`-+

Letter to Shareholders

LoCorr Funds seek to provide investments that, over time, will have low correlation to traditional asset classes such as stocks and bonds. We believe that adding low correlating investments to portfolios can significantly reduce the overall portfolio risk while enhancing returns. Correlation measures the degree to which the returns of two investments move together over time. LoCorr offers products that provide the potential for positive returns in rising or falling markets and are designed to generate returns independent of traditional stock, bond and commodity investments. In this report, LoCorr Funds are reporting on six mutual funds: LoCorr Macro Strategies Fund, LoCorr Long/ Short Commodities Strategy Fund, LoCorr Multi-Strategy Fund, LoCorr Market Trend Fund, LoCorr Dynamic Equity Fund and LoCorr Spectrum Income Fund (collectively, the “Funds”).

LoCorr Macro Strategies Fund

The LoCorr Macro Strategies Fund (the “Macro Strategies Fund” or the “Fund”) seeks capital appreciation as its primary investment objective, with managing volatility as a secondary objective. The Fund attempts to achieve its objective by investing in two main strategies – a Managed Futures Strategy and a Fixed Income Strategy.

The Fund invests up to 25% of its total assets into a portfolio of globally-diversified managed futures positions. The Fund employs three sub-advisers to manage the Managed Futures Strategy portion of the Fund: Millburn Ridgefield Corporation (“Millburn”), Graham Capital Management (“Graham”), and Revolution Capital Management (“Revolution”). Millburn traces its roots back to 1971 and manages $6.2 billion in assets. Graham was founded in 1994 and manages $15.0 billion in assets. Revolution was founded in 2004 and manages $555 million in assets. The allocations to each manager this year (subject to change) have been approximately 40% to Millburn, 40% to Graham and 20% to Revolution.

Millburn manages a portfolio for the Fund that is similar to its Millburn Diversified Program, which commenced operations in 1977. Millburn invests in a diversified portfolio of global futures and forward currency contracts by combining non-traditional and trend-following strategies in a systematic, multi-factor approach. Graham manages a portfolio for the Fund that is similar to its Tactical Trend strategy; a systematic, medium- to long-term trend-following program that commenced trading in 2006. Revolution manages a strategy for the Fund that is similar to its Alpha Program, which has been available in a managed account program since 2007. Revolution employs a short- to medium-term pattern recognition strategy that incorporates trend reversion and counter-trend signals.

The Fund’s Class I shares declined -5.02% during the semi-annual period ended June 30, 2018 versus a -2.19% decline for the Barclay CTA Index. During the semi-annual period, Millburn’s returns were slightly negative, with larger losses from Graham’s portfolio while Revolution’s results fell in between. Trading in Equities generated the largest losses during the period. Trading in Foreign Currency and Metals markets were also unprofitable, while the Fund benefitted from strong performance by trading in Energy and, to a lesser extent, Fixed Income.

Negative returns for the Fund were driven by challenging conditions in late January/early February when market dynamics in equities and oil, in particular, reversed sharply. These conditions were exceptionally challenging for trend following strategies, but also challenged the other strategies comprising the Fund. While the Fund’s positioning within Equities varied by sub-adviser, holdings overall were long in Equities and oil markets heading into the reversal. While this positioning adjusted, the speed and magnitude of the reversal was so dramatic that the Fund experienced a drawdown of -10.88% during late January/early February, similar to the Morningstar Managed Futures category (-9.40%) or the Credit Suisse Managed Futures Index (-10.55%). This brief period was the primary driver behind the Fund’s negative returns during the semi-annual period.

Market Commentary

Domestically, estimated first quarter gross domestic product (“GDP”) growth was revised slightly downwards to an annualized rate of 2.2%, but many economists expect that the effect of U.S. tax cuts will produce faster growth in the second quarter. The Federal Reserve has gradually adopted a more hawkish stance as it seeks to normalize monetary policy. Inflation remains elusive based on official government reports, but there seems to be a sense of unease that below-equilibrium, short-term interest rates could result in inflationary havoc if not pre-emptively checked via ongoing, scheduled hikes. The Trump administration has continued to threaten numerous trading partners with tariffs, most notably China.

The low volatility that characterized the 2017 Equity market came to an abrupt end in late January, as investors took notice of rising interest rates and building inflationary pressure. This led to selling pressure in equities, which sparked a surge in volatility as the Chicago Board of Exchange Volatility Index (“VIX”) jumped from 11.08 on January 26th to an intra-day high of 50.30 on February 6th. The spiking volatility led to the demise of a number of inverse (short) volatility Exchange Traded Funds (“ETFs”) that proved vulnerable to these conditions and exacerbated the sell-off. The Dow Jones Industrial Average (DJIA) corrected -10.26% from January 29 to February 8. The sell-off was rather short lived -- investors flocked back to stocks and Equity markets recovered much of their losses. Since the recovery in the second half of February, performance in Equities has been mixed. U.S. equities gained in the second quarter while international markets were negative, particularly Emerging Markets.

In Fixed Income markets, the Federal Reserve hiked the federal funds rate twice during the first half of the year and signaled for two more rate hikes in 2018, which is one more than many anticipated. This helped spur a rise in U.S. rates as evidenced by the U.S. 10-year Treasury, which rose approximately 45 basis points during the period, and in May briefly eclipsed 3% for the first time since January 2014.

Despite Fed optimism regarding the economy, the yield curve has continued to flatten and remains at its flattest level since 2007. Overseas, European yields reversed, moving higher through mid-March before grinding lower through the end of the period. The exception to this trend, Italian yields, surged higher due to political instability and default fear.

In the Commodities markets, oil continued to trend higher, with West Texas Intermediate (“WTI”) ending the semi-annual period over $70 a barrel. Despite the move higher during 2018, oil prices exhibited considerable volatility during the risk-off period in late January/ early February when WTI fell approximately 12% from its highs. Agricultural commodities were mixed, but generally moved lower. Corn and soybean prices moved higher during the first five months of the year before reversing course in June, falling precipitously as trade war concerns mounted, particularly between the U.S. and China. Cocoa prices surged approximately 30% on concerns regarding dry weather in West Africa, though prices came off their highs in May. Base and Precious Metals prices moved lower during the semi-annual period, with aluminum, copper, gold, and silver prices falling.

The U.S. Dollar Index fell early in the quarter as the U.S. dollar continued to weaken versus other major currencies, including the Euro, British Pound, and Yen. With strong economic growth, rising rates domestically, and trade war fears, the U.S. dollar reversed course and strengthened though the end of the second quarter.

Managed Futures Strategy

Commodities

Trading in Commodities was slightly profitable during the first half of 2018, though it varied significantly by sector. The Fund was positioned long oil and oil-derived commodities throughout the period, enabling it to benefit from the powerful move higher in oil prices, despite a setback in February during the correction. Unprofitable trading in Base Metals offset much of the gains from Energy. Choppy market conditions, coupled with sizable reversals, characterized many of the Base Metals (metals that are consumed in manufacturing) markets during the period. Long positions were hurt by these trading conditions, though exposure had been reduced sharply by June when commodities like copper and aluminum plummeted on trade tariff concerns.

Equity Indices

Unprofitable trading in the first quarter, particularly in the late January/early February correction, led to losses in Equities during the semi- annual period. High conviction long positions in Equities heading into 2018 benefitted through much of January (and 2017) from the ongoing move higher in global equity markets. Unfortunately, this positioning left the Fund vulnerable when volatility surged and equity markets corrected. The Fund’s positioning responded by moving short, which would have likely helped to protect capital if the equity sell-off had persisted -- which it did not. While positioning shifted back to long later in the first quarter, U.S. markets were choppy before advancing in the second quarter. Developed international markets were choppy and range-bound before selling off in the second quarter, while Emerging Markets were weak for most of the period.

Foreign Currencies

Trading in Foreign Currency markets was unprofitable during the period as investor sentiment regarding the U.S. dollar oscillated during the first half of 2018. Using the U.S. Dollar Index as a proxy, the greenback had trended higher for much of Fall 2017, before weakening late in the year and into early 2018. These conditions gave way to a range bound market beginning in February and ending in the first half of April. The U.S. dollar began strengthening beginning in mid-April, perhaps responding to strong domestic economic growth and the move higher in interest rates relative to the rest of the world. These range-bound conditions and reversals proved challenging for the Fund as exposure shifted between long and short during the period.

Fixed Income

Trading in Fixed Income was modestly profitable during the semi-annual period, with small gains from positions in both the long- and short-end of the curve. With U.S. rates rising, positioning in domestic fixed income was short (benefit from rising rates which causes bond prices to fall). Overseas, interest rates were generally flat to down during the period; but, particularly in European markets, they experienced some sizable reversals along the way. Positioning in international fixed income markets was long (benefit from falling rates, which causes bond prices to rise) for most of the semi-annual period.

Outlook

We continue to believe the Macro Strategies Fund has demonstrated an ability to perform in a variety of market environments, as the underlying sub-advisers employ varied investment strategies. Due to the diversified and complementary nature of this multi-manager fund, we expect it to generate less volatile returns than single-manager peers, with the potential to excel in a variety of market conditions. We believe that this current period, which has challenged trend-following and managed futures strategies in general, will give way to a more favorable environment that is more conducive to the Fund.

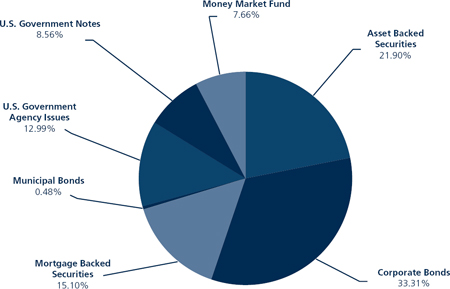

Fixed Income Strategy

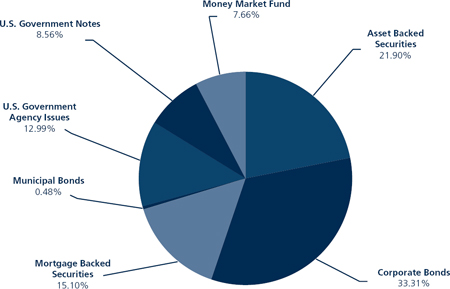

The Macro Strategies Fund invests most of its remaining assets in a fixed income strategy comprised of short-to intermediate-term, investment grade corporate and government agency securities. Nuveen Asset Management (“Nuveen”) is the sub-adviser for this strategy and manages a shorter duration, high quality portfolio.

The fixed income component of the Fund is managed against the Barclays 1-5 Government Credit Index. Returns for Nuveen were +0.13%, compared to -0.33% for the benchmark in the first half of 2018. Given Nuveen’s expectation for short-term rates to be gradually pressured higher, the fixed income portion of the Fund was focused on generating income while maintaining a defensive interest rate posture. Accordingly, the Fund was overweight non-government sectors of the bond market and had duration, or interest rate sensitivity, lower than the benchmark. The increase in rates on the short-end contributed positively to performance relative to the benchmark; however, a flatter yield curve over the period tempered those gains slightly. Exposure to non-government sectors didn’t have a material impact on performance. Overall, the defensive positioning in duration allowed the portfolio to outperform the benchmark with lower volatility.

The duration for the fixed income portfolio of the Fund was managed between 1.9 and 2.2 years during the period, shorter than the benchmark. Given that spreads for non-government securities were range-bound, Nuveen’s sector strategy was neutral to investment returns during the reporting period.

U.S. economic activity remained strong, accelerating from the first quarter. The unemployment rate dropped below 4%, with wage gains increasing as the labor market tightened. U.S. trade policy, geopolitical concerns, and rising rates provided a source of sporadic market volatility during the period. Risk assets retraced most of January’s strong gains and remained mostly range-bound during the remainder of the period. Rates remained on an upward trend, as the Fed hiked twice during the period and has communicated its commitment to continued gradual rate hikes. The 2-Year U.S. Treasury yield rose 65 basis points during the first half, while the 10-Year U.S. Treasury yield rose 45 basis points, continuing the curve flattening trend.

Investment-grade credit spreads widened during the first half of the year. Given the widening in spreads, investment-grade credit finished the period with negative excess returns versus Treasuries.

Short-duration residential mortgage-backed securities outperformed based on continued strong fundamentals and stable spreads during the period. The commercial mortgage-backed securities sector performed well, as heavy supply was met with strong investor demand. In addition, floating rate exposure across the sectors proved beneficial during the first half as rates rose. Securitized sectors in aggregate posted positive excess returns versus Treasuries.

LoCorr Long/Short Commodities Strategy Fund

The LoCorr Long/Short Commodities Strategy Fund (the “Long/Short Commodities Fund” or the “Fund”) provides investors with access to a commodities futures strategy in a mutual fund structure. Historically, investors have primarily accessed exposure to long-only commodities that rely on rising commodity prices to generate positive returns. The Long/Short Commodities Fund has the potential to profit while commodity prices increase or decrease. The Fund’s primary investment objective is capital appreciation in rising and falling commodities markets, and it attempts to achieve its investment objective by investing in two primary strategies – a Commodities Strategy and a Fixed Income Strategy.

The Fund accesses, via a total return swap agreement, the returns of Millburn’s Commodity Program (”MILCOM”), which began trading in 2005; and the returns of J E Moody’s Commodity Relative Value Program (JEM CRV), which began trading in 2006. MILCOM employs a systematic trading strategy that takes outright long/short directional positions and relative value positions across 40+ commodity futures markets. JEM CRV employs a market neutral, systematic trading strategy that invests in calendar spread positions across 20+ commodity markets. As of June 30, 2018, MILCOM managed about 68% of the strategy’s exposure while JEM CRV managed 32%.

The Fund’s Class I shares generated solid, positive returns during the semi-annual period ended June 30, 2018, gaining +6.42%. We were pleased that the Fund captured the majority of the upside in the S&P GSCI, a proxy for commodities, which gained +10.36% and outperformed the +2.65% return for the S&P 500 Index. Overall during the period, both directional and relative value trading were profitable. Positions in Energy were the largest contributors, with smaller gains from trading in Livestock markets. Trading in Metals was unprofitable, while Grains and Softs did not have a significant impact on Fund returns during the period.

Market Commentary

A number of factors broadly impacted global commodities during the semi-annual period, including, but not limited to: trade tariffs, volatility in the strength of the U.S. dollar, robust economic growth, and risk appetite by market participants. Following the upward move during the second half of 2017, commodity prices continued to advance during the first half of 2018 as evidenced by the +10.36% return for the S&P GSCI.

Agricultural commodities surged early in 2018 as cocoa, corn, wheat, and soybean made substantial moves higher. Cocoa prices soared +35.10% in the first quarter due to supply concerns in the Ivory Coast and Ghana, the largest producing regions in the world. Agricultural commodities sold-off sharply in the second quarter due to escalating global trade tension. In June, China’s Ministry of Finance indicated its intention to move forward with a 25% tariff on approximately $50 billion of U.S. imports, including a number of agricultural commodities such as soybean, corn, and wheat. The likely reduction in demand coupled with ample supplies caused a significant June sell-off.

Following their strong move in 2017, Base Metal prices retreated during the semi-annual period, particularly in the first quarter, due to heightened geopolitical tension, higher inventory, and soft Chinese demand. Trade war concerns in the second quarter further pressured many Base Metals, including copper, as China, the largest consumer of these commodities, announced its intention to move forward with retaliatory tariffs toward the end of the period. Precious Metal prices were generally little changed in the first quarter but weakened in the final three months of the period attributable to softness in gold and platinum. Following a significant move higher in late 2017/early 2018, gold prices have fallen since mid-April on a combination of a stronger U.S. dollar, higher interest rates, trade concerns, and less interest by market participants for this safe-haven asset.

In Energy markets, oil prices continued their climb as WTI ended the semi-annual period up approximately 23% at approximately $74/ barrel versus roughly $60/barrel at the end of 2017. This ongoing rise comes despite the announcement that Organization of Petroleum Exporting Countries (“OPEC”) would increase oil production and ease supply constraints that have been in place since 2017. The U.S. decision to pull out of the Iran nuclear deal, collapsing oil production in Venezuela as a result of their economic crisis, Libyan production woes due to political instability, and declining U.S. inventories served to restrict oil supply and boost prices.

Commodity Strategy

Energy

Trading in Energy markets was highly profitable during the semi-annual period. Long positions in directional trading benefitted from tight conditions in the oil markets, due to continued OPEC supply restraint, production disruptions, and strong economic growth that caused oil prices to move higher. Overall during the period, the Fund had significant gains from long positions in Brent, WTI, London gas oil, and heating oil. Relative value trading was also profitable during this period as models successfully captured volatility along the forward curve.

Grains

Profitable trading in June offset losses through the first five months of the year in Grains as modest gains from directional long/short positions offset small losses from calendar spread trading. In June, short positions, particularly in soybean and corn, benefitted as a number of agricultural commodities including corn, wheat, and soybean fell substantially. The downward move in these grain markets was attributable primarily to the escalating U.S./Chinese trade tariff situation described above.

Metals

Market dynamics in both Precious and Base metals proved challenging for the Fund, though the largest losses were attributable to trading in Base Metals. Overall, directional trading during the semi-annual period was unprofitable, while calendar spread positions edged higher. In the first quarter, losses from directional trading in copper and palladium markets more than offset gains from shorting silver. In April, short positions in Base Metals were hurt as prices for aluminum, copper, and zinc moved higher on U.S. sanctions on Russian aluminum.

Softs & Livestock

Trading in Livestock was the second largest contributor to the Fund’s robust first half returns. While directional trading was not a significant factor, calendar spread positions were highly profitable during the period. Calendar spread trading in both lean hogs and live cattle was profitable during the period. Uncertainty regarding potential declines in exports to Mexico and Canada due to the North American Free Trade Agreement (“NAFTA”) trade negotiations, along with ample domestic supplies, created favorable trading dynamics along the forward curve in the lean hog market. Cold weather and strong demand in January, and price declines in March due to concerns regarding a reduction in Chinese demand, created favorable trading conditions in live cattle. In Softs, slightly profitable trading from calendar spread trading offset modest losses from short positions.

Outlook

We continue to believe that the Fund’s potential to benefit from rising or falling commodity prices through its long/short approach, and exposure to relative value trading, is differentiated from other commodity funds. We believe this investment approach is particularly attractive given the high level of volatility in the commodity markets.

Market participants face potential uncertainties in the period ahead. Global trade tensions continue to cloud the outlook. Will the world be dragged into a trade war that could undermine global growth? The outcome may have a significant impact on agricultural, metal, and energy commodities. Looking at energy markets, crude oil prices seem to be trapped in a wide range with the OPEC/non-OPEC production control agreement and the prospect of increased shale production being balancing factors. Further, there exists potential global demand and supply disruptions from many sources—such as Iran, Venezuela and Libya.

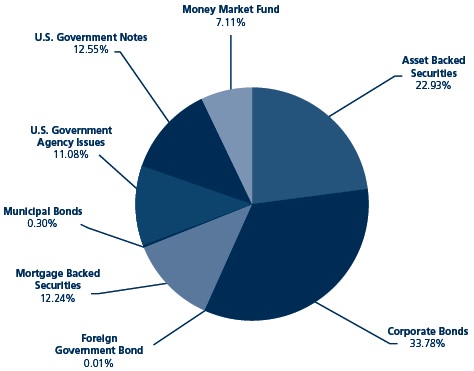

Fixed Income Strategy

The Fund invests most of its remaining assets in a Fixed Income Strategy comprised of short to intermediate term investment grade corporate and government agency securities. Nuveen is the sub-adviser for this strategy and manages a shorter duration, high quality portfolio.

Returns for the fixed income portion of the portfolio were +0.12% compared to -0.33% for the Bloomberg Barclays 1-5 Year Government Credit Index in the first half of 2018. The duration of the fixed income component of the fund was managed between 1.9 and 2.2 years during the period, compared to about 2.7 years for the benchmark. Nuveen’s decision to position the Fund’s duration defensively over the time period accounted for the outperformance versus the benchmark, while curve positioning was a detractor. The Fund’s corporate bond issuer exposure was well diversified, with modest overweight’s to both financials and industrials. Given that spreads for non-government securities were range bound, the sector strategy was neutral to investment returns during the reporting period.

LoCorr Multi-Strategy Fund (note: this Fund was liquidated on August 24, 2018)

The LoCorr Multi-Strategy Fund (the “Multi-Strategy Fund” or the “Fund”) objective is capital appreciation, and it invests in securities that are expected to produce a competitive level of current income. The Fund was launched, in part, due to demand for a Fund that would include a variety of our alternative investment strategies in one investment. Historically, the Fund’s exposure has been allocated approximately equally between an equity-oriented portfolio and a managed-futures-driven portfolio. The equity-oriented allocation has been comprised of an income-oriented strategy and a long/short strategy, while the managed futures allocation has been comprised of a diversified multi-asset trend-following futures strategy and a long/short commodity strategy.

For the semi-annual period ended June 30, 2018, the Fund’s Class I shares declined -8.75%. Challenging performance from the Fund’s trend-following allocation was the most significant driver of the negative returns, as market conditions proved challenging for this type of strategy, particularly during the risk-off period in late January/early February. The equity portfolio contributed positively to absolute returns, led by contributions from the income-oriented strategy while the long/short equity portfolio had negative returns.

Income Strategy

The income portfolio has been sub-advised by Trust and Fiduciary Income Partners, Inc. (“TFIP”) which has managed a similar strategy, through a predecessor firm, since 2001. The positive returns were attributable to master limited partnership (“MLPs”) holdings, as well as smaller contributions from business development companies (“BDCs”), equity real estate investment trusts (“REITs”), and positions in traditional c-corporation (“C Corps”) equities. TFIP’s portfolio continued to generate high income for the Fund throughout the period.

Long/Short Equity Strategy

The long/short equity portfolio has been sub-advised by Billings Capital Management LLC (“Billings”) which has managed a similar strategy since the firm’s inception in early 2008. The concentrated long/short equity portfolio produced negative returns during the period as a large Communication Services long position stumbled. This more than offset positive contributions from long positions in the Financial Services and Consumer Cyclical sectors. The short book also detracted from returns.

Commodities Strategy

The Fund has accessed the returns of the MILCOM which it has traded since 2005. During the semi-annual period ended June 30, 2018, the MILCOM portion of the Fund generated strong positive returns, led by long positions and relative value trading in the Energy markets as oil and oil-derived commodity prices surged. Trading was also profitable in the Grains and Livestock sectors, while trading in the Metals was the largest detractor.

Managed Futures Strategy

The Fund has accessed the returns of Graham’s Tactical Trend strategy (Graham), which the manager has traded since 2006. The Graham portion of the Fund had negative returns during the semi-annual period as gains from long positions in Energy trading was more than offset by losses in Foreign Currency and Base Metals positions, and to a lesser extent, unprofitable trading in Equities, Fixed Income, and Agricultural markets. Please refer to the commentary below for the LoCorr Market Trend Fund to learn more about current portfolio positioning and market outlook.

LoCorr Market Trend Fund

The LoCorr Market Trend Fund (the “Market Trend Fund” or the “Fund”) was created to provide investors with access to a trend-following futures strategy sub-advised by Graham. Graham was founded in 1994 and manages approximately $15 billion in assets. The Market Trend Strategy is managed similarly to Graham’s Tactical Trend program, a systematic medium- to long-term trend following strategy that commenced trading in 2006. The Fund seeks capital appreciation as its primary investment objective with managing volatility as a secondary objective. The Market Trend Fund attempts to achieve its objective by investing in two main strategies – a Market Trend Strategy and a Fixed Income Strategy.

The Fund’s Class I shares declined -8.03% during the semi-annual period ended June 30, 2018 versus a -5.28% decline for the SG Trend Index, which tracks the largest trend following commodity trading advisors. Following the sharp move higher in the fourth quarter 2017 (in which the Fund gained +9.15%), strong trending activity persisted, particular in Equities and oil markets, which continued to move higher through the end of January as the Fund got off to a strong start (+4.60% in January).

The momentum of fourth quarter and January did not persist, as conditions for trend followers turned on a dime at the end of January when equity and oil markets reversed dramatically (described in further detail in the next section). The challenge for the Fund, and other trend following strategies, was that leading up to this reversal, equity and oil markets had been exhibiting exceptionally strong bullish trending activity and accordingly, positions were quite long. While positioning adjusted, the speed and magnitude of the reversal was so dramatic that the Fund, along with similar trend following strategies, incurred significant losses. The Fund experienced a drawdown of -11.35% during this period as long positions in Equities and Energy suffered. This brief period was the primary driver behind the Fund’s negative returns during the semi-annual period ended June 30, 2018.

Market Commentary

See Macro Strategies Fund

Market Trend Strategy

Equity Indices

With equity markets trending higher since the Presidential elections in November 2016, the Fund had sizable long positions which were highly profitable in 2017 into January 2018. When volatility spiked and equity markets reversed course dramatically over a 9-day period in late January/early February, these long positions experienced sizable losses, offsetting gains from trading during the rest of the period. While the sell-off proved short-lived, the sub-adviser’s trend following models shifted to short equities, which prevented the Fund from benefitting from the subsequent recovery. If the sell-off in the equity markets had persisted, the short position in Equities may have helped the Fund protect capital. As equity markets continued to recover, the Fund’s positioning shifted back to long and remained that way through the end of the semi-annual period ended June 30, 2018.

Commodities

Trading in the commodity markets was unprofitable during the period, as substantial gains from Energy trading was more than offset by sizable losses in Base Metals and, to a lesser extent, unprofitable trading in Agricultural/Softs and Precious Metals. With oil prices trending higher since mid-2017, the Fund continued to maintain long positions in oil and oil-derived commodities, which enabled it to benefit from the significant move higher in the first six months of 2018. Trading in Base Metals offset much of the gains from Energy, as markets such as copper and aluminum experienced choppy trading conditions and frequent reversals that may be attributable to trade tariff concerns during the period, particularly with China, given their appetite for these commodities.

Foreign Currencies

The largest losses for the Fund stemmed from Foreign Currency positions as the U.S. dollar (using the U.S. Dollar Index as a proxy) was range-bound from February to April, experiencing sharp and frequent reversals during this period. These conditions are typically challenging for trend-following strategies like that employed by the Fund. Positioning shifted from long Foreign Currency versus the U.S. dollar to short, as the U.S. dollar began strengthening beginning in mid-April. This may have been in response to strong domestic economic growth and the move higher in interest rates relative to the rest of the world.

Fixed Income

Fixed Income trading generated modest losses during the period, as gains from trading in the short-end of the curve was offset by losses in intermediate and long-term positions. With U.S. rates rising, positioning in domestic fixed income was short (to benefit from rising rates, which causes bond prices to fall). Overseas, interest rates were generally flat to down during the period; but, particularly in European markets, experienced some sizable reversals along the way. Positioning in international fixed income markets was long (to benefit from falling rates which causes bond prices to rise) for most of the semi-annual period, though it was marked by periods of short positioning as well.

Outlook

With the notable exception of the fourth quarter of 2017, trend-following has faced challenging market conditions. This is attributable to a lack of significant trends across most asset classes, and a staggering January/February 2018 reversal from the markets that had been trending. What seems to be significant macro- and geo-political factors - tariffs/trade wars, more hawkish Federal Reserve, etc. - have generally not yet materialized in the form of consistent trending behavior as the market has shrugged off such news as being transient. Despite the challenging conditions, LoCorr remains optimistic that macro trading conditions will become more conducive to trend-following strategies like that employed by the Fund.

Fixed Income Strategy

The fixed income portion of the Fund is sub-advised by Nuveen in a conservatively managed short-duration portfolio of the highest credit quality. It is managed against the Barclays 1-3 Year Government Index and focuses primarily on U.S. Treasuries and U.S. Government securities but can own up to 30% in aggregate in corporate, municipal, and asset backed securities of the highest credit quality.

Returns for the fixed income portion of the Fund were +0.31% compared to +0.07% for the benchmark in the first half of 2018. Nuveen’s defensive interest rate strategy accounted for a portion of the outperformance relative to the index, as duration of the portfolio was positioned short to the benchmark by between .30 and .40 years during the period. Curve positioning was a slight detractor to performance. The portfolio generally owned about 26-28% in non-government securities during the time frame; this was a boost to performance, as these securities outperformed government securities. As of June 30, 2018, portfolio duration was 1.56 years compared to 1.86 years for the benchmark and about 72% of the portfolio was in U.S. government debt with the remainder in AAA rated non-government securities.

LoCorr Dynamic Equity Fund

The LoCorr Dynamic Equity Fund (the “Dynamic Equity Fund” or the “Fund”) seeks long-term capital appreciation, with reduced volatility compared to traditional broad-based equity market indices as a secondary objective. Consistent with the “low correlation” our LoCorr Fund family seeks, long/short equity funds have the ability to provide positive returns when equity markets are rising, yet they offer the potential for downside protection when equity prices are falling.

The Fund employs two sub-advisers—Billings and Kettle Hill Capital Management (“Kettle Hill”). Billings’ strategy is based on a value- oriented, fundamental, bottom-up long/short equity approach. This manager seeks to maximize absolute returns, exceeding the S&P 500 Index over the long term. The sub-portfolio managed by Billings is similar to a strategy that this manager has executed since its inception in 2008. Kettle Hill seeks to earn superior returns over an investment cycle, while focusing on capital preservation and downside volatility. The manager’s investment process combines bottom-up, fundamental analysis with a top-down opportunistic overlay. Investing primarily in small cap securities, Kettle Hill targets a conservative net exposure to the market. The sub-portfolio managed by Kettle Hill is similar to a strategy that this manager has executed since its inception in 2003. During the semi-annual period, each manager sub-advised about one-half of the Fund’s portfolio.

Market Commentary

While the S&P 500 Index had positive returns during the semi-annual period (+2.65%), there was significant disparity between growth and value stocks. Using the Russell 1000 Growth Index as a proxy for growth stocks and the Russell 1000 Value Index as a proxy for value stocks, growth outperformed +7.25% versus -1.69% during the period. Further, the market was particularly narrow during the first six months of the year led by Technology and Consumer Discretionary stocks, while the Industrial, Financial Service, and Consumer Staples stocks were amongst the worst performers. To further illustrate how narrow the market was during the period, the six stocks that make up FANGMA (Facebook, Amazon, Netflix, Alphabet (Google), Microsoft, and Apple) accounted for approximately 96% of the return for the S&P 500.

In 2017 the equity market, as measured by the S&P 500 Index, gained +21.83% and was characterized by historically low volatility levels. While this Goldilocks environment continued into late January 2018, investors took notice of rising interest rates and building inflationary pressure. This led to selling pressure in equities, sparking a surge in volatility with the VIX jumping from 11.08 on January 26th to an intra-day high of 50.30 on February 6th. The spiking volatility led to the demise of a number of inverse (short) volatility ETFs that proved vulnerable to these conditions and exacerbated the sell-off. The DJIA corrected -10.26% from January 29 to February 8. The sell-off was rather short lived -- investors flocked back to risk assets and Equity markets recovered much of their losses. Since the recovery in the second half of February, performance in Equities has been mixed, though the S&P 500 Index finished higher during the second quarter.

Portfolio Update

The Fund’s Class I Shares declined –4.18% versus a gain of +2.65% for the S&P 500 Index during the semi-annual period ended June 30th, 2018. Performance from the sub-advisers was mixed: Kettle Hill produced solid positive returns that were more than offset by negative returns in the concentrated portfolio managed by Billings. LoCorr believes that the Fund’s high conviction, concentrated approach is a compelling characteristic that distinguishes it from most peers and is beneficial over the long term. However, during the semi-annual period it was a significant factor in the Fund’s difficult performance.

Overall, both the long and short books contributed negatively to performance during the period. The aforementioned outperformance of growth versus value stocks also created a headwind, given the Fund’s value bias. Net exposure for the Fund ended the period at approximately 57%, which is near the high end of the typical 40 – 60% range.

A sizable position in the Communication Services sector had a significant negative effect on the long book. Gogo Inc., a provider of inflight broadband connectivity solutions and wireless entertainment to the aviation industry, stumbled due to a credit rating downgrade and execution issues around its next-generation 2Ku network. The Fund’s Industrial positions also struggled, led by losses from positions in Air Canada and Kennametal Inc. Partially offsetting these detractors were gains from long positions in Information Technology, Financial Services, Healthcare and Consumer Cyclical holdings. In the Consumer Cyclical sector, the Fund benefitted from signs that a turnaround in the operations for Advanced Auto Parts Inc., a provider of automotive replacement parts, was gaining steam. Positions in Syneos Healthcare Inc. and Credit Acceptance Corp. also contributed positively to results.

On the short side of the book, positions in the Consumer Defensive, Communication Services, and Financial Services sectors contributed positively to results during the period. In the Financial Services sector, positions in several banks and capital markets- related firms contributed positively to the Fund’s performance. Losses from the Consumer Cyclical and, to a lesser extent, the Industrial, Real Estate, and Information Technology sectors detracted from the Fund’s performance. A short position in a jewelry retailer detracted from results as the company’s stock moved higher following their release of second quarter earnings. Other positions that contributed negatively to the Fund’s results included a salon company and a manufacturer of electrical weapons.

Outlook

Billings - We continue to be constructive on U.S. markets and the economy. Many prognosticators continue to warn of frailty in the market and the bull market getting long in the tooth. Much the same was stated in 2016 when oil prices plummeted, Brexit took center stage and America was in the midst of an ugly presidential election campaign – all supposedly harbingers of an impending crash. The U.S. economy is looking quite balanced as consumer spending remains strong, and there has been an uptick in capital spending resulting from incentives to repatriate, new tax laws and CEO confidence. Economists would argue that the stimulus may facilitate improved labor productivity and the ability for companies to pay higher wages without crimping profit margins. Should this be correct, you could see earnings growth remain intact longer.

Kettle Hill - We attempt to protect capital through conservative exposure management (our primary objective), and we continue to operate cautiously. There are several indications that we are in a late-cycle market. The narrowing breadth of the equity market and the concentration of returns in a few large cap tech names is just one. Quantitative tightening and rising interest rates are become evident in global asset markets, leading to bursts of downward volatility in equities and rapid capital flight from riskier economies, most notably Italy, Turkey, Argentina and Brazil. Market signals are confusing, as economic growth and higher consumer confidence are creating greater inflationary pressures, while political and tariff uncertainty potentially delays capital investment and hiring decisions.

Given all the risks and uncertainty we’ll continue to manage net exposure tactically in a conservative and contrarian manner, adhering to our risk management discipline while operating within well-defined exposure bands. However, given all of the confusion in the market, we believe this is an environment that is rich with individual long and short opportunities.

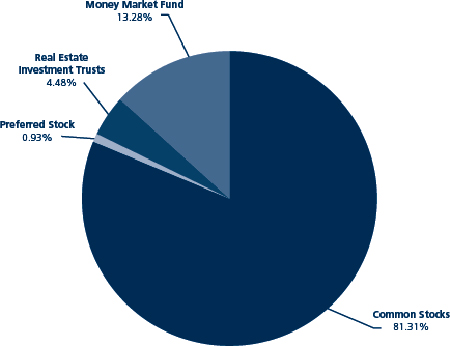

LoCorr Spectrum Income Fund

The LoCorr Spectrum Income Fund (the “Spectrum Income Fund” or the “Fund”) has an objective of current income with capital appreciation as a secondary objective. The Fund is designed to fit within the “low correlation” theme of the LoCorr Fund family by seeking to provide relatively high levels of income with low correlation to the bond market. The Fund is sub-advised by TFIP. TFIP invests primarily in pass- through securities to seek high current income, much of which the Fund distributes monthly to investors.

For the semi-annual period ended June 30, 2018, the Fund’s Class I shares gained +3.43%, significantly outperforming the Bloomberg Barclays U.S. Aggregate Bond Index which fell -1.62%. During this period, the Spectrum Income Fund continued to make consistent distributions. We are pleased that the Fund continued to outperform the Bloomberg Barclays U.S. Aggregate Bond Index, a proxy for bonds, as interest rates moved higher during the period.

Market Commentary

The Federal Reserve continued its policy of sustained monetary tightening, raising the federal funds rate 25 basis points each quarter this year and indicating its desire to continue on that path for the foreseeable future. The concern is that the Fed will raise rates too far or too quickly and will kill the aging bull market. TFIP continues to monitor leading growth indicators, both globally and domestically, for signs of imbalance.

Another concern is the elevated rhetoric concerning global trade wars. The fear of a trade war and its potential negative effect on global growth has weighed on the market. The investment team considers this possibility when constructing the portfolio and has striven to concentrate the Fund in stocks that have minimal direct impact.

At the last OPEC meeting in June, an agreement was reached to boost production after record-setting adherence to production limits enacted at the beginning of 2017. Both OPEC and large non-OPEC producers such as Russia showed unprecedented adherence to production discipline. This was one of the major factors contributing to the decline of global oil inventories. Oil has rallied nearly 40% in that time and supplies have become tight.

Although these developments have been problematic for much of the equity market, they have been generally helpful to many of the portfolio holdings. For example, higher interest rates are often helpful for the Fund’s BDC holdings, which lend to domestic companies at short term interest rates. Trade concerns are of little direct impact to the portfolio companies, which are relatively small companies serving domestic markets. Finally, higher oil prices and increased production in shipment through the pipelines support U.S. oil producers, which were well represented in the portfolio.

Portfolio Update

The Fund’s positive returns were driven by strong gains from the portfolio’s MLP holdings, as well as solid contributions from BDCs, equity REITs, and positions in traditional C-Corp equities.

MLPs, as measured by the Alerian MLP Index, fell almost -1% in the first half of 2018. The sector rallied in the second quarter after selling-off earlier in the year, following the surprise Federal Energy Regulatory Commission cost-of-service ruling. Despite the slightly negative returns by the Alerian MLP Index, the Fund enjoyed strong positive contributions from its holdings in this sector, with the largest gains from mid-stream and non-Energy MLPs.

Equity REITs were roughly flat in the first half of 2018 (FTSE NAREIT All Equity REIT Index, +1.27% through June 30, 2018), including dividends. Typically, REIT performance tends to be weak at the beginning of a rising rate cycle, but then tend to outperform as strengthening macroeconomic conditions lead to higher occupancy rates and rising property values.

BDCs, as measured by the Wells Fargo Business Development Company Index, rose nearly +4% in the first half of 2018. The sector benefitted from regulatory change which will allow BDCs to double their allowable leverage. This should provide growth capital for middle market businesses, though the investment team will continue to monitor how individual BDCs plan to employ additional capital.

The Fund was also aided by contributions from higher-yielding C-Corp positions. This included Macy’s, a holding that was exited following a sharp rally in its stock price, which was rewarded for executing on its turnaround plan and benefitted from consumer demand tailwinds. The worst-performing position in the Fund was Macquarie Infrastructure Partners, which cut its distribution after suffering a downturn in its heavy fuel oil storage business, in a move that took the street by surprise.

In the first six months of 2018, the sub-adviser added to REITs, with a focus on data centers with stable cash flow growth and the potential for stock price appreciation. TFIP also added to high yielding C-Corps that represented the manager’s bullish views on consumer spending, including retail, theme parks and fast casual dining. Closed-end-fund (CEFs) holdings were reduced, specifically those that benefit from a weaker dollar, as the dollar reversed its downward momentum in early Q2 and began to rally. Also reduced were select mortgage REITs (mREITs) that do well in a steepening yield curve environment, as well as some issues that tend to profit from rising rates, as interest rates (as measured by U.S. 10-year Treasuries) settled under 3% in the second quarter.

Outlook

Despite Fed tightening, some signs of inflation, and the risk of the negative effect that a potential trade war may have on global growth, TFIP remains constructive on the sectors and securities it holds. The investment team believes domestic growth is stable, cash flows are strong, and macro conditions such as interest rates and oil prices are supportive of the portfolio’s holdings. To the extent that geopolitical developments inhibit global trade growth, the manager believes there would be little effect to the portfolio as the businesses of its underlying holdings are concentrated in low-risk domestic activities such as building rentals, pipeline rates, and business lending. The team is encouraged that it is finding attractive, new opportunities that adhere to their approach of focusing on companies that produce strong cash flows and have the potential to increase distributions.

Thank you for investing in the LoCorr Funds

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Barclays 1-5 Year Government Credit Index-Index is an index of all investment grade bonds with maturities of more than one year and less than 5 years. Barclays 1-3 Year Government Bond Index-The Barclays U.S. 1-3 Year Government/Credit Bond Index is a part of the Barclays U.S. Government/Credit Bond Index. It includes Treasury and agency securities (U.S. Government Bond Index) and publicly issued U.S. corporate and foreign debentures and secured notes (U.S. Credit Bond Index). The bonds in the index are investment-grade with a maturity between one and three years. BofA Merrill Lynch 3-Month T-Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. Barclays CTA Index is an unweighted index which attempts to measure the performance of the Commodity Trading Advisor (“CTA”) industry. The Index measures the combined performance of all CTAs reporting to Barclay Trading Group who have more than 4 years past performance. Fees and transaction costs are reflected. CBOE VIX Index is the Chicago Board Options Exchange Volatility Index, which shows the 30-day volatility expectations of the S&P 500 Index. The VIX is a widely used measure of market risk and is often referred to as the “investor fear gauge.” S&P GSCI Commodity Index is a composite index of commodity sector returns which represents a broadly diversified, unleveraged, long-only position in commodity futures. Russell 1000 Value Index refers to a composite of large and mid-cap companies located in the United States that also exhibit a value probability. The Russell 1000 Value is published and maintained by FTSE Russell. Russell 1000 Growth Index refers to a composite that includes large and mid-cap companies located in the United States that also exhibit a growth probability. The Russell 1000 Growth is published and maintained by FTSE Russell. SG Trend Index is a subset of the SG CTA Index, and follows traders of trend following methodologies. The SG CTA Index is equal weighted, calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Russell 2000 Index measures the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States. Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based bond index comprised of government, corporate, mortgage and asset-back issues rated investment grade or higher. Alerian MLP Index is a market-cap weighted, float-adjusted index created to provide a comprehensive benchmark for investors to track the performance of the energy MLP sector. Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. U.S. Dollar Index is a proxy for the U.S. dollar versus a basket of major global currencies. Wells Fargo Business Development Company Index measures the performance of all BDCs that are listed on the New York Stock Exchange or NASDAQ and satisfy specified market capitalization and other eligibility requirements. Morningstar Managed Futures Category is made up of Funds that primarily trade futures, options, swaps and foreign exchange contracts, both listed and over the counter. Credit Suisse Managed Futures Index replicates the return of the managed futures fund industry. FTSE NAREIT All Equity REIT Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. One cannot invest directly in an index.

Alpha is an annualized return measure of how much better or worse a fund’s performance is relative to an index of funds in the same category, after allowing for differences in risk.

Basis Point (bps) - A unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Investment Grade - Investment Grade refers to bonds that are rated BBB or higher. Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. The curve is used to predict changes in economic output and growth.

Must be preceded or accompanied by a prospectus.

Opinions expressed are those of the Investment Manager and are subject to change, are not guaranteed and should not be considered investment advice.

Earnings growth is not representative of the Funds’ future performance.

Past performance is not a guarantee of future results.

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. The LoCorr Macro Strategies Fund, LoCorr Long/Short Commodities Strategy Fund, LoCorr Multi-Strategy Fund, LoCorr Market Trend Fund and LoCorr Spectrum Income Fund are diversified funds. The LoCorr Dynamic Equity Fund is a non-diversified fund, meaning it may invest its assets in fewer individual holdings than a diversified fund. Therefore, those Funds are more exposed to individual stock volatility than a diversified fund. The Funds invest in foreign investments and foreign currencies which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Investing in commodities may subject the Funds to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. The Funds may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in Asset Backed, Mortgage Backed, and Collateralized Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in Real Estate Investment Trusts involve additional risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments.

Derivative contracts ordinarily have leverage inherent in their terms which can magnify a Fund’s potential for gains or losses through increased long and short position exposure. A Fund may access derivatives via a swap agreement. A risk of a swap agreement is the risk that the counterparty to the agreement will default on its obligation to pay the Fund.

A Fund will incur a loss as a result of a short position if the price of the short position instrument increases in value between the date of the short position sale and the date on which an offsetting position is purchased.

Investments in small- and medium-capitalization companies involve additional risks such as limited liquidity and greater volatility. Investments in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. ETF investments are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. ETFs are subject to specific risks, depending on the nature of the ETF.

A Fund’s portfolio will be significantly impacted by the performance of the real estate market generally, and a Fund may be exposed to greater risk and experience higher volatility than would a more economically diversified portfolio. Property values may fall due to increasing vacancies or declining rents resulting from economic, legal, cultural, or technological developments. Investments in Limited Partnerships (including master limited partnerships) involve risks different from those of investing in common stock including risks related to limited control and limited rights to vote on matters affecting the Limited Partnership, risks related to potential conflicts of interest between the Limited Partnership and the Limited Partnership’s general partner, cash flow risks, dilution risks and risks related to the general partner’s limited call right. Underlying Funds are subject to management and other expenses, which will be indirectly paid by a Fund.

The LoCorr Macro Strategies Fund, LoCorr Long/Short Commodities Strategy Fund, LoCorr Multi-Strategy Fund, LoCorr Market Trend Fund, LoCorr Dynamic Equity Fund, and the LoCorr Spectrum Income Fund are distributed by Quasar Distributors, LLC.

LoCorr Macro Strategies Fund

Rate of Return — For the period ended June 30, 2018 (Unaudited)

| | Inception

Date | 6 Month | 1 Year | 5 Year | Average Annual

Since Inception |

| LoCorr Macro Strategies Fund - Class A (without maximum load) | 3/22/11 | -5.21% | 0.11% | 4.58% | 0.32% |

| LoCorr Macro Strategies Fund - Class A (with maximum load) | 3/22/11 | -10.69% | -5.65% | 3.35% | -0.49% |

| LoCorr Macro Strategies Fund - Class C | 3/24/11 | -6.39% | -1.44% | 3.84% | -0.40% |

| LoCorr Macro Strategies Fund - Class I | 3/24/11 | -5.02% | 0.47% | 4.89% | 0.59% |

| Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.81% | 1.36% | 0.42% | 0.32%1 |

| S&P 500 Total Return Index | | 2.65% | 14.37% | 13.42% | 12.93%1 |

| Barclay CTA Index | | -2.19% | 0.24% | 0.58% | -0.49%2 |

$100,000 investment in the

LoCorr Macro Strategies Fund – Class I

For the period ended June 30, 2018 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855. LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s May 1, 2018 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 2.31%, 3.06% and 2.06% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors.

One cannot invest directly in an index.

1 Since inception return as of March 24, 2011.

2 Since inception return as of March 31, 2011.

LoCorr Long/Short Commodities Strategy Fund

Rate of Return — For the period ended June 30, 2018 (Unaudited)

| | Inception

Date | 6 Month | 1 Year | 5 Year | Average Annual

Since Inception |

| LoCorr Long/Short Commodities Strategy Fund - Class A (without maximum load) | 12/31/11 | 6.28% | 16.11% | 9.60% | 3.50% |

LoCorr Long/Short Commodities Strategy Fund - Class A (with maximum load) | 12/31/11 | 0.19% | 9.46% | 8.32% | 2.56% |

| LoCorr Long/Short Commodities Strategy Fund - Class C | 12/31/11 | 4.84% | 14.17% | 8.76% | 2.67% |

| LoCorr Long/Short Commodities Strategy Fund - Class I | 12/31/11 | 6.42% | 16.41% | 9.89% | 3.75% |

| Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.81% | 1.36% | 0.42% | 0.35% |

| S&P 500 Total Return Index | | 2.65% | 14.37% | 13.42% | 14.98% |

| Morningstar Long/Short Commodity Index | | 6.66% | 13.63% | -0.82% | -2.05% |

$100,000 investment in the

LoCorr Long/Short Commodities Strategy Fund - Class I

For the period ended June 30, 2018 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s May 1, 2018 prospectus, the Fund’s annual operating expense ratio, before fee waivers is 2.79%, 3.54% and 2.54% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Morningstar Long/Short Commodity Index is a fully collateralized commodity futures index that uses the momentum rule to determine if each commodity is held long, short, or flat.

One cannot invest directly in an index.

LoCorr Multi-Strategy Fund

Rate of Return — For the period ended June 30, 2018 (Unaudited)

| | Inception Date | 6 Month | 1 Year | Average Annual

Since Inception |

| LoCorr Multi-Strategy Fund - Class A (without maximum load) | 4/6/15 | -8.76% | -2.19% | -5.75% |

| LoCorr Multi-Strategy Fund - Class A (with maximum load) | 4/6/15 | -14.06% | -7.82% | -7.46% |

| LoCorr Multi-Strategy Fund - Class C | 4/6/15 | -10.07% | -3.94% | -6.48% |

| LoCorr Multi-Strategy Fund - Class I | 4/6/15 | -8.75% | -2.01% | -5.54% |

| Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.81% | 1.36% | 0.63% |

| S&P 500 Total Return Index | | 2.65% | 14.37% | 10.90% |

| Morningstar Multialternative Category | | -1.09% | 2.17% | 0.10% |

$100,000 investment in the

LoCorr Multi-Strategy Fund - Class I

For the period ended June 30, 2018 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s May 1, 2018 prospectus, the Fund’s annual operating expense ratio, before fee waivers is 3.92%, 4.67% and 3.67% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The funds in the Morningstar Multialternative Category use a combination of alternative strategies. Funds in this category have a majority of their assets exposed to alternative strategies and include both funds with static allocations to alternative strategies and funds tactically allocating among alternative strategies and asset classes.

One cannot invest directly in an index.

LoCorr Market Trend Fund

Rate of Return — For the period ended June 30, 2018 (Unaudited)

| | Inception Date | 6 Month | 1 Year | Average Annual

Since Inception |

| LoCorr Market Trend Fund - Class A (without maximum load) | 6/30/14 | -8.16% | -1.55% | 1.89% |

| LoCorr Market Trend Fund - Class A (with maximum load) | 6/30/14 | -13.42% | -7.23% | 0.39% |

| LoCorr Market Trend Fund - Class C | 6/30/14 | -9.41% | -3.25% | 1.12% |

| LoCorr Market Trend Fund - Class I | 6/30/14 | -8.03% | -1.35% | 2.15% |

| Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.81% | 1.36% | 0.51% |

| S&P 500 Total Return Index | | 2.65% | 14.37% | 10.79% |

| Barclay CTA Index | | -2.19% | 0.24% | 0.66% |

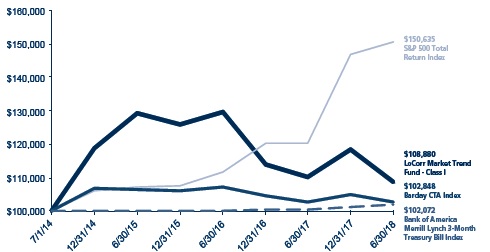

$100,000 investment in the

LoCorr Market Trend Fund - Class I

For the period ended June 30, 2018 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s May 1, 2018 prospectus, the Fund’s annual operating expense ratio is 2.01%, 2.76% and 1.76% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors.

One cannot invest directly in an index.

LoCorr Dynamic Equity Fund

Rate of Return — For the period ended June 30, 2018 (Unaudited)

| | Inception

Date | 6 Month | 1 Year | 5 Year | Average Annual

Since Inception |

| LoCorr Dynamic Equity Fund - Class A (without maximum load) | 5/10/13 | -4.40% | -1.56% | 3.87% | 3.36% |

| LoCorr Dynamic Equity Fund - Class A (with maximum load) | 5/10/13 | -9.89% | -7.20% | 2.65% | 2.18% |

| LoCorr Dynamic Equity Fund - Class C | 5/10/13 | -5.69% | -3.16% | 3.11% | 2.58% |

| LoCorr Dynamic Equity Fund - Class I | 5/10/13 | -4.18% | -1.20% | 4.16% | 3.63% |

| S&P 500 Total Return Index | | 2.65% | 14.37% | 13.42% | 12.73% |

| Morningstar Long/Short Equity Fund Index | | -0.65% | 5.48% | 4.08% | 3.80% |

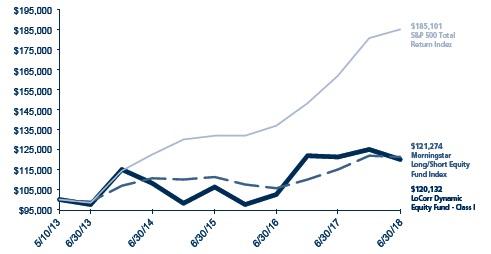

$100,000 investment in the

LoCorr Dynamic Equity Fund - Class I

For the period ended June 30, 2018 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s May 1, 2018 prospectus, the Fund’s annual operating expense ratio, before fee waivers is 3.46%, 4.21% and 3.21% for Class A, Class C and Class I shares, respectively.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Morningstar Long/Short Equity Index category holds sizeable stakes in both long and short positions in equities and related derivative. At least 75% of the assets are in equity securities or derivatives.

One cannot invest directly in an index.

LoCorr Spectrum Income Fund

Rate of Return — For the period ended June 30, 2018 (Unaudited)

| | Inception Date | 6 Month | 1 Year | Average Annual

Since Inception |

| LoCorr Spectrum Income Fund - Class A (without maximum load) | 12/31/13 | 3.24% | 4.06% | -0.04% |

| LoCorr Spectrum Income Fund - Class A (with maximum load) | 12/31/13 | -2.68% | -1.86% | -1.35% |

| LoCorr Spectrum Income Fund - Class C | 12/31/13 | 1.84% | 2.31% | -0.81% |

| LoCorr Spectrum Income Fund - Class I | 12/31/13 | 3.43% | 4.42% | 0.23% |

| Bloomberg Barclays U.S. Aggregate Bond Index | | -1.62% | -0.40% | 2.43% |

| S&P 500 Total Return Index | | 2.65% | 14.37% | 11.23% |

| Morningstar Allocation - 70% to 85% Equity | | 0.64% | 8.66% | 5.87% |

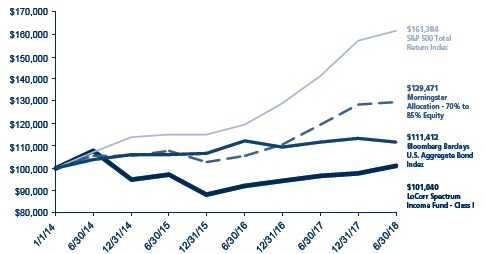

$100,000 investment in the

LoCorr Spectrum Income Fund - Class I

For the period ended June 30, 2018 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Performance data does not reflect the redemption fee. If it had, return would be reduced.

Per the fee table in the Fund’s May 1, 2018 prospectus, the Fund’s annual operating expense ratio is 2.99%, 3.74% and 2.74% for Class A, Class C and Class I shares, respectively.

The Bloomberg Barclays U.S. Aggregate Bond Index is a long term, market capitalization- weighted index used to represent investment grade bonds being traded in the United States.