united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22208 | |

| Valued Advisers Trust |

(Exact name of registrant as specified in charter) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

(Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Gregory Knoth

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | 10/31 | |

| | | |

| Date of reporting period: | 10/31/2020 | |

Item 1. Reports to Stockholders.

DANA LARGE CAP EQUITY FUND

DANA EPIPHANY ESG SMALL CAP EQUITY FUND

(formerly, the Dana Small Cap Equity Fund)

DANA EPIPHANY ESG EQUITY FUND

Annual Report

October 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at (855) 280-9648 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at (855) 280-9648. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Dana Investment Advisors, Inc.

20700 Swenson Drive, Suite 400

Waukesha, WI 53186

(855) 280-9648

www.danafunds.com

Dear Fellow Shareholders,

The year 2020 has been a challenging year on so many levels. The challenge of a persistent pandemic that has affected our society deeply has been the key event, and the pandemic has been the lens through which we will view all that has taken place this year. As investors, we have to continue to look forward for opportunities, and we have done that this year. We have experienced both a full bear market and a full market recovery over the last twelve months, and our portfolio management team has had to adapt to a rapidly changing landscape while looking forward at the same time. We look forward to both the challenges and opportunities that we will face in the future, and we will strive to be good stewards of the capital you have entrusted to our care.

Economic and Market Recap

From October 31, 2019 through the beginning of February 2020, markets continued to push higher, with the S&P 500® Index reaching a new high on February 19th. Economic growth was aided by low inflation and an accommodative Federal Reserve, which cut rates three times in the second half of 2019. Longer term interest rates drifted lower through this period, and market appreciation reflected the belief that the expansion would continue. On the political front, the race for the Democratic presidential nomination was wide open, and President Trump was acquitted by the Senate in his impeachment trial.

In January, our portfolio management team began to monitor a virus outbreak in a city named Wuhan in central China. Wuhan has a population larger than New York City. Reports of sickness and death, and images of entire new hospitals built in weeks, appeared on news feeds. By late February and into early March, it was clear that the virus was spreading around the world. Stocks fell over 30% in a five-week period, and the U.S. government and the Federal Reserve realized the threat to our economy and our markets. The Federal Reserve cut interest rates 150 basis points in a two-week period in early March while also coming out with a list of programs dedicated to supporting the markets. Emergency aid was passed by Congress, and the Treasury added its own emergency lending and asset purchase programs. Markets bottomed in late March and began to rebound, even as the virus spread. The S&P 500® Index briefly reached positive territory for the year in early June and moved up significantly through July and August.

Different market sectors were either rewarded or severely punished based on their economic prospects under an economy where many were either not working or working from home. Growth generally outperformed value by a significant margin through the market peak in early September, when the market began to broaden, and consolidate through the end of October. All of our strategies had to navigate this rotation into growth and tech companies early in the year, as well as a broadening and a move back to what had been weaker areas of the market towards the end of the year.

The presidential election provided yet another interesting backdrop to a tumultuous year. The widespread implementation of voting by mail delayed the results and increased the level of uncertainty surrounding the outcome. It appears that divided government will be the result, and the markets have continued to move higher on that news.

Looking forward, we are hopeful that the recent advances towards a workable vaccine can continue through production and distribution phases. Sectors of the economy that would benefit from more mobility and a more open economy are already beginning to rebound in the market. We continue to pursue opportunities in the market that offer attractive valuations and future prospects for expansion.

1

Dana Large Cap Fund (the “Large Cap Fund”) Discussion

Despite having to deal with the unique challenges we have all faced this year, our team continued to focus their efforts on finding high-quality companies and managing the Large Cap Fund with a longer-term investment horizon. The Large Cap Fund’s (Institutional Class) absolute performance of +4.65% was favorable in light of all that has transpired, and it was above the equal-weighted S&P 500® Index return of 0.58%. Yet, with a select few mega-cap growth companies dominating the cap-weighted S&P 500® Index, the Large Cap Fund trailed the benchmark S&P 500® Index return of +9.71%. The impacts of COVID-19 have extended the market’s preference for growth versus value-orientated stocks based on style indices to historic extremes. This dynamic is creating wonderful opportunities despite COVID-19 impacts still lingering over many industries. The Large Cap Fund was able to take advantage of the market’s pullback in early 2020, positioning itself in attractively valued securities that were driven down with the overall market swoon. This proved advantageous to performance when the market started bouncing back in April. Relative performance strengthened during the late spring and early summer.

For the full fiscal year, the performance of the Large Cap Fund’s holdings in Consumer Discretionary and Technology sectors helped deliver the strongest absolute returns. Energy was the weakest sector on an absolute basis, followed by Financials in the S&P 500® Index. Top performing contributors to the Large Cap Fund for the year included Consumer Discretionary holdings, Best Buy Co., Inc. (BBY), the consumer electronics retailer stalwart, and D.R. Horton, Inc. (DHI), the largest homebuilder in the United States. Other top performers were Thermo Fisher Scientific, Inc. (TMO), a key supplier in the health care and biotechnology industries, and Lam Research Corporation (LRCX), a key enabler of memory solutions for 5G and artificial intelligence. Holdings that detracted most from performance included companies that were negatively impacted by coronavirus shut downs, such as Starwood Property Trust, Inc., a REIT with exposure to hotels, and Sysco Corporation (SYY), a foodservice distributor to restaurants, hotels, and office buildings. Both companies were eventually sold from the Large Cap Fund. Marathon Petroleum Corporation (MPC), American Express Company (AXP), and Citizens Financial Group, Inc. (CFG) also lagged the market and were replaced with new alternatives.

Our analysis shows that the Dana Large Cap Equity Fund is trading at attractive relative valuations versus its benchmark and is performing well in terms of actual earnings and cash flow generation. We remain committed to our investment discipline as investors sort out expectations for the coming year.

Dana Epiphany ESG Small Cap Equity Fund (the “Small Cap Fund”) Discussion

The Small Cap Fund (Institutional Class) returned -4.04% versus the Russell 2000® Index return of -0.14% for the fiscal year. The numbers do little justice in telling the complete story of the underlying market environment in the prior twelve months. The Russell 2000® Index made 52-week highs throughout January and February then entered a bear market in the record time of 19 days, dropping further in the middle of March. The good news is that small cap stocks have historically outperformed large cap stocks coming off market bottoms, a pattern that repeated in the second quarter, as well as off the market lows this fall. The Small Cap Fund rode the same wave as the Index through much of the 1st quarter of 2020 and saw a strong rebound from April through July. August proved to be a difficult month for relative performance as there appeared to be a shift into deep value from many growthier names in an apparent profit-taking phase. The year finished in strong form in September and October, despite elevated uncertainty with a second round of stimulus and an undetermined and stressful political backdrop.

2

During the fiscal year, the Small Cap Fund realized strong returns from Technology, Consumer Discretionary, and Real Estate sectors, while Consumer Staples, Industrials, and Health Care detracted from relative performance. Two of the Small Cap Fund’s top contributing holdings were Horizon Therapeutics, PLC (HZNP) and Five9, Inc. (FIVN). Horizon is a pharmaceutical company with a legacy product line in rheumatoid arthritis and osteoarthritis, as well as newer offerings of treatment for gout and recently FDA approved product treatment for thyroid eye disease. Five9 is a leading contact center as a service software provider in the cloud that was in high demand before the pandemic, but their tailwind increased as a result of the work-from-home trend. Two of the larger detractors were Performance Food Group Company (PFGC) and CONMED Corporation (CNMD). Performance Food Group is a nationwide food supplier and distribution company whose customers in the restaurant, college, and theater industries were all greatly impacted by shutdowns related to COVID-19. The position was sold due to leverage and seriously impaired end markets. CONMED is a global medical technology company that specializes in the development and sale of surgical and patient-monitoring products and services utilized in specialized medicine fields. The line of products is sensitive to demand for elective procedures that were impacted heavily by hospital and clinic shutdowns.

Portfolio turnover is generally higher during periods of accelerating economic uncertainty, which almost always correlate with market volatility. Volatility can be both a threat and an opportunity, and the Small Cap Fund took advantage of opportunities to add excellent businesses at discounted prices in the first half of 2020. Some of the portfolio trading was done with an eye on tax efficiency, and the result should equal an advantageous position for Small Cap Fund owners when the accounting dust settles.

There are tremendous stories being written in small cap America. Exciting developments in various technologies and end markets are visible in many industries in our universe. The strength of the security selection in the Small Cap Fund is not always easy to see, especially with an increasingly complicated benchmark that has a rising sum of low-quality companies. One measure of our success is the maturation of Small Cap Fund holdings like Chegg, Inc. (CHGG), Horizon, and Five9 into midcap market winners. The Small Cap Fund continues to seek opportunities to add value through a relative value discipline that focuses on fundamentally driven stock selection and believes the Small Cap Fund will reward investors over the long term.

Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) Discussion

The Epiphany ESG Fund was exposed to the same challenges and news flow as it holds companies across the market capitalization spectrum. While it was rewarding for the Epiphany ESG Fund (Institutional Class) to return +4.76% during such a volatile fiscal year, the Epiphany ESG Fund did trail the cap-weighted S&P 500® Index return of +9.71%. While the relative performance headwind caused by concentrated growth stocks in the Index is disappointing, we continue to adhere to strong Environmental, Social, and Governance (ESG) pillars that are integrated into our relative value investment philosophy. Many of the underlying ESG themes in the portfolio point to longer-term sustainable trends; therefore, we remain focused on long-term prospects of these companies in lieu of short-term hurdles. ESG investing has been a boon for the industry during the last 12 months, and while we certainly appreciate the attention it has received, we pause to remind you that not all ESG offerings are created equal. We encourage you as shareholders to understand the comprehensive process we utilize and the active company engagement we undertake as shareholder advocates.

3

During the fiscal year, the Epiphany ESG Fund realized strong returns from the Consumer Discretionary and Utilities sectors, while Technology and Consumer Staples detracted from relative performance. Two of the top contributing holdings were Emergent BioSolutions, Inc. (EBS) and Best Buy Co., Inc. (BBY). Emergent is a specialty life sciences company focused on vaccines and anti-infectives sold primarily to government entities; their strong free cash flow and net cash position stand out in the biotech industry. Best Buy Co., Inc. (BBY), the consumer electronics retailer stalwart, showed strong performance in light of the work-from-home transition as many scrambled to update their home office capabilities. Marathon Petroleum Corporation (MPC) and Starwood Property Trust, Inc. (STWD) were two of the larger detractors in the fiscal year. In addition, the Epiphany ESG Fund’s relative performance in the Information Technology sector was primarily a result of lower weightings than what was held in the Index – a pillar risk control in Dana’s investment process.

The Dana Epiphany ESG Equity Fund continues to invest in companies that meet our ESG criteria and provide growth at attractive valuations relative to peers.

Respectfully submitted,

Mark R. Mirsberger, CPA

Chief Executive Officer – Dana Investment Advisors, Inc.

Duane Roberts, CFA

Portfolio Manager and Director of Equities – Dana Investment Advisors, Inc.

4

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2020

| One

Year | Five

Year | Ten

Year | Since

Inception

(10/29/13) |

Dana Large Cap Equity Fund | | |

Institutional Class | 4.65% | 9.83% | N/A | 9.93% |

Investor Class | 4.43% | 9.56% | 11.23% | N/A |

S&P 500® Index(b) | 9.71% | 11.71% | 13.01% | 11.38% |

| | Expense Ratios(c) |

| Institutional

Class | Investor

Class |

Gross | 0.85% | 1.10% |

With Applicable Waivers | 0.73% | 0.98% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Large Cap Equity Fund (the “Large Cap Fund”) distributions or the redemption of Large Cap Fund shares. Current performance of the Large Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Large Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. |

(b) | The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Large Cap Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in exchange-traded funds (“ETFs”) or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Large Cap Fund’s prospectus dated February 28, 2020. Expense ratios with applicable waivers reflect that Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to waive or limit its fees and to assume other expenses of the Large Cap Fund until February 28, 2021, so that total annual fund operating expenses do not exceed 0.73% of the Large Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date of such waiver or reimbursement, provided that the Large Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Large Cap Fund’s expense ratios as of October 31, 2020 can be found in the financial highlights. |

The Large Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Large Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Large Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

5

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2020

| One

Year | Since

Inception

(11/3/15) |

Dana Epiphany ESG Small Cap Equity Fund |

Institutional Class | (4.04)% | 1.48% |

Russell 2000® Index(b) | (0.14)% | 6.73% |

| | Expense

Ratios(c) |

| Institutional

Class |

Gross | 1.88% |

With Applicable Waivers | 0.95% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Small Cap Equity Fund (the “Small Cap Fund”) distributions or the redemption of Small Cap Fund shares. Current performance of the Small Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Small Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Effective at the close of business on June 4, 2020, Investor Class shares of the Small Cap Fund were exchanged for Institutional Class shares, resulting in the closing of the Investor Class. |

(b) | The Russell 2000® Index (“Russell Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Small Cap Fund’s portfolio. Individuals can not invest directly in the Russell Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Small Cap Fund’s prospectus dated February 28, 2020 (as amended October 1, 2020). Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Small Cap Fund until February 28, 2021, so that total annual fund operating expenses do not exceed 0.95% of the Small Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Small Cap Fund within three years following the date of such waiver or reimbursement, provided that the Small Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Small Cap Fund’s expense ratios as of October 31, 2020 can be found in the financial highlights. |

The Small Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Small Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

6

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2020

| One

Year | Five

Year | Ten

Year |

Dana Epiphany ESG Equity Fund | | | |

Institutional Class | 4.76% | 8.67% | 9.48% |

S&P 500® Index(b) | 9.71% | 11.71% | 13.01% |

| | Expense

Ratios(c) |

| Institutional

Class |

Gross | 2.13% |

With Applicable Waivers | 0.85% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) distributions or the redemption of Epiphany ESG Fund shares. Current performance of the Epiphany ESG Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Epiphany ESG Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Effective at the close of business on June 4, 2020, Investor Class shares of the Epiphany ESG Fund were exchanged for Institutional Class shares, resulting in the closing of the Investor Class. |

(b) | The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Epiphany ESG Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Epiphany ESG Fund’s prospectus dated February 28, 2020. Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Epiphany ESG Fund until February 28, 2021, so that total annual fund operating expenses do not exceed 0.85% of the Epiphany ESG Fund’s average net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Fund Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Epiphany ESG Fund within three years following the date of such waiver or reimbursement, provided that the Epiphany ESG Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Epiphany ESG Fund’s expense ratios as of October 31, 2020 can be found on the financial highlights. |

The Epiphany ESG Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Epiphany ESG Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Epiphany ESG Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

7

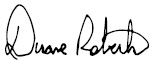

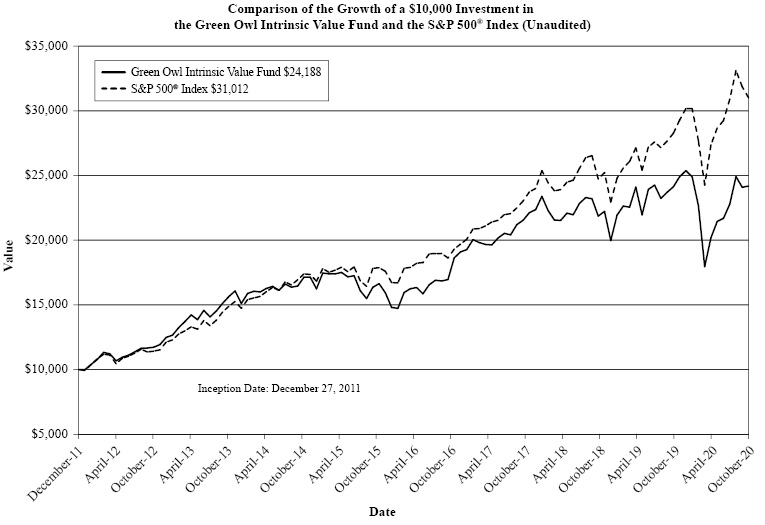

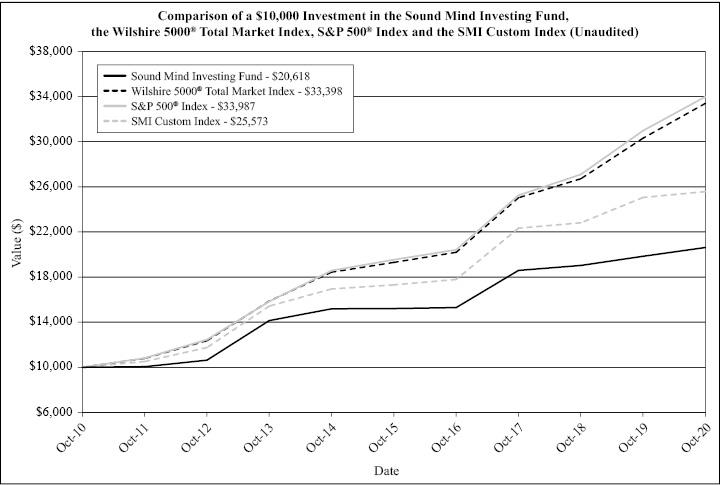

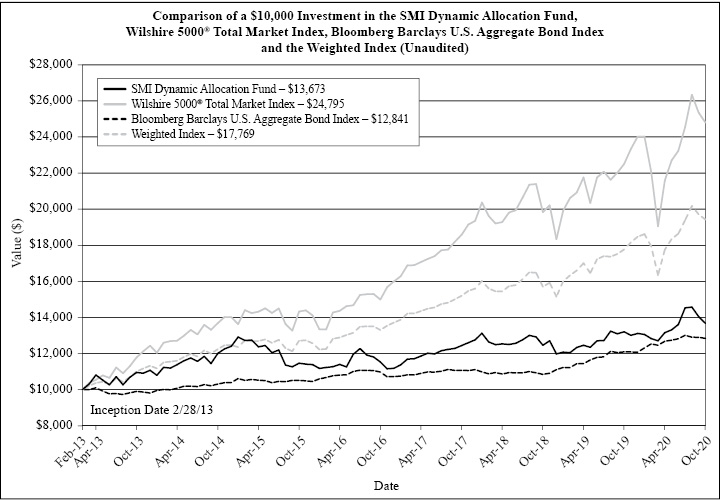

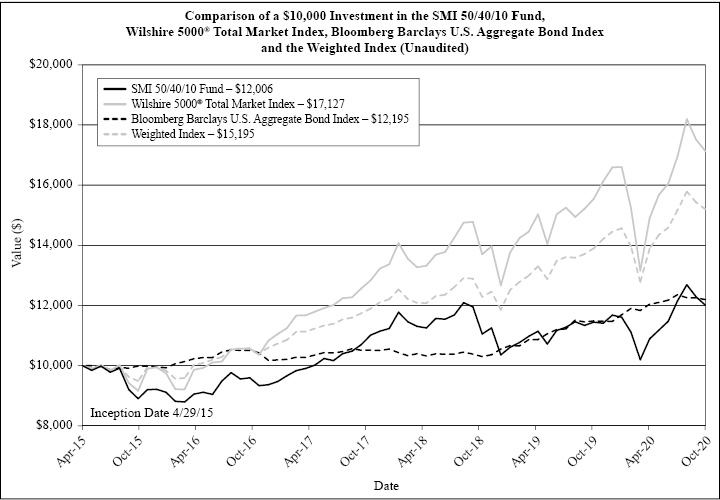

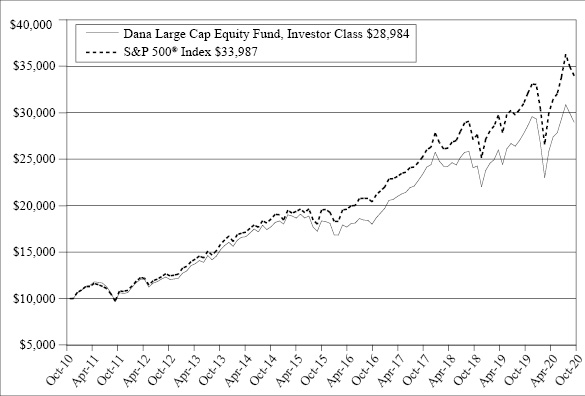

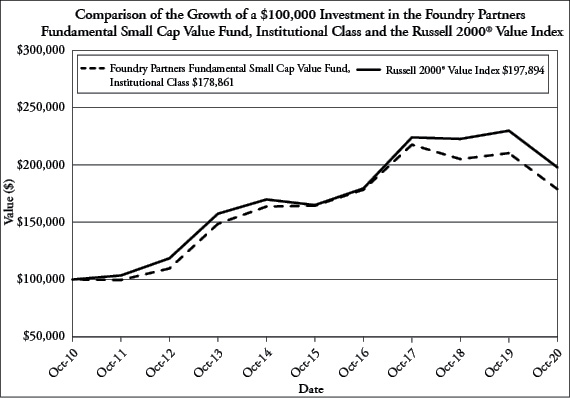

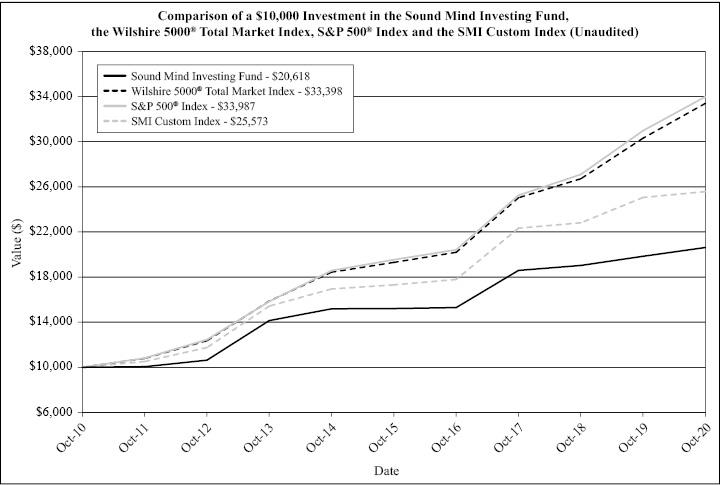

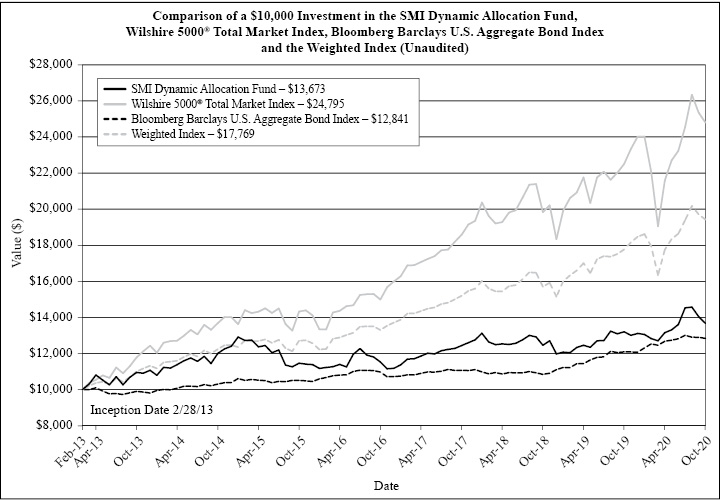

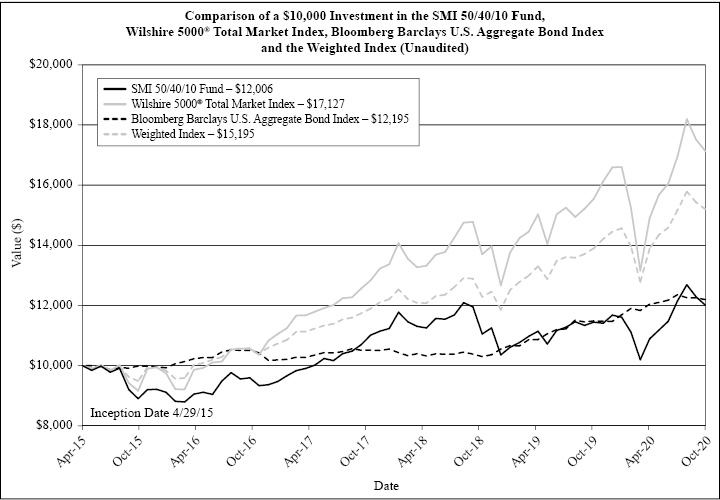

Comparison of Growth of $10,000 Investment in the

Dana Large Cap Equity Fund, Investor Class and

the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on October 31, 2010 held through October 31, 2020. THE LARGE CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Large Cap Fund distributions or the redemption of Large Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Large Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Large Cap Fund before investing. The Large Cap Fund’s prospectus contains this and other information about the Large Cap Fund, and should be read carefully before investing.

The Large Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

8

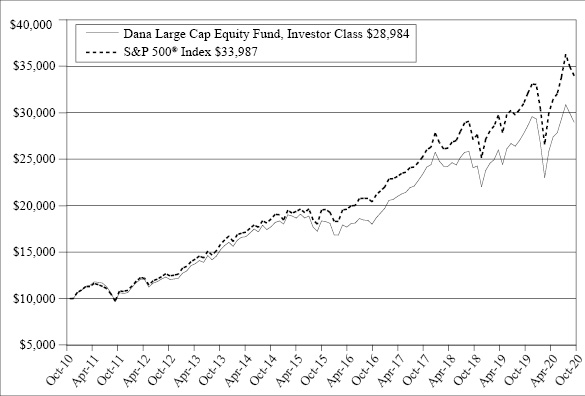

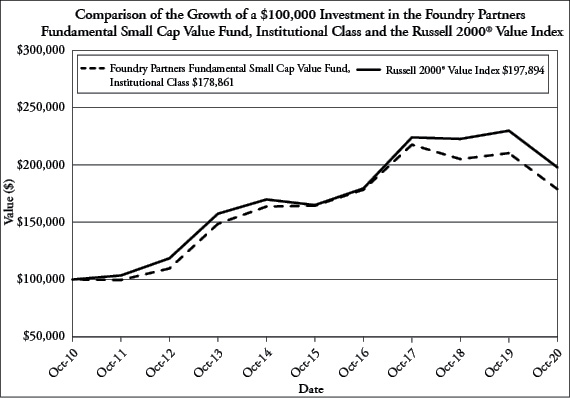

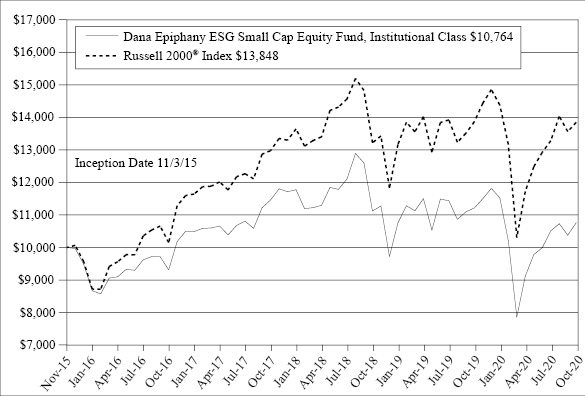

Comparison of Growth of $10,000 Investment in the

Dana Epiphany ESG Small Cap Equity Fund,

Institutional Class and the Russell 2000® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on November 3, 2015 (commencement of Institutional Class operations) held through October 31, 2020. THE SMALL CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Small Cap Fund distributions or the redemption of Small Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small Cap Fund before investing. The Small Cap Fund’s prospectus contains this and other information about the Small Cap Fund, and should be read carefully before investing.

The Small Cap Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

9

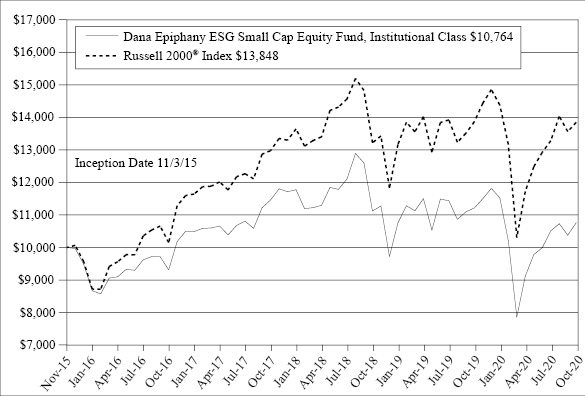

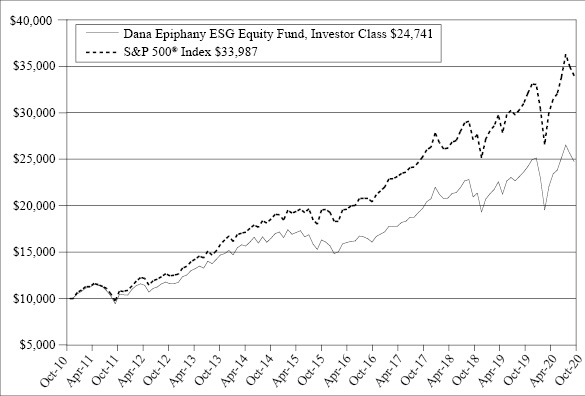

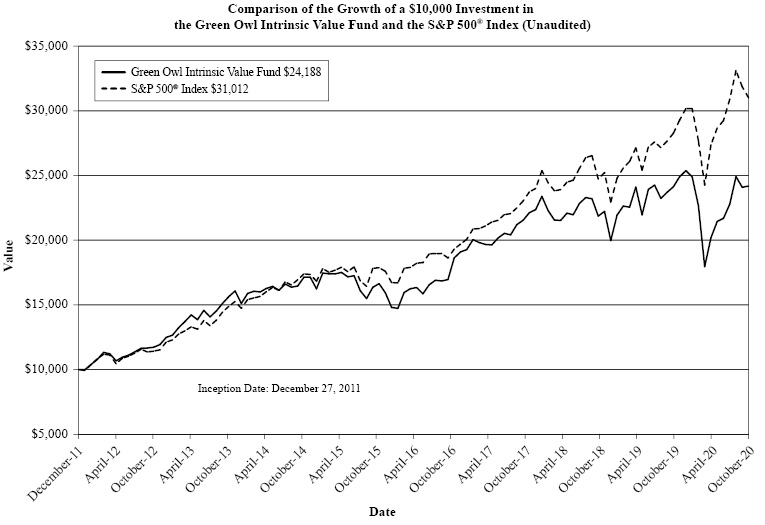

Comparison of Growth of $10,000 Investment in the

Dana Epiphany ESG Equity Fund, Institutional Class and

the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on October 31, 2010 held through October 31, 2020. THE EPIPHANY ESG FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Epiphany ESG Fund distributions or the redemption of Epiphany ESG Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Epiphany ESG Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Epiphany ESG Fund before investing. The Epiphany ESG Fund’s prospectus contains this and other information about the Epiphany ESG Fund, and should be read carefully before investing.

The Epiphany ESG Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

10

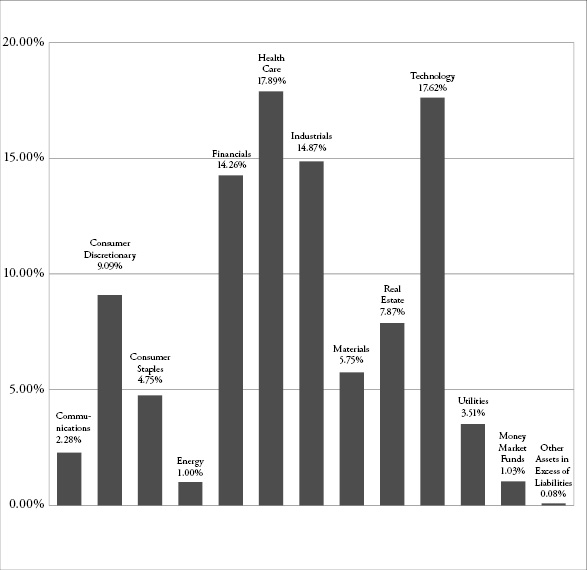

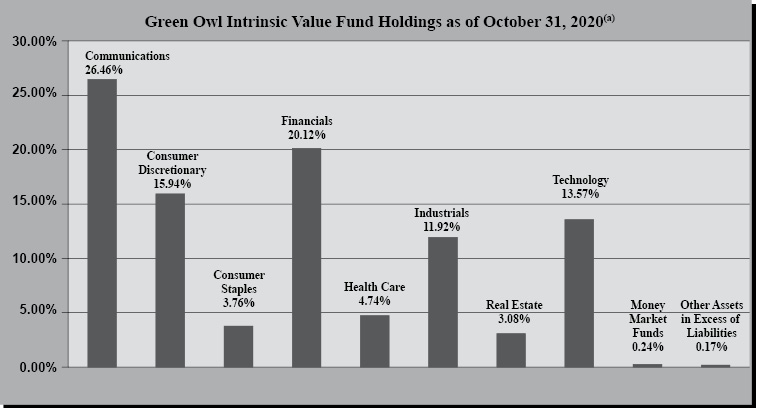

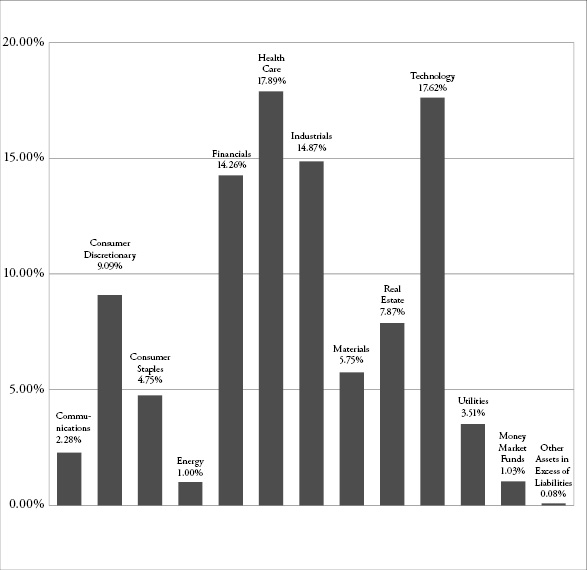

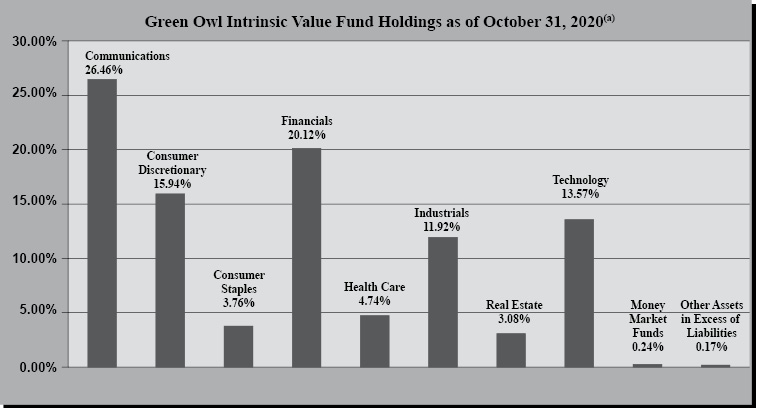

Portfolio Illustration (Unaudited)

October 31, 2020

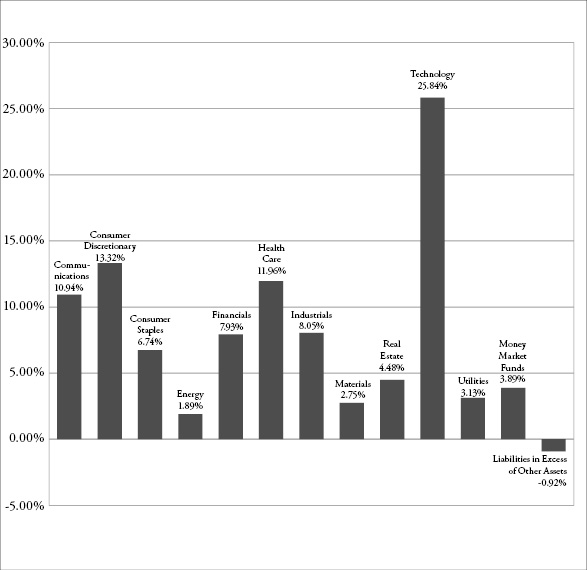

The following chart gives a visual breakdown of the Large Cap Fund by sector weighting as a percentage of net assets as of October 31, 2020.

11

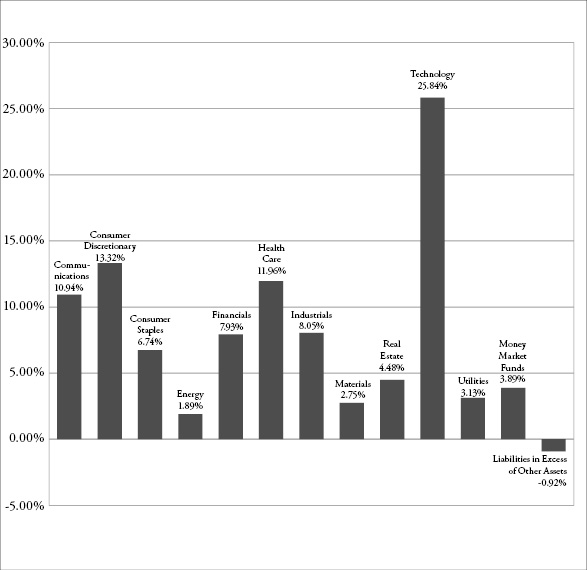

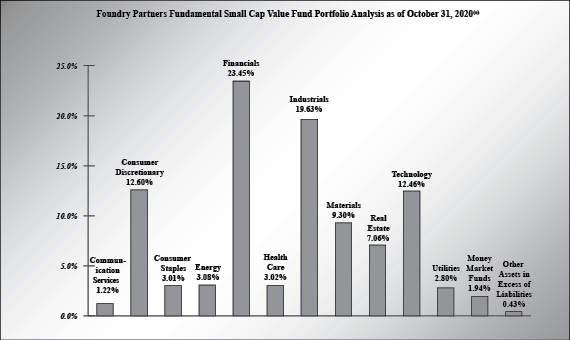

Portfolio Illustration (Unaudited)

October 31, 2020

The following chart gives a visual breakdown of the Small Cap Fund by sector weighting as a percentage of net assets as of October 31, 2020.

12

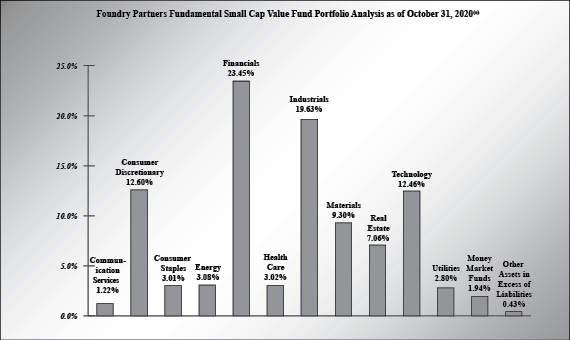

Portfolio Illustration (Unaudited)

October 31, 2020

The following chart gives a visual breakdown of the Epiphany ESG Fund by sector weighting as a percentage of net assets as of October 31, 2020.

Availability of Portfolio Schedules (Unaudited)

The Large Cap Fund, the Small Cap Fund and the Epiphany ESG Fund (each a “Fund” and collectively the “Funds”) file their complete schedules of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

13

Dana Large Cap Equity Fund

Schedule of Investments

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.22% | | | | | | | | |

Communications — 10.99% | | | | | | | | |

Activision Blizzard, Inc. | | | 18,400 | | | $ | 1,393,432 | |

Alphabet, Inc., Class A(a) | | | 2,100 | | | | 3,393,831 | |

AT&T, Inc. | | | 1,000 | | | | 27,020 | |

Comcast Corp., Class A | | | 36,000 | | | | 1,520,640 | |

Facebook, Inc., Class A(a) | | | 8,400 | | | | 2,210,124 | |

T-Mobile US, Inc.(a) | | | 19,600 | | | | 2,147,572 | |

Verizon Communications, Inc. | | | 36,000 | | | | 2,051,640 | |

| | | | | | | | 12,744,259 | |

Consumer Discretionary — 13.05% | | | | | | | | |

Amazon.com, Inc.(a) | | | 1,280 | | | | 3,886,272 | |

AutoZone, Inc.(a) | | | 1,200 | | | | 1,354,776 | |

Best Buy Co, Inc. | | | 20,500 | | | | 2,286,775 | |

BorgWarner, Inc. | | | 50,000 | | | | 1,749,000 | |

D.R. Horton, Inc. | | | 30,000 | | | | 2,004,300 | |

Fortune Brands Home & Security, Inc. | | | 22,000 | | | | 1,779,140 | |

Home Depot, Inc. (The) | | | 7,800 | | | | 2,080,338 | |

| | | | | | | | 15,140,601 | |

Consumer Staples — 6.90% | | | | | | | | |

Keurig Dr Pepper, Inc. | | | 1,000 | | | | 26,900 | |

Kimberly-Clark Corp. | | | 15,200 | | | | 2,015,368 | |

Mondelez International, Inc., Class A | | | 38,000 | | | | 2,018,560 | |

PepsiCo, Inc. | | | 14,000 | | | | 1,866,060 | |

Walmart, Inc. | | | 15,000 | | | | 2,081,250 | |

| | | | | | | | 8,008,138 | |

Energy — 1.88% | | | | | | | | |

Chevron Corp. | | | 500 | | | | 34,750 | |

ConocoPhillips | | | 32,000 | | | | 915,840 | |

Exxon Mobil Corp. | | | 1,000 | | | | 32,620 | |

Pioneer Natural Resources Co. | | | 15,000 | | | | 1,193,400 | |

| | | | | | | | 2,176,610 | |

Financials — 9.70% | | | | | | | | |

American Express Co. | | | 400 | | | | 36,496 | |

Aon PLC, Class A | | | 9,000 | | | | 1,656,090 | |

Bank of America Corp. | | | 80,000 | | | | 1,896,000 | |

Bank of New York Mellon Corp. (The) | | | 55,000 | | | | 1,889,800 | |

Discover Financial Services | | | 28,000 | | | | 1,820,280 | |

JPMorgan Chase & Co. | | | 20,200 | | | | 1,980,408 | |

Morgan Stanley | | | 41,000 | | | | 1,974,150 | |

| | | | | | | | 11,253,224 | |

14 | See accompanying notes which are an integral part of these financial statements. | |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.22% — (continued) |

Health Care — 14.01% | | | | | | | | |

Abbott Laboratories | | | 20,000 | | | $ | 2,102,200 | |

AbbVie, Inc. | | | 1,000 | | | | 85,100 | |

Amgen, Inc. | | | 9,400 | | | | 2,039,236 | |

Bristol-Myers Squibb Co. | | | 20,000 | | | | 1,169,000 | |

Horizon Therapeutics PLC(a) | | | 26,000 | | | | 1,948,180 | |

Merck & Co., Inc. | | | 27,000 | | | | 2,030,670 | |

STERIS PLC | | | 12,000 | | | | 2,126,280 | |

Thermo Fisher Scientific, Inc. | | | 5,200 | | | | 2,460,224 | |

UnitedHealth Group, Inc. | | | 7,500 | | | | 2,288,550 | |

| | | | | | | | 16,249,440 | |

Industrials — 6.84% | | | | | | | | |

Boeing Co. (The) | | | 200 | | | | 28,878 | |

Delta Air Lines, Inc. | | | 1,000 | | | | 30,640 | |

Dover Corp. | | | 17,700 | | | | 1,959,567 | |

Lockheed Martin Corp. | | | 5,500 | | | | 1,925,715 | |

Norfolk Southern Corp. | | | 9,600 | | | | 2,007,552 | |

Parker-Hannifin Corp. | | | 9,500 | | | | 1,979,420 | |

| | | | | | | | 7,931,772 | |

Materials — 2.91% | | | | | | | | |

Avery Dennison Corp. | | | 12,000 | | | | 1,660,680 | |

Packaging Corp. of America | | | 15,000 | | | | 1,717,350 | |

| | | | | | | | 3,378,030 | |

Real Estate — 2.64% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 4,800 | | | | 727,296 | |

American Tower Corp., Class A | | | 5,000 | | | | 1,148,250 | |

Prologis, Inc. | | | 12,000 | | | | 1,190,400 | |

| | | | | | | | 3,065,946 | |

Technology — 27.16% | | | | | | | | |

Adobe Systems, Inc.(a) | | | 4,800 | | | | 2,146,080 | |

Akamai Technologies, Inc.(a) | | | 22,000 | | | | 2,092,640 | |

Apple, Inc. | | | 38,000 | | | | 4,136,680 | |

Cadence Design Systems, Inc.(a) | | | 20,600 | | | | 2,253,022 | |

CDW Corp. | | | 18,000 | | | | 2,206,800 | |

Cisco Systems, Inc. | | | 1,000 | | | | 35,900 | |

Fidelity National Information Services, Inc. | | | 13,000 | | | | 1,619,670 | |

Intel Corp. | | | 700 | | | | 30,996 | |

Lam Research Corp. | | | 6,700 | | | | 2,291,936 | |

Leidos Holdings, Inc. | | | 1,000 | | | | 83,000 | |

MasterCard, Inc., Class A | | | 4,500 | | | | 1,298,880 | |

| | See accompanying notes which are an integral part of these financial statements. | 15 |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.22% — (continued) |

Technology — 27.16% — (continued) | | | | | | | | |

Microchip Technology, Inc. | | | 20,000 | | | $ | 2,101,600 | |

Microsoft Corp. | | | 18,000 | | | | 3,644,460 | |

PayPal Holdings, Inc.(a) | | | 10,000 | | | | 1,861,300 | |

Qorvo, Inc.(a) | | | 17,000 | | | | 2,165,120 | |

Visa, Inc., Class A | | | 7,600 | | | | 1,380,996 | |

Zebra Technologies Corp., Class A(a) | | | 7,600 | | | | 2,155,664 | |

| | | | | | | | 31,504,744 | |

Utilities — 3.14% | | | | | | | | |

Eversource Energy | | | 18,200 | | | | 1,588,314 | |

NextEra Energy, Inc. | | | 28,000 | | | | 2,049,880 | |

| | | | | | | | 3,638,194 | |

Total Common Stocks (Cost $91,656,839) | | | | | | | 115,090,958 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 0.43% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.02%(b) | | | 501,732 | | | | 501,732 | |

Total Money Market Funds (Cost $501,732) | | | | | | | 501,732 | |

| | | | | | | | | |

Total Investments — 99.65% (Cost $92,158,571) | | | | | | | 115,592,690 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.35% | | | | | | | 401,022 | |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 115,993,712 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2020. |

16 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Small Cap Equity Fund

Schedule of Investments

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.89% | | | | | | | | |

Communications — 2.28% | | | | | | | | |

Glu Mobile, Inc.(a) | | | 15,550 | | | $ | 111,338 | |

Vonage Holdings Corp.(a) | | | 10,701 | | | | 113,217 | |

| | | | | | | | 224,555 | |

Consumer Discretionary — 9.09% | | | | | | | | |

Boot Barn Holdings, Inc.(a) | | | 6,392 | | | | 204,672 | |

Chegg, Inc.(a) | | | 2,254 | | | | 165,534 | |

Deckers Outdoor Corp.(a) | | | 840 | | | | 212,830 | |

Malibu Boats, Inc., Class A(a) | | | 2,995 | | | | 152,236 | |

Marriott Vacations Worldwide Corp. | | | 1,668 | | | | 161,129 | |

| | | | | | | | 896,401 | |

Consumer Staples — 4.75% | | | | | | | | |

e.l.f. Beauty, Inc.(a) | | | 9,265 | | | | 187,801 | |

Helen of Troy Ltd.(a) | | | 902 | | | | 171,019 | |

Sprouts Farmers Market, Inc.(a) | | | 5,773 | | | | 109,976 | |

| | | | | | | | 468,796 | |

Energy — 1.00% | | | | | | | | |

WPX Energy, Inc.(a) | | | 21,376 | | | | 98,543 | |

| | | | | | | | | |

Financials — 14.26% | | | | | | | | |

Encore Capital Group, Inc.(a) | | | 4,666 | | | | 148,985 | |

Hanover Insurance Group, Inc. | | | 1,649 | | | | 157,744 | |

Home BancShares, Inc. | | | 9,942 | | | | 165,037 | |

Houlihan Lokey, Inc., Class A | | | 2,526 | | | | 158,380 | |

Jefferies Financial Group, Inc. | | | 7,750 | | | | 151,203 | |

LPL Financial Holdings, Inc. | | | 1,786 | | | | 142,755 | |

Pinnacle Financial Partners, Inc. | | | 3,915 | | | | 179,268 | |

Primerica, Inc. | | | 1,231 | | | | 135,705 | |

Western Alliance Bancorp | | | 4,061 | | | | 167,313 | |

| | | | | | | | 1,406,390 | |

Health Care — 17.89% | | | | | | | | |

Blueprint Medicines Corp.(a) | | | 2,350 | | | | 240,357 | |

CONMED Corp. | | | 1,271 | | | | 99,100 | |

Emergent BioSolutions, Inc.(a) | | | 2,235 | | | | 201,083 | |

Ensign Group, Inc. (The) | | | 3,383 | | | | 199,055 | |

HMS Holdings Corp.(a) | | | 6,011 | | | | 160,013 | |

Horizon Therapeutics PLC(a) | | | 2,619 | | | | 196,242 | |

Ligand Pharmaceuticals, Inc., Class B(a) | | | 2,176 | | | | 179,411 | |

| | See accompanying notes which are an integral part of these financial statements. | 17 |

Dana Epiphany ESG Small Cap Equity Fund

Schedule of Investments (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.89% — (continued) |

Health Care — 17.89% — (continued) |

Medpace Holdings, Inc.(a) | | | 1,558 | | | $ | 172,845 | |

NuVasive, Inc.(a) | | | 3,791 | | | | 168,434 | |

uniQure N.V.(a) | | | 3,644 | | | | 147,327 | |

| | | | | | | | 1,763,867 | |

Industrials — 14.87% | | | | | | | | |

Cactus, Inc., Class A | | | 5,471 | | | | 93,007 | |

Comfort Systems USA, Inc. | | | 3,372 | | | | 154,438 | |

Federal Signal Corp. | | | 6,077 | | | | 174,288 | |

Gibraltar Industries, Inc.(a) | | | 2,674 | | | | 153,621 | |

MasTec, Inc.(a) | | | 3,685 | | | | 182,923 | |

Regal-Beloit Corp. | | | 1,550 | | | | 152,908 | |

Rexnord Corp. | | | 5,803 | | | | 186,160 | |

TopBuild Corp.(a) | | | 1,383 | | | | 211,889 | |

TriNet Group, Inc.(a) | | | 2,280 | | | | 157,138 | |

| | | | | | | | 1,466,372 | |

Materials — 5.75% | | | | | | | | |

Advanced Drainage Systems, Inc. | | | 2,430 | | | | 154,135 | |

Avient Corp. | | | 5,607 | | | | 174,210 | |

Boise Cascade Co. | | | 3,245 | | | | 124,543 | |

W.R. Grace & Co. | | | 2,629 | | | | 114,335 | |

| | | | | | | | 567,223 | |

Real Estate — 7.87% | | | | | | | | |

EastGroup Properties, Inc. | | | 1,236 | | | | 164,487 | |

Global Medical REIT, Inc. | | | 14,311 | | | | 177,886 | |

Hannon Armstrong Sustainable Infrastructure | | | 3,483 | | | | 145,764 | |

QTS Realty Trust, Inc., Class A | | | 2,333 | | | | 143,503 | |

STAG Industrial, Inc. | | | 4,643 | | | | 144,490 | |

| | | | | | | | 776,130 | |

Technology — 17.62% | | | | | | | | |

Cohu, Inc. | | | 9,114 | | | | 198,047 | |

Cubic Corp. | | | 3,069 | | | | 181,409 | |

DXC Technology Co. | | | 8,976 | | | | 165,338 | |

Five9, Inc.(a) | | | 1,212 | | | | 183,885 | |

Omnicell, Inc.(a) | | | 2,529 | | | | 218,884 | |

Perficient, Inc.(a) | | | 3,748 | | | | 146,772 | |

Rapid7, Inc.(a) | | | 2,591 | | | | 160,461 | |

18 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Small Cap Equity Fund

Schedule of Investments (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.89% — (continued) |

Technology — 17.62% — (continued) |

Sailpoint Technologies Holdings, Inc.(a) | | | 3,790 | | | $ | 157,323 | |

Ultra Clean Holdings, Inc.(a) | | | 7,748 | | | | 164,955 | |

Upland Software, Inc.(a) | | | 3,838 | | | | 160,121 | |

| | | | | | | | 1,737,195 | |

Utilities — 3.51% | | | | | | | | |

Chesapeake Utilities Corp. | | | 1,892 | | | | 183,922 | |

Southwest Gas Holdings, Inc. | | | 2,470 | | | | 162,328 | |

| | | | | | | | 346,250 | |

Total Common Stocks (Cost $8,564,704) | | | | | | | 9,751,722 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 1.03% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.02%(b) | | | 101,402 | | | | 101,402 | |

Total Money Market Funds (Cost $101,402) | | | | | | | 101,402 | |

| | | | | | | | | |

Total Investments — 99.92% (Cost $8,666,106) | | | | | | | 9,853,124 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.08% | | | | | | | 8,262 | |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 9,861,386 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2020. |

REIT - Real Estate Investment Trust

| | See accompanying notes which are an integral part of these financial statements. | 19 |

Dana Epiphany ESG Equity Fund

Schedule of Investments

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 97.03% | | | | | | | | |

Communications — 10.94% | | | | | | | | |

Alphabet, Inc., Class A(a) | | | 30 | | | $ | 48,483 | |

Alphabet, Inc., Class C(a) | | | 230 | | | | 372,833 | |

Comcast Corp., Class A | | | 5,700 | | | | 240,768 | |

Facebook, Inc., Class A(a) | | | 1,000 | | | | 263,110 | |

T-Mobile US, Inc.(a) | | | 2,200 | | | | 241,054 | |

Verizon Communications, Inc. | | | 4,600 | | | | 262,154 | |

| | | | | | | | 1,428,402 | |

Consumer Discretionary — 13.32% | | | | | | | | |

Amazon.com, Inc.(a) | | | 120 | | | | 364,338 | |

Best Buy Co, Inc. | | | 2,200 | | | | 245,410 | |

BorgWarner, Inc. | | | 6,300 | | | | 220,374 | |

D.R. Horton, Inc. | | | 3,600 | | | | 240,516 | |

Fortune Brands Home & Security, Inc. | | | 3,100 | | | | 250,697 | |

Home Depot, Inc. (The) | | | 820 | | | | 218,702 | |

Tractor Supply Co. | | | 1,500 | | | | 199,815 | |

| | | | | | | | 1,739,852 | |

Consumer Staples — 6.74% | | | | | | | | |

General Mills, Inc. | | | 3,800 | | | | 224,656 | |

Keurig Dr Pepper, Inc. | | | 7,700 | | | | 207,130 | |

Kimberly-Clark Corp. | | | 1,700 | | | | 225,403 | |

Mondelez International, Inc., Class A | | | 4,200 | | | | 223,104 | |

| | | | | | | | 880,293 | |

Energy — 1.89% | | | | | | | | |

ConocoPhillips | | | 4,200 | | | | 120,204 | |

Pioneer Natural Resources Co. | | | 1,600 | | | | 127,296 | |

| | | | | | | | 247,500 | |

Financials — 7.93% | | | | | | | | |

American Express Co. | | | 1,100 | | | | 100,364 | |

Bank of New York Mellon Corp. (The) | | | 4,800 | | | | 164,928 | |

Discover Financial Services | | | 2,400 | | | | 156,024 | |

JPMorgan Chase & Co. | | | 2,100 | | | | 205,884 | |

Morgan Stanley | | | 4,100 | | | | 197,415 | |

Truist Financial Corp. | | | 5,000 | | | | 210,600 | |

| | | | | | | | 1,035,215 | |

20 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Equity Fund

Schedule of Investments (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 97.03% — (continued) |

Health Care — 11.96% | | | | | | | | |

CVS Health Corp. | | | 4,700 | | | $ | 263,623 | |

Emergent BioSolutions, Inc.(a) | | | 2,900 | | | | 260,913 | |

Encompass Health Corp. | | | 4,100 | | | | 251,371 | |

Horizon Therapeutics PLC(a) | | | 3,700 | | | | 277,241 | |

Humana, Inc. | | | 640 | | | | 255,539 | |

Zoetis, Inc. | | | 1,600 | | | | 253,680 | |

| | | | | | | | 1,562,367 | |

Industrials — 8.05% | | | | | | | | |

Norfolk Southern Corp. | | | 1,270 | | | | 265,582 | |

Regal-Beloit Corp. | | | 2,900 | | | | 286,085 | |

TE Connectivity Ltd. | | | 2,200 | | | | 213,136 | |

W.W. Grainger, Inc. | | | 820 | | | | 287,017 | |

| | | | | | | | 1,051,820 | |

Materials — 2.75% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 600 | | | | 165,744 | |

Avery Dennison Corp. | | | 1,400 | | | | 193,746 | |

| | | | | | | | 359,490 | |

Real Estate — 4.48% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 720 | | | | 109,094 | |

American Tower Corp., Class A | | | 500 | | | | 114,825 | |

Hannon Armstrong Sustainable Infrastructure, Inc. | | | 5,800 | | | | 242,730 | |

Prologis, Inc. | | | 1,200 | | | | 119,040 | |

| | | | | | | | 585,689 | |

Technology — 25.84% | | | | | | | | |

Accenture PLC, Class A | | | 1,100 | | | | 238,601 | |

Akamai Technologies, Inc.(a) | | | 2,300 | | | | 218,776 | |

Apple, Inc. | | | 4,000 | | | | 435,440 | |

Cadence Design Systems, Inc.(a) | | | 2,400 | | | | 262,488 | |

CDW Corp. | | | 2,100 | | | | 257,460 | |

Cisco Systems, Inc. | | | 5,900 | | | | 211,810 | |

Dropbox, Inc., Class A(a) | | | 9,000 | | | | 164,340 | |

Intel Corp. | | | 2,600 | | | | 115,128 | |

Lam Research Corp. | | | 740 | | | | 253,139 | |

MasterCard, Inc., Class A | | | 660 | | | | 190,502 | |

Microchip Technology, Inc. | | | 2,460 | | | | 258,497 | |

Microsoft Corp. | | | 1,700 | | | | 344,199 | |

PayPal Holdings, Inc.(a) | | | 1,300 | | | | 241,969 | |

Visa, Inc., Class A | | | 1,010 | | | | 183,527 | |

| | | | | | | | 3,375,876 | |

| | See accompanying notes which are an integral part of these financial statements. | 21 |

Dana Epiphany ESG Equity Fund

Schedule of Investments (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 97.03% — (continued) |

Utilities — 3.13% | | | | | | | | |

Eversource Energy | | | 2,200 | | | $ | 191,994 | |

NextEra Energy, Inc. | | | 2,960 | | | | 216,702 | |

| | | | | | | | 408,696 | |

Total Common Stocks (Cost $10,184,146) | | | | | | | 12,675,200 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 3.89% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.02%(b) | | | 507,720 | | | | 507,720 | |

Total Money Market Funds (Cost $507,720) | | | | | | | 507,720 | |

| | | | | | | | | |

Total Investments — 100.92% (Cost $10,691,866) | | | | | | | 13,182,920 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.92)% | | | | | | | (120,814 | ) |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 13,062,106 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2020. |

22 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Assets and Liabilities

October 31, 2020

| | | Dana Large Cap

Equity Fund | | | Dana Epiphany

ESG Small Cap

Equity Fund | | | Dana Epiphany

ESG Equity Fund | |

Assets | | | | | | | | |

Investments in securities at fair value (cost $92,158,571, $8,666,106 and $10,691,866) (Note 3) | | $ | 115,592,690 | | | $ | 9,853,124 | | | $ | 13,182,920 | |

Receivable for fund shares sold | | | 640,036 | | | | — | | | | 54,896 | |

Receivable for investments sold | | | — | | | | 49,060 | | | | 188,712 | |

Dividends receivable | | | 139,134 | | | | 5,920 | | | | 18,985 | |

Receivable from Adviser (Note 4) | | | — | | | | 8,695 | | | | 5,901 | |

Prepaid expenses | | | 23,240 | | | | 19,259 | | | | 12,214 | |

Total Assets | | | 116,395,100 | | | | 9,936,058 | | | | 13,463,628 | |

Liabilities | | | | | | | | |

Payable for fund shares redeemed | | | 290,135 | | | | — | | | | 2,452 | |

Payable for investments purchased | | | — | | | | 35,317 | | | | 361,420 | |

Payable to Adviser (Note 4) | | | 50,148 | | | | — | | | | — | |

Accrued Distribution (12b-1) fees (Note 4) | | | 5,523 | | | | — | | | | — | |

Payable to Administrator (Note 4) | | | 22,851 | | | | 12,667 | | | | 11,450 | |

Payable to trustees | | | 2,155 | | | | 1,424 | | | | 1,513 | |

Other accrued expenses | | | 30,576 | | | | 25,264 | | | | 24,687 | |

Total Liabilities | | | 401,388 | | | | 74,672 | | | | 401,522 | |

Net Assets | | $ | 115,993,712 | | | $ | 9,861,386 | | | $ | 13,062,106 | |

Net Assets consist of: | | | | | | | | | | | | |

Paid-in capital | | | 90,715,471 | | | | 10,083,044 | | | | 10,318,752 | |

Accumulated earnings (deficit) | | | 25,278,241 | | | | (221,658 | ) | | | 2,743,354 | |

Net Assets | | $ | 115,993,712 | | | $ | 9,861,386 | | | $ | 13,062,106 | |

Institutional Class: | | | | | | | | | | | | |

Net Assets | | $ | 91,379,130 | | | $ | 9,861,386 | | | $ | 13,062,106 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 4,299,265 | | | | 1,004,156 | | | | 1,273,744 | |

Net asset value, offering and redemption price per share (Note 2) | | $ | 21.25 | | | $ | 9.82 | | | $ | 10.25 | |

Investor Class: | | | | | | | | | | | | |

Net Assets | | $ | 24,614,582 | | | | | | | | | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,158,052 | | | | | | | | | |

Net asset value, offering and redemption price per share (Note 2) | | $ | 21.26 | | | | | | | | | |

| | See accompanying notes which are an integral part of these financial statements. | 23 |

Dana Funds

Statements of Operations

For the year ended October 31, 2020

| | | Dana Large Cap

Equity Fund | | | Dana Epiphany

ESG Small Cap

Equity Fund | | | Dana Epiphany

ESG Equity Fund | |

Investment Income | | | | | | | | | | | | |

Dividend income | | $ | 2,332,417 | | | $ | 112,243 | | | $ | 237,506 | |

Total investment income | | | 2,332,417 | | | | 112,243 | | | | 237,506 | |

Expenses | | | | | | | | | | | | |

Investment Adviser fees (Note 4) | | | 828,212 | | | | 87,190 | | | | 84,680 | |

Administration and compliance services fees (Note 4) | | | 78,889 | | | | 37,917 | | | | 32,133 | |

Distribution (12b-1) fees, Investor Class (Note 4) | | | 62,911 | | | | 2,694 | (a) | | | 11,229 | (a) |

Fund accounting fees (Note 4) | | | 48,168 | | | | 29,917 | | | | 24,625 | |

Registration expenses | | | 40,308 | | | | 36,512 | | | | 30,493 | |

Legal fees | | | 25,992 | | | | 25,645 | | | | 23,539 | |

Transfer agent fees (Note 4) | | | 25,433 | | | | 23,217 | | | | 18,441 | |

Custodian fees | | | 19,967 | | | | 5,647 | | | | 5,339 | |

Audit and tax preparation fees | | | 18,800 | | | | 18,800 | | | | 18,500 | |

Printing and postage expenses | | | 17,617 | | | | 2,689 | | | | 3,149 | |

Insurance expenses | | | 11,660 | | | | 3,234 | | | | 2,159 | |

Trustee fees | | | 9,726 | | | | 6,215 | | | | 5,146 | |

Interest | | | — | | | | 16 | | | | 19 | |

Miscellaneous expenses | | | 32,139 | | | | 21,085 | | | | 16,586 | |

Total expenses | | | 1,219,822 | | | | 300,778 | | | | 276,038 | |

Fees contractually waived and expenses reimbursed by Adviser (Note 4) | | | (227,431 | ) | | | (187,744 | ) | | | (154,164 | ) |

Net operating expenses | | | 992,391 | | | | 113,034 | | | | 121,874 | |

Net investment income (loss) | | | 1,340,026 | | | | (791 | ) | | | 115,632 | |

Net Realized and Change in Unrealized Gain (Loss) on Investments |

Net realized gain (loss) on investment securities transactions | | | 2,299,800 | | | | (1,256,551 | ) | | | 234,203 | |

Net change in unrealized appreciation (depreciation) on investment securities | | | 2,714,687 | | | | (80,215 | ) | | | 362,862 | |

Net realized and change in unrealized gain (loss) on investments | | | 5,014,487 | | | | (1,336,766 | ) | | | 597,065 | |

Net increase (decrease) in net assets resulting from operations | | $ | 6,354,513 | | | $ | (1,337,557 | ) | | $ | 712,697 | |

(a) | Effective at the close of business on June 4, 2020, Investor Class shares of the Dana Epiphany ESG Small Cap Fund and Dana Epiphany ESG Fund were consolidated into the Institutional Class shares of the Small Cap Fund and Epiphany ESG Fund. |

24 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Changes in Net Assets

| | | Dana Large Cap Equity Fund | | | Dana Epiphany ESG

Small Cap Equity Fund | |

| | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2019 | | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2019 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | | | | | |

Operations | | | | | | | | | | | | |

Net investment income (loss) | | $ | 1,340,026 | | | $ | 2,398,203 | | | $ | (791 | ) | | $ | 11,830 | |

Net realized gain (loss) on investment securities transactions | | | 2,299,800 | | | | 12,973,907 | | | | (1,256,551 | ) | | | (111,430 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 2,714,687 | | | | 2,070,388 | | | | (80,215 | ) | | | 73,430 | |

Net increase (decrease) in net assets resulting from operations | | | 6,354,513 | | | | 17,442,498 | | | | (1,337,557 | ) | | | (26,170 | ) |

Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

Institutional Class | | | (12,130,253 | ) | | | (15,403,587 | ) | | | (5,901 | ) | | | (1,098,363 | ) |

Investor Class | | | (2,798,272 | ) | | | (3,132,699 | ) | | | — | | | | (245,803 | ) |

Total distributions | | | (14,928,525 | ) | | | (18,536,286 | ) | | | (5,901 | ) | | | (1,344,166 | ) |

Capital Transactions – Institutional Class (a) | | | | | | | | |

Proceeds from shares sold | | | 31,507,881 | | | | 48,852,531 | | | | 1,008,397 | | | | 1,528,842 | |

Shares issued in connection with class consolidation | | | — | | | | — | | | | 1,513,471 | | | | — | |

Reinvestment of distributions | | | 5,707,638 | | | | 11,841,958 | | | | 5,764 | | | | 1,065,846 | |

Amount paid for shares redeemed | | | (46,107,580 | ) | | | (129,198,946 | ) | | | (3,966,219 | ) | | | (5,237,003 | ) |

Total – Institutional Class | | | (8,892,061 | ) | | | (68,504,457 | ) | | | (1,438,587 | ) | | | (2,642,315 | ) |

Capital Transactions – Investor Class (a) | | | | | | | | | | | | |

Proceeds from shares sold | | | 1,784,299 | | | | 604,696 | | | | 94,173 | | | | 152,674 | |

Reinvestment of distributions | | | 2,782,815 | | | | 3,128,798 | | | | — | | | | 245,803 | |

Amount paid for shares redeemed | | | (3,531,248 | ) | | | (7,535,002 | ) | | | (555,014 | ) | | | (1,436,942 | ) |

Shares redeemed in connection with class consolidation | | | — | | | | — | | | | (1,513,471 | ) | | | — | |

Total – Investor Class | | | 1,035,866 | | | | (3,801,508 | ) | | | (1,974,312 | ) | | | (1,038,465 | ) |

Net decrease in net assets resulting from capital transactions | | | (7,856,195 | ) | | | (72,305,965 | ) | | | (3,412,899 | ) | | | (3,680,780 | ) |

Total Decrease in Net Assets | | | (16,430,207 | ) | | | (73,399,753 | ) | | | (4,756,357 | ) | | | (5,051,116 | ) |

| | See accompanying notes which are an integral part of these financial statements. | 25 |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Large Cap Equity Fund | | | Dana Epiphany ESG

Small Cap Equity Fund | |

| | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2019 | | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2019 | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of year | | $ | 132,423,919 | | | $ | 205,823,672 | | | $ | 14,617,743 | | | $ | 19,668,859 | |

End of year | | $ | 115,993,712 | | | $ | 132,423,919 | | | $ | 9,861,386 | | | $ | 14,617,743 | |

Share Transactions – Institutional Class (a) | | | | | | | | |

Shares sold | | | 1,538,470 | | | | 2,457,771 | | | | 98,505 | | | | 155,114 | |

Shares issued in connection with class consolidation | | | — | | | | — | | | | 161,172 | | | | — | |

Shares issued in reinvestment of distributions | | | 262,762 | | | | 651,067 | | | | 657 | | | | 121,257 | |

Shares redeemed | | | (2,218,189 | ) | | | (6,308,605 | ) | | | (469,527 | ) | | | (523,215 | ) |

Total – Institutional Class | | | (416,957 | ) | | | (3,199,767 | ) | | | (209,193 | ) | | | (246,844 | ) |

Share Transactions – Investor Class (a) | | | | | | | | | | | | |

Shares sold | | | 85,588 | | | | 28,606 | | | | 11,511 | | | | 15,249 | |

Shares issued in reinvestment of distributions | | | 127,884 | | | | 171,527 | | | | — | | | | 28,188 | |

Shares redeemed | | | (174,728 | ) | | | (372,375 | ) | | | (65,194 | ) | | | (141,956 | ) |

Shares redeemed in connection with class consolidation | | | — | | | | — | | | | (163,036 | ) | | | — | |

Total – Investor Class | | | 38,744 | | | | (172,242 | ) | | | (216,719 | ) | | | (98,519 | ) |

(a) | Effective at the close of business on June 4, 2020, Investor Class shares of the Dana Epiphany ESG Small Cap Fund were consolidated into the Institutional Class shares. |

26 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Epiphany ESG Equity Fund | |

| | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2019 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 115,632 | | | $ | 134,153 | |

Net realized gain on investment securities transactions | | | 234,203 | | | | 1,947,772 | |

Net change in unrealized appreciation (depreciation) of investment securities | | | 362,862 | | | | (578,233 | ) |

Net increase in net assets resulting from operations | | | 712,697 | | | | 1,503,692 | |

Distributions to Shareholders from Earnings (Note 2) | | | | | | | | |

Institutional Class | | | (862,512 | ) | | | (746,819 | ) |

Investor Class | | | (1,182,772 | ) | | | (1,014,147 | ) |

Total distributions | | | (2,045,284 | ) | | | (1,760,966 | ) |

Capital Transactions – Institutional Class (a) | | | | | | | | |

Proceeds from shares sold | | | 2,228,653 | | | | 282,765 | |

Shares issued in connection with class consolidation | | | 7,410,006 | | | | — | |

Reinvestment of distributions | | | 856,169 | | | | 734,812 | |

Amount paid for shares redeemed | | | (2,402,606 | ) | | | (2,277,604 | ) |

Total – Institutional Class | | | 8,092,222 | | | | (1,260,027 | ) |

Capital Transactions – Investor Class (a) | | | | | | | | |

Proceeds from shares sold | | | 963,569 | | | | 394,428 | |

Reinvestment of distributions | | | 1,167,223 | | | | 993,640 | |

Amount paid for shares redeemed | | | (1,238,947 | ) | | | (2,571,196 | ) |

Shares redeemed in connection with class consolidation | | | (7,410,006 | ) | | | — | |

Total – Investor Class | | | (6,518,161 | ) | | | (1,183,128 | ) |

Net increase (decrease) in net assets resulting from capital transactions | | | 1,574,061 | | | | (2,443,155 | ) |

Total Increase (Decrease) in Net Assets | | | 241,474 | | | | (2,700,429 | ) |

Net Assets | | | | | | | | |

Beginning of year | | | 12,820,632 | | | | 15,521,061 | |

End of year | | $ | 13,062,106 | | | $ | 12,820,632 | |

| | See accompanying notes which are an integral part of these financial statements. | 27 |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Epiphany ESG Equity Fund | |

| | | For the

Year Ended

October 31, 2020 | | | For the

Year Ended

October 31, 2019 | |

Share Transactions – Institutional Class (a) | | | | |

Shares sold | | | 242,216 | | | | 25,958 | |

Shares issued in connection with class consolidation | | | 747,410 | | | | — | |

Shares issued in reinvestment of distributions | | | 82,565 | | | | 72,259 | |

Shares redeemed | | | (237,169 | ) | | | (208,847 | ) |

Total – Institutional Class | | | 835,022 | | | | (110,630 | ) |

Share Transactions – Investor Class (a) | | | | |

Shares sold | | | 87,988 | | | | 34,862 | |

Shares issued in reinvestment of distributions | | | 108,459 | | | | 95,050 | |

Shares redeemed | | | (123,629 | ) | | | (226,525 | ) |

Shares redeemed in connection with class consolidation | | | (722,853 | ) | | | — | |

Total – Investor Class | | | (650,035 | ) | | | (96,613 | ) |

(a) | Effective at the close of business on June 4, 2020, Investor Class shares of the Dana Epiphany ESG Fund were consolidated into the Institutional Class shares. |

28 | See accompanying notes which are an integral part of these financial statements. | |

Dana Large Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.67 | | | $ | 18.22 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.23 | | | | 0.38 | | | | 0.32 | | | | 0.32 | | | | 0.26 | (a) |

Net realized and unrealized gain (loss) on investments | | | 0.86 | | | | 2.46 | | | | 0.45 | | | | 4.96 | | | | (0.56 | ) |

Total from investment operations | | | 1.09 | | | | 2.84 | | | | 0.77 | | | | 5.28 | | | | (0.30 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.23 | ) | | | (0.36 | ) | | | (0.32 | ) | | | (0.31 | ) | | | (0.25 | ) |

Net realized gains | | | (2.30 | ) | | | (2.14 | ) | | | (0.74 | ) | | | — | | | | — | |

Total distributions | | | (2.53 | ) | | | (2.50 | ) | | | (1.06 | ) | | | (0.31 | ) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | (b) | | | — | (b) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 21.25 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.67 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(c) | | | 4.65 | % | | | 15.55 | % | | | 3.27 | % | | | 30.11 | % | | | (1.66 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 91,379 | | | $ | 107,026 | | | $ | 176,954 | | | $ | 134,291 | | | $ | 138,540 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.91 | % | | | 0.85 | % | | | 0.86 | % | | | 0.92 | % | | | 0.91 | % |

After waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.74 | %(d) | | | 0.73 | % |

Ratio of net investment income to average net assets | | | 1.10 | % | | | 1.68 | % | | | 1.41 | % | | | 1.48 | % | | | 1.45 | % |

Portfolio turnover rate(e) | | | 57 | % | | | 50 | % | | | 58 | % | | | 50 | % | | | 69 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Per share net investment income has been determined on the basis of average shares outstanding during the year. |

(b) | Rounds to less than $0.005 per share. |

(c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(d) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.73% for the fiscal year ended October 31, 2017. |

(e) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| | See accompanying notes which are an integral part of these financial statements. | 29 |

Dana Large Cap Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.68 | | | $ | 18.23 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.18 | | | | 0.30 | | | | 0.28 | | | | 0.24 | | | | 0.22 | (a) |

Net realized and unrealized gain (loss) on investments | | | 0.87 | | | | 2.50 | | | | 0.43 | | | | 4.98 | | | | (0.57 | ) |

Total from investment operations | | | 1.05 | | | | 2.80 | | | | 0.71 | | | | 5.22 | | | | (0.35 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.18 | ) | | | (0.32 | ) | | | (0.26 | ) | | | (0.26 | ) | | | (0.20 | ) |

Net realized gains | | | (2.30 | ) | | | (2.14 | ) | | | (0.74 | ) | | | — | | | | — | |

Total distributions | | | (2.48 | ) | | | (2.46 | ) | | | (1.00 | ) | | | (0.26 | ) | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | (b) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 21.26 | | | $ | 22.69 | | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.68 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(c) | | | 4.43 | % | | | 15.29 | % | | | 3.01 | % | | | 29.72 | % | | | (1.91 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 24,615 | | | $ | 25,398 | | | $ | 28,870 | | | $ | 40,957 | | | $ | 32,514 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % | | | 1.17 | % | | | 1.16 | % |

After waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.99 | %(d) | | | 0.98 | % |

Ratio of net investment income to average net assets | | | 0.85 | % | | | 1.40 | % | | | 1.17 | % | | | 1.20 | % | | | 1.22 | % |

Portfolio turnover rate(e) | | | 57 | % | | | 50 | % | | | 58 | % | | | 50 | % | | | 69 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Per share net investment income has been determined on the basis of average shares outstanding during the year. |

(b) | Rounds to less than $0.005 per share. |

(c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(d) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.98% for the fiscal year ended October 31, 2017. |

(e) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

30 | See accompanying notes which are an integral part of these financial statements. | |

Dana Epiphany ESG Small Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each period)

| | | Years Ended October 31, | | | For the

Period

Ended

October 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016(a) | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.24 | | | $ | 11.09 | | | $ | 11.43 | | | $ | 9.30 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.01 | | | | 0.01 | | | | (0.03 | ) | | | — | (b) | | | 0.01 | |

Net realized and unrealized gain (loss) on investments | | | (0.42 | ) | | | (0.05 | ) | | | (0.31 | ) | | | 2.14 | | | | (0.70 | )(c) |

Total from investment operations | | | (0.41 | ) | | | (0.04 | ) | | | (0.34 | ) | | | 2.14 | | | | (0.69 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | — | | | | — | (b) | | | (0.01 | ) | | | (0.01 | ) |

Net realized gains | | | — | | | | (0.81 | ) | | | — | | | | — | | | | — | |

Total distributions | | | (0.01 | ) | | | (0.81 | ) | | | — | (b) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | (b) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.82 | | | $ | 10.24 | | | $ | 11.09 | | | $ | 11.43 | | | $ | 9.30 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(d) | | | (4.04 | )% | | | 0.83 | % | | | (2.95 | )% | | | 23.08 | % | | | (6.87 | )%(e) |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 9,861 | | | $ | 12,421 | | | $ | 16,196 | | | $ | 14,011 | | | $ | 6,575 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 2.58 | % | | | 1.88 | % | | | 1.75 | % | | | 2.02 | % | | | 4.11 | %(f) |

After waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | %(f) |

Ratio of net investment income (loss) to average net assets | | | 0.02 | % | | | 0.11 | % | | | (0.24 | )% | | | — | % | | | 0.12 | %(f) |

Portfolio turnover rate(g) | | | 88 | % | | | 50 | % | | | 78 | % | | | 58 | % | | | 54 | %(e) |

| | | | | | | | | | | | | | | | | | | | | |

(a) | For the period November 3, 2015 (commencement of operations) to October 31, 2016. |

(b) | Rounds to less than $0.005 per share. |

(c) | The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating values during the year. |

(d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(g) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| | See accompanying notes which are an integral part of these financial statements. | 31 |

Dana Epiphany ESG Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017(a) | | | 2016 | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 11.58 | | | $ | 11.80 | | | $ | 13.09 | | | $ | 10.86 | | | $ | 11.64 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.09 | | | | 0.14 | | | | 0.08 | (b) | | | 0.04 | (b) | | | (0.03 | )(b) |

Net realized and unrealized gain (loss) on investments | | | 0.47 | | | | 1.15 | | | | 0.74 | | | | 2.37 | | | | (0.15 | ) |

Total from investment operations | | | 0.56 | | | | 1.29 | | | | 0.82 | | | | 2.41 | | | | (0.18 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.01 | ) | | | — | (c) |

Net realized gains | | | (1.79 | ) | | | (1.39 | ) | | | (2.03 | ) | | | (0.17 | ) | | | (0.60 | ) |

Total distributions | | | (1.89 | ) | | | (1.51 | ) | | | (2.11 | ) | | | (0.18 | ) | | | (0.60 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | | | | — | (c) | | | — | (c) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 10.25 | | | $ | 11.58 | | | $ | 11.80 | | | $ | 13.09 | | | $ | 10.86 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(d) | | | 4.76 | % | | | 12.76 | % | | | 6.32 | % | | | 22.46 | % | | | (1.46 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 13,062 | | | $ | 5,079 | | | $ | 6,485 | | | $ | 7,429 | | | $ | 6,748 | |

Before waiver | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 2.00 | % | | | 2.13 | % | | | 1.63 | % | | | 2.15 | % | | | 2.43 | % |

After waiver | | | | | | | | | | | | | | | | | | | | |