UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22509

LoCorr Investment Trust

(Exact name of registrant as specified in charter)

687 Excelsior Blvd

Excelsior, MN 55331

(Address of principal executive offices) (Zip code)

CT Corporation System

1300 East Ninth Street

Cleveland, OH 44114

(Name and address of agent for service)

952.767.2920

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Item 1. Reports to Stockholders.

Letter to Shareholders

LoCorr Funds seeks to provide investments that, over time, will have low correlation to traditional asset classes such as stocks and bonds. We believe that adding low correlating investments to portfolios can significantly reduce overall portfolio risk while enhancing returns. Correlation measures the degree to which the returns of two investments move together over time. LoCorr offers products that provide the potential for positive returns in rising or falling markets and are designed to generate returns independent of traditional stock, bond and commodity investments. In this report, LoCorr Funds are reporting on five mutual funds: LoCorr Macro Strategies Fund, LoCorr Long/Short Commodities Strategy Fund, LoCorr Market Trend Fund, LoCorr Dynamic Equity Fund and LoCorr Spectrum Income Fund (collectively, the “Funds”).

LoCorr Macro Strategies Fund

The LoCorr Macro Strategies Fund (the “Fund”) seeks capital appreciation as its primary investment objective with managing volatility as a secondary objective. The Fund attempts to achieve its objective by investing in two main strategies - a Managed Futures Strategy and a Fixed Income Strategy.

The Fund employs three sub-advisers to manage the managed futures portion of the Fund: Millburn Ridgefield Corporation (Millburn), Graham Capital Management (Graham), and Revolution Capital Management (Revolution). Millburn traces its roots back to 1971 and manages approximately $6.2 billion in assets. Graham was founded in 1994 and manages about $13.1 billion in assets. Revolution was founded in 2004 and manages approximately $470 million in assets.

Millburn manages a portfolio for the Fund that is similar to its Millburn Diversified Program, which commenced operations in 1977. They invest in a diversified portfolio of global futures contracts, by combining non-traditional and trend-following strategies in a systematic multi-factor approach. Graham manages a portfolio for the Fund that is similar to its Tactical Trend strategy, a systematic medium- to longterm trend following program that commenced trading in 2006. Revolution manages a strategy for the Fund that is similar to its Alpha Program, that has been available in a managed account program since 2007. They employ a short- to medium-term pattern recognition strategy that incorporates trend reversion and counter-trend signals.

Market Commentary

In 2018, markets in most asset classes and sectors experienced frequent reversals. These conditions challenged managed futures strategies, particularly trend following, which typically performs better when there are more persistent directional movements in markets. While the sub-advisers employ multiple investment strategies and disciplines, the Fund was challenged by these conditions.

Geopolitical influences such as the U.S./China trade war, Brexit, and Federal Reserve interest rate hikes created considerable volatility over the course of the year. Despite the upward move in the U.S. Dollar, for example, individual markets including the Euro and Japanese Yen experienced sizable reversals. Within Equities, the powerful up-trend that had been firmly entrenched stopped abruptly in late January. It then began moving higher until late September before selling-off sharply through year-end, with many individual equity indices entering “official” bear market territory (marked by a decline of greater than 20%). Commodities were heavily influenced by the trade war with China, while Fixed Income reversals were frequent throughout the year. In aggregate, there were few gradual and persistent directional moves during the course of the year that did not experience painful reversals.

For the calendar year ended December 31, 2018, the Fund’s Class I shares returned -5.08% versus +1.87% for the ICE BofAML 3M U.S. Treasury Bill Index, and -4.38% for the S&P 500 Index. The Fund outperformed the Morningstar US Fund Managed Futures category, which declined -6.02% during the year. The negative performance in 2018 broke a string of four consecutive calendar years of positive absolute returns. From a performance perspective for the year, the Fund was not able to overcome a difficult February. At that time, volatility spiked and markets corrected rapidly, as exhibited by the Dow Jones Industrial Average’s largest-ever intraday decline of nearly 1,600 points on February 5, during a massive flight-to-safety move. The speed of this shock was so rapid that the sub-adviser’s models were challenged to adapt quickly enough. The Fund was more successful in “protecting” capital during the equity market correction later in the year (9/21/18 - 12/24/18), which was longer in duration. During the period, the Fund remained essentially unchanged -0.30% versus the -19.36% decline for the S&P 500 Index.

The Fund’s diversified approach of allocating to three complementary sub-advisers helped to limit the Fund’s overall volatility and drawdowns during the year, providing a smoother ride relative to many peers. The Fund benefitted from its allocation to Millburn, whose machine-learning based, multi-factor model generated positive absolute returns. Revolution’s returns were negative in 2018, while the Fund’s trend following component managed by Graham produced the largest losses. By sector, trading in Commodities was the most profitable sector, led by gains in Energy. The largest losses during the period stemmed from trading in Equities, with smaller losses in Foreign Currency and Fixed Income. The target allocation to each sub-adviser remained unchanged versus the prior year:

• Millburn Ridgefield Corporation: 40%

• Graham Capital Management: 40%

• Revolution Capital Management: 20%

Managed Futures Strategy

Equity Indices

The environment in 2018 shifted dramatically, as volatility surged and the longest bull run in history that began in 2009 following the end of the financial crisis came to an abrupt end. To illustrate the extent of the volatility experienced in the equity markets, the S&P 500 had a daily percentage change in excess of 1% sixty-four times in 2018 versus eight times in 2017. Intra-day, the S&P 500 Index peaked on September 21 and entered bear market territory (a decline of at least -20%) by the close of trading on December 24. Other equity markets such as the Russell 2000 Index, a proxy for U.S. small cap stocks, experienced even larger drawdowns of -26.07% from September 21 through December 24. Further, the violent and sustained downward move in equities occurring during the final months of the year were the second major bout of sharp declines seen during 2018. In late January/early February 2018, risk assets including equities and oil corrected sharply as volatility rocketed higher, though that sell-off was relatively short-lived. Certainly, the equity market environment was far different in 2018 than it had been in recent memory.

Trading in Equity Indices was unprofitable during 2018, as the markets experienced sizable reversals from prevailing conditions in both late January/early February 2018 and again beginning late September 2018, which proved challenging. With upward-moving equity markets in 2017, the Fund entered 2018 with sizable long positions, which were hurt by the late January/early February sell-off before positioning shifted short. As equity markets corrected in the fourth quarter, the Fund experienced losses in October and November as long positions were hurt. The Fund’s exposure shifted to short during the quarter, particularly in European equities, leading to profitable trading in December as the sell-off intensified.

Fixed Income

Yields in the U.S. continued their climb early in the year as economic growth remained robust, expectations for inflation moved higher, and the Fed signaled its intent to continue on the path of hiking interest rates. U.S. rates were range-bound and trendless, moving higher and lower within that range. This dynamic shifted in September 2018, as rates pushed higher leading up to the Fed’s third hike of the year at the Federal Reserve Bank (Fed) meeting on the 26. The U.S. 10-year yield reached 3.23% in November 2018, before plummeting due to a rapid shift in sentiment, as concerns regarding slowing economic growth and the potential for a Fed- and trade war-induced recession surfaced, as well as the flight-to-safety caused by the sell-off in equities. The rally in Treasuries pushed the U.S. 10-year yield to 2.69% by the end of the year. The Treasury Curve also reached its flattest point in over a decade.

Activity outside the U.S. was sluggish amid global trade tensions and a continued slowdown in China. Yields outside the U.S. also wavered over the course of the year. The German 10-year Bund yield fell, with the period marked by sizable reversals. The Japanese 10-Year Government Bonds (10-Year JGB) moved higher beginning in July 2018, before peaking in October and reaching its lowest levels of the year during December, due to geopolitical fears and the general flight-to-safety environment.

Trading in Fixed Income was unprofitable in 2018. The bulk of the losses were attributable to unprofitable trading in long- and intermediate-term contracts. With interest rates in the U.S. moving higher for most of the year, the Fund was hurt by the sharp reversal late in 2018. As interest rates moved lower in November/December 2018 during the flight-to-safety rally, short U.S. positions were unprofitable.

Foreign Currencies

After peaking in December 2016, the U.S. Dollar Currency Index (DXY), a proxy for the U.S. Dollar versus a basket of major currencies, generally trended lower (U.S. Dollar weakening) as economic growth in the Euro zone and Asia strengthened, and prospects for interest rate hikes looked to be on the horizon. These trends reversed towards the end of the first quarter in 2018, with the U.S. Dollar strengthening as foreign economic data started to soften. European currency markets were also impacted by a brief Italian political crisis created by a hung parliament, though a coalition was eventually formed, resulting in fears of an Italian exit from the European Union as well as concerns regarding Italy’s excessive debt. The BOE (Bank of England) also backed away from an expected rate hike, while the Fed continued on its more hawkish path, which also contributed to the reversal in the currency markets. During the second half of the year, DXY was generally trendless and characterized by frequent small reversals, conditions that proved challenging for trend following strategies. The inability of the British government to reach a consensus on the specifics of its extraction from the EU (Brexit) further contributed to volatility in the currency market during 2018, particularly for the British Pound and Euro. After weakening against the Japanese Yen (Yen) in the first quarter, the U.S. Dollar reversed, strengthening against the Yen until late in the year, when the Yen recovered sharply on the flight-to-safety trade. Overall, the DXY increased approximately 4.4% during the year.

Trading in Foreign Currencies (FX) was unprofitable in 2018 due to losses during the first half of the year, which offset small gains from trading during the second half, as positioning shifted from long FX vs. U.S. Dollar to short FX vs. U.S. Dollar. Trading in the Japanese Yen was unprofitable, as positioning shifted between long and short at inopportune times. For example, late in the year, the Fund was short Japanese Yen vs. U.S. Dollar when the safe-haven Yen rallied sharply, as risk assets sold-off. Trading in the New Zealand Dollar was also significantly unprofitable during the year.

Commodities

Volatility in the commodity markets stemming from geopolitical factors, including the trade war with China, global growth concerns, OPEC production cuts, Fed rate hikes, etc., wreaked havoc in the commodity complex, leading to massive price movement and elevated volatility in a number of commodities. In the fourth quarter, oil prices were the poster child for this volatility, but agricultural and metal commodities, including soybean and copper, were also rocked by the U.S./China trade wars. China is a massive consumer of industrial metals and agricultural commodities, so its demand has a huge influence on these commodity prices given its massive economy.

Commodity trading was profitable during the year, as sizable gains from Energy positions and marginal gains from Precious Metals more than offset losses in Base Metals and Agricultural markets. In Energy, long positions in oil benefitted from rising prices, as represented by West Texas Intermediate crude (WTI), which moved from about $60/barrel at the end of 2017 to $75/barrel by the end of June. This strength in crude was attributable to geopolitical tension in the Middle East and uncertainty regarding the Iran nuclear deal, along with strong demand and OPEC/Russia production cuts. After peaking at nearly $77/barrel in early October 2018, WTI declined to a low near $42/barrel on December 24, 2018. This collapse came following OPEC’s decision to increase production at a June meeting, increased U.S. production, slowing global economic growth, and perhaps President Trump’s lobbying of Saudi Arabia for lower prices pressured crude and oil-derived commodities during the quarter. The Fund’s long positions in October 2018 were hurt by this sharp reversal, but positioning shifted short during November, resulting in profitable trading during the final two months of the year. Overall, the largest gains during the year came from trading in WTI and Brent crude.

Within Commodities, trading in Base Metals generated the largest losses for the Fund, as long positions from February through June were unprofitable as prices moved lower in commodities such as aluminum, copper, and zinc, primarily attributable to the U.S./China trade war. While base metal prices declined further during the second half of the year (with many falling approximately -20% for the year), the Fund’s positions moved short by July 2018, resulting in slightly profitable trading in the second half of the year. The largest losses in Base Metals trading were in aluminum and copper. Positions in Agricultural commodities were slightly unprofitable due to losses occurring during February 2018 and March 2018.

Outlook

2018 was a difficult period for the broader managed futures industry as the environment was characterized by a lack of directionality and trendless conditions in most asset classes. As we look forward to 2019, macro conditions have shifted considerably in comparison with the prior few years, which were marked by historically low volatility. With volatility returning to more historical norms and many equity indices entering bear markets (>20% decline), we believe the need for diversification and low correlating investment strategies like managed futures remains high.

Entering 2019, macro concerns remain abundant, ranging from the Chinese/U.S. trade war, the end game for a Brexit resolution, and the impact of Federal Reserve policy as global economic growth cools. While difficult to predict how these and other major geopolitical issues will be resolved, LoCorr believes we are likely to remain in a higher volatility regime and continue to see market corrections with more frequency than what we’ve experienced in the post-global financial crisis world.

We remain highly confident in the ability of the Fund to provide positive absolute returns and compelling diversification for investors. We believe the multi-manager structure that combines complementary investment strategies will help the Fund navigate markets in a smoother and less volatile fashion. Finally, the Fund has demonstrated an ability to perform in a variety of market environments, including periods of both rising and falling equity prices. This was most recently demonstrated during the September through December 2018 sell-off in equities, as the Fund returned -0.30% versus -19.36% for the S&P 500 Index.

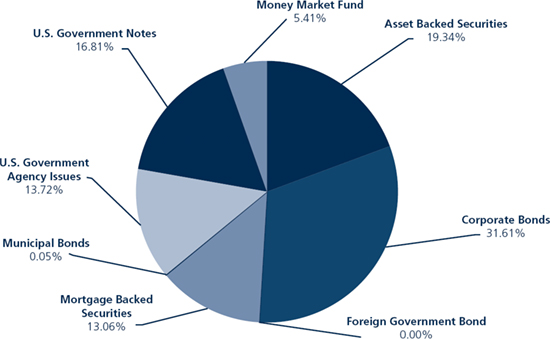

Fixed Income Strategy

The Macro Strategies Fund invests most of its remaining assets in a Fixed Income Strategy comprised of short- to intermediate-term, investment grade corporate and government agency securities. Nuveen Asset Management (Nuveen) is the sub-adviser for this strategy and manages a shorter duration, high quality portfolio.

The fixed income component of the Fund is managed against the Barlcay 1-5 Government/Credit Index. Returns for the fixed income portfolio in 2018 were +1.81% compared to +1.38% for the benchmark. Given that the sub-adviser expected short term rates to be gradually pressured higher as the Fed continued to normalize policy, the fixed income portfolio was focused on generating income, while maintaining a defensive interest rate posture. Accordingly, the portfolio was overweight non-government sectors of the bond market and had duration, or interest rate sensitivity, lower than the benchmark.

The duration of the portfolio was managed between 2.0 and 2.3 years during the period, versus approximately 2.6 years for the benchmark. The team’s decision to position duration defensively over the time period was a positive contributor versus the benchmark, however, curve position was a moderate detractor. Sector-wise, the portfolio was positioned with approximately 35% weighting to investment grade corporate bonds, along with 35-40% aggregate weighting to high-quality, short duration securitized instruments. The portfolio’s corporate bond issuer exposure was well diversified, with modest overweighting to both Financials and Industrials. An overweight to non-government sectors didn’t have a material impact on performance, as wider spreads were offset by security selection relative to the benchmark and the additional income these sectors provided.

U.S. economic growth accelerated during the year, with employment and income gains robust as fiscal stimulus impacted the domestic economy. Although U.S. inflation finally ticked up in the first half of the year, broader inflation risk remained benign. The Federal Reserve raised rates 100 basis points during the year as it continues to normalize monetary policy. Activity outside the U.S. was sluggish, amid global trade tensions and a continued slowdown in China.

Financial markets were volatile during the year as investors focused on growth and trade worries, equity market volatility, and Fed action. Risk assets finished the year down as Equities had a significant fourth quarter sell-off, while credit spreads widened to multi-year highs. The short end of the Treasury yield curve rose on solid economic growth and the Federal Reserve hiking four times, while the long end showed a more subdued increase as inflation remained benign and risk sectors struggled. Given this dynamic, the Treasury Curve is at its flattest point in over a decade.

Nuveen expects U.S. growth to stabilize near trend, with risks from geopolitical and trade developments. The Fed is likely to move rates higher in 2019, but with a policy rate now around neutral and tightening financial conditions, it will be responsive to incoming economic data. Nuveen’s current base case expectation is for more Fed rate hikes in 2019. Given this Fed outlook and expectation for higher rates, the investment team is looking to manage the Funds’ duration defensively versus the benchmark. However, the team also expects to cover the duration underweight over time as the Fed nears a neutral policy rate. Nuveen expects investment grade credit fundamentals to remain solid, and see a positive technical picture as new-issue supply is expected to decrease. In securitized sectors, Nuveen continues to focus the portfolio’s sector exposure on the consumer related asset-backed securities and residential mortgage segments of the securitized sector.

LoCorr Long/Short Commodities Strategy Fund

The LoCorr Long/Short Commodities Strategy Fund (the “Long/Short Commodities Fund” or the “Fund”) provides investors with access to a Commodities Strategy in a mutual fund structure. Historically, investors have primarily accessed exposure to long-only commodities that rely on rising commodity prices to generate positive returns. Of course, commodity prices don’t always appreciate and occasionally experience sharp declines, as was seen most recently in the fourth quarter of 2018 when oil prices collapsed. The Long/Short Commodities Fund has the potential to profit while commodity prices increase or decrease. The Fund’s primary investment objective is capital appreciation in rising and falling commodities markets. The Fund attempts to achieve its investment objective by investing in two primary strategies - a Commodities Strategy and a Fixed Income Strategy.

The Fund accesses, via a total return swap agreement, the returns of Millburn’s Commodity Program (MILCOM), which began trading in 2005 and the returns of J E Moody & Company Commodity Relative Value Program (JEM CRV), which began trading in 2006. MILCOM employs a systematic trading strategy that takes outright long/short positions and relative value spread positions across 40+ commodity futures markets. JEM CRV employs a market neutral, systematic trading strategy that invests in relative value calendar spread positions across 20+ commodity markets.

During 2018, the Fund’s Class I shares gained +15.40%, well ahead of the -13.82% decline for the S&P GSCI Index and the +1.87% return for the ICE BofAML Treasury Bill Index. The Fund also protected capital relative to the S&P 500 Index which fell -4.38% during the year. During the equity market correction from 9/21/18 - 12/24/18, the Fund’s compelling diversification attributes were in full force, as it gained +4.39% versus the -19.36% decline for the S&P 500 Index. Both underlying commodity programs, JEM CRV and MILCOM, generated positive absolute returns during 2018. The largest gains for the year stemmed from Energy trading with smaller positive contributions from trading in Livestock and Grain markets. Trading in Metal markets was unprofitable during the year. Both directional long/short and relative value positions were significant contributors to the Fund’s double-digit gains.

Volatility in the commodity markets stemming from geopolitical factors including the trade war with China, global growth concerns, OPEC production cuts, Fed rate hikes, etc. wreaked havoc in the commodity complex, leading to sizable price movement and elevated volatility in a number of commodities over the course of the year. Oil prices were the poster child for this volatility during the fourth quarter, but agricultural and metal commodities, including soybean and copper, were rocked by the U.S./China trade wars. This type of volatility, in LoCorr’s view, provided robust opportunities for the Fund.

Commodities Strategy

Energy

Energy trading was highly profitable during 2018, accounting for the bulk of the Fund’s gains, with significant contributions from both

directional long/short positions as well as from relative value trading. Over the course of the year, directional positions in Brent crude oil and West Texas Intermediate crude (WTI) were highly profitable, while the Fund had small losses from trading in heating oil. In directional trading, positioning was long through early July 2018 as the Fund benefitted from rising oil prices, as represented by WTI, which moved from about $61/barrel at the end of 2017 to $74/barrel by the end of June. This strength in crude was attributable to geopolitical tension in the Middle East and uncertainty regarding the Iran nuclear deal, along with strong demand and OPEC/Russia production cuts.

The Fund’s positioning was long in October 2018 when oil prices collapsed. After peaking in early October, WTI declined to about $65/barrel by the end of the month and to a low just near $42/barrel on December 24, 2018. This collapse came following OPEC’s decision to increase production at a June meeting, while increased U.S. production, slowing global economic growth, and perhaps President Trump’s lobbying of Saudi Arabia for lower prices, pressured crude and oil-derived commodities during the quarter. While the Fund experienced losses from directional Energy trading in October, these were more than offset by gains from short positions in November and December, as positioning adjusted and benefitted from the plunging oil prices.

Relative value trading was profitable each quarter in 2018, as the managers were able to benefit from volatility and shifts along the forward curve. Calendar spread positions in Reformulated Blendstock for Oxygenate Blending gasoline was particularly profitable during the year.

Metals

Trading in Metals was unprofitable in 2018, attributable to losses from directional trading while relative value was not a significant driver. Generally, base metal prices fell in 2018, led by substantial declines in copper and zinc, which were weighed down by higher interest rates, a stronger dollar, and the trade war with China, given that country’s global prominence as a consumer of these commodities. Directional trading in London Nickel was the largest positive contributor, as short positions benefitted from price declines late in the year. This was offset by losses from positions in London Copper and London Aluminum HG. During the fourth quarter, short positions in gold and silver were hurt as prices rallied during the flight-to-safety trade as the U.S. dollar and stock market retreated.

Softs

Trading in softs was slightly profitable in 2018, led by modest gains from relative value positions which were largely offset by small losses in directional trading. Profitable short positions in coffee and sugar were the largest positive contributors from directional trading, while losses from cocoa positions were the largest detractor. Plunging coffee prices in the third quarter helped short positions, as the commodity reached its lowest level since 2005 due to record crop and the weak Brazilian Real (largest global coffee producer). Cocoa prices were particularly volatile over the course of the year, as prices soared +35.1% during the first quarter due to supply concerns in the Ivory Coast and Ghana, the largest cocoa producers in the world. Cocoa prices then declined from May through August 2018, hurting long positions, as the production forecast from the Ivory Coast was larger than expected.

Livestock and Grains

Trading in Livestock was the second largest contributor to the Fund’s gains, from a sector perspective, driven by strong gains from relative value positions. Calendar spread positions in cattle and hog were both highly profitable, particularly during the first quarter, with smaller gains over the course of Q2 2018 through Q4 2018. Trading in Grains was profitable during the year, led by gains from directional positions, while contributions from relative value trading was also slightly positive. The largest gains came from short positions in soybean as the trade war with China caused prices to decline. China is a major consumer of U.S. soybean, importing an estimated 60% of U.S. soybean exports. Trading in corn was also profitable as prices declined nearly 10% during the second quarter, benefitting short positions. Relative value calendar spread trading in wheat was also profitable, as the Fund was able to benefit from favorable shifts in the forward curve. Calendar spread positions in soybean were unprofitable.

Outlook

We believe the Fund may be highly attractive to investors seeking solutions that are uncorrelated to most investment strategies and asset classes, or for investors that are seeking alternatives in the commodity market. Commodity markets are characterized by high volatility and subject to sizable drawdowns, as we saw in 2018. This volatility can also create tremendous opportunities. We believe the Fund has the potential to capture these opportunities, as the underlying managers have the ability to take both long and short directional positions (benefit from commodities moving up or down), as well as to trade along the forward curve (relative value calendar spread trading). Finally, the Fund’s multi-manager approach has the potential reduce risk for investors, as the underlying managers tend to perform at different times, which may help reduce volatility and limit drawdowns.

Fixed Income Strategy

The Managed Futures Fund invests most of its remaining assets in a Fixed Income Strategy comprised of short- to intermediate-term investment grade corporate and government agency securities. Nuveen Asset Management (Nuveen) is the sub-adviser for this strategy and manages a shorter duration, high quality portfolio.

The fixed income component of the LoCorr Long/Short Commodity (LCSIX) portfolio is managed against the Barclay 1-5 Year Government/ Credit Index. Returns for the fixed income portion of the Fund were +1.77%, compared to +1.38% for the benchmark during 2018. The duration of the fixed income component of the Fund was managed between 2.0 and 2.3 years during the period, compared to about 2.6 years for the benchmark. The sub-adviser’s decision to position duration defensively over the period accounted for the outperformance versus the benchmark, while curve positioning was a detractor. The Fund held approximately 35% exposure to investment grade corporate bonds and about 35-40% aggregate weighting to high quality, short duration securitized instruments. The Fund’s corporate bond issuer exposure was well diversified, with a modest overweight in both Financials and Industrials. The overweight to non-government sectors didn’t have a material impact on performance, as wider spreads were offset by security selection relative to the benchmark and the additional income these sectors provided.

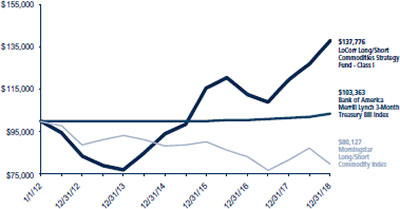

LoCorr Market Trend Fund

The LoCorr Market Trend Fund (the “Market Trend Fund” or the “Fund”) was created to provide investors with access to a trend-following futures strategy, managed by one of the leading managers in this space—Graham Capital Management. Graham was founded in 1994 and manages approximately $13.1 billion in assets. The Market Trend Strategy is managed similarly to Graham’s Tactical Trend program, a systematic medium- to long-term trend following strategy that commenced trading in 2006. The Fund seeks capital appreciation as its primary investment objective, with managing volatility as a secondary objective. The Fund attempts to achieve its objective by investing in two main strategies – a Market Trend Strategy and a Fixed Income Strategy.

In 2018, the environment for trend following strategies was challenging, as evidenced by the -8.10% decline for the SG Trend Index. Markets in most asset classes and sectors experienced frequent reversals during 2018, conditions that historically have challenged trend following strategies, which typically perform better when there is more persistent directional movement in markets. Geopolitical influences such as the U.S./China trade war, Brexit, and Federal Reserve interest rate hikes created considerable volatility over the course of the year. Despite the strength in the U.S. Dollar, for example, individual markets, including the Euro and Japanese Yen, experienced sizable reversals. Within Equities, the powerful up-trend that had been firmly entrenched stopped on a dime in late January, then began moving higher until late September, before selling-off sharply through year end. Many individual equity indices entered “official” bear market territory, marked by a decline of greater than 20%. Commodities were heavily influenced by the trade war with China, while Fixed Income reversals were frequent throughout the year. In aggregate, there were few gradual and persistent directional moves during the course of the year that did not experience painful reversals.

The Fund’s Class I shares fell -13.44% during the annual period ended December 31, 2018, trailing the +1.87% return for the ICE BofAML Treasury Bill Index and the -8.10% return for the SG Trend Index. The Fund was approximately flat (-0.27%) from a performance perspective year-to-date through October 3, but experienced sizable losses in the fourth quarter. Despite the negative returns in 2018, the Fund exhibited some of its diversification attributes during the last few months of the year. From the close on September 21 through December 24, the Fund outperformed the S&P 500 by approximately 12% as equity markets collapsed.

Market Trend Strategy

Equity Indices

The environment in 2018 shifted dramatically, as volatility surged, and the longest bull run in history that began in 2009 following the end of the great financial crisis came to an abrupt end. To illustrate the extent of the volatility experienced in the equity markets, the S&P 500 had a daily change in excess of 1% sixty-four times in 2018 versus eight times in 2017. Intra-day, the S&P 500 Index peaked on September 21 and entered bear market territory (decline of at least -20%) by the close of trading on December 24. Other equity markets experienced even larger drawdowns, such as the Russell 2000 Index, a proxy for U.S. small cap stocks, which declined -26.07% from September 21 through December 24. Further, the violent and sustained downward move in equities occurring during the final months of the year were the second major bout of sharp declines seen during 2018. In late January/early February, risk assets, including equities and oil, corrected sharply as volatility rocketed higher, though that sell-off was relatively short-lived. Certainly, the equity market environment was far different in 2018 than it had been in recent memory.

Trading for the Fund in Equities was unprofitable over the course of 2018. Entering the fourth quarter the Fund had gains in Equity trading, but those gains were more than offset by losses during the final quarter. The Fund entered the year with sizable long positions that shifted short as equity markets corrected in late January/early February. As markets reversed course again, positioning shifted, and were long when the equity markets imploded. While positioning shifted short during the fourth quarter, the Fund experienced losses before exposure adjusted. Losses were largest in U.S. markets, as long positions in the fourth quarter were hurt during the equity market correction. Trading in Asian markets was also unprofitable. European trading was marginally unprofitable, despite solid gains from short positions during the fourth quarter.

Fixed Income

Yields in the U.S. continued their climb early in the year as economic growth remained robust, expectations for inflation moved higher, and the Fed signaled its intent to continue on the path of hiking interest rates. U.S. rates were range-bound and trendless, moving higher and lower within that range. This dynamic shifted in September, as rates pushed higher leading up to the Fed’s third hike of the year at the FOMC meeting on the 26. The U.S. 10-year yield reached 3.23% in November, before plummeting due to a rapid shift in sentiment as concerns regarding slowing economic growth and the potential for a Fed- and trade war-induced recession surfaced, as well as the flight-to-safety caused by the sell-off in equities. The rally in Treasuries pushed the U.S. 10-year yield to 2.69% by the end of the year. The Treasury Curve also reached its flattest level in over a decade.

Activity outside the U.S. was sluggish, amid global trade tensions and a continued slowdown in China. Yields outside the U.S. also wavered over the course of the year. The German 10-year Bund yield fell, with the period marked by sizable reversals. The Japanese 10-Year Government Bonds (10-Year JGB) moved higher beginning in July, before peaking in October and reaching its lowest levels of the year during December, due to geopolitical fears and the general flight-to-safety environment.

Fixed Income trading was unprofitable, generating the largest losses for the Fund. These losses were primarily attributable to the intermediate and long end of the curve, while trading in short-term fixed income markets was only marginally unprofitable. The bulk of the performance difficulties came in the fourth quarter, as short positions (benefit from rising rates) in U.S. markets were hurt by falling interest rates caused by the aforementioned issues. Trading in European fixed income markets was also unprofitable, particularly early in the year, as yields on European instruments surged higher until mid-February before reversing course sharply, conditions that proved difficult for the sub-adviser’s trend-following models.

Foreign Currencies

After peaking in December 2016, the U.S. Dollar Currency Index (DXY), a proxy for the U.S. Dollar versus a basket of major currencies, generally trended lower (U.S. Dollar weakening) as economic growth in the Euro zone and Asia strengthened and prospects for interest rate hikes looked to be on the horizon. These trends reversed towards the end of the first quarter in 2018, with the U.S. Dollar strengthening as foreign economic data started to soften. European currency markets were also impacted by a brief Italian political crisis created by a hung parliament, though a coalition was eventually formed, resulting in fears of an Italian exit from the European Union as well as concerns regarding Italy’s excessive debt. The BOE (Bank of England) also backed away from an expected rate hike, while the Fed continued on its more hawkish path, which also contributed to the reversal in the currency markets. During the second half of the year, DXY was generally trendless and characterized by frequent small reversals, conditions that proved challenging for trend-following strategies. The inability of the British government to reach a consensus on the specifics of its extraction from the EU (Brexit) further contributed to volatility in the currency market during 2018, particularly for the British Pound and Euro. After weakening against the Japanese Yen (Yen) in the first quarter, the U.S. Dollar reversed, strengthening against the Yen until late in the year when the Yen recovered sharply on the flight-to-safety trade. Overall, the DXY increased approximately 4.4% during the year.

Trading in Foreign Currencies was unprofitable in 2018, as losses during the second quarter more than offset gains from the rest of the year. Short positions in the Canadian and Australian Dollar were the largest positive contributors, benefitting from the strength of the U.S. Dollar versus those currencies. These gains were more than offset, however, by losses from trading in the Yen and New Zealand Dollar. The sizable reversals in the Yen, for example, created particularly difficult trading conditions as positioning fluctuated over the course of the year.

Commodities

Volatility in the commodity markets, stemming from geopolitical factors including the trade war with China, global growth concerns, OPEC production cuts, Fed rate hikes, etc. wreaked havoc in the commodity complex, leading to massive price movement and elevated volatility in a number of commodities. In the fourth quarter, oil prices were quite volatile but agricultural and metal commodities, including soybean and copper, were also rocked by the U.S./China trade wars. China is a massive consumer of industrial metals and agricultural commodities, so its demand has a huge influence on these commodity prices given its massive economy.

Commodity positions were unprofitable in 2018 as gains from trading in Energy were offset by losses in Metal and Agricultural sectors. In Energy, long positions in oil during the first three quarters of the year benefitted from rising prices, as represented by West Texas Intermediate crude (WTI), which moved from about $60/barrel at the end of 2017 to $75/barrel by the end of June. This strength in crude was attributable to geopolitical tension in the Middle East and uncertainty regarding the Iran nuclear deal, along with strong demand and OPEC/Russia production cuts. After peaking at nearly $77/barrel in early October, WTI declined to a low near $42/barrel on December 24. This collapse came following OPEC’s decision to increase production at a June meeting, increased U.S. production, slowing global economic growth, and perhaps President Trump’s lobbying of Saudi Arabia for lower prices pressured crude and oil-derived commodities during the quarter. The Fund’s long positions in October were hurt by this sharp reversal, but overall for the year Energy trading remained profitable

Long positions in Base Metals during the first half of the year were unprofitable as prices moved lower in commodities such as aluminum, copper, and zinc, primarily attributable to the U.S./China trade war. While base metal prices declined further during the second half of the year (with many falling approximately -20% for the year), the Fund’s positions had moved short, resulting in profitable trading in the fourth quarter, albeit not enough to offset the aforementioned losses. Positions in Agricultural commodities were unprofitable, led by losses in trading Grains, while trading in Softs was marginally profitable.

Outlook

Similar to the last few years, 2018 was a difficult period for trend following as the environment was characterized by a lack of directionality

and trendless conditions in most asset classes. Where there had been some stronger directional moves like Equities, Energy, and Fixed income, these directional moves were followed by sharp reversals that have been difficult for trend followers to navigate. For example, interest rates had generally moved higher since mid-2016, as the Federal Reserve hiked and strong economic growth. This trend reversed sharply in November as the Fed adopted a more neutral stance and the outlook for economic growth quickly changed. Oil (WTI) experienced a similar rising trend that began in early 2016, also experiencing a dramatic reversal as WTI collapsed approximately 40% following its early October high.

Despite being out-of-favor over recent time periods, trend following has been a highly successful long-term approach. As we enter 2019, the macro environment looks considerably different than the beginning of 2018, as investors grapple with global growth concerns, tighter monetary policy, and heightened volatility across financial markets. We are hopeful that the difficult conditions plaguing trend following will abate, as geopolitical tensions, including the trade wars and Brexit, and the impact of Federal Reserve policy as it reaches a neutral stance, are resolved and diminish. We remain highly confident that the Fund will benefit from a favorable environment for trend following. We also remain confident in Graham Capital, who has a long and successful history in trend following.

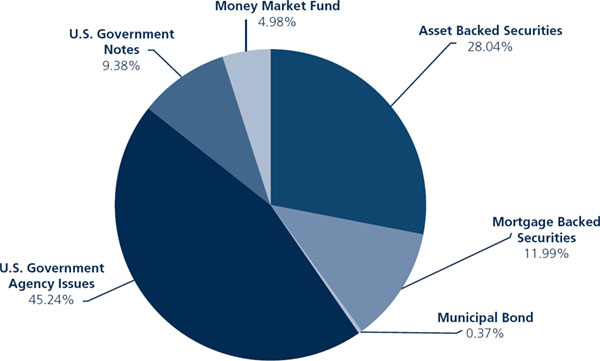

Fixed Income Strategy

The Fund invests most of its remaining assets in a high quality, short-duration fixed income portfolio comprised of primarily government securities and very highly rated corporate fixed income securities. Nuveen Asset Management (Nuveen) is the sub-adviser for this strategy.

The fixed income portion of LoCorr Market Trend is conservatively managed as a short duration portfolio of the highest credit quality. It is benchmarked against the Barclay 1-3 Year Government Index, and focuses primarily on U.S. Treasuries and U.S. Government securities, but may own up to 30% in aggregate in corporate, municipal, and asset-backed securities of the highest credit quality. Returns for the fixed income portion of the Fund were +1.80%, compared to +1.58% for the benchmark during 2018. Nuveen’s defensive interest-rate strategy accounted for a portion of the outperformance relative to the Index, as the sub-adviser had positioned the duration of the portfolio short to the benchmark by between .30 and .40 years. Curve positioning was a slight detractor to performance. The portfolio generally owned about 27-29% in non-government securities during the time frame. This was a slight detractor to performance, as these securities underperformed government securities over the time period. The portfolio also held about 8-10% of U.S. Agency multifamily mortgage-backed securities (MBS); these securities underperformed similar-duration government securities and were a detractor to performance. As of December 31, 2018, portfolio duration was 1.50 years compared to 1.85 years for the benchmark, and about 71% of the portfolio was in U.S. government debt with the remainder in AAA rated non-government securities.

LoCorr Dynamic Equity Fund

The LoCorr Dynamic Equity Fund (the “Fund”) seeks long-term capital appreciation with reduced volatility, compared to traditional broad-based equity market indices, as a secondary objective. Consistent with the “low correlation” our LoCorr Fund family seeks, long/short equity funds have the ability to provide positive returns when equity markets are rising, yet they offer the potential for “downside protection” when equity prices are falling.

The Fund employs three sub-advisers—Billings Capital Management (Billings), Kettle Hill Capital Management (Kettle Hill), and First Quadrant. Billings’ strategy is based on a value-oriented, concentrated, fundamental, bottom-up long/short equity approach. This manager seeks to maximize absolute returns, exceeding the S&P 500 index over the long term. The sub-portfolio managed by Billings is similar to a strategy that this manager has executed since 2008 with their current firm, and for many years prior to that at a different entity. Kettle Hill seeks to earn superior returns over an investment cycle, while focusing on capital preservation and downside volatility. The manager’s investment process combines bottom-up, fundamental analysis with a top-down, opportunistic overlay. Investing primarily in small cap securities, Kettle Hill targets a conservative net exposure to the market. The sub-portfolio managed by Kettle Hill is similar to a strategy that this manager has executed since its inception in 2003. First Quadrant was added to the portfolio in January 2019, and seeks to capture opportunity through a fundamentally-based, quantitative investment process with a dynamic and tactical approach to risk management. The sub-portfolio managed by First Quadrant is similar to a global long/short strategy the manager has executed since 2016, which invests in developed international and U.S. markets utilizing a systematic multi-factor approach, coupled with a target active beta management approach to maximize upside opportunities while reducing downside performance.

Market Commentary

The S&P 500 TR Index limped to the finish line, finishing an ugly year down -4.38% for 2018. This marked its first negative calendar year since 2008. Prominent themes for 2018 included tariffs and trade wars news, higher interest rate and Fed rate hikes, along with an unpredictable U.S. and global political climate. All of these factors contributed to an elevated level of volatility characterized by periodic spikes during the year.

While 2018 started out strong, in late January/early February inflation concerns, a hawkish Fed, and a spike in bond yields contributed to a massive market selloff and a dramatic rise in volatility. This negative market sentiment did not persist, however, as investors poured back into the markets after a strong jobs reports in March caused some relief after the February selloff. Following the market collapse that saw the S&P 500 fall -19.36% from September 21 to December 24, the Fed took a more dovish tone with respect to interest rates, causing the equity markets to rally during the final days of the year and into January 2019.

Portfolio Update

The Fund (LEQIX class I shares) struggled along with the broader equity markets, closing 2018 in the red, down -12.55%. The Fund underperformed both the Morningstar Long/Short Equity Fund Category, which was down -6.61%, and the S&P 500 TR, which was down -4.38%.

As market sentiment oscillated throughout 2018, albeit finishing in the red, the Fund’s market capitalization bias and stylistic approach both proved to be problematic in 2018. In more detail, the Fund’s small-to-mid capitalization market bias and stylistic value approach created headwinds as large cap stocks (Russell 1000 Index down -4.78%) outperformed small cap stocks (Russell 2000 Index down -11.01%). Headwinds from the Fund’s value bias were evidenced by the outperformance of growth (Russell 1000 Growth Index down -1.51%) versus value stocks (Russell 1000 Value Index down -8.27%). The Fund’s net exposure shifted throughout the year, but closed 2018 on the high end of its typical 40-60% range, at 62% net exposure.

The Fund’s long book was a detractor in 2018 as it struggled alongside the decline in the equity markets, but did see positive returns from the Financial Services, Healthcare, and Technology sectors. Within the Financial Services sector, Credit Acceptance Corp., a specialized auto financing company, benefited from better-than-estimated earnings along with strong loan growth, which was viewed favorably by investors. In the Healthcare sector, Syneos Health, a global contract research and outsourced commercialization organization that provides services to pharmaceutical and biotechnology firms, contributed positively to the Fund’s long book. Growth from its commercial solutions segment boosted revenues, along with an improving regulatory environment, helping the overall sector. In the Technology sector, Match Group, a provider of online dating services, was also a contributor to the Fund. The company has steadily created and acquired online dating products, as well as grown its advertising revenues, which has improved the Street’s sentiment towards the stock. A position in Advance Auto Parts, a supplier and distributor of automotive products, also proved to be beneficial to the Fund’s long book. The stock moved higher due to delivering better-than-expected earnings, as well as being a beneficiary of lower tax rates. Offsetting these gains were larger losses in the Communication Services sector and Consumer Cyclical sector. Within the Communication Services sector a concentrated position in Gogo, a U.S.-based in-flight connectivity systems and service provider, was the Fund’s largest detractor. The stock was hurt by ongoing operational execution issues, increasing costs with developing its air-to-ground network, and a shakeup in management, which all negatively impacted the stock. The position was exited in August as the stock had become too speculative and volatile in the sub-adviser’s opinion. In the Consumer Cyclical sector, positions in REV Group and Lear were also detractors, as both stocks were beaten up due to ongoing global trade tariff threats crippling their stock prices, and triggering negative sentiment from the Street. The Fund also had losses in the Industrials, Basic Materials, Consumer Defensive, and Utilities sectors.

Despite the significant market selloff towards the end of Q4 2018, the Fund’s short book finished slightly in the red and was a detractor to absolute returns. Short positions within the Financials Services and Consumer Defensive sectors were positive contributors, as both sectors came under downward pressure in 2018, though not enough to offset losses from the Consumer Cyclical sector. A position in an owner/ operator of retail beauty franchises, whose stock price moved higher as the company steadily beat earnings estimates, negatively impacted the Fund’s short position. The Fund’s short book also saw nominal losses from the Utilities, Real Estate, and Healthcare sectors.

Outlook

Given the 2018 market conditions, the Fund’s stylistic small-to-mid cap and value biases created headwinds. LoCorr remains confident in the outlook for this Fund, and believes the addition of First Quadrant will enhance the portfolio, can positively impact future risk-adjusted returns, and has been highly complementary to Billings and Kettle Hill.

Looking forward, we remain cautiously optimistic and expect volatile equity markets to continue in 2019. After the fourth quarter selloff, valuations have improved courtesy of the market’s correction, yet we do not believe that markets are necessarily “out of the woods”. On a positive note, the Fed has indicated a slowing of their recent tightening posture, trade war talks have dampened, and if temporary policy scares die down, positive sentiment could boost consumer and corporate spending in 2019. Conversely, if corporate earnings under-deliver, geopolitics and trade war discussions flare up, and the Fed makes unexpected moves, it could trigger volatility and sharp market moves causing negative sentiment. Knowing this to be true, we remain confident in the Fund’s multi-manager investment approach as sub-advisers seek to take advantage of the volatility and opportunity set in 2019.

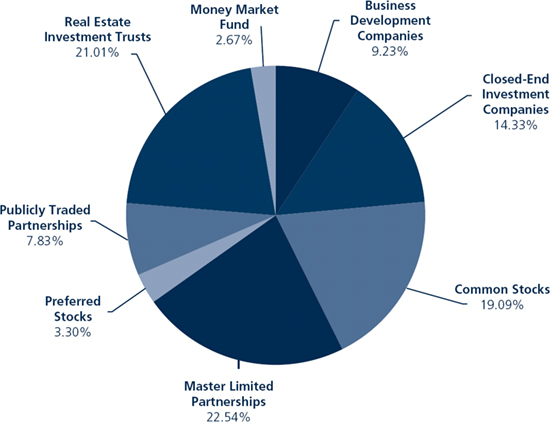

LoCorr Spectrum Income Fund

The LoCorr Spectrum Income Fund (the “Spectrum Income Fund” or the “Fund”) has an objective of current income with capital appreciation as a secondary objective. The Fund is designed to fit within the “low correlation” of the LoCorr Fund family by seeking to provide relatively high levels of income with low correlation to the bond market. The Fund’s sub-adviser is Trust and Fiduciary Income Partners (TFIP). TFIP invests in pass-through securities to seek high current income, much of which the Fund distributes monthly to investors.

The Fund’s Class I shares fell -7.91% during the annual period ending December 31, 2018 compared with the +0.01% return for the Barclay U.S. Aggregate Bond Index. Through the first nine months of the year, the Fund was up +8.37% versus the -1.60% decline for the Barclay U.S. Aggregate Bond Index, seemingly on its way to a solid year. In the manager’s view, the Fund’s challenging performance in the fourth quarter (which was enough to drag returns into negative territory for the year) is attributable primarily to the fact that portfolio positions are small- to mid-cap equities from a trading point of view. There were no significant issues in operating results for the Fund’s holdings. Indeed, many did quite well fundamentally, as they are not highly dependent upon strong economic growth.

Market Commentary

Capital markets in 2018 were characterized by the return of volatility, as U.S. equity markets posted their worst return since 2008. Despite moderate volatility early in the year, markets generally rose steadily to new all-time highs at the end of the third quarter, when the environment abruptly changed from one of coordinated global growth to one of fears of a growth slowdown or even a recession. Known factors, which had been in play well before the fourth quarter sell-off, such as trade tensions and retaliatory tariffs between the U.S. and China, were joined by a Federal Reserve stance seemingly unaware of the magnitude of economic slowdown. This led to a quarter-long decline, culminating in late December, that saw the S&P 500 decline by -19.36% from September 21 to December 24. The steepest declines were felt in Energy, Cyclicals, and smaller capitalization stocks, while defensive sectors generally outperformed.

Portfolio Update

For the year, the Fund’s best performing sectors included Business Development Companies (BDCs), Master Limited Partnerships (MLPs), and Mortgage Real Estate Investment Trusts (Mortgage REITs). During 2018, BDCs initially benefitted from low levels of corporate default and a strong economy, as well as a law enacted in the second quarter allowing these companies to increase leverage from 1:1 to 2:1. MLPs, as measured by the Alerian Index, fell nearly -12.5% in 2018, with the worst price action occurring in the fourth quarter as crude oil prices fell nearly -40%. The Fund’s Equity REIT holdings struggled during the year, particularly during the fourth quarter, as the concern that the Fed would allow rates to rise above equilibrium hurt sentiment for the group. Holdings in the Fund’s more cyclical or energy-sensitive common stocks struggled during 2018, caught up in concerns regarding slowing economic growth and the collapse in oil prices. Finally, Publicly Traded Partnerships (PTPs) detracted from results as market conditions soured.

The first quarter of 2018 initially saw the continuation of late 2017 tax reform stimulus, until signs of inflation and growth expectations drove yields sharply higher and the market sold-off violently in late January/early February. The Fund experienced losses during the quarter, but benefitted from a position in DineEquity, whose execution of its turnaround strategy was proceeding well, and general strength in the fast-casual dining sector. Icahn Enterprises rose on the back of strong first quarter earnings which drove a distribution increase. Macy’s also gained, driven by positive results by the continued execution in its turnaround plan, and supported by strengthening consumer demand. The Fund’s more defensive Closed End Fund (CEF) holdings also held up better during the market turmoil. MLPs were hit hard as investors combed through the fine print of the Tax Reform Bill, though the sub-adviser’s view is that individual MLP unit holder’s tax burden became significantly less onerous. Nevertheless, the Fund’s MLP holdings hurt returns, particularly in mid-stream positions, including Summit Midstream Partners LP, which reported weaker-than-expected earnings despite maintaining a healthy distribution. Other notable detractors included Macquarie Infrastructure Corp., which cut its distribution causing the TFIP team to reduce the position size. The most significant portfolio addition during the first quarter was to a group of data center Real Estate Investment Trusts (REITs) which had sold-off due to the two-fold impact of negative rate-driven REIT sentiment and technology sector volatility, driven by user data-privacy concerns.

In the second quarter, the Fund experienced sizable gains. Cross-currents abounded, with tailwinds coming from strong earnings growth and tighter labor markets, while headwinds came from brewing trade wars, a hawkish U.S. Federal Reserve, rising interest rates and a strengthening U.S. Dollar. OPEC agreed to boost production at their June meeting, and oil rallied as the increase was generally less than feared. MLP holdings were the strongest contributors during the second quarter, most notably mid-stream positions. Crestwood Equity Partners LP was a significant contributor, moving higher due to strength in its midstream operations, as well as having a clean structure and growing distribution coverage. Icahn Enterprise, a non-Energy MLP, also rose sharply, buoyed by favorable market conditions for its portfolio holdings. BDC holdings performed well on small business optimism and the favorable interest rate environment for the type of loans these companies originate. The Fund also benefitted from strong performance by its Equity REIT positions, including Washington Prime Group, a retail REIT, and a number of data center REIT holdings. Thematically, the most significant portfolio shifts occurred as the sub-adviser increased exposure to consumer spending and energy-related names, while reducing exposure to holdings that benefit from a weaker dollar, credit sensitivity and a steepening Yield Curve.

In the third quarter, the Fund performed well as the U.S. economy continued its strong growth, prompting the Fed to maintain its upward path with respect to interest rates. MLPs, as measured by the Alerian Index, rallied in the quarter, providing a nice tailwind for the Fund. Crestwood Equity Partners was a notable mid-stream MLP performer, moving higher as it continued to execute on their growth initiatives, while maintaining financial discipline. Energy Transfer Partners, another mid-stream position, rallied on the announcement that the firm was conducting a simplification transaction, eliminating incentive distribution rights (IDRs) and emerging with a cleaner structure. PTP positions were also strong as asset managers rallied on the favorable market backdrop. Detractors from performance included: L Brands, which suffered from weakness in some core product lines; Seagate Technology, which sold-off on NAND pricing deterioration; and Washington Prime, a mall REIT which tends to react unfavorably to sharp moves higher in rates. TFIP added to the Fund’s exposure to gold, as the underlying commodity rallied off of technical support, and the underlying economic environment may create conditions that are conducive to higher prices. The team reduced exposure to data center REITs early in the quarter after a significant run up in price, avoiding a correction as rates rose. Finally, TFIP added several mid-stream energy positions that generate strong cash flows, which support high levels of distribution coverage.

In the fourth quarter of 2018, most equity-related markets experienced a dramatic decline, culminating in a meltdown in late December. The decline began following a speech by Fed Chair Jerome Powell in early October, when he expressed an ebullient tone regarding U.S. economic strength, and implicitly reaffirmed the Fed’s prior guidance that three rate hikes would be required in 2019, apparently ignoring the fact that prior monetary tightening acts with a lag and was nonetheless producing a slowdown. The Fund struggled during this quarter, as negative returns were more than enough to offset gains from the first nine months of the year. MLP positions were hit hard, falling in sympathy with the approximately -40% drop in WTI crude. The Fund’s mid-stream MLP holdings, in particular, experienced significant declines. Dominion Energy Midstream Partners was an exception, gaining slightly, but significant losers included Crestwood Equity Partners, Summit Midstream Partners, and EnLink Midstream Partners, which got caught up in the oil price volatility. In REITs, detractors included Washington Prime, a retail REIT, which suffered from headlines concerning store closures such as Sears. The Fund was also hurt by some if its PTP asset manager positions, along with more cyclical and energy-sensitive C-Corp positions. BDC positions were also weak as concerns regarding the leverage loan market surfaced during the market collapse. More defensive Closed End Funds held up relatively well during the market onslaught. The Fund was also buoyed by Mortgage REIT holdings including Chimera Investment Corp, which was sold before year-end, and New York Mortgage Trust Inc. The most significant thematic portfolio shift in the quarter was to move away from economically sensitive issues such as BDCs tied to leveraged loans, and into more defensive sectors that were trading at wide discounts to what we consider fair value, such as municipal and utility CEFs.

Outlook

Subsequent to the December 24 sharp sell-off, Fed Chair Powell and other members of the Fed leadership have frequently spoken in public and appeared to “walk back” the public perception of their stance following the December meeting. Major talking points in these presentations have included acknowledging weakness in the economy; emphasizing their flexibility in responding to actual incoming data; noting that they emphasize communications with business leaders and financial markets regarding current economic conditions; and communicating that they are aware of limited actual current inflation and that they have no desire to cause a recession. Additionally, the recent release of the minutes from the December meeting had a notably more “dovish” tone than the prior press conference. In addition to the apparent adjustment in the Fed stance, Saudi Arabia and OPEC announced cuts in output, which may have been sufficient to place a bottom on oil prices for the coming year.

Although the Fund suffered in the fourth quarter, which offset solid gains during the first nine months, the investment team continues to see improving fundamentals with growing distributable cash flow, simplified organizational structures, and improving fundamentals. TFIP is concerned about negative conditions in the corporate credit market, which emerged in the fourth quarter; however, they have been reducing affected holdings and placing more emphasis on municipal and mortgage issuers, to avoid risk in this area as the economy slows. Absent an actual recession, however, TFIP believes the Fund is well positioned for a positive result in the coming year and will adjust positions as necessary, as economic and market conditions evolve.

Thank you for investing in the LoCorr Funds

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Barclays 1-5 Year Government Credit Index-The Barclays U.S. Government/Credit 1-5 Year Index is an index of all investment grade bonds with maturities of more than one year and less than 5 years. Barclays 1-3 Year Government Bond Index-The Barclays U.S. 1-3 Year Government/Credit Bond Index is a part of the Barclays U.S. Government/Credit Bond Index. It includes Treasury and agency securities (U.S. Government Bond Index) and publicly issued U.S. corporate and foreign debentures and secured notes (U.S. Credit Bond Index). The bonds in the index are investment-grade with a maturity between one and three years. Nikkei is Japan’s Nikkei 225 Stock Average, commonly used to measure a price-weighted index comprised of Japan’s top 225 blue-chip companies on the Tokyo Stock Exchange. Tokyo Stock Exchange is the largest stock exchange in Japan. The exchange has more than 2,200 listed companies, making it the third-largest in the world by this measure. Morningstar Global Long/Short Equity Index uses historical fund data dating back to the fund’s inception. Funds that have been liquidated or merged are included in analysis. The inception of the index is determined by the date at which the benchmark obtains five or more constituents, without falling below two constituents going forward. It includes funds with exposure to long and short positions in global equities or derivatives and is equally weighted. One cannot invest directly in an index.

Alerian MLP Index is a market-cap weighted, float-adjusted index created to provide a comprehensive benchmark for investors to track the performance of the energy MLP sector.

Alpha is an annualized return measure of how much better or worse a fund’s performance is relative to an index of funds in the same category, after allowing for differences in risk.

Basis Points (bps) - A unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security.

Beta - measures the sensitivity of a stock’s return relative to the return of a selected market index. When beta is greater than one, it means a stock will rise or fall more than the market.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based bond index comprised of government, corporate, mortgage and asset-back issues rated investment grade or higher.

Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

ICE BofA Merrill Lynch 3-Month T-Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

Investment Grade refers to bonds that are rated BBB or higher. Bond ratings are grades given to bonds that indicate their credit quality as determined by private

independent rating services such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade.

Russell 1000 Growth Index refers to a composite that includes large and mid-cap companies located in the United States that also exhibit a growth probability. The Russell 1000 Growth is published and maintained by FTSE Russell.

Russell 1000 Index is a stock market index that represents the highest-ranking 1,000 stocks in the Russell 3000 Index, which represents about 90% of the total market capitalization of that index.

Russell 1000 Value Index refers to a composite of large and mid-cap companies located in the United States that also exhibit a value probability. The Russell 1000 Value is published and maintained by FTSE Russell.

Russell 2000 Index measures the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

S&P GSCI Commodity Index is a total return index currently comprised of 24 basic commodities. The performance statistics presented for the index do not reflect any trading or administrative costs of investing in the index.

SG CTA Trend Sub-Index is a subset of the SG CTA Index, and follows traders of trend following methodologies. The SG CTA Index is equal weighted, calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. The curve is used to predict changes in economic output and growth.

Must be preceded or accompanied by a prospectus.

Opinions expressed are those of the Investment Manager and are subject to change, are not guaranteed and should not be considered investment advice.

Past performance is not a guarantee of future results.

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. LoCorr Macro Strategies Fund, LoCorr Long/Short Commodities Strategy Fund, LoCorr Market Trend Fund and LoCorr Spectrum Income Fund are diversified funds. LoCorr Dynamic Equity Fund is a non-diversified fund, meaning it may invest its assets in fewer individual holdings than a diversified fund. Therefore, those Funds are more exposed to individual stock volatility than a diversified fund. The Funds invest in foreign investments and foreign currencies which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Investing in commodities may subject the Funds to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. The Funds may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in Asset Backed, Mortgage Backed, and Collateralized Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in Real Estate Investment Trusts (REITs) involve additional risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments.

Derivative contracts ordinarily have leverage inherent in their terms which can magnify a Fund’s potential for gains or losses through increased long and short position exposure. A Fund may access derivatives via a swap agreement. A risk of a swap agreement is the risk that the counterparty to the agreement will default on its obligation to pay the Fund.

A Fund will incur a loss as a result of a short position if the price of the short position instrument increases in value between the date of the short position sale and the date on which an offsetting position is purchased.

Investments in small- and medium-capitalization companies involve additional risks such as limited liquidity and greater volatility. Investments in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. ETF investments are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. ETFs are subject to specific risks, depending on the nature of the ETF.

A Fund’s portfolio will be significantly impacted by the performance of the real estate market generally, and a Fund may be exposed to greater risk and experience higher volatility than would a more economically diversified portfolio. Property values may fall due to increasing vacancies or declining rents resulting from economic, legal, cultural, or technological developments. Investments in Limited Partnerships (including master limited partnerships) involve risks different from those of investing in common stock including risks related to limited control and limited rights to vote on matters affecting the Limited Partnership, risks related to potential conflicts of interest between the Limited Partnership and the Limited Partnership’s general partner, cash flow risks, dilution risks and risks related to the general partner’s limited call right. Underlying Funds are subject to management and other expenses, which will be indirectly paid by a Fund.

LoCorr Macro Strategies Fund, LoCorr Long/Short Commodities Strategy Fund, LoCorr Market Trend Fund, LoCorr Dynamic Equity Fund, and LoCorr Spectrum Income Fund are distributed by Quasar Distributors, LLC.

Please see the Schedule of Investments for a complete list of Fund holdings. Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security.

LoCorr Macro Strategies Fund

Rate of Return — For the period ended December 31, 2018 (Unaudited)

| | Inception

Date | 6 Month | 1 Year | 5 Year | Average Annual

Since Inception |

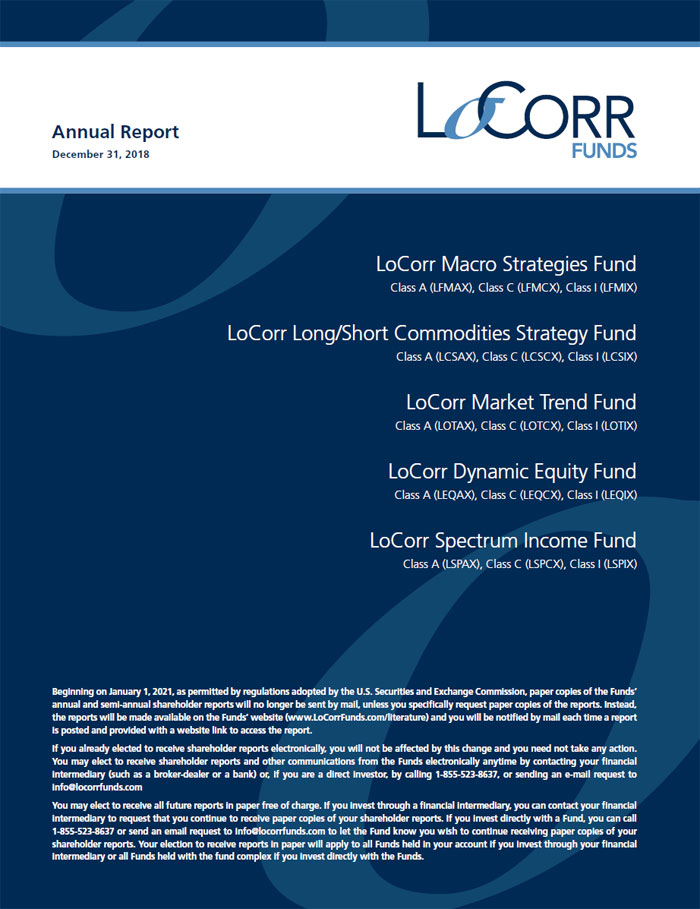

| LoCorr Macro Strategies Fund - Class A (without maximum load) | 3/22/11 | -0.15% | | -5.36% | | 4.28% | 0.28% | |

| LoCorr Macro Strategies Fund - Class A (with maximum load) | 3/22/11 | -5.90% | | -10.83% | | 3.04% | -0.48% | |

| LoCorr Macro Strategies Fund - Class C | 3/24/11 | -1.55% | | -6.91% | | 3.50% | -0.45% | |

| LoCorr Macro Strategies Fund - Class I | 3/24/11 | -0.06% | | -5.08% | | 4.56% | 0.54% | |

| Bank of America Merrill Lynch 3-Month Treasury Bill Index | | 1.06% | | 1.87% | | 0.63% | 0.43% | 1 |

| Barclay CTA Index | | -0.52% | | -2.69% | | 0.55% | -0.52% | 1 |

$100,000 investment in the

LoCorr Macro Strategies Fund – Class I

For the period ended December 31, 2018 (Unaudited)

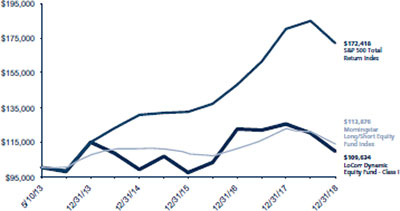

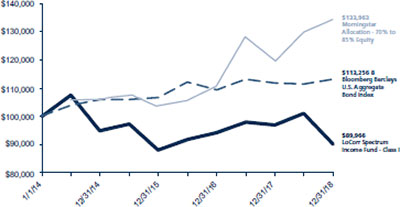

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of distributions, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The returns reflect the actual performance for each period and do not include the impact on trades executed on the last business day of the period that were recorded on the first business day of the next period.

Per the fee table in the Fund’s July 1, 2018 prospectus, the Fund’s annual operating expense ratio is, before fee waivers 2.31%, 3.06% and 2.06% for Class A, Class C and Class I shares, respectively.

The Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

The Barclays CTA Index is a leading industry benchmark of representative performance of commodity trading advisors.

One cannot invest directly in an index.

| 1 | Since inception return as of March 24, 2011. |

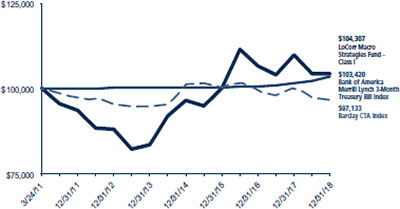

LoCorr Long/Short Commodities Strategy Fund

Rate of Return — For the period ended December 31, 2018 (Unaudited)

| | Inception

Date | 6 Month | 1 Year | 5 Year | Average Annual