UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22542

SSGA ACTIVE ETF TRUST

(Exact name of registrant as specified in charter)

One Lincoln Street,

Boston, Massachusetts 02111

(Address of principal executive offices) (zip code)

Christopher Madden, Esq.

State Street Bank and Trust Company

One Lincoln Street/CPH0326

Boston, Massachusetts 02111

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Bingham McCutchen LLP

2020 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: (866) 787-2257

Date of fiscal year end: June 30

Date of reporting period: June 30, 2014

Item 1. Reports to Shareholders.

TABLE OF CONTENTS

PRESIDENT’S LETTERTO SHAREHOLDERS

Dear Shareholders:

The past year unfolded contrary to expectations. Rather than continuing last year’s upward trajectory without interruption, equities faltered early in the year before recovering, bonds rallied, and interest rates fell. In countering these events, the market was supported by some important constants, including globally accommodative monetary policies and increasing investor confidence. World markets continue to grow at a slow but steady pace, with the United States and Europe leading the way.

While current volatility remains low, investors should be wary as recent geopolitical developments, including sectarian violence in Iraq, U.S. and European sanctions against Russia, and the conflict between Israel and Hamas, may produce future market turbulence.

With these uncertainties underscoring the need to implement investment decisions with precision, investors continued to embrace a broad array of ETFs for their ability to provide transparent, low cost and liquid access to global markets. Of particular note, the ETF industry’s overall assets under management are at an all-time high.

As part of our continued commitment to provide investment products to help achieve your investment goals, State Street Global Advisors introduced active ETFs to complement our passive funds. Since July 2013, State Street Global Advisors launched the following active SPDR ETFs:

SPDR SSgA Ultra Short Term Bond ETF (Ticker Symbol: ULST) seeks to provide current income consistent with preservation of capital and daily liquidity through short duration high quality investments. Each of SPDR MFS Systematic Core Equity ETF (Ticker Symbol: SYE), SPDR MFS Systematic Growth Equity ETF (Ticker Symbol: SYG), and SPDR MFS Systematic Value Equity ETF (Ticker Symbol: SYV) seeks capital appreciation.

We take great pride in these new additions to our SPDR family. You will find additional information on the SSgA Active ETF Trust Exchange Traded Funds, including Management’s Discussion of Fund Performance, in the enclosed June 30, 2014 Annual Report.

On behalf of the SSgA Active ETF Trust, I thank you for your continued support.

Sincerely,

Ellen M. Needham

President

1

SPDR SSgA MULTI-ASSET REAL RETURN ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Multi-Asset Real Return ETF (the “Fund”) normally invests substantially all of its assets in the SSgA Multi-Asset Real Return Portfolio (the “Portfolio”), which seeks to achieve real return consisting of capital appreciation and current income. As a result, the Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2014 (the “Reporting Period”), the total return for the Fund was 13.85%, and the total return for the Barclays U.S. Government Inflation-linked Bond Index (the “Index”) was 4.72%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund outperformed the Index during the Reporting Period. Developed economies globally experienced robust gains over the period. Though tame inflation and smaller advances in commodity prices could make returns more difficult in the real asset space, the Fund’s diverse exposure, including equities and REITs, allowed it to capture more of the upside enjoyed by risk markets.

Accommodative policies along with an optimistic shift in global growth expectations served to broadly benefit real assets during the Reporting Period. Commentary from the US Federal Reserve (the “Fed”) related to reduction in bond purchases prompted turmoil in the markets during May and June of 2013. However, after digesting the commentary and accepting that policymakers across the globe intended to carry on, accommodative yields slowly trended lower following the infamous “taper-tantrum.” Securitized Real Estate in the United States was a considerable beneficiary as investors sought attractive valuations and higher yields. Macroeconomic prints remained mixed during much of the period, but data demonstrated enough improvement to benefit market optimism for global growth. Despite risks to global growth such as the weather induced slowdown in the United States and potential for a Chinese hard landing, the market sentiment improved. This benefitted resource equities as investors began to tilt towards more economically sensitive sectors such as energy and materials, which were among top S&P sector performers over the period.

Allocations to broad natural resource equities, securitized real estate, along with targeted exposures to US energy and metals and mining equities provided positive contributions to the Fund’s performance over the period. Following the initial half of 2013, the market shifted focus from the potential for Fed tapering of bond purchases to glimmers of positive economic data. As unemployment and industrial production improved in the US, the market allocated to more economically sensitive sectors within the Fund’s resource equity exposure. The materials sector, which tends to perform well in periods of economic acceleration, represented the strongest S&P 500 sector performer over the one-year period. Battered mining companies benefited from attractive valuations and the potential for improved demand prospects in industrial metals benefited earnings prospects. The Portfolio’s targeted overweight to the US energy sector offered an additional boost to Portfolio returns. Oil prices were supported by a confluence of fundamental supply and demand factors, as geopolitical risks in the Middle East prompted consternation regarding oil supplies, and an uncharacteristically cold snap across the US increased demand. As oil prices trended upward, increased hydraulic fracturing “fracking” in US shale fields generated the largest domestic oil production in over two decades. These factors aided the S&P energy sector in outperforming the broader S&P 500 Index over the period as earnings prospects improved. REIT valuations improved markedly following the Fed’s tapering commentary during the middle months of 2013. Securitized real estate garnered a tailwind from declining government bond yields renewing investor interest for greater yields. Broadly speaking, the rally in REIT prices was also supported by increased lease rates across a number of sectors, improving growth in funds from operations.

Broadly speaking, Portfolio holdings predominantly offered positive returns during the fiscal year with the exception of agricultural commodities. Agricultural commodities were lead lower by corn, as 2013 yielded

2

SPDR SSgA MULTI-ASSET REAL RETURN ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE (CONTINUED)

a record corn harvest in the US, along with supportive planting conditions during 2014, which alleviated supply related concerns. US Treasury inflation-protected securities (TIPS) offered positive contribution to overall portfolio returns, but results lagged the majority of other portfolio holdings. Fundamentals for US inflation-linked bonds appeared less convincing, as negative to low real yields across the term structure of the real yield curve and low inflation expectations did not generate significant support for the asset class.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

3

SPDR SSgA MULTI-ASSET REAL RETURN ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/25/12, 4/26/12, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Multi-Asset Real Return ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2013 is 0.70%.

PERFORMANCE AS OF JUNE 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | | |

| | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCH

MARK:

BARCLAYS

US

GOVERNMENT

INFLATION-

LINKED

BOND

INDEX | | | SECONDARY

BENCH

MARK:

DBIQ

OPTIMUM

YIELD

DIVERSIFIED

COMMODITY

INDEX

EXCESS

RETURN | | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCH

MARK:

BARCLAYS

US

GOVERN

MENT

INFLATION-

LINKED

BOND

INDEX | | | SECONDARY

BENCH

MARK:

DBIQ

OPTIMUM

YIELD

DIVERSIFIED

COMMODITY

INDEX

EXCESS

RETURN | | | |

| | | ONE YEAR | | | 13.85% | | | | 13.93% | | | | 4.72% | | | | 6.38% | | | | | | 13.85% | | | | 13.93% | | | | 4.72% | | | | 6.38% | | | |

| | | SINCE INCEPTION

(1) | | | 8.10% | | | | 8.21% | | | | 0.95% | | | | -3.83% | | | | | | 3.63% | | | | 3.68% | | | | 0.43% | | | | -1.78% | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 25, 2012 to June 30, 2014. |

4

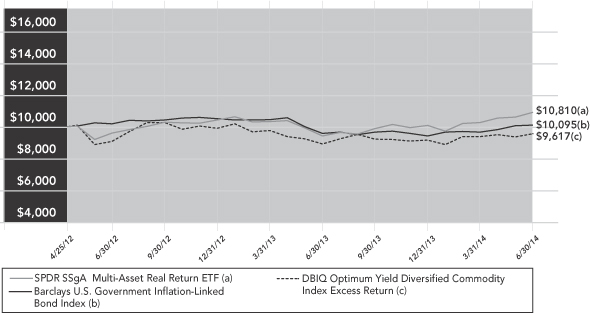

SPDR SSgA MULTI-ASSET REAL RETURN ETF — PERFORMANCE SUMMARY (CONTINUED)

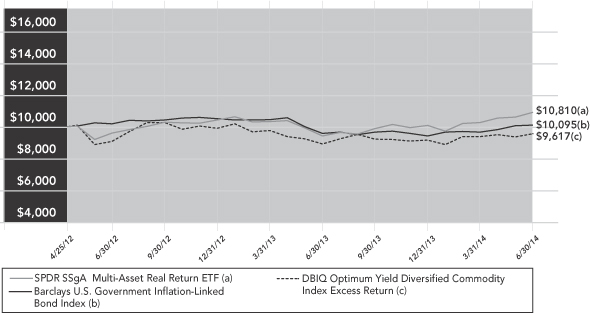

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

5

SPDR SSgA INCOME ALLOCATION ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Income Allocation ETF (the “Fund”) normally invests substantially all of its assets in the SSgA Income Allocation Portfolio (the “Portfolio”), which seeks to provide total return by focusing on investments in income and yield-generating assets. As a result, the Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2014 (the “Reporting Period”), the total return for the Fund was 13.57%, and the total return for the MSCI World Index (the “Index”) was 24.05%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund’s focus on income and yield-generating investments contributed to its underperformance relative to the Index during the Reporting Period. During the second half of 2013, interest rate volatility led to weak returns in the longer term government issues held in the Portfolio, but steady economic growth helped to lift the Portfolio’s equity investments and also served to compress credit spreads, which had a favorable impact on the performance of both investment grade and below investment grade exposures held in the Portfolio. The turn of the year brought indigestion to certain pockets of the global markets — most notably in emerging markets as fears of slower growth in China caused emerging market equities and currencies to tumble. However, most developed markets were able to recoup early 2014 losses and generate solid performance through the end of the Reporting Period. And in contrast to 2013, the assumption of interest rate risk proved a significant source of return as longer duration fixed-income instruments were among the best performing assets held in the Portfolio. Although the Portfolio was not able to maintain the same pace as its Index, its performance was comparable to a multi-asset portfolio of income-generating stocks and bonds.

During the Reporting Period, financial assets had to contend with the introduction of the Federal Reserve’s tapering of asset purchases, as well as a change in leadership as Janet Yellen assumed her role as Chair of the Board of Governors of the Federal Reserve System. The anticipation of lessened bond market support caused the longer duration fixed-income instruments held in the Portfolio to struggle, but by the time formal plans to reduce bond purchases were made in late 2013, those assets were poised to sustain an extended rally. Riskier assets had to contend with severe winter weather in the United States as well as geopolitical conflicts in Syria and the Ukraine. Yet the underlying growth of earnings and support from policymakers helped assets such as income equities and REITs deliver strong returns. Additionally, the Portfolio maintained a healthy diversification into non-US securities, which were bolstered by moderate weakness in the US dollar against broad averages of major currencies.

The top positive contributor to the Fund’s performance was the SPDR S&P Dividend ETF, which advanced steadily during the period and exhibited a maximum drawdown of just over 5%. This was the largest holding for the Portfolio on average, and it benefited from the low level of volatility exhibited in the markets, which helped to facilitate strong performance across equities in general. Other holdings that supported the Fund’s performance included longer term corporate bonds via the SPDR Barclays Long Term Corporate Bond ETF and international dividend payers via the SPDR S&P International Dividend ETF. Longer term corporates benefited from investor preference for credit assets, which was exemplified by a consistent trend of tighter credit spreads during the fiscal year, and they also benefited greatly from improved sentiment towards longer duration assets in the first half of 2014. International dividend stocks rode the same wave of equity market appreciation as US dividend payers, and were able to produce relatively better results as some of the countries and currencies represented in the ETF came back into favor.

In terms of negative contributions, the healthy market environment over the past fiscal year helped many asset classes deliver positive absolute returns, and the only holding in the Portfolio to demonstrate negative returns from an absolute return perspective was the SPDR Russell/Nomura PRIME Japan ETF. This holding did not have a particularly large impact on the Fund, as it was only held for a brief period in

6

SPDR SSgA INCOME ALLOCATION ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE (CONTINUED)

early 2014. Nonetheless, Japanese equities struggled with concerns over the upcoming VAT hike and as slower growth in China weighted on the market. Other holdings in the Portfolio with below average performance included the SPDR Barclays TIPS ETF and the SPDR Barclays Long Term Treasury ETF. Both of these ETFs delivered positive mid-single digit performance over the period, but lagged most other assets held in the Portfolio.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

7

SPDR SSgA INCOME ALLOCATION ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/25/12, 4/26/12, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Income Allocation ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2013 is 0.70%.

PERFORMANCE AS OF JUNE 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | | |

| | | | | NET

ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCH

MARK:

MSCI

WORLD

INDEX | | | SECONDARY

BENCHMARK:

BARCLAYS US

LONG

GOVE

RNMENT/

CREDIT

BOND

INDEX | | | | | NET

ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCH

MARK:

MSCI

WORLD

INDEX | | | SECONDARY

BENCH

MARK:

BARCLAYS US

LONG

GOVERN

MENT/

CREDIT BOND

INDEX | | | |

| | | ONE YEAR | | | 13.57% | | | | 13.59% | | | | 24.05% | | | | 10.77% | | | | | | 13.57% | | | | 13.59% | | | | 24.05% | | | | 10.77% | | | |

| | | SINCE INCEPTION (1) | | | 19.39% | | | | 19.40% | | | | 42.26% | | | | 10.50% | | | | | | 8.45% | | | | 8.46% | | | | 17.55% | | | | 4.69% | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 25, 2012 to June 30, 2014. |

8

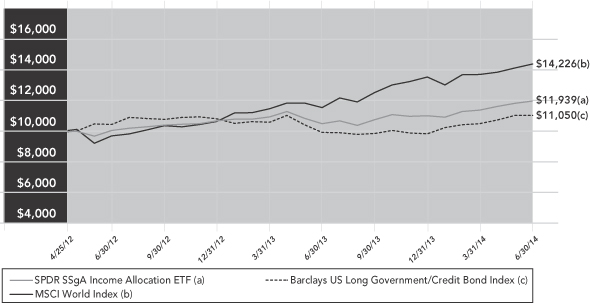

SPDR SSgA INCOME ALLOCATION ETF — PERFORMANCE SUMMARY (CONTINUED)

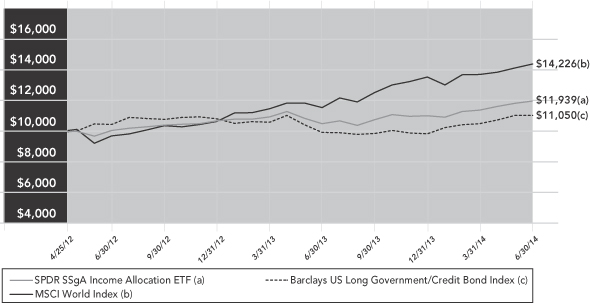

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

9

SPDR SSgA GLOBAL ALLOCATION ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Global Allocation ETF (the “Fund”) normally invests substantially all of its assets in the SSgA Global Allocation Portfolio (the “Portfolio”), which seeks to provide capital appreciation. As a result, the Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2014 (the “Reporting Period”), the total return for the Fund was 16.81%, and the total return for the MSCI ACWI IMI Index (the “Index”) was 23.35%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Portfolio invests broadly across regions and asset classes. During the Reporting Period, the Fund’s diversified investment exposures contributed to its underperformance relative to the equity only Index. Financial conditions over the last year remained relatively stable, bolstered largely by the accommodative policies coming from the central banks of many of the major developed markets. In turn, credit spreads narrowed, while volatility generally decreased across most equity markets. The already rosy environment for financial assets also drew support from a steady improvement in economic data.

With a favorable backdrop for risk assets firmly in place, equity markets experienced sound gains over the Reporting Period, particularly in the United States and Europe. Doubts in emerging economies persisted throughout, as these markets failed to keep pace with their developed counterparts. Still, the emerging markets as a whole were able to shrug off domestic and geopolitical risk to post very respectable gains. Higher global growth prospects combined with a sustained low interest rate environment also proved profitable for REIT securities, which overcame a sluggish end to 2013. And in contrast to 2013, the assumption of interest rate risk proved a significant source of return, as longer duration fixed-income instruments were among the best performing assets among the Portfolio’s fixed-income holdings.

Reflecting both the global exposures of the Fund and our tactical preference for risky assets in the past year, the Fund had overweight exposures to equities compared to bonds. The top positive contributor to performance over the Reporting Period was the SPDR S&P World ex-US ETF. Close behind was the SPDR S&P 500 ETF. Relative weightings in the SPDR Barclays Long Term Bond ETF also proved positive.

The SPDR Wells Fargo Preferred Stock ETF was the largest negative contributor to the Fund’s returns. Other detractors from performance were the SPDR Barclays Emerging Markets Local Bond ETF and the SPDR Barclays Aggregate Bond ETF. Lastly, an allocation to cash negatively impacted overall Fund performance.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

10

SPDR SSgA GLOBAL ALLOCATION ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/25/12, 4/26/12, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Global Allocation ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2013 is 0.35%.

PERFORMANCE AS OF JUNE 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | |

| | | | | NET

ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCH

MARK:

MSCI ACWI

IMI INDEX | | | SECONDARY

BENCH

MARK:

BARCLAYS US

AGGREGATE

INDEX | | | | | NET

ASSET

VALUE | | | MARKET

VALUE | | PRIMARY

BENCH

MARK:

MSCI ACWI

IMI INDEX | | SECONDARY

BENCH

MARK:

BARCLAYS

US

AGGREGATE

INDEX | | |

| | | ONE YEAR | | | 16.81% | | | | 16.84% | | | | 23.35% | | | | 4.37% | | | | | | 16.81% | | | 16.84% | | 23.35% | | 4.37% | | |

| | | SINCE INCEPTION (1) | | | 26.04% | | | | 26.06% | | | | 38.89% | | | | 4.88% | | | | | | 11.18% | | | 11.19% | | 16.27% | | 2.21% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 25, 2012 to June 30, 2014. |

11

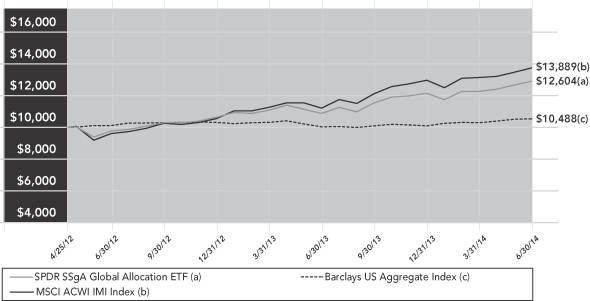

SPDR SSgA GLOBAL ALLOCATION ETF — PERFORMANCE SUMMARY (CONTINUED)

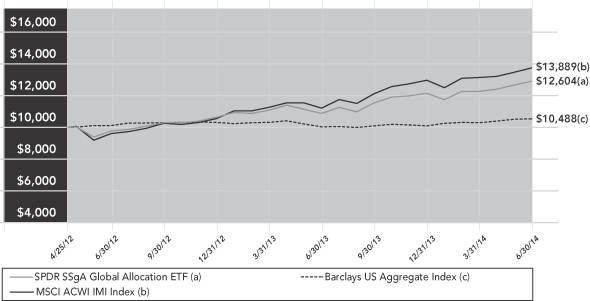

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

12

SPDR BLACKSTONE / GSO SENIOR LOAN ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR Blackstone / GSO Senior Loan ETF (the “Fund”) normally invests substantially all of its assets in the Blackstone / GSO Senior Loan Portfolio (the “Portfolio”), which seeks to provide current income consistent with the preservation of capital. As a result, the Fund invests indirectly through the Portfolio.

For the 12-month period ended June 30, 2014 (the “Reporting Period”), the total return for the Fund was 3.77%, and the total return for the Markit iBoxx USD Liquid Leveraged Loan Index (the “Index”) was 5.46%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund underperformed the Index during the Reporting Period, due primarily to (i) credit selection, as higher credit risk (as measured by corporate ratings) outperformed the less risky credits, and (ii) a higher cash balance, which was maintained to help meet potential liquidity needs. A benign credit environment (measured by a very low default rate versus the long-term average), coupled with significant interest in the leverage loan asset class (as represented by fund flows and issuance activity for collateralized loan obligations), was very supportive of secondary market prices, but also led to compression of credit spreads, as better rated companies refinanced at lower total interest costs. Lower quality loans rated CCC grossly outperformed high quality segments of the market. During this fiscal year, the return of loans rated CCC almost doubled those of B and BB rated loans. Since the Portfolio maintained a quality bias, and was underweighted in CCC and below rated assets throughout the year, it was unable to capture this return.

On an individual security level, the top positive contributors to the Fund’s performance were Weight Watchers (“WTW”), Caesars Entertainment Resort Properties (“CERP”) and Education Management. The Fund’s performance benefitted from the Portfolio’s decision to sell Weight Watchers early this year after a re-evaluation on the fundamental business model. WTW loans continued to decline in value after the Portfolio’s exit. The Portfolio purchased CERP through the primary refinancing transaction at a significant discount to par value. The CERP loans appreciated by more than 5 points prior to inclusion in the Index, contributing to both positive Portfolio performance and excess return versus the Index. The Portfolio’s full underweight to Education Management also contributed meaningfully to performance as the asset suffered a severe price decline after the company announced that it expected to breach its covenants. The top negative contributors were Texas Competitive Electric (“TXU”), Clear Channel, and Caesars Entertainment Operating Company (“CEOC”). The Portfolio had no exposure to TXU as the view was that the company would file bankruptcy and might not pay its pre-petition interest. However, TXU traded up considerably after filing for Chapter 11. The Portfolio added a position in Clear Channel, a generally high-beta credit on the belief that there are near-term catalysts for continued price appreciation. Local gaming authorities are currently reviewing recent amendments to the CEOC outstanding loans. The regulatory delay caused the CEOC loans in the Portfolio to underperform expectations.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

13

SPDR BLACKSTONE / GSO SENIOR LOAN ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/3/13, 4/4/13, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR Blackstone/GSO Senior Loan ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2013 (as supplemented on April 1, 2014) is 0.70%.

PERFORMANCE AS OF JUNE 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN | | | |

| | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

MARKIT

IBOXX USD

LIQUID

LEVERAGED

LOAN INDEX | | | SECONDARY

BENCHMARK:

S&P/LSTA U.S.

LEVERAGED

LOAN

100 INDEX | | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | PRIMARY

BENCHMARK:

MARKIT

IBOXX USD

LIQUID

LEVERAGED

LOAN INDEX | | | SECONDARY

BENCHMARK:

S&P/LSTA

U.S.

LEVERAGED

LOAN

100 INDEX | | | |

| | | ONE YEAR | | | 3.77% | | | | 3.61% | | | | 5.46% | | | | 5.56% | | | | | | 3.77% | | | | 3.61% | | | | 5.46% | | | | 5.56% | | | |

| | | SINCE INCEPTION (1) | | | 3.27% | | | | 3.26% | | | | 5.04% | | | | 5.32% | | | | | | 2.62% | | | | 2.62% | | | | 4.04% | | | | 4.27% | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period April 3, 2013 to June 30, 2014. |

14

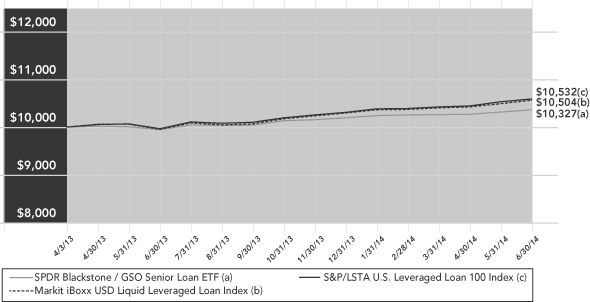

SPDR BLACKSTONE / GSO SENIOR LOAN ETF — PERFORMANCE SUMMARY (CONTINUED)

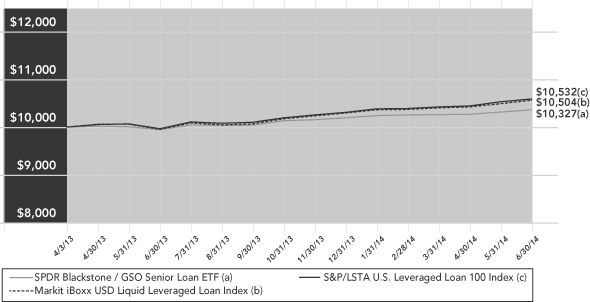

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

15

SPDR SSgA ULTRA SHORT TERM BOND ETF — MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

The SPDR SSgA Ultra Short Term Bond ETF (the “Fund”) normally invests substantially all of its assets in the SSgA Ultra Short Term Bond Portfolio (the “Portfolio”), which seeks to provide current income consistent with preservation of capital and daily liquidity through short duration high quality investments. As a result, the Fund invests indirectly through the Portfolio.

For the period that began October 9, 2013, and ended June 30, 2014 (the “Reporting Period”), the total return for the Fund was 0.46%, and the total return for the Barclays US Treasury Bellwether 3 Month Index (the “Index”) was 0.06%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Fund outperformed the Index during the Reporting Period. The Portfolio maintained a duration of approximately 0.5 years during the period versus the benchmark’s duration of 0.25 years. As of quarter end, the Portfolio’s asset allocation consisted of corporate bonds (72.8%), asset-backed securities (ABS) (25.3%) and cash (1.9%). 42.9% of fund assets had fixed rates and 57.1% had floating rate coupons. The Portfolio’s use of floating rate bonds allowed for substantial exposure to corporate bonds and ABS without adding significant interest rate risk. The Portfolio’s long duration stance and yield curve positioning was responsible for approximately half of the outperformance against the benchmark, while the Portfolio’s sector exposure (corporates and ABS) contributed the other half. The Federal Open Market Committee continued its accommodative monetary policy during the period by leaving the target federal funds rate unchanged at 0% – 0.25% and continuing with its Large Scale Asset Purchase (LSAP) program. As a result, yields in the front end (0-1 year) of the yield curve were virtually unchanged during the period. The Portfolio’s focus on corporate bonds and ABS allowed for a yield advantage compared to the benchmark. Further, credit spreads on corporate bonds and ABS narrowed during the period, giving the Portfolio another return advantage versus its benchmark. Overall, corporate bond credit spreads narrowed more than ABS. Generally speaking, longer maturity bonds in the portfolio performed better than shorter maturity bonds due to the combination of higher yields and more pronounced spread narrowing. The Fund maintained a weighted average maturity near the 1.5-year area in order to take advantage of the higher yields available in 2–5 year corporate bonds and ABS.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

16

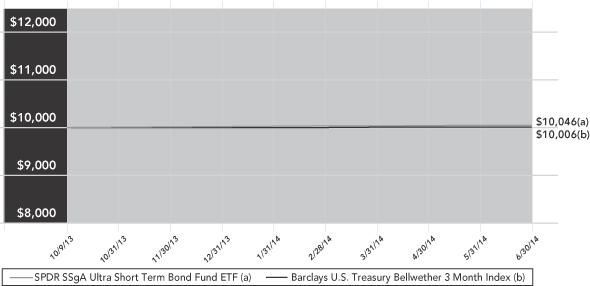

SPDR SSgA ULTRA SHORT TERM BOND ETF — PERFORMANCE SUMMARY

The following performance chart of the Fund’s total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (10/9/13, 10/10/13, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. The total expense ratio for SPDR SSgA Ultra Short Term Bond ETF as stated in the Fees and Expenses table of the prospectus dated October 31, 2013 is 0.20%.

PERFORMANCE AS OF JUNE 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | CUMULATIVE TOTAL RETURN | | | | | AVERAGE ANNUAL TOTAL RETURN (2) | | | |

| | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | BARCLAYS

US TREASURY

BELLWETHER

3 MONTH

INDEX | | | | | NET ASSET

VALUE | | | MARKET

VALUE | | | BARCLAYS

US TREASURY

BELLWETHER

3 MONTH

INDEX | | | |

| | | SINCE INCEPTION (1) | | | 0.46% | | | | 0.39% | | | | 0.06% | | | | | | N/A | | | | N/A | | | | N/A | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | For the period October 9, 2013 to June 30, 2014. |

| | (2) | Total returns for periods of less than one year are not annualized. |

17

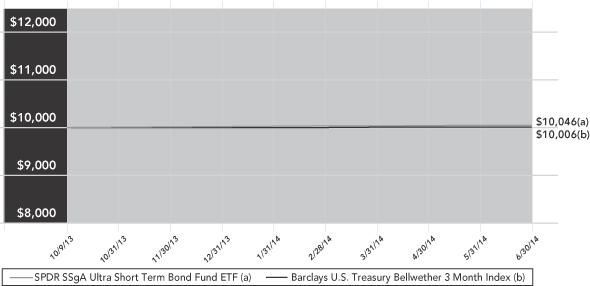

SPDR SSgA ULTRA SHORT TERM BOND ETF — PERFORMANCE SUMMARY

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT (BASED ON NET ASSET VALUE)

Past Performance is not a guarantee of future results.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

18

SPDR SSgA MFS Systematic Core Equity ETF

SPDR SSgA MFS Systematic Growth Equity ETF

SPDR SSgA MFS Systematic Value Equity ETF — PERFORMANCE SUMMARY

These Funds had less than six months of operations at reporting period end and therefore do not have performance history to provide in this report.

19

SSgA ACTIVE ETF TRUST

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2014

| | | | | | | | | | | | |

| | |

SPDR SSgA

Multi-Asset Real

Return ETF | | | SPDR SSgA

Income Allocation

ETF | | | SPDR SSgA

Global Allocation

ETF | |

ASSETS | | | | | | | | | | | | |

Investments in corresponding Portfolio, at market value (Note 1) | | $ | 164,633,907 | | | $ | 104,029,182 | | | $ | 98,490,352 | |

Due from Advisor | | | 1,030 | | | | — | | | | 11,204 | |

Receivable for fund shares sold | | | 24,685,995 | | | | — | | | | — | |

| | | | | | | | | | | | |

TOTAL ASSETS | | | 189,320,932 | | | | 104,029,182 | | | | 98,501,556 | |

| | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | |

Payable to Master Portfolio | | | 24,685,995 | | | | — | | | | — | |

Income distributions payable | | | 1,054,507 | | | | 981,401 | | | | 912,654 | |

Accrued Advisory fees | | | — | | | | 12,885 | | | | — | |

Accrued trustees’ fees and expenses | | | 77 | | | | 63 | | | | 34 | |

| | | | | | | | | | | | |

TOTAL LIABILITIES | | | 25,740,579 | | | | 994,349 | | | | 912,688 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 163,580,353 | | | $ | 103,034,833 | | | $ | 97,588,868 | |

| | | | | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | | | | | |

Paid-in capital (Note 4) | | $ | 162,658,930 | | | $ | 101,878,090 | | | $ | 90,729,373 | |

Undistributed (distributions in excess of) net investment income | | | (217,343 | ) | | | (264,228 | ) | | | (113,125 | ) |

Accumulated net realized gain (loss) on investments | | | (4,385,807 | ) | | | (3,830,418 | ) | | | 557,108 | |

Net unrealized appreciation (depreciation) on investments | | | 5,524,573 | | | | 5,251,389 | | | | 6,415,512 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 163,580,353 | | | $ | 103,034,833 | | | $ | 97,588,868 | |

| | | | | | | | | | | | |

NET ASSET VALUE PER SHARE | | | | | | | | | | | | |

Net asset value per share | | $ | 30.86 | | | $ | 32.70 | | | $ | 35.47 | |

| | | | | | | | | | | | |

Shares outstanding (unlimited amount authorized, $0.00 par value) | | | 5,301,111 | | | | 3,151,111 | | | | 2,751,111 | |

| | | | | | | | | | | | |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

20

| | | | | | | | | | | | | | | | | | |

SPDR Blackstone /

GSO Senior

Loan ETF | | | SPDR SSgA Ultra

Short Term Bond

ETF | | | SPDR MFS

Systematic Core

Equity ETF | | | SPDR MFS

Systematic

Growth Equity

ETF | | | SPDR MFS

Systematic Value

Equity ETF | |

| | | | | | | | | | | | | | | | | | |

| $ | 610,475,920 | | | $ | 14,034,928 | | | $ | 5,376,904 | | | $ | 5,371,501 | | | $ | 5,285,262 | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

| | 610,475,920 | | | | 14,034,928 | | | | 5,376,904 | | | | 5,371,501 | | | | 5,285,262 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | 15,957 | | | | 14,294 | | | | 16,870 | |

| | 200,342 | | | | — | | | | 1,323 | | | | 1,322 | | | | 1,298 | |

| | 299 | | | | 11 | | | | 10 | | | | 10 | | | | 10 | |

| | | | | | | | | | | | | | | | | | |

| | 200,641 | | | | 11 | | | | 17,290 | | | | 15,626 | | | | 18,178 | |

| | | | | | | | | | | | | | | | | | |

| $ | 610,275,279 | | | $ | 14,034,917 | | | $ | 5,359,614 | | | $ | 5,355,875 | | | $ | 5,267,084 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| $ | 610,197,772 | | | $ | 14,019,568 | | | $ | 5,000,000 | | | $ | 5,000,000 | | | $ | 5,000,000 | |

| | 1,246,787 | | | | 4,155 | | | | 710 | | | | 967 | | | | 679 | |

| | (2,786,254 | ) | | | 715 | | | | 68,567 | | | | 10,974 | | | | 4,237 | |

| | 1,616,974 | | | | 10,479 | | | | 290,337 | | | | 343,934 | | | | 262,168 | |

| | | | | | | | | | | | | | | | | | |

| $ | 610,275,279 | | | $ | 14,034,917 | | | $ | 5,359,614 | | | $ | 5,355,875 | | | $ | 5,267,084 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| $ | 50.02 | | | $ | 40.10 | | | $ | 53.60 | | | $ | 53.56 | | | $ | 52.67 | |

| | | | | | | | | | | | | | | | | | |

| | 12,200,000 | | | | 350,000 | | | | 100,000 | | | | 100,000 | | | | 100,000 | |

| | | | | | | | | | | | | | | | | | |

21

SSgA ACTIVE ETF TRUST

STATEMENTS OF OPERATIONS

For the Year Ended June 30, 2014

| | | | | | | | | | | | |

| | |

SPDR SSgA

Multi-Asset Real

Return ETF | | | SPDR SSgA

Income Allocation

ETF | | | SPDR SSgA

Global Allocation

ETF | |

INCOME AND EXPENSES ALLOCATED FROM PORTFOLIO | | | | | | | | | | | | |

Dividend income allocated from Portfolio (Note 2) | | $ | 2,847,611 | | | $ | 4,309,792 | | | $ | 2,012,056 | |

Expenses allocated from Portfolio (Note 2) | | | (260,599 | ) | | | (212,962 | ) | | | (137,182 | ) |

| | | | | | | | | | | | |

TOTAL INCOME | | | 2,587,012 | | | | 4,096,830 | | | | 1,874,874 | |

| | | | | | | | | | | | |

EXPENSES | | | | | | | | | | | | |

Advisory fees (Note 3) | | | 43,345 | | | | 163,921 | | | | — | |

Trustee Fees (Note 3) | | | 2,565 | | | | 2,315 | | | | 1,094 | |

| | | | | | | | | | | | |

TOTAL EXPENSES | | | 45,910 | | | | 166,236 | | | | 1,094 | |

| | | | | | | | | | | | |

Fees reimbursed by Adviser | | | — | | | | — | | | | (102,164 | ) |

| | | | | | | | | | | | |

NET INVESTMENT INCOME | | $ | 2,541,102 | | | $ | 3,930,594 | | | $ | 1,975,944 | |

| | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS | | | | | | | | | | | | |

Net realized gain (loss) allocated from Portfolio | | | (2,207,376 | ) | | | (1,346,776 | ) | | | 1,718,544 | |

Net change in unrealized appreciation (depreciation) from corresponding Portfolio | | | 16,133,379 | | | | 11,409,099 | | | | 6,937,749 | |

| | | | | | | | | | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | 13,926,003 | | | | 10,062,323 | | | | 8,656,293 | |

| | | | | | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 16,467,105 | | | $ | 13,992,917 | | | $ | 10,632,237 | |

| | | | | | | | | | | | |

| * | For the period October 9, 2013 (commencement of operations) to June 30, 2014. |

| ** | For the period January 8, 2014 (commencement of operations) to June 30, 2014. |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

22

| | | | | | | | | | | | | | | | | | |

SPDR Blackstone /

GSO Senior

Loan ETF | | | SPDR SSgA Ultra

Short Term Bond

ETF* | | | SPDR MFS

Systematic Core

Equity ETF** | | | SPDR MFS

Systematic

Growth Equity

ETF** | | | SPDR MFS

Systematic Value

Equity ETF** | |

| | | | | | | | | | | | | | | | | | |

| $ | 22,057,579 | | | $ | 51,616 | | | $ | 45,331 | | | $ | 43,055 | | | $ | 48,907 | |

| | (1,692,806 | ) | | | (19,265 | ) | | | (7,334 | ) | | | (7,332 | ) | | | (7,211 | ) |

| | | | | | | | | | | | | | | | | | |

| | 20,364,773 | | | | 32,351 | | | | 37,997 | | | | 35,723 | | | | 41,696 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | 3,056,063 | | | | — | | | | 7,309 | | | | 7,310 | | | | 7,189 | |

| | 9,412 | | | | 78 | | | | 20 | | | | 19 | | | | 20 | |

| | | | | | | | | | | | | | | | | | |

| | 3,065,475 | | | | 78 | | | | 7,329 | | | | 7,329 | | | | 7,209 | |

| | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

| $ | 17,299,298 | | | $ | 32,273 | | | $ | 30,668 | | | $ | 28,394 | | | $ | 34,487 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | (2,767,908 | ) | | | 888 | | | | 68,567 | | | | 10,974 | | | | 4,237 | |

| 4,689,705 | | | | 10,479 | | | | 290,337 | | | | 343,934 | | | | 262,168 | |

| | | | | | | | | | | | | | | | | | |

| 1,921,797 | | | | 11,367 | | | | 358,904 | | | | 354,908 | | | | 266,405 | |

| | | | | | | | | | | | | | | | | | |

$ | 19,221,095 | | | $ | 43,640 | | | $ | 389,572 | | | $ | 383,302 | | | $ | 300,892 | |

| | | | | | | | | | | | | | | | | | |

23

SSgA ACTIVE ETF TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | |

SPDR SSgA Multi-Asset Real Return ETF | | | SPDR SSgA Income Allocation ETF | |

| | |

Year Ended

6/30/14 | | | Year Ended

6/30/13 | | | Year Ended

6/30/14 | | | Year Ended

6/30/13 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 2,541,102 | | | $ | 1,713,977 | | | $ | 3,930,594 | | | $ | 3,492,721 | |

Net realized gain (loss) on

investments | | | (2,207,376 | ) | | | (924,336 | ) | | | (1,346,776 | ) | | | (1,103,415 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 16,133,379 | | | | (10,378,139 | ) | | | 11,409,099 | | | | (6,205,343 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 16,467,105 | | | | (9,588,498 | ) | | | 13,992,917 | | | | (3,816,037 | ) |

| | | | | | | | | | | | | | | | |

Net equalization credits and charges | | | 44,917 | | | | 57,257 | | | | (85,229 | ) | | | 300,070 | |

| | | | | | | | | | | | | | | | |

DISTRIBUTIONS TO

SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | |

Net investment income | | | (2,582,680 | ) | | | (1,773,687 | ) | | | (3,845,121 | ) | | | (3,792,817 | ) |

| | | | | | | | | | | | | | | | |

FROM BENEFICIAL INTEREST TRANSACTIONS: | | | | | | | | | | | | | | | | |

Proceeds from sale of shares | | | 91,367,609 | | | | 130,398,415 | | | | 7,804,637 | | | | 170,596,375 | |

Cost of shares redeemed | | | (62,105,980 | ) | | | (4,387,694 | ) | | | (86,894,211 | ) | | | — | |

Net income equalization (Note 2) | | | (44,917 | ) | | | (57,257 | ) | | | 85,229 | | | | (300,070 | ) |

Other capital (Note 4) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets from beneficial interest transactions | | | 29,216,712 | | | | 125,953,464 | | | | (79,004,345 | ) | | | 170,296,305 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets during the period | | | 43,146,054 | | | | 114,648,536 | | | | (68,941,778 | ) | | | 162,987,521 | |

Net assets at beginning of period | | | 120,434,299 | | | | 5,785,763 | | | | 171,976,611 | | | | 8,989,090 | |

| | | | | | | | | | | | | | | | |

NET ASSETS END OF PERIOD (1) | | $ | 163,580,353 | | | $ | 120,434,299 | | | $ | 103,034,833 | | | $ | 171,976,611 | |

| | | | | | | | | | | | | | | | |

SHARES OF BENEFICIAL INTEREST | | | | | | | | | | | | | | | | |

Shares sold | | | 3,100,000 | | | | 4,300,000 | | | | 250,000 | | | | 5,450,000 | |

Shares redeemed | | | (2,150,000 | ) | | | (150,000 | ) | | | (2,850,000 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in shares | | | 950,000 | | | | 4,150,000 | | | | (2,600,000 | ) | | | 5,450,000 | |

| | | | | | | | | | | | | | | | |

(1) Undistributed (distributions in excess of) net investment income | | $ | (217,343 | ) | | $ | (66,390 | ) | | $ | (264,228 | ) | | $ | (349,701 | ) |

| | | | | | | | | | | | | | | | |

| * | Commencement of operations |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

24

| | | | | | | | | | | | | | | | | | | | | | |

| SPDR SSgA Global Allocation ETF | | | SPDR Blackstone / GSO Senior Loan ETF | | | SPDR SSgA Ultra

Short Term Bond

ETF | | | SPDR MFS

Systematic Core

Equity ETF | |

Year Ended

6/30/14 | | | Year Ended

6/30/13 | | | Year Ended

6/30/14 | | | For the Period

4/3/13* -

6/30/13 | | | For the Period

10/9/13* -

6/30/14 | | | For the Period

1/8/14* -

6/30/14 | |

| | | | | | | | | | | | | | | | | | | | | | |

| $ | 1,975,944 | | | $ | 707,900 | | | $ | 17,299,298 | | | $ | 945,293 | | | $ | 32,273 | | | $ | 30,668 | |

|

1,718,544 |

| | | 31,543 | | | | (2,767,908 | ) | | | (18,346 | ) | | | 888 | | | | 68,567 | |

|

6,937,749 |

| | | (434,651 | ) | | | 4,689,705 | | | | (3,072,731 | ) | | | 10,479 | | | | 290,337 | |

| | | | | | | | | | | | | | | | | | | | | | |

|

10,632,237 |

| | | 304,792 | | | | 19,221,095 | | | | (2,145,784 | ) | | | 43,640 | | | | 389,572 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 45,650 | | | | 59,672 | | | | 381,936 | | | | 232,911 | | | | 134 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | (2,021,720 | ) | | | (768,378 | ) | | | (16,478,270 | ) | | | (519,534 | ) | | | (28,118 | ) | | | (29,958 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 47,337,163 | | | | 50,769,956 | | | | 286,897,792 | | | | 334,914,199 | | | | 16,009,331 | | | | 5,000,000 | |

| | (9,842,556 | ) | | | (3,233,657 | ) | | | (12,480,635 | ) | | | — | | | | (2,005,142 | ) | | | — | |

| | (45,650 | ) | | | (59,672 | ) | | | (381,936 | ) | | | (232,911 | ) | | | (134 | ) | | | — | |

| | — | | | | — | | | | 461,547 | | | | 404,869 | | | | 15,206 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

|

37,448,957 |

| | | 47,476,627 | | | | 274,496,768 | | | | 335,086,157 | | | | 14,019,261 | | | | 5,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

|

46,105,124 |

| | | 47,072,713 | | | | 277,621,529 | | | | 332,653,750 | | | | 14,034,917 | | | | 5,359,614 | |

| | 51,483,744 | | | | 4,411,031 | | | | 332,653,750 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

| $ | 97,588,868 | | | $ | 51,483,744 | | | $ | 610,275,279 | | | $ | 332,653,750 | | | $ | 14,034,917 | | | $ | 5,359,614 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 1,400,000 | | | | 1,600,000 | | | | 5,750,000 | | | | 6,700,000 | | | | 400,000 | | | | 100,000 | |

| | (300,000 | ) | | | (100,000 | ) | | | (250,000 | ) | | | — | | | | (50,000 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 1,100,000 | | | | 1,500,000 | | | | 5,500,000 | | | | 6,700,000 | | | | 350,000 | | | | 100,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| $ | (113,125 | ) | | $ | (65,033 | ) | | $ | 1,246,787 | | | $ | 425,759 | | | $ | 4,155 | | | $ | 710 | |

| | | | | | | | | | | | | | | | | | | | | | |

25

SSgA ACTIVE ETF TRUST

STATEMENTS OF CHANGES IN NET ASSETS (continued)

| | | | | | | | |

| | | SPDR MFS

Systematic Growth

Equity ETF | | | SPDR MFS

Systematic Value

Equity ETF | |

| | | For the Period

1/8/14* -

6/30/14 | | | For the Period

1/8/14* -

6/30/14 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 28,394 | | | $ | 34,487 | |

Net realized gain (loss) on investments | | | 10,974 | | | | 4,237 | |

Net change in unrealized appreciation (depreciation) on investments | | | 343,934 | | | | 262,168 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 383,302 | | | | 300,892 | |

| | | | | | | | |

Net equalization credits and charges | | | — | | | | — | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

Net investment income | | | (27,427 | ) | | | (33,808 | ) |

| | | | | | | | |

FROM BENEFICIAL INTEREST TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 5,000,000 | | | | 5,000,000 | |

Cost of shares redeemed | | | — | | | | — | |

Net income equalization (Note 2) | | | — | | | | — | |

Other capital (Note 4) | | | — | | | | — | |

| | | | | | | | |

Net increase (decrease) in net assets from beneficial interest transactions | | | 5,000,000 | | | | 5,000,000 | |

| | | | | | | | |

Net increase (decrease) in net assets during the period | | | 5,355,875 | | | | 5,267,084 | |

Net assets at beginning of period | | | — | | | | — | |

| | | | | | | | |

NET ASSETS END OF PERIOD (1) | | $ | 5,355,875 | | | $ | 5,267,084 | |

| | | | | | | | |

SHARES OF BENEFICIAL INTEREST | | | | | | | | |

Shares sold | | | 100,000 | | | | 100,000 | |

Shares redeemed | | | — | | | | — | |

| | | | | | | | |

Net increase (decrease) in shares | | | 100,000 | | | | 100,000 | |

| | | | | | | | |

(1) Undistributed (distributions in excess of) net investment income | | $ | 967 | | | $ | 679 | |

| | | | | | | | |

| * | Commencement of operations |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

26

[This Page Intentionally Left Blank]

27

SSgA ACTIVE ETF TRUST

FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding throughout each period is presented below (1):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

SPDR SSgA Multi-Asset Real Return ETF | | | SPDR SSgA Income Allocation ETF | |

| | | Year Ended

6/30/14 | | | Year Ended

6/30/13 | | |

For the Period

4/25/12* -

6/30/12 | | | Year Ended

6/30/14 | | | Year Ended

6/30/13 | | | For the Period

4/25/12* -

6/30/12 | |

Net asset value, beginning of period | | $ | 27.68 | | | $ | 28.77 | | | $ | 30.00 | | | $ | 29.90 | | | $ | 29.85 | | | $ | 30.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (2) | | | 0.57 | | | | 0.86 | | | | 0.20 | | | | 1.16 | | | | 1.41 | | | | 0.44 | |

Net realized and unrealized gain (loss) on investments (3) | | | 3.22 | | | | (1.33 | ) | | | (1.22 | ) | | | 2.86 | | | | (0.25 | ) | | | (0.29 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.79 | | | | (0.47 | ) | | | (1.02 | ) | | | 4.02 | | | | 1.16 | | | | 0.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net equalization credits and charges (2) | | | 0.01 | | | | 0.03 | | | | (0.01 | ) | | | (0.03 | ) | | | 0.12 | | | | 0.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other capital | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.62 | ) | | | (0.65 | ) | | | (0.20 | ) | | | (1.19 | ) | | | (1.23 | ) | | | (0.41 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 30.86 | | | $ | 27.68 | | | $ | 28.77 | | | $ | 32.70 | | | $ | 29.90 | | | $ | 29.85 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (5) | | | 13.85 | % | | | (1.67 | )% | | | (3.44 | )% | | | 13.57 | % | | | 4.22 | % | | | 0.87 | % |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000s) | | $ | 163,580 | | | $ | 120,434 | | | $ | 5,786 | | | $ | 103,035 | | | $ | 171,977 | | | $ | 8,989 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.24 | % | | | 0.25 | % | | | 0.27 | %(6) | | | 0.36 | % | | | 0.35 | % | | | 0.36 | %(6) |

Net operating expenses | | | 0.24 | % | | | 0.25 | % | | | 0.27 | %(6) | | | 0.36 | % | | | 0.35 | % | | | 0.36 | %(6) |

Net investment income | | | 1.97 | % | | | 2.86 | % | | | 3.77 | %(6) | | | 3.73 | % | | | 4.50 | % | | | 8.24 | %(6) |

Portfolio turnover rate (7) | | | 40 | % | | | 31 | % | | | 10 | % | | | 63 | % | | | 80 | % | | | 15 | % |

| * | Commencement of operations |

| (1) | The per share amounts and percentages include each Fund’s proportionate share of income and expenses of their respective Portfolio. |

| (2) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the period. |

| (3) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (4) | Amount is less that $0.005 per share. |

| (5) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each Fund. Total return for periods of less than one year is not annualized. Broker commission charges are not included in this calculation. |

| (7) | Portfolio turnover rate is from their respective Portfolio. |

See Notes to Financial Statements and Financial Statements of the Master Portfolios.

28

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SPDR SSgA Global Allocation ETF | | | SPDR Blackstone /

GSO

Senior Loan ETF | | | SPDR SSgA

Ultra Short

Term Bond

ETF | | | SPDR MFS

Systematic

Core Equity

ETF | | | SPDR MFS

Systematic

Growth

Equity ETF | | | SPDR MFS

Systematic

Value Equity

ETF | |

Year Ended

6/30/14 | | | Year Ended

6/30/13 | | | For the

Period

4/25/12* -

6/30/12 | | | Year Ended

6/30/14 | | | For the

Period

4/3/13* -

6/30/13 | | | For the

Period

10/9/13* -

6/30/14 | | | For the

Period

1/8/14* -

6/30/14 | | | For the

Period

1/8/14* -

6/30/14 | | | For the

Period

1/8/14* -

6/30/14 | |

| $ | 31.18 | | | $ | 29.19 | | | $ | 30.00 | | | $ | 49.65 | | | $ | 50.00 | | | $ | 40.00 | | | $ | 50.00 | | | $ | 50.00 | | | $ | 50.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.98 | | | | 1.03 | | | | 0.24 | | | | 1.54 | | | | 0.24 | | | | 0.10 | | | | 0.31 | | | | 0.28 | | | | 0.34 | |

|

4.20 |

| | | 1.77 | | | | (0.77 | ) | | | 0.24 | | | | (0.65 | ) | | | 0.03 | | | | 3.59 | | | | 3.55 | | | | 2.67 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 5.18 | | | | 2.80 | | | | (0.53 | ) | | | 1.78 | | | | (0.41 | ) | | | 0.13 | | | | 3.90 | | | | 3.83 | | | | 3.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.02 | | | | 0.09 | | | | (0.02 | ) | | | 0.03 | | | | 0.06 | | | | 0.00 | (4) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | 0.04 | | | | 0.10 | | | | 0.05 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (0.91 | ) | | | (0.90 | ) | | | (0.26 | ) | | | (1.48 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.30 | ) | | | (0.27 | ) | | | (0.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 35.47 | | | $ | 31.18 | | | $ | 29.19 | | | $ | 50.02 | | | $ | 49.65 | | | $ | 40.10 | | | $ | 53.60 | | | $ | 53.56 | | | $ | 52.67 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 16.81 | % | | | 9.91 | % | | | (1.82 | )% | | | 3.77 | % | | | (0.48 | )% | | | 0.46 | % | | | 7.81 | % | | | 7.68 | % | | | 6.04 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 97,589 | | | $ | 51,484 | | | $ | 4,411 | | | $ | 610,275 | | | $ | 332,654 | | | $ | 14,035 | | | $ | 5,360 | | | $ | 5,356 | | | $ | 5,267 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.20 | % | | | 0.20 | % | | | 0.20 | %(6) | | | 0.85 | % | | | 0.90 | %(6) | | | 0.20 | %(6) | | | 0.60 | %(6) | | | 0.60 | %(6) | | | 0.60 | %(6) |

| | 0.05 | % | | | 0.04 | % | | | 0.05 | %(6) | | | 0.85 | % | | | 0.90 | %(6) | | | 0.20 | %(6) | | | 0.60 | %(6) | | | 0.60 | %(6) | | | 0.60 | %(6) |

| | 2.91 | % | | | 3.23 | % | | | 4.48 | %(6) | | | 3.09 | % | | | 1.97 | %(6) | | | 0.34 | %(6) | | | 1.25 | %(6) | | | 1.16 | %(6) | | | 1.43 | %(6) |

| | 89 | % | | | 123 | % | | | 25 | % | | | 77 | % | | | 4 | % | | | 39 | % | | | 27 | % | | | 20 | % | | | 23 | % |

29

SSgA ACTIVE ETF TRUST

NOTES TO FINANCIAL STATEMENTS

June 30, 2014

SSgA Active ETF Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (“1940 Act”), is an open-end investment management company that was organized as a Massachusetts business trust on March 30, 2011.

As of June 30, 2014, the Trust offered eight (8) portfolios, each of which represents a separate series of beneficial interest in the Trust (each, a “Fund” and collectively, the “Funds”). The financial statements herein relate to the following eight (8) Funds: SPDR SSgA Multi-Asset Real Return ETF, SPDR SSgA Income Allocation ETF, SPDR SSgA Global Allocation ETF, SPDR Blackstone / GSO Senior Loan ETF, SPDR SSgA Ultra Short Term Bond ETF, SPDR MFS Systematic Core Equity ETF, SPDR MFS Systematic Growth Equity ETF and SPDR MFS Systematic Value Equity ETF.

The Trust is part of a master-feeder structure and each Fund invests substantially all of its assets in interests of its respective master portfolio: the SSgA Multi-Asset Real Return Portfolio, SSgA Income Allocation Portfolio, SSgA Global Allocation Portfolio, Blackstone / GSO Senior Loan Portfolio, SSgA Ultra Short Term Bond Portfolio, SSgA MFS Systematic Core Equity Portfolio, SSgA MFS Systematic Growth Equity Portfolio and SSgA MFS Systematic Value Equity Portfolio (each, a “Portfolio” and collectively, the “Portfolios”), each Portfolio is a series of a separately registered investment company called SSgA Master Trust (“Master Trust”). The investment objective and policies of each Fund are substantially similar to those of its respective Portfolio. The value of each Fund’s investment in its respective Portfolio reflects the Fund’s proportionate interest in the net assets of that Portfolio (99.99% for SPDR SSgA Multi-Asset Real Return ETF, 99.99% for SPDR SSgA Income Allocation ETF, 99.99% for SPDR SSgA Global Allocation ETF, 99.99% for SPDR Blackstone/GSO Senior Loan ETF, 99.99% for SPDR SSgA Ultra Short Term Bond ETF, 99.98% for SPDR MFS Systematic Core Equity ETF, 99.98% for SPDR MFS Systematic Growth Equity ETF and 99.98% for SPDR MFS Systematic Value Equity ETF at June 30, 2014). The performance of each Fund is directly affected by the performance of its respective Portfolio. The financial statements of the Portfolios, including their Schedules of Investments, are attached to this report and should be read in conjunction with the Fund’s financial statements.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this could involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

| 2. | Summary of Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. These financial statements are presented in United States dollars.

Security Valuation

Each Fund records its investments in its respective Portfolio at fair value each business day. The valuation policies of the Portfolios are discussed in Note 2 of the Portfolios’ Notes to Financial Statements, which are attached to this report.

The Portfolios adopted provisions surrounding fair value measurements and disclosures that define fair value, establish a framework for measuring fair value in generally accepted accounting principles and expand disclosures about fair value measurements. This applies to fair value measurements that are already required or permitted by other accounting standards and is intended to increase consistency of those measurements and applies broadly to securities and other types of assets and liabilities. The summary of the inputs used for each Portfolio, as of June 30, 2014, in valuing each Portfolio’s securities carried at fair value are discussed in Note 2 of the Portfolio’s Notes to Financial Statements, which are attached to this report.

30

SSgA ACTIVE ETF TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2014

Investment Income

Net investment income consists of a Fund’s pro-rata share of the net investment income of its respective Portfolio less expenses of the Fund.

Expenses

Advisory fees and other expenses, which are directly identifiable to a specific Fund, are applied to that Fund. Trustees’ fees and other expenses which cannot be attributed to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of the Funds. The Fund’s are allocated a pro-rata share of the expense of its respective Portfolio.

Equalization

The Funds follow the accounting practice known as “Equalization” by which a portion of the proceeds from sales and costs of reacquiring Fund shares, equivalent on a per share basis to the amount of distributable net investment income on the date of the transaction, is credited or charged to undistributed net investment income. As a result, undistributed net investment income per share is unaffected by sales or reacquisition of Fund shares. Amounts related to Equalization can be found on the Statements of Changes in Net Assets.

Investment Transactions

Investment transactions are recorded as of the trade date. Realized gains and losses from security transactions consist of a Fund’s pro-rata share of its respective Portfolio’s realized gains and losses. Realized gains and losses from security transactions are recorded on the identified cost basis. Corporate actions (including cash dividends) are recorded net of foreign tax withholdings on the ex-dividend date.

Federal Income Tax