UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22563 |

|

Mairs & Power Funds Trust |

(Exact name of registrant as specified in charter) |

|

332 Minnesota Street, Suite W1520, St. Paul, MN | | 55101 |

(Address of principal executive offices) | | (Zip code) |

|

Andrea C. Stimmel, Chief Compliance Officer & Treasurer, 332 Minnesota Street, Suite

W1520, St. Paul, MN 55101 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 651-222-8478 | |

|

Date of fiscal year end: | December 31, 2015 | |

|

Date of reporting period: | June 30, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Investing for the long-term

SEMI-ANNUAL REPORT

JUNE 30, 2015

- GROWTH FUND (MPGFX)

est. 1958

- BALANCED FUND (MAPOX)

est. 1961

- SMALL CAP FUND (MSCFX)

est. 2011

Mairs & Power W1520 First National Bank Building, 332 Minnesota Street, St. Paul, Minnesota 55101 www.mairsandpower.com

MAIRS & POWER FUNDS MARKET COMMENTARY (unaudited)

June 30, 2015

In a scenario we have seen for several quarters now, second quarter and the first half of the year delivered "more of the same" as the continuing strength of the dollar and low oil prices remained dominant factors for the economy and the markets, benefiting some companies while presenting a steady headwind against others.

Although low oil prices continued to pressure exploration and production companies as well as their equipment and service suppliers, the continued pressure on energy prices broadly benefited companies across multiple industries where fuel and energy or petroleum-based raw materials represent a significant portion of their costs. At the same time, the strong dollar continued to hurt export-oriented U.S. companies that do most or all of their manufacturing domestically. These companies find themselves squeezed between higher dollar-based production costs and less competitive prices when selling against foreign manufacturers. The industrial sector in particular continued to see this impact on revenue and profits in both the second quarter and first half.

One emerging concern we have is the market's current focus on chasing short-term returns wherever they can be found while ignoring earnings growth and stock valuations. Nine of the top ten factors driving market performance during the second quarter were technical and momentum factors instead of valuation fundamentals, according to a report from Bank of America Merrill Lynch. The top performing sectors in the quarter, technology and health care, were driven by merger and acquisition (M&A) or divestiture activity. Typically the market goes through periods where it loves either one or the other deal environment, but it currently seems enamored with both.

The market's focus on momentum and away from fundamentals hurt our performance in the second quarter and the first half for the simple reason that, as long-term investors, our investment discipline is all about the fundamentals. Nevertheless, we remain focused on finding and keeping stocks of good companies which have durable competitive advantages. For example, where stocks in the energy and industrial sectors have been punished, we look for well-managed companies able to get in front of current pressures by reducing their costs. We believe they present a buying opportunity and good value for patient investors. We will leave the momentum and headline chasing to others.

Worries about Greece, the strong dollar and expectations of higher interest rates all weighed on the market in both the second quarter and first half. The S&P 500 Total Return (TR) was up 0.28% and 1.23%, the Dow Jones Industrial Average TR was down 0.29% and up a slight 0.03%, the Barclay's Government/Credit Bond Index return was down 2.10% and down 0.30%, and the S&P Small Cap 600 TR was plus 0.19% and 4.16%, in each period respectively.

Outlook

There is no meaningful change to our outlook, which remains cautious near term and quite positive longer term. While our outlook is generally positive, we believe it will be difficult to generate returns above the level of earnings growth in the near term. Market expectations continue to call for the Federal Reserve (Fed) to raise short term interest rates later this year after an historic period of holding them near zero. We share that view and expect a series of gradual interest rate hikes beginning in the third quarter. Employment and GDP growth continue to indicate slow, steady economic expansion in the U.S. Moves by both Europe and Japan intended to add liquidity and stimulate growth show some positive early signs, which should help our holdings in export-oriented industrial companies down the road.

Given subdued earnings growth expectations and low interest rates, the market remains at the high end of what we view as an appropriate valuation range across key metrics. The dividend yield for the S&P 500 stands very close to its 10 year average of 2.13%, which is reasonable. However, the price/earnings ratio and enterprise value to sale ratios for the S&P 500 both have remained above their long term averages (10-year average P/E, 13.89; 10-year average EV/sales, 1.94) for more than a year and stand near the high end of their historic ranges. This is likely to limit upside movement in the overall market in the near term.

2

MAIRS & POWER FUNDS MARKET COMMENTARY (unaudited) (continued)

While we are not chasing after the M&A and spin-off stories that are driving much of the current market, we remain confident in our approach and still see good opportunities to buy high quality companies with demonstrated durable competitive advantages.

The S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the United States stock market. It tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

Dow Jones Industrial Average TR Index is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. It is not possible to invest directly in an index.

Barclays Government/Credit Bond Index. Barclays is composed of high-quality, investment-grade United States government and corporate fixed income securities with maturities greater than one year. It is not possible to invest directly in an index.

The S&P Small Cap Total Return (TR) is an index of small-company stocks managed by Standard and Poor's that covers a broad range of small cap stocks in the United States. The index is weighted according to market capitalization and covers about 3-4% of total market equities in the United States. It tracks both the capital gains of the group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

Dividend Yield is a ratio that shows how much a company pays out in dividends each year relative to its share price.

P/E (price per earnings) Ratio is the ratio of a company's share price to its per-share earnings.

EV/Sales (enterprise-value-to-sales) Ratio is a valuation measure that compares the enterprise value of a company to the company's sales.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period, though GDP is usually calculated on an annual basis.

3

MAIRS & POWER GROWTH FUND (unaudited)

To Our Shareholders: June 30, 2015

For the second quarter and first half ending June 30, 2015, the Mairs & Power Growth Fund was down 1.35% and 0.54% respectively, underperforming both its benchmark, the S&P 500 Total Return (TR) Index, which gained 0.28% and 1.23%, and its peer group, the Lipper Multi Cap Core Funds Index, which was up 0.15% and 2.31%, for the periods.

The Fund's performance in both the quarter and first half was negatively impacted by our overweight position in the industrial sector, which remains under pressure due to the strong dollar, as described in the market overview above. In addition, stock selection in healthcare hurt our performance. Although we are overweight in healthcare which was strong in both the quarter and the first half, we have focused on pharmaceutical and med tech industries where we believe demographics will drive long term demand. Recently we have seen increased merger and acquisition (M&A) activity in the insurance segment, where we have no exposure, and which drove outperformance in the overall healthcare sector.

The largest individual stock contributor to underperformance in both the second quarter and the first half was Stratasys (SSYS), a leader in 3D printing technology. We had gotten into the stock early on and had exited our position entirely in 2012 with a healthy gain after the market discovered the company and drove valuations to premium levels at 15 times revenue. We got back into the stock as valuations became more reasonable, but were early in our re-entry. The industry is still in its infancy and its growth rate is choppy, which has impacted the stock this year. But we remain convinced that, longer term, additive manufacturing will be transformative across multiple sectors in the economy and Stratasys is very well positioned to remain a leader in that transformation.

Perhaps it's the warmer weather, but the second quarter puts us in a nautical mood. Experienced sailors know that races are often won on the upwind leg. Those who can sail tight into the wind, change course at the right time without adding unnecessary tacks and take advantage of every bit of forward momentum come out ahead. It's an image that fits the current investing environment. Two of our portfolio companies neatly illustrate the point. They each highlight the type of managements we like to invest in, those who skillfully navigate at both the strategic and tactical levels.

Mairs & Power Growth Fund (MPGFX) Second Quarter Results (3/31/15 – 6/30/15)

Top Performers

| Second Quarter (3/31/15 – 6/30/15) | | Year To Date (12/31/14 – 6/30/15) | |

NVE Corporation | | | 13.48 | % | | The Walt Disney Company | | | 19.95 | % | |

St. Jude Medical, Inc. | | | 11.45 | % | | Fiserv, Inc. | | | 15.48 | % | |

Pentair Ltd. | | | 9.04 | % | | St. Jude Medical, Inc. | | | 11.13 | % | |

The Walt Disney Company | | | 8.54 | % | | Ecolab, Inc. | | | 6.95 | % | |

General Electric Co. | | | 6.81 | % | | Target Corp. | | | 6.31 | % | |

Weak Performers

| Second Quarter (3/31/15 – 6/30/15) | | Year To Date (12/31/14 – 6/30/15) | |

Stratasys, Inc. | | | -34.10 | % | | CH Robinson World Wide, Inc. | | | -17.92 | % | |

CH Robinson World Wide, Inc. | | | -15.07 | % | | Qualcomm, Inc. | | | -16.97 | % | |

MTS Systems Corp. | | | -9.14 | % | | Graco, Inc. | | | -12.64 | % | |

3M Co. | | | -6.74 | % | | Emerson Electric Co. | | | -11.44 | % | |

Medtronic, Inc. | | | -5.27 | % | | 3M Co. | | | -7.33 | % | |

Past performance is no guarantee of future results.

4

MAIRS & POWER GROWTH FUND (unaudited) (continued)

Ecolab (ECL) was a top contributor to performance in the first half despite facing headwinds from both lower oil prices and the stronger dollar. Almost half the company's revenues come from outside the U.S. across its institutional cleaning, sanitizing, water and energy management businesses. While it sources some products in its overseas markets, Ecolab still faces cost and price pressure from the strong dollar. In addition, a few years ago the company had made two acquisitions, Nalco and Champion Technologies, adding to its global presence in the oil and energy services arena. Last year, this segment contributed nearly one-third of the company's revenues. While lower oil prices benefit its legacy institutional and hospitality businesses in both raw material and fuel costs, the rapid decline in oil prices has pressured results in Ecolab's energy services segment. Ecolab management has transparently addressed both the currency impact and oil price issues with investors and has mitigated the effects somewhat through cost controls. Ecolab continues to impress us with exceptional tactical management of its business.

Hormel Foods (HRL) also was among the top contributors to performance in the first half. The recent acquisitions of strong niche brands such as Skippy (peanut butter), Muscle Milk (protein enhanced nutrition beverage) and Applegate (organically raised meats) are all moves management has taken to evolve from its heritage as a commodity meat processor to a multi-brand supplier of ready-to-use protein products where consumer demand is strong and growing. As it moves up the value-chain, Hormel's solid branding and merchandising capabilities strengthen these newly acquired businesses beyond the results they could achieve as stand-alone entities. On the tactical side, the recent avian influenza outbreak across the upper Midwest is challenging Hormel's Jennie-O Turkey brand business. Management acted quickly and decisively to limit the impact, cutting costs and curtailing its meat processing operations as supplies tightened.

Both companies exemplify what we would describe as skillful sailing into the wind.

Mark L. Henneman

Lead Manager | | Andrew R. Adams

Co-Manager | |

The Fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary prospectus or full prospectus contains this and other important information about the Fund, and they may be obtained by calling Shareholder Services at (800) 304-7404 or visiting www.mairsandpower.com. Read the summary prospectus or full prospectus carefully before investing.

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Growth Fund is designed for long-term investors. Equity investments are subject to market fluctuations, and the Fund's share price can fall because of weakness in the broad market, a particular industry, or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices, and greater fluctuations in price than United States corporations.

Diversification does not guarantee profit or protect against loss.

The S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the United States stock market. It tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

Lipper Multi-Cap Core Funds Index is an unmanaged index considered representative of multi-cap core funds tracked by Lipper. It is not possible to invest directly in an index.

5

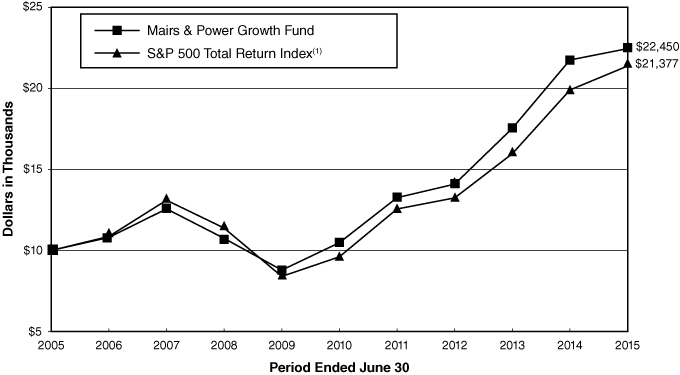

Mairs & Power Growth Fund

PERFORMANCE INFORMATION (unaudited) June 30, 2015

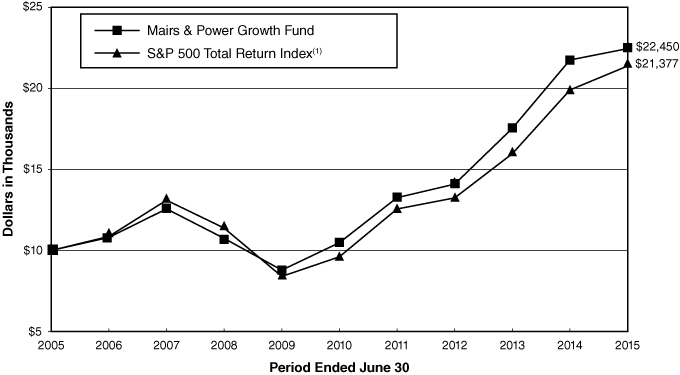

Ten years of investment performance (through June 30, 2015)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended June 30, 2015

| | | 1 year | | 5 years | | 10 years | | 20 years | |

Mairs & Power Growth Fund | | | 3.22 | % | | | 16.46 | % | | | 8.42 | % | | | 11.89 | % | |

S&P 500 Total Return Index(1) | | | 7.42 | % | | | 17.34 | % | | | 7.89 | % | | | 8.91 | % | |

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404.

(1) The S&P 500 Total Return Index is an unmanaged index of 500 common stocks which assumes reinvestment of dividends that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

6

Mairs & Power Growth Fund

FUND INFORMATION (unaudited) June 30, 2015

Portfolio Managers

Mark L. Henneman, lead manager since July 1, 2013, co-manager from January 1, 2006 through June 30, 2013

University of Minnesota, MBA Finance 1990

Andrew R. Adams, co-manager since January 1, 2015, University of Wisconsin-Madison, MS Finance 1997

General Information

Fund Symbol | | | MPGFX | | |

Net Asset Value (NAV) Per Share | | $ | 114.72 | | |

Expense Ratio | | | 0.65 | %1 | |

Portfolio Turnover Rate | | | 6.74 | % | |

Sales Charge | | | None2 | | |

Fund Inception Year | | | 1958 | | |

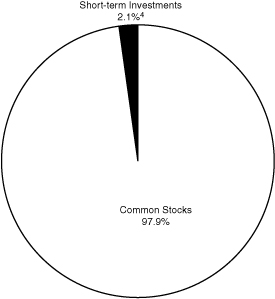

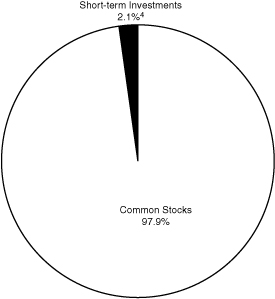

Portfolio Composition

Top Ten Portfolio Holdings

(Percent of Total Net Assets) 3

Ecolab Inc | | | 4.5 | % | |

US Bancorp/MN | | | 4.2 | | |

Honeywell International Inc | | | 3.8 | | |

| 3M Co | | | 3.7 | | |

Valspar Corp/The | | | 3.6 | | |

Bemis Co Inc | | | 3.4 | | |

Medtronic PLC | | | 3.4 | | |

Graco Inc | | | 3.1 | | |

Johnson & Johnson | | | 3.0 | | |

Schlumberger Ltd | | | 3.0 | | |

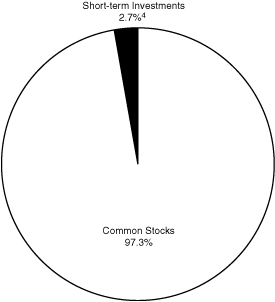

Portfolio Diversification

(Percent of Total Net Assets)

Common Stocks 97.9% | |

Industrials | | | 30.1 | % | |

Health Care | | | 17.9 | | |

Materials | | | 13.9 | | |

Information Technology | | | 11.3 | | |

Financials | | | 10.5 | | |

Consumer Staples | | | 5.8 | | |

Consumer Discretionary | | | 4.7 | | |

Energy | | | 3.0 | | |

Utilities | | | 0.7 | | |

Short-term Investments 2.1%4 | | | 2.1 | | |

| | | | 100.0 | % | |

1 Ratio has been annualized for the six month period ended June 30, 2015.

2 Although the Fund is no-load, investment management fees and other expenses still apply.

3 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

4 Represents short-term investments and other assets and liabilities (net).

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs and Power, Inc.

7

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (unaudited) June 30, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS 97.9% | |

| | | CONSUMER DISCRETIONARY 4.7% | |

| | 1,505,000 | | | Target Corp | | $ | 122,853,150 | | |

| | 640,000 | | | Walt Disney Co/The | | | 73,049,600 | | |

| | | | 195,902,750 | | |

| | | CONSUMER STAPLES 5.8% | |

| | 2,060,000 | | | General Mills Inc | | | 114,783,200 | | |

| | 2,200,000 | | | Hormel Foods Corp | | | 124,014,000 | | |

| | | | 238,797,200 | | |

| | | ENERGY 3.0% | |

| | 1,450,000 | | | Schlumberger Ltd (a) | | | 124,975,500 | | |

| | | FINANCIALS 10.5% | |

| | 230,000 | | | American Express Co | | | 17,875,600 | | |

| | 1,910,000 | | | Associated Banc-Corp | | | 38,715,700 | | |

| | 1,730,000 | | | Principal Financial Group Inc | | | 88,731,700 | | |

| | 300,000 | | | Travelers Cos Inc/The | | | 28,998,000 | | |

| | 4,020,000 | | | US Bancorp/MN | | | 174,468,000 | | |

| | 1,550,000 | | | Wells Fargo & Co | | | 87,172,000 | | |

| | | | 435,961,000 | | |

| | | HEALTH CARE 17.9% | |

| | 1,450,000 | | | Baxter International Inc | | | 101,398,500 | | |

| | 924,300 | | | Bio-Techne Corp | | | 91,015,821 | | |

| | 1,290,000 | | | Johnson & Johnson | | | 125,723,400 | | |

| | 1,920,000 | | | Medtronic PLC (f) | | | 142,272,000 | | |

| | 840,000 | | | Patterson Cos Inc | | | 40,866,000 | | |

| | 1,230,000 | | | Pfizer Inc | | | 41,241,900 | | |

| | 1,760,000 | | | Roche Holding AG ADR (e) | | | 61,723,200 | | |

| | 1,400,000 | | | St Jude Medical Inc | | | 102,298,000 | | |

| | 350,300 | | | Zimmer Holdings Inc | | | 38,263,269 | | |

| | | | 744,802,090 | | |

| | | INDUSTRIALS 30.1% | |

| | 1,005,000 | | | 3M Co | | | 155,071,500 | | |

| | 1,400,000 | | | CH Robinson Worldwide Inc | | | 87,346,000 | | |

| | 283,853 | | | Deluxe Corp | | | 17,598,886 | | |

| | 3,420,000 | | | Donaldson Co Inc | | | 122,436,000 | | |

| | 2,160,000 | | | Emerson Electric Co | | | 119,728,800 | | |

| | 1,450,000 | | | Fastenal Co | | | 61,161,000 | | |

| | 290,000 | | | G&K Services Inc, Class A | | | 20,050,600 | | |

| | 540,000 | | | Generac Holdings Inc (b) | | | 21,465,000 | | |

| | 2,310,000 | | | General Electric Co | | | 61,376,700 | | |

8

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS (continued) | |

| | | INDUSTRIALS (continued) | |

| | 1,800,000 | | | Graco Inc | | $ | 127,854,000 | | |

| | 1,550,000 | | | Honeywell International Inc | | | 158,053,500 | | |

| | 1,660,000 | | | Pentair PLC (a) | | | 114,125,000 | | |

| | 1,820,000 | | | Toro Co/The | | | 123,359,600 | | |

| | 640,000 | | | United Parcel Service Inc, Class B | | | 62,022,400 | | |

| | | | 1,251,648,986 | | |

| | | INFORMATION TECHNOLOGY 11.3% | |

| | 784,299 | | | Badger Meter Inc (d) | | | 49,795,143 | | |

| | 1,700,000 | | | Corning Inc | | | 33,541,000 | | |

| | 1,715,152 | | | Cray Inc (b) | | | 50,614,136 | | |

| | 1,000,000 | | | Fiserv Inc (b) | | | 82,830,000 | | |

| | 982,849 | | | MTS Systems Corp (d) | | | 67,767,439 | | |

| | 350,000 | | | NVE Corp (d) | | | 27,440,000 | | |

| | 940,000 | | | QUALCOMM Inc | | | 58,872,200 | | |

| | 1,100,000 | | | Stratasys Ltd (a) (b) | | | 38,423,000 | | |

| | 2,970,000 | | | Western Union Co/The | | | 60,380,100 | | |

| | | | 469,663,018 | | |

| | | MATERIALS 13.9% | |

| | 3,170,000 | | | Bemis Co Inc | | | 142,681,700 | | |

| | 1,639,999 | | | Ecolab Inc | | | 185,434,687 | | |

| | 2,481,600 | | | HB Fuller Co | | | 100,802,592 | | |

| | 1,830,000 | | | Valspar Corp/The | | | 149,730,600 | | |

| | | | 578,649,579 | | |

| | | UTILITIES 0.7% | |

| | 1,360,000 | | | MDU Resources Group Inc | | | 26,560,800 | | |

| | | | TOTAL COMMON STOCKS

(cost $2,207,067,386) | | $ | 4,066,960,923 | | |

| | | SHORT-TERM INVESTMENTS 1.9% | |

| 78,753,754 | | | First American Prime Obligations Fund, Class Z, 0.03% (c)

(cost $78,753,754) | | $ | 78,753,754 | | |

| | | | TOTAL INVESTMENTS 99.8%

(cost $2,285,821,140) | | $ | 4,145,714,677 | | |

| | | | | OTHER ASSETS AND LIABILITIES (NET) 0.2% | | | 7,286,825 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 4,153,001,502 | | |

(a) Foreign security denominated in U.S. dollars. As of June 30, 2015, these securities represented $277,523,500 or 6.7% of total net assets.

9

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

(b) Non-income producing.

(c) The rate quoted is the annualized seven-day effective yield as of June 30, 2015.

(d) Affiliated company.

(e) American Depositary Receipt.

(f) Issuer headquartered overseas but considered domestic. In determining whether a security is foreign or domestic, the Adviser will generally look at the location of the headquarters of the issuer. However, if the issuer is believed by the Adviser to be headquartered in a jurisdiction primarily for tax purposes, the Adviser will consider the following additional factors; 1) the location of the primary exchange trading its securities; 2) where it derives the majority of its revenues, or 3) where it earns the majority of its profits.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs and Power, Inc.

See accompanying Notes to Financial Statements.

10

MAIRS & POWER BALANCED FUND (unaudited)

To Our Shareholders: June 30, 2015

For the second quarter and six months ending June 30, 2015, the Mairs & Power Balanced Fund was down 1.56% and 0.79% respectively. The Fund underperformed its benchmark composite index (60% S&P 500 Total Return (TR) Index and 40% Barclays Government/Credit Bond Index), which was down 0.67% in the quarter and up 0.73% for the first half.

Much of the Fund's equity performance in both the second quarter and the first half can be explained by the dollar and interest rates. The Fund's performance in both periods was negatively impacted by our overweight position in the industrial sector, which remains under pressure due to the strong dollar as described in the market overview above. While the industrial sector has underperformed for the first half, we still like the names we hold and believe they represent real value for patient investors at their current levels.

The Federal Reserve is expected to begin raising rates later this year after an historic period of holding short term rates near zero. While much speculation has centered around when that will occur, we believe the more important question for investors is the pace at which rates will rise, which we believe will be modest. The market's anticipation of rising rates has had several effects which impacted the Fund's performance, some positively and some negatively. The financial sector generally, and banks in particular, did well in anticipation of rising rates since a steeper yield curve typically benefits their earnings. Conversely, investor focus on dividend paying stocks lost favor in anticipation of rising interest rates, which has made for choppy performance among many high yield dividend stocks. In particular, utility stocks pulled back as they again demonstrated their historical inverse relationship to interest rates. While this is a short term reaction to anticipated rising rates, the high quality stocks we hold should continue to provide a stream of income through dividends longer term.

Mairs & Power Balanced Fund (MAPOX) Second Quarter Results (3/31/15 – 6/30/15)

Top Performers

Second Quarter (3/31/15 – 6/30/15) | | Year To Date (12/31/14 – 6/30/15) | |

Eli Lilly & Co. | | | 14.64 | % | | Eli Lilly & Co. | | | 19.79 | % | |

Abbvie, Inc. | | | 14.50 | % | | Western Union Co. | | | 12.28 | % | |

JPMorgan Chase & Co. | | | 11.57 | % | | JPMorgan Chase & Co. | | | 7.05 | % | |

Pentair Ltd. | | | 9.04 | % | | Ecolab, Inc. | | | 6.95 | % | |

General Electric Co. | | | 6.81 | % | | Target Corp. | | | 6.31 | % | |

Weak Performers

Second Quarter (3/31/15 – 6/30/15) | | Year To Date (12/31/14 – 6/30/15) | |

CH Robinson World Wide, Inc. | | | -15.07 | % | | CH Robinson World Wide, Inc. | | | -17.92 | % | |

Corning Inc. | | | -13.29 | % | | Corning Inc. | | | -15.19 | % | |

Deluxe Corp. | | | -10.79 | % | | United Parcel Services, Inc., | | | | | |

3M Co. | | | -6.74 | % | | Class B | | | -14.06 | % | |

Medtronic, Inc. | | | -5.27 | % | | Emerson Electric Co. | | | -11.44 | % | |

| | | | | Exxon Mobil Corp. | | | -11.24 | % | |

Past performance is no guarantee of future results.

In addition to the financial sector, health care and consumer discretionary were also positive contributors to Fund performance in both the second quarter and first half. For individual stocks, the top contributors in both periods tended towards larger cap names such as JP Morgan Chase (JPM), Eli Lilly (LLY), General Electric (GE) and Abbot Labs (ABT). In addition, AbbVie (ABBV), the bio-pharmaceutical development company spun off from Abbott Labs in 2013, was a top contributor in the second quarter.

11

MAIRS & POWER BALANCED FUND (unaudited) (continued)

While economic indicators in the U.S. continue to show some modest improvements in GDP growth and declining unemployment, progress is neither straight line, nor without challenges. Although we are beginning to see some positive signs, concerns remain about the slow growth in Europe, Japan and China and the impact those economies have on the U.S. economy and interest rates. While macroeconomic worries and market ups and downs drive headlines, the Fund continues to focus on core holdings where we can expect to establish meaningful positions based on the fundamentals of individual stocks. We continue to hone the quality of the overall portfolio, both through the names we choose to own and those we choose to sell. Current out-of-favor sectors present us with buying opportunities for names we know and like. At the same time, we exited eight smaller positions in the quarter that we have determined will never become core positions. We also made a strategic shift out of British Petroleum (BP) into Chevron (CVX). We believe this is a higher quality holding, as BP has paid a heavy price in fines from its Gulf oil spill and the following litigation costs, as well as its large exposure in the Russian Republic. We prefer Chevron, which has neither.

On the fixed income side of the portfolio, the bond market sold off in June over concerns about a spillover from the Greek crisis as well as anticipation of Fed action on rates. This sell-off pushed the broad investment grade index into negative returns for the first six months (though it quickly recovered after the end of the quarter). In an unprecedented scenario which has existed through the first half of the year, four European central banks currently are offering their depositors negative interest rates, adding to the overall weak fixed income market. We continue to migrate the fixed income portfolio at the margins to shorter duration (the average length to maturity) and closer to the benchmark duration.

Ronald L. Kaliebe

Lead Manager | | Kevin V. Earley

Co-Manager | |

The Fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary prospectus or full prospectus contains this and other important information about the Fund, and they may be obtained by calling Shareholder Services at (800) 304-7404 or visiting www.mairsandpower.com. Read the summary prospectus or full prospectus carefully before investing.

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Balanced Fund is designed for long-term investors. Equity investments are subject to market fluctuations, and the Fund's share price can fall because of weakness in the broad market, a particular industry, or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices, and greater fluctuations in price than United States corporations. The Fund is subject to yield and share price variances with changes in interest rates and market conditions. Investors should note that if interest rates rise significantly from current levels, bond total returns will decline and may even turn negative in the short-term. There is also a chance that some of the Fund's holdings may have their credit rating downgraded or may default.

Diversification does not guarantee profit or protect against loss.

The Composite Index reflects an unmanaged portfolio comprised of 60% of the S&P 500 Index and 40% of the Barclays Government/Credit Bond Index. It is not possible to invest directly in an index.

Barclays government/Credit Bond Index is composed of high-quality, investment-grade United States government and corporate fixed income securities with maturities greater than one year. It is not possible to invest directly in an index.

The S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the United States stock market. It tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

12

Mairs & Power Balanced Fund

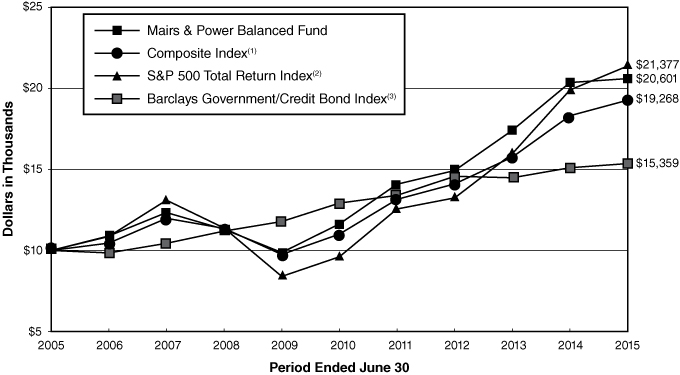

PERFORMANCE INFORMATION (unaudited) June 30, 2015

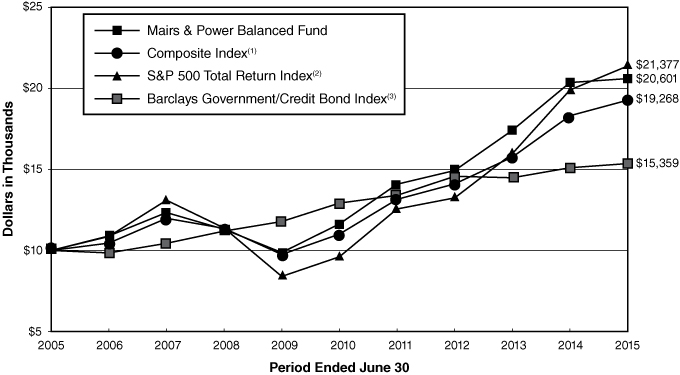

Ten years of investment performance (through June 30, 2015)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended June 30, 2015

| | | 1 year | | 5 years | | 10 years | | 20 years | |

Mairs & Power Balanced Fund | | | 1.19 | % | | | 12.10 | % | | | 7.50 | % | | | 9.43 | % | |

Composite Index(1) | | | 5.22 | % | | | 11.85 | % | | | 6.78 | % | | | 7.92 | % | |

S&P 500 Total Return Index(2) | | | 7.42 | % | | | 17.34 | % | | | 7.89 | % | | | 8.91 | % | |

Barclays Government/Credit

Bond Index(3) | | | 1.69 | % | | | 3.52 | % | | | 4.38 | % | | | 5.63 | % | |

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404.

(1) The Composite Index reflects an unmanaged portfolio comprised of 60% of the S&P 500 Index and 40% of the Barclays Government/Credit Bond Index. It is not possible to invest directly in an index.

(2) The S&P 500 Total Return Index is an unmanaged index of 500 common stocks which assumes reinvestment of dividends that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

(3) The Barclays Government/Credit Bond Index is composed of high-quality, investment-grade United States government and corporate fixed income securities with maturities greater than one year. It is not possible to invest directly in an index.

13

Mairs & Power Balanced Fund

FUND INFORMATION (unaudited) June 30, 2015

Portfolio Managers

Ronald L. Kaliebe, lead manager since July 1, 2013, co-manager from January 1, 2006 through June 30, 2013

University of Wisconsin-Madison, MBA Finance 1980

Kevin V. Earley, co-manager since January 1, 2015, University of Minnesota, MBA Finance 1990

General Information

Fund Symbol | | MAPOX | |

Net Asset Value (NAV) Per Share | | $ | 85.07 | | |

Expense Ratio | | | 0.72 | %1 | |

Portfolio Turnover Rate | | | 8.55 | % | |

Sales Charge | | | None2 | | |

Fund Inception Year | | | 1961 | | |

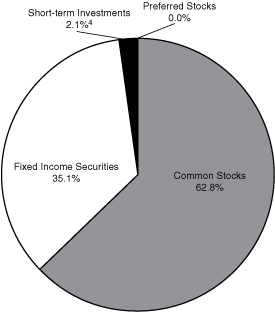

Portfolio Composition

Top Ten Common Stock Holdings

(Percent of Total Net Assets) 3

United Parcel Service Inc, Class B | | | 2.8 | % | |

Medtronic PLC | | | 2.6 | | |

US Bancorp/MN | | | 2.6 | | |

Target Corp | | | 2.4 | | |

Exxon Mobil Corp | | | 2.3 | | |

Deluxe Corp | | | 2.1 | | |

Johnson & Johnson | | | 2.0 | | |

Emerson Electric Co | | | 2.0 | | |

Ecolab Inc | | | 1.9 | | |

Schlumberger Ltd | | | 1.9 | | |

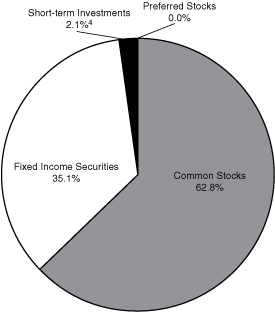

Portfolio Diversification

(Percent of Total Net Assets)

Fixed Income Securities 35.1% | |

Corporate Bonds | | | 28.2 | % | |

Federal Agency Obligations | | | 4.3 | | |

Asset Backed Securities | | | 1.5 | | |

Preferred Securities | | | 1.1 | | |

Common Stocks 62.8% | |

Industrials | | | 15.4 | | |

Health Care | | | 12.1 | | |

Financials | | | 9.2 | | |

Energy | | | 6.6 | | |

Information Technology | | | 6.0 | | |

Materials | | | 5.1 | | |

Consumer Discretionary | | | 3.5 | | |

Consumer Staples | | | 2.9 | | |

Utilities | | | 2.0 | | |

Preferred Stocks 0.0% | | | 0.0 | | |

Short-term Investments 2.1%4 | | | 2.1 | | |

| | | | 100.0 | % | |

1 Ratio has been annualized for the six month period ended June 30, 2015.

2 Although the Fund is no-load, investment management fees and other expenses still apply.

3 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

4 Represents short-term investments and other assets and liabilities (net).

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs and Power, Inc.

14

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES 35.1% | |

| | | FEDERAL AGENCY OBLIGATIONS 4.3% | |

$ | 1,000,000 | | | Federal National Mortgage Association | | | 3.250 | % | | 03/27/28 | | $ | 989,466 | | |

| | 500,000 | | | Federal Home Loan Banks | | | 3.480 | % | | 10/29/29 | | | 500,176 | | |

| | 2,030,000 | | | Federal Home Loan Banks | | | 3.620 | % | | 11/21/29 | | | 1,974,250 | | |

| | 500,000 | | | Federal Home Loan Banks | | | 3.625 | % | | 11/26/29 | | | 500,178 | | |

| | 1,400,000 | | | Federal Home Loan Banks | | | 3.650 | % | | 12/19/29 | | | 1,377,936 | | |

| | 1,000,000 | | | Federal Farm Credit Banks | | | 3.590 | % | | 12/24/29 | | | 994,719 | | |

| | 1,000,000 | | | Federal National Mortgage Association | | | 3.400 | % | | 02/27/30 | | | 975,821 | | |

| | 1,000,000 | | | Federal Farm Credit Banks | | | 3.440 | % | | 03/28/31 | | | 953,606 | | |

| | 1,400,000 | | | Federal National Mortgage Association | | | 3.520 | % | | 10/17/31 | | | 1,341,886 | | |

| | 2,000,000 | | | Federal National Mortgage Association | | | 3.500 | % | | 09/10/32 | | | 1,837,016 | | |

| | 500,000 | | | Federal National Mortgage Association | | | 3.400 | % | | 09/27/32 | | | 482,038 | | |

| | 1,590,000 | | | Federal Home Loan Banks | | | 3.300 | % | | 01/18/33 | | | 1,519,053 | | |

| | 3,000,000 | | | Federal Farm Credit Banks | | | 3.480 | % | | 02/07/33 | | | 2,904,162 | | |

| | 3,482,000 | | | Federal National Mortgage Association | | | 3.500 | % | | 03/07/33 | | | 3,383,982 | | |

| | 500,000 | | | Federal National Mortgage Association | | | 3.250 | % | | 04/29/33 | | | 479,007 | | |

| | 500,000 | | | Federal National Mortgage Association | | | 3.430 | % | | 05/27/33 | | | 474,831 | | |

| | 428,571 | | | Federal Home Loan Banks | | | 3.730 | % | | 07/01/33 | | | 420,888 | | |

| | 500,000 | | | Federal Home Loan Banks | | | 4.700 | % | | 07/25/33 | | | 514,172 | | |

| | 1,000,000 | | | Federal Farm Credit Banks | | | 4.375 | % | | 02/21/34 | | | 1,028,378 | | |

| | 1,250,000 | | | Federal Home Loan Banks | | | 4.050 | % | | 07/14/34 | | | 1,251,620 | | |

| | 1,000,000 | | | Federal Farm Credit Banks | | | 3.980 | % | | 08/14/34 | | | 999,339 | | |

| | 1,000,000 | | | Federal Home Loan Banks | | | 3.840 | % | | 12/26/34 | | | 973,323 | | |

| | 3,000,000 | | | Federal Home Loan Banks | | | 3.620 | % | | 02/12/35 | | | 2,779,551 | | |

| | 2,000,000 | | | Federal Home Loan Banks | | | 3.600 | % | | 03/16/35 | | | 1,911,624 | | |

| | | | 30,567,022 | | |

| | | CORPORATE BONDS 28.2% | |

| | | CONSUMER DISCRETIONARY 2.8% | |

| | 500,000 | | | Gannett Co Inc | | | 6.375 | % | | 09/01/15 | | | 502,812 | | |

| | 340,000 | | | Johnson Controls Inc | | | 5.500 | % | | 01/15/16 | | | 348,540 | | |

| | 250,000 | | | ServiceMaster Co LLC/The | | | 7.100 | % | | 03/01/18 | | | 262,500 | | |

| | 500,000 | | | Best Buy Co Inc | | | 5.000 | % | | 08/01/18 | | | 527,500 | | |

| | 1,000,000 | | | Ford Motor Credit Co LLC | | | 3.000 | % | | 12/20/18 | | | 1,010,297 | | |

| | 500,000 | | | Ford Motor Credit Co LLC | | | 3.450 | % | | 08/20/20 | | | 496,696 | | |

| | 1,000,000 | | | Time Warner Cable Inc | | | 4.125 | % | | 02/15/21 | | | 1,032,445 | | |

| | 1,000,000 | | | Best Buy Co Inc | | | 5.500 | % | | 03/15/21 | | | 1,037,100 | | |

| | 1,500,000 | | | Time Warner Cable Inc | | | 4.000 | % | | 09/01/21 | | | 1,539,954 | | |

| | 555,000 | | | Kohl's Corp | | | 4.000 | % | | 11/01/21 | | | 584,117 | | |

| | 500,000 | | | Whirlpool Corp | | | 4.700 | % | | 06/01/22 | | | 540,889 | | |

15

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | CONSUMER DISCRETIONARY (continued) | |

$ | 1,750,000 | | | Newell Rubbermaid Inc | | | 4.000 | % | | 06/15/22 | | $ | 1,777,633 | | |

| | 1,000,000 | | | Block Financial LLC | | | 5.500 | % | | 11/01/22 | | | 1,078,085 | | |

| | 318,000 | | | Darden Restaurants Inc | | | 3.350 | % | | 11/01/22 | | | 298,492 | | |

| | 1,000,000 | | | Staples Inc | | | 4.375 | % | | 01/12/23 | | | 1,003,966 | | |

| | 2,000,000 | | | Kohl's Corp | | | 3.250 | % | | 02/01/23 | | | 1,948,572 | | |

| | 1,000,000 | | | Wyndham Worldwide Corp | | | 3.900 | % | | 03/01/23 | | | 979,760 | | |

| | 500,000 | | | Hyatt Hotels Corp | | | 3.375 | % | | 07/15/23 | | | 486,887 | | |

| | 1,000,000 | | | Ford Motor Credit Co LLC | | | 4.000 | % | | 04/20/24 | | | 991,070 | | |

| | 1,000,000 | | | Coach Inc | | | 4.250 | % | | 04/01/25 | | | 960,419 | | |

| | 1,000,000 | | | Metropolitan Opera Association Inc | | | 4.349 | % | | 10/01/32 | | | 1,019,784 | | |

| | 2,000,000 | | | Comcast Corp | | | 4.250 | % | | 01/15/33 | | | 1,953,224 | | |

| | | | 20,380,742 | | |

| | | CONSUMER STAPLES 1.2% | |

| | 222,000 | | | SUPERVALU Inc | | | 8.000 | % | | 05/01/16 | | | 231,812 | | |

| | 525,000 | | | Cargill Inc (d) | | | 6.000 | % | | 11/27/17 | | | 580,031 | | |

| | 1,000,000 | | | Avon Products Inc | | | 4.200 | % | | 07/15/18 | | | 922,500 | | |

| | 1,000,000 | | | Safeway Inc | | | 3.950 | % | | 08/15/20 | | | 902,500 | | |

| | 500,000 | | | Safeway Inc | | | 4.750 | % | | 12/01/21 | | | 459,375 | | |

| | 1,274,000 | | | Avon Products Inc (c) | | | 5.750 | % | | 03/15/23 | | | 1,095,640 | | |

| | 2,949,000 | | | Land O'Lakes Capital Trust I (d) | | | 7.450 | % | | 03/15/28 | | | 3,133,313 | | |

| | 500,000 | | | Altria Group Inc | | | 4.250 | % | | 08/09/42 | | | 443,750 | | |

| | 1,000,000 | | | Cargill Inc (d) | | | 4.100 | % | | 11/01/42 | | | 941,401 | | |

| | | | 8,710,322 | | |

| | | ENERGY 2.2% | |

| | 500,000 | | | Anadarko Petroleum Corp | | | 5.950 | % | | 09/15/16 | | | 527,457 | | |

| | 250,000 | | | ConocoPhillips | | | 6.650 | % | | 07/15/18 | | | 286,130 | | |

| | 1,500,000 | | | Murphy Oil Corp | | | 4.000 | % | | 06/01/22 | | | 1,417,675 | | |

| | 500,000 | | | Western Gas Partners LP | | | 4.000 | % | | 07/01/22 | | | 501,733 | | |

| | 655,000 | | | FMC Technologies Inc | | | 3.450 | % | | 10/01/22 | | | 631,273 | | |

| | 3,000,000 | | | Transocean Inc (a) (c) | | | 4.300 | % | | 10/15/22 | | | 2,257,500 | | |

| | 1,000,000 | | | Murphy Oil Corp | | | 3.700 | % | | 12/01/22 | | | 915,030 | | |

| | 1,500,000 | | | Sunoco Logistics Partners Operations LP | | | 3.450 | % | | 01/15/23 | | | 1,419,546 | | |

| | 3,000,000 | | | Williams Cos Inc/The | | | 3.700 | % | | 01/15/23 | | | 2,793,330 | | |

| | 1,945,000 | | | Boardwalk Pipelines LP | | | 3.375 | % | | 02/01/23 | | | 1,763,672 | | |

| | 575,000 | | | DCP Midstream Operating LP | | | 3.875 | % | | 03/15/23 | | | 531,253 | | |

| | 1,000,000 | | | Diamond Offshore Drilling Inc | | | 3.450 | % | | 11/01/23 | | | 945,634 | | |

| | 500,000 | | | Kinder Morgan Energy Partners LP | | | 4.250 | % | | 09/01/24 | | | 486,967 | | |

16

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | ENERGY (continued) | |

$ | 500,000 | | | Global Marine Inc | | | 7.000 | % | | 06/01/28 | | $ | 370,000 | | |

| | 500,000 | | | Murphy Oil Corp | | | 5.125 | % | | 12/01/42 | | | 414,547 | | |

| | 500,000 | | | Apache Corp | | | 4.250 | % | | 01/15/44 | | | 434,217 | | |

| | | | 15,695,964 | | |

| | | FINANCIALS 10.0% | |

| | 500,000 | | | TCF National Bank | | | 5.500 | % | | 02/01/16 | | | 505,624 | | |

| | 500,000 | | | KeyBank NA/Cleveland OH | | | 5.450 | % | | 03/03/16 | | | 515,327 | | |

| | 500,000 | | | Symetra Financial Corp (d) | | | 6.125 | % | | 04/01/16 | | | 514,884 | | |

| | 250,000 | | | Security Benefit Life Insurance Co (d) | | | 8.750 | % | | 05/15/16 | | | 264,219 | | |

| | 500,000 | | | Bank of America Corp | | | 6.050 | % | | 05/16/16 | | | 519,198 | | |

| | 500,000 | | | Torchmark Corp | | | 6.375 | % | | 06/15/16 | | | 523,891 | | |

| | 500,000 | | | National City Bank/Cleveland OH | | | 5.250 | % | | 12/15/16 | | | 527,414 | | |

| | 500,000 | | | M&I Marshall & Ilsley Bank | | | 5.000 | % | | 01/17/17 | | | 524,672 | | |

| | 500,000 | | | Citigroup Inc | | | 5.500 | % | | 02/15/17 | | | 531,215 | | |

| | 500,000 | | | Sirius International Group Ltd (a) (d) | | | 6.375 | % | | 03/20/17 | | | 525,648 | | |

| | 250,000 | | | Bank of America Corp | | | 5.700 | % | | 05/02/17 | | | 266,722 | | |

| | 500,000 | | | Royal Bank of Scotland Group PLC (a) | | | 4.250 | % | | 07/15/17 | | | 521,832 | | |

| | 500,000 | | | Comerica Bank | | | 5.200 | % | | 08/22/17 | | | 533,309 | | |

| | 500,000 | | | Bank of America Corp | | | 6.000 | % | | 09/01/17 | | | 544,082 | | |

| | 500,000 | | | American Express Bank FSB | | | 6.000 | % | | 09/13/17 | | | 546,614 | | |

| | 500,000 | | | Bear Stearns Cos LLC/The | | | 6.400 | % | | 10/02/17 | | | 550,293 | | |

| | 500,000 | | | Prudential Financial Inc | | | 6.000 | % | | 12/01/17 | | | 551,708 | | |

| | 500,000 | | | Barclays Bank PLC (a) (d) | | | 6.050 | % | | 12/04/17 | | | 544,019 | | |

| | 1,000,000 | | | Morgan Stanley | | | 5.950 | % | | 12/28/17 | | | 1,099,215 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 5.950 | % | | 01/18/18 | | | 549,642 | | |

| | 500,000 | | | Wachovia Corp | | | 5.750 | % | | 02/01/18 | | | 552,212 | | |

| | 250,000 | | | Lincoln National Corp | | | 7.000 | % | | 03/15/18 | | | 281,703 | | |

| | 500,000 | | | SunTrust Bank/Atlanta GA | | | 7.250 | % | | 03/15/18 | | | 568,658 | | |

| | 500,000 | | | Morgan Stanley | | | 6.625 | % | | 04/01/18 | | | 561,028 | | |

| | 1,000,000 | | | Jefferies Group LLC | | | 5.125 | % | | 04/13/18 | | | 1,061,886 | | |

| | 500,000 | | | Bank of America Corp | | | 6.875 | % | | 04/25/18 | | | 564,840 | | |

| | 500,000 | | | Provident Cos Inc | | | 7.000 | % | | 07/15/18 | | | 566,077 | | |

| | 500,000 | | | MetLife Inc | | | 6.817 | % | | 08/15/18 | | | 575,473 | | |

| | 500,000 | | | Hartford Financial Services Group Inc/The | | | 6.000 | % | | 01/15/19 | | | 558,705 | | |

| | 500,000 | | | Royal Bank of Scotland Group PLC (a) | | | 5.250 | % | | 02/15/19 | | | 526,531 | | |

| | 500,000 | | | BB&T Corp | | | 6.850 | % | | 04/30/19 | | | 585,172 | | |

| | 250,000 | | | WR Berkley Corp | | | 6.150 | % | | 08/15/19 | | | 281,895 | | |

17

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 500,000 | | | Protective Life Corp | | | 7.375 | % | | 10/15/19 | | $ | 592,078 | | |

| | 500,000 | | | Prospect Capital Corp | | | 5.125 | % | | 11/15/19 | | | 498,488 | | |

| | 500,000 | | | Credit Suisse/New York NY (a) | | | 5.400 | % | | 01/14/20 | | | 552,832 | | |

| | 500,000 | | | Prospect Capital Corp | | | 4.000 | % | | 01/15/20 | | | 470,221 | | |

| | 500,000 | | | Morgan Stanley | | | 5.500 | % | | 01/26/20 | | | 557,997 | | |

| | 500,000 | | | Hartford Financial Services Group Inc/The | | | 5.500 | % | | 03/30/20 | | | 560,692 | | |

| | 450,000 | | | Compass Bank | | | 5.500 | % | | 04/01/20 | | | 489,624 | | |

| | 537,000 | | | Manufacturers & Traders Trust Co (c) | | | 5.585 | % | | 12/28/20 | | | 546,021 | | |

| | 500,000 | | | Wells Fargo & Co (c) | | | 2.000 | % | | 01/31/21 | | | 493,389 | | |

| | 1,000,000 | | | Nationwide Financial Services Inc (d) | | | 5.375 | % | | 03/25/21 | | | 1,097,408 | | |

| | 500,000 | | | Markel Corp | | | 5.350 | % | | 06/01/21 | | | 556,489 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 5.250 | % | | 07/27/21 | | | 555,259 | | |

| | 500,000 | | | Genworth Holdings Inc | | | 7.625 | % | | 09/24/21 | | | 526,250 | | |

| | 500,000 | | | Aflac Inc | | | 4.000 | % | | 02/15/22 | | | 528,645 | | |

| | 2,000,000 | | | OneBeacon US Holdings Inc | | | 4.600 | % | | 11/09/22 | | | 2,039,084 | | |

| | 1,000,000 | | | Standard Chartered PLC (a) (d) | | | 3.950 | % | | 01/11/23 | | | 975,886 | | |

| | 500,000 | | | Wells Fargo & Co | | | 3.450 | % | | 02/13/23 | | | 497,293 | | |

| | 2,500,000 | | | Assurant Inc | | | 4.000 | % | | 03/15/23 | | | 2,501,285 | | |

| | 1,000,000 | | | Markel Corp | | | 3.625 | % | | 03/30/23 | | | 985,593 | | |

| | 1,500,000 | | | Citigroup Inc | | | 3.500 | % | | 05/15/23 | | | 1,464,493 | | |

| | 500,000 | | | Morgan Stanley | | | 4.100 | % | | 05/22/23 | | | 500,935 | | |

| | 2,000,000 | | | Liberty Mutual Group Inc (d) | | | 4.250 | % | | 06/15/23 | | | 2,056,810 | | |

| | 500,000 | | | Ameriprise Financial Inc | | | 4.000 | % | | 10/15/23 | | | 522,140 | | |

| | 500,000 | | | CNA Financial Corp | | | 7.250 | % | | 11/15/23 | | | 603,333 | | |

| | 500,000 | | | Pacific Life Insurance Co (d) | | | 7.900 | % | | 12/30/23 | | | 618,166 | | |

| | 1,000,000 | | | Moody's Corp | | | 4.875 | % | | 02/15/24 | | | 1,074,038 | | |

| | 1,000,000 | | | NASDAQ OMX Group Inc/The | | | 4.250 | % | | 06/01/24 | | | 1,016,567 | | |

| | 500,000 | | | Wintrust Financial Corp | | | 5.000 | % | | 06/13/24 | | | 510,042 | | |

| | 250,000 | | | Assured Guaranty US Holdings Inc | | | 5.000 | % | | 07/01/24 | | | 245,190 | | |

| | 500,000 | | | Symetra Financial Corp | | | 4.250 | % | | 07/15/24 | | | 498,827 | | |

| | 1,000,000 | | | Stifel Financial Corp | | | 4.250 | % | | 07/18/24 | | | 988,062 | | |

| | 1,000,000 | | | Citigroup Inc | | | 4.000 | % | | 08/05/24 | | | 986,749 | | |

| | 1,500,000 | | | Synchrony Financial | | | 4.250 | % | | 08/15/24 | | | 1,506,443 | | |

| | 1,800,000 | | | Brown & Brown Inc | | | 4.200 | % | | 09/15/24 | | | 1,776,746 | | |

| | 2,000,000 | | | Old Republic International Corp | | | 4.875 | % | | 10/01/24 | | | 2,069,112 | | |

| | 2,000,000 | | | TIAA Asset Management Finance Co LLC (d) | | | 4.125 | % | | 11/01/24 | | | 2,014,320 | | |

| | 1,000,000 | | | Associated Banc-Corp | | | 4.250 | % | | 01/15/25 | | | 985,242 | | |

| | 2,000,000 | | | Kemper Corp | | | 4.350 | % | | 02/15/25 | | | 1,987,292 | | |

18

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 250,000 | | | Liberty Mutual Insurance Co (d) | | | 8.500 | % | | 05/15/25 | | $ | 312,441 | | |

| | 1,000,000 | | | Wells Fargo & Co | | | 4.100 | % | | 06/03/26 | | | 1,004,215 | | |

| | 500,000 | | | Morgan Stanley | | | 4.350 | % | | 09/08/26 | | | 489,940 | | |

| | 1,000,000 | | | National Rural Utilities Cooperative Finance Corp | | | 3.000 | % | | 11/15/26 | | | 961,299 | | |

| | 1,000,000 | | | Citigroup Inc | | | 4.300 | % | | 11/20/26 | | | 977,822 | | |

| | 1,000,000 | | | JPMorgan Chase & Co | | | 4.125 | % | | 12/15/26 | | | 983,276 | | |

| | 250,000 | | | Provident Cos Inc | | | 7.250 | % | | 03/15/28 | | | 308,069 | | |

| | 1,000,000 | | | JPMorgan Chase & Co (c) | | | 3.000 | % | | 03/21/28 | | | 922,556 | | |

| | 1,000,000 | | | JPMorgan Chase & Co (c) | | | 3.000 | % | | 03/22/28 | | | 969,541 | | |

| | 1,000,000 | | | Royal Bank of Canada (a) | | | 3.000 | % | | 05/10/28 | | | 916,620 | | |

| | 500,000 | | | Farmers Exchange Capital (d) | | | 7.050 | % | | 07/15/28 | | | 603,342 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.250 | % | | 11/15/30 | | | 492,811 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.000 | % | | 02/15/31 | | | 466,453 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.300 | % | | 12/15/32 | | | 498,567 | | |

| | 1,000,000 | | | JPMorgan Chase & Co (c) | | | 3.250 | % | | 01/31/33 | | | 959,226 | | |

| | 649,000 | | | Lloyds Bank PLC (a) (c) | | | 3.400 | % | | 01/31/33 | | | 615,229 | | |

| | 250,000 | | | Citigroup Inc (c) | | | 4.000 | % | | 06/27/34 | | | 242,937 | | |

| | 538,000 | | | Bank of America Corp | | | 4.000 | % | | 08/15/34 | | | 523,016 | | |

| | 1,000,000 | | | Prudential Financial Inc | | | 4.050 | % | | 11/15/34 | | | 970,737 | | |

| | 1,000,000 | | | Goldman Sachs Group Inc/The | | | 4.000 | % | | 01/30/35 | | | 885,817 | | |

| | 500,000 | | | Barclays Bank PLC (a) (c) | | | 4.000 | % | | 10/09/37 | | | 479,528 | | |

| | 1,000,000 | | | Berkshire Hathaway Finance Corp | | | 4.400 | % | | 05/15/42 | | | 984,698 | | |

| | 500,000 | | | MetLife Inc | | | 4.125 | % | | 08/13/42 | | | 465,351 | | |

| | 500,000 | | | Swiss Re Treasury US Corp (d) | | | 4.250 | % | | 12/06/42 | | | 482,438 | | |

| | 500,000 | | | Pacific LifeCorp (d) | | | 5.125 | % | | 01/30/43 | | | 503,789 | | |

| | 500,000 | | | Berkshire Hathaway Finance Corp | | | 4.300 | % | | 05/15/43 | | | 483,923 | | |

| | 500,000 | | | Principal Financial Group Inc | | | 4.350 | % | | 05/15/43 | | | 468,272 | | |

| | | | 71,764,662 | | |

| | | HEALTH CARE 0.7% | |

| | 500,000 | | | UnitedHealth Group Inc | | | 6.000 | % | | 02/15/18 | | | 555,893 | | |

| | 1,000,000 | | | Quest Diagnostics Inc | | | 4.700 | % | | 04/01/21 | | | 1,081,477 | | |

| | 1,000,000 | | | Laboratory Corp of America Holdings | | | 3.750 | % | | 08/23/22 | | | 1,011,416 | | |

| | 1,000,000 | | | Laboratory Corp of America Holdings | | | 4.000 | % | | 11/01/23 | | | 1,021,029 | | |

| | 1,000,000 | | | Mylan Inc/PA | | | 4.200 | % | | 11/29/23 | | | 1,020,669 | | |

| | 500,000 | | | Wyeth LLC | | | 6.450 | % | | 02/01/24 | | | 617,076 | | |

| | | | 5,307,560 | | |

19

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | INDUSTRIALS 3.0% | |

$ | 500,000 | | | Masco Corp | | | 7.125 | % | | 03/15/20 | | $ | 580,000 | | |

| | 500,000 | | | Pentair Finance SA (a) | | | 5.000 | % | | 05/15/21 | | | 546,922 | | |

| | 500,000 | | | IDEX Corp | | | 4.200 | % | | 12/15/21 | | | 521,895 | | |

| | 500,000 | | | Masco Corp | | | 5.950 | % | | 03/15/22 | | | 561,250 | | |

| | 500,000 | | | GATX Corp | | | 4.750 | % | | 06/15/22 | | | 531,410 | | |

| | 500,000 | | | Penske Truck Leasing Co Lp / PTL Finance Corp (d) | | | 4.875 | % | | 07/11/22 | | | 528,358 | | |

| | 1,000,000 | | | ADT Corp/The | | | 3.500 | % | | 07/15/22 | | | 905,000 | | |

| | 225,000 | | | Pentair Finance SA (a) | | | 3.150 | % | | 09/15/22 | | | 216,807 | | |

| | 2,000,000 | | | Dun & Bradstreet Corp/The | | | 4.375 | % | | 12/01/22 | | | 1,992,864 | | |

| | 1,000,000 | | | GATX Corp | | | 3.900 | % | | 03/30/23 | | | 1,011,187 | | |

| | 500,000 | | | ADT Corp/The | | | 4.125 | % | | 06/15/23 | | | 467,500 | | |

| | 500,000 | | | Ingersoll-Rand Global Holding Co Ltd (a) | | | 4.250 | % | | 06/15/23 | | | 518,365 | | |

| | 1,000,000 | | | Flowserve Corp | | | 4.000 | % | | 11/15/23 | | | 1,011,648 | | |

| | 2,126,000 | | | Air Lease Corp | | | 4.850 | % | | 02/01/24 | | | 2,115,370 | | |

| | 500,000 | | | Pitney Bowes Inc | | | 4.625 | % | | 03/15/24 | | | 504,290 | | |

| | 500,000 | | | Toro Co/The | | | 7.800 | % | | 06/15/27 | | | 634,155 | | |

| | 500,000 | | | General Electric Capital Corp | | | 3.500 | % | | 05/15/32 | | | 480,627 | | |

| | 200,000 | | | General Electric Capital Corp | | | 4.000 | % | | 08/17/32 | | | 194,028 | | |

| | 1,375,000 | | | General Electric Capital Corp | | | 4.000 | % | | 09/17/32 | | | 1,340,252 | | |

| | 3,000,000 | | | Eaton Corp | | | 4.000 | % | | 11/02/32 | | | 2,903,760 | | |

| | 2,000,000 | | | General Electric Capital Corp | | | 4.000 | % | | 02/14/33 | | | 1,966,720 | | |

| | 1,000,000 | | | Pitney Bowes Inc | | | 5.250 | % | | 01/15/37 | | | 1,030,837 | | |

| | 590,000 | | | Eaton Corp | | | 4.150 | % | | 11/02/42 | | | 544,303 | | |

| | 500,000 | | | Lockheed Martin Corp | | | 4.070 | % | | 12/15/42 | | | 472,446 | | |

| | | | 21,579,994 | | |

| | | INFORMATION TECHNOLOGY 3.8% | |

| | 500,000 | | | Western Union Co/The | | | 5.930 | % | | 10/01/16 | | | 524,960 | | |

| | 500,000 | | | Broadridge Financial Solutions Inc | | | 6.125 | % | | 06/01/17 | | | 536,362 | | |

| | 500,000 | | | Dell Inc | | | 5.875 | % | | 06/15/19 | | | 530,000 | | |

| | 500,000 | | | Broadridge Financial Solutions Inc | | | 3.950 | % | | 09/01/20 | | | 520,049 | | |

| | 500,000 | | | Hewlett-Packard Co | | | 3.750 | % | | 12/01/20 | | | 515,253 | | |

| | 500,000 | | | Dell Inc | | | 4.625 | % | | 04/01/21 | | | 502,165 | | |

| | 750,000 | | | Hewlett-Packard Co | | | 4.300 | % | | 06/01/21 | | | 779,023 | | |

| | 500,000 | | | Motorola Solutions Inc | | | 3.750 | % | | 05/15/22 | | | 492,090 | | |

| | 2,000,000 | | | Symantec Corp | | | 3.950 | % | | 06/15/22 | | | 2,006,000 | | |

| | 1,000,000 | | | Computer Sciences Corp | | | 4.450 | % | | 09/15/22 | | | 1,026,481 | | |

| | 1,000,000 | | | Hewlett-Packard Co | | | 4.050 | % | | 09/15/22 | | | 1,014,836 | | |

20

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | INFORMATION TECHNOLOGY (continued) | |

$ | 2,025,000 | | | Fiserv Inc | | | 3.500 | % | | 10/01/22 | | $ | 2,015,766 | | |

| | 1,000,000 | | | Autodesk Inc | | | 3.600 | % | | 12/15/22 | | | 994,722 | | |

| | 2,500,000 | | | Arrow Electronics Inc | | | 4.500 | % | | 03/01/23 | | | 2,555,030 | | |

| | 1,500,000 | | | Motorola Solutions Inc | | | 3.500 | % | | 03/01/23 | | | 1,414,753 | | |

| | 2,000,000 | | | Fidelity National Information Services Inc | | | 3.500 | % | | 04/15/23 | | | 1,941,282 | | |

| | 2,352,000 | | | Total System Services Inc | | | 3.750 | % | | 06/01/23 | | | 2,310,633 | | |

| | 1,000,000 | | | Altera Corp | | | 4.100 | % | | 11/15/23 | | | 1,051,903 | | |

| | 500,000 | | | Motorola Solutions Inc | | | 4.000 | % | | 09/01/24 | | | 484,988 | | |

| | 500,000 | | | Arrow Electronics Inc | | | 4.000 | % | | 04/01/25 | | | 488,848 | | |

| | 4,000,000 | | | Intel Corp | | | 4.000 | % | | 12/15/32 | | | 3,833,128 | | |

| | 1,500,000 | | | Western Union Co/The | | | 6.200 | % | | 11/17/36 | | | 1,501,907 | | |

| | | | 27,040,179 | | |

| | | MATERIALS 2.9% | |

| | 500,000 | | | International Paper Co | | | 5.250 | % | | 04/01/16 | | | 514,699 | | |

| | 500,000 | | | Valspar Corp/The | | | 6.050 | % | | 05/01/17 | | | 532,864 | | |

| | 500,000 | | | Cliffs Natural Resources Inc (c) | | | 4.950 | % | | 01/15/18 | | | 363,750 | | |

| | 500,000 | | | Cliffs Natural Resources Inc | | | 4.800 | % | | 10/01/20 | | | 237,500 | | |

| | 500,000 | | | Carpenter Technology Corp | | | 5.200 | % | | 07/15/21 | | | 534,376 | | |

| | 500,000 | | | Freeport-McMoRan Inc | | | 4.000 | % | | 11/14/21 | | | 490,988 | | |

| | 175,000 | | | Mosaic Co/The | | | 3.750 | % | | 11/15/21 | | | 180,484 | | |

| | 1,000,000 | | | Freeport-McMoRan Inc | | | 3.550 | % | | 03/01/22 | | | 925,628 | | |

| | 1,500,000 | | | Newmont Mining Corp | | | 3.500 | % | | 03/15/22 | | | 1,431,512 | | |

| | 500,000 | | | Barrick Gold Corp (a) | | | 3.850 | % | | 04/01/22 | | | 484,618 | | |

| | 1,000,000 | | | Domtar Corp | | | 4.400 | % | | 04/01/22 | | | 1,016,269 | | |

| | 2,000,000 | | | RPM International Inc | | | 3.450 | % | | 11/15/22 | | | 1,928,990 | | |

| | 500,000 | | | Carpenter Technology Corp | | | 4.450 | % | | 03/01/23 | | | 497,364 | | |

| | 500,000 | | | Freeport-McMoRan Inc | | | 3.875 | % | | 03/15/23 | | | 454,214 | | |

| | 2,059,000 | | | Reliance Steel & Aluminum Co | | | 4.500 | % | | 04/15/23 | | | 2,025,535 | | |

| | 1,750,000 | | | Barrick Gold Corp (a) | | | 4.100 | % | | 05/01/23 | | | 1,705,154 | | |

| | 2,000,000 | | | Nucor Corp | | | 4.000 | % | | 08/01/23 | | | 2,029,374 | | |

| | 1,000,000 | | | Mosaic Co/The | | | 4.250 | % | | 11/15/23 | | | 1,028,229 | | |

| | 865,000 | | | Union Carbide Corp | | | 7.500 | % | | 06/01/25 | | | 1,077,885 | | |

| | 1,250,000 | | | Dow Chemical Co/The | | | 4.250 | % | | 10/01/34 | | | 1,174,171 | | |

| | 1,000,000 | | | Alcoa Inc | | | 5.950 | % | | 02/01/37 | | | 997,500 | | |

| | 1,000,000 | | | Newmont Mining Corp | | | 4.875 | % | | 03/15/42 | | | 839,091 | | |

| | | | 20,470,195 | | |

21

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | TELECOMMUNICATION SERVICES 0.4% | |

$ | 250,000 | | | Verizon Communications Inc | | | 6.350 | % | | 04/01/19 | | $ | 285,686 | | |

| | 500,000 | | | CenturyLink Inc | | | 6.150 | % | | 09/15/19 | | | 526,250 | | |

| | 500,000 | | | Qwest Capital Funding Inc | | | 6.875 | % | | 07/15/28 | | | 491,250 | | |

| | 550,000 | | | Qwest Corp | | | 6.875 | % | | 09/15/33 | | | 543,834 | | |

| | 1,000,000 | | | Verizon Communications Inc | | | 4.400 | % | | 11/01/34 | | | 925,759 | | |

| | | | 2,772,779 | | |

| | | UTILITIES 1.2% | |

| | 500,000 | | | Commonwealth Edison Co | | | 6.150 | % | | 09/15/17 | | | 550,910 | | |

| | 250,000 | | | Vectren Utility Holdings Inc | | | 5.750 | % | | 08/01/18 | | | 274,035 | | |

| | 250,000 | | | South Jersey Gas Co | | | 7.125 | % | | 10/22/18 | | | 283,773 | | |

| | 250,000 | | | United Utilities PLC (a) | | | 5.375 | % | | 02/01/19 | | | 269,247 | | |

| | 2,000,000 | | | PPL Energy Supply LLC | | | 4.600 | % | | 12/15/21 | | | 1,835,000 | | |

| | 2,170,000 | | | ONEOK Inc | | | 4.250 | % | | 02/01/22 | | | 2,095,068 | | |

| | 785,000 | | | SCANA Corp | | | 4.125 | % | | 02/01/22 | | | 790,804 | | |

| | 1,000,000 | | | Exelon Generation Co LLC | | | 4.250 | % | | 06/15/22 | | | 1,023,596 | | |

| | 900,000 | | | National Fuel Gas Co | | | 3.750 | % | | 03/01/23 | | | 834,485 | | |

| | 500,000 | | | Entergy Gulf States Inc | | | 6.180 | % | | 03/01/35 | | | 501,529 | | |

| | | | 8,458,447 | | |

| | | TOTAL CORPORATE BONDS | | | 202,180,844 | | |

| | | ASSET BACKED SECURITIES 1.5% | |

| | 500,000 | | | Delta Air Lines 2010-2 Class B Pass Through Trust (d) | | | 6.750 | % | | 05/23/17 | | | 508,350 | | |

| | 357,370 | | | Continental Airlines 2009-1 Pass Through Trust | | | 9.000 | % | | 01/08/18 | | | 380,599 | | |

| | 353,258 | | | American Airlines 2011-1 Class B Pass Through Trust (d) | | | 7.000 | % | | 07/31/19 | | | 380,635 | | |

| | 106,772 | | | Continental Airlines 1999-1 Class B Pass Through Trust | | | 6.795 | % | | 02/02/20 | | | 111,777 | | |

| | 530,229 | | | Continental Airlines 2010-1 Class B Pass Through Trust | | | 6.000 | % | | 07/12/20 | | | 547,462 | | |

| | 319,898 | | | Delta Air Lines 2011-1 Class A Pass Through Trust | | | 5.300 | % | | 10/15/20 | | | 342,290 | | |

| | 624,056 | | | America West Airlines 2000-1 Pass Through Trust | | | 8.057 | % | | 01/02/22 | | | 695,435 | | |

| | 722,789 | | | American Airlines 2011-1 Class A Pass Through Trust | | | 5.250 | % | | 07/31/22 | | | 766,156 | | |

| | 190,000 | | | Continental Airlines 2007-1 Class A Pass Through Trust | | | 5.983 | % | | 10/19/23 | | | 209,000 | | |

| | 358,211 | | | Southwest Airlines Co 2007-1 Pass Through Trust | | | 6.150 | % | | 02/01/24 | | | 405,674 | | |

| | 756,600 | | | US Airways 2010-1 Class A Pass Through Trust | | | 6.250 | % | | 10/22/24 | | | 845,500 | | |

| | 1,000,000 | | | American Airlines 2015-1 Class B Pass Through Trust | | | 3.700 | % | | 11/01/24 | | | 980,000 | | |

22

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Par Value/Shares | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | ASSET BACKED SECURITIES (continued) | |

$ | 392,230 | | | US Airways 2011-1 Class A Pass Through Trust | | | 7.125 | % | | 04/22/25 | | $ | 448,860 | | |

| | 1,287,052 | | | Hawaiian Airlines 2013-1 Class A Pass Through Certificates | | | 3.900 | % | | 01/15/26 | | | 1,264,529 | | |

| | 566,943 | | | Continental Airlines 2012-2 Class A Pass Through Trust | | | 4.000 | % | | 04/29/26 | | | 576,071 | | |

| | 976,901 | | | United Airlines 2013-1 Class A Pass Through Trust | | | 4.300 | % | | 02/15/27 | | | 1,003,766 | | |

| | 937,053 | | | US Airways 2013-1 Class A Pass Through Trust | | | 3.950 | % | | 05/15/27 | | | 940,567 | | |

| | | | 10,406,671 | | |

| | | PREFERRED SECURITIES 1.1% | |

| | 105,000 | | | Affiliated Managers Group Inc | | | 5.250 | % | | 10/15/22 | | | 2,649,150 | | |

| | 20,000 | | | Pitney Bowes Inc | | | 5.250 | % | | 11/27/22 | | | 509,600 | | |

| | 23,000 | | | Stifel Financial Corp | | | 5.375 | % | | 12/31/22 | | | 586,500 | | |

| | 10,000 | | | Raymond James Financial Inc | | | 6.900 | % | | 03/15/42 | | | 261,600 | | |

| | 20,000 | | | Protective Life Corp | | | 6.000 | % | | 09/01/42 | | | 503,000 | | |

| | 20,000 | | | Selective Insurance Group Inc | | | 5.875 | % | | 02/09/43 | | | 496,600 | | |

| | 40,000 | | | WR Berkley Corp | | | 5.625 | % | | 04/30/53 | | | 967,600 | | |

| | 20,000 | | | Verizon Communications Inc | | | 5.900 | % | | 02/15/54 | | | 524,400 | | |

| | 20,000 | | | American Financial Group Inc/OH | | | 6.250 | % | | 09/30/54 | | | 508,400 | | |

| | 20,000 | | | Qwest Corp | | | 6.875 | % | | 10/01/54 | | | 517,400 | | |

| | 10,000 | | | NextEra Energy Capital Holdings Inc | | | 5.700 | % | | 03/01/72 | | | 241,000 | | |

| | | | 7,765,250 | | |

| | TOTAL FIXED INCOME SECURITIES

(cost $249,905,047) | | $ | 250,919,787 | | |

| | | COMMON STOCKS 62.8% | |

| | | CONSUMER DISCRETIONARY 3.5% | |

| | 74,000 | | | Home Depot Inc/The | | | | | | | | | | | 8,223,620 | | |

| | 210,000 | | | Target Corp | | | | | | | | | | | 17,142,300 | | |

| | | | 25,365,920 | | |

| | | CONSUMER STAPLES 2.9% | |

| | 63,000 | | | Hershey Co/The | | | | | | | | | | | 5,596,290 | | |

| | 120,000 | | | Hormel Foods Corp | | | | | | | | | | | 6,764,400 | | |

| | 31,000 | | | Kimberly-Clark Corp | | | | | | | | | | | 3,285,070 | | |

| | | | 20,660,560 | | |

| | | ENERGY 6.6% | |

| | 72,000 | | | Chevron Corp | | | | | | | | | | | 6,945,840 | | |

| | 172,000 | | | ConocoPhillips | | | | | | | | | | | 10,562,520 | | |

| | 196,000 | | | Exxon Mobil Corp | | | | | | | | | | | 16,307,200 | | |

| | 160,000 | | | Schlumberger Ltd (a) | | | | | | | | | | | 13,790,400 | | |

| | | | 47,605,960 | | |

23

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS (continued) | |

| | | FINANCIALS 9.2% | |

| | 46,000 | | | American Express Co | | $ | 3,575,120 | | |

| | 404,000 | | | Associated Banc-Corp | | | 8,189,080 | | |

| | 139,000 | | | JPMorgan Chase & Co | | | 9,418,640 | | |

| | 267,000 | | | Principal Financial Group Inc | | | 13,694,430 | | |

| | 35,000 | | | Travelers Cos Inc/The | | | 3,383,100 | | |

| | 427,000 | | | US Bancorp/MN | | | 18,531,800 | | |

| | 156,000 | | | Wells Fargo & Co | | | 8,773,440 | | |

| | | | 65,565,610 | | |

| | | HEALTH CARE 12.1% | |

| | 148,500 | | | Abbott Laboratories | | | 7,288,380 | | |

| | 84,000 | | | AbbVie Inc | | | 5,643,960 | | |

| | 131,000 | | | Baxter International Inc | | | 9,160,830 | | |

| | 74,500 | | | Bristol-Myers Squibb Co | | | 4,957,230 | | |

| | 74,000 | | | Eli Lilly & Co | | | 6,178,260 | | |

| | 150,000 | | | Johnson & Johnson | | | 14,619,000 | | |

| | 252,500 | | | Medtronic PLC (f) | | | 18,710,250 | | |

| | 295,000 | | | Pfizer Inc | | | 9,891,350 | | |

| | 296,000 | | | Roche Holding AG ADR (e) | | | 10,380,720 | | |

| | | | 86,829,980 | | |

| | | INDUSTRIALS 15.4% | |

| | 86,000 | | | 3M Co | | | 13,269,800 | | |

| | 115,000 | | | CH Robinson Worldwide Inc | | | 7,174,850 | | |

| | 239,500 | | | Deluxe Corp | | | 14,849,000 | | |

| | 256,000 | | | Emerson Electric Co | | | 14,190,080 | | |

| | 420,000 | | | General Electric Co | | | 11,159,400 | | |

| | 91,000 | | | Graco Inc | | | 6,463,730 | | |

| | 114,000 | | | Honeywell International Inc | | | 11,624,580 | | |

| | 136,000 | | | Pentair PLC (a) | | | 9,350,000 | | |

| | 40,000 | | | Toro Co/The | | | 2,711,200 | | |

| | 204,100 | | | United Parcel Service Inc, Class B | | | 19,779,331 | | |

| | | | 110,571,971 | | |

| | | INFORMATION TECHNOLOGY 6.0% | |

| | 420,000 | | | Corning Inc | | | 8,286,600 | | |

| | 70,000 | | | International Business Machines Corp | | | 11,386,200 | | |

| | 88,500 | | | MTS Systems Corp | | | 6,102,075 | | |

| | 86,000 | | | QUALCOMM Inc | | | 5,386,180 | | |

| | 569,000 | | | Western Union Co/The | | | 11,567,770 | | |

| | | | 42,728,825 | | |

24

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS (continued) | |

| | | MATERIALS 5.1% | |

| | 136,000 | | | Bemis Co Inc | | $ | 6,121,360 | | |

| | 123,000 | | | Ecolab Inc | | | 13,907,610 | | |

| | 156,000 | | | HB Fuller Co | | | 6,336,720 | | |

| | 124,000 | | | Valspar Corp/The | | | 10,145,680 | | |

| | | | 36,511,370 | | |

| | | UTILITIES 2.0% | |

| | 88,000 | | | ALLETE Inc | | | 4,082,320 | | |

| | 252,000 | | | MDU Resources Group Inc | | | 4,921,560 | | |

| | 173,000 | | | Xcel Energy Inc | | | 5,567,140 | | |

| | | | 14,571,020 | | |

| | | | TOTAL COMMON STOCKS

(cost $314,428,900) | | $ | 450,411,216 | | |

| | | PREFERRED STOCKS 0.0% | |

| | | UTILITIES 0.0% | |

| | 10,000 | | | SCE Trust I | | | 240,800 | | |

| | | | TOTAL PREFERRED STOCKS

(cost $250,000) | | $ | 240,800 | | |

| | | SHORT-TERM INVESTMENTS 1.6% | |

| 11,654,291 | | | First American Prime Obligations Fund, Class Z, 0.03% (b)

(cost $11,654,291) | | $ | 11,654,291 | | |

| | | | TOTAL INVESTMENTS 99.5%

(cost $576,238,238) | | $ | 713,226,094 | | |

| | | | | OTHER ASSETS AND LIABILITIES (NET) 0.5% | | | 3,315,842 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 716,541,936 | | |

(a) Foreign security denominated in U.S. dollars. As of June 30, 2015, these securities represented $34,797,138 or 4.9% of total net assets.

(b) The rate quoted is the annualized seven-day effective yield as of June 30, 2015.

(c) Step Bonds – Securities for which the coupon rate of interest will adjust on specified future date(s). The rate disclosed represents the coupon rate in effect as of June 30, 2015.

(d) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Fund's Board of Trustees. As of June 30, 2015, these securities represented $16,585,458 or 2.3% of total net assets.

(e) American Depositary Receipt.

(f) Issuer headquartered overseas but considered domestic. In determining whether a security is foreign or domestic, the Adviser will generally look at the location of the headquarters of the issuer. However, if the issuer is believed by the Adviser to be headquartered

25

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2015

in a jurisdiction primarily for tax purposes, the Adviser will consider the following additional factors; 1) the location of the primary exchange trading its securities; 2) where it derives the majority of its revenues, or 3) where it earns the majority of its profits.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs and Power, Inc.

See accompanying Notes to Financial Statements.

26

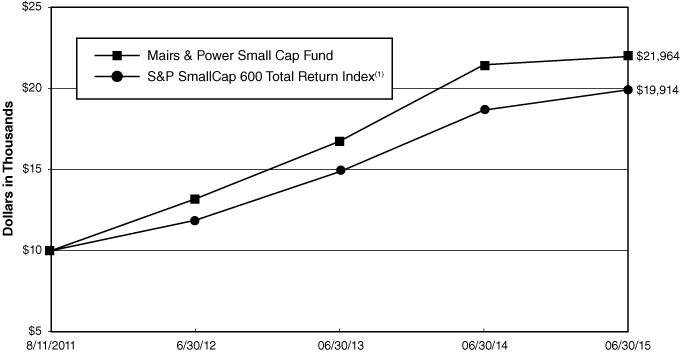

MAIRS & POWER SMALL CAP FUND (unaudited)

To Our Shareholders: June 30, 2015

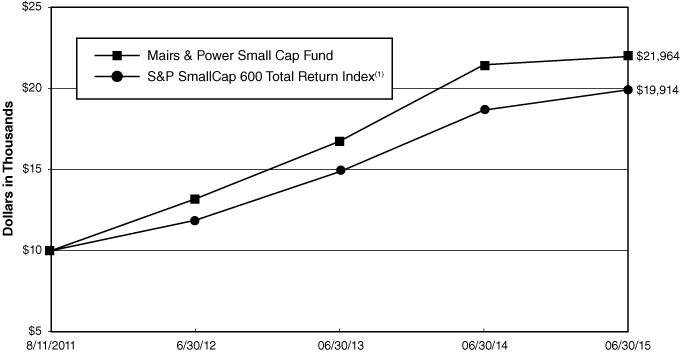

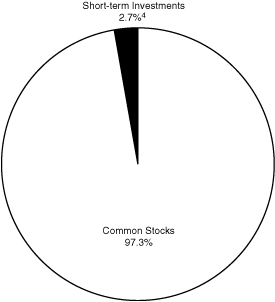

The Small Cap Fund was down 1.27% for the second quarter and up slightly for the first half at 1.31%, but has thus far underperformed both the index and peers in both periods ending June 30, 2015. The S&P 600 Small Cap Total Return (TR) Index was up 0.19% and 4.16% in the second quarter and first half and the peer group, as measured by the Lipper Small Cap Core index, was down 0.12% for the quarter and up 3.63% for the first half.

A combination of sector allocation and stock selection drove the Fund's relative underperformance for the first half. An underweight position in the healthcare sector and overweight position in the industrial sector were the primary negative factors in sector allocation. While the Fund is only slightly underweight in healthcare, that sector has been the best performing by far so far this year, up nearly 20%. Within healthcare, biotechnology has been the hot industry and the Fund has little exposure there due to the all-or-nothing risk those stocks pose. The other sector weight that impacted Fund performance negatively relative to the index was the Fund's overweight position in the industrial sector. While the sector has performed well through most of the economic recovery, it has been one of the worst performing sectors so far this year, due to the dollar's strength.