| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Khimmara Greer

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | October 31 | |

| | | |

| Date of reporting period: | April 30, 2022 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Westwood Quality Value Fund

Westwood Quality MidCap Fund

Westwood Quality SMidCap Fund

Westwood Quality SmallCap Fund

Westwood Quality AllCap Fund

Westwood Total Return Fund

Westwood Income Opportunity Fund

Westwood High Income Fund

Westwood Alternative Income Fund

Westwood SmallCap Growth Fund

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Investment Adviser: |

| | Westwood Management Corp. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

WESTWOOD FUNDS

| Shareholder Letter | 1 |

| Schedules of Investments | |

| Westwood Quality Value Fund | 14 |

| Westwood Quality MidCap Fund | 16 |

| Westwood Quality SMIDCap Fund | 18 |

| Westwood Quality SmallCap Fund | 20 |

| Westwood Quality AllCap Fund | 22 |

| Westwood Total Return Fund | 24 |

| Westwood Income Opportunity Fund | 29 |

| Westwood High Income Fund | 35 |

| Westwood Alternative Income Fund | 40 |

| Westwood SmallCap Growth Fund | 48 |

| Statements of Assets and Liabilities | 50 |

| Statements of Operations | 53 |

| Statements of Changes in Net Assets | 56 |

| Financial Highlights | 64 |

| Notes to Financial Statements | 74 |

| About Your Funds’ Expenses | 97 |

| Disclosure Regarding Approval of Investment Advisory Agreement | 102 |

| Customer Privacy Notice | 105 |

The Trust files a complete listing of portfolio holdings for the Funds with the U.S. Securities and Exchange Commission (“SEC”) as of the end of the first and third quarters of each fiscal year as an exhibit to its report on Form N-PORT. The filings are available upon request, by calling 1-877-386-3944. Furthermore, you may obtain a copy of these filings on the SEC’s website at www.sec.gov.

A description of the policies and procedures that the Funds use to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-877-386-3944, or on the SEC’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the period ended June 30, 2022 will be available on or about August 31, 2022 without charge upon request by calling 1-877-386-3944, or on the SEC’s website at www.sec.gov.

WESTWOOD FUNDS (Unaudited)

June 24, 2022

Dear Shareholders,

What a Difference Five Months Makes…

At the end of 2021, it was full steam ahead for risk assets. At the time, most of us knew the party had to end sooner or later, but the abruptness of the sentiment shifts certainly shocked more than just the casual investor. The change in momentum was further fueled by simultaneous events: Russia’s invasion of Ukraine, worsening global inflation and a Federal Reserve that enacted one of the most aggressive rate hike trajectories in history. As equities moved lower, high valuation growth stocks, largely tech names, took the worst of the blow, but all major stock indexes have sold off to or passed the widely accepted correction levels by 20% or more. That said, the broad indices don’t always paint a complete picture, and the sharp, broad selloff will uncover opportunities in securities that are deemed “guilty by association,” but have strong value or future growth potential as alibis.

It’s critical, however, that investors acknowledge the headwinds that America faces and with that adjust their approach to the markets with a different set of tactics that may have been applied over the last decade or so. There is no doubt that the current environment is certainly abnormal and, in many ways, unprecedented. When the pandemic hit, governments around the world acted swiftly, and perhaps in overabundance, to combat what seemed like another melt-down type event like what we experienced in 2009. Lawmakers launched tens of trillions of dollars in stimulus money directly to consumers and businesses alike. While their actions did stave off a potentially deep recession (the jury is still out on what would have happened), their actions have had unintended consequences, namely far-reaching inflation, and a hyper-demand rebound on a global supply chain that was crippled by lockdowns, travel and shipping restrictions, and a lack of workers. All of this, and the rate-hike remedies to combat sticky inflation, have resulted in massive financial penalties for consumers in the form of higher borrowing costs, high prices in nearly every consumable good and an obvious blow to sentiment.

We believe that relief is on the way for global supply and retailers, as supply chains either normalize or get re-routed. Some large retailers are already warning of excessive inventories as consumers start to pump the brakes on spending amid what’s already been a stressful couple of years. Now, more than ever, the Federal Reserve (Fed), and White House policy (mainly around energy and taxation), will likely be the deciding factors of whether a soft economic landing can actually be achieved.

Difficult Work for the Fed, and Consumers

At present, the Fed is dealing with record low unemployment and 40-year highs in inflation, setting the stage for their policy intervention. After keeping its benchmark interest rate anchored near zero since the beginning of the pandemic, the Federal Open Market Committee (FOMC) has begun raising interest rates at a break-neck pace, with many experts expecting another six rate hikes in 2022 alone. The trajectory is expected to push the effective federal funds rate somewhere between 2.75% and 3.25% by year end, which would be levels not seen since just before the housing meltdown and Great Recession. With these comparisons, it is obvious why the market is so skittish.

The reality is that a greater level of uncertainty prevails, and investors continue to scour data seeking, hard-to-find clues on where the economy and markets are headed from here. Broad expectations are for the Fed to deliver two more 50bps rate hikes by the time summer is over, but the question is how much tightening they signal thereafter; and obviously, what the effects of their actions will be.

And yes, these hikes have pushed the prime rate and mortgage rates higher, immediately increasing financing costs for many forms of consumer borrowing and credit. This has the potential to be a drag on corporate earnings into the back half of 2022. Currently, we see the risk of a recession in the United State growing; the Fed’s response to GDP contraction will predicate just how deep we go as they could certainly reverse course and cut rates if inflation rates cool during a contraction.

WESTWOOD FUNDS (Unaudited)

Eyes on Inflation

Central banks’ reaction to higher energy and food prices will prove difficult to predict, as the magnitude or speed of interest rate rises to combat inflation will have to be delicately balanced to support respective economies. The answer will depend on the extent to which higher energy prices dampen growth or alternatively fuel strong wage rises as workers try to protect their purchasing power amid a tight labor market. At the end of the day, the narrative the FOMC offers can either be solace or stress for both consumers and investors.

The Russia-Ukraine war is another wildcard that will complicate the task and effectiveness of the Fed’s monetary hawkishness. Its effects add to logistical troubles, corporate earnings (as many western companies have withdrawn from doing business in Russia) and food supply and costs. We believe that the conflict is likely to be drawn out, driving headline risk and continued disturbances, both temporary and permanent, in global trade and logistics.

While the risk of vaccine-resistant variants of COVID-19 remain, we continue to believe that the severity and spread of these variants will likely be controlled for most developed nations given the infrastructure and treatment options in place. This should allow for consumer spending, which has been strong, to persist into the second half of 2022.

Global Markets

Accommodative policies remain in effect for most developed nations, though some shifts in those policies may be underway given unique struggles faced. The Federal Reserve has signaled in the U.S. that the current level of monetary stimulus may no longer be warranted and plans to begin to taper their purchases of certain assets as a result. Conversely, in Europe, many of the same headwinds as seen in the U.S. are mounting, such as supply chain disruptions and rising prices from energy to food and more, putting pressure on the consumer. But unlike America, the European Central Bank seems to be in no hurry to reduce their monetary policy accommodations. China is also working hard to emerge from its worst economic slowdown since 2015, which many now believe will lead to additional stimulus through easier monetary policy. These factors, along with a relatively strong economy and rising rates, are pushing the U.S. Dollar higher, which in turn is creating additional earnings headwinds as roughly 40% of the earnings for the S&P 500 are derived outside of the U.S.; and those earnings will be worth less with a strong greenback.

Where Do Markets Head From Here?

The current market environment continues to produce dislocations with respect to valuation and increased levels of fundamental skepticism that play to our strength. Now, more than ever, highly tactical and surgical investment techniques, with properly hedged and balanced allocations, will be needed to reduce volatility and produce alpha. As it has for over 30 years, our investment process continues to seek out mispriced opportunities where fundamental analysis can uncover value being missed in the current market environment while maintaining a strong culture of risk management with a focus on mitigating potential downside risks.

Thank you for your trust.

Sincerely,

The Investment Team

The Westwood Funds

The information contained herein represents the views of the manager at a specific point in time and is based on information believed to be reliable. No representation or warranty is made concerning the accuracy or completeness of any data compiled herein. Any statements non-factual in nature constitute only current opinion, which is subject to change. Any statements concerning financial market trends are based on current market conditions, which will

WESTWOOD FUNDS (Unaudited)

fluctuate. Past performance is not indicative of future results. All information provided herein is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned. Investing involves risk, including possible loss of principal. A discussion of each fund’s performance during the semiannual period ending April 30, 2022, is presented below.

Westwood Quality Value Fund

The performance of the Westwood Quality Value Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Quality Value Fund – I Shares (WHGLX) | -3.99% | -6.47% |

| Westwood Quality Value Fund – A Shares (WWLAX)* | -4.19% | -6.51% |

| Westwood Quality Value Fund – C Shares (WWLCX) | -4.51% | -6.77% |

| Russell 1000 Value Index | -3.94% | -6.34% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024. In the absence of current fee waivers, total return and yield would have been reduced.

Positive stock selection in Health Care, Commercial Services and Energy added to relative performance. Global crude supply shortages and increasing demand helped drive oil and fuel prices higher, and in turn generated alpha in our energy-related holdings such as ConocoPhillips, Valero Energy and EOG Resources. McKesson continued to benefit from strong health care demand and saw Q4 revenues for its U.S. Pharmaceutical and Specialty Solutions jump 14% year over year, and its fourth-quarter earnings results beat consensus estimates, rising 38% year over year. Despite slowing vaccine distribution, Johnson & Johnson moved higher early in the year as the consumer and pharmaceutical segments continued to show relative value. Investors also saw the consumer staple giant as a relative safe haven from increased volatility.

Negative stock selection in Financials and Technology weighed on relative performance. Vertiv Holdings, which is focused on IT/data infrastructure, experienced heavy selling after its fourth- quarter earnings report lagged consensus estimates, while Teradyne, Inc., failed to impress investors (despite fairly strong earnings) with its weaker than expected outlook. Goldman Sachs, Bank of America and Western Alliance Bancorp all experienced headwinds as investor concerns regarding potential credit losses rose as the risk of recession and consumer weakness increased due to inflation and rising interest rates. Shares of Alphabet also fell late in the quarter as investors shifted away from growth stocks as rate-hike trajectories sharpened.

WESTWOOD FUNDS (Unaudited)

Westwood Quality MidCap Fund

The performance of the Westwood SmallCap Growth Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | Since Inception | Year to Date |

| Westwood Quality MidCap Fund – I Shares (WWMCX) | -2.60% | -8.29% |

| Russell Midcap Value Index | -1.86% | -7.65% |

WWMCX Inception Date: 11/30/2021

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024.

Relative performance was aided by positive stock selection within the Health Care sector and positive allocation to the Energy sector. The top six contributors to return all were scattered throughout different segments of the energy sector. Holdings included Devon Energy, McKesson, Valero, Diamondback, DTE Energy and Freeport-McMoran. Global crude and natural gas supply shortages, along with increasing demand for refined fuel-oils and liquefied natural gas helped drive oil and fuel prices higher, and in turn, helped generate positive returns in our energy-related holdings. Profitability in downstream (delivery to retail customers) has also been, on average, increasing as refiners, marketers and resellers of distillates have seen consumer demand stable even as retail prices rise to record levels.

Unfavorable selection in Consumer Discretionary, as well as unfavorable selection and over-allocation to Materials, detracted from relative performance. Popular consumer delivery company 1-800-FLOWERS.COM saw its revenue drop 1% in its fiscal third quarter as consumers shifted spending in a post-COVID-19 era. Automated test equipment maker, Teradyne, Inc., failed to impress investors (despite fairly strong earnings) with its weaker than expected outlook. And General Motors, along with several of its peers, saw shares turn weaker as inventories rose and consumer demand slowed in the first half of 2022. Dana Corporation, which is a major drivetrain supplier for the automotive industry, also detracted from performance as its revenue is largely tied to the sale of new automobiles globally.

Westwood Quality SMidCap Fund

The performance of the Westwood Quality SMidCap Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Quality SMidCap Fund – I Shares (WHGMX) | -10.21% | -10.92% |

| Westwood Quality SMidCap Fund – Ultra Shares (WWSMX) | -10.05% | -10.79% |

| Russell 2500 Value Index | -6.76% | -8.18% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024.

Positive stock selection in Health Care, Energy and Information Technology, along with allocation tailwinds, aided relative performance. As we’ve seen in the broad market, energy-related holdings in PDC and Magnolia Oil & Gas led to returns as energy prices rose due to global supply shortages and stable demand. First Horizon Corporation also contributed to performance as the regional bank remained isolated from many of the global risks that its larger peers

WESTWOOD FUNDS (Unaudited)

had to endure. The bank was able to focus on consumer lending and leverage rising rates to add to profitability. Despite a modest slowdown in new housing activity in aggregate, the nation’s largest supplier of structural building products, Builders FirstSource, was able to capture regional demand in Texas and other states. The company continues to aggressively capture additional market share and efficiencies through acquisitions.

Negative stock selection in Materials, Financials and Consumer Staples detracted from relative performance. Popular consumer delivery company 1-800-FLOWERS.COM saw its revenue drop 1% in its fiscal third quarter as consumers shifted spending in a post-COVID-19 era. Despite its second highest first quarter revenue reading in history, investment banking firm Perella Weinberg disappointed investors as a reduction in domestic mergers and acquisition activity added concerns about near-term future growth. Slowdowns in the U.S. housing market also had a bearish effect on Masonite International, while increasing costs negatively affected European frozen food company Nomad Foods.

Westwood Quality SmallCap Fund

The performance of the Westwood Quality SmallCap Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Quality SmallCap Fund – I Shares (WHGSX) | -12.27% | -14.60% |

| Westwood Quality SmallCap Fund – A Shares (WHGAX)* | -12.30% | -14.66% |

| Westwood Quality SmallCap Fund – C Shares (WHGCX) | -12.66% | -14.85% |

| Westwood Quality SmallCap Fund – Ultra Shares (WWSYX) | -12.20% | -14.60% |

| Russell 2000 Value Index | -9.50% | -9.97% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024. In the absence of current fee waivers, total return and yield would have been reduced.

Positive stock selection in Health Care and Utilities added to relative performance. South Jersey Industries drew added attraction from investors who continued to move into the utility sector as a volatility shelter, while the company was also able to capture profits amid a rising energy cost landscape. Its acquisition by Infrastructure Investment Fund (IIF) remains on track. Holdings in PDC and Whiting Petroleum contributed to returns as energy prices rose due to global supply shortages, stable demand and improved margins. In the face of rising price pressure, Twinkie maker Hostess Brands was still able to best analyst estimates, fueled by demonstrable consumption momentum across its sweet baked goods and cookies portfolio, year over year pricing and favorable investor sentiment toward staples.

Industrials and Financials detracted from relative performance due to unfavorable stock selection. Masonite International experienced earnings pressure as the U.S. housing market, and subsequent demand for its doors decreased in the first half. Triumph Bancorp shares struggled despite a rising rate environment on concerns around consumer health. The company announced a strategic reorganization of its executive management team to better align with future growth priorities. REPAY shares underperformed during the period as future earnings growth and increasing competition came into question.

WESTWOOD FUNDS (Unaudited)

Westwood Quality AllCap Fund

The performance of the Westwood Quality AllCap Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Quality AllCap Fund – I Shares (WQAIX) | -6.66% | -8.04% |

| Westwood Quality AllCap Fund – Ultra Shares (WQAUX) | -6.52% | -7.94% |

| Russell 3000 Value Index | -4.30% | -6.57% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March. 1, 2024. In the absence of current fee waivers, total return and yield would have been reduced.

Relative performance was aided by positive stock selection within the Health Care and Commercial Services sectors. Top individual contributors included McKesson, who continued to benefit from strong health care demand and saw Q4 revenues for its U.S. Pharmaceutical and Specialty Solutions jump 14% year over year, and its fourth-quarter earnings results beat consensus estimates, rising 38% year over year. Despite slowing vaccine distribution, another top contributor, Johnson & Johnson, moved higher early in the year as the consumer and pharmaceutical segments continued to show relative value. Investors also saw the consumer staple giant as a relative safe haven from increased volatility. Surging energy prices at the wholesale and retail levels helped fuel performance in Pioneer Natural Resources, Devon Energy and Freeport-McMoran.

Unfavorable selection and allocation in Industrials and Financials detracted from relative performance. Top individual detractors included Vertiv Holdings, which is focused on IT/data infrastructure and experienced heavy selling after its fourth-quarter earnings report lagged consensus estimates. Despite its second-highest, first-quarter revenue reading in history, investment banking firm Perella Weinberg disappointed investors as a reduction in domestic mergers and acquisition activity added concerns about near-term future growth. And as car inventories grew, and auto demand waned from pandemic highs, IAA Inc. failed to gather bullish momentum. Along those same lines, Aptiv PLC saw its shares come under pressure as investors grew concerned that the current auto cycle has peaked, especially in the face of $5 per gallon fuel in the U.S.

Westwood Total Return Fund

The performance of the Westwood Total Return Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Total Return Fund – I Shares (WLVIX) | -8.96% | -9.61% |

| Westwood Total Return Fund – A Shares (WWTAX)* | -9.10% | -9.68% |

| Westwood Total Return Fund – C Shares (WTOCX) | -9.49% | -9.98% |

| 60% S&P 500 Index / 40% Bloomberg U.S. Aggregate Bond Index | -9.46% | -11.48% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be

WESTWOOD FUNDS (Unaudited)

worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024. In the absence of current fee waivers, total return and yield would have been reduced.

The Westwood Total Return Fund was formerly known as Westwood Low Volatility Fund. Prior to Nov. 1, 2019, the Fund employed different investment strategies. Therefore, the past statistics and performance shown for periods prior to Nov. 1, 2019, may have differed had the Fund’s current investment strategy been in effect.

Market Commentary

Selling pressure in domestic and global markets shifted away from pandemic-related fears to growing inflation and rising interest rates now taking a toll on consumers. The consensus of economists now believes that an economic contraction is increasingly likely as the Federal Reserve may be unable to deliver a soft landing. With global supply chains already stressed, the Russia-Ukraine war not only added a highly volatile risk component to food and energy prices, it also created massive material changes in global trade routes and policies. This effect, along with dramatic shifts in the monetary policies of the world’s largest economies, leaves investors with an increasingly cloudy outlook. Ironically, 2019 had seen the largest easing in monetary policy by global central banks since the 2008 financial crisis, and 2022 may prove to be the largest tightening (at least domestically). Risk continues to be more “off,” with a flight to high- quality, value and/or dividend equities likely to remain for the foreseeable future. Given the broader breakdown of equity valuation, strategic investors can use market disconnections to uncover value and/or quasi-arbitrage opportunities while the masses revalue and reassess fair value and risk.

We remain tilted toward the lower duration range in bonds and are staying cautious in both equities and bonds, incrementally adding based on quality and fundamentals. The opportunity within credit is particularly encouraging, with certain quality tranches trading at spreads on the higher end of their historical ranges (i.e., they are relatively inexpensive).

Fund Performance

The Fund provided a positive return relative to its blended benchmark, driven in large part by asset allocation, with a slight tilt toward equities during the period.

Within the energy sector, shares of Devon Energy Corp. and Energy Transfer LP rose on the strength of higher natural gas and oil prices, and expectations of a colder-than-normal winter. Within Communication Services, our underweight position relative to the benchmark was a key factor, as the stocks in the index fell by more than 25%. Our positions in Consumer Discretionary were a net positive for the Fund, for somewhat unusual reasons. Equity holding amazon.com fell by more than 25% in the period, as investors began to price in the likelihood of slowing consumer spending. However, our underweight position in that stock, relative to the benchmark, was a net positive for the Fund. Finally, health care company Bristol Myers Squibb performed well in the period, rising after strong results for some experimental cancer treatments and acquisitions.

Our bond positions, generally, were a drag on performance during the period. As interest rates began to rise at the end of the period, investors reassessed their appetite for risk. In this type of environment, investment grade bonds tend to outperform high yield bonds, given the additional credit risk on high yield paper. Several short-term bonds held by the Fund, including those issued by Alarm.com Holdings, Expedia Group and MongoDB, Inc., were significant detractors to returns in the period.

Some equity positions were detrimental to total return as well. Positions in the Financials sector struggled as the Fed began to raise short-term interest rates, increasing the cost of capital for businesses and likely slowing down lending and other financial activity. Shares of banks like JP Morgan Chase, Citigroup and Truist Financial Corp. were among the laggards for the period.

WESTWOOD FUNDS (Unaudited)

Westwood Income Opportunity Fund

The performance of the Westwood Income Opportunity Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Income Opportunity Fund – I Shares (WHGIX) | -8.84% | -9.39% |

| Westwood Income Opportunity Fund – A Shares (WWIAX)* | -8.97% | -9.53% |

| Westwood Income Opportunity Fund – C Shares (WWICX) | -9.26% | -9.73% |

| Bloomberg U.S. Aggregate Bond Index | -9.47% | -9.50% |

| S&P 500 Index | -9.65% | -12.92% |

| Blended Benchmark** | -10.78% | -11.88% |

| ** | 40% S&P 500 Index / 60% Bloomberg U.S. Aggregate Bond Index |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024. In the absence of current fee waivers, total return and yield would have been reduced.

Market Commentary

Selling pressure in domestic and global markets shifted away from pandemic-related fears to growing inflation and rising interest rates now taking a toll on consumers. The consensus of economists now believes that an economic contraction is increasingly likely as the Federal Reserve may be unable to deliver a soft landing. With global supply chains already stressed, the Russia-Ukraine war not only added a highly volatile risk component to food and energy prices, it also created massive material changes in global trade routes and policies. This effect, along with dramatic shifts in the monetary policies of the world’s largest economies leaves investors with an increasingly cloudy outlook. Ironically, 2019 had seen the largest easing in monetary policy by global central banks since the 2008 financial crisis, and 2022 may prove to be the largest tightening (at least domestically). Risk continues to be more “off,” with a flight to high- quality, value and/or dividend equities likely to remain for the foreseeable future. Given the broader breakdown of equity valuation, strategic investors can use market disconnections to uncover value and/or quasi-arbitrage opportunities while the masses revalue and reassess fair value and risk.

We remain tilted toward the lower duration range in bonds and are staying cautious in both equities and bonds, incrementally adding based on quality and fundamentals. The opportunity within credit is particularly encouraging, with certain quality tranches trading at spreads on the higher end of their historical ranges (i.e., they are relatively inexpensive).

Fund Performance

The Fund declined by 8.84% in the period primarily due to higher levels of exposure in fixed income. This was offset by positive contributions from equity holdings across the Energy and Consumer Staples sectors. Equity exposure overall was reduced meaningfully during 2020, with proceeds redeployed into opportunities in dislocated markets, including convertible bonds, mortgage-backed securities, and corporate bond and rotations within equity allocation.

Energy stocks were one of the bright spots for the period, supported by higher oil and natural gas prices, leading to higher gasoline prices for consumers. Exxon Mobil, Energy Transfer LP and Baker Hughes Co. each handle a different

WESTWOOD FUNDS (Unaudited)

portion of the energy value chain — Exxon Mobil is an integrated oil company, Energy Transfer focuses on pipelines and Baker Hughes is involved in oilfield services — and all performed well during the period. Newmont Corp., a mining company that focuses on gold but also mines industrial material such as copper and lead, gained over 50% during the period, driven in large part by increased earnings from higher gold and copper prices.

As the equity market began to fall from its peak in early January, shares of financial companies were generally hit the hardest. Our position in shares of large banks Citigroup Inc. and JP Morgan Chase & Co. were detractors to performance, as investors began to price in slower future earnings and loan growth due to higher interest rates. Investment bank Moelis & Co. also struggled, given the likely impact of higher interest rates on their business, including mergers and acquisitions, initial public offerings and other activities. PayPal Holdings was another detractor during the period, as the stock fell significantly following their report of slowing transaction growth, reduced profitability and corporate restructuring to reduce headcount.

Westwood High Income Fund

The performance of the Westwood High Income Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood High Income Fund – I Shares (WHGHX) | -7.39% | -8.15% |

| Westwood High Income Fund – A Shares (WSDAX)* | -7.47% | -8.27% |

| Westwood High Income Fund – C Shares (WWHCX) | -7.85% | -8.48% |

| 80% Bloomberg U.S. Aggregate Bond Index / 20% S&P 500 Index | -9.43% | -10.14% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024.

The Westwood High Income Fund was formerly known as Westwood Short Duration High Yield. Prior to Nov. 1, 2019, the Fund employed different investment strategies. Therefore, the past statistics and performance shown for periods prior to Nov. 1, 2019, may have differed had the Fund’s current investment strategy been in effect.

Market Commentary

Selling pressure in domestic and global markets shifted away from pandemic-related fears to growing inflation and rising interest rates now taking a toll on consumers. The consensus of economists now believes that an economic contraction is increasingly likely as the Federal Reserve may be unable to deliver a soft landing. With global supply chains already stressed, the Russia-Ukraine war not only added a highly volatile risk component to food and energy prices, it also created massive material changes in global trade routes and policies. This effect, along with dramatic shifts in the monetary policies of the world’s largest economies leaves investors with an increasingly cloudy outlook. Ironically, 2019 had seen the largest easing in monetary policy by global central banks since the 2008 financial crisis, and 2022 may prove to be the largest tightening (at least domestically). Risk continues to be more “off,” with a flight to high- quality, value and/or dividend equities likely to remain for the foreseeable future. Given the broader breakdown of equity valuation, strategic investors can use market disconnections to uncover value and/or quasi-arbitrage opportunities while the masses revalue and reassess fair value and risk.

WESTWOOD FUNDS (Unaudited)

We remain tilted toward the lower duration range in bonds and are staying cautious in both equities and bonds, incrementally adding based on quality and fundamentals. The opportunity within credit is particularly encouraging, with certain quality tranches trading at spreads on the higher end of their historical ranges (i.e., they are relatively inexpensive).

Fund Performance

The Fund declined by -7.39% during the period, driven in large part by the allocation to fixed income, primarily the allocation to investment grade bonds. Our exposure to stocks was beneficial, as our stock portfolio produced a small gain on the period. On a relative basis, our stock exposure was responsible for substantially all of our outperformance compared to our blended benchmark.

Within the portfolio, our top contributors included a mining company, two health care companies, an energy firm and a consumer discretionary name. Newmont Corp., a mining company that focuses on gold but also mines industrial material such as copper and lead, gained over 50% during the period, driven in large part by increased earnings from higher gold and copper prices. Bristol Myers Squibb and Amgen, Inc. both advanced on largely company-specific news; Amgen continues to see positive results in their oncology drug pipeline, leading to strong earnings growth. EOG Resources, which develops, produces and markets oil and natural gas, has fared well amid rising oil and natural gas prices, expanding production and maintaining tight controls on costs. Last, Altria Corp. has fared well in an inflationary environment as it has been able to increase prices and pass on higher input costs to consumers.

The investment grade bond portion of the Fund was the primary detractor to returns in the period, though it was difficult to pin the problem on a single security. Our exposure to BBB-rated securities was hampered as interest rates began to rise: Investors fled longer-dated bonds and moved toward the short end of the yield curve, causing prices of bonds on the long end to decline. We typically pursue a barbell strategy, holding equal amounts on the long and short end of the curve, so that price increases on short-dated securities (less than five years to maturity) will balance out price declines on long-dated securities (10 or more years to maturity) over time. We shortened our duration during the period to reduce interest rate risk.

Westwood Alternative Income Fund

The performance of the Westwood Alternative Income Fund for the period ending April 30, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood Alternative Income Fund – I Shares (WMNIX) | -2.33% | -2.00% |

| Westwood Alternative Income Fund – Ultra Shares (WMNUX) | -2.28% | -1.97% |

| Westwood Alternative Income Fund – A Shares (WMNAX)* | -2.35% | -2.05% |

| Westwood Alternative Income Fund – C Shares (WWACX) | -2.68% | -2.22% |

| FTSE 1-Month Treasury Bill | 0.04% | 0.02% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024.

Prior to Nov. 1, 2019, the Westwood Alternative Income Fund was formerly known as the Westwood Market Neutral Fund. As of Nov. 1, 2019, the Fund began following the Sensible FeesTM framework.

WESTWOOD FUNDS (Unaudited)

Over the past six months, the market’s appetite for risk has waned. The combination of global supply issues, rising energy costs, the war in Ukraine and the Federal Reserve’s penchant for staving off inflation in the United States has global investors confused about where best to put money to work. As a result, the S&P 500 Index has declined by over 9.5% and the U.S. 10-Year Note Yield has increased by 138 basis points leaving U.S. investors with few places to turn. Equity volatility, as measured by the CBOE VIX index, has doubled over this time period, demonstrating the concern for risk asset valuations as the zero-interest-rate policy has left the building. The Fed has admitted that they were wrong regarding inflationary pressures being transitory and are now playing catch-up. Some of the biggest questions that have the markets on edge is: How far will the Fed go to tamp down inflation? Will they succeed? Will they overshoot and push the U.S. economy into recession? Will the draining of liquidity be effective in fighting the cost-push inflation that we are experiencing? These are all questions that the market is dealing with in typical fashion — sell first and ask questions later.

We believe that we are well positioned in the Alternative Income Fund as the strategy seeks to profit from market swings and lack of conviction. The portfolio holds short- dated convertibles and fixed income securities that have limited sensitivity to rising rates and declining equities. At the same time, we are long equity volatility that has sprung to life.

Within the fixed income yield book, our holdings performed in line as both investment grade and high yield sold off. Credit spreads did widen as risk asset liquidity became scarce, but we were positioned in higher grade and low duration names.

The convertible arbitrage strategy held up well relative to other asset classes as the long volatility component offset the negative rate and liquidity pressures. Convertible valuations declined as the hunt for liquidity impacted all asset classes. Gamma trading opportunities added value as the equity markets have made several attempts to rebound, only to end lower. Activity in the primary market has come to a halt following the lead of the high yield market.

Macro tail hedges added value as both the equity markets were risk off and rates were higher across the curve. We continue to monitor and systematically adjust these positions for maximum Fund flexibility, and as a means of capital preservation during periods of market volatility.

Westwood SmallCap Growth Fund

The performance of the Westwood SmallCap Growth Fund for the period ending April 20, 2022, was as follows:

| | | 2022 |

| | 6 Months | Year to Date |

| Westwood SmallCap Growth Fund – I Shares (WSCIX) | -15.82% | -15.59% |

| Russell 2000 Growth Index | -26.77% | -23.35% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2024. In the absence of current fee waivers, total return and yield would have been reduced.

Strong relative performance was aided by positive stock selection within Health Care and Financials. Top individual contributors included Krystal Biotech, as shares remained strong following the successful completion of GEM-3 pivotal trial. The company is also on track to file BLA for VYJUVEK™ for the treatment of dystrophic epidermolysis bullosa, with MAA filing anticipated in the back half of 2022. Wellhead and fracking company Cactus Inc. benefited from skyrocketing crude and natural gas prices, while health care company LHC Group delivered strong earnings

WESTWOOD FUNDS (Unaudited)

results that bested analysts’ estimates. HealthEquity Inc. shares also climbed in the period on strong sales and better-than-expected revenue forecasts as it is uniquely positioned in the HSA (Healthcare Savings Account) space.

Unfavorable selection in Utilities and slightly in Consumer Staples detracted from relative performance. Top individual detractors included NeoGenomics, Inc., which saw its CEO depart suddenly, likely under pressure after poor stock performance and guidance. Tactile Systems reported a wider-than-expected loss for the first quarter, prompting investors to sell. GrowGeneration also saw its net sales decline 9.2% as the industry as a whole softened. The CEO cited macro headwinds and growing competition. Rounding out the detractors was Power Integrations, which has seen its share price decline as its technology failed to impress the majority of investors who still see risks in the semiconductor sector.

To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and other information can be found in the Fund’s prospectus, which may be obtained by calling 1.877.386.3944. Read the prospectus carefully before investing or sending money.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-877-386-3944.

An investor should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The fund’s prospectus contains this and other important information. To obtain a copy of the fund’s prospectus please visit the fund’s website at www.westwoodfunds.com or call 1-877-386-3944 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the fund, may be sold at any time, and may no longer be held by the Funds. For a complete list of securities held by the Funds as of April 30, 2022, please see the Schedules of Investments section of this Report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

WESTWOOD FUNDS (Unaudited)

Definition of the Comparative Indices & Key Terms

Alpha is the measure of risk adjusted performance.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), which calculates the expected return of an asset based on its beta and expected market returns.

Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative.

FTSE 1-Month Treasury Bill Index is a market value-weighted index of public obligations of the U.S. Treasury bills with maturities of one month. The Index reflects no deduction for fees, expenses or taxes.

Gamma is the rate of change for delta with respect to the underlying asset’s price. Gamma is an important measure of the convexity of a derivative’s value, in relation to the underlying assets.

Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the Russell 3000 Index. The Russell 1000 Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are reflected.

Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

Russell 2000 Value Index is a broadly diversified index predominantly made up of value stocks of small U.S. companies.

Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 16% of the total market capitalization of the Russell 3000 Index.

Russell 2500 Value Index measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratio and lower forecasted growth values

S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic stock market through changes in the aggregate market value of 500 stocks representing all major industries.

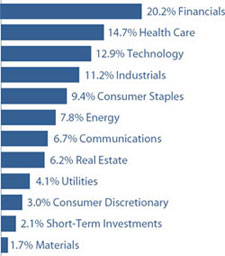

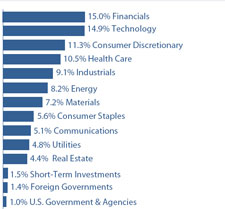

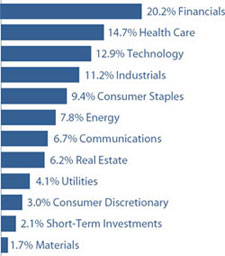

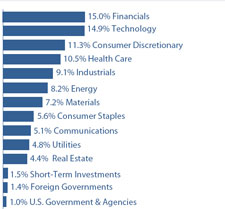

| WESTWOOD QUALITY VALUE FUND |

| APRIL 30, 2022 (Unaudited) |

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 97.9% |

| | | Shares | | | Value | |

| Communications — 6.8% | | | | | | | | |

| Internet Media & Services — 2.2% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 2,546 | | | $ | 5,810,456 | |

| | | | | | | | | |

| Telecommunications — 4.6% | | | | | | | | |

| AT&T, Inc. | | | 290,987 | | | | 5,488,015 | |

| T-Mobile US, Inc. (a) | | | 55,487 | | | | 6,832,669 | |

| | | | | | | | 12,320,684 | |

| Consumer Discretionary — 3.0% | | | | | | | | |

| Retail - Discretionary — 3.0% | | | | | | | | |

| Home Depot, Inc. (The) | | | 19,249 | | | | 5,782,400 | |

| O’Reilly Automotive, Inc. (a) | | | 3,886 | | | | 2,357,053 | |

| | | | | | | | 8,139,453 | |

| Consumer Staples — 9.4% | | | | | | | | |

| Beverages — 2.2% | | | | | | | | |

| PepsiCo, Inc. | | | 33,946 | | | | 5,828,868 | |

| | | | | | | | | |

| Food — 2.1% | | | | | | | | |

| McCormick & Company, Inc. | | | 56,608 | | | | 5,693,067 | |

| | | | | | | | | |

| Retail - Consumer Staples — 5.1% | | | | | | | | |

| Dollar General Corporation | | | 23,027 | | | | 5,469,603 | |

| Walmart, Inc. | | | 54,575 | | | | 8,349,429 | |

| | | | | | | | 13,819,032 | |

| Energy — 7.8% | | | | | | | | |

| Oil & Gas Producers — 7.8% | | | | | | | | |

| Chevron Corporation | | | 24,343 | | | | 3,813,818 | |

| ConocoPhillips | | | 71,401 | | | | 6,820,223 | |

| EOG Resources, Inc. | | | 47,690 | | | | 5,568,284 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Energy — continued | | | | | | | | |

| Oil & Gas Producers — continued | | | | | | | | |

| Valero Energy Corporation | | | 42,724 | | | $ | 4,762,872 | |

| | | | | | | | 20,965,197 | |

| Financials — 20.3% | | | | | | | | |

| Asset Management — 3.3% | | | | | | | | |

| Blackstone, Inc. | | | 43,836 | | | | 4,452,423 | |

| Charles Schwab Corporation (The) | | | 66,065 | | | | 4,382,091 | |

| | | | | | | | 8,834,514 | |

| Banking — 6.1% | | | | | | | | |

| Bank of America Corporation | | | 207,628 | | | | 7,408,167 | |

| PNC Financial Services Group, Inc. (The) | | | 29,135 | | | | 4,839,324 | |

| Western Alliance Bancorp | | | 53,271 | | | | 4,054,456 | |

| | | | | | | | 16,301,947 | |

| Institutional Financial Services — 4.9% | | | | | | | | |

| Goldman Sachs Group, Inc. (The) | | | 26,221 | | | | 8,010,253 | |

| Intercontinental Exchange, Inc. | | | 43,905 | | | | 5,084,638 | |

| | | | | | | | 13,094,891 | |

| Insurance — 6.0% | | | | | | | | |

| American International Group, Inc. | | | 92,854 | | | | 5,432,887 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 16,587 | | | | 5,354,781 | |

| Progressive Corporation (The) | | | 50,446 | | | | 5,415,883 | |

| | | | | | | | 16,203,551 | |

| Health Care — 14.7% | | | | | | | | |

| Biotech & Pharma — 5.5% | | | | | | | | |

| Gilead Sciences, Inc. | | | 94,466 | | | | 5,605,612 | |

| Johnson & Johnson | | | 50,661 | | | | 9,142,284 | |

| | | | | | | | 14,747,896 | |

| Health Care Facilities & Services — 6.7% | | | | | | | | |

| CVS Health Corporation | | | 57,152 | | | | 5,494,022 | |

| McKesson Corporation | | | 8,699 | | | | 2,693,297 | |

| UnitedHealth Group, Inc. | | | 19,165 | | | | 9,746,361 | |

| | | | | | | | 17,933,680 | |

| Medical Equipment & Devices — 2.5% | | | | | | | | |

| Becton, Dickinson and Company | | | 27,588 | | | | 6,819,478 | |

| | | | | | | | | |

| Industrials — 11.0% | | | | | | | | |

| Aerospace & Defense — 1.9% | | | | | | | | |

| L3Harris Technologies, Inc. | | | 22,709 | | | | 5,274,392 | |

| | | | | | | | | |

| Diversified Industrials — 5.2% | | | | | | | | |

| Eaton Corporation plc | | | 56,588 | | | | 8,206,392 | |

| Honeywell International, Inc. | | | 29,616 | | | | 5,730,992 | |

| | | | | | | | 13,937,384 | |

| Electrical Equipment — 1.4% | | | | | | | | |

| Veritiv Holdings Company | | | 299,943 | | | | 3,758,286 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY VALUE FUND |

| APRIL 30, 2022 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Industrials — continued | | | | | | | | |

| Transportation & Logistics — 2.5% | | | | | | | | |

| Union Pacific Corporation | | | 28,251 | | | $ | 6,618,927 | |

| | | | | | | | | |

| Materials — 1.7% | | | | | | | | |

| Chemicals — 1.7% | | | | | | | | |

| Huntsman Corporation | | | 136,171 | | | | 4,612,112 | |

| | | | | | | | | |

| Real Estate — 6.2% | | | | | | | | |

| REITs — 6.2% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 28,667 | | | | 5,221,980 | |

| Prologis, Inc. | | | 33,389 | | | | 5,351,923 | |

| VICI Properties, Inc. | | | 202,087 | | | | 6,024,214 | |

| | | | | | | | 16,598,117 | |

| Technology — 12.9% | | | | | | | | |

| Semiconductors — 4.2% | | | | | | | | |

| Microchip Technology, Inc. | | | 76,386 | | | | 4,980,367 | |

| Teradyne, Inc. | | | 60,524 | | | | 6,382,861 | |

| | | | | | | | 11,363,228 | |

| Software — 2.8% | | | | | | | | |

| Microsoft Corporation | | | 27,424 | | | | 7,610,708 | |

| | | | | | | | | |

| Technology Hardware — 2.0% | | | | | | | | |

| Cisco Systems, Inc. | | | 106,857 | | | | 5,233,856 | |

| | | | | | | | | |

| Technology Services — 3.9% | | | | | | | | |

| CACI International, Inc. - Class A (a) | | | 19,478 | | | | 5,167,514 | |

| Visa, Inc. - Class A | | | 25,179 | | | | 5,366,400 | |

| | | | | | | | 10,533,914 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Utilities — 4.1% | | | | | | | | |

| Electric Utilities — 4.1% | | | | | | | | |

| DTE Energy Company | | | 46,689 | | | $ | 6,118,127 | |

| NextEra Energy, Inc. | | | 67,660 | | | | 4,805,213 | |

| | | | | | | | 10,923,340 | |

| Total Common Stocks | | | | | | | | |

| (Cost $222,141,248) | | | | | | $ | 262,976,978 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 2.1% | | | | | | | | |

| SEI Daily Income Trust, Government Fund - Class F, 0.15% (b) (Cost $5,733,366) | | | 5,733,366 | | | $ | 5,733,366 | |

| | | | | | | | | |

| Investments at Value — 100.0% | | | | | | | | |

| (Cost $227,874,614) | | | | | | $ | 268,710,344 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.0% (c) | | | | | | | 108,840 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 268,819,184 | |

plc - Public Limited Company

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of April 30, 2022. |

| (c) | Percentage rounds to less than 0.1%. |

The accompanying notes are an integral part of the financial statements.

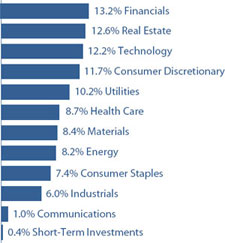

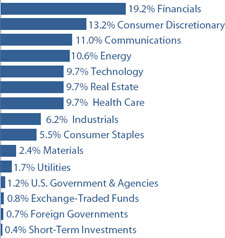

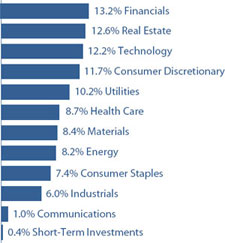

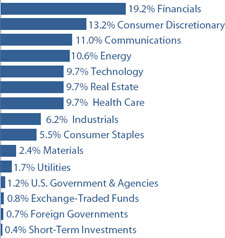

| WESTWOOD QUALITY MIDCAP FUND |

| APRIL 30, 2022 (Unaudited) |

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 97.8% |

| | | Shares | | | Value | |

| Communications — 1.0% | | | | | | | | |

| Cable & Satellite — 1.0% | | | | | | | | |

| Cable One, Inc. | | | 4 | | | $ | 4,665 | |

| | | | | | | | | |

| Consumer Discretionary — 11.5% | | | | | | | | |

| Apparel & Textile Products — 0.9% | | | | | | | | |

| Skechers U.S.A., Inc. - Class A (a) | | | 111 | | | | 4,252 | |

| | | | | | | | | |

| Automotive — 1.4% | | | | | | | | |

| Dana, Inc. | | | 467 | | | | 6,916 | |

| | | | | | | | | |

| Home & Office Products — 1.0% | | | | | | | | |

| Scotts Miracle-Gro Company (The) | | | 46 | | | | 4,781 | |

| | | | | | | | | |

| Home Construction — 4.0% | | | | | | | | |

| Armstrong World Industries, Inc. | | | 84 | | | | 7,111 | |

| Masonite International Corporation (a) | | | 67 | | | | 5,194 | |

| PulteGroup, Inc. | | | 171 | | | | 7,141 | |

| | | | | | | | 19,446 | |

| Leisure Facilities & Services — 4.2% | | | | | | | | |

| Darden Restaurants, Inc. | | | 78 | | | | 10,275 | |

| Texas Roadhouse, Inc. | | | 125 | | | | 10,291 | |

| | | | | | | | 20,566 | |

| Consumer Staples — 7.3% | | | | | | | | |

| Beverages — 2.1% | | | | | | | | |

| Constellation Brands, Inc. - Class A | | | 41 | | | | 10,090 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Consumer Staples — continued | | | | | | | | |

| Food — 5.2% | | | | | | | | |

| Darling Ingredients, Inc. (a) | | | 74 | | | $ | 5,431 | |

| Hostess Brands, Inc. (a) | | | 376 | | | | 8,531 | |

| McCormick & Company, Inc. | | | 112 | | | | 11,264 | |

| | | | | | | | 25,226 | |

| Energy — 8.0% | | | | | | | | |

| Oil & Gas Producers — 8.0% | | | | | | | | |

| Devon Energy Corporation | | | 127 | | | | 7,388 | |

| Diamondback Energy, Inc. | | | 101 | | | | 12,749 | |

| PDC Energy, Inc. | | | 134 | | | | 9,345 | |

| Valero Energy Corporation | | | 87 | | | | 9,699 | |

| | | | | | | | 39,181 | |

| Financials — 12.9% | | | | | | | | |

| Asset Management — 3.5% | | | | | | | | |

| Blue Owl Capital, Inc. | | | 419 | | | | 4,998 | |

| LPL Financial Holdings, Inc. | | | 63 | | | | 11,836 | |

| | | | | | | | 16,834 | |

| Banking — 3.9% | | | | | | | | |

| Pinnacle Financial Partners, Inc. | | | 81 | | | | 6,282 | |

| Synovus Financial Corporation | | | 113 | | | | 4,694 | |

| Veritex Holdings, Inc. | | | 252 | | | | 8,278 | |

| | | | | | | | 19,254 | |

| Institutional Financial Services — 1.8% | | | | | | | | |

| Intercontinental Exchange, Inc. | | | 76 | | | | 8,802 | |

| | | | | | | | | |

| Insurance — 3.7% | | | | | | | | |

| Arch Capital Group Ltd. (a) | | | 184 | | | | 8,403 | |

| Ryan Specialty Group Holdings, Inc. - Class A (a) | | | 262 | | | | 9,692 | |

| | | | | | | | 18,095 | |

| Health Care — 8.6% | | | | | | | | |

| Health Care Facilities & Services — 4.8% | | | | | | | | |

| Centene Corporation (a) | | | 139 | | | | 11,197 | |

| McKesson Corporation | | | 40 | | | | 12,384 | |

| | | | | | | | 23,581 | |

| Medical Equipment & Devices — 3.8% | | | | | | | | |

| Cooper Companies, Inc. (The) | | | 24 | | | | 8,665 | |

| ICU Medical, Inc. (a) | | | 45 | | | | 9,629 | |

| | | | | | | | 18,294 | |

| Industrials — 5.9% | | | | | | | | |

| Electrical Equipment — 2.1% | | | | | | | | |

| Fortive Corporation | | | 177 | | | | 10,177 | |

| | | | | | | | | |

| Machinery — 3.8% | | | | | | | | |

| AGCO Corporation | | | 75 | | | | 9,555 | |

| Middleby Corporation (The) (a) | | | 58 | | | | 8,926 | |

| | | | | | | | 18,481 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY MIDCAP FUND |

| APRIL 30, 2022 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Materials — 8.2% | | | | | | | | |

| Chemicals — 2.9% | | | | | | | | |

| Albemarle Corporation | | | 40 | | | $ | 7,713 | |

| Huntsman Corporation | | | 194 | | | | 6,571 | |

| | | | | | | | 14,284 | |

| Construction Materials — 0.7% | | | | | | | | |

| Cemex S.A.B. de C.V. - ADR (a) | | | 804 | | | | 3,537 | |

| | | | | | | | | |

| Containers & Packaging — 2.3% | | | | | | | | |

| WestRock Company | | | 224 | | | | 11,095 | |

| | | | | | | | | |

| Forestry, Paper & Wood Products — 2.3% | | | | | | | | |

| UFP Industries, Inc. | | | 146 | | | | 11,296 | |

| | | | | | | | | |

| Real Estate — 12.4% | | | | | | | | |

| REITs — 12.4% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 54 | | | | 9,837 | |

| Americold Realty Trust | | | 364 | | | | 9,602 | |

| National Retail Properties, Inc. | | | 223 | | | | 9,776 | |

| STAG Industrial, Inc. | | | 252 | | | | 9,405 | |

| Urban Edge Properties | | | 577 | | | | 10,784 | |

| VICI Properties, Inc. | | | 363 | | | | 10,821 | |

| | | | | | | | 60,225 | |

| Technology — 12.0% | | | | | | | | |

| Semiconductors — 5.8% | | | | | | | | |

| Microchip Technology, Inc. | | | 136 | | | | 8,867 | |

| Rambus, Inc. (a) | | | 394 | | | | 9,815 | |

| Teradyne, Inc. | | | 89 | | | | 9,386 | |

| | | | | | | | 28,068 | |

| Software — 1.9% | | | | | | | | |

| Tyler Technologies, Inc. (a) | | | 24 | | | | 9,473 | |

| | | | | | | | | |

| Technology Services — 4.3% | | | | | | | | |

| CACI International, Inc. - Class A (a) | | | 43 | | | | 11,408 | |

| Science Applications International Corporation | | | 113 | | | | 9,405 | |

| | | | | | | | 20,813 | |

| Utilities — 10.0% | | | | | | | | |

| Electric Utilities — 10.0% | | | | | | | | |

| Alliant Energy Corporation | | | 174 | | | | 10,233 | |

| CMS Energy Corporation | | | 192 | | | | 13,188 | |

| DTE Energy Company | | | 100 | | | | 13,104 | |

| Evergy, Inc. | | | 180 | | | | 12,213 | |

| | | | | | | | 48,738 | |

| Total Common Stocks | | | | | | | | |

| (Cost $489,761) | | | | | | | 476,170 | |

| MONEY MARKET FUNDS — 0.4% |

| | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class X, 0.28% (b) (Cost $1,866) | | | 1,866 | | | $ | 1,866 | |

| | | | | | | | | |

| Investments at Value — 98.2% | | | | | | | | |

| (Cost $491,627) | | | | | | $ | 478,036 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.8% | | | | | | | 8,817 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 486,853 | |

ADR - American Depositary Receipt

S.A.B d e C.V. - Societe Anonima Bursatil de Capital Variable

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of April 30, 2022. |

The accompanying notes are an integral part of the financial statements.

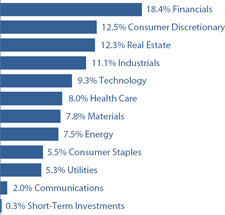

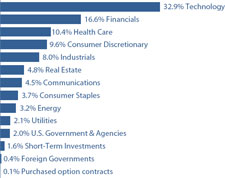

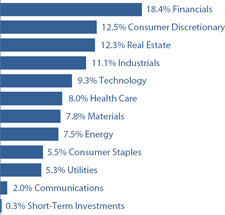

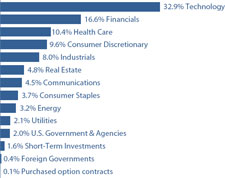

| WESTWOOD QUALITY SMIDCAP FUND |

| APRIL 30, 2022 (Unaudited) |

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 99.7% |

| | | Shares | | | Value | |

| Communications — 1.9% | | | | | | | | |

| Entertainment Content — 1.9% | | | | | | | | |

| Madison Square Garden | | | | | | | | |

| Entertainment Corporation (a) | | | 80,131 | | | $ | 5,869,596 | |

| | | | | | | | | |

| Consumer Discretionary — 12.5% | | | | | | | | |

| Automotive — 1.2% | | | | | | | | |

| Holley, Inc. (a) | | | 333,784 | | | | 3,518,084 | |

| | | | | | | | | |

| Home Construction — 1.9% | | | | | | | | |

| Armstrong World Industries, Inc. | | | 69,363 | | | | 5,872,272 | |

| | | | | | | | | |

| Leisure Facilities & Services — 3.1% | | | | | | | | |

| Jack in the Box, Inc. | | | 71,182 | | | | 5,891,022 | |

| Texas Roadhouse, Inc. | | | 40,139 | | | | 3,304,644 | |

| | | | | | | | 9,195,666 | |

| Leisure Products — 1.0% | | | | | | | | |

| Callaway Golf Company (a) | | | 137,914 | | | | 3,025,833 | |

| | | | | | | | | |

| Retail - Discretionary — 3.2% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 84,175 | | | | 3,144,778 | |

| Builders FirstSource, Inc. (a) | | | 103,818 | | | | 6,392,074 | |

| | | | | | | | 9,536,852 | |

| Wholesale - Discretionary — 2.1% | | | | | | | | |

| IAA, Inc. (a) | | | 176,457 | | | | 6,467,149 | |

| | | | | | | | | |

| Consumer Staples — 5.6% | | | | | | | | |

| Food — 5.6% | | | | | | | | |

| Hostess Brands, Inc. (a) | | | 280,857 | | | | 6,372,645 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Consumer Staples — continued | | | | | | | | |

| Food — continued | | | | | | | | |

| J & J Snack Foods Corporation | | | 41,582 | | | $ | 6,224,826 | |

| Nomad Foods Ltd. (a) | | | 220,772 | | | | 4,075,451 | |

| | | | | | | | 16,672,922 | |

| Energy — 7.5% | | | | | | | | |

| Oil & Gas Producers — 7.5% | | | | | | | | |

| Diamondback Energy, Inc. | | | 58,362 | | | | 7,367,035 | |

| Magnolia Oil & Gas Corporation - | | | | | | | | |

| Class A | | | 312,714 | | | | 7,267,473 | |

| PDC Energy, Inc. | | | 112,159 | | | | 7,821,969 | |

| | | | | | | | 22,456,477 | |

| Financials — 18.4% | | | | | | | | |

| Asset Management — 1.9% | | | | | | | | |

| LPL Financial Holdings, Inc. | | | 30,161 | | | | 5,666,347 | |

| | | | | | | | | |

| Banking — 10.1% | | | | | | | | |

| Pinnacle Financial Partners, Inc. | | | 75,005 | | | | 5,816,638 | |

| Simmons First National Corporation - Class A | | | 287,515 | | | | 6,862,983 | |

| Texas Capital Bancshares, Inc. (a) | | | 115,276 | | | | 5,920,575 | |

| Triumph Bancorp, Inc. (a) | | | 44,086 | | | | 3,061,332 | |

| Western Alliance Bancorp | | | 35,034 | | | | 2,666,438 | |

| Wintrust Financial Corporation | | | 69,534 | | | | 6,071,709 | |

| | | | | | | | 30,399,675 | |

| Institutional Financial Services — 1.4% | | | | | | | | |

| Perella Weinberg Partners | | | 547,262 | | | | 4,219,390 | |

| | | | | | | | | |

| Insurance — 3.1% | | | | | | | | |

| International General Insurance | | | | | | | | |

| Holdings Ltd. | | | 396,987 | | | | 3,005,191 | |

| Voya Financial, Inc. | | | 97,163 | | | | 6,134,872 | |

| | | | | | | | 9,140,063 | |

| Specialty Finance — 1.9% | | | | | | | | |

| MGIC Investment Corporation | | | 433,296 | | | | 5,658,846 | |

| | | | | | | | | |

| Health Care — 8.0% | | | | | | | | |

| Medical Equipment & Devices — 8.0% | | | | | | | | |

| Envista Holdings Corporation (a) | | | 76,102 | | | | 3,015,161 | |

| ICU Medical, Inc. (a) | | | 20,785 | | | | 4,447,782 | |

| Integer Holdings Corporation (a) | | | 59,501 | | | | 4,472,690 | |

| Integra LifeSciences Holdings Corporation (a) | | | 98,972 | | | | 6,053,128 | |

| Merit Medical Systems, Inc. (a) | | | 95,193 | | | | 5,902,918 | |

| | | | | | | | 23,891,679 | |

| Industrials — 11.1% | | | | | | | | |

| Aerospace & Defense — 1.9% | | | | | | | | |

| Moog, Inc. - Class A | | | 73,641 | | | | 5,881,707 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY SMIDCAP FUND |

| APRIL 30, 2022 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Industrials — continued | | | | | | | | |

| Electrical Equipment — 2.2% | | | | | | | | |

| Hubbell, Inc. | | | 33,406 | | | $ | 6,526,196 | |

| | | | | | | | | |

| Industrial Intermediate Products — 1.0% | | | | | | | | |

| AZZ, Inc. | | | 66,985 | | | | 3,057,195 | |

| | | | | | | | | |

| Machinery — 5.0% | | | | | | | | |

| AGCO Corporation | | | 45,286 | | | | 5,769,436 | |

| Albany International Corporation - Class A | | | 80,372 | | | | 6,286,698 | |

| Middleby Corporation (The) (a) | | | 18,437 | | | | 2,837,270 | |

| | | | | | | | 14,893,404 | |

| Transportation & Logistics — 1.0% | | | | | | | | |

| Alaska Air Group, Inc. (a) | | | 56,112 | | | | 3,051,932 | |

| | | | | | | | | |

| Materials — 7.8% | | | | | | | | |

| Chemicals — 2.4% | | | | | | | | |

| Ecovyst, Inc. | | | 708,066 | | | | 7,123,144 | |

| | | | | | | | | |

| Construction Materials — 2.1% | | | | | | | | |

| Eagle Materials, Inc. | | | 51,781 | | | | 6,385,633 | |

| | | | | | | | | |

| Containers & Packaging — 1.2% | | | | | | | | |

| WestRock Company | | | 74,173 | | | | 3,673,788 | |

| | | | | | | | | |

| Metals & Mining — 2.1% | | | | | | | | |

| Encore Wire Corporation | | | 28,760 | | | | 3,244,416 | |

| Livent Corporation (a) | | | 139,892 | | | | 2,988,093 | |

| | | | | | | | 6,232,509 | |

| Real Estate — 12.3% | | | | | | | | |

| Real Estate Owners & Developers — 2.0% | | | | | | | | |

| Radius Global Infrastructure, Inc. - Class A (a) | | | 479,856 | | | | 5,959,812 | |

| | | | | | | | | |

| REITs — 10.3% | | | | | | | | |

| Alexander & Baldwin, Inc. | | | 45,907 | | | | 973,229 | |

| American Assets Trust, Inc. | | | 170,564 | | | | 6,242,642 | |

| Americold Realty Trust | | | 233,806 | | | | 6,167,802 | |

| National Retail Properties, Inc. | | | 134,269 | | | | 5,886,353 | |

| STAG Industrial, Inc. | | | 155,612 | | | | 5,807,440 | |

| Urban Edge Properties | | | 312,419 | | | | 5,839,111 | |

| | | | | | | | 30,916,577 | |

| Technology — 9.3% | | | | | | | | |

| Semiconductors — 2.1% | | | | | | | | |

| Rambus, Inc. (a) | | | 246,641 | | | | 6,143,827 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Technology — continued | | | | | | | | |

| Technology Hardware — 2.8% | | | | | | | | |

| ADTRAN, Inc. | | | 239,263 | | | $ | 4,160,784 | |

| Viavi Solutions, Inc. (a) | | | 299,789 | | | | 4,298,974 | |

| | | | | | | | 8,459,758 | |

| Technology Services — 4.4% | | | | | | | | |

| CACI International, Inc. - Class A (a) | | | 26,841 | | | | 7,120,917 | |

| Science Applications International Corporation | | | 73,360 | | | | 6,105,753 | |

| | | | | | | | 13,226,670 | |

| Utilities — 5.3% | | | | | | | | |

| Electric Utilities — 5.3% | | | | | | | | |

| Alliant Energy Corporation | | | 104,288 | | | | 6,133,177 | |

| IDACORP, Inc. | | | 62,933 | | | | 6,619,293 | |

| NorthWestern Corporation | | | 55,549 | | | | 3,149,073 | |

| | | | | | | | 15,901,543 | |

| Total Common Stocks | | | | | | | | |

| (Cost $293,960,384) | | | | | | $ | 299,024,546 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.3% | | | | | | | | |

| SEI Daily Income Trust, Government Fund - Class F, 0.15% (b) (Cost $887,293) | | | 887,293 | | | $ | 887,293 | |

| | | | | | | | | |

| Investments at Value — 100.0% | | | | | | | | |

| (Cost $294,847,677) | | | | | | $ | 299,911,839 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.0% (c) | | | | | | | 58,565 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 299,970,404 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of April 30, 2022. |

| (c) | Percentage rounds to less than 0.1%. |

The accompanying notes are an integral part of the financial statements.

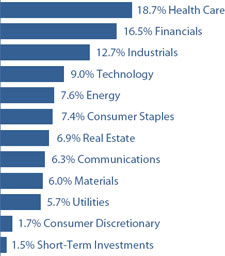

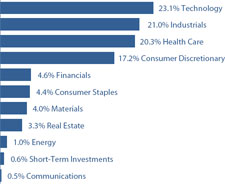

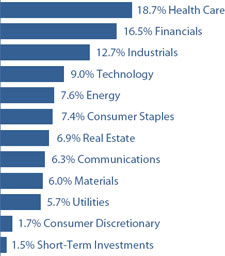

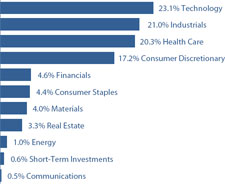

| WESTWOOD QUALITY SMALLCAP FUND |

| APRIL 30, 2022 (Unaudited) |

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 99.9% |

| | | Shares | | | Value | |

| Consumer Discretionary — 12.4% | | | | | | | | |

| Automotive — 1.2% | | | | | | | | |

| Methode Electronics, Inc. | | | 266,377 | | | $ | 11,883,078 | |

| | | | | | | | | |

| Home Construction — 4.0% | | | | | | | | |

| Century Communities, Inc. | | | 410,347 | | | | 21,633,494 | |

| Masonite International Corporation (a) | | | 241,428 | | | | 18,715,499 | |

| | | | | | | | 40,348,993 | |

| Leisure Facilities & Services — 3.8% | | | | | | | | |

| Chuy’s Holdings, Inc. (a) | | | 330,230 | | | | 8,259,052 | |

| Jack in the Box, Inc. | | | 232,683 | | | | 19,256,845 | |

| Papa John’s International, Inc. | | | 120,100 | | | | 10,935,105 | |

| | | | | | | | 38,451,002 | |

| Retail - Discretionary — 3.4% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 282,515 | | | | 10,554,760 | |

| Monro, Inc. | | | 523,846 | | | | 23,955,478 | |

| | | | | | | | 34,510,238 | |

| Consumer Staples — 7.6% | | | | | | | | |

| Beverages — 1.1% | | | | | | | | |

| Duckhorn Portfolio, Inc. (The) (a) | | | 553,415 | | | | 10,747,319 | |

| | | | | | | | | |

| Food — 4.3% | | | | | | | | |

| Hostess Brands, Inc. (a) | | | 1,007,195 | | | | 22,853,255 | |

| J & J Snack Foods Corporation | | | 137,797 | | | | 20,628,211 | |

| | | | | | | | 43,481,466 | |

| Household Products — 2.2% | | | | | | | | |

| Central Garden & Pet Company - Class A (a) | | | 535,623 | | | | 22,164,080 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Energy — 8.1% | | | | | | | | |

| Oil & Gas Producers — 8.1% | | | | | | | | |

| Brigham Minerals, Inc. - Class A | | | 724,921 | | | $ | 17,963,542 | |

| Northern Oil and Gas, Inc. | | | 867,841 | | | | 21,678,668 | |

| PDC Energy, Inc. | | | 304,893 | | | | 21,263,238 | |

| Whiting Petroleum Corporation | | | 288,413 | | | | 21,068,570 | |

| | | | | | | | 81,974,018 | |

| Financials — 22.0% | | | | | | | | |

| Banking — 15.6% | | | | | | | | |

| City Holding Company | | | 81,097 | | | | 6,275,286 | |

| Columbia Banking System, Inc. | | | 704,779 | | | | 19,790,194 | |

| Provident Financial Services, Inc. | | | 463,737 | | | | 10,262,500 | |

| Renasant Corporation | | | 639,952 | | | | 19,064,170 | |

| Sandy Spring Bancorp, Inc. | | | 497,849 | | | | 19,550,530 | |

| Seacoast Banking Corporation of Florida | | | 620,087 | | | | 20,152,827 | |

| Simmons First National Corporation - Class A | | | 785,311 | | | | 18,745,374 | |

| Triumph Bancorp, Inc. (a) | | | 248,798 | | | | 17,276,533 | |

| Trustmark Corporation | | | 230,379 | | | | 6,422,967 | |

| Veritex Holdings, Inc. | | | 589,857 | | | | 19,376,802 | |

| | | | | | | | 156,917,183 | |

| Institutional Financial Services — 4.3% | | | | | | | | |

| Moelis & Company - Class A | | | 439,924 | | | | 19,471,036 | |