UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

|

| Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300 Indianapolis, IN 46208 |

| (Address of principal executive offices) (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group

2041 W. 141st Terrace

Suite 119

Leawood, KS 66224

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 1/31

Date of reporting period: 1/31/13

Item 1. Reports to Stockholders.

Golub Group Equity Fund

Annual Report

January 31, 2013

Fund Adviser:

Golub Group, LLC

1850 Gateway Drive, Suite 100

San Mateo, CA 94404

Toll Free (866) 954-6682

TO OUR FELLOW SHAREHOLDERS:

“When everybody knows something, nobody knows nothing.” - Andy Grove, founder Intel Corporation

Many investors missed a year of positive stock market returns (the fourth year in a row) as they remained fixated on the daily news flow coming out of Washington and braced themselves for a plunge over the fiscal cliff. As usual, Congress waited till the last moment and avoided a crisis by passing a stop gap measure.

The events of the past year reinforced a fundamental belief we hold with regards to investing which is best understood through a quote attributed to Andy Grove, founder of Intel Corporation, which states, “When everybody knows something, nobody knows nothing.”

Everybody “knew” that stocks should be avoided due to the myriad of issues overhanging the markets. Wall Street predictors were bearish at the beginning of 2012, focusing their concerns on the European debt crisis, the upcoming U.S. Presidential election, and the U.S. fiscal cliff that they felt would lead to a major market sell-off. Despite what most people believed, the market responded with its best first quarter in 14 years and continued to build on those gains and ended up with a 16% annual total return for the S&P 500.

Our experience has shown that as long-term investors, we are best served focusing on the fundamentals and valuations of the individual companies we own, as opposed to the “noise” of the day. This is especially important to keep in mind now, since many of the issues that investors were so worried about are still present. Washington must still address several issues such as the spending cuts (sequestration) delayed until March, the debt ceiling, which was reached in December, and the 2013 fiscal budget, which still needs to be approved. With all of these issues unresolved, we anticipate more of the same this year, with many investors fixated on Washington, as opposed to taking advantage of the opportunity currently presenting itself in high-quality stocks.

“Those that cannot remember the past are condemned to repeat it.” George Santayana, 20th Century Philosopher

History has shown that investors are best served by focusing on the fundamentals of the businesses owned and the economies they operate in. As we stated in December, we are confident that the U.S. economy will continue its steady return to growth anchored by an improving labor market, a broadening housing recovery, increased strength in manufacturing, higher energy exports and improved consumer balance sheets. The latest economic data for December reinforces our confidence. The payroll report shows that 168,000 new jobs were added last month and the Institute of Supply Management (ISM) report, which provides insight into business activity, showed the highest reading since February. And even though the market was up 16% for the year, valuations remain attractive, both well-below historical averages and particularly attractive when compared to the alternative opportunities in cash and fixed income.

1

New Additions

In an effort to bolster our resources to focus on what matters (fundamentals and valuations), we have added two experienced professionals to our research team, both of which are CFA charter holders.

Michael Kon, CFA joins us from Morningstar Inc., in Chicago where he was a Senior Equity Analyst for the past six years. In 2011, Michael was recognized as a “Best on the Street” award winner for his coverage of the Financial Services sector. Prior to Morningstar, Michael was an Equity Analyst covering Telecom, Cable and Wireless companies for CIBC World Markets. Michael received his MBA from McGill University in 2004 and graduated at the top of his class.

Matt Gordon, CFA joins us from Chordant Capital Partners, a healthcare-focused investment firm based in Boston. Matt received his MBA from Columbia Business School in 2010 where he was on the Dean’s List and was the winner of the prestigious Pershing Square Value Investing and Philanthropy Challenge. Prior to Columbia, Matt was an Investment Associate at Putnam Investment Management, which he joined following graduation from Amherst College.

In closing, we appreciate your confidence in us. The true intent of the Golub Group Equity Fund is to provide a means by which our investors can build their wealth over the long term. We look forward to achieving this with you.

Sincerely,

Golub Group, LLC

2

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE FOR THE FISCAL YEAR ENDING JANUARY 31, 2013

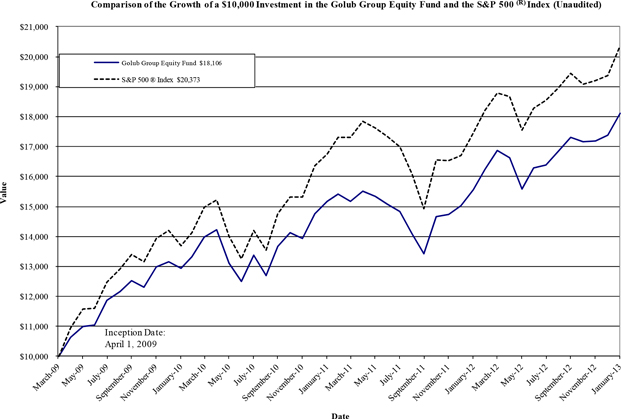

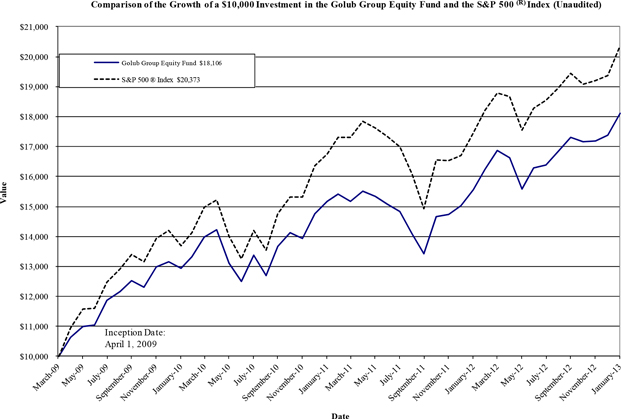

The Golub Group Equity Fund (“Fund”) returned 16.34% for the fiscal year ending January 31, 2013. In comparison, our benchmark, the S&P 500® Index*, gained 16.78% during the same period. Since inception on April 1, 2009, the Fund has returned 81.06% as compared to the 100.37% return of the benchmark.

Performance for the period was led by strong returns from the Financials, Consumer Discretionary and Industrials sectors with all sectors generating positive returns. The portfolio benefited most from its overweight allocation to Financials (21.9% of portfolio weight vs. 14.7% benchmark weight) which was the best performing sector in the S&P 500 and continues to benefit from the improving U.S. economy. Our Consumer Discretionary holdings, primarily the building supply stocks, continued their strong performance on the improved outlook for the U.S. housing market. Industrials, largely driven by General Electric, were a positive contributor despite our sector allocation being underweight relative to benchmark. Lowe’s, Bank of New York Mellon and Berkshire Hathaway were the largest positive contributors and returned 45.3%, 38.6% and 23.2% respectively. Berkshire Hathaway ended the period as our largest holding followed by Lowe’s, Microsoft and General Electric.

The largest detractor to performance was attributable to our underperformance in the Healthcare sector, where we were overweight relative to the benchmark and underperformed in terms of stock selection. Teva Pharmaceuticals had the biggest negative impact with a negative 13.8% return for the period. Despite strong returns in our Consumer Staples holdings, overall performance was hurt by our underweight allocation to the sector (6.4% of portfolio vs. 10.9% benchmark weight). Microsoft and Intel were the only other stocks that had a negative return during the period.

During the period, we added the following three new positions to the fund: Citigroup, Charles Schwab and Devon Energy. During the period we sold the following three positions in their entirety: Abbott Labs, Avon Products and Home Depot.

In addition to the stock and security selection, the advisor’s decision to waive fees and reimburse expenses to the fund due to the expense limitation cap impacted performance. Had the advisor not waived and reimbursed these expenses, the performance of the fund would have been lower.

We remain focused on our long term discipline of investing in high-quality, large-cap, dividend-paying businesses that trade at attractive valuations and are confident that our style of investing is particularly well-suited for the period ahead.

Sincerely,

Golub Group, LLC

3

* The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The views in the foregoing discussion were those of the Fund’s investment advisor as of the date set forth above and may not reflect its views on the date this Annual Report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Fund and do not constitute investment advice.

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling the Fund at 1-866-954-6682. Fee waivers and expense reimbursements have positively impacted Fund performance. An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s Prospectus contains this and other important information. For information on the Fund’s expense ratio, please see the Financial Highlights Table found within the accompanying Annual Report.

4

Investment Results – (Unaudited)

Total Returns*

(For the periods ended January 31, 2013)

| | | | | | | | | | | | |

| | | | | | Average Annual | |

| | | 1 Year | | | 3 Year | | | Since Inception

(April 1, 2009) | |

Golub Group Equity Fund | | | 16.34 | % | | | 11.86 | % | | | 16.73 | % |

S&P 500(R) Index** | | | 16.78 | % | | | 14.14 | % | | | 20.37 | % |

Total annual operating expenses, as disclosed in the most recent supplement to the Fund’s prospectus, were 1.76% of average daily net assets (1.26% after fee waivers/expense reimbursements by the Adviser.) The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund until May 31, 2013, so that Total Annual Fund Operating Expenses do not exceed 1.25%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Fund, and it will automatically terminate upon the termination of the investment advisory agreement between the Fund and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-866-954-6682.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing. The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

5

The chart above assumes an initial investment of $10,000 made on April 1, 2009 (commencement of Fund operations) and held through January 31, 2013. The S&P 500® Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-866-954-6682. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

6

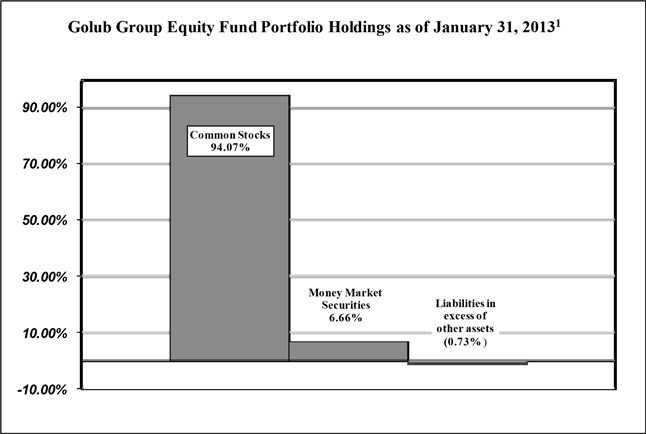

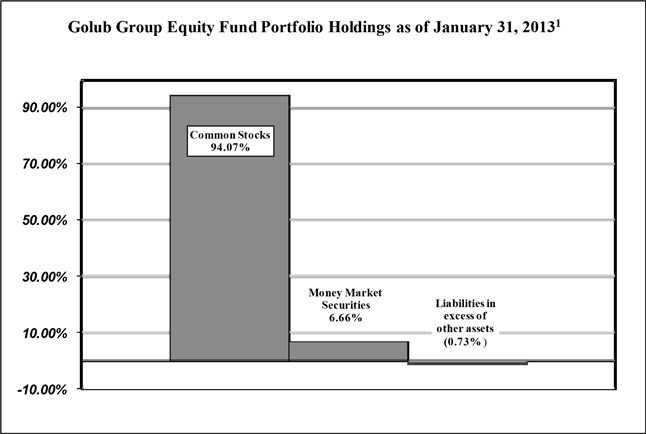

Fund Holdings – (Unaudited)

| 1 | As a percentage of net assets. |

The investment objective of the Golub Group Equity Fund is to provide long-term capital appreciation. A secondary objective is to provide current income.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Fund’s Expenses – (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning and held for the entire period from August 1, 2012 to January 31, 2013.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

7

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| | | | | | | | | | | | |

Golub Group Equity Fund | | Beginning Account

Value

August 1, 2012 | | | Ending Account

Value

January 31, 2013 | | | Expenses Paid

During the Period Ended

January 31, 2013 | |

Actual* | | $ | 1,000.00 | | | $ | 1,105.00 | | | $ | 6.61 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.34 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 184/366. |

| ** | Assumes a 5% return before expenses. |

8

Golub Group Equity Fund

Schedule of Investments

January 31, 2013

| | | | | | | | |

| | | Shares | | | Fair Value | |

Common Stocks - 94.07% | | | | | | | | |

| | |

Air Courier Services - 2.04% | | | | | | | | |

FedEx Corp. | | | 6,550 | | | $ | 664,498 | |

| | | | | | | | |

Aircraft Engines & Engine Parts - 1.54% | | | | | | | | |

United Technologies Corp. | | | 5,725 | | | | 501,338 | |

| | | | | | | | |

Beverages - 4.61% | | | | | | | | |

Diageo plc (b)(c) | | | 4,225 | | | | 504,042 | |

PepsiCo, Inc. | | | 13,650 | | | | 994,402 | |

| | | | | | | | |

| | | | | | | 1,498,444 | |

| | | | | | | | |

Brewery - 2.89% | | | | | | | | |

Anheuser-Busch InBev NV (b) | | | 10,600 | | | | 939,160 | |

| | | | | | | | |

Computer Communications Equipment - 3.90% | | | | | | | | |

Cisco Systems, Inc. | | | 61,700 | | | | 1,269,169 | |

| | | | | | | | |

Crude Petroleum & Natural Gas - 1.82% | | | | | | | | |

Devon Energy Corp. | | | 10,350 | | | | 591,917 | |

| | | | | | | | |

| | |

Electromedical & Electrotherapeutic Apparatus - 2.98% | | | | | | | | |

Medtronic, Inc. | | | 20,775 | | | | 968,115 | |

| | | | | | | | |

Electronic & Other Electrical Equipment (No Computer Equipment) - 4.14% | | | | | | | | |

General Electric Co. | | | 60,400 | | | | 1,345,712 | |

| | | | | | | | |

Electronic Computers - 3.00% | | | | | | | | |

Apple, Inc. | | | 2,140 | | | | 974,363 | |

| | | | | | | | |

Fire, Marine & Casualty Insurance - 4.09% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B (a) | | | 13,725 | | | | 1,330,364 | |

| | | | | | | | |

Investment Advice - 1.95% | | | | | | | | |

Franklin Resources, Inc. | | | 4,625 | | | | 633,070 | |

| | | | | | | | |

Medical - Generic Drugs - 2.94% | | | | | | | | |

Teva Pharmaceutical Industries, Ltd. (b) | | | 25,125 | | | | 954,499 | |

| | | | | | | | |

Motor Vehicles & Passenger Car Bodies - 2.99% | | | | | | | | |

General Motors Co. (a) | | | 34,600 | | | | 971,914 | |

| | | | | | | | |

National Commercial Banks - 3.18% | | | | | | | | |

Citigroup, Inc. | | | 24,550 | | | | 1,035,028 | |

| | | | | | | | |

Petroleum Refining - 8.36% | | | | | | | | |

Chevron Corp. | | | 8,675 | | | | 998,926 | |

ConocoPhillips | | | 10,900 | | | | 632,200 | |

Exxon Mobil Corp. | | | 12,100 | | | | 1,088,637 | |

| | | | | | | | |

| | | | | | | 2,719,763 | |

| | | | | | | | |

Pharmaceutical Preparations - 3.07% | | | | | | | | |

Johnson & Johnson | | | 13,500 | | | | 997,920 | |

| | | | | | | | |

Retail - Lumber & Other Building Materials Dealers - 3.95% | | | | | | | | |

Lowe’s Companies, Inc. | | | 33,600 | | | | 1,283,184 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

9

Golub Group Equity Fund

Schedule of Investments - continued

January 31, 2013

| | | | | | | | |

| | | Shares | | | Fair Value | |

Common Stocks - 94.07% - continued | | | | | | | | |

| | |

Security Brokers, Dealers & Flotation Companies - 1.61% | | | | | | | | |

Charles Schwab Corp./The | | | 31,700 | | | $ | 524,001 | |

| | | | | | | | |

| | |

Semiconductors & Related Devices - 2.92% | | | | | | | | |

Intel Corp. | | | 45,175 | | | | 950,482 | |

| | | | | | | | |

Services - Computer Processing & Data Preparation - 2.92% | | | | | | | | |

Fiserv, Inc. (a) | | | 11,825 | | | | 949,666 | |

| | | | | | | | |

Services - Computer Programming, Data Processing, Etc. - 3.08% | | | | | | | | |

Google Inc. - Class A (a) | | | 1,325 | | | | 1,001,289 | |

| | | | | | | | |

Services - Engineering, Accounting, Research, Management - 2.89% | | | | | | | | |

Paychex, Inc. | | | 28,850 | | | | 941,376 | |

| | | | | | | | |

Services - Prepackaged Software - 3.94% | | | | | | | | |

Microsoft Corp. | | | 46,700 | | | | 1,282,849 | |

| | | | | | | | |

Soap, Detergent, Cleaning Preparations, Perfumes, Cosmetics - 2.00% | | | | | | | | |

Procter & Gamble Co./The | | | 8,650 | | | | 650,134 | |

| | | | | | | | |

State Commercial Banks - 4.25% | | | | | | | | |

Bank of New York Mellon Corp./The | | | 50,825 | | | | 1,380,407 | |

| | | | | | | | |

Super-Regional Banks-US - 6.38% | | | | | | | | |

U.S. Bancorp | | | 28,825 | | | | 954,108 | |

Wells Fargo & Co. | | | 32,200 | | | | 1,121,526 | |

| | | | | | | | |

| | | | | | | 2,075,634 | |

| | | | | | | | |

Surgical & Medical Instruments & Apparatus - 2.09% | | | | | | | | |

Becton, Dickinson and Co. | | | 8,075 | | | | 678,623 | |

| | | | | | | | |

Telephone Communications (No Radio Telephone) - 3.00% | | | | | | | | |

China Mobile Ltd. (b) | | | 17,850 | | | | 976,395 | |

| | | | | | | | |

Trucking & Courier Services (No Air) - 1.54% | | | | | | | | |

United Parcel Service, Inc. - Class B | | | 6,298 | | | | 499,368 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $25,380,858) | | | | | | | 30,588,682 | |

| | | | | | | | |

Money Market Securities - 6.66% | | | | | | | | |

Fidelity Institutional Money Market Portfolio - Institutional Class, 0.16% (d) | | | 2,167,773 | | | | 2,167,773 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $2,167,773) | | | | | | | 2,167,773 | |

| | | | | | | | |

TOTAL INVESTMENTS (Cost $27,548,631) - 100.73% | | | | | | $ | 32,756,455 | |

| | | | | | | | |

Liabilities in excess of other assets - (0.73%) | | | | | | | (238,996 | ) |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 32,517,459 | |

| | | | | | | | |

| (b) | American Depositary Receipt. |

| (c) | Public Limited Company. |

| (d) | Variable rate security; the rate shown represents the 7-day yield at January 31, 2013. |

See accompanying notes which are an integral part of these financial statements.

10

Golub Group Equity Fund

Statement of Assets and Liabilities

January 31, 2013

| | | | |

Assets | | | | |

Investments in securities, at fair value (cost $27,548,631) | | $ | 32,756,455 | |

Receivable for fund shares sold | | | 85,000 | |

Dividends receivable | | | 25,892 | |

Interest receivable | | | 210 | |

Receivable for tax reclaim | | | 203 | |

Prepaid expenses | | | 8,575 | |

| | | | |

Total assets | | | 32,876,335 | |

| | | | |

Liabilities | | | | |

Payable to Adviser (a) | | | 19,982 | |

Payable for investments purchased | | | 296,469 | |

Payable for fund shares redeemed | | | 15,331 | |

Payable to administrator, fund accountant, and transfer agent (a) | | | 8,251 | |

Payable to custodian (a) | | | 414 | |

Payable to trustees | | | 613 | |

Other accrued expenses | | | 17,816 | |

| | | | |

Total liabilities | | | 358,876 | |

| | | | |

Net Assets | | $ | 32,517,459 | |

| | | | |

Net Assets consist of: | | | | |

Paid in capital | | $ | 27,082,547 | |

Undistributed net investment income (loss) | | | (7,946 | ) |

Accumulated net realized gain (loss) on investments | | | 235,034 | |

Net unrealized appreciation (depreciation) on investments | | | 5,207,824 | |

| | | | |

Net Assets | | $ | 32,517,459 | |

| | | | |

Shares outstanding (unlimited number of shares authorized; no par value) | | | 2,063,466 | |

| | | | |

Net Asset Value, offering and redemption price per share | | $ | 15.76 | |

| | | | |

| (a) | See Note 4 in the Notes to the Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

11

Golub Group Equity Fund

Statement of Operations

For the year ended January 31, 2013

| | | | |

Investment Income | | | | |

Dividend income (net of foreign withholding tax of $12,739) | | $ | 615,790 | |

Interest income | | | 3,011 | |

| | | | |

Total Investment Income | | | 618,801 | |

| | | | |

Expenses | | | | |

Investment Adviser fee (a) | | | 281,146 | |

Transfer agent expenses (a) | | | 36,176 | |

Administration expenses (a) | | | 34,998 | |

Fund accounting expenses (a) | | | 25,000 | |

Legal expenses | | | 16,203 | |

Audit expenses | | | 14,500 | |

Custodian expenses (a) | | | 8,183 | |

Printing expenses | | | 7,427 | |

Trustee expenses | | | 6,057 | |

Registration expenses | | | 4,200 | |

Insurance expenses | | | 4,177 | |

Miscellaneous expenses | | | 2,457 | |

Pricing expenses | | | 760 | |

CCO expenses | | | 750 | |

24f-2 fees | | | 730 | |

| | | | |

Total Expenses | | | 442,764 | |

Fees waived and expenses reimbursed by Adviser (a) | | | (91,129 | ) |

| | | | |

Net operating expenses | | | 351,635 | |

| | | | |

Net Investment Income | | | 267,166 | |

| | | | |

Realized & Unrealized Gain on Investments | | | | |

Net realized gain on investment securities | | | 1,167,364 | |

Change in unrealized appreciation on investment securities | | | 2,848,773 | |

| | | | |

Net realized and unrealized gain on investment securities | | | 4,016,137 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 4,283,303 | |

| | | | |

| (a) | See Note 4 in the Notes to the Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

12

Golub Group Equity Fund

Statements of Changes In Net Assets

| | | | | | | | |

| | | Year Ended

January 31, 2013 | | | Year Ended

January 31, 2012 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 267,166 | | | $ | 220,887 | |

Net realized gain on investment securities | | | 1,167,364 | | | | 697,262 | |

Change in unrealized appreciation (depreciation) on investment securities | | | 2,848,773 | | | | (291,148 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 4,283,303 | | | | 627,001 | |

| | | | | | | | |

Distributions | | | | | | | | |

From net investment income | | | (288,218 | ) | | | (212,526 | ) |

From net realized gains | | | (715,029 | ) | | | (1,261,149 | ) |

| | | | | | | | |

Total distributions | | | (1,003,247 | ) | | | (1,473,675 | ) |

| | | | | | | | |

Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | 9,029,658 | | | | 7,225,438 | |

Reinvestment of distributions | | | 1,003,247 | | | | 1,473,675 | |

Amount paid for shares redeemed | | | (4,741,918 | ) | | | (3,480,419 | ) |

| | | | | | | | |

Net increase in net assets resulting from capital share transactions | | | 5,290,987 | | | | 5,218,694 | |

| | | | | | | | |

Total Increase in Net Assets | | | 8,571,043 | | | | 4,372,020 | |

| | | | | | | | |

Net Assets | | | | | | | | |

Beginning of year | | | 23,946,416 | | | | 19,574,396 | |

| | | | | | | | |

End of year | | $ | 32,517,459 | | | $ | 23,946,416 | |

| | | | | | | | |

Undistributed net investment income (loss) included in net assets at end of year | | $ | (7,946 | ) | | $ | 8,233 | |

| | | | | | | | |

Capital Share Transactions | | | | | | | | |

Shares sold | | | 598,533 | | | | 508,241 | |

Shares issued in reinvestment of distributions | | | 67,151 | | | | 109,812 | |

Shares redeemed | | | (313,222 | ) | | | (249,482 | ) |

| | | | | | | | |

Net increase from capital share transactions | | | 352,462 | | | | 368,571 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

13

Golub Group Equity Fund

Financial Highlights

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| |

| For the

Year Ended

January 31, 2013 |

| |

| For the

Year Ended

January 31, 2012 |

| |

| For the

Year Ended

January 31, 2011 |

| |

| For the

Period Ended

January 31, 2010 |

(a) |

| | | | | | | | | | | | | | | | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 14.00 | | | $ | 14.58 | | | $ | 12.85 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (b) | | | 0.14 | | | | 0.15 | | | | 0.11 | | | | 0.11 | |

Net realized and unrealized gain on investments | | | 2.12 | | | | 0.20 | | | | 2.09 | | | | 2.83 | |

| | | | | | | | | | | | | | | | |

Total income from investment operations | | | 2.26 | | | | 0.35 | | | | 2.20 | | | | 2.94 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.14 | ) | | | (0.14 | ) | | | (0.09 | ) | | | (0.09 | ) |

From net realized gains | | | (0.36 | ) | | | (0.79 | ) | | | (0.38 | ) | | | — | (c) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.50 | ) | | | (0.93 | ) | | | (0.47 | ) | | | (0.09 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 15.76 | | | $ | 14.00 | | | $ | 14.58 | | | $ | 12.85 | |

| | | | | | | | | | | | | | | | |

Total Return (d) | | | 16.34 | % | | | 2.65 | % | | | 17.20 | % | | | 29.37 | % (e) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 32,517 | | | $ | 23,946 | | | $ | 19,574 | | | $ | 9,390 | |

Ratio of expenses to average net assets after expense reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % (f) |

Ratio of expenses to average net assets before waiver and reimbursement | | | 1.57 | % | | | 1.75 | % | | | 2.21 | % | | | 3.45 | % (f) |

Ratio of net investment income (loss) to average net assets after expense reimbursement | | | 0.95 | % | | | 1.03 | % | | | 0.82 | % | | | 1.07 | % (f) |

Ratio of net investment income (loss) to average net assets before waiver and reimbursement | | | 0.63 | % | | | 0.53 | % | | | (0.14 | )% | | | (1.13 | )%(f) |

Portfolio turnover rate | | | 16.79 | % | | | 27.33 | % | | | 23.15 | % | | | 8.58 | % (e) |

| (a) | For the period April 1, 2009 (Commencement of Operations) to January 31, 2010. |

| (b) | Net investment income per share is calculated by dividing net investment income by the average shares outstanding throughout the period. |

| (c) | Distributions to shareholders resulted in less than $0.005 per share. |

| (d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

14

Golub Group Equity Fund

Notes to the Financial Statements

January 31, 2013

NOTE 1. ORGANIZATION

The Golub Group Equity Fund (the “Fund”) was organized as an open-end diversified series of the Valued Advisers Trust (the “Trust”) on April 1, 2009. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Golub Group, LLC (the “Adviser”). The investment objective of the Fund is to provide long-term capital appreciation. A secondary objective is to provide current income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended January 31, 2013, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the year, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date. The first in, first out method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute all or substantially all of its net investment income, if any, as dividends to its shareholders on at least an annual basis. The Fund intends to distribute its net realized long term capital gains and its net realized short term capital gains, if any, at least once a year. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

15

Golub Group Equity Fund

Notes to the Financial Statements – continued

January 31, 2013

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

For the year ended January 31, 2013, the Fund made the following reclassifications to increase (decrease) the components of net assets.

| | | | | | | | | | | | |

| | | Paid in Capital | | | Accumulated Undistributed

Net Investment Income | | | Accumulated Net Realized

Loss from Investments | |

Golub Group Equity Fund | | $ | (1 | ) | | $ | 4,873 | | | $ | (4,872 | ) |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. Accounting principles generally accepted in the United States of America (“GAAP”) establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – quoted prices in active markets for identical securities |

| | • | | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the

16

Golub Group Equity Fund

Notes to the Financial Statements – continued

January 31, 2013

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review by the Board. These securities will be categorized as Level 3 securities.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

Fixed income securities that are valued using market quotations in an active market will be categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. These securities will generally be categorized as Level 2 securities. If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review of the Board. These securities will be categorized as Level 3 securities.

Short-term investments in fixed income securities (those with maturities of less than 60 days when acquired or which subsequently are within 60 days of maturity), are valued at amortized cost, which the Board has determined will represent fair value. These securities will be classified as Level 2 securities.

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Fund would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Fund’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Fund is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available. Any fair valuation pricing done outside the Fund’s approved pricing methods must be approved by the Pricing Committee of the Board.

The following is a summary of the inputs used to value the Fund’s investments as of January 31, 2013:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | |

Assets | | Level 1 - Quoted

Prices in Active

Markets | | | Level 2 - Other

Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Total | |

Common Stocks* | | $ | 30,588,682 | | | $ | — | | | $ | — | | | $ | 30,588,682 | |

Money Market Securities | | | 2,167,773 | | | | — | | | | — | | | | 2,167,773 | |

Total | | $ | 32,756,455 | | | $ | — | | | $ | — | | | $ | 32,756,455 | |

| * | Refer to the Schedule of Investments for industry classifications. |

17

Golub Group Equity Fund

Notes to the Financial Statements – continued

January 31, 2013

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

The Fund did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. During the year ended January 31, 2013, the Fund had no transfers between any Levels. The Fund did not hold any derivative instruments during the reporting period. The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the investment advisory agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Golub Group Equity Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.00% of the average daily net assets of the Fund. For the fiscal year ended January 31, 2013, the Adviser earned a fee of $281,146 from the Fund before the reimbursement described below. At January 31, 2013, the Fund owed the Adviser $19,982.

The Adviser has contractually agreed to waive or limit its fee and reimburse certain Fund operating expenses, until May 31, 2013, so that the ratio of total annual operating expenses does not exceed 1.25%. This operating expense limitation does not apply to interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a plan of distribution under Rule 12b-1, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses.” Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of investing in other investment companies, including ETFs, closed-end funds and money market funds that have their own expenses. The Adviser may be entitled to the reimbursement of any fees waived or expenses reimbursed pursuant to the agreement provided overall expenses fall below the limitations set forth above. The Adviser may recoup the sum of all fees previously waived or expenses reimbursed during any of the previous three (3) years, less any reimbursement previously paid, provided total expenses do not exceed the limitation set forth above. For the year ended January 31, 2013, the Adviser waived fees of $91,129.

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, at January 31, 2013 are as follows:

| | | | |

Amount | | | January 31, |

| | $129,687 | | | 2014 |

| | $107,613 | | | 2015 |

| | $ 91,129 | | | 2016 |

The Trust retains Huntington Asset Services, Inc. (“HASI”) to manage the Fund’s business affairs and provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the fiscal year ended January 31, 2013, HASI earned fees of $34,998 for administrative services provided to the Fund. At January 31, 2012, HASI was owed $2,917 from the Fund for administrative services. Certain officers of the Trust are members of management and/or employees of HASI. HASI is a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the “Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the fiscal year ended January 31, 2013, the Custodian earned fees of $8,183 for custody services provided to the Fund. At January 31, 2013, the Custodian was owed $414 from the Fund for custody services.

The Trust also retains HASI to act as the Fund’s transfer agent and to provide fund accounting services. For the fiscal year ended January 31, 2013, HASI earned fees of $36,176 for transfer agent services to the Fund. At January 31, 2013, the Fund owed HASI $3,251 for transfer agent services.

18

Golub Group Equity Fund

Notes to the Financial Statements – continued

January 31, 2013

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES – continued

For the fiscal year ended January 31, 2013, HASI earned fees of $25,000 from the Fund for fund accounting services. At January 31, 2013, HASI was owed $2,083 from the Fund for fund accounting services.

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 under the 1940 Act (the “Plan”). The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to achieve efficiently its investment objectives and to realize economies of scale. The Plan is not active and will not be activated prior to May 31, 2013.

Unified Financial Securities, Inc. acts as the principal distributor of the Fund’s shares. There were no payments made by the Fund to the Distributor during the fiscal year ended January 31, 2013. An officer of the Trust is an officer of the Distributor and such person may be deemed to be an affiliate of the Distributor.

NOTE 5. INVESTMENTS

For the fiscal year ended January 31, 2013, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| | | | |

| | | Amount | |

Purchases | | | | |

U.S. Government Obligations | | $ | — | |

Other | | | 8,314,744 | |

Sales | | | | |

U.S. Government Obligations | | $ | — | |

Other | | | 4,477,463 | |

At January 31, 2013, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | | |

Gross Appreciation | | $ | 5,513,251 | |

Gross (Depreciation) | | | (305,946 | ) |

| | | | |

Net Appreciation (Depreciation) on Investments | | $ | 5,207,305 | |

| | | | |

At January 31, 2013, the aggregate cost of securities, excluding U.S. government obligations, for federal income tax purposes was $27,549,150 for the Fund.

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

19

Golub Group Equity Fund

Notes to the Financial Statements – continued

January 31, 2013

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At January 31, 2013, Charles Schwab owned, as record shareholder, 95.99% of the outstanding shares of the Fund. The Trust does not know whether Charles Schwab or any of the underlying beneficial owners owned or controlled 25% or more of the voting securities of the Fund.

NOTE 8. DISTRIBUTIONS TO SHAREHOLDERS

On December 28, 2012, the Fund paid an income distribution of $0.1437 per share and a long-term capital gain distribution of $0.3565 per share, to shareholders of record on December 27, 2012.

The tax characterization of distributions for the fiscal periods ended January 31, 2013 and January 31, 2012, were as follows:

| | | | | | | | |

| | | 2013 | | | 2012 | |

Distributions paid from: | | | | | | | | |

Ordinary Income* | | $ | 283,345 | | | $ | 470,799 | |

Long-term Capital Gain | | | 719,902 | | | | 1,002,875 | |

| | | | | | | | |

| | $ | 1,003,247 | | | $ | 1,473,674 | |

| | | | | | | | |

| * | Short term capital gain distributions are treated as ordinary income for tax purposes. |

At January 31, 2013, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Undistributed long-term capital gains | | | 235,561 | |

Accumulated capital and other losses | | | (7,954 | ) |

Unrealized appreciation (depreciation) | | | 5,207,305 | |

| | | | |

| | $ | 5,434,912 | |

| | | | |

At January 31, 2013, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales in the amount of $519.

Under current tax law, net investment losses and capital losses realized after October 31 of a Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund deferred losses as follows:

| | | | |

| | | Late Year

Ordinary Loss | |

Golub Group Equity Fund | | $ | 7,954 | |

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

20

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Golub Group Equity Fund

(Valued Advisers Trust)

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Golub Group Equity Fund (the “Fund”), a series of the Valued Advisers Trust, as of January 31, 2013, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the two years in the year then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the periods ended prior to January 31, 2012, were audited by other auditors whose report dated March 22, 2011 expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of January 31, 2013, by correspondence with the custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Golub Group Equity Fund as of January 31, 2013, and the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the year then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

March 26, 2013

TRUSTEES AND OFFICERS (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following tables provide information regarding the Trustees and Officers.

The following table provides information regarding each of the Independent Trustees.

| | |

Name, Address*, (Age), Position with

Trust**, Term of Position with Trust | | Principal Occupation During Past 5 Years and Other Directorships |

| Dr. Merwyn R. Vanderlind, 76, Independent Trustee, August 2008 to present. | | Retired; Consultant to Battelle Memorial Institute (International Science and Technology Research Enterprise) on business investments from 2001 to 2003; Formerly employed with Battelle Memorial Institute from 1966 to 2003 in various positions, including the Executive Vice President of Battelle Institute from 1991 to 2001, General Manager from 1985 to 1991, Director of the Battelle Industrial Technology Center (Geneva, Switzerland) from 1983 to 1985, and Practicing Researcher from 1966 to 1983. |

| |

Ira Cohen, 53 Independent Trustee, June 2010 to present. | | Independent financial services consultant (Feb. 2005 - present); Senior Vice President, Dealer Services / Institutional Services, AIM Investment Services, Inc. (1992 – 2005). |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | The Trust consists of 15 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below should serve as a Trustee.

| | |

Name, Address*, (Age), Position with

Trust**, Term of Position with Trust | | Principal Occupation During Past 5 Years and Other Directorships |

| R. Jeffrey Young, 48, Trustee and Chairman, June 2010 to present. | | Principal Executive Officer and President, Valued Advisers Trust since February 2010; Senior Vice President, Huntington Asset Services, Inc. since January 2010; Chief Executive Officer, Huntington Funds since February 2010; Chief Executive Officer, The Huntington Strategy Shares since November 2010; President and Chief Executive Officer, Dreman Contrarian Funds March 2011 to February 2013; Trustee, Valued Advisers Trust, August 2008 to January 2010; Managing Director and Chief Operating Officer of Professional Planning Consultants 2007 to 2010; Co-Founder of Kinwood Group, LLC July 2007 to March 2008; President and Chief Executive Officer of The Coventry Group from 2000 to 2007; President and Chief Executive Officer of the STI Classic Funds from 2004 to 2007; Trustee of the Coventry Group from 1999 to 2005; and Senior Vice President of BISYS Fund Services / The Winsbury Company October 1993 to June 2007. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | The Trust consists of 15 series. |

The following table provides information regarding the Officers of the Trust:

| | |

Name, Address*, (Age), Position with

Trust,** Term of Position with Trust | | Principal Occupation During Past 5 Years and Other Directorships |

| R. Jeffrey Young, 48, Principal Executive Officer and President, February 2010 to present. | | Trustee, Valued Advisers Trust since June 2010; Senior Vice President, Huntington Asset Services, Inc. since January 2010; Chief Executive Officer, Huntington Funds since February 2010; President and Chief Executive Officer, Dreman Contrarian Funds since March 2011; Trustee, Valued Advisers Trust, August 2008 to January 2010; Managing Director and Chief Operating Officer of Professional Planning Consultants 2007 to 2010; Co-Founder of Kinwood Group, LLC July 2007 to March 2008; President and Chief Executive Officer of The Coventry Group from 2000 to 2007; President and Chief Executive Officer of the STI Classic Funds from 2004 to 2007; Trustee of the Coventry Group from 1999 to 2005; and Senior Vice President of BISYS Fund Services/The Winsbury Company October 1993 to June 2007. |

| |

| John C. Swhear, 51, Chief Compliance Officer, AML Officer and Vice President, August 2008 to present. | | Vice President of Legal Administration and Compliance for Huntington Asset Services, Inc., the Trust’s administrator, since April 2007; Chief Compliance Officer of Unified Financial Securities, Inc., the Trust’s distributor, since May 2007; Senior Vice President of the Unified Series Trust since May 2007; Secretary of Huntington Funds since April 2010; President and Chief Executive Officer of Dreman Contrarian Funds from March 2010 to March 2011, and Vice President and Acting Chief Executive Officer, 2007 to March 2010 ; Employed in various positions with American United Life Insurance Company from 1983 to April 2007, including: Associate General Counsel, April 2007; Investment Advisor Chief Compliance Officer, June 2004 to April 2007; Assistant Secretary to the Board of Directors, December 2002 to April 2007; Chief Compliance Officer of OneAmerica Funds, Inc., June 2004 to April 2007; Chief Counsel and Secretary, OneAmerica Securities, Inc., December 2002 to April 2007. |

| |

| Carol J. Highsmith, 48, Vice President, August 2008 to present. | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since November of 1994; currently Vice President of Legal Administration. |

| |

| Matthew J. Miller, 36, Vice President, December 2011 to present. | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since July of 1998; currently Vice President of Relationship Management; Vice President of Huntington Funds since February 2010. |

| |

Robert W. Silva, 46, Interim Treasurer, January 2013 to present | | Senior Vice President, Fund Administration for Huntington Asset Services, Inc., the Trust’s administrator, since October 2011, Vice President from September 2010 to October 2011; Treasurer of Huntington Funds since November 2010; Chief Financial Officer and Treasurer of The Huntington Strategy Shares since November 2010; Treasurer and Chief Financial Officer of Dreman Contrarian Funds March 2011 to February 2013; Treasurer and Chief Financial Officer of Unified Series Trust since June 2011; Senior Vice President of Citi Fund Services Ohio, Inc. from September 2007 to September 2010. |

| |

Heather Bonds, 37, Secretary, October 2012 to present. | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since January of 2004; currently Certified Paralegal and Section Manager 2. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | The Trust consists of 15 series. |

Other Information

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (866) 954-6682 to request a copy of the SAI or to make shareholder inquiries.

Management Agreement Renewal – (Unaudited)

At a meeting held on September 18, 2012, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (“Agreement”) between the Trust and Golub Group, LLC (the “Adviser”). Counsel noted that the 1940 Act requires the approval of the investment advisory agreements between the Trust and its service providers by a majority of the Independent Trustees. The Board discussed the arrangements between the Adviser and the Trust with respect to the Golub Group Equity Fund (the “Golub Fund”). The Board reviewed a memorandum from Counsel, and addressed to the Trustees that summarized, among other things, the fiduciary duties and responsibilities of the Board in reviewing and approving the renewal of the Agreement. A copy of this memorandum was circulated to the Trustees in advance of the meeting. Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the renewal of the Agreement, including the following material factors: (i) the nature, extent, and quality of the services provided by the Adviser; (ii) the investment performance of the Golub Fund; (iii) the costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Golub Fund; (iv) the extent to which economies of scale would be realized if the Golub Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Golub Fund’s investors; and (v) the Adviser’s practices regarding possible conflicts of interest.

In assessing these factors and reaching its decisions, the Board took into consideration information furnished for the Board’s review and consideration throughout the year at regular Board meetings, as well as information specifically prepared and/or presented in connection with the annual renewal process, including information presented at the Meeting. The Board requested and was provided with information and reports relevant to the annual renewal of the Agreement, including: (i) reports regarding the services and support provided to the Golub Fund and its shareholders by the Adviser; (ii) quarterly assessments of the investment performance of the Golub Fund by personnel of the Adviser; (iii) commentary on the reasons for the performance; (iv) presentations by Golub Fund management addressing Golub’s investment philosophy, investment strategy, personnel and operations; (v) compliance and audit reports concerning the Golub Fund and the Adviser; (vi) disclosure information contained in the registration statement of the Trust and the Form ADV of the Adviser; (vii) information on relevant developments in the mutual fund industry and how the Golub Fund and/or Golub are responding to them; and (viii) a memorandum from Counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Agreement, including the material factors set forth above and the types of information included in each factor that should be considered by the Board in order to make an informed decision. The Board also requested and received various informational materials including, without limitation: (i) documents containing information about Golub, including financial information, a description of personnel and the services provided to the Golub Fund, information on investment advice, performance, summaries of Fund expenses, compliance program, current legal matters, and other general information; (ii) comparative expense and performance information for other mutual funds with strategies similar to the Golub Fund; (iii) the anticipated effect of size on the Golub Fund’s performance and expenses; and (iv) benefits to be realized by the Adviser from its relationship with the Golub Fund. The Board did not identify any particular information that was most relevant to its consideration to approve the Agreement and each Trustee may have afforded different weight to the various factors.

1. The nature, extent, and quality of the services to be provided by the Adviser. In this regard, the Board considered the Adviser’s responsibilities under the Agreement. The Trustees considered the services being provided by the Adviser to the Fund including, without limitation: the quality of its investment advisory services (including research and recommendations with respect to portfolio securities), its process for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations, its coordination of services for the Fund among the Fund’s service providers, and its efforts to promote the Fund and grow its assets. The Trustees considered the Adviser’s continuity of, and commitment to retain, qualified personnel and the Adviser’s commitment to maintain and enhance its resources and systems, the commitment of the Adviser’s personnel to finding alternatives and options that allow the Golub Fund to maintain its goals, and the Adviser’s continued cooperation with the Independent Trustees and Counsel for the Fund. The Trustees considered the Adviser’s personnel, including the education and experience of the Adviser’s personnel. After considering the foregoing information and further information in the Meeting materials provided by the Adviser (including the Adviser’s Form ADV), the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by the Adviser were satisfactory and adequate for the Fund.

Management Agreement Renewal – (Unaudited) – continued

2. Investment Performance of the Fund and the Adviser. In considering the investment performance of the Fund and the Adviser, the Trustees compared the short-term and since inception performance of the Fund with the performance of funds with similar objectives managed by other investment advisers, as well as with aggregated peer group data. The Trustees also considered the consistency of the Adviser’s management of the Fund with its investment objective, strategies, and limitations. The Trustees considered the Fund’s performance relative to the performance of the Adviser’s composite for accounts managed similarly to the Fund based on recent data. The Trustees noted that the Fund’s performance on a year-to-date, three month, one-year, three-year, and since inception basis compared very favorably to many of its peers. After reviewing and discussing the investment performance of the Fund further, the Adviser’s experience managing the Fund, the Adviser’s historical performance, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Fund and the Adviser was acceptable.

3. The costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. In considering the costs of services to be provided and the profits to be realized by the Adviser from the relationship with the Fund, the Trustees considered: (1) the Adviser’s financial condition; (2) asset level of the Fund; (3) the overall expenses of the Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by the Adviser regarding its profits associated with managing the Fund. The Trustees also considered potential benefits for the Adviser in managing the Fund. The Trustees then compared the fees and expenses of the Fund (including the management fee) to other comparable mutual funds. The Trustees noted that the Fund’s management fee tended to be toward the higher end of the comparable mutual funds although the overall expense ratio of the Fund was lower than some of the specifically identified comparable funds and higher than others. Based on the foregoing, the Board concluded that the fees to be paid to the Adviser by the Fund and the profits to be realized by the Adviser, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by the Adviser.

4. The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with the Adviser. The Board considered that while the management fee remained the same at all asset levels, the Fund’s shareholders had experienced benefits from the Fund’s expense limitation arrangement. The Trustees noted that since the Fund’s expenses fell below the cap set by the arrangement, the Fund’s shareholders would continue to benefit from the economies of scale under the Fund’s agreements with service providers other than the Adviser. In light of its ongoing consideration of the Fund’s asset levels, expectations for growth in the Fund, and fee levels, the Board determined that the Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by the Adviser.

5. Possible conflicts of interest. In considering the Adviser’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and/or the Adviser’s other accounts; and the substance and administration of the Adviser’s code of ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to the Adviser’s potential conflicts of interest. Based on the foregoing, the Board determined that the Adviser’s standards and practices of the Advisers relating to the identification and mitigation of potential conflicts of interest were satisfactory.

After additional consideration of the factors delineated in the memorandum provided by Counsel and further discussion among the Board, the Board determined to renew the Agreement between the Trust and the Adviser for one additional year.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (866) 954-6682 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

R. Jeffrey Young, Chairman

Dr. Merwyn R. Vanderlind

Ira Cohen

OFFICERS

R. Jeffrey Young, Principal Executive Officer and President

John C. Swhear, Chief Compliance Officer, AML Officer and Vice-President

Carol J. Highsmith, Vice President

Matthew J. Miller, Vice President

Robert W. Silva, Interim Principal Financial Officer and Treasurer

Heather Bonds, Secretary

INVESTMENT ADVISER

Golub Group, LLC

1850 Gateway Drive, Suite 100

San Mateo, CA 94404

DISTRIBUTOR

Unified Financial Securities, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.,

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Pkwy, Suite 310

Leawood, KS 66211

CUSTODIAN

Huntington National Bank

41 S. High St.