UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22542

SSGA ACTIVE ETF TRUST

(Exact name of registrant as specified in charter)

One Lincoln Street, Boston, Massachusetts 02111

(Address of principal executive offices) (zip code)

Christopher A. Madden, Esq.

State Street Bank and Trust Company

One Lincoln Street/CPH0326

Boston, Massachusetts 02111

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Bingham McCutchen LLP

2020 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: (866) 787-2257

Date of fiscal year end: June 30

Date of reporting period: June 30, 2013

Item 1. Reports to Shareholders.

SSgA Active ETF Trust

Annual Report June 30, 2013

Precise in a world that isn’t.SM

TABLE OF CONTENTS

PRESIDENT’S LETTERTO SHAREHOLDERS

Dear Shareholders:

The economy continues to recover. Fueled by unprecedented injections of central bank liquidity and an improving economy, the S&P 500 Index posted a 13.82% gain through the second quarter of 2013 as markets around the globe hit record highs. However, after a May peak of the S&P 500 Index, volatility returned to the market when the Federal Reserve (the “Fed”) announced plans to ease off its quantitative easing policy. The Fed’s mere utterance of plans to taper its bond-buying program sparked a steep, across-the-board global sell-off. Also, in another troublesome development, interest rates spiked higher, pushing bond returns into uncharted negative territory.

The market’s immediate reaction to the Fed’s statement served both as a reality check for investors who had prematurely heralded a return to normalcy and as a harbinger of future challenges. The Fed’s decision to end cash infusions could negatively impact European economies that have just begun to move past the recession as well as more fragile emerging markets.

With market uncertainty underscoring the need to implement investment decisions with greater precision, investors continued to embrace a broad array of ETFs for their ability to provide transparent, low cost and liquid access to all corners of the global market.

As part of our continued commitment to provide the products you need to help achieve your investment goals, State Street Global Advisors, with GSO Capital Partners LP, launched SPDR® Blackstone / GSO Senior Loan ETF (Ticker Symbol: SRLN), an actively managed ETF that provides exposure to senior loans.

We take great pride in this new addition to our SPDR family. You will find additional information on the SSgA Active ETF Trust Exchange Traded Funds, including Management’s Discussion of Fund Performance, in the enclosed June 30, 2013 Annual Report.

On behalf of the SSgA Active ETF Trust, I thank you for your continued support.

Sincerely,

Ellen M. Needham

President

1

SPDR SSgA MULTI-ASSET REAL RETURN ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Multi-Asset Real Return ETF (the “Fund”), normally invests substantially all of its assets in the SSgA Multi-Asset Real Return Portfolio (the “Portfolio”), which seeks to achieve real return consisting of capital appreciation and current income. As a result, this Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2013 (the “Reporting Period”), the total return for the Fund was -1.67%, and the total return for the Barclays U.S. Government Inflation-linked Bond Index (the “Index”) was -5.16%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund outperformed the Index during the Reporting Period. As optimistic expectations related to global growth seemed unlikely to materialize and unease developed in connection with potential tapering of the U.S. Federal Reserve’s (the “Fed”) bond-buying program, the prospects for real assets moderated over the period. However, diversified exposure within the Fund’s portfolio offered a buffer from sharp increases in real yields that more negatively afflicted the Index following the Fed’s comments regarding tapering of the bond-buying program.

Benign inflation prints across many developed economies tempered the outlook for real assets over the period. Weaker than expected industrial production data out of China compounded growth concerns. Additionally, market reaction was rather severe given the change in tone of the Fed’s monetary policy during May and June of 2013, which caused nominal and real return bonds alike to sell off sharply. The unwelcome news prompted volatility beyond bond assets as the market reassessed outlooks amid the backdrop of tempered central bank policy.

Allocations to international and U.S. securitized real estate proved beneficial to the Fund’s performance as the low-rate environment served to benefit the asset class in multiple ways. First, low-cost financing enabled securitized real estate to bolster balance sheets and develop projects with more favorable terms. Second, investors desperate for yield acquiesced to taking on risk in favor of higher yielding asset classes. Another constructive portfolio holding was the targeted exposure to the U.S. energy sector, which was buoyed by attractive valuations and favorable increases in energy prices during the Reporting Period.

Exposure to resource equities detracted from performance as the composite group was overwhelmed by the negative performance of the metals and mining sector. Performance of this sector was hampered by bearish supply and demand fundamentals, falling metals prices, and concerns regarding rising production costs. A steady downward trend in gold prices over the period magnified the underperformance of the gold mining sub-industry relative to the broader metals and mining sector. U.S. inflation-linked bonds were also negative contributors to Fund performance. Performance of these bonds deteriorated as tapering concerns coupled with a reduction in forward looking inflation expectations prompted a dramatic back up in real yields.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

2

SPDR SSgA MULTI-ASSET REAL RETURN ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Multi-Asset Real Return ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2012 is 0.70%.

PERFORMANCE AS OF JUNE 30, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | | |

| | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

BARCLAYS

U.S. GOVERNMENT

INFLATION-

LINKED BOND

INDEX | | | SECONDARY

BENCHMARK:

SSgA

MULTI-ASSET

REAL RETURN

COMPOSITE

INDEX | | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

BARCLAYS

U.S. GOVERNMENT

INFLATION-

LINKED BOND

INDEX | | | SECONDARY

BENCHMARK:

SSgA

MULTI-ASSET

REAL RETURN

COMPOSITE

INDEX | | | |

| | | ONE YEAR | | | –1.67% | | | | –1.56% | | | | –5.16% | | | | 0.93% | | | | | | –1.67% | | | | –1.56% | | | | –5.16% | | | | 0.93% | | | |

| | | SINCE

INCEPTION (1) | | | –5.05% | | | | –5.02% | | | | –3.60% | | | | –2.76% | | | | | | –4.29% | | | | –4.25% | | | | –3.06% | | | | –2.34% | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 25, 2012 to June 30, 2013 |

3

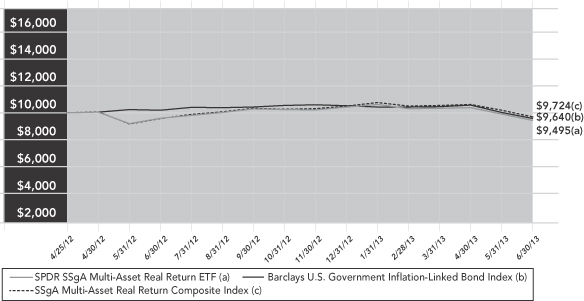

SPDR SSgA MULTI-ASSET REAL RETURN ETF — PERFORMANCE SUMMARY (CONTINUED)

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past Performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

4

SPDR SSgA INCOME ALLOCATION ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Income Allocation ETF (the “Fund”), normally invests substantially all of its assets in the SSgA Income Allocation Portfolio (the “Portfolio”), which seeks to provide total return by focusing on investments in income and yield-generating assets. As a result, this Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2013 (the “Reporting Period”), the total return for the Fund was 4.22%, and the total return for the MSCI World Index (the “Index”) was 18.58%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund’s focus on income and yield-generating investments, contributed to its underperformance relative to the Index during the Reporting Period. Unfortunately, a May 2013 shift in language from the U.S. Federal Reserve (the “Fed”) raised the possibility that the pace of asset purchases in its quantitative easing program might ebb later in 2013. Even though any tapering of asset purchases would be conditional on U.S. economic performance, investors had to adjust to the more nuanced priorities at the Fed. As a result, debt securities lost value across the board, and many higher dividend stocks faltered as well. While the Fund lagged the Index significantly during May and June of 2013, it performed more closely in line with a globally diversified portfolio of income-focused securities that includes broad exposure to both stocks and bonds.

The relative strength of the U.S. dollar and U.S. equities had a negative effect on performance because the Fund maintains ample holdings in non-U.S. securities. Concerns in late 2012 about U.S. fiscal constraints gradually dissipated in the first half of 2013, even as European growth stagnated and worries increased about decelerating activity in China. Moreover, the apparently hawkish turn in U.S. monetary emphasis encouraged significant capital withdrawal from international markets. Talk of tapered accommodation shocked the bond markets as well, taking a notable toll on the Fund’s holdings of both government and corporate debt. The simultaneous deterioration in stock and bond prices that arose from fears of altered policy represented a shift in market behavior. The more usual pattern had been bond appreciation when equities were declining, but the change in Fed language unleashed a sharp rise in real yields that hurt both fixed income and equities, resulting in greater realized volatility for the Fund.

The top positive contributor to the Fund’s performance was the SPDR S&P Dividend ETF, which appreciated during each quarter of the Reporting Period. This holding, which retained a healthy double-digit weighting in the Fund throughout the period, benefited from the growing global preference for U.S. equities during the first half of 2013. While other securities in the Fund had a much smaller influence on performance, both the SPDR S&P Global Infrastructure ETF and the SPDR Dow Jones REIT ETF were noted contributors. Even though their appeal waned when tapering of asset purchases became a possibility, they retained positive performance for the Reporting Period.

The most negative contributors to the Fund’s performance were its long duration, fixed-income holdings in the SPDR Barclays Long Term Treasury ETF and the SPDR Barclays Long Term Corporate Bond ETF. While these positions continued to provide consistent income to the Fund, the change in Fed posture during the second quarter of 2013 provoked a major adjustment in bond yields that diminished their value and compromised their role as a diversifier of equity risk. Also detracting from Fund performance was the SPDR S&P Emerging Markets Dividend ETF, which offered scant protection from rising concerns that growth prospects in emerging countries might be dimming.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

5

SPDR SSgA INCOME ALLOCATION ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Income Allocation ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2012 is 0.70%.

PERFORMANCE AS OF JUNE 30, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | | |

| | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

MSCI WORLD

INDEX | | | SECONDARY

BENCHMARK:

SSgA INCOME

ALLOCATION

COMPOSITE

INDEX | | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

MSCI WORLD

INDEX | | | SECONDARY

BENCHMARK:

SSgA INCOME

ALLOCATION

COMPOSITE

INDEX | | | |

| | | ONE YEAR | | | 4.22% | | | | 4.19% | | | | 18.58% | | | | 6.77% | | | | | | 4.22% | | | | 4.19% | | | | 18.58% | | | | 6.77% | | | |

| | | SINCE INCEPTION (1) | | | 5.12% | | | | 5.11% | | | | 14.68% | | | | 7.20% | | | | | | 4.31% | | | | 4.30% | | | | 12.31% | | | | 6.09% | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 25, 2012 to June 30, 2013 |

6

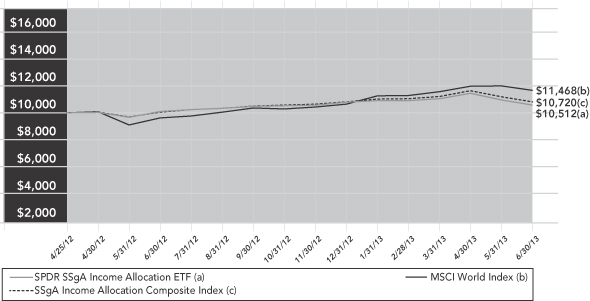

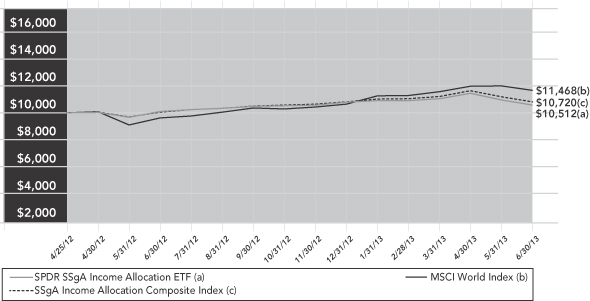

SPDR SSgA INCOME ALLOCATION ETF — PERFORMANCE SUMMARY (CONTINUED)

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past Performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

7

SPDR SSgA GLOBAL ALLOCATION ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Global Allocation ETF (the “Fund”), normally invests substantially all of its assets in the SSgA Global Allocation Portfolio (the “Portfolio”), which seeks to provide capital appreciation. As a result, this Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2013 (the “Reporting Period”), the total return for the Fund was 9.91%, and the total return for the MSCI All Country World IMI Index (the “Index”) was 17.08%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund invests broadly across regions and asset classes. The Fund’s diversified investment exposures, contributed to its underperformance relative to the equity only Index during the Reporting Period. The Fund generally enjoyed strong positive performance during the period until May 2013 when the shift in the language from the U.S. Federal Reserve (the “Fed”) raised the possibility that the pace of asset purchases in its quantitative easing program might ebb later in 2013. Even though any tapering of asset purchases would be conditional on U.S. economic performance, investors had to adjust to the more nuanced priorities at the Fed. As a result, debt securities, along with risky assets like equities, commodities, and real estate, lost value across the board.

The relative strength of the U.S. dollar and U.S. equities had a negative effect on performance because the Fund maintains ample holdings in non-U.S. securities. Concerns in late 2012 about U.S. fiscal constraints gradually dissipated in the first half of 2013, even as European growth stagnated and worries increased about decelerating activity in China. Moreover, the apparently hawkish turn in U.S. monetary emphasis encouraged significant capital withdrawal from international markets. Talk of tapered accommodation shocked the bond markets as well, taking a notable toll on the Fund’s holdings of both government and corporate debt. The simultaneous deterioration in stock and bond prices that arose from fears of altered policy represented a shift in market behavior. The more usual pattern had been bond appreciation when equities were declining, but the change in Fed language unleashed a sharp rise in real yields that hurt both fixed income and equities, resulting in greater realized volatility for the Fund.

Reflecting both the global exposures of the Fund and our tactical preference for risky assets in the past year, the Fund had overweight exposures to equities compared to bonds. The top positive contributors to the Fund’s performance were the SPDR S&P 500 ETF and the SPDR S&P World ex-US ETF. Other strong contributors within equities include SPDR S&P International Small Cap ETF, SPDR STOXX Europe 50 ETF, SPDR S&P Dividend ETF, and SPDR S&P 600 Small Cap ETF. In addition, investments in equity sectors added significant value to the Fund’s portfolio, with The Consumer Discretionary Select Sector SPDR Fund and The Financial Select Sector SPDR Fund performing strongly for the Fund. The Fund also enjoyed positive contributions from its real estate and high yield exposures through investments in the SPDR Dow Jones International Real Estate ETF and the SPDR Barclays High Yield Bond ETF.

The most negative contributors to the Fund’s performance were its holdings in the PowerShares DB Gold Fund and the SPDR Barclays TIPS ETF. Other detractors from performance were the SPDR Barclays Emerging Markets Local Bond ETF and the SPDR Barclays Aggregate Bond ETF.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

8

SPDR SSgA GLOBAL ALLOCATION ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Global Allocation ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2012 is 0.35%.

PERFORMANCE AS OF JUNE 30, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | | |

| | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

MSCI ACWI

IMI INDEX | | | SECONDARY

BENCHMARK:

SSgA GLOBAL

ALLOCIATION

COMPOSITE

INDEX | | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

MSCI ACWI

IMI INDEX | | | SECONDARY

BENCHMARK:

SSgA GLOBAL

ALLOCIATION

COMPOSITE

INDEX | | | |

| | | ONE YEAR | | | 9.91% | | | | 10.01% | | | | 17.08% | | | | 10.28% | | | | | | 9.91% | | | | 10.01% | | | | 17.08% | | | | 10.28% | | | |

| | | SINCE INCEPTION (1) | | | 7.90% | | | | 7.90% | | | | 12.60% | | | | 8.26% | | | | | | 6.64% | | | | 6.63% | | | | 10.58% | | | | 6.96% | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 25, 2012 to June 30, 2013 |

9

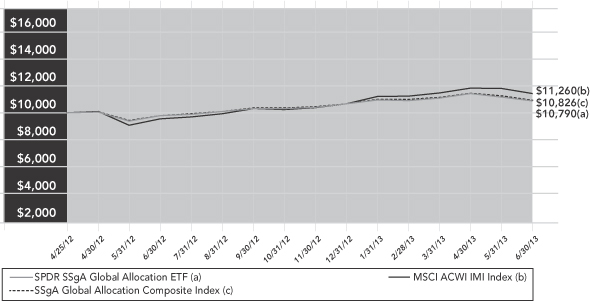

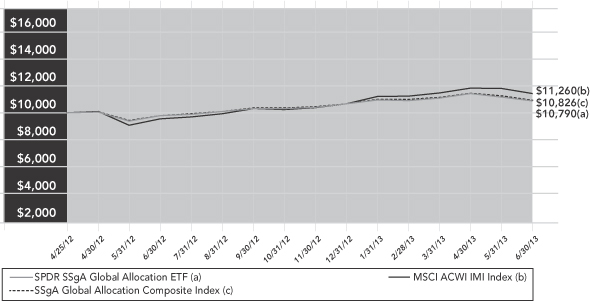

SPDR SSgA GLOBAL ALLOCATION ETF — PERFORMANCE SUMMARY (CONTINUED)

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past Performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

10

SPDR BLACKSTONE / GSO SENIOR LOAN ETF — PERFORMANCE SUMMARY

The Fund had less than six months of operations at reporting period end and therefore does not have performance history to provide in this report.

11

SSgA ACTIVE ETF TRUST

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2013

| | | | | | | | | | | | | | | | |

| | | SPDR SSgA

Multi-Asset

Real Return

ETF | | | SPDR SSgA

Income

Allocation

ETF | | | SPDR SSgA

Global

Allocation

ETF | | | SPDR

Blackstone / GSO

Senior Loan

ETF | |

ASSETS | | | | | | | | | | | | | | | | |

Investments in corresponding Portfolio, at market value (Note 1) | | $ | 121,583,035 | | | $ | 174,253,776 | | | $ | 51,934,532 | | | $ | 332,791,500 | |

Due from Advisor | | | — | | | | — | | | | 6,126 | | | | — | |

| | | | | | | | | | | | | | | | |

TOTAL ASSETS | | | 121,583,035 | | | | 174,253,776 | | | | 51,940,658 | | | | 332,791,500 | |

| | | | | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | | | | | |

Income distributions payable | | | 1,144,521 | | | | 2,261,400 | | | | 456,897 | | | | — | |

Accrued Advisory fees | | | 4,167 | | | | 15,703 | | | | — | | | | 137,595 | |

Accrued trustees’ fees and expenses | | | 48 | | | | 62 | | | | 17 | | | | 155 | |

| | | | | | | | | | | | | | | | |

TOTAL LIABILITIES | | | 1,148,736 | | | | 2,277,165 | | | | 456,914 | | | | 137,750 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 120,434,299 | | | $ | 171,976,611 | | | $ | 51,483,744 | | | $ | 332,653,750 | |

| | | | | | | | | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | | | | | | | | | |

Paid-in capital (Note 4) | | $ | 132,135,990 | | | $ | 179,580,951 | | | $ | 52,361,000 | | | $ | 335,319,068 | |

Undistributed (distributions in excess of) net investment income | | | (66,390 | ) | | | (349,701 | ) | | | (65,033 | ) | | | 425,759 | |

Accumulated net realized gain (loss) on investments | | | (1,026,495 | ) | | | (1,096,929 | ) | | | (289,986 | ) | | | (18,346 | ) |

Net unrealized appreciation (depreciation) on investments | | | (10,608,806 | ) | | | (6,157,710 | ) | | | (522,237 | ) | | | (3,072,731 | ) |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 120,434,299 | | | $ | 171,976,611 | | | $ | 51,483,744 | | | $ | 332,653,750 | |

| | | | | | | | | | | | | | | | |

NET ASSET VALUE PER SHARE | | | | | | | | | | | | | | | | |

Net asset value per share | | $ | 27.68 | | | $ | 29.90 | | | $ | 31.18 | | | $ | 49.65 | |

| | | | | | | | | | | | | | | | |

Shares outstanding (unlimited amount authorized, $0.00 par value) | | | 4,351,111 | | | | 5,751,111 | | | | 1,651,111 | | | | 6,700,000 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

12

SSgA ACTIVE ETF TRUST

STATEMENTS OF OPERATIONS

Periods Ended June 30, 2013

| | | | | | | | | | | | | | | | |

| | | SPDR SSgA

Multi-Asset

Real Return

ETF | | | SPDR SSgA

Income

Allocation

ETF | | | SPDR SSgA

Global

Allocation

ETF | | | SPDR

Blackstone / GSO

Senior Loan

ETF* | |

INCOME AND EXPENSES ALLOCATED FROM PORTFOLIO | | | | | | | | | | | | | | | | |

Dividend income allocated from Portfolio (Note 2) | | $ | 1,860,768 | | | $ | 3,763,417 | | | $ | 716,581 | | | $ | 1,378,207 | |

Expenses allocated from Portfolio (Note 2) | | | (120,352 | ) | | | (156,089 | ) | | | (44,008 | ) | | | (144,375 | ) |

| | | | | | | | | | | | | | | | |

TOTAL INCOME | | | 1,740,416 | | | | 3,607,328 | | | | 672,573 | | | | 1,233,832 | |

| | | | | | | | | | | | | | | | |

EXPENSES | | | | | | | | | | | | | | | | |

Advisory fees (Note 3) | | | 25,833 | | | | 113,843 | | | | — | | | | 288,262 | |

Trustee Fees (Note 3) | | | 577 | | | | 727 | | | | 199 | | | | 277 | |

Miscellaneous expenses | | | 29 | | | | 37 | | | | 9 | | | | — | |

| | | | | | | | | | | | | | | | |

TOTAL EXPENSES | | | 26,439 | | | | 114,607 | | | | 208 | | | | 288,539 | |

| | | | | | | | | | | | | | | | |

Fees reimbursed by Adviser | | | — | | | | — | | | | (35,535 | ) | | | — | |

| | | | | | | | | | | | | | | | |

NET INVESTMENT INCOME | | | 1,713,977 | | | | 3,492,721 | | | | 707,900 | | | | 945,293 | |

| | | | | | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | | | | | | | | | |

Net realized gain (loss) allocated from Portfolio | | | (924,336 | ) | | | (1,103,415 | ) | | | 31,543 | | | | (18,346 | ) |

Net change in unrealized appreciation (depreciation) from corresponding Portfolio | | | (10,378,139 | ) | | | (6,205,343 | ) | | | (434,651 | ) | | | (3,072,731 | ) |

| | | | | | | | | | | | | | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | (11,302,475 | ) | | | (7,308,758 | ) | | | (403,108 | ) | | | (3,091,077 | ) |

| | | | | | | | | | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (9,588,498 | ) | | $ | (3,816,037 | ) | | $ | 304,792 | | | $ | (2,145,784 | ) |

| | | | | | | | | | | | | | | | |

| * | For the period April 3, 2013 (commencement of operations) to June 30, 2013. |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

13

SSgA ACTIVE ETF TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | |

SPDR SSgA Multi-Asset Real Return ETF | | | SPDR SSgA Income Allocation ETF | |

| | | Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | | | Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 1,713,977 | | | $ | 40,831 | | | $ | 3,492,721 | | | $ | 97,347 | |

Net realized gain (loss) on investments | | | (924,336 | ) | | | (6,834 | ) | | | (1,103,415 | ) | | | (17,901 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (10,378,139 | ) | | | (230,667 | ) | | | (6,205,343 | ) | | | 47,633 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (9,588,498 | ) | | | (196,670 | ) | | | (3,816,037 | ) | | | 127,079 | |

| | | | | | | | | | | | | | | | |

Net equalization credits and charges | | | 57,257 | | | | (1,313 | ) | | | 300,070 | | | | 25,031 | |

| | | | | | | | | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | |

Net investment income | | | (1,773,687 | ) | | | (39,652 | ) | | | (3,792,817 | ) | | | (122,565 | ) |

| | | | | | | | | | | | | | | | |

FROM BENEFICIAL INTEREST TRANSACTIONS: | | | | | | | | | | | | | | | | |

Proceeds from sale of shares | | | 130,398,415 | | | | 7,426,281 | | | | 170,596,375 | | | | 8,984,576 | |

Cost of shares redeemed | | | (4,387,694 | ) | | | (1,404,196 | ) | | | — | | | | — | |

Net income equalization (Note 2) | | | (57,257 | ) | | | 1,313 | | | | (300,070 | ) | | | (25,031 | ) |

Other capital (Note 4) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets from beneficial interest transactions | | | 125,953,464 | | | | 6,023,398 | | | | 170,296,305 | | | | 8,959,545 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets during the period | | | 114,648,536 | | | | 5,785,763 | | | | 162,987,521 | | | | 8,989,090 | |

Net assets at beginning of period | | | 5,785,763 | | | | — | | | | 8,989,090 | | | | — | |

| | | | | | | | | | | | | | | | |

NET ASSETS END OF PERIOD (1) | | $ | 120,434,299 | | | $ | 5,785,763 | | | $ | 171,976,611 | | | $ | 8,989,090 | |

| | | | | | | | | | | | | | | | |

SHARES OF BENEFICIAL INTEREST | | | | | | | | | | | | | | | | |

Shares sold | | | 4,300,000 | | | | 251,111 | | | | 5,450,000 | | | | 301,111 | |

Shares redeemed | | | (150,000 | ) | | | (50,000 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net increase in shares | | | 4,150,000 | | | | 201,111 | | | | 5,450,000 | | | | 301,111 | |

| | | | | | | | | | | | | | | | |

(1) Undistributed (distributions in excess of) net investment income | | $ | (66,390 | ) | | $ | 1,179 | | | $ | (349,701 | ) | | $ | (25,218 | ) |

| | | | | | | | | | | | | | | | |

| * | Commencement of operations |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

14

| | | | | | | | | | |

| SPDR SSgA Global Allocation ETF | | | SPDR Blackstone / GSO Senior

Loan ETF | |

Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | | | For the Period

4/3/13* -

6/30/13 | |

| | | | | | | | | | |

| $ | 707,900 | | | $ | 42,385 | | | $ | 945,293 | |

| | 31,543 | | | | (140,394 | ) | | | (18,346 | ) |

| (434,651 | ) | | | (87,586 | ) | | | (3,072,731 | ) |

| | | | | | | | | | |

| 304,792 | | | | (185,595 | ) | | | (2,145,784 | ) |

| | | | | | | | | | |

| | 59,672 | | | | (3,002 | ) | | | 232,911 | |

| | | | | | | | | | |

| | |

| | | | | | | | | | |

| | (768,378 | ) | | | (39,306 | ) | | | (519,534 | ) |

| | | | | | | | | | |

| | |

| | | | | | | | | | |

| | 50,769,956 | | | | 6,033,333 | | | | 334,914,199 | |

| | (3,233,657 | ) | | | (1,397,401 | ) | | | — | |

| | (59,672 | ) | | | 3,002 | | | | (232,911 | ) |

| | — | | | | — | | | | 404,869 | |

| | | | | | | | | | |

| 47,476,627 | | | | 4,638,934 | | | | 335,086,157 | |

| | | | | | | | | | |

| | |

| | 47,072,713 | | | | 4,411,031 | | | | 332,653,750 | |

| | 4,411,031 | | | | — | | | | — | |

| | | | | | | | | | |

| $ | 51,483,744 | | | $ | 4,411,031 | | | $ | 332,653,750 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | 1,600,000 | | | | 201,111 | | | | 6,700,000 | |

| | (100,000 | ) | | | (50,000 | ) | | | — | |

| | | | | | | | | | |

| | 1,500,000 | | | | 151,111 | | | | 6,700,000 | |

| | | | | | | | | | |

$ |

(65,033 |

) | | $ | 3,079 | | | $ | 425,759 | |

| | | | | | | | | | |

15

SSgA ACTIVE ETF TRUST

FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding throughout each period is presented below (1):

| | | | | | | | | | | | | | | | |

| | | SPDR SSgA Multi-Asset Real

Return ETF | | | SPDR SSgA Income Allocation

ETF | |

| | | Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | | | Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | |

Net asset value, beginning of period | | $ | 28.77 | | | $ | 30.00 | | | $ | 29.85 | | | $ | 30.00 | |

| | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (2) | | | 0.86 | | | | 0.20 | | | | 1.41 | | | | 0.44 | |

Net realized and unrealized gain (loss) on investments (3) | | | (1.33 | ) | | | (1.22 | ) | | | (0.25 | ) | | | (0.29 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.47 | ) | | | (1.02 | ) | | | 1.16 | | | | 0.15 | |

| | | | | | | | | | | | | | | | |

Net equalization credits and charges (2) | | | 0.03 | | | | (0.01 | ) | | | 0.12 | | | | 0.11 | |

| | | | | | | | | | | | | | | | |

Other capital | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.65 | ) | | | (0.20 | ) | | | (1.23 | ) | | | (0.41 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.65 | ) | | | (0.20 | ) | | | (1.23 | ) | | | (0.41 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 27.68 | | | $ | 28.77 | | | $ | 29.90 | | | $ | 29.85 | |

| | | | | | | | | | | | | | | | |

Total Return (4) | | | (1.67 | )% | | | (3.44 | )% | | | 4.22 | % | | | 0.87 | % |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000s) | | $ | 120,434 | | | $ | 5,786 | | | $ | 171,977 | | | $ | 8,989 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | |

Total expenses | | | 0.25 | % | | | 0.27 | %(5) | | | 0.35 | % | | | 0.36 | %(5) |

Net operating expenses | | | 0.25 | % | | | 0.27 | %(5) | | | 0.35 | % | | | 0.36 | %(5) |

Net investment income | | | 2.86 | % | | | 3.77 | %(5) | | | 4.50 | % | | | 8.24 | %(5) |

Portfolio turnover rate (6) | | | 31 | % | | | 10 | % | | | 80 | % | | | 15 | % |

| * | Commencement of operations |

| (1) | The per share amounts and percentages include each Fund’s proportionate share of income and expenses of their respective Portfolio. |

| (2) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the period. |

| (3) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (4) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each Fund. Total return for periods of less than one year is not annualized. Broker commission charges are not included in this calculation. |

| (6) | Portfolio turnover rate is from their respective Portfolio. |

16

| | | | | | | | | | |

SPDR SSgA Global

Allocation ETF | | | SPDR Blackstone / GSO

Senior Loan ETF | |

Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | | | For the Period

4/3/13* -

6/30/13 | |

| $ | 29.19 | | | $ | 30.00 | | | $ | 50.00 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | 1.03 | | | | 0.24 | | | | 0.24 | |

| | 1.77 | | | | (0.77 | ) | | | (0.65 | ) |

| | | | | | | | | | |

| | 2.80 | | | | (0.53 | ) | | | (0.41 | ) |

| | | | | | | | | | |

| | 0.09 | | | | (0.02 | ) | | | 0.06 | |

| | | | | | | | | | |

| | — | | | | — | | | | 0.10 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | (0.90 | ) | | | (0.26 | ) | | | (0.10 | ) |

| | | | | | | | | | |

| | (0.90 | ) | | | (0.26 | ) | | | (0.10 | ) |

| | | | | | | | | | |

| $ | 31.18 | | | $ | 29.19 | | | $ | 49.65 | |

| | | | | | | | | | |

| | 9.91 | % | | | (1.82 | )% | | | (0.48 | )% |

| | | | | | | | | | |

| $ | 51,484 | | | $ | 4,411 | | | $ | 332,654 | |

| | | | | | | | | | |

| | 0.20 | % | | | 0.20 | %(5) | | | 0.90 | %(5) |

| | 0.04 | % | | | 0.05 | %(5) | | | 0.90 | %(5) |

| | 3.23 | % | | | 4.48 | %(5) | | | 1.97 | %(5) |

| | 123 | % | | | 25 | % | | | 4 | % |

17

SSgA ACTIVE ETF TRUST

NOTES TO FINANCIAL STATEMENTS

June 30, 2013

SSgA Active ETF Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (“1940 Act”), is an open-end investment management company that was organized as a Massachusetts business trust on March 30, 2011.

As of June 30, 2013, the Trust offered four (4) portfolios, each of which represents a separate series of beneficial interest in the Trust (each referred to as a “Fund”, collectively as the “Funds”). The financial statements herein relate to the following four (4) Funds: SPDR SSgA Multi-Asset Real Return ETF, SPDR SSgA Income Allocation ETF, SPDR SSgA Global Allocation ETF and SPDR Blackstone / GSO Senior Loan ETF.

The Trust is part of a master-feeder structure and each Fund invests substantially all of its assets in interests of its respective master portfolio; the SSgA Multi-Asset Real Return Portfolio, SSgA Income Allocation Portfolio, SSgA Global Allocation Portfolio and Blackstone / GSO Senior Loan Portfolio (each referred to as a “Portfolio”; collectively as “Portfolios”), each of which is a series of a separately registered investment company called SSgA Master Trust (“Master Trust”). The investment objective and policies of each Fund are substantially similar to those of its respective Portfolio. The value of each Fund’s investment in its respective Portfolio reflects the Fund’s proportionate interest in the net assets of that Portfolio (99.99% for SPDR SSgA Multi-Asset Real Return ETF, 99.99% for SPDR SSgA Income Allocation ETF, 99.99% for SPDR SSgA Global Allocation ETF and 99.99% for SPDR Blackstone / GSO Senior Loan ETF at June 30, 2013). The performance of each Fund is directly affected by the performance of its respective Portfolio. The financial statements of the Portfolios, including their Schedules of Investments, are attached to this report and should be read in conjunction with the Fund’s financial statements.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this could involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

| 2. | Summary of Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. These financial statements are presented in United States dollars.

Security Valuation

Each Fund records its investments in its respective Portfolio at value each business day. The valuation policies of the Portfolios are discussed in Note 2 of the Portfolios’ Notes to Financial Statements, which are attached to this report.

The Portfolios adopted provisions surrounding fair value measurements and disclosures that define fair value, establish a framework for measuring fair value in generally accepted accounting principles and expand disclosures about fair value measurements. This applies to fair value measurements that are already required or permitted by other accounting standards and is intended to increase consistency of those measurements and applies broadly to securities and other types of assets and liabilities. The summary of the inputs used for each Portfolio, as of June 30, 2013, in valuing each Portfolio’s securities carried at fair value are discussed in Note 2 of the Portfolio’s Notes to Financial Statements, which are attached to this report.

Investment Income

Net investment income consists of a Fund’s pro-rata share of the net investment income of its respective Portfolio, less expenses of the Fund.

18

SSgA ACTIVE ETF TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2013

Expenses

Advisory fees and other expenses, which are directly identifiable to a specific Fund, are applied to that Fund. Trustees’ fees and other expenses which cannot be attributed to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of the Funds. The Fund’s are allocated a pro-rata share of the expenses of its respective Portfolio.

Equalization

The Funds follow the accounting practice known as “Equalization” by which a portion of the proceeds from sales and costs of reacquiring Fund shares, equivalent on a per share basis to the amount of distributable net investment income on the date of the transaction, is credited or charged to undistributed net investment income. As a result, undistributed net investment income per share is unaffected by sales or reacquisition of Fund shares. Amounts related to Equalization can be found on the Statements of Changes in Net Assets.

Investment Transactions

Investment transactions are recorded as of the trade date. Realized gains and losses from security transactions consist of a Fund’s pro-rata share of its respective Portfolio’s realized gains and losses. Realized gains and losses from security transactions are recorded on the identified cost basis. Corporate actions (including cash dividends) are recorded net of foreign tax withholdings on the ex-dividend date.

Federal Income Tax

The Funds have qualified and intend to continue to qualify for and elect treatment as “regulated investment companies” under Subchapter M of the Internal Revenue Code of 1986, as amended. By so qualifying and electing, each Fund will not be subject to federal income taxes to the extent it distributes its taxable income, including any net realized capital gains, for each fiscal year. In addition, by distributing during each calendar year substantially all of their net investment income and capital gains, if any, the Funds will not be subject to federal excise tax. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from U.S. generally accepted accounting principles. These book-tax differences are primarily due to differing treatments for tax equalization, in-kind transactions for financial statement purposes and losses deferred due to wash sales.

Additionally, based on the Funds’ understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which the applicable Funds invest, the Funds will provide for foreign taxes and, where appropriate, deferred foreign taxes. The Funds have reviewed the tax positions for the open tax years as of June 30, 2013 and have determined that no provision for income tax is required in the Funds’ Financial Statements. The Funds’ federal tax returns are subject to examination by the Funds’ major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts. The Funds recognized interest and penalties, if any, related to tax liabilities as income tax expense in the Statements of Operations.

For the year ended June 30, 2013, the following Funds reclassified non-taxable security gains and losses realized on the in-kind redemption of Creation Units (Note 4) as an increase or decrease to paid in capital in the Statements of Assets and Liabilities as follows:

| | | | |

| | | Net Gain (Loss)

Reclassified

to Paid in Capital | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 89,690 | |

SPDR SSgA Income Allocation ETF | | | — | |

SPDR SSgA Global Allocation ETF | | | 285,159 | |

SPDR Blackstone / GSO Senior Loan ETF | | | — | |

19

SSgA ACTIVE ETF TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2013

At June 30, 2013, the Funds had capital loss carryforwards which may be utilized to offset any net realized capital gains. These losses will not expire and are treated as though the losses were incurred on the first day of the next fiscal year:

| | | | | | | | |

| | | Short Term | | | Long Term | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 636,237 | | | $ | 60,440 | |

SPDR SSgA Income Allocation ETF | | | 949,441 | | | | — | |

SPDR SSgA Global Allocation ETF | | | 159,781 | | | | 19,428 | |

SPDR Blackstone / GSO Senior Loan ETF | | | 12,487 | | | | — | |

For the year ended June 30, 2013, there were no significant differences between the book basis and the tax basis character of distributions to shareholders.

The tax character of distributions paid during the years ended June 30, 2012 and June 30, 2013 was as follows:

| | | | | | | | | | | | | | | | |

| | | Distributions Paid in 2013 | | | Distributions Paid in 2012 | |

| | | Ordinary

Income | | | Long-term

Capital Gains | | | Ordinary

Income | | | Long-term

Capital Gains | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 1,773,687 | | | $ | — | | | $ | 39,652 | | | $ | — | |

SPDR SSgA Income Allocation ETF | | | 3,792,817 | | | | — | | | | 122,565 | | | | — | |

SPDR SSgA Global Allocation ETF | | | 768,378 | | | | — | | | | 39,306 | | | | — | |

SPDR Blackstone / GSO Senior Loan ETF | | | 519,534 | | | | — | | | | — | | | | — | |

For the year ended June 30, 2013, there were no significant differences between the book basis and the tax basis of components of net assets other than differences in the net unrealized appreciation (depreciation) in the value of investments attributable to the tax deferral of losses on wash sales, the cumulative return of capital payment, PFICs (Passive Foreign Investment Companies), redemptions in-kind, dividend payables and the deferral of post-October losses.

As of June 30, 2013, the components of distributable earnings on a tax basis were as follows:

| | | | | | | | | | | | |

| | | Undistributed

Ordinary Income | | | Undistributed

Long-Term

Capital Gains | | | Net Unrealized

Appreciation

(Depreciation) | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 1,078,131 | | | $ | — | | | $ | (10,938,624 | ) |

SPDR SSgA Income Allocation ETF | | | 1,911,699 | | | | — | | | | (6,305,198 | ) |

SPDR SSgA Global Allocation ETF | | | 391,864 | | | | — | | | | (633,014 | ) |

SPDR Blackstone / GSO Senior Loan ETF | | | 425,759 | | | | — | | | | (3,078,590 | ) |

Distributions

Each Fund declares and distributes dividends from net investment income, if any, to its shareholders quarterly (monthly for SPDR Blackstone / GSO Senior Loan ETF). Each Fund declares and distributes net realized capital gains, if any, at least annually. Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

| 3. | Fees and Compensation Paid to Affiliates and Other Related Party Transactions |

Advisory Fee

Each Fund has entered into an Investment Advisory Agreement with SSgA Funds Management, Inc. (the “Adviser” or “SSgA FM”). As compensation for the services rendered, facilities furnished, and expenses borne by the Adviser, each

20

SSgA ACTIVE ETF TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2013

Fund pays the Adviser a fee accrued daily and paid monthly, based on a percentage of each Fund’s average daily net assets as shown in the following table:

| | | | |

| | | Annual Rate* | |

SPDR SSgA Multi-Asset Real Return ETF | | | 0.70 | % |

SPDR SSgA Income Allocation ETF | | | 0.70 | |

SPDR SSgA Global Allocation ETF | | | 0.35 | |

SPDR Blackstone / GSO Senior Loan ETF | | | 0.90 | |

| * | The Advisory fee is reduced by the proportional amount of the advisory fee, as well as, for SPDR SSgA Multi-Asset Real Return ETF, SPDR SSgA Income Allocation ETF and the SPDR SSgA Global Allocation ETF, acquired fund fees and expenses of each Fund’s respective Portfolio. For the period ended June 30, 2013, the net annualized advisory fee was 0.04%, 0.15%, (0.16)% and 0.60% for the SPDR SSgA Multi-Asset Real Return ETF, SPDR SSgA Income Allocation ETF, SPDR SSgA Global Allocation ETF and SPDR Blackstone / GSO Senior Loan ETF, respectively. For the SPDR SSgA Global Allocation ETF the reduction resulted in a fee reimbursement which is identified on the Statement of Operations. |

The Adviser pays all operating expenses of each Fund other than management fee, distribution fee pursuant to each Fund’s Distribution and Service Plan, if any, brokerage, taxes, interest, fees and expenses of the Independent Trustees (including any Trustees’ counsel fees), litigation expenses, and other extraordinary expenses.

State Street Bank and Trust Company (“State Street”), an affiliate of the Adviser, receives fees for its services as Custodian, Administrator and Transfer Agent from the Adviser.

State Street Global Markets, LLC (the “Distributor”), an affiliate of the Adviser, serves as the distributor of the shares of each Fund. Pursuant to a Distribution and Service Plan adopted in accordance with Rule 12b-1 under the 1940 Act, each Fund is authorized to pay an amount of up to 0.25% of its average daily net assets for certain distribution-related activities. However, the Board of Trustees has determined that no such payments will be made through at least October 31, 2013 and therefore no such payments have been made.

The Distributor has established an assisted trading program to aid Authorized Participants in certain creation and redemption activity for which the Distributor receives commissions from Authorized Participants. In addition, the Distributor receives compensation from State Street associated with on-line creation and redemption activity of Authorized Participants.

Trustees’ Fees

The Trust, SSgA Master Trust, SPDR Series Trust and SPDR Index Shares Funds pay, in the aggregate, each Independent Trustee an annual fee of $150,000 plus $10,000 per in-person meeting attended and $1,250 for each telephonic or video conference meeting attended. The Chairman of the Board receives an additional annual fee of $50,000 and the Chairman of the Audit Committee receives an additional annual fee of $20,000. The Trust also reimburses each Independent Trustee for travel and other out-of-pocket expenses incurred by him/her in connection with attending such meetings and in connection with attending industry seminars and meetings. Trustee fees are allocated among the Trusts and each of their respective series in such a manner as deemed equitable, taking into consideration the relative net assets of the series.

| 4. | Shareholder Transactions |

Shares are issued and redeemed by a Fund only in Creation Unit size aggregations of 50,000 shares. Such transactions are generally permitted on an in-kind basis, with a separate cash payment, which is a balancing cash component to equate the transaction to the net asset value per unit of the Fund on the transaction date. Transaction fees ranging from of $100 to $400 per Creation Unit for each Fund, regardless of the number of Creation Units that are created or redeemed on the same day, are charged to those persons creating or redeeming Creation Units. An additional variable fee may be charged for certain transactions. Transaction fees are received by the Trust and/or Custodian and are used to defray related expenses. The Custodian also receives amounts earned on cash collateral provided by Authorized Participants pending delivery of missing deposit securities. The amounts are included in Other Capital on the Statements of Changes in Net Assets.

21

SSgA ACTIVE ETF TRUST

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

June 30, 2013

To the Shareholders and Board of Trustees of

SSgA Active ETF Trust

We have audited the accompanying statements of assets and liabilities of SSgA Active ETF Trust (comprising, respectively, SPDR SSgA Multi-Asset Real Return ETF, SPDR SSgA Income Allocation ETF, SPDR SSgA Global Allocation ETF, and SPDR Blackstone / GSO Senior Loan ETF) (collectively, the “Funds”) as of June 30, 2013, and the related statements of operations, statements of changes in net assets and financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the respective Funds constituting SSgA Active ETF Trust at June 30, 2013, and the results of their operations, the changes in their net assets and their financial highlights for each of the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

August 29, 2013

22

SSgA ACTIVE ETF TRUST

OTHER INFORMATION

June 30, 2013 (Unaudited)

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, which may include creation and redemption fees or brokerage charges and (2) ongoing costs, including management fees, trustee fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested on January 1, 2013 and held for the six months ended June 30, 2013.

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first table under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The Funds charge transaction fees at scheduled amounts ranging from $100 to $400 per Creation Unit to those persons creating or redeeming Creation Units. If you buy or sell the Funds’ shares in the secondary market, you will incur customary brokerage commissions and charges.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

Actual | | Annualized

Expense Ratio | | | Beginning Account

Value

1/1/13 | | | Ending Account

Value

6/30/13 | | | Expenses Paid

During Period*

1/1/13 to

6/30/13 | |

SPDR SSgA Multi-Asset Real Return ETF | | | 0.25 | % | | $ | 1,000 | | | $ | 913.90 | | | $ | 1.19 | |

SPDR SSgA Income Allocation ETF | | | 0.35 | | | | 1,000 | | | | 983.70 | | | | 1.72 | |

SPDR SSgA Global Allocation ETF | | | 0.04 | | | | 1,000 | | | | 1,019.50 | | | | 0.20 | |

SPDR Blackstone / GSO Senior Loan ETF** | | | 0.90 | | | | 1,000 | | | | 995.20 | | | | 2.16 | |

| | | | | | | | | | | | | | | | |

Hypothetical

(assuming a 5% return before expenses) | | Annualized

Expense Ratio | | | Beginning Account

Value

1/1/13 | | | Ending Account

Value

6/30/13 | | | Expenses Paid

During Period*

1/1/13 to

6/30/13 | |

SPDR SSgA Multi-Asset Real Return ETF | | | 0.25 | % | | $ | 1,000 | | | $ | 1,023.56 | | | $ | 1.25 | |

SPDR SSgA Income Allocation ETF | | | 0.35 | | | | 1,000 | | | | 1,023.06 | | | | 1.76 | |

SPDR SSgA Global Allocation ETF | | | 0.04 | | | | 1,000 | | | | 1,024.60 | | | | 0.20 | |

SPDR Blackstone / GSO Senior Loan ETF** | | | 0.90 | | | | 1,000 | | | | 1,020.34 | | | | 4.51 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value of the period, multiplied by the number of days in the most recent six month period, then divided by 365. |

| ** | Actual period is from commencement of operations 4/3/13. Hypothetical period is from 1/1/13. |

23

SSgA ACTIVE ETF TRUST

OTHER INFORMATION (continued)

June 30, 2013 (Unaudited)

Premium/Discount Information

Information regarding how often the Shares of each Fund traded on the Exchange at a price above (i.e. at a premium) or below (i.e. at a discount) the net asset value of the Fund for the past calendar year can be found on the Funds’ website at www.spdrs.com.

Tax Information

For federal income tax purposes, the following information is furnished with respect to the distributions of the Trust for its fiscal year ended June 30, 2013.

Qualified Dividend Income

A portion of dividends distributed by the Funds during the fiscal year ended June 30, 2013, are considered qualified dividend income, and are eligible for reduced tax rates. These lower rates range from 5% to 15% depending on the individual’s tax bracket. These amounts are noted below:

| | | | |

| | | Amount | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 767,262 | |

SPDR SSgA Income Allocation ETF | | | 977,824 | |

SPDR SSgA Global Allocation ETF | | | 125,926 | |

Qualified Interest Income

The Funds designated a portion of dividends distributed during the fiscal year ended June 30, 2013, as qualified interest income. These amounts are noted below:

| | | | |

| | | Amount | |

SPDR Blackstone / GSO Senior Loan ETF | | $ | 115,745 | |

At June 30, 2013, the Funds had foreign source income. These amounts are noted below:

| | | | |

| | | Amount | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 1,220,163 | |

SPDR SSgA Income Allocation ETF | | | 1,436,358 | |

SPDR SSgA Global Allocation ETF | | | 320,893 | |

Foreign Tax Credit

The Trust has made an election under Internal Revenue Code Section 853 to pass through foreign taxes paid by a Fund to its shareholders. For the year ended June 30, 2013, the total amount of foreign taxes that will be passed through are:

| | | | |

| | | Amount | |

SPDR SSgA Multi-Asset Real Return ETF | | $ | 13,006 | |

SPDR SSgA Income Allocation ETF | | | 21,557 | |

SPDR SSgA Global Allocation ETF | | | 3,862 | |

Percentage of distributions which qualify for the corporate dividends received deduction:

| | | | |

| | | Percentage | |

SPDR SSgA Multi-Asset Real Return ETF | | | 12.45 | % |

SPDR SSgA Income Allocation ETF | | | 11.83 | |

SPDR SSgA Global Allocation ETF | | | 20.84 | |

SPDR Blackstone / GSO Senior Loan ETF | | | 0.00 | |

24

SSgA ACTIVE ETF TRUST

OTHER INFORMATION (continued)

June 30, 2013 (Unaudited)

Proxy Voting Policies and Procedures and Records

A description of the Trust’s proxy voting policies and procedures that are used by the Funds’ investment adviser to vote proxies relating to the Funds’ portfolio of securities are available (i) without charge, upon request by calling 1-866-787-2257 (toll free) or (ii) on the website of the Securities and Exchange Commission, at www.sec.gov. Information regarding how the investment advisor voted for the prior 12-months period ended June 30 is available by August 31 of each year by calling the same number and on the SEC’s website, at www.sec.gov, and on the Funds’ website at www.spdrs.com.

Quarterly Portfolio Schedule

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The information on the Form N-Q is available upon request, without charge, by calling 1-866-787-2257 (toll free) and on the Funds’ website at www.spdrs.com.

Approval of Advisory Agreement

At in-person meetings held prior to June 30, 2013, the Board of Trustees of the Trust (the “Board”) evaluated various proposals related to advisory arrangements for new series of the Trusts, including a proposal to approve the Investment Advisory Agreements (the “Agreement”) with respect to the SPDR Blackstone / GSO Senior Loan ETF, a new series of the Trust (the “New ETF”), and its underlying master fund, the Blackstone / GSO Senior Loan Portfolio, both of which commenced operations during the most recent fiscal half-year period covered by this Annual Report. The Trustees who are not “interested persons” of the Trust within the meaning of the Investment Company Act of 1940, as amended (the “Independent Trustees”) also met separately with their independent legal counsel to consider the Agreement.

In evaluating the Agreement, the Board drew on materials provided to them by the Adviser and on other materials provided by State Street Bank and Trust Company, the Trust’s Administrator, Transfer Agent and Custodian (“State Street”). In deciding whether to approve the Agreement, the Board considered various factors, including (i) the nature, extent and quality of services to be provided by the Adviser with respect to the New ETF under the Agreement, (ii) costs to the Adviser of its services, and (iii) the extent to which economies of scale would be realized if and as the New ETF grows and whether the fee in the Agreement reflects these economies of scale.

The Board considered the nature, extent and quality of services to be provided by the Adviser. In doing so, they relied on their prior experience with the Trust and materials provided prior to and at the meeting. The Board reviewed the Agreement and the Adviser’s anticipated responsibilities for managing investment operations of the New ETF, in accordance with the New ETF’s investment objective and policies, and applicable legal and regulatory requirements. The Board appreciated the relatively unique nature of the New ETF, as an exchange-traded fund in a master-feeder structure, and the experience and expertise of the Adviser with exchange-traded funds. The Board considered the background and experience of the Adviser’s senior management, including those individuals responsible for oversight of the sub-adviser for, and compliance of, the New ETF. The Board also considered the portfolio oversight resources, structures and practices of the Adviser, including those associated with monitoring and securing the New ETF’s compliance with its investment objectives and policies and with applicable laws and regulations. The Board also considered information about the Adviser’s overall investment management business, noting that the Adviser serves a wide range of clients across a broad spectrum of asset classes. The Board looked at the Adviser’s general knowledge of the investment business and that of its affiliates which make up State Street Global Advisors, with which the Adviser shares all of its senior personnel. The Board considered that the Adviser and its affiliates constitute one of the world’s largest investment management enterprises for ETFs. The Board also considered the Adviser’s experience in active management, in managing exchange-traded funds, in overseeing third-party sub-advisers, and in master-feeder structures.

The Board considered whether the Adviser benefited in other ways from its relationship with the Trust, noting that the Adviser does not maintain soft-dollar arrangements in connection with the Trust’s brokerage transactions.

The Board reviewed information regarding economies of scale or other efficiencies that may result as the New ETF’s assets grow in size. The Board noted that the Agreement did not provide for breakpoints in the Fund’s advisory fee rates

25

SSgA ACTIVE ETF TRUST

OTHER INFORMATION (continued)

June 30, 2013 (Unaudited)

as assets of the Fund increase. However, the Board further noted the Adviser’s assertion that future economies of scale had been taken into consideration for the New ETF by fixing relatively low advisory fees, effectively sharing the benefits of lower fees with the New Fund from inception. The Board noted that it intends to continue to monitor fees as the New ETF grows in size and assess whether fee breakpoints may be warranted.

The Board evaluated the New ETF’s unitary fee through review of comparative information with respect to fees paid by similar funds — i.e., exchange-traded funds that are actively managed, as applicable. The Board reviewed the universe of similar exchange-traded funds for the New ETF based upon data from Lipper Analytical Services and related comparative information for similar exchange-traded funds. The Board also reviewed the estimated expense ratio for the New ETF, noting the differences in fees between the feeder and corresponding master fund in connection with the master-feeder structure.

The Board, including the Independent Trustees voting separately, approved the Agreement for the New ETF after weighing the foregoing factors, none of which was dispositive in itself and may have been weighed differently by each Trustee. The Board’s conclusions with respect to the Agreement were as follows: (a) the nature and extent of the services expected to be provided by the Adviser with respect to the New ETF were appropriate; (b) the Adviser’s fee for the New ETF and the unitary fee, considered in relation to services expected to be provided, were fair and reasonable; (c) any additional benefits to the Adviser were not of a magnitude materially to affect the Board’s conclusions; and (d) fees expected to be paid to the Adviser were expected to share economies of scale with respect to the New ETF by way of the relatively low fee structure of the Trust.

At in-person meetings held prior to June 30, 2013, the Board also considered the approval of a Sub-Advisory Agreement (the “Blackstone / GSO Sub-Advisory Agreement”) between the SSgA Master Trust and GSO / Blackstone Debt Funds Management LLC (“Blackstone / GSO”) with respect to the Blackstone / GSO Senior Loan Portfolio (the “New Portfolio”) which would serve as the master fund for the New ETF.

In evaluating the Blackstone / GSO Sub-Advisory Agreement, the Board drew on materials provided to them by Blackstone / GSO and the Adviser. In deciding whether to approve the Blackstone / GSO Sub-Advisory Agreement, the Board considered various factors, including: (i) the nature, extent and quality of services expected to be provided by Blackstone / GSO with respect to the New Portfolio under the Blackstone / GSO Sub-Advisory Agreement; and (ii) investment performance of customized credit strategies, including senior secured loan strategies, managed by Blackstone / GSO. The Board was apprised of the portion of the current advisory fee that the Adviser would pay to Blackstone / GSO under the Blackstone / GSO Sub-Advisory Agreement and also considered that such fees would be paid directly by the Adviser and would not result in increased fees payable by the New Portfolio.

The Board considered the background and experience of Blackstone / GSO’s senior management and in particular Blackstone / GSO’s experience in investing in senior secured loans. The Board noted that Blackstone / GSO would bring significant senior secured loan experience to bear in managing the New Portfolio. The Board noted that Blackstone / GSO has extensive experience in managing senior loan portfolios and reviewed Blackstone / GSO’s assets under management in portfolios of senior loans for a wide array of closed-end funds, hedge funds and other accounts.

The Board, including the Independent Trustees voting separately, approved the Blackstone / GSO Sub-Advisory Agreement for the New Portfolio after weighing the foregoing factors, none of which was dispositive in itself and may have been weighed differently by each Trustee. The Board’s conclusions with respect to the Agreement were as follows: (a) the nature and extent of the services expected to be provided by Blackstone / GSO to the New Portfolio were adequate and appropriate; and (b) Blackstone / GSO’s experience in managing senior loan portfolios is extensive.

26

SSgA ACTIVE ETF TRUST

OTHER INFORMATION (continued)

June 30, 2013 (Unaudited)

TRUSTEES

| | | | | | | | | | | | |

Name, Address and Year of Birth | | Position(s)

with Fund | | Term of

Office and

Length of

Time Served | | Principal

Occupation(s)

During Past

5 Years | | Number of

Portfolios

in Fund

Complex

Overseen

by Trustee | | | Other

Directorships

Held by Trustee |

Independent Trustees | | | | | | | | | | | | |

FRANK NESVET

c/o SSgA Active ETF Trust

State Street Financial Center

One Lincoln Street

Boston, MA 02111-2900

1943 | | Independent

Trustee,

Chairman,

Trustee

Committee

Chair | | Term: Unlimited Served: since March 2011 | | Chief Executive Officer, Libra Group, Inc. (1998-present) (a financial services consulting company). | | | 170 | | | SPDR Series Trust (Trustee); SPDR Index Shares Funds (Trustee); SSgA Master Trust (Trustee). |

DAVID M. KELLY

c/o SSgA Active ETF Trust

State Street Financial Center

One Lincoln Street

Boston, MA 02111-2900

1938 | | Independent

Trustee,

Audit

Committee