united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC

Attn: Zachary Richmond

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2022

Item 1. Reports to Stockholders.

(a)

DANA LARGE CAP EQUITY FUND

DANA EPIPHANY ESG SMALL CAP EQUITY FUND

DANA EPIPHANY ESG EQUITY FUND

Annual Report

October 31, 2022

Dana Investment Advisors, Inc.

20700 Swenson Drive, Suite 400

Waukesha, WI 53186

(855) 280-9648

www.danafunds.com

Management Discussion of Fund Performance (Unaudited)

Dear Fellow Shareholders,

Many of us are likely looking forward to putting the prior twelve months behind us, but we should take pause to remember that markets are not always positive and that the trailing two years have still been profitable for many. We have a glass half full perspective and believe bear markets create new opportunities for growth and value creation, and feel well positioned to capitalize. Looking back at the past couple of years, it’s clear that ‘free money’ often leads to irrational pricing and eventually market instability. High inflation has forced the hand of the Federal Reserve (the “Fed”) and, combined with tighter monetary policy, has put pressure on asset prices. Dealing correctly with these challenges may determine how investments perform in the next bull market. We have confidence that Dana’s investment strategy, which relies on fundamental analysis and valuation discipline, should serve us well in an environment where excess risk taking is no longer in vogue. We remain thankful for your continued trust and support of the Dana Funds. We are happy to share this discussion and analysis of the prior twelve months in the financial markets and the Dana Funds performance.

Economic and Market Recap

For virtually all of 2022, inflation, interest rates, and the Fed have dominated market psychology. Markets moved decidedly negative and exhibited wild swings in sentiment through the year, with leadership shifting frequently between value and growth, large and small companies, commodity sensitivity, and a host of other factors. November marked the start of Fed downshifting -- looking toward the conclusion of rate increases. The market has begun to rally off the October low, with the S&P 500 Index up over 10%.

All these macro tugs have led to factor tilts and violent rotations. For example, rotation out of semiconductors (which are more cyclical relative to other tech industries) and into growth software made a full round trip in 2022. Defensives and cyclicals have also played one on one. But as the Fed posture became increasingly hawkish, recession fears increased. Despite negative GDP in the first and second quarters of 2022, the economy has escaped recession thus far. Part of the explanation is strong, under-supplied labor markets with trade and inventory data also contributing. But the massive escalation in rates since June has created widespread concern about a potential economic slowdown, which is expected to manifest in 2023.

From its peak on 1/3/2022, the S&P 500 Index declined -24.5% on a total return basis through 10/12/2022 before bouncing back to end October. Fed policy and interest rate expectations were the dominant influence on the markets. Any hints of falling inflation or dovishness from the Fed drove market bounces (often led by big rebounds in growth or speculative stocks), while expressions of Fed resolve (usually from Chairman Powell) to raise rates until inflation was demonstrably moving closer to a 2% target led the markets lower.

Management Discussion of Fund Performance (Unaudited) (continued)

The challenge for the Fed has been that they are fighting inflation caused by supply constraints and exacerbated by fiscal stimulus. The only option they see is to crush demand. The Fed cannot stimulate supply with monetary policy. The market expectation is that sales and earnings will fall. As we approach the holidays, consumers are still spending, but housing has hit the brakes, and companies are draining inventory stocks and reducing discretionary spending. Big tech is even talking layoffs. Earnings estimates have declined for Q4 and have started to fall for 2023. A topping process for inflation is still not yet apparent and will continue to be a key fiscal and monetary issue in 2023.

Dana Large Cap Equity Fund (the “Large Cap Fund”) Discussion

During fiscal year 2022, the S&P 500 Index declined -14.61%, while the Large Cap Fund (Institutional Class) retreated -17.16%. Generally speaking, the Large Cap Fund performed well on a relative basis when the market was broad and favored value, but lagged during periods of recovery for growth and more speculative stocks. U.S. Equities entered the Large Cap Fund’s fiscal year with positive momentum as the S&P 500 Index extended record closing highs into the first week of November 2021. After a period of choppiness, equities finished the calendar year with a flourish. Supported by generous monetary and fiscal policies, the S&P 500 Index ended 2021 near a record high, and the Large Cap Fund was up 110% in less than two years from the March 2020 COVID-19 low.

There are many names in the portfolio that we feel have been unfairly punished; names where the fundamentals have held up and where valuation looks compelling, yet the names have significantly underperformed. One such example is Adobe (ADBE), the dominant provider of digital market software, where earnings expectations have been improving all year and yet the stock is down in excess of 50%, and the valuation is cheaper than any time in the past 10 years. Within the Large Cap Fund, there are many names that fit this general pattern—good fundamentals and discounted valuations—which have hurt relative performance, but names we are excited about going forward. Other large detractors with positive outlooks include Lam Research (LRCX), Verizon (VZ), Comcast (CMCSA), and Abbott Labs (ABT).

The worst performing sector in the S&P 500 was the Communications Sector, led by large declines in Meta Platforms (META) and Netflix (NFLX). The Large Cap Fund sold META in June, avoiding a larger loss (META subsequently declined another 40%+) while our valuation discipline kept us out of Netflix (NFLX). Netflix had been a performance drag for several years, but valuation finally mattered this year, as excessive speculation, manifested as extremely high valuations, came back to reality.

The best relative performance sector for the Large Cap Fund was Real Estate, where Large Cap Fund holdings netted a small positive return for the fiscal year in a sector that

Management Discussion of Fund Performance (Unaudited) (continued)

was significantly more negative than the overall market. Gaming and Leisure Properties (GLPI) and Prologis (PLD) were sector standouts with strong positive returns for the year.

The strongest sector in the market and the Large Cap Fund by far was Energy, where most stocks had very large positive returns. Energy prices have been in part driven by an unpredictable event—the Ukraine war—which is prompting countries to shift their energy reliance from Russia. The Large Cap Fund holdings were led by ConocoPhillips (COP), which gained 76%, an eye-popping return, especially in a down market. Sector neutrality, a hallmark of Dana’s risk control, ensured exposure to this sector, to the benefit of Large Cap Fund shareholders.

It was a dynamic year for both macro and company-specific news. Inflation was a major consideration in our positioning, as was the relative strength of different segments of consumers. We are seeing an increase in the importance of traditional fundamental factors (e.g., profitability, cash flow, leverage, etc.) as liquidity-driven growth slows. This shift should be favorable to Dana’s investment style and process, and we are optimistic about the opportunities we see in the Large Cap Fund holdings.

Dana Epiphany ESG Small Cap Equity Fund (the “Small Cap Fund”) Discussion

The Small Cap Fund returned -20.59% compared to -18.54% for the Russell 2000 Index and -11.44% for the benchmark Morningstar US Small Core Index during the fiscal year 2022. The Small Cap Fund’s strategy of sector neutral allocation to the Russell 2000 Index posed a headwind during the fiscal year as an overweight to the Heath Care and Technology sectors and underweight to Industrials and Real Estate sectors negatively impacted relative performance. The beginning of the fiscal year marked a definitive transition from the post-COVID bull market into a bear market correction. Just days into November 2021, the Russell 2000 Index hit a brief peak after months of range-bound action. Behind the wheel of the bear market bus were Jerome Powell and the Fed, who had been previously concerned that the Omicron COVID strain could create economic havoc and that any visible inflation pressure was “transitory.”

As we later learned, the Omicron wave was less lethal than feared, and economic activity remained robust with most post-2020 trends continuing – work from home, high consumer spending, the re-opening of industries like travel, a red hot home buying market, and investment in cloud computing services. On the other side of demand were persistent supply chain issues and a Chinese manufacturing base that could not figure out how to re-open.

With strong demand and limited supply, inflationary pressure was more than transitory, but the Fed had been stuck in 5th gear for too long, and now the bus was gaining too much speed. When inflation data surprised to the upside, it spooked the Fed into a series of 75

Management Discussion of Fund Performance (Unaudited) (continued)

basis point hikes (an unusual move for the Fed after the dot-com bust). As this new normal of higher rates began to set in, excess speculation began to dissipate, and a renewed focus on valuation and fundamentals took precedence.

We have longed to get out of this era of bureaucratic monetary policy driving the market, and back to where corporate margins and earnings matter more, which finally seems to be happening. The macro is very relevant to small cap stocks in several ways. First, small caps are more sensitive to upward and downward changes in economic growth. Second, this sensitivity means more beta and volatility, and investors typically react by reducing exposure. Third, small caps usually bottom in downturns ahead of large caps, and then are poised to rebound faster when the worst fears are priced in. Considerations for less currency exposure and lower international sales can be pluses in this environment. Small cap companies have tended to be more nimble in these conditions than huge mega corporations, and this cycle could magnify the extent of this.

Drilling into performance, only two index sectors were positive in the fiscal year: Utilities and Energy. Communication, Technology and Health Care led the decliners. Growth companies in Health Care and Info Tech explain much of the damage, as higher interest rates discount future cash flows to a greater degree.

The portfolio had some tremendous winners amidst the chaos. Ovintiv (OVV) and Cactus (WHD) rode higher as gas and crude prices rallied. e.l.f. Beauty (ELF) had a strong run on positive fundamentals, and uptake and sell-through of their cosmetics products gained market share. Shockwave Medical (SWAV) sold off in Q1 giving us a nice entry, and sales of their medical devices remained robust through the year. SailPoint Technologies (SAIL) was taken private by a firm building a portfolio of bolt-on security software features. Cytokinetics (CYTK) is a biotech firm with a drug nearing commercial status in the cardiac space; it rose, bucking the trend of peers that saw their valuations plummet.

Quality growth companies fared less well as valuations compressed. Some portfolio holdings had execution missteps and were punished. Rapid7 (RPD) showed slowing sales trends and concern about spending increased. Veritone (VERI) has artificial intelligence software and a lot of exposure to Amazon staffing trends, and May news from the consumer giant scared investors despite a low valuation relative to peers. Omnicell (OMCL) sells software and equipment into health care facilities, and first had supply chain challenges and then end-market challenges, including reduced budgets and understaffing.

Tension between growth and value stocks will persist. Companies with extreme valuations have been punished. However, companies with strong growth trends, clean balance sheets, and growing profitability will continue to attract flows. Many quality growth companies will grow through this downturn, and their scarcity will be valuable. As for value stocks, lower priced companies have seen brief periods of interest, but there is reason to believe the

Management Discussion of Fund Performance (Unaudited) (continued)

market will focus more on predictable cash flow and dividends as the Fed sucks liquidity out of the economy. The distinction between companies that are relatively cheap, and those that are intrinsically cheap (for a reason) may grow more relevant.

This is where our process and philosophy comes into play. We believe in constructing portfolios with considerations of risk at the forefront. Our penchant for firms that manage their balance sheets and grow their EBITDA means we will continue to lean into quality factors. Our relative value bias means we are exposed to dynamic market segments while we carefully watch valuation multiples. Today the portfolio exhibits a valuation discount, a growth premium, and superior profitability. This is always our portfolio goal.

We are in this business because we love the puzzles the market creates. We get excited finding good companies at the right price, and continue to find new stories in the small cap space that warrant our attention and curiosity. As older holdings mature, we will add new positions that we think can support the long-term success of the Small Cap Fund through a relative value discipline that focuses on fundamentally driven stock selection to reward investors over the long term.

Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) Discussion

The Epiphany ESG Fund posted a return of -15.76% in a challenging market, trailing the benchmark S&P 500 Index return of -14.61% during the fiscal year 2022. The Epiphany ESG Fund shares an investment philosophy that is common to all the Dana Funds, but adds a faith-based values component to security selection. The market environment discussions above for the Large Cap Equity Fund (describing the large cap U.S. equity market) and the Small Cap Fund (focusing on the small cap part of the market) give the market context in which the Epiphany ESG Fund operated. The frequent shifts in market dynamics and leadership during the year (as described earlier) yielded high volatility in the relative performance of the Epiphany ESG Fund. The periods of rebounds in growth and speculative stocks were challenging for the Epiphany ESG Fund, while value-oriented and broader performance conditions were favorable to the Epiphany ESG Fund, particularly when breadth was evident in the mid-cap and small-cap segments of the market.

On a sector level, the Epiphany ESG Fund outperformed the benchmark S&P 500 Index in 7 of 11 sectors. The two weakest sectors were Financials and Health Care. Similar to the Large Cap Fund, there are names in the portfolio where the stocks appear disconnected with the fundamentals. In the Financials sector, we would highlight Hannon Armstrong (HASI), which provides financing for renewable energy. Despite higher interest rates, the company’s outlook continues to improve and is poised to be a beneficiary of the Inflation Reduction Act, yet the stock is down in excess of 50%, resulting in the lowest valuation seen in the past 10 years. While certainly a detriment to trailing performance, the setup seems quite favorable. There is a similar story in healthcare, where very high-quality

Management Discussion of Fund Performance (Unaudited) (continued)

names with solid fundamentals are trading at multi-year low valuations, including Zoetis (ZTS) and IQVIA (IQV).

As discussed previously, the weakest sector in the S&P 500 was Communications Services. For the Epiphany ESG Fund, however, this sector provided the strongest relative performance by avoiding the large declines in Meta Platforms (META) and Netflix (NFLX).

Absolute sector leadership in the market and the Epiphany ESG Fund was Energy, where most stocks had very large positive returns. The Epiphany ESG Fund holdings were led by ConocoPhillips (COP).

We believe the portfolio is well positioned going forward. Our fundamental and value-oriented approach to stock selection appears to be slowly moving into favor as the market resets away from exceptional monetary and fiscal policies.

Investment Results (Unaudited)

Average Annual Total Returns(a) as of October 31, 2022

| | | | | Since |

| | | | | Inception |

| | One Year | Five Year | Ten Year | (10/29/13) |

| Dana Large Cap Equity Fund | | | | |

| Institutional Class | (17.16)% | 7.82% | N/A | 9.51% |

| Investor Class | (17.38)% | 7.56% | 10.79% | N/A |

| S&P 500® Index(b) | (14.61)% | 10.44% | 12.79% | 11.18% |

| | | | | |

| | | Expense Ratios(c) | |

| | | Institutional | Investor | |

| | | Class | Class | |

| Gross | | 0.86% | 1.11% | |

| With Applicable Waivers | | 0.73% | 0.98% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Large Cap Equity Fund (the “Large Cap Fund”) distributions or the redemption of Large Cap Fund shares. Current performance of the Large Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 280-9648.

(a) Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Large Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower.

(b) The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Large Cap Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in exchange-traded funds (“ETFs”) or other investment vehicles that attempt to track the performance of a benchmark index.

(c) The expense ratios are from the Large Cap Fund’s prospectus dated February 28, 2022. Expense ratios with applicable waivers reflect that Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to waive or limit its fees and to assume other expenses of the Large Cap Fund until February 28, 2023, so that total annual fund operating expenses do not exceed 0.73% of the Large Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Large Cap Fund within three years following the date of such waiver or reimbursement, provided that the Large Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Large Cap Fund’s expense ratios as of October 31, 2022 can be found

Investment Results (Unaudited) (continued)

in the financial highlights.

The Large Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Large Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Large Cap Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns(a) as of October 31, 2022

| | | | Since |

| | | | Inception |

| | One Year | Five Year | (11/3/15) |

| Dana Epiphany ESG Small Cap Equity Fund | | | |

| Institutional Class | (20.59)% | 3.85% | 4.76% |

| Morningstar US Small Core Index(b) | (11.44)% | 5.40% | 7.36% |

| Russell 2000® Index(c) | (18.54)% | 5.56% | 7.89% |

| | | | |

| | | Expense Ratios(d) | |

| | | Institutional | |

| | | Class | |

| Gross | | 2.05% | |

| With Applicable Waivers | | 0.95% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Small Cap Equity Fund (the “Small Cap Fund”) distributions or the redemption of Small Cap Fund shares. Current performance of the Small Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 280-9648.

(a) Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Small Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower.

(b) The Morningstar US Small Core Index (“Morningstar Index”) provides a comprehensive depiction of the performance and fundamental characteristics of the Small Core segment of U.S. equity markets. The Morningstar Index does not incorporate Environmental, Social, or Governance (ESG) criteria. Individuals can not invest directly in the Morningstar Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index.

(c) The Russell 2000® Index (“Russell Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Small Cap Fund’s portfolio. Individuals can not invest directly in the Russell Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index.

The Small Cap Fund is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to individuals who invest in the Small Cap Fund or any member of the public regarding the advisability of investing in equity securities generally or in the Funds in particular or the ability of the Small Cap Fund to track the Morningstar Indices or general equity market performance. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE MORNINGSTAR US SMALL CORE INDEX OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

Investment Results (Unaudited) (continued)

(d) The expense ratios are from the Small Cap Fund’s prospectus dated February 28, 2022. Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Small Cap Fund until February 28, 2023, so that total annual fund operating expenses do not exceed 0.95% of the Small Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Small Cap Fund within three years following the date of such waiver or reimbursement, provided that the Small Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Small Cap Fund’s expense ratios as of October 31, 2022 can be found in the financial highlights.

The Small Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Small Cap Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns(a) as of October 31, 2022

| | One Year | Five Year | Ten Year |

| Dana Epiphany ESG Equity Fund | | | |

| Institutional Class | (15.76)% | 7.97% | 9.56% |

| S&P 500® Index(b) | (14.61)% | 10.44% | 12.79% |

| | | | |

| | | Expense Ratios(c) | |

| Gross | | 1.12% | |

| With Applicable Waivers | | 0.85% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) distributions or the redemption of Epiphany ESG Fund shares. Current performance of the Epiphany ESG Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 280-9648.

(a) Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Epiphany ESG Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower.

(b) The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Epiphany ESG Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index.

(c) The expense ratios are from the Epiphany ESG Fund’s prospectus dated February 28, 2022. Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Epiphany ESG Fund until February 28, 2023, so that total annual fund operating expenses do not exceed 0.85% of the Epiphany ESG Fund’s average net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Epiphany ESG Fund within three years following the date of such waiver or reimbursement, provided that the Epiphany ESG Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Epiphany ESG Fund’s expense ratios as of October 31, 2022 can be found in the financial highlights.

The Epiphany ESG Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Epiphany ESG Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Epiphany ESG Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

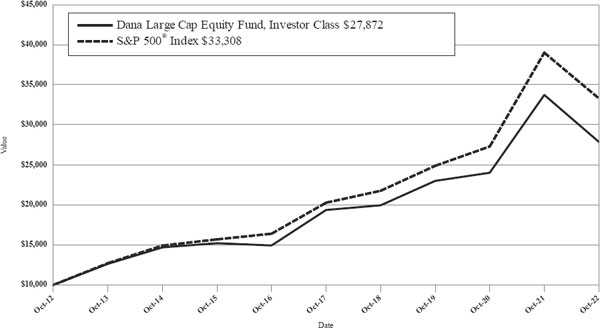

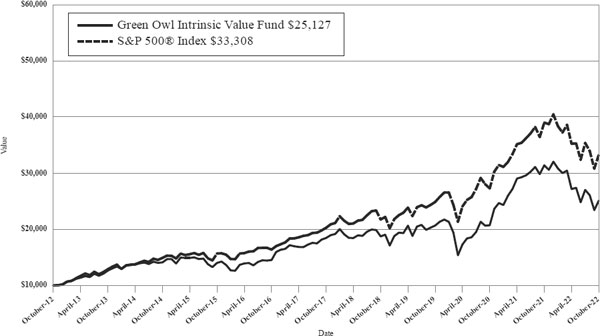

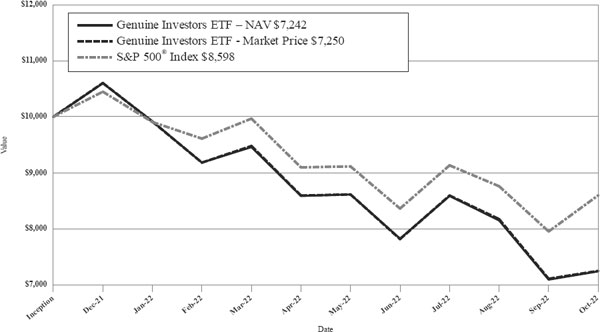

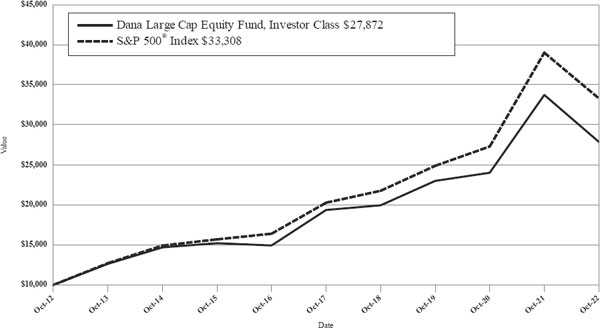

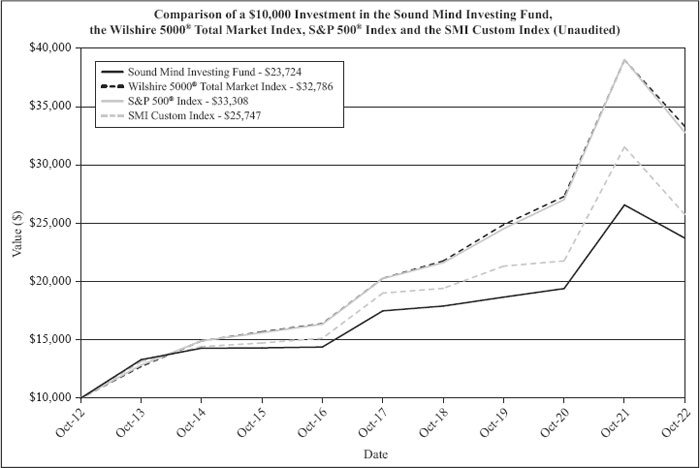

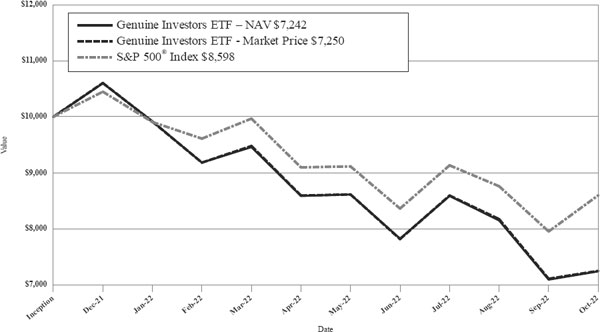

Comparison of the Growth of a $10,000 Investment in the Dana Large Cap Equity Fund, Investor Class and the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on October 31, 2012 held through October 31, 2022. THE LARGE CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Large Cap Fund distributions or the redemption of Large Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Large Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (855) 280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Large Cap Fund before investing. The Large Cap Fund’s prospectus contains this and other information about the Large Cap Fund, and should be read carefully before investing.

The Large Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

Investment Results (Unaudited) (continued)

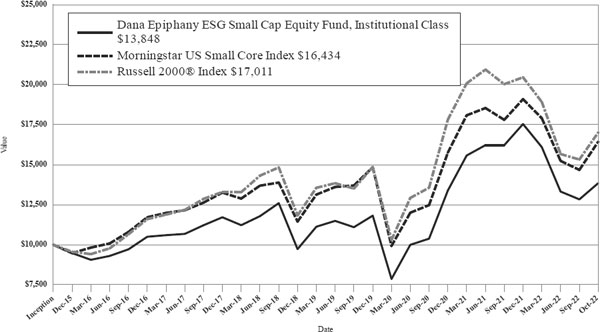

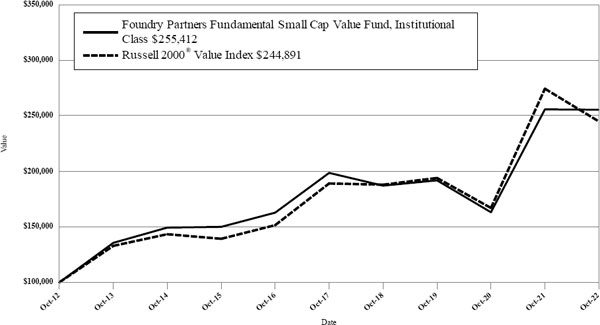

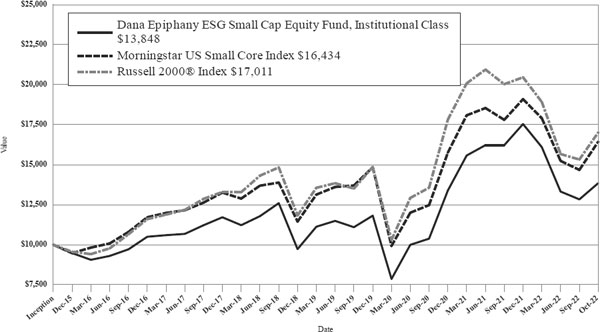

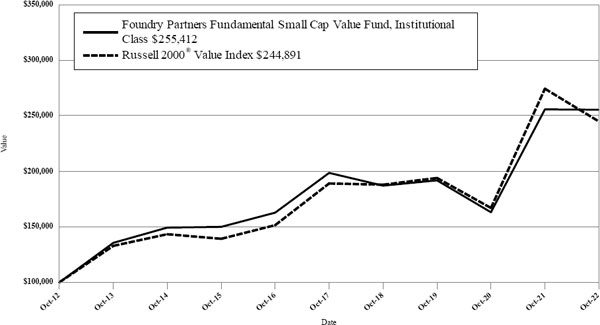

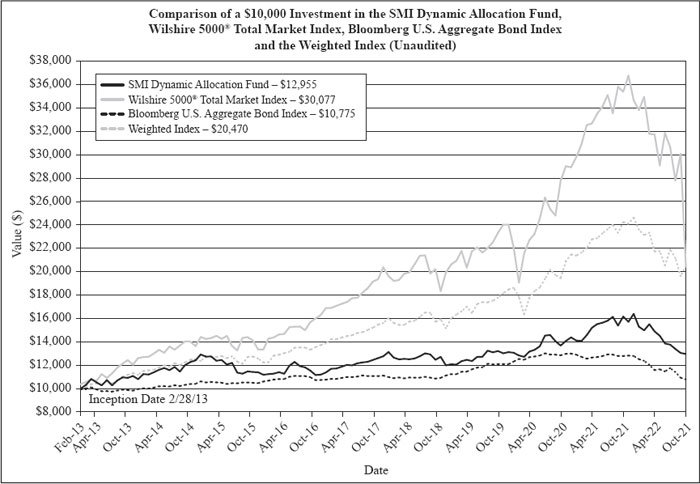

Comparison of the Growth of a $10,000 Investment in the Dana Epiphany ESG Small Cap Equity Fund, Institutional Class, Morningstar US Small Core Index and the Russell 2000® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on November 3, 2015 (commencement of Institutional Class operations) held through October 31, 2022. THE SMALL CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Small Cap Fund distributions or the redemption of Small Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (855) 280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small Cap Fund before investing. The Small Cap Fund’s prospectus contains this and other information about the Small Cap Fund, and should be read carefully before investing.

The Small Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

Investment Results (Unaudited) (continued)

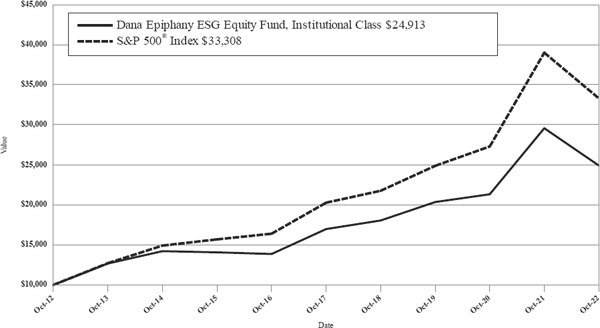

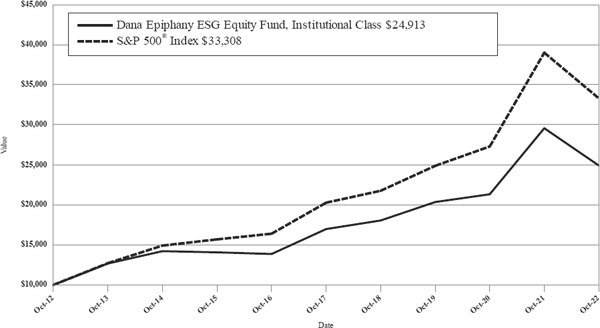

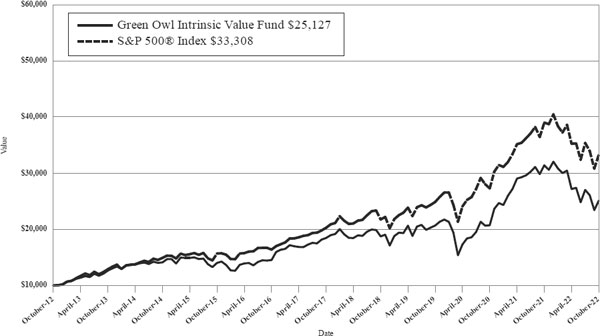

Comparison of the Growth of a $10,000 Investment in the Dana Epiphany ESG Equity Fund, Institutional Class and the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on October 31, 2012 held through October 31, 2022. THE EPIPHANY ESG FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Epiphany ESG Fund distributions or the redemption of Epiphany ESG Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Epiphany ESG Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (855) 280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Epiphany ESG Fund before investing. The Epiphany ESG Fund’s prospectus contains this and other information about the Epiphany ESG Fund, and should be read carefully before investing.

The Epiphany ESG Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

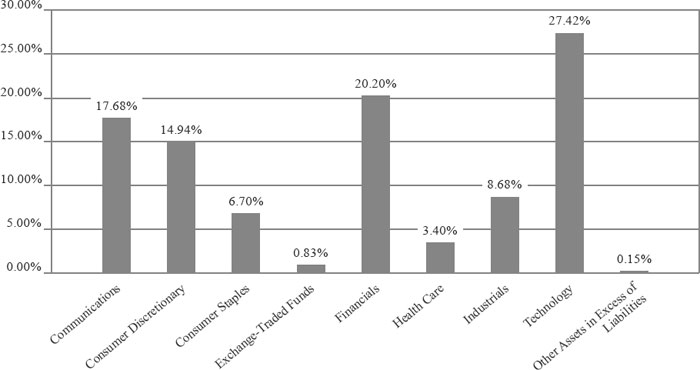

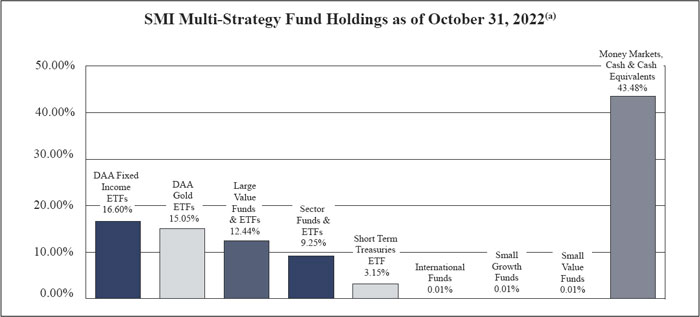

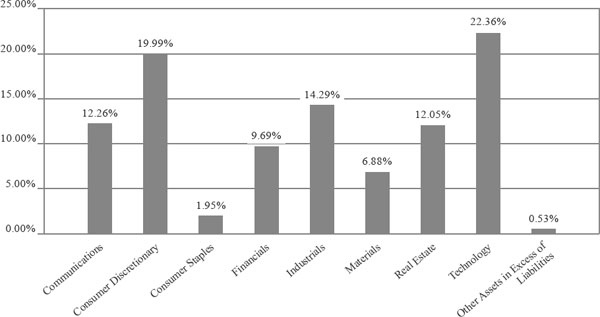

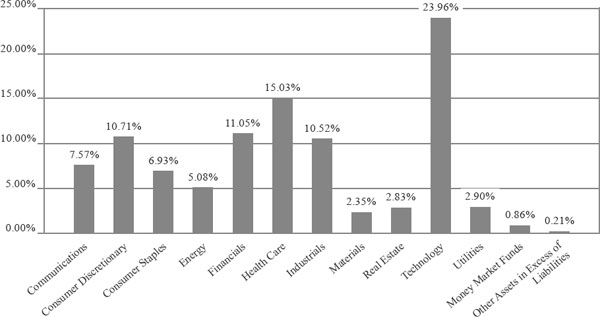

Fund Holdings (Unaudited)

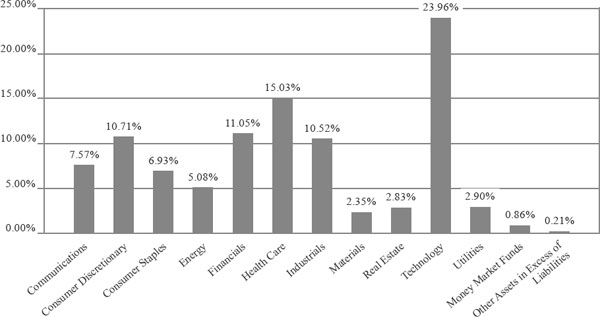

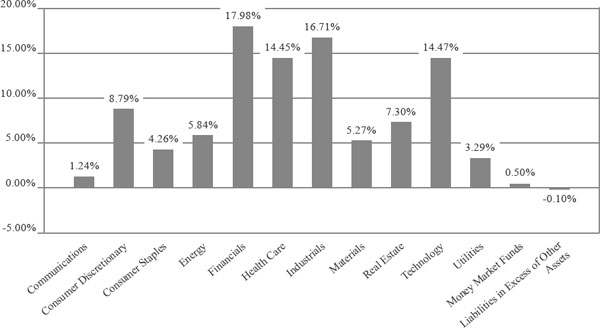

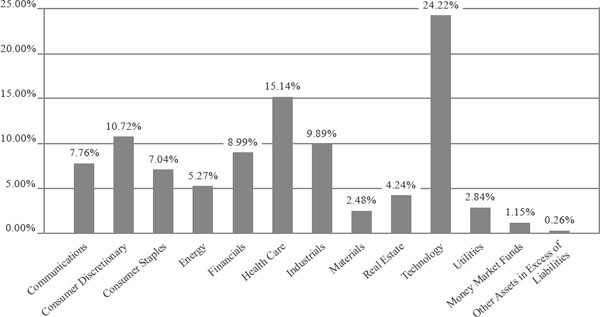

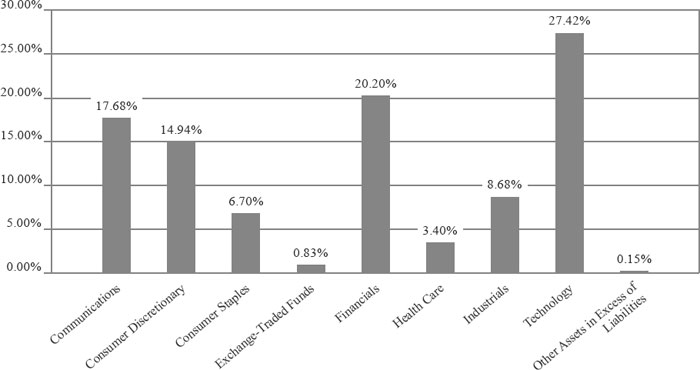

The following chart gives a visual breakdown of the Large Cap Fund by sector weighting as a percentage of net assets as of October 31, 2022.

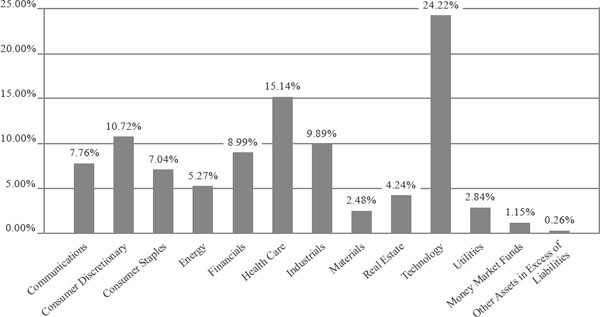

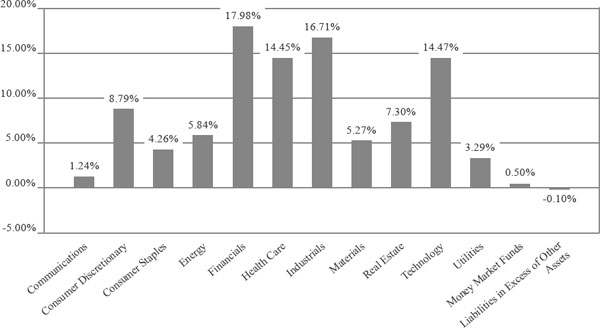

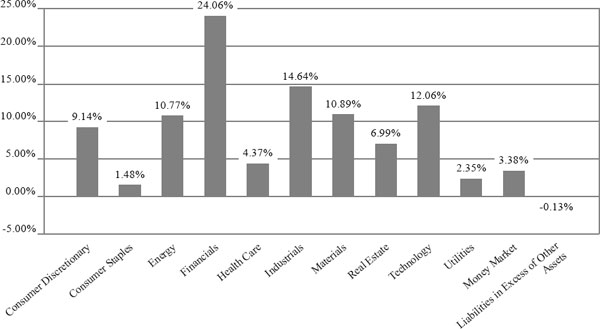

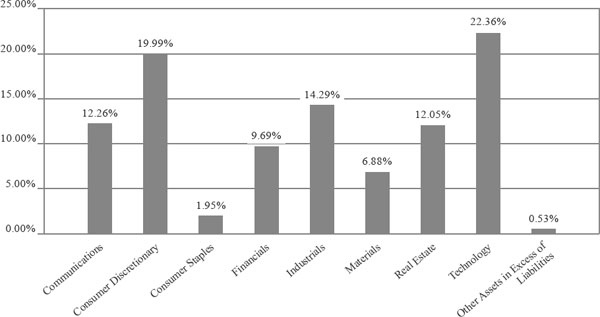

The following chart gives a visual breakdown of the Small Cap Fund by sector weighting as a percentage of net assets as of October 31, 2022.

Fund Holdings (Unaudited)

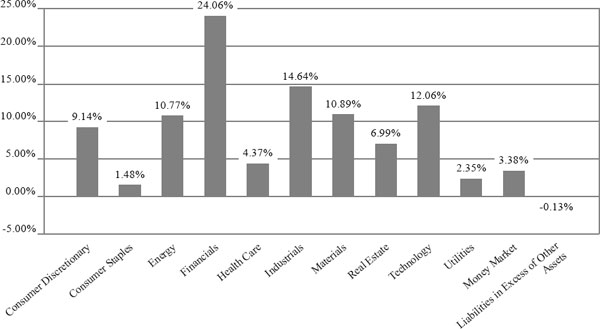

The following chart gives a visual breakdown of the Epiphany ESG Fund by sector weighting as a percentage of net assets as of October 31, 2022.

Availability of Portfolio Schedules (Unaudited)

The Large Cap Fund, the Small Cap Fund and the Epiphany ESG Fund (each a “Fund” and collectively the “Funds”) file their complete schedules of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www.sec.gov and on the Funds’ website at http://www.danafunds.com.

| Dana Large Cap Equity Fund |

| Schedule of Investments |

| October 31, 2022 |

| COMMON STOCKS — 98.93% | | Shares | | | Fair Value | |

| Communications — 7.57% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 33,200 | | | $ | 3,137,732 | |

| AT&T, Inc. | | | 1,000 | | | | 18,230 | |

| Comcast Corp., Class A | | | 46,000 | | | | 1,460,040 | |

| Interpublic Group of Cos., Inc. | | | 60,000 | | | | 1,787,400 | |

| Verizon Communications, Inc. | | | 36,000 | | | | 1,345,320 | |

| | | | | | | | 7,748,722 | |

| Consumer Discretionary — 10.71% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 28,000 | | | | 2,868,320 | |

| D.R. Horton, Inc. | | | 25,000 | | | | 1,922,000 | |

| Home Depot, Inc. (The) | | | 5,000 | | | | 1,480,650 | |

| Newell Brands, Inc. | | | 40,000 | | | | 552,400 | |

| Tapestry, Inc. | | | 51,000 | | | | 1,615,680 | |

| Ulta Beauty, Inc.(a) | | | 3,700 | | | | 1,551,669 | |

| Vail Resorts, Inc. | | | 4,400 | | | | 964,172 | |

| | | | | | | | 10,954,891 | |

| Consumer Staples — 6.93% | | | | | | | | |

| Keurig Dr Pepper, Inc. | | | 12,000 | | | | 466,080 | |

| Kimberly-Clark Corp. | | | 11,000 | | | | 1,369,060 | |

| Mondelez International, Inc., Class A | | | 33,000 | | | | 2,028,840 | |

| PepsiCo, Inc. | | | 6,500 | | | | 1,180,270 | |

| Walmart, Inc. | | | 14,400 | | | | 2,049,552 | |

| | | | | | | | 7,093,802 | |

| Energy — 5.08% | | | | | | | | |

| Cheniere Energy, Inc. | | | 1,800 | | | | 317,538 | |

| Chevron Corp. | | | 500 | | | | 90,450 | |

| ConocoPhillips | | | 13,200 | | | | 1,664,388 | |

| Exxon Mobil Corp. | | | 1,000 | | | | 110,810 | |

| Ovintiv, Inc. | | | 19,000 | | | | 962,350 | |

| Pioneer Natural Resources Co. | | | 8,000 | | | | 2,051,280 | |

| | | | | | | | 5,196,816 | |

| Financials — 11.05% | | | | | | | | |

| Allstate Corp. (The) | | | 14,000 | | | | 1,767,500 | |

| American Express Co. | | | 12,800 | | | | 1,900,160 | |

| Bank of America Corp. | | | 57,000 | | | | 2,054,280 | |

| Bank of New York Mellon Corp. (The) | | | 46,000 | | | | 1,937,060 | |

| JPMorgan Chase & Co. | | | 7,000 | | | | 881,160 | |

| Morgan Stanley | | | 23,000 | | | | 1,889,910 | |

| Wells Fargo & Co. | | | 19,000 | | | | 873,810 | |

| | | | | | | | 11,303,880 | |

| Health Care — 15.03% | | | | | | | | |

| Abbott Laboratories | | | 18,600 | | | | 1,840,284 | |

| AbbVie, Inc. | | | 15,000 | | | | 2,196,000 | |

| Bristol-Myers Squibb Co. | | | 23,000 | | | | 1,781,810 | |

| CVS Health Corp. | | | 25,000 | | | | 2,367,500 | |

| McKesson Corp. | | | 5,200 | | | | 2,024,724 | |

| Merck & Co., Inc. | | | 28,000 | | | | 2,833,600 | |

See accompanying notes which are an integral part of these financial statements.

| Dana Large Cap Equity Fund |

| Schedule of Investments (continued) |

| October 31, 2022 |

| COMMON STOCKS — 98.93% - continued | | Shares | | | Fair Value | |

| Health Care — 15.03% - continued | | | | | | | | |

| UnitedHealth Group, Inc. | | | 4,200 | | | $ | 2,331,630 | |

| | | | | | | | 15,375,548 | |

| Industrials — 10.52% | | | | | | | | |

| Boeing Co. (The)(a) | | | 200 | | | | 28,502 | |

| Deere & Co. | | | 5,000 | | | | 1,979,100 | |

| Dover Corp. | | | 12,000 | | | | 1,568,280 | |

| Norfolk Southern Corp. | | | 7,800 | | | | 1,778,946 | |

| Parker-Hannifin Corp. | | | 6,000 | | | | 1,743,720 | |

| Raytheon Technologies Corp. | | | 16,000 | | | | 1,517,120 | |

| TE Connectivity Ltd. | | | 17,600 | | | | 2,151,248 | |

| | | | | | | | 10,766,916 | |

| Materials — 2.35% | | | | | | | | |

| Albemarle Corp. | | | 1,800 | | | | 503,766 | |

| Avery Dennison Corp. | | | 6,600 | | | | 1,119,030 | |

| Packaging Corp. of America | | | 6,500 | | | | 781,365 | |

| | | | | | | | 2,404,161 | |

| Real Estate — 2.83% | | | | | | | | |

| American Tower Corp., Class A | | | 1,400 | | | | 290,066 | |

| Gaming and Leisure Properties, Inc. | | | 28,000 | | | | 1,403,360 | |

| Iron Mountain, Inc. | | | 24,000 | | | | 1,201,680 | |

| | | | | | | | 2,895,106 | |

| Technology — 23.96% | | | | | | | | |

| Accenture PLC, Class A | | | 6,600 | | | | 1,873,740 | |

| Adobe, Inc.(a) | | | 4,200 | | | | 1,337,700 | |

| Analog Devices, Inc. | | | 12,000 | | | | 1,711,440 | |

| Apple, Inc. | | | 28,000 | | | | 4,293,520 | |

| Broadcom, Inc. | | | 3,600 | | | | 1,692,432 | |

| CDW Corp. | | | 13,400 | | | | 2,315,654 | |

| Cisco Systems, Inc. | | | 28,000 | | | | 1,272,040 | |

| Fiserv, Inc.(a) | | | 17,000 | | | | 1,746,580 | |

| Lam Research Corp. | | | 3,200 | | | | 1,295,296 | |

| Microsoft Corp. | | | 15,000 | | | | 3,481,950 | |

| Visa, Inc., Class A | | | 10,800 | | | | 2,237,328 | |

| Workday, Inc., Class A(a) | | | 8,000 | | | | 1,246,560 | |

| | | | | | | | 24,504,240 | |

| Utilities — 2.90% | | | | | | | | |

| Eversource Energy | | | 18,600 | | | | 1,418,808 | |

| NextEra Energy, Inc. | | | 20,000 | | | | 1,550,000 | |

| | | | | | | | 2,968,808 | |

| Total Common Stocks (Cost $83,074,562) | | | | | | | 101,212,890 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 0.86% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.91%(b) | | | 881,557 | | | | 881,557 | |

| Total Money Market Funds (Cost $881,557) | | | | | | | 881,557 | |

See accompanying notes which are an integral part of these financial statements.

| Dana Large Cap Equity Fund |

| Schedule of Investments (continued) |

| October 31, 2022 |

| Total Investments — 99.79% (Cost $83,956,119) | | $ | 102,094,447 | |

| Other Assets in Excess of Liabilities — 0.21% | | | 210,592 | |

| NET ASSETS — 100.00% | | $ | 102,305,039 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

See accompanying notes which are an integral part of these financial statements.

| Dana Epiphany ESG Small Cap Equity Fund |

| Schedule of Investments |

| October 31, 2022 |

| COMMON STOCKS — 99.60% | | Shares | | | Fair Value | |

| Communications — 1.24% | | | | | | | | |

| TechTarget, Inc.(a) | | | 2,583 | | | $ | 166,733 | |

| Consumer Discretionary — 8.79% | | | | | | | | |

| Bloomin’ Brands, Inc. | | | 11,352 | | | | 272,562 | |

| Boot Barn Holdings, Inc.(a) | | | 3,679 | | | | 208,967 | |

| Deckers Outdoor Corp.(a) | | | 742 | | | | 259,648 | |

| Group 1 Automotive, Inc. | | | 1,334 | | | | 230,782 | |

| Malibu Boats, Inc., Class A(a) | | | 3,999 | | | | 211,547 | |

| | | | | | | | 1,183,506 | |

| Consumer Staples — 4.26% | | | | | | | | |

| e.l.f. Beauty, Inc.(a) | | | 6,196 | | | | 268,039 | |

| Simply Good Foods Co. (The)(a) | | | 7,979 | | | | 305,596 | |

| | | | | | | | 573,635 | |

| Energy — 5.84% | | | | | | | | |

| Chord Energy Corp. | | | 1,857 | | | | 284,288 | |

| EnerSys | | | 3,321 | | | | 220,149 | |

| Ovintiv, Inc. | | | 5,557 | | | | 281,462 | |

| | | | | | | | 785,899 | |

| Financials — 17.98% | | | | | | | | |

| AXIS Capital Holdings Ltd. | | | 4,798 | | | | 262,306 | |

| Evercore, Inc., Class A | | | 2,540 | | | | 266,954 | |

| Pinnacle Financial Partners, Inc. | | | 3,478 | | | | 288,639 | |

| Primerica, Inc. | | | 1,701 | | | | 246,135 | |

| SouthState Corp. | | | 2,727 | | | | 246,603 | |

| Stifel Financial Corp. | | | 4,441 | | | | 274,765 | |

| Synovus Financial Corp. | | | 6,955 | | | | 277,157 | |

| Veritex Holdings, Inc. | | | 8,457 | | | | 267,072 | |

| Wintrust Financial Corp. | | | 3,091 | | | | 289,378 | |

| | | | | | | | 2,419,009 | |

| Health Care — 14.45% | | | | | | | | |

| Aurinia Pharmaceuticals, Inc.(a) | | | 12,102 | | | | 98,389 | |

| Axsome Therapeutics, Inc.(a) | | | 3,237 | | | | 146,151 | |

| Blueprint Medicines Corp.(a) | | | 3,474 | | | | 180,092 | |

| Cytokinetics, Inc.(a) | | | 2,692 | | | | 117,533 | |

| Deciphera Pharmaceuticals, Inc.(a) | | | 5,447 | | | | 88,350 | |

| Denali Therapeutics, Inc.(a) | | | 2,901 | | | | 83,201 | |

| Ensign Group, Inc. (The) | | | 3,503 | | | | 314,499 | |

| Envista Holdings Corp.(a) | | | 7,334 | | | | 242,095 | |

| Halozyme Therapeutics, Inc.(a) | | | 2,292 | | | | 109,581 | |

| Horizon Therapeutics PLC(a) | | | 4,116 | | | | 256,509 | |

| ShockWave Medical, Inc.(a) | | | 825 | | | | 241,849 | |

| Travere Therapeutics, Inc.(a) | | | 3,077 | | | | 66,709 | |

| | | | | | | | 1,944,958 | |

| Industrials — 16.71% | | | | | | | | |

| Atkore, Inc.(a) | | | 2,555 | | | | 243,492 | |

| Cactus, Inc., Class A | | | 7,068 | | | | 365,557 | |

| Clean Harbors, Inc.(a) | | | 2,233 | | | | 273,453 | |

| FTI Consulting, Inc.(a) | | | 1,408 | | | | 219,127 | |

See accompanying notes which are an integral part of these financial statements.

| Dana Epiphany ESG Small Cap Equity Fund |

| Schedule of Investments (continued) |

| October 31, 2022 |

| COMMON STOCKS — 99.60% - continued | | Shares | | | Fair Value | |

| Industrials — 16.71% - continued | | | | | | | | |

| Hub Group, Inc., Class A(a) | | | 3,426 | | | $ | 265,858 | |

| John Bean Technologies Corp. | | | 1,950 | | | | 177,840 | |

| MasTec, Inc.(a) | | | 2,977 | | | | 229,467 | |

| Regal-Beloit Corp. | | | 1,850 | | | | 234,099 | |

| TopBuild Corp.(a) | | | 1,401 | | | | 238,366 | |

| | | | | | | | 2,247,259 | |

| Materials — 5.27% | | | | | | | | |

| Advanced Drainage Systems, Inc. | | | 1,697 | | | | 196,649 | |

| Avient Corp. | | | 4,533 | | | | 156,343 | |

| Element Solutions, Inc. | | | 9,655 | | | | 166,066 | |

| Summit Materials, Inc., Class A(a) | | | 7,241 | | | | 190,800 | |

| | | | | | | | 709,858 | |

| Real Estate — 7.30% | | | | | | | | |

| Agree Realty Corp. | | | 3,056 | | | | 209,947 | |

| Global Medical REIT, Inc. | | | 17,456 | | | | 159,548 | |

| Radius Global Infrastructure, Inc., Class A(a) | | | 12,429 | | | | 116,211 | |

| Spirit Realty Capital, Inc. | | | 6,234 | | | | 242,066 | |

| STAG Industrial, Inc. | | | 8,076 | | | | 255,121 | |

| | | | | | | | 982,893 | |

| Technology — 14.47% | | | | | | | | |

| ADTRAN Holdings, Inc. | | | 9,388 | | | | 210,854 | |

| Axcelis Technologies, Inc.(a) | | | 4,117 | | | | 238,786 | |

| Box, Inc., Class A(a) | | | 8,348 | | | | 242,509 | |

| i3 Verticals, Inc., Class A(a) | | | 9,252 | | | | 201,324 | |

| Omnicell, Inc.(a) | | | 3,433 | | | | 265,441 | |

| Perficient,Inc(a) | | | 3,106 | | | | 208,008 | |

| Rapid7, Inc.(a) | | | 3,323 | | | | 150,432 | |

| Tenable Holdings, Inc.(a) | | | 5,766 | | | | 234,330 | |

| Veeco Instruments, Inc.(a) | | | 10,769 | | | | 196,319 | |

| | | | | | | | 1,948,003 | |

| Utilities — 3.29% | | | | | | | | |

| Chesapeake Utilities Corp. | | | 1,785 | | | | 222,018 | |

| Clearway Energy, Inc., Class C | | | 6,348 | | | | 220,530 | |

| | | | | | | | 442,548 | |

| Total Common Stocks (Cost $13,495,479) | | | | | | | 13,404,301 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 0.50% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.91%(b) | | | 67,550 | | | | 67,550 | |

| Total Money Market Funds (Cost $67,550) | | | | | | | 67,550 | |

| | | | | | | | | |

| Total Investments — 100.10% (Cost $13,563,029) | | | | | | | 13,471,851 | |

| Liabilities in Excess of Other Assets — (0.10)% | | | | | | | (13,792 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 13,458,059 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

REIT- Real Estate Investment Trust

See accompanying notes which are an integral part of these financial statements.

| Dana Epiphany ESG Equity Fund |

| Schedule of Investments |

| October 31, 2022 |

| COMMON STOCKS — 98.59% | | Shares | | | Fair Value | |

| Communications — 7.76% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 18,400 | | | $ | 1,738,984 | |

| Alphabet, Inc., Class C(a) | | | 4,600 | | | | 435,436 | |

| Comcast Corp., Class A | | | 31,000 | | | | 983,940 | |

| Interpublic Group of Cos., Inc. | | | 46,400 | | | | 1,382,256 | |

| Verizon Communications, Inc. | | | 30,000 | | | | 1,121,100 | |

| | | | | | | | 5,661,716 | |

| Consumer Discretionary — 10.72% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 7,400 | | | | 1,405,408 | |

| Amazon.com, Inc.(a) | | | 8,500 | | | | 870,740 | |

| D.R. Horton, Inc. | | | 17,400 | | | | 1,337,712 | |

| Home Depot, Inc. (The) | | | 3,600 | | | | 1,066,068 | |

| Tapestry, Inc. | | | 39,000 | | | | 1,235,520 | |

| Tractor Supply Co. | | | 2,400 | | | | 527,448 | |

| Ulta Beauty, Inc.(a) | | | 3,300 | | | | 1,383,921 | |

| | | | | | | | 7,826,817 | |

| Consumer Staples — 7.04% | | | | | | | | |

| Darling Ingredients, Inc.(a) | | | 20,000 | | | | 1,569,600 | |

| General Mills, Inc. | | | 20,000 | | | | 1,631,600 | |

| Kimberly-Clark Corp. | | | 6,800 | | | | 846,328 | |

| Mondelez International, Inc., Class A | | | 17,800 | | | | 1,094,344 | |

| | | | | | | | 5,141,872 | |

| Energy — 5.27% | | | | | | | | |

| Cheniere Energy, Inc. | | | 5,500 | | | | 970,255 | |

| ConocoPhillips | | | 4,600 | | | | 580,014 | |

| Ovintiv, Inc. | | | 18,000 | | | | 911,700 | |

| Pioneer Natural Resources Co. | | | 5,400 | | | | 1,384,614 | |

| | | | | | | | 3,846,583 | |

| Financials — 8.99% | | | | | | | | |

| Allstate Corp. (The) | | | 11,000 | | | | 1,388,750 | |

| American Express Co. | | | 9,200 | | | | 1,365,740 | |

| Bank of New York Mellon Corp. (The) | | | 30,400 | | | | 1,280,144 | |

| Morgan Stanley | | | 14,400 | | | | 1,183,248 | |

| Truist Financial Corp. | | | 30,000 | | | | 1,343,700 | |

| | | | | | | | 6,561,582 | |

| Health Care — 15.14% | | | | | | | | |

| Cigna Corp. | | | 5,900 | | | | 1,906,054 | |

| CVS Health Corp. | | | 15,600 | | | | 1,477,320 | |

| Envista Holdings Corp.(a) | | | 16,000 | | | | 528,160 | |

| Humana, Inc. | | | 2,900 | | | | 1,618,432 | |

| IQVIA Holdings, Inc.(a) | | | 7,600 | | | | 1,593,492 | |

| STERIS PLC | | | 8,800 | | | | 1,518,704 | |

| Syneos Health, Inc.(a) | | | 20,000 | | | | 1,007,600 | |

| Zoetis, Inc., Class A | | | 9,300 | | | | 1,402,254 | |

| | | | | | | | 11,052,016 | |

| Industrials — 9.89% | | | | | | | | |

| Deere & Co. | | | 3,900 | | | | 1,543,698 | |

| Norfolk Southern Corp. | | | 6,100 | | | | 1,391,227 | |

See accompanying notes which are an integral part of these financial statements.

| Dana Epiphany ESG Equity Fund |

| Schedule of Investments (continued) |

| October 31, 2022 |

| COMMON STOCKS — 98.59% - continued | | Shares | | | Fair Value | |

| Industrials — 9.89% - continued | | | | | | | | |

| Regal-Beloit Corp. | | | 10,200 | | | $ | 1,290,708 | |

| TE Connectivity Ltd. | | | 11,800 | | | | 1,442,314 | |

| W.W. Grainger, Inc. | | | 2,650 | | | | 1,548,528 | |

| | | | | | | | 7,216,475 | |

| Materials — 2.48% | | | | | | | | |

| Albemarle Corp. | | | 1,900 | | | | 531,753 | |

| Avery Dennison Corp. | | | 4,300 | | | | 729,065 | |

| Packaging Corp. of America | | | 4,600 | | | | 552,966 | |

| | | | | | | | 1,813,784 | |

| Real Estate — 4.24% | | | | | | | | |

| American Tower Corp., Class A | | | 1,800 | | | | 372,942 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 42,000 | | | | 1,141,560 | |

| Iron Mountain, Inc. | | | 23,000 | | | | 1,151,610 | |

| Spirit Realty Capital, Inc. | | | 11,000 | | | | 427,130 | |

| | | | | | | | 3,093,242 | |

| Technology — 24.22% | | | | | | | | |

| Accenture PLC, Class A | | | 4,700 | | | | 1,334,330 | |

| Advanced Micro Devices, Inc.(a) | | | 14,000 | | | | 840,840 | |

| Analog Devices, Inc. | | | 9,000 | | | | 1,283,580 | |

| Apple, Inc. | | | 17,400 | | | | 2,668,116 | |

| Cadence Design Systems, Inc.(a) | | | 7,300 | | | | 1,105,147 | |

| CDW Corp. | | | 8,000 | | | | 1,382,480 | |

| Cisco Systems, Inc. | | | 30,000 | | | | 1,362,900 | |

| Cognizant Technology Solutions Corp., Class A | | | 20,000 | | | | 1,245,000 | |

| Fiserv, Inc.(a) | | | 9,000 | | | | 924,660 | |

| Lam Research Corp. | | | 2,600 | | | | 1,052,428 | |

| Microsoft Corp. | | | 9,800 | | | | 2,274,874 | |

| Visa, Inc., Class A | | | 7,000 | | | | 1,450,119 | |

| Workday, Inc., Class A(a) | | | 4,800 | | | | 747,936 | |

| | | | | | | | 17,672,410 | |

| Utilities — 2.84% | | | | | | | | |

| Avangrid, Inc. | | | 7,400 | | | | 301,032 | |

| Eversource Energy | | | 11,000 | | | | 839,080 | |

| NextEra Energy, Inc. | | | 12,000 | | | | 930,000 | |

| | | | | | | | 2,070,112 | |

| Total Common Stocks (Cost $73,497,511) | | | | | | | 71,956,609 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 1.15% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.91%(b) | | | 842,259 | | | | 842,259 | |

| Total Money Market Funds (Cost $842,259) | | | | | | | 842,259 | |

| | | | | | | | | |

| Total Investments — 99.74% (Cost $74,339,770) | | | | | | | 72,798,868 | |

| Other Assets in Excess of Liabilities — 0.26% | | | | | | | 192,269 | |

| NET ASSETS — 100.00% | | | | | | $ | 72,991,137 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

See accompanying notes which are an integral part of these financial statements.

| Dana Funds |

| Statements of Assets and Liabilities |

| October 31, 2022 |

| | | | | | Dana | | | | |

| | | | | | Epiphany | | | Dana | |

| | | Dana Large | | | ESG Small | | | Epiphany | |

| | | Cap Equity | | | Cap Equity | | | ESG Equity | |

| | | Fund | | | Fund | | | Fund | |

| Assets | | | | | | | | | | | | |

| Investments in securities at fair value (cost $83,956,119, $13,563,029 and $74,339,770) (Note 3) | | $ | 102,094,447 | | | $ | 13,471,851 | | | $ | 72,798,868 | |

| Receivable for fund shares sold | | | 204 | | | | 60 | | | | 238,868 | |

| Receivable for investments sold | | | 1,391,946 | | | | 455,970 | | | | 592,791 | |

| Dividends receivable | | | 141,451 | | | | 2,499 | | | | 84,275 | |

| Receivable from Adviser (Note 4) | | | — | | | | 10,184 | | | | — | |

| Prepaid expenses | | | 20,865 | | | | 14,669 | | | | 14,434 | |

| Total Assets | | | 103,648,913 | | | | 13,955,233 | | | | 73,729,236 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Payable for fund shares redeemed | | | 54,363 | | | | — | | | | 75,943 | |

| Payable for investments purchased | | | 1,205,628 | | | | 465,807 | | | | 601,626 | |

| Payable to Adviser (Note 4) | | | 41,829 | | | | — | | | | 25,956 | |

| Accrued Distribution (12b-1) fees (Note 4) | | | 4,064 | | | | — | | | | — | |

| Payable to Administrator (Note 4) | | | 10,501 | | | | 6,516 | | | | 7,652 | |

| Payable to trustees (Note 4) | | | 1,917 | | | | 1,917 | | | | 1,917 | |

| Other accrued expenses | | | 25,572 | | | | 22,934 | | | | 25,005 | |

| Total Liabilities | | | 1,343,874 | | | | 497,174 | | | | 738,099 | |

| Net Assets | | $ | 102,305,039 | | | $ | 13,458,059 | | | $ | 72,991,137 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 76,399,874 | | | $ | 12,436,176 | | | $ | 75,604,695 | |

| Accumulated earnings (deficit) | | | 25,905,165 | | | | 1,021,883 | | | | (2,613,558 | ) |

| Net Assets | | $ | 102,305,039 | | | $ | 13,458,059 | | | $ | 72,991,137 | |

| Institutional Class: | | | | | | | | | | | | |

| Net Assets | | $ | 82,372,665 | | | $ | 13,458,059 | | | $ | 72,991,137 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 3,874,352 | | | | 1,158,409 | | | | 6,339,859 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 21.26 | | | $ | 11.62 | | | $ | 11.51 | |

| Investor Class: | | | | | | | | | | | | |

| Net Assets | | $ | 19,932,374 | | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 937,359 | | | | | | | | | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 21.26 | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dana Funds |

| Statements of Operations |

| For the year ended October 31, 2022 |

| | | | | | Dana Epiphany | | | Dana Epiphany | |

| | | Dana Large Cap | | | ESG Small Cap | | | ESG Equity | |

| | | Equity Fund | | | Equity Fund | | | Fund | |

| Investment Income | | | | | | | | | | | | |

| Dividend income | | $ | 2,281,839 | | | $ | 154,688 | | | $ | 1,312,495 | |

| Total investment income | | | 2,281,839 | | | | 154,688 | | | | 1,312,495 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Investment Adviser fees (Note 4) | | | 792,266 | | | | 114,992 | | | | 485,120 | |

| Administration and compliance service fees (Note 4) | | | 71,713 | | | | 33,525 | | | | 47,921 | |

| Distribution (12b-1) fees, Investor Class (Note 4) | | | 57,446 | | | | — | | | | — | |

| Fund accounting fees (Note 4) | | | 43,277 | | | | 25,437 | | | | 29,920 | |

| Registration expenses | | | 40,999 | | | | 22,136 | | | | 34,578 | |

| Transfer agent fees (Note 4) | | | 23,402 | | | | 18,315 | | | | 18,315 | |

| Legal fees | | | 18,690 | | | | 27,938 | | | | 27,900 | |

| Audit and tax preparation fees | | | 18,410 | | | | 18,411 | | | | 18,411 | |

| Custodian fees | | | 15,540 | | | | 6,142 | | | | 13,500 | |

| Trustee fees (Note 4) | | | 7,723 | | | | 6,579 | | | | 7,233 | |

| Printing and postage expenses | | | 5,205 | | | | 2,070 | | | | 7,395 | |

| Insurance expenses | | | 4,064 | | | | 2,562 | | | | 3,073 | |

| Miscellaneous expenses | | | 24,233 | | | | 20,977 | | | | 25,653 | |

| Total expenses | | | 1,122,968 | | | | 299,084 | | | | 719,019 | |

| Fees contractually waived and expenses reimbursed by Adviser (Note 4) | | | (176,583 | ) | | | (153,559 | ) | | | (84,961 | ) |

| Net operating expenses | | | 946,385 | | | | 145,525 | | | | 634,058 | |

| Net investment income | | | 1,335,454 | | | | 9,163 | | | | 678,437 | |

| | | | | | | | | | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

| Net realized gain (loss) on investment securities transactions | | | 7,882,982 | | | | 1,159,913 | | | | (1,150,639 | ) |

| Net change in unrealized depreciation on investment securities | | | (32,144,030 | ) | | | (4,828,049 | ) | | | (12,474,484 | ) |

| Net realized and change in unrealized loss on investments | | | (24,261,048 | ) | | | (3,668,136 | ) | | | (13,625,123 | ) |

| Net decrease in net assets resulting from operations | | $ | (22,925,594 | ) | | $ | (3,658,973 | ) | | $ | (12,946,686 | ) |

See accompanying notes which are an integral part of these financial statements.

| Dana Funds |

| Statements of Changes in Net Assets |

| | | Dana Large Cap Equity Fund | |

| | | For the Year | | | For the Year | |

| | | Ended October | | | Ended October | |

| | | 31, 2022 | | | 31, 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 1,335,454 | | | $ | 798,820 | |

| Net realized gain on investment securities transactions | | | 7,882,982 | | | | 16,461,777 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (32,144,030 | ) | | | 26,848,239 | |

| Net increase (decrease) in net assets resulting from operations | | | (22,925,594 | ) | | | 44,108,836 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

| Institutional Class | | | (14,198,810 | ) | | | (2,521,779 | ) |

| Investor Class | | | (3,218,987 | ) | | | (616,743 | ) |

| Total distributions | | | (17,417,797 | ) | | | (3,138,522 | ) |

| Capital Transactions – Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 14,475,937 | | | | 19,866,697 | |

| Reinvestment of distributions | | | 7,925,662 | | | | 1,261,457 | |

| Amount paid for shares redeemed | | | (22,829,242 | ) | | | (29,994,338 | ) |

| Total – Institutional Class | | | (427,643 | ) | | | (8,866,184 | ) |

| Capital Transactions – Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 368,279 | | | | 955,765 | |

| Reinvestment of distributions | | | 3,041,633 | | | | 610,137 | |

| Amount paid for shares redeemed | | | (2,415,054 | ) | | | (7,582,529 | ) |

| Total – Investor Class | | | 994,858 | | | | (6,016,627 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 567,215 | | | | (14,882,811 | ) |

| Total Increase (Decrease) in Net Assets | | | (39,776,176 | ) | | | 26,087,503 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 142,081,215 | | | | 115,993,712 | |

| End of year | | $ | 102,305,039 | | | $ | 142,081,215 | |

| | | | | | | | | |

| Share Transactions - Institutional Class | | | | | | | | |

| Shares sold | | | 577,714 | | | | 784,104 | |

| Shares issued in reinvestment of distributions | | | 299,112 | | | | 51,614 | |

| Shares redeemed | | | (959,176 | ) | | | (1,178,281 | ) |

| Total – Institutional Class | | | (82,350 | ) | | | (342,563 | ) |

| Share Transactions - Investor Class | | | | | | | | |

| Shares sold | | | 15,632 | | | | 36,024 | |

| Shares issued in reinvestment of distributions | | | 114,484 | | | | 25,319 | |

| Shares redeemed | | | (101,487 | ) | | | (310,665 | ) |

| Total – Investor Class | | | 28,629 | | | | (249,322 | ) |

See accompanying notes which are an integral part of these financial statements.

| Dana Funds |

| Statements of Changes in Net Assets (continued) |

| | | Dana Epiphany ESG Small Cap | |

| | | Equity Fund | |

| | | For the Year | | | For the Year | |

| | | Ended October | | | Ended October | |

| | | 31, 2022 | | | 31, 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | 9,163 | | | $ | (35,266 | ) |

| Net realized gain on investment securities transactions | | | 1,159,913 | | | | 2,817,117 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (4,828,049 | ) | | | 3,549,853 | |

| Net increase (decrease) in net assets resulting from operations | | | (3,658,973 | ) | | | 6,331,704 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

| Institutional Class | | | (1,429,190 | ) | | | — | |

| Total distributions | | | (1,429,190 | ) | | | — | |

| Capital Transactions – Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 4,022,076 | | | | 4,001,045 | |

| Reinvestment of distributions | | | 1,400,259 | | | | — | |

| Amount paid for shares redeemed | | | (4,314,843 | ) | | | (2,755,405 | ) |

| Total – Institutional Class | | | 1,107,492 | | | | 1,245,640 | |

| Net increase in net assets resulting from capital transactions | | | 1,107,492 | | | | 1,245,640 | |

| Total Increase (Decrease) in Net Assets | | | (3,980,671 | ) | | | 7,577,344 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 17,438,730 | | | | 9,861,386 | |

| End of year | | $ | 13,458,059 | | | $ | 17,438,730 | |

| | | | | | | | | |

| Share Transactions - Institutional Class | | | | | | | | |

| Shares sold | | | 291,572 | | | | 285,750 | |

| Shares issued in reinvestment of distributions | | | 95,256 | | | | — | |

| Shares redeemed | | | (324,787 | ) | | | (193,538 | ) |

| Total – Institutional Class | | | 62,041 | | | | 92,212 | |

See accompanying notes which are an integral part of these financial statements.

| Dana Funds |

| Statements of Changes in Net Assets (continued) |

| | | Dana Epiphany ESG Equity Fund | |

| | | For the Year | | | For the Year | |

| | | Ended October | | | Ended October | |

| | | 31, 2022 | | | 31, 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 678,437 | | | $ | 234,908 | |

| Net realized gain (loss) on investment securities transactions | | | (1,150,639 | ) | | | 1,024,321 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (12,474,484 | ) | | | 8,442,528 | |

| Net increase (decrease) in net assets resulting from operations | | | (12,946,686 | ) | | | 9,701,757 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

| Institutional Class | | | (1,696,546 | ) | | | (415,436 | ) |

| Total distributions | | | (1,696,546 | ) | | | (415,436 | ) |

| Capital Transactions – Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 36,072,130 | | | | 52,799,761 | |

| Reinvestment of distributions | | | 1,650,842 | | | | 412,645 | |

| Amount paid for shares redeemed | | | (17,645,598 | ) | | | (8,003,838 | ) |

| Total – Institutional Class | | | 20,077,374 | | | | 45,208,568 | |

| Net increase in net assets resulting from capital transactions | | | 20,077,374 | | | | 45,208,568 | |

| Total Increase in Net Assets | | | 5,434,142 | | | | 54,494,889 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 67,556,995 | | | | 13,062,106 | |

| End of year | | $ | 72,991,137 | | | $ | 67,556,995 | |

| | | | | | | | | |

| Share Transactions - Institutional Class | | | | | | | | |

| Shares sold | | | 2,777,361 | | | | 4,143,277 | |

| Shares issued in reinvestment of distributions | | | 121,043 | | | | 34,346 | |

| Shares redeemed | | | (1,394,549 | ) | | | (615,363 | ) |

| Total – Institutional Class | | | 1,503,855 | | | | 3,562,260 | |

See accompanying notes which are an integral part of these financial statements.

| Dana Large Cap Equity Fund – Institutional Class |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 29.20 | | | $ | 21.25 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.28 | | | | 0.17 | | | | 0.23 | | | | 0.38 | | | | 0.32 | |

| Net realized and unrealized gain (loss) on investments | | | (4.60 | ) | | | 8.39 | | | | 0.86 | | | | 2.46 | | | | 0.45 | |

| Total from investment operations | | | (4.32 | ) | | | 8.56 | | | | 1.09 | | | | 2.84 | | | | 0.77 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.25 | ) | | | (0.17 | ) | | | (0.23 | ) | | | (0.36 | ) | | | (0.32 | ) |

| Net realized gains | | | (3.37 | ) | | | (0.44 | ) | | | (2.30 | ) | | | (2.14 | ) | | | (0.74 | ) |

| Total distributions | | | (3.62 | ) | | | (0.61 | ) | | | (2.53 | ) | | | (2.50 | ) | | | (1.06 | ) |

| Net asset value, end of year | | $ | 21.26 | | | $ | 29.20 | | | $ | 21.25 | | | $ | 22.69 | | | $ | 22.35 | |

| Total Return(a) | | | (17.16 | )% | | | 40.89 | % | | | 4.65 | % | | | 15.55 | % | | | 3.27 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 82,373 | | | $ | 115,544 | | | $ | 91,379 | | | $ | 107,026 | | | $ | 176,954 | |

| Before waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.87 | % | | | 0.86 | % | | | 0.91 | % | | | 0.85 | % | | | 0.86 | % |

| After waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % |

| Ratio of net investment income to average net assets | | | 1.14 | % | | | 0.65 | % | | | 1.10 | % | | | 1.68 | % | | | 1.41 | % |

| Portfolio turnover rate(b) | | | 38 | % | | | 30 | % | | | 57 | % | | | 50 | % | | | 58 | % |

| (a) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (b) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

| Dana Large Cap Equity Fund – Investor Class |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 29.20 | | | $ | 21.26 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.22 | | | | 0.10 | | | | 0.18 | | | | 0.30 | | | | 0.28 | |

| Net realized and unrealized gain (loss) on investments | | | (4.60 | ) | | | 8.39 | | | | 0.87 | | | | 2.50 | | | | 0.43 | |

| Total from investment operations | | | (4.38 | ) | | | 8.49 | | | | 1.05 | | | | 2.80 | | | | 0.71 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.19 | ) | | | (0.11 | ) | | | (0.18 | ) | | | (0.32 | ) | | | (0.26 | ) |

| Net realized gains | | | (3.37 | ) | | | (0.44 | ) | | | (2.30 | ) | | | (2.14 | ) | | | (0.74 | ) |

| Total distributions | | | (3.56 | ) | | | (0.55 | ) | | | (2.48 | ) | | | (2.46 | ) | | | (1.00 | ) |

| Net asset value, end of year | | $ | 21.26 | | | $ | 29.20 | | | $ | 21.26 | | | $ | 22.69 | | | $ | 22.35 | |

| Total Return(a) | | | (17.38 | )% | | | 40.48 | % | | | 4.43 | % | | | 15.29 | % | | | 3.01 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 19,932 | | | $ | 26,537 | | | $ | 24,615 | | | $ | 25,398 | | | $ | 28,870 | |

| Before waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.12 | % | | | 1.11 | % | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % |

| After waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % |

| Ratio of net investment income to average net assets | | | 0.89 | % | | | 0.40 | % | | | 0.85 | % | | | 1.40 | % | | | 1.17 | % |

| Portfolio turnover rate(b) | | | 38 | % | | | 30 | % | | | 57 | % | | | 50 | % | | | 58 | % |

| (a) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (b) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

| Dana Epiphany ESG Small Cap Equity Fund – Institutional Class |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 15.91 | | | $ | 9.82 | | | $ | 10.24 | | | $ | 11.09 | | | $ | 11.43 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.01 | | | | (0.03 | ) | | | 0.01 | | | | 0.01 | | | | (0.03 | ) |

| Net realized and unrealized gain (loss) on investments | | | (3.02 | ) | | | 6.12 | | | | (0.42 | ) | | | (0.05 | ) | | | (0.31 | ) |

| Total from investment operations | | | (3.01 | ) | | | 6.09 | | | | (0.41 | ) | | | (0.04 | ) | | | (0.34 | ) |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | (0.01 | ) | | | — | | | | — | (a) |

| Net realized gains | | | (1.28 | ) | | | — | | | | — | | | | (0.81 | ) | | | — | |

| Total distributions | | | (1.28 | ) | | | — | | | | (0.01 | ) | | | (0.81 | ) | | | — | (a) |

| Net asset value, end of year | | $ | 11.62 | | | $ | 15.91 | | | $ | 9.82 | | | $ | 10.24 | | | $ | 11.09 | |

| Total Return(b) | | | (20.59 | )% | | | 62.02 | % | | | (4.04 | )% | | | 0.83 | % | | | (2.95 | )% |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 13,458 | | | $ | 17,439 | | | $ | 9,861 | | | $ | 12,421 | | | $ | 16,196 | |

| Before waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.95 | % | | | 2.05 | % | | | 2.58 | % | | | 1.88 | % | | | 1.75 | % |

| After waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.06 | % | | | (0.24 | )% | | | 0.02 | % | | | 0.11 | % | | | (0.24 | )% |

| Portfolio turnover rate | | | 82 | % | | | 92 | % | | | 88 | % | | | 50 | % | | | 78 | % |

| (a) | Rounds to less than $0.005 per share. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Dana Epiphany ESG Equity Fund – Institutional Class |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 13.97 | | | $ | 10.25 | | | $ | 11.58 | | | $ | 11.80 | | | $ | 13.09 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | | | 0.06 | | | | 0.09 | | | | 0.14 | | | | 0.08 | (a) |

| Net realized and unrealized gain (loss) on investments | | | (2.27 | ) | | | 3.87 | | | | 0.47 | | | | 1.15 | | | | 0.74 | |

| Total from investment operations | | | (2.16 | ) | | | 3.93 | | | | 0.56 | | | | 1.29 | | | | 0.82 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.11 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.12 | ) | | | (0.08 | ) |

| Net realized gains | | | (0.19 | ) | | | (0.15 | ) | | | (1.79 | ) | | | (1.39 | ) | | | (2.03 | ) |

| Total distributions | | | (0.30 | ) | | | (0.21 | ) | | | (1.89 | ) | | | (1.51 | ) | | | (2.11 | ) |

| Net asset value, end of year | | $ | 11.51 | | | $ | 13.97 | | | $ | 10.25 | | | $ | 11.58 | | | $ | 11.80 | |

| Total Return(b) | | | (15.76 | )% | | | 38.70 | % | | | 4.76 | % | | | 12.76 | % | | | 6.32 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 72,991 | | | $ | 67,557 | | | $ | 13,062 | | | $ | 5,079 | | | $ | 6,485 | |

| Before waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.96 | % | | | 1.12 | % | | | 2.00 | % | | | 2.13 | % | | | 1.63 | % |

| After waiver | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.90 | % | | | 1.25 | % |

| Ratio of net investment income to average net assets | | | 0.91 | % | | | 0.57 | % | | | 0.89 | % | | | 1.19 | % | | | 0.62 | % |

| Portfolio turnover rate | | | 33 | % | | | 18 | % | | | 67 | % | | | 60 | % | | | 23 | % |

| (a) | Per share net investment income (loss) has been determined on the basis of average shares outstanding during the period. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Dana Funds |

| Notes to the Financial Statements |

| October 31, 2022 |

NOTE 1. ORGANIZATION

The Dana Large Cap Equity Fund (the “Large Cap Fund”), the Dana Epiphany ESG Small Cap Equity Fund (the “Small Cap Fund”), and the Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) (each a “Fund” and collectively, the “Funds”) are each registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (“Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. Each Fund is one of a series of funds currently authorized by the Board. The investment adviser to the Funds is Dana Investment Advisors, Inc. (the “Adviser”). Each Fund seeks long-term growth of capital.