UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22563 |

|

Mairs & Power Funds Trust |

(Exact name of registrant as specified in charter) |

|

332 Minnesota Street, Suite W1520, St. Paul, MN | | 55101 |

(Address of principal executive offices) | | (Zip code) |

|

Andrea C. Stimmel, Chief Compliance Officer & Treasurer, 332 Minnesota Street, Suite

W1520, St. Paul, MN 55101 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 651-222-8478 | |

|

Date of fiscal year end: | December 31, 2015 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Investing for the long-term

ANNUAL REPORT

DECEMBER 31, 2015

- GROWTH FUND (MPGFX)

est. 1958

- BALANCED FUND (MAPOX)

est. 1961

- SMALL CAP FUND (MSCFX)

est. 2011

Mairs & Power W1520 First National Bank Building, 332 Minnesota Street, St. Paul, Minnesota 55101 www.mairsandpower.com

MAIRS & POWER FUNDS MARKET COMMENTARY (unaudited)

December 31, 2015

Investors facing growing uncertainty in the sixth year of a bull market finally saw the long anticipated correction in the third quarter, with a ten-plus percentage point drop unfolding in one tumultuous week in late August. Though the market recovered in the fourth quarter, the last day of trading for the year pushed both the Dow and S&P 500 into slightly negative territory before dividends, the first down market since 2008. (The indices' total returns were positive, including dividends).

In 2015, oil prices fell to their lowest level in more than a decade, the dollar continued to strengthen against other currencies, Europe remained weak and economic growth in China slowed. These factors resulted in persistent underperformance in the Industrial, Energy and Materials sectors. The collapse in oil prices led to a sell off in high yield energy debt, putting fixed income markets on edge. Even in the face of this pressure, the U.S. economy continued its steady improvement with GDP growth inching above two percent. Nominal unemployment fell to near pre-recession levels, buoying consumer confidence and spending which drove solid performance in the Consumer Discretionary and Consumer Staples sectors as well as the Information Technology and Telecom sectors. We exited 2015 with signs of a modest recovery in Europe, unprecedented negative interest rates in several industrialized countries and continuing concerns about the impact of slowing growth in China on the global economy. Late in the year, the U.S. Federal Reserve (Fed) increased rates for the first time in a decade, reversing a six year run of near zero interest rates.

Outlook

The New Year has started off badly for the stock market. While the Fed communicated the likelihood of a series of rate increases in 2016, that doesn't seem quite as likely now given concerns over global economic conditions. The U.S. markets have reflected this uncertainty early this year.

The dividend yield is back above the yield on 10 year treasuries, favoring income stocks as an attractive asset class. Small cap stocks are trading in line with large caps on an earnings basis, essentially erasing the historical premium that faster growing small caps typically have enjoyed. This positions them to potentially perform well relative to large caps as they regain that premium. In another historical perspective, Industrials start working when things look most grim for the sector and well ahead of any evidence of improvement. We don't pretend to know when that turn will happen but in our opinion, we do know that investors get paid for being patient.

2015 was a year of two markets engaged in a tug-of-war, where consumer-facing companies did well while energy, commodities and export-oriented manufacturing companies struggled. The big question for U.S. investors in 2016 is: Who wins this tug-of-war? Will the pressure felt by the industrial sectors overwhelm the economy and push us into a slowdown or will strong job growth, low interest rates and persistently low oil prices buoy consumer confidence and spending, extending the current cycle? We remain positive, viewing the latter as more likely, with potential upside if some of the current headwinds begin to abate.

The S&P 500 Total Return (TR) Index (S&P 500) is an unmanaged index of 500 common stocks that is generally considered representative of the United States stock market. It tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

Dow Jones Industrial Average TR Index (Dow) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. It is not possible to invest directly in an index.

Dividend Yield is a ratio that shows how much a company pays out in dividends each year relative to its share price.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period, though GDP is usually calculated on an annual basis.

1

MAIRS & POWER GROWTH FUND (unaudited)

To Our Shareholders: December 31, 2015

The Mairs & Power Growth Fund gained 6.14% in the fourth quarter, and finished down 3.07% for the year compared with the benchmark S&P 500 Total Return (TR) which gained 7.04% for the quarter and 1.38% for the year, and the Dow Jones Industrial Average (DJIA) TR which gained 7.70% for the quarter and 0.21% for the year.

Our multi-cap approach proved a major factor affecting the Growth Fund's relative performance in 2015 as mid cap and small cap stocks lagged large cap stocks. Because both the DJIA and S&P 500 indices are made up exclusively of large cap stocks, our comparative performance lagged these large cap benchmarks. As patient investors, we remain comfortable with our multi-cap approach which includes a long-term bet on smaller companies that we expect to grow faster than larger companies.

A top contributor to Fund performance in both the fourth quarter and full year was Hormel (HRL) which gained 24.91% and 51.79% respectively. The Fund's relative performance also benefited from an overweight positon in the Health Care sector, which performed well in both the fourth quarter and the full year. In addition, relative performance benefited from an underweight position in the Energy sector which remained under pressure throughout the year.

Stratasys (SSYS) and Qualcomm (QCOM) were among bottom contributors to performance in both the quarter and the year. Stratasys is well positioned in the additive manufacturing space, but that market is currently under pressure as manufacturers are holding back expansion. Qualcomm lost a major customer and has had to negotiate lower prices to Chinese manufacturers. An overweight position and the under performance of certain stocks in the struggling Industrial sector detracted from the Fund's relative performance for the year. In addition, an extremely narrow group of large cap information technology stocks that we do not hold, Amazon (AMZN), Alphabet (GOOGL) and Microsoft (MSFT), dominated performance in 2015 in the Information Technology and Consumer Discretionary sectors as well as the broader market.

MAIRS & POWER GROWTH FUND (MPGFX)

Top Performers

Fourth Quarter (9/30/15 – 12/31/15) | | Year To Date (12/31/14 – 12/31/15) | |

CRAY INC. | | | 63.81 | % | | HORMEL FOODS CORP. | | | 51.79 | % | |

HORMEL FOODS CORP. | | | 24.91 | % | | FISERV, INC. | | | 28.87 | % | |

GENERAL ELECTRIC CO. | | | 23.51 | % | | GENERAL ELECTRIC CO. | | | 23.27 | % | |

VALSPAR CORP. | | | 15.40 | % | | TORO CO. | | | 14.51 | % | |

MEDTRONIC, INC. | | | 14.91 | % | | ECOLAB, INC. | | | 9.43 | % | |

Weak Performers

Fourth Quarter (9/30/15 – 12/31/15) | | Year To Date (12/31/14 – 12/31/15) | |

CH ROBINSON WORLD WIDE, INC. | | | -8.50 | % | | QUALCOMM INC. | | | -32.75 | % | |

TARGET CORP. | | | -7.69 | % | | DONALDSON CO., INC. | | | -25.81 | % | |

PRINCIPAL FINANCIAL GROUP | | | -4.99 | % | | PENTAIR LTD. | | | -25.43 | % | |

PENTAIR LTD. | | | -2.96 | % | | EMERSON ELECTRIC CO. | | | -22.52 | % | |

ST. JUDE MEDICAL, INC. | | | -2.09 | % | | SCHLUMBERGER, LTD. | | | -18.34 | % | |

Past performance is no guarantee of future results.

With the S&P 500 price-to-earnings ratio above its long-term average, margins trending down and an expectation for only moderate sales and earnings growth in 2016, the market is not cheap. The equity market is currently being led by a narrow group of stocks showing strong revenue growth. This market has given us the

3

MAIRS & POWER GROWTH FUND (unaudited) (continued)

opportunity to build long-term positions in very good companies at attractive valuations. As some investors pay too much for short-term performance, we are trimming selectively in stocks such as Hormel, Toro (TTC) and Fiserv (FISV). At the same time we are adding to positions in quality names, especially in the beaten down Industrial sector. One such stock we have added is Proto Labs (PRLB) which we feel is well positioned in direct digital manufacturing.

One of our portfolio companies, Fastenal (FAST), will likely be an early indicator of improving conditions in the Industrial sector. Fastenal competes in the highly fragmented industrial distribution market, serving customers in manufacturing and non-residential construction industries. Because of weakness in manufacturing, the stock declined 14% in 2015. The company is not standing flat-footed, however. Fastenal continues to invest in its business in order to strengthen its durable competitive advantage, and we like that. With more than 2,600 stores (four times as many as the next largest competitor), the company enjoys broad market coverage as it takes share from smaller regional players. Fastenal's product breadth, market penetration and in-house distribution capabilities provide both cost and pricing leverage, delivering above industry average margins. In addition, with more than 54,000 on-site industrial vending machines and plans to aggressively add to this network in 2016, Fastenal is able to grow incremental revenue while building "sticky" customer relationships. Earnings have grown 22% and the dividend 23% annually over the last five years. While not classically cheap, the stock is nevertheless very inexpensive relative to intrinsic value, providing an opportunity to add selectively to our position. When the sector begins to recover, we believe that Fastenal's strength and our patience will reward investors.

Mark L. Henneman

Lead Manager | | Andrew R. Adams

Co-Manager | |

The Fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary prospectus or full prospectus contains this and other important information about the Fund, and they may be obtained by calling Shareholder Services at (800) 304-7404 or visiting www.mairsandpower.com. Read the summary prospectus or full prospectus carefully before investing.

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Growth Fund is designed for long-term investors. Equity investments are subject to market fluctuations, and the Fund's share price can fall because of weakness in the broad market, a particular industry, or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices, and greater fluctuations in price than United States corporations.

Diversification does not guarantee profit or protect against loss.

The S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the United States stock market. It tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

Dow Jones Industrial Average TR Index is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. It is not possible to invest directly in an index.

P/E (price per earnings) Ratio is the ratio of a company's share price to its per-share earnings.

4

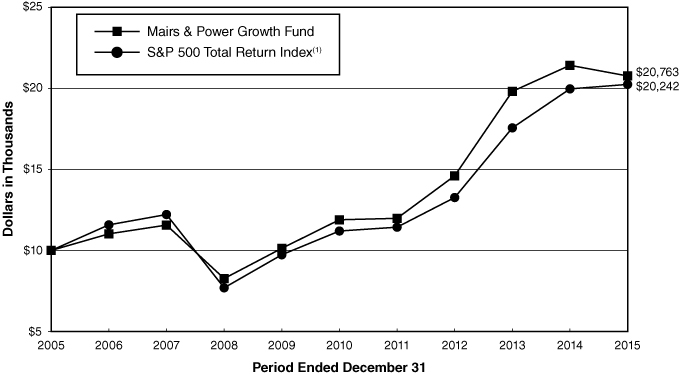

Mairs & Power Growth Fund

PERFORMANCE INFORMATION (unaudited) December 31, 2015

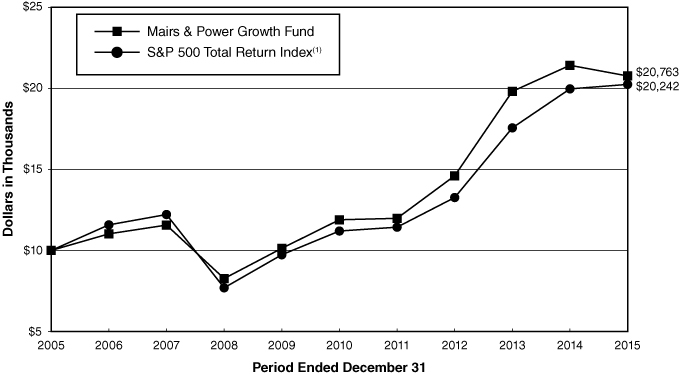

Ten years of investment performance (through December 31, 2015)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended December 31, 2015

| | | 1 year | | 5 years | | 10 years | | 20 years | |

Mairs & Power Growth Fund | | | -3.07 | % | | | 11.79 | % | | | 7.58 | % | | | 10.69 | % | |

S&P 500 Total Return Index(1) | | | 1.38 | % | | | 12.57 | % | | | 7.31 | % | | | 8.19 | % | |

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404.

(1) The S&P 500 Total Return Index is an unmanaged index of 500 common stocks which assumes reinvestment of dividends that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

5

Mairs & Power Growth Fund

FUND INFORMATION (unaudited) December 31, 2015

Portfolio Managers

Mark L. Henneman, lead manager since July 1, 2013, co-manager from January 1, 2006 through June 30, 2013

University of Minnesota, MBA Finance 1990

Andrew R. Adams, co-manager since January 1, 2015, University of Wisconsin-Madison, MS Finance 1997

General Information

Fund Symbol | | | MPGFX | | |

Net Asset Value (NAV) Per Share | | $ | 104.44 | | |

Expense Ratio | | | 0.65 | % | |

Portfolio Turnover Rate | | | 9.64 | % | |

Sales Charge | | | None1 | | |

Fund Inception Year | | | 1958 | | |

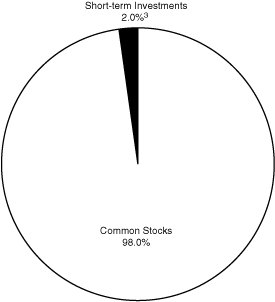

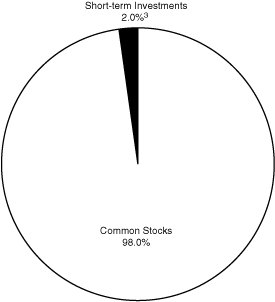

Portfolio Composition

Top Ten Portfolio Holdings

(Percent of Total Net Assets)2

Ecolab Inc | | | 4.7 | % | |

US Bancorp/MN | | | 4.5 | | |

| 3M Co | | | 3.9 | | |

Medtronic PLC | | | 3.8 | | |

Valspar Corp/The | | | 3.8 | | |

Honeywell International Inc | | | 3.8 | | |

Bemis Co Inc | | | 3.5 | | |

Johnson & Johnson | | | 3.5 | | |

Graco Inc | | | 3.4 | | |

General Mills Inc | | | 3.1 | | |

Portfolio Diversification

(Percent of Total Net Assets)

Common Stocks 98.6% | |

Industrials | | | 29.2 | % | |

Health Care | | | 20.2 | | |

Materials | | | 14.4 | | |

Financials | | | 11.3 | | |

Information Technology | | | 10.7 | | |

Consumer Staples | | | 5.6 | | |

Consumer Discretionary | | | 4.1 | | |

Energy | | | 2.6 | | |

Utilities | | | 0.5 | | |

Short-term Investments 1.4%3 | | | 1.4 | | |

| | | | 100.0 | % | |

1 Although the Fund is no-load, investment management fees and other expenses still apply.

2 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

3 Represents short-term investments and other assets and liabilities (net).

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs & Power, Inc. (the "Adviser").

6

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS December 31, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS 98.6% | |

| | | CONSUMER DISCRETIONARY 4.1% | |

| | 1,430,000 | | | Target Corp | | $ | 103,832,300 | | |

| | 510,000 | | | Walt Disney Co/The | | | 53,590,800 | | |

| | | | 157,423,100 | | |

| | | CONSUMER STAPLES 5.6% | |

| | 2,060,000 | | | General Mills Inc | | | 118,779,600 | | |

| | 1,220,000 | | | Hormel Foods Corp | | | 96,477,600 | | |

| | | | 215,257,200 | | |

| | | ENERGY 2.6% | |

| | 1,450,000 | | | Schlumberger Ltd (a) | | | 101,137,500 | | |

| | | FINANCIALS 11.3% | |

| | 520,000 | | | American Express Co | | | 36,166,000 | | |

| | 1,910,000 | | | Associated Banc-Corp | | | 35,812,500 | | |

| | 1,730,000 | | | Principal Financial Group Inc | | | 77,815,400 | | |

| | 280,000 | | | Travelers Cos Inc/The | | | 31,600,800 | | |

| | 4,020,000 | | | US Bancorp/MN | | | 171,533,400 | | |

| | 1,530,000 | | | Wells Fargo & Co | | | 83,170,800 | | |

| | | | 436,098,900 | | |

| | | HEALTH CARE 20.2% | |

| | 980,000 | | | Baxalta Inc | | | 38,249,400 | | |

| | 1,420,000 | | | Baxter International Inc | | | 54,173,000 | | |

| | 851,450 | | | Bio-Techne Corp | | | 76,630,500 | | |

| | 1,290,000 | | | Johnson & Johnson | | | 132,508,800 | | |

| | 1,900,000 | | | Medtronic PLC (f) | | | 146,148,000 | | |

| | 790,000 | | | Patterson Cos Inc | | | 35,715,900 | | |

| | 2,360,000 | | | Pfizer Inc | | | 76,180,800 | | |

| | 1,760,000 | | | Roche Holding AG ADR (e) | | | 60,667,200 | | |

| | 1,610,000 | | | St Jude Medical Inc | | | 99,449,700 | | |

| | 530,000 | | | Zimmer Holdings Inc | | | 54,372,700 | | |

| | | | 774,096,000 | | |

| | | INDUSTRIALS 29.2% | |

| | 990,000 | | | 3M Co | | | 149,133,600 | | |

| | 1,340,000 | | | CH Robinson Worldwide Inc | | | 83,106,800 | | |

| | 283,853 | | | Deluxe Corp | | | 15,481,343 | | |

| | 3,530,000 | | | Donaldson Co Inc | | | 101,169,800 | | |

| | 1,610,000 | | | Emerson Electric Co | | | 77,006,300 | | |

| | 1,450,000 | | | Fastenal Co | | | 59,189,000 | | |

| | 280,000 | | | G&K Services Inc, Class A | | | 17,612,000 | | |

7

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS (continued) | |

| | | INDUSTRIALS (continued) | |

| | 540,000 | | | Generac Holdings Inc (b) | | $ | 16,075,800 | | |

| | 2,170,000 | | | General Electric Co | | | 67,595,500 | | |

| | 1,800,000 | | | Graco Inc | | | 129,726,000 | | |

| | 1,390,000 | | | Honeywell International Inc | | | 143,962,300 | | |

| | 1,660,000 | | | Pentair PLC (a) | | | 82,219,800 | | |

| | 150,000 | | | Proto Labs Inc (b) | | | 9,553,500 | | |

| | 1,510,000 | | | Toro Co/The | | | 110,335,700 | | |

| | 600,000 | | | United Parcel Service Inc, Class B | | | 57,738,000 | | |

| | | | 1,119,905,443 | | |

| | | INFORMATION TECHNOLOGY 10.7% | |

| | 712,227 | | | Badger Meter Inc | | | 41,729,380 | | |

| | 1,700,000 | | | Corning Inc | | | 31,076,000 | | |

| | 1,710,000 | | | Cray Inc (b) | | | 55,489,500 | | |

| | 830,000 | | | Fiserv Inc (b) | | | 75,911,800 | | |

| | 982,849 | | | MTS Systems Corp (d) | | | 62,322,455 | | |

| | 348,891 | | | NVE Corp (d) | | | 19,600,696 | | |

| | 940,000 | | | QUALCOMM Inc | | | 46,985,900 | | |

| | 980,000 | | | Stratasys Ltd (a) (b) | | | 23,010,400 | | |

| | 2,970,000 | | | Western Union Co/The | | | 53,192,700 | | |

| | | | 409,318,831 | | |

| | | MATERIALS 14.4% | |

| | 3,020,000 | | | Bemis Co Inc | | | 134,963,800 | | |

| | 1,589,999 | | | Ecolab Inc | | | 181,864,086 | | |

| | 2,481,600 | | | HB Fuller Co | | | 90,503,952 | | |

| | 1,760,000 | | | Valspar Corp/The | | | 145,992,000 | | |

| | | | 553,323,838 | | |

| | | UTILITIES 0.5% | |

| | 1,010,000 | | | MDU Resources Group Inc | | | 18,503,200 | | |

| | | | | TOTAL COMMON STOCKS

(cost $2,162,928,416) | | $ | 3,785,064,012

| | |

| | | SHORT-TERM INVESTMENTS 1.0% | |

| 37,628,649

| | | First American Prime Obligations Fund, Class Z, 0.21% (c)

(cost $37,628,649) | | $ | 37,628,649

| | |

8

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Shares | | Security Description | | Fair Value | |

| | | TOTAL INVESTMENTS 99.6%

(cost $2,200,557,065) | | $ | 3,822,692,661

| | |

| | | OTHER ASSETS AND LIABILITIES (NET) 0.4% | | | 14,571,602 | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 3,837,264,263 | | |

(a) Foreign security denominated in U.S. dollars. As of December 31, 2015, these securities represented $206,367,700 or 5.4% of total net assets.

(b) Non-income producing.

(c) The rate quoted is the annualized seven-day effective yield as of December 31, 2015.

(d) Affiliated company at December 31, 2015.

(e) American Depositary Receipt.

(f) Issuer headquartered overseas but considered domestic. In determining whether a security is foreign or domestic, Mairs & Power, Inc. (the Adviser) will generally look at the location of the headquarters of the issuer. However, if the issuer is believed by the Adviser to be headquartered in a jurisdiction primarily for tax purposes, the Adviser will consider the following additional factors: 1) the location of the primary exchange trading its securities; 2) where it derives the majority of its revenues, or 3) where it earns the majority of its profits.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Adviser.

See accompanying Notes to Financial Statements.

9

MAIRS & POWER BALANCED FUND (unaudited)

To Our Shareholders: December 31, 2015

The Balanced Fund gained 3.25% in the quarter and declined 2.54% for the year compared with its benchmark Composite Index (60% S&P 500 Total Return (TR) Index and 40% Barclays Government/Credit Bond Index), which gained 3.94% and 1.13% for the three month and full year periods, respectively.

Major positive factors on equity performance for the year included an overweight position in the Health Care sector and performance of certain stocks in the Consumer Staples sector. Negative factors included an underweight position and under performance of certain stocks in the Information Technology sector as well as overweight positions in the Energy and Industrials sectors which detracted from performance.

Top performers for both the fourth quarter and full year included Hormel (HRL), up 24.91% and 51.79%, General Electric (GE), up 23.51% and 23.27% and Home Depot (HD) up 14.51% and 25.99%, respectively. United Parcel Services (UPS) was among the bottom performers in both periods, declining 2.49% and 13.44%, respectively.

MAIRS & POWER BALANCED FUND (MAPOX)

Top Performers

Fourth Quarter (9/30/15 – 12/31/15) | | Year To Date (12/31/14 – 12/31/15) | |

HORMEL FOODS CORP | | | 24.91 | % | | HORMEL FOODS CORP | | | 51.79 | % | |

BAXALTA INC. | | | 23.87 | % | | HOME DEPOT, INC. | | | 25.99 | % | |

GENERAL ELECTRIC CO. | | | 23.51 | % | | GENERAL ELECTRIC CO. | | | 23.27 | % | |

VALSPAR CORP. | | | 15.40 | % | | ELI LILLY & CO. | | | 22.13 | % | |

MEDTRONIC, INC. | | | 14.91 | % | | MEDTRONIC, INC. | | | 6.54 | % | |

Weak Performers

Fourth Quarter (9/30/15 – 12/31/15) | | Year To Date (12/31/14 – 12/31/15) | |

CH ROBINSON WORLD WIDE, INC. | | | -8.50 | % | | CONOCOPHILLIPS | | | -32.39 | % | |

TARGET CORP. | | | -7.69 | % | | EMERSON ELECTRIC CO. | | | -22.52 | % | |

PRINCIPAL FINANCIAL GROUP | | | -4.99 | % | | SCHLUMBERGER, LTD | | | -18.34 | % | |

UNITED PARCEL SERVICES, | | | | EXXON MOBIL CORP. | | | -15.68 | % | |

INC., CLASS B | | | -2.49 | % | | UNITED PARCEL SERVICES, INC., | | | |

DELUXE CORP. | | | -2.15 | % | | CLASS B | | | -13.44 | % | |

Past performance is no guarantee of future results.

Home Depot is one of our portfolio companies that illustrates the importance of a company's management focus and strategic vision. In an environment buoyed by an improving housing market and rising consumer confidence, Home Depot has gained share from its primary competitor, Lowes, while also benefitting from the ongoing struggles at Sears. In addition, it has benefited from continued industry consolidation as smaller regional players have retrenched or folded following the housing market crash in 2008 – 09. Management has not simply taken these share gains and sat back. The company has invested in building what it describes as an interconnected retail operation between suppliers, stores and customers which will link the customers' in-store and on-line shopping experiences. Operational improvements, including a "lights out" warehousing and distribution capability and enhancements to its in-store customer experience, are designed to drive cost efficiencies while tightening customer relationships.

While Home Depot is an example of a stock we expect to hold for the long-term, over the past year we have eliminated nine smaller positions where we did not see similar evidence of a stable or improving durable

10

MAIRS & POWER BALANCED FUND (unaudited) (continued)

competitive advantage. It is fair to say we are concentrating the portfolio in stocks where we have greater confidence over the long-term.

On the fixed income side of the Fund, the big news was the U.S. Federal Reserve's (Fed) action late in the year, finally raising short-term interest rates for the first time in a decade. While we did get a 25 basis point (0.25%) hike in rates, we remain skeptical that the central bank will repeat that action more than once or twice in the coming year, as had been suggested earlier by Fed officials. Both investment grade and high yield corporate bonds performed poorly in 2015, posting losses for the year. High yield bonds in particular were under pressure because of that market's heavy exposure to issuers in the stressed energy sector. The market adjusted, widening spreads as we saw ratings downgrades. We expect this to continue as the ratings agencies have signaled their intentions to remain aggressive.

Ronald L. Kaliebe

Lead Manager | | Kevin V. Earley

Co-Manager | |

The Fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary prospectus or full prospectus contains this and other important information about the Fund, and they may be obtained by calling Shareholder Services at (800) 304-7404 or visiting www.mairsandpower.com. Read the summary prospectus or full prospectus carefully before investing.

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Balanced Fund is designed for long-term investors. Equity investments are subject to market fluctuations, and the Fund's share price can fall because of weakness in the broad market, a particular industry, or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices, and greater fluctuations in price than United States corporations. The Fund is subject to yield and share price variances with changes in interest rates and market conditions. Investors should note that if interest rates rise significantly from current levels, bond total returns will decline and may even turn negative in the short-term. There is also a chance that some of the Fund's holdings may have their credit rating downgraded or may default.

Diversification does not guarantee profit or protect against loss.

Barclays Government/Credit Bond Index is composed of high-quality, investment-grade United States government and corporate fixed income securities with maturities greater than one year. It is not possible to invest directly in an index.

The S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the United States stock market. It tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

11

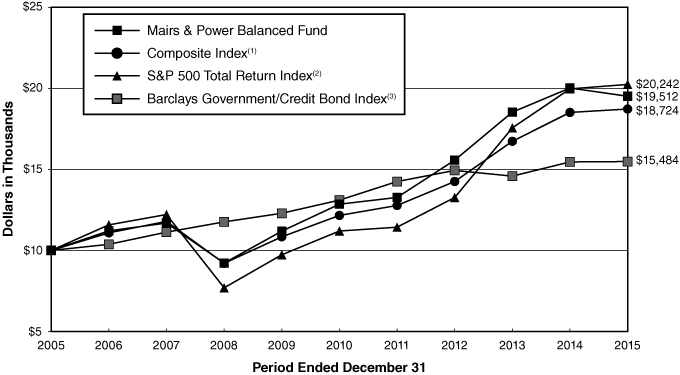

Mairs & Power Balanced Fund

PERFORMANCE INFORMATION (unaudited) December 31, 2015

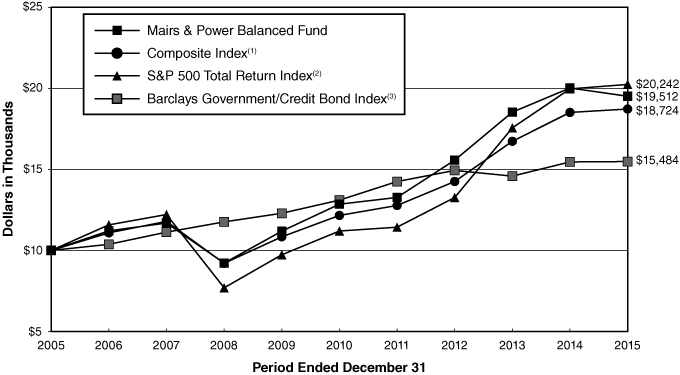

Ten years of investment performance (through December 31, 2015)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended December 31, 2015

| | | 1 year | | 5 years | | 10 years | | 20 years | |

Mairs & Power Balanced Fund | | | -2.54 | % | | | 8.71 | % | | | 6.91 | % | | | 8.79 | % | |

Composite Index(1) | | | 1.13 | % | | | 9.02 | % | | | 6.47 | % | | | 7.36 | % | |

S&P 500 Total Return Index(2) | | | 1.38 | % | | | 12.57 | % | | | 7.31 | % | | | 8.19 | % | |

Barclays Government/

Credit Bond Index(3) | | | 0.15 | % | | | 3.39 | % | | | 4.47 | % | | | 5.32 | % | |

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404.

(1) The Composite Index reflects an unmanaged portfolio comprised of 60% of the S&P 500 Index and 40% of the Barclays Government/Credit Bond Index. It is not possible to invest directly in an index.

(2) The S&P 500 Total Return Index is an unmanaged index of 500 common stocks which assumes reinvestment of dividends that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

(3) The Barclays Government/Credit Bond Index is composed of high-quality, investment-grade United States government and corporate fixed income securities with maturities greater than one year. It is not possible to invest directly in an index.

12

Mairs & Power Balanced Fund

FUND INFORMATION (unaudited) December 31, 2015

Portfolio Managers

Ronald L. Kaliebe, lead manager since July 1, 2013, co-manager from January 1, 2006 through

June 30, 2013

University of Wisconsin-Madison, MBA Finance 1980

Kevin V. Earley, co-manager since January 1, 2015, University of Minnesota, MBA Finance 1990

General Information

Fund Symbol | | MAPOX | |

Net Asset Value (NAV) Per Share | | $ | 81.16 | | |

Expense Ratio | | | 0.73 | % | |

Portfolio Turnover Rate | | | 14.05 | % | |

Sales Charge | | | None1 | | |

Fund Inception Year | | | 1961 | | |

Portfolio Composition

Top Ten Common Stock Holdings

(Percent of Total Net Assets)2

United Parcel Service Inc, Class B | | | 2.9 | % | |

Medtronic PLC | | | 2.9 | | |

US Bancorp/MN | | | 2.9 | | |

Johnson & Johnson | | | 2.5 | | |

Exxon Mobil Corp | | | 2.3 | | |

Ecolab Inc | | | 2.1 | | |

Valspar Corp/The | | | 2.1 | | |

| 3M Co | | | 2.1 | | |

Honeywell International Inc | | | 2.0 | | |

Pfizer Inc | | | 1.9 | | |

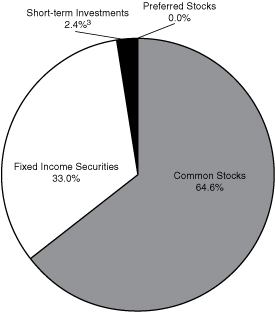

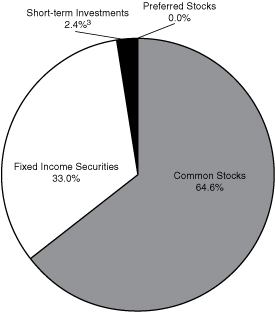

Portfolio Diversification

(Percent of Total Net Assets)

Fixed Income Securities 33.0% | |

Corporate Bonds | | | 27.7 | % | |

Federal Agency Obligations | | | 2.5 | | |

Asset Backed Securities | | | 2.1 | | |

Preferred Securities | | | 0.7 | | |

Common Stocks 64.6% | |

Industrials | | | 15.6 | % | |

Health Care | | | 13.5 | | |

Financials | | | 9.6 | | |

Energy | | | 6.2 | | |

Materials | | | 6.0 | | |

Information Technology | | | 5.5 | | |

Consumer Staples | | | 3.5 | | |

Consumer Discretionary | | | 2.9 | | |

Utilities | | | 1.8 | | |

Preferred Stocks 0.0% | | | 0.0 | % | |

Short-term Investments 2.4%3 | | | 2.4 | % | |

| | | | 100.0 | % | |

1 Although the Fund is no-load, investment management fees and other expenses still apply.

2 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

3 Represents short-term investments and other assets and liabilities (net).

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs & Power, Inc.

13

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES 33.0% | |

| | | FEDERAL AGENCY OBLIGATIONS 2.5% | |

$ | 500,000 | | | Federal Home Loan Banks | | | 3.480 | % | | 10/29/29 | | $ | 500,035 | | |

| | 500,000 | | | Federal Home Loan Banks | | | 3.625 | % | | 11/26/29 | | | 500,041 | | |

| | 1,400,000 | | | Federal Home Loan Banks | | | 3.650 | % | | 12/19/29 | | | 1,400,098 | | |

| | 1,000,000 | | | Federal Farm Credit Banks | | | 3.590 | % | | 12/24/29 | | | 1,000,013 | | |

| | 1,000,000 | | | Federal National Mortgage Association | | | 3.400 | % | | 02/27/30 | | | 1,000,451 | | |

| | 1,000,000 | | | Federal Farm Credit Banks | | | 3.440 | % | | 03/28/31 | | | 960,992 | | |

| | 2,000,000 | | | Federal National Mortgage Association | | | 3.500 | % | | 09/10/32 | | | 1,984,624 | | |

| | 2,000,000 | | | Federal Farm Credit Banks | | | 3.480 | % | | 02/07/33 | | | 1,932,312 | | |

| | 1,982,000 | | | Federal National Mortgage Association | | | 3.500 | % | | 03/07/33 | | | 1,917,099 | | |

| | 1,000,000 | | | Federal Home Loan Banks | | | 3.840 | % | | 12/26/34 | | | 981,489 | | |

| | 3,000,000 | | | Federal Home Loan Banks | | | 3.620 | % | | 02/12/35 | | | 2,888,202 | | |

| | 2,000,000 | | | Federal Home Loan Banks | | | 3.600 | % | | 03/16/35 | | | 1,914,982 | | |

| | | | 16,980,338 | | |

| | | CORPORATE BONDS 27.7% | |

| | | CONSUMER DISCRETIONARY 2.9% | |

| | 340,000 | | | Johnson Controls Inc | | | 5.500 | % | | 01/15/16 | | | 340,369 | | |

| | 250,000 | | | ServiceMaster Co LLC/The | | | 7.100 | % | | 03/01/18 | | | 248,750 | | |

| | 500,000 | | | Best Buy Co Inc | | | 5.000 | % | | 08/01/18 | | | 519,250 | | |

| | 1,000,000 | | | Ford Motor Credit Co LLC | | | 3.000 | % | | 12/20/18 | | | 1,000,585 | | |

| | 500,000 | | | Ford Motor Credit Co LLC | | | 3.450 | % | | 08/20/20 | | | 492,378 | | |

| | 1,000,000 | | | Time Warner Cable Inc | | | 4.125 | % | | 02/15/21 | | | 1,021,076 | | |

| | 1,000,000 | | | Best Buy Co Inc | | | 5.500 | % | | 03/15/21 | | | 1,035,000 | | |

| | 1,500,000 | | | Time Warner Cable Inc | | | 4.000 | % | | 09/01/21 | | | 1,514,596 | | |

| | 555,000 | | | Kohl's Corp | | | 4.000 | % | | 11/01/21 | | | 569,658 | | |

| | 500,000 | | | Whirlpool Corp | | | 4.700 | % | | 06/01/22 | | | 531,884 | | |

| | 1,750,000 | | | Newell Rubbermaid Inc | | | 4.000 | % | | 06/15/22 | | | 1,679,554 | | |

| | 1,000,000 | | | Block Financial LLC | | | 5.500 | % | | 11/01/22 | | | 1,055,884 | | |

| | 1,000,000 | | | Staples Inc | | | 4.375 | % | | 01/12/23 | | | 955,661 | | |

| | 2,000,000 | | | Kohl's Corp | | | 3.250 | % | | 02/01/23 | | | 1,900,950 | | |

| | 1,000,000 | | | Wyndham Worldwide Corp | | | 3.900 | % | | 03/01/23 | | | 972,982 | | |

| | 500,000 | | | Hyatt Hotels Corp | | | 3.375 | % | | 07/15/23 | | | 474,768 | | |

| | 1,000,000 | | | Ford Motor Credit Co LLC | | | 4.000 | % | | 04/20/24 | | | 980,252 | | |

| | 1,000,000 | | | Coach Inc | | | 4.250 | % | | 04/01/25 | | | 950,188 | | |

| | 1,000,000 | | | Metropolitan Opera Association Inc | | | 4.349 | % | | 10/01/32 | | | 1,026,159 | | |

| | 2,000,000 | | | Comcast Corp | | | 4.250 | % | | 01/15/33 | | | 1,965,250 | | |

| | | | 19,235,194 | | |

14

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | CONSUMER STAPLES 0.6% | |

$ | 222,000 | | | SUPERVALU Inc | | | 8.000 | % | | 05/01/16 | | $ | 226,595 | | |

| | 525,000 | | | Cargill Inc (d) | | | 6.000 | % | | 11/27/17 | | | 563,608 | | |

| | 1,949,000 | | | Land O'Lakes Capital Trust I (d) | | | 7.450 | % | | 03/15/28 | | | 2,065,940 | | |

| | 500,000 | | | Altria Group Inc | | | 4.250 | % | | 08/09/42 | | | 458,770 | | |

| | 1,000,000 | | | Cargill Inc (d) | | | 4.100 | % | | 11/01/42 | | | 911,778 | | |

| | | | 4,226,691 | | |

| | | ENERGY 1.8% | |

| | 500,000 | | | Anadarko Petroleum Corp | | | 5.950 | % | | 09/15/16 | | | 513,778 | | |

| | 250,000 | | | ConocoPhillips | | | 6.650 | % | | 07/15/18 | | | 276,403 | | |

| | 1,500,000 | | | Murphy Oil Corp | | | 4.000 | % | | 06/01/22 | | | 1,137,235 | | |

| | 500,000 | | | Western Gas Partners LP | | | 4.000 | % | | 07/01/22 | | | 442,258 | | |

| | 655,000 | | | FMC Technologies Inc | | | 3.450 | % | | 10/01/22 | | | 574,051 | | |

| | 1,500,000 | | | Transocean Inc (a) (c) | | | 4.300 | % | | 10/15/22 | | | 795,000 | | |

| | 1,000,000 | | | Murphy Oil Corp | | | 3.700 | % | | 12/01/22 | | | 765,020 | | |

| | 1,500,000 | | | Sunoco Logistics Partners Operations LP | | | 3.450 | % | | 01/15/23 | | | 1,266,060 | | |

| | 3,000,000 | | | Williams Cos Inc/The | | | 3.700 | % | | 01/15/23 | | | 2,072,292 | | |

| | 1,945,000 | | | Boardwalk Pipelines LP | | | 3.375 | % | | 02/01/23 | | | 1,563,903 | | |

| | 575,000 | | | DCP Midstream Operating LP | | | 3.875 | % | | 03/15/23 | | | 434,029 | | |

| | 1,000,000 | | | Diamond Offshore Drilling Inc | | | 3.450 | % | | 11/01/23 | | | 826,208 | | |

| | 500,000 | | | Kinder Morgan Energy Partners LP | | | 4.250 | % | | 09/01/24 | | | 425,318 | | |

| | 500,000 | | | Murphy Oil Corp | | | 5.125 | % | | 12/01/42 | | | 307,640 | | |

| | 500,000 | | | Apache Corp | | | 4.250 | % | | 01/15/44 | | | 391,425 | | |

| | | | 11,790,620 | | |

| | | FINANCIALS 10.7% | |

| | 500,000 | | | TCF National Bank | | | 5.500 | % | | 02/01/16 | | | 501,489 | | |

| | 500,000 | | | KeyBank NA/Cleveland OH | | | 5.450 | % | | 03/03/16 | | | 503,408 | | |

| | 500,000 | | | Symetra Financial Corp (d) | | | 6.125 | % | | 04/01/16 | | | 505,153 | | |

| | 250,000 | | | Security Benefit Life Insurance Co (d) | | | 8.750 | % | | 05/15/16 | | | 255,737 | | |

| | 500,000 | | | Bank of America Corp | | | 6.050 | % | | 05/16/16 | | | 508,246 | | |

| | 500,000 | | | Torchmark Corp | | | 6.375 | % | | 06/15/16 | | | 510,407 | | |

| | 500,000 | | | National City Bank/Cleveland OH | | | 5.250 | % | | 12/15/16 | | | 517,576 | | |

| | 500,000 | | | M&I Marshall & Ilsley Bank | | | 5.000 | % | | 01/17/17 | | | 515,383 | | |

| | 500,000 | | | Citigroup Inc | | | 5.500 | % | | 02/15/17 | | | 516,728 | | |

| | 500,000 | | | Sirius International Group Ltd (a) (d) | | | 6.375 | % | | 03/20/17 | | | 510,757 | | |

| | 250,000 | | | Bank of America Corp | | | 5.700 | % | | 05/02/17 | | | 260,719 | | |

| | 500,000 | | | Royal Bank of Scotland Group PLC (a) | | | 4.250 | % | | 07/15/17 | | | 512,633 | | |

| | 500,000 | | | Comerica Bank | | | 5.200 | % | | 08/22/17 | | | 524,540 | | |

| | 500,000 | | | Bank of America Corp | | | 6.000 | % | | 09/01/17 | | | 532,105 | | |

15

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 500,000 | | | American Express Bank FSB | | | 6.000 | % | | 09/13/17 | | $ | 535,570 | | |

| | 500,000 | | | Bear Stearns Cos LLC/The | | | 6.400 | % | | 10/02/17 | | | 538,463 | | |

| | 500,000 | | | Prudential Financial Inc | | | 6.000 | % | | 12/01/17 | | | 536,911 | | |

| | 500,000 | | | Barclays Bank PLC (a) (d) | | | 6.050 | % | | 12/04/17 | | | 533,333 | | |

| | 1,000,000 | | | Morgan Stanley | | | 5.950 | % | | 12/28/17 | | | 1,075,327 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 5.950 | % | | 01/18/18 | | | 538,488 | | |

| | 500,000 | | | Wachovia Corp | | | 5.750 | % | | 02/01/18 | | | 540,045 | | |

| | 250,000 | | | Lincoln National Corp | | | 7.000 | % | | 03/15/18 | | | 274,052 | | |

| | 500,000 | | | SunTrust Bank/Atlanta GA | | | 7.250 | % | | 03/15/18 | | | 552,808 | | |

| | 500,000 | | | Morgan Stanley | | | 6.625 | % | | 04/01/18 | | | 548,265 | | |

| | 1,000,000 | | | Jefferies Group LLC | | | 5.125 | % | | 04/13/18 | | | 1,040,073 | | |

| | 500,000 | | | Bank of America Corp | | | 6.875 | % | | 04/25/18 | | | 551,629 | | |

| | 500,000 | | | Provident Cos Inc | | | 7.000 | % | | 07/15/18 | | | 553,263 | | |

| | 500,000 | | | MetLife Inc | | | 6.817 | % | | 08/15/18 | | | 563,071 | | |

| | 500,000 | | | Hartford Financial Services Group Inc/The | | | 6.000 | % | | 01/15/19 | | | 549,886 | | |

| | 500,000 | | | Royal Bank of Scotland Group PLC (a) | | | 5.250 | % | | 02/15/19 | | | 533,515 | | |

| | 500,000 | | | BB&T Corp | | | 6.850 | % | | 04/30/19 | | | 569,916 | | |

| | 250,000 | | | WR Berkley Corp | | | 6.150 | % | | 08/15/19 | | | 277,903 | | |

| | 500,000 | | | Protective Life Corp | | | 7.375 | % | | 10/15/19 | | | 578,397 | | |

| | 500,000 | | | Prospect Capital Corp | | | 5.125 | % | | 11/15/19 | | | 480,752 | | |

| | 500,000 | | | Credit Suisse/New York NY (a) | | | 5.400 | % | | 01/14/20 | | | 547,456 | | |

| | 500,000 | | | Prospect Capital Corp | | | 4.000 | % | | 01/15/20 | | | 473,361 | | |

| | 500,000 | | | Morgan Stanley | | | 5.500 | % | | 01/26/20 | | | 550,456 | | |

| | 500,000 | | | Hartford Financial Services Group Inc/The | | | 5.500 | % | | 03/30/20 | | | 553,496 | | |

| | 450,000 | | | Compass Bank | | | 5.500 | % | | 04/01/20 | | | 479,397 | | |

| | 537,000 | | | Manufacturers & Traders Trust Co (c) | | | 5.585 | % | | 12/28/20 | | | 536,359 | | |

| | 1,000,000 | | | Nationwide Financial Services Inc (d) | | | 5.375 | % | | 03/25/21 | | | 1,094,752 | | |

| | 500,000 | | | Markel Corp | | | 5.350 | % | | 06/01/21 | | | 549,092 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 5.250 | % | | 07/27/21 | | | 552,810 | | |

| | 500,000 | | | Genworth Holdings Inc | | | 7.625 | % | | 09/24/21 | | | 415,225 | | |

| | 500,000 | | | Aflac Inc | | | 4.000 | % | | 02/15/22 | | | 528,347 | | |

| | 2,000,000 | | | OneBeacon US Holdings Inc | | | 4.600 | % | | 11/09/22 | | | 2,010,208 | | |

| | 1,000,000 | | | Standard Chartered PLC (a) (d) | | | 3.950 | % | | 01/11/23 | | | 961,998 | | |

| | 500,000 | | | Wells Fargo & Co | | | 3.450 | % | | 02/13/23 | | | 501,178 | | |

| | 2,500,000 | | | Assurant Inc | | | 4.000 | % | | 03/15/23 | | | 2,500,500 | | |

| | 1,000,000 | | | Markel Corp | | | 3.625 | % | | 03/30/23 | | | 986,112 | | |

| | 1,500,000 | | | Citigroup Inc | | | 3.500 | % | | 05/15/23 | | | 1,474,825 | | |

| | 500,000 | | | Morgan Stanley | | | 4.100 | % | | 05/22/23 | | | 505,101 | | |

16

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 2,000,000 | | | Liberty Mutual Group Inc (d) | | | 4.250 | % | | 06/15/23 | | $ | 2,032,136 | | |

| | 500,000 | | | Ameriprise Financial Inc | | | 4.000 | % | | 10/15/23 | | | 519,405 | | |

| | 500,000 | | | CNA Financial Corp | | | 7.250 | % | | 11/15/23 | | | 590,963 | | |

| | 500,000 | | | Pacific Life Insurance Co (d) | | | 7.900 | % | | 12/30/23 | | | 617,118 | | |

| | 1,000,000 | | | Moody's Corp | | | 4.875 | % | | 02/15/24 | | | 1,064,078 | | |

| | 1,000,000 | | | NASDAQ OMX Group Inc/The | | | 4.250 | % | | 06/01/24 | | | 1,008,534 | | |

| | 500,000 | | | Wintrust Financial Corp | | | 5.000 | % | | 06/13/24 | | | 498,144 | | |

| | 250,000 | | | Assured Guaranty US Holdings Inc | | | 5.000 | % | | 07/01/24 | | | 259,724 | | |

| | 500,000 | | | Symetra Financial Corp | | | 4.250 | % | | 07/15/24 | | | 503,944 | | |

| | 1,000,000 | | | Stifel Financial Corp | | | 4.250 | % | | 07/18/24 | | | 993,546 | | |

| | 1,000,000 | | | Citigroup Inc | | | 4.000 | % | | 08/05/24 | | | 990,386 | | |

| | 1,500,000 | | | Synchrony Financial | | | 4.250 | % | | 08/15/24 | | | 1,479,693 | | |

| | 1,800,000 | | | Brown & Brown Inc | | | 4.200 | % | | 09/15/24 | | | 1,777,419 | | |

| | 2,000,000 | | | Old Republic International Corp | | | 4.875 | % | | 10/01/24 | | | 2,049,530 | | |

| | 2,000,000 | | | TIAA Asset Management Finance Co LLC (d) | | | 4.125 | % | | 11/01/24 | | | 2,006,794 | | |

| | 1,000,000 | | | Associated Banc-Corp | | | 4.250 | % | | 01/15/25 | | | 1,000,612 | | |

| | 2,000,000 | | | Kemper Corp | | | 4.350 | % | | 02/15/25 | | | 1,986,744 | | |

| | 1,050,000 | | | TCF National Bank | | | 4.600 | % | | 02/27/25 | | | 1,025,257 | | |

| | 250,000 | | | Liberty Mutual Insurance Co (d) | | | 8.500 | % | | 05/15/25 | | | 310,546 | | |

| | 1,000,000 | | | Wells Fargo & Co | | | 4.100 | % | | 06/03/26 | | | 1,009,394 | | |

| | 500,000 | | | Morgan Stanley | | | 4.350 | % | | 09/08/26 | | | 501,635 | | |

| | 1,000,000 | | | National Rural Utilities Cooperative Finance Corp | | | 3.000 | % | | 11/15/26 | | | 943,021 | | |

| | 1,000,000 | | | Citigroup Inc | | | 4.300 | % | | 11/20/26 | | | 995,064 | | |

| | 1,000,000 | | | JPMorgan Chase & Co | | | 4.125 | % | | 12/15/26 | | | 997,243 | | |

| | 250,000 | | | Provident Cos Inc | | | 7.250 | % | | 03/15/28 | | | 290,753 | | |

| | 1,000,000 | | | JPMorgan Chase & Co (c) | | | 3.000 | % | | 03/21/28 | | | 932,385 | | |

| | 1,000,000 | | | JPMorgan Chase & Co (c) | | | 3.000 | % | | 03/22/28 | | | 971,633 | | |

| | 1,000,000 | | | Royal Bank of Canada (a) | | | 3.000 | % | | 05/10/28 | | | 884,897 | | |

| | 500,000 | | | Farmers Exchange Capital (d) | | | 7.050 | % | | 07/15/28 | | | 598,158 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.250 | % | | 11/15/30 | | | 496,236 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.000 | % | | 02/15/31 | | | 480,261 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.300 | % | | 12/15/32 | | | 488,750 | | |

| | 1,000,000 | | | JPMorgan Chase & Co (c) | | | 3.250 | % | | 01/31/33 | | | 953,634 | | |

| | 649,000 | | | Lloyds Bank PLC (a) (c) | | | 3.400 | % | | 01/31/33 | | | 594,958 | | |

| | 250,000 | | | Citigroup Inc (c) | | | 4.000 | % | | 06/27/34 | | | 240,239 | | |

| | 538,000 | | | Bank of America Corp | | | 4.000 | % | | 08/15/34 | | | 517,367 | | |

| | 1,000,000 | | | Prudential Financial Inc | | | 4.050 | % | | 11/15/34 | | | 977,668 | | |

| | 1,000,000 | | | Goldman Sachs Group Inc/The | | | 4.000 | % | | 01/30/35 | | | 1,000,308 | | |

17

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 500,000 | | | Barclays Bank PLC (a) (c) | | | 4.000 | % | | 10/09/37 | | $ | 487,530 | | |

| | 1,000,000 | | | Berkshire Hathaway Finance Corp | | | 4.400 | % | | 05/15/42 | | | 990,123 | | |

| | 500,000 | | | MetLife Inc | | | 4.125 | % | | 08/13/42 | | | 474,523 | | |

| | 500,000 | | | Swiss Re Treasury US Corp (d) | | | 4.250 | % | | 12/06/42 | | | 472,286 | | |

| | 500,000 | | | Pacific LifeCorp (d) | | | 5.125 | % | | 01/30/43 | | | 509,428 | | |

| | 500,000 | | | Berkshire Hathaway Finance Corp | | | 4.300 | % | | 05/15/43 | | | 490,337 | | |

| | 500,000 | | | Principal Financial Group Inc | | | 4.350 | % | | 05/15/43 | | | 467,888 | | |

| | | | 71,747,513 | | |

| | | HEALTH CARE 0.8% | |

| | 500,000 | | | UnitedHealth Group Inc | | | 6.000 | % | | 02/15/18 | | | 543,806 | | |

| | 1,000,000 | | | Quest Diagnostics Inc | | | 4.700 | % | | 04/01/21 | | | 1,058,982 | | |

| | 1,000,000 | | | Laboratory Corp of America Holdings | | | 3.750 | % | | 08/23/22 | | | 1,006,465 | | |

| | 1,000,000 | | | Laboratory Corp of America Holdings | | | 4.000 | % | | 11/01/23 | | | 1,010,075 | | |

| | 1,000,000 | | | Mylan Inc/PA | | | 4.200 | % | | 11/29/23 | | | 991,612 | | |

| | 500,000 | | | Wyeth LLC | | | 6.450 | % | | 02/01/24 | | | 611,607 | | |

| | | | 5,222,547 | | |

| | | INDUSTRIALS 3.1% | |

| | 500,000 | | | Masco Corp | | | 7.125 | % | | 03/15/20 | | | 577,500 | | |

| | 500,000 | | | Pentair Finance SA (a) | | | 5.000 | % | | 05/15/21 | | | 521,265 | | |

| | 500,000 | | | IDEX Corp | | | 4.200 | % | | 12/15/21 | | | 517,808 | | |

| | 500,000 | | | Masco Corp | | | 5.950 | % | | 03/15/22 | | | 540,000 | | |

| | 500,000 | | | GATX Corp | | | 4.750 | % | | 06/15/22 | | | 524,721 | | |

| | 500,000 | | | Penske Truck Leasing Co Lp / PTL Finance Corp (d) | | | 4.875 | % | | 07/11/22 | | | 520,047 | | |

| | 1,000,000 | | | ADT Corp/The | | | 3.500 | % | | 07/15/22 | | | 895,000 | | |

| | 818,000 | | | Pentair Finance SA (a) | | | 3.150 | % | | 09/15/22 | | | 769,520 | | |

| | 2,000,000 | | | Dun & Bradstreet Corp/The | | | 4.375 | % | | 12/01/22 | | | 1,957,716 | | |

| | 1,000,000 | | | GATX Corp | | | 3.900 | % | | 03/30/23 | | | 991,902 | | |

| | 500,000 | | | ADT Corp/The | | | 4.125 | % | | 06/15/23 | | | 467,500 | | |

| | 500,000 | | | Ingersoll-Rand Global Holding Co Ltd (a) | | | 4.250 | % | | 06/15/23 | | | 514,925 | | |

| | 1,000,000 | | | Flowserve Corp | | | 4.000 | % | | 11/15/23 | | | 988,485 | | |

| | 2,126,000 | | | Air Lease Corp | | | 4.850 | % | | 02/01/24 | | | 2,088,795 | | |

| | 500,000 | | | Pitney Bowes Inc | | | 4.625 | % | | 03/15/24 | | | 489,849 | | |

| | 500,000 | | | Toro Co/The | | | 7.800 | % | | 06/15/27 | | | 631,435 | | |

| | 500,000 | | | General Electric Capital Corp | | | 3.500 | % | | 05/15/32 | | | 481,382 | | |

| | 3,000,000 | | | Eaton Corp | | | 4.000 | % | | 11/02/32 | | | 2,859,165 | | |

| | 2,000,000 | | | General Electric Capital Corp | | | 4.000 | % | | 02/14/33 | | | 2,004,680 | | |

| | 1,000,000 | | | Pitney Bowes Inc | | | 5.250 | % | | 01/15/37 | | | 1,009,901 | | |

18

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | INDUSTRIALS (continued) | |

$ | 590,000 | | | Eaton Corp | | | 4.150 | % | | 11/02/42 | | $ | 544,054 | | |

| | 500,000 | | | Lockheed Martin Corp | | | 4.070 | % | | 12/15/42 | | | 462,710 | | |

| | | | 20,358,360 | | |

| | | INFORMATION TECHNOLOGY 3.9% | |

| | 500,000 | | | Western Union Co/The | | | 5.930 | % | | 10/01/16 | | | 515,877 | | |

| | 500,000 | | | Broadridge Financial Solutions Inc | | | 6.125 | % | | 06/01/17 | | | 527,933 | | |

| | 500,000 | | | Dell Inc | | | 5.875 | % | | 06/15/19 | | | 514,630 | | |

| | 500,000 | | | Broadridge Financial Solutions Inc | | | 3.950 | % | | 09/01/20 | | | 518,227 | | |

| | 81,000 | | | Hewlett-Packard Co | | | 3.750 | % | | 12/01/20 | | | 80,371 | | |

| | 500,000 | | | Dell Inc | | | 4.625 | % | | 04/01/21 | | | 485,000 | | |

| | 750,000 | | | Hewlett-Packard Co | | | 4.300 | % | | 06/01/21 | | | 742,709 | | |

| | 500,000 | | | Motorola Solutions Inc | | | 3.750 | % | | 05/15/22 | | | 458,086 | | |

| | 2,000,000 | | | Symantec Corp | | | 3.950 | % | | 06/15/22 | | | 1,976,704 | | |

| | 1,000,000 | | | Computer Sciences Corp | | | 4.450 | % | | 09/15/22 | | | 1,025,765 | | |

| | 1,000,000 | | | Hewlett-Packard Co | | | 4.050 | % | | 09/15/22 | | | 952,541 | | |

| | 2,025,000 | | | Fiserv Inc | | | 3.500 | % | | 10/01/22 | | | 2,020,831 | | |

| | 1,000,000 | | | Autodesk Inc | | | 3.600 | % | | 12/15/22 | | | 971,381 | | |

| | 2,500,000 | | | Arrow Electronics Inc | | | 4.500 | % | | 03/01/23 | | | 2,525,712 | | |

| | 1,500,000 | | | Motorola Solutions Inc | | | 3.500 | % | | 03/01/23 | | | 1,315,866 | | |

| | 2,000,000 | | | Fidelity National Information Services Inc | | | 3.500 | % | | 04/15/23 | | | 1,909,620 | | |

| | 2,352,000 | | | Total System Services Inc | | | 3.750 | % | | 06/01/23 | | | 2,281,932 | | |

| | 1,000,000 | | | Altera Corp | | | 4.100 | % | | 11/15/23 | | | 1,041,325 | | |

| | 500,000 | | | Motorola Solutions Inc | | | 4.000 | % | | 09/01/24 | | | 433,908 | | |

| | 500,000 | | | Arrow Electronics Inc | | | 4.000 | % | | 04/01/25 | | | 480,318 | | |

| | 4,000,000 | | | Intel Corp | | | 4.000 | % | | 12/15/32 | | | 3,981,104 | | |

| | 1,500,000 | | | Western Union Co/The | | | 6.200 | % | | 11/17/36 | | | 1,458,380 | | |

| | | | 26,218,220 | | |

| | | MATERIALS 2.7% | |

| | 500,000 | | | International Paper Co | | | 5.250 | % | | 04/01/16 | | | 504,624 | | |

| | 500,000 | | | Valspar Corp/The | | | 6.050 | % | | 05/01/17 | | | 525,944 | | |

| | 500,000 | | | Carpenter Technology Corp | | | 5.200 | % | | 07/15/21 | | | 502,808 | | |

| | 500,000 | | | Freeport-McMoRan Inc | | | 4.000 | % | | 11/14/21 | | | 300,000 | | |

| | 175,000 | | | Mosaic Co/The | | | 3.750 | % | | 11/15/21 | | | 175,469 | | |

| | 1,000,000 | | | Freeport-McMoRan Inc | | | 3.550 | % | | 03/01/22 | | | 580,000 | | |

| | 1,500,000 | | | Newmont Mining Corp | | | 3.500 | % | | 03/15/22 | | | 1,336,961 | | |

| | 500,000 | | | Barrick Gold Corp (a) | | | 3.850 | % | | 04/01/22 | | | 438,632 | | |

| | 1,000,000 | | | Domtar Corp | | | 4.400 | % | | 04/01/22 | | | 1,016,828 | | |

19

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | MATERIALS (continued) | |

$ | 2,000,000 | | | RPM International Inc | | | 3.450 | % | | 11/15/22 | | $ | 1,917,598 | | |

| | 500,000 | | | Carpenter Technology Corp | | | 4.450 | % | | 03/01/23 | | | 480,379 | | |

| | 500,000 | | | Freeport-McMoRan Inc | | | 3.875 | % | | 03/15/23 | | | 285,000 | | |

| | 2,059,000 | | | Reliance Steel & Aluminum Co | | | 4.500 | % | | 04/15/23 | | | 1,916,639 | | |

| | 1,750,000 | | | Barrick Gold Corp (a) | | | 4.100 | % | | 05/01/23 | | | 1,501,255 | | |

| | 2,000,000 | | | Nucor Corp | | | 4.000 | % | | 08/01/23 | | | 1,939,178 | | |

| | 1,000,000 | | | Mosaic Co/The | | | 4.250 | % | | 11/15/23 | | | 990,425 | | |

| | 865,000 | | | Union Carbide Corp | | | 7.500 | % | | 06/01/25 | | | 1,028,760 | | |

| | 1,250,000 | | | Dow Chemical Co/The | | | 4.250 | % | | 10/01/34 | | | 1,128,149 | | |

| | 1,000,000 | | | Alcoa Inc | | | 5.950 | % | | 02/01/37 | | | 805,000 | | |

| | 1,000,000 | | | Newmont Mining Corp | | | 4.875 | % | | 03/15/42 | | | 714,559 | | |

| | | | 18,088,208 | | |

| | | TELECOMMUNICATION SERVICES 0.4% | |

| | 250,000 | | | Verizon Communications Inc | | | 6.350 | % | | 04/01/19 | | | 281,259 | | |

| | 500,000 | | | CenturyLink Inc | | | 6.150 | % | | 09/15/19 | | | 510,000 | | |

| | 500,000 | | | Qwest Capital Funding Inc | | | 6.875 | % | | 07/15/28 | | | 390,000 | | |

| | 468,000 | | | Qwest Corp | | | 6.875 | % | | 09/15/33 | | | 449,091 | | |

| | 1,000,000 | | | Verizon Communications Inc | | | 4.400 | % | | 11/01/34 | | | 922,629 | | |

| | | | 2,552,979 | | |

| | | UTILITIES 0.8% | |

| | 500,000 | | | Commonwealth Edison Co | | | 6.150 | % | | 09/15/17 | | | 536,797 | | |

| | 250,000 | | | Vectren Utility Holdings Inc | | | 5.750 | % | | 08/01/18 | | | 268,827 | | |

| | 250,000 | | | South Jersey Gas Co | | | 7.125 | % | | 10/22/18 | | | 277,265 | | |

| | 250,000 | | | United Utilities PLC (a) | | | 5.375 | % | | 02/01/19 | | | 268,245 | | |

| | 1,170,000 | | | ONEOK Inc | | | 4.250 | % | | 02/01/22 | | | 842,400 | | |

| | 785,000 | | | SCANA Corp | | | 4.125 | % | | 02/01/22 | | | 769,055 | | |

| | 1,000,000 | | | Exelon Generation Co LLC | | | 4.250 | % | | 06/15/22 | | | 1,013,195 | | |

| | 900,000 | | | National Fuel Gas Co | | | 3.750 | % | | 03/01/23 | | | 833,556 | | |

| | 500,000 | | | Entergy Gulf States Inc | | | 6.180 | % | | 03/01/35 | | | 499,876 | | |

| | | | 5,309,216 | | |

| | | TOTAL CORPORATE BONDS | | | 184,749,548 | | |

| | | ASSET BACKED SECURITIES 2.1% | |

| | 341,420 | | | Continental Airlines 2009-1 Pass Through Trust | | | 9.000 | % | | 01/08/18 | | | 352,175 | | |

| | 335,640 | | | American Airlines 2011-1 Class B Pass Through Trust (d) | | | 7.000 | % | | 07/31/19 | | | 352,422 | | |

| | 106,772 | | | Continental Airlines 1999-1 Class B Pass Through Trust | | | 6.795 | % | | 02/02/20 | | | 111,576 | | |

20

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Par Value | | Security Description | | Fair Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | ASSET BACKED SECURITIES (continued) | |

$ | 479,453 | | | Continental Airlines 2010-1 Class B Pass Through Trust | | | 6.000 | % | | 07/12/20 | | $ | 498,631 | | |

| | 299,402 | | | Delta Air Lines 2011-1 Class A Pass Through Trust | | | 5.300 | % | | 10/15/20 | | | 317,366 | | |

| | 527,466 | | | America West Airlines 2000-1 Pass Through Trust | | | 8.057 | % | | 01/02/22 | | | 592,081 | | |

| | 679,846 | | | American Airlines 2011-1 Class A Pass Through Trust | | | 5.250 | % | | 07/31/22 | | | 720,637 | | |

| | 185,740 | | | Continental Airlines 2007-1 Class A Pass Through Trust | | | 5.983 | % | | 10/19/23 | | | 205,113 | | |

| | 349,470 | | | Southwest Airlines Co 2007-1 Pass Through Trust | | | 6.150 | % | | 02/01/24 | | | 391,407 | | |

| | 1,000,000 | | | United Airlines 2015-1 Class A Pass Through Trust | | | 3.700 | % | | 06/01/24 | | | 997,500 | | |

| | 723,675 | | | US Airways 2010-1 Class A Pass Through Trust | | | 6.250 | % | | 10/22/24 | | | 810,516 | | |

| | 959,077 | | | American Airlines 2015-1 Class B Pass Through Trust | | | 3.700 | % | | 11/01/24 | | | 937,497 | | |

| | 1,500,000 | | | Delta Air Lines 2015-1 Class B Pass Through Trust | | | 4.250 | % | | 01/30/25 | | | 1,511,250 | | |

| | 377,199 | | | US Airways 2011-1 Class A Pass Through Trust | | | 7.125 | % | | 04/22/25 | | | 433,779 | | |

| | 1,603,752 | | | Hawaiian Airlines 2013-1 Class A Pass Through Certificates | | | 3.900 | % | | 01/15/26 | | | 1,563,658 | | |

| | 551,637 | | | Continental Airlines 2012-2 Class A Pass Through Trust | | | 4.000 | % | | 04/29/26 | | | 565,428 | | |

| | 951,987 | | | United Airlines 2013-1 Class A Pass Through Trust | | | 4.300 | % | | 02/15/27 | | | 985,306 | | |

| | 904,619 | | | US Airways 2013-1 Class A Pass Through Trust | | | 3.950 | % | | 05/15/27 | | | 911,404 | | |

| | 941,824 | | | American Airlines 2014-1 Class A Pass Through Trust | | | 3.700 | % | | 04/01/28 | | | 942,390 | | |

| | 500,000 | | | American Airlines 2015-2 Class A Pass Through Trust | | | 4.000 | % | | 03/22/29 | | | 498,750 | | |

| | | | 13,698,886 | | |

| | | PREFERRED SECURITIES 0.7% | |

| | 23,000 | | | Stifel Financial Corp | | | 5.375 | % | | 12/31/22 | | | 578,910 | | |

| | 10,000 | | | Raymond James Financial Inc | | | 6.900 | % | | 03/15/42 | | | 266,600 | | |

| | 20,000 | | | Protective Life Corp | | | 6.000 | % | | 09/01/42 | | | 518,000 | | |

| | 20,000 | | | Selective Insurance Group Inc | | | 5.875 | % | | 02/09/43 | | | 519,800 | | |

| | 40,000 | | | WR Berkley Corp | | | 5.625 | % | | 04/30/53 | | | 1,016,800 | | |

| | 20,000 | | | Verizon Communications Inc | | | 5.900 | % | | 02/15/54 | | | 552,400 | | |

| | 20,000 | | | American Financial Group Inc/OH | | | 6.250 | % | | 09/30/54 | | | 521,000 | | |

| | 20,000 | | | Qwest Corp | | | 6.875 | % | | 10/01/54 | | | 515,000 | | |

| | 10,000 | | | NextEra Energy Capital Holdings Inc | | | 5.700 | % | | 03/01/72 | | | 256,000 | | |

| | | | 4,744,510 | | |

| | TOTAL FIXED INCOME SECURITIES

(cost $223,658,760) | | $ | 220,173,282 | | |

21

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS 64.6% | |

| | | CONSUMER DISCRETIONARY 2.9% | |

| | 73,000 | | | Home Depot Inc/The | | $ | 9,654,250 | | |

| | 130,000 | | | Target Corp | | | 9,439,300 | | |

| | | | 19,093,550 | | |

| | | CONSUMER STAPLES 3.5% | |

| | 90,000 | | | General Mills Inc | | | 5,189,400 | | |

| | 64,000 | | | Hershey Co/The | | | 5,713,280 | | |

| | 109,000 | | | Hormel Foods Corp | | | 8,619,720 | | |

| | 31,000 | | | Kimberly-Clark Corp | | | 3,946,300 | | |

| | | | 23,468,700 | | |

| | | ENERGY 6.2% | |

| | 76,000 | | | Chevron Corp | | | 6,836,960 | | |

| | 172,000 | | | ConocoPhillips | | | 8,030,680 | | |

| | 197,000 | | | Exxon Mobil Corp | | | 15,356,150 | | |

| | 165,000 | | | Schlumberger Ltd (a) | | | 11,508,750 | | |

| | | | 41,732,540 | | |

| | | FINANCIALS 9.6% | |

| | 55,000 | | | American Express Co | | | 3,825,250 | | |

| | 404,000 | | | Associated Banc-Corp | | | 7,575,000 | | |

| | 139,000 | | | JPMorgan Chase & Co | | | 9,178,170 | | |

| | 267,000 | | | Principal Financial Group Inc | | | 12,009,660 | | |

| | 35,000 | | | Travelers Cos Inc/The | | | 3,950,100 | | |

| | 448,500 | | | US Bancorp/MN | | | 19,137,495 | | |

| | 156,000 | | | Wells Fargo & Co | | | 8,480,160 | | |

| | | | 64,155,835 | | |

| | | HEALTH CARE 13.5% | |

| | 148,500 | | | Abbott Laboratories | | | 6,669,135 | | |

| | 84,000 | | | AbbVie Inc | | | 4,976,160 | | |

| | 131,000 | | | Baxalta Inc | | | 5,112,930 | | |

| | 131,000 | | | Baxter International Inc | | | 4,997,650 | | |

| | 74,500 | | | Bristol-Myers Squibb Co | | | 5,124,855 | | |

| | 44,000 | | | Eli Lilly & Co | | | 3,707,440 | | |

| | 160,000 | | | Johnson & Johnson | | | 16,435,200 | | |

| | 252,500 | | | Medtronic PLC (f) | | | 19,422,300 | | |

| | 400,000 | | | Pfizer Inc | | | 12,912,000 | | |

| | 305,000 | | | Roche Holding AG ADR (e) | | | 10,513,350 | | |

| | | | 89,871,020 | | |

22

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Shares | | Security Description | | Fair Value | |

| | | COMMON STOCKS (continued) | |

| | | INDUSTRIALS 15.6% | |

| | 91,000 | | | 3M Co | | $ | 13,708,240 | | |

| | 127,000 | | | CH Robinson Worldwide Inc | | | 7,876,540 | | |

| | 146,500 | | | Deluxe Corp | | | 7,990,110 | | |

| | 256,000 | | | Emerson Electric Co | | | 12,244,480 | | |

| | 412,000 | | | General Electric Co | | | 12,833,800 | | |

| | 91,000 | | | Graco Inc | | | 6,558,370 | | |

| | 129,000 | | | Honeywell International Inc | | | 13,360,530 | | |

| | 138,000 | | | Pentair PLC (a) | | | 6,835,140 | | |

| | 40,000 | | | Toro Co/The | | | 2,922,800 | | |

| | 204,100 | | | United Parcel Service Inc, Class B | | | 19,640,543 | | |

| | | | 103,970,553 | | |

| | | INFORMATION TECHNOLOGY 5.5% | |

| | 420,000 | | | Corning Inc | | | 7,677,600 | | |

| | 60,000 | | | International Business Machines Corp | | | 8,257,200 | | |

| | 88,500 | | | MTS Systems Corp | | | 5,611,785 | | |

| | 89,000 | | | QUALCOMM Inc | | | 4,448,665 | | |

| | 581,000 | | | Western Union Co/The | | | 10,405,710 | | |

| | | | 36,400,960 | | |

| | | MATERIALS 6.0% | |

| | 143,000 | | | Bemis Co Inc | | | 6,390,670 | | |

| | 124,000 | | | Ecolab Inc | | | 14,183,120 | | |

| | 156,000 | | | HB Fuller Co | | | 5,689,320 | | |

| | 169,000 | | | Valspar Corp/The | | | 14,018,550 | | |

| | | | 40,281,660 | | |

| | | UTILITIES 1.8% | |

| | 88,000 | | | ALLETE Inc | | | 4,473,040 | | |

| | 81,000 | | | MDU Resources Group Inc | | | 1,483,920 | | |

| | 173,000 | | | Xcel Energy Inc | | | 6,212,430 | | |

| | | | 12,169,390 | | |

| | | | | TOTAL COMMON STOCKS

(cost $312,386,102) | | $ | 431,144,208

| | |

23

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2015

Shares | | Security Description | | Fair Value | |

| | | PREFERRED STOCKS 0.0% (g) | |

| | | UTILITIES 0.0% (g) | |

| | 10,000 | | | SCE Trust I | | | | | | | | | | $ | 253,100 | | |

| | TOTAL PREFERRED STOCKS

(cost $250,000) | | $ | 253,100 | | |

| | | SHORT-TERM INVESTMENTS 1.8% | |

| | 12,019,982 | | | First American Prime Obligations Fund, Class Z, 0.21% (b) | | | |

(cost $12,019,982) | | $ | 12,019,982 | | |

| | | TOTAL INVESTMENTS 99.4%

(cost $548,314,844) | | |

| | | | | | | $ | 663,590,572

| | |

| | | OTHER ASSETS AND LIABILITIES (NET) 0.6% | | | | | | | | | | | 4,089,689 | | |

| | | TOTAL NET ASSETS 100.0% | | | | | | | | | | $ | 667,680,261 | | |

(a) Foreign security denominated in U.S. dollars. As of December 31, 2015, these securities represented $28,719,809 or 4.3% of total net assets.

(b) The rate quoted is the annualized seven-day effective yield as of December 31, 2015.

(c) Step bonds – securities for which the interest rate will adjust on specified future date(s). The rate disclosed represents the coupon rate in effect as of December 31, 2015.

(d) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Fund's Board of Trustees. As of December 31, 2015, these securities represented $14,821,991 or 2.2% of total net assets.

(e) American Depositary Receipt.

(f) Issuer headquartered overseas but considered domestic. In determining whether a security is foreign or domestic, the Adviser will generally look at the location of the headquarters of the issuer. However, if the issuer is believed by the Adviser to be headquartered in a jurisdiction primarily for tax purposes, the Adviser will consider the following additional factors: 1) the location of the primary exchange trading its securities; 2) where it derives the majority of its revenues, or 3) where it earns the majority of its profits.

(g) Percentage is less than 0.05%.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Adviser.

See accompanying Notes to Financial Statements.

24

MAIRS & POWER SMALL CAP FUND (unaudited)

To Our Shareholders: December 31, 2015

The Mairs & Power Small Cap Fund rallied in the fourth quarter of the year, gaining 4.75%, ahead of both the S&P 600 and the peer group as measured by the Lipper Small-Cap Core Funds Index which were up 3.72% and 2.80%, respectively. For the year the Fund finished down 4.68%, versus the index and peer group which were down 1.97% and 4.23%, respectively.

Overall, allocation played a small role in relative performance for the year. The Fund was underweight in the Energy sector compared to the benchmark S&P 600. With the small cap Energy sector down over 40% in 2015, our underweight posture added to relative performance. Somewhat offsetting this, the Fund carried an overweight position in the Materials sector, which was the second worst performing sector, hurting performance on a relative basis.

Importantly, stock selection was again the primary driver of relative performance for the year. Unfortunately, strong performance from certain stocks in the fourth quarter of the year wasn't quite enough to offset selection related performance earlier in the year.

MAIRS & POWER SMALL CAP FUND (MSCFX)

Top Performers

Fourth Quarter (9/30/15 – 12/31/15) | | Year To Date (12/31/14 – 12/31/15) | |

CRAY INC. | | | 63.81 | % | | CASEY'S GENERAL STORES, INC. | | | 33.36 | % | |

ACTUANT CORP | | | 30.29 | % | | GENTHERM, INC. | | | 29.44 | % | |

CASEY'S GENERAL STORES, INC. | | | 17.03 | % | | UNITED FIRE GROUP | | | 28.86 | % | |

AGREE REALTY CORPORATION | | | 13.87 | % | | VASCULAR SOLUTIONS, INC. | | | 26.62 | % | |

BEMIS CO., INC. | | | 12.94 | % | | PRIVATEBANCORP, INC. | | | 22.81 | % | |

Weak Performers

Fourth Quarter (9/30/15 – 12/31/15) | | Year To Date (12/31/14 – 12/31/15) | |

BUFFALO WILD WINGS, INC. | | | -17.46 | % | | CARDIOVASCULAR SYSTEMS INC. | | | -49.73 | % | |

STRATASYS, INC | | | -11.36 | % | | VASCO DATA SECURITY INT'L, INC. | | | -40.69 | % | |

HUB GROUP, INC. | | | -9.50 | % | | GENERAC HOLDINGS | | | -36.33 | % | |

WINTRUST FINANCIAL | | | | DONALDSON INC. | | | -25.81 | % | |

CORPORATION | | | -9.19 | % | | MDU RESOURCES GROUP, INC. | | | -22.04 | % | |

HAWKINS, INC. | | | -7.09 | % | | | | | |

Past performance is no guarantee of future results.

Cray (CRAY) was a significant outperformer for the Fund in the fourth quarter. For over a year, management has been indicating that IBM's re-positioning within the high performance computing space would create opportunities for Cray to take share. Given significant upside surprises to total revenue the last couple quarters, it appears this scenario is starting to play out. In addition, after a few fits and starts, it appears Cray is gaining traction in the rapidly evolving big data space with a couple of new high performance computer offerings. A strong competitive position, coupled with solid growth prospects and a very reasonable valuation support our large holding in Cray.

We didn't hold Stratasys (SSYS) for the entire year so it doesn't appear in the one-year table of top and bottom contributors. But when examining full year performance, it was clearly the one stock in the portfolio with the greatest negative impact on performance. Stratasys is in the additive manufacturing or 3D printing space. With their systems, companies have the ability to rapidly build prototypes to aid in designing new products or create fixtures to quickly adjust manufacturing lines for new products. While we believe in the long-term

25

MAIRS & POWER SMALL CAP FUND (unaudited) (continued)

opportunity in the additive manufacturing space, the industry is going through an unforeseen period of slower growth caused by a lot of free press and headlines in 2013 and 2014. The excitement over 3D printing spurred a lot of buying of systems (and the stocks of these companies) ahead of end-user capacity needs. After a period of digestion, we believe growth will accelerate as the industry starts to make headway into end-use parts and finished products.

United Fire (UFCS), a property, casualty and life insurance company based in Cedar Falls, Iowa, was a top contributor to performance for the year. Solid execution in building the book value of the company, accompanied by an improving valuation as the stock went from trading at a discount to book value to a slight premium, has driven performance. We like the company's long-term focus on driving value for shareholders, customers and employees.

Gentherm (THRM) also was a top contributor to performance for the year. Gentherm supplies major automobile manufacturers with personal comfort modules for heating and cooling seats, steering wheels and cup holders. Through volume growth led by new platform wins, Gentherm was able to grow top line revenues at double digits while increasing the bottom line in the mid-teens as margin improvement took hold in 2015. This led to a nice increase in the stock price for the year. We believe the outlook remains positive for these products and for Gentherm's business going into 2016.

Two stocks were added to the portfolio in the fourth quarter; Oasis Petroleum (OAS) and Workiva (WK). Oasis is a stock we exited earlier in the energy market downturn and have now just started to revisit as oil prices have dropped even further, providing an opportunity to pick up the stock at depressed levels. Workiva is a software as a service or "cloud-based" software company, based in Ames, Iowa. They are in the business of providing software to public companies to create and audit information contained in regulatory filings.

On a fundamental basis, the outlook for small cap stocks appears fairly positive as the more domestic focus of small companies relative to large has helped insulate their financial performance from a slowing global economy and a strengthening dollar. However, it has not insulated them from what appears to be a flight to safety by investors. This has resulted in a valuation compression across the S&P 600 causing the index to trade nearly in line with the S&P 500 on an earnings basis. As small cap stocks have historically grown faster than larger companies, it has been rare that small cap stocks have not carried a premium valuation to large. With less international headwind and reduced relative valuations, we feel small caps are positioned to perform well.

Andrew R. Adams

Lead Manager | | Allen D. Steinkopf

Co-Manager | |

The Fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary prospectus or full prospectus contains this and other important information about the Fund, and they may be obtained by calling Shareholder Services at (800) 304-7404 or visiting www.mairsandpower.com. Read the summary prospectus or full prospectus carefully before investing.

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Small Cap Fund is designed for long-term investors. Equity investments are subject to market fluctuations, and the Fund's share price can fall because of weakness in the broad market, a particular industry, or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices, and greater fluctuations in price than United States corporations. The Fund may invest in initial public offerings by small cap companies, which can involve greater risk than investments in companies that are already publicly traded.

26

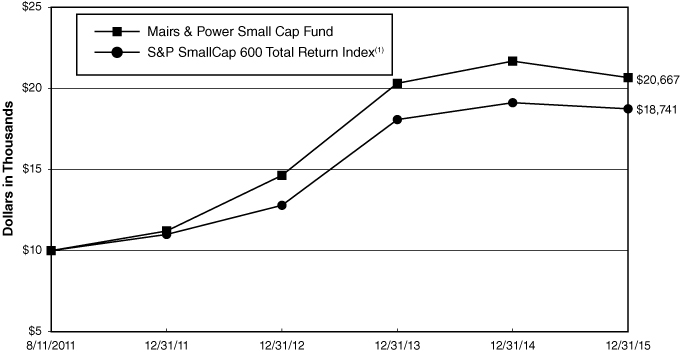

MAIRS & POWER SMALL CAP FUND (unaudited) (continued)

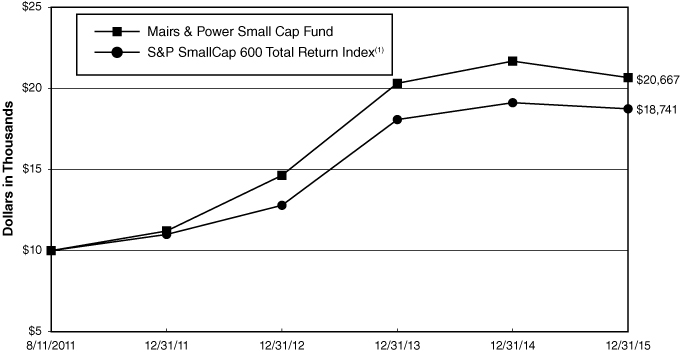

Diversification does not guarantee profit or protect against loss.