united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22208 | |

Valued Advisers Trust |

| (Exact name of registrant as specified in charter) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 | Cincinnati, OH 45246 |

| (Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Zachary Richmond

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/2021 | |

Item 1. Reports to Stockholders.

(a)

DANA LARGE CAP EQUITY FUND

DANA EPIPHANY ESG SMALL CAP EQUITY FUND

DANA EPIPHANY ESG EQUITY FUND

Annual Report

October 31, 2021

Dana Investment Advisors, Inc.

20700 Swenson Drive, Suite 400

Waukesha, WI 53186

(855) 280-9648

www.danafunds.com

Dear Fellow Shareholders,

Many of us were happy to see the calendar flip from 2020 to 2021 with hopes of returning to a sense of normalcy in both our professional and personal lives. While road bumps were experienced along the way, we certainly feel progress was made towards pre-pandemic interactions with the return to more in-person activities. As investors, we continue to watch the ever-changing global economic and geopolitical environment with an eye out for opportunities. We remain thankful for your continued trust and support of the Dana Funds. We are happy to share this discussion and analysis of the prior twelve months in the financial markets and the Dana Funds’ performance.

Economic and Market Recap

Most of 2021 has been a year dominated by news surrounding COVID-19 and its effect on the economy and expected growth. GDP grew at a rate of over 6% annualized through the first six months of the year before slowing to 2.1% in the third quarter. Large fiscal spending plans targeted at supporting the economy were passed in December of 2020 and March of 2021. The Federal Reserve did its part by maintaining a zero interest-rate policy and continuing to purchase both Treasuries and mortgage-backed securities in the open market. Longer market interest rates rose significantly in the first quarter of the year before plateauing and falling slightly in the second and third quarters.

Following a spike in COVID-19 cases at the end of 2020, cases and deaths began to fall in 2021 while the percentage of the population that had been vaccinated continued to rise. Market sectors that stood to gain the most from a decline in the severity of COVID-19 were the best performers in the first half of the year. These sectors included Energy, Industrials, and Financials. The S&P 500 rose over 6% in the first quarter and over 8% in the second quarter as confidence grew that COVID-19 was on the decline as a serious threat. This sector performance reversed somewhat in the third quarter as growth slowed and the Delta variant became prevalent and cases rose.

Inflation has continued to run at a high level through most of 2021. Home prices, automobiles, and energy were areas that have shown significant price increases over the past year. Manufacturing and supply chain disruptions due to COVID-19 have been blamed for the widespread increase in price levels. Fiscal and monetary stimulus may also have played a role, but these same factors failed to produce inflation in the decade prior to COVID-19. The Federal Reserve has taken notice, and has done its best to try and control rates through tough talk and an incremental reduction in their bond purchases. A topping process for inflation is not yet apparent and will be a key fiscal and monetary issue in 2022.

Dana Large Cap Fund (the “Large Cap Fund”) Discussion

The Dana Large Cap Equity Fund (Institutional Class) returned 40.89%, slightly trailing the S&P 500® Index return of 42.91% in a very strong equity market during the fiscal year 2021. Just a week into the Dana Funds’ fiscal year, Pfizer announced a COVID-19 vaccine (followed by Moderna a week later), which started a strong and sustained COVID-19 recovery rally. Equity indexes began setting new record highs at the end of 2020. The market broadened, but much of the initial leadership came from lower-quality stocks that had been severely beaten down in the first 10 months of calendar 2020. As 2021 kicked off, excess liquidity and speculative fervor created an atmosphere where “meme stocks” and SPACs juiced market returns. Corporate earnings were strong, driving equities higher, and the Large Cap Fund participated in the upward move. But in the final two months of the fiscal year ended October 31, 2021, fear over rising interest rates, inflation, labor, politics, COVID variants, and other global concerns led to a 5% market correction (deeper for mid-cap, small-cap, and foreign stock indexes) and a return to a narrow market led by mega-cap growth companies.

1

Rising fuel prices drove the Energy sector to lead the market and the Large Cap Fund in terms of absolute returns during the fiscal year, with the Large Cap Fund’s Energy holdings outperforming the S&P 500 sector. Relative performance contribution was strongest for the Large Cap Fund’s in the Financials sector, generally rewarding our patience with bank stocks. Conversely, the weakest (though still well-positive) absolute sector return came in the Utilities sector for both the Large Cap Fund and the S&P 500® Index, with the Large Cap Fund’s Utilities holdings slightly lagging the S&P 500 sector return. The largest relative contribution deficit to the benchmark was in the Health Care sector despite generally strong performance from new positions in Avantor, Inc. (AVTR), CVS Health Corporation (CVS), and longer-term holding Horizon Therapeutics PLC (HZNP). Health Care stock Zimmer Biomet Holdings, Inc. (ZBH) was the Large Cap Fund’s weakest performer for the fiscal year. As the world’s leading manufacturer of replacement hips and knees, combined with an attractive valuation, it had appeared well positioned as a reopening play with more elective surgical procedures on the horizon. Walt Disney Company (DIS), purchased just prior to the market weakness in September and October, was the Large Cap Fund’s second worst detractor, yet we continue to see good value as parks reopen and they monetize their extensive content catalog for streaming. Alphabet Inc. (GOOGL) was the largest positive contributor to Fund performance, thanks in part to its relatively high portfolio weight, followed by Morgan Stanley (MS). The biggest absolute returns came from Energy holdings ConocoPhillips (COP) and Pioneer Natural Resources Company (PXD).

Late in the fiscal year, the Large Cap Fund sold a few of our higher-valuation stocks that had performed very well in the COVID-19-dominated market that played out during the fiscal year. Our focus has recently been on identifying quality companies that we feel are likely to fare well as new macro factors (e.g., inflation, tight labor) become more significant and GDP and corporate earnings growth revert to long-term trend. We believe fundamentals will become more important to stock performance, which should provide a tailwind to our portfolio.

Dana Epiphany ESG Small Cap Fund (the “Small Cap Fund”) Discussion

The Small Cap Fund (Institutional class) returned 62.02% versus 45.84% for its benchmark Morningstar U.S. Small Core Index and 50.80% for the Russell 2000® Index during the fiscal year 2021. The fiscal year erupted with a bang as news in early November 2020 about viable COVID-19 vaccines snapped the spell cast upon the equity markets. Similar to the dynamics around the Spring 2009 market lows, the rebound was initially led by more distressed companies, especially those whose fortunes hung in the balance with continued lockdowns and other stifling virus mitigation tactics. A quick tip of our hat to last year’s commentary where we reminded investors that small caps were facing a positive set-up:

“The good news is that small cap stocks have historically outperformed large cap stocks coming off market bottoms, a pattern that repeated in the second quarter, as well as off the market lows this fall.”

Indeed, small caps outperformed larger market caps during the closing of 2020 and for much of the next quarter. The Small Cap Fund benefitted from strong returns in this period, but didn’t really start to gain on the benchmark index until fourth quarter 2020 earnings season ramped up in February. Fundamental news flow dominated earnings season though July. The set-up of weak expectations, re-opening activity, and supply chain replenishment provided a fertile background for stocks to appreciate if they exceeded expectations on earnings, margins, and especially revenues.

While distressed names bounced highest from their lows, January and May also featured interesting trading dynamics that showed the retail investor was alive and clicking. Meme stocks and the so-called Reddit stocks had positive returns that in some cases defied gravity, but they also caught

2

lazy institutions napping on stale short positions, as evidenced by AMC Entertainment (AMC) where short interest as a percentage of float declined from over 40% to nearly 10% from December to February as the stock surged. Symbolic of the improving economic background post-vaccines, tactically alert management capitalized on the share shortage and issued new shares to bolster the balance sheet and feed an acquisition budget. AMC helped the Communication Services sector earn the second highest sector return for the period (second to the resurgent Energy sector, home to the great majority of domestic exploration and production companies).

Fund attribution reflects these periods of tension between retail interest, reopening optimism, and improving fundamentals. November, December, and January were months where the Small Cap Fund accrued negative alpha despite strong performance, while from February to mid-May, the Fund earned positive alpha due to its positioning in quality growing companies. After another retail rally in late May, the Small Cap Fund continued to outperform with a degree of consistency through the end of October.

Most sectors were alpha-positive for the year, but the greatest strength came from Financials and Health Care. Western Alliance Bancorp (WAL) and Pinnacle Financial Partners (PNFP) continued to execute on growth plans and benefitted from expanding multiples for banks, as the economic recovery helps the Federal Reserve calculate a path to a steeper yield curve. In the Health Care sector, strength was dispersed as holdings in Equipment, Biotechnology, and Health Care Technology outpaced peer averages. In total, fourteen holdings from six different sectors had triple-digit performance returns in the fiscal year. Atkore Inc. (ATKR), an industrial company, paced all gainers. Atkore is followed by only four research firms, yet it reached a market cap over $4 billion. Atkore makes commercial electrical construction products and, in addition to strong demand in their end markets, has exhibited very strong pricing power from product innovations that have exceeded estimates. As of November 18, management has raised their initial guidance of $400 mm EBITDA for 2022 four times and now expects EBITA in the range of $650-700mm. Management has plans to deploy capital in 2022 on capital expenditures, accretive M&A, and a $400mm share buyback authorization.

Due to the dramatic rebound in share prices, there were few opportunities to tax harvest into the fiscal year end. We feel a benefit to our process is culling weaker names at losses on a quarterly basis, but, more often than not, those swaps were at gains this year. Some of the portfolio trading was done with an eye on tax efficiency, and the result should help as much as possible to minimize the taxable gains.

The dynamic environment of the last 12 months has been a very exciting time to search for investments. We continue to find new stories in the small cap space that warrant our attention and curiosity. As older holdings mature, we will continue to add new positions that we think can support the long-term success of the Dana Small Cap Fund through a relative value discipline that focuses on fundamentally driven stock selection to reward investors over the long term.

Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) Discussion

The Dana Epiphany ESG Fund (Institutional Class) posted a positive return of 38.70%, trailing the benchmark S&P 500® Index returns of 42.91% during the fiscal year 2021. The Epiphany ESG Fund shares an investment philosophy that is common to all the Dana Funds, but adds a faith-based values component to security selection. While we use the S&P 500® Index as the benchmark for the strategy, values considerations lead the portfolio to have higher exposure to mid-cap stocks, and occasionally stocks that qualify as small cap. The market environment discussions above for the Large Cap Equity Fund (describing the large cap U.S. equity market) and the Small Cap Fund (describing the small cap market) give the market context in which the Epiphany ESG Fund operated.

3

Similar to the Large Cap Equity Fund, the market-leading Energy sector also led the Epiphany ESG Fund in terms of absolute returns during the fiscal year. Relative performance contribution was strongest for the Epiphany ESG Fund in the Financials sector, rewarding our patience with bank stocks. The highest absolute returns in the Epiphany ESG Fund were posted by Energy holdings ConocoPhillips (COP) and Pioneer Natural Resources Company (PXD), with both names outperforming the very strong sector average. The biggest individual contributions to the Epiphany ESG Fund’s total return (thanks to larger portfolio weights) came from Microsoft Corporation (MSFT) and Morgan Stanley (MS). Conversely, the weakest absolute sector return came in the Utilities sector for both the Epiphany ESG Fund and the S&P 500® Index, with the Epiphany ESG Fund Utilities holdings slightly lagging the S&P 500 sector return. The largest sector detractor versus the benchmark came in Health Care. The values mandate for the Epiphany ESG Fund can create specific challenges in the Health Care sector, and elevated dispersion among Health Care stocks magnified tracking error over the past year. Emergent BioSolutions Inc. (EBS) was the weakest performer in the Epiphany ESG Fund following manufacturing problems on the company’s part of the Johnson & Johnson COVID-19 vaccine. These manufacturing problems were cause for concerns with management, and the position was eliminated from the Epiphany ESG Fund. The Information Technology sector also produced meaningful relative weakness, with IT holdings Fidelity National Information Services (FIS) and Micron Technology, Inc. (MU) being the biggest relative detractors in the Epiphany ESG Fund. We believe Fidelity National Information Services earnings and revenue show reasonable growth and Micron is still well positioned to improve pricing, margins, and cash flow in the face of significant supply constraints.

The Epiphany ESG Fund delivered generally good relative performance during the first half of the fiscal year as breadth in the market improved (even though much of the leadership in that period came from lower-quality stocks). Mega-cap stocks drove the return of the S&P 500® Index during the second half of the fiscal year, resulting in lagging performance for the Epiphany ESG Fund despite reasonable performance in many sectors (particularly those not dominated by mega-cap names). Consistent with the other Dana Funds, late in the year, the Epiphany ESG Fund sold a few higher-valuation stocks that had performed very well in the COVID-19-dominated market that played out during the fiscal year. As discussed earlier, we believe fundamentals will become more important to stock performance, and our focus has recently been on identifying quality companies that we feel are likely to fare well as new macro factors (e.g., inflation, tight labor) become more significant, and GDP and corporate earnings growth revert to long-term trend. We see good opportunities in the market for selective stocks and are optimistic that the market-cap flexibility of the Epiphany ESG Fund combined with a broader, more fundamentally-driven market will have a positive influence on the Epiphany ESG Fund in the coming year (and beyond).

Respectfully submitted,

Mark R. Mirsberger, CPA

Chief Executive Officer – Dana Investment Advisors, Inc.

Duane Roberts, CFA

Portfolio Manager and Director of Equities – Dana Investment Advisors, Inc.

4

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2021

| One

Year | Five

Year | Ten

Year | Since

Inception

(10/29/13) |

Dana Large Cap Equity Fund | | |

Institutional Class | 40.89% | 18.01% | N/A | 13.39% |

Investor Class | 40.48% | 17.71% | 14.36% | N/A |

S&P 500® Index(b) | 42.91% | 18.93% | 16.21% | 14.90% |

| | Expense Ratios(c) |

| Institutional

Class | Investor

Class |

Gross | 0.91% | 1.16% |

With Applicable Waivers | 0.73% | 0.98% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Large Cap Equity Fund (the “Large Cap Fund”) distributions or the redemption of Large Cap Fund shares. Current performance of the Large Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Large Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. |

(b) | The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Large Cap Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in exchange-traded funds (“ETFs”) or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Large Cap Fund’s prospectus dated February 26, 2021. Expense ratios with applicable waivers reflect that Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to waive or limit its fees and to assume other expenses of the Large Cap Fund until February 28, 2022, so that total annual fund operating expenses do not exceed 0.73% of the Large Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Large Cap Fund within three years following the date of such waiver or reimbursement, provided that the Large Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Large Cap Fund’s expense ratios as of October 31, 2021 can be found in the financial highlights. |

The Large Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Large Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Large Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

5

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2021

| One

Year | Five

Year | Since

Inception

(11/3/15) |

Dana Epiphany ESG Small Cap Equity Fund |

Institutional Class | 62.02% | 13.37% | 9.72% |

Morningstar US Small Core Index(b) | 45.84% | 12.24% | 10.86% |

Russell 2000® Index(c) | 50.80% | 15.52% | 13.07% |

| | Expense

Ratios(d) |

| Institutional

Class |

Gross | 2.58% |

With Applicable Waivers | 0.95% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Small Cap Equity Fund (the “Small Cap Fund”) distributions or the redemption of Small Cap Fund shares. Current performance of the Small Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Small Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Effective at the close of business on June 4, 2020, Investor Class shares of the Small Cap Fund were exchanged for Institutional Class shares, resulting in the closing of the Investor Class. The Small Cap Fund has changed its primary benchmark from the Russell 2000® Index to the Morningstar US Small Core Index. The composition of the two indexes is substantially similar, and in the opinion of Dana Investment Advisors, Inc., (the “Adviser”), the Morningstar US Small Core Index provides an appropriate broad-based market comparison for the Small Cap Fund. |

(b) | The Morningstar US Small Core Index (“Morningstar Index”) provides a comprehensive depiction of the performance and fundamental characteristics of the Small Core segment of U.S. equity markets. The Morningstar Index does not incorporate Environmental, Social, Or Governance (ESG) criteria. Individuals can not invest directly in the Morningstar Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The Russell 2000® Index (“Russell Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Small Cap Fund’s portfolio. Individuals can not invest directly in the Russell Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(d) | The expense ratios are from the Small Cap Fund’s prospectus dated February 26, 2021. Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Small Cap Fund until February 28, 2022, so that total annual fund operating expenses do not exceed 0.95% of the Small Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Small Cap Fund within three years following the date of such waiver or reimbursement, provided that the Small Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Small Cap Fund’s expense ratios as of October 31, 2021 can be found in the financial highlights. |

The Small Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Small Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

6

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2021

| One

Year | Five

Year | Ten

Year |

Dana Epiphany ESG Equity Fund | | | |

Institutional Class | 38.70% | 16.36% | 12.62% |

S&P 500® Index(b) | 42.91% | 18.93% | 16.21% |

| | Expense

Ratios(c) |

| Institutional

Class |

Gross | 2.00% |

With Applicable Waivers | 0.85% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) distributions or the redemption of Epiphany ESG Fund shares. Current performance of the Epiphany ESG Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Epiphany ESG Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Effective at the close of business on June 4, 2020, Investor Class shares of the Epiphany ESG Fund were exchanged for Institutional Class Shares, resulting in the closing of the Investor Class. |

(b) | The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Epiphany ESG Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Epiphany ESG Fund’s prospectus dated February 26, 2021. Expense ratios with applicable waivers reflect that Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to waive or limit its fees and to assume other expenses of the Epiphany ESG Fund until February 28, 2022, so that total annual fund operating expenses do not exceed 0.85% of the Epiphany ESG Fund’s average net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Epiphany ESG Fund within three years following the date of such waiver or reimbursement, provided that the Epiphany ESG Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Epiphany ESG Fund’s expense ratios as of October 31, 2021 can be found in the financial highlights. |

The Epiphany ESG Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Epiphany ESG Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Epiphany ESG Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

7

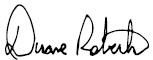

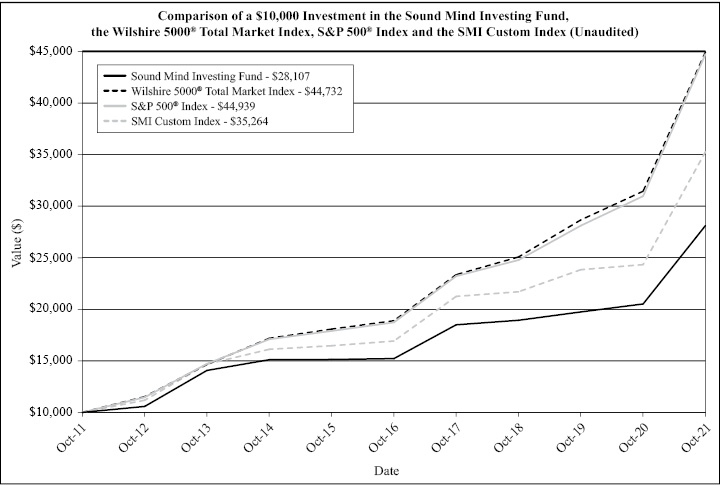

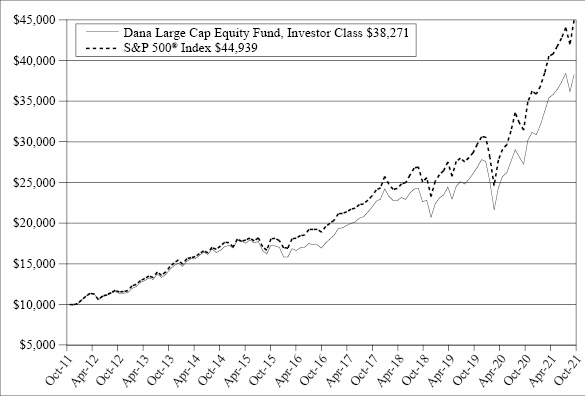

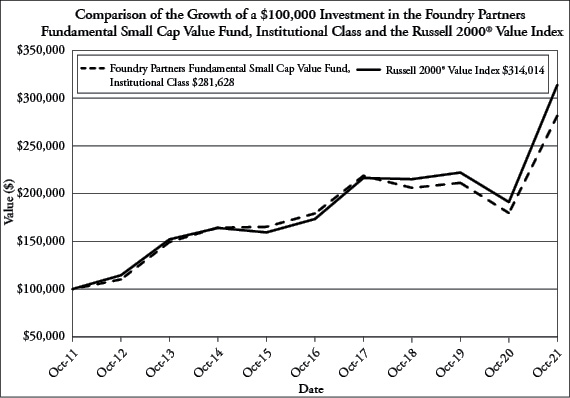

Comparison of Growth of $10,000 Investment in the

Dana Large Cap Equity Fund, Investor Class and

the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on October 31, 2011 held through October 31, 2021. THE LARGE CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Large Cap Fund distributions or the redemption of Large Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Large Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Large Cap Fund before investing. The Large Cap Fund’s prospectus contains this and other information about the Large Cap Fund, and should be read carefully before investing.

The Large Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

8

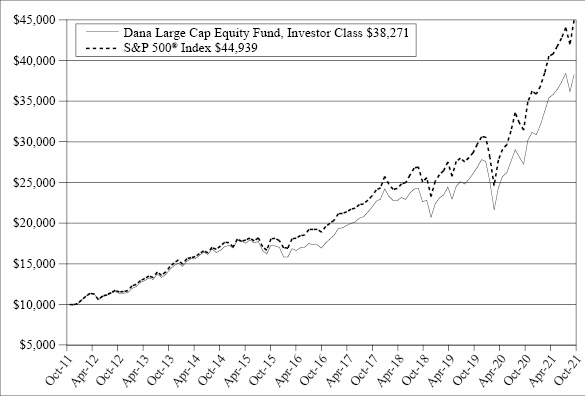

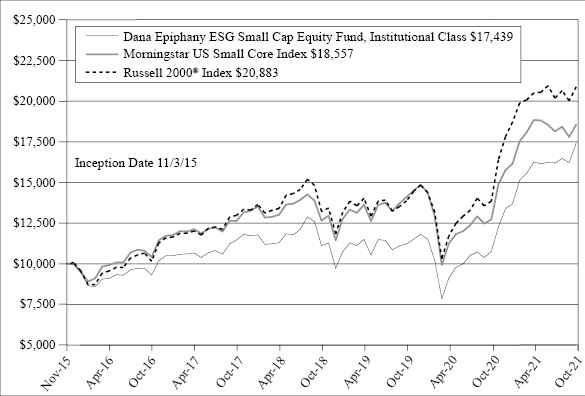

Comparison of Growth of $10,000 Investment in the

Dana Epiphany ESG Small Cap Equity Fund, Institutional Class, the Russell 2000® Index, and the Morningstar US Small Core Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on November 3, 2015 (commencement of Institutional Class operations) held through October 31, 2021. THE SMALL CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Small Cap Fund distributions or the redemption of Small Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small Cap Fund before investing. The Small Cap Fund’s prospectus contains this and other information about the Small Cap Fund, and should be read carefully before investing.

The Small Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

9

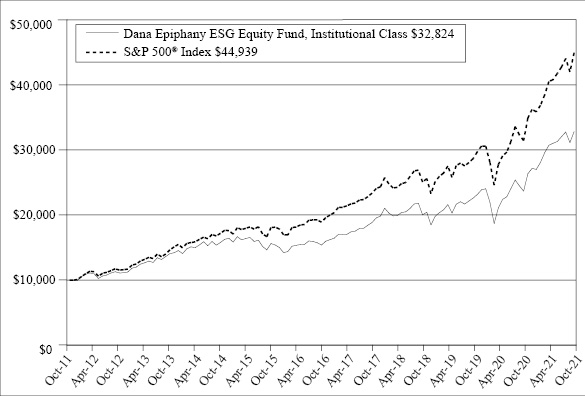

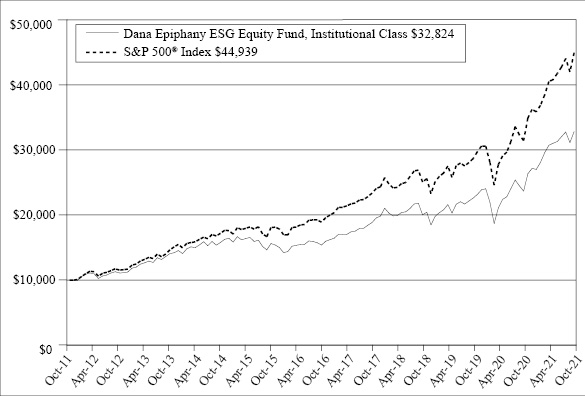

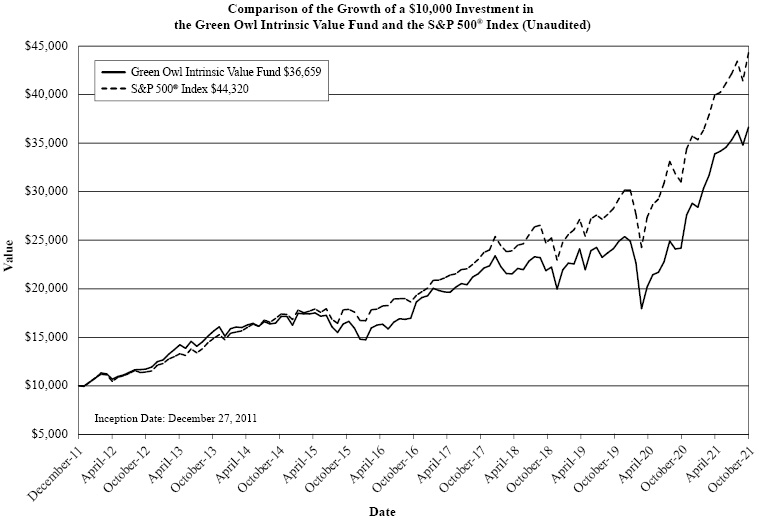

Comparison of Growth of $10,000 Investment in the

Dana Epiphany ESG Equity Fund, Institutional Class and

the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on October 31, 2011 held through October 31, 2021. THE EPIPHANY ESG FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Epiphany ESG Fund distributions or the redemption of Epiphany ESG Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Epiphany ESG Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Epiphany ESG Fund before investing. The Epiphany ESG Fund’s prospectus contains this and other information about the Epiphany ESG Fund, and should be read carefully before investing.

The Epiphany ESG Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

10

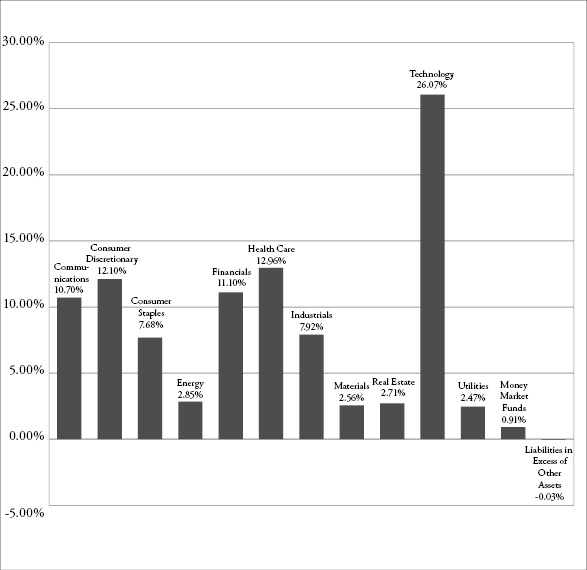

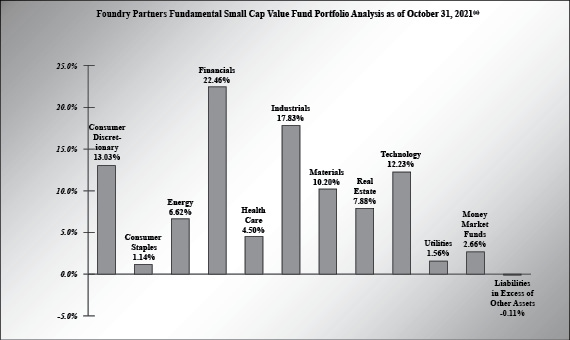

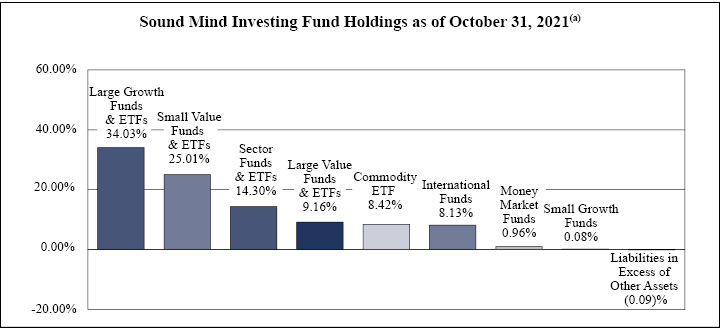

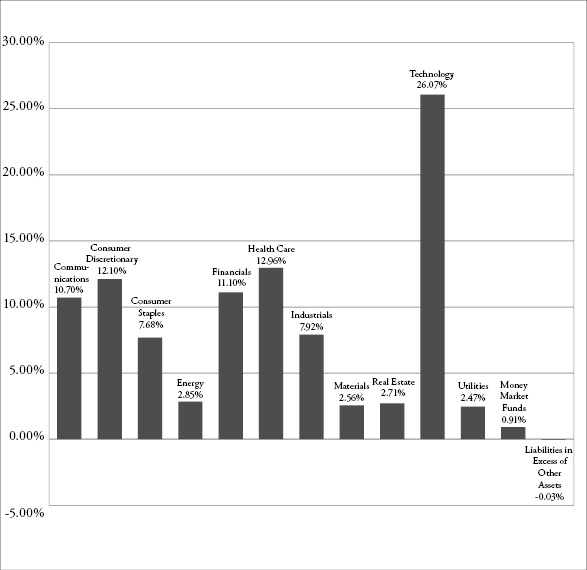

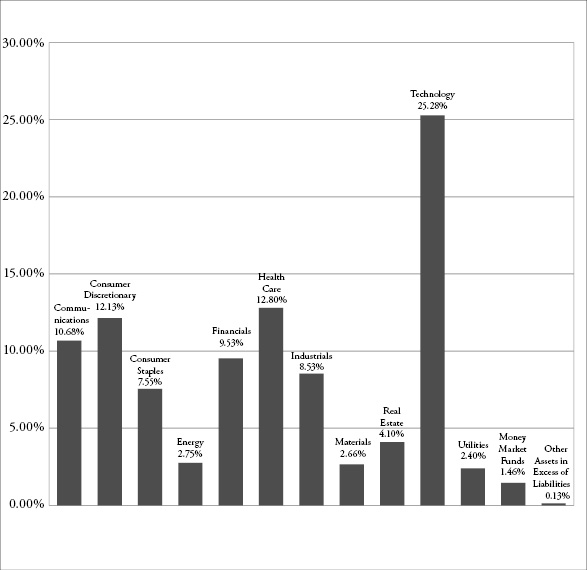

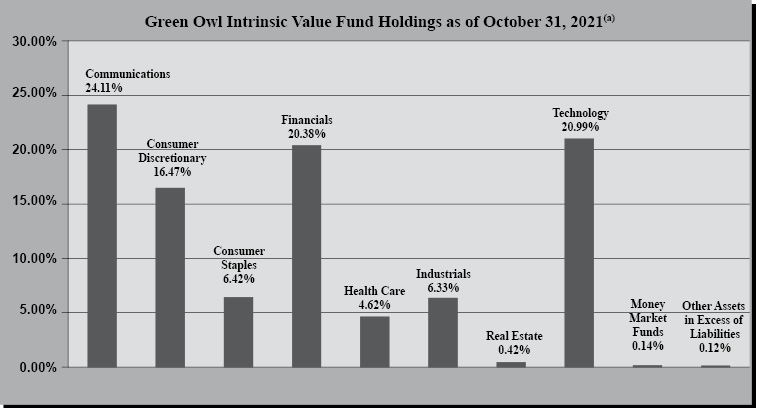

Portfolio Illustration (Unaudited)

October 31, 2021

The following chart gives a visual breakdown of the Large Cap Fund by sector weighting as a percentage of net assets as of October 31, 2021.

11

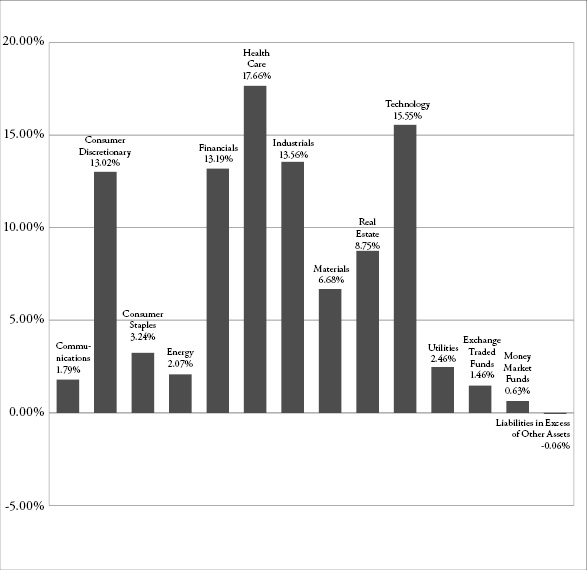

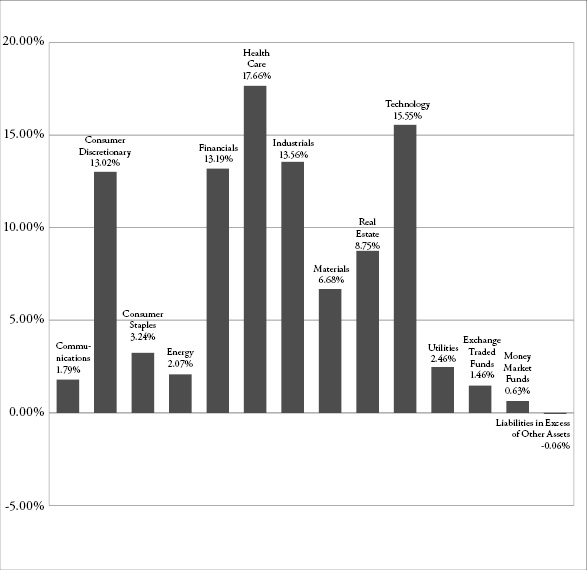

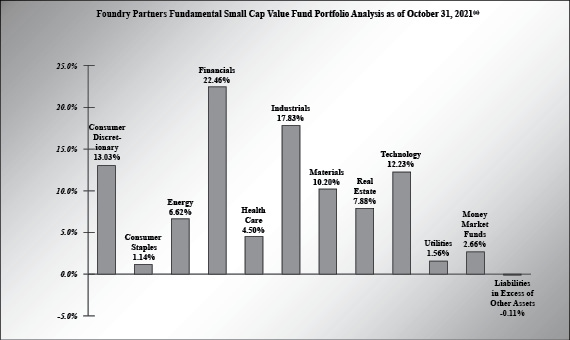

Portfolio Illustration (Unaudited)

October 31, 2021

The following chart gives a visual breakdown of the Small Cap Fund by sector weighting as a percentage of net assets as of October 31, 2021.

12

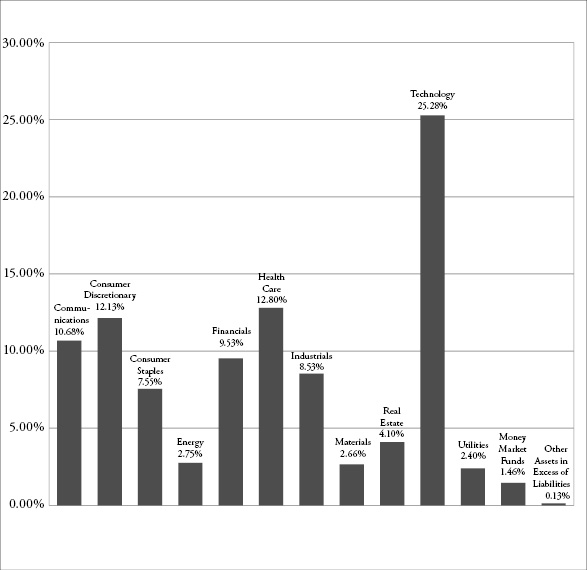

Portfolio Illustration (Unaudited)

October 31, 2021

The following chart gives a visual breakdown of the Epiphany ESG Fund by sector weighting as a percentage of net assets as of October 31, 2021.

Availability of Portfolio Schedules (Unaudited)

The Large Cap Fund, the Small Cap Fund and the Epiphany ESG Fund (each a “Fund” and collectively the “Funds”) file their complete schedules of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www.sec.gov and on the Funds’ website at http://www.danafunds.com.

13

Dana Large Cap Equity Fund

Schedule of Investments

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.12% | | | | | | | | |

Communications — 10.70% | | | | | | | | |

Alphabet, Inc., Class A(a) | | | 1,850 | | | $ | 5,477,702 | |

AT&T, Inc. | | | 1,000 | | | | 25,260 | |

Comcast Corp., Class A | | | 51,600 | | | | 2,653,788 | |

Facebook, Inc., Class A(a) | | | 7,000 | | | | 2,264,990 | |

Interpublic Group of Cos., Inc. | | | 74,600 | | | | 2,728,122 | |

Verizon Communications, Inc. | | | 500 | | | | 26,495 | |

Walt Disney Co. (The)(a) | | | 12,000 | | | | 2,028,840 | |

| | | | | | | | 15,205,197 | |

Consumer Discretionary — 12.10% | | | | | | | | |

Amazon.com, Inc.(a) | | | 1,280 | | | | 4,316,710 | |

Best Buy Co., Inc. | | | 8,000 | | | | 977,920 | |

D.R. Horton, Inc. | | | 28,000 | | | | 2,499,560 | |

Deckers Outdoor Corp.(a) | | | 6,600 | | | | 2,609,046 | |

Fortune Brands Home & Security, Inc. | | | 21,000 | | | | 2,129,400 | |

General Motors Co.(a) | | | 33,000 | | | | 1,796,190 | |

Home Depot, Inc. (The) | | | 7,700 | | | | 2,862,398 | |

| | | | | | | | 17,191,224 | |

Consumer Staples — 7.68% | | | | | | | | |

Keurig Dr Pepper, Inc. | | | 5,000 | | | | 180,450 | |

Kimberly-Clark Corp. | | | 15,200 | | | | 1,968,248 | |

Mondelez International, Inc., Class A | | | 37,000 | | | | 2,247,380 | |

PepsiCo, Inc. | | | 9,400 | | | | 1,519,040 | |

Target Corp. | | | 10,600 | | | | 2,751,972 | |

Walmart, Inc. | | | 15,000 | | | | 2,241,300 | |

| | | | | | | | 10,908,390 | |

Energy — 2.85% | | | | | | | | |

Chevron Corp. | | | 500 | | | | 57,245 | |

ConocoPhillips | | | 20,000 | | | | 1,489,800 | |

Exxon Mobil Corp. | | | 1,000 | | | | 64,470 | |

Pioneer Natural Resources Co. | | | 11,400 | | | | 2,131,572 | |

Williams Cos., Inc. (The) | | | 11,000 | | | | 308,990 | |

| | | | | | | | 4,052,077 | |

Financials — 11.10% | | | | | | | | |

American Express Co. | | | 10,000 | | | | 1,737,800 | |

Bank of America Corp. | | | 62,000 | | | | 2,962,360 | |

Bank of New York Mellon Corp. (The) | | | 49,000 | | | | 2,900,800 | |

Discover Financial Services | | | 21,000 | | | | 2,379,720 | |

JPMorgan Chase & Co. | | | 16,500 | | | | 2,803,185 | |

14 | See accompanying notes which are an integral part of these financial statements. | |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.12% — (continued) |

Financials — 11.10% — (continued) | | | | | | | | |

Morgan Stanley | | | 29,000 | | | $ | 2,980,620 | |

| | | | | | | | 15,764,485 | |

Health Care — 12.96% | | | | | | | | |

Abbott Laboratories | | | 19,000 | | | | 2,448,910 | |

AbbVie, Inc. | | | 23,600 | | | | 2,706,212 | |

Avantor, Inc.(a) | | | 72,000 | | | | 2,907,360 | |

CVS Health Corp. | | | 33,000 | | | | 2,946,240 | |

Horizon Therapeutics PLC(a) | | | 26,000 | | | | 3,117,660 | |

Syneos Health, Inc.(a) | | | 26,000 | | | | 2,426,840 | |

Zimmer Biomet Holdings, Inc. | | | 13,000 | | | | 1,860,560 | |

| | | | | | | | 18,413,782 | |

Industrials — 7.92% | | | | | | | | |

Boeing Co. (The)(a) | | | 200 | | | | 41,406 | |

Deere & Co. | | | 6,000 | | | | 2,053,860 | |

Delta Air Lines, Inc.(a) | | | 1,000 | | | | 39,130 | |

Dover Corp. | | | 16,000 | | | | 2,705,280 | |

Norfolk Southern Corp. | | | 8,400 | | | | 2,461,620 | |

Parker-Hannifin Corp. | | | 7,400 | | | | 2,194,766 | |

TE Connectivity Ltd. | | | 12,000 | | | | 1,752,000 | |

| | | | | | | | 11,248,062 | |

Materials — 2.56% | | | | | | | | |

Avery Dennison Corp. | | | 8,000 | | | | 1,741,760 | |

Nucor Corp. | | | 17,000 | | | | 1,898,050 | |

| | | | | | | | 3,639,810 | |

Real Estate — 2.71% | | | | | | | | |

American Tower Corp., Class A | | | 4,500 | | | | 1,268,865 | |

Gaming and Leisure Properties, Inc. | | | 24,400 | | | | 1,183,156 | |

Prologis, Inc. | | | 9,600 | | | | 1,391,616 | |

| | | | | | | | 3,843,637 | |

Technology — 26.07% | | | | | | | | |

Adobe Systems, Inc.(a) | | | 4,800 | | | | 3,121,728 | |

Apple, Inc. | | | 36,000 | | | | 5,392,800 | |

Cadence Design Systems, Inc.(a) | | | 16,200 | | | | 2,804,382 | |

CDW Corp. | | | 15,000 | | | | 2,799,750 | |

Cisco Systems, Inc. | | | 1,000 | | | | 55,970 | |

Cognizant Technology Solutions Corp., Class A | | | 31,000 | | | | 2,420,790 | |

Intel Corp. | | | 700 | | | | 34,300 | |

Lam Research Corp. | | | 4,400 | | | | 2,479,708 | |

| | See accompanying notes which are an integral part of these financial statements. | 15 |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.12% — (continued) |

Technology — 26.07% — (continued) | | | | | | | | |

Microchip Technology, Inc. | | | 34,000 | | | $ | 2,519,060 | |

Microsoft Corp. | | | 16,000 | | | | 5,305,920 | |

Qorvo, Inc.(a) | | | 14,600 | | | | 2,456,158 | |

Texas Instruments, Inc. | | | 14,000 | | | | 2,624,720 | |

Visa, Inc., Class A | | | 11,200 | | | | 2,371,824 | |

Zebra Technologies Corp., Class A(a) | | | 5,000 | | | | 2,669,750 | |

| | | | | | | | 37,056,860 | |

Utilities — 2.47% | | | | | | | | |

Eversource Energy | | | 20,200 | | | | 1,714,980 | |

NextEra Energy, Inc. | | | 21,000 | | | | 1,791,930 | |

| | | | | | | | 3,506,910 | |

Total Common Stocks (Cost $90,548,076) | | | | | | | 140,830,434 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 0.91% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.01%(b) | | | 1,289,908 | | | | 1,289,908 | |

Total Money Market Funds (Cost $1,289,908) | | | | | | | 1,289,908 | |

| | | | | | | | | |

Total Investments — 100.03% (Cost $91,837,984) | | | | | | | 142,120,342 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.03)% | | | | | | | (39,127 | ) |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 142,081,215 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2021. |

16 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Small Cap Equity Fund

Schedule of Investments

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.43% | | | | | | | | |

Communications — 1.79% | | | | | | | | |

TechTarget, Inc.(a) | | | 3,304 | | | $ | 311,600 | |

| | | | | | | | | |

Consumer Discretionary — 13.02% | | | | | | | | |

Bloomin’ Brands, Inc.(a) | | | 13,870 | | | | 299,869 | |

Boot Barn Holdings, Inc.(a) | | | 3,601 | | | | 376,268 | |

Deckers Outdoor Corp.(a) | | | 929 | | | | 367,243 | |

Group 1 Automotive, Inc. | | | 1,741 | | | | 313,032 | |

Jack in the Box, Inc. | | | 3,365 | | | | 332,967 | |

Malibu Boats, Inc., Class A(a) | | | 4,006 | | | | 282,864 | |

Masonite International Corp.(a) | | | 2,481 | | | | 297,745 | |

| | | | | | | | 2,269,988 | |

Consumer Staples — 3.24% | | | | | | | | |

e.l.f. Beauty, Inc.(a) | | | 9,030 | | | | 291,760 | |

Simply Good Foods Co. (The)(a) | | | 6,879 | | | | 272,752 | |

| | | | | | | | 564,512 | |

Energy — 2.07% | | | | | | | | |

Ovintiv, Inc. | | | 9,630 | | | | 361,318 | |

| | | | | | | | | |

Financials — 13.19% | | | | | | | | |

Ameris Bancorp | | | 5,364 | | | | 281,020 | |

Cowen Group, Inc., Class A | | | 7,119 | | | | 268,600 | |

Hanover Insurance Group, Inc. | | | 1,934 | | | | 243,684 | |

Home BancShares, Inc. | | | 12,653 | | | | 300,636 | |

Investors Bancorp, Inc. | | | 18,837 | | | | 288,206 | |

Jefferies Financial Group, Inc. | | | 7,648 | | | | 328,864 | |

Pinnacle Financial Partners, Inc. | | | 3,085 | | | | 297,918 | |

Primerica, Inc. | | | 1,730 | | | | 291,055 | |

| | | | | | | | 2,299,983 | |

Health Care — 17.66% | | | | | | | | |

Acceleron Pharma, Inc.(a) | | | 805 | | | | 140,215 | |

Aurinia Pharmaceuticals, Inc.(a) | | | 10,392 | | | | 343,767 | |

Axsome Therapeutics, Inc.(a) | | | 4,628 | | | | 178,178 | |

Blueprint Medicines Corp.(a) | | | 3,168 | | | | 356,368 | |

CONMED Corp. | | | 2,620 | | | | 383,254 | |

Cytokinetics, Inc.(a) | | | 4,234 | | | | 147,809 | |

Denali Therapeutics, Inc.(a) | | | 1,564 | | | | 75,619 | |

DYNAVAX TECHNOLOGIES CORPORATION(a) | | | 7,046 | | | | 140,709 | |

Ensign Group, Inc. (The) | | | 3,957 | | | | 308,686 | |

Envista Holdings Corp.(a) | | | 8,230 | | | | 321,793 | |

| | See accompanying notes which are an integral part of these financial statements. | 17 |

Dana Epiphany ESG Small Cap Equity Fund

Schedule of Investments (continued)

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.43% — (continued) |

Health Care — 17.66% — (continued) | | | | | | | | |

Exelixis, Inc.(a) | | | 6,015 | | | $ | 129,383 | |

Horizon Therapeutics PLC(a) | | | 3,524 | | | | 422,562 | |

Travere Therapeutics, Inc.(a) | | | 4,594 | | | | 132,353 | |

| | | | | | | | 3,080,696 | |

Industrials — 13.56% | | | | | | | | |

Atkore, Inc.(a) | | | 3,780 | | | | 357,323 | |

Cactus, Inc., Class A | | | 7,686 | | | | 334,340 | |

Gates Industrial Corp. PLC(a) | | | 17,023 | | | | 279,858 | |

Hub Group, Inc., Class A(a) | | | 4,572 | | | | 359,222 | |

MasTec, Inc.(a) | | | 2,824 | | | | 251,703 | |

Regal-Beloit Corp. | | | 1,186 | | | | 180,619 | |

SkyWest, Inc.(a) | | | 6,751 | | | | 290,496 | |

Zurn Water Solutions, Inc. | | | 8,584 | | | | 311,428 | |

| | | | | | | | 2,364,989 | |

Materials — 6.68% | | | | | | | | |

Advanced Drainage Systems, Inc. | | | 2,706 | | | | 305,237 | |

Avient Corp. | | | 4,409 | | | | 237,557 | |

Codexis, Inc.(a) | | | 5,399 | | | | 187,723 | |

Element Solutions, Inc. | | | 9,924 | | | | 225,374 | |

Summit Materials, Inc., Class A(a) | | | 5,878 | | | | 209,551 | |

| | | | | | | | 1,165,442 | |

Real Estate — 8.75% | | | | | | | | |

Agree Realty Corp. | | | 4,315 | | | | 306,624 | |

Global Medical REIT, Inc. | | | 18,878 | | | | 312,998 | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 4,743 | | | | 286,477 | |

Spirit Realty Capital, Inc. | | | 6,288 | | | | 307,672 | |

STAG Industrial, Inc. | | | 7,174 | | | | 312,284 | |

| | | | | | | | 1,526,055 | |

Technology — 15.55% | | | | | | | | |

Cohu, Inc.(a) | | | 9,629 | | | | 308,513 | |

Kulicke & Soffa Industries, Inc. | | | 5,258 | | | | 299,706 | |

Omnicell, Inc.(a) | | | 2,403 | | | | 428,095 | |

Perficient, Inc.(a) | | | 2,988 | | | | 369,317 | |

Rapid7, Inc.(a) | | | 2,497 | | | | 321,489 | |

Sailpoint Technologies Holdings, Inc.(a) | | | 6,126 | | | | 293,925 | |

Semtech Corp.(a) | | | 4,229 | | | | 359,592 | |

Ultra Clean Holdings, Inc.(a) | | | 6,669 | | | | 330,582 | |

| | | | | | | | 2,711,219 | |

18 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Small Cap Equity Fund

Schedule of Investments (continued)

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.43% — (continued) |

Utilities — 2.46% | | | | | | | | |

Chesapeake Utilities Corp. | | | 1,703 | | | $ | 223,212 | |

Southwest Gas Holdings, Inc. | | | 2,964 | | | | 205,257 | |

| | | | | | | | 428,469 | |

Total Common Stocks (Cost $12,348,412) | | | | | | | 17,084,271 | |

| | | | | | | | | |

EXCHANGE-TRADED FUNDS — 1.46% | | | | | | | | |

| | | | | | | | | |

iShares Russell 2000 ETF | | | 1,118 | | | | 254,960 | |

Total Exchange-Traded Funds (Cost $253,948) | | | | | | | 254,960 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 0.63% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.01%(b) | | | 110,441 | | | | 110,441 | |

Total Money Market Funds (Cost $110,441) | | | | | | | 110,441 | |

| | | | | | | | | |

Total Investments — 100.06% (Cost $12,712,801) | | | | | | | 17,449,672 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.06)% | | | | | | | (10,942 | ) |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 17,438,730 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2021. |

ETF - Exchange-Traded Fund

REIT - Real Estate Investment Trust

| | See accompanying notes which are an integral part of these financial statements. | 19 |

Dana Epiphany ESG Equity Fund

Schedule of Investments

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.41% | | | | | | | | |

Communications — 10.68% | | | | | | | | |

Alphabet, Inc., Class A(a) | | | 570 | | | $ | 1,687,725 | |

Alphabet, Inc., Class C(a) | | | 230 | | | | 682,044 | |

AT&T, Inc. | | | 1,000 | | | | 25,260 | |

Comcast Corp., Class A | | | 24,400 | | | | 1,254,892 | |

Interpublic Group of Cos., Inc. | | | 37,000 | | | | 1,353,090 | |

Verizon Communications, Inc. | | | 22,000 | | | | 1,165,780 | |

Walt Disney Co. (The)(a) | | | 6,200 | | | | 1,048,234 | |

| | | | | | | | 7,217,025 | |

Consumer Discretionary — 12.13% | | | | | | | | |

Amazon.com, Inc.(a) | | | 300 | | | | 1,011,729 | |

Best Buy Co., Inc. | | | 10,800 | | | | 1,320,192 | |

D.R. Horton, Inc. | | | 14,200 | | | | 1,267,634 | |

Deckers Outdoor Corp.(a) | | | 3,600 | | | | 1,423,116 | |

Fortune Brands Home & Security, Inc. | | | 10,600 | | | | 1,074,840 | |

Home Depot, Inc. (The) | | | 2,200 | | | | 817,828 | |

McDonald’s Corp. | | | 2,200 | | | | 540,210 | |

Tractor Supply Co. | | | 3,400 | | | | 738,378 | |

| | | | | | | | 8,193,927 | |

Consumer Staples — 7.55% | | | | | | | | |

Darling Ingredients, Inc.(a) | | | 12,400 | | | | 1,048,048 | |

General Mills, Inc. | | | 16,000 | | | | 988,800 | |

Kimberly-Clark Corp. | | | 6,200 | | | | 802,838 | |

Mondelez International, Inc., Class A | | | 15,000 | | | | 911,100 | |

Target Corp. | | | 5,200 | | | | 1,350,024 | |

| | | | | | | | 5,100,810 | |

Energy — 2.75% | | | | | | | | |

ConocoPhillips | | | 6,000 | | | | 446,940 | |

Pioneer Natural Resources Co. | | | 4,400 | | | | 822,712 | |

Williams Cos., Inc. (The) | | | 21,000 | | | | 589,890 | |

| | | | | | | | 1,859,542 | |

Financials — 9.53% | | | | | | | | |

American Express Co. | | | 4,800 | | | | 834,144 | |

Bank of New York Mellon Corp. (The) | | | 20,000 | | | | 1,184,000 | |

Discover Financial Services | | | 9,200 | | | | 1,042,544 | |

JPMorgan Chase & Co. | | | 6,000 | | | | 1,019,340 | |

Morgan Stanley | | | 11,200 | | | | 1,151,136 | |

Truist Financial Corp. | | | 19,000 | | | | 1,205,930 | |

| | | | | | | | 6,437,094 | |

20 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Equity Fund

Schedule of Investments (continued)

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.41% — (continued) |

Health Care — 12.80% | | | | | | | | |

Cigna Corp. | | | 5,800 | | | $ | 1,238,938 | |

CVS Health Corp. | | | 14,000 | | | | 1,249,920 | |

Emergent BioSolutions, Inc.(a) | | | 400 | | | | 19,068 | |

Encompass Health Corp. | | | 15,300 | | | | 972,468 | |

Envista Holdings Corp.(a) | | | 28,000 | | | | 1,094,800 | |

Horizon Therapeutics PLC(a) | | | 10,600 | | | | 1,271,046 | |

IQVIA Holdings, Inc.(a) | | | 4,500 | | | | 1,176,390 | |

Syneos Health, Inc.(a) | | | 4,000 | | | | 373,360 | |

Zoetis, Inc. | | | 5,800 | | | | 1,253,960 | |

| | | | | | | | 8,649,950 | |

Industrials — 8.53% | | | | | | | | |

Deere & Co. | | | 3,100 | | | | 1,061,161 | |

Norfolk Southern Corp. | | | 3,400 | | | | 996,370 | |

Regal-Beloit Corp. | | | 9,600 | | | | 1,462,368 | |

TE Connectivity Ltd. | | | 9,000 | | | | 1,314,000 | |

W.W. Grainger, Inc. | | | 2,000 | | | | 926,220 | |

| | | | | | | | 5,760,119 | |

Materials — 2.66% | | | | | | | | |

Avery Dennison Corp. | | | 2,700 | | | | 587,844 | |

Nucor Corp. | | | 7,400 | | | | 826,210 | |

Sherwin-Williams Co. (The) | | | 1,200 | | | | 379,932 | |

| | | | | | | | 1,793,986 | |

Real Estate — 4.10% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 3,300 | | | | 673,662 | |

American Tower Corp., Class A | | | 1,800 | | | | 507,546 | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 17,400 | | | | 1,050,960 | |

Iron Mountain, Inc. | | | 4,200 | | | | 191,688 | |

Prologis, Inc. | | | 2,400 | | | | 347,904 | |

| | | | | | | | 2,771,760 | |

Technology — 25.28% | | | | | | | | |

Accenture PLC, Class A | | | 3,800 | | | | 1,363,402 | |

Apple, Inc. | | | 14,000 | | | | 2,097,200 | |

Cadence Design Systems, Inc.(a) | | | 6,800 | | | | 1,177,148 | |

CDW Corp. | | | 7,200 | | | | 1,343,880 | |

Cisco Systems, Inc. | | | 5,000 | | | | 279,850 | |

Cognizant Technology Solutions Corp., Class A | | | 16,400 | | | | 1,280,676 | |

Fidelity National Information Services, Inc. | | | 10,400 | | | | 1,151,696 | |

Intel Corp. | | | 2,600 | | | | 127,400 | |

Lam Research Corp. | | | 2,300 | | | | 1,296,211 | |

| | See accompanying notes which are an integral part of these financial statements. | 21 |

Dana Epiphany ESG Equity Fund

Schedule of Investments (continued)

October 31, 2021

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.41% — (continued) |

Technology — 25.28% — (continued) | | | | | | | | |

Microchip Technology, Inc. | | | 17,800 | | | $ | 1,318,802 | |

Micron Technology, Inc. | | | 15,000 | | | | 1,036,500 | |

Microsoft Corp. | | | 6,700 | | | | 2,221,854 | |

Texas Instruments, Inc. | | | 6,600 | | | | 1,237,368 | |

Visa, Inc., Class A | | | 5,400 | | | | 1,143,558 | |

| | | | | | | | 17,075,545 | |

Utilities — 2.40% | | | | | | | | |

Avangrid, Inc. | | | 7,400 | | | | 389,980 | |

Eversource Energy | | | 8,000 | | | | 679,200 | |

NextEra Energy, Inc. | | | 6,500 | | | | 554,645 | |

| | | | | | | | 1,623,825 | |

Total Common Stocks (Cost $55,550,001) | | | | | | | 66,483,583 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 1.46% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.01%(b) | | | 985,936 | | | | 985,936 | |

Total Money Market Funds (Cost $985,936) | | | | | | | 985,936 | |

| | | | | | | | | |

Total Investments — 99.87% (Cost $56,535,937) | | | | | | | 67,469,519 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.13% | | | | | | | 87,476 | |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 67,556,995 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2021. |

22 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Assets and Liabilities

October 31, 2021

| | | Dana Large Cap

Equity Fund | | | Dana Epiphany

ESG Small Cap

Equity Fund | | | Dana Epiphany

ESG Equity Fund | |

Assets | | | | | | | | |

Investments in securities at fair value (cost $91,837,984, $12,712,801 and $56,535,937) (Note 3) | | $ | 142,120,342 | | | $ | 17,449,672 | | | $ | 67,469,519 | |

Cash | | | 16,500 | | | | 208 | | | | 6,000 | |

Receivable for fund shares sold | | | 24,487 | | | | — | | | | 57,197 | |

Dividends receivable | | | 136,730 | | | | 1,848 | | | | 67,411 | |

Receivable from Adviser (Note 4) | | | — | | | | 4,255 | | | | — | |

Prepaid expenses | | | 24,634 | | | | 16,006 | | | | 21,488 | |

Total Assets | | | 142,322,693 | | | | 17,471,989 | | | | 67,621,615 | |

Liabilities | | | | | | | | |

Payable for fund shares redeemed | | | 126,201 | | | | — | | | | 1,402 | |

Payable to Adviser (Note 4) | | | 61,524 | | | | — | | | | 26,250 | |

Accrued Distribution (12b-1) fees (Note 4) | | | 5,513 | | | | — | | | | — | |

Payable to Administrator (Note 4) | | | 12,252 | | | | 6,333 | | | | 6,913 | |

Payable to trustees (Note 4) | | | 1,599 | | | | 2,058 | | | | 1,632 | |

Other accrued expenses | | | 34,389 | | | | 24,868 | | | | 28,423 | |

Total Liabilities | | | 241,478 | | | | 33,259 | | | | 64,620 | |

Net Assets | | $ | 142,081,215 | | | $ | 17,438,730 | | | $ | 67,556,995 | |

Net Assets consist of: | | | | | | | | | | | | |

Paid-in capital | | | 75,832,660 | | | | 11,328,684 | | | | 55,527,320 | |

Accumulated earnings | | | 66,248,555 | | | | 6,110,046 | | | | 12,029,675 | |

Net Assets | | $ | 142,081,215 | | | $ | 17,438,730 | | | $ | 67,556,995 | |

Institutional Class: | | | | | | | | | | | | |

Net Assets | | $ | 115,544,440 | | | $ | 17,438,730 | | | $ | 67,556,995 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 3,956,702 | | | | 1,096,368 | | | | 4,836,004 | |

Net asset value, offering and redemption price per share (Note 2) | | $ | 29.20 | | | $ | 15.91 | | | $ | 13.97 | |

Investor Class: | | | | | | | | | | | | |

Net Assets | | $ | 26,536,775 | | | | | | | | | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 908,730 | | | | | | | | | |

Net asset value, offering and redemption price per share (Note 2) | | $ | 29.20 | | | | | | | | | |

| | See accompanying notes which are an integral part of these financial statements. | 23 |

Dana Funds

Statements of Operations

For the year ended October 31, 2021

| | | Dana Large Cap

Equity Fund | | | Dana Epiphany

ESG Small Cap

Equity Fund | | | Dana Epiphany

ESG Equity Fund | |

Investment Income | | | | | | | | | | | | |

Dividend income | | $ | 1,836,873 | | | $ | 106,016 | | | $ | 582,919 | |

Total investment income | | | 1,836,873 | | | | 106,016 | | | | 582,919 | |

Expenses | | | | | | | | | | | | |

Investment Adviser fees (Note 4) | | | 866,362 | | | | 111,370 | | | | 265,910 | |

Administration and compliance services fees (Note 4) | | | 76,453 | | | | 33,000 | | | | 34,333 | |

Distribution (12b-1) fees, Investor Class (Note 4) | | | 63,778 | | | | — | | | | — | |

Fund accounting fees (Note 4) | | | 45,045 | | | | 24,999 | | | | 24,583 | |

Registration expenses | | | 40,624 | | | | 26,455 | | | | 29,016 | |

Transfer agent fees (Note 4) | | | 23,000 | | | | 18,000 | | | | 17,700 | |

Audit and tax preparation fees | | | 17,960 | | | | 17,960 | | | | 17,960 | |

Custodian fees | | | 17,294 | | | | 5,434 | | | | 16,556 | |

Legal fees | | | 15,289 | | | | 37,037 | | | | 15,283 | |

Printing and postage expenses | | | 12,368 | | | | 5,292 | | | | 6,760 | |

Trustee fees (Note 4) | | | 6,671 | | | | 5,296 | | | | 5,141 | |

Insurance expenses | | | 1,693 | | | | 2,238 | | | | 2,086 | |

Interest | | | — | | | | — | | | | — | |

Miscellaneous expenses | | | 25,912 | | | | 18,334 | | | | 21,509 | |

Total expenses | | | 1,212,450 | | | | 305,415 | | | | 456,837 | |

Fees contractually waived and expenses reimbursed by Adviser (Note 4) | | | (174,396 | ) | | | (164,133 | ) | | | (108,826 | ) |

Net operating expenses | | | 1,038,053 | | | | 141,282 | | | | 348,011 | |

Net investment income (loss) | | | 798,820 | | | | (35,266 | ) | | | 234,908 | |

Net Realized and Change in Unrealized Gain (Loss) on Investments |

Net realized gain on investment securities transactions | | | 16,461,777 | | | | 2,817,117 | | | | 1,024,321 | |

Net change in unrealized appreciation on investment securities | | | 26,848,239 | | | | 3,549,853 | | | | 8,442,528 | |

Net realized and change in unrealized gain on investments | | | 43,310,016 | | | | 6,366,970 | | | | 9,466,849 | |

Net increase in net assets resulting from operations | | $ | 44,108,836 | | | $ | 6,331,704 | | | $ | 9,701,757 | |

24 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Changes in Net Assets

| | | Dana Large Cap Equity Fund | | | Dana Epiphany ESG

Small Cap Equity Fund | |

| | | For the

Year Ended

October 31, 2021 | | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2021 | | | For the

Year Ended

October 31, 2020 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | | | | | |

Operations | | | | | | | | | | | | |

Net investment income (loss) | | $ | 798,820 | | | $ | 1,340,026 | | | $ | (35,266 | ) | | $ | (791 | ) |

Net realized gain (loss) on investment securities transactions | | | 16,461,777 | | | | 2,299,800 | | | | 2,817,117 | | | | (1,256,551 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 26,848,239 | | | | 2,714,687 | | | | 3,549,853 | | | | (80,215 | ) |

Net increase (decrease) in net assets resulting from operations | | | 44,108,836 | | | | 6,354,513 | | | | 6,331,704 | | | | (1,337,557 | ) |

Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

Institutional Class | | | (2,521,779 | ) | | | (12,130,253 | ) | | | — | | | | (5,901 | ) |

Investor Class | | | (616,743 | ) | | | (2,798,272 | ) | | | — | | | | — | |

Total distributions | | | (3,138,522 | ) | | | (14,928,525 | ) | | | — | | | | (5,901 | ) |

Capital Transactions – Institutional Class(a) | | | | | | | | |

Proceeds from shares sold | | | 19,866,697 | | | | 31,507,881 | | | | 4,001,045 | | | | 1,008,397 | |

Shares issued in connection with class consolidation | | | — | | | | — | | | | — | | | | 1,513,471 | |

Reinvestment of distributions | | | 1,261,457 | | | | 5,707,638 | | | | — | | | | 5,764 | |

Amount paid for shares redeemed | | | (29,994,338 | ) | | | (46,107,580 | ) | | | (2,755,405 | ) | | | (3,966,219 | ) |

Total – Institutional Class | | | (8,866,184 | ) | | | (8,892,061 | ) | | | 1,245,640 | | | | (1,438,587 | ) |

Capital Transactions – Investor Class(a) | | | | | | | | | | | | |

Proceeds from shares sold | | | 955,765 | | | | 1,784,299 | | | | — | | | | 94,173 | |

Shares issued in connection with class consolidation | | | — | | | | — | | | | — | | | | (1,513,471 | ) |

Reinvestment of distributions | | | 610,137 | | | | 2,782,815 | | | | — | | | | — | |

Amount paid for shares redeemed | | | (7,582,529 | ) | | | (3,531,248 | ) | | | — | | | | (555,014 | ) |

Total – Investor Class | | | (6,016,627 | ) | | | 1,035,866 | | | | — | | | | (1,974,312 | ) |

Net increase (decrease) in net assets resulting from capital transactions | | | (14,882,811 | ) | | | (7,856,195 | ) | | | 1,245,640 | | | | (3,412,899 | ) |

Total Increase (Decrease) in Net Assets | | | 26,087,503 | | | | (16,430,207 | ) | | | 7,577,344 | | | | (4,756,357 | ) |

| | See accompanying notes which are an integral part of these financial statements. | 25 |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Large Cap Equity Fund | | | Dana Epiphany ESG

Small Cap Equity Fund | |

| | | For the

Year Ended

October 31, 2021 | | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2021 | | | For the

Year Ended

October 31, 2020 | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of year | | $ | 115,993,712 | | | $ | 132,423,919 | | | $ | 9,861,386 | | | $ | 14,617,743 | |

End of year | | $ | 142,081,215 | | | $ | 115,993,712 | | | $ | 17,438,730 | | | $ | 9,861,386 | |

Share Transactions – Institutional Class(a) | | | | | | | | |

Shares sold | | | 784,104 | | | | 1,538,470 | | | | 285,750 | | | | 98,505 | |

Shares issued in connection with class consolidation | | | — | | | | — | | | | — | | | | 161,172 | |

Shares issued in reinvestment of distributions | | | 51,614 | | | | 262,762 | | | | — | | | | 657 | |

Shares redeemed | | | (1,178,281 | ) | | | (2,218,189 | ) | | | (193,538 | ) | | | (469,527 | ) |

Total – Institutional Class | | | (342,563 | ) | | | (416,957 | ) | | | 92,212 | | | | (209,193 | ) |

Share Transactions - Investor Class(a) | | | | | | | | | | | | |

Shares sold | | | 36,024 | | | | 85,588 | | | | — | | | | 11,511 | |

Shares redeemed in connection with class consolidation | | | — | | | | — | | | | — | | | | (163,036 | ) |

Shares issued in reinvestment of distributions | | | 25,319 | | | | 127,884 | | | | — | | | | — | |

Shares redeemed | | | (310,665 | ) | | | (174,728 | ) | | | — | | | | (65,194 | ) |

Total – Investor Class | | | (249,322 | ) | | | 38,744 | | | | — | | | | (216,719 | ) |

(a) | Effective at the close of business on June 4, 2020, Investor Class Shares of the Dana Epiphany ESG Small Cap Fund were consolidated into the Institutional Class shares. |

26 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Epiphany ESG Equity Fund | |

| | | For the

Year Ended

October 31, 2021 | | | For the

Year Ended

October 31, 2020 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 234,908 | | | $ | 115,632 | |

Net realized gain on investment securities transactions | | | 1,024,321 | | | | 234,203 | |

Net change in unrealized appreciation of investment securities | | | 8,442,528 | | | | 362,862 | |

Net increase in net assets resulting from operations | | | 9,701,757 | | | | 712,697 | |

Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

Institutional Class | | | (415,436 | ) | | | (862,512 | ) |

Investor Class | | | — | | | | (1,182,772 | ) |

Total distributions | | | (415,436 | ) | | | (2,045,284 | ) |

Capital Transactions – Institutional Class(a) | | | | | | | | |

Proceeds from shares sold | | | 52,799,761 | | | | 2,228,653 | |

Shares issued in connection with class consolidation | | | — | | | | 7,410,006 | |

Reinvestment of distributions | | | 412,645 | | | | 856,169 | |

Amount paid for shares redeemed | | | (8,003,838 | ) | | | (2,402,606 | ) |

Total – Institutional Class | | | 45,208,568 | | | | 8,092,222 | |

Capital Transactions – Investor Class(a) | | | | | | | | |

Proceeds from shares sold | | | — | | | | 963,569 | |

Shares issued in connection with class consolidation | | | — | | | | (7,410,006 | ) |

Reinvestment of distributions | | | — | | | | 1,167,223 | |

Amount paid for shares redeemed | | | — | | | | (1,238,947 | ) |

Total – Investor Class | | | — | | | | (6,518,161 | ) |

Net increase in net assets resulting from capital transactions | | | 45,208,568 | | | | 1,574,061 | |

Total Increase in Net Assets | | | 54,494,889 | | | | 241,474 | |

Net Assets | | | | | | | | |

Beginning of year | | | 13,062,106 | | | | 12,820,632 | |

End of year | | $ | 67,556,995 | | | $ | 13,062,106 | |

| | See accompanying notes which are an integral part of these financial statements. | 27 |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Epiphany ESG Equity Fund | |

| | | For the

Year Ended

October 31, 2021 | | | For the

Year Ended

October 31, 2020 | |

Share Transactions – Institutional Class(a) | | | | |

Shares sold | | | 4,143,277 | | | | 242,216 | |

Shares issued in connection with class consolidation | | | — | | | | 747,410 | |

Shares issued in reinvestment of distributions | | | 34,346 | | | | 82,565 | |

Shares redeemed | | | (615,363 | ) | | | (237,169 | ) |

Total – Institutional Class | | | 3,562,260 | | | | 835,022 | |

Share Transactions - Investor Class(a) | | | | |

Shares sold | | | — | | | | 87,988 | |

Shares redeemed in connection with class consolidation | | | — | | | | (722,853 | ) |

Shares issued in reinvestment of distributions | | | — | | | | 108,459 | |

Shares redeemed | | | — | | | | (123,629 | ) |

Total – Investor Class | | | — | | | | (650,035 | ) |

(a) | Effective at the close of business on June 4, 2020, Investor Class Shares of the Dana Epiphany ESG Fund were consolidated into the Institutional Class shares. |

28 | See accompanying notes which are an integral part of these financial statements. | |

Dana Large Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 21.25 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.67 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.17 | | | | 0.23 | | | | 0.38 | | | | 0.32 | | | | 0.32 | |

Net realized and unrealized gain (loss) on investments | | | 8.39 | | | | 0.86 | | | | 2.46 | | | | 0.45 | | | | 4.96 | |

Total from investment operations | | | 8.56 | | | | 1.09 | | | | 2.84 | | | | 0.77 | | | | 5.28 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.17 | ) | | | (0.23 | ) | | | (0.36 | ) | | | (0.32 | ) | | | (0.31 | ) |

Net realized gains | | | (0.44 | ) | | | (2.30 | ) | | | (2.14 | ) | | | (0.74 | ) | | | — | |

Total distributions | | | (0.61 | ) | | | (2.53 | ) | | | (2.50 | ) | | | (1.06 | ) | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | (a) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 29.20 | | | $ | 21.25 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(b) | | | 40.89 | % | | | 4.65 | % | | | 15.55 | % | | | 3.27 | % | | | 30.11 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 115,544 | | | $ | 91,379 | | | $ | 107,026 | | | $ | 176,954 | | | $ | 134,291 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.86 | % | | | 0.91 | % | | | 0.85 | % | | | 0.86 | % | | | 0.92 | % |

After waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.74 | %(c) |

Ratio of net investment income to average net assets | | | 0.65 | % | �� | | 1.10 | % | | | 1.68 | % | | | 1.41 | % | | | 1.48 | % |

Portfolio turnover rate(d) | | | 30 | % | | | 57 | % | | | 50 | % | | | 58 | % | | | 50 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Rounds to less than $0.005 per share. |

(b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(c) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.73% for the fiscal year ended October 31, 2017. |

(d) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| | See accompanying notes which are an integral part of these financial statements. | 29 |

Dana Large Cap Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 21.26 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.68 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.10 | | | | 0.18 | | | | 0.30 | | | | 0.28 | | | | 0.24 | |

Net realized and unrealized gain (loss) on investments | | | 8.39 | | | | 0.87 | | | | 2.50 | | | | 0.43 | | | | 4.98 | |

Total from investment operations | | | 8.49 | | | | 1.05 | | | | 2.80 | | | | 0.71 | | | | 5.22 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.11 | ) | | | (0.18 | ) | | | (0.32 | ) | | | (0.26 | ) | | | (0.26 | ) |

Net realized gains | | | (0.44 | ) | | | (2.30 | ) | | | (2.14 | ) | | | (0.74 | ) | | | — | |

Total distributions | | | (0.55 | ) | | | (2.48 | ) | | | (2.46 | ) | | | (1.00 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 29.20 | | | $ | 21.26 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(a) | | | 40.48 | % | | | 4.43 | % | | | 15.29 | % | | | 3.01 | % | | | 29.72 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 26,537 | | | $ | 24,615 | | | $ | 25,398 | | | $ | 28,870 | | | $ | 40,957 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 1.11 | % | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % | | | 1.17 | % |

After waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.99 | %(b) |

Ratio of net investment income to average net assets | | | 0.40 | % | | | 0.85 | % | | | 1.40 | % | | | 1.17 | % | | | 1.20 | % |

Portfolio turnover rate(c) | | | 30 | % | | | 57 | % | | | 50 | % | | | 58 | % | | | 50 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(b) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.98% for the fiscal year ended October 31, 2017. |

(c) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

30 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Small Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 9.82 | | | $ | 10.24 | | | $ | 11.09 | | | $ | 11.43 | | | $ | 9.30 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.03 | ) | | | 0.01 | | | | 0.01 | | | | (0.03 | ) | | | — | (a) |

Net realized and unrealized gain (loss) on investments | | | 6.12 | | | | (0.42 | ) | | | (0.05 | ) | | | (0.31 | ) | | | 2.14 | |

Total from investment operations | | | 6.09 | | | | (0.41 | ) | | | (0.04 | ) | | | (0.34 | ) | | | 2.14 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.01 | ) | | | — | | | | — | (a) | | | (0.01 | ) |

Net realized gains | | | — | | | | — | | | | (0.81 | ) | | | — | | | | — | |

Total distributions | | | — | | | | (0.01 | ) | | | (0.81 | ) | | | — | (a) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 15.91 | | | $ | 9.82 | | | $ | 10.24 | | | $ | 11.09 | | | $ | 11.43 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(b) | | | 62.02 | % | | | (4.04 | )% | | | 0.83 | % | | | (2.95 | )% | | | 23.08 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 17,439 | | | $ | 9,861 | | | $ | 12,421 | | | $ | 16,196 | | | $ | 14,011 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 2.05 | % | | | 2.58 | % | | | 1.88 | % | | | 1.75 | % | | | 2.02 | % |

After waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % |

Ratio of net investment income (loss) to average net assets | | | (0.24 | )% | | | 0.02 | % | | | 0.11 | % | | | (0.24 | )% | | | — | % |

Portfolio turnover rate | | | 92 | % | | | 88 | % | | | 50 | % | | | 78 | % | | | 58 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Rounds to less than $0.005 per share. |

(b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| | See accompanying notes which are an integral part of these financial statements. | 31 |

Dana Epiphany ESG Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017(a) | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 10.25 | | | $ | 11.58 | | | $ | 11.80 | | | $ | 13.09 | | | $ | 10.86 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.06 | | | | 0.09 | | | | 0.14 | | | | 0.08 | (b) | | | 0.04 | (b) |

Net realized and unrealized gain (loss) on investments | | | 3.87 | | | | 0.47 | | | | 1.15 | | | | 0.74 | | | | 2.37 | |