UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22558

BROOKFIELD INVESTMENT FUNDS

(Exact name of registrant as specified in charter)

BROOKFIELD PLACE

250 VESEY STREET, 15th Floor

NEW YORK, NEW YORK 10281-1023

(Address of principal executive offices) (Zip code)

BRIAN F. HURLEY, PRESIDENT

BROOKFIELD INVESTMENT FUNDS

BROOKFIELD PLACE

250 VESEY STREET 15th Floor

NEW YORK, NEW YORK 10281-1023

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 777-8001

Date of fiscal year end: September 30

Date of reporting period: September 30, 2018

Item 1. Reports to Shareholders.

Brookfield Investment Management

ANNUAL REPORT

September 30, 2018

Center Coast Brookfield MLP Focus Fund

Brookfield Investment Management (the “Firm”) is an SEC-registered investment adviser and represents the Public Securities platform of Brookfield Asset Management. The Firm provides global listed real assets strategies including real estate equities, infrastructure equities, energy infrastructure equities, real asset debt and diversified real assets. With over $19 billion of assets under management as of September 30, 2018, the Firm manages separate accounts, registered funds and opportunistic strategies for institutional and individual clients, including financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net worth investors. The Firm is a wholly owned subsidiary of Brookfield Asset Management, a leading global alternative asset manager with more than $330 billion of assets under management as of September 30, 2018. For more information, go to www.brookfield.com.

Brookfield Investment Funds is managed by Brookfield Investment Management. The Trust uses its website as a channel of distribution of material company information. Financial and other material information regarding the Fund is routinely posted on and accessible at www.brookfield.com.

This report is for shareholder information. This is not a prospectus intended for the use in the purchase or sale of Fund shares.

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

[THIS PAGE IS INTENTIONALLY LEFT BLANK]

Dear Shareholders,

We are pleased to provide the Annual Report for Center Coast Brookfield MLP Focus Fund (the “Fund”) for the period from December 1, 2017 to September 30, 2018 (the “Period”). The Fund changed its fiscal year end from November 30 to September 30.

After a pullback during the first quarter of 2018, the MSCI World1 and S&P 500®2 Indexes hit yet another record high, returning 7.37% and 11.79% respectively over the period. The synchronized global economic expansion of 2017 continued throughout the first nine months of this year, with the U.S. firmly leading the world in terms of economic growth. U.S. small business optimism has reached its highest level in nearly a decade, while U.S. consumer sentiment still hovers near 10-year highs.3 For the calendar third quarter of 2018, U.S. GDP growth posted 3.5% year-over-year growth rate, while corporate profits grew by approximately 16% over the same period (the largest in six years)4. However, markets continued to contend with a number of headwinds including rising interest rates, the specter of higher inflation and escalating trade tensions with China.

In response to U.S. economic strength, the U.S. Federal Open Market Committee (FOMC) raised the federal funds rate on four occasions throughout the period (December, March, June, and September) to a target range of 2.0%-2.25%5. A fourth increase is expected by the end of 2018—not surprising given the notable removal of the word “accommodative” from the FOMC notes in the September 2018 press release. Meanwhile, monetary policy outside of the U.S. remains much more accommodative amid more muted consumer sentiment and softer economic data.

The spot price of West Texas Intermediate Crude Oil rose over 25% throughout the period closing at $73.16 per barrel. While U.S. crude oil production hit record levels, U.S. infrastructure bottlenecks, concerns around global supply shocks from Iran sanctions and economic turmoil in Venezuela have led to an increase in prices. Subsequent to period end, crude oil prices fell 30% in response to sanction waivers and fears that crude oil demand would slow with trade uncertainty, protectionism, and macro-economic malaise.

Global real asset returns were mixed throughout the period. Master limited partnerships were the best-performing real asset sector for the period. Global and U.S. real estate posted modest returns for the period while global infrastructure declined. Real asset debt posted positive returns for the period, outperforming broader-based high yield and investment grade indexes. Master limited partnerships were the best-performing real asset sector for the period but have given up some of that performance amid the recent crude oil price decline.

In addition to performance information, this report provides the Fund’s audited financial statements as of September 30, 2018.

We welcome your questions and comments, and encourage you to contact our Investor Relations team at (855) 777-8001 or to visit us at www.brookfield.com for more information. Thank you for your support.

Sincerely,

Brian F. Hurley

President

Center Coast Brookfield MLP Focus Fund

Craig Noble, CFA

CEO, Chief Investment Officer and Portfolio Manager

Brookfield Investment Management Inc.

Letter to Shareholders (continued)

Past performance is no guarantee of future results.

Must be preceded or accompanied by a prospectus.

1 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

2 The S&P 500® Index is an equity index of 500 widely held, large-capitalization U.S. companies. Special cash dividends trigger a price adjustment in the price return index. Indices are not managed and an investor cannot invest directly in an index.

3 Source: Source: The National Federation of Independent Business Research Foundation and the University of Michigan Survey of Consumers.

4 Source: Source: Bureau of Economic of Economic Analysis, U.S. Department of Commerce.

5 Source: Source: The U.S. Federal Reserve.

Indices are not managed and an investor cannot invest directly in an index.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on September 30, 2018 and subject to change based on subsequent developments.

The Funds’ portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Funds currently hold these securities. Please refer to the Schedules of Investments contained in this report for a full listing of Funds’ holdings.

Mutual fund investing involves risk. Principal loss is possible.

Quasar Distributors, LLC is the distributor of Brookfield Investment Funds.

A basis point (bps) is a unit that is equal to 1/100 of 1%, and is used to denote the change in a financial instrument.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

2Brookfield Investment Management Inc.

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges and redemption fees on redemptions; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with hypothetical examples that appear in shareholders’ reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs overall would have been higher.

| | Annualized Expense Ratio | Beginning Account Value

(04/01/18) | Ending Account Value

(09/30/18) | Expenses Paid During Period

(04/01/18–

09/30/18)(1) |

| Actual | | | | |

Class A Shares

| 1.46% | $1,000.00 | $1,187.80 | $ 8.01 |

Class C Shares

| 2.21% | 1,000.00 | 1,182.60 | 12.09 |

Class I Shares

| 1.21% | 1,000.00 | 1,189.30 | 6.64 |

Class Y Shares

| 1.21% | 1,000.00 | 1,189.00 | 6.64 |

| Hypothetical (assuming a 5% return before expenses) | | | | |

Class A Shares

| 1.46% | 1,000.00 | 1,017.75 | 7.38 |

Class C Shares

| 2.21% | 1,000.00 | 1,013.99 | 11.16 |

Class I Shares

| 1.21% | 1,000.00 | 1,019.00 | 6.12 |

Class Y Shares

| 1.21% | 1,000.00 | 1,019.99 | 6.12 |

| (1) | Expenses are equal to the Funds’ annualized expense ratio by class multiplied by the average account value over the period, multiplied by 183/365 (to reflect a six-month period). |

Center Coast Brookfield MLP Focus Fund

Management Discussion of Fund Performance

For the ten month period ended September 30, 2018, the Fund's Class Y had a total return of 10.35%, which assumes the reinvestment of dividends and is exclusive of brokerage commissions, underperforming the S&P 500®1 and Alerian MLP Index2, which returned 11.79% and 10.92%, respectively.

MARKET OVERVIEW

Introduction

A positive fundamental backdrop supported the midstream market in late 2017 but was ultimately overpowered by corporate finance announcements, capital markets fatigue, and other technical factors such as tax harvesting. Year-end tax harvesting has occurred consistently throughout the energy downturn, particularly in years with an absence of widespread losses in other market sectors. This appeared to cause indiscriminate selling across the board, but likely affected some names more than others. Despite this technical headwind, we thought that late-year federal tax reform could serve to boost sentiment for midstream products. Broadly speaking, we expected significant benefits for most investors of MLPs or MLP investment funds structured as C corporations from the new tax code, including the 20% pass-through income deduction and the lowering of the corporate tax rate.

So, heading into 2018, we were optimistic that the abatement of technical pressures would allow strong industry fundamentals to start to shine through—and that record production and midstream throughput, increasing commodity prices, cheap valuations, and the market’s recognition of a healthier, transitioning midstream sector would lift the figurative clouds that had been pervasive for the better part of four years.

January 2018-March 2018 Fund Summary Observations (-10.68% NAV total return by the Fund's Y share class)

Unfortunately, the market wasn’t ready to buy this turnaround story—early 2018 performance started off well then reversed quickly in February before accelerating downward from mid-March to quarter-end. This acceleration into quarter-end came after the FERC3 announced that regulated interstate gas and oil pipelines within the Master Limited Partnership (“MLP”) structure would no longer be able to recover an income tax allowance in cost-of-service rate-making. This was an unexpected policy change that caused a sell-off across all midstream equities, although we believed that most companies would ultimately experience little or no cash flow impact (more on that below).

Back in February, however, a handful of announcements like the NuStar and Macquarie Infrastructure Corporation distribution cuts took attention away from other positive developments prior to the unexpected FERC announcement that surprised an already wary investor base. Like many other times in this prolonged downturn, just as things started to recover, an unexpected issue popped up and disrupted the fragile recovery that had started to find traction—another tail started wagging the dog. We believe these company-specific events do not define the midstream story and do not fundamentally change its long-term trajectory, yet they continue to be a source of stress and confusion for investors looking for sustainable and drama-free market recovery.

March’s performance was mostly driven by the unexpected FERC announcement. Although we knew the FERC was looking at this issue, the announcement was surprising for several reasons. The prior FERC policy survived a legal challenge in 2007 and had been vetted through the court system. Most of the FERC commissioners were appointed by a pro-infrastructure, pro-energy administration. Also, the FERC failed to consider the complexities involved with this abrupt policy change and ended up creating more questions than answers.

The Alerian MLP Index traded down almost 8% in the seven days following the FERC announcement, and once again the entire midstream universe (C-Corps included) got painted with a broad brush. The types of assets that could be materially affected by this FERC ruling do not represent the entirety of the midstream value chain. We estimated that the March FERC ruling, at that time, could affect 1-2% of our universe’s cash flow in the aggregate. Yet the ultimate impact and timing is still unknown given the complexity and nuances involved in pipeline rate-making and the amount of analysis FERC needs to undertake. With minimal expected cash flow impairment

4Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

and a prolonged timeline, we believe the magnitude of the market sell-off was most definitely overdone in the short time after the mid-March announcement.

For the few companies that did have moderate cash flow impact expectations, the market immediately priced in a worst-case scenario while also failing to recognize some of the potential mitigating factors. First, negotiated rates, which make up a substantial portion of cash flows on interstate pipelines, are not affected by the ruling. Second, rate cases are all encompassing and have many moving parts—income tax allowance is just one part of a larger equation (the FERC’s July update gave midstream companies a win by allowing for the removal of accumulated deferred income taxes from rate base). Lastly, all the companies that are facing cash flow headwinds due to the removal of the income tax allowance have an easy out—they are all owned by a C-Corp parent and could be bought out or restructured before cash flow degradation materializes. We have seen these announcements for nearly all of the MLPs that expected a moderate cash flow impact from the initial March FERC ruling.

Outside of the FERC policy reversal impacting a few names, not much changed from a fundamental perspective during this time period. We anticipated attractive cash flow growth in 2018 and that started to materialize in the weeks that followed as first quarter earnings were reported. Thus, valuation levels at the time suggested that the first quarter’s energy market was like the energy market of the 2008-2009 financial crisis or the sub-$30 crude oil market of early 2016. Sentiment continued to be extremely low; energy equities, and particularly MLPs, struggled to attract new investors. We hoped that the second quarter and a strong reporting period would start to turn the tide for midstream equities.

April 2018-June 2018 Fund Summary Observations (+10.22% NAV total return by the Fund's Y share class)

Midstream equities did indeed snap back in the second quarter, generating outperformance after the difficult first quarter that ended with a tremendous amount of investor frustration. While the handful of companies impacted by the FERC’s revised policies continued to underperform during the second quarter, the ability of the unimpacted companies to perform well suggested that investors were willing to ignore some of the noise. This was in stark contrast to other disruptive events over the past few years in which we saw midstream companies sold indiscriminately as a group regardless of fundamentals, including whether these events had any meaningful impact on midstream companies otherwise.

We presume that this dispersion and performance was the result of the positive industry fundamentals that were on display during the April-May earnings season. Growing production, demand, and exports filled many existing midstream assets to max capacity. As a result, the industry still needs to build new assets in key growth regions, and existing assets are being marketed to find new revenue opportunities. Further, regions with underutilized assets like the Eagle Ford, Haynesville, and Oklahoma received renewed attention and highlighted an opportunity for midstream companies to increase cash flow through operating leverage.

While we’ve spoken about industry fundamentals constantly over the last few years, first quarter earnings results provided the most tangible reflection of those fundamentals we could recall. The Fund’s holdings reported impressive year-over-year eanings before interest, tax, depreciation and amortization (“EBITDA”) growth by 25%, and we expected similarly impressive results to continue throughout the year. Continued earnings strength is a result of myriad factors, including: (i) record production of crude oil, natural gas, and natural gas liquids (“NGLs”); (ii) record exports of U.S. produced hydrocarbons and products; (iii) the completion of long-dated pipeline projects like EPD’s Midland-to-Sealy pipeline; (iv) record seasonal natural gas demand, and; (v) start-ups of the first few world-scale ethane crackers being built along the Gulf Coast.

However, as mentioned above, not every midstream equity performed well during the second quarter. Those few names impacted by the mid-March FERC policy change sold off with uncertainty, reduced growth estimates, and as many general partners waved the white flag to avoid rate degradation on cost-of-service interstate pipelines.

Unfortunately, in a few instances, historically strong and supportive sponsors demonstrated very little patience and either made statements or announced decisions that were severely detrimental to the limited partners. Instead of support and patience, certain sponsors/general partners appeared reactionary and almost adversarial to the

Center Coast Brookfield MLP Focus Fund

limited partners. Because of this, and in response to the associated uncertainty, certain partnerships experienced disproportionate equity price moves (losses of up to 50% for some) that far exceeded the potential FERC-related cash flow degradation (5%-15% of EBITDA by our estimates for those names). While we could not go back in time to avoid those situations, we moved forward with heightened awareness of sponsor alignment and management incentives. We believe these situations highlighted how the ongoing and accelerating “simplification” trend should benefit investors over the long term by better aligning general partners with limited partners and management teams with common equity investors. And that simplification trend continued with fervor during the second quarter.

There were a total of six limited partner acquisitions and one incentive distribution right (“IDR”) buy-out transaction in the second quarter, and a large portion of these were in response to the FERC announcement. We believe MLPs that were not impacted by the FERC policy change will look at their own fact patterns and circumstances to determine the best and most tax-efficient way of simplifying their corporate structure. Seeing that many midstream companies and investors prefer the tax-advantaged status of the MLP structure, and considering the potential tax consequences of a C-Corp conversion, we expect a large handful of companies to remain in a partnership structure. Others may indeed end up converting to a C-Corp structure, particularly if there is a pre-existing public C-Corp parent vehicle that might be able to utilize a basis step-up upon acquisition. When the dust settles, however, the underlying entities should be stronger and better aligned than they were previously—regardless of the corporate structure.

As the second quarter came to a close, crude oil price correlation was down, fundamentals stayed up, and the industry remained “under-built.” Further, the ability of many pipeline MLPs to outperform shortly after the unexpected FERC policy change felt like a reversal of some of the extreme bearishness that sold the group indiscriminately in the three years prior. As we entered July, there were still some simplifications and FERC issues to sort out while the asset class continued to make progress in its evolution—a process we like to call the transition from “Midstream 1.0” to “Midstream 2.0.”4

July 2018-September 2018 Fund Summary Observations (+7.87% NAV total return by the Fund's Y share class)

A strong mid-summer run overpowered a soft final few weeks to keep us squarely in the green during the third quarter. Looking back, most of the market strength occurred in the middle of earnings season. From the first earnings report on July 18th to the final one on August 9th, the AMZ returned nearly 11%, ending with its peak value for the quarter. Since this was one of the most fundamentally bullish earnings seasons we can recall, this feels like more than just coincidence.

There were, however, other notable events that also affected sector performance during the quarter. The FERC clarified its mid-March ruling on July 18th in a way that was viewed as incrementally positive to the handful of partnerships impacted by the initial ruling. The simplification wave also continued, with the highly-anticipated Energy Transfer announcement coming much sooner than projected and with more favorable terms than many had expected. The Enbridge MLP subsidiaries received revised takeout offers at higher premiums, and Dominion announced an offer to buy-out its MLP.

The weakness seen in the last few weeks of the third quarter was frustrating to many, particularly since crude oil prices rose higher at the end of the quarter. While it’s impossible to identify the exact cause with 100% certainty, we would highlight heightened regulatory concerns as a potential culprit. Currently there’s a ballot initiative that threatens future oil and gas production growth in Colorado, an important state for four or five companies in our investable universe. A couple of large pipeline projects also experienced delays and cost overruns due to state-level opposition. With the risk of these headwinds isolated and likely already priced into the market, we exited the quarter optimistic about another solid earnings season and an asset class that is well on its way to becoming more mature, simplified, self-funding, and incrementally investable. With more progress and continued execution at the operational level, we are cautiously optimistic that fund flows could improve, generalist investors could rotate, retail investors could return, and valuations could re-rate to a level more commensurate with the

6Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

top-tier fundamental backdrop. In the meantime, we’ll take another solid quarter as a positive sign that things are heading in the right direction.

1 The S&P 500® Total Return Index is the total return version of S&P 500® Index. Dividends are reinvested on a daily basis and the base date for the index is January 1, 1988. All regular cash dividends are assumed reinvested in the S&P 500® Index on the ex-date. Special cash dividends trigger a price adjustment in the price return index.

2 The Alerian MLP Index is a composite of the 50 most prominent energy MLPs calculated by Standard & Poor’s using a float-adjusted market-capitalization methodology. The index is disseminated by the New York Stock Exchange real-time on a price return basis (NYSE: AMZ) and on a total-return basis (NYSE: AMZX).

3 Federal Energy Regulatory Commission.

4 A term used to illustrate the evolution of the midstream sector from one that was previously characterized by capital funding from external sources, lower distribution coverage, and the presence of incentive distribution rights “IDRs,” to one that places a greater emphasis on self-funding of capital projects with excess cash flow (higher distribution coverage) and corporate governance simplification through the elimination of IDRs and/or structural combination of multiple affiliated public securities.

Indices are not managed and an investor cannot invest directly in an index.

CONCLUSION

Even though the fiscal 2018 ended with a whimper in September, it wasn’t a bad one in the end—a positive 10.35% NAV return by the Fund's Y share class; FERC clarification after March uncertainty; impressive earnings; bullish company guidance; improved LP premiums, and; continued progress on the structural evolution and progression to “Midstream 2.0.” This was accomplished even as the 10-year Treasury rate climbed above 3%, trade tensions escalated, and tariff talk increased the risk of a broader economic slowdown and reduced hydrocarbon exports out of the U.S. These macro factors are top of mind and increasingly important should the U.S. oil and gas market continue to gain global market share.

Yet domestic progress—supply, demand, and the critical need for more midstream assets—keeps us optimistic about the earnings and cash flow potential of our midstream investments. Coupled with an ongoing maturation of the asset class through simplification and self-funding, we believe the sector continues to improve and become more appealing to a broader set of investors. The catalyst for continued performance, in our opinion, is continued execution with fewer surprises. The outlook is exciting, and the plan ahead is a good one; if companies are able to execute the plan and deliver on stated objectives, we believe the future will be bright.

AVERAGE ANNUAL TOTAL RETURNS

| As of September 30, 2018 | | | |

| | One Year | Five Years | Since Inception* |

| Class A Shares (Excluding Sales Charge) | 3.12% | -0.50% | 3.03% |

| Class A Shares (Including Sales Charge) | -2.81% | -1.68% | 2.25% |

| Class C Shares (Excluding Sales Charge) | 2.19% | -1.27% | 2.21% |

| Class I Shares | 3.20% | -0.29% | 3.23% |

| Class Y Shares | 3.33% | -0.26% | 3.24% |

| S&P 500® Index | 17.91% | 13.95% | 13.82% |

| Alerian MLP Index | 4.89% | -2.72% | 3.03% |

* Class A, Class C and Class Y were incepted on December 31, 2010 and Class I was was incepted on February 5, 2018. The Alerian MLP Index references Class Y’s inception date. All returns shown in USD.

The table and graphs do not reflect the deductions of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. Performance shown including sales charge reflects the Class A maximum sales charge of 4.75%

Center Coast Brookfield MLP Focus Fund

and the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance data excluding sales charge does not reflect the deduction of the sales charge or CDSC and if reflected, the sales charge or fee would reduce the performance quoted.

The gross expense ratio in the prospectus dated February 5, 2018 is 1.46% for Class A Shares, 2.21% for Class C Shares, 1.21% for Class I Shares and 1.21% for Class Y Shares, as applicable to investors respectively.

The Fund’s gross and net expense ratios in the financial highlights of this report are as follows: Class A is 1.47% and 1.46%, Class C is 2.22% and 2.21%, Class I is 1.22% and 1.21% and Class Y is 1.22% and 1.21%, respectively for the fiscal year ended September 30, 2018.

The Adviser has contractually agreed to reimburse the Fund's expenses through February 5, 2020. There is no guarantee that such reimbursement will be continued after that date.

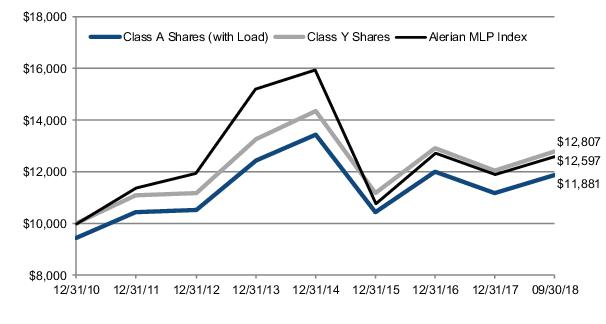

The graphs below illustrate a hypothetical investment of $10,000 in the Fund's Class A Shares (including sales charge) and Class Y Shares the from the commencement of investment operations on December 31, 2010 to September 30, 2018 compared to the Alerian MLP Index.

Disclosure

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Center Coast Brookfield MLP Focus Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Performance data quoted represents past performance and is no guarantee of future results. S&P 500 Index and Alerian MLP Index references Class A’s inception date. Total return figures include the reinvestment of dividends and capital gains, and as the Fund is taxable as a “C” corporation, performance is net of federal, state and local taxes paid by the Fund. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month end performance, please call (855) 244-4859.

8Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

Following the close of business on February 2, 2018, the Fund acquired all of the assets, subject to liabilities, of the Center Coast MLP Focus Fund (the “Predecessor Fund”) through a tax-free reorganization (the “Reorganization”). The Fund is a newly created series of Brookfield Investment Funds, which has the same investment objective and substantially similar investment strategies and policies as the Predecessor Fund. The Fund offers multiple share classes, which are subject to different sales charges and distribution and servicing fees. As a result of the Reorganization, shareholders of the Predecessor Fund’s Class A and Class C Shares received Class A and Class C Shares of the Fund, respectively, and shareholders of the Predecessor Fund’s Institutional Class Shares received Class Y Shares of the Fund. In addition, as a result of the Reorganization, the Fund’s Class A and Class C Shares adopted the Predecessor Fund’s Class A and Class C Shares’ performance and accounting history, and the Fund’s Class Y Shares adopted the Predecessor Fund’s Institutional Class Shares’ performance and accounting history.

Brookfield Investment Management Inc., the Fund’s investment adviser (the “Adviser”), has contractually agreed to waive all or a portion of its investment advisory or administration fees and/or to reimburse certain expenses of the Fund to the extent necessary to maintain the Fund’s total annual fund operating expenses (i.e., the Fund’s gross expense ratios) (excluding any front-end or contingent deferred sales loads, brokerage commissions and other transactional expenses, acquired fund fees and expenses, interest, taxes, such as deferred income tax expenses, and extraordinary expenses, such as litigation; and other expenses not incurred in the ordinary course of the Fund’s business), at no more than 1.46% for Class A Shares, 2.21% for Class C Shares, 1.46% for Class T Shares, 1.21% for Class I Shares and 1.21% for Class Y Shares, as applicable to investors respectively. The fee waiver and expense reimbursement arrangement will continue for two years following the Fund’s Reorganization and may not be terminated by the Fund or the Adviser before such time. Current performance of the Fund may be lower or higher than the performance quoted. Performance shown including sales charge reflects the Class A maximum sales charge of 5.75% of the Predecessor Fund. Performance data excluding sales charge does not reflect the deduction of the sales charge and if reflected, the sales charge or fee would reduce the performance quoted. Investment performance reflects fee waivers, expenses and reimbursements in effect. In the absence of such waivers, total return and NAV would be reduced. On purchases of Class A Shares, no sales charge is payable at the time of purchase on investments of $1 million or more, although for such investments the Fund will impose a CDSC of 1.00% on redemptions made within 18 months of the purchase. If imposed, the CDSC is based on the original cost of the shares redeemed. Class C Shares are subject to a CDSC of 1.00% when redeemed within 12 months of the purchase.

The Fund is not required to make distributions and in the future could decide not to make such distributions or not to make distributions at a rate that over time is similar to the distribution rate it receives from the MLPs in which it invests. It is expected that a portion of the distributions will be considered tax deferred return of capital (ROC). ROC is tax deferred and reduces the shareholder’s cost basis (until the cost basis reaches zero); and when the Fund shares are sold, if the result is a gain, it would then be taxable to the shareholder at the capital gains rate. Any portion of distributions that are not considered ROC are expected to be characterized as qualified dividends for tax purposes. Qualified dividends are taxable in the year received and do not serve to reduce the shareholder’s cost basis. The portion of the Fund’s distributions that are considered ROC may vary materially from year to year. Accordingly, there is no guarantee that future distributions will maintain the same classification for tax purposes as past distributions. An investment in the Fund may not receive the same tax treatment as a direct investment in the MLP. Because deferred tax liability may be reflected in the daily NAV, the MLP Fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

A Basis Point is one hundredth of one percent (0.01%). Cash flow refers to the amount of cash generated and used by a company over a given period.

Earnings growth is not a measure of the Fund’s future performance.

Investing in Master Limited Partnerships (“MLPs”) involves additional risks as compared to the risks of investing in common stock, including risks related to cash flow, dilution and voting rights. The Fund’s investments are concentrated in the energy infrastructure industry with an emphasis on securities issued by MLPs, which may increase volatility. Energy infrastructure companies are subject to risks specific to

Center Coast Brookfield MLP Focus Fund

the industry such as fluctuations in commodity prices, reduced volumes of natural gas or other energy commodities, environmental hazards, changes in the macroeconomic or the regulatory environment or extreme weather. MLPs may trade less frequently than larger companies due to their smaller capitalizations which may result in erratic price movement or difficulty in buying or selling. The Fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. Additional management fees and other expenses are associated with investing in MLPs. Additionally, investing in MLPs involves material income tax risks and certain other risks. Actual results, performance or events may be affected by, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) changes in laws and regulations and (5) changes in the policies of governments and/or regulatory authorities. Unlike most other open-end mutual funds, the Fund will be taxable as a regular corporation, or “C” corporation. Consequently, the Fund will accrue and pay federal, state and local income taxes on its taxable income, if any, at the Fund level, which will ultimately reduce the returns that the shareholder would have otherwise received. Additionally, on a daily basis the Fund’s net asset value per share (“NAV”) will include a deferred tax expense (which reduces the Fund’s NAV) or asset (which increases the Fund’s NAV, unless offset by a valuation allowance). To the extent the Fund has a deferred tax asset, consideration is given as to whether or not a valuation allowance is required. The Fund’s deferred tax expense or asset is based on estimates that could vary dramatically from the Fund’s actual tax liability/benefit and, therefore, could have a material impact on the Fund’s NAV. This material is provided for general and educational purposes only, and is not intended to provide legal, tax or investment advice or to avoid legal penalties that may be imposed under U.S. federal tax laws. Investors should contact their own legal or tax advisors to learn more about the rules that may affect individual situations.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on September 30, 2018 and subject to change based on subsequent developments.

10Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

Portfolio Characteristics (Unaudited)

September 30, 2018

| Asset Allocation by Sector | Percent of

Net Assets |

| Master Limited Partnerships | |

| Diversified Midstream | 26.5% |

| Petroleum Transportation & Storage | 23.1% |

| Gathering & Processing | 15.2% |

| Natural Gas Transportation & Storage | 11.0% |

| Total Master Limited Partnerships | 75.8% |

| Common Stocks | |

| Midstream C-corps | 22.7% |

| Petroleum Transportation & Storage | 0.5% |

| Total Common Stocks | 23.2% |

| Other Assets in Excess of Liabilities | 1.0% |

| Net Assets | 100.0% |

| TOP TEN HOLDINGS | |

| Energy Transfer Partners LP | 8.6% |

| Enterprise Products Partners LP | 8.4% |

| Williams Companies, Inc. | 7.6% |

| Targa Resources Corp. | 7.3% |

| NuStar Energy LP | 5.9% |

| Enlink Midstream Partners LP | 5.8% |

| MPLX LP | 5.2% |

| Plains All American Pipeline LP | 5.2% |

| Spectra Energy Partners LP | 5.0% |

| Western Gas Partners LP | 4.9% |

Center Coast Brookfield MLP Focus Fund

Schedule of Investments

September 30, 2018

| | | | Shares | Value |

| MASTER LIMITED PARTNERSHIPS – 75.8% | | | |

| Diversified Midstream – 26.5% | | | |

Andeavor Logistics LP

| | | 2,299,950 | $ 111,685,572 |

Energy Transfer Partners LP

| | | 10,007,043 | 222,756,775 |

Enterprise Products Partners LP

| | | 7,546,444 | 216,809,336 |

MPLX LP

| | | 3,909,375 | 135,577,125 |

| Total Diversified Midstream | | | | 686,828,808 |

| Gathering & Processing – 15.2% | | | |

Crestwood Equity Partners LP

| | | 698,860 | 25,683,105 |

DCP Midstream LP

| | | 1,721,902 | 68,170,100 |

Enlink Midstream Partners LP

| | | 8,112,994 | 151,226,208 |

Summit Midstream Partners LP

| | | 1,623,249 | 23,212,461 |

Western Gas Partners LP

| | | 2,877,402 | 125,684,920 |

| Total Gathering & Processing | | | | 393,976,794 |

| Natural Gas Transportation & Storage – 11.0% | | | |

EQT Midstream Partners LP

| | | 1,190,729 | 62,846,675 |

Spectra Energy Partners LP

| | | 3,610,302 | 128,923,884 |

TC Pipelines LP

| | | 3,096,530 | 93,917,755 |

| Total Natural Gas Transportation & Storage | | | | 285,688,314 |

| Petroleum Transportation & Storage – 23.1% | | | |

Buckeye Partners LP

| | | 3,052,597 | 109,008,239 |

Enbridge Energy Partners LP

| | | 6,649,008 | 73,072,598 |

Magellan Midstream Partners LP

| | | 1,529,569 | 103,582,413 |

NuStar Energy LP 1

| | | 5,517,766 | 153,393,895 |

Phillips 66 Partners LP

| | | 506,333 | 25,893,869 |

Plains All American Pipeline LP

| | | 5,393,728 | 134,897,137 |

| Total Petroleum Transportation & Storage | | | | 599,848,151 |

Total MASTER LIMITED PARTNERSHIPS

(Cost $1,834,292,201)

| | | | 1,966,342,067 |

| COMMON STOCKS – 23.2% | | | |

| Midstream C-corps – 22.8% | | | |

Kinder Morgan Inc.

| | | 3,942,520 | 69,900,880 |

ONEOK, Inc

| | | 1,612,699 | 109,324,865 |

SemGroup Corp

| | | 1,103,306 | 24,327,897 |

Targa Resources Corp.

| | | 3,353,852 | 188,855,406 |

Williams Companies, Inc.

| | | 7,285,441 | 198,091,141 |

| Total Midstream C-corps | | | | 590,500,189 |

| Petroleum Transportation & Storage – 0.4% | | | |

Enbridge Energy Management LLC 2

| | | 1,072,160 | 11,707,987 |

Total COMMON STOCKS

(Cost $477,533,362)

| | | | 602,208,176 |

Total Investments – 99.0%

(Cost $2,311,825,563)

| | | | 2,568,550,243 |

Other Assets in Excess of Liabilities – 1.0%

| | | | 25,618,179 |

TOTAL NET ASSETS – 100.0%

| | | | $2,594,168,422 |

See Notes to Financial Statements.

12Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

Schedule of Investments (continued)

September 30, 2018

| The following notes should be read in conjunction with the accompanying Schedule of Investments. |

| LP— Limited Partnership |

| LLC— Limited Liability Company |

| 1 | — Affiliate issuer. (Note 8) |

| 2 | — Non-income producing security. |

See Notes to Financial Statements.

CENTER COAST BROOKFIELD MLP FOCUS FUND

Statement of Assets and Liabilities

September 30, 2018

| Assets: | |

Investments in securities, at value:

| |

| Unaffiliated securities (cost $2,136,286,334) | $2,415,156,348 |

| Affiliated securities (cost $175,539,229) | 153,393,895 |

| Total investments (cost $2,311,825,563) | 2,568,550,243 |

Cash

| 28,554,266 |

Receivable for fund shares sold

| 4,675,868 |

Prepaid expenses

| 127,333 |

Total assets

| 2,601,907,710 |

| Liabilities: | |

Payable for fund shares purchased

| 3,032,889 |

Distribution fee payable (Note 4)

| 1,799,435 |

Investment advisory fee payable (Note 4)

| 1,952,698 |

Administration fee payable (Note 4)

| 332,638 |

Trustees' fees payable

| 14,619 |

Accrued expenses

| 607,009 |

Total liabilities

| 7,739,288 |

Commitments and contingencies (Note 10)

| |

Net Assets

| $2,594,168,422 |

| Composition of Net Assets: | |

Paid-in capital

| 2,733,146,187 |

Accumulated distributable earnings

| (138,977,765) |

Net Assets

| $2,594,168,422 |

| Net Assets | |

Class A Shares - Net Assets

| $ 388,010,479 |

Shares outstanding

| 53,842,647 |

Net asset value and redemption price per share

| $ 7.21 |

Offering price per share based on a maximum sales charge of 4.75%

| $ 7.57 |

Class C Shares - Net Assets

| $ 637,181,644 |

Shares outstanding

| 96,371,115 |

Net asset value and redemption price per share

| $ 6.61 |

Class I Shares - Net Assets

| $ 257 |

Shares outstanding

| 35 |

Net asset value and redemption price per share

| $ 7.35* |

Class Y Shares - Net Assets

| $1,568,976,042 |

Shares outstanding

| 213,233,668 |

Net asset value and redemption price per share

| $ 7.36 |

| * | Net asset value does not recalculate due to fractional shares outstanding. |

See Notes to Financial Statements.

14Brookfield Investment Management Inc.

CENTER COAST BROOKFIELD MLP FOCUS FUND

Statements of Operations

For the Period Ended September 30, 2018

| | For the Ten

Months Ended

September 30,

2018* | | For the Fiscal

Year Ended

November 30,

2017 |

| Investment Income (Note 2): | | | |

Distributions from:

| | | |

Unaffiliated master limited partnerships

| $ 133,109,561 | | $ 170,231,126 |

Affiliated master limited partnerships

| 12,878,760 | | 20,048,836 |

Less return of capital on distributions from:

| | | |

Unaffiliated master limited partnerships

| (133,109,561) | | (170,231,126) |

Affiliated master limited partnerships

| (12,878,760) | | (20,048,836) |

Distributions from corporations

| 16,285,196 | | 16,162,742 |

Less return of capital distributions from corporations

| (9,037,015) | | (14,714,064) |

Interest

| 499 | | 3,252 |

Total investment income

| 7,248,680 | | 1,451,930 |

| Expenses: | | | |

Investment advisory fees (Note 4)

| 21,702,614 | | 27,464,343 |

Administration fees (Note 4)

| 2,795,153 | | — |

Shareholder servicing fees (Note 4)

| 99,001 | | 2,031,770 |

Distribution fees — Class A

| 788,600 | | 1,102,866 |

Distribution fees — Class C

| 5,335,793 | | 7,818,484 |

Fund administration fees

| — | | 1,458,397 |

Transfer agency fees

| 394,616 | | 497,536 |

Reports to stockholders

| 230,929 | | 233,786 |

Audit and tax services

| 222,076 | | 135,999 |

Fund accounting fees

| 217,269 | | 359,778 |

Registration fees

| 187,685 | | 169,956 |

Trustees' fees

| 109,891 | | 16,100 |

Legal fees

| 100,711 | | 31,666 |

Franchise tax

| 100,317 | | 41,784 |

Custodian fees

| 89,921 | | 145,799 |

Insurance

| 85,984 | | 8,079 |

Chief compliance officer fees

| — | | 15,549 |

Miscellaneous

| 36,479 | | 84,100 |

Total operating expenses

| 32,497,039 | | 41,615,992 |

Less expenses waived by the investment adviser (Note 4)

| (251,919) | | — |

Net expenses

| 32,245,120 | | 41,615,992 |

Net investment loss, before taxes

| (24,996,440) | | (40,164,062) |

Deferred tax benefit

| 6,185,719 | | 2,496,107 |

Net investment loss, net of deferred taxes

| (18,810,721) | | (37,667,955) |

| Net Realized and Unrealized Gain (Loss): | | | |

| Net realized gain (loss) on: | | | |

Investments in unaffiliated companies

| 124,581,072 | | 40,642,768 |

Investments in affiliated companies

| 10,710,766 | | (2,047,841) |

Deferred tax expense

| (33,479,859) | | (14,241,528) |

Net realized gain on investments, net of deferred taxes

| 101,811,979 | | 24,353,399 |

| Net change in unrealized appreciation (depreciation) on: | | | |

Investments in unaffiliated companies

| 110,805,710 | | (176,417,685) |

Investments in affiliated companies

| 6,551,046 | | (25,983,260) |

Deferred tax benefit

| 27,294,140 | | 11,745,721 |

Net change in unrealized appreciation (depreciation), net of deferred taxes

| 144,650,896 | | (190,655,524) |

Net realized and unrealized gain (loss) on investments, net of deferred taxes

| 246,462,875 | | (166,302,125) |

Net increase (decrease) in net assets resulting from operations

| $ 227,652,154 | | $(203,970,080) |

| * | The Fund changed its fiscal year end from November 30 to September 30. |

See Notes to Financial Statements.

CENTER COAST BROOKFIELD MLP FOCUS FUND

Statements of Changes in Net Assets

| | For the

Ten Months

Ended

September 30,

2018* | | For the

Fiscal Year

Ended

November 30,

2017 | | For the

Fiscal Year

Ended

November 30,

2016 |

| Increase (Decrease) in Net Assets Resulting from Operations: | | | | | |

Net investment loss

| $ (18,810,721) | | $ (37,667,955) | | $ (18,457,731) |

Net realized gain (loss) on investments, net of deferred taxes

| 101,811,979 | | 24,353,399 | | (217,090,150) |

Net unrealized appreciation (depreciation) on investments, net of deferred taxes

| 144,650,896 | | (190,655,524) | | 414,340,744 |

Net increase (decrease) in net assets resulting from operations, net of deferred taxes

| 227,652,154 | | (203,970,080) | | 178,792,863 |

| Distributions to Shareholders (Note 2): | | | | | |

From distributable earnings

| (59,061,149) | | — | | — |

From return of capital

| (130,055,561) | | (238,098,484) | | (204,222,812) |

Total distributions paid

| (189,116,710) | | (238,098,484) | | (204,222,812) |

| Capital Share Transactions (Note 6): | | | | | |

Subscriptions

| 885,813,665 | | 1,100,942,631 | | 1,086,360,954 |

Reinvestment of distributions

| 180,614,093 | | 228,728,796 | | 199,614,680 |

Redemption

| (1,031,270,834) | | (969,472,726) | | (1,061,323,973) |

Net increase in net assets from capital share transactions

| 35,156,924 | | 360,198,701 | | 224,651,661 |

Total increase (decrease) in net assets

| 73,692,368 | | (81,869,863) | | 199,221,712 |

| Net Assets: | | | | | |

Beginning of period

| 2,520,476,054 | | 2,602,345,917 | | 2,403,124,205 |

End of period

| $ 2,594,168,422 | | $2,520,476,054 | | $ 2,602,345,917 |

| * | The Fund changed its fiscal year end from November 30 to September 30. |

See Notes to Financial Statements.

16Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

Financial Highlights

| | For the Ten Month Period Ended September 30, | For the Year Ended November 30, |

| Class A | 2018 2 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Per Share Operating Performance: | | | | | | |

Net asset value, beginning of period

| $ 7.03 | $ 8.23 | $ 8.30 | $ 11.49 | $ 11.02 | $ 10.13 |

Income from investment Operations:

| | | | | | |

Net investment loss1

| (0.07) | (0.11) | (0.05) | (0.04) | (0.08) | (0.10) |

Return of capital1

| 0.33 | 0.38 | 0.37 | 0.34 | 0.33 | 0.39 |

Net realized and unrealized gain (loss) on investments1,3

| 0.43 | (0.79) | 0.29 | (2.77) | 0.90 | 1.27 |

Total from investment operations

| 0.69 | (0.52) | 0.61 | (2.47) | 1.15 | 1.56 |

| Distributions to Shareholders: | | | | | | |

From net investment income/distributable earnings

| (0.16) | — | — | — | (0.30) | — |

From return of capital

| (0.35) | (0.68) | (0.68) | (0.72) | (0.38) | (0.67) |

Total distributions to shareholders

| (0.51) | (0.68) | (0.68) | (0.72) | (0.68) | (0.67) |

Net asset value, end of period

| $ 7.21 | $ 7.03 | $ 8.23 | $ 8.30 | $ 11.49 | $ 11.02 |

Total Return†

| 10.26% 9 | -6.88% | 8.17% | -22.27% | 10.62% | 15.67% 4 |

| Ratios and Supplemental Data: | | | | | | |

Net assets, end of period (in thousands)

| $388,010 | $369,684 | $451,900 | $416,593 | $566,018 | $798,021 |

Ratio of Expenses to Average Net Assets:

| | | | | | |

Before expense recoupment/(waivers) and deferred tax expense

| 1.47% 10 | 1.44% | 1.46% | 1.47% | 1.44% | 1.46% |

Expense recoupment/(waivers)

| (0.01)% 10 | —% | —% | —% | —% | 0.03% |

Net of expense recoupment/(waivers) and before deferred tax expense

| 1.46% 10 | 1.44% | 1.46% | 1.47% | 1.44% | 1.49% |

Deferred tax expense/(benefit)5,6

| —% 10 | —% | 5.61% | (14.59)% | 5.62% | 7.49% 7 |

Total expenses/(benefit)

| 1.46% 10 | 1.44% | 7.07% | (13.12)% | 7.06% | 8.98% 7 |

Ratio of Net Investment Income (Loss) to Average Net Assets:

| | | | | | |

Before expense recovery/(reimbursement) and deferred tax benefit

| (1.13)% 10 | (1.39)% | (1.10)% | 0.95% | (1.20)% | (1.46)% |

Expense recoupment/(waivers)

| 0.01% 10 | —% | —% | —% | —% | 0.03% |

Net of expense recoupment/(waivers) and before deferred tax benefit

| (1.12)% 10 | (1.39)% | (1.10)% | 0.95% | (1.20)% | (1.49)% |

Deferred tax benefit6,8

| —% 10 | 0.09% | 0.41% | 0.59% | 0.50% | 0.61% 7 |

Net investment loss

| (1.12)% 10 | (1.30)% | (0.69)% | (0.36)% | (0.70)% | (0.88)% 7 |

Portfolio turnover rate

| 35% 9 | 32% | 60% | 51% | 55% | 9% |

| † | Total investment return is computed based upon the net asset value of the Fund’s shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution. |

| 1 | Per share amounts presented are based on average shares outstanding throughout the period indicated. |

| 2 | Amounts shown are for the ten month period ended September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30. |

| 3 | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share in the period. It may not agree to the aggregate gains and losses in the Statement of Operations due to the fluctuation in share transactions this period. |

| 4 | For the fiscal year ended November 30, 2013, total returns would have been lower had expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of sales load of 5.75% of offering price which is reduced on sales of $50,000 or more. Returns do not include a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on certain purchases of $1 million or more that are redeemed in whole or in part within 12 months of purchase. If sales charges and CDSC were included total return would be lower. The return includes Rule 12b-1 fees of 0.25% and does not reflect the deduction of taxes that a shareholder would pay on the redemption of Fund shares. |

| 5 | Deferred tax expense (benefit) estimate for the ratio calculation is derived from net investment income (loss), and realized and unrealized gains (losses). |

| 6 | Effective December 1, 2012 the deferred tax expense and deferred tax benefit are allocated based on average net assets. |

| 7 | Ratios have been restated due to a change in accounting methodology. |

| 8 | Deferred tax benefit (expense) estimate for the ratio calculation is derived from net investment income (loss) only. |

| 9 | Not annualized. |

| 10 | Annualized. |

See Notes to Financial Statements.

Center Coast Brookfield MLP Focus Fund

Financial Highlights

| | For the Ten Month Period Ended September 30, | For the Year Ended November 30, |

| Class C | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Operating Performance:

| | | | | | |

Net asset value, beginning of period

| $ 6.54 | $ 7.75 | $ 7.91 | $ 11.08 | $ 10.72 | $ 9.94 |

| Income from investment Operations: | | | | | | |

Net investment loss1

| (0.10) | (0.16) | (0.11) | (0.11) | (0.16) | (0.15) |

Return of capital1

| 0.30 | 0.36 | 0.35 | 0.32 | 0.32 | 0.38 |

Net realized and unrealized gain (loss) on investments1,3

| 0.38 | (0.73) | 0.28 | (2.66) | 0.88 | 1.22 |

Total from investment operations

| 0.58 | (0.53) | 0.52 | (2.45) | 1.04 | 1.45 |

| Distributions to Shareholders: | | | | | | |

From net investment income/distributable earnings

| (0.16) | — | — | — | (0.30) | — |

From return of capital

| (0.35) | (0.68) | (0.68) | (0.72) | (0.38) | (0.67) |

Total distributions to shareholders

| (0.51) | (0.68) | (0.68) | (0.72) | (0.68) | (0.67) |

Net asset value, end of period

| $ 6.61 | $ 6.54 | $ 7.75 | $ 7.91 | $ 11.08 | $ 10.72 |

Total Return†

| 9.31% 9 | -7.44% | 7.40% | -22.93% | 9.87% | 14.84% 4 |

| Ratios and Supplemental Data: | | | | | | |

Net assets, end of period (in thousands)

| $637,182 | $660,663 | $796,542 | $841,555 | $1,056,466 | $762,945 |

Ratio of Expenses to Average Net Assets:

| | | | | | |

Before expense recoupment/(waivers) and deferred tax expense

| 2.22% 10 | 2.19% | 2.21% | 2.22% | 2.19% | 2.21% |

Expense recoupment/(waivers)

| (0.01)% 10 | —% | —% | —% | —% | 0.03% |

Net of expense recoupment/(waivers) and before deferred tax expense

| 2.21% 10 | 2.19% | 2.21% | 2.22% | 2.19% | 2.24% |

Deferred tax expense/(benefit)5,6

| —% 10 | —% | 5.61% | (14.59)% | 5.62% | 7.49% 7 |

Total expenses/(benefit)

| 2.21% 10 | 2.19% | 7.82% | (12.37)% | 7.81% | 9.72% 7 |

Ratio of Net Investment Income (Loss) to Average Net Assets:

| | | | | | |

Before expense recovery/(reimbursement) and deferred tax benefit

| (1.88)% 10 | (2.14)% | (1.85)% | (1.70)% | (1.95)% | (2.21)% |

Expense recoupment/(waivers)

| 0.01% 10 | —% | —% | —% | —% | 0.03% |

Net of expense recoupment/(waivers) and before deferred tax benefit

| (1.87)% 10 | (2.14)% | (1.85)% | (1.70)% | (1.95)% | (2.24)% |

Deferred tax benefit6,8

| —% 10 | 0.09% | 0.41% | 0.59% | 0.50% | 0.61% 7 |

Net investment loss

| (1.87)% 10 | (2.05)% | (1.44)% | (1.11)% | (1.45)% | (1.62)% 7 |

Portfolio turnover rate

| 35% 9 | 32% | 60% | 51% | 55% | 9% |

| † | Total investment return is computed based upon the net asset value of the Fund’s shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution. |

| 1 | Per share amounts presented are based on average shares outstanding throughout the period indicated. |

| 2 | Amounts shown are for the ten month period ended September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30. |

| 3 | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share in the period. It may not agree to the aggregate gains and losses in the Statement of Operations due to the fluctuation in share transactions this period. |

| 4 | For the fiscal year ended November 30, 2013, total returns would have been lower had expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of sales load of 5.75% of offering price which is reduced on sales of $50,000 or more. Returns do not include a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on certain purchases of $1 million or more that are redeemed in whole or in part within 12 months of purchase. If sales charges and CDSC were included total return would be lower. The return includes Rule 12b-1 fees of 0.25% and does not reflect the deduction of taxes that a shareholder would pay on the redemption of Fund shares. |

| 5 | Deferred tax expense (benefit) estimate for the ratio calculation is derived from net investment income (loss), and realized and unrealized gains (losses). |

| 6 | Effective December 1, 2012 the deferred tax expense and deferred tax benefit are allocated based on average net assets. |

| 7 | Ratios have been restated due to a change in accounting methodology. |

| 8 | Deferred tax benefit (expense) estimate for the ratio calculation is derived from net investment income (loss) only. |

| 9 | Not Annualized. |

| 10 | Annualized. |

See Notes to Financial Statements.

18Brookfield Investment Management Inc.

Center Coast Brookfield MLP Focus Fund

Financial Highlights

| | For the Period

February 5,

2018 to

September 30, |

| Class I | 2018 2,3 |

Per Share Operating Performance:

| |

Net asset value, beginning of period

| $ 7.64 |

| Income from investment Operations: | |

Net investment income1

| (0.04) |

Return of capital1

| 0.32 |

Net realized and unrealized gain (loss) on investments1,2

| (0.11) |

Total from investment operations

| 0.17 |

| Distributions to Shareholders: | |

From net investment income/distributable earnings

| (0.14) |

From return of capital

| (0.32) |

Total distributions to shareholders

| (0.46) |

Net asset value, end of period

| $ 7.35 |

Total Return†

| 2.55% 4 |

| Ratios and Supplemental Data: | |

Net assets, end of period

| $ 257 |

Ratio of Expenses to Average Net Assets:

| |

Before expense recoupment/(waivers) and deferred tax expense

| 1.22% 5 |

Expense recoupment/(waivers)

| (0.01)% 5 |

Net of expense recoupment/(waivers) and before deferred tax expense

| 1.21% 5 |

Deferred tax expense/(benefit)

| —% 5 |

Total expenses/(benefit)

| 1.21% 5 |

| Ratio of Net Investment Income (Loss) to Average Net Assets: | |

Before expense recovery/(reimbursement) and deferred tax benefit

| (0.80)% 5 |

Expense recoupment/(waivers)

| 0.01% 5 |

Net of expense recoupment/(waivers) and before deferred tax benefit

| (0.79)% 5 |

Deferred tax benefit

| —% 5 |

Net investment income

| (0.79)% 5 |

Portfolio turnover rate

| 35% 4 |

| † | Total investment return is computed based upon the net asset value of the Fund’s shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution. |

| 1 | Per share amounts presented are based on average shares outstanding throughout the period indicated. |

| 2 | Amounts shown are for the period February 5, 2018 to September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30. |

| 3 | Class I was incepted on February 5, 2018. |

| 4 | Not Annualized. |

| 5 | Annualized. |

See Notes to Financial Statements.

Center Coast Brookfield MLP Focus Fund

Financial Highlights

| | For the Ten Month Period Ended September 30, | For the Year Ended November 30, |

| Class Y | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Operating Performance:

| | | | | | |

Net asset value, beginning of period

| $ 7.16 | $ 8.34 | $ 8.38 | $ 11.57 | $ 11.06 | $ 10.14 |

| Income from investment Operations: | | | | | | |

Net investment loss1

| (0.05) | (0.09) | (0.03) | (0.01) | (0.05) | (0.09) |

Return of capital1

| 0.33 | 0.39 | 0.38 | 0.34 | 0.32 | 0.39 |

Net realized and unrealized gain (loss) on investments1,3

| 0.43 | (0.80) | 0.29 | (2.80) | 0.91 | 1.29 |

Total from investment operations

| 0.71 | (0.50) | 0.64 | (2.47) | 1.19 | 1.59 |

| Distributions to Shareholders: | | | | | | |

From net investment income/distributable earnings

| (0.16) | — | — | — | (0.30) | — |

From return of capital

| (0.35) | (0.68) | (0.68) | (0.72) | (0.38) | (0.67) |

Total distributions to shareholders

| (0.51) | (0.68) | (0.68) | (0.72) | (0.68) | (0.67) |

Net asset value, end of period

| $ 7.36 | $ 7.16 | $ 8.34 | $ 8.38 | $ 11.57 | $ 11.06 |

Total Return†

| 10.35% 10 | -6.53% | 8.46% | -22.11% | 10.95% | 15.96% 5 |

| Ratios and Supplemental Data: | | | | | | |

Net assets, end of period (in thousands)

| $1,568,976 | $1,490,129 | $1,353,904 | $1,144,976 | $1,568,738 | $642,660 |

Ratio of Expenses to Average Net Assets:

| | | | | | |

Before expense recoupment/(waivers) and deferred tax expense

| 1.22% 9 | 1.19% | 1.21% | 1.22% | 1.19% | 1.21% |

Expense recoupment/(waivers)

| (0.01)% 9 | —% | —% | —% | —% | 0.03% |

Net of expense recoupment/(waivers) and before deferred tax expense

| 1.21% 9 | 1.19% | 1.21% | 1.22% | 1.19% | 1.24% |

Deferred tax expense/(benefit)6,7

| —% 9 | —% | 5.61% | (14.59)% | 5.62% | 7.49% 8 |

Total expenses/(benefit)

| 1.21% 9 | 1.19% | 6.82% | (13.37)% | 6.81% | 8.73% 8 |

Ratio of Net Investment Income (Loss) to Average Net Assets:

| | | | | | |

Before expense recovery/(reimbursement) and deferred tax benefit

| (0.88)% 9 | (1.14)% | (0.85)% | (0.70)% | (0.95)% | (1.21)% |

Expense recoupment/(waivers)

| 0.01% 9 | —% | —% | —% | —% | 0.03% |

Net of expense recoupment/(waivers) and before deferred tax benefit

| (0.87)% 9 | (1.14)% | (0.85)% | (0.70)% | (0.95)% | (1.24)% |

Deferred tax benefit7,9

| —% 9 | 0.09% | 0.41% | 0.59% | 0.50% | 0.62% 8 |

Net investment loss

| (0.87)% 9 | (1.05)% | (0.44)% | (0.11)% | (0.45)% | (0.62)% 8 |

Portfolio turnover rate

| 35% 10 | 32% | 60% | 51% | 55% | 9% |

| † | Total investment return is computed based upon the net asset value of the Fund’s shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution. |

| 1 | Per share amounts presented are based on average shares outstanding throughout the period indicated. |

| 2 | Amounts shown are for the ten month period ended September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30. |

| 3 | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share in the period. It may not agree to the aggregate gains and losses in the Statement of Operations due to the fluctuation in share transactions this period. |

| 4 | Prior to February 3, 2018 this Fund operated under a different name. Please see Note 1 of the Notes to Financial Statements for details of this name change. Effective before the opening of business on February 5, 2018, the Institutional share classe was redesignated as Y. See Note 1 for further information. |

| 5 | For the fiscal year ended November 30, 2013, total returns would have been lower had expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of sales load of 5.75% of offering price which is reduced on sales of $50,000 or more. Returns do not include a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on certain purchases of $1 million or more that are redeemed in whole or in part within 12 months of purchase. If sales charges and CDSC were included total return would be lower. The return includes Rule 12b-1 fees of 0.25% and does not reflect the deduction of taxes that a shareholder would pay on the redemption of Fund shares. |

| 6 | Deferred tax expense (benefit) estimate for the ratio calculation is derived from net investment income (loss), and realized and unrealized gains (losses). |

| 7 | Effective December 1, 2012 the deferred tax expense and deferred tax benefit are allocated based on average net assets. |

| 8 | Ratios have been restated due to a change in accounting methodology. |

| 9 | Deferred tax benefit (expense) estimate for the ratio calculation is derived from net investment income (loss) only. |

| 10 | Not annualized. |

| 11 | Annualized. |

See Notes to Financial Statements.

20Brookfield Investment Management Inc.

CENTER COAST BROOKFIELD MLP FOCUS FUND

Notes to Financial Statements

September 30, 2018

1.Organization

Brookfield Investment Funds, a Delaware statutory trust (the "Trust"), is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act"). The Trust consists of six different series of underlying portfolios as of September 30, 2018. Center Coast Brookfield MLP Focus Fund (the ‘‘Fund’’), a series of the Trust, is non-diversified as that term is defined in the 1940 Act. The Fund’s primary investment objective is to seek maximum total return with an emphasis on providing cash distributions to shareholders. The Fund currently offers four classes of shares: Class A Shares, Class C Shares, Class I Shares, and Class Y Shares.

Following the close of business on February 2, 2018, the Fund acquired all of the assets, subject to liabilities, of the Center Coast MLP Focus Fund (the “Predecessor Fund”) through a tax-free reorganization (the “Reorganization”). The Fund is a newly created series of the Trust, which has the same investment objective and substantially similar investment strategies and policies as the Predecessor Fund. As a result of the Reorganization, shareholders of the Predecessor Fund’s Class A and Class C Shares received Class A and Class C Shares of the Fund, respectively, and shareholders of the Predecessor Fund’s Institutional Class Shares received Class Y Shares of the Fund. In addition, as a result of the Reorganization, the Fund’s Class A and Class C Shares adopted the Predecessor Fund’s Class A and Class C Shares’ performance and accounting history, and the Fund’s Class Y Shares adopted the Predecessor Fund’s Institutional Class Shares’ performance and accounting history. The Predecessor Fund commenced operations on December 31, 2010. The Fund's Class I Shares commenced operations on February 5, 2018.

Each class represents an interest in the same portfolio of assets and has identical voting, dividend, liquidation and other rights except that: (i) Class A Shares have a maximum front end sales charge of 4.75% and Class C shares have a maximum deferred sales charge of 1.00%; (ii) Class A shares have a 12b-1 fee of 0.25% and Class C shares have a 12b-1 fee of 1.00%; and (iii) each class has exclusive voting rights with respect to matters relating to its own distribution arrangements.

Brookfield Investment Management Inc. (the “Adviser”), a wholly-owned subsidiary of Brookfield Asset Management Inc., is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and serves as investment adviser to the Fund.

2.Significant Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company within the scope of Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2013-08 and follows accounting and reporting guidance under FASB Accounting Standards Codification (“ASC”) Topic 946 Financial Services-Investment Companies.

Valuation of Investments: The Fund’s Board of Trustees (the “Board”) has adopted procedures for the valuation of the Fund’s securities. The Adviser oversees the day to day responsibilities for valuation determinations under these procedures. The Board regularly reviews the application of these procedures to the securities in the Fund’s portfolio. The Adviser’s Valuation Committee is comprised of senior members of the Adviser’s management team.

Investments in equity securities listed or traded on any securities exchange or traded in the over-the-counter market are valued at the last trade price as of the close of business on the valuation date. Prices of foreign equities that are principally traded on certain foreign markets will generally be adjusted daily pursuant to a fair value pricing service approved by the Board in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE close. When fair value pricing is employed, the value of the

CENTER COAST BROOKFIELD MLP FOCUS FUND

Notes to Financial Statements (continued)

September 30, 2018

portfolio securities used to calculate the Fund’s net asset values may differ from quoted or official closing prices. Investments in open-end registered investment companies, if any, are valued at the NAV as reported by those investment companies.

Debt securities, including U.S. government securities, listed corporate bonds, other fixed income and asset-backed securities, and unlisted securities and private placement securities, are generally valued at the bid prices furnished by an independent pricing service or, if not valued by an independent pricing service, using bid prices obtained from active and reliable market makers in any such security or a broker-dealer. The broker-dealers or pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the broker-dealers or pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the broker-dealers or pricing services may also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon-rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair values. Short-term debt securities with remaining maturities of sixty days or less are valued at amortized cost of discount or premium to maturity, unless such valuation, in the judgment of the Adviser’s Valuation Committee, does not represent fair value.

Securities for which market prices are not readily available or which cannot be valued using the sources described above will be valued using an internal proprietary fair value methodology. For any security warranting such fair value measurement, a memorandum, including the specific methodology and supporting information, will be provided to the Valuation Committee by a portfolio manager or analyst looking to fair value a particular security utilizing the internal proprietary fair value methodology. A portfolio manager or analyst shall use their best efforts to maximize the use of relevant observable inputs and minimize the use of unobservable inputs within their valuation technique. The Valuation Committee shall review the memorandum and supporting information provided by a portfolio manager or analyst and consider all relevant factors as it deems appropriate before approving the fair value recommendation.

The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or an independent pricing service is inaccurate.

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including, but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality.