united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC

Attn: Gregory Knoth

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 5/31

Date of reporting period: 5/31/2021

Item 1. Reports to Stockholders.

(a)

| |

| BFS Equity Fund |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| ANNUAL REPORT |

| |

| |

| May 31, 2021 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| 185 Asylum Street ● City Place II ● Hartford, CT 06103 ● (855) 575-2430 |

BFS Equity Fund

Letter to Shareholders

Dear Fellow Shareholders,

This annual report covers the period June 1, 2020, through May 31, 2021 – the BFS Equity Fund’s seventh full fiscal year.

The BFS Equity Fund (the “Fund”) was launched on November 8, 2013, with initial funds from investors of $1.1 million. On June 1, 2020, at the start of the Fund’s fiscal year, the Fund had net assets of $38.9 million. During the fiscal year, the net assets of the Fund increased 25.4% to $48.8 million, as of May 31, 2021. This growth was driven by net inflows from investors into the Fund, as well as by the positive investment return achieved by the Fund over the past fiscal year. As of May 31, 2021, there were approximately 700 investors in the Fund.

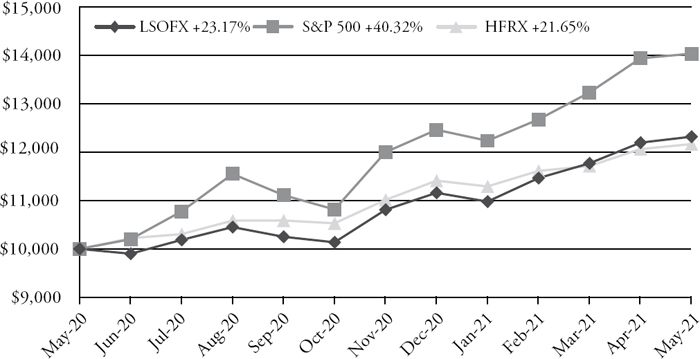

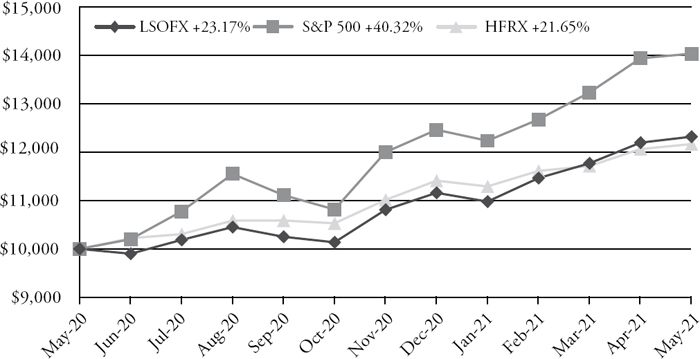

The BFS Equity Fund achieved a total return of 34.68% for the fiscal year commencing June 1, 2020, and ending May 31, 2021, underperforming the S&P 500® Index (“S&P 500”) total return of 40.32% and underperforming the Dow Jones Industrial Average (“Dow Jones”) total return of 38.79% for the same period. For the three-year period commencing June 1, 2018, and ending May 31, 2021, the Fund achieved an annualized total return of 15.23%, underperforming the S&P 500 annualized three-year total return of 18.00% and outperforming the Dow Jones annualized three-year total return of 14.82% for the same period. For the five-year period commencing June 1, 2016, and ending May 31, 2021, the Fund achieved an annualized total return of 14.83%, underperforming the S&P 500 annualized five-year total return of 17.16% and underperforming the Dow Jones annualized five-year total return of 16.88% for the same period.

This report includes a commentary from the Lead Portfolio Manager, Rob Bradley, and Co-Portfolio Managers, Tom Sargent, and Keith LaRose. Rob Bradley assumed the role of Lead Portfolio Manager of the Fund April 1, 2020, from Tim Foster who, after 25 years of providing substantial leadership for Bradley, Foster & Sargent, Inc., the company he co-founded and the investment advisor for the Fund, elected to transition into a reduced role at Bradley, Foster & Sargent, Inc. In his reduced role, as of March 31, 2020, Tim Foster completed his tour as Lead Portfolio Manager of the Fund. In the report you

will also find a listing of the portfolio holdings as of May 31, 2021, as well as financial statements and detailed information about the performance and positioning of the BFS Equity Fund.

The last twelve months has been a period of change. The equity market has been more anticipatory than in previous cycles, with returns being pulled forward. U.S. corporate debt has risen to the highest level on record – now at about 50% of GDP, while cash holdings of S&P 500 companies increased to an all-time high during 2020. The Fed has maintained an accommodative monetary policy during the last year but a continued rise in inflation that proves not to be transitory could lead to a tightening of monetary conditions and slower growth in output and business profits. The prospects for the passage of large fiscal spending programs before the end of the calendar year are uncertain and the resulting impact on deficit spending is unclear. Housing prices are rising rapidly because of a shortfall in supply and a rise in construction costs. There has been considerable shrinkage in the workforce and the remote work from anywhere employment model could persist indefinitely. Digitalization of the workforce has rapidly accelerated through the application of technology, automation, and robotics and the differential in wages based on education and skill levels continues to widen. There is increasing concern that the COVID-19 pandemic has not stabilized and that the Delta and other new variants are more threatening than initially perceived, especially for the unvaccinated. And the U.S. vaccination programs have slowed dramatically, even stalling in numerous states, as resistance to inoculations appears, at least at the moment, to be firmly entrenched.

All of these are potential catalysts that could impact the risk of investing in common stocks in the near-term. We believe that it is important for investors to take the long view. The important principle for creating wealth in the U.S. stock market is time in the market, not timing the market. Now, more than ever, it is important for investors to focus on quality companies ‒ with great brands, sound business models, quality management, wide moats, strong balance sheets, and strong cash flows. Investing in these companies for the long term rather than focusing on the short-term gyrations of the market will preserve capital in times of economic adversity and create wealth in times of economic growth.

In closing, it is important to reiterate our belief that, now more than ever, our investment strategy of investing in quality growth stocks purchased with a risk-mitigating approach and positioned to provide a margin of safety in the case of economic or market weakness is effective over the longer term. We believe the Fund’s ownership of shares in quality

companies with sound business models, strong brands, good balance sheets, professional management, and robust cash flow should be able to withstand market corrections, even bear markets, and perform well over the longer term.

The Portfolio Managers of the BFS Equity Fund and I are shareholders together with you. We thank you for the trust that you have placed in us to manage your assets.

Sincerely

Stephen L. Willcox

President and CEO

Bradley, Foster & Sargent, Inc.

BFS Equity Fund

Portfolio Managers’ Letter

The BFS Equity Fund celebrated its seventh anniversary last fall. As of the close of the Fund’s fiscal year on May 31, 2021, Fund assets were $48.8 million – up from $38.9 million at the start of the fiscal year on June 1, 2020. The price per share of the BFS Equity Fund has grown from $10 at its inception to $21.36 on May 31, 2021 – a compound annual growth rate of 11.79%. Our number of shareholders exceeds 700, primarily client families and friends of Bradley, Foster & Sargent, as well as principals of the firm.

The performance of the Fund for the year ending May 31, 2021, was 34.68%, compared to the total return for the Dow Jones of 38.79% and the S&P 500 of 40.32% for the period. In the six-month period ending May 31, 2021, the Fund returned 14.36% vs. the S&P 500’s total return of 16.95%.

As noted in our November 2020 Semi-Annual letter, volatility was the byword for the stock market. At the start of the Fund’s fiscal year on June 1, 2020, the S&P 500 opened at 3038.78; it closed the Fund’s fiscal year on May 28, 2021, at 4204.11 with a total return of 40.32%. However, during this seemingly unstoppable bull market, the S&P 500 tumbled 10.6% (intraday) in September. This was followed with an 8.5% drop in October, both caused primarily by uncertainties in the outcome of the 2020 elections. Finally, in November 2020, amidst the resulting clarity from the Biden win, the 12+ year bull market continued its relentless ascent, shrugging off the January 6 riot in the Capitol building in Washington D.C., spikes in the prices of commodities, and the specter of inflation. Buoyancy over the domestic housing market, a swift economic recovery from stimulus, superior earnings from agile companies, and burgeoning consumer optimism propelled the gains.

During this period, the Fund’s underweighting in industrials, materials, and energy undercut comparative performance, as did a sizeable cash position of 3%-5%. Our positioning in communication services, healthcare, consumer discretionary, and real estate recaptured some of the difference and, more recently with the start of the 2021 calendar year, our valuation-sensitive underweighting in technology has served the Fund well as in the first five months of 2021, the Fund outperformed the NASDAQ. Stock-selection, premised on valuation and fundamentals, continue to inspire our analyses, as does a longer-term outlook with an eye for the competitive leadership and growth prospects that make for outstanding companies and successful investments.

For the three calendar years ending 2020, the Fund’s total cumulative return of 42.54% compared favorably with the equal-weighted S&P 500® Index’s total return of 34.64% and the Dow Jones total return of 32.75% - outperformances of 7.90% and 9.79%, respectively. However, the Fund underperformed the technology-ascendant (FAANG+) S&P 500’s total return of 48.82% during this period. It is the goal of the Fund’s portfolio managers to overcome this underperformance over the coming years.

STOCK MARKET COMMENTARY

The first five calendar months of 2021 has started similarly to 2020 - a robust stock market on a path to taking out all new highs with volatility somewhat subdued. As this letter is written on June 30, 2021, the S&P 500 stands at 4295 – just below its all-time high of 4300 – 92.1% above the March 23, 2020, low of the Covid-abyss. Remarkably the S&P 500 is 26.9% above its February 19th, 2020, high mark, before the news of the pandemic took hold.

However, the outward optics belie an uneasy tension in the market, perhaps best illuminated by the much-loved NASDAQ. Amidst the course of this implacable bull market, the growth stock-laden NASDAQ has been the bellwether for risk appetite, as many investors have been attracted to so-called growth stocks at any price. Many hedge funds, often known for their nimbleness, have been caught flatfooted recently. Several long-tenured equity long-short hedge funds nearly went out of business, caught in a short squeeze in Gamestop and AMC (see the Bradley, Foster & Sargent Quarterly Commentary, March 2021). Other reputable funds have negative returns for the year, 14% or more below the S&P 500’s total return.

The government’s massive fiscal stimulus combined with the Federal Reserve’s dramatic increase in the money supply has resuscitated U.S. GDP growth, which miraculously contracted only -3.5% in 2020, after plunging 32.4% in the second quarter. This was the U.S. economy’s first contraction in twelve years. During the first quarter of 2021, U.S. GDP accelerated to +6.4% in Q1, and economists are projecting 6.6% GDP growth in Q2 2021. Employment has recovered with unemployment halving to 6.2% in March 2021 (from 13.1% in June 2020), but it is still a long way from the 3.6% pre-pandemic levels in February 2020.

In formulating our strategy for the Fund in the coming year, we are mindful of the following data points: (1) since February 2020, the Fed’s balance sheet has doubled, from $4.2 trillion to $8.1 trillion; (2) COVID-19 stimulus spending under the Trump

and Biden administrations now totals approximately $4.5 trillion, all funded by deficit spending; (3) the U.S. equity market has surged to all-time highs, resulting in a market cap equivalent of more than 200% of U.S. GDP; and (4) the yield on the U.S. 10-year Treasury Note exploded from 0.51% in August 2020 to 1.45% at present. Accordingly, the stock market should be bolstered by the strong fiscal and monetary tail winds, as well as the rock bottom level of interest rates, but the market’s rich valuation and the possibility of higher inflation and interest rates lead us to take a cautionary approach in the year to come.

INVESTMENT COMMENTARY

For the fiscal year ending May 31, 2021, the Fund returned 34.68%. Financials, Communications, Consumer Discretionary, and Real Estate were our most profitable investments, and our performance exceeded the respective S&P sectors most notably in Health Care (+38.1% vs +22.0%), Real Estate (+41.5% vs +29.7%), Consumer Discretion (+47.4% vs +38.6%), and Utilities (+17.0% vs +13.0%).

Stocks contributing to our outperformance in these sectors in the fiscal year included Danaher (+54.3%) Iqvia (+36.0%) and Thermo Fisher (+34.8%) in Healthcare, DR Horton (+74.0%), Home Depot (31.3%), and Lowes (26.8%) in Consumer Discretionary, and JPMorgan (+74.2%) and American Express (+71.0%) in Financials. Deere (+140.6%) and Caterpillar (105.4%) in Industrials, boosted performance.

Regarding relative performance, the Fund’s total return for the year was 34.68% – below the S&P 500’s total return of 40.32%. There were several reasons for this underperformance: underweighting the industrial and financial sectors, security selection in these sectors, as well as in the materials sector, and a sizeable cash position. For much of the year, the Fund was underweight the industrial sector and had only small positions in Deere and Caterpillar, which performed very well, and had no exposure to UPS. On the other hand, the Fund was overweight in the Materials sector, but its holdings of Barrick Gold Corporation, Agnico Eagle, and Ecolabs hurt relative performance considerably. Finally, the Fund’s cash position, which averaged 4-5% throughout the year, contributed approximately 2% to the Fund’s relative underperformance to the S&P 500.

As we discussed in our Semi-Annual letter, we believed 2021 was going to see a strong rebound in corporate earnings. We also cited caution over speculative and momentum stocks and a recognition that volatility could elevate, necessitating a higher-than-average cash holding to deploy into dislocations. Consequently, we structured the Fund with

broad diversity and balance in stocks of high-quality companies. For example, our largest weighting, the S&P 500 Technology Sector, which has two of our largest positions (Microsoft and Apple at 8.4% of our overall portfolio) posted the strongest return of any sector during the period under review at 42.64%. In the final seven months of 2020, this sector was up 34.1%, yet for first five months of 2021, it appreciated only 6.4%, trailing the S&P 500 by nearly 625 bps. Our weighting of 22.0% in this sub-sector (vs its 26.2% weighting in the S&P 500) led to underperformance in the latter half of 2020 and outperformance in first half of 2021 from this dynamic.

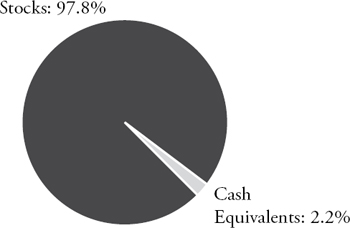

The Fund is off to a strong start in the first six months of 2021 up 12.10%. Our largest positions at the end of the fiscal year are Microsoft, Amazon, Alphabet, Apple, and Fiserv, which account for 19.5% of the overall portfolio, with our top ten holdings responsible for roughly 1/3 of our total portfolio of forty-nine stocks. Cash is 2.2%, down from the 5.0% that we kept on hand during much of the first part of the Fund’s fiscal year.

INVESTMENT STRATEGY

We recognize four dominant themes in the equity market right now: (1) inflation and its implications on sectoral leadership and corporate earnings; (2) labor shortages; (3) rising yields in the 10-year and 30-year bonds; and (4) tax policies at the corporate and personal level.

Despite these potential issues that could derail the market’s upward trend, there are still reasons to be bullish, even with the view that the best days of the market cycle may be behind us. A lower return environment is not tantamount to a bear market. We remain in a period of accommodative monetary policy and negative real rates of interest. Moreover, there are world-class companies which are structural winners with robust cash flows that are still trading below their intrinsic value. This suggests equities continue to provide a superior risk/reward opportunity for longer-term capital appreciation.

World-class companies with strong cash flow, margins, earnings growth, and balance sheets will continue to anchor our portfolio. The stalwarts of Microsoft, Amazon, Alphabet, and Facebook (newly added) feature prominently, along with best-in-class consumer companies (Home Depot, Lowes, Costco, Starbucks), financials (American Express, JP Morgan, Goldman Sachs), industrials (Caterpillar, Deere), media (Comcast, Disney), and healthcare (which we are overweight). We are also looking to add more

cyclical plays, with FedEx being a recent addition. Finally, we are long Oil (Conoco Phillips), Gold (Agnico Eagle) and Copper (Freeport McMoRan) as proxies for economic recovery and hedges against inflation.

We also note two important factors. Firstly, U.S. equities, according to a JP Morgan report, have beaten the rest of the world MSCI indices by 7% per annum over the past 13 years, but U.S. multiples are now at all-time highs against the rest of the world. Thus, we are keeping an eye out for best-in-class opportunities outside of the US that blend value with growth. Our position in Taiwan Semiconductors reflects this. Secondly, during the year under review, there has been a rotation in the market from Growth to Value, and then more recently investors have been favoring Growth. The implication for the Fund is that Value or GARP “growth at a reasonable price” stocks may not do as well as Growth stocks, as risk-loving investors regather confidence and chase performance. We carry a 2.2% cash position to deploy into dislocations which may arise.

CONCLUSION

We, the portfolio managers at Bradley, Foster & Sargent, Inc., are also shareholders of the BFS Equity Fund. We look forward to serving you through our management of the Fund. Thank you for placing your capital under our care.

| Robert H. Bradley | Keith G. LaRose | Thomas D. Sargent |

| Lead Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

BFS Equity Fund

ANNUAL PERFORMANCE REVIEW (UNAUDITED)

The Fund returned +34.68% for the twelve month period commencing June 1, 2020, and ending May 31, 2021, underperforming the S&P 500, which returned +40.32% and the Dow Jones, which gained +38.79% over the same period.

Key Detractors from Relative Results

| ● | The Industrial sector in the Fund, which was up 18.16% for the year, was the worst performing sector relatively, as this sector in the S&P 500, with its large concentration of Deere, Caterpillar, and UPS advanced 57.96%. The Fund was slightly underweight this sector but had only modest positions in Deere and Caterpillar and did not own UPS. |

| ● | The Fund was significantly overweight the Materials sector, but its positions in Barrick Gold and Agnico Eagle as well as Ecolabs hurt relative performance. |

| ● | The Fund’s cash position of 4-5% during the year contributed approximately 2% to the Fund’s underperformance relative to the S&P 500. |

Key Contributors to Relative Results

| ● | The Consumer Discretionary sector of the Fund returned 47.39% during the period, which compared favorably relative to the S&P 500’s sector return of +38.64%. D.R. Horton and Amazon were the best performers with returns of 72.46% and 38.41% for the fiscal year. |

| ● | The Fund’s health care sector returned 38.09% - considerably ahead of the S&P 500 sector’s return of 22.02%. Danaher and Thermo Fisher were the standouts with returns for the period of 62.81% and 43.60%, respectively. |

| ● | The Fund’s position in Apple was the Fund’s single largest contributor in dollar terms, adding over $1 million in realized and unrealized gains. |

FUND INFORMATION

May 31, 2021 (Unaudited)

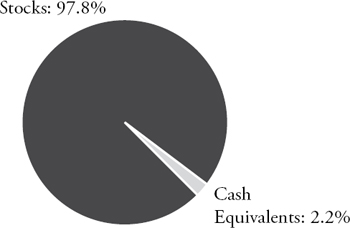

ASSET ALLOCATION

(as a percentage of net assets)

| TEN LARGEST HOLDINGS (%) | | FUND |

| Microsoft | | 4.7 |

| Amazon.com | | 4.2 |

| Alphabet, Class A | | 3.9 |

| Apple | | 3.9 |

| Fiserv | | 3.1 |

| Berkshire Hathaway, Class B | | 3.0 |

| Agnico Eagle Mines | | 3.0 |

| ConocoPhillips | | 2.9 |

| Costco | | 2.8 |

| Facebook | | 2.8 |

| SECTOR | | | | |

| DIVERSIFICATION (%) | | FUND | | S&P 500 |

| Technology | | 22.0 | | 26.2 |

| Healthcare | | 15.8 | | 13.0 |

| Consumer Discretionary | | 12.1 | | 12.1 |

| Communication Services | | 11.5 | | 11.1 |

| Materials | | 10.2 | | 2.8 |

| Financials | | 9.6 | | 11.9 |

| Industrials | | 8.5 | | 8.9 |

| Consumer Staples | | 5.2 | | 6.0 |

| Energy | | 2.9 | | 2.8 |

| Cash Equivalents | | 2.2 | | 0.0 |

| Utilities | | 0.0 | | 2.6 |

| Real Estate | | 0.0 | | 2.6 |

Availability of Portfolio Schedules (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

BFS Equity Fund

Investment Results (Unaudited)

Average Annual Total Returns(a) (For the periods ended May 31, 2021)

| | One | Three | Five | Since Inception |

| | Year | Year | Year | (November 8, 2013) |

| BFS Equity Fund | 34.68% | 15.23% | 14.83% | 11.79% |

| S&P 500® Index(b) | 40.32% | 18.00% | 17.16% | 14.38% |

| Dow Jones Industrial Average®(c) | 38.79% | 14.82% | 16.88% | 13.61% |

Total annual fund operating expenses, as disclosed in the BFS Equity Fund’s prospectus dated September 28, 2020, as supplemented May 6, 2021, were 1.52% of average daily net assets (1.25% after fee waivers/expense reimbursements by Bradley, Foster & Sargent, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until September 30, 2021, so that Total Annual Fund Operating Expenses does not exceed 1.00%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees of the Valued Advisers Trust (the “Trust”), and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset or brokerage/service arrangements, if applicable, in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including exchange-traded funds, that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 575-2430.

| (a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The Dow Jones Industrial Average® is a widely recognized unmanaged index of equity prices and is representative of a narrower market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

BFS Equity Fund

Investment Results (Unaudited) (continued)

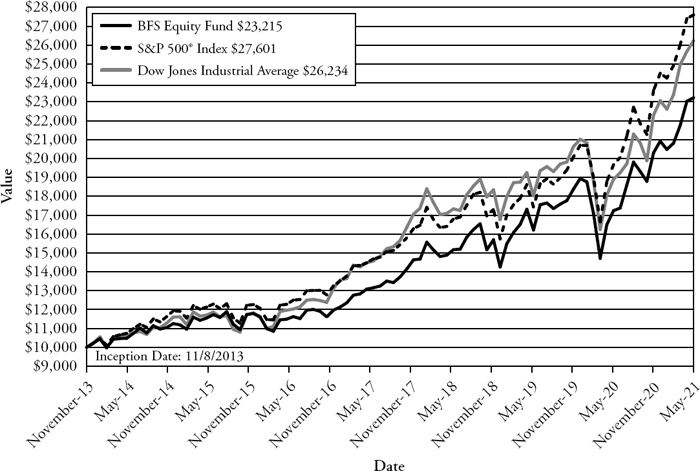

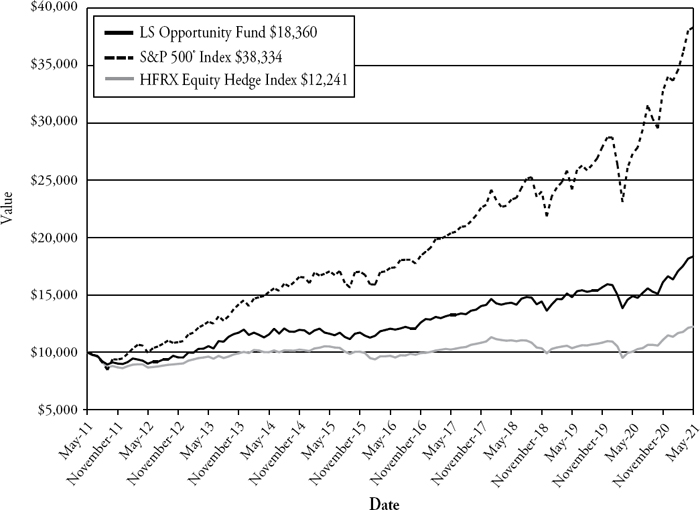

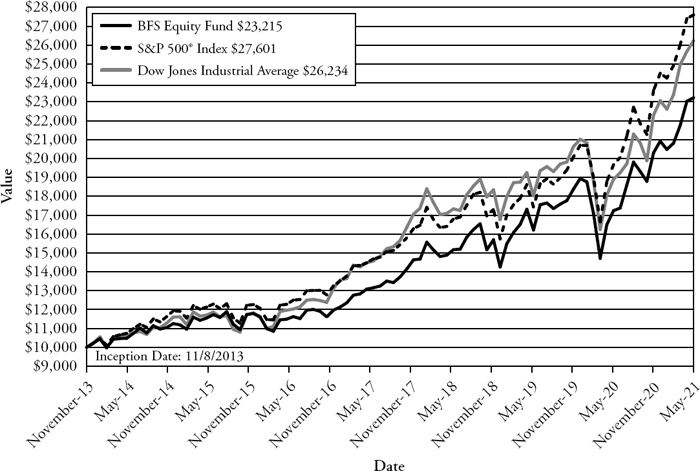

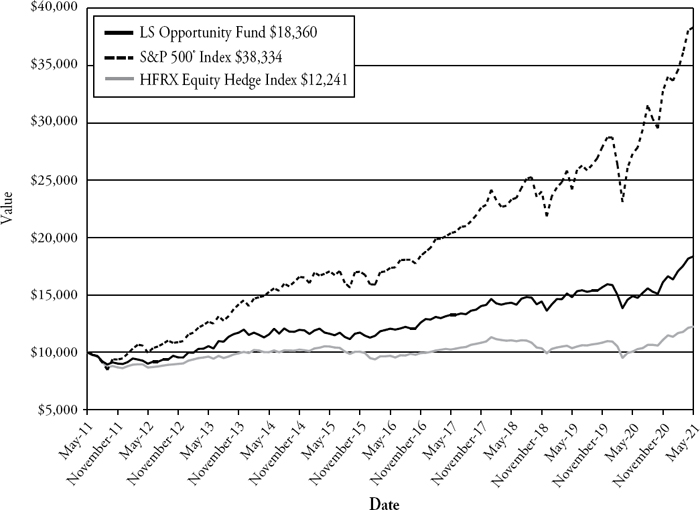

$10,000 Over 10 Years

Let’s say hypothetically that $10,000 was invested in the Fund, on November 8, 2013. The following chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index and Dow Jones Industrial Average performed over the same period.

Comparison of the Growth of a $10,000 Investment in the

BFS Equity Fund, the S&P 500® Index and the Dow Jones Industrial Average (Unaudited)

The chart above assumes an initial investment of $10,000 made on November 8, 2013 (commencement of operations) held through May 31, 2021. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (855) 575-2430. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

| BFS Equity Fund |

| Schedule of Investments |

| May 31, 2021 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.85% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense — 2.14% | | | | | | | | |

| Northrop Grumman Corp. | | | 2,000 | | | $ | 731,740 | |

| Raytheon Technologies Corp. | | | 3,500 | | | | 310,485 | |

| | | | | | | | 1,042,225 | |

| Banking — 2.53% | | | | | | | | |

| JPMorgan Chase & Co. | | | 7,500 | | | | 1,231,800 | |

| | | | | | | | | |

| Beverages — 1.21% | | | | | | | | |

| PepsiCo, Inc. | | | 4,000 | | | | 591,760 | |

| | | | | | | | | |

| Biotech & Pharmaceuticals — 5.17% | | | | | | | | |

| AbbVie, Inc. | | | 10,000 | | | | 1,132,000 | |

| Johnson & Johnson | | | 3,000 | | | | 507,750 | |

| Zoetis, Inc. | | | 5,000 | | | | 883,400 | |

| | | | | | | | 2,523,150 | |

| Cable & Satellite — 2.35% | | | | | | | | |

| Comcast Corp., Class A | | | 20,000 | | | | 1,146,800 | |

| | | | | | | | | |

| Chemicals — 4.60% | | | | | | | | |

| Ecolab, Inc. | | | 4,500 | | | | 967,860 | |

| Sherwin-Williams Co. (The) | | | 4,500 | | | | 1,275,885 | |

| | | | | | | | 2,243,745 | |

| E-Commerce Discretionary — 4.13% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 625 | | | | 2,014,419 | |

| | | | | | | | | |

| Electrical Equipment — 1.17% | | | | | | | | |

| Keysight Technologies, Inc.(a) | | | 4,000 | | | | 569,520 | |

| | | | | | | | | |

| Entertainment Content — 1.46% | | | | | | | | |

| Walt Disney Co. (The)(a) | | | 4,000 | | | | 714,600 | |

| | | | | | | | | |

| Food — 1.30% | | | | | | | | |

| Mondelez International, Inc., Class A | | | 10,000 | | | | 635,300 | |

| | | | | | | | | |

| Health Care Facilities & Services — 4.01% | | | | | | | | |

| IQVIA Holdings, Inc.(a) | | | 3,000 | | | | 720,480 | |

| UnitedHealth Group, Inc. | | | 3,000 | | | | 1,235,760 | |

| | | | | | | | 1,956,240 | |

| Home Construction — 2.44% | | | | | | | | |

| D.R. Horton, Inc. | | | 12,500 | | | | 1,191,125 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Schedule of Investments (continued) |

| May 31, 2021 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.85% - continued | | | | | | | | |

| | | | | | | | | |

| Institutional Financial Services — 1.83% | | | | | | | | |

| Goldman Sachs Group, Inc. (The) | | | 2,400 | | | $ | 892,848 | |

| | | | | | | | | |

| Insurance — 4.38% | | | | | | | | |

| Berkshire Hathaway, Inc., Class B(a) | | | 5,000 | | | | 1,447,200 | |

| Marsh & McLennan Cos., Inc. | | | 5,000 | | | | 691,750 | |

| | | | | | | | 2,138,950 | |

| Internet Media & Services — 6.57% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 800 | | | | 1,885,480 | |

| Facebook, Inc., Class A(a) | | | 4,000 | | | | 1,314,920 | |

| | | | | | | | 3,200,400 | |

| Leisure Facilities & Services — 0.58% | | | | | | | | |

| Starbucks Corp. | | | 2,500 | | | | 284,700 | |

| | | | | | | | | |

| Machinery — 3.76% | | | | | | | | |

| Caterpillar, Inc. | | | 1,000 | | | | 241,080 | |

| Deere & Co. | | | 1,000 | | | | 361,100 | |

| Parker-Hannifin Corp. | | | 4,000 | | | | 1,232,600 | |

| | | | | | | | 1,834,780 | |

| Medical Equipment & Devices — 6.60% | | | | | | | | |

| Danaher Corp. | | | 4,000 | | | | 1,024,560 | |

| Stryker Corp. | | | 4,000 | | | | 1,021,080 | |

| Thermo Fisher Scientific, Inc. | | | 2,500 | | | | 1,173,750 | |

| | | | | | | | 3,219,390 | |

| Metals & Mining — 5.57% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 20,000 | | | | 1,435,000 | |

| Freeport-McMoRan, Inc. | | | 30,000 | | | | 1,281,600 | |

| | | | | | | | 2,716,600 | |

| Oil & Gas Producers — 2.86% | | | | | | | | |

| ConocoPhillips | | | 25,000 | | | | 1,393,500 | |

| | | | | | | | | |

| Retail - Consumer Staples — 2.72% | | | | | | | | |

| Costco Wholesale Corp. | | | 3,500 | | | | 1,323,945 | |

| | | | | | | | | |

| Retail - Discretionary — 5.02% | | | | | | | | |

| Home Depot, Inc. (The) | | | 4,000 | | | | 1,275,640 | |

| Lowe’s Cos., Inc. | | | 6,000 | | | | 1,168,980 | |

| | | | | | | | 2,444,620 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Schedule of Investments (continued) |

| May 31, 2021 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.85% - continued | | | | | | | | |

| | | | | | | | | |

| Semiconductors — 1.20% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. - ADR | | | 5,000 | | | $ | 586,800 | |

| | | | | | | | | |

| Software — 9.54% | | | | | | | | |

| Adobe Systems, Inc.(a) | | | 2,000 | | | | 1,009,160 | |

| Microsoft Corp. | | | 9,000 | | | | 2,247,120 | |

| Oracle Corp. | | | 7,500 | | | | 590,550 | |

| SS&C Technologies Holdings, Inc. | | | 11,000 | | | | 812,570 | |

| | | | | | | | 4,659,400 | |

| Specialty Finance — 0.82% | | | | | | | | |

| American Express Co. | | | 2,500 | | | | 400,325 | |

| | | | | | | | | |

| Technology Hardware — 3.83% | | | | | | | | |

| Apple, Inc. | | | 15,000 | | | | 1,869,150 | |

| | | | | | | | | |

| Technology Services — 6.32% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 3,000 | | | | 588,060 | |

| Fiserv, Inc.(a) | | | 13,000 | | | | 1,497,600 | |

| MasterCard, Inc., Class A | | | 1,500 | | | | 540,870 | |

| Visa, Inc., Class A | | | 2,000 | | | | 454,600 | |

| | | | | | | | 3,081,130 | |

| Telecommunications — 1.16% | | | | | | | | |

| T-Mobile US, Inc.(a) | | | 4,000 | | | | 565,800 | |

| | | | | | | | | |

| Transportation & Logistics — 2.58% | | | | | | | | |

| FedEx Corp. | | | 4,000 | | | | 1,259,240 | |

| | | | | | | | | |

| Total Common Stocks (Cost $28,336,092) | | | | | | | 47,732,262 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Schedule of Investments (continued) |

| May 31, 2021 |

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS — 3.58% | | | | | | | | |

| | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.01%(b) | | | 1,745,424 | | | $ | 1,745,424 | |

| Total Money Market Funds (Cost $1,745,424) | | | | | | | 1,745,424 | |

| | | | | | | | | |

| Total Investments — 101.43% (Cost $30,081,516) | | | | | | | 49,477,686 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (1.43)% | | | | | | | (696,897 | ) |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 48,780,789 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of May 31, 2021. |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Statement of Assets and Liabilities |

| May 31, 2021 |

| Assets | | | |

| Investments in securities at fair value (cost $30,081,516) (Note 3) | | $ | 49,477,686 | |

| Receivable for fund shares sold | | | 57,196 | |

| Receivable for investments sold | | | 591,232 | |

| Dividends receivable | | | 45,602 | |

| Prepaid expenses | | | 8,688 | |

| Total Assets | | | 50,180,404 | |

| Liabilities | | | | |

| Payable for fund shares redeemed | | | 1,400 | |

| Payable for investments purchased | | | 1,317,410 | |

| Payable to Adviser (Note 4) | | | 24,155 | |

| Payable to Administrator (Note 4) | | | 7,169 | |

| Distribution (12b-1) fees accrued (Note 4) | | | 20,010 | |

| Other accrued expenses | | | 29,471 | |

| Total Liabilities | | | 1,399,615 | |

| Net Assets | | $ | 48,780,789 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 25,090,960 | |

| Accumulated earnings | | | 23,689,829 | |

| Net Assets | | $ | 48,780,789 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,283,606 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 21.36 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Statement of Operations |

| For the year ended May 31, 2021 |

| Investment Income | | | | |

| Dividend income (net of foreign taxes withheld of $11,876) | | $ | 499,504 | |

| Total investment income | | | 499,504 | |

| Expenses | | | | |

| Investment Adviser fees (Note 4) | | | 329,262 | |

| Distribution (12b-1) fees (Note 4) | | | 109,754 | |

| Administration and compliance services fees (Note 4) | | | 39,097 | |

| Registration expenses | | | 27,185 | |

| Fund accounting fees (Note 4) | | | 25,000 | |

| Legal fees | | | 20,623 | |

| Transfer agent fees (Note 4) | | | 18,000 | |

| Audit and tax preparation fees | | | 17,500 | |

| Printing and postage expenses | | | 9,376 | |

| Trustee fees | | | 4,971 | |

| Custodian fees | | | 4,319 | |

| Insurance expenses | | | 3,081 | |

| Miscellaneous | | | 35,324 | |

| Total expenses | | | 643,492 | |

| Fees contractually waived by Adviser (Note 4) | | | (93,387 | ) |

| Net operating expenses | | | 550,105 | |

| Net investment loss | | | (50,601 | ) |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on: | | | | |

| Investment securities transactions | | | 6,170,271 | |

| Foreign currency | | | 19 | |

| Net change in unrealized appreciation on investments | | | 6,794,817 | |

| Net realized and change in unrealized gain on investments | | | 12,965,107 | |

| Net increase in net assets resulting from operations | | $ | 12,914,506 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| Increase (Decrease) in Net Assets due to: | | May 31, 2021 | | | May 31, 2020 | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | (50,601 | ) | | $ | 84,280 | |

| Net realized gain (loss) on investment securities transactions and foreign currency | | | 6,170,290 | | | | (910,939 | ) |

| Net change in unrealized appreciation on investments | | | 6,794,817 | | | | 2,979,164 | |

| Net increase in net assets resulting from operations | | | 12,914,506 | | | | 2,152,505 | |

| Distributions to Shareholders from Earnings (Note 2) | | | (677,735 | ) | | | (729,409 | ) |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 3,372,117 | | | | 4,251,409 | |

| Reinvestment of distributions | | | 565,222 | | | | 608,093 | |

| Amount paid for shares redeemed | | | (6,257,021 | ) | | | (3,379,179 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | (2,319,682 | ) | | | 1,480,323 | |

| Total Increase in Net Assets | | | 9,917,089 | | | | 2,903,419 | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 38,863,700 | | | | 35,960,281 | |

| End of year | | $ | 48,780,789 | | | $ | 38,863,700 | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 175,156 | | | | 255,499 | |

| Shares issued in reinvestment of distributions | | | 29,717 | | | | 34,570 | |

| Shares redeemed | | | (334,774 | ) | | | (211,771 | ) |

| Net increase (decrease) in shares outstanding | | | (129,901 | ) | | | 78,298 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | May 31, | | | May 31, | | | May 31, | | | May 31, | | | May 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 16.10 | | | $ | 15.40 | | | $ | 14.96 | | | $ | 13.01 | | | $ | 11.55 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.02 | ) | | | 0.03 | | | | 0.04 | | | | 0.04 | | | | 0.04 | |

| Net realized and unrealized gain on investments | | | 5.57 | | | | 0.97 | | | | 0.90 | | | | 1.96 | | | | 1.47 | |

| Total from investment operations | | | 5.55 | | | | 1.00 | | | | 0.94 | | | | 2.00 | | | | 1.51 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.03 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.05 | ) |

| Net realized gains | | | (0.29 | ) | | | (0.27 | ) | | | (0.46 | ) | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.29 | ) | | | (0.30 | ) | | | (0.50 | ) | | | (0.05 | ) | | | (0.05 | ) |

| Net asset value, end of year | | $ | 21.36 | | | $ | 16.10 | | | $ | 15.40 | | | $ | 14.96 | | | $ | 13.01 | |

| Total Return(a) | | | 34.68 | % | | | 6.32 | % | | | 6.84 | % | | | 15.36 | % | | | 13.15 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 48,781 | | | $ | 38,864 | | | $ | 35,960 | | | $ | 31,750 | | | $ | 27,185 | |

| Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 1.46 | % | | | 1.52 | % | | | 1.57 | % | | | 1.65 | % | | | 1.75 | % |

| Ratio of net investment income (loss) to average net assets | | | (0.12 | )% | | | 0.21 | % | | | 0.28 | % | | | 0.26 | % | | | 0.35 | % |

| Portfolio turnover rate | | | 68.77 | % | | | 49.27 | % | | | 38.71 | % | | | 38.17 | % | | | 47.82 | % |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Notes to the Financial Statements |

| May 31, 2021 |

NOTE 1. ORGANIZATION

The BFS Equity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end diversified series of Valued Advisers Trust (the “Trust”) and commenced operations on November 8, 2013. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board” or the “Trustees”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Bradley, Foster & Sargent, Inc. (the “Adviser”). The investment objective of the Fund is long-term appreciation through growth of principal and income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended May 31, 2021, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the fiscal year ended May 31, 2021, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2021 |

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For financial statement and income tax purposes, the specific identification method is used for determining capital gains or losses. Dividend income and dividend expense are recorded on the ex-dividend date and interest income is recorded on an accrual basis. Dividend income from real estate investment trusts (REITs) and distributions from limited partnerships are recognized on the ex-date. The calendar year end classification of distributions received from REITs during the fiscal year are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available. Income or loss from Limited Partnerships is reclassified among the components of net assets upon receipt of Schedules K-1 (Form 1065). Non-cash income, if any, is recorded at the fair market value of the securities received. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the unrealized gain or loss from investments. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2021 |

For the fiscal year ended May 31, 2021, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | Accumulated Earnings |

| Paid-In Capital | | (Deficit) |

| $(1) | | $1 |

Share Valuation – The NAV is calculated each day the New York Stock Exchange (the “NYSE”) is open by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding for the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/ or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2021 |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2021:

| | | Valuation Inputs | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks(a) | | $ | 47,732,262 | | | $ | — | | | $ | — | | | $ | 47,732,262 | |

| Money Market Funds | | | 1,745,424 | | | | — | | | | — | | | | 1,745,424 | |

| Total | | $ | 49,477,686 | | | $ | — | | | $ | — | | | $ | 49,477,686 | |

| (a) | Refer to Schedule of Investments for industry classifications. |

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2021 |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the investment advisory agreement on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund. For the fiscal year ended May 31, 2021, the Adviser earned a fee of $329,262 from the Fund before the waivers described below. At May 31, 2021, the Fund owed the Adviser $24,155.

The Adviser has contractually agreed to waive or limit its management fee and/or reimburse certain operating expenses until September 30, 2021, but only to the extent necessary so that the Fund’s net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1 fees and indirect expenses (such as “acquired funds fees and expenses”) do not exceed 1.00%.

Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. The contractual agreement is in effect through September 30, 2021. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board, and it will automatically terminate upon the termination of the investment advisory agreement between the Fund and the Adviser. For the fiscal year ended May 31, 2021, the Adviser waived fees of $93,387.

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are as follows:

| Recoverable through | | Amount | |

| May 31, 2022 | | $ | 110,755 | |

| May 31, 2023 | | | 108,051 | |

| May 31, 2024 | | | 93,387 | |

The Trust retains Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”) to provide the Fund with administration and compliance (including a chief compliance officer), fund accounting, and transfer agent services, including all regulatory reporting. For the fiscal year ended May 31, 2021, the Administrator earned fees of $39,097 for administration and compliance services, $25,000 for fund accounting services and $18,000 for transfer agent services. At May 31, 2021, the Fund owed the Administrator $7,169 for such services.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator and are not paid by the Trust for services to the Fund. Ultimus Fund Distributors, LLC (the “Distributor”), a wholly owned subsidiary of Ultimus, acts as the distributor of the Fund’s shares.

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2021 |

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of shareholder support services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 fees”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. For the fiscal year ended May 31, 2021, 12b-1 fees incurred by the Fund were $109,754. The Fund owed $20,010 for 12b-1 fees as of May 31, 2021.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended May 31, 2021, purchases and sales of investment securities, other than short-term investments, were $29,211,752 and $31,873,837, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended May 31, 2021.

NOTE 6. FEDERAL TAX INFORMATION

At May 31, 2021, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 19,402,767 | |

| Gross unrealized depreciation | | | (19,617 | ) |

| Net unrealized appreciation on investments | | $ | 19,383,150 | |

| Tax cost of investments | | $ | 30,094,536 | |

At May 31, 2021, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

The tax character of distributions paid for the fiscal years ended May 31, 2021 and May 31, 2020 were as follows:

| | | 2021 | | | 2020 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income(a) | | $ | — | | | $ | 123,761 | |

| Long-term capital gains | | | 677,735 | | | | 605,648 | |

| Total distributions paid | | $ | 677,735 | | | $ | 729,409 | |

| (a) | For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2021 |

At May 31, 2021, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 1,733,996 | |

| Undistributed long-term capital gains | | | 2,572,683 | |

| Unrealized appreciation (depreciation) | | | 19,383,150 | |

| Total accumulated earnings | | $ | 23,689,829 | |

NOTE 7. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosure and/or adjustments resulting from subsequent events through the date these financial statements were issued. Effective July 23, 2021, the Adviser completed an equity recapitalization to reallocate capital ownership interests among its management team in an effort to ensure firm continuity as certain founding shareholders of the Adviser move toward retirement. Because this recapitalization resulted in a technical change of control of the Adviser, the investment advisory agreement between the Adviser and the Trust with respect to the Fund automatically terminated. At a meeting held on April 28, 2021, the Board approved an interim investment advisory agreement and a new investment advisory agreement. The new investment advisory agreement is subject to shareholder approval. The interim agreement, which became effective on July 23, 2021, will terminate upon the earlier of (i) 150 days from its effective date or (ii) the date of approval of a new investment advisory agreement by the shareholders of the Fund. Except for the effective and termination dates, the deposit of advisory fees into an escrow account, and other terms required by the 1940 Act, the terms of the interim agreement and the new agreement are identical to the terms of the previous investment advisory agreement. There were no changes in the investment strategy of the Fund or the portfolio managers of the Fund as a result of the change of control of the Adviser. There were no changes to the fees paid to the Adviser by the Fund, and all fees under the interim agreement will be held in escrow pending shareholder approval of the new agreement. The new agreement was submitted to the shareholders of the Fund for approval via a proxy solicitation. There are no additional items requiring adjustment of financial statements or additional disclosure.

| Report of Independent Registered Public Accounting Firm |

To the Shareholders of BFS Equity Fund and

Board of Trustees of Valued Advisers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BFS Equity Fund (the “Fund”), a series of Valued Advisers Trust, as of May 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2021, by correspondence with the custodian and broker. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2013.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 28, 2021

| BFS Equity Fund |

| Summary of Fund Expenses (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2020 through May 31, 2021.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | Ending | | | | |

| | | Account Value | | Account Value | | Expenses Paid | | Annualized |

| | | December 1, 2020 | | May 31, 2021 | | During Period(a) | | Expense Ratio |

| | | | | | | | | |

| Actual | | $1,000.00 | | $1,143.60 | | $6.68 | | 1.25% |

| Hypothetical(b) | | $1,000.00 | | $1,018.70 | | $6.29 | | 1.25% |

| (a) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| Additional Federal Income Tax Information (Unaudited) |

The Form 1099-DIV you receive in January 2022 will show the tax status of all distributions paid to your account in calendar year 2021. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 0% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2021 ordinary income dividends, 0% qualifies for the corporate dividends received deduction.

For the year ended May 31, 2021, the Fund designated $677,735 as long-term capital gain distributions.

| Trustees and Officers (Unaudited) |

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each of the Independent Trustees.

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other Directorships | Other Directorships |

Andrea N. Mullins, (54)

Independent Trustee

Since December 2013

Chairperson since

March 2017 | Current: Private investor; Independent Contractor, SWM Advisors (since April 2014). | Trustee, Angel Oak Funds Trust (since February 2019) (5 portfolios); Trustee, Angel Oak Strategic Credit Fund (since February 2019); Trustee, Angel Oak Financial Strategies Income Term Trust (since May 2019); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (since June 2020). |

| Trustees and Officers (Unaudited) (continued) |

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other Directorships | Other Directorships |

Ira P. Cohen, (62)

Independent Trustee

Since June 2010 | Current: Independent financial services consultant (since February 2005); Executive Vice President of Asset Management Services, Recognos Financial (since August 2015). | Trustee and Audit Committee Chairman, Griffin Institutional Access Credit Fund (since January 2017); Trustee and Audit Committee Chairman, Griffin Institutional Real Estate Access Fund (since May 2014); Trustee, Angel Oak Funds Trust (since October 2014) (5 portfolios) Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Strategic Credit Fund (since December 2017) Trustee and Chairman, Angel Oak Financial Strategies Income Term Trust (since May 2019); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (since June 2020). |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below should serve as a Trustee.

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other Directorships | Other Directorships |

Mark J. Seger***, (59)

Trustee

Since March 2017 | Current: Vice Chairman and Co-Founder, Ultimus Fund Solutions, LLC and its subsidiaries (since 1999). | None. |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 13 series. |

| *** | Mr. Seger is considered an “interested person” of the Trust because of his relationship with the Trust’s administrator, transfer agent, and distributor. |

| Trustees and Officers (Unaudited) (continued) |

The following table provides information regarding the Officers of the Trust:

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During Past 5 Years | Other Directorships |

Adam T. Kornegay, (36)

Principal Executive Officer

and President

Since April 2018 | Current: Vice President, Business Development Director, Ultimus Fund Solutions, LLC (since March 2015). | None. |

Gregory T. Knoth, (51)

Principal Financial Officer

and Treasurer

Since April 2019 | Current: Senior Vice President, Mutual Fund Controller, Ultimus Fund Solutions, LLC (since January 2016). | None. |

Kevin J. Patton, (51)

Chief Compliance Officer

Since March 2020 | Current: Assistant Vice President, Compliance Officer, Ultimus Fund Solutions, LLC (since January 2020). Previous: Partner and Chief Compliance Officer, Renaissance Investment Management (August 2005 to January 2020). | None. |

Carol J. Highsmith, (56)

Vice President

Since August 2008

Secretary

Since March 2014 | Current: Vice President, Ultimus Fund Solutions, LLC (since December 2015). | None. |

Matthew J. Miller, (45)

Vice President

since December 2011 | Current: Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (since December 2015). | None. |

Stephen L. Preston, (54)

AML Officer

since June 2017 | Current: Chief Compliance Officer of Ultimus Fund Distributors, LLC (since June 2011). Previous: Chief Compliance Officer, Ultimus Fund Solutions, LLC (June 2011 to August 2019); Chief Compliance Officer, Unified Financial Securities, LLC (April 2018 to December 2019). | None. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 13 series. |

| BFS Equity Fund |

| Investment Advisory Agreement Approval (Unaudited) |

At a meeting held on April 28, 2021, the Board of Trustees (the “Board”) considered the approval of an Interim Investment Advisory Agreement (the “Interim Agreement”) between Valued Advisers Trust (the “Trust”) and Bradley, Foster & Sargent, Inc. (“BFS”) with respect to the BFS Equity Fund (the “Fund”), and the approval of a new Investment Advisory Agreement (the “BFS Agreement”) between the Trust and BFS with respect to the Fund. BFS provided written information to the Board to assist the Board in its considerations.

The Interim Agreement and the BFS Agreement were necessary because of a transaction whereby BFS completed an equity recapitalization to reallocate capital ownership interests among its management team in an effort to ensure firm continuity as certain founding shareholders of BFS move toward retirement. Because this recapitalization resulted in a technical change of control of BFS, the existing investment advisory agreement between BFS and the Trust with respect to the Fund automatically terminated.