UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Item 1. Report to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

AXS Alternative Growth Fund

(Class A: EEHAX)

(Class I: EEHIX)

AXS Aspect Core Diversified Strategy Fund

(Class A: EQAAX)

(Class C: EQACX)

(Class I: EQAIX)

AXS Chesapeake Strategy Fund

(Class A: ECHAX)

(Class C: ECHCX)

(Class I: EQCHX)

AXS Managed Futures Strategy Fund

(Class A: MHFAX)

(Class C: MHFCX)

(Class I: MHFIX)

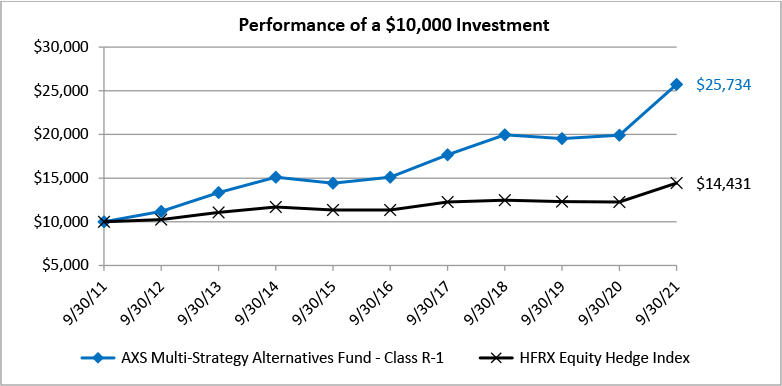

AXS Multi-Strategy Alternatives Fund

(Class I: KCMIX)

(Class R-1: KCMTX)

AXS Sustainable Income Fund

(Class I: AXSKX)

AXS Thomson Reuters Private Equity Return Tracker Fund

(Class A: LDPAX)

(Class C: LDPCX)

(Class I: LDPIX)

AXS Thomson Reuters Venture Capital Return Tracker Fund

(Class A: LDVAX)

(Class C: LDVCX)

(Class I: LDVIX)

ANNUAL REPORT

SEPTEMBER 30, 2021

AXS Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 42 |

| Consolidated Schedule of Investments | 58 |

| Consolidated Statements of Assets and Liabilities | 124 |

| Consolidated Statements of Operations | 130 |

| Consolidated Statements of Changes in Net Assets | 133 |

| Consolidated Financial Highlights | 141 |

| Notes to Consolidated Financial Statements | 161 |

| Report of Independent Registered Public Accounting Firm | 205 |

| Supplemental Information | 210 |

| Expense Examples | 213 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the AXS Funds. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.axsinvestments.com

AXS Alternative Growth Fund

Annual Letter to Shareholders for the year ended September 30, 2021

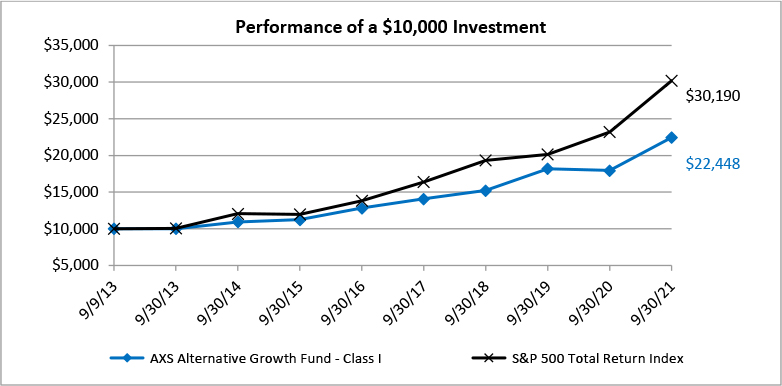

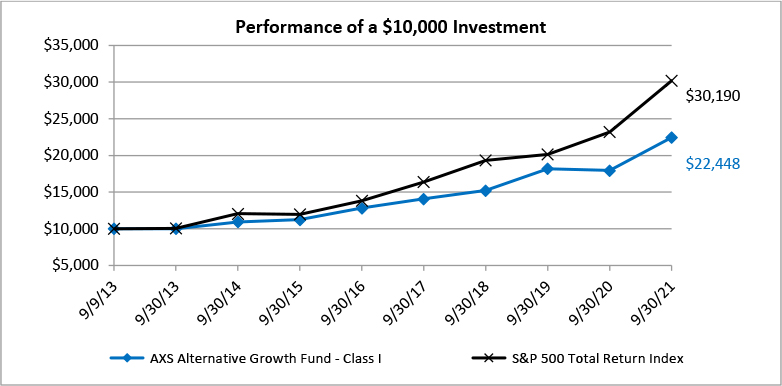

For the fiscal year ending September 30, 2021, the AXS Alternative Growth Fund’s Class I and Class A shares were up +25.04% and +24.82%, respectively, underperforming the S&P 500 Total Return Index® (“S&P 500®”), which was up +30.00%.

| Return 12-Mo | Annualized Rate of Return (AROR) Since Inception (9/9/2013 to 9/30/2021) | Annualized Standard Deviation Since Inception (9/9/2013 to 9/30/2021) |

| AXS Alternative Growth – Class I | 25.04% | 10.56% | 15.61% |

| AXS Alternative Growth – Class A | 24.82% | 10.27% | 15.47% |

| AXS Alternative Growth – Class A (w/ 5.75% max sales charge) | 17.60% | 9.46% | -- |

| S&P 500® | 30.00% | 14.70% | 13.68% |

Past performance does not guarantee future results. Investors cannot directly invest in an index.

RATIONALE

Over the years, we have observed that many investor portfolios are inadequately diversified because of the perceived opportunity cost of selling equities to gain exposure to diversifying alternative assets. We believe an overlay strategy offers the potential for superior and meaningful diversification without the need to reduce exposure to core holdings. This is the concept implemented in the Alternative Growth Fund. The Fund provides futures-based exposure to the broad US equity market, while simultaneously seeking to diversify equity factor risk through strategic and meaningful exposure to a futures-based portfolio of (i) uncorrelated diversifiers and (ii) negatively correlated dynamic equity-hedging strategies.

ANALYSIS OF PERFORMANCE

The Fund’s underperformance can be attributed mainly to the hedge strategy, as shown in the Table below. Further, most of the hedge strategy’s underperformance can be attributed to the Quadriga Smart Gold options and futures trading program. This absolute return strategy aims to generate negatively correlated returns (“crisis alpha”) during adverse and hostile equity markets, while seeking to earn neutral to positive returns during benign markets. Thus, the strategy seeks to earn, in the long run, higher risk-adjusted overall returns, particularly on the downside, through the combination of potentially higher compounded returns, lower realized volatility, and shallower drawdowns. Unfortunately, during a very strong year for equity markets (+30% for the Equities Index), a volatile and down year for gold (spot gold depreciated by about −8%), and a losing year for US Treasury securities (the 10-year bond returned about −4.5%), the Quadriga program lost about −50%, representing a contribution of −706 bps to the Fund’s performance. The allocation to the Quadriga program was reduced progressively during the year, and the program was removed from the Fund’s portfolio in October 2021, shortly after the end of the fiscal year.

ampersandinvestments.com • 609.454.5200

TABLE 1: FUND CONTRIBUTION BY STRATEGY

| Strategy | Oct-2020 to Sep-2021 |

| Long Only | 34.19% |

| Diversifier | 4.70% |

| Hedge | -14.04% |

| Fixed Income | 0.19% |

| Fund Total | 25.04% |

Eight of our diversifying trading programs contributed positively, totaling 927 bps, while seven programs combined to yield negative performance of −457 bps. The best performer was a discretionary global macro trading program, followed by a trend-following program and an adaptive machine-learning program. Negative contributions came from across the board, including both currency trading programs.

As mentioned earlier, the Quadriga Smart Gold strategy was the worst performer for the year, although the QDRA strategy and the Quest Hedging Strategy were also significant negative contributors. While negative performance by hedging strategies is not entirely unexpected during a strong year for equity markets, its magnitude was disappointing.

TABLE 2: PERFORMANCE ATTRIBUTION BY CTAS:

| Commodity Trading Advisor | Program | Oct-2020 to Sep-2021 |

| Diversifiers | | |

| Arctic Blue Capital | Arctic Blue Inuvik | 0.00% |

| Crabel Capital Management | Crabel Multi-Product | 0.48% |

| Emil van Essen | Emil Van Essen | -0.42% |

| FORT, L.P. | Fort Global Contrarian | -0.57% |

| H20 Asset Management | H2O Asset Management | 4.58% |

| IPM Informed Portfolio Mgmt. | IPM Systematic Macro | -0.71% |

| J E Moody | JEM CRV Program | 0.99% |

| KeyQuant | Key Trends Financials Program | -0.53% |

| LCJ Investments | LCJ | -0.63% |

| Mesirow Financial (Currency Management) | Cambridge Strategy Emerging Markets Alpha | -1.00% |

| QMS Capital Management | QMS Financials Only Global Macro | -0.71% |

| Quantica Capital | Quantica | 1.45% |

| Quantitative Investment Management | QIM | 0.15% |

| Quest Partners | Quest QTI | 0.35% |

| SCT Capital Management | SCT Capital - AQT Program | 1.27% |

| Total Diversifier | | 4.70% |

| Hedges | | |

| QDRA Pty. Ltd | QDRA Dynamic Macro | -4.63% |

| Quadriga Asset Managers | Quadriga | -7.06% |

| Quest Partners | Quest Hedging Program | -2.35% |

| Total Hedge | | -14.04% |

ampersandinvestments.com • 609.454.5200

Performance attribution is estimated by Ampersand Investment Management and is net of fees. Past performance does not guarantee future results.

At the sector level, equity indices were, not surprisingly, the biggest positive contributors to performance, followed by energy. Interest rates were the largest negative contributors, followed by metals and currencies, while agricultural commodities were negative but close to flat.

TABLE 3: FUND PERFORMANCE ATTRIBUTION BY SECTOR (10/1/2020 to 9/30/2021)

| Sector | Contribution |

| Currencies | -3.18% |

| Equity Indices | 4.95% |

| Interest Rates | -8.71% |

| Agricultural Commodities | -0.35% |

| Metals | -3.21% |

| Energy | 1.16% |

| Total | -9.34% |

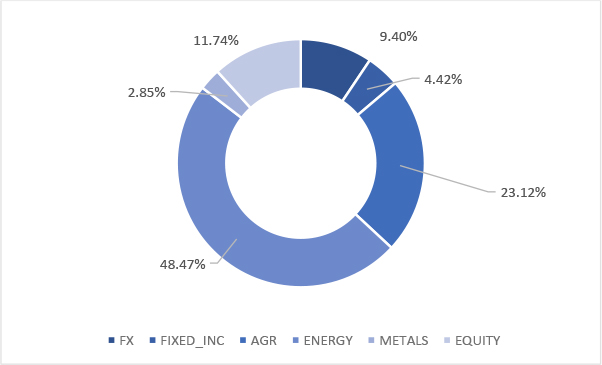

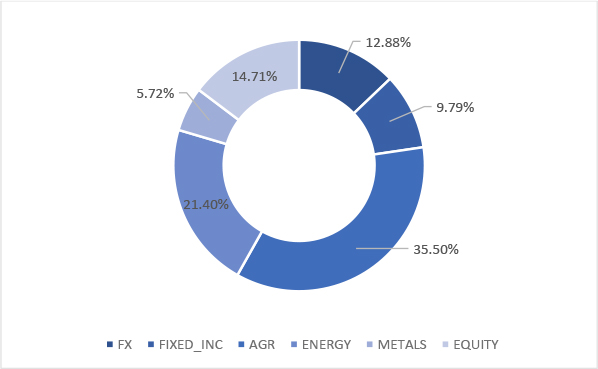

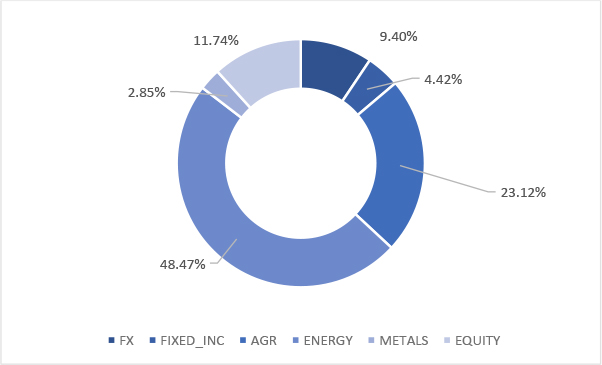

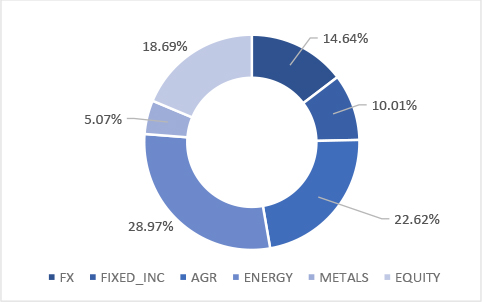

The overlay’s largest gross exposure as of fiscal year-end was to energy (about 48%), followed by agricultural commodities (about 23%), equity indices (about 12%), currencies (about 10%), fixed income (about 4%), and metals (about 3%). Together, the physical commodity sectors represent about 74% of the Fund’s exposure, higher than at the previous year-end.

At the end of September, the dynamic hedging strategies had a negative beta of about −0.08 with respect to the S&P 500 Index®. It is expected that this beta will be negative, on average and over time. Currencies and equity indices had the largest negative betas (−0.17 and −0.07, respectively) and energy had the largest positive beta (+0.17), while the betas for all other sectors were relatively close to zero.

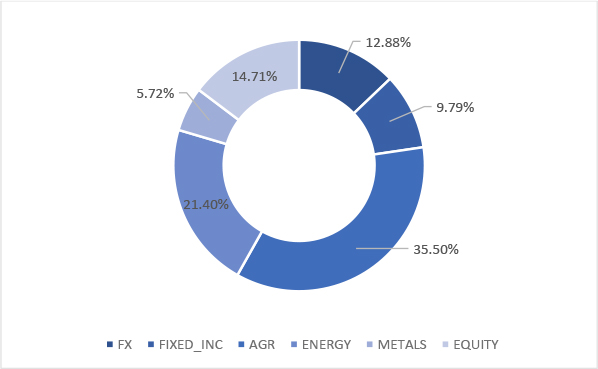

FUND SECTOR DIVERSIFICATION

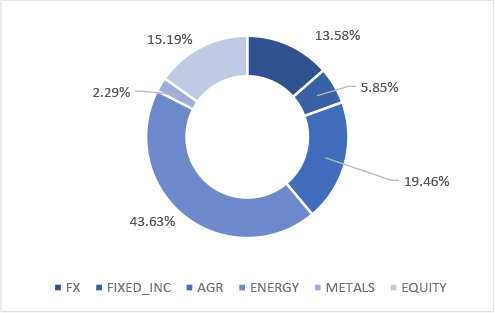

GROSS SECTOR EXPOSURE AS OF 9/30/2020

ampersandinvestments.com • 609.454.5200

GROSS SECTOR EXPOSURE AS OF 9/30/2021

Source: Ampersand Investment Management and Bloomberg, LP. Reflects aggregate sector gross risk exposures. Sector exposures and positions held may vary depending on market conditions and may not be representative of the Fund’s current or future exposures. Portfolio positions are subject to change and should not be considered investment advice. Attribution numbers have been rounded for ease of use.

MARKET COMMENTARY

Q4 2020

For Q4 2020, the Ampersand Fund’s Class I shares earned a return of +11.41%. The Fund slightly underperformed the S&P 500 Total Return Index, which was up +12.15% for the same period.

It was another very good quarter for global equity markets. Equity market volatility as measured by the VIX Index started the quarter at about 27% and continued to climb, peaking at about 40% towards month-end. By the second week of November, it declined to about 25%, and it remained in a fairly narrow band between 20% and 25% for the rest of the quarter, still higher than its long-term historical average but significantly below the levels seen earlier during 2020.

ampersandinvestments.com • 609.454.5200

OCTOBER 2020

The Fund’s Class I shares were down significantly during October (−6.51%), driven mainly by the long strategy (−2.78%). The hedge strategy (−1.97%) and the diversifier strategy (−1.83%) were also down for the month.

Financial and commodity markets remained anxious in a month where global coronavirus cases rose by a single-day record of half a million. Renewed national lockdowns were imposed across Europe, leading to a crash in oil prices. Investor appetite for risk assets was also dampened by upcoming US election uncertainty and a breakdown in US fiscal stimulus talks. Brexit negotiations continued, with focus on a few sticking points, although markets were relieved when the UK did not walk away from a self-imposed deadline. On the data front, the US posted a muted labor market picture, signaling a slowdown in recovery while most data out of Europe also indicated a worsening outlook as the virus continued to spread.

Long fixed income positions were hurt as key Asian and North American bond yields rose, with the latter partly attributable to expectations of additional US stimulus. Fears of an economic slowdown amid increased coronavirus cases led to major stock market selloffs, which detracted from long positions. In currencies, the Chinese Yuan benefited from a positive economic backdrop in China.

Short energy positions gained as the outlook for global consumption weakened with new pandemic-driven mobility restrictions. In metals, improving Chinese demand boosted aluminum prices. Weather concerns in the Americas helped boost key agricultural markets such as soybean, cotton, and wheat.

NOVEMBER 2020

The Fund performed handsomely in November (up +12.96%), driven by both the long strategy (+12.55%) and the diversifier strategy (+5.57%). The hedge strategy (−5.21%) detracted from performance.

Not surprisingly, November was dominated by COVID-19 developments. There were several significant announcements, notable among which was the news that three strong vaccine candidates, claiming up to 95% efficacy, had completed Phase 3 testing and were filing for emergency use. This prompted a strong rally in risk assets and led to one of the biggest stock market spikes in history. Investors rotated out of growth and momentum stocks into value stocks as the prospects of a vaccine accelerated the outlook for a global recovery. Risk assets were also bolstered by the US election results which pointed to a Joe Biden victory, although the Trump campaign was still trying to overturn the election outcomes in courts. Despite this positive news, the fact that much of the world was still battling an increase in COVID-19 cases and hospitalizations with varying degrees of lockdowns continued to cast a pall on markets.

Many government bond yields surged on the vaccine news, causing losses for net long fixed income exposure. Long stock index positions benefited, as a vaccine-induced, broad-based rally in equities ensued. Gains were generated by the currencies sector where net short US Dollar exposure yielded profits, particularly against the New Zealand Dollar, after data on China’s PMI (Purchasing Managers’ Index) surprised on the upside.

Net long metals exposure also generated gains. Industrial metals rallied, especially copper, on the optimistic vaccine announcement, growing demand, and signs that China's manufacturing PMIs were accelerating at the fastest rate in a decade. Net long agricultural commodity exposure was also profitable as dry weather and strong demand from China for products such as soybeans boosted prices. Long positions in crude oil also profited as prices rallied on vaccine hopes, while natural gas prices fell on forecasts of a warmer winter.

ampersandinvestments.com • 609.454.5200

DECEMBER 2020

December was another positive month for the Fund (+5.49%), driven again by both the long strategy (+4.57%) and the diversifier strategy (+1.10%), while the hedge strategy (−0.20%) detracted slightly.

Risk assets rallied strongly, bolstered by the deployment of several COVID-19 vaccines. After months of negotiations, the US signed into law the second largest relief bill in its history ($900bn) while the EU was able to secure its $2.2 trillion budget and stimulus plan. The UK and EU agreed to a post-Brexit trade agreement. All these agreements helped to boost market sentiment further while a global surge in coronavirus cases and hospitalizations counteracted some of these positive developments.

Equity markets appreciated strongly throughout the month, as the near-term optimism surrounding vaccinations, additional stimulus measures and strong IPO activity drove positive sentiment throughout the month. Core government bond yields were more mixed.

One of the main themes generating positive performance this month was continued US dollar weakness. Among the best performing currency positions were long exposures to commodity-sensitive regions such as Australia, Chile and South Africa. Long metals exposure also generated gains, with the sector overall appreciating in price as the US dollar weakened. Soybeans reached a six-year high on export optimism and supply concerns as dry weather conditions continued in key growing areas in South America.

In energy, short natural gas positions made strong gains as forecasters projected warmer trends and reduced heating demand. Crude oil prices soared as major oil producers agreed to persist with production cuts.

Q1 2021

For Q1 2021, the Ampersand Fund’s Class I shares earned a return of +1.68%. The Fund underperformed the S&P 500 Total Return Index, which was up +6.17% for the same period.

It was another positive albeit volatile quarter for global equity markets. Equity market volatility as measured by the VIX® Index started the quarter north of 25% and stayed in the 20-25% range, before spiking up to about 37% towards month-end. By the second week of February, it dropped and then remained in a fairly narrow band around 20% for most of the month before another brief spike up to about 28% at month-end. By the second week of March, it subsided to a range from 18% to 20%, still higher than its long-term historical average but significantly below the levels seen during early 2020.

January 2021

The Fund’s Class I shares were down significantly during January (−5.60%). The long strategy (−1.28%), the hedge strategy (−1.84%) and the diversifier strategy (−2.51%) were all down for the month.

The overall positive sentiment that had lifted markets towards the end of 2020 carried over into 2021. Global equities continued their march upwards, spurred by optimism around the inauguration of President Biden and the expected effect of the new administration on both domestic stimulus plans and foreign policy. However, the month ended on a more cautious tone as the market experienced jitters on valuation concerns and disappointing economic data.

ampersandinvestments.com • 609.454.5200

Early gains from net long stock indices were eroded from bouts of uncertainty in the final trading days of the month. The early investor optimism went against long fixed income positions as yields rose.

Higher US yields also supported a stronger US dollar, which moved against its multi-month downward trend, generating losses on short positions, mainly versus emerging market currencies.

Long positions in agricultural commodities benefited from strong Chinese export demand and supply concerns. The growing risk appetite played out as expected in the energy sector, with net positive performance from long positions. Industrial metals were helped by the improved global manufacturing outlook, while precious metal prices were weighed down by the stronger US dollar.

February 2021

The Fund had a positive February (up +1.78%), driven by both the long strategy (+3.38%) and the diversifier strategy (+2.45%). The hedge strategy (−4.07%) detracted from performance.

Global bond markets experienced a rout, as investors were more spooked by inflation threats than encouraged by the possible positive impact of fiscal stimulus on economic growth. Cyclical assets such as value stocks and oil were boosted by accelerating vaccine rollouts, while growth stocks and gold suffered from rising yields. Major price moves occurred towards the end of the month as global policymakers sought to quell the panic through dovish rhetoric.

Developed market bond yields had some of their biggest monthly jumps in more than a decade, reflecting fears that central banks may need to tighten policy earlier than expected to suppress inflation. Long bond positions suffered. Net long exposure to stock indices made gains despite investors dumping highly valued stock market segments in the face of spiking bond yields. Initially, long positions in emerging market and commodity currencies benefited from the improving growth outlook. However, these gains were largely erased during the final days as the dollar rose, while risk appetite waned amid inflation concerns.

Long energy market positions produced gains as frigid weather in the US boosted fuel demand, while supply was hampered by a winter storm in Texas. China's strong economic story helped long positions in agricultural markets such as cotton, where demand from China's textile industry grew while inventories fell. Sturdy Chinese manufacturing activity and supply issues also drove gains in industrial metals such as copper and aluminum.

MARCH 2021

March was a good month for the Fund (+5.83%), driven again by both the long strategy (+5.18%) and the diversifier strategy (+1.19%), while the hedge strategy (−0.54%) detracted slightly.

Major government bonds, particularly longer-dated US treasuries, continued to sell off and yields surged as the Federal Reserve pledged to stay accommodative for at least another two years and reiterated its position to allow inflation to rise above 2%. This amplified growing concerns that vast government spending and monetary stimulus would fuel inflation.

Equities rose on strong economic growth signals as President Joe Biden signed a $1.9tn spending bill into law and accelerated vaccination efforts. Meanwhile, details began to emerge of a further multi-trillion-dollar infrastructure plan. Yields climbed in response to the Federal Reserve's dovish tones and rising growth expectations. The rise in yields and increasing expectation of a strong US recovery helped drive further US Dollar appreciation against major currencies, leading to losses, while the Euro lost value against its peers amidst a third wave of COVID-19 infections. Losses came from net long metals exposure as metal prices fell with the strengthening US Dollar. Oil markets were increasingly volatile as a container ship accidentally blocked up the Suez Canal. Long positions in lean hogs contributed to profits in the agricultural sector on news of another outbreak of African swine fever in China; however, these were offset by other losses.

ampersandinvestments.com • 609.454.5200

Q2 2021

For Q2 2021, the Ampersand Fund’s Class I shares earned a return of +12.27%. The Fund outperformed the S&P 500 Total Return Index, which was up +8.55% for the same period.

It was a much less volatile quarter for global equity markets. Equity market volatility as measured by the VIX® Index started the quarter well below 20% and stayed in the 16-20% range, except for a brief spike into 20%-27% territory during the middle third of May. Towards the end of June, it had subsided to just above 15%, close to its long-term historical average and significantly below the pandemic highs seen during 2020.

APRIL 2021

The Fund’s Class I shares were up nicely during April (+4.96%). This was mainly attributable to the long strategy (+6.13%) and the diversifier strategy (+0.49%), while the hedge strategy (−1.66%) was down for the month.

Risk assets, mainly equities and commodities, thrived on upbeat economic data that pointed to strong signs of an accelerating recovery in the US. While the Federal Reserve reaffirmed its accommodative policies, President Biden came out in support of aggressive new tax hikes, causing investors to look past inflationary fears and send US treasury yields lower. Risk-off assets were also supported by a sharp increase in COVID cases, particularly in India, which struggled to contain a new coronavirus variant.

Long stock index positions gained as US stock markets reached record highs and European equities erased all their pandemic losses. Short positions in longer-dated US treasuries were large detractors as recent trends reversed. Gains from long positions in commodity-sensitive currencies were offset by losses on short positions in the Swiss Franc, the Japanese Yen and, especially, the Euro, with that currency strengthening as the vaccination rollout in the Eurozone picked up speed.

Long exposures across commodity markets generated gains as adverse weather conditions in key growing regions caused grain prices (corn, soy and wheat) to rally. Long positions in industrial metals were profitable as prices surged on the back of a weakening US dollar and accelerating demand. An optimistic OPEC report for global oil demand coupled with generally strengthening risk appetite resulted in gains on long energy positions.

MaY 2021

The Fund had an even better May (+5.17%). The long strategy (+0.81%), the diversifier strategy (+1.50%), and the hedge strategy (+2.86%) all contributed to performance.

The “reflation trade” (a bet on assets that benefit from a strengthening economy and a pickup in inflation) contributed most of May’s returns. Risk assets continued their year-long rise, although mixed economic data releases from the US caused markets to fluctuate throughout the month. The specter of inflation continued to worry investors, although Federal Reserve officials attempted to reassure markets via dovish signals. This accommodative messaging caused the US Dollar to weaken against major peers, continuing its recent slide.

Net short US Dollar positions benefited from the currency’s ongoing weakness, mainly against commodity currencies and the British Pound. The US Dollar erased virtually all the gains it had made at the start of the year. A mid-month wobble, caused by the highest monthly core Consumer Price Index (CPI) rise in years and associated inflation fears, did not deter stock markets from rising by month-end. Prices were pushed higher by the continued easing of lockdown restrictions and strong Purchasing Managers' Index (PMI) data releases out of Europe. Fixed income positions finished the month down, as small gains in long positions in shorter-dated bonds were offset by losses on short exposures.

ampersandinvestments.com • 609.454.5200

Long commodity exposures continue to be profitable. Lean hogs were one of the best performers, as the reopening of restaurants across the US stimulated pork demand. Gas oil and gasoline prices rose on fears of supply shortages due to a cyberattack on a major US fuel pipeline operator, benefiting long exposures. Metal markets joined other commodities, with prices rising as the reopening of economies continued to drive up demand.

JUNE 2021

June was another positive month for the Fund (+1.71%), capping off an excellent quarter. Performance was driven by the long strategy (+2.54%), while the diversifier strategy (−0.61%) and the hedge strategy (−0.22%) detracted slightly.

The Federal Reserve surprised markets with its hawkish rate projections, causing the yield curve to flatten. Investors also temporarily pulled out of the hitherto popular “reflation trade.” US stock markets subsequently rallied to all-time highs on hopes for President Biden's new infrastructure deal. By the end of the month, however, investors had begun to weigh economic growth prospects against rising inflationary pressures and the spread of the highly infectious Delta coronavirus variant.

Q3 2021

After a very good Q2, the Alternative Growth Fund’s Class I shares returned -1.68% for Q3. The Fund underperformed the S&P 500 Total Return Index, which was up +0.58% for the same period.

July and August were relatively quiet months for global equity markets. Equity market volatility as measured by the VIX® Index started the quarter at about 15% and stayed in the 15-20% range for the most part. Hurricane Ida contributed to a turbulent September, with the VIX® moving into the 20-25% range for most of the month, and ending the quarter at about 23%.

July 2021

The Fund’s Class I shares were up nicely during July (+5.33%). This was mainly attributable to the long strategy (+2.85%), while both the diversifier strategy (+1.14%) and the hedge strategy (+1.34%) were also up for the month.

Risk assets started the month strong, with US stocks reaching record highs. However, concerns about the coronavirus Delta variant and indications that inflation in the US may be picking up stoked uncertainty about global growth. Investors flocked out of the “reflation trade” (a bet on assets that benefit from a strengthening economy) and into safe-haven assets. Longer-dated US treasury yields experienced sharp declines. Many longer-term trends within commodities, fixed income and FX continued their reversal, while the US Dollar showed further strength.

Long commodities exposure generated profits, particularly in the energy sector. Natural gas prices rallied on the prospect of higher weather-related demand. Long industrial metals positions were profitable; nickel prices neared a seven-year high on robust demand and constrained supply.

In financial markets, fixed income rallied strongly, leading to gains in long positions. Long stock index exposures suffered losses on fears of a slowdown in the economic recovery. In currencies, gains from long US Dollar positions against emerging market currencies were more than offset by Euro losses, as the Euro also appreciated on the European Central Bank’s announcement that it would allow inflation to overshoot its target.

AUGUST 2021

The Fund had a positive August (+2.26%). The long strategy (+3.50%) was the main contributor, while the diversifier strategy (-0.18%) and the hedge strategy (-1.06%) both detracted from performance.

ampersandinvestments.com • 609.454.5200

Robust economic data and earning releases helped European and US stocks reach record highs despite the spread of the coronavirus Delta variant. Asian stocks suffered, however, spooked by the Chinese regulatory clampdown and fears of consequent growth deceleration. The Federal Reserve sent strong signals that it would soon start to unwind its accommodative policies. As other central banks followed suit, investors fled into the safe-haven US dollar and away from government bonds, as prospects for tighter monetary policy appeared more likely. This sharp reversal led to losses on long fixed income exposures.

As economies continued to gradually reopen, hopes of an improving recovery sent most stock indices higher. The US dollar strengthened due to increasing talk of tapering, political tensions, and disappointing economic data from China, before weakening again towards the end of the month.

US natural gas continued to rally on reports of inventory levels well below expectations, while other energy positions suffered losses. In agricultural commodities, sugar and coffee prices rose due to adverse weather conditions and prospects of lower output in key regions. Metal prices fell as the US dollar strengthened, causing losses from long exposures.

SEPTEMBER 2021

September was a disappointing month for the Fund (-8.72%), ending a streak of positive months that began in February. Negative performance was driven mainly by the long strategy (-5.61%), but the diversifier strategy (−2.28%) and the hedge strategy (−0.83%) also detracted from performance.

The villain behind this stormy month was Hurricane Ida, which forced oil production shutdowns in the Gulf of Mexico. Oil prices surged further on the decision by OPEC+ to increase output only modestly. Energy prices continued to march upwards in the second half of the month, spurred by low European gas inventories and fears of potential supply shortages during winter. Stocks reversed their near-relentless climb, as central banks, including the Federal Reserve, signaled less accommodative policy stances. The impending halt to supportive monetary policy also helped the US Dollar and Treasury yields to rise.

CONCLUSION

We believe that concerns about the global economy and geopolitics have been exacerbated by the coronavirus crisis. Historically, futures trading programs have tended to perform well in a variety of market conditions, perhaps particularly so during periods of market turbulence and volatility expansion. A period of a few weeks or months is far too short to judge the long-term potential of any strategy or asset class.

The Fund seeks to provide returns that, in the long run, are comparable to the S&P 500® Total Return Index with comparable volatility, while seeking to mitigate downside risk. We continue to believe that a significant and strategic allocation to the Fund as a substitute for core equity exposure in a portfolio may provide “smarter” equity exposure: equity exposure that is dynamically hedged, coupled with the potential for uncorrelated alpha in the long run.

Definition of Terms

Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund’s alpha.

Annualized rate of return (AROR) is the geometric average return for a period greater than or equal to one year, expressed on an annual basis or as a return per year.

ampersandinvestments.com • 609.454.5200

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. A beta of 1 indicates that the security's return will move with the market. A beta of less than 1 means that the security’s return will be less volatile than the market. A beta of greater than 1 indicates that the security's return will be more volatile than the market. For example, if a stock's beta is 1.2, it's return is theoretically 20% more volatile than the market’s return.

Basis Points (bps) is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Brexit is an abbreviation of “British exit,” which refers to the June 23, 2016 referendum by British voters to exit the European Union. The referendum roiled global markets, including currencies, causing the British pound to fall to its lowest level in decades. Prime Minister David Cameron, who supported the UK remaining in the EU announced he would step down in October.

Call options are financial contracts that give the option buyer the right, but not the obligation, to buy a stock, bond, commodity or other asset or instrument at a specified price within a specific time period.

Commodity Trading Advisors (CTA) provide advice and services related to trading in futures contracts. They are responsible for the trading within managed futures accounts.

Correlation is a statistical measure of how two securities move in relation to each other.

Crisis alpha: Refers to profits or gains that can be made by exploiting certain market trends during times of market turmoil.

Hedge is making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

Long position refers to buying a security such as a stock, commodity, or currency, with the expectation that the asset will rise in value.

The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. The PMI is based on a monthly survey sent to senior executives at more than 400 companies in 19 primary industries, which are weighted by their contribution to U.S. GDP.

The S&P 500 Total Return Index® is widely regarded as the best single gauge of the U.S. equities market. This world-renowned Index includes 500 leading companies in leading industries of the U.S. economy.

Short position is a position whereby an investor sells borrowed securities in anticipation of a price decline and is required to return an equal number of shares at some point in the future.

Standard Deviation (Volatility) is a measure of fluctuation in the value of an asset or investment. Lower volatility improves the stability and lowers the risk of an investment portfolio.

The VIX® Index (VIX) is a forward-looking measure of equity market volatility. Since its introduction, the VIX is considered by many to be the world’s premier barometer of investor sentiment and market volatility.

Yield is the income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

ampersandinvestments.com • 609.454.5200

Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The views in this letter were as of September 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

ampersandinvestments.com • 609.454.5200

Annual Commentary – AXS Aspect Core Diversified Strategy Fund

| 30 September 2021 | Private and Confidential |

Q4 2020 Commentary

In October, markets appeared anxious in a month where global coronavirus cases rose by a single-day record of half a million. To curb the spread, renewed national lockdowns were imposed, particularly across Europe which led to a crash in global oil prices. Investor appetite for riskier assets was also dented by upcoming US election uncertainty and a breakdown in US fiscal stimulus talks. Like other months this year, November was also dominated by COVID-19 developments. Several significant vaccine announcements, some boasting up to 95% efficacy, prompted a strong rally in risk assets and led to one of the biggest stock market factor upheavals in history. Investors rotated out of growth and momentum stocks into value stocks, as the prospect of a vaccine accelerated the outlook for a global recovery. Risk assets were also bolstered by the US election results which increasingly pointed to a Joe Biden victory. However, concerns over soaring rates of COVID-19 infections helped to temper the market’s buoyancy somewhat. Risk assets continued to rally strongly in December, bolstered by the deployment of several COVID-19 vaccines which fuelled global growth optimism. After months of negotiations, the US signed into law the second largest relief bill in its history and the UK and EU agreed to a post-Brexit trade agreement. Both agreements helped to boost market sentiment further. However, like in November, a global surge in coronavirus cases and hospitalisations counteracted some of these positive developments.

The main themes generating positive performance in Q4 were continued US Dollar weakness as well as rallying commodity markets, particularly in metals and agriculturals. Unsurprisingly, some of the Fund’s best performing currency positions were longs* in commodity sensitive regions such as Australia and New Zealand. The Fund’s long metals exposure generated gains, with the sector overall appreciating in price as the US Dollar weakened. Notable strong positive performance was seen in both copper markets, as price rises were supported by strong industry optimism globally and robust demand from China, the largest consumer of the metal. The Fund’s net long agriculturals exposure was steadily profitable throughout the quarter. Poor weather conditions in key grain growing areas coupled with strong export demand caused prices to rise. Sizeable profits were seen in long soybean positions as the market reached a six-year high by the end of the quarter. In energies, large gains from the short** natural gas position were offset by smaller losses in short positions in other energy markets. Similar to other commodity markets, prices were lifted by hope of renewed demand.

The positive sentiment surrounding news of several COVID-19 vaccines induced a broad-based rally in equity markets in November. The Fund was positioned net short stock indices for the first half of the month resulting in losses. These were partially offset by positive performance from the net long sector exposure in December, as markets continued to be buoyed by positive sentiment. The Fund produced broadly muted returns in fixed income over the quarter. The near-term optimism surrounding vaccinations and additional stimulus measures was hampered by the resurgent pandemic wave throughout the quarter leading to mixed movements across core government bond yields.

Portfolio Positioning – Q4 2020

Long positioning in fixed income has remained stable throughout the quarter. Stock indices exposure changed from net short to net long. In commodities, both the metals and agriculturals sectors extended net long exposures driven by strong trends seen in the sectors. Energies continue to hold a net short position. However, this was reduced during the latter months of Q4. In currencies, largest positioning changes were seen in the US Dollar and the Euro, with the Dollar extending its net short whereas the net long exposure in the Euro was reduced.

Q1 2021 Commentary

Positive sentiment that had buoyed markets in the closing months of 2020 spilled over into the start of 2021. Global equities initially continued their march upwards fuelled by optimism around the inauguration of President Biden and the expected effect a Biden government could have on both domestic stimulus plans and foreign policy. However, January ended on a more cautious tone caused by market jitters surrounding valuation concerns, retail investment turbulence and disappointing economic data announcements. In February, global bond markets experienced a rout as investors weighed inflation threats against the possible impact of fiscal stimulus on economic growth. Cyclical assets such as value stocks and oil were boosted by accelerating vaccine rollouts whilst growth stocks and gold suffered from rising yields. Major price moves occurred towards the end of February as global policymakers sought to quell panic through dovish rhetoric. In the final month of the quarter, government bonds - particularly longer-dated US treasuries - continued to sell off and yields surged as the Federal Reserve pledged to stay accommodative for at least another two years and reiterated its position to allow inflation to rise above 2%. This amplified growing concerns that vast government spending and monetary stimulus would fuel inflation. Equities rose and the US Dollar strengthened as President Joe Biden signed a USD1.9tn spending bill into law and accelerated vaccination efforts, meanwhile details emerged of a further multi-trillion dollar infrastructure plan.

| Private and Confidential |

Annual Commentary – AXS Aspect Core Diversified Strategy Fund

Over the course of Q1, the Fund maintained a net long exposure to risk assets such as commodity markets and stock indices which resulted in gains. Within commodities, markets generally rallied on the improved global outlook, strong Chinese export demand and weather-driven supply issues. The Fund’s profitable long positions in the sector were spread across agricultural, metal and energy markets. Net long agriculturals exposure remained stable over the quarter whilst energy exposure grew, however net long exposure to metals declined as the US Dollar strengthened, weighing on metals prices. In stock indices, the Fund’s small net long exposure steadily grew and successfully captured the general upward trend in prices. Initial gains from long positions during January were eroded by bouts of uncertainty in the final trading days of the month. However losses were recouped and the Fund continued to make gains from nearly every market in the sector for the rest of the quarter as positive sentiment increased.

Currencies proved to be more challenging. The US Dollar generally strengthened, moving against its multi-month downward trend, resulting in losses for the Fund’s net short position. Over the course of Q1, the Fund’s net short USD position more than halved in response to the currency’s trend. Losses in the sector were widespread, with only a limited number of gains from the Fund’s variable positions in safe-haven currencies such as the Japanese Yen and Swiss Franc. Overall, returns from fixed income were muted. In January, investor optimism went against the Fund’s long fixed income positions as yields rose. The Fund switched to a net short exposure mid-way through February and earlier losses were recouped as developed market bond yields had some of their biggest monthly jumps in over a decade, reflecting fears that central banks may tighten policy earlier than expected in order to suppress inflation.

Portfolio Positioning – Q1 2021

Long positioning in agriculturals remained stable over the quarter whilst the Fund’s fixed income and metals net long exposure more than halved. Energies switched from a small net short to net long mid-way through January and continued to grow for most of the quarter. The Fund’s small net long stock indices exposure steadily grew and had nearly doubled by the end of March. In currencies, the Fund’s net short US Dollar position was significantly reduced and remains the largest net short currency exposure. The Fund’s next largest currency positions are a net long in Pound Sterling and net short in Japanese Yen.

Q2 2021 Commentary

The start of the quarter saw risk assets such as equities and commodities thrive amidst upbeat economic data from the US, with the region showing strong signs of an accelerating recovery. The Federal Reserve reaffirmed their accommodative policies and President Joe Biden announced aggressive new tax hikes, allowing investors to look past inflationary fears and send US treasury yields lower. Safe haven assets were also supported by a record rise in coronavirus cases, particularly from India as it struggled to contain a new variant.

Risk assets continued their year-long rise in May. However, mixed economic data releases from the US caused markets to waver throughout the month. Inflation worries continued to prevail amongst investors, yet Federal Reserve officials attempted to calm markets by sending reassuring dovish tones. This accommodative messaging caused the US Dollar to weaken against major peers as it struggled to abate its recent slide.

| Private and Confidential |

Annual Commentary – AXS Aspect Core Diversified Strategy Fund

In June, the Federal Reserve surprised markets with hawkish rate projections which caused major yield curves to flatten. Investors also temporarily pulled out of the popular reflation trade. Markets subsequently steadied and US stock markets rallied to all-time highs amid President Biden’s new infrastructure deal. Towards the end of the month, investors balanced economic growth prospects against rising inflationary pressures and the spread of the highly infectious Delta coronavirus variant.

Portfolio Positioning – Q2 2021

Long positioning in agriculturals remained stable over the quarter whilst the Fund’s fixed income exposure remained short. Metals, energies, and stock indices remained relatively consistently long. In currencies, the Fund’s net short US Dollar position increased and then decreased significantly but still remains the largest net short currency exposure. The Fund’s next largest currency positions are a net short in the Euro and a net long in Pound Sterling.

Q3 2021 Commentary

Safe-haven assets found support at the start of the quarter from the rapid spread of the coronavirus Delta variant, hot inflation data and disappointing US economic data. All of which added to the uncertainty around global growth and caused some investors to reconsider the ‘reflation trade’. Longer-dated US treasury yields experienced sharp declines as investors flocked to the perceived safety of government bonds. Risk assets also started July strong and US stocks reached record highs as US jobs data surprised on the upside. Robust economic data and earning releases helped European and US stocks reach record highs despite the spread of the Delta variant in August. Asian stock indices suffered however, weighed down by Chinese regulatory clampdown and associated growth deceleration concerns. The Federal Reserve then sent their strongest signal yet that their accommodative policies would start to unwind by the end of this year. As other central banks followed suit, investors fled into the safe-haven US dollar and away from government bonds as tighter monetary policy became more likely. In September, it was energy markets which dominated headlines. Hurricane Ida forced oil production shutdowns off the Gulf of Mexico in the opening weeks of the month. Energies continued to be propelled upwards in the second half of September by low European gas inventories and fears of potential supply shortages during the coming winter months. Stocks also fell as central banks, including the Federal Reserve, again pointed towards less accommodative policy stances. The potential end to ultra-supportive monetary policy also helped strengthen the US Dollar and caused Treasury yields to rise.

The Fund successfully navigated the surge in energy prices. With particularly strong trends, and resulting performance, being seen in natural gas during September. Its net long exposure in the other commodities sectors also provided profits. Stock indices finished the quarter flat. Gains made in August were given back in September as equities went against their recent trends and fell due to increasing rhetoric from central banks that interest rate hikes may be on the horizon. The changing environment throughout the quarter between delta variant fears and the associated need for safe-haven assets and then inflationary concerns proved challenging in both the fixed income and currencies sectors. Losses were gradual throughout the quarter; the long British Pound position and variable German bond exposures were amongst the worst performing markets for the Fund.

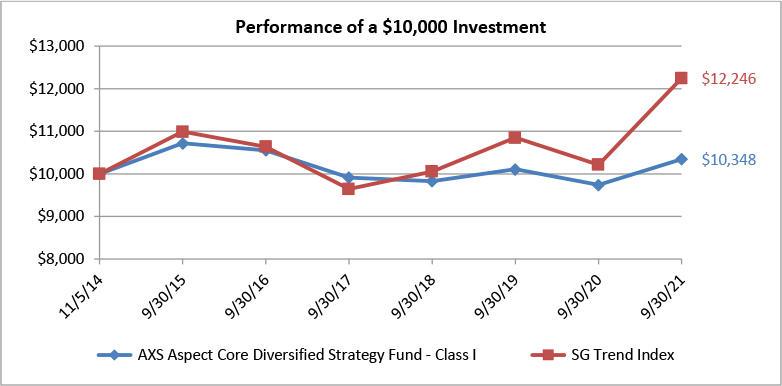

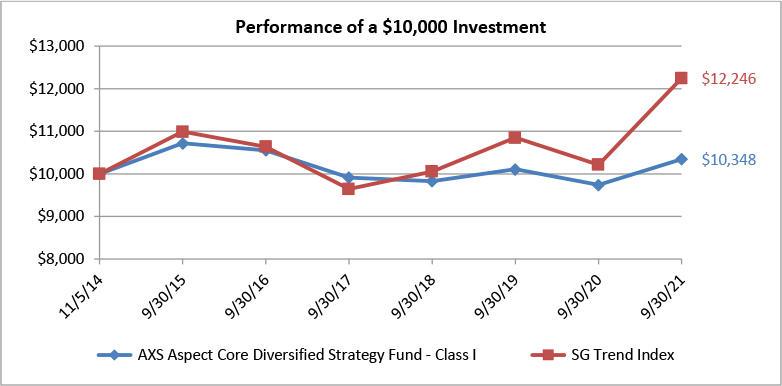

Portfolio Positioning – Q3 2021

The Fund’s net long commodities exposure remained in place over the quarter. Positioning in agriculturals and metals remained relatively stable, whilst energies increased. In financials, the Fund’s net short bond exposure flipped to a net long at the end of July before then returning to a net short by the end of September. The net long stock indices positioning remained consistently long. The Fund’s US Dollar exposure changed from a net short at the start of the quarter to a net long by the end of the period. However, there was some variability during August caused by the oscillating market demand for safe-haven assets. The Fund’s largest net long position is in the US Dollar, whereas it’s largest net short is in the Euro. The 12 months net return for the Fund to 30 September 2021 were 5.98% for Class A, 5.17% for Class C and 6.21% for Class I.

| Private and Confidential |

Annual Commentary – AXS Aspect Core Diversified Strategy Fund

The views in this letter were as of September 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice

| * | A long position refers to getting economic exposure to a reference asset, and this position will increase in value if the reference asset’s price increases. |

| ** | A short position refers to getting economic exposure to a reference asset, and this position will increase in value if the reference asset’s price decreases. |

| Private and Confidential |

| Annual Commentary 2021 |

AXS Chesapeake Strategy Fund

The fiscal year for the fund was profitable as the portfolio was able to take advantage of trends that developed and/ or continued over the period. Performance for the fiscal year for the Class I shares1 was 29.89%. The portfolio was able to capitalize on higher price trends in the commodity sector and continues to hold net long positions in the commodity sector; including long positions in the Energy, Agricultural and industrial metals complexes. Short positions in the US dollar also posted positive results. However, as the trend has reversed and the fund is positioned long US dollars vs some G7 counterparts. Positions remain intact on long US and global equity markets. The fixed income sector also saw a reversal in trend during the period and the fund is now positioned for an increasing global rate environment. Below is the monthly breakdown for the year where the monthly performance reflects the Class I shares.

OCTOBER 2020

The AXS Chesapeake Strategy Fund posted a loss of -0.95% for October. Losses were recorded for the Fund in the fixed income, equity, and currency complexes, while the commodity sector was positive.

| · | The commodity sector posted positive results for the month. The grain complex produced gains on long soybean and canola positions and more than losses from being long corn. In the energy and meat complex, short positions posted minor gains and losses, respectively. |

| · | The fixed income sector was negative as long positions in the global rate markets produced gains that were offset from losses in the US rate market. |

| · | The equity sector produced negative results as long positions in the Nasdaq and S&P 500 incurred losses that exceeded gains from positions in the London FTSE market. |

| · | The currency sector also produced slight losses for the month. Gains were recorded on short US Dollar positions against the Japanese Yen, Swiss Franc and Swedish Krona, and were offset by losses in the Australian and Canadian dollar as well as the Euro. Gains were incurred on long dollar positions versus the Brazilian Real. |

NOVEMBER 2020

The Fund posted a gain of 7.97% for November. Gains were recorded in three sectors: equities, currencies and commodities. The fixed income sector was basically flat.

| · | The currency sector was the best performing sector for the month. Gains were recorded on short US Dollar positions with the biggest contributors to gains being the British Pound, Euro, Canadian Dollar, New Zealand and the Australian Dollar. |

| · | The commodity sector posted positive results for the month. Gains on long positions in the agricultural complex, led by long positions in canola, soybeans and corn were the best performing sub sectors. Gains on long positions in the industrial metals complex, led by aluminum, copper and zinc also contributed positive results. Losses were recorded in the energy and softs complex. |

| · | The equity sector posted positive results for the month. Gains were led by long positions in the broad indices, the Nasdaq and S&P 500. |

| · | The fixed income sector was basically flat for the month. |

DECEMBER 2020

The Fund posted a gain 8.86% for December. The month saw a continuation of established trends and the Fund posted positive results in all four sectors in which it trades: currencies, equities, fixed income, and commodities.

| · | The currency sector contributed the most to the positive results for the Fund for the month as most currency positions were profitable. Gains were recorded on short US Dollar positions against the Swiss Franc, Swedish Krona and Euro Dollar, as well as the British Pound, Canadian Dollar and the Australian Dollar. |

| 1 | Class A and Class C shares returned 29.62% and 28.66%, respectively, for the fiscal year. |

308 Long Lane ¨ Richmond, Virginia 23221

Tel: 804.836.1617 ¨ Fax: 804.836.1610 ¨ E-mail: clientservices@chesapeakecapital.com

| Annual Commentary 2021 |

| · | In fixed income, interest rate performance was positive for the month. Global bond markets contributed the most to the positive performance led by Italian, German and British interest rate positions. |

| · | The equity sector produced gains on long positions on Us indexes, as well as some global indices including those in China and Japan. |

| · | The commodity sector posted strong positive results for the month. The grain complex produced gains on long soybean, corn, wheat and canola positions. The gain from the metals complex was led by long positions in the precious metals, namely, gold and silver. Long positions in cotton and sugar added gains for the month as well. |

January 2021

The AXS Chesapeake Strategy Fund posted a gain of 0.54% for the month. Gains came from the commodity complex, while the currency and fixed income sectors were negative. Equities were quiet.

| · | The commodity sector posted positive results for the month. The grain complex produced gains on long soybean, corn and canola positions. Gains were also registered in the soft complex on long positions in sugar and cotton. The energy sector produced gains on long crude oil and gasoline positions. Losses were incurred on various long positions in the metals complex. |

| · | The fixed income sector was negative as long positions in the global rate markets produced losses as interest rates trended lower during the month. |

| · | The equity sector was basically flat for the month. |

| · | The currency sector produced losses for the month. Losses were recorded on short US Dollar positions against the Canadian and Australian dollars. Long US dollar positions versus the Brazilian Real produced gains. |

February 2021

The AXS Chesapeake Strategy Fund posted a gain of 7.19% for the month as market trends continued to be favorable for the portfolio. Gains were recorded for the Fund in the fixed income, commodity and equity complexes, while the currency sector produced negative results.

| · | The commodity sector posted positive results for the month. The grain complex produced gains on long soybean, soybean oil, corn and canola positions. Gains were also registered in the soft complex on long positions in sugar and cotton. The energy sector produced strong gains on long crude oil, heating oil and gasoline positions. Gains were also posted on long positions in the metals complex, led by the base metals which included copper and aluminum. |

| · | The fixed income sector was positive as long positions in the global rate markets produced gains particularly on the long end of the yield curve during the month. |

| · | The equity sector produced positive results as long positions in Global stock indices led the gains. The Japanese and French stock indices were the best performers in this sector. |

| · | The currency sector produced losses for the month. Losses were recorded on short US Dollar positions against the Swiss franc. Long US dollar positions versus the Brazilian Real produced gains. |

March 2021

The AXS Chesapeake Strategy Fund posted a loss of -0.08% for the month as losses incurred in the currency and commodity sectors offset gains in the fixed income and equity complexes.

| · | The commodity sector posted negative results for the month. The grain complex produced gains on long soybean, soybean oil, corn and canola positions, and losses on long wheat positions. Losses were also registered in the soft complex on long positions in sugar, coffee, and cotton. The energy sector produced losses on long crude oil and heating oil positions. Losses were also posted on long positions in the metals complex, led by nickel and silver. The meat complex produced gains on long lean hog and live cattle positions. |

| · | The fixed income sector was positive as long positions in the global rate markets produced gains as global interest rates continued their recent trend of higher yields during the month. |

| · | The equity sector produced positive results on long positions in Global stock indices. Gains were recorded on long positions in European and US indices. |

| · | The currency sector produced losses as the US dollar strengthened during the month. Losses were recorded on short US Dollar positions against the Euro, New Zealand dollar, Swiss Franc and British Pound. |

308 Long Lane ¨ Richmond, Virginia 23221

Tel: 804.836.1617 ¨ Fax: 804.836.1610 ¨ E-mail: clientservices@chesapeakecapital.com

| Annual Commentary 2021 |

APRIL 2021

The AXS Chesapeake Strategy Fund posted a gain of 6.05% for the month as market trends continued to be favorable for the portfolio. Gains were recorded in the commodity, currency, and equity sectors while the fixed income sectors produced negative results.

| · | The commodity sector posted positive results for the month. The grain complex produced gains on long soybean, soybean oil, corn, and canola positions. Gains were also registered in the soft complex on long positions in coffee, sugar, and cotton. The energy sector produced gains on long crude oil, heating oil and gasoline positions. The metals complex produced gains on long industrial metal positions, including copper, aluminum, lead, nickel, and zinc. |

| · | The equity sector produced gains on both foreign and domestic stock indices. Long positions in the CAC40 and DAX led the gains. |

| · | The currency sector produced gains for the month. Gains were recorded on short dollar positions versus the Australian and New Zealand dollars and the Euro. Long dollar positions against the Japanese yen produced losses for the month. |

| · | The fixed income sector was negative as long positions in the interest rate markets produced losses as interest rates trended lower during the month. Losses were incurred on short positions in the US 10-year note and 30-year bond. |

MAY 2021

The Fund posted a gain of 2.06% for the month. Gains were recorded for the Fund in the commodity, currency, and equity complexes, while the fixed income sector produced negative results.

| · | The commodity sector posted positive results for the month. Gains were posted on long positions in the metals complex, led by the base metals, namely, copper, zinc and aluminum. Losses were posted on short gold positions. Gains in the softs complex were from long positions in sugar and coffee. Long positions in cotton were negative. The grain complex produced slight gains on long soybean oil and canola positions. Losses were incurred on long positions in wheat, corn, and soybeans. The energy sector produced gains on long crude oil, heating oil and gasoline positions. |

| · | The equity sector produced positive results as long positions in global stock indices led the way. The best performers were the Chinese and French stock indices. |

| · | The currency sector produced gains for the month. Gains were recorded on short dollar positions versus the Indian rupee, British pound, and the Euro. Long US dollar positions versus the Brazilian Real produced losses. |

JUNE 2021

The AXS Chesapeake Strategy Fund posted a loss of -4.03% for the month as losses were incurred in three of the four sectors traded. The currency, commodity and fixed income sectors produced losses while the equity sector produced gains.

| · | The equity sector produced positive results on long positions in global stock indices. Gains were recorded on long positions in European and US indices. |

| · | The commodity sector posted negative results for the month. Only the energy sector produced gains in the sector as the upwards price trend continued in the complex. Gains were recorded on long crude oil, heating oil and gasoline positions. The grain complex produced losses as long soybean and soybean oil results more than negated the gains on long positions in wheat, corn, and canola. Losses were also posted on long positions in metals complex, led by copper, platinum, nickel, and silver. The meat and soft complexes were relatively flat for the month. |

| · | The currency sector produced losses for the month as the US dollar strengthened, reversing its trend against most world currencies. Losses were recorded on short US Dollar positions against the Euro, British pound, Russian ruble as well as the New Zealand, Australian and Canadian dollars. |

| · | The fixed income sector was negative as short positions in the domestic and global rate markets produced losses during the month. |

308 Long Lane ¨ Richmond, Virginia 23221

Tel: 804.836.1617 ¨ Fax: 804.836.1610 ¨ E-mail: clientservices@chesapeakecapital.com

| Annual Commentary 2021 |

JULY 2021

The AXS Chesapeake Strategy Fund posted a loss of -2.34% for the month, as three of the four sectors traded incurred losses, led by fixed income, while the commodity sector produced gains.

| · | The fixed income sector was negative as short positions in the interest rate markets produced losses as interest rates moved substantially lower during the month. Losses were incurred on short positions in the US 10-year note and 30-year bond as well as European fixed income positions. |

| · | The equity sector produced losses as long positions in the emerging market index and the Asian indices more than offset gains from US and European positions. |

| · | The currency sector produced losses for the month. Losses were recorded on short dollar positions versus the Australian and Canadian dollars as well as the Brazilian Real. |

| · | The commodity sector posted positive results for the month. Losses from the grain sector were more than offset from gains in the metals, energy, and soft complexes. RBOB gas, heating oil, coffee, sugar, and cotton continued their upward trends and produced gains for the month. |

AUGUST 2021

The Fund posted a gain of 0.17% for the month, with gains in the fixed income and equity complexes. The currency sector produced negative results, and the commodity sector was flat.

| · | The equity sector produced positive results as long positions in global stock indices led the gains. |

| · | The fixed income sector was positive as short positions in the global rate markets produced gains as interest rates rose during the month. |

| · | The currency sector produced losses for the month. Losses were recorded on short dollar positions versus the Australian and Canadian Dollars and the British pound. |

| · | The commodity sector was basically flat. Losses were posted on long positions in metals complex led by copper, silver, and palladium. Gains were posted on long aluminum positions. Gains in the Softs complex came from long positions in sugar, coffee and cotton. The grain complex was basically flat as gains from canola were mostly offset by losses from long positions in corn and soybean oil. The energy sector produced losses due to price declines from being long crude oil, heating oil and gasoline. |

September 2021

The AXS Chesapeake Strategy Fund posted a gain of 1.98% for the month as gains in the fixed income and commodity sectors more than offset losses in the equity and currency complexes.

| · | The fixed income sector was positive as short positions in the domestic and global rate markets produced gains during the month. The Long Gilt produced the greatest gain. Profits were also recorded across the yield curve of US notes and bonds. |

| · | The commodity sector posted positive results for the month. The energy sector produced gains as the upward price trend continued in the complex. Gains were recorded on long crude oil, heating oil and gasoline positions. The Softs complex produced gains due to being long cotton. Losses were posted on long positions in the metals complex. The meat and grain complexes were relatively flat for the month. |

| · | The currency sector produced a small loss for the month as the US dollar strengthened versus the Euro, producing gains that were more than offset by US dollar positions in several emerging market currencies. |

| · | The equity sector produced negative results on long positions in global stock indices. Losses were recorded on long positions in European and US indices with some of these losses being offset by gains from being long the Japan’s stock index. |

The views in this letter were as of September 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

308 Long Lane ¨ Richmond, Virginia 23221

Tel: 804.836.1617 ¨ Fax: 804.836.1610 ¨ E-mail: clientservices@chesapeakecapital.com

| Annual Commentary 2021 |

Past performance is not necessarily indicative of future results. Futures trading is speculative and involves substantial risk of loss. This report is for use by current clients, authorized selling agents and prospective clients who have received a current Chesapeake disclosure document.

Actual Performance for Individual Capital Accounts may vary from the rate of return for the Company overall depending on the timing of the initial investment and subsequent additions and/or withdrawals.

308 Long Lane ¨ Richmond, Virginia 23221

Tel: 804.836.1617 ¨ Fax: 804.836.1610 ¨ E-mail: clientservices@chesapeakecapital.com

AXS Managed Futures Strategy Fund

Annual Letter to Shareholders for the year ended September 30, 2021

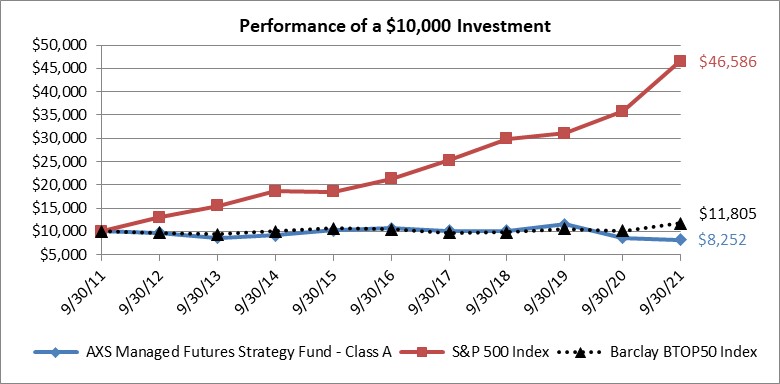

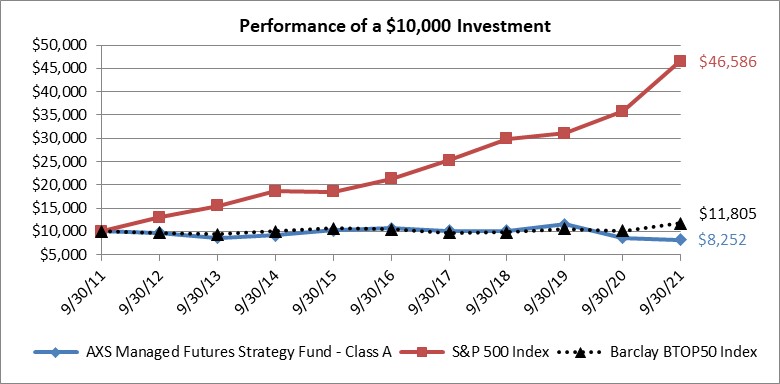

For the fiscal year ending September 30, 2021, the Fund’s Class A Shares (with No Load) returned −4.78%, Class A Shares (with Maximum Load) returned −10.25%, Class C Shares returned −5.58%, and Class I Shares returned −4.55%. During the period, the Fund’s Class I Shares underperformed both the Barclay BTOP50 Index® (the “Managed Futures Index”), which returned +16.08%, and US equities as represented by S&P 500® Total Return Index (the “Equities Index”), which returned +30.00%.

Much of the Fund’s underperformance can be attributed to a single trading program, the Quadriga Smart Gold options and futures trading program. This absolute return strategy aims to protect capital and generate negatively correlated returns (“crisis alpha”) during adverse and hostile equity markets, while seeking to earn neutral to positive returns during benign markets. Thus, the strategy seeks to earn, in the long run, higher risk-adjusted overall returns, particularly on the downside, through the combination of potentially higher compounded returns, lower realized volatility, and shallower drawdowns. Unfortunately, during a very strong year for equity markets (+30% for the Equities Index), a volatile and down year for gold (spot gold depreciated by about −8%), and a losing year for US Treasury securities (the 10-year bond returned about −4.5%), the Quadriga program lost about −50%, representing a contribution of −969 bps to the Fund’s performance, which eclipsed the combined positive contribution (+514 bps) made by all the other trading programs. The allocation to the Quadriga program was reduced progressively during the year, and the program was removed from the Fund’s portfolio in October 2021, shortly after the end of the fiscal year.

The Fund’s return has remained virtually uncorrelated to equities since inception, with a 0.19 correlation to the Equities Index. Like the managed futures asset class, to which it has had a correlation of 0.76 since inception, the Fund offers the potential for diversification benefits when added to traditional investment portfolios that have equities as their core holding.

FUND STRATEGY

The Fund’s investment objective is to seek capital appreciation in both rising and falling equity markets, with an annualized long-run volatility that is generally lower than the historical level of volatility experienced by the Equities Index.1 The Fund’s realized volatility since inception has been about 10.7%.

The Sub-Advisor pursues the Fund’s investment objectives mainly by investing in (i) fixed-income securities, and (ii) global derivatives markets, through the proprietary programs of one or more commodity trading advisors (“CTAs”), which are often labeled “managed futures” programs.

| 1 | The Fund’s sub-advisor seeks to manage the long-term volatility of the Fund’s returns within a target band of 8%-12%. This is only a voluntarily imposed internal target, and short-term volatility may fall outside this range. |

ampersandinvestments.com • 609.454.5200

The Sub-Advisor draws on its experience in the managed futures space to select futures trading programs and, by analyzing the interrelationships among them, to combine them in a portfolio that seeks to offer more consistent performance potential with lower volatility than individual programs. The portfolio is designed to be diversified across (i) trading methodologies (e.g., trend-following, global macro trading, relative value trading); (ii) trading time horizons (short-term, medium-term, long-term); (iii) sectors (energy, metals, agricultural commodities, equity indices, interest rates, currencies); and (iv) geography (US, Europe, Far East). The Sub-Advisor seeks to manage the risk of the portfolio by monitoring key parameters such as returns, volatility, drawdowns, value at risk (VaR), and sector exposures. While the portfolio is actively managed, it does not express or incorporate tactical views on markets or trading programs; rather, the Sub-Advisor emphasizes strategic allocation and long-term risk-adjusted returns.

PORTFOLIO

As of September 30, 2021, the Fund’s portfolio consisted of 17 futures trading programs. Four machine-learning/short-term trading programs (Crabel, Katonah, QIM and SCT) had a 20% allocation, as did two currency trading programs (LCJ and Mesirow). Two global macro programs (H2O and QMS) represented about 17% of the Fund’s portfolio, while four diversified intermediate-term to long-term (primarily) trend-following programs (Winton, KeyQuant, Quantica, and Quest) represented approximately 17% of the Fund’s portfolio. Two relative-value/commodity trading programs (EVE and J E Moody) represented approximately 15%, while the remaining 11% was allocated to other strategies (FORT Contrarian, QDRA and Quadriga).2 The Sub-Advisor believes that this diversification across trading styles and horizons has the potential, over time, to earn positive returns under a wide range of market conditions while keeping the volatility of the Fund’s returns within the desired range.

Table 1 displays the Fund’s quarter-by-quarter allocations to futures trading programs. This year, there were two deletions. In February, we discontinued our allocation to the Arctic Blue Inuvik commodity trading program. We increased our allocations to the other commodity programs in the portfolio. During April, we discontinued our allocation to the IPM Systematic Macro trading program. Both programs were wound down by their managers.

| 2 | It is worth mentioning that the above allocations are based on “notional trading,” whereas the Sub-Advisor employs a modified “risk-parity” allocation approach to determine allocations. |

ampersandinvestments.com • 609.454.5200

TABLE 1: QUARTER-END PORTFOLIO ALLOCATIONS

| Advisor | 9/30/2020 | 12/31/2020 | 3/31/2021 | 6/30/2021 | 9/30/2021 |

| Arctic Blue | 5.0% | 5.0% | | | |

| Crabel | 7.0% | 6.0% | 7.0% | 7.0% | 7.0% |

| Emil van Essen | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

| Fort Contrarian | 5.0% | 5.0% | 5.0% | 5.0% | 4.0% |

| H2O Asset Management | 9.0% | 9.0% | 8.0% | 9.0% | 10.0% |

| IPM | 7.0% | 7.0% | 8.0% | | |

| J E Moody | 5.0% | 6.0% | 10.0% | 10.0% | 10.0% |

| Katonah | 4.0% | 6.0% | 5.0% | 6.0% | 5.0% |

| Key Trends | 5.0% | 5.0% | 5.0% | 6.0% | 6.0% |

| LCJ | 5.0% | 6.0% | 7.0% | 8.0% | 8.0% |

| Mesirow Financial | 4.0% | 6.0% | 9.0% | 10.0% | 12.0% |

| QDRA | 6.0% | 5.0% | 5.0% | 6.0% | 6.0% |

| QIM | 6.0% | 4.0% | 4.0% | 4.0% | 4.0% |

| QMS | 5.0% | 4.0% | 6.0% | 7.0% | 7.0% |

| Quadriga | 4.0% | 5.0% | 2.0% | 2.0% | 1.0% |

| Quantica | 6.0% | 4.0% | 3.0% | 3.0% | 3.0% |

| Quest | 3.0% | 3.0% | 3.0% | 3.0% | 3.0% |

| SCT | 4.0% | 4.0% | 4.0% | 4.0% | 4.0% |

| Winton | 5.0% | 5.0% | 4.0% | 5.0% | 5.0% |

ANALYSIS OF FUND PERFORMANCE

As shown in Table 2, the Fund underperformed both the Managed Futures Index and the Equities Index. The Fund’s volatility since inception is lower than that of the Equities Index.

TABLE 2: PERFORMANCE STATISTICS OF THE FUND

| | RETURN (Fiscal Year) | VOLATILITY (5/24/2011-9/30/2021) | CORRELATION (5/24/2011 – 9/30/2021) |

| Fund (Class I shares) | -4.55% | 10.67% | 1.00 |

| Barclay BTOP50 Index® | 16.08% | 6.43% | 0.76 |

| S&P 500 Total Return Index® | 30.00% | 13.48% | 0.19 |

FUND PERFORMANCE ATTRIBUTION BY TRADING PROGRAM AND SECTOR

As we have mentioned in earlier years, the Fund’s diversified portfolio of trading allocations generally results in the number of positive and negative performers being roughly balanced, even in a bad year: there were ten positive contributors to performance (including fixed-income securities), adding up to +22.71%. There were also ten negative contributions, which totaled −27.26%. In addition to the Quadriga program highlighted previously, negative contributions came from a wide range of trading strategies, notably global macro and currencies. The largest positive contribution was from a discretionary global macro trading program, with smaller contributions coming from across the board.

ampersandinvestments.com • 609.454.5200

TABLE 3: TRADING PROGRAM CONTRIBUTIONS TO PERFORMANCE (10/1/2020 to 9/30/2021)

| Trading Program | Contribution |

| Arctic Blue | 0.02% |

| Crabel | 0.71% |

| Emil van Essen | -0.84% |

| Fort Contrarian | -0.88% |

| H2O Asset Management | 11.00% |

| IPM | -0.98% |

| J E Moody | 2.14% |

| Katonah | -2.15% |

| Key Trends | -2.09% |

| LCJ | -1.23% |

| Mesirow Financial | -3.24% |

| QDRA | -4.21% |

| QIM | 0.18% |

| QMS | -1.95% |

| Quadriga | -9.69% |

| Quantica | 2.88% |

| Quest | 1.42% |

| SCT | 2.05% |

| Winton | 2.14% |

| Fixed Income Securities | 0.17% |

| TOTAL | -4.55% |

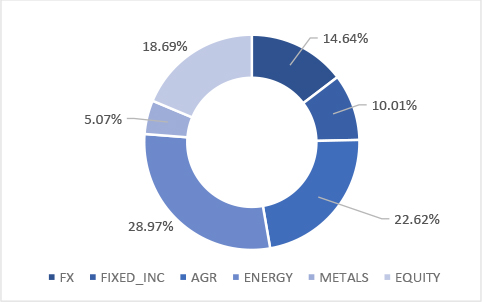

At the sector level, as shown in Table 4, equity indices were, not surprisingly, the biggest positive contributors to performance, followed by agricultural commodities and energy. Interest rates were the largest negative contributors, followed by currencies and metals.

TABLE 4: FUND PERFORMANCE ATTRIBUTION BY SECTOR (10/1/2020 to 9/30/2021)

| Sector | Contribution |

| Currencies | -7.58% |

| Equity Indices | 15.39% |

| Interest Rates | -14.10% |

| Agricultural Commodities | 3.43% |

| Energy | 2.48% |

| Metals | -4.34% |

| Fixed Income Securities | 0.17% |

| Total | -4.55% |

ampersandinvestments.com • 609.454.5200

Performance contribution is estimated by Ampersand Investment Management and is net of fees. Past performance does not guarantee future results.

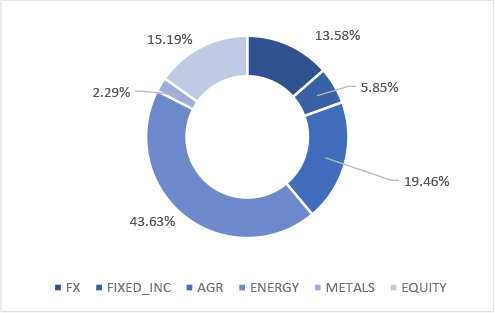

FUND SECTOR DIVERSIFICATION

RISK EXPOSURE AS OF 9/30/2021

RISK EXPOSURE AS OF 9/30/2020

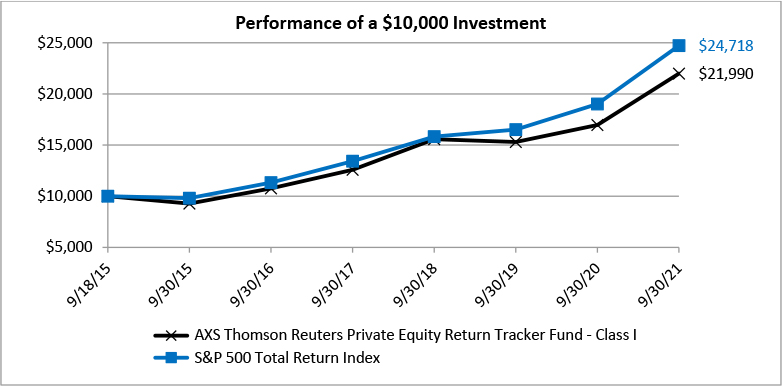

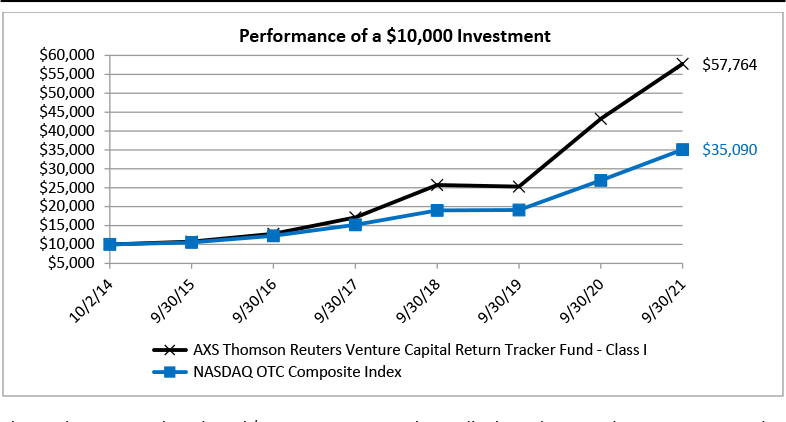

Source: Ampersand Investment Management and Bloomberg, LP. Reflects aggregate sector gross risk exposures