UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Huntington Asset Services, Inc.

2960 N. Meridian Street, Suite 300

Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group

11300 Tomahawk Creek Parkway, Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 10/31

Date of reporting period: 10/31/12

Item 1. Reports to Stockholders.

Annual Report

October 31, 2012

Fund Adviser:

TEAM Financial Asset Management, LLC

800 Corporate Circle, Suite 106

Harrisburg, PA 17110

Toll Free (877) 832-6952

Management’s Discussion of Fund Performance

As we remind our shareholders in each annual and semi-annual report, our investment process is active on three basic timeframes: secular, cyclical and tactical. These could also be labeled as long, intermediate, and short term. It is within that context we discuss the Fund’s performance.

During the past year through 10/31/2012, our performance suffered from a combination of a poor environment for our secular exposure, a very difficult period as the current business cycle transitions, and some mixed results in our tactical trading. The net result was a 12 month period that was very disappointing. I will address the challenges we’ve encountered within those three time frames, and then offer our outlook.

The business and market cycle from 2009 into 2012 has unfolded in two chapters. The first chapter was from early 2009 into the spring of 2010, when global markets exploded higher in a nearly uniform fashion. This market explosion coincided with the global economy ramping off the business cycle trough. The second chapter has unfolded from the spring of 2010 through the fall of 2012. During that period, equity stock markets and sectors in the areas we are most bullish on long term underperformed dramatically. At the country level, equity markets in countries with strong demographics and reasonable government fiscal strength performed very poorly relative to countries with poor demographics and impaired, if not dangerous, long term fiscal conditions. For example, the Brazilian stock market was down over 30% in US dollar terms since its peak in 2010, while the US stock market was up over 15% from its 2010 peak – a massive 45%+ outperformance.

We remain long term bullish on commodities and related operating companies like those in energy, agriculture and precious metals mining. Over the past 12 months that this report covers, the broad energy sector was down about 2%, while stocks in the pharmaceutical industry were up about 15%. The gold mining industry was down about 13% over the period, while US financials were up about 14%. In both these comparisons, we believe the long term fundamentals for the companies in energy and precious metals mining are excellent, and the opposite for companies in the pharmaceutical and financial businesses.

This dynamic created a significant performance headwind for the Fund, as our core positions underperformed major US stock market indexes dramatically. We began to become concerned in the 4th quarter 2011 that a new recession was likely to occur in the US sometime in 2012, with our best guess being it

1

would start sometime in the first half of the year. Historically since 1900, the US stock market has peaked about 2.5-3.0 months prior to the start of a recession. We retained a bullish net long position from mid-August 2011 into February 2012. However, our concentration long equity exposure in our preferred long term areas, resulted in the fund underperforming broad stock market indexes. This underperformance in equity selection was partially offset by gains harvested in foreign exchange positions that were short the US dollar versus various currencies, such as the Mexican peso.

By February 2012, we saw enough evidence within our analysis to believe that a cyclical peak in the US stock market was likely to emerge within six to eight weeks. As a result, we began to implement significant portfolio hedges that would benefit from a decline in major US stock indexes. Our long exposure rebounded from the severe 4th quarter 2011 decline with a sharp rally in January and into February. From mid-February into April, the Fund suffered significantly, as our long term core positions in precious metals mining stock fell sharply, while the US stock market continued to rally until its peak in early April. Metals Miners continued to fall very sharply into mid-May, while the US stock market did not decline with any vigor until the last three weeks of May.

The decline in US stocks combined with our reversal to be long the US dollar versus various foreign currencies prior to it rallying resulted in the Fund appreciating sharply from early May into the beginning of June. Our analysis suggested that markets would likely bottom sometime mid-June and with the S&P 500™ index falling to the 1230 or even 1160 levels. The decline terminated in early June prior to reaching our parameters and markets proceeded to launch into an explosive and persistent rally, which terminated in late September. We were tardy in recognizing the nature of the rebound off of the June low and the Fund suffered significant losses in short positions and put option premium, which declined sharply in value as stock markets rose.

After the initial rally into July, markets had ascended back up to levels from which we had expected a failed rally to stall and for the cyclical bear market to assert its force. As a result, we reloaded our short and put exposure with the expectation that the rally would exhaust into late July or early August. This too ended up being a costly misstep, as markets exploded in late July on news that the European Central Bank would “do anything” to preserve the euro.

With hindsight, we believe that normal cycle dynamics began to unfold starting in April 2012, but that process was impacted significantly by the actual and implied central bank interventions starting in June 2012. We underestimated

2

the ability of central bank policies and rhetoric to influence markets in a way so that they diverged so dramatically from fundamentals.

The Fund’s value stabilized at lower levels by mid August, as our short exposure was reduced and our additions to positions in precious metals mining stocks began to flourish as the industry rallied sharply after the Federal Reserve minutes for July were released in early August. The broader stock market continued to rally sharply into mid-September; fueled by the anticipation of the Federal Reserve announcing additional quantitative easing (QE). The Fund continued to trade in a relatively stable, but volatile range, as we re-built short exposure following the September peak and the early October retest of those highs. The Fund closed 10/31/2012 with a very significant short stocks profile, with long US dollar positions versus various currencies, and positioning in precious metals miners scaled back to core positions only.

As we look ahead, our fundamental forecast remains intact. We are now seeing evidence confirming that a US recession likely began sometime around June or July. This recession, assuming our assessment is correct, is arriving within the context of much of the rest of the global economy also plunging into recession. Central banks in the US and Europe have gone “all in” and have indicated that they will do “whatever it takes.” Markets appear to be very complacent and displaying a very high degree of faith in both the willingness and ability of central banks to deliver. We do not question their collective willingness, but believe the consensus faith in their ability to effectively revoke the business cycle and/or prop up markets no matter what in perpetuity, is both dangerous and wrong.

The large scale of the complacency in markets is reflected in the plunging in implied volatility across financial and currency markets. It appears that there has been a wholesale selling of options and other derivatives across markets based on the belief that tail risks have been eliminated due to central bank policies. We believe this has created a highly unstable situation for markets, as many investors are effectively selling flood insurance at a very low price thinking they are in the Sahara desert. It is our contention that they are doing so as a hurricane, in the form of a global recession, is barreling down on markets.

We’ve maintained a relatively high volatility profile in the Fund’s portfolio since February, and it increased even more since May. We do not expect such volatility to be a constant characteristic for the Fund in future cycles. We’ve structured portfolio exposure in alignment with the opportunities and risk we see present in financial markets. The Fund’s strategy is designed to try and navigate full business and market cycles, and we believe the cycle from early 2009 to 2012 has completed.

3

A significant contributor to the Fund’s increased volatility profile has been the deployment of various derivative instruments, which increases the Fund’s gross exposure and introduces various forms of leverage and other risks. As disclosed in the Fund’s prospectus, we may deploy various derivative instruments for both hedging and speculative purposes. As cycles mature and we forecast that a potential significant inflection point has been reached, we have shorted equity index futures, shorted European and Japanese sovereign debt futures, and purchased equity and equity index put options.

These instruments provide a leveraged potential return profile if we are able to accurately anticipate both direction and timing of market movements. For example, the Fund’s sharp rally in May 2012 was significantly driven by gains in equity put options, short equity index futures, as well as long US dollar currency forwards versus various foreign currencies. However, the leverage introduced is a dual edge sword, as those gains were subsequently surrendered as markets rallied sharply in June and July.

The Fund suffered significant realized losses from equity put options expiring without value, as well as short equity index futures in June, July and August 2012. The realized losses were significantly larger than gains realized in late May and early June on a portion of the Fund’s equity put options.

Our expectation that a major cycle high had been realized in early April proved premature, which resulted in the ill timed deployment of equity puts and short equity index futures during most of the summer 2012. Those losses were only partially offset by gains in equity call options on precious metals mining stocks purchased and held in July and August. The derivatives exposure was scaled back from mid-August into mid-September, when our analysis suggested that an overthrow test of the spring high was unfolding. This increased our conviction that a cycle peak was still likely to unfold, and we once again began deploying significant equity put options, combined with short equity index futures.

While these positions have increased Fund volatility significantly, we expect them to help the Fund achieve its long term investment objectives as a full market cycle unfolds. However, they inherently increase the Fund’s risk profile and there are no assurances that we will be successful in utilizing them.

The scope of the use of derivatives is varied within the Fund’s strategy depending on our assessment of the market climate. We are likely to use derivatives more extensively when we believe there is a wide disparity between market fundamentals and market prices. When we believe markets are moving towards fundamentals, we are likely to reduce derivatives exposure significantly.

4

Foreign exchange forwards are a core and ongoing part of the Fund’s strategy. These derivative contracts provide the Fund exposure movements in foreign exchange markets. While the relative size of exposure to foreign exchange forwards can change, we expect it to remain a meaningful part of the Fund’s exposure most of the time.

We recognize and can appreciate that such high levels of volatility can be cause for concern. Our Fund’s strategy is one which is classified by most as an “alternative,” which means it is used by most as a complimentary allocation within a broader asset allocation. As the Fund’s portfolio manager, I have made a decision to invest a substantially significant portion of my liquid investable assets in the Fund, but I am also personally comfortable doing so given its risk and volatility profile.

The vast majority of our investors own the Fund as part of a diversified portfolio of risk assets, many of which we believe are extremely vulnerable to significantly large declines given the confluence of risks this cycle. While we may certainly end up being mistaken, it is our belief that our investors’ overall investment well being will be most benefited this cycle by us maintaining the high volatility profile we’ve deployed until the current cycle completes. We fully expect future cycles to entail different dynamics that are not likely to present the same portfolio risks, and we are likely to manage the Fund during future cycles with relatively lower levels of volatility as a result.

The views in the foregoing discussion were those of the Fund’s investment adviser as of the date set forth above and may not reflect its views on the date this Annual Report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Fund and do not consistitute investment advice.

5

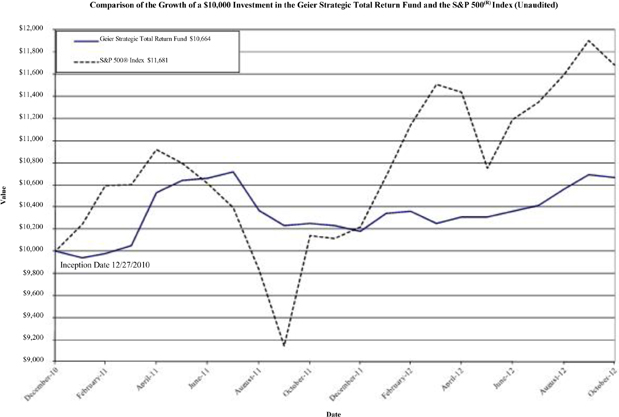

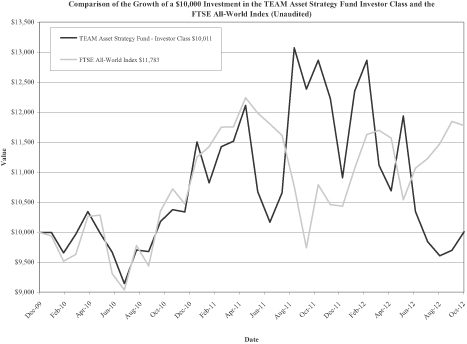

Investment Results – (Unaudited)

| | | | | | | | |

Total Returns*

(For the period ended October 31, 2012) | |

| | | 1 Year | | | Average Annual

Since Inception

(December 30, 2009) | |

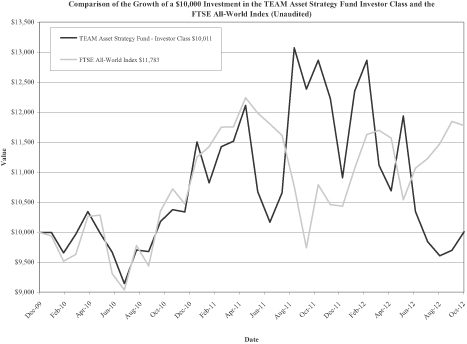

TEAM Asset Strategy Fund - Investor Class | | | -22.21 | % | | | 0.04% | |

FTSE All-World Index** | | | 9.16 | % | | | 5.95% | |

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 28, 2012 were 2.07% of average daily net assets. The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2013, so that Total Annual Fund Operating Expenses do not exceed 2.20%. This agreement may not be terminated by the Adviser until after February 28, 2013. This operating expense limitation does not apply to (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, and (vii) expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the 1940 Act.

6

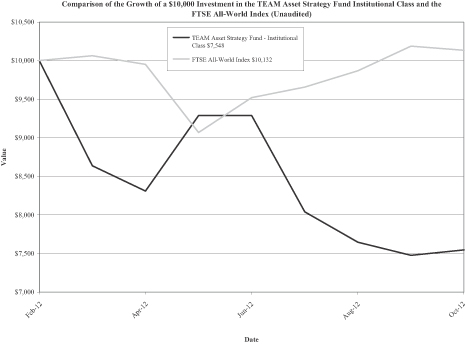

| | | | |

Total Returns*

(For the period ended October 31, 2012) | |

| | | Since Inception

(February 28, 2012) | |

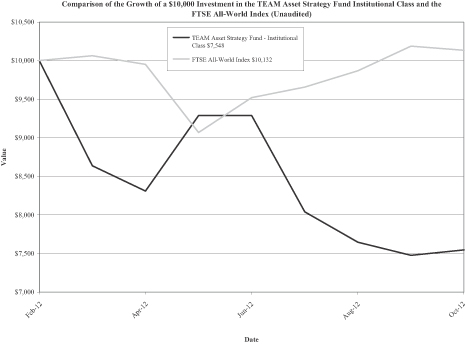

TEAM Asset Strategy Fund - Institutional Class | | | -23.15% | |

FTSE All-World Index** | | | 1.20% | |

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 28, 2012 were 1.82% of average daily net assets. The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2013, so that Total Annual Fund Operating Expenses do not exceed 1.95%. This agreement may not be terminated by the Adviser until after February 28, 2013. This operating expense limitation does not apply to (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, and (vii) expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the 1940 Act.

7

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-877-832-6952.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions.

** The FTSE All-World Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling the same number as above. Please read it carefully before investing. The Fund is distributed by Unified Financial Securities, Inc. Member FINRA.

8

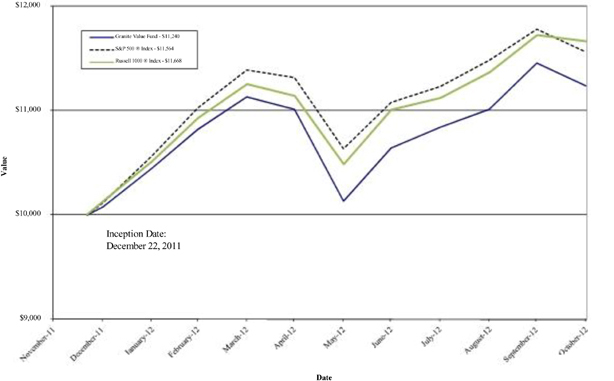

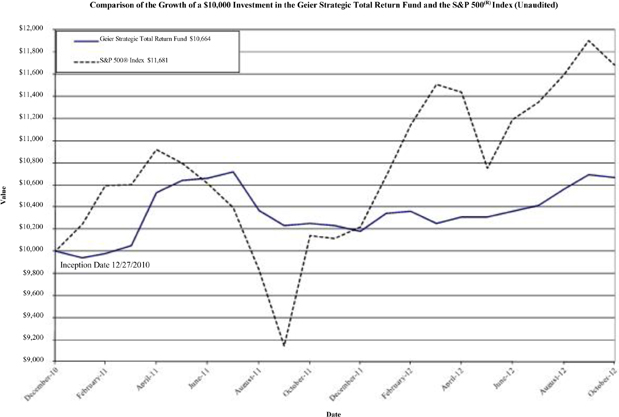

This graph shows the value of a hypothetical initial investment of $10,000 made on December 30, 2009 for the Investor Class (commencement of Fund operations) and held through October 31, 2012. The chart above assumes an initial investment of $10,000 made on December 30, 2009 (commencement of Fund operations) and held through October 31, 2012. The FTSE All-World Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-877-832-6952. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

9

This graph shows the value of a hypothetical initial investment of $10,000 made on February 28, 2012 for the Institutional Class (commencement of Fund operations) and held through October 31, 2012. The chart above assumes an initial investment of $10,000 made on February 29, 2012 (commencement of Fund operations) and held through October 31, 2012. The FTSE All-World Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-877-832-6952. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

10

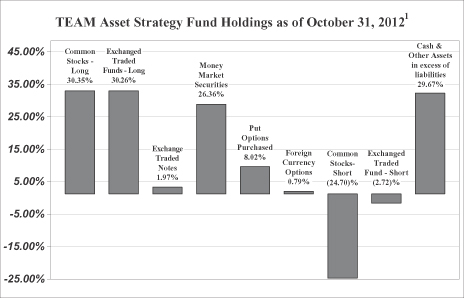

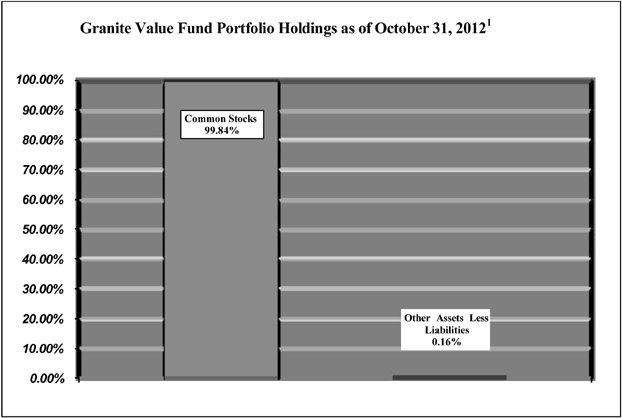

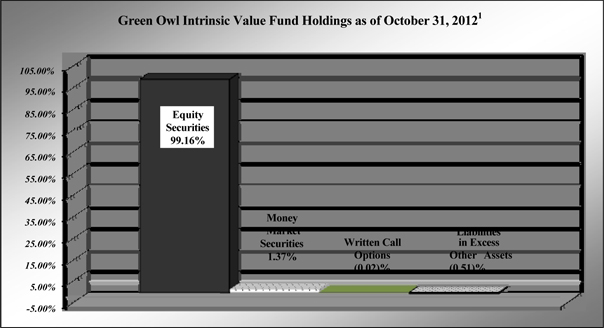

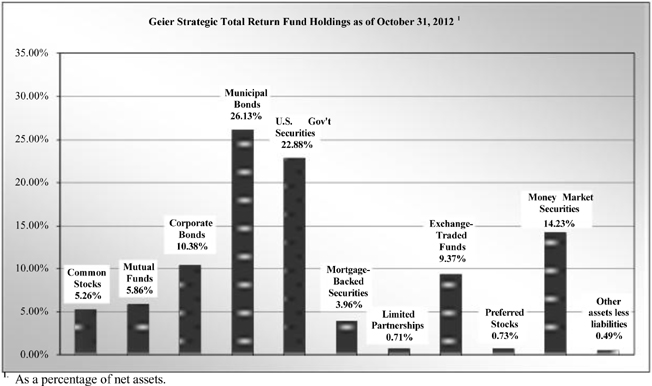

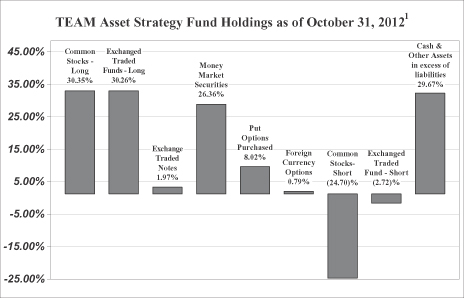

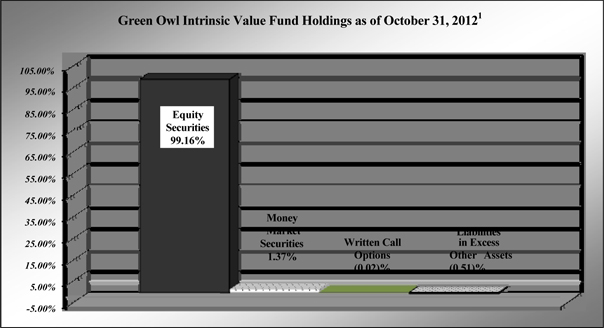

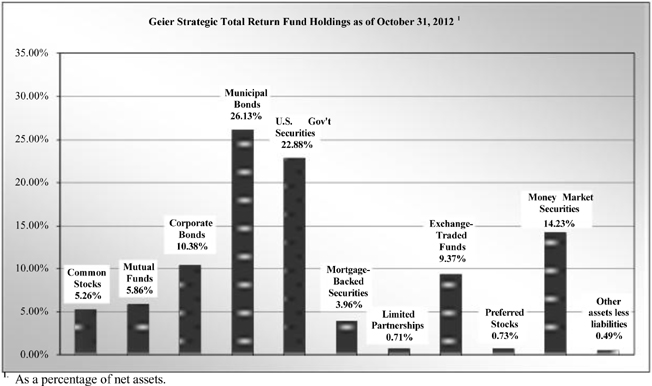

Fund Holdings – (Unaudited)

1As a percentage of net assets.

The investment objective of the TEAM Asset Strategy Fund (the “Fund”) is to provide high total investment return, which will generally be achieved through a combination of appreciation in capital and income.

Availability of Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Fund’s Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning and held for the entire period from May 1, 2012 through October 31, 2012.

11

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as the redemption fee imposed on short-term redemptions. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if the short-term redemption fee imposed by the Fund were included, your costs would have been higher.

| | | | | | | | | | | | |

TEAM Asset Strategy

Fund Investor | | Beginning Account

Value May 1, 2012 | | | Ending Account Value October 31, 2012 | | | Expenses Paid During the Period Ended October 31, 2012 | |

Actual* | | $ | 1,000.00 | | | $ | 937.30 | | | $ | 11.27 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,013.50 | | | $ | 11.71 | |

*Expenses are equal to the Investor Class’s annualized expense ratio of 2.31%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the partial year).

**Assumes a 5% return before expenses

12

| | | | | | | | | | | | |

TEAM Asset Strategy

Fund Institutional | | Beginning Account

Value May 1, 2012 | | | Ending Account Value October 31, 2012 | | | Expenses Paid During the Period Ended October 31, 2012 | |

Actual* | | $ | 1,000.00 | | | $ | 937.30 | | | $ | 9.03 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,015.82 | | | $ | 9.39 | |

*Expenses are equal to the Institutional Class’s annualized expense ratio of 1.85%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the partial year).

**Assumes a 5% return before expenses.

13

TEAM Asset Strategy Fund

Schedule of Investments

October 31, 2012

| | | | | | | | |

| | | Shares | | | Fair Value | |

Common Stocks - Long - 30.35% | | | | | | | | |

| | |

Gold & Silver Ores - 14.52% | | | | | | | | |

Eldorado Gold Corp. (b)(c) | | | 187,000 | | | $ | 2,771,340 | |

Gold Resource Corp. (f) | | | 175,000 | | | | 2,926,000 | |

Yamana Gold, Inc. (b)(c) | | | 151,000 | | | | 3,051,710 | |

| | | | | | | | |

| | | | | | | 8,749,050 | |

| | | | | | | | |

| | |

Mining - 9.76% | | | | | | | | |

New Gold, Inc. (a)(b)(c) | | | 243,000 | | | | 2,850,390 | |

Rubicon Minerals Corp. (a) | | | 850,000 | | | | 3,026,000 | |

| | | | | | | | |

| | | | | | | 5,876,390 | |

| | | | | | | | |

| | |

Oil, Gas Field Services - 1.74% | | | | | | | | |

Heckmann Corp. (a)(g) | | | 300,000 | | | | 1,050,000 | |

| | | | | | | | |

| | |

Services - 4.33% | | | | | | | | |

U.S. Global Investors, Inc. - Class A (b)(c) | | | 475,200 | | | | 2,608,848 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS - LONG (Cost $17,731,522) | | | | | | | 18,284,288 | |

| | | | | | | | |

| | |

Exchange Traded Funds - 30.26% | | | | | | | | |

Direxion Daily Emerging Markets Bear 3X Shares (a)(f) | | | 200,000 | | | | 2,350,000 | |

Direxion Daily Energy Bear 3X Shares (a)(f) | | | 225,000 | | | | 1,812,375 | |

Direxion Daily Small Cap Bear 3X Shares (a) | | | 235,000 | | | | 3,724,750 | |

ProShares UltraShort MSCI Europe (a) | | | 56,000 | | | | 1,699,040 | |

ProShares UltraShort QQQ (a) | | | 82,000 | | | | 2,510,020 | |

ProShares UltraPro Short QQQ (a) | | | 62,000 | | | | 2,652,980 | |

ProShares UltraPro Short S&P 500 (a) | | | 86,000 | | | | 3,482,140 | |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED FUNDS (Cost $17,258,537) | | | | | | | 18,231,305 | |

| | | | | | | | |

| | |

Exchange Trade Notes - 1.97% | | | | | | | | |

iPath Dow Jones-UBS Sugar Subindex Total Return ETN | | | 17,000 | | | | 1,190,170 | |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED NOTES (Cost $1,209,528) | | | | | | | 1,190,170 | |

| | | | | | | | |

| | |

Money Market Securities - 26.36% | | | | | | | | |

Federated US Treasury Cash Reserves, 0.00% (b)(c)(d) | | | 10,600,000 | | | | 10,600,000 | |

Fidelity Institutional Treasury Only Portfolio, 0.01% (d)(g) | | | 4,180,121 | | | | 4,180,121 | |

Fidelity Institutional Treasury Only Portfolio, 0.01% (d) | | | 1,099,682 | | | | 1,099,682 | |

| | | | | | | | |

| | |

TOTAL MONEY MARKET SECURITIES (Cost $15,879,803) | | | | | | | 15,879,803 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

14

TEAM Asset Strategy Fund

Schedule of Investments - continued

October 31, 2012

| | | | | | | | |

| | | Outstanding

Contracts | | | Fair Value | |

Put Options Purchased - 8.02% | | | | | | | | |

| | |

Capital One Financial Corp./ November 2012/ Strike $57.50 (e) | | | 2,000 | | | $ | 116,000 | |

Financial Select Sector SPDR Fund/ November 2012/ Strike $15.00 (e) | | | 10,000 | | | | 60,000 | |

General Mills, Inc/ November 2012/ Strike $39.00 (e) | | | 2,000 | | | | 26,000 | |

iShares MSCI Emerging Markets Index Fund/ November 2012/ Strike $41.00 (c)(e) | | | 2,000 | | | | 134,000 | |

iShares MSCI Emerging Markets Index Fund/ January 2013/ Strike $40.00 (c)(e) | | | 4,000 | | | | 532,000 | |

iShares MSCI Hong Kong Index Fund/ January 2013/ Strike $19.00 (e) | | | 5,000 | | | | 475,000 | |

iShares Russell 2000 Index/ January 2013/ Strike $85.00 (e) | | | 1,000 | | | | 510,000 | |

Market Vectors Gold Miners ETF/ January 2013/

Strike $45.00 (e) | | | 2,000 | | | | 152,000 | |

Powershares QQQ Trust Series 1/ January 2013/

Strike $65.00 (e) | | | 10,000 | | | | 2,330,000 | |

Salesforce.com. Inc./ November 2012/ $120.00 (e) | | | 600 | | | | 14,400 | |

Toll Brothers, Inc/ November 2012/35.00 (e) | | | 2,000 | | | | 480,000 | |

| | | | | | | | |

| | |

TOTAL PUT OPTIONS PURCHASED (Cost $4,126,368) | | | | | | | 4,829,400 | |

| | | | | | | | |

| | |

| Foreign Currency Call Options Purchased - 0.79% | | Notional

Amount | | | | |

OTC U.S. Dollar versus Australian Dollar/ November 2012/ Strike AUD 1.03 | | $ | 20,000,000 | | | | 90,680 | |

OTC U.S. Dollar versus British Pound/ November 2012/ Strike GBP 1.60 | | | 16,000,000 | | | | 53,488 | |

OTC U.S. Dollar versus Canadian Dollar/ November 2012/ Strike CAD 0.99 | | | 20,000,000 | | | | 314,864 | |

OTC U.S. Dollar versus New Zealand Dollar/ November 2012/ Strike NZD 0.80 | | | 20,000,000 | | | | 13,920 | |

| | | | | | | | |

| | |

TOTAL FOREIGN CURRENCY CALL OPTIONS CONTRACTS (Cost $391,598) | | | | | | | 472,952 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - LONG

(Cost $56,597,356) - 97.75% | | | | | | $ | 58,887,918 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - SHORT

(Proceeds $16,641,925) - (27.42)% | | | | | | | (16,520,185 | ) |

| | | | | | | | |

| | |

Cash & other assets in excess of liabilities - 29.67% | | | | | | | 17,876,771 | |

| | | | | | | | |

| | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 60,244,504 | |

| | | | | | | | |

| (b) | All or a portion of this security is held as collateral on forward currency exchange contracts. |

| (c) | All or portion of this security is held as collateral for securities sold short. |

| (d) | Variable rate security; the rate shown represents the 7 day yield at October 31, 2012. |

| (e) | Each Call/Put contract has a multiplier of 100 shares. |

| (f) | The security or a partial position of the security was on loan as of October 31, 2012. The total value of securities on loan as of October 31, 2012 was $4,143,033. |

| (g) | Purchased with cash collateral held from securities lending. This represents the value of collateral as of October 31, 2012. |

See accompanying notes which are an integral part of these financial statements.

15

TEAM Asset Strategy Fund

Schedule of Securities Sold Short

October 31, 2012

| | | | | | | | |

| | | Shares | | | Fair Value | |

Common Stocks - Short - (24.70)% | | | | | | | | |

| | |

Air Courier Services - (2.29)% | | | | | | | | |

FedEx Corp | | | (15,000 | ) | | $ | (1,379,850 | ) |

| | | | | | | | |

| | |

Banks - (8.18)% | | | | | | | | |

Banco Bilbao Vizcaya Argentaria, SA (a) | | | (145,000 | ) | | | (1,203,500 | ) |

Banco Santander, SA (a) | | | (157,000 | ) | | | (1,171,220 | ) |

Barclays PLC (a) | | | (80,000 | ) | | | (1,184,000 | ) |

Deutsche Bank, AG | | | (30,000 | ) | | | (1,371,300 | ) |

| | | | | | | | |

| | | | | | | (4,930,020 | ) |

| | | | | | | | |

| | |

Finance Services - (1.39)% | | | | | | | | |

American Express Co | | | (15,000 | ) | | | (839,550 | ) |

| | | | | | | | |

| | |

General Building Contractors - Residential Buildings - (1.56)% | | | | | | | | |

Lennar Corp. Class A | | | (25,000 | ) | | | (936,750 | ) |

| | | | | | | | |

| | |

Operative Builders - (5.87)% | | | | | | | | |

DR Horton, Inc | | | (54,000 | ) | | | (1,131,840 | ) |

PulteGroup, Inc | | | (72,000 | ) | | | (1,248,480 | ) |

Toll Brothers, Inc | | | (35,000 | ) | | | (1,155,350 | ) |

| | | | | | | | |

| | | | | | | (3,535,670 | ) |

| | | | | | | | |

| |

Services - Computer Programming, Data Processing Etc. - (1.69)% | | | | | |

Google, Inc - Class A | | | (1,500 | ) | | | (1,019,655 | ) |

| | | | | | | | |

| | |

Services - Prepackaged Software - (1.70)% | | | | | | | | |

Salesforce.com, Inc | | | (7,000 | ) | | | (1,021,860 | ) |

| | | | | | | | |

| | |

Telephone Communications (No Radio Telephone) - (2.02)% | | | | | | | | |

China Mobile Ltd (a) | | | (22,000 | ) | | | (1,218,580 | ) |

| | | | | | | | |

| |

TOTAL COMMON STOCKS - SHORT - (Proceeds $15,022,391) | | | | (14,881,935 | ) |

| | | | | | | | |

| | |

Exchanged Traded Funds - (2.72)% | | | | | | | | |

iShares MSCI Mexico Investable Market Index Fund | | | (25,000 | ) | | | (1,638,250 | ) |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED FUNDS - SHORT -

(Proceeds $1,619,534) | | | | | | | (1,638,250 | ) |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - SHORT - COMMON STOCKS & EXCHANGE TRADED FUNDS

(Proceeds $16,641,925) - (27.42)% | | | | | | $ | (16,520,185 | ) |

| | | | | | | | |

| (a) | American Depositary Receipt. |

See accompanying notes which are an integral part of these financial statements.

16

TEAM Asset Strategy Fund

Schedule of Short Futures Contracts

October 31, 2012

| | | | | | | | | | | | |

Short Futures Contracts | | Number of

(Short)

Contracts | | | Underlying

Face

Amount at

Fair Value | | | Unrealized

Appreciation

(Depreciation) | |

E-Mini Russell 2000 Futures Contract December 2012 (a) | | | (250 | ) | | $ | (20,407,500 | ) | | $ | (93,885 | ) |

Euro - BTP Italian Government Bond Futures December 2012 (b) | | | (100 | ) | | $ | (13,937,698 | ) | | | 43,552 | |

Euro - OAT Futures December 2012 (c) | | | (100 | ) | | $ | (17,442,855 | ) | | | (7,658 | ) |

Japanese 10-Year Government Bond Futures December 2012 (d) | | | (20 | ) | | $ | (36,094,082 | ) | | | (9,005 | ) |

| | | | | | | | | | | | |

Total Short Futures Contracts | | | | | | | | | | $ | (66,996 | ) |

| | | | | | | | | | | | |

| (a) | Each E-Mini Russell 2000 Futures contract has a multiplier of 100 shares. |

| (b) | Each Euro - BTP Italian Government Bond Futures contract has a multiplier of 1,000 shares. |

| (c) | Each Euro - OAT Futures contract has a multiplier of 1,000 shares. |

| (d) | Japanese 10-Year Government Bond Futures of 1,000,000 shares. |

See accompanying notes which are an integral part of these financial statements.

17

TEAM Asset Strategy Fund

Schedule of Forward Currency Exchange Contracts

October 31, 2012

| | | | | | | | | | | | | | | | |

Settlement

Date | | Currency to

be Delivered | | U.S. $

Value at

Oct. 31, 2012 | | | Currency to

be Received | | U.S. $

Value at

Oct. 31, 2012 | | | Unrealized

Appreciation

(Depreciation) | |

11/23/12 | | 9,301,047 Australian Dollars (b) | | | 9,625,263 | | | 9,696,248 U.S. Dollars | | | 9,696,248 | | | | 70,985 | |

11/23/12 | | 9,576,462 Australian Dollars (a) | | | 9,910,278 | | | 9,931,068 U.S. Dollars | | | 9,931,068 | | | | 20,790 | |

11/23/12 | | 9,797,870 Australian Dollars (a) | | | 10,139,404 | | | 10,000,000 U.S. Dollars | | | 10,000,000 | | | | (139,404 | ) |

11/23/12 | | 6,182,801 British Pounds (a) | | | 9,958,761 | | | 10,000,000 U.S. Dollars | | | 10,000,000 | | | | 41,239 | |

11/23/12 | | 6,373,771 British Pounds (a) | | | 10,266,361 | | | 10,336,382 U.S. Dollars | | | 10,336,382 | | | | 70,021 | |

11/26/12 | | 782,570,000 Japanese Yen (b) | | | 9,794,940 | | | 9,994,636 U.S. Dollars | | | 9,994,636 | | | | 199,696 | |

11/26/12 | | 782,620,000 Japanese Yen (a) | | | 9,795,566 | | | 9,997,713 U.S. Dollars | | | 9,997,713 | | | | 202,147 | |

11/23/12 | | 64,515,500 Mexican Peso (b) | | | 4,918,457 | | | 5,000,000 U.S. Dollars | | | 5,000,000 | | | | 81,543 | |

11/23/12 | | 131,800,000 Mexican Peso (b) | | | 10,048,092 | | | 10,174,511 U.S. Dollars | | | 10,174,511 | | | | 126,419 | |

11/23/12 | | 12,340,499 New Zealand Dollars (b) | | | 10,127,301 | | | 10,161,414 U.S. Dollars | | | 10,161,414 | | | | 34,113 | |

11/23/12 | | 12,493,129 New Zealand Dollars (a) | | | 10,252,557 | | | 10,292,127 U.S. Dollars | | | 10,292,127 | | | | 39,570 | |

11/23/12 | | 65,616,000 Swedish Krona (a) | | | 9,884,553 | | | 10,000,000 U.S. Dollars | | | 10,000,000 | | | | 115,447 | |

11/23/12 | | 66,290,000 Swedish Krona (b) | | | 9,986,086 | | | 10,000,000 U.S. Dollars | | | 10,000,000 | | | | 13,914 | |

11/23/12 | | 66,957,050 Swedish Krona (b) | | | 10,086,572 | | | 10,265,707 U.S. Dollars | | | 10,265,707 | | | | 179,135 | |

11/23/12 | | 9,450,142 U.S. Dollars (b) | | | 9,450,142 | | | 9,301,047 Australian Dollars | | | 9,625,262 | | | | 175,120 | |

11/23/12 | | 10,267,380 U.S. Dollars (a) | | | 10,267,380 | | | 6,373,771 British Pounds | | | 10,266,361 | | | | (1,019 | ) |

11/23/12 | | 9,825,093 U.S. Dollars (a) | | | 9,825,093 | | | 65,616,000 Swedish Krona | | | 9,884,553 | | | | 59,460 | |

| | | | | | | | | | | | | | | | |

| | | | $ | 164,336,806 | | | | | $ | 165,625,982 | | | $ | 1,289,176 | |

| | | | | | | | | | | | | | | | |

| (a) | Barclay’s PLC. is the counterparty for the open forward currency exchange contract held by the Fund as of October 31, 2012. |

| (b) | UBS AG. is the counterparty for the open forward currency exchange contract held by the Fund as of October 31, 2012. |

See accompanying notes which are an integral part of these financial statements.

18

TEAM Asset Strategy Fund

Statement of Assets and Liabilities

October 31, 2012

| | | | |

Assets | | | | |

Investments in securities, at fair value (cost $56,597,356) (a) | | $ | 58,887,918 | |

Cash (a)(b) | | | 16,214,465 | |

Cash held at broker (c) | | | 4,867,107 | |

Receivables for forward currency exchange contracts | | | 1,429,599 | |

Receivable for investments sold | | | 2,754,362 | |

Receivable for net variation margin on futures contracts | | | 79,920 | |

Prepaid expenses | | | 32,275 | |

Receivables for securities lending income | | | 15,625 | |

Receivable for fund shares sold | | | 11,800 | |

Interest receivable | | | 60 | |

| | | | |

Total assets | | | 84,293,131 | |

| | | | |

Liabilities | | | | |

Investments in securities sold short, at fair value (Proceeds $16,641,925) | | | 16,520,185 | |

Payable upon return of securities loaned | | | 4,180,121 | |

Cash overdraft | | | 2,276,970 | |

Payable for investments purchased | | | 593,301 | |

Payable for forward currency exchange contracts | | | 140,423 | |

Payable for net variation margin on futures contracts | | | 138,401 | |

Payable to Adviser (d) | | | 61,311 | |

Payable for fund shares redeemed | | | 49,187 | |

Dividend expense payable on short positions | | | 41,511 | |

Payable to administrator, fund accountant, and transfer agent (d) | | | 13,663 | |

12b-1 fees accrued, Investor Class (d) | | | 6,549 | |

Payable to custodian (d) | | | 4,113 | |

Payable to trustees | | | 237 | |

Other accrued expenses | | | 22,655 | |

| | | | |

Total liabilities | | | 24,048,627 | |

| | | | |

Net Assets | | $ | 60,244,504 | |

| | | | |

Net Assets consist of: | | | | |

Paid in capital | | $ | 73,322,728 | |

Accumulated undistributed net investment income (loss) | | | 1,355,250 | |

Accumulated net realized gain (loss) from investment securities, securities sold short, forward currency exchange contracts, options and futures contracts | | | (18,067,957 | ) |

Net unrealized appreciation (depreciation) on: | | | | |

Investment securities, securities sold short, and options | | | 2,412,303 | |

Forward currency exchange contracts | | | 1,289,176 | |

Futures contracts | | | (66,996 | ) |

| | | | |

Net Assets | | $ | 60,244,504 | |

| | | | |

Net Assets: Investor Class | | $ | 32,454,588 | |

| | | | |

Shares outstanding (unlimited number of shares authorized) | | | 4,178,171 | |

| | | | |

Net Asset Value and offering price per share | | $ | 7.77 | |

| | | | |

Redemption price per share (NAV * 99%) (e) | | $ | 7.69 | |

| | | | |

Net Assets: Institutional Class | | $ | 27,789,916 | |

| | | | |

Shares outstanding (unlimited number of shares authorized) | | | 3,574,815 | |

| | | | |

Net Asset Value and offering price per share | | $ | 7.77 | |

| | | | |

Redemption price per share (NAV * 99%) (d) | | $ | 7.69 | |

| | | | |

| (a) | See Note 2 in the Notes to the Financial Statements. |

| (b) | A portion of cash is used as collateral for securities sold short. |

| (c) | Cash used as collateral for futures contract transactions. |

| (d) | See Note 5 in the Notes to the Financial Statements. |

| (e) | The Fund charges a 1.00% redemption fee on shares redeemed within 30 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

19

TEAM Asset Strategy Fund

Statement of Operations

October 31, 2012

| | | | |

Investment Income | | | | |

Dividend income (net of foreign withholding tax of $69,381) | | $ | 1,016,370 | |

Interest income | | | 963 | |

Income from securities loaned | | | 268,438 | |

| | | | |

Total Investment Income | | | 1,285,771 | |

| | | | |

| |

Expenses | | | | |

Investment Adviser fee (a) | | | 814,725 | |

12b-1 fees, Investor Class (a) | | | 83,297 | |

Administration expenses (a) | | | 65,616 | |

Transfer agent expenses (a) | | | 54,887 | |

Custodian expenses (a) | | | 43,308 | |

Registration expenses | | | 43,232 | |

Fund accounting expenses (a) | | | 39,437 | |

Legal expenses | | | 23,787 | |

Printing expenses | | | 24,816 | |

Auditing expenses | | | 14,500 | |

Trustee expenses | | | 5,225 | |

Insurance expense | | | 3,854 | |

24f-2 expense | | | 3,331 | |

Pricing expenses | | | 967 | |

Miscellaneous expenses | | | 2,162 | |

Other expense – short sale & interest expense | | | 6,530 | |

Dividend on securities sold short | | | 42,511 | |

| | | | |

Total Expenses | | | 1,272,185 | |

| | | | |

Net Investment Income (Loss) | | | 13,586 | |

| | | | |

| |

Realized & Unrealized Gain (Loss) on Investments | | | | |

Net realized gain (loss) on: | | | | |

Investment securities | | | (3,367,375 | ) |

Short securities | | | 109,315 | |

Options | | | (15,733,693 | ) |

Futures contracts | | | (124,030 | ) |

Forward currency exchange contracts | | | 4,412,221 | |

Change in unrealized appreciation (depreciation) on: | | | | |

Investment securities | | | (2,950,572 | ) |

Short securities | | | 121,740 | |

Options | | | 406,950 | |

Futures contracts | | | (66,996 | ) |

Forward currency exchange contracts | | | 573,260 | |

| | | | |

Net realized and unrealized gain (loss) on investment securities | | | (16,619,180 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (16,605,594 | ) |

| | | | |

| (a) | See Note 5 in the Notes to the Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

20

TEAM Asset Strategy Fund

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | For the

Year Ended

October 31, 2012 | | | | | For the

Year Ended

October 31, 2011 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | | | |

Operations | | | | | | | | | | |

Net investment income (loss) | | $ | 13,586 | | | | | $ | (42,558 | ) |

Net realized gain (loss) on investment securities, securities sold short, options, futures and foreign currency exchange contracts | | | (14,703,562 | ) | | | | | 7,708,430 | |

Change in unrealized appreciation (depreciation) on investment securities, options, futures and foreign currency exchange contracts | | | (1,915,618 | ) | | | | | 3,844,431 | |

| | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (16,605,594 | ) | | | | | 11,510,303 | |

| | | | | | | | | | |

Distributions | | | | | | | | | | |

From net investment income | | | (3,645,856 | ) | | | | | - | |

From net realized gains | | | (7,600,904 | ) | | | | | - | |

| | | | | | | | | | |

Total distributions | | | (11,246,760 | ) | | | | | - | |

| | | | | | | | | | |

Capital Share Transactions - Investor Class | | | | | | | | | | |

Proceeds from shares sold | | | 34,719,994 | | | | | | 21,293,399 | |

Reinvestment of distributions | | | 11,230,739 | | | | | | - | |

Amount paid for shares redeemed | | | (57,473,322 | ) | | | | | (6,887,786 | ) |

Proceeds from redemption fees collected (a) | | | 3,783 | | | | | | 3,708 | |

| | | | | | | | | | |

Net increase (decrease) in net assets resulting from Investor Class capital share transactions | | | (11,518,806 | ) | | | | | 14,409,321 | |

| | | | | | | | | | |

Capital Share Transactions - Institutional Class | | | | | | | | | | |

Proceeds from shares sold | | | 32,606,506 | | | | | | - | |

Amount paid for shares redeemed | | | (2,237,243 | ) | | | | | - | |

Proceeds from redemption fees collected (a) | | | 30 | | | | | | - | |

| | | | | | | | | | |

Net increase (decrease) in net assets resulting from Institutional Class capital share transactions | | | 30,369,293 | | | | | | - | |

| | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (9,001,867 | ) | | | | | 25,919,624 | |

| | | | | | | | | | |

Net Assets | | | | | | | | | | |

Beginning of year | | | 69,246,371 | | | | | | 43,326,747 | |

| | | | | | | | | | |

End of year | | $ | 60,244,504 | | | | | $ | 69,246,371 | |

| | | | | | | | | | |

Undistributed net investment income (loss) included in net assets at end of year | | $ | 1,355,250 | | | | | $ | 1,623,613 | |

| | | | | | | | | | |

Capital Share Transactions - Investor Class | | | | | | | | | | |

Shares sold | | | 3,840,041 | | | | | | 1,769,421 | |

Shares issued in reinvestment of distributions | | | 1,298,351 | | | | | | - | |

Shares redeemed | | | (6,340,490 | ) | | | | | (564,703 | ) |

| | | | | | | | | | |

Net increase (decrease) in Investor Class shares outstanding | | | (1,202,098 | ) | | | | | 1,204,718 | |

| | | | | | | | | | |

Capital Share Transactions - Institutional Class | | | | | | | | | | |

Shares sold | | | 3,843,662 | | | | | | - | |

Shares issued in reinvestment of distributions | | | - | | | | | | - | |

Shares redeemed | | | (268,847 | ) | | | | | - | |

| | | | | | | | | | |

Net increase (decrease) in Institutional Class shares outstanding | | | 3,574,815 | | | | | | - | |

| | | | | | | | | | |

| (a) | The Fund charges a 1% redemption fee on shares redeemed within 30 calendar days of purchase. |

See accompanying notes which are an integral part of these financial statements.

21

TEAM Asset Strategy Fund - Investor Class

Financial Highlights

(For a share outstanding during the period)

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

October 31, 2012 | | | | | For the

Year Ended

October 31, 2011 | | | | | For the

Period Ended

October 31, 2010 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 12.87 | | | | | $ | 10.38 | | | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.04 | | | | | | (0.01) | | | | | | (0.01) | |

Net realized and unrealized gain (loss) on investments | | | (2.64) | | | | | | 2.50 | | | | | | 0.39 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (2.60) | | | | | | 2.49 | | | | | | 0.38 | |

| | | | | | | | | | | | | | | | |

Less Distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.81) | | | | | | - | | | | | | - | |

From net realized gains | | | (1.69) | | | | | | - | | | | | | - | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (2.50) | | | | | | - | | | | | | - | |

| | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (e) | | | - | | | | | | - | | | | | | - | |

| | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 7.77 | | | | | $ | 12.87 | | | | | $ | 10.38 | |

| | | | | | | | | | | | | | | | |

Total Return (b) | | | (22.21)% | | | | | | 23.99% | | | | | | 3.80% | (c) |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 32,455 | | | | | $ | 69,246 | | | | | $ | 43,327 | |

Ratio of expenses to average net assets | | | 1.98% | (f) | | | | | 1.74% | | | | | | 1.93% | (d) |

Ratio of net investment income (loss) to average net assets | | | 0.12% | | | | | | (0.08)% | | | | | | (0.09)% | (d) |

Portfolio turnover rate | | | 439.34% | | | | | | 490.64% | | | | | | 313.40% | |

| (a) | For the period December 30, 2009 (Commencement of Operations) to October 31, 2010. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends if any. |

| (e) | Redemption fees resulted in less than $0.005 per share. |

| (f) | Includes dividend and interest expense of .05% for the year ended October 31, 2012. |

See accompanying notes which are an integral part of these financial statements.

22

TEAM Asset Strategy Fund - Institutional Class

Financial Highlights - continued

(For a share outstanding during the period)

| | | | |

| | | For the

Period Ended

October 31, 2012 (a) | |

Selected Per Share Data: | | | | |

Net asset value, beginning of period | | $ | 10.11 | |

| | | | |

Income from investment operations: | | | | |

Net investment income (loss) | | | (0.03) | (b) |

Net realized and unrealized gain (loss) on investments | | | (2.31) | |

| | | | |

Total from investment operations | | | (2.34) | |

| | | | |

Paid in capital from redemption fees (c) | | | - | |

| |

| | | | |

Net asset value, end of period | | $ | 7.77 | |

| | | | |

| |

Total Return (d) | | | (23.15)% | (e) |

| |

Ratios and Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 27,790 | |

Ratio of expenses to average net assets | | | 1.80% | (f)(g) |

Ratio of net investment income (loss) to average net assets | | | (0.58)% | (f) |

Portfolio turnover rate | | | 439.34% | |

| (a) | For the period February 28, 2012 (Commencement of Operations) to October 31, 2012. |

| (b) | Calculated using the average share method. |

| (c) | Redemption fees resulted in less than $0.005 per share. |

| (d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends if any. |

| (g) | Includes dividend and interest expense of .25% for the period ended October 31, 2012. |

See accompanying notes which are an integral part of these financial statements.

23

TEAM Asset Strategy Fund

Notes to the Financial Statements

October 31, 2012

NOTE 1. ORGANIZATION

The TEAM Asset Strategy Fund (the “Fund”) is an open-end, non-diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund’s investment adviser is TEAM Financial Asset Management, LLC (the “Adviser”). The investment objective of the Fund is to provide high total investment return, which will generally be achieved through a combination of appreciation in capital and income.

The Fund currently offers two classes of shares, Investor Class and Institutional Class. Investor Class shares were first offered to the public on December 30, 2009; and Institutional Class shares were first offered to the public on February 29, 2012. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Trustees. On matters that affect the Fund as a whole, each class has the same voting and other rights and preferences as any other class. On matters that affect only one class, only shareholders of that class may vote. Each class votes separately on matters affecting only that class, or on matters expressly required to be voted on separately by state or federal law. Shares of each class of a series have the same voting and other rights and preferences as the other classes and series of the Trust for matters that affect the Trust as a whole. The Fund may offer additional classes of shares in the future.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Futures Contracts – The Fund may enter into futures contracts and may short futures contracts to hedge various investments for risk management, obtain market exposure, and for speculative purposes. The Fund may also use futures for leverage and to manage cash. Initial margin deposits are made upon entering into futures contracts and can be either cash or securities. Secondary margin limits are required to be maintained while futures are held, as defined by each contract. Cash held at the broker as of October 31, 2012, is held for collateral for futures transactions and is restricted from withdrawal.

24

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

During the period a futures contract is open, changes in the value of the contract are recognized as unrealized gains or losses by “marking-to-market” on a daily basis to reflect the fair value of the contract at the end of each day’s trading. Variation margin receivables or payables represent the difference between the change in unrealized appreciation and depreciation on the open contracts and the cash deposits made on the margin accounts. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from the closing transaction and the Fund’s cost of entering into a contract. The use of futures contracts involves the risk of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities, or that the counterparty will fail to perform its obligations. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded. Should market conditions move unexpectedly, the Fund may not achieve the anticipated benefits of the futures contract and may realize a loss. See Note 4 for information on futures contract activity during the fiscal year ended October 31, 2012.

Inverse and Leveraged ETFs – The Fund may invest in inverse and leveraged exchange traded funds (“ETFs”). These ETFs are subject to additional risks not generally associated with traditional ETFs. To the extent that the Fund invests in inverse ETFs, the value of the Funds investment will decrease when the index underlying the ETFs benchmark rises. Because inverse and leveraged ETFs typically seek to obtain their objective on a daily basis, holding inverse ETFs for longer than a day may produce unexpected results particularly when the benchmark index experiences large ups and downs. The net asset value and market price of leveraged or inverse ETFs is usually more volatile than the value of the tracked index or of other ETFs that do not use leverage.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended October 31, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of

25

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

operations. During the period, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Trustees).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date. The first in, first out method is used for determining gains or losses for financial statement and income tax purposes. Dividend income and expense is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to its shareholders on at least an annual basis. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

For the year ended October 31, 2012, the Fund made the following reclassifications to increase/(decrease) the components of net assets:

| | | | |

Accumulated Undistributed Net

Investment Income | | | | Accumulated Net

Realized Gain (Loss) |

$3,363,907 | | | | $(3,363,907) |

Security loans – Under the terms of the securities lending agreement with Huntington National Bank, the Fund may make loans of its portfolio securities (in an amount up to 33 1/3% of Fund assets) to parties such as broker-dealers, banks, or institutional investors. Securities lending allows the Fund to retain ownership of the securities

26

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

loaned and, at the same time, to earn additional income. Since there may be delays in the recovery of loaned securities, or even a loss of rights in collateral supplied, should the borrower fail financially, loans will be made only to parties whose creditworthiness has been reviewed and deemed satisfactory by the Adviser. Furthermore, loans will only be made if, in the judgment of the Adviser, the consideration to be earned from such loans would justify the risk. In accordance with current positions of the staff of the U.S. Securities and Exchange Commission that a Fund may engage in loan transactions only under the following conditions: (1) a Fund must receive 100% collateral in the form of cash, cash equivalents (e.g., U.S. Treasury bills or notes) or other high grade liquid debt instruments from the borrower; (2) the borrower must increase the collateral whenever the market value of the securities loaned (determined on a daily basis) rises above the value of the collateral; (3) after giving notice, the Fund must be able to terminate the loan at any time; (4) the Fund must receive reasonable interest on the loan or a flat fee from the borrower, as well as amounts equivalent to any dividends, interest, or other distributions on the securities loaned and to any increase in market value; (5) the Fund may pay only reasonable fees in connection with the loan; and (6) the Fund must be able to vote proxies on the securities loaned as deemed appropriate by the Adviser, either by terminating the loan or by entering into an alternative arrangement with the borrower. Cash received through loan transactions may be invested in any security in which a Fund is authorized to invest. Investing this cash subjects that investment, as well as the security loaned, to market forces (i.e., capital appreciation or depreciation). The margin of collateral to market value of loaned securities shall be at least 102%. If the collateral falls below 102%, the borrower will provide additional collateral to bring the collateralization to 102% on the next business day. As of October 31, 2012, the Fund loaned securities having a fair value of $4,143,033 and received $4,180,121 of cash collateral for the loan from its counterparty, Morgan Stanley. This cash was invested in a money market mutual fund.

Forward Currency Exchange Contracts – The Fund may engage in foreign currency exchange transactions. The value of the Fund’s portfolio securities that are invested in non-U.S. dollar denominated instruments as measured in U.S. dollars may be affected favorably or unfavorably by changes in foreign currency exchange rates, and the Fund may incur costs in connection with conversions between various currencies. The Fund will conduct its foreign currency exchange transactions either on a spot (i.e., cash) basis at the spot rate prevailing in the foreign currency exchange market, or through forward contracts to purchase or sell foreign currencies. A forward foreign currency exchange contract involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract

27

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

agreed upon by the parties, at a price set at the time of the contract. These contracts are traded directly between currency traders (usually large commercial banks) and their customers. The Fund will not, however, hold foreign currency except in connection with the purchase and sale of foreign portfolio securities. The Fund has engaged in foreign currency exchange transactions for the purpose of capitalizing on the movements of foreign currency value versus the U.S. dollar. See Note 4 for additional disclosures.

Purchasing Put Options – The Fund may purchase put options. As the holder of a put option, the Fund has the right to sell the underlying security at the exercise price at any time during the option period. The Fund may enter into closing sale transactions with respect to such options, exercise them or permit them to expire. The Fund may also purchase put options at a time when it does not own the underlying security. By purchasing put options on a security it does not own, the Fund seeks to benefit from a decline in the market price of the underlying security. If the put option is not sold when it has remaining value, and if the market price of the underlying security remains equal to or greater than the exercise price during the life of the put option, the Fund will lose its entire investment in the put option. In order for the purchase of a put option to be profitable, the market price of the underlying security must decline sufficiently below the exercise price to cover the premium and transaction costs, unless the put option is sold in a closing sale transaction. See Note 4 for additional disclosures.

Purchasing Call Options – The Fund may purchase call options. As the holder of a call option, the Fund has the right to purchase the underlying security or currencies at the exercise price at any time during the option period. The Fund may enter into closing sale transactions with respect to such options, exercise them or permit them to expire. The Fund may also purchase call options on relevant stock indexes. Call options may also be purchased by the Fund for the purpose of acquiring the underlying securities or currencies for its portfolio. Utilized in this fashion, the purchase of call options enables the Fund to acquire the securities at the exercise price of the call option plus the premium paid. At times the net cost of acquiring securities in this manner may be less than the cost of acquiring the securities directly. This technique may also be useful to the Fund in purchasing a large block of securities that would be more difficult to acquire by direct market purchases. So long as it holds such a call option rather than the underlying security or currency itself, the Fund is partially protected from any unexpected decline in the market price of the underlying security and in such event could allow the call option to expire, incurring a loss only to the extent of the premium paid for the option. See Note 4 for additional disclosures.

28

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Short Sales – The Fund may make short sales as part of its overall portfolio management strategies or to offset a potential decline in value of a security. The Fund may engage in short sales with respect to various types of securities, including Common Stocks, Futures, and Exchange Traded Funds (ETFs). A short sale involves the sale of a security that is borrowed from a broker or other institution to complete the sale. The Fund may engage in short sales with respect to securities it owns, as well as securities that it does not own. Short sales expose the Fund to the risk that it will be required to acquire, convert or exchange securities to replace the borrowed securities (also known as “covering” the short position) at a time when the securities sold short have appreciated in value, thus resulting in a loss to the Fund. The Fund’s investment performance may also suffer if the Fund is required to close out a short position earlier than it had intended. The Fund must segregate assets determined to be liquid in accordance with procedures established by the Board of Trustees, or otherwise cover its position in a permissible manner. The Fund will be required to pledge its liquid assets to the broker in order to secure its performance on short sales. As a result, the assets pledged may not be available to meet the Fund’s needs for immediate cash or other liquidity. In addition, the Fund may be subject to expenses related to short sales that are not typically associated with investing in securities directly, such as costs of borrowing and margin account maintenance costs associated with the Fund’s open short positions. These types of short sales expenses are sometimes referred to as the “negative cost of carry,” and will tend to cause the Fund to lose money on a short sale even in instances where the price of the underlying security sold short does not change over the duration of the short sale. Dividend expenses on securities sold short and borrowing costs are not covered under the Advisor’s expense limitation agreement with the Fund and, therefore, these expenses will be borne by the shareholders of the Fund. The amount of restricted cash held at the broker as collateral for securities sold short was $16,204,966 as of October 31, 2012.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as pricing model and/or the risk

29

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

— Level 1 – quoted prices in active markets for identical securities

— Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

— Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available)

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, exchange traded funds and exchange traded notes, are generally valued by using market quotations, furnished by a pricing service. Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security is classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security is classified as a Level 2 security.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities are categorized as Level 1 securities.

30

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

Fixed income securities that are valued using market quotations in an active market are categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. These securities are generally categorized as Level 2 securities.

Short-term investments in fixed income securities, (those with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity), are valued using the amortized cost method of valuation, which the Board has determined represents fair value. These securities will be classified as Level 2 securities.

If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review of the Board. These securities will be categorized as Level 3 securities.

Derivative instruments the Fund invests in, such as forward currency exchange contracts, are valued by a pricing service at the interpolated rates based on the prevailing banking rates and are generally categorized as Level 2 securities.

Call and put options that the Fund invests in are generally traded on an exchange. The options in which the Fund invests are generally valued at the last trade price as provided by a pricing service. If the last sale price is not available, the options will be valued using the last bid price. The options will generally be categorized as Level 1 securities.

Futures contracts that the Fund invests in are valued at the settlement price established each day by the board of trade or exchange on which they are traded and when the market is considered active will generally be categorized as Level 1 securities.

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the

31

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

October 31, 2012

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued