April 2024 Project Zodiac Discussion Materials Exhibit 16(c)(ii) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Agenda Zodiac Financial Overview Zodiac Preliminary Valuation Perspectives Strategic Considerations

Zodiac Financial Overview

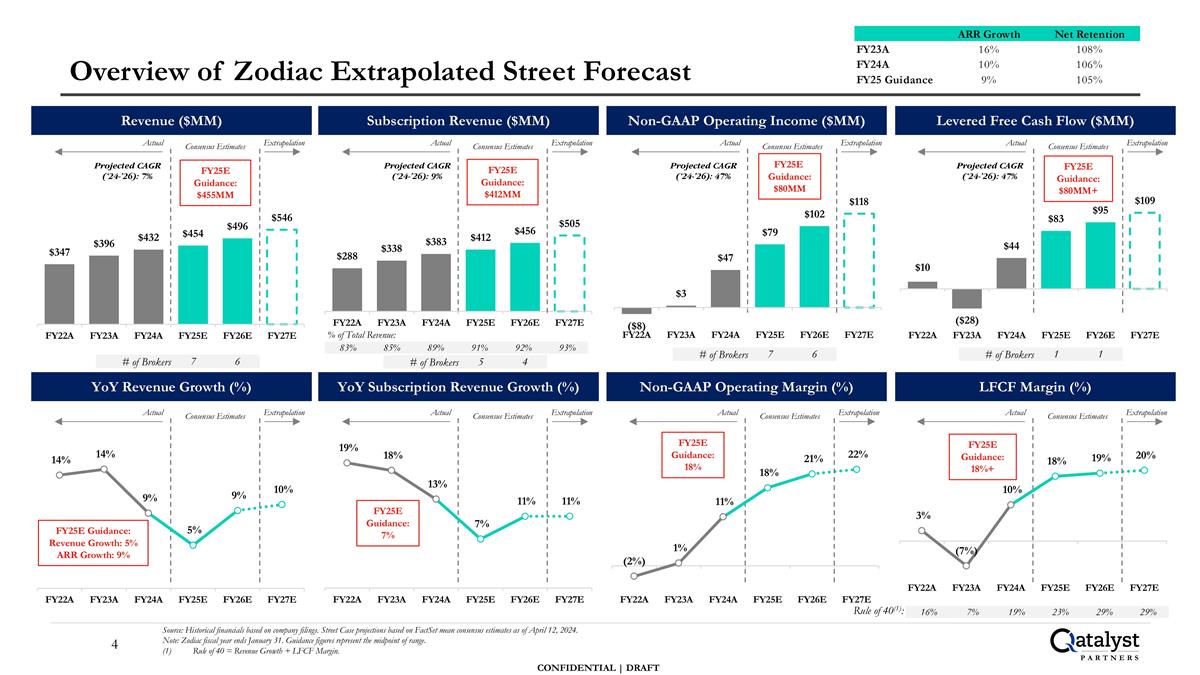

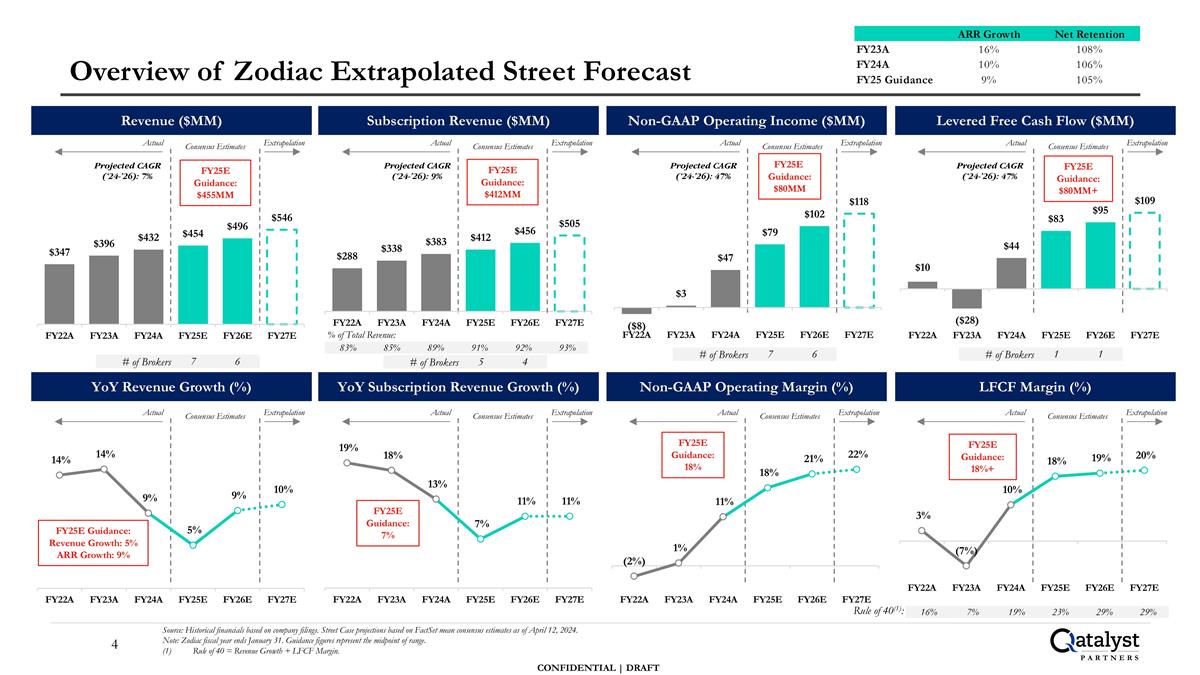

Source: Historical financials based on company filings. Street Case projections based on FactSet mean consensus estimates as of April 12, 2024. Note: Zodiac fiscal year ends January 31. Guidance figures represent the midpoint of range. Rule of 40 = Revenue Growth + LFCF Margin. Overview of Zodiac Extrapolated Street Forecast Non-GAAP Operating Income ($MM) Levered Free Cash Flow ($MM) Non-GAAP Operating Margin (%) LFCF Margin (%) # of Brokers 7 6 Revenue ($MM) YoY Revenue Growth (%) Subscription Revenue ($MM) YoY Subscription Revenue Growth (%) Actual Consensus Estimates FY25E Guidance: $455MM 16% 7% 19% 23% 29% 29% Rule of 40(1): FY25E Guidance: 18% FY25E Guidance: 18%+ Extrapolation # of Brokers 7 6 Actual Consensus Estimates Extrapolation FY25E Guidance: $80MM # of Brokers 1 1 Actual Consensus Estimates Extrapolation Actual Consensus Estimates Extrapolation Actual Consensus Estimates Extrapolation Actual Consensus Estimates Extrapolation # of Brokers 5 4 Actual Consensus Estimates Extrapolation Actual Consensus Estimates Extrapolation 83% 85% 89% 91% 92% 93% % of Total Revenue: FY25E Guidance: $412MM FY25E Guidance: 7% FY25E Guidance: Revenue Growth: 5% ARR Growth: 9% Projected CAGR (‘24-’26): 7% FY25E Guidance: $80MM+ Projected CAGR (‘24-’26): 9% Projected CAGR (‘24-’26): 47% Projected CAGR (‘24-’26): 47%

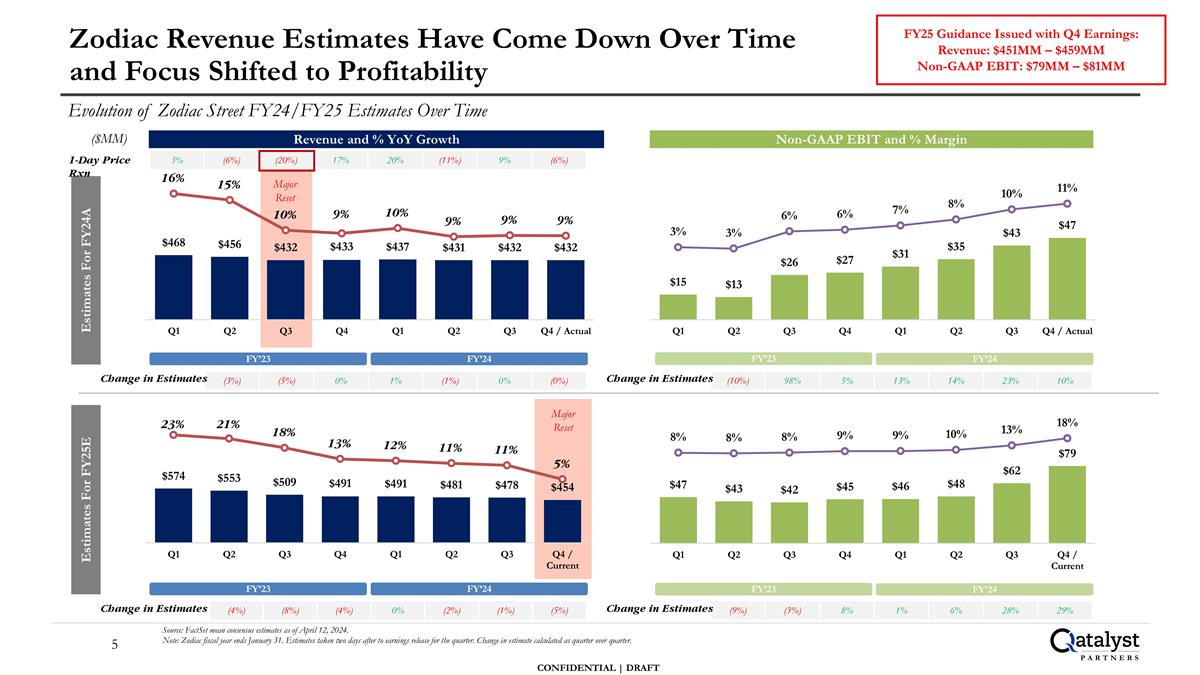

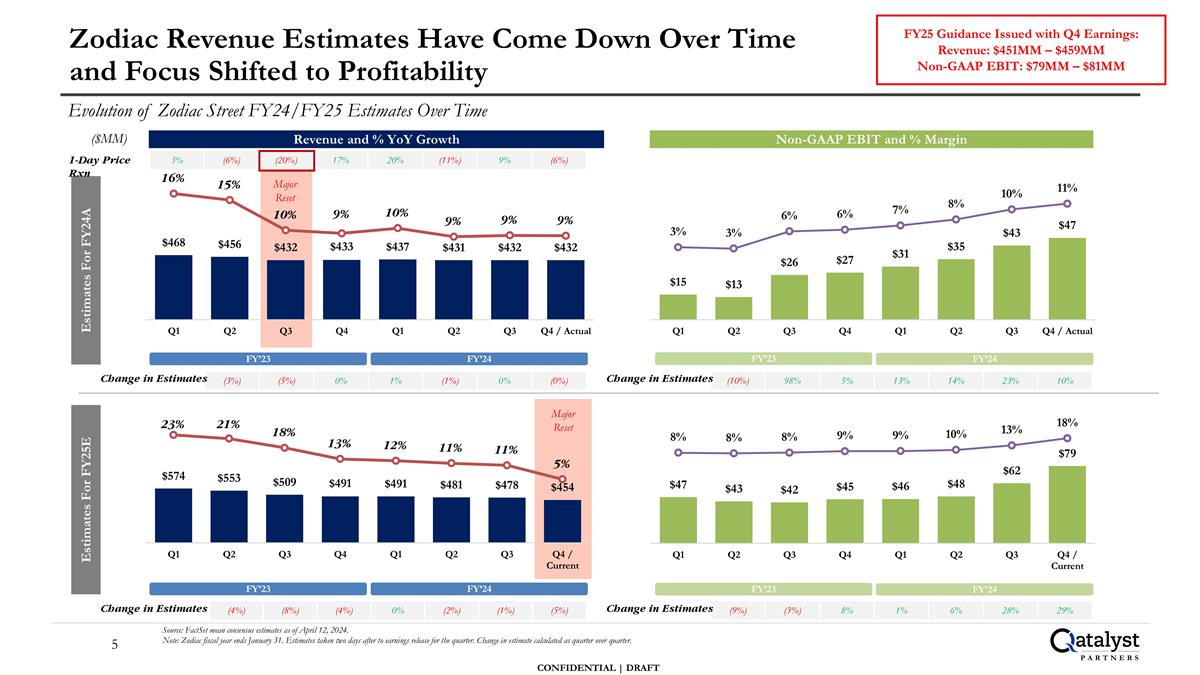

(3%) (5%) 0% 1% (1%) 0% (0%) Source: FactSet mean consensus estimates as of April 12, 2024. Note: Zodiac fiscal year ends January 31. Estimates taken two days after to earnings release for the quarter. Change in estimate calculated as quarter over quarter. Zodiac Revenue Estimates Have Come Down Over Time and Focus Shifted to Profitability Evolution of Zodiac Street FY24/FY25 Estimates Over Time Revenue and % YoY Growth Non-GAAP EBIT and % Margin Estimates For FY24A ($MM) Estimates For FY25E (4%) (8%) (4%) 0% (2%) (1%) (5%) Change in Estimates (9%) (3%) 8% 1% 6% 28% 29% (10%) 98% 5% 13% 14% 23% 10% FY’23 FY’24 3% (6%) (20%) 17% 20% (11%) 9% (6%) 1-Day Price Rxn Change in Estimates Change in Estimates Change in Estimates FY’23 FY’24 FY’23 FY’24 FY’23 FY’24 FY25 Guidance Issued with Q4 Earnings: Revenue: $451MM – $459MM Non-GAAP EBIT: $79MM – $81MM Major Reset Major Reset

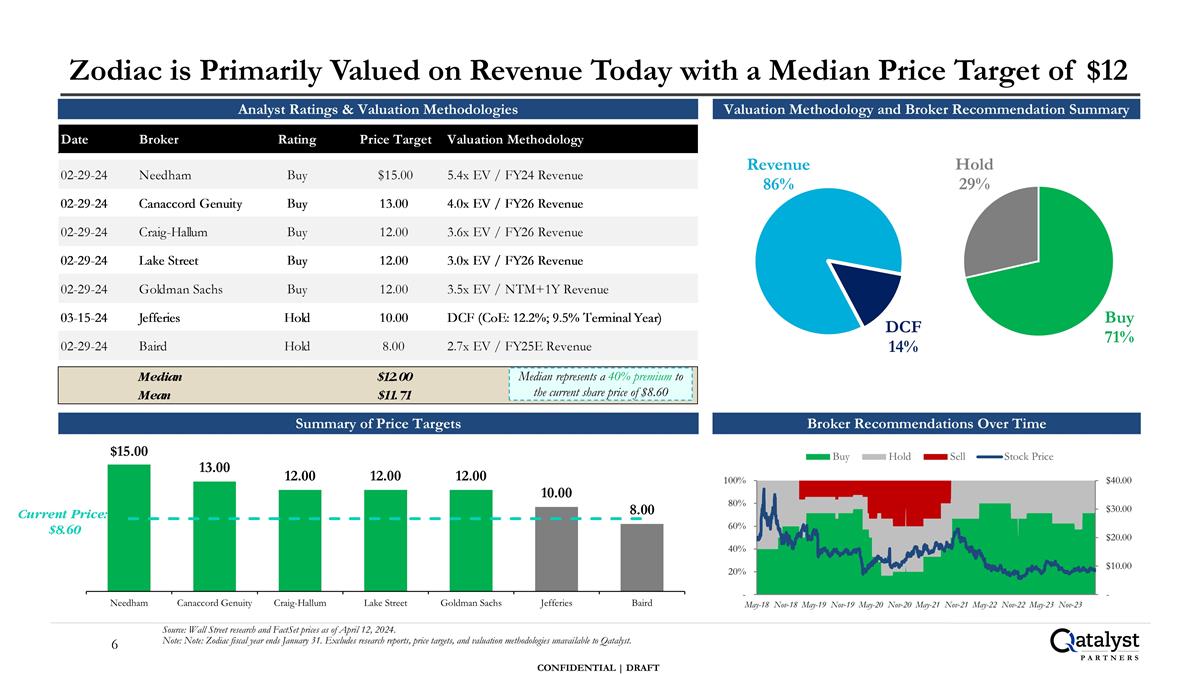

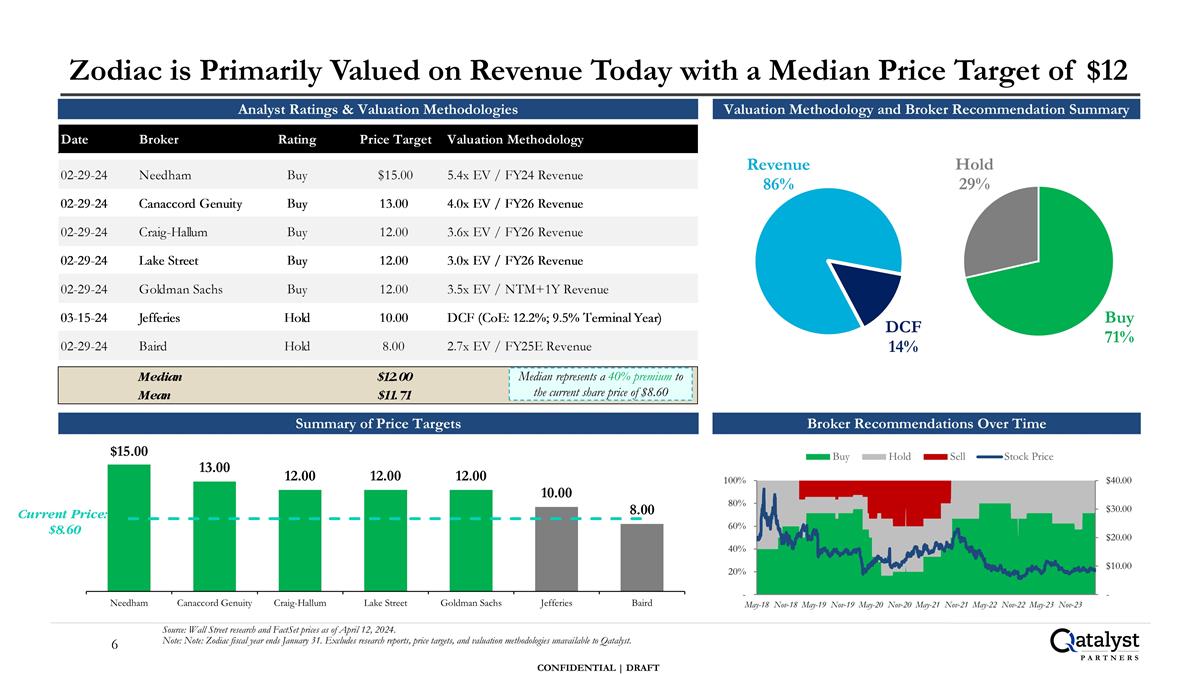

Zodiac is Primarily Valued on Revenue Today with a Median Price Target of $12 Source: Wall Street research and FactSet prices as of April 12, 2024. Note: Note: Zodiac fiscal year ends January 31. Excludes research reports, price targets, and valuation methodologies unavailable to Qatalyst. Analyst Ratings & Valuation Methodologies Summary of Price Targets Valuation Methodology and Broker Recommendation Summary Current Price: $8.60 Median represents a 40% premium to the current share price of $8.60 Broker Recommendations Over Time

Zodiac Preliminary Valuation Perspectives

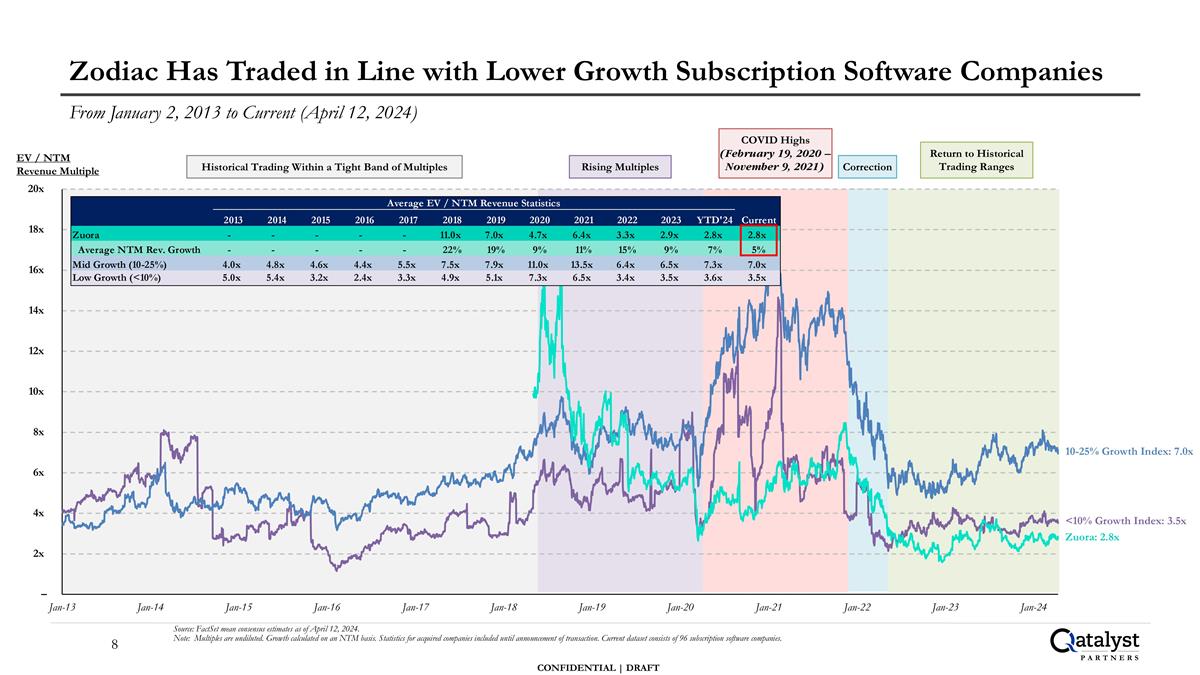

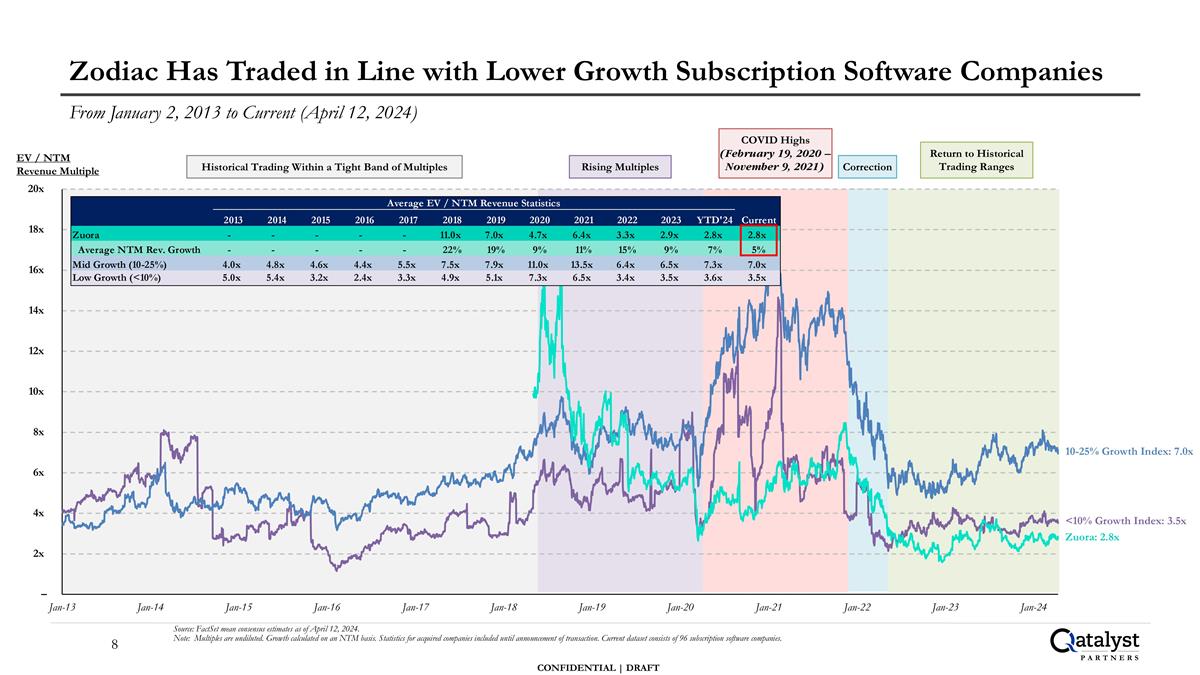

Zodiac Has Traded in Line with Lower Growth Subscription Software Companies From January 2, 2013 to Current (April 12, 2024) Source: FactSet mean consensus estimates as of April 12, 2024. Note: Multiples are undiluted. Growth calculated on an NTM basis. Statistics for acquired companies included until announcement of transaction. Current dataset consists of 96 subscription software companies. <10% Growth Index: 3.5x Zuora: 2.8x 10-25% Growth Index: 7.0x EV / NTM Revenue Multiple Correction Rising Multiples Historical Trading Within a Tight Band of Multiples Return to Historical Trading Ranges COVID Highs (February 19, 2020 – November 9, 2021)

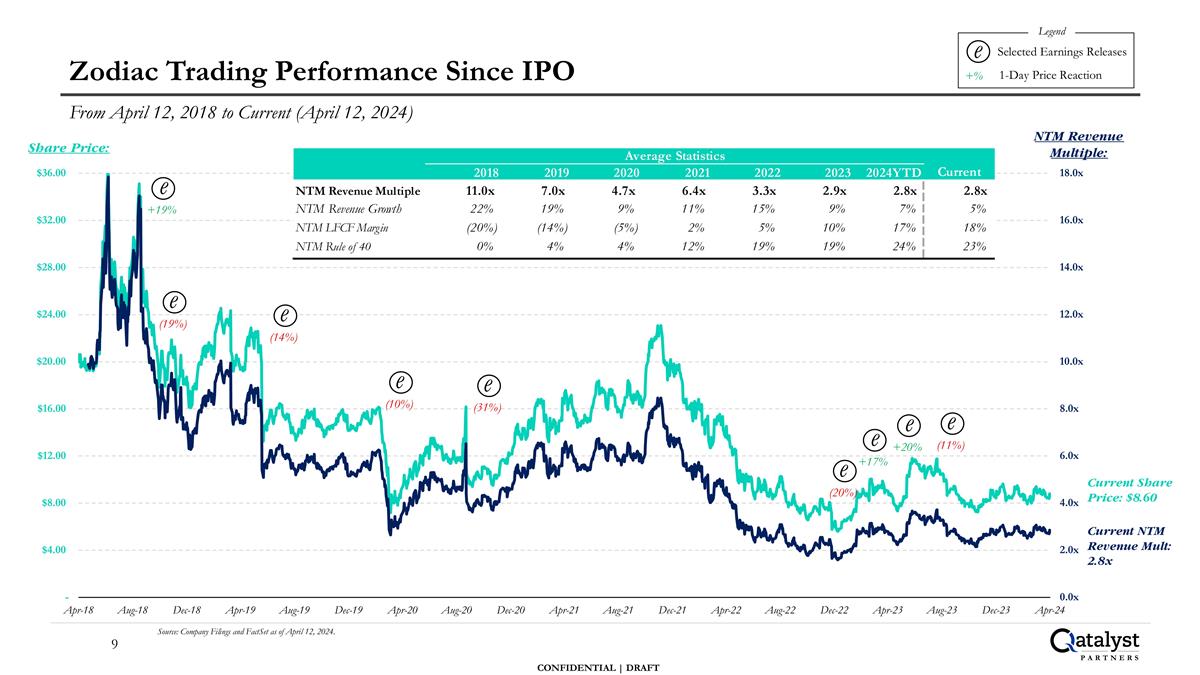

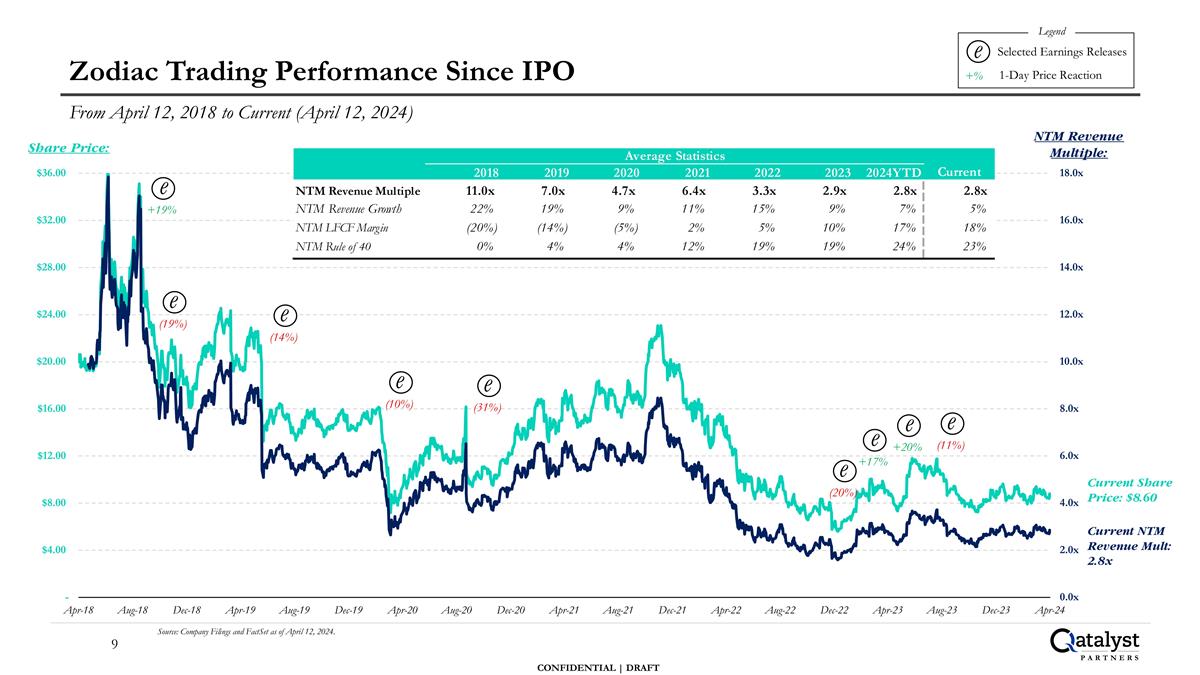

Zodiac Trading Performance Since IPO From April 12, 2018 to Current (April 12, 2024) NTM Revenue Multiple: Share Price: Current NTM Revenue Mult: 2.8x Current Share Price: $8.60 Source: Company Filings and FactSet as of April 12, 2024. e (11%) e +20% e +17% e (20%) e (31%) e (10%) e (19%) e (14%) e +19% Selected Earnings Releases e Legend 1-Day Price Reaction +%

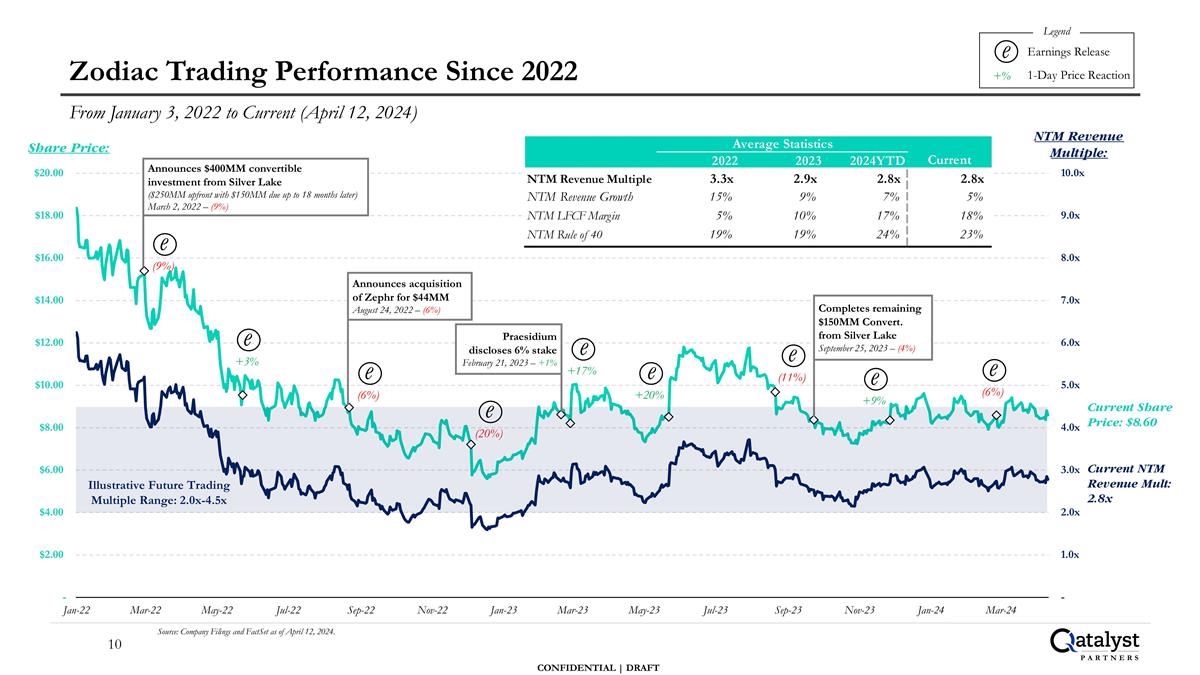

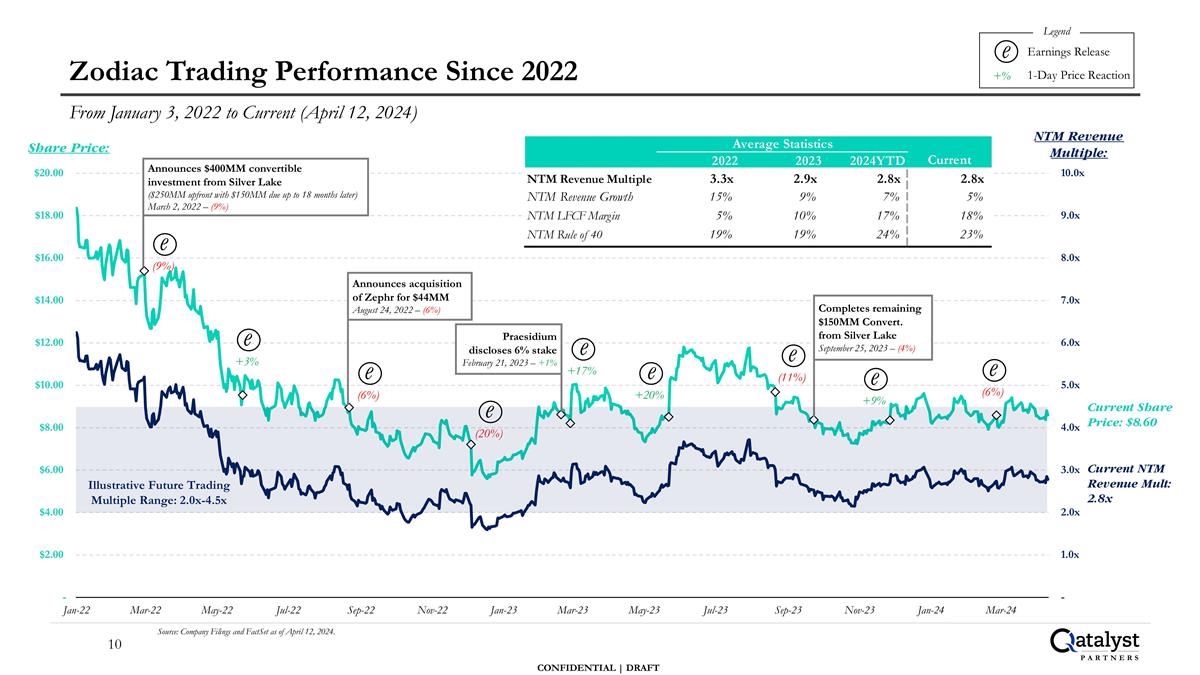

Zodiac Trading Performance Since 2022 From January 3, 2022 to Current (April 12, 2024) NTM Revenue Multiple: Share Price: Current NTM Revenue Mult: 2.8x Current Share Price: $8.60 Source: Company Filings and FactSet as of April 12, 2024. Earnings Release e Legend 1-Day Price Reaction +% e +3% e (6%) e (11%) e +20% e +9% e +17% Announces $400MM convertible investment from Silver Lake ($250MM upfront with $150MM due up to 18 months later) March 2, 2022 – (9%) e (9%) Announces acquisition of Zephr for $44MM August 24, 2022 – (6%) Praesidium discloses 6% stake February 21, 2023 – +1% Completes remaining $150MM Convert. from Silver Lake September 25, 2023 – (4%) e (6%) e (20%) Illustrative Future Trading Multiple Range: 2.0x-4.5x

CY24E Operating Statistics of Selected Companies $454 $805 $475 $767 $617 $2,383 $331 $2,926 $721 $293 $4,382 $281 $1,499 $1,083 $2,544 Source: FactSet consensus estimates as of April 12, 2024. Rule of 40 = Revenue Growth + LFCF margin. Dropbox and Box LFCF adjusted for assets obtained under finance leases. Revenue Growth Non-GAAP Operating Margin Rule of 40 (1) LFCF Margin CY24 Rev. ($MM) Selected Subscription Software Legend CY24 Gross Margin (%) 74% 86% 83% 81% 80% 60% 79% 76% 82% 85% 52% 75% 85% 78% 83% (2) (2) (2) (2)

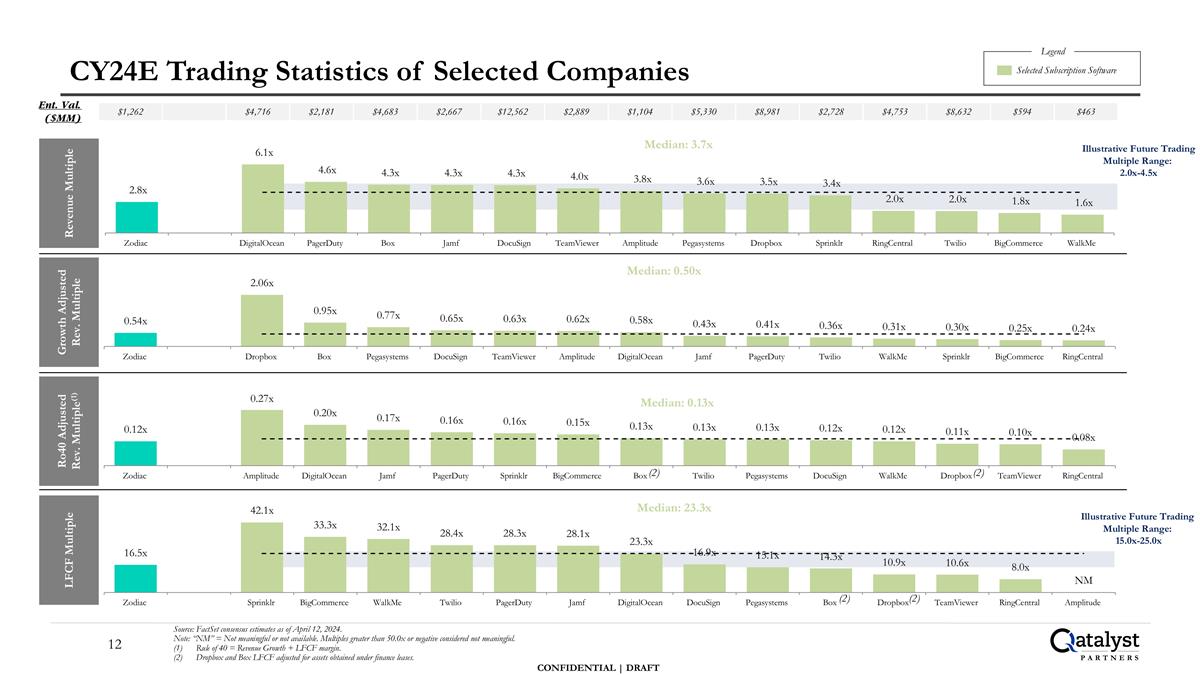

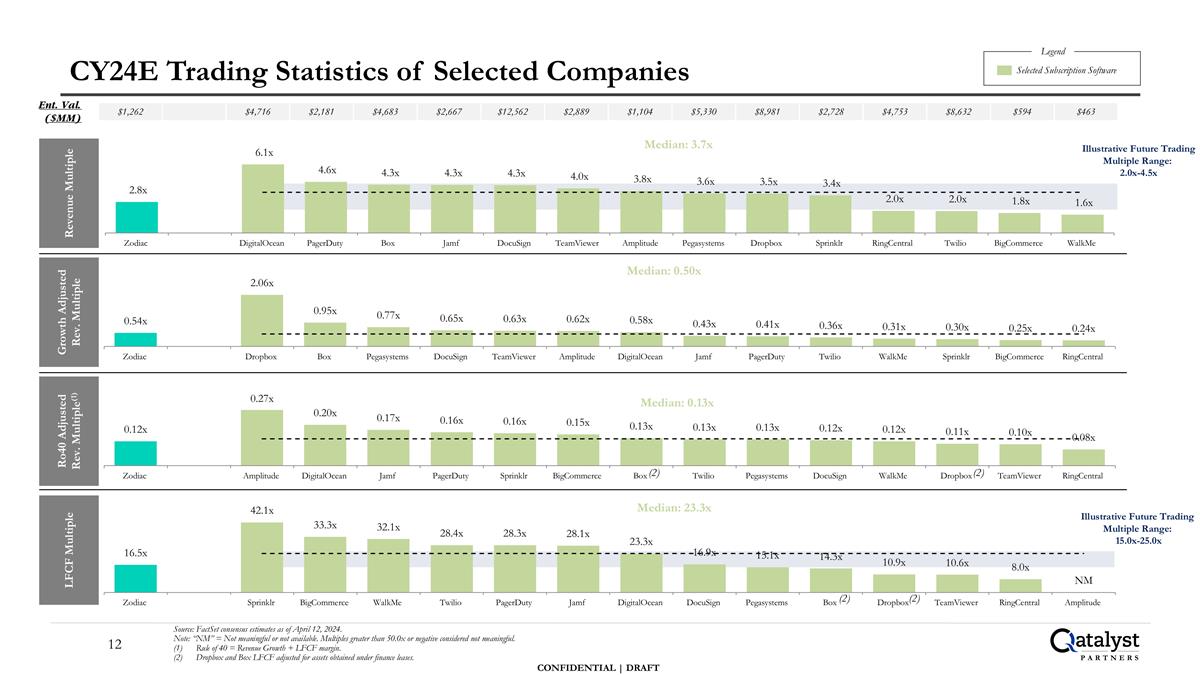

CY24E Trading Statistics of Selected Companies Revenue Multiple Ro40 Adjusted Rev. Multiple(1) Growth Adjusted Rev. Multiple Ent. Val. ($MM) Source: FactSet consensus estimates as of April 12, 2024. Note: “NM” = Not meaningful or not available. Multiples greater than 50.0x or negative considered not meaningful. Rule of 40 = Revenue Growth + LFCF margin. Dropbox and Box LFCF adjusted for assets obtained under finance leases. LFCF Multiple $1,262 $4,716 $2,181 $4,683 $2,667 $12,562 $2,889 $1,104 $5,330 $8,981 $2,728 $4,753 $8,632 $594 $463 Selected Subscription Software Legend (2) (2) (2) (2) Illustrative Future Trading Multiple Range: 2.0x-4.5x Illustrative Future Trading Multiple Range: 15.0x-25.0x

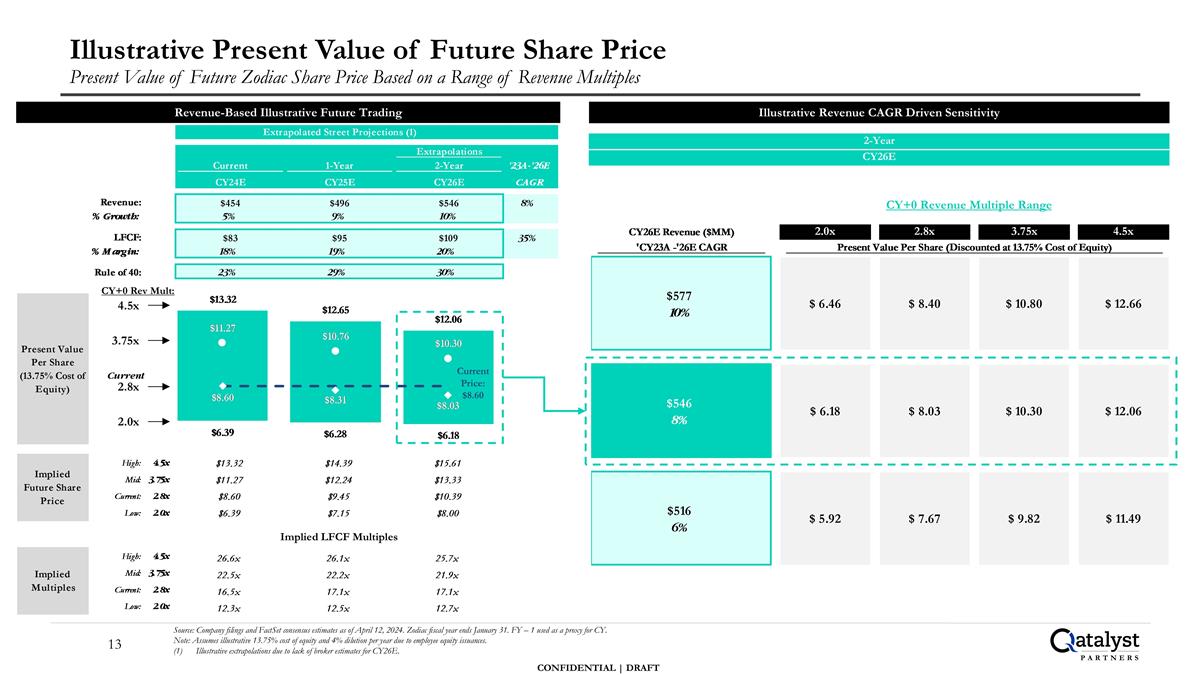

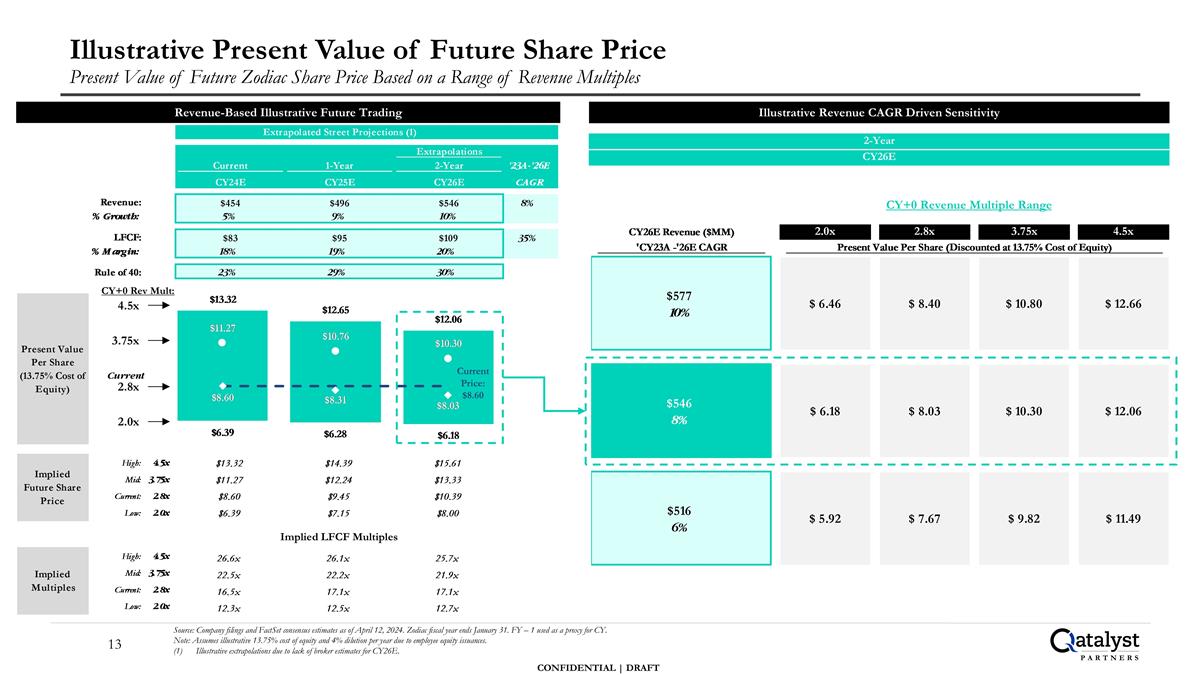

Illustrative Present Value of Future Share Price Present Value of Future Zodiac Share Price Based on a Range of Revenue Multiples Source: Company filings and FactSet consensus estimates as of April 12, 2024. Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Note: Assumes illustrative 13.75% cost of equity and 4% dilution per year due to employee equity issuances. Illustrative extrapolations due to lack of broker estimates for CY26E. Illustrative Revenue CAGR Driven Sensitivity 2-Year CY26E CY+0 Revenue Multiple Range 2.0x 3.75x 4.5x CY+0 Rev Mult: Revenue-Based Illustrative Future Trading Current 2.8x Implied LFCF Multiples Current Price: $8.60

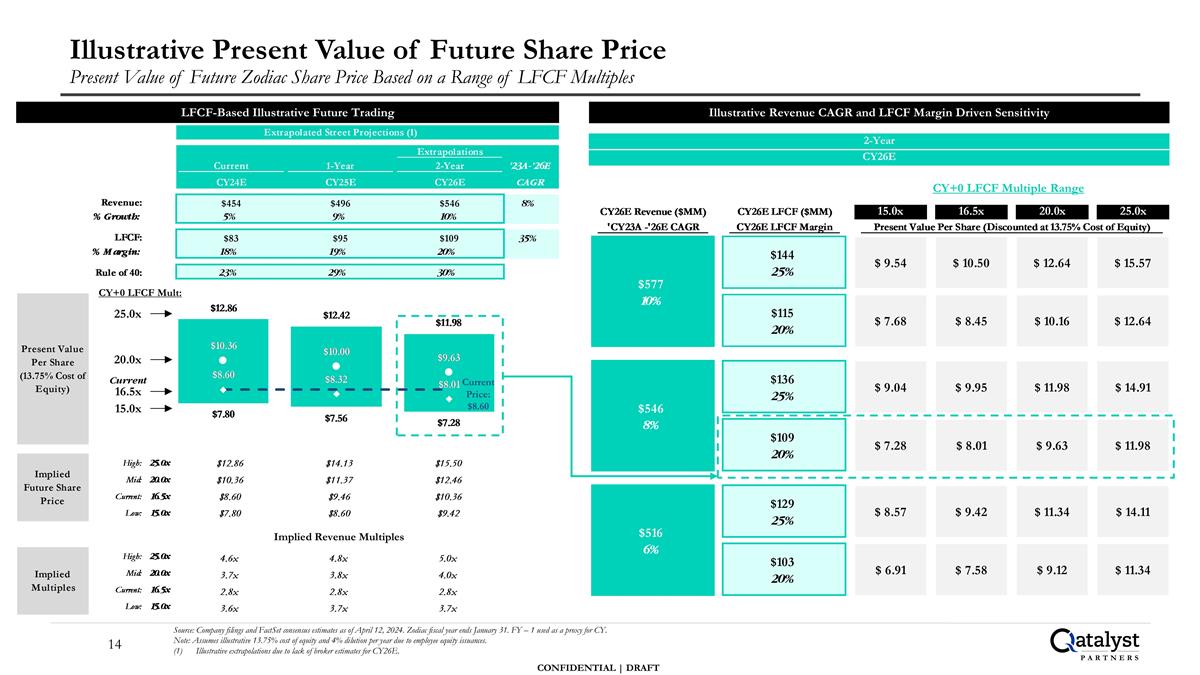

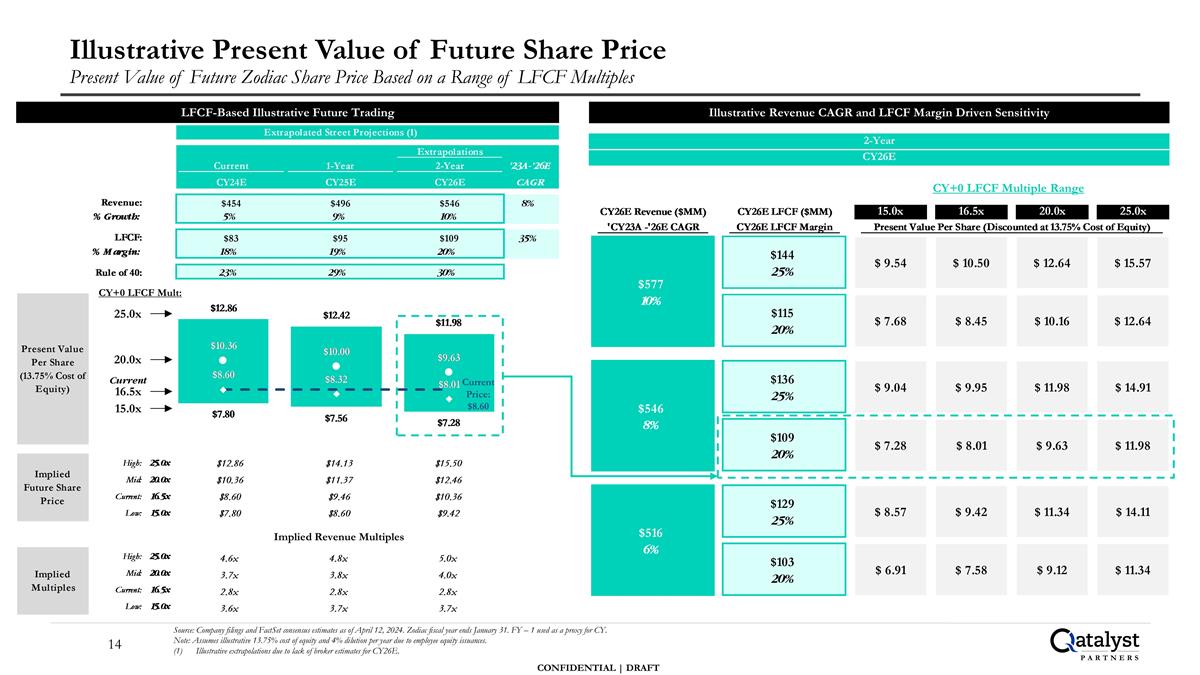

Illustrative Present Value of Future Share Price Present Value of Future Zodiac Share Price Based on a Range of LFCF Multiples Source: Company filings and FactSet consensus estimates as of April 12, 2024. Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Note: Assumes illustrative 13.75% cost of equity and 4% dilution per year due to employee equity issuances. Illustrative extrapolations due to lack of broker estimates for CY26E. Illustrative Revenue CAGR and LFCF Margin Driven Sensitivity 2-Year CY26E CY+0 LFCF Multiple Range CY+0 LFCF Mult: 15.0x 20.0x 25.0x LFCF-Based Illustrative Future Trading Current Price: $8.60 Current 16.5x Implied Revenue Multiples

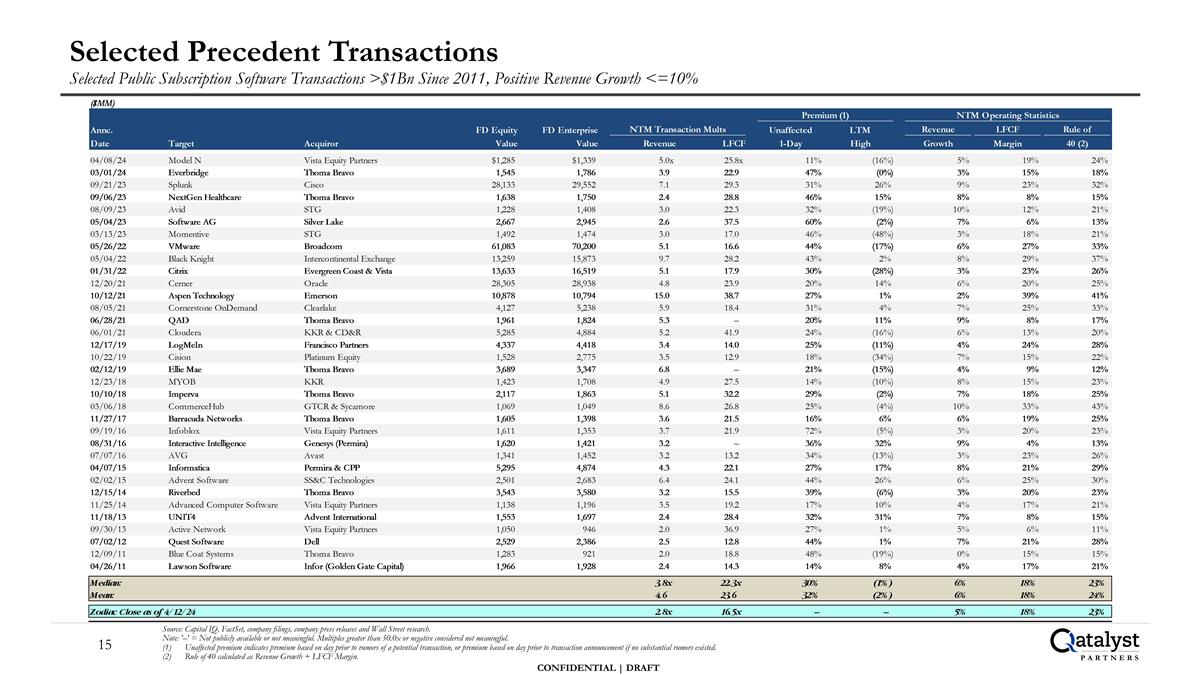

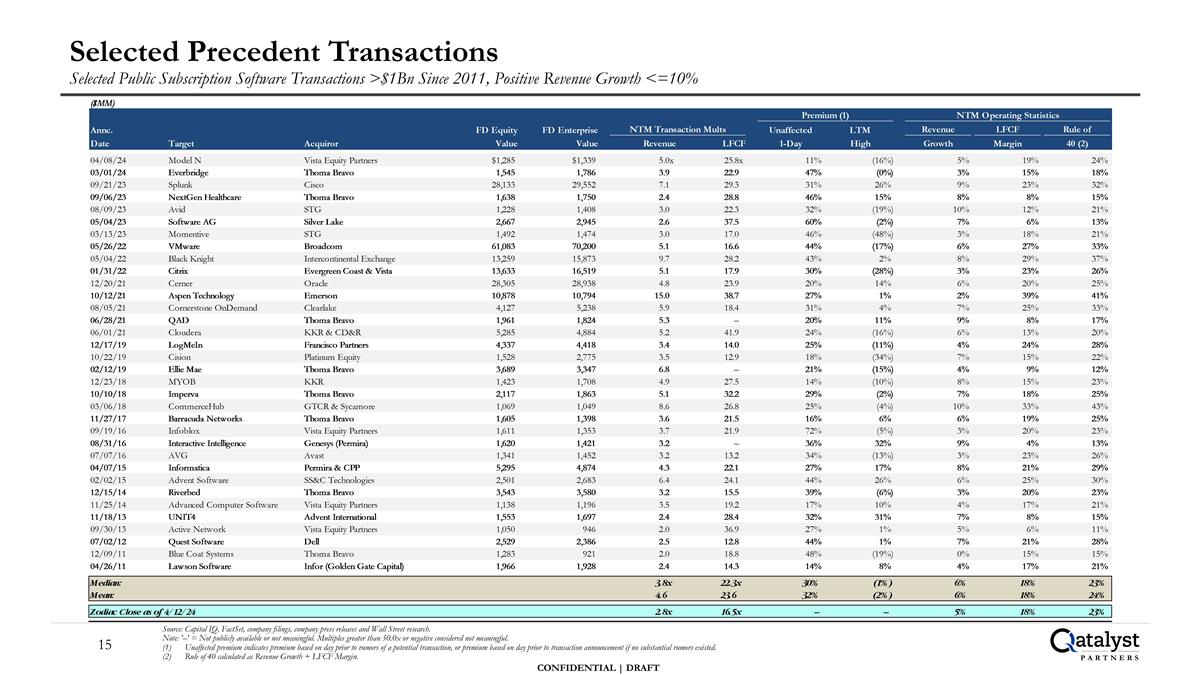

Selected Precedent Transactions Selected Public Subscription Software Transactions >$1Bn Since 2011, Positive Revenue Growth <=10% Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. Note: '–' = Not publicly available or not meaningful. Multiples greater than 50.0x or negative considered not meaningful. Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. Rule of 40 calculated as Revenue Growth + LFCF Margin.

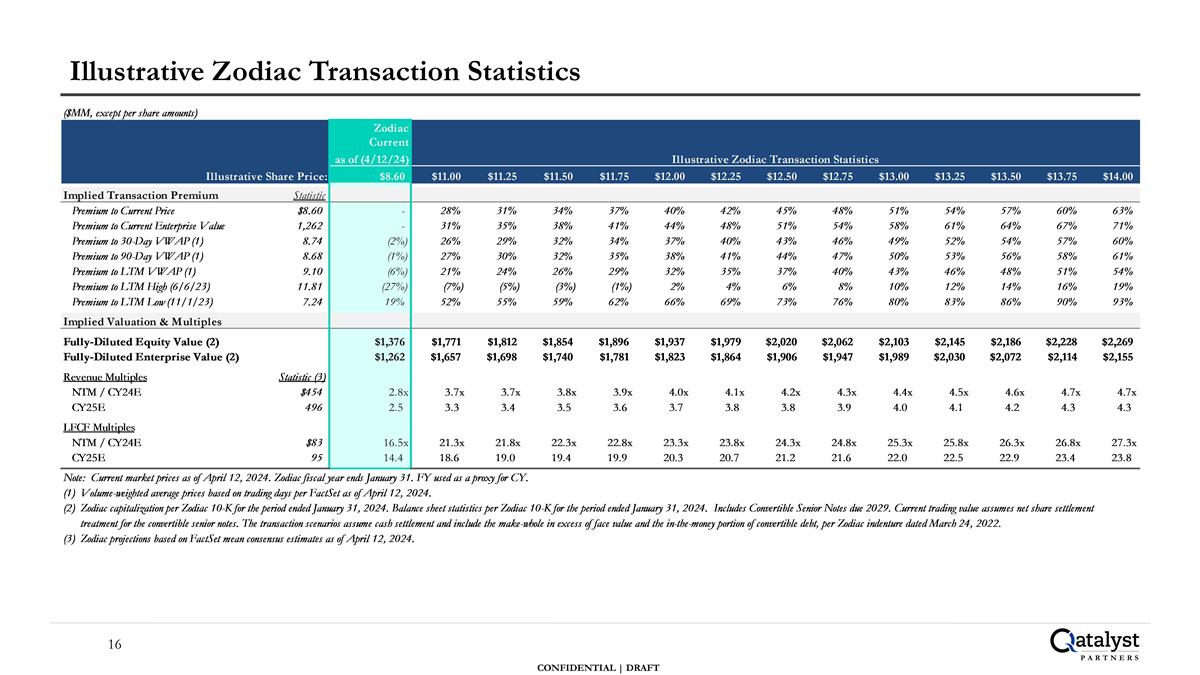

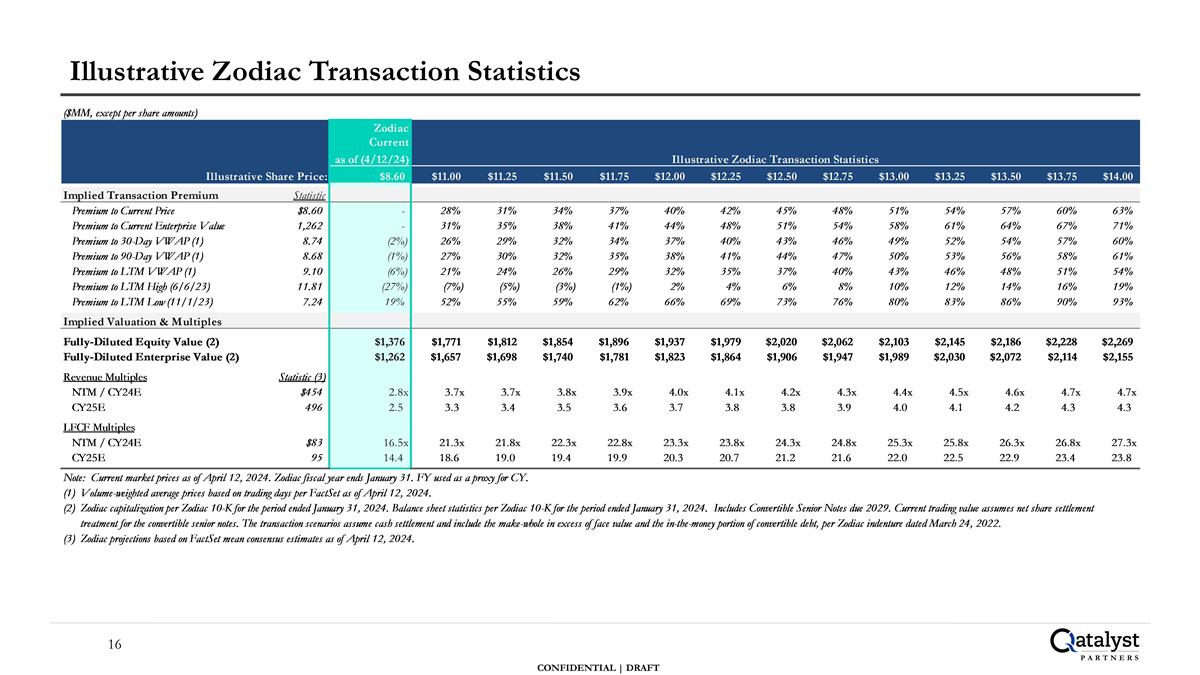

Illustrative Zodiac Transaction Statistics

Strategic Considerations

Selected Potential Partners [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

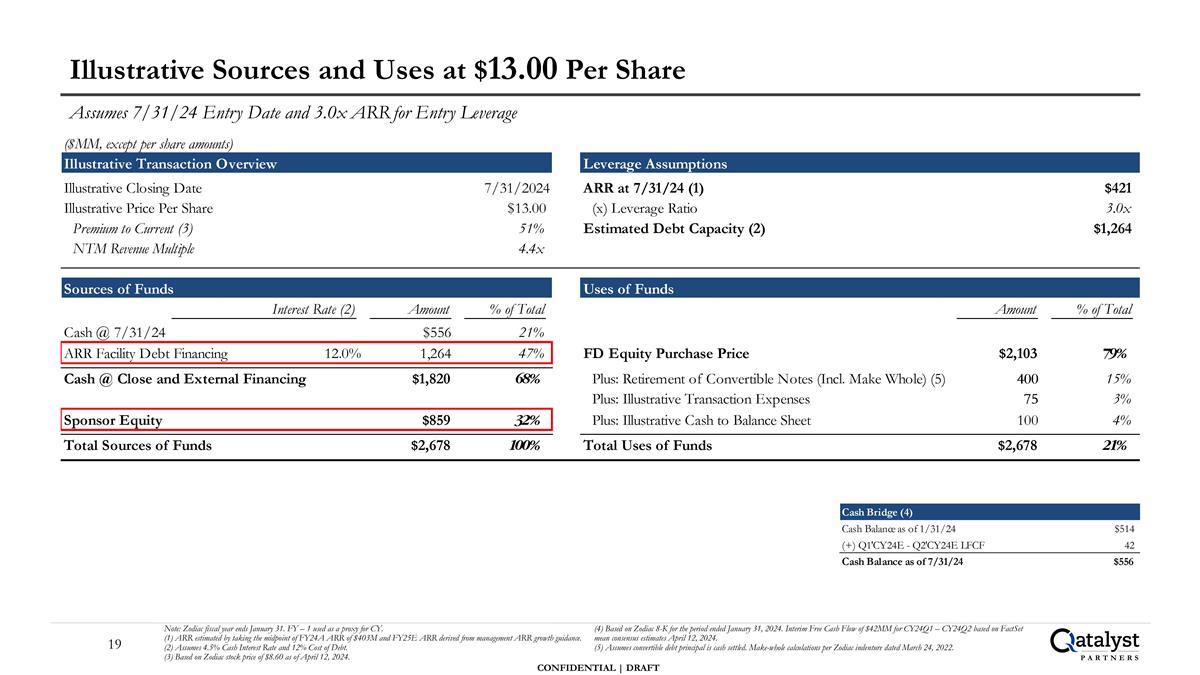

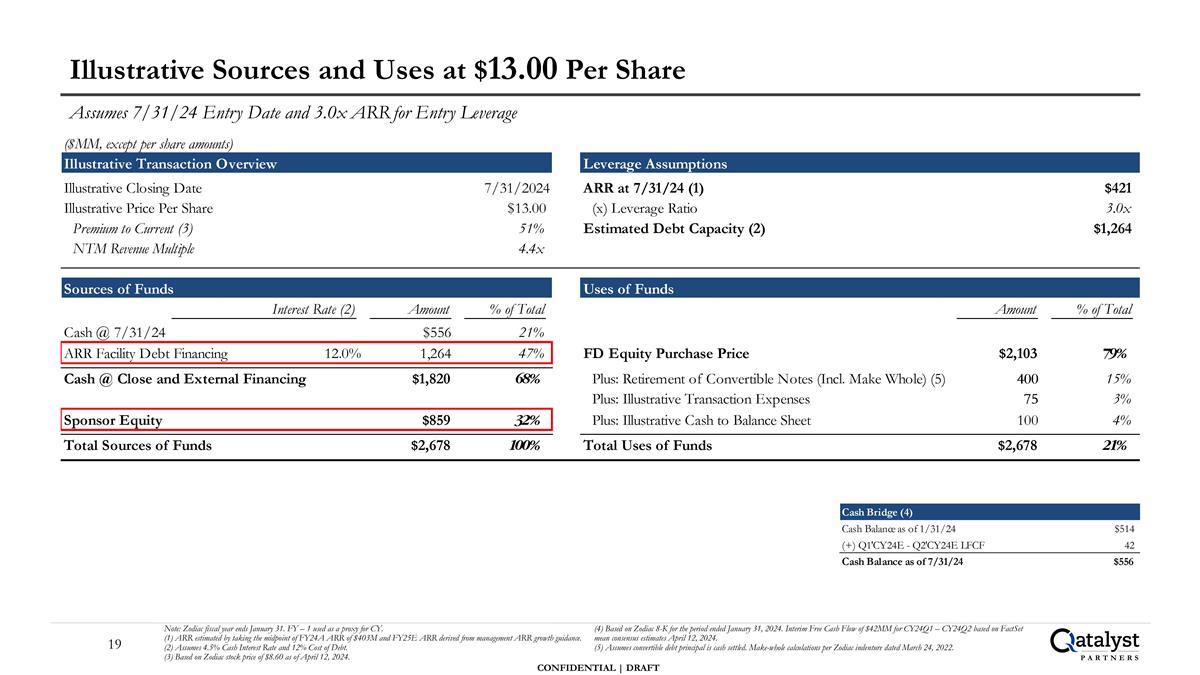

Illustrative Sources and Uses at $13.00 Per Share Assumes 7/31/24 Entry Date and 3.0x ARR for Entry Leverage Note: Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. (1) ARR estimated by taking the midpoint of FY24A ARR of $403M and FY25E ARR derived from management ARR growth guidance. (2) Assumes 4.5% Cash Interest Rate and 12% Cost of Debt. (3) Based on Zodiac stock price of $8.60 as of April 12, 2024. (4) Based on Zodiac 8-K for the period ended January 31, 2024. Interim Free Cash Flow of $42MM for CY24Q1 – CY24Q2 based on FactSet mean consensus estimates April 12, 2024. (5) Assumes convertible debt principal is cash settled. Make-whole calculations per Zodiac indenture dated March 24, 2022.

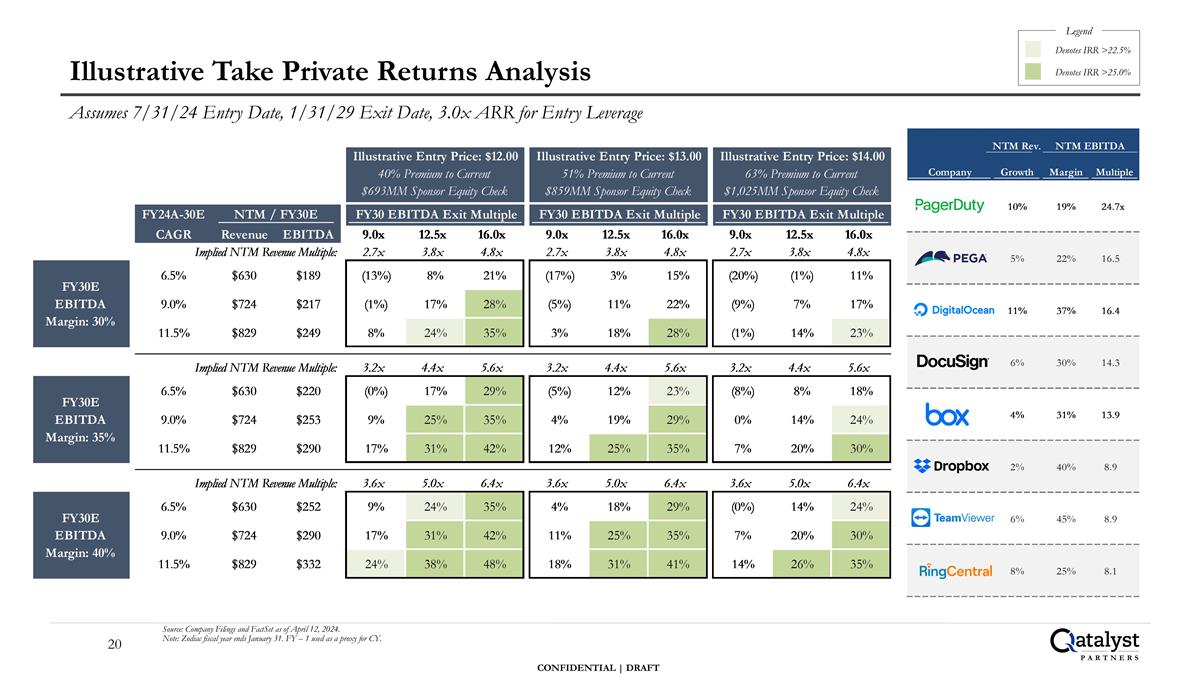

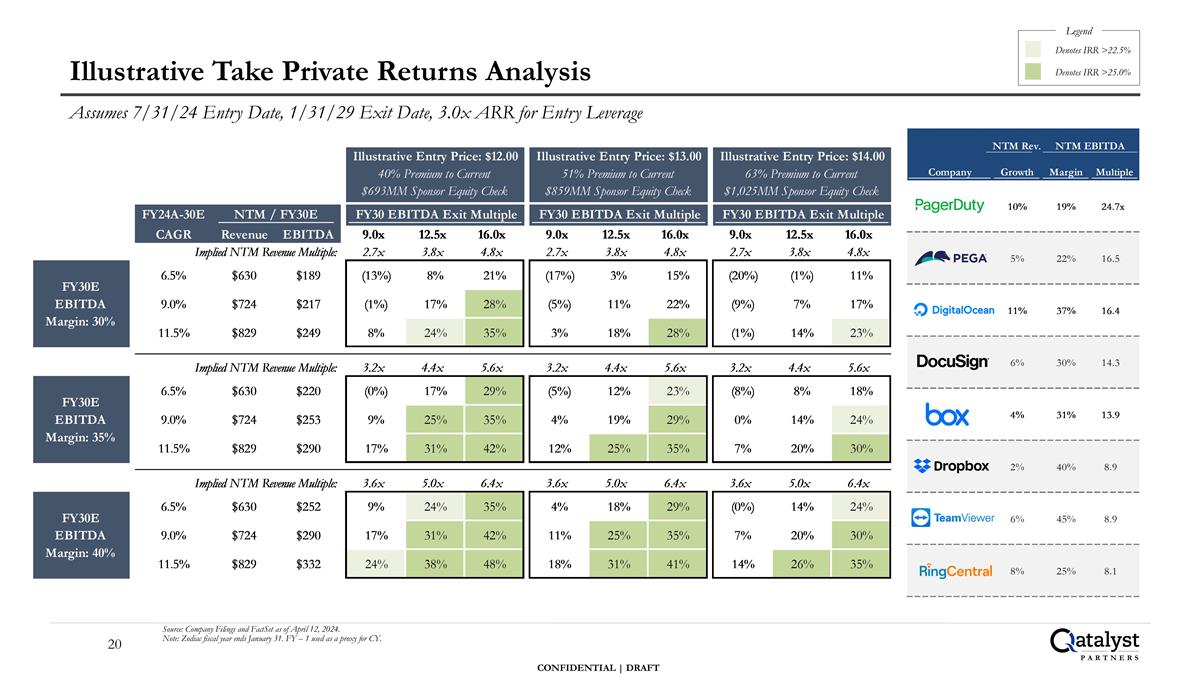

Illustrative Take Private Returns Analysis Assumes 7/31/24 Entry Date, 1/31/29 Exit Date, 3.0x ARR for Entry Leverage Source: Company Filings and FactSet as of April 12, 2024. Note: Zodiac fiscal year ends January 31. FY – 1 used as a proxy for CY. Legend Denotes IRR >25.0% Denotes IRR >22.5%

Overview of Selected Potential Partners Legend Strategic Partners Financial Sponsors Market Cap ($Bn) | Net Cash ($Bn)| CY24E Rev Mult Source: FactSet mean consensus estimates as of April 12, 2024. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Appendix [***] Detail [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Company Overview Sources: Pitchbook, company filings, company website, and FactSet consensus estimates as of April 12, 2023. [***] capitalization and balance sheet statistics per 10-K for the period ended [***]. Valuation & Trading Statistics Stock Price Performance Over Time Company Overview Selected Management Team Board Members Core Strategic Priorities [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] and Zodiac Pro Forma Income Statement Source: Company filings, Company transcripts, Wall Street research, and FactSet mean consensus estimates as of April 12, 2024. (1) Pro Forma [***] does not account for transaction adjustments (interest rate on new debt, foregone interest on cash, etc.) for illustrative purposes. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Illustrative [***] Transaction Summary [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Capitalization Summary [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Acquisition History Source: 451 Research. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Appendix Financial Sponsor Selected Transactions

[***] Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. (3) NDA from first process remained in effect throughout second process. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

[***] Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] [***] Selected Bidding History [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] Selected Bidding History Source: Capital IQ, FactSet, company filings, company press releases, merger proxies, and Wall Street research. (1) Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. (2) Initial interaction (e.g., email, phone call, or management meeting) that led to a transaction, not including interactions from previous processes. [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***]

Appendix Additional Information

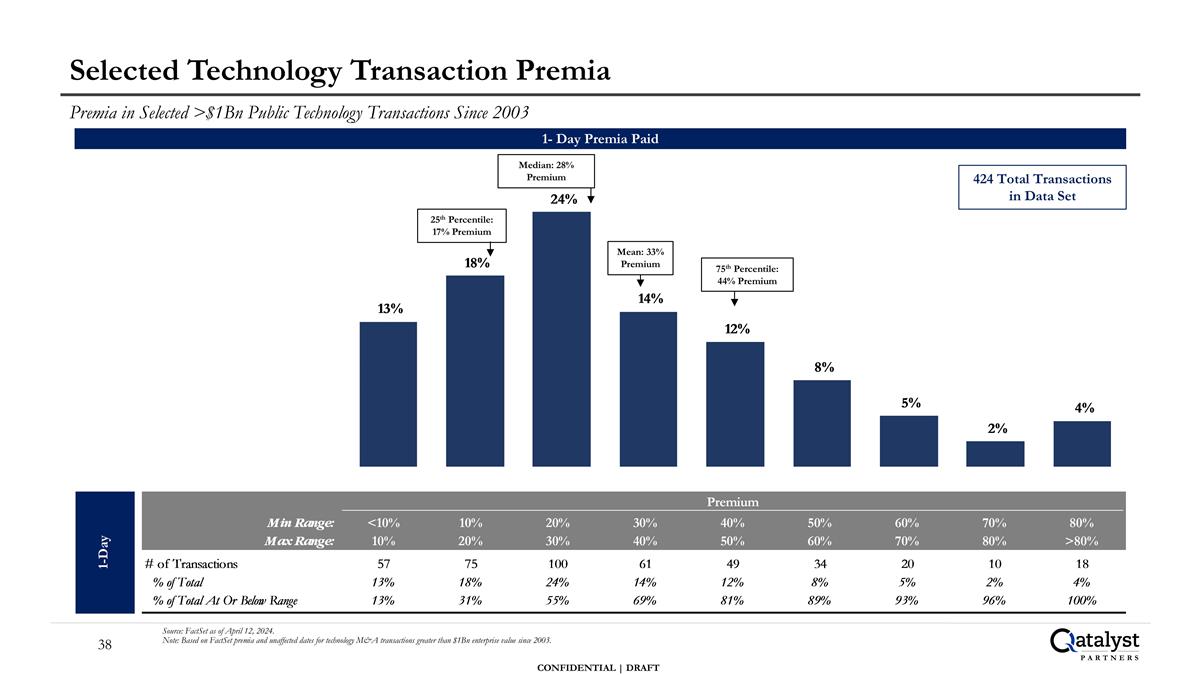

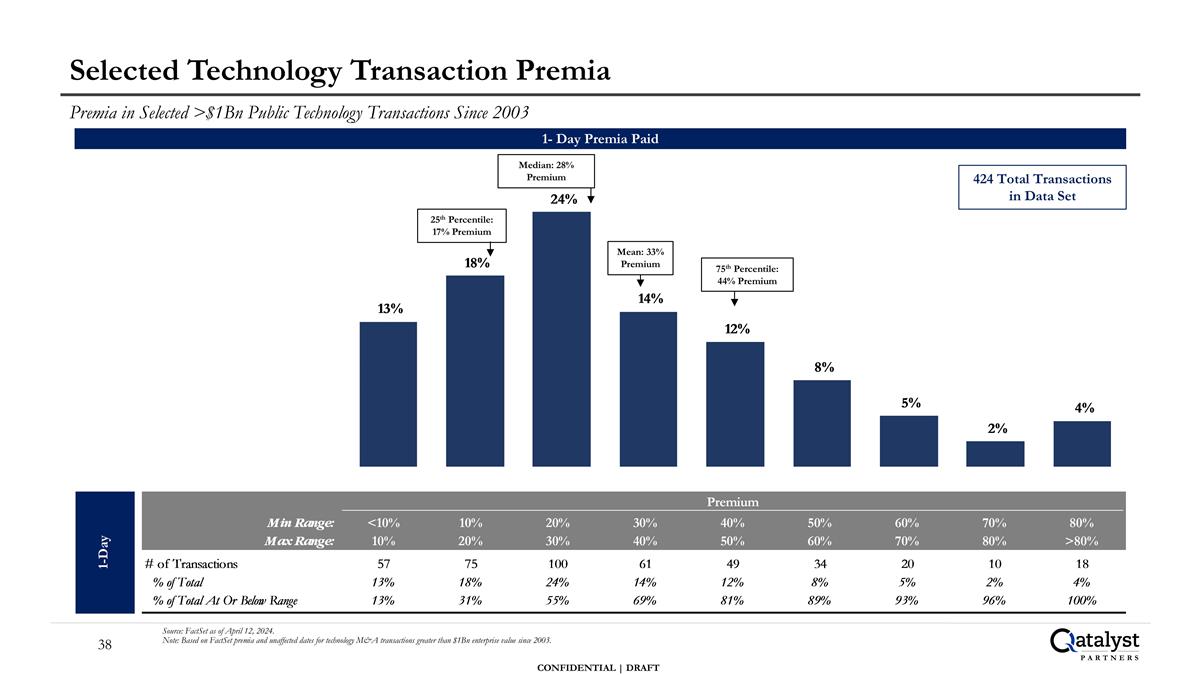

Selected Technology Transaction Premia Premia in Selected >$1Bn Public Technology Transactions Since 2003 Source: FactSet as of April 12, 2024. Note: Based on FactSet premia and unaffected dates for technology M&A transactions greater than $1Bn enterprise value since 2003. 1- Day Premia Paid 424 Total Transactions in Data Set 25th Percentile: 17% Premium 75th Percentile: 44% Premium Median: 28% Premium Mean: 33% Premium

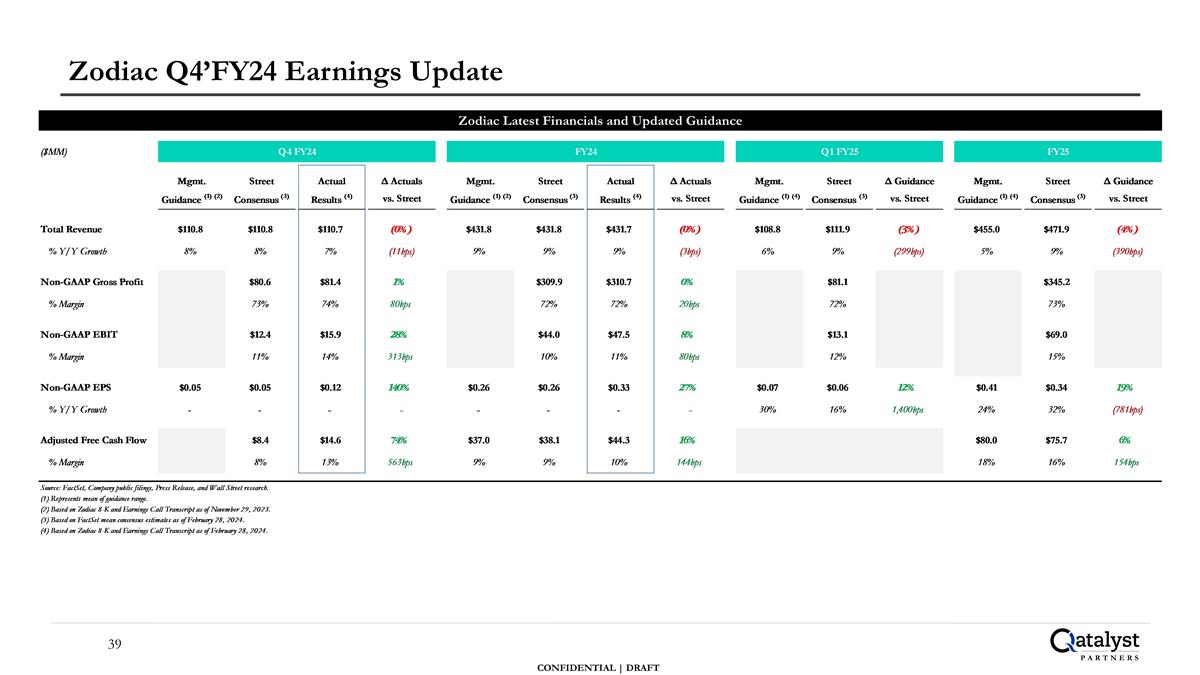

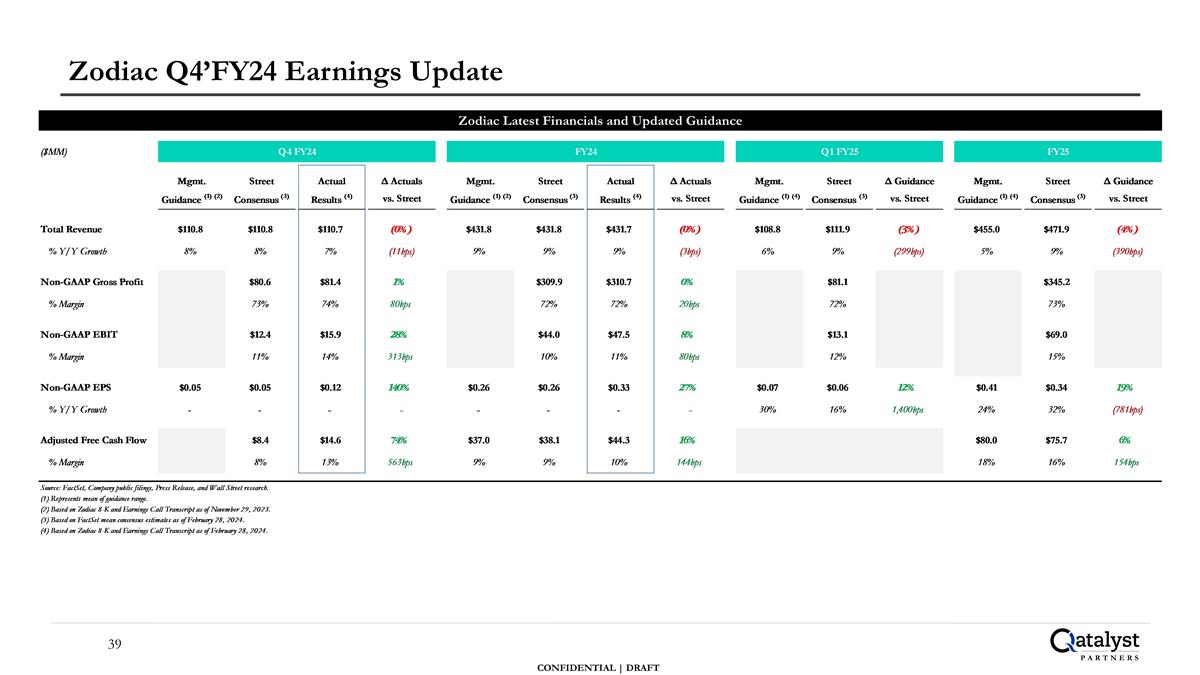

Zodiac Q4’FY24 Earnings Update Zodiac Latest Financials and Updated Guidance

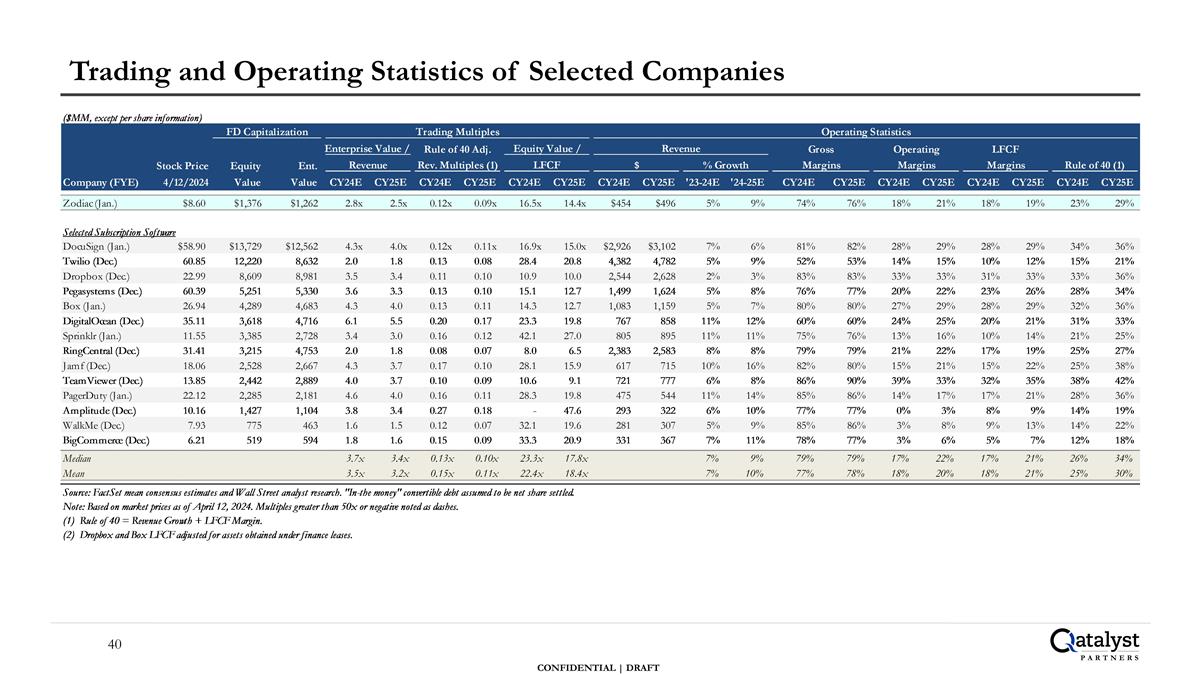

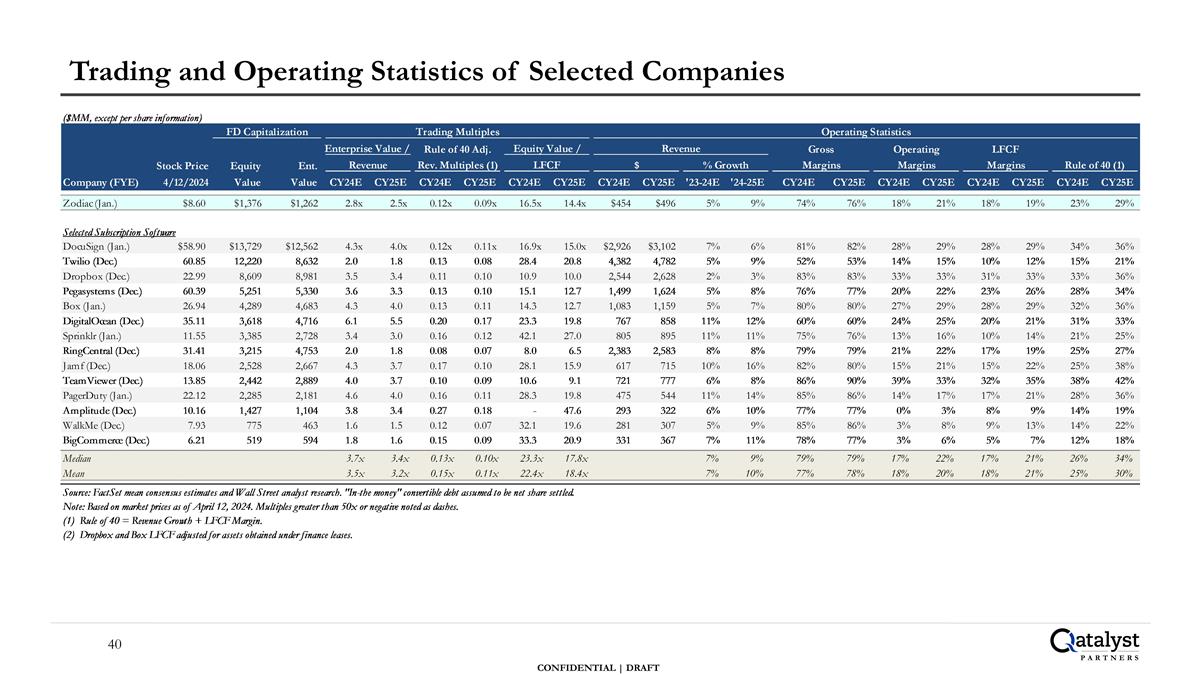

Trading and Operating Statistics of Selected Companies

Trading and Operating Statistics of Potential Strategic Partners Source: FactSet mean consensus estimates and Wall Street analyst research. "In-the money" convertible debt assumed to be net share settled. Note: Based on market prices as of April 12, 2024. Multiples greater than 50x or negative noted as dashes. (1) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***] [***] [***]

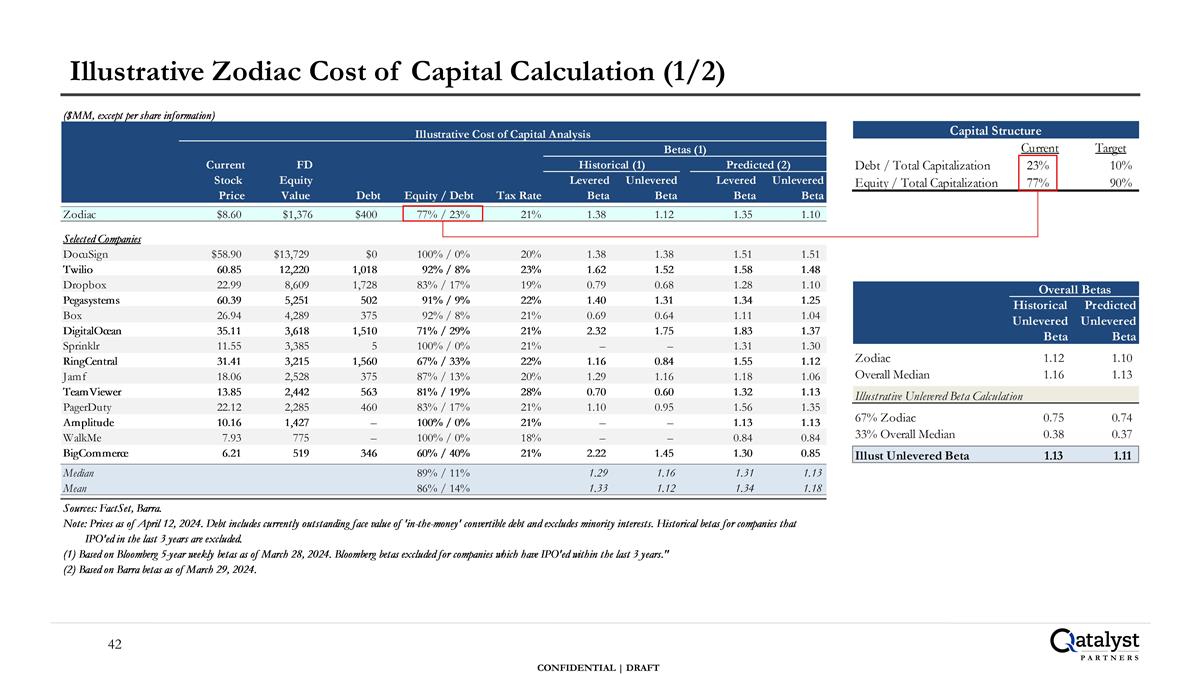

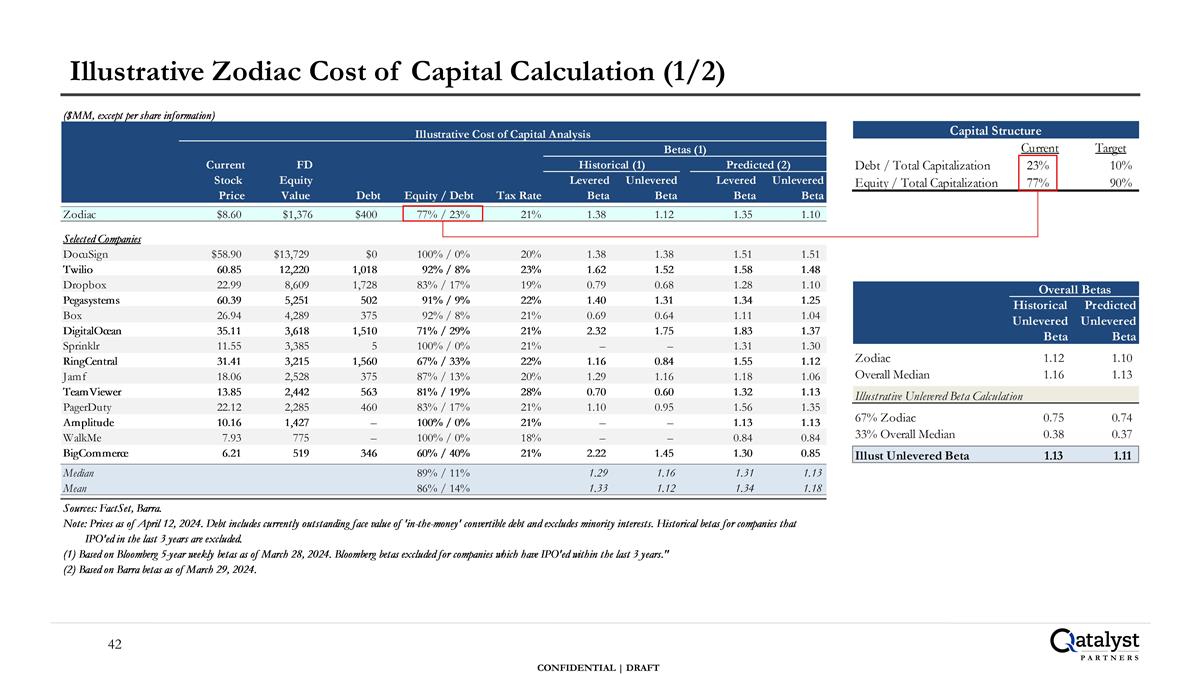

Illustrative Zodiac Cost of Capital Calculation (1/2)

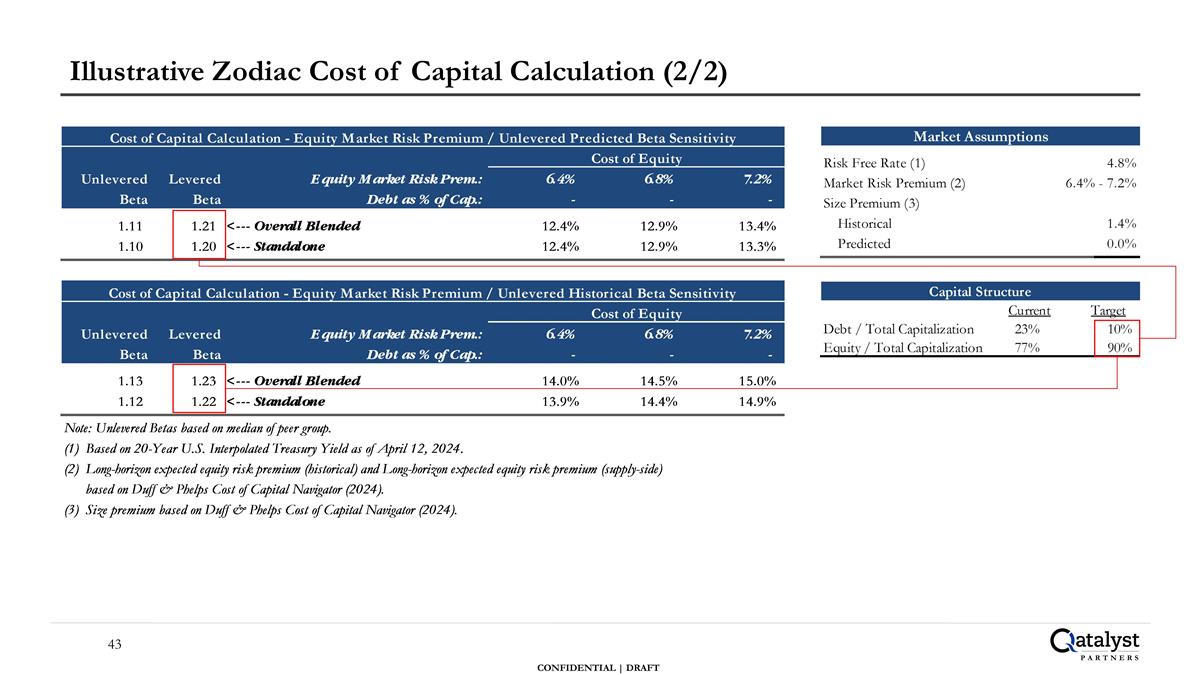

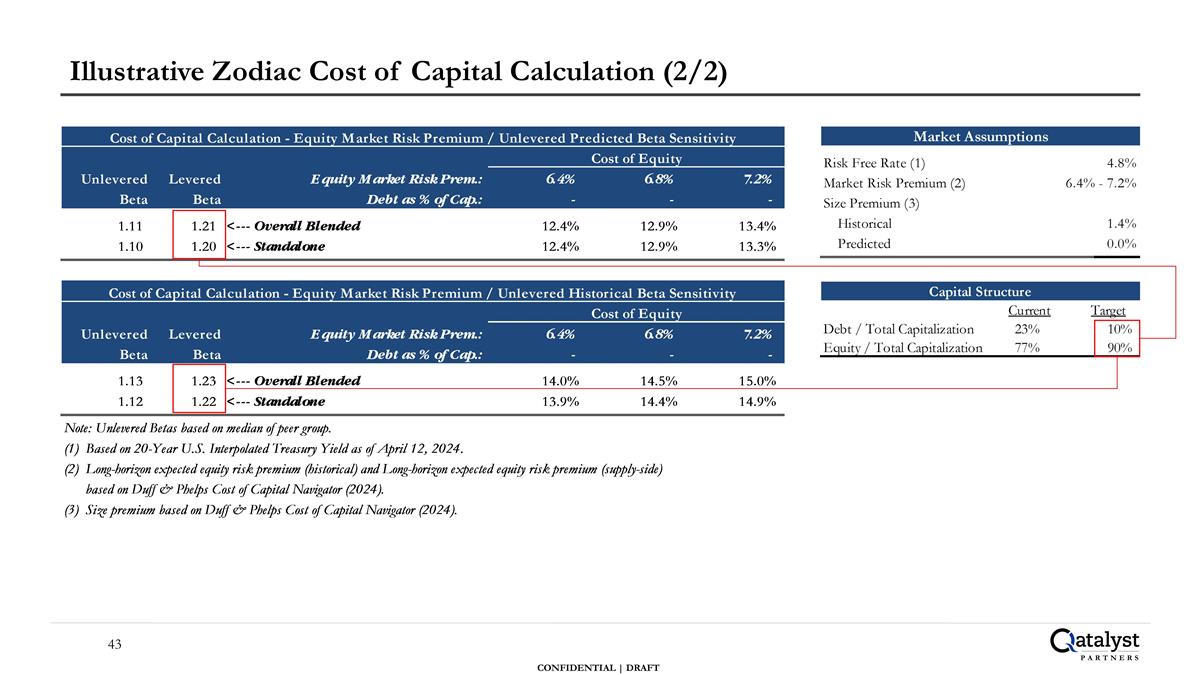

Illustrative Zodiac Cost of Capital Calculation (2/2)

Disclaimer