July 2024 Project Zodiac Reference Materials Exhibit 16(c)(vi) [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

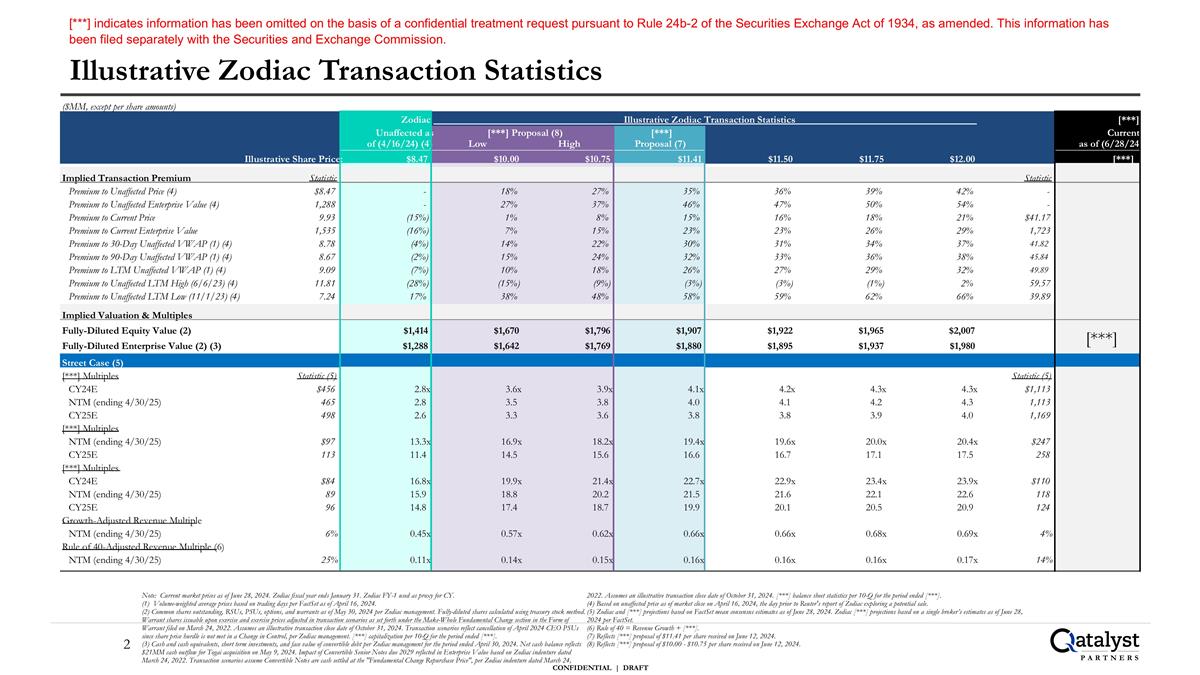

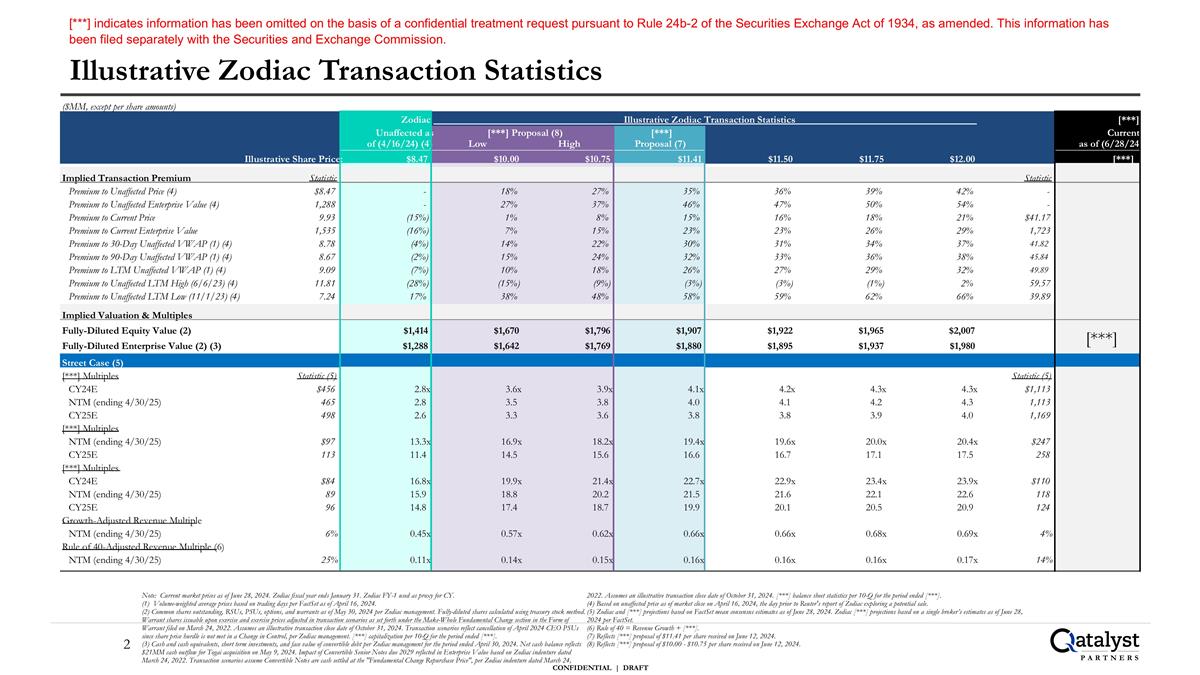

Illustrative Zodiac Transaction Statistics Note: Current market prices as of June 28, 2024. Zodiac fiscal year ends January 31. Zodiac FY-1 used as proxy for CY. (1) Volume-weighted average prices based on trading days per FactSet as of April 16, 2024. (2) Common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Warrant shares issuable upon exercise and exercise prices adjusted in transaction scenarios as set forth under the Make-Whole Fundamental Change section in the Form of Warrant filed on March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. Transaction scenarios reflect cancellation of April 2024 CEO PSUs since share price hurdle is not met in a Change in Control, per Zodiac management. [***] capitalization per 10-Q for the period ended [***]. (3) Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. Impact of Convertible Senior Notes due 2029 reflected in Enterprise Value based on Zodiac indenture dated March 24, 2022. Transaction scenarios assume Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. Assumes an illustrative transaction close date of October 31, 2024. [***] balance sheet statistics per 10-Q for the period ended [***]. (4) Based on unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. (5) Zodiac and [***] projections based on FactSet mean consensus estimates as of June 28, 2024. Zodiac [***] projections based on a single broker’s estimates as of June 28, 2024 per FactSet. (6) Rule of 40 = Revenue Growth + [***]. (7) Reflects [***] proposal of $11.41 per share received on June 12, 2024. (8) Reflects [***] proposal of $10.00 - $10.75 per share received on June 12, 2024. ($MM, except per share amounts) Zodiac Illustrative Zodiac Transaction Statistics [***] Unaffected as [***] Proposal (8) [***] Current of (4/16/24) (4) Low High Proposal (7) as of (6/28/24) Illustrative Share Price: $8.47 $10.00 $10.75 $11.41 $11.50 $11.75 $12.00 [***] Implied Transaction Premium Statistic Statistic Premium to Unaffected Price (4) $8.47 - 18% 27% 35% 36% 39% 42% - Premium to Unaffected Enterprise Value (4) 1,288 - 27% 37% 46% 47% 50% 54% - Premium to Current Price 9.93 (15%) 1% 8% 15% 16% 18% 21% $41.17 Premium to Current Enterprise Value 1,535 (16%) 7% 15% 23% 23% 26% 29% 1,723 Premium to 30-Day Unaffected VWAP (1) (4) 8.78 (4%) 14% 22% 30% 31% 34% 37% 41.82 Premium to 90-Day Unaffected VWAP (1) (4) 8.67 (2%) 15% 24% 32% 33% 36% 38% 45.84 Premium to LTM Unaffected VWAP (1) (4) 9.09 (7%) 10% 18% 26% 27% 29% 32% 49.89 Premium to Unaffected LTM High (6/6/23) (4) 11.81 (28%) (15%) (9%) (3%) (3%) (1%) 2% 59.57 Premium to Unaffected LTM Low (11/1/23) (4) 7.24 17% 38% 48% 58% 59% 62% 66% 39.89 Implied Valuation & Multiples Fully-Diluted Equity Value (2) $1,414 $1,670 $1,796 $1,907 $1,922 $1,965 $2,007 Fully-Diluted Enterprise Value (2) (3) $1,288 $1,642 $1,769 $1,880 $1,895 $1,937 $1,980 Street Case (5) [***] Multiples Statistic (5) Statistic (5) CY24E $456 2.8x 3.6x 3.9x 4.1x 4.2x 4.3x 4.3x $1,113 NTM (ending 4/30/25) 465 2.8 3.5 3.8 4.0 4.1 4.2 4.3 1,113 CY25E 498 2.6 3.3 3.6 3.8 3.8 3.9 4.0 1,169 [***] Multiples NTM (ending 4/30/25) $97 13.3x 16.9x 18.2x 19.4x 19.6x 20.0x 20.4x $247 CY25E 113 11.4 14.5 15.6 16.6 16.7 17.1 17.5 258 [***] Multiples CY24E $84 16.8x 19.9x 21.4x 22.7x 22.9x 23.4x 23.9x $110 NTM (ending 4/30/25) 89 15.9 18.8 20.2 21.5 21.6 22.1 22.6 118 CY25E 96 14.8 17.4 18.7 19.9 20.1 20.5 20.9 124 Growth-Adjusted Revenue Multiple NTM (ending 4/30/25) 6% 0.45x 0.57x 0.62x 0.66x 0.66x 0.68x 0.69x 4% Rule of 40-Adjusted Revenue Multiple (6) NTM (ending 4/30/25) 25% 0.11x 0.14x 0.15x 0.16x 0.16x 0.16x 0.17x 14% [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Company Overview Sources: Pitchbook, company filings, company website, and FactSet consensus estimates as of June 28, 2024. [***] capitalization and balance sheet statistics per 10-Q for the period ended [***]. Valuation & Trading Statistics(1) Company Overview Core Strategic Priorities [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

[***] and Zodiac Pro Forma Income Statement Source: Company filings, Company transcripts, Wall Street research, and FactSet mean consensus estimates as of June 28, 2024. Note: Zodiac fiscal year ends January 31. Zodiac FY-1 used as proxy for CY. (1) Pro Forma [***] does not account for transaction adjustments (interest rate on new debt, foregone interest on cash, etc.) for illustrative purposes. [***] [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

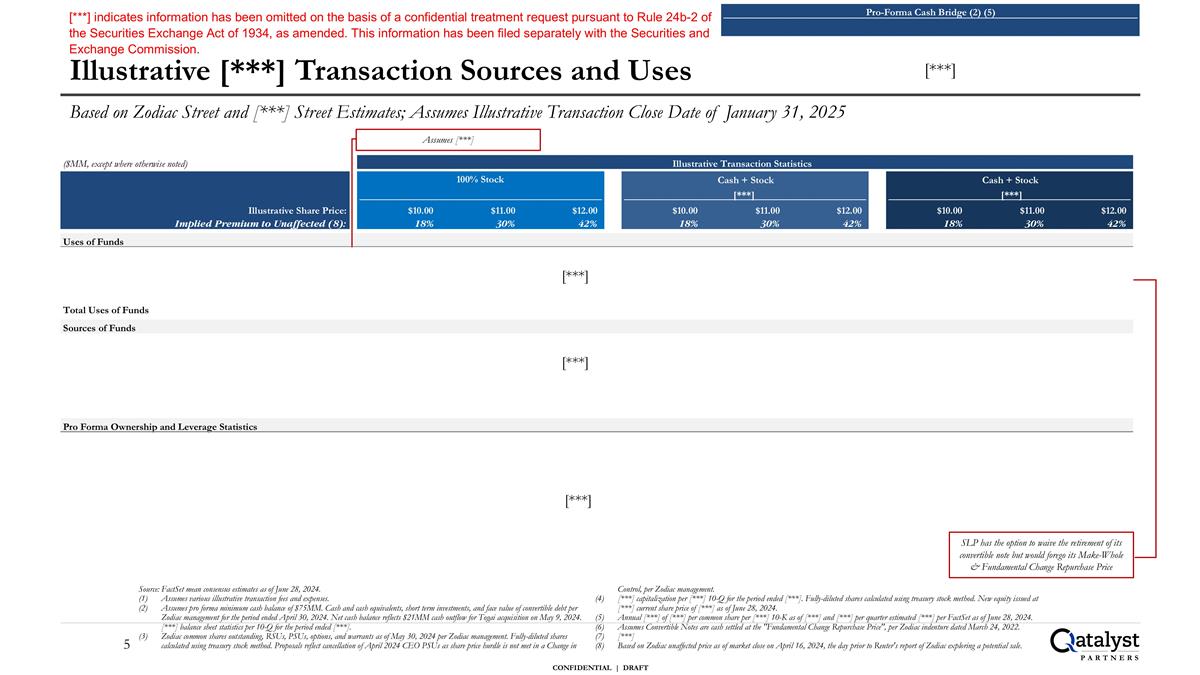

Illustrative [***] Transaction Sources and Uses Source: FactSet mean consensus estimates as of June 28, 2024. Assumes various illustrative transaction fees and expenses. Assumes pro forma minimum cash balance of $75MM. Cash and cash equivalents, short term investments, and face value of convertible debt per Zodiac management for the period ended April 30, 2024. Net cash balance reflects $21MM cash outflow for Togai acquisition on May 9, 2024. [***] balance sheet statistics per 10-Q for the period ended [***]. Zodiac common shares outstanding, RSUs, PSUs, options, and warrants as of May 30, 2024 per Zodiac management. Fully-diluted shares calculated using treasury stock method. Proposals reflect cancellation of April 2024 CEO PSUs as share price hurdle is not met in a Change in Control, per Zodiac management. [***] capitalization per [***] 10-Q for the period ended [***]. Fully-diluted shares calculated using treasury stock method. New equity issued at [***] current share price of [***] as of June 28, 2024. Annual [***] of [***] per common share per [***] 10-K as of [***] and [***] per quarter estimated [***] per FactSet as of June 28, 2024. Assumes Convertible Notes are cash settled at the "Fundamental Change Repurchase Price", per Zodiac indenture dated March 24, 2022. [***] Based on Zodiac unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Based on Zodiac Street and [***] Street Estimates; Assumes Illustrative Transaction Close Date of January 31, 2025 SLP has the option to waive the retirement of its convertible note but would forego its Make-Whole & Fundamental Change Repurchase Price Assumes [***] Pro-Forma Cash Bridge (2) (5) [***] ($MM, except where otherwise noted) Illustrative Transaction Statistics Cash + Stock Cash + Stock [***] [***] Illustrative Share Price: $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 Implied Premium to Unaffected (8): 18% 30% 42% 18% 30% 42% 18% 30% 42% Uses of Funds Total Uses of Funds Sources of Funds Pro Forma Ownership and Leverage Statistics 100% Stock [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. [***] [***] [***]

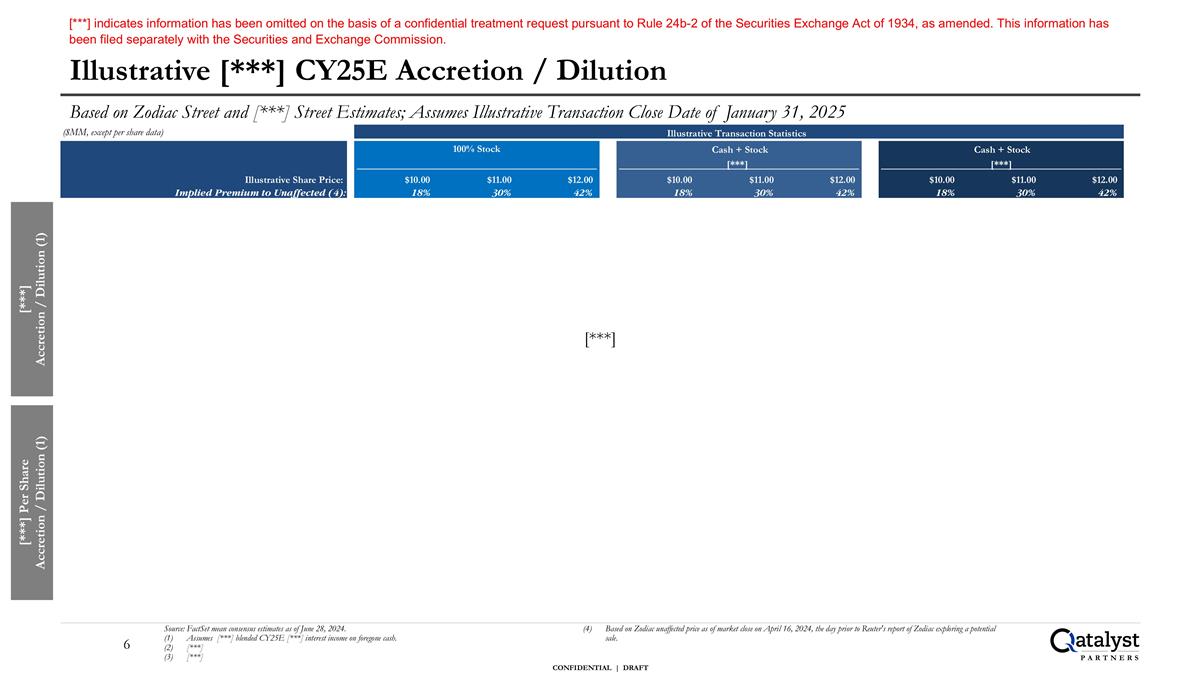

Illustrative [***] CY25E Accretion / Dilution Source: FactSet mean consensus estimates as of June 28, 2024. Assumes [***] blended CY25E [***] interest income on foregone cash. [***] [***] Based on Zodiac unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Based on Zodiac Street and [***] Street Estimates; Assumes Illustrative Transaction Close Date of January 31, 2025 [***] Accretion / Dilution (1) [***] Per Share Accretion / Dilution (1) ($MM, except per share data) Illustrative Transaction Statistics Cash + Stock Cash + Stock [***] [***] Illustrative Share Price: $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 Implied Premium to Unaffected (4): 18% 30% 42% 18% 30% 42% 18% 30% 42% 100% Stock [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Appendix

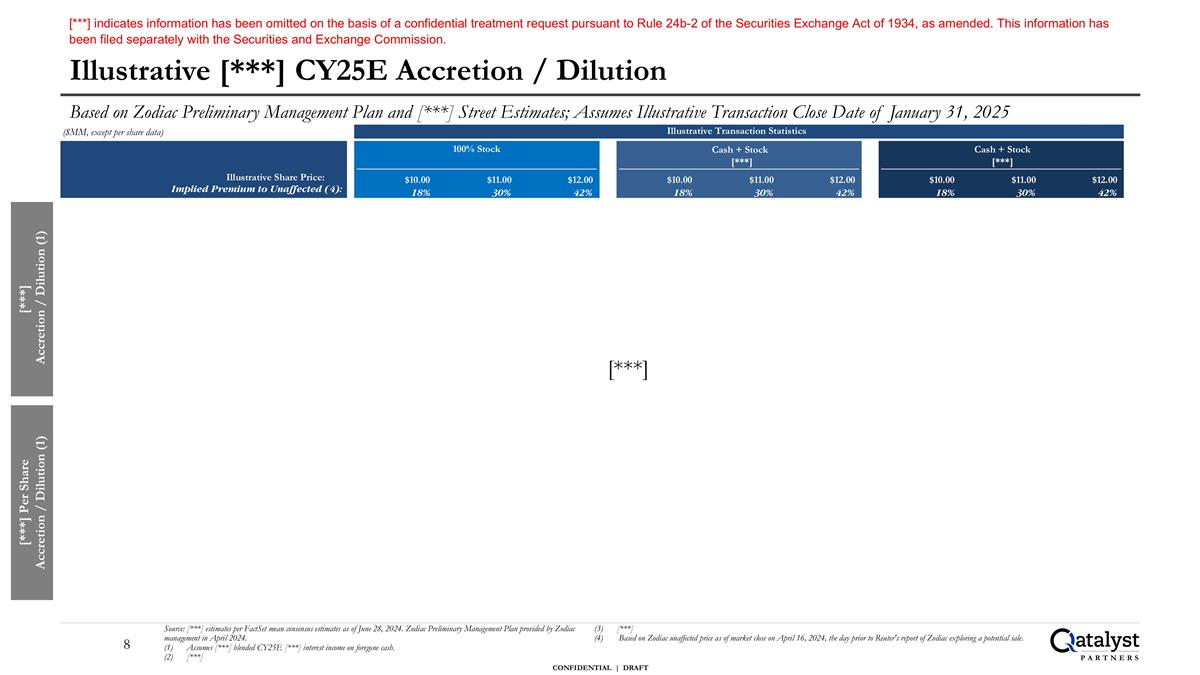

Illustrative [***] CY25E Accretion / Dilution Source: [***] estimates per FactSet mean consensus estimates as of June 28, 2024. Zodiac Preliminary Management Plan provided by Zodiac management in April 2024. Assumes [***] blended CY25E [***] interest income on foregone cash. [***] [***] Based on Zodiac unaffected price as of market close on April 16, 2024, the day prior to Reuter's report of Zodiac exploring a potential sale. Based on Zodiac Preliminary Management Plan and [***] Street Estimates; Assumes Illustrative Transaction Close Date of January 31, 2025 [***] Accretion / Dilution (1) [***] Per Share Accretion / Dilution (1) ($MM, except per share data) Illustrative Transaction Statistics Cash + Stock Cash + Stock [***] [***] Illustrative Share Price: $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 $10.00 $11.00 $12.00 Implied Premium to Unaffected (4): 18% 30% 42% 18% 30% 42% 18% 30% 42% 100% Stock [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

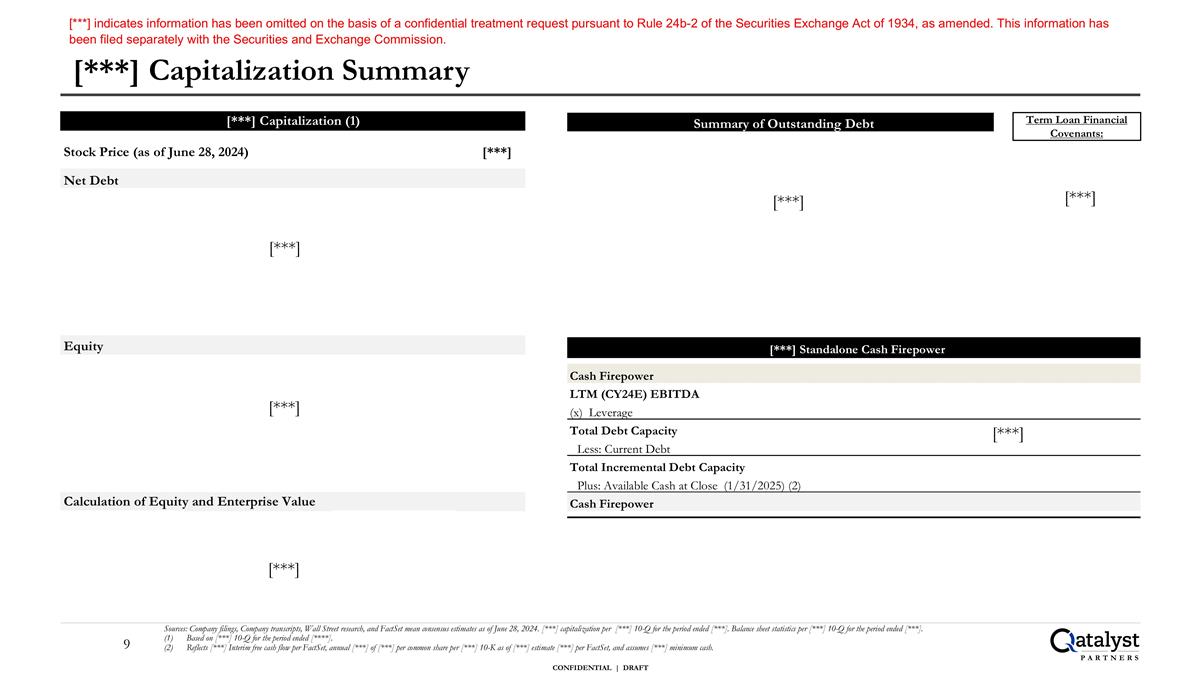

[***] Capitalization Summary Sources: Company filings, Company transcripts, Wall Street research, and FactSet mean consensus estimates as of June 28, 2024. [***] capitalization per [***] 10-Q for the period ended [***]. Balance sheet statistics per [***] 10-Q for the period ended [***]. Based on [***] 10-Q for the period ended [****]. Reflects [***] Interim free cash flow per FactSet, annual [***] of [***] per common share per [***] 10-K as of [***] estimate [***] per FactSet, and assumes [***] minimum cash. Term Loan Financial Covenants: [***] Capitalization (1) Stock Price (as of June 28, 2024) [***] Net Debt Equity Calculation of Equity and Enterprise Value [***] [***] [***] Summary of Outstanding Debt [***] [***] [***] Standalone Cash Firepower Cash Firepower LTM (CY24E) EBITDA (x) Leverage Total Debt Capacity Less: Current Debt Total Incremental Debt Capacity Plus: Available Cash at Close (1/31/2025) (2) Cash Firepower [***] [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission.

Disclaimer