UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-22641

__Franklin Alternative Strategies Funds

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: _650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: _5/31/14

Item 1. Reports to Stockholders.

| Contents | |||||

| Shareholder Letter | 1 | Annual Report | |||

| Franklin K2 Alternative Strategies | Notes to Consolidated Financial | ||||

| Fund | 3 | Statements | 79 | ||

| Performance Summary | 9 | Report of Independent Registered | |||

| Public Accounting Firm | 100 | ||||

| Your Fund’s Expenses | 15 | ||||

| Tax Information | 101 | ||||

| Consolidated Financial Highlights and | |||||

| Consolidated Statement of | Board Members and Officers | 102 | |||

| Investments | 17 | ||||

| Shareholder Information | 107 | ||||

| Consolidated Financial Statements | 74 | ||||

| 1

Annual Report

Franklin K2 Alternative Strategies Fund

Your Fund’s Goal and Main Investments: Franklin K2 Alternative Strategies Fund seeks capital appreciation with lower volatility relative to the broad equity markets. The Fund seeks to achieve its investment goal by allocating its assets across multiple non-traditional or “alternative” strategies, including but not limited to long short equity, event driven, relative value and global macro. The Fund is structured as a multi-manager fund, meaning the Fund’s assets are independently managed by multiple investment managers (subadvisors), while the Fund’s investment manager retains overall responsibility for the Fund’s investments. The Fund may invest in a wide range of securities and other investments including, but not limited to: equity securities including common stocks, preferred stocks, convertible securities, rights and warrants, private and registered investment vehicles and exchange-traded funds (ETFs); and debt securities including bonds, notes, debentures and commercial paper; loans and loan participations; and mortgage-backed or other asset-backed securities, including collateralized debt obligations; as well as derivatives, commodities and currencies.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin K2 Alternative Strategies Fund’s inaugural annual report for the period from the Fund’s inception on October 11, 2013, through May 31, 2014.

Performance Overview

For the period under review, Franklin K2 Alternative Strategies Fund –Class A delivered a +6.82% cumulative total return. For comparison, the Fund’s primary benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, which tracks the performance of short-term U.S. government securities with a remaining term to final maturity of less than three months, produced a +0.03% total return.1, 2 Also for comparison, the Fund’s secondary benchmark, the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe, generated a +2.74% total return.3, 4 You can find more of the Fund’s performance data in the Performance Summary beginning on page 9.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI). The Consolidated SOI begins on page 22.

Annual Report | 3

*Portfolio breakdown figures are stated as a percentage of total investments and may not equal 100% or may be negative due to rounding, use of any derivatives, unsettled trades or other factors.

Economic and Market Overview

During the period from October 11, 2013, through May 31, 2014, the global economy grew moderately as many developed markets continued to recover and many emerging markets recorded continued growth. Major developed market central banks reaffirmed their accommodative monetary policies in an effort to support the ongoing recovery. In emerging markets, many central banks cut interest rates to boost economic growth, while others raised rates to control inflation and currency depreciation.

U.S. economic growth and employment trends were generally encouraging during the period, despite severe weather across many states in early 2014 that suppressed economic activity. In October 2013, a budget impasse resulted in a temporary federal government shutdown. However, Congress passed a spending bill in January to fund the federal government through September 2014. Congress also approved the suspension of the debt ceiling until March 2015. The U.S. Federal Reserve Board (Fed) began reducing bond purchases by $10 billion a month in January 2014, based on continued favorable economic and employment data.

Outside the U.S., the U.K. economy grew, supported by the services and manufacturing sectors. Economic activity was slower in Japan, although business sentiment and private consumption improved and unemployment reached its lowest level since 2007. Despite a relatively weak yen, export growth slowed toward period-end, resulting partly from lower shipments to

4 | Annual Report

the U.S. and China. The Bank of Japan kept its monetary policy unchanged as it maintained an upbeat inflation forecast and reiterated that the economy continued to recover moderately, despite challenges resulting from a sales tax increase in April. Although out of recession, the eurozone experienced weak employment trends and deflationary risks. The German parliament’s reelection of Chancellor Angela Merkel and the European Central Bank’s (ECB’s) highly accommodative monetary policy contributed to investor confidence in the region. However, economic growth remained subdued, and near period-end the ECB announced that it would provide additional stimulus should deflationary risks increase.

In several emerging markets, including China, growth remained solid though moderating, as domestic demand and exports were relatively soft. Emerging market equities generally rose for the period, despite volatility resulting from concerns about moderating economic growth, geopolitical tensions in certain regions and the potential impact of the Fed’s tapering its asset purchases. Many emerging market currencies depreciated against the U.S. dollar, leading central banks in several countries, including Brazil, India, Turkey, South Africa and Russia, to raise interest rates in an effort to curb inflation and support their currencies.

Stocks in developed markets rallied during the period amid a generally accommodative monetary policy environment, continued strength in corporate earnings and signs of an economic recovery. Global government and corporate bonds delivered solid performance as interest rates in many developed market countries remained low. Gold prices declined for the period despite rallying in early 2014, while oil prices generally rose amid supply concerns related to geopolitical tensions.

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we allocate assets to multiple sub-advisors, each of whom independently manages a separate portion of the Fund’s portfolio in accordance with some or all of the following strategies: long short equity, event driven, relative value and global macro. We allocate the Fund’s assets among these strategies utilizing a top-down approach, generating strategy weightings by taking into account market conditions, risk factors, diversification, liquidity, transparency, and availability of various subadvisors and other investment options, among other things. The allocations to the strategies may change from time to time based upon our assessment of their correlations to various markets and to each other, their risk profiles and return expectations. Long short equity strategies generally seek to produce returns from investments in the global equity markets by

| Subadvisors |

| 5/31/14 |

| Long Short Equity |

| Chilton Investment Company, LLC |

| Impala Asset Management, LLC |

| Independence Capital Asset Partners, LLC |

| Jennison Associates, LLC |

| Wellington Management Company, LLP |

| Event Driven |

| P. Schoenfeld Asset Management L.P. |

| York Registered Holdings, L.P. |

| Relative Value |

| Basso Capital Management, L.P. |

| Chatham Asset Management, LLC |

| Lazard Asset Management, LLC |

| Loomis Sayles & Company, L.P. |

| Global Macro |

| Graham Capital Management, L.P. |

Annual Report | 5

What is a futures contract?

A futures contract, also called a “future,” is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell an asset at a specific price on a future date.

What is a swap agreement?

A swap agreement, such as an equity total return swap, is a contract between the Fund and a counterparty to exchange on a future date the returns, or differentials in rates of return, that would have been earned or realized if a notional amount were invested in specific instruments.

A credit default swap, or CDS, is an agreement between two parties whereby the buyer receives credit protection from the seller. The buyer makes periodic payments over the term of the agreement in return for a payment by the seller in the event of a default or other credit event.

taking long and short positions in stocks and common stock indexes (through the use of derivatives or through a short position in an ETF). Event driven strategies generally invest in securities of companies undergoing significant corporate changes and new developments. Relative value strategies encompass a wide range of investment techniques that are intended to profit from pricing inefficiencies. Global macro strategies generally focus on major economic opportunities across numerous markets and investments.

The Fund may take long and/or short positions in a wide range of asset classes, including equities, fixed income, commodities and currencies, among others. Long positions benefit from an increase in the price of the underlying instrument or asset class, while short positions benefit from a decrease in that price. The Fund may use derivatives for hedging and nonhedging (investment) purposes. Such derivative investments may include futures contracts, swaps, options and currency forward contracts. The Fund may engage in active and frequent trading as part of its investment strategies.

Manager’s Discussion

All four strategies in which the Fund’s assets were allocated contributed to absolute performance during the period, with performance attribution generally dispersed evenly across relative value, event driven and long short equity, while global macro lagged.

The Fund’s relative value strategy managers were Basso Capital Management, Chatham Asset Management, Lazard Asset Management and Loomis Sayles & Co. The relative value strategy was the largest contributor, as all subadvisors generated positive returns for the period. Convertible arbitrage was a notable substrategy performer. Other performance drivers were broad based and included security selection in European and North American bonds and equities, investment-grade new issues and residential mortgage-backed securities. Against a backdrop of rising equity markets, hedges were the one consistent detractor, primarily in the forms of equity and credit index futures, options and swaps, along with several single-issuer short exposures.

Our event driven strategy managers were P. Schoenfeld Asset Management and York Registered Holdings. Both subadvisors contributed strong positive performance for the period, as they benefited from a diverse set of trading opportunities that included special situations equity, credit and merger arbi-trage. Performance drivers included holdings in the telecommunication services and energy sectors, as well as sovereign fixed income positions, following several positive event catalysts such as continued sector consolidations and supportive regulatory regimes.5 Detractors tended to be portfolio hedges as well as soft catalyst event-driven positions that sold off

6 | Annual Report

more than the market. A soft catalyst is an expected event without a defined timeline, such as a restructuring.

The Fund’s long short equity strategy managers were Chilton Investment Co., Impala Asset Management, Independent Capital Asset Partners, Jenni-son Associates and Wellington Management Co. The long short equity strategy generated positive performance for the period. Long positions in several biopharmaceutical companies proved beneficial as favorable drug approvals in orphan diseases and oncology drove returns, as did several acquisitions, initial public offerings and strategic partnerships. Other meaningful contributors for the strategy included long positions in the consumer non-cyclical (e.g., health care), consumer cyclical (e.g., consumer discretionary), industrials and materials sectors.6 Detractors included short exposures to indexes and the utilities sector through positions in ETFs.7

Our global macro strategy manager was Graham Capital Management. The global macro strategy underperformed the other strategies as sharp intramonth market reversals posed challenges for this tactical trading strategy. In aggregate, the strategy’s fixed income and commodity positions tended to drive positive performance while equity and currency positions generally detracted.

Thank you for your participation in Franklin K2 Alternative Strategies Fund. We look forward to continuing to serve your investment needs.

What is an option?

An option is a contract to buy or sell a specific financial product known as the option’s underlying instrument at a specific price. The buyer of an option has the right, but not the obligation, to buy or sell the underlying instrument at or until a specified expiration date. Conversely,the seller(“writer”)ofan option who opens a transaction is obligated to buy or sell the underlying instrument should the option holder exercise that right.

What is a currency forward contract?

A currency forward contract, or a currency forward, is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date.

Annual Report | 7

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

1. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. Source BofA Merrill Lynch, used with permission. BOFA MERRILL LYNCH IS LICENSING THE MERRILL LYNCH INDICES “AS IS,” MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE QUALITY, ACCURACY AND/OR COMPLETENESS OF THE MERRILL LYNCH INDICES OR ANY DATA INCLUDED THEREIN OR DERIVED THEREFROM, AND ASSUMES NO LIABILITY IN CONNECTION WITH THEIR USE.

3. Source: FactSet. © 2014 FactSet Research Systems Inc. All Rights Reserved. The information contained herein: (1) is proprietary to FactSet Research Systems Inc. and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither FactSet Research Systems Inc. nor its content providers are responsible for any damages or losses arising from any use of this information.

4. Source: Hedge Fund Research, Inc. The HFRX Global Hedge Fund Index is being used under license from Hedge Fund Research, Inc., which does not endorse or approve of any of the contents of this report.

5. The telecommunication services sector comprises diversified telecommunication services, wireless telecommunication services and telecommunication services in the consolidated SOI. The energy sector comprises energy; energy equipment and services; oil, gas and consumable fuels; and pipelines in the consolidated SOI.

6. The health care sector comprises biotechnology, health care equipment and supplies, health care providers and services, health care technology, life sciences tools and services, and pharmaceuticals in the consolidated SOI. The consumer discretionary sector comprises auto components; automobiles; consumer durables and apparel; entertainment; hotels, restaurants and leisure; household durables; Internet and catalog retail; leisure equipment and products; media; multiline retail; retailing; specialty retail; and textiles, apparel and luxury goods in the consolidated SOI. The industrials sector comprises aerospace and defense, air freight and logistics, airlines, building products, commercial services and supplies, construction and engineering, electrical equipment, industrial conglomerates, machinery, marine, professional services, road and rail, trading companies and distributors, transportation, and transportation infrastructure in the consolidated SOI. The materials sector comprises chemicals, construction materials, containers and packaging, metals and mining, and paper and forest products in the consolidated SOI.

7. The utilities sector comprises electric utilities and gas utilities in the consolidated SOI.

8 | Annual Report

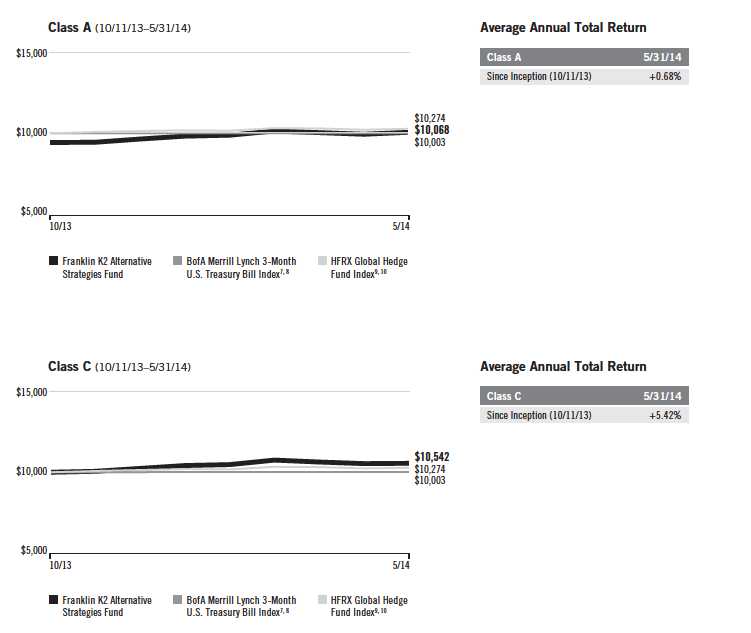

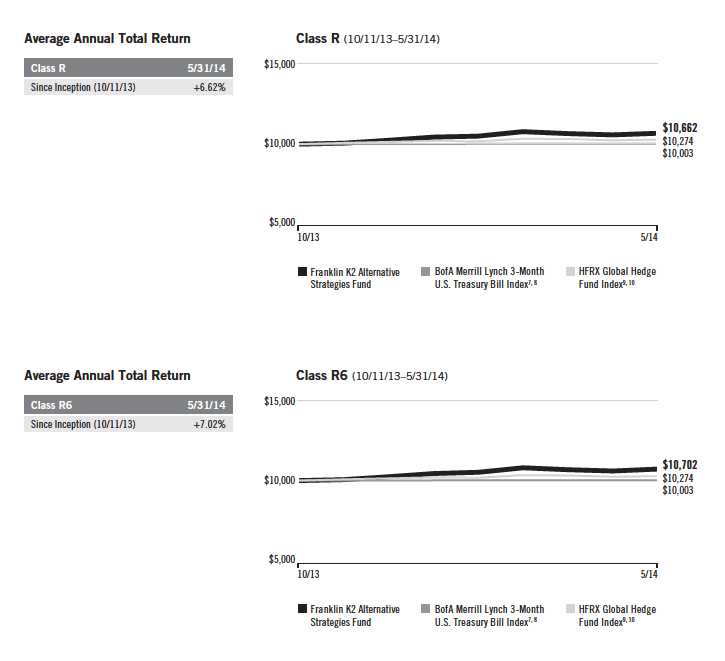

Performance Summary as of 5/31/14

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | ||||||||

| Share Class | 5/31/14 | 10/11/13 | Change | |||||

| A (FAAAX) | $ | 10.64 | $ | 10.00 | +$ | 0.64 | ||

| C (FASCX) | $ | 10.60 | $ | 10.00 | +$ | 0.60 | ||

| R (FSKKX) | $ | 10.62 | $ | 10.00 | +$ | 0.62 | ||

| R6 (FASRX) | $ | 10.66 | $ | 10.00 | +$ | 0.66 | ||

| Advisor (FABZX) | $ | 10.65 | $ | 10.00 | +$ | 0.65 | ||

| Distributions | ||||||||

| Dividend | ||||||||

| Share Class | Income | |||||||

| A | (10/11/13–5/31/14 | ) | $ | 0.0406 | ||||

| C | (10/11/13–5/31/14 | ) | $ | 0.0406 | ||||

| R | (10/11/13–5/31/14 | ) | $ | 0.0406 | ||||

| R6 | (10/11/13–5/31/14) | $ | 0.0408 | |||||

| Advisor (10/11/13–5/31/14) | $ | 0.0406 | ||||||

Annual Report | 9

Performance Summary (continued)

Performance as of 5/31/141

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges.

Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

| Value of | Average Annual | ||||||||||||||

| Cumulative | Average Annual | $ | 10,000 | Total Return | Total Annual Operating Expenses6 | ||||||||||

| Share Class | Total Return2 | Total Return3 | Investment4 | (6/30/14 | )5 | (with waiver) | (without waiver) | ||||||||

| A | 2.75 | % | 3.54 | % | |||||||||||

| Since Inception (10/11/13) | + | 6.82 | % | + | 0.68 | % | $ | 10,068 | + | 2.00 | % | ||||

| C | 3.45 | % | 4.24 | % | |||||||||||

| Since Inception (10/11/13) | + | 6.42 | % | + | 5.42 | % | $ | 10,542 | + | 6.72 | % | ||||

| R | 2.95 | % | 3.74 | % | |||||||||||

| Since Inception (10/11/13) | + | 6.62 | % | + | 6.62 | % | $ | 10,662 | + | 8.02 | % | ||||

| R6 | 2.44 | % | 3.23 | % | |||||||||||

| Since Inception (10/11/13) | + | 7.02 | % | + | 7.02 | % | $ | 10,702 | + | 8.43 | % | ||||

| Advisor | 2.45 | % | 3.24 | % | |||||||||||

| Since Inception (10/11/13) | + | 6.92 | % | + | 6.92 | % | $ | 10,692 | + | 8.32 | % | ||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

10 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 11

Performance Summary (continued)

12 | Annual Report

All investments involve risks, including possible loss of principal. The market values of securities owned by the Fund will go up or down, sometimes rapidly or unpredictably. The

Fund’s performance depends on the manager’s skill in selecting, overseeing and allocating fund assets. The Fund is actively managed and could experience losses if the

investment manager’s and subadvisors’ judgment about particular investments made for the Fund’s portfolio prove to be incorrect. Some subadvisors mayhavelittleorno

experience managing registered investment companies. Foreign investments are subject to greater investment risk such as political, economic, credit and information risks as

well as risk of currency fluctuations. Investments in derivatives involve costs and create economic leverage, may result in significant volatility and cause the Fund to partic-

ipate in losses that significantly exceed the Fund’s initial investment. Lower rated or high yield debt securities involve greater credit risk, including the possibility of default or

bankruptcy. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Merger arbitrage investments risk loss

if a proposed reorganization in which the Fund invests is renegotiated or terminated. Liquidity risk exists when securities have become more difficult to sell at the price they

have been valued. The Fund may invest in investment funds, which may be more costly than investing in the underlying securities directly. The Fund’s prospectus also includes

a description of the main investment risks.

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

Annual Report | 13

Performance Summary (continued)

1. The Fund has an expense reduction contractually guaranteed through at least 10/4/14 and a fee waiver related to a subsidiary. Fund investment results reflect the expense reductions, to the extent applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the period indicated.

3. Average annual total return represents the average annual change in value of an investment over the period indicated. Since the Fund has existed for less than one year, average annual total returns are not available. Performance shown is not annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the period indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Source: © 2014 Morningstar. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. government securities with a remaining term to final maturity of less than three months.

8. Source BofA Merrill Lynch, used with permission. BOFA MERRILL LYNCH IS LICENSING THE MERRILL LYNCH INDICES “AS IS,” MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE QUALITY, ACCURACY AND/OR COMPLETENESS OF THE MERRILL LYNCH INDICES OR ANY DATA INCLUDED THEREIN OR DERIVED THEREFROM, AND ASSUMES NO LIABILITY IN CONNNECTION WITH THEIR USE.

9. Source: FactSet. © 2014 FactSet Research Systems Inc. All Rights Reserved. The information contained herein: (1) is proprietary to FactSet Research Systems Inc. and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Fact-Set Research Systems Inc. nor its content providers are responsible for any damages or losses arising from any use of this information. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is composed of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

10. Source: Hedge Fund Research, Inc. The HFRX Global Hedge Fund Index is being used under license from Hedge Fund Research, Inc., which does not endorse or approve of any of the contents of this report.

14 | Annual Report

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 15

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 12/1/13 | Value 5/31/14 | Period* 12/1/13–5/31/14 | |||

| A | ||||||

| Actual | $ | 1,000 | $ | 1,044.20 | $ | 14.58 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,010.67 | $ | 14.34 |

| C | ||||||

| Actual | $ | 1,000 | $ | 1,040.20 | $ | 18.67 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,006.63 | $ | 18.36 |

| R | ||||||

| Actual | $ | 1,000 | $ | 1,042.20 | $ | 16.45 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,008.83 | $ | 16.18 |

| R6 | ||||||

| Actual | $ | 1,000 | $ | 1,046.10 | $ | 13.82 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,011.42 | $ | 13.59 |

| Advisor | ||||||

| Actual | $ | 1,000 | $ | 1,045.10 | $ | 13.92 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,011.32 | $ | 13.69 |

| *Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 2.86%; C: 3.67%; | ||||||

| R: 3.23%; R6: 2.71% and Advisor: 2.73%), multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year | ||||||

| period. | ||||||

16 | Annual Report

Franklin Alternative Strategies Funds

Consolidated Financial Highlights

| Franklin K2 Alternative Strategies Fund | |||

| Period Ended | |||

| May 31, | |||

| Class A | 2014 | a | |

| Per share operating performance | |||

| (for a share outstanding throughout the period) | |||

| Net asset value, beginning of period | $ | 10.00 | |

| Income from investment operationsb: | |||

| Net investment income (loss)c | (0.02 | ) | |

| Net realized and unrealized gains (losses) | 0.70 | ||

| Total from investment operations | 0.68 | ||

| Less distributions from net investment income | (0.04 | ) | |

| Net asset value, end of period | $ | 10.64 | |

| Total returnd | 6.82 | % | |

| Ratios to average net assetse | |||

| Expenses before waiver and payments by affiliatesf | 3.33 | % | |

| Expenses net of waiver and payments by affiliatesf | 2.83 | % | |

| Expenses incurred in connection with securities sold short | 0.56 | % | |

| Net investment income (loss) | (0.35 | )% | |

| Supplemental data | |||

| Net assets, end of period (000’s) | $ | 96,889 | |

| Portfolio turnover rate | 181.06 | % | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the period pre-

sented. See Note 1(g).

Annual Report | The accompanying notes are an integral part of these consolidated financial statements. | 17

Franklin Alternative Strategies Funds

Consolidated Financial Highlights (continued)

| Franklin K2 Alternative Strategies Fund | |||

| Period Ended | |||

| May 31, | |||

| Class C | 2014 | a | |

| Per share operating performance | |||

| (for a share outstanding throughout the period) | |||

| Net asset value, beginning of period | $ | 10.00 | |

| Income from investment operationsb: | |||

| Net investment income (loss)c | (0.08 | ) | |

| Net realized and unrealized gains (losses) | 0.72 | ||

| Total from investment operations | 0.64 | ||

| Less distributions from net investment income | (0.04 | ) | |

| Net asset value, end of period | $ | 10.60 | |

| Total returnd | 6.42 | % | |

| Ratios to average net assetse | |||

| Expenses before waiver and payments by affiliatesf | 4.03 | % | |

| Expenses net of waiver and payments by affiliatesf | 3.53 | % | |

| Expenses incurred in connection with securities sold short | 0.56 | % | |

| Net investment income (loss) | (1.05 | )% | |

| Supplemental data | |||

| Net assets, end of period (000’s) | $ | 16,618 | |

| Portfolio turnover rate | 181.06 | % | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the period pre-

sented. See Note 1(g).

18 | The accompanying notes are an integral part of these consolidated financial statements. | Annual Report

Franklin Alternative Strategies Funds

Consolidated Financial Highlights (continued)

| Franklin K2 Alternative Strategies Fund | |||

| Period Ended | |||

| May 31, | |||

| Class R | 2014 | a | |

| Per share operating performance | |||

| (for a share outstanding throughout the period) | |||

| Net asset value, beginning of period | $ | 10.00 | |

| Income from investment operationsb: | |||

| Net investment income (loss)c | (0.05 | ) | |

| Net realized and unrealized gains (losses) | 0.71 | ||

| Total from investment operations | 0.66 | ||

| Less distributions from net investment income | (0.04 | ) | |

| Net asset value, end of period | $ | 10.62 | |

| Total returnd | 6.62 | % | |

| Ratios to average net assetse | |||

| Expenses before waiver and payments by affiliatesf | 3.63 | % | |

| Expenses net of waiver and payments by affiliatesf | 3.13 | % | |

| Expenses incurred in connection with securities sold short | 0.56 | % | |

| Net investment income (loss) | (0.65 | )% | |

| Supplemental data | |||

| Net assets, end of period (000’s) | $ | 11,660 | |

| Portfolio turnover rate | 181.06 | % | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the period pre-

sented. See Note 1(g).

Annual Report | The accompanying notes are an integral part of these consolidated financial statements. | 19

Franklin Alternative Strategies Funds

Consolidated Financial Highlights (continued)

| Franklin K2 Alternative Strategies Fund | |||

| Period Ended | |||

| May 31, | |||

| Class R6 | 2014 | a | |

| Per share operating performance | |||

| (for a share outstanding throughout the period) | |||

| Net asset value, beginning of period | $ | 10.00 | |

| Income from investment operationsb: | |||

| Net investment income (loss)c | (0.01 | ) | |

| Net realized and unrealized gains (losses) | 0.71 | ||

| Total from investment operations | 0.70 | ||

| Less distributions from net investment income | (0.04 | ) | |

| Net asset value, end of period | $ | 10.66 | |

| Total returnd | 7.02 | % | |

| Ratios to average net assetse | |||

| Expenses before waiver and payments by affiliatesf | 3.19 | % | |

| Expenses net of waiver and payments by affiliatesf | 2.69 | % | |

| Expenses incurred in connection with securities sold short | 0.56 | % | |

| Net investment income (loss) | (0.21 | )% | |

| Supplemental data | |||

| Net assets, end of period (000’s) | $ | 215,526 | |

| Portfolio turnover rate | 181.06 | % | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the period pre-

sented. See Note 1(g).

20 | The accompanying notes are an integral part of these consolidated financial statements. | Annual Report

Franklin Alternative Strategies Funds

Consolidated Financial Highlights (continued)

| Franklin K2 Alternative Strategies Fund | |||

| Period Ended | |||

| May 31, | |||

| Advisor Class | 2014 | a | |

| Per share operating performance | |||

| (for a share outstanding throughout the period) | |||

| Net asset value, beginning of period | $ | 10.00 | |

| Income from investment operationsb: | |||

| Net investment income (loss)c | (0.02 | ) | |

| Net realized and unrealized gains (losses) | 0.71 | ||

| Total from investment operations | 0.69 | ||

| Less distributions from net investment income | (0.04 | ) | |

| Net asset value, end of period | $ | 10.65 | |

| Total returnd | 6.92 | % | |

| Ratios to average net assetse | |||

| Expenses before waiver and payments by affiliatesf | 3.21 | % | |

| Expenses net of waiver and payments by affiliatesf | 2.71 | % | |

| Expenses incurred in connection with securities sold short | 0.56 | % | |

| Net investment income (loss) | (0.23 | )% | |

| Supplemental data | |||

| Net assets, end of period (000’s) | $ | 54,593 | |

| Portfolio turnover rate | 181.06 | % | |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the period pre-

sented. See Note 1(g).

Annual Report | The accompanying notes are an integral part of these consolidated financial statements. | 21

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests 49.9% | ||||

| Aerospace & Defense 0.8% | ||||

| Airbus Group NV | France | 3,541 | $ | 253,946 |

| aB/E Aerospace Inc | United States | 10,279 | 994,493 | |

| bThe Boeing Co | United States | 4,037 | 546,004 | |

| bGeneral Dynamics Corp | United States | 7,701 | 909,642 | |

| bTransdigm Group Inc | United States | 2,414 | 455,546 | |

| 3,159,631 | ||||

| Air Freight & Logistics 0.7% | ||||

| bFedEx Corp | United States | 9,907 | 1,428,193 | |

| bUnited Parcel Service Inc., B | United States | 13,235 | 1,374,852 | |

| 2,803,045 | ||||

| Airlines 1.8% | ||||

| aAir Canada, B | Canada | 13,765 | 112,349 | |

| Alaska Air Group Inc | United States | 4,678 | 460,596 | |

| a,bAmerican Airlines Group Inc | United States | 62,985 | 2,529,478 | |

| a,c,dAMR Corp., Contingent Distribution | United States | 3,268 | — | |

| Copa Holdings SA, A | Panama | 3,098 | 442,797 | |

| bDelta Air Lines Inc | United States | 58,526 | 2,335,773 | |

| Deutsche Lufthansa AG | Germany | 29,526 | 778,811 | |

| Japan Airlines Co. Ltd | Japan | 1,700 | 88,674 | |

| aUnited Continental Holdings Inc | United States | 10,004 | 443,877 | |

| 7,192,355 | ||||

| Auto Components 0.4% | ||||

| bAllison Transmission Holdings Inc | United States | 37,007 | 1,146,107 | |

| a,bTenneco Inc | United States | 3,663 | 233,516 | |

| aTRW Automotive Holdings Corp | United States | 150 | 12,731 | |

| a,b,eVisteon Corp | United States | 1,880 | 171,343 | |

| 1,563,697 | ||||

| Automobiles 0.2% | ||||

| General Motors Co | United States | 645 | 22,304 | |

| bHarley-Davidson Inc | United States | 11,850 | 844,194 | |

| Toyota Motor Corp., ADR | Japan | 123 | 13,913 | |

| 880,411 | ||||

| Banks 0.9% | ||||

| aBanca Popolare di Milano Scarl | Italy | 284,152 | 259,521 | |

| aBanco Popolare SC | Italy | 12,129 | 233,952 | |

| bCitigroup Inc | United States | 2,676 | 127,297 | |

| aCommerzbank AG | Germany | 23,244 | 368,975 | |

| Danske Bank AS | Denmark | 35,072 | 985,814 | |

| HSBC Holdings PLC, ADR | United Kingdom | 146 | 7,697 | |

| Intesa Sanpaolo SpA | Italy | 109,725 | 312,906 | |

| bWells Fargo & Co | United States | 22,919 | 1,163,827 | |

| Wing Hang Bank Ltd | Hong Kong | 11,981 | 191,314 | |

| 3,651,303 | ||||

| Beverages 1.5% | ||||

| bAnheuser-Busch InBev NV, ADR | Belgium | 21,956 | 2,413,404 | |

| bBrown-Forman Corp., B | United States | 15,444 | 1,431,195 | |

| 22 | Annual Report | ||||

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 (continued) | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Beverages (continued) | ||||

| a,bConstellation Brands Inc., A | United States | 10,181 | $ | 856,528 |

| Cott Corp | Canada | 9,652 | 68,529 | |

| bDiageo PLC, ADR | United Kingdom | 8,758 | 1,127,943 | |

| 5,897,599 | ||||

| Biotechnology 2.8% | ||||

| aACADIA Pharmaceuticals Inc | United States | 8,514 | 175,814 | |

| a,bAcceleron Pharma Inc | United States | 472 | 14,009 | |

| a,bAgios Pharmaceuticals Inc | United States | 1,181 | 41,524 | |

| aAkebia Therapeutics Inc | United States | 1,631 | 39,633 | |

| aAlder Biopharmaceuticals Inc | United States | 899 | 9,655 | |

| a,bAlexion Pharmaceuticals Inc | United States | 6,822 | 1,134,635 | |

| a,bAlnylam Pharmaceuticals Inc | United States | 7,247 | 429,675 | |

| aApplied Genetic Technologies Corp | United States | 3,247 | 44,484 | |

| aArrowhead Research Corp | United States | 2,438 | 30,670 | |

| aAuspex Pharmaceuticals Inc | United States | 1,992 | 42,131 | |

| aBioCryst Pharmaceuticals Inc | United States | 3,042 | 30,298 | |

| a,bBiogen Idec Inc | United States | 2,362 | 754,352 | |

| a,bBioMarin Pharmaceutical Inc | United States | 22,618 | 1,310,939 | |

| aBluebird Bio Inc | United States | 4,221 | 97,589 | |

| aCara Therapeutics Inc | United States | 2,085 | 28,731 | |

| a,bCelgene Corp | United States | 3,328 | 509,284 | |

| a,bCelldex Therapeutics Inc | United States | 24,552 | 358,705 | |

| aCepheid | United States | 5,325 | 239,891 | |

| aChimerix Inc | United States | 3,604 | 66,494 | |

| aEagle Pharmaceuticals Inc | United States | 4,734 | 56,098 | |

| aFibrocell Science Inc | United States | 16,084 | 48,252 | |

| aFlexion Therapeutics Inc | United States | 784 | 9,988 | |

| a,bGilead Sciences Inc | United States | 10,995 | 892,904 | |

| a,bIncyte Corp. Ltd | United States | 15,009 | 743,696 | |

| a,bIntercept Pharmaceuticals Inc | United States | 2,429 | 574,726 | |

| a,bInterMune Inc | United States | 8,127 | 321,992 | |

| aIntrexon Corp | United States | 688 | 14,510 | |

| a,bIsis Pharmaceuticals Inc | United States | 13,822 | 403,879 | |

| aKindred Biosciences Inc | United States | 8,109 | 137,042 | |

| a,bKYTHERA Biopharmaceuticals Inc | United States | 1,694 | 56,698 | |

| aMacroGenics Inc | United States | 843 | 15,730 | |

| aMerrimack Pharmaceuticals Inc | United States | 35,457 | 275,501 | |

| aOphthotech Corp | United States | 3,846 | 156,532 | |

| a,bOvaScience Inc | United States | 8,753 | 63,459 | |

| aPortola Pharmaceuticals Inc | United States | 6,075 | 134,622 | |

| aProthena Corp. PLC | Ireland | 4,440 | 92,441 | |

| a,bPuma Biotechnology Inc | United States | 1,970 | 150,567 | |

| aReceptos Inc | United States | 2,175 | 64,728 | |

| aRegulus Therapeutics Inc | United States | 3,057 | 20,574 | |

| aRetrophin Inc | United States | 2,994 | 43,772 | |

| a,bSangamo BioSciences Inc | United States | 12,604 | 165,617 | |

| a,bSynta Pharmaceuticals Corp | United States | 24,871 | 101,971 | |

| a,bTargacept Inc | United States | 5,717 | 21,439 | |

| aTetraphase Pharmaceuticals Inc | United States | 6,131 | 64,621 | |

| Annual Report | 23 | ||||

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 (continued) | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Biotechnology (continued) | ||||

| aTG Therapeutics Inc | United States | 3,875 | $ | 25,304 |

| aUltragenyx Pharmaceutical Inc | United States | 5,242 | 196,889 | |

| aVerastem Inc | United States | 4,253 | 39,468 | |

| aVersartis Inc | United States | 455 | 13,600 | |

| a,bVertex Pharmaceuticals Inc | United States | 12,130 | 876,514 | |

| aZIOPHARM Oncology Inc | United States | 14,017 | 50,461 | |

| 11,192,108 | ||||

| Building Products 0.3% | ||||

| Fortune Brands Home & Security Inc | United States | 16,503 | 659,790 | |

| Masco Corp | United States | 17,184 | 366,019 | |

| 1,025,809 | ||||

| Capital Markets 0.1% | ||||

| Lazard Ltd., A | United States | 10,753 | 543,027 | |

| Chemicals 2.8% | ||||

| bAir Products & Chemicals Inc | United States | 23,415 | 2,809,097 | |

| bAirgas Inc | United States | 2,169 | 230,608 | |

| Akzo Nobel NV | Netherlands | 14,755 | 1,105,835 | |

| The Dow Chemical Co | United States | 1,156 | 60,251 | |

| bEastman Chemical Co | United States | 7,127 | 629,029 | |

| bEcolab Inc | United States | 11,303 | 1,234,174 | |

| LyondellBasell Industries NV, A | United States | 3,119 | 310,559 | |

| bMonsanto Co | United States | 3,960 | 482,526 | |

| Potash Corp. of Saskatchewan Inc | Canada | 4,150 | 150,728 | |

| Rockwood Holdings Inc | United States | 437 | 33,374 | |

| bThe Sherwin-Williams Co | United States | 6,421 | 1,313,801 | |

| Tronox Ltd., A | United States | 500 | 13,285 | |

| Westlake Chemical Corp | United States | 1,682 | 135,990 | |

| a,bWR Grace & Co | United States | 25,770 | 2,372,902 | |

| 10,882,159 | ||||

| Commercial Services & Supplies 0.8% | ||||

| Edenred | France | 15,972 | 500,656 | |

| a,bEnernoc Inc | United States | 18,398 | 353,058 | |

| aMetalico Inc | United States | 114,883 | 144,948 | |

| Mitie Group PLC | United Kingdom | 23,271 | 130,789 | |

| Tyco International Ltd | United States | 46,850 | 2,044,534 | |

| West Corp | United States | 3,770 | 101,036 | |

| 3,275,021 | ||||

| Communications Equipment 0.4% | ||||

| aAruba Networks Inc | United States | 13,315 | 246,527 | |

| a,bF5 Networks Inc | United States | 2,265 | 245,866 | |

| a,bJuniper Networks Inc | United States | 16,330 | 399,432 | |

| bQUALCOMM Inc | United States | 4,478 | 360,255 | |

| aRuckus Wireless Inc | United States | 6,200 | 66,960 | |

| aShoreTel Inc | United States | 27,975 | 194,706 | |

| aUbiquiti Networks Inc | United States | 5,300 | 185,288 | |

| 1,699,034 | ||||

| 24 | Annual Report | ||||

Franklin Alternative Strategies Funds

Consolidated Statement of Investments, May 31, 2014 (continued)

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Construction & Engineering 0.3% | ||||

| Chicago Bridge & Iron Co. NV | United States | 2,168 | $ | 176,475 |

| Fluor Corp | United States | 9,672 | 726,174 | |

| Foster Wheeler AG | Switzerland | 6,784 | 229,706 | |

| aMasTec Inc | United States | 1,100 | 39,600 | |

| 1,171,955 | ||||

| Construction Materials 0.1% | ||||

| aHolcim Ltd | Switzerland | 4,453 | 390,601 | |

| Consumer Finance 0.1% | ||||

| American Express Co | United States | 3,000 | 274,500 | |

| Containers & Packaging 0.2% | ||||

| bBall Corp | United States | 3,225 | 194,661 | |

| aCrown Holdings Inc | United States | 2,105 | 102,829 | |

| DS Smith PLC | United Kingdom | 36,497 | 194,234 | |

| aGraphic Packaging Holding Co | United States | 20,695 | 227,438 | |

| 719,162 | ||||

| Diversified Financial Services 0.8% | ||||

| a,bAlly Financial Inc | United States | 19,431 | 457,794 | |

| aElement Financial Corp | Canada | 730 | 9,190 | |

| aING Groep NV | Netherlands | 83,715 | 1,172,551 | |

| bMoody’s Corp | United States | 12,745 | 1,090,207 | |

| aMSCI Inc | United States | 7,610 | 328,448 | |

| 3,058,190 | ||||

| Diversified Telecommunication Services 0.6% | ||||

| eAT&T Inc | United States | 901 | 31,959 | |

| a,eKoninklijke KPN NV | Netherlands | 182,477 | 674,348 | |

| Telecom Italia SpA | Italy | 301,008 | 287,430 | |

| Telefonica Czech Republic AS | Czech Republic | 10,086 | 146,159 | |

| atw telecom Inc | United States | 2,143 | 70,269 | |

| Verizon Communications Inc | United States | 1,120 | 55,955 | |

| Ziggo NV | Netherlands | 25,811 | 1,216,856 | |

| 2,482,976 | ||||

| Electric Utilities 0.0%† | ||||

| PPL Corp | United States | 2,059 | 72,250 | |

| Electrical Equipment 0.2% | ||||

| Nidec Corp | Japan | 3,500 | 203,502 | |

| bRockwell Automation Inc | United States | 5,420 | 656,254 | |

| 859,756 | ||||

| Electronic Equipment, Instruments & Components 0.1% | ||||

| Sunny Optical Technology Group Co. Ltd | China | 175,000 | 209,920 | |

| Energy Equipment & Services 0.6% | ||||

| CARBO Ceramics Inc | United States | 3,711 | 510,522 | |

| aFMC Technologies Inc | United States | 2,880 | 167,213 | |

| bHelmerich & Payne Inc | United States | 8,446 | 928,638 |

Annual Report | 25

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 (continued) | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Energy Equipment & Services (continued) | ||||

| Schlumberger Ltd | United States | 7,330 | $ | 762,613 |

| 2,368,986 | ||||

| Food & Staples Retailing 1.5% | ||||

| bCostco Wholesale Corp | United States | 20,365 | 2,362,747 | |

| CVS Caremark Corp | United States | 593 | 46,444 | |

| a,bRite Aid Corp | United States | 27,463 | 229,590 | |

| bSafeway Inc | United States | 22,647 | 777,698 | |

| bWal-Mart Stores Inc | United States | 11,405 | 875,562 | |

| bWalgreen Co | United States | 23,292 | 1,674,928 | |

| 5,966,969 | ||||

| Food Products 0.7% | ||||

| a,bChiquita Brands International Inc | United States | 27,000 | 277,020 | |

| Cranswick PLC | United Kingdom | 13,528 | 287,072 | |

| aDiamond Foods Inc | United States | 3,109 | 99,333 | |

| Greencore Group PLC | Ireland | 50,228 | 245,335 | |

| The Hillshire Brands Co | United States | 4,892 | 260,646 | |

| Keurig Green Mountain Inc | United States | 136 | 15,338 | |

| Lindt & Spruengli AG | Switzerland | 16 | 951,424 | |

| Mondelez International Inc | United States | 10,690 | 402,158 | |

| a,bThe WhiteWave Foods Co., A | United States | 10,299 | 324,315 | |

| 2,862,641 | ||||

| Gas Utilities 0.0%† | ||||

| Tokyo Gas Co. Ltd., ADR | Japan | 362 | 8,246 | |

| Health Care Equipment & Supplies 0.4% | ||||

| bBecton Dickinson and Co | United States | 6,337 | 745,865 | |

| a,bDerma Sciences Inc | United States | 8,706 | 88,627 | |

| aGenMark Diagnostics Inc | United States | 17,000 | 187,170 | |

| a,bHologic Inc | United States | 10,663 | 260,604 | |

| aInspireMD Inc | United Kingdom | 14,923 | 37,307 | |

| aNovadaq Technologies Inc | Canada | 8,524 | 124,195 | |

| aTandem Diabetes Care Inc | United States | 610 | 9,906 | |

| aTornier NV | United States | 1,941 | 41,751 | |

| 1,495,425 | ||||

| Health Care Providers & Services 1.5% | ||||

| aAcadia Healthcare Co. Inc | United States | 5,089 | 216,995 | |

| bAetna Inc | United States | 6,551 | 508,030 | |

| aCambian Group PLC | United Kingdom | 8,649 | 32,981 | |

| aCelesio AG | Germany | 25,996 | 924,543 | |

| a,bCentene Corp | United States | 4,746 | 353,672 | |

| bCigna Corp | United States | 3,155 | 283,256 | |

| aCommunity Health Systems Inc | United States | 27,875 | 2,091 | |

| a,bDaVita HealthCare Partners Inc | United States | 3,463 | 244,453 | |

| aEnvision Healthcare Holdings Inc | United States | 6,666 | 229,844 | |

| a,bHCA Holdings Inc | United States | 20,073 | 1,063,668 | |

| a,bHealthways Inc | United States | 16,034 | 276,266 | |

| Humana Inc | United States | 1,405 | 174,866 | |

| 26 | Annual Report | ||||

Franklin Alternative Strategies Funds

Consolidated Statement of Investments, May 31, 2014 (continued)

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Health Care Providers & Services (continued) | ||||

| McKesson Corp | United States | 2,653 | $ | 503,115 |

| aMolina Healthcare Inc | United States | 3,118 | 134,355 | |

| a,bPremier Inc., A | United States | 1,886 | 55,901 | |

| Rhoen Klinikum AG | Germany | 7,309 | 241,063 | |

| bUnitedHealth Group Inc | United States | 2,079 | 165,551 | |

| bUniversal Health Services Inc., B | United States | 4,155 | 372,163 | |

| 5,782,813 | ||||

| Health Care Technology 0.1% | ||||

| aAllscripts Healthcare Solutions Inc | United States | 6,720 | 99,053 | |

| aCastlight Health Inc | United States | 287 | 4,357 | |

| aIMS Health Holdings Inc | United States | 4,620 | 111,896 | |

| 215,306 | ||||

| Hotels, Restaurants & Leisure 1.2% | ||||

| Compass Group PLC | United Kingdom | 5,635 | 94,028 | |

| bDomino’s Pizza Inc | United States | 14,502 | 1,050,670 | |

| Extended Stay America Inc | United States | 2,332 | 51,537 | |

| bLas Vegas Sands Corp | United States | 11,501 | 880,057 | |

| Marriott International Inc., A | United States | 2,500 | 154,050 | |

| bStarbucks Corp | United States | 3,000 | 219,720 | |

| Starwood Hotels & Resorts Worldwide Inc | United States | 1,900 | 151,715 | |

| bWyndham Worldwide Corp | United States | 28,348 | 2,095,768 | |

| 4,697,545 | ||||

| Household Durables 0.9% | ||||

| Lennar Corp., A | United States | 25,218 | 1,031,416 | |

| MDC Holdings Inc | United States | 5,155 | 147,485 | |

| aMeritage Homes Corp | United States | 3,285 | 131,761 | |

| aMohawk Industries Inc | United States | 1,664 | 225,738 | |

| a,bNVR Inc | United States | 946 | 1,053,504 | |

| bThe Ryland Group Inc | United States | 20,926 | 788,910 | |

| aSharp Corp | Japan | 19,741 | 55,849 | |

| aTempur Sealy International Inc | United States | 3,548 | 194,998 | |

| 3,629,661 | ||||

| Household Products 0.1% | ||||

| bColgate-Palmolive Co | United States | 8,506 | 581,810 | |

| Industrial Conglomerates 0.0%† | ||||

| Siemens AG, ADR | Germany | 154 | 20,470 | |

| Insurance 0.3% | ||||

| bAmerican International Group Inc | United States | 7,607 | 411,311 | |

| Aspen Insurance Holdings Ltd | United States | 13,259 | 609,251 | |

| 1,020,562 | ||||

| Internet & Catalog Retail 0.9% | ||||

| a,bAmazon.com Inc | United States | 1,255 | 392,250 | |

| Expedia Inc | United States | 3,400 | 249,220 | |

| a,bHomeAway Inc | United States | 12,730 | 392,084 |

Annual Report | 27

Franklin Alternative Strategies Funds

Consolidated Statement of Investments, May 31, 2014 (continued)

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Internet & Catalog Retail (continued) | ||||

| aNetflix Inc | United States | 610 | $ | 254,876 |

| a,bPriceline Group Inc | United States | 1,430 | 1,828,441 | |

| a,bTripAdvisor Inc | United States | 4,980 | 483,907 | |

| 3,600,778 | ||||

| Internet Software & Services 1.1% | ||||

| a,bAkamai Technologies Inc | United States | 7,120 | 386,901 | |

| aBaidu Inc., ADR | China | 1,243 | 206,338 | |

| aBankrate Inc | United States | 13,840 | 209,676 | |

| aCoStar Group Inc | United States | 1,100 | 174,405 | |

| aDealertrack Technologies Inc | United States | 2,100 | 83,391 | |

| aDemandware Inc | United States | 1,670 | 101,686 | |

| a,beBay Inc | United States | 8,915 | 452,258 | |

| aEquinix Inc | United States | 1,900 | 377,625 | |

| a,bGoogle Inc., A | United States | 1,248 | 713,419 | |

| a,bGoogle Inc., C | United States | 415 | 232,807 | |

| bIAC/InterActiveCorp | United States | 8,445 | 559,144 | |

| a,bPandora Media Inc | United States | 9,825 | 241,007 | |

| aVeriSign Inc | United States | 4,640 | 232,371 | |

| aXoom Corp | United States | 10,100 | 224,220 | |

| aYelp Inc | United States | 3,900 | 257,985 | |

| aZillow Inc., A | United States | 700 | 82,614 | |

| 4,535,847 | ||||

| IT Services 2.6% | ||||

| Accenture PLC, A | United States | 8,060 | 656,487 | |

| aAlliance Data Systems Corp | United States | 1,645 | 421,202 | |

| bAutomatic Data Processing Inc | United States | 10,585 | 843,413 | |

| aCACI International Inc., A | United States | 2,812 | 200,777 | |

| aCardtronics Inc | United States | 13,420 | 388,912 | |

| a,bCognizant Technology Solutions Corp., A | United States | 9,220 | 448,184 | |

| a,bEPAM Systems Inc | United States | 5,610 | 236,013 | |

| EVERTEC Inc | Puerto Rico | 17,165 | 410,415 | |

| a,bExlService Holdings Inc | United States | 16,185 | 458,683 | |

| bForrester Research Inc | United States | 7,000 | 264,740 | |

| aGartner Inc | United States | 3,825 | 271,919 | |

| aGenpact Ltd | United States | 33,490 | 564,307 | |

| bGlobal Payments Inc | United States | 8,100 | 555,336 | |

| bHeartland Payment Systems Inc | United States | 12,435 | 515,431 | |

| aInterXion Holding NV | Netherlands | 3,005 | 79,001 | |

| bMasterCard Inc., A | United States | 21,501 | 1,643,751 | |

| QIWI PLC, ADR | Russia | 2,725 | 115,131 | |

| a,bSapient Corp | United States | 13,895 | 228,573 | |

| aServiceSource International Inc | United States | 21,940 | 99,827 | |

| a,bVantiv Inc., A | United States | 12,025 | 372,655 | |

| aVeriFone Systems Inc | United States | 4,745 | 155,683 | |

| bVisa Inc., A | United States | 2,045 | 439,327 | |

| aWEX Inc | United States | 7,657 | 737,293 | |

| 10,107,060 |

28 | Annual Report

Franklin Alternative Strategies Funds

Consolidated Statement of Investments, May 31, 2014 (continued)

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Leisure Equipment & Products 0.3% | ||||

| Brunswick Corp | United States | 14,570 | $ | 627,967 |

| bPolaris Industries Inc | United States | 5,300 | 683,276 | |

| 1,311,243 | ||||

| Life Sciences Tools & Services 0.3% | ||||

| aBruker Corp | United States | 4,851 | 101,628 | |

| aFluidigm Corp | United States | 6,401 | 177,564 | |

| aICON PLC | Ireland | 1,759 | 74,353 | |

| a,bIllumina Inc | United States | 3,122 | 494,057 | |

| Thermo Fisher Scientific Inc | United States | 844 | 98,672 | |

| a,bWuXi Pharmatech Cayman Inc., ADR | China | 6,193 | 206,660 | |

| 1,152,934 | ||||

| Machinery 1.8% | ||||

| Flowserve Corp | United States | 1,571 | 115,846 | |

| PACCAR Inc | United States | 2,352 | 149,023 | |

| Pall Corp | United States | 1,773 | 150,244 | |

| Parker Hannifin Corp | United States | 4,070 | 509,686 | |

| bThe Timken Co | United States | 33,317 | 2,139,618 | |

| bThe Toro Co | United States | 15,106 | 975,545 | |

| Trinity Industries Inc | United States | 9,945 | 860,541 | |

| Volvo AB, B | Sweden | 80,913 | 1,176,455 | |

| Wabtec Corp | United States | 6,456 | 508,345 | |

| Wartsila OY | Finland | 6,498 | 350,592 | |

| bXylem Inc | United States | 2,711 | 101,120 | |

| 7,037,015 | ||||

| Marine 0.2% | ||||

| aAmerican Shipping ASA | Norway | 8,218 | 70,111 | |

| Irish Continental Group PLC | Ireland | 18,797 | 689,523 | |

| 759,634 | ||||

| Media 3.5% | ||||

| bCBS Corp., B | United States | 19,807 | 1,180,695 | |

| bComcast Corp., A | United States | 20,133 | 1,050,943 | |

| CyberAgent Inc | Japan | 2,400 | 95,717 | |

| aDIRECTV | United States | 5,590 | 460,840 | |

| a,bDISH Network Corp., A | United States | 27,693 | 1,624,471 | |

| aDreamWorks Animation SKG Inc | United States | 4,510 | 126,641 | |

| bGrupo Televisa SAB, ADR | Mexico | 28,288 | 956,134 | |

| aImax Corp | Canada | 5,625 | 147,544 | |

| Liberty Global PLC | United Kingdom | 12,629 | 540,521 | |

| Liberty Global PLC, A | United Kingdom | 14,198 | 639,194 | |

| a,bLiberty Media Corp., A | United States | 11,487 | 1,460,342 | |

| aSirius XM Holdings Inc | United States | 123,519 | 405,142 | |

| b,eTime Warner Cable Inc | United States | 15,397 | 2,173,441 | |

| Time Warner Inc | United States | 8,787 | 613,596 | |

| a,bTribune Co | United States | 4,818 | 381,586 | |

| aTVN SA | Poland | 16,434 | 84,338 | |

| bThe Walt Disney Co | United States | 20,646 | 1,734,470 | |

| 13,675,615 | ||||

Annual Report | 29

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 (continued) | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Metals & Mining 0.5% | ||||

| aConstellium NV, A | Netherlands | 8,743 | $ | 254,771 |

| aRTI International Metals Inc | United States | 8,323 | 223,223 | |

| aThompson Creek Metals Co. Inc | United States | 55,000 | 154,550 | |

| aThyssenKrupp AG | Germany | 44,332 | 1,331,307 | |

| United States Steel Corp | United States | 1,378 | 31,749 | |

| US Silica Holdings Inc | United States | 1,126 | 56,942 | |

| 2,052,542 | ||||

| Multiline Retail 0.5% | ||||

| Dillard’s Inc., A | United States | 660 | 74,415 | |

| a,bDollar General Corp | United States | 19,308 | 1,038,384 | |

| bMacy’s Inc | United States | 16,074 | 962,672 | |

| 2,075,471 | ||||

| Oil, Gas & Consumable Fuels 1.1% | ||||

| Anadarko Petroleum Corp | United States | 2,071 | 213,023 | |

| aAthabasca Oil Corp | Canada | 95,877 | 667,593 | |

| DHT Holdings Inc | United States | 12,663 | 92,567 | |

| EnCana Corp | Canada | 13,005 | 302,846 | |

| Exxon Mobil Corp | United States | 318 | 31,969 | |

| aGaslog Ltd | Monaco | 5,830 | 136,131 | |

| Gaslog Partners LP | Monaco | 8,858 | 234,914 | |

| Hess Corp | United States | 2,517 | 229,802 | |

| Marathon Petroleum Corp | United States | 7,760 | 693,666 | |

| Navios Maritime Acquisition | United States | 17,259 | 61,615 | |

| bOccidental Petroleum Corp | United States | 6,167 | 614,788 | |

| bPhillips 66 | United States | 1,876 | 159,066 | |

| bPioneer Natural Resources Co | United States | 1,925 | 404,558 | |

| Statoil ASA, ADR | Norway | 354 | 10,797 | |

| The Williams Cos Inc | United States | 6,413 | 301,154 | |

| 4,154,489 | ||||

| Paper & Forest Products 0.0%† | ||||

| aKapStone Paper and Packaging Corp | United States | 3,495 | 101,530 | |

| Pharmaceuticals 3.6% | ||||

| AbbVie Inc | United States | 3,984 | 216,451 | |

| Actavis PLC | United States | 1,603 | 339,099 | |

| aAerie Pharmaceuticals Inc | United States | 2,141 | 33,550 | |

| Allergan Inc | United States | 21,863 | 3,661,178 | |

| a,bAratana Therapeutics Inc | United States | 8,319 | 116,965 | |

| AstraZeneca PLC, ADR | United Kingdom | 6,997 | 505,183 | |

| Bayer AG, ADR | Germany | 131 | 18,925 | |

| bBristol-Myers Squibb Co | United States | 12,138 | 603,744 | |

| CFR Pharmaceuticals SA | Chile | 996,272 | 324,572 | |

| Eli Lilly & Co | United States | 927 | 55,490 | |

| aFlamel Technologies SA, ADR | France | 8,194 | 91,609 | |

| a,bForest Laboratories Inc | United States | 14,802 | 1,402,934 | |

| GlaxoSmithKline PLC, ADR | United Kingdom | 161 | 8,684 | |

| aGW Pharmaceuticals PLC, ADR | United Kingdom | 2,389 | 162,858 | |

| aImpax Laboratories Inc | United States | 4,627 | 128,446 | |

| 30 | Annual Report | ||||

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 (continued) | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Pharmaceuticals (continued) | ||||

| aJazz Pharmaceuticals PLC | United States | 2,920 | $ | 414,231 |

| Johnson & Johnson | United States | 443 | 44,947 | |

| a,bThe Medicines Co | United States | 8,340 | 232,686 | |

| aMediwound Ltd | Israel | 1,638 | 19,459 | |

| bMerck & Co. Inc | United States | 11,399 | 659,546 | |

| aMylan Inc | United States | 16,138 | 804,318 | |

| Novo Nordisk AS, ADR | Denmark | 4,581 | 193,685 | |

| a,bPacira Pharmaceuticals Inc | United States | 6,866 | 532,870 | |

| Perrigo Co. PLC | United States | 2,087 | 288,423 | |

| Pfizer Inc | United States | 29,947 | 887,330 | |

| bQuestcor Pharmaceuticals Inc | United States | 6,833 | 615,858 | |

| aRevance Therapeutics Inc | United States | 1,878 | 59,138 | |

| Roche Holding AG | Switzerland | 2,680 | 788,587 | |

| Roche Holding AG, ADR | Switzerland | 1,182 | 43,604 | |

| Sanofi, ADR | France | 611 | 32,566 | |

| Shire PLC, ADR | Ireland | 1,462 | 253,496 | |

| Teva Pharmaceutical Industries Ltd., ADR | Israel | 5,346 | 269,920 | |

| aValeant Pharmaceuticals International Inc | Canada | 2,803 | 367,782 | |

| a,bXenoPort Inc | United States | 4,145 | 16,787 | |

| 14,194,921 | ||||

| Professional Services 1.2% | ||||

| bEquifax Inc | United States | 11,485 | 813,023 | |

| Experian PLC | United Kingdom | 26,498 | 460,592 | |

| a,bHuron Consulting Group Inc | United States | 8,035 | 545,416 | |

| bManpowerGroup Inc | United States | 6,120 | 501,718 | |

| Nielsen NV | United States | 6,571 | 317,116 | |

| bRobert Half International Inc | United States | 10,060 | 458,635 | |

| SThree PLC | United Kingdom | 62,747 | 370,220 | |

| Towers Watson & Co., A | United States | 7,567 | 851,363 | |

| aVerisk Analytics Inc., A | United States | 1,835 | 108,614 | |

| aWageWorks Inc | United States | 5,550 | 224,664 | |

| 4,651,361 | ||||

| Real Estate Investment Trusts (REITs) 1.3% | ||||

| Acadia Realty Trust | United States | 5,801 | 160,050 | |

| American Realty Capital Properties Inc | United States | 43,641 | 541,585 | |

| bAmerican Tower Corp | United States | 5,607 | 502,555 | |

| AvalonBay Communities Inc | United States | 1,211 | 171,768 | |

| Corrections Corp. of America | United States | 3,246 | 105,592 | |

| Equity Lifestyle Properties Inc | United States | 878 | 38,404 | |

| Equity One Inc | United States | 1,327 | 30,468 | |

| Excel Trust Inc | United States | 5,988 | 79,042 | |

| Gaming and Leisure Properties Inc | United States | 2,420 | 81,215 | |

| bMid-America Apartment Communities Inc | United States | 10,086 | 729,722 | |

| bNorthStar Realty Finance Corp | United States | 42,139 | 697,596 | |

| Post Properties Inc | United States | 654 | 33,452 | |

| Ryman Hospitality Properties Inc | United States | 4,211 | 194,254 | |

| Spirit Realty Capital Inc | United States | 44,762 | 505,363 | |

| bSunstone Hotel Investors Inc | United States | 16,786 | 246,586 | |

| Annual Report | 31 | ||||

| Franklin Alternative Strategies Funds | ||||

| Consolidated Statement of Investments, May 31, 2014 (continued) | ||||

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Real Estate Investment Trusts (REITs) (continued) | ||||

| Tanger Factory Outlet Centers Inc | United States | 1,991 | $ | 70,521 |

| Taubman Centers Inc | United States | 2,916 | 218,408 | |

| Ventas Inc | United States | 442 | 29,526 | |

| Weyerhaeuser Co | United States | 7,265 | 228,266 | |

| bWP Carey Inc | United States | 8,653 | 550,677 | |

| 5,215,050 | ||||

| Real Estate Management & Development 0.4% | ||||

| a,bCBRE Group Inc., A | United States | 43,130 | 1,287,195 | |

| a,bRealogy Holdings Corp | United States | 11,102 | 412,772 | |

| 1,699,967 | ||||

| Road & Rail 1.4% | ||||

| a,bHertz Global Holdings Inc | United States | 57,044 | 1,684,134 | |

| JB Hunt Transport Services Inc | United States | 4,350 | 337,821 | |

| Ryder System Inc | United States | 7,672 | 665,853 | |

| aSwift Transportation Co | United States | 10,906 | 270,032 | |

| bUnion Pacific Corp | United States | 13,169 | 2,624,187 | |

| 5,582,027 | ||||

| Semiconductors & Semiconductor Equipment 1.5% | ||||

| Altera Corp | United States | 6,100 | 202,093 | |

| Applied Materials Inc | United States | 3,000 | 60,570 | |

| aApplied Micro Circuits Corp | United States | 33,715 | 303,435 | |

| Avago Technologies Ltd | Singapore | 8,683 | 613,628 | |

| aFreescale Semiconductor Ltd | United States | 15,800 | 350,602 | |

| aGT Advanced Technologies Inc | United States | 2,650 | 44,679 | |

| KLA-Tencor Corp | United States | 323 | 21,163 | |

| aLam Research Corp | United States | 1,900 | 117,876 | |

| bMaxim Integrated Products Inc | United States | 10,325 | 353,631 | |

| MediaTek Inc | Taiwan | 14,300 | 232,249 | |

| aMicron Technology Inc | United States | 3,505 | 100,208 | |

| aMontage Technology Group Ltd | China | 2,300 | 43,608 | |

| aNXP Semiconductors NV | Netherlands | 45,936 | 2,852,626 | |

| aSilicon Laboratories Inc | United States | 2,325 | 104,904 | |

| aSK Hynix Inc | South Korea | 5,770 | 249,701 | |

| aSunEdison Inc | United States | 20,762 | 408,804 | |

| Texas Instruments Inc | United States | 396 | 18,604 | |

| 6,078,381 | ||||

| Software 1.2% | ||||

| bActivision Blizzard Inc | United States | 17,365 | 360,845 | |

| a,bAdobe Systems Inc | United States | 13,280 | 857,091 | |

| a,bAspen Technology Inc | United States | 4,116 | 176,947 | |

| a,bCadence Design Systems Inc | United States | 13,715 | 228,903 | |

| a,bCitrix Systems Inc | United States | 5,703 | 353,415 | |

| Giant Interactive Group Inc., ADR | China | 16,907 | 198,826 | |

| aGuidewire Software Inc | United States | 2,620 | 98,957 | |

| Intuit Inc | United States | 5,580 | 442,438 | |

| a,bMICROS Systems Inc | United States | 9,225 | 492,800 | |

| 32 | Annual Report | ||||

Franklin Alternative Strategies Funds

Consolidated Statement of Investments, May 31, 2014 (continued)

| Franklin K2 Alternative Strategies Fund | Country | Shares/Units | Value | |

| Common Stocks and Other Equity Interests (continued) | ||||

| Software (continued) | ||||

| bMicrosoft Corp | United States | 12,705 | $ | 520,143 |

| aNetScout Systems Inc | United States | 775 | 30,124 | |

| aNetSuite Inc | United States | 2,085 | 167,822 | |

| aQualys Inc | United States | 5,255 | 124,228 | |

| aRed Hat Inc | United States | 3,060 | 153,367 | |

| a,bVerint Systems Inc | United States | 7,020 | 325,237 | |

| aVMware Inc., A | United States | 1,705 | 164,533 | |

| 4,695,676 | ||||

| Specialty Retail 1.1% | ||||

| Best Buy Co. Inc | United States | 9,957 | 275,411 | |

| aCabela’s Inc | United States | 2,423 | 148,360 | |

| bCST Brands Inc | United States | 24,703 | 816,928 | |

| DSW Inc., A | United States | 2,780 | 69,639 | |

| bThe Gap Inc | United States | 17,600 | 725,648 | |

| bThe Home Depot Inc | United States | 11,014 | 883,653 | |

| The Men’s Wearhouse Inc | United States | 6,983 | 347,614 | |

| Signet Jewelers Ltd | United States | 3,331 | 353,386 | |

| bTiffany & Co | United States | 9,026 | 897,275 | |

| 4,517,914 | ||||

| Technology Hardware, Storage & Peripherals 0.6% | ||||

| bApple Inc | United States | 1,300 | 822,900 | |

| Canon Inc., ADR | Japan | 125 | 4,129 | |

| EMC Corp | United States | 25,125 | 667,320 | |

| Hewlett-Packard Co | United States | 7,100 | 237,850 | |

| Lenovo Group Ltd | China | 200,000 | 247,647 | |

| aStratasys Ltd | United States | 1,600 | 148,832 | |

| Western Digital Corp | United States | 2,700 | 237,195 | |

| 2,365,873 | ||||

| Textiles, Apparel & Luxury Goods 0.4% | ||||

| Cie Financiere Richemont SA | Switzerland | 7,976 | 840,353 | |

| Coach Inc | United States | 9,365 | 381,249 | |

| Hermes International | France | 561 | 198,830 | |