UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22509

LoCorr Investment Trust

(Exact name of registrant as specified in charter)

687 Excelsior Blvd

Excelsior, MN 55331

(Address of principal executive offices) (Zip code)

CT Corporation System

1300 East Ninth Street

Cleveland, OH 44114

(Name and address of agent for service)

952.767.2920

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

(a)

Letter to Shareholders

LoCorr Funds seeks to provide investments that, over time, will have low correlation to traditional asset classes such as stocks and bonds. We believe that adding low correlating investments to portfolios can significantly reduce overall portfolio risk while enhancing returns. Correlation measures the degree to which the returns of two investments move together over time. LoCorr offers products that provide the potential for positive returns in rising or falling markets and are designed to generate returns independent of traditional stock, bond and commodity investments. In this report, LoCorr Funds is reporting on five mutual funds: LoCorr Macro Strategies Fund, LoCorr Long/Short Commodities Strategy Fund, LoCorr Market Trend Fund, LoCorr Dynamic Equity Fund and LoCorr Spectrum Income Fund (collectively, the “Funds”).

Market Commentary

COVID

In early 2021, new COVID-19 infections were surging, an increasing number of hospitals were at or near capacity, while the number of deaths in the U.S. surpassed 4,000 per day. At the same time, the first vaccines were rolling out and providing a sense of optimism that the worst of the pandemic may be behind us. While governments around the globe would continue to respond to surges in cases and new variants in diverse ways, in the U.S., the vaccine rollout largely signaled the end of broad-based lockdowns.

While COVID would recede from the forefront of investor minds, later in the Spring the growing threat of the Delta variant would rekindle concerns as infections began rising again. Concerns regarding Delta, along with the emergence of the more contagious yet seemingly less deadly Omicron variant late in the year, would cause bouts of volatility in risk assets. The effectiveness of the vaccines and the willingness of many, though not all, governments to manage through the pandemic without wide-scale shutdowns contributed to quick rebounds by risk assets following any sell-off. There seemed to exist a pattern of reduced negative economic and market impact from each COVID variant, providing a sense of optimism looking forward.

Economic Recovery & Inflation

Meanwhile, during the first half of the year, supported by fiscal and monetary stimulus, the global economy continued its recovery from the pandemic shutdowns. The U.S. economy, as measured by real GDP, reached new heights in Q2 2021, climbing +6.7%. The rapid recovery was beginning to feel the strain of stressed supply chains and labor market constraints which began disrupting economic activity. Q3 2021 U.S. GDP growth would decelerate to +2.3%, its slowest pace since the recovery began, though fourth quarter activity appeared to rebound. Unemployment rates continued to decline over the course of 2021, falling to 3.9% by the end of the year. Unfortunately, the labor participation rate remained low as many workers were unwilling or unable to rejoin the workforce. Coupled with strong demand and supply chain disruptions, the labor shortage helped exacerbate the rising cost issue. Inflationary pressure continued to build as the year progressed, with the Consumer Price Index surging an astonishing +7.0% year-over-year in December, its fastest pace in four decades.

Fed Policy Shifts

Federal Reserve policy, which had been so stimulative since the pandemic began in early 2020, began to shift in the second half of 2021 as the Fed began moving toward a withdrawal of its accommodative monetary policy in response to the strong increase in demand and persistently high inflation. At its September meeting, the Fed signaled that it would likely announce the start of tapering in Q4. It would begin the taper in November and accelerated the pace at its December meeting. Fed Chairman Powell famously indicated that it was a good time to “retire” the word transitory to describe the inflation that was more persistent than originally expected. Central banks moved forward the timetable for completing its taper to March 2022 and the Fed’s dot plot now shows three rate hikes for 2022. Thus, the Fed’s stance exiting 2021 was increasingly hawkish and represented a massive change from the supportive policy that had boosted prices for risk assets since the pandemic shutdowns in March 2020.

Equities

Major equity markets marched upward during the year, exhibiting persistent strength with only brief bouts of volatility. Supported by the accommodative Federal Reserve, robust economic growth, strong corporate earnings, U.S. stock indices reached record highs during the year. The S&P 500 finished 2021 up a staggering +28.71%. This strength in stocks was evident outside the U.S. as developed international markets also performed well, though emerging markets had slightly negative returns. In aggregate, equity markets provided robust opportunities for managed futures strategies in 2021. All eleven S&P 500 sectors made gains in 2021 led by the Energy sector, which was up +53.43%, and Real Estate, up +33.30%. For the first time in

the past ten years, all sectors in the S&P 500 gained over +15% in the calendar year. Valuation for the S&P 500 skyrocketed into the end of 2021 as the Cyclically Adjusted S&P 500 P/E (price-earnings ratio) closed the year at 38.68, the highest level in the past twenty years. This is well above 33.77 at the end of 2020.

Fixed Income

Conditions in global fixed income markets were more challenging in 2021, leading to a -1.54% decline in the Bloomberg U.S. Aggregate Bond Index. While yields at the short end of the curve moved higher, particularly in the second half of the year, the long end of the curve was choppier and experienced sizable reversals that were difficult to navigate. The U.S. Treasury 10-Year yield increased from approximately 0.9% to finish 2021 near 1.5%. This sizable increase masked underlying choppiness, however. Yields moved higher through the first quarter of 2021 on optimism surrounding the rollout of the vaccines and continued economic recovery. As the Delta variant emerged and concerns began to mount about an economic slowdown, bonds rallied and yields fell. These conditions did not persist, however, as surging inflation prompted the Fed to shift its posture with yields moving higher again beginning in August. Global bond yields followed a similar winding pattern over the course of the year, ending 2021 substantially higher than where they started.

Commodities

The Bloomberg Commodity Index rose an impressive +27.11% in 2021 as commodity prices continued to move higher, though the bulk of the upward move came in the first six months of the year. After lagging other commodities in the prior year, oil prices moved sharply higher, exhibiting strength for most of 2021 except for brief periods including a sharp drop in November. Overall for the year, rising demand, low inventories, and constrained production led West Texas Intermediate crude (“WTI”) to climb nearly $30, finishing 2021 near $77 per barrel. The volatility in oil in November was notable, however, as Omicron and Fed tightening related concerns caused a dramatic $10+ one-day plunge in crude oil. In metals, precious metal prices moved lower despite negative real rates and high inflation. Base metal prices moved higher with copper, nickel, aluminum, and zinc prices rising more than +25% during the year. Agricultural commodities also moved sharply higher, led by sizable gains in grains and soft prices. Overall, the persistent upward movement in commodities produced robust opportunities for the Fund’s managed futures strategies.

Foreign Currency

The U.S. Dollar Index appreciated +6.71% during the year. While the greenback experienced choppy conditions through May, it strengthened persistently from early June through the end of 2021. The strength in the U.S. dollar (“USD”) was attributable to strong relative economic growth and interest rates in the U.S. and the Federal Reserve’s shift to a more hawkish posture. During the year, the Euro declined just over -7% while the Japanese Yen lost more than -11%. The Turkish Lira plunged more than -40% as President Erdogan maintained low interest rates despite hyper-inflation and is at risk of defaulting on Turkey’s debt. The Chinese yuan and Canadian dollar were the only major currencies that had a positive return vs. the dollar.

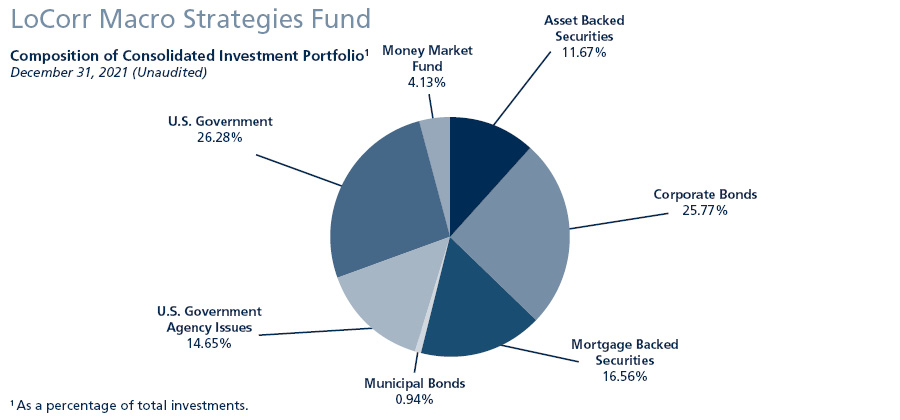

LoCorr Macro Strategies Fund

The LoCorr Macro Strategies Fund (the “Fund”) seeks capital appreciation as its primary investment objective with managing volatility as a secondary objective. The Fund attempts to achieve its objective by investing in two main strategies – a Managed Futures Strategy and a Fixed Income Strategy.

The Fund employs three sub-advisers to manage the Managed Futures Strategy of the Fund:

● | Millburn Ridgefield Corporation (“Millburn”) manages a portfolio for the Fund that is similar to its Millburn Diversified Program which commenced operations in 1977. Millburn invests in a diversified portfolio of global futures contracts by employing a systematic, statistical learning-based, multi-factor approach. |

● | Graham Capital Management, LLC (“Graham”) manages a portfolio for the Fund that is similar to its Tactical Trend strategy, a systematic medium- to long-term trend-following program that commenced trading in 2006. |

● | Revolution Capital Management (“Revolution”) manages a strategy for the Fund that is similar to its Alpha Program that has been available in a managed account program since 2007. Revolution employs a short-term pattern recognition strategy. |

Fund Performance Summary

For the annual period ended December 31st, 2021, the Fund’s Class I shares gained +0.08% as gains in the first half of the year were largely offset in the second half. The Fund underperformed the +4.72% return for the Morningstar Systematic Trend Futures category. While performance for the year lagged, we would note this is the first year since 2013 that the Fund was not ranked in the top half of its Morningstar peer group. Similarly, the Fund has only had one year in the past eight with a negative return, demonstrating its consistent track record.

During 2021, the Fund’s allocation to the short-term pattern recognition strategy utilized by Revolution was the largest detractor, a reversal from 2020 when this was its strongest performing allocation. Overall, markets, and equities in particular, exhibited strong mean reverting tendencies over short time scales which challenged this sub-adviser whose models tend to follow short-term price momentum. These conditions were particularly prevalent during the second half of the year.

Graham, on the other hand, utilizes a trend-following strategy which generated slightly positive returns during the year, while Millburn’s statistical learning-based, multi-factor strategy produced the strongest positive returns.

For the second year in a row, trading in commodities produced the largest gains for the Fund, led by energies. Trading in equities also produced healthy gains while positions in currencies and fixed income markets were detractors. The target allocation to each sub-adviser at the end of the period was as follows:

● | Millburn Ridgefield Corporation: 40% |

● | Graham Capital Management: 40% |

● | Revolution Capital Management: 20% |

Managed Futures Strategy

Commodities

Trading in commodities produced the largest profits for the Fund as the bull market in commodities continued. The largest gains stemmed from energy trading. Positions in agricultural and base metal markets were also profitable while precious metals produced losses. In energy, prolonged long exposure benefitted from the upward climb in most oil and oil-related commodities. The largest winners in the energy sector included long positions in brent crude and reformulated blendstock for oxygenate blending (RBOB) gasoline. In agricultural markets, the Fund benefitted from solid positive contributions from long grain and soft positions, notably long corn and coffee exposure. Metal markets were mixed as gains from long positions in copper and aluminum were offset by losses in precious metals commodities including gold and silver. The Fund ended the year with long positions in energy, agriculture, and base metals while precious metal exposure was slightly short.

Fixed Income

Trading in fixed income markets produced the largest losses during the period, particularly exposure at the longer end of the curve. Positions in shorter duration maturities produced small profits for the Fund. The bulk of the losses occurred in the third quarter as positioning turned long in response to the downward move in global rates from April/May though early August. Building inflationary pressure and the hawkish rhetoric from the Fed caused rates to reverse course, climbing higher which hurt the Fund’s long-biased exposure. The largest losses were outside the U.S., particularly in Europe led by unprofitable trading in the Euro Bobl and Euro Bund. Trading in Asia and Canada debt produced smaller losses while positions in the U.S. were modestly profitable. The Fund ended 2021 with modest long exposure in fixed income, notably in the U.S., while European positions were slightly short. Asian fixed income positions were also slightly long. Overall, medium- and long-maturity instruments were positioned long while exposure at the front end of the curve was short at year end.

Equity Indices

Trading in global equities was the second largest positive contributor during 2021 behind commodities, as the Fund was able to benefit from the strong returns in stocks. The Fund’s equity trading has now been profitable in six of the past seven quarters. Profits during the year were concentrated in the U.S., as long positions in the E-Mini NASDAQ and S&P 500 produced the biggest gains. Elsewhere, trading was more muted with notable losses from positions in the Nikkei, Euro Stoxx 50, and Hang Seng. Positives outside the U.S. included positions in the CAC 40 and the Canadian TSE 60. The Fund’s equity exposure finished 2021 modestly long with the largest positions in U.S. markets. Europe was slightly long while Asian markets were short.

Foreign Currencies

Trading in currencies was unprofitable in 2021 as conditions proved challenging throughout the year. Positioning vacillated between long and short during the first half of the year as currency markets experienced sizable reversals. As the USD began strengthening persistently during the second half of the year, the Fund’s exposure shifted long USD/short FX beginning in the third quarter and remained that way through the end of 2021. The largest losses occurred in European currencies, notably from trading in the Swiss Franc. Asian trading was mixed, with gains in the Japanese Yen more than offset by losses in the New Zealand and Australian dollar. Finally, trading in the Canadian dollar was also unprofitable. Overall, foreign currency exposure finished the year short versus the USD, notably the Euro, Yen, British Pound, and Canadian dollar.

Outlook

As we turn the page on 2021, we believe the outlook for managed futures/macro is compelling and expect robust market opportunities for the Fund. With persistently high inflation, the Federal Reserve’s acceleration of its tapering program, and expected interest rate hikes, the potential exists for powerful moves across multiple asset classes including currencies, commodities, and fixed income. Given this backdrop along with high valuations, the potential exists for sustained periods of heightened volatility in equities as well. Finally, our expectation is for considerable divergence in economic growth and central bank policy around the globe in 2022 which may further contribute to opportunities for profits.

In our view, this favorable outlook coincides with a murky outlook for bonds. True, the 60/40 asset allocation model has served the investment community well for the past 40 years. Our belief, however, is with the tailwind of declining rates since the 1970s in the rearview mirror, we have entered a new era for the bond market. With the current environment marked by low interest rates which are likely to rise along with near historically tight credit spreads, the likelihood of bonds performing well over the short- to intermediate-terms seems remote. Of course, evidence of this more challenging environment for bonds emerged in 2021, as evidenced by the negative return for the Bloomberg U.S. Aggregate Bond Index. We believe the challenging outlook for bonds is just beginning and recommend investors consider the broader use of alternative diversifying strategies like managed futures which have the flexibility to invest long or short across multiple asset classes and markets.

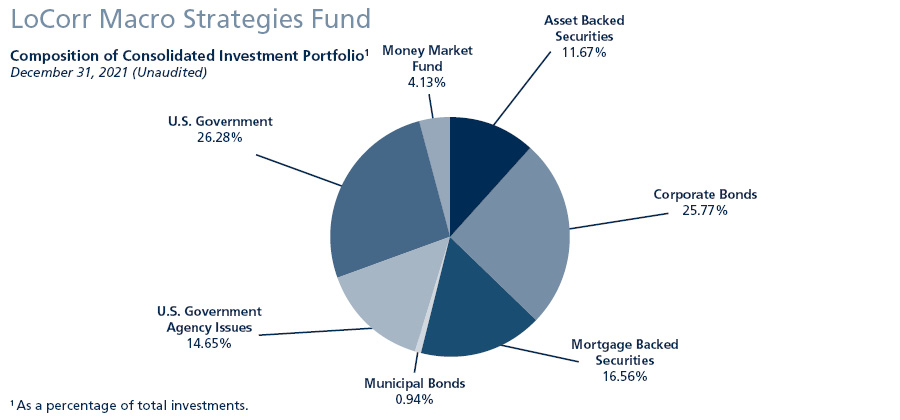

Fixed Income Strategy

The Fund invests most of its excess cash not needed for futures margin requirements in a Fixed Income Strategy comprised of high quality, short to intermediate term investment grade corporate (“IG”) and government agency securities managed by Nuveen Asset Management (“Nuveen”).

The fixed income component of the Fund is managed against the Barclay’s 1-5 Government Credit Index. Returns for the fixed income portfolio were -0.52% compared to -0.97% for the benchmark during 2021. The duration of the portfolio was managed between 1.7 and 2.5 years. The shorter duration and yield curve positioning had a positive impact on performance. During the year, the Fund’s fixed income allocation was between 25-28% in investment grade corporate bonds and 22-28% in high quality, short duration securitized sectors. The Fund maintained broad corporate bond diversification with a modest overweight in financials. Given that spreads for non-government securities tightened, Nuveen’s sector strategy was a positive contributor to returns during the period.

In 2022, Nuveen expects the U.S. and global economies to continue expanding at an above trend pace, though growth is likely to slow in most major regions. The U.S. labor market is likely to reach “full employment” this year which, when paired with still present support from prior fiscal stimulus, should drive robust growth in consumer spending. Supply chain challenges will remain in the near term, but are likely to unwind as the year progresses, resulting in a decelerated rate of inflation by year end. That said, Nuveen still anticipate prices to be rising by about +3% year-on-year by the end of 2022, above the Fed’s long-term target. After providing substantial support in 2021, fiscal policy will become a headwind to headline growth this year, a direct result of lower spending. The portfolio managers believe the first Fed rate hike will occur during the first half of the year, with the potential for more depending on incoming economic data. Given this outlook, Nuveen expects to manage the Fund’s duration underweight versus the benchmark.

Nuveen expects Investment grade credit spread tightening in the near term to offset the widening seen in the fourth quarter of 2021, with spreads remaining range bound in 2022. Overall, 2022 will likely look a lot like 2021 for investment grade credit. Strong technical indicators and above-trend growth should help keep a lid on major spread moves in 2022. Investors and corporations are flush with cash, and company fundamentals are improving as debt reduction continues. Among sectors, Nuveen still favors banking, communications, and energy.

Considering favorable volatility-adjusted return potential, the team at Nuveen expects to continue to position the portfolio broadly across the securitized sectors. Mortgaged-backed Securities’ credit is expected to continue positive performance given the strength of the residential housing market and improving delinquency picture. Strong economic growth in the year ahead could benefit commercial real estate fundamentals, with all property types expected to show an improvement in 2022. New

issue underwriting remains conservative, so Nuveen expects some loosening, though not to a worrying degree. Asset-backed Securities’ (“ABS”) fundamentals are expected to continue improving as unemployment remains low and consumer savings remain elevated. The team continues to view Consumer ABS as a potential source of stable returns.

LoCorr Long/Short Commodities Strategy Fund

The LoCorr Long/Short Commodities Strategy Fund (the “Long/Short Commodities Fund” or the “Fund”) provides investors with access to a commodities futures strategy in a mutual fund structure. Generally speaking, an investment in commodities relies on rising prices to generate positive returns. Of course, commodity prices do not always appreciate and occasionally experience sharp declines, as was seen in 2020, 2018, 2014/2015 and 2008. The Long/Short Commodities Fund has the potential to profit while commodity prices increase or decrease which differentiates it from most commodity-oriented mutual funds. The Fund’s primary investment objective is capital appreciation in rising and falling commodities markets. The Fund attempts to achieve this objective by investing in two primary strategies – a Commodities Strategy and a Fixed Income Strategy.

The Fund’s Commodities Strategy is comprised of:

● | ARCOM Capital LLC (“ARCOM”), which began trading in 2015. ARCOM is led by Alastair Riach, who has over 30 years of experience trading commodities, and manages a discretionary natural gas specialist strategy that trades primarily relative value. |

● | CoreCommodity, which began trading its current strategy in 2017 but traces its roots back to the firm’s inception in 2003. CoreCommodity utilizes a discretionary approach based on a microeconomic analysis centered on four dimensions; quantitative, fundamental, market dynamics, and manager discretion. The portfolio will hold long/short directional, relative value (inter-market), and structural (calendar spread) positions. |

● | East X, which was founded in 2017 and manages a strategy that traces its roots back to 2014. East Alpha manages a systematic approach that combines fundamental insights gleaned from discretionary traders with pattern recognition technique in a rigorous systematic framework. The portfolio will hold long/short directional, relative value (inter-market), and structural (calendar spread) positions. |

● | First Quadrant’s Long/Short Commodities strategy, which began trading in 2010, employs a systematic long/short directional strategy that attempts to capture commercial market participant behavior across 20+ commodity markets. |

● | J E Moody & Company Commodity Relative Value Program (“JEM CRV”), which began trading in 2006. JEM CRV employs a market neutral, systematic trading strategy that invests in relative value calendar spread positions across 20+ commodity markets. |

● | Millburn’s Commodity Program (“Millburn”), which began trading in 2005. Millburn employs a systematic trading strategy that takes outright long/short positions and relative value spread positions across 40+ commodity futures markets. |

Fund Performance Summary

The Fund’s Class I shares gained +14.82% during the year ended December 31, 2021, versus the +27.11% return for the Bloomberg Commodity Total Return Index and the +0.05% gain for the Bank of America Merrill Lynch 3-Month Treasury Bill Index (“ICE BofAML T-Bill Index”). We are pleased with the performance of the Fund in 2021 as it has demonstrated the ability to participate in the strong upward movement of commodity prices. However, due to the Fund’s long/short philosophy, we wouldn’t expect it to fully keep pace with a long-only index. All the Fund’s managers in the Commodities Strategy finished 2021 in positive territory with East X and ARCOM leading the way. Trading in energy was the largest driver of the Fund’s positive returns while grains, metals, and livestock positions also contributed positively. The Fund had modest losses from trading in softs, specifically in coffee.

Energy

For the second year in a row, trading in energy produced the largest gains for the Fund. With oil market fundamentals improving from pandemic lows, the Fund’s exposure remained long most of the year, however, briefly moving to a short posture for about one week at the end of November. Overall, the largest contributors in 2021 were from trading in natural gas, with smaller gains from positions in Brent crude. The Fund finished 2021 with long exposure in oil, natural gas, and power markets.

Agricultural

Trading in agricultural commodities was profitable as gains from positions in grain and livestock markets were partially offset by modest losses in softs. In livestock markets, the Fund experienced gains from both feeder and live cattle markets. The Fund was able to take advantage of strong fundamentals in grain markets, particularly corn and soybeans, as aforementioned reasons drove grain prices higher during the first half of the year. Finally, trading in soft markets was more challenging with positions in cocoa and coffee producing the largest losses. While coffee prices surged, we do not expect the fund to participate in each upward trending market due to the Fund’s long/short strategy. At the end of 2021, positions in grain and livestock markets were long while softs exposure was marginally short.

Metals

Trading in metals was a modest contributor to Fund performance during the period as positions in base metals experienced gains and trading in precious metal markets suffered small losses. In base metals, consistent long positions during the year were profitable as global demand mixed with supply concerns caused widespread price appreciation. The largest gains in base metals came from long copper and aluminum positioning. In precious metals, small losses were driven by varying exposure in gold as prices remained fairly range bound in 2021. This tight trading range market proved difficult for the Fund’s managers as infrequent opportunities were presented. The Fund finished the period with long exposure in both base and precious metals.

Outlook

As we turn the page on 2021, we believe the outlook for long/short commodity exposure in investor portfolio’s is compelling. We expect robust market opportunities for the Fund. With persistently high inflation, the Federal Reserve’s acceleration of its tapering program, and rising expectations for earlier-than-expected interest rate hikes, the potential exists for powerful moves across multiple asset classes including commodities.

Finally, there is increasing discussion about the potential for a commodity super cycle. In the metal markets for example, with weaker prices there has been a lack of new investment over the past decade which is potentially bullish as demand improves. Further, many are pointing to the growth in the electric vehicle market and overall green movement as new secular growth drivers, given how metal-intensive these developments are, further fueling the bullish sentiment. Finally, prices for most cyclical commodity prices have rallied sharply from their lows and, in some cases like copper, have moved to multi-year highs adding support to this outlook.

Overall, we are pleased with the Fund’s performance in 2021, providing welcomed diversification to investors. We believe the Fund may be highly attractive to investors seeking uncorrelated solutions to most investment strategies and asset classes, or for investors seeking alternatives in the commodity market. While commodity prices have been surging higher, they are also characterized by high volatility and sizable drawdowns. This volatility may create tremendous opportunities which we believe the Fund can take advantage of. The underlying managers in the Fund can take both long and short directional positions (benefit from commodities moving up or down), as well as relative value positions (calendar, geographic, and inter-market spreads) to capture this diverse and robust set of opportunities over time, making it a potentially ideal solution regardless of the market environment for commodities. Finally, the Fund’s multi-manager approach has the potential to smooth the ride for investors as the underlying managers tend to zig and zag at different times which may help reduce volatility and limit drawdowns. We remain confident in the outlook for the Fund and the underlying managers and strategies.

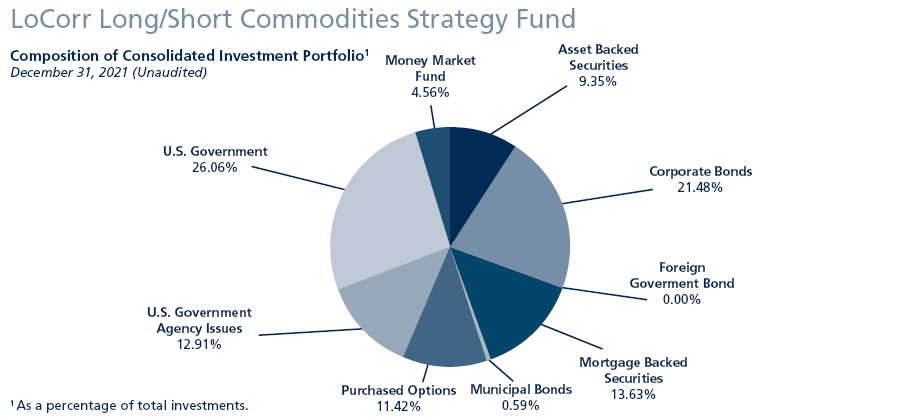

Fixed Income Strategy

The Fund invests most of its excess cash not needed for margin requirements in a Fixed Income Strategy comprised of high quality, short to intermediate term investment grade corporate (“IG”) and government agency securities managed by Nuveen Asset Management (“Nuveen”).

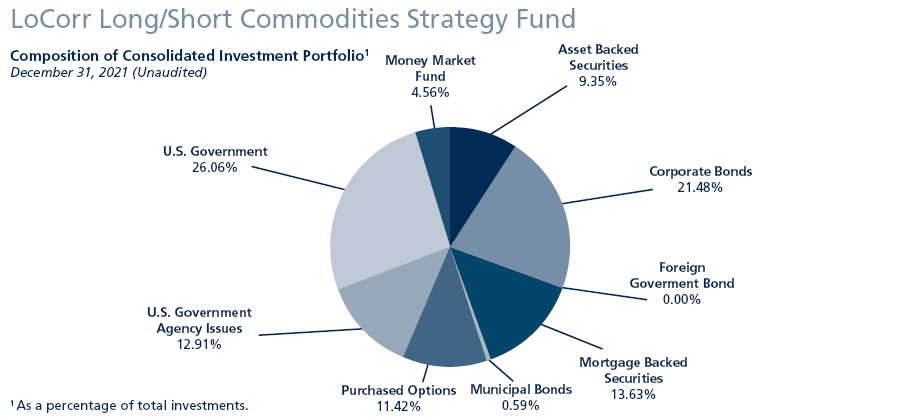

The fixed income component of the Fund is managed against the Barclay’s 1-5 Government Credit Index. Returns for the fixed income portfolio were -0.55% compared to -0.97% for the benchmark during 2021. The duration of the portfolio was managed between 1.7 and 2.5 years. The short duration and yield curve positioning had a positive impact on performance. The During the year, the Fund’s fixed income allocation was between 25-28% in investment grade corporate bonds and 22-28% in high quality, short duration securitized sectors. The Fund maintained broad corporate bond diversification with a modest overweight in financials. Given that spreads for non-government securities tightened, Nuveen’s sector strategy was a positive contributor to investment returns during the reporting period.

LoCorr Market Trend Fund

The LoCorr Market Trend Fund (“Market Trend Fund” or the “Fund”) was created to provide investors with access to a trend-following futures strategy managed by one of the leading managers in this space—Graham Capital Management. Graham was founded in 1994 and manages approximately $15.4 billion in assets. The Market Trend Strategy is managed similarly to Graham’s Tactical Trend program, a systematic medium- to long-term trend-following strategy that commenced trading in 2006. The Fund seeks capital appreciation as its primary investment objective with managing volatility as a secondary objective. The Fund attempts to achieve its objective by investing in two main strategies – a Managed Futures Strategy and a Fixed Income Strategy.

Fund Performance Summary

The Fund’s Class I shares gained +1.04% during the year ended December 31, 2021 versus +4.72% for the Morningstar Systematic Trend category. Overall, the Fund had a strong first half of the year, gaining +5.71% but lost ground in the second half as more challenging market conditions emerged. Gains for the year were led by trading in commodities and equities, while fixed income positions were unprofitable. While performance overall lagged, this was the Fund’s third consecutive year of positive returns, annualizing at a rate of +7.87% over that period and ranking in the top 18th percentile of its Morningstar peer group.

Market Trend Strategy

Fixed Income

Fixed income trading produced the largest losses during the period, particularly from exposure at the longer end of the curve. The environment was particularly challenging for trend followers and the Fund experienced losses in each quarter during the year. Over the course of 2021, the Fund’s positioning in fixed income shifted between long and short as interest rates, which finished higher overall during the year, experienced sizable reversals. It’s these reversals that challenged trend followers including Graham. Seemingly as the Fund’s positioning adapted to prevailing trends, those trends reversed negatively impacting returns. Trading across all major regions was unprofitable, though positions in Europe produced the largest losses led by losses in the 10-Year UK Gilt and Euro Bund. Losses occurred in U.S. markets as well, led by trading in the 5-Year U.S. Treasury. Positions at the front end of the curve were modestly profitable as persistent short exposure in the second half of the year benefited from the rise in rates. The Fund ended 2021 with a modest long exposure in medium- to long-term fixed income markets, notably in the U.S. and, to a lesser extent Asia, while European positions were short. In short-term instruments, positioning was short at the end of 2021.

Commodities

Trading in commodities produced sizable profits as the Fund was able to capture the powerful upward trend across most segments of the commodity markets. The largest gains stemmed from energy trading, though positions in agricultural and base metals were also profitable. Trading in precious metals on the other hand was unprofitable. In energy, prolonged long exposure benefitted from the upward climb in most oil and oil-related commodities, notably long RBOB gasoline and heating oil positions. In agricultural markets, the Fund benefitted from robust gains from long grain, notably corn; and long soft, notably coffee, positions. Metal markets were mixed as gains from long positions in base metals including copper and aluminum were offset by losses in precious metals, notably gold. The Fund ended the year with long positions in energy, agriculture, and base metals while precious metal exposure was short.

Equity Indices

Trading in global equities was the second largest positive contributor during 2021 behind commodities, as the Fund was able to benefit from the strong returns in stocks. The Fund’s equity trading has now been profitable in six of the past seven quarters. Profits during the year were concentrated in the U.S., as long positions in the E-Mini NASDAQ and S&P 500 produced the biggest gains. Elsewhere, trading was more muted with notable losses from positions in the Nikkei, Euro Stoxx 50, and Hang Seng. Positives outside the U.S. included positions in the CAC 40 and the Canadian TSE 60. The Fund’s equity exposure finished 2021 modestly long with the largest positions in U.S. markets. Europe was slightly long while Asian markets were short.

Foreign Currencies

Trading in currencies was unprofitable in 2021 as conditions proved challenging in the first half of the year, though the Fund was able to profit from the upward trending USD in the second half. Positioning shifted from short USD in the first quarter to long USD in the second half of the year in response to the strengthening dollar. The largest losses occurred in European currencies, notably from trading in the Swiss Franc that was partially offset by gains from positions in the Euro. Asian currency markets were profitable led by gains in the Japanese Yen. Overall, the USD finished 2021 significantly long, notably against the Japanese Yen, Euro, and British Pound.

Outlook

As we turn the page on 2021, we believe the outlook for managed futures/macro is compelling and expect robust market opportunities for the Fund. With persistently high inflation, the Federal Reserve’s acceleration of its tapering program, and expected interest rate hikes, the potential exists for powerful moves across multiple asset classes including currencies, commodities, and fixed income. Given this backdrop along with high valuations, the potential exists for sustained periods of heightened volatility in equities as well. Finally, our expectation is for considerable divergence in economic growth and central bank policy around the globe in 2022 which may further contribute to opportunities for profits.

In our view, this favorable outlook coincides with a murky outlook for bonds. True, the 60/40 asset allocation model has served the investment community well for the past 40 years. Our belief, however, is with the tailwind of declining rates since the 1970s in the rearview mirror, we have entered a new era for the bond market. With the current environment marked by low interest rates which are likely to rise along with near historically tight credit spreads, the likelihood of bonds performing well over the short- to intermediate-terms seems remote. Of course, evidence of this more challenging environment for bonds emerged in 2021, as evidenced by the negative return for the Bloomberg U.S. Aggregate Bond Index. We believe the challenging outlook for bonds is just beginning and recommend investors consider the broader use of alternative diversifying strategies like managed futures which have the flexibility to invest long or short across multiple asset classes and markets.

Fixed Income Strategy

The Fund invests most of its excess cash not needed for margin requirements in a Fixed Income Strategy comprised of high quality, short to intermediate term investment grade corporate (“IG”) and government agency securities managed by Nuveen Asset Management (“Nuveen”).

The fixed income component of the Fund is managed against the Barclay’s 1-5 Government Credit Index. Returns for the fixed income portfolio were -0.50% compared to -0.97% for the benchmark during 2021. The duration of the portfolio was managed between 1.7 and 2.5 years. The short duration and yield curve positioning had a positive impact on performance. The During the year, the Fund’s fixed income allocation was between 25-28% in investment grade corporate bonds and 22-28% in high quality, short duration securitized sectors. The Fund maintained broad corporate bond diversification with a modest overweight in financials. Given that spreads for non-government securities tightened, Nuveen’s sector strategy was a positive contributor to investment returns during the reporting period.

LoCorr Dynamic Equity Fund

The LoCorr Dynamic Equity Fund (“Dynamic Equity Fund” or the “Fund”) seeks long-term capital appreciation with reduced volatility compared to traditional broad-based equity market indices as a secondary objective. Consistent with the “low correlation” our LoCorr Fund family seeks, long/short equity funds have the ability to provide positive returns when equity markets are rising, yet they offer the potential for downside protection when equity prices are falling.

The Fund employs three sub-advisers to manage the Fund’s long/short equity strategy:

● | Billings Capital Management (“Billings”) manages a strategy which is based on a value-oriented, concentrated, fundamental, bottom-up long/short equity approach. This manager seeks to outperform the S&P 500 over the long term. The sub-portfolio managed by Billings is similar to a strategy that this manager has executed since 2008 with their current firm and for many years prior to that at a different entity. |

● | Kettle Hill Capital Management (“Kettle Hill”) seeks to generate alpha by combining a bottom-up, fundamental analysis with a top-down opportunistic overlay. Investing primarily in small cap securities, Kettle Hill targets a conservative net exposure to the market. The sub-portfolio managed by Kettle Hill is similar to a strategy that this manager has executed since its inception in 2003. |

● | First Quadrant (“FQ”) manages a strategy for the Fund which is similar to a global long/short strategy that they have traded since 2016. They utilize a systematic multi-factor approach coupled with an active beta management approach to maximize upside opportunities while reducing downside performance. The strategy invests in developed international and U.S. markets and was added to the portfolio in 2019. |

Fund Performance Summary

The Fund’s Class I shares finished 2021 in positive territory, up +14.58%, outperforming the Morningstar Long/Short Equity Fund Index which closed up +12.55%. The Fund’s small cap bias was a headwind during the period as the Russell 2000 Index finished 2021 up +14.82% versus the +28.71% gain for the S&P 500. The Fund continued to outperform the category on a 3-year trailing basis by a margin of +0.70%.

Billings led the way for the Fund, posting stellar 2021 returns and finishing well in the black. First Quadrant ended the year closely behind Billings, while Kettle Hill had only modest gains. The Fund’s overall net exposure oscillated throughout 2021, ending the year on the higher end of its typical 40-60% range, at 55% net exposure.

The Fund’s long book was a positive contributor in three out of four quarters in 2021 with the bulk of the gains recorded in the first quarter. During the year, the Fund saw its strongest returns from the Financial Services, Industrials, and Communication Services sectors. Within the Financial Services sector, Credit Acceptance Corp (6.3% of the Fund’s net assets as of 12/31/2021), a specialized consumer finance company within the auto industry, was the top performer for the year. The company was the largest holding in the portfolio throughout the year and consequentially was the largest contributor to performance. Another contributor within the Financial Services sector, Wells Fargo (1.1% of the Fund as of 12/31/2021), traded higher after the Fed’s outlook turned more hawkish. In the Industrials sector, Mastec (2.69% of the Fund as of 12/31/2021), a multinational infrastructure engineering and construction company, traded higher in the second quarter on news that President Biden secured a deal on an infrastructure bill that was intended to expand roads, bridges and broadband networks. In the Communication Services sector, Nexstar Media Group Inc (2.27% of the Fund as of 12/31/2021), a media company with significant television station ownership in the US, trended higher with better-than-expected earnings and strong forward guidance. Offsetting these gains were losses in the Consumer Cyclical, Communication Services, and Technology sectors. In the Consumer Cyclical sector, a position in Frontdoor (3.63% of the Fund as of 12/31/2021), a home service plan and appliance company, was negatively impacted by the spread of COVID-19 in 2021. In the Communication Services sector, Media and Games Invest (2.00% of the Fund as of 12/31/2021), a multinational digitally integrated games and media company, traded lower with the sell-off in high multiple technology-related stocks in the fourth quarter.

The Fund’s short book faced losses in the first half of the year but experienced gains in the second half. Overall, these losses during the year were led by Consumer Cyclical and Communication Services sectors as broader equity markets rallied in 2021. In the Consumer Cyclical sector, a short position in Express, Inc. (0.00% of the Fund as of 12/31/2021), an American fashion retailer, was caught up in the “meme stock craze” in the first quarter of the year, and the Fund’s short position was negatively impacted. Fortunately, the Fund avoided significant losses in other “meme stocks” in 2021. In the Communication Services sector, a short position in Live Nation Entertainment Inc. (-0.34% of the Fund as of 12/31/2021), a global entertainment company, detracted as the stock moved higher in 2021 due to general market optimism. The short book had gains within the Financial Services and Consumer Cyclical sectors. In the Financial Services sector, a short position in Lemonade Inc. (0.00% of the Fund as of 12/31/2021), a multinational insurance company, benefitted the Fund as the stock fell dramatically due to negative sentiment in the insurance market as well as reporting disappointing earnings during the quarter. The Fund also benefited from a short position in Peloton Interactive (0.00% of the Fund as of 12/31/2021), an exercise equipment and media company, after the company reported disappointing earnings results in November.

Outlook

As we enter 2022, many questions remain unanswered. Investors will need to continue to assess the long-term implications of the COVID-19 virus and potentially new variants on economies around the globe and what a “return-to-normal” environment may look like. All these questions must be considered against the increasingly hawkish view of the Fed that had previously been stimulative and supportive to the prices of risk assets yet must now deal with persistently high inflation. The equity market proved its robustness in 2021, pushing higher through the final weeks of the year in the face of the omicron variant emergence and a shift in Federal Reserve policy. However, if these concerns continue or worsen, it could foster heightened market volatility and possibly put an end to the current bull market.

Amid continued uncertainty, a long/short equity strategy may allow for continued participation in rising equity markets while the strategy’s hedged approach and ability to benefit from falling stock prices could mitigate losses if equities were to sell off. With the Cyclically Adjusted S&P 500 P/E ratio at the highest level in twenty years coupled with the recent shift to a hawkish Federal Reserve, a turbulent equity market is a strong possibility in 2022. We remain highly confident in the ability of the Fund to provide positive absolute returns and compelling diversification for investors’ portfolios.

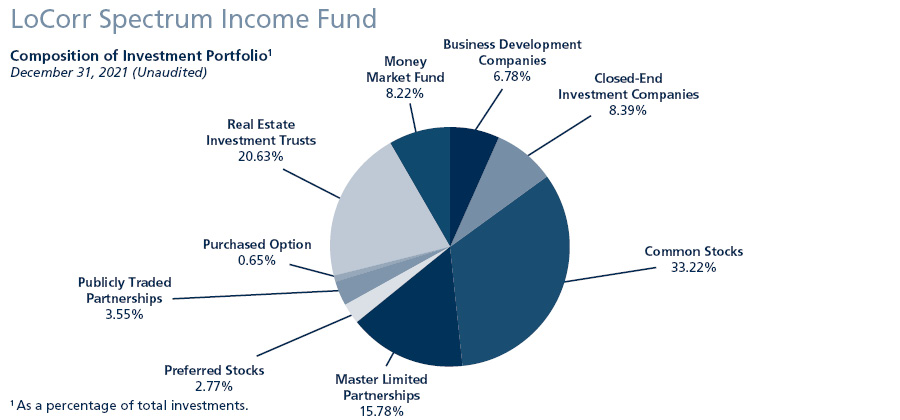

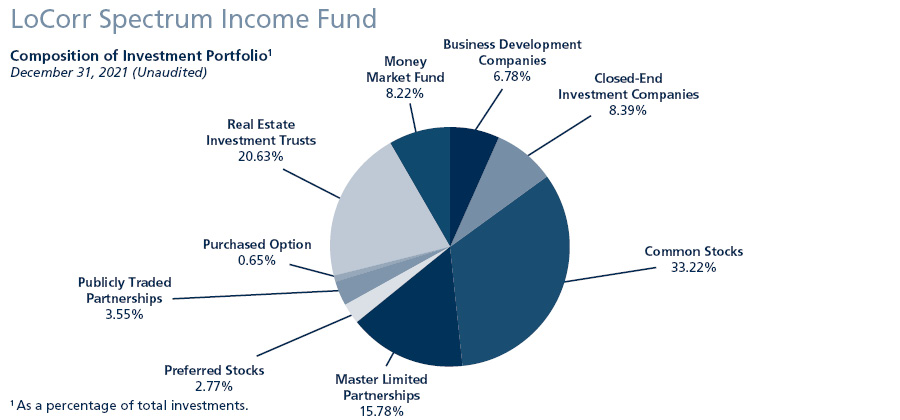

LoCorr Spectrum Income Fund

The LoCorr Spectrum Income Fund (“Spectrum Income Fund” or the “Fund”) has an objective of current income with capital appreciation as a secondary objective. The Fund is designed to fit within the “low correlation” of the LoCorr Fund family by seeking to provide relatively high levels of income with low correlation to the bond market. The Fund is sub-advised by Bramshill Investments. Bramshill invests in a portfolio of primarily pass-through securities with an integrated covered call and hedging strategy. Bramshill seeks to generate high current income, much of which the Fund distributes monthly to investors.

Fund Performance Summary

The Fund’s Class I shares were up +21.53% in 2021 compared to the -1.54% loss for the Bloomberg U.S. Aggregate Bond Index. In a year where bonds were challenged by rising rates, The Fund benefited from positive contributions in all but one sector with the largest contributions from Master Limited Partnerships (“MLPs”), Business Development Companies (“BDCs”), C-Corporations, and Real Estate Investment Trusts (“REITs”). The only detracting sector was Mortgage Real Estate Investment Trusts (“mREITs”), and the losses in this sector were comparatively modest.

The Master Limited Partnerships sector was the top contributor to the Fund’s 2021 performance. The broad sector rebounded from a rough 2020 and gained +39.9%, as measured by the Alerian MLP Index. The largest contributor within the sector was Crestwood Equity Partners (2.28% of the Fund as of 12/31/21), a midstream MLP, which rallied on news that it bought out its General Partner interest simplifying its structure, as well as benefiting from a generally strong energy market. Also contributing were the Crestwood preferred shares (1.49% of the Fund as of 12/31/21), where the market seems to be realizing the value of the high and stable nature of distributions in this part of the company’s capital structure. Global Partners (2.18% of the Fund as of 12/31/21), a downstream MLP, consistently beat analyst estimates during 2021 and continues to raise its distribution. The company’s plans to ramp up its renewable fuels capabilities was also well received by the market.

Business Development companies, which rallied +37.38% in 2021, as measured by the MVIS U.S. Business Development Companies Index, were also strong contributors to the Fund. The Fund maintained exposure to this sector in Q1, but tactically reduced positions through the remainder of the year as completion for loans increased and credit quality deteriorated despite lower default rates. The top performing BDC holding within the Fund was Newtek Business Services (0.87% of the Fund as of 12/31/21), a BDC which engages in the provision of business and financial solutions, reported solid earnings, increased its distribution guidance, and benefited from a strong credit environment.

Equity Real Estate Investment Trusts, as measured by the MSCI U.S. IMI Real Estate 25/50 Index, rallied +40.78% in 2021. The sector was aided by rent relief programs provided by the federal government early in the year and was further propelled by the reopening of the economy and strong economic growth. Real estate has historically been considered an inflation hedge, and with increasing concerns of inflation, the sub-adviser, Bramshill, has maintained exposure to the sector and opportunistically added in the second half of the year. The top performer in the Equity REITs sector was Iron Mountain (0.97% of the Fund as of 12/31/21), an enterprise information management services company. Iron Mountain benefited from an expansion of its data center business segment and overall growth in this area of the market.

In C-Corps, the Fund began the year heavily weighted towards reflation beneficiaries. Bramshill changed their stance in the third quarter to a more defensive approach when growth stocks began to wane as the sub-adviser became more concerned that the Fed posture was shifting. Allocations to securities in the Utilities and Consumer Staples sectors increased during this time. When growth stocks began to re-accelerate in the fourth quarter, these defensive positions were exited and Bramshill began cautiously entering into more cyclical securities and identifying companies that were paying large, special year-end distributions to add to the portfolio. One example of a cyclical security that paid a special distribution in 2021 is Boise Cascade (1.09% of the Fund as of 12/31/21), a North American manufacturer of wood products and a wholesale distributor of building materials. The company raised its quarterly dividend by 20% and paid a supplemental dividend of $3.00 per share to common stockholders in the fourth quarter.

The only sector that was a detractor for the Fund in 2021 was Mortgage REITs. The broad sector gained +15.64%, as measured by the FTSE Nareit Mortgage REITs index. The Fund’s allocation to mREITs was increased in the second and third quarter, then reduced in in the fourth quarter as concerns about spread tightening began to manifest. The largest detracting mREIT in the Fund in 2021 was Invesco Mortgage Capital (1.18% of the fund as of 12/31/21). The security was hampered by the increasing concerns regarding the Fed rate hikes and tapering expectations, as these events tend to have negative effects on spreads.

Outlook

As Bramshill looks toward 2022, caution is indicated as the Fed faces a longer-term process of tightening in an environment of extended financial markets and a potentially fragile national economy that is still dealing with COVID-19 impacts and uncertain degrees of labor market participation.

Bramshill has high confidence that the portfolio holdings’ cash flow and distributions will be sustainable in this environment. However, investor skepticism regarding the Fed’s ability to tighten policy without negatively impacting the economy could produce meaningful increases in volatility. Given this expectation for heightened volatility over the near-term, Bramshill began selling covered calls late in 2021 to help fund a partial hedge that it added to in the early days of 2022. Bramshill anticipates that visibility concerning longer term macroeconomics conditions could support reasonable growth but may include somewhat greater inflation than the market has experienced over the past few decades. Bramshill expects that this environment will benefit the Fund’s opportunity set relative to many other investment options.

Thank you for investing in the LoCorr Funds

The S&P 500 Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Barclays 1-5 Year Government Credit Index-The Barclays U.S. Government/Credit 1-5 Year Index is an index of all investment grade bonds with maturities of more than one year and less than 5 years. The MSCI EAFE Index was designed to measure the equity market performance of developed markets outside of the U.S. & Canada. VIX - Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments. It is also known by other names like “Fear Gauge” or “Fear Index.” Investors, research analysts and portfolio managers look to VIX values as a way to measure market risk, fear and stress before they take investment decisions. The ICE BofAML 3-M T-Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. The Morningstar Managed Futures Category is an average monthly return of all funds in the Morningstar Managed Futures Category. These funds typically take long and short positions in futures options, swaps, and foreign exchange contracts, both listed and over the counter, based on market trends or momentum. (A long position is a bet an investment will gain in value, while a short position is a bet that an investment will decline in value.) A majority of these funds follow trend-following, price-momentum strategies. Other strategies included in this category are systematic mean-reversion, discretionary global macro strategies, commodity index tracking, and other futures strategies. More than 60% of these funds’ exposure is invested through derivative securities. The TOPIX Index (Tokyo Stock Price Index) is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, tracking all domestic companies of the exchange’s First Section. The Dow Jones EURO STOXX 50 Index is a market capitalization-weighted stock index of 50 large, blue-chip European companies operating within eurozone nations. The Bloomberg Commodity Index is a broadly diversified commodity price index distributed by Bloomberg Indexes. The index was originally launched in 1998 as the Dow Jones-AIG Commodity Index and renamed to Dow Jones-UBS Commodity Index in 2009, when UBS acquired the index from AIG. The SG Trend Index is a subset of the SG CTA Index and follows traders of trend-following methodologies. The SG CTA Index is equal weighted, calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. The Morningstar Long/Short Equity Category is an average monthly return of all funds in the Morningstar Long-Short Equity Category. The category contains a universe of funds with similar investment objectives and investment style, as defined by Morningstar. Performance of the indices and Morningstar Category Average is generated on the first business day of the month. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based bond index comprised of government, corporate, mortgage and asset-back issues rated investment grade or higher. West Texas Intermediate is a crude oil that serves as one of the main global oil benchmarks. It is sourced primarily from Texas and is one of the highest quality oils in the world, which is easy to refine. WTI is the underlying commodity for the NYMEX’s oil futures contract. One cannot invest directly in an index.

Please refer to the Schedule of Investments in this report for full holdings information. Fund holdings and sector allocations are subject to change and should not be considered recommendations to buy or sell any security.

Alpha is an annualized return measure of how much better or worse a fund’s performance is relative to an index of funds in the same category, after allowing for differences in risk. Basis Points (bps) - A unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. Beta measures the sensitivity of a stock’s return relative to the return of a selected market index. When beta is greater than one, it means a stock will rise or fall more than the market. Cash Flows refers to a company’s free cash flow which is a measure of how much cash a business generates after capital expenditures.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration. Investment Grade refers to bonds that are rated BBB or higher. Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds. Calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying asset at the same strike price but with different delivery months. It is sometimes referred to as an inter-delivery, intra-market, time, or horizontal spread. Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. The curve is used to predict changes in economic output and growth. Mortgage-backed securities (MBS)_ are an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them. Asset-backed securities (ABC) are a type of financial investment that is collateralized by an underlying pool of assets – usually ones that generate a cash flow from debt, such as loans, leases, credit card balances, or receivables. It takes the form of a bond or note, paying income at a fixed rate for a set amount of time, until maturity.

Must be preceded or accompanied by a prospectus.

Opinions expressed are those of the Investment Manager and are subject to change, are not guaranteed and should not be considered investment advice.

Earnings growth is not representative of the Funds’ future performance.

Past performance is not a guarantee of future results.

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Macro Strategies Fund, Long/Short Commodities Strategy Fund, Market Trend Fund and Spectrum Income Fund are diversified funds. Dynamic Equity Fund is a non-diversified fund, meaning it may invest its assets in fewer individual holdings than a diversified fund. Therefore, Dynamic Equity Fund is more exposed to individual stock volatility than a diversified fund. The Funds invest in foreign investments and foreign currencies which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Investing in commodities may subject the Funds to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. The Funds may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be

volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in Asset Backed, Mortgage Backed, and Collateralized Mortgage-Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in Real Estate Investment Trusts (REITs) involve additional risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments.

Derivative contracts ordinarily have leverage inherent in their terms which can magnify a Fund’s potential for gains or losses through increased long and short position exposure. A Fund may access derivatives via a swap agreement. A risk of a swap agreement is the risk that the counterparty to the agreement will default on its obligation to pay the Fund.

A Fund will incur a loss as a result of a short position if the price of the short position instrument increases in value between the date of the short position sale and the date on which an offsetting position is purchased.

Investments in small- and medium-capitalization companies involve additional risks such as limited liquidity and greater volatility. Investments in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. ETF investments are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. ETFs are subject to specific risks, depending on the nature of the ETF.

A Fund’s portfolio will be significantly impacted by the performance of the real estate market generally, and a Fund may be exposed to greater risk and experience higher volatility than would a more economically diversified portfolio. Property values may fall due to increasing vacancies or declining rents resulting from economic, legal, cultural, or technological developments. Investments in Limited Partnerships (including master limited partnerships) involve risks different from those of investing in common stock including risks related to limited control and limited rights to vote on matters affecting the Limited Partnership, risks related to potential conflicts of interest between the Limited Partnership and the Limited Partnership’s general partner, cash flow risks, dilution risks and risks related to the general partner’s limited call right. Underlying Funds are subject to management and other expenses, which will be indirectly paid by a Fund.

The LoCorr Funds are distributed by Quasar Distributors, LLC.

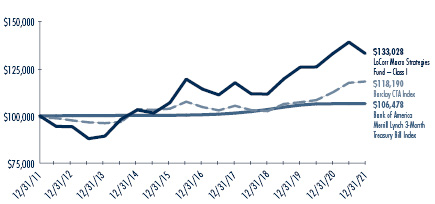

LoCorr Macro Strategies Fund

Rate of Return — For the period ended December 31, 2021 (Unaudited)

| | Inception | | Average Annual |

| | Date | 6 Month | 1 Year | 5 Year | 10 Year | Since Inception |

LoCorr Macro Strategies Fund - Class A (without maximum load) | 3/22/11 | -4.41% | -0.15% | 2.84% | 2.64% | 1.79% |

LoCorr Macro Strategies Fund - Class A (with maximum load) | 3/22/11 | -9.87% | -5.89% | 1.64% | 2.03% | 1.23% |

LoCorr Macro Strategies Fund - Class C | 3/24/11 | -5.70% | -1.86% | 2.09% | 1.87% | 1.04% |

LoCorr Macro Strategies Fund - Class I | 3/24/11 | -4.33% | 0.08% | 3.11% | 2.89% | 2.05% |

Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.02% | 0.05% | 1.14% | 0.63% | 0.59% |

Barclay CTA Index | | 0.58% | 5.07% | 2.63% | 0.65% | 1.01% |

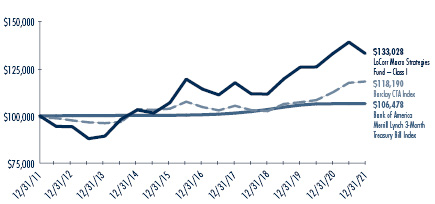

$100,000 investment in the

LoCorr Macro Strategies Fund – Class I

For the period ended December 31, 2021 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s April 30, 2021 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 2.18%, 2.93% and 1.93% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors.

One cannot invest directly in an index.

LoCorr Long/Short Commodities Strategy Fund

Rate of Return — For the period ended December 31, 2021 (Unaudited)

| | Inception | | Average Annual |

| | Date | 6 Month | 1 Year | 5 Year | 10 Year | Since Inception |

LoCorr Long/Short Commodities Strategy Fund - Class A (without maximum load) | 12/31/11 | 5.48% | 14.55% | 7.49% | 4.78% | 4.78% |

LoCorr Long/Short Commodities Strategy Fund - Class A (with maximum load) | 12/31/11 | -0.63% | 7.99% | 6.22% | 4.16% | 4.16% |

LoCorr Long/Short Commodities Strategy Fund - Class C | 12/31/11 | 4.02% | 12.66% | 6.68% | 3.96% | 3.96% |

LoCorr Long/Short Commodities Strategy Fund - Class I | 12/31/11 | 5.64% | 14.82% | 7.78% | 5.04% | 5.04% |

Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.02% | 0.05% | 1.14% | 0.63% | 0.63% |

HFRI Macro Commodity Index* | | 8.28% | 23.98% | 6.13% | 2.77% | 2.77% |

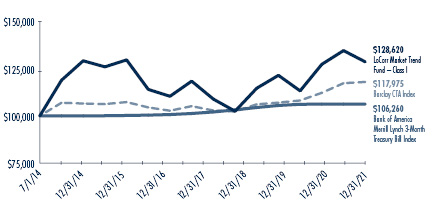

$100,000 investment in the

LoCorr Long/Short Commodities Strategy Fund – Class I

For the period ended December 31, 2021 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s April 30, 2021 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 2.57%, 3.32% and 2.32% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The HFRI Macro Commodity Index employs an investment process designed to identify opportunities in markets exhibiting trending or momentum characteristics across commodity assets classes, frequently with related ancillary exposure in commodity sensitive equities or other derivative instruments.

* Prior to May 3, 2021, the LLSCS Fund utilized the Morningstar Long/Short Commodity Index as a primary benchmark. The Index was discontinued as of May 3, 2021 and replaced by the HFRI Macro Commodity Index. The Morningstar Long/Short Commodity Index is a fully collateralized commodity futures index that uses the momentum rule to determine if each commodity is held long, short, or flat.

One cannot invest directly in an index.

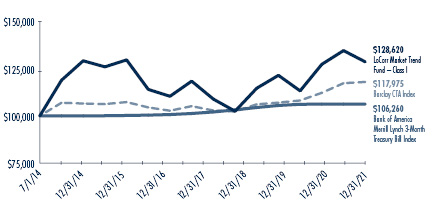

LoCorr Market Trend Fund

Rate of Return — For the period ended December 31, 2021 (Unaudited)

| | Inception | | Average Annual |

| | Date | 6 Month | 1 Year | 5 Year | Since Inception |

LoCorr Market Trend Fund - Class A (without maximum load) | 6/30/14 | -4.52% | 0.87% | 2.19% | 3.16% |

LoCorr Market Trend Fund - Class A (with maximum load) | 6/30/14 | -9.99% | -4.91% | 0.99% | 2.35% |

LoCorr Market Trend Fund - Class C | 6/30/14 | -5.84% | -0.92% | 1.43% | 2.38% |

LoCorr Market Trend Fund - Class I | 6/30/14 | -4.42% | 1.04% | 2.44% | 3.41% |

Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 0.02% | 0.05% | 1.14% | 0.81% |

Barclay CTA Index | | 0.58% | 5.07% | 2.63% | 2.30% |

$100,000 investment in the

LoCorr Market Trend Fund - Class I

For the period ended December 31, 2021 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s April 30, 2021 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 2.05%, 2.80% and 1.80% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors.

One cannot invest directly in an index.

LoCorr Dynamic Equity Fund

Rate of Return — For the period ended December 31, 2021 (Unaudited)

| | Inception | | Average Annual |

| | Date | 6 Month | 1 Year | 5 Year | Since Inception |

LoCorr Dynamic Equity Fund - Class A (without maximum load) | 5/10/13 | 2.24% | 14.38% | 3.72% | 4.42% |

LoCorr Dynamic Equity Fund - Class A (with maximum load) | 5/10/13 | -3.62% | 7.79% | 2.49% | 3.71% |

LoCorr Dynamic Equity Fund - Class C | 5/10/13 | 0.86% | 12.46% | 2.95% | 3.63% |

LoCorr Dynamic Equity Fund - Class I | 5/10/13 | 2.34% | 14.58% | 3.99% | 4.69% |

S&P 500 Total Return Index | | 11.67% | 28.71% | 18.47% | 15.42% |

Morningstar Long/Short Equity Fund Index | | 3.22% | 12.55% | 6.54% | 4.89% |

$100,000 investment in the

LoCorr Dynamic Equity Fund - Class I

For the period ended December 31, 2021 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s April 30, 2021 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 4.53%, 5.28% and 4.28% for Class A, Class C and Class I shares, respectively.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Morningstar Long/Short Equity Index category holds sizeable stakes in both long and short positions in equities and related derivative. At least 75% of the assets are in equity securities or derivatives.

One cannot invest directly in an index.

LoCorr Spectrum Income Fund

Rate of Return — For the period ended December 31, 2021 (Unaudited)

| | Inception | | Average Annual |

| | Date | 6 Month | 1 Year | 5 Year | Since Inception |

LoCorr Spectrum Income Fund - Class A (without maximum load) | 12/31/13 | -0.89% | 21.33% | 5.82% | 2.72% |

LoCorr Spectrum Income Fund - Class A (with maximum load) | 12/31/13 | -6.54% | 14.27% | 4.57% | 1.96% |

LoCorr Spectrum Income Fund - Class C | 12/31/13 | -2.30% | 19.47% | 5.00% | 1.93% |

LoCorr Spectrum Income Fund - Class I | 12/31/13 | -0.78% | 21.53% | 6.09% | 2.98% |

Bloomberg U.S. Aggregate Bond Index | | 0.06% | -1.54% | 3.57% | 3.37% |

Morningstar Allocation - 70% to 85% Equity | | 4.49% | 16.33% | 10.86% | 8.01% |

$100,000 investment in the

LoCorr Spectrum Income Fund - Class I

For the period ended December 31, 2021 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s April 30, 2021 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 3.57%, 4.32% and 3.32% for Class A, Class C and Class I shares, respectively.

The Bloomberg Barclay U.S. Aggregate Bond Index is a long term, market capitalization-weighted index used to represent investment grade bonds being traded in the United States.