united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC

Attn: Zachary Richmond

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 5/31

Date of reporting period: 5/31/2022

Item 1. Reports to Stockholders.

(a)

BFS Equity Fund

ANNUAL REPORT

May 31, 2022

185 Asylum Street • City Place II • Hartford, CT 06103 • (855) 575-2430

BFS Equity Fund

Letter to Shareholders (Unaudited)

Dear Shareholders,

This annual report covers the period June 1, 2021 through May 31, 2022 – the BFS Equity Fund’s eighth full fiscal year.

The BFS Equity Fund (the “Fund”) was launched on November 8, 2013, with initial funds from investors of $1.1 million. On June 1, 2021, at the start of the Fund’s fiscal year, the Fund had net assets of $48.8 million. During the fiscal year, the net assets of the Fund declined modestly to $46.8 million due to the difficult market environment. As of May 31, 2022, there were approximately 731 investors in the Fund.

The Fund generated a net return of -4.71% for the fiscal year commencing June 1, 2021 and ending May 31, 2022. For the three-year period commencing June 1, 2019, and ending May 31, 2022, the Fund achieved an annualized total return of 10.92%; and for the five-year period commencing June 1, 2017, and ending May 31, 2022, the Fund achieved an annualized total return of 10.96%.

Given the very challenging investment environment and unsettled economic outlook, it is important to reiterate our belief that, now more than ever, our investment strategy of investing in quality growth and value stocks purchased with a risk-mitigating approach and positioned to provide a margin of safety in the case of economic or market weakness is effective over the longer term. We believe the Fund’s ownership of shares in quality companies with sound business models, strong brands, good balance sheets, professional management, and robust cash flow should be able to withstand market corrections, even bear markets, and perform well over the longer term.

This report includes an extensive commentary from the Lead Portfolio Manager, Rob Bradley, and Co-Portfolio Managers, Tom Sargent and Keith LaRose.

We thank you for the trust that you have placed in us to manage your assets. Sincerely,

Galan G. Daukas

President and CEO

Bradley, Foster & Sargent, Inc.

BFS Equity Fund

Portfolio Manager’s Letter (Unaudited)

May 31, 2022

The BFS Equity Fund (the “Fund”) celebrated its eighth anniversary last fall. As of the close of the Fund’s fiscal year on May 31, 2022, Fund assets were $46.8 million. The price per share of the Fund has grown from $10 at its inception to $18.52 on May 31, 2022 – a compound annual growth rate (including dividends paid) of 9.72%.

The performance of the Fund for the year ended May 31, 2022, was -4.71%, compared to the total return for the Dow Jones Industrial Average (“Dow Jones”) of -2.65% and the S&P 500 Index (“S&P 500”) of -0.30% for the period. In the six-month period ended May 31, 2022, the Fund returned -12.60% vs. the S&P 500’s total return of -8.85%.

For the three calendar years ending 2021, the Fund’s total cumulative return of 83.11% compared favorably with the total cumulative return of the Dow Jones of 66.34% during this period - an outperformance of 16.77%. However, the Fund underperformed the total cumulative return of 100.37% for the S&P 500 during this period due to the heavy weighting of the FAANG plus Microsoft stocks in the S&P 500. It is the goal of the Fund’s portfolio managers to overcome this underperformance vs the S&P 500 over the coming years

The long bull market that commenced in March 2009 came to an end during the first months of 2022. There were two main reasons that caused the stock market to roll over: the first was the expectation of higher interest rates to combat the highest level of inflation in the U.S. in 40 years; the second was Russia’s invasion of Ukraine in February 2022.

From its all-time intra-day high of 16,212.23 on November 22, 2021, the NASDAQ Composite dropped 31.9% to its intra-day low on May 20, 2022. The S&P 500 did not decline as much as the technology-laden NASDAQ Composite, but the S&P 500 dropped 20.9% from its all-time intra-day high of 4,818.62 to its intra-day low of 3,810.32 on May 20, 2022. Bear markets are generally defined as a 20% drop so investors experienced a bear market decline during this period.

INVESTMENT COMMENTARY

For the fiscal year ended May 31, 2022, the Fund’s total return was -4.71%. The most profitable sector by far was the Energy sector followed by the Health Care and Consumer Staples sectors. The sectors which were the major detractors in terms of absolute performance were the Consumer Discretionary, Communications and Materials sectors.

The stock that contributed most to absolute performance was Conoco Phillips (+107.5%). In the Consumer Staples sector, Costco contributed most (+32.2%). In the Health Care sector, the two stocks that contributed most positively to performance were United Health

BFS Equity Fund

Portfolio Manager’s Letter (Unaudited) (continued)

May 31, 2022

Group (21.4%) and Thermo Fisher Scientific (21.1%). In the Technology sector, Apple was up 20.2%

The key detractors from the absolute performance of the Fund were the following: FedEx (-35.8%), Agnico Eagle Mines (-32.7%), Amazon (-25.4%), and Qualcomm (-21.3%).

Regarding relative performance, the Fund’s total return for the year was -4.71%, below the S&P 500’s total return of -0.30%. The main reason for this underperformance was security selection in the Materials (Agnico Eagle), Industrial (FedEx), and Information Technology (Qualcomm) sectors. Positive security selection in the Consumer Staples (Costco) and Energy (Conoco Phillips) sectors helped to mitigate the underperformance.

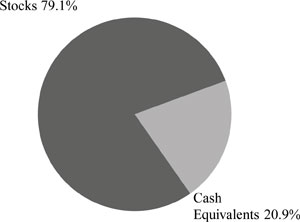

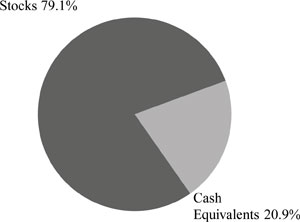

As discussed in the paragraphs below in the Stock Market Outlook section, the Federal Reserve’s steps to curb inflation have resulted in a steep upward trajectory in the path of interest rates. This has caused a contraction in the valuation of most stocks. The greatest sell-off has occurred thus far in 2022 in stocks of growth companies with rapid revenue growth but negative cash flow. Value stocks have declined less than growth stocks, but both have been affected by this revaluation. The Fund owns both value stocks and growth stocks. Based upon the statements of the Federal Reserve this year that they intend to raise interest rates throughout 2022, the Fund has accumulated significant cash reserves (which include short-term U.S. Treasury bills) which, as of May 31, 2022, represented 20.9% of the market value of the Fund.

Our largest five equity positions at the end of the fiscal year are in this order: Conoco Phillips, Microsoft, Alphabet, Apple, and United Health Group, which accounted for 25.1% of the overall portfolio. Our top ten holdings are responsible for roughly 40% of our total portfolio of thirty-six stocks.

STOCK MARKET OUTLOOK

At its January 2022 meeting, the Federal Reserve announced that the Fed Funds rate would be increased at its March meeting. With the Federal Reserve well behind the curve in dealing with an inflation rate of approximately 8%, investors understood that the increase in the Fed Funds rate in March would likely be the first in a series of interest rate hikes throughout 2022. Additionally, the Federal Reserve announced that the bank would curtail its quantitative easing policy, reducing its holdings of U.S. Treasury bonds and mortgage-backed securities. Since the beginning of 2022, the yield on the bellwether 10-year U.S. Treasury has increased almost 100% from 1.6% to 3.0%, as this letter goes to press. Many analysts believe that the yield on the 10-year U.S. Treasury will rise to 4% or more by the end of the year.

BFS Equity Fund

Portfolio Manager’s Letter (Unaudited) (continued)

May 31, 2022

The upward trajectory of interest rates is the primary reason for the stock market’s decline thus far in 2022. Higher interest rates not only result in falling bond prices but also cause a contraction in the valuation (Price/Earnings ratio) of the stock market. At the start of 2022, the P/E ratio on the forward operating earnings was approximately 21.5; at the end of May 2022, the P/E ratio had fallen to 18.0. If interest rates continue their steep upward climb, as the Federal Reserve seeks to bring inflation under control, the P/E ratio on the S&P 500 could fall to 16 or less, which would cause a further 10% or more drop in the market.

Investors are also worried that the Federal Reserve’s efforts to bring inflation down to the 2-3% level might cause a recession later this year or in 2023. Despite ample levels of liquidity and the likelihood of fiscal stimulus to the tune of a projected $1 trillion federal budget deficit for the fiscal year ending September 30, 2022, many analysts point to the serious recession in 1981-1982 caused by President Reagan’s and Federal Reserve Chairman Volker’s successful effort to break the back of inflation. Moreover, the U.S. highest gasoline prices on record will surely put a dent in the pocket of consumers in America. All the above has resulted in the lowest reading of consumer sentiment in the U.S. since 2011. Accordingly, we are cautious about the likely path of the stock market over the coming months.

INVESTMENT STRATEGY

In formulating our strategy for the Fund for the remainder of 2022, we remain cautious about the market’s trajectory, due to Federal Reserve need to get out in front of the highest level of inflation in 40 years. Realizing that it is currently behind the curve, the Federal Reserve will be not only raising the Fed Funds rate at future meetings but also shrinking its balance sheet through QT (Quantitative Tightening), reducing the financial assets it holds on its balance sheet by selling them into the financial markets or letting them mature without rolling them over. These may well cause a further contraction in the valuation of the stock market and even induce a recession as discussed above.

Accordingly, our strategy for the Fund is to continue to own what we consider to be world-class companies with strong cash flow, good margins, robust earnings growth, and strong balance sheets. We plan for the foreseeable future to remain overweight in the Energy and Materials sectors as a hedge against inflation. We also intend to own a combination of core/value stocks as well as growth stocks. Finally, we plan to continue to hold substantial dry powder in cash reserves and T-bills, as we observe the rise in interest rates, and its consequences, as the Federal Reserve deals with inflation. Although this current downturn in the stock market with high levels of volatility is painful, we look forward to the time when high quality stocks can be bought at bargain prices.

BFS Equity Fund

Portfolio Manager’s Letter (Unaudited) (continued)

May 31, 2022

CONCLUSION

We, the portfolio managers at Bradley, Foster & Sargent, Inc., are also shareholders of the BFS Equity Fund. We look forward to continuing to serve you through our management of the Fund. Thank you for placing your capital under our care.

| Robert Bradley | Keith LaRose | Thomas Sargent |

| Lead Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

BFS Equity Fund

Performance Review (Unaudited)

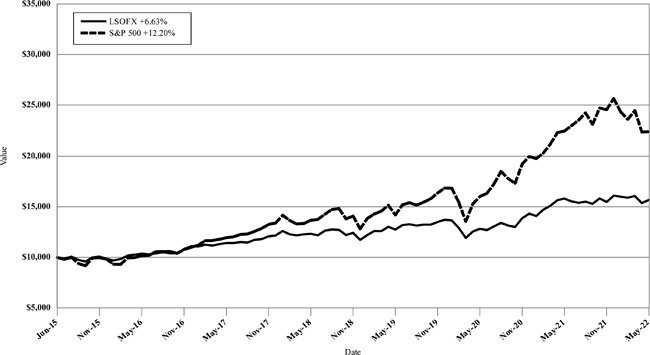

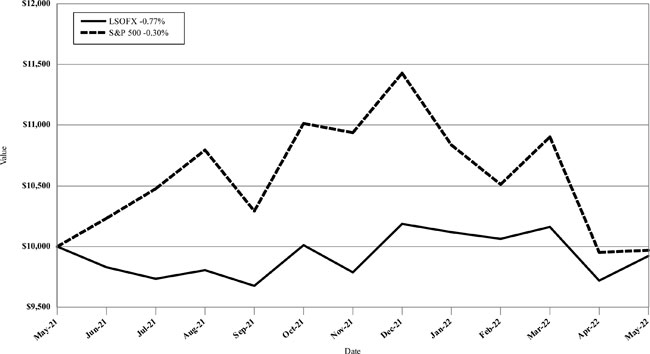

The Fund returned -4.71% for the twelve-month period commencing June 1, 2021 and ending May 31, 2022, underperforming the S&P 500, which returned -0.30% and the Dow Jones, which returned -2.65% over the same period.

Key Detractors from Relative Results

| 1. | The Fund was significantly overweight the Materials sector relative to S&P 500 sector weighting, and the Materials sector of the Fund was down -24.36% for the year. This was the Fund’s worst performing sector relatively with its positions in Agnico Eagle, Freeport McMoRan and Ecolab. |

| 2. | The Fund’s positions in Amazon, D.R. Horton, and Dick’s Sporting Goods detracted from the Fund’s performance in the Consumer Discretionary sector relative to the corresponding sector in the S&P 500. |

| 3. | The Fund’s positions in Qualcomm, Nvidia and Palo Alto caused the Fund’s underperformance in the Technology sector relative to the corresponding sector in the S&P 500. |

Key Contributors to Relative Results

| 1. | The Fund was overweight in the Energy sector, and its position in ConocoPhillips (+107.5%) helped the Fund’s Energy sector significantly outperform the corresponding sector in the S&P 500. The Fund’s position in ConocoPhillips contributed over $1.4 million in unrealized gains in the Fund for the period. |

| 2. | The Fund’s Consumer Staples sector returned 13.22% – ahead of the S&P 500 sector’s return of 9.19%. Costco and Pepsi were the leaders in this sector with returns for the period of 32.2% and 16.5%. |

FUND INFORMATION

May 31, 2022

ASSET ALLOCATION

(as a percentage of net assets)

| TEN LARGEST HOLDINGS (%) | | | | FUND |

| ConocoPhillips | | | | 6.0 |

| Microsoft | | | | 5.2 |

| Alphabet | | | | 4.9 |

| Apple | | | | 4.8 |

| UnitedHealth Group | | | | 4.3 |

| Amazon | | | | 3.6 |

| Raytheon | | | | 3.0 |

| Thermo Fisher Scientific | | | | 3.0 |

| Home Depot | | | | 2.6 |

| Sherwin-Williams | | | | 2.6 |

| | | | | |

| SECTOR | | | | |

| DIVERSIFICATION (%) | | FUND | | S&P 500 |

| Technology | | 16.8 | | 27.1 |

| Healthcare | | 16.0 | | 14.4 |

| Consumer Discretionary | | 9.5 | | 10.9 |

| Financials | | 7.4 | | 11.2 |

| Communication Services | | 7.4 | | 8.8 |

| Industrials | | 6.0 | | 7.8 |

| Energy | | 6.0 | | 4.8 |

| Consumer Staples | | 5.0 | | 6.5 |

| Materials | | 5.0 | | 2.8 |

| Utilities | | 0.0 | | 3.0 |

| Real Estate | | 0.0 | | 2.7 |

| Cash Equivalents | | 20.9 | | 0.0 |

BFS Equity Fund

Performance Review (Unaudited) (continued)

Availability of Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www. sec.gov and on the Fund’s website at www.bfsfunds.com.

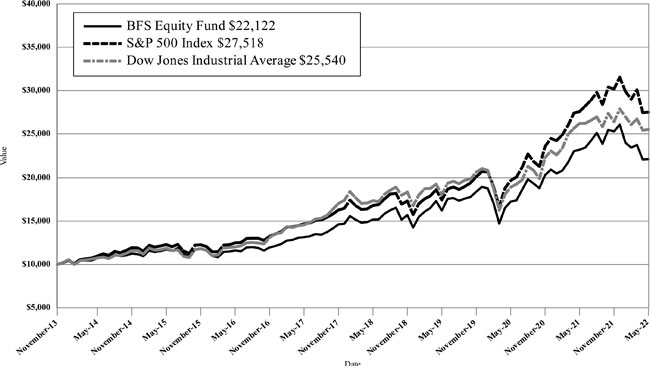

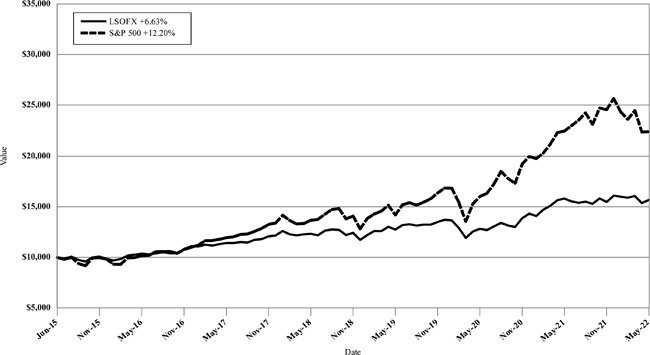

Investment Results (Unaudited)

Average Annual Total Returns* as of May 31, 2022

| | | | | | | Since Inception |

| | | One Year | | Five Year | | (November 8, 2013) |

| BFS Equity Fund | | (4.71)% | | 10.96% | | 9.72% |

| S&P 500® Index(a) | | (0.30)% | | 13.38% | | 12.55% |

| Dow Jones Industrial Average(b) | | (2.65)% | | 11.87% | | 11.58% |

Total annual fund operating expenses, as disclosed in the BFS Equity Fund’s (the “Fund”) prospectus dated September 28, 2021 were 1.46% of average daily net assets (1.25% after fee waivers/expense reimbursements by Bradley, Foster & Sargent, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until September 30, 2022, so that Total Annual Fund Operating Expenses does not exceed 1.00%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees of the Valued Advisers Trust (the “Trust”), and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset or brokerage/service arrangements, if applicable, in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including exchange-traded funds, that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following the date of such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 575-2430.

| * | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (a) | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

Investment Results (Unaudited) (continued)

| (b) | The Dow Jones Industrial Average® is a widely recognized unmanaged index of equity prices and is representative of a narrower market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (855) 575-2430. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

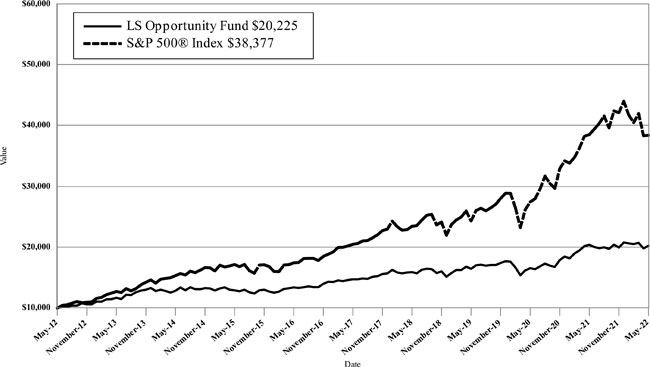

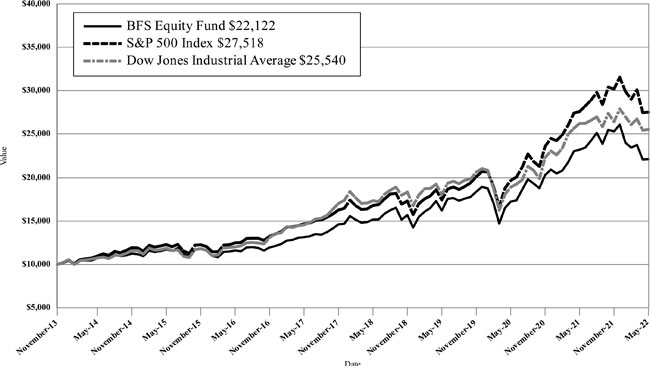

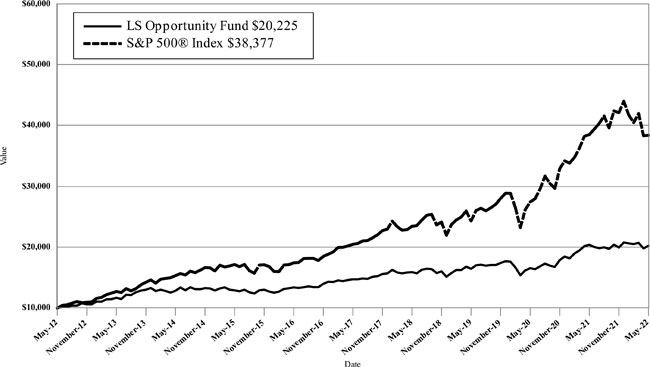

Investment Results (Unaudited)

$10,000 Over 10 Years

Let’s say hypothetically that $10,000 was invested in the Fund, on November 8, 2013. The following chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index and Dow Jones Industrial Average® performed over the same period.

Comparison of the Growth of a $10,000 Investment in the BFS Equity Fund, the S&P 500® Index, and the Dow Jones Industrial Average (Unaudited)

The chart above assumes an initial investment of $10,000 made on November 8, 2013 (commencement of operations) and held through May 31, 2022. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (855) 575-2430. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

| BFS Equity Fund |

| Schedule of Investments |

| May 31, 2022 |

| COMMON STOCKS — 79.08% | | Shares | | | Fair Value | |

| Aerospace & Defense — 5.05% | | | | | | | | |

| Northrop Grumman Corp. | | | 2,000 | | | $ | 935,940 | |

| Raytheon Technologies Corp. | | | 15,000 | | | | 1,426,800 | |

| | | | | | | | 2,362,740 | |

| Banking — 2.12% | | | | | | | | |

| JPMorgan Chase & Co. | | | 7,500 | | | | 991,725 | |

| | | | | | | | | |

| Beverages — 2.48% | | | | | | | | |

| Constellation Brands, Inc., Class A | | | 2,000 | | | | 490,940 | |

| PepsiCo, Inc. | | | 4,000 | | | | 671,000 | |

| | | | | | | | 1,161,940 | |

| Biotech & Pharmaceuticals — 3.86% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 10,000 | | | | 754,500 | |

| Johnson & Johnson | | | 3,000 | | | | 538,590 | |

| Zoetis, Inc., Class A | | | 3,000 | | | | 512,790 | |

| | | | | | | | 1,805,880 | |

| Cable & Satellite — 0.47% | | | | | | | | |

| Comcast Corp., Class A | | | 5,000 | | | | 221,400 | |

| | | | | | | | | |

| Chemicals — 3.28% | | | | | | | | |

| Ecolab, Inc. | | | 2,000 | | | | 327,820 | |

| Sherwin-Williams Co. (The) | | | 4,500 | | | | 1,206,180 | |

| | | | | | | | 1,534,000 | |

| E-Commerce Discretionary — 3.60% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 700 | | | | 1,682,933 | |

| | | | | | | | | |

| Health Care Facilities & Services — 5.63% | | | | | | | | |

| IQVIA Holdings, Inc.(a) | | | 3,000 | | | | 645,750 | |

| UnitedHealth Group, Inc. | | | 4,000 | | | | 1,987,120 | |

| | | | | | | | 2,632,870 | |

| Home Construction — 0.80% | | | | | | | | |

| D.R. Horton, Inc. | | | 5,000 | | | | 375,750 | |

| | | | | | | | | |

| Institutional Financial Services — 1.68% | | | | | | | | |

| Goldman Sachs Group, Inc. (The) | | | 2,400 | | | | 784,440 | |

| | | | | | | | | |

| Insurance — 2.72% | | | | | | | | |

| Berkshire Hathaway, Inc., Class B(a) | | | 1,500 | | | | 473,970 | |

| Marsh & McLennan Cos., Inc. | | | 5,000 | | | | 799,750 | |

| | | | | | | | 1,273,720 | |

| Internet Media & Services — 6.94% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 1,000 | | | | 2,275,240 | |

| Meta Platforms, Inc., Class A(a) | | | 5,000 | | | | 968,200 | |

| | | | | | | | 3,243,440 | |

| Medical Equipment & Devices — 6.55% | | | | | | | | |

| Danaher Corp. | | | 4,000 | | | | 1,055,280 | |

| Stryker Corp. | | | 2,500 | | | | 586,250 | |

| Thermo Fisher Scientific, Inc. | | | 2,500 | | | | 1,418,925 | |

| | | | | | | | 3,060,455 | |

| Metals & Mining — 1.70% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 15,000 | | | | 793,950 | |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Schedule of Investments (continued) |

| May 31, 2022 |

| COMMON STOCKS — 79.08% - continued | | Shares | | | Fair Value | |

| Oil & Gas Producers — 6.01% | | | | | | | | |

| ConocoPhillips | | | 25,000 | | | $ | 2,809,000 | |

| | | | | | | | | |

| Retail - Consumer Staples — 2.50% | | | | | | | | |

| Costco Wholesale Corp. | | | 2,500 | | | | 1,165,550 | |

| | | | | | | | | |

| Retail - Discretionary — 5.10% | | | | | | | | |

| Home Depot, Inc. (The) | | | 4,000 | | | | 1,211,000 | |

| Lowe’s Cos., Inc. | | | 6,000 | | | | 1,171,800 | |

| | | | | | | | 2,382,800 | |

| Software — 8.23% | | | | | | | | |

| Adobe, Inc.(a) | | | 2,000 | | | | 832,960 | |

| Microsoft Corp. | | | 9,000 | | | | 2,446,830 | |

| SS&C Technologies Holdings, Inc. | | | 9,000 | | | | 575,910 | |

| | | | | | | | 3,855,700 | |

| Specialty Finance — 0.90% | | | | | | | | |

| American Express Co. | | | 2,500 | | | | 422,050 | |

| | | | | | | | | |

| Technology Hardware — 4.77% | | | | | | | | |

| Apple, Inc. | | | 15,000 | | | | 2,232,600 | |

| | | | | | | | | |

| Technology Services — 3.73% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 3,000 | | | | 668,820 | |

| MasterCard, Inc., Class A | | | 3,000 | | | | 1,073,610 | |

| | | | | | | | 1,742,430 | |

| Transportation & Logistics — 0.96% | | | | | | | | |

| FedEx Corp. | | | 2,000 | | | | 449,160 | |

| | | | | | | | | |

| Total Common Stocks (Cost $20,915,013) | | | | | | | 36,984,533 | |

| | | | | | | | | |

| | | Principal | | | | |

| U.S. GOVERNMENT & AGENCIES — 10.64% | | Amount | | | | |

| United States Treasury Bill, 0.84%, 8/4/2022(b) | | $ | 2,000,000 | | | | 1,996,557 | |

| United States Treasury Bill, 1.40%, 11/10/2022(b) | | | 3,000,000 | | | | 2,980,682 | |

| Total U.S. Government & Agencies (Cost $4,978,305) | | | | | | | 4,977,239 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 9.26% | | Shares | | | | |

| Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.64%(c) | | | 4,329,568 | | | | 4,329,568 | |

| Total Money Market Funds (Cost $4,329,568) | | | | | | | 4,329,568 | |

| | | | | | | | | |

| Total Investments — 98.98% (Cost $30,222,886) | | | | | | | 46,291,340 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.02% | | | | | | | 475,021 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 46,766,361 | |

| (a) | Non-income producing security. |

| (b) | Rate shown is the effective yield at time of purchase. |

| (c) | Rate disclosed is the seven day effective yield as of May 31, 2022. |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Statement of Assets and Liabilities |

| May 31, 2022 |

| Assets | | | |

| Investments in securities at fair value (cost $30,222,886) (Note 3) | | $ | 46,291,340 | |

| Receivable for investments sold | | | 492,821 | |

| Dividends receivable | | | 52,470 | |

| Prepaid expenses | | | 8,292 | |

| Total Assets | | | 46,844,923 | |

| Liabilities | | | | |

| Payable for fund shares redeemed | | | 1,000 | |

| Payable to Adviser (Note 4) | | | 22,587 | |

| Payable to Administrator (Note 4) | | | 6,926 | |

| Distribution (12b-1) fees accrued (Note 4) | | | 19,871 | |

| Other accrued expenses | | | 28,178 | |

| Total Liabilities | | | 78,562 | |

| Net Assets | | $ | 46,766,361 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 30,287,311 | |

| Accumulated earnings | | | 16,479,050 | |

| Net Assets | | $ | 46,766,361 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,524,501 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 18.52 | |

See accompanying notes which are an integral part of these financial statements

| BFS Equity Fund |

| Statement of Operations |

| For the year ended May 31, 2022 |

| Investment Income | | | |

| Dividend income (net of foreign taxes withheld of $2,961) | | $ | 569,162 | |

| Interest income | | | 3,239 | |

| Total investment income | | | 572,401 | |

| Expenses | | | | |

| Investment Adviser fees (Note 4) | | | 383,752 | |

| Distribution (12b-1) fees (Note 4) | | | 127,918 | |

| Administration and compliance services fees (Note 4) | | | 43,772 | |

| Registration expenses | | | 25,900 | |

| Fund accounting fees (Note 4) | | | 25,063 | |

| Legal fees | | | 19,819 | |

| Audit and tax preparation fees | | | 18,460 | |

| Transfer agent fees (Note 4) | | | 18,090 | |

| Printing and postage expenses | | | 13,078 | |

| Trustee fees | | | 6,137 | |

| Custodian fees | | | 4,731 | |

| Insurance expenses | | | 2,658 | |

| Interest expense | | | 91 | |

| Miscellaneous | | | 33,752 | |

| Total expenses | | | 723,221 | |

| Fees contractually waived by Adviser (Note 4) | | | (83,599 | ) |

| Net operating expenses | | | 639,622 | |

| Net investment loss | | | (67,221 | ) |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on: | | | | |

| Investment securities transactions | | | 1,088,978 | |

| Net change in unrealized depreciation on investments | | | (3,327,716 | ) |

| Net realized and change in unrealized loss on investments | | | (2,238,738 | ) |

| Net decrease in net assets resulting from operations | | $ | (2,305,959 | ) |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Statements of Changes in Net Assets |

| | | For the Year Ended For the Year Ended | |

| | | May 31, 2022 | | | May 31, 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment loss | | $ | (67,221 | ) | | $ | (50,601 | ) |

| Net realized gain on investment securities transactions | | | 1,088,978 | | | | 6,170,290 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (3,327,716 | ) | | | 6,794,817 | |

| Net increase (decrease) in net assets resulting from operations | | | (2,305,959 | ) | | | 12,914,506 | |

| Distributions to Shareholders from Earnings (Note 2) | | | (4,932,792 | ) | | | (677,735 | ) |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 4,636,535 | | | | 3,372,117 | |

| Reinvestment of distributions | | | 3,969,021 | | | | 565,222 | |

| Amount paid for shares redeemed | | | (3,381,233 | ) | | | (6,257,021 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 5,224,323 | | | | (2,319,682 | ) |

| Total Increase (Decrease) in Net Assets | | | (2,014,428 | ) | | | 9,917,089 | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 48,780,789 | | | | 38,863,700 | |

| End of year | | $ | 46,766,361 | | | $ | 48,780,789 | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 212,101 | | | | 175,156 | |

| Shares issued in reinvestment of distributions | | | 186,866 | | | | 29,717 | |

| Shares redeemed | | | (158,072 | ) | | | (334,774 | ) |

| Net increase (decrease) in shares outstanding | | | 240,895 | | | | (129,901 | ) |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended May 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 21.36 | | | $ | 16.10 | | | $ | 15.40 | | | $ | 14.96 | | | $ | 13.01 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.03 | ) | | | (0.02 | ) | | | 0.03 | | | | 0.04 | | | | 0.04 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.71 | ) | | | 5.57 | | | | 0.97 | | | | 0.90 | | | | 1.96 | |

| Total from investment operations | | | (0.74 | ) | | | 5.55 | | | | 1.00 | | | | 0.94 | | | | 2.00 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | (0.03 | ) | | | (0.04 | ) | | | (0.04 | ) |

| Net realized gains | | | (2.10 | ) | | | (0.29 | ) | | | (0.27 | ) | | | (0.46 | ) | | | (0.01 | ) |

| Total distributions | | | (2.10 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.50 | ) | | | (0.05 | ) |

| Net asset value, end of year | | $ | 18.52 | | | $ | 21.36 | | | $ | 16.10 | | | $ | 15.40 | | | $ | 14.96 | |

| Total Return(a) | | | (4.71 | )% | | | 34.68 | % | | | 6.32 | % | | | 6.84 | % | | | 15.36 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 46,766 | | | $ | 48,781 | | | $ | 38,864 | | | $ | 35,960 | | | $ | 31,750 | |

| Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 1.41 | % | | | 1.46 | % | | | 1.52 | % | | | 1.57 | % | | | 1.65 | % |

| Ratio of net investment income (loss) to average net assets | | | (0.13 | )% | | | (0.12 | )% | | | 0.21 | % | | | 0.28 | % | | | 0.26 | % |

| Portfolio turnover rate | | | 61.08 | % | | | 68.77 | % | | | 49.27 | % | | | 38.71 | % | | | 38.17 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| BFS Equity Fund |

| Notes to the Financial Statements |

| May 31, 2022 |

NOTE 1. ORGANIZATION

The BFS Equity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end diversified series of Valued Advisers Trust (the “Trust”) and commenced operations on November 8, 2013. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board” or the “Trustees”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Bradley, Foster & Sargent, Inc. (the “Adviser”). The investment objective of the Fund is long-term appreciation through growth of principal and income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”, including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended May 31, 2022, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the fiscal year ended May 31, 2022, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For financial statement and income tax purposes, the specific identification method is used for determining capital gains or losses. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Dividend income from real estate investment trusts (REITs) and distributions from limited partnerships are recognized on the ex-date. The calendar year end classification of distributions received from REITs during the fiscal year are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available. Income or loss from Limited Partnerships is reclassified among the components of net assets upon receipt of Schedules K-1 (Form 1065). Non-cash income, if any, is recorded at the fair market value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the unrealized gain or loss from investments. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended May 31, 2022, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | Accumulated Earnings |

| Paid-In Capital | | (Deficit) |

| $(27,972) | | $27,972 |

Share Valuation – The NAV is calculated each day the New York Stock Exchange (the “NYSE”) is open by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding for the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2022:

| | | Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks (a) | | $ | 36,984,533 | | | $ | — | | | $ | — | | | $ | 36,984,533 | |

| U.S. Government & Agencies | | | — | | | | 4,977,239 | | | | — | | | | 4,977,239 | |

| Money Market Funds | | | 4,329,568 | | | | — | | | | — | | | | 4,329,568 | |

| Total | | $ | 41,314,101 | | | $ | 4,977,239 | | | $ | — | | | $ | 46,291,340 | |

| (a) | Refer to Schedule of Investments for industry classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund. For the fiscal year ended May 31, 2022, the Adviser earned a fee of $383,752 from the Fund before the waivers described below. At May 31, 2022, the Fund owed the Adviser $22,587.

The Adviser has contractually agreed to waive or limit its management fee and/or reimburse certain operating expenses until September 30, 2022, but only to the extent necessary so that the Fund’s net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1 fees and indirect expenses (such as “acquired funds fees and expenses”) do not exceed 1.00%.

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following the date of such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board, and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. For the fiscal year ended May 31, 2022, the Adviser waived fees of $83,599.

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are as follows:

| Recoverable Through |

| May 31, 2023 | | $ | 108,051 | |

| May 31, 2024 | | | 93,387 | |

| May 31, 2025 | | | 83,599 | |

The Trust retains Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”) to provide the Fund with administration, fund accounting, and transfer agent services, including all regulatory reporting. Prior to April 1, 2022, the Administrator also provided certain compliance services to the Fund. For the fiscal year ended May 31, 2022, the Administrator earned fees of $43,772 for administration and compliance services, $25,063 for fund accounting services and $18,090 for transfer agent services. At May 31, 2022, the Fund owed the Administrator $6,926 for such services.

Effective April 1, 2022, Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator or of NLCS, and are not paid by the Trust for services to the Fund. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the distributor of the Fund’s shares. The Distributor is a wholly-owned subsidiary of Ultimus. There were no payments made to the Distributor by the Fund for the fiscal year ended May 31, 2022.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of shareholder support services to shareholders, including, but not necessarily limited to, advertising,

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 fees”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. For the fiscal year ended May 31, 2022, 12b-1 fees incurred by the Fund were $127,918. The Fund owed $19,871 for 12b-1 fees as of May 31, 2022.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended May 31, 2022, purchases and sales of investment securities, other than short-term investments, were $28,970,439 and $37,479,999, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended May 31, 2022.

NOTE 6. FEDERAL TAX INFORMATION

At May 31, 2022, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 16,414,696 | |

| Gross unrealized depreciation | | | (402,598 | ) |

| Net unrealized appreciation on investments | | $ | 16,012,098 | |

| | | | | |

| Tax cost of investments | | $ | 30,279,242 | |

At May 31, 2022, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

The tax character of distributions paid for the fiscal years ended May 31, 2022 and May 31, 2021, were as follows:

| | | 2022 | | | 2021 | |

| Distributions paid from: | | | |

| Ordinary income(a) | | $ | 1,733,996 | | | $ | — | |

| Long-term capital gains | | | 3,198,796 | | | | 677,735 | |

| Total distributions paid | | $ | 4,932,792 | | | $ | 677,735 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

| BFS Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2022 |

At May 31, 2022, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed long-term capital gains | | $ | 506,201 | |

| Accumulated capital and other losses | | | (39,249 | ) |

| Unrealized appreciation (depreciation) | | | 16,012,098 | |

| Total accumulated earnings | | $ | 16,479,050 | |

Certain qualified late year ordinary losses incurred after December 31, and within the current taxable year, are deemed to arise on the first business day of the Fund’s following taxable year. For the tax year ended May 31, 2022, the Fund deferred Qualified Late Year Ordinary Losses in the amount of $39,249.

NOTE 7. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Report of Independent Registered Public Accounting Firm

To the Shareholders of BFS Equity Fund and

Board of Trustees of Valued Advisers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BFS Equity Fund (the “Fund”), a series of Valued Advisers Trust, as of May 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2022, the results of its operations the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2022, by correspondence with the custodian and broker. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2013.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 26, 2022

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2021 through May 31, 2022.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | | Ending | | | | | | |

| | | Account | | | Account | | | Expenses | | | |

| | | Value | | | Value | | | Paid | | | Annualized |

| | | December | | | May 31, | | | During | | | Expense |

| | | 1, 2021 | | | 2022 | | | Period(a) | | | Ratio |

| Actual | | $ | 1,000.00 | | | $ | 874.00 | | | $ | 5.84 | | | 1.25% |

| Hypothetical(b) | | $ | 1,000.00 | | | $ | 1,018.70 | | | $ | 6.29 | | | 1.25% |

| (a) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| Additional Federal Income Tax Information (Unaudited) |

The Form 1099-DIV you receive in January 2023 will show the tax status of all distributions paid to your account in calendar year 2022. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 28.63% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2022 ordinary income dividends, 27.02% qualifies for the corporate dividends received deduction.

For the year ended May 31, 2022, the Fund designated $3,198,796 as long-term capital gain distributions.

| Trustees and Officers (Unaudited) |

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each of the Independent Trustees.

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other

Directorships | Other Directorships |

Andrea N. Mullins, 55

Independent Trustee

Since December 2013

Chairperson since

March 2017 | Current: Private investor; Independent Contractor, SWM Advisors (since April 2014). | Trustee, Angel Oak Funds Trust (since February 2019) (5 portfolios); Trustee, Angel Oak Strategic Credit Fund (since February 2019); Trustee, Angel Oak Financial Strategies Income Term Trust (since May 2019); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (since June 2020); Trustee, Angel Oak Credit Opportunities Term Trust (since January 2021); Trustee and Audit Committee Chair, Cushing Mutual Funds Trust (since November 2021) (2 portfolios); Trustee and Audit Committee Chair,Cushing MLP & Infrastructure Fund (since November 2021). |

| Trustees and Officers (Unaudited) (continued) |

Name, Address*, (Age),

Position with Trust**, Term

of Position with Trust | Principal Occupation During

Past 5 Years and Other

Directorships | Other Directorships |

Ira P. Cohen, 63

Independent Trustee

Since June 2010 | Current: Independent financial services consultant (since February 2005); Executive Vice President of Asset Management Services, Recognos Financial (since August 2015). | Trustee and Audit Committee Chairman, Apollo Diversified Real Estate Fund (since March 2022); Trustee, Chairman and Nominating and Governance Committee Chairman, Angel Oak Funds Trust (since October 2014) (5 portfolios); Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Strategic Credit Fund (since December 2017); Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Financial Strategies Income Term Trust (since May 2019); Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Dynamic Financial Strategies Income Term Trust (since June 2020); Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Credit Opportunities Term Trust (since January 2021); Trustee and Nominating and Governance Committee Chairman, U.S. Fixed Income Trust (since March 2019). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 15 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act.

| Trustees and Officers (Unaudited) (continued) |

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other

Directorships | Other Directorships |

Mark J. Seger***, 60

Trustee Since March 2017 | Current: Vice Chairman and Co-Founder, Ultimus Fund Solutions, LLC and its subsidiaries (since 1999). | None. |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 16 series. |

| *** | Mr. Seger is considered an “interested person” of the Trust because of his relationship with the Trust’s administrator, transfer agent, and distributor. |

The following table provides information regarding the Officers of the Trust:

Name, Address*, (Age),

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years | Other Directorships |

Matthew J. Miller, 46

Principal Excecutive Officer

and President Since March

2022

Vice President

From December 2011 to

March 2022 | Current: Vice President, Ultimus Fund Solutions, LLC (since December 2015). | None. |

N. Lynn Bowley, 63

Chief Compliance Officer

Since April 2022 | Current: Senior Vice President, Senior Compliance Officer, Northern Lights Compliance Services, LLC (since January 2007). | None. |

Carol J. Highsmith, 57

Vice President Since August

2008

Secretary Since March 2014 | Current: Vice President, Ultimus Fund Solutions, LLC (since December 2015). | None. |

Zachary P. Richmond, 42

Principal Financial Officer

and Treasurer Since

September 2021 | Current:Vice President, Financial Administration, Ultimus Fund Solutions, LLC (since February 2019). Previous:Assistant Vice President, Associate Director of Financial Administration, Ultimus Fund Solutions, LLC (December 2015 to February 2019). | None. |

| Trustees and Officers (Unaudited) (continued) |

Name, Address*, (Age),

Position with Trust**, Term

of Position with Trust | Principal Occupation During

Past 5 Years and Other

Directorships | Other Directorships |

Stephen L. Preston, 55

AML Officer Since June

2017 | Current: Chief Compliance Officer of Ultimus Fund Distributors, LLC (since June 2011), Vice President, Financial Operations Principal, and Anti-Money Laundering Officer, Ultimus Fund Distributors, LLC (since April 2021), Treasurer, Financial Operations Principal, Chief Compliance Officer, and Anti-Money Laundering Officer, Northern Lights Distributors, LLC (since April 2021). Previous: Chief Compliance Officer, Ultimus Fund Solutions, LLC (June 2011 to August 2019); Chief Compliance Officer, Unified Financial Securities, LLC (April 2018 to December 2019) | None. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 15 series. |

Other Information (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (855) 575-2430 to request a copy of the SAI or to make shareholder inquiries.

Privacy Policy

| FACTS | WHAT DOES BFS EQUITY FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| | |

| | ■ Social Security number |

| | |

| | ■ account balances and account transactions |

| | |

| | ■ transaction or loss history and purchase history |

| | |

| | ■ checking account information and wire transfer instructions |

| | |

| | When you are no longer our customer, we continue to share your information as described in this notice. |

| |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes —

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes —

to offer our products and services to you | No |

| For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes —

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes —

information about your creditworthiness | No |

| For nonaffiliates to market to you | No |

| Questions? | Call (855) 575-2430 |

| Who we are |

| Who is providing this notice? | BFS Equity Fund

Ultimus Fund Distributors, LLC (Distributor)

Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Bradley, Foster & Sargent, Inc., the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ■ The Fund does not share your personal information with nonaffiliates so they can market to you |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ The Fund does not jointly market. |

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (855) 575-2430 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

TRUSTEES

Andrea N. Mullins, Chairperson

Ira P. Cohen

Mark J. Seger

OFFICERS

Matthew J. Miller, Principal Executive Officer and

President

Zachary P. Richmond, Principal Financial Officer and

Treasurer

N. Lynn Bowley, Chief Compliance Officer

Carol J. Highsmith, Vice President and Secretary INVESTMENT ADVISER

Bradley, Foster & Sargent, Inc.

185 Asylum Street, City Place II

Hartford, CT 06103 DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115 LEGAL COUNSEL

Troutman Pepper Hamilton Sanders LLP

3000 Two Logan Square

18th and Arch Streets

Philadelphia, PA 19103 CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215 ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC

BFS-AR-22

LS Opportunity Fund

Management’s Discussion of Fund Performance

May 31, 2022 - (Unaudited)

To Shareholders of the LS Opportunity Fund,

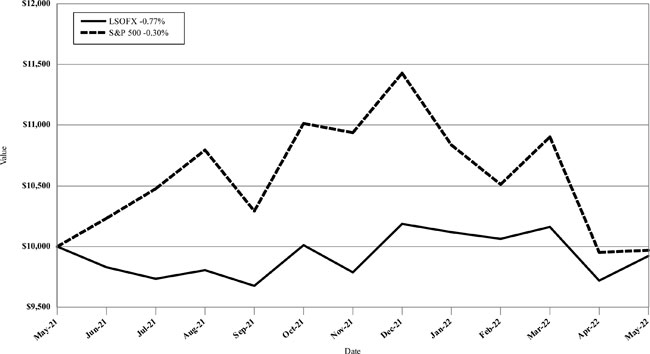

Long Short Advisors, LLC, based in Palm Beach Gardens, FL is the advisor of the LS Opportunity Fund (“LSOFX” or the “Fund”) and Prospector Partners, LLC (“Prospector”), based in Guildford, CT is the sub-advisor of the Fund. Prospector has a long/short hedge fund track record that spans 24 years with a substantially similar investment objective to LSOFX and brings its experience to our Fund in a daily liquid mutual fund format with a goal of downside risk mitigation and consistency of returns.

The Fund aims to generate long-term capital appreciation by investing in both long and short positions within a portfolio consisting of primarily publicly traded common stock, with less net exposure than that of the stock market in general. Through extensive research, risk management, and no leverage in the long book, the Fund strives to preserve capital while delivering solid risk-adjusted returns and managing volatility. For additional information, please visit our website at www.longshortadvisors.com.

First and foremost, we at Long Short Advisors would like to thank the team at Prospector Partners for another job well done and we look forward to the years to come. As of May 31, 2022, Prospector Partners has been the sub-advisor of the Fund for seven years. The team’s absolute and risk-adjusted returns earned the Fund a 4-Star Overall Morningstar Rating™ out of 179 funds in the US Fund Long Short category as of May 31, 2022 based on risk-adjusted returns.*

Building on that success, we believe 2022 is the most exciting time to invest in Prospector Partners’ long short style of investing in over 20 years. While we do not believe there is a bad time to invest with Prospector Partners or in long short, there can be times, like now, where the stars align and offer investors what we see as a great opportunity to invest in what is otherwise a challenging investment climate. As evidenced by asset flows across the industry, money is leaving traditional bonds and stocks and seeking opportunities in alternatives of which we believe long short is a favorable choice.

Investors should think of the multiple potential ways to win with the Fund and consider how it might complement their portfolios. Headwinds have in our opinion become tailwinds for long short value style investing in the following ways:

| 1. | Growth has switched to value, which benefits the long book relative to core and growth equity. |

| 2. | Rates are rising which allows us to earn interest on our short proceeds that sit in cash. |

LS Opportunity Fund

Management’s Discussion of Fund Performance (continued)

May 31, 2022 - (Unaudited)

| 3. | Fed tightening is increasing the cost of capital and challenging corporate balance sheets creating the best shorting environment since the lead up to the Great Financial Crisis during the market correction of October 2007 to March 2009. |