UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| | |

Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300 | | Indianapolis, IN 46208 |

| (Address of principal executive offices) | | (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway,

Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 10/31

Date of reporting period: 10/31/13

| Item 1. | Reports to Stockholders. |

To the Shareholders of the Geier Strategic Total Return Fund (the “Fund”):

As noted in the Supplement to the Prospectus dated October 21, 2013, The Board of Trustees has determined to liquidate the Geier Strategic Total Return Fund and to cease operations of the Fund due to the difficulty encountered by the adviser in attracting and maintaining assets in the Fund given the Fund’s conservative strategy and the current bull market. The Fund ceased operations on November 25, 2013.

Although the Adviser believes in the long term prospects for the strategy of the Fund, the Fund is not currently attractive to new and existing prospects given the performance of the Fund and the current overall bullishness of the market. Investors currently seek higher levels of risk/return than our conservative strategy offers.��We expect this very bullish environment to be sustained for as long as the Federal Reserve maintains its Quantitative Easing Programs and Zero Interest Rate Policies, now stated to last well into 2016.

Performance

As of October 31, 2013, our calendar year to date return was -7.6%. The Fund was positioned with a diversified mix of bonds with an average duration of approximately four years. We had lowered the duration from 5.7 years as of last year to help mitigate expected increases in interest rates. Over 90% of our bonds were investment grade.

We also maintained our positions in investments that would hedge an environment of increasing money supply leading to an eventual debased dollar and inflation. To that end, we kept assets such as TIPs (Treasury Inflation-Protected Securities) and commodities that provide degrees of inflation protection, which were purchased in 2012. TIPS, which move in lockstep with inflation and commodities like silver and gold, should perform well in inflationary periods.

Our cash position represented a fairly substantial holding throughout the year. In general, we do not like to hold cash and would prefer to employ it. Even though the equity market has risen substantially, we believe that Federal Reserve intervention rather than improving equity fundamentals has fueled the optimism. Once the stimulus is removed, we believe this artificial bull market will deflate to a level supported by fundamentals.

Unfortunately, our longer term themes proved to be significant short term performance detractors. Approximately 4% of the negative performance was due to the bond portfolio. Yields rose during the year in spite of Federal Reserve intervention, causing our bond prices to drop. For example, the US Treasury 10 year yield rose from about 1.8% at the beginning of the year to about 2.8%. Although these price drops are unrealized and will self-correct as the bonds approach maturity over the next few years, the short term impact on our NAV was painful.

The remainder of the negative performance was due to our Hard Asset allocation. We were wrong in the short term as investors see more opportunity in purchasing equities in spite of the longer term risks for inflation and dollar debasement. Investors aggressively sold their Hard Asset allocations to free up cash for equity purchases.

Impact

The shift in sentiment of investors to assume more risk as long as the Federal Reserve continues its Quantitative Easing Programs impacted not only our short term performance but the longer term viability of the Fund. In our first annual report, we wrote:

“Over the past few years, more and more investors like you have expressed concern for and exhaustion with the “roller coaster” feel of the markets. The stock market crash of 2008 brought a heightened sense of worry over the inherent risks of investing. Although the rebound since early 2009 has helped restore depleted portfolios, many investors acknowledge that they do not want to go through such an experience again.”

1

Our conservative, low volatility strategy attracted shareholders during the first two years as our Fund assets grew from approximately $26 million on December 31, 2010 to $38 million on December 31, 2012. However, investor sentiment shifted dramatically this year. Shareholders withdrew assets down to about $30 million as of March 31, 2013, $26 million as of June 30, 2013, and $15 million as of September 30, 2013. (Approximately $2.9 million of the decrease in net assets year to date was due to the negative performance.)

Based on its recent proclamations, we believe that the Federal Reserve will continue its Quantitative Easing Programs and Zero Interest Rate Policies well into 2016. Such an environment is not conducive to our Fund’s potential for growth and success. We therefore determined that it was in the best interest of shareholders to cease operations.

Feel free to contact us if you have any questions.

2

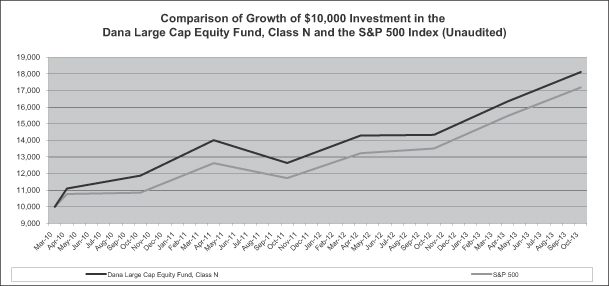

Investment Results – (Unaudited)

Total Returns *

(For the periods ended October 31, 2013)

| | | | | | | | |

| | | | | | Average Annual Returns | |

| | | | | | Since Inception | |

| | | One Year | | | (December 27, 2010) | |

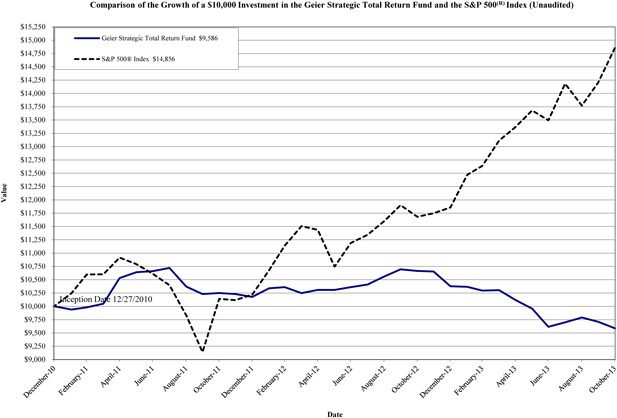

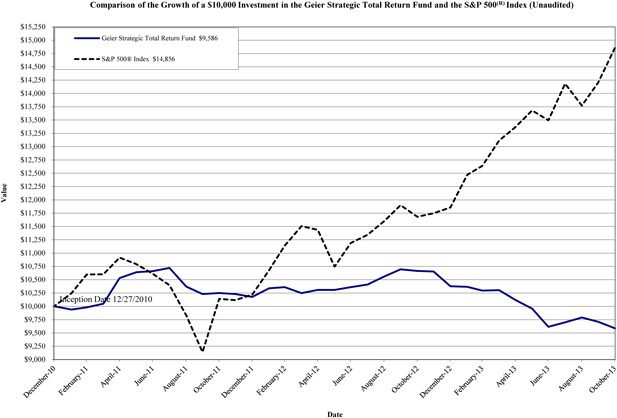

Geier Strategic Total Return Fund | | | -10.11 | % | | | -1.48 | % |

S&P 500® Index** | | | 27.18 | % | | | 14.92 | % |

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 28, 2013, were 2.04% of average daily net assets (2.08% after fee recoupments by the Adviser). Prior to the decision to liquidate the Fund and cease operations, the Adviser contractually agreed to cap certain operating expenses of the Fund until February 28, 2014, so that total annual fund operating expenses do not exceed 1.70%. This operating expense limitation did not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Under certain circumstances, the Adviser would have been able to recover any expenses waived and/or reimbursed during the three-year period prior to the period in which such expenses are waived and/or reimbursed (the “Recoupment Right”). To the extent the Adviser reimburses the Fund for any Excluded Expenses, the Adviser would have been entitled to include such reimbursed Excluded Expenses in the amounts that are subject to recovery under the Recoupment Right.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-747-4268.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index |

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-877-747-4268. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., Member FINRA.

3

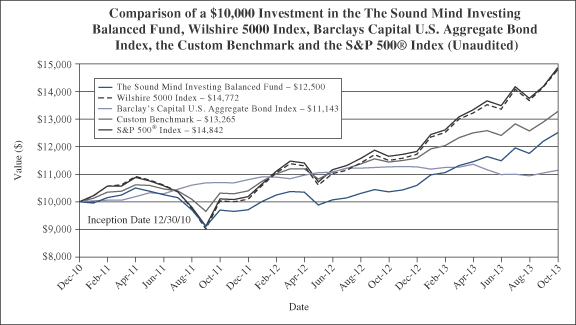

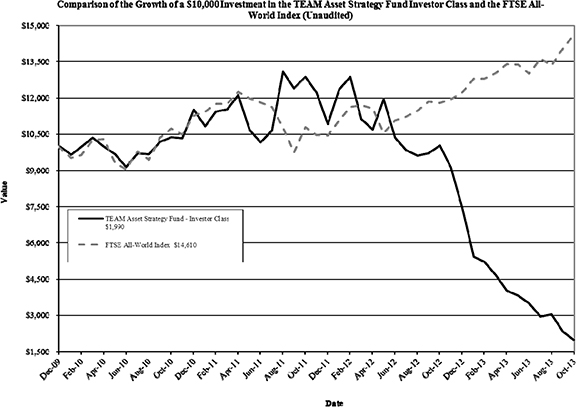

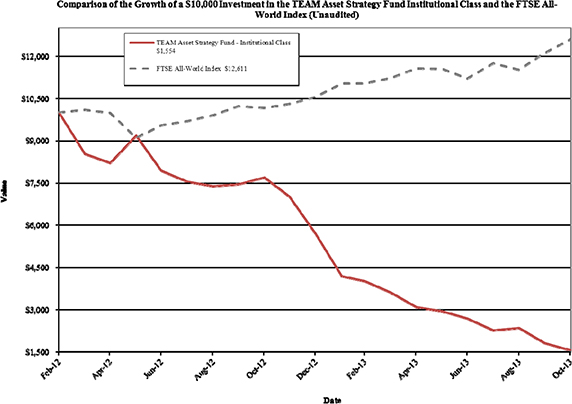

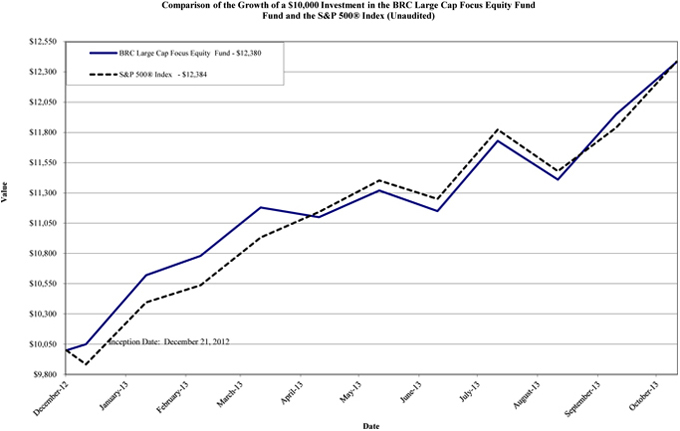

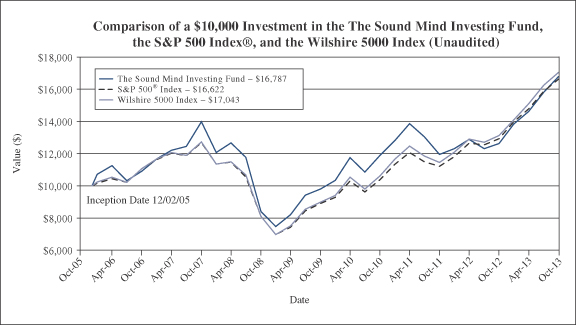

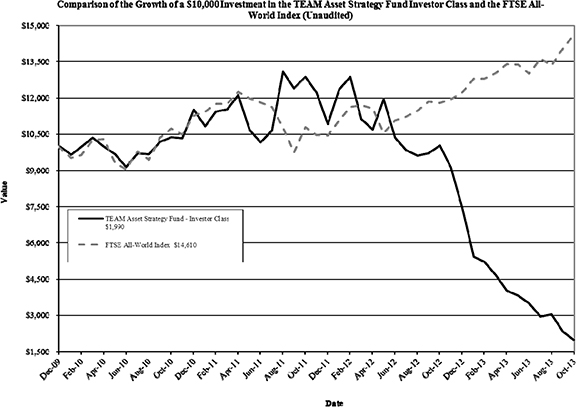

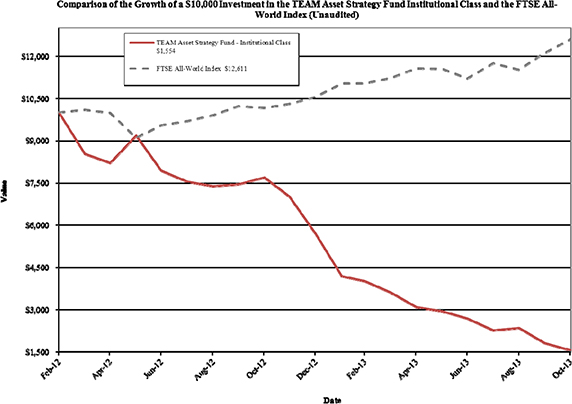

The chart above assumes an initial investment of $10,000 made on December 27, 2010 (inception date of the Fund) and held through October 31, 2013. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares; although the performance does reflect the effect of the Fund paying certain taxes resulting from its failure to satisfy certain requirements under the Internal Revenue Code applicable to “regulated investment companies.” Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-877-747-4268. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

4

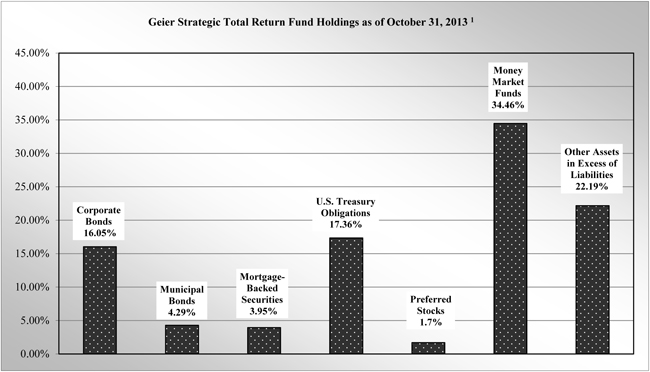

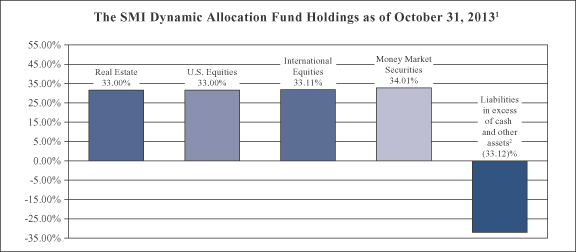

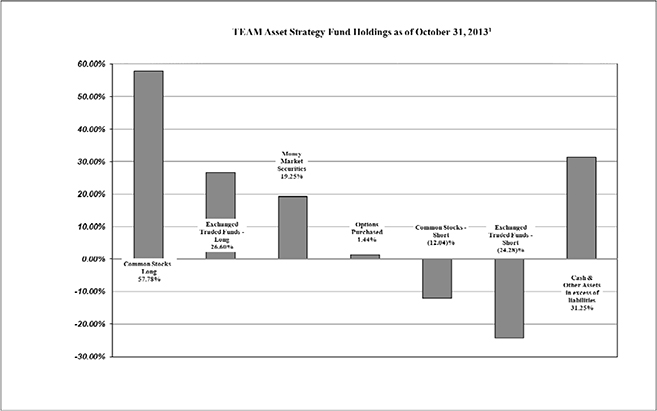

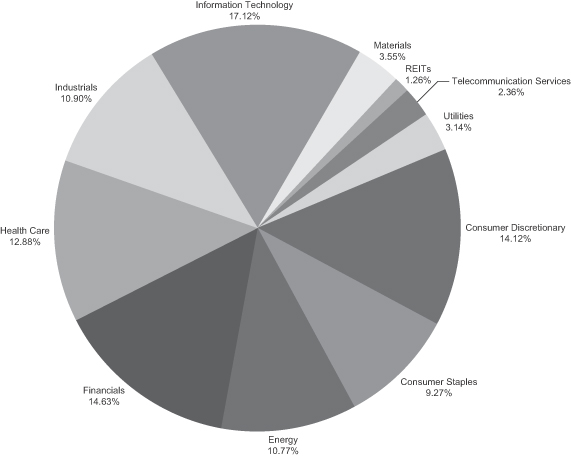

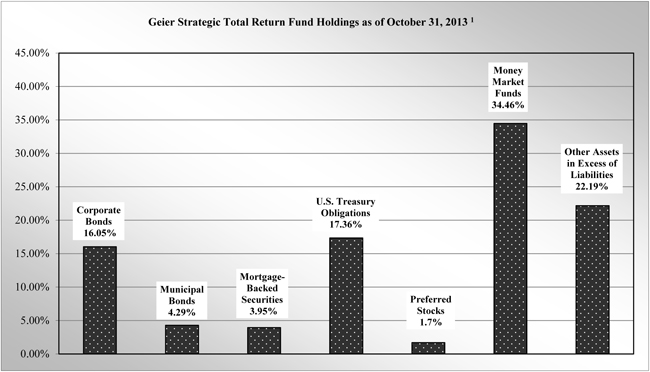

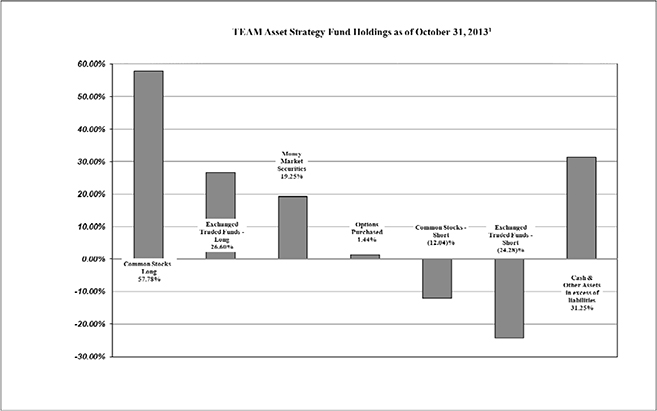

FUND HOLDINGS – (Unaudited)

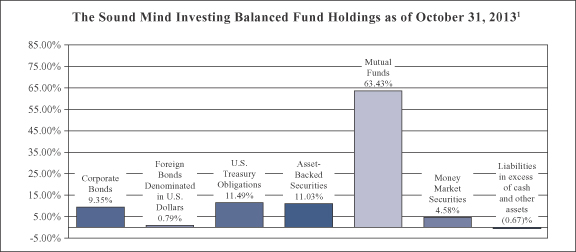

| 1. | As a percentage of net assets. |

The investment objective of the Geier Strategic Total Return Fund is to provide long-term total return from income and capital appreciation, with an emphasis on protection of capital under all market conditions.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

ABOUT THE FUND’S EXPENSES – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs (such as short-term redemption fees); and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, and held for the entire period from May 1, 2013 to October 31, 2013.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

5

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

Geier Strategic Total Return Fund | | Beginning

Account Value

May 1, 2013 | | | Ending Account

Value

October 31, 2013 | | | Expenses Paid During

the Period Ended

October 31, 2013* | |

Actual | | $ | 1,000.00 | | | $ | 947.20 | | | $ | 9.57 | |

Hypothetical ** (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.37 | | | $ | 9.91 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average account value over the period, multiplied by 184/365. |

| ** | Assumes a 5% return before expenses. |

6

Geier Strategic Total Return Fund

Schedule of Investments

October 31, 2013

| | | | | | | | |

| | | Principal

Amount or

Shares | | | Fair Value | |

Corporate Bonds — 16.05% | |

AngloGold Ashanti Holdings PLC, 5.125%, 8/1/2022 (a) | | $ | 200,000 | | | $ | 178,076 | |

General Electric Capital Corp., 0.443%, 1/8/2016 (b) | | | 250,000 | | | | 249,400 | |

Lincoln National Corp., 7.000%, 5/17/2066 (b) | | | 250,000 | | | | 259,375 | |

Macy’s Retail Holdings, Inc., 7.450%, 10/15/2016 | | | 500,000 | | | | 574,571 | |

SLM Corp., 1.777%, 11/1/2016 (b) | | | 300,000 | | | | 291,144 | |

Tyson Foods, Inc., 6.600%, 4/1/2016 | | | 350,000 | | | | 393,146 | |

Whirlpool Corp., 6.500%, 6/15/2016 | | | 325,000 | | | | 365,192 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $2,240,031) | | | | 2,310,904 | |

| | | | | | | | |

Municipal Bonds — 4.29% | | | | | | | | |

County of Bertie, NC, 1.000%, 11/1/2013 | | | 200,000 | | | | 200,000 | |

County of Mahoning, OH, 5.500%, 12/1/2025 | | | 75,000 | | | | 79,218 | |

Utah State Board of Regents, 4.000%, 4/1/2019 | | | 305,000 | | | | 337,919 | |

| | | | | | | | |

Total Municipal Bonds

(Cost $622,210) | | | | 617,137 | |

| | | | | | | | |

Mortgage Backed Securities — 3.95% | | | | | | | | |

Credit Suisse First Boston Mortgage Securities Corp., 2.564%, 10/25/2033 (b) | | | 181,809 | | | | 174,212 | |

Freddie Mac REMICS, 0.076%, 6/15/2036 (c) | | | 14,392 | | | | 13,353 | |

Morgan Stanley Mortgage Loan Trust, 2.469%, 10/25/2034 (b) | | | 217,972 | | | | 219,330 | |

Structured Asset Securities Corp. Mortgage Pass-Through Certificates 2.412%, 4/25/2033 (b) | | | 164,632 | | | | 162,147 | |

| | | | | | | | |

Total Mortgage Backed Securities

(Cost $552,780) | | | | 569,042 | |

| | | | | | | | |

U.S. Treasury Obligations — 17.36% | | | | | | | | |

U.S. Treasury Note, 8.750%, 5/15/2020 | | | 1,500,000 | | | | 2,154,843 | |

U.S. Treasury Note, 6.125%, 8/15/2029 | | | 250,000 | | | | 343,750 | |

| | | | | | | | |

Total U.S. Treasury Obligations

(Cost $2,314,198) | | | | 2,498,593 | |

| | | | | | | | |

Preferred Stocks — 1.70% | | | | | | | | |

Public Storage, Inc., 6.350% | | | 10,000 | | | | 244,300 | |

| | | | | | | | |

Total Preferred Stocks

(Cost $250,000) | | | | 244,300 | |

| | | | | | | | |

Money Market Funds — 34.46% | | | | | | | | |

Fidelity Institutional Money Market Treasury Only - Class I, 0.01% (d) | | | 4,960,177 | | | | 4,960,177 | |

| | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

7

Geier Strategic Total Return Fund

Schedule of Investments - continued

October 31, 2013

| | | | |

| | | Fair Value | |

Total Money Market Funds

(Cost $4,960,177) | | $ | 4,960,177 | |

| | | | |

Total Investments – 77.81%

(Cost $10,939,396) | | | 11,200,153 | |

| | | | |

Other Assets in Excess of Liabilities – 22.19% | | | 3,193,630 | |

| | | | |

TOTAL NET ASSETS – 100.00% | | $ | 14,393,783 | |

| | | | |

| (a) | Foreign corporate bond denominated in U.S. dollars. |

| (b) | Variable or Floating Rate Security. Rate disclosed is as of October 31, 2013. |

| (c) | Zero coupon bond. Rate disclosed is the effective rate as of October 31, 2013. |

| (d) | Rate disclosed is the seven day yield as of October 31, 2013. |

See accompanying notes which are an integral part of the financial statements.

8

Geier Strategic Total Return Fund

Statement of Assets and Liabilities (a)

October 31, 2013

| | | | |

Assets | | | | |

Investments in securities at fair value (cost $10,939,396) | | $ | 11,200,153 | |

Receivable for investments sold | | | 3,116,252 | |

Dividends receivable | | | 3,125 | |

Interest receivable | | | 142,966 | |

Receivable from Adviser | | | 4,200 | |

| | | | |

Total Assets | | | 14,466,696 | |

| | | | |

Liabilities | | | | |

Payable for fund shares redeemed | | | 35,500 | |

Payable to administrator, fund accountant, and transfer agent | | | 6,734 | |

Payable to custodian | | | 1,467 | |

Payable to trustees | | | 199 | |

12b-1 fees accrued | | | 3,114 | |

Other accrued expenses | | | 25,899 | |

| | | | |

Total Liabilities | | | 72,913 | |

| | | | |

Net Assets | | $ | 14,393,783 | |

| | | | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 16,076,944 | |

Accumulated undistributed net investment (loss) | | | (8,868 | ) |

Accumulated undistributed net realized loss from investment transactions | | | (1,935,050 | ) |

Net unrealized appreciation on investments | | | 260,757 | |

| | | | |

Net Assets | | $ | 14,393,783 | |

| | | | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,544,474 | |

| | | | |

Net asset value (“NAV”) and offering price per share | | $ | 9.32 | |

| | | | |

Redemption price per share (NAV * 99%) (b) | | $ | 9.23 | |

| | | | |

| (b) | The redemption price per share reflects a redemption fee of 1.00% on shares redeemed within 30 calendar days of purchase. |

See accompanying notes which are an integral part of these financial statements.

9

Geier Strategic Total Return Fund

Statement of Operations (a)

For the year ended October 31, 2013

| | | | |

Investment Income | | | | |

Dividend income (net of foreign withholding tax of $3,075) | | $ | 77,059 | |

Interest income | | | 454,850 | |

| | | | |

Total investment income | | | 531,909 | |

| | | | |

Expenses | | | | |

Investment Adviser fee | | | 295,432 | |

12b-1 fees | | | 67,102 | |

Administration expenses | | | 27,991 | |

Fund accounting expenses | | | 25,000 | |

Transfer agent expenses | | | 26,012 | |

Legal expenses | | | 19,583 | |

Registration expenses | | | 31,182 | |

Custodian expenses | | | 9,565 | |

Audit expenses | | | 15,000 | |

Trustee expenses | | | 7,299 | |

Insurance expense | | | 5,063 | |

Pricing expenses | | | 14,130 | |

Miscellaneous expenses | | | 14,884 | |

| | | | |

Total expenses | | | 558,243 | |

| | | | |

Fees waived and reimbursed by Adviser, net of recoupment | | | (35,240 | ) |

| | | | |

Net operating expenses | | | 523,003 | |

| | | | |

Net investment loss | | | 8,906 | |

| | | | |

Net Realized and Unrealized Loss on Investments | | | | |

Net realized loss on investment securities | | | (1,931,735 | ) |

Net change in unrealized depreciation of investment securities | | | (1,040,037 | ) |

| | | | |

Net realized and unrealized loss on investments | | | (2,971,772 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (2,962,866 | ) |

| | | | |

See accompanying notes which are an integral part of these financial statements.

10

Geier Strategic Total Return Fund

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the Year

Ended

October 31, 2013 (a) | | | For the Year

Ended

October 31, 2012 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 8,906 | | | $ | 158,876 | |

Net realized gain (loss) on investment securities | | | (1,931,735 | ) | | | 252,511 | |

Net change in unrealized appreciation (depreciation) of investments | | | (1,040,037 | ) | | | 1,046,048 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (2,962,866 | ) | | | 1,457,435 | |

| | | | | | | | |

Distributions | | | | | | | | |

From net investment income | | | (135,991 | ) | | | (217,686 | ) |

From net realized gains | | | (344,119 | ) | | | (240,354 | ) |

From return of capital | | | (58,839 | ) | | | — | |

| | | | | | | | |

Total distributions | | | (538,949 | ) | | | (458,040 | ) |

| | | | | | | | |

Capital Transactions | | | | | | | | |

Proceeds from shares sold | | | 1,996,946 | | | | 6,195,156 | |

Proceeds from redemption fees (b) | | | 645 | | | | 10 | |

Reinvestment of distributions | | | 20,806 | | | | 45,555 | |

Amount paid for shares redeemed | | | (21,881,379 | ) | | | (4,069,011 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from capital transactions | | | (19,862,982 | ) | | | 2,171,710 | |

| | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (23,364,797 | ) | | | 3,171,105 | |

| | | | | | | | |

Net Assets | | | | | | | | |

Beginning of period | | | 37,758,580 | | | | 34,587,475 | |

| | | | | | | | |

End of period | | $ | 14,393,783 | | | $ | 37,758,580 | |

| | | | | | | | |

Accumulated undistributed net investment (loss) included in net assets at end of period | | $ | (8,868 | ) | | $ | (54,312 | ) |

| | | | | | | | |

Share Transactions | | | | | | | | |

Shares sold | | | 195,099 | | | | 606,695 | |

Shares issued in reinvestment of distributions | | | 2,064 | | | | 4,537 | |

Shares redeemed | | | (2,239,566 | ) | | | (399,656 | ) |

| | | | | | | | |

Net increase (decrease) in share transactions | | | (2,042,403 | ) | | | 211,576 | |

| | | | | | | | |

| (b) | The Fund charges a redemption fee of 1.00% on shares redeemed within 30 calendar days of purchase. |

See accompanying notes which are an integral part of these financial statements.

11

Geier Strategic Total Return Fund

Financial Highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | |

| | | Year Ended

October 31, 2013* | | | Year Ended

October 31, 2012 | | | Period Ended

October 31, 2011 (a) | |

Selected Per Share Data | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.53 | | | $ | 10.25 | | | $ | 10.00 | |

| | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | |

Net investment income (loss) | | | — | (b)(c) | | | 0.04 | | | | — | |

Net realized and unrealized gains (losses) | | | (1.05 | ) | | | 0.37 | | | | 0.25 | |

| | | | | | | | | | | | |

Total from investment activities | | | (1.05 | ) | | | 0.41 | | | | 0.25 | |

| | | | | | | | | | | | |

Less Distributions to Shareholders: | | | | | | | | | | | | |

From net investment income | | | (0.04 | ) | | | (0.06 | ) | | | — | |

From net realized gains | | | (0.10 | ) | | | (0.07 | ) | | | — | |

From return of capital | | | (0.02 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

Total distributions | | | (0.16 | ) | | | (0.13 | ) | | | — | |

| | | | | | | | | | | | |

Paid in capital from redemption fees (d) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.32 | | | $ | 10.53 | | | $ | 10.25 | |

| | | | | | | | | | | | |

Total Return (e) | | | (10.11 | )% | | | 4.03 | % | | | 2.50 | %(f) |

Ratios and Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 14,394 | | | $ | 37,759 | | | $ | 34,587 | |

Ratio of expenses to average net assets | | | 1.95 | % | | | 1.95 | % | | | 2.65 | %(g)(h) |

Ratio of expenses to average net assets before recoupment/reimbursement | | | 2.08 | % | | | 1.91 | % | | | 2.97 | %(g)(i) |

Ratio of net investment income (loss) to average net assets | | | 0.03 | % | | | 0.44 | % | | | (0.06 | )%(g)(h) |

Portfolio turnover rate | | | 34 | % | | | 91 | % | | | 502 | %(f) |

| (a) | For the period December 27, 2010 (commencement of operations) through October 31, 2011. |

| (b) | Calculated using the average share method. |

| (c) | Amount represents less than $0.005 per share. |

| (d) | Redemption fees resulted in less than $0.005 per share in each period. |

| (e) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (h) | The expense ratio and net investment income ratio includes the effect of federal tax expense of 0.70%, which is the portion of federal tax expense not reimbursed by the Adviser. |

| (i) | The expense ratio before reimbursements includes taxes of 0.92%, a portion of which was voluntarily reimbursed by the Adviser. |

See accompanying notes which are an integral part of these financial statements.

12

Geier Strategic Total Return Fund

Notes to the Financial Statements

October 31, 2013

NOTE 1. ORGANIZATION

The Geier Strategic Total Return Fund (the “Fund”) is an open-end, non-diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund commenced operations on December 27, 2010. The Fund’s investment Adviser is Geier Asset Management, Inc. (the “Adviser”). The investment objective of the Fund is to provide long-term total return from income and capital appreciation, with an emphasis on protection of capital under all market conditions.

On October 29, 2013, the Board approved a plan to liquidate the Fund. Under that plan of liquidation, the Fund liquidated its assets and ceased operations effective as of November 25, 2013. The accompanying 2013 financial statements for the Fund are prepared on the liquidation basis of accounting in accordance with accounting principles generally accepted in the United States of America. Under the liquidation basis of accounting, assets are stated at their fair value or estimated realizable amount, liabilities are stated at their anticipated settlement amounts and all other costs of liquidation have been accrued. Assets and liabilities historically were carried at values that approximated fair value.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Taxes – The Fund intends to qualify each year as a “regulated investment company” (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended October 31, 2013, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The First In, First Out method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions from Limited Partnerships are recognized on the ex-date. Income or loss from Limited Partnerships is reclassified in the components of net assets upon receipt of K-1’s. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

13

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

October 31, 2013

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Redemption Fees – The Fund charges a 1.00% redemption fee for shares redeemed within 30 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily NAV calculation.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to its shareholders on at least an annual basis. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the year ended October 31, 2013, the Fund made the following reclassifications to increase (decrease) the components of net assets.

| | | | | | | | | | |

| Paid in Capital | | | Accumulated Undistributed

Net Investment Loss | | | Accumulated Net Realized

Gain from Investments | |

| $ | (227,873 | ) | | $ | 231,368 | | | $ | (3,495 | ) |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (ex., the risk inherent in a particular valuation technique used to measure fair value including items such as pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – quoted prices in active markets for identical securities |

| | • | | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

14

Geier Strategic Total Return Fund

Notes to the Financial Statements — continued

October 31, 2013

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

Equity securities, including common stocks, exchange-traded funds, closed end funds, and preferred stocks, are generally valued by using market quotations, furnished by a pricing service. Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security is classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security is classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review by the Board. These securities are categorized as Level 3 securities.

Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities are categorized as Level 1 securities.

Fixed income securities such as corporate bonds, municipal bonds, U.S. government securities, and mortgage-backed securities when valued using market quotations in an active market, will be categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. A pricing service uses various inputs and techniques, which include broker-dealer quotations, like trading levels, recently executed transactions in securities of the issuer or comparable issuers, and option adjusted spread models that include base curve and spread curve inputs. Adjustments to individual bonds can be applied to recognize trading differences compared to other bonds issued by the same issuer. The broker-dealer quotations received are supported by credit analysis of the issuer that takes into consideration credit quality assessments, daily trading activity, and the activity of the underlying equities, listed bonds and sector-specific trends. To the extent that these inputs are observable, the values of fixed income securities are categorized as Level 2 securities. If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review of the Board. These securities will be categorized as Level 3 securities.

Short-term investments in fixed income securities, (those with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity), including U.S. government securities, are valued by using the amortized cost method of valuation, which the Board has determined represents fair value. These securities will be classified as Level 2 securities.

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Fund would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Fund’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of

15

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

October 31, 2013

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Fund is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available. Any fair value pricing done outside the Fund’s approved pricing methods must be approved by the Pricing Committee of the Board.

The following is a summary of the inputs used to value the Fund’s investments as of October 31, 2013:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | |

Assets | | Level 1 - Quoted

Prices in Active

Markets | | | Level 2 - Other

Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Total | |

Corporate Bonds | | $ | — | | | $ | 2,310,904 | | | $ | — | | | $ | 2,310,904 | |

Municipal Bonds | | | — | | | | 617,137 | | | | — | | | | 617,137 | |

Mortgage Backed Securities | | | — | | | | 569,042 | | | | — | | | | 569,042 | |

U.S. Treasury Obligations | | | — | | | | 2,498,593 | | | | — | | | | 2,498,593 | |

Preferred Stocks | | | 244,300 | | | | — | | | | — | | | | 244,300 | |

Money Market Funds | | | 4,960,177 | | | | — | | | | — | | | | 4,960,177 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 5,204,477 | | | $ | 5,995,676 | | | $ | — | | | $ | 11,200,153 | |

| | | | | | | | | | | | | | | | |

The Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund recognizes transfers between fair value hierarchy levels at the reporting period end. There were no transfers between any Levels for the fiscal year ended October 31, 2013.

NOTE 4. ADVISER FEES AND OTHER TRANSACTIONS

The Adviser, under the terms of the management agreement (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.10% of the Fund’s average net assets. For the fiscal year ended October 31, 2013, the Adviser earned fees of $295,432 from the Fund before the reimbursement/recoupment described below.

The Adviser has agreed to contractually cap certain operating expenses of the Fund until February 28, 2014, so that total annual fund operating expenses do not exceed 1.70%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”).

16

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

October 31, 2013

NOTE 4. ADVISER FEES AND OTHER TRANSACTIONS – continued

Under certain circumstances, the Adviser may recover any expenses waived and/or reimbursed during the three-year period prior to the period in which such expenses are waived and/or reimbursed. For the fiscal year ended October 31, 2013, expenses totaling $35,240 were waived or reimbursed by the Adviser and are subject to potential recoupment by the Adviser until October 31, 2016. At October 31, 2013, the Adviser owed the Fund $4,200.

The amount subject to repayment by the Fund pursuant to the aforementioned conditions at October 31, 2013 was:

| | | | | | |

| Amount | | | Recoverable through

October 31, | |

| $ | 60,654 | | | | 2014 | |

| | 35,240 | | | | 2016 | |

The Trust retains Huntington Asset Services, Inc. (“HASI”), to manage the Fund’s business affairs and to provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the fiscal year ended October 31, 2013, HASI earned fees of $27,991 for administrative services provided to the Fund. At October 31, 2013, the Fund owed HASI $2,333 for administrative services. Certain officers of the Trust are members of management and/or employees of HASI. HASI operates as a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the “Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the fiscal year ended October 31, 2013, the Custodian earned fees of $9,565 for custody services provided to the Fund. At October 31, 2013, the Fund owed the Custodian $1,467 for custody services.

The Trust retains HASI to act as the Fund’s transfer agent and to provide fund accounting services. For the fiscal year ended October 31, 2013, HASI earned fees of $26,012 from the Fund for transfer agent services. For the fiscal year ended October 31, 2013, HASI earned fees of $25,000 from the Fund for fund accounting services. At October 31, 2013, the Fund owed HASI $2,318 for transfer agent services and $2,083 for fund accounting services.

Unified Financial Securities, Inc. acts as the principal distributor of the Fund’s shares. There were no payments made to the Distributor by the Fund for the fiscal year ended October 31, 2013. A Trustee of the Trust is a member of management of Huntington National Bank, a subsidiary of Huntington Bancshares, Inc., (the parent of the Distributor) and officers of the Trust are officers of the Distributor and such persons may be deemed to be affiliates of the Distributor.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts. The Fund or Adviser may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 expenses actually incurred. It is anticipated that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to efficiently achieve its investment objectives and to realize economies of scale. For the fiscal year ended October 31, 2013, the 12b-1 expense incurred by the Fund was $67,102. The Fund owed $3,114 for 12b-1 fees as of October 31, 2013.

17

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

October 31, 2013

NOTE 5. PURCHASES AND SALES

For the fiscal year ended October 31, 2013, purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | |

Purchases | | | | |

U.S. Government Obligations | | $ | — | |

Other | | | 7,670,898 | |

Sales | | | | |

U.S. Government Obligations | | $ | 5,884,600 | |

Other | | | 24,435,586 | |

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 7. FEDERAL TAX INFORMATION

As of October 31, 2013, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | | |

| | | Amount | |

Gross Appreciation | | $ | 296,987 | |

Gross (Depreciation) | | | (36,230 | ) |

| | | | |

Net Appreciation (Depreciation) on Investments | | $ | 260,757 | |

| | | | |

At October 31, 2013, the aggregate cost of securities for federal income tax purposes, was $10,939,396.

The tax characterization of distributions for the fiscal years ended October 31, 2013 and October 31, 2012 were as follows:

| | | | | | | | |

| | | 2013 | | | 2012 | |

Distributions paid from: | | | | | | | | |

Ordinary Income* | | $ | 430,461 | | | $ | 397,472 | |

Long-term capital gains | | | 49,649 | | | | 60,568 | |

| | | | | | | | |

Total Taxable Distributions | | | 480,110 | | | | 458,040 | |

| | | | | | | | |

Return of Capital | | | 58,839 | | | | — | |

| | | | | | | | |

Total Distributions | | $ | 538,949 | | | $ | 458,040 | |

| | | | | | | | |

18

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

October 31, 2013

NOTE 7. FEDERAL TAX INFORMATION – continued

At October 31, 2013, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Unrealized appreciation (depreciation) | | $ | 260,757 | |

Accumulated capital and other losses | | | (1,943,918 | ) |

| | | | |

| | $ | (1,683,161 | ) |

| | | | |

At October 31, 2013, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to cumulative wash sales and mark to market of passive foreign investment companies.

As of October 31, 2013, accumulated capital and other losses consist of:

| | | | | | | | | | | | | | |

Qualified Late Year

Ordinary Losses | | | Capital Loss

Carryforwards | | | Other Cumulative Book to Tax

Differences | | | Total | |

| $ | 823 | | | $ | 1,935,050 | | | $ | 8,045 | | | $ | 1,943,918 | |

At October 31, 2013, for federal income tax purposes, the Fund has capital loss carryforwards, in the following amounts:

| | | | |

No expiration - short term | | $ | 786,380 | |

No expiration - long term | | | 1,148,670 | |

| | | | |

| | $ | 1,935,050 | |

| | | | |

Capital loss carryforwards are available to offset future realized capital gains. To the extent that these carryforwards are used to offset future capital gains, it is probable that the amount offset will not be distributed to shareholders.

NOTE 8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based on this evaluation, and at a Board meeting held December 9-11, 2013, Bryan W. Ashmus was appointed to serve as Principal Financial Officer and Treasurer. This information is reflected in the “Trustees and Officers” table.

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Geier Strategic Total Return Fund

(Valued Advisers Trust)

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Geier Strategic Total Return Fund (the “Fund”), a series of the Valued Advisers Trust, as of October 31, 2013, and the related statement of operations for the year then ended, and the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three periods in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2013 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Geier Strategic Total Return Fund as of October 31, 2013, the results of its operations for the year then ended, and the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the three periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

As described in Note 1 to the financial statements, on October 29, 2013, the Board of Trustees approved a plan of liquidation for the Fund, to be effective November 25, 2013. As a result, the Fund changed its basis of accounting for periods after October 29, 2013, from the going concern basis to the liquidation basis.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

December 27, 2013

TRUSTEES AND OFFICERS (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following tables provide information regarding the Trustees and Officers.

The following table provides information regarding each of the Independent Trustees.

| | |

Name, Address*, (Age), Position with

Trust**, Term of Position with Trust | | Principal Occupation During Past 5 Years and Other Directorships |

| Dr. Merwyn R. Vanderlind, 77, Independent Trustee, August 2008 to present. | | Retired; Consultant to Battelle Memorial Institute (International Science and Technology Research Enterprise) on business investments. |

| |

Ira Cohen, 54 Independent Trustee, June 2010 to present. | | Independent financial services consultant (Feb. 2005 — present). |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | The Trust consists of 16 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below should serve as a Trustee.

| | |

Name, Address*, (Age), Position with

Trust**, Term of Position with Trust | | Principal Occupation During Past 5 Years and Other Directorships |

| R. Jeffrey Young, 49, Trustee and Chairman, June 2010 to present. | | Principal Executive Officer and President, Valued Advisers Trust since February 2010; Senior Vice President, Huntington Asset Services, Inc. since January 2010; Chief Executive Officer, Huntington Funds since February 2010; President and Chief Executive Officer, Dreman Contrarian Funds March 2011 to February 2013; Trustee, Valued Advisers Trust, August 2008 to January 2010; Managing Director and Chief Operating Officer of Professional Planning Consultants 2007 to 2010. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | The Trust consists of 16 series. |

The following table provides information regarding the Officers of the Trust:

| | |

Name, Address*, (Age), Position with

Trust,** Term of Position with Trust | | Principal Occupation During Past 5 Years and Other Directorships |

| R. Jeffrey Young, 49, Principal Executive Officer and President, February 2010 to present. | | Trustee, Valued Advisers Trust since June 2010; Senior Vice President, Huntington Asset Services, Inc. since January 2010; Chief Executive Officer, Huntington Funds since February 2010; President and Chief Executive Officer, Dreman Contrarian Funds March 2011 to February 2013; Trustee, Valued Advisers Trust, August 2008 to January 2010; Managing Director and Chief Operating Officer of Professional Planning Consultants 2007 to 2010. |

| |

| John C. Swhear, 52, Chief Compliance Officer, AML Officer and Vice President, August 2008 to present. | | Vice President of Legal Administration and Compliance for Huntington Asset Services, Inc., the Trust’s administrator, since April 2007; Chief Compliance Officer of Unified Financial Securities, Inc., the Trust’s distributor, since May 2007; Senior Vice President of the Unified Series Trust since May 2007; Secretary of Huntington Funds since April 2010; President and Chief Executive Officer of Dreman Contrarian Funds from March 2010 to March 2011, and Vice President and Acting Chief Executive Officer, 2007 to March 2010. |

| |

| Carol J. Highsmith, 48, Vice President, August 2008 to present. | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since November of 1994; currently Vice President of Legal Administration. |

| | |

| Matthew J. Miller, 37, Vice President, December 2011 to present. | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since July of 1998; currently Vice President of Relationship Management; Vice President of Huntington Funds since February 2010. |

| |

Bryan W. Ashmus, 40, Treasurer and Principal Financial Officer, December 2013 to present | | Vice President, Financial Administration, HASI (September 2013 to present); Chief Financial Officer and Treasurer, The Huntington Strategy Shares and The Huntington Funds Trust (November 2013 to present). Vice President, Treasurer Services, Citi Fund Services Ohio, Inc., (May 2005 to September 2013). |

| |

Heather Bonds, 38, Secretary, September 2012 to present. | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since January of 2004; currently Certified Paralegal and Section Manager 2. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | The Trust consists of 16 series. |

OTHER INFORMATION

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (888) 442-9893 to request a copy of the SAI or to make shareholder inquiries.

Management Agreement Renewal – (Unaudited)

At a meeting held on September 16-17, 2013, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (the “Agreement”) between the Trust and Geier Asset Management, Inc. (the “Adviser”) with respect to the Geier Strategic Total Return Fund (the “Fund”). Counsel noted that the 1940 Act requires the approval of the investment advisory agreement between the Trust and its investment adviser by the Board, including a majority of the Independent Trustees. The Board discussed the arrangements between the Adviser and the Trust with respect to the Fund. The Board reviewed a memorandum from Counsel, and addressed to the Trustees that summarized, among other things, the fiduciary duties and responsibilities of the Board in reviewing and approving the renewal of the Agreement. A copy of this memorandum was circulated to the Trustees in advance of the Meeting. Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the renewal of the Agreement, including the following material factors: (i) the nature, extent, and quality of the services provided by the Adviser; (ii) the investment performance of the Fund; (iii) the costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund; (iv) the extent to which economies of scale would be realized if the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; and (v) the Adviser’s practices regarding possible conflicts of interest.

In assessing these factors and reaching its decisions, the Board took into consideration information furnished for the Board’s review and consideration throughout the year at regular Board meetings, as well as information specifically prepared and/or presented in connection with the annual renewal process, including information presented at the Meeting. The Board requested and was provided with information and reports relevant to the annual renewal of the Agreement, including: (i) reports regarding the services and support provided to the Fund and its shareholders by the Adviser; (ii) quarterly assessments of the investment performance of the Fund by personnel of the Adviser; (iii) commentary on the reasons for the performance; (iv) presentations by Fund management addressing the Adviser’s investment philosophy, investment strategy, personnel and operations; (v) compliance and audit reports concerning the Fund and the Adviser; (vi) disclosure information contained in the registration statement of the Trust and the Form ADV of the Adviser; and (vii) a memorandum from Counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Agreement, including the material factors set forth above and the types of information included in each factor that should be considered by the Board in order to make an informed decision. The Board also requested and received various informational materials including, without limitation: (i) documents containing information about the Adviser, including financial information, a description of personnel and the services provided to the Fund, information on investment advice, performance, summaries of Fund expenses, compliance program, current legal matters, and other general information; (ii) comparative expense and performance information for other mutual funds with strategies similar to the Fund; (iii) the anticipated effect of size on the Fund’s performance and expenses; and (iv) conflicts of interest and benefits to be realized by the Adviser from its relationship with the Fund. The Board did not identify any particular information that was most relevant to its consideration to approve the Agreement and each Trustee may have afforded different weight to the various factors.

| 1. | The nature, extent, and quality of the services to be provided by the Adviser. In this regard, the Board considered the Adviser’s responsibilities under the Advisory Agreement. The Trustees considered the services being provided by the Adviser to the Fund including, without limitation: the quality of its investment advisory services (including research and recommendations with respect to portfolio securities), its process for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations, its coordination of services for the Fund among the Fund’s service providers, and its efforts to promote the Fund and grow its assets. The Trustees considered the Adviser’s continuity of, and commitment to retain, qualified personnel and the Adviser’s commitment to maintain its resources and systems that allow the Fund to maintain its goals, and the Adviser’s continued cooperation with the Independent Trustees and Counsel for the Fund. The Trustees considered the Adviser’s personnel, including the education and experience of the Adviser’s personnel. After considering the foregoing information and further information in the Meeting materials provided by the Adviser (including the Adviser’s Form ADV), the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by the Adviser were satisfactory and adequate for the Fund. |

| 2. | Investment Performance of the Fund and the Adviser. In considering the investment performance of the Fund and the Adviser, the Trustees compared the short-term performance, including the 1-year cumulative return and since inception annualized returns of the Fund with the performance of funds with similar objectives managed by other investment advisers, as well as with aggregated peer group data. The Trustees also considered the consistency of the Adviser’s management of the Fund with its investment objective, strategies, and limitations. The Trustees noted that the Fund’s performance in all periods (for the periods ending July 31, 2013) reviewed were above certain funds and below others, but that it generally performed below the average and median performance levels. After reviewing and discussing the investment performance of the Fund further, which included extensive consideration of the investment strategy of the Fund, the Adviser’s experience managing the Fund, the Fund’s historical performance, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Fund and the Adviser was acceptable. |

| 3. | The costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. In considering the costs of services to be provided and the profits to be realized by the Adviser from the relationship with the Fund, the Trustees considered: (1) the Adviser’s financial condition; (2) the asset levels of the Fund; (3) the overall expenses of the Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by the Adviser regarding its profits associated with managing the Fund. The Trustees also considered potential benefits for the Adviser in managing the Fund. The Trustees then compared the fees and expenses of the Fund (including the management fee) to other comparable mutual funds. The Trustees noted that the Fund’s management fee was in the mid to lower end of its peer group and the overall expense ratio was below the peer group average. Based on the foregoing, the Board concluded that the fees to be paid to the Adviser by the Fund and the profits to be realized by the Fund, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by the Adviser. |

| 4. | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with the Adviser. The Board considered that while the management fee remained the same at all asset levels, the Fund’s shareholders had experienced benefits from the Fund’s expense limitation arrangement. The Trustees noted the Adviser’s representation that it intended to keep this arrangement in place even after the expiration of the current term of the arrangement. The Trustees noted that once the Fund’s expenses fell below the cap set by the arrangement, the Fund’s shareholders would continue to benefit from the economies of scale under the Fund’s agreements with service providers other than the Adviser. In light of its ongoing consideration of the Fund’s asset levels, expectations for growth in the Fund, and fee levels, the Board determined that the Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by the Adviser. |

| 5. | Possible conflicts of interest and benefits to the Adviser. In considering the Adviser’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund; and the substance and administration of the Adviser’s code of ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to the Adviser’s potential conflicts of interest. The Trustees noted that the Adviser does not utilize soft dollars. The Trustees noted that the Adviser benefited from the Fund in that it is able to utilize the Fund as a vehicle into which to direct advisory clients with small account balances. The Trustees also noted the possible positive publicity that is derived by the Adviser from managing the Fund. The Trustees did not identify any other potential benefits (other than the management fee) that would inure to the Adviser. Based on the foregoing, the Board determined that the standards and practices of the Adviser relating to the identification and mitigation of potential conflicts of interest and the benefits that it derives from managing the Fund are acceptable. |

After additional consideration of the factors delineated in the memorandum provided by Counsel and further discussion among the Board, the Board determined to approve the continuation of the Agreement between the Trust and the Adviser.

Geier Strategic Total Return Fund

Other Federal Income Tax Information (Unaudited)

The Form 1099-DIV you receive in January 2014 will show the tax status of all distributions paid to your account in calendar year 2013. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 32.68% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2013 ordinary income dividends, 82.07% qualifies for the corporate dividends received deduction.

For the year ended October 31, 2013, the Fund designated $294,534 as short-term capital gain distributions.

For the year ended October 31, 2013, the Fund designated $49,765 as long-term capital gain distributions.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (888) 442-9893 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

R. Jeffrey Young, Chairman

Dr. Merwyn R. Vanderlind

Ira Cohen

OFFICERS

R. Jeffrey Young, Principal Executive Officer and President

John C. Swhear, Chief Compliance Officer, AML Officer and Vice President

Carol J. Highsmith, Vice President

Matthew J. Miller, Vice President

Bryan W. Ashmus, Principal Financial Officer and Treasurer

Heather Bonds, Secretary

INVESTMENT ADVISER

Geier Asset Management, Inc.

2205 Warwick Way, Suite 200

Marriottsville, MD 21104

DISTRIBUTOR

Unified Financial Securities, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway, Ste. 310

Leawood, KS 66211

CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215

ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Huntington Asset Services, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

PRIVACY POLICY

The following is a description of the Fund’s policies regarding disclosure of nonpublic personal information that you provide to the Fund or that the Fund collects from other sources. In the event that you hold shares of the Fund through a broker-dealer or other financial intermediary, the privacy policy of your financial intermediary would govern how your nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information the Fund Collects. The Fund collects the following nonpublic personal information about you:

| | • | | Information the Fund receives from you on applications or other forms, correspondence, or conversations (such as your name, address, phone number, social security number, and date of birth); and |

| | • | | Information about your transactions with the Fund, its affiliates, or others (such as your account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information the Fund Discloses. The Fund does not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. The Fund is permitted by law to disclose all of the information it collects, as described above, to service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process your transactions and otherwise provide services to you.

Confidentiality and Security. The Fund restricts access to your nonpublic personal information to those persons who require such information to provide products or services to you. The Fund maintains physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Disposal of Information. The Fund, through its transfer agent, has taken steps to reasonably ensure that the privacy of your nonpublic personal information is maintained at all times, including in connection with the disposal of information that is no longer required to be maintained by the Fund. Such steps shall include, whenever possible, shredding paper documents and records prior to disposal, requiring off-site storage vendors to shred documents maintained in such locations prior to disposal, and erasing and/or obliterating any data contained on electronic media in such a manner that the information can no longer be read or reconstructed.

Annual Report

October 31, 2013

BRC Large Cap Focus Equity Fund

Fund Adviser:

BRC Investment Management LLC

8400 East Prentice Avenue, Suite 1401

Greenwood Village, Colorado 80111

303-414-1100

Management’s Discussion of Fund Performance

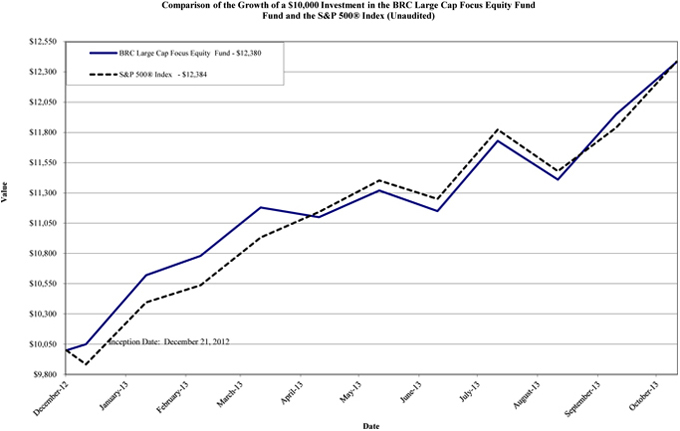

The BRC Large Cap Focus Equity Fund (the “Fund”) was established on December 21, 2012. The Fund’s investment strategy is based on our belief that future investor expectations are strongly influenced by the opinions, forecasts and announcements of perceived market experts, including Wall Street analysts and company management. By incorporating a combination of proprietary quantitative, fundamental and behavioral valuation techniques, we seek to invest in companies that are likely to be the beneficiaries of future favorable earnings announcements and upward earnings estimate revisions.

For the past year, the Fund held 33 equity positions representing those securities that were highly ranked by our quantitative models and were evaluated and approved by our fundamental analysts. For the year, the management team was satisfied with the predictive abilities of the quantitative model and the implementation of the investment process. As expected, the performance results were consistent with our 16+ year old flagship large cap concentrated equity strategy the Fund is mirroring.