Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22375

PIMCO Equity Series

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer and Principal Financial Officer

PIMCO Equity Series

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (866) 746-2602

Date of fiscal year end: June 30

Date of reporting period: June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

| • | PIMCO Equity Series—Institutional, P, Administrative, D, A, C and R Classes |

Table of Contents

Your Global Investment Authority

PIMCO Equity Series

Annual Report

June 30, 2011

PIMCO Emerging Multi-Asset Fund

PIMCO EqS Emerging Markets Fund

PIMCO EqS Pathfinder Fund™

Share Classes

| n | Institutional |

| n | P |

| n | Administrative |

| n | D |

| n | A |

| n | C |

| n | R |

Table of Contents

| Page | ||||||||

| 2 | ||||||||

| 4 | ||||||||

| 6 | ||||||||

| 18 | ||||||||

| 20 | ||||||||

| 22 | ||||||||

| 23 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| 26 | ||||||||

| 27 | ||||||||

| 43 | ||||||||

| 53 | ||||||||

| 54 | ||||||||

| 55 | ||||||||

| 56 | ||||||||

| 58 | ||||||||

Approval of Investment Advisory Contract and Supervision and Administration Agreement | 59 | |||||||

| FUND | Fund Summary | Schedule of Investments | ||||||

| 8 | 28 | |||||||

| 12 | 30 | |||||||

| 17 | 37 | |||||||

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series prospectus. Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. This and other information is contained in the Fund’s prospectus. Please read the prospectus carefully before you invest or send money.

Table of Contents

Dear Shareholder,

Please find enclosed the Annual Report for the PIMCO Equity Series. During the reporting period, we introduced the PIMCO EqS Emerging Markets Fund and the PIMCO Emerging Multi-Asset Fund, two new investment strategies designed to further investor access to emerging markets via seasoned stock selection combined with PIMCO’s thought leadership, risk management, and investment expertise.

| n | PIMCO EqS Emerging Markets Fund (launched on March 22, 2011) combines thorough bottom-up equity selection in emerging markets, top-down macroeconomic analysis and rigorous risk management with PIMCO’s expertise in emerging markets fixed income and currencies. |

| n | PIMCO Emerging Multi-Asset Fund (launched on April 12, 2011) offers a comprehensive asset allocation solution for emerging markets investing combined with active risk management. |

We remain committed to expanding the PIMCO Equity Series by introducing active equity strategies where we believe we can deliver PIMCO quality to our clients, via a broad range of opportunities that attempts to capture attractive risk-adjusted returns in equity markets around the world.

In addition, outside of the reporting period on August 5, 2011, Standard & Poor’s (an independent credit rating agency) downgraded its credit rating on U.S. sovereign debt from AAA to AA+, followed by a similar downgrade announced on August 8, 2011, on debt issued by the Federal National Mortgage Association (“Fannie Mae”), the Federal Home Loan Mortgage Corporation (“Freddie Mac”), as well as farm lenders and U.S. government-backed debt issued by certain banks and credit unions. Furthermore, in reaction to the growing sovereign debt crisis in the Eurozone, the European Central Bank announced on August 7, 2011 that it will begin buying debt issued by Italy and Spain to help prevent contagion. As such, these events present investors with heightened allocation challenges amidst market price disruptions.

In this market environment and more generally in all market environments, PIMCO remains highly focused on risk management and on how best to mitigate risks in each of our investment strategies. As investors, the importance of being prepared and vigilant to multiple scenarios is crucial to successful investing, while searching for attractive investment opportunities throughout the global marketplace.

General highlights of the financial markets during our twelve-month reporting period include:

| n | Equity markets worldwide remained volatile throughout the reporting period as investors responded to rising concerns over the European sovereign debt crisis, the U.S. debt ceiling impasse, social unrest in the Middle East/North Africa, and the devastating after effects of the earthquake and tsunami in Japan. U.S. equities, as measured by the S&P 500 Index, returned 30.69% and global equities, as represented by the MSCI World Index, returned 30.51%. Emerging market equities slightly underperformed developed market equities during the reporting period, as represented by the MSCI Emerging Markets Index, which returned 27.80%. This slight underperformance reflected the fact that after years of strong growth, emerging market economies appear to be undergoing a mid-cycle correction, even though the long-term fundamentals remain intact, including demographics favorable to growth, an unleveraged consumer, and investment that is poised to underpin future productivity gains. |

| 2 | PIMCO Equity Series |

Table of Contents

| n | Yields on U.S. Treasury securities were volatile during the reporting period and generally ended lower for maturities of five years and less, but higher for longer-term maturities. Continued concern over the European sovereign debt crisis resulted in a flight-to-quality towards the latter part of the period, boosting demand for U.S. Treasury securities, which generally outperformed other developed sovereign bond markets on a hedged basis. The Federal Reserve kept the Federal Funds Rate anchored within a range of zero to 0.25%, and the Bank of England held its key lending rate at 0.50%. The European Central Bank raised its main policy rate to 1.50% (which included a 0.25% increase during the reporting period and a further increase of 0.25% outside of the reporting period) in response to concerns over rising inflation despite slower economic activity. The benchmark ten-year U.S. Treasury note yielded 3.16% at the end of the reporting period, as compared to 2.93% on June 30, 2010. |

On the following pages are specific details about the investment performance of each Fund and a discussion of the factors that affected performance during the reporting period. In addition, the letters from the portfolio managers provide a further review of the factors that influenced each Fund’s performance as well as an overview of each Fund’s investment strategy and philosophy. If you have any questions regarding the PIMCO Equity Series, please contact your account manager or financial adviser, or call one of our shareholder associates at 1 (866) 746-2602. We also invite you to visit www.pimco.com/investments, as well as our investment manager’s website at www.pimco.com.

Thank you again for the trust you have placed in us. We value your commitment and will continue to work diligently to meet your broad investment needs.

| Sincerely,

Brent R. Harris Chairman of the Board, PIMCO Equity Series

August 8, 2011 |

| Annual Report | June 30, 2011 | 3 |

Table of Contents

Important Information About the Funds

The PIMCO Emerging Multi-Asset Fund may invest in Institutional Class or, as applicable, Class M shares of any of the funds of PIMCO Funds and PIMCO Equity Series, affiliated open-end investment companies, except the PIMCO All Asset, PIMCO All Asset All Authority, PIMCO Global Multi-Asset, and PIMCO RealRetirement® Funds (“Underlying PIMCO Funds”) and other affiliated, including PIMCO ETF Trust, and unaffiliated funds (collectively, the “Acquired Funds”). The PIMCO Emerging Multi-Asset Fund may invest in a combination of affiliated and unaffiliated funds, which may or may not be registered under the Investment Company Act of 1940, as amended (the “1940 Act”), fixed income instruments, equity securities, forwards and derivatives, to the extent permitted under the 1940 Act or exemptive relief therefrom. The PIMCO EqS Emerging Markets Fund invests in a diversified portfolio of investments economically tied to emerging market countries. The PIMCO EqS Emerging Markets Fund will invest a substantial portion of its assets in equity and equity-related securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock). The PIMCO EqS Pathfinder Fund™ seeks capital appreciation by investing under normal circumstances in equity securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), of issuers that PIMCO believes are undervalued. The PIMCO EqS Pathfinder Fund’s bottom-up value investment style attempts to identify securities that are undervalued by the market in comparison to PIMCO’s own determination of the company’s value, taking into account criteria such as asset value, book value and cash flow and earnings estimates.

The Funds may be subject to various risks as described in the Funds’ prospectus. Some of these risks may include, but are not limited to, the following: allocation risk, acquired fund risk, equity risk, value investing risk, foreign (non-U.S.) investment risk, emerging markets risk, market risk, issuer risk, interest rate risk, credit risk, high yield and distressed company risk, currency risk, real estate risk, liquidity risk, leveraging risk, management risk, small-cap and mid-cap company risk, arbitrage risk, derivatives risk, short sale risk, commodity risk, convertible securities risk, tax risk, subsidiary risk and issuer non-diversification risk. A complete description of these risks and other risks is contained in the Funds’ prospectus. The Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, leverage risk, mispricing or improper valuation risk and the risk that the Funds could not close out a position when it would be most advantageous to do so. The Funds could lose more than the principal amount invested in these derivative instruments.

On each individual Fund Summary page in this Annual Report (“Shareholder Report”), the Average Annual Total Return table and/or Cumulative Total Return chart measure performance assuming that any dividend and capital gain distributions were reinvested.

For periods prior to the inception date of the Administrative Class performance information shown is based on the performance of a Fund’s Institutional Class shares. The prior Institutional Class performance has been adjusted to reflect the and/or service fees and other expenses paid by the Administrative Class shares. A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in a Fund.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO Equity Series as the policies and procedures that PIMCO will use when voting proxies on behalf of a Fund. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of a Fund, and information about how the Fund voted proxies relating to portfolio securities held from its inception through June 30th, are available without charge, upon request, by calling (800) 927-4648 for Institutional Class, Class P and Administrative Class shares or (800) 426-0107 for Class A, Class C, Class D and Class R shares, on the Fund’s website at http://www.pimco.com/investments, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PIMCO Equity Series files a complete schedule of each Fund’s portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of a Fund’s Form N-Q, once available, will be available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. A Fund’s Form N-Q will also be available without charge, upon request, by calling (800) 927-4648 for Institutional Class, Class P and Administrative Class shares or (800) 426-0107 for Class A, Class C, Class D and Class R shares and on the Fund’s website at http://www.pimco.com/investments. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| 4 | PIMCO Equity Series |

Table of Contents

The following disclosure provides important information regarding a Fund’s Expense Example, which appears in this Shareholder Report. Please refer to this information when reviewing the Expense Examples for the Funds.

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, from January 1, 2011 to June 30, 2011, with the exception of the PIMCO EqS Emerging Markets Fund, which is from March 22, 2011 (the date the Fund commenced operations) to June 30, 2011 and the PIMCO Emerging Multi-Asset Fund, which is from April 12, 2011 (the date the Fund commenced operations) to June 30, 2011.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class, in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments and exchange fees. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense ratios may vary from period to period because of various factors such as an increase in expenses that are not covered by the management fees, such as fees and expenses of the independent trustees and their counsel, extraordinary expenses and interest expense.

PIMCO Equity Series is distributed by PIMCO Investments LLC, 1633 Broadway, New York, New York 10019, http://www.pimco.com/investments, (888) 87-PIMCO.

| Annual Report | June 30, 2011 | 5 |

Table of Contents

Insights from the Portfolio Managers PIMCO Emerging Multi-Asset Fund

Dear Shareholder,

We appreciate your investment in the PIMCO Emerging Multi-Asset Fund (the “Fund”). In the following letter, please find additional detail on the Fund’s investment process and philosophy, why we believe emerging markets (“EM”) offer a compelling investment opportunity, and in the last section, a discussion on the current market and positioning of the Fund.

Investment Process and Philosophy

The Fund was launched in April 2011 and is designed to be a comprehensive emerging markets solution that combines strategic exposure to a diversified range of emerging markets asset classes with robust risk management. Specifically, the Fund provides access to key asset classes within EM including equity, locally denominated sovereign debt, U.S. dollar denominated sovereign debt, corporate debt, and currencies. The Fund benefits from PIMCO’s asset allocation framework and the attention of four portfolio managers who contribute their input to optimize the mix of assets. The Fund offers investors the following three key benefits: 1) active management across EM asset classes based on PIMCO’s ‘top down’ macroeconomic views; 2) potential excess returns generated through relative value strategies and currency positions, driven by PIMCO’s ‘bottom up’ EM expertise; and 3) tail-risk hedges designed to limit losses in the event of a market crisis, thereby enhancing longer term return potential.

The Fund’s portfolio architecture begins with PIMCO’s three- to five-year secular outlook, which identifies key trends, risks, and opportunities across the global economy. This longer term outlook is supplemented by our cyclical outlook, which is used to develop a near term forecast for economic growth and inflation in key regions. The Fund’s four person portfolio management team then combines these ‘top down’ macroeconomic views with ‘bottom-up’ inputs from their respective areas of emerging markets expertise and from the firm’s other sector and regional specialist portfolio teams. These inputs help them in developing their views of the specific regions, countries, and industries that are likely to experience strong performance in the current market environment. Each PM then makes specific investments in their area of expertise and contributes to the overall asset allocation decisions.

The Fund’s investment decisions within EM equities combine rigorous ‘bottom-up’ driven stock selection with a comprehensive ‘top-down’ macroeconomic framework. Equities are selected from a broad opportunity set with an emphasis on those that look cheap based on normalized earnings or intrinsic value. Valuations are determined using a proprietary framework that incorporates analysis of company financials, discussions with company management, conversations with

industry participants, and a full analysis of the capital structure. Expectations regarding growth and inflation over both cyclical and secular timeframes are considered carefully. The Fund’s investment decisions within the EM debt allocation are developed by first identifying countries and corporations with strong, underlying credit fundamentals. Next, the impact of our global outlook on these entities is considered. Finally, the technical conditions of the credit are evaluated to identify both the upside and imbalances that could lead to market dislocations. This framework provides the basis for country weighting, duration, curve, credit exposure and currency selection decisions, as well as relative value assessments.

We believe that rigorous risk management is essential as EM has generally experienced higher volatility as compared with developed markets. In an effort to guard the Fund from periodic market stresses that may affect emerging economies, tail risk hedges are employed. Specifically, PIMCO seeks to identify and actively manage a mix of cost-efficient hedges that offer the potential for outsized returns, which may mitigate the impact of EM asset classes losing value amid market stress.

In summary, our approach combines bottom-up, fundamental research with macroeconomic insights and focused risk management in order to maximize the return potential from an EM allocation while managing risk inherent in the space.

Emerging Markets Are a Compelling Asset Class

EM countries are in the midst of a secular increase in global economic importance. Emerging economies look more robust than their developed market peers on many traditional macroeconomic metrics, including current account balances, degree of indebtedness, foreign currency reserves and fiscal balances. These fundamental factors support higher growth rates which contribute to a wealth effect that supports an expansion of the EM middle class and stronger domestic consumption trends.

We believe EM equities stand poised to benefit from the earnings growth and capital appreciation potential of companies based in leading EM countries. EM equities are also likely to benefit from increased investor demand as they evolve from a satellite allocation to a core holding in portfolios. The sovereign debt of EM countries with low levels of indebtedness, strong growth prospects and higher yields than debt from leading developed nations may contribute the potential for attractive returns with lower volatility than equities. EM corporate debt offers a compelling investment opportunity as these companies tend to experience stronger growth and lower leverage than similarly rated companies in developed markets. EM corporates also tend to offer higher yields than their developed market peers. Finally, PIMCO

| 6 | PIMCO Equity Series |

Table of Contents

believes that EM currencies are well positioned to appreciate over time as they correct their current undervaluation and benefit from positive secular trends.

Managers’ Discussion & Market Overview

From the inception of the Fund in April 2011 through the end of the second quarter, EM asset returns were mixed. In early May, investor concerns surrounding the European debt crisis, the U.S. debt ceiling impasse, and signs of slowing global growth caused the EM equity market to sell off. Austerity measures were passed in Greece at the end of the quarter, leading to a subsequent rally. U.S. dollar denominated EM sovereign debt benefited over the period as investors sought the security of the U.S. dollar due to global uncertainty. EM local currency denominated sovereign debt also gained as EM central banks appeared less likely to raise interest rates on eased inflationary concerns due to softening global growth. EM corporate bonds also moved higher and continue to have an attractive yield premium over comparable U.S. Treasuries. EM currencies posted moderate gains during the period despite downward pressure as a result of uncertainty around the Greek debt situation, which drove investors away from foreign currencies and back to the U.S. dollar. However, this pressure was partially alleviated towards the end of the quarter with the passage of a Greek austerity package.

PIMCO’s view is the year-to-date underperformance of EM equities versus developed equities represents a mid-cycle correction, rather than a systemic downward trend. We believe the secular forces driving growth and profitability remain. We are still confident in long-term opportunities within EM equity as valuations are attractive relative to developed country equities, and demand exists in the overall market as investors remain underweight EM, in our opinion. We believe EM currencies are positioned to perform well over the secular horizon due to support from strong local balance sheets, while currencies of developed countries are likely to face downward pressure due to fiscal deficits and debt concerns. Additionally, we expect EM debt may also continue to be supported by strong balance sheets of EM countries. However, we remain cognizant of the potential for EM asset classes to experience increased volatility in the near term, stemming from uncertainty surrounding the U.S. debt ceiling and the passage of more austerity packages in Europe and the potential for slowing global growth. As such, we review our portfolio positioning on an ongoing basis and make shifts in exposures as we deem appropriate.

We believe that emerging markets present an attractive opportunity for the investor who remains focused on the long term. Again, we thank you for your continued investment in the Fund and look forward to serving your investment needs.

Sincerely,

Curtis Mewbourne Portfolio Manager Generalist |

Maria (Masha) Gordon Portfolio Manager EM Equities | |

Michael Gomez Portfolio Manager EM Local Debt |

Ramin Toloui Portfolio Manager EM External Debt | |

Top Holdings1

| PIMCO EqS Emerging Markets Fund | 36.0% | |||||

| Vanguard MSCI Emerging Markets ETF | 17.8% | |||||

| PIMCO Emerging Local Bond Fund | 13.5% | |||||

| PIMCO Emerging Markets Corporate Bond Fund | 9.2% | |||||

| PIMCO Emerging Markets Currency Fund | 6.9% | |||||

| PIMCO Emerging Markets Bond Fund | 5.1% |

| 1 | % of Total Investments as of 06/30/2011. Top Holdings solely reflect long positions. Financial derivative instruments and short-term instruments are not taken into consideration. |

| Annual Report | June 30, 2011 | 7 |

Table of Contents

PIMCO Emerging Multi-Asset Fund

Institutional Class - PEAWX | Class A - PEAAX | |

Class P - PEAQX | Class C - PEACX | |

| Administrative Class - PEAMX | Class R - PEARX | |

Class D - PEAEX |

| Cumulative Total Return for the period ended June 30, 2011 | ||||

| Fund Inception (04/12/11) | ||||

PIMCO Emerging Multi-Asset Fund Institutional Class | -1.10 | % | ||

PIMCO Emerging Multi-Asset Fund Class P | -1.00 | % | ||

PIMCO Emerging Multi-Asset Fund Administrative Class | -1.11 | % | ||

PIMCO Emerging Multi-Asset Fund Class D | -1.10 | % | ||

PIMCO Emerging Multi-Asset Fund Class A | -1.20 | % | ||

PIMCO Emerging Multi-Asset Fund Class A (adjusted) | -6.63 | % | ||

PIMCO Emerging Multi-Asset Fund Class C | -1.20 | % | ||

PIMCO Emerging Multi-Asset Fund Class C (adjusted) | -2.19 | % | ||

PIMCO Emerging Multi-Asset Fund Class R | -1.20 | % | ||

MSCI Emerging Markets Index** | -1.78 | % | ||

50% MSCI Emerging Markets Index, 25% JPMorgan Emerging Markets Bond Index (EMBI) Global, 25% JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged)*** | 0.45 | % | ||

All Fund returns are net of fees and expenses.

** MSCI (Morgan Stanley Capital International) Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure emerging market equity performance. It is not possible to invest directly in an unmanaged index.

*** The benchmark is a blend of 50% MSCI Emerging Markets Index, 25% JPMorgan Emerging Markets Bond Index (EMBI) Global, 25% JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged). MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of May 27, 2010 the MSCI Emerging Markets Index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. JPMorgan Emerging Markets Bond Index (EMBI) Global tracks total returns for United States Dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. It is not possible to invest directly in an unmanaged index. JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged) is a comprehensive global local emerging markets index, and consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure.

Performance quoted represents past performance. Past performance is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum sales charge of 5.5% on A shares and 1% CDSC on C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus dated 10/29/10, as supplemented to date, is 2.49% for the Institutional Class shares, 2.59% for the Class P shares, 2.74% for the Administrative Class shares, 2.84% for the Class D shares, 2.84% for the Class A shares, 3.59% for the Class C shares and 3.09% for the Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at http://www.pimco.com/investments.

A line graph is not included since the Fund has less than six months of performance.

Portfolio Insights

| » | The PIMCO Emerging Multi-Asset Fund seeks maximum total return, consistent with prudent investment management, by investing under normal circumstances at least 80% of its assets in investments economically tied to emerging market countries. The Fund will typically invest 20% to 80% of its total assets in equity-related instruments (including investments in common stock, preferred stock, and equity-related Underlying PIMCO Funds or Acquired Funds). The Fund is designed to provide concurrent exposure to a broad spectrum of emerging market asset classes, such as equity, fixed income and currencies, and other investments, including commodities. |

| » | The Fund commenced operations on April 12, 2011. |

| » | An allocation to emerging market corporate bonds contributed to performance as the JPMorgan Corporate Emerging Markets Bond Index Diversified returned 1.70% over the reporting period. |

| » | An allocation to emerging market currencies contributed to performance as the JPMorgan Emerging Local Markets Index Plus Composite returned 0.52% percent over the reporting period. |

| » | An asset allocation decision to overweight emerging market equities detracted from relative performance as the MSCI Emerging Markets Index declined 1.78% over the reporting period. |

| » | An underweight to emerging market local denominated sovereign debt detracted from relative performance as the JPMorgan Global Bond Index—Emerging Markets Global Diversified Index (Unhedged) returned 1.77% for the reporting period. |

| » | A tactical underweight to emerging market external denominated sovereign debt detratced from relative performance as the JPMorgan Emerging Markets Bond Index Global returned 3.61% for the reporting period. |

| 8 | PIMCO Equity Series |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Annual Report | June 30, 2011 | 9 |

Table of Contents

Insights from the Portfolio Manager PIMCO EqS Emerging Markets Fund

Dear Shareholder,

We appreciate your investment in the PIMCO EqS Emerging Markets Fund (the “Fund”). In the following letter, please find additional detail on the Fund’s investment process and philosophy, why we view emerging markets (“EM”) equity as a compelling asset class, and in the last section, a discussion on the current market, performance and positioning of the Fund.

Investment Process and Philosophy

We launched PIMCO’s EM equity strategy in March 2011. In building the strategy, we had the opportunity to assemble a team and design an investment approach that we believe will deliver a compelling opportunity for investors to capture attractive risk-adjusted returns. Given the complexities of the EM landscape, it was important to us that our process incorporate several key characteristics: 1) an experienced team of investors who perform fundamental, company-specific research; 2) the ability to leverage PIMCO’s proven EM expertise and incorporate the macroeconomic insights of the broader investment platform; and 3) proactive risk management that may help protect the portfolio in periods of extreme market stress.

Our approach to finding return asymmetries in EM rests first on evaluating an unconstrained universe of potential investments, focusing on the beneficiaries of emerging market growth with a goal of not limiting the opportunity set or being bound by the parameters of a benchmark. Through in-depth fundamental research, we focus on pricing of normalized earnings and intrinsic value, seeking situations in which the market is not recognizing the current and future earnings power of a company based on reasonable assumptions of long-term performance. This bottom-up work is critical considering the less efficient and less transparent nature of the emerging equity markets.

Still, in emerging markets, country or currency specific factors can often dominate more idiosyncratic factors as drivers of returns. To be successful in EM equities, therefore, we feel it is essential that the investment process fully incorporate top-down considerations. In our investment process, we look to leverage PIMCO’s carefully vetted global macroeconomic outlook, which is driven by the firm’s Investment Committee and secular and cyclical forums. This macro framework is key to not only assessing country and currency factors, but also in helping us identify themes that have implications for industries and the path of earnings of individual companies.

By combining a bottom-up perspective with macroeconomic insights, and by placing a particular emphasis on patience with entry points, we believe that macro volatility and shorter EM business cycles will provide us with ample opportunities to enter a strong equity story with an appropriate cushion.

Finally, we recognize that emerging market equities can be a volatile asset class and may experience periodic, broad-based drawdowns, so rigorous risk management is essential. We evaluate and stress test the risk exposures inherent in our portfolio on an ongoing basis, and by employing tail-risk hedging strategies, we will seek to guard against the risk of a large sell-off across EM equities. Tail-risk management involves hedging against those unforeseeable crises that appear as outlying ‘tails’ on bell-shaped ‘normal’ curves of possible outcomes and that can have devastating effects on a portfolio.

In summary, our approach is research intensive, and by combining bottom-up, fundamental research with macroeconomic insights and focused risk management, we believe we can deliver attractive risk-adjusted returns for our clients over the long term.

Emerging Markets Are a Compelling Asset Class

The emerging markets have evolved from being an opportunistic investment choice earlier in the decade to a core allocation for investors worldwide. This shift reflects a recognition that EM companies account for a substantial and rapidly growing share of the global corporate profit pool.

Over our secular horizon, we believe emerging economies are likely to continue on a path of stronger trend growth relative to developed markets. Emerging economies look more robust than their developed market peers on many traditional macroeconomic metrics, in our opinion, including current account balances, degree of indebtedness, foreign currency reserves and fiscal balances. In addition, higher growth rates in emerging economies are contributing to a burgeoning wealth effect that supports an expansion of the emerging market middle class and which should lead to stronger and more durable domestic consumption trends. In our opinion, these fundamental factors are likely to support continued positive top- and bottom-line growth among emerging market companies and thus, the compelling nature of the investment opportunity in EM equities.

Manager’s Discussion & Market Overview

From the inception of the Fund in late March through the end of the second quarter, equity markets delivered modestly positive returns. After a quite benign start to the performance period, in early May investor focus turned to concerns surrounding the European debt crisis, the U.S. budget impasse, and the potential impact on growth of policies in emerging markets designed to stem inflation. These concerns caused the market to sell off, before the passing of austerity measures in Greece sparked a sharp quarter-end rally.

Emerging market equities have underperformed developed market equities in 2011, reflecting the fact that after years of

| 10 | PIMCO Equity Series |

Table of Contents

very strong growth, emerging market economies appear to be undergoing a mid-cycle correction. We view this as a welcome cyclical adjustment rather than the end of their growth cycle. We remain convinced that the long-term fundamentals remain intact, including demographics favorable to growth, an unleveraged consumer, and investment that is poised to underpin future productivity gains. In addition, we believe emerging market equity valuations are very reasonable relative to history, developed markets and when considering profits as a percentage of Gross Domestic Product (“GDP”).

We believe the recent volatility in the markets and changes in investor sentiment create opportunities for the investor who performs rigorous research and remains focused on the long term. Again, we thank you for your continued investment in the Fund and look forward to serving your investment needs.

Sincerely,

Maria (Masha) Gordon | ||

Portfolio Manager

Top Holdings1

| Samsung Electronics Co. Ltd. | 4.4% | |||||

| Sberbank of Russia2 | 2.6% | |||||

| ETF Palladium Trust | 2.5% | |||||

| BOCI-Prudential—W.I.S.E. Fund | 2.5% | |||||

| Hon Hai Precision Industry Co. Ltd. | 2.4% | |||||

| Banco de Brazil S.A2 | 2.3% | |||||

| Agricultural Bank of China Ltd. | 2.2% | |||||

| MTN Group Ltd.2 | 2.1% | |||||

| AIA Group Ltd. | 2.1% | |||||

| Boshiwa International Holding Ltd. | 2.0% |

| 1 | % of Net Assets as of 06/30/2011. The Fund's top holdings reflect long positions and company specific equity exposure, including exposure obtained through the use of financial derivative instruments. Securities sold short, index derivatives, cash and cash equivelents, are not taken into consideration. |

| 2 | Positions represent company specific equity exposure obtained through the use of financial derivative instruments. |

Geographic Breakdown3

| South Korea | 12.0% | |||||

| China | 11.3% | |||||

| Hong Kong | 9.2% | |||||

| Russia | 6.5% | |||||

| United Kingdom | 5.2% | |||||

| India | 4.7% | |||||

| Taiwan | 3.9% | |||||

| Indonesia | 2.7% | |||||

| United States | 2.6% | |||||

| Brazil | 1.9% | |||||

| Poland | 1.8% | |||||

| Australia | 1.8% | |||||

| Thailand | 1.8% | |||||

| Czech Republic | 1.6% | |||||

| Bermuda | 1.5% | |||||

| Other | 12.3% |

Sector Breakdown3

| Financials | 18.0% | |||||

| Information Technology | 15.6% | |||||

| Energy | 12.1% | |||||

| Materials | 8.7% | |||||

| Consumer Discretionary | 7.0% | |||||

| Industrials | 6.7% | |||||

| Consumer Staples | 4.0% | |||||

| Utilities | 2.8% | |||||

| Other | 6.0% |

| 3 | % of Total Investments as of 06/30/2011. Geographic and Sector Breakdown solely reflect long positions. Financial derivative instruments and short-term instruments are not taken into consideration. |

| Annual Report | June 30, 2011 | 11 |

Table of Contents

PIMCO EqS Emerging Markets Fund

Institutional Class - PEQWX | Class A - PEQAX | |

Class P - PEQQX | Class C - PEQEX | |

| Administrative Class - PEQTX | Class R - PEQHX | |

Class D - PEQDX |

| Cumulative Total Return for the period ended June 30, 2011 | ||||

| Fund Inception (03/22/2011) | ||||

| PIMCO EqS Emerging Markets Fund Institutional Class | 1.90 | % | ||

| PIMCO EqS Emerging Markets Fund Class P | 1.90 | % | ||

| PIMCO EqS Emerging Markets Fund Administrative Class | 1.78 | % | ||

| PIMCO EqS Emerging Markets Fund Class D | 1.80 | % | ||

| PIMCO EqS Emerging Markets Fund Class A | 1.80 | % | ||

| PIMCO EqS Emerging Markets Fund Class A (adjusted) | -3.78 | % | ||

| PIMCO EqS Emerging Markets Fund Class C | 1.70 | % | ||

| PIMCO EqS Emerging Markets Fund Class C (adjusted) | 0.70 | % | ||

| PIMCO EqS Emerging Markets Fund Class R | 1.80 | % | ||

| MSCI Emerging Markets Index* | 3.38 | % | ||

All Fund returns are net of fees and expenses.

* MSCI (Morgan Stanley Capital International) Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure emerging market equity performance. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum sales charge of 5.5% on A shares and 1% CDSC on C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus dated 10/29/10, as supplemented to date, is 1.60% for the Institutional Class shares, 1.70% for the Class P shares, 1.85% for the Administrative Class shares, 1.95% for the Class D shares, 1.95% for the Class A shares, 2.70% for the Class C shares and 2.20% for the Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at http://www.pimco.com/investments.

A line graph is not included since the Fund has less than six months of performance.

Portfolio Insights

| » | The PIMCO EqS Emerging Markets Fund seeks capital appreciation by investing under normal circumstances at least 80% of its assets in a diversified portfolio of investments economically tied to emerging market countries. The Fund will invest a substantial portion of its assets in equity and equity-related securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock). The Fund may also invest in fixed income securities, including debt securities issued by both corporate and government issuers. The Fund may invest in commodity related instruments, including exchange-traded funds, futures and other investment companies. The Fund may also invest in derivative instruments, such as options, futures contracts or swap agreements. |

| » | The Fund commenced operations on March 22, 2011. |

| » | From a sector perspective, positive stock selection within Industrials, including a Korean equipment manufacturer and a Taiwanese property developer, contributed to the Fund’s performance. The Fund’s technology holdings, including a Russian internet business, added to returns. |

| » | On the downside, weakness within the consumer discretionary sector, including a Korean diversified electronics company, detracted from performance. Select holdings within financials, including a Peruvian bank, also detracted from the Fund’s results. |

| » | From a country perspective, our underweight to Brazil contributed to the Fund’s performance relative to the benchmark. Positive stock selection within China also added to the Fund’s returns. |

| » | On the downside, the Fund’s underweight to India as well as negative stock selection detracted from results. |

| 12 | PIMCO Equity Series |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Annual Report | June 30, 2011 | 13 |

Table of Contents

Insights from the Portfolio Managers PIMCO EqS Pathfinder Fund™

Dear Shareholder,

It’s our pleasure to be speaking to you for the first complete year since the launch of the PIMCO EqS Pathfinder Fund™ (the “Fund”). Thank you for your investment in the Fund. Our commitment continues to be to seek an absolute return that beats the market over the cycle and to do so with less volatility than the overall market. It’s no surprise that the last twelve months have been interesting as well as thought provoking and we’d like to share some observations and our outlook with you.

The Last Twelve Months in Review

Almost to the day, July 1, 2010 marks a trough in many global equity markets and the twelve months following saw both the MSCI World Index and the S&P 500 Index up over 30%, the Dow Jones EuroSTOXX 50 Index up over 15%, and Japan’s TOPIX (Tokyo Stock Exchange Tokyo Price Index) up 3%. A number of factors drove this strong advance (an advance seen only 13% of the time over the last 30 years) but amongst them were the 27% growth seen in corporate earnings, a temporary respite seen in Europe’s sovereign debt crisis, an extension of lower tax rates in the U.S., and extraordinary action by the U.S. Federal Reserve in the form of quantitative easing 2 (commonly referred to as QE2). With this backdrop, the Fund returned positive results over the reporting period with generally a third less volatility than the overall market.

Among the securities that contributed to performance were the Fund’s investments in Lorillard, Pfizer, and the Marshall & Ilsley/Bank of Montreal merger.

Lorillard is the third largest cigarette manufacturer in the U.S., with an approximate 10% market share (per industry reports). The company derives about 90% of its sales from Newport, the largest menthol brand in the U.S., which enjoys a 35% share of the menthol market. After a long period of uncertainty regarding a potential ban on the sale of menthol cigarettes, the TPSAC (Tobacco Products Scientific Advisory Committee) came public with a recommendation in mid-March 2011 and we believe it is now highly unlikely that menthol cigarettes will be removed from the market place. The stock of Lorillard was subsequently upgraded by sell-side equity analysts and rose approximately 50% following the TPSAC announcement. The Newport franchise continues to increase sales volume in its core Eastern U.S. market due to the market’s unique demographic profile, higher consumer loyalty, and price increases totaling almost 7% in the first quarter of 2011 (per company reports). Management is also aggressively seeking to increase volume outside its core franchise: i.e. geographically West of the Mississippi and in other cigarette brand categories such as Lights. We believe the company continues to deploy its cash to grow its franchise, and rewards its shareholders with a generous 4.9% dividend yield and a stock buy-back program, which was just recently increased by 40% in May 2011.

The Fund’s holding in Pfizer contributed positively to performance since inclusion in the portfolio in the fall of 2010 when we purchased a fraction of a misunderstood and cheap major pharmaceutical company trading for less than the discounted value of its existing marketed drugs. Over the period under review, Pfizer benefited from a management change with the new CEO, Ian Read, opening discussions about selling non-core businesses as well as acting in a more shareholder friendly way. In April 2011, a deal to sell Capsugel, a unit of the company which manufactures wholesale pill casings, for $2.4 billion was announced. Management subsequently used cash from this transaction and from the large amount of free cash flow generated to repurchase its own undervalued shares. Management also raised the dividend, continued to cut costs and reported solid earnings. In addition, the company received favorable news on a few drugs in late stage trials.

The Fund invested in the merger of Marshall & Ilsley Bank (“MI”) with the BMO Financial Group (“BMO”) by going “long” the MI/BMO merger arbitrage spread (long MI, short BMO in the appropriate ratio). BMO is a $412 billion (asset) Canadian bank with a Chicago-based U.S. subsidiary, which was purchasing a $52 billion (asset) U.S. regional bank, MI, headquartered in Milwaukee. Market analysts predict that the market overlaps in the businesses may lead to an estimated $250 million of cost synergies. The Fund captured a mid-to-high single digit annualized return over the transaction’s approximate six-month life span and did so with very little correlation to the overall market, as measured by the Keefe, Bruyette & Woods (“KBW”) Bank Index, which declined over 2% during the same time period.

Among the securities that detracted from performance were the Fund’s investments in Lloyds Banking Group, Carrefour, and Nintendo.

The Fund’s holdings in Lloyds Banking Group detracted from performance as a new CEO, Antonio Horta-Osorio, joined the bank and sought to clear the deck of many issues. This resulted in a share price decline which was further compounded by a harsh legal and regulatory environment in the U.K. mandating the disposal of over 600 branches and the creation of a reserve for insurance “mis-selling.” We continue to feel that Lloyds Banking Group is a compelling restructuring opportunity and that the new management team’s plan for shareholder value creation will be successful, in our opinion.

Carrefour is the second largest retailer in the world with leading positions in Western Europe, Latin America and some parts of Asia (primarily China and Taiwan). It is a multi-format operator with presence in hypermarkets, supermarkets, and convenience stores. Carrefour is currently in the middle of a turnaround initiative including a cost cutting program and the development of a new hypermarket concept called Planet that has shown very encouraging signs with

| 14 | PIMCO Equity Series |

Table of Contents

double digit sales increases, in our opinion. Carrefour is also looking at ways to monetize the value of some of its assets, such as real estate and its operations in Brazil; however, we believe the stock got penalized due to poor execution. Carrefour passed on higher costs to its French consumers while some of its local competitors backed off, leading to some market share loss for Carrefour and some profit downgrades. Management has also now postponed plans to list its property arm and to combine its Brazilian operation with the leading player in this market. The main shareholder, Blue Capital, with a 14% stake, is estimated to have lost over 50% on its investment and is expected to put pressure on the company to realize some value from its ownership.

The share price of Nintendo, a manufacturer of home-use video game hardware and software, has been under pressure for some time due to struggling sales and weaker than expected profits due in large part to issues associated with its 3DS gaming device. First, there was a delay in the issuance of the new device and it was not available for sale in time for the 2010 Christmas season. Second, we believe there is a lack of big software titles for the device, in which the device lacks content and some consumers are now opting to wait for the upcoming release of Sony’s new PlayStation Vita handheld device. Third, we believe Microsoft is enjoying some success with its Kinect game controller and its Xbox 360 game console, which is cutting into sales of Nintendo’s Wii U. Finally, we believe the company’s fortunes are being hampered by the somewhat strong Japanese yen, which is negatively affecting operating profits. In our opinion, Nintendo is a very cheap stock these days, which appears to be priced as if the company’s 3DS and Wii U products will be failures—something we do not believe will prove to be the case.

Why Equities

After this much of an advance in equity markets over the reporting period, many investors are asking themselves if equities are still the asset class offering the most long-term promise. Our answer is a resounding yes, but with the guidance that an investor has to be able to tolerate fickle markets and price swings in a market environment in which uncertainty abounds and will likely persist. We wouldn’t be surprised if investors questioned our wisdom on recommending equities as the asset class best poised to produce long term returns, so let’s expound on this concept.

First, for an investor deploying long-term capital into equities, the initial conditions are favorable. What are those initial conditions? Above all else in this case, we would point to the valuation of equity

markets. Over any period, the starting point of valuation is the most critical factor in determining equity returns over the next ten years and today’s valuation levels on major markets are undemanding. For example, the trailing twelve-month price to earnings (“P/E”) ratio for the MSCI World Index is around 14x. For context, this ratio has ranged anywhere from 10 to 36 and today’s valuation level is a little bit below average. Historically, when valuation levels have been at this level, it has led to returns in the mid to high single digits. While there is no guarantee the past will repeat itself, we remain optimistic.

Second, more and more companies are seeing their organic investments as well as prior acquisitions in emerging markets come to fruition and make a meaningful contribution to the bottom line. In the Fund’s portfolio, we estimate that well over one third of the earnings come from higher growth emerging markets and in many cases we have the advantage of consolidating those earnings in more established developed market firms with lower valuations. And while this is a secular theme that we’re leveraging within the Fund, we believe it applies to the broader market as well. In the U.S. and Europe, many companies are harvesting cash flows from emerging market economies where incomes are growing rapidly, sovereign balance sheets are unencumbered and Gross Domestic Product (“GDP”) growth is persistently higher than in developed markets.

Third, companies have kept costs and capital expenditures (“CAPEX”) under tight control and are generally showing no sign of relaxing their strict criteria. Free cash flow yield compared to equity and GDP are reaching new highs. With many companies in the process of quickly deleveraging their balance sheets, we believe this will translate favorably for returns to shareholders in the form of dividends and potential share buy-backs. Over the long run, dividends have contributed two thirds of real returns. This should not go unnoticed by an aging population looking increasingly for cash returns and the stability that dividend returns have produced.

Finally, we believe that low to negative real interest rates in developed markets and the competition for returns will likely naturally drive capital into assets that have the potential for higher returns. Equities can possibly shine here compared to other asset classes for a number of reasons. The ability of equities to return capital to shareholders and to grow earnings are all indicative that investors can expect to be rewarded for tolerating the volatility inherent in the asset class, in our opinion. Further, it’s instructive to look at the level of real interest rates in the U.S., which are negative, and then to consider that we’ve never had a bear market start with negative real interest rates.

| Annual Report | June 30, 2011 | 15 |

Table of Contents

Insights from the Portfolio Managers PIMCO EqS Pathfinder Fund™ (Cont.)

Nonetheless, risks exist and we’re as cognizant of them as ever. In particular, we would cite the recent economic news coming out of the U.S. as an indicator that we’ve seen a slowdown in economic growth and the sovereign debt crisis in Europe seems to be escalating. Concern among investors of a hard landing in China is also growing. The choppy waters we’re seeing don’t come as a surprise given our global macro views; in fact, we believe these views give us an edge in being able to navigate these risks. Also, our long practiced style of investing has proved to capture far less downside risk than the market offers. As a consequence of this, we’re using stock price pullbacks as opportunities to put cash to work in the form of new ideas that we believe are unaffected by the prevailing risks and that have the potential to provide outstanding returns. In our last letter to you at the end of December 2010, the Fund’s investments in cash and short-term securities were 32%. As of the end of the reporting on June 30, 2011, the Fund’s investments in cash and short-term securities were 11%.

Conclusion

We look forward to the next twelve months as an opportunity to continue identifying investments with long-term potential and at less volatility than the overall market, in our opinion. We believe a number of compelling opportunities are set to be offered by the market, in our view, and they are quite broad ranging. From merger arbitrage to companies found in far flung corners of the globe, our ability to consistently apply our value investing philosophy around the world gives us confidence that we’ll be able to continue having a portfolio that provides upside with the critical elements of capital preservation.

Again, thank you for your investment in the Fund.

Sincerely,

Anne Gudefin, CFA Co-Portfolio Manager |

Charles Lahr, CFA Co-Portfolio Manager | |

Top Holdings1

| SPDR Gold Trust | 3.8% | |||

| Imperial Tobacco Group PLC | 3.0% | |||

| Danone | 2.8% | |||

| British American Tobacco PLC | 2.7% | |||

| Microsoft Corp. | 2.2% | |||

| Morgan Stanley BV, Carrefour S.A.—Exp. 03/23/2012 | 2.0% | |||

| AIA Group Ltd. | 2.0% | |||

| Koninklijke KPN NV | 1.9% | |||

| BP PLC | 1.9% | |||

| Carlsberg A/S | 1.9% |

Geographic Breakdown1

| United States | 27.5% | |||

| United Kingdom | 13.8% | |||

| France | 12.4% | |||

| Netherlands | 6.6% | |||

| Switzerland | 5.8% | |||

| Bermuda | 5.5% | |||

| Hong Kong | 3.6% | |||

| Germany | 3.5% | |||

| Denmark | 2.7% | |||

| Norway | 1.8% | |||

| Other | 6.6% |

Sector Breakdown1

| Financials | 26.3% | |||

| Consumer Staples | 24.9% | |||

| Energy | 8.7% | |||

| Industrials | 6.6% | |||

| Information Technology | 6.2% | |||

| Consumer Discretionary | 3.7% | |||

| Health Care | 3.6% | |||

| Other | 9.8% |

| 1 | % of Total Investments as of 06/30/2011. Top Holdings, Geographic and Sector Breakdown solely reflect long positions. Securities sold short, financial derivative instruments and short-term instruments are not taken into consideration. |

| 16 | PIMCO Equity Series |

Table of Contents

Institutional Class - PTHWX | Class A - PATHX | |

Class P - PTHPX | Class C - PTHCX | |

Class D - PTHDX | Class R - PTHRX |

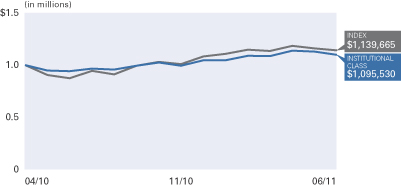

Cumulative Returns for the period ended June 30, 2011

$1,000,000 invested at the end of the month when the Fund’s Institutional Class commenced operations. The minimum initial investment amount for Institutional Class or Class P Shares is $1,000,000. The minimum initial investment for Class A, Class C or Class D Shares is $1,000. There is no minimum initial investment amount for Class R Shares.

| Average Annual Total Return for the period ended June 30, 2011 | ||||||||||

| 1 Year | Fund Inception (04/14/2010) | |||||||||

| PIMCO EqS Pathfinder Fund™ Institutional Class | 16.68% | 6.31% | |||||||

| PIMCO EqS Pathfinder Fund™ Class P | 16.55% | 6.22% | ||||||||

| PIMCO EqS Pathfinder Fund™ Class D | 16.39% | 5.90% | ||||||||

| PIMCO EqS Pathfinder Fund™ Class A | 16.30% | 5.93% | ||||||||

| PIMCO EqS Pathfinder Fund™ Class A (adjusted) | 9.90% | 1.10% | ||||||||

| PIMCO EqS Pathfinder Fund™ Class C | 15.50% | 5.23% | ||||||||

| PIMCO EqS Pathfinder Fund™ Class C (adjusted) | 14.50% | 4.42% | ||||||||

| PIMCO EqS Pathfinder Fund™ Class R | 16.02% | 5.63% | ||||||||

| MSCI World Index* | 30.51% | 8.47% | |||||||

All Fund returns are net of fees and expenses.

* The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. As of May 27, 2010 the MSCI World Index consisted of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The index represents the unhedged performance of the constituent stocks, in US dollars. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum sales charge of 5.5% on A shares and 1% CDSC on C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current Institutional Class, Class P, Class D, Class A, Class C and Class R prospectus dated 10/29/10, as supplemented to date, is 1.16% for the Institutional Class shares, 1.26% for the Class P shares, 1.51% for the Class D shares, 1.51% for the Class A shares, 2.26% for the Class C shares and 1.76% for the Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at http://www.pimco.com/investments.

Portfolio Insights

| » | The PIMCO EqS Pathfinder Fund™ seeks capital appreciation by investing under normal circumstances in equity securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), of issuers that PIMCO believes are undervalued. The Fund’s bottom-up value investment style attempts to identify securities that are undervalued by the market in comparison to PIMCO’s own determination of the company’s value, taking into account criteria such as asset value, book value, cash flow and earnings estimates. |

| » | During the reporting period, the Fund’s Institutional class shares returned 16.68% after fees, and the Fund’s benchmark index, the MSCI World Index, returned 30.51%. The Fund’s performance, although positive, underperformed its benchmark index by 13.83% after fees. |

| » | Stock selection in the consumer staples, financials, and energy sectors were notable contributors to returns as stock selections within these sectors appreciated during the reporting period. |

| » | Holdings in Seadrill Ltd, British American Tobacco PLC, and Lorillard were notable contributors to returns as prices on these securities appreciated during the reporting period. |

| » | Holdings in Nintendo, CBOE Holdings, and Carrefour were moderate detractors from returns as prices on these securities declined during the reporting period. |

| » | Given the sharp recovery and appreciation in the equity markets over the reporting period, the Fund’s market risk hedging strategies slightly detracted from performance as these hedging strategies declined in value. |

| » | At the end of the reporting period, the Fund held approximately 81% in equities we believe are undervalued, approximately 4% (on the long side only) in merger arbitrage investments, approximately 11% in cash equivalents, and held the balance of the portfolio in currency and market risk hedges, including approximately 4% in gold. |

| Annual Report | June 30, 2011 | 17 |

Table of Contents

| Actual Performance | Hypothetical Performance | |||||||||||||||||||||||||||||||||

| Beginning Account Value (01/01/11) | Ending Account Value (06/30/11) | Expenses Paid During Period † | Beginning Account Value (01/01/11) | Ending Account Value (06/30/11) | Expenses Paid During Period † | Net Annualized Expense Ratio †† | ||||||||||||||||||||||||||||

PIMCO Emerging Multi-Asset Fund | ||||||||||||||||||||||||||||||||||

| Institutional Class | $ | 1,000.00 | ** | $ | 989.00 | $ | 1.03 | $ | 1,000.00 | $ | 1,022.41 | $ | 2.41 | 0.48 | % | |||||||||||||||||||

| Class P | 1,000.00 | ** | 990.00 | 1.25 | 1,000.00 | 1,021.92 | 2.91 | 0.58 | ||||||||||||||||||||||||||

| Administrative Class | 1,000.00 | *** | 987.03 | 1.43 | 1,000.00 | 1,021.17 | 3.66 | 0.73 | ||||||||||||||||||||||||||

| Class D | 1,000.00 | ** | 989.00 | 1.79 | 1,000.00 | 1,020.68 | 4.16 | 0.83 | ||||||||||||||||||||||||||

| Class A | 1,000.00 | ** | 988.00 | 1.79 | 1,000.00 | 1,020.68 | 4.16 | 0.83 | ||||||||||||||||||||||||||

| Class C | 1,000.00 | ** | 988.00 | 3.40 | 1,000.00 | 1,016.96 | 7.90 | 1.58 | ||||||||||||||||||||||||||

| Class R | 1,000.00 | ** | 988.00 | 2.32 | 1,000.00 | 1,019.44 | 5.41 | 1.08 | ||||||||||||||||||||||||||

PIMCO EqS Emerging Markets Fund | ||||||||||||||||||||||||||||||||||

| Institutional Class | $ | 1,000.00 | * | $ | 1,019.00 | $ | 3.46 | $ | 1,000.00 | $ | 1,018.60 | $ | 6.26 | 1.25 | % | |||||||||||||||||||

| Class P | 1,000.00 | * | 1,019.00 | 3.73 | 1,000.00 | 1,018.10 | 6.76 | 1.35 | ||||||||||||||||||||||||||

| Administrative Class | 1,000.00 | *** | 968.60 | 2.91 | 1,000.00 | 1,017.36 | 7.50 | 1.50 | ||||||||||||||||||||||||||

| Class D | 1,000.00 | * | 1,018.00 | 4.42 | 1,000.00 | 1,016.86 | 8.00 | 1.60 | ||||||||||||||||||||||||||

| Class A | 1,000.00 | * | 1,018.00 | 4.42 | 1,000.00 | 1,016.86 | 8.00 | 1.60 | ||||||||||||||||||||||||||

| Class C | 1,000.00 | * | 1,017.00 | 6.49 | 1,000.00 | 1,013.14 | 11.73 | 2.35 | ||||||||||||||||||||||||||

| Class R | 1,000.00 | * | 1,018.00 | 5.11 | 1,000.00 | 1,015.62 | 9.25 | 1.85 | ||||||||||||||||||||||||||

PIMCO EqS Pathfinder FundTM | ||||||||||||||||||||||||||||||||||

| Institutional Class | $ | 1,000.00 | $ | 1,048.23 | $ | 4.72 | $ | 1,000.00 | $ | 1,020.18 | $ | 4.66 | 0.93 | % | ||||||||||||||||||||

| Class P | 1,000.00 | 1,048.28 | 5.23 | 1,000.00 | 1,019.69 | 5.16 | 1.03 | |||||||||||||||||||||||||||

| Class D | 1,000.00 | 1,046.35 | 6.49 | 1,000.00 | 1,018.45 | 6.41 | 1.28 | |||||||||||||||||||||||||||

| Class A | 1,000.00 | 1,046.21 | 6.49 | 1,000.00 | 1,018.45 | 6.41 | 1.28 | |||||||||||||||||||||||||||

| Class C | 1,000.00 | 1,042.49 | 10.28 | 1,000.00 | 1,014.73 | 10.14 | 2.03 | |||||||||||||||||||||||||||

| Class R | 1,000.00 | 1,045.41 | 7.76 | 1,000.00 | 1,017.21 | 7.65 | 1.53 | |||||||||||||||||||||||||||

† Expenses are equal to the net annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period), 100/365 for the Institutional Class, Class P, Class D, Class A, Class C and Class R shares of the PIMCO EqS Emerging Markets Fund (to reflect the period since inception date of 03/22/11), 79/365 for the Institutional Class, Class P, Class D, Class A, Class C and Class R shares of the PIMCO Emerging Multi-Asset Fund (to reflect the period since inception date of 04/12/11), and 72/365 for the Administrative Class shares of the PIMCO EqS Emerging Markets Fund and PIMCO Emerging Multi-Asset Fund (to reflect the period since inception date of 04/19/11). The PIMCO Eqs Emerging Markets and PIMCO Emerging Multi-Asset Funds’ hypothetical expenses reflect an amount as if the classes had been operational for the entire fiscal half year.

†† The annualized expense ratio in the Institutional Class, Class P, Administrative Class, Class D, Class A, Class C, and Class R shares of PIMCO Emerging Multi-Asset Fund reflects net annualized expenses after an application of an expense waiver of 0.87%. The annualized expense ratio in the Institutional Class, Class P, Administrative Class, Class D, Class A, Class C, and Class R shares of PIMCO EqS Emerging Markets Fund reflects net annualized expenses after an application of an expense waiver of 0.20%. The annualized expense ratio in the Institutional Class, Class P, Class D, Class A, Class C, and Class R shares of PIMCO EqS Pathfinder FundTM reflects net annualized expenses after an application of an expense waiver of 0.16%.

* The Beginning Account Value is reflective as of 03/22/11 for Actual Performance.

** The Beginning Account Value is reflective as of 04/12/11 for Actual Performance.

*** The Beginning Account Value is reflective as of 04/19/11 for Actual Performance.

Please refer to the Important Information section for an explanation of the information presented in the above Expense Examples.

| 18 | PIMCO Equity Series |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Annual Report | June 30, 2011 | 19 |

Table of Contents

| Selected Per Share Data for the Year or Period Ended: | Net Asset Value Beginning of Year or Period | Net Investment Income (a) | Net Realized/ Unrealized Gain (Loss) on Investments | Total Income (Loss) from Investment Operations | Dividends from Net Investment Income | Distributions from Net Realized Capital Gains | ||||||||||||||||||

PIMCO Emerging Multi-Asset Fund | ||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||

04/12/2011 - 06/30/2011 | $ | 10.00 | $ | 0.02 | $ | (0.13 | ) | $ | (0.11 | ) | $ | 0.00 | $ | 0.00 | ||||||||||

| Class P | ||||||||||||||||||||||||

04/12/2011 - 06/30/2011 | 10.00 | 0.02 | (0.12 | ) | (0.10 | ) | 0.00 | 0.00 | ||||||||||||||||

| Administrative Class | ||||||||||||||||||||||||

04/19/2011 - 06/30/2011 | 10.02 | 0.02 | (0.15 | ) | (0.13 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class D | ||||||||||||||||||||||||

04/12/2011 - 06/30/2011 | 10.00 | 0.02 | (0.13 | ) | (0.11 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class A | ||||||||||||||||||||||||

04/12/2011 - 06/30/2011 | 10.00 | 0.02 | (0.14 | ) | (0.12 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class C | ||||||||||||||||||||||||

04/12/2011 - 06/30/2011 | 10.00 | 0.00 | ^ | (0.12 | ) | (0.12 | ) | 0.00 | 0.00 | |||||||||||||||

| Class R | ||||||||||||||||||||||||

04/12/2011 - 06/30/2011 | 10.00 | 0.01 | (0.13 | ) | (0.12 | ) | 0.00 | 0.00 | ||||||||||||||||

PIMCO EqS Emerging Markets Fund | ||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||

03/22/2011 - 06/30/2011 | $ | 10.00 | $ | 0.05 | $ | 0.14 | $ | 0.19 | $ | 0.00 | $ | 0.00 | ||||||||||||

| Class P | ||||||||||||||||||||||||

03/22/2011 - 06/30/2011 | 10.00 | 0.04 | 0.15 | 0.19 | 0.00 | 0.00 | ||||||||||||||||||

| Administrative Class | ||||||||||||||||||||||||

04/19/2011 - 06/30/2011 | 10.51 | 0.04 | (0.37 | ) | (0.33 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class D | ||||||||||||||||||||||||

03/22/2011 - 06/30/2011 | 10.00 | 0.06 | 0.12 | 0.18 | 0.00 | 0.00 | ||||||||||||||||||

| Class A | ||||||||||||||||||||||||

03/22/2011 - 06/30/2011 | 10.00 | 0.05 | 0.13 | 0.18 | 0.00 | 0.00 | ||||||||||||||||||

| Class C | ||||||||||||||||||||||||

03/22/2011 - 06/30/2011 | 10.00 | 0.03 | 0.14 | 0.17 | 0.00 | 0.00 | ||||||||||||||||||

| Class R | ||||||||||||||||||||||||

03/22/2011 - 06/30/2011 | 10.00 | 0.06 | 0.12 | 0.18 | 0.00 | 0.00 | ||||||||||||||||||

PIMCO EqS Pathfinder Fund™ | ||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||

06/30/2011 | $ | 9.23 | $ | 0.19 | $ | 1.34 | $ | 1.53 | $ | (0.09 | ) | $ | (0.02 | ) | ||||||||||

04/14/2010 - 06/30/2010 | 10.00 | 0.07 | (0.84 | ) | (0.77 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class P | ||||||||||||||||||||||||

06/30/2011 | 9.23 | 0.18 | 1.34 | 1.52 | (0.09 | ) | (0.02 | ) | ||||||||||||||||

04/14/2010 - 06/30/2010 | 10.00 | 0.07 | (0.84 | ) | (0.77 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class D | ||||||||||||||||||||||||

06/30/2011 | 9.21 | 0.16 | 1.34 | 1.50 | (0.08 | ) | (0.02 | ) | ||||||||||||||||

04/14/2010 - 06/30/2010 | 10.00 | 0.06 | (0.85 | ) | (0.79 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class A | ||||||||||||||||||||||||

06/30/2011 | 9.22 | 0.17 | 1.33 | 1.50 | (0.06 | ) | (0.02 | ) | ||||||||||||||||

04/14/2010 - 06/30/2010 | 10.00 | 0.07 | (0.85 | ) | (0.78 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class C | ||||||||||||||||||||||||

06/30/2011 | 9.21 | 0.11 | 1.31 | 1.42 | (0.06 | ) | (0.02 | ) | ||||||||||||||||

04/14/2010 - 06/30/2010 | 10.00 | 0.05 | (0.84 | ) | (0.79 | ) | 0.00 | 0.00 | ||||||||||||||||

| Class R | ||||||||||||||||||||||||

06/30/2011 | 9.21 | 0.12 | 1.35 | 1.47 | (0.07 | ) | (0.02 | ) | ||||||||||||||||

04/14/2010 - 06/30/2010 | 10.00 | 0.06 | (0.85 | ) | (0.79 | ) | 0.00 | 0.00 | ||||||||||||||||

| * | Annualized |

| ** | The ratio excludes PIMCO Short-Term Floating NAV Portfolio. |

| ^ | Reflects an amount rounding to less than one cent. |

| (a) | Per share amounts based on average number of shares outstanding during the period. |

| 20 | PIMCO Equity Series | See Accompanying Notes |

Table of Contents

| Total Distributions | Net Asset Value End of Year or Period | Total Return | Net Assets End of Year or Period (000s) | Ratio of Expenses to Average Net Assets | Ratio of Expenses to Average Net Assets Excluding Waivers | Ratio of Expenses to Average Net Assets Excluding Interest Expense and Dividends on Securities Sold Short | Ratio of Expenses to Average Net Assets Excluding Interest Expense, Dividends on Securities Sold Short and Waivers | Ratio of Net Investment Income to Average Net Assets | Portfolio Turnover Rate | |||||||||||||||||||||||||||||

| $ | 0.00 | $ | 9.89 | (1.10 | )% | $ | 9,755 | 0.53 | %* | 6.96 | %* | 0.53 | %* | 6.96 | %* | 1.13 | %* | 0 | %** | |||||||||||||||||||

| 0.00 | 9.90 | (1.00 | ) | 74 | 0.63 | * | 17.34 | * | 0.63 | * | 17.34 | * | 0.96 | * | 0 | ** | ||||||||||||||||||||||

| 0.00 | 9.89 | (1.30 | ) | 10 | 0.78 | * | 6.47 | * | 0.78 | * | 6.47 | * | 0.88 | * | 0 | ** | ||||||||||||||||||||||

| 0.00 | 9.89 | (1.10 | ) | 2,745 | 0.88 | * | 8.20 | * | 0.88 | * | 8.20 | * | 0.81 | * | 0 | ** | ||||||||||||||||||||||

| 0.00 | 9.88 | (1.20 | ) | 1,801 | 0.88 | * | 9.28 | * | 0.88 | * | 9.28 | * | 0.82 | * | 0 | ** | ||||||||||||||||||||||

| 0.00 | 9.88 | (1.20 | ) | 649 | 1.63 | * | 9.73 | * | 1.63 | * | 9.73 | * | 0.08 | * | 0 | ** | ||||||||||||||||||||||

| 0.00 | 9.88 | (1.20 | ) | 10 | 1.13 | * | 6.40 | * | 1.13 | * | 6.40 | * | 0.50 | * | 0 | ** | ||||||||||||||||||||||

| $ | 0.00 | $ | 10.19 | 1.90 | % | $ | 353,099 | 1.25 | %* | 1.62 | %* | 1.25 | %* | 1.62 | %* | 1.77 | %* | 41 | %** | |||||||||||||||||||

| 0.00 | 10.19 | 1.90 | 37 | 1.35 | * | 1.94 | * | 1.35 | * | 1.94 | * | 1.42 | * | 41 | ** | |||||||||||||||||||||||

| 0.00 | 10.18 | (3.14 | ) | 10 | 1.50 | * | 1.90 | * | 1.50 | * | 1.90 | * | 1.72 | * | 41 | ** | ||||||||||||||||||||||

| 0.00 | 10.18 | 1.80 | 1,080 | 1.60 | * | 2.11 | * | 1.60 | * | 2.11 | * | 1.98 | * | 41 | ** | |||||||||||||||||||||||

| 0.00 | 10.18 | 1.80 | 764 | 1.60 | * | 2.02 | * | 1.60 | * | 2.02 | * | 1.89 | * | 41 | ** | |||||||||||||||||||||||

| 0.00 | 10.17 | 1.70 | 98 | 2.35 | * | 2.80 | * | 2.35 | * | 2.80 | * | 0.98 | * | 41 | ** | |||||||||||||||||||||||

| 0.00 | 10.18 | 1.80 | 39 | 1.85 | * | 2.34 | * | 1.85 | * | 2.34 | * | 1.97 | * | 41 | ** | |||||||||||||||||||||||