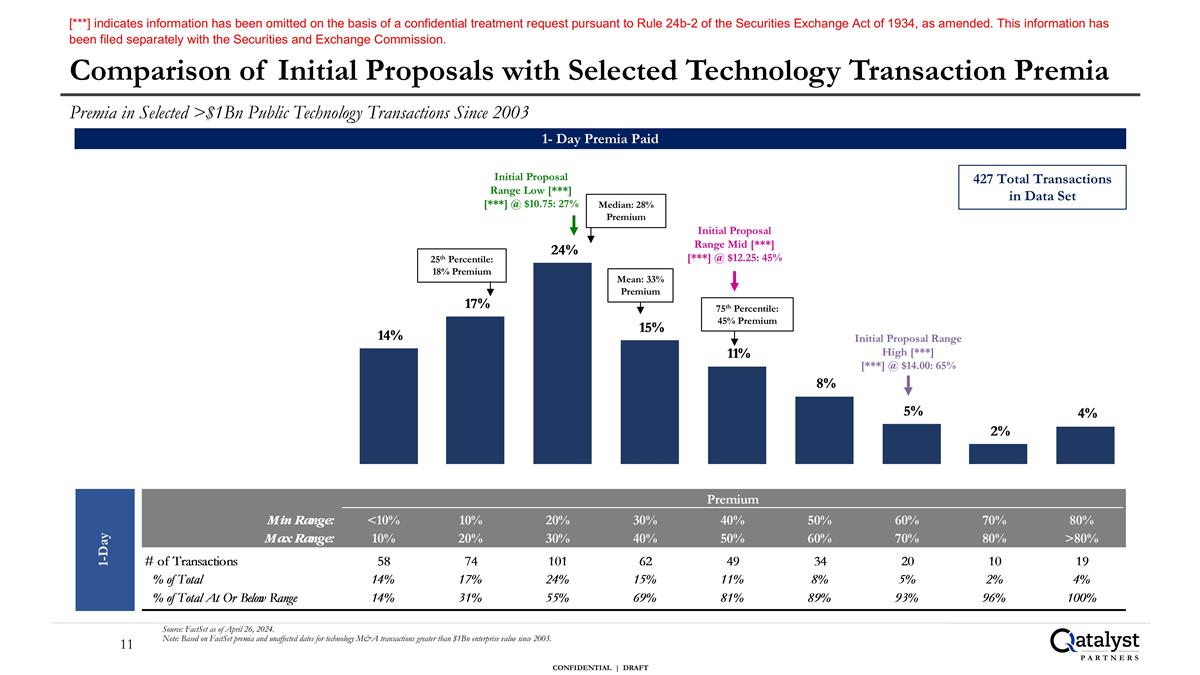

Comparison of Initial Proposals with Selected Technology Transaction Premia Premia in Selected >$1Bn Public Technology Transactions Since 2003 Source: FactSet as of April 26, 2024. Note: Based on FactSet premia and unaffected dates for technology M&A transactions greater than $1Bn enterprise value since 2003. 1- Day Premia Paid 427 Total Transactions in Data Set 25th Percentile: 18% Premium 75th Percentile: 45% Premium Median: 28% Premium Mean: 33% Premium Initial Proposal Range High [***] [***] @ $14.00: 65% Initial Proposal Range Mid [***] [***] @ $12.25: 45% Initial Proposal Range Low [***] [***] @ $10.75: 27% [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

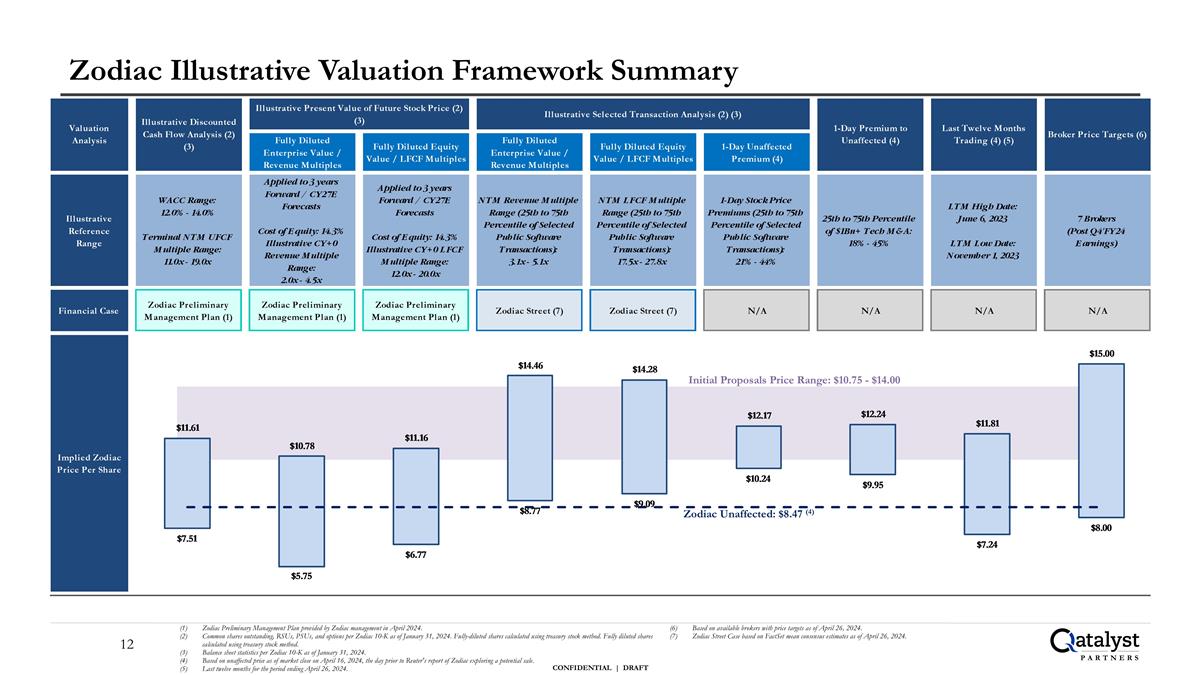

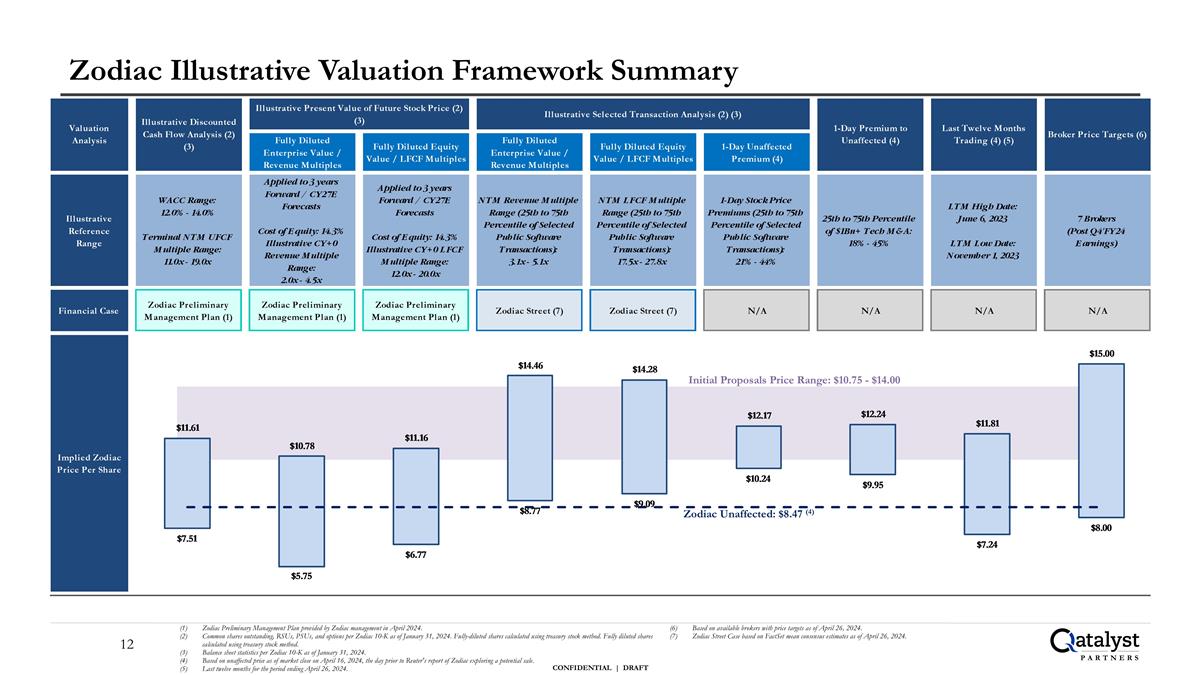

Zodiac Illustrative Valuation Framework Summary Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Common shares outstanding, RSUs, PSUs, and options per Zodiac 10-K as of January 31, 2024. Fully-diluted shares calculated using treasury stock method. Fully diluted shares calculated using treasury stock method. Balance sheet statistics per Zodiac 10-K as of January 31, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Last twelve months for the period ending April 26, 2024. Based on available brokers with price targets as of April 26, 2024. Zodiac Street Case based on FactSet mean consensus estimates as of April 26, 2024. Zodiac Unaffected: $8.47 (4) Initial Proposals Price Range: $10.75 - $14.00

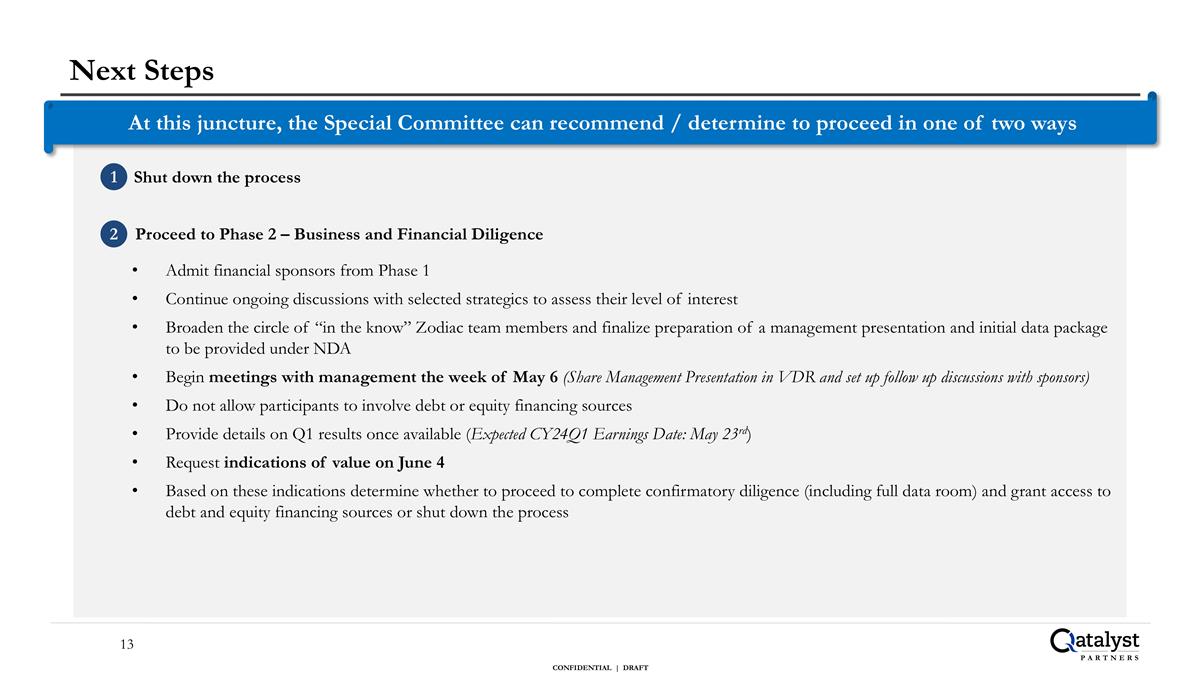

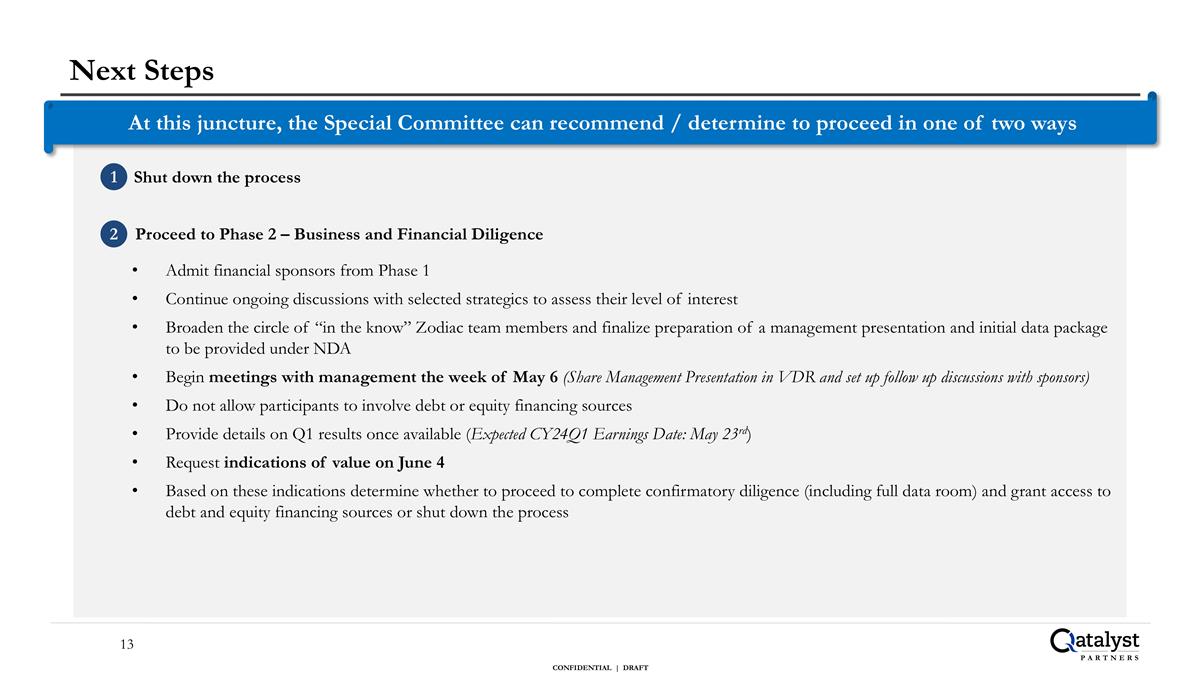

Next Steps 1 Shut down the process 2. Proceed to Phase 2 – Business and Financial Diligence Admit financial sponsors from Phase 1 Continue ongoing discussions with selected strategics to assess their level of interest Broaden the circle of “in the know” Zodiac team members and finalize preparation of a management presentation and initial data package to be provided under NDA Begin meetings with management the week of May 6 (Share Management Presentation in VDR and set up follow up discussions with sponsors) Do not allow participants to involve debt or equity financing sources Provide details on Q1 results once available (Expected CY24Q1 Earnings Date: May 23rd) Request indications of value on June 4 Based on these indications determine whether to proceed to complete confirmatory diligence (including full data room) and grant access to debt and equity financing sources or shut down the process 1 2 At this juncture, the Special Committee can recommend / determine to proceed in one of two ways

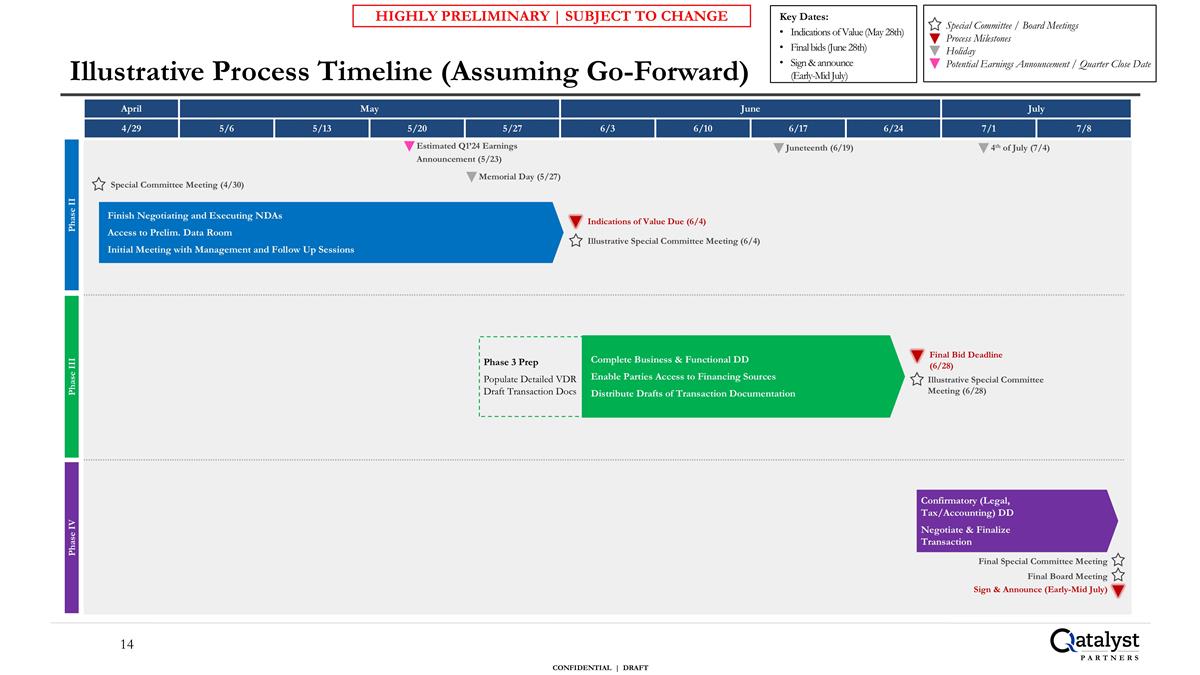

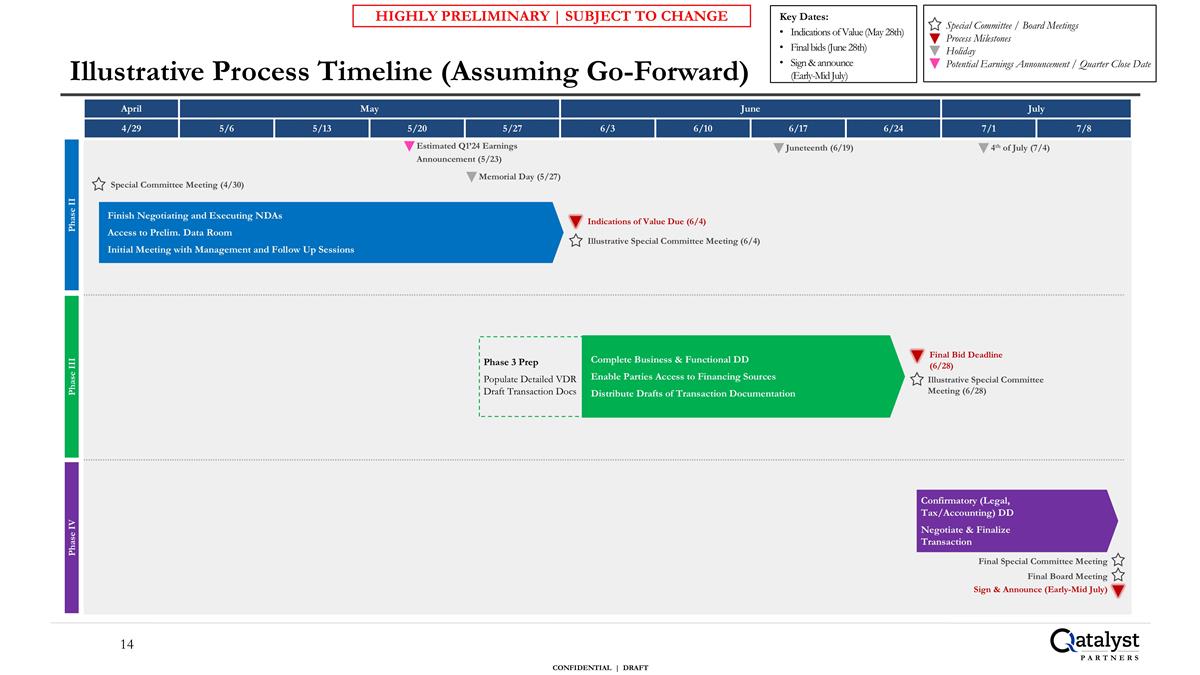

Phase II Phase IV Phase III Illustrative Process Timeline (Assuming Go-Forward) Illustrative Special Committee Meeting (6/4) Phase 3 Prep Populate Detailed VDR Draft Transaction Docs Complete Business & Functional DD Enable Parties Access to Financing Sources Distribute Drafts of Transaction Documentation Final Bid Deadline (6/28) Sign & Announce (Early-Mid July) Confirmatory (Legal, Tax/Accounting) DD Negotiate & Finalize Transaction Illustrative Special Committee Meeting (6/28) Final Special Committee Meeting Special Committee / Board Meetings Process Milestones Holiday Potential Earnings Announcement / Quarter Close Date Key Dates: Indications of Value (May 28th) Final bids (June 28th) Sign & announce (Early-Mid July) April May June May July June 4/29 5/6 5/13 5/20 5/27 6/3 6/10 6/17 6/24 7/1 7/8 Memorial Day (5/27) Estimated Q1’24 Earnings Announcement (5/23) HIGHLY PRELIMINARY | SUBJECT TO CHANGE Finish Negotiating and Executing NDAs Access to Prelim. Data Room Initial Meeting with Management and Follow Up Sessions Juneteenth (6/19) 4th of July (7/4) Final Board Meeting Indications of Value Due (6/4) Special Committee Meeting (4/30)

Appendix Zodiac Preliminary Valuation Framework

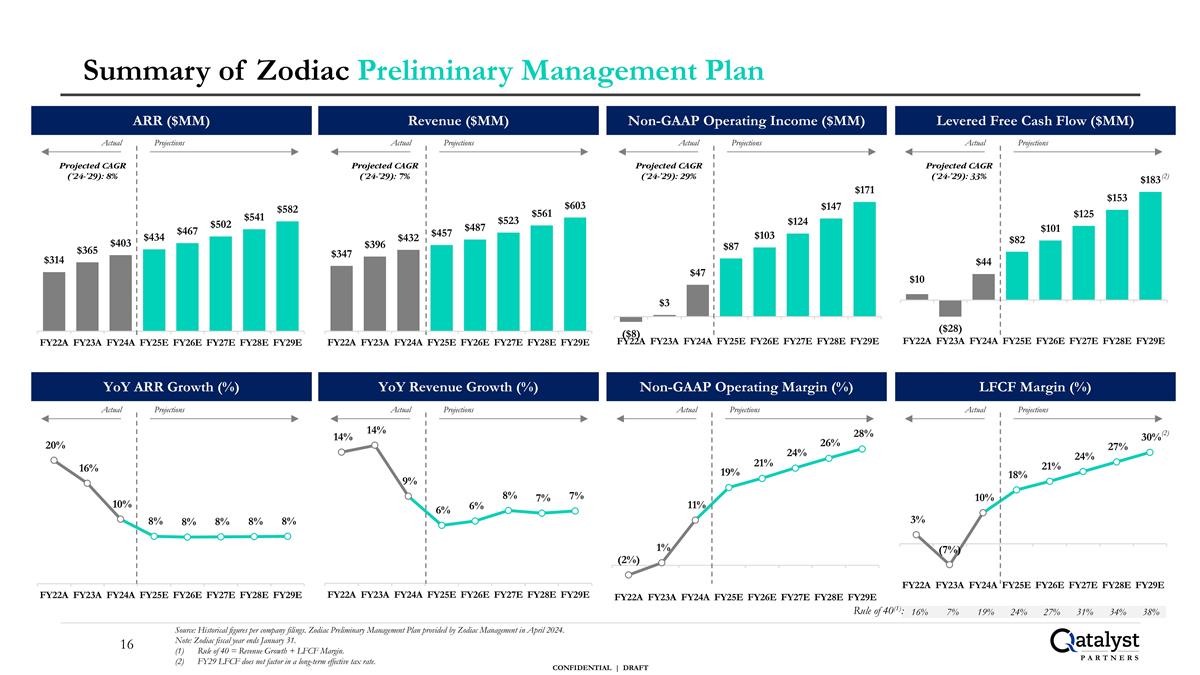

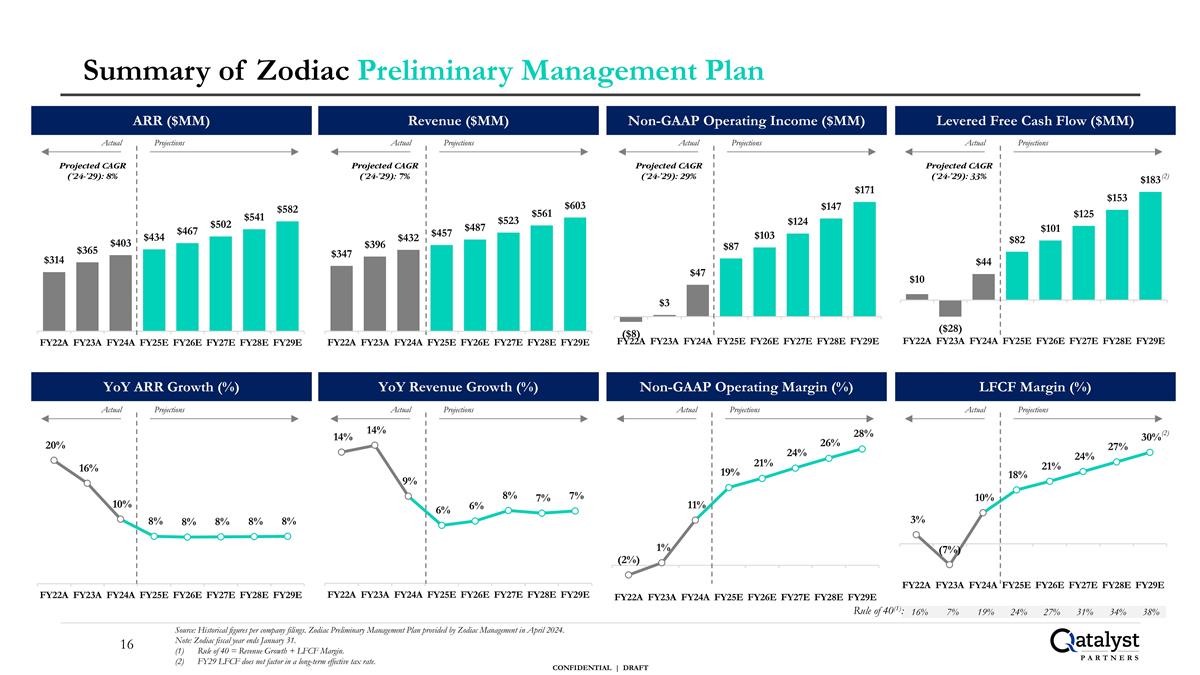

Summary of Zodiac Preliminary Management Plan Source: Historical figures per company filings. Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Note: Zodiac fiscal year ends January 31. Rule of 40 = Revenue Growth + LFCF Margin. FY29 LFCF does not factor in a long-term effective tax rate. Non-GAAP Operating Income ($MM) Levered Free Cash Flow ($MM) Non-GAAP Operating Margin (%) LFCF Margin (%) ARR ($MM) YoY ARR Growth (%) Revenue ($MM) YoY Revenue Growth (%) 16% 7% 19% 24% 27% 31% 34% 38% Rule of 40(1): Actual Projections Projected CAGR (‘24-’29): 8% Projected CAGR (‘24-’29): 7% Projected CAGR (‘24-’29): 29% Projected CAGR (‘24-’29): 33% Actual Projections Actual Projections Actual Projections Actual Projections Actual Projections Actual Projections Actual Projections (2) (2)

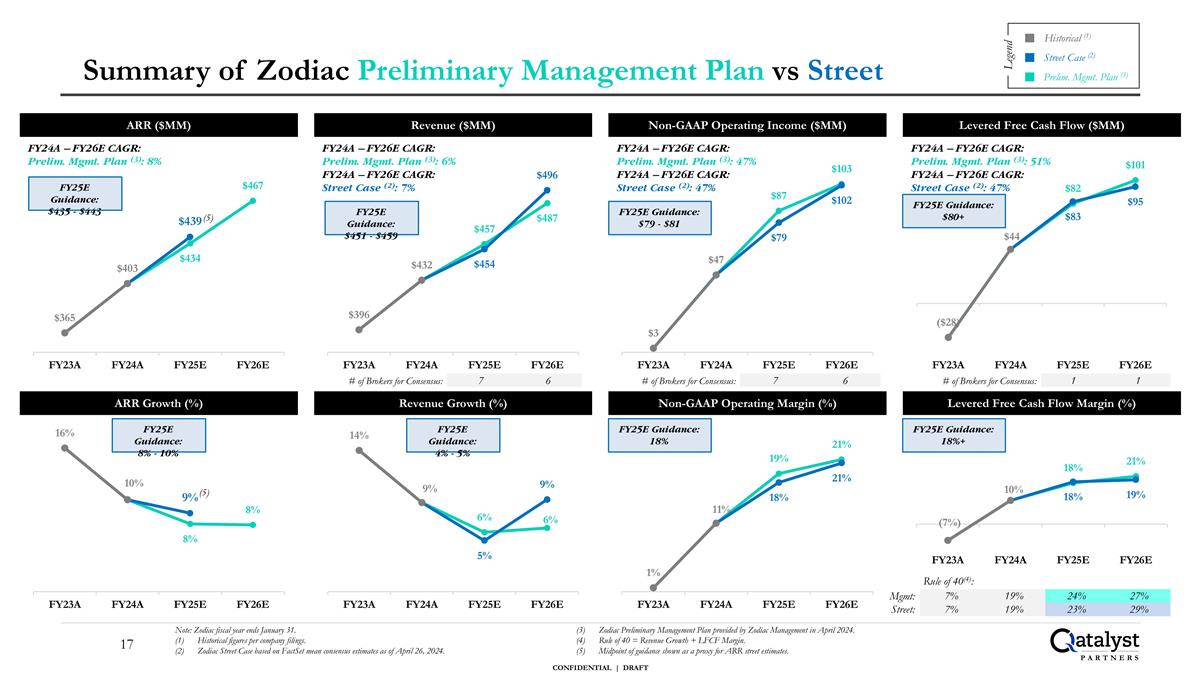

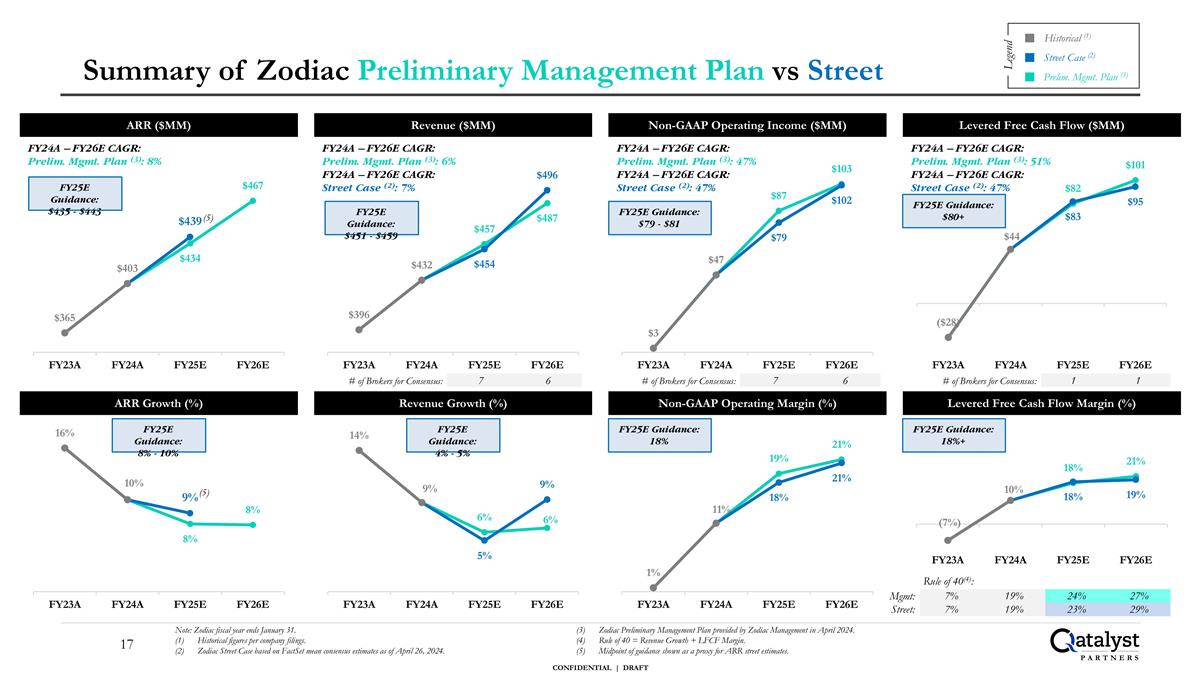

Summary of Zodiac Preliminary Management Plan vs Street Note: Zodiac fiscal year ends January 31. Historical figures per company filings. Zodiac Street Case based on FactSet mean consensus estimates as of April 26, 2024. Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Rule of 40 = Revenue Growth + LFCF Margin. Midpoint of guidance shown as a proxy for ARR street estimates. 7 6 # of Brokers for Consensus: 7% 19% 24% 27% 7% 19% 23% 29% Rule of 40(4): Revenue ($MM) Revenue Growth (%) FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 6% FY24A – FY26E CAGR: Street Case (2): 7% FY25E Guidance: $451 - $459 Non-GAAP Operating Income ($MM) Non-GAAP Operating Margin (%) FY25E Guidance: $79 - $81 Levered Free Cash Flow ($MM) Levered Free Cash Flow Margin (%) FY25E Guidance: $80+ Legend Historical (1) Street Case (2) Prelim. Mgmt. Plan (3) 7 6 # of Brokers for Consensus: 1 1 # of Brokers for Consensus: ARR ($MM) ARR Growth (%) FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 8% FY25E Guidance: $435 - $443 Mgmt: Street: FY25E Guidance: 8% - 10% FY25E Guidance: 4% - 5% FY25E Guidance: 18% FY25E Guidance: 18%+ (5) (5) FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 47% FY24A – FY26E CAGR: Street Case (2): 47% FY24A – FY26E CAGR: Prelim. Mgmt. Plan (3): 51% FY24A – FY26E CAGR: Street Case (2): 47%

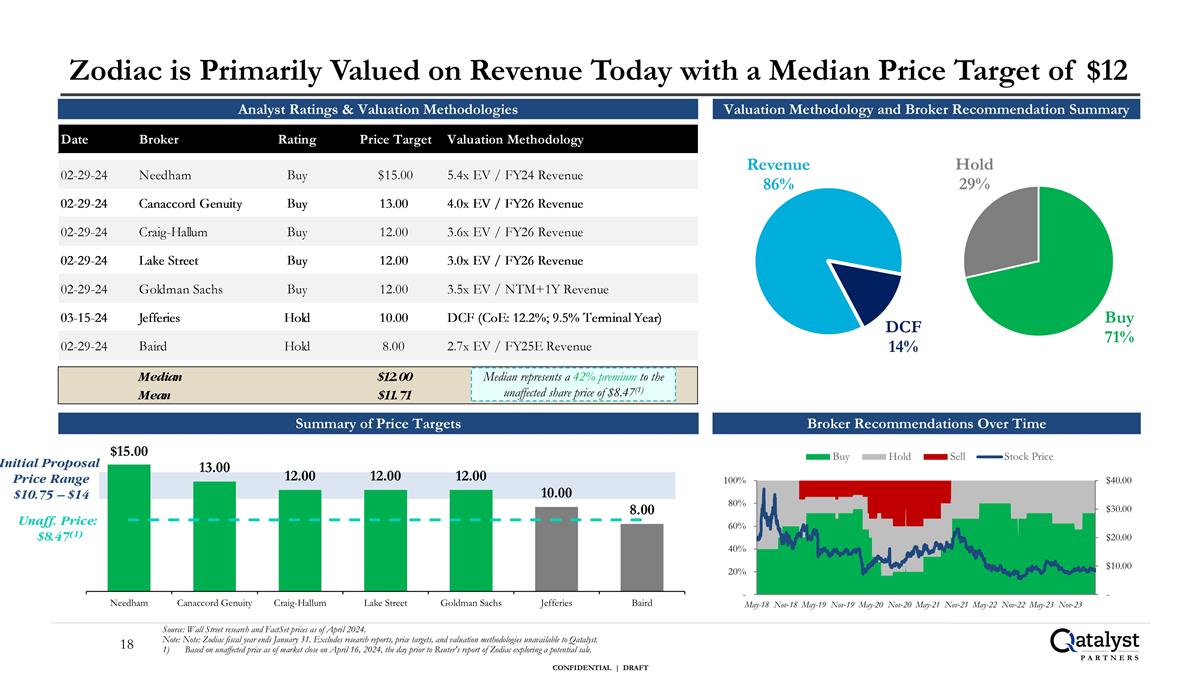

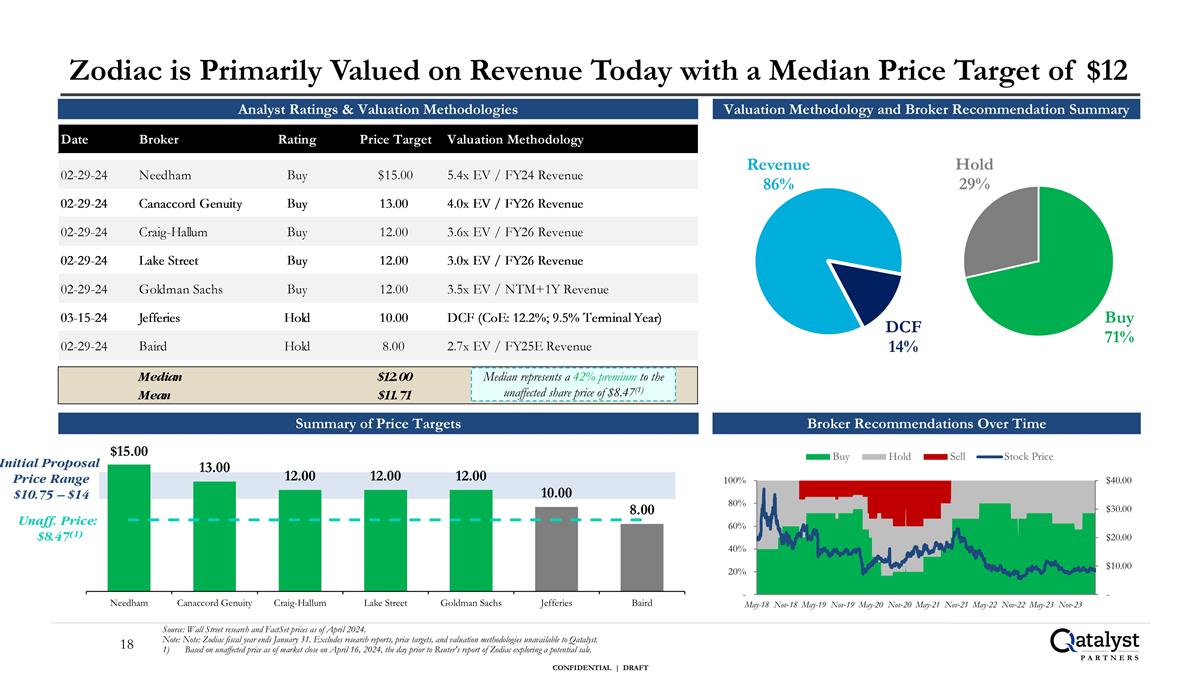

Zodiac is Primarily Valued on Revenue Today with a Median Price Target of $12 Source: Wall Street research and FactSet prices as of April 2024. Note: Note: Zodiac fiscal year ends January 31. Excludes research reports, price targets, and valuation methodologies unavailable to Qatalyst. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Analyst Ratings & Valuation Methodologies Summary of Price Targets Valuation Methodology and Broker Recommendation Summary Median represents a 42% premium to the unaffected share price of $8.47(1) Broker Recommendations Over Time Unaff. Price: $8.47(1) Initial Proposal Price Range $10.75 – $14

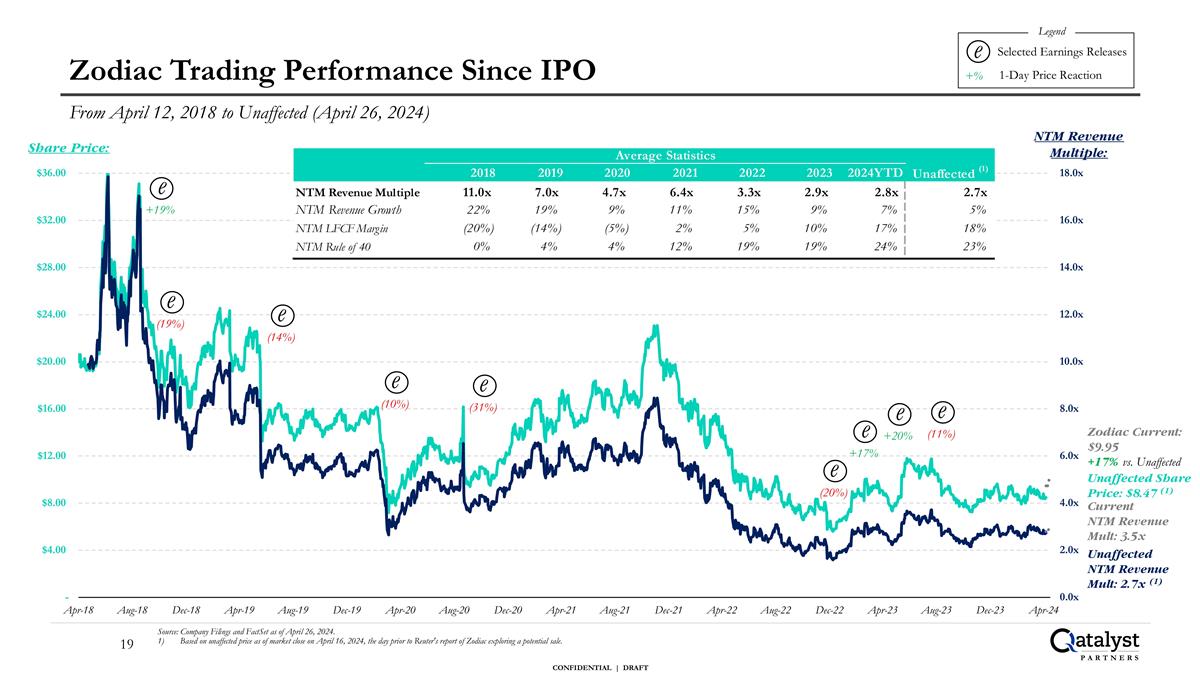

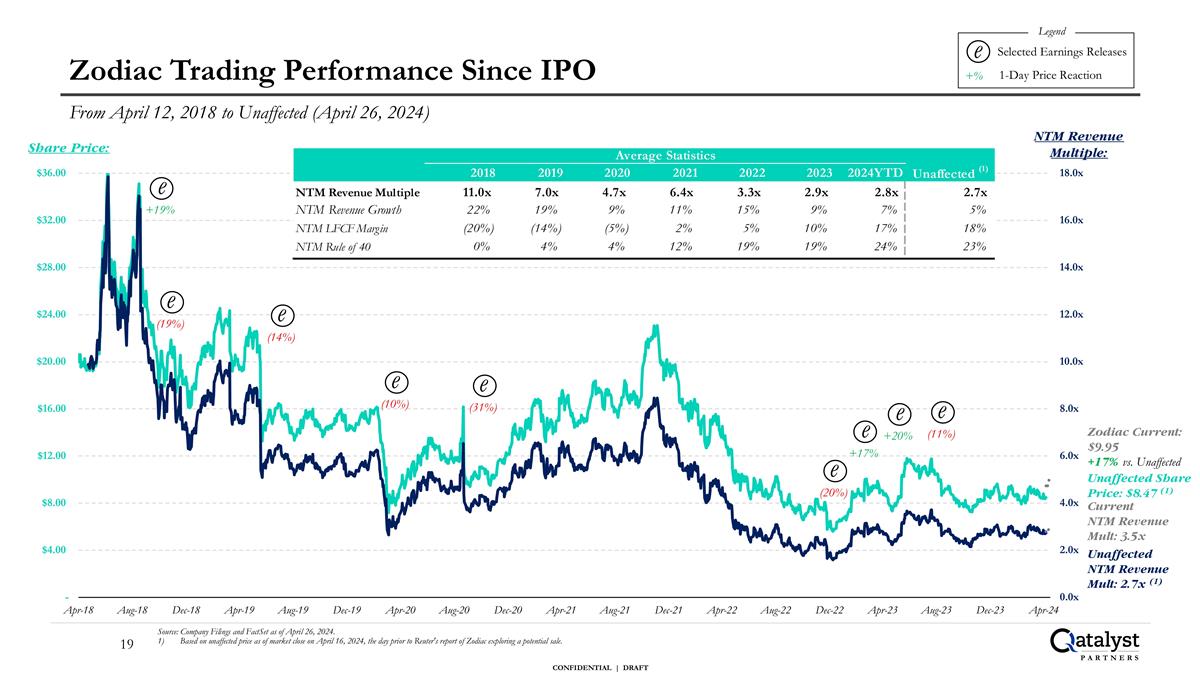

Zodiac Trading Performance Since IPO From April 12, 2018 to Unaffected (April 26, 2024) NTM Revenue Multiple: Share Price: Source: Company Filings and FactSet as of April 26, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. e (11%) e +20% e +17% e (20%) e (31%) e (10%) e (19%) e (14%) e +19% Selected Earnings Releases e Legend 1-Day Price Reaction +% Unaffected NTM Revenue Mult: 2.7x (1) Unaffected Share Price: $8.47 (1) Zodiac Current: $9.95 +17% vs. Unaffected Current NTM Revenue Mult: 3.5x

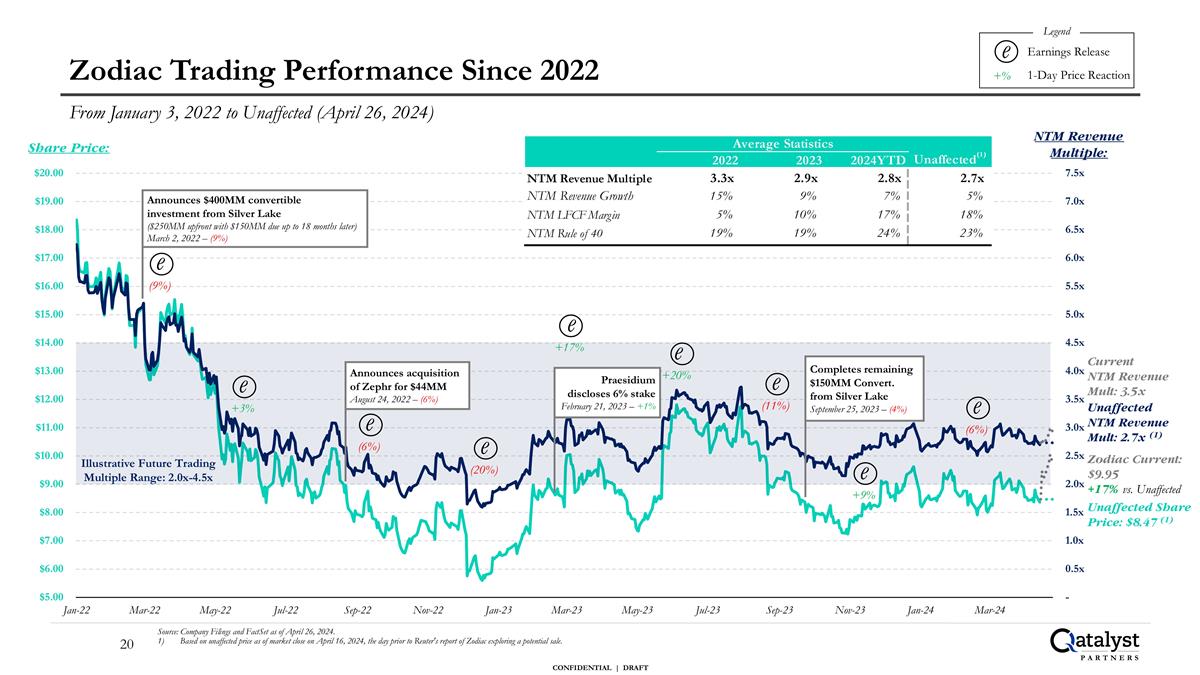

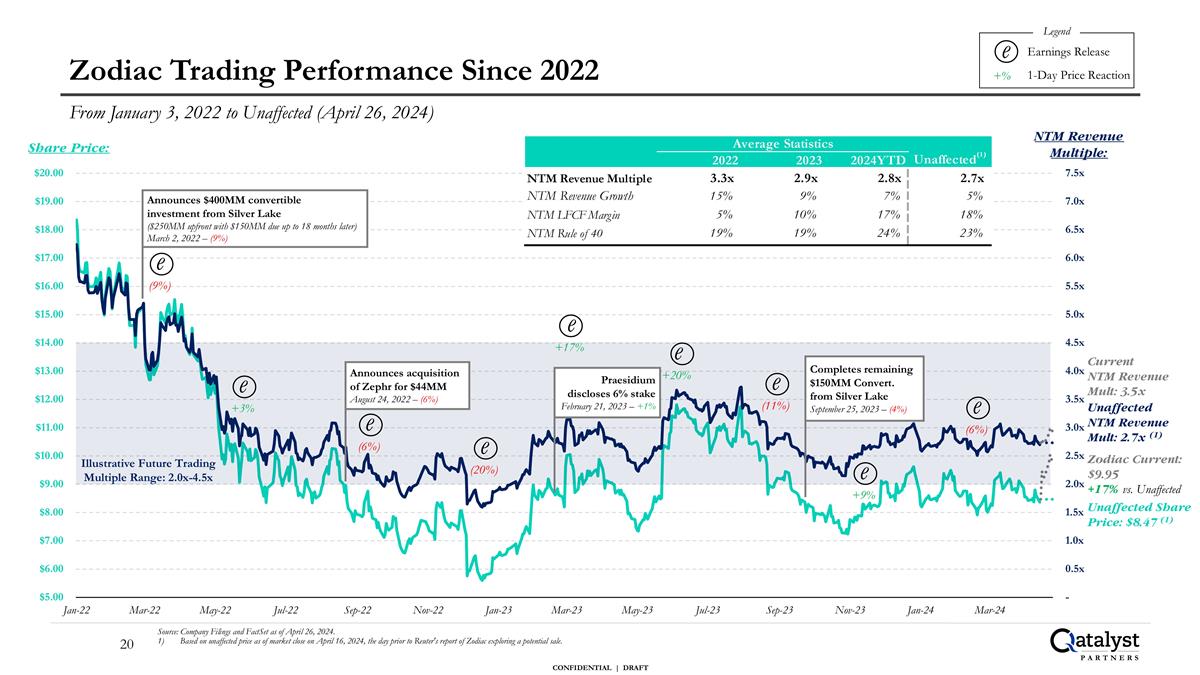

Zodiac Trading Performance Since 2022 From January 3, 2022 to Unaffected (April 26, 2024) NTM Revenue Multiple: Share Price: Unaffected NTM Revenue Mult: 2.7x (1) Source: Company Filings and FactSet as of April 26, 2024. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Earnings Release e Legend 1-Day Price Reaction +% Announces $400MM convertible investment from Silver Lake ($250MM upfront with $150MM due up to 18 months later) March 2, 2022 – (9%) e (9%) Illustrative Future Trading Multiple Range: 2.0x-4.5x e (6%) Unaffected Share Price: $8.47 (1) e (11%) e +20% e +9% e +17% Praesidium discloses 6% stake February 21, 2023 – +1% Completes remaining $150MM Convert. from Silver Lake September 25, 2023 – (4%) e (6%) e (20%) Announces acquisition of Zephr for $44MM August 24, 2022 – (6%) e +3% Zodiac Current: $9.95 +17% vs. Unaffected Current NTM Revenue Mult: 3.5x

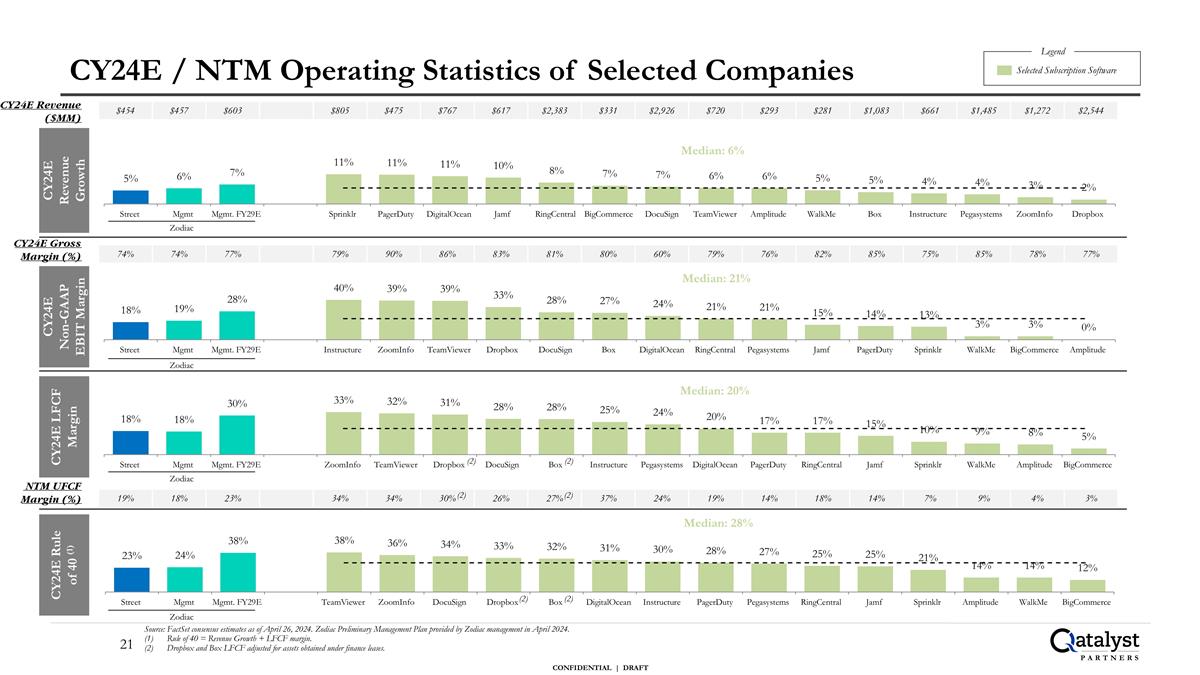

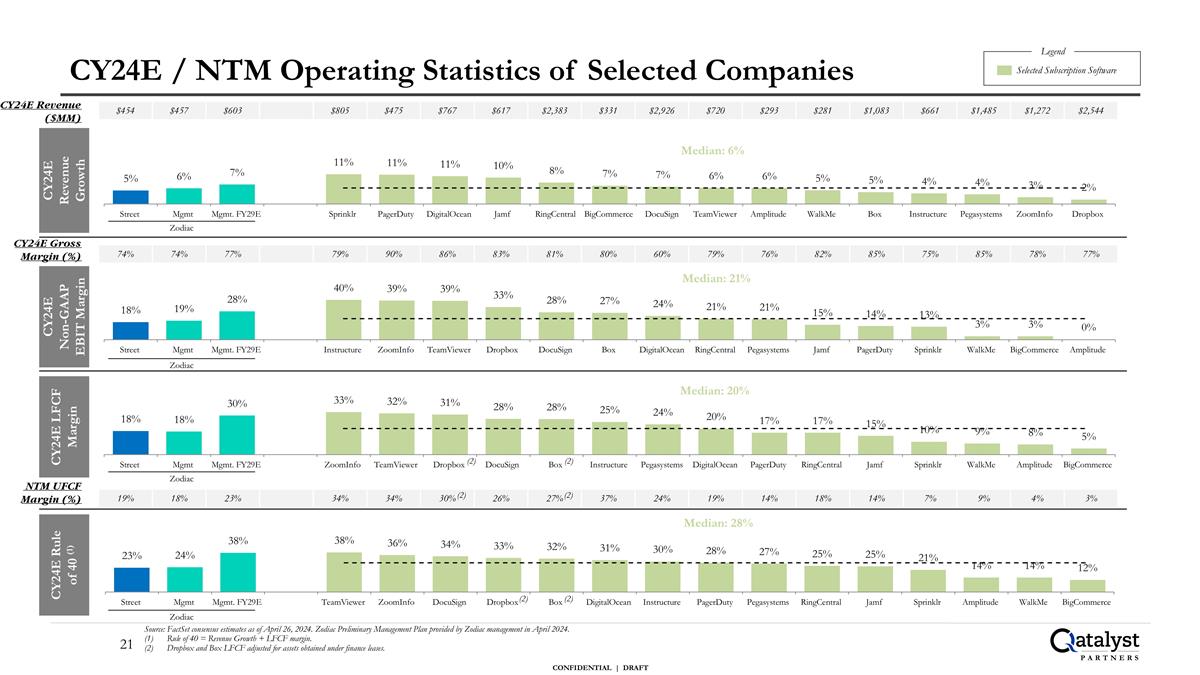

CY24E / NTM Operating Statistics of Selected Companies $454 $457 $603 $805 $475 $767 $617 $2,383 $331 $2,926 $720 $293 $281 $1,083 $661 $1,485 $1,272 $2,544 Source: FactSet consensus estimates as of April 26, 2024. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Rule of 40 = Revenue Growth + LFCF margin. Dropbox and Box LFCF adjusted for assets obtained under finance leases. CY24E Revenue ($MM) Selected Subscription Software Legend CY24E Gross Margin (%) 74% 74% 77% 79% 90% 86% 83% 81% 80% 60% 79% 76% 82% 85% 75% 85% 78% 77% (2) (2) (2) (2) NTM UFCF Margin (%) 19% 18% 23% 34% 34% 30% 26% 27% 37% 24% 19% 14% 18% 14% 7% 9% 4% 3% Zodiac Zodiac Zodiac Zodiac (2) (2) CY24E Revenue Growth CY24E Non-GAAP EBIT Margin CY24E Rule of 40 (1) CY24E LFCF Margin

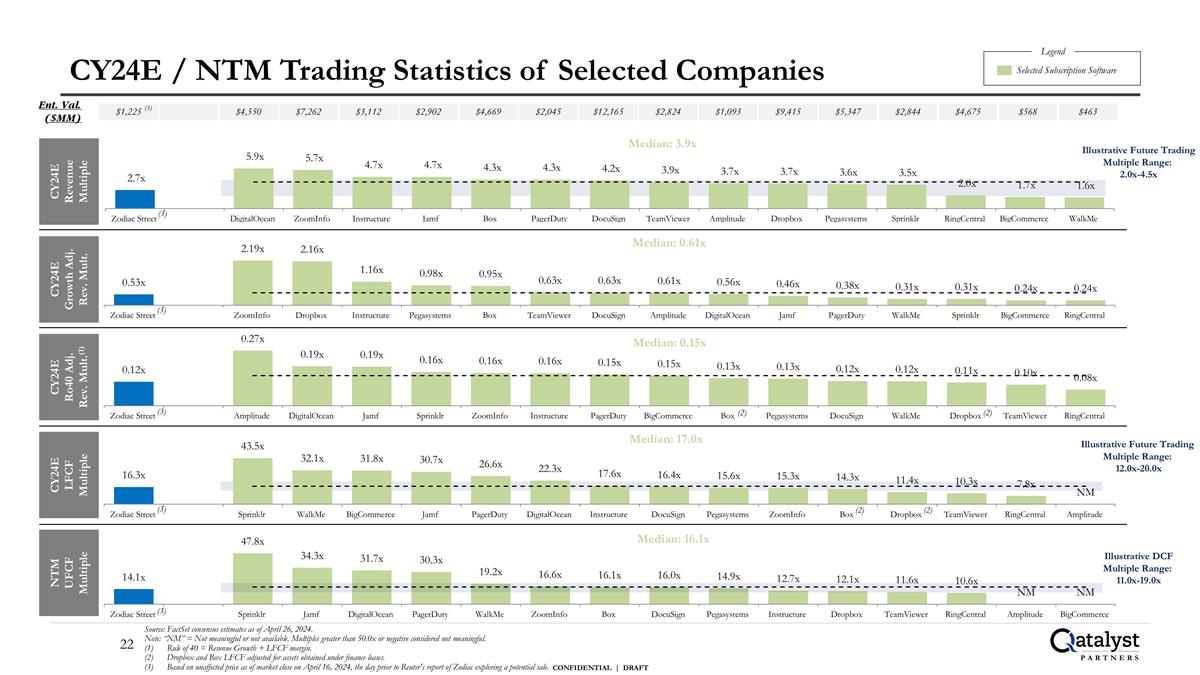

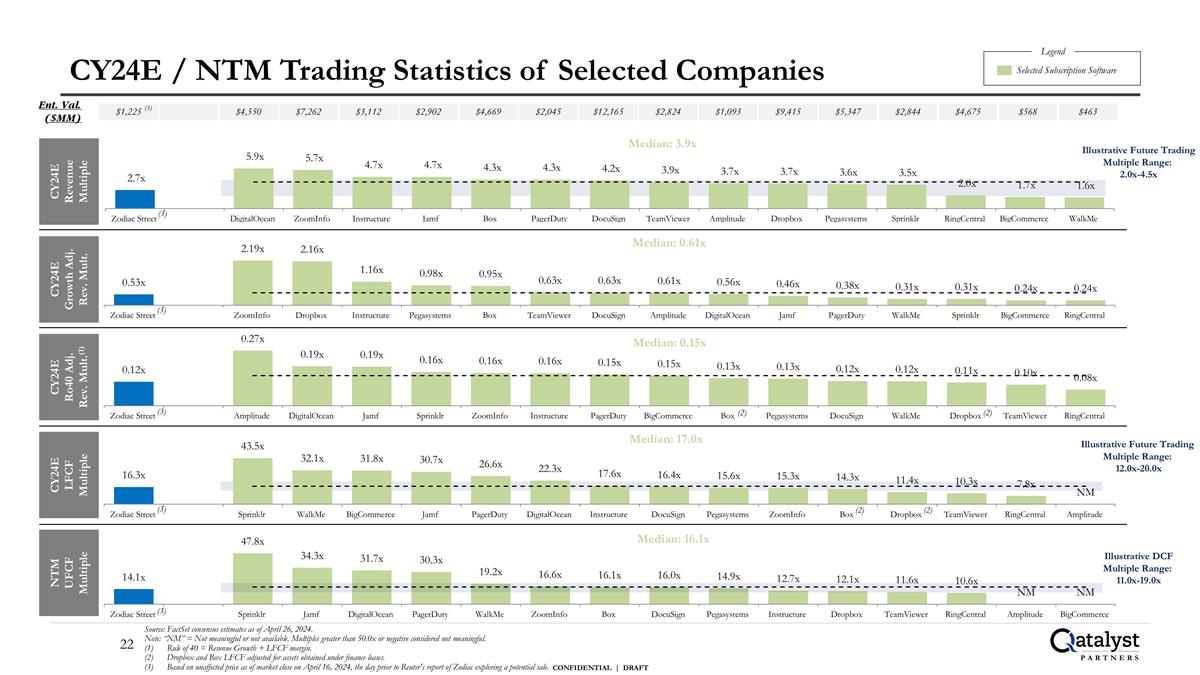

CY24E / NTM Trading Statistics of Selected Companies Ent. Val. ($MM) Source: FactSet consensus estimates as of April 26, 2024. Note: “NM” = Not meaningful or not available. Multiples greater than 50.0x or negative considered not meaningful. Rule of 40 = Revenue Growth + LFCF margin. Dropbox and Box LFCF adjusted for assets obtained under finance leases. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. $1,225 $4,550 $7,262 $3,112 $2,902 $4,669 $2,045 $12,165 $2,824 $1,093 $9,415 $5,347 $2,844 $4,675 $568 $463 Selected Subscription Software Legend (2) (2) (2) (2) Illustrative Future Trading Multiple Range: 2.0x-4.5x Illustrative Future Trading Multiple Range: 12.0x-20.0x Illustrative DCF Multiple Range: 11.0x-19.0x (3) (3) (3) (3) (3) (3) CY24E Revenue Multiple NTM UFCF Multiple CY24E Ro40 Adj. Rev. Mult.(1) CY24E Growth Adj. Rev. Mult. CY24E LFCF Multiple

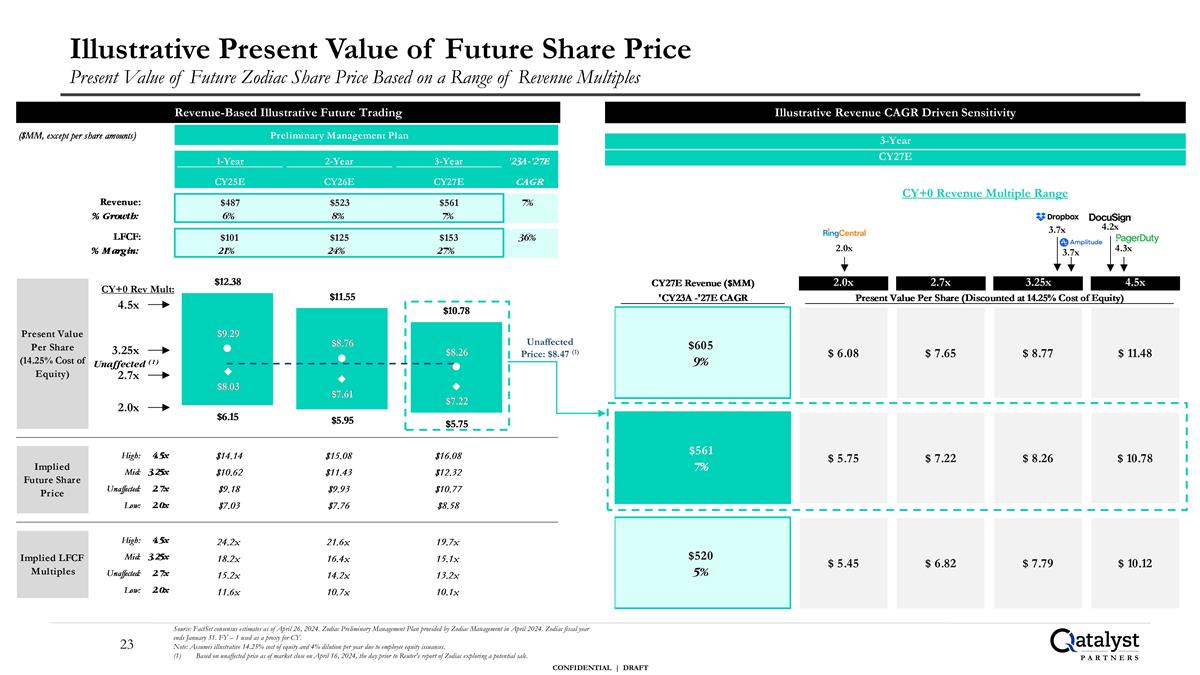

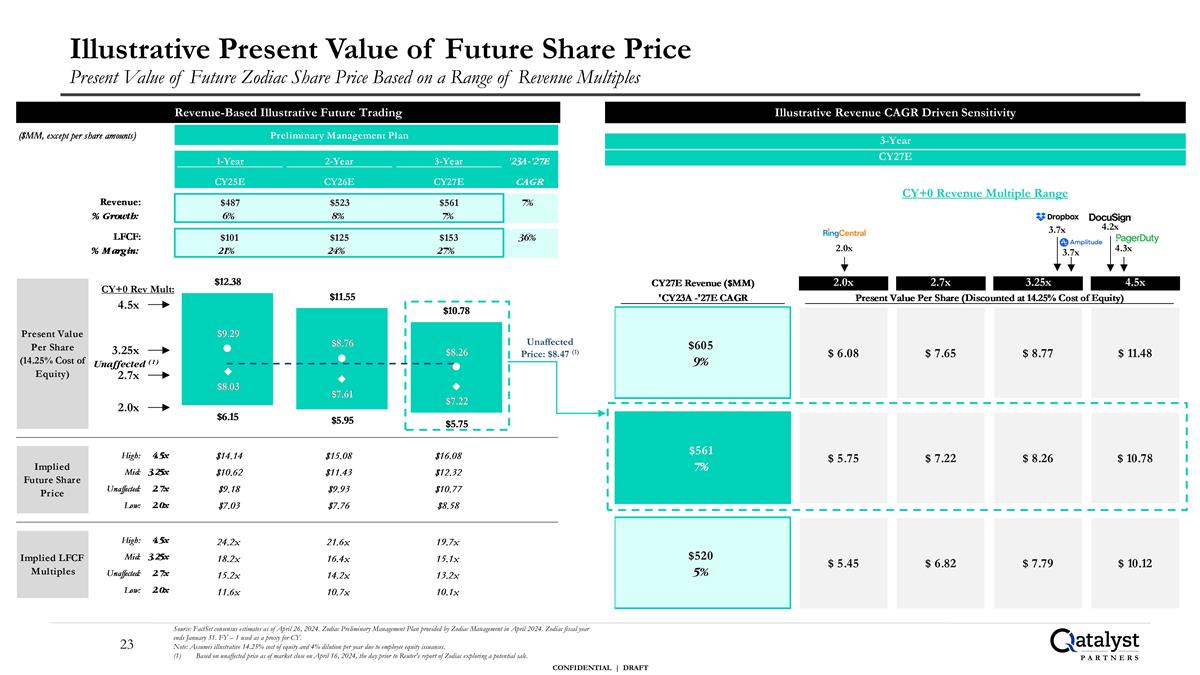

Illustrative Present Value of Future Share Price Present Value of Future Zodiac Share Price Based on a Range of Revenue Multiples Illustrative Revenue CAGR Driven Sensitivity 3-Year CY27E CY+0 Revenue Multiple Range 2.0x 3.25x 4.5x CY+0 Rev Mult: Revenue-Based Illustrative Future Trading Unaffected (1) 2.7x 4.2x 2.0x 3.7x 4.3x 3.7x Unaffected Price: $8.47 (1) Source: FactSet consensus estimates as of April 26, 2024. Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Note: Assumes illustrative 14.25% cost of equity and 4% dilution per year due to employee equity issuances. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale.

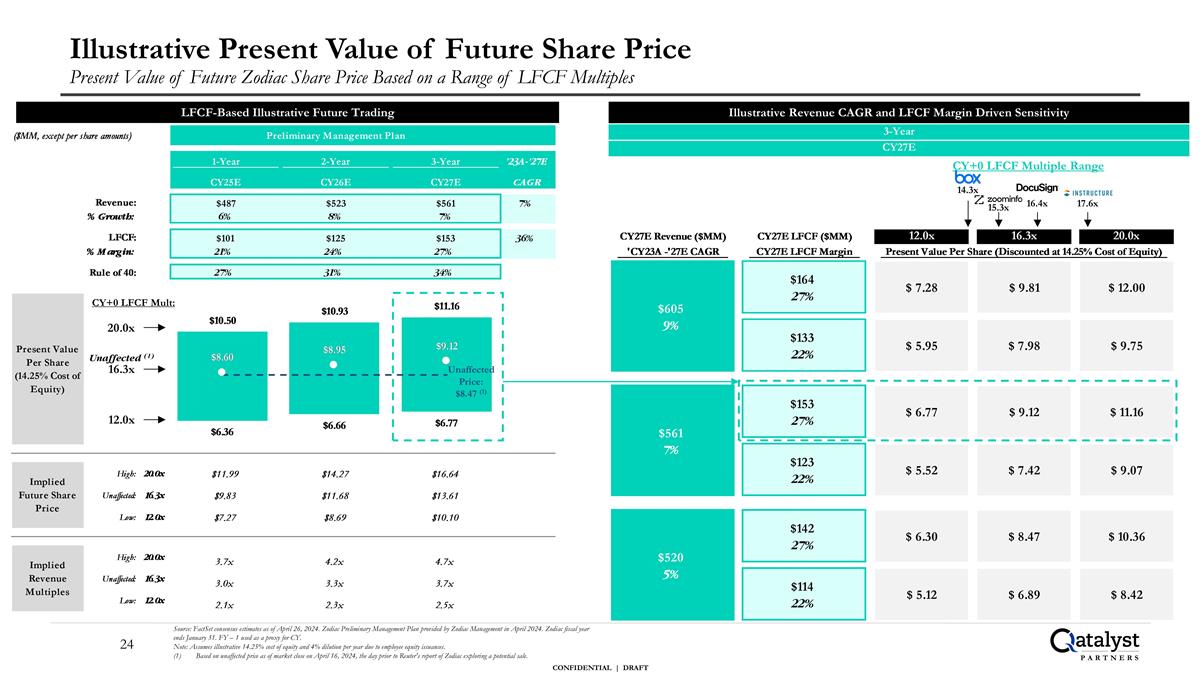

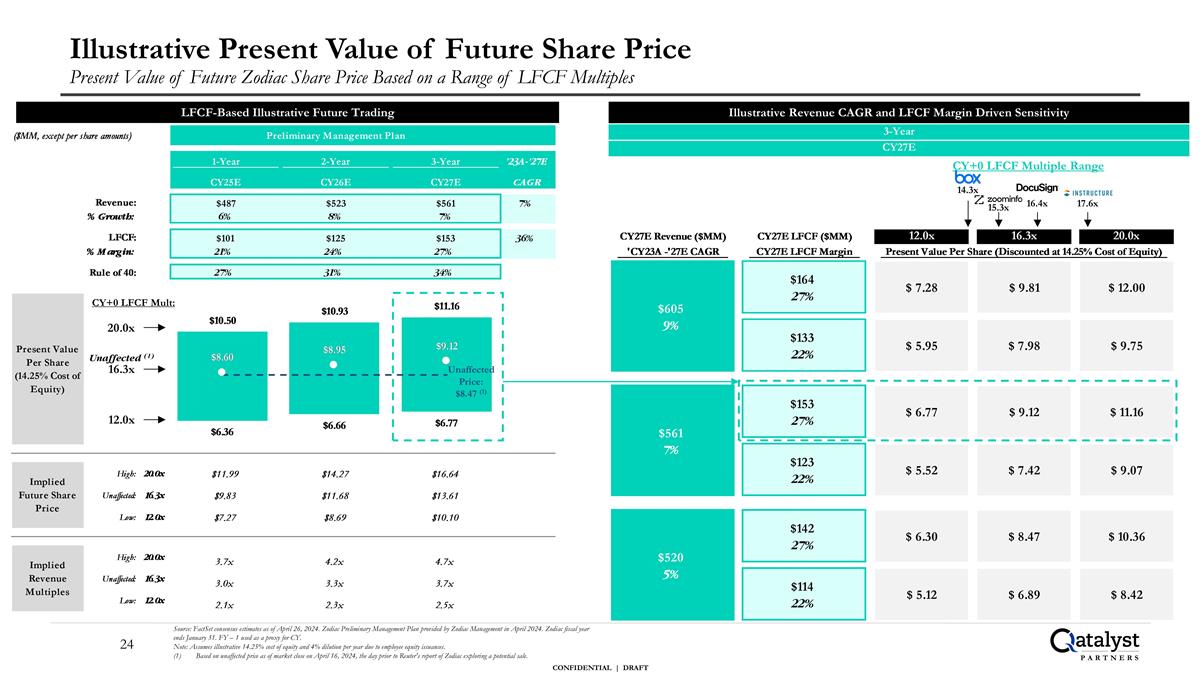

Illustrative Present Value of Future Share Price Present Value of Future Zodiac Share Price Based on a Range of LFCF Multiples Illustrative Revenue CAGR and LFCF Margin Driven Sensitivity 3-Year CY27E CY+0 LFCF Multiple Range CY+0 LFCF Mult: 12.0x 20.0x LFCF-Based Illustrative Future Trading Unaffected (1) 16.3x 16.4x 14.3x 15.3x 17.6x Unaffected Price: $8.47 (1) Source: FactSet consensus estimates as of April 26, 2024. Zodiac Preliminary Management Plan provided by Zodiac Management in April 2024. Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Note: Assumes illustrative 14.25% cost of equity and 4% dilution per year due to employee equity issuances. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale.

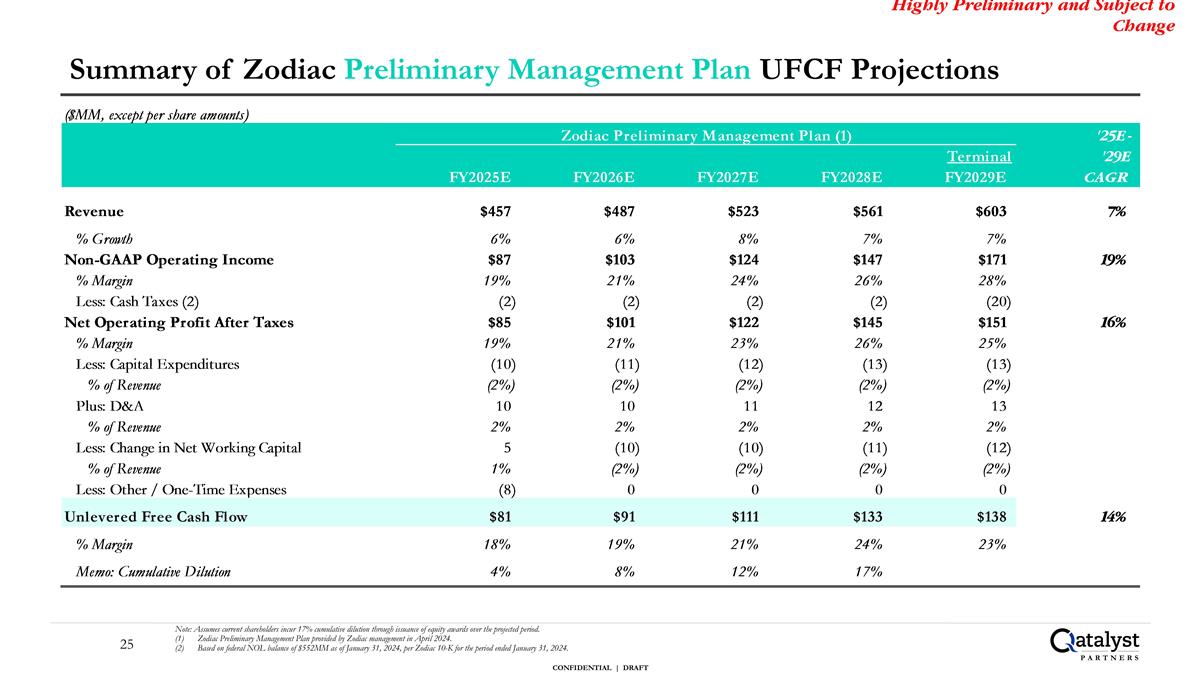

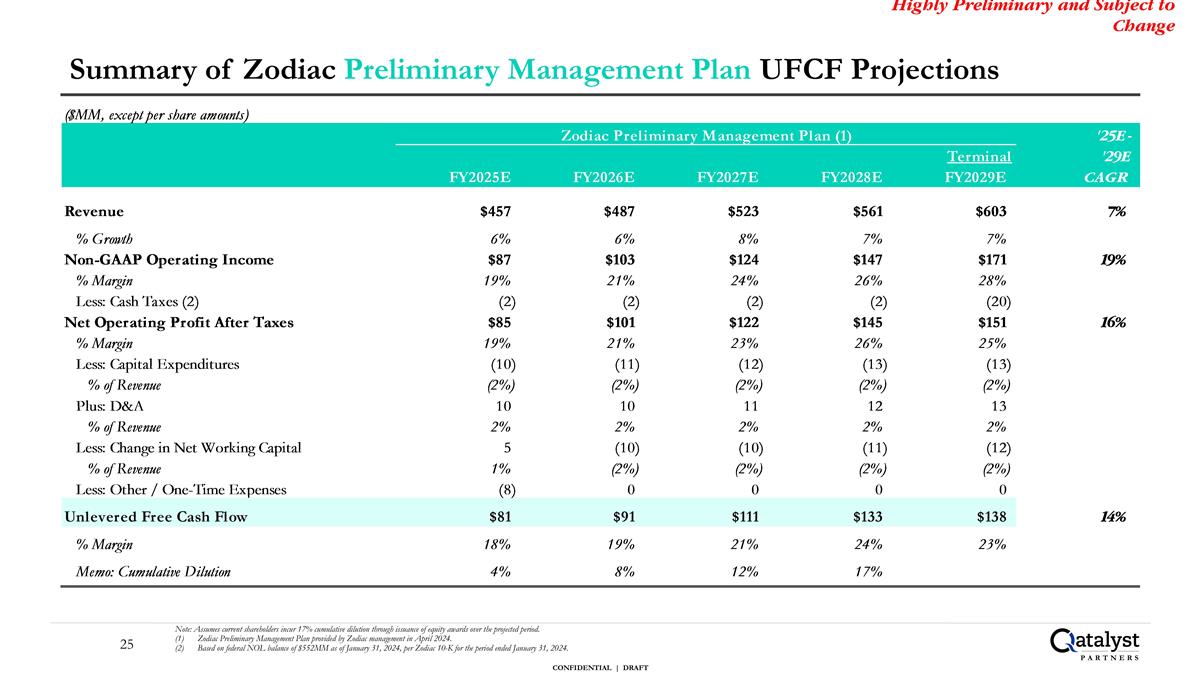

Summary of Zodiac Preliminary Management Plan UFCF Projections Highly Preliminary and Subject to Change Note: Assumes current shareholders incur 17% cumulative dilution through issuance of equity awards over the projected period. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Based on federal NOL balance of $552MM as of January 31, 2024, per Zodiac 10-K for the period ended January 31, 2024.

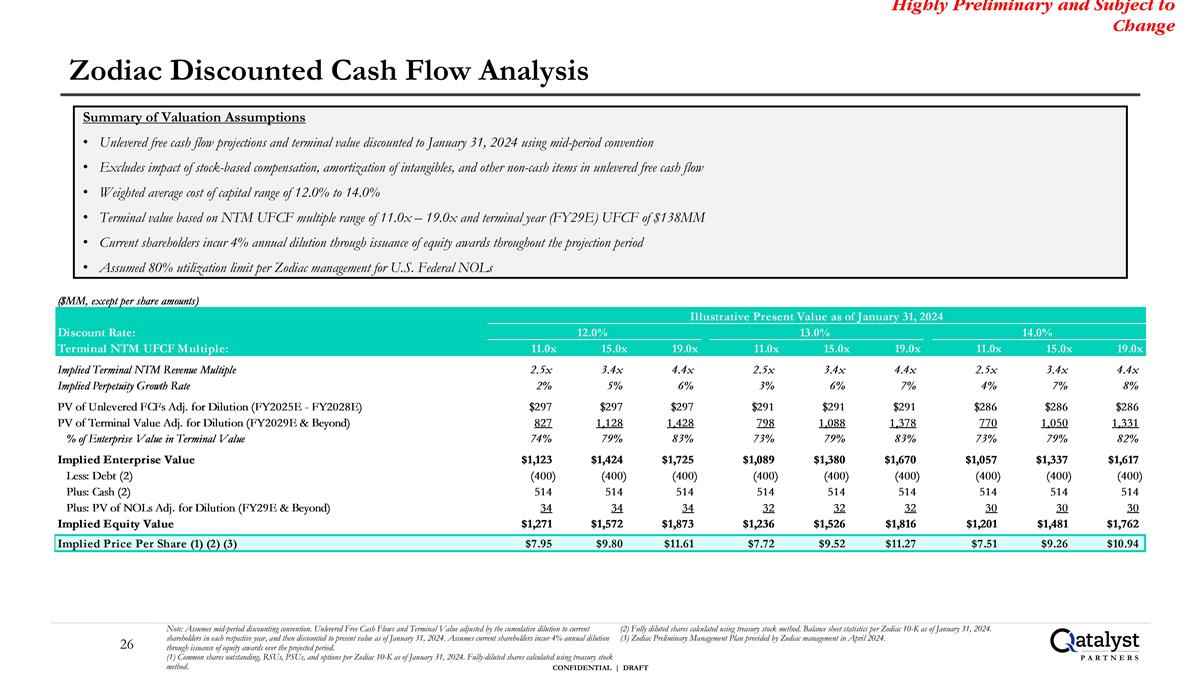

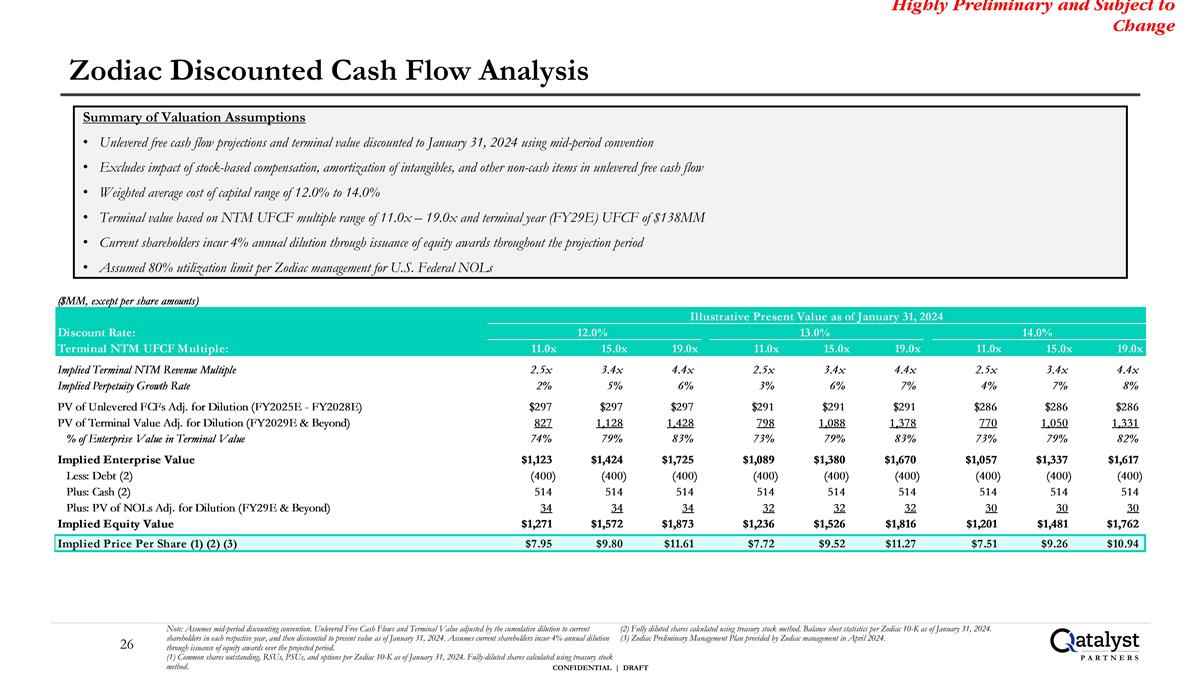

Zodiac Discounted Cash Flow Analysis Summary of Valuation Assumptions Unlevered free cash flow projections and terminal value discounted to January 31, 2024 using mid-period convention Excludes impact of stock-based compensation, amortization of intangibles, and other non-cash items in unlevered free cash flow Weighted average cost of capital range of 12.0% to 14.0% Terminal value based on NTM UFCF multiple range of 11.0x – 19.0x and terminal year (FY29E) UFCF of $138MM Current shareholders incur 4% annual dilution through issuance of equity awards throughout the projection period Assumed 80% utilization limit per Zodiac management for U.S. Federal NOLs Highly Preliminary and Subject to Change Note: Assumes mid-period discounting convention. Unlevered Free Cash Flows and Terminal Value adjusted by the cumulative dilution to current shareholders in each respective year, and then discounted to present value as of January 31, 2024. Assumes current shareholders incur 4% annual dilution through issuance of equity awards over the projected period. (1) Common shares outstanding, RSUs, PSUs, and options per Zodiac 10-K as of January 31, 2024. Fully-diluted shares calculated using treasury stock method. (2) Fully diluted shares calculated using treasury stock method. Balance sheet statistics per Zodiac 10-K as of January 31, 2024. (3) Zodiac Preliminary Management Plan provided by Zodiac management in April 2024.

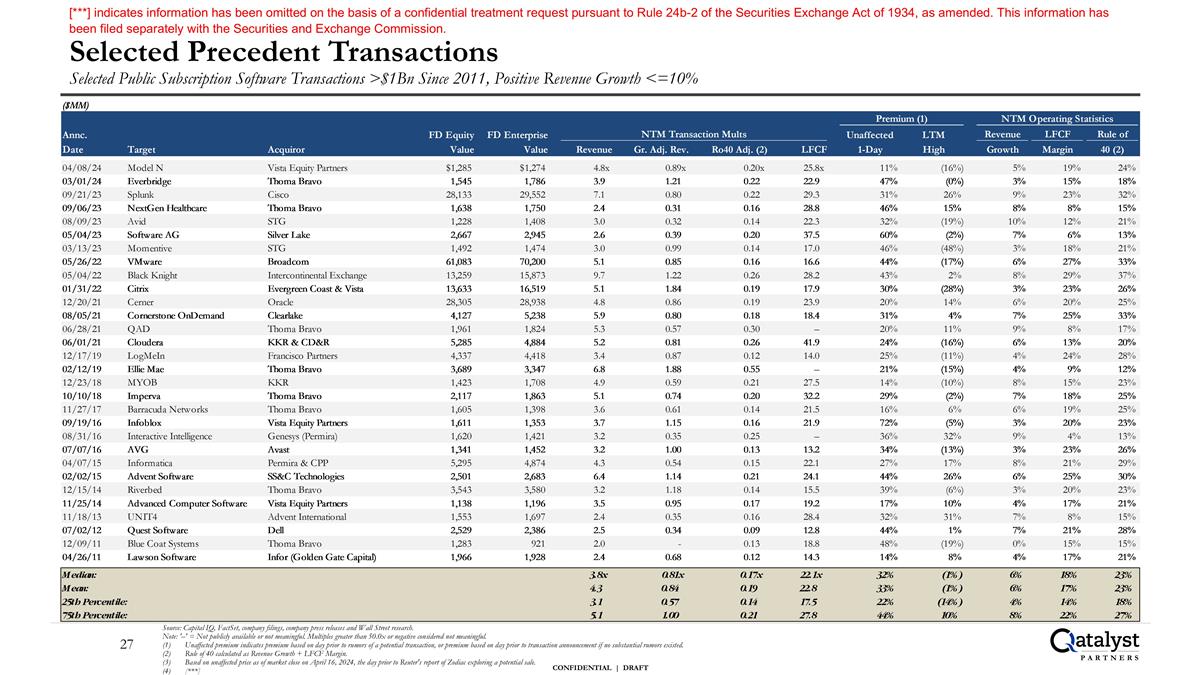

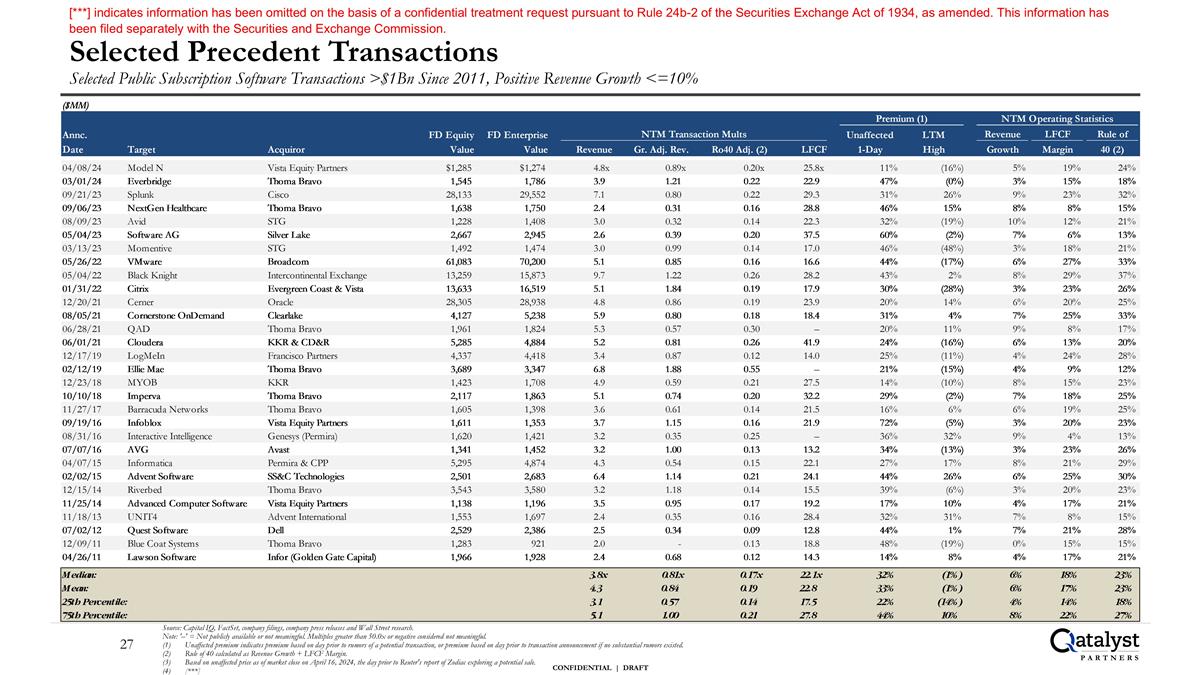

Selected Precedent Transactions Selected Public Subscription Software Transactions >$1Bn Since 2011, Positive Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Note: '–' = Not publicly available or not meaningful. Multiples greater than 50.0x or negative considered not meaningful. Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. Rule of 40 calculated as Revenue Growth + LFCF Margin. Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Appendix Illustrative Take-Private Analysis

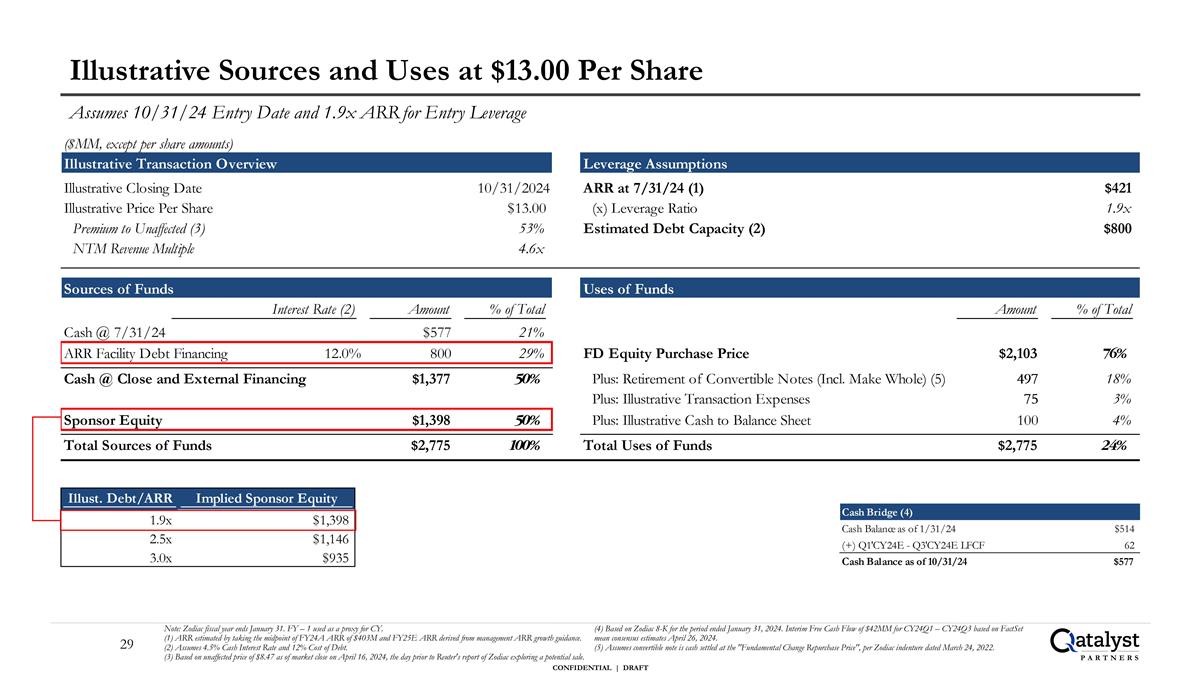

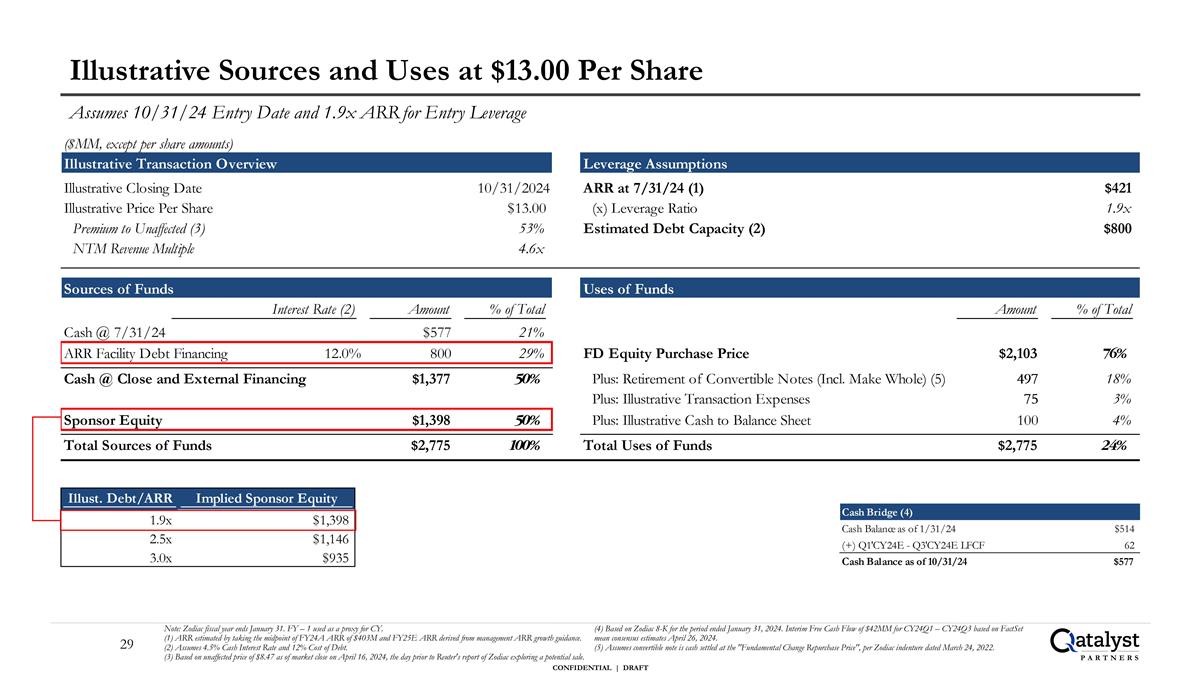

Illustrative Sources and Uses at $13.00 Per Share Assumes 10/31/24 Entry Date and 1.9x ARR for Entry Leverage Note: Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. (1) ARR estimated by taking the midpoint of FY24A ARR of $403M and FY25E ARR derived from management ARR growth guidance. (2) Assumes 4.5% Cash Interest Rate and 12% Cost of Debt. (3) Based on unaffected price of $8.47 as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. (4) Based on Zodiac 8-K for the period ended January 31, 2024. Interim Free Cash Flow of $42MM for CY24Q1 – CY24Q3 based on FactSet mean consensus estimates April 26, 2024. (5) Assumes convertible note is cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022.

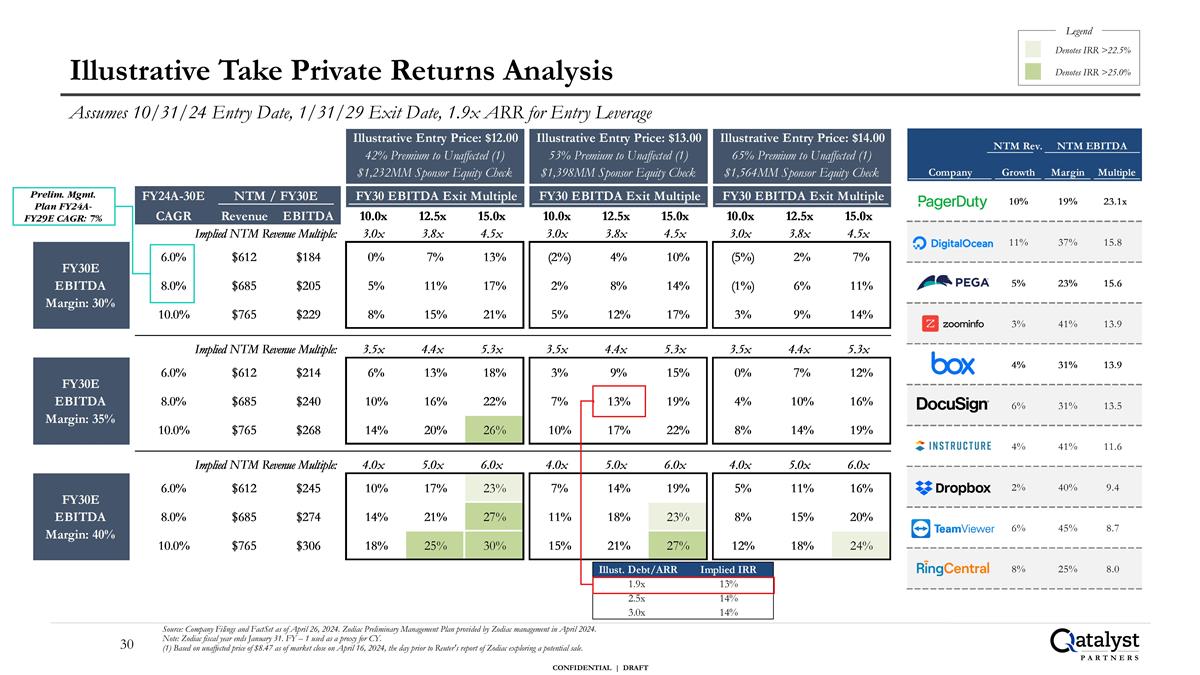

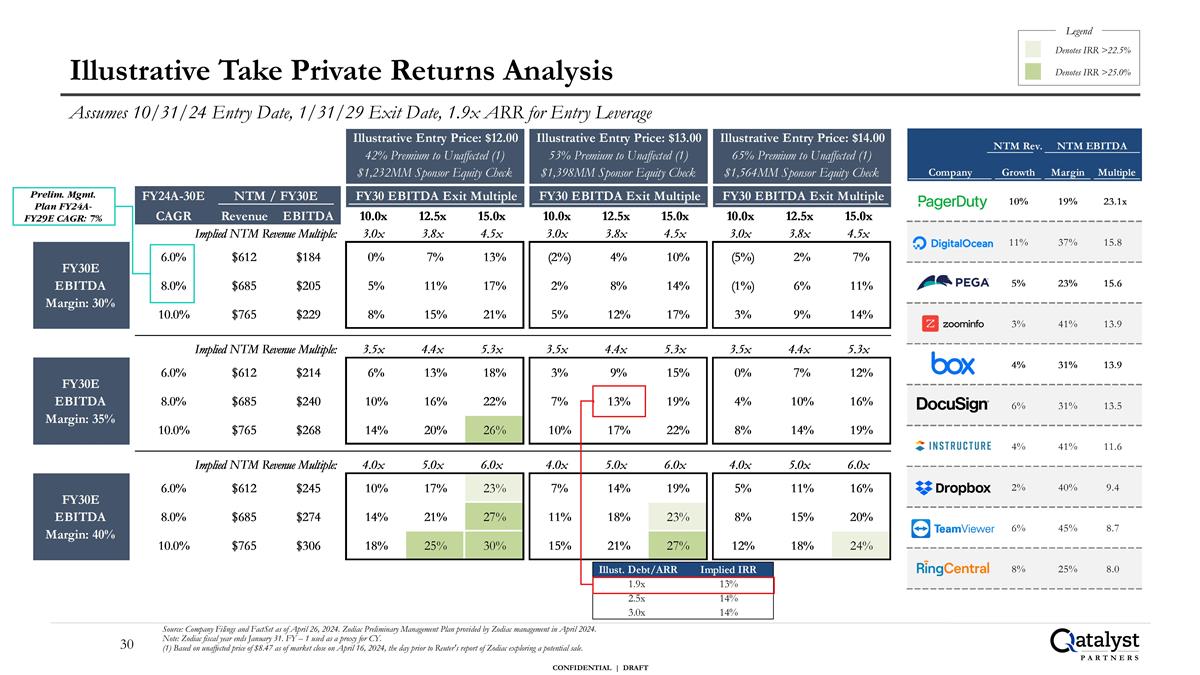

Illustrative Take Private Returns Analysis Assumes 10/31/24 Entry Date, 1/31/29 Exit Date, 1.9x ARR for Entry Leverage Source: Company Filings and FactSet as of April 26, 2024. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Note: Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. (1) Based on unaffected price of $8.47 as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Legend Denotes IRR >25.0% Denotes IRR >22.5% Prelim. Mgmt. Plan FY24A-FY29E CAGR: 7%

Appendix Additional Information

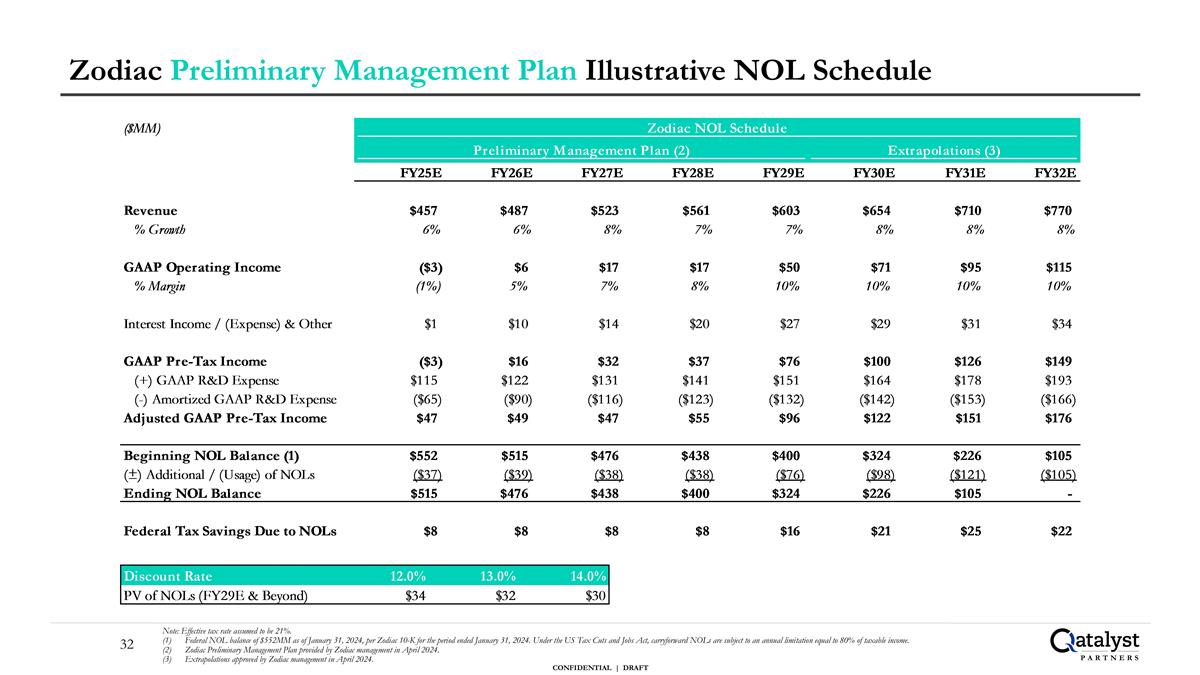

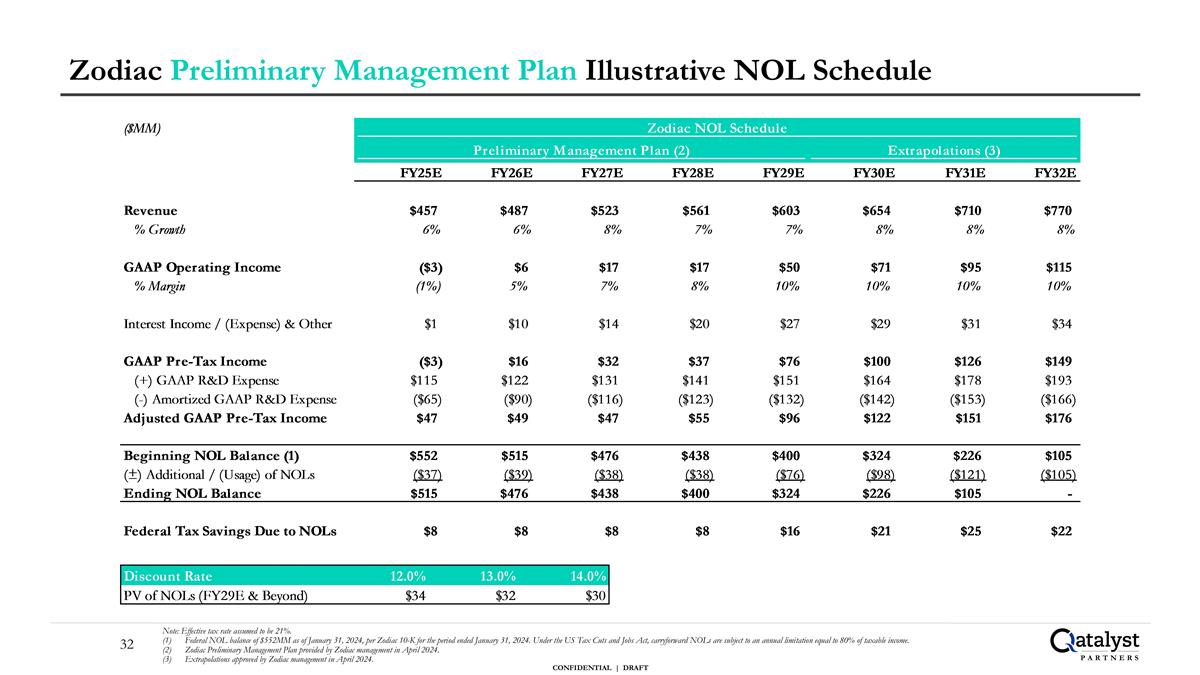

Zodiac Preliminary Management Plan Illustrative NOL Schedule Note: Effective tax rate assumed to be 21%. Federal NOL balance of $552MM as of January 31, 2024, per Zodiac 10-K for the period ended January 31, 2024. Under the US Tax Cuts and Jobs Act, carryforward NOLs are subject to an annual limitation equal to 80% of taxable income. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Extrapolations approved by Zodiac management in April 2024.

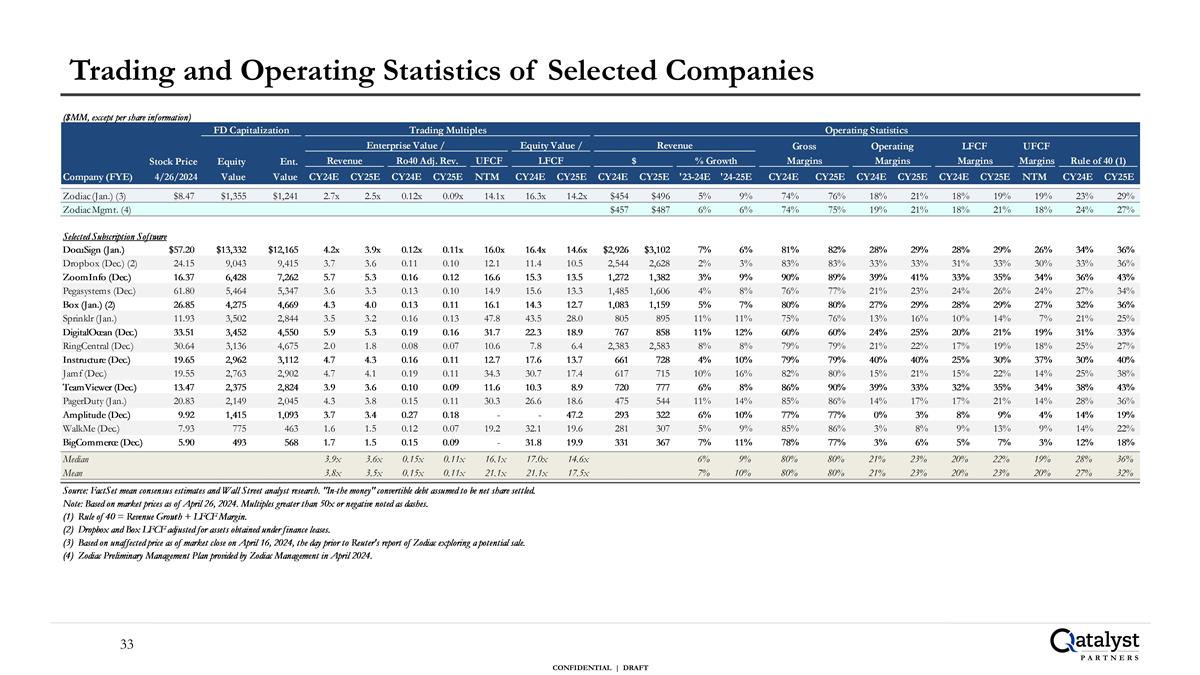

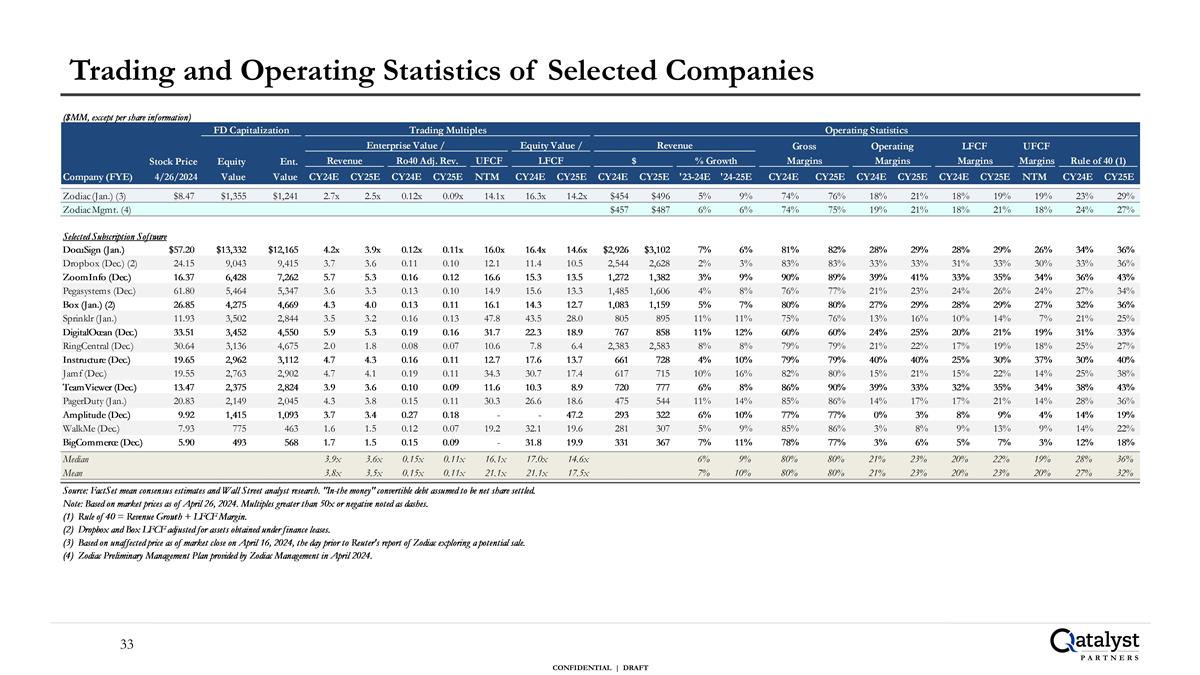

Trading and Operating Statistics of Selected Companies

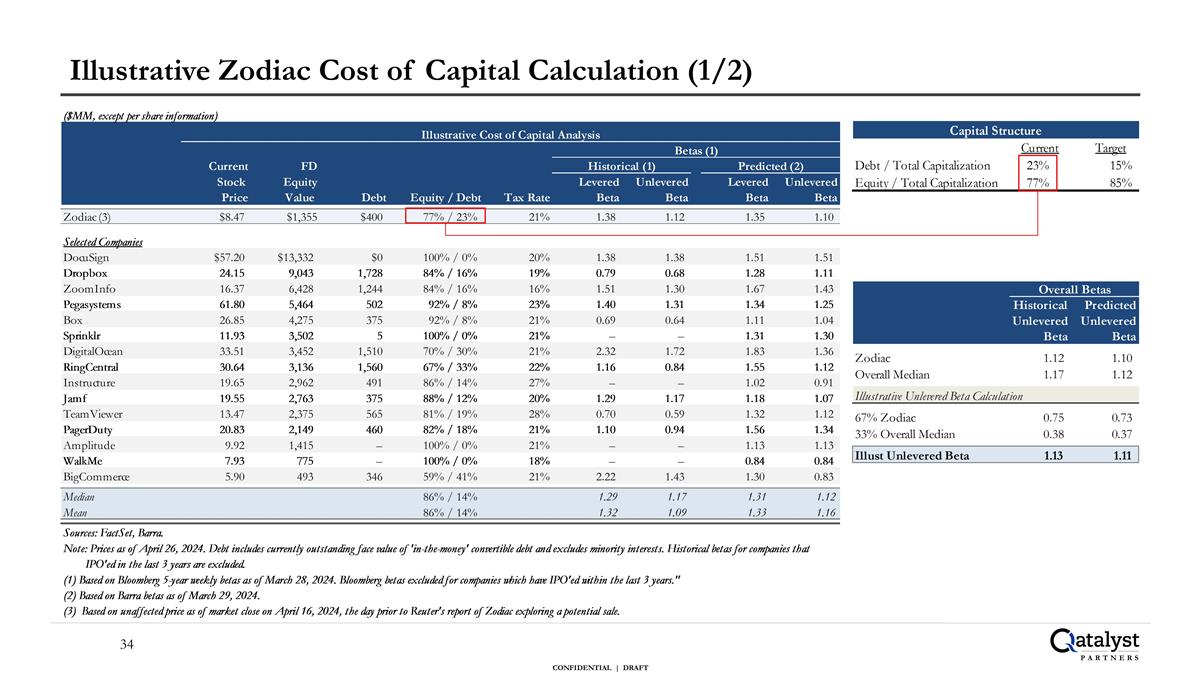

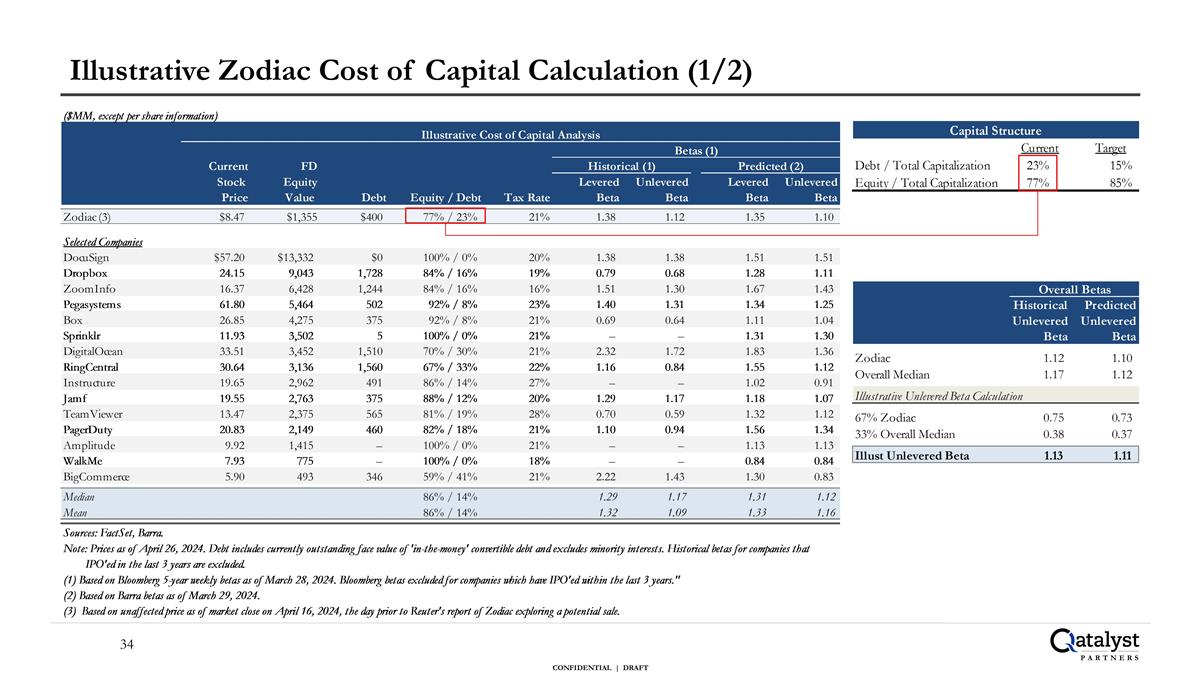

Illustrative Zodiac Cost of Capital Calculation (1/2)

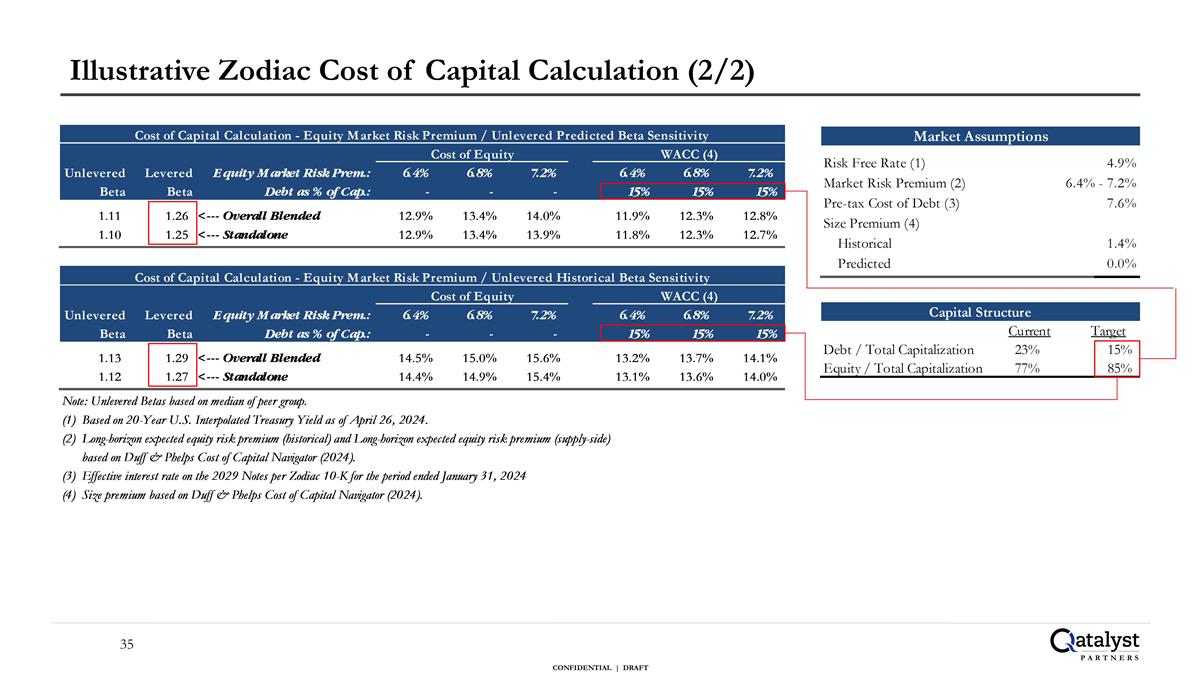

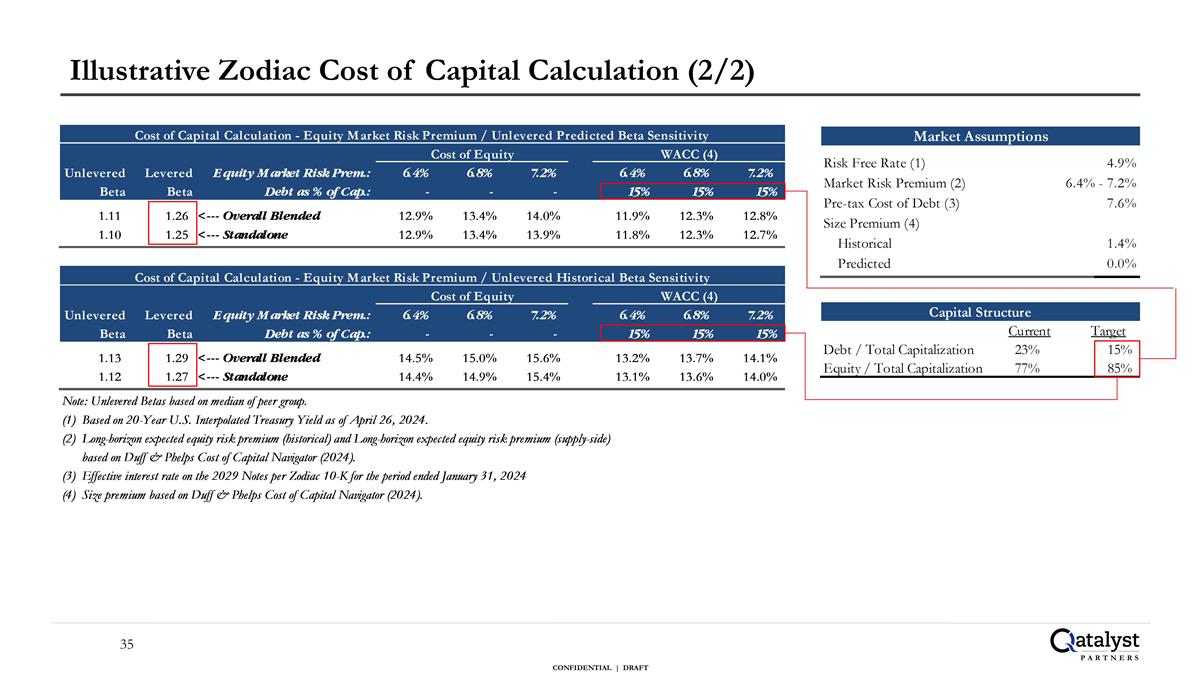

Illustrative Zodiac Cost of Capital Calculation (2/2)

Disclaimer