| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

| Investment Company Act file number | 811-22680 |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 |

| Date of fiscal year end: | August 31 | |

| Date of reporting period: | August 31, 2016 |

| Item 1. | Reports to Stockholders. |

ALAMBIC SMALL CAP VALUE PLUS FUND

ALAMBIC SMALL CAP GROWTH PLUS FUND

Annual Report

August 31, 2016

ALAMBIC FUNDS | September 16, 2016 |

It’s hard to believe that Alambic Investment Management LP has been in the mutual fund business now for over a year. Alambic Small Cap Value Plus Fund (ALAMX) has a 12-month track record as of August 31, 2016 and Alambic Small Cap Growth Plus Fund (ALGSX) is following right behind with 8 months under its belt. Although we always have room to improve our returns, we are very happy with our progress to date, and we are well within the bounds of our original expectations.

In regards to the broader market, small cap stocks (“Small Caps”) continue to do well. With volatility remaining low and credit spreads continuing to narrow, the Small Cap rally that began following February 2016 has continued and has helped to boost the returns of both of our funds. Since the February cycle lows, Small Caps have rallied an impressive 30% through August 2016 versus 25% for Mid-Caps and 20% for Large Caps. Unlike mid-cap stocks (“Mid-Caps) and large cap stocks (“Large Caps”), Small Caps are still 5% off their cycle highs last year. Concerns persist in the market that Small Caps are expensive with the forward price-to-earnings ratios at 17.3x at the end of August relative to the historical average of 15.3x. This however is still well below the cycle high of 19.3x in 2013.

Looking forward, as the equity markets gradually grind higher, we continue to see an elevated risk of correction in the coming months which we would expect to disproportionately impact Small Caps. Current high valuations, high expectations for growth, an increase in bullish positioning by managers and very low volatility point to a complacent market ripe for disappointment. Weak credit fundamentals, a potentially tightening Fed along with corresponding higher volatility around election time could provide the catalysts for disappointment.

The potential silver lining in all of this is that lower prices may help to reverse the mutual fund and exchange-traded fund (“ETF”) outflows that we have seen in the market this year. Recent flow data indicates it may already be happening.

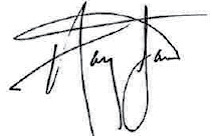

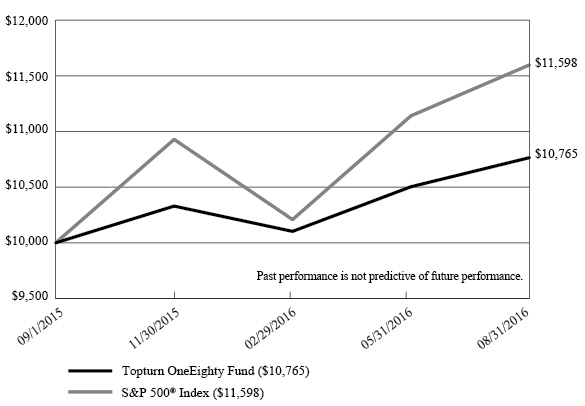

Since inception, September 1, 2015, through August 31, 2016, ALAMX delivered a return of 16.31% versus its benchmark the Russell 2000® Value Index at 17.09%. Year-to-date (“YTD”) through August 31, 2016 ALAMX delivered a return of 14.06% versus the Russell 2000® Value Index at 14.58%.

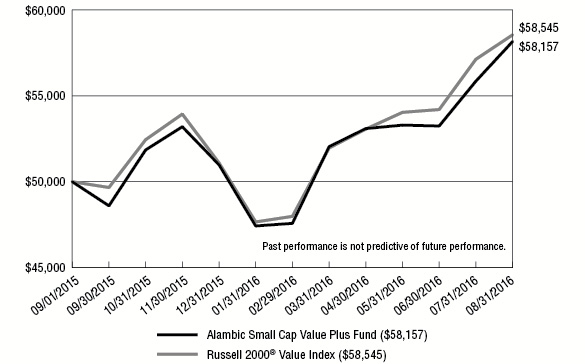

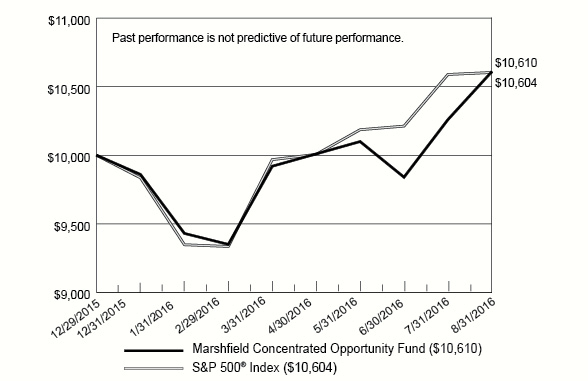

Since inception, December 29, 2015, through August 31, 2016, ALGSX delivered a return of 11.40% versus its benchmark the Russell 2000® Growth Index at 3.74%. YTD through August 31, 2016, ALGSX delivered a return of 13.44% versus the Russell 2000® Growth Index at 5.96%.

Our tracking error to our benchmark for ALAMX has averaged 3.84% since inception through August 31, 2016 and for ALGSX, 5.01% for the same period.

Portfolio turnover for our past quarter is averaging 340% annualized for ALAMX and 296% for ALGSX. Both have increased slightly as a result of the increased trading in the portfolios during our re-weighting in June but they are consistent with our assumptions at the time we launched the funds.

1

At this point in the evolution of our mutual fund business, we are quite pleased with each fund’s performance relative to its benchmark and more importantly, our peer groups. We have spent much of the last 12 months tweaking the ALAMX portfolio in an effort to offset through superior stock selection our traditional underweight in the Financials, REITs, and Utilities sectors. In the past two months as each fund’s performance has improved relative to its benchmark, we believe we are making progress. We will continue to work on building the optimal portfolio that will provide attractive returns relative to each fund’s benchmark and its peers.

While we are managing both funds well within our original assumptions for performance, tracking error, and portfolio turnover, and any minor portfolio modifications are an effort to boost returns. Our quantitative approach to stock selection appears to be performing well and we have proven with our portfolio reweighting this year that we can continue to extract performance improvements going forward.

Thank you for your ongoing trust and commitment.

Sincerely

Albert Richards | Brian Thompson | Rob Slaymaker |

CEO | CRO | Partner |

2

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-890-8988.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus please visit our website at https://alambicfunds.com or call 1-888-890-8988 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Alambic Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Funds, may be sold at any time and may no longer be held by the Funds. For a complete list of securities held by the Funds as of August 31, 2016, please see the Schedules of Investments sections of the annual report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

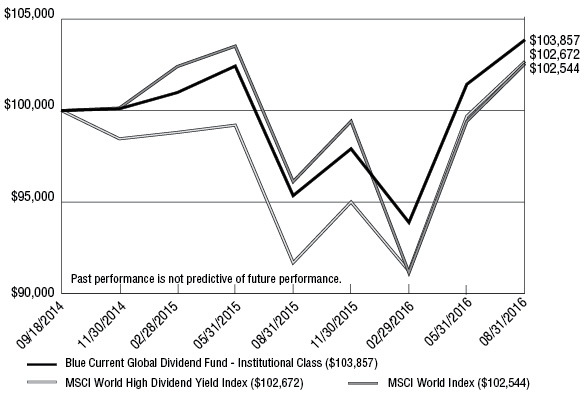

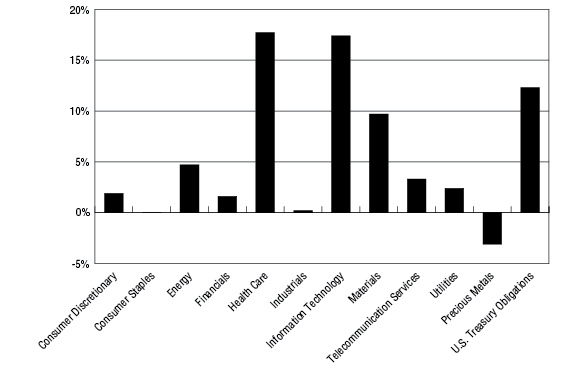

ALAMBIC SMALL CAP VALUE PLUS FUND

PERFORMANCE INFORMATION

August 31, 2016 (Unaudited)

Comparison of the Change in Value of a $50,000 Investment

in Alambic Small Cap Value Plus Fund versus the

Russell 2000® Value Index.

|

Total Returns | ||

Since | ||

Alambic Small Cap Value Plus Fund (a) | 16.31% | |

Russell 2000® Value Index | 17.09% | |

(a) | The total return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

(b) | Commencement of operations for Alambic Small Cap Value Plus Fund was September 1, 2015. |

4

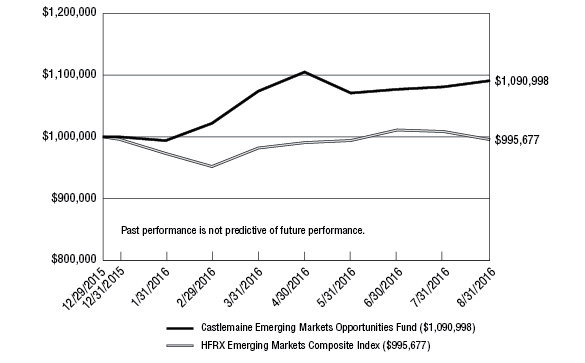

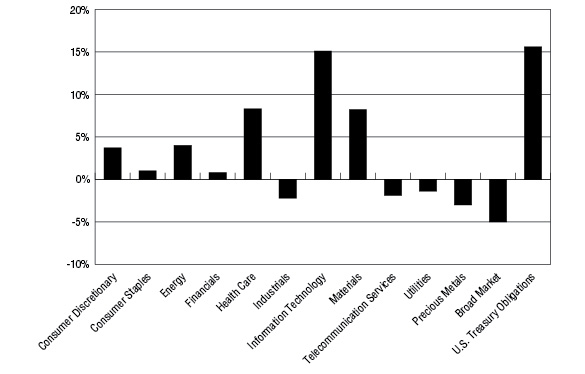

ALAMBIC SMALL CAP GROWTH PLUS FUND

PERFORMANCE INFORMATION

August 31, 2016 (Unaudited)

Comparison of the Change in Value of a $50,000 Investment

in Alambic Small Cap Growth Plus Fund versus the

Russell 2000® Growth Index.

|

Total Returns | ||

Since | ||

Alambic Small Cap Growth Plus Fund (a) | 11.40% | |

Russell 2000® Growth Index | 3.74% | |

(a) | The total return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

(b) | Commencement of operations for Alambic Small Cap Growth Plus Fund was December 29, 2015. |

5

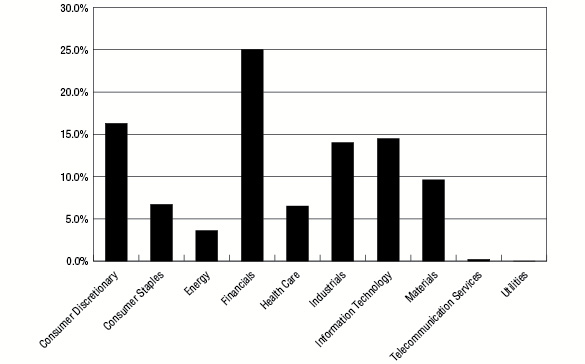

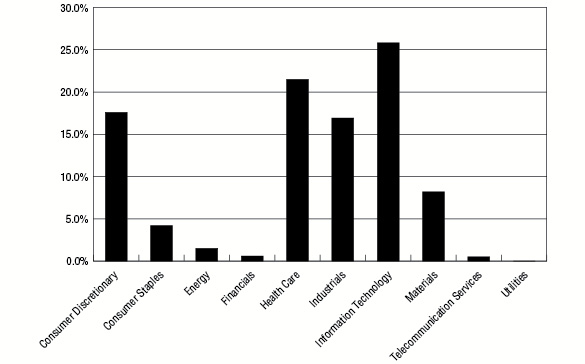

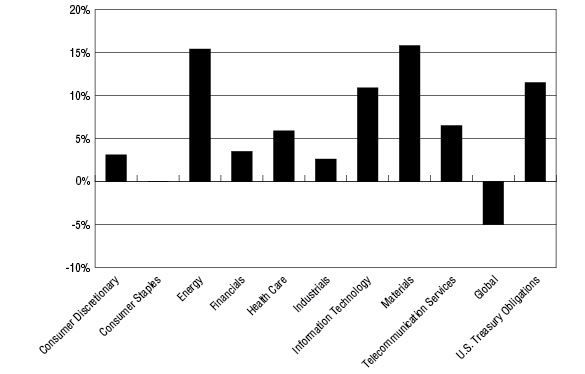

ALAMBIC SMALL CAP VALUE PLUS FUND

PORTFOLIO INFORMATION

August 31, 2016 (Unaudited)

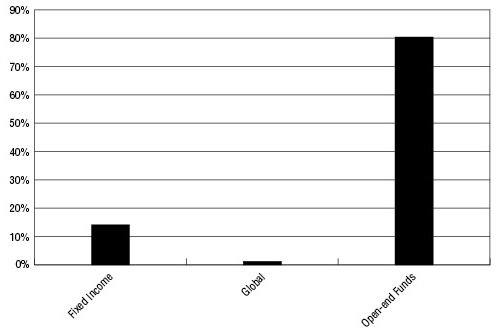

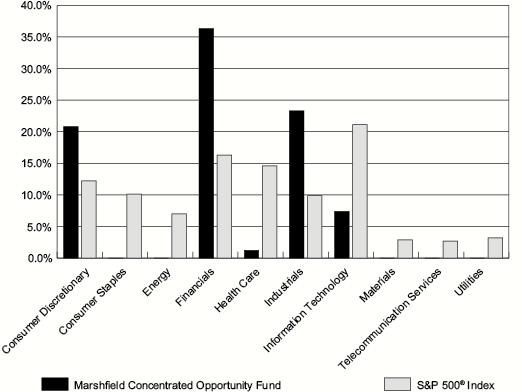

Sector Diversification (% of Net Assets)

|

Top 10 Equity Holdings

Security Description | % of Net Assets |

MSG Networks, Inc. - Class A | 1.8% |

Alpha & Omega Semiconductor Ltd. | 1.6% |

Greif, Inc. - Class A | 1.6% |

SUPERVALU, Inc. | 1.4% |

SpartanNash Company | 1.4% |

Quad/Graphics, Inc. - Class A | 1.4% |

Vectrus, Inc. | 1.2% |

Acacia Research Corporation | 1.1% |

Chase Corporation | 1.1% |

Stepan Company | 1.1% |

6

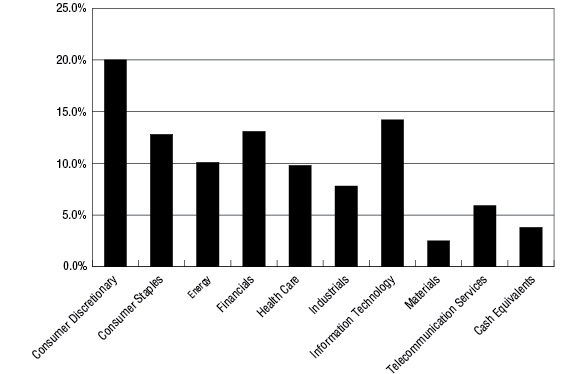

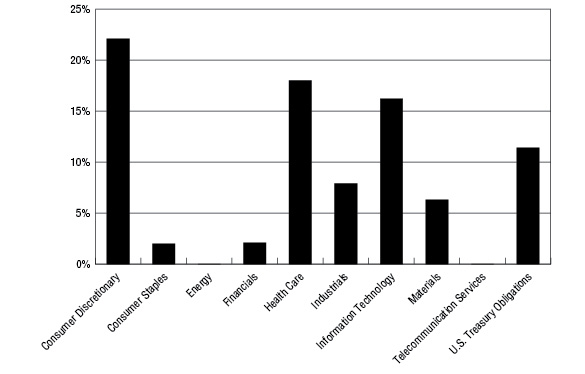

ALAMBIC SMALL CAP GROWTH PLUS FUND

PORTFOLIO INFORMATION

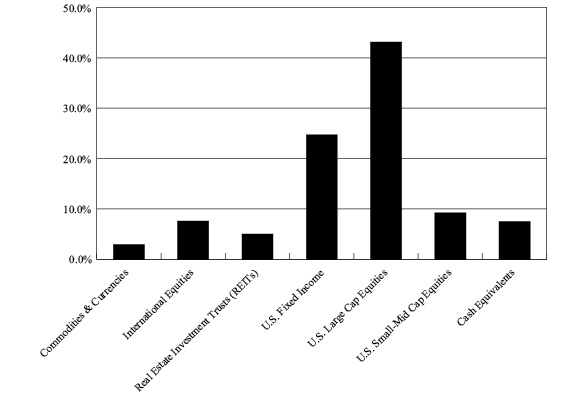

August 31, 2016 (Unaudited)

Sector Diversification (% of Net Assets)

|

Top 10 Equity Holdings

Security Description | % of Net Assets |

Accuray, Inc. | 1.7% |

CSG Systems International, Inc. | 1.7% |

Convergys Corporation | 1.5% |

Chase Corporation | 1.4% |

MSG Networks, Inc. - Class A | 1.4% |

Unisys Corporation | 1.4% |

Ironwood Pharmaceuticals, Inc. - Class A | 1.4% |

HRG Group, Inc. | 1.3% |

Kimball International, Inc. - Class B | 1.2% |

General Cable Corporation | 1.2% |

7

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% | Shares | Value | ||||||

Consumer Discretionary — 16.3% | ||||||||

Auto Components — 0.4% | ||||||||

Modine Manufacturing Company (a) | 600 | $ | 6,426 | |||||

Tower International, Inc. | 200 | 4,860 | ||||||

11,286 | ||||||||

Diversified Consumer Services — 1.5% | ||||||||

Career Education Corporation (a) | 2,900 | 18,966 | ||||||

K12, Inc. (a) | 1,483 | 17,722 | ||||||

Liberty Tax, Inc. - Class A | 200 | 2,718 | ||||||

39,406 | ||||||||

Hotels, Restaurants & Leisure — 2.7% | ||||||||

Bravo Brio Restaurant Group, Inc. (a) | 300 | 1,410 | ||||||

Caesars Acquisition Company - Class A (a) | 1,300 | 15,821 | ||||||

Century Casinos, Inc. (a) | 2,300 | 14,697 | ||||||

Intrawest Resorts Holdings, Inc. (a) | 500 | 7,460 | ||||||

J. Alexander's Holdings, Inc. (a) | 800 | 7,976 | ||||||

Potbelly Corporation (a) | 600 | 7,776 | ||||||

RCI Hospitality Holdings, Inc. | 100 | 1,099 | ||||||

Red Lion Hotels Corporation (a) | 300 | 1,962 | ||||||

Scientific Games Corporation - Class A (a) | 300 | 2,475 | ||||||

Speedway Motorsports, Inc. | 500 | 8,945 | ||||||

69,621 | ||||||||

Household Durables — 1.3% | ||||||||

Bassett Furniture Industries, Inc. | 200 | 4,952 | ||||||

Flexsteel Industries, Inc. | 350 | 16,607 | ||||||

Libbey, Inc. | 600 | 10,638 | ||||||

TRI Pointe Group, Inc. (a) | 100 | 1,356 | ||||||

33,553 | ||||||||

Internet & Catalog Retail — 0.9% | ||||||||

FTD Companies, Inc. (a) | 600 | 14,100 | ||||||

RetailMeNot, Inc. (a) | 800 | 9,048 | ||||||

23,148 | ||||||||

Leisure Products — 0.7% | ||||||||

Callaway Golf Company | 1,000 | 11,420 | ||||||

Johnson Outdoors, Inc. - Class A | 200 | 6,730 | ||||||

18,150 | ||||||||

Media — 2.6% | ||||||||

Lee Enterprises, Inc. (a) | 1,300 | 3,627 | ||||||

MSG Networks, Inc. - Class A (a) | 2,600 | 45,448 | ||||||

Radio One, Inc. - Class D (a) | 1,800 | 6,228 | ||||||

Scholastic Corporation | 50 | 2,013 | ||||||

TEGNA, Inc. | 400 | 8,104 | ||||||

65,420 | ||||||||

See accompanying notes to financial statements. |

8

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Consumer Discretionary — 16.3% (Continued) | ||||||||

Multi-Line Retail — 0.1% | ||||||||

Dillard's, Inc. - Class A | 50 | $ | 3,012 | |||||

Specialty Retail — 4.3% | ||||||||

Aaron's, Inc. | 200 | 4,872 | ||||||

Cato Corporation (The) - Class A | 250 | 8,570 | ||||||

Citi Trends, Inc. | 1,400 | 27,370 | ||||||

Haverty Furniture Companies, Inc. | 300 | 6,000 | ||||||

Kirkland's, Inc. (a) | 200 | 2,506 | ||||||

Office Depot, Inc. | 3,800 | 13,984 | ||||||

Rent-A-Center, Inc. | 1,500 | 18,330 | ||||||

Shoe Carnival, Inc. | 703 | 20,851 | ||||||

Tilly's, Inc. - Class A (a) | 600 | 5,244 | ||||||

West Marine, Inc. (a) | 200 | 1,846 | ||||||

109,573 | ||||||||

Textiles, Apparel & Luxury Goods — 1.8% | ||||||||

Cherokee, Inc. (a) | 800 | 9,008 | ||||||

Crocs, Inc. (a) | 1,300 | 11,232 | ||||||

Perry Ellis International, Inc. (a) | 1,400 | 26,096 | ||||||

46,336 | ||||||||

Consumer Staples — 6.7% | ||||||||

Beverages — 0.1% | ||||||||

Cott Corporation | 200 | 3,188 | ||||||

Food & Staples Retailing — 4.6% | ||||||||

SpartanNash Company | 1,100 | 35,222 | ||||||

SUPERVALU, Inc. (a) | 6,600 | 36,168 | ||||||

Village Super Market, Inc. - Class A | 600 | 19,194 | ||||||

Weis Markets, Inc. | 550 | 28,017 | ||||||

118,601 | ||||||||

Food Products — 0.9% | ||||||||

Darling Ingredients, Inc. (a) | 100 | 1,408 | ||||||

Dean Foods Company | 200 | 3,442 | ||||||

Farmer Brothers Company (a) | 400 | 12,808 | ||||||

Omega Protein Corporation (a) | 200 | 5,042 | ||||||

22,700 | ||||||||

Household Products — 0.7% | ||||||||

Central Garden & Pet Company (a) | 400 | 10,272 | ||||||

Oil-Dri Corporation of America | 200 | 7,558 | ||||||

17,830 | ||||||||

Personal Products — 0.4% | ||||||||

Avon Products, Inc. | 1,600 | 9,120 | ||||||

See accompanying notes to financial statements. |

9

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Energy — 3.6% | ||||||||

Energy Equipment & Services — 1.2% | ||||||||

Dawson Geophysical Company (a) | 800 | $ | 5,768 | |||||

Gulf Island Fabrication, Inc. | 300 | 2,640 | ||||||

Natural Gas Services Group, Inc. (a) | 400 | 9,456 | ||||||

Oceaneering International, Inc. | 100 | 2,652 | ||||||

PHI, Inc. (a) | 200 | 3,726 | ||||||

RigNet, Inc. (a) | 100 | 1,262 | ||||||

SAExploration Holdings, Inc. (a) | 100 | 1,090 | ||||||

Unit Corporation (a) | 200 | 3,418 | ||||||

Willbros Group, Inc. (a) | 500 | 970 | ||||||

30,982 | ||||||||

Oil, Gas & Consumable Fuels — 2.4% | ||||||||

Chesapeake Energy Corporation (a) | 1,200 | 7,620 | ||||||

Clean Energy Fuels Corporation (a) | 2,400 | 10,488 | ||||||

Denbury Resources, Inc. (a) | 600 | 1,848 | ||||||

EP Energy Corporation - Class A (a) | 200 | 824 | ||||||

Green Plains, Inc. | 300 | 7,284 | ||||||

Pacific Ethanol, Inc. (a) | 400 | 2,584 | ||||||

REX American Resources Corporation (a) | 300 | 24,132 | ||||||

Western Refining, Inc. | 200 | 5,032 | ||||||

Westmoreland Coal Company (a) | 100 | 767 | ||||||

60,579 | ||||||||

Financials — 25.0% | ||||||||

Banks — 12.7% | ||||||||

Associated Banc-Corp | 400 | 7,936 | ||||||

BancorpSouth, Inc. | 500 | 12,450 | ||||||

BOK Financial Corporation | 100 | 6,907 | ||||||

Cathay General Bancorp | 300 | 9,426 | ||||||

Citigroup, Inc. | 150 | 7,161 | ||||||

Columbia Banking System, Inc. | 300 | 9,912 | ||||||

Commerce Bancshares, Inc. | 262 | 13,278 | ||||||

Cullen/Frost Bankers, Inc. | 190 | 13,851 | ||||||

CVB Financial Corporation | 200 | 3,558 | ||||||

East West Bancorp, Inc. | 100 | 3,714 | ||||||

F.N.B. Corporation | 400 | 4,996 | ||||||

First Bancorp (Puerto Rico) (a) | 600 | 2,940 | ||||||

First Citizens BancShares, Inc. - Class A | 20 | 5,698 | ||||||

First Horizon National Corporation | 800 | 12,304 | ||||||

Fulton Financial Corporation | 500 | 7,230 | ||||||

Glacier Bancorp, Inc. | 100 | 2,994 | ||||||

Great Western Bancorp, Inc. | 100 | 3,424 | ||||||

Hancock Holding Company | 200 | 6,526 | ||||||

See accompanying notes to financial statements. |

10

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Financials — 25.0% (Continued) | ||||||||

Banks — 12.7% (Continued) | ||||||||

Hilltop Holdings, Inc. (a) | 300 | $ | 6,792 | |||||

Huntington Bancshares, Inc. | 1,204 | 12,052 | ||||||

IBERIABANK Corporation | 50 | 3,438 | ||||||

International Bancshares Corporation | 100 | 2,965 | ||||||

Investors Bancorp, Inc. | 100 | 1,225 | ||||||

LegacyTexas Financial Group, Inc. | 100 | 3,033 | ||||||

MB Financial, Inc. | 550 | 21,549 | ||||||

Old National Bancorp | 400 | 5,664 | ||||||

PacWest Bancorp | 150 | 6,496 | ||||||

People's United Financial, Inc. | 200 | 3,250 | ||||||

Popular, Inc. | 100 | 3,931 | ||||||

PrivateBancorp, Inc. | 200 | 9,190 | ||||||

Prosperity Bancshares, Inc. | 450 | 24,962 | ||||||

Sterling Bancorp | 300 | 5,355 | ||||||

Synovus Financial Corporation | 250 | 8,270 | ||||||

TCF Financial Corporation | 500 | 7,325 | ||||||

Texas Capital Bancshares, Inc. (a) | 100 | 5,252 | ||||||

UMB Financial Corporation | 150 | 9,120 | ||||||

Umpqua Holdings Corporation | 700 | 11,494 | ||||||

United Bankshares, Inc. | 150 | 5,910 | ||||||

Webster Financial Corporation | 550 | 21,247 | ||||||

Western Alliance Bancorp (a) | 100 | 3,822 | ||||||

Wintrust Financial Corporation | 50 | 2,779 | ||||||

Zions Bancorporation | 200 | 6,118 | ||||||

325,544 | ||||||||

Capital Markets — 0.1% | ||||||||

American Capital Ltd. (a) | 200 | 3,378 | ||||||

Consumer Finance — 0.8% | ||||||||

Navient Corporation | 500 | 7,190 | ||||||

Nelnet, Inc. - Class A | 200 | 7,080 | ||||||

OneMain Holdings, Inc. (a) | 100 | 3,101 | ||||||

Santander Consumer USA Holdings, Inc. (a) | 200 | 2,516 | ||||||

19,887 | ||||||||

Diversified Financial Services — 0.3% | ||||||||

MarketAxess Holdings, Inc. | 40 | 6,742 | ||||||

On Deck Capital, Inc. (a) | 300 | 1,899 | ||||||

8,641 | ||||||||

Insurance — 1.0% | ||||||||

American Equity Investment Life Holding Company | 200 | 3,524 | ||||||

Assurant, Inc. | 20 | 1,791 | ||||||

See accompanying notes to financial statements. |

11

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Financials — 25.0% (Continued) | ||||||||

Insurance — 1.0% (Continued) | ||||||||

Genworth Financial, Inc. - Class A (a) | 800 | $ | 3,784 | |||||

Marsh & McLennan Companies, Inc. | 120 | 8,116 | ||||||

MBIA, Inc. (a) | 400 | 3,224 | ||||||

Primerica, Inc. | 50 | 2,846 | ||||||

RLI Corporation | 50 | 3,549 | ||||||

26,834 | ||||||||

Real Estate Investment Trusts (REITs) — 9.9% | ||||||||

Acadia Realty Trust | 450 | 16,623 | ||||||

Altisource Residential Corporation | 300 | 3,291 | ||||||

American Campus Communities, Inc. | 50 | 2,505 | ||||||

American Tower Corporation | 70 | 7,937 | ||||||

AvalonBay Communities, Inc. | 30 | 5,250 | ||||||

Capstead Mortgage Corporation | 1,200 | 11,904 | ||||||

Communications Sales & Leasing, Inc. | 100 | 3,120 | ||||||

CubeSmart | 200 | 5,506 | ||||||

CyrusOne, Inc. | 100 | 5,084 | ||||||

DCT Industrial Trust, Inc. | 150 | 7,306 | ||||||

Douglas Emmett, Inc. | 100 | 3,756 | ||||||

Education Realty Trust, Inc. | 100 | 4,531 | ||||||

Equity One, Inc. | 200 | 6,208 | ||||||

Extra Space Storage, Inc. | 60 | 4,833 | ||||||

Federal Realty Investment Trust | 50 | 7,950 | ||||||

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 850 | 20,383 | ||||||

Healthcare Realty Trust, Inc. | 100 | 3,506 | ||||||

Ladder Capital Corporation | 900 | 11,952 | ||||||

Lexington Realty Trust | 300 | 3,237 | ||||||

MFA Financial, Inc. | 1,100 | 8,492 | ||||||

Monogram Residential Trust, Inc. | 1,000 | 10,520 | ||||||

New Residential Investment Corporation | 900 | 12,915 | ||||||

Prologis, Inc. | 350 | 18,589 | ||||||

Public Storage | 50 | 11,197 | ||||||

Redwood Trust, Inc. | 200 | 2,960 | ||||||

Resource Capital Corporation | 100 | 1,327 | ||||||

Starwood Property Trust, Inc. | 700 | 16,030 | ||||||

STORE Capital Corporation | 800 | 23,704 | ||||||

Two Harbors Investment Corporation | 1,100 | 9,790 | ||||||

Vornado Realty Trust | 20 | 2,066 | ||||||

Weingarten Realty Investors | 50 | 2,063 | ||||||

254,535 | ||||||||

Real Estate Management & Development — 0.2% | ||||||||

St. Joe Company (The) (a) | 200 | 3,778 | ||||||

See accompanying notes to financial statements. |

12

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Health Care — 6.5% | ||||||||

Biotechnology — 1.4% | ||||||||

Acorda Therapeutics, Inc. (a) | 100 | $ | 2,408 | |||||

Array BioPharma, Inc. (a) | 1,300 | 4,459 | ||||||

PDL BioPharma, Inc. | 3,000 | 8,730 | ||||||

Retrophin, Inc. (a) | 400 | 6,408 | ||||||

Spectrum Pharmaceuticals, Inc. (a) | 2,500 | 13,275 | ||||||

35,280 | ||||||||

Health Care Equipment & Supplies — 2.9% | ||||||||

Accuray, Inc. (a) | 800 | 4,264 | ||||||

AngioDynamics, Inc. (a) | 1,300 | 21,502 | ||||||

Electromed, Inc. (a) | 700 | 3,773 | ||||||

Exactech, Inc. (a) | 500 | 13,895 | ||||||

Halyard Health, Inc. (a) | 600 | 21,870 | ||||||

Invacare Corporation | 200 | 2,374 | ||||||

Lantheus Holdings, Inc. (a) | 600 | 5,712 | ||||||

RTI Surgical, Inc. (a) | 600 | 1,926 | ||||||

75,316 | ||||||||

Health Care Providers & Services — 0.9% | ||||||||

Alliance HealthCare Services, Inc. (a) | 100 | 630 | ||||||

Five Star Quality Care, Inc. (a) | 4,800 | 10,176 | ||||||

Healthways, Inc. (a) | 400 | 10,004 | ||||||

National HealthCare Corporation | 50 | 3,249 | ||||||

24,059 | ||||||||

Health Care Technology — 0.3% | ||||||||

Computer Programs & Systems, Inc. | 200 | 5,164 | ||||||

Simulations Plus, Inc. | 300 | 2,586 | ||||||

7,750 | ||||||||

Pharmaceuticals — 1.0% | ||||||||

Prestige Brands Holdings, Inc. (a) | 540 | 25,990 | ||||||

Industrials — 14.0% | ||||||||

Aerospace & Defense — 2.6% | ||||||||

AAR Corporation | 100 | 2,461 | ||||||

Moog, Inc. - Class A (a) | 200 | 11,798 | ||||||

National Presto Industries, Inc. | 120 | 10,471 | ||||||

Triumph Group, Inc. | 400 | 12,744 | ||||||

Vectrus, Inc. (a) | 900 | 30,366 | ||||||

67,840 | ||||||||

Air Freight & Logistics — 0.4% | ||||||||

Park-Ohio Holdings Corporation | 250 | 9,220 | ||||||

See accompanying notes to financial statements. |

13

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Industrials — 14.0% (Continued) | ||||||||

Building Products — 0.6% | ||||||||

Continental Building Products, Inc. (a) | 200 | $ | 4,442 | |||||

Ply Gem Holdings, Inc. (a) | 800 | 11,176 | ||||||

15,618 | ||||||||

Commercial Services & Supplies — 2.7% | ||||||||

ACCO Brands Corporation (a) | 1,000 | 10,000 | ||||||

ARC Document Solutions, Inc. (a) | 700 | 2,366 | ||||||

Ennis, Inc. | 300 | 4,974 | ||||||

Kimball International, Inc. - Class B | 700 | 8,715 | ||||||

Quad/Graphics, Inc. - Class A | 1,300 | 35,217 | ||||||

West Corporation | 300 | 7,029 | ||||||

68,301 | ||||||||

Construction & Engineering — 0.2% | ||||||||

Goldfield Corporation (The) (a) | 800 | 2,376 | ||||||

Sterling Construction Company, Inc. (a) | 300 | 1,935 | ||||||

4,311 | ||||||||

Electrical Equipment — 0.4% | ||||||||

General Cable Corporation | 300 | 4,839 | ||||||

Powell Industries, Inc. | 150 | 5,963 | ||||||

10,802 | ||||||||

Machinery — 3.7% | ||||||||

AGCO Corporation | 350 | 16,989 | ||||||

Briggs & Stratton Corporation | 300 | 5,703 | ||||||

Chart Industries, Inc. (a) | 100 | 3,012 | ||||||

Commercial Vehicle Group, Inc. (a) | 2,200 | 11,858 | ||||||

Gencor Industries, Inc. (a) | 1,450 | 16,602 | ||||||

Hurco Companies, Inc. | 500 | 13,505 | ||||||

Lydall, Inc. (a) | 100 | 4,804 | ||||||

Meritor, Inc. (a) | 200 | 2,230 | ||||||

Navistar International Corporation (a) | 900 | 12,636 | ||||||

Supreme Industries, Inc. - Class A | 100 | 1,724 | ||||||

TriMas Corporation (a) | 200 | 3,836 | ||||||

Wabash National Corporation (a) | 100 | 1,395 | ||||||

94,294 | ||||||||

Professional Services — 1.7% | ||||||||

Acacia Research Corporation | 4,900 | 29,302 | ||||||

Heidrick & Struggles International, Inc. | 100 | 1,869 | ||||||

Resources Connection, Inc. | 800 | 12,072 | ||||||

43,243 | ||||||||

Road & Rail — 1.4% | ||||||||

ArcBest Corporation | 400 | 7,324 | ||||||

Marten Transport Ltd. | 100 | 2,157 | ||||||

See accompanying notes to financial statements. |

14

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Industrials — 14.0% (Continued) | ||||||||

Road & Rail — 1.4% (Continued) | ||||||||

YRC Worldwide, Inc. (a) | 2,400 | $ | 27,816 | |||||

37,297 | ||||||||

Trading Companies & Distributors — 0.2% | ||||||||

WESCO International, Inc. (a) | 100 | 6,216 | ||||||

Transportation Infrastructure — 0.1% | ||||||||

Wesco Aircraft Holdings, Inc. (a) | 200 | 2,748 | ||||||

Information Technology — 14.5% | ||||||||

Communications Equipment — 0.7% | ||||||||

Bel Fuse, Inc. - Class B | 500 | 11,485 | ||||||

Digi International, Inc. (a) | 600 | 6,882 | ||||||

18,367 | ||||||||

Electronic Equipment, Instruments & Components — 1.3% | ||||||||

Electro Scientific Industries, Inc. (a) | 3,200 | 17,824 | ||||||

Insight Enterprises, Inc. (a) | 200 | 6,120 | ||||||

KEMET Corporation (a) | 300 | 1,023 | ||||||

PC Connection, Inc. | 200 | 5,214 | ||||||

TTM Technologies, Inc. (a) | 300 | 3,219 | ||||||

33,400 | ||||||||

Internet Software & Services — 1.3% | ||||||||

Limelight Networks, Inc. (a) | 1,000 | 1,780 | ||||||

Liquidity Services, Inc. (a) | 400 | 4,000 | ||||||

MeetMe, Inc. (a) | 100 | 576 | ||||||

Monster Worldwide, Inc. (a) | 2,700 | 9,882 | ||||||

QuinStreet, Inc. (a) | 2,500 | 7,650 | ||||||

Rocket Fuel, Inc. (a) | 500 | 1,500 | ||||||

Travelzoo, Inc. (a) | 600 | 7,548 | ||||||

32,936 | ||||||||

IT Services — 2.8% | ||||||||

Convergys Corporation | 800 | 23,864 | ||||||

ManTech International Corporation - Class A | 250 | 10,010 | ||||||

NeuStar, Inc. - Class A (a) | 700 | 17,787 | ||||||

Unisys Corporation (a) | 2,100 | 21,210 | ||||||

72,871 | ||||||||

Semiconductors & Semiconductor Equipment — 4.7% | ||||||||

Alpha & Omega Semiconductor Ltd. (a) | 2,000 | 42,140 | ||||||

Cohu, Inc. | 1,600 | 17,392 | ||||||

IXYS Corporation | 1,700 | 19,754 | ||||||

SunEdison Semiconductor Ltd. (a) | 500 | 5,745 | ||||||

Teradyne, Inc. | 1,100 | 23,166 | ||||||

See accompanying notes to financial statements. |

15

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Information Technology — 14.5% (Continued) | ||||||||

Semiconductors & Semiconductor Equipment — 4.7% (Continued) | ||||||||

Xcerra Corporation (a) | 2,000 | $ | 11,720 | |||||

119,917 | ||||||||

Software — 2.6% | ||||||||

American Software, Inc. - Class A | 2,000 | 20,820 | ||||||

BSQUARE Corporation (a) | 1,400 | 7,000 | ||||||

Epiq Systems, Inc. | 400 | 6,568 | ||||||

Progress Software Corporation (a) | 100 | 2,901 | ||||||

QAD, Inc. - Class A | 654 | 15,153 | ||||||

Rovi Corporation (a) | 100 | 2,047 | ||||||

Rubicon Project, Inc. (The) (a) | 200 | 1,700 | ||||||

Zynga, Inc. - Class A (a) | 4,000 | 10,920 | ||||||

67,109 | ||||||||

Technology Hardware, Storage & Peripherals — 1.1% | ||||||||

Avid Technology, Inc. (a) | 1,900 | 17,081 | ||||||

HP, Inc. | 200 | 2,874 | ||||||

Hutchinson Technology, Inc. (a) | 1,200 | 1,800 | ||||||

Lexmark International, Inc. - Class A | 150 | 5,372 | ||||||

27,127 | ||||||||

Materials — 9.6% | ||||||||

Chemicals — 5.3% | ||||||||

Cabot Corporation | 100 | 4,986 | ||||||

Chase Corporation | 440 | 28,323 | ||||||

Codexis, Inc. (a) | 1,400 | 5,838 | ||||||

Core Molding Technologies, Inc. (a) | 500 | 7,325 | ||||||

Huntsman Corporation | 200 | 3,458 | ||||||

OMNOVA Solutions, Inc. (a) | 2,430 | 24,300 | ||||||

Rayonier Advanced Materials, Inc. | 300 | 3,690 | ||||||

Stepan Company | 400 | 28,104 | ||||||

Tredegar Corporation | 700 | 13,188 | ||||||

Trinseo S.A. | 300 | 17,358 | ||||||

136,570 | ||||||||

Construction Materials — 1.0% | ||||||||

Headwaters, Inc. (a) | 800 | 14,504 | ||||||

United States Lime & Minerals, Inc. | 170 | 10,902 | ||||||

25,406 | ||||||||

Containers & Packaging — 1.7% | ||||||||

Greif, Inc. - Class A | 950 | 40,499 | ||||||

Myers Industries, Inc. | 300 | 4,305 | ||||||

44,804 | ||||||||

See accompanying notes to financial statements. |

16

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||||||

COMMON STOCKS — 96.4% (Continued) | Shares | Value | ||||||

Materials — 9.6% (Continued) | ||||||||

Metals & Mining — 1.6% | ||||||||

AK Steel Holding Corporation (a) | 1,500 | $ | 6,690 | |||||

Gold Resource Corporation | 1,100 | 5,742 | ||||||

Handy & Harman Ltd. (a) | 100 | 2,235 | ||||||

Materion Corporation | 600 | 17,604 | ||||||

Olympic Steel, Inc. | 300 | 5,799 | ||||||

Schnitzer Steel Industries, Inc. - Class A | 100 | 1,878 | ||||||

39,948 | ||||||||

Telecommunication Services — 0.2% | ||||||||

Diversified Telecommunication Services — 0.2% | ||||||||

CenturyLink, Inc. | 100 | 2,780 | ||||||

FairPoint Communications, Inc. (a) | 100 | 1,394 | ||||||

4,174 | ||||||||

Total Investments at Value — 96.4% (Cost $2,076,779) | $ | 2,476,016 | ||||||

Other Assets in Excess of Liabilities — 3.6% | 91,030 | |||||||

Net Assets — 100.0% | $ | 2,567,046 | ||||||

(a) | Non-income producing security. |

See accompanying notes to financial statements. |

17

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% | Shares | Value | ||||||

Consumer Discretionary — 17.6% | ||||||||

Auto Components — 0.9% | ||||||||

Horizon Global Corporation (a) | 100 | $ | 1,782 | |||||

Metaldyne Performance Group, Inc. | 700 | 11,109 | ||||||

Modine Manufacturing Company (a) | 300 | 3,213 | ||||||

Tenneco, Inc. (a) | 60 | 3,350 | ||||||

19,454 | ||||||||

Automobiles — 0.6% | ||||||||

Thor Industries, Inc. | 160 | 12,984 | ||||||

Diversified Consumer Services — 0.6% | ||||||||

Bridgepoint Education, Inc. (a) | 117 | 848 | ||||||

Career Education Corporation (a) | 700 | 4,578 | ||||||

K12, Inc. (a) | 400 | 4,780 | ||||||

Liberty Tax, Inc. - Class A | 200 | 2,718 | ||||||

12,924 | ||||||||

Hotels, Restaurants & Leisure — 3.8% | ||||||||

Bloomin' Brands, Inc. | 800 | 15,632 | ||||||

Bojangles', Inc. (a) | 500 | 8,075 | ||||||

Bravo Brio Restaurant Group, Inc. (a) | 300 | 1,410 | ||||||

Buffalo Wild Wings, Inc. (a) | 10 | 1,622 | ||||||

Caesars Acquisition Company - Class A (a) | 900 | 10,953 | ||||||

Century Casinos, Inc. (a) | 1,975 | 12,620 | ||||||

Intrawest Resorts Holdings, Inc. (a) | 100 | 1,492 | ||||||

Isle of Capri Casinos, Inc. (a) | 100 | 1,735 | ||||||

Potbelly Corporation (a) | 700 | 9,072 | ||||||

RCI Hospitality Holdings, Inc. | 200 | 2,198 | ||||||

Scientific Games Corporation - Class A (a) | 2,400 | 19,800 | ||||||

Speedway Motorsports, Inc. | 100 | 1,789 | ||||||

86,398 | ||||||||

Household Durables — 2.5% | ||||||||

Bassett Furniture Industries, Inc. | 600 | 14,856 | ||||||

Ethan Allen Interiors, Inc. | 300 | 10,038 | ||||||

La-Z-Boy, Inc. | 350 | 9,334 | ||||||

Libbey, Inc. | 500 | 8,865 | ||||||

Tupperware Brands Corporation | 200 | 13,106 | ||||||

56,199 | ||||||||

Internet & Catalog Retail — 0.7% | ||||||||

Groupon, Inc. - Class A (a) | 1,100 | 5,863 | ||||||

HSN, Inc. | 150 | 6,267 | ||||||

Nutrisystem, Inc. | 100 | 2,882 | ||||||

15,012 | ||||||||

See accompanying notes to financial statements. |

18

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Consumer Discretionary — 17.6% (Continued) | ||||||||

Leisure Products — 0.7% | ||||||||

Callaway Golf Company | 800 | $ | 9,136 | |||||

MCBC Holdings, Inc. | 400 | 4,776 | ||||||

Sturm, Ruger & Company, Inc. | 20 | 1,226 | ||||||

15,138 | ||||||||

Media — 3.5% | ||||||||

Discovery Communications, Inc. - Series A (a) | 650 | 16,581 | ||||||

DISH Network Corporation - Class A (a) | 50 | 2,512 | ||||||

Lee Enterprises, Inc. (a) | 3,300 | 9,207 | ||||||

MSG Networks, Inc. - Class A (a) | 1,800 | 31,464 | ||||||

Radio One, Inc. - Class D (a) | 1,200 | 4,152 | ||||||

Starz - Series A (a) | 500 | 15,595 | ||||||

79,511 | ||||||||

Multi-Line Retail — 0.3% | ||||||||

Big Lots, Inc. | 130 | 6,412 | ||||||

Specialty Retail — 3.1% | ||||||||

American Eagle Outfitters, Inc. | 200 | 3,708 | ||||||

Chico's FAS, Inc. | 1,600 | 20,288 | ||||||

Christopher & Banks Corporation (a) | 600 | 888 | ||||||

Citi Trends, Inc. | 300 | 5,865 | ||||||

Hibbett Sports, Inc. (a) | 400 | 15,348 | ||||||

Kirkland's, Inc. (a) | 300 | 3,759 | ||||||

MarineMax, Inc. (a) | 200 | 3,966 | ||||||

Shoe Carnival, Inc. | 300 | 8,898 | ||||||

Stein Mart, Inc. | 800 | 6,432 | ||||||

69,152 | ||||||||

Textiles, Apparel & Luxury Goods — 0.9% | ||||||||

Cherokee, Inc. (a) | 1,000 | 11,260 | ||||||

Crocs, Inc. (a) | 1,200 | 10,368 | ||||||

21,628 | ||||||||

Consumer Staples — 4.2% | ||||||||

Beverages — 0.7% | ||||||||

Boston Beer Company, Inc. (The) - Class A (a) | 30 | 5,479 | ||||||

Cott Corporation | 100 | 1,594 | ||||||

Dr Pepper Snapple Group, Inc. | 100 | 9,370 | ||||||

16,443 | ||||||||

Food & Staples Retailing — 1.3% | ||||||||

SpartanNash Company | 250 | 8,005 | ||||||

SUPERVALU, Inc. (a) | 900 | 4,932 | ||||||

Village Super Market, Inc. - Class A | 100 | 3,199 | ||||||

Weis Markets, Inc. | 250 | 12,735 | ||||||

28,871 | ||||||||

See accompanying notes to financial statements. |

19

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Consumer Staples — 4.2% (Continued) | ||||||||

Food Products — 0.2% | ||||||||

Darling Ingredients, Inc. | 100 | $ | 1,408 | |||||

Flowers Foods, Inc. | 100 | 1,491 | ||||||

Rocky Mountain Chocolate Factory, Inc. | 200 | 2,186 | ||||||

5,085 | ||||||||

Household Products — 1.4% | ||||||||

Central Garden & Pet Company (a) | 100 | 2,568 | ||||||

HRG Group, Inc. (a) | 1,800 | 29,106 | ||||||

31,674 | ||||||||

Personal Products — 0.6% | ||||||||

Medifast, Inc. | 350 | 12,870 | ||||||

Energy — 1.5% | ||||||||

Energy Equipment & Services — 0.6% | ||||||||

Dawson Geophysical Company (a) | 400 | 2,884 | ||||||

Gulf Island Fabrication, Inc. | 300 | 2,640 | ||||||

RigNet, Inc. (a) | 100 | 1,262 | ||||||

SAExploration Holdings, Inc. (a) | 100 | 1,090 | ||||||

Willbros Group, Inc. (a) | 3,000 | 5,820 | ||||||

13,696 | ||||||||

Oil, Gas & Consumable Fuels — 0.9% | ||||||||

Carrizo Oil & Gas, Inc. (a) | 100 | 3,829 | ||||||

Chesapeake Energy Corporation (a) | 600 | 3,810 | ||||||

EP Energy Corporation - Class A (a) | 100 | 412 | ||||||

Murphy Oil Corporation | 100 | 2,672 | ||||||

ONEOK, Inc. | 150 | 7,034 | ||||||

Southwestern Energy Company (a) | 200 | 2,782 | ||||||

20,539 | ||||||||

Financials — 0.6% | ||||||||

Capital Markets — 0.3% | ||||||||

Charles Schwab Corporation (The) | 100 | 3,146 | ||||||

Financial Engines, Inc. | 100 | 3,197 | ||||||

6,343 | ||||||||

Consumer Finance — 0.3% | ||||||||

LendingClub Corporation (a) | 1,300 | 7,033 | ||||||

Health Care — 21.5% | ||||||||

Biotechnology — 8.0% | ||||||||

AbbVie, Inc. | 160 | 10,256 | ||||||

ARIAD Pharmaceuticals, Inc. (a) | 400 | 4,136 | ||||||

Biogen, Inc. (a) | 20 | 6,113 | ||||||

BioSpecifics Technologies Corporation (a) | 50 | 1,829 | ||||||

See accompanying notes to financial statements. |

20

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Health Care — 21.5% (Continued) | ||||||||

Biotechnology — 8.0% (Continued) | ||||||||

Celgene Corporation (a) | 60 | $ | 6,404 | |||||

FibroGen, Inc. (a) | 800 | 13,848 | ||||||

Genomic Health, Inc. (a) | 400 | 10,588 | ||||||

Halozyme Therapeutics, Inc. (a) | 800 | 7,840 | ||||||

Incyte Corporation (a) | 20 | 1,622 | ||||||

Ironwood Pharmaceuticals, Inc. - Class A (a) | 2,300 | 30,682 | ||||||

Lexicon Pharmaceuticals, Inc. (a) | 200 | 2,776 | ||||||

MacroGenics, Inc. (a) | 100 | 2,981 | ||||||

Medivation, Inc. (a) | 200 | 16,112 | ||||||

Myriad Genetics, Inc. (a) | 450 | 9,162 | ||||||

Neurocrine Biosciences, Inc. (a) | 50 | 2,423 | ||||||

Progenics Pharmaceuticals, Inc. (a) | 1,400 | 8,792 | ||||||

Puma Biotechnology, Inc. (a) | 50 | 2,957 | ||||||

Raptor Pharmaceutical Corporation (a) | 200 | 1,490 | ||||||

Regeneron Pharmaceuticals, Inc. (a) | 10 | 3,926 | ||||||

Repligen Corporation (a) | 150 | 4,649 | ||||||

Seattle Genetics, Inc. (a) | 210 | 9,356 | ||||||

Spectrum Pharmaceuticals, Inc. (a) | 1,000 | 5,310 | ||||||

TESARO, Inc. (a) | 20 | 1,694 | ||||||

Vertex Pharmaceuticals, Inc. (a) | 140 | 13,231 | ||||||

Xencor, Inc. (a) | 100 | 2,113 | ||||||

180,290 | ||||||||

Health Care Equipment & Supplies — 4.8% | ||||||||

Accuray, Inc. (a) | 7,100 | 37,843 | ||||||

AngioDynamics, Inc. (a) | 1,500 | 24,810 | ||||||

Electromed, Inc. (a) | 400 | 2,156 | ||||||

FONAR Corporation (a) | 100 | 2,056 | ||||||

Halyard Health, Inc. (a) | 200 | 7,290 | ||||||

Hill-Rom Holdings, Inc. | 210 | 12,455 | ||||||

Hologic, Inc. (a) | 350 | 13,447 | ||||||

Insulet Corporation (a) | 100 | 4,233 | ||||||

Lantheus Holdings, Inc. (a) | 400 | 3,808 | ||||||

108,098 | ||||||||

Health Care Providers & Services — 4.1% | ||||||||

Aceto Corporation | 1,300 | 26,247 | ||||||

Alliance HealthCare Services, Inc. (a) | 200 | 1,260 | ||||||

BioTelemetry, Inc. (a) | 400 | 7,388 | ||||||

Express Scripts Holding Company (a) | 160 | 11,632 | ||||||

Five Star Quality Care, Inc. (a) | 2,900 | 6,148 | ||||||

Healthways, Inc. (a) | 500 | 12,505 | ||||||

HMS Holdings Corporation (a) | 700 | 15,267 | ||||||

See accompanying notes to financial statements. |

21

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Health Care — 21.5% (Continued) | ||||||||

Health Care Providers & Services — 4.1% (Continued) | ||||||||

National Research Corporation - Class A | 685 | $ | 10,844 | |||||

91,291 | ||||||||

Health Care Technology — 1.9% | ||||||||

Computer Programs & Systems, Inc. | 400 | 10,328 | ||||||

Cotiviti Holdings, Inc. (a) | 200 | 6,648 | ||||||

IMS Health Holdings, Inc. (a) | 100 | 2,982 | ||||||

Press Ganey Holdings, Inc. (a) | 350 | 14,101 | ||||||

Quality Systems, Inc. | 400 | 4,708 | ||||||

Simulations Plus, Inc. | 500 | 4,310 | ||||||

43,077 | ||||||||

Life Sciences Tools & Services — 0.4% | ||||||||

INC Research Holdings, Inc. - Class A (a) | 200 | 8,726 | ||||||

Pharmaceuticals — 2.3% | ||||||||

Akorn, Inc. (a) | 100 | 2,692 | ||||||

Corcept Therapeutics, Inc. (a) | 2,500 | 13,325 | ||||||

Depomed, Inc. (a) | 200 | 4,058 | ||||||

Innoviva, Inc. | 200 | 2,218 | ||||||

Nektar Therapeutics (a) | 100 | 1,785 | ||||||

Phibro Animal Health Corporation - Class A | 100 | 2,427 | ||||||

Prestige Brands Holdings, Inc. (a) | 520 | 25,028 | ||||||

51,533 | ||||||||

Industrials — 16.9% | ||||||||

Aerospace & Defense — 1.6% | ||||||||

Moog, Inc. - Class A (a) | 150 | 8,849 | ||||||

Vectrus, Inc. (a) | 800 | 26,992 | ||||||

35,841 | ||||||||

Air Freight & Logistics — 0.7% | ||||||||

Hub Group, Inc. - Class A (a) | 250 | 10,187 | ||||||

Park-Ohio Holdings Corporation | 150 | 5,532 | ||||||

15,719 | ||||||||

Airlines — 0.5% | ||||||||

Hawaiian Holdings, Inc. (a) | 250 | 11,745 | ||||||

Building Products — 1.5% | ||||||||

American Woodmark Corporation (a) | 40 | 3,480 | ||||||

Continental Building Products, Inc. (a) | 300 | 6,663 | ||||||

Gibraltar Industries, Inc. (a) | 100 | 3,816 | ||||||

Insteel Industries, Inc. | 300 | 9,990 | ||||||

Ply Gem Holdings, Inc. (a) | 100 | 1,397 | ||||||

Trex Company, Inc. (a) | 150 | 9,291 | ||||||

34,637 | ||||||||

See accompanying notes to financial statements. |

22

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Industrials — 16.9% (Continued) | ||||||||

Commercial Services & Supplies — 4.2% | ||||||||

Brady Corporation - Class A | 450 | $ | 15,070 | |||||

Brink's Company (The) | 100 | 3,650 | ||||||

Deluxe Corporation | 280 | 19,088 | ||||||

Ennis, Inc. | 200 | 3,316 | ||||||

Kimball International, Inc. - Class B | 2,251 | 28,025 | ||||||

Quad/Graphics, Inc. - Class A | 300 | 8,127 | ||||||

R.R. Donnelley & Sons Company | 100 | 1,710 | ||||||

SP Plus Corporation (a) | 200 | 5,000 | ||||||

West Corporation | 400 | 9,372 | ||||||

93,358 | ||||||||

Construction & Engineering — 0.8% | ||||||||

Argan, Inc. | 100 | 4,781 | ||||||

Dycom Industries, Inc. (a) | 40 | 3,245 | ||||||

Goldfield Corporation (The) (a) | 1,300 | 3,861 | ||||||

Jacobs Engineering Group, Inc. (a) | 60 | 3,161 | ||||||

Sterling Construction Company, Inc. (a) | 400 | 2,580 | ||||||

17,628 | ||||||||

Electrical Equipment — 2.2% | ||||||||

Allied Motion Technologies, Inc. | 100 | 2,253 | ||||||

AZZ, Inc. | 80 | 5,315 | ||||||

Belden, Inc. | 160 | 11,934 | ||||||

EnerSys | 40 | 2,815 | ||||||

General Cable Corporation | 1,730 | 27,905 | ||||||

50,222 | ||||||||

Machinery — 2.5% | ||||||||

Altra Industrial Motion Corporation | 250 | 7,050 | ||||||

Commercial Vehicle Group, Inc. (a) | 1,552 | 8,365 | ||||||

Gencor Industries, Inc. (a) | 450 | 5,152 | ||||||

Global Brass & Copper Holdings, Inc. | 100 | 2,807 | ||||||

Hillenbrand, Inc. | 50 | 1,608 | ||||||

L.B. Foster Company | 300 | 3,603 | ||||||

Lydall, Inc. (a) | 100 | 4,804 | ||||||

Mueller Water Products, Inc. - Series A | 500 | 6,045 | ||||||

Navistar International Corporation (a) | 1,000 | 14,040 | ||||||

Supreme Industries, Inc. - Class A | 100 | 1,724 | ||||||

55,198 | ||||||||

Professional Services — 0.6% | ||||||||

Acacia Research Corporation | 2,000 | 11,960 | ||||||

GP Strategies Corporation (a) | 100 | 2,390 | ||||||

14,350 | ||||||||

See accompanying notes to financial statements. |

23

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Industrials — 16.9% (Continued) | ||||||||

Road & Rail — 1.7% | ||||||||

Swift Transportation Company - Class A (a) | 700 | $ | 13,027 | |||||

YRC Worldwide, Inc. (a) | 2,100 | 24,339 | ||||||

37,366 | ||||||||

Trading Companies & Distributors — 0.6% | ||||||||

H&E Equipment Services, Inc. | 500 | 7,965 | ||||||

HD Supply Holdings, Inc. (a) | 100 | 3,611 | ||||||

SiteOne Landscape Supply, Inc. (a) | 50 | 1,912 | ||||||

13,488 | ||||||||

Information Technology — 25.8% | ||||||||

Communications Equipment — 1.2% | ||||||||

ARRIS International plc (a) | 150 | 4,211 | ||||||

Digi International, Inc. (a) | 1,000 | 11,470 | ||||||

Extreme Networks, Inc. (a) | 2,200 | 8,646 | ||||||

NETGEAR, Inc. (a) | 50 | 2,850 | ||||||

27,177 | ||||||||

Electronic Equipment, Instruments & Components — 1.0% | ||||||||

Methode Electronics, Inc. | 200 | 7,330 | ||||||

Radisys Corporation (a) | 3,200 | 15,712 | ||||||

23,042 | ||||||||

Internet Software & Services — 5.9% | ||||||||

DHI Group, Inc. (a) | 2,300 | 17,802 | ||||||

EarthLink Holdings Corporation | 2,600 | 16,562 | ||||||

Endurance International Group Holdings, Inc. (a) | 1,600 | 12,720 | ||||||

GTT Communications, Inc. (a) | 200 | 4,246 | ||||||

LivePerson, Inc. (a) | 1,800 | 14,022 | ||||||

MeetMe, Inc. (a) | 1,400 | 8,064 | ||||||

NIC, Inc. | 500 | 11,490 | ||||||

QuinStreet, Inc. (a) | 3,200 | 9,792 | ||||||

Rackspace Hosting, Inc. (a) | 100 | 3,145 | ||||||

Rocket Fuel, Inc. (a) | 1,400 | 4,200 | ||||||

Travelzoo, Inc. (a) | 700 | 8,806 | ||||||

Web.com Group, Inc. (a) | 500 | 8,730 | ||||||

XO Group, Inc. (a) | 700 | 13,048 | ||||||

132,627 | ||||||||

IT Services — 6.6% | ||||||||

Convergys Corporation | 1,100 | 32,813 | ||||||

CSG Systems International, Inc. | 850 | 37,162 | ||||||

DST Systems, Inc. | 40 | 4,860 | ||||||

EVERTEC, Inc. | 400 | 6,824 | ||||||

Lionbridge Technologies, Inc. (a) | 1,900 | 9,253 | ||||||

MAXIMUS, Inc. | 50 | 2,941 | ||||||

See accompanying notes to financial statements. |

24

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Information Technology — 25.8% (Continued) | ||||||||

IT Services — 6.6% (Continued) | ||||||||

NeuStar, Inc. - Class A (a) | 250 | $ | 6,352 | |||||

Teradata Corporation (a) | 550 | 17,452 | ||||||

Unisys Corporation (a) | 3,100 | 31,310 | ||||||

148,967 | ||||||||

Semiconductors & Semiconductor Equipment — 2.9% | ||||||||

Advanced Energy Industries, Inc. (a) | 50 | 2,197 | ||||||

Alpha & Omega Semiconductor Ltd. (a) | 300 | 6,321 | ||||||

Cohu, Inc. | 800 | 8,696 | ||||||

IXYS Corporation | 400 | 4,648 | ||||||

MaxLinear, Inc. - Class A (a) | 700 | 13,419 | ||||||

Microsemi Corporation (a) | 150 | 5,994 | ||||||

Semtech Corporation (a) | 400 | 10,640 | ||||||

Teradyne, Inc. | 100 | 2,106 | ||||||

Texas Instruments, Inc. | 100 | 6,954 | ||||||

Xcerra Corporation (a) | 500 | 2,930 | ||||||

63,905 | ||||||||

Software — 6.8% | ||||||||

A10 Networks, Inc. (a) | 300 | 2,955 | ||||||

American Software, Inc. - Class A | 2,400 | 24,984 | ||||||

Aspen Technology, Inc. (a) | 50 | 2,273 | ||||||

Barracuda Networks, Inc. (a) | 200 | 4,640 | ||||||

BSQUARE Corporation (a) | 2,200 | 11,000 | ||||||

CDK Global, Inc. | 140 | 8,117 | ||||||

EnerNOC, Inc. (a) | 1,100 | 6,281 | ||||||

Epiq Systems, Inc. | 650 | 10,673 | ||||||

Fair Isaac Corporation | 80 | 10,235 | ||||||

Interactive Intelligence Group, Inc. (a) | 150 | 8,977 | ||||||

Intuit, Inc. | 140 | 15,603 | ||||||

Jive Software, Inc. (a) | 4,000 | 16,880 | ||||||

Manhattan Associates, Inc. (a) | 50 | 3,026 | ||||||

Monotype Imaging Holdings, Inc. | 100 | 2,110 | ||||||

Nuance Communications, Inc. (a) | 300 | 4,374 | ||||||

Pegasystems, Inc. | 350 | 9,013 | ||||||

Synchronoss Technologies, Inc. (a) | 150 | 6,263 | ||||||

TiVo, Inc. (a) | 500 | 5,305 | ||||||

152,709 | ||||||||

Technology Hardware, Storage & Peripherals — 1.4% | ||||||||

Avid Technology, Inc. (a) | 2,300 | 20,677 | ||||||

Hutchinson Technology, Inc. (a) | 1,700 | 2,550 | ||||||

NCR Corporation (a) | 150 | 5,078 | ||||||

See accompanying notes to financial statements. |

25

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||||||

COMMON STOCKS — 96.8% (Continued) | Shares | Value | ||||||

Information Technology — 25.8% (Continued) | ||||||||

Technology Hardware, Storage & Peripherals — 1.4% (Continued) | ||||||||

Silicon Graphics International Corporation (a) | 400 | $ | 3,084 | |||||

31,389 | ||||||||

Materials — 8.2% | ||||||||

Chemicals — 4.6% | ||||||||

Chase Corporation | 490 | 31,541 | ||||||

Codexis, Inc. (a) | 800 | 3,336 | ||||||

Core Molding Technologies, Inc. (a) | 300 | 4,395 | ||||||

OMNOVA Solutions, Inc. (a) | 1,811 | 18,110 | ||||||

PolyOne Corporation | 150 | 5,171 | ||||||

Rayonier Advanced Materials, Inc. | 500 | 6,150 | ||||||

Stepan Company | 120 | 8,431 | ||||||

Tredegar Corporation | 300 | 5,652 | ||||||

Trinseo S.A. | 350 | 20,251 | ||||||

103,037 | ||||||||

Construction Materials — 0.8% | ||||||||

Headwaters, Inc. (a) | 800 | 14,504 | ||||||

United States Lime & Minerals, Inc. | 60 | 3,848 | ||||||

18,352 | ||||||||

Containers & Packaging — 2.3% | ||||||||

AEP Industries, Inc. | 160 | 17,696 | ||||||

Greif, Inc. - Class A | 550 | 23,446 | ||||||

Myers Industries, Inc. | 700 | 10,045 | ||||||

51,187 | ||||||||

Metals & Mining — 0.5% | ||||||||

Gold Resource Corporation | 1,700 | 8,874 | ||||||

Handy & Harman Ltd. (a) | 100 | 2,235 | ||||||

11,109 | ||||||||

Telecommunication Services — 0.5% | ||||||||

Diversified Telecommunication Services — 0.5% | ||||||||

FairPoint Communications, Inc. (a) | 800 | 11,152 | ||||||

Total Investments at Value — 96.8% (Cost $1,897,437) | $ | 2,174,586 | ||||||

Other Assets in Excess of Liabilities — 3.2% | 71,113 | |||||||

Net Assets — 100.0% | $ | 2,245,699 | ||||||

(a) | Non-income producing security. |

See accompanying notes to financial statements. |

26

ALAMBIC FUNDS | ||||||||

| Alambic Small Cap Value PlusFund | Alambic Small Cap Growth Plus Fund | ||||||

ASSETS | ||||||||

Investments in securities: | ||||||||

At acquisition cost | $ | 2,076,779 | $ | 1,897,437 | ||||

At value (Note 2) | $ | 2,476,016 | $ | 2,174,586 | ||||

Cash (Note 2) | 84,537 | 69,940 | ||||||

Dividends receivable | 2,233 | 777 | ||||||

Receivable for investment securities sold | 82,743 | 60,456 | ||||||

Receivable from Adviser (Note 4) | 8,967 | 8,263 | ||||||

Other assets | 3,068 | 2,716 | ||||||

Total assets | 2,657,564 | 2,316,738 | ||||||

LIABILITIES | ||||||||

Payable for investment securities purchased | 80,020 | 60,872 | ||||||

Payable to administrator (Note 4) | 6,021 | 6,019 | ||||||

Other accrued expenses | 4,477 | 4,148 | ||||||

Total liabilities | 90,518 | 71,039 | ||||||

NET ASSETS | $ | 2,567,046 | $ | 2,245,699 | ||||

NET ASSETS CONSIST OF: | ||||||||

Paid-in capital | $ | 2,220,852 | $ | 1,989,541 | ||||

Undistributed net investment income (loss) | 5,650 | (1,697 | ) | |||||

Accumulated net realized losses from security transactions | (58,693 | ) | (19,294 | ) | ||||

Net unrealized appreciation on investments | 399,237 | 277,149 | ||||||

NET ASSETS | $ | 2,567,046 | $ | 2,245,699 | ||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 221,268 | 201,597 | ||||||

Net asset value, offering price and redemption price per share (Note 2) | $ | 11.60 | $ | 11.14 | ||||

See accompanying notes to financial statements. |

27

ALAMBIC FUNDS | ||||||||

| Alambic Small Cap Value Plus Fund(a) | Alambic Small Cap Growth Plus Fund(b) | ||||||

INVESTMENT INCOME | ||||||||

Dividend income | $ | 36,207 | $ | 11,089 | ||||

Foreign withholding taxes on dividends | (2 | ) | (2 | ) | ||||

Total investment income | 36,205 | 11,087 | ||||||

EXPENSES | ||||||||

Fund accounting fees (Note 4) | 24,209 | 16,107 | ||||||

Administration fees (Note 4) | 24,000 | 16,000 | ||||||

Investment advisory fees (Note 4) | 19,830 | 10,172 | ||||||

Professional fees | 17,992 | 10,926 | ||||||

Compliance fees (Note 4) | 12,510 | 8,510 | ||||||

Transfer agent fees (Note 4) | 12,000 | 8,000 | ||||||

Trustees' fees and expenses (Note 4) | 9,947 | 7,394 | ||||||

Custody and bank service fees | 9,208 | 5,985 | ||||||

Pricing costs | 4,891 | 3,137 | ||||||

Registration and filing fees | 3,372 | 2,631 | ||||||

Postage and supplies | 4,082 | 1,492 | ||||||

Printing of shareholder reports | 1,846 | 1,695 | ||||||

Other expenses | 7,567 | 3,701 | ||||||

Total expenses | 151,454 | 95,750 | ||||||

Less fee reductions and expense reimbursements by the Adviser (Note 4) | (126,406 | ) | (82,902 | ) | ||||

Net expenses | 25,048 | 12,848 | ||||||

NET INVESTMENT INCOME (LOSS) | 11,157 | (1,761 | ) | |||||

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | ||||||||

Net realized losses from investment transactions | (58,693 | ) | (19,294 | ) | ||||

Net change in unrealized appreciation (depreciation) on investments | 399,237 | 277,149 | ||||||

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | 340,544 | 257,855 | ||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 351,701 | $ | 256,094 | ||||

(a) | Represents the period from the commencement of operations (September 1, 2015) through August 31, 2016. |

(b) | Represents the period from the commencement of operations (December 29, 2015) through August 31, 2016. |

See accompanying notes to financial statements. | |

28

ALAMBIC FUNDS | ||||||||

| Alambic Small Cap Value Plus Fund(a) | Alambic Small Cap Growth Plus Fund(b) | ||||||

FROM OPERATIONS | ||||||||

Net investment income (loss) | $ | 11,157 | $ | (1,761 | ) | |||

Net realized losses from security transactions | (58,693 | ) | (19,294 | ) | ||||

Net change in unrealized appreciation (depreciation) on investments | 399,237 | 277,149 | ||||||

Net increase in net assets resulting from operations | 351,701 | 256,094 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

From net investment income | (5,507 | ) | — | |||||

CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 2,215,345 | 1,989,605 | ||||||

Net asset value of shares issued in reinvestment of distributions to shareholders | 5,507 | — | ||||||

Net increase from capital share transactions | 2,220,852 | 1,989,605 | ||||||

TOTAL INCREASE IN NET ASSETS | 2,567,046 | 2,245,699 | ||||||

NET ASSETS | ||||||||

Beginning of period | — | — | ||||||

End of period | $ | 2,567,046 | $ | 2,245,699 | ||||

UNDISTRIBUTED NET INVESTMENT INCOME (LOSS) | $ | 5,650 | $ | (1,697 | ) | |||

CAPITAL SHARE ACTIVITY | ||||||||

Shares sold | 220,726 | 201,597 | ||||||

Shares issued in reinvestment of distributions to shareholders | 542 | — | ||||||

Net increase in shares outstanding | 221,268 | 201,597 | ||||||

Shares outstanding at beginning of period | — | — | ||||||

Shares outstanding at end of period | 221,268 | 201,597 | ||||||

(a) | Represents the period from the commencement of operations (September 1, 2015) through August 31, 2016. |

(b) | Represents the period from the commencement of operations (December 29, 2015) through August 31, 2016. |

See accompanying notes to financial statements. | |

29

ALAMBIC SMALL CAP VALUE PLUS FUND | ||||

Per Share Data for a Share Outstanding Throughout the Period | ||||

| Period Ended August 31, 2016(a) | |||

Net asset value at beginning of period | $ | 10.00 | ||

Income from investment operations: | ||||

Net investment income | 0.05 | |||

Net realized and unrealized gains on investments | 1.58 | |||

Total from investment operations | 1.63 | |||

Less distributions: | ||||

Dividends from net investment income | (0.03 | ) | ||

Net asset value at end of period | $ | 11.60 | ||

Total return (b) | 16.31 | %(c) | ||

Net assets at end of period (000's) | $ | 2,567 | ||

Ratios/supplementary data: | ||||

Ratio of total expenses to average net assets | 7.24 | %(d) | ||

Ratio of net expenses to average net assets (e) | 1.20 | %(d) | ||

Ratio of net investment income to average net assets (e) | 0.53 | %(d) | ||

Portfolio turnover rate | 350 | %(c) | ||

(a) | Represents the period from the commencement of operations (September 1, 2015) through August 31, 2016. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and reimbursed expenses (Note 4). |

(c) | Not annualized. |

(d) | Annualized. |

(e) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

See accompanying notes to financial statements. | |

30

ALAMBIC SMALL CAP GROWTH PLUS FUND | ||||

Per Share Data for a Share Outstanding Throughout the Period | ||||

| Period Ended August 31, 2016(a) | |||

Net asset value at beginning of period | $ | 10.00 | ||

Income (loss) from investment operations: | ||||

Net investment loss | (0.01 | ) | ||

Net realized and unrealized gains on investments | 1.15 | |||

Total from investment operations | 1.14 | |||

Net asset value at end of period | $ | 11.14 | ||

Total return (b) | 11.40 | %(c) | ||

Net assets at end of period (000's) | $ | 2,246 | ||

Ratios/supplementary data: | ||||

Ratio of total expenses to average net assets | 8.89 | %(d) | ||

Ratio of net expenses to average net assets (e) | 1.20 | %(d) | ||

Ratio of net investment loss to average net assets (e) | (0.16 | %)(d) | ||

Portfolio turnover rate | 309 | %(c) | ||

(a) | Represents the period from the commencement of operations (December 29, 2015) through August 31, 2016. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and reimbursed expenses (Note 4). |

(c) | Not annualized. |

(d) | Annualized. |

(e) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

See accompanying notes to financial statements. | |

31

ALAMBIC FUNDS

NOTES TO FINANCIAL STATEMENTS

August 31, 2016

1. Organization

Alambic Small Cap Value Plus Fund and Alambic Small Cap Growth Plus Fund (individually, a “Fund” and collectively, the “Funds”) are each a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. Alambic Small Cap Value Plus Fund commenced operations on September 1, 2015. Alambic Small Cap Growth Plus Fund commenced operations on December 29, 2015.

The investment objective of each Fund is long-term capital appreciation.

2. Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Funds follow accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – Each Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Funds value their listed securities, including common stocks, on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. The Funds value securities traded in the over-the-counter market at the last sale price, if available, otherwise at the most recently quoted mean price. When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Funds value their securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate each Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

32

ALAMBIC FUNDS |

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Funds’ investments as of August 31, 2016:

Alambic Small Cap Value Plus Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks | $ | 2,476,016 | $ | — | $ | — | $ | 2,476,016 | ||||||||

Alambic Small Cap Growth Plus Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks | $ | 2,174,586 | $ | — | $ | — | $ | 2,174,586 | ||||||||

Refer to the Funds’ Schedules of Investments for a listing of the common stocks by industry type. As of August 31, 2016, the Funds did not have any transfers between Levels. In addition, the Funds did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of August 31, 2016. It is the Funds’ policy to recognize transfers between Levels at the end of the reporting period.

Cash account – As of August 31, 2016, the cash balance for each Fund represents amounts in deposit sweep accounts. These accounts have balances which may exceed the amount of related federal insurance.

Share valuation – The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the NAV per share.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income, if any, is accrued as earned. Withholding taxes on foreign dividends have been recorded for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Security transactions – Security transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on a specific identification basis.

33

ALAMBIC FUNDS |

Common expenses – Common expenses of the Trust are allocated among the Funds and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – The Funds distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid by Alambic Small Cap Value Plus Fund to shareholders during the period ended August 31, 2016 was ordinary income. There were no distributions paid by Alambic Small Cap Growth Plus Fund during the period ended August 31, 2016.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions which affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – Each Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986 (the “Code”). Qualification generally will relieve each Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of August 31, 2016:

Alambic Small Cap Value Plus Fund | Alambic Small Cap Growth Plus Fund | |||||||

Tax cost of portfolio investments | $ | 2,086,215 | $ | 1,908,347 | ||||

Gross unrealized appreciation | $ | 410,455 | $ | 298,289 | ||||

Gross unrealized depreciation | (20,654 | ) | (32,050 | ) | ||||

Net unrealized appreciation | 389,801 | 266,239 | ||||||

Undistributed ordinary income | 5,650 | — | ||||||

Accumulated capital and other losses | (49,257 | ) | (10,081 | ) | ||||

Accumulated earnings | $ | 346,194 | $ | 256,158 | ||||

34

ALAMBIC FUNDS |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of each Fund is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due primarily to the tax deferral of losses on wash sales.

As of August 31, 2016, Alambic Small Cap Value Plus Fund had a short-term capital loss carryforward of $6,420 for federal income tax purposes. This capital loss carryforward, which does not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

Qualified late year ordinary losses incurred after December 31, 2015 and within the taxable year are deemed to arise on the first day of a Fund’s next taxable year. For the period ended August 31, 2016, Alambic Small Cap Growth Plus Fund deferred until September 1, 2016 late year ordinary losses of $1,697.

Capital losses incurred after October 31, 2015 and within the current taxable year are deemed to arise on the first business day of a Fund’s next taxable year. For the period ended August 31, 2016, Alambic Small Cap Value Plus Fund and Alambic Small Cap Growth Plus Fund deferred until September 1, 2016 post-October capital losses in the amount of $42,837 and $8,384, respectively.

For the period ended August 31, 2016, the following reclassification was made on the Statement of Assets and Liabilities for Alambic Small Cap Growth Plus Fund as a result of permanent differences in the recognition of capital gains or losses under income tax regulations and GAAP:

Accumulated net investment income | $ | 64 | ||

Paid-in capital | $ | (64 | ) |

Such reclassification, the result of permanent differences between financial statement and income tax reporting requirements, had no effect on Alambic Small Cap Growth Plus Fund’s net assets or NAV per share.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for the current period and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Funds identify their major tax jurisdiction as U.S. Federal.

35

ALAMBIC FUNDS |

3. Investment Transactions

During the periods ended August 31, 2016, cost of purchases and proceeds from sales of investment securities, other than short-term investments were as follows:

Alambic Small Cap Value Plus Fund | Alambic Small Cap Growth Plus Fund | |||||||

Purchases of investment securities | $ | 9,303,358 | $ | 6,681,995 | ||||

Proceeds from sales of investment securities | $ | 7,166,926 | $ | 4,765,265 | ||||

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

Each Fund’s investments are managed by Alambic Investment Management, L.P. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, each Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 0.95% of its average daily net assets.

Pursuant to an Expense Limitation Agreement (the “ELA”) between each Fund and the Adviser, the Adviser has contractually agreed, until August 31, 2018, to reduce investment advisory fees and reimburse other expenses to the extent necessary to limit Total Annual Fund Operating Expenses (exclusive of brokerage costs; taxes; interest; acquired fund fees and expenses; costs to organize the Fund; extraordinary expenses such as litigation and merger or reorganization costs; and other expenses not incurred in the ordinary course of the Fund’s business; and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”)) to 1.20% of each Fund’s average daily net assets. Accordingly, during the period ended August 31, 2016, the Adviser did not collect any of its investment advisory fees and reimbursed other operating expenses totaling $106,576 and $72,730 for Alambic Small Cap Value Plus Fund and Alambic Small Cap Growth Plus Fund, respectively.

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by each Fund for a period of three years after such fees and expenses were incurred, provided the repayments do not cause Total Annual Fund Operating Expenses to exceed (i) the expense limitations then in effect, if any, and (ii) the expense limitations in effect at the time the expenses to be repaid were incurred. As of August 31, 2016, the Adviser may seek repayment of investment advisory fee reductions and expense reimbursements totaling $126,406 and $82,902 for Alambic Small Cap Value Plus Fund and Alambic Small Cap Growth Plus Fund, respectively, no later than August 31, 2019.

The Adviser has agreed to pay all expenses incurred related to the organization, offering and initial registrations of the Funds. Such expenses are not subject to recoupment by the Funds to the Adviser.

An officer of the Funds is also an officer of the Adviser.

36

ALAMBIC FUNDS |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides fund administration, fund accounting, compliance and transfer agency services to the Funds. Each Fund pays Ultimus fees in accordance with the agreements for such services. In addition, each Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and costs of pricing its portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as the principal underwriter to each Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Funds) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor and are not paid by the Funds for serving in such capacities.

TRUSTEE COMPENSATION

During the periods ended August 31, 2016, each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) received from each Fund a fee of $500 for each Board meeting attended plus reimbursement of travel and other meeting-related expenses. Each Independent Trustee also received a $500 annual retainer from each Fund. Effective October 1, 2016, each Independent Trustee will receive a $1,000 annual retainer from each Fund, except for the Board Chairman, who will receive a $1,200 annual retainer from each Fund.

PRINCIPAL HOLDERS OF FUND SHARES

As of August 31, 2016, the following shareholders owned of record 5% or more of the outstanding shares of each Fund:

Name of Record Owner | % Ownership |

Alambic Small Cap Value Plus Fund | |

Kawishiwi Partners Trust | 45% |

Robert T. Slaymaker | 23% |

Brian Eric Thompson | 7% |

Lauren Richards | 6% |

William Richards | 6% |

Jonathan Richards | 6% |

Alambic Small Cap Growth Plus Fund | |

Kawishiwi Partners Trust | 50% |

Robert T. Slaymaker | 13% |

Lauren Richards | 8% |

William Richards | 8% |

Jonathan Richards | 8% |

Brian Eric Thompson | 7% |

37

ALAMBIC FUNDS |

A beneficial owner of 25% or more of a Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholder’s meeting.

5. Sector Risk

If a Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s NAV per share. Occasionally, market conditions, regulatory changes or other developments may negatively impact this sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of August 31, 2016, Alambic Small Cap Value Plus Fund had 25.0% of the value of its net assets invested in securities within the Financials sector and Alambic Small Cap Growth Plus Fund had 25.8% of the value of its net assets invested in securities within the Information Technology sector.

6. Contingencies and Commitments