As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ (defined below) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Funds’ website (www.globalxetfs.com/explore), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “SEC” or “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Forms N-PORT are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-493-8631; and (ii) on the Commission’s website at http://www.sec.gov

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

Percentages are based on Net Assets of $2,536,449,225.

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Internet of Things ETF | |

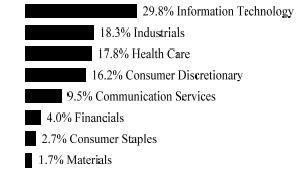

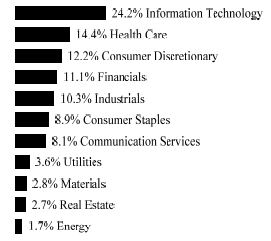

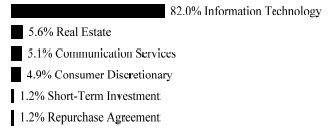

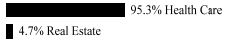

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | | | | | |

| COMMON STOCK — 99.8% | | | | | | |

| AUSTRIA — 4.2% | | | | | | |

| Information Technology — 4.2% | | | | | | |

AMS * | | | 713,611 | | | $ | 14,049,427 | |

S&T (A) | | | 171,113 | | | | 4,293,875 | |

| | | | | | | | | |

TOTAL AUSTRIA | | | | | | | 18,343,302 | |

| | | | | | | | | |

| CANADA — 0.4% | | | | | | | | |

| Information Technology — 0.4% | | | | | | | | |

Sierra Wireless * | | | 104,481 | | | | 1,625,724 | |

| | | | | | | | | |

| CHINA — 2.6% | | | | | | | | |

| Information Technology — 2.6% | | | | | | | | |

NXP Semiconductors | | | 54,390 | | | | 11,499,134 | |

| | | | | | | | | |

| FRANCE — 1.5% | | | | | | | | |

| Industrials — 1.5% | | | | | | | | |

Legrand (A) | | | 61,454 | | | | 6,440,947 | |

| | | | | | | | | |

| ITALY — 0.9% | | | | | | | | |

| Information Technology — 0.9% | | | | | | | | |

Datalogic | | | 149,893 | | | | 3,907,458 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Internet of Things ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| JAPAN — 1.4% | | | | | | | | |

| Information Technology — 1.4% | | | | | | | | |

Nippon Ceramic | | | 70,382 | | | $ | 1,786,189 | |

Renesas Electronics * | | | 394,336 | | | | 4,227,526 | |

| | | | | | | | | |

TOTAL JAPAN | | | | | | | 6,013,715 | |

| | | | | | | | | |

| NORWAY — 3.0% | | | | | | | | |

| Information Technology — 3.0% | | | | | | | | |

Nordic Semiconductor * | | | 467,361 | | | | 13,021,248 | |

| | | | | | | | | |

| SWEDEN — 0.5% | | | | | | | | |

| Information Technology — 0.5% | | | | | | | | |

Fingerprint Cards, Cl B * | | | 513,707 | | | | 2,129,694 | |

| | | | | | | | | |

| SWITZERLAND — 9.8% | | | | | | | | |

| Industrials — 2.3% | | | | | | | | |

ABB | | | 291,825 | | | | 9,947,437 | |

| | | | | | | | | |

| Information Technology — 7.5% | | | | | | | | |

Landis+Gyr Group | | | 75,950 | | | | 5,535,604 | |

STMicroelectronics | | | 718,034 | | | | 26,817,378 | |

| | | | | | | | 32,352,982 | |

| | | | | | | | | |

TOTAL SWITZERLAND | | | | | | | 42,300,419 | |

| | | | | | | | | |

| TAIWAN — 9.5% | | | | | | | | |

| Information Technology — 9.5% | | | | | | | | |

Advantech | | | 2,006,521 | | | | 23,616,341 | |

eMemory Technology | | | 200,182 | | | | 6,768,830 | |

MediaTek | | | 330,480 | | | | 11,448,650 | |

| | | | | | | | | |

TOTAL TAIWAN | | | | | | | 41,833,821 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Internet of Things ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| UNITED KINGDOM — 0.2% | | | | | | | | |

| Information Technology — 0.2% | | | | | | | | |

Spirent Communications | | | 306,165 | | | $ | 1,083,509 | |

| | | | | | | | | |

| UNITED STATES — 65.8% | | | | | | | | |

| Consumer Discretionary — 7.8% | | | | | | | | |

Garmin | | | 196,001 | | | | 27,879,182 | |

Vivint Smart Home * | | | 462,393 | | | | 6,431,887 | |

| | | | | | | | 34,311,069 | |

| | | | | | | | | |

| | | | | | | | | |

| Health Care — 4.0% | | | | | | | | |

DexCom * | | | 47,018 | | | | 17,367,979 | |

| | | | | | | | | |

| | | | | | | | | |

| Industrials — 22.1% | | | | | | | | |

ADT | | | 1,978,281 | | | | 20,455,426 | |

Emerson Electric | | | 103,616 | | | | 9,915,015 | |

Honeywell International | | | 43,939 | | | | 10,145,954 | |

Johnson Controls International | | | 182,340 | | | | 12,132,904 | |

Resideo Technologies * | | | 81,358 | | | | 2,432,604 | |

Rockwell Automation | | | 30,230 | | | | 7,972,256 | |

Schneider Electric | | | 59,090 | | | | 9,402,056 | |

Sensata Technologies Holding * | | | 409,005 | | | | 24,307,167 | |

| | | | | | | | 96,763,382 | |

| | | | | | | | | |

| Information Technology — 31.9% | | | | | | | | |

Alarm.com Holdings * | | | 126,838 | | | | 10,385,496 | |

Ambarella * | | | 89,335 | | | | 8,967,447 | |

Analog Devices | | | 52,829 | | | | 8,695,653 | |

Badger Meter | | | 75,686 | | | | 7,233,311 | |

Belden | | | 115,639 | | | | 5,851,333 | |

Cisco Systems | | | 140,909 | | | | 7,454,087 | |

Digi International * | | | 87,924 | | | | 1,667,039 | |

Impinj * | | | 58,836 | | | | 3,062,414 | |

InterDigital | | | 79,840 | | | | 6,449,475 | |

| International Business Machines | | | 52,575 | | | | 7,557,130 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Internet of Things ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

Itron * | | | 104,582 | | | $ | 9,971,894 | |

NETGEAR * | | | 76,599 | | | | 2,978,169 | |

PTC * | | | 26,582 | | | | 3,565,709 | |

QUALCOMM | | | 71,461 | | | | 9,614,363 | |

Rambus * | | | 294,341 | | | | 5,757,310 | |

Silicon Laboratories * | | | 113,661 | | | | 15,521,546 | |

Skyworks Solutions | | | 149,871 | | | | 25,478,070 | |

| | | | | | | | 140,210,446 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 288,652,876 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $331,889,217) | | | | | | | 436,851,847 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(B)(C) — 1.0% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.010% | | | | | | | | |

(Cost $4,357,766) | | | 4,357,766 | | | | 4,357,766 | |

| | | | | | | | | |

REPURCHASE AGREEMENT(B) — 1.0% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 0.000%, dated 05/28/2021, to be repurchased on 06/01/21, repurchase price $4,180,906 (collateralized by U.S. Treasury Obligations, ranging in par value $82,948 - $603,053, 2.000%, 10/31/2022, with a total market value of $4,262,472) | | | | | | | | |

(Cost $4,180,906) | | $ | 4,180,906 | | | | 4,180,906 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 101.8% | | | | | | | | |

(Cost $340,427,889) | | | | | | $ | 445,390,519 | |

Percentages are based on Net Assets of $437,492,500.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Internet of Things ETF | |

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at May 31, 2021. The total value of securities on loan at May 31, 2021 was $8,025,312. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2021 was $8,538,672. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2021. |

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | | | | | | | | | | | | |

| Common Stock | | $ | 436,851,847 | | | $ | — | | | $ | — | | | $ | 436,851,847 | |

| Short-Term Investment | | | 4,357,766 | | | | — | | | | — | | | | 4,357,766 | |

| Repurchase Agreement | | | — | | | | 4,180,906 | | | | — | | | | 4,180,906 | |

| Total Investments in Securities | | $ | 441,209,613 | | | $ | 4,180,906 | | | $ | — | | | $ | 445,390,519 | |

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | | |

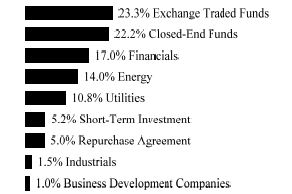

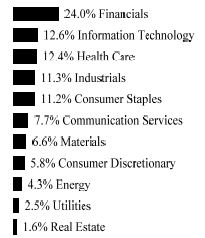

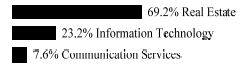

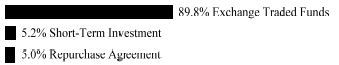

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | | | | | |

| COMMON STOCK — 99.9% | | | | | | |

| AUSTRALIA — 7.4% | | | | | | |

| Financials — 1.4% | | | | | | |

HUB24 | | | 318,212 | | | $ | 6,582,089 | |

Zip * (A) | | | 1,934,415 | | | | 10,722,723 | |

| | | | | | | | 17,304,812 | |

| | | | | | | | | |

| Information Technology — 6.0% | | | | | | | | |

Afterpay * | | | 910,446 | | | | 65,930,301 | |

IRESS | | | 948,997 | | | | 7,791,857 | |

| | | | | | | | 73,722,158 | |

| | | | | | | | | |

TOTAL AUSTRALIA | | | | | | | 91,026,970 | |

| | | | | | | | | |

| BRAZIL — 8.5% | | | | | | | | |

| Information Technology — 8.5% | | | | | | | | |

Pagseguro Digital, Cl A * | | | 896,666 | | | | 44,035,267 | |

StoneCo, Cl A * | | | 894,603 | | | | 59,016,960 | |

| | | | | | | | | |

TOTAL BRAZIL | | | | | | | 103,052,227 | |

| | | | | | | | | |

| CANADA — 1.1% | | | | | | | | |

| Information Technology — 1.1% | | | | | | | | |

Nuvei * | | | 174,465 | | | | 12,992,443 | |

| | | | | | | | | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X FinTech ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| CHINA — 4.6% | | | | | | | | |

| Financials — 3.7% | | | | | | | | |

Lufax Holding ADR * (A) | | | 3,726,363 | | | $ | 45,424,364 | |

| | | | | | | | | |

| Information Technology — 0.9% | | | | | | | | |

Yeahka * (A) | | | 1,697,414 | | | | 10,847,354 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 56,271,718 | |

| | | | | | | | | |

| DENMARK — 2.2% | | | | | | | | |

| Information Technology — 2.2% | | | | | | | | |

SimCorp | | | 201,678 | | | | 27,320,525 | |

| | | | | | | | | |

| GERMANY — 1.5% | | | | | | | | |

| Financials — 1.5% | | | | | | | | |

Hypoport * | | | 32,316 | | | | 18,084,552 | |

| | | | | | | | | |

| ISRAEL — 0.6% | | | | | | | | |

| Information Technology — 0.6% | | | | | | | | |

Sapiens International | | | 248,904 | | | | 7,146,034 | |

| | | | | | | | | |

| ITALY — 3.6% | | | | | | | | |

| Information Technology — 3.6% | | | | | | | | |

Nexi * | | | 2,139,820 | | | | 43,439,191 | |

| | | | | | | | | |

| JAPAN — 0.3% | | | | | | | | |

| Industrials — 0.3% | | | | | | | | |

Makuake * (A) | | | 56,819 | | | | 3,167,088 | |

| | | | | | | | | |

| NETHERLANDS — 6.4% | | | | | | | | |

| Information Technology — 6.4% | | | | | | | | |

Adyen * | | | 33,500 | | | | 77,624,738 | |

| | | | | | | | | |

| NEW ZEALAND — 4.9% | | | | | | | | |

| Information Technology — 4.9% | | | | | | | | |

Xero * | | | 595,831 | | | | 59,918,430 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X FinTech ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| SWITZERLAND — 3.5% | | | | | | | | |

| Financials — 0.4% | | | | | | | | |

Leonteq | | | 93,876 | | | $ | 4,813,485 | |

| | | | | | | | | |

| Information Technology — 3.1% | | | | | | | | |

Temenos | | | 241,963 | | | | 37,475,298 | |

| | | | | | | | | |

TOTAL SWITZERLAND | | | | | | | 42,288,783 | |

| | | | | | | | | |

| UNITED STATES — 55.3% | | | | | | | | |

| Financials — 3.6% | | | | | | | | |

Blucora * | | | 235,840 | | | | 4,089,466 | |

LendingClub * | | | 481,371 | | | | 7,355,349 | |

LendingTree * | | | 64,947 | | | | 13,330,372 | |

Virtu Financial, Cl A | | | 598,502 | | | | 18,224,386 | |

| | | | | | | | 42,999,573 | |

| | | | | | | | | |

| Health Care — 2.4% | | | | | | | | |

HealthEquity * | | | 355,109 | | | | 29,516,660 | |

| | | | | | | | | |

| Information Technology — 49.3% | | | | | | | | |

Bill.com Holdings * | | | 386,026 | | | | 57,486,992 | |

Black Knight * | | | 499,680 | | | | 36,671,515 | |

Bottomline Technologies * | | | 218,045 | | | | 8,150,522 | |

Envestnet * | | | 266,129 | | | | 19,153,304 | |

| Fidelity National Information Services | | | 348,915 | | | | 51,981,357 | |

Fiserv * | | | 478,669 | | | | 55,142,669 | |

GreenSky, Cl A * | | | 466,990 | | | | 2,736,561 | |

Guidewire Software * | | | 334,655 | | | | 32,709,180 | |

Intuit | | | 164,831 | | | | 72,375,644 | |

Mitek Systems * | | | 247,164 | | | | 4,191,901 | |

nCino * | | | 351,433 | | | | 21,479,585 | |

PayPal Holdings * | | | 284,821 | | | | 74,059,156 | |

Shift4 Payments, Cl A * | | | 145,914 | | | | 13,612,317 | |

Square, Cl A * | | | 465,374 | | | | 103,555,021 | |

SS&C Technologies Holdings | | | 615,394 | | | | 45,459,155 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X FinTech ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

Vertex, Cl A * | | | 96,812 | | | $ | 1,859,759 | |

| | | | | | | | 600,624,638 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 673,140,871 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $914,726,769) | | | | | | | 1,215,473,570 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(B)(C) — 1.9% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.010% | | | | | | | | |

(Cost $22,668,575) | | | 22,668,575 | | | | 22,668,575 | |

| | | | | | | | | |

REPURCHASE AGREEMENT(B) — 1.8% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 0.000%, dated 05/28/2021, to be repurchased on 06/01/2021, repurchase price $21,748,566 (collateralized by U.S. Treasury Obligations, ranging in par value $431,485 - $3,137,011, 2.000%, 10/31/2022, with a total market value of $22,172,879) | | | | | | | | |

(Cost $21,748,566) | | $ | 21,748,566 | | | | 21,748,566 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 103.6% | | | | | | | | |

(Cost $959,143,910) | | | | | | $ | 1,259,890,711 | |

Percentages are based on Net Assets of $1,216,182,854.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X FinTech ETF | |

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at May 31, 2021. The total value of securities on loan at May 31, 2021 was $41,722,700. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2021 was $44,417,141. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2021. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | | | | | | | | | | | | |

| Common Stock | | $ | 1,215,473,570 | | | $ | — | | | $ | — | | | $ | 1,215,473,570 | |

| Short-Term Investment | | | 22,668,575 | | | | — | | | | — | | | | 22,668,575 | |

| Repurchase Agreement | | | — | | | | 21,748,566 | | | | — | | | | 21,748,566 | |

| Total Investments in Securities | | $ | 1,238,142,145 | | | $ | 21,748,566 | | | $ | — | | | $ | 1,259,890,711 | |

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Video Games & Esports ETF | |

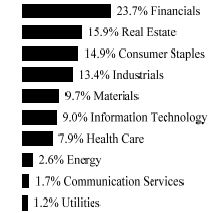

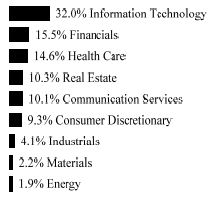

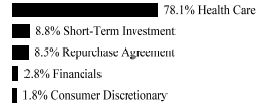

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | | | | | |

| COMMON STOCK — 99.9% | | | | | | |

| CHINA — 13.2% | | | | | | |

| Communication Services — 13.2% | | | | | | |

Bilibili ADR * | | | 247,728 | | | $ | 26,551,487 | |

DouYu International Holdings ADR * | | | 1,449,546 | | | | 11,451,413 | |

HUYA ADR * (A) | | | 266,250 | | | | 4,073,625 | |

NetEase ADR | | | 385,577 | | | | 45,471,096 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 87,547,621 | |

| | | | | | | | | |

| FRANCE — 3.3% | | | | | | | | |

| Communication Services — 3.3% | | | | | | | | |

Ubisoft Entertainment * | | | 300,756 | | | | 21,945,238 | |

| | | | | | | | | |

| IRELAND — 1.7% | | | | | | | | |

| Information Technology — 1.7% | | | | | | | | |

Keywords Studios * | | | 309,086 | | | | 11,446,818 | |

| | | | | | | | | |

| JAPAN — 23.4% | | | | | | | | |

| Communication Services — 23.4% | | | | | | | | |

Akatsuki | | | 46,756 | | | | 1,515,664 | |

Capcom | | | 905,524 | | | | 29,065,694 | |

DeNA | | | 399,742 | | | | 8,098,433 | |

Gumi (A) | | | 245,224 | | | | 2,539,760 | |

GungHo Online Entertainment * | | | 348,248 | | | | 6,577,050 | |

KLab * | | | 241,386 | | | | 1,523,272 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Video Games & Esports ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Communication Services — continued | | | | | | | | |

Konami Holdings | | | 440,855 | | | $ | 28,541,829 | |

Nexon | | | 966,557 | | | | 22,886,242 | |

Nintendo | | | 64,088 | | | | 39,609,560 | |

Square Enix Holdings | | | 315,486 | | | | 16,954,056 | |

| | | | | | | | | |

TOTAL JAPAN | | | | | | | 157,311,560 | |

| | | | | | | | | |

| | | | | | | | | |

| SINGAPORE — 0.8% | | | | | | | | |

| Communication Services — 0.8% | | | | | | | | |

IGG | | | 3,620,700 | | | | 5,392,681 | |

| | | | | | | | | |

| SOUTH KOREA — 12.3% | | | | | | | | |

| Communication Services — 12.3% | | | | | | | | |

Com2uSCorp | | | 40,706 | | | | 4,832,309 | |

Gravity ADR * | | | 31,059 | | | | 4,067,487 | |

JoyCity * | | | 236,400 | | | | 1,990,313 | |

Kakao Games * | | | 334,752 | | | | 15,637,568 | |

NCSoft | | | 35,748 | | | | 27,308,613 | |

Neowiz * | | | 90,081 | | | | 1,877,865 | |

Netmarble | | | 93,032 | | | | 11,427,763 | |

Nexon GT * | | | 156,457 | | | | 1,809,643 | |

Pearl Abyss * | | | 154,666 | | | | 8,070,977 | |

Webzen * | | | 85,494 | | | | 2,456,812 | |

Wemade | | | 57,648 | | | | 3,013,430 | |

| | | | | | | | | |

TOTAL SOUTH KOREA | | | | | | | 82,492,780 | |

| | | | | | | | | |

| SWEDEN — 7.6% | | | | | | | | |

| Communication Services — 7.6% | | | | | | | | |

Embracer Group, Cl B * | | | 1,191,227 | | | | 34,913,152 | |

Stillfront Group * | | | 1,565,159 | | | | 16,391,118 | |

| | | | | | | | | |

TOTAL SWEDEN | | | | | | | 51,304,270 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Video Games & Esports ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| TAIWAN — 7.4% | | | | | | | | |

| Communication Services — 7.4% | | | | | | | | |

Chinese Gamer International * | | | 920,500 | | | $ | 1,888,086 | |

Gamania Digital Entertainment | | | 866,100 | | | | 2,007,542 | |

Sea ADR * | | | 179,189 | | | | 45,377,822 | |

| | | | | | | | | |

TOTAL TAIWAN | | | | | | | 49,273,450 | |

| | | | | | | | | |

| UNITED STATES — 30.2% | | | | | | | | |

| Communication Services — 22.1% | | | | | | | | |

Activision Blizzard | | | 446,705 | | | | 43,442,061 | |

Electronic Arts | | | 291,445 | | | | 41,656,234 | |

Take-Two Interactive Software * | | | 154,767 | | | | 28,718,565 | |

Zynga, Cl A * | | | 3,142,062 | | | | 34,059,952 | |

| | | | | | | | 147,876,812 | |

| | | | | | | | | |

| Information Technology — 8.1% | | | | | | | | |

NVIDIA | | | 78,770 | | | | 51,183,170 | |

Turtle Beach * | | | 92,007 | | | | 3,045,432 | |

| | | | | | | | 54,228,602 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 202,105,414 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $649,445,059) | | | | | | | 668,819,832 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(B)(C) — 0.2% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.010% | | | | | | | | |

(Cost $1,406,241) | | | 1,406,241 | | | | 1,406,241 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Video Games & Esports ETF | |

| | | | | | | |

REPURCHASE AGREEMENT(B) — 0.2% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 0.000%, dated 05/28/2021, to be repurchased on 06/01/2021, repurchase price $1,349,169 (collateralized by U.S. Treasury Obligations, ranging in par value $26,767 - $194,604, 2.000%, 10/31/2022, with a total market value of $1,375,491) | | | | | | | | |

(Cost $1,349,169) | | $ | 1,349,169 | | | $ | 1,349,169 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 100.3% | | | | | | | | |

(Cost $652,200,469) | | | | | | $ | 671,575,242 | |

Percentages are based on Net Assets of $669,813,038.

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at May 31, 2021. The total value of securities on loan at May 31, 2021 was $2,640,318. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2021 was $2,755,410. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2021. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | | | | | | | | | | | | |

| Common Stock | | $ | 668,819,832 | | | $ | — | | | $ | — | | | $ | 668,819,832 | |

| Short-Term Investment | | | 1,406,241 | | | | — | | | | — | | | | 1,406,241 | |

| Repurchase Agreement | | | — | | | | 1,349,169 | | | | — | | | | 1,349,169 | |

| Total Investments in Securities | | $ | 670,226,073 | | | $ | 1,349,169 | | | $ | — | | | $ | 671,575,242 | |

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Autonomous & Electric Vehicles ETF | |

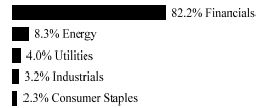

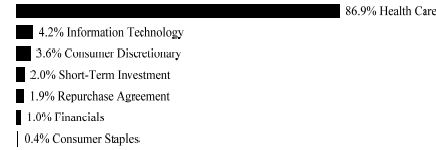

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | | | | | |

| COMMON STOCK — 98.0% | | | | | | |

| AUSTRALIA — 2.1% | | | | | | |

| Materials — 2.1% | | | | | | |

Orocobre * | | | 1,927,620 | | | $ | 9,793,397 | |

Pilbara Minerals * | | | 9,298,742 | | | | 8,781,867 | |

| | | | | | | | | |

TOTAL AUSTRALIA | | | | | | | 18,575,264 | |

| | | | | | | | | |

| BELGIUM — 1.0% | | | | | | | | |

| Materials — 1.0% | | | | | | | | |

Umicore | | | 155,622 | | | | 9,366,666 | |

| | | | | | | | | |

| CANADA — 1.6% | | | | | | | | |

| Industrials — 0.5% | | | | | | | | |

Ballard Power Systems * (A) | | | 237,730 | | | | 4,117,483 | |

| | | | | | | | | |

| Information Technology — 1.1% | | | | | | | | |

BlackBerry * (A) | | | 1,010,095 | | | | 10,171,657 | |

| | | | | | | | | |

TOTAL CANADA | | | | | | | 14,289,140 | |

| | | | | | | | | |

| CHILE — 1.8% | | | | | | | | |

| Materials — 1.8% | | | | | | | | |

Lundin Mining | | | 883,233 | | | | 9,483,056 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Autonomous & Electric Vehicles ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Materials — continued | | | | | | | | |

| Sociedad Quimica y Minera de Chile ADR | | | 158,489 | | | $ | 6,873,668 | |

| | | | | | | | | |

TOTAL CHILE | | | | | | | 16,356,724 | |

| | | | | | | | | |

| CHINA — 6.4% | | | | | | | | |

| Communication Services — 1.3% | | | | | | | | |

Baidu ADR * | | | 61,152 | | | | 12,002,303 | |

| | | | | | | | | |

| Consumer Discretionary — 2.6% | | | | | | | | |

BYD, Cl H | | | 303,530 | | | | 6,949,337 | |

Geely Automobile Holdings | | | 2,400,700 | | | | 6,081,010 | |

NIO ADR * | | | 264,277 | | | | 10,206,378 | |

| | | | | | | | 23,236,725 | |

| | | | | | | | | |

| Information Technology — 1.7% | | | | | | | | |

NXP Semiconductors | | | 73,052 | | | | 15,444,654 | |

| | | | | | | | | |

| Materials — 0.8% | | | | | | | | |

Ganfeng Lithium, Cl H | | | 518,424 | | | | 6,953,287 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 57,636,969 | |

| | | | | | | | | |

| FRANCE — 0.9% | | | | | | | | |

| Consumer Discretionary — 0.9% | | | | | | | | |

Faurecia | | | 8,815 | | | | 484,067 | |

Renault * | | | 182,263 | | | | 7,576,530 | |

| | | | | | | | | |

TOTAL FRANCE | | | | | | | 8,060,597 | |

| | | | | | | | | |

| GERMANY — 2.5% | | | | | | | | |

| Consumer Discretionary — 1.0% | | | | | | | | |

Continental * | | | 62,092 | | | | 9,202,008 | |

| | | | | | | | | |

| Information Technology — 1.5% | | | | | | | | |

Infineon Technologies | | | 320,621 | | | | 12,972,551 | |

| | | | | | | | | |

TOTAL GERMANY | | | | | | | 22,174,559 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Autonomous & Electric Vehicles ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| JAPAN — 8.4% | | | | | | | | |

| Consumer Discretionary — 7.7% | | | | | | | | |

Denso | | | 171,451 | | | $ | 11,756,417 | |

Honda Motor | | | 429,632 | | | | 13,548,204 | |

Nissan Motor * | | | 1,634,450 | | | | 8,223,153 | |

Panasonic | | | 829,969 | | | | 9,482,665 | |

Toyota Motor | | | 314,961 | | | | 26,162,025 | |

| | | | | | | | 69,172,464 | |

| | | | | | | | | |

| Industrials — 0.7% | | | | | | | | |

GS Yuasa | | | 235,726 | | | | 6,751,870 | |

| | | | | | | | | |

TOTAL JAPAN | | | | | | | 75,924,334 | |

| | | | | | | | | |

| LUXEMBOURG — 1.0% | | | | | | | | |

| Materials — 1.0% | | | | | | | | |

APERAM | | | 166,425 | | | | 9,167,445 | |

| | | | | | | | | |

| NETHERLANDS — 0.7% | | | | | | | | |

| Consumer Discretionary — 0.7% | | | | | | | | |

TomTom * | | | 663,014 | | | | 6,041,204 | |

| | | | | | | | | |

| RUSSIA — 1.1% | | | | | | | | |

| Communication Services — 1.1% | | | | | | | | |

Yandex, Cl A * | | | 138,921 | | | | 9,382,724 | |

| | | | | | | | | |

| SOUTH KOREA — 2.3% | | | | | | | | |

| Consumer Discretionary — 2.3% | | | | | | | | |

Hyundai Motor | | | 46,588 | | | | 9,691,039 | |

Kia Motors | | | 143,390 | | | | 10,889,566 | |

| | | | | | | | | |

TOTAL SOUTH KOREA | | | | | | | 20,580,605 | |

| | | | | | | | | |

| SWEDEN — 2.0% | | | | | | | | |

| Consumer Discretionary — 2.0% | | | | | | | | |

Autoliv | | | 87,826 | | | | 9,312,191 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Autonomous & Electric Vehicles ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Consumer Discretionary — continued | | | | | | | | |

Veoneer * (A) | | | 361,720 | | | $ | 8,561,912 | |

| | | | | | | | | |

TOTAL SWEDEN | | | | | | | 17,874,103 | |

| | | | | | | | | |

| UNITED KINGDOM — 1.0% | | | | | | | | |

| Materials — 1.0% | | | | | | | | |

Johnson Matthey | | | 217,058 | | | | 9,374,281 | |

| | | | | | | | | |

| UNITED STATES — 65.2% | | | | | | | | |

| Communication Services — 3.9% | | | | | | | | |

Alphabet, Cl A * | | | 14,774 | | | | 34,820,102 | |

| | | | | | | | | |

| Consumer Discretionary — 15.5% | | | | | | | | |

American Axle & Manufacturing Holdings * | | | 796,761 | | | | 8,923,723 | |

Aptiv * | | | 79,270 | | | | 11,923,793 | |

BorgWarner | | | 205,193 | | | | 10,524,349 | |

Dana | | | 338,257 | | | | 9,176,912 | |

Ford Motor * | | | 1,186,821 | | | | 17,244,509 | |

General Motors * | | | 304,016 | | | | 18,031,189 | |

Gentherm * | | | 107,414 | | | | 7,790,738 | |

Harley-Davidson | | | 201,528 | | | | 9,768,062 | |

Lear | | | 50,646 | | | | 9,792,911 | |

Stellantis * | | | 535,246 | | | | 10,501,233 | |

Tesla * | | | 30,446 | | | | 19,035,448 | |

Visteon * | | | 53,341 | | | | 6,532,139 | |

| | | | | | | | 139,245,006 | |

| | | | | | | | | |

| Industrials — 11.3% | | | | | | | | |

Bloom Energy, Cl A * | | | 219,641 | | | | 5,308,723 | |

CBAK Energy Technology * (A) | | | 1,001,435 | | | | 4,196,013 | |

EnerSys | | | 84,859 | | | | 7,997,112 | |

General Electric | | | 1,456,139 | | | | 20,473,314 | |

Honeywell International | | | 82,052 | | | | 18,946,627 | |

| Hyster-Yale Materials Handling | | | 96,840 | | | | 7,320,136 | |

ITT | | | 98,690 | | | | 9,266,991 | |

Johnson Controls International | | | 222,097 | | | | 14,778,334 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Autonomous & Electric Vehicles ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Industrials — continued | | | | | | | | |

Plug Power * | | | 156,174 | | | $ | 4,794,542 | |

| Westinghouse Air Brake Technologies | | | 107,999 | | | | 8,937,997 | |

| | | | | | | | 102,019,789 | |

| | | | | | | | | |

| Information Technology — 27.5% | | | | | | | | |

Advanced Micro Devices * | | | 179,888 | | | | 14,405,431 | |

Ambarella * | | | 78,416 | | | | 7,871,398 | |

Apple | | | 200,313 | | | | 24,961,003 | |

CEVA * | | | 133,648 | | | | 5,996,786 | |

Cisco Systems | | | 374,762 | | | | 19,824,910 | |

II-VI * | | | 95,425 | | | | 6,428,782 | |

Intel | | | 484,584 | | | | 27,679,438 | |

Maxim Integrated Products * | | | 106,765 | | | | 10,891,098 | |

Micron Technology * | | | 219,040 | | | | 18,430,026 | |

Microsoft | | | 120,086 | | | | 29,983,072 | |

NVIDIA | | | 47,832 | | | | 31,080,277 | |

ON Semiconductor * | | | 247,058 | | | | 9,892,202 | |

QUALCOMM | | | 167,052 | | | | 22,475,176 | |

Rogers * | | | 44,160 | | | | 8,273,376 | |

Xilinx * | | | 78,018 | | | | 9,908,286 | |

| | | | | | | | 248,101,261 | |

| | | | | | | | | |

| Materials — 7.0% | | | | | | | | |

Albemarle | | | 52,166 | | | | 8,715,895 | |

Allegheny Technologies * | | | 402,724 | | | | 9,862,711 | |

Cabot | | | 153,138 | | | | 9,736,514 | |

Carpenter Technology | | | 221,553 | | | | 10,616,820 | |

| Freeport-McMoRan Copper & Gold | | | 399,036 | | | | 17,046,818 | |

Livent * | | | 356,669 | | | | 6,958,612 | |

| | | | | | | | 62,937,370 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 587,123,528 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $841,166,592) | | | | | | | 881,928,143 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Autonomous & Electric Vehicles ETF | |

| | | | | | | |

| PREFERRED STOCK — 1.9% | | | | | | | | |

| GERMANY— 1.9% | | | | | | | | |

| Consumer Discretionary — 1.9% | | | | | | | | |

Volkswagen (B) | | | | | | | | |

(Cost $12,106,072) | | | 61,860 | | | $ | 17,041,416 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(C)(D) — 1.2% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.010% | | | | | | | | |

(Cost $10,626,940) | | | 10,626,940 | | | | 10,626,940 | |

| | | | | | | | | |

REPURCHASE AGREEMENT(C) — 1.1% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 0.000%, dated 05/28/2021, to be repurchased on 06/01/2021, repurchase price $10,195,643 (collateralized by U.S. Treasury Obligations, ranging in par value $202,278 - $1,470,619, 2.000%, 10/31/2022, with a total market value of $10,394,561) | | | | | | | | |

(Cost $10,195,643) | | $ | 10,195,643 | | | | 10,195,643 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 102.2% | | | | | | | | |

(Cost $874,095,247) | | | | | | $ | 919,792,142 | |

Percentages are based on Net Assets of $900,379,020.

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at May 31, 2021. The total value of securities on loan at May 31, 2021 was $20,442,006. |

| (B) | There is currently no stated interest rate. |

| (C) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2021 was $20,822,583. |

| (D) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2021. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | | | | | | | | | | | | |

| Common Stock | | $ | 881,928,143 | | | $ | — | | | $ | — | | | $ | 881,928,143 | |

| Preferred Stock | | | 17,041,416 | | | | — | | | | — | | | | 17,041,416 | |

| Short-Term Investment | | | 10,626,940 | | | | — | | | | — | | | | 10,626,940 | |

| Repurchase Agreement | | | — | | | | 10,195,643 | | | | — | | | | 10,195,643 | |

| Total Investments in Securities | | $ | 909,596,499 | | | $ | 10,195,643 | | | $ | — | | | $ | 919,792,142 | |

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cloud Computing ETF | |

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | | | | | |

| COMMON STOCK — 99.9% | | | | | | |

| CANADA — 4.3% | | | | | | |

| Information Technology — 4.3% | | | | | | |

Shopify, Cl A * | | | 45,205 | | | $ | 56,183,939 | |

| | | | | | | | | |

| CHINA — 3.2% | | | | | | | | |

| Consumer Discretionary — 1.1% | | | | | | | | |

Alibaba Group Holding ADR * | | | 68,916 | | | | 14,745,267 | |

| | | | | | | | | |

| Information Technology — 2.1% | | | | | | | | |

21Vianet Group ADR * | | | 1,035,936 | | | | 23,122,092 | |

Kingsoft | | | 522,700 | | | | 3,528,890 | |

| | | | | | | | 26,650,982 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 41,396,249 | |

| | | | | | | | | |

| NEW ZEALAND — 3.6% | | | | | | | | |

| Information Technology — 3.6% | | | | | | | | |

Xero * | | | 464,909 | | | | 46,752,548 | |

| | | | | | | | | |

| UNITED STATES — 88.8% | | | | | | | | |

| Communication Services — 5.3% | | | | | | | | |

Alphabet, Cl A * | | | 7,625 | | | | 17,970,981 | |

Netflix * | | | 98,689 | | | | 49,621,816 | |

| | | | | | | | 67,592,797 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cloud Computing ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | |

| Consumer Discretionary — 4.0% | | | | | | |

2U * | | | 716,283 | | | $ | 26,087,027 | |

Amazon.com * | | | 7,460 | | | | 24,044,102 | |

| | | | | | | | 50,131,129 | |

| | | | | | | | | |

| Information Technology — 73.8% | | | | | | | | |

Akamai Technologies * | | | 447,454 | | | | 51,103,721 | |

Anaplan * | | | 906,593 | | | | 46,698,605 | |

Benefitfocus * | | | 309,912 | | | | 4,583,598 | |

Box, Cl A * | | | 1,567,045 | | | | 36,527,819 | |

Cornerstone OnDemand * | | | 637,217 | | | | 28,018,431 | |

Coupa Software * | | | 210,966 | | | | 50,252,101 | |

Dropbox, Cl A * | | | 2,010,121 | | | | 54,976,809 | |

Everbridge * | | | 362,338 | | | | 42,574,715 | |

Fastly, Cl A * (A) | | | 1,018,841 | | | | 48,079,107 | |

| International Business Machines | | | 24,723 | | | | 3,553,684 | |

Microsoft | | | 99,160 | | | | 24,758,269 | |

Mimecast * | | | 620,050 | | | | 30,996,300 | |

Paycom Software * | | | 150,672 | | | | 49,661,491 | |

Paylocity Holding * | | | 289,676 | | | | 49,195,675 | |

Proofpoint * | | | 286,938 | | | | 49,585,756 | |

Qualys * | | | 377,066 | | | | 36,454,741 | |

salesforce.com * | | | 226,090 | | | | 53,832,029 | |

SPS Commerce * | | | 345,544 | | | | 32,432,760 | |

Twilio, Cl A * | | | 162,956 | | | | 54,753,216 | |

Workday, Cl A * | | | 210,937 | | | | 48,245,511 | |

Workiva, Cl A * | | | 405,673 | | | | 38,498,368 | |

Zoom Video Communications, Cl A * | | | 168,282 | | | | 55,790,531 | |

Zscaler * | | | 294,576 | | | | 57,206,659 | |

| | | | | | | | 947,779,896 | |

| | | | | | | | | |

| Real Estate — 5.7% | | | | | | | | |

CoreSite Realty ‡ | | | 53,306 | | | | 6,463,353 | |

CyrusOne ‡ | | | 150,604 | | | | 11,107,045 | |

Digital Realty Trust ‡ | | | 329,713 | | | | 49,971,302 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cloud Computing ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | |

| Real Estate — continued | | | | | | |

QTS Realty Trust, Cl A ‡ | | | 84,389 | | | $ | 5,348,575 | |

| | | | | | | | 72,890,275 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 1,138,394,097 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $1,116,449,830) | | | | | | | 1,282,726,833 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(B)(C) — 1.2% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.010% | | | | | | | | |

(Cost $15,855,160) | | | 15,855,160 | | | | 15,855,160 | |

| | | | | | | | | |

REPURCHASE AGREEMENT(B) — 1.2% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 0.000%, dated 05/28/2021, to be repurchased on 06/01/2021, repurchase price $15,211,675 (collateralized by U.S. Treasury Obligations, ranging in par value $301,795 - $2,194,131, 2.000%, 10/31/2022, with a total market value of $15,508,457) | | | | | | | | |

(Cost $15,211,675) | | $ | 15,211,675 | | | | 15,211,675 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 102.3% | | | | | | | | |

(Cost $1,147,516,665) | | | | | | $ | 1,313,793,668 | |

Percentages are based on Net Assets of $1,283,700,238.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cloud Computing ETF | |

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

| (A) | This security or a partial position of this security is on loan at May 31, 2021. The total value of securities on loan at May 31, 2021 was $29,791,047. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2021 was $31,066,835. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2021. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | | | | | | | | | | | | |

| Common Stock | | $ | 1,282,726,833 | | | $ | — | | | $ | — | | | $ | 1,282,726,833 | |

| Short-Term Investment | | | 15,855,160 | | | | — | | | | — | | | | 15,855,160 | |

| Repurchase Agreement | | | — | | | | 15,211,675 | | | | — | | | | 15,211,675 | |

| Total Investments in Securities | | $ | 1,298,581,993 | | | $ | 15,211,675 | | | $ | — | | | $ | 1,313,793,668 | |

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Data Center REITs & Digital Infrastructure ETF | |

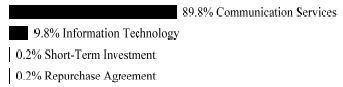

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments.

| | | | | | | |

| COMMON STOCK — 99.8% | | | | | | |

| AUSTRALIA — 3.2% | | | | | | |

| Information Technology — 3.2% | | | | | | |

NEXTDC * | | | 202,016 | | | $ | 1,720,975 | |

| | | | | | | | | |

| CHINA — 9.0% | | | | | | | | |

| Communication Services — 4.0% | | | | | | | | |

China Tower, Cl H | | | 15,661,400 | | | | 2,138,901 | |

| | | | | | | | | |

| Information Technology — 5.0% | | | | | | | | |

21Vianet Group ADR * | | | 46,482 | | | | 1,037,478 | |

GDS Holdings ADR * | | | 22,361 | | | | 1,681,994 | |

| | | | | | | | 2,719,472 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 4,858,373 | |

| | | | | | | | | |

| HONG KONG — 0.6% | | | | | | | | |

| Information Technology — 0.6% | | | | | | | | |

SUNeVision Holdings | | | 288,181 | | | | 299,264 | |

| | | | | | | | | |

| INDONESIA — 2.8% | | | | | | | | |

| Communication Services — 2.8% | | | | | | | | |

Sarana Menara Nusantara | | | 10,921,778 | | | | 898,361 | |

Tower Bersama Infrastructure | | | 3,664,585 | | | | 613,116 | |

| | | | | | | | | |

TOTAL INDONESIA | | | | | | | 1,511,477 | |

| | | | | | | | | |

| SINGAPORE — 2.1% | | | | | | | | |

| Real Estate — 2.1% | | | | | | | | |

Keppel ‡ | | | 581,570 | | | | 1,129,560 | |

| | | | | | | | | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Data Center REITs & Digital Infrastructure ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| TAIWAN — 2.4% | | | | | | | | |

| Information Technology — 2.4% | | | | | | | | |

Winbond Electronics | | | 1,016,204 | | | $ | 1,240,011 | |

| | | | | | | | | |

| UNITED STATES — 79.7% | | | | | | | | |

| Communication Services — 0.8% | | | | | | | | |

Radius Global Infrastructure, Cl A * | | | 27,242 | | | | 435,872 | |

| | | | | | | | | |

| Information Technology — 12.0% | | | | | | | | |

Advanced Micro Devices * | | | 10,900 | | | | 872,872 | |

Microchip Technology | | | 6,632 | | | | 1,040,892 | |

Micron Technology * | | | 12,529 | | | | 1,054,190 | |

NVIDIA | | | 1,876 | | | | 1,218,987 | |

Switch, Cl A | | | 44,132 | | | | 832,771 | |

Western Digital * | | | 20,385 | | | | 1,533,564 | |

| | | | | | | | 6,553,276 | |

| | | | | | | | | |

| Real Estate — 66.9% | | | | | | | | |

American Tower, Cl A ‡ | | | 27,832 | | | | 7,109,963 | |

CoreSite Realty ‡ | | | 18,851 | | | | 2,285,684 | |

Crown Castle International ‡ | | | 39,523 | | | | 7,489,609 | |

CyrusOne ‡ | | | 31,986 | | | | 2,358,968 | |

Digital Realty Trust ‡ | | | 33,963 | | | | 5,147,432 | |

Equinix ‡ | | | 8,708 | | | | 6,415,358 | |

QTS Realty Trust, Cl A ‡ | | | 28,382 | | | | 1,798,851 | |

SBA Communications, Cl A ‡ | | | 8,533 | | | | 2,543,858 | |

Uniti Group ‡ | | | 99,074 | | | | 1,075,944 | |

| | | | | | | | 36,225,667 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 43,214,815 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $51,999,205) | | | | | | | 53,974,475 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Data Center REITs & Digital Infrastructure ETF | |

| | | | | | | | |

| TOTAL INVESTMENTS — 99.8% | | | | | | | | |

(Cost $51,999,205) | | | | | | $ | 53,974,475 | |

Percentages are based on Net Assets of $54,081,522.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

ADR — American Depositary Receipt

Cl — Class

As of May 31, 2021, all of the Fund’s investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cybersecurity ETF | |

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments.

| | | | | | | |

| COMMON STOCK — 100.0% | | | | | | |

| CANADA — 0.6% | | | | | | |

| Information Technology — 0.6% | | | | | | |

Absolute Software | | | 158,039 | | | $ | 2,200,510 | |

| | | | | | | | | |

| ISRAEL — 6.9% | | | | | | | | |

| Information Technology — 6.9% | | | | | | | | |

Check Point Software Technologies * | | | 165,716 | | | | 19,385,458 | |

Radware * | | | 148,732 | | | | 4,342,974 | |

Tufin Software Technologies * | | | 112,833 | | | | 1,025,652 | |

| | | | | | | | | |

TOTAL ISRAEL | | | | | | | 24,754,084 | |

| | | | | | | | | |

| JAPAN — 5.6% | | | | | | | | |

| Information Technology — 5.6% | | | | | | | | |

Cyber Security Cloud * | | | 36,264 | | | | 955,609 | |

Digital Arts | | | 45,539 | | | | 3,354,089 | |

Trend Micro * | | | 311,010 | | | | 15,836,836 | |

| | | | | | | | | |

TOTAL JAPAN | | | | | | | 20,146,534 | |

| | | | | | | | | |

| SOUTH KOREA — 0.5% | | | | | | | | |

| Information Technology — 0.5% | | | | | | | | |

Ahnlab | | | 32,145 | | | | 1,957,003 | |

| | | | | | | | | |

| UNITED KINGDOM — 4.4% | | | | | | | | |

| Information Technology — 4.4% | | | | | | | | |

Avast | | | 2,373,412 | | | | 15,849,892 | |

| | | | | | | | | |

| UNITED STATES — 82.0% | | | | | | | | |

| Information Technology — 82.0% | | | | | | | | |

A10 Networks * | | | 248,485 | | | | 2,417,759 | |

Crowdstrike Holdings, Cl A * | | | 106,298 | | | | 23,614,100 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cybersecurity ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

CyberArk Software * | | | 126,300 | | | $ | 15,982,002 | |

FireEye * | | | 770,357 | | | | 17,232,886 | |

Fortinet * | | | 96,329 | | | | 21,051,740 | |

Intrusion * | | | 96,393 | | | | 1,432,400 | |

McAfee, Cl A | | | 524,527 | | | | 13,181,364 | |

Mimecast * | | | 207,879 | | | | 10,391,871 | |

NortonLifeLock | | | 716,484 | | | | 19,817,947 | |

Okta, Cl A * | | | 84,858 | | | | 18,875,814 | |

OneSpan * | | | 129,635 | | | | 3,389,955 | |

Palo Alto Networks * | | | 58,935 | | | | 21,408,139 | |

Ping Identity Holding * | | | 264,641 | | | | 6,380,495 | |

Proofpoint * | | | 86,843 | | | | 15,007,339 | |

Qualys * | | | 126,439 | | | | 12,224,123 | |

Rapid7 * | | | 177,953 | | | | 14,885,768 | |

Sailpoint Technologies Holdings * | | | 297,086 | | | | 13,823,412 | |

Telos * | | | 212,572 | | | | 6,989,367 | |

Tenable Holdings * | | | 341,075 | | | | 14,256,935 | |

Varonis Systems, Cl B * | | | 315,721 | | | | 15,249,324 | |

VirnetX Holding * | | | 223,018 | | | | 1,021,422 | |

Zix * | | | 182,301 | | | | 1,270,638 | |

Zscaler * | | | 118,851 | | | | 23,080,864 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 292,985,664 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $383,605,863) | | | | | | | 357,893,687 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 100.0% | | | | | | | | |

(Cost $383,605,863) | | | | | | $ | 357,893,687 | |

Percentages are based on Net Assets of $357,759,420.

| * | Non-income producing security. |

Cl — Class

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Cybersecurity ETF | |

As of May 31, 2021, all of the Fund’s investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | | | | | |

| COMMON STOCK — 99.9% | | | | | | |

| BRAZIL — 0.6% | | | | | | |

| Consumer Discretionary — 0.3% | | | | | | |

Afya, Cl A * | | | 25,087 | | | $ | 587,287 | |

| | | | | | | | | |

| Information Technology — 0.3% | | | | | | | | |

StoneCo, Cl A * | | | 9,562 | | | | 630,805 | |

| | | | | | | | | |

TOTAL BRAZIL | | | | | | | 1,218,092 | |

| | | | | | | | | |

| CANADA — 4.1% | | | | | | | | |

| Industrials — 1.0% | | | | | | | | |

Thomson Reuters | | | 21,030 | | | | 2,060,309 | |

| | | | | | | | | |

| Information Technology — 3.1% | | | | | | | | |

Shopify, Cl A * | | | 5,089 | | | | 6,324,965 | |

| | | | | | | | | |

TOTAL CANADA | | | | | | | 8,385,274 | |

| | | | | | | | | |

| CHINA — 10.5% | | | | | | | | |

| Communication Services — 3.7% | | | | | | | | |

Baidu ADR * | | | 11,521 | | | | 2,261,227 | |

Tencent Holdings | | | 69,443 | | | | 5,381,687 | |

| | | | | | | | 7,642,914 | |

| | | | | | | | | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Consumer Discretionary — 4.6% | | | | | | | | |

Alibaba Group Holding ADR * | | | 23,469 | | | $ | 5,021,427 | |

Meituan, Cl B * | | | 127,041 | | | | 4,340,820 | |

| | | | | | | | 9,362,247 | |

| | | | | | | | | |

| Information Technology — 2.2% | | | | | | | | |

21Vianet Group ADR * | | | 15,605 | | | | 348,304 | |

Canaan ADR * (A) | | | 126,637 | | | | 1,063,751 | |

NXP Semiconductors | | | 12,126 | | | | 2,563,679 | |

ZTE, Cl H | | | 202,300 | | | | 546,052 | |

| | | | | | | | 4,521,786 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 21,526,947 | |

| | | | | | | | | |

| FINLAND — 0.3% | | | | | | | | |

| Information Technology — 0.3% | | | | | | | | |

TietoEVRY | | | 17,862 | | | | 582,693 | |

| | | | | | | | | |

| FRANCE — 0.2% | | | | | | | | |

| Communication Services — 0.2% | | | | | | | | |

Ubisoft Entertainment * | | | 5,735 | | | | 418,465 | |

| | | | | | | | | |

| GERMANY — 4.4% | | | | | | | | |

| Industrials — 3.3% | | | | | | | | |

Siemens | | | 40,573 | | | | 6,667,273 | |

| | | | | | | | | |

| Information Technology — 1.1% | | | | | | | | |

Infineon Technologies | | | 55,250 | | | | 2,235,454 | |

| | | | | | | | | |

TOTAL GERMANY | | | | | | | 8,902,727 | |

| | | | | | | | | |

| IRELAND — 0.5% | | | | | | | | |

| Information Technology — 0.5% | | | | | | | | |

Seagate Technology Holdings | | | 10,829 | | | | 1,036,877 | |

| | | | | | | | | |

| ISRAEL — 0.7% | | | | | | | | |

| Information Technology — 0.7% | | | | | | | | |

Cognyte Software * | | | 8,318 | | | | 214,105 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

Tower Semiconductor * | | | 19,916 | | | $ | 547,092 | |

Wix.com * | | | 2,419 | | | | 628,601 | |

| | | | | | | | | |

TOTAL ISRAEL | | | | | | | 1,389,798 | |

| | | | | | | | | |

| ITALY — 0.3% | | | | | | | | |

| Health Care — 0.3% | | | | | | | | |

Amplifon | | | 14,709 | | | | 691,444 | |

| | | | | | | | | |

| JAPAN — 1.8% | | | | | | | | |

| Industrials — 1.7% | | | | | | | | |

FANUC | | | 8,572 | | | | 2,066,322 | |

Fujikura | | | 128,362 | | | | 556,751 | |

Toshiba | | | 21,070 | | | | 890,889 | |

| | | | | | | | 3,513,962 | |

| | | | | | | | | |

| Information Technology — 0.1% | | | | | | | | |

AI inside * | | | 919 | | | | 144,149 | |

| | | | | | | | | |

TOTAL JAPAN | | | | | | | 3,658,111 | |

| | | | | | | | | |

| NETHERLANDS — 0.5% | | | | | | | | |

| Industrials — 0.5% | | | | | | | | |

Wolters Kluwer | | | 11,300 | | | | 1,083,859 | |

| | | | | | | | | |

| SOUTH KOREA — 4.4% | | | | | | | | |

| Information Technology — 4.4% | | | | | | | | |

Samsung Electronics | | | 76,137 | | | | 5,468,102 | |

SK Hynix | | | 30,788 | | | | 3,450,641 | |

| | | | | | | | | |

TOTAL SOUTH KOREA | | | | | | | 8,918,743 | |

| | | | | | | | | |

| SWEDEN — 0.8% | | | | | | | | |

| Information Technology — 0.8% | | | | | | | | |

| Telefonaktiebolaget LM Ericsson ADR | | | 129,856 | | | | 1,743,966 | |

| | | | | | | | | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| SWITZERLAND — 0.7% | | | | | | | | |

| Information Technology — 0.7% | | | | | | | | |

STMicroelectronics (A) | | | 38,459 | | | $ | 1,434,974 | |

| | | | | | | | | |

| TAIWAN — 1.2% | | | | | | | | |

| Industrials — 0.3% | | | | | | | | |

Bizlink Holding | | | 60,300 | | | | 523,866 | |

| | | | | | | | | |

| Information Technology — 0.9% | | | | | | | | |

Acer | | | 708,000 | | | | 811,608 | |

Alchip Technologies | | | 17,690 | | | | 337,979 | |

Global Unichip | | | 43,000 | | | | 553,379 | |

| | | | | | | | 1,702,966 | |

| | | | | | | | | |

TOTAL TAIWAN | | | | | | | 2,226,832 | |

| | | | | | | | | |

| UNITED KINGDOM — 1.1% | | | | | | | | |

| Industrials — 0.7% | | | | | | | | |

Experian | | | 38,732 | | | | 1,484,391 | |

| | | | | | | | | |

| Information Technology — 0.4% | | | | | | | | |

Dialog Semiconductor * | | | 9,517 | | | | 754,710 | |

| | | | | | | | | |

TOTAL UNITED KINGDOM | | | | | | | 2,239,101 | |

| | | | | | | | | |

| UNITED STATES — 67.8% | | | | | | | | |

| Communication Services — 12.5% | | | | | | | | |

Alphabet, Cl A * | | | 3,260 | | | | 7,683,331 | |

Facebook, Cl A * | | | 22,392 | | | | 7,360,922 | |

Netflix * | | | 10,532 | | | | 5,295,595 | |

Snap, Cl A * | | | 52,251 | | | | 3,245,832 | |

Twitter * | | | 33,608 | | | | 1,949,264 | |

| | | | | | | | 25,534,944 | |

| | | | | | | | | |

| Consumer Discretionary — 3.8% | | | | | | | | |

Amazon.com * | | | 1,862 | | | | 6,001,356 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Consumer Discretionary — continued | | | | | | | | |

eBay | | | 29,461 | | | $ | 1,793,586 | |

| | | | | | | | 7,794,942 | |

| | | | | | | | | |

| Health Care — 0.3% | | | | | | | | |

ABIOMED * | | | 1,912 | | | | 544,117 | |

| | | | | | | | | |

| Industrials — 4.1% | | | | | | | | |

| Booz Allen Hamilton Holding, Cl A | | | 6,404 | | | | 543,892 | |

Hubbell, Cl B | | | 3,663 | | | | 698,314 | |

Nielsen Holdings | | | 27,885 | | | | 758,751 | |

Rockwell Automation | | | 4,916 | | | | 1,296,447 | |

Uber Technologies * | | | 78,332 | | | | 3,981,616 | |

Verisk Analytics, Cl A | | | 6,876 | | | | 1,188,379 | |

| | | | | | | | 8,467,399 | |

| | | | | | | | | |

| Information Technology — 47.1% | | | | | | | | |

Accenture, Cl A | | | 23,651 | | | | 6,673,366 | |

Adobe * | | | 12,922 | | | | 6,520,183 | |

Apple | | | 44,603 | | | | 5,557,980 | |

Cadence Design Systems * | | | 11,804 | | | | 1,498,990 | |

Cisco Systems | | | 135,326 | | | | 7,158,745 | |

Cornerstone OnDemand * | | | 14,138 | | | | 621,648 | |

Datadog, Cl A * | | | 8,765 | | | | 798,053 | |

DXC Technology * | | | 20,730 | | | | 786,081 | |

FireEye * | | | 26,876 | | | | 601,216 | |

Genpact | | | 14,918 | | | | 682,349 | |

Hewlett Packard Enterprise | | | 54,542 | | | | 870,490 | |

Intel | | | 97,728 | | | | 5,582,223 | |

| International Business Machines | | | 37,710 | | | | 5,420,435 | |

Microsoft | | | 27,123 | | | | 6,772,071 | |

NVIDIA | | | 11,028 | | | | 7,165,774 | |

Okta, Cl A * | | | 5,111 | | | | 1,136,891 | |

Oracle | | | 99,732 | | | | 7,852,898 | |

Pegasystems | | | 4,257 | | | | 502,922 | |

PROS Holdings * | | | 14,428 | | | | 640,170 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

QUALCOMM | | | 37,042 | | | $ | 4,983,631 | |

salesforce.com * | | | 27,490 | | | | 6,545,369 | |

ServiceNow * | | | 8,270 | | | | 3,918,988 | |

Smartsheet, Cl A * | | | 8,611 | | | | 508,738 | |

Splunk * | | | 6,843 | | | | 829,372 | |

Super Micro Computer * | | | 17,972 | | | | 624,347 | |

Synopsys * | | | 6,470 | | | | 1,645,580 | |

Teradata * | | | 23,402 | | | | 1,120,254 | |

Trade Desk, Cl A * | | | 1,797 | | | | 1,056,887 | |

Twilio, Cl A * | | | 5,920 | | | | 1,989,120 | |

Ubiquiti | | | 2,663 | | | | 802,948 | |

Verint Systems * | | | 8,498 | | | | 391,843 | |

Viasat * | | | 15,556 | | | | 827,268 | |

Workday, Cl A * | | | 7,626 | | | | 1,744,219 | |

Xilinx | | | 10,374 | | | | 1,317,498 | |

Zebra Technologies, Cl A * | | | 2,245 | | | | 1,115,877 | |

Zscaler * | | | 5,669 | | | | 1,100,920 | |

| | | | | | | | 97,365,344 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 139,706,746 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $188,369,523) | | | | | | | 205,164,649 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(B)(C) — 0.3% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.010% | | | | | | | | |

(Cost $624,354) | | | 624,354 | | | | 624,354 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Artificial Intelligence & Technology ETF | |

| | | | | | | |

REPURCHASE AGREEMENT(B) — 0.3% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 0.000%, dated 05/28/2021, to be repurchased on 06/01/2021, repurchase price $599,015 (collateralized by U.S. Treasury Obligations, ranging in par value $11,884 - $86,402, 2.000%, 10/31/2022, with a total market value of $610,702) | | | | | | | | |

(Cost $599,015) | | $ | 599,015 | | | $ | 599,015 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 100.5% | | | | | | | | |

(Cost $189,592,892) | | | | | | $ | 206,388,018 | |

Percentages are based on Net Assets of $205,446,857.

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at May 31, 2021. The total value of securities on loan at May 31, 2021 was $1,212,639. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2021 was $1,223,369. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2021. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | | | | | | | | | | | | |

| Common Stock | | $ | 205,164,649 | | | $ | — | | | $ | — | | | $ | 205,164,649 | |

| Short-Term Investment | | | 624,354 | | | | — | | | | — | | | | 624,354 | |

| Repurchase Agreement | | | — | | | | 599,015 | | | | — | | | | 599,015 | |

| Total Investments in Securities | | $ | 205,789,003 | | | $ | 599,015 | | | $ | — | | | $ | 206,388,018 | |

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Millennial Consumer ETF | |

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments.

| | | | | | | |

| COMMON STOCK — 99.9% | | | | | | |

| GERMANY — 0.3% | | | | | | |

| Communication Services — 0.3% | | | | | | |

Trivago ADR * | | | 136,325 | | | $ | 539,847 | |

| | | | | | | | | |

| TAIWAN — 3.1% | | | | | | | | |

| Communication Services — 3.1% | | | | | | | | |

Sea ADR * | | | 22,495 | | | | 5,696,634 | |

| | | | | | | | | |

| UNITED STATES — 96.5% | | | | | | | | |

| Communication Services — 27.8% | | | | | | | | |

Activision Blizzard | | | 59,026 | | | | 5,740,279 | |

Alphabet, Cl A * | | | 2,516 | | | | 5,929,835 | |

Angi, Cl A * | | | 36,408 | | | | 516,265 | |

Cargurus, Cl A * | | | 22,654 | | | | 639,296 | |

Cars.com * | | | 41,776 | | | | 610,347 | |

Facebook, Cl A * | | | 18,103 | | | | 5,951,000 | |

IAC * | | | 6,730 | | | | 1,073,233 | |

iHeartMedia * | | | 31,827 | | | | 738,705 | |

Liberty TripAdvisor Holdings, Cl A * | | | 89,801 | | | | 427,453 | |

Match Group * | | | 21,850 | | | | 3,132,853 | |

Netflix * | | | 10,268 | | | | 5,162,853 | |

Snap, Cl A * | | | 90,056 | | | | 5,594,279 | |

Spotify Technology * | | | 15,499 | | | | 3,744,093 | |

TripAdvisor * | | | 10,961 | | | | 476,255 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Millennial Consumer ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Communication Services — continued | | | | | | | | |

Twitter * | | | 64,849 | | | $ | 3,761,242 | |

Vimeo * | | | 10,901 | | | | 457,842 | |

Walt Disney * | | | 30,399 | | | | 5,430,781 | |

Yelp, Cl A * | | | 13,784 | | | | 552,876 | |

Zillow Group, Cl A * | | | 4,943 | | | | 584,707 | |

Zynga, Cl A * | | | 87,900 | | | | 952,836 | |

| | | | | | | | 51,477,030 | |

| | | | | | | | | |

| Consumer Discretionary — 39.9% | | | | | | | | |

2U * | | | 13,672 | | | | 497,934 | |

Aaron’s | | | 22,146 | | | | 796,592 | |

Airbnb, Cl A * | | | 9,803 | | | | 1,376,341 | |

Amazon.com * | | | 1,717 | | | | 5,534,011 | |

AutoNation * | | | 6,519 | | | | 665,785 | |

Bed Bath & Beyond * | | | 19,094 | | | | 534,441 | |

Booking Holdings * | | | 2,344 | | | | 5,535,473 | |

Capri Holdings * | | | 12,215 | | | | 692,713 | |

CarMax * | | | 13,188 | | | | 1,519,126 | |

Carter’s | | | 6,202 | | | | 634,092 | |

Carvana, Cl A * | | | 6,353 | | | | 1,684,117 | |

Chegg * | | | 11,365 | | | | 874,081 | |

Children’s Place Retail Stores * | | | 7,877 | | | | 732,482 | |

Chipotle Mexican Grill, Cl A * | | | 2,289 | | | | 3,140,462 | |

Columbia Sportswear | | | 5,366 | | | | 551,249 | |

Designer Brands, Cl A * | | | 32,367 | | | | 566,099 | |

Dick’s Sporting Goods | | | 6,738 | | | | 657,157 | |

eBay | | | 55,276 | | | | 3,365,203 | |

Etsy * | | | 10,231 | | | | 1,685,353 | |

Expedia Group * | | | 11,229 | | | | 1,986,972 | |

GoPro, Cl A * | | | 45,024 | | | | 505,169 | |

Graham Holdings, Cl B | | | 918 | | | | 608,212 | |

Groupon, Cl A * | | | 11,648 | | | | 550,368 | |

Grubhub * | | | 8,665 | | | | 520,853 | |

Home Depot | | | 18,107 | | | | 5,774,503 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Millennial Consumer ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Consumer Discretionary — continued | | | | | | | | |

L Brands | | | 22,607 | | | $ | 1,579,551 | |

Laureate Education, Cl A * | | | 42,679 | | | | 623,540 | |

Lowe’s | | | 29,317 | | | | 5,711,831 | |

Lululemon Athletica * | | | 10,166 | | | | 3,284,939 | |

NIKE, Cl B | | | 42,595 | | | | 5,812,513 | |

Peloton Interactive, Cl A * | | | 21,410 | | | | 2,361,737 | |

Planet Fitness, Cl A * | | | 6,718 | | | | 529,177 | |

Skechers USA, Cl A * | | | 13,309 | | | | 632,178 | |

Starbucks | | | 50,371 | | | | 5,736,250 | |

Strategic Education | | | 6,127 | | | | 434,037 | |

Stride * | | | 16,436 | | | | 441,800 | |

Under Armour, Cl A * | | | 24,889 | | | | 561,994 | |

VF | | | 31,812 | | | | 2,536,053 | |

Wayfair, Cl A * | | | 6,260 | | | | 1,918,940 | |

WW International * | | | 18,765 | | | | 737,465 | |

| | | | | | | | 73,890,793 | |

| | | | | | | | | |

| Consumer Staples — 3.5% | | | | | | | | |

Costco Wholesale | | | 15,762 | | | | 5,962,292 | |

Sprouts Farmers Market * | | | 21,804 | | | | 579,986 | |

| | | | | | | | 6,542,278 | |

| | | | | | | | | |

| Financials — 1.5% | | | | | | | | |

Blucora * | | | 33,423 | | | | 579,555 | |

LendingClub * | | | 35,202 | | | | 537,887 | |

LendingTree * | | | 2,512 | | | | 515,588 | |

Nelnet, Cl A | | | 7,576 | | | | 572,140 | |

SLM | | | 29,748 | | | | 602,396 | |

| | | | | | | | 2,807,566 | |

| | | | | | | | | |

| Industrials — 3.9% | | | | | | | | |

Avis Budget Group * | | | 7,619 | | | | 669,101 | |

Lyft, Cl A * | | | 25,978 | | | | 1,483,084 | |

Uber Technologies * | | | 98,459 | | | | 5,004,671 | |

| | | | | | | | 7,156,856 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Millennial Consumer ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — 14.7% | | | | | | | | |

Apple | | | 43,657 | | | $ | 5,440,099 | |

Fiserv * | | | 45,862 | | | | 5,283,302 | |

Intuit | | | 13,844 | | | | 6,078,762 | |

PayPal Holdings * | | | 21,518 | | | | 5,595,111 | |

Square, Cl A * | | | 22,027 | | | | 4,901,448 | |

| | | | | | | | 27,298,722 | |

| | | | | | | | | |

| Real Estate — 5.2% | | | | | | | | |

AvalonBay Communities ‡ | | | 11,332 | | | | 2,345,045 | |

Camden Property Trust ‡ | | | 8,094 | | | | 1,014,826 | |

Centerspace ‡ | | | 8,343 | | | | 593,938 | |

Equity Residential ‡ | | | 30,252 | | | | 2,343,017 | |

Independence Realty Trust ‡ | | | 34,863 | | | | 595,460 | |

Invitation Homes ‡ | | | 46,022 | | | | 1,669,218 | |

UDR ‡ | | | 24,061 | | | | 1,146,025 | |

| | | | | | | | 9,707,529 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 178,880,774 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $161,399,846) | | | | | | | 185,117,255 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 99.9% | | | | | | | | |

(Cost $161,399,846) | | | | | | $ | 185,117,255 | |

Percentages are based on Net Assets of $185,241,722.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

ADR — American Depositary Receipt

Cl — Class

As of May 31, 2021, all of the Fund’s investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | | |

Sector Weightings †:

†�� Sector weightings percentages are based on the total market value of investments.

| | | | | | | |

| COMMON STOCK — 99.4% | | | | | | |

| AUSTRALIA — 5.1% | | | | | | |

| Consumer Discretionary — 5.1% | | | | | | |

G8 Education * | | | 106,034 | | | $ | 82,564 | |

IDP Education | | | 35,122 | | | | 609,240 | |

| | | | | | | | | |

TOTAL AUSTRALIA | | | | | | | 691,804 | |

| | | | | | | | | |

| BRAZIL — 2.6% | | | | | | | | |

| Consumer Discretionary — 2.6% | | | | | | | | |

Arco Platform, Cl A * | | | 3,783 | | | | 109,934 | |

YDUQS Participacoes | | | 38,950 | | | | 247,720 | |

| | | | | | | | | |

TOTAL BRAZIL | | | | | | | 357,654 | |

| | | | | | | | | |

| CANADA — 1.6% | | | | | | | | |

| Information Technology — 1.6% | | | | | | | | |

Docebo * | | | 4,115 | | | | 213,210 | |

| | | | | | | | | |

| CHINA — 25.9% | | | | | | | | |

| Communication Services — 0.2% | | | | | | | | |

iHuman ADR * | | | 2,907 | | | | 26,047 | |

| | | | | | | | | |

| Consumer Discretionary — 25.7% | | | | | | | | |

17 Education & Technology Group ADR * | | | 21,295 | | | | 103,494 | |

China East Education Holdings | | | 277,092 | | | | 600,488 | |

GSX Techedu ADR * | | | 18,257 | | | | 338,485 | |

Koolearn Technology Holding * | | | 125,882 | | | | 204,356 | |

New Oriental Education & Technology Group ADR * | | | 96,842 | | | | 990,694 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Education ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | |

| Consumer Discretionary — continued | | | | | | |

Puxin ADR * | | | 10,806 | | | $ | 20,856 | |

Scholar Education Group | | | 70,000 | | | | 48,612 | |

TAL Education Group ADR * | | | 25,592 | | | | 1,022,912 | |

Youdao ADR * | | | 4,374 | | | | 105,195 | |

| | | | | | | | 3,435,092 | |

| | | | | | | | | |

TOTAL CHINA | | | | | | | 3,461,139 | |

| | | | | | | | | |

| JAPAN — 5.9% | | | | | | | | |

| Communication Services — 1.0% | | | | | | | | |

Gakken Holdings | | | 5,569 | | | | 68,666 | |

V-Cube | | | 3,040 | | | | 68,167 | |

| | | | | | | | 136,833 | |

| | | | | | | | | |

| Consumer Discretionary — 4.1% | | | | | | | | |

Benesse Holdings | | | 12,932 | | | | 299,855 | |

Edulab * | | | 1,262 | | | | 64,721 | |

Media Do * | | | 2,036 | | | | 102,193 | |

RareJob | | | 1,286 | | | | 21,107 | |

Riso Kyoiku | | | 19,495 | | | | 55,662 | |

| | | | | | | | 543,538 | |

| | | | | | | | | |

| Industrials — 0.8% | | | | | | | | |

Insource | | | 5,398 | | | | 107,101 | |

| | | | | | | | | |

TOTAL JAPAN | | | | | | | 787,472 | |

| | | | | | | | | |

| NORWAY — 3.4% | | | | | | | | |

| Communication Services — 3.4% | | | | | | | | |

Kahoot! * | | | 56,327 | | | | 451,657 | |

| | | | | | | | | |

| SOUTH KOREA — 0.6% | | | | | | | | |

| Consumer Discretionary — 0.6% | | | | | | | | |

MegaStudyEdu | | | 1,481 | | | | 87,774 | |

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Education ETF | |

| | | | | | | |

| COMMON STOCK — continued | | | | | | | | |

| UNITED KINGDOM — 8.2% | | | | | | | | |

| Communication Services — 8.2% | | | | | | | | |

Pearson | | | 95,164 | | | $ | 1,103,988 | |

| | | | | | | | | |

| UNITED STATES — 46.1% | | | | | | | | |

| Communication Services — 6.3% | | | | | | | | |

Bandwidth, Cl A * | | | 2,864 | | | | 338,782 | |

John Wiley & Sons, Cl A | | | 5,901 | | | | 374,006 | |

Scholastic | | | 4,102 | | | | 138,155 | |

| | | | | | | | 850,943 | |

| | | | | | | | | |

| Consumer Discretionary — 22.3% | | | | | | | | |

2U * | | | 9,381 | | | | 341,656 | |

Bright Horizons Family Solutions * | | | 7,675 | | | | 1,060,915 | |

Chegg * | | | 16,928 | | | | 1,301,932 | |

Houghton Mifflin Harcourt * | | | 15,848 | | | | 157,529 | |

Stride * | | | 5,221 | | | | 140,340 | |

| | | | | | | | 3,002,372 | |

| | | | | | | | | |

| Information Technology — 17.5% | | | | | | | | |

8x8 * | | | 13,472 | | | | 317,266 | |

Brightcove * | | | 5,003 | | | | 72,544 | |

RingCentral, Cl A * | | | 2,161 | | | | 567,198 | |

Slack Technologies, Cl A * | | | 16,729 | | | | 736,745 | |

Zoom Video Communications, Cl A * | | | 1,982 | | | | 657,092 | |

| | | | | | | | 2,350,845 | |

| | | | | | | | | |

TOTAL UNITED STATES | | | | | | | 6,204,160 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

(Cost $15,753,282) | | | | | | | 13,358,858 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 99.4% | | | | | | | | |

(Cost $15,753,282) | | | | | | $ | 13,358,858 | |

Percentages are based on Net Assets of $13,438,444.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | Global X Education ETF | |

| * | Non-income producing security. |

ADR — American Depositary Receipt

Cl — Class

As of May 31, 2021, all of the Fund’s investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended May 31, 2021, there were no transfers in or out of Level 3.

| Schedule of Investments | | May 31, 2021 (Unaudited) |

| | | |

Sector Weightings †: