UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number(s) 811-22845

Babson Capital Funds Trust

(Exact Name of Registrant as Specified in Charter)

550 South Tryon Street

Suite 3300

Charlotte, NC 28202

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (704) 805-7200

Janice M. Bishop

Secretary and Chief Legal Officer

c/o Babson Capital Management LLC

Independence Wharf

470 Atlantic Avenue

Boston MA 02210

(Name and Address of Agent for Service)

Date of fiscal year end: June 30

Date of reporting period: December 31, 2015

Item 1. Reports to Stockholders.

BABSON CAPITAL FUNDS TRUST

Semi-Annual Report

December 31, 2015

This page intentionally left blank.

Anthony Sciacca

President

Babson Capital Funds Trust

Babson Capital Funds Trust

Babson Global Floating Rate Fund

Babson Global Credit Income Opportunities Fund

Babson Active Short Duration Bond Fund

Babson Total Return Bond Fund

Babson Emerging Market Debt Blended Total Return Fund

Babson Emerging Market Local Currency Debt Fund

Babson Global High Yield Fund

Babson U.S. High Yield Fund

Dear Shareholder,

Markets were volatile throughout 2015, and the final six months of the year did little to soothe investors’ angst about the future direction of the global economy. Falling commodity prices, currency market swings, uneven economic growth and opposing central bank monetary policies cast a negative pall on the minds of investors in the third and fourth quarters. Policy divergence among central banks was notably evident in December, as the U.S. Federal Reserve (Fed) began tightening monetary policy by raising interest rates for the first time in nearly a decade while central banks in Europe, China and Japan continued a loose monetary policy stance. The Fed’s move in December offered a glimmer of hope that the U.S. economy had recovered sufficiently to begin to raise interest rates after a decade of moribund growth and elevated unemployment levels. But that glimmer may already be dissipating, as recent Fed policy guidance indicates additional interest rate increases in 2016 may be muted.

The dichotomy among central banks in their efforts to manage economies is just one of several headwinds facing investors in 2016. Decelerating global growth remains a concern, with China, the world’s second-largest economy, showing signs of strain. Inflation expectations are declining globally, making it difficult for central banks to identify catalysts to move interest rates significantly higher than current levels. Case in point—the European Central Bank (ECB) elected to extend its current quantitative easing program by at least six months to March 2017. Add to the mix the U.S. presidential election and rising geopolitical tensions across Europe, the Middle East and parts of Asia, and 2016 is off to an inauspicious beginning. Investors are understandably tentative.

At Babson, we believe that with uncertainty comes opportunity. Our mutual fund platform has been constructed to reflect the best of our core competencies as an organization. With the addition of six new funds during the fourth quarter, our platform offers a diverse selection of investment vehicles that provide investors with access to the global fixed income markets, leveraging the same investment experience that we provide to the many institutional clients that we are privileged to serve. Our investment teams conduct rigorous fundamental analysis on every company in which we invest, while also bringing local market insights from our investment teams around the globe. While we expect continued headwinds in the near term, we believe the market volatility will likely provide opportunities to invest in high-conviction names. The markets in which we invest are inherently volatile, but by adhering to a disciplined, repeatable, bottom-up investment process and investing through the economic cycle, we believe we can identify attractive investment opportunities and create portfolios that are able to weather market turbulence over the long term. Our process has served our clients well for decades, through many market cycles and in adverse market conditions.

On behalf of the entire Babson team, we thank you for your partnership and trust, and we look forward to helping you achieve your investment objectives.

Sincerely,

Anthony Sciacca

Cautionary Notice: Certain statements contained in this report may be “forward looking” statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date in which they are made and reflect management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of Babson Capital Funds Trust’s (the “Trust”) trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Trust’s current or future investments. We undertake no obligation to publicly update these forward looking statements, whether as a result of new information, future events, or otherwise.

ALPS Distributors, Inc. is the distributor for the Babson mutual funds. ALPS and Babson are separate and unaffiliated. A prospectus can be obtained by calling 1.855.439.5459. Read the prospectus carefully before investing. Investors should carefully consider the investment objective, risks, charges and expenses of any mutual fund before investing. This and other important information is contained in the prospectus and summary prospectus.

1

Babson Global Floating Rate Fund 2015 Semi-Annual Report

Investment Objective

The investment objective of the Babson Global Floating Rate Fund (“Global Floating Rate Fund” or the “Fund”) is to seek a high level of current income. Preservation of capital is a secondary goal.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a net total rate of return for the semi-annual reporting period from July 1, 2015 through December 31, 2015 of -3.50% and underperformed the Credit Suisse Global Loan Benchmark, which returned -2.66%.1 |

What factors influenced performance of the Fund?

| | n | | For the semi-annual reporting period, the Fund was overweight to European assets. The Fund’s European assets provided positive contribution to returns, while U.S. assets detracted from the Fund’s performance. |

| | n | | The Fund’s investments in the Energy sector and Metals/Mining sector were the leading detractors to contribution to return. Continued volatility and pressure on the price of oil caused commodity-related issuers to face significant selling pressure over the period. Seven of the Fund’s bottom ten contributors to its performance were commodity-related issuers. |

Describe recent portfolio activity.

| | n | | The number of portfolio holdings decreased to 185 from 197 during the reporting period. As a result, the portfolio’s positioning in Floating Rate Debt increased to 86.07% from 83.65%, and Fixed Rate Debt holdings decreased to 6.55% from 9.47%. |

| | n | | The Fund’s positioning across geographies remains relatively unchanged as the Fund remained overweight to European assets relative to the European weight in the global senior secured loan market. Even with the overweight positioning, the Fund modestly increased its exposure to U.S. assets over the past six months as the U.S. market experienced greater pricing pressure than the European market. |

| | n | | Over the past six months, the Fund’s Top 5 Industry concentrations remain unchanged with Healthcare, Education and Childcare maintaining the highest concentration, followed by Diversified/Conglomerate Service, Finance, Chemicals, Plastics and Rubber, and Retails Stores, respectively. |

Describe portfolio positioning at period end.

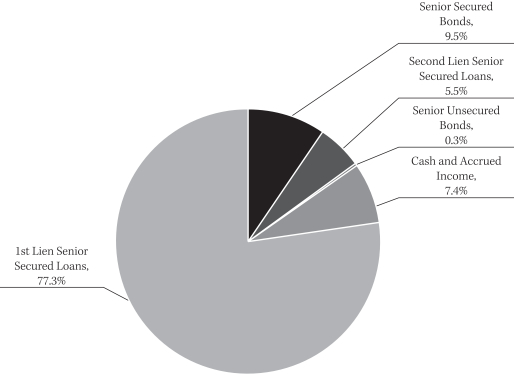

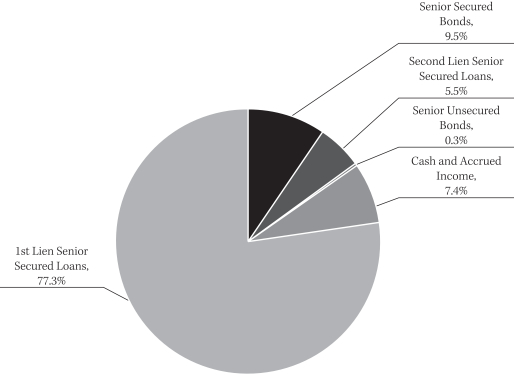

| | n | | The Fund finished the semi-annual reporting period, December 31, 2015, with holdings primarily in senior secured debt, namely 77.3% in First Lien Senior Secured Loans, 5.5% in Second Lien Senior Secured Loans, and 9.5% in Senior Secured Bonds. Senior Unsecured bonds composed just 0.3% of the portfolio. |

| | n | | From an industry perspective, the Fund remains well-diversified across a number of sectors based on Moody’s Industry Classification, with higher concentrations in Healthcare, Education and Childcare (10.5%), Diversified/Conglomerate Service (7.7%), and non-bank related Finance companies (7.4%) as of December 31, 2015. |

| 1. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The Credit Suisse Global Loan Benchmark is a market capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leveraged loan market, with loans denominated in U.S. and Western European currencies. Indices are unmanaged. It is not possible to invest directly in an index. |

2

Babson Global Floating Rate Fund 2015 Semi-Annual Report

| | n | | As of December 31, 2015, the Fund had the following credit quality breakdown: 16.6% in Ba assets, 59.6% in single-B credits and a small exposure to Caa and below at 4.4%. Approximately 10.6% of the Fund’s assets are not publicly rated, primarily consisting of European issuers that we believe have a credit quality similar to that of other assets in the portfolio. Cash and accrued income was 7.4% and Baa assets accounted for the remaining 2.2% of the portfolio assets.2 |

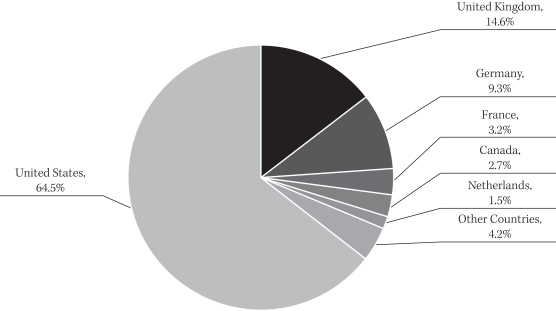

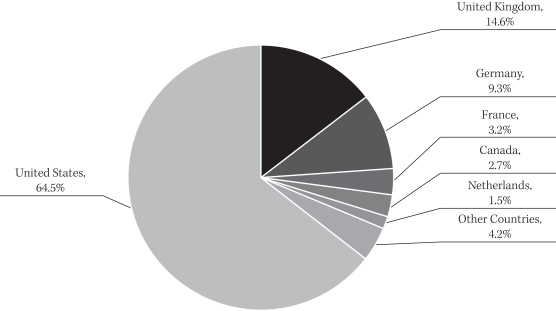

| | n | | The Top 5 countries in the portfolio at the end of the semi-annual reporting period are the U.S. (64.5%), the United Kingdom (14.6%), Germany (9.3%), France (3.2%) and Canada (2.7%). Overall, the Fund has exposure to 16 different countries, and we continue to focus on building a well-diversified portfolio of global floating rate securities. |

Describe market and portfolio outlook.

| | n | | As we look into 2016, the Energy and Commodity sectors will continue to remain volatile as a result of the supply and demand imbalance. This volatility should be primarily concentrated in the U.S., as the European loan market has very little exposure to the Energy sector. |

| | n | | Despite a volatile reporting period, we believe issuer fundamentals outside of Energy and Commodity related sectors remain largely intact. With the exception of those troubled sectors, we expect loan market default rates to remain below long-term averages; within Energy and Commodities, however, we anticipate an increase in defaults in 2016. |

| | n | | Further divergence of Fed and ECB monetary policy will likely impact the global loan market to varying degrees in 2016. |

| 2. | Ratings shown are the highest rating given by one of the following national rating agencies: S&P or Moody’s. Additional information about ratings can be found at www.moodys.com and www.standardandpoors.com. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

3

Babson Global Floating Rate Fund 2015 Semi-Annual Report

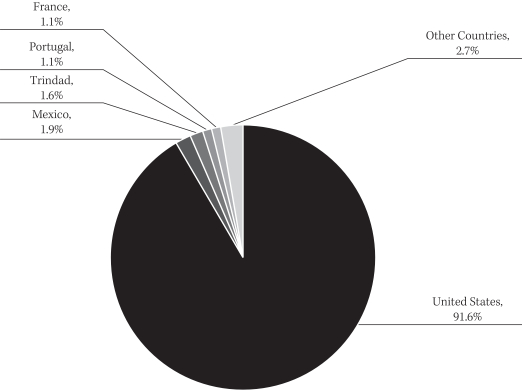

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of December 31, 2015. |

COUNTRY COMPOSITION (% OF ASSETS**)

| ** | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of December 31, 2015. |

4

Babson Global Credit Income Opportunities Fund 2015 Semi-Annual Report

Investment Objective

The investment objective of the Babson Global Credit Income Opportunities Fund (“Global Credit Income Opportunities Fund” or the “Fund”) is to seek an absolute return, primarily through current income and secondarily through capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a net total rate of return for the semi-annual reporting period from July 1, 2015 through December 31, 2015, of -4.95% and underperformed the 3 Month USD LIBOR + 500 basis points1 Benchmark, which retuned 2.72%2 |

What factors influenced performance of the Fund?

| | n | | During the semi-annual reporting period, European assets were the main contributors to performance, while the U.S. assets, special situations and CLO’s were the main detractors. |

| | n | | The Energy sector was the largest detractor to contribution to return over the six month period. Continued volatility and pressure on the price of oil caused commodity-related issuers to face significant selling pressure over the period. The Fund was negatively impacted by its exposure to these credits. Six of the Fund’s bottom ten contributors to its underperformance were commodity-related issuers. |

| | n | | During the period, CLO’s also faced significant selling pressure and three of the Fund’s bottom ten contributors were CLO’s. |

| | n | | The Fund’s special situation credits had a negative impact on performance during the semi-annual reporting period; however, we believe these assets provide attractive current income to the portfolio and should contribute to the Fund’s performance in the future. |

Describe recent portfolio activity.

| | n | | The number of holdings in the portfolio decreased slightly during the second half of the year even though the Fund’s assets grew slightly. Despite the small decrease in the number of holdings, the Fund’s positioning across geographies remained fairly consistent and the Fund continues to maintain significant positions in high conviction credits while maintaining an average credit rating of single-B. |

| | n | | The Fund increased its exposure to global high yield bonds while reducing senior secured loans in order to focus on what we believe to be a more attractive part of the below-investment grade market from a risk-adjusted basis. |

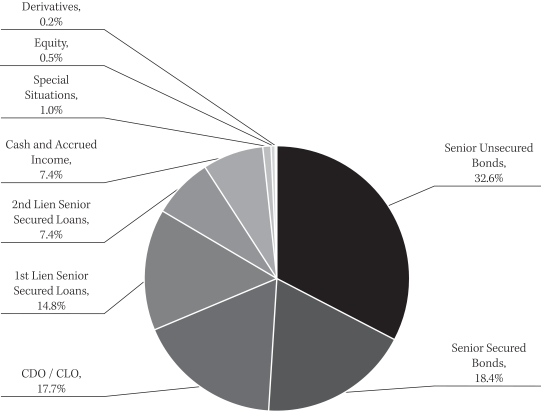

| | n | | The Fund remains well diversified across industries with the largest concentration in CLO’s at 17.7% (a 1.0% increase from June 30, 2015), the next two largest industries are Healthcare, Education and Childcare at 6.5% and Chemicals, Plastics and Rubber at 5.7%. Over the past six months, the Fund’s top 3 industry exposures have shifted as the Fund reduced exposure to Oil & Gas (down 3.1%) and Telecom (down 4.5%) and increased exposure to Chemicals, Plastics and Rubber (up 2.0%). |

Describe portfolio positioning at period end.

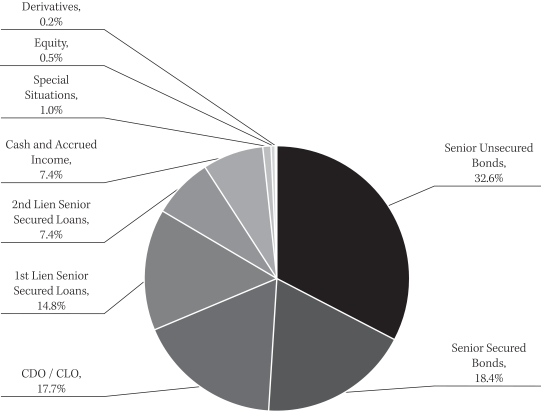

| | n | | The Fund finished the semi-annual reporting period, December 31, 2015, with an allocation of 51.0%, 22.0%, and 17.7% to global high yield bonds, global senior secured loans and CLOs, respectively. The remainder of the portfolio was invested in a few opportunistic special situation credits at 1.0%, derivatives at 0.2%, equity 0.5% and cash at 7.4%. A significant portion of the portfolio (40.4%) is senior secured in nature, which can potentially mitigate principal loss in the event that default rates increase. |

| 1. | A unit that is equal to 1/100th of 1% or 0.01%. |

| 2. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The 3 Month USD LIBOR (London Interbank Offered Rate) is an average interest rate, determined by the British Bankers Association, that banks charge one another for the use of short-term money (3 months) in England’s Eurodollar market. The return shown includes 3 Month USD LIBOR plus 500 bps, or 5% per annum. LIBOR is unmanaged. It is not possible to invest directly in LIBOR. No assurance can be given that the Fund’s performance will exceed that of LIBOR by any given increment, or at all. |

5

Babson Global Credit Income Opportunities Fund 2015 Semi-Annual Report

| | n | | From an industry perspective, the Fund remains well-diversified across a number of sectors based on Moody’s Industry Classification, with higher concentrations in CLOs (17.7%), Healthcare, Education and Childcare (6.5%) and Chemicals, Plastics and Rubber (5.7%) as of December 31, 2015. |

| | n | | As of December 31, 2015, the Fund had the following credit quality breakdown: 28.0% in Ba assets, 49.2% in single-B credits and a modest exposure to Caa and below at 11.7%. Approximately 3.6% of the Fund’s assets are not publicly rated. Over the course of the last six months, the single-B and Caa and below increased slightly as the Fund’s exposure to unrated, Ba and Baa rated assets decreased slightly.3 |

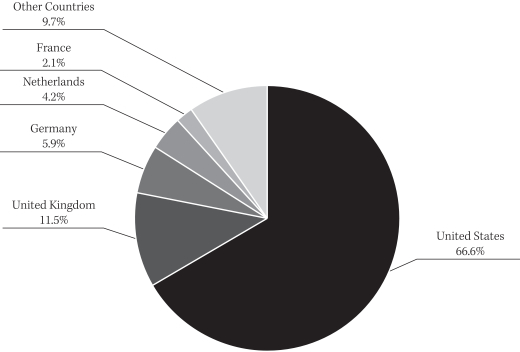

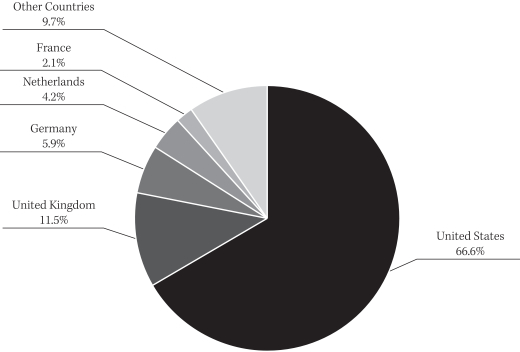

| | n | | The Top 5 countries in the portfolio at the end of the semi-annual reporting period are the U.S. (66.6%), the United Kingdom (11.5%), Germany (5.9%), the Netherlands (4.2%) and France (2.1%). The U.S. exposure includes the Cayman Islands, which is related to the Fund’s CLO holdings that is predominantly invested in U.S. senior secured loans. Overall, the Fund has exposure to 17 different countries, and we continue to focus on building a well-diversified portfolio of global high yield securities. |

Describe market and portfolio outlook.

| | n | | As we look into 2016, the Energy and Commodity sectors will continue to remain volatile as a result of the supply and demand imbalance. This volatility should be primarily concentrated in the U.S., as the European high yield markets have minimal exposure to the Energy sector. |

| | n | | Despite a volatile reporting period, we believe issuer fundamentals outside of Energy and Commodity related sectors remain largely intact. With the exception of those troubled sectors, we expect high yield market default rates to remain below long-term averages, with Europe expecting to experience the fewest defaults; within Energy and Commodities, mostly in the U.S., however, we anticipate an increase in defaults in 2016. |

| | n | | Further divergence of Fed and ECB monetary policy will likely impact the global high yield markets to varying degrees in 2016. |

| 3. | Ratings shown are the highest rating given by one of the following national rating agencies: S&P or Moody’s. Additional information about ratings can be found at www.moodys.com and www.standardandpoors.com. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

6

Babson Global Credit Income Opportunities Fund 2015 Semi-Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of December 31, 2015. |

7

Babson Global Credit Income Opportunities Fund 2015 Semi-Annual Report

COUNTRY COMPOSITION (% OF ASSETS**)

| ** | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of December 31, 2015. |

8

Babson Active Short Duration Fund 2015 Semi-Annual Report

Investment Objective

Babson Active Short Duration Bond Fund (“Active Short Duration Bond Fund” or the “Fund”) seeks to achieve a high total rate of return primarily from current income while minimizing fluctuations in capital values by investing primarily in a diversified portfolio of short-term investment grade fixed income securities.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund was launched on July 8, 2015 and reported a net total rate of return for the reporting period through December 31, 2015 of -0.93%, underperforming the Barclays U.S. 1-3 Year Government Bond Index, which returned -0.24%.1 |

What factors influenced performance of the Fund?

| | n | | The Fund’s allocation to investment grade corporate, BB-rated high yield bonds and convertible securities were detractors to performance driven largely by the sell-off in Metals & Mining and Oil & Gas producers. |

| | n | | The Securitized sector positively impacted performance over the period. Specific allocations that contributed were U.S. agency MBS, CMBS, non-agency residential mortgage backed securities (RMBS) and consumer ABS. Student loan ABS, however, was a modest negative due to rating agency action within the sector. |

| | n | | Duration positioning positively contributed to performance. The front-end of the yield curve, particularly the two to three year area, flattened as the market priced in a lower probability of an extended series of Fed interest rate hikes. The Fund was at its maximum duration of approximately 2.9 years for much of the period, given the steepness of the yield curve. |

Describe recent portfolio activity.

| | n | | The Fund experienced positive flows during the period and purchases were across Corporate, Securitized and Government sectors. |

| | n | | The Fund reduced holdings in lower quality energy corporates and convertible securities that were believed to be downgrade candidates. Purchases were in Automotive, Banking, Consumer, Insurance and Real Estate Investment Trust (REIT) sectors. The Fund selectively added exposure to student loan ABS due to pricing dislocations. These securities are backed by the federal government and pricing has become attractive as a result of rating agency action. However, this did negatively impact recent performance. |

Describe portfolio positioning at period end.

| | n | | The Fund duration ended the period at 2.9 years, which is about the maximum for the strategy. The steepness of the yield curve between three months and three years led us to retain a maximum duration for the period. |

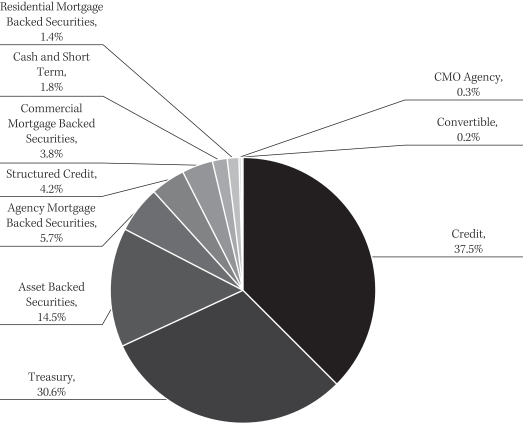

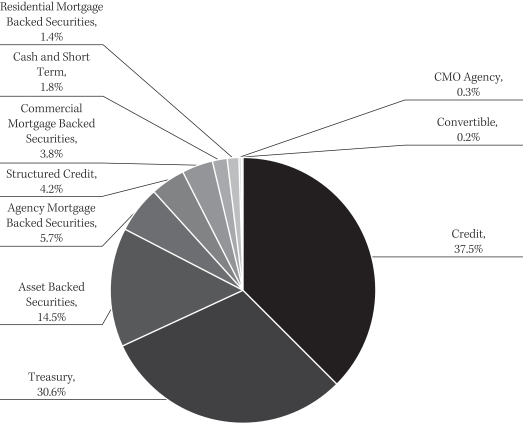

| | n | | From a sector perspective, the Fund has been well-diversified across Corporates, Securitized and Governments. The Corporate allocation represents approximately 37.5%, with 31% in investment grade corporates and 6% in BB-rated and crossover high yield. Banking represents the largest industry at almost 10% followed by Diversified Industrials (9%). The Fund had a 2.7% allocation to Energy and 0.2% in Convertible Securities. |

| | n | | Securitized ABS represents a 14.5% allocation, it was largely comprised of traditional automotive loan collateral and compelling esoteric collateral such as timeshares, cell towers, medical receivables, and personal consumer loans. CMBS made up 3.8% of the Fund. |

| 1. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The Barclays U.S. 1-3 Year Government Bond Index is comprised of the U.S. Treasury and U.S. Agency Indices. The U.S. Government Index includes Treasuries (public obligations of the U.S. Treasury) and U.S. agency debentures (publicly issued debt of U.S. Government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the U.S. Government) that have remaining maturities of more than one year and up to but not including 3 years. Indices are unmanaged. It is not possible to invest directly in an index. |

9

Babson Active Short Duration Fund 2015 Semi-Annual Report

| | n | | The agency MBS allocation (5.7%) was in lower coupon 15 year FNMAs. The Fund also had a small allocation to agency collateralize mortgage obligations (CMO) with compelling structural features. |

Describe market and portfolio outlook.

| | n | | Volatility will likely persist in 2016, driven by global monetary policies, shifting global growth patterns and fluctuating commodity prices. |

| | n | | U.S. Government yields rose modestly in 2015. However, the case for significantly higher rates is challenging to make, with inflation low and real growth hobbling along at 2%-2.5%. The shape of the short-end of the yield curve bears watching, as there has been a significant flattening from three months to three years. Should this continue, the duration of the Fund may start to shorten. |

| | n | | Commodities will continue to necessitate close monitoring. The Fund is taking opportunities to reduce Energy and Metals & Mining exposure, as well as any other names that may possess idiosyncratic risks. |

| | n | | The recent bout of spread widening should provide the Fund select opportunities. Short weighted average life CLOs offer attractive yields and have experienced less volatility than other asset classes. FFELP student loans may represent one of the better opportunities in ABS. |

10

Babson Active Short Duration Fund 2015 Semi-Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of December 31, 2015. |

11

Babson Total Return Bond Fund 2015 Semi-Annual Report

Investment Objective

Babson Total Return Bond Fund (“Total Return Bond Fund” or the “Fund”) seeks a superior total rate of return by investing in fixed income instruments.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund was launched on July 8, 2015 and reported a net total rate of return for the reporting period through December 31, 2015 of -0.78%, underperforming the Barclays U.S. Aggregate Bond Index, which returned 0.16%.1 |

What factors influenced performance of the Fund?

| | n | | An overweight to investment grade corporate credit and an allocation to convertible and high yield corporate securities were the primary detractors to performance. Within those allocations, exposures to commodity related industries were the main negative drivers. The Fund was positioned in shorter maturity names, however credit curves flattened with shorter maturity credits underperforming the most. Asset backed securities (ABS) were the primary detractor in the Securitized sector largely due to holdings in government guaranteed FFELP student loans which underperformed during the period. |

| | n | | USD/CNH and IGCDX put spread options performed well during the period due to multiple devaluations of the Chinese yuan. |

Describe recent portfolio activity.

| | n | | Corporate purchases were in Banking, Technology and Consumer sectors with only modest purchases in Energy. |

| | n | | The Fund selectively added exposure to ABS in such esoteric sectors as business franchise whole loans and personal consumer loans. |

| | n | | The agency mortgage backed securities ( MBS) allocation began transitioning into more liquid specified pools. |

| | n | | Purchased synthetic investment grade credit put options due to heightened volatility within the credit markets. |

| | n | | Recent purchases also include AAA-rated, short weighted average life CLO’s. |

Describe portfolio positioning at period end.

| | n | | The Fund was duration and curve neutral relative to the benchmark. |

| | n | | The largest overweight relative to the benchmark was corporate credit representing approximately a 41.7% allocation versus 30.0% for the index. High yield corporate made up 8.5% of that exposure. Banking and diversified industrials were the largest industries within corporate credit. The energy allocation represented about 3.1% of the Fund and was 0.5% overweight relative to the benchmark. The allocation to convertible securities was 0.4%. |

| | n | | The Fund was underweight in agency MBS (25.0%) relative to the benchmark (28.6%). More recently, the Fund rotated into specified mortgage pools becoming more balanced along the coupon stack, this change also enhanced the overall liquidity profile of the Fund. |

| | n | | Securitized ABS represents a 11.8% allocation, it was largely comprised of traditional automotive loan collateral and compelling esoteric collateral such as timeshares, cell towers, medical receivables, and personal consumer loans. |

| | n | | Commercial mortgage backed securities (CMBS) made up 6.0% of the Fund representing a 4.2% overweight. BBB-rated tranches backed by 2012 vintage collateral represent the best value. However, they are difficult to source given their strong underwriting profile. The Fund gained exposure to these vintages using CMBX, a synthetic index. |

| 1. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Indices are unmanaged. It is not possible to invest directly in an index. |

12

Babson Total Return Bond Fund 2015 Semi-Annual Report

Describe market and portfolio outlook.

| | n | | Volatility will likely persist in 2016, driven by global monetary policies, shifting global growth patterns and fluctuating commodity prices. |

| | n | | U.S. Government yields rose modestly in 2015. However, the case for significantly higher rates is challenging to make, with inflation low and real growth hobbling along at 2%-2.5%. |

| | n | | Commodities will continue to necessitate close monitoring. The Fund is taking opportunities to reduce Energy and Metals & Mining exposure, as well as any other names that may possess idiosyncratic risks. |

| | n | | The recent bout of spread widening should provide the Fund select opportunities. Short weighted average life CLOs offer attractive yields and have experienced less volatility than other asset classes. FFELP student loans may represent one of the better opportunities in ABS. |

13

Babson Total Return Bond Fund 2015 Semi-Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assests as of December 31, 2015 |

14

Babson Emerging Markets Debt Blended Total Return Fund 2015 Semi-Annual Report

Investment Objective

The investment objective of the Babson Emerging Markets Debt Blended Total Return (“EMD Blended Total Return “ or the “Fund”) is to seek a long-term total return through a combination of current income and capital appreciation though exposure to a diversified portfolio of emerging markets corporate, sovereign hard currency and local currency-denominated debt securities.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a net total rate of return of -3.321 since the Fund’s inception date of October 21, 2015. |

What factors influenced performance of the Fund?

| | n | | For the period ended December 31, 2015, the Fund’s currency positions against the Russian Ruble, British Pound, Canadian Dollar, and Singaporean Dollar, as well as an Ecuadorian sovereign bond were the primary contributors to performance. Corporate holdings in Yasar, ICICI Bank and Sino-Ocean Land Holdings also aided returns. Key detractors from performance were the Fund’s local bond positions in South Africa, Mexico and Colombia, while the Fund’s holding in Digicel Group also detracted from returns. |

| | n | | Emerging Markets local currency bonds experienced large sell-offs during December on the heels of the U.S. Fed’s rate hike, the ECB’s disappointing actions and a further sell-off of commodities. Within the portfolio, South Africa detracted more than 1% following President Zuma’s unexpected termination of finance minister Neve, while naming someone who was perceived to be a weak replacement. Following heavy criticism at home, President Zuma then named Pravin Gordhan as finance minister. Although Minister Gordhan previously held the position from 2009-2014, investors were less than impressed; impacting both rates and pushing the currency to its weakest point ever. |

Describe recent portfolio activity.

| | n | | The portfolio launched on October 21, 2015 with US$10 million, therefore, the activity in Fund primarily represents the initial investment of seed capital and some monthly adjustments as a result of our currency framework. |

Describe portfolio positioning at period end.

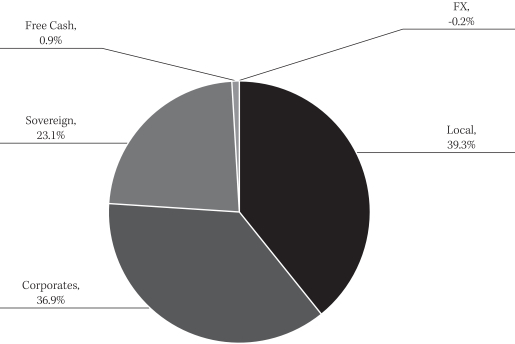

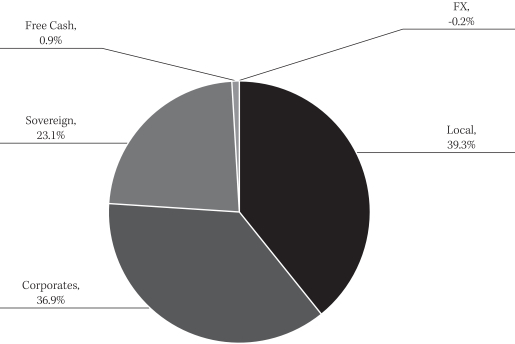

| | n | | The Fund finished the year with a 37% exposure to Emerging Markets Corporate bonds, 39% exposure to Emerging Markets Local Debt and Currencies, 23% exposure to Sovereign Hard Currency bonds and a 1% cash position. |

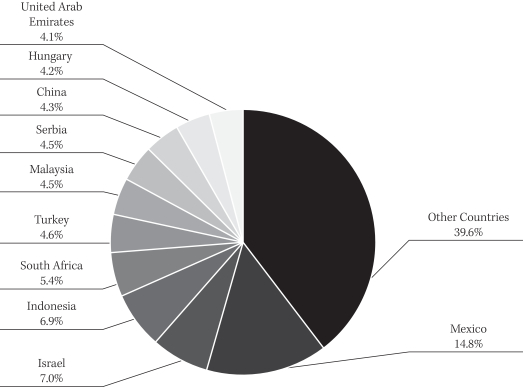

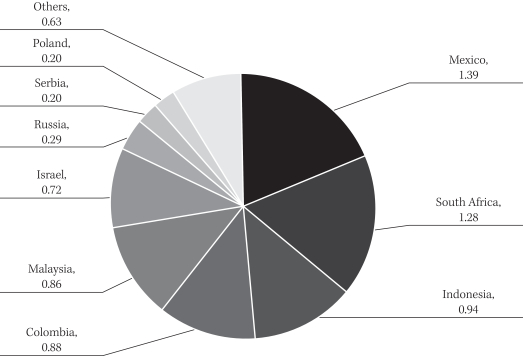

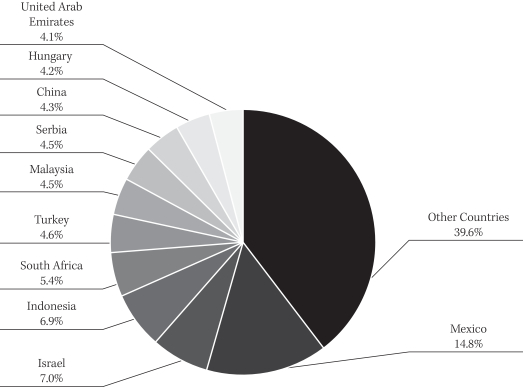

| | n | | The Top 5 countries in the portfolio at the end of the period are Mexico (10.6%), Indonesia (6.9%), South Africa (5.4%), Israel (4.7%) and Turkey (4.6%). The top 3 corporate bonds are AES Corp (3.7%), Israel Electric Corp (2.4%) and Cemex (2.2%). Overall, the Fund has exposure to 17 countries, 21 corporates, and 24 different currencies. |

Describe market and portfolio outlook.

| | n | | We remain optimistic that some Emerging Markets headwinds are poised to reverse and become tailwinds or at least stabilize |

| 1. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The Credit Suisse Global Loan Benchmark is a market capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leveraged loan market, with loans denominated in U.S. and Western European currencies. Indices are unmanaged. It is not possible to invest directly in an index. |

15

Babson Emerging Markets Debt Blended Total Return Fund 2015 Semi-Annual Report

| | n | | Credit selection will be key to seeking the best risk-adjusted return opportunities across the Emerging Market corporate debt spectrum. |

| | n | | Lower net supply, driven by reduced issuance and heightened buyback activity, will likely serve as a strong supportive technical factor for Emerging Market corporate debt. For Emerging Market Sovereigns, we continue to favor Central European countries, as well as Caribbean and Central American countries, which should continue to be beneficiaries of the pickup in growth out of core Europe and the U.S. |

| | n | | Currency valuations have adjusted significantly over the past 24 months and we are now seeing some Emerging Market currencies at their most attractive levels in more than 10 years, thereby providing for selective Emerging Market growth prospects. |

| | n | | The portfolio continues to be positioned in selective rates where inflation is falling along with narrowing current account deficits. A picture of global disinflation should remain favorable for emerging markets local debt and the Fund. |

16

Babson Emerging Markets Debt Blended Total Return Fund 2015 Semi-Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of December 31, 2015. |

COUNTRY COMPOSITION (% OF ASSETS**)

| ** | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of December 31, 2015. |

17

Babson Emerging Markets Local Currency Debt Fund 2015 Semi-Annual Report

Investment Objective

The investment objective of the Babson Emerging Markets Local Currency Debt Fund (“EM Local Currency Debt Fund” or the “Fund”) is to seek a high level of current income. Preservation of capital is a secondary goal.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a net total rate of return of -1.59%1 since the Fund’s inception date of December 8, 2015. |

What factors influenced performance of the Fund?

| | n | | For the period ended December 31, 2015, the Fund’s positions in Colombia, Indonesia, Malaysia and South Africa were the primary detractors from performance relative to the benchmark. The Fund’s underweight in Brazilian rates and overall underweight exposure to emerging markets currencies positively impacted Fund performance. |

| | n | | Colombia, Indonesia, Malaysia and South Africa all experienced large sell-offs during December and our overweight positions were more negatively affected than the benchmark. South Africa, in particular, underperformed due to President Zuma’s unexpected termination of finance minister Neve, while naming someone who was perceived to be a weak replacement. Following heavy criticism at home, President Zuma then named Pravin Gordhan as finance minister. Although Minister Gordhan previously held the position from 2009-2014, investors were less than impressed; impacting both rates and pushing the currency to its weakest point ever. |

Describe recent portfolio activity.

| | n | | The portfolio launched on December 8, 2015 with US$5 million, therefore, the trades reflected initial seed capital being invested. |

Describe portfolio positioning at period end.

| | n | | The Fund finished the year with a 92.1% exposure to Emerging Market bonds and a 7.5% cash position. |

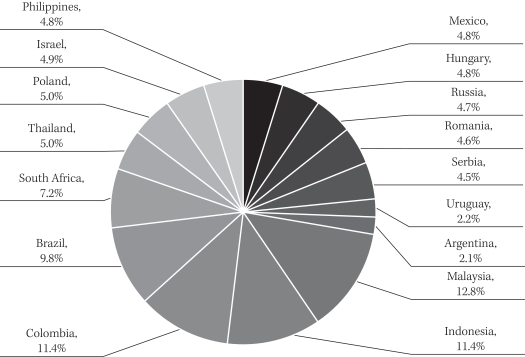

| | n | | The Top 5 countries in the portfolio at the end of the period are Malaysia (12.8%), Indonesia (11.4%), Colombia (11.4%), Brazil (9.8%) and South Africa (7.2%). Overall, the Fund has exposure to 16 different countries and 28 different currencies. |

Describe market and portfolio outlook.

| | n | | We remain optimistic that some Emerging Markets headwinds are poised to reverse and become tailwinds or at least stabilize. |

| | n | | Currency valuations have adjusted significantly over the past 24 months and we are now seeing some emerging markets currencies at their most attractive levels in more than 10 years, thereby providing for selective emerging markets growth prospects. |

| | n | | The portfolio continues to add to constructive positioning on selected European and Latin American currencies, less so on Asian currencies, while maintaining a watchful eye on commodity prices. |

| | n | | The portfolio continues to be positioned in selective rates where inflation is falling along with narrowing current account deficits. A picture of global disinflation should remain favorable for emerging markets local debt and the Fund. |

| 1. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The Credit Suisse Global Loan Benchmark is a market capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leveraged loan market, with loans denominated in U.S. and Western European currencies. Indices are unmanaged. It is not possible to invest directly in an index. |

18

Babson Emerging Markets Local Currency Debt Fund 2015 Semi-Annual Report

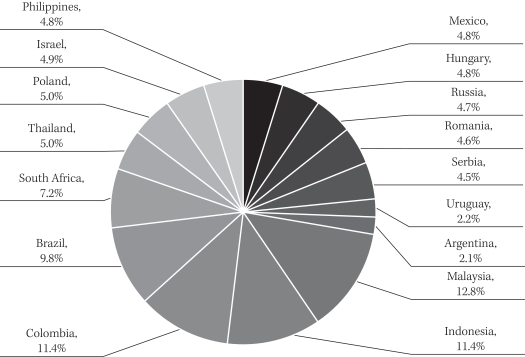

COUNTRY COMPOSITION (% OF ASSETS*)

| * | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of December 31, 2015. |

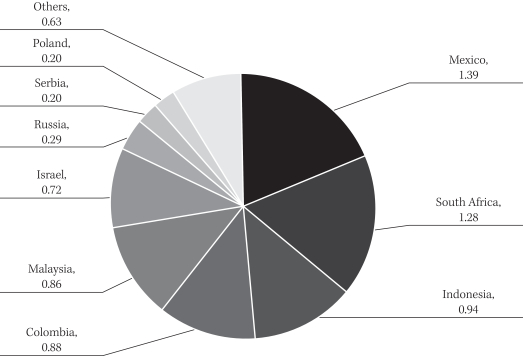

CONTRIBUTION TO DURATION (IN YEARS)

| ** | The values shown above represent the contribution to duration, in years, of the assets as of December 31, 2015. |

19

Babson Global High Yield Fund 2015 Semi-Annual Report

Investment Objective

The investment objective of the Babson Global High Yield Fund (“Global High Yield Fund” or the “Fund”) is to provide high current income generation and, where appropriate, capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a total rate of return of -2.40% since the Fund’s inception date of October 30, 2015. |

What factors influenced performance of the Fund?

| | n | | The initial ramping of the portfolio positively influenced the performance of the Fund during this period as a higher cash balance helped protect the portfolio from the volatility the U.S. and European high yield bond markets experienced at the end of the year. |

| | n | | In addition, strong security selection, particularly high quality credits with improving outlooks, and the Fund’s underweight to commodities relative to the market positively influenced performance. |

Describe recent portfolio activity.

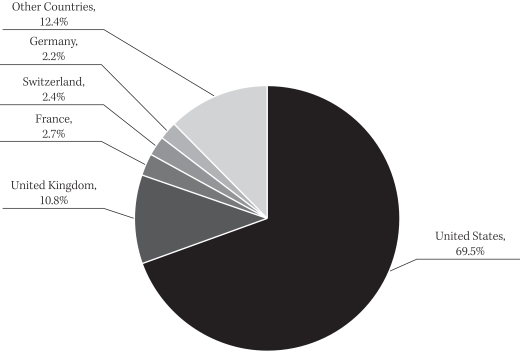

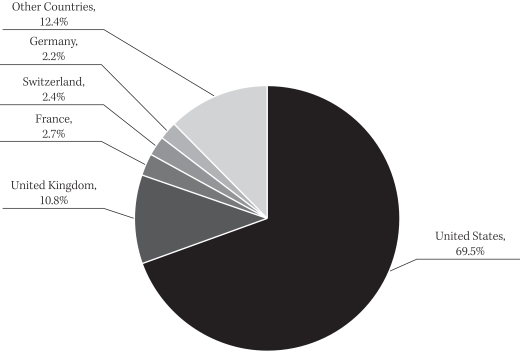

| | n | | During the period, the Fund continued to ramp the initial capital funding by constructing a well-diversified portfolio across issuers, ratings, countries and industries. As of December 31, 2015, the portfolio had a geographical weighting of 69.5% in U.S. and 30.5% in primarily European issuers and other non-U.S. domiciled issuers. |

| | n | | Due to the initial ramping of the portfolio, approximately one-third of the assets were purchased in the U.S. and European new issue market and the remaining two-thirds were purchased on the secondary markets to take advantage of opportunities that we believe offer attractive yields and the potential for capital appreciation. |

Describe portfolio positioning at period end.

| | n | | On a traded basis, the Fund ended the year with a 24.6% weighting to senior secured high yield bonds and a 75.4% weighting to senior unsecured bonds. |

| | n | | From an industry perspective, the Fund remains well-diversified across a number of Moody’s-based industries, with higher concentrations in Healthcare, Education and Childcare (11.6%), Finance (8.2%), and Telecommunications (7.7%) as of year-end. |

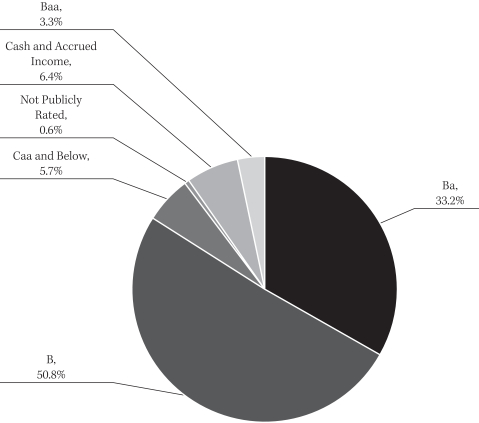

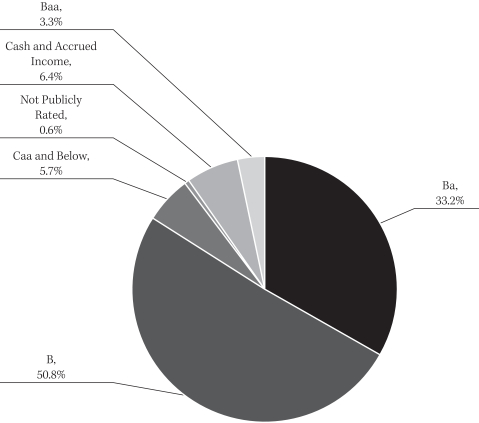

| | n | | In terms of portfolio credit quality as of December 31, 2015, the Fund had the following weighting breakdown: 3.3% in Baa, 33.2% in Ba, 50.8% in single-B, 5.7% in Caa and below and 6.4% in cash and accrued income. A small portion of the assets are not publicly rated (0.6%), but we believe have a similar ratings profile as other assets in the portfolio. |

Describe market and portfolio outlook.

| | n | | Although the Fed’s December announcement of the first interest rate increase since 2006 marks the conclusion of one of the biggest question marks for the market, uncertainty remains around the potential consequences increased interest rate volatility may have on currencies, treasury yields, and risk assets going forward. While the extensive volatility we have seen in the commodity space will likely persist, we expect general corporate fundamentals to remain intact. This should continue to support high yield valuations in the near-term as we believe the market is now pricing in a higher level of defaults than we anticipated. Despite recent pressure, any further pull back in prices will likely provide opportunities to add to positions in “high conviction” names offering attractive relative value. |

20

Babson Global High Yield Fund 2015 Semi-Annual Report

CREDIT QUALITY COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of December 31, 2015. |

21

Babson Global High Yield Fund 2015 Semi-Annual Report

COUNTRY COMPOSITION (% OF ASSETS*)

| * | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of December 31, 2015. |

22

Babson U.S. High Yield Fund 2015 Semi-Annual Report

Investment Objective

The investment objective of the Babson U.S. High Yield Fund (“U.S. High Yield Fund” or the “Fund”) is to seek a high level of total return, with an emphasis on current income.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a total rate of return of -2.84% since the Fund’s inception date of October 30, 2015. |

What factors influenced performance of the Fund?

| | n | | The initial ramping of the portfolio positively influenced the performance of the Fund during this period as a higher cash balance helped protect the portfolio from the volatility the U.S. high yield bond market experienced at the end of the year. |

| | n | | In addition, strong security selection, particularly high quality credits with improving outlooks, and the Fund’s underweight to commodities relative to the market positively influenced performance. |

Describe recent portfolio activity.

| | n | | During the period, the Fund continued to ramp the initial capital funding by constructing a well-diversified portfolio across issuers, ratings and industries. |

| | n | | Due to the initial ramping of the portfolio, approximately one-third of the assets were purchased in the U.S. new issue market and the remaining two-thirds were purchased on the secondary market to take advantage of opportunities that we believe offer attractive yields and the potential for capital appreciation. |

Describe portfolio positioning at period end.

| | n | | On a traded basis, the Fund ended the year with a 99.6% weighting to high yield bonds. The remaining balance of the portfolio was invested in senior secured loans (0.4%). |

| | n | | From an industry perspective, the Fund remains well-diversified across a number of Moody’s-based industries, with higher concentrations in Healthcare, Education and Childcare (12.8%), Oil and Gas (7.8%), and Aerospace and Defense (7.1%) as of year-end. |

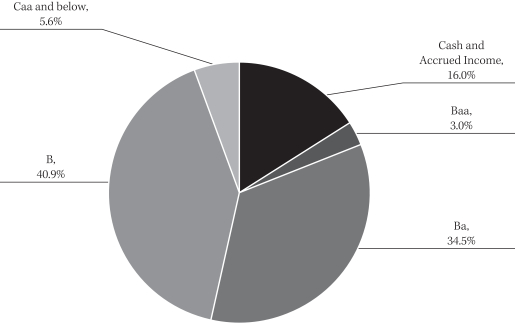

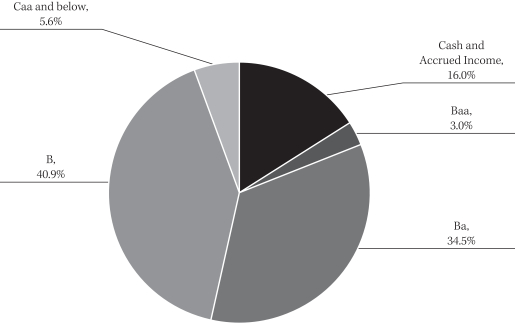

| | n | | In terms of portfolio credit quality as of December 31, 2015, the Fund had the following weighting breakdown: 3.0% in Baa, 34.5% in Ba, 40.9% in single-B, 5.6% in Caa and below and cash and accrued income at 16.0%. |

Describe market and portfolio outlook.

| | n | | Although the Fed’s December announcement of the first interest rate increase since 2006 marks the conclusion of one of the biggest question marks for the market, uncertainty remains around the potential consequences increased interest rate volatility may have on currencies, treasury yields, and risk assets going forward. While the extensive volatility we have seen in the commodity space will likely persist, we expect general corporate fundamentals to remain intact. This should continue to support high yield valuations in the near-term as we believe the market is now pricing in a higher level of defaults than we anticipated. Despite recent pressure, any further pull back in prices will likely provide opportunities to add to positions in high conviction names offering attractive relative value. |

23

Babson U.S. High Yield Fund 2015 Semi-Annual Report

CREDIT QUALITY COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of December 31, 2015. |

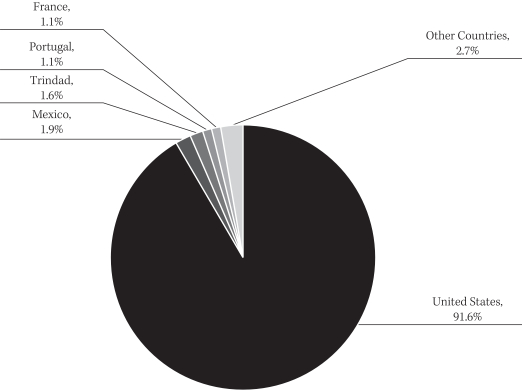

COUNTRY COMPOSITION (% OF ASSETS*)

| * | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of December 31, 2015. |

24

Babson Capital Funds Trust 2015 Semi-Annual Report

SHAREHOLDER EXPENSES (UNAUDITED)

As a shareholder of Babson Global Floating Rate Fund, Babson Global Credit Income Opportunities Fund, Babson Active Short Duration Bond Fund, Babson Total Return Bond Fund, Babson Emerging Markets Debt Blended Total Return Fund, Babson Emerging Markets Local Currency Debt Fund, Babson Global High Yield Fund or Babson U.S. High Yield Fund (each a “Fund” and collectively, the “Funds”) you incur ongoing expenses, such as management fees, shareholder service fees, distribution fees and other fund expenses. The following table is intended to help you understand your ongoing expenses (in dollars and cents) of investing in the Funds and to compare these expenses with the ongoing expenses of investing in other funds.

The table is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2015 to December 31, 2015.

Actual Expenses

The first line in the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Operating Expenses Incurred” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Babson Global Floating Rate Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.05 | % | | $ | 1,000.00 | | | $ | 963.60 | | | $ | 981.80 | | | $ | 5.18 | |

Hypothetical | | | 1.05 | % | | | 1,000.00 | | | | 1,019.90 | | | | 1,009.95 | | | | 5.33 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.80 | % | | | 1,000.00 | | | | 959.80 | | | | 979.90 | | | | 8.87 | |

Hypothetical | | | 1.80 | % | | | 1,000.00 | | | | 1,016.10 | | | | 1,008.05 | | | | 9.12 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.75 | % | | | 1,000.00 | | | | 965.00 | | | | 982.50 | | | | 3.70 | |

Hypothetical | | | 0.75 | % | | | 1,000.00 | | | | 1,021.40 | | | | 1,010.70 | | | | 3.81 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.75 | % | | | 1,000.00 | | | | 964.70 | | | | 982.35 | | | | 3.70 | |

Hypothetical | | | 0.75 | % | | | 1,000.00 | | | | 1,021.40 | | | | 1,010.70 | | | | 3.81 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 184/366. |

25

Babson Capital Funds Trust 2015 Semi-Annual Report

SHAREHOLDER EXPENSES (UNAUDITED) (CONTINUED)

Babson Global Credit Income Opportunities Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.20 | % | | $ | 1,000.00 | | | $ | 949.50 | | | $ | 974.75 | | | $ | 5.88 | |

Hypothetical | | | 1.20 | % | | | 1,000.00 | | | | 1,019.10 | | | | 1,009.55 | | | | 6.09 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.95 | % | | | 1,000.00 | | | | 945.90 | | | | 972.95 | | | | 9.54 | |

Hypothetical | | | 1.95 | % | | | 1,000.00 | | | | 1,015.30 | | | | 1,007.65 | | | | 9.88 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 950.60 | | | | 975.30 | | | | 4.66 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,020.40 | | | | 1,010.20 | | | | 4.82 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 950.50 | | | | 975.25 | | | | 4.66 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,020.40 | | | | 1,010.20 | | | | 4.82 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 184/366. |

Babson Active Short Duration Bond Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.66 | % | | $ | 1,000.00 | | | $ | 990.00 | | | $ | 995.00 | | | $ | 3.16 | |

Hypothetical | | | 0.66 | % | | | 1,000.00 | | | | 1,020.90 | | | | 1,010.45 | | | | 3.21 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.44 | % | | | 1,000.00 | | | | 986.10 | | | | 993.05 | | | | 6.88 | |

Hypothetical | | | 1.44 | % | | | 1,000.00 | | | | 1,017.10 | | | | 1,008.55 | | | | 6.98 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.47 | % | | | 1,000.00 | | | | 990.80 | | | | 995.40 | | | | 2.25 | |

Hypothetical | | | 0.47 | % | | | 1,000.00 | | | | 1,021.80 | | | | 1,010.90 | | | | 2.28 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.45 | % | | | 1,000.00 | | | | 990.70 | | | | 995.35 | | | | 2.15 | |

Hypothetical | | | 0.45 | % | | | 1,000.00 | | | | 1,021.90 | | | | 1,010.95 | | | | 2.19 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 176/366. |

Expense Changes Impacting the Table

Changes to the Fund’s fee arrangements occurred during the period. Had these fee changes been in effect throughout the entire period, the annualized expense ratios would have been 0.65%, 1.40%, 0.40%, and 0.40% for Classes A, C, I, and Y, respectively; the actual expenses paid during the period would have been approximately $3.11, $6.69, $1.91, and $1.91 and the hypothetical expenses paid during the period would have been approximately $3.16, $6.79, $1.94, and $1.94 for Classes A, C, I, and Y, respectively.

26

Babson Capital Funds Trust 2015 Semi-Annual Report

SHAREHOLDER EXPENSES (UNAUDITED) (CONTINUED)

Babson Total Return Bond Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.80 | % | | $ | 1,000.00 | | | $ | 991.00 | | | $ | 995.50 | | | $ | 3.83 | |

Hypothetical | | | 0.80 | % | | | 1,000.00 | | | | 1,020.20 | | | | 1,010.10 | | | | 3.89 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.55 | % | | | 1,000.00 | | | | 987.50 | | | | 993.75 | | | | 7.41 | |

Hypothetical | | | 1.55 | % | | | 1,000.00 | | | | 1,016.60 | | | | 1,008.30 | | | | 7.52 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.55 | % | | | 1,000.00 | | | | 992.20 | | | | 996.10 | | | | 2.63 | |

Hypothetical | | | 0.55 | % | | | 1,000.00 | | | | 1,021.40 | | | | 1,010.70 | | | | 2.67 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.55 | % | | | 1,000.00 | | | | 992.20 | | | | 996.10 | | | | 2.63 | |

Hypothetical | | | 0.55 | % | | | 1,000.00 | | | | 1,021.40 | | | | 1,010.70 | | | | 2.67 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 176/366. |

Babson Emerging Markets Debt Blended Total Return Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.20 | % | | $ | 1,000.00 | | | $ | 965.30 | | | $ | 982.65 | | | $ | 2.29 | |

Hypothetical | | | 1.20 | % | | | 1,000.00 | | | | 1,007.40 | | | | 1,003.70 | | | | 2.34 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.95 | % | | | 1,000.00 | | | | 964.00 | | | | 982.00 | | | | 3.71 | |

Hypothetical | | | 1.95 | % | | | 1,000.00 | | | | 1,005.90 | | | | 1,002.95 | | | | 3.79 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 965.80 | | | | 982.90 | | | | 1.81 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,007.90 | | | | 1,003.95 | | | | 1.85 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 965.80 | | | | 982.90 | | | | 1.81 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,007.90 | | | | 1,003.95 | | | | 1.85 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 71/366. |

27

Babson Capital Funds Trust 2015 Semi-Annual Report

SHAREHOLDER EXPENSES (UNAUDITED) (CONTINUED)

Babson Emerging Markets Local Currency Debt Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.20 | % | | $ | 1,000.00 | | | $ | 971.90 | | | $ | 985.95 | | | $ | 0.74 | |

Hypothetical | | | 1.20 | % | | | 1,000.00 | | | | 1,002.40 | | | | 1,001.20 | | | | 0.76 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.95 | % | | | 1,000.00 | | | | 971.60 | | | | 985.80 | | | | 1.21 | |

Hypothetical | | | 1.95 | % | | | 1,000.00 | | | | 1,001.90 | | | | 1,000.95 | | | | 1.23 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 972.00 | | | | 986.00 | | | | 0.59 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,002.50 | | | | 1,001.25 | | | | 0.60 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 972.00 | | | | 986.00 | | | | 0.59 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,002.50 | | | | 1,001.25 | | | | 0.60 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 23/366. |

Babson Global High Yield Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.05 | % | | $ | 1,000.00 | | | $ | 975.60 | | | $ | 987.80 | | | $ | 1.70 | |

Hypothetical | | | 1.05 | % | | | 1,000.00 | | | | 1,006.50 | | | | 1,003.25 | | | | 1.73 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.80 | % | | | 1,000.00 | | | | 974.50 | | | | 987.25 | | | | 2.91 | |

Hypothetical | | | 1.80 | % | | | 1,000.00 | | | | 1,005.20 | | | | 1,002.60 | | | | 2.96 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.80 | % | | | 1,000.00 | | | | 976.00 | | | | 988.00 | | | | 1.30 | |

Hypothetical | | | 0.80 | % | | | 1,000.00 | | | | 1,006.90 | | | | 1,003.45 | | | | 1.32 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.80 | % | | | 1,000.00 | | | | 976.00 | | | | 988.00 | | | | 1.30 | |

Hypothetical | | | 0.80 | % | | | 1,000.00 | | | | 1,006.90 | | | | 1,003.45 | | | | 1.32 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 60/366. |

28

Babson Capital Funds Trust 2015 Semi-Annual Report

SHAREHOLDER EXPENSES (UNAUDITED) (CONTINUED)

Babson U.S. High Yield Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.00 | % | | $ | 1,000.00 | | | $ | 971.20 | | | $ | 985.60 | | | $ | 1.62 | |

Hypothetical | | | 1.00 | % | | | 1,000.00 | | | | 1,006.60 | | | | 1,003.30 | | | | 1.64 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.75 | % | | | 1,000.00 | | | | 970.10 | | | | 985.05 | | | | 2.83 | |

Hypothetical | | | 1.75 | % | | | 1,000.00 | | | | 1,005.30 | | | | 1,002.65 | | | | 2.88 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.75 | % | | | 1,000.00 | | | | 971.60 | | | | 985.80 | | | | 1.21 | |

Hypothetical | | | 0.75 | % | | | 1,000.00 | | | | 1,007.00 | | | | 1,003.50 | | | | 1.23 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.75 | % | | | 1,000.00 | | | | 971.60 | | | | 985.80 | | | | 1.21 | |

Hypothetical | | | 0.75 | % | | | 1,000.00 | | | | 1,007.00 | | | | 1,003.50 | | | | 1.23 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio net of any expenses waived or reimbursed by the advisor for such class multiplied by the average account value over the period, multiplied by 60/366. |

29

Babson Capital Funds Trust 2015 Semi-Annual Report

BABSON CAPITAL FUNDS TRUST

FINANCIAL REPORT

30

Babson Capital Funds Trust 2015 Semi-Annual Report

STATEMENTS OF ASSETS AND LIABILITIES

December 31, 2015 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | BABSON GLOBAL

FLOATING RATE

FUND | | | BABSON GLOBAL

CREDIT INCOME

OPPORTUNITIES

FUND | | | BABSON ACTIVE

SHORT DURATION

BOND FUND | | | BABSON TOTAL

RETURN BOND

FUND | |

| | | | |

| Assets | | | | | | | | | | | | | | | | |

| Investments, at fair value (cost $172,954,252, $93,332,587, $99,872,848 and $30,208,344, respectively) | | $ | 158,958,569 | | | $ | 82,456,570 | | | $ | 99,041,894 | | | $ | 29,941,778 | |

| Foreign currency, at value (cost $635,089, $55,476, $0 and $0, respectively) | | | 629,529 | | | | 54,798 | | | | – | | | | – | |

| Receivable for investments sold | | | 4,331,635 | | | | 719,129 | | | | 2,356,969 | | | | – | |

| Receivable for Fund shares sold | | | 84,756 | | | | 1,590,937 | | | | 136,766 | | | | – | |

| Interest receivable | | | 1,036,593 | | | | 1,291,268 | | | | 471,333 | | | | 136,076 | |

| Receivable from adviser (see Note 3) | | | – | | | | – | | | | 10,584 | | | | 28,884 | |

| Receivable for variation margin on open futures contracts | | | – | | | | – | | | | 3,407 | | | | 3,697 | |

| Foreign tax reclaims receivable | | | – | | | | – | | | | 2,139 | | | | – | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 394,403 | | | | 197,214 | | | | – | | | | 4,766 | |

| Prepaid expenses | | | 37,666 | | | | 37,256 | | | | 12,638 | | | | 10,617 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 165,473,151 | | | | 86,347,172 | | | | 102,035,730 | | | | 30,125,818 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Payable for investments purchased | | | 9,948,630 | | | | 2,124,412 | | | | 10,729,984 | | | | 5,207,799 | |

| Payable for Fund shares repurchased | | | 265,933 | | | | 1,033,040 | | | | 212,407 | | | | – | |

| Swap contracts, at fair value (up-front net premiums received of $0, $0, $562 and $147, respectively) | | | – | | | | – | | | | 7,229 | | | | 1,885 | |

| Investment advisory fee payable (see Note 3) | | | 16,802 | | | | 4,870 | | | | – | | | | – | |

| Distribution fees payable | | | 6,773 | | | | 5,439 | | | | 2,452 | | | | 209 | |

| Dividends payable | | | 328,329 | | | | 600,819 | | | | 66,092 | | | | 185,135 | |

| Written options, at fair value (premiums of $972,000) | | | – | | | | 207,921 | | | | – | | | | – | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 11,957 | | | | 8,461 | | | | – | | | | 12,870 | |

| Accrued expenses and other liabilities | | | 263,531 | | | | 216,824 | | | | 179,476 | | | | 183,361 | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 10,841,955 | | | | 4,201,786 | | | | 11,197,640 | | | | 5,591,259 | |

| | | | | | | | | | | | | | | | |

Total net assets | | $ | 154,631,196 | | | $ | 82,145,386 | | | $ | 90,838,090 | | | $ | 24,534,559 | |

| | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

31

Babson Capital Funds Trust 2015 Semi-Annual Report

STATEMENTS OF ASSETS AND LIABILITIES (CONTINUED)

December 31, 2015 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | BABSON GLOBAL

FLOATING RATE

FUND | | | BABSON GLOBAL

CREDIT INCOME

OPPORTUNITIES

FUND | | | BABSON ACTIVE

SHORT DURATION

BOND FUND | | | BABSON TOTAL

RETURN BOND

FUND | |

| | | | |

| Composition of net assets | | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding (par value $0.00001 per share), unlimited number of shares authorized | | $ | 171 | | | $ | 94 | | | $ | 92 | | | $ | 25 | |

| Additional paid-in capital | | | 170,715,425 | | | | 94,602,432 | | | | 91,904,125 | | | | 25,131,900 | |

| Undistributed (distributions in excess of) net investment income | | | 85,033 | | | | 337,961 | | | | (3,130 | ) | | | (1,352 | ) |

| Accumulated net realized loss | | | (2,591,436 | ) | | | (2,891,685 | ) | | | (161,348 | ) | | | (311,100 | ) |

| Net unrealized depreciation | | | (13,577,997 | ) | | | (9,903,416 | ) | | | (901,649 | ) | | | (284,914 | ) |

| | | | | | | | | | | | | | | | |

Total net assets | | $ | 154,631,196 | | | $ | 82,145,386 | | | $ | 90,838,090 | | | $ | 24,534,559 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class A | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 5,578,247 | | | $ | 11,924,553 | | | $ | 10,518,584 | | | $ | 196,032 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 618,563 | | | | 1,368,677 | | | | 1,069,223 | | | | 20,082 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 9.02 | | | $ | 8.71 | | | $ | 9.84 | | | $ | 9.76 | |

| | | | | | | | | | | | | | | | |

| Maximum offering price per share outstanding (Net asset value plus sales charge of 3.00%, 4.00%, 0.00% and 4.00%, respectively) | | $ | 9.30 | | | $ | 9.07 | | | $ | – | | | $ | 10.17 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class C | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 6,597,783 | | | $ | 3,302,315 | | | $ | 340,667 | | | $ | 195,825 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 734,085 | | | | 379,418 | | | | 34,649 | | | | 20,061 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 8.99 | | | $ | 8.70 | | | $ | 9.83 | | | $ | 9.76 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class I | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 22,130,131 | | | $ | 24,445,056 | | | $ | 21,968,595 | | | $ | 12,060,376 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 2,449,029 | | | | 2,806,051 | | | | 2,234,436 | | | | 1,235,482 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 9.04 | | | $ | 8.71 | | | $ | 9.83 | | | $ | 9.76 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class Y | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 120,325,035 | | | $ | 42,473,462 | | | $ | 58,010,244 | | | $ | 12,082,326 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 13,320,246 | | | | 4,875,730 | | | | 5,900,387 | | | | 1,237,731 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 9.03 | | | $ | 8.71 | | | $ | 9.83 | | | $ | 9.76 | |

| | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

��

32

Babson Capital Funds Trust 2015 Semi-Annual Report

STATEMENTS OF ASSETS AND LIABILITIES (CONTINUED)

December 31, 2015 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | BABSON

EMERGING

MARKETS DEBT

BLENDED TOTAL

RETURN FUND | | | BABSON

EMERGING

MARKETS LOCAL

CURRENCY DEBT

FUND | | | BABSON GLOBAL

HIGH YIELD

FUND | | | BABSON U.S.

HIGH YIELD

FUND | |

| | | | |

| Assets | | | | | | | | | | | | | | | | |

| Investments, at fair value (cost $9,935,402, $4,928,972, $24,902,440 and $26,953,697, respectively) | | $ | 9,521,067 | | | $ | 4,828,638 | | | $ | 23,969,550 | | | $ | 26,020,071 | |

| Foreign currency, at value (cost $0, $0, $17,809 and $0, respectively) | | | – | | | | – | | | | 17,362 | | | | – | |

| Interest receivable | | | 151,312 | | | | 75,510 | | | | 405,837 | | | | 359,358 | |

| Receivable from adviser (see Note 3) | | | 36,071 | | | | 35,259 | | | | 26,852 | | | | 27,615 | |

| Receivable for variation margin on open futures contracts | | | 7,524 | | | | – | | | | – | | | | – | |

| Swap contracts, at fair value | | | 10,877 | | | | 7,952 | | | | – | | | | – | |

| Foreign tax reclaims receivable | | | – | | | | 383 | | | | – | | | | – | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 130,248 | | | | 24,387 | | | | 61,325 | | | | – | |

| Prepaid expenses | | | 1,059 | | | | 50 | | | | 1,059 | | | | 1,059 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 9,858,158 | | | | 4,972,179 | | | | 24,481,985 | | | | 26,408,103 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Swap contracts, at fair value (up-front net premiums received of $9,276, $0, $0 and $0, respectively) | | | 7,281 | | | | 29,065 | | | | – | | | | – | |

| Directors’ fees payable | | | 6,144 | | | | 2,524 | | | | 4,958 | | | | 4,958 | |

| Distribution fees payable | | | 204 | | | | 77 | | | | 103 | | | | 103 | |

| Dividends payable | | | 45,780 | | | | 12,275 | | | | 118,898 | | | | 121,847 | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 146,056 | | | | 47,969 | | | | 68,199 | | | | – | |

| Accrued expenses and other liabilities | | | 89,724 | | | | 32,383 | | | | 74,515 | | | | 74,513 | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 295,189 | | | | 124,293 | | | | 266,673 | | | | 201,421 | |

| | | | | | | | | | | | | | | | |

Total net assets | | $ | 9,562,969 | | | $ | 4,847,886 | | | $ | 24,215,312 | | | $ | 26,206,682 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Composition of net assets | | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding (par value $0.00001 per share), unlimited number of shares authorized | | $ | 10 | | | $ | 5 | | | $ | 25 | | | $ | 27 | |

| Additional paid-in capital | | | 10,003,090 | | | | 4,999,995 | | | | 25,007,488 | | | | 27,102,498 | |

| Undistributed (distributions in excess of) net investment income | | | (1,110 | ) | | | – | | | | – | | | | – | |

| Accumulated net realized gain (loss) | | | (20,407 | ) | | | (6,794 | ) | | | 149,372 | | | | 37,783 | |

| Net unrealized depreciation | | | (418,614 | ) | | | (145,320 | ) | | | (941,573 | ) | | | (933,626 | ) |

| | | | | | | | | | | | | | | | |

Total net assets | | $ | 9,562,969 | | | $ | 4,847,886 | | | $ | 24,215,312 | | | $ | 26,206,682 | |

| | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

33

Babson Capital Funds Trust 2015 Semi-Annual Report

STATEMENTS OF ASSETS AND LIABILITIES (CONTINUED)

December 31, 2015 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | BABSON

EMERGING

MARKETS DEBT

BLENDED TOTAL

RETURN FUND | | | BABSON

EMERGING

MARKETS LOCAL

CURRENCY DEBT

FUND | | | BABSON GLOBAL

HIGH YIELD

FUND | | | BABSON U.S.

HIGH YIELD

FUND | |

| | | | |

| Class A | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 191,258 | | | $ | 96,958 | | | $ | 96,831 | | | $ | 96,397 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 20,006 | | | | 10,000 | | | | 10,000 | | | | 10,000 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 9.56 | | | $ | 9.70 | | | $ | 9.68 | | | $ | 9.64 | |

| | | | | | | | | | | | | | | | |

| Maximum offering price per share outstanding (Net asset value plus sales charge of 4.00%) | | $ | 9.96 | | | $ | 10.10 | | | $ | 10.08 | | | $ | 10.04 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class C | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 191,254 | | | $ | 96,958 | | | $ | 96,831 | | | $ | 96,397 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 20,006 | | | | 10,000 | | | | 10,000 | | | | 10,000 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 9.56 | | | $ | 9.70 | | | $ | 9.68 | | | $ | 9.64 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class I | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 4,590,229 | | | $ | 2,326,985 | | | $ | 12,007,048 | | | $ | 14,060,706 | |

| | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 480,156 | | | | 240,000 | | | | 1,240,000 | | | | 1,458,557 | |

| | | | | | | | | | | | | | | | |

| Net asset value per share outstanding | | $ | 9.56 | | | $ | 9.70 | | | $ | 9.68 | | | $ | 9.64 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Class Y | | | | | | | | | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 4,590,228 | | | $ | 2,326,985 | | | $ | 12,014,602 | | | $ | 11,953,182 | |