united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC

Attn: Zachary P. Richmond

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 1/31

Date of reporting period: 1/31/2022

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Belmont Theta Income Fund |

| |

| |

| |

| |

| |

| Annual Report |

| |

| January 31, 2022 |

| |

| |

| |

| |

| |

| Fund Adviser: |

Belmont Capital, LLC d/b/a Belmont Capital GroupTM

1875 Century Park E., Suite 1780

Los Angeles, CA 90067 |

| |

| |

| |

| |

| |

| Belmont Theta Income Fund |

| Management’s discussion of Fund performance (Unaudited) |

| January 31, 2022 |

Dear Shareholders:

Overview:

The Belmont Theta Income Fund was launched on April 30, 2018, with the goal of offering our income generating Theta Overlay Program options strategy in a mutual fund format. The objective of the Fund is the long-term growth of capital and income generation with limited correlation to equity markets.

Performance Results:

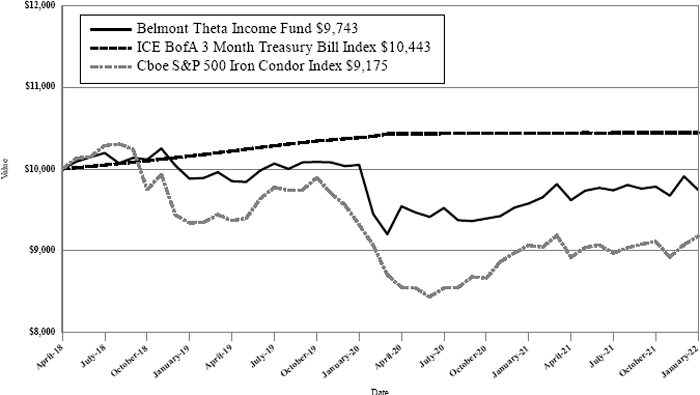

For the 12 months ended January 31, 2022, Institutional Class shares of the Belmont Theta Income Fund returned 1.73% at net asset value. The Fund’s primary benchmark, the Cboe S&P 500® Iron Condor Index, returned 1.22% for the same period.

Explanation of Fund Performance:

The Fund seeks to generate returns through yield of the Government short-term fixed income securities and realized option premium income. The Fund purchases short-term Government fixed income as collateral for the Theta Overlay Program options strategy. The options strategy writes out of the money call and put spreads on the S&P 500® Index (SPX) to capitalize on time decay and the volatility risk premium (VRP) typically imbedded in option pricing. Historically, there has been a premium between the implied volatility of option pricing and realized volatility of the SPX which the Fund seeks to exploit through its risk managed process. The strategy should benefit from higher short term interest rates along with moderate volatility in the SPX relative to the option premium collected. Lower short term interest rates and high velocity moves in either direction in the price of the SPX can be potentially negative for strategy performance.

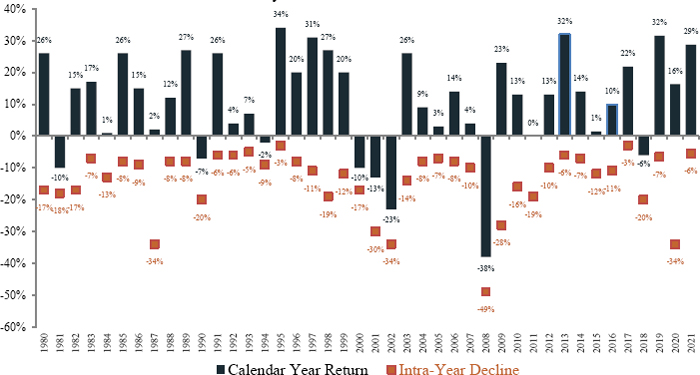

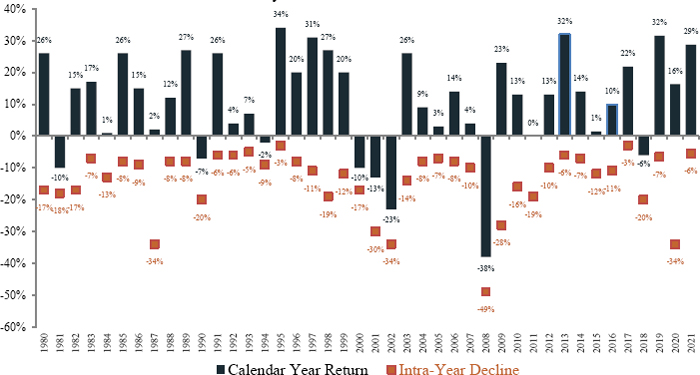

The economic recovery continued in 2021 and the SPX rallied to all-time highs notching a +26.89% return for the calendar year ended December 2021. Fueled by historically low interest rates and continued quantitative easing from the Federal Reserve, the upward trend in the S&P 500 persisted throughout the calendar year with the worst peak-to-trough drawdown being just 5.2%. That puts it in the bottom 10% of all calendar year drawdowns over the past 94 years of data. This allowed the Fund to realize the majority of option premium collected through the selling of its put spreads. Conversely, the lack of “back and forth” for the better part of the fiscal year ended January 2022 challenged the call spread positions. Additional loses to the call spreads were mitigated through active risk management, placing the fund in a position to end the fiscal year with positive returns.

| Belmont Theta Income Fund |

| Management’s discussion of Fund performance (Unaudited) |

| (continued) |

| January 31, 2022 |

Finally, the fixed income portion of the Fund’s strategy added almost no additional return as short-term rates were near zero for the entire fiscal year.

Outlook:

Looking forward we feel that, the Theta Overlay Program options strategy should continue to benefit from elevated Cboe Exchange’s Cboe Volatility Index levels, and our proactive risk management approach tested since 2011. Additionally, there is an opportunity to continue collecting higher VRP than in previous years, as many of the specialized funds which previously provided the option market supply have shut down and have yet to be replaced. An equity market with less extremes (upside & downside) than experienced recently could also benefit the option component of the Fund. We anticipate that the fixed income strategy will continue to be invested in high quality US Treasury securities and would benefit from the Federal Open Market Committee’s follow through with proposed rate increases.

Thank you for your continued support and please reach out with any questions or visit www.belmontcapfunds.com for other information about the Fund.

Stephen J. Solaka

Managing Partner & Portfolio Manager

Investment Results (Unaudited)

Average Annual Total Returns* as of January 31, 2022

| | | | | | Since |

| | | | | | Inception |

| | | | | | (April 30, |

| | One Year | | Three Years | | 2018) |

| Belmont Theta Income Fund | 1.73% | | (0.46)% | | (0.69)% |

| Cboe S&P 500® Iron Condor Index(a) | 1.22% | | (0.58)% | | (2.27)% |

| ICE BofA US 3-Month Treasury Bill Index(b) | 0.03% | | 0.93% | | 1.16% |

Total annual operating expenses as disclosed in the Belmont Theta Income Fund (the “Fund”) prospectus dated May 28, 2021, were 3.20% of average daily net assets (2.10% after fee waivers/ expense reimbursements by Belmont Capital, LLC (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until May 31, 2022, so that total annual fund operating expenses do not exceed 1.99%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees of the Value Advisers Trust (the “Trust”), and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including exchange-traded funds, that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following the date on which the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. Additional information pertaining to the Fund’s expense ratios as of January 31, 2022 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 789-1087.

| * | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (a) | Cboe S&P 500® Iron Condor Index (“Index”) is designed to track the performance of a hypothetical option trading strategy that 1) sells a rolling monthly out-of-the-money (OTM) S&P 500® Index (SPX) put option (delta ≈ - 0.20) and a rolling monthly OTM SPX call option (delta ≈ 0.20); 2) buys a rolling monthly OTM SPX put option (delta ≈ - 0.05) and a rolling monthly OTM SPX call option (delta ≈ 0.05) to reduce risk; and 3) holds a money market account invested in one- |

Investment Results (Unaudited) (continued)

month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the Index.

| (b) | ICE BofA US 3-Month Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify, an issue must have settled on or before the rebalancing date. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (800) 789-1087. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

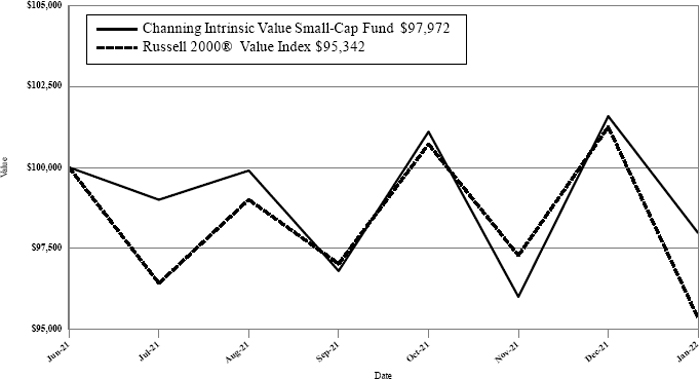

Investment Results (Unaudited) (continued)

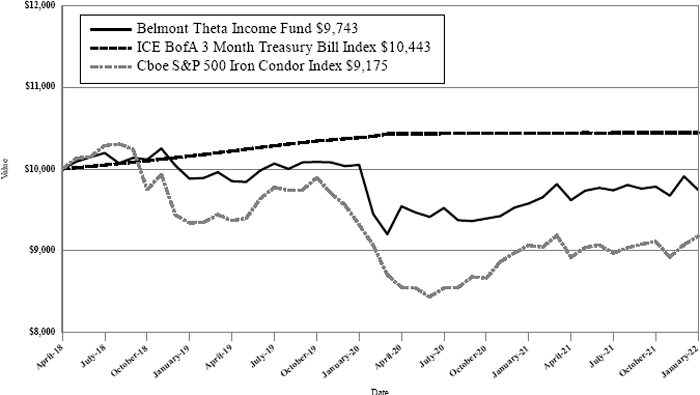

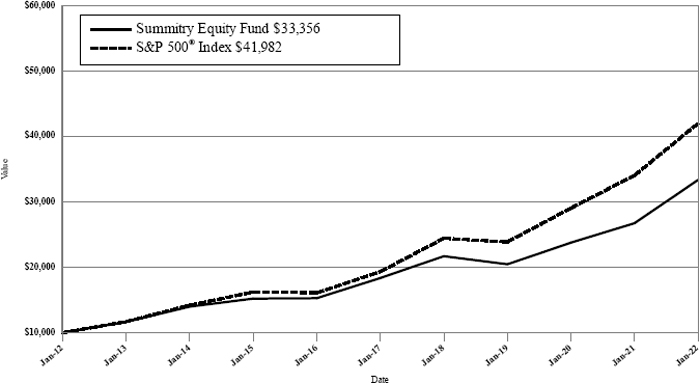

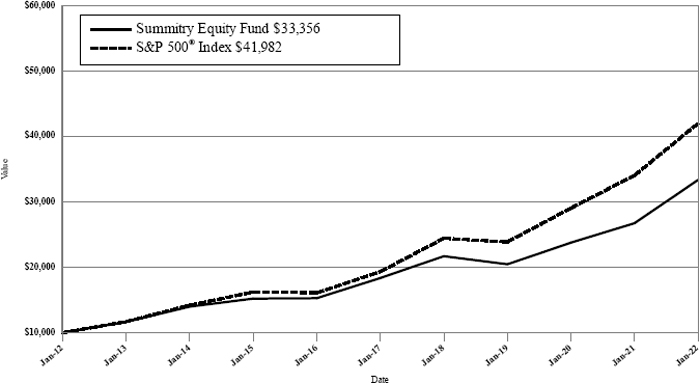

Comparison of the Growth of a $10,000 Investment in the Belmont Theta Income Fund, the Cboe S&P 500® Iron Condor Index and the ICE BofA US 3-Month Treasury Bill Index.

The chart above assumes an initial investment of $10,000 made on April 30, 2018 (commencement of operations) and held through January 31, 2022. The Cboe S&P 500 Iron Condor Index (“Index”) is designed to track the performance of a hypothetical option trading strategy that 1) sells a rolling monthly out-of-the-money (OTM) S&P 500 Index (SPX) put option (delta ≈ - 0.20) and a rolling monthly out-of-the-money (OTM) SPX call option (delta ≈ 0.20); 2) buys a rolling monthly OTM SPX put option (delta ≈ - 0.05) and a rolling monthly OTM SPX call option (delta ≈ 0.05) to reduce risk; and 3) holds a money market account invested in one-month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the index. Individuals cannot invest directly in the Index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 789-1087. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

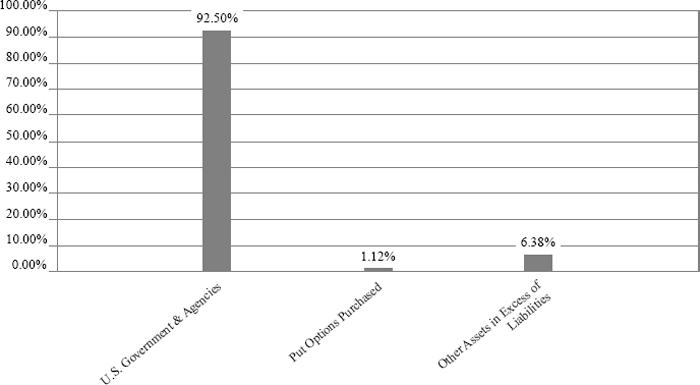

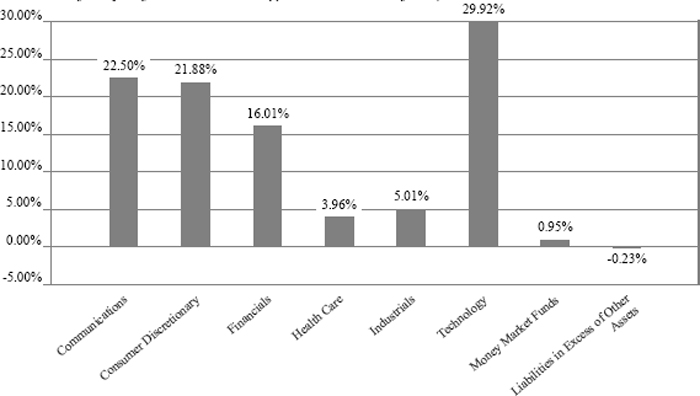

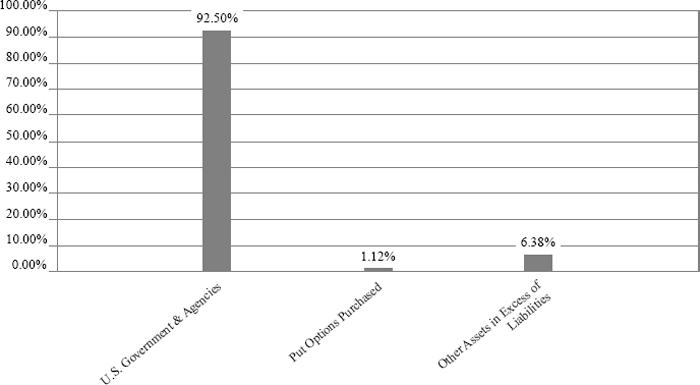

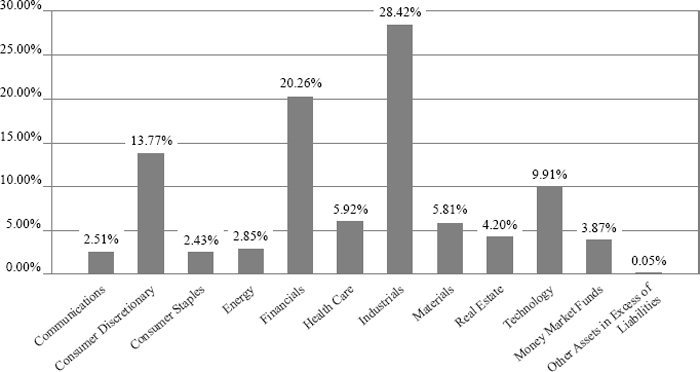

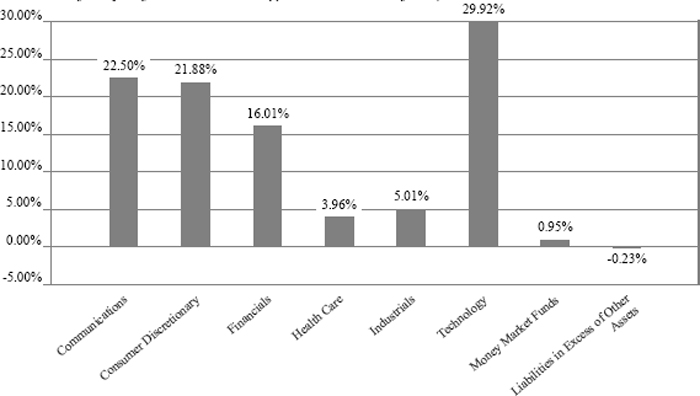

Fund Holdings (Unaudited)

Belmont Theta Income Fund Holdings as of January 31, 2022*

| * | As a percentage of net assets. |

The investment objective of the Fund is to seek long-term growth of capital and income generation with limited correlation to equity markets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http:// www.sec.gov and on the Fund’s website at http://www.belmontcapfunds.com.

Belmont Theta Income Fund

Schedule of Investments

January 31, 2022

| | | Principal | | | | | |

| | | Amount | | | Fair Value | |

| U.S. GOVERNMENT & AGENCIES(a)(b)(c) — 92.50% | | | | | | | | |

| United States Treasury Bill, 0.03%, 3/24/2022 | | $ | 2,000,000 | | | $ | 1,999,795 | |

| United States Treasury Bill, 0.02%, 5/19/2022 | | | 1,000,000 | | | | 999,235 | |

| United States Treasury Bill, 0.04%, 8/11/2022 | | | 2,000,000 | | | | 1,995,198 | |

| United States Treasury Bill, 0.08%, 11/3/2022 | | | 2,000,000 | | | | 1,991,302 | |

| United States Treasury Bill, 0.14%, 12/1/2022 | | | 2,000,000 | | | | 1,989,542 | |

| United States Treasury Bill, 0.29%, 12/29/2022 | | | 1,000,000 | | | | 993,440 | |

| United States Treasury Bill, 0.54%, 1/26/2023 | | | 2,000,000 | | | | 1,984,792 | |

| Total U.S. Government & Agencies (Cost $11,982,426) | | | | | | | 11,953,304 | |

| | | Number of | | | Notional | | | Exercise | | | Expiration | | | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | Fair Value | |

| PUT OPTIONS PURCHASED — 1.12% | | | | | | | | | | | | | | | | | | |

| S & P 500 Index(c) | | | 85 | | | $ | 38,382,155 | | | $ | 3,950.00 | | | March 2022 | | $ | 144,925 | |

| Total Options Purchased (Cost $751,684) | | | | | | | | | | | | | | | | | 144,925 | |

| Total Investments — 93.62% (Cost $12,734,110) | | | | | 12,098,229 | |

| Other Assets in Excess of Liabilities — 6.38% | | | 824,716 | |

| NET ASSETS — 100.00% | | | $ | 12,922,945 | |

| (a) | All of these securities are held as collateral for options. |

| (b) | The rate shown represents effective yield at time of purchase. |

| (c) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

Belmont Theta Income Fund

Schedule of Open Written Option Contracts

January 31, 2022

| | | Number of | | | Notional | | | Exercise | | | Expiration | | | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | Fair Value | |

| WRITTEN PUT OPTIONS (2.21)% | | | | | | | | | | | | | | | | | | |

| S & P 500 Index(a) | | | (85 | ) | | $ | (38,382,155 | ) | | $ | 4,150.00 | | | March 2022 | | $ | (285,175 | ) |

| | | | | | | | | | | | | | | | | | | |

| Total Written Options (Premiums Received $1,209,007) | | $ | (285,175 | ) |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

Belmont Theta Income Fund

Statement of Assets and Liabilities

January 31, 2022

| Assets | | | | | | | | |

| Investments in securities at fair value (cost $12,734,110) (Note 3) | | | $ | | | | 12,098,229 | |

| Cash | | | | | | | 270,242 | |

| Cash held at broker for options transactions | | | | | | | 871,992 | |

| Interest receivable | | | | | | | 4 | |

| Prepaid expenses | | | | | | | 6,797 | |

| Total Assets | | | | | | | 13,247,264 | |

| Liabilities | | | | | | | | |

| Options written, at value (premium received $1,209,007) | | | | | | | 285,175 | |

| Payable to Adviser (Note 4) | | | | | | | 4,922 | |

| Payable to Administrator (Note 4) | | | | | | | 7,107 | |

| Payable to trustees | | | | | | | 2,130 | |

| Other accrued expenses | | | | | | | 24,985 | |

| Total Liabilities | | | | | | | 324,319 | |

| Net Assets | | | $ | | | | 12,922,945 | |

| Net Assets consist of: | | | | | | | | |

| Paid-in capital | | | $ | | | | 13,143,284 | |

| Accumulated deficit | | | | | | | (220,339 | ) |

| Net Assets | | | $ | | | | 12,922,945 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | | | | | 665,399 | |

| Net asset value, offering and redemption price per share (Note 2) | | | $ | | | | 19.42 | |

See accompanying notes which are an integral part of these financial statements.

Belmont Theta Income Fund

Statement of Operations

For the year ended January 31, 2022

| Investment Income | | | | |

| Interest income | | $ | 7,078 | |

| Total investment income | | | 7,078 | |

| Expenses | | | | |

| Investment Adviser fees (Note 4) | | | 229,178 | |

| Administration fees (Note 4) | | | 42,000 | |

| Fund accounting fees (Note 4) | | | 31,270 | |

| Legal fees | | | 21,185 | |

| Audit and tax preparation fees | | | 18,460 | |

| Registration expenses | | | 16,932 | |

| Transfer agent fees (Note 4) | | | 12,000 | |

| Printing and postage expenses | | | 8,002 | |

| Trustee fees | | | 5,368 | |

| Interest expense | | | 4,053 | |

| Custodian fees | | | 3,000 | |

| Miscellaneous expense | | | 26,624 | |

| Total expenses | | | 418,072 | |

| Fees contractually waived by Adviser (Note 4) | | | (153,403 | ) |

| Net operating expenses | | | 264,669 | |

| Net investment loss | | | (257,591 | ) |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain (loss) on: | | | | |

| Investment securities | | | (458,973 | ) |

| Written options | | | 736,668 | |

| Change in unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | (565,287 | ) |

| Written options | | | 773,397 | |

| Net realized and change in unrealized gain on investments | | | 485,805 | |

| Net increase in net assets resulting from operations | | $ | 228,214 | |

See accompanying notes which are an integral part of these financial statements.

Belmont Theta Income Fund

Statements of Changes in Net Assets

| | | For the Year | | | For the Year | |

| | | Ended January | | | Ended January | |

| | | 31, 2022 | | | 31, 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment loss | | $ | (257,591 | ) | | $ | (148,363 | ) |

| Net realized gain (loss) on investment securities transactions and written options | | | 277,695 | | | | (700,877 | ) |

| Net change in unrealized appreciation of investment securities and written options | | | 208,110 | | | | 42,581 | |

| Net increase (decrease) in net assets resulting from operations | | | 228,214 | | | | (806,659 | ) |

| Capital Transactions - Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 1,667,519 | | | | 1,302,524 | |

| Amount paid for shares redeemed | | | (1,797,810 | ) | | | (3,684,440 | ) |

| Net decrease in net assets resulting from capital transactions | | | (130,291 | ) | | | (2,381,916 | ) |

| Total Increase (Decrease) in Net Assets | | | 97,923 | | | | (3,188,575 | ) |

| Net Assets | | | | | | | | |

| Beginning of year | | | 12,825,022 | | | | 16,013,597 | |

| End of year | | $ | 12,922,945 | | | $ | 12,825,022 | |

| Share Transactions - Institutional Class: | | | | | | | | |

| Shares sold | | | 85,715 | | | | 69,094 | |

| Shares redeemed | | | (92,260 | ) | | | (196,459 | ) |

| Net decrease in shares | | | (6,545 | ) | | | (127,365 | ) |

See accompanying notes which are an integral part of these financial statements.

Belmont Theta Income Fund - Institutional Class

Financial Highlights

(For a share outstanding during each period)

| | | For the Years Ended January 31, | | | For the | |

| | | | | | | | | | | | Period | |

| | | | | | | | | | | | Ended | |

| | | | | | | | | | | | January 31, | |

| | 2022 | | | 2021 | | | 2020 | | | 2019(a) | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 19.09 | | | $ | 20.03 | | | $ | 19.76 | | | $ | 20.00 | |

| Investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.39 | ) | | | (0.22 | ) | | | 0.01 | | | | — | (b) |

| Net realized and unrealized gain (loss) | | | 0.72 | | | | (0.72 | ) | | | 0.32 | | | | (0.24 | ) |

| Total from investment operations | | | 0.33 | | | | (0.94 | ) | | | 0.33 | | | | (0.24 | ) |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Net realized gains | | | — | | | | — | | | | (0.05 | ) | | | — | |

| Total distributions | | | — | | | | — | | | | (0.06 | ) | | | — | |

| Net asset value, end of period | | $ | 19.42 | | | $ | 19.09 | | | $ | 20.03 | | | $ | 19.76 | |

| Total Return(c) | | | 1.73 | % | | | (4.69 | )% | | | 1.71 | % | | | (1.20 | )% (d) |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 12,923 | | | $ | 12,825 | | | $ | 16,014 | | | $ | 12,839 | |

| Ratio of net expenses to average net assets(e) | | | 2.02 | % | | | 2.10 | % | | | 2.14 | % | | | 2.20 | % (f) |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 3.19 | % | | | 3.20 | % | | | 3.02 | % | | | 4.97 | % (f) |

| Ratio of net investment income (loss) to average net assets | | | (1.97 | )% | | | (1.08 | )% | | | 0.06 | % | | | (0.05 | )% (f) |

| Portfolio turnover rate | | | — | % | | | — | % | | | —% | | | | — | % (d) |

| (a) | For the period April 30, 2018 (commencement of operations) to January 31, 2019. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (e) | This ratio includes the impact of broker interest fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 1.99% for the periods ended January 31, 2022, January 31, 2021, January 31, 2020 and January 31, 2019, respectively. |

See accompanying notes which are an integral part of these financial statements.

Belmont Theta Income Fund

Notes to the Financial Statements

January 31, 2022

NOTE 1. ORGANIZATION

The Belmont Theta Income Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund currently offers one class of shares: Institutional Shares. The Fund commenced operations on April 30, 2018. The Fund’s investment adviser is Belmont Capital, LLC d/b/a Belmont Capital GroupTM (the “Adviser”). The investment objective of the Fund is to seek long-term growth of capital and income generation with limited correlation to equity markets.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended January 31, 2022, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the fiscal year ended January 31, 2022, the Fund did not incur any

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. Non-cash income, if any, is recorded at the fair market value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended January 31, 2022, the Fund made the following reclassifications to increase (decrease) the components of net assets due to net operating losses:

| | | Accumulated Earnings |

| Paid-In Capital | | (Deficit) |

| $(256,147) | | $256,147 |

Share Valuation – The NAV is calculated each day the New York Stock Exchange (the “NYSE”) is open by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding for the Fund.

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

Options – The Fund utilizes an option premium collection strategy that implements a put spread and a call spread on the S&P 500® Index (SPX) to create a number of defined-risk trades. A defined-risk trade is essentially where a series of financial instruments (such as options) are entered into where the terms and conditions of the financial instruments are, in combination, designed to limit the overall risk. Stock index options are put options and call options on various stock indices. In most respects, they are identical to listed options on common stocks. The option holder who exercises the index option receives an amount of cash if the closing level of the stock index upon which the option is based is greater than, in the case of a call, or less than, in the case of a put, the exercise price of the option. Options trading is a highly specialized activity that entails greater than ordinary investment risk. Options may be more volatile than the underlying investments, and therefore may be subject to greater fluctuation than an investment in the underlying instruments themselves.

In implementing its option premium collection strategy, the Fund will sell (write) a put option (creating a short position) while simultaneously purchasing another put option at a different strike price (creating a long position) – the combination of these two put option positions creates a defined-risk trade. Additionally, the Fund will sell (write) a call option (creating another short position) while simultaneously purchasing another call option at a different strike price (creating another long position) – the combination of these two call options positions creates another defined-risk trade for the Fund. The Fund’s put spreads and call spreads each contain the following characteristics: (i) the long and short options of each spread have the same number of contracts, (ii) the long option of each spread will have a further out-of-the-money strike price than the short option; (iii) the long option of each spread will have at least the same or longer expiration date than the short option.

The Fund generally utilizes weekly and monthly SPX options with expirations of 90 days or less. SPX options are European-style options, which means that they can be exercised only at expiration. Based on the Adviser’s assessment of market conditions, the Adviser may close one or more sides of a spread at any time for purposes of risk management of the Fund.

The Adviser monitors all SPX option strikes for the optimal sale of put spreads and call spreads. Once the Fund has entered into a position, the Adviser attempts to realize as much of the net premium as possible. The Fund may decide to close its option spread positions prior to expiration, which may result in realizing less than the net option premium initially collected. Positions are generally re-set on a monthly basis, but the Adviser may determine to close and/or adjust option spreads prior to expiration for purposes of risk management. The Adviser may at times determine to take a temporary defensive position and not implement its option spread writing investment strategy. The option premium collection strategy may result in the generation of positive returns for the Fund; however, the loss potential if the strategy is not effective may be greater than the profit potential. The

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

Fund may lose significantly more than the premium it receives in highly volatile market conditions.

The Fund is required to pledge collateral for the option trades and it will hold cash, money market instruments, or treasury bills as collateral for all such options trades. The Fund’s custodian will segregate such collateral for the benefit of the counterparty. Therefore, the Fund must typically maintain a large percentage of cash and cash equivalents within the Fund. The Fund’s option spread positions will effectively lever the portfolio and will target a notional exposure of no greater than three times the pledged collateral value.

Derivative Transactions – The following tables identify the location and fair value of derivative instruments on the Statement of Assets and Liabilities as of January 31, 2022 and the effect of derivative instruments on the Statement of Operations for the fiscal year ended January 31, 2022.

As of January 31, 2022:

| Location of Derivatives on Statement of Assets and Liabilities |

| Derivatives | | Asset Derivatives | | Liability Derivatives | | Fair Value | |

| Equity Price Risk: | | | | | | | |

| Options Purchased | | Investments in securities at fair value | | | | $ | 144,925 | |

| | | | | | | | | |

| Options Written | | | | Options written, at fair value | | | (285,175 | ) |

For the fiscal year ended January 31, 2022:

| | | | | | | | Change in Unrealized | |

| | | Location of Gain (Loss) on | | Realized Gain | | | Appreciation | |

| | | Derivatives on Statement of | | (Loss) on | | | (Depreciation) on | |

| Derivatives | | Operations | | Derivatives | | | Derivatives | |

| Equity Price Risk: | | | | | | | | | | |

| Options purchased | | Net realized gain and change in unrealized appreciation (depreciation) on investment securities | | $ | (458,973 | ) | | $ | (537,133 | ) |

| Options written | | Net realized gain and change in unrealized appreciation (depreciation) on written options | | | 736,668 | | | | 773,397 | |

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

The following summarizes the average ending monthly fair value of derivatives outstanding during the fiscal year ended January 31, 2022:

| | Average Ending Monthly |

| Derivatives | Fair Value(a) |

| Options Purchased | $64,633 |

| Options Written | (188,621) |

| (a) | Average based on the eleven months during the period that had activity |

The following table provides a summary of offsetting financial liabilities and derivatives and the effect of derivative instruments on the Statement of Assets and Liabilities as of January 31, 2022:

| | | | | | | | | | | | Gross Amounts Not Offset | | | | |

| | | | | | | | | | | | in Statements of Assets and | | | | |

| | | | | | | | | | | | Liabilities | | | | |

| | | | | | | | | Net Amounts | | | | | | | | | | |

| | | | | | Gross Amounts | | | of Liabilities | | | | | | | | | | |

| | | | | | Offset in | | | Presented in | | | | | | | | | | |

| | | Gross Amounts | | | Statement of | | | Statement of | | | | | | | | | | |

| | | of Recognized | | | Assets and | | | Assets and | | | Financial | | | Collateral | | | Net | |

| | | Liabilities | | | liabilities | | | Liabilities | | | Instruments | | | Pledged | | | Amount | |

| Written Options | | $ | 285,175 | | | $ | — | | | $ | 285,175 | | | $ | (285,175 | ) | | $ | — | | | $ | — | |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

● Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date

● Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

● Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available)

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Debt securities are valued by using the mean between the closing bid and ask prices provided by a pricing service. If the closing bid and ask prices are not readily available, the pricing service may provide a price determined by a matrix pricing method. Matrix pricing is a mathematical technique used to value fixed income securities without relying exclusively on quoted prices. Matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, coupon, maturity, type of issue and any other factors or market data the pricing service deems relevant for the actual security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Adviser, in conformity with guidelines adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

Exchange-traded options on securities and indices purchased or sold by the Fund generally will be valued at the mean of the last bid and ask prices. If there is no such reported ask on the valuation date, purchased options are valued at the most recent bid price. If there is no such reported bid on the valuation date, written options are valued at the most recent ask price. On the last business day of each month, the Cboe Options Exchange (“Cboe”) conducts special end-of-month non-trading closing rotations for the sole purpose of determining the fair value of the S&P 500 Index (SPX) option series. For month end valuations of SPX, the Cboe adjusted price will be used if the special end-of-month non-trading closing rotation fair value price differs from the price provided at market close. Options will generally be categorized as Level 2 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

The following is a summary of the inputs used to value the Fund’s investments as of January 31, 2022:

| Valuation Inputs |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Government & Agencies | | $ | — | | | $ | 11,953,304 | | | $ | — | | | $ | 11,953,304 | |

| Put Options Purchased | | | — | | | | 144,925 | | | | — | | | | 144,925 | |

| Total | | $ | — | | | $ | 12,098,229 | | | $ | — | | | $ | 12,098,229 | |

| Valuation Inputs |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Written Put Options | | $ | — | | | $ | (285,175 | ) | | $ | — | | | $ | (285,175 | ) |

| Total | | $ | — | | | $ | (285,175 | ) | | $ | — | | | $ | (285,175 | ) |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly at an annual rate of 1.75% of the average daily net assets of the Fund. For the fiscal year ended January 31, 2022, the Adviser earned a fee of $229,178 from the Fund before the waivers described below. At January 31, 2022, the Fund owed the Adviser $4,922.

The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until May 31, 2022, so that total annual fund operating expenses do not exceed 1.99%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board, and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

market funds or other investment companies, including exchange-traded funds, that have their own expenses.

Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Fund within the three years following the date the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. For the fiscal year ended January 31, 2022, the Adviser waived fees or reimbursed expenses totaling $153,403. As of January 31, 2022, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements as follows:

| Recoverable Through | | | | |

| January 31, 2023 | | $ | 140,267 | |

| January 31, 2024 | | | 151,031 | |

| January 31, 2025 | | | 153,403 | |

The Trust retains Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”) to provide the Fund with administration and compliance (including a chief compliance officer), fund accounting, and transfer agent services, including all regulatory reporting. For the fiscal year ended January 31, 2022, the Administrator earned fees of $42,000 for administration and compliance services, $31,270 for fund accounting services and $12,000 for transfer agent services. At January 31, 2022, the Administrator was owed $7,107 for these services.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator and are not paid by the Trust for services to the Fund. Ultimus Fund Distributors, LLC (the “Distributor”), a wholly-owned subsidiary of Ultimus, acts as the distributor of the Fund’s shares. There were no payments made to the Distributor by the Fund for the fiscal year ended January 31, 2022.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended January 31, 2022, there were no purchases or sales of investment securities, other than short-term investments and short-term U.S. government obligations.

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

January 31, 2022

NOTE 6. FEDERAL TAX INFORMATION

At January 31, 2022, the net unrealized appreciation (depreciation) and tax cost of investments, including written options, for tax purposes was as follows:

| Gross unrealized appreciation | | $ | — | |

| Gross unrealized depreciation | | | (29,122 | ) |

| Net unrealized depreciation on investments | | $ | (29,122 | ) |

| Tax cost of investments | | $ | 11,842,176 | |

The difference between book basis and tax basis of unrealized appreciation (depreciation) is primarily attributable to the mark to market adjustments on options contracts.

At January 31, 2022, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated capital and other losses | | $ | (191,217 | ) |

| Unrealized depreciation on investments | | | (29,122 | ) |

| Total accumulated deficit | | $ | (220,339 | ) |

As of January 31, 2022, the Fund had short-term and long-term capital loss carryforwards of $67,991 and $101,852, respectively. These capital loss carryforwards, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

As of January 31, 2022, the Fund deferred Qualified Late Year Ordinary losses of $21,374. During the fiscal year ended January 31, 2022, the Fund utilized capital loss carryforwards of $513,959.

NOTE 7. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Belmont Theta Income Fund and

Board of Trustees of Valued Advisers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedules of investments and open written option contracts, of Belmont Theta Income Fund (the “Fund”), a series of Valued Advisers Trust, as of January 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the four periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of January 31, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the four periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of January 31, 2022, by correspondence with the custodian and broker. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2018.

COHEN & COMPANY, LTD.

Cleveland, Ohio

March 25, 2022

Liquidity Risk Management Program (Unaudited)

Valued Advisers Trust has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board of Trustees approved the appointment of a Liquidity Administrator Committee, which includes representatives from Belmont Capital, LLC, the Fund’s investment adviser, and Ultimus Fund Solutions, LLC, the Fund’s Administrator. The Liquidity Administrator Committee is responsible for the program’s administration and oversight and for reporting to the Board on at least an annual basis regarding the program’s operation and effectiveness. The Liquidity Administrator Committee updated its assessment of the Fund’s liquidity risk profile, considering additional data gathered during the period June 1, 2020 through May 31, 2021 (the “Review Period”) and the adequacy and effectiveness of the liquidity risk management program’s operations during the Review Period in order to prepare a written report for the Board of Trustees (the “Report”) for consideration at its meeting held on September 1, 2021. The Report noted that during the Review Period the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. It further noted that during the Review Period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that (i) the Trust’s liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Trust’s liquidity risk management program had been effectively implemented during the Review Period.

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from August 1, 2021 through January 31, 2022.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Expenses | | | | |

| | | Value | | | Value | | | Paid | | | Annualized | |

| | | August 1, | | | January 31, | | | During | | | Expense | |

| | | 2021 | | | 2022 | | | Period(a) | | | Ratio | |

| Actual | | | 1,000.00 | | | $ | 1,000.50 | | | $ | 10.18 | | | | 2.02 | % |

| Hypothetical(b) | | | 1,000.00 | | | $ | 1,015.02 | | | $ | 10.26 | | | | 2.02 | % |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| Trustees and Officers (Unaudited) |

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each of the Independent Trustees.

| Name, Address*, (Age), | Principal Occupation During | |

| Position with Trust**, | Past 5 Years and Other | |

| Term of Position with Trust | Directorships | Other Directorships |

Andrea N. Mullins, 54

Independent Trustee

Since December 2013

Chairperson since

March 2017 | Current: Private investor; Independent Contractor, SWM Advisors (since April 2014). | Trustee, Angel Oak Funds Trust (since February 2019) (5 portfolios); Trustee, Angel Oak Strategic Credit Fund (since February 2019); Trustee, Angel Oak Financial Strategies Income Term Trust (since May 2019); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (since June 2020); Trustee, Angel Oak Credit Opportunities Term Trust (since January 2021); Trustee and Audit Committee Chair, Cushing Mutual Funds Trust (since November 2021) (2 portfolios); Trustee and Audit Committee Chair, Cushing MLP & Infrastructure Fund (since November 2021). |

| Trustees and Officers (Unaudited) (continued) |

| Name, Address*, (Age), | Principal Occupation During | |

| Position with Trust**, Term | Past 5 Years and Other | |

| of Position with Trust | Directorships | Other Directorships |

Ira P. Cohen, 63

Independent Trustee

Since June 2010 | Current: Independent financial services consultant (since February 2005); Executive Vice President of Asset Management Services, Recognos Financial (since August 2015). | Trustee and Audit Committee Chairman, Griffin Institutional Access Credit Fund (since January 2017); Trustee and Audit Committee Chairman, Griffin Institutional Real Estate Access Fund (since May 2014); Trustee, Angel Oak Funds Trust (since October 2014) (5 portfolios); Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Strategic Credit Fund (since December 2017); Trustee, U.S. Fixed Income Trust (since March 2019); Trustee and Chairman, Angel Oak Financial Strategies Income Term Trust (since May 2019); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (since June 2020); Trustee, Angel Oak Credit Opportunities Term Trust (since January 2021). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 15 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act.

| Name, Address*, (Age), | Principal Occupation During | |

| Position with Trust**, | Past 5 Years and Other | |

| Term of Position with Trust | Directorships | Other Directorships |

Mark J. Seger***, 60

Trustee Since March 2017

Interim President Since December 2021 | Current: Vice Chairman and Co- Founder, Ultimus Fund Solutions, LLC and its subsidiaries (since 1999). | None. |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 15 series. |

| *** | Mr. Seger is considered an “interested person” of the Trust because of his relationship with the Trust’s administrator, transfer agent, and distributor. |

| Trustees and Officers (Unaudited) (continued) |

The following table provides information regarding the Officers of the Trust:

| Name, Address*, (Age), | | |

| Position with Trust**, | Principal Occupation During | |

| Term of Position with Trust | Past 5 Years | Other Directorships |

Mark J. Seger***, 60

Trustee Since March 2017

Interim President

Since December 2021 | Current: Vice Chairman and Co- Founder, Ultimus Fund Solutions, LLC and its subsidiaries (since 1999). | None. |

Kevin J. Patton, 51

Chief Compliance Officer

Since March 2020 | Current: Assistant Vice President, Compliance Officer, Ultimus Fund Solutions, LLC (since January 2020). Previous: Partner and Chief Compliance Officer, Renaissance Investment Management (August 2005 to January 2020). | None. |

Carol J. Highsmith, 57

Vice President Since August

2008 Secretary Since March 2014 | Current: Vice President, Ultimus Fund Solutions, LLC (since December 2015). | None. |

Matt J. Miller, 46

Vice President Since

December 2011 | Current: Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (since December 2015). | None. |

Zachary P. Richmond, 41

Principal Financial Officer

and Treasurer Since

September 2021 | Current: Vice President, Financial Administration, Ultimus Fund Solutions, LLC (since February 2019). Previous: Assistant Vice President, Associate Director of Financial Administration, Ultimus Fund Solutions, LLC (December 2015 to February 2019). | None. |

| Trustees and Officers (Unaudited) (continued) |

| Name, Address*, (Age), | Principal Occupation During | |

| Position with Trust**, Term | Past 5 Years and Other | |

| of Position with Trust | Directorships | Other Directorships |

Stephen L. Preston, 55

AML Officer Since June

2017 | Current: Chief Compliance Officer of Ultimus Fund Distributors, LLC (since June 2011), Vice President, Financial Operations Principal, and Anti- Money Laundering Officer, Ultimus Fund Distributors, LLC (since April 2021), Treasurer, Financial Operations Principal, Chief Compliance Officer, and Anti-Money Laundering Officer, Northern Lights Distributors, LLC (since April 2021). Previous: Chief Compliance Officer, Ultimus Fund Solutions, LLC (June 2011 to August 2019); Chief Compliance Officer, Unified Financial Securities, LLC (April 2018 to December 2019) | None. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 15 series. |

| Other Information (Unaudited) |

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (800) 789-1087 to request a copy of the SAI or to make shareholder inquiries.

| Investment Advisory Agreement Approval (Unaudited) |

At a meeting held on December 2-3, 2021, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (the “Belmont Agreement”) between Valued Advisers Trust (the “Trust”) and Belmont Capital, LLC (“Belmont”) with respect to the Belmont Theta Income Fund (the “Belmont Fund”). Belmont provided written information to the Board to assist the Board in its considerations.

Counsel reminded the Trustees of their fiduciary duties and responsibilities as summarized in a memorandum from his firm, including the factors to be considered, and the application of those factors to Belmont and the Belmont Agreement. In assessing these factors and reaching its decision, the Board took into consideration information furnished by Belmont and the Trust’s other service providers for the Board’s review and consideration throughout the year at regular Board meetings, as well as information specifically prepared or presented in connection with the annual renewal process, including: (i) reports regarding the services and support provided to the Belmont Fund by Belmont; (ii) quarterly assessments of the investment performance of the Belmont Fund by personnel of Belmont; (iii) commentary on the reasons for the Belmont Fund’s performance; (iv) presentations by Belmont addressing its investment philosophy, investment strategy, personnel, and operations; (v) compliance and audit reports concerning the Belmont Fund and Belmont; (vi) disclosure information contained in the Trust’s registration statement and Belmont’s Form ADV; and (vii) a memorandum from Counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Belmont Agreement. The Board also requested and received various informational materials including, without limitation: (a) documents containing information about Belmont, including its financial information, a description of personnel and the services it provides to the Belmont Fund; information on Belmont’s investment advice and performance; summaries of the Belmont Fund’s expenses, compliance program, current legal matters, and other general information; (b) comparative expense and performance information for other mutual funds with strategies similar to the Belmont Fund; and (c) the benefits to be realized by Belmont from its relationship with the Belmont Fund. The Board did not identify any particular information that was most relevant to its consideration of the Belmont Agreement and each Trustee may have afforded different weight to the various factors.

1. The nature, extent, and quality of the services to be provided by Belmont. In this regard, the Board considered Belmont’s responsibilities under the Belmont Agreement. The Trustees considered the services being provided by Belmont to the Belmont Fund. The Trustees discussed, among other things: the quality of Belmont’s investment advisory services (including research and recommendations with respect to portfolio securities), its process for formulating investment recommendations and assuring compliance with the Belmont Fund’s investment objectives and limitations, its coordination of services for the Belmont Fund among the Belmont Fund’s service providers, and its efforts to promote the Belmont Fund and grow its assets. The Trustees considered Belmont’s continuity of, and commitment to retain, qualified personnel and Belmont’s commitment to maintain and enhance its resources and systems. The Trustees considered Belmont’s personnel, including the education and experience of the personnel. After considering the foregoing information and further information in the Meeting materials provided by Belmont (including Belmont’s Form ADV), the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by Belmont were satisfactory and adequate for the Belmont Fund.

2. Investment Performance of the Belmont Fund and Belmont. In considering the investment performance of the Belmont Fund and Belmont, the Trustees compared the performance of the Belmont Fund with the performance of funds in the same Morningstar category, as well as

| Investment Advisory Agreement Approval (Unaudited) |

| (continued) |

with peer group data and the Belmont Fund’s benchmark. The Trustees noted that the Belmont Fund had underperformed compared to its peer group median for the one year, three year, and since inception periods ended September 30, 2021. They observed that the Belmont Fund performed better than its style-specific benchmark for the year-to-date, three year, and since inception periods ended September 30, 2021, but underperformed for the one year period. With regard to its broad market benchmark, they noted that the Belmont Fund performed better for the one year period, and underperformed for the three year and since inception periods. The Trustees observed that the Belmont Fund had outperformed its category average for the year-to-date, one-year, and three year periods ended September 30, 2021, and had underperformed the category median for the period since inception. The Trustees also considered the consistency of Belmont’s management of the Belmont Fund with its investment objective, strategies, and limitations. The Trustees considered the Belmont Fund’s performance relative to the performance of Belmont’s theta overlay program and noted that the performance was very close. They considered Belmont’s explanation regarding the reasons for the small difference, and determined that the explanation was reasonable. After reviewing and discussing the investment performance of the Belmont Fund further, Belmont’s experience managing the Belmont Fund, Belmont’s historical performance, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Belmont Fund and Belmont was acceptable.

3. The costs of the services to be provided and profits to be realized by Belmont from the relationship with the Belmont Fund. In considering the costs of services to be provided and the profits to be realized by Belmont from the relationship with the Belmont Fund, the Trustees considered: (1) Belmont’s financial condition; (2) the asset level of the Belmont Fund; (3) the overall expenses of the Belmont Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by Belmont regarding its profits associated with managing the Belmont Fund. The Trustees also considered potential benefits for Belmont in managing the Belmont Fund. The Trustees then compared the fees and expenses of the Belmont Fund (including the management fee) to other comparable mutual funds. The Trustees observed that the Belmont Fund’s advisory fee was the highest in its Morningstar category, and equal to the highest of its peer group. They also noted that the Belmont Fund’s net expense ratio was above the average and median of its peer group and its Morningstar category, but was below the maximum in both cases. The Trustees considered Belmont’s view that the funds included in the Morningstar category and in the peer group are not comparable to the Belmont Fund, and the Board was satisfied that Belmont had sufficiently differentiated the Belmont Fund from others in the peer group. Based on the foregoing, the Board concluded that the fees to be paid to Belmont by the Belmont Fund and the profits to be realized by Belmont, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Belmont.

4. The extent to which economies of scale would be realized as the Belmont Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Belmont Fund’s investors. In this regard, the Board considered the Belmont Fund’s fee arrangements with Belmont. The Board considered that while the management fee remained the same at all asset levels, the Belmont Fund’s shareholders had experienced benefits from the Belmont Fund’s expense limitation arrangement, and that Belmont had agreed to extend that arrangement for another year. They also noted that the Belmont Fund’s shareholders would continue to benefit from the economies of scale under the Trust’s agreements with service providers other than Belmont. In light of the

| Investment Advisory Agreement Approval (Unaudited) |

| (continued) |

foregoing, the Board determined that the Belmont Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Belmont.

5. Possible conflicts of interest and benefits to Belmont. In considering Belmont’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Belmont Fund; the basis of decisions to buy or sell securities for the Belmont Fund and/or Belmont’s other accounts; and the substance and administration of Belmont’s code of ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to Belmont’s potential conflicts of interest. The Trustees discussed Belmont’s practices for seeking best execution for the Belmont Fund’s portfolio transactions. The Board noted that Belmont does not engage in soft dollar arrangements and has not identified any indirect benefits from its relationship with the Belmont Fund. Based on the foregoing, the Board determined that Belmont’s standards and practices relating to the identification and mitigation of potential conflicts of interest were satisfactory.

After additional consideration of the factors delineated in the memorandum provided by counsel and further discussion among the Board members, the Board determined to approve the continuation of the Belmont Agreement.

| FACTS | WHAT DOES BELMONT THETA INCOME FUND (THE “Fund”) DO WITH YOUR PERSONAL INFORMATION? |

| |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| | |

| | ■ Social Security number |

| | |

| | ■ account balances and account transactions |

| | |

| | ■ transaction or loss history and purchase history |

| | |

| | ■ checking account information and wire transfer instructions |

| | |

| | When you are no longer our customer, we continue to share your information as described in this notice. |

| |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes —

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes —

to offer our products and services to you | No |

| For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes —

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes —

information about your creditworthiness | No |

| For nonaffiliates to market to you | No |

| Questions? | Call (800) 789-1087 |

| Who we are |

| Who is providing this notice? | Belmont Theta Income Fund

Ultimus Fund Distributors, LLC (Distributor)

Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |