UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22558

BROOKFIELD INVESTMENT FUNDS

(Exact name of registrant as specified in charter)

BROOKFIELD PLACE

250 VESEY STREET, 15th Floor

NEW YORK, NEW YORK 10281-1023

(Address of principal executive offices) (Zip code)

BRIAN F. HURLEY, PRESIDENT

BROOKFIELD INVESTMENT FUNDS

BROOKFIELD PLACE

250 VESEY STREET 15th Floor

NEW YORK, NEW YORK 10281-1023

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 777-8001

Date of fiscal year end: December 31, 2017

Date of reporting period: December 31, 2017

Item 1. Reports to Shareholders.

Brookfield Investment Management

ANNUAL REPORT

December 31, 2017

Brookfield Global Listed Infrastructure Fund

Brookfield Global Listed Real Estate Fund

Brookfield U.S. Listed Real Estate Fund

Brookfield Real Assets Securities Fund

Brookfield Investment Management (the “Firm”) is an SEC-registered investment adviser and represents the Public Securities platform of Brookfield Asset Management. The Firm provides global listed real assets strategies including real estate equities, infrastructure equities, real asset debt and diversified real assets. With more than $16 billion of assets under management as of December 31, 2017, the Firm manages separate accounts, registered funds and opportunistic strategies for institutional and individual clients, including financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net worth investors. The Firm is a wholly owned subsidiary of Brookfield Asset Management, a leading global alternative asset manager with approximately $285 billion of assets under management as of December 31, 2017. For more information, go to www.brookfield.com.

Brookfield Investment Funds is managed by Brookfield Investment Management, and uses its website as a channel of distribution of material company information. Financial and other material information regarding the Fund is routinely posted on and accessible at www.brookfield.com.

This report is for shareholder information. This is not a prospectus intended for the use in the purchase or sale of Fund shares.

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

[THIS PAGE IS INTENTIONALLY LEFT BLANK]

Dear Shareholders,

We are pleased to provide the Annual Report for Brookfield Global Listed Infrastructure Fund (the “Infrastructure Fund”), Brookfield Global Listed Real Estate Fund (the “Global Real Estate Fund”), Brookfield U.S. Listed Real Estate Fund (the “U.S. Real Estate Fund”) and Brookfield Real Assets Securities Fund (the “Real Assets Securities Fund”) (each, a “Fund”, and collectively, the “Funds”) for the year ended December 31, 2017.

The MSCI World1 and S&P 500 Total Return2 Indexes reached record highs in 2017 amid accelerating economic growth, strong corporate earnings and investor optimism. For the year, the MSCI World and the S&P 500 Indexes returned 23.1% and 21.8%, respectively. It was the first time in the history of both indexes (going back to 1970 for the MSCI World and 1928 for the S&P 500) where total returns were positive in every calendar month over the course of a year.

Global economic expansion continued in 2017 and was remarkably synchronized across the globe. In fact, it was the first year since 2007 that no Organization for Economic Cooperation and Development economy showed signs of contraction. Across developed market economies, the European recovery witnessed the strongest acceleration in recent quarters, with economic and policy surprise indexes in Europe generally outpacing those in Asia and the Americas over the last 12 months. Adding to this global optimism, the U.S. Tax Cuts and Jobs Act of 2017—which lowers federal tax rates for U.S. companies and individuals—was signed into law in the final days of December.

The Federal Open Market Committee (“FOMC”) increased the federal funds rate by 25 basis points on three occasions in 2017 (in March, June and December), to a target range from 1.25% to 1.5% at the end of the year. The FOMC also began to reduce the size of its $4.4 trillion balance sheet.

The spot price of West Texas Intermediate Crude Oil rose 12.5% during the year, closing at $60.46 per barrel. In November, the Organization of the Petroleum Exporting Countries (“OPEC”) and Russia agreed to extend oil production cuts until the end of 2018. OPEC members Libya and Nigeria, which were exempt from the initial deal in 2016 to curb output, agreed not to increase their production in 2018 above current levels.

Global real assets also performed well during the year. With the exception of Master Limited Partnerships, all real asset sectors delivered positive performance. Global real estate, infrastructure and natural resource indexes all posted double-digit returns; however, none managed to outpace global equities more broadly. Real asset high-yield and investment grade debt also posted strong returns and performed on par with their respective broad market high-yield and investment-grade indexes.

In addition to performance information and additional discussion on factors impacting the Funds, this report provides the Funds’ audited financial statements and schedule of investments as of December 31, 2017.

We welcome your questions and comments, and encourage you to contact our Investor Relations team at (855) 777-8001 or visit us at www.brookfieldim.com for more information. Thank you for your support.

Brian F. Hurley

President

Brookfield Investment Funds

Craig Noble, CFA

CEO, Chief Investment Officer and Portfolio Manager

Brookfield Investment Management Inc.

Letter to Shareholders (continued)

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC is the distributor of Brookfield Investment Funds.

1 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

2 The S&P 500 Total Return Index is the total return version of S&P 500 Index. Dividends are reinvested on a daily basis and the base date for the index is January 1, 1988. All regular cash dividends are assumed reinvested in the S&P 500 Index on the ex-date. Special cash dividends trigger a price adjustment in the price return index.

Indices are not managed and an investor cannot invest directly in an index.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2017 and subject to change based on subsequent developments.

The Funds’ portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Funds currently hold these securities. Please refer to the Schedules of Investments contained in this report for a full listing of Funds’ holdings.

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible.

A basis point (bps) is a unit that is equal to 1/100 of 1%, and is used to denote the change in a financial instrument.

The Securities and Exchange Commission (SEC) does not approve, endorse, nor indemnify any security.

Earnings growth is not representative of the Fund’s future performance.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

2Brookfield Investment Management Inc.

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges and redemption fees on redemptions; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with hypothetical examples that appear in shareholders’ reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs overall would have been higher.

| | Annualized Expense Ratio | Beginning Account Value

(07/01/17) | Ending Account Value

(12/31/17) | Expenses Paid During Period

(07/01/17–

12/31/17) (1) |

| INFRASTRUCTURE FUND | | | | |

| Actual | | | | |

Class A Shares

| 1.35% | $1,000.00 | $1,015.00 | $ 6.86 |

Class C Shares

| 2.10% | 1,000.00 | 1,011.00 | 10.64 |

Class Y Shares

| 1.10% | 1,000.00 | 1,016.40 | 5.59 |

Class I Shares

| 1.10% | 1,000.00 | 1,015.60 | 5.59 |

| Hypothetical (assuming a 5% return before expenses) | | | | |

Class A Shares

| 1.35% | 1,000.00 | 1,018.40 | 6.87 |

Class C Shares

| 2.10% | 1,000.00 | 1,014.62 | 10.66 |

Class Y Shares

| 1.10% | 1,000.00 | 1,019.66 | 5.60 |

Class I Shares

| 1.10% | 1,000.00 | 1,019.66 | 5.60 |

About Your Fund’s Expenses (continued)

| | Annualized Expense Ratio | Beginning Account Value

(07/01/17) | Ending Account Value

(12/31/17) | Expenses Paid During Period

(07/01/17–

12/31/17) (1) |

| GLOBAL REAL ESTATE FUND | | | | |

| Actual | | | | |

Class A Shares

| 1.20% | $1,000.00 | $1,047.10 | $ 6.19 |

Class C Shares

| 1.95% | 1,000.00 | 1,043.30 | 10.04 |

Class Y Shares

| 0.95% | 1,000.00 | 1,049.30 | 4.91 |

Class I Shares

| 0.95% | 1,000.00 | 1,048.60 | 4.91 |

| Hypothetical (assuming a 5% return before expenses) | | | | |

Class A Shares

| 1.20% | 1,000.00 | 1,019.16 | 6.11 |

Class C Shares

| 1.95% | 1,000.00 | 1,015.38 | 9.91 |

Class Y Shares

| 0.95% | 1,000.00 | 1,020.42 | 4.84 |

Class I Shares

| 0.95% | 1,000.00 | 1,020.42 | 4.84 |

| U.S. REAL ESTATE FUND | | | | |

| Actual | | | | |

Class A Shares

| 1.20% | $1,000.00 | $1,005.20 | $ 6.07 |

Class C Shares

| 1.95% | 1,000.00 | 1,002.10 | 9.84 |

Class Y Shares

| 0.95% | 1,000.00 | 1,007.50 | 4.81 |

Class I Shares

| 0.95% | 1,000.00 | 1,006.50 | 4.80 |

| Hypothetical (assuming a 5% return before expenses) | | | | |

Class A Shares

| 1.20% | 1,000.00 | 1,019.16 | 6.11 |

Class C Shares

| 1.95% | 1,000.00 | 1,015.38 | 9.91 |

Class Y Shares

| 0.95% | 1,000.00 | 1,020.42 | 4.84 |

Class I Shares

| 0.95% | 1,000.00 | 1,020.42 | 4.84 |

| REAL ASSETS SECURITIES FUND | | | | |

| Actual | | | | |

Class A Shares

| 1.35% | $1,000.00 | $1,025.60 | $ 6.89 |

Class C Shares

| 2.10% | 1,000.00 | 1,023.00 | 10.71 |

Class Y Shares

| 1.10% | 1,000.00 | 1,024.70 | 5.61 |

Class I Shares

| 1.10% | 1,000.00 | 1,025.90 | 5.62 |

| Hypothetical (assuming a 5% return before expenses) | | | | |

Class A Shares

| 1.35% | 1,000.00 | 1,018.40 | 6.87 |

Class C Shares

| 2.10% | 1,000.00 | 1,014.62 | 10.66 |

Class Y Shares

| 1.10% | 1,000.00 | 1,019.66 | 5.60 |

Class I Shares

| 1.10% | 1,000.00 | 1,019.66 | 5.60 |

| (1) | Expenses are equal to the Funds’ annualized expense ratio by class multiplied by the average account value over the period, multiplied by 184/365 (to reflect a six-month period). |

4Brookfield Investment Management Inc.

Brookfield Global Listed Infrastructure Fund

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

For the year ended December 31, 2017, the Infrastructure Fund, Class I had a total return of 10.7%, which assumes the reinvestment of dividends and is exclusive of brokerage commissions, underperforming the Dow Jones Brookfield Global Infrastructure Composite Index1, which returned 12.7%. During the 12-month period ended December 31, 2017, the leading contributor to relative performance was the non-index Renewables/Electric Generation sector. Stock selection within the Pipelines sector also contributed, largely driven by underweight exposure to a number of Canadian pipeline operators. Stock selection within the Communications sector also contributed. Overweight positions in select U.S. tower companies meaningfully contributed as the sector performed well in 2017.

In contrast, MLPs were the leading sector detractor in 2017 due to a combination of stock selection and overweight exposure to the underperforming sector. Investor sentiment for MLPs failed to keep pace with energy infrastructure fundamentals, which continued to be positive in 2017.

The Airports sector was also a significant detractor (underweight allocation and stock selection). Underperformance was primarily driven by underweight positions in European airports, which experienced meaningful multiple expansion as capital flowed into the region following the outcome of regional elections in the spring.

The Electricity Transmission & Distribution sector was the third largest detractor in 2017. Positive allocation effect from our underweight exposure was offset by negative security selection. We maintained zero exposure to select T&D utilities, which performed well over the period. Our positioning in these sectors was driven by our view that valuations were elevated, particularly relative to stocks in the Renewables/Electric Generation sector.

By region, Continental Europe was the leading contributor to relative performance due to stock selection. Canada also contributed due to a combination of stock selection and underweight exposure. The U.S. was the leading detractor due to stock selection. Asia Pacific (underweight exposure and stock selection) was also a leading regional detractor.

By security, overweight positions in SBA Communications Corp. (SBAC, Communications, U.S.) and American Tower Corporation (AMT, Communications, U.S.) were among the leading contributors to relative performance in 2017. Tower assets performed well amid positive trends for data usage, deployment of new technologies and the pending rollout of The First Responder Network Authority (FirstNet). Not owning SES SA (SESG.FP, Communications, Continental Europe) was also a leading contributor, as the stock declined nearly 35% during the year.

Conversely, underweight exposure to Crown Castle International Corp. (CCI, Communications, U.S.) was the leading detractor from relative performance. We maintained overweight positions to SBA Communications and American Tower over Crown Castle based on our view of relative valuation. Overweight positions in Enbridge Energy Partners, L.P. (EEP, MLP, U.S.) and Energy Transfer Partners, L.P. (ETP, MLP, U.S.) were also leading detractors as the MLP sector underperformed in 2017.

INFRASTRUCTURE MARKET OVERVIEW AND OUTLOOK

Listed infrastructure returns were positive in 2017, with the Dow Jones Brookfield Global Infrastructure Composite Index posting a gain of 12.7%.1 Regional returns were particularly strong in Europe, where listed infrastructure stocks rose 27.2%. The Asia Pacific and Americas regions of the Dow Jones Brookfield Global Infrastructure Index returned 24.0% and 10.0%, respectively. By sector, Toll Roads gained 43.1%, followed by Airports (39.5%), Diversified (36.8%), Communications (33.9%), Water (20.0%), Ports (7.7%), Oil & Gas Storage & Transportation (6.4%) and Electricity Transmission & Distribution (4.4%). Conversely, the Alerian MLP Index declined 6.5%.2

U.S. communication tower stocks performed very well in 2017. Again, positive demand drivers including increased data usage, deployment of new technologies and the pending rollout of FirstNet provided tailwinds for the sector during the year. Transport stocks also performed well in 2017. Notably, European airports and toll roads benefitted

Brookfield Global Listed Infrastructure Fund

from an expanding economy, as well as capital flows into the region following the outcome of regional elections in which several populist candidates were defeated.

Performance among utilities was mixed in 2017. U.K. water and electric utilities underperformed amid uncertainties related to Brexit, currency and in some cases possible nationalization of assets if the labor party gains control of the government. Gas utilities in China/Hong Kong performed well as regulation around their allowed returns became more transparent. And in the U.S., while some transmission & distribution operators produced double-digit returns, wildfires in California had a significantly negative impact on two public utilities in the state.

Lastly, energy infrastructure lagged the broader asset class in 2017 as investor sentiment failed to keep pace with positive fundamentals. However, that trend began to reverse in the final weeks of the year, with Master Limited Partnerships ("MLPs") outperforming broader listed infrastructure in December.

1 The Dow Jones Brookfield Global Infrastructure Composite Index is calculated and maintained by S&P Dow Jones Indices and comprises infrastructure companies with at least 70% of its annual cash flows derived from owning and operating infrastructure assets, including MLPs.

2 The Alerian MLP Index is a composite of the 50 most prominent energy MLPs calculated by Standard & Poor's using a float-adjusted market-capitalization methodology. The index is disseminated by the New York Stock Exchange real-time on a price return basis (NYSE: AMZ) and on a total-return basis (NYSE: AMZX).

Indices are not managed and an investor cannot invest directly in an index.

OUTLOOK

In our view, the fundamental picture for the North American energy infrastructure sector continues to be strong. Monthly crude oil production in the U.S. recently hit its highest level since 1971, and U.S. natural gas gross monthly withdrawals are at record highs. Additionally, we believe the widening spread between West Texas Intermediate and Brent Crude oil could be a positive sign for exports of U.S. oil, which could boost midstream throughput volumes further. The recent cooperation between OPEC and Russia to extend production cuts through 2018 may further support balanced markets. We are encouraged by the recent change in market sentiment for midstream energy infrastructure and believe there is more room for investor sentiment to catch up with fundamentals; we therefore remain overweight.

Fundamentally, we believe that transmission and distribution utility companies in North America and Europe are performing well amid low financing costs and (generally) healthy growth rates. However, valuations appear to be elevated and investors are having to pay very high multiples for exposure to these businesses. We maintain our preference for utilities exposed to low-cost renewables generation. California—a market where we previously saw regulatory support—is now contending with the potential liabilities from widespread fires, making the region less attractive for investors. Underperformance among U.K. utilities amid uncertainties related to Brexit, currency and regulations created more attractive valuations. Recently we added exposure opportunistically, but will continue to monitor the risks—particularly those regarding regulations.

Traffic and cash flow growth has been positive for toll roads globally. We continue to prefer companies with European exposure, where growth has been steady. However, we are monitoring the political environment as some risks have re-emerged in the region. We remain optimistic for the prospect of passenger traffic in certain markets within Latin America, particularly Mexican toll road operators. The political situation in Mexico, specifically as it pertains to the North American Free Trade Agreement (NAFTA) negotiations, continues to be a risk factor we are considering.

Our outlook for the communications sector is unchanged as we continue to see long-term growth prospects. However, amid very strong performance for U.S. tower companies this year we have decreased our exposure recently.

If infrastructure stocks trade more in-line with our estimation of appropriate risk-adjusted cost of capital (which varies by sector), we see the potential for double-digit upside in some groups. However, we also see equal downside risk among sectors most exposed to certain factors, notably rising interest rates or adverse regulatory

6Brookfield Investment Management Inc.

Brookfield Global Listed Infrastructure Fund

changes. We are being particularly selective within rate-sensitive sectors, as we do not believe the prospect for higher interest rates is appropriately discounted at current levels.

AVERAGE ANNUAL TOTAL RETURNS

| As of December 31, 2017 | One Year | Five Years | Since Inception* |

| Class A Shares (excluding sales charge) | 10.52% | 5.73% | 7.54% |

| Class A Shares (including sales charge) | 5.24% | 4.71% | 6.66% |

| Class C Shares (excluding sales charge) | 9.62% | 4.94% | 5.61% |

| Class C Shares (including sales charge) | 8.62% | 4.94% | 5.61% |

| Class Y Shares | 10.79% | 6.00% | 7.93% |

| Class I Shares | 10.70% | 5.98% | 7.93% |

| Dow Jones Brookfield Global Infrastructure Composite Total Return Index | 12.73% | 8.12% | 9.45% |

* Class A was incepted on December 29, 2011, Class C was incepted on May 1, 2012 and Classes Y and I were incepted on December 1, 2011. The Dow Jones Brookfield Global Infrastructure Composite Total Return Index references Class I’s inception date. All returns shown in USD.

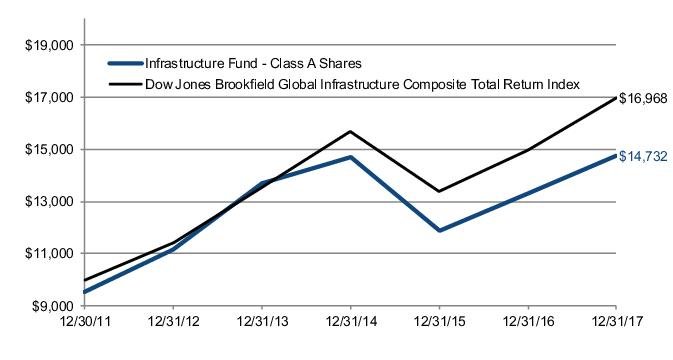

The table and graphs do not reflect the deductions of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. Performance shown including sales charge reflects the Class A maximum sales charge of 4.75% and the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance data excluding sales charge does not reflect the deduction of the sales charge or CDSC and if reflected, the sales charge or fee would reduce the performance quoted.

The Fund’s gross and net expense ratios for Class A is 1.50% and 1.35%, Class C is 2.25% and 2.10%, Class Y is 1.25% and 1.10% and Class I is 1.25% and 1.10%, respectively for the year ended December 31, 2017.

The Adviser has contractually agreed to reimburse the Fund's expenses through May 1, 2018. There is no guarantee that such reimbursement will be continued after that date.

The graphs below illustrate a hypothetical investment of $10,000 in the Infrastructure Fund—Class A Shares (including sales charge) from the commencement of investment operations on December 29, 2011 to December 31, 2017 compared to the Dow Jones Brookfield Global Infrastructure Composite Total Return Index, and Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2017 compared to the Dow Jones Brookfield Global Infrastructure Composite Total Return Index.

Brookfield Global Listed Infrastructure Fund

Class A Shares

Class I Shares

Disclosure

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance

8Brookfield Investment Management Inc.

Brookfield Global Listed Infrastructure Fund

that the Brookfield Global Listed Infrastructure Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Infrastructure companies may be subject to a variety of factors that may adversely affect their business, including high interest costs, high leverage, regulation costs, economic slowdown, surplus capacity, increased competition, lack of fuel availability and energy conversation policies. The Fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Investing in emerging markets may entail special risks relating to potential economic, political or social instability and the risks of nationalization, confiscation or the imposition of restrictions on foreign investment. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Some securities held may be difficult to sell, particularly during times of market turmoil. If the Fund is forced to sell an illiquid asset to meet redemption, it may be forced to sell at a loss. Investing in MLPs involves certain risks related to investing in the underlying assets of the MLPs and risks associated with pooled investment vehicles. Using derivatives exposes the Fund to additional risks, may increase the volatility of the Fund’s net asset value and may not provide the result intended. Since the Fund will invest more than 25% of its total assets in securities in the Infrastructure industry, the Fund may be subject to greater volatility than a fund that is more broadly diversified.

A Basis Point is one hundredth of one percent (0.01%). Cash flow refers to the amount of cash generated and used by a company over a given period.

Earnings growth is not a measure of the Fund’s future performance.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2017 and subject to change based on subsequent developments.

Brookfield Global Listed Infrastructure Fund

Portfolio Characteristics (Unaudited)

December 31, 2017

| ASSET ALLOCATION BY GEOGRAPHY | Percent of Net Assets |

| United States | 50.2% |

| Canada | 14.1% |

| United Kingdom | 7.3% |

| France | 7.3% |

| Spain | 4.4% |

| Italy | 3.0% |

| China | 2.4% |

| Denmark | 2.3% |

| Australia | 2.1% |

| Mexico | 1.4% |

| Brazil | 1.2% |

| New Zealand | 1.1% |

| Switzerland | 1.0% |

| Hong Kong | 0.7% |

| Other Assets in Excess of Liabilities | 1.5% |

| Total | 100.0% |

| ASSET ALLOCATION BY SECTOR | |

| Pipelines | 20.6% |

| Master Limited Partnerships | 15.1% |

| Toll Roads | 13.7% |

| Communications | 11.3% |

| Electricity Transmission & Distribution | 10.2% |

| Renewables/Electric Generation | 10.1% |

| Midstream | 6.7% |

| Water | 4.7% |

| Gas Utilities | 3.2% |

| Airports | 2.9% |

| Other Assets in Excess of Liabilities | 1.5% |

| Total | 100.0% |

| TOP TEN HOLDINGS | |

| American Tower Corp. | 6.6% |

| TransCanada Corp. | 5.0% |

| Enbridge, Inc. | 4.6% |

| National Grid PLC | 4.3% |

| Kinder Morgan, Inc. | 4.2% |

| Enterprise Products Partners LP | 4.2% |

| Vinci SA | 3.6% |

| SBA Communications Corp. | 3.5% |

| Energy Transfer Partners LP | 3.5% |

| The Williams Companies, Inc. | 3.3% |

10Brookfield Investment Management Inc.

Brookfield Global Listed Infrastructure Fund

Schedule of Investments

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS – 98.5% | | | |

| AUSTRALIA – 2.1% | | | |

| Pipelines – 1.3% | | | |

APA Group

| | | 500,100 | $ 3,242,881 |

| Toll Roads – 0.8% | | | |

Macquarie Atlas Roads Group

| | | 369,300 | 1,805,723 |

| Total AUSTRALIA | | | | 5,048,604 |

| BRAZIL – 1.2% | | | |

| Water – 1.2% | | | |

Cia de Saneamento Basico do Estado de Sao Paulo - ADR

| | | 287,600 | 3,005,420 |

| Total BRAZIL | | | | 3,005,420 |

| CANADA – 14.1% | | | |

| Pipelines – 14.1% | | | |

Enbridge, Inc.

| | | 288,200 | 11,271,211 |

Inter Pipeline Ltd.

| | | 170,700 | 3,534,862 |

Pembina Pipeline Corp.

| | | 206,500 | 7,476,384 |

TransCanada Corp.

| | | 250,635 | 12,198,766 |

| Total Pipelines | | | | 34,481,223 |

| Total CANADA | | | | 34,481,223 |

| CHINA – 2.4% | | | |

| Airports – 0.4% | | | |

Beijing Capital International Airport Company Ltd.

| | | 718,300 | 1,081,165 |

| Gas Utilities – 0.5% | | | |

ENN Energy Holdings Ltd.

| | | 166,000 | 1,180,669 |

| Pipelines – 1.0% | | | |

Beijing Enterprises Holdings Ltd.

| | | 205,700 | 1,217,551 |

Kunlun Energy Company Ltd.

| | | 1,185,300 | 1,231,928 |

| Total Pipelines | | | | 2,449,479 |

| Water – 0.5% | | | |

Guangdong Investment Ltd.

| | | 837,600 | 1,119,874 |

| Total CHINA | | | | 5,831,187 |

| DENMARK – 2.3% | | | |

| Renewables/Electric Generation – 2.3% | | | |

Orsted A/S 1

| | | 103,000 | 5,614,408 |

| Total DENMARK | | | | 5,614,408 |

| FRANCE – 7.3% | | | |

| Communications – 0.7% | | | |

Eutelsat Communications SA

| | | 75,200 | 1,741,067 |

| Toll Roads – 6.6% | | | |

Eiffage SA

| | | 31,900 | 3,491,174 |

Getlink SE

| | | 298,500 | 3,839,413 |

Vinci SA

| | | 85,700 | 8,749,230 |

| Total Toll Roads | | | | 16,079,817 |

| Total FRANCE | | | | 17,820,884 |

See Notes to Financial Statements.

Brookfield Global Listed Infrastructure Fund

Schedule of Investments (continued)

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS (continued) | | | |

| HONG KONG – 0.7% | | | |

| Gas Utilities – 0.7% | | | |

China Resources Gas Group Ltd.

| | | 452,100 | $ 1,636,413 |

| Total HONG KONG | | | | 1,636,413 |

| ITALY – 3.0% | | | |

| Gas Utilities – 0.6% | | | |

Italgas SpA

| | | 262,824 | 1,603,686 |

| Renewables/Electric Generation – 1.0% | | | |

Enel SpA

| | | 387,300 | 2,381,606 |

| Toll Roads – 1.4% | | | |

Atlantia SpA

| | | 108,400 | 3,417,452 |

| Total ITALY | | | | 7,402,744 |

| MEXICO – 1.4% | | | |

| Airports – 0.4% | | | |

Grupo Aeroportuario del Pacifico SAB de CV

| | | 89,200 | 916,384 |

| Toll Roads – 1.0% | | | |

Promotora y Operadora de Infraestructura SAB de CV

| | | 247,677 | 2,447,105 |

| Total MEXICO | | | | 3,363,489 |

| NEW ZEALAND – 1.1% | | | |

| Airports – 1.1% | | | |

Auckland International Airport Ltd.

| | | 602,700 | 2,766,571 |

| Total NEW ZEALAND | | | | 2,766,571 |

| SPAIN – 4.4% | | | |

| Communications – 0.5% | | | |

Cellnex Telecom SA 1

| | | 49,000 | 1,253,683 |

| Toll Roads – 3.9% | | | |

Abertis Infraestructuras SA

| | | 157,400 | 3,502,088 |

Ferrovial SA

| | | 184,383 | 4,184,222 |

Obrascon Huarte Lain SA 2

| | | 296,300 | 1,768,263 |

| Total Toll Roads | | | | 9,454,573 |

| Total SPAIN | | | | 10,708,256 |

| SWITZERLAND – 1.0% | | | |

| Airports – 1.0% | | | |

Flughafen Zurich AG

| | | 10,735 | 2,453,665 |

| Total SWITZERLAND | | | | 2,453,665 |

| UNITED KINGDOM – 7.3% | | | |

| Electricity Transmission & Distribution – 4.3% | | | |

National Grid PLC

| | | 901,132 | 10,622,994 |

| Water – 3.0% | | | |

Pennon Group PLC

| | | 247,400 | 2,611,861 |

Severn Trent PLC

| | | 162,500 | 4,735,009 |

| Total Water | | | | 7,346,870 |

| Total UNITED KINGDOM | | | | 17,969,864 |

See Notes to Financial Statements.

12Brookfield Investment Management Inc.

Brookfield Global Listed Infrastructure Fund

Schedule of Investments (continued)

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS (continued) | | | |

| UNITED STATES – 50.2% | | | |

| Communications – 10.1% | | | |

American Tower Corp.

| | | 113,533 | $ 16,197,753 |

SBA Communications Corp. 2

| | | 52,200 | 8,527,392 |

| Total Communications | | | | 24,725,145 |

| Electricity Transmission & Distribution – 5.9% | | | |

Edison International

| | | 68,900 | 4,357,236 |

PG&E Corp. 2

| | | 98,734 | 4,426,245 |

Sempra Energy

| | | 51,600 | 5,517,072 |

| Total Electricity Transmission & Distribution | | | | 14,300,553 |

| Gas Utilities – 1.4% | | | |

Atmos Energy Corp.

| | | 20,600 | 1,769,334 |

Southwest Gas Holdings, Inc.

| | | 20,400 | 1,641,792 |

| Total Gas Utilities | | | | 3,411,126 |

| Master Limited Partnerships – 15.1% | | | |

Boardwalk Pipeline Partners LP

| | | 149,300 | 1,927,463 |

Cone Midstream Partners LP

| | | 19,400 | 325,338 |

Energy Transfer Equity LP

| | | 137,200 | 2,368,072 |

Energy Transfer Partners LP

| | | 472,600 | 8,468,992 |

EnLink Midstream Partners LP

| | | 158,500 | 2,436,145 |

Enterprise Products Partners LP

| | | 388,269 | 10,293,011 |

MPLX LP

| | | 166,976 | 5,922,639 |

Plains All American Pipeline LP

| | | 159,200 | 3,285,888 |

Rice Midstream Partners LP

| | | 89,920 | 1,930,583 |

| Total Master Limited Partnerships | | | | 36,958,131 |

| Midstream – 6.7% | | | |

Cheniere Energy, Inc. 2

| | | 32,600 | 1,755,184 |

Targa Resources Corp.

| | | 132,900 | 6,435,018 |

The Williams Companies, Inc.

| | | 268,000 | 8,171,320 |

| Total Midstream | | | | 16,361,522 |

| Pipelines – 4.2% | | | |

Kinder Morgan, Inc.

| | | 574,600 | 10,383,022 |

| Renewables/Electric Generation – 6.8% | | | |

American Electric Power Company, Inc.

| | | 39,400 | 2,898,658 |

CMS Energy Corp.

| | | 49,800 | 2,355,540 |

Entergy Corp.

| | | 60,100 | 4,891,539 |

FirstEnergy Corp.

| | | 52,100 | 1,595,302 |

Great Plains Energy, Inc.

| | | 51,700 | 1,666,808 |

NRG Energy, Inc.

| | | 31,100 | 885,728 |

See Notes to Financial Statements.

Brookfield Global Listed Infrastructure Fund

Schedule of Investments (continued)

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS (continued) | | | |

Pattern Energy Group, Inc.

| | | 110,600 | $ 2,376,794 |

| Total Renewables/Electric Generation | | | | 16,670,369 |

| Total UNITED STATES | | | | 122,809,868 |

Total COMMON STOCKS

(Cost $204,564,714)

| | | | 240,912,596 |

Total Investments – 98.5%

(Cost $204,564,714)

| | | | 240,912,596 |

Other Assets in Excess of Liabilities – 1.5%

| | | | 3,699,989 |

TOTAL NET ASSETS – 100.0%

| | | | $244,612,585 |

| ADR— American Depositary Receipt |

| 1 | — Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. As of December 31, 2017, the total value of all such securities was $6,868,091 or 2.8% of net assets. |

| 2 | — Non-income producing security. |

See Notes to Financial Statements.

14Brookfield Investment Management Inc.

Brookfield Global Listed Real Estate Fund

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

For the year ended December 31, 2017, the Global Real Estate Fund had a total return 10.1%, which assumes the reinvestment of dividends and is exclusive of brokerage commissions, underperforming the FTSE EPRA/NAREIT Developed Index1, which returned 11.4% During the 12-month period ended December 31, 2017, the Industrial sector was the leading contributor to relative performance, driven by positive stock selection and underweight exposure. The Diversified and Specialty sectors were also leading contributors, both due to stock selection. Conversely, Retail was the leading sector detractor due to stock selection and overweight exposure. Stock selection within the Self Storage sector also detracted, and overweight exposures within Datacenters detracted as well.

By region, Singapore was the leading contributor to relative performance due to stock selection and an overweight allocation. Stock selection and underweight exposure in China/Hong Kong contributed as well. The U.S. was the leading detractor due to stock selection, while overweight exposure in the U.K. detracted as well.

By security, non-index holding SOHO China Ltd. (410.HK, Office, China/Hong Kong) was the leading contributor during the year. The company executed several successful asset sales, helping to illustrate the size of the disconnect between public market and private market valuations. It also announced two special dividends during the year. The timing of our overweight allocation to Wharf (Holdings) Ltd. (4 HK, Diversified, Hong Kong) also contributed, as Hong Kong stocks rallied following a period of underperformance after the U.S. elections in 2016. An overweight position in City Developments Limited (CIT.SP, Diversified, Singapore) contributed as well.

By security, an overweight position in CBL & Associates Properties, Inc. (CBL, Retail, U.S.) was the leading detractor from performance during the year. The stock declined meaningfully after reporting disappointing quarterly results in November. Rent spreads declined from prior-quarter levels due to the company using more aggressive rental rates to maintain occupancy. This decline in rent spreads was greater than for any of the company’s mall peers. Additionally, class A mall operators continued to report positive rent spreads during the period.

Overweight exposure to Mitsubishi Estate Company, Limited (8802.JP, Office, Japan) detracted as well as Japanese developers declined amid a strengthening Yen. An overweight position in Brixmor Property Group, Inc. (BRX, Retail, U.S.) also detracted. The stock declined on weakness within the sector in 2017.

GLOBAL REAL ESTATE MARKET OVERVIEW

Global real estate securities, as measured by the FTSE EPRA/NAREIT Developed Index (the “Benchmark”)1 returned 11.4%. By region, Europe returned 29.1%, followed by Asia Pacific (up 16.1%) and North America (up 4.6%).

European real estate equities benefitted from an expanding economy, as well as capital flows into the region following the outcome of regional elections in which a number of populist candidates were defeated. In the Asia Pacific region, real estate stocks performed particularly well in China and Hong Kong, following a period of underperformance immediately following the U.S. presidential election in 2016. Returns were also strong across all property types in Singapore. Fundamentals in the region have improved – particularly within the residential sector where supply has moderated, and affordability is better compared to the recent past.

By U.S. property type, Industrial gained 23.3%, followed by Diversified (9.6%), Hotels (7.4%), Residential (6.2%), Mixed (5.2%), Office (5.1%), Self Storage (3.6%) and Healthcare (0.7%). Retail was the only property type to post negative returns (down 4.8%) during the year.

The Industrial sector benefitted from strong fundamentals as e-commerce continues to be a major demand driver. Datacenters and communication tower stocks also performed very well in 2017, benefiting from increased demand for data consumption and transmission. Hotels benefitted from the improving economic outlook throughout the global economy. Conversely, the Retail sector declined amid concerns around the prospect for tenant

Brookfield Global Listed Real Estate Fund

bankruptcies, store closures and the perceived threat from e-commerce. Healthcare stocks, while slightly positive for the year, struggled amid sector-specific fundamental headwinds, as well as the prospect for higher interest rates.

1The FTSE EPRA/NAREIT Developed Index is a free-float adjusted, liquidity, size and revenue screened index designed to track the performance of listed real estate companies and REITs worldwide.

Indices are not managed and an investor cannot invest directly in an index.

OUTLOOK

In our view, the U.S. economy remains healthy as we continue to see job growth and improving GDP—both of which are positive for real estate. We believe the recent tax bill may help stimulate the economy further and help accelerate or extend the current business cycle. Despite these positives for the overall economy, we continue to view the real estate market with a cautious eye. Interest rates have likely reached their cyclical low and are likely to drift higher over time, which could potentially present a risk to real estate values. We therefore maintain a cautious approach to investing in assets with limited growth potential. We favor companies trading at discounts to NAV or companies we believe are positioned for growth.

Two real estate sectors that are currently experiencing a long-term cyclical demand shift are Datacenters and Towers. Both sectors are benefiting from increased demand for data consumption and transmission. This trend may continue for several more years and should lead to outsized revenue growth relative to more traditional real estate sectors.

The current real estate cycle has had much more limited supply growth than prior cycles, which has helped to keep supply and demand relatively well balanced. We will continue to closely monitor the supply pipeline.

Outside the U.S., we continue to see better value opportunities in the U.K. compared to Continental Europe and are encouraged by the progress made so far in the Brexit negotiations. We favor exposure to London office properties, where we believe the public market discount is widest and where we believe market sentiment has created the greatest opportunity. In continental Europe, we believe interest rates have likely bottomed, as the region continues to see economic growth. Should interest rates rise incrementally from current levels, this could create downward pressure on property prices, putting equity values at risk as many companies trade above NAV.

In the Asia Pacific region, we have seen reflationary government policy in China through relaxed credit standards and housing policies, as well as increased infrastructure spending. We believe some of the inflationary policies in China could be reversed, which would likely lead to a slowdown in economic growth. There is also a risk of tightening housing and credit policies that would also put downward pressure on stocks in the region. We continue to see attractive opportunities in the Singapore market as the government begins to ease or reverse many measures designed to cool the property market over the last several years. We see the potential for a recovery in the country’s property market as these measures are reversed and growth returns. In Japan, developers continue to trade at large discounts to NAV and we believe there is potential for this discount to close as demand remains positive. Japanese REITs on the other hand continue to trade at large premiums to NAV and we believe may be more negatively affected by new supply in 2018. However, recent underperformance for the REITs has improved valuation.

Global economic growth trends continue to be positive. However, we believe global interest rates have reached—or are near a bottom—and we expect rates to drift higher from here. Our view on interest rates, combined with our position in the property cycle, leads us to invest somewhat cautiously. We are seeking investment opportunities in companies that provide exposure to outsized growth at a reasonable price and companies that represent attractive value opportunities. We are encouraged by the wide variations in valuation between companies and sectors, which we believe presents attractive opportunities for active management.

16Brookfield Investment Management Inc.

Brookfield Global Listed Real Estate Fund

AVERAGE ANNUAL TOTAL RETURNS

| As of December 31, 2017 | One Year | Five Years | Since Inception* |

| Class A Shares (excluding sales charge) | 9.84% | 7.49% | 9.22% |

| Class A Shares (including sales charge) | 4.61% | 6.45% | 8.28% |

| Class C Shares (excluding sales charge) | 9.08% | 6.68% | 8.41% |

| Class C Shares (including sales charge) | 8.08% | 6.68% | 8.41% |

| Class Y Shares | 10.20% | 7.76% | 11.53% |

| Class I Shares | 10.13% | 7.74% | 11.51% |

| FTSE EPRA/NAREIT Developed Total Return Index | 11.42% | 7.20% | 10.53% |

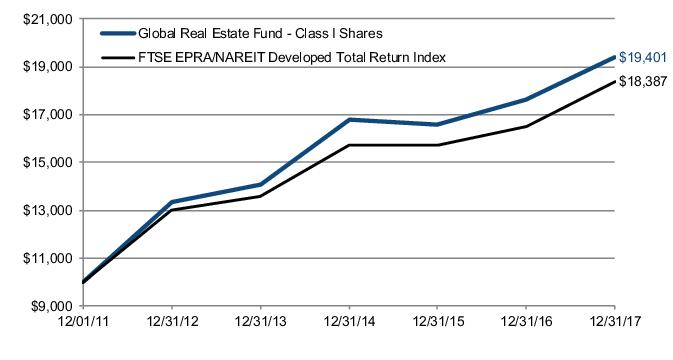

* Classes A and C were incepted on May 1, 2012 and Classes Y and I were incepted on December 1, 2011. The FTSE/EPRA NAREIT Developed Total Return Index references Class I's inception date. All returns shown in USD.

The table and graphs do not reflect the deductions of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. Performance shown including sales charge reflects the Class A maximum sales charge of 4.75% and the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance data excluding sales charge does not reflect the deduction of the sales charge or CDSC and if reflected, the sales charge or fee would reduce the performance quoted.

The Fund’s gross and net expense ratios for Class A is 1.24% and 1.20%, Class C is 1.99% and 1.95%, Class Y is 0.99% and 0.95% and Class I is 0.99% and 0.95%, respectively for the year ended December 31, 2017.

The Adviser has contractually agreed to reimburse the Fund's expenses through May 1, 2018. There is no guarantee that such reimbursement will be continued after that date.

The graphs below illustrate a hypothetical investment of $10,000 in the Global Real Estate Fund—Class A Shares (including sales charge) from the commencement of investment operations on May 1, 2012 to December 31, 2017 compared to the FTSE EPRA/NAREIT Developed Total Return Index, and Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2017 compared to the FTSE EPRA/NAREIT Developed Total Return Index.

Brookfield Global Listed Real Estate Fund

Class A Shares

Class I Shares

Disclosure

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance

18Brookfield Investment Management Inc.

Brookfield Global Listed Real Estate Fund

that the Brookfield Global Listed Real Estate Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Investors should be aware of the risks involved with investing in a fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. Investing in emerging markets may entail special risks relating to potential economic, political or social instability and the risks of nationalization, confiscation or the imposition of restrictions on foreign investment. The Fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Some securities held may be difficult to sell, particularly during times of market turmoil. If the Fund is forced to sell an illiquid asset to meet redemption, the Fund may be forced to sell at a loss. Using derivatives exposes the Fund to additional risks, may increase the volatility of the Fund’s net asset value and may not provide the result intended. Since the Fund will invest more than 25% of its total assets in securities in the Real Estate industry, the Fund may be subject to greater volatility than a fund that is more broadly diversified.

A basis point (bps) is a unit that is equal to 1/100th of 1% and is used to denote a change in a financial statement.

Earnings growth is not a measure of the Fund’s future performance.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2017 and subject to change based on subsequent developments.

Brookfield Global Listed Real Estate Fund

Portfolio Characteristics (Unaudited)

December 31, 2017

| ASSET ALLOCATION BY GEOGRAPHY | Percent of Net Assets |

| United States | 49.4% |

| United Kingdom | 13.5% |

| Japan | 9.4% |

| Germany | 5.7% |

| Singapore | 4.8% |

| Hong Kong | 3.8% |

| Australia | 3.4% |

| Spain | 3.0% |

| France | 2.7% |

| China | 1.4% |

| Other Assets in Excess of Liabilities | 2.9% |

| Total | 100.0% |

| ASSET ALLOCATION BY SECTOR | |

| Office | 27.2% |

| Retail | 19.6% |

| Diversified | 14.4% |

| Residential | 12.6% |

| Healthcare | 4.9% |

| Industrial | 3.9% |

| Datacenters | 3.9% |

| Specialty | 3.1% |

| Net Lease | 2.9% |

| Hotel | 2.6% |

| Self Storage | 2.0% |

| Other Assets in Excess of Liabilities | 2.9% |

| Total | 100.0% |

| TOP TEN HOLDINGS | |

| Simon Property Group, Inc. | 8.3% |

| Mitsubishi Estate Company Ltd. | 4.3% |

| Land Securities Group PLC | 4.1% |

| Great Portland Estates PLC | 3.7% |

| Mitsui Fudosan Company Ltd. | 3.6% |

| Merlin Properties Socimi SA | 3.0% |

| Hammerson PLC | 2.7% |

| American Homes 4 Rent | 2.5% |

| Dexus | 2.4% |

| City Developments Ltd. | 2.3% |

20Brookfield Investment Management Inc.

Brookfield Global Listed Real Estate Fund

Schedule of Investments

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS – 97.1% | | | |

| AUSTRALIA – 3.4% | | | |

| Diversified – 3.4% | | | |

Dexus

| | | 6,483,900 | $ 49,203,525 |

The GPT Group

| | | 4,664,500 | 18,554,573 |

| Total Diversified | | | | 67,758,098 |

| Total AUSTRALIA | | | | 67,758,098 |

| CHINA – 1.4% | | | |

| Office – 1.4% | | | |

SOHO China Ltd.

| | | 50,071,200 | 29,235,336 |

| Total CHINA | | | | 29,235,336 |

| FRANCE – 2.7% | | | |

| Office – 2.0% | | | |

Gecina SA

| | | 212,303 | 39,201,105 |

| Retail – 0.7% | | | |

Eurocommercial Properties NV

| | | 334,000 | 14,565,489 |

| Total FRANCE | | | | 53,766,594 |

| GERMANY – 5.7% | | | |

| Office – 2.0% | | | |

alstria office REIT-AG

| | | 2,580,678 | 39,881,514 |

| Residential – 3.7% | | | |

Grand City Properties SA

| | | 1,335,187 | 31,428,931 |

Vonovia SE

| | | 866,055 | 42,910,565 |

| Total Residential | | | | 74,339,496 |

| Total GERMANY | | | | 114,221,010 |

| HONG KONG – 3.8% | | | |

| Diversified – 1.6% | | | |

Wharf Real Estate Investment Company Ltd. 1

| | | 4,718,012 | 31,401,681 |

| Office – 2.2% | | | |

Hongkong Land Holdings Ltd.

| | | 6,418,300 | 45,145,250 |

| Total HONG KONG | | | | 76,546,931 |

| JAPAN – 9.4% | | | |

| Office – 8.3% | | | |

Hulic REIT, Inc.

| | | 5,505 | 8,008,793 |

Mitsubishi Estate Company Ltd.

| | | 4,970,255 | 86,298,742 |

Mitsui Fudosan Company Ltd.

| | | 3,207,500 | 71,737,272 |

| Total Office | | | | 166,044,807 |

| Residential – 1.1% | | | |

Leopalace21 Corp.

| | | 2,552,525 | 19,821,895 |

Nippon Accommodations Fund, Inc.

| | | 442 | 1,824,096 |

| Total Residential | | | | 21,645,991 |

| Total JAPAN | | | | 187,690,798 |

| SINGAPORE – 4.8% | | | |

| Diversified – 2.3% | | | |

City Developments Ltd.

| | | 5,027,700 | 46,758,230 |

See Notes to Financial Statements.

Brookfield Global Listed Real Estate Fund

Schedule of Investments (continued)

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS (continued) | | | |

| Office – 1.1% | | | |

CapitaLand Commercial Trust

| | | 15,333,200 | $ 22,086,217 |

| Retail – 1.4% | | | |

CapitaLand Mall Trust

| | | 17,144,500 | 27,275,733 |

| Total SINGAPORE | | | | 96,120,180 |

| SPAIN – 3.0% | | | |

| Diversified – 3.0% | | | |

Merlin Properties Socimi SA

| | | 4,429,400 | 59,991,994 |

| Total SPAIN | | | | 59,991,994 |

| UNITED KINGDOM – 13.5% | | | |

| Diversified – 4.1% | | | |

Land Securities Group PLC

| | | 6,037,913 | 82,035,332 |

| Industrial – 0.7% | | | |

Tritax Big Box REIT PLC

| | | 7,259,657 | 14,594,590 |

| Office – 4.9% | | | |

Derwent London PLC

| | | 577,017 | 24,291,024 |

Great Portland Estates PLC

| | | 8,040,411 | 74,620,679 |

| Total Office | | | | 98,911,703 |

| Retail – 3.8% | | | |

Capital & Counties Properties PLC

| | | 5,202,617 | 22,430,854 |

Hammerson PLC

| | | 7,233,837 | 53,370,630 |

| Total Retail | | | | 75,801,484 |

| Total UNITED KINGDOM | | | | 271,343,109 |

| UNITED STATES – 49.4% | | | |

| Datacenters – 3.9% | | | |

Equinix, Inc.

| | | 95,333 | 43,206,822 |

QTS Realty Trust, Inc.

| | | 646,047 | 34,989,906 |

| Total Datacenters | | | | 78,196,728 |

| Healthcare – 4.9% | | | |

HCP, Inc.

| | | 1,421,625 | 37,075,980 |

Physicians Realty Trust

| | | 1,072,000 | 19,285,280 |

Ventas, Inc.

| | | 682,025 | 40,928,320 |

| Total Healthcare | | | | 97,289,580 |

| Hotel – 2.6% | | | |

LaSalle Hotel Properties

| | | 646,300 | 18,141,641 |

Park Hotels & Resorts, Inc.

| | | 1,184,722 | 34,060,757 |

| Total Hotel | | | | 52,202,398 |

| Industrial – 3.2% | | | |

Duke Realty Corp.

| | | 1,519,077 | 41,334,085 |

Prologis, Inc.

| | | 364,600 | 23,520,346 |

| Total Industrial | | | | 64,854,431 |

| Net Lease – 2.9% | | | |

Gramercy Property Trust

| | | 1,079,668 | 28,783,949 |

See Notes to Financial Statements.

22Brookfield Investment Management Inc.

Brookfield Global Listed Real Estate Fund

Schedule of Investments (continued)

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS (continued) | | | |

MGM Growth Properties LLC

| | | 967,021 | $ 28,188,662 |

| Total Net Lease | | | | 56,972,611 |

| Office – 5.3% | | | |

Hudson Pacific Properties, Inc.

| | | 982,951 | 33,666,072 |

Kilroy Realty Corp.

| | | 382,984 | 28,589,755 |

SL Green Realty Corp.

| | | 430,700 | 43,470,551 |

| Total Office | | | | 105,726,378 |

| Residential – 7.8% | | | |

American Campus Communities, Inc.

| | | 631,600 | 25,914,548 |

American Homes 4 Rent

| | | 2,266,703 | 49,504,793 |

Essex Property Trust, Inc.

| | | 142,611 | 34,422,017 |

Mid-America Apartment Communities, Inc.

| | | 454,128 | 45,667,112 |

| Total Residential | | | | 155,508,470 |

| Retail – 13.7% | | | |

Brixmor Property Group, Inc.

| | | 1,251,726 | 23,357,207 |

DDR Corp.

| | | 3,878,000 | 34,746,880 |

Federal Realty Investment Trust

| | | 221,500 | 29,417,415 |

Simon Property Group, Inc.

| | | 963,133 | 165,408,462 |

Taubman Centers, Inc.

| | | 330,500 | 21,624,615 |

| Total Retail | | | | 274,554,579 |

| Self Storage – 2.0% | | | |

Public Storage

| | | 194,600 | 40,671,400 |

| Specialty – 3.1% | | | |

American Tower Corp.

| | | 135,400 | 19,317,518 |

Crown Castle International Corp.

| | | 392,855 | 43,610,834 |

| Total Specialty | | | | 62,928,352 |

| Total UNITED STATES | | | | 988,904,927 |

Total COMMON STOCKS

(Cost $1,841,571,832)

| | | | 1,945,578,977 |

Total Investments – 97.1%

(Cost $1,841,571,832)

| | | | 1,945,578,977 |

Other Assets in Excess of Liabilities – 2.9%

| | | | 57,103,513 |

TOTAL NET ASSETS – 100.0%

| | | | $2,002,682,490 |

| 1 | — Non-income producing security. |

See Notes to Financial Statements.

Brookfield U.S. Listed Real Estate Fund

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

For the year ended December 31, 2017, the U.S. Real Estate Fund had a total return 3.0%, which assumes the reinvestment of dividends and is exclusive of brokerage commissions, underperforming the MSCI U.S. REIT Total Return Index1, which returned 5.1%. During the 12-month period ended December 31, 2017, the Industrial sector was the leading contributor to relative performance due to an overweight allocation to the outperforming sector. Industrial real estate stocks performed well in 2017 amid positive fundamentals as e-commerce continues to be a major demand driver for the sector. Stock selection and overweight exposure within the Specialty sector also contributed, largely driven by non-index exposure to communication tower operators, which performed well in 2017. Underweight exposure with Healthcare also contributed. Conversely, Retail was the leading detractor from relative performance due to stock selection and overweight exposure. The sector performed poorly in 2017 amid continued concerns around retailer bankruptcies, store closures and the threat from e-commerce. Underweight exposure and stock selection in the Datacenters sector also detracted, as did stock selection and an underweight allocation within Self Storage.

By security, overweight exposure to Prologis, Inc. (PLD, Industrial) was the leading contributor to relative performance as the stock returned more than 25% during the year. Non-index holding Crown Castle International Corp. (CCI, Specialty) also contributed as communication towers performed very well in 2017. The timing of our overweight exposure to Taubman Centers, Inc. (TCO, Retail) contributed as well. We added exposure to Taubman later in the period to upgrade the quality of our retail holdings and the stock subsequently performed well as the retail sector rebounded during the fourth quarter.

By security, an overweight position in CBL & Associates Properties, Inc. (CBL, Retail) was the leading detractor from performance during the year. The stock declined meaningfully after reporting disappointing quarterly results in November. Rent spreads declined from prior-quarter levels due to the company using more aggressive rental rates to maintain occupancy. This decline in rent spreads was greater than for any of the company’s mall peers. Additionally, class A mall operators continued to report positive rent spreads during the period. The timing of our underweight exposure to Equinix, Inc. (EQIX, Datacenters) was the second largest detractor from relative performance. An overweight position in Brixmor Property Group, Inc. (BRX, Retail) also detracted. The stock declined on weakness within the sector in 2017.

U.S. REAL ESTATE MARKET OVERVIEW

U.S. real estate securities were up 5.1% for the year, as measured by the MSCI US REIT Total Return Index1 (the “Benchmark”). By property type, Industrial gained 23.3%, followed by Diversified (9.6%), Hotels (7.4%), Residential (6.2%), Mixed (5.2%), Office (5.1%), Self Storage (3.6%) and Healthcare (0.7%). Retail was the only property type to post negative returns (down 4.8%) during the year.2

The Industrial sector benefitted from strong fundamentals as e-commerce continues to be a major demand driver for the sector. Datacenters and communication tower stocks also performed very well in 2017, benefiting from increased demand for data consumption and transmission. Hotels benefitted from the improving economic outlook throughout the global economy.

Conversely, the Retail sector declined amid concerns around the prospect for tenant bankruptcies, store closures and the perceived threat from e-commerce. Healthcare stocks, while slightly positive for the year, struggled amid sector-specific fundamental headwinds, as well as the prospect for higher interest rates.

1 The MSCI US REIT Total Return Index (RMS) is a total return market capitalization-weighted index which prices once per day after market close. It is calculated by MSCI and is composed of equity REITs that are included in the MSCI US Investable Market 2500 Index. You cannot invest directly in an index.

2 Sector returns represented by the U.S. portion of the FTSE EPRA/NAREIT Developed North America Index. The FTSE EPRA/NAREIT Developed Index is calculated by the FTSE Group. Performance is calculated by price, total return and net total return and the Index is calculated daily. Constituents must meet minimum market capitalization, liquidity requirements, and real estate activity requirements in order to be included within the Index. North American and Asian companies must be of a minimum of US$200 million in market capitalization with liquidity of US$100 million. European companies are bound by €50 million (approximately $60 million) market cap minimum and liquidity of €25 million (approximately $30 million).

24Brookfield Investment Management Inc.

Brookfield U.S. Listed Real Estate Fund

Indices are not managed and an investor cannot invest directly in an index.

OUTLOOK

In our view, the U.S. economy remains healthy as we continue to see job growth and improving GDP—both of which are positive for real estate. We believe the recent tax bill may help stimulate the economy further and help accelerate or extend the current business cycle. Despite these positives for the overall economy, we continue to view the real estate market with a cautious eye. Interest rates have likely reached their cyclical low and are likely to drift higher over time, which could potentially present a risk to real estate values. We therefore maintain a cautious approach to investing in assets with limited growth potential. We favor companies trading at discounts to net asset value (NAV) or companies we believe are positioned for growth.

Two real estate sectors which are currently experiencing a long-term cyclical demand shift are Datacenters and Towers. Both sectors are benefiting from increased demand for data consumption and transmission. This trend may continue for several more years and should lead to outsized revenue growth relative to more traditional real estate sectors.

The current real estate cycle has had much more limited supply growth than prior cycles, which has helped to keep supply and demand relatively well balanced. We will continue to closely monitor the supply pipeline.

We believe the U.S. REIT market overall continues to trade near fair value. However, we see a wide variation in valuation between companies and sectors which presents an attractive opportunity for active management.

AVERAGE ANNUAL TOTAL RETURNS

| As of December 31, 2017 | One Year | Since Inception* |

| Class A Shares (excluding sales charge) | 2.73% | 8.23% |

| Class A Shares (including sales charge) | -2.17% | 6.93% |

| Class C Shares (excluding sales charge) | 1.95% | 7.48% |

| Class C Shares (including sales charge) | 0.96% | 7.48% |

| Class Y Shares | 3.19% | 8.60% |

| Class I Shares | 3.00% | 8.51% |

| MSCI US REIT Total Return Index | 5.07% | 10.76% |

* Classes A, C , Y and I were incepted on December 11, 2013. All returns shown in USD.

The table and graphs do not reflect the deductions of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. Performance shown including sales charge reflects the Class A maximum sales charge of 4.75% and the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance data excluding sales charge does not reflect the deduction of the sales charge or CDSC and if reflected, the sales charge or fee would reduce the performance quoted.

The Fund’s gross and net expense ratios for Class A is 2.22% and 1.20%, Class C is 2.97% and 1.95%, Class Y is 1.97% and 0.95% and Class I is 1.97% and 0.95%, respectively for the year ended December 31, 2017.

The Adviser has contractually agreed to reimburse the Fund's expenses through May 1, 2018. There is no guarantee that such reimbursement will be continued after that date.

The graphs below illustrate a hypothetical investment of $10,000 in the U.S Real Estate Fund—Class A Shares

Brookfield U.S. Listed Real Estate Fund

(including sales charge) from the commencement of investment operations on December 11, 2013 to December 31, 2017 compared to the MSCI U.S. REIT Total Return Index, and Class I Shares from the commencement of investment operations on December 11, 2013 to December 31, 2017 compared to the MSCI U.S. REIT Total Return Index.

Class A Shares

Class I Shares

26Brookfield Investment Management Inc.

Brookfield U.S. Listed Real Estate Fund

Disclosure

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Brookfield U.S. Listed Real Estate Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Investors should be aware of the risks involved with investing in a fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. Investing in emerging markets may entail special risks relating to potential economic, political or social instability and the risks of nationalization, confiscation or the imposition of restrictions on foreign investment. The Fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Some securities held may be difficult to sell, particularly during times of market turmoil. If the Fund is forced to sell an illiquid asset to meet redemption, the Fund may be forced to sell at a loss. Using derivatives exposes the Fund to additional risks, may increase the volatility of the Fund’s net asset value and may not provide the result intended. Since the Fund will invest more than 25% of its total assets in securities in the Real Estate industry, the Fund may be subject to greater volatility than a fund that is more broadly diversified. Using derivatives exposes the Fund to additional risks, may increase the volatility of the Fund’s net asset value and may not provide the result intended.

Earnings growth is not a measure of the Fund’s future performance.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2017 and subject to change based on subsequent developments.

Brookfield U.S. Listed Real Estate Fund

Portfolio Characteristics (Unaudited)

December 31, 2017

| ASSET ALLOCATION BY SECTOR | Percent of Net Assets |

| Retail | 23.7% |

| Residential | 13.4% |

| Office | 11.1% |

| Healthcare | 11.0% |

| Datacenters | 10.1% |

| Industrial | 7.3% |

| Specialty | 6.5% |

| Net Lease | 6.0% |

| Hotel | 5.8% |

| Self Storage | 3.7% |

| Other Assets in Excess of Liabilities | 1.4% |

| Total | 100.0% |

| TOP TEN HOLDINGS | |

| Simon Property Group, Inc. | 14.0% |

| SL Green Realty Corp. | 5.6% |

| QTS Realty Trust, Inc. | 5.1% |

| Equinix, Inc. | 5.0% |

| American Homes 4 Rent | 4.8% |

| Ventas, Inc. | 4.5% |

| Prologis, Inc. | 4.5% |

| HCP, Inc. | 4.5% |

| Crown Castle International Corp. | 4.5% |

| Park Hotels & Resorts, Inc. | 4.0% |

28Brookfield Investment Management Inc.

Brookfield U.S. Listed Real Estate Fund

Schedule of Investments

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS – 98.6% | | | |

| Datacenters – 10.1% | | | |

Equinix, Inc.

| | | 2,700 | $ 1,223,694 |

QTS Realty Trust, Inc.

| | | 23,200 | 1,256,512 |

| Total Datacenters | | | | 2,480,206 |

| Healthcare – 11.0% | | | |

HCP, Inc.

| | | 42,200 | 1,100,576 |

Physicians Realty Trust

| | | 27,000 | 485,730 |

Ventas, Inc.

| | | 18,400 | 1,104,184 |

| Total Healthcare | | | | 2,690,490 |

| Hotel – 5.8% | | | |

LaSalle Hotel Properties

| | | 15,900 | 446,313 |

Park Hotels & Resorts, Inc.

| | | 33,936 | 975,660 |

| Total Hotel | | | | 1,421,973 |

| Industrial – 7.3% | | | |

Duke Realty Corp.

| | | 25,400 | 691,134 |

Prologis, Inc.

| | | 17,100 | 1,103,122 |

| Total Industrial | | | | 1,794,256 |

| Net Lease – 6.0% | | | |

Gramercy Property Trust

| | | 28,066 | 748,240 |

MGM Growth Properties LLC

| | | 24,600 | 717,090 |

| Total Net Lease | | | | 1,465,330 |

| Office – 11.1% | | | |

Hudson Pacific Properties, Inc.

| | | 22,200 | 760,350 |

Kilroy Realty Corp.

| | | 8,000 | 597,200 |

SL Green Realty Corp.

| | | 13,500 | 1,362,555 |

| Total Office | | | | 2,720,105 |

| Residential – 13.4% | | | |

American Campus Communities, Inc.

| | | 10,100 | 414,403 |

American Homes 4 Rent

| | | 53,800 | 1,174,992 |

Essex Property Trust, Inc.

| | | 3,450 | 832,727 |

Mid-America Apartment Communities, Inc.

| | | 8,500 | 854,760 |

| Total Residential | | | | 3,276,882 |

| Retail – 23.7% | | | |

Brixmor Property Group, Inc.

| | | 23,500 | 438,510 |

DDR Corp.

| | | 54,700 | 490,112 |

Federal Realty Investment Trust

| | | 6,800 | 903,108 |

Simon Property Group, Inc.

| | | 19,949 | 3,426,041 |

Taubman Centers, Inc.

| | | 8,300 | 543,069 |

| Total Retail | | | | 5,800,840 |

| Self Storage – 3.7% | | | |

Public Storage

| | | 4,400 | 919,600 |

| Specialty – 6.5% | | | |

American Tower Corp.

| | | 3,400 | 485,078 |

See Notes to Financial Statements.

Brookfield U.S. Listed Real Estate Fund

Schedule of Investments (continued)

December 31, 2017

| | | | Shares | Value |

| COMMON STOCKS (continued) | | | |

Crown Castle International Corp.

| | | 9,900 | $ 1,098,999 |

| Total Specialty | | | | 1,584,077 |

Total COMMON STOCKS

(Cost $23,024,281)

| | | | 24,153,759 |

Total Investments – 98.6%

(Cost $23,024,281)

| | | | 24,153,759 |

Other Assets in Excess of Liabilities – 1.4%

| | | | 340,006 |

TOTAL NET ASSETS – 100.0%

| | | | $ 24,493,765 |

See Notes to Financial Statements.

30Brookfield Investment Management Inc.

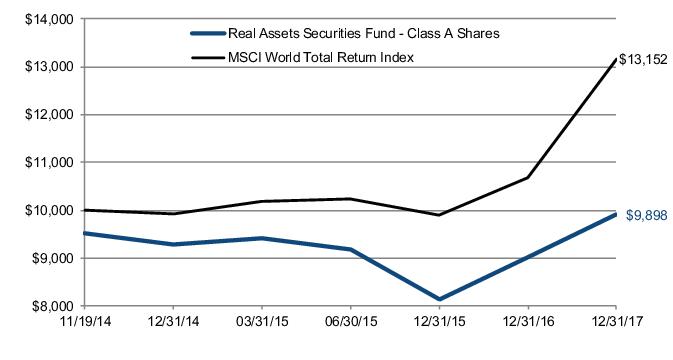

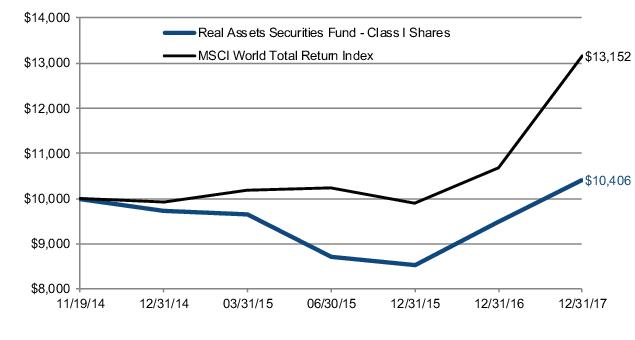

Brookfield Real Assets Securities Fund

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

For the year ended December 31, 2017, the Real Assets Securities Fund, Class I had a total return 9.7%, which assumes the reinvestment of dividends and is exclusive of brokerage commissions, underperforming the Fund’s Blended Index1, which returned 12.1%.

On an absolute performance basis, all asset class components of the strategy except Master Limited Partnerships ("MLPs") contributed positively to performance during the period.

On a relative performance basis, Global Real Estate was the leading contributor, driven by security selection within the sector, as well as an underweight allocation. Real Asset Debt was the second largest contributor to relative performance, also driven by security selection within the sector and an underweight allocation.

In the next section, we provide further detail on the performance of each asset class, along with our outlook for investing in real asset-related securities.

1 The Blended Index for the period from October 1, 2016 forward consists of 35% FTSE EPRA/NAREIT Developed Index, 5% BofA Merrill Lynch Preferred Stock REITs 7% Constrained Index, 40% Dow Jones Brookfield Global Infrastructure Index, 5% Alerian MLP Index, and 15% the ICE BofA Merrill Lynch Global High Yield Index and ICE BofA Merrill Lynch Global Corporate Index, weighted 70% and 30%, respectively. For the period from November 19, 2014 through September 30, 2016, the Blended Index consisted of 33.33% Dow Jones Brookfield Global Infrastructure Composite Index, 33.33% FTSE EPRA/NAREIT Developed Index, 13.33% the BofA Merrill Lynch Global High Yield Index and BofA Merrill Lynch Global Corporate Index, weighted 70% and 30%, respectively, 10% S&P Global Natural Resources Index, 6.66% Bloomberg Commodity Index and 3.33% Barclays Global Inflation-Linked Index.

GLOBAL INFRASTRUCTURE SECURITIES

Listed infrastructure returns were positive in 2017, with the Dow Jones Brookfield Global Infrastructure Composite Index posting a gain of 12.7%.2 Regional returns were particularly strong in Europe, where listed infrastructure stocks rose 27.2%. The Asia Pacific and Americas regions of the Dow Jones Brookfield Global Infrastructure Index returned 24.0% and 10.0%, respectively. By sector, Toll Roads gained 43.1%, followed by Airports (39.5%), Diversified (36.8%), Communications (33.9%), Water (20.0%), Ports (7.7%), Oil & Gas Storage & Transportation (6.4%) and Electricity Transmission & Distribution (4.4%). Conversely, the Alerian MLP Index declined 6.5%.3

U.S. communication tower stocks performed very well in 2017. Again, positive demand drivers including increased data usage, deployment of new technologies and the pending rollout of The First Responder Network Authority (FirstNet) provided tailwinds for the sector during the year. Transport stocks also performed well in 2017. Notably, European airports and toll roads benefitted from an expanding economy, as well as capital flows into the region following the outcome of regional elections in which several populist candidates were defeated.