UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-22641

Franklin Alternative Strategies Funds

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 5/31/18

Item 1. Reports to Stockholders.

| | |

| | Annual Report and Shareholder Letter May 31, 2018 |

Franklin K2 Alternative Strategies Fund

A SERIES OF FRANKLIN ALTERNATIVE STRATEGIES FUNDS

Sign up for electronic delivery at franklintempleton.com/edelivery

Franklin Templeton Investments

Why choose Franklin Templeton Investments?

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Fellow Shareholder:

During the 12 months ended May 31, 2018, global markets were aided by price gains in commodities, generally upbeat economic data across regions and encouraging corporate earnings reports. Markets were also supported by the European Central Bank’s extension of its monetary easing program and the passage of US tax reforms. However, investor sentiment was dampened by Korean peninsula tensions, protectionist US trade policies and US-China trade disputes, consumer data privacy concerns, and worries that central banks could raise interest rates in response to strong economic growth and rising inflation. In this environment, global developed stock markets, as measured by the MSCI World Index, generated a +12.18% total return for the period.1 Global emerging market stocks, as measured by the MSCI Emerging Markets Index, produced a +14.43% total return.1 Global government bonds, as measured by the Citigroup World Government Bond Index, posted a +2.06% total return.1

We are committed to our long-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

We believe active, professional investment management serves investors well. We also recognize the important role of financial advisors in today’s markets and encourage investors to continue to seek their advice. Amid changing markets and economic

conditions, we are confident investors with a well-diversified portfolio and a patient, long-term outlook should be well positioned for the years ahead.

On the following pages, the Fund’s portfolio management team reviews investment decisions that pertain to performance during the past 12 months in light of the economic environment and other factors. Please remember all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin Templeton, welcome your questions and comments, and look forward to continuing to serve your investment needs in the years ahead.

Sincerely,

Madison S. Gulley, CFA

President and Chief Executive Officer – Investment Management

Franklin Alternative Strategies Funds

This letter reflects our analysis and opinions as of May 31, 2018, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

CFA® is a trademark owned by CFA Institute.

1. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

| | | | | | |

| franklintempleton.com | | Not part of the annual report | | | 1 | |

Contents

Annual Report

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

| | | | | | |

| | 2 | | | Annual Report | | franklintempleton.com |

Annual Report

Franklin K2 Alternative Strategies Fund

We are pleased to bring you Franklin K2 Alternative Strategies Fund’s annual report for the fiscal year ended May 31, 2018.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation with lower volatility relative to the broad equity markets. The Fund seeks to achieve its investment goal by allocating its assets across multiple nontraditional or “alternative” strategies, including, but not limited to, some or all of the following strategies: long short equity, relative value, event driven and global macro. The Fund is structured as a multi-manager fund, meaning the Fund’s assets are independently managed by multiple subadvisors, while the Fund’s investment manager retains overall responsibility for the Fund’s investments. The Fund may invest in a wide range of securities and other investments including, but not limited to: equity securities including common stocks, preferred stocks, convertible securities, rights and warrants, private and registered investment vehicles and exchange-traded funds (ETFs); debt securities including bonds, notes, debentures, banker’s acceptances and commercial paper; loans and loan participations; and mortgage-backed or other asset-backed securities, including collateralized debt obligations; as well as derivatives, commodities and currencies.

Performance Overview

The Fund’s Class A shares delivered a +3.57% cumulative total return for the 12 months under review. For comparison, the Fund’s new primary and old secondary benchmark, the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe, generated a +2.88% total return for the same period.1 As the investment manager believes the composition of the HFRX Global Hedge Fund Index more accurately reflects the Fund’s holdings, it has replaced the ICE BofA Merrill Lynch US 3-Month Treasury Bill Index as the Fund’s primary benchmark. Also for comparison, the Fund’s new secondary and old primary benchmark, the ICE BofA Merrill Lynch US 3-Month Treasury Bill Index, which tracks the performance of short-term US government securities with a remaining term to final maturity of less than three months, posted a +1.28% total return for

the same period.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

The global economy expanded during the 12-month period under review amid generally upbeat economic data across regions. In this environment, global developed and emerging market stocks reached a new all-time high in January 2018 and generated a +12.43% total return for the period, as measured by the MSCI All Country World Index.2 Global markets were aided by price gains in oil and other commodities, as well as the European Central Bank’s (ECB’s) extension of its monetary easing program. Further supporting global stocks were the passage of the US tax reform bill and encouraging corporate earnings reports.

However, global markets reflected investor concerns about tensions in the Korean peninsula and political uncertainties in the US and the European Union, as well as worries that strong economic growth and rising inflation in some parts of the world, particularly in the US, would lead central banks to increase interest rates sooner than expected. Global markets were further pressured by the Trump administration’s protectionist trade policies, uncertainty surrounding the US-China trade relationship, and a broad sell-off in information technology stocks in March due to a potential for tighter regulation in the sector arising from concerns about consumer data privacy. However, an overall easing of tensions in the Korean peninsula and intermittent US-China trade negotiations partially offset some of these concerns during the period.

After accelerating in 2017’s third quarter, the US economy expanded at a slower pace in the fourth quarter. Growth continued to moderate in 2018’s first quarter due to a slowdown in

1. Source: FactSet. Hedge Fund Research, Inc. – www.hedgefundresearch.com. The HFRX Global Hedge Fund Index is being used under license from Hedge Fund Research, Inc., which does not endorse or approve of any of the contents of this report.

2. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Unlike most asset class indexes, HFR Index returns reflect fees and expenses.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI). The Consolidated SOI begins on page 16.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 3 | |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

consumer spending, exports, and state and local government spending, as well as a decline in residential fixed income investment. The unemployment rate declined from 4.3% in May 2017, as reported at the beginning of the 12-month period, to an 18-year low of 3.8% at period-end.3 Annual inflation, as measured by the Consumer Price Index, increased from 1.9% in May 2017, as reported at the beginning of the period, to 2.8% at period-end.3 The US Federal Reserve (Fed) raised its target range for the federal funds rate three times during the period and began reducing its balance sheet in October as part of its ongoing plan to normalize its monetary policy.

In Europe, the UK’s economic growth accelerated in 2017’s third quarter over the previous quarter and remained stable in the fourth quarter. However, growth moderated in 2018’s first quarter amid a decline in construction output. In November, the Bank of England raised its key policy rate for the first time in a decade. The eurozone’s quarterly growth held steady in 2017’s third and fourth quarters but moderated in 2018’s first quarter. The bloc’s annual inflation rate ended the period higher than in May 2017. The ECB kept its benchmark interest rate unchanged during the period. However, at its October meeting, the ECB extended the time frame for its massive bond-buying program from December 2017 to at least September 2018, while reducing the amount of monthly bond purchases in half beginning in January 2018.

In Asia, Japan’s quarterly gross domestic product (GDP) growth held steady in 2017’s third quarter but slowed in the fourth quarter. GDP growth in 2018’s first quarter declined, the country’s first contraction since 2015’s fourth quarter, mainly due to a decline in private residential investment. The Bank of Japan left its benchmark interest rate unchanged during the period and continued its monetary stimulus measures.

In emerging markets, Brazil’s quarterly GDP grew in 2017’s third and fourth quarters, although at a slower pace than the previous quarters. However, growth accelerated in 2018’s first quarter. The country’s central bank cut its benchmark interest rate several times during the period to spur economic growth. Russia’s annual GDP growth rate remained positive in 2017’s third and fourth quarters as well as 2018’s first quarter, amid the Bank of Russia’s continued policy support. China’s annual GDP moderated in 2017’s third quarter but grew at a stable rate in the following two quarters. The People’s Bank of China left its benchmark interest rate unchanged during the period. Overall, emerging market stocks, as measured by the MSCI Emerging Markets Index, rose during the period.

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we allocate assets to multiple subadvisors, each of whom independently manages a separate portion of the Fund’s portfolio in accordance with some or all of the following strategies: long short equity, relative value, event driven and global macro. We allocate the Fund’s assets among these strategies utilizing a top-down approach, generating the Fund’s strategy weightings by taking into account market conditions, risk factors, diversification, liquidity, transparency, and availability of various subadvisors and other investment options, among other things. The allocations to specific subadvisors may change from time to time based upon our assessment of their correlations to various markets and to each other, their risk profiles and return expectations. Long short equity strategies generally seek to produce returns from investments in the equity markets by taking long and short positions in stocks and stock indexes (through the use of derivatives or ETFs). Relative value strategies encompass a wide range of investment techniques that are intended to profit from pricing inefficiencies. Event driven strategies generally invest in securities of companies undergoing significant corporate events. Global macro strategies generally focus on broad-based economic opportunities across numerous markets and investments.

The Fund may take long and/or short positions in a wide range of asset classes, including equities, fixed income, commodities and currencies, among others. Long positions benefit from an increase in the price of the underlying instrument or asset class, while short positions benefit from a decrease in that price. The Fund may use derivatives for hedging and non-hedging (investment) purposes, although no subadvisor is required to hedge any of the Fund’s positions or to use derivatives. Such derivative investments may include futures contracts, swaps, options and currency forward contracts. As a result of the Fund’s use of derivatives, the Fund may have economic leverage, which means the sum of the Fund’s investment exposures through its use of derivatives may significantly exceed the amount of assets invested in the Fund, although these exposures may vary over time. The Fund may engage in active and frequent trading as part of its investment strategies.

What is a futures contract?

A futures contract is an agreement between the Fund and a counterparty made through a US or foreign futures exchange to buy or sell an underlying instrument or asset at a specific price on a future date.

3. Source: US Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| 4 | | Annual Report | | franklintempleton.com |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

What are swap agreements?

Swap agreements, such as interest rate, currency and credit default swaps, are contracts between the Fund and another party (the swap counterparty). In a basic swap transaction, the Fund agrees with the swap counterparty to exchange the returns (or differentials in rates of return) earned or realized on a particular “notional amount” of underlying instruments. The notional amount is the set amount selected by the parties as the basis on which to calculate the obligations that they have agreed to exchange. The parties typically do not actually exchange the notional amount. Instead, they agree to exchange the returns that would be earned or realized if the notional amount were invested in given instruments or at given interest rates.

What is an option?

An option is a contract to buy or sell a specific financial product known as the option’s underlying instrument at a specific price. The buyer of an option has the right, but not the obligation, to buy or sell the underlying instrument at or until a specified expiration date. Conversely, the seller (“writer”) of an option who opens a transaction is obligated to buy or sell the underlying instrument should the option holder exercise that right.

What is a currency forward contract?

A currency forward contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency in exchange for another currency at a specific exchange rate on a future date. Currency forward contracts are privately traded in the interbank market, not on a centralized exchange.

Manager’s Discussion

The Fund’s positive performance for the period resulted from gains for three of the four underlying strategies in which assets were allocated—long short equity, event driven and relative value. Performance contribution was led by long short equity, followed by event driven and relative value. The fourth underlying strategy, global macro, had a slight decline. A conditional risk overlay (CRO) was implemented for part of the review period to help mitigate downside risk exposure, and this weighed on results. Volatility of returns was low during the period, averaging approximately one-fourth the volatility of the Standard & Poor’s® 500 during the one-year period ending May 31, 2018. The CRO strategy was not active at period-end. The allocation percentages for each strategy are listed in the Strategy Allocation table on this page.

What is a conditional risk overlay (CRO) strategy?

From time to time, the Fund’s investment manager may implement its CRO strategy, which seeks to neutralize certain market sensitivities that may exist in the Fund. The CRO strategy involves investing in derivatives or other instruments in an effort to reduce volatility and provide a hedge against market declines. When implemented, the strategy will reduce the Fund’s ability to benefit from positive market movements.

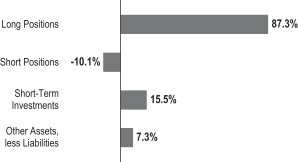

| | | | | | | | | | |

| Strategy Allocation* | |

| Based on Total Investments as of 5/31/18 | |

| | | Strategy Total | | Long

Positions | | | Short

Positions | |

Relative Value | | 30.2% | | | 35.5% | | | | -5.3% | |

Long Short Equity | | 38.0% | | | 56.2% | | | | -18.2% | |

Event Driven | | 18.4% | | | 21.5% | | | | -3.1% | |

Global Macro | | 13.4% | | | 15.5% | | | | -2.1% | |

*Figures represent the net Fund exposure and include certain derivatives held in the portfolio (or their underlying reference assets) or unsettled trades and may not total 100% or may be negative due to rounding, use of any derivatives or other factors.

| | | | |

| Subadvisors | | | |

| 5/31/18 | | | |

| |

| Long Short Equity | | | | |

Chilton Investment Company, LLC | | | | |

Impala Asset Management LLC | | | | |

Jennison Associates, LLC | | | | |

Portland Hill Asset Management Limited | | | | |

Wellington Management Company, LLP | | | | |

| |

| Relative Value | | | | |

Basso Capital Management, L.P. | | | | |

Chatham Asset Management, LLC | | | | |

Lazard Asset Management, LLC | | | | |

Loomis Sayles & Company, L.P. | | | | |

| |

| Event Driven | | | | |

Halcyon Arbitrage IC Management LP | | | | |

P. Schoenfeld Asset Management L.P. | | | | |

| |

| Global Macro | | | | |

Emso Asset Management Limited | | | | |

Graham Capital Management, L.P. | | | | |

Grantham, Mayo, Van Otterloo & Co. LLC | | | | |

H2O AM LLP | | | | |

The Fund’s long short equity strategy subadvisors were Chilton Investment Company, Impala Asset Management, Jennison Associates, Portland Hill Asset Management and Wellington Management Company. Four of the five subadvisors contributed to gains for the period, led by Impala Asset Management and Jennison Associates. In contrast, Portland Hill Asset Management experienced a small decline. On a sector level, performance drivers for the strategy included information technology (IT), health care and materials. Conversely, equity index hedges and telecommunication services dampened returns. In terms of geographical exposure, positions in US, Canadian and UK equities were the top contributors to gains, while exposure to France detracted.

P. Schoenfeld Asset Management and Halcyon were the Fund’s event driven strategy subadvisors. Both subadvisors enjoyed gains for the period. In aggregate, the top performance drivers for the strategy by asset class were equities, credit and cash. No asset class detracted from the strategy’s performance over the period. In terms of sectors, utilities, consumer discretionary and IT contributed to returns, while equity index hedges detracted.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 5 | |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

The Fund’s relative value strategy subadvisors were Basso Capital Management, Chatham Asset Management, Lazard Asset Management and Loomis Sayles & Company. Three of the four subadvisors benefited performance during the period, with Basso Capital Management the only exception. In aggregate, the top performance drivers for the strategy by asset class were credit and cash exposures, while currencies and equities were the largest detractors. In terms of aggregate sector performance, the top contributors were consumer discretionary, health care and IT. Conversely, short exposures to equity index hedges and long exposures to industrials detracted.

Graham Capital Management and Emso Asset Management represented the global macro strategy. Emso Asset Management’s gains for the 12-month period were more than offset by negative results for Graham Capital Management, and the strategy had a small decline. Currencies and government bonds detracted from performance, while long exposure to equity indexes, along with the energy and environment industry, benefited returns. The Fund added two global macro strategy subadvisors to the approved list in March—H2O AM and Grantham, Mayo, Van Otterloo & Co.—but the Fund had not allocated assets to these two subadvisors as of May 31, 2018.

Thank you for your participation in Franklin K2 Alternative Strategies Fund. We look forward to continuing to serve your investment needs.

| | |

| |

David C. Saunders |

| | |

| |

Brooks Ritchey |

| | |

| |

Robert Christian |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

David C. Saunders is the founding managing director of K2 Advisors, which he co-founded in 1994. He has worked at Tucker Anthony & R.L. Day as an equity trader; First Boston Corp. as vice president on the equity block trading desk; WaterStreet Capital, a hedge fund, as head trader; Tiger Management, as head trader; WorldSec Securities as president and ABN Amro Inc. as a senior managing director. Mr. Saunders graduated from the University of Maryland, College Park, with a B.S. degree in business.

Brooks Ritchey is a senior managing director and head of portfolio construction for K2 Advisors. Since 1987 Mr. Ritchey has managed multi-asset mutual fund and hedge fund portfolios during his employment with organizations including Steinhardt Partners, Citibank, Finch Asset Management, Paribas, AIG and ING. Mr. Ritchey joined K2 Advisors in 2005. Mr. Ritchey graduated from Franklin & Marshall College in 1982 and holds a National Futures Association Series 3 license.

Robert Christian is a senior managing director and head of investment research for K2 Advisors, which he joined in 2010. Mr. Christian worked at Graham Capital Management LP from 1998 to 2003 as a portfolio manager and researcher of quantitative-based trading strategies. At Julius Baer Investment Management from 2003 to 2005, he was the head of macro strategies. From 2005 to 2010, he worked at FRM Americas LLC where he was the global head of directional trading strategies and portfolio advisor to numerous funds. Mr. Christian holds a Bachelor of Arts and Science in biology and economics from Stanford University (1985) and an M.B.A. in finance from Leonard N. Stern School of Business – New York University (1990).

| | | | |

| 6 | | Annual Report | | franklintempleton.com |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

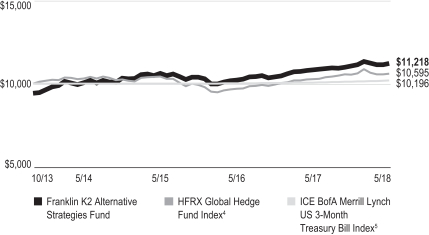

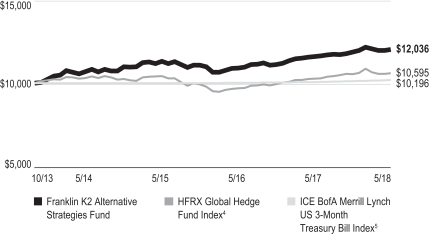

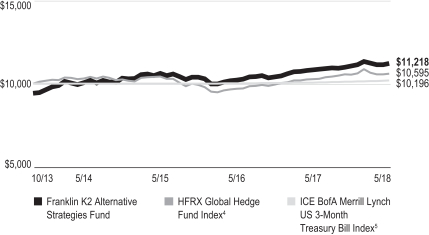

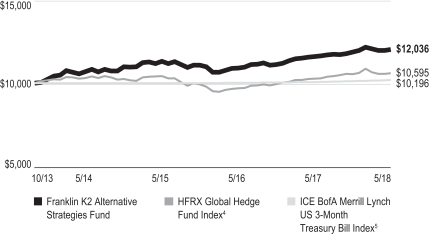

Performance Summary as of May 31, 2018

The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.75% and the minimum is 0%. Class A: 5.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

| | |

| A | | | | | | | | |

1-Year | | | +3.57% | | | | -2.39% | |

3-Year | | | +5.58% | | | | -0.16% | |

Since Inception (10/11/13) | | | +19.02% | | | | +2.51% | |

| | |

| Advisor | | | | | | | | |

1-Year | | | +3.75% | | | | +3.75% | |

3-Year | | | +6.33% | | | | +2.07% | |

Since Inception (10/11/13) | | | +20.36% | | | | +4.08% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 9 for Performance Summary footnotes.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 7 | |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

PERFORMANCE SUMMARY

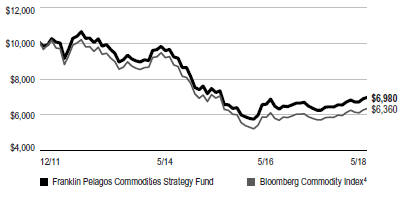

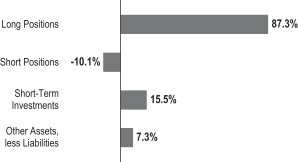

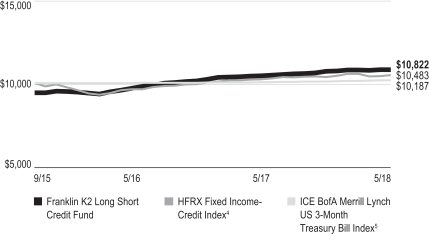

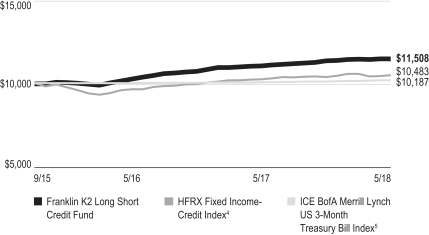

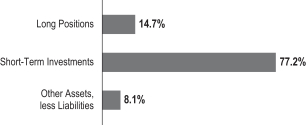

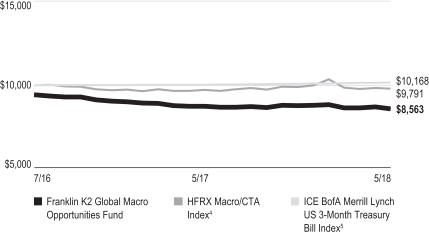

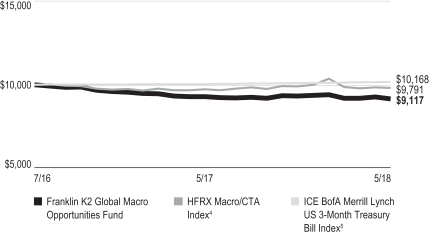

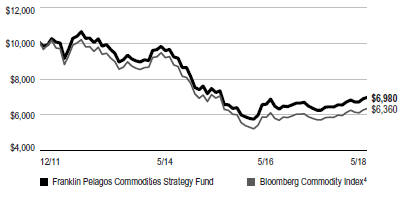

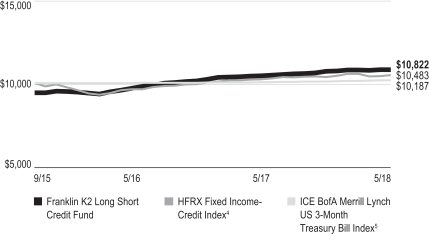

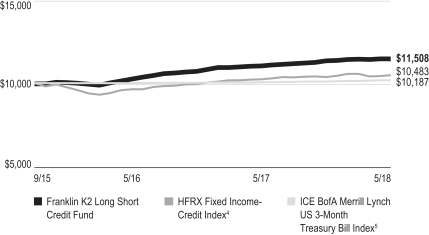

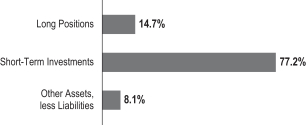

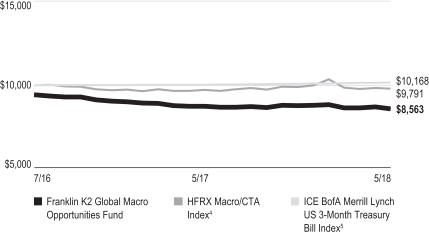

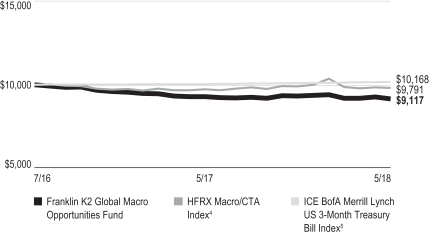

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. These differ from the Fund in composition and, except for the HFR Index, do not pay management fees or expenses. Unlike most asset class indexes, HFR Index returns reflect management fees and expenses. One cannot invest directly in an index.

Class A (10/11/13–5/31/18)

Advisor Class (10/11/13–5/31/18)

See page 9 for Performance Summary footnotes.

| | | | |

| 8 | | Annual Report | | franklintempleton.com |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

PERFORMANCE SUMMARY

Distributions (6/1/17–5/31/18)

| | | | |

| Share Class | | Dividend

Income | |

A | | | $0.1471 | |

C | | | $0.0602 | |

R | | | $0.1161 | |

R6 | | | $0.1865 | |

Advisor | | | $0.1773 | |

Total Annual Operating Expenses6

| | | | | | | | |

| Share Class | | With Waiver | | | Without Waiver | |

A | | | 2.76% | | | | 3.01% | |

Advisor | | | 2.51% | | | | 2.76% | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The market values of securities owned by the Fund will go up or down, sometimes rapidly or unpredictably. The Fund’s performance depends on the manager’s skill in selecting, overseeing and allocating Fund assets to the subadvisors. The Fund is actively managed and could experience losses if the investment manager’s and subadvisors’ judgment about particular investments made for the Fund’s portfolio prove to be incorrect. Some subadvisors may have little or no experience managing the assets of a registered investment company. Foreign investments are subject to greater investment risk such as political, economic, credit and information risks as well as risk of currency fluctuations. Investments in derivatives involve costs and create economic leverage, which may result in significant volatility and cause the Fund to participate in losses (as well as gains) that significantly exceed the Fund’s initial investment. Lower rated or high yield debt securities involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or subadvisor expects. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Merger arbitrage investments risk loss if a proposed reorganization in which the Fund invests is renegotiated or terminated. Liquidity risk exists when securities have become more difficult to sell, or are unable to be sold, at the price at which they have been valued. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/18 and a fee waiver related to the management fee paid by a subsidiary. The Fund also has a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund contractually guaranteed through 9/30/18. Fund investment results reflect the expense reduction and fee waivers; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: FactSet. Hedge Fund Research, Inc. – www.hedgefundresearch.com. The HFRX Global Hedge Fund Index is being used under license from Hedge Fund Research, Inc., which does not endorse or approve of any of the contents of this report. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is composed of all eligible hedge fund strategies, including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

5. Source: Morningstar. The ICE BofA Merrill Lynch US 3-Month Treasury Bill Index is an index of short-term US government securities with a remaining term to final maturity of less than three months.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Consolidated Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 9 | |

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 =$64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual

(actual return after expenses) | | | Hypothetical

(5% annual return before expenses) | | | | |

Share

Class | | Beginning

Account

Value 12/1/17 | | | Ending

Account

Value 5/31/18 | | | Expenses

Paid During

Period

12/1/17–5/31/181,2 | | | Ending

Account

Value 5/31/18 | | | Expenses

Paid During

Period

12/1/17–5/31/181,2 | | | Net

Annualized

Expense

Ratio2 | |

| A | | $ | 1,000 | | | $ | 1,013.90 | | | $ | 12.95 | | | $ | 1,012.07 | | | $ | 12.94 | | | | 2.58 | % |

| C | | $ | 1,000 | | | $ | 1,009.80 | | | $ | 16.69 | | | $ | 1,008.33 | | | $ | 16.67 | | | | 3.33 | % |

| R | | $ | 1,000 | | | $ | 1,012.00 | | | $ | 14.20 | | | $ | 1,010.82 | | | $ | 14.19 | | | | 2.83 | % |

| R6 | | $ | 1,000 | | | $ | 1,014.70 | | | $ | 11.20 | | | $ | 1,013.81 | | | $ | 11.20 | | | | 2.23 | % |

| Advisor | | $ | 1,000 | | | $ | 1,013.90 | | | $ | 11.70 | | | $ | 1,013.31 | | | $ | 11.70 | | | | 2.33 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| 10 | | Annual Report | | franklintempleton.com |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

Consolidated Financial Highlights

Franklin K2 Alternative Strategies Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014a | |

| Class A | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 11.14 | | | $ | 10.55 | | | $ | 11.16 | | | $ | 10.64 | | | $ | 10.00 | |

| | | | |

| | | | | |

| Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)c | | | 0.01 | | | | 0.03 | | | | (0.05 | ) | | | (0.11 | ) | | | (0.02 | ) |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.38 | | | | 0.61 | | | | (0.38 | ) | | | 0.70 | | | | 0.70 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.39 | | | | 0.64 | | | | (0.43 | ) | | | 0.59 | | | | 0.68 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.15 | ) | | | (0.05 | ) | | | (0.14 | ) | | | (0.07 | ) | | | (0.04 | ) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | | | |

| | | | | |

Total distributions | | | (0.15 | ) | | | (0.05 | ) | | | (0.18 | ) | | | (0.07 | ) | | | (0.04 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | $ | 11.38 | | | $ | 11.14 | | | $ | 10.55 | | | $ | 11.16 | | | $ | 10.64 | |

| | | | |

| | | | | |

Total returnd | | | 3.57% | | | | 6.07% | | | | (3.89)% | | | | 5.53% | | | | 6.82% | |

| | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver, payments by affiliates and expense reductionf | | | 2.81% | | | | 3.07% | | | | 3.22% | | | | 3.40% | | | | 3.33% | |

| | | | | |

Expenses net of waiver, payments by affiliates and expense reductionf | | | 2.59% | | | | 2.73% | | | | 2.88% | g | | | 2.99% | g | | | 2.83% | |

| | | | | |

Expenses incurred in connection with securities sold short | | | 0.39% | | | | 0.53% | | | | 0.67% | | | | 0.65% | | | | 0.56% | |

| | | | | |

Net investment income (loss) | | | 0.06% | | | | 0.10% | | | | (0.44)% | | | | (0.95)% | | | | (0.35)% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $119,214 | | | | $119,385 | | | | $177,412 | | | | $148,991 | | | | $96,889 | |

| | | | | |

Portfolio turnover rate | | | 234.77% | | | | 209.45% | | | | 229.90% | | | | 295.81% | | | | 181.06% | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

| | | | | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | | 11 | |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014a | |

| Class C | | | | | | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 11.00 | | | $ | 10.45 | | | $ | 11.09 | | | $ | 10.60 | | | $ | 10.00 | |

| | | | |

| | | | | |

| Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)c | | | (0.08 | ) | | | (0.04 | ) | | | (0.12 | ) | | | (0.17 | ) | | | (0.08 | ) |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.39 | | | | 0.59 | | | | (0.39 | ) | | | 0.69 | | | | 0.72 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.31 | | | | 0.55 | | | | (0.51 | ) | | | 0.52 | | | | 0.64 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.06 | ) | | | — | | | | (0.09 | ) | | | (0.03 | ) | | | (0.04 | ) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | | | |

| | | | | |

Total distributions | | | (0.06 | ) | | | — | | | | (0.13 | ) | | | (0.03 | ) | | | (0.04 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | $ | 11.25 | | | $ | 11.00 | | | $ | 10.45 | | | $ | 11.09 | | | $ | 10.60 | |

| | | | |

| | | | | |

Total returnd | | | 2.82% | | | | 5.26% | | | | (4.62)% | | | | 4.87% | | | | 6.42% | |

| | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver, payments by affiliates and expense reductionf | | | 3.56% | | | | 3.79% | | | | 3.96% | | | | 4.04% | | | | 4.03% | |

| | | | | |

Expenses net of waiver, payments by affiliates and expense reductionf | | | 3.34% | | | | 3.45% | | | | 3.62% | g | | | 3.63% | g | | | 3.53% | |

| | | | | |

Expenses incurred in connection with securities sold short | | | 0.39% | | | | 0.53% | | | | 0.67% | | | | 0.65% | | | | 0.56% | |

| | | | | |

Net investment income (loss) | | | (0.69)% | | | | (0.62)% | | | | (1.18)% | | | | (1.59)% | | | | (1.05)% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $53,196 | | | | $55,496 | | | | $71,154 | | | | $37,937 | | | | $16,618 | |

| | | | | |

Portfolio turnover rate | | | 234.77% | | | | 209.45% | | | | 229.90% | | | | 295.81% | | | | 181.06% | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| 12 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014a | |

| Class R | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 11.17 | | | $ | 10.61 | | | $ | 11.15 | | | $ | 10.62 | | | $ | 10.00 | |

| | | | |

| | | | | |

| Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)c | | | (0.02 | ) | | | (0.25 | ) | | | (0.10 | ) | | | (0.16 | ) | | | (0.05 | ) |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.39 | | | | 0.86 | | | | (0.40 | ) | | | 0.73 | | | | 0.71 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.37 | | | | 0.61 | | | | (0.50 | ) | | | 0.57 | | | | 0.66 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.12 | ) | | | (0.05 | ) | | | — | | | | (0.04 | ) | | | (0.04 | ) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | | | |

| | | | | |

Total distributions | | | (0.12 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | $ | 11.42 | | | $ | 11.17 | | | $ | 10.61 | | | $ | 11.15 | | | $ | 10.62 | |

| | | | |

| | | | | |

Total returnd | | | 3.28% | | | | 5.79% | | | | (4.51)% | | | | 5.39% | | | | 6.62% | |

| | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver, payments by affiliates and expense reductionf | | | 3.06% | | | | 3.32% | | | | 3.46% | | | | 3.57% | | | | 3.63% | |

| | | | | |

Expenses net of waiver, payments by affiliates and expense reductionf | | | 2.84% | | | | 2.98% | | | | 3.12% | g | | | 3.16% | g | | | 3.13% | |

| | | | | |

Expenses incurred in connection with securities sold short | | | 0.39% | | | | 0.53% | | | | 0.67% | | | | 0.65% | | | | 0.56% | |

| | | | | |

Net investment income (loss) | | | (0.19)% | | | | (0.15)% | | | | (0.68)% | | | | (1.12)% | | | | (0.65)% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $648 | | | | $597 | | | | $341 | | | | $9,173 | | | | $11,660 | |

| | | | | |

Portfolio turnover rate | | | 234.77% | | | | 209.45% | | | | 229.90% | | | | 295.81% | | | | 181.06% | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

| | | | | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | | 13 | |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014a | |

| Class R6 | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 11.17 | | | $ | 10.59 | | | $ | 11.18 | | | $ | 10.66 | | | $ | 10.00 | |

| | | | |

| | | | | |

| Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)c | | | 0.03 | | | | 0.02 | | | | (0.01 | ) | | | (0.08 | ) | | | (0.01 | ) |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.40 | | | | 0.65 | | | | (0.37 | ) | | | 0.70 | | | | 0.71 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.43 | | | | 0.67 | | | | (0.38 | ) | | | 0.62 | | | | 0.70 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.19 | ) | | | (0.09 | ) | | | (0.17 | ) | | | (0.10 | ) | | | (0.04 | ) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | | | |

| | | | | |

Total distributions | | | (0.19 | ) | | | (0.09 | ) | | | (0.21 | ) | | | (0.10 | ) | | | (0.04 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | $ | 11.41 | | | $ | 11.17 | | | $ | 10.59 | | | $ | 11.18 | | | $ | 10.66 | |

| | | | |

| | | | | |

Total returnd | | | 3.83% | | | | 6.40% | | | | (3.45)% | | | | 5.80% | | | | 7.02% | |

| | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver, payments by affiliates and expense reductionf | | | 2.46% | | | | 2.73% | | | | 2.87% | | | | 2.98% | | | | 3.19% | |

| | | | | |

Expenses net of waiver, payments by affiliates and expense reductionf | | | 2.24% | | | | 2.39% | | | | 2.53% | g | | | 2.60% | g | | | 2.69% | |

| | | | | |

Expenses incurred in connection with securities sold short | | | 0.39% | | | | 0.53% | | | | 0.67% | | | | 0.65% | | | | 0.56% | |

| | | | | |

Net investment income (loss) | | | 0.41% | | | | 0.44% | | | | (0.09)% | | | | (0.56)% | | | | (0.21)% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $31,805 | | | | $265,247 | | | | $265,517 | | | | $239,754 | | | | $215,526 | |

| | | | | |

Portfolio turnover rate | | | 234.77% | | | | 209.45% | | | | 229.90% | | | | 295.81% | | | | 181.06% | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| 14 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014a | |

| Advisor Class | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 11.16 | | | $ | 10.58 | | | $ | 11.18 | | | $ | 10.65 | | | $ | 10.00 | |

| | | | |

| | | | | |

| Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)c | | | 0.04 | | | | 0.04 | | | | (0.02 | ) | | | (0.02 | ) | | | (0.02 | ) |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.38 | | | | 0.62 | | | | (0.38 | ) | | | 0.64 | | | | 0.71 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.42 | | | | 0.66 | | | | (0.40 | ) | | | 0.62 | | | | 0.69 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.18 | ) | | | (0.08 | ) | | | (0.16 | ) | | | (0.09 | ) | | | (0.04 | ) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | | | |

| | | | | |

Total distributions | | | (0.18 | ) | | | (0.08 | ) | | | (0.20 | ) | | | (0.09 | ) | | | (0.04 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | $ | 11.40 | | | $ | 11.16 | | | $ | 10.58 | | | $ | 11.18 | | | $ | 10.65 | |

| | | | |

| | | | | |

Total returnd | | | 3.75% | | | | 6.29% | | | | (3.58)% | | | | 5.88% | | | | 6.92% | |

| | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver, payments by affiliates and expense reductionf | | | 2.56% | | | | 2.82% | | | | 2.96% | | | | 3.07% | | | | 3.21% | |

| | | | | |

Expenses net of waiver, payments by affiliates and expense reductionf | | | 2.34% | | | | 2.48% | | | | 2.62% | g | | | 2.66% | g | | | 2.71% | |

| | | | | |

Expenses incurred in connection with securities sold short | | | 0.39% | | | | 0.53% | | | | 0.67% | | | | 0.65% | | | | 0.56% | |

| | | | | |

Net investment income (loss) | | | 0.31% | | | | 0.35% | | | | (0.18)% | | | | (0.62)% | | | | (0.23)% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $896,278 | | | | $674,828 | | | | $722,216 | | | | $329,139 | | | | $54,593 | |

| | | | | |

Portfolio turnover rate | | | 234.77% | | | | 209.45% | | | | 229.90% | | | | 295.81% | | | | 181.06% | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

| | | | | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | | 15 | |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

Consolidated Statement of Investments, May 31, 2018

| | | | | | | | | | | | | | |

| Franklin K2 Alternative Strategies Fund | | | | | | | | | |

| | | | | Country | | | Shares/

Warrants | | | Value | |

| | | Common Stocks and Other Equity Interests 47.7% | | | | | | | | | |

| | | Aerospace & Defense 1.3% | | | | | | | | | |

| | Airbus SE | | | France | | | | 15,264 | | | $ | 1,736,427 | |

| a | | The Boeing Co. | | | United States | | | | 1,541 | | | | 542,678 | |

| | Harris Corp. | | | United States | | | | 9,578 | | | | 1,441,202 | |

| | Heico Corp. | | | United States | | | | 25,750 | | | | 2,365,395 | |

| a | | Lockheed Martin Corp. | | | United States | | | | 8,035 | | | | 2,527,329 | |

| b | | Mercury Systems Inc. | | | United States | | | | 8,110 | | | | 299,502 | |

| | Northrop Grumman Corp. | | | United States | | | | 178 | | | | 58,251 | |

| a | | Rockwell Collins Inc. | | | United States | | | | 37,410 | | | | 5,144,249 | |

| | United Technologies Corp. | | | United States | | | | 778 | | | | 97,110 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 14,212,143 | |

| | | | | | | | | | | | | | |

| | | Air Freight & Logistics 0.4% | | | | | | | | | |

| a | | FedEx Corp. | | | United States | | | | 15,719 | | | | 3,915,917 | |

| | | | | | | | | | | | | | |

| | | Airlines 0.1% | | | | | | | | | |

| | Delta Air Lines Inc. | | | United States | | | | 722 | | | | 39,024 | |

| a | | Southwest Airlines Co. | | | United States | | | | 24,773 | | | | 1,265,405 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 1,304,429 | |

| | | | | | | | | | | | | | |

| | | Auto Components 0.0%† | | | | | | | | | |

| | Aptiv PLC | | | United States | | | | 389 | | | | 37,927 | |

| | | | | | | | | | | | | | |

| | | Automobiles 0.4% | | | | | | | | | |

| | General Motors Co. | | | United States | | | | 1,267 | | | | 54,101 | |

| b,c | | Tesla Inc. | | | United States | | | | 5,101 | | | | 1,452,408 | |

| | Thor Industries Inc. | | | United States | | | | 31,137 | | | | 2,883,286 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 4,389,795 | |

| | | | | | | | | | | | | | |

| | | Banks 0.5% | | | | | | | | | |

| | Bank of America Corp. | | | United States | | | | 3,223 | | | | 93,596 | |

| | Barclays PLC, ADR | | | United Kingdom | | | | 108,406 | | | | 284,241 | |

| | BB&T Corp. | | | United States | | | | 1,427 | | | | 74,917 | |

| a | | Citigroup Inc. | | | United States | | | | 67,540 | | | | 4,504,243 | |

| | JPMorgan Chase & Co. | | | United States | | | | 1,610 | | | | 172,286 | |

| | Pacwest Bancorp | | | United States | | | | 1,201 | | | | 63,725 | |

| | The PNC Financial Services Group Inc. | | | United States | | | | 581 | | | | 83,321 | |

| | Wells Fargo & Co. | | | United States | | | | 1,193 | | | | 64,410 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 5,340,739 | |

| | | | | | | | | | | | | | |

| | | Beverages 0.5% | | | | | | | | | |

| a | | Brown-Forman Corp., B | | | United States | | | | 1,136 | | | | 64,252 | |

| a | | Constellation Brands Inc., A | | | United States | | | | 5,764 | | | | 1,285,833 | |

| | Davide Campari-Milano SpA | | | Italy | | | | 471,498 | | | | 3,522,180 | |

| | PepsiCo Inc. | | | United States | | | | 961 | | | | 96,340 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 4,968,605 | |

| | | | | | | | | | | | | | |

| | | Biotechnology 3.3% | | | | | | | | | |

| | Abbvie Inc. | | | United States | | | | 2,513 | | | | 248,636 | |

| b | | Aeglea BioTherapeutics Inc. | | | United States | | | | 17,146 | | | | 183,119 | |

| b | | Agios Pharmaceuticals Inc. | | | United States | | | | 3,544 | | | | 331,364 | |

| b,c | | Aileron Therapeutics Inc. | | | United States | | | | 5,954 | | | | 30,723 | |

| b | | Aimmune Therapeutics Inc. | | | United States | | | | 8,546 | | | | 282,787 | |

| b | | Alexion Pharmaceuticals Inc. | | | United States | | | | 12,393 | | | | 1,439,199 | |

| b | | Amicus Therapeutics Inc. | | | United States | | | | 98,781 | | | | 1,669,399 | |

| | | | |

| 16 | | Annual Report | | franklintempleton.com |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country | | | Shares/

Warrants | | | Value | |

| | | Common Stocks and Other Equity Interests (continued) | | | | | | | | | |

| | | Biotechnology (continued) | | | | | | | | | |

| b | | Apellis Pharmaceuticals Inc. | | | United States | | | | 10,889 | | | $ | 222,244 | |

| b | | Argenx SE, ADR | | | Netherlands | | | | 5,908 | | | | 564,214 | |

| b | | Audentes Therapeutics Inc. | | | United States | | | | 20,098 | | | | 761,714 | |

| b | | BioCryst Pharmaceuticals Inc. | | | United States | | | | 63,655 | | | | 409,302 | |

| b | | Biogen Inc. | | | United States | | | | 2,879 | | | | 846,311 | |

| b | | BioMarin Pharmaceutical Inc. | | | United States | | | | 43,160 | | | | 3,899,074 | |

| b | | Bluebird Bio Inc. | | | United States | | | | 10,782 | | | | 1,930,517 | |

| b | | Blueprint Medicines Corp. | | | United States | | | | 4,108 | | | | 345,401 | |

| b | | Celgene Corp. | | | United States | | | | 15,159 | | | | 1,192,710 | |

| b | | Clovis Oncology Inc. | | | United States | | | | 13,576 | | | | 637,529 | |

| b | | DBV Technologies SA, ADR | | | France | | | | 23,073 | | | | 519,143 | |

| b | | Eiger Biopharmaceuticals Inc. | | | United States | | | | 18,528 | | | | 264,024 | |

| b,c | | Epizyme Inc. | | | United States | | | | 40,259 | | | | 702,520 | |

| b | | Exact Sciences Corp. | | | United States | | | | 19,744 | | | | 1,175,558 | |

| b | | Exelixis Inc. | | | United States | | | | 43,461 | | | | 900,947 | |

| b | | Fibrogen Inc. | | | United States | | | | 6,689 | | | | 360,537 | |

| b | | Foundation Medicine Inc. | | | United States | | | | 2,787 | | | | 276,331 | |

| b | | GlycoMimetics Inc. | | | United States | | | | 30,314 | | | | 541,711 | |

| b,c | | Immunomedics Inc. | | | United States | | | | 39,496 | | | | 871,282 | |

| a,b | | Incyte Corp. | | | United States | | | | 12,752 | | | | 870,579 | |

| b | | La Jolla Pharmaceutical Co. | | | United States | | | | 25,969 | | | | 810,233 | |

| a,b | | Madrigal Pharmaceuticals Inc. | | | United States | | | | 3,824 | | | | 1,015,693 | |

| b | | Mirati Therapeutics Inc. | | | United States | | | | 7,408 | | | | 314,840 | |

| b | | Natera Inc. | | | United States | | | | 41,228 | | | | 480,718 | |

| b | | Neurocrine Biosciences Inc. | | | United States | | | | 8,817 | | | | 848,724 | |

| b | | Ovid Therapeutics Inc. | | | United States | | | | 6,719 | | | | 53,013 | |

| b | | ProQR Therapeutics NV | | | Netherlands | | | | 41,964 | | | | 239,195 | |

| b | | Proteostasis Therapeutics Inc. | | | United States | | | | 65,507 | | | | 317,054 | |

| b | | Puma Biotechnology Inc. | | | United States | | | | 4,132 | | | | 218,789 | |

| b | | Retrophin Inc. | | | United States | | | | 15,417 | | | | 431,830 | |

| b | | Sage Therapeutics Inc. | | | United States | | | | 15,960 | | | | 2,436,932 | |

| b | | Sarepta Therapeutics Inc. | | | United States | | | | 25,776 | | | | 2,419,078 | |

| b | | Savara Inc. | | | United States | | | | 11,866 | | | | 120,084 | |

| b | | Savara Inc., wts., 6/14/18 | | | United States | | | | 68,920 | | | | — | |

| a | | Shire PLC, ADR | | | United Kingdom | | | | 15,044 | | | | 2,470,827 | |

| | Shire PLC | | | United States | | | | 22,284 | | | | 1,214,548 | |

| b | | Tesaro Inc. | | | United States | | | | 7,424 | | | | 339,796 | |

| b | | Unum Therapeutics Inc. | | | United States | | | | 13,080 | | | | 161,015 | |

| b | | Vertex Pharmaceuticals Inc. | | | United States | | | | 7,308 | | | | 1,125,432 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 36,494,676 | |

| | | | | | | | | | | | | | |

| | | Building Products 0.4% | | | | | | | | | |

| a | | AO Smith Corp. | | | United States | | | | 6,371 | | | | 401,819 | |

| a,b | | Builders FirstSource Inc. | | | United States | | | | 17,693 | | | | 346,429 | |

| a | | Fortune Brands Home & Security Inc. | | | United States | | | | 37,850 | | | | 2,126,034 | |

| a,b | | USG Corp. | | | United States | | | | 31,519 | | | | 1,307,408 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 4,181,690 | |

| | | | | | | | | | | | | | |

| | | Capital Markets 0.2% | | | | | | | | | |

| | Moody’s Corp. | | | United States | | | | 13,807 | | | | 2,355,060 | |

| | | | | | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | 17 | |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country | | | Shares/

Warrants | | | Value | |

| | | Common Stocks and Other Equity Interests (continued) | | | | | | | | | |

| | | Chemicals 2.3% | | | | | | | | | |

| | Celanese Corp., A | | | United States | | | | 364 | | | $ | 41,103 | |

| a | | DowDuPont Inc. | | | United States | | | | 30,465 | | | | 1,953,111 | |

| | Huntsman Corp. | | | United States | | | | 1,374 | | | | 43,927 | |

| a,b | | Ingevity Corp. | | | United States | | | | 39,618 | | | | 3,016,515 | |

| a | | Monsanto Co. | | | United States | | | | 72,903 | | | | 9,292,217 | |

| a | | The Mosaic Co. | | | United States | | | | 17,929 | | | | 492,868 | |

| a | | Praxair Inc. | | | United States | | | | 14,917 | | | | 2,330,930 | |

| a | | The Sherwin-Williams Co. | | | United States | | | | 22,062 | | | | 8,367,013 | |

| b,d,e | | TerraVia Holdings Inc., Contingent Distribution | | | United States | | | | 1,117,000 | | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 25,537,684 | |

| | | | | | | | | | | | | | |

| | | Commercial Services & Supplies 0.6% | | | | | | | | | |

| | Atento SA | | | Spain | | | | 142,593 | | | | 1,076,577 | |

| | Cintas Corp. | | | United States | | | | 17,228 | | | | 3,139,803 | |

| | Edenred | | | France | | | | 35,790 | | | | 1,147,673 | |

| | Republic Services Inc., A | | | United States | | | | 21,190 | | | | 1,428,842 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 6,792,895 | |

| | | | | | | | | | | | | | |

| | | Communications Equipment 0.2% | | | | | | | | | |

| | Cisco Systems Inc. | | | United States | | | | 6,559 | | | | 280,135 | |

| b | | Commscope Holding Co. Inc. | | | United States | | | | 50,312 | | | | 1,475,148 | |

| b,e | | Nortel Networks Capital Corp., Contingent Distribution | | | Canada | | | | 324,000 | | | | 10,530 | |

| b,e | | Nortel Networks Ltd., Contingent Distribution | | | Canada | | | | 5,031,000 | | | | 163,507 | |

| a,b | | Quantenna Communications Inc. | | | United States | | | | 10,202 | | | | 163,232 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 2,092,552 | |

| | | | | | | | | | | | | | |

| | | Construction Materials 0.7% | | | | �� | | | | | |

| | Buzzi Unicem SpA | | | Italy | | | | 22,966 | | | | 554,685 | |

| b | | Cemex SAB de CV, ADR | | | Mexico | | | | 80,904 | | | | 482,188 | |

| | HeidelbergCement AG | | | Germany | | | | 29,195 | | | | 2,587,072 | |

| a | | Martin Marietta Materials Inc. | | | United States | | | | 14,382 | | | | 3,205,316 | |

| a,b | | Summit Materials Inc., A | | | United States | | | | 45,583 | | | | 1,295,469 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 8,124,730 | |

| | | | | | | | | | | | | | |

| | | Consumer Finance 0.3% | | | | | | | | | |

| b,d | | iPayment Inc. | | | United States | | | | 4,383,614 | | | | 3,550,727 | |

| | | | | | | | | | | | | | |

| | | Containers & Packaging 0.6% | | | | | | | | | |

| a | | Ball Corp. | | | United States | | | | 189,079 | | | | 6,986,469 | |

| | WestRock Co. | | | United States | | | | 542 | | | | 31,913 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 7,018,382 | |

| | | | | | | | | | | | | | |

| | | Diversified Consumer Services 0.1% | | | | | | | | | |

| b | | Bright Horizons Family Solutions Inc. | | | United States | | | | 7,890 | | | | 798,468 | |

| | | | | | | | | | | | | | |

| | | Diversified Financial Services 0.3% | | | | | | | | | |

| a,b | | Berkshire Hathaway Inc., B | | | United States | | | | 17,817 | | | | 3,412,490 | |

| | | | | | | | | | | | | | |

| | | Diversified Telecommunication Services 0.4% | | | | | | | | | |

| | AT&T Inc. | | | United States | | | | 758 | | | | 24,499 | |

| | CenturyLink Inc. | | | United States | | | | 2,761 | | | | 50,305 | |

| | China Unicom Hong Kong Ltd., ADR | | | China | | | | 48,546 | | | | 659,740 | |

| b | | ORBCOMM Inc. | | | United States | | | | 60,703 | | | | 586,391 | |

| | | | |

| 18 | | Annual Report | | franklintempleton.com |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country | | | Shares/

Warrants | | | Value | |

| | | Common Stocks and Other Equity Interests (continued) | | | | | | | | | |

| | | Diversified Telecommunication Services (continued) | | | | | | | | | |

| b,f | | Telecom Italia SpA | | | Italy | | | | 2,548,291 | | | $ | 2,047,213 | |

| a | | Verizon Communications Inc. | | | United States | | | | 16,082 | | | | 766,629 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 4,134,777 | |

| | | | | | | | | | | | | | |

| | | Electric Utilities 0.0%† | | | | | | | | | |

| | American Electric Power Co. Inc. | | | United States | | | | 501 | | | | 34,043 | |

| | Exelon Corp. | | | United States | | | | 1,906 | | | | 78,889 | |

| | NextEra Energy Inc. | | | United States | | | | 704 | | | | 116,730 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 229,662 | |

| | | | | | | | | | | | | | |

| | | Electrical Equipment 0.0%† | | | | | | | | | |

| | General Cable Corp. | | | United States | | | | 6,483 | | | | 192,221 | |

| | | | | | | | | | | | | | |

| | | Electronic Equipment, Instruments & Components 0.7% | |

| | Chroma Ate Inc. | | | Taiwan | | | | 84,000 | | | | 419,138 | |

| b | | Fabrinet | | | Thailand | | | | 22,024 | | | | 773,703 | |

| b | | Flex Ltd. | | | Singapore | | | | 193,718 | | | | 2,690,743 | |

| b | | II-VI Inc. | | | United States | | | | 38,595 | | | | 1,696,250 | |

| b | | IPG Photonics Corp. | | | United States | | | | 3,088 | | | | 745,042 | |

| b | | Itron Inc. | | | United States | | | | 5,811 | | | | 331,808 | |

| | Sunny Optical Technology Group Co. Ltd. | | | China | | | | 21,700 | | | | 441,570 | |

| b | | Zebra Technologies Corp., A | | | United States | | | | 4,747 | | | | 728,712 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 7,826,966 | |

| | | | | | | | | | | | | | |

| | | Energy Equipment & Services 0.0%† | | | | | | | | | |

| | Patterson-UTI Energy Inc. | | | United States | | | | 2,175 | | | | 44,979 | |

| a,c | | RPC Inc. | | | United States | | | | 22,325 | | | | 366,576 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 411,555 | |

| | | | | | | | | | | | | | |

| | | Equity Real Estate Investment Trusts (REITs) 0.0%† | | | | | | | | | |

| | Lasalle Hotel Properties | | | United States | | | | 12,913 | | | | 442,916 | |

| | | | | | | | | | | | | | |

| | | Food & Staples Retailing 0.3% | | | | | | | | | |

| a | | Costco Wholesale Corp. | | | United States | | | | 17,624 | | | | 3,493,782 | |

| | Wal-Mart Stores, Inc. | | | United States | | | | 532 | | | | 43,911 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,537,693 | |

| | | | | | | | | | | | | | |

| | | Food Products 0.1% | | | | | | | | | |

| | Chocoladefabriken Lindt & Spruengli AG | | | Switzerland | | | | 13 | | | | 982,650 | �� |

| | The JM Smucker Co. | | | United States | | | | 4,160 | | | | 447,200 | |

| | Mondelez International Inc., A | | | United States | | | | 2,100 | | | | 82,467 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 1,512,317 | |

| | | | | | | | | | | | | | |

| | | Health Care Equipment & Supplies 1.2% | | | | | | | | | |

| | Abbott Laboratories | | | United States | | | | 13,377 | | | | 823,087 | |

| b | | Align Technology Inc. | | | United States | | | | 2,265 | | | | 751,867 | |

| b | | Axogen Inc. | | | United States | | | | 7,495 | | | | 368,004 | |

| b | | Boston Scientific Corp. | | | United States | | | | 39,936 | | | | 1,213,655 | |

| b | | DexCom Inc. | | | United States | | | | 14,196 | | | | 1,249,106 | |

| b | | Edwards Lifesciences Corp. | | | United States | | | | 7,560 | | | | 1,038,064 | |

| b | | Haemonetics Corp. | | | United States | | | | 14,537 | | | | 1,313,418 | |

| b | | IDEXX Laboratories Inc. | | | United States | | | | 13,099 | | | | 2,727,343 | |

| b | | Inogen Inc. | | | United States | | | | 764 | | | | 139,575 | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | 19 | |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS

Franklin K2 Alternative Strategies Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country | | | Shares/

Warrants | | | Value | |

| | | Common Stocks and Other Equity Interests (continued) | | | | | | | | | |

| | | Health Care Equipment & Supplies (continued) | | | | | | | | | |

| b | | iRhythm Technologies Inc. | | | United States | | | | 1,840 | | | $ | 139,895 | |

| | Medtronic PLC | | | United States | | | | 1,230 | | | | 106,174 | |

| b | | Nevro Corp. | | | United States | | | | 15,727 | | | | 1,237,558 | |

| b,g | | Siemens Healthineers AG, 144A | | | Germany | | | | 7,564 | | | | 300,694 | |

| | Smith & Nephew PLC | | | United Kingdom | | | | 91,292 | | | | 1,660,792 | |

| | West Pharmaceutical Services Inc. | | | United States | | | | 3,921 | | | | 364,653 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 13,433,885 | |

| | | | | | | | | | | | | | |

| | | Health Care Providers & Services 1.7% | | | | | | | | | |

| a | | Aetna Inc. | | | United States | | | | 38,147 | | | | 6,718,832 | |

| b | | Centene Corp. | | | United States | | | | 14,112 | | | | 1,653,362 | |

| | Cigna Corp. | | | United States | | | | 9,736 | | | | 1,648,986 | |

| b | | Express Scripts Holding Co. | | | United States | | | | 11,446 | | | | 867,721 | |

| b | | Healthequity Inc. | | | United States | | | | 3,875 | | | | 287,951 | |

| a | | Humana Inc. | | | United States | | | | 6,912 | | | | 2,011,254 | |

| b | | Laboratory Corp. of America Holdings | | | United States | | | | 205 | | | | 37,021 | |

| a | | UnitedHealth Group Inc. | | | United States | | | | 20,828 | | | | 5,030,170 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 18,255,297 | |

| | | | | | | | | | | | | | |

| | | Health Care Technology 0.1% | | | | | | | | | |

| b | | Inspire Medical Systems Inc. | | | United States | | | | 1,670 | | | | 50,100 | |

| b | | Tabula Rasa HealthCare Inc. | | | United States | | | | 9,382 | | | | 511,788 | |

| b | | Teladoc Inc. | | | United States | | | | 5,924 | | | | 301,532 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 863,420 | |

| | | | | | | | | | | | | | |

| | | Hotels, Restaurants & Leisure 1.3% | | | | | | | | | |

| | Carnival Corp. | | | United States | | | | 47,128 | | | | 2,935,132 | |

| a | | Domino’s Pizza Inc. | | | United States | | | | 9,285 | | | | 2,334,992 | |

| | Hilton Worldwide Holdings Inc. | | | United States | | | | 1,478 | | | | 119,289 | |

| a | | Marriott International Inc., A | | | United States | | | | 12,952 | | | | 1,753,183 | |

| | McDonald’s Corp. | | | United States | | | | 651 | | | | 104,166 | |

| b | | Norwegian Cruise Line Holdings Ltd. | | | United States | | | | 55,989 | | | | 2,930,464 | |

| | Restaurant Brands International Inc. | | | Canada | | | | 44,780 | | | | 2,642,916 | |

| | Royal Caribbean Cruises Ltd. | | | United States | | | | 5,168 | | | | 542,537 | |

| b,c | | Seaworld Entertainment Inc. | | | United States | | | | 77,587 | | | | 1,377,169 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 14,739,848 | |

| | | | | | | | | | | | | | |

| | | Household Durables 0.3% | | | | | | | | | |

| a | | D.R. Horton Inc. | | | United States | | | | 23,436 | | | | 989,233 | |

| b,c | | iRobot Corp. | | | United States | | | | 6,161 | | | | 384,508 | |

| b | | NVR Inc. | | | United States | | | | 326 | | | | 974,916 | |

| b,c | | Roku Inc., A | | | United States | | | | 21,584 | | | | 808,537 | |

| | | | | | | | | | | | | | |